Visitor Economy

(Tourism & Culture)

Data Pack

Final Version 23.04.2018

CONFIDENTIAL

Contents

Page

-

Introduction to the Sector Data Pack

3

-

Introduction to and Definition of the Visitor Economy

3

-

The Visitor Economy in New Anglia

4

o Overview

5

o Employment

9

o Enterprises

23

-

Visitor Economy Skills Supply and Demand

30

o Qualifications

31

o UKCES Employer Skills Survey sector analysis

33

▪ Vacancies

34

▪ Skills Gaps

35

▪ Training

36

▪ Staff

38

o Further Education Learning Aims analysis

39

o Apprenticeships

46

o Labour Insight Jobs tool sector analysis

49

o

‘Where the Work is’ tool sector analysis

56

-

A Future View of the Visitor Economy

61

-

Appendix - Visitor Economy sector definition

78

2

Introduction to the Sector Data Pack

The role of the Sector Data Pack is to bring together the latest socio-economic and labour market data and present both an up-to-date, and

future view, of the sector and any underlying issues within the area that could impact upon it. Data is presented in a navigable format without

comment with interpretation at this stage left to the reader

The Data Pack informs the Sector Evidence Report, the key findings from which help to inform the priorities developed in the Sector Skills Plan.

The Sector Evidence Report is also summarised within the Sector Skills Plan and appears in full in the its appendices.

In most instances data has been analysed and presented down to local authority level. In some instances, and even where local authority data

is available, it has not been presented in the data pack due to issues of unreliability and small sample sizes. This is particularly the case with

data from the Annual Population Survey and the Annual Survey of Hours and Earnings.

Introduction to and Definition of the Visitor Economy

In terms of local skills planning for New Anglia, it was decided that the needs of the ‘tourism’ and ‘culture’ sectors are quite different and a

sector plan for each has been developed - led by Visit East Anglia and the New Anglia Cultural Board respectively. However, in terms of the

data pack then in the main, data has been provided for the overall ‘Visitor Economy’ except for some key variables.

The definition of the tourism sector used by New Anglia LEP covers Accommodation for visitors; Food and beverage serving activities; rail,

road, water and air passenger transport; transport equipment rental; travel agencies and other reservation service activities, cultural activities;

sporting and recreational activities; country-specific tourism activities plus culture and the arts. The sector can often be referred to as ‘Tourism’

with significant overlaps between ‘Tourism’ and ‘Cultural’ Sector activities such as heritage, sport, conferences and events. It is also worth

noting that there is some overlap between what is considered ‘tourism’ and that deemed ‘arts’ in respect of cultural tourism.

The definition of the culture sector used by New Anglia LEP broadly follows that used by the Department for Culture, Media and Sport to define

the Creative Industries. However, that definition used by New Anglia differs in some key areas in that it does not include activities related to

‘advertising and marketing’, ‘architecture’, and ‘specialised design activities’. In addition, the New Anglia definition of the sector captures activity

around sports, amusements and recreation, and some specialised retail. The sector can also be referred to as ‘Culture and the Arts’ and

overlaps significantly with Digital Tech sector activities such as publishing, production, and certain manufacturing elements. It is also worth

noting that there is some overlap between what is considered ‘tourism’ and that deemed ‘arts’ in respect of cultural tourism.

For full definitions of each element of the sector then please refer to the appendix.

3

The Visitor Economy in

New Anglia

4

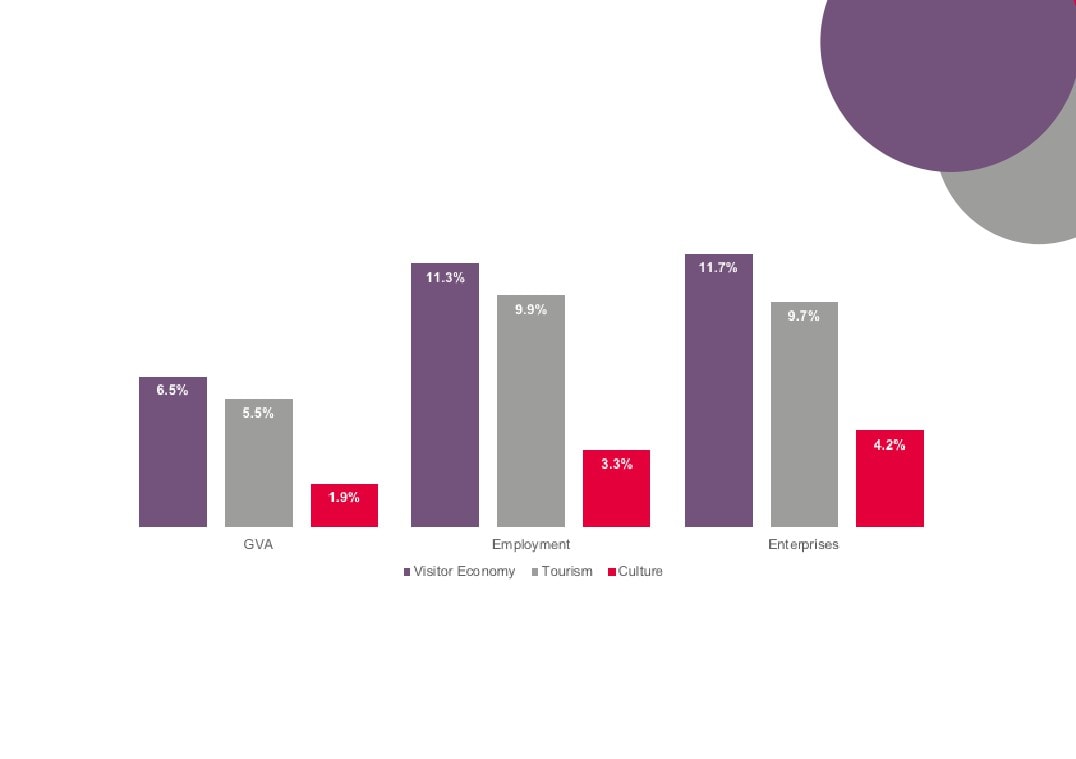

Overview

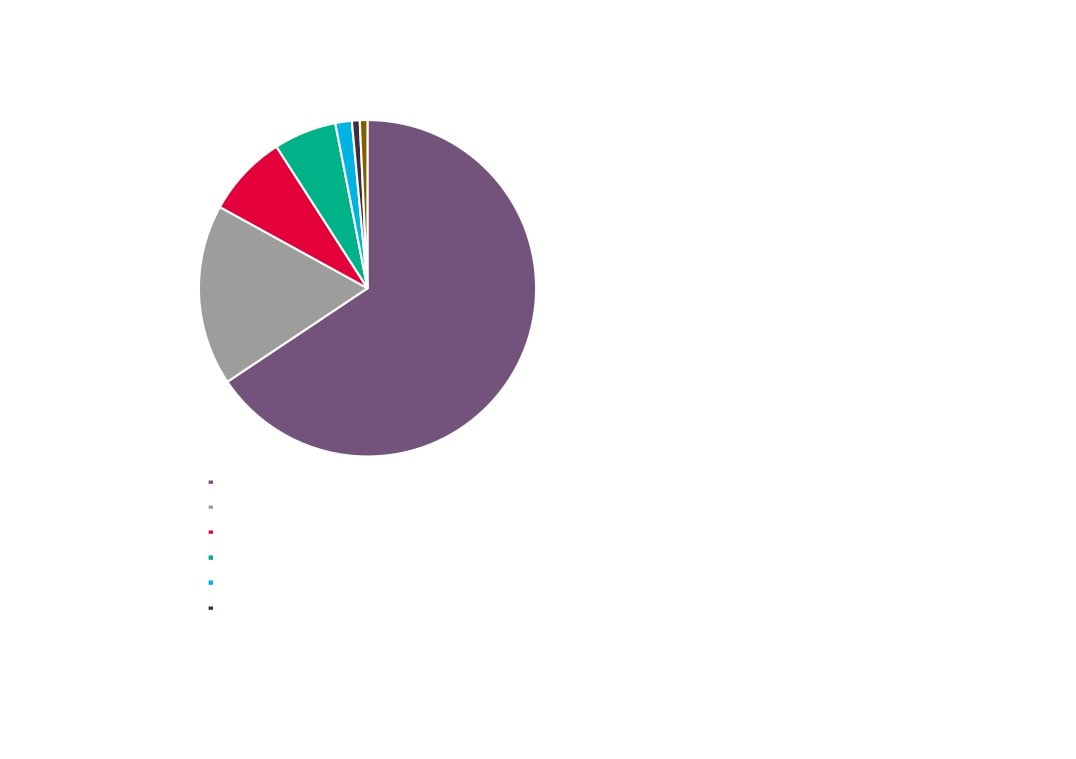

Visitor Economy (Tourism & Culture) contribution to

the local economy

7,140

89,100

78,200

5,895

£2.3bn

£2.0bn

2,535

26,300

£676m

Source: New Anglia LEP Economic Strategy evidence base work

Please note that figures do not sum due to the overlapping nature of

Tourism and Culture definitions in producing the Visitor Economy

5

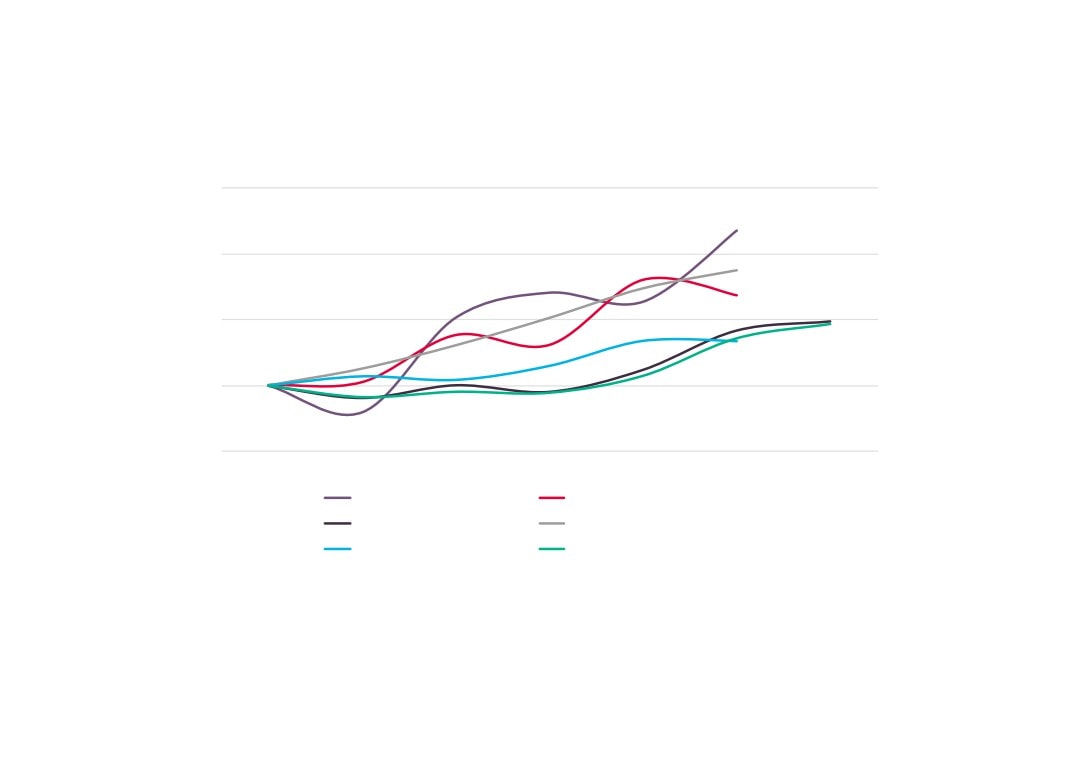

Visitor Economy contribution to growth in the local economy (2010=100)

130

120

110

100

90

2010

2011

2012

2013

2014

2015

2016

Visitor Economy GVA

Visitor Economy Employment

Visitor Economy Enterprises

Total GVA

Total Employment

Total Enterprises

Source: New Anglia LEP Economic Strategy evidence base work

6

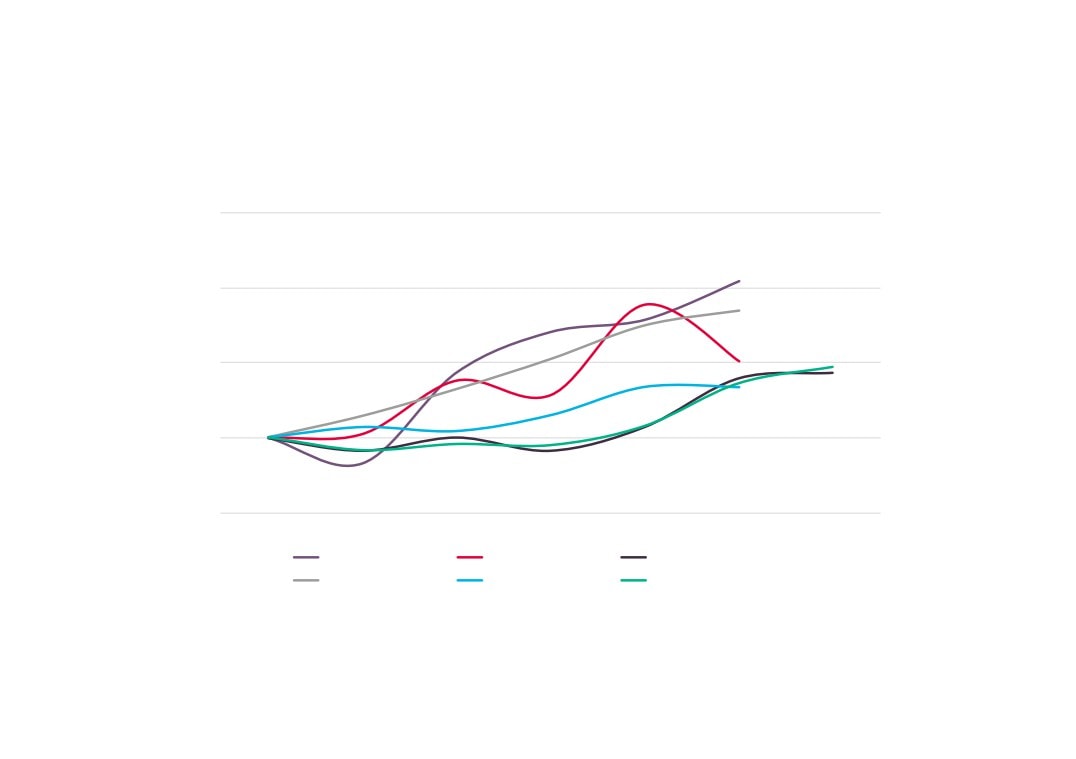

Tourism Sector contribution to growth in the local economy (2010=100)

130

120

110

100

90

2010

2011

2012

2013

2014

2015

2016

Tourism GVA

Tourism Employment

Tourism Enterprises

Total GVA

Total Employment

Total Enterprises

Source: New Anglia LEP Economic Strategy evidence base work

7

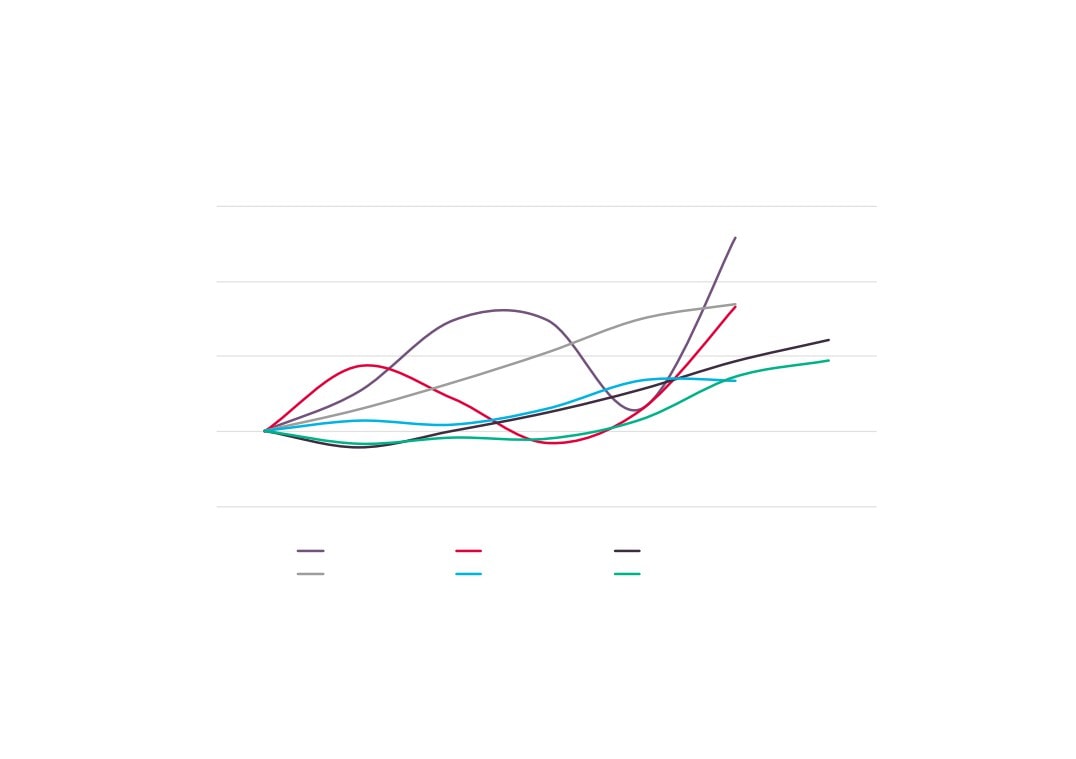

Cultural Sector contribution to growth in the local economy (2010=100)

130

120

110

100

90

2010

2011

2012

2013

2014

2015

2016

Culture GVA

Culture Employment

Culture Enterprises

Total GVA

Total Employment

Total Enterprises

Source: New Anglia LEP Economic Strategy evidence base work

8

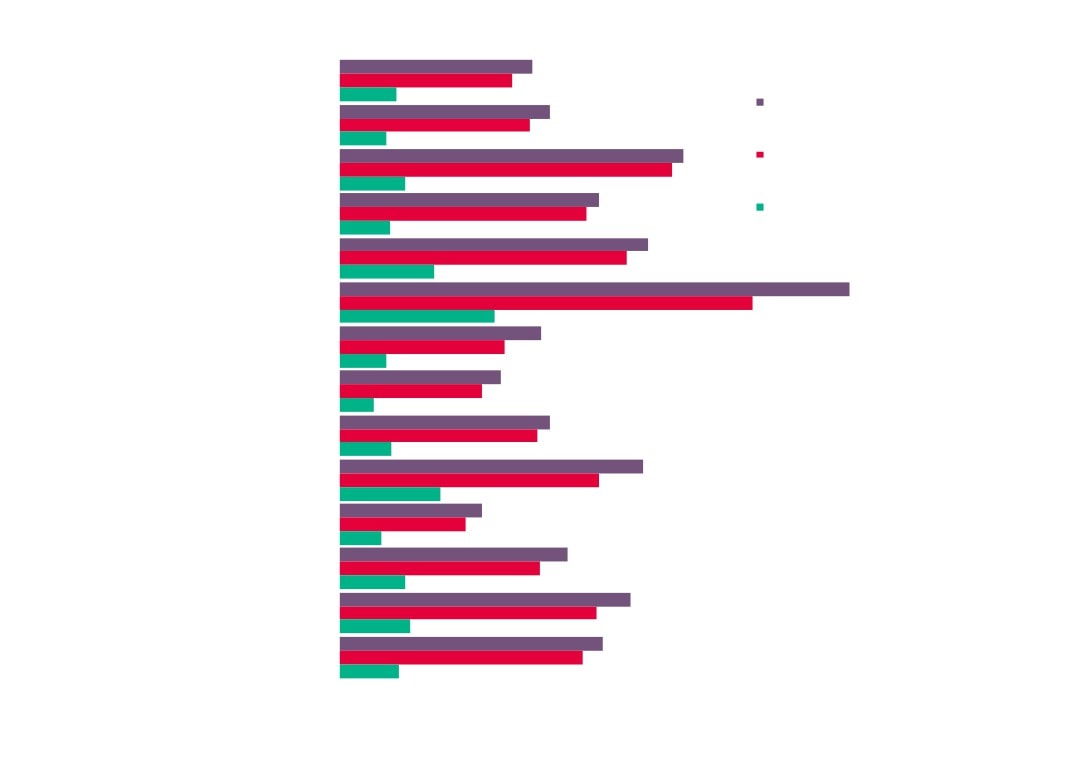

81,400

New Anglia

72,865

Employment

21,600

45,400

Norfolk

40,650

11,725

36,000

Employment provided by the

Suf folk

32,360

Visitor Economy (Tourism and

9,645

37,600

Culture) across comparator

Cornwall and Isles of Scilly LEP

35,045

6,415

areas, 2015

42,600

Source: Business Register and Employment

Dorset LEP

40,010

Survey, Office for National Statistics

8,130

GCGP LEP

Visitor Economy

21,900

42,400

Tourism

Greater Lincolnshire LEP

39,435

8,620

87,700

Cultural

Heart of the South West LEP

81,545

16,710

London LEP

266,325

5

186,700

South East LEP

162,640

49,190

288,700

88,700

East of England

246,360

82,480

9

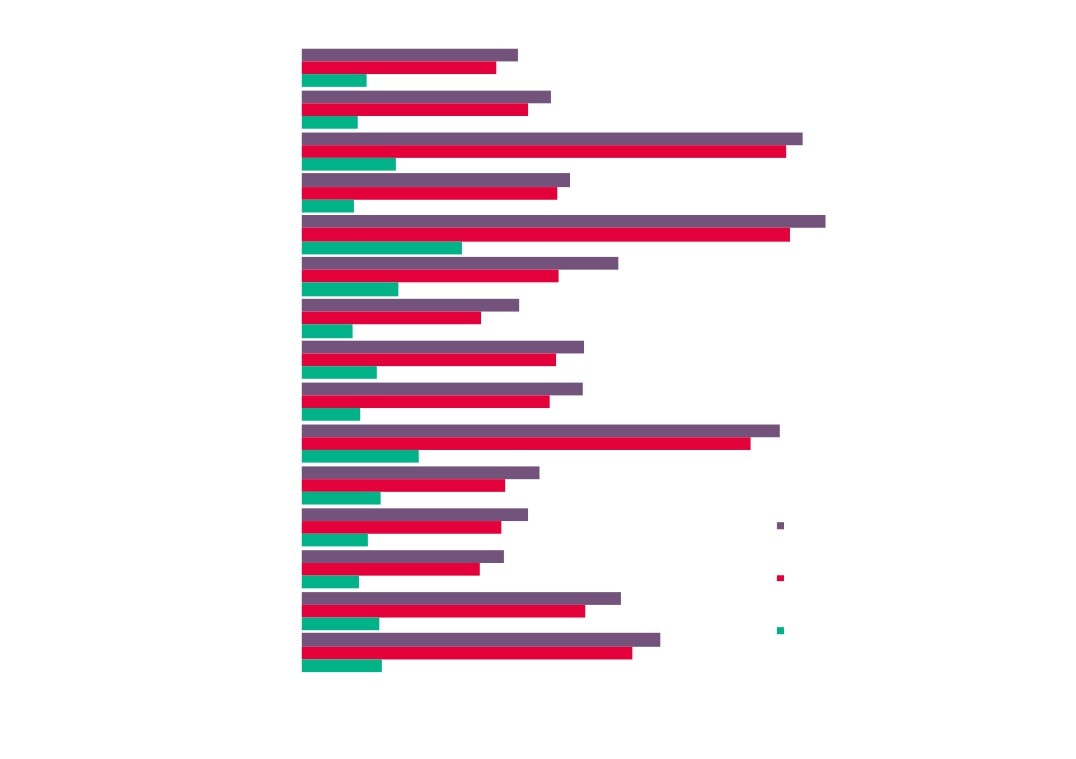

12.0%

New Anglia

10.8%

3.2%

12.6%

Norfolk

11.3%

3.3%

11.4%

Suffolk

10.3%

3.1%

17.7%

Cornwall and Isles of Scilly LEP

16.5%

3.0%

13.1%

Visitor Economy

Dorset LEP

12.3%

2.5%

Tourism

GCGP LEP

Cultural

2.9%

10.0%

Greater Lincolnshire LEP

9.3%

2.0%

12.3%

Heart of the South West LEP

11.5%

2.4%

Proportion of employment

provided by the Visitor

London LEP

5.3%

Economy (Tourism and

11.7%

South East LEP

10.2%

Culture) across comparator

3.1%

areas, 2015

10.7%

East of England

9.1%

Source: Business Register and Employment

3.1%

Survey, Office for National Statistics

11.6%

England

10.1%

3.2%

10

6,415

42,600

Dorset LEP

40,010

8,130

GCGP LEP

Visitor Economy

21,900

42,400

Tourism

Greater Lincolnshire LEP

39,435

8,620

87,700

Cultural

Kings Lynn a

Heart of the South West LEP

81,545

16,710

London LEP

266,325

186,700

South East LEP

162,640

49,190

288,700

East of England

Employment provided by

246,360

the

82,480

Visitor Economy (Tourism

4,700

Forest Heath

4,415

and Culture) across New

1,155

6,800

Anglia, 2015

Ipswich

5,800

2,270

3,200

Source: Business Register and Employment

Mid Suffolk

2,830

Survey, Office for National Statistics

940

5,100

St Edmundsbury

4,490

1,455

6,500

Suffolk Coastal

5,760

1,575

5,900

Waveney

5,450

1,325

11

8.7%

Breckland

7.9%

2.6%

10.1%

Broadland

9.1%

2.3%

20.2%

Great Yarmouth

19.6%

3.8%

10.8%

Kings Lynn and West Norfolk

10.3%

2.1%

81,400

North

New Anglia

72,865

21,600

Proportion of employment

N

45,400

Norfolk

40,650

provided by the Visitor

South

11,725

Economy (Tourism and Culture)

36,000

Suf folk

32,360

across New Anglia, 2015

9,645

Source: Business Register and Employment

37,600

B

Survey, Office for National Statistics

Cornwall and Isles of Scilly LEP

35,045

6,415

Fores

42,600

Dorset LEP

40,010

I

8,130

Mid

GCGP LEP

Visitor Economy

21,900

42,400

St Edmun

Tourism

Greater Lincolnshire LEP

39,435

8,620

Suffolk

87,700

Cultural

Heart of the South West LEP

81,545

W

16,710

London LEP

266,325

186,700

South East LEP

162,640

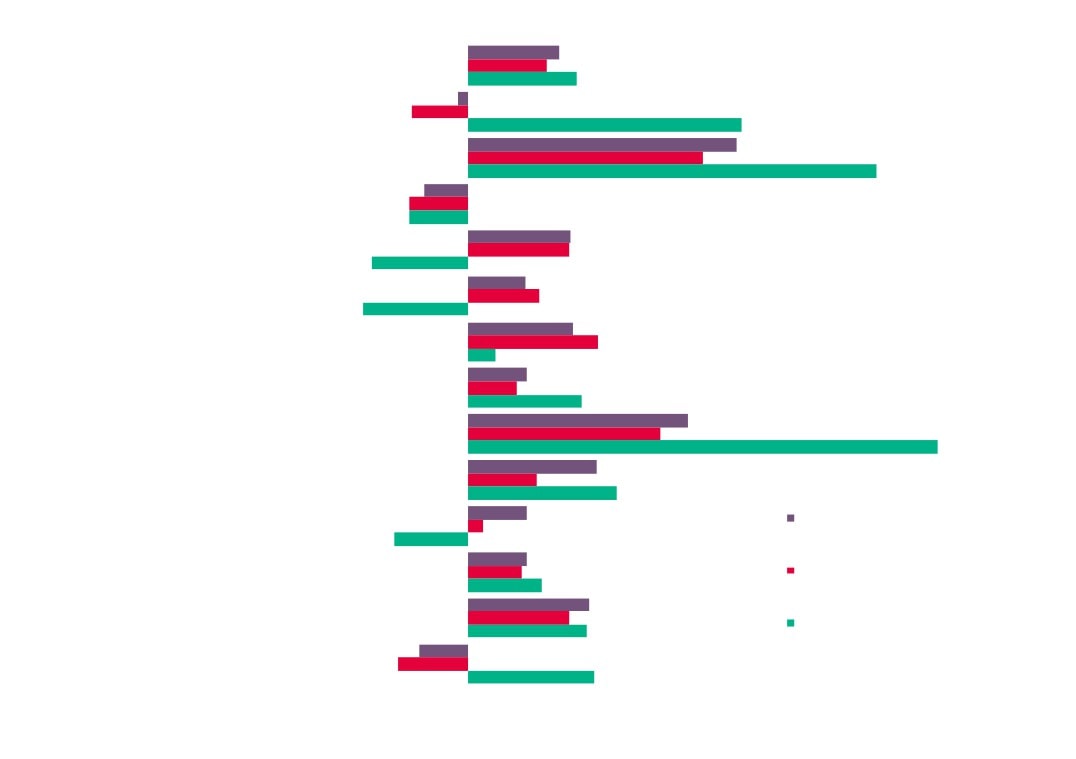

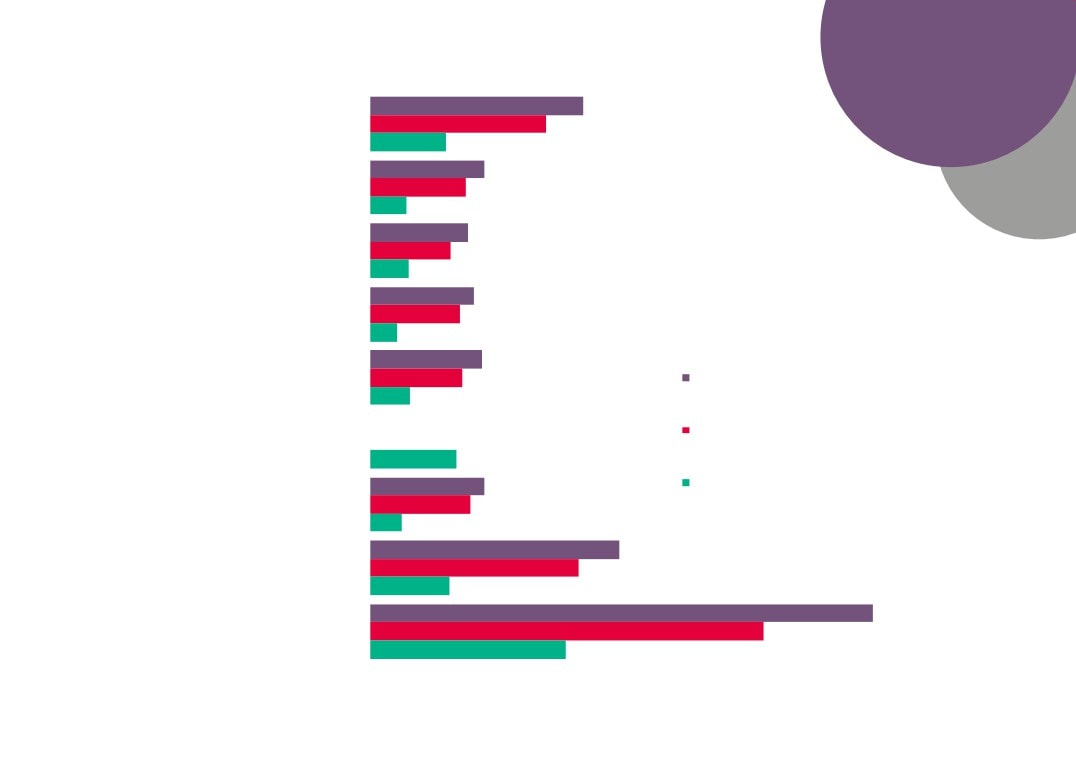

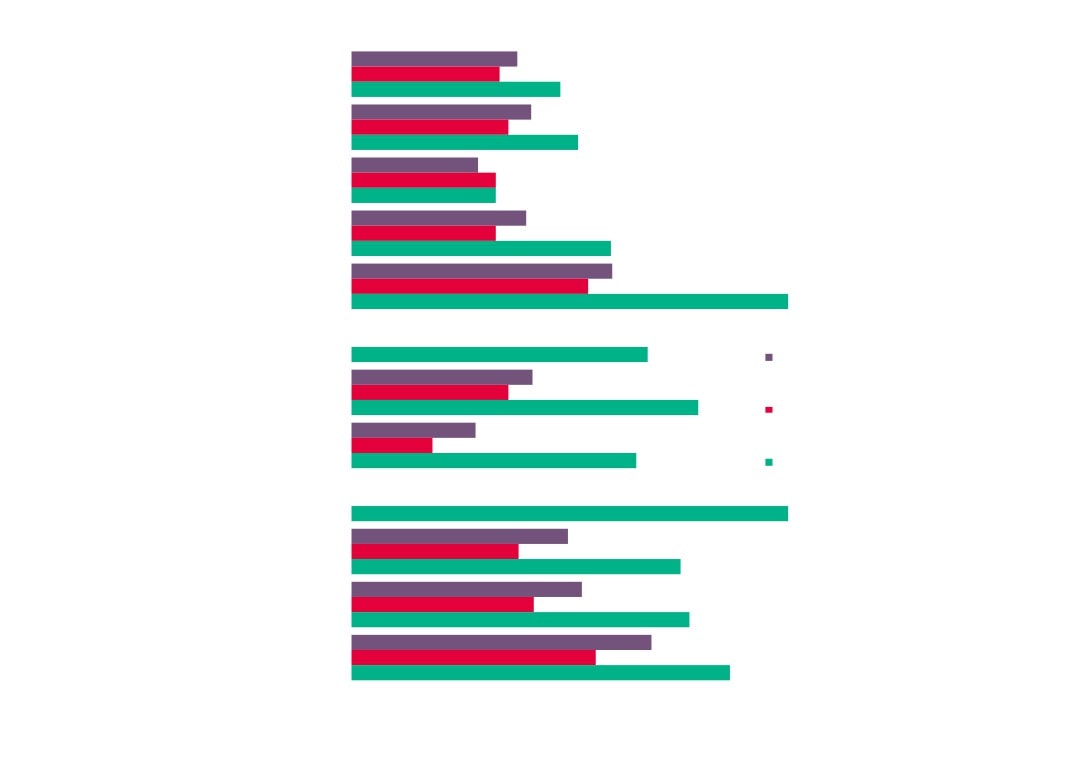

Change in Visitor Economy (Tourism and Culture) employment across

comparator areas, 2010 - 2015

11%

New Anglia

9%

15%

15%

Norfolk

12%

17%

6%

Suffolk

5%

4%

-6%

Source: Business Register

Cornwall and Isles of Scilly LEP

-6%

and Employment Survey,

-28%

Office for National Statistics

2%

Dorset LEP

3%

-9%

GCGP

11%

6%

Greater Lincolnshire LEP

6%

-12%

-10%

Heart of the South West LEP

-10%

-19%

London LEP

15%

17%

South East LEP

Visitor Economy

17%

16%

15%

Tourism

East

11%

16%

Culture

12%

England

13%

8%

13

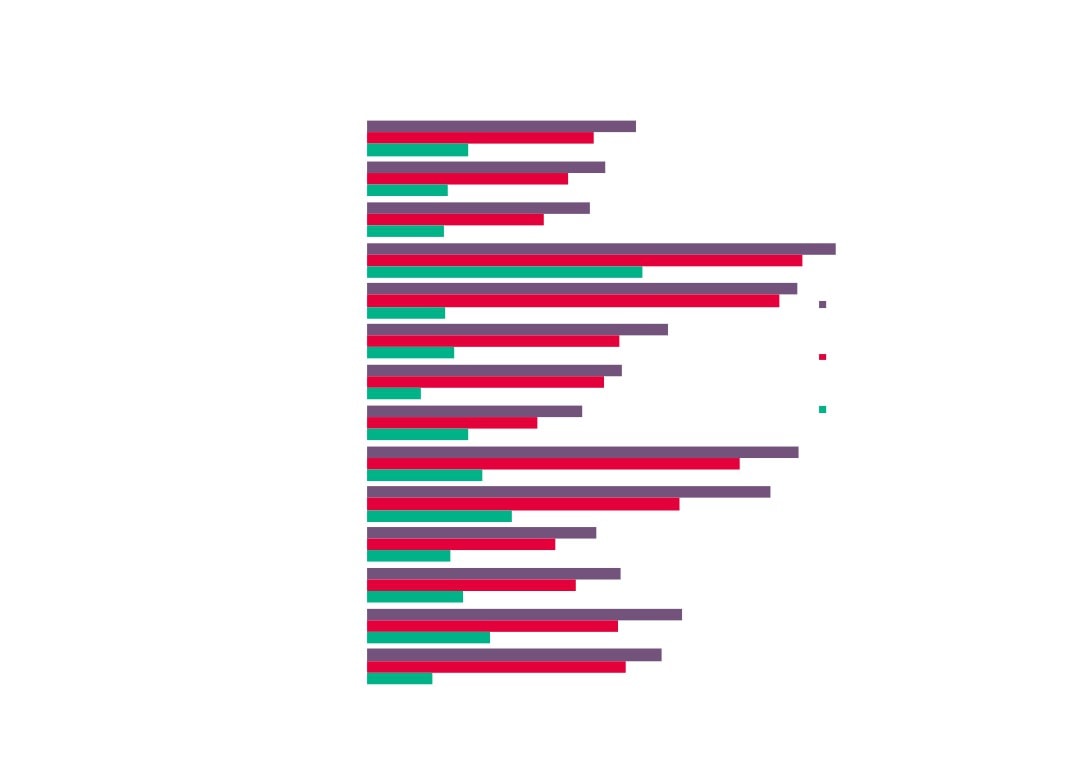

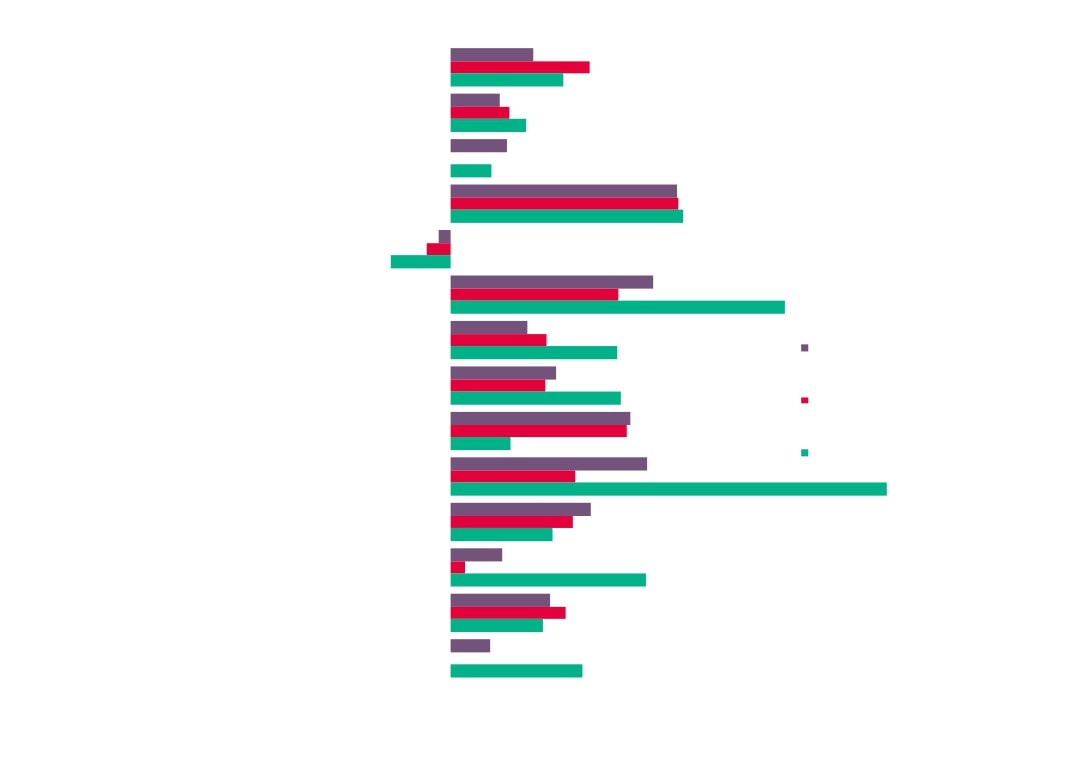

11%

Babergh

9%

13%

Breckland

-7%

32%

31%

Broadland

27%

48%

-5%

Forest Heath

-7%

81,400

New Anglia

72,865

Change in Visitor Economy

Great Yarm

21,600

(Tourism and Culture)

45,400

Norfolk

40,650

employment across New

Ips

11,725

Anglia, 2010 - 2015

36,000

King`s Lynn and West N

Suf folk

32,360

Source: Business Register

9,645

and Employment Survey,

Mid S

37,600

Office for National Statistics

Cornwall and Isles of Scilly LEP

35,045

6,415

North N

42,600

Dorset LEP

40,010

Nor

8,130

GCGP LEP

Visitor Economy

South N

21,900

42,400

St Edmunds

Tourism

Greater Lincolnshire LEP

39,435

8,620

87,700

Suf folk Co

Cultural

Heart of the South West LEP

81,545

16,710

Wav

London LEP

266,325

186,700

South East LEP

162,640

49,190

Top Visitor Economy sub sectors by employment, 2015

% of total Visitor

Change in

Industry Sector Code

Industry Sector Name

Employment

Economy

employment 2010 -

employment

2015

56302

Public houses and bars

13,300

15%

15%

55100

Hotels and similar accommodation

8,900

10%

-5%

56101

Licensed restaurants

8,500

9%

26%

56102

Unlicensed restaurants and cafes

6,000

7%

87%

93110

Operation of sports facilities

4,000

4%

-6%

56103

Take away food shops and mobile food stands

3,900

4%

22%

55201

Holiday centres and villages

3,400

4%

1%

55300

Camping grounds, recreational vehicle parks and trailer parks

3,100

3%

46%

93290

Other amusement and recreation activities

3,000

3%

60%

56210

Event catering activities

2,700

3%

-29%

Source: New Anglia LEP Economic Strategy evidence base work

15

Top Visitor Economy sub sectors with 100 employees or more by growth in

employment

% of total Visitor

Change in

Industry Sector Code

Industry Sector Name

Employment

Economy

employment

employment

2010 - 2015

59112

Video production activities

200

0.2%

1893%

58210

Publishing of computer games

100

0.1%

1673%

77210

Renting and leasing of recreational and sports goods

900

1.0%

1340%

56290

Other food service activities

1,700

1.9%

778%

82301

Activities of exhibition and fair organizers

100

0.2%

386%

58142

Publishing of consumer, business and professional journals and periodicals

1,700

1.9%

325%

59131

Motion picture distribution activities

100

0.1%

231%

59200

Sound recording and music publishing activities

300

0.3%

192%

49100

Passenger rail transport, interurban

1,000

1.1%

191%

Source: New Anglia LEP Economic Strategy evidence base work

16

Visitor Economy location quotients

across comparator areas, 2015

1.0

New Anglia

1.0

1.1

Norfolk

2015

1.0

1.0

2010

Suffolk

1.0

1.5

Cornwall and Isles of Scilly

1.7

1.1

Dorset

Location quotients (LQs) are a

1.2

useful way of showing a sectors

0.9

importance to the local economy

Greater Lincolnshire

relative to the national picture. The

0.9

analysis presented here uses

1.1

employment with an LQ above 1

Heart of the South West

1.3

showing a higher concentration than

nationally, and an LQ of below than

1.0

1 a lower concentration.

South East

1.0

Source: Business Register and Employment Survey, Office

for National Statistics

17

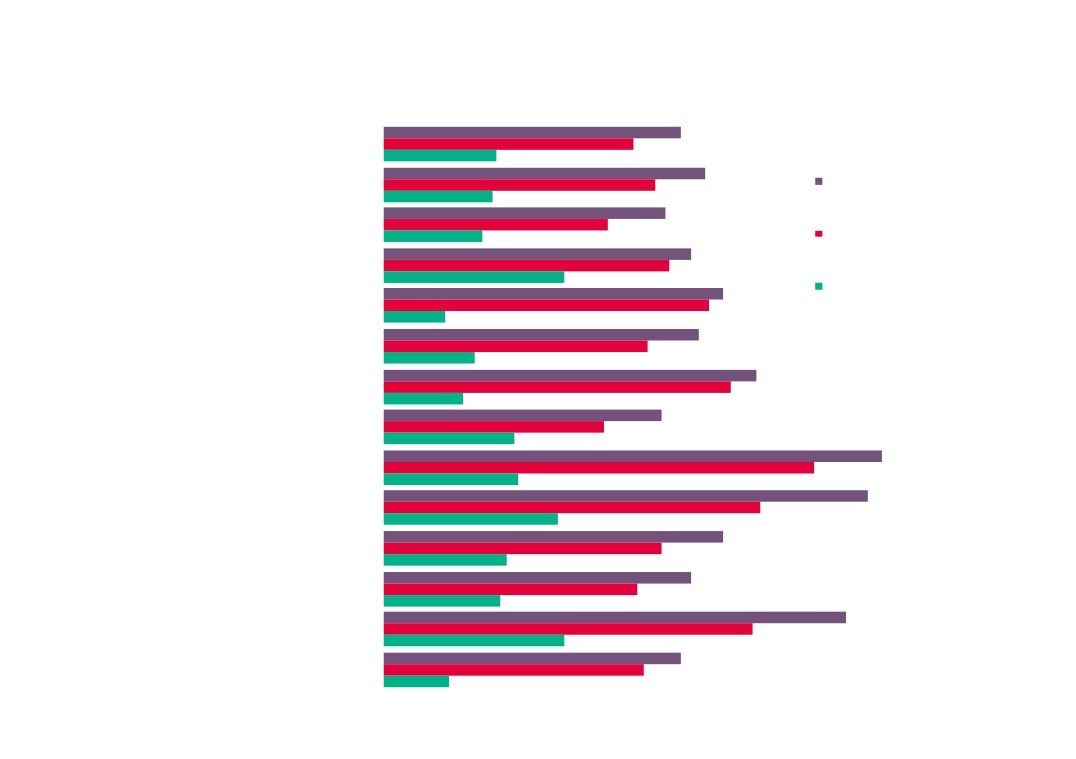

Visitor Economy location quotients

across New Anglia, 2015

1.0

Babergh

1.0

0.8

Breckland

1.0

0.9

Broadland

0.7

1.7

Forest Heath

1.8

1.7

Great Yarmouth

1.6

0.8

Ipswich

0.9

2015

King`s Lynn and West

0.9

Norfolk

0.9

2010

0.8

Mid Suffolk

0.8

1.8

North Norfolk

1.6

1.1

Norwich

1.1

0.7

South Norfolk

0.8

0.7

St Edmundsbury

0.8

1.1

Suffolk Coastal

1.1

1.2

Waveney

1.4

Source: Business Register and Employment Survey, Office for National Statistics

18

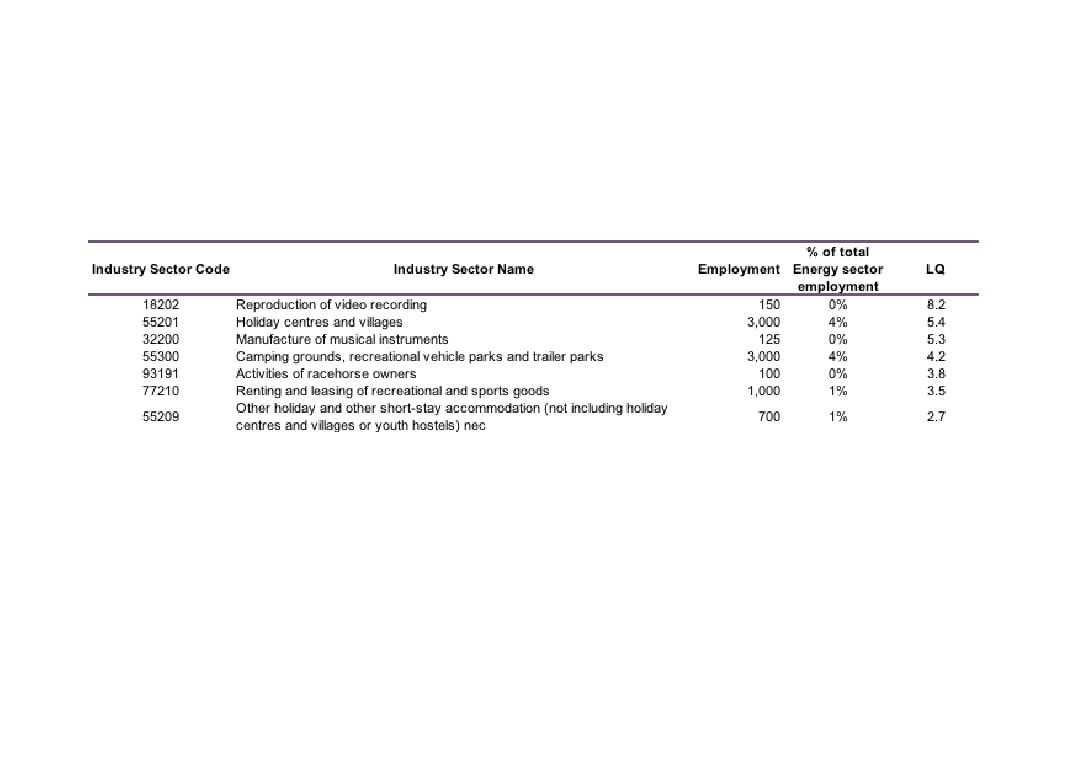

Visitor Economy sub sectors with location quotients (LQs) above 2

Source: Business Register and Employment Survey 2015, Office for National Statistics

19

Full time, part time, and self-employment in the

Visitor Economy (Tourism and Culture), 2015

New Anglia

57%

29%

14%

Culture

40%

39%

21%

Tourism

39%

51%

11%

Visitor Economy

40%

48%

12%

0%

Full time

Part time

Self Employed

100%

Source: New Anglia LEP Economic Strategy evidence base work

20

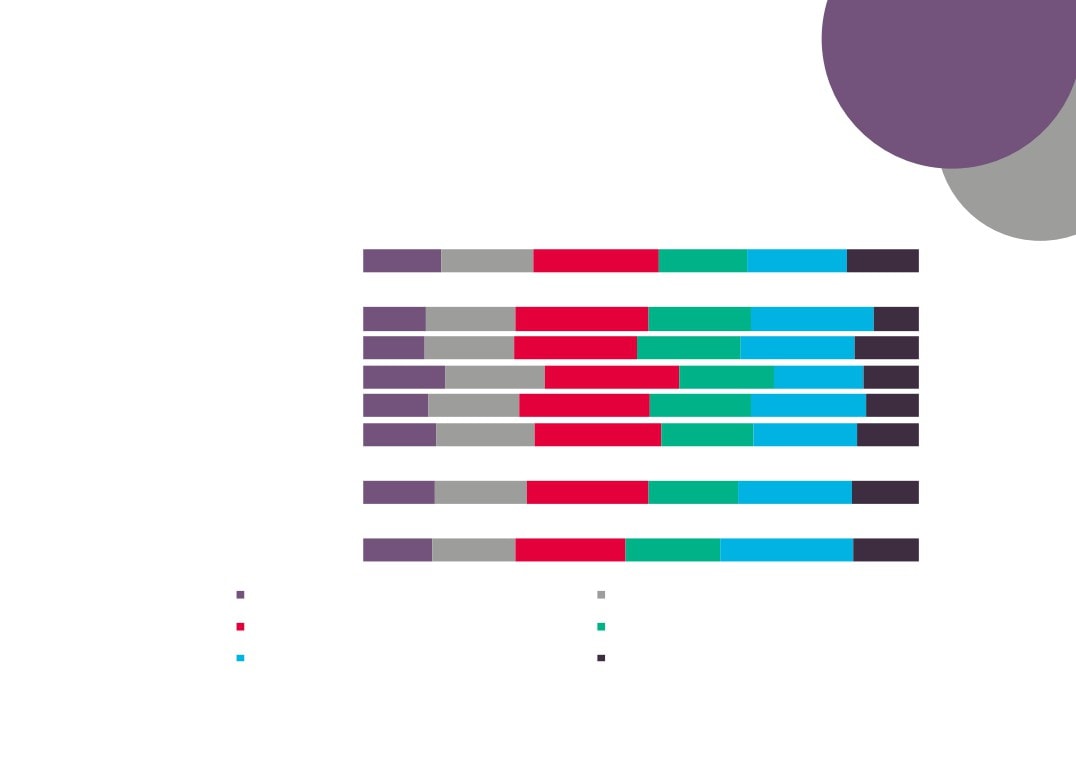

0%

100%

New Anglia LEP

22%

5%

15%

6%

7%

34%

9%

Norfolk

23%

5%

15%

6%

6%

34%

9%

Suffolk

21%

4%

15%

7%

9%

33%

10%

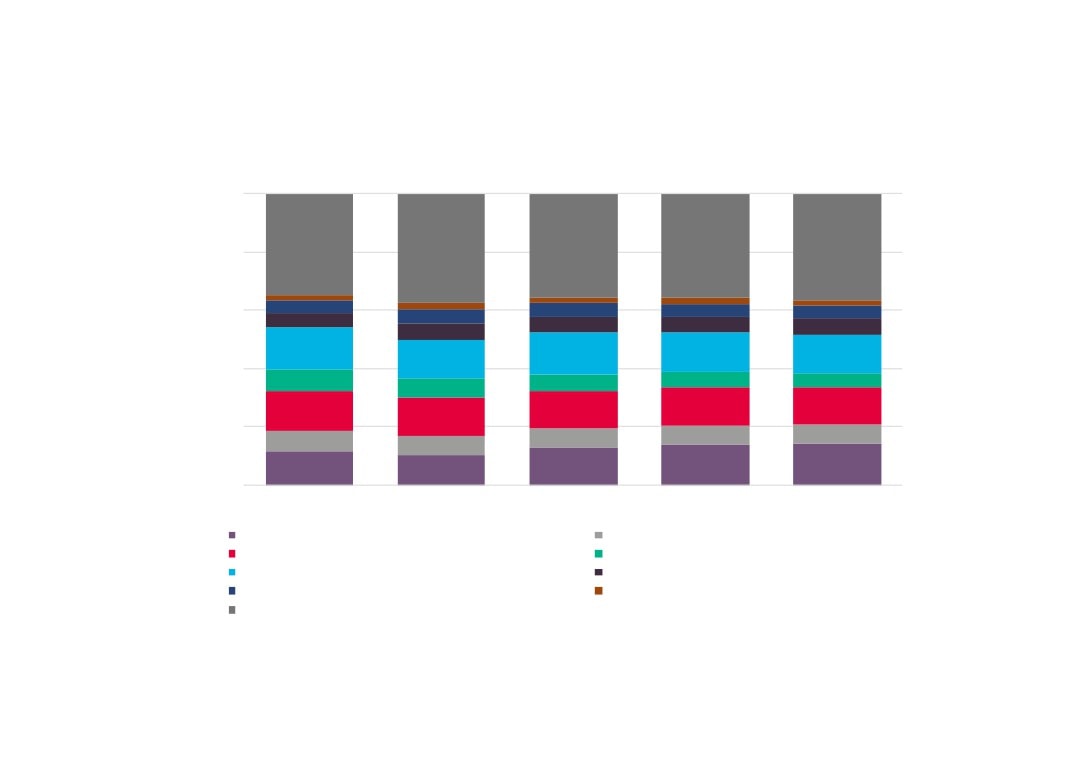

Workplace Visitor Economy

Cornwall and Isles of Scilly

31%

3%

16%

5%

5%

32%

7%

employment 2011 by broad

Dorset

25%

5%

15%

7%

8%

29%

9%

Standard Occupational

Greater Lincolnshire

24%

3%

12%

5%

7%

38%

9%

Classification (SOC) across

Heart of the South West

26%

4%

15%

6%

7%

32%

8%

comparator areas

South East

19%

5%

16%

7%

8%

31%

11%

Source: 2011 Census, Office for National Statistics

East

19%

6%

16%

8%

8%

30%

11%

England

18%

8%

19%

8%

7%

27%

11%

122 Managers and Proprietors in Hospitality and Leisure Services

245 Librarians and Related Professionals

247 Media Professionals

341 Artistic, Literary and Media Occupations

342 Design Occupations

344 Sports and Fitness Occupations

543 Food Preparation and Hospitality Trades

621 Leisure and Travel Services

21

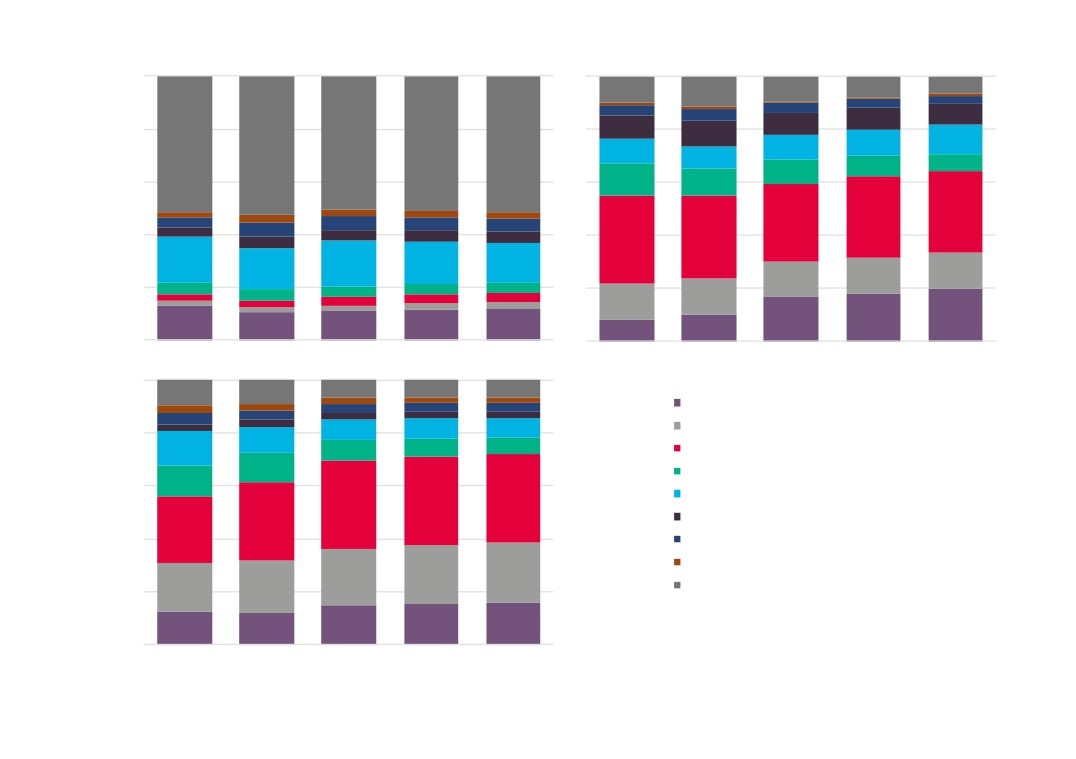

0%

100%

Breckland

22%

13%

5%

8%

40%

8%

Broadland

22%

15%

8%

9%

34%

6%

Great Yarmouth

32%

12%

3%5%

34%

12%

King`s Lynn and West Norfolk

25%

12%

5%

6%

40%

8%

Workplace Visitor Economy

North Norfolk

30%

14%

4%

6%

36%

6%

employment 2011 by broad

Norwich

16%

10%

19%

8%

5%

28%

11%

Standard Occupational

South Norfolk

19%

6%

19%

7%

8%

33%

6%

Classification (SOC) across

Babergh

23%

5%

16%

10%

7%

32%

6%

Forest Heath

21%

7%

4%

16%

31%

16%

New Anglia

Ipswich

18%

6%

13%

7%

9%

33%

12%

Source: 2011 Census, Office for National Statistics

Mid Suffolk

20%

5%

19%

8%

9%

30%

6%

St Edmundsbury

20%

4%

12%

8%

8%

38%

9%

Suffolk Coastal

23%

4%

18%

7%

7%

33%

7%

Waveney

24%

15%

6% 5%

35%

12%

122 Managers and Proprietors in Hospitality and Leisure Services

245 Librarians and Related Professionals

247 Media Professionals

341 Artistic, Literary and Media Occupations

342 Design Occupations

344 Sports and Fitness Occupations

543 Food Preparation and Hospitality Trades

621 Leisure and Travel Services

22

81,400

Enterprises

New Anglia

72,865

21,600

45,400

Norfolk

40,650

11,725

36,000

Suf folk

32,360

Visitor Economy (Tourism and

9,645

37,600

Culture) enterprises across

Cornwall and Isles of Scilly LEP

35,045

comparator areas, 2016

6,415

42,600

Source: UK Business Counts, Office for

National Statistics

Dorset LEP

40,010

8,130

GCGP LEP

Visitor Economy

21,900

42,400

Tourism

Greater Lincolnshire LEP

39,435

8,620

87,700

Cultural

Heart of the South West LEP

81,545

16,710

London LEP

266,325

186,700

South East LEP

162,640

49,190

288,700

East of England

246,360

82,480

23

81,400

Visitor Economya(Tourism and Culture)

21,600

enterprises as a proportion

of total enterprises

45,400

across comparator areas, 2016

11,725

New

36,000

Suf folk

32,360

9,645

37,600

Cornwall and Isles of Scilly LEP

35,045

6,415

42,600

Dorset LEP

40,010

Cornwall and Isles of Scil

8,130

Dors

GCGP LEP

Visitor Economy

21,900

GCG

42,400

Tourism

Greater Lincolnshire LEP

39,435

8,620

Great er Lincolnshi

87,700

Cultural

Heart of the South West LEP

81,545

Heart of the South We

16,710

Source: UK Business Counts,

London LEP

Office for National Statistics

Londo

266,325

186,700

South Ea

South East LEP

162,640

49,190

East of E

288,700

East of England

246,360

82,480

England

8.7%

4.8%

24

Suf folk

32,360

9,645

37,600

CornVisitor Econom

y (Tourism

and Culture)

6,415

enterprises across New Anglia, 2016

Dorset LEP

40,010

8,130

GCGP LEP

Visitor Economy

21,900

42,400

Tourism

Greater Lincolnshire LEP

39,435

8,620

87,700

Cultural

Heart of the South West LEP

81,545

G

16,710

Source: UK Business Counts,

Office for National Statistics

London LEP

266,325

King`s Lynn and

186,700

South East LEP

162,640

49,190

288,700

East of England

246,360

82,480

670

Norwich

520

240

470

South Norfolk

385

170

425

St Edmundsbury

350

160

640

Suffolk Coastal

510

250

410

Waveney

360

90

25

81,400

New Anglia

72,865

21,600

45,400

Visitor Economy (Tourism and

Culture) enterprises as a

Norfolk

40,650

proportion of total enterprises

across New Anglia, 2016

36,000

Suf folk

32,360

9,645

37,600

Cornwall and Isles of Scilly LEP

35,045

6,415

42,600

Dorset LEP

40,010

Fo

8,130

Grea

GCGP LEP

Visitor Economy

21,900

42,400

Tourism

Greater Lincolnshire LEP

39,435

8,620

King`s Lynn and W

87,700

Cultural

Heart of the South West LEP

81,545

16,710

No

London LEP

266,325

186,700

South East LEP

162,640

So

49,190

Source: UK Business Counts,

Office for National Statistics

288,700

St Ed

East of England

246,360

82,480

Suffolk Coastal

9.4%

4.6%

11.0%

Waveney

9.7%

2.4%

26

New Anglia

82%

16%

2%

Cornwall and Isles of Scilly LEP

76%

23%

1%

Dorset LEP

81%

17%

2%

Visitor Economy enterprise

Greater Lincolnshire LEP

82%

17%

1%

numbers by size across

Heart of the South West LEP

80%

19%

1%

comparator areas, 2016

South East LEP

85%

13%

1%

East

85%

14%

1%

Please note that at Local Authority level that

England

84%

14%

2%

businesses employing more than 250 people are

not reported due to their very small numbers and

No. of employees

resulting disclosive nature.

Micro (0 to 9)

Small (10 to 49)

Medium-sized (50 to 249)

Large (250+)

Source: UK Business Counts, Office for

Babergh

86%

13%

1%

National Statistics

Breckland

88%

Broadland

82%

Forest Heath

90%

1%

Great Yarmouth

82%

17%

1%

Ipswich

89%

Visitor Economy enterprise

King`s Lynn and West Norfolk

81%

1%

numbers by size across

Mid Suffolk

90%

North Norfolk

80%

20%

New Anglia, 2016

Norwich

83%

17%

South Norfolk

84%

St Edmundsbury

84%

1%

Suffolk Coastal

82%

Waveney

85%

15%

27

81,400

New Anglia

72,865

21,600

45,400

Change in Visitor Economy

Norfolk

40,650

(Tourism and Culture)

11,725

36,000

enterprises across comparator

Suf folk

32,360

9,645

areas, 2010 - 2016

37,600

Source: UK Business Counts,

Cornwall and I

Cornwall and Isles of Scilly LEP

35,045

Office for National Statistics

6,415

42,600

Dorset LEP

40,010

8,130

GCGP LEP

Visitor Economy

21,900

Greater

42,400

Tourism

Greater Lincolnshire LEP

39,435

8,620

Heart of the

87,700

Cultural

Heart of the South West LEP

81,545

16,710

London LEP

266,325

186,700

South East LEP

162,640

49,190

288,700

East of England

246,360

82,480

22%

28

81,400

New Anglia

72,865

21,600

45,400

Change in Visitor

Norfolk

40,650

Economy (Tourism and

11,725

36,000

Culture) enterprises

Suf folk

32,360

across New Anglia,

9,645

Fo

37,600

2010 - 2016

Cornwall and Isles of Scilly LEP

35,045

Grea

6,415

Sources: UK Business Counts,

Office for National Statistics

42,600

Dorset LEP

40,010

8,130

King`s Lynn and W

GCGP LEP

Visitor Economy

21,900

42,400

Tourism

Greater Lincolnshire LEP

39,435

8,620

No

87,700

Cultural

Heart of the South West LEP

81,545

16,710

London LEP

So

266,325

186,700

St Ed

South East LEP

162,640

49,190

Suff

288,700

East of England

246,360

82,480

13%

29

Visitor Economy Skills

Supply and Demand

30

Qualifications

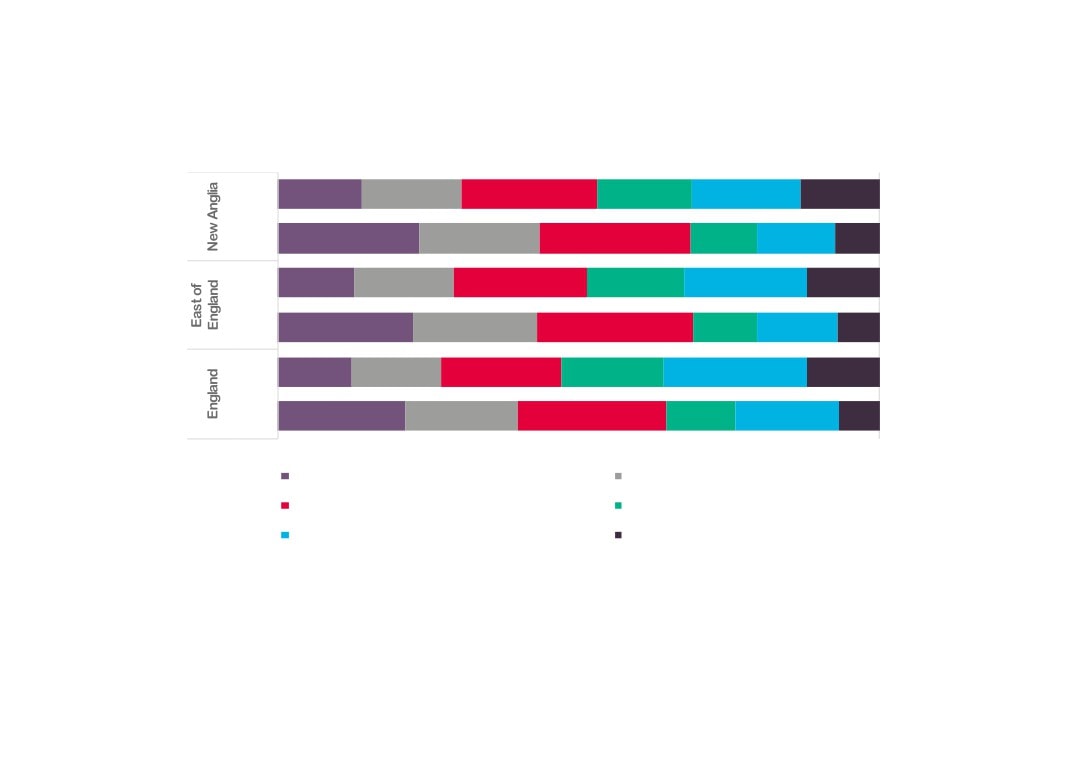

Visitor Economy (Accommodation & food service activities; Other

services) Workplace Qualifications across Comparator Areas, 2011

New Anglia

14%

17%

22%

16%

18%

13%

Cornwall and Isles of Scilly LEP

11%

16%

24%

18%

22%

8%

Dorset LEP

11%

16%

22%

19%

21%

12%

Greater Lincolnshire LEP

15%

18%

24%

17%

16%

10%

Heart of the South West LEP

12%

16%

23%

18%

21%

10%

South East LEP

13%

18%

23%

17%

18%

11%

Source: 2011 Census, Office for National Statistics

East of England

13%

17%

22%

16%

20%

12%

England

12%

15%

20%

17%

24%

12%

No qualifications

Level 1 qualifications

Level 2 qualifications

Level 3 qualifications

Level 4 qualifications and above

Apprenticeships and other qualifications

31

Change in Visitor Economy workplace qualifications, 2001 - 2011

2011

14%

17%

22%

16%

18%

13%

2001

24%

20%

25%

11%

13%

7%

2011

13%

17%

22%

16%

20%

12%

2001

22%

21%

26%

11%

13%

7%

2011

12%

15%

20%

17%

24%

12%

2001

21%

19%

24%

11%

17%

7%

0%

100%

No qualifications

Level 1 qualifications

Level 2 qualifications

Level 3 qualifications

Level 4 qualifications and above

Apprenticeships and other qualifications

Source: 2001 and 2011 Census, Office for National Statistics

32

UKCES ESS

2015

The following analysis uses the LEP level data released as part of the UK Commission for Employment and Skills (UKCES) Employer

Skills Survey (ESS) 2015. The data covers the areas of vacancies, skills gaps, training, and staff retention and underutilisation.

Data is published for a limited number of broad sectors at LEP level and we have chosen the sectors of ‘Hotels and Restaurants’ and ‘Arts and

Other Services’ as those closest to encapsulating Tourism, Culture and The Arts activity. In all instances, national, regional, and New Anglia

LEP averages are presented as comparators.

In total, 2,364 employers in New Anglia were surveyed, 199 of which were ‘Hotels and Restaurants’ employers, and 176 were classed as ‘Arts

and Other Services’.

33

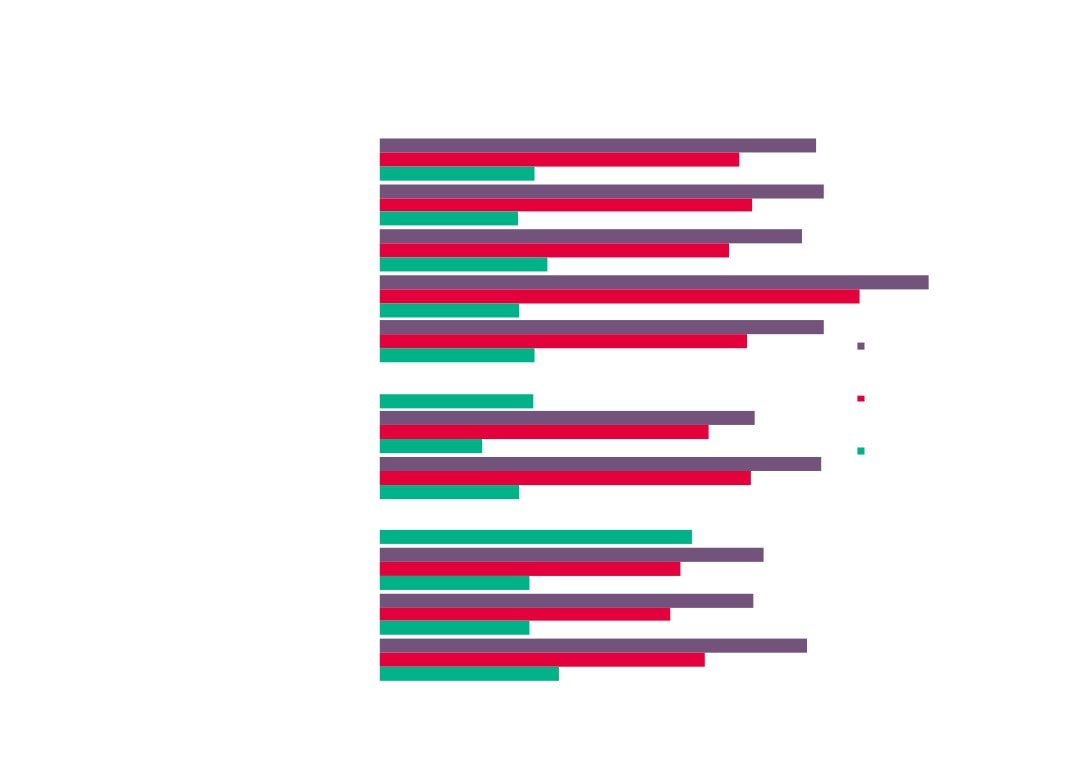

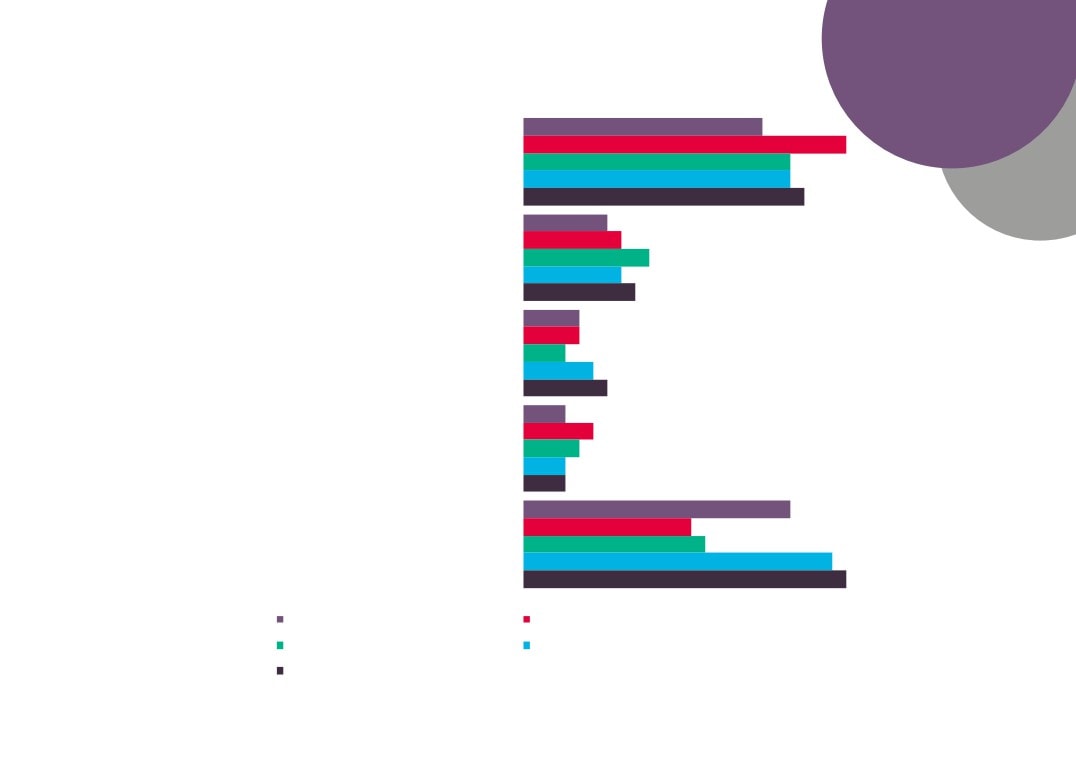

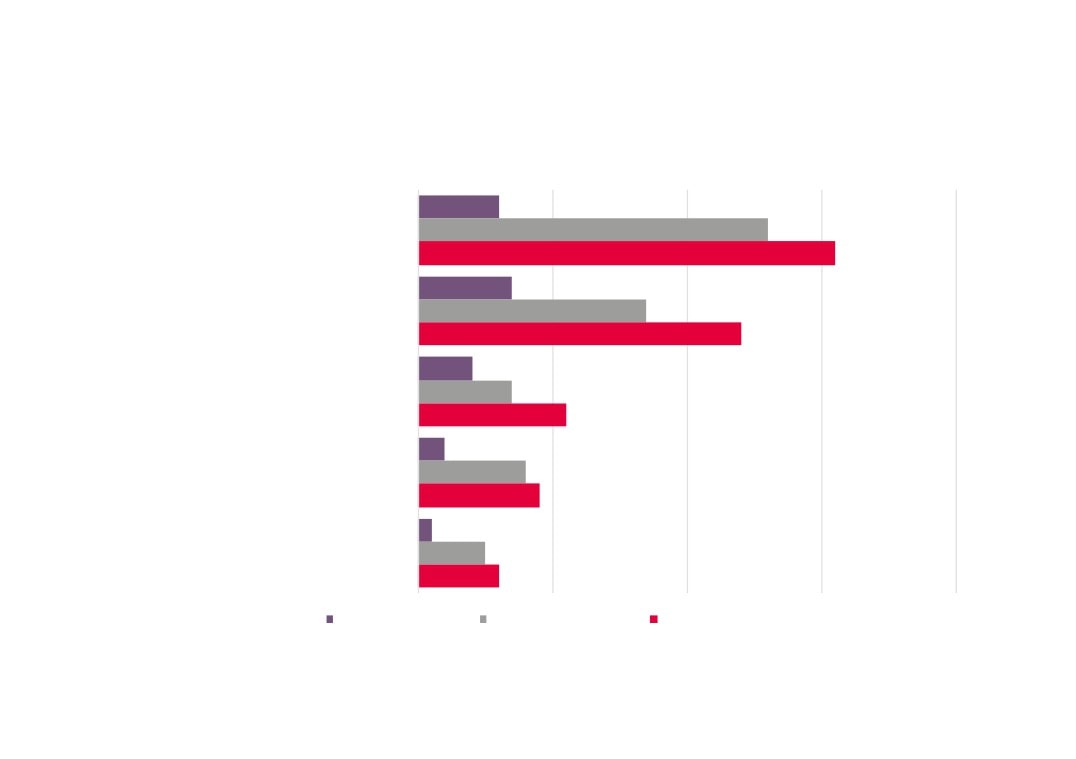

Vacancies

17%

23%

Establishments with any vacancies

19%

19%

20%

6%

7%

Have at least one vacancy that is hard to fill

9%

7%

8%

4%

4%

Have a skills shortage vacancy (prompted or

3%

unprompted)

5%

Source: UKCES Employer

Skills Survey 2015

6%

3%

5%

Number of vacancies as a % of all employment

4%

3%

3%

19%

12%

% of all vacancies which are SSVs

13%

22%

23%

New Anglia (Average)

Hotels and restaurants (New Anglia)

Arts and Other Services (New Anglia) East of England (Average)

England (Average)

34

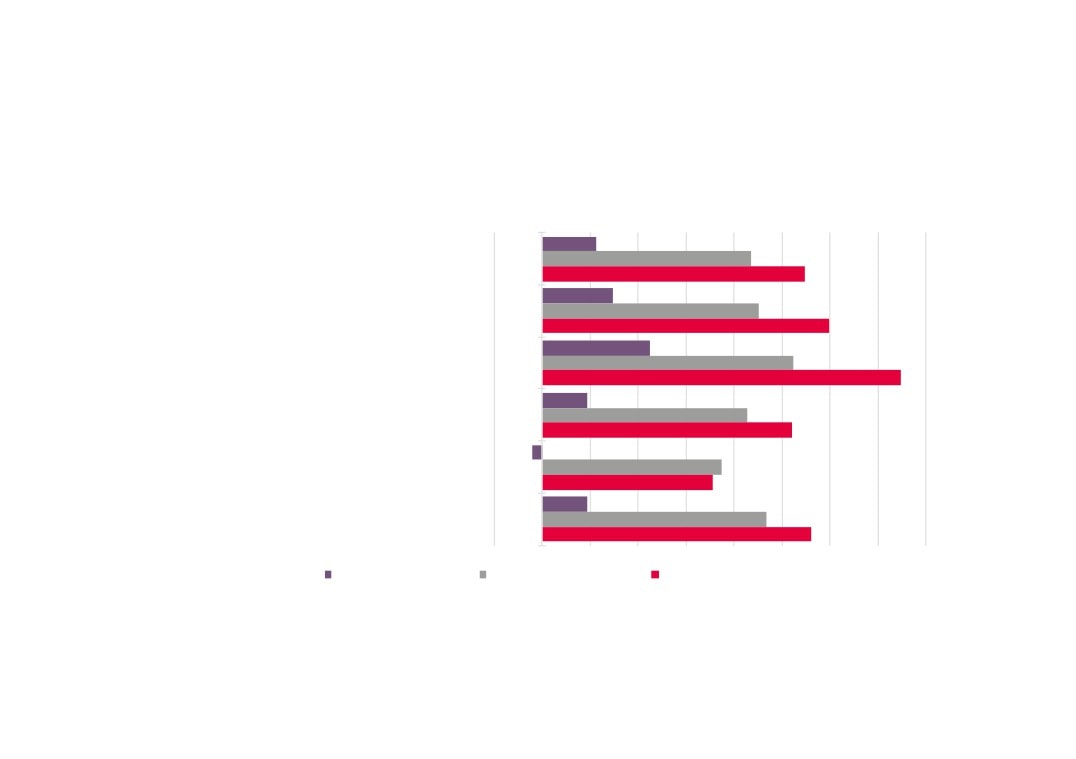

Skills Gaps

14%

23%

% of establishments with any staff not fully

11%

proficient

13%

14%

3%

7%

Number of staff not fully proficient as a % of

3%

employment

Source: UKCES Employer

5%

Skills Survey 2015

5%

New Anglia (Average)

Hotels and restaurants (New Anglia)

Arts and Other Services (New Anglia) East of England (Average)

England (Average)

35

Training

7.5

10.8

Training days per trainee

7.0

6.3

6.8

4.7

6.1

Training days per staff

4.9

4.0

4.3

New Anglia (Average)

Hotels and restaurants (New Anglia)

Arts and Other Services (New Anglia) East of England (Average)

England (Average)

Source: UKCES Employer Skills Survey 2015

36

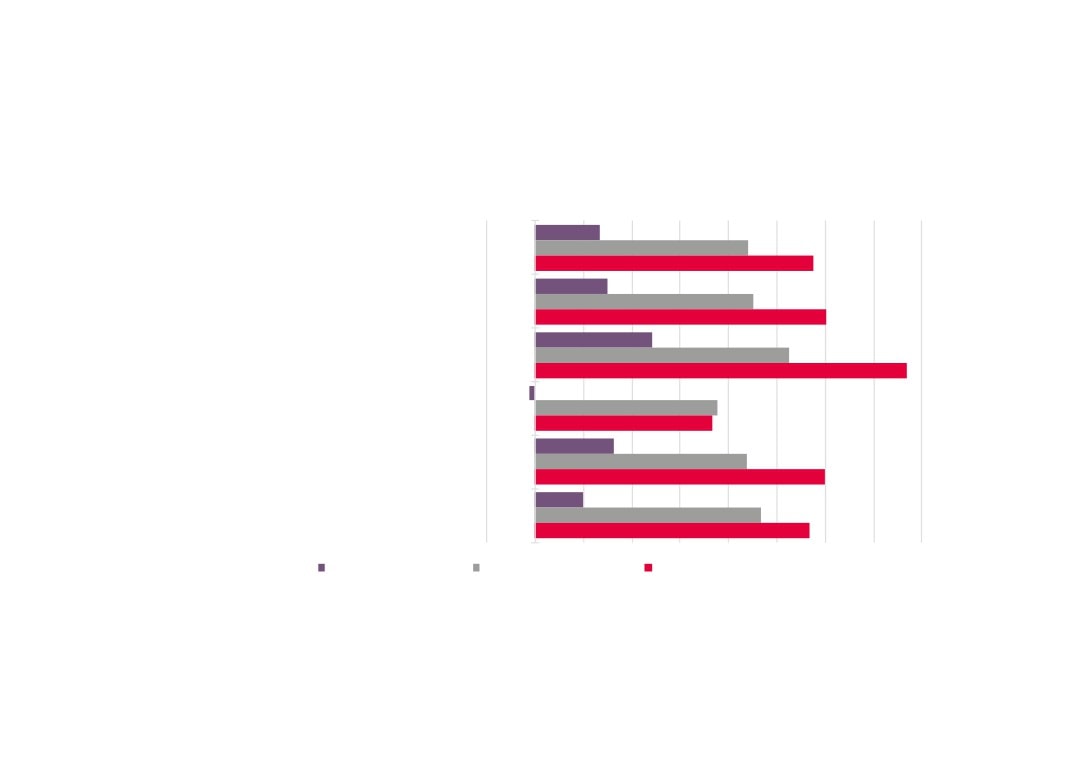

65%

60%

% of establishments training staff over the

63%

last 12 months

64%

66%

48%

39%

% of establishments providing off-the-job

47%

training in the last 12 months

47%

48%

51%

51%

% of establishments providing on-the-job

52%

training in the last 12 months

51%

52%

42%

% of training establishments providing

49%

online training or e-learning in the last 12

43%

months

44%

45%

63%

57%

Number trained as % of total staff

70%

64%

63%

New Anglia (Average)

Hotels and restaurants (New Anglia)

Arts and Other Services (New Anglia)

East of England (Average)

England (Average)

Source: UKCES Employer Skills Survey 2015

37

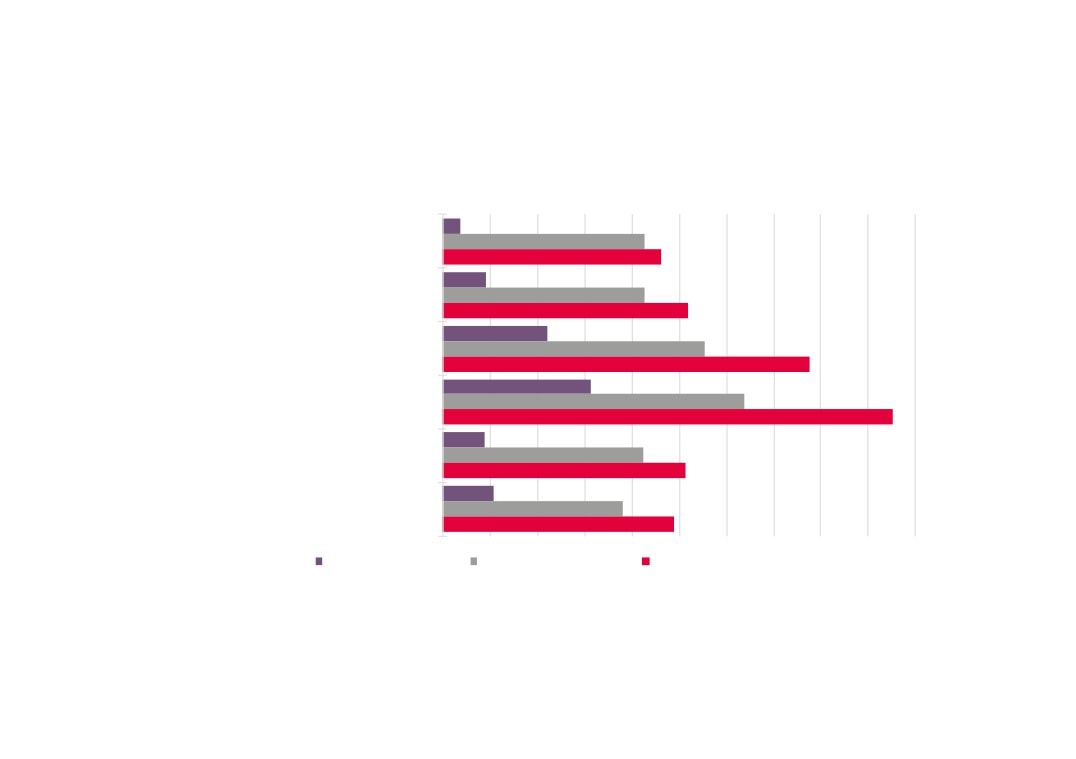

Staff

25%

29%

Establishments with underutilised staff

31%

25%

30%

7%

11%

Whether any jobs in which have difficulties

9%

retaining staff

7%

8%

New Anglia (Average)

Hotels and restaurants (New Anglia)

Arts and Other Services (New Anglia)

East of England (Average)

England (Average)

Source: UKCES Employer Skills Survey 2015

38

FE Learning

Aims

All data (unless stated otherwise) is sourced from the Department for Education’s Further Education data library

In order to present information that is relevant to New Anglia LEPs high performing and underpinning sectors then we have

identified FE and skills provision data split by Sector Lead Body and aligned a best-fit with each sector.

The Sector Lead Bodies identified as being the most relevant to the Visitor Economy are: Hospitality, Leisure, Travel and Tourism; Creative and

Cultural; Creative Media; and Passenger Transport.

However, not all FE and Skills learning aims align with a sector lead body. In fact, on average around two thirds are classed as unknown. This

means that we are basing results here on roughly a third of the data.

Please note that all data is rounded to the nearest 10 and that therefore some figures presented may not add to the sum totals presented.

39

Visitor Economy learning aims delivered to New Anglia

learners by Sector Lead Body, 2012/13

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

New Anglia

4,900

4,020

1,080

410

National

182,300

142,800

48,800

42,700

Hospitality, Leisure, Travel & Tourism Creative & Cultural Creative Media Passenger Transport

Source: FE Data Library, Department for Education

40

Visitor Economy learning aims delivered to New Anglia

learners by Sector Lead Body, 2010/11 and 2012/13

5,140

4,900

4,290

4,020

2010/11

2012/13

1,080

920

480

410

Hospitality, Leisure, Travel

Creative & Cultural

Creative Media

Passenger Transport

& Tourism

Source: FE Data Library, Department for Education

41

Change in Visitor Economy learning aims delivered to

resident learners by Sector Lead Body, 2010/11 - 2012/13

11%

Total inc. Unknown

9%

4%

Total not inc. Unknown

7%

-4%

Tourism, Culture and The Arts

7%

-5%

Hospitality, Leisure, Travel & Tourism

15%

-6%

Creative & Cultural

5%

17%

Creative Media

23%

-15%

Passenger Transport

-21%

New Anglia National

Source: FE Data Library, Department for Education

42

Visitor Economy learning aims delivered to New Anglia

residents by New Anglia based and external providers by

Sector Lead Body, 2012/13

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Tourism, Culture and The Arts

8,260

2,150

Hospitality, Leisure, Travel & Tourism

3,570

1,330

Creative & Cultural

3,600

420

Creative Media

1,000

80

Passenger Transport

90

320

Total inc. unknown

158,480

52,170

Total with unknown removed

55,340

24,770

New Anglia Provider

External Provider

Source: FE Data Library, Department for Education

43

Visitor Economy learning aims delivered to New Anglia learners

by providers by Sector Lead Body, 2010/11 and 2012/13

3,570

3,600

2010/11

2012/13

2,440

2,110

1,100

1,000

870

90

Hospitality, Leisure, Travel

Creative & Cultural

Creative Media

Passenger Transport

& Tourism

Source: FE Data Library, Department for Education

44

Change in Visitor Economy learning aims delivered to resident learners

by domiciled providers by Sector Lead Body, 2010/11 - 2012/13

5%

Total inc. Unknown

9%

-38%

Total not inc. Unknown

7%

27%

Tourism, Culture and The Arts

7%

46%

Hospitality, Leisure, Travel & Tourism

15%

71%

Creative & Cultural

5%

15%

Creative Media

23%

-92%

Passenger Transport

-21%

New Anglia

National

Source: FE Data Library, Department for Education

45

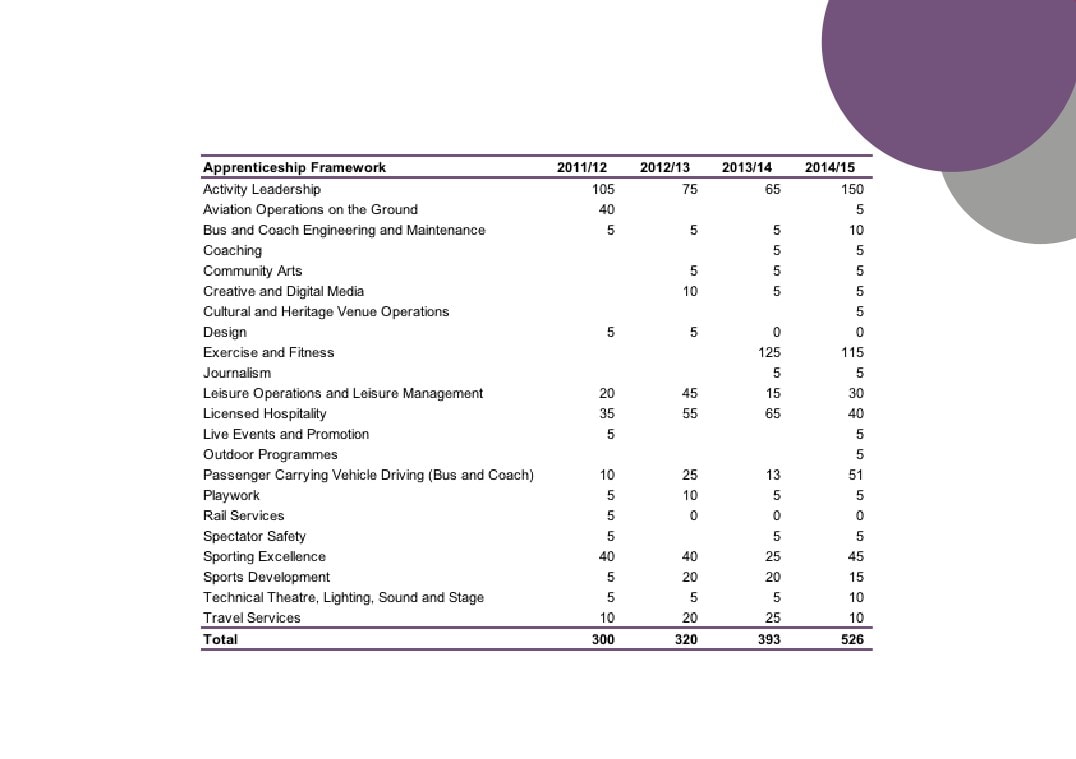

Apprenticeships

Visitor Economy apprenticeship starts by year

Source: Skills Funding Agency Data Cube

46

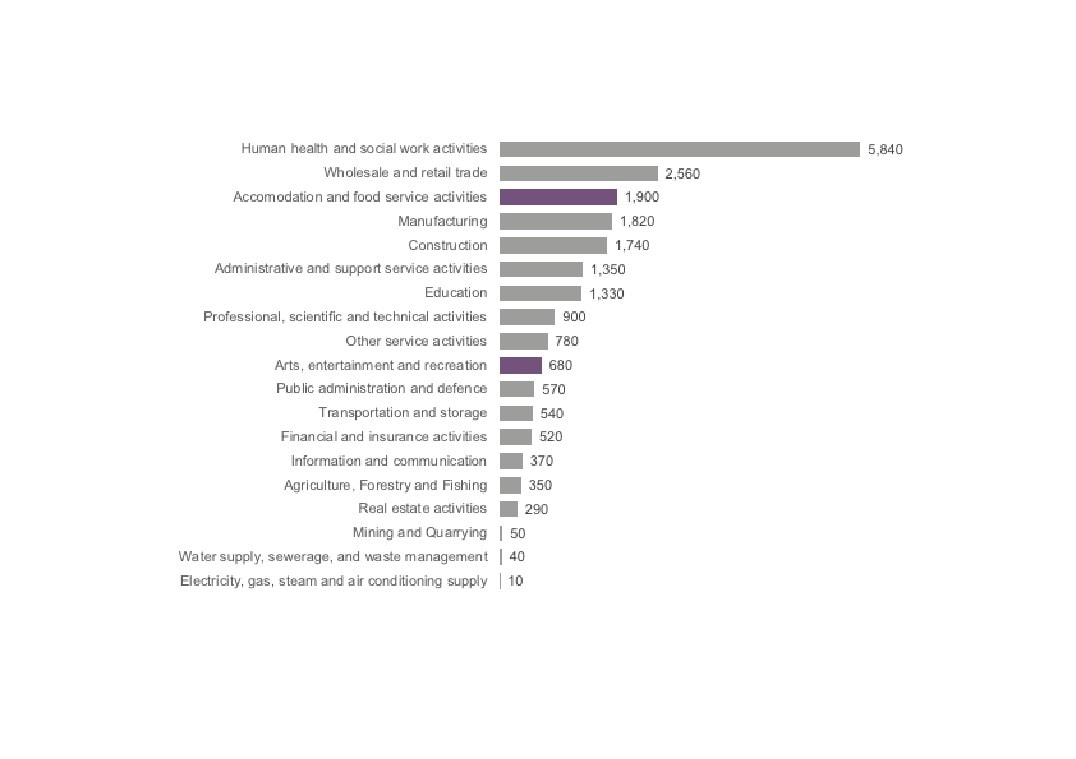

Apprenticeship participation by sector, 2014/15

Source: FE Data Library, Department for Education

47

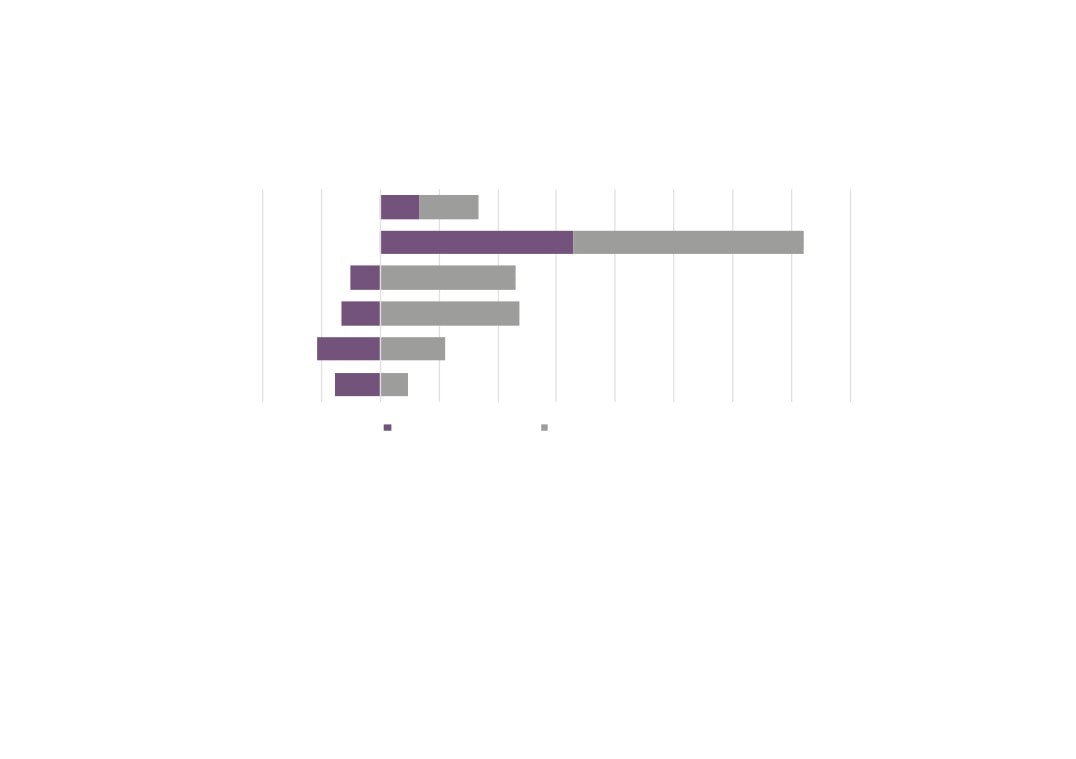

Apprenticeship Participation in the Visitor Economy

2014/15 as a proportion of total participation

11.9%

Visitor Economy

10.0%

3.1%

Arts, entertainment and recreation

2.6%

8.8%

Accomodation and food service activities

7.4%

New Anglia England

Source: FE Data Library, Department for Education

48

Labour Insight

Jobs

The following section presents data from Labour Insight, a Burning Glass analytical tool. This tool collects details of online

job postings from multiple sources and enables the analysis of these postings based on specific skills, educational

requirements, and job titles, for example.

Please note that whilst Labour Insight will capture more information on the jobs market than more traditional Department

for Work and Pensions vacancy data, the fact that not all job vacancies are advertised means that there will still be gaps in

the findings.

In terms of the Visitor Economy then according to the Labour Insight Jobs tool, then there were 36,823 postings for the

sector in New Anglia between Jan. 1, 2012 and Dec. 31, 2016.

The definition for the Visitor Economy in this exercise captures the following industry and sectors: ‘Accommodation and

Food Service Activities’, ‘Travel agency, tour operator and other reservation service and related activities’, ‘Gambling and

betting activities’, and ‘Sports activities and amusement and recreation activities’.

49

Vacancies

Visitor Economy vacancies across

New Anglia, Jan 2012 - Dec 2016

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

9,000

Norwich

Ipswich

St Edmundsbury

King's Lynn and West Norfolk

Waveney

Suffolk Coastal

Forest Heath

North Norfolk

Breckland

Great Yarmouth

Broadland

Babergh

South Norfolk

5,349 unspecified or unclassified postings

Mid Suffolk

Source: Labour Insight Jobs, Burning Glass

Technologies

50

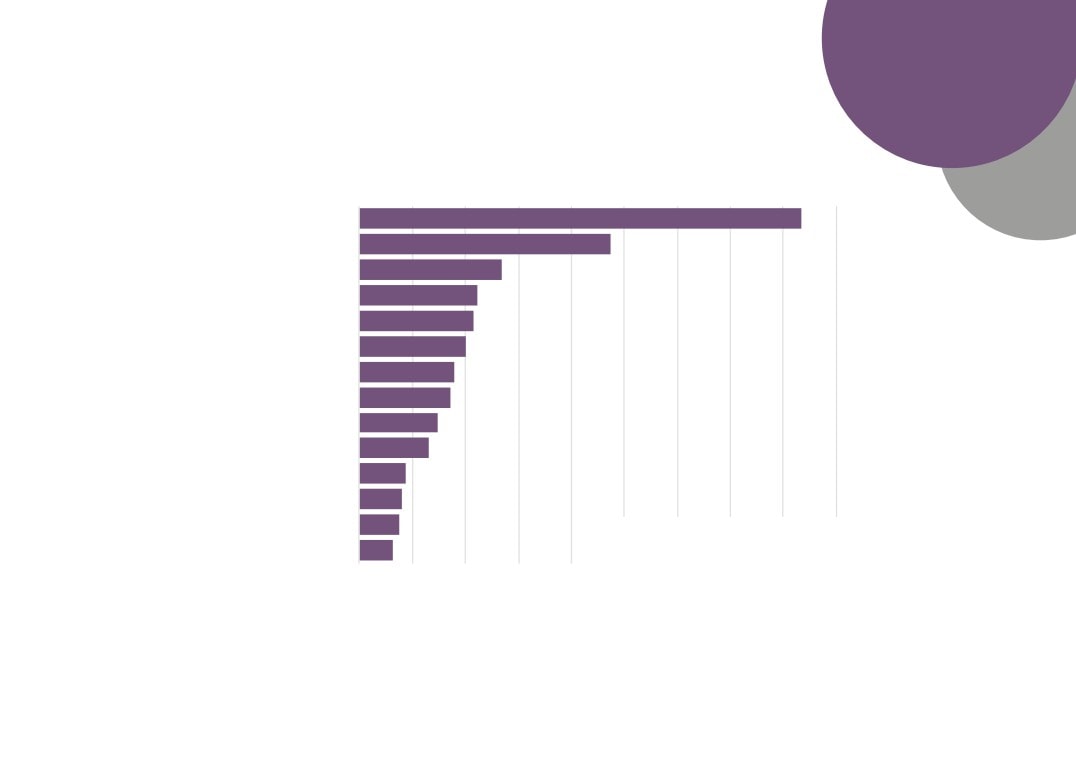

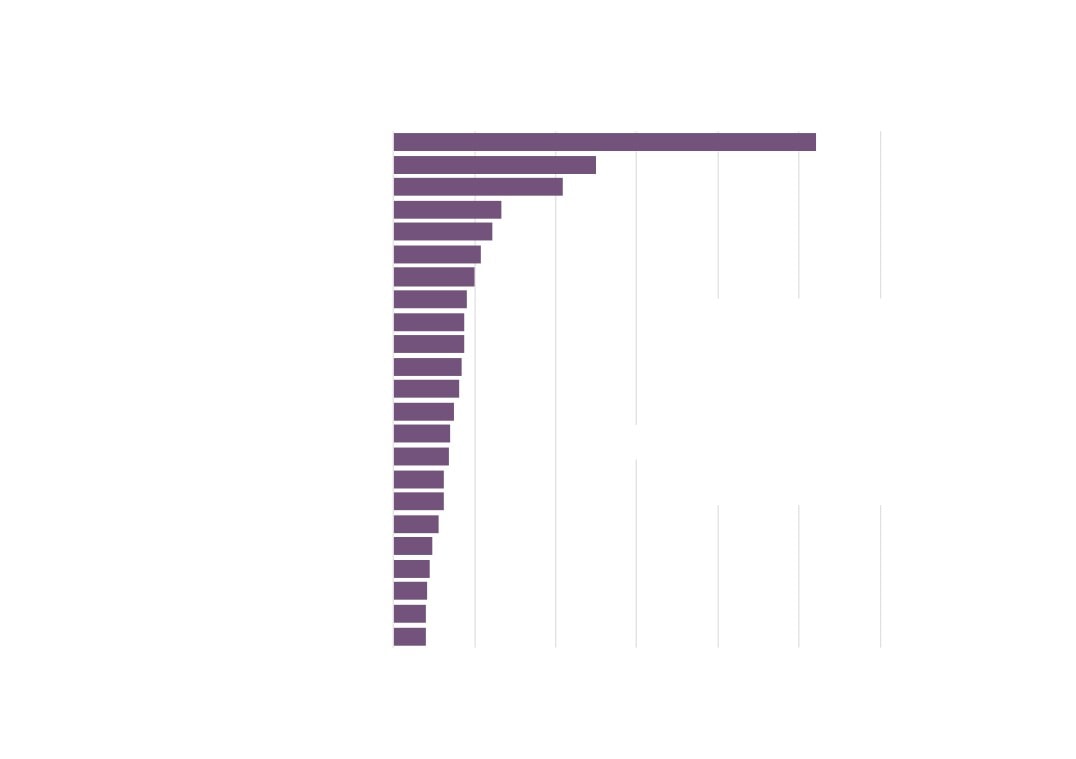

Nuffield Health

Top Visitor Economy

Holiday Inn

Whitbread

Employers across New

Travelodge

Anglia, Jan 2012 - Dec 2016

Ladbrokes

20,864 unspecified or unclassified postings

Hilton Worldwide

Source: Labour Insight Jobs, Burning Glass

Premier Inn

Technologies

Catering, Cleaning, Caretaking and Grounds

Puma Hotels Collection

William Hill

Pizza Hut

David Lloyd

Haven

J D Wetherspoon

Fitness First

Martson's

Mitchells & Butlers

Sodexo

Intercontinental Hotels Group

Marriott International

Huntercombe

Compass Group

Greene King

Center Parcs

McDonald's Restaurants

0

100

200

300

400

500

600

700

800

900

51

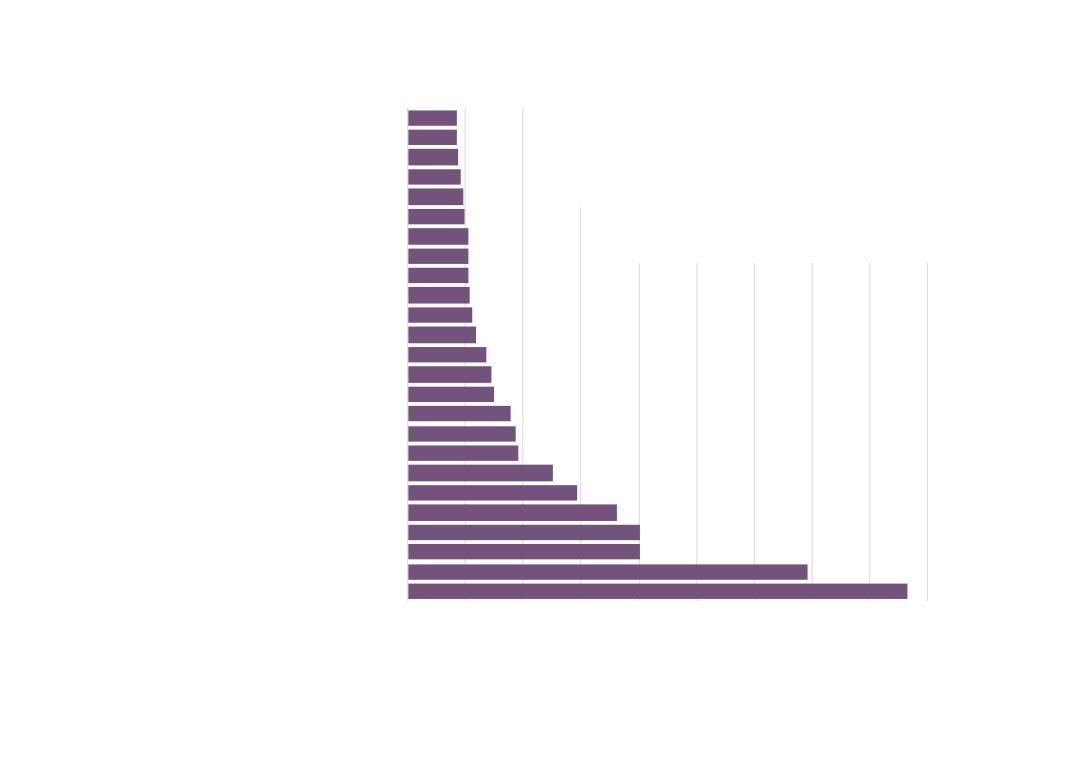

0

2,000

4,000

6,000

8,000

10,000

12,000

Chefs (5434)

Kitchen and catering assistants (9272)

Cooks (5435)

Waiters and waitresses (9273)

Bar staff (9274)

Restaurant and catering establishment managers and proprietors (1223)

Receptionists (4216)

Catering and bar managers (5436)

Managers and proprietors in other services n.e.c. (1259)

Other administrative occupations n.e.c. (4159)

Visitor Economy

Other elementary services occupations n.e.c. (9279)

vacancies by occupation,

Housekeeprs and related occupations (6231)

Managers and directors in retail and wholesale (1190)

Jan 2012 - Dec 2016

Sales and retail assistants (7111)

140 unspecified or unclassified postings

Customer service occupations n.e.c. (7219)

Source: Labour Insight Jobs, Burning

Glass Technologies

Sales supervisors (7130)

Conference and exhibition managers and organisers (3546)

Cleaners and domestics (9233)

Fitness instructors (3443)

Hotel and accomodation managers and proprietors (1221)

Business sales executives (3542)

Caretakers (6232)

Sales related occupations n.e.c. (7129)

Travel agents (6212)

Van drivers (8212)

52

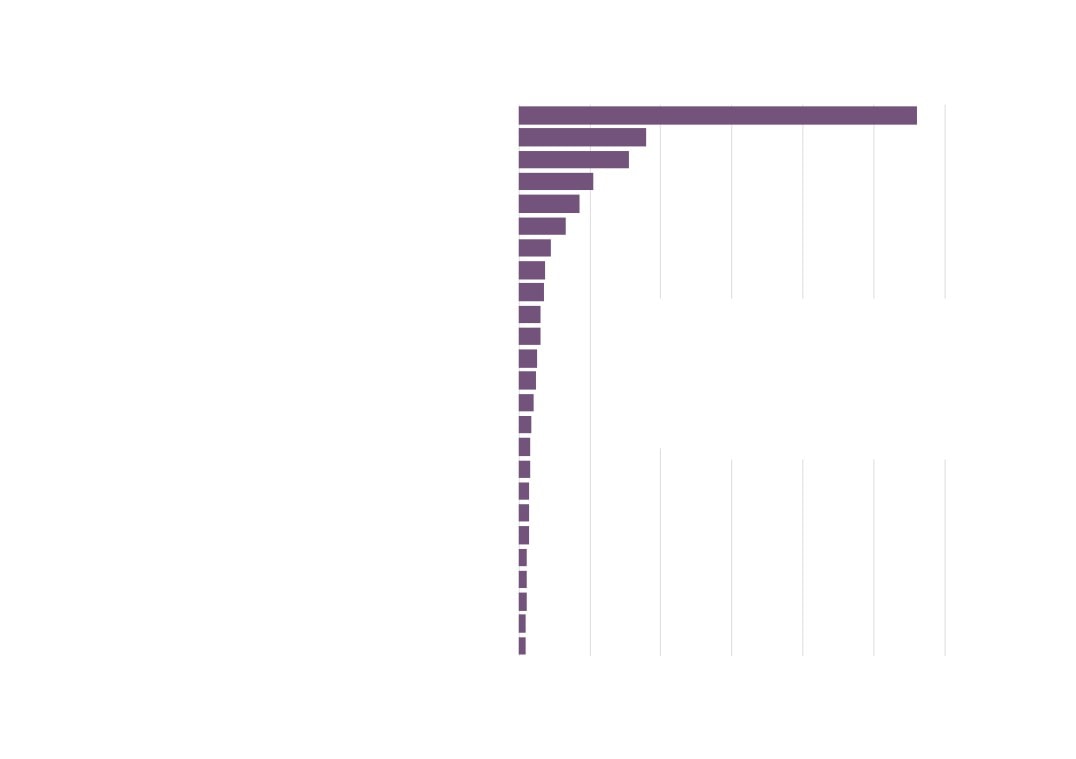

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

Chef

Sous Chef

Head Chef

Waiting Staff

Assistant Manager

Catering Assistant

Receptionist

Cook

Restaurant Manager

Visitor Economy

Bar Staff

Kitchen Assistant

vacancies by job title,

Housekeeper

Jan 2012 - Dec 2016

Kitchen Porter

Cleaner

1 unspecified or unclassified postings

Kitchen Manager

Source: Labour Insight Jobs, Burning Glass

Technologies

Sales Executive

General Manager

Restaurant Supervisor

Assistant Restaurant Manager

Chef Manager

Bar Manager

Personal Care Assistant

Personal Trainer

Hotel Manager

Bartender

53

32

31

67

255

335

Economy vacancies by

ification level required,

738

Jan 2012 - Dec 2016

32,583 unspecified or unclassified postings

2782

Source: Labour Insight Jobs, Burning Glass Technologies

GCSEs, Standard Grades, and Level 2 S/NVQs

A-Levels, Highers, and Level 3 S/NVQs

Level 1 S/NVQs

Bachelor's degrees, graduate certificates and diplomas

Level 4 diplomas and certificates, HNCs, Level S/NVQs

Foundation degrees and HNDs

54

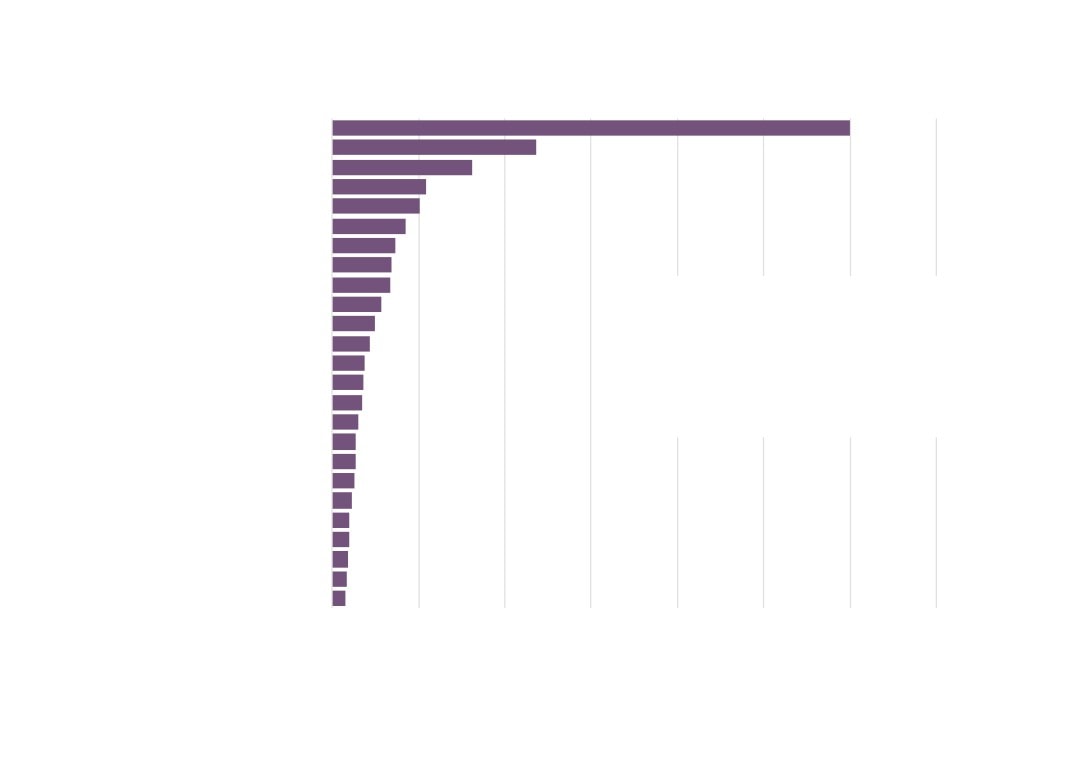

0

1,000

2,000

3,000

4,000

5,000

6,000

Cooking

Customer Service

Cleaning

Product Sales

Food Safety

Product Sale and Delivery

Food Service Industry Background

Stock Control

Hospitality Industry Experience

Visitor Economy

Supervisory Skills

vacancies by skills

Budgeting

required, Jan 2012

Business Management

Cash Handling

- Dec 2016

Restaurant Industry Experience

22,740 unspecified or unclassified postings

Sales

Source: Labour Insight Jobs, Burning

Glass Technologies

Customer Contact

Restaurant Management

Marketing Sales

Product Promotion

Budget Management

Dining Experience

Contract Management

Housekeeping

55

Where the

Work is

The following analysis makes use of data and findings available via the online toolkit http://wheretheworkis.org/ . The findings presented

are a result of combining data from the UKCES ‘Working Futures’ programme and job vacancy data from the Labour Market Insight tool

developed by Burning Glass.

Limitations

Though the ‘Where the work is’ tool provides a comprehensive and detailed free-to-use dashboard of supply and demand in the UK, the

following limitations should be taken into account when interpreting the data:

- Senior Management and Elementary roles

Occupations not open to recent HR graduates or FE finishers are not considered. Similarly, occupations that do not require any formal

qualifications or training are also excluded from this tool, since the number of job-seekers cannot be meaningfully quantified.

- Matching supply and demand

Some occupations do not have specific qualifications or subject-specific requirements (such as sales, marketing and related associate

professionals). As a result of this, and despite the fact that many people with a broad range of qualifications can apply for these occupations,

they frequently appear ‘undersupplied’ in the tool, i.e. when the “job opportunity” is low. Occupations with very small sample sizes (either of

finishers or job postings) are excluded from the dataset.

- Internal and international migration

Some occupations do not rely solely on FE finishers or HE graduates from their immediate location. Many people travel to find work, often

moving across the country. Other occupations, such as those on the Migration Advisory Committee’s shortage occupation list, may rely more

heavily on jobseekers arriving from outside the UK.

- Online and offline postings

Burning Glass Technologies (BGT) acknowledge that not all jobs are posted online, although a comparison of the Annual Survey of Hours and

Earnings (ASHE) employment data and BGT postings data for UK in 2014 showed a 94 per cent correlation between ASHE and BGT

occupational distributions. The BGT posting data slightly overestimate the proportion of professional and associate professional occupations,

while slightly underestimating the proportion of elementary occupations.

56

Location

Quotient

Location Quotient - Measure of Job Posting Density

relative to employment indexed to the national density

relative to employment

Sports Occs

0.80

Librarians

1.15

Leisure

0.99

Hospitality Trades

1.09

57

Vacancies by

Opportunity

Number of Job Postings asking for entry-level (2 years of

experience or fewer) and school leaver education levels,

further education levels, and higher education levels

Sports Occs

174

365

Librarians

Leisure

313

296

Hospitality Trades

1,377

1,900

School leaver

FE

HE

58

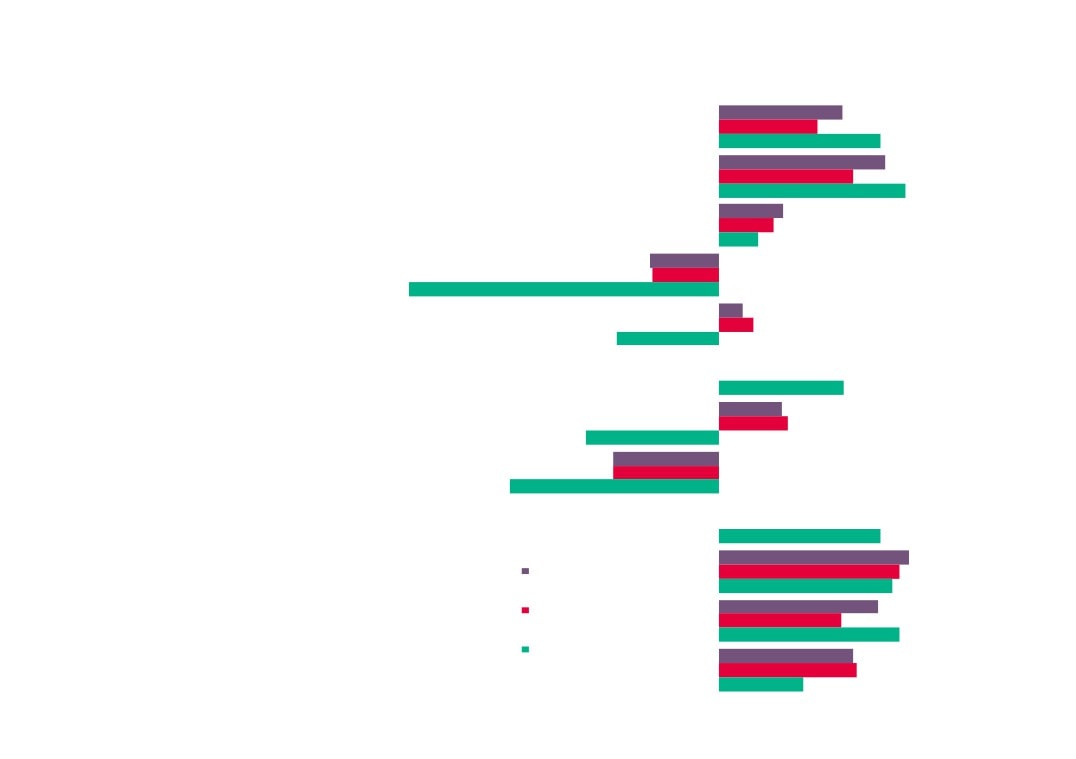

Average

Wages

Advertised Salaries for Job Postings in 2015

£25,100

Sports Occs

£33,600

£40,900

£20,800

Librarians

£25,700

£36,400

£18,800

Leisure

£25,200

£28,500

£23,800

Hospitality Trades

£23,900

£28,500

New Anglia

East of England

England

59

Opportunity

Scores

Opportunity Score - Score based on the Demand

Supply Ratio of FE / HE postings within a

geography, from Very Low (0) to Very High (100)

Further Education

Higher Education

50

68

Sports Occs

55

Sports Occs

65

52

57

Librarians

Librarians

58

Leisure

Leisure

78

58

51

Hospitality Trades

Hospitality Trades

New Anglia

East of England

England

New Anglia

East of England

Englan

60

A Future View of the

Visitor Economy

61

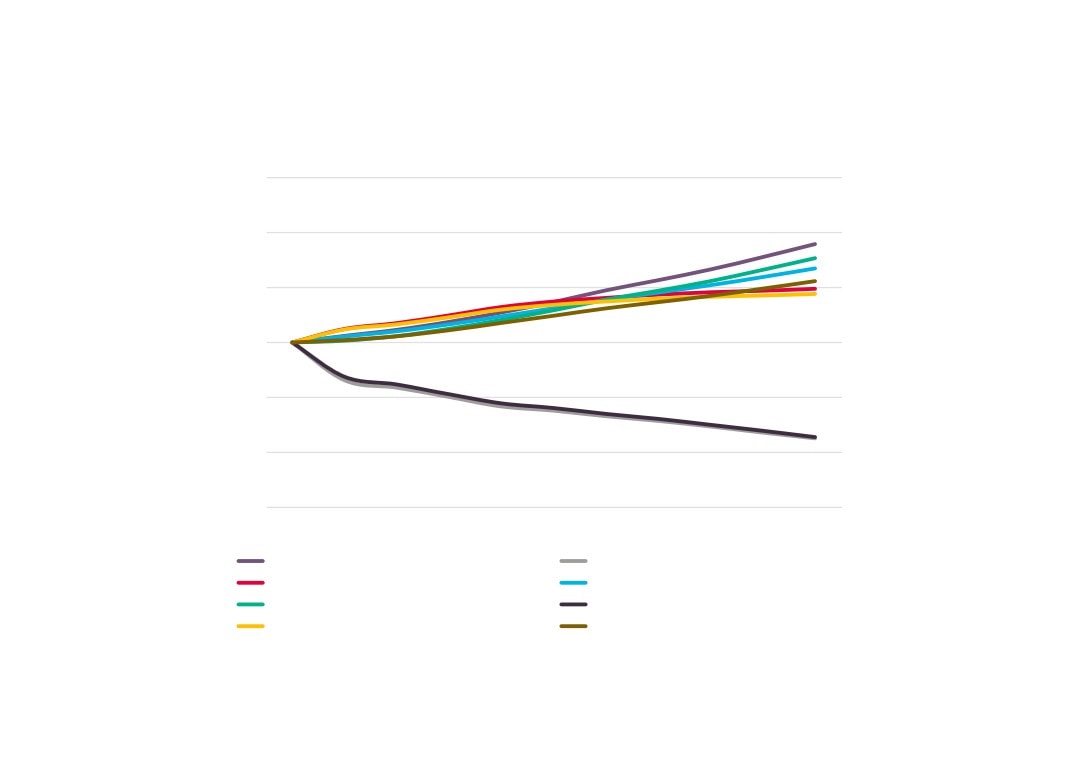

The following analysis uses data from the East of England Forecasting Model (EEFM) and the UKCES Working Futures data

(WF). In each case the Visitor Economy sector has been approximated from the sector splits available in each model. In the case

of the East of England Forecasting Model then ‘Accommodation & food services’, ‘Publishing & broadcasting’, and ‘Arts &

entertainment’ have been combined and used to provide forecasts for the Visitor Economy. For the Working Futures data, the

sectors of ‘Accommodation & food services’, ‘Media’, and ‘Arts & entertainment’ have been used.

Please note that neither model, or the forecasts they produce, take into account the New Anglia LEPs ambitions for growth in

Gross Value Added (GVA) and employment.

62

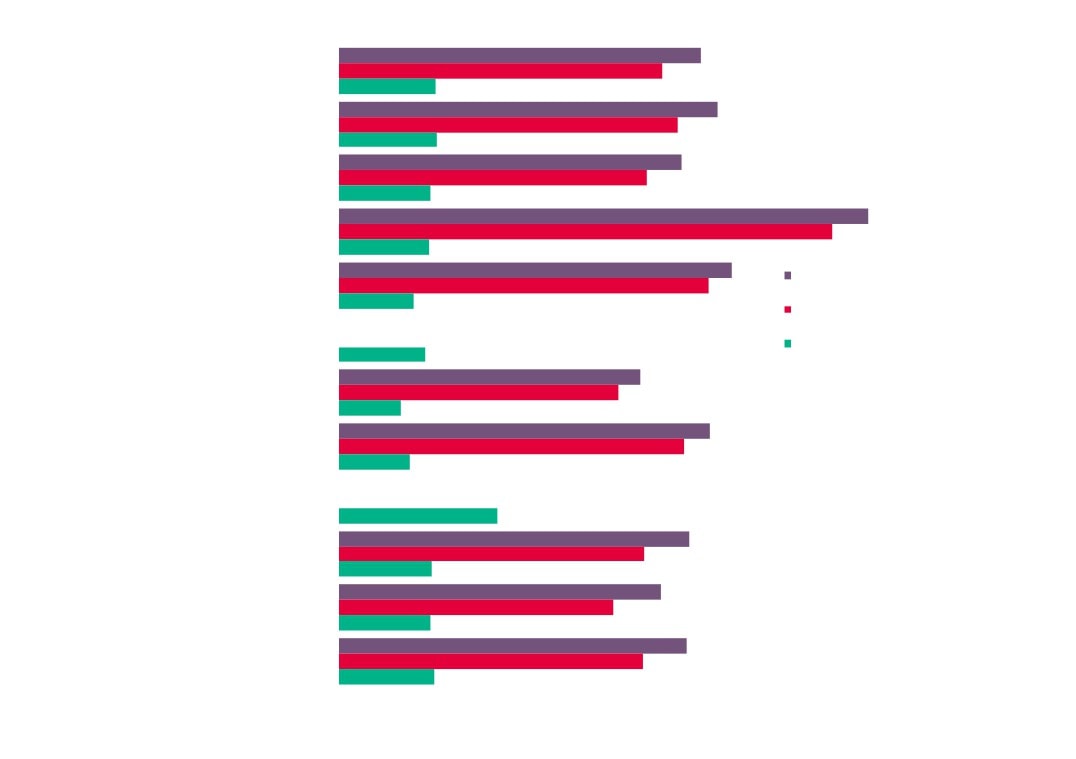

Forecasts for change in Visitor Economy employment in

New Anglia (2014 = 100)

130

120

110

100

90

80

70

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

Accommodation & food services (EEFM)

Publishing & broadcasting (EEFM)

Arts & entertainment (EEFM)

Visitor Economy (EEFM)

Accommodation & food services (WF)

Media (WF)

Arts & entertainment (WF)

Visitor Economy (WF)

Sources: East of England Forecasting Model, Cambridge

Econometrics; UKCES Working Futures 2014 - 2024

63

Occupational composition of employment in New Anglia’s

Visitor Economy over time

100%

35%

36%

36%

37%

37%

80%

4%

5%

4%

60%

4%

5%

15%

15%

14%

13%

13%

40%

7%

6%

5%

5%

6%

13%

13%

13%

13%

13%

20%

7%

7%

7%

7%

7%

13%

14%

14%

12%

10%

0%

2004

2009

2014

2019

2024

Managers, directors and senior officials

Professional occupations

Associate professional and technical

Administrative and secretarial

Skilled trades occupations

Caring, leisure and other service

Sales and customer service

Process, plant and machine operatives

Elementary occupations

Source: UKCES Working Futures 2014 - 2024

64

Accommodation & Food

Arts & Entertaint

ment

100%

100%

8%

7%

10%

12%

9%

3%

3%

4%

4%

4%

8%

8%

8%

80%

80%

9%

9%

51%

52%

50%

51%

51%

10%

11%

9%

9%

8%

6%

100%

60%

2%

%

4%

35%

36%

36%

37%

37%

3%

80%

40%

17%

%

20%

4%

60%

4%

5%

4%

4%

5%

%

13%

15%

15%

14%

13%

13%

0%

40%

7%

6%

5%

5%

4

6%

100%

13%

13%

13%

13%

9%

13%

20%

Managers, directors and senior officials

7%

7%

7%

4%

7%

7%

Professional occupations

80%

13%

14%

14%

13%

12%

10%

Associate professional and technical

0%

Administrative and secretarial

12%

2004

2009

2014

2019

2024

60%

Skilled trades occupations

Caring, leisure and other service

25%

40%

Sales and customer service

Process, plant and machine operatives

19%

Elementary occupations

20%

Source: UKCES Working Futures 2014 - 2024

15%

16%

16%

12%

12%

0%

2004

2009

2014

2019

2024

Media

65

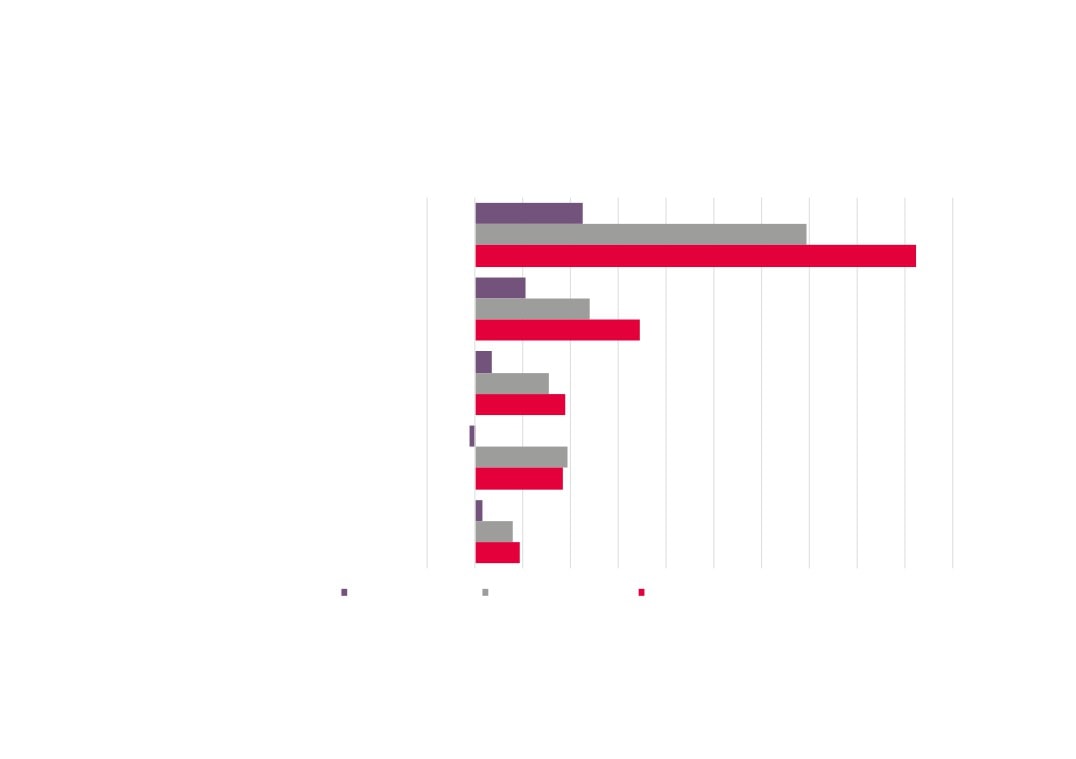

Visitor Economy replacement and expansion demand by occupation

(top 5 in terms of net requirement), 2014 - 2024

-2,000

0

2,000

4,000

6,000

8,000

10,000 12,000 14,000 16,000 18,000 20,000

Elementary administrat ion and service occupations

Other managers and proprietors

Culture, media and sports occupations

Textiles, printing and other skilled trades

Leisure, travel and related personal service occupations

Expansion demand

Replacement demand

Net requirement

Source: UKCES Working Futures 2014 - 2024

66

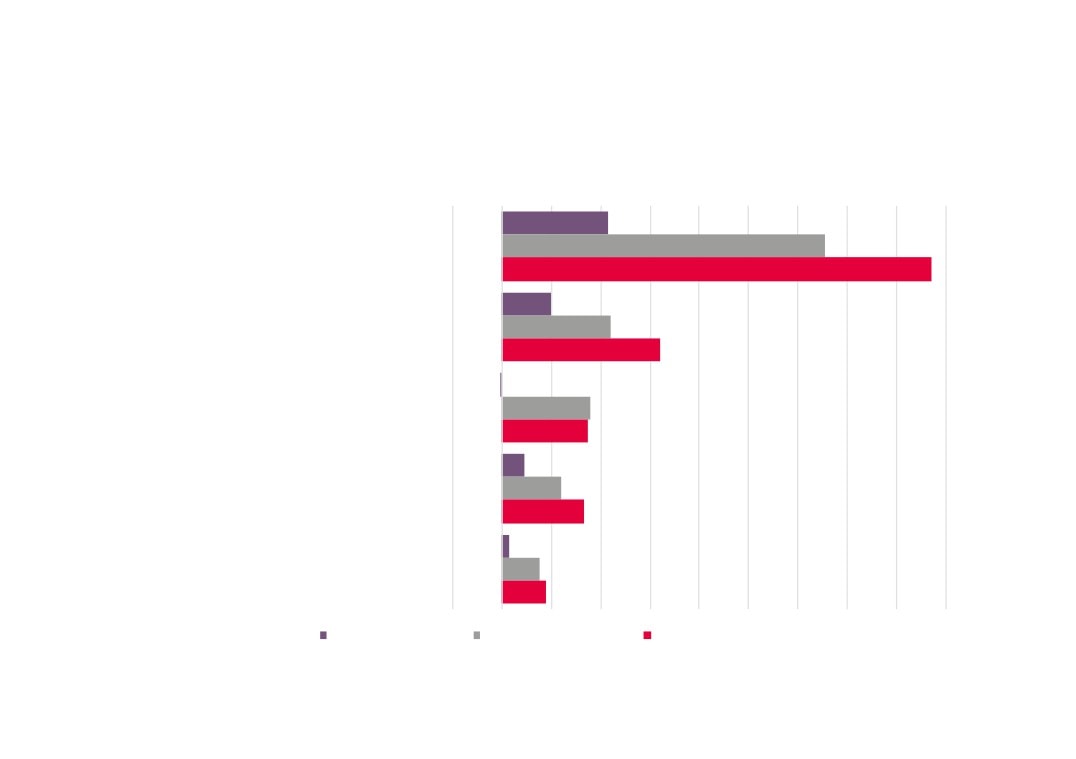

Tourism sector replacement and expansion demand by occupation (top

5 in terms of net requirement), 2014 - 2024

-2,000

0

2,000

4,000

6,000

8,000

10,000 12,000 14,000 16,000 18,000

Elementary administrat ion and service occupations

Other managers and proprietors

Culture, media and sports occupations

Textiles, printing and other skilled trades

Leisure, travel and related personal service occupations

Expansion demand

Replacement demand

Net requirement

Source: UKCES Working Futures 2014 - 2024

67

Culture sector replacement and expansion demand by occupation (top

5 in terms of net requirement), 2014 - 2024

0

1,000

2,000

3,000

4,000

Culture, media and sports occupations

Other managers and proprietors

Skilled agricultural and related trades

Business, media and public service professionals

Corporate managers and directors

Expansion demand

Replacement demand

Net requirement

Source: UKCES Working Futures 2014 - 2024

68

Visitor Economy replacement and expansion demand as a

proportion of employment by occupation, 2014 - 2024

-10%

0%

10%

20%

30%

40%

50%

60%

70%

80%

All occupations

Elementary administration and service occupations

Other managers and proprietors

Culture, media and sports occupations

Textiles, printing and other skilled trades

Leisure, travel and related personal service occupations

Expansion demand

Replacement demand

Net requirement

Source: UKCES Working Futures 2014 - 2024

69

Tourism sector replacement and expansion demand as a proportion

of employment by occupation, 2014 - 2024

-10%

0%

10%

20%

30%

40%

50%

60%

70%

80%

All occupations

Elementary administrat ion and service occupations

Other managers and proprietors

Culture, media and sports occupations

Textiles, printing and other skilled trades

Leisure, travel and related personal service occupations

Expansion demand

Replacement demand

Net requirement

Source: UKCES Working Futures 2014 - 2024

70

Culture sector replacement and expansion demand as a proportion

of employment by occupation, 2014 - 2024

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

All occupations

Culture, media and sports occupations

Other managers and proprietors

Skilled agricultural and related trades

Business, media and public service professionals

Corporate managers and directors

Expansion demand

Replacement demand

Net requirement

Source: UKCES Working Futures 2014 - 2024

71

Visitor Economy replacement and expansion demand by

qualification, 2014 - 2024

-10,000

-5,000

0

5,000

10,000

15,000

20,000

25,000

30,000

QCF 7-8

QCF 4-6

QCF 3

QCF 2

QCF 1

No Qual

Expansion Demand

Replacement Demand

Please note that the Working Futures data uses the

following breakout of qualification levels:

QCF8 - Doctorate

QCF7 - Other higher degree

QCF6 - First degree

QCF5 - Foundation degree; Nursing; Teaching

QCF4 - HE below degree level

QCF3 - A level & equivalent

QCF2 - GCSE (A-C) & equivalent

QCF1 - GCSE (below grade C) & equivalent

No Q - No Qualification

Source: UKCES Working Futures 2014 - 2024

72

Tourism sector replacement and expansion demand by

qualification, 2014 - 2024

-10,000

-5,000

0

5,000

10,000

15,000

20,000

25,000

QCF 7-8

QCF 4-6

QCF 3

QCF 2

QCF 1

No Qual

Expansion Demand

Replacement Demand

Please note that the Working Futures data uses the

following breakout of qualification levels:

QCF8 - Doctorate

QCF7 - Other higher degree

QCF6 - First degree

QCF5 - Foundation degree; Nursing; Teaching

QCF4 - HE below degree level

QCF3 - A level & equivalent

QCF2 - GCSE (A-C) & equivalent

QCF1 - GCSE (below grade C) & equivalent

No Q - No Qualification

Source: UKCES Working Futures 2014 - 2024

73

Culture sector replacement and expansion demand by

qualification, 2014 - 2024

-2,000

-1,000

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

QCF 7-8

QCF 4-6

QCF 3

QCF 2

QCF 1

No Qual

Expansion Demand

Replacement Demand

Please note that the Working Futures data uses the

following breakout of qualification levels:

QCF8 - Doctorate

QCF7 - Other higher degree

QCF6 - First degree

QCF5 - Foundation degree; Nursing; Teaching

QCF4 - HE below degree level

QCF3 - A level & equivalent

QCF2 - GCSE (A-C) & equivalent

QCF1 - GCSE (below grade C) & equivalent

No Q - No Qualification

Source: UKCES Working Futures 2014 - 2024

74

Visitor Economy qualifications, 2014 - 2024

2024

6%

36%

21%

25%

10%

Source: UKCES Working Futures 2014 - 2024

2014

5%

23%

22%

27%

16%

0%

100%

QCF 7-8

QCF 4-6

QCF 3

QCF 2

QCF 1

No Qual

Please note that the Working Futures data uses the

following breakout of qualification levels:

QCF8 - Doctorate

QCF7 - Other higher degree

QCF6 - First degree

QCF5 - Foundation degree; Nursing; Teaching

QCF4 - HE below degree level

QCF3 - A level & equivalent

QCF2 - GCSE (A-C) & equivalent

QCF1 - GCSE (below grade C) & equivalent

No Q - No Qualification

75

Tourism sector qualifications, 2014 - 2024

2024

6%

35%

21%

25%

11%

Source: UKCES Working Futures 2014 - 2024

2014

4%

22%

22%

28%

17%

0%

100%

QCF 7-8

QCF 4-6

QCF 3

QCF 2

QCF 1

No Qual

Please note that the Working Futures data uses the

following breakout of qualification levels:

QCF8 - Doctorate

QCF7 - Other higher degree

QCF6 - First degree

QCF5 - Foundation degree; Nursing; Teaching

QCF4 - HE below degree level

QCF3 - A level & equivalent

QCF2 - GCSE (A-C) & equivalent

QCF1 - GCSE (below grade C) & equivalent

No Q - No Qualification

76

Culture sector qualifications, 2014 - 2024

2024

11%

46%

18%

18%

6%

Source: UKCES Working Futures 2014 - 2024

2014

9%

35%

21%

21%

10%

0%

100%

QCF 7-8

QCF 4-6

QCF 3

QCF 2

QCF 1

No Qual

Please note that the Working Futures data uses the

following breakout of qualification levels:

QCF8 - Doctorate

QCF7 - Other higher degree

QCF6 - First degree

QCF5 - Foundation degree; Nursing; Teaching

QCF4 - HE below degree level

QCF3 - A level & equivalent

QCF2 - GCSE (A-C) & equivalent

QCF1 - GCSE (below grade C) & equivalent

No Q - No Qualification

77

Appendix - Visitor Economy sector definition

The following five digit SIC codes have been used to measure levels of, and change in, both employment and enterprise numbers in the sector.

Accomodation for visitors

55100 : Hotels and similar accommodation

55201 : Holiday centres and villages

55202 : Youth hostels

55209 : Other holiday and other short-stay accommodation (not including holiday centres and villages or youth hostels) nec

55300 : Camping grounds, recreational vehicle parks and trailer parks

55900 : Other accommodation

Food and beverage serving activities

56101 : Licensed restaurants

56102 : Unlicensed restaurants and cafes

56103 : Take away food shops and mobile food stands

56210 : Event catering activities

56290 : Other food service activities

56301 : Licensed clubs

56302 : Public houses and bars

Rail passenger transport

49100 : Passenger rail transport, interurban

Road passenger transport

49320 : Taxi operation

49390 : Other passenger land transport nec

Water passenger transport

50100 : Sea and coastal passenger water transport

50300 : Inland passenger water transport

Air passenger transport

51101 : Scheduled passenger air transport

51102 : Non-scheduled passenger air transport

79

Transport equipment rental

77110 : Renting and leasing of cars and light motor vehicles

77341 : Renting and leasing of passenger water transport equipment

77351 : Renting and leasing of passenger air transport equipment

Travel agencies and other reservation service activites

79110 : Travel agency activities

79120 : Tour operator activities

79901 : Activities of tourist guides

79909 : Other reservation service activities (not including activities of tourist guides)

Cultural activites

90010 : Performing arts

90020 : Support activities to performing arts

90030 : Artistic creation

90040 : Operation of arts facilities

91020 : Museum activities

91030 : Operation of historical sites and buildings and similar visitor attractions

91040 : Botanical and zoological gardens and nature reserve activities

Sporting & Recreational activities

92000 : Gambling and betting activities

93110 : Operation of sports facilities

93191 : Activities of racehorse owners

93199 : Other sports activities (not including activities of racehorse owners) nec

93210 : Activities of amusement parks and theme parks

93290 : Other amusement and recreation activities

77210 : Renting and leasing of recreational and sports goods

Country-specific tourism characteristic activities

82301 : Activities of exhibition and fair organizers

82302 : Activities of conference organizers

68202 : Letting and operating of conference and exhibition centres

80

Culture and The Arts

18140 : Binding and related services

18201 : Reproduction of sound recording

18202 : Reproduction of video recording

18203 : Reproduction of computer media

32120 : Manufacture of jewellery and related articles

32130 : Manufacture of imitation jewellery and related articles

32200 : Manufacture of musical instruments

46431 : Wholesale of gramophone records, audio tapes, compact discs and video tapes and of the equipment on which these are played

46491 : Wholesale of musical instruments

47591 : Retail sale of musical instruments and scores in specialised stores

47610 : Retail sale of books in specialised stores

47630 : Retail sale of music and video recordings in specialised stores

47781 : Retail sale in commercial art galleries

47791 : Retail sale of antiques including antique books, in stores

58120 : Publishing of directories and mailing lists

58141 : Publishing of learned journals

58142 : Publishing of consumer, business and professional journals and periodicals

58190 : Other publishing activities

58210 : Publishing of computer games

58290 : Other software publishing

59111 : Motion picture production activities

59112 : Video production activities

59113 : Television programme production activities

59120 : Motion picture, video and television programme post-production activities

59131 : Motion picture distribution activities

59132 : Video distribution activities

59133 : Television programme distribution activities

81

59140 : Motion picture projection activities

59200 : Sound recording and music publishing activities

60100 : Radio broadcasting

60200 : Television programming and broadcasting activities

74201 : Portrait photographic activities

74202 : Other specialist photography (not including portrait photography)

74203 : Film processing

74209 : Other photographic activities (not including portrait and other specialist photography and film processing) nec

74300 : Translation and interpretation activities

77291 : Renting and leasing of media entertainment equipment

78101 : Motion picture, television and other theatrical casting

85520 : Cultural education

90010 : Performing arts

90020 : Support activities to performing arts

90030 : Artistic creation

90040 : Operation of arts facilities

91011 : Library activities

91012 : Archive activities

91020 : Museum activities

91030 : Operation of historical sites and buildings and similar visitor attractions

91040 : Botanical and zoological gardens and nature reserve activities

92000 : Gambling and betting activities

93110 : Operation of sports facilities

93191 : Activities of racehorse owners

93199 : Other sports activities (not including activities of racehorse owners) nec

93210 : Activities of amusement parks and theme parks

93290 : Other amusement and recreation activities

94910 : Activities of religious organisations

82