Ports & Logistics

Data Pack

Version 3 09.03.2018

CONFIDENTIAL

Contents

Page

-

Introduction to the Sector Data Pack

3

-

Introduction to and Definition of the Ports & Logistics Sector

3

-

The Ports & Logistics Sector in New Anglia

o Overview

5

o Employment

7

o Enterprises

22

-

Ports & Logistics Sector Skills Supply and Demand

o Qualifications

30

o UKCES Employer Skills Survey sector analysis

32

▪ Vacancies

33

▪ Skills Gaps

34

▪ Training

35

▪ Staff

37

o Further Education Learning Aims analysis

38

o Apprenticeships

45

o Labour Insight Jobs tool sector analysis

48

o

‘Where the Work is’ tool sector analysis

55

-

A Future View of the Ports & Logistics Sector

60

-

Appendix - Ports & Logistics Sector Definition

68

2

Introduction to the Sector Data Pack

The role of the Sector Data Pack is to bring together the latest socio-economic and labour market data and present both an up-to-date, and

future view, of the sector and any underlying issues within the area that could impact upon it. Data is presented in a navigable format without

comment with interpretation at this stage left to the reader

The Data Pack informs the Sector Evidence Report, the key findings from which help to inform the priorities developed in the Sector Skills Plan.

The Sector Evidence Report is also summarised within the Sector Skills Plan and appears in full in the its appendices.

In most instances data has been analysed and presented down to local authority level. In some instances, and even where local authority data

is available, it has not been presented in the data pack due to issues of unreliability and small sample sizes. This is particularly the case with

data from the Annual Population Survey and the Annual Survey of Hours and Earnings.

Introduction to and Definition of the Ports & Logistics Sector

3

The Ports & Logistics

Sector in New Anglia

4

Ports & Logistics sector contribution to the

local economy

4,085

£2.33bn

6.7%

6.5%

48,700

6.2%

GVA

Employment

Enterprises

Source: New Anglia LEP Economic Strategy evidence base work

5

Ports & Logistics sector contribution to growth in the

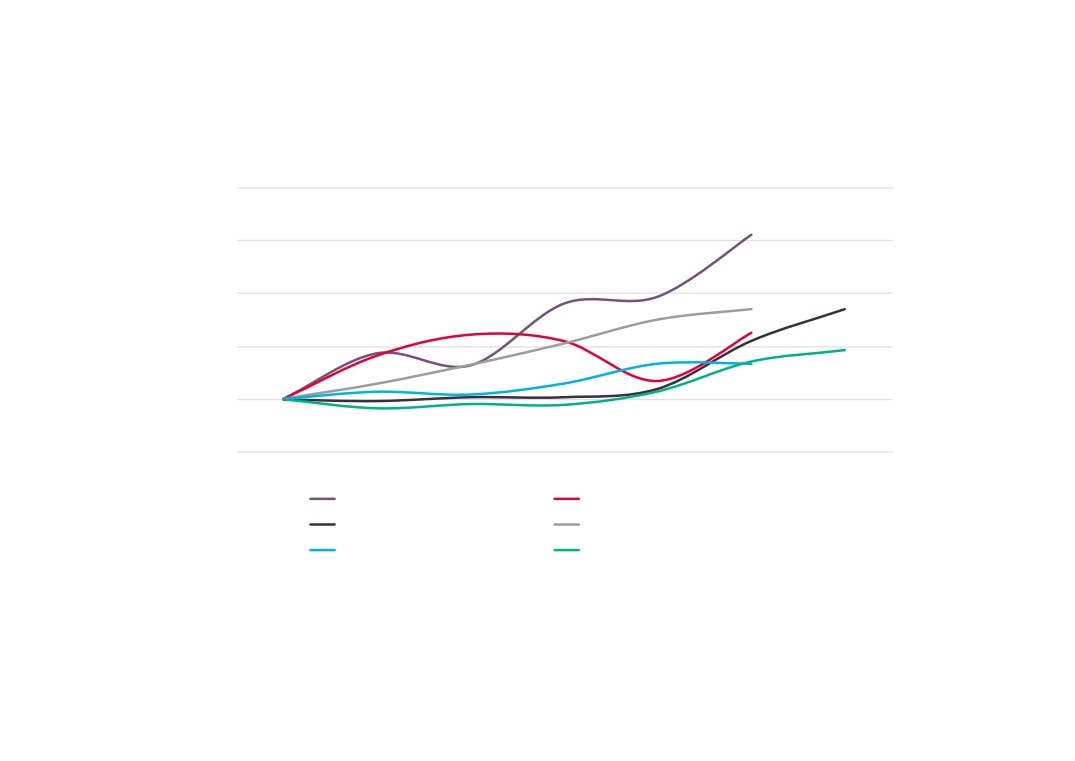

local economy (2010=100)

140

130

120

110

100

90

2010

2011

2012

2013

2014

2015

2016

Transport & Logistics GVA

Transport & Logistics Employment

Transport & Logistics Enterprises

Total GVA

Total Employment

Total Enterprises

Source: New Anglia LEP Economic Strategy evidence base work

6

Employment

Employment provided by the Ports & Logistics sector

across comparator areas, 2015

New Anglia

45,000

Norfolk

18,900

Suffolk

26,000

Greater Lincolnshire LEP

32,000

Humber LEP

28,000

Solent LEP

39,000

South East LEP

103,800

East of England

166,100

Source: Business Register and Employment Survey, Office for National Statistics

Please note that due to the experimental nature of the employment statistics produced by New Anglia LEP for the New Anglia

area presented on page 5, these have not been able to be replicated for comparator areas, hence why the figures for New

Anglia here are different to those reported previously.

7

Proportion of employment provided by the Ports &

Logistics sector across comparator areas, 2015

New Anglia

6.7%

Norfolk

5.2%

Suffolk

8.2%

Greater Lincolnshire LEP

7.6%

Humber LEP

7.3%

Solent LEP

7.4%

South East LEP

6.5%

East of England

6.2%

England

5.9%

Source: Business Register and Employment Survey, Office for National Statistics

Please note that due to the experimental nature of the employment statistics produced by New Anglia LEP for the New Anglia

area presented on page 5, these have not been able to be replicated for comparator areas, hence why the figures for New

Anglia here are different to those reported previously.

8

https://newanglia.co.uk/wp-content/uploads/2021/05/background09-28.jpg8b50540a-b235-11eb-8b25-0cc47a792c0a_id_8b50540a-b235-11eb-8b25-0cc47a792c0a_files/background09.jpg" width=841 height=595>

Employment provided by the Ports & Logistics sector

across New Anglia, 2015

Babergh

1,450

Breckland

3,225

Broadland

1,655

Forest Heath

1,200

Great Yarmouth

1,780

Ipswich

5,240

King`s Lynn and West Norfolk

3,000

Mid Suffolk

3,915

North Norfolk

1,625

Norwich

5,530

South Norfolk

1,750

St Edmundsbury

3,195

Suffolk Coastal

9,205

Waveney

2,040

Source: Business Register and Employment Survey, Office for National Statistics

9

Proportion of employment provided by the Ports &

Logistics sector across New Anglia, 2015

Breckland

6.5%

Broadland

3.6%

Great Yarmouth

4.7%

Kings Lynn and West Norfolk

5.6%

North Norfolk

9.8%

Norwich

10.3%

South Norfolk

3.9%

Babergh

4.7%

Forest Heath

4.9%

Ipswich

7.3%

Mid Suffolk

11.1%

St Edmundsbury

2.6%

Suffolk Coastal

10.9%

Waveney

4.4%

Source: Business Register and Employment Survey, Office for National Statistics

10

Change in Ports & Logistics employment across

comparator areas, 2010 - 2015

New Anglia

10%

Norfolk

7%

Suffolk

13%

Greater Lincolnshire LEP

6%

Humber LEP

16%

Solent LEP

20%

South East LEP

9%

East of England

11%

England

9%

Source: Business Register and Employment Survey, Office for National Statistics

11

Change in Ports & Logistics employment

across New Anglia, 2010 - 2015

Babergh

4%

Breckland

-10%

Broadland

-6%

Forest Heath

32%

Great Yarmouth

-10%

Ipswich

14%

King`s Lynn and West Norfolk

7%

Mid Suffolk

11%

North Norfolk

19%

Norwich

25%

South Norfolk

0%

St Edmundsbury

9%

Suffolk Coastal

16%

Waveney

14%

Source: Business Register and Employment

Survey, Office for National Statistics

12

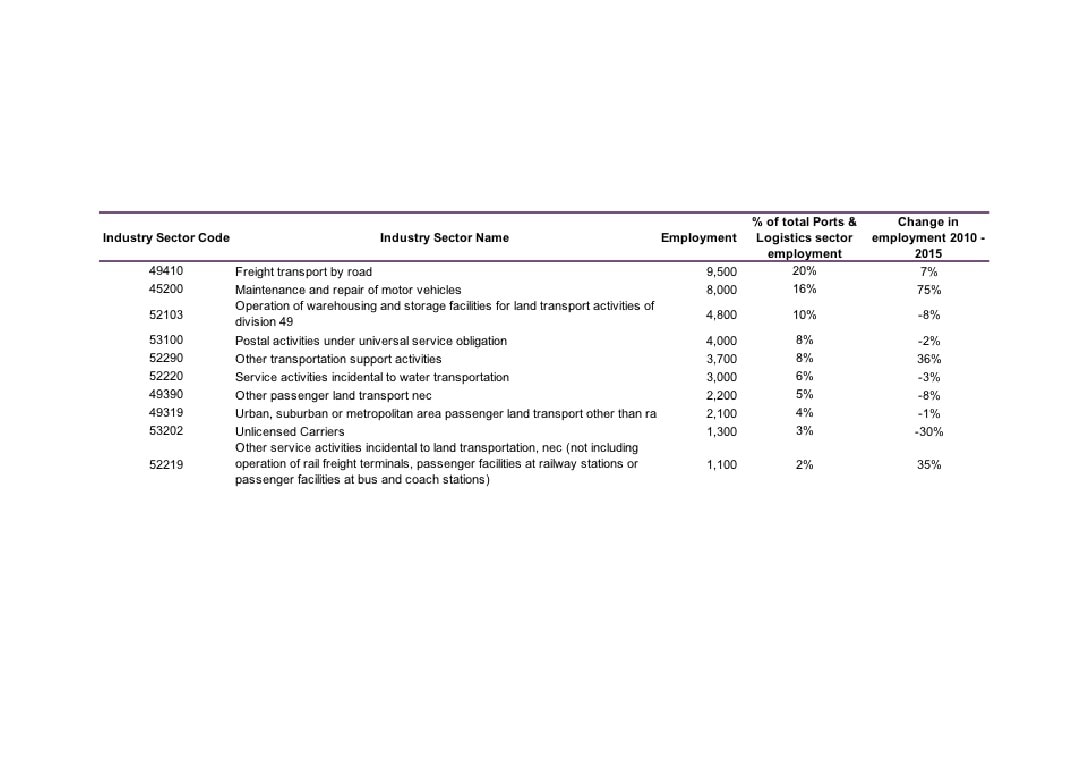

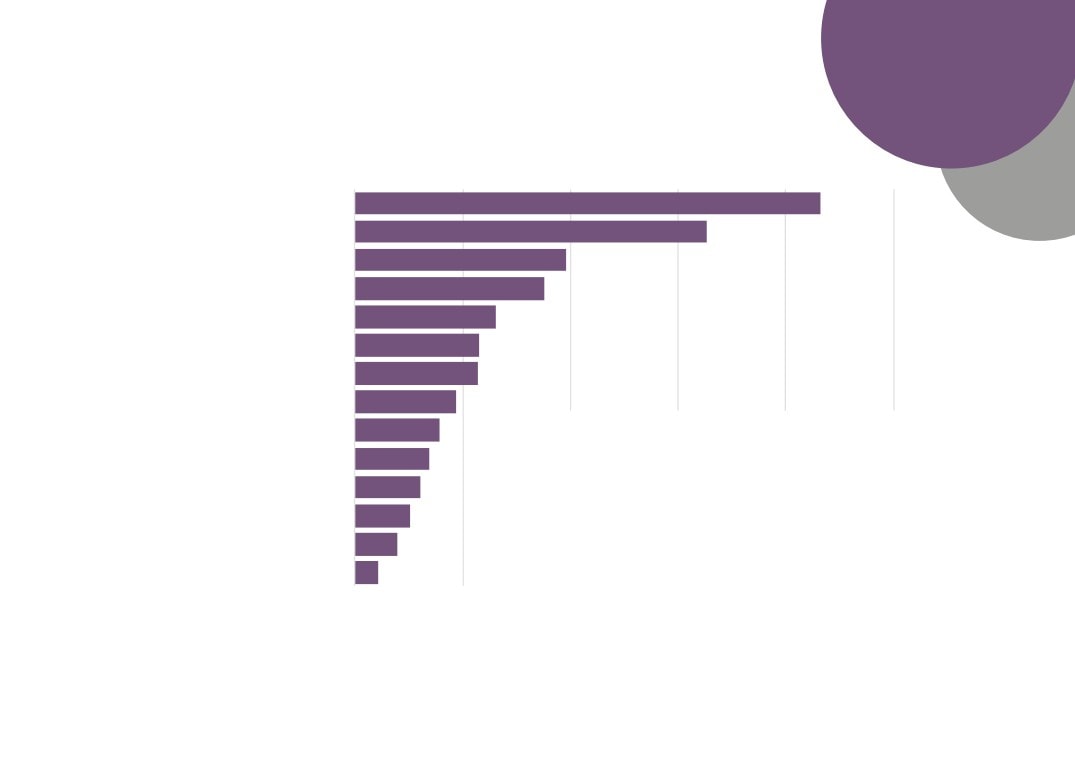

Top Ports & Logistics sub sectors by employment, 2015

Source: New Anglia LEP Economic Strategy evidence base work

13

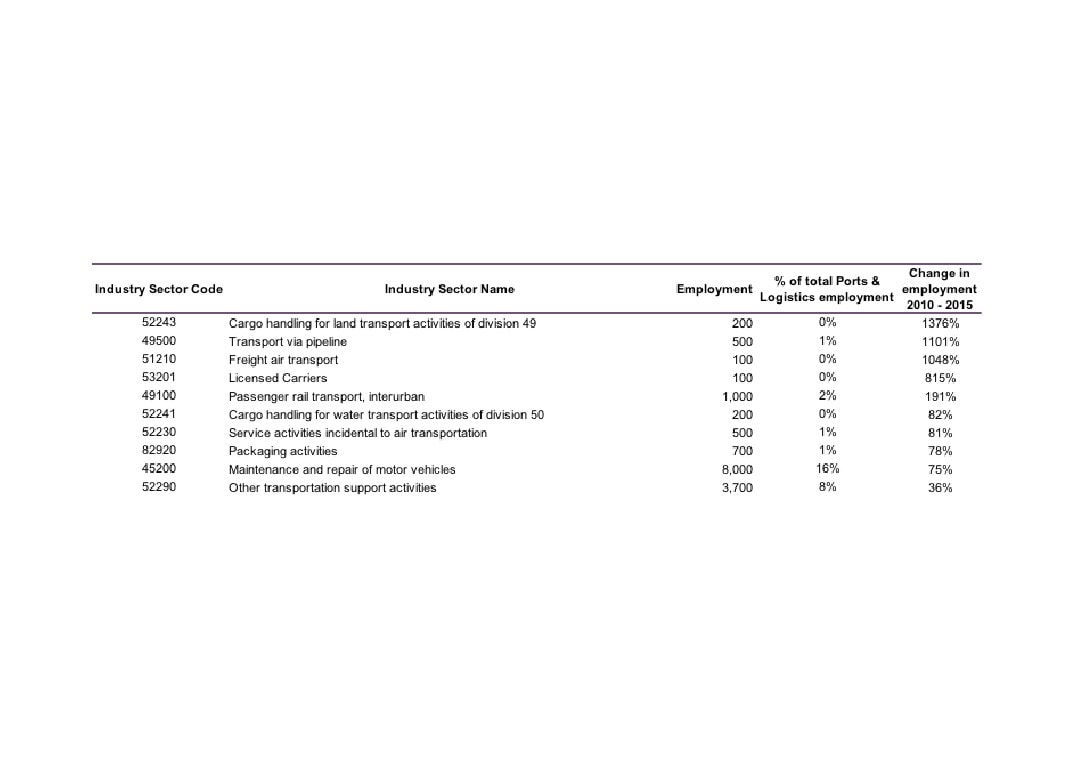

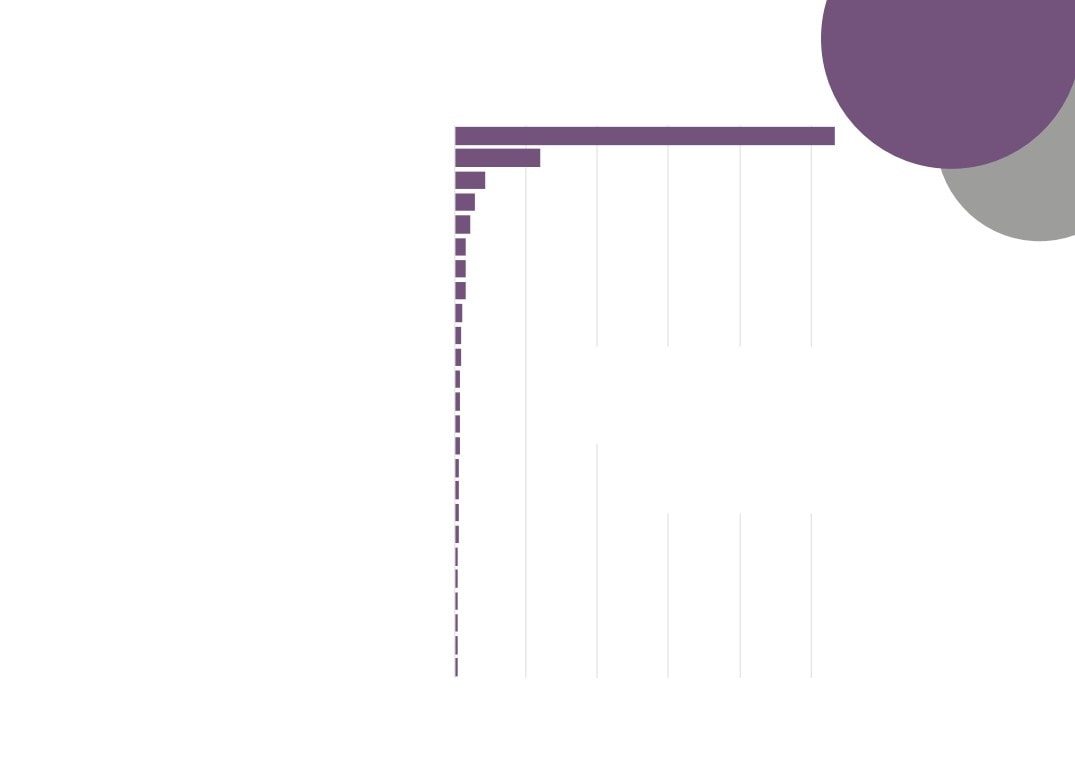

Top Ports & Logistics sub sectors with 100 employees or more by growth in

employment

Source: New Anglia LEP Economic Strategy evidence base work

14

Ports & Logistics location quotients across

comparator areas, 2010 and 2015

1.1

New Anglia

1.1

0.9

Location quotients (LQs) are a

Norfolk

0.9

useful way of showing a sectors

importance to the local economy

1.4

Suffolk

relative to the national picture. The

1.3

analysis presented here uses

employment with an LQ above 1

showing a higher concentration than

nationally, and an LQ of below than

1.3

1 a lower concentration.

Greater Lincolnshire LEP

1.3

1.3

Humber LEP

1.1

1.3

Solent LEP

1.1

2015

1.1

South East LEP

1.1

2010

1.1

East of England

1.0

Source: Business Register and Employment Survey, Office

for National Statistics

15

Ports & Logistics location quotients

across New Anglia, 2015

0.8

Babergh

0.8

1.1

Breckland

1.5

0.6

Broadland

0.6

0.8

Forest Heath

0.6

0.8

Great Yarmouth

0.9

1.3

Ipswich

1.2

1.0

King`s Lynn and West Norfolk

0.9

1.9

Mid Suffolk

1.8

0.8

North Norfolk

0.8

1.1

2015

Norwich

0.9

0.6

South Norfolk

2010

0.6

0.9

St Edmundsbury

0.9

3.1

Suf folk Coastal

2.9

0.9

Waveney

0.7

Source: Business Register and Employment Survey, Office for National Statistics

16

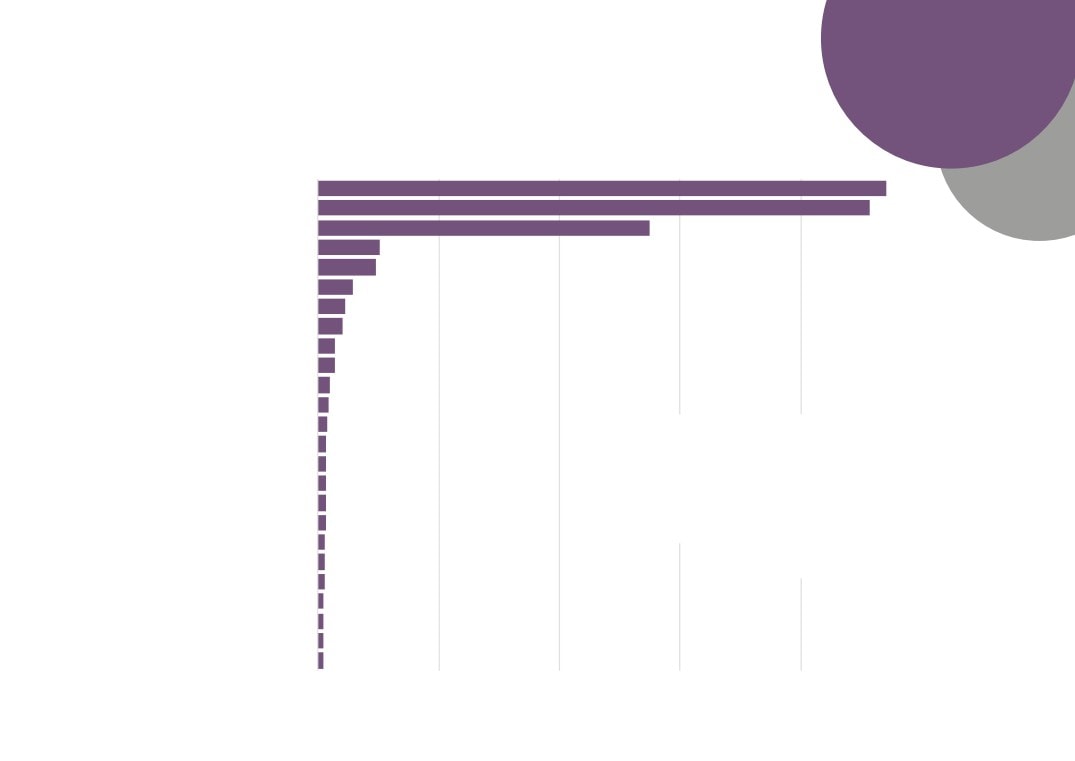

Ports & Logistics sub sectors with location quotients (LQs) above 2

Source: Business Register and Employment Survey 2015, Office for National Statistics

17

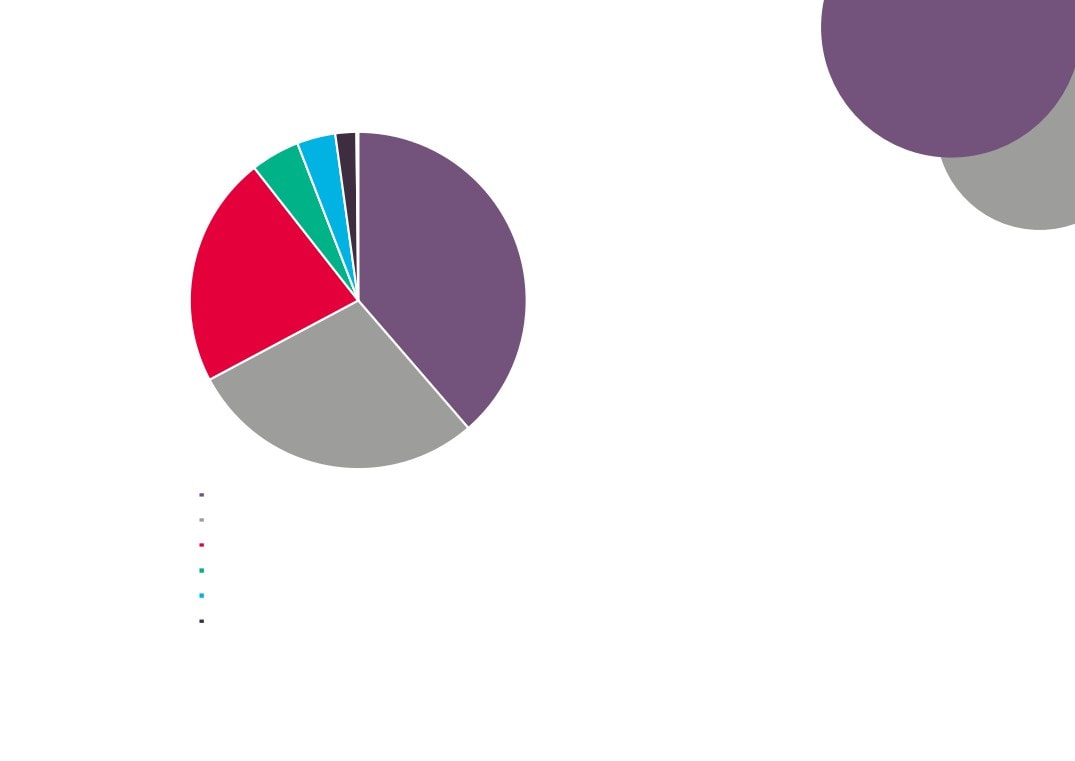

Full time, part time, and self-employment in the

Ports & Logistics sector, 2015

New Anglia

57%

29%

14%

Transport & Logistics

76%

12%

12%

0%

100%

Full time

Part time

Self Employed

Source: New Anglia LEP Economic Strategy evidence base work

18

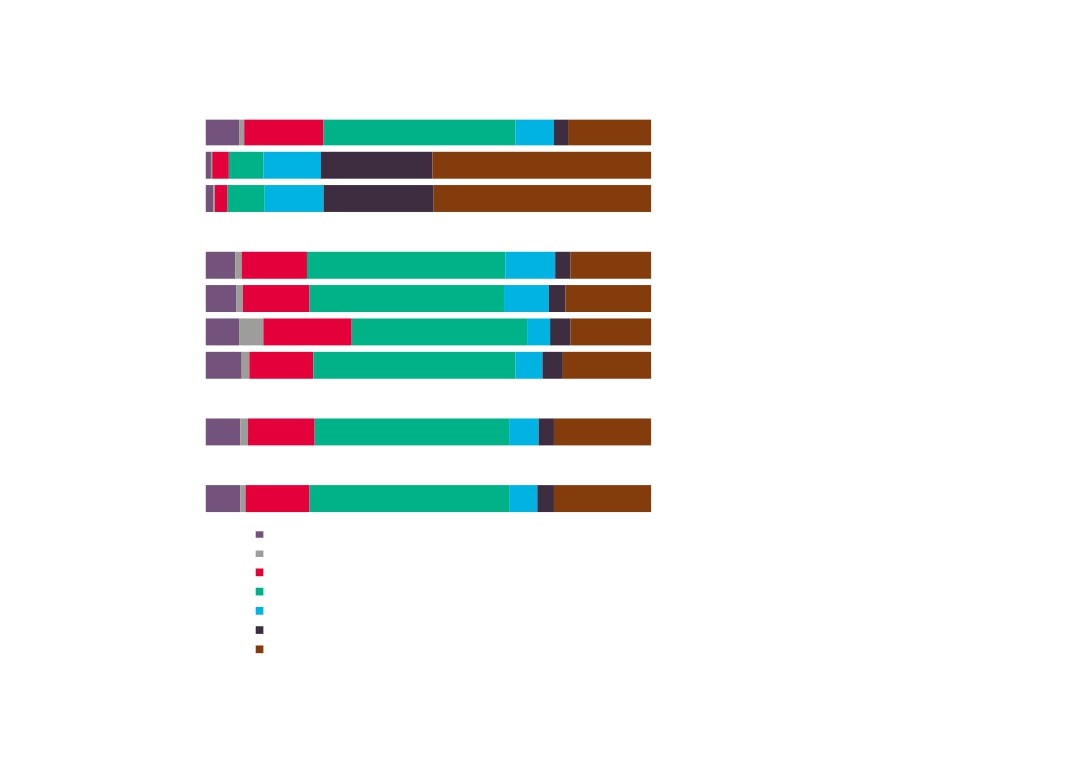

Change in full time, part time, and self-employment

in the Ports & Logistics sector, 2010 - 2015

Source: New Anglia LEP Economic Strategy evidence base work

19

New Anglia LEP

7%

18%

43%

9%

3%

19%

Norfolk

4%

8%

13%

25%

49%

Suffolk

3%

8%

13%

25%

49%

Workplace Ports &

Logistics sector

Greater

7%

15%

44%

11%

3%

18%

Lincolnshire LEP

employment 2011 by broad

Humber LEP

7%

15%

44%

10%

4%

20%

Standard Occupational

Solent LEP

7%

6%

20%

39%

5%5%

18%

Classification (SOC)

South East LEP

8%

15%

45%

6%

5%

20%

across comparator areas

Source: 2011 Census, Office for National Statistics

East

8%

15%

44%

7%3%

22%

England

8%

14%

45%

6%4%

22%

116 Managers and Directors in Transport and Logistics

351 Transport Associate Professionals

523 Vehicle Trades

821 Road Transport Drivers

822 Mobile Machine Drivers and Operatives

823 Other Drivers and Transport Operatives

926 Elementary Storage Occupations

20

Breckland

7%

15%

45%

10%

20%

Broadland

5%

19%

42%

8%

22%

Great Yarmouth

7%

18%

46%

7%

4%

16%

King`s Lynn and West Norfolk

6%

24%

39%

13%

15%

North Norfolk

5%

27%

43%

9%

13%

Workplace Ports & Logistics

Norwich

6%

21%

44%

5%

16%

sector employment 2011 by

South Norfolk

7%

21%

45%

9%

16%

broad Standard Occupational

Babergh

9%

16%

44%

9%

19%

Classification (SOC) across

Forest Heath

7%

22%

37%

7%

22%

New Anglia

Ipswich

8%

14%

46%

6%

5%

20%

Mid Suffolk

8%

18%

44%

9%

17%

Source: 2011 Census, Office for National Statistics

St Edmundsbury

7%

13%

43%

8%

27%

Suffolk Coastal

11%

10%

41%

10%

6%

21%

Waveney

6%

20%

42%

8% 6%

16%

116 Managers and Directors in Transport and Logistics

351 Transport Associate Professionals

523 Vehicle Trades

821 Road Transport Drivers

822 Mobile Machine Drivers and Operatives

823 Other Drivers and Transport Operatives

926 Elementary Storage Occupations

21

Enterprises

Ports & Logistics sector enterprises across

comparator areas, 2016

New Anglia

4,085

Norfolk

1,970

Suffolk

2,110

Greater Lincolnshire LEP

4,120

Humber LEP

2,555

Solent LEP

2,500

South East LEP

10,090

Source: UK Business Counts, Office for National Statistics

22

Ports & Logistics sector enterprises as a proportion of

total enterprises across comparator areas, 2016

New Anglia

6.7%

Norfolk

6.1%

Suffolk

7.3%

Greater Lincolnshire LEP

10.9%

Humber LEP

8.7%

Solent LEP

6.3%

South East LEP

6.1%

East of England

6.6%

England

5.8%

Source: UK Business Counts, Office for National Statistics

23

Ports & Logistics sector enterprise numbers

across New Anglia, 2016

Suffolk Coastal

500

King`s Lynn and West Norfolk

380

Ipswich

375

Breckland

375

South Norfolk

320

Mid Suffolk

315

St Edmundsbury

285

Norwich

240

Broadland

240

Waveney

220

North Norfolk

205

Babergh

205

Great Yarmouth

155

Forest Heath

145

Source: UK Business Counts, Office for National Statistics

24

Ports & Logistics enterprises as a proportion of total

enterprises across New Anglia, 2016

Ipswich

%

10%

Suffolk Coastal

9%

Breckland

8%

King`s Lynn and West Norfolk

7%

Mid Suffolk

7%

St Edmundsbury

6%

Forest Heath

6%

Waveney

6%

South Norfolk

6%

Norwich

5%

Great Yarmouth

5%

Broadland

5%

Babergh

5%

North Norfolk

5%

Source: UK Business Counts, Office for National Statistics

25

New Anglia

88%

10%

2%

Norfolk

89%

9%

1%

Suffolk

87%

11%

2%

Ports & Logistics sector

Greater Lincolnshire

92%

7%

1%

LEP

enterprise numbers by size

Humber LEP

88%

11%

1%

Solent LEP

91%

8%

1%

across comparator areas,

South East LEP

90%

9%

1%

2016

East of England

90%

9%

1%

Please note that at Local Authority level that

England

91%

7%

1%

businesses employing more than 250 people are

not reported due to their very small numbers and

No. of employees

resulting disclosive nature.

Micro (0 to 9) Small (10 to 49) Medium-sized (50 to 249)

Large (250+)

Source: UK Business Counts, Office for

Babergh

92%

8%

National Statistics

Breckland

91%

8%

1%

Broadland

93%

7%

Forest Heath

96%

4%

Great Yarmouth

94%

6%

Ipswich

93%

6%

1%

Ports & Logistics sector

King`s Lynn and West Norfolk

91%

9%

Mid Suffolk

90%

10%

enterprise numbers by size

North Norfolk

95%

5%

across New Anglia, 2016

Norwich

91%

9%

South Norfolk

95%

5%

St Edmundsbury

91%

9%

Suffolk Coastal

86%

12%

2%

Waveney

88%

13%

26

Change in Ports & Logistics sector enterprises

across comparator areas, 2010 - 2016

New Anglia

17%

Norfolk

14%

Suffolk

18%

Greater Lincolnshire LEP

65%

Humber LEP

18%

Solent LEP

27%

South East LEP

23%

East of England

33%

England

36%

Source: UK Business Counts, Office for National Statistics

27

Change in Ports & Logistics sector enterprises across

New Anglia, 2010 - 2016

Babergh

5%

Breckland

17%

Broadland

2%

Forest Heath

7%

Great Yarmouth

0%

Ipswich

56%

King`s Lynn and West Norfolk

21%

Mid Suffolk

3%

North Norfolk

0%

Norwich

30%

South Norfolk

21%

St Edmundsbury

33%

Suffolk Coastal

16%

Waveney

13%

Sources: UK Business Counts, Office for National Statistics

28

Ports & Logistics Skills

Supply and Demand

29

Qualifications

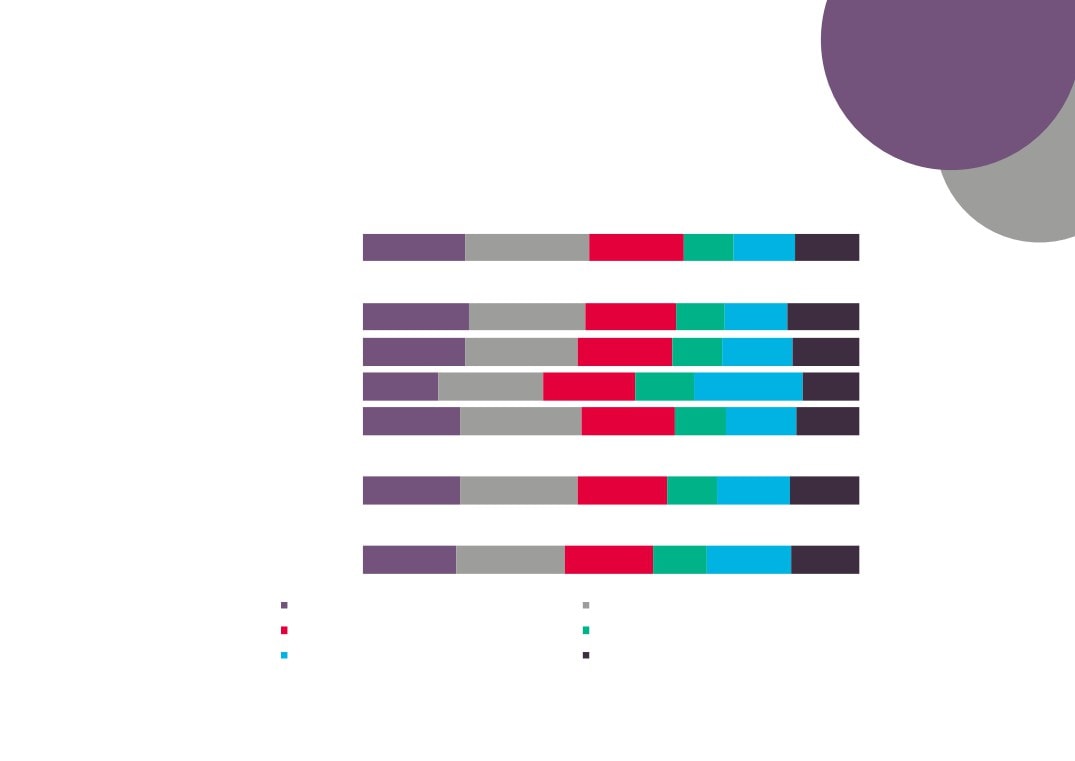

Ports & Logistics sector workplace qualifications across comparator

areas, 2011

New Anglia

21%

25%

19%

10%

12%

13%

Greater Lincolnshire LEP

21%

23%

18%

10%

13%

15%

Humber LEP

21%

23%

19%

10%

14%

14%

Solent LEP

15%

21%

18%

12%

22%

12%

South East LEP

20%

24%

19%

10%

14%

13%

Source: 2011 Census, Office for National Statistics

East of England

20%

24%

18%

10%

15%

14%

England

19%

22%

18%

11%

17%

14%

No qualifications

Level 1 qualifications

Level 2 qualifications

Level 3 qualifications

Level 4 qualifications and above

Apprenticeships and other qualifications

30

Change in Ports & Logistics sector workplace qualifications,

2001 - 2011

2011

21%

25%

19%

10%

12%

13%

2001

25%

25%

22%

7%

12%

10%

2011

20%

24%

18%

10%

15%

14%

2001

23%

25%

23%

8%

13%

9%

2011

19%

22%

18%

11%

17%

14%

2001

22%

24%

23%

8%

15%

8%

0%

100%

No qualifications

Level 1 qualifications

Level 2 qualifications

Level 3 qualifications

Level 4 qualifications and above

Apprenticeships and other qualifications

Source: 2001 and 2011 Census, Office for National Statistics

31

UKCES ESS

2015

The following analysis uses the LEP level data released as part of the UK Commission for Employment and Skills (UKCES) Employer Skills

Survey (ESS) 2015. The data covers the areas of vacancies, skills gaps, training, and staff retention and underutilisation.

Data is published for a limited number of broad sectors at LEP level and we have chosen the sector of ‘Transport, Storage and Comms’ as that

being closest to encapsulating Ports & Logistics sector activity. In all instances, national, regional, and New Anglia LEP averages are presented

as comparators.

In total, 2,364 employers in New Anglia were surveyed, 253 of which were ‘Transport, Storage and Comms’ employers.

32

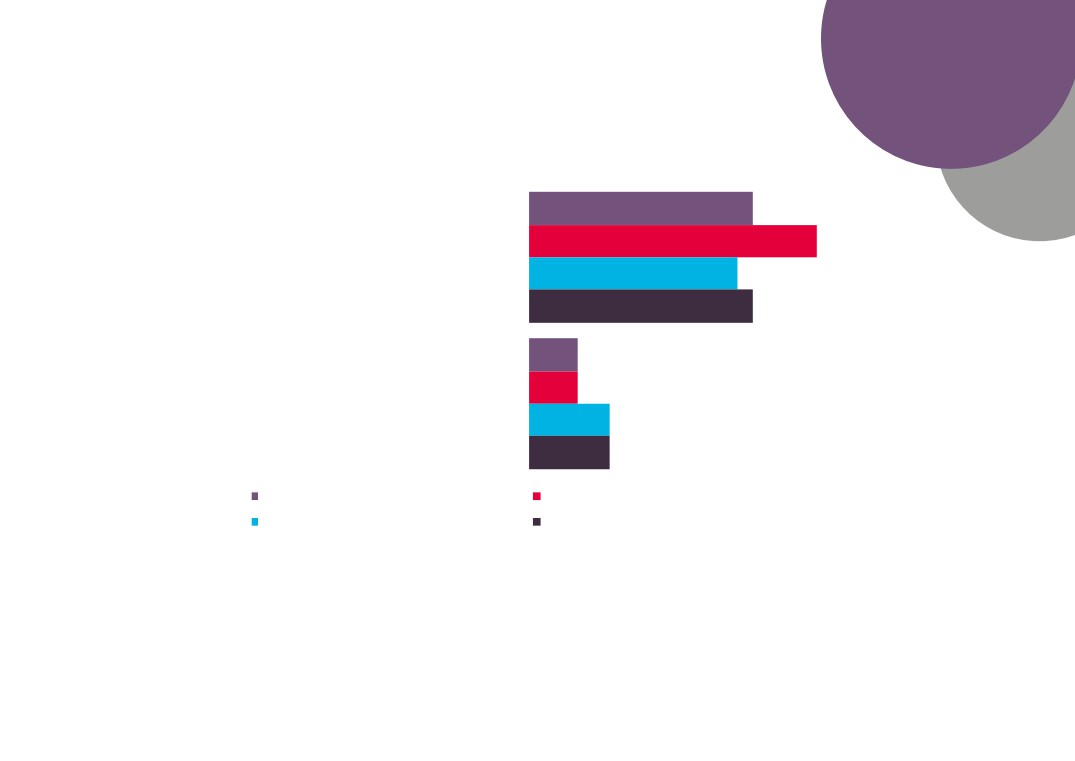

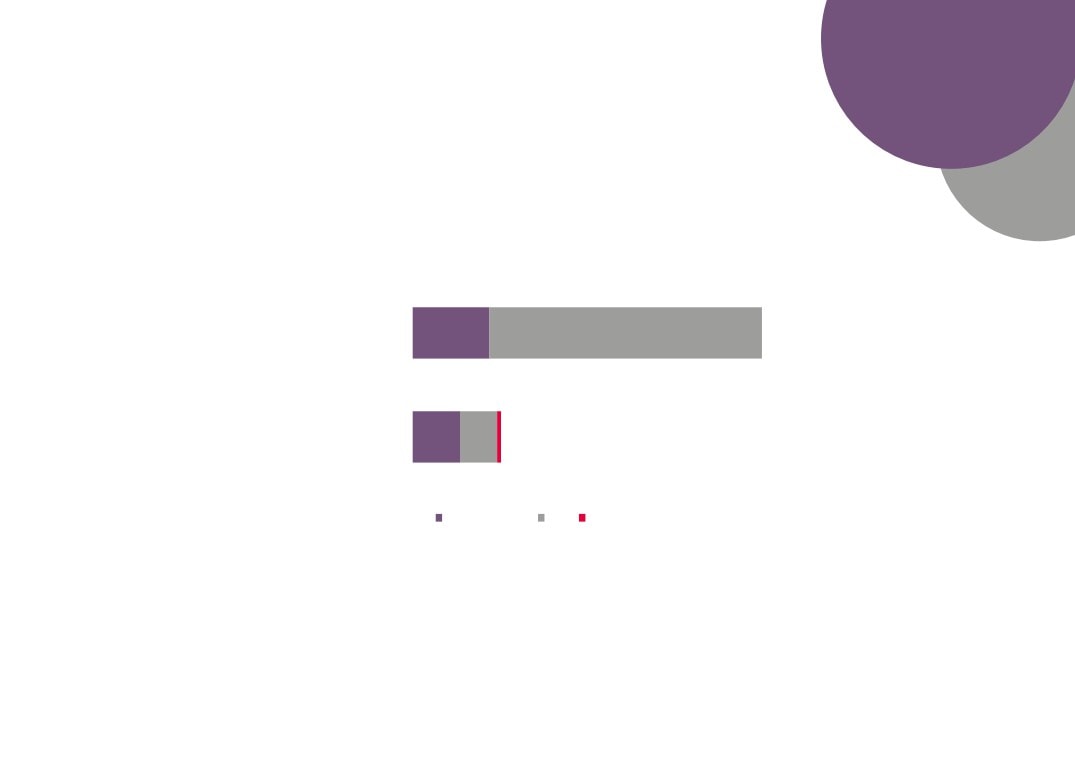

Vacancies

17%

17%

Establishments with any vacancies

19%

20%

6%

10%

Have at least one vacancy that is hard to fill

7%

8%

4%

8%

Have a skills shortage vacancy (prompted or

unprompted)

5%

Source: UKCES Employer

Skills Survey 2015

6%

3%

2%

Number of vacancies as a % of all employment

3%

3%

19%

41%

% of all vacancies which are SSVs

22%

23%

New Anglia (Average)

Transport, Storage & Comms (New Anglia)

East of England (Average)

England (Average)

33

Skills Gaps

14%

18%

% of establishments with any staff not fully

proficient

13%

14%

3%

3%

Number of staff not fully proficient as a % of

employment

5%

5%

New Anglia (Average)

Transport, Storage & Comms (New Anglia)

East of England (Average)

England (Average)

Source: UKCES Employer Skills Survey 2015

34

Training

7.5

4.6

Training days per trainee

6.3

6.8

4.7

2.0

Training days per staff

4.0

4.3

New Anglia (Average)

Transport, Storage & Comms (New Anglia)

East of England (Average)

England (Average)

Source: UKCES Employer Skills Survey 2015

35

65%

58%

% of establishments training staff over the last 12 months

64%

66%

48%

% of establishments providing off-the-job training in the last

43%

12 months

47%

48%

51%

% of establishments providing on-the-job training in the last

43%

12 months

51%

52%

42%

% of training establishments providing online training or e-

40%

learning in the last 12 months

44%

45%

63%

43%

Number trained as % of total staff

64%

63%

Source: UKCES Employer Skills Survey 2015

New Anglia (Average) Transport, Storage & Comms (New Anglia) East of England (Average) England (Average)

36

Staff

25%

29%

Establishments with underutilised staff

25%

30%

7%

8%

Whether any jobs in which have difficulties retaining staff

Source: UKCES Employer

Skills Survey 2015

7%

8%

New Anglia (Average) Transport, Storage & Comms (New Anglia) East of England (Average) England (Average)

37

FE Learning

Aims

All data (unless stated otherwise) is sourced from the Department for Education’s Further Education data library

In order to present information that is relevant to New Anglia LEPs high performing and underpinning sectors then we have

identified FE and skills provision data split by Sector Lead Body and aligned a best-fit with each sector.

The Sector Lead Bodies identified as being the most relevant to the Ports & Logistics sector are ‘Automotive Industries’, ‘Freight, Logistics &

Wholesale’, ‘Maritime’ and ‘Passenger Transport’.

However, not all FE and Skills learning aims align with a sector lead body. In fact, on average around two thirds are classed as unknown. This

means that we are basing results here on roughly a third of the data.

Please note that all data is rounded to the nearest 10 and that therefore some figures presented may not add to the sum totals presented.

38

Ports & Logistics sector learning aims delivered to

domiciled learners by Sector Lead Body

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

New Anglia

2,020

610

410

National

62,100

62,400

42,700

Automotive Industries

Freight Logistics & Wholesale

Maritime

Passenger Transport

Source: FE Data Library, Department for Education

39

Ports & Logistics sector learning aims delivered to New Anglia

learners by Sector Lead Body, 2010/11 and 2012/13

2,020

1,900

1,130

610

480

410

170

20

Automotive

Freight Logistics &

Maritime

Passenger

Industries

Wholesale

Transport

2010/11

2012/13

Source: FE Data Library, Department for Education

40

Change in Ports & Logistics sector learning aims delivered to resident

learners by Sector Lead Body, 2010/11 - 2012/13

11%

Total inc. Unknown

9%

4%

Total not inc. Unknown

7%

-17%

Transport & Logistics

-13%

6%

Automotive Industries

-5%

-46%

Freight Logistics & Wholesale

-11%

-88%

Maritime

-79%

-15%

Passenger Transport

-21%

New Anglia

National

Source: FE Data Library, Department for Education

41

Ports & Logistics learning aims delivered to New Anglia

residents by New Anglia based and external providers by

Sector Lead Body, 2012/13

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Transport & Logistics

1,990

1,070

Automotive Industries

1,670

350

Freight Logistics & Wholesale

210

400

Maritime

20

-

Passenger Transport

90

320

Total inc. unknown

158,480

52,170

Total with unknown removed

55,340

24,770

New Anglia Provider

External Provider

Source: FE Data Library, Department for Education

42

Ports & Logistics learning aims delivered to New Anglia learners by

New Anglia providers by Sector Lead Body, 2010/11 and 2012/13

1,670

1,590

2010/11

2012/13

250

210

170

130

90

20

Automotive Industries

Freight Logistics &

Maritime

Passenger Transport

Wholesale

Source: FE Data Library, Department for Education

43

Change in Ports & Logistics learning aims delivered to resident learners

by domiciled providers by Sector Lead Body, 2010/11 - 2012/13

5%

Total inc. Unknown

9%

-38%

Total not inc. Unknown

7%

-7%

Transport & Logistics

-13%

5%

Automotive Industries

-5%

62%

Freight Logistics & Wholesale

-11%

-88%

Maritime

-79%

-64%

Passenger Transport

-21%

New Anglia

National

Source: FE Data Library, Department for Education

44

Apprenticeships

Ports & Logistics sector apprenticeship starts

by year

Apprenticeship Framework

2011/12

2012/13

2013/14

2014/15

Aviation Operations on the Ground

40

0

0

<5

Bus and Coach Engineering and Maintenance

<5

5

5

10

Driving Goods Vehicles

70

70

85

35

International Trade and Logistics Operations

65

15

30

20

Logistics Operations

20

25

15

20

Marine Industry

0

<5

0

Passenger Carrying Vehicle Driving (Bus and Coach)

10

20

15

50

Print and Printed Packaging

25

10

<5

10

Rail Engineering (Track)

<5

5

<5

<5

Rail Infrastructure Engineering

<5

<5

10

20

Rail Services

5

0

0

0

Vehicle Body and Paint

35

40

120

80

Vehicle Fitting

5

20

10

10

Vehicle Maintenance and Repair

275

315

300

330

Vehicle Parts

20

25

20

15

Warehousing and Storage

110

95

100

90

Grand Total

685

650

720

690

Source: Skills Funding Agency Data Cube

45

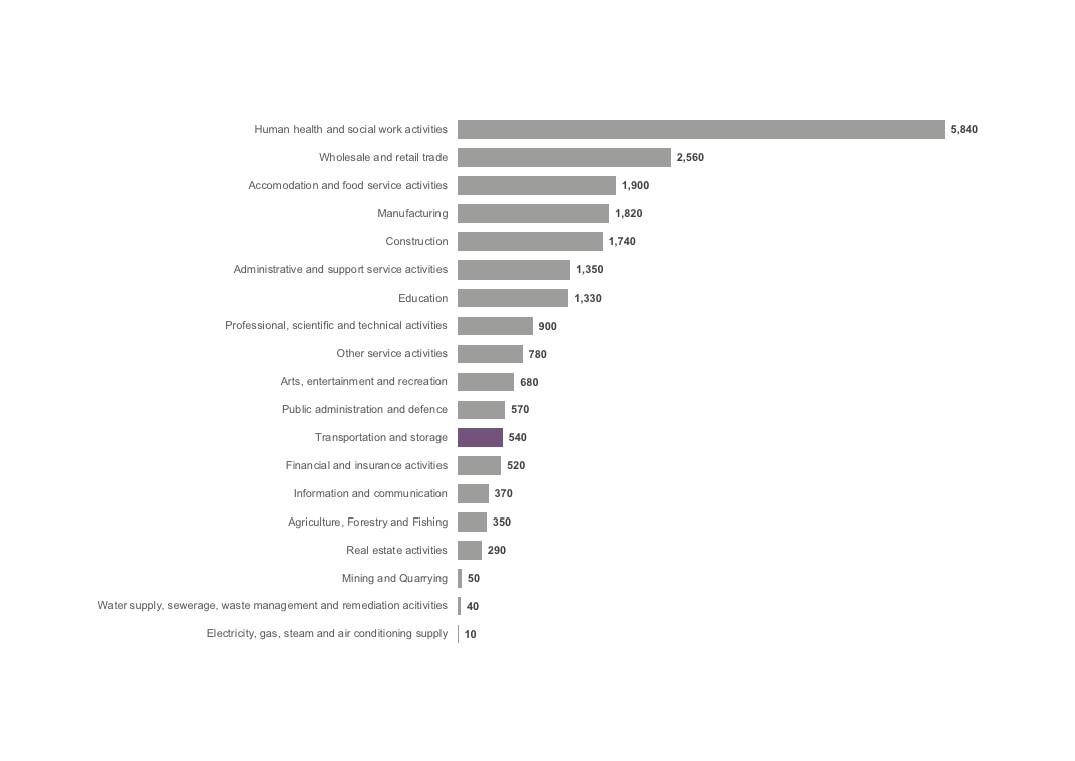

Apprenticeship participation by sector, 2014/15

Source: FE Data Library, Department for Education

46

Apprenticeship participation in the Ports & Logistics sector

2014/15 as a proportion of total participation

New Anglia

2.5%

England

2.9%

New Anglia England

Source: FE Data Library, Department for Education

47

Labour Insight

Jobs

The following section presents data from Labour Insight, a Burning Glass analytical tool. This tool collects details of online

job postings from multiple sources and enables the analysis of these postings based on specific skills, educational

requirements, and job titles, for example.

Please note that whilst Labour Insight will capture more information on the jobs market than more traditional Department

for Work and Pensions vacancy data, the fact that not all job vacancies are advertised means that there will still be gaps in

the findings.

According to the Labour Insight Jobs tool, then there were 10,516 postings for the Ports & Logistics sector in New Anglia

between Jan. 1, 2012 and Dec. 31, 2016.

The definition for the Ports & Logistics sector in this exercise captures the following industry and sectors: ‘Transportation

and Storage’.

48

Location

0

500

1,000

1,500

2,000

2,500

Norwich

Ipswich

Breckland

St Edmundsbury

Suffolk Coastal

Mid Suffolk

King's Lynn and West Norfolk

Forest Heath

Waveney

Ports & Logistics sector

South Norfolk

vacancies across New Anglia,

Great Yarmouth

Jan 2012 - Dec 2016

North Norfolk

1,004 unspecified or unclassified postings

Source: Labour Insight Jobs, Burning

Babergh

Glass Technologies

Broadland

49

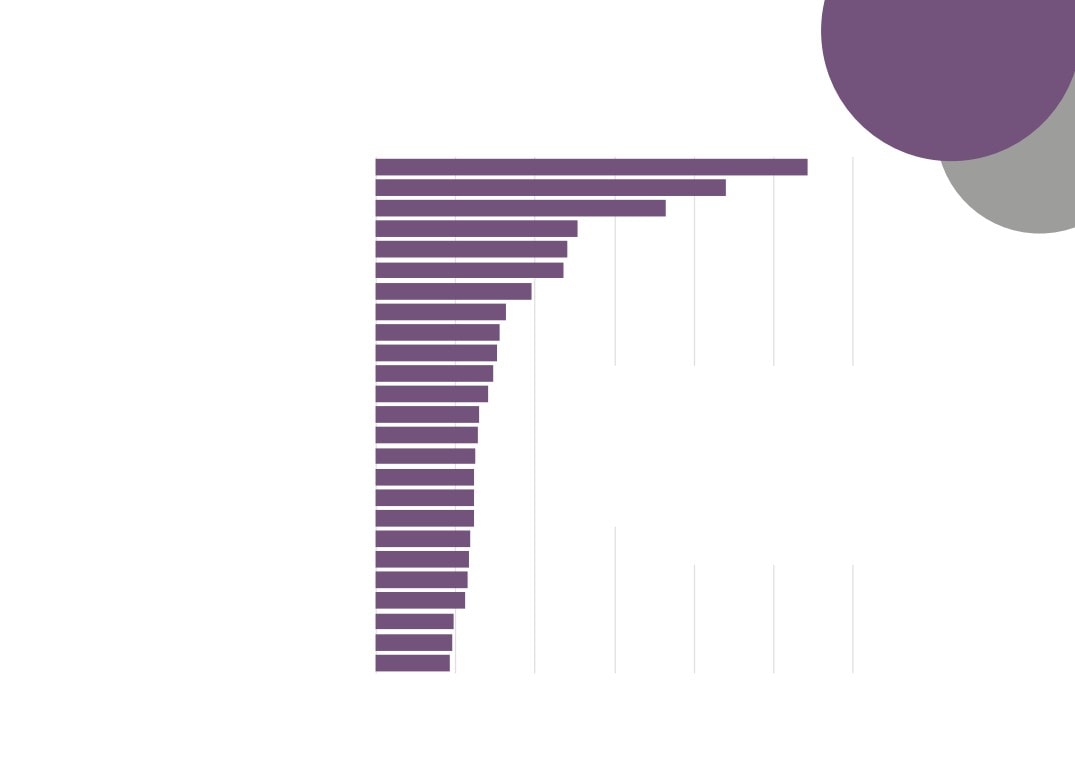

Recruiters

Reliance Employment Limited

British Marine

Truckdriver4hire

Parcelforce

Driverbase East

British Airways

Top Ports & Logistics sector

TNT UK Ltd

Firstgroup Plc

recruiters across New Anglia,

East of England Co-operative Society

Jan 2012 - Dec 2016

APRS Ltd

7,096 unspecified or unclassified postings

Associated British Ports Holdings

First Scotrail

Source: Labour Insight Jobs, Burning Glass

Technologies

UK Mail Group

Scotrail

First Captial Connect

Yodel

DHL Express

Park Resorts

UPS - UK

Post Office Ltd

Arc Norwich Ltd

Arc Incorporated Ltd

Royal Mail

Dee Set Logistics

Salian Group

0

50

100

150

200

250

50

Occupation

0

1,000

2,000

3,000

4,000

5,000

Large goods vehicle drivers (8211)

Fork-lift truck drivers (8222)

Van drivers (8212)

Bus and coach drivers (8213)

Sales and retail assistants (7111)

Other administrative occupations n.e.c. (4159)

Programmers and software development managers (2136)

Plant and machine operatives n.e.c. (8129)

Postal workers, mail sorters, messengers and couriers (9211)

Taxi and cab drivers and chauffeurs (8214)

Call and contact centre occupations (7211)

Ports & Logistics sector

Business sales executives (3542)

Managers and directors in retail and wholesale (1190)

vacancies by occupation,

Transport and distribtuion clerks and assistants (4134)

Jan 2012 - Dec 2016

Customer service occupations n.e.c. (7219)

26 unspecified or unclassified postings

Elementary storage occupations (9260)

Source: Labour Insight Jobs, Burning

Merchandisers and window dressers (7215)

Glass Technologies

Sales accounts and business development managers (3545)

Vehicle technicians, mechanics and electricians (5231)

Construction operatives n.e.c.

Managers and proprietors in other services n.e.c.

Sales related occupations n.e.c. (7129)

Managers and directors in storage and distribution (1161)

Managers and directors in storage and warehousing (1162)

Telephone salespersons (7113)

51

Job Title

0

500

1,000

1,500

2,000

HGV2 / LGV C Driver

HGV1 / LGV C1+E Driver

Forklift Driver

Bus / Coach Driver

HGV Driver

Sales Executive

Merchandiser

Truck Driver

LGV Driver

Delivery Driver

Taxi Driver

Trainee HGV Driver

Retail Salesperson

Ports & Logistics sector

Retail

Business Development Executive

vacancies by job title, Jan

Cleaner

2012 - Dec 2016

Office Manager

Quantity Surveyor

0 unspecified or unclassified postings

Hiab Driver

Source: Labour Insight Jobs, Burning

Glass Technologies

Receptionist

Warehouse Operative

Office Clerk

Distributor

Post Office Assistant

Distributor for Delivery A

52

Qualification

Requirements

1

22

28

230

Ports & Logistics sector

132

vacancies by qualification level

required, Jan 2012 - Dec 2016

9,921 unspecified or unclassified postings

Source: Labour Insight Jobs, Burning Glass Technologies

170

GCSEs, Standard Grades, and Level 2 S/NVQs

Bachelor's degrees, graduate certificates and diplomas

A-Levels, Highers, and Level 3 S/NVQs

Post graduate degrees, Level 5 S/NVQs, certificates and

diplomas

Level 4 diplomas and certificates, HNCs, Level S/NVQs

Foundation degrees and HNDs

53

Skills

Requirements

0

100

200

300

400

500

600

Customer Service

Forklift Operation

Product Sales

Product Sale and Delivery

Microsoft Excel

Customer Contact

Transportation Logistics

Repair

Microsoft Office

Business Management

Project Management

Ports & Logistics sector

Construction Industry Knowledge

Merchandising

vacancies by skills

Sales

required, Jan 2012 - Dec

Key Performance Indicators

Invoicing

2016

Office Management

7,625 unspecified or unclassified postings

Order and Invoice Processing

Source: Labour Insight Jobs, Burning

Lift Trucks

Glass Technologies

Logistics

Heavy / Large Goods Vehicle Driving

Marketing Sales

Scheduling

Microsoft Windows

Cleaning

54

Where the

Work is

The following analysis makes use of data and findings available via the online toolkit http://wheretheworkis.org/ . The findings presented

are a result of combining data from the UKCES ‘Working Futures’ programme and job vacancy data from the Labour Market Insight tool

developed by Burning Glass.

Limitations

Though the ‘Where the work is’ tool provides a comprehensive and detailed free-to-use dashboard of supply and demand in the UK, the

following limitations should be taken into account when interpreting the data:

- Senior Management and Elementary roles

Occupations not open to recent HR graduates or FE finishers are not considered. Similarly, occupations that do not require any formal

qualifications or training are also excluded from this tool, since the number of job-seekers cannot be meaningfully quantified.

- Matching supply and demand

Some occupations do not have specific qualifications or subject-specific requirements (such as sales, marketing and related associate

professionals). As a result of this, and despite the fact that many people with a broad range of qualifications can apply for these occupations,

they frequently appear ‘undersupplied’ in the tool, i.e. when the “job opportunity” is low. Occupations with very small sample sizes (either of

finishers or job postings) are excluded from the dataset.

- Internal and international migration

Some occupations do not rely solely on FE finishers or HE graduates from their immediate location. Many people travel to find work, often

moving across the country. Other occupations, such as those on the Migration Advisory Committee’s shortage occupation list, may rely more

heavily on jobseekers arriving from outside the UK.

- Online and offline postings

Burning Glass Technologies (BGT) acknowledge that not all jobs are posted online, although a comparison of the Annual Survey of Hours and

Earnings (ASHE) employment data and BGT postings data for UK in 2014 showed a 94 per cent correlation between ASHE and BGT

occupational distributions. The BGT posting data slightly overestimate the proportion of professional and associate professional occupations,

while slightly underestimating the proportion of elementary occupations.

55

Location

Quotient

Location Quotient - Measure of Job Posting Density

relative to employment indexed to the national density

relative to employment

Vehicle Trades

0.88

Skilled Trades (Other)

0.73

56

Vacancies by

Opportunity

Number of Job Postings asking for entry-level (2 years of

experience or fewer) and school leaver education levels,

further education levels, and higher education levels

Vehicle Trades

192

684

Skilled Trades (Other)

117

95

School leaver

FE HE

57

Average

Wages

Advertised Salaries for Job Postings in 2015

£27,100

Vehicle Trades

£29,600

£34,200

£24,100

Skilled Trades (Other)

£32,000

£42,400

New Anglia

East of England

England

58

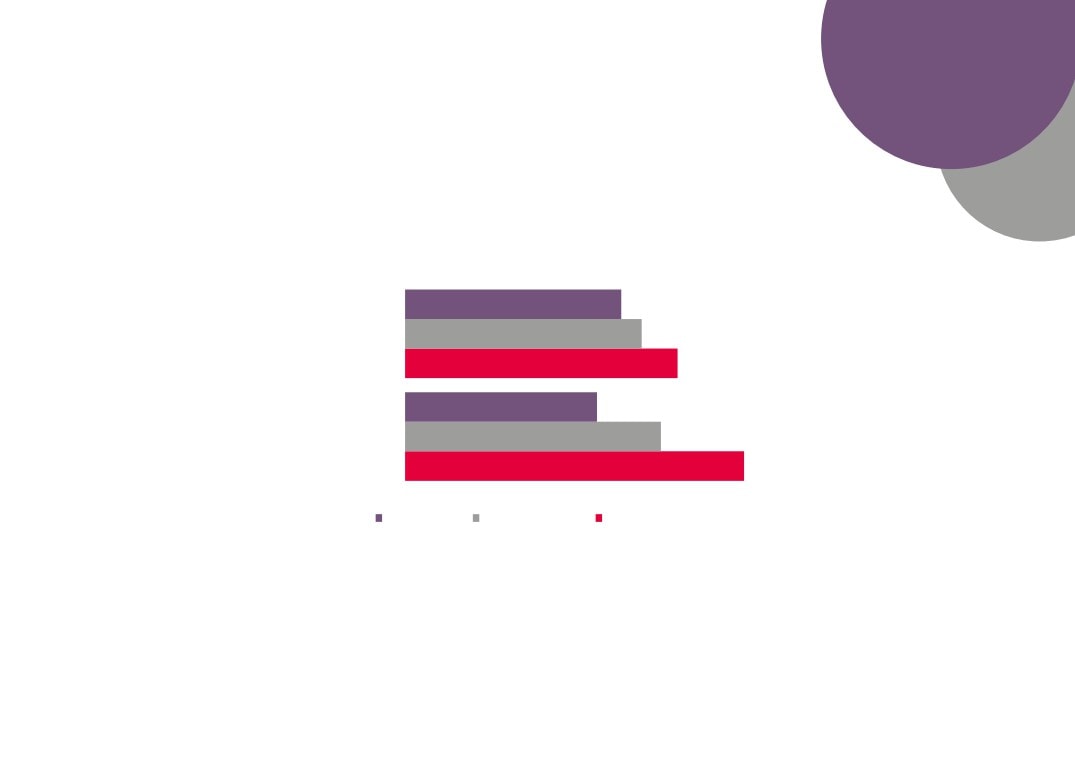

Opportunity

Scores

Opportunity Score - Score based on the Demand

Supply Ratio of FE postings within a geography,

from Very Low (0) to Very High (100)

54

Vehicle Trades

72

63

39

Skilled Trades (Other)

55

50

New Anglia

East of England

England

59

A Future View of the

Ports & Logistics Sector

60

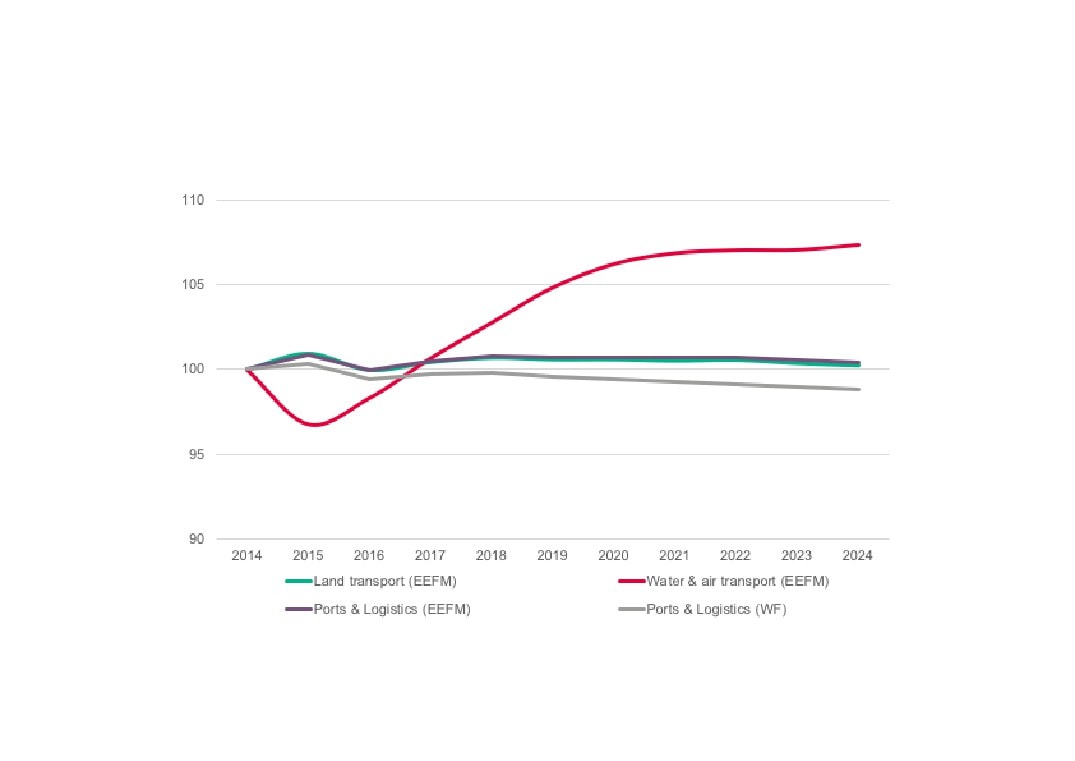

The following analysis uses data from the East of England Forecasting Model (EEFM) and the UKCES Working Futures data

(WF). In each case the Financial Services & Insurance sector has been approximated from the sector splits available in each

model. In the case of the East of England Forecasting Model then ‘Land transport’ and ‘Water & air transport’ have been

combined to provide forecasts for the Ports & Logistics sector. For the Working Futures data, the sector ‘Transport & Logistics’

has been referred to.

Please note that neither model, or the forecasts they produce, take into account the New Anglia LEPs ambitions for growth in

Gross Value Added (GVA) and employment.

61

Forecasts for change in Ports & Logistics sector

employment in New Anglia (2014 = 100)

Sources: East of England Forecasting Model, Cambridge Econometrics;

UKCES Working Futures 2014 - 2024

62

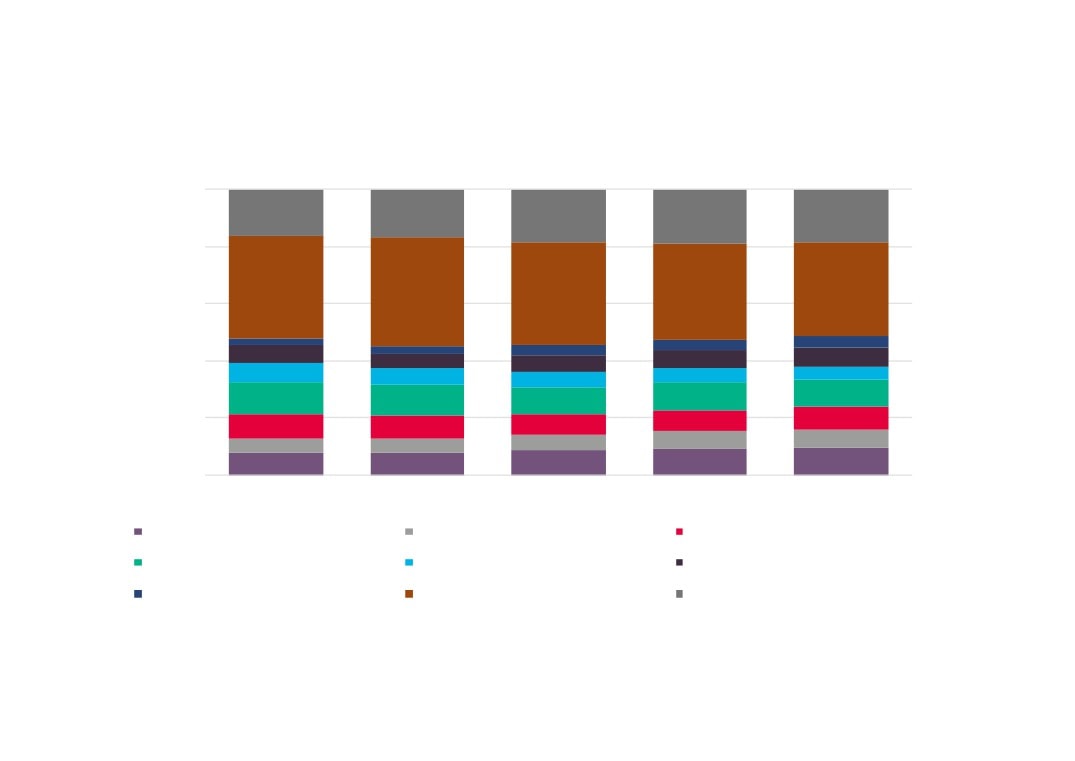

Occupational composition of employment in New Anglia’s

Ports & Logistics sector over time

100%

16%

17%

19%

19%

19%

80%

36%

38%

34%

33%

36%

60%

3%

4%

4%

3%

3%

40%

7%

6%

5%

5%

6%

11%

10%

10%

11%

10%

20%

8%

8%

8%

8%

7%

6%

6%

6%

5%

5%

8%

8%

9%

9%

10%

0%

2004

2009

2014

2019

2024

Managers, directors and senior officials

Professional occupations

Associate professional and technical

Administrative and secretarial

Skilled trades occupations

Caring, leisure and other service

Sales and customer service

Process, plant and machine operatives

Elementary occupations

Source: UKCES Working Futures 2014 - 2024

63

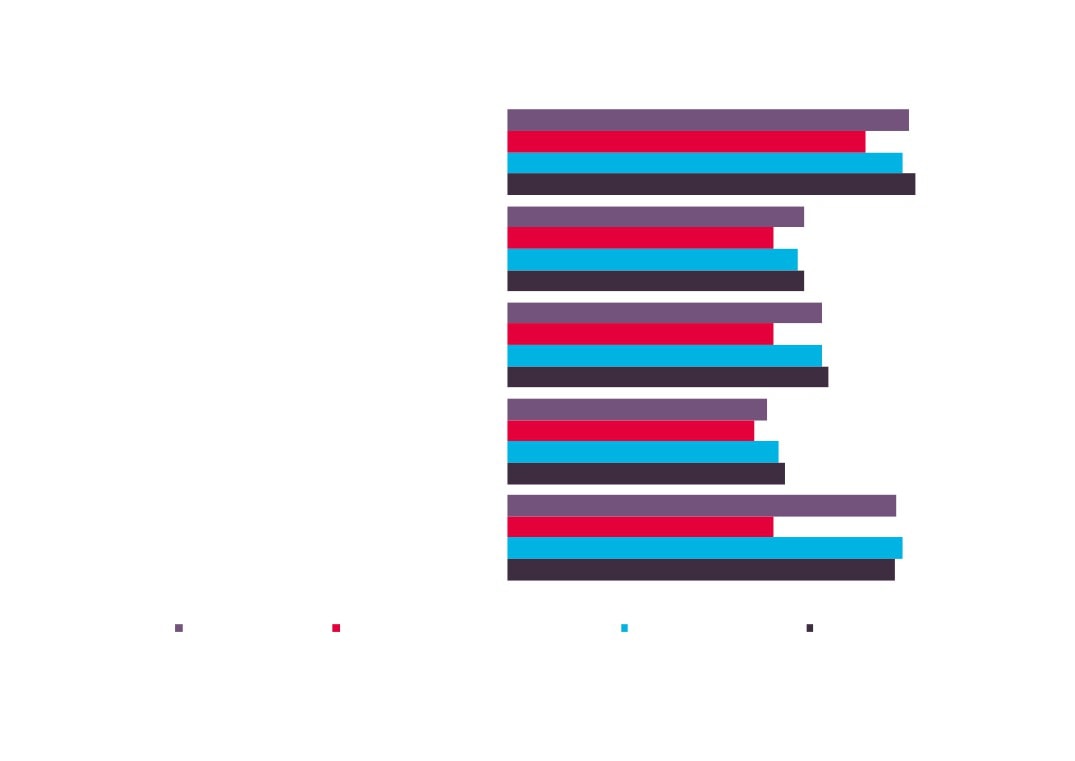

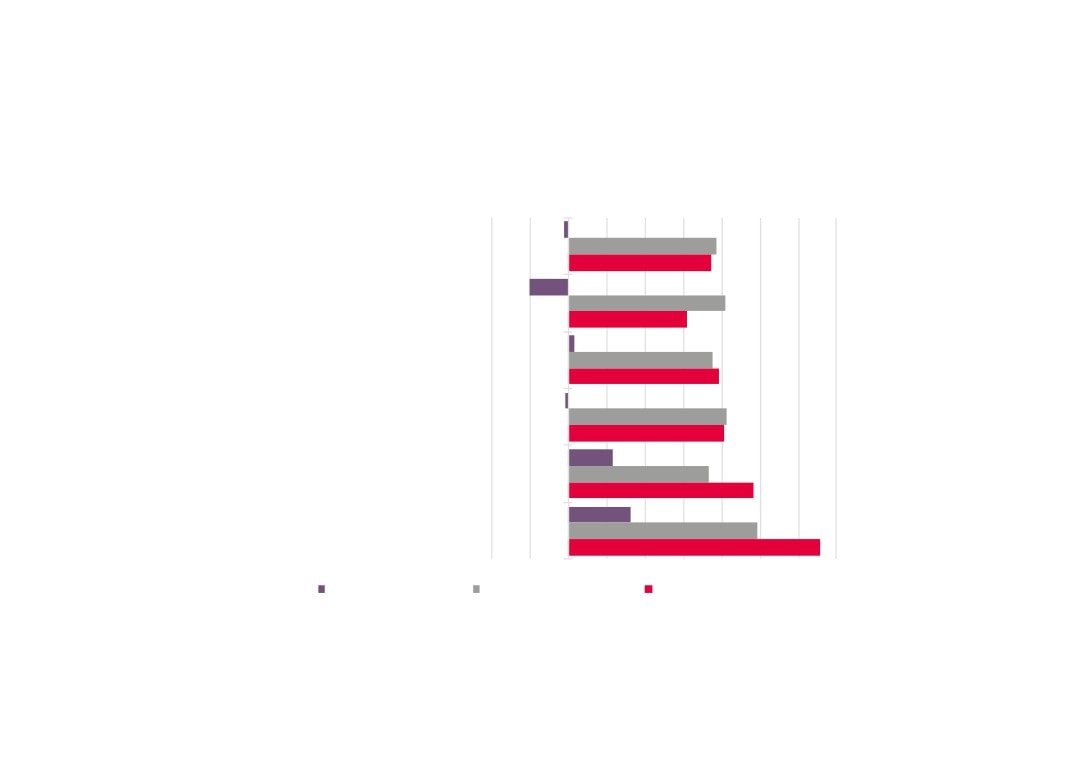

Ports & Logistics sector replacement and expansion demand by

occupation (top 5 in terms of net requirement), 2014 - 2024

-1,000

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

Transport and mobile machine drivers and

operatives

Elementary administration and service occupations

Administrative occupations

Corporate managers and directors

Leisure, travel and related personal service

occupations

Expansion demand

Replacement demand

Net requirement

Source: UKCES Working Futures 2014 - 2024

64

Ports & Logistics sector replacement and expansion demand as a

proportion of employment by occupation, 2014 - 2024 requirement)

-20% -10%

0%

10% 20% 30% 40% 50% 60% 70%

All occupations

Transport and mobile machine drivers and

operatives

Elementary administration and service

occupations

Administrative occupations

Corporate managers and directors

Leisure, travel and related personal service

occupations

Expansion demand

Replacement demand

Net requirement

Source: UKCES Working Futures 2014 - 2024

65

Ports & Logistics sector replacement and expansion demand by

qualification, 2014 - 2024

-5,000

-2,500

0

2,500

5,000

7,500

10,000

QCF 7-8

QCF 4-6

QCF 3

QCF 2

QCF 1

No Qual

Expansion Demand

Replacement Demand

Source: UKCES Working Futures 2014 - 2024

Please note that the Working Futures data uses the

following breakout of qualification levels:

QCF8 - Doctorate

QCF7 - Other higher degree

QCF6 - First degree

QCF5 - Foundation degree; Nursing; Teaching

QCF4 - HE below degree level

QCF3 - A level & equivalent

QCF2 - GCSE (A-C) & equivalent

QCF1 - GCSE (below grade C) & equivalent

No Q - No Qualification

66

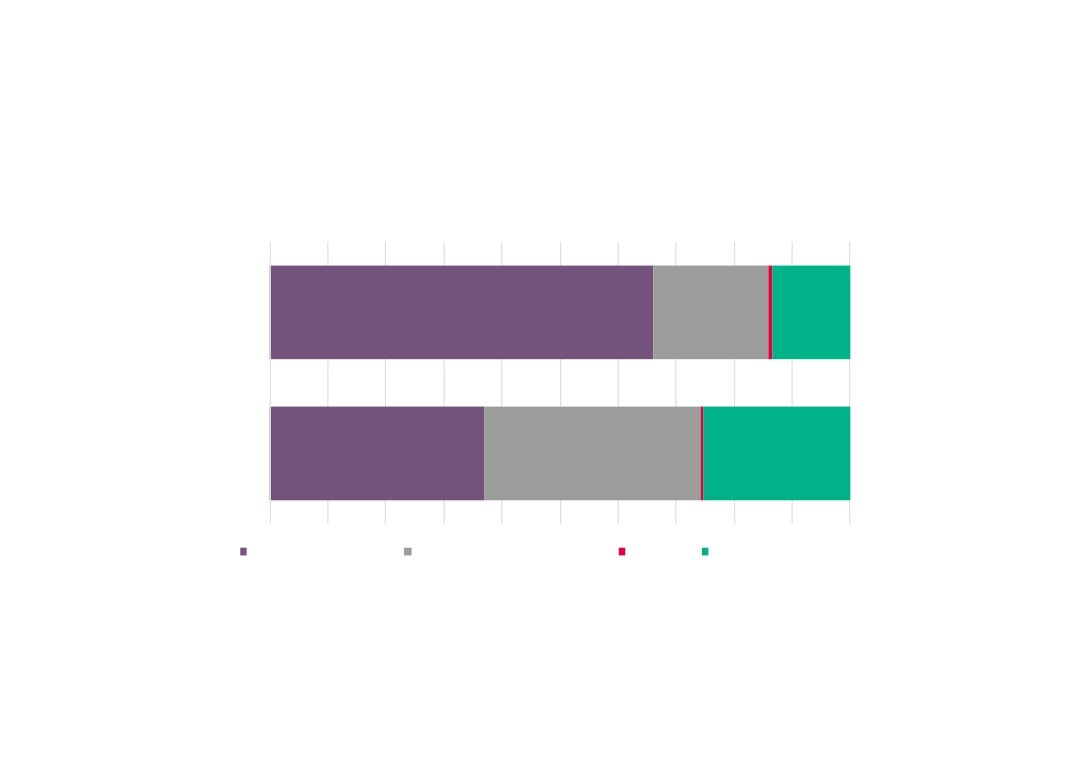

Ports & Logistics sector qualifications, 2014 - 2024

2024

4%

26%

21%

31%

16%

QCF 7-8

QCF 4-6

QCF 3

QCF 2

QCF 1

No Qual

2014 2%

16%

22%

30%

22%

8%

Source: UKCES Working Futures 2014 - 2024

0%

100%

Please note that the Working Futures data uses the

following breakout of qualification levels:

QCF8 - Doctorate

QCF7 - Other higher degree

QCF6 - First degree

QCF5 - Foundation degree; Nursing; Teaching

QCF4 - HE below degree level

QCF3 - A level & equivalent

QCF2 - GCSE (A-C) & equivalent

QCF1 - GCSE (below grade C) & equivalent

No Q - No Qualification

67

Appendix - Ports & Logistics Sector Definition

The following five digit SIC codes are being used to measure levels of, and change in, both employment and enterprise numbers in the sector.

69