Enabling Growth in the

New Anglia Ports &

Logistics Sector

through Skills

Development

2018-‘25

A Skills Plan for New Anglia

March 2018

ports and logistics final plan post skills board 2018.docx

Page 2

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

Contents

Background Context

3

Introduction

4

Overview and Sector Definition of the Ports and Logistics Sector

5

Skills & Workforce Supply

12

Opportunities and Challenges

17

Consultee Feedback

21

The Ports and Logistics Sector Skills Plan

29

Priorities for Action

29

Ports and Logistics Sector Skills Plan Delivery

31

Proposed Skills Interventions

33

Appendix A - Sector Skills Plan Development Process

37

Consultees

38

Appendix B - Summary of DataPack & Other Sector Intelligence

40

Links to Other Sector Skills Plans

46

Appendix C - Current Skills and Training Provision for Ports and Logistics

48

Task and Finish Groups

53

Page 3

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

Background Context

The Ports and Logistics Sector Skills Plan has been developed by the sector in Norfolk and

Suffolk, working alongside the New Anglia Local Enterprise Partnership, the New Anglia

Skills Board and supported by SkillsReach.

SkillsReach was contracted to facilitate and prepare eight sector skills plans for the New

Anglia LEP priority sectors. The project was commissioned by the Education and Skills

Funding Agency, in partnership with New Anglia LEP, and funded through the European

Social Fund. Each Sector Skills plan and supporting Data Pack has been developed in

collaboration with local employers and other stakeholders.

The New Anglia Skills Board places employers at the centre of decision making on skills in

Norfolk and Suffolk to ensure the skills system becomes more responsive to the needs of

employers, and the future economy.

Whilst there is currently not a formal industry led sector group for Ports and Logistics which

covers the whole of New Anglia, there are a range of bodies such as the New Anglia Local

Transport Board, Suffolk Chamber of Commerce Transport and Infrastructure Board and

bodies which cross the regional boundary such as the Haven Gateway Partnership, which

collectively focus on and represent the industry.

SkillsReach is an established East of England-based strategic skills consultancy with an

associate project team with extensive experience of developing skills plans.

Acknowledgements

The New Anglia LEP wish to thank the employers, training providers and stakeholders who

contributed to the plan by attending events, being interviewed or by making referrals to

employers and organisations in the sector. The sector skills plan was developed in 2017/18

by SkillsReach.

Page 4

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

Introduction

The ports and logistics sector is a large and diverse sector which includes companies from

owner operators to multinationals. It covers storage as well as distribution and is changing

rapidly due to new technology and new business models (e.g. online purchasing and

delivery services). In New Anglia passenger transport is important, but this only provides

14% of the jobs in the sector locally which is dominated by the transport of freight.

This concentration on freight is a function of the region’s historic and strategic position on the

East Coast and the proximity of the Continent. The Ports of Norfolk and Suffolk have for

Centuries served as a gateway to Europe and the World, with the Wool Towns and merchant

houses across the region standing testamount to the wealth this brought.

This critical role in UK trade continues to grow, with New Anglia home to the UK’s largest

container port at Felixstowe and other bulk cargo and general ports at Kings Lynn, Great

Yarmouth, Lowestoft and Ipswich. The ports, with Norwich Airport, have for over 40 years

been instrumental in supporting the growth of the energy sector in the North Sea, with the

growth of offshore renewables guaranteeing this role for at least another generation.

But the sector is also expected to see substantial changes in the next decade. Brexit is

likely to change our trading relationships and place even more emphasis on the importance

of trade with Europe and the rest of the World. We must ensure that Felixstowe and other

ports continue to grow so that the region benefits from this, but to do this a focus on the

leadership, management and efficiency skills needed to compete globally is essential.

The other major changes expected are the rapid growth in technology and a focus on clean

transport systems. Whether it is automation, electric vehicles, supply chain digitalisation or

clean air zones in cities, the sector will need to embrace new skills in engineering and ICT.

Industry members are clear that whilst they expect many current roles to be displaced by

these changes, we will create many new roles needing different and, in many cases, higher

level skills. There is therefore a real challenge in ensuring that we have the skills needed.

The plan therefore proposes a focus on three linked skills areas: meeting short term staff

shortages; management and leadership skills; and, technology skills. However, the region

has relatively few training facilities for the logistics sector and therefore needs additional

investment in physical training facilities to support enhanced course provision.

To deliver this change the industry is clear it has to help lead the process. Further work is

needed to define how this leadership is provided given the current lack of a New Anglia

sector group for Ports and Logistics. Employers were clear that their commercial success

and that of the region depends fundamentally on links to other logistics hubs in the UK. For

this reason, employers suggest that New Anglia should explore the potential to work with

other LEP areas e.g. SELEP, SEMLEP, GLLEP and Solent, with large logistics sectors to

develop a national focus on sector growth and how skills development underpins this.

March 2018

Page 5

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

Overview and Sector Definition of the Ports and Logistics Sector

Ports and Logistics is both a sector in its own right and provides the support to move

workers, goods and services around for all other sectors.

Change in the industry is being enabled by digital technologies to plan logistics (e.g.

backloading, most efficient routes and rerouting, geofencing, load optimisation etc), energy

efficiency (storage and transport) and, it is expected, that further major changes will occur in

the next decade for example through the potential widespread adoption of autonomous

and/or electric vehicles.

Global trade volumes continue to grow and with the UK’s largest container port at

Felixstowe, the New Anglia area is well placed to benefit from this development. This port is

significant as the only UK port able to take the World’s largest ships which connect the UK to

markets in some of the fastest growing parts of the World.

This focus on international connectivity also has implications for decision making as many of

the larger companies are part of international groups, with decisions taken internationally for

future investment. Making the region attractive to investment, including through a skilled

workforce, is thus critical in attracting investment.

Whilst global trade by volume is predominantly conducted by sea, there is a continuing

growth in air freight and a planned new ‘silk route’ rail line from the UK to China, as part of

China’s ‘Belt and Road’ initiative. Whilst the overland route is projected to be more

expensive (per container) than sea, it will nearly halve the journey time.

More locally, distribution is changing quickly as consumers embrace online purchasing

leading to a move from physical bricks and mortar retailing to home delivery and the

development of fulfilment centres from which orders are dispatched via van. Drone delivery

is also now being trialled and this or other disruptive technologies can be expected to

develop in the next few years.

Ports and Logistics in New Anglia

The EADT list of top 100 regional businesses included 10 in the ports and logistics sector:

Hutchisons; Maritime Group; Mediterranean Shipping Company (UK); OOCL Europe;

Gardline Shipping; Truckeast; Damco; Goldstar Transport; LV Shipping; George J. Goff.

Road:

The New Anglia road system includes major freight and distribution routes including:

A14 corridor servicing Suffolk, links to the Midlands and North, to the UK’s largest

container port at Felixstowe

A11 corridor which links Norfolk and North Suffolk to Cambridge, London and the

Midlands

A47 corridor which links Great Yarmouth, Norwich and Norfolk to Peterborough and the

A1 and beyond this to Leicester and the Midlands

Page 6

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

A12 which runs south from Great Yarmouth linking the East Coast ports to Essex,

London and the Channel

A10 which links King’s Lynn and West Norfolk to Cambridge and London

Work by the A47 Alliance, of which New Anglia is a member, on the A47 Business Case1

proposes significant further investment beyond the initial £300m of improvements scheduled

for 2015-2020. The aim is to unlock further growth, housing and business, along this

strategic route through schemes costing just over £200m in Norfolk between Tilney and East

Winch and on the Acle Straight.

Ports:

The LEP area is well served with ports around its long coastline including (North to South):

Kings Lynn (0.5million tonnes per annum), part of ABP;

Wells (mainly wind farm servicing and leisure);

Great Yarmouth, has both the original harbour area which services the energy sector

and handles bulk cargo (handles a wide range of cargoes including aggregates, cement,

dry and liquid bulks, fertilisers, forest products, grain and minerals), as well as the new

Outer Harbour, part of Peel Ports;

Lowestoft (offshore wind servicing and 100,000tonnes per annum), part of ABP;

Ipswich (2million tonnes per annum and RoRo facilities), part of ABP;

Felixstowe handles circa 38% of the UK container traffic and is the 7th largest container

port in Europe. Reports suggest (Haven Gateway) that the port and logistics sector

sustained circa 20,000 jobs in Babergh, Ipswich, Mid Suffolk and Suffolk Coastal in

2007, with a 2017 report by SQW2 putting the figure now at 22,500 in these 4 districts in

‘Ports and Logistics’.

The region contains some major logistics cluster such as that found in and around the Port

of Felixstowe with work by Haven Gateway3 reporting that there are 870 transport

companies (VAT or PAYE registered) in the Babergh, Ipswich, Mid Suffolk and Suffolk

Coastal districts. It further estimated that expansion of the Port of Felixstowe will directly

create 600 jobs and a further 860 in the local economy. A further study by Suffolk Coastal

District Council is currently underway into the Port of Felixstowe’s development.

More recent work (2017) for Haven Gateway by SQW (2017) has estimated that four districts

(Babergh, Ipswich, Mid Suffolk and Suffolk Coastal) have 22,500 staff employed in jobs

related to Ports and Logistics, in 2,015 companies. The concentration is particularly high in

Suffolk Coastal which has an employment LQ (location quotient: ratio comparing the area to

national average) for the sector of 2.0, signifying it is twice as important locally as nationally.

Continued expansion is expected at the ports, with the EADT reporting in May 20174 that:

1 A47 Alliance (September 2017), A47 Business Case: Gateway to Growth

2 SQW (2017), Growth Sectors and Innovation in Haven Gateway

3 Haven Gateway, Driving the Haven Gateway Forward: the Economic Impact of the Ports and Logistics Sector

4 Lorna Laycock (15/05/17), EADT, Ports think big

Page 7

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

the tonnage of ships calling at the port increasing by 13% year-on-year. ABP, which in

year in new facilities at Ipswich; the UK’s leading export port for agricultural products. This

includes a new 40,000sqft bulk store, opened April 2017’.

In June 20175 Hutchison Ports announced that the World’s largest container ship, the 21,413

TEU OOCL Hong Kong, has made its maiden call at Hutchison Ports Port of Felixstowe,

which represented a double celebration as it also marked the return of OOCL to the UK’s

largest container port after a 17 year absence. The 210,890 gross tonne ship measures 400

metres in length with a width of 58.8 metres and serves the Asia-Europe trade lane as part

of OOCL’s LL1 service.

Port of Felixstowe (PFL) was the UK's first purpose-built container-handling facility and is the

largest and busiest container port in the country. With three rail terminals, it also has the

busiest and largest intermodal rail freight facility in the UK. The latest development, Berths

8&9, provides additional deep-water capacity for the world’s largest container ships. PFL is a

member of Hutchison Ports which has a network of port operations in 48 ports spanning 25

countries throughout Asia, the Middle East, Africa, Europe, the Americas and Australasia.

The smaller ports have been boosted by the development of the offshore energy sector, with

for example Norfolk based Gardline (sold to Dutch firm, Royal Boskalis Westminster in

2017), operating 40 vessels primarily focused on transferring staff to offshore energy

infrastructure or conducting marine surveys. However, the other main ports at Kings Lynn,

Great Yarmouth, Ipswich and Felixstowe remain primarily cargo ports.

Further expansion is though being driven by expansion of the energy sector, with Peel Ports

Great Yarmouth for example announcing investment in an additional 100,000sqm of land

and 350m of new quayside to support Vattenfal in the construction of the Norfolk Vanguard

and Boreas offshore wind farms. This aligns with the Great Yarmouth Economic Growth

Strategy 2017-216 which identified the Ports and Logistics sector as one of three key

economic growth priorities for the district.

The development of London Gateway is a potential constraint on growth in the New Anglia

ports, although to date the impact is believed to have been modest. The growth in UK trade

which has been seen in recent years has more than covered the increased capacity

provided by London Gateway. Whilst there is some uncertainty created by Brexit, the

expectation is that trade volumes will continue to grow in the medium and long term.

Airports:

New Anglia has only relatively limited airport capacity, with Norwich the only commercial

airport of any scale. It current has 520,000 passengers per year and aims to grow this

modestly over the next few years, but will remain a relatively small local airport focused on

5 22 June 2017, Hutchison Ports Press Release, World’s Largest Container Ship calls at the Port of Felixstowe

6 Great Yarmouth Borough Council, Economic Growth Strategy 2017-2021

Page 8

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

domestic, short haul and service routes for the offshore energy sector. The airport is linked

to Schipol in Amsterdam to provide connectivity globally.

Via the A11/A14/M11 and A12/A120 routes the LEP area also has good links to Stansted

(less than 20 miles outside the LEP boundary) which has grown its cargo business

substantially in recent decades (now the UK’s 4th largest cargo airport) and via the M25 to

the UK’s largest freight airport at Heathrow.

Stansted announced major expansion plans in February 20187 which would see its

passenger numbers grow to its current cap of 35million by 2023, with permission now being

sought to expand this to 43million, creating an extra 5,000 jobs. Expansion of Stansted is a

5 year £600m programme.

Rail:

New Anglia’ railways are, in common with national statistics, dominated by passenger traffic

with the Great Eastern and West Anglia mainlines from Norwich (and limited branch services

north of the city) via Ipswich to London and the Kings Lynn via Cambridge to London routes.

Both of these routes carry some freight, but the priority is for passenger traffic which has

grown substantially and system capacity constraints means that future investment is likely to

continue to prioritise passengers, at least in the short term.

East West rail routes, particularly Felixstowe to the Midlands and the north, in contrast whilst

having many fewer passengers, are significant freight routes.

In December 2017 the Secretary of State for Transport and the Port of Felixstowe gave the

greenlight for a £60mm investment in a second track between Trimley Station and Grimston

Lane to allow up to 47 freight trains per day (each equivalent to 60 lorries). This will double

capacity on this route.

The LEP has spearheaded work on studies and campaigns for increased rail capacity

including a Rail Prospectus for East Anglia8 and a Business Case for the Great Eastern

Mainline9. The LEP has also part funded the Ely North feasibility work to improve this key

bottleneck in the network which affects both passenger and freight routes and is working

with partners to facilitate work on the Haughley junction.

Clearly if the major developments in the network proposed in these studies and plans are

taken forward it would have an impact on the demand for skills.

Storage and Warehousing:

The LEP area already has substantial storage capacity in business parks, logistics centres

and the ports across the region and is adding more through new major projects. With major

7 BBC Business (22nd February 2018), Stansted Airport Plan for 43 million passengers

8 New Anglia, Our Counties Connected: A Rail Prospectus for East Anglia

9 Great Eastern Rail Campaign (November 2014), Great Eastern Main Line Taskforce: the Business Case,

Releases the Potential

Page 9

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

future growth planned in existing Enterprise Zones and other business parks this may

increase the demand for warehouse skills even if new technology is adopted.

The area is also developing the three Food Enterprise Zones, two of which have a major

focus on storage and distribution.

The Port of Felixstowe Logistics Park which received planning permission in December

201510 will create a further 1.4 million square feet of logistics space.

Defining the Scope

The definition of the sector covers all aspects of freight and passenger transport (road, rail,

air), port and cargo handling/storage activity, and postal communication and distribution

activities. The sector definition aligns well with broad industrial group H, Transport and

storage (including postal), which enables good data comparison. In addition to those service

activities the definition also captures elements of repair and maintenance of all transport

vehicles, which whilst creating an overlap with the NALEP Advanced Manufacturing &

Engineering (AME) sector definition, does inflate the scale of the sector considerably.

The sector is diverse and as well as general cargo and passenger transport also includes

more specialist areas such as products which are subject to special taxation e.g. bonded

warehouses (both at Ports such as PD Ports facility at Felixstowe or directly in alcohol

businesses such as Adnams11) or regulatory controls due to health and safety e.g. the

transportation of fuels, chemicals and nuclear material.

As shown in more detail in the section below on the skills and workforce for logistics12, nearly

one third of those who work in logistics nationally are not employed in logistics companies,

but in the logistics departments of companies in other sectors.

Rurality

As a large predominantly rural region, New Anglia faces particularly challenges with

transport and distribution for both people and goods. Research by DfT13 shows that those

who live in rural villages, hamlets and isolated dwellings travelled an average of 10,159

miles in 2014/15, compared to only 5,219 miles or those who live in urban conurbations.

Further analysis of this data shows that rural dwellers: walked less (107 miles as opposed to

202 miles); used buses less (177 miles as opposed to 350 miles); and, rail less (534 miles

as opposed to 775 miles) than residents of urban conurbations.

However, rural residents travelled over 2.5times as far by car or van as urban residents each

year: 5,862 miles as driver and 3,064 miles as a passenger; compared to only 2,210 miles

as a driver and 1,372 miles as a passenger, for residents of urban conurbations.

10 Felixstowe Forward (2017), Coastal Community Team: Economic Plan

11 Bonded Warehouse Association members

12 FTA (2017), FTA Skills Shortage Report

13 DfT, National Travel Survey 2015/16

Page 10

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

Road infrastructure and public transport provision are therefore key political and stakeholder

in concerns in rural areas such as much of Norfolk and Suffolk.

Sector Representation

The diversity of the sector means that there are a wide range of bodies which represent

parts of the sector both nationally, regionally and locally. New Anglia has a named sector

contact, Paul Davey of Hutchison Ports, but no formal sector group for Ports and Logistics.

Suffolk Chamber has an active Transport and Infrastructure group with 150 stakeholder

which has developed a Transport and Infrastructure Manifesto14. There are also local

groups such as Felixstowe Port Users Association (FPUA) focused on specific areas. The

LEP convenes a Local Transport Board but this focused primarily on major capital

investments rather than skills and workforce issues.

Nationally the sector is represented by a wide range of business groups and trade bodies

including in freight alone: Freight Transport Association (FTA); Road Haulage Association

(RHA); Transport Association (TA); Chartered Institute of Logistics and Transport (CILT);

Institute of Grocery and Distribution (IGD); UK Warehouse Association (UKWA);

Transfrigoroute; European Freight Forwarders Association (EFFA); British International

Freight Association (BIFA).

A challenge for the sector in developing an effective skills programme is this diversity of

representational bodies and a lack of a single body who can liaise with government at local

and national level, training providers and stakeholders such as the LEP.

Sector Skills Issues

Analysis of LEP level results for ‘Transport, Storage and Communications’ from the UKCES

Employer Skills Survey (2015) found that: The ‘Transport, Storage and Comms’ sector was

much more likely to report skills shortage vacancies (41%) as a proportion of all vacancies

than both the averages for all sectors in New Anglia (19%) and nationally (23%).

This wide definition means that there are sizeable overlaps between the Ports and Logistics

sector and other New Anglia key sectors which utilise transport services for people and

freight. This includes particular demands for Ports and Logistics services in the following

key sectors in New Anglia:

Agrifood Tech which is a major use of freight services (circa 30% of UK road freight by

weight is food chain related);

Energy which uses freight services to move its products (e.g. oil) or inputs around (e.g.

wind turbine components) as well as passenger services for staff to service facilities (e.g.

Norwich airport has major contracts to move staff to and from North sea energy facilities

and this also uses boat services);

Advanced Manufacturing and Engineering which sources materials from and supplies

finished products to end users in both the UK and globally;

14 Suffolk Chamber of Commerce (2015), Transport and Infrastructure Manifesto

Page 11

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

Construction which uses transport services to move construction materials around;

Tourism and culture which relies on transport services to provide access to local

facilities and events.

Feedback from consultees also suggested that the Ports and Logistics sector itself will need

to increase its dependence on skills in both the Advanced Manufacturing and Engineering

and Digital Tech sectors, as it adopts more automation and computerised control systems.

Page 12

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

Skills & Workforce Supply

National Employment in Logistics

The FTA (2017)15 reports that the logistics sector employs 2.53million staff in the UK of

which 1.72million are employed directly in logistics companies and 0.81million in logistics

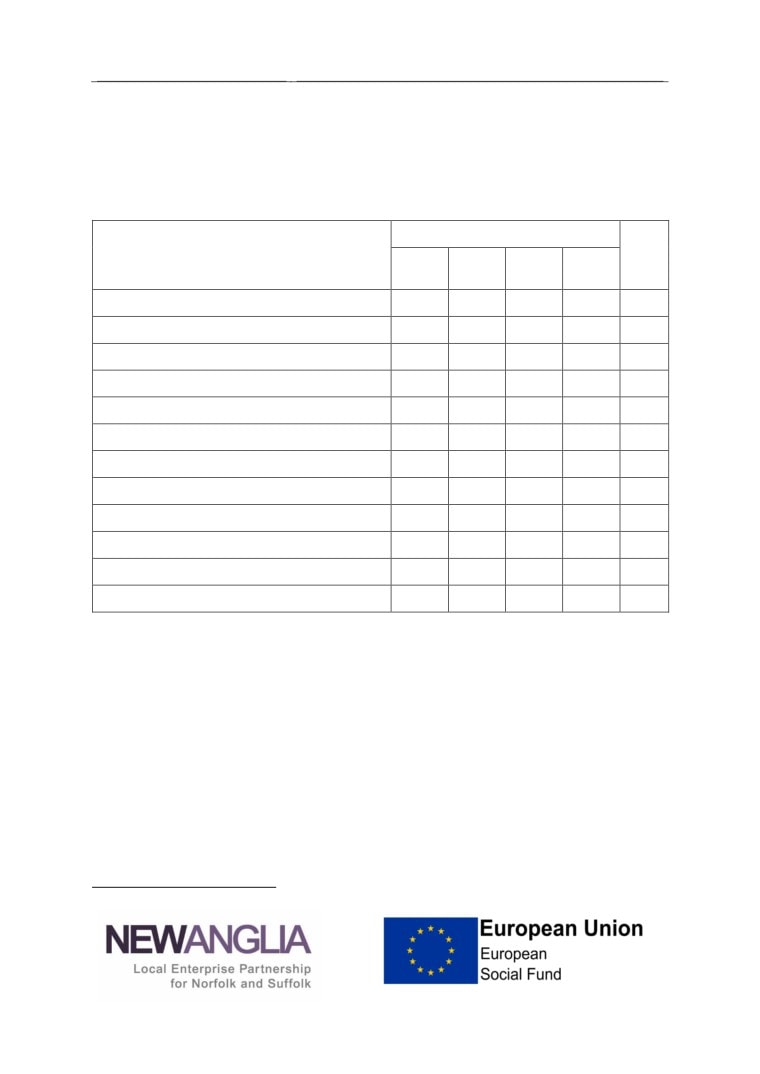

departments in companies in other sectors. In Q4 2016 the estimated workforce was:

Employment (‘000)

%

EU

Logistic

Other

Total

%

sector

sector

Purchasing managers & directors

7

49

56

2.2

1.8

Managers directors transport & distribution

36

51

87

3.4

3.4

Managers & directors storage & warehousing

35

69

104

4.1

8.7

Importers & exporters

9

2

11

0.4

27.3

Transport & distribution clerks & assistants

22

30

52

2.1

3.8

Large goods vehicle drivers

207

126

333

13.2

12.9

Van drivers

107

152

259

10.2

8.5

Forklift truck drivers

35

52

87

3.4

18.4

Postal work, sorters, messengers, couriers

126

28

154

6.1

4.5

Elementary storage occupations

186

253

439

17.4

25.7

Other occupations within the logistics sector

948

-

948

37.5

9.7

Total

1,718

812

2,530

100.0

12.3

This shows that nearly 10% of the workforce are in management roles, with truck, van and

forklift truck drivers representing nearly 27% of the workforce and storage a further 17%.

The FTA work shows that the most acute job shortages are for staff skilled in (ranked):

Importing and exporting;

Managers and directors in transport and distribution;

Van drivers;

Managers and directors in storage and warehousing;

Transport and distribution clerks;

Forklift truck drivers

Large goods vehicle drivers

In contrast there was relatively little shortage of postal workers.

15 FTA (2017), FTA Skills Shortage Report

Page 13

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

The reliance on EU migrants varies from 26-27% of those in elementary storage and import

and export roles to less than 2% of purchasing managers and directors.

Transport & Logistics in New Anglia16

In terms of Gross Value Added (GVA) in 2015 the sector was worth approximately £2.33bn,

which equates to 6.5 % of the total New Anglia economy. This is an increase of £553m on

2010, or +31% which is much higher than growth seen across the whole economy over the

same period (+17%).

In total, the sector currently employs 48,700 people, which is just over 6% of the total New

Anglia workforce. Employment numbers in 2015 are around 5,500 more than they were in

2010 (an increase of +13%, compared to +7% across the New Anglia economy as a whole)

but this does mask some large fluctuations in employment during this period which suggests

that this is not a particularly long term growth trend.

Passenger transport makes up about 6,700 jobs within the transport and logistics sector

(about 14%), with the rest focused on freight services.

‘Freight transport by road’ is the largest employer with 9,500 workers, a fifth of the sectors

workforce. This is closely followed by the sub sector ‘Maintenance and repair of motor

vehicles’ with 8,000 workers. The third largest sub sector is that of ‘Operation of

warehousing and storage facilities for land transport activities’ with 4,800 workers,

approximately a tenth of the sector workforce.

The top two sub sectors, freight transport by road, maintenance and repair of motor vehicles,

both experienced growth in employment between 2010 and 2015 of +7% and +75%

respectively. During the same period, employment within operation of warehousing and

storage facilities for land transport activities fell by -8%. This suggests that against overall

sector growth, storage is becoming more efficient in its use of labour.

With regards to the structure of employment, the Transport & Logistics sector is much more

geared towards full-time employment, with 76% of employment in the sector full-time

compared to 57% across the whole economy.

In terms of enterprise numbers, in 2016 there were 4,085 Transport & Logistics enterprises

operating in the New Anglia area, or nearly 7% of all enterprises. Since 2010 the number of

Transport & Logistics enterprises has increased by 595, or +17%, again much higher than

the total New Anglia rate of growth (+9%). However, this growth rate is still below regional

and national growth rates for the sector (+33% and +36% respectively).

Transport & Logistics Skills Supply and Demand

Unlike other sectors which have experienced a considerable shift towards higher skilled

workers, analysis of 2001 and 2011 Census data shows that whilst movement towards

higher skills within the Transport & Logistics sector has been positive it is also small.

16 The data in this section is explored in more detail in the datapack which accompanies the sector

skills plan. The datapack provides referencing for all these key facts and figures

Page 14

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

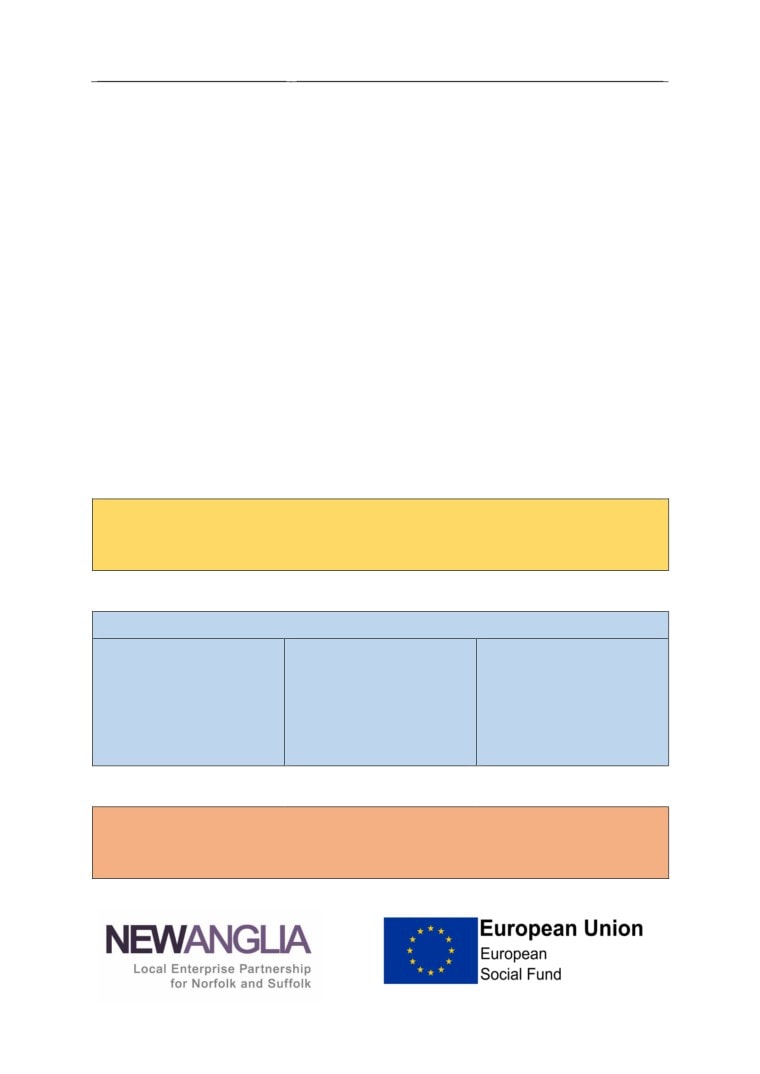

2011

21%

25%

19%

10%

12%

13%

2001

25%

25%

22%

7%

12%

10%

2011

20%

24%

18%

10%

15%

14%

2001

23%

25%

23%

8%

13%

9%

2011

19%

22%

18%

11%

17%

14%

2001

22%

24%

23%

8%

15%

8%

0%

100%

No qualifications

Level 1 qualifications

Level 2 qualifications

Level 3 qualifications

Level 4 qualifications and above

Apprenticeships and other qualifications

Based on data sourced from the Department for Education’s Further Education data library,

the Sector Lead Bodies identified as being the most relevant to the Transport & Logistics

Sector are: Automotive Industries; Freight, Logistics & Wholesale; Maritime; and Passenger

Transport.

In total, 3,060 learning aims related to the Transport & Logistics sector were delivered to

New Anglia residents in 2012/13. This formed 3.8% of all known learning aims delivered in

New Anglia, compared to 5.0% nationally. If we consider all learning aims delivered (i.e.

including those classed as ‘unknown’ then these figures fall to 1.5% and 1.8% respectively).

Compared to 2010/11, when the number of learning aims delivered to New Anglia residents

was 3,680, numbers are down across three of the four sector lead body elements of the

Transport & Logistics sector. Only ‘Automotive Industries’ experienced an increase in

learning aims, from 1,900 in 2010/11 to 2,020 in 2012/13. Overall, there has been a 17%

decrease in the number of Transport & Logistics learning aims delivered to New Anglia

residents over the period in question. Nationally, and over the same period, learning aims for

the sector decreased by 13%.

The majority of these learning aims (1,990 or 65%) achieved by New Anglia residents were

delivered by New Anglia based providers. This is slightly less than the average for New

Anglia (75%).

Provision of Transport & Logistics learning aims by New Anglia providers to New Anglia

residents has also decreased over the time period in question, from 2,140. This decrease in

numbers was driven by sizable falls in numbers ‘Maritime’ and ‘Passenger Transport’

learning aims. Both ‘Automotive Industries’ and ‘Freight Logistics & Wholesale’ experienced

small increases in learning aim numbers.

In terms of apprenticeships, information from the Data Cube for 2014/15 shows that there

were 690 starts in the ‘Transport and Logistics’ sector related apprenticeships in New Anglia.

The data goes on to show that growth since 2011/12 in these apprenticeships has

essentially been flat.

Page 15

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

Data on apprenticeship participation by sector shows that the ‘Transportation and storage’

sector accounted for 2.5% (540) of all apprenticeships in 2014/15 (compared to 2.9%

nationally), which is much lower than the level of employment it provides.

Analysis of LEP level results for the Transport, Storage & Comms sector from the UKCES

Employer Skills Survey 201 found that:

‘Transport, Storage & Comms’ establishments with at least one vacancy are more likely

to describe it as being hard to fill, with over two fifths of all vacancies in the sector being

described as being Skills Shortage Vacancies (SSVs) compared to the average of a fifth

across all sectors.

‘Transport, Storage & Comms’ employers are also more likely to report having any staff

that are not fully proficient with 18% stating this compared to a New Anglia, regional, and

national average of around 14%. The data suggests that this is a training issue, with the

sectors performance against training measures (such as the provision of training in the

last year, and on-the-job training) being lower than local, regional and national averages

for all indicators. Similarly, training days per trainee, and trainee days per staff, are both

much lower than all other comparators.

Conversely, ‘Transport, Storage & Comms’ employers are also more likely to report

underutilised staff than local and regional averages (29% compared to 25%), though

broadly in line with the national average (30%).

based on combining data from the UKCES ‘Working Futures’ programme and job vacancy

data from the Labour Market Insight tool developed by Burning Glass. There is little in the

way of data that refers explicitly to the ‘Transport & Logistics’ sector with the following

analysis referring to the occupations of ‘Other Skilled Trades’ and ‘Vehicle Trades’.

Job vacancy postings during 2015 for the Transport & Logistics sector in New Anglia

overwhelmingly required FE skills (71% of opportunities) with some opportunities for

school leavers (28%) and very little in the way of postings requiring Higher Education

level skills (one % of opportunities).

Advertised salaries for the sector in New Anglia were also generally lower than those

advertised regionally and nationally.

‘Vehicle trades’ were seen as providing the best opportunities for employment for those

with FE level skills based on a ratio of local employer demand and supply of these skills

locally. In terms of HE level skills, then there was not enough data at the New Anglia

level to provide accurate analysis.

However, some caution is needed with this data, as many especially higher skilled roles and

those in smaller companies are not advertised via the routes which this analysis draws on

and so care is needed in reaching detailed conclusions from this analysis.

Page 16

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

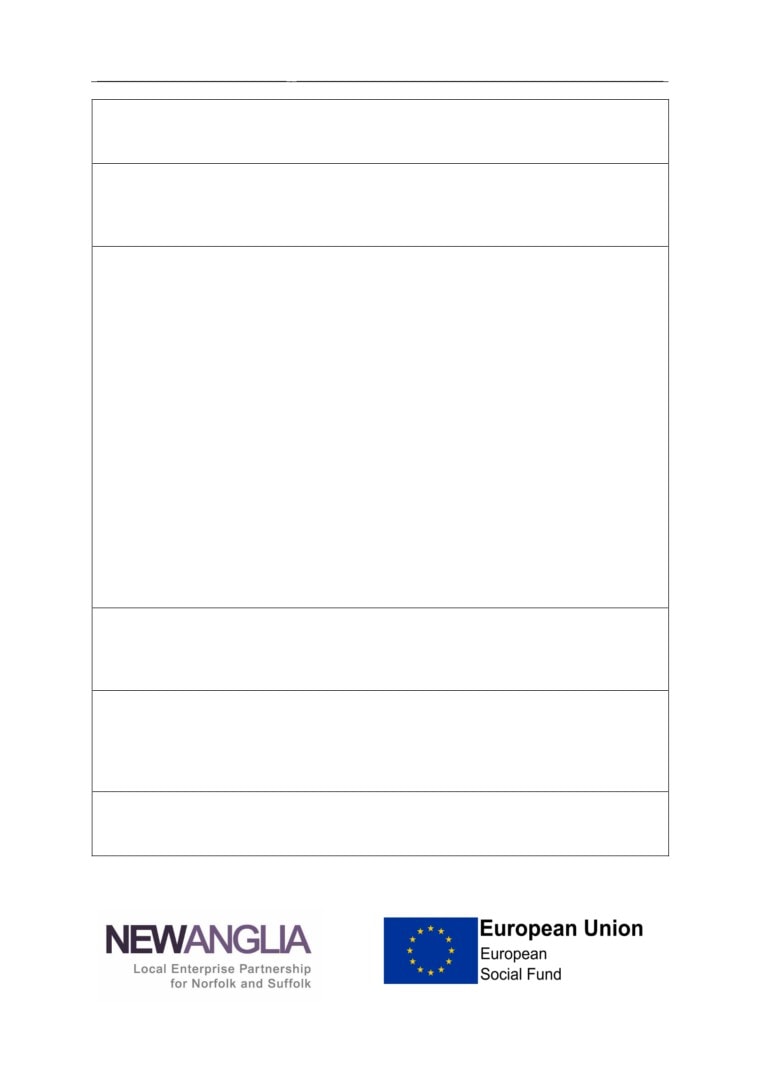

A Future View of the Ports and Logistics Sector Economy

Looking ahead, and using information from both the East of England Forecasting Model, and

the UKCES Working Futures model (and bearing in mind earlier comments with regards to

fluctuating numbers in employment), sector employment is projected to decrease slightly

between 2014 and 2024 by around 1% (approximately 600 jobs).

Despite this overall projected decline in job numbers there will still be growth areas within the

sector with nearly 6,000 new jobs at Level 4 to 6 (HE to First degree level) and above. At the

same time, there will be a significant number of existing jobs to replace as people leave the

sector workforce

Over the period 2014 - 2024, replacement demand is expected to be somewhere in the

region of 19,000 jobs. This places a net requirement for jobs requiring to be filled in the

sector at around 25,000. Much of this replacement demand is centred on Level 3 (A level

and equivalent) roles and below though Level 4 to 6 (HE to First degree level) roles also

feature quite strongly.

-5,000

-2,500

0

2,500

5,000

7,500

10,000

QCF 7-8

QCF 4-6

QCF 3

QCF 2

QCF 1

No Qual

Expansion Demand

Replacement Demand

Page 17

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

Opportunities and Challenges

Consultees and a range of reports have identified key drivers for the industry in the next 5-10

years which provide the backdrop to skills demand in the medium to long term.

Brexit and Trade

The impact of Brexit on the industry is very uncertain given that the sector’s fortunes are

very closely aligned with the health of the economy and trade. There is widespread

research and data evidence that recessions lead to falls in transport volumes (passenger

and freight), whereas growth leads to increased activity. As a region with major ports and

export intensive companies across many sectors, growth in international trade also has a

major impact on the Ports and Logistics sector more generally.

With continuing debate about how Brexit will affect both the health of the UK economy and

its impact on trade with both Europe and the rest of the World, companies were in general

cautiously optimistic that the sector will, except in the more extreme negative Brexit

scenarios, continue to grow. Long term there has been steady growth in trade volumes, e.g.

the value of global merchandise trade rose by +32% to $16trillion in the decade to 201617

even as the economy recovered from the 2007-’10 downturn. Whilst this was a big fall from

the +124% growth seen from 1996-2006, it shows that the value of World trade has

continued to grow even during slow growth periods.

In the Ports sector in particular the proximity to major economic centres in Europe has been

a key feature of the region for hundreds of years if not longer. The Hanseatic League in

which Kings Lynn was the UK leading centre, the ‘wool towns’ of Suffolk and strong Flemish

influences in Norwich all stand testament to these long standing ties. Our continued future

trade relationship with Europe will therefore have a major impact on the Ports sector. The

region is, however, at Felixstowe, home to the UK’s largest container port which handles

40% of UK container traffic, which with its deep water harbour is the only port in the UK able

to handle the World’s largest ships. Given the stated intention to use Brexit to increase trade

with the rest of the World this should help the Port to grow even if trade with Europe falls.

Domestic Travel and Freight

Data from DfT (2017)18 shows that annual motor vehicle traffic increased to a record high in

the year to September 2017 with:

Car traffic up by 0.9% to 253.7billion miles;

Lorry traffic fell by 1.5% to 16.5billion miles but van traffic rose by 3% to 50.1billion miles.

This short term trend in 2016-’17 is a continuation of what has been seen in the last decade,

during which:

Car traffic increased by +2.2%;

Lorry traffic fell by 8.7% but van miles rose by +21.2%.

17 WTO (2018), World Trade Statistics

18 DfT (2017), Statistical Release (30th November 2017): Provisional Road Traffic Estimates Great Britain -

October 2016 - September 2017

Page 18

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

This shows a clear trend for lorry volumes to be static or fall slightly, whilst more freight

transfers to van delivery, which is mainly attributed to the rise in online purchasing and direct

delivery to the home or workplace. Consultees expected these trends to continue as the

way products are distributed continues to change, with LGVs likely to be excluded from

many city centres, but a greater use of hubs from which vans or pods do the ‘last mile’.

Another interesting trend is that whilst in the medium to long term traffic volumes on the

motorway network (+35.4% in 20 years) and rural roads (+21% for A roads and +24.5% for

minor roads in 20 years) have grown strongly, those in urban areas have seen much smaller

growth (-0.9% on urban A roads and +7.8% on other urban roads). This is due to

investment in urban public transport, encouragement to cycle and walk and in some cities

(such as London) increases in road pricing.

The use of trains (DFT 2017) has been growing more strongly than other modes of surface

transport but only accounts for 1:50 total trips by all means (car, bus, train, walk, cycle).

From 2002-2016 the number of passengers using trains rose by +56%, travelling +23%

more miles, suggesting that average journey length has been falling. The rail system is

focused on London, with 64% of all rail journeys starting or ending in the capital19.

Rail freight is 9% of domestic freight at circa 15billion net tonne kilometres and has fallen in

the last 5 years by about a quarter, although all this fall is attributed to the fall in the volume

of coal moved by rail freight to power stations in other regions of the UK (DfT 2017).

Automation and Technology

The ports and logistics sector is changing rapidly, with new technology likely to transform the

industry in the next 10 years. Some local reports have anticipated that 45% of current jobs

could be displaced by automation, but nett overall jobs loss would be much smaller or the

sector may, if its growth continues, be able to create jobs. However the new jobs will be in

engineering and ICT for autonomous vehicles, automated and digitally enabled operations

etc. There is a real worry amongst some sector groups that many in the industry and skills

providers have not realised the scale of the change coming.

The Port of Felixstowe is already very automated, certainly one of the best in the World, but

when the freight leaves the port the rest of the logistics system is much less efficient and

very traditional. Felixstowe itself also expects to make substantial investments in automation

to address both workforce supply and health and safety drivers. It is currently, in early 2018,

installing new automated cranes for unloading ships and this will be followed with automated

gantry cranes to move containers around the port and load lorries in the next few years.

These new cranes can in theory be operated from anywhere, but will require new skills.

Trials of lorry platoons using wireless technology to accelerate, brake and steer in sync were

announced by government in August 201720 with a £8.1m grant. The aim is to reduce

congestion by allowing closer spacing between the vehicles and to reduce fuel usage.

19 DfT (2017), Rail Factsheet November 2017

20 Gov.UK (25th August 2017), Lorry technology trials could slash fuel costs and congestion

Page 19

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

Work for Haven Gateway by SQW (2017)21 suggests that there are five key innovation

drivers and needs for future logistics:

Autonomous logistics e.g. self-driving vehicles;

Data driven logistics e.g. complete digital tracking of the supply chain;

Machine-human collaboration so that humans and automation can work side by side;

Changes in distribution chains e.g. direct delivery services;

Security concerns which demand enhanced cyber security.

The Government’s Made Smarter Review (2017)22, identifies the distribution sector as one

which is ripe for change and disruption as new, digitally enabled technology, rolls out across

industry allowing more efficient systems to be deployed. The challenge is that all sectors are

seeing the same trend with a challenge therefore in meeting the skills needs this leads to. In

the Review government cited a report by the World Bank (2015)23 which stated that the UK

needed 745,000 additional workers with digital skills to meet rising demand from employers

between 2013 and 2017, and that almost 90% of new jobs will require digital skills.

A report by UKCES (2014)24 highlighted that the UK logistics sector ranked only 22nd globally

for the extent of training provided which it considered to be a major strategic weakness as

the sector seeks to embrace technology. It recommended that there was a need to broaden

the sector’s attractiveness through improved careers advice which demonstrates the

diversity and high tech nature of many current and future roles in the industry.

Automation is also seen as a key way in which the industry can improve its record on health

and safety by separating workers from the movement of heavy loads. Whether on the

railways, ports and shipping or road freight many accidents are the result of workers being

crushed or run into by vehicles.

Key risks25 in the transportation and storage sector include 52,000 workers suffering from a

work-related illness each year (LFS) of which 53% relate to musculo-skeletal disorders. 39%

of the Fatal injuries reportable under RIDDOR, over the period 2012/13-2016/17 related to

being struck by a moving vehicle and a further 18% due to being struck by a moving object.

Separation of workers from the physical operation of moving material around, though

automation, can help to reduce these risks.

Clean Transport

Feedback from local consultees included a view that for the foreseeable future most long

distance road freight will probably be diesel powered, but that large trucks are unlikely to go

into city centres in the medium term. This will require new distribution models, with edge of

21 SQW (2017), Growth Sectors and Innovation in Haven Gateway

22 HMG (2017), Made Smarter Review

23 The Effects of Technology on Employment and Implications for Public Employment Services. The World Bank

Group. Report prepared for the G20 Employment Working Group Meeting Istanbul, Turkey, 6-8 May 2015.

24 UKCES (2014), Understanding Skills and Performance Challenges in the Logistics Sector

25 Health and Safety Executive (2018), Health and safety statistics for the transportation and storage sector in

Great Britain

Page 20

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

town/city hubs into which bulk deliveries are made, from which light, probably EV and

autonomous vehicles will travel into the urban area. Clean transport is as a result receiving

much more attention with regional events, e.g. UEA and Hethel Innovation Futuristic

Transport event on 21st March 2018 at UEA, and national events, e.g. Investing in Clean

Transport event 14th March 2018 in London, promoting this agenda actively with industry.

Employer feedback on how quickly the transition to new transport models will occur,

including the use of EVs and autonomous vehicles, varied, but all consultees felt that this

change is inevitable in the medium to long term.

There is growing pressure from government and consumers for the transport sector to

demonstrate lower environmental impact. The UK Clean Growth Strategy (2017)26 focused

many of its recommendations on the transport industry which is responsible for 24% of UK

carbon emissions (2015). Whilst it recognised that engine technology has helped reduce

emissions per kilometre by up to 16% since 1990, the strategy calls for further substantive

cuts in transport emissions. It states that: ‘accelerating the rollout of low emission vehicles

contains a triple win for the UK in terms of industrial opportunity, cleaner air and lower

greenhouse gas emissions’. The measures proposed for transport are:

Accelerating the shift to low carbon transport - 24% of UK emissions:

End the sale of new conventional petrol and diesel cars and vans by 2040

Spend £1 billion supporting the take-up of ultra low emission vehicles (ULEV), including

helping consumers to overcome the upfront cost of an electric car

Develop one of the best electric vehicle charging networks in the world by:

o investing an additional £80 million, alongside £15 million from Highways England, to

support charging infrastructure deployment

o taking new powers under the Automated and Electric Vehicles Bill, allowing the

government to set requirements for the provision of charging points

Accelerate the uptake of low emission taxis and buses by:

o providing £50 million for the Plug-in Taxi programme, which gives taxi drivers up to

£7,500 off the purchase price of a new ULEV taxi, alongside £14 million to support

10 local areas to deliver dedicated charge points for taxis

o providing £100 million for a national programme of support for retrofitting and new

low emission buses in England and Wales

Work with industry as they develop an Automotive Sector Deal to accelerate the

transition to zero emission vehicles

Announce plans for the public sector to lead the way in transitioning to zero emissions

vehicles

Invest £1.2 billion to make cycling and walking the natural choice for shorter journeys

Work to enable cost-effective options for shifting more freight from road to rail, including

using low emission rail freight for deliveries into urban areas, with zero emission last mile

deliveries

26 BEIS (2017), Clean Growth Strategy

Page 21

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

Position the UK at the forefront of research, development and demonstration of

Connected and Autonomous Vehicle technologies, including through the establishment

of the Centre for Connected and Autonomous Vehicles and investment of over £250

million, matched by industry

Innovation: Invest around £841 million of public funds in innovation in low carbon

transport technology and fuels including:

o ensuring the UK builds on its strengths and leads the world in the design,

development and manufacture of electric batteries through investment of up to £246

o delivering trials of Heavy Goods Vehicle (HGV) platoons, which could deliver

significant fuel and emissions savings

Consultee Feedback

Consultees in New Anglia identified a range of key workforce and skills challenges which

need to be addressed to facilitate future growth of the Ports and Logistics sector, many of

which concur with the changes identified in the reports reviewed above. The two task and

finish groups (detailed in the appendices) also reinforced many of the issues raised in one to

one consultations. The consultations identified key issues and views including:

Sector potential and change:

The sector is growing and major developments such as offshore energy will continue to

support demand for logistics skills. But competition is also increasing and this will

increase the focus on efficiency and productivity of labour use.

Significant investments in regional road and rail capacity are now included in spending

commitments nationally and regionally and this will increase logistics capacity. Major

strategic issues both inside and just outside (e.g. Ely North rail) the region are, however,

constraining capacity increases. The budget in autumn 2017 committed to an NIC

inquiry into freight infrastructure which will include East-West rail and the A14.

Technology will change the industry and this process is accelerating with UK trials of

autonomous vehicles, platooning of multiple vehicles, blockchain and other technologies

to improve supply chain data. However, adoption will be constrained by the ability of the

whole supply chain to adopt the technology and so it is likely that the ‘last mile’ in urban

areas will adopt technology such as drones or autonomous vehicles first.

More broadly IT skills capacity is a limiting factor in the takeup of new technologies in the

ports and logistics sector. Without the skills to adopt technology the ability of companies

to gain the benefits will be constrained. The challenge is to ensure a supply of staff who

have both logistics and ICT skills so that they can develop and apply the potential of ICT

to the industry.

Warehousing and automated loading/unloading is also likely to see early adoption

because warehouses are relatively easy to automate, are controlled/private sites and

involves moving large weights where health and safety concerns are paramount.

Felixstowe is introducing new remote controlled quayside cranes by Easter 2018 and will

Page 22

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

have remote controlled gantry cranes on trial later in 2018. Driverless trucks for use on

the port will arrive in 5-10 years. This will increase the demand for engineering and ICT

skills. Unless the East of England invests in this new technology competition is likely to

mean that the area will lose market share.

Home delivery will continue to grow strongly and bring fundamental changes to how

supply chains are organised.

Workforce supply:

The driver shortage affects the coach, bus and freight sectors, with most businesses

struggling to secure the number of drivers needed. There is a Christmas driver shortage

every year which is getting worse. Some consultees felt that ‘driverless vehicle

propaganda’ is not helping them recruit as people are less likely to enter an industry if

they think they will be out of a job within 5 years.

EU nationals who have met workforce supply gaps are increasingly going home and

exacerbating the challenges in a UK sector which is already short of 55,000 drivers.

Key decisions for major international logistics companies are taken overseas and this

includes decisions on skills programmes. The sector is also very competitive which

makes it hard to collaborate on skills or other issues.

There are already recruitment and retention problems and the move to new technology

will exacerbate this. Low unemployment and a reliance on migration to meet labour

needs in recent years compound this problem.

In lower paid roles, such as customer service and security, it can be hard to retain staff

as they are in short supply and can easily change jobs.

Engineers at most levels are hard to find.

Specialist roles such as air traffic control have no local providers, but there is potential

for the International Aviation Academy Norwich (IAAN) to develop this provision.

Investment in CPD has been constrained by low profit margins and this now creates a

major challenge as the sector seeks to move forward quickly with new technology, as

there is a mismatch between current and future skills needs. Many of those in jobs

which are likely to be displaced, e.g. many driving roles, lack the basic skills in maths

and literacy to progress into the jobs which will be created.

Careers Advice:

The industry has a perception problem especially as the industry changes and for

example lorry driver jobs are replaced with a need for ICT and logistics planners.

Economic development officers reported that they work with a wide range of young

people and that it is evident that both the young people and their School/College Career

Co-ordinators have a lack of knowledge on the types of jobs involved and the

progression routes available in the Ports and Logistics sector.

Most young people do not understand what Logistics is and it may be better to talk about

as the delivery part of ‘business’ which gets goods or people where they are needed.

Page 23

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

The NW of England and Midlands are much better at promoting logistics as a career

than the East of England. The Think Logistics programme27 (Career Ready) is working

successfully in some regions and has strategic partners including DHL, DAF, FTA, RHA

etc. It includes 22 Career Ready Logistics centres nationally, but has virtually no activity

in the New Anglia area. It focuses on apprenticeships, paid work experience and

internships to prepare young people for a career in logistics.

Work experience opportunities at a Port or Logistics Company would be useful,

especially in showcasing the wide range of skills needed and careers on offer (e.g. DHL

has in house doctors). It is also important to show how it is important to other industries

such as manufacturing and food. This is really important as drivers can be as young as

18 now and so it is important to attract younger workers.

The mature workforce and those looking to upskill/reskill need to understand how new

technology will impact the sector. Salaries and wages may need to rise to attract more

staff, although for many roles rewards are already very competitive.

The challenges in logistics recruitment need to be seen in the context of the wider

challenges with low skills attainment and aspirations in Norfolk and Suffolk.

Responsiveness of skills provision:

Providers and employers need to work together much more closely to meet future needs.

There is a need for Colleges and Universities to be able to change courses much more

rapidly to meet the pace of change in the industry.

Colleges have a big role to play, but the sector has been poor at articulating its skills

needs and the Colleges have not focused on the ports and logistics sector as a result.

Nationally the best provision for ports and logistics is in the West (Liverpool, Cardiff) and

on the Humber (new Modal Centre etc.).

The skills providers could also fulfil a very useful role in skills and sector development by

providing the thought leadership, technology exemplars and courses to help the industry

modernise, but current local provision (Colleges and Universities) are not really doing

this and substantial change is needed for them to be able to deliver this leadership.

There is too much admin with apprentices and many companies see it as more hassle

than its worth (one local employer took on 50 office apprentices with only 12 successfully

completing as the training provider went under). The levy is difficult to access.

There is currently no L6 apprenticeship standard for the sector. This is a challenge as

courses, such as degree apprenticeships, which combined practical experience with

study would suit this sector well. They would help to meet future demands for

operational and strategic managers to grow the industry who can combine logistics

experience with management, technical and digital skills. Apprenticeship standards

which allow a combination of engineering and ICT and logistics skills are needed -

current standards are far too restrictive to meet future employer needs.

Page 24

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

Nationally NOVUS (linked to CILT) working with Aston University and the University of

Huddersfield have developed a very practical course and students have always had jobs

at the end of the course since it started in 2012.

There are issues with drivers being able to get tests even if they do their training

(theoretically you could start and finish within 10 days and be fully qualified as an LGV

driver), however, the earliest available tests at the moment are nearly 3 months away.

Many young people are put off applying for offshore logistics jobs as the initial training

costs to secure the safety training needed is prohibitively expensive.

Some consultees reported using national courses such as those offered by BIFA (British

International Freight Association), but are concerned at the costs of accessing these

national courses which require travel and accommodation costs on top of course fees.

College and University facilities and staffing:

The Ports and Logistics sector has received little attention from most FE and HE

providers which have seen it as an unattractive sector to work in. Local Universities are

weak in engineering and with the exception of the University of Essex have limited ICT

capability linked to logistics.

The International Aviation Academy Norwich (IAAN) has potential to expand substantially

but needs to do more to develop the national market to do this. Its provision of a degree

and qualified air engineer status in the first in the UK. The initial Air Traffic Control

course costs £20,000 and there is scope to develop local provision.

Specific areas with skills gaps identified by local employers included:

Management skills to adopt new technology were seen as a major constraint to industry

modernisation. There will be a growing need to focus on performance management,

enabled by digital data and dependent on a wide range of ICT skills.

The lack of an apprenticeship programme for drivers means that they have to pursue the

CPC route which is very costly (at least £3,000 and £5,000 if including in company time)

and has a 44% failure rate. This is a serious disincentive to young people to train.

Consultees also reported that in their view generic office administration apprenticeships

did not prepare young people for roles in the logistics sector.

The ports and logistics sector is changing very rapidly, with new technology likely to

transform the industry in the next 10 years. It is anticipated that 45% of current jobs

could be displaced by automation, but nett overall jobs loss would be much smaller or

the sector may, if its growth continues, be able to create jobs. However the new jobs will

be in engineering and ICT (including electrical engineering) for autonomous vehicles,

automated and digitally enabled operations etc. There is a real worry that many in the

industry and skills providers have not realised the scale of the change coming.

There is a real lack of ICT staff and engineers who understand ports and logistics. Staff

who have this mix of skills are in very short supply and ‘earn more than bankers’ with

salaries of £100k per annum or £1,000 per day for contract staff not unusual.

Page 25

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

Felixstowe is very automated, one of the best ports in the World, but when the freight

leaves the port the rest of the logistics system is much less efficient. The same concerns

were reported for the coach sector where modern technology has not been adopted.

Air traffic engineering is suffering a shortfall of staff nationally and most employers are

thus trying to take on former RAF staff and retrain them for civilian roles.

Challenges in finding construction staff to build new infrastructure e.g. roads, rail links,

will also potentially constrain the ability to transform the industry.

Marine pilots are a major gap as without them boat owners are very reluctant to use your

ports as the Ports Act requires safe operation. The old progression routes from being at

sea as a Master Mariner to becoming a pilot has broken down. Some local companies

are trying to run in house courses to fill the gap, but it is a growing problem as there is no

nationally recognised pilot training provision. There is a need to develop a national

legislative framework to support apprentice marine pilots and the potential to link this

with other major ports which are facing similar challenges, such as Rotterdam.

Regional connectivity with neighbouring areas and national provision:

Responding to macro economic issues including Brexit, trade policies and other changes

make it hard for ports and logistics companies to focus on future workforce needs.

Infrastructure problems mean that developments which should happen, e.g. more freight

by rail from Felixstowe to the Midlands, are constrained by poor infrastructure (e.g. Ely

North junction and the focus in the rail industry on passenger traffic growth).

Links to Midlands distribution centres and networks are the key to the sector given that

most imports go there and exports come from there. On skills it would be useful to link

with other LEP areas which have large logistics sectors such as SEMLEP, SELEP and

GLLEP to develop national leadership on logistics skills development.

Additional National and Regional Reports and Examples of Ports and Logistics Skills

Needs and Provision

The feedback from New Anglia employers and stakeholders is broadly consistent with

national and regional reports on the challenges and opportunities in the Ports and Logistics

sector. Key reports include:

The Government Office for Science ran a Foresight Future of Mobility Project in

201728 which include a freight roundtable. This concluded that: automation of freight

handling will be transformation, particularly for road freight, though it would strongly

affect a large, low-skilled workforce. The exercise also identified that advanced

manufacturing may change patterns of freight and competition for land in built up areas

may increase competition between roads and land for other uses.

Work for New Anglia29 by Mouchel on future Transport scenarios has identified major drivers

which affect transport including: digital connectivity; AI; automation and robotics; new forms

28 Government Office of Science (2017), Foresight Future of Mobility Project

29 New Anglia (2018), Mouchel Technical report re. future technological changes in the transport sector

Page 26

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

of propulsion; light-weight materials for vehicles; 3D printing and collaborative consumption,

all of which have the potential to change transport needs.

Further recent national and international media reports and examples of training innovation

which deal with the Ports and Logistics sector include:

An article in UK Haulier in December 201730 noted that: introduced in 2009, the Driver

Certificate of Professional Competence (CPC) has pushed older drivers to retire rather

than pay £3,000 for the certificate. There has been a 45% fall in drivers obtaining the

licence in five years, according to the non-profit, Skills for Logistics. It concludes that ‘a

lot of businesses in the sector now are looking at reducing their reliance on drivers - and

seeking out more efficient and cost-effective way of operating’. It goes on to state that

technology has a key role to play in reducing the reliance on drivers with systems such

as vehicle-tracking Telematics, which can save up to 20% in costs by ensuring the

nearest driver is directed to a job, cutting driving time and optimising drop routes.

Peel Ports HR Director (2016)31 Howard Sloane in a Port Strategy article stated that the

industry was ‘a watershed moment in recruitment for our industry because we can no

longer rely on the traditional sources for senior and executive-level managers. To be

able to respond to a shifting environment, driven by changing customer needs, the ports

industry needs to broaden its talent pool. Indeed, we are looking for individuals with the

ability to drive transformation that will deliver success for our business. That means

attracting a far wider range of leaders and innovators with different skill sets’. The article

goes on to say that changes in the market, continued growth and increased demand for

new business and technical skills will drive change.

Port Strategy (2015)32, reported that: ‘for ports and terminals, a wide range of courses

and initiatives allows operators and employees to train, re-train or work on Continuous

Professional Development (CPD). Julia Bradley, group marketing director of Peel Ports,

explained that the range of courses undertaken by the Peel group: “We place all

managers and supervisors on a MTP (Managing Terminal Performance) course for five

days. We also place our people on a number of industry related courses/seminars, for

example ISPS, CTPAT, IMDG, IOSH-MSIP and NUG.” Meanwhile, Peel Ports'

managers and future leaders are placed on a range of courses: for example, MBAs,

Masters, degrees in science or engineering, and more specific HNDs and HNCs. In

addition, Peel Ports also offers the active support of an apprentice scheme.’ The article

is also clear that the international nature of the sector and the fact that many of the

companies in the sector operate in multiple countries, often means that companies want

to ensure consistency across their geography either through in house programmes or by

using a single training provider.

Page 27

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

During 2014 the Humber LEP conducted a series of meetings culminating in a report on

the skills needs of the Ports and Logistics sector33, which concluded that there was

potential to increase sector productivity, but that this would require new training provision

as the sector had been overlooked for several decades and was therefore poorly served

by mainstream provision.

Port Strategy (2017)34 carried an article from PD Ports urging the sector to embrace

apprenticeships with a focus on engineering to address the need to attract new young

people to the industry. It was responding to the fall in apprentices during 2017, by

stressing that apprenticeships are essential to the future of the sector. Another article in

Ports Strategy 201535 also suggested that it expected the use of online simulated games

to provide training to increase, for example the uptake of Standard Operating Procedures

(SOPs) and health and safety training.

More sophisticated simulators are also now being used in the Ports and Logistics, with

for example Modal Training at Immingham36 on the South Bank of the Humber hosting a

£7.5m investment in crane, driving and ships bridge simulators (NB East Coast College

has links to Modal). Mersey Maritime CEO Chris Shirling-Rooke stated in 201737 that:

‘we need to focus on core areas: advanced manufacturing; professional knowledge; and

skills and the logistics industry as a whole is facing a skills shortage, so skills will remain

a big issue’. In response it has worked with Liverpool John Moores University (LJMU) to

open a Maritime Knowledge Hub (in 2016) which includes ships bridge simulators.

Logistics Manager in an article in December 201738 explored the potential for automation

to help address the workforce supply challenge in logistics with companies saying that

‘skill shortages lead to higher wages and this is increasingly tipping the balance in favour

of automation in ROI calculations’. With current technology it reports that automated

warehousing systems can usually only address 95% of the picking needs, with the rest

still dependent on humans, with companies such as Amazon still seeing a role for

humans working alongside automated systems to complete the more complex tasks.

Longer term the report suggests that Artificial Intelligence (AI) systems will allow more

sophisticated automation with companies such as Ocado working on this technology with

research partners using EU H2020 project funding.

Conclusions

What unites all the national and international reports is a belief, borne out by local

employers, that the Ports and Logistics sector will see major change, which in its speed and

nature will be as significant as any of the earlier changes seen in the industry.

33 Humber LEP/HCUK Training (2014), Skills Support for the Workforce Local Response Fund: Skills Gap Report

- Ports and Logistics

Page 28

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

However, this has to be set against uncertainty over travel volumes, both domestically and

internationally, which are dependent on the health of the economy, post Brexit trading

relationships in both Europe and globally and investment in transport and distribution

infrastructure.

Most consultees expect medium to long term growth in trade and transport volumes even if

the short term sees some downturn in growth rates until Brexit and future trade uncertainties

are resolved.

The challenges on workforce and skills are mainly focused on three areas:

A short to medium term (or possibly longer term depending on how quickly automation

arrives) challenge in securing the workforce needed to sustain day to day operations e.g.

drivers and warehouse staff. This need is driven partly by concerns that the supply of

migrants who have filled these gaps in the workforce in recent years may become

restricted;

An expectation that the moves now being seen to invest in automation and clean

transport systems will accelerate rapidly in the next 5-10 years leading to a big increase

in the demand for staff skilled in engineering, ICT and digital;

A current and longer term challenge in securing the management skills to drive change

and promote trade, innovation and growth in the industry.

In developing the sector skills plan, it would be easy to focus on the first of these challenges

to address short term workforce supply issues, but most consultees were clear that whilst

this is a pressing issue for the industry, we must also be looking to embrace the medium to

long terms changes which the Ports and Logistics sector will see, so that our local industry

can be at the forefront of these changes and thus safeguard its competitive position.

Page 29

New Anglia LEP

Ports and Logistics Sector Skills Plan, March 2018

The Ports and Logistics Sector Skills Plan

The Ports and Logistics sector skills plan includes measures to help the sector act

collectively, short term locally responsive actions to meet immediate workforce supply

challenges and longer term, strategic and often larger scale development of new centres and

programmes to meet the long term workforce and skills needs of the sector.

Priorities for Action

The Ports and Logistics sector faces a series of current and future challenges in sourcing the

workforce and skills needed to support both current operations and to deliver growth.

Ports and Logistics has been relatively poorly served by mainstream post 16 education, with

relatively few courses in the FE or HE sector, with the exception of FE vehicle maintenance

provision. Many employers use private sector providers for ‘certified courses’ e.g. driver

training, access national specialist provision and several have developed their own training

centres e.g. the Goldstar Transport Training Centre and Seven Lincs Driver Academy.

Employers are aware that this lack of local FE and HE provision is in part due to the lack of

engagement that they have had with Colleges. Given the changes anticipated in future skills

needs of the industry there is a view, from both employers, Colleges and Universities that