Enabling Growth in the New

Anglia Visitor Economy Sector

through Skills Development

New Anglia LEP / Visit East Anglia -

Visitor Economy (Tourism) Skills Plan

April 2018

Page 2 of 43

Background Context

This Visitor Economy Sector Skills Plan has been developed with the Visitor Economy sector in Norfolk and

Suffolk, led by Visit East Anglia.

SkillsReach was contracted to facilitate and prepare eight sector skills plans for the New Anglia LEP priority

sectors. The project was commissioned by the Education and Skills Funding Agency, in partnership with New

Anglia LEP, and funded through the European Social Fund. Each Sector Skills plan and supporting Datapack has

been developed in collaboration with local employers and other stakeholders.

The Visitor Economy Sector Skills Plan has been developed in partnership with Visit East Anglia, the lead

organisation taking forward the further development and implementation of this plan in conjunction with New Anglia

LEP, local education institutions and other sector champions.

The New Anglia Skills Board places employers at the centre of decision making on skills in Norfolk and Suffolk to

ensure the skills system becomes more responsive to the needs of employers, residents and the future economy.

Visit East Anglia is an organisation that is business-led, and promotes tourism across East Anglia: Norfolk,

Suffolk, Essex and Cambridgeshire. It is consumer, customer and membership focussed to bring a unified tourism

voice to East Anglia. It works closely with Greater Anglia the new East Anglian rail franchise operator, and has

other links to major airports, seaports and other gateways in East Anglia and neighbouring counties. It is fully

aligned with the Tourism strategy for England. It supports businesses to reach out to markets with marketing and

PR opportunities, both domestically and internationally.

Visit Norfolk is the strategic voice of the Norfolk visitor industry and responsible for promoting all that the county

has to offer at local, regional and national levels. It aims to develop promotional campaigns and initiatives and work

with other DMOs to grow the county’s visitor economy. Visit Norfolk’s marketing activity is supported by local district

councils, the Broads Authority, and private sector partnerships including Visit Norwich, Enjoy the Broads, Visit

North Norfolk, Norfolk and Suffolk Tourist Attractions and Gt Yarmouth Tourism Business Improvement District. A

key objective is to encourage all the tourism organisations involved in promoting Norfolk to become more self-

sustaining and less reliant on public funding.

Visit Suffolk is the strategic voice of the Suffolk visitor industry working alongside DMOs to support tourism

development and engagement with local businesses, with the overall objective of continuing to increase visitor

numbers and spend within the county by promoting the Suffolk offer at a regional and national level. It aims to

develop promotional campaigns and initiatives and work with other DMOs to grow the county’s tourism economy.

One of Visit Suffolk’s key objectives is to encourage all the county’s tourism organisations involved in promoting

Suffolk to become more self-sustaining and less reliant on public funding.

SkillsReach is an established East of England-based strategic skills consultancy with an associate project team

with extensive experience of developing skills plans.

Acknowledgements

The New Anglia LEP wish to thank the employers, providers and stakeholders who contributed to the plan by

attending events or being interviewed

Page 3 of 43

Contents

Introduction (Indicative foreword)

4

The UK Visitor Economy Sector and its impact

4

New Anglia Visitor Economy Sector Strategy and Assets

5

How is the New Anglia Visitor Economy defined?

5

How was the Plan Developed?

6

Section 2: New Anglia Visitor Economy Sector Skills Plan

7

An Overview - Context

7

Drivers for Change

9

The Skills Plan - Overall Framework

10

Sector Leadership - Establish a skills voice for New Anglia

11

Priority 1 - ‘Developing the business and employment offer’

12

Intervention 1 - Marketing and Customer Engagement Capability

12

Intervention 2 - Innovation

12

Priority 2 - ‘Overcoming skills obstacles to growth’

13

Intervention 3 - Tackling Pressing Skills Shortages for Frontline, Chefs and Supervisory Staff

................................................................................................................................................................................13

Intervention 4 - Improved Career Pathways for New Entrants and Existing Workforce

13

Priority 3 - Promoting local and global career opportunities in the Visitor Economy

14

Intervention 5 - Inspiring Promotion of Career Opportunities for Young People and Adults

14

Alignment with Policies and Initiatives

15

Section 3: Understanding the Evidence Informing the Plan

16

Appendix

29

Appendix A - Consultation and development process

29

Appendix B - Current Skills and Training Provision - wider Visitor Economy

31

Appendix C - References

40

Page 4 of 43

Introduction (Indicative foreword)

‘Welcome to the Visitor Economy Sector Skills Plan for New Anglia. It sets out our collective

vision for how skills development can support the growth of the sector, increasing local

competitiveness and productivity, supporting inclusive economic growth and ensuring quality

careers in our exciting, high potential, sector are recognised, accessible and taken up by local

people.

Our plans align well with the recent UK Sector Tourism Deal bid in that:

• New Anglia is very well positioned as a potential ‘tourism zone’, collectively developing

our product as a 24/7/365 offer and building for the future

• Innovation is very important in terms of both embracing the most recent technologies to

boost productivity, connecting even better with our customers and developing engaging,

sustainable, career-friendly workplaces

• Skills is an absolute priority - we are up for the challenge of getting more people of all

ages motivated by, contributing to, and benefitting from, our dynamic exciting sector

This plan is a key step in the development of a regional collaboration between business,

localities and skills providers to ensure inclusive growth and skills opportunities are connected

and maximised for businesses and local residents. We look forward to this new partnership

shaping the future of a vibrant New Anglia Visitor Economy sector’.

Signed……

Chair

Visit East Anglia

The UK Visitor Economy Sector and its impact

Since 2010 tourism has been the fastest growing sector in the UK in employment terms. Britain

is forecast to have a tourism industry worth over £257 billion by 2025.- just under 10% of UK

GDP and supporting almost 3.8 million jobs, which is around 11% of the total UK number.

Tourism’s impact is amplified through the economy, so its impact is much wider than just the

direct spending levels. Deloitte estimate the tourism GVA multiplier to be 2.8 - meaning that for

every £1,000 generated in direct tourism GVA, there is a further £1,800 that is supported

elsewhere in the economy through the supply chain and consumer spending.

(https://www.visitbritain.org/visitor-economy-facts)

The sector is predicted to grow at an annual rate of 3.8% through to 2025 - significantly faster

than the overall UK economy (with a predicted annual rate of 3% per annum) and much faster

than sectors such as manufacturing, construction and retail.

Page 5 of 43

Section 1: Overall Ambition

Visit East Anglia: Our Ambition

Development of the year-round New Anglia Visitor Economy to grow overall value and

productivity; decreasing the reliance on traditional short-season ‘holiday-makers’ and

converting ‘day trippers’ to ‘stay’ visitors by:

1. Championing a consistent, contemporary customer service offer of the highest

standard

2. Encouraging job creation and increasing skills levels, salaries and career

potential

3. Encouraging the connection, communication and collaboration of local visitor

economy businesses to enable growth and development

New Anglia Visitor Economy Sector Strategy and Assets

The New Anglia area has one of the most comprehensive and diverse visitor offerings in the

UK, making it an ideal destination for all ages throughout the year.

Its natural capital includes 140 miles of coast, from pristine beaches to huge estuaries, two

Areas of Outstanding Natural Beauty, and The Broads National Park. Its built capital includes

many National Trust properties, The Queen’s rural retreat, fantastic museums and a wide range

of family attractions.

BBC Countryfile viewers recently voted Holkham the best beach in Britain, Springwatch has

been broadcast from Minsmere and Pensthorpe, Newmarket is the world-renowned home of

horseracing, Norwich one of the top shopping locations in England as well as being the best-

preserved medieval city, and there is a huge wealth of festivals, including The Norfolk &

Norwich, Latitude and Snape Proms.

This is an area where the visitor economy is worth £5bn a year overall, almost twice as much as

Cornwall’s, but has the potential for accelerated growth over the coming years.

Looking ahead, this sector locally is projected to grow in employment terms by over 11,000 jobs

(12 per cent, double the growth projected across the New Anglia economy) between 2014 and

2024.

How is the New Anglia Visitor Economy defined?

The definition of the sector used by New Anglia LEP covers Accommodation for visitors; Food

and beverage serving activities; rail, road, water and air passenger transport; transport

equipment rental; travel agencies and other reservation service activities, cultural activities;

sporting and recreational activities; country-specific tourism activities plus culture and the arts.

The sector can often be referred to as ‘Tourism’ with significant overlaps between ‘Tourism’ and

‘Cultural’ Sector activities such as heritage, sport, conferences and events. It is also worth

noting that there is some overlap between what is considered ‘tourism’ and that deemed ‘arts’ in

respect of cultural tourism.

Page 6 of 43

In terms of local skills planning for New Anglia, it was decided that the needs of the ‘tourism’

and ‘culture’ sectors are quite different and a sector plan for each was developed - led by Visit

East Anglia and the New Anglia Cultural Board respectively.

How was the Plan Developed?

The development process for the Visitor Economy Sector Skills Plan was overseen by the New

Anglia LEP and Visit East Anglia with significant input from Visit Norfolk and Visit Suffolk - both

as representative groups, and through individual employers and other stakeholders. An

advanced draft of the Plan was fully endorsed in principle by the Visit East Anglia Board at its

meeting on March 26 2018. There has been considerable consensus throughout from

consultees on the opportunities and challenges and the interventions prioritised in the Plan.

The development of the plan was also informed by individual consultations with sector

stakeholders including other key employers, national / local skills partners, local authorities and

New Anglia LEP. (See Appendix A).

In addition to this sector skills plan, a supporting Datapack has been produced outlining the

current workforce, trends in skills levels and how the local Visitor Economy sector in New Anglia

compares with other areas. (See Appendix B for the Current Skills and Training Provision). In

the main, this report aligns with the New Anglia Local Economic Strategy Visitor Economy

sector definition, although it also refers to other useful sources which are based on different

sector or geographical definitions. Highlights and key evidence can be found in summary format

in Section Three.

The Datapack also reports on the underlying socio-economic context for the sector locally and

reports on projected changes in future skills needs. It is presented as a separate document and

provides the data to underpin many of the comments made providing a more detailed reference

source in conjunction with the Skills Plan.

Page 7 of 43

Section 2: New Anglia Visitor Economy Sector Skills Plan

An Overview - Context

With a key, growing contribution to the New Anglia economy the Visitor Economy sector needs

to plan for the skills needed now and in the future.

Visit East Anglia: Our Ambition

Development of the year-round New Anglia Visitor Economy to grow overall value and

productivity; decreasing the reliance on traditional short-season ‘holiday-makers’ and

converting ‘day trippers’ to ‘stay’ visitors by:

1. Championing a consistent, contemporary customer service offer of the highest

standard

2. Encouraging job creation and increasing skills levels, salaries and career

potential

3. Encouraging the connection, communication and collaboration of local visitor

economy businesses to enable growth and development

The proposed actions are as follows:

Local sector leadership through stronger strategic partnerships with education and skills

providers

• Improving strategic collaboration with FE / HE partners, employers, DMOs, LEP and

DWP to establish a shared agenda to develop New Anglia as an Area of Excellence for

collaborative Visitor Economy skills development.

• bringing together private and public investment

• encouraging the development of, and support for, local provision

• providing a skills voice locally and nationally, working with the New Anglia LEP

• Informing on and promoting business development, innovation, collaborative pilots and

skills opportunities

Page 8 of 43

Priority 1. Developing the business and employment offer

1. Marketing and Customer Engagement Capability

2. Innovation

What Success looks like for Priority 1

Competitive advantage for Norfolk and Suffolk visitor economy businesses achieved through

‘connection, collaboration and innovation’ with contemporary workplaces that invest in and

realise their workforce and business potential

Priority 2. Overcoming skills obstacles to growth

1. Tackling Pressing Skills Shortages for Frontline, Chefs and Supervisory Staff

2. Improved Career Pathways for New Entrants and Existing Workforce

What Success looks like for Priority 2

Skills supply and development is a recognised strength of the New Anglia visitor economy,

with reliable, diverse, accessible pathways for local people

Priority 3. Promoting local and global career opportunities in the Visitor Economy

1. Inspiring Promotion of Career Opportunities for Young People and Adults

What Success looks like for Priority 3

Local people have a stronger understanding of the local and international career

opportunities provided by the Visitor Economy and can easily access those opportunities

through creative, proactive, ‘real’ work experience

This Sector Skills Plan will be led by a new sub group of the Visit East Anglia Board in

partnership with New Anglia LEP, Visit Suffolk and Visit Norfolk and local skills sector

stakeholders such as FE Colleges and DWP. This group will oversee sector skills development

and seek to be representative of all employment and skills interests.

Page 9 of 43

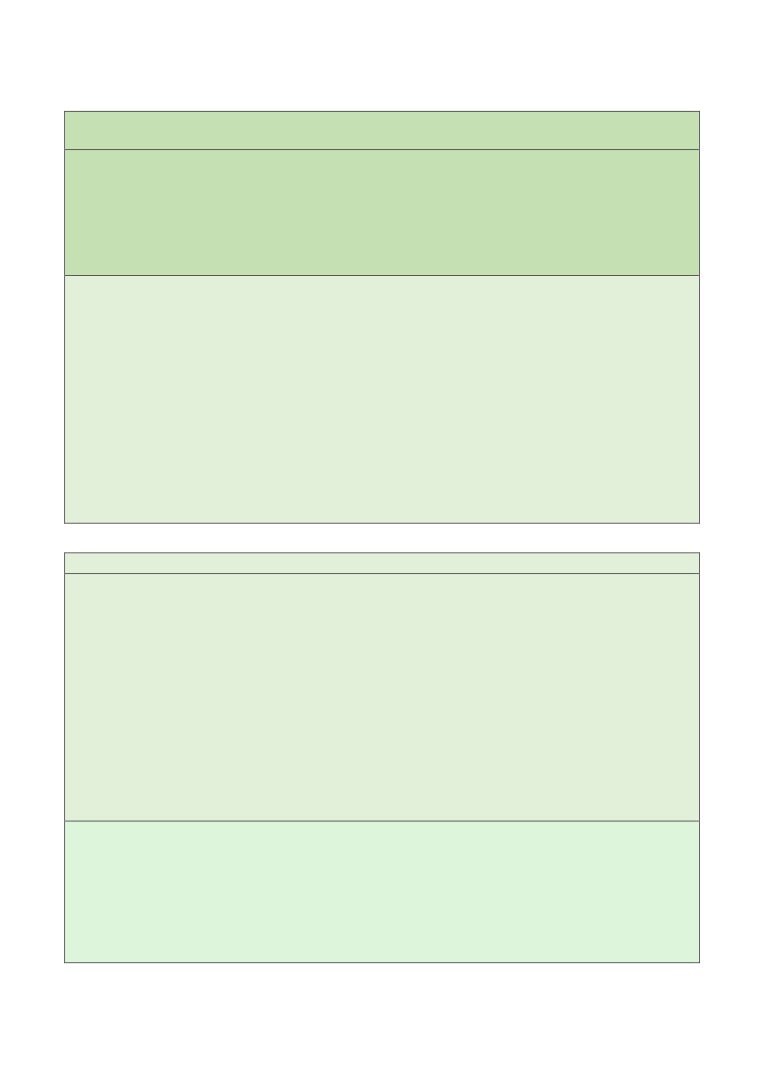

Drivers for Change

Barriers to overcome!

Opportunities to grasp!

A lack of a consistent local sector/employer

The sector is projected to grow in

voice on skills for the whole region making a

employment terms by over 11,000 jobs (12

cohesive national ‘pitch’ and representation

per cent, double the growth projected across

a challenge

the New Anglia economy) between 2014 and

2024. New jobs are relatively quickly created

and provide accessible opportunities for the

whole community.

Major concerns about filling immediate front-

New Anglia is well positioned to make a

line vacancies in areas such as

major contribution to the final UK tourism

housekeeping / bar-work with a concern that

sector deal, with clear regional leadership

this situation will be exacerbated

and close alignment locally with the sector

significantly by impending BREXIT

priorities identified in the national sector deal

bid.

Employers voiced concerns that young

Innovation through an enhanced digital offer

people consider tourism as a short-term job

at a region, destination and business level in

rather than a career and underestimate the

terms of marketing, customer engagement

exciting progression opportunities available

and potentially productivity gains

locally and globally

Rurality and seasonality of the sector -

‘Hospitality trades’ are providing the best

especially in coastal locations - make

opportunities for employment for those with

strategic skills investment and career

FE level skills based on a ratio of local

planning a real challenge

employer demand and supply of these skills

locally

Recruitment and retention of staff is a key

Destinations, businesses and workforces to

issue with turnover estimated as high as

embrace innovation / product development in

75%.

areas such as:

• Sustainable Tourism

• An authentic English Offer

• Local / national campaign connection

Skills shortages of trained Chefs and other

Collaborations with other destination

kitchen staff. Management shortage

partners such as Manchester, NCTA,

nationally, with 471,000 additional managers

Bournemouth, or over funding bids such as

needed by 2024

Coastal Communities Fund. Knowledge

Transfer Networks etc.

A view that the work environment for many

Opportunities stemming from the

tourism businesses needs to evolve to best

development of T Levels with substantially

engage with potential ‘millennial’ recruits-

increased requirements for work experience

e.g. work-life balance / career development

agendas

Lack of educational pathways in areas such

Opportunities to build on some outstanding

as Catering - e.g. recent removal of A Level

local practice such as the now national Hotel

pathway, local Hospitality Management

Takeover that was initiated in New Anglia

Degree

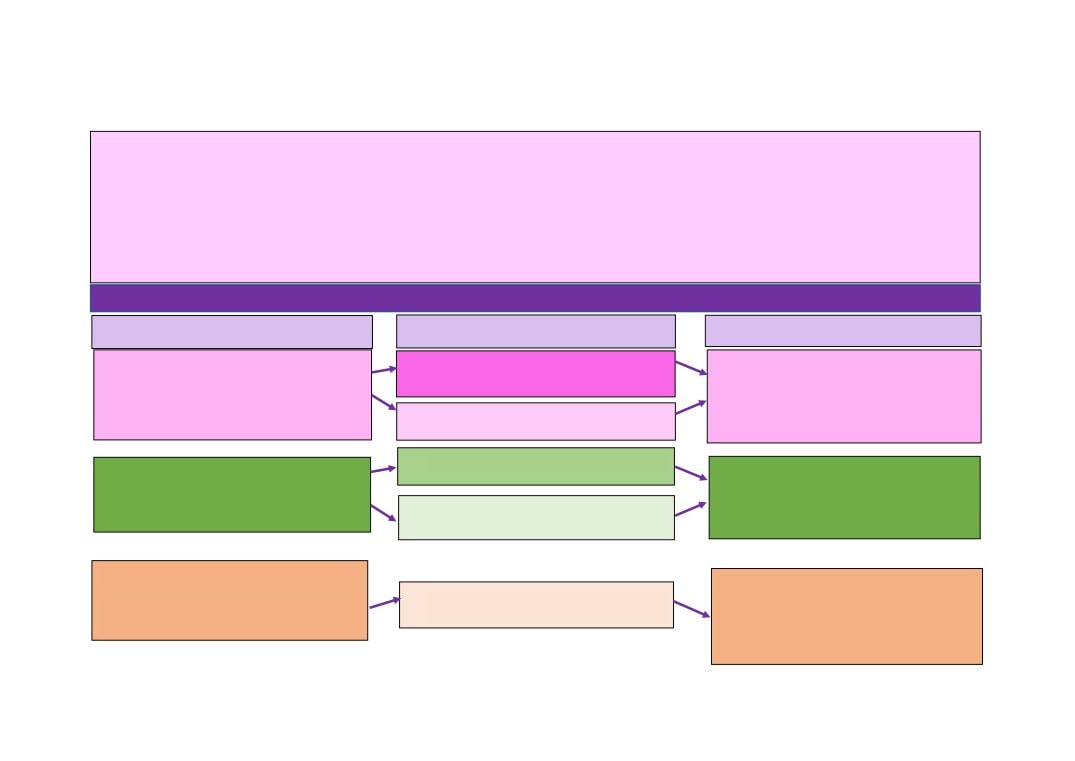

The Skills Plan - Overall Framework

Visit East Anglia - Our Ambition

Development of the year-round New Anglia Visitor Economy to grow overall value and productivity; decreasing the reliance on

traditional short-season ‘holiday-makers’ and converting ‘day trippers’ to ‘stay’ visitors by:

1. Championing a consistent, contemporary customer service offer of the highest standard

2. Encouraging job creation and increasing skills levels, salaries and career potential

3. Encouraging the connection, communication and collaboration of local visitor economy businesses to enable growth and

development

Sector Leadership - Establishing a skills voice for New Anglia

Priorities

Interventions

Success Indicators

1

1. Marketing and Customer

1

Engagement Capability

Developing the business and

Competitive advantage achieved

employment offer

through ‘connection, collaboration

2. Innovation

and innovation’

3. Tackling Skills Shortages

2

2

Overcoming skills obstacles to

Reliable, diverse, accessible

4. Local Career Pathway

growth

pathways for local people

Development

3

3

5. Promote Career

Promoting local and global career

Career opportunities profiled

Opportunities

opportunities

through creative, proactive, ‘real’

work experience

Sector Leadership - Establish a skills voice for New Anglia

Sector Leadership - The plan will be employer-led by a new, strategic,

collaborative private sector / skills partnership, adding value through:

• articulating the strategic skills priorities for the sector

• bringing together private and public investment

• encouraging the development of, and support for, local provision

• providing a skills voice locally and nationally

• Informing on and promoting business development and skills

opportunities

Rationale -

There is an excellent opportunity to create a New Anglia-wide, private sector-led

strategic skills voice for Norfolk and Suffolk; ‘connected in’ to the diversity of the

local Visitor Economy sector. The current lack of a consistent local

sector/employer voice on skills for the whole region makes local influence, a

cohesive national ‘pitch’ and business representation a challenge and a

competitive disadvantage.

Action to be Taken:

1. Establish a dedicated Skills Sub Group for the VEA Board; chaired by a

member of the main board and with representation of both employers and

skills stakeholders such as DMOs, Further Education, Universities, LEP,

DWP etc

2. Terms of Reference should position the Sub Group as not a skills delivery

body, but rather a catalyst and supporter of innovative ideas; a skills voice

for the sector; and a sponsor of collaborative pilots and initiatives

3. Identify immediate and longer-term opportunities for proactive, strategic

collaboration and local sector led skills initiatives

4. VEA implements targeted skills research of the whole membership base -

utilising resources such as Knowledge Transfer Networks

5. Ensure that New Anglia responds as a sector to skills opportunities relating

to Industrial Strategy Sector Deals

6. Work in partnership with New Anglia LEP to identify national and local

funding opportunities

Page 12 of 43

Priority 1 - ‘Developing the business and employment offer’

Intervention 1 - Marketing and Customer Engagement Capability

Rationale: VEA is currently proposing a digital solution for the whole New Anglia visitor

economy (including cultural sector) that will offer an overarching promotional, booking and

business-communications portal, supporting the development of a year-round visitor economy,

and providing business development and skills opportunities for all local visitor economy

businesses. Professional marketing skills were raised by consultees as a shortage area for local

businesses - large and small.

Action to be Taken:

1. The proposed VEA portal development provides an excellent opportunity to build overall

digital engagement with 7,000+ New Anglia Visitor Economy businesses - including a

Hub for visitor economy businesses to network and share best practise

2. Ensure close connections between ‘campaigns’ e.g. ‘Friendly Invasion’ and their

connection to any business skills implications - for example, the implications of a large

influx of American visitors

3. Establish the feasibility of the longer-term opportunity to build, through the portal,

customer service and local ambassador learning programmes - in collaboration with

partners such as DMOS and national partners such as Culture Partners (e.g. Marketing

Manchester), NCTA etc

Intervention 2 - Innovation

Rationale:

Recruitment and retention of staff is a key issue with national staff turnover estimated as high as

75%. Several consultees took the view that there are opportunities to develop the workplace

environment to enable tourism businesses to better engage, recruit and retain - especially

young people, but also people returning to work, people with additional needs and different

expectations of their workplace- e.g. flexible-working, adaptations, work-life balance, career

development.

There is also the opportunity for the sector, to benefit greatly from digitalisation in terms of both

productivity and business development capacity.

Action to be Taken:

1. Champion employers where engaging, contemporary employment practice has had

positive outcomes in terms of staff recruitment and retention, sharing best practice and

considering local awards showcasing great, engaging employers

2. Support businesses (particularly SMEs without their own HR/Skills functions) to develop

and lead engaging, flexible workplaces, supporting improved retention and career

development and embracing diversity

3. Targeted digital development support:

• at a strategic level to improve staff productivity through exploring new work methods,

working ‘smarter’ through innovative methods

• for marketing (especially smaller businesses) to optimise digital customer engagement

e.g. ‘managing online customer reviews’, Digital Eagle programme

4. Consider opportunities to share good practice and promote CPD through local leadership

insight events on matters such as waste minimisation, green tourism

Page 13 of 43

Priority 2 - ‘Overcoming skills obstacles to growth’

Intervention 3 - Tackling Pressing Skills Shortages for Frontline, Chefs and

Supervisory Staff

Rationale:

• Major concerns about filling immediate front-line vacancies in areas such as

housekeeping / bar-work with a concern that this situation will be exacerbated

significantly by impending BREXIT

• Skills shortages of trained Chefs and other kitchen staff. Management shortage

nationally, with 471,000 additional managers needed by 2024.

Action to be Taken:

1. Identify new recruitment channels / target audiences for current vacancies in

partnership with stakeholders such as DWP e.g. older workers / returners /

disadvantaged groups / retirees - with data evidence to focus upon one or two

groups that could constitute a greater part of the workforce

2. Scope out a programme of high-profile community campaigns such as the ‘Big

Hospitality Conversation’- style event in partnership with BHA / DWP / LEP -perhaps

targeting over 25s, where skills support e.g. apprenticeships are now more

accessible

3. Identify scope for strategic partnerships / potential sponsorships of excellent local

community/social enterprise initiatives such as Feed Norwich, Britannia Café, The

Clink, particularly seeking to extend opportunities beyond Norwich with the support

of local FE Colleges

Intervention 4 - Improved Career Pathways for New Entrants and Existing Workforce

Rationale:

Consultees raised examples of excellent provision and robust college/business

partnerships across the area, although also articulated some concerns about how ‘joined

up’ the education system is in terms of industry-connections, and whether young people

are work-ready and informed about the opportunities and dynamics of visitor economy

careers. Both business and skills sector consultees raised the lack of educational pathways

in areas such as Catering - e.g. recent removal of ‘A’ Level pathway, yet opportunities to

develop great practice in respect of the forthcoming ‘T’ Levels for which a local pilot

programme is currently being planned. It was regularly commented that Apprenticeships

are a ‘missed’ opportunity for the sector, with some businesses failing to find suitable

applicants and other larger businesses concerned about the lack of industry-specific

provision for higher / degree Apprenticeships. This situation was seen to be potentially

deteriorating with both full time degree and degree Apprenticeship options limited - due

either to a lack of sustainable demand or national ‘qualification ceilings’ on the sector

Action to be Taken:

1. With skills/FE sector partners, raise awareness of existing FE/ HE/ Apprenticeship

local pathways (Including forthcoming T Levels) to establish the evidence, and

opportunities for closer alignment with employers - e.g. both Levy-payers and SMEs

2. Establish the feasibility of a locally-led employer collaboration to identify

opportunities to aggregate demand for higher level apprenticeships (especially levy-

payer demand) in areas such as marketing / leadership

Page 14 of 43

Priority 3 - Promoting local and global career opportunities in the Visitor Economy

Intervention 5 - Inspiring Promotion of Career Opportunities for Young People and

Adults

Rationale: Employers voiced concerns that young people consider tourism as a short-term

job rather than a professional opportunity and underestimate the exciting, well-paid

progression opportunities available locally and globally. This is contributing to a lack of

people considering the Visitor Economy as a career - and insufficient recognition of the

breadth of broader professional jobs available in the sector - for example Marketing, HR,

Data Science professionals

Action to be Taken:

1. Ensure existing careers assets such as Icanbea….; Enterprise Advisors properly

understand and represent the Visitor Economy sector; links with Norwich and

Ipswich Opportunity Areas

2. Consider new career campaigns based upon countering unhelpful public

stereotypes about the sector - both to potential applicants but also to the wider

community

3. Evaluate and expand practical, experiential ‘Hotel /Restaurant Takeover’-style

initiatives as a way of providing very powerful work experience across the region in

partnership with FE Colleges

Page 15 of 43

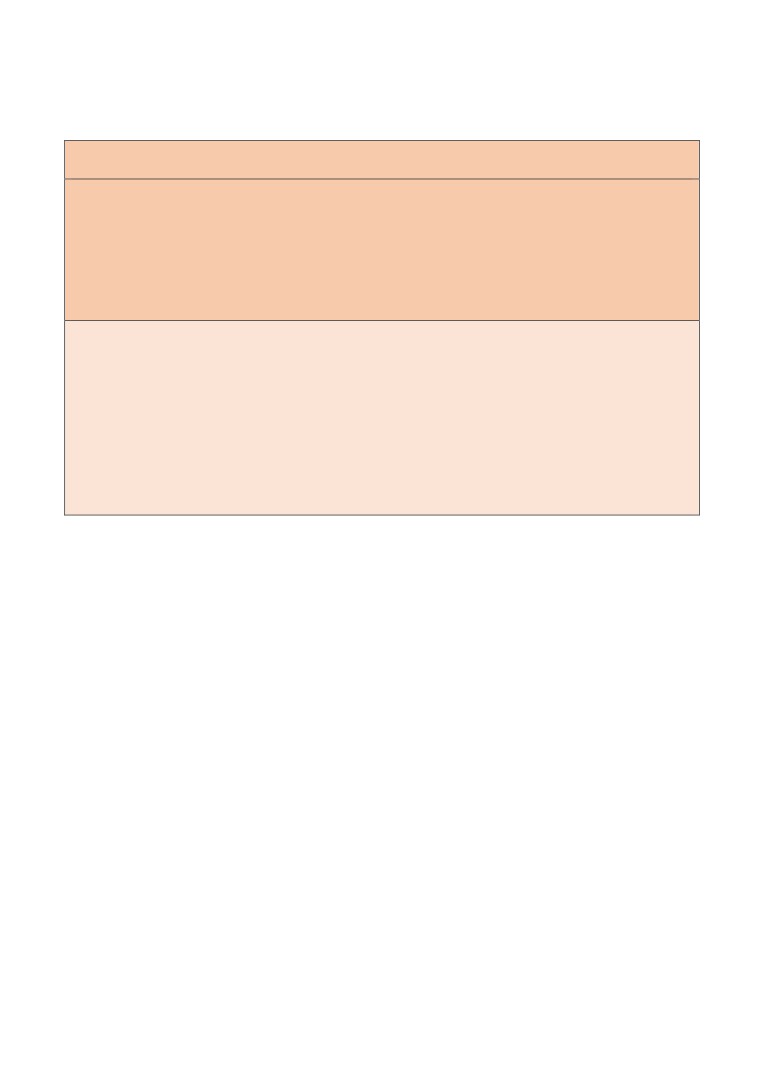

Alignment with Policies and Initiatives

Priority 1

Priority 2

Priority 3

Alignment

Intervention 1

Intervention

Intervention

Intervention

Intervention 5

Marketing and

2

3

4

Promotion of

Customer

Innovation

Skills

Improved

Careers

Engagement

Shortages

Career

Capability

Pathways

Careers &

✓

✓

Enterprise

Company

ESF

✓

workforce

development

Icanbea

✓

✓

Industry 4.0

✓

Innovate UK

✓

National

✓

✓

Careers

Strategy

New Anglia

✓

✓

Cultural

Sector Skills

plan

New Anglia

✓

✓

Growth Hub

New Anglia

✓

✓

Youth Pledge

Norwich/

✓

✓

✓

Ipswich

Opportunity

Areas

Modern

✓

✓

✓

✓

✓

Industrial

Strategy

(Tourism

Sector Deal

Bid)

UK

✓

✓

✓

✓

✓

Hospitality

People 1st

✓

✓

✓

✓

(including

career

mapping tool)

Visit Britain

✓

✓

Page 16 of 43

Section 3: Understanding the Evidence Informing the Plan

Section 3 is divided into Sector Leadership, then the three Priorities with their

corresponding interventions. In each category, the employer/stakeholder views are

presented first.

Sector Leadership- Establish a skills voice for New Anglia

Employer/Stakeholder Views

• There are many effective local and/or specialist sector groups and initiatives,

but the overall picture is quite fragmented and lacks a clear voice, and pitch at

a regional and national level

• The formal education and training system (e.g. through FE) is vital although

the importance of in-house training - generally non-accredited- can be under-

estimated and ‘under the radar’

• Major recruitment challenges in isolated, rural areas such as the North Norfolk

and Suffolk Coasts - seen as an influence on ‘investment withdrawal’

• Recognition that course development, and the underpinning funding model, is

unwieldy

• Visitor economy businesses not always benefitting from funded business and

skills support - either due to eligibility (e.g. ERDF) or simply low-

awareness/demand

• A relatively high proportion of lifestyle businesses in the sector makes

wholesale transformation a challenge

• Some of the challenges faced are ‘infrastructure-related’ and cannot be

tackled on a sector basis - for example, housing costs in visitor economy

‘hotspots’ such as Wells-next-the-Sea/Southwold: a lack of public transport;

poor broadband connections

National Data

• Since 2010 tourism has been the fastest growing sector in the UK in

employment terms.

• Britain will have a tourism industry worth over £257 billion by 2025 - just

under 10% of UK GDP and supporting almost 3.8 million jobs, which is around

11% of the total UK number.

• Tourism’s impact is amplified through the economy; it being much wider than

just the direct spending levels. Deloitte estimates the tourism GVA multiplier

to be 2.8 - meaning that for every £1,000 generated in direct tourism GVA

there is a further £1,800 that is supported elsewhere in the economy through

the supply chain and consumer spending.

• The sector is predicted to grow at an annual rate of 3.8% through to 2025 -

significantly faster than the overall UK economy (with a predicted annual rate

Page 17 of 43

of 3% per annum) and much faster than sectors such as manufacturing,

construction and retail.1

Local Data

The Visitor Economy in New Anglia

In terms of Gross Value Added (GVA) then the Visitor Economy in 2015 was worth

directly approximately £2.32bn, which equates to just over 7 per cent of the total

New Anglia economy. This is an increase of nearly £450m on 2010 (24 per cent)

which is broadly in line with growth across the whole economy. Both the tourism (21

per cent) and cultural (28 per cent) elements of the sector experienced economic

growth over this period.

In total the sector currently employs 89,100 people, which is approximately 11 per

cent of the workforce. Employment in the sector has grown by 14 per cent since

2010 (around 10,700 jobs), a rate of growth which is above that experienced across

the New Anglia economy. This however masks a drop in employment of 1,800

between 2014 and 2015.

Tourism accounts for 78,200 jobs with Culture and The Arts providing 26,300 jobs

(noting that the two do not sum to 89,100 due to the overlap in the sectors in

‘Cultural’ and ‘Sporting & Recreational’ activities). As for the various sub sectors then

‘Food and beverage serving activities’ is by far the largest with 38,200 workers,

followed by ‘Accommodation for visitors’ (16,300), and ‘Sporting and recreational

activities’ (12,500). It is worth noting that it is the two largest sub sectors which have

experienced the largest drops in employment between 2014 and 2015 totalling

approximately 7,000 jobs.

With regards to the structure of employment, then the Visitor Economy sector is

much more geared towards part-time employment. 48 per cent of employment in the

sector is part-time compared to 29 per cent across the whole economy

In terms of enterprise numbers, as of 2016 there were 7,140 Visitor Economy

enterprises operating in the New Anglia area, or just under 12 per cent of all

enterprises. Since 2010 the number of Visitor Economy enterprises has increased by

630, or around ten per cent, in line with the total New Anglia rate of growth.

However, this growth rate is below that experienced regionally (13 per cent),

nationally (17 per cent), and by some comparator LEP areas such as Dorset (15 per

cent).

The following is based on analysis of LEP level results for the sectors of ‘Hotels and

restaurants’ and ‘Arts and other services’ from the UKCES Employer Skills Survey

2015.

‘Hotels and restaurants’ employers have on average more vacancies than locally,

regionally, and nationally. However, these are less likely to be Skills Shortage

1 Visit Britain. Britain’s Visitor Economy Facts.

Page 18 of 43

Vacancies (SSVs) and could point to high levels of churn in staff. ‘Arts and Other

Services’ employers are more likely to have a vacancy that is hard to fill.

‘Hotels and restaurants’ employers are more likely to have staff that are not fully

proficient, again symptomatic of high staff turnover. The opposite is true of ‘Arts and

Other Services’ employers.

Performance against training measures (such as the provision of training in the last

year, and on-the-job training) of ‘Hotels and restaurants’ employers is below local,

regional and national averages for all indicators apart from online or e-learning

training. Conversely, training days per trainee, and trainee days per staff, are both

much higher than all other comparators.

‘Hotels and restaurants’ employers are more likely to report difficulties in retaining

staff, with ‘Arts and Other Services’ employers more likely to report underutilised

staff.

The following makes use of data and findings available via the online toolkit

from the UKCES ‘Working Futures’ programme and job vacancy data from the

Labour Market Insight tool developed by Burning Glass.

Job vacancy postings during 2015 for the Visitor Economy in New Anglia generally

required school leaver and FE skills with very little in the way of postings requiring

Higher Education level skills.

Advertised salaries for the sector in New Anglia were also generally lower than those

advertised regionally and nationally.

‘Hospitality trades’ are seen as providing the best opportunities for employment for

those with FE level skills based on a ratio of local employer demand and supply of

these skills locally. In terms of HE level skills, then New Anglia provides better

opportunities than regionally or nationally for those looking for employment in ‘Sports

Occupations’.

A Future View of the Visitor Economy

Looking ahead and using information from both the East of England Forecasting

Model, and the UKCES Working Futures model, then the sector is projected to grow

in employment terms by over 11,000 jobs (12 per cent, double the growth projected

across the New Anglia economy) between 2014 and 2024.

Much of this growth in employment is set to be delivered by the ‘accommodation and

food services’ element of tourism with 10,000 jobs. ‘Arts and entertainment’ will grow

by over 2,000 jobs over the same period whilst the media elements of the sector are

set to shrink by around 1,000 jobs.

At the same time the Visitor Economy is growing there will be a significant amount of

existing jobs to replace as people leave the sector workforce. Over the period 2014 -

2024, replacement demand is expected to be somewhere in the region of 37 -

Page 19 of 43

40,000 jobs. This places a net requirement for jobs requiring to be filled in the sector

at around 50,000.

-10,000

-5,000

0

5,000

10,000

15,000

20,000

25,000

QCF 7-8

QCF 4-6

QCF 3

QCF 2

QCF 1

No Qual

Expansion Demand

Replacement Demand

Much of this replacement demand is centred on Level 3 (A level and equivalent)

roles and below though Level 4 to 6 (HE to First degree level) roles also feature

strongly. In terms of new jobs created (expansion demand) then this will be primarily

in Level 4 roles and higher with job losses in Level 1 (GCSE below grade C) roles

and below.

Lack of Private Sector Skills Voice

The consultation process identified a potentially fragmented situation with a number

of different groups with strong sector interests at either a county level(e.g. Visit

Suffolk and Visit Norfolk); a local level (e.g. DMOs. coastal communities teams); or

with a special interest areas such as the Horseracing cluster around Newmarket or

groups linked to heritage or other visitor attractions).

Page 20 of 43

Priority 1 - Developing the Business and Employment Offer

Intervention 1 - Marketing and Customer Engagement Capability

Employer/Stakeholder Views

• A lack of connectivity currently between marketing / product development and

any underpinning skills considerations

• The need to connect at a locality level and be responsive to the needs of

local/specialist elements such as Horseracing around Newmarket or Cultural

Tourism

• The importance of digital skills within the small business community so

important to this sector - especially social media / online marketing, but also

the need strategically to look at ways of boosting productivity and raising job

value through technology

• Positive comments about Welcome Host / World Host / Ambassador-style

initiatives although viewed as ad hoc and ‘stop/start’ and therefore reducing

the longer term impact

• Interest in online learning development potential for local ambassador-type

provision

Product/Market Development

• Travellers want ‘authenticity’ and an opportunity to learn or self-improve2;

there could be a gap in businesses marketing English food and/or running

courses in how people can learn to make English food (this could be cooking

dishes, but also typical English food products) or trips to places where

authentic English food/drink is made as a tour. It could also be authentic

English crafts; this is a need for skills-training mostly in how to market English

authenticity to appeal to tourists.

• With 70% of UK people wanting more information about how environmentally

friendly a brand is, and 95% of people worldwide concerned about the

environment3, showing a tourism business to be sustainable and

environmentally friendly could give them a competitive edge, as well as being

better for the environment too and reducing energy consumption etc.

Businesses may need training on how to be more sustainable, and how to

market this; for example, they could work towards gaining a ‘Sustainable

Tourism Certificate’. There is advice available on reducing food waste.

• For Rural Tourism, there is a Rural Tourism Business Toolkit that has been

created as part of the COOL Tourism Project by the COOL Partnership and

tourism development charity Hidden Britain, with various modules to work

through, if anyone needs help/support in this area.4

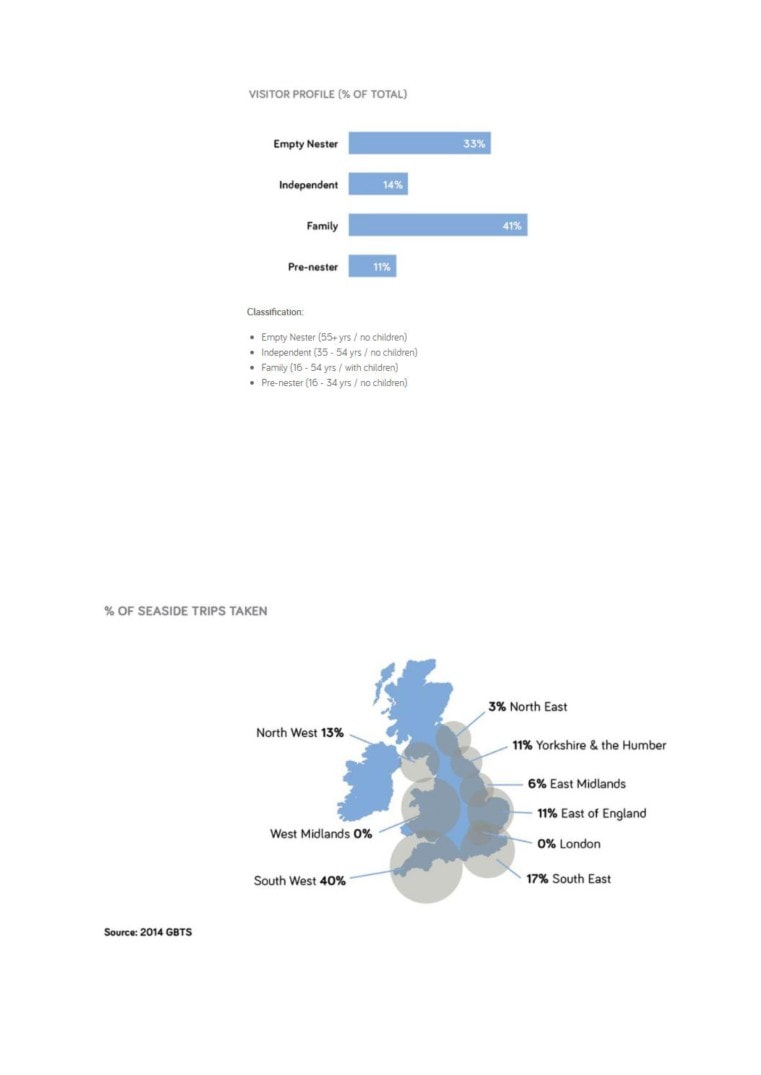

• See below analysis of the visitor profile for coastal tourism, demonstrating

perhaps the changing balance between families and empty nesters, with

knock-on skills implications in terms of target markets and customer needs.

2 Visit Britain. The Future Travel Journey: Trends for Tourism Product Development

3 Visit Britain. Maximising Your Sustainability.

4 Visit Britain. Maximising Your Sustainability.

Page 21 of 43

Source: cited in National Coastal Tourism Academy

National Significance of Seaside Trips

The national significance of the New Anglia (termed East of England below)

coastline in relation to ‘seaside trips’ is shown below and is important in terms of

wider Visit East Anglia ambitions to extend ‘day trips’ to longer stays.

Source: National Coastal Tourism Academy (NCTA)

Page 22 of 43

Intervention 2 - Innovation

Employer/Stakeholder Views

• Damaging perceptions of the sector as a source of short term, zero hours,

seasonal, low paid work rather than being a career option with a wide range of

professional roles - for example Data Science for sophisticated online

consumer engagement

• There may be scope for considerable business innovation in areas such as

staff engagement, flexible working, culture development as a business

differentiation strategy to improve recruitment and retention

Digitalisation

• People booking their holidays online is increasing and is predicted to

continue to rise to 63% by 20235; therefore, companies will need to offer

smooth booking online services, and ideally have the ability to book and

communicate through social media apps such as WhatsApp and Facebook

Messenger too. Businesses may need skills-training in technology, social

media and conversational commerce.

• Travellers want an immersive interactive experience, with audio-tours,

Augmented Reality (AR) and Virtual Reality (VR). Businesses may need

skills-training in how to implement audio-tours, AR and VR.

• Attractions have said “we can’t afford to do a lot of advertising”6 - so perhaps

businesses need training in social media, which is less expensive to gain a

competitive edge.

• Attractions mentioned that they struggle “because of a lack of funding”7 so

they may benefit from training in how to search/apply for funding.

Customer Service

• There are a variety of Customer Services courses/qualifications available

such as local Ambassador programmes, WorldHost, Welcome Host etc.8

• A lot of businesses are acknowledging that they want ‘softer skills’ in

hospitality and tourism.9

•

“Skills gaps are particularly noticeable for chefs, house-keeping and more

generally for customer service and other soft skills.”10

• Seasonal staff need to be developed and invested in, regardless of the

seasonal nature of their work.11

5 Visit Britain. The Future Travel Journey: Trends for Tourism Product Development

6 Visit Britain. Tourism Business Monitor 2017. Wave 4 - Post Christmas and New Year. Full Report.

7 Visit Britain. Tourism Business Monitor 2017. Wave 4 - Post Christmas and New Year. Full Report.

8 People 1st. WorldHost Training.

9 Kent, Martin-Christian. People 1st. The Chef Shortage: A Solvable Crisis? Understanding why we have a chef

shortage and how it can be addressed. Executive Summary.

10 National Coastal Tourism Academy (NCTA) - Coastal Visitor Economy: Vision, Strategy and Action Plan (Jan

2017)

11 National Coastal Tourism Academy (NCTA) - Coastal Visitor Economy: Vision, Strategy and Action Plan (Jan

2017)

Page 23 of 43

•

In another Insight report by People 1st, which focussed on Customer Service

Skills (Dec. 2016) they stated “High levels of staff turnover are

exacerbating skills gaps in the existing workforce, as staff aren’t

remaining in post long enough to become fully competent.”12(p.4) People

1st predict that as unemployment decreases, it will be harder for employers to

gain people with the skills they require.

•

The report by KPMG state that “People 1st estimate organisation level

turnover to be 30% in the sector … our survey of BHA members puts the

estimate as high as 50.2%.”13

•

For tourism staff working in coastal communities, it is still important that

they’re given training, even if their work is seasonal, because otherwise skills

will not be retained.14

•

The visitor economy sector has a rapid turnover of staff (75% compared

to the usual 15% average)15

•

There are things such as ‘Fast Track’ and the Service Profit Chain that can

help tourism and hospitality staff to feel more valued, perform better, and to

grow the business and profit.16 In People’s 1st ‘Skills and Workforce Profile:

Hospitality and Tourism’ (Dec. 16)17 it suggests that there are skill shortages

because there are not many people with the skills; not enough people are

interested in learning the skill; people are put off by shift work/unsociable

hours; not enough people are applying for the jobs. The skills that were

lacking were interpersonal and employability skills: 66% not able to manage

own time and prioritise tasks; 61% lacking customer handling skills; 55%

lacking team working; 47% lacking the specialist skills or knowledge to

perform the role and 46% lacking sales skills.

•

KPMG have noted that whilst “there may be some scope to reduce the

sector’s labour force requirements through productivity improvements and

automation, however extensive productivity gains are unlikely to be possible

due to the manual nature of many of the roles and the demand from

customers for the human interaction that typifies the sector.”18

•

“16.2% of BHA (UK Hospitality was created in 2018 by a merger of the

Association for Licensed Multiple Retailers (ALMR) and the British Hospitality

Association (BHA) to provide a strong unified voice for the industry) members

surveyed felt that there was a gap in the skills and experience between EU

12 People 1st. Insight Report: Customer Service Skills (Dec. 2016)

13 KPMG. Labour Migration in the Hospitality Sector: A KPMG Report for the British Hospitality Association.

(March 2017)

14 National Coastal Tourism Academy (NCTA) - Coastal Visitor Economy: Vision, Strategy and Action Plan (Jan

2017)

15 People 1st. Race to improve productivity in hospitality and tourism - rising costs, recruitment difficulties and

Brexit create perfect storm. (July 2017).

16 National Coastal Tourism Academy (NCTA) (n.d) [online] FastTrack: Addressing employee pay and

progression in coastal SMEs

17 People 1st. (Dec. 2016) Skills and Workforce Profile: Hospitality and Tourism.

18 KPMG. Labour Migration in the Hospitality Sector: A KPMG Report for the British Hospitality Association.

(March 2017)

Page 24 of 43

and UK workers. The most common skill gaps … related to language skills

and customer service skills.”19

Priority 2 - Overcoming Obstacles to Growth

Intervention 3 - Tackling Skills Shortages

Employer/Stakeholder Views

• A real shortage of ‘good quality staff’ - particularly in frontline areas such as

housekeeping, bar-staff, waiters

• Anecdotal comments about the difficulty of recruiting and retaining qualified

Chefs

• Concerns about the impact of BREXIT across the whole workforce

• Challenges recruiting higher level marketing, leadership and digital (including

Maths for coding/developers) skills

Immediate Front Line Shortages & BREXIT

• There ‘could’ be a shortage of housekeeping staff in 2019 after Brexit, if there

are difficulties in recruiting EU workers. Because EU workers currently make

up at least 28% of housekeeping staff, though People 1st suspect the figure is

more. Hotels and accommodation providers need to consider and prepare for

this. This is also echoed by the BHA (UK Hospitality was created in 2018 by a

merger of the Association for Licensed Multiple Retailers (ALMR) and the

British Hospitality Association (BHA) to provide a strong unified voice for the

industry), who would like the government to have a 10-year phased approach

for industries reliant upon service workers from the EU, to give time to recruit

UK workers.20 In a report by KPMG commissioned by the BHA, “75 per cent of

waiters and waitresses, 25 per cent of chefs and 37 per cent of housekeeping

staff are from the EU.”21

• There is a disparity between what students are taught and what they’re

required to do in the workplace: “In college I am being taught different skills

and I go into the workplace and have yet to be asked to use any of them. I

also notice the difference in what I’m taught and then what I’m expected to

know, or what I should know.”22 - Chef student.

• Skills Retention - is an issue in the Tourism and Visitor economy for several

reasons. Firstly, EU staff may be impacted by Brexit, and the skills they bring

to this area, may not be retained if they’re predominantly done by EU workers.

If EU nationals have specific language skills, these too may be lost.23 The

Tourism response paper highlighted that EU nationals working in the tourism

19 Ibid.

20 British Hospitality Association (BHA) - Recommendations for Government

21 BHA. Hospitality and Tourism industry announces first post-Brexit sector skills strategy (March 31st, 2017).

22 Kent, Martin-Christian. People 1st. The Chef Shortage: A Solvable Crisis? Understanding why we have a chef

shortage and how it can be addressed. Executive Summary.

23 People 1st. Understanding the impact of Brexit on housekeeping teams.

Page 25 of 43

sector in the UK have excellent, “customer service, culinary and language

skills.” 24

• Attractions also mentioned “we haven’t got the staff resources”25

• Tourism and Hospitality businesses have training needs in how to increase

productivity.26

• The British Hospitality Association (BHA - UK Hospitality was created in 2018

by a merger of the Association for Licensed Multiple Retailers (ALMR) and the

British Hospitality Association (BHA) to provide a strong unified voice for the

industry), commissioned KPMG to undertake an independent report, they

predicted “the hospitality sector faces a recruitment shortfall of upwards of 60k

per annum workers from 2019.” and “based on this scenario, by 2029, the

hospitality sector could face a total recruitment gap of over 1 million workers.”

They also added that “the hospitality sector currently needs around 62,000

new EU migrants per annum to maintain its current activities and grow.”27

Their analysis shows that “12.3% employees in the UK’s hospitality sector are

EU nationals” with “43% of lower level occupations in the hospitality sector are

filled by EU nationals.” KPMGs research looked at the reasons for the level of

EU nationals currently hired, and their largest reason was “lack of interest in

work from local UK labour,” with jobs being perceived as not attractive or

undesirable.

Chef Shortage

• There is a severe shortage of Chefs, with 11,000 predicted to be needed in

the next five years.28 There are plenty of student chefs, but they’re not

entering or staying in the profession; plus 20% of existing chefs are also

leaving. 64% of businesses said that” they can’t find applicants with the

required skills, which means we are not just dealing with a labour shortage,

but a skill shortage.”29

• People 1st recommend changing the perception of jobs in the visitor economy.

There is evidence that trainee chefs don’t enter the workforce and that

existing chefs don’t stay in their jobs - this means that all these skills aren’t

being retained and utilised. Amongst many interventions People 1st

recommended: maximising opportunities from FE Colleges and creating a

quality workplace.30

24 Tourism Industry Council - Brexit Response Paper: Tourism Industry Responses for the Tourism Industry

Council (December 2016)

25 Visit Britain. Tourism Business Monitor 2017. Wave 4 - Post Christmas and New Year. Full Report.

26 People 1st. Race to improve productivity in hospitality and tourism - rising costs, recruitment difficulties and

Brexit create perfect storm. (July 2017).

27 KPMG. Labour Migration in the Hospitality Sector: A KPMG Report for the British Hospitality Association.

(March 2017)

28 People 1st. The Chef Shortage: A Solvable Crisis? New People 1st Report Urges Joined-up Approach (29 Nov

2017)

29 Kent, Martin-Christian. People 1st. The Chef Shortage: A Solvable Crisis? Understanding why we have a chef

shortage and how it can be addressed. Executive Summary.

30 People 1st. The Chef Shortage: A Solvable Crisis? New People 1st Report Urges Joined-up Approach (29 Nov

2017)

Page 26 of 43

•

“Chefs and front of house staff are the two most frequently cited hard-to-fill

roles during KPMG’s interviews with BHA members.”31

Manager Shortage

• There is a management shortage in the Visitor Economy, with 471,000

additional managers needed by 202432. Apprenticeships and Higher

Education could help, as well as ensuring current managers are suitably

skilled.

• A report by People 1st The performance and talent management revolution:

Driving productivity in hospitality and tourism shows that recruitment and

retention of staff is a huge issue in the tourism sector, with turnover being

75%. Perhaps there’s a skills need here, to ensure that people are recruiting

the ‘right’ staff who want to make a career out of tourism, and therefore will

stay working in this environment and that staff are performance managed, and

have excellent opportunities for learning and development.33 It has been

highlighted that management skills are certainly an area for development, so

that manager can motivate and retain staff. It’s beneficial to recruit graduates

to management positions and to offer higher-level apprenticeships.

Businesses may need training about apprenticeships and the higher-level

options.

• Martin-Christian Kent, suggested that managers need training to “manage,

motivate and retain staff”34 - by retaining staff, the investment in training and

skill development and experience would also be retained and not lost.

Intervention 4 - Local Career Pathway Review and Development

Employer/Stakeholder Views

• Questions about the likelihood of those on tourism courses actually building

careers in the sector

• Concerns that recent Apprenticeship reforms are not supporting increased

demand for Apprenticeships - by either employer of individual

• A view that educational provision is not as well connected to industry as it

could be

Skills Supply and Demand in the Visitor Economy

31 KPMG. Labour Migration in the Hospitality Sector: A KPMG Report for the British Hospitality Association.

(March 2017) UK Hospitality was created in 2018 by a merger of the Association for Licensed Multiple Retailers

(ALMR) and the British Hospitality Association (BHA) to provide a strong unified voice for the industry.

32 People 1st. What do our future managers look like? How much autonomy will they have and how will they

manage?

33 People 1st. Race to improve productivity in hospitality and tourism - rising costs, recruitment difficulties and

Brexit create perfect storm. (July 2017).

34 Kent, Martin-Christian. (June 2017). The Performance & Talent Management Revolution: Driving Productivity

in Hospitality and Tourism. Executive Summary.

Page 27 of 43

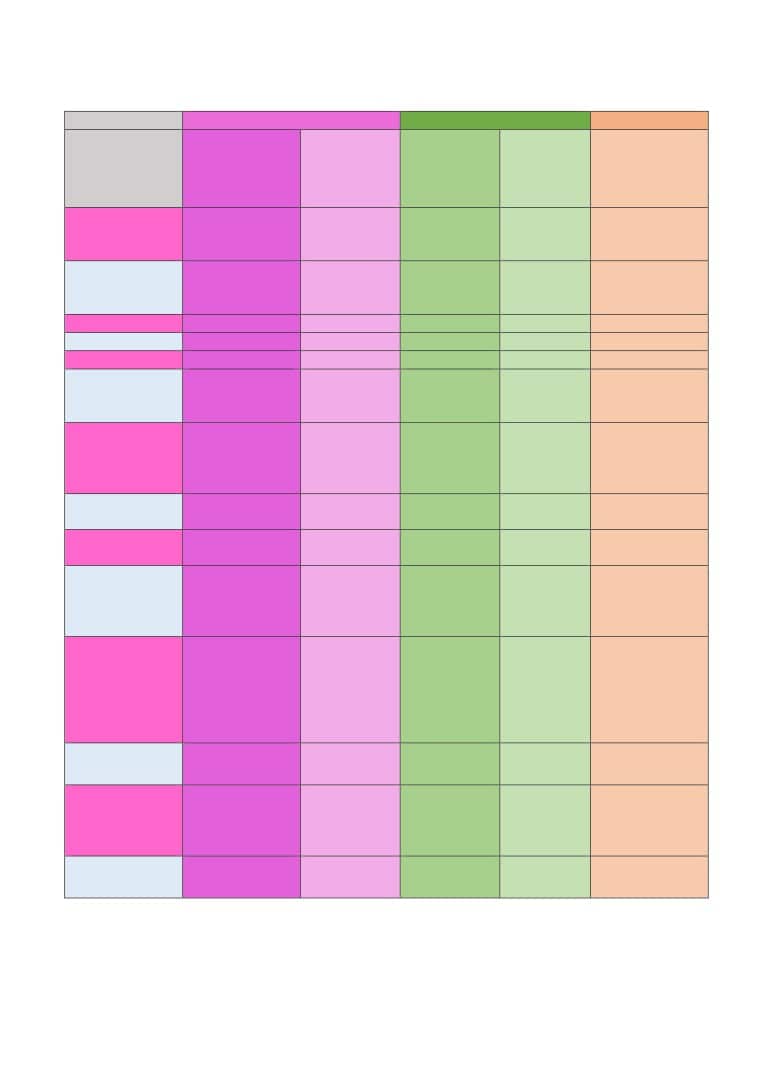

In line with the local population, the Visitor Economy workforce in New Anglia is

becoming higher skilled as analysis of 2001 and 2011 Census data shows. However,

in terms of this shift in qualifications then New Anglia still lags a bit behind regional

and national averages for the sector.

2011

14%

17%

22%

16%

18%

13%

2001

24%

20%

25%

11%

13%

7%

2011

13%

17%

22%

16%

20%

12%

2001

22%

21%

26%

11%

13%

7%

2011

12%

15%

20%

17%

24%

12%

2001

21%

19%

24%

11%

17%

7%

0%

100%

No qualifications

Level 1 qualifications

Level 2 qualifications

Level 3 qualifications

Level 4 qualifications and above

Apprenticeships and other qualifications

The following analysis is based on data sourced from the Department for Education’s

Further Education data library. The Sector Lead Bodies identified as being the most

relevant to the Visitor Economy are: Hospitality, Leisure, Travel and Tourism;

Creative and Cultural; Creative Media; and Passenger Transport.

In total, 10,410 learning aims related to the Visitor Economy were delivered to New

Anglia residents in 2012/13. This formed 13 per cent of all known learning aims

delivered in New Anglia, compared to 12.4 per cent nationally. If we consider all

learning aims delivered (i.e. including those classed as ‘unknown’ then these figures

fall to 4.9 and 4.5 per cent respectively).

Compared to 2010/11, when the number of learning aims delivered to New Anglia

residents was 10,830, then numbers are down for all sector lead body elements of

the Visitor Economy apart from ‘Creative Media’. Overall, this results in there having

been a slight drop (-4 per cent) in the number of Visitor Economy learning aims

delivered to New Anglia residents over the period in question. Nationally, and over

the same period, learning aims for the sector increased by seven per cent.

The clear majority of these learning aims (8,260 or 79 per cent) achieved by New

Anglia residents were delivered by New Anglia based providers. This is slightly more

than the average for New Anglia (75 per cent).

Provision of Visitor Economy learning aims by New Anglia providers to New Anglia

residents has increased over the period in question, from 6,520. Growth has been

strongest in the elements of ‘Hospitality, Leisure, Travel and Tourism, and ‘Creative

and Cultural’. So, whilst Visitor Economy learning aims have fallen slightly in New

Anglia, local provision to local learners has still grown in demand, and at 27 per cent

is much higher than national growth (seven per cent).

Page 28 of 43

In terms of apprenticeships, then in 2015/16 there were 510 starts in ‘Leisure, Travel

and Tourism’ apprenticeships in New Anglia, which is a reasonably small proportion

(four per cent) of all apprenticeship starts in the area. Growth over time in ‘Leisure,

Travel and Tourism’ apprenticeship starts is below that of regional and national

comparators, and that of growth in apprenticeship starts overall. However, if we

consider recent data on apprenticeship participation by sector then the Visitor

Economy accounted for 12 per cent (2,580) of all apprenticeships in 2014/15

(compared to 10 per cent) which is much more in line with the amount of

employment it provides (11 per cent).

Priority 3- Promoting Local and Global Career Opportunities

Intervention 5 - Promote Career Opportunities

Employer/Stakeholder Views

• Perceptions that the public do not view key roles such as Chefs / Waiters as

‘valued professionals’ as is the case in continental Europe

• Support for initiatives giving real insight and experience such as National

Hotel Takeover Week. The Big Hospitality Conversation

National Data

Modern Industrial Strategy: Tourism Sector Deal Bid. Tourism: a leading

industry for the Government’s future economic planning35

•

“A clear plan to extend the seasons, making British tourism product more

efficient, for longer.”

•

“upskilling in digital and use of new technology.”

•

“A big, industry-led, 10-year campaign to shift perceptions about tourism and

hospitality jobs and to encourage more people to join the industry.”

•

“Tourism and hospitality to be included in Government’s new T-Levels and

apprenticeship schemes.”

•

“To get many more industry figures out into schools and colleges to promote

the industry.”

• There are also leadership programmes if graduates want to go into Hotel

management.36

• There is a drive to get young people into working in hospitality, through the

Big Hospitality Conversation37, with the BHA, and DWP, and National

Apprenticeship Services and other partners.

• People 1st Career Mapping Tool.38

35 Visit Britain. Modern Industrial Strategy: Tourism Sector Deal. Tourism: a leading industry for the

Government’s future economic planning. (2017)

36 IHG - Spotlight on: Future Leaders Programme

37 BHA. The Big Hospitality Conversation. UK Hospitality was created in 2018 by a merger of the Association for

Licensed Multiple Retailers (ALMR) and the British Hospitality Association (BHA) to provide a strong unified

voice for the industry.

38 People 1st - Career Mapping Tool

Page 29 of 43

Appendix

Appendix A - Consultation and development process

The development process for this Visitor Economy Skills Plan was sponsored by

Visit East Anglia; actively involving Visit Norfolk and Visit Suffolk - at a collective

level and also through individual discussions with their stakeholders The original aim

was to produce an integrated Visitor Economy Plan for ‘Tourism’ and ‘Culture’, but

local stakeholders saw more benefit in developing separate plans - particularly due

to the fact that skills priorities are seen as very different in the two sectors. An

advanced version of this Skills Plan was endorsed by the Visit East Anglia Board at

its March 2018 Board Meeting and skills planning was discussed with both Visit

Norfolk and Visit Suffolk stakeholder meetings. An additional stakeholder meeting

was also held in March at the Royal Norfolk Showground.

In addition to this sector skills plan document, a supporting Datapack has been

produced which outlines the current workforce in the sector, trends in its skills levels

and how the local Visitor Economy sector in New Anglia compares with other areas.

This Datapack also reports on the underlying socio-economic context for the sector

locally and reports on projected changes in future skills needs and current student

numbers. It is presented as a separate document and provides data to underpin

many of the comments made in the sector plan and is a useful reference source

when read in conjunction with the plan.

Thanks in particular to the following stakeholders for their support, ideas and

contribution to this process.

In the Task and Finish consultations, and through one to one consultations with

employers and stakeholders the key questions posed were:

Question 1 - Current and Future Skills Supply and Demand

What are the key skills issues facing the Visitor Economy Sector in New Anglia?

This could include for example:

• Workforce supply or demographics

• Skills supply

• New technology

• Recruitment and retention

• Nature of training and education provided (courses and providers)

Question 2 - Proposed Skills Actions

What are the key actions which are needed to address anticipated skills & workforce

challenges in the Visitor Economy Sector in the next 5 years?

This could include for example:

Page 30 of 43

• New provision by Schools, Colleges or Universities

• New centres for training or education

• New models of delivery e.g. Higher Apprenticeships

• Groups of employers working together to procure training and skills development

• Careers advice and guidance

• New funding models

• Workforce development programmes

Discussions focussed on both short term quick ‘wins’, as well as longer term more

strategic interventions and on the basis of co-investment between the private and

public sectors.

Consultees

A series of key informant interviews were conducted with a mix of employers, sector

skills providers and representative bodies. In total over 30 consultees were

interviewed in depth and/or attended the task and finish consultation meetings held

or provided other direct input which has informed the plan (presentations at events,

referrals, links to reports).

The consultation process has also included reviewing the feedback collected from

other key sectors of the New Anglia economy for which sector skills plans have been

developed. Additional input, advice and guidance was received from officers of the

LEP and County Councils:

The Visit East Anglia Board which

Particular thanks also to the following for

acted as sponsors for this plan

their direct input and support:

included:

Richard Ellis (Chair): Original

Visit Norfolk stakeholders

Cottage Co.

Visit Suffolk stakeholders

Sean Clark: Clark St James

Newmarket Equine Cluster stakeholders

Victoria Savory: Adnams PLC

Simon Altham: Hoseasons

Tom Blofeld: Bewilderwood

Robert Gough: Gough Hotels / Southwold Pier

Martin Dupee: ZSEA

Bill Heath: IHG / Holiday Inn

Chris Scargill: Larking Gowen

Chris Couborough: Flying Kiwi Inns

Pete Waters: Visit East Anglia

Amanda Parker: Fred Olsen Travel

Victoria Norris: Woodland Holiday Park

Valerie Watson-Brown: Tasty Flavours

Barbara Greasley: Norfolk Broads Direct

Andy Hutcheson: Norfolk County Council

Steve Thorpe: City College, Norwich

Natasha Waller/ Kenny Lang: New Anglia LEP

Holly Loxham: Visit East Anglia

Eve Cronin/Jan Feeney: Norfolk County

Council

Michael Gray / Jazz Joolia: Suffolk County

Council

Page 31 of 43

Appendix B - Current Skills and Training Provision - wider Visitor Economy

The listing below is not exhaustive but is intended to give an overview of the range of

provision available in Norfolk and Suffolk. The courses listed have a Visitor Economy

focus (including Tourism and Hospitality, as well as Culture) because they fall within

the New Anglia Visitor Economy definition with some provision relevant to both

areas.

University of East Anglia (UEA)

Tourism/Hospitality

• MA Agriculture and Rural Development (full and part-time)

• MA Landscape History

Culture

• BA History of Art with Gallery and Museum Studies

• BA Society, Culture and Media

• MA Cultural Heritage and Museum Studies (full and part-time)

• MA Media, Culture and Society (full and part-time)

• BA & MA in Film and Television Studies

University of Suffolk (UoS)

Tourism/Hospitality

• BA (Hons) Event Management

• BA (Hons) Event and Tourism Management

• BA (Hons) Tourism Management

• BSc (Hons) Wildlife, Ecology and Conservation Science

• FdA Hospitality and Event Management

• FdSc Wildlife Conservation and Animal Management

Culture

• BA (Hons) Dance

• BA (Hons) Digital Film Production

• MSci Football Coaching

• MA Professional Practice in Heritage Management

• MSci Performance Analysis for Football

• BA (Hons) Photography

• BSc (Hons) Sport Coaching

• BSc (Hons) Sport Performance Analysis

• BSc (Hons) and MSci Sport Psychology

• BSc (Hons) Sport and Exercise Science

• FdA Commercial Arts Practice

Page 32 of 43

• BSc (Hons) Sport

• FdSc Sport, Health and Exercise

• BSc (Hons) Sport, Health and Exercise

• FdSc Sports Coaching and Development

Norwich University of the Arts (NUA)

Culture

• BA (Hons) Animation

• BA (Hons) Architecture

• BA (Hons) Design for Publishing

• BA (Hons) Fashion

• BA (Hons) Fashion, Communication and Promotion

• BA (Hons) Film and Moving Image Production

• BA (Hons) Fine Art

• BA (Hons) Games Art & Design

• BA (Hons) Illustration

• BA (Hons) Photography

• BA (Hons) VFX

• MA Communication Design

• MA Curation

• MA Fashion

• MA Fine Art

• MA Games

• MA Moving Image and Sound

• MA Photography

• MA Textile Design

City College Norwich (CCN)

Tourism/Hospitality

• Entry Level - Supported Learning - Hospitality Enterprise

• L2 - Culinary Skills City College Norwich Hotel School Diploma

• L2 - Food Safety in Catering Award

• L2 - Health & Safety in Workplace (QCF)

• L2 - Award in Wines and Spirits

• L2 - Commis Chef Apprenticeship

• L2 - Intermediate Apprenticeship in Customer Service

• L3 - Advanced Apprenticeship in Customer Service

• L3 - Award in Wines and Spirits

• L3 - Culinary Skills City College Norwich Hotel School Diploma

• L3 - Team Leader Apprenticeship

• A Touch of Patisserie and Confectionary - part time adult learning

Page 33 of 43

• Junior Chef, Gluten Free Chef, Gastro Chef, Great British Bake Off, Junior

Chef Academy Summer, Student cookery, Italian cookery - other part time

courses

• BA (Hons) Hospitality and Events Management

Culture

• Entry Level - Supported Learning - Creative Media Pathways

• L3 - Advanced Apprenticeship in Creative & Digital media

• L3 - Advanced Apprenticeship in Digital Marketing

• L3 - Art & Design (Art, Textiles, Photography) A Level

• L3 - Coaching

• L3 - Drama & Theatre Studies A Level

• L3 - Film Studies A Level

• L3 - Media Studies A Level

• L3 - Access to Higher Education: Art & Design

• Digital Photography for beginners - part time adult learning

• L4 - Advanced Nutrition for Physical Performance - part time

• BSc (Hons) Applied Sport, Health and Exercise

College of West Anglia

Tourism/Hospitality

• L1 - Business and Tourism

• L1 - Hospitality Certificate

• L1 - Professional Cookery

• L2 - Animal Care Practical Skills

• L2 - Catering and Hospitality Apprenticeship (Intermediate)

• L2 & L3 - Customer Service Apprenticeship

• L2 - Hospitality Services Diploma

• L2 - Professional Cookery

• L2 - Team Leading - Apprenticeship - Workplace

• L2 - Technical Certificate in Animal Care

• L3 - Advanced Technical Diploma in Animal Management

• L3 - Hospitality Supervision and Leadership Diploma - Workplace

• L3 - Hospitality/Supervision Apprenticeship (Advanced) - Workplace

• L3 - Professional Cookery

• L3 - Professional Cookery - Confectionery & Patisserie

• L3 - Travel and Tourism - Extended Diploma

• Sugarcraft - Further Techniques - part-time

• BSc (Hons) Tourism Management (full or part-time) - recently discontinued

Culture

• Entry Level - Bridge to Sport

• L1 - Sport & Leisure Instructor Diploma

• L2 & 3 - Performing Arts (Acting, Dance or Musical Theatre)

Page 34 of 43

• L2 - Sport - Activity Leadership and Coaching - Apprenticeship - Workplace

• L2 - Instructing Exercise and Fitness - Diploma

• L2 - Sport Leisure Operations - Apprenticeship - Workplace

• L3 - Art and Design A Level

• L3 - Film A Level

• L3 - Media A Level

• L3 - Photography A Level

• L3 - Sport Leisure Management - Apprenticeships - Workplace

East Coast College

Tourism/Hospitality

•

Entry 3 Certificate in the Introduction to the Hospitality Industry

•

L1, L2, L3 in Animal Care and Management

•

L1 - Aspire to Catering

•

L1 - Food and Beverage Service

•

L2 - Air Cabin Crew - C&G Level 2 Diploma in Air Cabin Crew (with First Aid,

and Basic Sea Survival)

•

L2 - Apprenticeship in Customer Service

•

L2 - Apprenticeship in Hospitality (Food and Beverage Service)

•

L2 - Apprenticeship in Hospitality (Front of House Reception)

•

L2 - Apprenticeship in Hospitality (Hospitality Services)

•

L2 - Apprenticeship in Hospitality (Professional Cookery)

•

L2 - Apprenticeship in Hospitality (Food production and cooking)

•

L2 - Apprenticeship in Team Leading

•

L2 - Award in Beer and Cellar Quality (Cask and Keg) ESF

•

L2 - Award for Personal Licence Holders

•

L2 - C&G Food Safety

•

L2 - Food and Beverage Service

•

L2 - Hospitality and Catering

•

L2 - Professional Cookery or Kitchen Services

•

L3 - Apprenticeship in Customer Service

•

L3 - Apprenticeship in Hospitality (Professional Cookery)

•

L3 - Apprenticeship in Hospitality (Supervision and Leadership)

•

L3 - Diploma in Professional Cookery

•

L3 - Certificate in General Patisserie and Confectionery

•

L3 - CIEH Award in First Aid at Work

•

L3 - Diploma in Hospitality Supervision and Leadership

•

Working in Travel Diploma or Extended Diploma

•

FdSc Wildlife Conservation and Animal Management

Culture

•

Entry 3 Certificate in Skills for Sport and Active Leisure

•

Access to Art, Design and Photography

•

L2 - Certificate in Fitness Instructing

Page 35 of 43

• L2 & 3 in Film Production, TV & Animation

• L2 - Performing Arts (Musical Theatre)

• L2 - Sport

• L3 - Performing Arts (Music Theatre)

• L3 - Extended Diploma in Sport (or Sport & Exercise Science)