Page 1

New Anglia LEP

Clean Energy Skills Plan, March 2019

Enabling Growth in

New Anglia Clean Energy

Industry through Skills

Development

2019-‘36

LEP Officer Version

A Skills Plan for New Anglia

March 2019

Page 2

New Anglia LEP

Clean Energy Skills Plan, March 2019

Table of Contents

Executive Summary

4

Background Context

16

1. Clean Energy Skills Plan Priorities

17

Sector Deals

17

Reforming the Skills System- The Grand Challenges for Skills

19

Alignment with other Sector Skills Plans

20

Priority Skills Actions to be Taken

22

2. Defining the Clean Energy Theme and Growth Opportunity

36

Low Carbon and Renewable Energy (LCRE)

36

National Support for the LCRE Sector

37

UK Clean Growth Strategy

38

International Potential

39

3. The New Anglia Local Industrial Strategy and Clean Energy

41

The Local Industrial Strategy

41

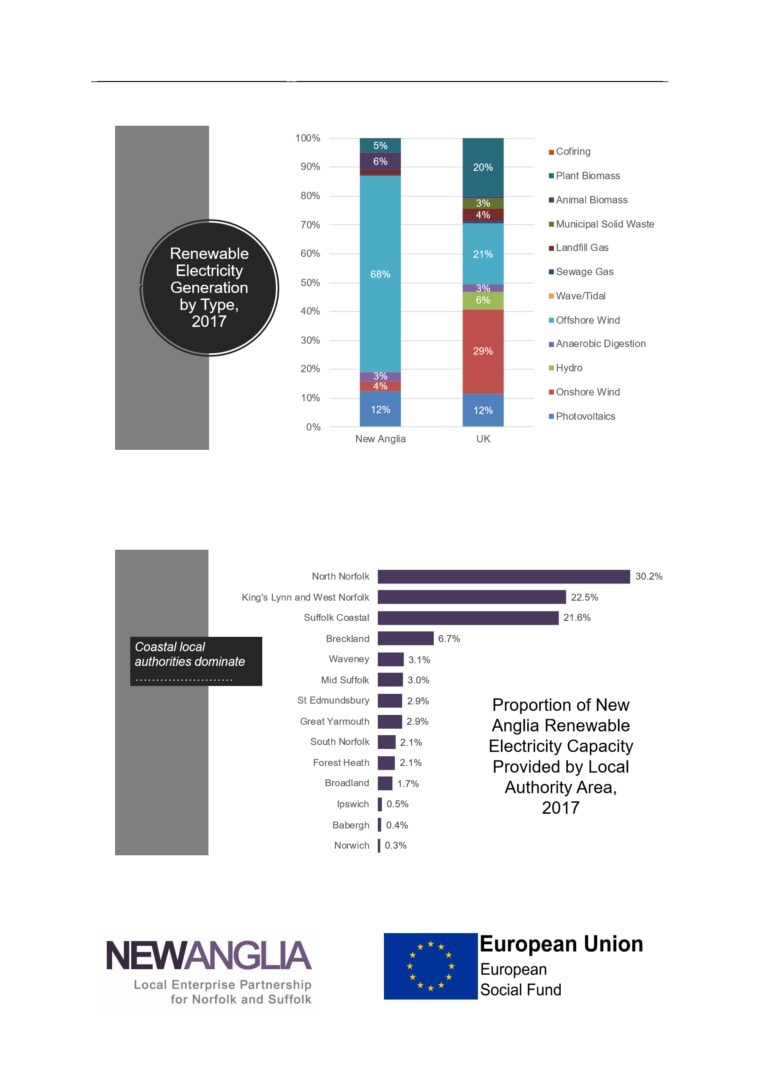

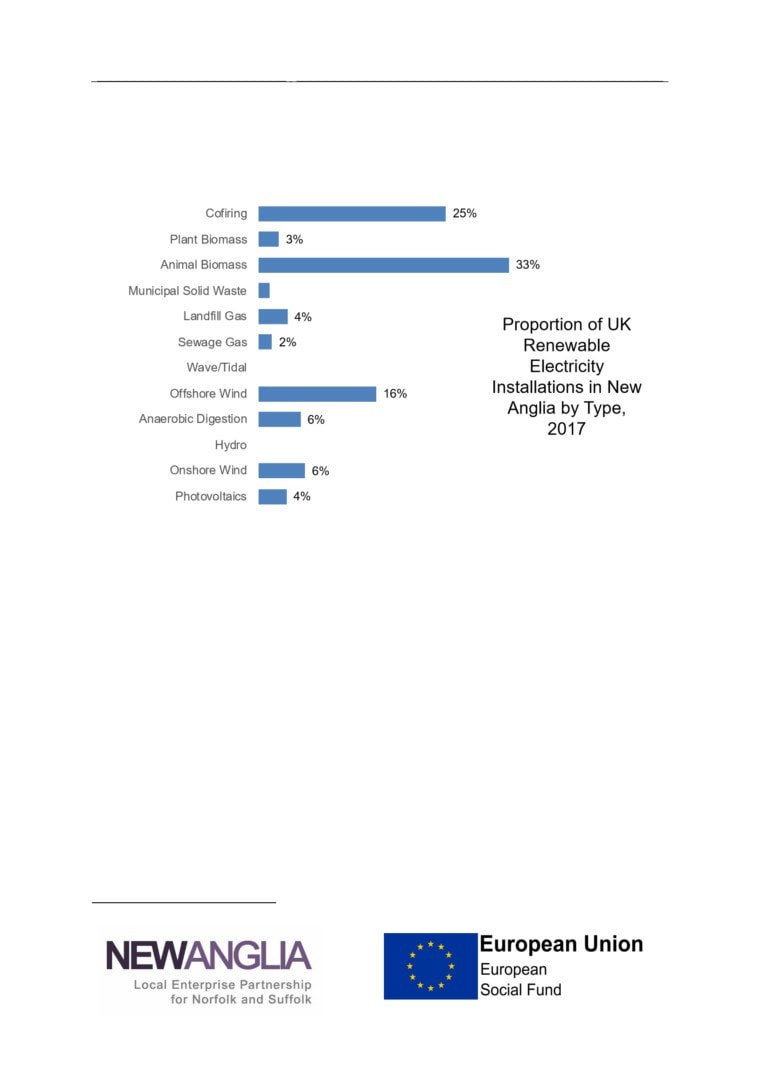

Renewable Electricity Generation

44

Biomass and Bio-energy

47

Solar

49

Nuclear

50

Future Technologies for Generation and Storage

52

Energy Efficiency Transformation

53

Infrastructure and Energy Grids

54

New Anglia USP for Clean Energy

55

Capex and Opex

57

The Enabling Role of Skills and Innovation

58

4. Clean Energy Implications for Employment and Skills

60

Employment

60

Workforce and Skills

61

Oil & Gas - Transitional Skills for Supply to Clean Energy

63

Carbon Capture, Use and Storage (CCUS)

64

Wind, Wave and Tidal

65

Biomass

67

Alternative Fuels & Electric Vehicles

67

Page 3

New Anglia LEP

Clean Energy Skills Plan, March 2019

Solar

68

Geo-thermal

68

Nuclear

69

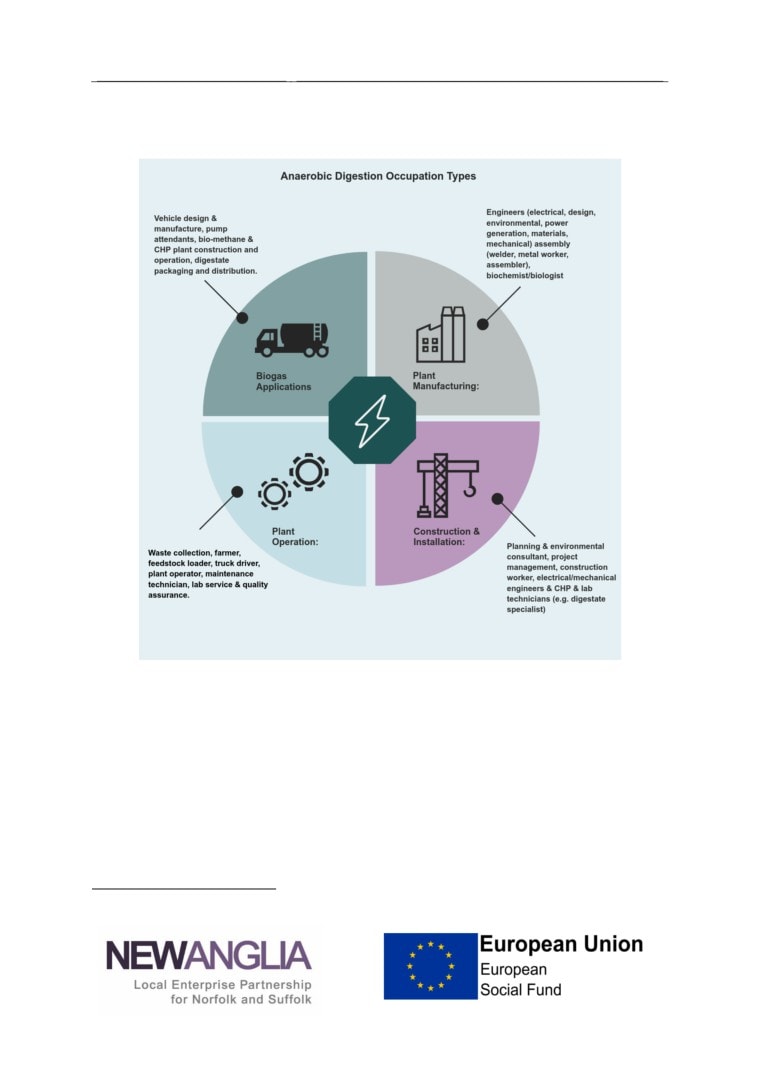

Anaerobic Digestion

71

Annex 1 - Clean Energy Skills Plan Action Matrix

73

Annex 1 - Clean Energy Skills Plan Action Matrix

74

Annex 2 - Existing Course Provision for Energy and Clean Energy

93

Annex 3 - Energy Policy - Extract from BEIS departmental plan

97

Annex 4 - Carbon Brief report

100

Page 4

New Anglia LEP

Clean Energy Skills Plan, March 2019

Executive Summary

1. Introduction

Background

This document sets out a Skills Plan to support ambitions for the local Low Carbon and

Renewable Energy sector, while also delivering against the bigger picture of Clean Energy,

which has been identified as one of Norfolk and Suffolk’s three key market opportunities for

the Local Industrial Strategy, alongside Agri Food and ICT.

Local Industrial Strategies focus on distinctive economic strands where an area can

demonstrate a competitive advantage and is able to play a significant national role in

delivering productivity growth against the UK Industrial Strategy1

low carbon

reduce the

electricity

carbon

low carbon heat

intensity of the

energy from waste

economy by

and biomass

holistically

energy efficient

addressing

products

generation,

low carbon

services

distribution and

consumption of

low emission

vehicles

clean energy

Ambitions

Norfolk and Suffolk has ambitions to build its reputation as a Centre of Excellence for Clean

Energy skills, by developing best-in-class elements such as :

• Operations + Maintenance Excellence

• Skills transfer

• Inspiring Clean Energy Careers

• A local and diverse talent pipeline and workforce

• Test bedding for emerging skills needs

• Multi-disciplinary local learning programmes

1 UK Government (2017), Industrial Strategy: The Grand Challenges

Page 5

New Anglia LEP

Clean Energy Skills Plan, March 2019

People are identified as one of the key pillars for growth in the UK’s Industrial Strategy and

by placing skills development at the heart of the Norfolk and Suffolk Clean Energy theme in

the Local Industrial Strategy, economic ambitions will be supported by increasing the

number of high value, higher skilled and higher paid jobs supported in Clean Energy, to

increase Clean Energy GVA in Norfolk and Suffolk.

2. Economic analysis

World-leaders in clean energy

Norfolk and Suffolk is recognised nationally and internationally for its Low Carbon and

Renewable Energy (LCRE) activities and for its contribution and commitment towards the

broader agenda of Clean Energy, where the

focus is on enabling a transition to a low carbon

energy system through capacity building in low

carbon generation, distribution and efficiency.

£1bn value

Nationally, the energy sector is in transition,

with over 50% of power now coming from LCRE

sources and further substantial expansion

2,000 businesses

expected as the UK seeks to lead the world in

decarbonising energy supply.

5300 jobs

Norfolk and Suffolk is unique amongst UK

regions in having strengths in the full range of

major clean energy technologies and is a leader

in:

£193K value per job

•

Offshore renewable energy

•

Bioenergy and solar

Norfolk and Suffolk renewable energy and

•

Nuclear

low carbon economy, 2016

The strengths of the area as a leader in Clean

Energy have been built upon:

• the natural advantages of its coastal and agricultural topography;

• A long history of investment in nuclear power generation at Sizewell and in the

offshore oil and gas industry in the southern North Sea;

• The commitment made locally to invest in the low carbon and renewables sector

from the start of the new Millennium

Page 6

New Anglia LEP

Clean Energy Skills Plan, March 2019

Local policy support for commercial investment has helped

to establish Norfolk and Suffolk as national leaders in

renewable energy, with specialist innovation centre Orbis

Energy providing support and the East of England Energy

48%

Group and the New Anglia All Energy Industry Council giving

a voice to the economy.

The increase in renewable

Currently, Norfolk and Suffolk generates 43% of the UK’s

energy generation in Norfolk

animal biomass energy production and 27% of wind power

and Suffolk between 2014-17

and renewable energy generation increased overall by 48%

between 2014-17.

Building prowess : the opportunities for future economic success

The International Energy Agency has calculated that to meet the targets agreed by 195

countries in Paris in 2015, $13.5 trillion of investment is needed globally in new generation

capacity, demonstrating the size of the global market and the huge export opportunities

offered by the industry.

The national Clean Growth Strategy (2018)2 highlights substantial growth in the UK’s low

carbon economy, reporting that since 1990 UK GDP has grown by 67%, the fastest rate in

the G7, whilst carbon emissions have fallen by 42%, much faster than the 3% reduction

seen in the G7 countries

The UK low carbon economy is expected to grow nationally by 11% each year through to

2030, which is four times faster than the overall economy, giving the potential for between

£60-170billion of exports of low carbon goods and services by 2030.

Norfolk and Suffolk is the only region in the UK which is strong in all areas of LCRE energy

generation and in building the market opportunity of Clean Energy through the Local

Industrial Strategy, the objective is to support both the:

• Energy Industry - to grow the productivity and economic contribution of the energy

industry to position Norfolk and Suffolk as a leading global centre for Clean Energy

technology and deployment;

• Wider economy - to enable economic growth across the economy by ensuring that the

area offers a modern energy infrastructure and affordable, sustainable energy supplies

to facilitate growth.

The strategy for Clean Energy developments builds upon existing core strengths, including:

Wind

The Southern North Sea, with Norfolk and Suffolk at its centre, is currently the largest

offshore wind development zone in the World with the Government’s Offshore Wind Sector

Deal3 setting out ambitions to grow offshore wind capacity in the UK to 30GW by 2030 at a

cost of £40billion.

2 UK Government (2018), Clean Growth Strategy

3 HMG (2019), Industrial Strategy, Offshore Wind Sector Deal

Page 7

New Anglia LEP

Clean Energy Skills Plan, March 2019

Of this, the East of England would deliver almost half of the capacity, representing a five-fold

increase in installed capacity in just over a decade. This would add a further 27,000 jobs

nationally by 2030 and the aspiration is

GLOBAL POTENTIAL

for one third of the staff to be female by

that time.

The case for clean energy

Predictions for long-term growth in global

demand highlight the potential for exporting

Biomass and Bio-energy

talent and technology world-wide

The Committee on Climate Change has

• Electricity consumption will double by

reported that 15% of UK energy demand

2050, with 50% from renewables by

could be met by biomass by 2050, double

2035

the rate today. Norfolk and Suffolk is

• Gas consumption will continue to grow

already the leading area for animal

until 2035 and then decline

biomass installations, with a third of

• Oil demand will peak between 2025-30

national capacity delivered through two

and then decline

major plants founded on the area’s

intensive livestock activities. There is

McKinsey

also a strong and growing anaerobic

digestion (AD) sector, and a number of

power plants fuelled by straw and other biomass, all providing a springboard for further

growth as this field expands. With some 8% of England’s farmland, there is a large potential

to increase the output of biomass in the area.

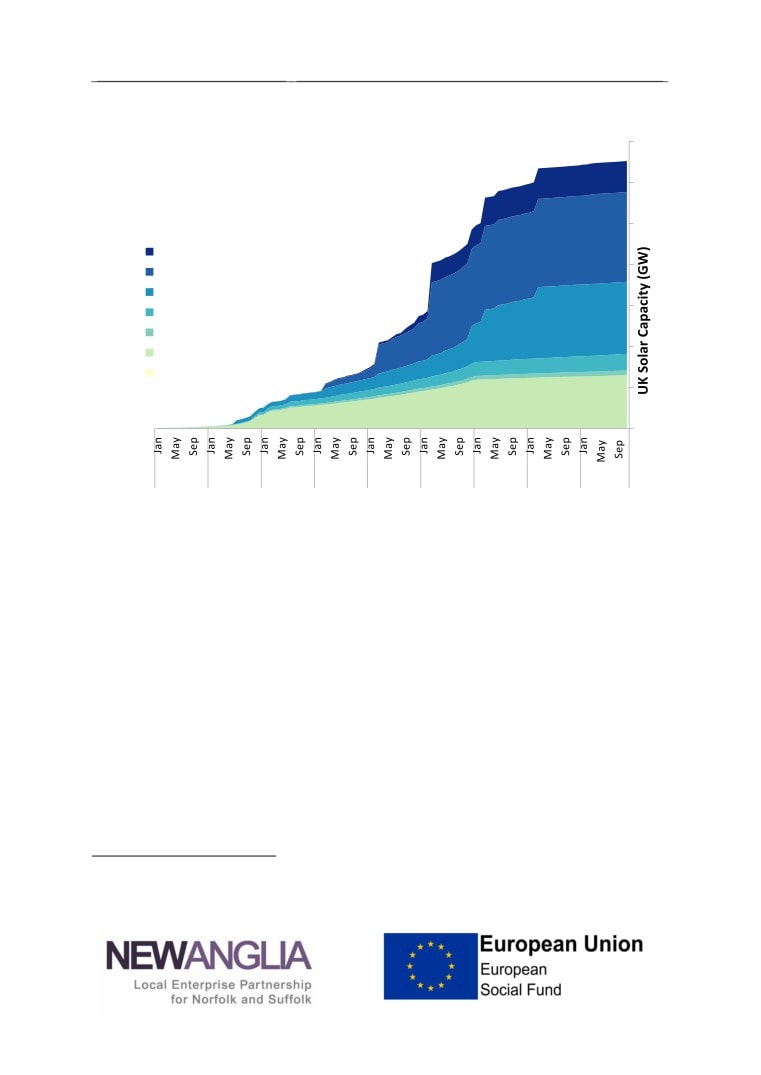

Solar

From 2012 to 2018 the installed UK solar capacity rose

from 2GW to 13GW4 and Norfolk and Suffolk has 4% of

UK installations with an output of 0.5GW.

$13.5 trn

Since 2014, most of the increase in solar capacity has

come from larger commercial (10KW+) installations,

The investment needed globally in

rather than domestic schemes. Norfolk and Suffolk is

new generation capacity to meet the

well placed to provide the large physical land area

objectives of the 2015 Paris

required to develop further commercial installations,

Agreement on climate change

with farmers keen to develop new income streams as

agricultural policy change focuses them on diversifying

their incomes.

Nuclear

Sizewell in Suffolk is a significant asset in the local LCRE energy sector. Sizewell A is

currently being decommissioned, whilst Sizewell B is still operational and generate 2.5GW of

4 UK Solar capacity installed - BEIS (20th December 2018)

Page 8

New Anglia LEP

Clean Energy Skills Plan, March 2019

low carbon power. Plans for Sizewell C are well advanced and is projected to create 5,600

jobs during peak construction5 in a plant which will generate 7GW of power

The implementation of the Nuclear Sector Deal6 is currently being developed nationally, with

New Anglia LEP working closely with government, alongside the Heart of the South West

and Cumbria LEPs. The key areas of focus include cost reductions; increasing workforce

diversity and securing more contracts for UK suppliers.

New technologies

Innovation is a constant feature of the Clean Energy industry and Norfolk and Suffolk has

potential to build on existing strengths to grow the LCRE economy by investing in

knowledge, skills and infrastructure to grow the LCRE economy in areas such as:

• Carbon Capture Usage and Storage (CCUS)

• Wave and tidal power

• Alternative high yield biomass crops such as algae

• Hydrogen generated through renewable power to produce a zero carbon fuel

Energy Efficiency Transformation

Alongside innovation in energy generation, continued gains in energy efficiency are needed,

coupled to energy grids which ensure that end users have the clean energy needed to

facilitate growth across the economy. With its clean energy generation potential, Norfolk and

Suffolk is well placed to lead this work on behalf of the wider region.

This will require investment in energy grids, including smart technologies and new grid

infrastructures. With much of the transformation in energy use is being enabled by Industry

4.0 and digitalisation, this is closely aligned with the ICT and Digital themes in the Local

Industrial Strategy in Norfolk and Suffolk, which provides a strong foundation for the

development of new smart, digitally facilitated energy systems.

An important opportunity for Norfolk and Suffolk lies in driving innovation around the

transformation of transport to clean energy systems. The region is home to a major ports

and logistics sector, with nearly 50,000 employees and a GVA of 2.3billion7. The potential to

move to clean energy in rail and road freight is a significant opportunity where Norfolk and

Suffolk can lead, with direct local impact and associated potential for technology and

systems sales.

Capex and Opex

LCRE infrastructure and generation capacity requires a mix of capital expenditure (Capex)

and operational expenditure (Opex). Much of the Capex is focused on comparatively short

periods of time, from a few weeks for a solar farm to a few years for a wind farm, whereas

Opex costs to maintain generation capacity will typically last for 25 years or more.

5 Hardisty-Jones Associates (2018), Sizewell C Economic Impact Assessment, Executive Summary

6 HMG Industrial Strategy (2018), Nuclear Sector Deal

7 New Anglia (2018), Sector Skills Plan for the Ports and Logistics Sector Through Skills Development 2018-‘25

Page 9

New Anglia LEP

Clean Energy Skills Plan, March 2019

Norfolk and Suffolk can develop capacity in the Capex phases of LCRE systems, focusing

on those areas where it can develop globally competitive, exportable expertise, such as in

the field of offshore wind energy. As the largest development zone in the world, Norfolk and

Suffolk is well placed to develop capacity and expertise in areas such as environmental

assessment, consultancy, grid infrastructure or financing as well as physical construction of

turbines, with such capacity opening up substantial national and global opportunities as

clean energy investment accelerates across the world. The area also has the potential to

position itself as a global solutions provider for LCRE maintenance including emerging areas

such as Industry 4.0-related remote monitoring and control of LCRE installations, with

control rooms in Norfolk and Suffolk already being used to monitor wind farms in Scotland.

Job creation

Local and national projections suggest an additional 14-16,000 new jobs will be created in

Norfolk and Suffolk by 2030 if the ambitions outlined here are realised.

This would be through direct jobs created in :

•

5,000 to 6,000 jobs in Offshore Wind

•

5,000 to 6,000 jobs in Nuclear

•

1,000 in other LCRE activities, such as bioenergy, solar etc

A further 3,000 Clean Energy jobs would be created indirectly across the economy.

Reflecting the innovation in the industry and Norfolk and Suffolk’s ambitions to lead the

development and deployment of new technologies, such jobs will make a significant

difference to the skills profile of the area as they are likely to be:

• High value

• High skilled

• High tech

• High wage

Page 10

New Anglia LEP

Clean Energy Skills Plan, March 2019

3. Skills analysis

Skills profile

The skills opportunities and challenges underpinning this Skills Plan have been identified

through a combination of desk-based research, drawing on national and local intelligence,

and stakeholder consultations, including the newly-established New Anglia All-Energy

Industry Council and other nationally-generated research and statistics such as the recent

Sector Deals for Nuclear and Offshore Wind. These include, for example, the low number of

women and ethnic minorities represented in the industry.

Feedback shows that energy is often not seen as a career route or valued source of jobs,

with many associating the sector with heavy, labour-intensive jobs such as those on oil rigs.

A key backdrop to the skills planning of the energy utilities industry is the pressures

surrounding an ageing workforce of Engineers and a mismatch with current entrants. Some

20% of the existing workforce are due to retire in the ten year period 2017-2027.

Skills gaps and shortages

Skills system gaps

Current skills shortages

According to UKCES, specific areas of

These include:

higher skills reported by employers as not

Graduate and Post Graduate Engineers

Data Science

being well supported via existing training

Construction - both trade and

standards include:

professionals

• Energy storage and management

Logistics - on and offshore

Commercial and Business Development

solutions

• Data analytics

• Installation, operations, testing and

maintenance within energy

infrastructure

• Adoption of latest design, surveying

and testing tools

Skills demand

The skills demands of the industry are broad and complex and the pace of innovation means

that future skills demand is relatively unpredictable.

A range of energy-related skills are needed by allied sectors as well as those directly

employed in the energy industry - for example by those installing and maintaining LCRE

technologies. Additionally, the pursuit of greater energy efficiency further broadens the range

of job roles and skills needed e.g. within construction and the transport sector.

Page 11

New Anglia LEP

Clean Energy Skills Plan, March 2019

Alongside the requirement for traditional engineering skills, Industry 4.0 is behind rapid

developments in sensor and control systems, which increases the focus on ICT skills. This

also creates demand for analysts and business managers who can evaluate and make

decisions on the data generated.

Skills development

There is a need to attract new entrants to the industry and to upskill the existing workforce

as new technology and Industry 4.0 impacts across the sector.

Many of the skills development needs to support future growth in Clean Energy have been

identified in two sector deals - Offshore Wind, March 2019, and Nuclear, June 2018. The

result of industry input, these outline the major priorities for supporting People, one of the

pillars for growth established in the UK’s Industrial Strategy.

The sector deals headline several major skills interventions, which in turn support the

existing priorities established within New Anglia LEP’s related Skills Plans.

Offshore Wind Deal

• Enhancing definition & accreditation

• Better workforce insight

• Increasing workforce diversity

• Reforming Post 16 Technical Skills

• Higher level R & D Skills

Nuclear Deal

• Enhancing Leadership & Diversity

• Apprenticeships and Supplier investment

• Building subject expertise

• Supporting workforce flexibility

• Promoting STEM careers

In addition, the industry will require new skills to enable local ambitions for innovation and

growth, where specific skillsets may be as yet unknown due to the fast pace of technological

change and the innovation required to deliver on the Clean Energy agenda. The types of

projects where this may be relevant include:

The expansion of low carbon energy generation

Energy efficiency technologies and systems

Disruptive low carbon technologies in sectors such as transportation

Developing the energy grid infrastructure

Using digitalization and Industry 4.0 to facilitate innovative new energy systems

Page 12

New Anglia LEP

Clean Energy Skills Plan, March 2019

4. Skills Plan

In support of the economic ambitions for Clean Energy, and reflecting the skills demands

and priorities identified, the Skills Plan will focus on seven key areas. Outlined below are

some indicative key actions in each of these areas:

Sector Skills Plan Alignment

1

Why?

To ensure that this plan adds value to the existing suite of New Anglia LEP’s

skills plans.

What?

Develop connectivity and feed into other skills plans to ensure the needs of

clean energy are met.

How?

Identify and support skills actions being led through other sector skills plans.

The closest alignments are with Energy, Advanced Manufacturing and Engineering, Digital

Tech and Emerging Technology. Additionally, while clean energy relates to the whole local

economy, major end-users of clean energy include three sectors with local skills plans: Ports

and Logistics, AgriFood Tech and Construction.

Skills Passports

2

Why?

To retain local talent and provide long-term local careers by supporting skills

transition across the energy sector - for example from oil and gas to offshore wind.

What?

Develop local retraining and accreditation initiatives to facilitate the transition

of skilled workers between different elements of the energy production mix.

How?

Review and build upon the local good practice examples coming through

early targeted action, for example through East Coast College’s Skills Deal pilot.

Page 13

New Anglia LEP

Clean Energy Skills Plan, March 2019

Strengthen Operations + Maintenance

3

Why?

To capitalize on the position of Norfolk and Suffolk as a leader in both CAPEX

and OPEX and particularly Operations and Maintenance (O+M) skillsets with the potential to

provide long-term, quality, global jobs.

What?

Develop a stronger supply chain of Operations and Maintenance engineers

and technicians to support Norfolk and Suffolk’s local, UK and global LCRE service

development

How?

Increase the capacity of local provision to train more O+M engineers and

technicians by working with industry partners.

Inspire Clean Energy Careers

4

Why?

To overcome the lack of local awareness amongst young people and the

adult workforce of the high quality career opportunities available in the LCRE sector and

across the clean energy agenda.

What?

Develop a strategy to ensure that students, local residents and career

influencers understand the scope, quality, value and growth potential of jobs in the local

clean energy industry.

How?

Build a strong positive identity for Energy Jobs locally in partnership with

local businesses.

Increasing Local employment and workforce diversity

5

Page 14

New Anglia LEP

Clean Energy Skills Plan, March 2019

Why?

To ensure that high quality opportunities realised through Clean Energy

growth are accessible to the whole community

What?

Norfolk and Suffolk positioned as a beacon of best practice in encouraging a

workforce that is gender and BAME diverse to spearhead the national commitments in the

Nuclear and Offshore Wind Sector Deals.

How?

Support diversity and social mobility by developing new pathways for all into

Clean Energy, working through pilots with partners such as DWP and progressive

employers.

Technical Standards and Skills Reform

6

Why?

To ensure high quality learning pathways and skills that match fast-

developing areas such as bioenergy

What?

Norfolk and Suffolk recognised as a Centre of Excellence for Clean Energy

learning, skills and accreditation by leading the development of new industry defined

standards

How?

Identify routes to testbed new skills development for emerging occupations

Emerging Technology / Multi-disciplinary Skills

7

Why?

To meet the needs of students and businesses in exploiting the full growth

potential of new, disruptive technologies needed for Clean Energy

What?

Ensure local course provision best positions students to build Clean Energy

careers through a multi-disciplinary curriculum which builds on the foundations of energy

engineering, through supporting the development of multi-skilled workers who can facilitate

the transition to Clean Energy through Industry 4.0 and AI, environmental and project

management skills

How?

Work with local FE and Higher Education Institutes that deliver qualifications

in energy and engineering-related disciplines to create multi-skilled works with the full range

of skills needed in the rapidly evolving Clean Energy sector

Page 15

New Anglia LEP

Clean Energy Skills Plan, March 2019

Page 16

New Anglia LEP

Clean Energy Skills Plan, March 2019

Background Context

The Clean Energy Skills Plan has been developed by the industry in Norfolk and Suffolk,

working alongside the New Anglia Local Enterprise Partnership, the New Anglia Skills Board

and supported by SkillsReach.

SkillsReach was contracted to facilitate and prepare sector skills plans for the New Anglia

LEP priority sectors. The project was commissioned by the Education and Skills Funding

Agency, in partnership with New Anglia LEP, and funded through the European Social Fund.

Each Sector Skills plan and supporting Data Pack has been developed in collaboration with

local employers and other stakeholders.

The New Anglia Skills Board places employers at the centre of decision making on skills in

Norfolk and Suffolk to ensure the skills system becomes more responsive to the needs of

employers, and the future economy.

Whilst there is not a formal industry led group for Clean Energy for New Anglia, there are a

range of bodies which collectively focus on and represent the energy industry. The energy

sector in New Anglia is also now being supported by a new All Energy Industry Council,

which will play a key role in overseeing the Clean Energy theme in the New Anglia Local

Industrial Strategy.

SkillsReach is an established East of England-based strategic skills consultancy with an

associate project team with extensive experience of developing skills plans.

Acknowledgements

The New Anglia LEP wish to thank the employers, training providers and stakeholders who

contributed to the plan by attending events, being interviewed or by making referrals to

employers and organisations in the sector. The skills plan was developed in 2018/19 by

SkillsReach.

Page 17

New Anglia LEP

Clean Energy Skills Plan, March 2019

1. Clean Energy Skills Plan Priorities

When determining the priorities for skills, in support of the Clean Energy Plan in the

Local Industrial Strategy, the following elements have been assessed:

• The definition and economic growth opportunities for Clean Energy industries across

New Anglia, recognising the relative strengths and competitive advantage of specific

clean tech activities for the area;

• The context of identifying skills demands in relation to the Local Industrial Strategy

and the scope of Clean Energy within it, consolidating the existing priorities defined

within the Offshore Wind and Nuclear national Sector Deals;

• Existing national and local plans that summarise skills priorities for industries that will

support the growth of the clean energy market, specifically the priorities recently

defined across Skills Plans for the Energy, Advanced Manufacturing and Digital Tech

Sectors;

• Assessing the policy landscape surrounding the reform of technical and post-16

skills, this includes an appraisal of the challenges within the existing skills system

and the opportunities presented by New Anglia’s Learning and Skills sector.

Sector Deals

The Offshore Wind and Nuclear Sector Deals agreed between industry and government

outline the major priorities for ‘People’, one of the ‘pillars for growth’ established by

government in the national Industrial Strategy. Both sector deals overlap on several

major skills interventions, which in turn support the existing priorities established within

New Anglia LEP’s related Skills Plans. Specifically, for Nuclear and Offshore Wind, the

process for developing the Energy Skills Plan (2018), included consultation with key

employers - EDF, ScottishPower Renewables, Vattenfall and Siemens - to ensure the

nascent development with national skills prioritisation via Sector Deals, could be cross-

referenced with the Energy Skills Plan. Sector Deal priorities relevant for Clean Energy

locally cover:

• Increasing the diversity of the workforce, with a focus on gender, social background

and ethnicity;

• Developing processes to assess the existing workforce skillset and systems to better

capture intelligence on patterns of skills demands across occupational areas;

• Reviewing the existing technical standards and ensuring gaps/emerging technical

competencies can be defined and used to inform the development of new training

products;

• Promoting STEM careers, addressing significant replacement demands and growth,

in line with an ageing workforce and planned infrastructure developments;

• Recognition of the generic and interdependent workforce needs across a range of

industries and sectors (construction, engineering, manufacturing etc) and developing

schemes to allow the ‘passporting’ of the workforce in line with the demand cycles.

Page 18

New Anglia LEP

Clean Energy Skills Plan, March 2019

Figure 7 National Sector Deals and the Local Industrial Strategy

Page 19

New Anglia LEP

Clean Energy Skills Plan, March 2019

Reforming the Skills System- The Grand Challenges for Skills

Ultimately positioning ‘People’ as a pillar for growth and productivity for a New Anglia

Clean Energy plan requires the skills system itself locally to be reformed. Much of the

current and emerging skills demands for Clean Energy require industry to engage with

the skills system to define and design new skills products. There are limitations on how

the existing skills funding and accreditation system allows training and education

suppliers to deliver skills solutions that meet the demands of industry, particularly within

areas of niche technical demand that often involves short-burst technical training and

does not accord within longer defined vocational qualifications that form the basis for

apprenticeships and emerging T level qualifications.

Figure 8 The Grand Challenges for Skills

These challenges become exacerbated for SMEs, who often rely on statutory

funded/subsidised funding of skills and training to enable them to invest in training itself,

excluding construction and the construction engineering industries.

There is no levy system that affords a systemic industry led response to investment.

On the back of increasing localism there needs to be new strategic development and

support that combines public intervention and support with industry investment in growth,

productivity and business support. This has to include people and skills, including

effective work organisation and skills utilisation as inherent elements; rather than the

development of skills as a separate response.

Key elements to support a transformative skills system, include:

• The co-design of new standards and training products with industry, building on

previous ‘trailblazer’ initiatives for apprenticeship and T Level reform.

• Developing routes for effective diagnostic and brokerage of skills needs for

employers, particularly SMEs, which is responsive to the competitive market that

skills providers operate in but is inherently employer driven. This has to be

independent and able to advocate for new and flexible training solutions rather than

focus on what is currently available on the training market.

Page 20

New Anglia LEP

Clean Energy Skills Plan, March 2019

• Developing new methods for capturing and defining labour market intelligence that is

not reliant on existing SIC and SOC processes (because these are limited to

traditional sector classification and occupational roles), rather than responsive to the

market and transformative inter-disciplinary roles which are now becoming common.

Such data can inform new product demand and strategies for developing careers and

enterprise activity. Such data would act as a catalyst for investment in training and

provide leverage with government on future funding initiatives that entail localised

skills leadership. Essentially New Anglia would be developing unique, proprietary

data that can inform policymaking at a national level.

• Developing joined up planning on skills between providers, industry and civic

stakeholders to underpin the development of skills priorities which address

sustainable planning/development, the growth in community energy and how skills

can affect energy use behaviour change.

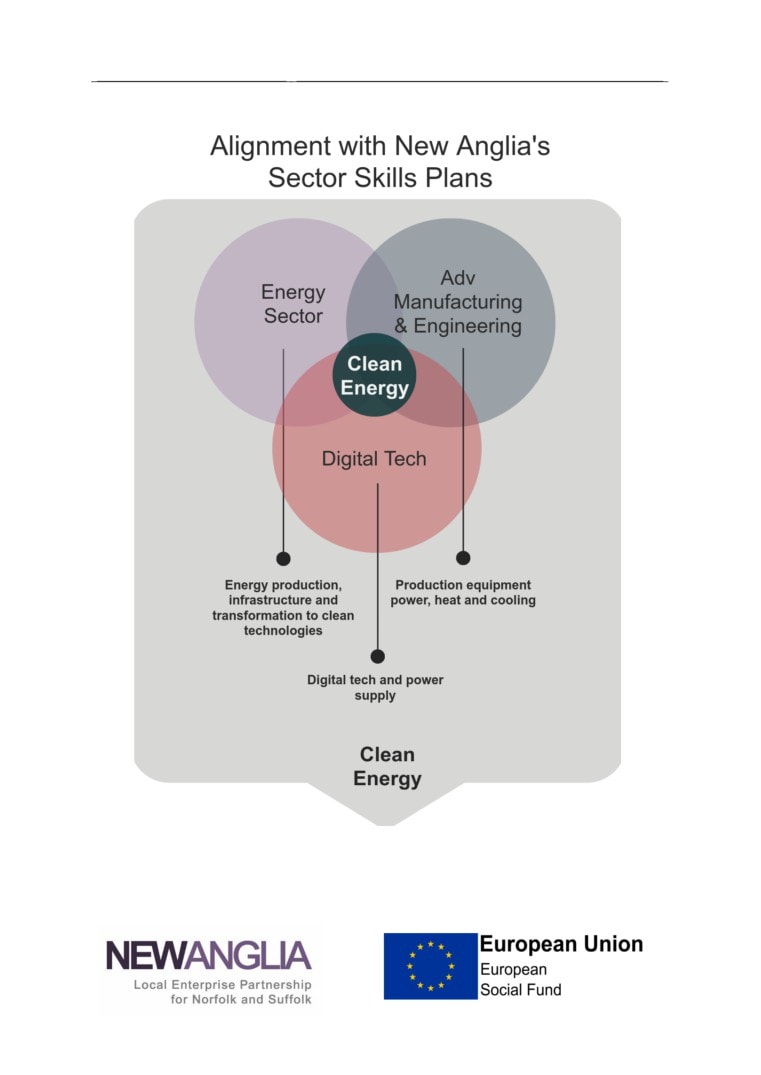

Alignment with other Sector Skills Plans

During 2016-’18 New Anglia developed a suite of other sector skills plans covering

• Energy

• Emerging technology - smart grids, IoT, demand side response etc.

• Digital tech - totally dependent on power supply, plus ability to provide IoT

frameworks etc.

• Construction - energy efficient construction methods, building energy performance

• Agri-food Tech - biomass, biofuel, AD, wind, solar

• Ports and logistics - motive power for transport

• Advanced manufacturing and engineering - production equipment power, heat and

cooling

• Life Sciences & the bio-economy - biomass conversion technology, living energy

systems (algae)

• Finance - investment needed for clean energy

• Culture - transport

The existing Sector Skills Plans on Energy and the Advanced Manufacturing and

Engineering have a particularly close alignment with clean energy.

The Oil and Gas industry is strong in New Anglia and has already been covered in detail

in the Energy Sector Skills Plan.

Furthermore, in parallel with the plan for Clean Energy, a plan for the skills required in

Emerging Technology based on Industry 4.0 is being developed. This has a strong

alignment with the move to smart energy systems which allow grid balancing, improved

energy efficiency and which help to manage the inherent variability in some renewable

energy technologies.

Page 21

New Anglia LEP

Clean Energy Skills Plan, March 2019

Figure 9 Alignment Between Clean Energy and Sector Skills Plans

Page 22

New Anglia LEP

Clean Energy Skills Plan, March 2019

Priority Skills Actions to be Taken

Sector Skills Plan Alignment

1

Clean Energy is dependent on workforce development and skills demands which have,

to a large extent, already been evidenced in New Anglia’s Skills Plans; specifically, for

Advanced Manufacturing and Engineering, Energy and Digital Tech. It is important to

reduce duplication and recognise the crosscutting nature of skills requirement inherent in

clean energy. Existing skills demands for Clean Energy include:

• Engineering- both mechanical and electrical;

• Technicians- at L3/4+ in relation to installation, operations and maintenance roles;

• Craft technicians- linked to fabrication/manufacture and installation roles;

• Commercial and management;

• Industry 4.0 expertise.

There is growing potential, under the auspices of the Offshore Wind Sector Deal,

to define New Anglia as an area of technical excellence for Operations &

Maintenance (O&M). Skills within the context of People and Place, plays an

important role in supporting an O&M strategy. As highlighted, the combination of

skills recommendations across Energy, Advanced Manufacturing and Engineering

and Emerging Technologies underpin the training demands for O&M roles overall.

By ensuring that cross-sector alignment is managed the inherent O&M demands

for Clean Energy can be supported.

In support of the Local Industrial Strategy these crosscutting areas require a high degree

of integration. Furthermore, they are skills demands that run deeply through New

Anglia’s supply chains for related sectors such as agri-food, construction and

transport/logistics

They represent a significant operating expenditure to ensure suppliers remain

competitive in the market place and can in turn invest in effective skills development for

New Anglia’s workforce. It also important to plan for future demand and build resilience

in supply chains through supporting the capital expenditure a business and industry

cluster can make in training and development.

RATIONALE - The current and forecast skills needs for Clean Energy correlate greatly

with the skills demands defined across several of New Anglia’s priority sectors -

specifically the Energy Sector, Advanced Manufacturing and Engineering and Digital

Page 23

New Anglia LEP

Clean Energy Skills Plan, March 2019

Tech. New Anglia’s Skills Board is already overseeing a range of action emanating from

sector skills plans, which represents an underpinning series of actions for Clean Energy.

AIM - To ensure that the existing skills priorities developing through partnership action

cross-refer to Clean Energy, avoiding duplication and re-enforcing the aggregate

demand for key skills - particularly technical, STEM related roles.

OUTCOME - The outcome of which is a joined up and highly responsive skills offer;

ensuring Clean Energy industries can benefit from an appropriately skilled, flexible and

buoyant local labour market.

THE APPENDIX INCLUDES A DETAILED ASSESSMENT OF THE KEY ALIGNMENT

ACTIVITY, LINKING THE RECOMMENDED ACTIONS FOR CLEAN ENERGY WITH

EXISTING SKILLS PRIORITIES.

RECOMMENDED ACTIONS

a. Establish a Cross-sector Clean Energy Skills Leadership Group (acting as a sub-

group to the New Anglia All Energy Council), which can meet bi-annually to

assess the progress made in addressing Clean Energy skills though existing

Sector Skills Plans - with a particular emphasis on the progress made within the

Energy Skills Plan (the scope of which however did not wholly cover onshore

renewable and Clean Energy industry not related to nuclear or offshore wind).

The aim of the group would be to provide a supportive “scrutiny and oversight

role”; reviewing progress and identifying solutions at a strategic level linked to

future investment in skills supply, at an operational and capital level. The group

should consist of senior private sector representation and involvement from

Sector Deal representation at a New Anglia level. The group should have the

capability of lobbying/engaging with government directly on skills policy, focusing

on outcomes linked to maximising local investment in Clean Energy skills for New

Anglia.

MEASURING SUCCESS

• Strategically the priorities defined for Clean Energy are delivered via cross-sector

working, with controls in place to manage change.

Page 24

New Anglia LEP

Clean Energy Skills Plan, March 2019

Skills Passports

2

Clean Energy is dependent on workforce development and skills demands which have,

to a large extent, already been evidenced in New Anglia’s Skills Plans; specifically, for

Advanced Manufacturing and Engineering, Energy and Digital Tech. It is important to

reduce duplication and recognise the crosscutting nature of skills requirement inherent in

clean energy. Existing skills demands for Clean Energy include:

• Engineering- both mechanical and electrical;

• Technicians- at L3/4+ in relation to installation, operations and maintenance roles;

• Craft technicians- linked to fabrication/manufacture and installation roles;

• Commercial and management;

• Industry 4.0 expertise.

In support of the Local Industrial Strategy these crosscutting areas require a high degree

of integration. Furthermore, they are skills demands that run deeply through New

Anglia’s supply chains for related sectors such as agri-food, construction and

transport/logistics

They represent a significant operating expenditure to ensure suppliers remain

competitive in the market place and can in turn invest in effective skills development for

New Anglia’s workforce. It also important to plan for future demand and build resilience

in supply chains through supporting the capital expenditure a business and industry

cluster can make in training and development.

RATIONALE - The current and forecast skills needs for Clean Energy correlate greatly

with the skills demands defined across several of New Anglia’s priority sectors -

specifically the Energy Sector, Advanced Manufacturing and Engineering and Digital

Tech. New Anglia’s Skills Board is already overseeing a range of action emanating from

sector skills plans, which represents an underpinning series of actions for Clean Energy.

AIM - To ensure that the existing skills priorities developing through partnership action

cross-refer to Clean Energy, avoiding duplication and re-enforcing the aggregate

demand for key skills - particularly technical, STEM related roles.

OUTCOME - The outcome of which is a joined up and highly responsive skills offer;

ensuring Clean Energy industries can benefit from an appropriately skilled, flexible and

buoyant local labour market.

Page 25

New Anglia LEP

Clean Energy Skills Plan, March 2019

RECOMMENDED ACTIONS

a. Establish a Cross-sector Clean Energy Skills Leadership Group (acting as a sub-

group to the New Anglia All Energy Council), which can meet bi-annually to

assess the progress made in addressing Clean Energy skills though existing

Sector Skills Plans - with a particular emphasis on the progress made within the

Energy Skills Plan (the scope of which however did not wholly cover onshore

renewable and Clean Energy industry not related to nuclear or offshore wind).

The aim of the group would be to provide a supportive “scrutiny and oversight

role”; reviewing progress and identifying solutions at a strategic level linked to

future investment in skills supply, at an operational and capital level. The group

should consist of senior private sector representation and involvement from

Sector Deal representation at a New Anglia level. The group should have the

capability of lobbying/engaging with government directly on skills policy, focusing

on outcomes linked to maximising local investment in Clean Energy skills for New

Anglia.

MEASURING SUCCESS

• Strategically the priorities defined for Clean Energy are delivered via cross-sector

working, with controls in place to manage change.

Strengthen Operations + Maintenance

3

As the largest development zone in the world, New Anglia is well placed to develop

operational and maintenance (O + M) capacity that can not only support local

installations, but also compete to provide support nationally and globally. For example,

control rooms in New Anglia already monitor wind farms in Scotland. In an arena where

Engineers and Technicians are already in very short supply already, there is a need to

strengthen the pipeline of skilled staff as a key part of any developing the local 'O + M

service offer'.

RATIONALE - Local stakeholders recognise the huge potential in this field to export

services and skills nationally and globally, and are keen to explore what the underpinning

skill supply and development implications are, and develop a proactive skills response.

Page 26

New Anglia LEP

Clean Energy Skills Plan, March 2019

AIM - To support the area to build its reputation for CAPEX and OPEX investment

services backed up by developing the locally-led based skillsets to support long-term

operations and maintenance that can support energy installations locally, nationally and

globally

OUTCOME -New Anglia builds a national reputation for excellence in O + M business

services and the professional skills that underpin it

RECOMMENDED ACTIONS

a. Identify the current key job and skills elements of world-class O+M and audit the

scale and scope of current local skills pathways (FE / HE / Apprenticeships) for

those key job roles - including earlier pre-degree access-points

b. Agree a strategy to either establish new pathways, underpinned by the

forecasted sector job growth or grow the scale of existing talent pipelines (e.g.

Graduate entry / Apprentices) - particularly where known skill shortages exist

c. Identify whether there are opportunities locally to develop provision for O + M

specialists in the newer emerging areas such as AD, Solar etc.

MEASURING SUCCESS

• An increase in the numbers entering O+M pathways In New Anglia and the

numbers qualifying and ready to take up local vacancies in Clean Energy

Inspire Clean Energy Careers

4

The promotion of STEM careers and a more diverse labour market have been prioritised

in several of the existing Skills Plans for New Anglia. The Learning and Skills Sector

Skills Plan (2019 in Draft) highlights:

“The production of the national White Paper on the Industrial Strategy coincided with

an extensive re-focus on the efficacy of careers and enterprise delivery in education

nationally. Since the implementation of the new National Careers Strategy in 20178

and the establishment of the national Careers and Enterprise Company (CEC),

schools are encouraged to take a more proactive and strategic approach towards

careers and enterprise delivery in order to equip the next generation of school

8 Careers Strategy- Making the Most of Everyone’s Skills and Talents (2017), DfE

Page 27

New Anglia LEP

Clean Energy Skills Plan, March 2019

leavers with the appropriate employability and enterprise development that

employers will value. The national policy uses the Gatsby Foundation’s key

recommendations for developing careers and enterprise activity within schools, which

includes promoting more opportunity for employer encounters for students, a greater

understanding of the local labour market to inform careers choice and responding to

the needs of each student.”

Consultation with the learning and skills sector indicates a degree of concern regarding

the production and dissemination of accurate labour market information and the planning

for enterprise and careers guidance activities that can effectively support the adoption of

the National Careers Strategy. The recent DfE Area Review9 corroborated this issue,

with a commitment from Norfolk and Suffolk County Councils and the New Anglia LEP to

work collaboratively to develop good quality information on local employment, skills

needs and key developments that may provide opportunities for learners to progress.

RATIONALE - The New Anglia Energy Skills Plan recommended the development of a

STEM enterprise programme across New Anglia. This advocated the production of a

STEM engagement plan, working jointly with the existing STEM ambassador programme

and the Advanced Manufacturing Skills Plan to develop cross links with engineering

sector bodies and existing STEM enterprise initiatives. The Clean Energy plan should

seek to support the STEM activity captured in these reports, which in summary aim to

improve the flow of intelligence on STEM careers across education and reorganise how

STEM careers are promoted locally. As Clean Energy contains niche and emerging jobs

it would be advisable to consider how specifically Clean Energy STEM careers can be

featured in this planned activity.

AIM - To support the existing priorities for promoting STEM careers guidance and

enterprise initiatives across education in New Anglia, ensuring specific Clean Energy

careers are effectively promoted within careers delivery plans.

OUTCOME - Young people across New Anglia engaged with education are inspired and

well prepared to pursue STEM careers; they can make informed choices regarding

ongoing education routeways which can lead to Clean Energy jobs.

RECOMMENDED ACTIONS

a. Develop a STEM “careers prospectus” for Clean Energy to highlight a range of

key career pathways in the industries that represent the most significant growth

potential for New Anglia over the next decade (e.g. Offshore wind, Bio Energy);

9 Norfolk and Suffolk Area Review (DfE 2017)

Page 28

New Anglia LEP

Clean Energy Skills Plan, March 2019

b. Work with the New Anglia Careers Hub and Enterprise Adviser Network to

effectively promote Clean Energy in schools;

c. Build an ‘Energy Jobs’ identity locally - in partnership with local businesses

d. Consult with industry and education on how underrepresented groups can be

positively encouraged into education and careers in the Clean Energy sector.

This should involve close cooperation with the learning and skills community to

promote equal opportunity and increased diversity in the Clean Energy workforce.

MEASURING SUCCESS

• The delivery of the Gatsby Recommendations that are STEM related

• The development of a Clean Energy Careers Prospectus

• Volume of Post 16 education destinations that are STEM related

• Volume of STEM graduates

Increasing Local employment and workforce diversity

5

There are no national or local labour market programmes that provide a formal

‘intermediate labour market’ route (the combination of pre-employment training and

support involving subsidised wages/industry placement, targeted at unemployed,

economically active, people) specifically for the Clean Energy sector.

A range of national and local initiatives offer the opportunity for unemployed people to

benefit from generic employability interventions, including limited work focused training

and the opportunity to experience work over a short-term voluntary period. For example,

the Opportunity Areas and Talent Match programmes have provided targeted support for

unemployed people across New Anglia focused in areas of relatively high

deprivation. These programmes, however, have not had a specific sector-based focus

for Clean Energy.

RATIONALE - Given the proximity and scale of the Energy sector overall across New

Anglia, partners have indicated the importance of successfully maximising local job

opportunities for local people and planning interventions that target opportunities, linked

to training and employment, for areas which experience high levels of economic and

social deprivation.

Much of the skills requirements for Clean Energy is highly technical and STEM

oriented. However, several of the key industries defined as Clean Energy highlight that

Page 29

New Anglia LEP

Clean Energy Skills Plan, March 2019

the major barrier to employment is the financial cost of training for mainly non-accredited,

short term courses; rather than the level of prior qualification. A plan for maximising the

local employment opportunities for Clean Energy, specifically targeted at unemployed

New Anglia residents would therefore be recommended.

AIM - To develop action that can increase the diversity of the Clean Energy workforce

and provide greater employment opportunities for New Anglia residents.

OUTCOME - Clean Energy jobs are accessible to local people, with employers

benefitting from a diverse local labour market supply.

RECOMMENDED ACTIONS

a. Undertake a consultation (establishing a representative sample) with Clean

Energy employers to identify job roles which could be available for those with ‘entry

level’ skills, to help increase recruitment into the sector.

b. Using the data from (a), work with DWP to develop a sector-based

unemployment support package for the Clean Energy sector. This could build on

sector-based work academy models already in operation, with further development

of how Clean Energy pre-employment action can be developed.

c. Consult with the Community and Voluntary Sector and Local Authorities

regarding local programmes and outreach activity that can maximise the reach of a

Clean Energy Local Jobs strategy and build on existing practice aimed at combining

employment support alongside social inclusion. The formation of action should

consider multiple barriers into training and work, such as travel and rurality and work

with Local Authorities and other relevant stakeholders to build an inclusive approach.

d. Consult directly with government and key industry connected with the Sector

Deals and planned investment programmes, to identify how resources can be ring

fenced to support a new Intermediate Labour Market programme for Clean Energy

(involving the opportunity to train and earn whilst actively registered with DWP).

There is no active intermediate labour market in place for the Energy Industry - the

design of a scheme for New Anglia would need to leverage support and resources

from government - following guidelines of benefit rules and wage subsidy and

investment from the private sector through appropriate funding.

e. Assess how the priorities for building workforce flexibility/skills passporting and

labour transfer between the industries in the Energy Skills Plan, can also support the

growth and supply of entry level employment/skills for Clean Energy.

MEASURING SUCCESS

• Number of females working within Clean Energy industry

• Number of BAME working within Clean Energy industry

Page 30

New Anglia LEP

Clean Energy Skills Plan, March 2019

• Delivery of pre-employment routeways aligned to Clean Energy employment

• Subsidised employment placements (Intermediate Labour Market)

• Number of local people within Clean Energy jobs

Technical Standards and Skills Reform

6

Key industries within Clean Energy, as defined within this report, have highly technical

and regulatory training needs linked to the development and operation of activities - for

example within Anaerobic Digestion and Biomass operations. Training is often non

accredited. This means it is not supported by existing standards for vocational training

such as apprenticeship standards.

This impacts on the quality of provision, its availability and the cost of training itself and

restricts skills acquisition for the workforce. Within the Offshore Wind Sector Deal, the

auditing of technical competency and definition of new standards in support of skills

reform has been positioned as a national priority. Both the Offshore Wind and Nuclear

Sector Deals recognise that employer involvement and co-design of skills is of increasing

importance in ensuring skills demands are met by a quality and accessible skills offer.

As the skills system itself becomes increasingly localised via devolved programmes

(IoTs, National Colleges etc), local employer led skills partnerships become

fundamentally important for identifying the gaps in technical standards and measuring

the scale of demand in line with growth. Simultaneously, a devolved skills agenda is still

reliant on centralised skills policy and funding systems. This remains a high-level,

strategic challenge that runs across the national skills system.

Clean Energy is crosscutting by nature and contains highly technical, emerging and often

niche skills needs: it is imperative that employers are effectively consulted and play a

lead role at the local in developing the case for skills investment. Weaknesses in the

skills system exacerbate the risk of a mismatch in skills supply affecting growth. These

are national challenges, which require local advocacy and lobbying and can in turn lead

to policy/political leverage and potential future investment in line with emerging skills

reform policy, for New Anglia. Essentially, developing skills for Clean Energy

requires a strategic and comprehensive response.

RATIONALE - Key industries within Clean Energy, as defined within this report, have

highly technical and regulatory training needs linked to the development and operation of

activities. The reform of skills - both vocational and academic - places a greater

Page 31

New Anglia LEP

Clean Energy Skills Plan, March 2019

emphasis on local employer led partnerships developing plans to support the investment

in skills. There are however structural barriers within the ‘skills system’. Training is often

non accredited, this means it is not supported by existing standards for vocational

training such as apprenticeship standards. This impacts on the quality, cost and

availability of training - ultimately impinging the acquisition of skills and growth.

Furthermore, there is a paucity of available labour market intelligence defined and made

accessible to the learning and skills sector for Clean Energy jobs, this reduces

confidence in the provision of training. Finally, the investment of capital investment costs

to support the provision of training itself a key priority, involving cooperative resource

planning between employers and providers.

AIM - To develop a local employer led skills strategy for Clean Energy, ensuring skills

supply matches demand, that training is available locally and that training providers are

supported to invest in the delivery of high-quality skills provision.

OUTCOME - The outcome of which is a skilled and capable Clean Energy workforce,

technically competent and working in high performing, productive roles.

RECOMMENDED ACTIONS

Ongoing consultation with industry, including national Sector Deal stakeholders with

significant interests in the New Anglia Clean Energy market, would help to develop the

‘asks’ of government nationally, in line with the consultative approach adopted to

develop the Local Industrial Strategy. The key actions to address cover:

a. Create a ‘Testbed’ Model for developing and seeking accredited definition of new

technical standards for Clean Energy industry. Using the economic evidence,

determine the initial industry to define, recognising the role that new technical skills

standards will play in driving competitiveness and growth. The stages to develop

include:

a) Establish an employer-led task and finish ‘trailblazer’ group to map and

identify technical standards for key occupational areas. As the Offshore Wind

Sector Deal has prioritised new standards within its forward plan, local

stakeholders from the Offshore Wind industry should be consulted to seek

advice on the progress they are making nationally, helping to inform Clean

Energy standard definition for this plan.

b) Define an occupational map to set standards for, following an agreed process

like with the initial routes mapped for T Levels. Cross-refer to the

recommendations developed within New Anglia’s Learning and Skills

Sector Skills Plan, ensuring the learning and skills community can play

a lead role.

c) Government should be lobbied, via an employer led partnership (for example

the New Anglia LEP direct or the nascent All Energy Council) to support a

Page 32

New Anglia LEP

Clean Energy Skills Plan, March 2019

formal agreement of standards for technical skills. Furthermore, national

trade association representatives should be consulted to gain maximum

industry support, (for example for Biomass the Woodheat Association and for

Anaerobic Digestion - the Anaerobic Digestion & Bioresources Association

(ADBA)).

d) Guidance should be sought from the Institute for Apprenticeships

(Department for Education) on the procedure for formal accreditation, in line

with apprenticeship reform and the appropriate involvement of industry to

agree on end point appraisal.

e) This initial task and finish group can act as the Testbed model for further

technical standard development covering priority Clean Energy skills.

b.

Consult with the offshore wind sector to firstly understand and then refine - at a New

Anglia level, the methodology being developed nationally for capturing workforce

development intelligence for key occupational areas and explore the potential for

developing local intelligence systems to support the Clean Energy sector’s key

industries. This will provide proprietary data at a Norfolk and Suffolk level enabling

the flow of workforce data to inform ongoing skills planning and support a range of

planning and development priorities across the related sector skills plans. It could

also serve to support the technical skills legacy planning work being developed via

the Suffolk Growth Programme Board.

c.

Develop a resource investment plan, steered via employer representation from

Clean Energy and in consultation with the education sector, which aims to measure

the level of resource required to respond to clean energy growth. An appraisal

should consider costs in response to technical demands and include workforce

development, investment in capital and training resources. Any appraisal must also

cross-refer to the range of technical skills demands captured in the skills plans

already approved by the Skills Board; thus, giving an aggregate perspective. The

development of a resource plan can be used to inform national advocacy to leverage

investment through government programmes supported by industry investment.

MEASURING SUCCESS

• An increase in the number of technical standards available for Clean Energy

occupational roles.

• An increase in the delivery of vocational training qualifications for occupational

roles aligned to Clean Energy industries.

• Quantifiable investment in training (capital and revenue) from government and

private sources, which can directly support the delivery of Clean Energy skills

priorities.

• The development of Clean Energy industry specific labour market intelligence

Page 33

New Anglia LEP

Clean Energy Skills Plan, March 2019

Emerging Technology / Multi-disciplinary Skills

7

The themes of automation and developing a resilient skills supply that responds to

emerging technological demands are critical to Clean Energy’s growth in New Anglia.

The Electric Vehicle, CCUS and alternative fuel/energy storage industries highlight that a

core engineering requirement at graduate level demand remains strong but must also

come with multi-disciplinary capability. This covers the skills for areas including AI and

advanced data management, testing and feasibility assessment of new energy

investment programmes in highly sensitive environments and the challenge of innovation

in the transportation, supply and storage of energy.

The Emerging Tech Sector Skills plan (2018) summarises the importance of responding

to technology adoption:

“It is this ability to adapt rapidly which is at the heart of the skills challenge which

Industry 4.0 (and the Emerging Technology which is driving it) is creating across the

economy.

Evidence shows that there is a generic shortfall of workforce supply across the

economy as the population ages, people spend more time in education and migration

falls. The dependency ratio is also rising (i.e. the number of people who are

dependent on each worker) and this means that society needs to focus on increasing

productivity.

Whilst the adoption of technology can increase productivity it will also lead to many

job roles being completely or partially automated and this process needs to be

managed. Evidence also suggests that new job roles will need to be undertaken to

support the adoption of emerging technology.

These new job roles could be to design, build, install and manage the new systems

which are created, but are equally likely to be created by allowing end user sectors of

the economy to develop new or enhanced services.”10

The documented shortfall in STEM graduates into the energy sector (and so by definition

Clean Energy too), is addressed by the Institute of Engineering and Technology (IET)11,

which advocates a new approach to engineering in higher education. Using case studies

from HEIs across the UK, the IET calls for a ‘shake-up’ in the skills system to increase

the flow of new STEM graduates, the quality of engineering higher education and the

overall diversity of the future workforce. The IET establishes three key challenges that

10 New Anglia (2019), Emerging Tech Sector Skills Plan (in press)

11 “New Approaches to Engineering Higher Education”, (2017), IET

Page 34

New Anglia LEP

Clean Energy Skills Plan, March 2019

require a response from FE, HEIs, employers and policymakers. These challenges

focus on:

• Greater employer input in the development of education to ensure skills are

responsive to industry needs;

• The promotion of more workplace experience to enable students to engage with

‘real-life’ industry experiences and build work capability alongside academic

achievement;

• A greater focus on inter-disciplinary skills, via engineering frameworks developed on

project-based activities with a greater emphasis on problem solving and adoption of

modular approach toward the engineering disciplines studied.

RATIONALE - For Clean Energy technologies employers require flexible, multi-

disciplinary skills. Traditional STEM based courses need to be responsive to automation

and the convergence of electrical, mechanical and digital technologies. This requires

more involvement of employers in supporting the planning and delivery of further/ higher

education to ensure the skills output is fit for purpose and greater flexibility in the

structure of courses to respond to changing demands.

AIM - To assess the multi-disciplinary skills required of Clean Energy employment and

work in partnership with New Anglia’s HEIs, FE and Clean Tech industry to plan for

ongoing and emerging multi-disciplinary demands.

OUTCOME - The outcome of which is a highly innovative, cutting-edge Clean Energy

New Anglia post-16 offer, creating a supply of STEM graduates adaptive to the multi-

disciplinary demands of Clean Energy employment.

RECOMMENDED ACTIONS

a. Consult with FE and Higher Education Institutes in New Anglia that deliver

qualifications in Engineering related disciplines and assess the impact the Clean

Energy’s key industries (as defined in this report) have on the structure and content

of course content and delivery methodology. The assessment should consider:

i.

The multi-disciplinary skills requirement in each of the key industries within

Clean Energy;

ii.

A methodology for assessing current content/delivery against (ii) above,

which includes an assessment of the responsiveness of the content against

industry needs.

b. The New Anglia LEP in partnership with New Anglia’s HEIs should consider how to

develop an innovation network to connect with national and international best

practice in Engineering Multi-disciplinary standards in relation to Clean Energy. This

Page 35

New Anglia LEP

Clean Energy Skills Plan, March 2019

can build on the current progress being developed by the New Anglia LEP under the

Innovation Board and Forum for key sectors. Furthermore, it could connect in with

existing case studies highlighted by key organisations such as the IET and relevant

Innovation Catapults/Partnerships for Clean Energy related industry active both in

the UK and internationally.

MEASURING SUCCESS

• The definition of multi-disciplinary STEM courses at all levels

• The supply of STEM graduates and post-graduates into New Anglia Clean Energy

employment

• Development of a Clean Energy Innovation Network and subsequent delivery of

events that promote skills within a HE context

Page 36

New Anglia LEP

Clean Energy Skills Plan, March 2019

2. Defining the Clean Energy Theme and Growth Opportunity

Low Carbon and Renewable Energy (LCRE)

The LCRE sector is a significant and growing sector both in New Anglia and the UK

economy. New Anglia is adopting Clean Energy as one of three themes on which it will

focus its Local Industrial Strategy.

Clean Energy focuses on progressively shifting the mix of energy sources used so that a

larger share comes from renewable and low carbon sources. It includes energy for:

• Heating and cooling;

• Power for machinery and processes (industrial, domestic, utilities, pumping etc.);

• Transport, including rail; air; boats; cars and motorbikes; trucks and vans; buses;

tractors, land management and construction machinery.

The transition to cleaner energy also requires a focus on energy efficiency, including:

• Heat - energy efficient design, demand side response12;

• Power - energy efficient design, demand side response;

• Reducing need for energy through system redesign e.g. reducing the need to pump

water due to embracing new flood protection systems; urban farming systems etc.

This twin track approach backed up by a new report from Carbon Brief13 (see Annex 3),

which shows good progress in decarbonising the UK energy supply, both through

changing the energy mix and by improving the efficiency with which energy is used.

This report argues that energy efficiency has made more impact than renewables to date

(just over 50% of the gains since 2005), whilst government policy and funding has

focused on renewables. It also reports that in 2018, just over half (53%) of UK energy

supply can be classified as being LCRE, the highest ever recorded.

The third area of energy planning which needs to be embraced is the change needed in

energy infrastructure to enable the efficient distribution of LCRE energy as new capacity

is added, often in areas which have not traditionally generated energy, and to ensure

that energy is available in the right places to support housing and commercial growth.

This pressure on the electricity infrastructure will increase in future given the move to low

carbon transport. Whilst electricity use has seen a modest decrease in the UK, due to

efficiency, it is expected to increase again once Electric Vehicle (EV) roll out accelerates.

12 Demand side response facilitates the optimisation of energy use when it is available, thus helping to smooth

peaks in demand or supply. This allows more use to be made of intermittent renewables.

13 Carbon Brief (2019), Analysis: UK electricity generation in 2018 falls to lowest level since 1994

Page 37

New Anglia LEP

Clean Energy Skills Plan, March 2019

This will place increased demand on power generation and on the electricity grid which

in many places lacks the capacity to meet growth in demand, particularly in rural areas14.

National Support for the LCRE Sector

Renewable generation has been growing strongly and BEIS has committed to continued

growth in this sector (Annex 2). This includes clean energy being a government

commitment through a ‘Clean Growth Grand Challenge’, making it a priority across

government. Specifically, the Industrial Strategy, states that15:

‘We will maximise the advantages for UK industry from the global shift to clean growth -

through leading the world in the development, manufacture and use of low carbon

technologies, systems and services that cost less than high carbon alternatives. The

move to cleaner economic growth - through low carbon technologies and the efficient

use of resources - is one of the greatest industrial opportunities of our time. By one

estimate, the UK’s clean economy could grow at four times the rate of GDP16. Whole

new industries will be created, and existing industries transformed as we move towards a

low carbon, more resource-efficient economy. The UK has been at the forefront of

encouraging the world to move towards clean growth. We are determined to play a

leading role in providing the technologies, innovations, goods and services of this future.’

The strategy further outlies a desire to embrace both energy efficiency and new low

carbon forms of generation. This broader definition is in line with ONS who define the

low carbon economy as ‘economic activities that deliver goods and services that

generate significantly lower emissions of greenhouse gases; predominantly carbon

dioxide’. The low carbon sectors recorded by ONS are:

• offshore wind;

• onshore wind;

• solar photovoltaic;

• hydropower;

• other renewable energy;

• bioenergy;

• alternative fuels;

• renewable heat;

• renewable combined heat and power;

• energy efficient lighting;

• energy efficient products;

• energy monitoring;

• saving or control systems;

• low carbon financial and advisory services;

• low emission vehicles and infrastructure;

14 A ‘Tesla’ fast charger is broadly equivalent to the normal demand of 15 houses

15 BEIS (2018), Policy Paper: The Grand Challenges

16 UK Government (2018), Clean Growth Strategy

Page 38

New Anglia LEP

Clean Energy Skills Plan, March 2019

• carbon capture and storage;

• nuclear power;

• fuel cells;

• energy storage systems.

These low carbon sectors are then subsequently grouped into six low carbon groups:

• low carbon electricity;

• low carbon heat;

• energy from waste and biomass;

• energy efficient products;

• low carbon services;

• low emission vehicles.

UK Clean Growth Strategy

The national Clean Growth Strategy (2018)17 highlights substantial growth in the UK’s

low carbon economy, reporting that since 1990 UK GDP has grown by 67%, the fastest

rate in the G7, whilst carbon emissions have fallen by 42%, much faster than the 3%

reduction seen in the G7 countries. This decoupling of carbon emissions from growth is

seen as critical in securing public support for a transition to a low carbon economy.

The strategy also reports that whilst we have outperformed the 1st and 2nd and expect to

outperform on the 3rd five-year carbon budget (the period to 2022), beyond this the

challenge increases again as most of the easier gains have been made.

From 2010-’16 the share of low carbon electricity doubled to 47%. At the same time

household energy demand has fallen by 17% since 1990, due to improved energy

efficiency. Since 2000 cars have become 16% more energy efficient. The costs of low

carbon and renewable technologies is also falling with energy efficient bulbs 80%

cheaper than in 2010 and car battery pack costs falling by 70% in the same period.

This growth has translated into jobs, with ONS18 in 2016 reporting that low carbon

businesses and the associated supply chain employed 430,000 people in 2015.

The Paris agreement signed by 195 countries in 2015 agreed targets which aimed to

keep global temperature rises to under 2 degrees. The International Energy Agency has

suggested that to meet this $13.5 trillion of investment is needed globally between 2015-

’30 by the public and private sector, with the UK government keen for the UK to benefit