Enabling Growth in the

New Anglia AgriFood Tech

Sector through Skills

Development

2017-‘25

New Anglia LEP Sector Skills Plan - AgriFood Tech

Submitted to the New Anglia Food, Drink &

Agriculture Board in September 2017

Page 2

New Anglia LEP

AgriFood Tech Sector Skills Plan, Sept 2017

Contents

Introduction

3

Executive summary

4

1. The AgriFood Tech Sector in the New Anglia LEP area

5

2. Employment

6

3. Current Skills and Training Provision

7

a)

Centres and courses

7

b)

Numbers Trained

8

c)

Anticipated Changes in Skills Provision

9

4. Skills Supply Challenges

10

a)

Labour Substitution Through Automation

11

b)

Meeting Existing Skills Shortages in Industry

12

c)

Meeting the Demand for Research and Development Staff

12

d)

Young People and Progression

13

e)

Attracting Talent to the Industry

14

f)

Meeting the Demand for Trainers and Academics

14

5. Future Skill Needs

16

a)

Anticipated Trends in the Key Determinants of Future Skills Demand

16

b)

Projections for Future Skills Needs

16

c)

Immediate Pressures

17

d)

Other Future Skills Supply Challenges

18

6. Sector Skills Plan Delivery

19

a)

Priorities for Action

19

b)

Proposed Future Skills Interventions

20

Appendix 1 - AgriFood Tech definition

26

Appendix 2 - Consultees

28

Appendix 3 - The AgriFood Tech Sector in the New Anglia LEP area

30

Appendix 4 - Current employment

34

Appendix 5 - Links to Other Sector Skills Plans

37

Appendix 6 - The Datapack

39

Page 3

New Anglia LEP

AgriFood Tech Sector Skills Plan, Sept 2017

Introduction

The food chain from farm to fork is the largest manufacturing sector in the New Anglia region

and generates more GVA and jobs than any other sector. It is also the largest

manufacturing sector nationally and internationally and within both the national and

international context, New Anglia is seen as a leader, with progressive companies, world

class supply chains and the largest research concentration in Europe.

This sector skills plan is focused on how the industry and employers, working with the LEP

and skills providers, can ensure that the sector has the skills needed for future success.

As an international sector, the food chain will be impacted by the UK’s decision to exit the

EU, but I am sure we can rise to the challenges this presents and the opportunities which

this will offer. One thing is for certain, we will only succeed if we are competitive and, in

delivering competitiveness, arguably nothing is a critical as the skills and expertise of our

workforce.

Recent years have seen an increased focus on the role of new technology in delivering a

competitive food chain, from the launch of the UK Strategy for Agricultural Technologies, to

increased investment by industry in research and innovation and a growth in both UK and

EU innovation funding. In New Anglia we have a world leading research base which is

increasingly well connected to the industries it serves both at home and abroad.

We could have developed separate sector skills plans for agriculture, the food chain and the

technology base which underpins the food chain. However, given the interdependence of

agriculture and food companies and the role which technology plays in both, the New Anglia

Food, Drink and Agriculture Board was determined that we would see the challenge as a

holistic one, which embraced the whole food chain and which was driven by the need to

innovate and embrace technology. I hope you agree that a sector skills plan focused on

‘AgriFood Tech’ rises to this challenge.

I want to stress one very important aspect of the Plan. Whilst the LEP and County Councils

have helped lead the process to develop the Plan, which I am very grateful to them for

doing, it is not their plan: the Plan belongs to the industry and it essential that employers are

prepared to play a full role in delivering the priority actions it identifies. We cannot expect

the LEP, Councils or skills providers to address the future skills needs of the industry alone.

Unless employers are prepared to invest in skills and help to steer future skills provision we

will not be able to deliver the skills needed. So, in closing I want to encourage you all to

work with us to meet the skills challenge.

Doug Field

East of England Co-Op & Chair of the New Anglia Food, Drink & Agriculture (FDA) Board

Acknowledgements

The FDA Board & New Anglia LEP wish to thank the employers, providers and stakeholders

who contributed to the plan by attending events, being interviewed or by responding to the

consultation. The sector skills plan was developed in spring 2017 by SkillsReach.

Page 4

New Anglia LEP

AgriFood Tech Sector Skills Plan, Sept 2017

Executive summary

The food chain is the world’s largest sector and one which is growing at a compound growth

rate of 6%. New Anglia is a UK leader in this sector and has world-leading research centres

which are supporting the technology led growth of the industry. The challenges of meeting

the needs of a growing and increasingly wealthy population is also requiring agriculture and

the food chain to reduce its environmental impact.

This sector skills plan deals with the skills needed both in the existing workforce and

amongst new recruits to rise to this challenge. It also prioritises the skills needed not only in

agriculture and food production, but also the skills needed by the technology businesses

which support the industry and the research base which drives innovation.

The New Anglia AgriFood Tech sector (excluding food retail and catering) generated 7% of

the area’s GVA and employed 50,000 staff or 7.4% of the workforce, double the national

average. It also accounts for 10.8% of all businesses in the LEP area. However, whilst

nationally the sector has grown since 2010 by 5%, in New Anglia employment has fallen by

3%, whereas neighbouring LEP areas to the north and south have both seen growth of +5%

and +7% respectively. The sector skills plan must therefore focus on driving growth.

Meeting the growth challenge through skills supply is made more challenging by major

strategic changes such as Brexit, increases in wage levels and restrictions on labour supply.

New technology and specifically data, sensors and automation (Industry 4.0), is likely to

have a major impact on the industry and will require new skills amongst the existing

workforce and new recruits as ways of working change. Securing the tutors,lecturers and

assessors needed to facilitate this transition will also be a challenge.

Locally the skills system is good at meeting FE and postgraduate training needs, but has a

significant deficit in undergraduate skills provision. This is very relevant to future sector

growth as forecasts show that the proportion of sector staff employed in elementary

occupations has already fallen from 26% in 2004 to 15% in 2014, with a further fall to 13%

predicted by 2024. In contrast the proportion in skilled trades has risen from 40% in 2004 to

58% in 2014 and is expected to reach 59% by 2024. The projections also suggest that the

largest demand for new staff, 6,700 over the period 2014-’24, will be for those qualified to

QCF4-6, the level at which the New Anglia area has very little training provision currently.

The proposed skills interventions are to establish a New Anglia AgriFood Tech Skills Group,

which initially facilities five targeted skills actions, to:

Co-ordinate Sector Careers Promotion;

Develop New Progression Routes to Higher Education in AgriFood Tech;

Develop a new Higher Education Centre to Meet the Shortfall in Technical Higher

Education in the Industry;

Develop the Supply of Trainers to Meet the Needs of the AgriFood Tech Sector;

Develop a Workforce Development Programme to Equip the Sector with the Skills

Needed for Growth.

Page 5

New Anglia LEP

AgriFood Tech Sector Skills Plan, Sept 2017

1.

The AgriFood Tech Sector in the New Anglia LEP area

The food chain is the largest manufacturing sector in the world, UK and New Anglia

region. New Anglia is arguably the most productive farming region in the UK, with the

most profitable farms, a dynamic food chain and the largest concentration of agri-food

research in Europe.

New Anglia’s agriculture has a turnover of £1.65billion.in 2013, 14% of all employees in

the LEP area worked in the food and drink supply chain.

The New Anglia AgriFood Tech sector had exports of £479m in 2015, with £300m going

to the EU and £179m elsewhere. At 17% of the exports in New Anglia the sector is more

important to exports than in any comparator LEP area.

The New Anglia AgriFood Tech sector contains 7,875 companies. Over the period 2010-

’16, the number of business units in New Anglia has grown by 7.4% although this is a

slower growth rate in business unit numbers than seen in comparator LEPs or the much

larger increase seen nationally (+13.3%).

New Anglia has an internationally significant concentration of research and development

in both agriculture and food. This research base is also a significant provider of post

graduate training with a global reputation and creates a significant market for those with

higher level skills and qualifications.

The strength and breadth of the research base is built on a highly skilled, global

workforce and attracted to Norfolk and Suffolk by the global reputation of centres such as

the John Innes Centre.

A more detailed analysis of the sector is provided in Appendices 1 and 3.

Page 6

New Anglia LEP

AgriFood Tech Sector Skills Plan, Sept 2017

2.

Employment

AgriFood Tech sector jobs are not evenly distributed across the New Anglia area. The

sector is much more important in the rural districts with over 10% of the workforce in

every rural district, but it accounts for less than 2.5% in all three major urban districts of

Norwich, Ipswich and Great Yarmouth.

The AgriFood Tech sector workforce is dominated by employment in agricultural

production (46% of the workforce) and food processing (35%).

This skewing of the sector towards agricultural production adversely affects the sector’s

contribution to the economy. Recent data does, however, show that the sub-sectors with

the fastest growth rates in employment have been in processing and marketing.

In jobs terms, the AgriFood Tech sector has nearly double the importance in the area as

it has nationally.

Against New Anglia averages, many jobs in the AgriFood Tech sector compare well in

wage terms with production managers and directors achieving £57,155, scientists

£41,127, conservation professionals £34,980, farmers £28,079 and agricultural

machinery drivers £25,523. However, food manufacturing operatives at £19,807 and

elementary agricultural occupations at £19,776 had wages below the LEP average.

The sector has performed relatively poorly in the last 5 years with staff numbers falling

by 3%. This contrasts markedly with a 5% increase in employment across England and

a 5% increase in neighbouring Greater Lincolnshire and an increase of 7% in the South

East LEP area.

Clearly the national growth in the sector or that seen in neighbouring LEP areas has not

translated into growth in New Anglia. Locally the trend is more negative in Suffolk with

employment falling by 5% against a 1% fall in Norfolk.

The New Anglia AgriFood Tech sector has been recruiting internationally for many years,

whether to attract the best scientists to NRP, or to fill a shortfall in local labour supply for

production agriculture. The Food and Drink sector estimates that nationally over 25% of

the workforce are migrants. Anecdotally most larger food chain employers report that

over 35% of their workforce are currently drawn from overseas, with some putting the

figure at over 60% (both directly employed and via labour providers).

A more detailed analysis of current employment is provided in Appendix 4.

Page 7

New Anglia LEP

AgriFood Tech Sector Skills Plan, Sept 2017

3.

Current Skills and Training Provision

a)

Centres and courses

The provision of New Anglia skills and training for the AgriFood Tech sector includes:

Easton and Otley College, which is the largest provider locally to this sector with

predominantly FE provision, a turnover of just over £20m and 6,000 students

across full and part time provision. It is also active in schools provision and has a

small (circa 200) HE student cohort. It operates two campuses at Easton near

Norwich and Otley near Ipswich.

Poultec, based at Mattishall near Norwich is a specialist food sector training

provider which works nationally with 740 employers and which has 1,000

apprentices and other learners and delivers up to L5. Originally focused on the

poultry sector, it has expanded into many other areas and has a good range of

provision with a focus on the meat and food sector.

UK Rural Skills operates nationally, but is based in Norfolk and works with

industry owned Rural Training Groups (most set up as Agricultural Training Board

groups) to provide tailored short courses and legislative training (e.g. spraying

certificates). It provides training to over 500 people in East Anglia each year.

Whilst UEA does not provide any specific agricultural degree courses it provides

a wide range of courses relevant to the industry, including those linked to plant

sciences, climate change, overseas development and the environment. In

conjunction with JIC it runs post graduate plant science courses and food and

nutrition with IFR and the University Hospital, making it one of the largest

postgraduate training centres in the UK supporting the food chain.

In addition to full cost workforce development courses provided by Rural Training

Groups and Colleges, the New Anglia area was a leader in the delivery of the

previous two Rural Development Programme for England skills programmes.

Landskills East was managed by Easton and Otley College as a regional 3 year

programme and UK Rural Skills, based in Norfolk, formerly ran one of 7 national

contracts for agricultural and forestry training under the Rural Development

Programme for England skills framework (which DEFRA are not currently operating).

It is currently unclear if and when DEFRA will restart these programmes.

Some local companies have also developed their own training provision to meet

specific gaps in provision or to address challenges in securing the staff needed. For

example Claas UK, based in Suffolk, has developed a 4 year bespoke Agricultural

Technician Apprenticeship with Reaseheath College in Cheshire and Barony College

near Dumfries. Also in the engineering sector, local John Deere Dealers including

Ben Burgess and Doubledays access the national training provision provided by

John Deere UK at Langar in Nottinghamshire. Just 2 miles outside the LEP area in

Wisbech, the largest independent agronomy company in the UK, Hutchinsons, has

established its own agronomy training centre to provide post graduate, professional

training to secure a supply of qualified agronomists.

Page 8

New Anglia LEP

AgriFood Tech Sector Skills Plan, Sept 2017

b)

Numbers Trained

The New Anglia AgriFood Tech sector has seen a growth in apprentices over the

period 2011/12 to 2014/15 from 505 to 665. Particular increases have been seen in

agriculture, up by 35, horticulture up by 30, food and drink up by 60 and land based

engineering up by 40 (from a zero start position).

Whilst both England (+80%) and the East of England (+50%) have seen an increase

in AgriFood Tech apprenticeships in the last decade, this trend has been much

stronger in the New Anglia area with apprentice numbers rising by nearly 150%.

The Edge Apprenticeships programme originally funded by UKCES with Anglia

Farmers, Fram Farmers and Easton and Otley College, helped to increase agri-

apprenticeship numbers by engaging new employers and additional students.

The learning from this programme has supported the development of the new

Trailblazer Apprenticeships for the sector; and the development of this skills plan

although the Edge Apprenticeship Programme is no longer active.

Nationally the number of HE students in agriculture and related subjects has

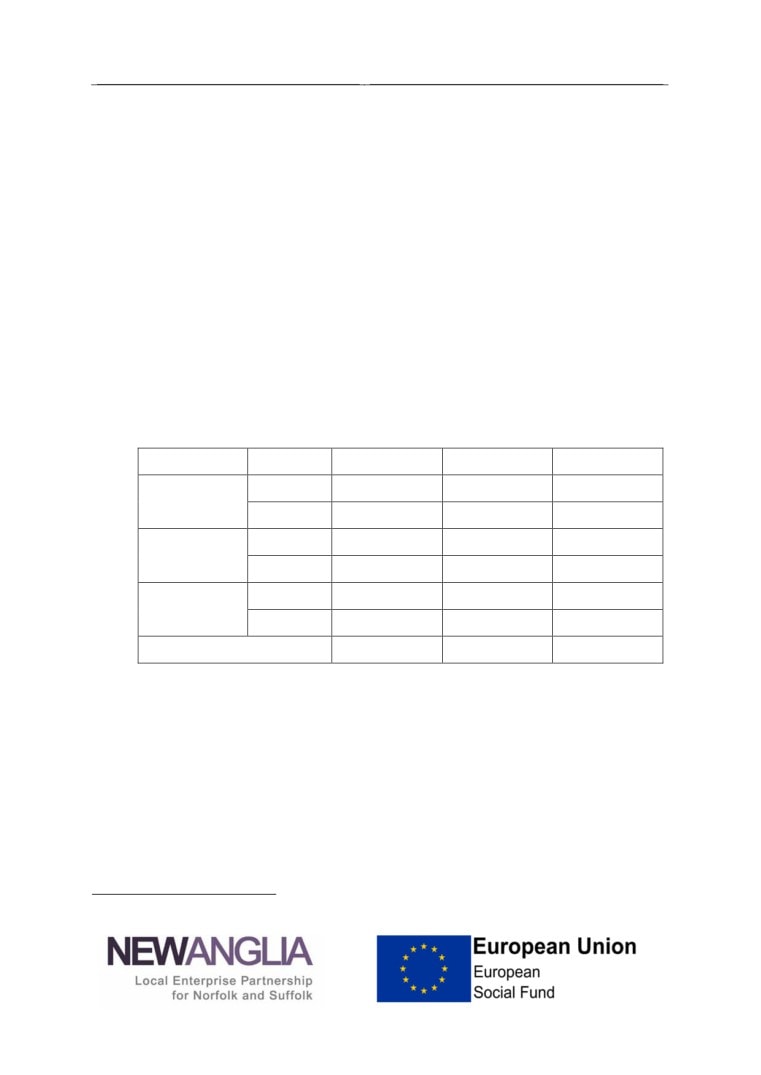

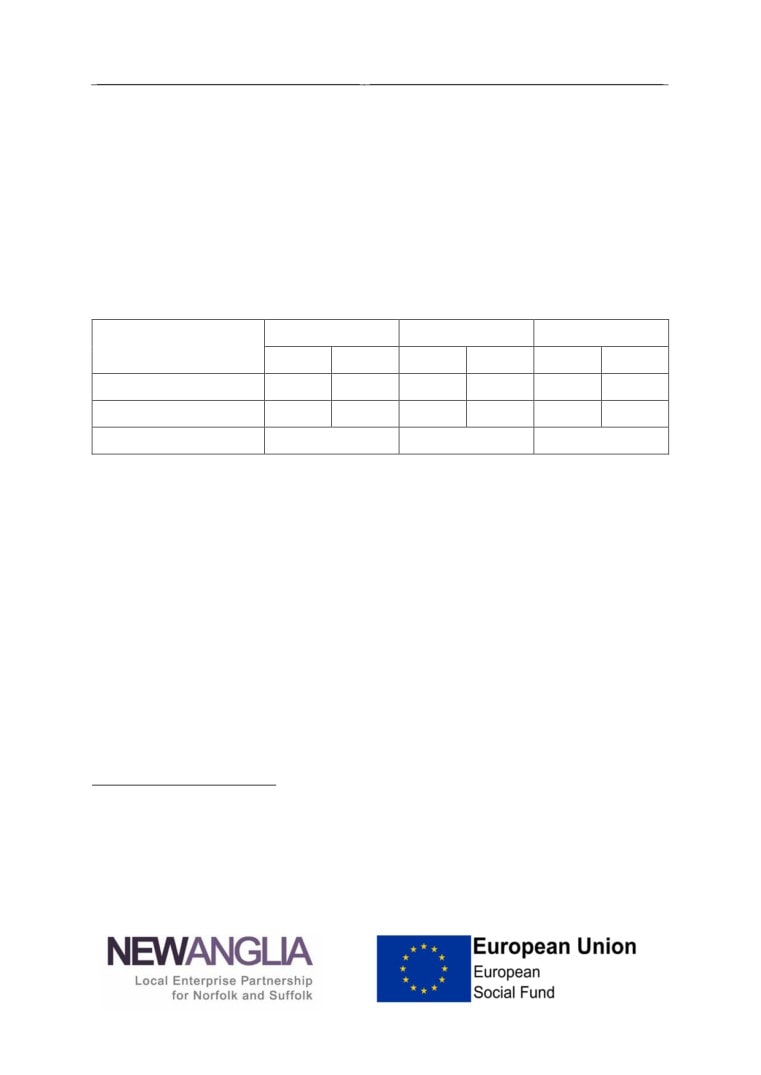

increased in the last decade, with HESA1 data showing the following trends:

2011/12

2015/16

5 year Trend

Postgraduate

Full time

1,340

1,795

+34%

Part time

850

1,635

+92%

First degree

Full time

6,305

9,280

+47%

Part time

360

305

-15%

Other HE

Full time

3,305

2,780

-16%

Part time

5,105

3,235

-37%

Total

17,280

19,025

+10%

New Anglia has a net outflow of students to access Higher Education across many

disciplines, with HEFCE data showing that whilst the outflow has fallen from over

10,500 in 2008-09 to 8,500 in 2013/14, it is still much higher than comparator LEP

areas. Over half of those who leave New Anglia to study went to London,

Cambridgeshire and Essex.

More specifically in the AgriFood Tech sector, there is a long standing flow of HE

students from New Anglia to specialist national land based providers such as Writtle

University College, Harper Adams University, Royal Agricultural University and other

Universities with significant agricultural provision such as Newcastle and Nottingham.

1 HESA, students by subject of study

Page 9

New Anglia LEP

AgriFood Tech Sector Skills Plan, Sept 2017

As well as developing additional local provision to reduce the outflow of students

from New Anglia, it was argued strongly by consultees that new high quality and

flexible provision for HE in AgriFood Tech should also seek to attract students from

other parts of the UK to come to New Anglia to study. Hopefully some of these would

then develop their careers in Norfolk and Suffolk and help to address the challenges

local employers face with recruitment.

In the food sector, the National Centre for Food Manufacturing (University of Lincoln),

is only 10 miles outside the LEP area and as the largest national provider of FE and

HE provision to food processing trains a large number of New Anglia students.

Poultec also offers courses for the food chain up to L5.

The AgriFood Tech sector nationally is unusual in its provision of HE, because

whereas typically only 12% of HE provision is delivered by FE institutions across all

subjects, in AgriFood Tech this rises to 50%. Where this works well, this helps to

ensure good progression from FE to HE provision in this subject area as students

can readily see the progression routes from FE to HE.

Easton and Otley College is currently working on a plan to develop new progression

routes by developing an integrated curriculum covering Levels 3, 4 and 5, to aid

progression opportunities. Poultec and the National Centre for Food Manufacturing

at Holbeach both offer provision which bridges these levels.

Feedback suggests that employers would welcome the merging of the interface

between FE and HE as they do not recognise the FE/HE division.

c)

Anticipated Changes in Skills Provision

Consultees feel that the introduction of the Apprenticeship Levy from April 2017 is

potentially very significant for parts of the industry. Whilst in agriculture very few

employers have a large enough payroll to be affected directly by the Levy, in the

ancillary sectors and food processing most staff are employed in companies who will

be affected. What is currently unclear is how levy payers will respond, although

anecdotal evidence is suggesting most are keen not to see the Levy as a tax that

they pay, but to increase their apprenticeship provision (perhaps through upskilling

their existing workforces) so that they fully utilise the levy.

Given that for many larger employers the levy rate is set at a level which would

necessitate apprenticeship provision which was orders of magnitude higher than they

have supported before, evidence suggest some will decide to focus on higher level

apprenticeships (L4+), where costs per learner are higher. This could also support

the move to Higher Apprenticeships linked to degree qualifications and address the

industry’s growing need for higher level skills.

Consultees also noted that the requirement in the new apprenticeship model for

smaller, non-levy-paying employers to contribute towards the training costs for an

apprentice, may discourage some employers from participating.

Page 10

New Anglia LEP

AgriFood Tech Sector Skills Plan, Sept 2017

4.

Skills Supply Challenges

The sector will continue to develop rapidly in the next decade. Arguably it will also be

the major UK sector most affected by the decision to leave the EU. Brexit will impact on

the sector through: changes from the CAP to a UK agricultural policy (CAP support

represents approximately 75% of net farm income); trade - Europe is the largest trading

partner for the sector for both imports and exports; skills supply with estimates

suggesting approximately 20% of the current workforce are EU migrants; and, most

agrifood policy has been based on EU decisions for over 40 years.

It is too early to speculate in detail about what a final post Brexit deal for the agrifood

sector will contain, but regardless of the outcome, three challenges will be important to

the future growth and success of the industry:

Challenge 1 - Meeting changes in consumer need and demand - in local, UK and

international markets consumers continue to change the food choices they are

making, both in terms of the foods they choose and how they choose to consume

them (e.g. online purchases, eating out of the home). This will create increased

demand for added value, processed foods;

Challenge 2 - Competitiveness in production - the food market is already

international with the UK only meeting approximately 50-60% of its domestic demand

for food from UK production. Brexit could help develop new trade deals and drive

exports or help companies in the UK replace imports, but this will only be achieved if

UK production is competitive in its cost base and use of resources;

Challenge 3 - Supply chain focus - the food chain is complex with numerous

companies involved from research and input suppliers, through farmers and growers,

food processors and distribution companies, to food retail and catering. Driving

efficiency in supply chains is essential to future success of the industry.

Skills, innovation and new ways of working will be essential to deliver success in all three

areas. These sector specific challenges are also happening at a time of profound

changes in the wider economy and technology, with developments such as the Internet

of Things (IoT) and Industry 4.0, set to revolutionise how people work as reported in the

NCUB report on AgriFood Tech sector skills in 20152.

Given New Anglia’s productive agrifood sector, world class science base and

sophisticated supply chains, it should aim to be at the forefront of these changes.

Locally major developments such as the £81m investment in the Quadram Institute to

create a new national centre for dietary health, will position the region at the forefront of

food innovation and address the first challenge of meeting changing consumer needs.

The development of three proposed Food Enterprise Zones, one in Norfolk and two in

Suffolk, will help address challenges 2 and 3 by helping make the sector more

competitive through supply chain efficiency.

2 NCUB (2015), Leading Food 4.0: Growing Business-University Collaboration for the UK's Food Economy

Page 11

New Anglia LEP

AgriFood Tech Sector Skills Plan, Sept 2017

Feedback from industry shows a desire to focus on growth, exports and the potential to

change how land and resources are used to create more value in the food chain e.g. by

focusing on high value crops and livestock enterprises, innovative production systems

and added value food production. To create more value the AgriFood Tech sector in

New Anglia was seen by consultees to need to focus on:

Growing the skills to support high GVA parts of the sector e.g. more food processing,

horticulture and intensive livestock production and the commercialisation of the

science and technology to underpin competitive production in these sectors.

Exports to Europe given the proximity of New Anglia to the Continent and major port

facilities in both Norfolk and Suffolk which can help the region access the markets

there.

Within this industry context the top six issues for skills development were identified to be:

a)

Labour Substitution Through Automation

The industry is rapidly adopting new technology enabled by digital technology,

sensors, data analysis, robotics and control systems. This may reduce the workforce

needed for the same level of output and could thus be expected to cost jobs, but will

also address key local weaknesses by raising labour productivity and creating higher

skilled, higher paid jobs. If this development improves competitiveness of the New

Anglia AgriFood Tech sector it may also lead to growth of the sector through import

substitution and growth in exports. It could also help the industry address challenges

created by a lack of supply of labour, rising wage costs and potential further

restrictions on supply post Brexit. However, this will create skills challenges

including:

Skills for engineering, soft robotics, artificial intelligence (AI), data are growing in

importance and more supply will be needed to meet industry needs;

An agile workforce with higher level technical skills will be needed given the

speed of change in the industry;

There will be a need for applied research and skills in new disciplines such as

acoustics and vibration sensors to identify problems early in mechanised systems

to allow timely remedial action to be taken.

The skill set that unites all these areas is the need for skills in the collection,

manipulation, presentation and use of data. Employers reported that current maths

performance is poor for those entering the industry from school and, that even those

with degrees in data focused disciplines, often struggled to apply their knowledge to

business problems.

The need for data skills supports AgriFood Tech companies in assessing markets,

driving production efficiency and managing their businesses.

The growth in demand for technical and data skills will also need to be underpinned

by a supply of soft skills in leadership, management and project working, to enable

Page 12

New Anglia LEP

AgriFood Tech Sector Skills Plan, Sept 2017

new production systems or the use of data to support decisions to be integrated into

the workplace.

b)

Meeting Existing Skills Shortages in Industry

The reliance on migration, which has met many industry skills needs in the last 20

years for both basic and increasingly highly skilled workers, is seen as a key strategic

weakness. Whilst employers accept that this means we need to train more UK staff,

most felt that this would not meet future skills needs given that many sectors are

facing this challenge and there simply are not enough unemployed or under-

employed UK nationals to fill all the jobs available. A need for continued supply of

overseas labour was therefore seen as essential. This is backed up by national

research and policy documents produced by amongst others the NFU, CLA and

Food and Drink Federation (FDF), all of whom have argued for continued access to

migrant labour to meet industry needs for highly skilled staff.

Notwithstanding the demands of automation, feedback also showed a continued

challenge for employers in meeting the supply of basic skills for the AgriFood Tech

sector. Farmers reported that they find it hard to secure skills to address fundamental

challenges such as soil management, irrigation and the use of modern technology.

The supply of business management skills including benchmarking, supervision and

HR skills were seen as challenges at a time when the industry needs to ensure it is

more attractive to new recruits and thus needs to focus on improved staff

management and progression. Employers also accepted that this meant they

needed to be more involved in apprenticeship provision.

It was noted that most of the workforce business management training was delivered

by RDPE skills funding and now this funding support is unavailable, it has stopped.

Legislative training has continued, as it is compulsory, but has little impact on growth

and productivity.

Employers also reported problems with a lack of ‘practical’ focus in new recruits and

would like to see more technical short courses for the existing workforce in winter.

Many argued for a focus in Colleges on producing highly qualified operators and to fill

gaps such as staff who are skilled in working with livestock.

Employers continued to rank communication skills, numeracy, literacy and the right

attitude very highly. Problems in these basic areas are seen as fundamental without

which the more advanced skills needed are difficult to apply effectively.

c)

Meeting the Demand for Research and Development Staff

The world leading AgriFood Tech R&D base in New Anglia is very dependent on a

global recruitment base and this could create challenges post Brexit with potentially

increased constraints on migration. The R&D sector needs the ability to recruit the

best staff from across the world to attract leading researchers and restrictions on

migration would seriously erode its capacity to conduct world leading research.

Page 13

New Anglia LEP

AgriFood Tech Sector Skills Plan, Sept 2017

As well as the need for scientists, R&D centres need enhanced commercialisation

skills to address the big challenge on translation of science into practice and need

access to staff with specific knowledge exchange and commercial skills.

There is potential to increase local recruitment to the R&D base, for roles from

laboratory staff through to researchers and commercial roles, but these roles all

require degree or postgraduate qualifications and thus a better supply chain of STEM

skills from local schools and colleges. It was also noted that the research sector is

not working together on this challenge as much as it could.

The Life Sciences and Bioeconomy Sector Skills Plan considers this challenge in

more detail.

d)

Young People and Progression

There are recognised challenges in equipping young people for entry level jobs in the

industry given the problems created by the rapid increase in the ‘tickets’ which are

needed. For example young people cannot tow with 4x4s without doing extra tests

as the basic driving licence does not now cover it. Also, recently telehandlers have

been classified as commercial vehicles and not farm vehicles which means they

cannot be used to tow a trailer without an extra test (cost £700-800 per person).

The AgriFood Tech industry is still struggling with the concept of Foundation Degrees

and prefers HNDs/HNCs with more practical content. The development of Higher

Apprenticeships can address this, but have not yet been developed in this sector

locally. More generally there is felt to be a need for new models of HE provision

which are responsive and fleet of foot in meeting industry and young people’s needs.

There is a real challenge in regards to the loss of young people out of the New Anglia

area to study at HE level who then never return. Whilst this is seen as an issue

across all sectors, it was flagged as a specific concern for the AgriFood Tech sector.

Consultees noted that ‘Skills delivered locally are more likely to retain future staff

than those delivered beyond the region’.

New Anglia is seen as an area which has low aspirations for HE participation. As

one consultee noted ‘Young people need to be encouraged to strive for excellence.

Good enough just isn't. There needs to be a change from school level upwards’.

Progression rates from FE to HE study are a big challenge and this is even more

acute in some, often rural and remote New Anglia communities in which the AgriFood

Tech sector is important but which lack a tradition of HE participation. In New Anglia,

FE provision in AgriFood Tech is strong as is postgraduate training, but there is a big

gap in undergraduate provision which disrupts local progression opportunities.

Another consultee noted that ‘at secondary school level we have to promote

manufacturing as a career of choice across all sectors’, arguing that at present the

sector is not well served by the way it is presented in schools. They further argued

that this can be addressed through carefully designed curriculum materials which

show how the manufacturing sector uses the skills developed in maths, physics etc.

Page 14

New Anglia LEP

AgriFood Tech Sector Skills Plan, Sept 2017

Employers felt that the industry needed to work with training providers to link to

schools, develop internships and other innovative experience models and potentially

to offer knowledge exchange programmes of the types used in the USA.

e)

Attracting Talent to the Industry

Across all parts of the sector, the image of the industry remains an issue in terms of

its ability to attract new staff, either as young people or as career changers later in

life. Employers felt that the industry lacked cohesion, often did not project itself as

attractive and often lacked ambition. It was also noted that SMEs often struggle to

engage in skills provision as they often lack professional HR support.

It was considered essential for the industry to present a single coherent voice for the

whole supply chain, stressing the multitude of different opportunities in the sector,

excellent career progression possibilities and how training and skills can help to

facilitate growth in a career.

Research into current careers promotion for the industry by the Royal Norfolk

Agricultural Association in 20163, found that the largest challenges were that there

were too many initiatives, all of which were small and difficult to sustain and that most

were focused on the relatively easy target of engaging primary age school children.

This finding was born out by the consultees for this plan, who argued strongly that

the focus needs to be on secondary schools, ideally before GCSE choices are made

and continue through to working with schools to promote curriculum linked materials

on the agrifood sector to support GCSEs and A Levels.

Whilst the need to promote the industry was seen as a national need, it was stressed

that delivery had to be local and promote the industry as ‘as an interesting, well paid

futuristic industry’. It has to stress for example that ‘[it] is no longer a low skilled job.

Good understanding of computers/satellite, good literacy and numeracy skills, and

good spoken English are all vital. We ask them to drive machinery worth £400,000+,

handle chemicals and communicate with our customers’.

Employers also recognised that the industry needs to address working conditions

and improve the rewards it provides as well as improving staff support and

management.

f)

Meeting the Demand for Trainers and Academics

The consultation also raised concerns about how the sector can ensure that it has a

supply of committed and highly qualified trainers, lecturers and academics. It was

noted that recruitment to ‘teaching’ roles in the sector is challenging, that trainers are

in short supply and many are old or close to retiring.

3 RNAA (2016), Food, Farming and Countryside Education: developing new approaches for schools in Norfolk

and Suffolk

Page 15

New Anglia LEP

AgriFood Tech Sector Skills Plan, Sept 2017

There is seen to be a particular problem with growing areas of demand, such as

engineering, where the shortage in industry has raised wage levels and made it even

harder to recruit trainers.

Furthermore, providers reported that changes to the way assessors are used by

awarding bodies, such as City and Guilds, is putting additional strain on the system

by attracting some tutors to move across into these roles and will exacerbate the

challenges of securing tutors.

Providers reported that tutor supply in some topic areas was the largest barrier to

growth they faced in being able to meet the demand from students and employers.

Skills providers noted that this is a national problem with other areas of the country

also reporting particular problems with agricultural and engineering tutor recruitment.

However, it was stressed that there is no national structure to address this weakness

and therefore it is important to take local action.

One potential solution is to attract older skilled workers to a new career in teaching,

but the current systems make it expensive and time consuming (often more than a

year) to qualify. For those with relevant industry experience it was felt that we need

to the process more accessible so they pass on their valuable skills.

Other providers reported that they actively sought to retain some of the students they

have trained as tutors.

It was also suggested that working with larger employers to release experienced staff

on a part time basis, possibly as part of Corporate Social Responsibility (CSR)

programmes, could be fruitful in helping to support training delivery by contextualising

courses with real life examples. However, it was recognised that this is not a

substitute for a sufficient pool of talented and committed tutors.

More broadly on provision, cuts to FE funding mean that there is now a major

challenge with maintaining FE provision because agriculture is not being classified as

a STEM subject and therefore funding has been halved for some courses, with L2

Agriculture now funded in the lowest band at £1,500 per learner per year, which is

lower than business administration. This is surprising given that all AgriFood Tech

provision at HE level is science based (FDSc and BSc) and this decision at FE level

does not therefore either equip FE agriculture students for progression or provide the

funding needed to meet industry course needs.

Page 16

New Anglia LEP

AgriFood Tech Sector Skills Plan, Sept 2017

5.

Future Skill Needs

a)

Anticipated Trends in the Key Determinants of Future Skills Demand

Consultee Feedback

In addition to the meetings held to develop this plan, an online consultation received

36 responses from employers. Consultees saw the largest future demand for

employees to be in professional and higher technical roles (72%); skilled manual and

lower technical (69%); supervisory (39%); and, middle/senior management (36%). In

contrast only 8% foresaw an increase in the demand for unskilled staff.

Interestingly, consultees rated basic skills (literacy and numeracy), management and

supervisory skills, team working and communication skills more highly than the need

for technical skills and ICT skills. This suggests that employers continue to require

employees who can work in and lead teams and have the basic skills needed to learn

and apply new ideas. This mirrors work conducted by Farmers Weekly in 20164

which identified communication skills supported by technology awareness as the

main attributes which employers were looking for in new recruits.

Scale of the Food Chain

As shown above, at the national level the AgriFood Tech sector has been growing,

with particularly strong growth being seen in LEP areas to the North and South of

New Anglia. In contrast New Anglia has seen its workforce in this sector decline

recently and it has seen a slower rate of new business creation than elsewhere. It is

not clear why, given its strong industrial base and world class research sector in

AgriFood Tech, it should have underperformed in this way.

Looking forward, at national level continued growth in agrifood demand coupled to a

global market which is growing at a compound growth rate of 6% is expected to lead

to continued growth in the AgriFood Tech sector.

Clearly if New Anglia could take a larger share of this growth, it would be expected

that its workforce and skills demand in the sector would be higher than the current

East of England Forecasting Model suggests (see below).

b)

Projections for Future Skills Needs

UKCES Working Futures (see datapack) and the East of England Forecasting Model

foresees continued change in the future skills needs of the AgriFood Tech sector.

The East of England Forecasting Model is based on previous trends and because

employment in this sector has fallen locally (in contrast to the growth seen

nationally), is projecting that this trend will continue in the next decade.

Furthermore these projections suggest that the gradual trend seen in employment

away from elementary (manual) work and process and plant operatives, which had

fallen from 45% of the workforce in 2004 to 39% in 2014, will continue, reaching only

4 Farmers Weekly (2016), Grow 2016: Farmer’s Weekly Guide to Careers in the gricultural Industry

Page 17

New Anglia LEP

AgriFood Tech Sector Skills Plan, Sept 2017

37% of the workforce by 2024. In contrast the proportion employed in associate

professional, technical, professional and managerial roles will grow from 18% in 2004

to 20% by 2024.

At sub-sector level the largest changes in workforce structure are expected in

agriculture, where UKCES report that the proportion of staff employed in elementary

occupations has already fallen from 26% in 2004 to 15% in 2014, with a further

modest fall to 13% predicted by 2024. In contrast the proportion in skilled trades has

risen from 40% in 2004 to 58% in 2014 and is expected to be 59% by 2024.

When looking at projections for future demand for skills it is clear that demand is

focused on higher skills levels, with a net demand over the period 2014-‘24 of:

+600 for QCF8 (Doctorate);

+6,700 for QCF4-6 (HNCs, FD and degrees);

+2,000 for QCF3;

+2,500 for QCF2;

no net increase in demand for QCF 1;

and a net fall in demand for those with no qualifications.

This suggests that continued recruitment at QCF levels 2 and 3 is needed, but that

there is a need to support more of these new entrants to progress to QCF4+ where

the larger increase in demand for labour is projected to be.

Given the current weak supply of L4-6 provision for the AgriFood Tech sector locally

this projected future labour demand profile will not be met without substantial

interventions.

c)

Immediate Pressures

The industry reported that it has major short term issues in meeting skills supply

which have been exacerbated by the decision to leave the EU. This is already

having an effect on the willingness of migrants to travel to the UK to work in the

industry. Furthermore, anecdotal evidence from some employers is reporting that the

uncertainty this is creating in migrant workers minds about their long term future in

the UK and the fall in the value of £ relative to the Euro, is already leading to some

long standing migrants moving to jobs in other EU states. This is increasing the long

standing challenge in securing the local workforce needed in food manufacturing, on

farms and particularly for short term jobs such as harvesting.

To address these issues the industry has been arguing for the return of the Seasonal

Agricultural Workers Scheme (SAWS) or an equivalent, but this has been rejected by

the government. However a report by the EFRA Select Committee (April 2017)5, has

supported the industry view that there is a real risk to the industry: ‘the best guess is

that there are 75,000 temporary migrant workers employed in UK agriculture and

horticulture’ but that this is ‘below the sector’s annual need of 80,000 seasonal

5 EFRA Select Committee (2017), Feeding the Nation: Labour Constraints, Seventh Report of Session 2016-17

Page 18

New Anglia LEP

AgriFood Tech Sector Skills Plan, Sept 2017

workers and further below the expected demand of 95,000by 2021’. The report

further noted that the British Meat Processors Association research shows that 63%

of the workers in their sector were from other EU states.

The EFRA Select Committee noted that Ministers evidence stressed that as well as

reforms to the tax and benefits system to make work pay, there is a need to look at:

greater automation; increased skills and qualifications; increasing apprenticeships in

the sector; and, changing perceptions of the industry from a young age to make it

more attractive to potential workers - all themes identified locally by the consultees

for this plan.

Whilst in the R&D sector the driver of overseas recruitment is different, focused as it

is on the desire to attract the best skills in the world to create globally leading teams

of scientists, the same political pressures are being felt in this sector as in agrifood

production companies.

d)

Other Future Skills Supply Challenges

Implicit in much of the feedback received from consultees and industry reports is a

recognition that technology and political changes are and will continue to affect the

AgriFood Tech industry and thus its demand for workforce and skills.

Major changes are anticipated in relation to:

Employment conditions - with all the main political parties now committed to the

National Living Wage (NLW)6, apprenticeship levy and similar costs. This will

increase the cost of employing staff and, all things being equal, lead to increased

incentives for employers to focus on using technology to drive labour efficiency.

As we are currently only 1 year into the planned 4 year first phase of the

introduction of the NLW and the apprenticeship levy has only just started, it is too

early to be definitive on how much change this will lead to. However feedback

from employers suggest these additional costs are already leading to change.

Unpublished analysis by Martin Collison (SkillsReach Associate) for Greater

Lincolnshire LEP (2016) suggests that the NLW will increase wage costs in the

UK food chain by £7-10billion per annum by 2020.

Technology and Industry 4.0 - driven by both changes in employment conditions

and potential restrictions on labour supply, the demand for automation will

increase. This requires more staff with STEM skills across engineering, data and

managerial functions to design, install, operate and maintain more technically

advanced production systems.

6 Some political parties and many lobby groups are arguing that the proposed increase to £9per hour by 2020

set out by the current Government does not go far enough and thus the political pressure to increase wages

could be expected to intensify

Page 19

New Anglia LEP

AgriFood Tech Sector Skills Plan, Sept 2017

6.

Sector Skills Plan Delivery

a)

Priorities for Action

As a major contributor to the New Anglia economy the AgriFood Tech sector needs

to rise to the well documented and broadly recognised challenges it has in attracting

the skills needed in the future.

Consultees raised a long list of suggested areas for intervention, but it is recognised

that to be delivered successfully there is a need to focus on a relatively small number

of priority areas which command industry support and which will have a major impact

on the sector. The ability to align these areas with the potential for public sector

intervention is also desirable, but unless the industry is willing to invest and support

the actions proposed they are very unlikely to be deliverable.

The following section therefore sets out one overarching area and five targeted

subsequent interventions which it is believed are needed to help meet the future

skills supply needs of the industry.

The overarching action is to:

o Establish a New Anglia AgriFood Tech Skills Group (working title);

The proposed subsequent skills interventions are to:

o Co-ordinate Sector Careers Promotion;

o Develop New Progression Routes to Higher Education in AgriFood Tech;

o Develop a new Higher Education Centre to Meet the Shortfall in Technical Higher

Education in the Industry;

o Develop the Supply of Trainers to Meet the Needs of the AgriFood Tech Sector;

o Develop a Workforce Development Programme to Equip the Sector with the

Skills Needed for Growth.

The action plan set out below, which initially focuses on these six areas, should be

kept under constant review by the proposed New Anglia AgriFood Tech Skills Group.

As actions are delivered, the Skills Group should seek to consult with industry, using

its members existing contacts to refresh and add to the action plan.

Page 20

New Anglia LEP

AgriFood Tech Sector Skills Plan, Sept 2017

b) Proposed Future Skills Interventions

Intervention 1 - Establish a New Anglia AgriFood Tech Skills Group

Rationale: there is a need to develop a more co-ordinated approach to planning

interventions to promote the supply of skills for the New Anglia AgriFood Tech sector.

Action to be Taken:

The AgriFood Tech industry will work with the New Anglia LEP to develop a Group

focused on the skills needs of the industry which can act as a sub group of both the New

Anglia Food, Drink and Agriculture (FDA) Board and the LEP Skills Board.

Its functions will be to:

Act as an expert panel to advise the LEP Skills Board and FDA on the skills needs of

the AgriFood Tech sector in the New Anglia area;

Promote the potential for skills intervention with the AgriFood Tech sector by seeking

ideas for potential project interventions led by industry;

Develop ideas for and act as a champion for interventions (funding and strategic

investments) which could be developed to equip the New Anglia AgriFood Tech sector

with the skills needed to facilitate sector growth.

The group will be action focused, avoid being a ‘talking shop’ and focus on scoping and

promoting a limited number of priority actions (including initially the other 5 proposed

interventions in this plan). It will have clear KPIs and focus on industry needs and the

areas in which industry co-investment can be secured.

In delivering its work, the group will seek to represent the whole AgriFood Tech sector.

However, it is recognised that industry members are much more likely to be interested in

supporting actions on a case by case basis, rather than attending regular meetings.

The Task and Finish group for this plan therefore recommended that initially the group

should, whilst meeting 3-4 times per year, focus on securing a core membership including

training providers, industry representative bodies and the LEP, with employers invited to

attend meetings which directly relate to projects in which they would be partners rather

than expecting them to be regular attendees.

Leadership: it is important for the Skills Group to have an independent, industry based

chair who is able to commit time to promoting the skills needs of the industry and acting as

a bridge between the New Anglia FDA Board and LEP Skills Board.

When: the proposed group should be fully established by the 1st September 2017, with an

intermediate target to agree a set of terms of reference with both the LEP Skills Board and

FDA Board by 1st August 2017.

Resources and support: the group should explore with the LEP and other stakeholders

how secretariat and co-ordination / engagement support (e.g. organising meetings,

providing administrative support, booking venues, employer consultations) can be

provided across New Anglia.

Page 21

New Anglia LEP

AgriFood Tech Sector Skills Plan, Sept 2017

Intervention 2 - Co-ordinate Sector Careers Promotion

Rationale: it is widely recognised that careers promotion needs further investment to

attract the staff needed to grow the New Anglia AgriFood Tech sector, but that at the

current time there are too many uncoordinated initiatives and interventions.

Action to be Taken: promoting the AgriFood Tech industry as a career of choice requires

all the actions being taken by industry, major employers including the research centres

and providers e.g. Easton and Otley College, to pool their activity into one comprehensive

programme. The programme should be developed so that it targets the 12-18 age group

who currently have relatively little interaction with the sector on careers, especially beyond

the age of 14. Building on the mapping work undertaken by the Royal Norfolk Agricultural

Association (RNAA) in this area in 2015/16, the coordination of careers advice should:

Promote careers at all levels of the sector from entry level to post graduate and across

the full breadth of the AgriFood Tech sector, by telling a coherent story, which explains

the highly skilled, well paid and dynamic careers which are on offer in the sector;

Attract older people to transfer into the sector and explain the routes available to them

(including linking to programmes for former armed forces personnel);

Align industry and learning provider investment with the funding committed by the

agrifood charitable sector across New Anglia;

Build on the existing work by Easton and Otley Schools liaison team and schools

engagement and work carried out by Norwich Research Park and Edge Careers;

Influence the school curriculum by engaging with teachers and using examples which

can be linked to curriculum content e.g. Easton’s dynamometer in physics.

The development of a coordinated programme should seek to ensure that it engages with

every secondary school and college in Norfolk and Suffolk to promote the careers

available in the AgriFood Tech sector.

Leadership: the RNAA are willing to lead this work with the research base, industry, SAA

and major providers including Easton and Otley College supporting this co-ordination role.

When: the careers promotion coordination function should be established by 1st January

2018, with bids for further resources to target additional support for engaging with

secondary schools submitted by June 2018.

Resources and support: resource needs for co-ordination are comparatively modest,

circa £50,000 per annum, and will be initially secured via the RNAA Trustees who have

committed to coordinating the existing investments being made in careers promotion in the

sector. This will focus initially in Norfolk before being extended to Suffolk. Links should

also be made to existing projects such as ‘icanbea’ (SAA involved) and the New Anglia

Enterprise Advisors network. The industry should consider moving some of the current

investment in primary school provision across to the secondary level where it can have

more impact. The existing substantial investments made by Norfolk and Suffolk charities

and trusts should also be co-ordinated to create longer term, more sustainable

interventions.

Page 22

New Anglia LEP

AgriFood Tech Sector Skills Plan, Sept 2017

Intervention 3 - Develop New Progression Routes to Higher Education in AgriFood

Tech

Rationale: progression from FE to HE in the AgriFood Tech sector needs to be improved

to meet the large predicted increase in the demand for L3-6 qualified ‘technical’ staff. The

existing workforce will also need to upgrade their qualifications as the demand for lower

level skills falls and new technology is introduced, but the existing workforce and their

employers find it very difficult to release them for traditional full time HE study.

Action to be Taken: to facilitate improved rates of progression from the strong local

provision of FE AgriFood Tech courses to local HE provision in these subjects new,

flexible and industry linked modes of delivery need to be established jointly facilitated by

providers and industry. Furthermore, this new provision should help the existing workforce

to upgrade their skills to meet the changing nature of work in the industry, in particular the

widely anticipated increase in levels of technology. This intervention will focus on:

L3, 4 and 5 to facilitate progression routes to develop skilled technical staff with the

applied skills needed by a changing industry where technology adoption is the norm;

Developing a Higher (degree) Apprenticeship (HA) route in AgriFood Tech to respond

to the opportunities from the Apprenticeship Levy;

Integrating HA routes into linked provision which includes HNCs/HNDs and degrees;

Exploring the potential for new undergraduate provision which combines multiple work

placements with academic study (as Management Development Services have

successfully used at postgraduate level for over 20 years);

Working with A Level and L3 FE providers to develop progression routes from other

STEM subjects into the AgriFood Tech sector;

Developing e-learning and flexible modes of part-time study to help the existing

AgriFood Tech workforce upgrade their qualifications.

This intervention would link to intervention 4 which will create a new HE centre focused on

developing the physical facilities to support an increase in the supply of L4-6 AgriFood

Tech qualified staff. Links to the National Centre for Food Manufacturing which already

offers this type of L4-6 provision for the food processing sector should also be explored.

Leadership: the industry will work with Easton and Otley College to develop, trial and roll

out new models of HE undergraduate technical provision which are responsive to industry

needs and flexible in delivery.

When: the development of new HE routes should be completed by June 2018 with the

aim to trial them from September 2018, ready for full rollout in 2019/20 to align with the

proposed new HE centre (see intervention 4).

Resources and support: the resources required are mainly a commitment of time by staff

at Easton and Otley College in conjunction with industry partners to develop proposals for

new models of technical HE pathways. The potential to develop a major ESF/ERDF

project to support interventions 3 and 4 should be explored with the LEP by summer 2017.

Page 23

New Anglia LEP

AgriFood Tech Sector Skills Plan, Sept 2017

Intervention 4 - Develop a new Higher Education Centre to Meet the Shortfall in

Technical Higher Education in the Industry

Rationale: the New Anglia area has a strong supply of FE and postgraduate provision for

the AgriFood Tech sector, but a significant shortfall in L4-6 undergraduate provision.

Given that the largest demand for new recruits will be at L4-6 in the next decade this lack

of local provision has to be addressed.

Action to be Taken: local provision of HE to meet the technical needs of the AgriFood

Tech industry at levels 4-6 (HNC to Bachelors degree) requires dedicated investment, but

should be seen as part of a wider LEP need to increase undergraduate provision to retain

talented young people in the New Anglia area.

The area also needs to attract young people from other areas to study in the New Anglia

to help meet industry needs but needs competitive facilities and provision to do this. The

proposal is to create a new HE Centre with a local University providing validation services

and support (with the potential in the future for the centre to offer its own degrees if this is

considered desirable).

The physical Centre would focus on providing the facilities and staff to:

Facilitate FE to HE progression in a breadth of disciplines including AgriFood Tech,

with a strong focus on science, technical and project management skills;

Support technical HE (including Higher Apprenticeships) linked to and supported by

industry to meet the need for engineers, technicians, skilled operatives and managers;

Offer Higher Apprenticeships, HNCs/HNDs and undergraduate degrees;

Link to local research and technical centres serving AgriFood Tech including UEA’s

science and engineering schools, NRP, Hethel, National Centre for Food

Manufacturing (NCFM) in Holbeach and Poultec at Mattishall.

The aim would be to significantly increase the supply of technical HE skills to the industry

within 5 years.

Leadership: The proposed New Anglia AgriFood Tech Skills Group will advise on this

development, providing the essential sector and industry voice.

When: developing a new HE centre of the type proposed will require considerable time

and it is suggested that the aim should be to develop an initial proposal and business plan

by December 2017, with the aim to have the centre fully planned and funded by

December 2018 to open in 2019/’20.

Resources and support: this proposal will require substantial investment in the tens of

millions to bring to fruition and will therefore require strategic intervention from the

government (HEFCE), supported by the industry and New Anglia LEP. To develop the

business plan and market assessment the delivery partners should consider an

application to the New Anglia LEP Skills Deal.

Page 24

New Anglia LEP

AgriFood Tech Sector Skills Plan, Sept 2017

Intervention 5 - Develop the Supply of Trainers to Meet the Needs of the AgriFood

Tech Sector Skills Providers

Rationale: the development of the skills system in New Anglia’s AgriFood Tech sector is

constrained by an ageing tutor group and challenges in recruiting new trainers at every

level, with particular issues in growing skills-areas such as engineering, where industry is

also short of staff and thus paying higher salaries. Addressing gaps in more traditional

topics such as soils and water management where the tutor pool is now ageing rapidly is

also critical. Without an adequate supply of tutors and lecturers it will be impossible to

deliver the ambitions to increase the supply of local talent to the industry.

Action to be Taken: there is a need to address the shortfall in trainers and lecturers

available to the AgriFood Tech sector by recruiting and training additional staff. One area

which should be explored and which some other technology sectors have already used, is

to retrain older experienced staff as trainers as they seek to reduce their working hours

when approaching retirement.

The proposed programme would be structured to:

Recognise industry experience as valuable and important to students, alongside or as

an alternative to formal qualifications, to help broaden the pool of potential tutors

available to the sector;

Recruit, train and accredit additional staff to act as trainers on a full and part time basis

to meet the evolving skills needs of the AgriFood Tech sector;

Promote a training role as a viable, straightforward and attractive career change option

for staff in the AgriFood Tech sector, with clear and cost effective routes to

accreditation, employment and career progression

The potential to develop CSR programmes which link larger employers with training

providers to support provision with experienced and skilled staff input should also be

explored.

Particular attention needs to be paid to easing the transition into a training role for new

tutors through careful structuring of the time commitment and costs involved which can

make the transition period daunting and off-putting.

Leadership: providers including UKRS, Poultec and Easton and Otley are struggling to

secure the trainers and lecturing staff needed for a wide range of disciplines. Working

together to develop the supply of qualified staff could help to address this challenge.

When: a programme to develop an increased supply of new trainers and lecturers should

be developed by March 2018.

Resources and support: a programme to develop new staff to act as trainers would help

to ensure older workers and those at risk of redundancy could retrain into new roles as

tutors. The potential for ESF and similar funding should be explored to support this need,

possibly building on the Industry Educator Model developed by Bishop Grosseteste

University in Lincolnshire using ESF funding.

Page 25

New Anglia LEP

AgriFood Tech Sector Skills Plan, Sept 2017

Intervention 6 - Develop a Workforce Development Programme to Equip the Sector

with the Skills Needed for Growth

Rationale: the existing AgriFood Tech workforce faces unprecedented challenges through

the adoption of new technology, pressures to raise labour productivity and to fill gaps in

the workforce left by a fall in migration. Former programmes to support the sector’s

workforce development (e.g. EAFRD skills) have been suspended and other programmes

specifically exclude the agricultural industry. Industry growth needs a focus on skills for

the existing workforce as well as attracting new entrants, as most of the post 2020

workforce are already in work.

Action to be Taken: there is a need to address the workforce development needs of the

existing AgriFood Tech workforce by offering a programme of Training Needs Analyses

(TNA) to assess business development needs, linked to a programme of short courses

tailored to fit around existing work commitments and focused on new technology,

management and industry growth.

The proposed programme would be structured to train existing sector staff to:

Adopt new technology which can improve labour efficiency, develop new enhanced

products and services and exploit the data now available to manage production;

Develop enhanced management and supervisory skills to develop the leadership and

project management skills needed by the industry, including transferring management

techniques used in other industries, e.g. Lean Manufacturing, 6 Sigma, into the

AgriFood Tech sector. Where possible linking this provision with courses offered

across sectors to facilitate knowledge exchange should be explored;

Respond to the opportunities and challenges which are flowing from major strategic

changes such as Brexit and the adoption of new technology.

The provision should be designed in active collaboration with industry and be challenge -

led i.e. which skills need to be developed, with providers then invited to tender to deliver

packages of workforce development with and co-funded by the AgriFood Tech industry.

Working with supply chain partners e.g. major food processors, supermarkets, Co-ops,

who can both support and promote the courses would increase effectiveness.

Leadership: the programme should be developed by the LEP in conjunction with the

AgriFood Tech Skills Group and seek tenders from training delivery bodies to deliver

specific packages of support. The LEP should ensure that whether delivered at local level,

or nationally by DEFRA and/or ESFA, that the needs of the New Anglia AgriFood Tech

sector are reflected in workforce development programmes.

When: a programme to deliver an AgriFood Tech workforce development programme

should be developed by November 2017 and implemented from January 2018.

Resources and support: the programme should be supported with EU funding (ESF,

EAFRD and ERDF) and future UK structural funds. A minimum budget of £1m per annum

should be sought, with an initial 3-5 year programme agreed.

Page 26

New Anglia LEP

AgriFood Tech Sector Skills Plan, Sept 2017

Appendix 1 - AgriFood Tech definition

Agri Food Tech Sector - agreed sector definition (December 2016)

Purpose - the purpose of the sector definition is to agree which types of employment are in

scope for the sector skills plan.

AgriFood

In scope:

Agricultural, horticultural and forestry production (crops, livestock, ornamental crops,

biomass and biofuels, renewable materials)

Food and drink processing (including artisan foods)

Input supplies (e.g. machinery, fertilisers, seeds, packaging etc.)

Food wholesaling and marketing

Food logistics

AgriTech (see full national definition in annex)

In scope:

Plant genetic improvement; plant health; crop storage and silage

Animal genetic improvement; animal nutrition; animal health and welfare

ICT systems

Soil and substrate management; environmental interactions; harvest and early stage

processing

Engineering and precision farming

Infrastructure

Advisory services

Food Tech:

Food production technology

Dietary health and consumer food technology

The sector skills plans will not include the skills needs of the food retail and catering

industries, but will, where relevant identify how changes in these sectors will affect the

demand for skills in the rest of the food chain and the technology employers which support it

Links to other New Anglia LEP Priority Sectors - in developing the Agri Food Tech Sector

Skills Plan the SkillsReach New Anglia LEP Skills Team will also explore the potential to link

to the skills requirements in other sectors for which sector skills plans are being developed

by New Anglia LEP, including:

ICT and Digital - due to the rapid growth in the use of big data and sensor technologies

in agri-food

Energy - due to the agri-food sector potential for biomass and biofuel production

Life Sciences - due to the underpinning science and innovation from life sciences which

supports both agricultural and food production

Ports and Logistics - given that 28% of road freight in the UK relates to the food chain

and that Lowestoft is the largest food port in the UK

Advanced Manufacturing - given the increased use or robotics and autonomous systems

in the food chain

Tourism and culture - given that over 30% of tourism expenditure is on food and drink

Page 27

New Anglia LEP

AgriFood Tech Sector Skills Plan, Sept 2017

AgriFood Technology Leadership Council Definition of AgriTech7

The farming industry, including diversified activities such as on-farm waste and biomass (grass,

energy crops, specialist crops) for non-food uses.

Plant subsectors (crops including cereals, oilseeds, pulses, forage, potato, sugar beet,

vegetables, salads, mushrooms and fruit) including:

Plant genetic improvement: genetics, genomics, biotechnology, breeding/ propagation,

genetic conservation

Plant health: plant production (physiology, agronomy, crop management and nutrition such

as fertilizer/ agri-chemicals) and plant protection (identification, diagnostics, epidemiology ,

management / control including biological controls / vaccines / therapeutics of pest disease

and weeds)

Crop storage and silage (including post-harvest storage and on-farm waste and biomass for

non-food uses)

Animal subsectors (livestock: dairy, beef, sheep, pigs, poultry (egg and meat) and aquaculture

for fish: salmon, trout, shellfish) including:

Animal genetic improvement: genetics/ genomics; breeding/reproductive technologies;

genetic conservation

Animal nutrition, including ingredients for animal feed; grazing systems and pasture diversity

Animal health and welfare (endemic diseases, exotic diseases, behaviour): identification,

diagnostics, epidemiology, management / control, vaccines, therapeutics, surveillance;

building and environmental design to reduce stress and promote welfare

ICT systems and decision support: to support production planning, scheduling; input use

efficiency (e.g. irrigation scheduling)

Environmental and physical subsectors including:

Soil/ substrate management: soil physics, biology and chemistry, soil amendments (e. g.

biosolids, AD digestates, water retention gels etc.); controlled traffic farming; reduced ground

pressure; soil sampling; soilless growing media (glasshouse crops)

Environmental interactions (air, water, biodiversity - plant and animal; ie. technology /

decision support tools to improve animal welfare & environmental outcomes including

reducing air and water pollution, greenhouse gas emissions including quantity and quality of

air and water)

Harvest and early-stage processing including harvest technologies, post-harvest cleaning,

postharvest storage (chemicals and storage conditions), on-farm waste (AD and other waste

treatment plants) and biomass for non-food uses

Engineering and precision farming, including machinery (cultivation, crop and grass health

(drilling, spraying, fertiliser application), tractors, harvesters, pickers, post-harvest transport and

cleaning), robotics including GPS applications and autonomous devices, sensor technology

(hand held, fixed and remote including animal welfare and monitoring)

Infrastructure: buildings (including glasshouses, livestock production buildings), heating and

cooling systems, storage of crop and animal products in ambient, controlled atmosphere, cold

stores and freezing plants, irrigation/ water management storage and distribution systems, dirty

water systems, lighting (intensive livestock and glasshouse crops); ‘vertical’ and enclosed

farming systems

Advisory services

7 BIS RESEARCH PAPER NUMBER 284 (July 2016), Agri-Tech Industrial Strategy: Evaluation Scoping Study and

Baseline

Page 28

New Anglia LEP

AgriFood Tech Sector Skills Plan, Sept 2017

Appendix 2 - Consultees

Sector Skills Plan Development Process

The development process for the AgriFood Tech Sector Skills Plan was overseen by the

New Anglia Food, Drink and Agriculture (FDA) Board, which met in March 2017.

In addition a Task and Finish group established by the FDA Board met to: agree the scope

of the plan (December 2016); develop initial thoughts and agree the engagement strategy

(January 2017); to receive and comment on the draft plan (April 2017).

The development of the plan was also informed by a meeting of the Norfolk Rural

Development Strategy Delivery Group which met in March 2017 on the theme of rural skills.

A series of key informant interviews were conducted with a mix of employers, sector skills

providers and representative bodies.

An employer questionnaire was also circulated widely by industry groups to seek the views

of employers on key gaps in current skills provision, how they thought skills needs may

evolve in the future and the areas in which further investment in skills is needed.

In total 30 consultees were interviewed and/or attended the meetings held (several of whom

attended more than one meeting) and 36 employers completed the online questionnaire.

More details of those consulted is set out in appendix 2.

In addition to this sector skills plan, a supporting datapack has been developed which