New Anglia Local Enterprise Partnership Board Meeting

Wednesday 21st February 2018

10.00am to 12.30pm

Marble Hall, Surrey Street, Norwich, Norfolk

Agenda

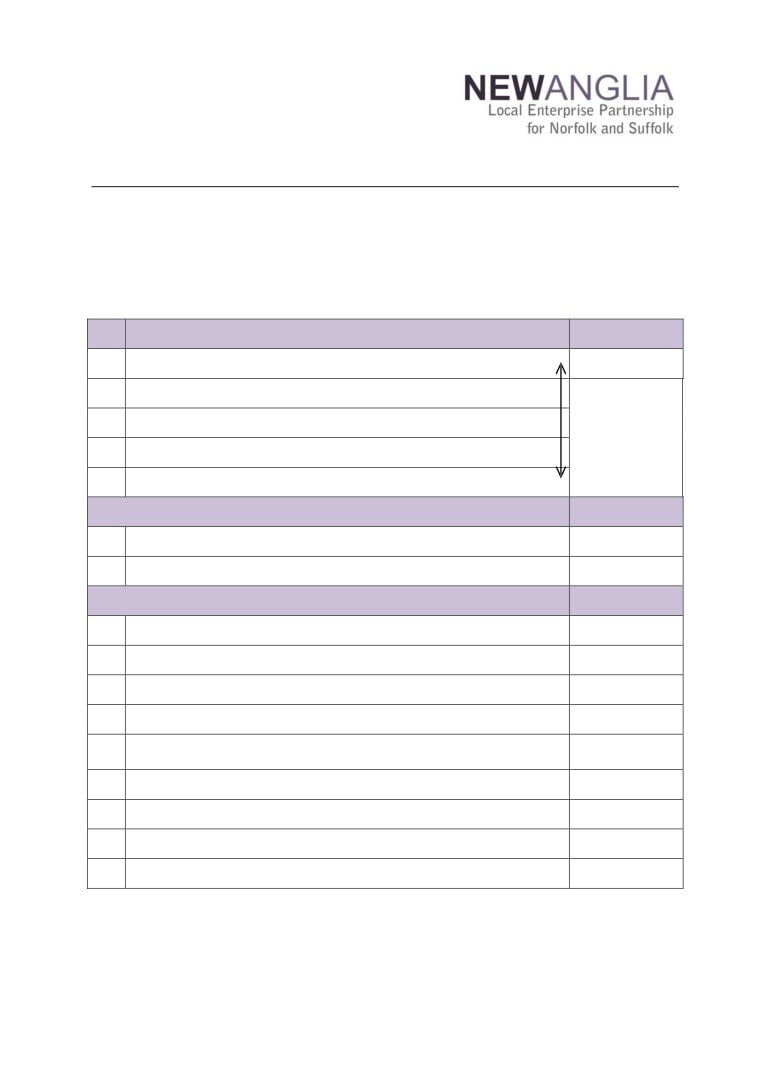

No.

Item

Duration

1.

Welcome

20 mins

2.

Apologies

3.

Declarations of Interest

4.

Welcome from Lindsey Rix

5.

Actions / Minutes from the last meeting

Forward looking

60 mins

6.

Brexit Analysis

For Discussion

7.

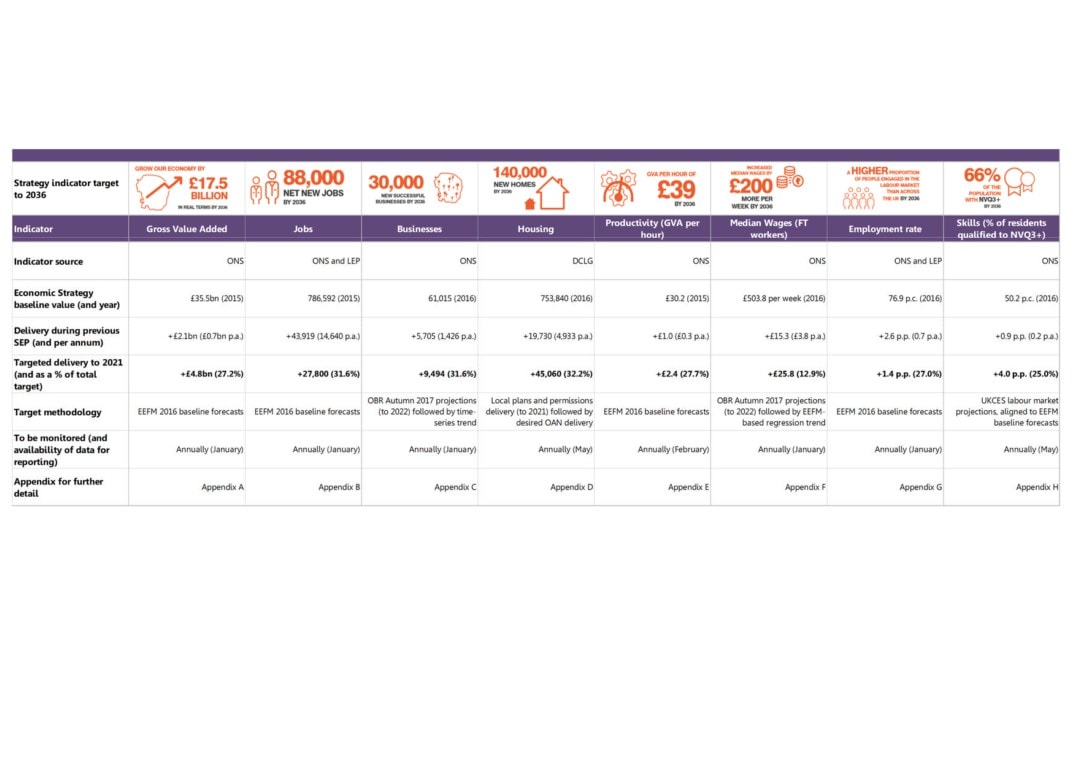

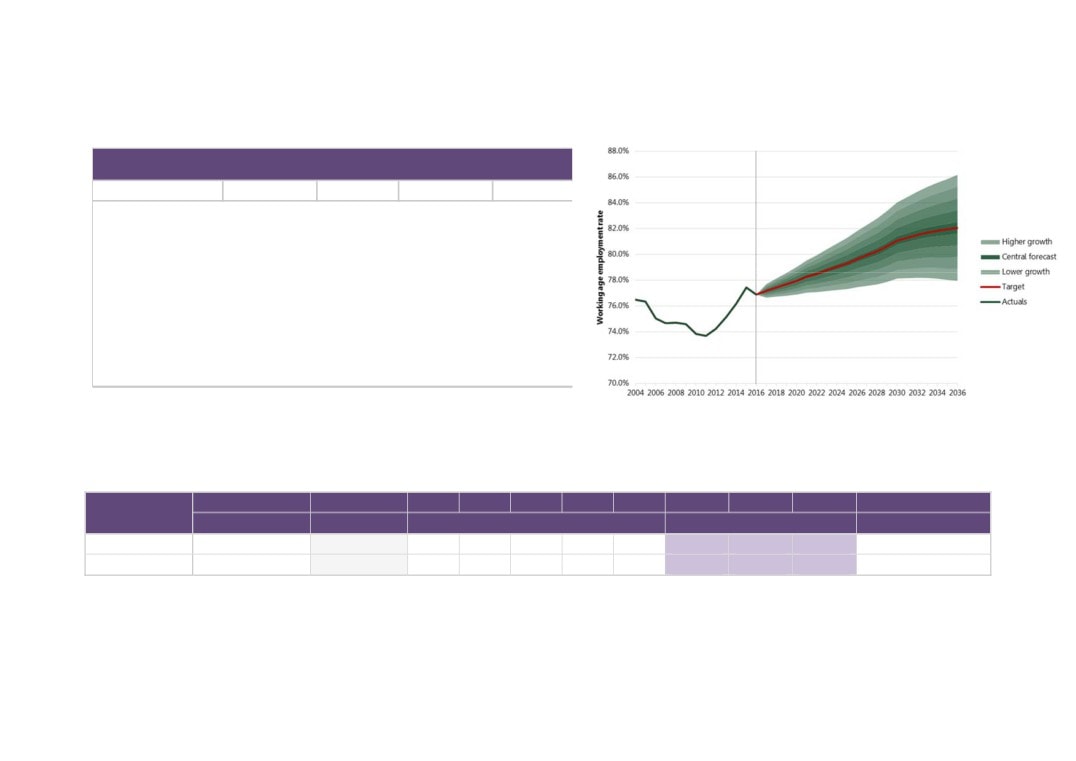

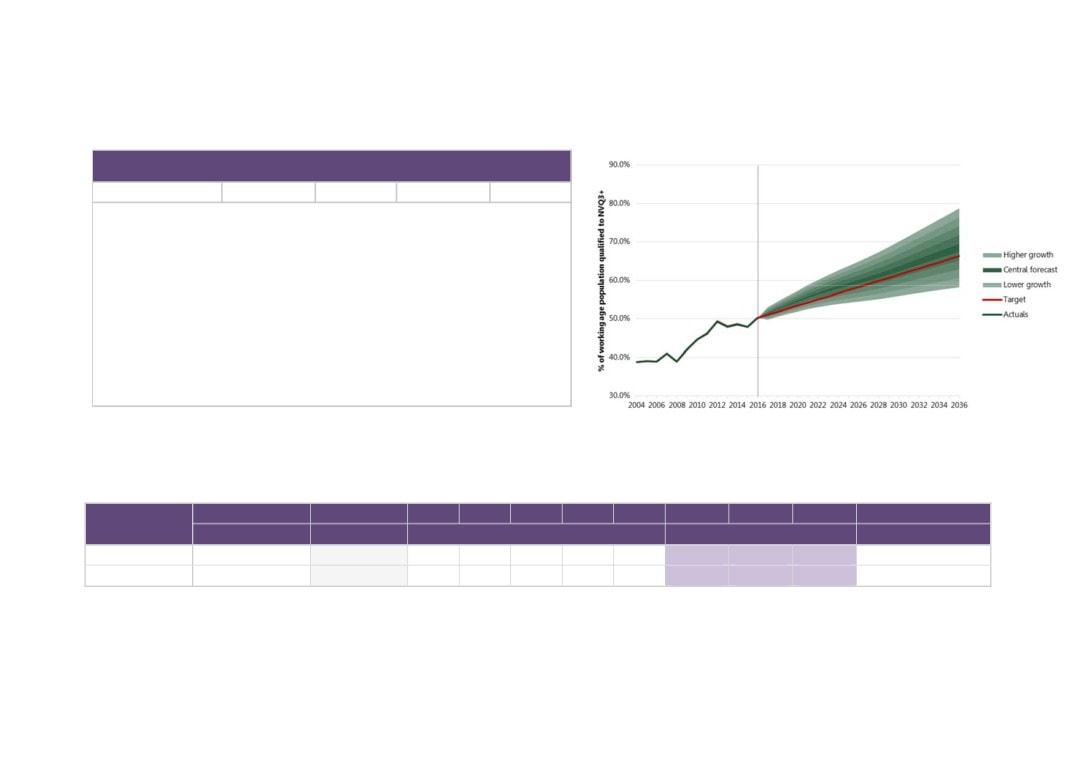

Economic Indicator Trajectories and Targets

For Discussion

Governance and delivery

70 mins

8.

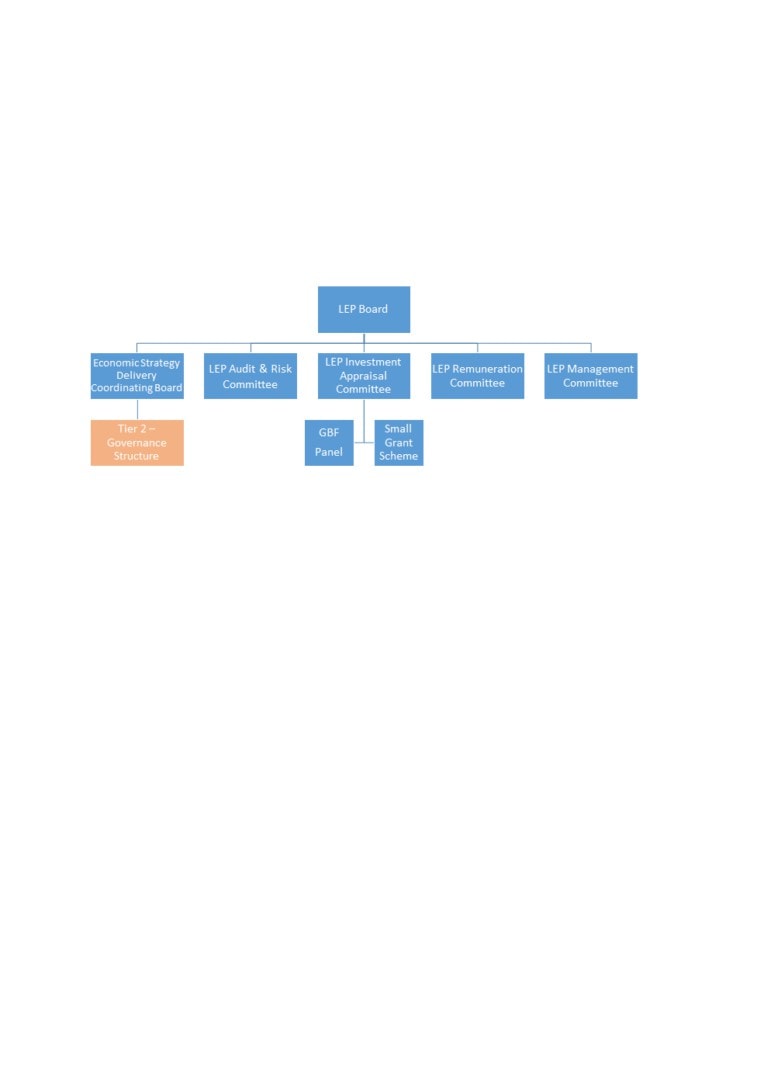

Governance Review

For Approval

9.

24 Month Operation Plan Review

Update

10.

New Anglia LEP ERDF Bid

For Approval

11.

Sub-National Transport Forum

For Approval

Chief Executive’s report

12.

Update

including PwC and Mary Ney Review Implementation Plan

13.

Finance Report including Confidential Appendices

Update

14.

Any Other Business

Date and time of next meeting: 21st March 2018. 10am-12.30pm

Venue: The Jockey Club, Newmarket, Suffolk

1

New Anglia Board Meeting Minutes (Unconfirmed)

17th January 2018

Present:

Cllr David Ellesmere (DE)

Ipswich Borough Council

Doug Field (DF)

East of England Coop

Cllr John Griffiths (JG)

St Edmundsbury Borough Council

Cllr Cliff Jordan (CJ)

Norfolk County Council

Dominic Keen (DK)

High Growth Robotics

Steve Oliver (SO)

MLM Group

Cllr Andrew Proctor (AP)

Broadland District Council

Prof David Richardson (DR)

UEA

Lindsey Rix (LR)

Aviva

Sandy Ruddock (SR)

Scarlett & Mustard

Dr Nikos Savvas (NS)

West Suffolk College

Cllr Alan Waters

Norwich City Council

Jeanette Wheeler (JW)

Birketts

Tim Whitley (TW)

BT

In Attendance:

Cllr Richard Smith (RS)

Suffolk County Council (For Colin Noble)

Shan Lloyd (SL)

BEIS

Chris Dashper (CD)

New Anglia LEP

Iain Dunnett (ID)

New Anglia LEP

Chris Starkie (CS)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

Tracey Jessop (TJ)

Norfolk County Council

Sue Roper (SuR)

Suffolk County Council

Johnathan Reynolds (JR)

Orbis (For Item 4)

Page 1 of 6

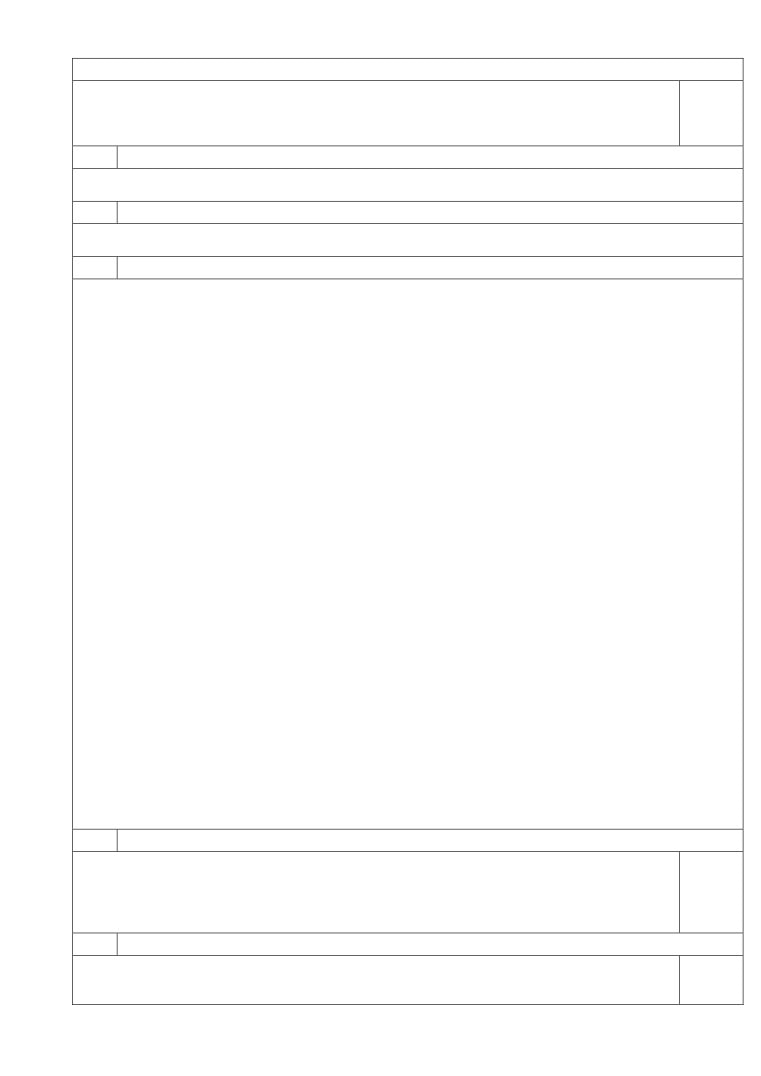

3

Actions from the meeting: (17.01.18)

Capital Growth Programme Projects

Identify whether other LEPS have received requests for investment in flood defence schemes.

CD

Chief Executive’s Report

For CS to produce a paper on the impact of GCGP changes

CS

1

Welcome from the Chairman

Doug Field (DF) welcomed everyone to the meeting and thanked Jonathan Reynolds and Orbis for

hosting the meeting. He welcomed Richard Smith who is deputising for Colin Noble.

2

Apologies

Apologies were received from:

Cllr Colin Noble

3

Declarations of Interest

The board were reminded that declarations of interest are required as part of LEP scrutiny and must be

submitted to the LEP office at the earliest convenience.

Declarations relevant to this meeting:

Item 7: Capital Growth Programme Projects

Projects for Approval

David Richardson and Steve Oliver

Projects for Deferral

Nikos Savvas, Richard Smith, Cliff Jordan, Sue Roper and Tracy Jessop

Projects for Rejection

David Richardson, Richard Smith, Cliff Jordan, Sue Roper and Tracy Jessop

Item 9: Integrated Health and Employment Service Proposal

Cliff Jordan & Tracy Jessop

Item 10:Growing Places Fund investment The Malthouse

David Ellesmere and Steve Oliver

Item 11: New Anglia Capital

Doug Field declared an interest in the investments in MBASO and Novofarina

Chris Starkie (CS) reminded Board members that the new Declaration of Interest form supplied by

Government needed to be completed and returned by the next Board meeting on 21st February as it must

be published on the LEP web site by 28th February in order for the LEP to remain compliant.

In the future any declarations made at the Board meetings will be transposed onto Board member’s forms

as well as recorded in the minutes. Any changes identified between Board meetings should be advised

to Charley Purves and forms will be updated accordingly.

Lindsey Rix (LR) asked about the process should a Board member participate in the investment approval

process and subsequently became involved in the contract. CS advised that the LEP should be notified

at the earliest opportunity either directly to the Office Manager or at the next Board Meeting and the

relevant Declaration of Interest form would be updated accordingly.

4

Welcome from Orbis Energy

Johnathan Reynolds welcomed Board members to Orbis Energy and provided an overview of

the organisation covering the range of work carried out, its achievements over the past 9 years

and provided examples of some of the programmes in which it has been involved. The

presentation included details of the importance of the UK and the East in the world renewable

energy market. Johnathan then left the meeting.

5

Minutes of the last meeting 22nd November 2018

Actions from last meeting updated as follows:

LEP Governance Review

Page 2 of 6

4

To express preferences over committee roles to LiR by 1st December - Complete - a table of

ALL

proposed committee members will be circulated prior to next Board.

Business Investment Proposal - Confidential

NK

To receive more detail on the skills spending within the proposal - details are available at the

meeting or on request.

May Ney Review Including Standards of Conduct

HM

To receive details of where the policies can be accessed - complete

Board Forward Plan

ALL

To provide feedback on the plan and propose any additional items - complete

Business Performance Reports

To receive a proposal on the Eastern Agi-Tech initiative by email - On hold due to the winding

CS

up of GCGP and awaiting clarification about their financial position.

6

Aims and Objectives for the Year

Chris Starkie (CS) provided a presentation on the strategic aims and objectives for the LEP for

2018.

Board members discussed the importance of promoting the East as a brand and Dominic Keen

(DK) felt that more could be done to champion local business success stories.

David Ellesmere (DE) asked how New Anglia compared to other high performing LEPs and

whether it was proactively looking to identify best practise elsewhere. CS confirmed that New

Anglia was actively involved in the LEP network and was also increasing its involvement in

ADEPT.

Sandy Ruddock (SR) noted that the region had many micro and start-up businesses who would

benefit from support from the LEP which needed to be promoted as the go-to organisation for

small businesses.

DF asked CS what he viewed as the 3 key aims to be achieved in the next 12 months. CS

stated that he wanted the Board to have confidence in the LEP’s internal processes, to

continue to promote local business successes and to have secured a local industrial strategy.

Steve Oliver (SO) asked that the LEP’s aims include social mobility and social inclusion.

The Board agreed:

To note the content of the presentation

7

Capital Growth Programme Projects

DF proposed breaking this item into the various bid groupings namely those which were

proposed to be approved, deferred or rejected. It was agreed that meeting attendees would

register their interest in each group individually.

Chris Dashper (CD) took the majority of the paper as read and reviewed the key points of the

proposal.

He explained that the projects had also been considered by the Investment Appraisal

Committee.

Approved Projects

David Richardson (DR) and SO declared an interest in this item and left the room

CD proposed that the Board approve the award of Growth Deal grant funding to the Bacton to

Walcott Coastal Management Scheme and to the Cefas Research Centre.

This was approved by the Board

DR & SO returned to the room.

Deferred Projects

Nikos Savvas (NS), Richard Smith (RS), Cliff Jordan (CJ), Sue Roper (SuR), Tracy Jessop (TJ)

declared an interest in this item and left the room.

CD advised that further work would be carried out on these projects and some would be

included in a later round of funding as appropriate.

LR noted that the Board should have a holistic view of future projects in order to properly

assess which were the best projects in which to invest the limited funds available so that

investments were not solely made in those projects presented first.

Page 3 of 6

5

The meeting discussed the issue of whether flood defences should be funded locally or

nationally. SR asked if other LEPs had received requests to fund similar projects.

CD asked for approval to defer the projects as listed. This was agreed by the meeting.

Rejected Projects

DR declared an interest in this item and left the room. NS returned to the room.

RS, CJ, SuR and TJ also declared an interest in this item and therefore remained outside the

room.

CD reviewed the list of rejected projects detailing the rationale behind the decisions.

SO asked whether any could be referred to New Anglia Capital. CD advised that Liquid 11

could possibly apply for New Anglia Capital but would be more suitable for Growing Business

Fund.

CD asked for approval to reject the projects as listed. This was agreed by the meeting.

DR, RS, CJ, SuR and TJ returned to the meeting.

The Board agreed:

To note the contents of the report

To approve the award of Growth Deal grant funding to the following projects in table 1:

Bacton to Walcott Coastal Management Scheme

Cefas Research Centre

To approve the recommended decision option for each of the projects in tables 1, 2 and

3. (Table 2: Recommended to defer and Table 3: Recommended to reject)

CD to Identify whether other LEPS have received requests for investment in flood

CD

defence schemes.

8

New Anglia Voluntary Community Sector Programme Extension

Iain Dunnett (ID) took the majority of the paper as read and reviewed the key points of the

paper including the history of the fund and its achievements to date.

DE expressed his support highlighting the importance of multi-year grants for organisations in

order to assure future funding. He noted that this should be based on performance over a 1

year deal rather than the size of the organisation.

DE also queried how performance was rated proposing using the length of unemployment prior

to entering employment as one criteria.

ID advised that the criteria would be reviewed as part of the re-scoping of the fund.

The meetings agreed to the proposal.

NS and SO offered to sit on the Funds Appraisal Panel.

The Board agreed:

To note the content of the proposal

To agree the re-scoping of the criteria for the fund as described in the paper.

To agree that the LEP makes the further commitment of a £250,000 grant from the

Growing Places Fund for 2018/19 and to agree to review further commitments for two

years beyond 2018 at an appropriate stage.

To agree that NS and SO would sit on the Funds Appraisal Panel.

9

Integrated Health and Employment Service Proposal

CJ & TJ declared an interest in this item and left the room.

Iain Dunnett (ID) took the majority of the paper as read and reviewed the key points of the

paper.

RS expressed support for the project noting that there was a similar scheme in Suffolk and CD

confirmed that the LEP were already in discussion with them.

CS proposed that the funding be agreed subject to the funding being matched as detailed in

the proposal.

The meeting discussed the benefits of the project.

Page 4 of 6

6

The Board agreed:

To note the content of the proposal

To support the overall purpose of the proposal against the key LEP objectives of

employability and skills.

To provide matching finance at a rate of £120k per annum for three years to the project

to assist in leveraging over £2million of European Social Funds (ESF). This is

dependent on other matched funding being secured.

10

Growing Places Fund investment The Malthouse - Confidential

DE & SO declared an interest in this item and left the room.

ID took the majority of the paper as read and highlighted the key points of the proposal. He

explained that the LEPs Investment Appraisal Committee have reviewed an initial appraisal

and a full appraisal of the development, including an externally completed assessment of the

loan application. These reviews included an assessment of the development for strategic fit

from an economic perspective and the financial aspects.

LR noted that if the further £900k is raised from another party then the point of the LEP having

first charge would be renegotiated at the Investment Appraisal Committee.

DF noted that a discussion was required at a future date as to how the board balances fairness

& transparency in similar investments.

The Board agreed:

To note the content of the proposal.

To approve a recommendation made by the LEPs Investment Appraisal Committee that

an offer of a £600,000 loan is made to the current owner of the Ipswich Malthouse for its

redevelopment into bespoke business units.

11

New Anglia Capital

DF declared an interest in the investments MBASO and Novofarina and took no further part in

the discussion.

CD advised the meeting that this was the bi-annual report as requested by the Board and took

the majority of the paper as read and asked the Board for questions.

The Board reviewed the approach to risk with DE noting that some investments will naturally

fail but that the portfolio should be assessed as a whole.

CS noted that the jobs created by NAC were generally high value jobs with a lower cost per job

than that in the Growing Business Fund.

The Board agreed:

To note the content of the report.

12

Chief Executive’s report including PwC and Mary Ney Review Implementation Plan

CS took the majority of the paper as read and provided an update on the following items:

Mary Ney Review - CS noted that the Board is compliant with the Mary Ney recommendations

on the issuing and publication of papers and minutes however this process is still being rolled

out to the relevant sub-committees. This will be achieved by 28th February 2018.

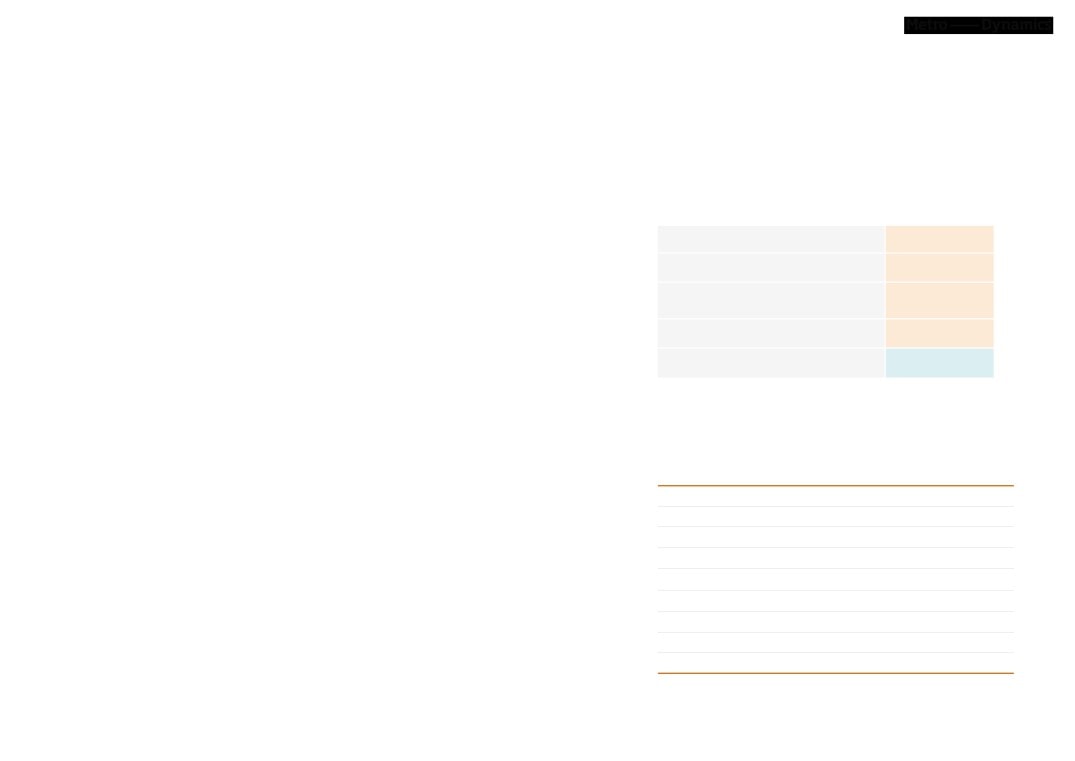

Government Dashboard - The proposed dashboard was circulated to attendees. CS

requested approval for the dashboard and asked whether the Board wanted to see the report

on a regular basis. Board agreed to the Dashboard and confirmed that there was no

requirement to include it in Board papers. Improvements to Board reporting are being

progressed in line with the timeframes included in the PwC report.

Unilever - The meeting discussed the current situation. Jeanette Wheeler (JW) noted that the

recent press stories had provided a negative view of the state of investment in the region and

Page 5 of 6

7

that more positive promotion was required. CS agreed noting that the LEP had to balance

sensitivity to job losses and the promotion of other investments.

COO Recruitment - short listing has begun with first interviews scheduled to take place before

the end of January.

CGCP - CS reviewed the issues raised by the changes to GCGP including the impact of

possible changes to the boarders of the LEPS. CS offered to produce a paper on the subject

detailing known facts and potential impacts. JW requested details of the impact of changes on

LEP programmes and investments.

The Board agreed:

To note the content of the report

To endorse the Dashboard

For CS to produce a paper on the impact of GCGP changes

CS

13

Finance Report

CS took the majority of the papers as read and asked for questions from the Board.

The Board agreed:

To note the content of the report.

14

Appointment of New Director

Andrew Proctor (AP) & LR met to interview two candidates and proposed Jonathan Reynolds

as the new board member.

The Board agreed:

To approve the appointment

16

Any Other Business

It was agreed that Item 16 would be completed prior to Item 15 given the latter’s confidential

nature.

Tim Whitley (TW) advised that Adastral Park is hosting the Innovate UK Conference on 27th

January to which Board Members were invited.

TJ updated the meeting on the position with Carillion advising that the Council had been in

discussion with Highways England and received confirmation that contingency plans were in

place and no projects in the East would be impacted by the collapse.

NS advised that on 16th April East of England Education providers would be hosting a

promotional event and requested promotion from the LEP.

15

Remuneration Committee - Confidential

Non Board Members left the meeting.

The confidential minutes of the Remuneration committee were presented by DF. The minutes

contained a salary recommendation for the Chief Executive Officer (CEO) and a salary banding

for the Chief Operating Officer (COO). There was also details of the performance management

process for the CEO.

The Board agreed:

To note the content of the minutes for the Remuneration Committee

To agree the recommendations made by the Remuneration Committee

Next meeting:

Date and time of next meeting: 21st February, 2018. 10am-12.30pm

Venue: The Marble Hall, Surry Street, Norwich, NR1 3NG

Page 6 of 6

8

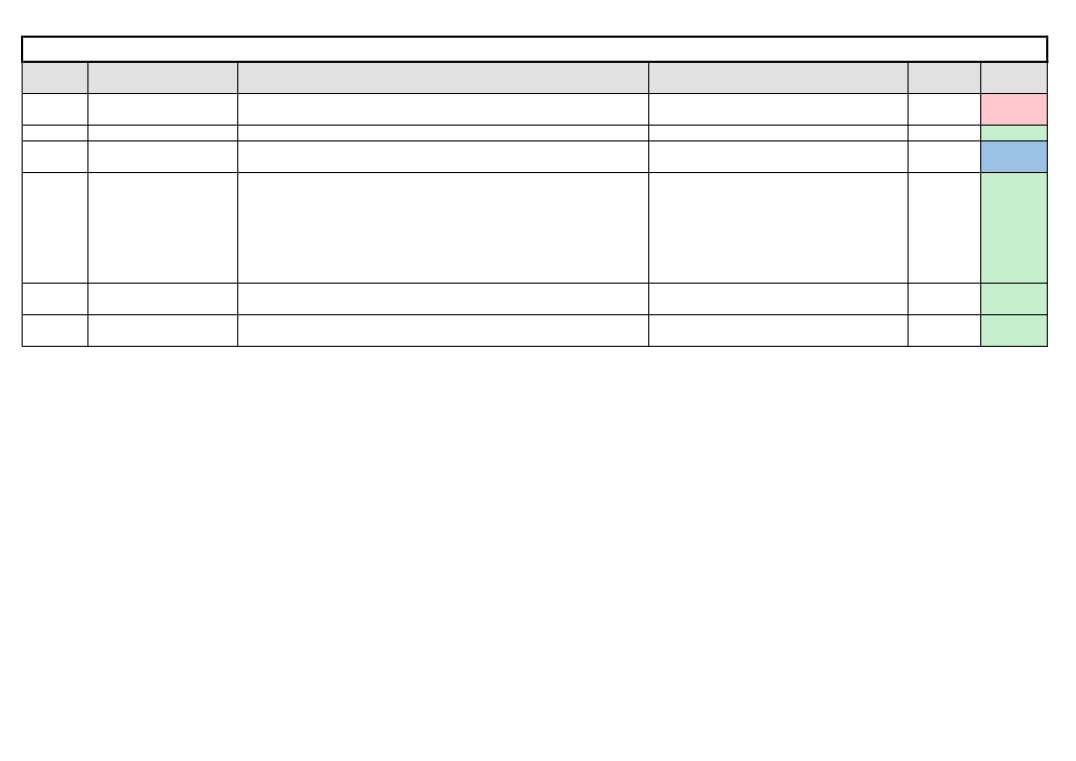

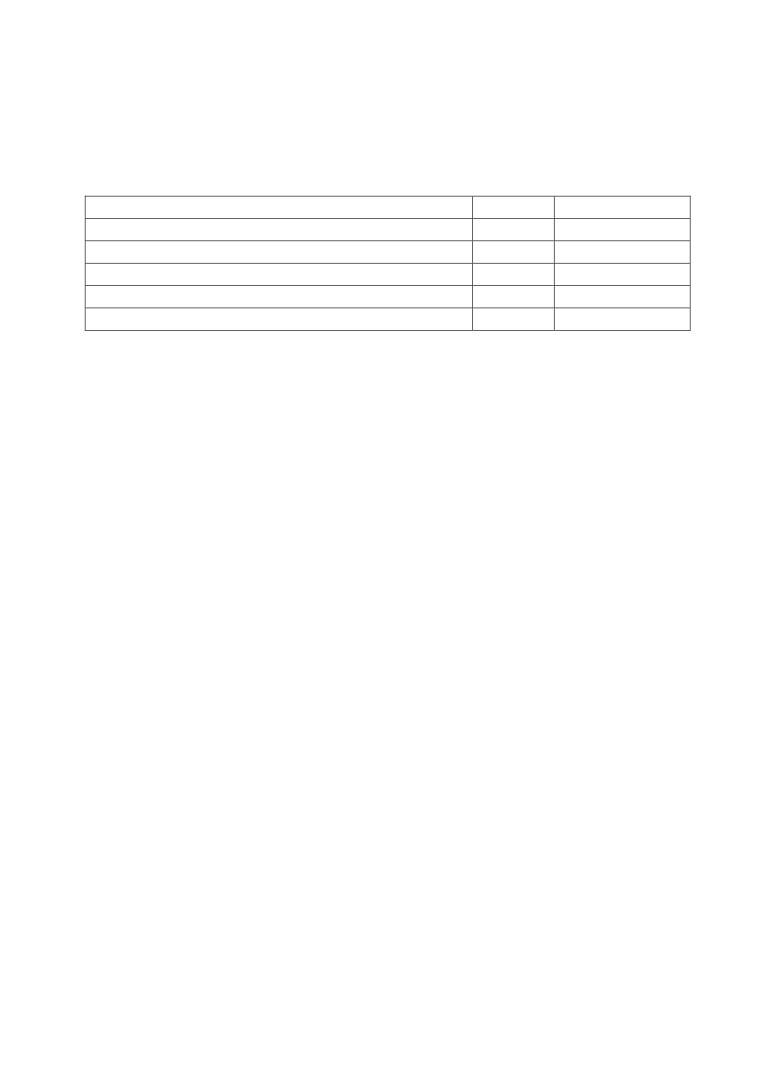

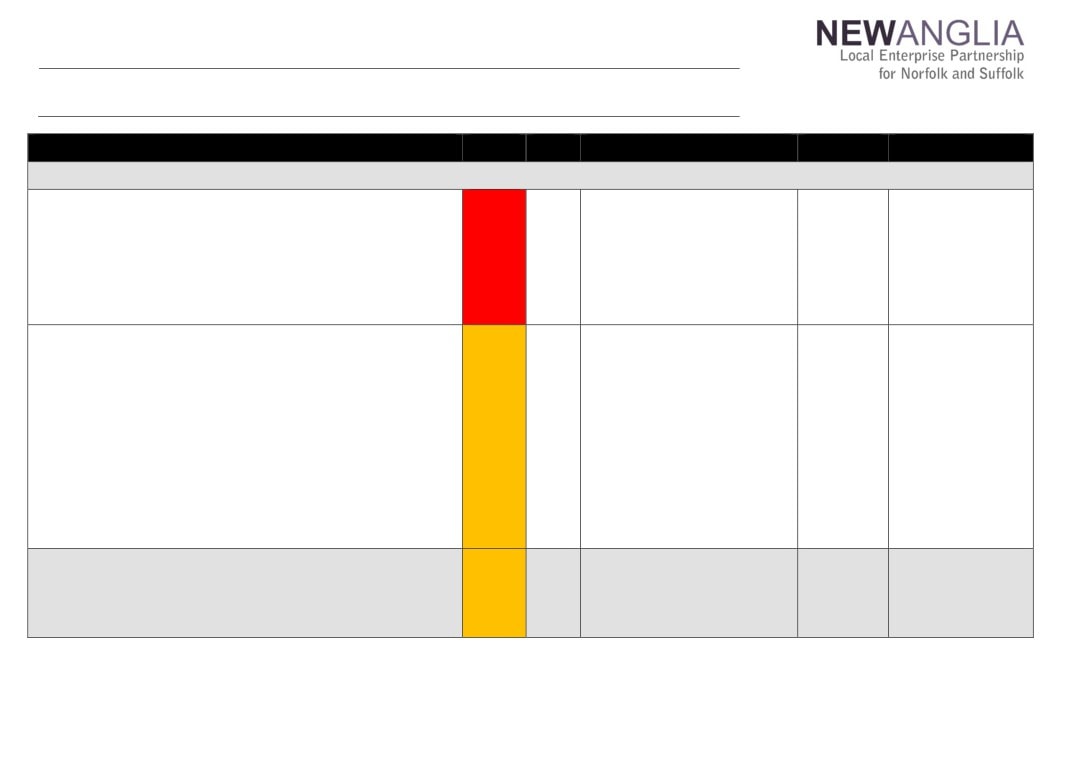

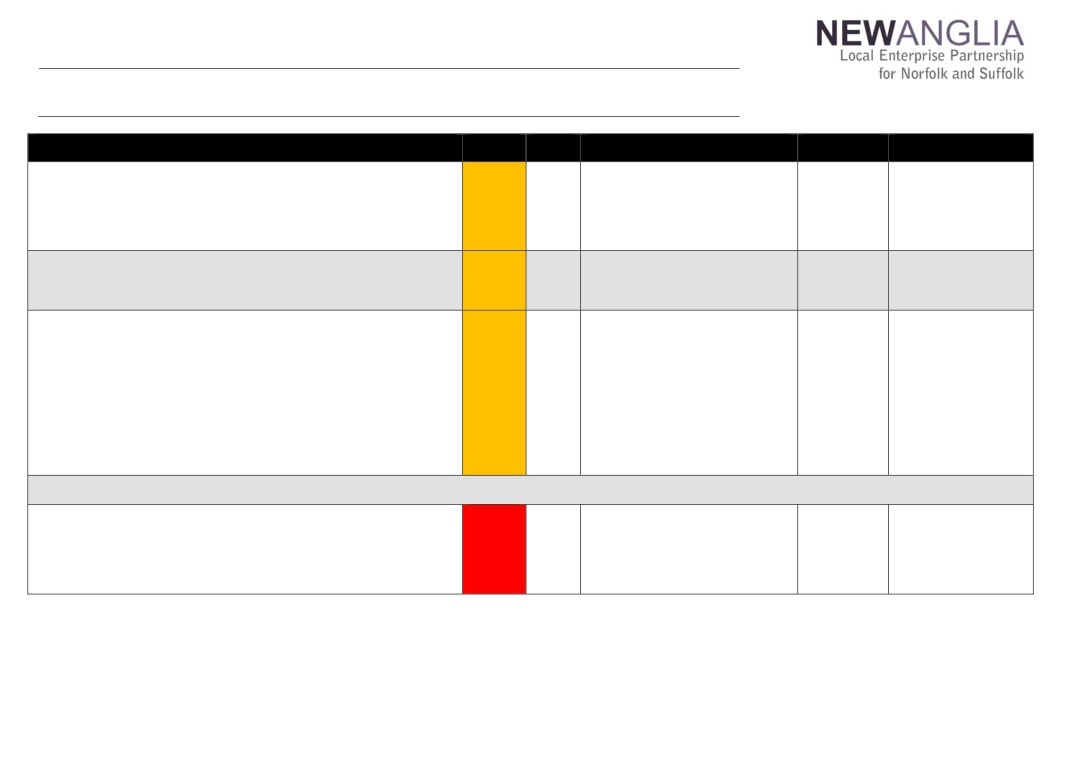

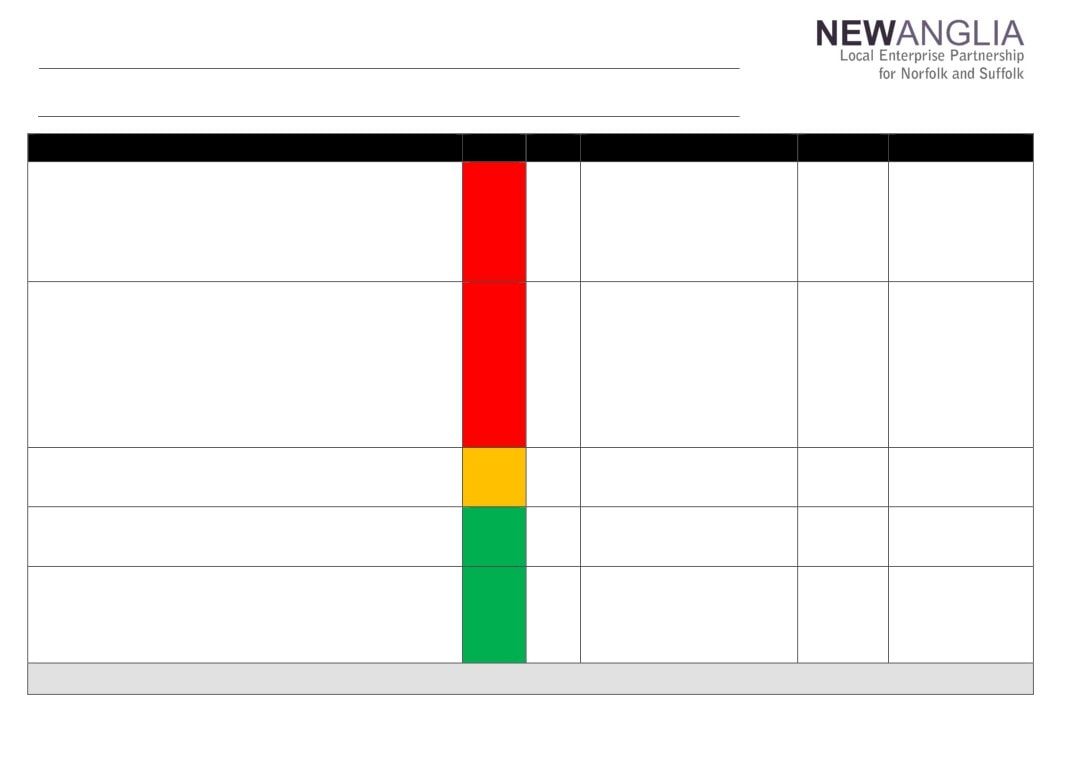

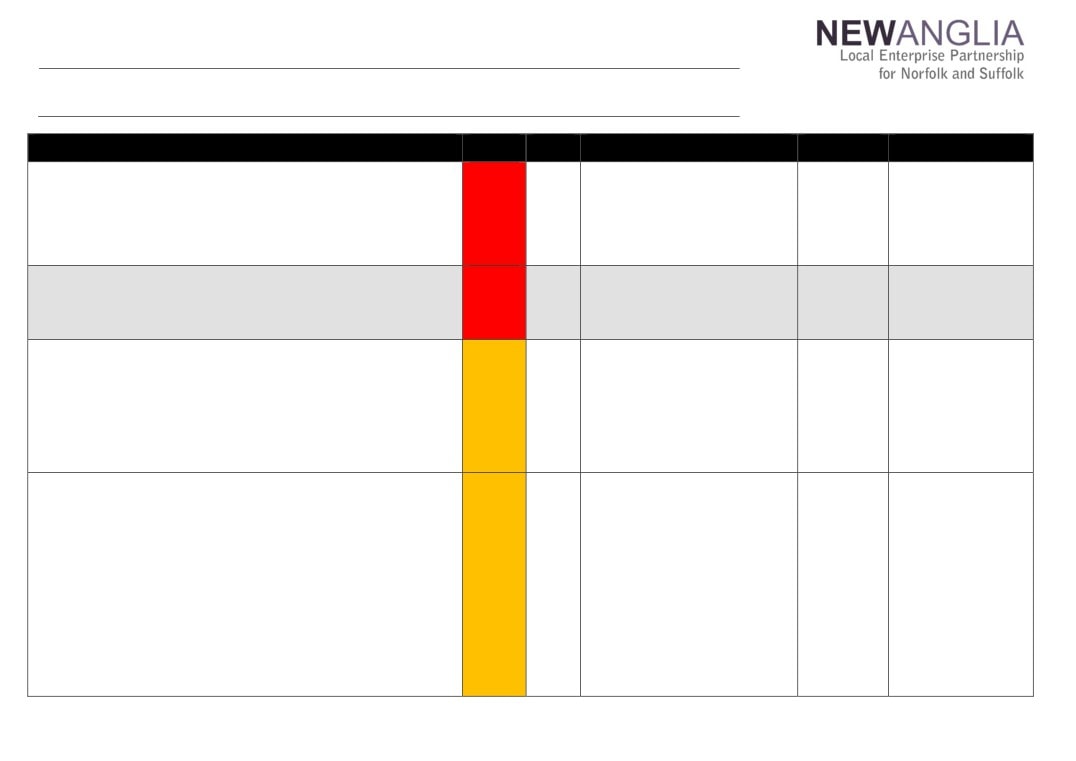

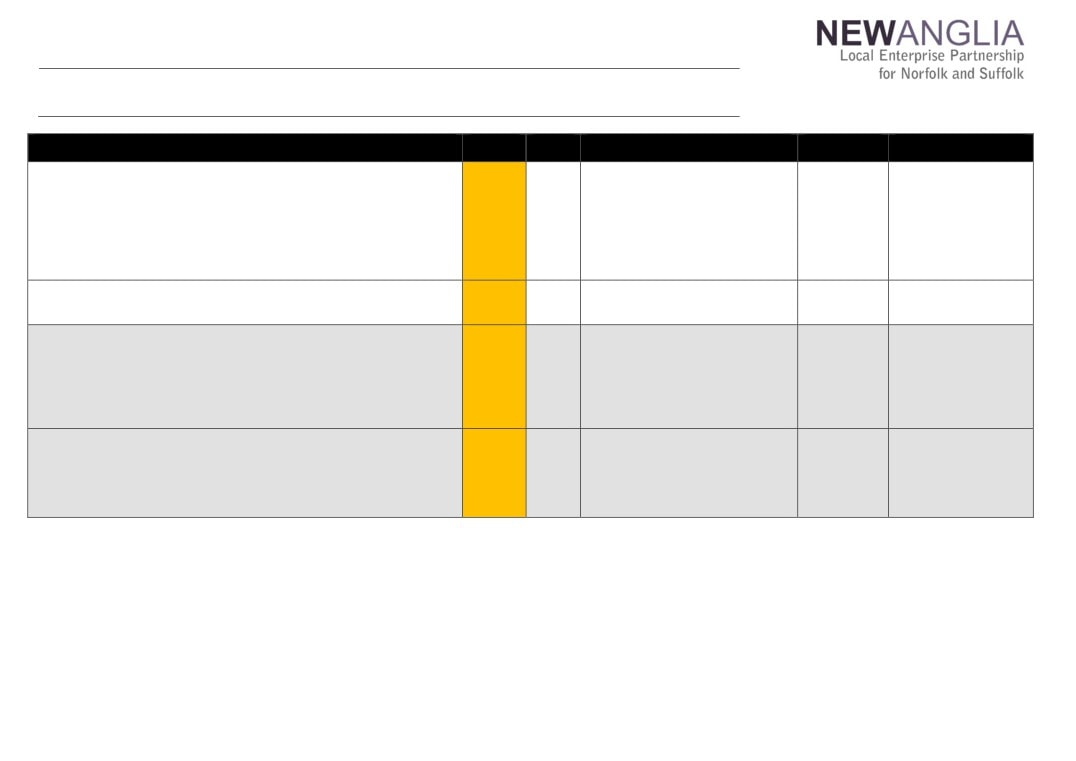

Actions from New Anglia LEP Board Meetings

Date

Item

Action

Update

Actioned By

Status

17/01/2018

Capital Growth Programme

Identify whether other LEPS have received requests for investment in flood

CD

On-Going

Projects

defence schemes.

17/01/2018

Chief Executive’s Report

For CS to produce a paper on the impact of GCGP changes

CS

Completed

22/11/2017

Business Performance

To receive a proposal on the Eastern Agi-Tech initiative by email.

On hold pending clarification on the situation at

CS

On Hold

Reports

GCGP

25/10/2017

Implementing the Economic

To be advised of the retention rate of jobs created through the VCS Challenge

NCF provided three case studies of projects

ID

Completed

Strategy

Fund

supported by the VCSE Challenge Fund with figures

for job creation and retention. Across the Access to

Community Trust, Pro Corda and Museum of EA

Life a total of 21 people have found employment

and have been retained in those jobs.

25/10/2017

Implementing the Economic

Investigate whether any Co-Ops have applied for the VCS Challenge Fund

The number of Coops/ social enterprises supported

CD/ID

Completed

Strategy

by the Vcse fund was 6

20/09/2017

Business Performance

To receive a future report on the approach to NAC investments

Included in the January half-yearly update

CD

Completed

Reports

9

New Anglia Local Enterprise Partnership Board

Wednesday 21st February 2018

Agenda Item 6

Brexit Analysis for Norfolk and Suffolk

Author: Alexander Riley / Lisa Roberts

Summary

This paper provides a summary of the report that has been produced by Metro Dynamics on

the potential impacts of Brexit for Norfolk and Suffolk.

Patrick White from Metro Dynamics is attending the Board meeting and will present the

conclusions of the research and draw out some of the most important findings by sector.

The report also highlights measures the LEP and partners are taking to minimise the

challenges and maximize the opportunities of Brexit.

Recommendation

The board is asked to:

Support the recommendations in the report

Support the activities the LEP is undertaking to mitigate the challenges and take

advantage of the opportunities of Brexit and identify additional activities or areas of

focus

Background

The LEP, Norfolk County Council and Suffolk County Council commissioned consultants Metro

Dynamics to assess the potential impact of Brexit on the region’s economy, focusing on the

potential challenges and opportunities across different economic sectors and identifying

individual companies that might be significantly affected.

The attached report has been developed as a result of this work and this paper provides a high-

level summary of the key points.

Main Report

The report presents a detailed analysis of the potential impacts of Brexit on six sectors that are

particularly exposed to Brexit in Norfolk and Suffolk - Agriculture, Manufacturing, Construction,

Offshore wind energy, Digital and Life Sciences.

The report considers the impact of Brexit specifically on the workforce, trade, regulations and

funding for each of these sectors.

It also poses a set of challenges and opportunities for Norfolk and Suffolk in relation to Brexit,

identifying a key role for the LEP and partners in supporting local businesses and institutions to

secure the skills and funding needed to grow, internationalise and innovate - in line with the

Government’s Industrial Strategy.

1

11

The report also proposes that the LEP, as well as local authorities, should be more proactive in

engaging with businesses pre and post-Brexit to ensure that they are well-placed to address

any future challenges.

It concludes with a set of policy recommendations to help inform the LEP and local authorities

on the strategic approach that they might take in the period ahead.

Key recommendations of the report include:

Develop a local industrial strategy to further reinforce the sectoral specialisms that

Norfolk and Suffolk have, and to ensure that central Government is fully aware of the

contribution that those specialisations make to the national economy.

Review and focus the LEP’s Growth Hub, Innovation Hubs and skills deal activity to

more proactively reach out to those businesses which could have opportunities for

growth and/or be more challenged by Brexit.

Focus and strengthen place marketing and inward investment in order to reach out to

the people that need to be attracted and retained as well as the investment needed to

drive productivity.

Attract large scale private sector investment in infrastructure and development, requiring

places to further focus their investment marketing activity and develop a very strong

place based story and proposition.

Collaborate with other regions and sectors elsewhere where there is a common interest

in reaching out to new markets or designing new products.

New Anglia LEP Activity

In order to respond to the recommendations, the LEP executive has developed an initial eight

point Brexit action plan outlining our approach to taking forward the recommendations in the

report, in line with the implementation of our Economic Strategy.

1.

Local Industrial Strategy. The LEP will use the opportunity to develop a Local

Industrial Strategy to reinforce the sectoral specialisms of Norfolk and Suffolk, building

on the work of the Science and Innovation Audit and wider evidence base. We are

actively pursuing the opportunity with Government to be a pilot area.

2.

Developing our sector and innovation strengths. As part of this process we are

working with the national Knowledge Transfer Network and Smart Specialisation Hub to

improve the way innovation and sectoral specialisms are mapped nationally. The

limitations of the data that is used means strengths within Norfolk and Suffolk sectors

are not recognised nationally. We are also working with them on developing a cluster

evidence pack which will support our cluster development. We will pilot this with the

view for it to be scaled up across the UK. This will place us is a good position to respond

to the Industrial Strategy Strengths in Places fund when it is launched later this year.

3.

Driving Inward Investment and place marketing. The LEP is leading on the

development of a shared inward investment strategy which is due to be presented to the

LEP Board in May. This strategy will aim to enable integrated inward investment and

business location offer and will include activity around building a stronger place offer

and proposition to help attract new infrastructure investment and non-EU Foreign Direct

Investment.

4.

Gathering intelligence. James Allen joins the LEP Executive team later this month

from the CBI. His role includes building business intelligence which includes working

with local partners on impacts of Brexit on businesses. This intelligence is regularly fed

into Government.

5.

Championing local business. The LEP is developing a range of case studies which

championing local "trail-blazers" and actively promote them through national, regional

and local opportunities. These will be presented in a range of ways including videos,

blogs, leaflets and report interviews.

2

12

6. Improved targeting of support. The new Business Growth Programme is being

refined to better align with the new Economic Strategy and enabling the LEP’s Growth

Hub to focus on more complex problems such as the challenges posed by rule changes

caused by Brexit and skills shortages and also concentrate on higher growth

businesses.

7. Supporting exporters. The LEP working with the Growth Hub, Chambers and

Department of International Trade are exploring how collectively we can enhance the

international trade service for our businesses which have the greatest potential for

overseas trade.

8. Collaborating with other parts of the UK. The LEP is actively looking at ways to help

identify opportunities to collaborate with other parts of the country where there are

common interest or complementary strengths which will open opportunities to new

markets and new products. Examples include the Local Energy East Strategy and

Energy Hub and Nuclear Sector Deal.

Recommendation

The Board is asked to:

Support the recommendations in the attached report

Support the activities the LEP is undertaking to mitigate the challenges and take

advantage of the opportunities of Brexit and identify additional activities or areas of

focus

3

13

The potential implications of

Brexit for Norfolk and Suffolk

Threats and opportunities of Brexit for key economic

sectors

November 2017

15

Contents

1. Introduction

2

2. Sectoral impacts of Brexit on Norfolk and Suffolk

4

Agriculture

4

Manufacturing

8

Construction

12

Offshore wind energy

15

Digital

19

Life sciences

23

3. Concluding remarks

26

4. Policy recommendations

28

References

29

16

1. Introduction

Introduction

The councils of Norfolk and Suffolk, together with New Anglia LEP, have

▪ Trade - including future arrangements after the expected departure of the UK

commissioned Metro Dynamics to assess the potential impact of Brexit on the

from the European Single Market.

region’s economy, focusing on the potential challenges and opportunities across

▪ Regulations - in regards to the many EU directives incorporated into UK law.

different economic sectors and identifying individual companies that might be

significantly affected.

▪ Funding and Investment - including the role of European funds and subsidies

and the capacity to continue to attract foreign private investment.

This report presents the findings of a detailed analysis of the potential impacts of

Brexit on six economic sectors that are particularly exposed to Brexit in Norfolk and

Our approach has been to identify local economic strengths, based on an analysis of

Suffolk, as agreed with the Steering Group. It is part of a broader research process,

Norfolk and Suffolk’s employment patterns and companies, to sit alongside analysis

undertaken over several stages and in close consultation with our clients. This

of the sectoral impacts of Brexit, which are often reflective of national trends.

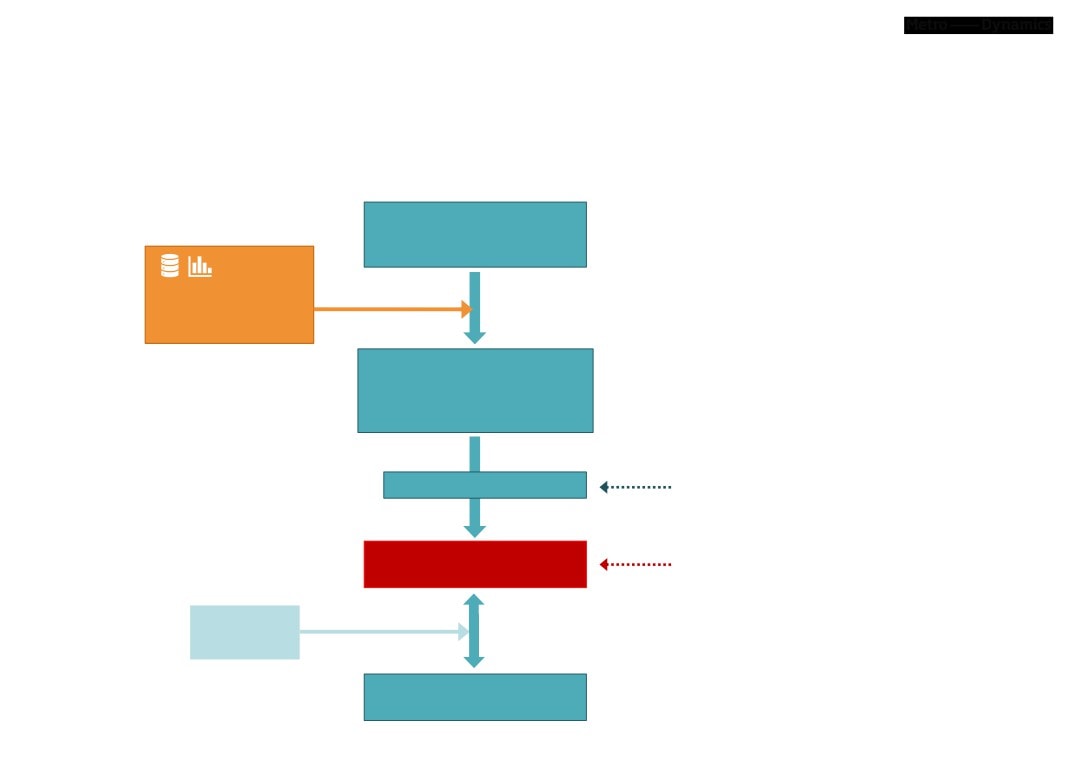

process is illustrated in the diagram on the next page.

Although considerable uncertainty remains on the specific outcomes of Brexit, this

Following a background analysis of the key economic and policy implications of

report identified a set of challenges and opportunities for Norfolk and Suffolk,

Brexit at the national level based on recent studies and the Government’s position,

including:

we produced a high-level assessment of potential impacts in Norfolk and Suffolk on

▪ Retaining the current EU workforce, both low and highly skilled, who are key to

19 different sectors. These were drawn from the strategic sectors identified in the

the future success of some of Norfolk and Suffolk most important sectors, such as

Norfolk and Suffolk Strategy and other prominent sectors in the Norfolk and Suffolk

agriculture, manufacturing, construction and life sciences.

economy. Building on the findings of this work, we agreed with the Steering Group a

set of six sectors for a more detailed analysis: Agriculture, Manufacturing,

▪ New opportunities to uplift the economy, using innovation and technology to

Construction, Offshore wind energy, Digital and Life sciences. The analysis was

upskill the workforce and create better paid jobs.

complemented by research into significant Norfolk and Suffolk companies operating

in these sectors.

▪ The need for companies to adjust to new trade arrangements and potential tariffs

and other barriers, while using the opportunity to increase the UK share of their

Naturally, the impact of Brexit is not limited to the chosen sectors. As such, the final

supply chains and open their products to new markets worldwide.

six sectors and the extent to which they were aggregated (for instance by choosing

to focus on Offshore wind rather than the wide energy sector more broadly), were

▪ The importance of ensuring continued funding for research and development and

selected on the basis of: (1) their particular significance to the Norfolk and Suffolk

innovation, as well as alternative sources of funding for agriculture and farming

economy (both in terms of employment and value added); (2) the likelihood of their

businesses that often rely on EU subsidies.

being highly impacted by Brexit; and (3) their strategic importance to Norfolk and

▪ The need to continue to be attractive to foreign investment.

Suffolk. This was determined in consultation with the Steering Group.

The LEP could have a key role in this process, supporting local businesses and

The analysis presented here focuses on these six sectors and considers potential

institutions in securing the necessary skills and funding to continue to grow,

challenges and opportunities brought about by the impact of Brexit on:

internationalise and innovate, in line with the National Industrial Strategy.

▪ Workforce - including the EU labour force and the potential impacts of Brexit on

immigration patterns.

17

1. Introduction

The purpose of this project

Identify the impacts of Brexit on Norfolk and Suffolk’s economic sectors and businesses

Assessment of the key

economic and policy

implications of Brexit

Norfolk and Suffolk

Economic Strategy

Strong and strategic

evidence base

sectors

High-level analysis of Brexit

impacts on 19 Norfolk and

Suffolk’s strategic and strong

sectors

Input from

Select key impact sectors

Steering Group

Detailed analysis of 6 high-

This report

impact economic sectors

Companies

database

Identifying the business

base

18

2. Sectoral impacts of Brexit in Norfolk and Suffolk

Agriculture

Table 1: Crop hectarage in East of England as a percentage

Agriculture is a crucial sector in the economy of Norfolk and Suffolk. The region is not only strong in

of total hectarage in England (2016)

in crop farming and animal production, but also in the strong supply chains these agricultural

sectors provide to other local sectors of specialism, particularly manufacturing of food, beverages

East of England: percentage

and machinery.

Crop

of total national hectarage

The last official data shows that 16,160 Norfolk and Suffolk residents work in Agriculture, forestry

Wheat

28.0

and fishing, which amounts to 2.2% of the region’s workforce, a much higher share than the 0.8%

in England (ONS, 2011). Even when farm agriculture activities are excluded, Agriculture, forestry

Barley

21.4

and fishing composes 2.8% of the GVA produced in Norfolk and Suffolk, compared to a figure of

0.7% for the whole of England excluding London (ONS, 2015). Important sub-sectors for Norfolk

Oilseed rape

24.7

and Suffolk include the production of sugar, malt, poultry and pork, and potatoes.

For the broader East of England region, the Department for Environment, Food and Rural Affairs

Sugar beet

65.6

estimates a total of 40,698 jobs in agriculture, including short-term and seasonal workers. This

region accounts for 13.4% of farming jobs in England, and, as Table 1 shows, sugar beet and

Potatoes

32.3

potatoes are the of two most significant crops. In fact, the East of England grows 32.3% of

England’s total potato crop and 65.6% of England’s sugar beet crop (Defra, 2017).

Field grown vegetables

28.8

Sugar beet production is particularly important in Norfolk and Suffolk as the LEP area is home to

three of the largest sugar manufacturing facilities in the UK: Wissington, Bury St. Edmunds and

Cantley. According to British Sugar (2017), these facilities employ 335, 230 and 180 workers

respectively and together make use of over 1,900 suppliers growing sugar beet across the wider

Table 2: Large Agriculture companies in Norfolk and

region.

Suffolk (examples)

Company

Location

Growing cereals for the production of malt is also significant in Norfolk and Suffolk, due to the

area’s favourable growing conditions (NFU, 2016b) and links to the regional specialisation in

Cofco International UK

The Havens, Ipswich

beverage manufacturing. Furthermore, East Anglia has the second largest number of pigs in

Hutchinson Group

Hunstanton

England.

Banham Group

Attleborough

In Agriculture, forestry and fishing, 10% of workers in the UK are EU nationals (36,000) according

Heathpatch

Semer, Ipswich,

to data from the Annual Population Survey (ONS, 2017). It is important to note that the sample

used in this survey does not account for short-term or seasonal workers.

Traditional Norfolk Poultry

Shropham, Attleborough

Lawson Partners

Stadbroke

H.G. Gladwell & Sons

Copdock, Ipswich

19

2. Sectoral impacts of Brexit in Norfolk and Suffolk

Brexit impact on Agriculture

Trade

Regulations

The agricultural sector is likely to be significantly impacted by Brexit, as it is highly

EU rules regarding marketing standards and product safety apply for products sold

reliant on trade with EU countries. In 2016, 73.3% of UK exports of agricultural

on the EU market, even for non-EU imports, so continued adherence to these is

products were to the EU (ONS, 2017). According to the CBI (2016), this is likely to

essential (NFU, 2016a). Regulatory stability and certainty will be necessary to ease

continue due to the difficulty of transporting perishable goods, which would impede

trade in agricultural products (CBI, 2016).

trade further afield.

However, changes to EU regulations may bring positives by allowing the UK to

Given this dependence, UK agricultural exports would be particularly vulnerable to

establish its own domestic regulatory policy (ibid.). For example, in an article by the

the introduction of trade barriers such as tariffs. On average, tariffs are 36% on

Managing Director of British Sugar, Paul Kenwood (2017) writes that Brexit provides

dairy products, 20% on animal products and 10% for fruit and vegetables. This

the chance to design a sugar policy which benefits the UK’s domestic industry. The

would reduce competitiveness vis-a-vis EU countries. As the agricultural sector in

EU-imposed quota system has previously controlled the quantity of sugar produced in

Norfolk and Suffolk is intrinsically linked to other sectors, most notably food and

and sold by the UK (British Sugar, 2017), so that, for instance, when there was a

drink manufacturing, trade barriers to agricultural products could have deleterious

surplus crop in 2015, it could not be sold on the UK, EU or world markets (Kenwood,

effects on interconnected sectors (CBI, 2016).

2017). In October 2017, this quota system will be revoked (British Sugar Beet

Review, 2017).

To mitigate this, Paul Kenwood (2017), the Managing Director of British Sugar, has

stated that he would wish for any tariffs which act as barriers to trade with Ireland,

In the case of regulatory changes to the wider agricultural sector, new policies will

France and Italy to be matched by reciprocal tariffs to protect the thriving British

need to ensure that favourable access between the UK and EU markets is

sugar beet industry.

maintained.

Despite the relative dependency of the UK agricultural system on the EU, the

sector could become more open looking. Brexit offers the UK the opportunity to

expand its exports globally. This optimism is shared by British Sugar (2017),

particularly given the removal of the quota system, as will be discussed in the

following section.

20

2. Sectoral impacts of Brexit in Norfolk and Suffolk

Brexit impact on Agriculture

Workforce

Funding and investment

A restriction on the free movement of people in the EU is highly likely to affect the

The main source of funding for the agricultural sector comes from the Common

agricultural sector in Norfolk and Suffolk.

Agricultural Policy (CAP), which has become central to the agricultural sector in the

UK. The aim of CAP is to address the failure of agricultural markets in delivering fair

Agriculture is a labour-intensive sector which is reliant upon both full-time and

incomes to farmers by helping farmers deal with market volatility and to buffer them

seasonal EU labour. Between April 2016 and March 2017, 10% of the workforce

against shocks.

(36,000 people) were non-UK EU nationals (ONS, 2017). This figure is unlikely to

In 2015 alone, farmers in the UK received €3.084 billion in direct payments (NFU,

account for temporary and seasonal workers, as it is from the Annual Population

2016a). On average, these payments contribute 55% of the total income from farming

Survey, which uses a sample of UK residents.

(CBI, 2016). CAP payments enable farmers to meet the higher cost associated with

higher welfare and environmental standards, without which many farms would be

UK agriculture’s reliance on seasonal EU labour derives from many farms’ inability

unable to survive (NFU, 2016a).

to recruit sufficient domestic workers (NFU, 2016a). According to the National

Farmer’s Union Deputy President Minette Batters, “…80,000 seasonal workers

Alongside CAP subsidies, the UK was allocated €5.2 billion for rural development

plant, pick, grade and pack over nine million tonnes and 300 types of fruit,

projects between 2014 and 2020 (NFU, 2016a). These funds are used to support

vegetable and flower crops in Britain every year” (NFU, 2017). This underlines the

increased farm productivity, micro/small enterprises and farm diversification, rural

extent to which the official estimate of 36,000 EU workers diverges from the

tourism, rural services, cultural and heritage activities, and forestry productivity, and

will no longer be available after the current funding round ends in 2020.

number of seasonal workers in reality.

This reliance on EU labour applies to Norfolk and Suffolk. Across the region,

thousands of Eastern European workers pick fruit, vegetables and salads. A

supply of both seasonal and permanent workers is similarly important to poultry

and pig farming (NFU, 2017).

Without access to a ready supply of relatively cheap EU labour and absent desire

among UK nationals for agricultural work, farms may find it difficult to locate

sufficient work for the season. Labour shortages may reduce the production and

growth of UK farms, necessitating increased imports and price rises (Smithson Hill,

2017).

21

2. Sectoral impacts of Brexit in Norfolk and Suffolk

Table 3: Top Manufacturing sub-sectors in employment

(Norfolk and Suffolk, 2015)

Manufacturing

Main SIC-2 sub-sectors

Number of jobs

Food products

13,681

Norfolk and Suffolk has a wide and diverse manufacturing sector employing over 61,000 workers.

Fabricated metal products

6,820

Manufacture of food products is by far the largest sub-sector, employing 13,681 people. Half of

these jobs are concentrated in production and processing of poultry meat (detailed analysis on

Machinery and equipment

6,452

page 9), an area of high employment growth and specialization in Norfolk and Suffolk. Firms

Rubber and plastic products

5,883

operating in the area include Bernard Matthews, Tulip and 2 Sisters Food Group. Manufacturing of

beverages is also an area of high local specialisation that employs over 2,000 people in Norfolk

Printing/reproduction of recorded media

3,122

and Suffolk. Most of these jobs are in beer manufacturing, with Adnams based in Southwold and

Motor vehicles

2,833

Greene King in St Edmundsbury. In addition, Aspalls, based in Mid Suffolk, drives local strength in

the production of cider, Muntons, a major malt exporter, is based in Stowmarket, and Britvic,

Chemicals and chemical products

2,707

located in Norwich, is an important soft drinks manufacturer. Other significant food products

produced in the region include prepared meals, cocoa and chocolate, condiments and animal

Furniture

2,584

feeds. Finally, the manufacture of sugar also has a large workforce in the area through the British

Wood products

2,456

Sugar manufacturing facilities in Wissington, Bury St. Edmunds and Cantley.

Beverages

2,272

Other important sub-sectors in terms of employment include the manufacture of fabricated metal

products, machinery and equipment, and rubber and plastic products - all with more than 5,000

Total Manufacturing

61,017

jobs in Norfolk and Suffolk. The manufacture of metal products primarily involves metal structures

for industrial use, structures and elements for the construction industry and machining. Machinery

and equipment includes non-domestic cooling and ventilation equipment and agricultural and

forestry machinery. Plastic and rubber manufacture encompasses a broad range of products,

Table 4: Large Manufacturing companies in Norfolk and

including packing goods and plastic elements for construction.

Suffolk (examples)

Other manufacturing sub-sectors with more than 2,000 jobs in Norfolk and Suffolk include the

Company

Location

printing and reproduction of recorded media, manufacture of motor vehicles (eg. Hethel

Engineering Centre), chemicals, and furniture and wood products. Finally, the manufacture of

Greene King

Bury St Edmunds

pharmaceuticals is also an important sector for Norfolk and Suffolk. Although not amongst the top

Forfarmers UK

Bury St Edmunds

manufacturing sub-sectors in terms of employment (with just below 1,000 jobs), the concentration

Baxter Healthcare

Thetford

of pharmaceutical jobs in Norfolk and Suffolk is 17% higher than in Great Britain. This sector is key

for innovation in manufacturing based on high-skilled and high-wage jobs. Pharmaceutical

Bosch Lawn And Garden

Stowmarket

companies in Norfolk and Suffolk include Baxter Healthcare, in Thetford, and Genzyme, in

Direct Table Foods

Little Saxham

Haverhill.

British Sugar

Wissington; Bury St. Ed.; Cantley

Palm Paper

King’s Lynn

Bernard Matthews

Norwich

Tulip

Stadbroke

22

2 Sister Group

Thetford

2. Sectoral impacts of Brexit in Norfolk and Suffolk

Manufacturing

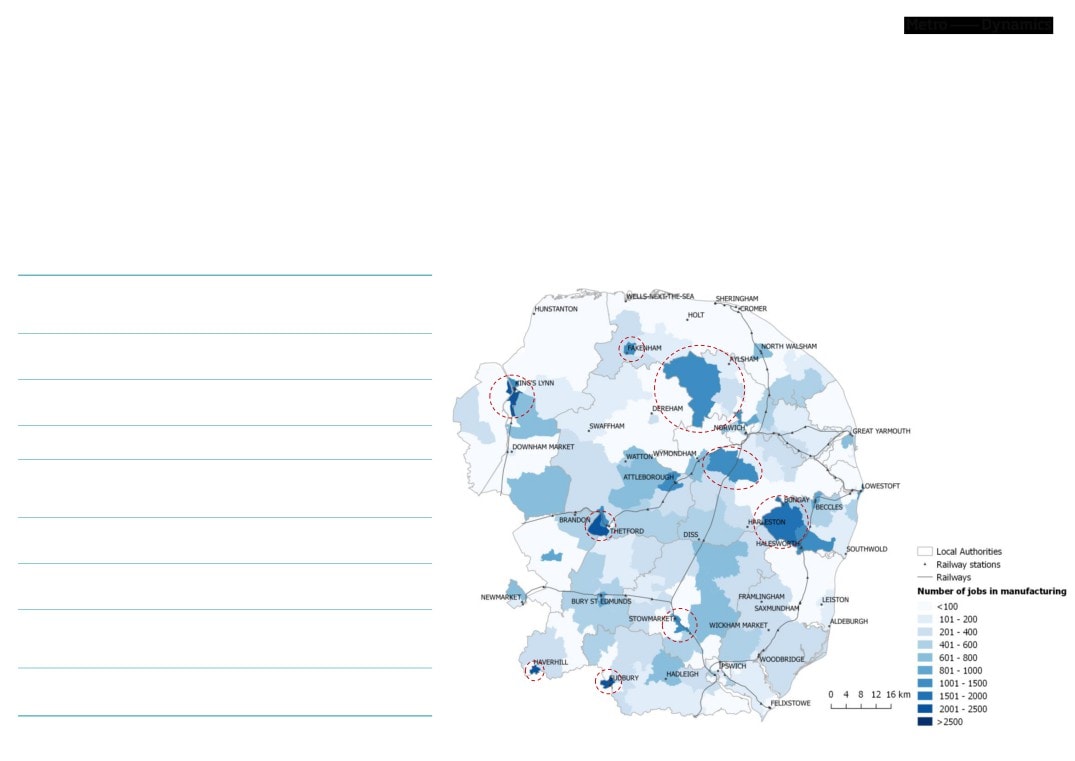

Figure 1 maps the spatial distribution of manufacturing jobs in Norfolk and Suffolk.

Overall, it shows that jobs in the manufacturing sector are fairly dispersed across the

whole area of Norfolk and Suffolk. Nonetheless, the following areas have particularly

high concentrations of jobs in manufacturing:

No.

SIC-2 sub-

Figure 1: Spatial distribution of manufacturing jobs in Norfolk and Suffolk (2015)

Geographic area

jobs

sectors

Example companies

Paper and paper

Palm Paper, Cooper

King’s Lynn and

products;

Roller Bearings

1

surrounding

3,752

machinery and

Company, A T

area

equipment

Promotions

Pharmaceuticals;

Baxter Healthcare, Trox

2

Thetford

3,216

fabricated metal;

UK, Advanced Air (UK),

8

rubber and plastic

Camvac

A144 between

3

Bungay and

2,816

Food products

Cleveleys Foods

Halesworth

1

7

Silk Industries, 4 BG

4

Sudbury

2,135

Textiles

Group, Walters Holdings

Pharmaceuticals;

computer,

Genzyme, IFF, Herbert

5

Haverhill (East)

2,125

9

electronic and

Group

optical products

Chemicals and

Stowmarket

PPG Industries (UK),

6

1,417

chemical products;

2

3

(South East,)

Muntons

beverages

Between

7

Dereham and

1,324

Beverages

Broadland Wineries

Aylsham

Machinery and

equipment;

8

Fakenham

1,256

PMC Harvesters, P4

6

electrical

equipment

Hethel

Lotus, MSF

5

9

Engineering

1,185

Motor vehicles

Technologies, Multimac

4

Centre

23

2. Sectoral impacts of Brexit in Norfolk and Suffolk

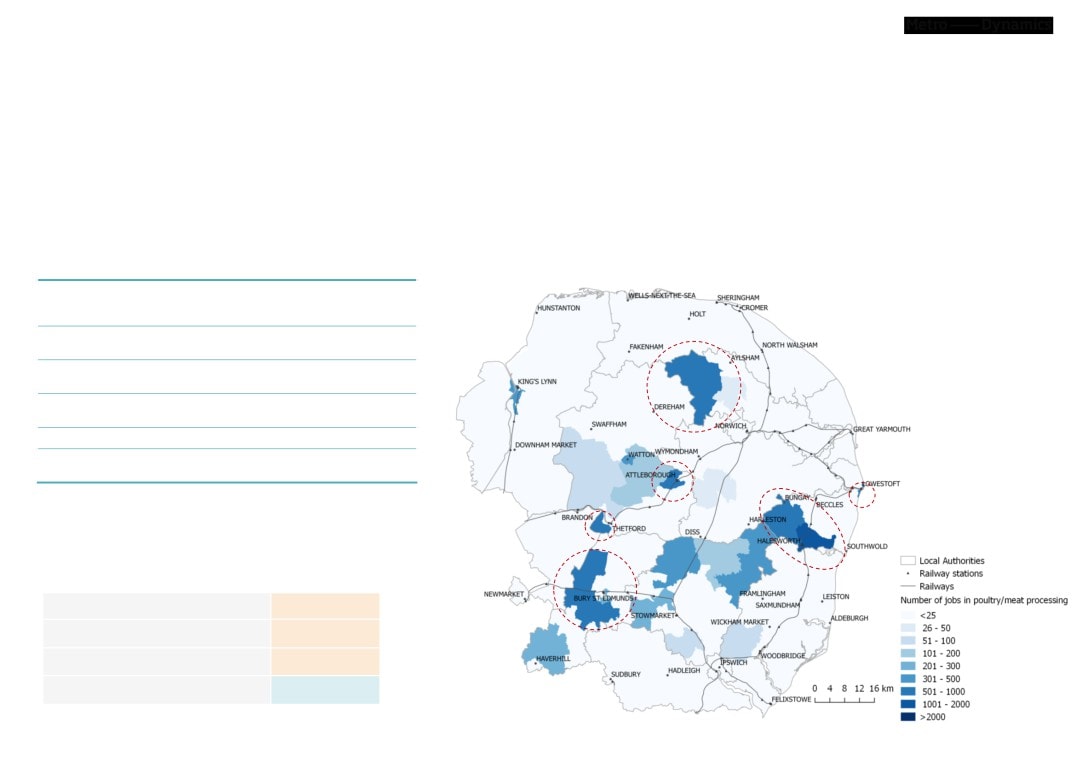

Poultry and meat processing

Within food production, Norfolk and Suffolk have particular strengths in the processing and

preserving of poultry meat, and the production of meat and poultry meat products. Together,

these sectors employ nearly 8,000 people in the region. These jobs are mainly located in the

following areas:

Figure 2: Spatial distribution of poultry/meat manufacturing jobs in Norfolk and

Number of

Geographic area

Example companies

jobs (2015)

Suffolk (2015)

Area South East from

1

Bungay and

1,589

Cleveleys Foods

Halesworth

Attleborough and

2

871

Banham Poultry

surrounding area

Between Dereham and

3

862

Bernard Matthews

Aylsham

Waveney Valley

4

Lowestoft Harbour

543

Smokehouse

3

5

Thetford

526

2 Sisters Food Group

Outskirts of Bury St

6

502

Direct Table

Edmunds

2

4

Table 5: Top poultry/meat manufacturing sub-sectors in

employment (Norfolk and Suffolk, 2015)

5

1

Number of jobs

Main SIC-5 detailed sectors

(2015)

Processing and preserving poultry meat

4,347

6

Production of meat and poultry meat

3,041

products

Processing and preserving meat

471

Total Poultry And Meat Processing

7,859

24

2. Sectoral impacts of Brexit in Norfolk and Suffolk

Brexit impact on Manufacturing

Regulations

Trade

Manufactured products account for 89.8% of total goods exports and 91.0% of

The EU determines many manufacturing regulations and laws which are

total goods imports in the UK, and UK-EU trade is substantial. In 2016, the EU

standardised across EU member states. EU laws and regulations apply to many

share of exports in manufactured products was 47.7%, whilst the EU share of

different legislative areas, including product safety, employment, health and safety,

imports was 57.7% (ONS, 2017). Manufactured goods move along complex

and environmental and consumer protection (EEF, 2016b). Regulatory compliance is

central to trade and investment agreements, particularly as many EU laws (for

supply chains which operate across the EU. The UK is reliant on exports to the

EU, and the interdependency of companies along the supply chain in the single

example those concerning labour markets and health and safety) have been

market means that the any imposition of tariffs would increase costs for

integrated into domestic law (ibid.). For instance, exports of manufactured goods are

manufacturers (CBI, 2016).

subject to various regulations and standards, which facilitates their easy trade

between EU countries (CBI, 2016). In order to continue trading in the EU, UK

The fall of the value of the pound post-Brexit has impacted trade of manufactured

manufacturers would have to conform to EU product safety and product standards

goods in different ways, and sterling appears set to remain weak. Firstly, this has

(EEF, 2016b). Therefore, it is recommended that the UK continue to comply with

increased the cost of imported manufactured products (Tait Walker, 2016).

certain legislations, such as employment and health and safety regulations, in order

Auditors Creaseys believe that this may boost the UK domestic market, as

to maintain stability. However, the UK may opt for a more flexible legislative and

companies are forced to source nationally. Secondly, the weak pound cheapens

regulatory framework, which is independent of the EU (ibid.).

exports, making UK exports more competitive.

The pharmaceutical sub-sector is highly regulated by the EU, consisting of both

The UK pharmaceuticals sector trades a lot with the EU. A total of 44% of UK

regulations, guidelines to be followed by national governments, and directives, which

exports are to the EU. Supply chains in pharmaceuticals operate across borders,

are integrated into domestic law (Bird and Bird LLP, 2017). Prevalent at multiple

which has raised fears of trade barriers at various stages of production. In the EU,

stages of production, the EU has harmonised regulation in the following areas:

there are no import tariffs on pharmaceuticals; however, tariffs exist on raw

clinical trials, pharmacovigilance, joint procurement, marketing authorisations, data

materials and machinery, which, if imposed, would increase production costs

flows and intellectual property (ibid., Simmons and Simmons LLP, 2017). Continued

(CBI, 2016). It is unclear whether the UK will be able to negotiate favourable

regulatory alignment would enable UK medicines to be sold in the EU. It is

terms of trade for these items (Simmons and Simmons LLP, 2017).

particularly important that manufacturing standards and safety regulations are

consistent (PwC, 2016b), as non-compliance would affect UK pharmaceutical

Concerning poultry and meat processing, less than 25% of British meat is

companies’ competitiveness if their products were perceived to be of lower standard

exported (Global Meat News, 2016); however the EU is the UK’s most important

than those produced in the EU (Norton Rose Fulbright, 2016a). Outside of the EU,

export market. In 2016, exports of preserved meat and meat products to the EU

the freedom of pharmaceutical companies to assert intellectual property rights could

comprised 78.1% of total exports (ONS, 2017). For poultry, it is primarily ‘dark

prevent parallel importation into the UK (Bird and Bird LLP, 2017).

meat’ (thighs and legs) that is exported, while ‘white meat’ (breast and wings)

serves the domestic market (FWI, 2016). Estimates suggest that tariffs would fall

Similarly, EU regulations dictate the terms of trade in poultry and meat processing.

between €187-1,283 per tonne of poultry meat or €1,024-2,765 per tonne of

The majority of export health certificates and trade agreements have an EU

processed poultry meat. Given the disparity in domestic demand for ‘dark’ and

dimension (Jean-Pierre Garnier, Head of Exports at AHDB Beef and Lamb, Global

‘white’ meat, a fall in exports of dark meat precipitated by the imposition of tariffs

Meat News, 2016). The UK has health certification agreements with over 100

would result in its overproduction, severely damaging poultry manufacturers’

countries (FWI, 2016), demonstrating the importance of EU regulation for trade

profitability (ADBH, 2016). A failure to impose tariffs or quotas on imports or form

globally, not only with other EU member states. As with manufacturing, it is deemed

free trade agreements with other countries may flood the domestic market with

preferential for regulatory compliance to be maintained in order to ease trade.

cheaper global imports (ibid.), further damaging the domestic industry.

25

2. Sectoral impacts of Brexit in Norfolk and Suffolk

Brexit impact on Manufacturing

Funding and Investment

Workforce

As with agriculture, manufacturing is reliant on EU labour. Sector-wide in the UK,

EU funding is integral to maintaining a dynamic and innovative manufacturing sector

between April 2016 and March 2017, 10.9% of the workforce (318,000 people)

in the UK. In 2015, the majority (68%) of Research and Development expenditure in

were non-UK EU nationals (ONS, 2017). A survey conducted by CBI in 2016

the UK was channelled to manufacturing (CBI, 2016). A number of specific schemes

found that nearly two-thirds of manufacturing companies surveyed anticipated

have benefitted the sector and driven innovation. Between 2007 and 2013, €7 billion

recruitment problems in the immediate future.

was granted to the UK as part of the EU Framework Programme 7 (FP7), €1.2 billion

of which was used to support around 10,000 companies (with the majority used for

Underlying the need for EU workers in manufacturing in the UK is a long-standing

skills gap, rooted in disparities between the skills provided by education/training

education/training) (EEF, 2016b). Under Horizon 2020, the UK was the second

and those required by employers (EEF, 2016a). A report presented at the

largest recipient of funding of all EU countries, totalling €1.8 billion, with 22% directed

National Manufacturing Debate, an annual conference for the manufacturing

to businesses (ibid.). Locally, EU funding has been important, as the Hethel

industry, listed shortages in technical skills, such as robotics, artificial intelligence,

Engineering Centre is funded by the EU Regional Development Fund. Losing

software, data analysis, and electrical/electronic engineering (Cranfield

eligibility for these funds may damage UK manufacturing’s long-term vibrancy and

University, 2017). Responding to these shortages is the common practice of

competitiveness.

moving highly-skilled engineers at short notice across the EU, which may be

threatened by the end to freedom of movement (CBI, 2016).

Foreign investment also maintains the health of the sector. Manufacturing receives a

relatively low share of foreign direct investment (FDI); however, it is vital to boosting

Furthermore, Brexit may result in the movement of manufacturing away from the

UK. The increased reliance upon UK workers could lead to higher wages,

productivity through efficiency improvements and the development of new products.

however as UK workers generally expect to be paid more than their EU

Therefore, lower levels of investment would diminish potential future productivity

counterparts, companies may choose to move their operations abroad where

gains (Beck, 2016). In a letter from the Japanese government to the UK and EU, the

labour costs are lower.

sustainability of inward investment and continued presence of European

headquarters of Japanese companies was called into question (Andy Neely, Head of

The EU workforce is also important in pharmaceuticals. Multinational

the Institute for Manufacturing at Cambridge University, 2016). The impacts of this

pharmaceutical companies in the UK often draw on an international talent base

(PwC, 2016b). Skilled workers, mainly from the EU, are seen to have been key to

have already been felt in the auto industry, which experienced a 30% decrease in

the strength of UK pharmaceutical research and development (Bruegel, 2017b).

investment in 2016 compared to the previous year (Campbell, 2017).

Restricted freedom of movement may encourage companies to relocate to an

alternative EU country with easier access to EU labour, and the UK may become

EU funding has been central to the development of the UK as a centre of

a less attractive destination for highly-educated EU workers (ibid.).

pharmaceutical research and development, particularly given as the UK is the largest

beneficiary of EU funding (Bruegel, 2017b). Key funds for this sector include the

Typically referring to a lower skills set, industries relating to the manufacturing of

Innovative Medicines Initiative and Horizon 2020 (Bird and Bird LLP, 2017). In the

food products rely heavily on EU migrant labour. EU workers represent 30% of

face of funding uncertainty, UK multinationals may move their research projects

the labour force in the food production sector and 60% in the poultry meat

outside the UK to ensure continued access to funding streams or change their lead

industry, according to the British Poultry Council Chief Executive, Richard

Griffiths (Open Britain, 2017). Sourcing these jobs domestically is considered

team (PwC, 2016b). Furthermore, international firms may be reluctant to invest in

problematic due to their perceived undesirability (AHDB Pork, 2016).

research and development projects in the UK (UNESCO, 2016).

The impact of EU funding post-Brexit in poultry and meat processing are likely derive

from the agricultural sector. If CAP payments were removed from farms without a

replacement scheme designed and implemented by the UK government, this could

result in farm closures or lower levels of output, impacting the supply of meat to

26

process.

2. Sectoral impacts of Brexit in Norfolk and Suffolk

Construction

The construction sector is strong and diverse in Norfolk and Suffolk, employing just under

Table 6: Top construction sub-sectors in employment

50,000 people across a wide set of specialisms. Construction activities in Norfolk and Suffolk

(Norfolk and Suffolk, 2015)

are mainly related to the general construction of buildings and infrastructure and to the more

specialized construction and engineering activities of the energy sector, comprising offshore

Main SIC-2 sub-sectors

Number of jobs

wind, oil and gas.

Specialised construction activities

22,183

As shown in Table 6, there are 22,183 jobs in specialized construction activities in Norfolk and

Suffolk. Most of these jobs are related to building construction, including electrical installation

Construction of buildings

12,629

(4,800 jobs), plumbing, heating and AC (3,800 jobs), and joinery and building finishing (both

Architectural and engineering activities;

with roughly 2,600 jobs). Together with construction of buildings (12,629 jobs), these activities

8,781

technical testing and analysis

form the core of the construction industry related to building construction. However, there are

2,300 more specialized construction activities based in the area, focusing on different types of

Civil engineering

6,176

structures and requiring specialized skills or equipment. These include activities related to the

offshore wind, oil and gas energy sector. Derrick Services (specialized in drilling), East Coast

Total Construction

49,769

Pipe and Fittings (piping services and equipment), and CLS Global Solutions (engineering,

project management, fabrication and personnel services), all based in Great Yarmouth, are

examples of companies working in this sector.

Architectural and engineering activities, technical testing and analysis employs 8,781 people in

Table 7: Large construction companies in Norfolk and

Norfolk and Suffolk and also includes activities related both to building construction (e.g.

Suffolk (examples)

architectural and engineering design and consulting activities) and to the offshore energy

Company

Location

sectors (e.g. technical testing and specialised engineering design and consulting). Gardline, a

marine surveying business providing geotechnical services to the offshore wind, oil and gas

R.G. Carter Construction

Drayton, Norwich

sectors, and 3Sun Group, which provides skilled technicians for installation, inspections,

Anglian Windows

Norwich

operation and maintenance of wind turbines, and other services to the oil and gas industry, are

examples of companies in this sector, both based in Great Yarmouth.

One Group Construction

Ipswich

Hopkins and Moore (Developments)

Melton, Woodbridge

Finally, civil engineering activities employ 6,176 people in Norfolk and Suffolk. The principal

activities are construction of roads and motorways and other civil engineering projects such as

Derrick Services (UK)

Great Yarmouth

industrial facilities (except buildings) and outdoor sports and leisure facilities.

East Coast Pipe and Fittings

Great Yarmouth

CLS Global Solutions

Great Yarmouth

Gardline Shipping

Great Yarmouth

3Sun Group

Great Yarmouth

27

2. Sectoral impacts of Brexit in Norfolk and Suffolk

Brexit impact on Construction

Trade

Regulations

Trade is not the most significant aspect of Brexit impact in the construction sector.

Regulatory change following Brexit may be of less concern. According to Burges

According to Sarah McMonagle, director of external affairs at the Federation of

Salmon (2016), EU law has minimal presence in the construction sector. Instead, its

Master Builders, only 25% of construction materials are imported (Allen, 2017).

regulatory framework is a combination of UK and EU-directed legislation.

Nevertheless, the EU is an important trading partner. According to a 2010 study

Areas of regulation where the EU is influential include working conditions, climate and

conducted by the Department of Business Skills and Innovation (Designing

the environment, health and safety, and import standards (CBI, 2016). In many

Buildings, 2017), the EU is the origin of 64% of imports and destination for 63% of

cases, the UK chooses to conform to EU standards. For legislation relating to

exports in building materials. Furthermore, of the top four countries from which

construction materials, continued compliance will be necessary to maintain ease of

the UK imports (Germany, China, Italy and Sweden), three are in the EU

trade (CBI, 2016; Designing Buildings, 2017). It is unlikely that altering construction

(Shepherd and Wedderburn, 2016).

legislation and standards will be a priority (Burges Salmon, 2016).

Loss of access to the single market will have a significant impact on the industry.

In some instances, EU directives have been fully integrated into UK law. The most

If duties or complex restrictions were placed on materials, this may cause

significant of which, according to Burges Salmon (2016), are Construction Design

shortages (Designing Buildings, 2017) or delays in importing and exporting

and Management (CDM) Regulations (CMS, 2016) and Energy Performance of

essential resources (Gateley PLC, 2016). Consequently, materials will become

Buildings (Eversheds-Sutherland, 2016). The repeal or dilution of EU directives is

more expensive, increasing the cost of construction, affecting both construction

possible in the long term (ibid.). Fisher Scoggins Waters (2016) state that if the UK

companies and those who use their services (Paul Manchester, Manchester

were to establish its own domestic policy, this could reduce the costs associated with

Safety Services, Builder and Engineer, year unknown). The weakness of the

complying with EU directives. Deregulation of this type could make the UK seem

pound has already contributed to increased material costs (Scape Group, 2017).

more attractive to investors (Ashfords, 2016).

28

2. Sectoral impacts of Brexit in Norfolk and Suffolk

Brexit impact on Construction

Funding and Investment

Workforce

Construction is considered to be one of the largest beneficiaries of EU funding

The construction sector is highly dependent upon the free movement of workers

from the EU. Both unskilled and skilled positions are filled by EU migrants

(Fisher Scoggins Waters, 2016). It is funded both by the European Investment Bank

(Builder and Engineer, year unknown). There are high numbers of non-UK EU

(EIB) and European Investment Fund (EIF) and has access to the European

nationals working in the sector, accounting for 8.8% of the workforce between

Structural Investment Fund (ESIF), European Regional Development Fund (ERDF)

April 2016 and March 2017 (ONS, 2017). RICS (2017) have shown that the

and Joint European Support for Sustainable Investment in City Areas (Jessica). In

sector could lose 176,500 workers should restrictions be placed on freedom of

2015, the EIB and EIF together invested €7.8 billion in UK infrastructure projects

movement.

(CBI, 2016). This is important for construction, as much of the sector is involved in

the engineering, construction and design of infrastructure projects. These institutions

The main reason for the reliance on skilled EU workers, who are typically from

Eastern European countries (Fisher Coggins Waters, 2016), is the failure to

also lent €665.8 to SMEs in 2015 (Designing Buildings, 2017).

recruit from the domestic market due to a skills shortage within the sector

The future sustainability of funding is of vital importance to the sector’s continued

(Eversheds Sutherland, 2016).

success, particularly for infrastructure projects (CBI, 2016) and regeneration projects

Restrictions on migration are likely to have broad implications for the construction

(Ashfords, 2016), and may also impinge on the ability of start-ups to emerge and

sector. Firstly, it may impact wages and costs. The increased demand for skilled

thrive in the market (Designing Buildings, 2017). Existing UK contributions to these

workers may drive up wages, resulting in higher project costs (Eversheds

funds could be directed to infrastructure projects (Ashfords, 2016), however, Fisher

Sutherland, 2016). Monika Slowikowsa, Founder of Golden House

Scoggins Waters (2016) suggest that projects may consequently receive funding for

Developments, predicts that labour costs may rise by 15-20. If labour demand

political reasons rather than based on merit.

supersedes supply, project costs may increase, eventually impacting the

fulfilment of housing targets (Designing Buildings, 2017). Higher material import

In the short-term, the weak pound has attracted international investment (Savills,

costs and labour costs are forecast to cost the sector £570 million (Scape Group,

2017).

2016a), but in the long term, the construction sector will likely suffer from the subdued

private investment climate post-Brexit. Of particular concern is a reduction in foreign

Secondly, it may have implications for the productivity and dynamism of the

investment in commercial and residential development (Norton Rose Fulbright,

sector. A weaker workforce may reduce the capacity of house builders, further

2017a). There is predicted to be a 30-40% decline across the country in commercial

contributing to an increase in costs (Gateley PLC, 2016). Another impact may be

that a lack of skilled labour results in project delays (Eversheds Sutherland,

developments over the next five years (Savills, 2016b). Infrastructure projects will

2016). Uncertainties over workforce numbers have already begun to impact

also be impacted. A study conducted by EY showed that Brexit has reduced the UK’s

companies’ willingness to bid for future projects (CBI, 2016).

long-term attractiveness to foreign investors (Construction News, 2017). Overall, this

will likely cause an economic slump in the industry.

More optimistically, UK workers may benefit from reduced competition for jobs

and access to larger selection of roles within the industry (Builder and Engineer,

year unknown). Without migrant workers to fill vacancies, a skills shortage may

fuel investment in training and upskilling (Ashfords, 2016).

29

2. Sectoral impacts of Brexit in Norfolk and Suffolk

Offshore wind energy

Norfolk and Suffolk have a strong and diverse offshore wind sector, and the region is key to

upholding the UK’s status as the world leader in offshore wind in hosting almost 70% of the

UK’s offshore wind capacity.

Table 8: Large offshore wind energy companies in

There are several offshore wind farms located off the coast of the two counties, including

Norfolk and Suffolk (examples)

Sheringham Shoal (17-23 km north of Sheringham), Scroby Sands (2.5km off coast of Great

Company

Location

Yarmouth) and Greater Gabbard (23km off the coast of Suffolk). The farms create jobs while

under construction and also thereafter in their long-term operation and maintenance.

Scira Offshore Energy

Walshingham

Sheringham Shoal created 50 permanent jobs, whilst Greater Gabbard created 100 permanent

Scroby Sands Operations and

Great Yarmouth

jobs with 95% employed from the local area.

Maintenance Facility

Greater Gabbard Operations Base

Lowestoft

Other projects are currently in the planning and construction phase. Vattenfall are planning to

Gardline Shipping

Great Yarmouth

develop Norfolk Vanguard, which will be one of the largest offshore wind farms in the UK. Its

sister project, Norfolk Boreas, will be of a similar size. It is likely that the two projects combined

(more examples on next page)

will require 160 technicians and managers by the mid-2020s. The Galloper wind farm is

currently under construction, creating up to 700 jobs in the process and leaving 90 permanent

jobs in operations thereafter. Furthermore, Dudgeon wind farm is also currently under

construction and will be fully operational at the end of 2017, employing a further 70 people.

A wider economy surrounds the windfarms. Local companies are present at all stages of the

supply chain, offering a range of support services integral to the functioning of the farms. They

focus mainly on supply, installation, commissioning, operations and maintenance. Typically,

these companies are located in coastal areas so as to be in close proximity to other marine

services, ports and the wind farms themselves. Particular clusters exist in Great Yarmouth and

Lowestoft.

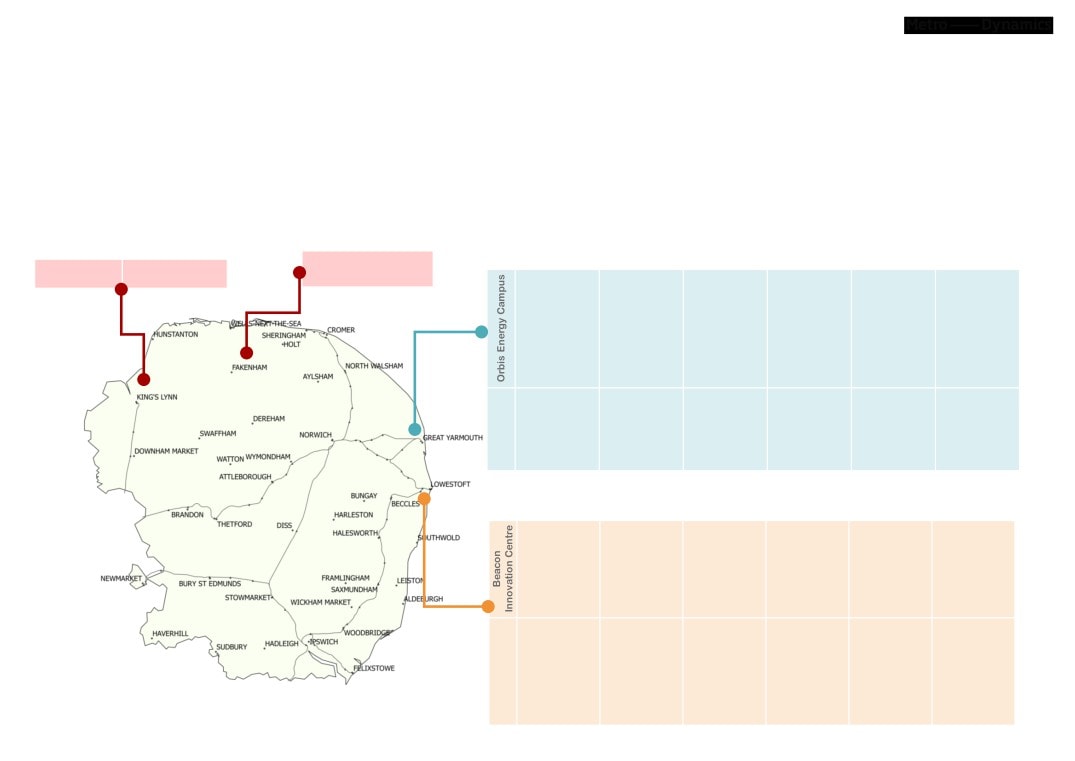

Figure 3 on the following page illustrates the presence of companies across the supply chain.

30

2. Sectoral impacts of Brexit in Norfolk and Suffolk

Offshore wind energy

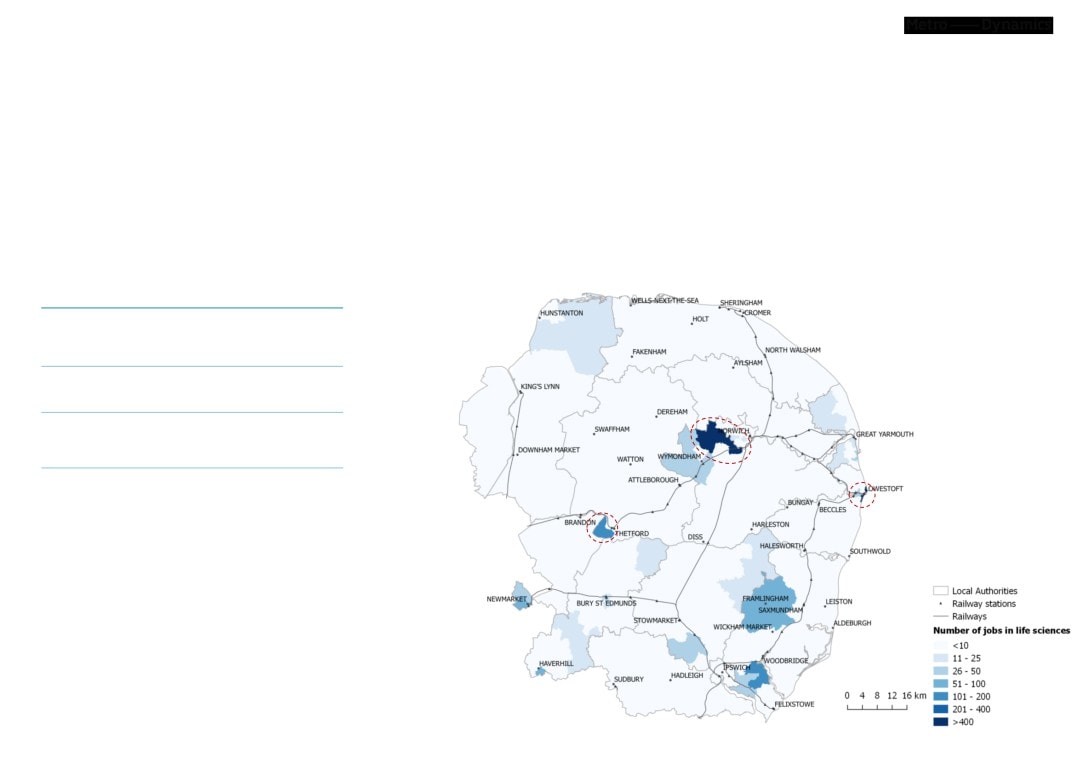

Figure 3: Location of significant wind energy companies and supply chains in Norfolk and Suffolk

Construction/

Engineering/

Operations

Installation

maintenance

Manufacture/

Construction

Logistics/

Engineering/

Operations

Consultancy

Statoil (Scira Offshore

Supply

/ Installation

Marine

maintenance

Rotos 360

Rotos

360

Energy) Walsingham

Green Spur

Delpro Wind

Engie

James Fisher

Manor

renewables

CHPV

Fabricom

& Sons

Renewable

Offshore

Statoil

Rhenus

Energy

Energy Media

Offshore UK

Engie

Services

Osbit

Fabricom

Global Wind

World Cargo

Railstons

Service

Logistics

Global Wind

Fred Olsen

Fred Olsen

Service

Windcarrier

Windcarrier

GWS

Statoil (Scoby

Seajacks

Statoil (Scoby

4C Offshore

Amec Foster

Sands)

Sands)

Amec Foster

Wheeler

Amec Foster

Wheeler

Wheeler

CLS Global

Solutions

Manufacture/

Construction

Logistics/

Engineering/

Operations

Consultancy

Supply

/ Installation

Marine

maintenance

CTR Secure

DAP UK

GEV Offshore

Nautilus

Services

Associates

3Sun Group

3Sun Group

3Sun Group

Gardline

3Sun Group

Subsea

Greater

Marine

Moughton

Protection

Gabbard

Sciences

Engineering

Systems

Operations

ODE

Pharos

Base

Greater

Marine Sims

Gabbard

Systems

Operations

Base

31

2. Sectoral impacts of Brexit in Norfolk and Suffolk

Brexit impact on Offshore wind energy

Trade

Regulations

The UK is a net importer of energy (CBI, 2016) but leads the world in offshore

Much energy policy has been shaped by the EU, encompassing member states’

wind, therefore the country exports related services. These include cable

competitiveness, and security and environment policies (Chatham House, 2016).

Post-Brexit, the UK will no longer be represented by EU energy bodies (Allen and

installation, equipment repair and construction (Renewable UK, 2016). These

Overy LLP, 2016). The most likely outcome of this for the UK offshore wind sector will

services are exported worldwide to Europe, the USA and Asia - in recent years,

be the necessity for continued adherence to EU regulations absent UK influence over

UK offshore wind sector companies have won 115 contracts to build and service

their formation (RCG, 2016). In the long-term, the UK may choose to determine its

50 offshore wind projects abroad (ibid.). In a report by Renewable UK surveying

own regulations, but this may make the UK less competitive than other EU countries

36 companies (2017), the UK offshore wind sector had won contracts in 18

(ibid.). Regulatory changes are likely to impact business, funding and investment.

countries in 2016.

For instance, some contracts may have particular clauses which necessitate

This sector is considered to have great potential for growth in exports. It presents

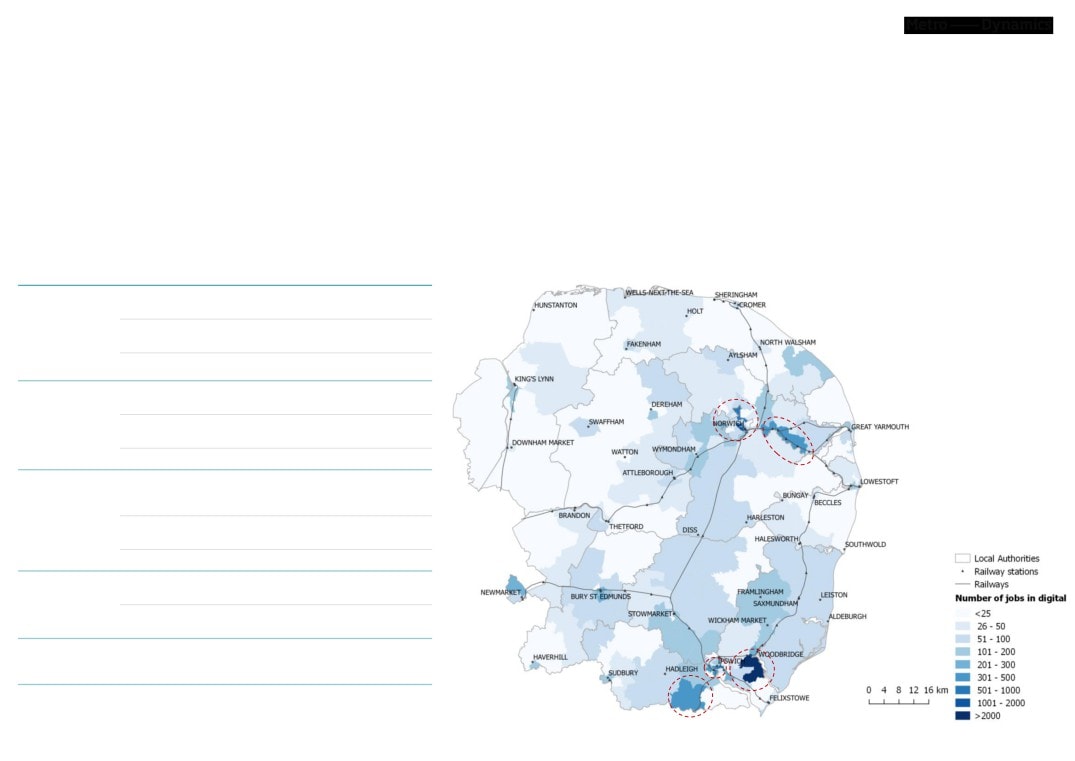

continued compliance with EU law. For projects which have secured EU funding, it