New Anglia LEP - Construction Labour and Skills

Research

Final Report

Client: New Anglia LEP

Author: Sandra Lilley, Doug

Forbes and Martin Turner

Approved by: CITB

Date: 12/02/16

New Anglia LEP

Construction Labour Research

February 2016

Version

Date

Details of modifications

Draft 1

17/09/15

Initial draft release

Draft 2

05/02/16

Updated labour demand and supply projections

This report was commissioned by, and prepared for the New Anglia LEP by a consortium of CITB and Whole Life Consultants

Ltd, ('The Consortium’)͘ The findings and conclusions set forth in this report represent the best professional judgment of the

Consortium based on information made available to it at a point in time. The Consortium has relied on, and not

independently verified, data provided to it by such sources and secondary sources of information cited in the report. We

disclaim any responsibility to the client and others in respect of any matters outside the scope of the above. We accept no

responsibility to third parties to whom this report, or any part, thereof is made available. Any such party relies upon the

report at their own risk.

CITB

Whole Life Consultants Limited

Bircham Newton

Dundee University Incubator

Kings Lynn

James Lindsay Place

Norfolk

Dundee

PE31 6RH

DD1 5JJ

t: +44 (0)344 994 4400

t/f: +44 (0)1382 224 304

CITB is registered in England and Wales Charity No 264289

Whole Life Consultants Ltd is registered in Scotland as

and in Scotland Charity No SC044875

SC259987, VAT number 852809506

Registered office c/o 14 City Quay, Dundee DD1 3JA

i

New Anglia LEP

Construction Labour Research

February 2016

Table of Contents

TABLE OF CONTENTS

II

LIST OF FIGURES

IV

LIST OF TABLES

V

INTRODUCTION

1

Background

1

Defining strategic objectives

1

Creating the evidence base

2

METHODOLOGY

3

A VIEW OF DEMAND

4

Introduction

4

Pipeline analysis

4

3.2.1.

Glenigan pipeline

4

3.2.2.

Breakdown of spend by project type

7

3.2.3.

Producing estimates of labour demand

12

Breakdown of labour demand by project type

16

Sizewell C nuclear power station

16

Assessing the wider demand within New Anglia

18

3.5.1.

Methodology and assumptions

18

3.5.2.

Updated labour demand calculations and projections

19

Neighbouring regions

21

Summary of demand

25

A PICTURE OF SUPPLY

26

Main points

26

Existing workforce

27

Employer Structure

29

Training provision

29

Mobility of the workforce

31

Main points

31

Work history

31

Worker origins

32

Travel to site

32

Site duration and change

33

Sub-sector and sector mobility

33

Leaving the sector

34

DEMAND AGAINST SUPPLY

35

Main points

35

Gap Analysis

36

ii

New Anglia LEP

Construction Labour Research

February 2016

5.2.1. Construction specific occupations

38

5.2.2. Cross-sector occupations

39

Long term construction employment forecast

39

CONCLUSIONS AND RECOMMENDATIONS

41

Summary of Concluding Remarks

41

Recommendations

42

iii

New Anglia LEP

Construction Labour Research

February 2016

List of Figures

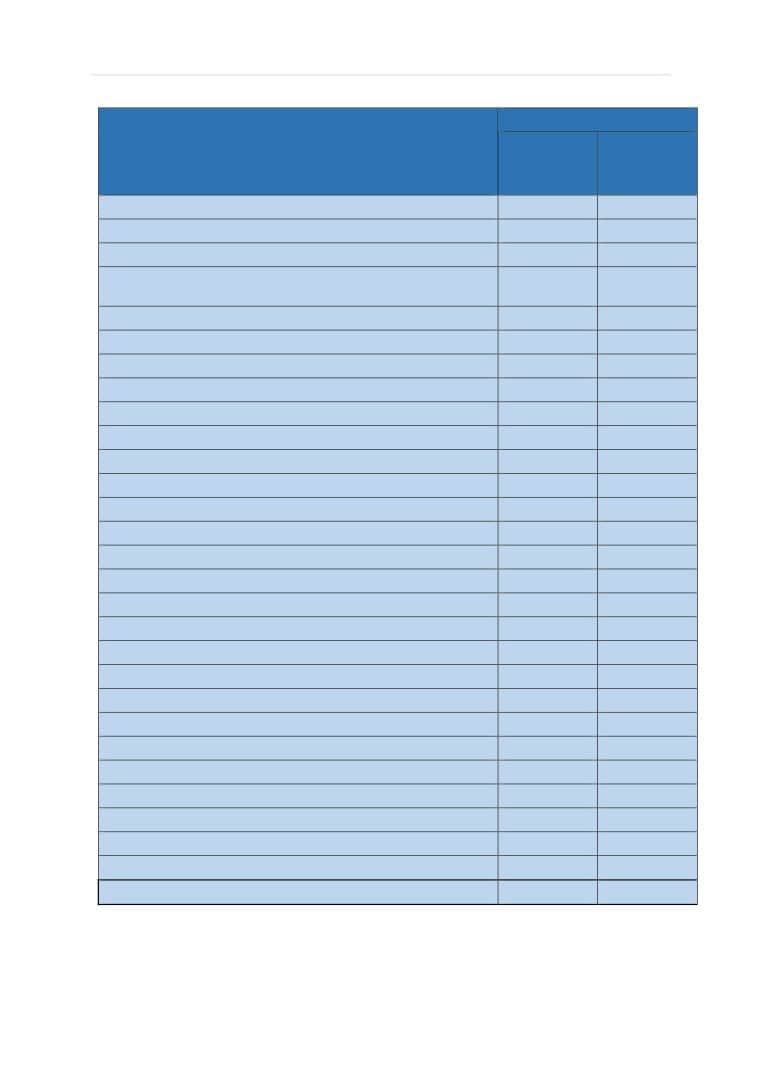

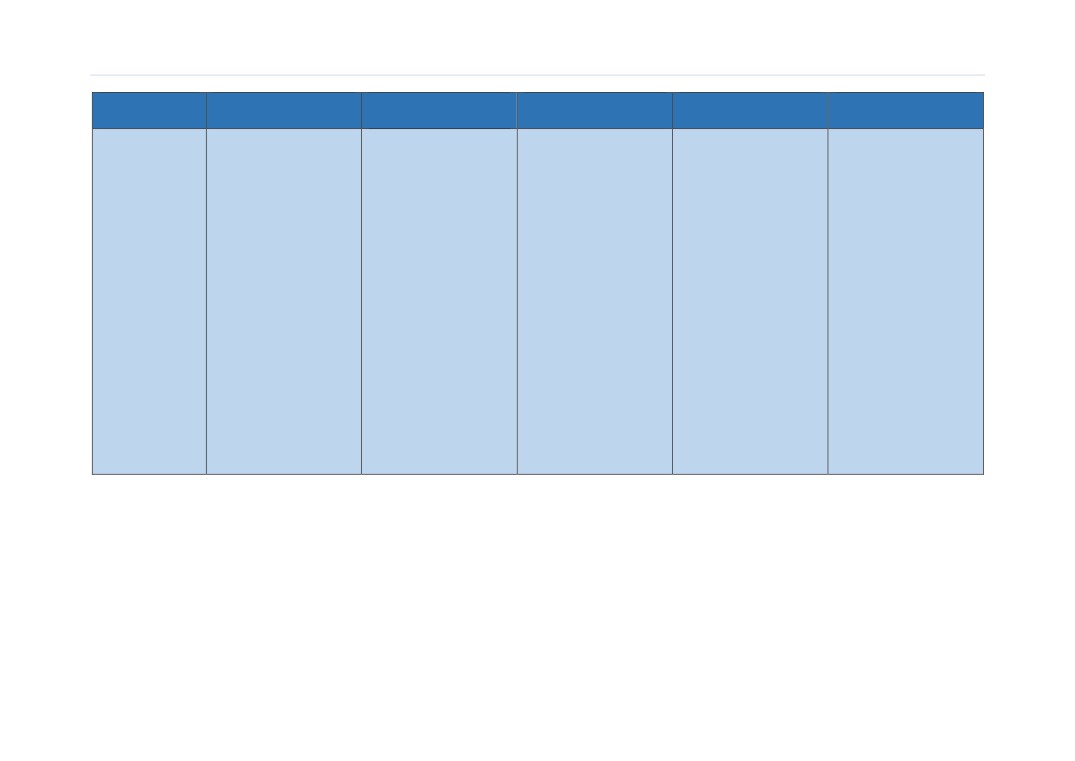

Figure 1: The significant projects in Glenigan used in this analysis

7

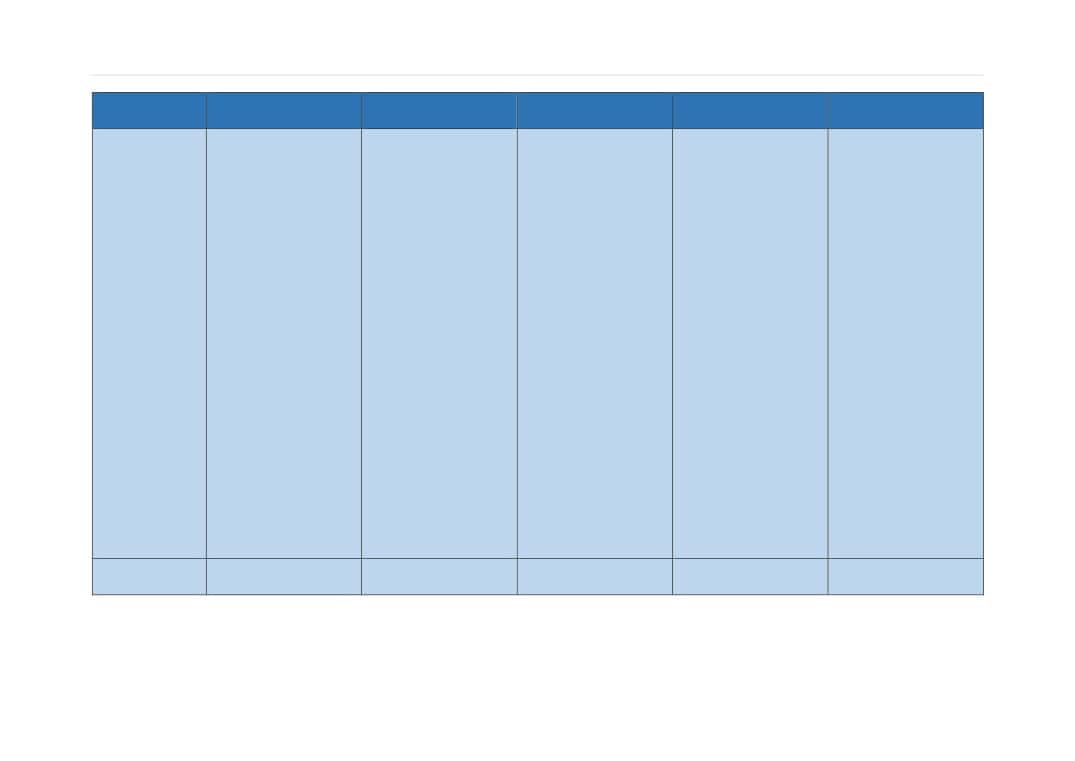

Figure 2: Total Construction labour demand arising from the Glenigan data

for the LEP including projected growth (excluding Sizewell C)

14

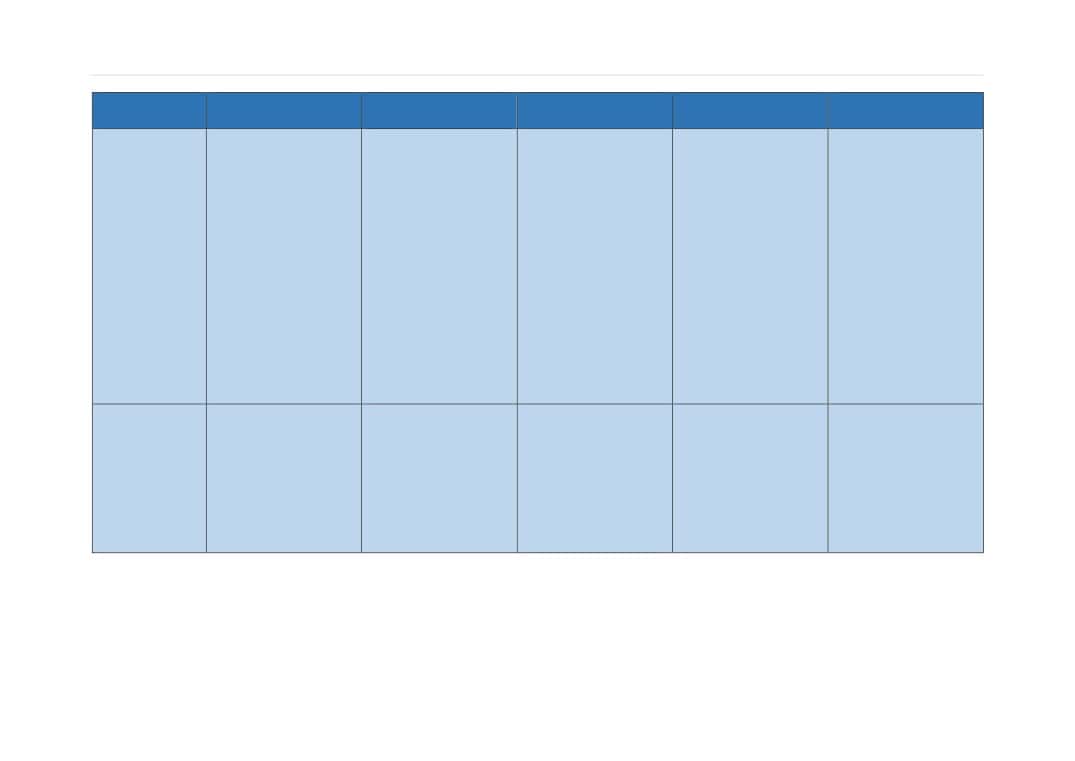

Figure 3: Construction labour demand arising from the Glenigan Pipeline by

occupation in the peak year

15

Figure 4: Construction labour demand arising by sector and sub-sector

16

Figure 5: Construction labour demand of the Sizewell C development

compared to the rest of the demand in the New Anglia LEP

17

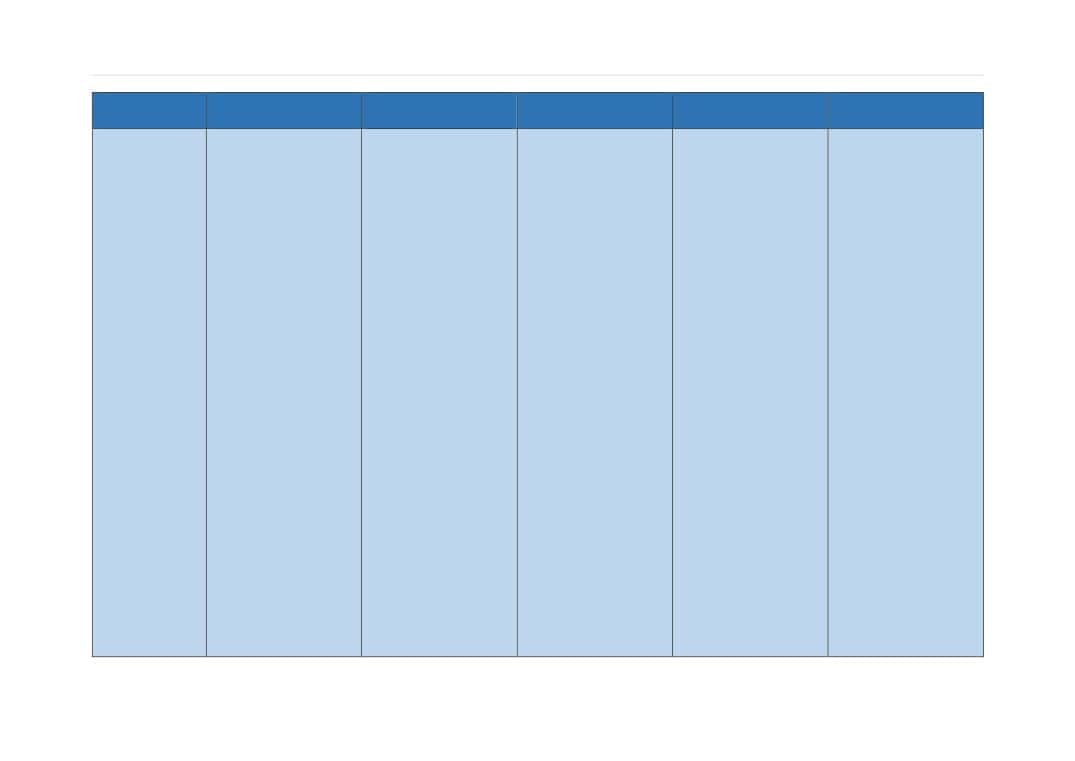

Figure 6: Total construction labour demand including estimate for R&M and

projects not in the Glenigan database

20

Figure 7: Construction employment in the East of England: 2002-2019

(Source: Experian & CITB)

27

Figure 8: Construction firms by size, 2014 (Source: ONS/NOMIS)

29

Figure 9: Furthest distance worked in past 12 months (CITB, 2015)

33

Figure 10: Average number of weeks from planning to work on site, UK 2010-

2013 (Source: UKCG/Glenigan)

35

iv

New Anglia LEP

Construction Labour Research

February 2016

List of Tables

Table 1: Details of large projects

5

Table 2: Breakdown of the significant project and total values in the LEP, as

captured in Glenigan

5

Table 3: Proportion of total value related to construction

6

Table 4: List of 20 significant projects

8

Table 5: Construction spend per sector for the period 2015-2019

9

Table 6: Construction spend per infrastructure sub-sector for the period

2015-2019

10

Table 7: Total labour demand in the LEP (excluding mine and offshore)

13

Table 8: Comparison of labour demand arising from Sizewell C to the New

Anglia LEP

18

Table 9: Total labour demand in the New Anglia LEP area

19

Table 10: Significant projects in neighbouring areas

22

Table 11: Construction occupational breakdown, 2015 (Source Experian &

CITB)

28

Table 12: Type of projects spent significant periods on (CITB, 2015)

34

Table 13: Demand as a % of 2015 employment (Source: CITB/WLC)

36

Table 14: Occupational breakdown of demand for New Anglia LEP (Source

CITB/WLC)

37

v

New Anglia LEP

Construction Labour Research

February 2016

Introduction

Background

The New Anglia Local Enterprise Partnership (LEP) and the Construction Industry Training Board (CITB)

are working together on the creation of a plan for action to enable some of the challenges the LEP

faces to be addressed through local construction activity.

This research report creates a detailed ‘evidence base’ that should be utilised to inform decision

making and enable the creation and execution of that action plan.

CITB and New Anglia LEP have held a series of discussions highlighting the objectives that this research

should inform. This report represents the concluded research, taking into account key questions posed

by the LEP, the New Anglia Skills Board and Building Growth Group; addressing issues so that a

practical approach can be taken to realising the opportunities that activity in the construction sector

can generate in terms of developing skills and creating jobs.

Defining strategic objectives

Underpinning the action plan is the New Anglia LEP, which is a partnership for growth between the

private sector, local authorities, universities, further education and other stakeholders across Norfolk

and Suffolk.

The LEP’s Strategic Economic Plan (SEP) outlines how the New Anglia LEP will:

Create the right conditions for business to thrive, establishing New Anglia as a centre of global

business excellence.

Create 95,000 more jobs across all sectors feeding a more efficient local economy;

Create a further 10,000 new businesses, with a focus on SMEs.

Shape the local workforce to provide people with skills that businesses need to succeed and

that will provide them with job opportunities.

Improve productivity, ensuring that by 2026 gross value add per job will equal the national

average.

Create 117,000 new homes by 2026, a 32% increase in delivery.

To achieve the goal of increased high value jobs and increased productivity across businesses New

Anglia LEP recognises the need to improve the skills system across Norfolk and Suffolk. Activity has

taken place through the City Deal approach to bring stakeholders together, including local businesses,

training providers and local authorities to ensure a common approach was identified and an effective

strategy developed. This strategy (which includes the creation of a Skills Manifesto and Skills Board)

focuses on improving processes, utilising funding streams with improved effect and ensuring national

programmes are relevant for local stakeholders.

Understanding the challenges that exist in each sector has become key, hence the commission of this

study. Construction as a sector is significant and is still feeling the impact of the recession that saw a

considerable decline in its skills base and people leaving the sector. Construction projects of all sizes

create jobs that contribute to economic growth and stability and require a significantly skilled

workforce that needs to be supported and trained, mainly locally. In addition 95% of the construction

sector workforce is supplied by SME and micro employers throughout the New Anglia LEP area. The

sector is, therefore, dominated by micro businesses and there is a significant proportion of self-

employed labour in the sector.

1

New Anglia LEP

Construction Labour Research

February 2016

Traditionally employers in this segment of the market can be difficult to reach. However, the LEP has

made supporting small businesses a priority, which should create significant benefits for the

construction sector in this area.

CITB’s primary remit includes:

Assisting and directing the further education offer to employers - improving the quality,

relevance and impact of the most significant providers of initial training and up-skilling.

Sharing labour market intelligence - creating a ‘bespoke evidence base’ where required͘

Improving employability with a focus on ensuring that young people aged 16-24 have the best

opportunity to get a job locally and are work ready.

Supporting business-provider collaboration.

The subsequent action plan co-created by the New Anglia LEP and the CITB team will seek to ensure

that a continuing supply of appropriately qualified local people is available to meet the identified local

skills and employment outcomes. This approach will be supported and informed by the development

of a comprehensive evidence base that will provide information to support decision making and help

ensure that the vision and objectives for the New Anglia LEP and CITB are met.

Creating the evidence base

This evidence base will:

Analyse the demand pipeline in the New Anglia area

(by occupation, sector and

geographically) to understand what construction opportunities are likely to be created, the

skills challenges and how employment and training opportunities can be maximised. This

analysis will include the impact of any potential new nuclear new build at Sizewell in Suffolk.

Create additional analysis based on the development of a scenario that estimates an element

of ‘unknown’ construction projects that have a value less that £250,000 or will be repair &

maintenance focussed. The purpose of this is to ascertain additional elements of the demand

pipeline but it should be noted that this part of the analysis cannot be assessed at occupational

level.

Analyse the wider New Anglia demand pipeline to understand what additional projects will be

taking place that will potentially draw on the localised skills base.

What major employers exist in New Anglia that will employ the construction workforce and

deliver the forecasted projects.

Conduct analysis into current supply including the existing workforce, provision supplied by

local colleges, technical and higher level skills development and retention and how new

entrants feed into construction.

Understand the impact of the loss of skills from construction into other sectors post-recession

and the risks associated with an aging workforce.

Consider inter-regional supply mobility and how this might impact on construction skills and

employment in the area.

Evaluate existing construction training provision in the area, the extent to which this is fit for

purpose and the potential viability of a range of flexible training options in the future

incorporating innovation within the sector.

CITB will engage local stakeholders, as appropriate, during the development of this action plan and

evidence base.

2

New Anglia LEP

Construction Labour Research

February 2016

Methodology

The methodology utilised covers a range of research approaches rather than relying on a singul

method, therefore enhancing the ability to produce a richer evidence base through a range of

approaches that are both quantitative and qualitative.

CITB offers a bespoke research service that builds on the detailed Labour Market Intelligence it

produces utilising its unique forecasting model known as the Labour Forecasting Tool (LFT). The team

works in close partnership with WLC Ltd (a spin out company from the University of Dundee) that

specialises in labour productivity, planning and control and building labour forecasting models. Please

refer to Appendix A for an explanation of the methodology followed to produce the labour demand

figures.

This research has been supported by the CITB research team that specialises in labour market analysis

relating to the supply of labour and identifying skills ‘pinch-points’͘ To date our work has been

significantly tested and extends to a portfolio of bespoke research skills commissions at project,

programme and regional level to create a compelling evidence base to support decision making.

The research has included:

Demand analysis of construction projects projected over a five year period in the LEP area at

a detailed occupational level, utilising the Labour Forecasting Tool.

Analysis of labour supply; including the existing workforce, new entrants

(including

apprentices) and labour mobility.

Gap analysis to determine occupational pinch-points and decipher recommendations

regarding training interventions.

A map of existing provision to support recommendations relating to capacity, capability and

collaboration on future curriculum offers.

This methodology has enabled a comprehensive research report to be produced that will identify

current and emerging skills needs and make recommendations on strategies and actions to ensure the

LEP has a construction workforce that is fit for purpose.

This will underpin the wider construction strategy work that the LEP is progressing with CITB and

support the LEP in meeting its strategic priorities in the production of detailed, specific labour market

intelligence for construction. The information it will generate will enable stakeholders to hold effective

conversations and work across the LEP and with other agencies, employers and providers to ensure

maximum employment and training opportunities for local residents.

The Labour Market Intelligence (LMI) and its recommendations will provide the evidence base to

enable the New Anglia LEP to ensure that there are adequate and effective programmes of skills

development and employment interventions that meet demand during the construction phase of key

projects.

3

New Anglia LEP

Construction Labour Research

February 2016

A view of demand

Introduction

This section provides an evidence base of the labour demand that construction investment will create

across the LEP over the next five years. Please refer to Appendix A for an explanation of the

methodology followed to produce the labour demand figures. First, in Section 3.2, we analyse the

demand based solely on the data contained on the Glenigan database. In Section 3.3, we add to the

Glenigan data our estimates of the total value of new build projects that is not included in Glenigan

and the value of repair and maintenance projects. We have input this data to our Labour Forecasting

Tool1 (LFT) to analyse the skills requirements in each of 28 occupations listed in Appendix B. The results

are also presented at a trade, craft and professional level that will enable the LEP to take a

comprehensive view of the demand generated by planned projects.

This study includes a detailed analysis of the projects taking place wholly within the counties of Norfolk

and Suffolk as well as the relevant portions of frameworks taking place within the area. A detailed

picture of the labour demand for the New Anglia LEP area and for the two areas of Norfolk and Suffolk

are presented in Appendix E and Appendix F.

Pipeline analysis

Our analysis of the demand in the area initially considers the demand from the known pipeline of

work. This demand is principally generated by those projects included within the Glenigan database

although it is supplemented with additional knowledge of the New nglia area’s construction output.

3.2.1.

Glenigan pipeline

Our initial analysis of the pipeline of construction work taking place in New Anglia is based on the

projects contained in the Glenigan database. This contains details of the planning applications from

local authorities. Glenigan supplements this with additional project-specific data. The Glenigan

database does not identify every single project in an area as some small projects (typically but not

exclusively those less than £250,000 in value) and those which do not require a planning application

(including repair and maintenance) are not included. An initial assessment of the projects in the

database ensured that only projects which had a) a defined value and b) defined start and end dates

were considered in the analysis. Also excluded were two consultancy projects2 and a number of

projects (16 in total) which were clearly identified as duplicates. A full set of the projects which were

omitted from the analysis are shown in Appendix D. Values given in the Glenigan database are the

total value of construction and engineering works. The scope of this study is limited to the

construction sector and where appropriate an estimate of the engineering value has been made and

removed from the total value to provide what we have termed the construction value.

Included in the Glenigan pipeline are two projects related to the Sizewell C nuclear new build site.

These are large, one off projects, which warrant special consideration in understanding the

construction labour market in the LEP area. The labour demand figures and timeframe of the Sizewell

C project used in the report were provided by the Nuclear Energy Skills Alliance (NESA).

1 A methodological note on the LFT is provided in Appendix A

2 The LFT calculates the demand for professional occupations from a project’s construction value͘ To include consultancy

projects separately would result in double counting

4

New Anglia LEP

Construction Labour Research

February 2016

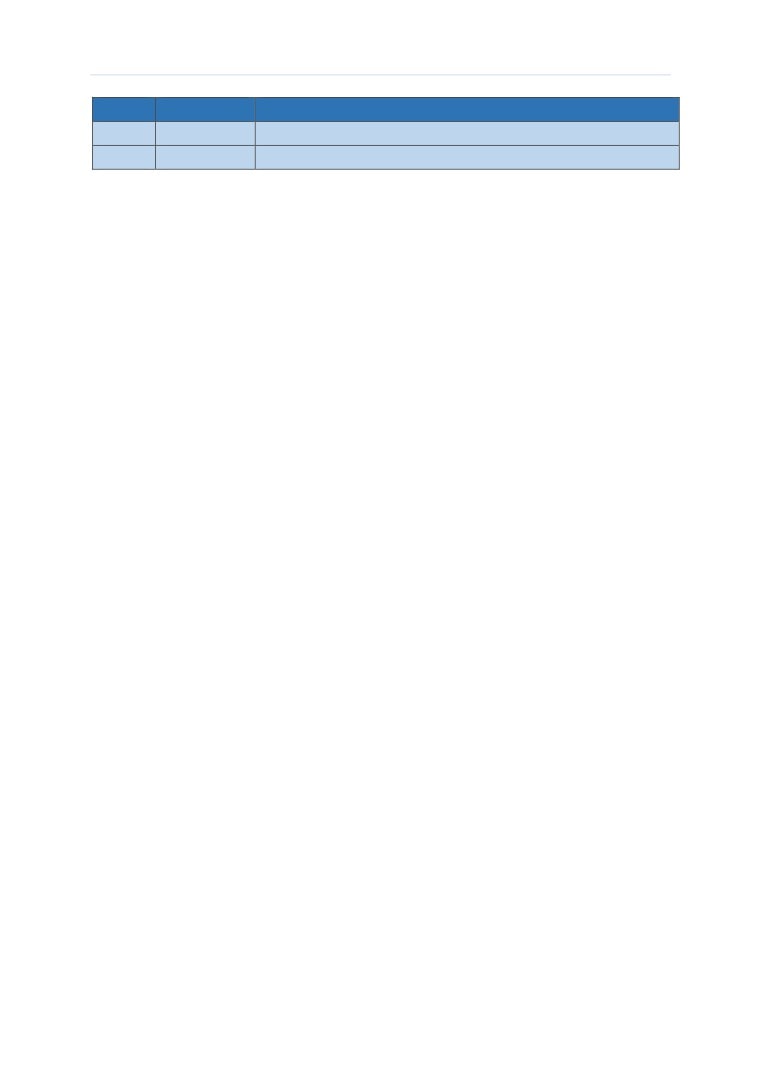

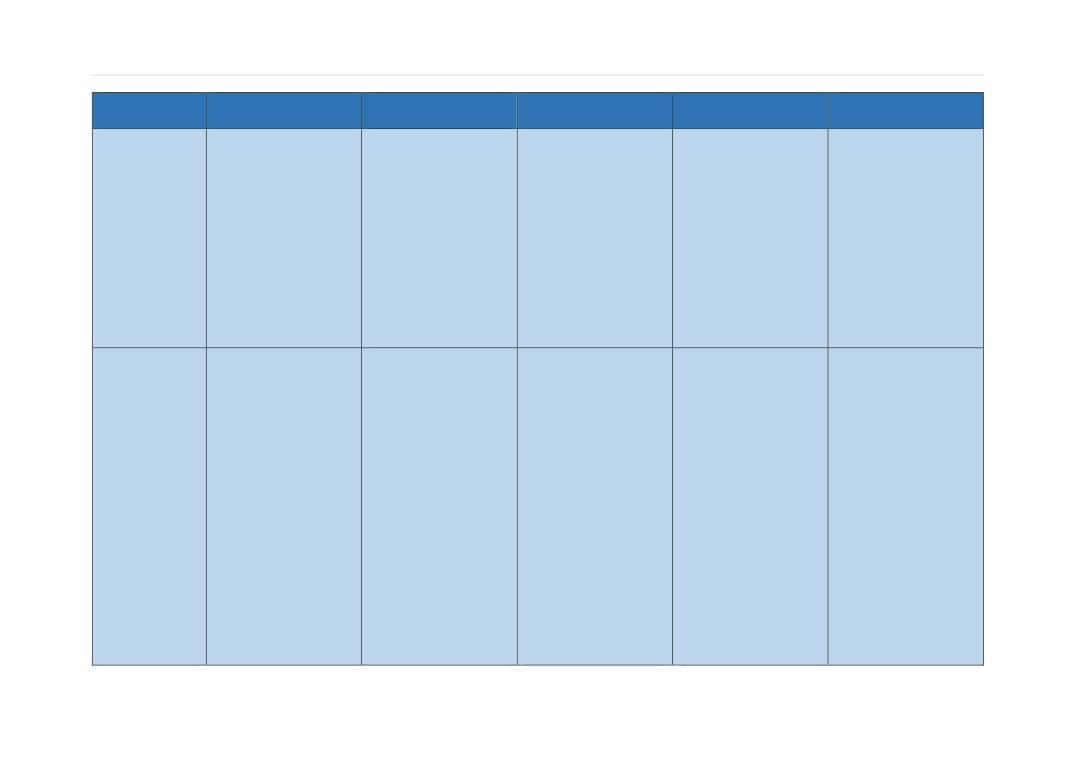

Table 1: Details of large projects

Project

Area

Construction

Proportion of total Glenigan

Value (£m -

Construction spend

2015 values)

Sizewell C Power Stations - Contract 1

Suffolk

5,000

46.0%

Sizewell C Power Stations - Contract 23

Suffolk

1,000

9.2%

The Mean Value Theorem4 was applied to the remainder of the pipeline for Norfolk and Suffolk

separately, excluding the two Sizewell C projects in Table 1, to identify the significant projects in the

LEP. This process identified 61 significant projects in Norfolk and 74 in Suffolk, in both cases accounting

for over 70% of the construction spend in each respective county. This allowed a detailed analysis of

a large proportion of all the projects and a comprehensive consideration of the project types to which

they were assigned.

Table 2 shows the number of significant projects within each county and the percentage of spend per

area arising from the significant projects. The total spend per area can also be seen. The construction

spend shown in this table takes account of any adjustments for engineering works and any incomplete,

duplicate or consultancy projects. Values are shown in 2015 prices as this was provided in the Glenigan

database.

Table 2: Breakdown of the significant project and total values in the LEP, as captured in Glenigan5

Areas

Total (New Anglia LEP)

Norfolk

Suffolk

Total number of projects

412

330

742

Construction spend (£m - 2015

3,741

2,135

5,876

values)

Number of significant projects

61

74

135

Construction spend in

2,868

1,721

4,589

significant projects (£m - 2015

values)

Percentage of construction

76.7%

80.6%

78.1%

spend in significant projects

Some of the projects within the Glenigan database have elements that cover more than one area.

Elements of the UK-wide Social Infrastructure Development (SID) framework are taking place within

the New Anglia LEP. These were estimated to be proportional to the population of the Norfolk and

Suffolk counties relative to the UK’s total population͘ maintenance and works framework taking

place in Norfolk and the surrounding counties was broken down proportionally to each county’s

population and the appropriate elements were used for the analysis in Norfolk and Suffolk. A

construction framework comprising works in the East of England region was broken down into the

3 Glenigan lists two separate contracts for Sizewell C

4 The Mean Value Theorem states that most information is obtained for least effort simply by considering only those data

whose annual construction spend is higher than the mean. This approach is used to identify the few significant values that

account for the largest amount of expenditure.

5 The values in this table are the values from the Glenigan database to which the construction element percentage has

been applied and thus reflect the adjusted values of the infrastructure projects to distinguish between construction and

engineering construction.

5

New Anglia LEP

Construction Labour Research

February 2016

counties of East of England in proportion to their population and the appropriate elements for Norfolk

and Suffolk were used in the analysis.

The labour demand for all of the projects in the Glenigan database was produced using the Labour

Forecasting Tool. The following input data was used to produce the forecasts.

The value of each project in the pipeline provided in the Glenigan database, for all projects

excluding infrastructure.

As noted previously for infrastructure projects, the value used was a percentage of the value

in the Glenigan database, representing the construction portion of the value, excluding

engineering construction. The percentages applied can be seen in Table 3. The construction

proportions have been validated in work we have undertaken for other clients.

Start and end dates of each project provided in the Glenigan database.

For the significant projects, project descriptions in the database enabled us to apply the most

appropriate project type (each type is driven by a different underlying model) to each forecast

that was run through the LFT. Cases where a project consisted of more than one type were

broken down into multiple forecasts that were assigned specific project types to more closely

predict the labour demand. This took account of the different types of work within a single

project, e.g. mixed developments comprising housing, commercial and industrial.

For the rest of the projects, the default project type allocation as defined in the Glenigan

database was applied, except for the infrastructure projects which were individually allocated

to the most appropriate type from the available LFT infrastructure types.

Table 3: Proportion of total value related to construction

Sector

Proportion of construction

activity

Flooding

90%

Science & Research

100%

Roads

100%

Airports

100%

Ports

90%

Stations (Underground/Network rail)

80%

Mixed Rail (Track, stations, E&P etc.)

55%

Bridges

100%

WTW/WTWW

90%

Generation (Renewables - Offshore)

20%

Generation (Renewables - Onshore)

10%

Biomass

50%

Undefined Energy

40%

Nuclear Decommissioning

60%

Photovoltaics

80%

Gas Transmission/distribution

30%

General Infrastructure

100%

6

New Anglia LEP

Construction Labour Research

February 2016

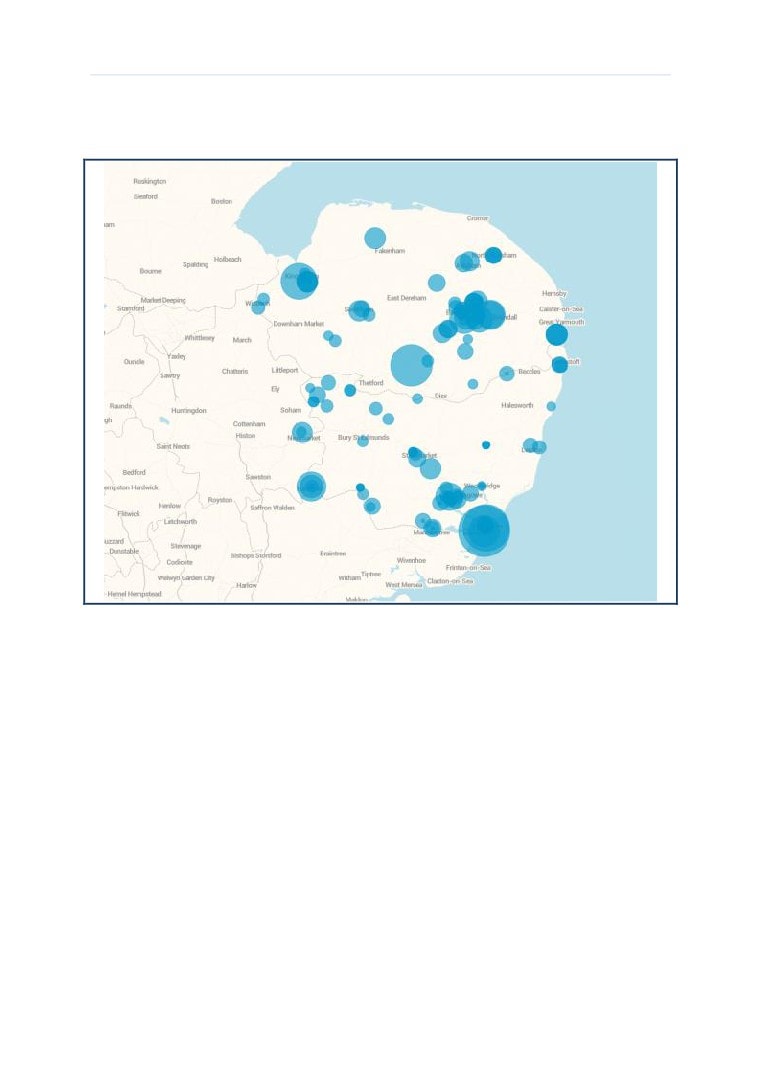

Appendix C provides a full breakdown of the significant projects and their construction values. The

significant projects’ locations can be seen in Figure 1. The radius of the markers are in proportion to

the value of the project.

Figure 1: The significant projects in Glenigan used in this analysis

Table 4 lists the top 20 significant projects, by value, taking place within the LEP in the period 2015-

2019.

The data relating to all of the projects has been stored in the version of the LFT for which the LEP will

have a licence. All the assumptions regarding the input parameters - including project duration and

values - can be updated by the LEP as and when more specific information becomes available. The

forecasts have been saved within the LFT for access by the LEP and any changes to scope (including

updates to the construction value) can readily be made.

3.2.2.

Breakdown of spend by project type

This section provides an overview of the development spend (£m - 2015 values) in the LEP broken

down by project type based on the projects included in the Glenigan database.

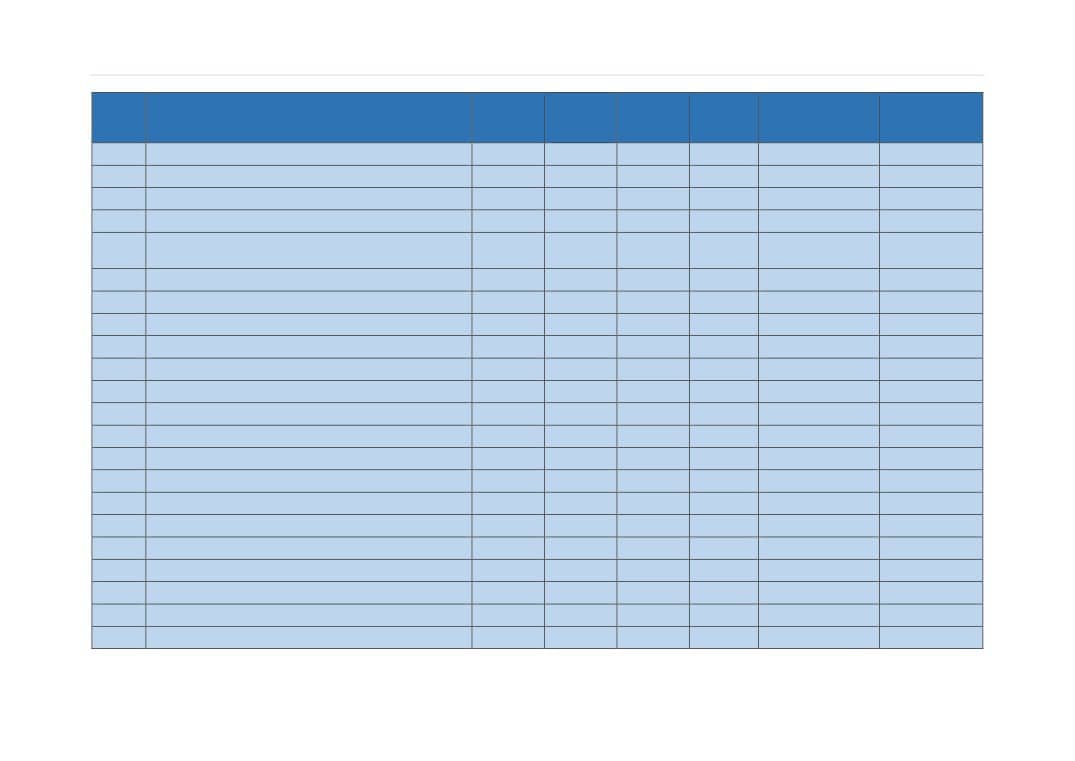

Table 5 shows the construction spend for each sector. It is clear that housing accounts for some 40%

of the construction spend. Infrastructure accounts for around a third of the spend and is particularly

driven by offshore wind in Norfolk which accounts for more than 60% of the infrastructure spend in

the New Anglia LEP, as can be seen in Table 6. Public non-housing projects account for almost 15% of

the spend.

7

New Anglia LEP

Construction Labour Research

February 2016

Table 4: List of 20 significant projects

Value (£m -

Number

Description

Local Authority

Start Date

End Date

Project Type

2015 values)

1

Offshore Wind Farm

Norfolk

400.0

01/04/2016

01/04/2020

Infrastructure

2

5,000 Eco Homes

Norfolk

375.0

09/10/2017

04/10/2021

New Housing

3

Offshore Wind Farm

Norfolk

360.0

01/04/2016

01/04/2019

Infrastructure

4

Minor/Major/Maintenance Works Framework

Norfolk

244.3

01/04/2015

03/04/2019

Public Non-housing

5

Wind Farm Development

Norfolk

108.0

30/04/2018

27/01/2020

Infrastructure

6

Offshore Wind Farm

Norfolk

100.0

20/08/2017

20/08/2019

Infrastructure

7

Offshore Wind Farm

Norfolk

100.0

12/06/2016

09/06/2019

Infrastructure

8

1000 Residential Units Development Partner

Norfolk

80.9

13/07/2015

08/07/2019

New Housing

9

Biomass Power Plant

Norfolk

80.0

02/03/2015

31/05/2017

Infrastructure

10

Social Infrastructure Framework

Norfolk

73.9

01/04/2015

01/04/2019

New Housing

11

910 Houses/Flats/School/Village Hall/Shop Units

Norfolk

68.3

03/03/2016

31/03/2017

New Housing

12

850 Residential Units/1 School & Commercial Units

Norfolk

63.8

29/12/2014

27/06/2016

New Housing

13

1110 Residential Units/1 School & Commercial Units

Norfolk

60.9

01/08/2016

29/07/2019

Private Commercial

14

CCGT Power Station

Norfolk

60.0

05/06/2017

05/12/2019

Infrastructure

15

Centre for Food & Health

Norfolk

55.0

04/01/2016

09/07/2018

Private Industrial

16

Solar Photovoltaic Array

Norfolk

48.0

02/02/2015

09/11/2015

Infrastructure

17

800 Residential Units & 1 School/Local Centre

Norfolk

44.6

05/10/2015

03/09/2018

Private Commercial

18

Commercial Units

Norfolk

42.6

14/09/2015

11/09/2017

Private Industrial

19

Council Office (Refurbishment)

Norfolk

32.0

04/03/2013

06/05/2016

Public Non-housing

20

Junction (Improvements)

Norfolk

30.0

11/04/2016

11/04/2017

Infrastructure

8

New Anglia LEP

Construction Labour Research

February 2016

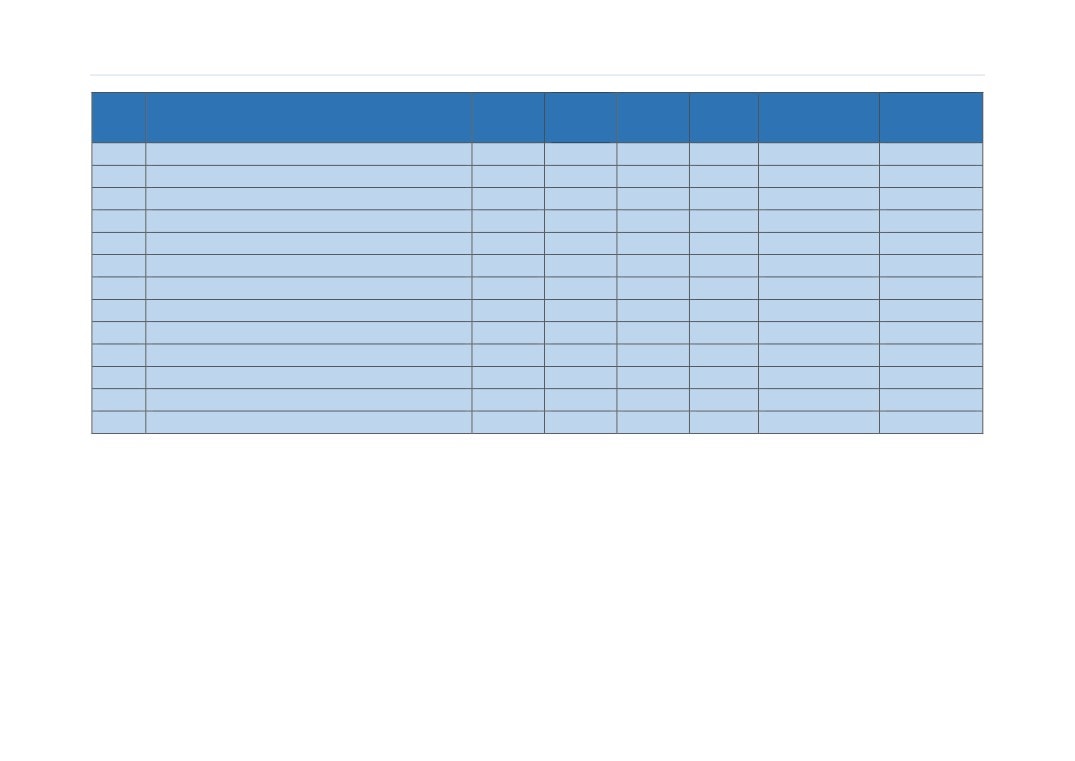

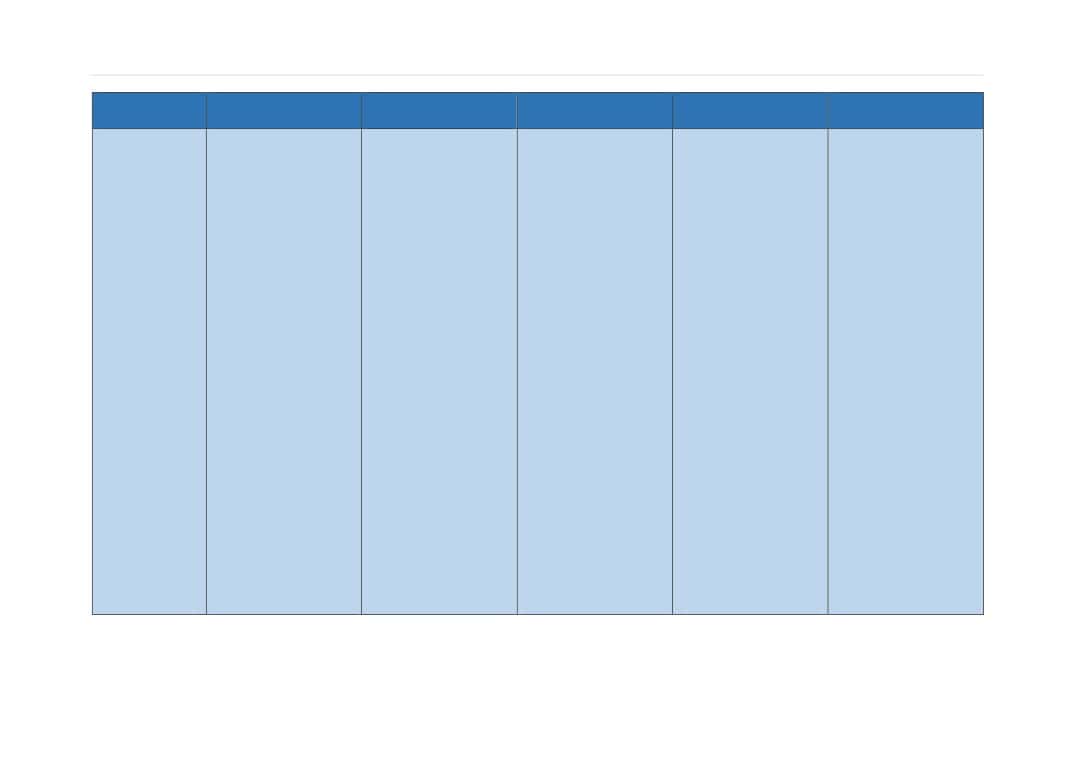

Table 5: Construction spend per sector for the period 2015-2019

Sector

Construction spend in the

% of total -

Construction spend in the

% of total -

Construction spend in the

% of total -

period 2015-2019 (2015

Norfolk

period 2015-2019 (2015

Suffolk

period 2015-2019 (2015

New Anglia

values - £m) - Norfolk

values - £m) - Suffolk

values - £m) - New Anglia LEP

LEP

New Housing

1,272.5

36.9%

932.4

47.1%

2,204.9

40.6%

Infrastructure

1,484.4

43.1%

264.4

13.4%

1,748.8

32.2%

Public Non-residential

440.4

12.8%

321.1

16.2%

761.5

14.0%

Private Commercial

139.6

4.1%

246.1

12.4%

385.7

7.1%

Private Industrial

64.7

1.9%

165.4

8.4%

230.1

4.2%

Non-housing R&M

19.4

0.6%

45.4

2.3%

64.8

1.2%

Housing R&M

23.9

0.7%

5.5

0.3%

29.4

0.5%

Total

3,444.9

100.0%

1,980.3

100.0%

5,425.2

100.0%

9

New Anglia LEP

Construction Labour Research

February 2016

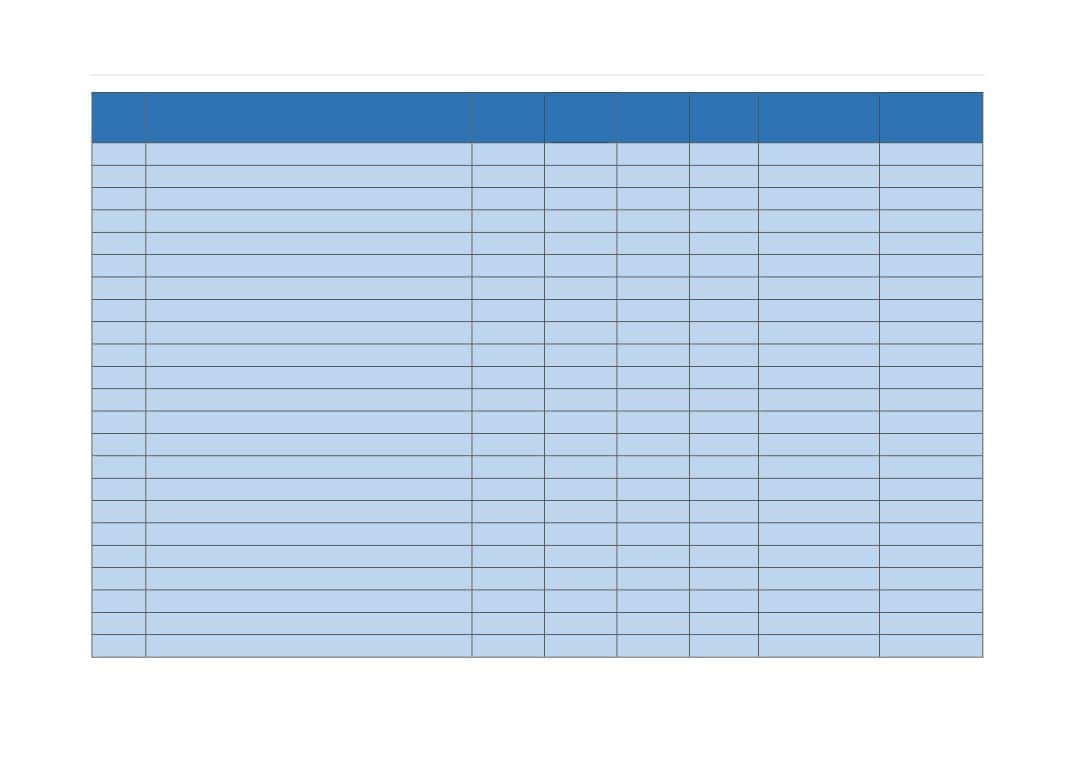

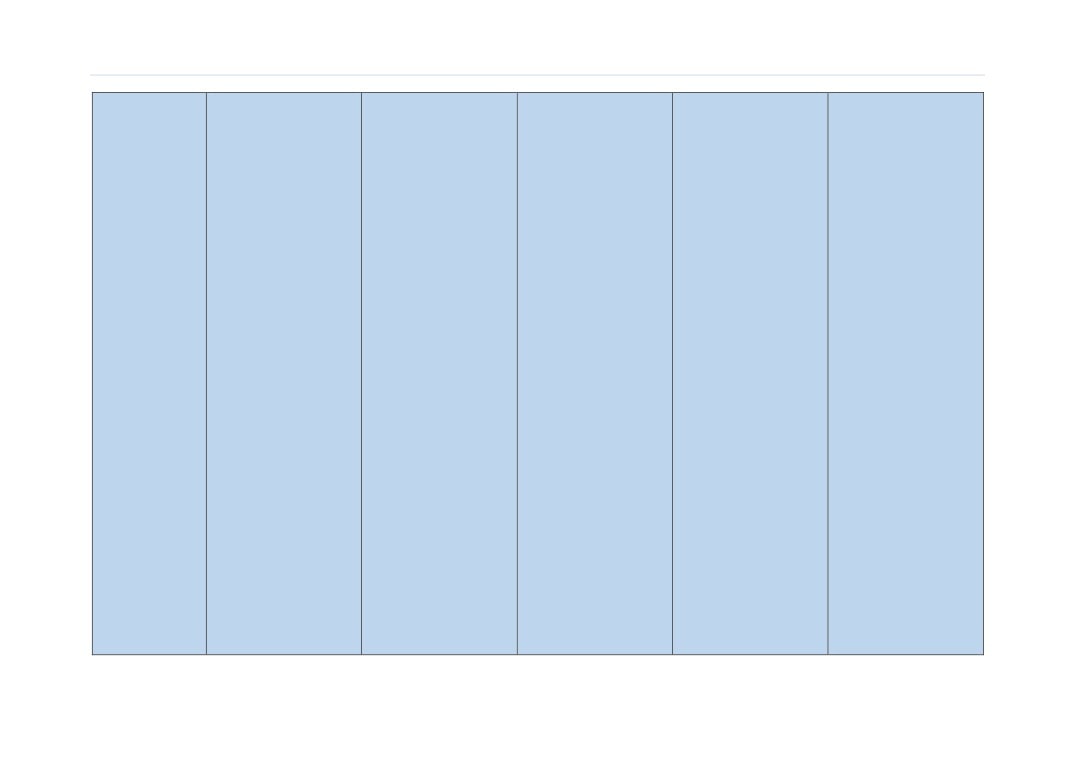

Table 6: Construction spend per infrastructure sub-sector for the period 2015-2019

Infrastructure sub-sector

Construction spend in the

% of total -

Construction spend in the

% of total -

Construction spend in the

% of total -

period 2015-2019 (2015

Norfolk

period 2015-2019 (2015

Suffolk

period 2015-2019 (2015

New Anglia

values - £m) - Norfolk

values - £m) - Suffolk

values - £m) - New Anglia LEP

LEP

Generation (Renewables

1,043.2

70.3%

67.2

25.4%

1,110.40

63.5%

- Offshore)

Undefined Energy

63.0

4.2%

80.4

30.4%

143.40

8.2%

Photovoltaics

122.6

8.3%

18.8

7.1%

141.40

8.1%

Biomass

85.8

5.8%

-

0.0%

85.80

4.9%

Roads

63.5

4.3%

15.5

5.9%

79.00

4.5%

Stations

41.9

2.8%

-

0.0%

41.90

2.4%

(Underground/Network

rail)

Ports

1.0

0.1%

37.9

14.3%

38.90

2.2%

Flooding

20.0

1.3%

5.5

2.1%

25.50

1.5%

WTW/WWTW

7.9

0.5%

11.2

4.2%

19.10

1.1%

General Infrastructure

4.1

0.3%

12.7

4.8%

16.80

1.0%

Science & Research

14.2

1.0%

-

0.0%

14.20

0.8%

Airports

14.2

1.0%

-

0.0%

14.20

0.8%

Bridges

-

0.0%

9.7

3.7%

9.70

0.6%

Generation (Renewables

2.7

0.2%

0.8

0.3%

3.50

0.2%

- Onshore)

Nuclear

-

0.0%

3.5

1.3%

3.50

0.2%

Decommissioning

Mixed Rail (Track,

-

0.0%

1.2

0.5%

1.20

0.1%

stations, E&P etc)

10

New Anglia LEP

Construction Labour Research

February 2016

Table 6: Construction spend per infrastructure sub-sector for the period 2015-2019

Infrastructure sub-sector

Construction spend in the

% of total -

Construction spend in the

% of total -

Construction spend in the

% of total -

period 2015-2019 (2015

Norfolk

period 2015-2019 (2015

Suffolk

period 2015-2019 (2015

New Anglia

values - £m) - Norfolk

values - £m) - Suffolk

values - £m) - New Anglia LEP

LEP

Gas

0.3

0.0%

-

0.0%

0.30

0.0%

Transmission/distribution

Total

1,484.4

100.0%

264.4

100.0%

1,748.8

100.0%

11

New Anglia LEP

Construction Labour Research

February 2016

3.2.3.

Producing estimates of labour demand

Based on the analysis of the Glenigan database this section presents the labour demand arising within

the LEP. Additional detail is shown in Appendix E.

The data in the Glenigan database presents a picture of the forthcoming projects. As the time horizon

extends there is less clarity on what is planned. For instance, in some cases a small number of projects

are due to complete in the 2020s. However, the small workload shown by the demand profile is highly

unlikely to reflect the total amount of work that will take place at that time. It is almost certain that

there will be additional projects that come on stream at that time that have not yet been considered.

The CSN forecasts, which consider the availability of labour, look forward five years. For consistency

we have presented the demand forecasts for the five year period 2015-19 used in the CSN model.

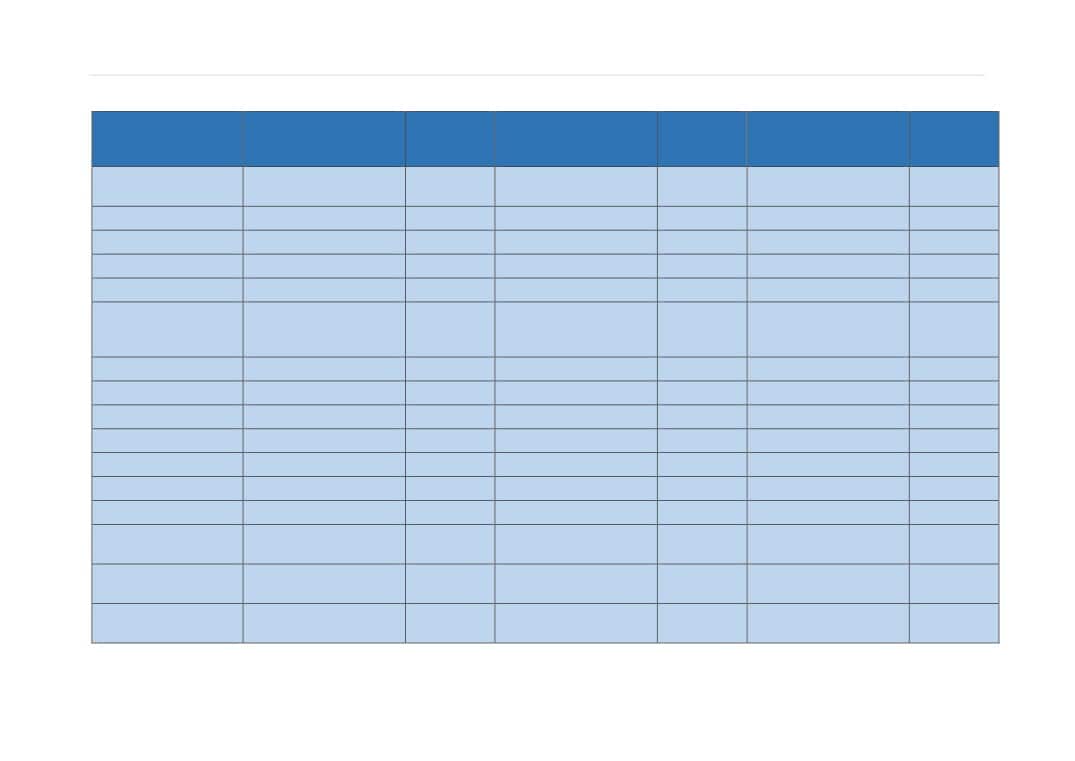

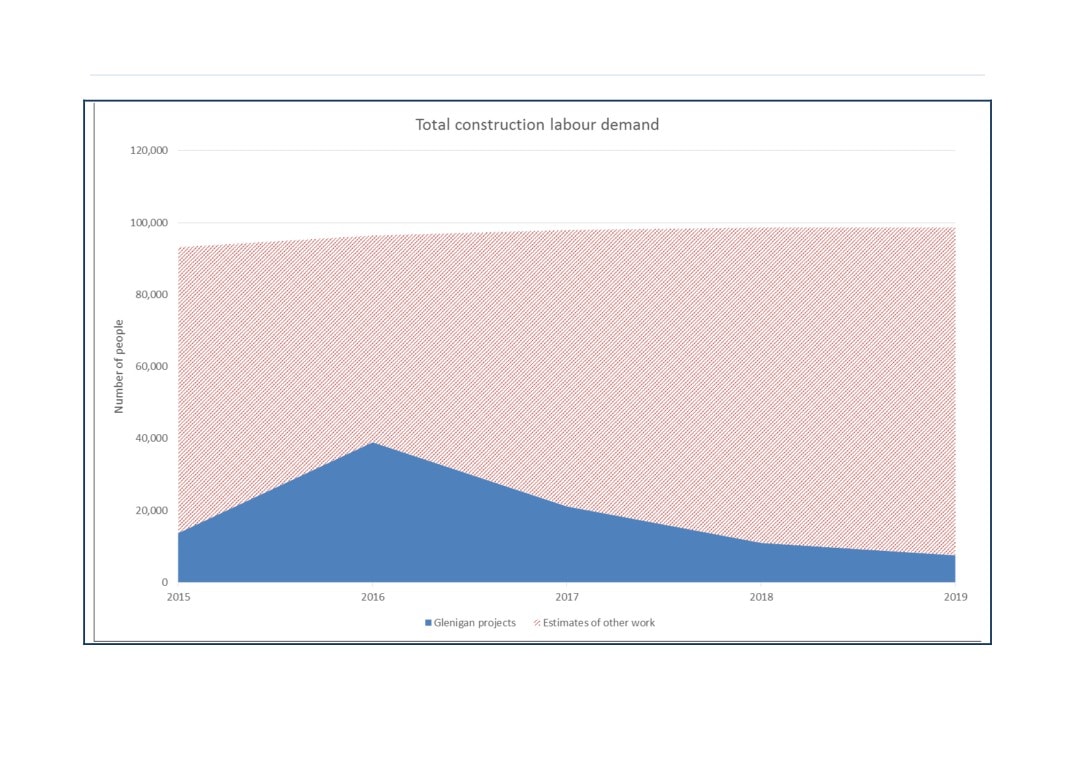

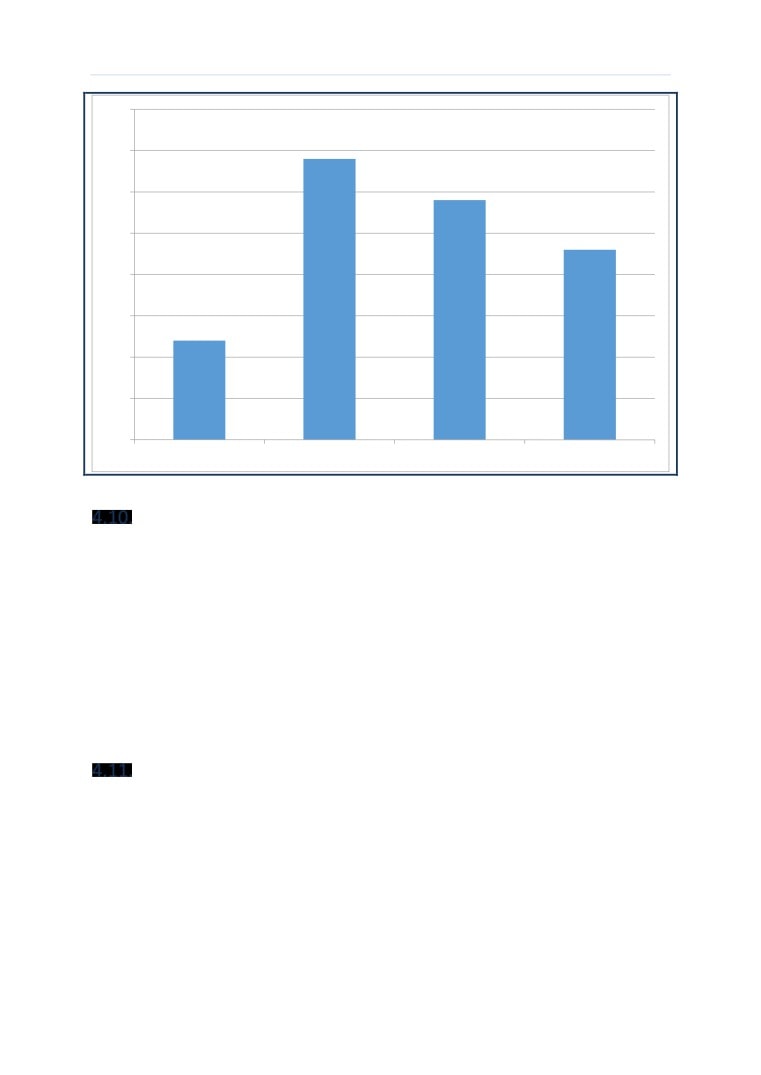

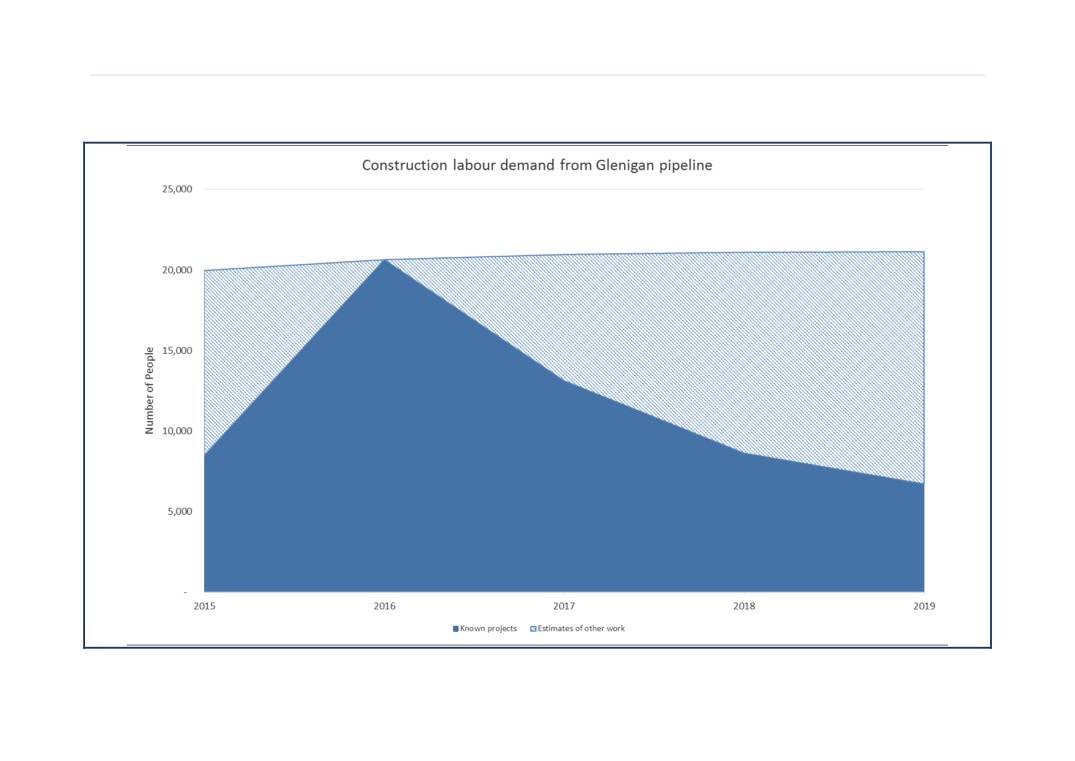

Labour demand figures have been rounded to the nearest 50. Figure 2 shows the construction labour

demand arising from the Glenigan data for the period 2015-2019 in the LEP.

It should be noted that the workforce will only peak for a relatively short period of time. The ramp up

and ramp down to that peak may be quite large. We have therefore presented the average workforce

during the year of the peak.

Table 7 shows the labour demand arising from the entire pipeline of projects, as well as the portion of

this demand within the 2015-2019 period. It also shows the peak workforce requirement of around

39,000 people occurring in 2016. As noted above the drop off, and indeed the ramp up, of projects

from an analysis of a pipeline is somewhat artificial. An approach to overcome this has been applied

to the analysis. The approach uses the assumption that the future workforce is approximately equal

to the peak. The peak has, therefore, been projected forward and backcast6 to create a more likely

scenario of the ongoing workforce. The growth rate is based on the CSN employment forecast for the

whole East of England region. The demand with an employment growth rate included is shown in

Figure 2. The shaded area shows the likely total labour demand arising from as yet undefined projects.

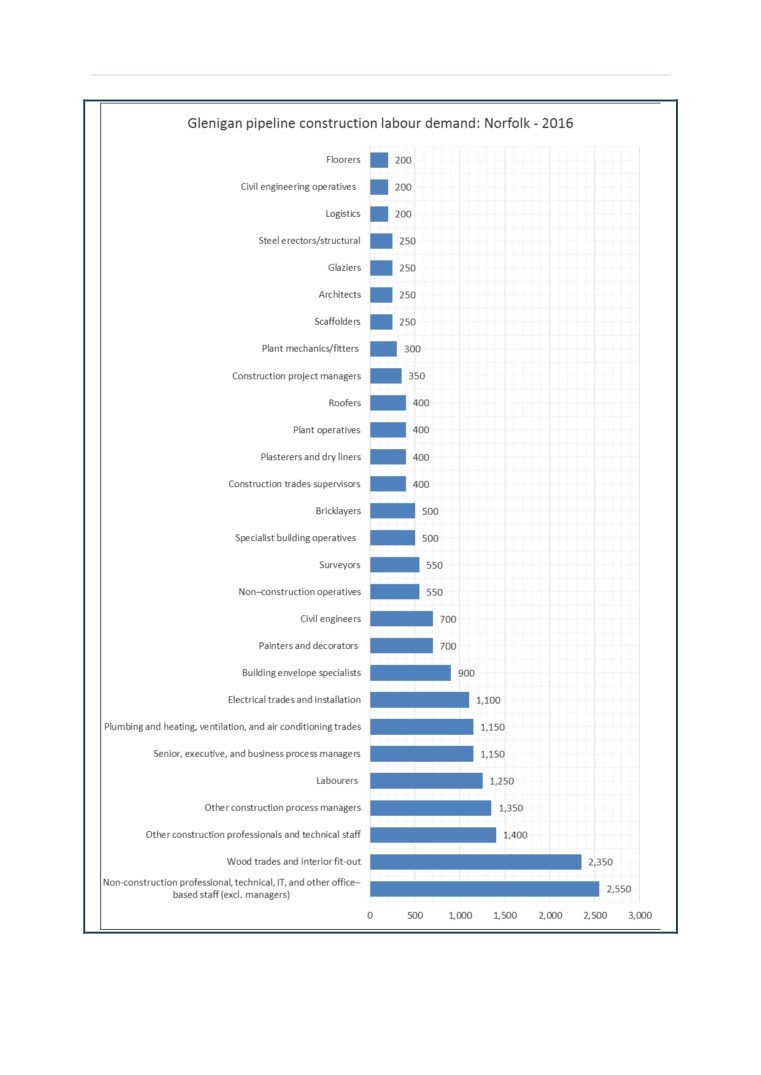

For the peak year we have shown a detailed breakdown by each of the 28 occupational groups for

which the forecast has been produced. These are shown in Figure 3. The projections of labour demand

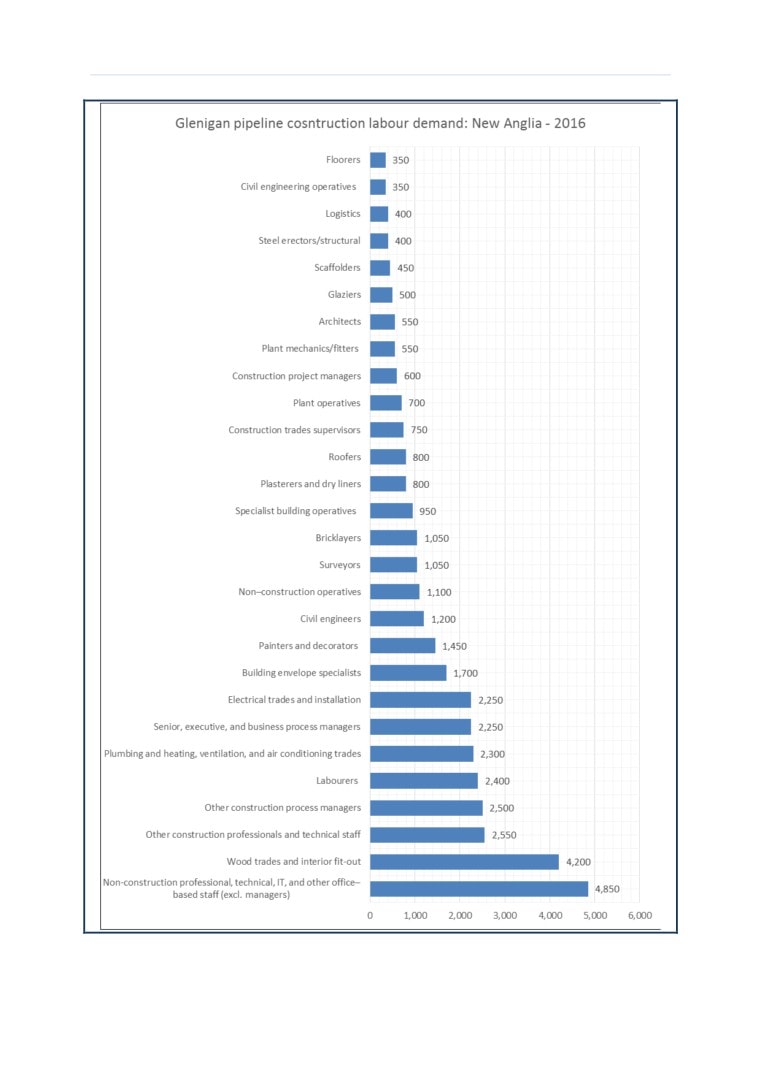

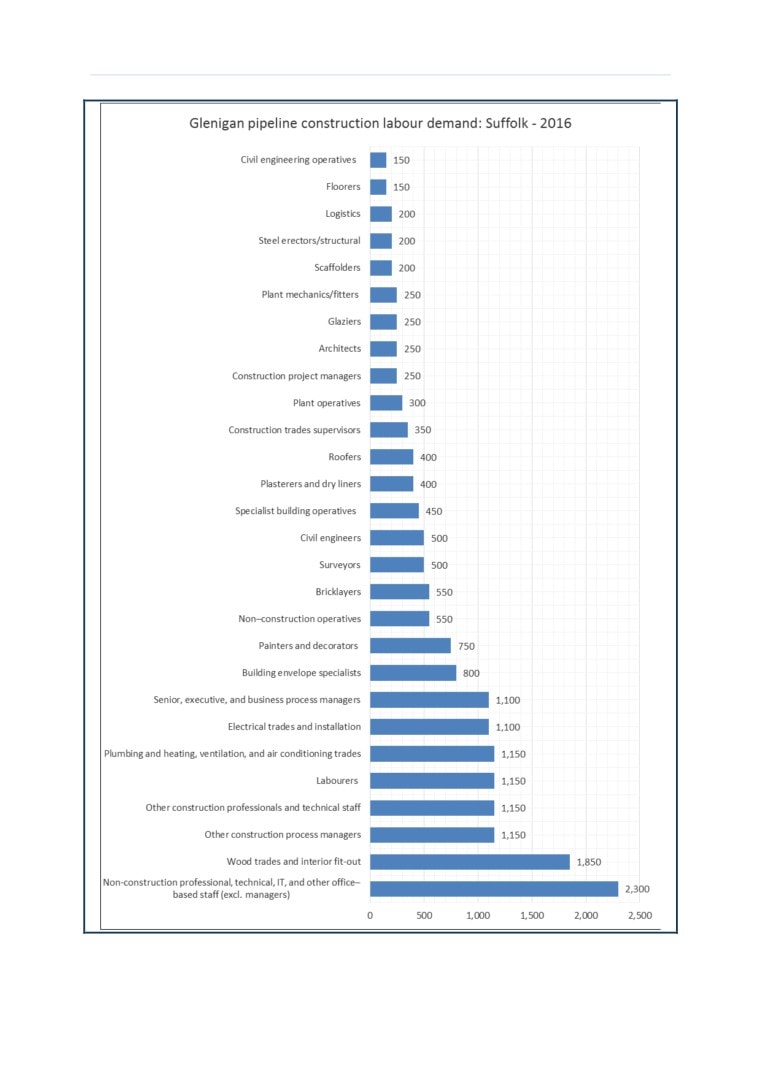

for the trades occupations for the peak year of 2016 are as follows.

The trade occupation displaying the highest demand is “wood trades and interior fit-out”

peaking at 4,200 people;

“general labourers” follow with 2,400 people;

“plumbing and heating, ventilation and air conditioning trades” rank third with 2,300 people;

“electrical trades and installation” come next, with around 2,250 people demanded.

All other trades display a demand of less than 2,000 people each.

6 This takes account of the fact that the 2015 Glenigan figures which are tailing off and are past their peak than those in

2016.

12

New Anglia LEP

Construction Labour Research

February 2016

Table 7: Total labour demand in the LEP (excluding mine and offshore)

Area

Total Person-Years

Person-Years

% of total demand

Average workforce

2012-2025

2015-2019

in 2015-2019

during year of peak

Norfolk

62,600

57,650

92.1%

20,650

Suffolk

37,800

34,850

92.2%

18,350

New Anglia LEP area

100,400

92,500

92.1%

39,000

13

New Anglia LEP

Construction Labour Research

February 2016

Figure 2: Total Construction labour demand arising from the Glenigan data for the LEP including projected growth (excluding Sizewell C)

14

New Anglia LEP

Construction Labour Research

February 2016

Figure 3: Construction labour demand arising from the Glenigan Pipeline by occupation in the peak year

15

New Anglia LEP

Construction Labour Research

February 2016

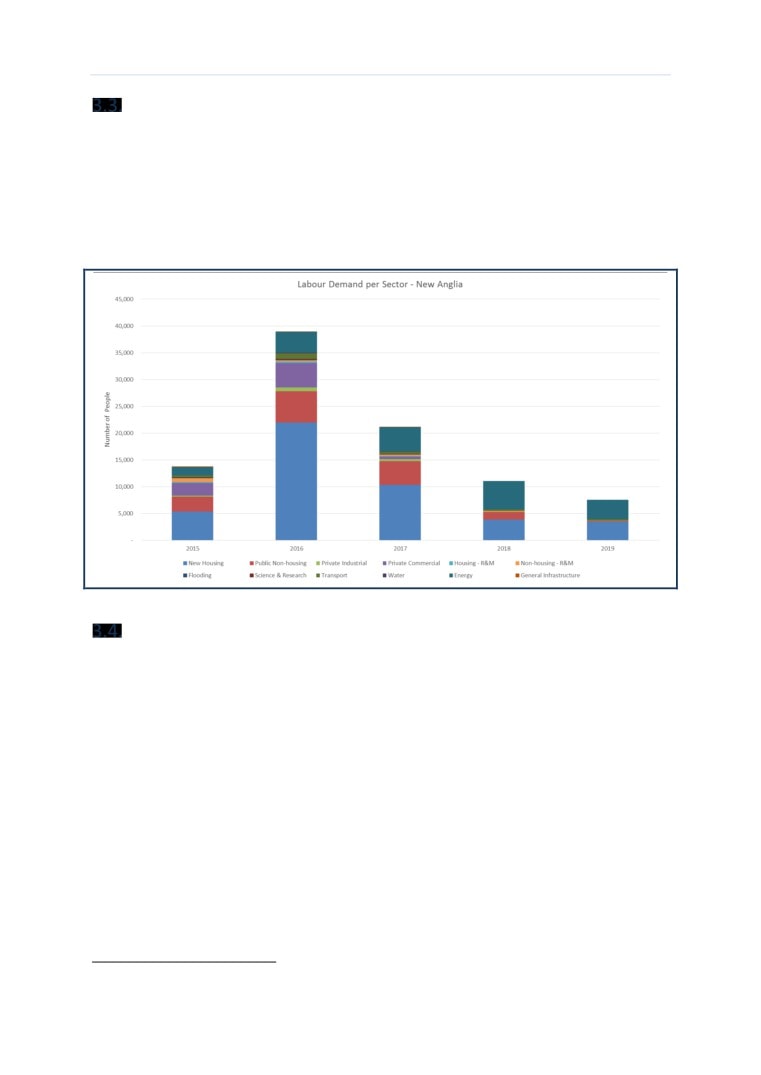

Breakdown of labour demand by project type

The labour demand has been calculated from the spend in each project type. In this section we have

considered the total labour demand. The peak workforce in 2016 is around 39,000. Figure 4 shows the

breakdown of labour demand by project type. For the peak year (2016) it can be seen that more than

half of the labour is generated by housing. This is due to the nature of housing work, which tends to

be more labour intensive than other types. Towards the end of the five year period there is a ramp-

up in infrastructure and particularly energy. This is driven primarily by offshore wind projects in

Norfolk.

Figure 4: Construction labour demand arising by sector and sub-sector

Sizewell C nuclear power station

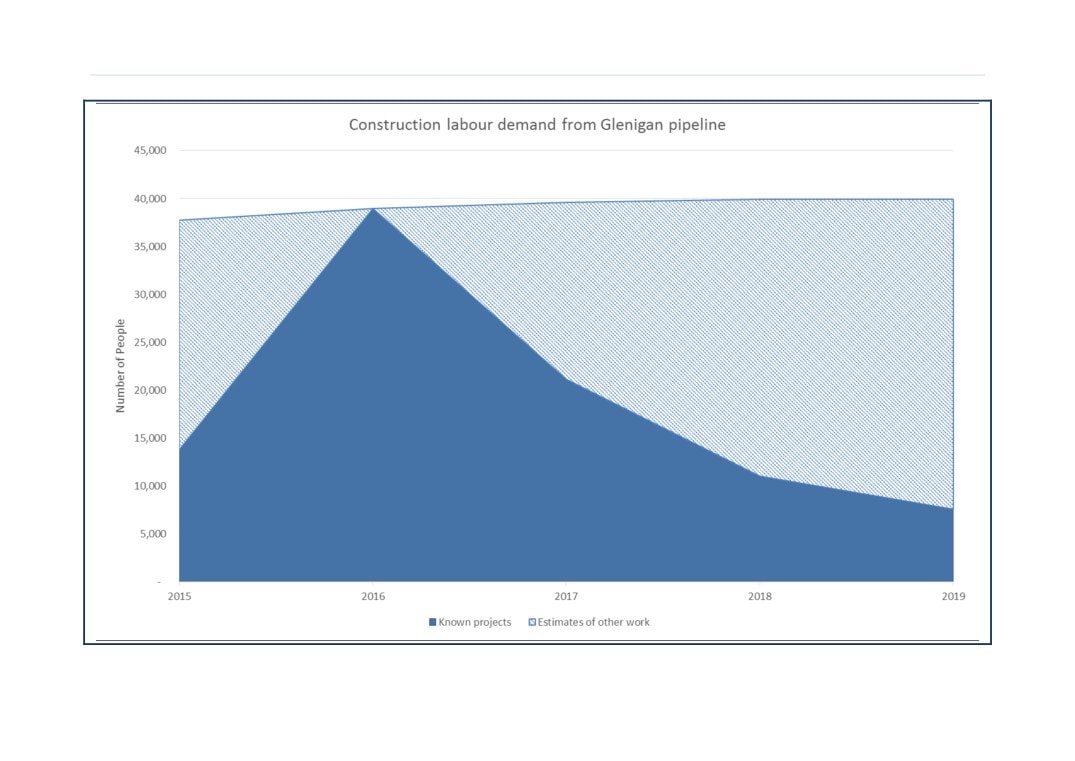

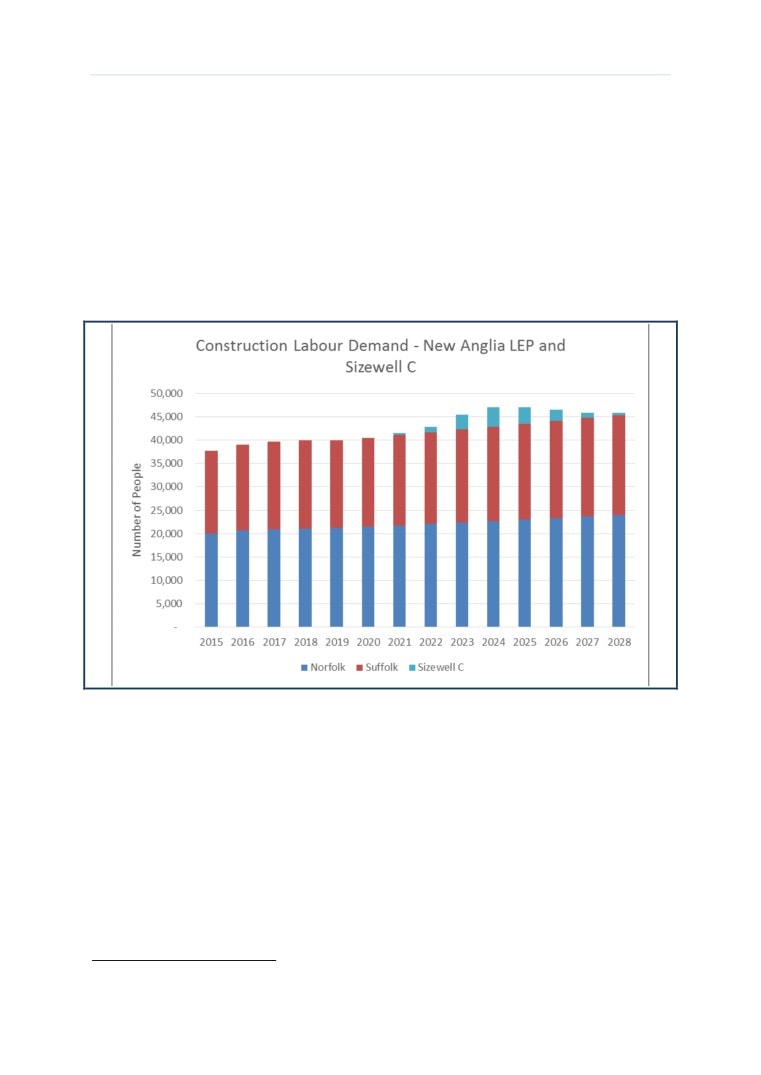

The Sizewell C Nuclear New Build plant-related projects have been estimated at a total construction

value of £6bn (based on a Glenigan total project value of £12bn, which includes an engineering

construction element estimated from previous work to be 50% of the total value). The labour demand

arising from this development will account for a large additional demand in the local authorities in

proximity to Suffolk, including Norfolk and other neighbouring counties. For the purposes of this

analysis we have consulted directly with EDFE, but have relied on data that is in the public domain.

The data we have used has not been confirmed by EDFE. Stage 2 of the EDFE consultation is yet to

start and this analysis should be updated in collaboration with EDFE once that process has

commenced. The current estimated timescale for the main civils works of Sizewell C is 2021-2028 7.

For the purposes of the demand arising from the Sizewell C work we have used the labour demand

figures produced by the Nuclear Energy Skills Alliance (NESA). The NESA analysis shows a peak

workforce of almost 4,200 construction people in 2024 for Sizewell C. This analysis is broken down by

occupation and these have been mapped to the relevant 28 occupational groups used by CITB. It

should be noted that this is an annual average construction workforce demand. It does not include

the operations or engineering construction workforce. In their consultation document, EDFE forecast

16

New Anglia LEP

Construction Labour Research

February 2016

a total monthly peak workforce of 5,600 people 8. From the data available to us, a construction

workforce of 4,200 is not inconsistent with a total workforce of 5,600.

We have aggregated the monthly demand across the New Anglia LEP into annual figures and

superimposed the demand arising from Sizewell C. For clarity we have presented the forecasts in this

section over a 14-year period to coincide with the predicted construction programme of Sizewell. This

is shown in Figure 5 with a continued employment rate projected at 2015-19 levels. At peak the

Sizewell work accounts for a workload equal to roughly 9.3% of the demand arising from the Glenigan

pipeline in the New Anglia LEP. Table 8 shows the impact of Sizewell C as a proportion of the peak

workforce from the projects in Glenigan in the Norfolk and Suffolk. This has been projected forward

assuming that the growth rate from 2015-19 continues into the next decade at the same rate. It shows

that the Sizewell C workforce accounts for up to around 9.3% of the workforce working on the

Glenigan pipeline of projects in the New Anglia LEP area.

Figure 5: Construction labour demand of the Sizewell C development compared to the rest of the demand in the

New Anglia LEP

17

New Anglia LEP

Construction Labour Research

February 2016

Table 8: Comparison of labour demand arising from Sizewell C to the New Anglia LEP

Sizewell C labour

Labour demand in

Sizewell C Labour Demand as a percentage of peak

demand (number of

the New Anglia LEP

demand (39,000 people) in the New Anglia LEP

people)

(number of people)

areas

2015

-

37,750

0.0%

2016

-

39,000

0.0%

2017

-

39,650

0.0%

2018

-

39,900

0.0%

2019

-

39,950

0.0%

2020

-

40,550

0.0%

2021

450

41,100

1.0%

2022

1,150

41,700

2.5%

2023

3,100

42,300

6.8%

2024

4,200

42,900

9.3%

2025

3,600

43,500

7.9%

2026

2,350

44,100

5.2%

2027

1,150

44,700

2.5%

2028

500

45,350

1.1%

Assessing the wider demand within New Anglia

3.5.1. Methodology and assumptions

The Glenigan database has two characteristics that prevent the results from providing the entire

labour demand profile for the area:

It does not record all smaller projects (roughly those of less than £250,000 value).

It records mainly new build projects and with only a small amount of repair and maintenance

works included.

These two issues could have an effect on the calculated labour demand and produce lower figures

than expected. We have developed a methodology to provide a complete picture of the labour

demand. The following steps are undertaken to provide an estimate of the total labour demand across

a region.

1. Only the new build projects arising from the Glenigan database were run through the LFT,

excluding any repair and maintenance work.

2. To estimate the full amount of new build work not captured in Glenigan we compared the

total Glenigan new build spend in the region (East of England) with the output estimates for

the CSN for the peak year, 2016. This allowed us to estimate the new build spend for the entire

region not included in the Glenigan database from which we could then factor the

corresponding output for the New Anglia LEP area.

18

New Anglia LEP

Construction Labour Research

February 2016

3. The non-Glenigan new build spend calculated in the previous step was assigned to different

sectors, reflecting the mix of works recorded in Glenigan for New Anglia. A separate item was

created for each construction sector (e.g. general infrastructure, housing) and assigned a

value proportional to each sector’s contribution to the pipeline spend in Glenigan͘

4. To calculate the R&M elements of work taking place within the LEP, the CSN output data was

used to calculate the ratio of R&M to new build work in the East of England. We assumed this

ratio to be constant throughout the region.

5. The LFT was used to calculate the labour demand profile based on the values of different types

of work estimated above.

6. Labour demand for 2016 was then projected forward and backcast as required throughout

the period analysed. For this process we used the construction employment growth factors

applied previously to the known projects.

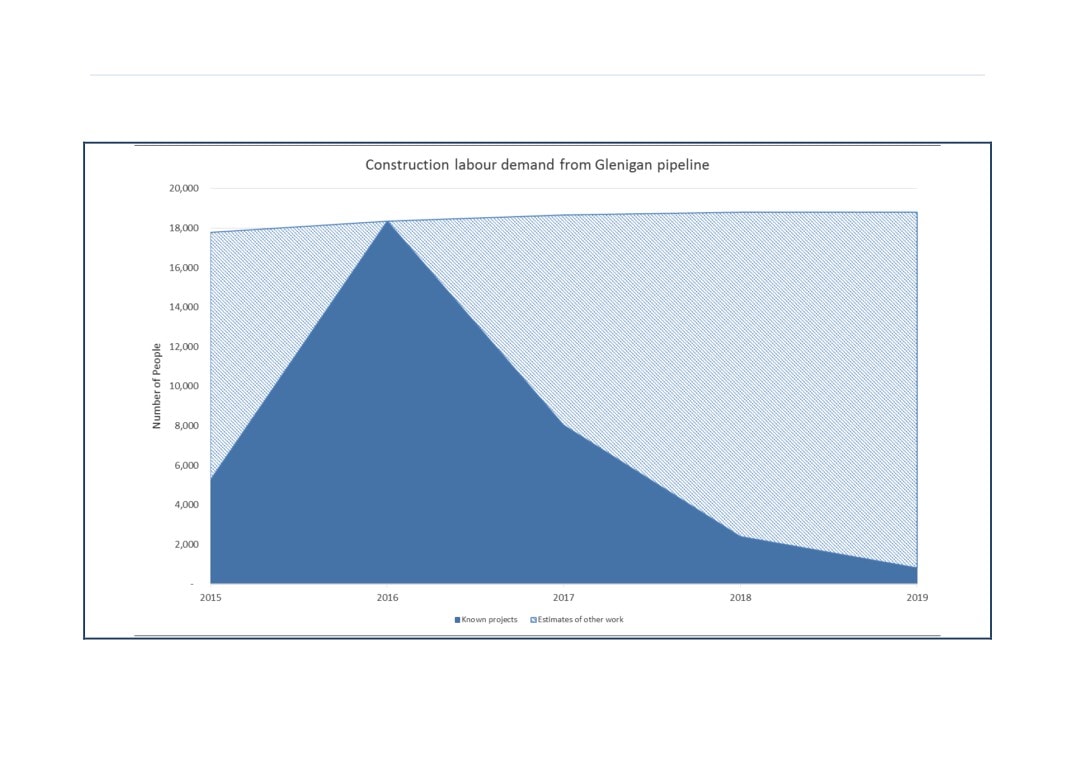

3.5.2. Updated labour demand calculations and projections

Table 7 shows the labour demand arising from the entire pipeline of projects including the allowance

we made for R&M amounting to 96,350 people in 2016, the peak year of Glenigan data, including the

allowance made for R&M. The demand is shown in Figure 6. The total labour demand rises from

93,250 people in 2015 to a peak of 98,700 people in 2019.

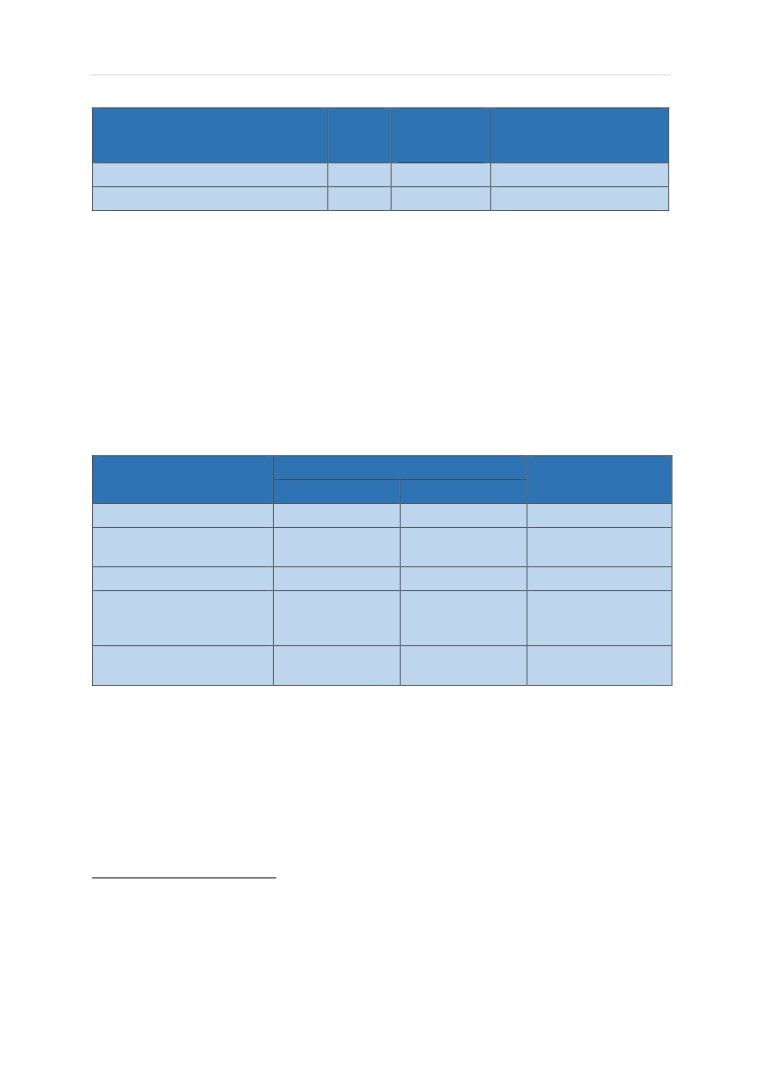

Table 9: Total labour demand in the New Anglia LEP area

Area

Glenigan labour

Undefined potential

Average workforce

demand

projects labour

during 2016

demand

2015-2019

2015-2019

Norfolk

57,600

202,450

51,650

Suffolk

34,850

189,950

44,650

New Anglia

92,450

392,400

96,350

19

New Anglia LEP

Construction Labour Research

February 2016

Figure 6: Total construction labour demand including estimate for R&M and projects not in the Glenigan database

20

New Anglia LEP

Construction Labour Research

February 2016

Neighbouring regions

This section provides an overview of the large projects and related developments and frameworks

that are current or are scheduled to begin within the next five years in the four counties in close

proximity to the New Anglia LEP: Essex, Cambridgeshire, Peterborough and Lincolnshire. The Mean

Value Theorem was applied twice to identify the significant projects measured by their average annual

spend in Glenigan. Table 10 presents the spending profiles of these projects. Values are given in 2015

values.

21

New Anglia LEP

Construction Labour Research

February 2016

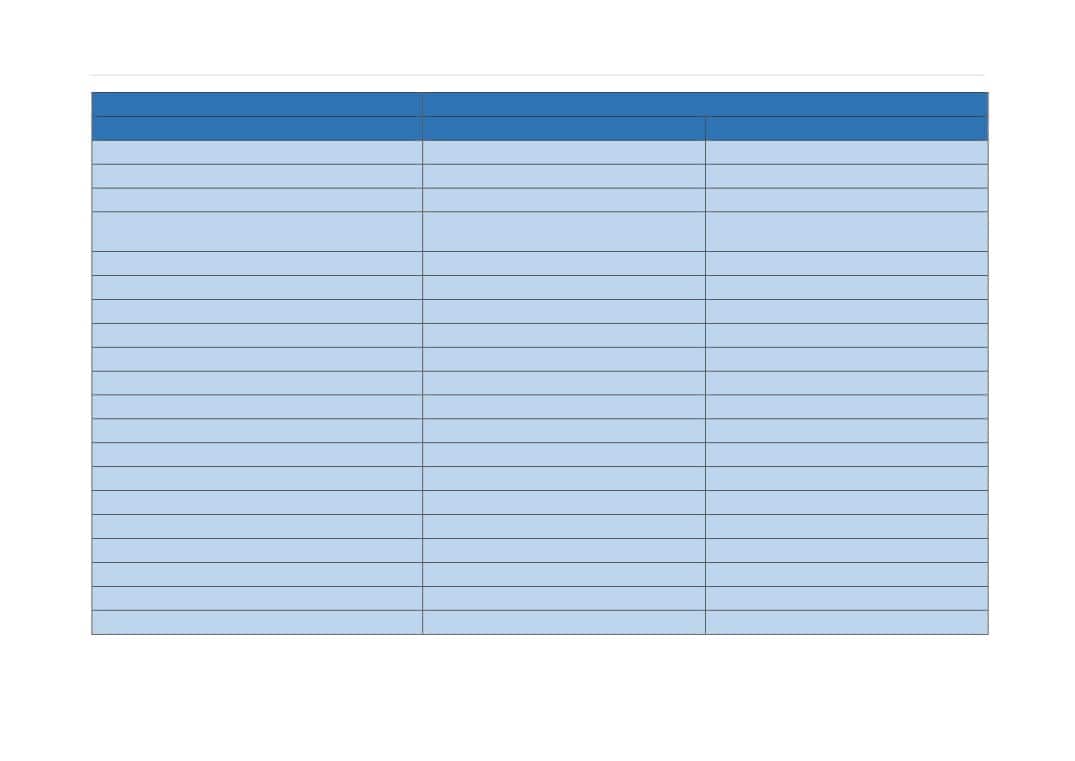

Table 10: Significant projects in neighbouring areas

Number

Description

Local Authority

Construction

Average Annual

Start Date

End Date

Project Type

Value (£m -

Spend (£m -

2015 values)

2015 values)

1

9 Eco Towns Masterplan

Cambridge

200.0

544.8

21/07/2015

02/12/2015

New Housing

2

Road Improvement Scheme

East

1,500.0

376.0

23/11/2015

18/11/2019

Infrastructure

Cambridgeshire

3

Road Improvement Scheme

Huntingdonshire

600.0

300.8

28/11/2016

26/11/2018

Infrastructure

4

Road Improvement Scheme

Cambridge

300.0

300.8

17/10/2016

16/10/2017

Infrastructure

5

3703 Residential/Schools/Care

South Kesteven

277.7

257.9

11/11/2015

08/12/2016

Private Commercial

Home/Commercial Units

6

Residential & Commercial

Peterborough

999.0

249.6

04/04/2016

04/04/2020

New Housing

7

Water/Wastewater Integrated Main Works

Peterborough

3,600.0

239.8

01/04/2015

01/04/2030

Public Non-housing

Capital Framework

8

5,015 Residential/Commercial Units

Huntingdonshire

270.0

230.8

06/07/2015

05/09/2016

New Housing

9

Water (Maintenance)

Peterborough

900.0

224.5

24/11/2014

26/11/2018

Infrastructure

10

Roads (Framework)

Cambridge

750.0

187.4

11/04/2016

11/04/2020

Infrastructure

11

2355 Houses/Flats/Schools/Commercial Units

Cambridge

176.6

164.5

09/11/2015

05/12/2016

New Housing

12

2202 Residential & Commercial Units

Uttlesford

142.3

132.2

01/08/2014

29/08/2015

New Housing

13

Energy Park

Peterborough

360.0

120.3

24/08/2015

20/08/2018

Infrastructure

14

4,005 Residential/Commercial Units

Cambridge

500.0

105.6

29/09/2011

23/06/2016

Private Commercial

15

1505 Houses/Flats/Student

Cambridge

112.9

104.8

22/07/2015

18/08/2016

New Housing

Accommodation/Commercial Units

16

Capital Works (Framework)

Colchester

400.0

99.9

30/09/2015

30/09/2019

Public Non-housing

17

Hospital Redevelopment

Cambridge

120.0

89.4

15/07/2015

16/11/2016

Public Non-housing

18

5 Research & Development Buildings

Cambridge

67.2

88.2

30/04/2016

02/02/2017

Private Industrial

22

New Anglia LEP

Construction Labour Research

February 2016

19

Airport (Refurbishment)

Uttlesford

80.0

80.0

01/10/2014

01/10/2015

Infrastructure

20

Offshore Wind Farm

East Lindsey

400.0

80.0

02/01/2017

02/01/2022

Infrastructure

21

1038 Residential/Care

Maldon

77.9

72.3

15/07/2016

12/08/2017

New Housing

Home/School/Commercial Units

22

3200 Residential Units & Commercial Land

Huntingdonshire

600.0

72.0

16/11/2015

16/03/2024

New Housing

23

5 Warehouse & Distribution Units

Peterborough

140.0

70.2

17/08/2015

14/08/2017

Private Industrial

24

1000 Houses/Flats & 3 School/Industrial &

Maldon

75.2

69.9

28/01/2016

24/02/2017

New Housing

Local Centre

25

900 Houses/Flats

South Holland

67.5

62.7

28/08/2015

24/09/2016

New Housing

26

Solar Photovoltaic Farm

North Kesteven

48.0

62.6

13/03/2017

18/12/2017

Infrastructure

27

Hospital

Cambridge

165.0

56.6

30/03/2015

26/02/2018

Public Non-housing

28

208 Houses/Flats

Cambridge

60.0

55.9

10/08/2015

05/09/2016

New Housing

29

800 Homes & 6 Commercial Units

Uttlesford

60.3

55.7

01/06/2016

01/07/2017

Private Commercial

30

233 Residential/Commercial Units

North Kesteven

55.0

55.2

04/01/2016

02/01/2017

New Housing

(New/Conversion)

31

Housing (External Works Programme)

Harlow

55.0

54.8

01/06/2015

01/06/2016

New Housing

32

Power Station (Expansion)

South Holland

160.0

53.5

01/07/2020

28/06/2023

Infrastructure

33

18 Industrial/Office/Distribution & Storage

Braintree

28.2

53.1

06/04/2016

17/10/2016

Private Industrial

Units

34

3,500 Homes, Commercial Units & 3 Schools

Cambridge

262.8

52.5

08/11/2016

09/11/2021

Private Commercial

35

750 Houses/Flats & 1 School/1 Enterprise

Braintree

56.4

52.4

16/06/2016

14/07/2017

New Housing

Centre

36

Shopping Centre (Extension/Refurbishment)

Peterborough

30.0

51.9

14/08/2016

13/03/2017

Private Commercial

37

Junction (Improvements)

Chelmsford

30.0

51.7

08/12/2014

08/07/2015

Infrastructure

38

Trunk Road (Dualling)

Colchester

203.0

50.7

04/05/2020

04/05/2024

Infrastructure

23

New Anglia LEP

Construction Labour Research

February 2016

39

Contractors Framework Agreement

Basildon

200.0

50.1

01/09/2014

27/08/2018

New Housing

40

Bypass

Lincoln

100.0

50.1

15/02/2016

12/02/2018

Infrastructure

41

Multi Storey Car Park

Uttlesford

48.9

48.9

11/07/2016

11/07/2017

Infrastructure

42

Key Worker Accommodation

Huntingdonshire

60.0

48.0

18/01/2016

18/04/2017

New Housing

43

Industrial & Commercial Development

Castle Point

22.7

42.6

04/11/2015

16/05/2016

Private Industrial

24

New Anglia LEP

Construction Labour Research

February 2016

Summary of demand

The analysis of the labour demand arising from the development spend in the New Anglia LEP peaks

at around 39,000 people in 2016. The tail off beyond this point is not likely to represent an actual drop

off in construction activity but reflects projects that have not yet been identified. It should also be

noted that these figures only represent the developments that are included in Glenigan, which will

not necessarily capture all of the construction activity. To project forward this cliff edge in construction

activity we have produced an indication of how construction activity in the region (East of England) as

a whole is forecast to change over the next five years. This shows a constantly increasing construction

spend and activity rising to almost 40,000 by 2019. The labour demand is split in roughly equal

proportions between Norfolk and Suffolk.

In the short-term, construction activity in the area is dominated by housing, with public non-

residential and infrastructure activity also comprising significant parts of the total spend, the latter

mostly owing to offshore wind installations in Norfolk. The largest occupational group is wood trades

and interior fit out, with a large labour demand arising from non-manual occupations.

The analysis was extended to include the work planned for Sizewell C Nuclear New Build, commencing

in 2021. The demand figures from NESA were used for the analysis and superimposed on the demand

in the East of England region, assuming that for the years beyond 2019, a steady yearly increase of

1.4% will be observed in the employment, equal to the average yearly increase for the period 2015-

2019 predicted by the CSN. It shows that across the two counties the peak demand at Sizewell

accounts for up to almost 10% of the rest of the workload. Should there be any changes in timescales

to the works then the increased demand will be delayed.

By supplementing the Glenigan pipeline with the data provided by the projections of non-Glenigan

new build and R&M work, we were able to produce a labour demand analysis that represented the

wider construction work taking place within the New Anglia LEP area in the period 2015-2019

incorporating the projected growth of the sector. According to these projections, the total labour

demand will rise to a number of around 98,700 people in 2019.

25

New Anglia LEP

Construction Labour Research

February 2016

A picture of supply

When looking at the supply of workers there are two main elements to consider: the size of the current

workforce and the existing amount of training.

The first element of this section takes a view on the current employment levels for the New Anglia

LEP, how this is made up from the local authorities of Norfolk and Suffolk, and then how this relates

to overall employment across the East of England Region͘ Data from CITB’s Construction Skills Network

is used along with official Government sources.

For the second section, while training occurs at Further Education (FE) and Higher Education (HE)

levels, the focus will be on FE that takes place in the New Anglia LEP and wider East of England Region.

FE tends to be sourced and delivered in a closer proximity to home and workplace, whereas the length

of study time and specialisms for Universities for HE can give greater degrees of mobility.

The demand forecasts can then be compared against employment, training and workforce mobility to

give an indication of possible gaps and/or occupational pinch points.

Main points

Current construction workforce estimates for the East of England are just over 247,000

workers.

New nglia LEP accounts for 24% of the East’s current construction employment (approx͘

59,500 workers).

Within the LEP construction employment is fairly evenly spread between the counties of

Norfolk and Suffolk (25,700 in Norfolk and 23,400 in Suffolk).

Construction businesses are also fairly evenly split between Norfolk and Suffolk with 3,885 in

Norfolk and 3,485 in Suffolk, and the size profile of these employers is the same across both

counties with the overwhelming majority (over 93%) being micro sized companies (0-9

employees) in both.

There were just under 5,600 Construction and Building Services Engineering learning aims

delivered in the LEP area, accounting for 6.5% of the total number of learning aims in

2012/139.

Twenty-eight training providers delivered construction relevant FE courses within the LEP

area, with the six main providers delivering almost two-thirds (64%) of all FE Construction and

Building Services Engineering learning.

9 Note: a leaner can have multiple learning aims depending upon the nature of the course learning.

26

New Anglia LEP

Construction Labour Research

February 2016

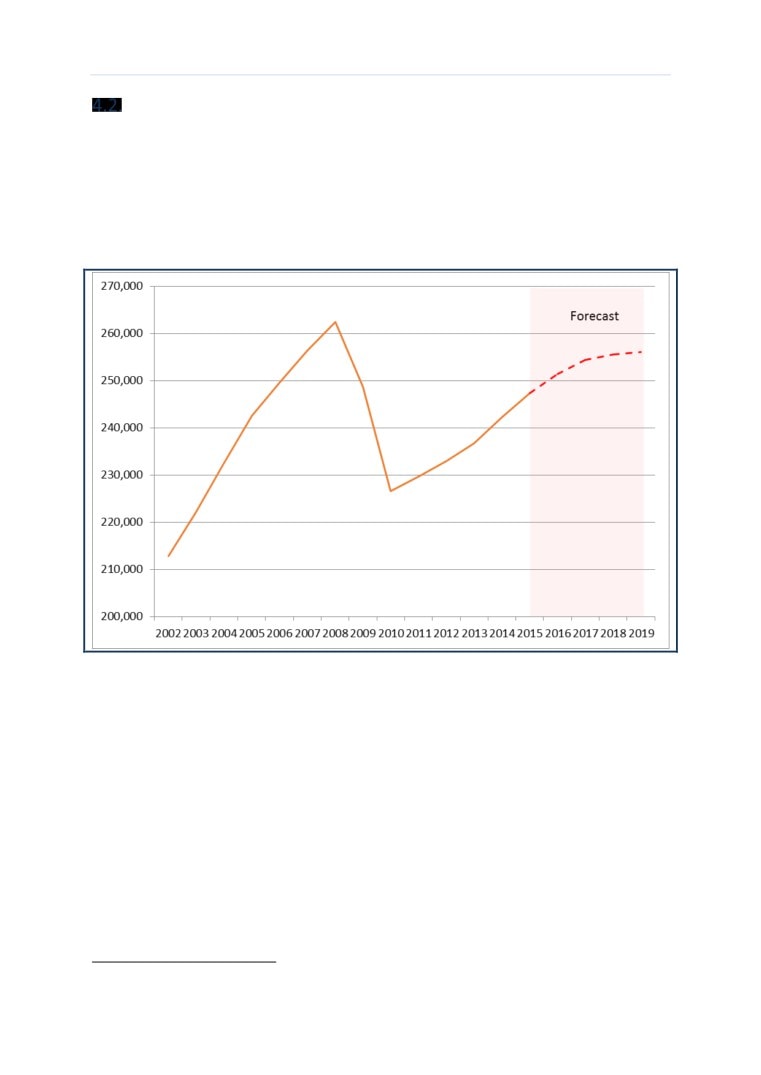

Existing workforce

Construction employment across the UK suffered significant declines during the recent recession, and

the East was no exception as shown in Figure 7 below. Employment in the region increased steadily

from just under 213,000 in 2002 to over 262,000 2008. The recession saw a steep fall in this figure to

a low of 226,600 workers two years later in 2010 before beginning to recover. By 2014 the number of

construction workers in the region had climbed to over 242,250, and the current CSN forecast is for

continued employment growth to just over 256,000 in 2019, although this will still be below its 2008

peak.

Figure 7: Construction employment in the East of England: 2002-2019 (Source: Experian & CITB)

An analysis of the Annual Population Survey10 gives an indication of the share of Eastern England’s

construction workforce located in the LEP. The latest data shows that the LEP area accounts for 24%

of regional construction employment, Table 11 below shows what this means for total employment

at occupational and industry level in the LEP region.

10 ONS/NOMIS (2015) Annual Population Survey workplace analysis by industry Jan-14 to Dec-14.

27

New Anglia LEP

Construction Labour Research

February 2016

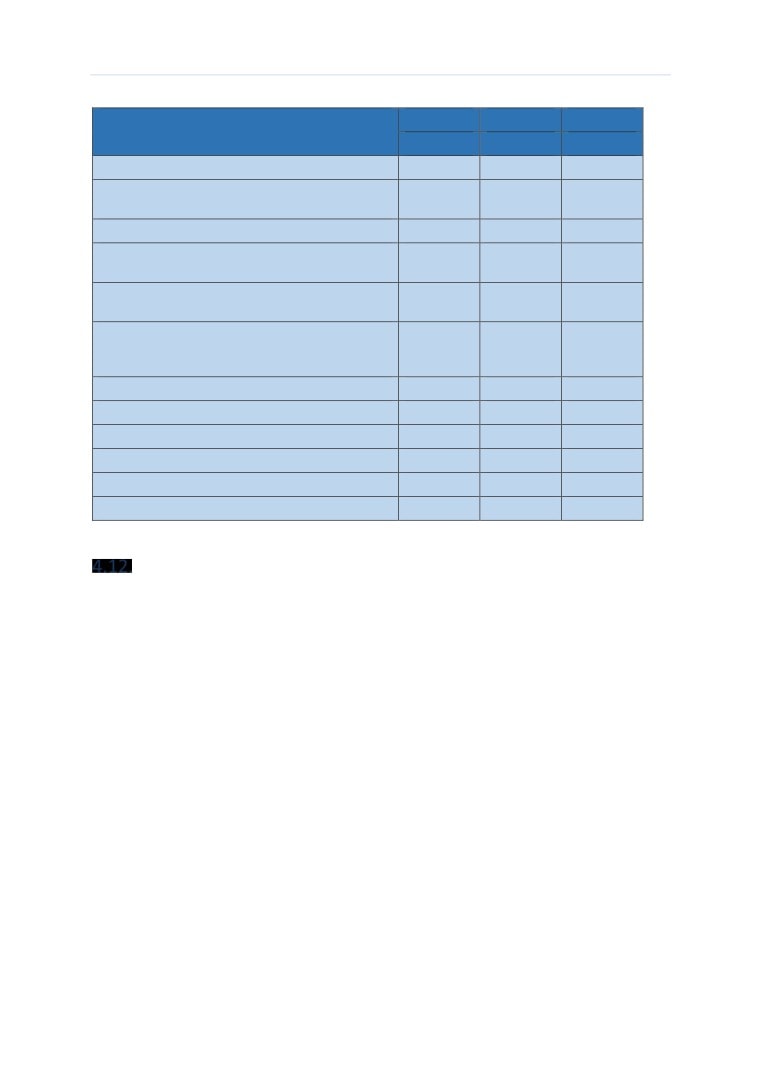

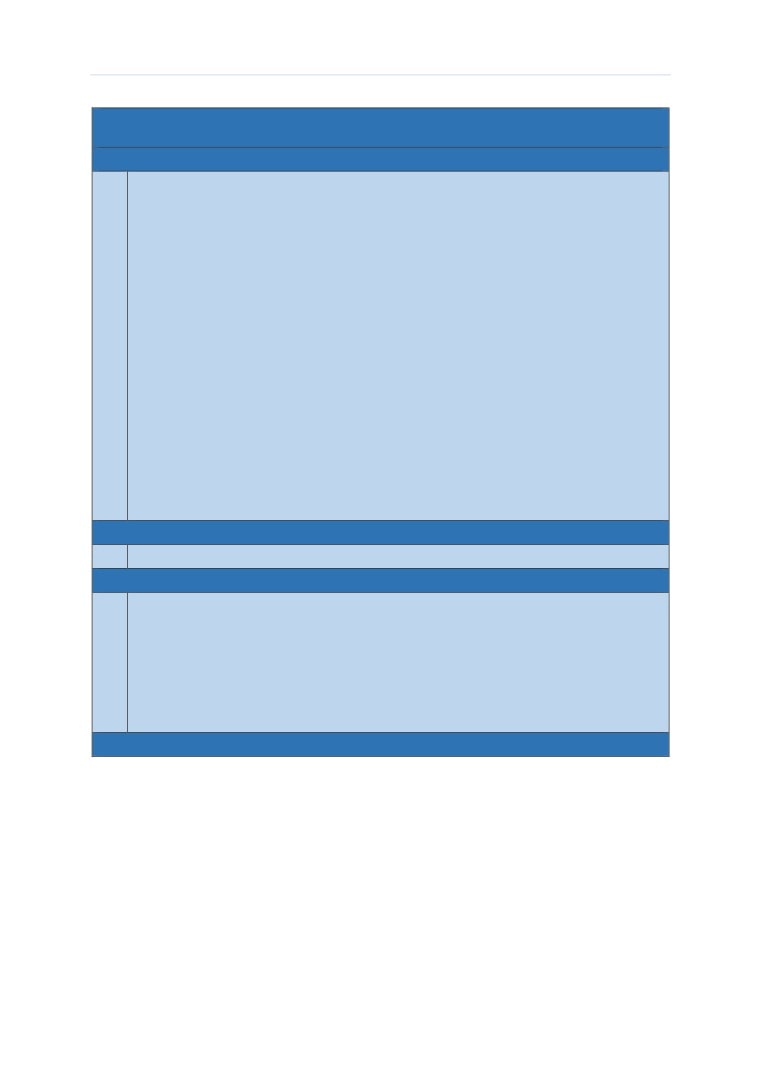

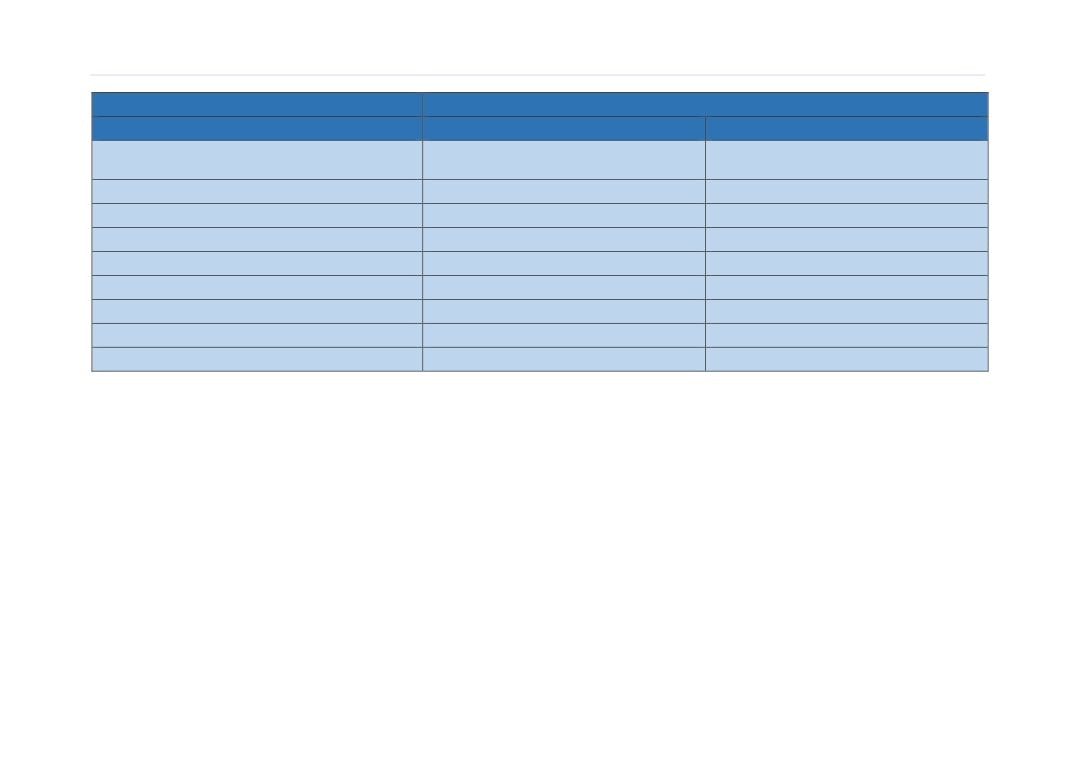

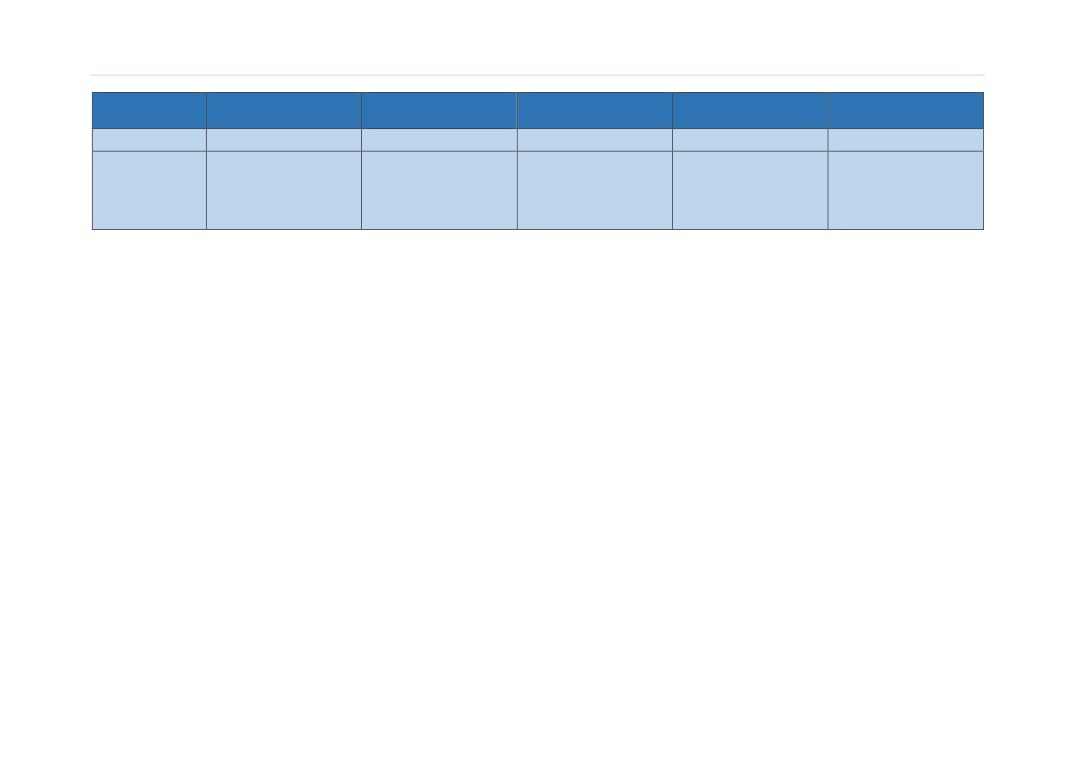

Table 11: Construction occupational breakdown, 2015 (Source Experian & CITB)

New Anglia

East of

Occupation

LEP

England

Senior, executive, and business process managers

3,370

14,050

Construction project managers

1,100

4,590

Other construction process managers

3,990

16,610

Non-construction professional, technical, IT, and other office-based staff

8,450

35,200

Construction trades supervisors

1,380

5,730

Wood trades and interior fit-out

5,970

24,870

Bricklayers

1,940

8,090

Building envelope specialists

2,470

10,280

Painters and decorators

2,450

10,210

Plasterers

1,340

5,590

Roofers

940

3,920

Floorers

860

3,580

Glaziers

680

2,830

Specialist building operatives nec*

970

4,050

Scaffolders

650

2,700

Plant operatives

850

3,550

Plant mechanics/fitters

670

2,780

Steel erectors/structural fabrication

460

1,920

Labourers nec*

2,850

11,890

Electrical trades and installation

4,650

19,360

Plumbing and HVAC Trades

3,800

15,820

Logistics

720

3,020

Civil engineering operatives nec*

260

1,100

Non-construction operatives

390

1,620

Civil engineers

1,760

7,350

Other construction professionals and technical staff

3,930

16,380

Architects

1,280

5,330

Surveyors

1,190

4,950

Total

59,380

247,370

*nec - not elsewhere classified

Sub-regional analysis shows that in the New Anglia LEP area the construction workforce is more or

less evenly split between Norfolk and Suffolk (52% and 48% respectively), although there is

considerable difference in the levels of self-employment between Norfolk and Suffolk with over half

28

New Anglia LEP

Construction Labour Research

February 2016

the construction workforce in Norfolk being self-employed (51%) while just over one-third (35%) of

the Suffolk workforce is self-employed.

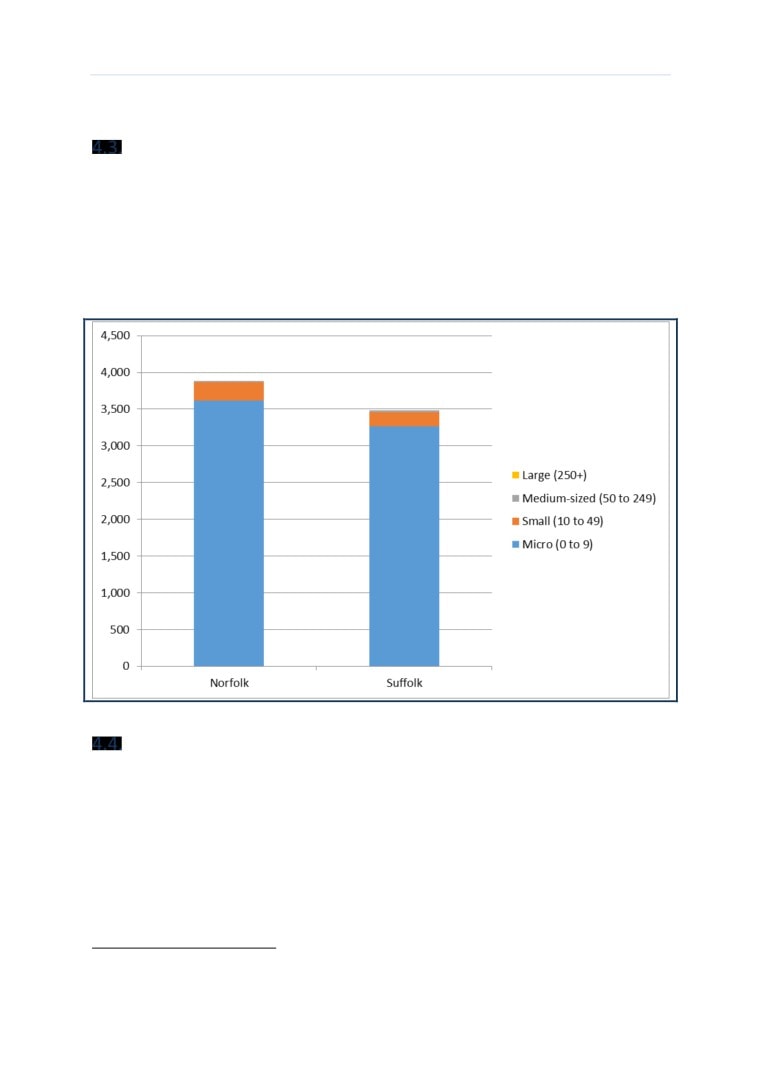

Employer Structure

Analysis of construction firms reveals that just under a quarter (23%) of all construction firms within

Eastern England are located in the LEP area. As with employment, the number of employers are fairly

evenly split between Norfolk and Suffolk (53% and 47% respectively).

Overall the pattern of firm size is similar in each county, as shown in Figure 8, with just over 93% of

firms being micro (employing fewer than 10 people). There are five large employers (with more than

250 employees) in the New Anglia LEP area, although the numbers are too small to identify them any

further than this.

Figure 8: Construction firms by size, 2014 (Source: ONS/NOMIS)

Training provision

In terms of delivering skills to the construction workforce, further education providers play a

significant role in equipping people with vocational skills for all sectors of UK business, and for

construction in particular.

Data available at local authority level produced by the Skills Funding Agency11 shows that in Further

Education learner volumes, Norfolk and Suffolk accounted for just under 69,840 learners which

represents 25% of total provision in the East of England (all learners, all sectors).

11 Skills Funding Agency (2014) Overall FE and Skills Participation by Level and Age and by Region, Local Education Authority

and Local Authority (2005/06 to 2013/14) - Learner Volumes.

29

New Anglia LEP

Construction Labour Research

February 2016

Although the number of learners can be identified, it is more difficult to identify training as this is

reported by learning aims, and not the number of learners; ‘learners’ generally refers to the number

of individuals who are funded in each year, while the term ‘learning aims’ refers to the number of

discreet pieces of learning that are funded. It is possible for an individual to complete multiple learning

aims in each year, with each aim having some level of funding against it.

There are two main categories of learning aims relevant to the Construction Sector, Construction and

Building Services Engineering; together they accounted for almost 5,600 learning aims delivered in the

LEP area (Norfolk 2,980 and 6%; Suffolk 2,600 and 7%)12. This represents just over 6.5% of the total

number of learning aims across all sectors, and gives an indication of how construction training fits

within the overall FE provision which is lower than the 8% share that construction has for total

employment in the New Anglia LEP area.

Data from the Skills Funding Agency13 identified 28 training providers delivering FE and skills

Construction and Building Services Engineering learning at all levels across the LEP area, with the six

main providers being responsible for almost two-thirds of construction training, these are:

Peopleplus (was A4E LTD)

City College, Norwich

West Suffolk College

The College of West Anglia

Lowestoft College

National Construction College, CITB

Six further providers (Easton and Otley College, Suffolk New College, Great Yarmouth College, Norfolk

Training Services Ltd, JTL, and Norfolk County Council) deliver training volumes of around 100 - 400

aims per year along with a wider number that deliver learning aim volumes of less than 50 aims per

year. Although not identified in the figures, there will also be providers delivering training at very low

volumes such as less than 10 learning aims per year.

Note the training will cover full and part time further education, apprenticeships and on-site

assessment for qualifications such as National Vocational Qualifications (NVQs) and QCF Diplomas and

Certificates.

Data available from the Skills Funding Agency do not allow identification of course level detail,

however the websites of the main training providers (links in Appendix G) indicate that there is a range

of courses on offer that would relate to the main occupations, while also covering some of the

technical and higher level skills that would be relevant to work currently underway in the LEP and

future planned projects.

12 NOMIS - 2012/13, recognised sectors, all levels, all ages

13 Skills Funding Agency (2014): 2012/13 FE and Skills learning aims by delivery in each Local Authority by Provider and level

These learning aims include Apprenticeships, Workplace Learning, Community Learning and Education and Training

provision taken at General Further Education Colleges (including Tertiary), Sixth Form Colleges, Specialist Colleges and

External Institutions.

30

New Anglia LEP

Construction Labour Research

February 2016

Mobility of the workforce

The construction workforce is highly mobile, with workers tending to move from project to project

which may mean working in other counties or regions (or even countries) from where they usually

live. To measure the extent of this movement of workers, CITB commissioned research (Workforce

Mobility and Skills in the UK Construction Sector 2015) to provide a reliable evidence base of the

nature of the construction workforce in the UK concerning its qualification levels and the extent of

occupational and geographic mobility to offer insight into where skills gaps might emerge as a result

of occupational/geographic movement. The research provides data at a regional level so that future

training interventions and the supply of job opportunities for local people can be understood.

Main points

More than a quarter of East of England construction workers have worked in the construction

industry for over 20 years (27%) and a total of more than half have worked in the industry for

at least 10 years (52%).

At the time of the research just over half of all construction workers in the East of England

were working in the same region/nation in which they were living in when they started their

construction career (55%).

The average (mean) distance from workers’ current residence (taking into account temporary

residences) to their current site was 27 miles (22 miles is the UK average).

Three quarters of all East of England construction workers are confident that when they finish

their current job their next job will allow them to travel to work from their permanent home

on a daily basis (76%).

Overall two-fifths of all construction workers have only worked on one project type (40%).

Amongst construction workers under the age of 60 in the East of England, well over a third

(38%) believe they will definitely want to be working in the construction sector in five years’

time, a further third (33%) believe it is very likely they will, and 10% believe it is quite likely

they will. In total over four-fifths of workers in the region aged under 60 believe that it is likely

they will still be working in construction in five years’ time͘

Work history

More than a quarter of East of England construction workers have worked in the construction industry

for over 20 years (27%) and a total of more than half have worked in the industry for at least 10 years

(52%).

The most likely reason for employees working in the East of England region is because their employers

sent them there (50% of all workers), this compares to just 36% for the UK as a whole, suggesting a

greater reliance on workers from other regions than may be typical in other parts of the UK. Just over

two-fifths (43%) of workers in the East state that they work in the region because they grew up there,

this compares to 55% across the whole of the UK.

In terms of the regions/nations in which workers’ current employer operates, around two-thirds (67%)

of workers in the East of England reported that their employer operated within the region they were

currently working in (the second lowest figure in the UK after the South East at 65%), while 27%

operated in London, 23% in the South East and 16% in the East Midlands, as shown in Appendix H.

These figures suggest the workforce in the East is more transitory that might be expected in other

regions.

31

New Anglia LEP

Construction Labour Research

February 2016

Worker origins

Workers were asked which region/nation they were living in just before they got their first job in

construction in the UK. Overall just over half of all construction workers in the East of England were

working in the same region/nation in which they were living in when they started their construction

career (55%) the same as for the South East and slightly higher than London at 50%. Workers currently

based in the East of England, therefore, are among the least likely to have remained in the same

region/nation in which they were based for their first construction job.

In addition, only half of the construction workers in the East of England (50%) have remained in the

same region/nation as they did their first qualification/training in. This is the lowest proportion of all

the regions/nations in the UK, meaning that workers in the East are the most mobile. Among other

regions/nations, the figure ranges from 55% of workers in the South East remaining in the area where

they took their first qualification to 96% in Northern Ireland.

Travel to site

Almost two-thirds (63%) of construction workers in the East of England have their current residence

in the region, with 37% travelling into the region for work from another region/nation in which their

current residence is based. Only the South East had a higher figure for inward travel to work with 42%

of workers living outside the region. At the time of the survey 12% of construction workers in the East

had travelled into the region from the East Midlands, and a further 12% had travelled in from London.

Workers in the East were asked to indicate the furthest distance they have worked from their

permanent or current home in the last 12 months. Figure 9 shows that 1 in 8 construction workers

have worked no more than 20 miles away (12%) and a further third have worked between 21 and 50

miles away (34%). This leaves more than half that have worked more than 50 miles away from their

permanent home (52%), with more than a quarter that have worked between 51 and 100 miles away

(29%). Just under a quarter of construction workers in the East that have worked more than 100 miles

away (23%) which is about average for the UK.

32

New Anglia LEP

Construction Labour Research

February 2016

40%

35%

30%

25%

20%

15%

10%

5%

0%

0-20 miles

21-50 miles

51-100 miles

100+ miles

Figure 9: Furthest distance worked in past 12 months (CITB, 2015)

Site duration and change

In order to get a measure of workplace stability, workers were asked to indicate how long in total they

expect to work at that specific site during this phase.

Three in ten construction workers in the East of England (30%) do not expect to work on that site for

more than a month, including 7% that only expect to be there for about a week or less. About 4 in 10

anticipated being on site for more than a month, but less than a year (39%), while one in eight expects

to stay on that site for a year or longer (13%). In just under 1 in 5 cases (18%) workers did not know

how much longer they could expect to be on site, indicating that a significant minority of temporary

workers are living with a certain amount of uncertainty and insecurity.

Three quarters of all construction workers in the East of England are confident that when they finish

this job they will get a job that allows them to travel from their permanent home to work on a daily

basis (70%).

Sub-sector and sector mobility

All workers were asked which of six types of construction work (New Housing, Housing Repair and

Maintenance, Commercial, Private Industrial, Public Non-Housing, or Infrastructure) they have spent

periods of at least three months at a time working in (Table 12).

Overall two fifths of all construction workers have only worked on one project type (40%), compared

with a fifth in 2012 (19%), which again suggests a pattern of increased stability in the sector.

33

New Anglia LEP

Construction Labour Research

February 2016

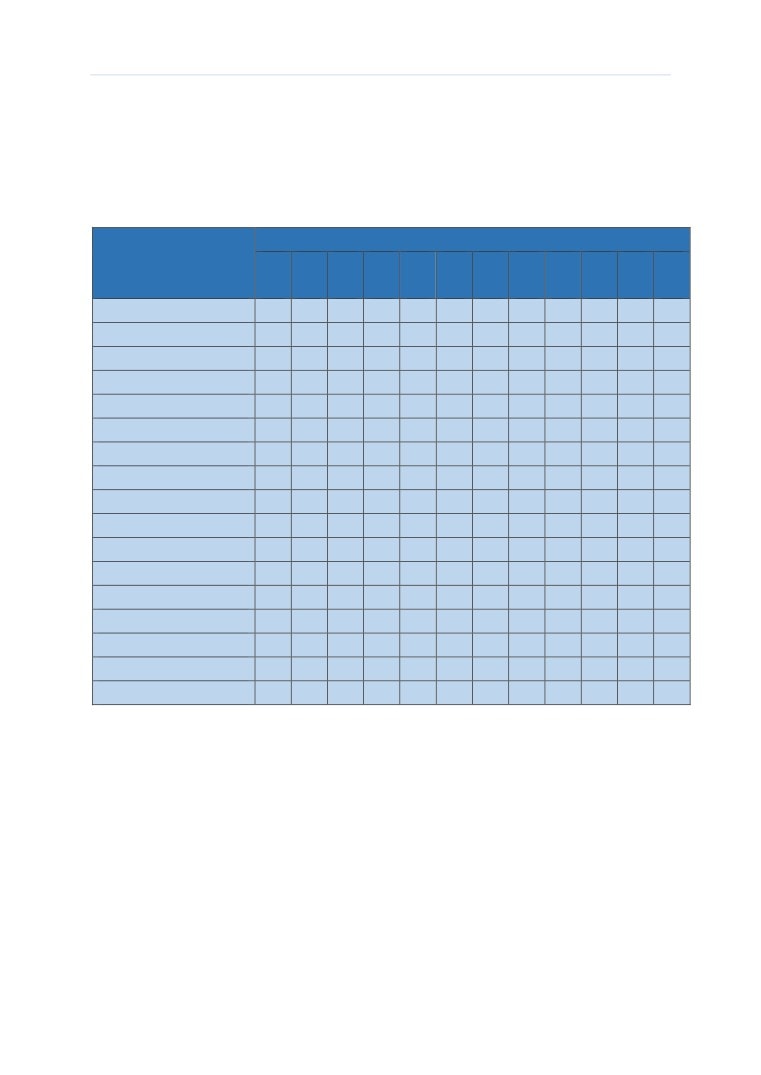

Table 12: Type of projects spent significant periods on (CITB, 2015)

EE 2015

EE 2012

UK 2015

%

%

%

New housing

77

80

83

Housing repair and maintenance including

36

47

36

extensions/loft conversions

Commercial work such as shops, office, pubs etc

39

61

35

Private industrial work such as factories, warehousing,

36

57

30

mechanical engineering, land reclamation

Public non-housing work such as schools, sports

39

68

33

facilities, landscaping

Infrastructure building projects, such as

road/rail/airport, sewerage/water treatment, power

23

35

21

stations

ONE TYPE ONLY

40

19

48

TWO TYPES

18

13

14

THREE TYPES

11

15

11

FOUR TYPES

10

16

8

FIVE TYPES

8

20

9

SIX TYPES

11

15

9

Leaving the sector

In order to assess the potential outflow from the sector in the next five years (based on workers’

preferences), all workers were asked how likely it is that in 5 years’ time they will still want to be

working in construction. Excluding those aged 60 and over (as those over 60 may be assumed to be

considering retirement in the next five years): 38% believe they will definitely want to be working in

the construction sector, 33% believe it is very likely they will want to be working in the construction

sector and 10% believe it is quite likely they will want to be working in the construction sector, a total

of 81%. Only 5% think that they will not want to be working in the construction sector in five years’

time which is less than in 2012 (18%).

Overall the findings from the Mobility survey indicate that the East of England has one of the most

mobile construction workforces in the UK. There is evidence of a high degree of movement between

neighbouring regions, (specifically nearly one-quarter of the workforce is from either the East

Midlands or London).

34

New Anglia LEP

Construction Labour Research

February 2016

Demand against supply

Main points

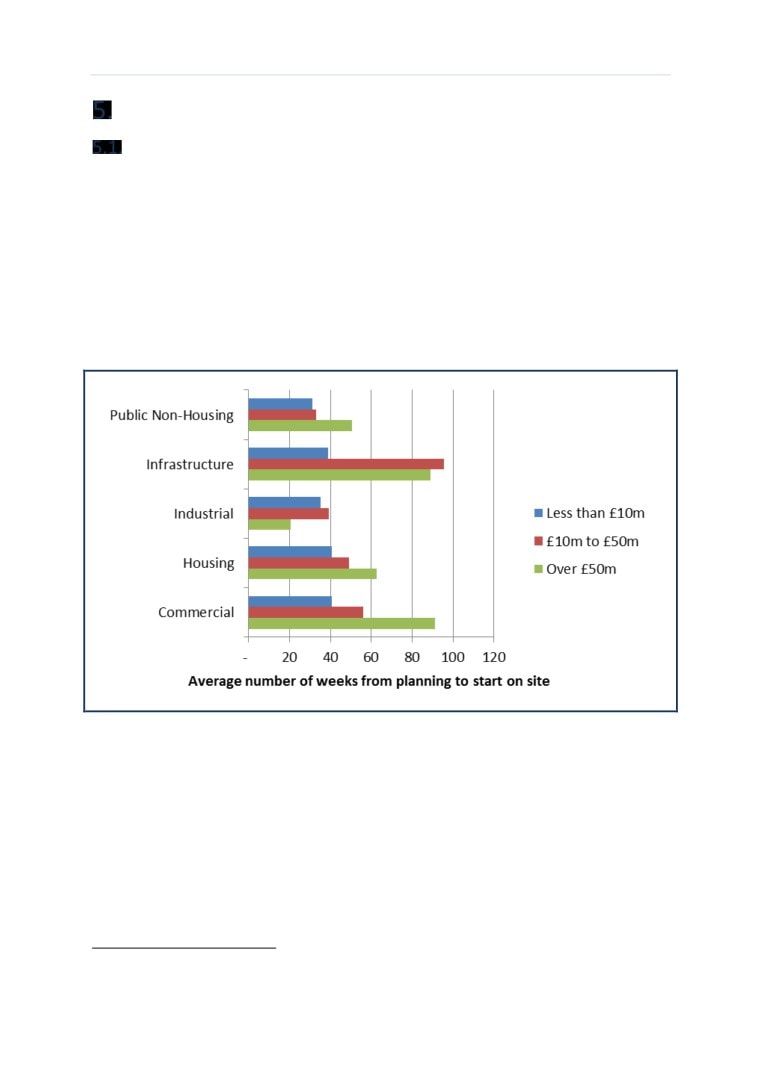

Before looking at demand against supply, it should be noted that the Glenigan dataset used to produce

the demand view is based on projects that are picked up at various stages of the planning process. As