New Anglia Local Enterprise Partnership Board Meeting

Wednesday 29th January

10.00am to 12.30pm

Liftshare Office, 4 Duke St, Norwich NR3 3AJ, Norfolk

Agenda

No.

Item

Duration

10 mins

1.

Welcome from the Chair

2.

Apologies

3.

Welcome from Ali Clabburn, Liftshare

4.

Declarations of Interest

5.

Actions / Minutes from the last meeting

Forward Looking

40 mins

6.

Aims & Objectives for the Year

Presentation

7.

Brexit Impact Report

Update

Break

10 mins

Governance and Delivery

90 mins

8.

Local Industrial Strategy and Investment Plan

Update

9.

LEP Evaluation framework

For Approval

10.

Board Recruitment

Update

11.

Remuneration Committee Terms of Reference

For Approval

12.

Chief Executive’s Report including confidential items

Update

January Programme Performance Reports including a confidential

13.

Update

report

14.

Quarterly Management Accounts - confidential

Update

15.

Board Forward Plan

Update

16

Any Other Business

Update

1

New Anglia Board Meeting Minutes (Unconfirmed)

27th November 2019

Present:

Sam Chapman-Allen (SC)

Breckland Council

Claire Cullens (CC)

Norfolk Community Foundation

David Ellesmere (DE)

Ipswich Borough Council

Doug Field (DF)

East of England Coop

Matthew Hicks (MH)

Suffolk County Council

Pete Joyner (PJ)

Shorthose Russell

Helen Langdon (HL)

University of Suffolk

Dominic Keen (DK)

Britbots

Andrew Proctor (AP)

Norfolk County Council

Johnathan Reynolds (JR)

Nautilus

Sandy Ruddock (SR)

Scarlett & Mustard

Alan Waters (AW)

Norwich City Council

Jeanette Wheeler (JW)

Birketts

Tim Whitley (TW)

BT

Attendees

Steve Gallant (SG)

East Suffolk Council - For John Griffiths

Viv Gillespie (VG)

Suffolk New Collage - For Nikos Savvas

Shan Lloyd (SL)

BEIS

Sue Roper (SuR)

Suffolk County Council

Lisa Perkins (LP)

BT - For Item 4

Ben Miller (BM)

Konica Minolta - For Item 6

Ellen Goodwin (EG)

New Anglia LEP - For Item 7

Lisa Roberts (LR)

New Anglia LEP - For Items 6 and 9

Chris Starkie (CS)

New Anglia LEP

Glen Todd (GT)

New Anglia LEP - For Item 6

Rosanne Wijnberg (RW)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

1

3

Actions from the meeting: (27.11.19)

The LEP’s role in enabling infrastructure for growth

A document detailing infrastructure priorities to be drafted and circulated to Board members

EG

before submission to the new government.

1

Welcome from the Chair

Doug Field (DF) welcomed everyone to the meeting including Steve Gallant and Viv Gillespie who

were observing for John Griffiths and Nikos Savvas respectively.

2

Apologies

Apologies were received from Steve Oliver, Nikos Savvas, Lindsey Rix, Claire Cullens and John

Griffiths.

3

Declarations of Interest

Full declarations of interest can be found at http://www.newanglia.co.uk/about-us/the-board.

None

4

Welcome from BT - Lisa Perkins

Doug Field (DF) welcomed everyone to the meeting and thanked Tim Whitley (TW) and Lisa

Perkins (LP) for hosting the meeting.

LP provided the Board with an overview of key successes at Adastral Park since the Board

had last visited in 2017 and highlighting the park’s role as one of BT’s key strategic sites.

LP advised that Innovation Martlesham had seen significant growth and now includes 132

businesses varying from start ups to established companies. Events are held regularly and

those such as the recent showcase help promote the cluster to a wider audience.

Considerable work continues to go into skills and training with 8000 students attending events

through the year. Important partnerships with West Suffolk College and the University of

Suffolk are in place and the training programmes initiated at Adastral continue to have a

national impact.

LP was pleased to inform the Board that Princess Ann had recently visited Adastral Park to

unveil a plaque for the new Digitech Centre, which received LEP funding, and which will

provide a strong offering for the area and help further identify Adastral as a key site.

5

Minutes of the last meeting 30th October 2019

The minutes were accepted as a true record of the meeting held on 30th October 2019.

Actions from last meeting updated as follows:

CS confirmed that written updates on the two enterprise zone items will be circulated shortly.

Enterprise Adviser Network and Careers Hub / Insight from Enterprise Adviser Ben

6

Miller

EAN and Careers Hub Extension

Glen Todd (GT) introduced Ben Miller (BM) from Konica Minolta who is an Enterprise Advisor

at Northgate School in Ipswich.

BM reviewed his career path and his role as a careers advisor. He stressed the importance

of providing appropriate work experience for students and noted that the programme can be

a two-way street keeping companies in touch with the views of students.

BM reviewed the extent of his work with Northgate and the initiatives which have been

introduced to assist students in gaining experience and making informed choices in the

career paths.

BM reviewed the successes to date and the aims for the future including sharing best

practice, meeting the Gatsby Benchmarks and focussing on the school’s approach to careers

support.

GT explained the Gatsby Benchmarks and highlighted research which has demonstrated the

importance of young people’s engagement with employers which has been confirmed to have

a positive impact both on the student’s study and future employment.

2

4

Lisa Roberts (LiR) addressed the board and confirmed that it had been a year since the EAN

had been transferred into the LEP and had achieved a great deal although there was still

much to do and funding would run out in August 2020. The Careers Enterprise Company

(CEC) had hoped to confirm another year’s funding but this has been delayed due to Purdah.

The Careers Hub currently covers schools in Norwich & Ipswich and the aim is to extend this

to cover all Norfolk and Suffolk schools by securing funding until August 2023 and also

extending contact to primary schools.

LiR asked the Board to approve spend of £155k to continue with the expansion of the current

model, assuming that the CEC will add £240k as per the current year.

The Board was also asked to agree funding to match the ESF bid which will be submitted in

January 2020.

The meeting discussed the coverage of the Careers Hub, the crossover with the Opportunity

Areas and the need to address those sectors highlighted in the LIS.

GT confirmed that the EAN used data provided to the LEP to assist in focussing on the needs

of keys sectors and companies.

Sam Chapman-Allen (SC) asked what the funding would be used for and asked for further

details of the numbers of students engaged to date.

LiR confirmed that work was ongoing to identify and quantify the impact of EAN intervention

which was challenging given the difficulties in tracking students’ movements. Most of the

students are still in education therefore their career choice cannot yet be identified. An

evidence base is being established.

The funding will be used to continue employment of the Careers Hub manager and the EAN

team and further funding will increase the EAN team from 8 to 10 allowing extended contact

between schools and businesses. It will also allow the development of the a platform to

assist in lesson planning.

Jeanette Wheeler (JW) asked for further information on the numbers of contacts with

employers to identify if pupils were hitting the recommended 4 contacts. LiR confirmed that

KPIs would be included should the expansion be agreed. Matthew Hicks (MH) noted that

there were other platforms in place and that any new system should not duplicate one

already in place. This was agreed.

The Board agreed:

To note the content of the report

To agree an allocation of £155k in the LEP budget for 2020/21 to enable a one-year

extension of the Enterprise Adviser Network and Careers Hub

To agree to the drafting and submission of an ESF bid by the LEP and partners to enhance

the EAN and Careers Hub

To agree an allocation in principle of up to £220k for 2021/22 and up to £225k for 2022/23

in match funding towards the ESF bid

7

The LEP’s role in enabling infrastructure for growth

Ellen Goodwin (EG) provided the meeting with a presentation outlining the different roles of

the LEP and its partners in the provision of infrastructure and highlighting the progress being

made in key strategic projects over the past year.

EG reviewed key achievements to date including projects delivered through the Growth Deal

and provided the meeting with an update on the work of Transport East and other sub

national transport bodies such East West Rail.

EG advised the Board of plans to hold a Connections Café in February 2020 to improve

networking amongst the SME community in the region and also the project to establish

integrated ticketing.

DF noted the extent of the work being done on infrastructure and proposed that the Board

should identify the priorities areas.

3

5

The Board discussed the issues around the Ely Junction project. EG advised that a revised

strategic outline business case will be provided at the end of the financial year noting that

there is now a funding gap.

SC noted that this junction was delaying growth in the region and at some point Network Rail

should be challenged on the rising costs.

It was agreed that issues with energy supply to some sites were preventing growth and CS

agreed there were currently issues with UKPN.

JW asked for an update on the issues around the Trowse junction. EG confirmed that a

meeting was scheduled for January 2020. CS noted that this was a complicated area with no

rapid solution due to the number of parties involved.

Andrew Proctor (AP) stressed the importance of contacting the new government immediately

to provide a joint submission detailing the key priorities for infrastructure.

ACTION: A document detailing infrastructure priorities to be drafted and circulated to Board

EG

members before submission to the new Government.

The Board agreed:

To note the content of the report

To task the LEP’s sub boards and working groups responsible for infrastructure with

considering how the clean growth agenda might be achieved.

To receive a document for submission to the new Government detailing infrastructure

priorities

8

Towns Fund and the role of LEPs

CS provided the Board with the background to the new Towns Fund including details of how

this fund aligns with much of the work of the LEP. Norwich, Ipswich, King’s Lynn, Great

Yarmouth and Lowestoft have been invited to put forward bids to deliver long term economic

and productivity and the LEP will be providing support to all towns in the production of their

bids.

The Board agreed:

To note the content of the reports

9

ESIF Strategy

The Board was provided with an update of the European Investment Strategy for Norfolk and

Suffolk which underpins the allocation of the £86.43m European Structural and Investment

(ESIF) funding allocated to the New Anglia LEP area. Changes to the strategy were required

to support links to the national reserve fund.

The Board agreed:

To note the content of the report

To note the amendments to the European Investment Strategy Update November 2019 and

endorse its adoption by the ESIF Committee

10

Brexit

CS presented the Board with an update on the latest intelligence and advised that

Metrodynamics have been tasked with refreshing the work they carried out in 2017. The

Government has also requested detail of economics shocks.

The Board agreed:

To note the content of the report

11

Chief Executive’s Report

CS noted some of the highlights of the report asked for questions from the board.

CS advised that Claire Cullens had submitted her application for the role of chair of the Skills

Advisory Panel (SAP) and had attended a meeting to review its workings.

4

6

Her appointment was approved by the board.

CS also noted that 50 applications had been received for the Innovative Projects Fund call

meaning that it will be oversubscribed. Applications will now be assessed.

DE asked if the call had received more application from private businesses in this round. CS

confirmed that this was the case.

CS reminded Board members that they had previously granted approval for CS to sit on the

Board of the South East Energy Hub however in order to make funding decisions he was now

requesting agreement to fully exercise the role of the LEP.

This was approved by the Board.

CS noted that he and DF would be appearing before the Norfolk County Council Scrutiny

Committee in December. Alan Waters (AW) confirmed that he would also be appearing

before the Norwich City Scrutiny Committee and requested a copy of the report which the

LEP will be submitting.

The Board discussed the importance of project evaluations and LiR confirmed that a proposal

would be submitted at the January Board. Subsequent project evaluations will be based on

the criteria agreed by the Board at that time.

The Board agreed:

To note the content of the report

To support the appointment of Claire Cullens as Chair of the SAP

12

November Programme Performance Reports

Rosanne Wijnberg (RW) reviewed the reports for November and provided details of those

Growth Deal Projects where the rating had been downgraded. The Board was advised that

the overall finance rating had been moved from Green to Amber as the Lowestoft Flood Risk

Management and Ely Junction Projects have not yet claimed the expected amount. Work is

ongoing to reduce rollover into 20/21 but approximately £5m in underclaimed spend is

expected to the carried forward into 2020/21.

Work continues to progress Lowestoft Flood defences and Ely Junction but the delays are

due issues beyond the control of the LEP.

RW noted that the outputs on the dashboards have been extended beyond 2021 which has

allowed lagged outputs to be demonstrated.

The Board approved the Growth Deal Dashboard.

DE highlighted the issue of creating jobs which paid below the median salary and noted that

the Board considers the numbers of jobs a project will create but not the salary and this

should be included in future proposals

Helen Langton (HL) agreed and noted that universities were now being assessed on the

salaries of graduating students.

The Board agreed:

To note the contents of the reports

To approve the Growth Deal Dashboard

13

Board Forward Plan

CS advised that the forward plan for 2020 had been populated and asked for any additional

items from the Board.

The Board agreed:

To note the content of the plan

14

Any Other Business

5

7

MIPIM Cannes - CS confirmed that the LEP had been invited to attend MIPIM in Cannes to

exhibit under the Norfolk & Suffolk Unlimited brand alongside the London Stansted

Cambridge Corridor in the London pavilion. This is one of the largest and most visited areas

of the show, with 2,500 delegates from 70 companies and 33 London Boroughs attached to

the pavilion. The budget is £25k.

Dominic Keen (DK) asked what the success criteria from attendance would be. CS advised

that the aim would be the introduction potential investors to Norfolk and Suffolk as other

regions attend and are able to establish a presence which we are currently missing.

Matthew Hicks (MH) enquired about results from attendance of the London MIPIM event.

CS confirmed that investment had been generated along with significantly raising awareness

of Norfolk and Suffolk and that staying away from Cannes would leave the counties as an

obvious gap.

AW confirmed that this had been discussed historically at Board meetings and it had been

noted that the East had been missing from the event and expressed his support for

attendance.

Pete Joyner (PJ) noted that there were limited other opportunities to promote NSU in this way

and that Cannes was the best event to attend.

The Board approved the spend of £25k and agreed it was vital to ensure that this event was

part of the inward investment strategy and that specific aims and objectives be produced.

The Board agreed:

For the LEP to attend MIPIM in Cannes to exhibit under the Norfolk & Suffolk Unlimited brand

at a cost of £25k.

Next meeting:

Date and time of next meeting:

10.00am - 12.30pm, 29th January 2020

Venue: Liftshare Office, 4 Duke St, Norwich, NR3 3AJ, Norfolk

6

8

Actions from New Anglia LEP Board Meetings

Date

Item

Action

Update

Actioned

Target Date

By

27/11/2019

The LEP’s role in enabling

A document detailing infrastructure priorities to be drafted and circulated to Board members

Letter circulated to Board members on 10th January before submission

EG

Complete

infrastructure for growth

before submission to the new government.

to Grant Shapps & Rishi Sunak

25/09/2019

Enterprise Zones

Details of the overall EZ investment and the funding split to be provided

Written update included with the January EZ PPR

JM

Complete

25/09/2019

Enterprise Zones

A confidential update on the stalled sites to be provided to the Board

Written update included with the January EZ PPR

JM

Complete

23/07/2019

July Programme Performance

A programme summary including performance against targets will be included in future NAC

Included in the January NAC report.

CD

Complete

Reports

reports

25/06/2019

GE Update Report

To provide the Board with regular reporting of the pipeline of visits relating to inward

To be included in the next Inward Investment update report

DD

May-20

investment and subsequent outcomes

23/05/2019

Growth Hub Presentation

Growth Hub Annual review to be circulated to the Board when published

Review began in autumn 2019. Final report is expected in spring 2020

CD

May-20

9

New Anglia Local Enterprise Partnership

Board Decision Log - Public

Date

Decision

Decision Made

Making

Body*

27/11/19

LEP Board

The Board made the following decisions:

Enterprise Adviser Network and Careers Hub

• To agree an allocation of £155k in the LEP budget for 2020/21 to enable a one-year extension of the Enterprise Adviser Network and Careers

Hub

• To agree to the drafting and submission of an ESF bid by the LEP and partners to enhance the EAN and Careers Hub

• To agree an allocation in principle of up to £220k for 2021/22 and up to £225k for 2022/23 in match funding towards the ESF bid

The LEP’s role in enabling infrastructure for growth

• To task the LEP’s sub boards and working groups responsible for infrastructure with considering how the clean growth agenda might be

achieved

• To receive a document for submission to the new Government detailing infrastructure priorities

ESIF Strategy

To note the amendments to the European Investment Strategy Update November 2019 and endorse its adoption by the ESIF Committee

AOB

•

For the LEP to attend MIPIM in Cannes to exhibit under the Norfolk & Suffolk Unlimited brand at a cost of £25k.

06/11/2019

Growing

The Panel approved the following application:

Business

• LiMAR Oil Tools (UK) Limited - Agreed to support

Fund Panel

Approved Grant: £70,690

• Plastech Industries Limited t/a Plastech Additive Manufacturing - Agreed to support

Approved Grant - £56,500

25/9/19

LEP Board

The Board made the following decisions:

Local Industrial Strategy

To endorse and sign off the Norfolk and Suffolk Local Industrial Strategy subject to the amendments agreed at the meeting.

Apprenticeships Levy Transfer Pool

To approve the business plan and to endorse a further £60,000 of funds to allow support to continue for an additional year

Innovative Projects Fund

• To approve the establishment of the £1.5m Innovative Projects Fund jointly with local authorities from Norfolk and Suffolk

• To approve the new governance arrangement including the Terms of Reference

• To approve the launch of a 2019/20 Innovative Projects Fund Call in October 2019

Working Agreement with the Cambridge and Peterborough Combined Authority

To approve the agreement subject to the above amendments

10/9/19

Investment

The IAC made the following decisions:

Appraisal

Innovative Projects Fund Proposal

Committee

To approve the proposal recommending the fund and the call to the LEP Board. To approve the Terms of Reference.

* New Anglia Local Enterprise Partnership Board, Investment Appraisal Committee, Growing Business Fund Panel, Remuneration Committee, Audit & Risk Committee

New Anglia Local Enterprise Partnership Board

Wednesday 29th January 2020

Agenda Item 7

Brexit Impact Report

Author: James Allen Presenter: James Allen and Simon Papworth

Summary

This report provides an assessment of the updated ‘potential implications of Brexit for Norfolk

and Suffolk report’ (Appendix A), which explores the two scenarios remaining on the table -

withdrawal agreement with a trade deal and no deal after the transition period - and assesses

four sectors identified through intelligence reports (agriculture, energy, manufacturing and

health and social care), setting out implications and responses to consider in the lens of the

delivery plans for the Economic Strategy and Local Industrial Strategy.

Recommendation

The Board is asked to note the contents of the report and agree that its recommendations are

used to influence the implementation plans for the Economic Strategy and Local Industrial

Strategy.

Background

New Anglia LEP was awarded £28k from BEIS in 2019 for Brexit intelligence to be used by the

end of March 2020.

£14k of the Brexit intelligence funding was used to update the 2017 potential implications of

Brexit for Norfolk and Suffolk report, prepared by MetroDynamics. MetroDynamics were

successfully appointed as consultants for this next phase.

The remaining £14k has been used to support the LEP Executive in developing and submitting

weekly intelligence reports into central government.

Brexit impact report

MetroDynamics started updating this piece of work in November 2019, ahead of the General

Election in December 2019.

Following the outcome of the election, it became much clearer which scenarios remained on

the table moving forward:

The Withdrawal Agreement, including a trade deal by the end of December 2020.

No Deal, with no trade deal agreed by the end of the transition period.

For each scenario, MetroDynamics have prepared an overview of its features and timeline, a

forecasted potential economic impact and information on the potential national implications for

the workforce; funding and investment; trade; and regulation.

1

11

Under the withdrawal agreement scenario, the UK will begin its departure from the EU on 31st

January 2020 with a transition period to December 2020 by which time the UK government

expects to have agreed a new trade deal with the EU (deal to cover trade in goods only -

agreements to cover services will follow in future). Nationally, growth will be lower than if the

UK remained in the EU but higher than under a no deal exit. GDP for Norfolk and Suffolk is

predicted to be 4% smaller in 2030 under the withdrawal agreement than it otherwise would

have been.

The most likely No deal exit scenario is that the UK leaves at the end of 2020 if a permanent

agreement cannot be reached during the transition period. No deal is the most economically

damaging form of Brexit with GDP expected to be 5-6% lower than remaining in the EU in 10

years’ time. GDP for Norfolk and Suffolk is predicted to be 5.7% smaller in 2030 than it

otherwise would have been.

The report reviews how Brexit is likely to affect four priority sectors in Norfolk and Suffolk:

manufacturing; agriculture; energy; and health and social care. To determine the likely impacts

and implications of Brexit on these sectors, MetroDynamics have reviewed national

assessments of impacts and then applied those assessments to these sectors within the

context of the Norfolk and Suffolk economy, taking into account local economic conditions and

factors affecting businesses.

Implications and responses to consider have been set out under the consistent headings of

workforce; funding and investment; trade; and regulation. The majority are consistent with the

implementation plans in place for the Economic Strategy and Local Industrial Strategy. These

include:

Closely monitoring / checking in on changing skills needs in those affected sectors, and

the links to local provision.

Supporting businesses to develop opportunities to reduce seasonality of some work

Innovation support.

Support for entering new domestic markets, alongside supporting firms new to exports.

Work with government to ensure future trade deals support Norfolk and Suffolk’s key

sectors

Support farm businesses to improve their resilience, including through technological

innovation and thinking differently given new revenue sources.

Help local businesses find and apply for alternative funding sources where possible

Use the Local Industrial Strategy to articulate Norfolk and Suffolk’s industrial priorities

and how future regulatory arrangements and trade agreements can support these.

The report highlights how Brexit will amplify the effects of larger global economic trends which

already exist such as full employment, ageing demographic and climate change. Whilst it does

not underplay the implications of Brexit (particularly no deal) the analysis is clear that wider

global trends and market uncertainties facing China and the US in particular together with the

underlying productivity weaknesses in the UK economy are both very strong drivers of change

and may have been obscured by worries about Brexit. It is also clear that the long term effect of

the slowdown in business investment since the referendum in 2016 has already baked in a

structural reduction in business performance. This link between a lack of investment in

productivity and innovation and our ability to compete in an uncertain global market provides a

strong rationale for the investment and actions set out in the Economic Strategy and Local

Industrial Strategy.

Recommendation

The Board is asked to note the contents of the report and agree that its recommendations are

used to influence the implementation plans for the Economic Strategy and Local Industrial

Strategy.

Appendix A - Potential Implications of Brexit for Norfolk and Suffolk report

2

12

New Anglia Local Enterprise Partnership Board

Wednesday 29th January 2020

Agenda Item 8

Local Industrial Strategy and Investment Plan

Author: Lisa Roberts

Presenter: Lisa Roberts

Summary

This paper provides an update on Local Industrial Strategy and sets out the proposed approach for

developing the Investment Plan and supporting tools.

Recommendation

It is recommended that the LEP Board approves:

• The publication of the designed version of the draft Norfolk and Suffolk Local Industrial

Strategy.

• To approve the approach and timetable to the development of the Investment Plan and

supporting tools.

Background

Government Update - Following the Norfolk and Suffolk Local Industrial Strategy being signed off

at the October 2019 Board meeting the LIS was submitted to the department for Business, Energy

and Industrial Strategy (BEIS) to start the sign off process with Government.

The LIS was due to be discussed at the Government LIS Implementation Board on 5th November

however, due to purdah, the meeting was cancelled.

Since the General Election the Government has renewed its interest in Local Industrial Strategies.

We understand that up to three Local Industrial Strategies will be published imminently - possibly

before the end of January.

This is a positive sign, and given the readiness of our plan, puts us in a good position. We are

continuing to press Government officials to move ours towards Government sign off as soon as

possible, but there is no firm date yet.

Implementation of LIS - We are keen that the LIS is used to drive activity and is not a strategy

that just sits on a shelf.

As a first piece of work we have aligned the LIS interventions with the Economic Strategy

objectives as a first step towards developing the delivery plan for 2020/21, to ensure maximum

alignment of both strategies.

As a reminder the Economic Strategy remains our broad based strategy to deliver increased

productivity and inclusive growth across a wide range of sectors and places.

13

1

The Local Industrial Strategy distils the strategy focusing more closely on our areas of competitive

strength and strategic opportunities and is a key delivery tool for the Economic Strategy.

Over the last few months a range of activity to take forward the LIS has commenced. Below are

some examples of this activity.

Apprenticeship Levy Transfer - Alison Ward started as our Apprenticeship Levy Sharing

Coordinator at the beginning of December. This role will work with partners to identify businesses

which want to take part in levy sharing and will match them with one another and potential

apprenticeship providers. There has been a high level of interest from business to engage and sign

up.

The LEP has held two short sprint sessions to drive forward two of the interventions in the LIS. The

first sprint session examined the ambition to ‘Introduce a new integrated offer and programme of

activity that will stimulate collaboration and innovation’. The second looked at business support,

and how large companies could support small scale up companies through a volunteering

mentoring scheme.

Both sessions were facilitated by Simon Burckitt from Aviva and attended by a mix of businesses,

academia and LEP executives. Several ideas were generated, and a plan has been developed to

carry out some pilot activity.

The LEP and partners have developed the business case for the Food Hub and submitted a bid to

the European Regional Development Fund which has passed gateway and will progress to full

application with a March 2020 deadline. The LEP Investment Appraisal Committee will examine

the business case to assess and make recommendations on the LEP’s contribution to the project.

Key Considerations

1 Publishing the Local Industrial Strategy

Although we are continuing to wait to hear from Government about next steps, we would like to go

publish a designed version of the LIS, in line with the new ‘Norfolk and Suffolk Unlimited’ branding.

A designed version of the executive summary is attached, and printed copies will be available for

Board members at the Board meeting.

The LIS has been well received by partners who are actively getting on with delivering the

interventions within it.

The LIS is part of the suite of documents which is being used to raise the profile of Norfolk and

Suffolk, the designed version will simply replace the word version which is currently available on

the LEP website. As with the word version it will contain the caveat that this version is yet to be

signed off by Government. Once we have Government sign off a new version will be published.

The Board is asked to approve the publication of the designed version of Norfolk and Suffolk Local

Industrial Strategy.

2 Development of Investment Plan

The next step in driving effective delivery of the Economic Strategy and the LIS is to develop an

overarching Investment Plan and update the portfolio of outputs.

The Investment Plan will capture the interventions that will deliver the ambitions and goals in the

Economic Strategy and LIS - projects, programmes and initiatives - which require funding. This

will enable the LEP and partners to take a proactive approach to securing funding for the we have

identified as the interventions that will deliver the desired impact rather than funding projects just

because they are ‘shovel ready’.

14

2

In many areas we will be building on existing pipelines and investment plans from local partners

and local areas.

However there will be areas such as skills, where an investment plan for the area does not yet

exist. In this case the LEP’s Skills Advisory Panel is well placed to lead on the development of a

workshop and plan to incorporate into the overarching investment plan.

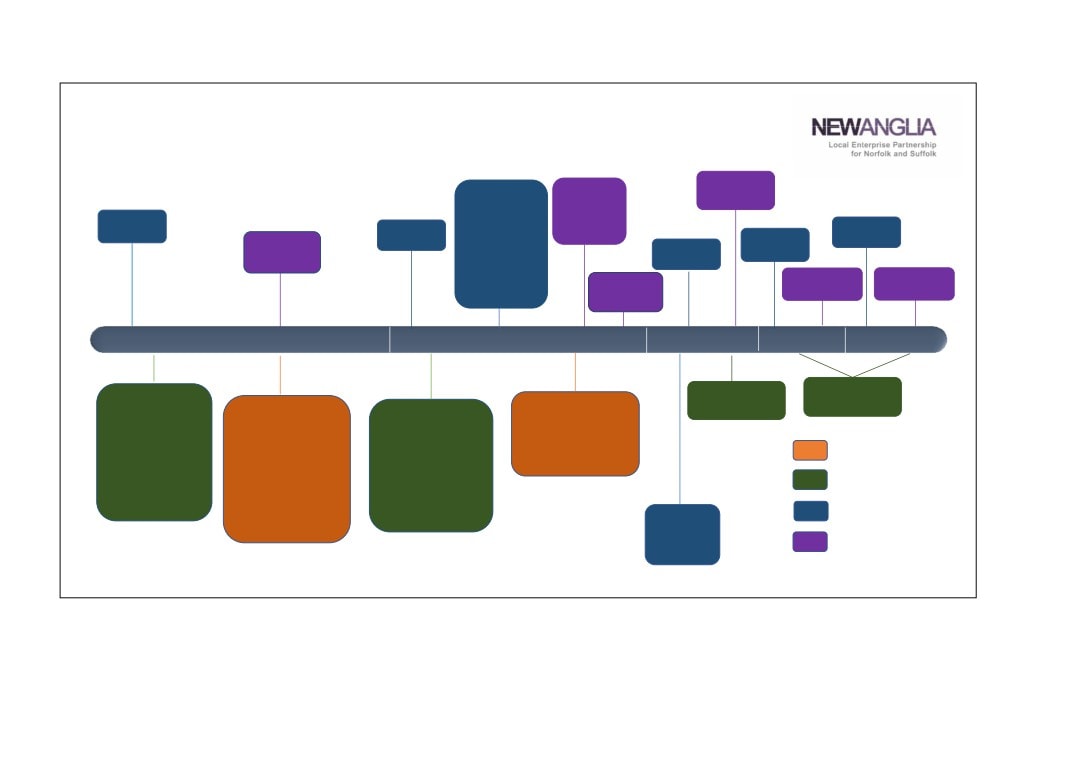

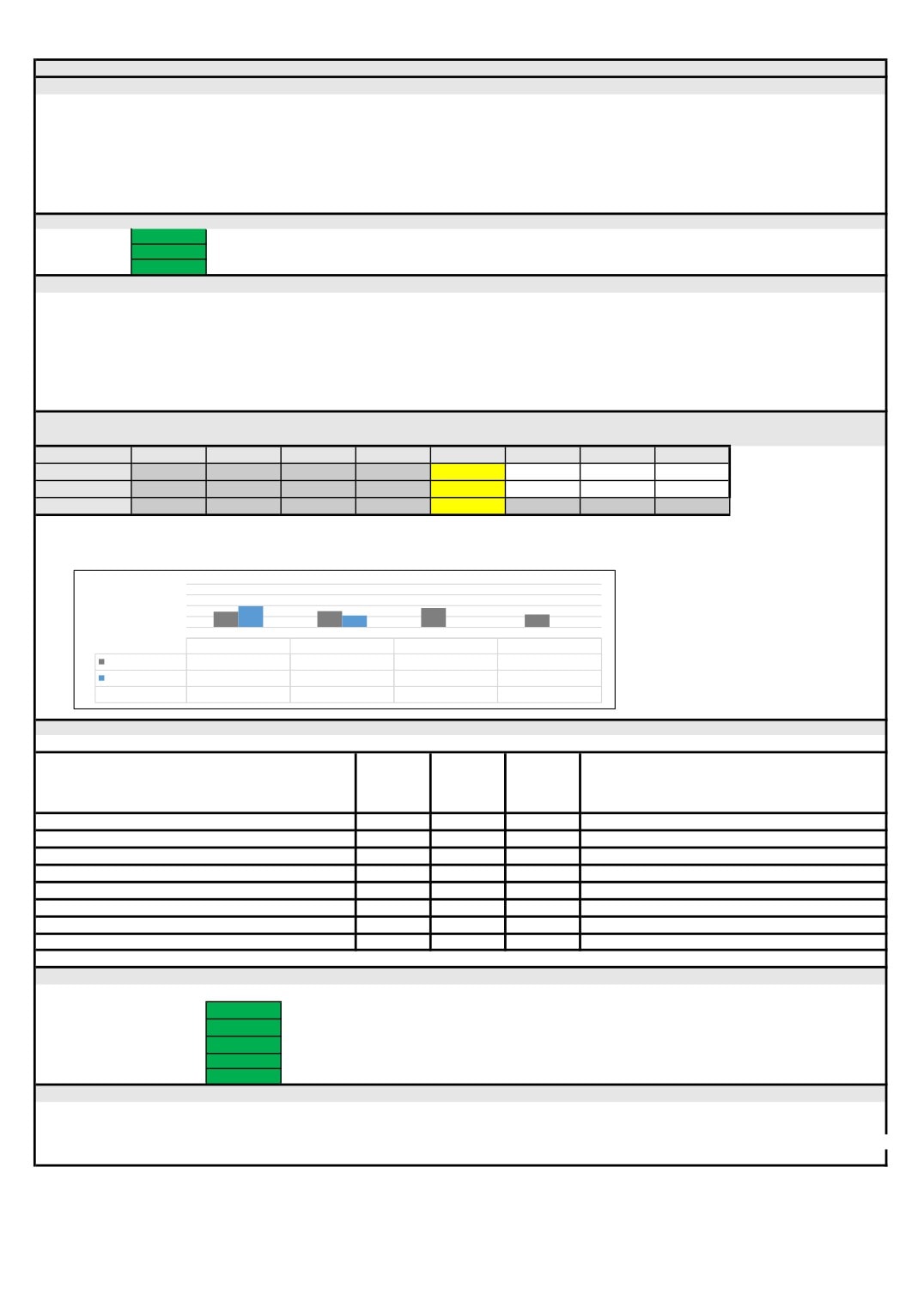

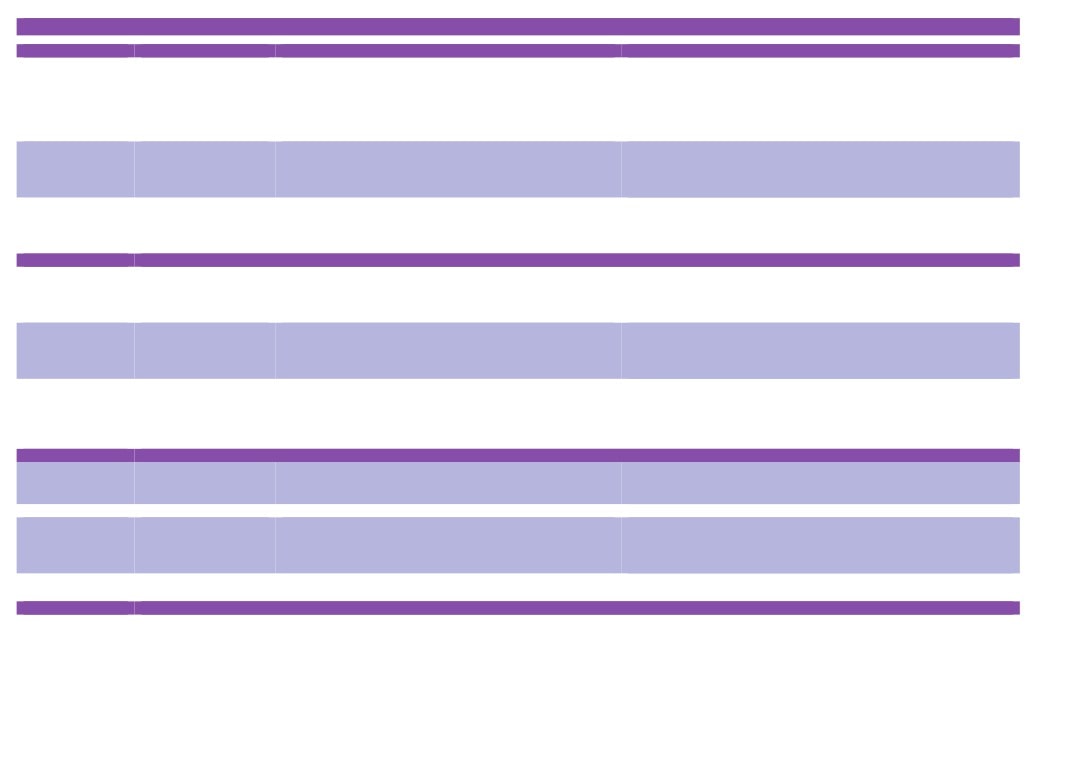

Norfolk and Suffolk Economic Strategy - Blueprint for productive,

inclusive growth.

Local Industrial Strategy - Focused on Strategic Opportunities

Tools

Clean Growth, Clean Energy, Agri-food, ICT & Digital

• Assurance Framework

• Evidence Workbooks

• Prioritisation Framework

Investment Plan

• Inclusive Growth Toolkit

• Evaluation Framwork

The investment plan will summaries the key investments which will deliver the

• Funding Framework

strategies for example:

• Updated Output Portfolio

LEP

Project

Major

Sub Boards

Local

EU Structural

Programmes/

Pipeline

Projects

and Industry

Partners

Investment

Initiatives

£10m<

Council

Delivery

Funds

Delivery plans

Plans

There are several tools which will help support the implementation of the strategies and investment

plan these are listed in the red box in the diagram above. The ones in black are existing tools and

the white ones are in development.

Updating the outputs portfolio - Currently the outputs that are monitored and measured have been

directed by government. To ensure that we are supporting interventions that deliver against the

strategies and be able to effectively evaluate its impact the suite of outputs needs to be expanded.

We will work with partners to develop a shared portfolio which sets out metrics, definitions and

methodologies.

Funding Framework - this is a tool that will help to identify the best route of funding for an

intervention. It is intended to ensure we focus on the funding streams that will give us the largest

chance of success as well as enable us to speed up the initial stages of funding identifications.

This will also include funding factsheets that will summaries national funding opportunities which

will be shared with partners as they arise.

Next Steps - Approach and Timetable

The diagram below sets out the proposed approach and timetable to the development of the

Investment Plan.

The Economic Strategy Delivery Co-ordinating Board would provide the day to day steering with the

LEP Board approving the Investment Plan at the July Board meeting.

15

3

Define

Identify

Review & Identify

Design & Publish

Gaps

ESDCB to review

All Partners to

High-level Norfolk

Investment plan

identify key

Strategy Board

and Suffolk

approach 18th Dec.

investments and

reviews the

Investment Plan is

LEP Board to agree

projects. Workshops

investments and

designed.

scope and approach

to take place.

projects identified by

29th January. - up to

partners and

Investment Plan

Call runs from

2036. ESDCB to

identifies gaps in

published following

review IP template

19 Feb - 20 March

delivery 20th April.

LEP Board in July

14th Feb.

2020.

Feb - March 2020

April 2020

June - July 2020

The Board are asked to approve the approach and timetable to the development of the

Implementation plan and supporting tools.

Link to the Economic Strategy and Local Industrial Strategy

The investment plan and supporting tools will enable partners to focus resources and investment on

interventions that will provide the biggest impact on the ambitions set out in the Economic Strategy

and the LIS. It will put us in a stronger position to influence future funding opportunities.

Recommendation

• The publication of the designed version of Norfolk and Suffolk Local Industrial Strategy.

• To approve the approach and timetable to the development of the Investment Plan and

supporting tools.

16

4

New Anglia Local Enterprise Partnership Board

Wednesday 29th January 2020

Agenda Item 9

LEP Evaluation Framework

Author: Marie Finbow

Presenter: Lisa Roberts

Summary

This paper sets out the proposed updated Evaluation Framework and programme of evaluation

and sets out the proposed approach to implementing the framework.

Recommendation

It is recommended that the LEP Board approves:

the updated Evaluation Framework and programme of evaluation for inclusion in the

2020 Local Assurance Framework.

the proposed approach to have a call-on, call-off list of companies that will provide

external support.

a 50K allocation of the Growth Deal top slice to appoint a company to carry out an

evaluation on three LEP programmes.

Background

An evaluation plan was developed as part of the Growth Deal three process in 2015. LEP

programmes and projects have been in delivery phase for several years now. Learning lessons

and ensuring continuous improvement is important to ensure LEP funds are being invested

effectively, deliver the desired impact and shape strategies and new interventions.

An Evaluation Framework has been developed which supersedes the Growth Deal Evaluation

Plan. The Framework sets out a more robust approach and programme to evaluation than the

Plan.

At the outset of the Local Growth Programme (Growth Deals) the Department of Business,

Energy and Industrial Strategy set out requirements of Local Enterprise Partnerships to monitor

and evaluate Local Growth Fund projects. These requirements are embedded in the MHCLG

Accounting Officer System Statement1 and are reiterated in the National Local Growth

Assurance Framework2 where it is stated that arrangements must be in place to deliver

effectively and provide good value for money along with highlighting the need for LEPs to

develop a local evaluation plan.

Government has set out its minimum expectations for evaluation, which are to:

1 MHCLG Accounting Officer System Statement can be found here

2 National Local Growth Assurance Framework can be found here

1

17

Provide government with evidence on the effectiveness of delivery and value for money

of Local Growth Fund interventions, and other programmes.

Identify causal effects on planned outcomes and impacts.

Learn lessons about what works, either to create desired impact on outcomes or to

ensure efficient delivery of outputs.

Provide the evidence base to influence funding policy decisions.

It is down to LEPs themselves to decide which approaches are the most appropriate for their

Local Growth Fund and other programmes.

Key Considerations

Evaluations play an important role in setting and delivering the ambitions and objectives in the

Economic Strategy and Local Industrial Strategy, demonstrating accountability and providing

evidence for independent scrutiny processes. Good evaluations also contribute valuable

knowledge towards our evidence base, feeding into future strategy development and occupying

a crucial role in determining our future projects and interventions.

The proposed Evaluation Framework has been published on the LEPs website as a

requirement of Government and is referred to within our Local Assurance Framework. It sets

out:

the purpose and scope of evaluation;

types of evaluation - impact, process and cost benefit and how to identify the relevant

one for the project, programme or initiative;

example questions which will be examined;

the approach to implementing the framework; and

a programme of evaluation which sets out a four-year rolling timetable which will be

reviewed on a quarterly basis. Appendix A provides a high-level summary.

The full programme of evaluation includes: an overview of what will be evaluated by when;

whether the evaluation will be conducted internally or externally commissioned; whether the

evaluation is a contractual requirement; the chosen evaluation approach; who is leading the

evaluation; who the evaluation will report back to; and records the data being collected and

monitored. As part of our review of programmes we will be looking to develop criteria around

inclusive growth and clean growth which will be reflected in the evaluation.

There is a need to secure external expertise to carry out some of the evaluations which will

provide a skills set that doesn’t currently exist within the LEP Executive. It will also adhere to

contractual requirements of some of the LEP’s funding.

This paper is seeking the Board’s approval to carry out a tender process to develop a call-on,

call-off contract list of companies that we can call upon as and when required. This would be

reviewed every three years.

Funds will be required to carry out external evaluations. Requests for funding will be included

in the LEP budget or through a Board paper if required. During 2020 we would like to carry out

an external evaluation which covers Growing Business Fund, Growing Places Fund and New

Anglia Capital. This would be a combination evaluation covering impact, process and cost-

benefit and would look at each of the programmes on an individual basis as well as considering

them at a high-level; evaluating the portfolio of programmes to determine whether the LEP’s

portfolio provides the range of funding options that best delivers our ambitions.

To progress this work so that it is delivered in 2020 we are seeking the Board’s approval to

allocate £50k of the Local Growth Fund top slice to deliver the LEP Programme Portfolio

evaluation.

2

18

Link to the Economic Strategy and Local Industrial Strategy

The programme of evaluation incorporates all the LEP’s programmes and projects, as well as

the Economic Strategy annual review to ensure continued alignment.

Next Steps

End January

Publish confirmed Evaluation Framework with any amendments following LEP

Board meeting.

February

Develop the evaluation specification for the LEP Programmes Portfolio

evaluation.

February/

Run a tender process to identify external consultants for a call-on, call-off

March

contract to conduct evaluations as and when required.

End March

Include in the Local Assurance Framework update.

Spring/

Appoint consultants and undergo evaluation.

Summer

Autumn

Report findings to LEP Board.

Recommendation

It is recommended that the LEP Board approves:

the proposed updated Evaluation Framework and programme of evaluation for inclusion

in the 2020 Local Assurance Framework.

the proposed approach to have a call-on, call-off list of companies that will provide

external support.

A 50K allocation of the Growth Deal top slice to appoint a company to carry out an

evaluation on three LEP programmes.

Appendices

A high-level overview of the LEP’s programme of evaluation is attached as Appendix 1.

3

19

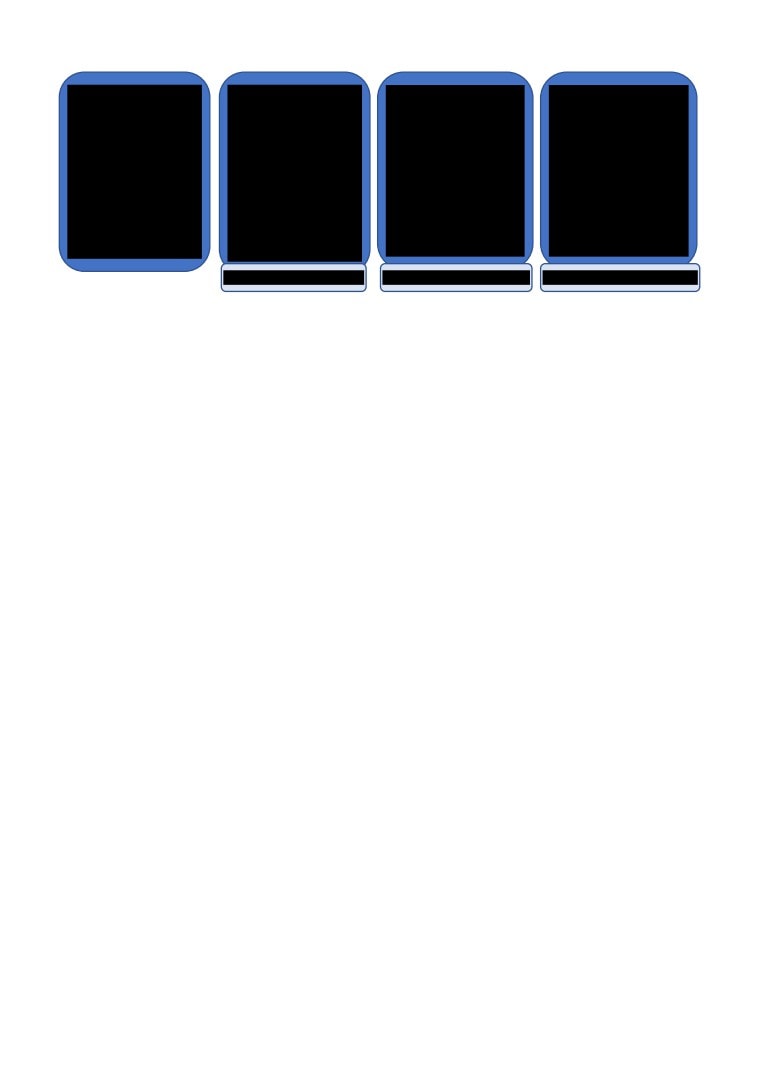

Appendix 1

LEP Evaluation Programme

2 x Growth

Internal

3 x EZ

Deal

evaluations on:

Accelerator

Projects

Annual

Fund

• EZ

Annual

Annual

projects

Review

15 x Growth

Accelerator

Annual

Review

Review

Annual

Deal

Fund

Review

Review

projects

• Innovation

11 x Growth

5 x Growth

5 x Growth

Projects

Deal

Deal Projects

Deal Projects

2018 call

Projects

2020

2021

2022

2023

2024

Business Growth

External

Business Growth

Evaluations on:

Evaluations on

Programme

evaluations on

External evaluations

Programme

on:

• Invest East

• Business Growth

• Eastern Agri-Tech

Programme

Initiative

• Business Growth

• Norwich Opportunity

Key:

Externally led programme

Programme

Area National

• New Anglia

• Cambridge-

Evaluation

Norwich Tech

Capital

• Growing Places

Externally commissioned

Corridor

Fund

evaluation

• Enterprise

Adviser Network

• Norwich

• VCS Challenge

Innovative

Internal evaluation

Opportunity Area

Fund

Projects

National deep dive

Fund 2019

Project Closure evaluations

Call

* Contractual requirement

4

20

New Anglia Local Enterprise Partnership Board

Wednesday 29th January 2020

Agenda Item 10

Board recruitment

Author: Charley Purves

Presenter: Doug Field

Summary

New Anglia will lose two board members this year, Lindsey Rix and Doug Field. This paper

provides detail of the recruitment process and timeline, as well as asks for volunteers to form

the recruitment panel.

Recommendation

The board is asked to note the contents of the report and recruitment packs, as well as support

and promote the opportunities.

The board are further asked to nominate and approve the interview panels for the vacancies.

Background

Doug Field’s role as Chair of the Board comes to an end at the AGM in September 2020. This

means that we need to find a successor to take over the Chair from September. Government

requires that local enterprise partnerships recruit externally for their chair vacancies, although

current board members are also welcome to apply.

Lindsey Rix has also tendered her resignation from the board as her work commitments have

increased and she is unable to devote the time required as a board member. She will stand

down from April 2020.

This means that we are looking to recruit one board member and a chair, and it would be

preferable to complete this recruitment simultaneously.

Key Considerations

A recruitment pack has been developed for the role of chair and the board member. These

recruitment packs are available on request, or via the LEP website.

For the chair of the board, we are looking for a senior business leader with at least three years

in a board level role, with experience of stakeholder management including public and private

sector partnerships.

For the board member, we are looking for an experienced person with at least three years in a

senior appointment.

1

21

For both roles, consideration needs to be given to sector and geographical coverage, as well as

the commitment to have at least a third of the board female, and equal representation by 2023.

The proposal is to have open recruitment from January to March with interviews end of March

and beginning of April, subject to panel availability. The appointments will then be ratified at the

May board meeting. The successful board member can take up their appointment from June,

with the appointed candidate to become chair after the AGM.

Next Steps

Once approved, the recruitment will be opened and advertised widely. Volunteers are required

to form the interview panels for the roles. The executive team will coordinate applications and

set up the interview arrangements.

Specific timelines are detailed in the recruitment packs.

Recommendation

The board is asked to note the contents of the report and recruitment packs, as well as support

and promote the opportunities.

The board are further asked to nominate and approve the interview panels for the vacancies.

2

22

New Anglia Local Enterprise Partnership Board

Wednesday 29th January 2020

Agenda Item 11

Remuneration Committee Terms of Reference

Author: Charley Purves Presenter: Jeanette Wheeler

Summary

This report summarises the amendments made to the Remuneration Committee Terms of

Reference, as agreed at their meeting on 30th October 2019. It also details the Gender Pay Gap

Report endorsed by the committee and subsequently published on the LEP website and the

government gender pay gap service website.

Recommendation

The board is invited to approve the Remuneration Committee Terms of Reference.

The board is invited to note the contents of the Gender Pay Gap Report.

The board is requested to review the committee membership.

Update from last meeting

At the meeting held 30th October 2019, the committee agreed to accepting and reviewing a

voluntary gender pay gap report. This report can be found in appendix A. Once submitted, the

gender pay gap report must be produced each year, following the government’s requirements.

In light of agreeing to the gender pay gap reporting, the committee amended the Terms of

Reference, appendix B, to incorporate this, as well as reducing the frequency of meetings to

yearly with the option to call additional meetings as required.

Committee membership

The committee is chaired by Mark Jeffries. Committee members are Andrew Proctor and

Jeanette Wheeler. Doug Field is a co-opted member.

Recommendation

The board is invited to approve the Remuneration Committee Terms of Reference.

The board is invited to note the contents of the Gender Pay Gap Report.

The board is requested to review the committee membership.

1

23

Appendix A

Gender Pay Gap Report 2019

Summary

Whilst not legally required to report on the gender pay gap at New Anglia LEP, it is felt that it

is good practice to review this and report on it publicly. Appointments to the LEP executive

team are made on merit with a rigorous recruitment process followed. Opportunities for

development are open to all members of the team and we follow a continuous performance

management process.

The LEP is governed by a non-remunerated board of directors. The LEP board is committed

to achieving equal representation of female board members by 2023 in line with government

requirements. As the board are non-remunerated, they do not influence the statistics

provided within this report.

Background

We are an employer voluntarily choosing to carry out Gender Pay Reporting under the

Equality Act 2010 (Gender Pay Gap Information) Regulations 2017.

This involves carrying out calculations that show the difference between the average

earnings of men and women in our organisation; it will not involve publishing individual

employee’s data.

We can use these results to assess:

the levels of gender equality in our workplace

the balance of male and female employees at different levels

how effectively talent is being maximised and rewarded.

This gender pay gap report show the overall difference in average pay for all men and

women working for New Anglia. It does not compare men and women doing the same role.

Results

As at 5th April 2019, New Anglia LEP employed 54 people, 52 of which are deemed to be

relevant full pay employees. Of the overall team, 43% are male and 57% are female.

Looking specifically at the relevant full pay employees, the mean gender pay gap is 1.11%.

This is the difference between the mean hourly rate of pay for men and women, which is

calculated by adding together all the male and female hourly pay separately and then

dividing by the number of men and women respectively.

The median gender pay gap, the difference between the median hourly rate of pay for men

and women is -5.55%. The median rate of pay is the mid-point of the salary range for men

and women.

24

The gender pay gap nationally stands at 8.9% for 2019 which indicates that New Anglia LEP

is one of the lowest. Equally, the local government sector pay gaps stands at 6.1% for 2019,

a reduction of 0.7% from 2018.

New Anglia does not award bonus payments and therefore cannot report on gender pay

bonus gaps.

The proportions of male and female full pay relevant employees within the quartile pay

bands are listed below:

Quartile

Male

Female

Lower

38%

62%

Lower middle

54%

46%

Upper middle

38%

62%

Upper

38%

62%

Actions

New Anglia has an open recruitment policy with vacancies advertised widely and appoints

on skills and competencies. This ensures that the right person is appointed to the roles

available.

Flexible working is made available to all employees and there are a number of family friendly

policies in place to support all members of the team.

The equality and diversity policy has been strengthened and an action plan has been

developed to roll out across the organisation, including board members. This will provide

better visibility of equality and diversity in recruitment and promotion.

We are also committed to developing our team with a focus on formal external and internal

training plans.

Conclusion

The results show that New Anglia LEP is in a good position with a low mean gender pay

gap, however the median gender pay gap is in a negative figure as this data is skewed by a

higher proportion of females in the upper and upper middle quartiles.

25

Appendix B

LEP Remuneration Committee

Terms of Reference

Purpose

To provide a formal and transparent procedure for developing policy on executive remuneration.

Responsibilities

To determine and agree with the Board the framework or broad policy for the remuneration

of the executive team, as it is designated to consider.

In determining such policy, take into account all factors which it deems necessary. The

objective of such policy shall be to ensure that members of the executive team are provided

with appropriate incentives to encourage enhanced performance and are, in a fair and

responsible manner, rewarded for their individual contributions to the success of the LEP.

To approve the design of, and determine targets for, any performance related pay schemes

operated by the LEP and approve the total annual payments made under such schemes.

To ensure that contractual terms on termination, and any payments made, are fair to the

individual, and the LEP.

To review the outcomes of the performance review process in respect of the Chief

Executive Officer and any other executives appointed from time to time.

Within the terms of the agreed policy make recommendations to take to the Board

regarding the total individual remuneration package of the Chief Executive Officer and any

other senior executive officers or employees who may be appointed from time to time,

including bonuses and incentive payments.

In determining such packages and arrangements, to give due regard to any relevant legal

requirements;

To review and note annually the remuneration trends across the public and private sectors.

To review and approve the annual Gender Pay Gap Report.

The Committee is authorised by the Board to seek any information it requires from any

employee of the LEP, in order to perform its duties.

In connection with its duties the Committee is authorised by the Board to obtain, at the

LEP’s expense, any outside legal or other professional advice, within budgetary constraints.

Membership and Frequency

The committee shall appoint an Independent Chair, who shall serve for maximum five-year term.

The Committee shall be made up of at least three members, including the Independent Committee

Chair. No Board Member who is an employee of the LEP or who has left the LEP’s employment

within three years to the LEP, or a spouse or partner of such employee, shall serve on the

Committee. Two members of the Committee shall be appointed by and from the members of the

New Anglia LEP Board.

26

Substitutes may only be accepted in exceptional circumstances and only for public sector members

at the discretion of the Chair.

The Committee is authorised to co-opt the Chair of the LEP as a Committee Member (if not already

appointed) for the purposes of facilitating the annual performance review process in respect of the

Chief Executive Officer.

Only members of the Remuneration Committee have the right to attend Remuneration Committee

meetings. However, other individuals and external advisers may be invited to attend for all or part

of any meeting as and when appropriate. Appointments to the Committee shall be reviewed

annually by the Board.

The Committee shall meet a minimum of once a year. Where necessary, additional meetings may

be called as agreed with the Committee Chair.

Quorum

The quorum necessary for the transaction of business shall be three. A duly convened meeting of

the Committee at which a quorum is present shall be competent to exercise all or any of the

authorities, powers and discretions vested in or exercisable by the committee.

Monitoring and Reporting

Minutes of Committee meetings shall be circulated promptly to the Chair and, once agreed, to all

members of the Board.

The Committee Chair shall report formally to the Board on its proceedings after each meeting on

all matters within its duties and responsibilities.

The Committee shall make whatever recommendations to the Board it deems appropriate on any

area within its remit where action or improvement is needed.

The Board shall, at least once a year, review the performance of the Remuneration Committee,

constitution and terms of reference to ensure it is operating at maximum effectiveness.

Review

The Committee shall, review its own performance once a year and terms of reference to ensure it is

operating at maximum effectiveness and recommend any changes it considers necessary to the

LEP Board for approval.

The membership of the Committee will be reviewed annually.

Approved by LEP Board:

Last Updated: 30th October 2019

27

New Anglia Local Enterprise Partnership Board

Wednesday 29th January 2020

Agenda Item 12 - Chief Executive’s Report

Author: Chris Starkie

Summary

This report provides an overview of LEP team activities since the November board, structured

around:

1) Programmes

2) Strategy

3) Engagement and promotion

4) Governance, Operations and Finance

Given two month gap to the previous meeting and the wide range of activities being undertaken

by the LEP, the report is slightly longer than normal.

The media dashboard is attached as an appendix to the report.

Recommendations

The board is asked to:

Note the contents of the report

1) LEP Programmes

Growth Deal

The Hempnall Roundabout on the A140 was officially opened on 16 December 2019, although

some drainage issues and landscaping work remains to be completed.

The majority of Grant Agreements for new projects have been completed, delivery has begun

and the first grant claims are now being received. Changes within the school of engineering by

UEA in relation to the development of Productivity East has already increased projected student

numbers.

East Suffolk Council has resolved the delay to ground investigations and the planning application

for the Flood Risk Management Project (Lowestoft Flood Defences) will have gone before the

council’s planning committee on 14 January 2020. Detailed design and works on the tidal walls,

which have been delayed for some time, are then expected to proceed over the next few months.

A Project Board to be held on 7 February 2020 should clarify the revised delivery schedule.

The overall level of anticipated expenditure has fallen and it is likely that some grants will not be

claimed in accordance with the draw down schedule. However, achievement of outputs remains

reasonably on track to meet forecasts, even though some will be realised later than expected.

Business Growth Programme

The Business Growth Programme is ahead of its overall output target and cumulative spend

profile by £700k despite a reduction in approvals and payments of the Small Grant Scheme over

the last few months.

The financial claim for Q2 2019 covering the period July - September with a value of just over

£1m has been paid by MHCLG.

We are currently working on the Q3 20019 claim covering the period October - December 2019.

More data can be found in the programme performance report at agenda item 13.

1

29

New Anglia Local Enterprise Partnership Board

Wednesday 29th January 2020

Agenda Item 12 - Chief Executive’s Report

In September 2019 a £1.1m application to extend the Growth Hub activity for a further three

months (to end of November 2021) and employ two additional Business Growth Advisers was

submitted to MHCLG. We are awaiting MHCLG’s decision on this, prior to submitting a further

extension as part of a national call due in the spring of 2020.

Over a 2 month period to December 2019 four Growth Advisers (2 BEIS and 2 ERDF funded)

and a new Growth Hub Manager were recruited, all of whom have now taken up their roles.

The fourth annual evaluation of the Programme is in progress.

The application for the new Innovation, Research and Development Grant Scheme is still being

considered by MHCLG, with the application delayed because of staffing problems at MHCLG.

The delays mean that we have had to put the start date of the scheme back to February 2019.

Growing Business Fund

The Growing Business Fund continues to experience a fall in demand, with fewer and lower

value applications coming forward. The January 2020 Approvals Panel was cancelled, due to a

lack of applications being ready for the meeting. Several pipeline projects are now looking to

move forward, now that there is greater political certainty.

Fresh Asia Foods, awarded £400k from GBF in 2014 to relocate its business producing Chinese

meals from Erith near Dartford to Little Melton have decided not to proceed with the move. They

have specifically cited Brexit and the uncertainty generated as a result in the local labour market

as the reasons for this decision.

The grant, which was awarded on the condition that the move went ahead and that funding was

kept in a separate bank account until that time, has now been recovered by Suffolk County

Council. Since the funding for the project was allocated from the earlier Regional Growth Fund

rather than the LEP’s Growth Deal, it is likely the funding will need to be returned to UK Treasury,

but this is currently under discussion.

Eastern Agri tech Initiative

The Eastern Agri tech Initiative continues to receive steady interest following a boost in marketing

across both regions, to encourage new applications; this is being led by the Cambridge and

Peterborough Combined Authority as the delivery body.

Over 50% of the available fund has been paid out so far in support of 12 projects, a mix of R&D

and growth grants in the Cambridge and Peterborough Combined Authority area. A number of

projects in the New Anglia area are expected to come forward to projects panels in the spring of

2020. Improvements to the governance of the programme have been made, a requirement of the

New Anglia funding.

Growing Places Fund

The LEP has supported the Nest Community sports and enterprise project in North Norwich. The

project held a Parliamentary reception on 14 January 2020, supported by Lord Dannant.

The Saxmundham Creative Enterprise Hub plans to start the refurbishment of the old post office

and telephone exchange in Saxmundham in January as a first phase of development towards

opening as a new creative enterprise hub in the summer.

2

30

New Anglia Local Enterprise Partnership Board

Wednesday 29th January 2020

Agenda Item 12 - Chief Executive’s Report

LEP Innovative Projects Fund

2018 Call of the Innovative Projects Fund - £500,000.

The Fit for Nuclear project has now met the conditions of the IAC’s offer for IPF Funding.

£118,000 was approved for this project. Fit for Nuclear will be led by West Suffolk College and

will commence after receipt of a signed offer letter.

There are now seven projects under the 2018 call of the Innovative Projects Fund with a

combined IPF allocation and commitment of £539,531.

There are no further projects waiting for offer letters.

3 project claims were received for 2019/20 Quarter 2 period.

2 payments totaling £37,201 have been made and one payment of £32,499 is pending.

1 monitoring form has been received demonstrating expenditure of £19,589.

Total forecast spend by the end of Quarter 2 was £85,682, Actual spend is £43,781 with a

further pending claim of £32,499 (bringing the total actual spend to £76,280 - £9,402 behind

the expenditure schedule).

To date, 4 part time jobs have been created and 6 businesses have received support.

Local Authority match funding of £47,579.05 and Private Match Funding of £28,287.89 have

been recorded.

3

31

New Anglia Local Enterprise Partnership Board

Wednesday 29th January 2020

Agenda Item 12 - Chief Executive’s Report

2019 Call of the Innovative Projects Fund (Norfolk & Suffolk) - £1.5m

The 2019 Call of the Innovative Projects Fund was launched on Monday 7th October and

closed on 20th December 2019.

The call received in the region of 80 enquiries.

37 applications were received and a total of £3,095,196 was asked of the Innovative

Projects Fund with a total projects value of £6,790,048;

18 projects appear to be regional projects (across Norfolk & Suffolk);

12 projects are based in or operating across Suffolk county;

7 projects are based in or operating across Norfolk county

The applications are now with the externally appointed appraisal consultants. A report

highlighting the recommendations for the approval and rejection of projects will be made

available to the IPF Panel on 11th March 2020.

4

32

New Anglia Local Enterprise Partnership Board

Wednesday 29th January 2020

Agenda Item 12 - Chief Executive’s Report

Enterprise Zones Update

Space to Innovate Enterprise Zone

Chancerygate has begun construction of 19 units at Futura Park in Ipswich which are due to

complete in April 2020.

Three of these already have pre-construction deals agreed. Meanwhile there is interest in the plot

at the front of the site which in addition to the recently completed Lok ‘n’ Store building, would

complete Futura Park.

At Sproughton, 46% of the developable land is either being developed or has occupiers secured.

A major second occupier hopes to operate from summer 2020 with 500 new jobs.

On Princes Street the Connexions 159 building is now fully occupied. A new multi-storey car park

is expected to complete in 2021, after which the site is expected to develop rapidly with the

possible addition of a hotel and two final office units.

Norwich Research Park is progressing well with a temporary displacement car park completed.

This enables construction of the multi-storey car park to begin January 2020 with a one-year

build time. The 1,765m2 zone 4 building construction is due to commence in March 2020. This

building will be occupied by a food science business.

To date*, the Space to Innovate zone has delivered 1,159 jobs, 107 new businesses, £174m of

public sector investment and £107m of private investment.

Great Yarmouth & Lowestoft Enterprise Zone

At Beacon Park the vacancy rate as of November 2019 was down 7.5% with a healthy pipeline of

leads coming in. This is mirrored at Ellough where the first unit is now occupied with a second

enquiry looking to take between 1 and 4 further units. In response to this the developer has now

5

33

New Anglia Local Enterprise Partnership Board

Wednesday 29th January 2020

Agenda Item 12 - Chief Executive’s Report

indicated willingness to commence speculative construction in addition to land sales

and planning has gone in for the extension to the Mobbs Way site.

To date*, the Great Yarmouth & Lowestoft zone has delivered 1,898 new jobs, 66 new

businesses, £178m of public investment and £51m of private investment.

*Data correct at the end of Q2 2019-20

2) Strategy

Economic Strategy Delivery Co-ordinating Board (ESDCB)

Collaborating to Grow Deep Dive

The ESDCB have identified 14 priority objectives from the Economic Strategy which they focus

on during 2019/20. At each meeting there is a deep dive into a grouping of these objectives

which covers a presentation of evidence and understanding the current activity and testing to see

what more can be done to ensure maximum impact of current activity. In addition, there is a

discussion on gaps and the actions required to fill them.

The session on the 18th December focused on four objectives within the Collaborating to Grow

theme - linking up our innovation hubs, opening up supply chain opportunities, supporting

businesses through a smoother planning system; and helping businesses solve the challenges in

service provision that the public sector faces.

The Board discussed how the LEP and partners can more effectively co-ordinate activity around

the innovation ecosystem and maximise the impact of the Innovation Forum. It was suggested

that a workshop take place at the next Innovation Forum to identify what is needed to join up the

innovation hubs and the capacity required to create this - to help inform a future funding bid.

Economic Strategy Annual Performance Review

Work on the Economic Strategy Performance review has commenced. The first stage is to

update the evidence workbooks this will be completed by the end of January.

The LEP Board will be presented with a dashboard showing progress against the Economic

Strategy Indicators in February.

Dates for the annual business and public Leaders performance session is being arranged for

Friday, 24th April. This session will involve a presentation of the Economic Strategy performance

and will have a focus on the developing Investment plan.

Skills

Skills Advisory Panels (SAPs)

The Skills Advisory Panel met in November at the East Coast College Energy Centre. We

received an update on the provision that the college provides for this sector and the opportunities

for new employer partnership due to the new facilities funded by the LEP.

6

34

New Anglia Local Enterprise Partnership Board

Wednesday 29th January 2020

Agenda Item 12 - Chief Executive’s Report

A forward plan for 2020 was agreed together with key skills data to start monitoring. Influences

on this data cannot just be through the work of the SAP but we can support change/interventions

where possible.

Claire Cullens has agreed to Chair the Panel. She is meeting with some of the members to

understand where the focus is best placed and will chair her first meeting on January 24th.

Apprenticeship Levy Transfer

Alison Ward joined the Strategy Team at the beginning of December. She is formalising the

governance process around the transfers plus has had a number of meetings with levy payers,

businesses looking to receive levy and providers. Many more are booked in for the new year.

Alongside Jan Feeney (Norfolk County Council), we also presented to a number of Levy paying

Energy businesses who are interested in maximising the use of their levy.

EAN and Careers Hub

The EAN and Careers Hub are on track to meet the Careers and Enterprise Company Grant

agreement targets for July 2020 having met last academic years targets. Continued focus over

the coming months will be to recruit further Enterprise Advisers aligned to key sectors identified

in the Local Industrial Strategy and disseminating best practice across the network to support

schools with achieving the Gatsby Benchmarks.

This month we submitted our ESF bid for an expanded Careers Hub, which if successful would

run from January 2021 to December 2023.

We have welcomed Madeline Matthews to the team as maternity cover for Hannah Colledge.

Madeline will be covering the Norwich Opportunity Area.

Stronger Towns Fund

Five towns in the LEP area are developing Town Deals: Norwich, Ipswich, King’s Lynn, Great

Yarmouth and Lowestoft.

The LEP is taking an active part in all five Town Deals. Senior members of the LEP executive

have been assigned to each of the Town Deals, actively supporting creation of the Town Boards

and in development of Town Investment Plans, ensuring alignment with the Norfolk and Suffolk

Economic Strategy and the Local Industrial Strategy.

Transport

Transport East

The first carbon inquiry was postponed due to the General Election. The Suffolk and Norfolk

sessions are now due to take place on 27 and 31 January respectively. Transport East’s annual

summit, due to take place on 11 December, has been postponed until 26 February.

Transport Board

The next Transport Board will take place on 25 February and will focus on the Agile to Change

theme of the Integrated Transport Strategy. The agenda will consider innovation in transport and

clean growth, at the request of the November Board meeting. The Board will take place after a

‘Connections Café' which Norfolk and Suffolk are hosting on behalf of the Connected Places

Catapult. The event is designed to improve networking amongst the SME community in the

context of the Industrial Strategy’s grand challenges.

7

35

New Anglia Local Enterprise Partnership Board

Wednesday 29th January 2020

Agenda Item 12 - Chief Executive’s Report

Great Eastern Mainline (GEML) Taskforce

Work on the evidence refresh continues and Network Rail is in the process of carrying out

additional work on enhancements, including prioritisation, timetabling and costs, for inclusion in

the business case. The project board will consider the revised draft business case at its next

meeting on 27 February. Following the parliamentary election, Giles Watling MP has agreed to

take over the role of Chair of the GEML Rail Taskforce.

Trowse Rail Bridge Upgrade

A stakeholder meeting took place on 7 January looking at how we gain momentum around

improving the rail bridge at Trowse.

Ely Taskforce - 22 November/20 December

Recent discussions include how we might deliver the scheme using a programme