New Anglia Local Enterprise Partnership Board Meeting

Wednesday 23rd May 2018

10.00am to 12.30pm

Co-op Education Centre, 11 Fore St, Ipswich IP4 1JW

Agenda

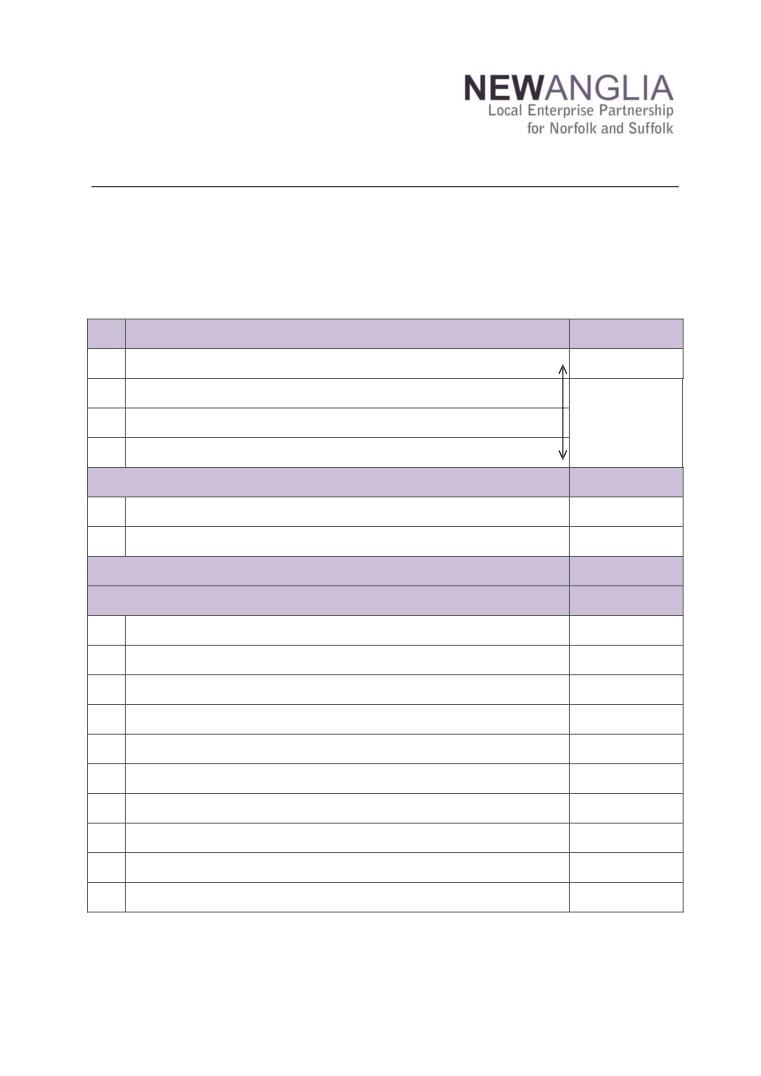

No.

Item

Duration

1.

Welcome and Introduction

15 mins

2.

Apologies

3.

Declarations of Interest

4.

Actions / Minutes from the last meeting including Decision Log

Forward looking

40 mins

5.

Integrated Transport Strategy

For Approval

6.

Enterprise Zones including a Confidential Appendix

Update

Break

10 mins

Governance and delivery

85 mins

7.

West Suffolk College Engineering Centre 2nd Phase

For Approval

8.

Capital Growth Programme Projects - Confidential

For Approval

9.

Speculative Development

For Approval

10.

Growing Places Fund - Atex Park Loan - Confidential

For Approval

11.

Data Dashboard

Update

12.

PwC Report - Review of Implementation

Update

13.

Chief Executive’s Report

Update

14.

Finance Report including a Confidential Appendix

Update

15.

Board Forward Plan

Update

16.

Any Other Business

Update

Date and time of next meeting:

10.00am - 12.30pm, 20th June 2018

Venue: The Council House, University of East Anglia, Norwich, NR4 7TJ

1

New Anglia Board Meeting Minutes (Unconfirmed)

18th April 2018

Present:

Cllr David Ellesmere (DE)

Ipswich Borough Council

Doug Field (DF)

East of England Coop

Cliff Jordan (CJ)

Norfolk County Council

Dominic Keen (DK)

High Growth Robotics

Colin Noble (CN)

Suffolk County Council

Johnathan Reynolds (JR)

Nautilus

David Richardson (DR)

UEA

Lindsey Rix (LR)

Aviva

Nikos Savvas (NS)

West Suffolk College

Jeanette Wheeler (JW)

Birketts

Tim Whitley (TW)

BT

In Attendance:

Sue Roper (SuR)

Suffolk County Council

Shan Lloyd (SL)

BEIS

Mike Stonard (MS)

Norwich City Council (For Alan Waters)

Tom Fitzpatrick (TF)

North Norfolk District Council (For Andrew Proctor)

Linn Clabburn

New Anglia LEP For Item 6

Chris Dashper (CD)

New Anglia LEP

Iain Dunnett (ID)

New Anglia LEP For Item 5

Chris Starkie (CS)

New Anglia LEP

Keith Spanton (KS)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

1

3

Actions from the meeting: (18.04.18)

Chief Executive’s Report

To receive regional branding examples from Hayley Mace

HM

1

Welcome from the Chair

Doug Field (DF) welcomed everyone to the meeting and including Mike Stonard deputising for Alan

Waters and Tom Fitzpatrick deputising for Andrew Proctor.

2

Apologies

Apologies were received from: Andrew Proctor, Steve Oliver, Alan Waters, John Griffiths and Sandy

Ruddock.

3

Declarations of Interest

Declarations relevant to this meeting: Jeanette Wheeler - Item 8.

Chris Starkie (CS) reminded those deputising that a Declaration of Interest form needed to be completed

and returned to Charley Purves.

4

Minutes of the last meeting 21st February 2018

The minutes were accepted as a true record of the meeting held on 21st March 2018.

Actions from last meeting updated as follows:

Flood Defence Schemes

CD

Chris Dashper to produce a brief paper on LEP funding of flood defences to be circulated to

Board Members - Included in the Chief Executive’s Report

Institute of Technology

HM

Board members to be provided with details of the top 3 key messages from the LEP on a

monthly basis - An IoT brochure is being completed and will be circulated to Board members

when available.

5

Tri-LEP Local Energy East Strategy

Iain Dunnett (ID) provided the Board with a presentation on the work of the Local Energy East

Strategy.

Board members were advised that BEIS funding had become available nationally in March 2017

to establish Local Energy Networks and Strategies and that funding had been secured to cover

the tri-LEP area consisting of New Anglia, Greater Cambridgeshire and Peterborough and

Hertfordshire. This secured resources to produce a Local Energy Strategy supported by a

baseline of information including Energy Mapping, Analysis, Modelling, and the development of

a Web Portal.

The Strategy has identified four key priorities - Clean Economic Growth, Housing Growth and

Commercial Site Infrastructure, Secure, Affordable Low Carbon Consumption and Clean

Transport Networks including Electric Vehicles.

Work to date has included the mapping of energy assets across the counties which will assist

in producing a model to allow the faster planning and delivery of projects such as Snetterton

Heath.

ID noted that private sector involvement was limited and the hope was that joining investment

opportunities together would encourage more investment.

The Energy Strategy will be presented to the Board in May, which will be followed by the

release of a dedicated technical resource funded by BEIS for 2 years.

Mike Stonard (MS) asked whether the project would be funded after the initial 2 years. ID

advised that BEIS had proposed that the programme will be self-sufficient after 2 years but that

this issue needed to be considered and included in the plan.

2

4

Johnathan Reynolds (JR) noted that there was other tri-LEP work ongoing across other regions

which needed to be brought together and that this geographical grouping was based on the

power networks rather than LEP areas.

DF asked whether there was any impact from the winding up of GCGP. CS advised that this

had not caused any issues and that the Energy Strategy was on the forward plan for the new

Business Board for the Combined Authority.

The Board agreed:

To note the content of the presentation

6

Cambridge-Norwich Tech Corridor Presentation

Linn Clabburn (LC) provided the Board with an update on the progress on the Cambridge -

Norwich Tech Corridor.

The partnership was set up with the relevant LEPs and Local Authorities to investigate how

best to exploit the opportunities in the corridor which has been identified as a priority place in

the Economic Strategy. Studies have suggested that the area has the potential to deliver an

additional 26,000 jobs and add a further £2.75bn to the economy.

LC reviewed the vision for the Corridor and identified the tangible ambitions for the programme

noting that cross-cluster development was viewed as key to the development.

A private sector lead delivery group is being set up and LC asked Board Members for

suggestions on suitable business leaders to join the group.

Jeanette Wheeler (JW) asked how the CNTC can compete with the Cambridge - Oxford

corridor. LC confirmed that Cambridge were fully engaged in the initiative and proposed that

the CNTC could focus on presenting its own identity such as specialising in clean efficient

growth to compliment other corridors rather than competing with them.

LC noted that businesses were being involved in the process and were advising of their labour

requirements so that the project looked at a wide approach providing jobs across the full supply

chain rather than just highly skilled jobs.

Colin Noble (CN) advised that an A14 corridor had just been launched focussing on developing

exports and exploiting the opportunities to allow companies to increase exports. There is

scope for the corridors to work together to complement each other in their offering.

David Richardson (DR) advised that he had recently met with the new vice-chancellor of

Cambridge and looked that the USPs of Norwich, the UEA and Norwich Research Park as an

attractive terminus at the end of the corridor but stressed that it still required additional

investment.

Nikos Savvas (NS) and Tim Whitley (TW) noted the importance of the Tech Triangle including

Ipswich and felt that the national significance of the area should be stressed to central

Government in order to establish the East of England as an economic powerhouse.

The Board agreed:

To note the content of the presentation

To suggest private sector representatives to sit on the delivery group (to be submitted to

Helen Wilton)

7

LEP Capital Budget 2018/ 19 - Confidential

CS presented the LEP 2018/19 capital budget to the Board and provided further details of

larger ongoing projects.

The Board was advised that some projects had slipped and although work was looking at

bringing forward spend where possible this had always proved challenging historically.

CS reviewed the main points of the budget relating to the Growth Deals Programme, Growing

Business Fund, New Anglia Capital and Agritech.

CS requested the allocation of £1m of the Growing Places Fund budget to New Anglia Capital

to allow for further investments to be made.

3

5

CS advised the meeting that £1m had previously been allocated to Eastern Agritech and

requested that this allocation continue while discussions are ongoing with the Combined

Authority on the future of the programme and the production of a business plan.

JW queried why this was still being progressed with the Combined Authority and not

independently. CS advised that the programme could be continued alone but this was

originally set up as a joint bid out of the Regional Growth Fund. The panel also contains

technical expertise which would be lost if the work was not combined

TW asked who would approved the business plan - the IAC or the LEP Board. CS

recommended that the Board should approve the plan.

DR felt that the New Anglia LEP had not received sufficient credit for the Agritech programme

to date and that this new start provided the opportunity for New Anglia to take the lead.

This should be a pre-requisite of the business plan.

DF asked when the plan would be completed. CS confirmed that it was currently scheduled for

agreement at the June Board meeting.

The Board agreed:

To note the content of the budget

To approve the 2018/19 capital budget

To approve the allocation of £1m from the GPF fund budget to New Anglia Capital.

To approve the allocation of £1m to Agritech subject to the production and approval of a

business plan

8

Review of Professional Advisers

JW left the room.

CS reviewed the paper included in the meeting pack and reviewed the proposal to develop a

multi-supplier procurement framework.

DF asked who will be managing the process. CS confirmed that Rosanne Wijnberg will join on

1st May as COO and will be managing the process.

The meeting was advised that Lovell Blake will be used for the current audit but it is proposed

to carry out a re-tendering process for the following one.

David Ellesmere (DE) asked whether there would be various framework for the different areas

of work or a single one. CS advised that there would be multiple lists of advisors but it was

envisaged only to have one framework. Sue Roper (SuR) offered to provide assistance.

The Board agreed:

To approve the development of a supplier procurement framework

To carry out a retendering process for the audit

JW returned to the room.

9

Decision Log

CS highlighted the key points of the proposal to record the decisions of the various boards.

JR asked if there would be both confidential & non-confidential versions. CS agreed that the

confidential log would be added to Board papers and the non-confidential version would be

published on the web site.

It was agreed that this would start at the beginning of the 18/19 financial year at the start of

April 2018.

The Board agreed:

To approve adoption of the decisions log

10

Growth Deal Quarterly Dashboard

Chris Dashper (CD) presented the Growth Deal update report paper noting that only projects

with an Amber status were now included. The Board were advised that there are no issues with

the delivery of the projects however some were delayed.

4

6

CD reviewed the data contained in the Quarterly Dashboard which is submitted to Government

noting that this contained data from Q3 2017 and that some outputs were out of date as data

takes time to feed through to the dashboard.

CS noted that the data in the dashboard will always be a quarter behind and will be older that

the data supplied to Board members on a regular basis.

TW asked whether the outputs were on track to meet targets. CD advised that the outputs

were behind in some areas due to a mixture of delays in spend and delays in capturing the

outputs from projects where the funds have already been spent.

The Board agreed:

To agree the Quarterly Dashboard.

11

Chief Executive’s report including PwC Implementation Plan

CS reviewed the Chief Executive’s report and thanked CN for his involvement in the deep dive

in which the LEP had performed very well.

The Board were updated on the key points of the report.

ERDF bid - CS & DF met with MHCLG to discuss the bid and take action to address the delay.

Further information has been provided and the ESIF Committee will discuss the extension at a

meeting in the 3rd week in April.

JR queried the long term exit strategy. CS advised that the new UK Shared Prosperity will be

the initial source for requesting funding but other sources will be investigated. Shan Lloyd (SL)

advised that more information on the fund will be issued before the summer recess and that the

industrial strategy was a key part of this identifying how funding should be prioritised.

GEML - Pritti Patel has asked for the evidence based to be refreshed and work is ongoing to

produce a business case for infrastructure improvements.

East Branding workshop - JW updated the meeting on the workshop and the Board

discussed the importance of this work to the promotion of Norfolk and Suffolk. JW offered to

ask Hayley Mace to send details of examples of branding from other regions.

COO Recruitment - Rosanne Wijnberg will be starting on 1st May. CS advised Board

members of the broad scope of the division of responsibilities.

Structure Chart - revised structure chart was issued to Board members.

HR - CS updated the Board on the work Charley Purves has been carrying out on workplace

wellbeing.

David Ellesmere (DE) asked about the progress of the delivery of the Tier 2 of the Governance

review. CS advised that the LEP Executive would be progressing this as a priority but it had

been delayed slightly by the deep dive.

The Board agreed:

To note the content of the report

To receive regional branding examples from Hayley Mace

HM

12

Finance Report

Keith Spanton (KS) reviewed the key points of the paper and asked for questions from the

Board.

The Board agreed:

To note the content of the report

13

Board Forward Plan

CS reviewed the items to be covered at the May Board.

The Board agreed:

To note the content of the report

14

Any Other Business

DF advised the board of recent events promoting businesses in the region.

JW noted that the MAC Interim report needed to be included in the Brexit analysis and planning.

5

7

Next meeting:

Date and time of next meeting:

10.00am - 12.00pm, 23rd May 2018

Venue: Co-op Education Centre, 11 Fore St, Ipswich IP4 1JW

6

8

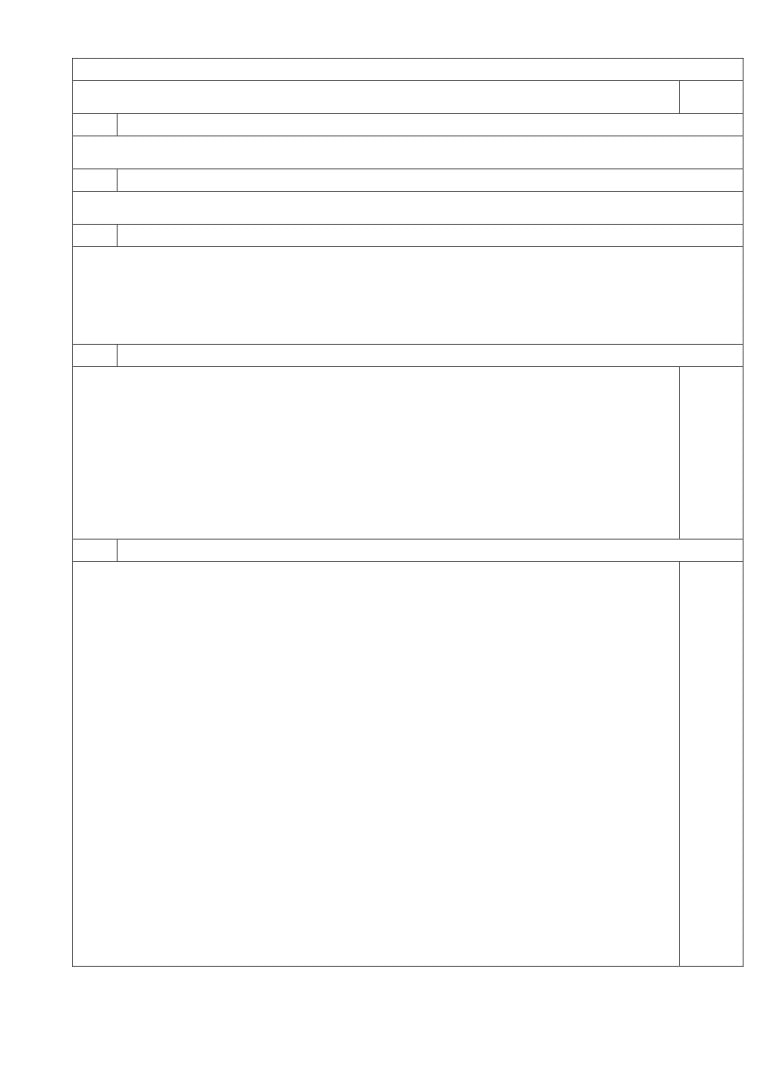

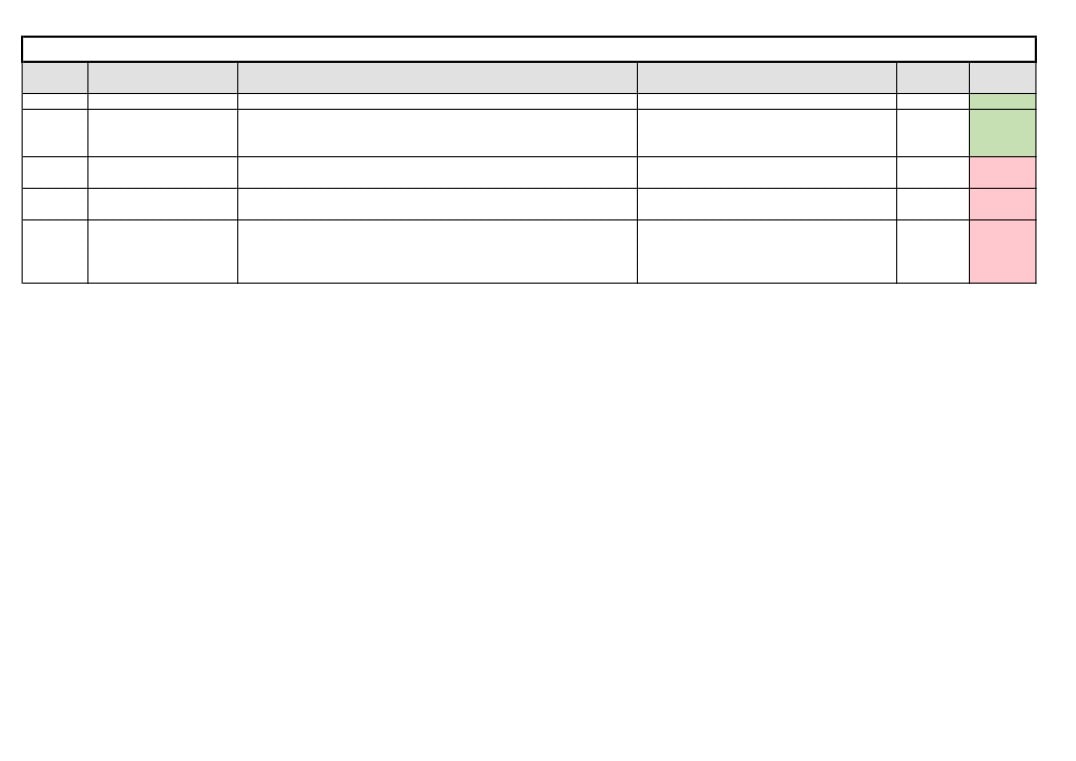

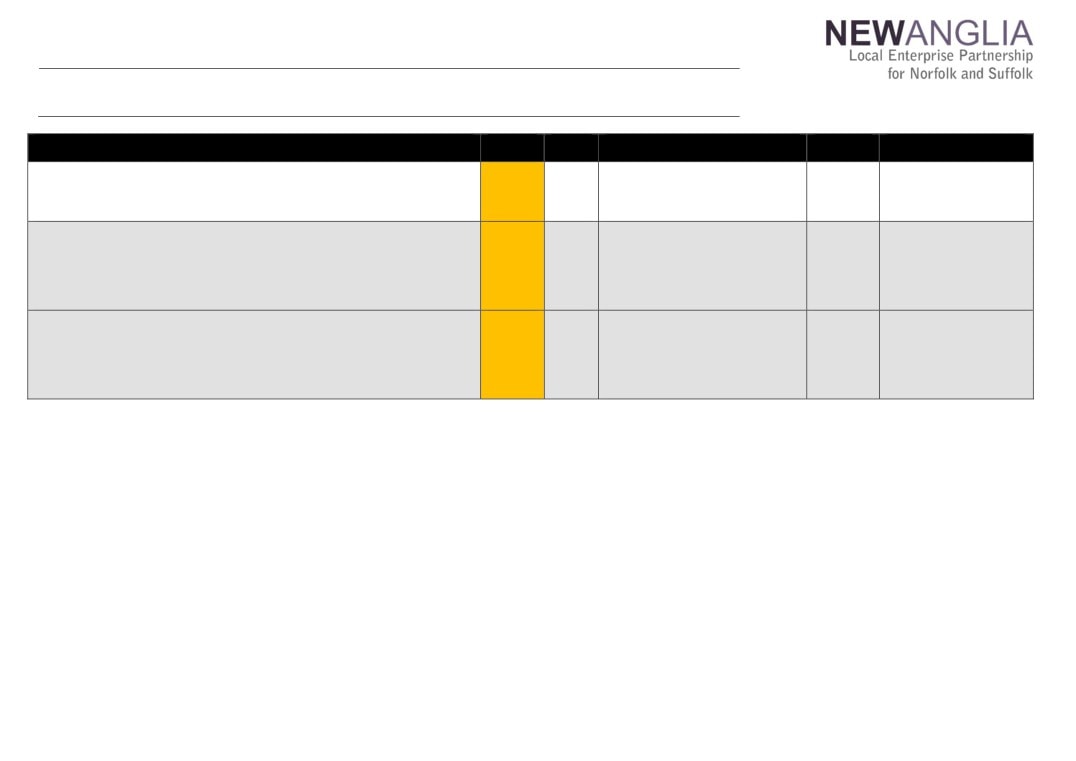

Actions from New Anglia LEP Board Meetings

Date

Item

Action

Update

Actioned By

Status

18/04/2018

Chief Executive’s Report

To receive regional branding examples from Hayley Mace

HM

Complete

21/02/2018

Declarations of Interest

Ascertain whether regular Board substitutes need to complete

Declarations will be required. Charley Purves will

CS

Complete

Declaration of Interest Forms.

contact Board substitutes to arrange completion

21/02/2018

Economic Indicator

To receive a paper on CO2 reductions for

CS and JR liaising

CS/JR

On-Going

Trajectories and Targets:

consideration of inclusion in the economic strategy targets

21/02/2018

Brexit Analysis

To receive an action plan detailing the next steps, timescales and measures of

Draft action plan is being produced & will be

LiR

On-Going

success

presented at the September Board meeting

22/11/2017

Business Performance

To receive a proposal on the Eastern Agi-Tech initiative by email.

CS has written to the Combined Authority and is

CS

On-Going

Reports

now liaising over a paper which will go to the June

Combined Authority Board meeting

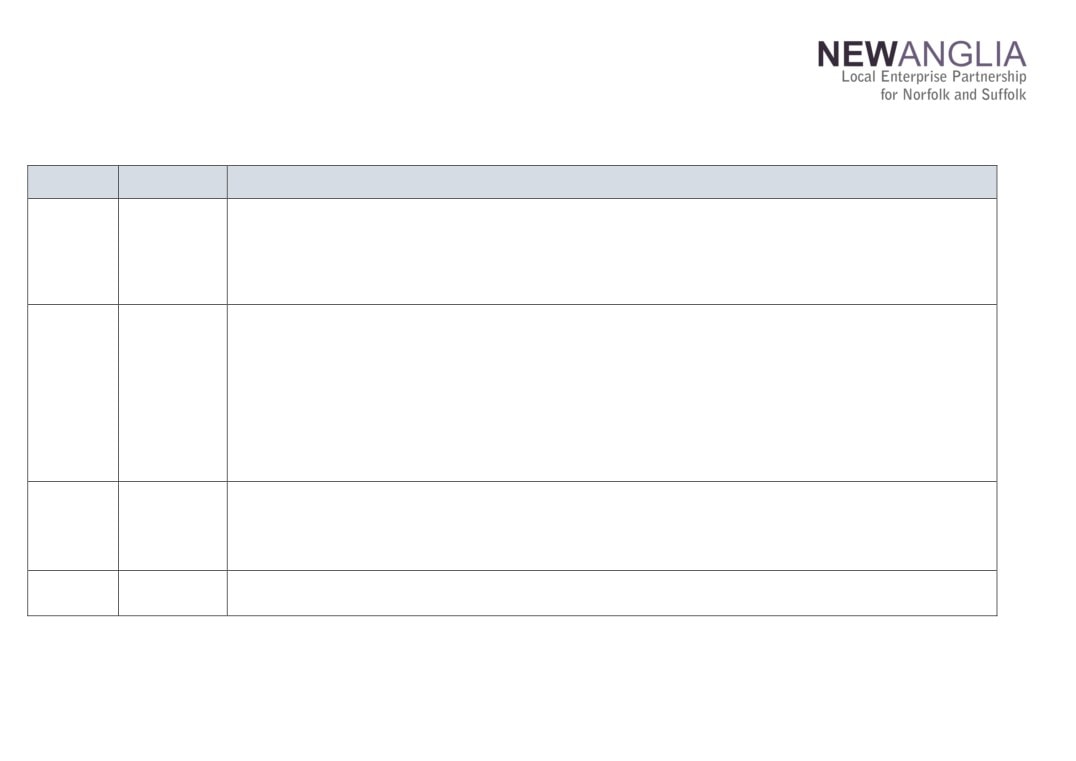

9

New Anglia Local Enterprise Partnership

Board Decision Log

Date

Decision

Decision Made

Making Body*

02/05/2018

Growing

The Panel approved the following applications:

Business Fund

Warren Services Limited - Agreed to Support

Panel

Approved Grant: £32,000

Food Forensics Limited - Agreed to Support

Approved Grant: £36,980

Renvale Limited - Agreed to Support

Approved Grant: £184,552

18/04/2018

LEP Board

The Board made the following decisions:

LEP Capital Budget 2018/ 19 - Confidential

To approve the 2018/19 capital budget

To approve the allocation of £1m from the GPF fund budget to New Anglia Capital.

To approve the allocation of £1m to Agritech subject to the production and approval of a business plan

Review of Professional Advisers

To approve the development of a supplier procurement framework

To carry out a retendering process for the audit

Decision Log

To approve adoption of the decisions log

Growth Deal Quarterly Dashboard

To agree the Quarterly Dashboard.

18/04/2018

Investment

The IAC made the following decisions:

Appraisal

West Suffolk College Engineering and Technology Centre

Committee

It was agreed that the proposal would be presented at the LEP board meeting on the 23rd May 2018 for the release of the remaining

£3m to West Suffolk College Engineering and Technology Centre

Any Other Business

Cash Deposits - It was agreed that funding would be deposited until drawn down by the approved projects

11/04/2018

Remuneration

The Committee made the following decisions:

Committee

360-degree feedback - The committee agreed that this would be used initially with the CEO in August 2018.

CEO Objectives - Current CEO objectives were agreed by the committee

* New Anglia Local Enterprise Partnership Board, Investment Appraisal Committee, Growing Business Fund Panel, Remuneration Committee, Audit & Risk Committee

10

04/04/2018

Growing

The Panel approved the following applications:

Business Fund

Computer Service Centre Ltd - Agreed to support

Panel

Approved Grant: £265,800

Panel Graphics Ltd (2) - Agreed to support

Approved Grant: £64,414

Broadway Colours Ltd - Agreed to support

Approved Grant: £40,000

* New Anglia Local Enterprise Partnership Board, Investment Appraisal Committee, Growing Business Fund Panel, Remuneration Committee, Audit & Risk Committee

11

New Anglia Local Enterprise Partnership Board

Wednesday 23rd May

Agenda Item 5

Integrated Transport Strategy for Norfolk and Suffolk

Author: Ellen Goodwin

Summary

This report seeks Board approval to adopt the Integrated Transport Strategy for Norfolk and

Suffolk.

It also outlines the next steps with regard to launching the strategy, developing an associated

delivery plan and how we ensure full integration with the developing work programme of the

newly formed Transport East, which covers a wider East of England geography

Recommendation

The Board are asked to:

Adopt the strategy as a supporting strategy for the Norfolk and Suffolk Economic

Strategy; and

Endorse the relevant next steps and provide a steer as to direction going forward.

Background

Working with our partners, good progress has been made in unlocking the growth potential of

The East through targeted transport and digital investment.

However, the absence of a well-evidenced and clear transport strategy setting out the capital

investments needed to fully realise the economic potential of The East has been recognised by

the Local Transport Board and our partners.

It was also noted by the Department for Transport’s Executive Committee when they visited the

area in October 2016. A number of other regions, including Transport for the North, have

already attracted significant interest and investment from Government on the basis of similar

initiatives.

The New Anglia Local Transport Board commissioned WSP, Norfolk County Council’s partner

consultant, who have produced similar well-regarded work for Transport for the North (amongst

others), to develop an Integrated Transport Strategy, with supporting technical evidence, to look

at how the two counties’ economies might develop and the transport interventions needed to

support this.

The Strategy looks forward to 2050 and sets out the context for short, medium and longer-term

capital investments to support economic growth in Norfolk and Suffolk.

1

13

The development of the strategy has been funded jointly by Norfolk County Council, Suffolk

County Council and the LEP.

The work has been co-developed through a funders reference group, working closely with the

Local Transport Board who provided governance and direction for the work. Close liaison with

Norfolk and Suffolk Chambers of Commerce and with District Council partners has also

occurred as part of the stakeholder engagement plan.

The Integrated Transport Strategy was endorsed at the Local Transport Board meeting on 23

February 2018, Norfolk Chamber of Commerce on 9 April 2018, Suffolk Chamber of Commerce

on 17 April 2018, Suffolk County Council’s Cabinet on 15 May 2018 and is due to be endorsed

by Norfolk County Council’s Environment, Development and Transport Committee on 18 May

2018.

A final draft of the Strategy is attached as Appendix 1 for the LEP Board’s consideration and

approval.

Key Considerations

The Board are asked to adopt the Norfolk and Suffolk Integrated Transport Strategy noting the

stakeholder engagement and endorsement that has occurred during its development. It is also

asked to consider the next steps described below.

The Board has already committed budget to this project. No further contribution is being

sought.

Link to the Economic strategy

The Integrated Transport Strategy has been developed so that it fully aligns with the Norfolk

and Suffolk Economic Strategy through mapping connectivity and Economic Strategy themes

accordingly.

It will contribute to the delivery of the high-level ambition that Norfolk and Suffolk be a well-

connected place. It will also contribute to, albeit to a lesser extent, all of the other key

ambitions in the Strategy.

Next Steps and Key Dates

Strategy Launch

Ideally the Launch will be linked to another event in order to maximise impact. Members of this

Board, Local Authorities and the Local Transport Board will be invited. The launch will also

invite the DfT executive committee back to our area, as well as local MPs. The Board is asked

for their thoughts regarding other possible promotional events.

Delivery Plan

A supporting Delivery Plan will be developed and published alongside the Norfolk and Suffolk

Economic Strategy.

Transport East

The next meeting of Transport East is scheduled for 4 June 2018 and the Integrated Transport

Strategy will form a crucial building block for the Strategy they produce.

The Integrated Transport Strategy has the potential to attract investment into the region to

secure transport improvements in support of the economy both through local lobbying and

advocacy and via the newly formed Transport East Forum.

Recommendation

2

14

The Board are asked to:

Adopt the strategy as a supporting strategy for the Norfolk and Suffolk Economic

Strategy; and

Endorse the relevant next steps and provide a steer as to direction going forward.

Appendices

Appendix A - Integrated Transport Strategy for Norfolk and Suffolk

3

15

New Anglia Local Enterprise Partnership Board

23rd May 2018

Agenda Item 6

Enterprise Zones: Progress Update

Author: Julian Munson/Eunice Edwards. Presenter: Julian Munson

Summary

To provide a progress update report on New Anglia Local Enterprise Partnership’s two

Enterprise Zones;

1. Great Yarmouth & Lowestoft (New Anglia) Enterprise Zone (started 2012) & extensions

(started 2017).

2. Space to Innovate Enterprise Zone (started 2016).

This report will cover Enterprise Zone outputs to date, a financial analysis of income generated

to date, strategy, timeline and forward plan for delivery (to 2021).

Recommendation

The Board is asked to note progress and endorse the proposed strategy and forward plan.

Background

New Anglia LEP successfully bid to Ministry of Housing, communities and Local Government

(MHCLG) for two ‘multi-site’ Enterprise Zones in Norfolk & Suffolk.

Enterprise Zones are designated areas that provide business rates discounts of up to £275k

over a five year period to businesses if locating in the zones in the first 5/6 years & simplified

planning. Enterprise Zones are part of the Government’s wider Industrial Strategy to support

businesses and enable local economic growth.

The Great Yarmouth & Lowestoft Enterprise Zone began in April 2012 & encompasses six

sites; Beacon Park in Gorleston, South Denes in Great Yarmouth, Riverside Road in Lowestoft,

Mobbs Way in Oulton, South Lowestoft Industrial Estate in Lowestoft and Ellough in Beccles.

Four of these sites (Beacon Park, South Denes, Mobbs Way and Riverside) were also awarded

extensions where benefits started in 2017. This Enterprise Zone has an energy sector focus.

The Space to Innovate Enterprise Zone began in April 2016 and encompasses 10 sites;

Norwich Research Park, Suffolk Park in Bury St Edmunds, Scottow Enterprise Park near

Coltishall, Egmere Business Zone near Wells-next-the-Sea, Nar Ouse Business Park in King’s

Lynn, Stowmarket Enterprise Park and the 4 sites in the Ipswich area are Princes Street, Futura

Park, Waterfront Island and Sproughton Road (Swich Park). The sectors identified for this

1

17

Enterprise Zone include: agritech, food and health, offshore energy, the green economy, ICT

and digital creative sectors in which Norfolk and Suffolk has a competitive advantage.

Enterprise Zones have established themselves as a driving force of local economies as they

unlock key development sites, consolidate infrastructure, attract business and create jobs.

Both EZ’s have long range stretch targets they are working towards with annual targets set with

local authority partners each year. However progress to date on some sites has been slower

than expected. More details can be found at Appendix 1 - Enterprise Zones Targets to 2021.

Outputs are recorded and reported on a quarterly basis to MHCLG and New Anglia LEP Board.

Activity across the two Enterprise Zones is coordinated by two partnership/ development

groups, chaired by New Anglia LEP, involving County and District/Borough Council officers and

MHCLG.

In Summary, to date, the Great Yarmouth & Lowestoft Enterprise Zone has delivered 1,694

Jobs,

773 construction jobs,

50 businesses,

£44m private investment,

£178m public

investment, 18.3ha land developed & 52,223SqM floor-space.

To date the Space to Innovate Enterprise Zone has delivered 438 Jobs, 1,145 construction jobs,

72 businesses,

£14m private investment, £105m public investment, 13ha land developed and

9,170 SqM of floor-space.

All business rates growth generated by the Enterprise Zones are kept by the relevant Local

Enterprise Partnership and local authorities in the areas for 25 years to reinvest in local

economic growth. This reflects the Government’s commitment to long-term economic growth

and enables LEPs to reinvest in site development and other local initiatives.

The 100% retained rates is split into 4 separate funds;

Fund A1 is for the Collecting (or District) Authority

Fund A2 is for the County Council

Fund B is for the development of the Enterprise Zone sites

Fund C is for New Anglia LEP to fund activity in the Economic Strategy for Norfolk and Suffolk.

Please see Appendix 2 New Anglia Enterprise Zones Finances for more information

Key Considerations

Enterprise Zones remain a key priority programme for New Anglia LEP. They not only

demonstrate an effective method of intervention to unlock and accelerate the development of

key commercial sites but also support local economic development and job creation. In

addition they also enable the retention of business rates income to further enhance the

development and delivery of sites and provide an additional source of income for New Anglia

LEP for other project activity.

This programme has proven to be effective in unlocking and accelerating commercial

development in the Great Yarmouth and Lowestoft Enterprise Zone and in the case of the

Beacon Park site for example has had a highly significant impact on business investment and

jobs growth for the energy sector supply chain in that area.

There is progress on the majority of the Space to Innovate Enterprise Zone sites but it is

important that New Anglia LEP continues to work closely with partners to ensure that we

identify creative ways of removing any barriers to development and provide an even stronger

focus on delivery over the next couple of years. There are cases where development has been

limited and the issue of land ownership and level of ambition to build can be a major factor

inhibiting progress. The New Anglia LEP with Local Authority partners has the potential to help

2

18

overcome these barriers through the new EZ Accelerator Fund and opportunities around land

acquisition and co-investment to help ‘kick start’ new development.

It is also important that the Enterprise Zones ‘offer’ is more proactively marketed through

various channels and leveraging the Growth Hub, Growth Programme and inward investment

activity in a more coordinated and targeted way.

It is also important to note that a priority for Enterprise Zones is encouraging a net increase in

investment, business growth and job creation and so careful consideration is always given to

minimising ‘displacement’ within the locality of all enterprise zone sites.

Link to the Economic strategy

The New Anglia Enterprise Zone sites are all located in the Priority Places identified with the

new Economic Strategy. These include the Ipswich area, Norwich area, Norfolk/Suffolk Energy

Coast

(including North Norfolk, Great Yarmouth and Lowestoft areas), A14 Corridor

(Stowmarket and Bury St Edmunds) and the A47 Corridor (King’s Lynn).

As an incentive based programme focused on unlocking and delivering growth on key

commercial sites, Enterprise Zones support the objectives of the following priority themes;

Our Offer to the World (inward investment and trade support)

Driving Business Growth and Productivity (clustering, enhancing supply chain

activity, promoting innovation, targeting business support etc)

Collaborating to Grow (partnership activity to unlock development and delivery)

Competitive Clusters, Close to Global Centres (development and promotion of

innovative business clusters)

Next Steps

The proposed strategy and forward plan for Enterprise Zones to 2021 is outlined as follows;

May/June 2018 - desktop review of all enterprise zone sites, identifying progress status,

key issues, barriers to development, investment potential and opportunities etc.

July/August 2018 - update EZ site delivery plans and timelines (as a result of review)

July 2018 - sign off of outstanding legal agreements

August - December 2018

- Development of inward investment delivery plan (part of the Economic Strategy)

with specific objectives for attracting businesses to enterprise zone sites

September 2018 - December 2019

- Development and promotion of a joint package of potential business grant/loan

support for enterprise zone based businesses

- Enhanced promotion of enterprise zone sites at MIPIM UK event

- Promotion of business case studies (focus on innovative businesses)

- Targeted, direct marketing to expanding businesses via Growth Hub, Local

Authorities, Chambers of Commerce, Sector Groups, DIT, property agents etc

- Enhanced promotion of the enterprise zone sites via the inward investment

activity e.g. Invest Suffolk, Locate Norfolk, Tech Corridor and Invest East activity

3

19

- Active progression of potential Enterprise Zone Accelerator funded projects

working with Local Authorities (development of infrastructure and new buildings)

The New Anglia LEP has the responsibility of progressing this strategy and activity, in

partnership with Local Authorities, land owners and developers.

Recommendation

The Board is asked to note progress and endorse the proposed strategy and forward plan.

Appendices

Appendix 1 - EZ Targets

GY&L to 2021

S2I to 2021

Appendix 2 - New Anglia EZ Finances

Graph of income for both EZs - Fund A1, A2, B & C split

4

20

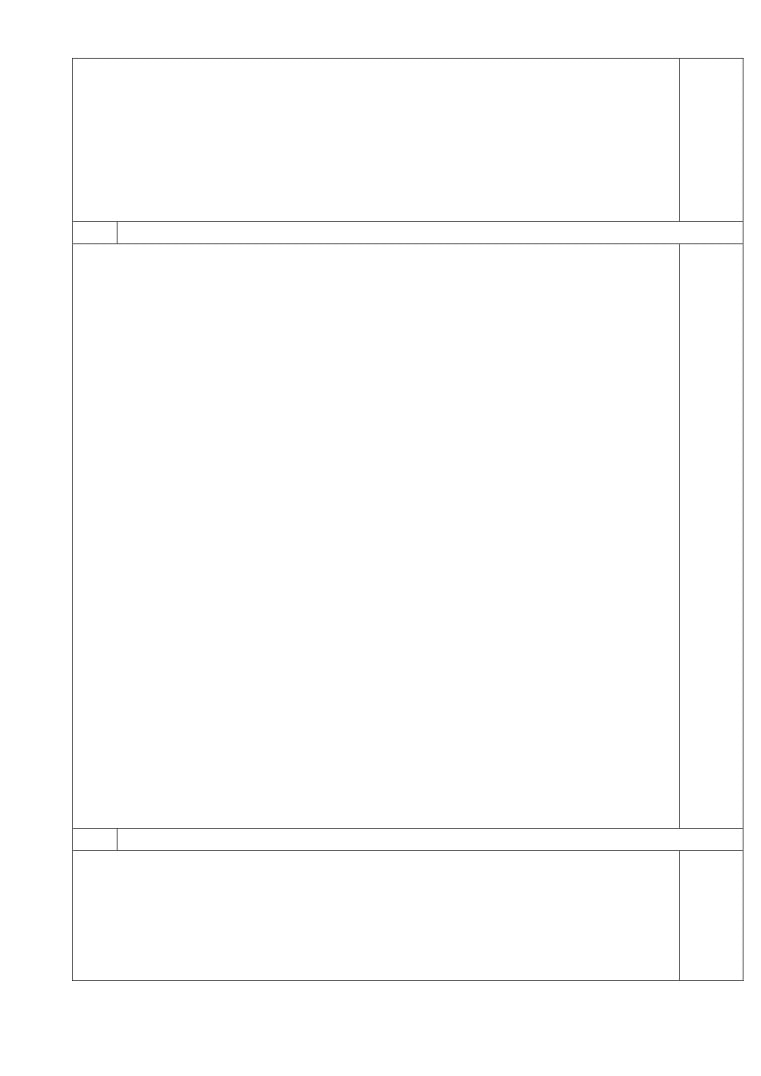

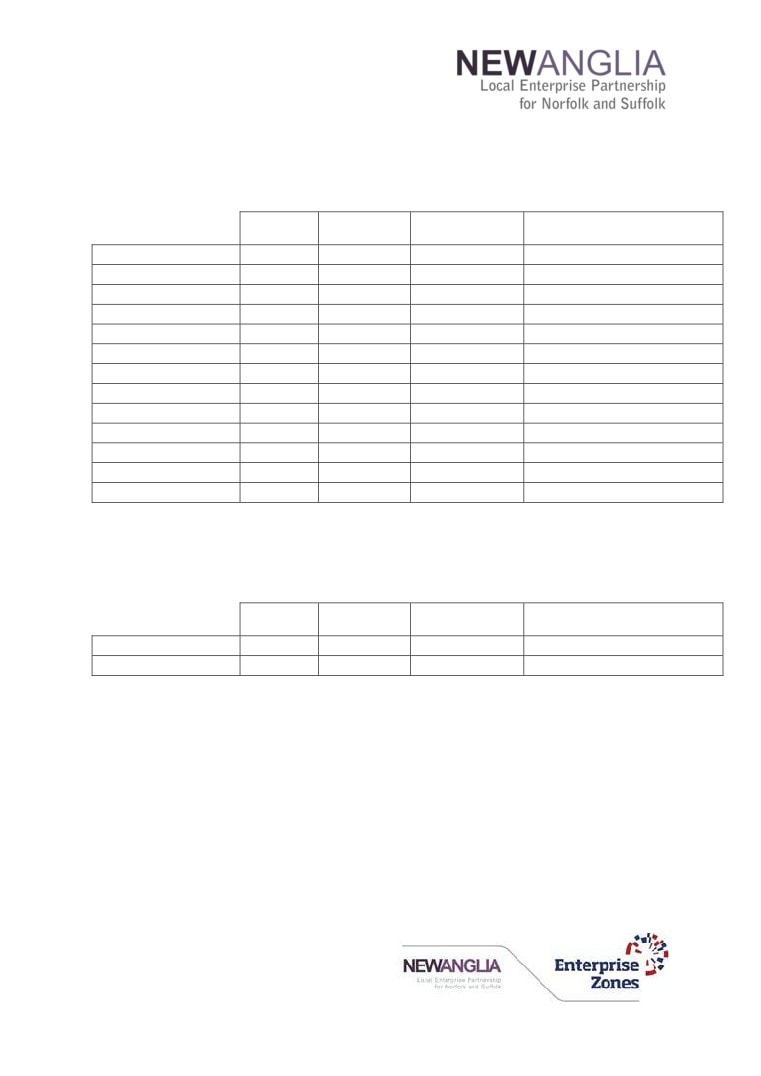

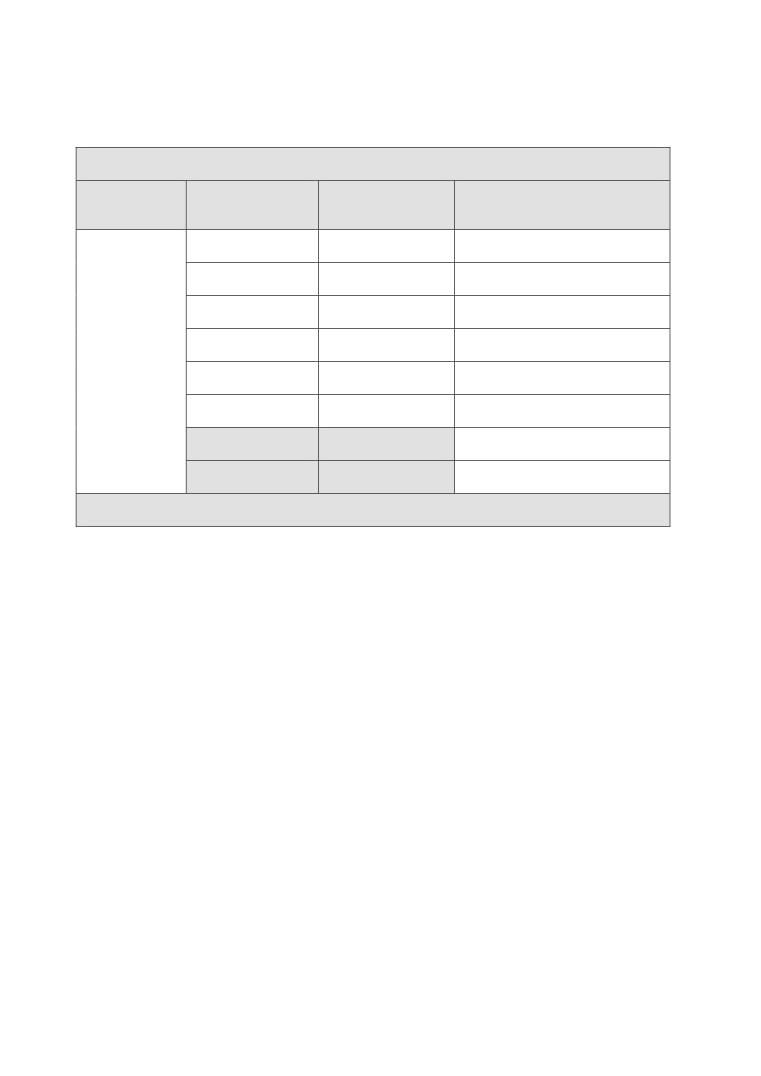

Appendix 1 - Enterprise Zones targets to 2021

Space to Innovate Enterprise Zone

2018-2021 (3 year period)

Construction

Private Capital investment

Jobs

Businesses

jobs *

£M

NRP

909

6

102

20

Nar Ouse

695

28

238

5

Suffolk BP

375

8

255

10

Stowmarket

205

20

102

2

Scottow

236

24

17

1

Egmere

43

9

34

2

Futura Park

296

9

255

10

Princes Street Total

417

2

85

5

IBC

-

-

-

-

141-145

-

-

-

-

Fisons

417

2

85

5

Island site

63

12

13

4

Sproughton

249

6

255

12

TOTALS S2I

3,488

124

1,356

£71M

Great Yarmouth & Lowestoft (New Anglia EZ)

2018-2021 (3 year period)

Construction

Private Capital investment

Jobs

Businesses

jobs*

£M

GY sites

558

10

119

6

WDC sites

708

20

85

4

TOTALS GY & L

1,266

30

204

10

EZ TOTAL

4,754

154

1,560

£81M

*Construction jobs. MHCLG requirements;

Permanent paid full time equivalent construction jobs that are newly created in connection with

the Enterprise Zone i.e. that did not exist before this quarter. A "permanent" job is expected to

last 26 weeks or more.

21

New Anglia Local Enterprise Partnership Board

Wednesday 23rd May 2018

Agenda Item 7

Engineering and Technology Centre, West Suffolk College (Vinten’s Building)

Author: Natasha Waller & Michael Gray. Presenter Chris Dashper

Summary

This paper seeks approval by the LEP Board of a £3m investment from the Growth

Deal towards the development of an Engineering and Technology Centre at West

Suffolk College.

This will be the second phase of a £7m LEP investment in the centre. £4m was

previously provided by the LEP to acquire the site and 9000m2 premises in 2016.

The £3m will be used to refurbish at least 3000m2 of the building so that it is fit to

deliver training in areas required by key sectors of our local economy.

The project will result in 536 additional learners over the first four years. 246 of which

will be engineering courses at level 3 and above.

Acquisition and refurbishment of the site provides the potential to unlock further

strategic opportunities.

Recommendation

To approve the release of the remaining £3m, originally allocated through the Skills Capital

funding application process, for the refurbishment of part a building in order to create a new

Engineering and Technology Centre at West Suffolk College.

Background

In

2014, as part of the then skills capital allocation process the New Anglia Skills Board

prioritised a £7m investment for the acquisition, modernisation and refurbishment of premises

within walking distance of the main West Suffolk College (WSC) campus to be used for full-time

further and higher education provision for the energy, engineering and advanced manufacturing

sectors. This building was acquired from Vitec who are relocating to other premises in the town.

As the current college campus have limited capacity to grow curriculum areas including their

ability to demonstrate engineering principles on a practical basis, the project was approved to

enable growth and improve the quality of the college’s offer in these key economic areas. The

project also represented a unique opportunity to secure land and property on the periphery of

the main WSC campus.

Following the prioritisation of the project by the Skills Board, WSC was invited to submit a

detailed application to ensure full due diligence was applied before funding was granted and to

help inform the final decision to be made by the LEP Board.

During this process it was decided that the project would be split into two distinct phases.

1

23

The first, to acquire the site, and the second to undertake modernisation and refurbishment.

This was due to both the annual allocation timescales of the Growth Deal allocation from

Government and the level of detail available at that point regarding the refurbishment due to the

commercial sensitivity of purchasing the building from the Vitec company.

In January 2016, the LEP invested £4m to acquire the site.

It was expected that the previous owners would be able to vacate the site earlier than has been

the case. With the purchase of the site the previous owners of the site became tenants, with

West Suffolk College receiving a rental income. This rental income (£669,000) has been ring

fenced and will be invested back into the development of the centre, either increasing the levels

of refurbishment due to take place or helping to cover any increase in refurbishment costs.

The LEP Board is now asked to approve release of the remaining £3 million of Growth Deal

funding previously ringfenced for the modernisation and refurbishment of the building.

The £3m grant will be used by West Suffolk College to fund the necessary modifications of a

proportion of the premises. This includes the discharging/meeting the planning conditions,

improving the building façade and creating the teaching spaces required including six higher

education engineering classrooms complimented by demonstration areas providing students

with a more ‘hands-on’ enhanced experience - vital for employability.

There will also be the creation of professional training facilities within three rooms in the centre

specifically designed to meet employers demands for targeted higher-level skills training for

their workforce.

The investment is expected to enhance the regional engineering and STEM provision offer. It

will result in at least an additional 536 learners over the first four years:

- 246 of which will be engineering courses at level 3 and above.

- 290 across ICT, business management, science and health and social care due to releasing

classroom space at the main campus.

This growth is expected to continue beyond the initial four years.

Acquisition and refurbishment of the site also provides the potential to unlock strategically

important opportunities to further enhance the regional training offer in important areas.

The Engineering and Technology Centre is an integral part of the bid to establish an

Institute of Technology in the East (EIoT), providing the space and industry standard

facilities to deliver the Institute’s higher level technical engineering curriculum.

There are many large-scale engineering/ technology and infrastructure projects planned for the

area that are of national significance which will substantially drive demand for high value skills

beyond current levels such as offshore wind, offshore decommissioning and the potential

Sizewell C and Bradwell B nuclear new builds. Many of the organisations involved in these

developments are supporting partners of the EIoT bid and will be working with WSC to support

the development and delivery of its curriculum.

This facility could potentially become part of a National College for Nuclear proposal, providing

many of the core technical skills that will be required for constructing and operating a Nuclear

Power Facility. WSC are also in dialogue with the Advanced Manufacturing Centre in Coventry

to become a ‘spoke’ site that would lead to innovative manufacturing and productivity solutions

for employers.

2

24

These developments will take place in the refurbished area if approved plus in the remaining

6000m2 of the site which will fall outside of this part of this current application. It is fully

anticipated that this area will be developed without further LEP funding.

Key considerations

£4m has already been committed to the Centre and spent to purchase the site and the rental

income has been ring fenced to go back into this project. £1 million has been committed by the

College to support the proposal. This was previously agreed by the LEP Board and approved

by the government appraisal process.

Timescales, vision and costings have all evolved since the original concept and proposal to the

Board but the college is committed to the Science, Technology, Engineering and Maths (STEM)

agenda and this is part of process of developing this curriculum for the region.

A full building inspection has not been carried out to date due to restriction issues with the

original owner who then became a tenant. This may lead to further costs in creating a safe

teaching environment. This is in addition to the known change of use redevelopments already

identified by planning regulations.

The college is clear that there will be no additional funds available from the LEP to cover any

contingencies if costings increase dramatically for the area of the building identified in the

Detailed Application Form (dated 16/03/2018).

West Suffolk College has agreed to cover these costs or review the level of resourcing. A Grant

Agreement would be put in place to secure this position. The college has a strong history of

financial management and monitor reserves robustly. Any further delay risks increasing costs

and delay in revenue from increased student capacity.

Link to the Economic Strategy

This new facility will support the growth in numbers of engineering students that are able to be

trained at the college. Advanced Manufacturing and Engineering & Energy are key sectors for

the LEP and the recently endorsed sector skills plans highlight a clear need for increase in

numbers of entrants to these sectors and an upskilling of the existing workforce.

This building also has areas earmarked for the proposed Eastern Institute of Technology and if

successful, funding will support further development over the coming years. Expansion of the

curriculum will also occur together with establishment of stronger links with other educational

providers in the region and key employers. Some of this is already underway and some new

equipment has been part funded through the Skills Deal which will be housed here. Training

has also been offered by an employer to improve the social mobility of a number of individuals

referred by the DWP showing that this building will clearly drive inclusion and skills.

The release of classroom space in the main college will allow other curriculum to grow as well -

Health & social care, Science, ICT and Business Management.

Next Steps

Grant agreement will be developed and signed.

Further structural reviews will be carried out and building work commissioned.

Centre to be operational for the 2019/20 academic year.

Further STEM based proposals to be developed for the unoccupied area.

Recommendation

To approve the release of the remaining £3 million, originally allocated through the Skills

Capital funding application process, for the refurbishment of part a building in order to create a

new Engineering and Technology Centre at West Suffolk College.

3

25

New Anglia Local Enterprise Partnership Board

Wednesday 23rd May 2018

Agenda Item 9

New Anglia LEP: Speculative Investment

Author and presenter: Chris Dashper

Summary

Since 2012, when the Growing Places Fund was first launched, New Anglia LEP has had the

opportunity to support commercial projects with repayable loans.

Due to the requirement to ensure that best value is secured through the use of public funds at

minimal risk, the majority of loans made by New Anglia LEP to date have been non-speculative,

with either a confirmed end user or occupant or a defined and manageable repayment method

in place from the outset.

New Anglia LEP continues to receive regular requests for funding through the Growing Places

Fund, many of which could be considered as speculative projects.

In lower risk circumstances, a loan for a speculative project may be appropriate for LEP

support. This paper proposes a framework through which the LEP can determine whether it

should or should not invest in speculative developments.

The paper also includes a table to calculate the appropriateness of investments in terms of the

return received.

Recommendation

The Board is recommended to consider using Growing Places Fund and other funds if available

to support speculative investments in certain lower risk circumstances.

Background

The term ‘speculative construction’ or ‘speculative development’ describes a process in which

unused land is purchased or a building project is undertaken with no formal commitment from

any end users.

Despite the end user being unknown, the developer is confident not only that they will be able

to find one but also that the type of development being undertaken is suitable. This contrasts

with custom building when a builder is contracted for a specific development by a client who is

able to provide a brief of their requirements.

Speculative development does have a degree of notoriety attached to it, from the 1980s in

particular where in cities and major growth areas de-regulation of the financial sector and the

availability of international financing led to significant commercial developments and property

booms.

1

49

Examples of speculative construction include:

Constructing retail space to lease space from or to sell

Constructing a business park or office space to sell or lease

Building houses to sell

Conversion of existing buildings into other uses to lease or sell

Speculative developers typically profit from carefully timing the buying and selling of land or

property for development.

Land for office or housing developments can often be purchased at a cheaper rate during a

market depression and then sold once developed when the market has recovered. However

there is risk in this as the costs are often high, the timescales are long and the consequences of

misjudging the market and not finding a buyer can be serious.

Public funding is not traditionally used to support the purchase of land and the LEP would not

consider requests to solely support the purchase of land through any of the programmes. The

growing issue of land banking is also a reason not to support land purchases.

For any other type of development the LEP already operates a policy of supporting ‘shovel

ready’ projects to ensure that funding is not tied into projects that have no chance of an

immediate start.

It can be common for speculative developments to remain empty or partially empty for a long

time after construction and for developers to suffer financially as a result, which can then have

a corresponding impact on the ability to repay any debt finance.

It is rare that large scale speculative developments such as large offices will be undertaken by

anyone other than the largest developers as the amount of investment and duration can be

prohibitive.

Building companies speculating on small scale industrial developments are more common and

of the type that New Anglia LEP has often been approached to support, for example the

Malthouse in Ipswich and Atex in Stowmarket.

It is also common with owner-occupied housing, where there is a relatively short build time,

limited capital is tied up in the building and there may be greater willingness from commercial

banks to extend credit on the security of land holdings. The LEP has had few approaches for

such investments because there is a less obvious failure in the traditional funding available in

the market.

New Anglia LEP has funded a number of commercial and public projects through repayable

loans since the launch of the Growing Places Fund in 2012.

Table of LEP loans to date

Project

Loan £

Public

/

Loan type

Commercial

Haverhill Research Park

£2m

Commercial

Road infrastructure

Barton Mills Roundabout

£500k

Commercial

Road infrastructure

Kesgrave Hall

£300k

Commercial

Commercial business

Kings Lynn Innovation Centre

£2.5m

Public

Innovation Centre

Pasta Foods

£2.4m

Commercial

Commercial business

Peel Estates, North Walsham

£2.3m

Commercial

Housing infrastructure

Ipswich Flood Defence

£6.6m

Public

Flood defence infrastructure

Scheme

Ipswich Winerack

£5m

Commercial

Housing infrastructure

Malthouse Ipswich

£600k

Commercial

Commercial business space

2

50

Loans have been awarded for a variety of purposes, from unlocking stalled sites with

infrastructure, which was the original purpose of the Growing Places Fund, through to the

purchase of capital equipment and capital build and flood defences.

To ensure appropriate use of public funding, all loans to date aside from Ipswich Malthouse

have been awarded on a non-speculative basis, with either an existing owner or an identified

future occupier or a pre-arranged repayment arrangement in place.

Where housing projects have been supported through the Growing Places Fund, the loan has

been provided for the infrastructure to unlock the site, not to fund the houses themselves.

The exception to this is the Ipswich Winerack, where the fund has supported a mixture of

infrastructure and housing, but only because the Homes and Communities Agency was the

senior partner in the project, which reduces the overall risk for the LEP. The deal also included

a significant number of pre-sales of flats.

Ipswich Malthouse, which has received agreement for a GPF loan is considered to be a

speculative project, because the project had no confirmed future occupiers at the time of

approval, however, the project was considered to address a market failure in Ipswich, with a

significant level of un-serviced demand for small, easy terms business lets, particularly in a

prime location between the railway station and the Princes Street EZ in Ipswich

Key considerations

Evidence of demand

Recent discussions around commercial developments such as the Malthouse in Ipswich and

ATEX in Stowmarket suggest that demand for speculative type investment exists and that a

market failure remains concerning the ability to secure all necessary funding to commence such

developments.

Our Economic Strategy development work has highlighted a shortage of quality office and

commercial accommodation in our area.

Furthermore there remains a lack of appetite amongst commercial lenders to provide finance to

these schemes. There are a number of factors for this.

Commercial lenders have focused lending on larger projects, in London and the South East and

in centres such as Cambridge.

This means that SME developers in Norfolk and Suffolk are finding it harder to secure finance.

Our experience has shown that LEP support is an enabling factor in securing commercial

finance.

Consequently, on an appropriate scale and where other factors are met and a strategic benefit

exists, a degree of limited speculative commercial investment should be considered by the

LEP.

Residential vs Commercial investment

The criteria in this document applies to speculative commercial investments only, unlocking

residential developments should be considered a different scale of risk and a more common

use of LEP funds, with several residential developments already supported by the LEP in the

past.

Skills and capabilities

It is appreciated that appraising speculative developments will require additional skills and

capabilities given the increased risks attached.

3

51

The LEP’s newly appointed Chief Operating Officer Rosanne Wjinberg is leading a review of

LEP programme delivery.

This will look at performance of our programmes, reporting mechanisms and will also ensure

additional skills and capabilities are added to the existing team. This could be through

accessing additional skills on a retainer or as and when basis.

This will include the skills required to analyse and recommend to the LEP Appraisal Committee

and LEP Board Investment more complex investments including speculative developments.

Financial impact

A higher proportion of speculative loans completed would have an impact on the overall funding

available to the LEP for more traditional interventions. However, speculative loans are likely to

be an exceptional request, rather than the standard.

In addition, delivery of our economic strategy ambitions through our programmes is the priority.

Speculative investments will be used to supplement programmes only to the extent that they do

not prevent them from delivering the promised targets

Assessment of applications

The following list defines the factors recommended to be reviewed each time a speculative

investment is being considered:

Projects should follow the original principles of the Growing Places Fund, with a focus

on unlocking stalled sites and addressing market failures

A suitable site should have been identified and any ownership issues resolved

Necessary approvals such as planning permission should be in place

Projects should be of appropriate size and complexity to be considered

Residual valuation exceeding loan request by appropriate ratio, to be determined by the

IAC

Amount of request should be within LEP preferential limits- the range of investment

would be between £300k and £1m.

Match funding or financing arrangements in place, LEP investment should not be the

only source of funding

Delivery and repayment within a 3-5 year time period

The market conditions and evidence of need at the time and in the future

The potential return on investment is commensurate with risk and value

Comparison with other potential projects to ensure best value

LEP delivery costs should be recovered from the applicant and the overall benefit to the

LEP as a result of investing should at least match the rate of inflation

4

52

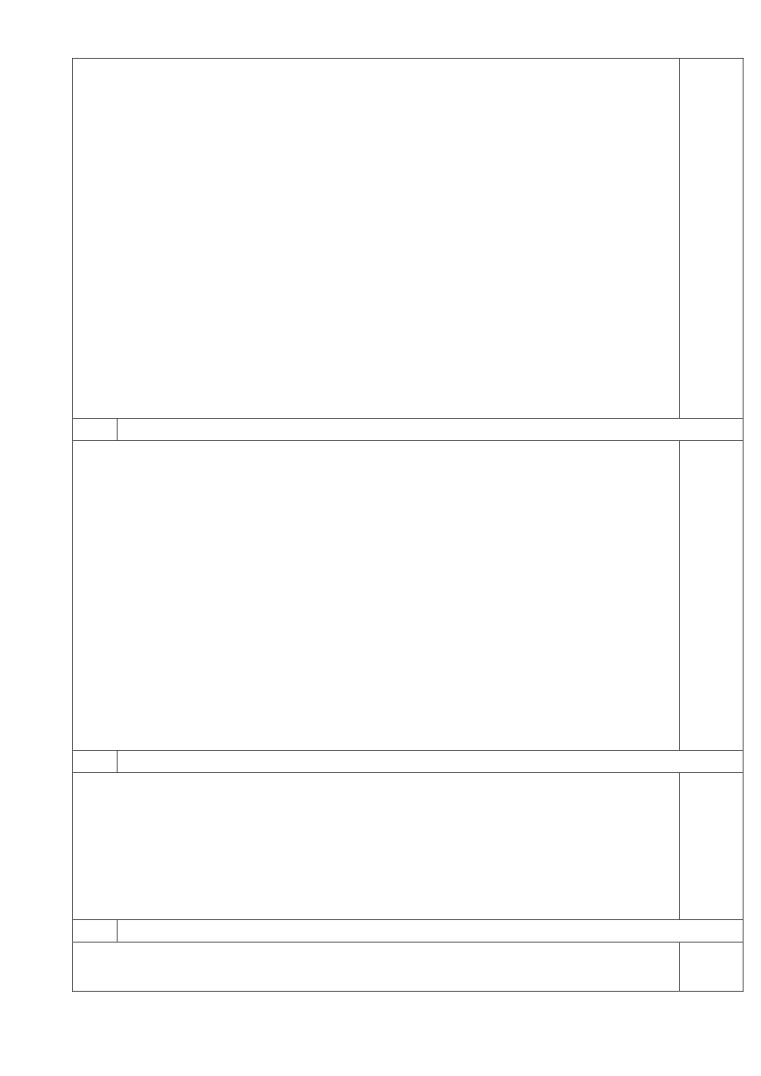

Acceptable Return on Investment scoring table

The table below can be used to score applications to provide an initial acceptability assessment

of applications for speculative developments.

Acceptable Return on Investment framework

scoring values in brackets

Public or

LTV % (b)

Period of loan

Interest Rate % (d)

Commercial

(years) (c)

applicant (a)

Less than or equal

1 Year (1)

2%-3% (8)

to 10 (1)

Greater than 10 or

2 Years (2)

3%-4% (7)

less than 20 (2)

Greater than 20

3 Years (3)

4%-5% (6)

or less than 30 (3)

Greater than 30 or

4 Years (4)

5%-6% (5)

Public: (5)

less than 40 (4)

Greater than 40 or

5 Years (5)

6%-7% (4)

Commercial:

less than 50 (5)

(10)

Greater than 50 or

6 Years (6)

7%-8% (3)

less than 60 (6)

8%-9% (2)

9%-10% (1)

Scoring (a+b+c+d)

Acceptable scoring range 15-24

Should the above factors be satisfied and the project is considered to be of appropriate type

and scale for LEP investment (or the investment requested from the LEP can be scaled in a

way that still allows the project to proceed) then a legally binding, secured loan should be

considered by the IAC and subsequently by the LEP Board.

Link to the Economic Strategy

Support to developments of all types through LEP programmes links to the creation of jobs,

new homes, support to new and existing businesses and the promotion of growth locations and

Enterprise Zones.

The Economic Strategy seeks to influence the creation of high quality commercial space and

housing in the right places, along with appropriate infrastructure to support the growth of

communities and the places for them to live. Not all such developments are supportable by the

traditional finance marketplace, giving the LEP the opportunity to consider investing in certain

speculative opportunities.

Recommendation

The Board is recommended to consider using Growing Places Fund and other funds if available

to support speculative investments in certain lower risk circumstances.

5

53

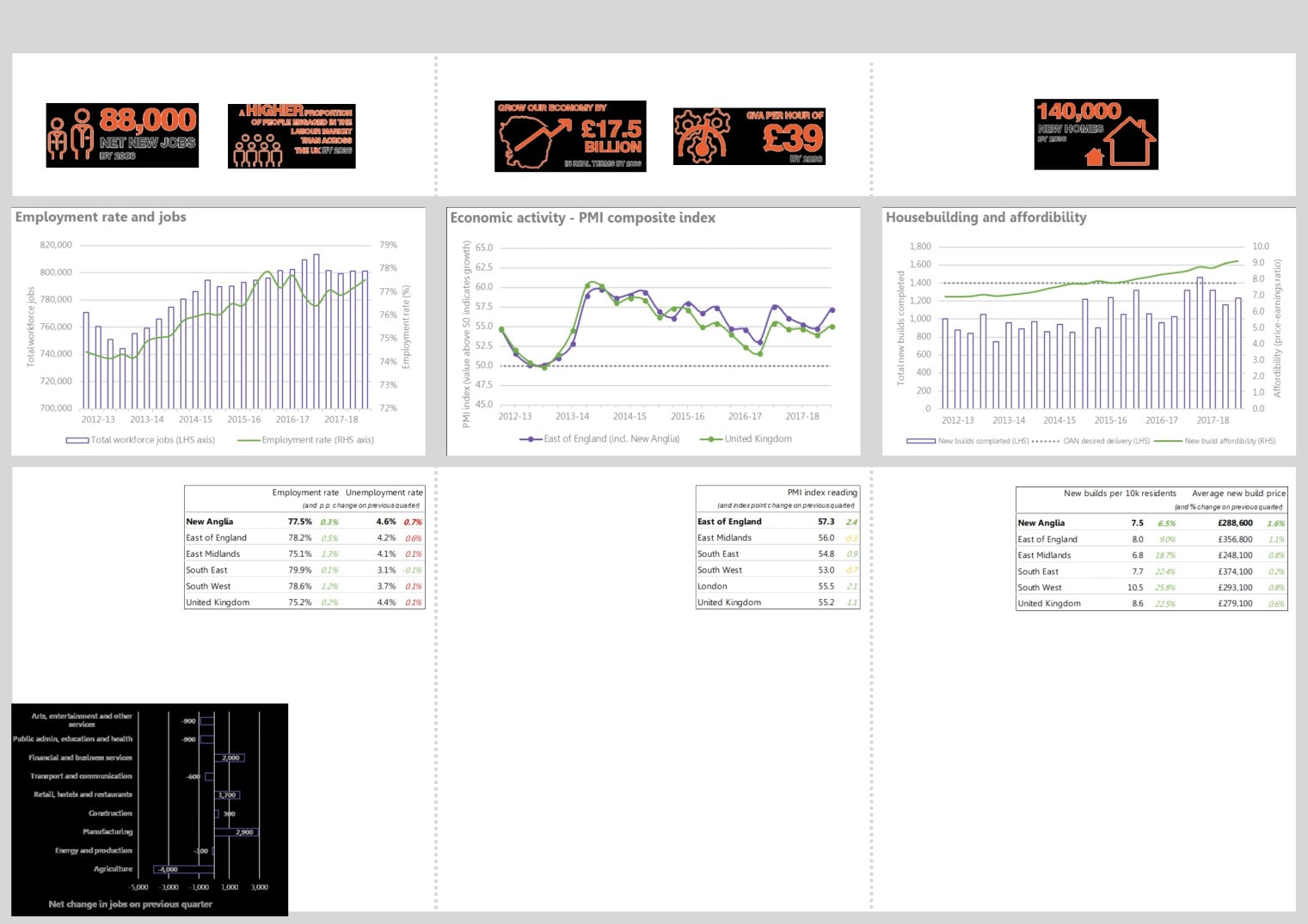

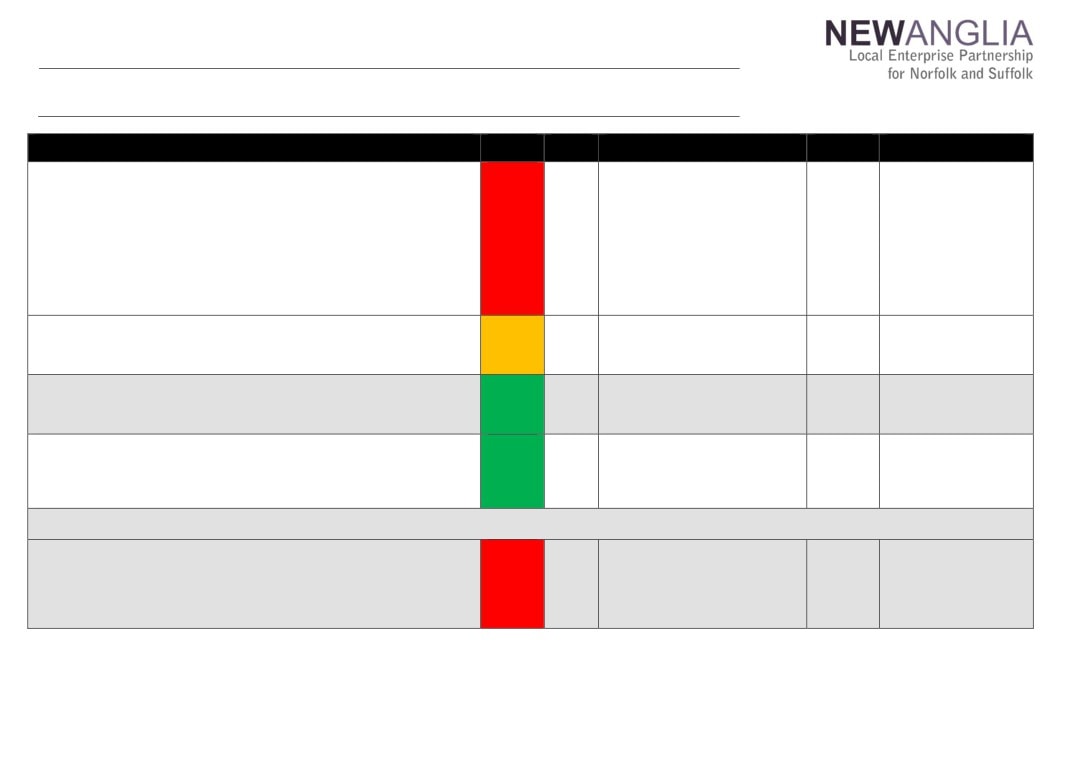

Item 11

New Anglia LEP quarterly economic dashboard - Q3 2017/18

Data as of April 2018

Labour market

Economic output & growth

Housing market

Associated Economic Strategy (ES) indicators

Associated Economic Strategy (ES) indicators

Associated Economic Strategy (ES) indicators

NOTE: Proxy metrics (used below) are leading indicators used to informally track quarterly trajectory and

NOTE: Proxy metrics (used below) are leading indicators used to informally track quarterly trajectory and

NOTE: Proxy metrics (used below) are leading indicators used to informally track quarterly trajectory and

context - actual progress of ES indicators will be officially reported annually (Feb)

context - actual progress of ES indicators will be officially reported annually (Feb)

context - actual progress of ES indicators will be officially reported annually (Feb)

Comparator profile - Q3 17-18

Comparator profile - Q3 17-18

Comparator profile - Q3 17-18

Leading indicators show local

The regional economy of the East - en-

Despite seasonal volatility

labour market conditions contin-

compassing Norfolk and Suffolk as well as neigh-

rates of housebuilding in

ue to recalibrate after a slow start

bouring counties - remains one of the strongest

Norfolk and Suffolk con-

to the year. The employment rate

performing in the country, according to the IHS

tinue to maintain a robust

for prime-aged workers remains

Markit Purchasing Managers’ Index (PMI).

upward trajectory, with the

high (77.5%), particularly com-

2017 calendar year aver-

A recognised barometer of short-term economic

pared with historic trends and UK

aging the highest rate of

activity, an index reading above 50 signals an

average (75.2%).

quarterly delivery (1,300

increase in activity (i.e. growth in economic out-

new homes per quarter)

However unemployment rates

put), whilst a reading below 50 signals a decline.

since the recession.

have seen a sharp increase (to 4.6%) - above the UK average (4.4%) - though this has

The greater the divergence from 50, the greater the rate of change indicated.

been driven by a positive trend of people re-entering the labour market from

This rate of delivery remains slightly below, but still within reach, of the OAN

Between October and December 2017, regional managers reported a significant

(typically long-term) economic inactivity. In fact, economic activity rates (the share of

(Objectively Assessed Need, which was used to inform setting of the ES indicator)

uplift in economic activity with a PMI reading of 57.3. This remains comfortably

people either in work or looking for work) has reached a record high (82.1%).

desired delivery for the two counties (some 1,400 new build homes per quarter).

ahead of the UK average (55.2—which it has outpaced for much of the post-2012

Since 2012, this desired level of delivery has been reached in only one quarter (out

Job creation remains steadi-

recovery and resulting growth cycle), and was the 2nd highest rating of all its re-

Sectoral profile - Q3 17-18

of 24.)

ly positive (+300 q-o-q) af-

gions.

ter a surprising and sudden

Demand continues to remain buoyant though, with prices accelerating during the

This halted three consecutive quarters of easing, but still positive, growth across

slowdown at the start of the

quarter. The 1.6% quarter-on-quarter increase in the average price of a new build

the region in 2017, which looks like being one of the slowest growing calendar

year (though a large degree

property outpaced the UK and regional (including the wider Eastern and South

years since 2012. Accompanied by a cooling labour market though, this may indi-

of this could be attributable

Eastern market) averages, with prices now just shy of the £290,000 mark.

cate some short term improvements to productivity within the regional economy.

to statistical volatility.)

This contributed to an increase in affordability pressures though, with the average

Such trends will likely translate into a slower than anticipated start towards the am-

Progress towards the associ-

new build property now costing just over 9x the gross earnings of the average full

bition for £17.5bn of additional growth in the local economy, though there are po-

ated ES indicators could

time worker in the two counties, a record high, and up from 8x two years previous

tentially positive signs around the productivity ambition.

therefore be off to a slower

and above the UK average (also 8x).

start than anticipated, but

with a reassuring pick up

heading into the new year.

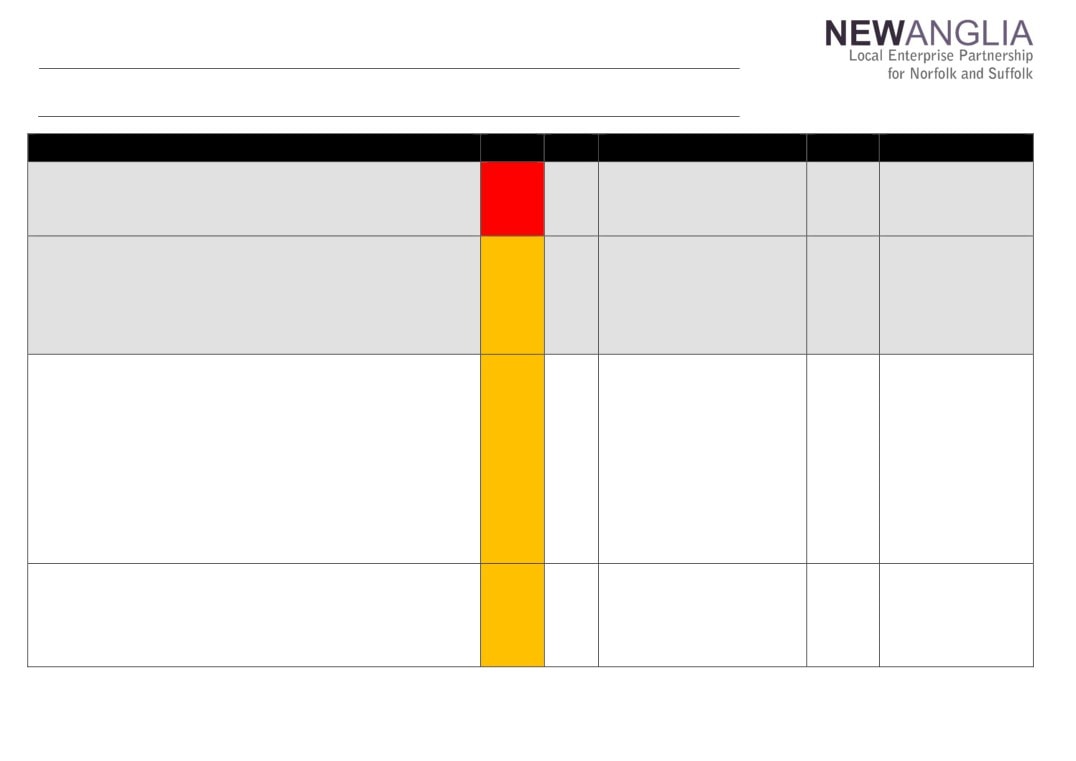

59

New Anglia LEP quarterly economic dashboard - Q3 2017/18

Data as of April 2018

Business & enterprise

Earnings & income

Skills & qualifications

Associated Economic Strategy (ES) indicators

Associated Economic Strategy (ES) indicators

Associated Economic Strategy (ES) indicators

NOTE: Proxy metrics (used below) are leading indicators used to informally track quarterly trajectory and

NOTE: Proxy metrics (used below) are leading indicators used to informally track quarterly trajectory and

NOTE: Proxy metrics (used below) are leading indicators used to informally track quarterly trajectory and

context - actual progress of ES indicators will be officially reported annually (Feb)

context - actual progress of ES indicators will be officially reported annually (Feb)

context - actual progress of ES indicators will be officially reported annually (Feb)

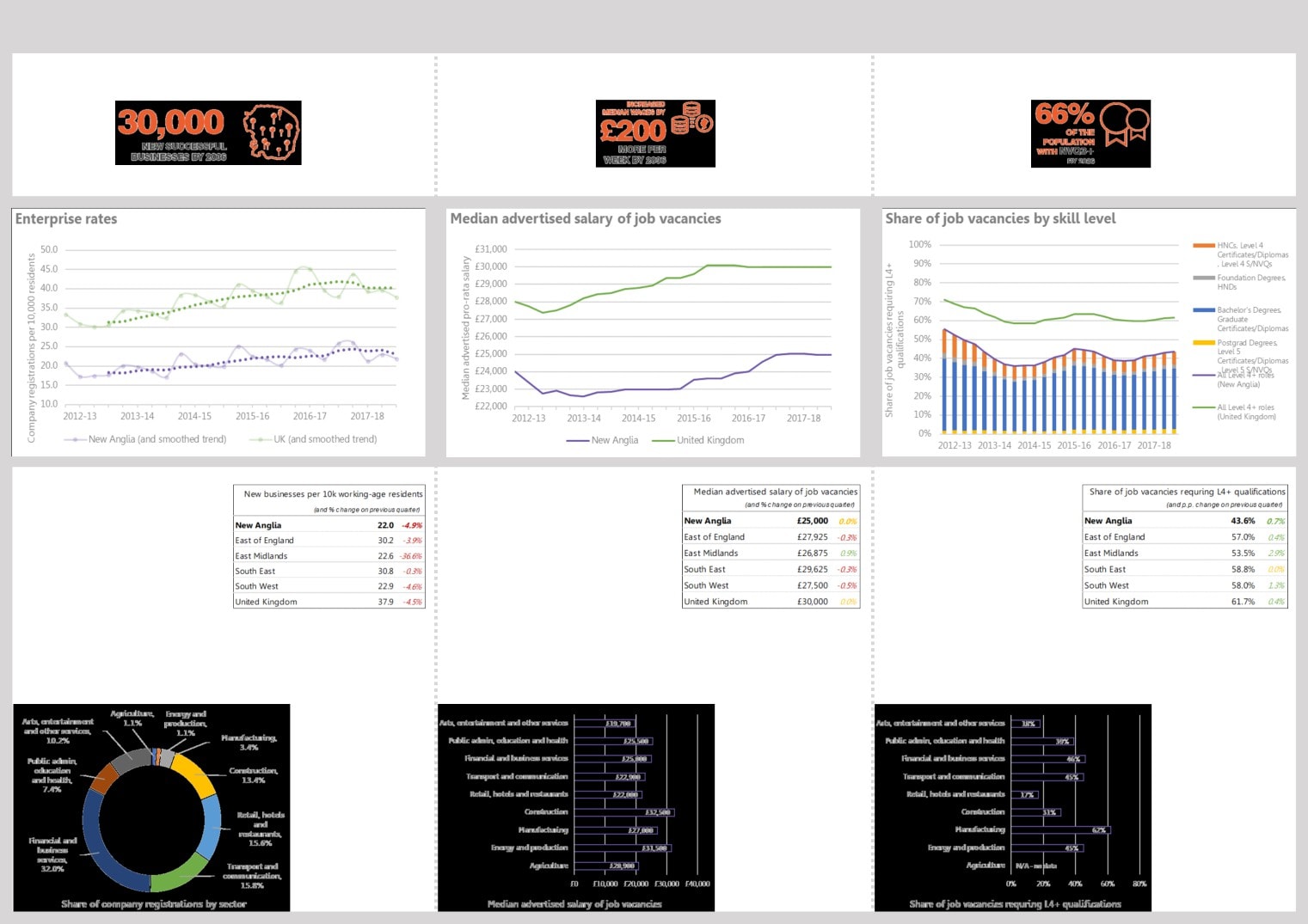

Comparator profile - Q3 17-18

Comparator profile - Q3 17-18

Comparator profile - Q3 17-18

After surging post-2012, local enterprise

After consecutive years of relatively ro-

Part of Norfolk and Suffolk’s

rates have eased over recent quarters

bust increases in advertised earnings, growth

’earnings gap’ can be explained by the

(even when accounting for seasonal vola-

has experienced a slowdown lately, and this

lower density of highly skilled (and thus

tility), though this is replicated across the

trend continued over the last quarter.

higher paying) job opportunities in the

rest of the country.

two counties. Between October and

Quarterly growth averaged a stationary 0.0%

December, just under half - 46% - of all

A tighter labour market (in particular high

throughout the 2017 calendar year. Though

job opportunities in the two counties

employment) and challenging trading

advertised salaries are only one interaction of

required a degree level qualification

conditions in entrepreneurial sectors (such

wages in the labour market, this trend does

(Level 4 equivalent and above), com-

as retail, food and construction) may be

highlight the challenge of boosting wages and

pared with 62% across the UK.

contributory factors.

supporting higher-paid job opportunities locally.

Positively, higher skilled job opportunities are beginning to increase in number after

Between October and December, 2,140 businesses were registered in the two

This is a trend that is being replicated elsewhere though; in fact, the median adver-

easing off over the 2012-16 period (the slowdown reflecting a relative - though by

counties, equating to 22 registrations per 10,000 residents. This means local resi-

tised salary across the UK has failed to see any substantial increase over the past two

no means exclusive - shift in job creation to traditionally lower skilled occupations

dents are some 40% less likely to register a business than those elsewhere in the

years, whilst some regions have even experienced contractions.

and industries).

country, a gap that has

Sectoral profile - Q3 17-18

Sectoral profile - Q3 17-18

And though median adver-

Sectoral profile - Q3 17-18

stubbornly persisted in

Recent progress has helped

tised salaries locally are still

recent years.

the local area ‘close the gap’

some 17% below the UK av-

with the rest of the UK

Within the context of the

erage (£25k against £30k),

though; the gap between

associated ES indicator,

this gap has closed by some

the relative share of job op-

this likely means forthcom-

5 p.p. (percentage points) on

portunities that are highly

ing delivery will remain

the same quarter in 2015.

skilled has closed by 4 p.p.

positive but more stable

Though this means progress

since 2016.

than that experienced pre-

towards the associated ES

viously, and again disap-

The positivity of such short

indicator will likely remain

pointing compared to na-

term trends shows poten-

stalled, growth potential re-

tional and regional averag-

tially faster than expected

mains more positive than

es.

60

progress towards the asso-

large parts of the UK.

ciated ES indicator.

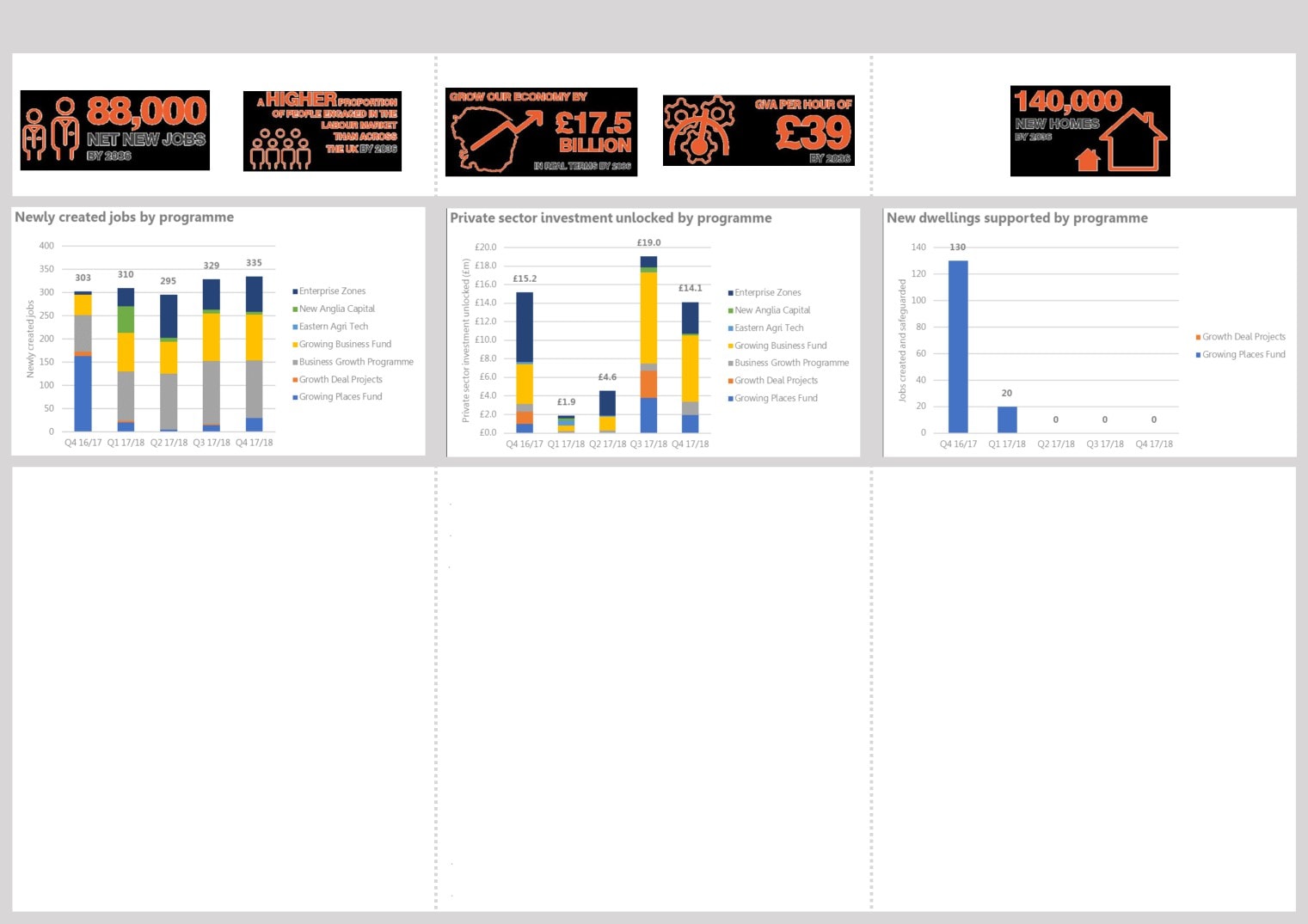

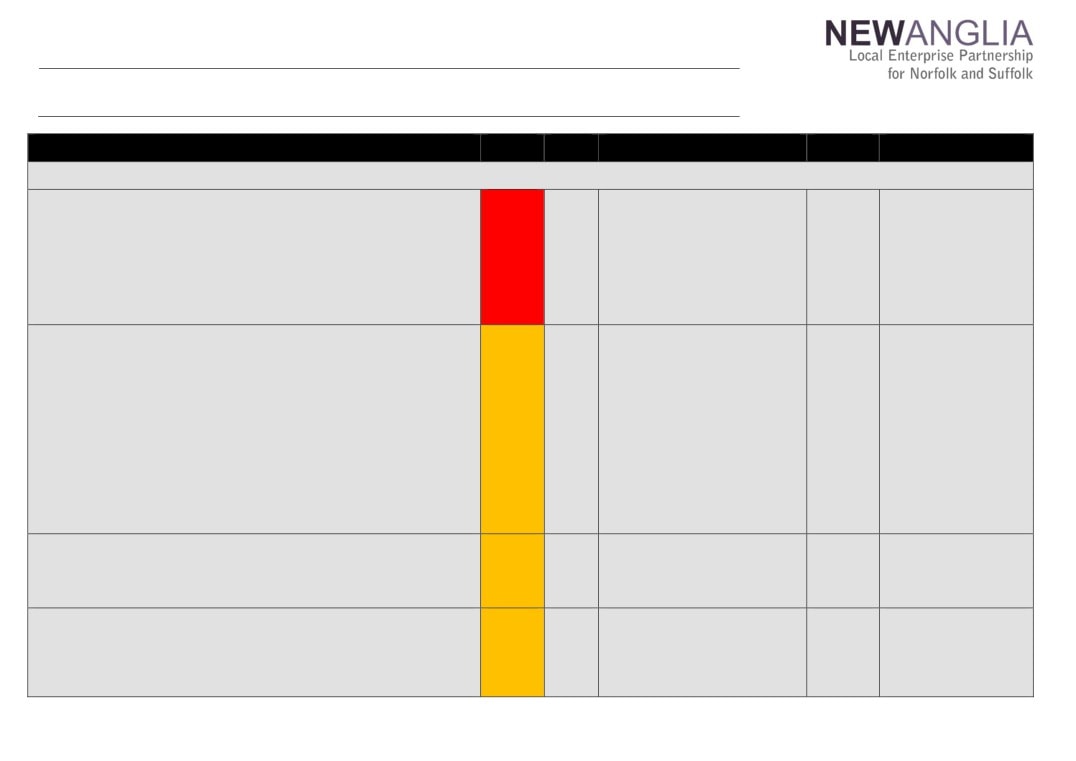

New Anglia LEP programme outputs dashboard - Q4 2017/18

Data as of May 2018

Jobs created

Private sector investment unlocked

New dwellings supported

Primary Economic Strategy (ES) indicators supported

Primary Economic Strategy (ES) indicators supported

Primary Economic Strategy (ES) indicators supported

Delivery, this quarter (Q4, Jan-March 2018):

335

Delivery, this quarter (Q4, Jan-March 2018):

£14.1m

Delivery, this quarter (Q4, Jan-March 2018):

0

Delivery, year to date (2017-18 financial year):

1,269

Delivery, year to date (2017-18 financial year):

£39.6m

Delivery, year to date (2017-18 financial year):

20

Delivery, cumulative to date (2012-):

6,672

Delivery, cumulative to date (2012-):

£293.0m

Delivery, cumulative to date (2012-):

549

With a proven track record of creating jobs and supporting employment

LEP programmes continue to leverage in significant private sector invest-

Though typically small-scale and limited in terms of direct tangible out-

opportunities in the local economy, LEP programmes have a demonstra-

ment, helping to unlock jobs, housing, capital and growth. In fact, the IMF

puts, LEP programmes still have a demonstrable role in supporting the

ble and clearly measurable impact on the ambitions of the ES and associ-

estimates every £1 of private sector investment can stimulate a further £3

delivery of new homes and leveraging in resources to unlock sites and

ated indicators.

of economic growth, highlighting its direct impact on the delivery of the

development.

aims and ambitions in the ES.

Between January and March 2018, some 335 new jobs were directly cre-

After a spike in delivery last year (attributable to a large-scale develop-

ated by LEP programmes in Norfolk and Suffolk. Enterprise Zones, Grow-

Delivery was robust in the final quarter after an initially slow start to the

ment in North Walsham) delivery throughout the 2017-18 financial year

ing Business Fund and Business Growth Programme continue to be the

year, with the £14m of private sector investment unlocked between January

has remained subdued, though this specific output does often follow a

primary drivers, accounting for 90% of all jobs in the quarter.

and March, more than the Q1 and Q2 totals combined.

volatile pattern of delivery.

This means that a total of 1,269 new jobs have been directly created by

Despite this strong end to the year, the £39.6m of unlocked investment

The 20 new dwellings supported in Q1 was therefore the only delivery

LEP programmes over 2017-18, marginally ahead of 1,250 new jobs tar-

over 2017-18 was a fifth lower than the ambitious annual target of £52.2.

for the year, meaning annual delivery was only a third of the annual tar-

geted at the start of the year. This was the third consecutive year that the

get of 60 new dwellings.

The lag in the capture of match versus the award of projects may explain

targeted level of delivery been achieved.

this shortfall, meaning projected delivery - rather than not being achieved -

Some of this shortfall is expected to be captured in next years delivery

will not be captured in the data until future reporting periods (i.e. 2018-19.)

though, with a number of LEP-supported projects (e.g. Winerack) soon

to come online.

Target, this year (2017-18 financial year):

1,250

Target, this year (2017-18 financial year):

£52.2m

Target, this year (2017-18 financial year):

60

Delivery, year to date, as % of target:

G102%

Delivery, year to date, as % of target:

R76%

Delivery, year to date, as % of target:

R33%

61

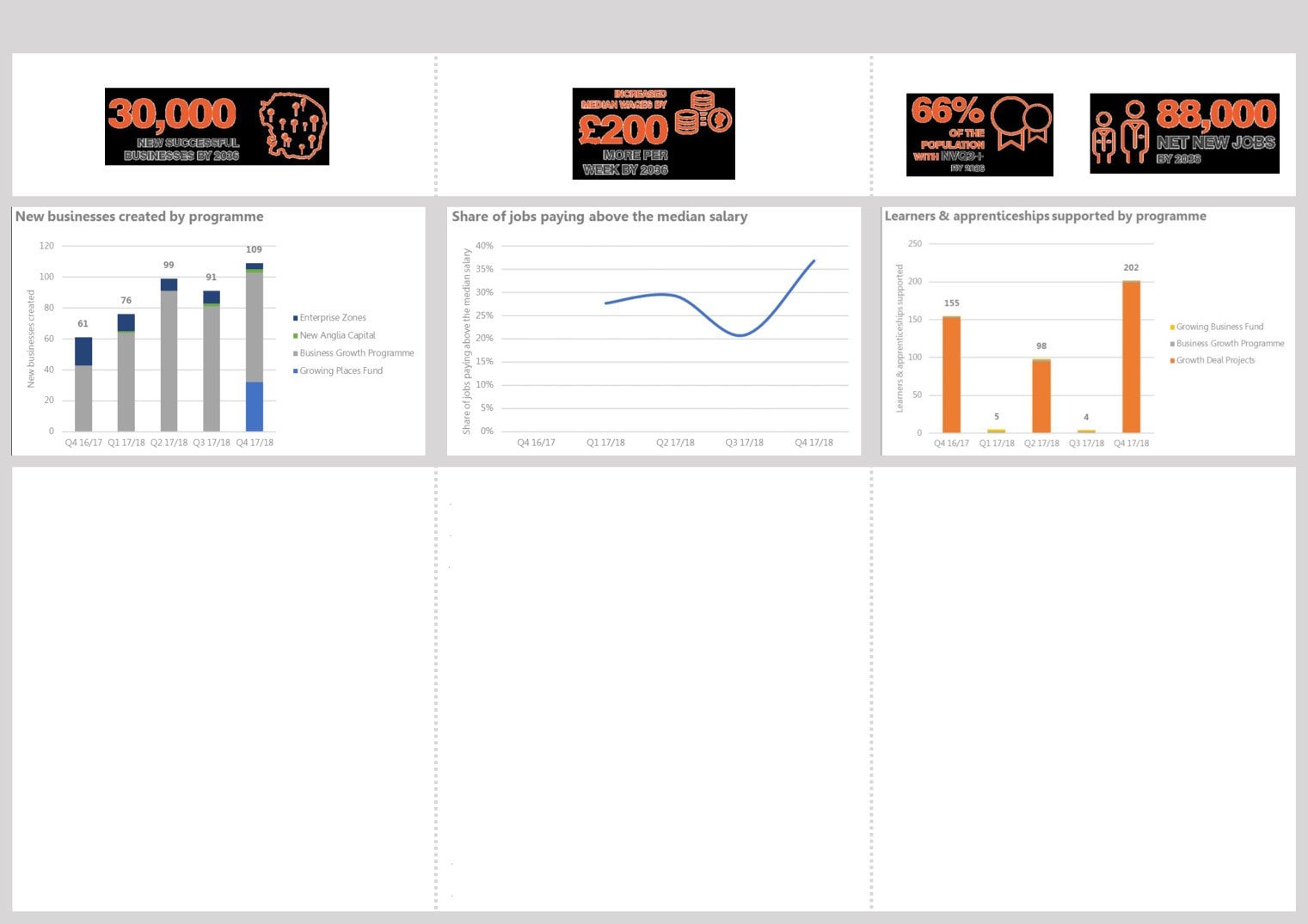

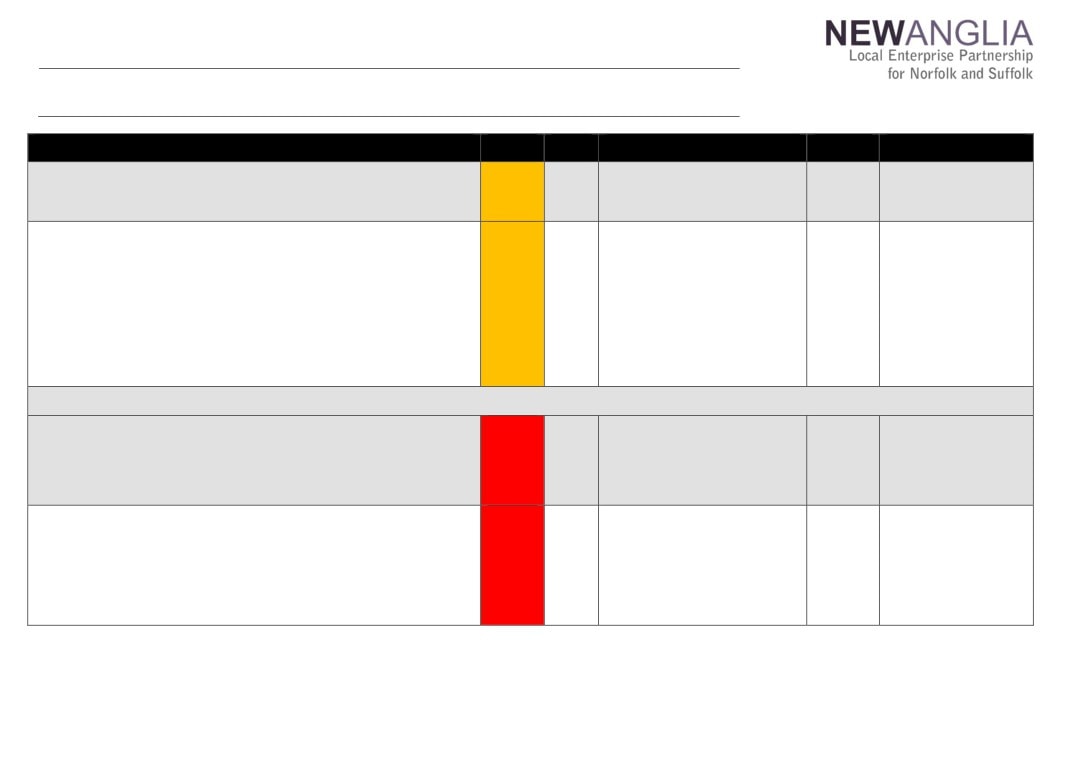

New Anglia LEP programme outputs dashboard - Q4 2017/18

Data as of May 2018

New businesses created

Jobs paying above the median salary*

Learners & apprenticeships supported

Primary Economic Strategy (ES) indicators supported

Primary Economic Strategy (ES) indicators supported

Primary Economic Strategy (ES) indicators supported

Delivery, this quarter (Q4, Jan-March 2018):

109

Delivery, this quarter (Q4, Jan-March 2018):

37%

Delivery, this quarter (Q4, Jan-March 2018):

202

Delivery, year to date (2017-18 financial year):

375

Delivery, year to date (2017-18 financial year):

28%

Delivery, year to date (2017-18 financial year):

309

Delivery, cumulative to date (2012-):

921

Delivery, cumulative to date (2017-):

28%

Delivery, cumulative to date (2012-):

823

The scale and breadth of the LEPs activity within enterprise support

Delivering quality jobs though its programmes and interventions - particu-

LEP programmes play an important role in creating and supporting new

means it has a vital and unrivalled role to play in supporting and stimu-

larly in terms of remuneration - is important for the LEP to achieve the aims

learners and apprenticeships, ensuring a demonstrable impact on the

lating the uplift in enterprise required to achieve the aims and ambitions

and ambitions around inclusive growth and its associated ES indicators.

ambitious skills-related aims of the ES and associated indicators.

of the ES.

Between January and March, 37% of new LEP-supported jobs* were paying

Some 202 new learners and apprenticeships were supported in the final

Quarterly delivery continued its strong upward momentum, with LEP

above the median wage as a starting salary. This was the highest quarterly

quarter of the year, which was more than the other three quarters of the

programmes supporting the creation of 109 new businesses in the final

tally recorded yet, and above the 26% average for the preceding quarters.

year combined.

quarter of the year. Growing Places Fund and its investment in new en-

This translates into an average share of 28% over 2017-18. Since this is a

For the 2017-18 financial year, a total of 309 new learners and appren-

terprise hubs at NUA and Holkham Hall underpinned the above-average

newly reported output, adopted mid-way through the year, no targets were

ticeships have been supported, which, though a record amount of an-

delivery for the quarter.

set at the start of the year. As such, there is no official progress or a target

nual delivery, was marginally below the target of 350 for the year.

This strong performance over 2017-18 therefore saw a total of 375 new

to report against.

This target was however set a number of years previous, and will not

businesses created through the support of LEP programmes, comfortably

have taken account of short term trends and contextual factors associ-

*Please note currently data is only available for two LEP programmes;

achieving the target of 250 set at the start of the year. Almost a 1,000

Growing Business Fund and the Business Growth Programme. Stated totals

ated with specific projects and programmes. The lag in the capture of

new businesses have now been created by LEP programmes since 2012.

may therefore not be reflective of LEP delivery as a whole.

outputs could also explain some of this shortfall.

Target, this year (2017-18 financial year):

250

Target, this year (2017-18 financial year):

N/A

Target, this year (2017-18 financial year):

350

Delivery, year to date, as % of target:

G150%

Delivery, year to date, as % of target:

-

Delivery, year to date, as % of target:

R88%

62

New Anglia Local Enterprise Partnership Board

23rd May 2018

Agenda Item 12

PWC Governance Review - implementation progress report

Author: Chris Starkie

Summary

This report summarises progress being made on the implementation of the review conducted

by PwC into the Governance and Operations of the LEP.

Recommendation