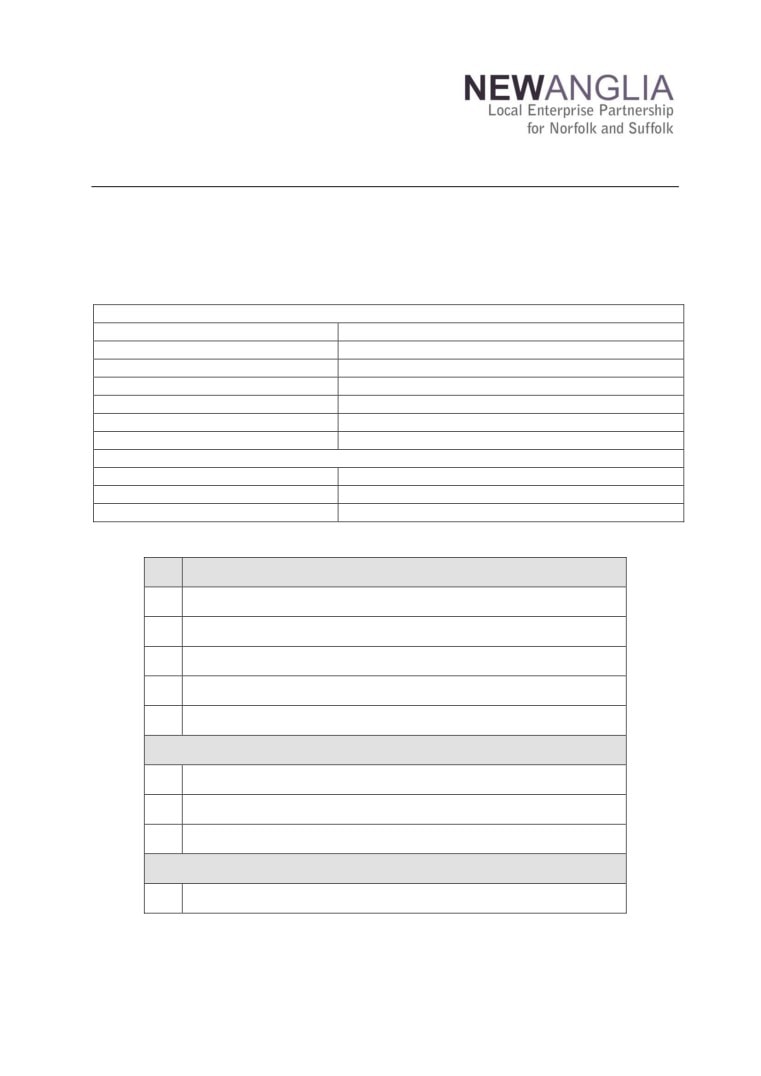

New Anglia LEP Investment Appraisal Committee

Wednesday 18th April 2018

9am to 9:45am

Green Britain, Swaffham, Norfolk

Agenda

Committee Members

Lindsey Rix

Aviva

Cllr David Ellesmere

Ipswich Borough Council

John Griffiths

St Edmundsbury Borough Council

Sandy Ruddock

Scarlett and Mustard

Alan Waters

Norfolk County Council

Tim Whitley

BT

Dominic Keen

High Growth Robotics

Exec Members

Iain Dunnett

New Anglia LEP

Chris Dashper

New Anglia LEP

Tracie Ashford

New Anglia LEP

No.

Item

1.

Welcome

2.

Apologies

3.

Declarations of Interest

4.

Minutes from last Meeting

5.

Horizon Projects Table - Confidential

Items for discussion

6.

Speculative Investment Paper

7.

West Suffolk College Engineering and Technology Centre

8.

Draft Capital Growth Programme Call - Confidential Appendices

Other

9.

Any Other Business

Date and time of next meeting: Wednesday 23rd May, 2018. 9am-9:45am

Venue: Co-op Education Centre, 11 Fore St, Ipswich IP4 1JW

New Anglia Investment Appraisal Committee

Meeting Minutes (Unconfirmed)

21st March 2018

Present:

Committee Members

Cllr David Ellesmere (DE)

Ipswich Borough Council

Lindsey Rix (LR) By Phone

Aviva

John Griffiths (JG)

St Edmundsbury Borough Council

Sandy Ruddock (SR)

Scarlett and Mustard

Alan Waters (AW)

Norwich City Council

In Attendance

Iain Dunnett (ID)

New Anglia LEP

Chris Starkie (CS)

New Anglia LEP

Chris Dashper (CD)

New Anglia LEP

Tracie Ashford (TA)

New Anglia LEP

Actions from meeting 21.03.18

Minutes from Last meeting

All attendees to be listed on the agenda.

TA

Minutes from Last meeting

Horizon information to be visible at the beginning of the meeting papers in future from May

ID

2018.

1

Welcome from the Chair

Lindsey Rix (LR) went round the table and everyone introduced themselves and apologised for being on

the phone.

2

Apologies

Apologies were received from Tim Whitley and Dominic Keen.

3

Declarations of Interest

Full declarations of interest can be found at http://www.newanglia.co.uk/about-us/the-board/.

Declarations relevant to this meeting:

Item 8 Alan Waters (AW)

Item 9 David Ellesmere (DE)

4

Minutes of the last meeting

The committee agreed the minutes were a true account from the last meeting on 21.02.18.

LR requested that the list of attendees appeared on the agenda and the Horizon Details

should be at the front of the paper in future and needed to include broad financial

parameters for the Growing Places Fund.

Actions from last meeting updated as follows:

Capital Growth Programme Verbal Update

CD/ID to review Cultural Projects - to be completed as part of the Growth Deal appraisal of

deferred projects.

CD to oversee review of Growth Deal projects in May - Ongoing.

Terms of Reference

CD To make amendments to Terms of Reference and ensure on website by 28/02/18 -

Completed

AOB

Page 1 of 3

ID to bring a dashboard of headline projects to the next meeting - Completed

The Committee Agreed that

The list of attendees should be listed in the agenda

The Horizon information should be visible at the beginning of the meeting papers in

future

5

Stowmarket Atex - Confidential

The committee agreed

To note the content of the application.

6

Carlton Marshes

Iain Dunnett (ID) took the majority of the paper as read and highlighted the key points of the

paper.

JG said it offered a good opportunity to invest in with very good leverage, CD confirmed the

match funding was important.

LR recommended supporting the proposal provided Heritage Lottery Fund funding is also

awarded.

The Committee agreed

To note the content of the paper.

To award the grant of £250,000 to Suffolk Wildlife Trust for Carlton Marshes,

dependent upon a successful outcome on the HLF application.

7

Snetterton Heath Power - Confidential Appendices

CD took the majority of the paper as read and highlighted the key areas.

AW questioned whether the LEP was subsidising an increase in land value and wanted to

know if the LEP would get a return on investment.

CS compared the project with investment in the Norwich Anglian Square development.

CD explained there was a clawback that could be incorporated into the agreement to give a

return and could be fixed at a de minimus level.

JG asked if a grant/loan combination could be considered and CS explained that this had

been explored over a 6 month period but was not viable.

The Committee Agreed

To note the content of the paper.

That CD would present the committee recommendation at the LEP board meeting on

the 21st March 2018 to offer a grant of £2.65m.

8

Norwich Area Transportation Strategy

Alan Waters (AW) left the room while this was discussed.

CD took the majority of the paper as read and reviewed the keys points of the paper.

The committee agreed

To note the content of the paper.

To transfer of £350,000 from NATS A11 Corridor Package to the NATS City Centre

Package.

The inclusion of the Plumstead Road roundabout scheme into the NATS City Centre

Package and use of £400,000 of previously allocated fund.

Alan Waters returned to the room.

9

Ipswich Cornhill

David Ellesmere (DE) left the room while this was discussed.

Page 2 of 3

CS took the majority of the paper as read and reviewed the keys points of the paper.

The Committee Agreed

To note the content of the paper.

That CS would present the committee recommendation at the LEP board meeting on

the 21st March 2018 to offer an additional £50,000 grant.

David Ellesmere returned to the room

10

Verbal Update Great Yarmouth Investment - Confidential

Governance

11

Growing Places Fund Horizon Projects

This was discussed under previous meeting minutes and was agreed that this would feature

at the front of papers for future meetings from May 2018 following approval of the LEP

Capital Budget in April 2018.

12

Terms of Reference - Growing Business Fund

The Committee Agreed

To note the content of the paper

To adopt the Terms of Reference

13

Terms of Reference - Investment Appraisal Committee

The Committee Agreed

To note the content of the paper

To adopt the Terms of Reference

Other

14

Any Other Business

None

Next Meeting

Wednesday 18th April 2018, 9am - 9.45am.

Green Britain, Swaffham, Norfolk

Page 3 of 3

New Anglia Local Enterprise Partnership Investment Appraisal Committee

18 April 2018

Agenda Item 6

New Anglia LEP: Speculative Investment

Author: Chris Dashper

Summary

Since 2012, when the Growing Places Fund was first launched, New Anglia LEP has had the

opportunity to support commercial projects with repayable loan interventions.

Due to the requirement to ensure that best value is secured through the use of public funds at

minimal risk, the majority of loans made by New Anglia LEP to date have been non-speculative,

with either a confirmed end user or occupant or a defined and manageable repayment method

in place from the outset.

New Anglia LEP continues to receive regular requests for funding through the Growing Places

Fund, many of which could be considered as speculative projects.

In lower risk circumstances, a loan for a speculative project may be appropriate for LEP

support. This paper outlines for the Board the issues of speculative development and when

such an intervention might be considered by the LEP.

Recommendation

The Board is recommended to consider using Growing Places Fund and other funds if available

to support speculative investments in certain lower risk circumstances.

Background

The term ‘speculative construction’ or ‘speculative development’ describes a process in which

unused land is purchased or a building project is undertaken with no formal commitment from

any end users.

Despite the end user being unknown, the developer is confident not only that they will be able

to find one but also that the type of development being undertaken is suitable. This contrasts

with custom building when a builder is contracted for a specific development by a client who is

able to provide a brief of their requirements.

Speculative development does have a degree of notoriety attached to it, from the 1980’s in

particular where in cities and major growth areas de-regulation of the financial sector and the

availability of international financing led to significant commercial developments and property

booms.

1

Examples of speculative construction include:

Constructing retail space to lease space from or to sell

Constructing a business park or office space to sell or lease

Building houses to sell

Conversion of existing buildings into other uses to lease or sell

Speculative developers typically profit from carefully timing the buying and selling of land or

property for development. Land for office or housing developments can often be purchased at a

cheaper rate during a market depression and then sold once developed when the market has

recovered. However there is risk in this as the costs are often high, the timescales are long and

the consequences of misjudging the market and not finding a buyer can be serious. Public

funding is not traditionally used to support the purchase of land and the LEP would not consider

requests to solely support the purchase of land through any of the programmes. The growing

issue of land banking is also a reason not to support land purchases. For any other type of

development the LEP already operates a policy of supporting ‘shovel ready’ projects to ensure

that funding is not tied into projects that have no chance of an immediate start.

It can be common for speculative developments to remain empty or partially empty for a long

time after construction and for developers to suffer financially as a result, which can then have

a corresponding impact on the ability to repay any debt finance.

It is rare that large scale speculative developments such as large offices will be undertaken by

anyone other than the largest developers as the amount of investment and duration can be

prohibitive. Building companies speculating on small scale industrial developments are more

common and of the type that New Anglia LEP has often been approached to support, for

example the Malthouse in Ipswich and Atex in Stowmarket.

It is also common with owner-occupied housing, where there is a relatively short build time,

limited capital is tied up in the building and there may be greater willingness from commercial

banks to extend credit on the security of land holdings. The LEP has had few approaches for

such investments because there is a less obvious failure in the traditional funding available in

the market.

New Anglia LEP has funded a number of commercial and public projects through repayable

loans since the launch of the Growing Places Fund in 2012.

Table of LEP loans to date

Project

Loan £

Public/Commercial

Loan type

Haverhill Research Park

£2m

Commercial

Road infrastructure

Barton Mills Roundabout

£500k

Commercial

Road infrastructure

Kesgrave Hall

£300k

Commercial

Commercial business

Kings Lynn Innovation

£2.5m

Public

Innovation Centre

Centre

Pasta Foods

£2.4m

Commercial

Commercial business

Peel Estates, North

£2.3m

Commercial

Housing infrastructure

Walsham

Ipswich Flood Defence

£6.6m

Public

Flood defence infrastructure

Scheme

Ipswich Winerack

£5m

Commercial

Housing infrastructure

Malthouse Ipswich

£600k

Commercial

Commercial business space

Loans have been awarded for a variety of purposes, from unlocking stalled sites with

infrastructure, the original purpose of the Growing Places Fund, through to the purchase of

capital equipment and capital build and flood defences.

2

To ensure appropriate use of public funding, all loans to date aside from Ipswich Malthouse

have been awarded on a non-speculative basis, with either an existing owner or an identified

future occupier or a pre-arranged repayment arrangement in place.

Where housing projects have been supported through the Growing Places Fund, the loan has

been provided for the infrastructure to unlock the site, not to fund the houses themselves. The

exception to this is the Ipswich Winerack, where the fund has supported a mixture of

infrastructure and housing, but only because the Homes and Communities Agency was the

senior partner in the project, which reduces the overall risk for the LEP.

Ipswich Malthouse, which has received agreement for a GPF loan is considered to be a

speculative project, because the project had no confirmed future occupiers at the time of

approval, however, the project was considered to address a market failure in Ipswich, with a

significant level of un-serviced demand for small, easy terms business lets, particularly in a

prime location between the railway station and the Princes Street EZ in Ipswich

Key issues

Recent discussions around projects such as the Malthouse in Ipswich and ATEX in Stowmarket

suggest that on an appropriate scale, a degree of limited speculative investment should be

considered by the LEP. The following list defines the factors we recommend should be

reviewed when a speculative investment is being considered.

Necessary approvals such as planning permission in place

Suitable site identified and ownership issues resolved

Appropriate size and complexity of the development

Residual valuation exceeding loan request by appropriate ratio, to be determined by the

IAC

Amount of request within LEP preferential limits- recommended range would be

between £500k and £1m.

Match funding or financing arrangements in place

Delivery and repayment within 3-5 year time period

The market conditions and evidence of need at the time and in the future

The potential return on investment is commensurate with risk and value

Comparison with other potential projects to ensure best value

Should the above factors be satisfied and the project is considered to be of appropriate type

and scale for LEP investment (or the investment requested from the LEP can be scaled in a

way that still allows the project to proceed) then a legally binding, secured loan should be

considered by the IAC and subsequently by the LEP Board

Link to the Economic Strategy

Support to developments of all types through LEP programmes links to the creation of jobs,

new homes, support to new and existing businesses and the promotion of growth locations and

Enterprise Zones.

Recommendation

The Board is recommended to consider using Growing Places Fund and other funds if available

to support speculative investments in certain lower risk circumstances.

3

New Anglia Local Enterprise Partnership Board

Wednesday 23rd May 2018

Agenda Item 7

Engineering and Technology Centre, West Suffolk College (Vinten’s Building)

Author: Natasha Waller & Michael Gray. Presenter Chris Dashper

Summary

This paper seeks approval by the LEP Board of a £3m investment from the Growth

Deal towards the development of an Engineering and Technology Centre at West

Suffolk College.

This will be the second tranche of a £7m LEP investment in the centre. £4m was

previously provided by the LEP to acquire the site and 9000m2 premises in 2016.

The £3m will be used to refurbish at least 3000m2 of the building so that it is fit to

deliver training in areas required by key sectors of our local economy.

The project will result in 536 additional learners over the first four years. 246 of which

will be engineering courses at level 3 and above.

Acquisition and refurbishment of the site provides the potential to unlock further

strategic opportunities.

Recommendation

To approve the release of the remaining £3 million, originally allocated through the Skills

Capital funding application process, for the refurbishment of part a building in order to create a

new Engineering and Technology Centre at West Suffolk College.

Background

In 2014, as part of the then skills capital allocation process the New Anglia Skills Board

prioritised a £7 million investment for the acquisition, modernisation and refurbishment of

premises within walking distance of the main West Suffolk College (WSC) campus to be used

for full-time further and higher education provision for the energy, engineering and advanced

manufacturing sectors. This building was acquired from Vitec who are relocating to other

premises in the town.

As the current college campus have limited capacity to grow curriculum areas including their

ability to demonstrate engineering principles on a practical basis, the project was approved to

enable growth and improve the quality of the college’s offer in these key economic areas. The

project also represented a unique opportunity to secure land and property on the periphery of

the main WSC campus.

Following the prioritisation of the project by the Skills Board, WSC were invited to submit a

detailed application to ensure full due diligence was applied before funding was granted and to

help inform the final decision to be made by the LEP Board. During this process it was decided

1

that the project would be split into two distinct phases. The first, to acquire the site and the

second to undertake modernisation and refurbishment. This was due to both the annual

allocation timescales of the Growth Deal allocation from Government and the level of detail

available at that point regarding the refurbishment due to the commercial sensitivity of

purchasing the building from the Vitec company.

In January 2016, the LEP invested £4 million to acquire the site.

It was expected that the previous owners would be able to vacate the site earlier than has been

the case. With the purchase of the site the previous owners of the site became tenants, with

West Suffolk College receiving a rental income. This rental income (£669,000) has been ring

fenced and will be invested back into the development of the centre, either increasing the levels

of refurbishment due to take place or helping to cover any increase in refurbishment costs.

The LEP Board is now asked to approve release of the remaining £3 million of Growth Deal

funding already ringfenced for the modernisation and refurbishment of the building.

The £3m grant will be used by West Suffolk College to fund the necessary modifications of a

proportion of the premises. This includes the discharging/meeting the planning conditions,

improving the building façade and creating the teaching spaces required including six higher

education engineering classrooms complimented by demonstration areas providing students

with a more ‘hands-on’ enhanced experience - vital for employability.

There will also be the creation of professional training facilities within three rooms in the centre

specifically designed to meet employers demands for targeted higher-level skills training for

their workforce.

The investment is expected to enhance the regional engineering and STEM provision offer. It

will result in at least an additional 536 learners over the first four years:

- 246 of which will be engineering courses at level 3 and above.

- 290 across ICT, business management, science and health and social care due to releasing

classroom space at the main campus.

This growth is expected to continue beyond the initial four years.

Acquisition and refurbishment of the site also provides the potential to unlock strategically

important opportunities to further enhance the regional training offer in important areas.

The Engineering and Technology Centre is an integral part of the bid to establish an Institute of

Technology in the East (EIoT), providing the space and industry standard facilities to deliver the

Institute’s higher level technical engineering curriculum. There are many large-scale

engineering/ technology and infrastructure projects planned for the area that are of national

significance which will substantially drive demand for high value skills beyond current levels

such as offshore wind, offshore decommissioning and the potential Sizewell C and Bradwell B

nuclear new builds. Many of the organisations involved in these developments are supporting

partners of the EIoT bid and will be working with WSC to support the development and delivery

of its curriculum.

This facility could potentially become part of a National College for Nuclear proposal, providing

many of the core technical skills that will be required for constructing and operating a Nuclear

Power Facility. WSC are also in dialogue with the Advanced Manufacturing Centre in Coventry

to become a ‘spoke’ site that would lead to innovative manufacturing and productivity solutions

for employers.

2

These developments will take place in the refurbished area if approved plus in the remaining

6000m2 of the site which will fall outside of this part of this current application. It is fully

anticipated that this area will be developed without further LEP funding.

Key issues/consideration

£4million has already been committed to the Centre and spent to purchase the site and the

rental income has been ring fenced to go back into this project. £1 million has been committed

by the College to support the proposal. This was previously agreed by the LEP Board and

approved by the government appraisal process.

Timescales, vision and costings have all evolved since the original concept and proposal to the

Board but the college is committed to the Science, Technology, Engineering and Maths (STEM)

agenda and this is part of process of developing this curriculum for the region.

The Board do need to be aware that a full building inspection has not been carried out to date

due to restriction issues with the original owner who then became a tenant. This may lead to

further costs in creating a safe teaching environment. This is in addition to the known change of

use redevelopments already identified by planning regulations.

The LEP have made it very clear that there will be no additional funds available to cover any

contingencies if costings increase dramatically for the area of the building identified in the

Detailed Application Form (dated 16/03/2018). West Suffolk College have agreed to cover

these costs or review the level of resourcing. A Grant Agreement would be put in place to

secure this position (i.e. that any cost overruns would be met by the College). They have a

strong history of financial management and monitor their reserves robustly. Any further delay

risks increasing costs and delay in revenue from increased student capacity.

As identified below, this development intertwines with other submitted proposals to grow the

provision in the area.

Link to the Economic Strategy

This new facility will support the growth in numbers of engineering students that are able to be

trained at the college. Advanced Manufacturing and Engineering & Energy are key sectors for

the LEP and the recently endorsed sector skills plans highlight a clear need for increase in

numbers of entrants to these sectors and an upskilling of the existing workforce.

This building also has areas earmarked for the proposed Eastern Institute of Technology and if

successful, funding will support further development over the coming years. Expansion of the

curriculum will also occur together with establishment of stronger links with other educational

providers in the region and key employers. Some of this is already underway and some new

equipment has been part funded through the Skills Deal which will be housed here. Training

has also been offered by an employer to improve the social mobility of a number of individuals

referred by the DWP showing that this building will clearly drive inclusion and skills.

The release of classroom space in the main college will allow other curriculum to grow as well -

Health & social care, Science, ICT and Business Management. Again these are all vital areas

of curriculum backed up by our ambitions and endorsed by their representative sector skills

plans.

3

Next Steps

Grant agreement will be developed and signed.

Further structural reviews will be carried out and building work commissioned.

Centre to be operational for the 2019/20 academic year.

Further STEM based proposals to be developed for the unoccupied area.

Recommendation

To approve the release of the remaining £3 million, originally allocated through the Skills

Capital funding application process, for the refurbishment of part a building in order to create a

new Engineering and Technology Centre at West Suffolk College.

4

New Anglia Local Enterprise Partnership Board

Wednesday 23rd May 2018

Agenda Item 8

Draft Paper - Capital Growth Programme Call: recommendations

Author: Emily Manser / Chris Dashper

Summary

The Capital Growth Programme call for projects was launched in October 2017. Under this call,

£9m of grant funding from Growth Deal was made available, of which £5.13m has been

allocated to projects.

A number of projects were deferred pending further information, which has now been received

and appraised.

This paper is to decide whether to financially support these projects in order to allocate the

remaining £3.87m of the project.

Tables 2 and 3 are deemed confidential because they contain commercially sensitive

information.

Recommendation

Approve the award of Growth Deal grant funding to the following projects in table 1:

Project X

Project Y

Project Z

Approve the recommended decision option for each of the projects in tables 2 and 3:

Table 2: Recommended to defer - Confidential

Table 3: Recommended to reject - Confidential

Background

The Capital Growth Programme call for projects was launched immediately following the

October 2017 LEP Board meeting.

Under the call £9m of grant funding from the Growth Deal has been made available to support

projects that help deliver the new Economic Strategy.

A total of 29 project Expressions of Interest were received, with sectors including infrastructure,

transport, employment projects, skills and cultural themed projects.

1

The Board considered the 29 projects in January. The Board approved 2 of these, Bacton to

Walcott Coastal Management Scheme and the Cefas Research Centre. 7 projects were

rejected as they were deemed ineligible for the funding. 20 projects were deferred as they

required further information to allow a more detailed assessment to take place before a

decision could be made on whether or not they should be recommended for funding. All

projects were written to with a clear request as to the further information we required.

Subsequently, the Board approved 1 of the deferred projects at the March Board. This was the

Snetterton Heath Employment Area Electricity Upgrade Scheme, as it required an earlier

decision.

Fourteen projects have now submitted further information, which have again been

independently appraised. Of the remaining 6 projects that were deferred in January, one has

since been approved (Snetterton Electricity Scheme) and five did not submit the requested

further information by the deadline.

Recommendations for the approval, deferral or rejection of these projects are outlined in the

tables below.

Appendix 1 provides a summary appraisal of each project recommended to be approved.

Appendix 2 provides further information regarding the appraisal methodology.

Looking further ahead, once the £9m from this call is fully allocated, the Capital Growth Round

will still have £23m available and we are planning a second call for strategic projects later in the

year. This will be in the autumn.

Key Considerations

The fourteen projects recommended for approval would utilise the remaining £3.87m of the

£9m.

The remaining £5.13m of the £9m has already been allocated. This consists of £2.48m

allocated at the January 2018 Board meeting to Bacton Flood Scheme and Cefas Research

Centre, and £2.65m allocated to Snetterton Electricity Scheme at the March 2018 Board

meeting.

A further £23m would then remain for a future call to be held in the autumn.

[Depending on appraisals- if many projects score a high result, the Board may wish to consider

whether to utilise any of the £23m funding ring-fenced for the autumn call].

The funding is for projects that are complete by March 2021 at the latest.

Link to the Economic strategy

The approved projects will help to deliver the new Economic Strategy. All projects

recommended for approval have been appraised and prioritised against their fit with the

Economic Strategy along with other criteria (outlined in Appendix 2).

Next Steps

Issue grant agreements for the approved projects and monitor progress.

2

Prepare criteria and appraisal process for the autumn 2018 call.

All new projects to be in progress by 2019, for completion by March 2021 at the latest.

Recommendation

Approve the award of Growth Deal grant funding to the following projects in table 1:

Project X

Project Y

Project Z

Approve the recommended decision option for each of the projects in tables 2 and 3:

Table 2: Recommended to defer - Confidential

Table 3: Recommended to reject - Confidential

3