New Anglia Local Enterprise Partnership Board Meeting

Wednesday 24th February 2021

10.00 - 12.30pm

Via MS Teams

Agenda

No.

Item

1.

Welcome from the Chair

2.

Presentation - The University of Suffolk Strategy and Vision 2020-2030

3.

Apologies

4.

Declarations of Interest

5.

Actions / Minutes from the last meeting

Strategic

6.

Energy Sector Recovery and Resilience Plan

For Approval

Operational

7.

Enterprise Zone Accelerator Fund Amendment - Nar Ouse - Confidential

For Approval

8.

Great Yarmouth O&M Campus - Confidential

For Approval

BREAK - 15 Mins

9.

Enterprise Zone Accelerator Fund - Norwich Research Park - Confidential

For Approval

10.

Norfolk & Suffolk Transport Board Update

Update

11.

Chief Executive’s Report - including confidential items

Update

12.

February Performance Report inc & Economic Dashboards

Update

13.

Board Forward Plan

Update

14.

Any Other Business

1

New Anglia Board Meeting Minutes (Unconfirmed)

27th January 2021

Present:

Kathy Atkinson (KA)

Kettle Foods

Sam Chapman-Allen (SC)

Breckland Council

Claire Cullens (CC)

Norfolk Community Foundation

David Ellesmere (DE)

Ipswich Borough Council

C-J Green (CJG)

Brave Goose

John Griffiths (JG)

West Suffolk Council

Matthew Hicks (MH)

Suffolk County Council

Pete Joyner (PJ)

Shorthose Russell

Helen Langton (HL)

University of Suffolk

Steve Oliver (SO)

MLM Group

Corrienne Peasgood (CP)

Norwich City College

Andrew Proctor (AP)

Norfolk County Council

Johnathan Reynolds (JR)

Opergy

Sandy Ruddock (SR)

Scarlet & Mustard

Alan Waters (AW)

Norwich City Council

Jeanette Wheeler (JW)

Birketts

Tim Whitley (TW)

BT

Attendees

Ian Whitehead (IH)

Lane Farm - For Item 2

Rebecca Miles (RM)

Lane Farm - For Item 2

Harry Youngson (HY)

Lane Farm - For Item 2

Shan Lloyd (SL)

BEIS

Mark Ash (MA)

Suffolk County Council

Vince Muspratt (VM)

Norfolk County Council

James Allen (JA)

New Anglia LEP - For Item 7

Chris Dashper (CD)

New Anglia LEP - For Item 11

Julian Munson (JM)

New Anglia LEP - For Item 10

Chris Starkie (CS)

New Anglia LEP

Emma Taylor (ET)

New Anglia LEP - For Item 8

Rosanne Wijnberg (RW)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

1

Actions from the meeting: (27.1.21)

2021 LEP Strategic Priorities

Any comments on the strategic priorities to be submitted to CS & CJG

ALL

Strategic priorities slides to be circulated to the board

HW

Chief Executive’s Report

An update on Ely Junction to be provided at the next board meeting

EG

1

Welcome from the Chair

CJ Green (CJG) welcomed everyone to the meeting and thanked them for attending.

2

Presentation from Ian Whitehead, Lane Farm

CJG welcomed Ian Whitehead (IW), Rebecca Miles (RM) and Harry Youngson (HY) from Lane Farm

who provided the board with a presentation on their family run pig farm explaining that over the past

20 years they have diversified the business by setting up a cutting plant which had allowed them to

produce their own products and sell to local stores. IW explained that they then moved into cooking

and processing their pork and by bringing processing into a single building in 2019 allowing customers

to visit the site which resulted in larger orders.

The LEP’s agri-food grant will be used to purchase packaging machines allowing increased

productivity, reduced wrapping costs and allowing the use of recycled materials.

RM confirmed that a web site had been set up for the Suffolk Salami arm of the business which is

being used to test the processes and that this was doing well without promotion and that they would

look to expand this going forward.

The meeting discussed the impact of the pandemic which has reduced the demand from the

commercial food trade but noted that sales in local shops had increased.

CJG thanked them for the presentation and they left the meeting.

3

Apologies

Apologies were received from Dominic Keen.

4

Declarations of Interest

None

5

Actions/Minutes from the last Meeting

The minutes were accepted as a true record of the meeting held on 25th November 2020.

CJG reviewed the outstanding actions and Chris Starkie (CS) provided an update on the

sources of traffic on the web site vacancy board details of which will be circulated with the

minutes.

6

2021 LEP Strategic Priorities

CS provided the board with a presentation on the LEP’s key achievements of 2020 and the

strategic priorities for the year ahead.

CS highlighted 10 ways in which the LEP had supported local businesses during the

pandemic including the PPE database, the successes of partnership working and the

provision of grants in particular the Business Resilience and Recovery Scheme. It was also

noted that the LEP team had continued to deliver business as normal throughout its full

portfolio of programmes.

CS proposed the following priorities for 2021:

• Covid-19 Reponses & Recovery - continued practical support for business and support

during the recovery

• Clean Growth Region - driving forward the key elements of the Local Industrial Strategy

including establishing the Clean Growth Taskforce

• International Profile & Trade - working with the Department for International Trade and

other partners to promote the region, navigate any issues related to Brexit and take

advantage of new opportunities.

2

• Strengthening the LEP - securing future financing as programmes come to an end and

identifying funding from other areas.

The meeting discussed the new UK Shared Prosperity Fund details of which will be set out at

the budget in March.

CS also recommended a continuing focus on underpinning themes of inclusive growth,

innovation and digitalisation which will support all areas of work.

Claire Cullens (CC) noted that support for skills needed to be explicit in the objectives and the

meeting discussed the Skills White paper and the role of the Chambers of Commerce. CS

advised that he was meeting with both local chambers to discuss this further and would also

arrange a meeting with CC.

CS agreed to add an explicit reference to skills into the objectives

ACTIONS: Any comments on the strategic priorities to be submitted to CS & CJG

All

Strategic priorities slides to be circulated to the board

HW

The Board agreed:

• To note the content of the presentation and agreed the priorities identified with the addition

of skills

7

Trade and Cooperation Agreement Between the EU and the UK

James Allen (JA) presented the board with a summary of the report on the Trade and

Cooperation Agreement struck between the EU and the UK detailing the contents of the deal,

potential implications for sectors, potential economic impact, emerging intelligence and LEP

activity.

The board discussed the potential impact on the economy of leaving the EU coupled with the

pandemic and current anecdotal evidence of issues.

CS advised the board that the presentation could be provided to partners and anyone

interested should contact him or JA.

The Board praised the quality of the report and presentation and agreed:

• To note the content of the report

8

Agri-Food Industry Council Report

Corrienne Peasgood (CP), chair of the Agri-food Council, presented the board with an update

on the work of the Agri-Food Industry Council and reviewed the key objectives:

• Supporting business recovery, promoting long term growth and ensuring business

resilience.

• Explore ways of attracting inward investment to increase the volume and value of food

processing within Norfolk & Suffolk.

• Collaborate with partners including Lincolnshire, Cambridgeshire and Peterborough

leveraging the existing strengths of Agri-TechE to realise the collective power as the UK

centre for hi-tech, precision agriculture and food production.

• Support the development of a Food Innovation Centre at the Food Enterprise Park at

Honingham Thorpe to deliver regional business growth through innovation, productivity,

processing and to support the further development of the wider Norwich Food Enterprise

Park.

• Develop a world-leading hub for plant and microbial research at the Norwich Research

Park.

• Understanding, supporting and developing the Clean Growth agenda for the agri-food

value chain.

• Enabling Growth in the New Anglia Agri-food sector through skills development.

CP highlighted some of the concerns which have been raised by businesses regarding the

UK leaving the EU and noted that the full impacts have not yet been seen.

3

Emma Taylor (ET) advised that the next Agri-food sector report will be issued shortly

providing feedback from council members, project updates and case studies.

Johnathan Reynolds (JR) asked if the council included aqua foods within its scope. CP

confirmed it did but this area would be expanded in the future.

The Board agreed:

• To note the content of the report

9

Chief Executive’s Report

CS highlighted key projects including the successful delivery of the Peer to Peer Network and

the announcement of a further round of funding to which the LEP will be submitting a bid.

Annual Performance Review - CS was pleased to confirm that Government’s preliminary

assessment was that all requirements have been met. The review meeting between

Government and the LEP team will take place on 28th January.

Covid-19 Response - The LEP is also working with partners in Public Health teams to assist

in setting up Covid-19 testing programmes for businesses with less than 250 employees.

Andrew Proctor (AP) asked if the Peer to Peer network included the care sector. CS

confirmed that the network had been promoted to all sectors.

CS agreed with AP’s comment that progress on Ely Junction had been slow but that the

funding proved by the LEP and local authorities had moved the project onto the next stage.

It was agreed that an update would be provided for the next board meeting.

ACTION: An update on the Ely junction project to be provided at the February board meeting

EG

JR asked how inward investment queries connected to the Industry Councils. CS noted that

this could be challenging given the confidential nature of the investment discussions, but it

would be possible to share some details.

The Board agreed:

• To note the content of the report

10

Connected Innovation

Julian Munson (JM) provided the board with an update on the LEP’s ‘Connected Innovation’

initiative which is being driven by the LEP’s Innovation Board and includes a new programme

to connect and promote Norfolk and Suffolk’s Innovation Hubs and the development of an

Innovation Prospectus. The prospectus is still undergoing amendments and will be circulated

to the Board on completion.

The two year project will provide a more collaborative approach to innovation across the

region and will also support cross sector innovation.

JR expressed thanks to both local authorities for their support and noted the success of

pulling together the innovation hubs and the opportunities which this provides.

The Board agreed:

• To note the content of the report

11

New Anglia Capital Report - Confidential

Chris Dashper (CD) presented the report noting the change in format and advised that this

was still being reviewed and amended.

The Board agreed:

• To note the content of the report

12

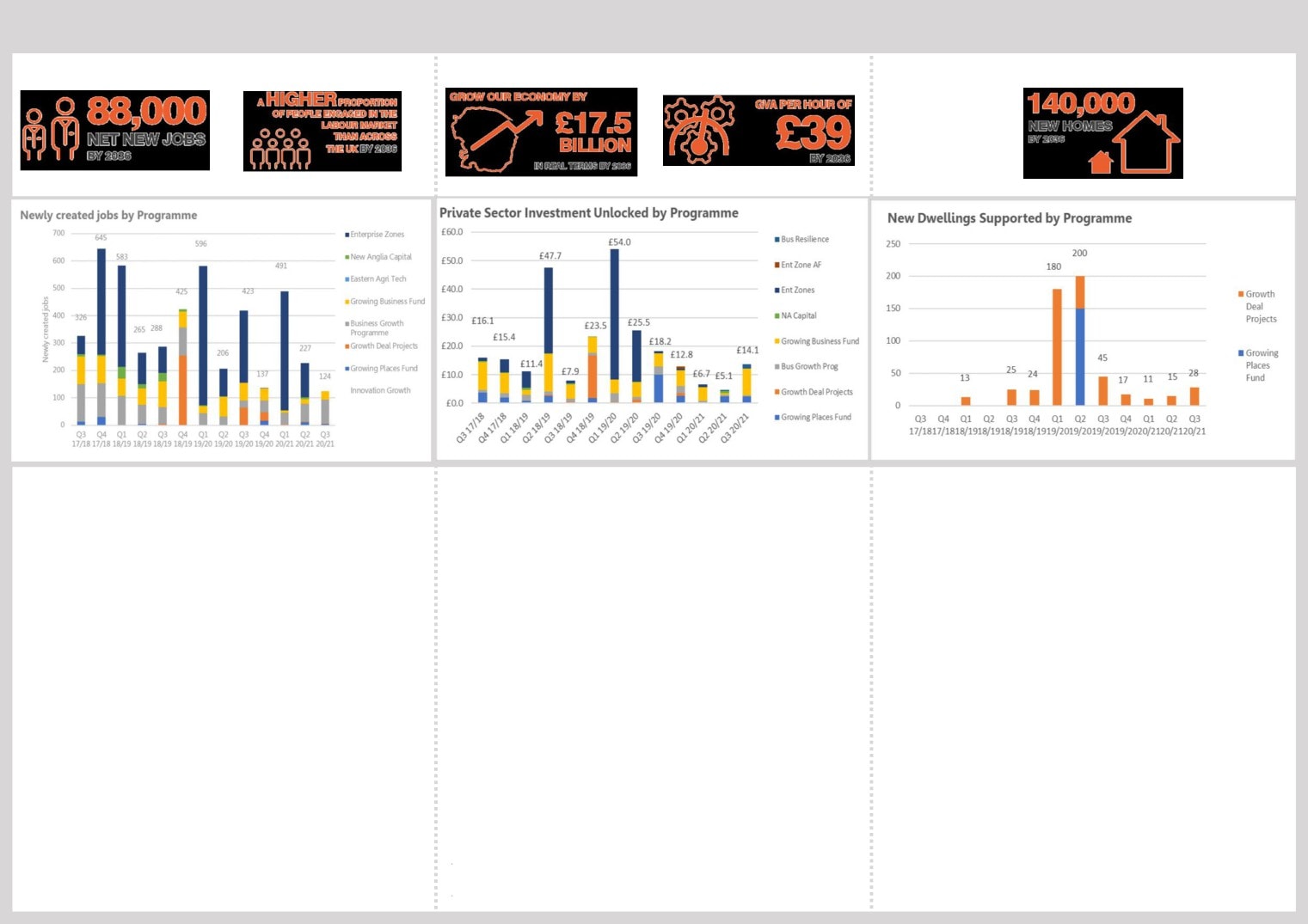

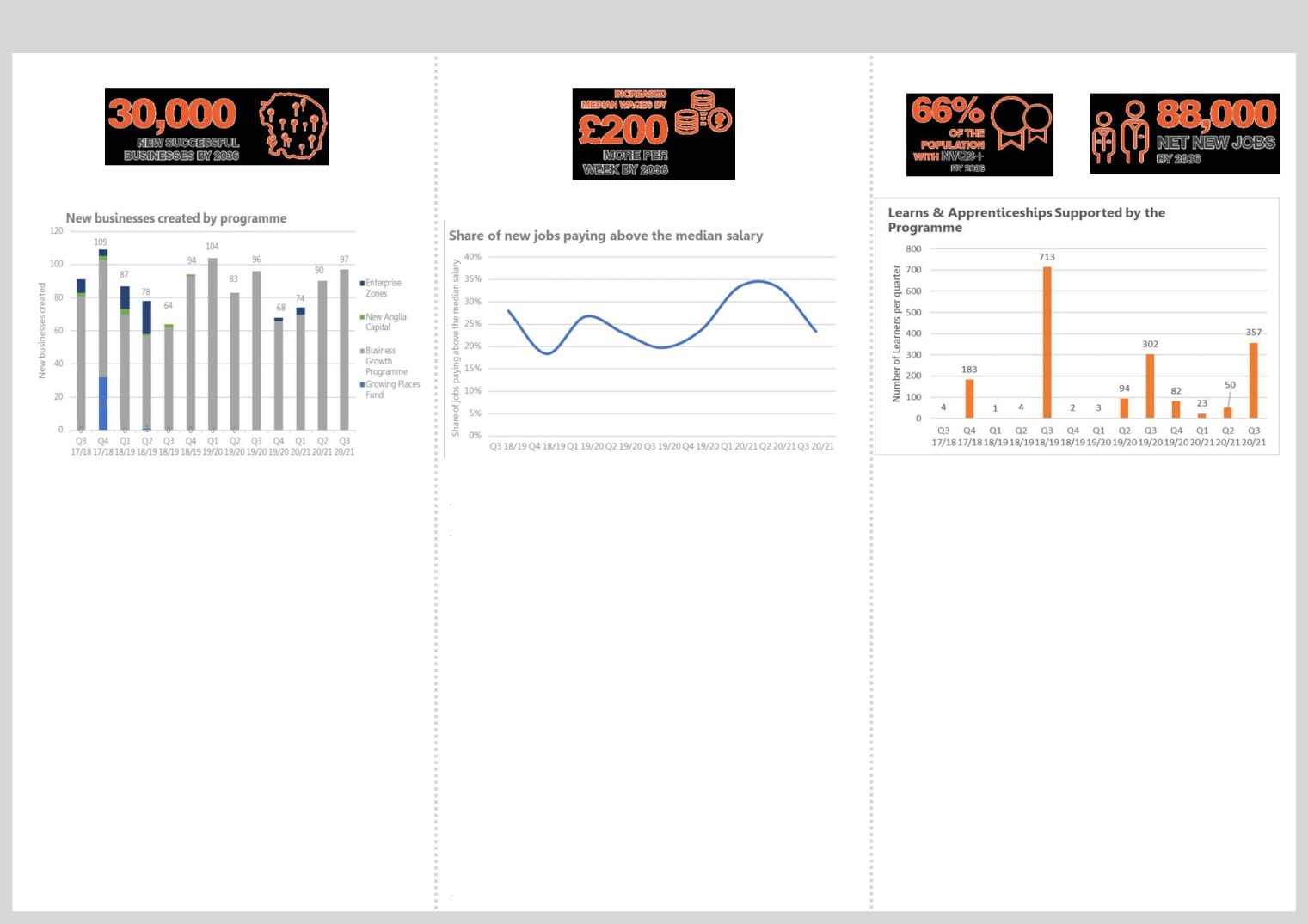

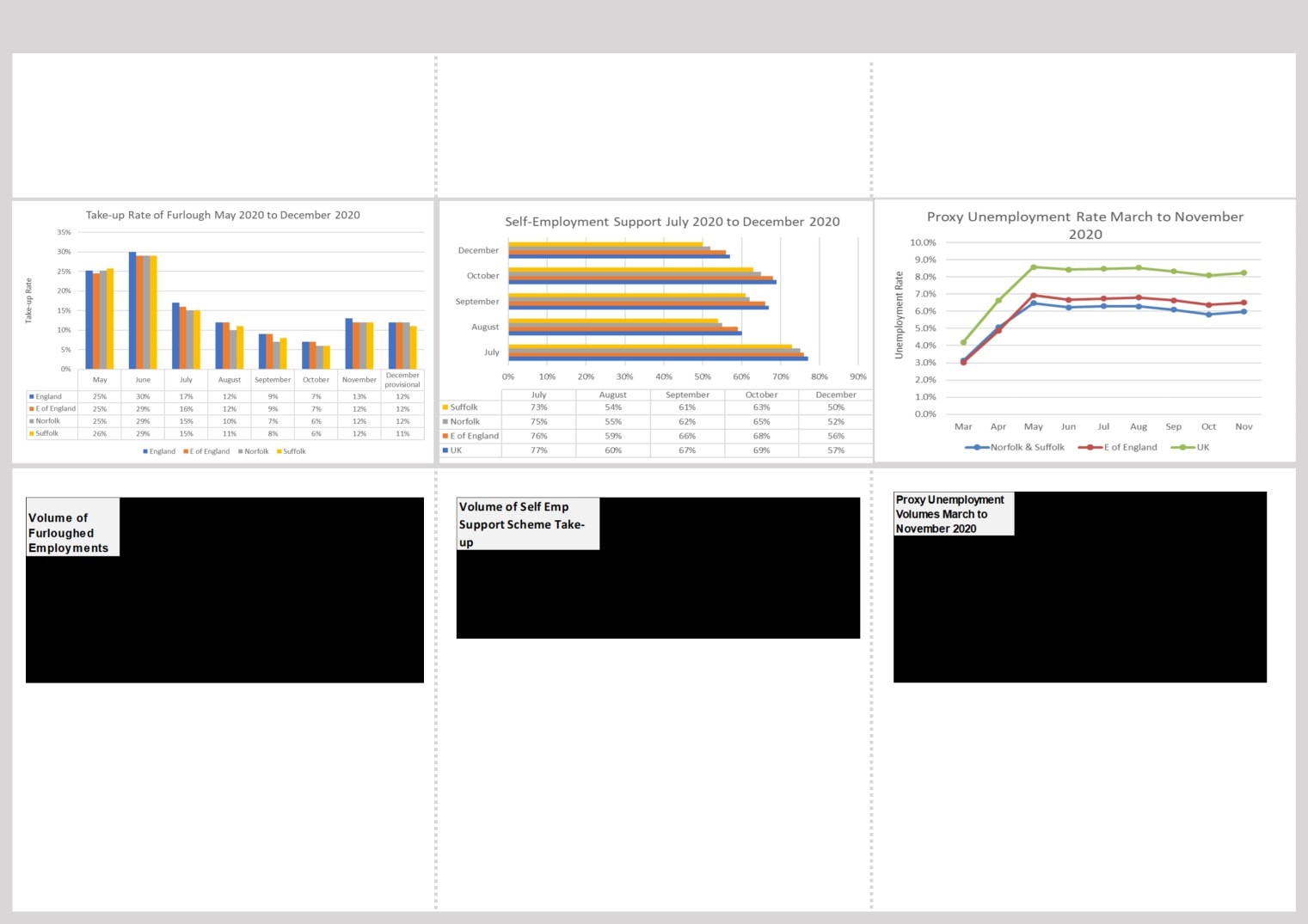

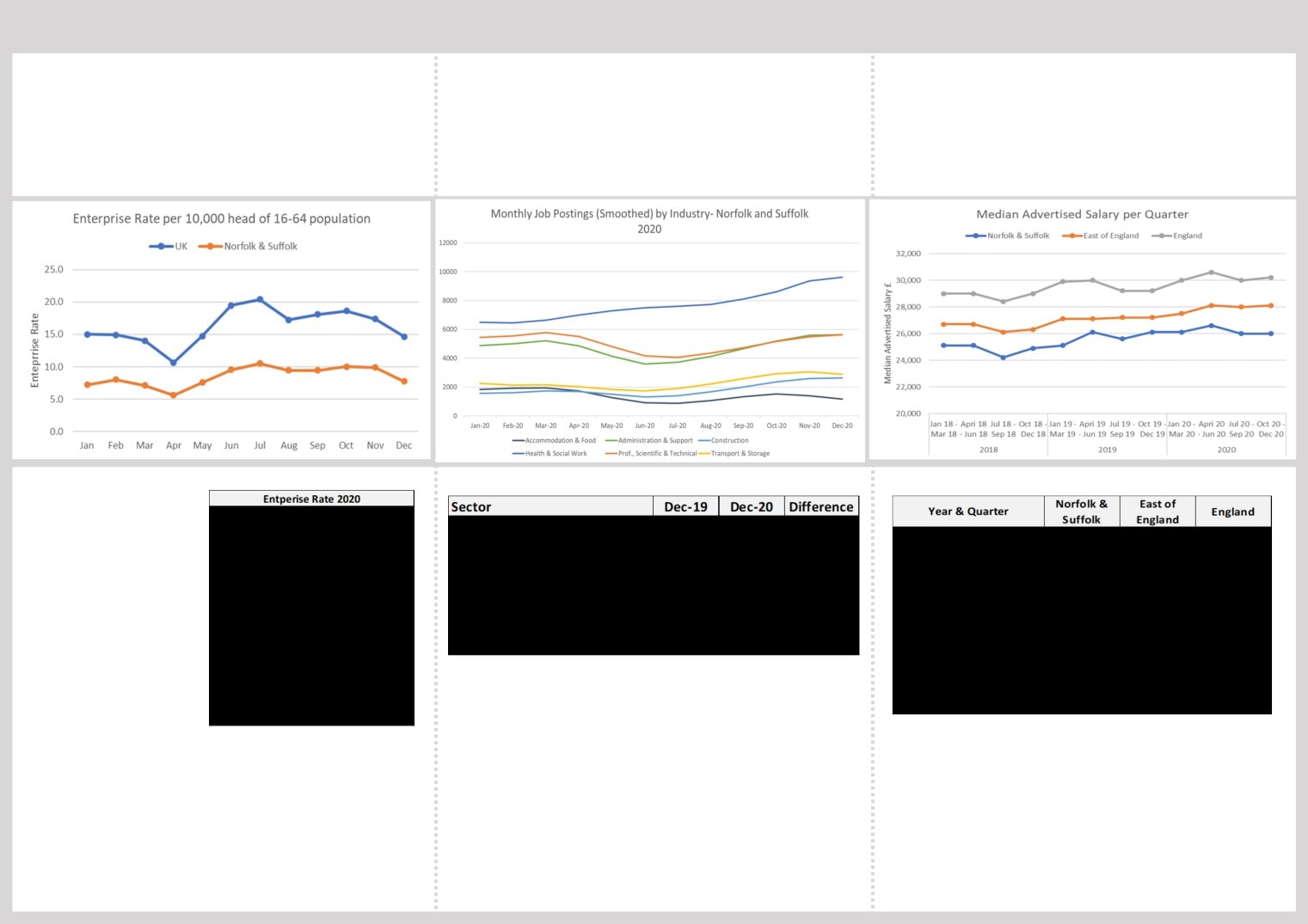

January Performance Reports

Rosanne Wijnberg (RW) presented the reports to the Board and highlighted key items.

Growth Programme - the Small Grants Programme runs until September 2021 and further

funding was being investigated.

4

Enterprise Advisor Network - Outputs are as at the end of the autumn term and are rated red

as they are centred on work with businesses. The advisors have been working on other

initiatives which are not reflected in the captured outputs but which are recognised by the

Careers Enterprise Company.

Enterprise Zones - Activity has slowed on the Great Yarmouth & Lowestoft EZ while Space to

Innovate remains busy.

The Board agreed:

• To note the content of the reports

13

Quarterly Management Accounts

RW presented the management accounts to the board and asked for approval of the virement

of funds from the Business Resilience and Recovery Fund (R&R) to the Growing Business

Fund.

The Board agreed:

• To note the content of the accounts

• To approve the budget transfer (subject to government agreement) of £1m from R&R to

Growing Business Fund.

14

Board Forward Plan

CS presented the forward plan highlighting the agenda items for the next meeting.

The Board agreed:

• To note the content of the plan

15

Any Other Business

None

5

Actions from New Anglia LEP Board Meetings

Date

Item

Action

Update

Actioned

Target Date

By

21/01/2021

Chrief Executives's Report

An update on Ely Junction to be provided at the next board meeting

Included in the Transport board update paper

EG

Complete

27/01/2021

2021 LEP Strategic Priorities

Any comments on the strategic priorities to be submitted to CS & CJG

Slides circulated with January Board minutes

Complete

CS

Strategic priorities slides to be circulated to the board

25/11/2020

Economic Recovery Restart Plan

Details have been circulated with the January Board papers

Complete

Sources of visitors to the vacancy page on the New Anglia Web site to be circulated

CS

Progress Report

25/11/2020

Economic Recovery Restart Plan

Insolvency advice to be provided to the Growth Hub

RW & Jeanette Wheeler in discussion to progress.

Feb-21

RW

Progress Report

23/09/2020

New Anglia Capital

Board members to consider putting themselves forward to join the NAC board

Kathey Atkinson has offered to join the NAC Board and has been invited to

CS

Mar-21

meet the NAC directors at the NAC Board meeting in March.

23/05/2019

Growth Hub Presentation

Growth Hub Annual review to be circulated to the Board when published

This review will now take place early in 2021

CD

Apr-21

9

New Anglia Local Enterprise Partnership Board

Wednesday 24th February 2021

Agenda Item 6

Energy Sector Recovery and Resilience Plan

Authors: Julian Munson/Katie Snell Presenter: Julian Munson

Summary

This paper provides an update on the production of a Sector Recovery and Resilience Plan

for the energy sector developed by New Anglia LEP with All Energy Industry Council

partners.

Background

Norfolk and Suffolk is fast becoming the UK’s epicentre for energy generation and systems

integration with a unique mix of onshore and offshore renewables, gas, nuclear and

hydrogen and is experiencing significant levels of investment, particularly in the offshore

wind sector.

The All-Energy Industry Council (AEIC) recognises the strategic importance and value of the

energy sector as identified in the draft Local Industry Strategy. The AEIC is one of three

Industry Councils, established as strategic public/private sector partnerships to provide a

focus for decision making and leadership in the high value sectors for Norfolk and Suffolk.

The AEIC acts as the LEP’s sector group for energy and provides the strategic direction in

delivering the aspiration to be recognised as the UK’s All Energy Region.

The impact of Covid19 has been significant on some parts of the sector, particularly with

regards to delays with operational contracts impacting on supply chains and furloughing of

staff. There have also been delays reported with respect to approvals from Government for

major offshore projects. To this extent the AEIC has developed a recovery plan for the

sector which not only identifies the key challenges but also the significant opportunities and

major interventions that are being planned or considered to help with economic recovery and

to enhance resilience within the sector.

The Recovery and Resilience plan for Norfolk and Suffolk’s energy sector will support a

range of priorities and interventions to drive growth, investment and innovation, strengthen

the supply chain and boost sustainable employment in Norfolk and Suffolk.

Energy Sector Recovery and Resilience Plan

The Energy Recovery and Resilience Plan has been produced with the support of an Energy

Recovery Task and Finish Group which was made up of selected members from the All-

Energy Industry Council including Local Authority partners and chaired by the LEP’s Head of

Enterprise Zones and Innovation. The LEP Board has endorsed this work as referenced in

the October 2020 LEP Board Meeting discussion on the AEIC.

1

11

The plan sets out how the energy sector within Norfolk and Suffolk can support economic

recovery from Covid-19 in a way which helps to achieve Net Zero. It further supports the

Five Foundations of Productivity (Business Environment, Place, ideas, Infrastructure and

People) and the Grand Challenges aligning to the Local Industrial Strategy and Economic

Strategy.

It acknowledges the Government’s 10 Point Plan for a Green Industrial Revolution and the

Energy White Paper which were recently published, making it clear that the energy sector

will provide jobs and boost growth, while strengthening the resilience of energy systems and

making energy more affordable, thereby supporting broad economic activity and jobs in all

parts of the economy. Reference to the Government’s energy Sector Deals and the North

Sea Transmission Deal have also been included.

Importantly, it includes current projects and investments within the region of Norfolk and

Suffolk and looks to the medium-long term with several interventions planned. It highlights

the unique mix of energy both onshore and offshore as well as statistics based on GVA,

capital investment, power and job generation which help to set the scene.

The plan is important as improved energy sector resilience and reliability would greatly

reduce economic losses and lost labour hours. Investment in energy is also needed to

develop more sustainable systems, speed up clean energy transitions and reduce emissions

in pursuit of the goals of the Paris Agreement.

Collectively the sector has major long-term investors in the economy providing vital

infrastructure, high skilled jobs, apprenticeships, and training opportunities. The plan

highlights how the region of Norfolk and Suffolk is exceptionally well positioned to play its

part in the goal to recovery with clear actions to take forward.

Lastly, we have included some clear asks to Government presenting an opportunity for

Norfolk and Suffolk to play an important lead role in delivering the UK’s Green Industrial

Revolution.

Planned Interventions

A range of interventions and planned actions are highlighted within the plan. Examples

include;

Launching a new branding and marketing campaign to consolidate the region’s

position as a world leader in energy to maximise visibility to Government and

investors

Enhancing supply chain programme activity to create contract opportunities for local

businesses from the emerging offshore wind and nuclear new build opportunities

Researching and progressing emerging opportunities for hydrogen production and

innovation in Norfolk and Suffolk

Supporting skills development programmes to maximise job opportunities in the

energy sector

Recommendation

Endorse the Recovery and Resilience Plan for Norfolk and Suffolk’s energy sector

2

12

New Anglia Local Enterprise Partnership Board

Wednesday 24th February 2021

Agenda Item 10

Norfolk and Suffolk Transport Board Update

Author: Ellen Goodwin

Presenter: Steve Oliver, Ellen Goodwin

Summary

This paper provides an update on the Transport Board, a sub-group of New Anglia LEP.

Recommendations

The Board is invited to:

Note the contents of the paper, sub-board report (appendix A) and the overview

presented at the meeting;

Note the update provided on the Ely Area Capacity Enhancement programme

(Appendix B) and

Agree in principle to the broadening of scope for the Transport Board to include clean

growth and its necessary connected elements i.e. energy and digital networks.

Background

The Transport Board was established in its current form after the abolishment of the Local

Transport Body and Board in November 2018 with the high-level objective of implementing

the Integrated Transport Strategy.

Its current terms of reference, due to be reviewed in March 2021 state that the Board’s

expected outcomes are as follows:

A reliable, resilient and integrated transport network with improved capacity and

journey times, providing good connectivity both within and around Norfolk and

Suffolk, and to other UK, European and worldwide destinations;

A Delivery Plan for the Integrated Transport Strategy for Norfolk and Suffolk, current

and valued by transport bodies; and

Central government understanding of the transport infrastructure needs and priorities

of Norfolk and Suffolk businesses and residents to support inward investment and

growth.

Transport East

Since its inception in late 2017 Transport East, the Sub-National Transport Board for Norfolk,

Suffolk, Essex, Southend-On-Sea and Thurrock has grown in strength and influence

significantly. It is currently developing its own Transport Strategy along similar themes to

that identified locally. New Anglia LEP is a member of Transport East.

1

27

Transport Board Objectives

The Integrated Transport Strategy for Norfolk and Suffolk was adopted in May 2018 and

highlighted four key areas for intervention which are laid out below alongside the equivalent

priorities for Transport East.

Integrated Transport Strategy

Transport East

Connecting

Quicker, more reliable and

Global

Better connected ports

the East,

resilient strategic connections

Gateways

and airports to help UK

Accessing

to boost our contribution to UK

businesses thrive.

the World

plc, encouraging improved

Boosting the nation’s

perceptions, economic

economy through greater

participation and inward

access to international

investment for our key sectors

markets and Foreign

and competitive clusters

Direct Investment.

Regional

Keeping people and products

Multi-centred

Better links between our

Connectivit

moving in and around our

Connections

fastest growing places

y and our

Priority Places and Enterprise

and business clusters.

Priority

Zones through new investment,

This helps the area to

Places

placemaking, maintenance and

function as a coherent

an integrated public transport

economy and improves

network with opportunities for

productivity.

walking and cycling

Local and

Innovative on-demand transport

Energised

A reinvented, sustainable

Coastal

solutions and improvements to

Coastal

coast for the 21st

facilitate local sustainable

Communities

century. Supporting the

growth, walking and cycling,

growing importance of

recognising local

the energy generated

distinctiveness, and offering

along our coastline, as

access to services and

well as our fantastic

opportunities through digital

visitor experiences.

means

Agile to

Embracing new technologies

Decarbonisati

An evidence report on

Change

and digital connectivity to enable

on

this topic was

remote access to services and

commissioned and will

opportunities to facilitate

be used in the strategy

Mobility as a Service.

development work

currently underway.

New Anglia LEP will continue to work through Tran sport East to achieve the transport

ambitions for Norfolk and Suffolk. Given the clear alignment in priorities there is an

opportunity locally to broaden the scope of the Transport Board and use the platform that

Transport East has in order to achieve a wider set of objectives and avoid resource

repetition.

Delivery and key achievements to date

Accessing the World

Freeport East: A consortium of partners including the relevant local authorities from South

Suffolk and North Essex and New Anglia LEP have been working with officers from

Hutchison Ports to prepare and submit a case for Freeport status built around Felixstowe

2

28

and Harwich Ports. As part of the bid submitted to Government on 5 February three tax sites

and five parallel customs sites have been shortlisted. The case is built on innovation, trade

expansion, clean growth and regeneration. With the potential to generate up to 13,500

additional jobs over time the sponsors of the bid believe it represents a strong case for one

of the 10 Freeport designations available across the UK. The benefits Freeports will enjoy

flexible tariff structures, simplified customs processes, additional funding for infrastructure

upgrades, and tax measures as an incentive for investment. The two ports unrivalled

connections with Europe and the Far East and transport /freight links with the UK’s Midland

Engine make it ideally placed to benefit for the new opportunities that Freeport status offers.

Union Connectivity: The Transport Board recently responded to this call for evidence

focussing on rail freight movements from the Port of Felixstowe to the Midlands, North and

central belt of Scotland and regular air connectivity to/from Aberdeen and Belfast via

Norwich Airport. The response also highlighted the Airport as an important base for offshore

energy operations.

Connecting the East

Ely

The New Anglia LEP is represented on the Ely Taskforce, the Ely Area Capacity

Enhancement Programme Delivery Board and the Ely Communications Working Group.

In March 2017, the Board agreed to fund the advancement of the Ely Area Capacity

Enhancement (EACE) scheme by £3.3m as part of a wider funding package. The road/rail

scheme being worked up will allow for increased passenger services (yet to be determined)

as well as freight capacity on the network. Any new services may be subject to other

improvements on the network if they are to be fully realised. New Anglia LEP funding has

not only helped to accelerate the programme of works on Ely it has also helped to leverage

in additional funding from other partners and DfT.

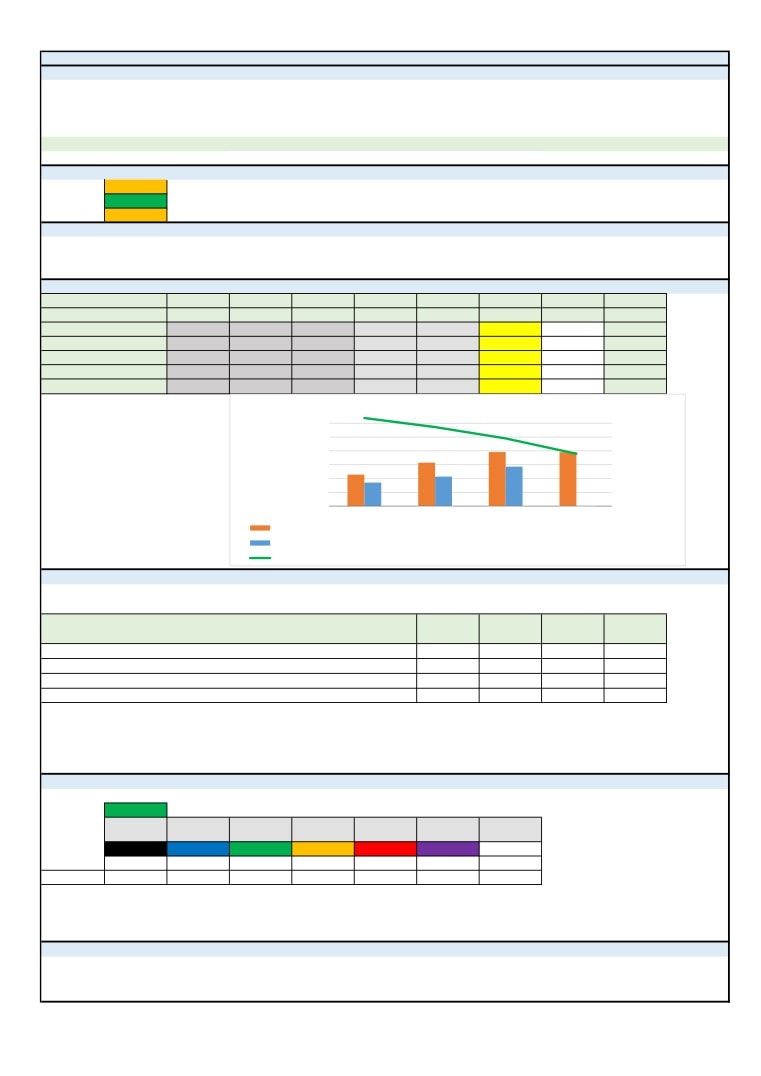

The Transport Board has created an infographic highlighting the benefits of improving Ely

junction for influencing purposes. This can be found at Appendix B.

Last year the Strategic Outline Business Case was submitted to Government, a positive

decision and the additional £13.1m of funding from DfT obtained. Work is underway on the

next stages of the programme with further public consultations on options for the Ely area

planned in the summer and autumn. The Outline Business Case will be prepared in the latter

half of 2021 with a decision to design expected by summer 2022, this now includes the level

crossing work between Ely and Ipswich which has been accelerated. The current timetable

suggests that a preferred option consultation is programmed for autumn/winter

2022. Subject to various decisions construction could begin 2025. A piece of work is

underway to aggressively pursue ways of shortening the overall programme without

compromising on the benefits.

Alongside this workstream, New Anglia LEP is part of the East-West Rail Eastern Section

Executive Board to advance work on the project in Norfolk and Suffolk.

GEML: The Summary Business Case is currently being finalised following the GEML

Taskforce meeting on 28 January. This document brings together the key elements from

both the Strategic Outline Business Case and the Wider Economic Benefits study and the

purpose is to replace the original business case published in 2014, as the key lobbying

document for GEML investment.

The next step is to complete the gap analysis work to finalise the SOBC and progress the

GEML programme to the next stage on the Rail Network Enhancement Pipeline. The gap

analysis work will be undertaken by Network Rail and the Taskforce is currently awaiting

approval from DfT to release the funds to carry out this work. The gap analysis will provide

3

29

more clarity in terms of costs and although this extends the timings for putting forward the

SOBC to the next stage, overall it does not impact on the timescales for the programme as

this work was already planned by Network Rail. Once funding has been released, the gap

analysis work is expected to take between 6 - 9 months to complete.

The work on the Great Eastern Mainline described above includes improvement at Haughley

junction.

East Norwich regeneration: New Anglia LEP is working with Norwich City Council, Norfolk

County Council, the Broads Authority and other partners including landowners, Greater

Anglia and Network Rail to consider the opportunities to regenerate East Norwich including a

potential improvement to Trowse rail swingbridge.

A14 Strategy Board: New Anglia LEP sits on the A14 Strategy Board led by the Suffolk

Chamber of Commerce. The Board, although disappointed that the schemes put forward for

delivery between 2020 and 2025 were not approved remains focussed that the improvement

at Copdock be included in the following programme period and that other improvements on

the route are delivered in the future too.

A47 Alliance: New Anglia LEP will continue to work as part of the A47 Alliance, led by

Norfolk County Council to see agreed schemes delivered. The four remaining schemes to

be delivered in Norfolk (Blofield to Burlingham dualling, North Tuddenham to Easton

dualling, Thickthorn junction and Great Yarmouth junctions) should have been completed by

the end of 2020 according to the original timeline. The Alliance remains committed to seeing

further improvements delivered in the future.

Other projects

Transforming Cities Fund: New Anglia LEP continues to be a member of the Joint

Committee for the Transforming Cities Fund programme in Norwich.

Proposed Sizewell C: New Anglia LEP continues to encourage EDF to consider a

sustainable transport strategy for construction.

Connected Places Catapult: the Transport Board continues to work with the Connected

Places Catapult on achieving a balanced approach between public transport and active

travel.

COVID-19

The Transport Board continues to consider the impacts of covid-19. One area that requires

particular support is the rebuilding of confidence in public transport and a working group has

been established to consider just this.

There are transport benefits with respect to the pandemic. The increase in active travel and

the subsequent Emergency Active Travel Fund have benefited Norfolk and Suffolk who have

collectively secured just over £4m.

Transport East have three sub-groups considering passenger transport, active travel and

rural connectivity, each of which have had a pandemic focus since their establishment.

New Anglia LEP is currently commissioning a piece of work to look at the new business

landscape, including the shift to home working/learning, which has resulted from the

pandemic. The shift to home working, if more permanent will have a lasting effect on our

need to travel. Through improving digital connectivity, we have the opportunity to improve

access to employment, learning and services through virtual means.

4

30

Looking Ahead

Clean growth

In November 2020 New Anglia LEP responded to the Prime Minister on the opportunities for

a Green Industrial Revolution in Norfolk and Suffolk, many of which have a distinct transport

focus/element:

1. Alternative Fuels (electric and hydrogen) - we are working across the public and

private sectors, with partners at the Cambridge and Peterborough Combined

Authority and Transport East to explore the opportunities for the collaborative and

strategic deployment of alternative fuels across the wider region. This work will build

on work that is already taking place across Norfolk and Suffolk via Norfolk County

Council’s EV Strategy and the Suffolk Climate Emergency Plan.

2. Modal shift (public transport and active travel) - building on the Covid-19 response

described above we will continue to encourage modal shift, encouraging people back

on to public transport and strive to maintain the trend for more active travel.

3. Jet zero and green maritime - we will work with both the aviation and maritime sector

to support their decarbonisation efforts. From a maritime perspective this includes

developing a bid to the Clean Maritime Demonstration Competition.

In moving forward, there is an opportunity to rationalise the activity of the Transport Board to

avoid repetition and embed clean growth principles. This will likely extend to conversations

about energy networks and digital connectivity. This paper seeks a broad view on this form

the Board ahead of a discussion at the next Transport Board on 18 March.

Influencer and Enabler

Moving forward the Transport Board can continue to work with key partners to enhance its

role as an Influencer and Enabler, developing key messages about infrastructure

improvements in the context of clean and inclusive growth within and outside of Norfolk and

Suffolk and ensure those messages are communicated effectively and in a holistic way

which links to the broader work of the Norfolk and Suffolk Economic Strategy, Local

Industrial Strategy and the Economic Recovery Restart Plan.

Strengthening Governance

The Transport Board will also consider its links with the broader governance of the LEP

including the Skills Advisory Panel, the Industry Councils and the other sector groups, in

particularly the visitor economy.

International Profile and Trade

The Transport Board will also consider its role in supporting international profile and trade.

Recommendations

The Board is invited to:

Note the contents of the paper, sub-board report (appendix A) and the overview

presented at the meeting;

Note the update provided on the Ely Area Capacity Enhancement programme; and

Agree in principle to the broadening of scope for the Transport Board to include clean

growth and its necessary connected elements i.e. energy and digital networks

5

31

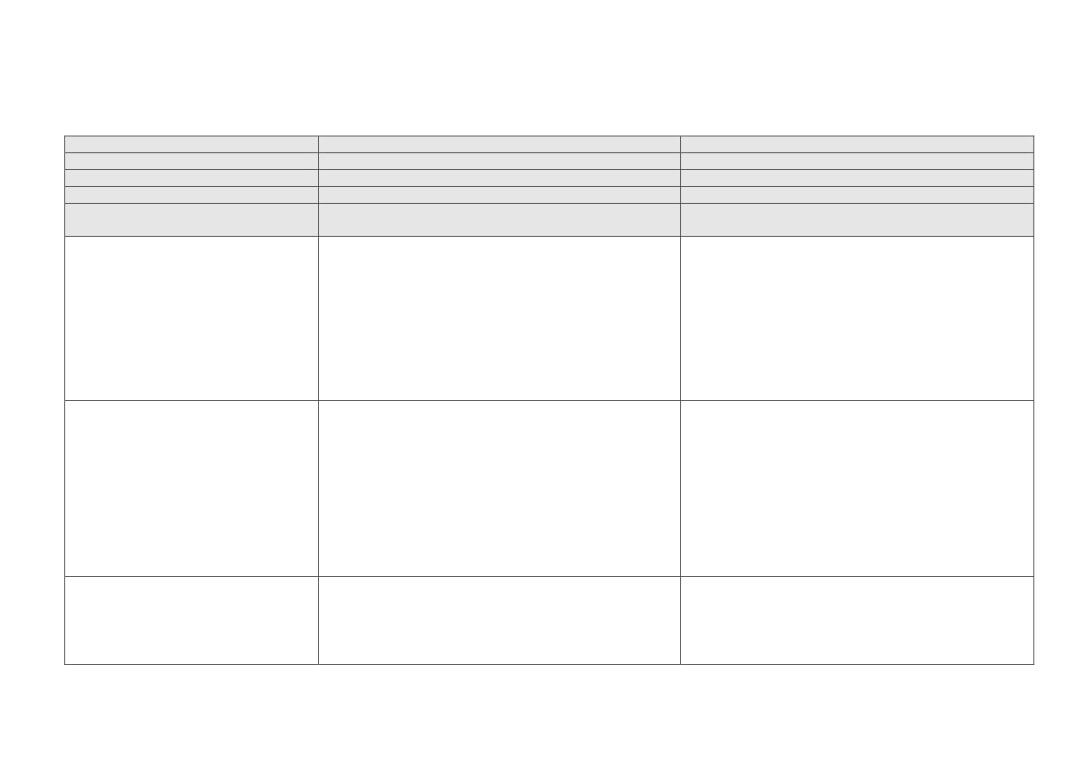

Appendix A

Sub- Board Reporting

Sub-Board:

Transport Board

Representatives:

LEP Board: Steve Oliver

LEP Team: Ellen Goodwin

Meeting Frequency:

Quarterly

Key Objectives and their link to the

Update on actions / activity

Next Steps

NSES and LIS

NSES: Our offer to the world/competitive

Significant reduction in public transport use during the

Meeting set up to discuss how we re-build confidence

clusters close to global markets

pandemic will require renewed confidence building drive

and re-drive modal shift

LIS: Infrastructure/Clean growth

Facilitated initial discussions on a maritime

Working together on the Clean Maritime Demonstration

Connecting the East, Accessing the

cluster/network for Norfolk, Suffolk and North Essex

Competition: £20m opportunity as part of the 10-pt

World: quicker, more reliable and

working with SELEP

plan. Update at Transport Board 18 March

resilient strategic connections,

Freeport East bid submitted in support of levelling up and

Awaiting government decision

encouraging improved perceptions,

clean growth

economic participation and inward

Union connectivity response

None yet

investment

NSES: Driving business growth and

Transport East Strategy development

Transport East Forum/ Summit scheduled for 24

productivity

February/9 March respectively

LIS: Infrastructure/Clean growth

Influencing GEML and Ely taskforces to focus on the

Continued engagement

Regional Connectivity and Our Priority

strategic case and political influencing

Places: keeping people and products

East Norwich regeneration inc. Trowse swingbridge

Working through a number of Forums to advance

moving through new investment,

Support projects on A14/A47

Ongoing - A47 comms update at Transport Board 18

placemaking, maintenance and an

March

integrated public transport network with

Transforming Cities engagement in programme delivery

Ongoing

active travel opportunities

NSES: Driving business growth and

Alternative fuels - electrification and hydrogen

Working with the CPCA on an Alternative Fuel Strategy

productivity

opportunities

LIS: Infrastructure/Clean growth

Prevalence of home working/learning - link to digital

Work currently being commissioned

Agile to Change: embracing new

connectivity

technologies and digital connectivity to

33

enable remote access and facilitate

Mobility as a Service

NSES: Driving Inclusion and Skills

CPC active travel/public transport balance

Update report expected at next Transport Board - 18

LIS: Infrastructure/Clean growth

March

Local and Coastal: innovative on-demand

Reduce the need to travel/flexibility

Ongoing considerations

transport solutions and improvements,

Proposed Sizewell C - sustainable transport opportunity

Ongoing discussions about reducing impact with EDF

walking and cycling and offering access to

services and opportunities through digital

means

34

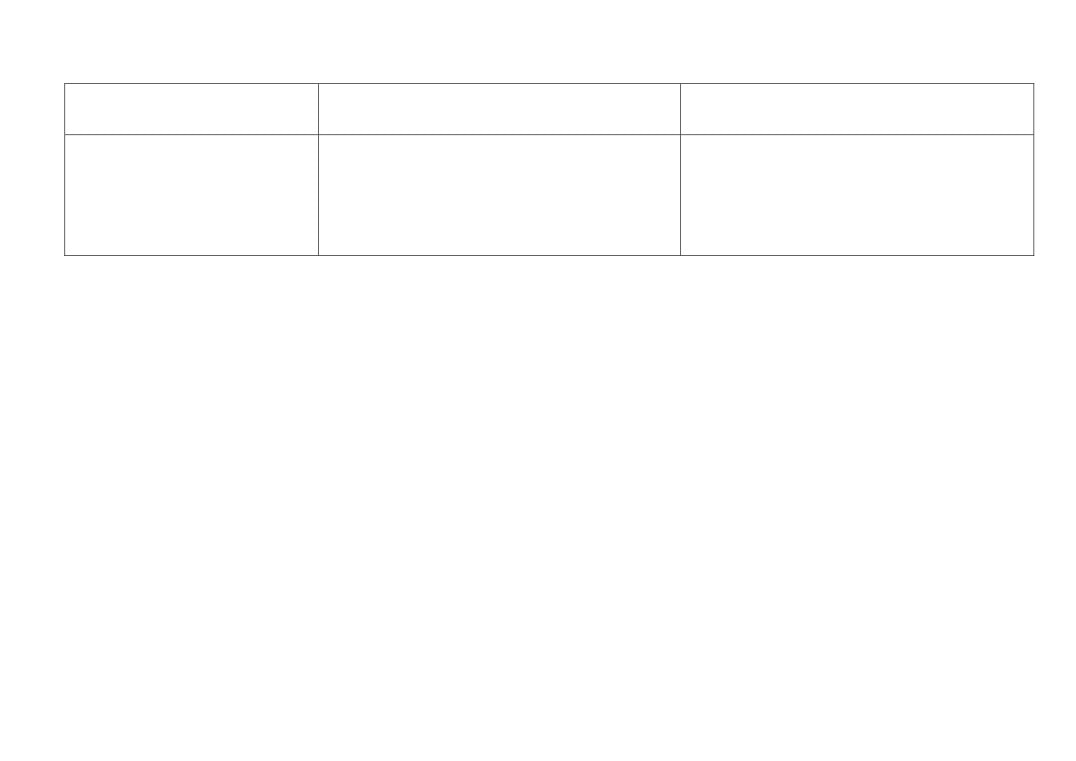

Appendix B

INCREASING CAPACITY AT

ELY JUNCTION

Integral to FREIGHT and

PASSENGER

STRATEGY

Ely capacity

to 2043

DIRECTLY LINKED

to UKs growth -

necessary to accommodate the

Ely is the artery of the UKs

COUNTRY’S DEMANDS

301,859

HIGHEST PRIORITY

rail freight

MINUTES LOST

corridor

at Ely each year-

and supply

equivalent of playing

chain

3,354

ELY

FOOTBALL

MATCHES

70%

or 629

OF CONTAINERS

work days lost

that arrive at Felixstowe are

delivered via Ely to the

Midlands, Manchester,

Liverpool and Yorkshire

and hit

decarbonisation

CO2

targets

Improvements to Ely would allow for

half hourly trains between Norwich

and Cambridge, and hourly services

between Ipswich and Peterborough

NORWICH

IPSWICH

FELIXSTOWE PORT

CAMBRIDGE

PETERBOROUGH

is committed to rail with an

existing 28% modal share, the

highest of any UK port

35

New Anglia Local Enterprise Partnership Board

Wednesday 24th February 2021

Agenda Item 11 - Chief Executive’s Report

Author: Chris Starkie

Summary

This report provides an overview of LEP team activities since the January board and is split into

five parts, reflecting the different strands of LEP activity:

1) LEP managed programmes

2) Strategy

3) Industry Councils, sector groups and external partnerships

4) Engagement and promotion

5) Governance, Operations and Finance

The media dashboard is attached as Appendix B to the report.

Recommendation

The board is asked to note the contents of the report

Highlights

Support for Covid testing for businesses

The LEP team and Growth Hub have begun supporting Norfolk and Suffolk Public Health

colleagues in the roll out of asymptomatic testing for businesses.

The LEP has agreed to assist both counties by proactively contacting businesses in priority

sectors to highlight the importance of regular testing of their workforces and encouraging them to

sign up their staff to programmes being run by the public health teams from Suffolk County

Council and Norfolk County Council.

We will also be using our sector groups and working with business bodies such as the chambers

and the FSB to broaden out this work.

Approval for ESF project

The LEP has received official approval from the Department of Work and Pensions for the bid we

submitted for our Careers Hub programme.

The £1.5m programme is funded through the European ESF programme with match funding from

the Careers Enterprise Company and will allow us to build on the excellent work of the LEP’s

Careers Hub and Enterprise Adviser Network.

Business Resilience and Recovery Scheme

Project approvals are continuing, with 115 projects agreed to date, providing grants valued at

£4.4m.

The programme has attracted £6.9m of private sector match funding - giving a total value of

£11.3m for the 115 projects. Investment in the approved projects will create 196 Full Time

Equivalent (FTE) jobs and safeguard 2,722.

1) LEP Programmes

Business Support

New Anglia Growth Hub

Over the last month the Growth Hub have seen an increase in businesses seeking EU Exit

related support.

Since 11th January 2021 the Growth Hub has also been delivering specialist EU Exit related

support to SMEs across Norfolk and Suffolk.

Around a quarter of businesses enquiring have been seeking in-depth and specialist support

around key topics, particularly exporting and customs advice and guidance. We are also

developing a number of EU Exit related webinars on key topics, to support SMEs to gain the

1

37

New Anglia Local Enterprise Partnership Board

Wednesday 24th February 2021

Agenda Item 11 - Chief Executive’s Report

knowledge they need to continue to operate effectively and with the minimum of disruption to

trading. (See further information on EU Transition in the strategy section on page 7 of the report).

The Growth Hub team continue to see a steady rise in the number of enquires relating to grant

schemes and are working with a diverse range of businesses to ensure that they have access to

appropriate financial support to both sustain and grow businesses.

Peer Network Programme

A total of 19 cohorts are up and running, with 162 businesses participating in the Peer Network

programme, which runs to the end of March 2021. Discussions are taking place within the

Department for Business, Energy and Industrial Strategy to run another round of Peer Networks

in 2021/22.

Start-Up Programme

The number of people coming forward seeking support to start their own business continues to

be at a high level. Both NWES and Menta continue to deliver support to those seeking helps and

advice. With our current ERDF funding ending in September, we are working with partners to

seek alternative funding to enable the delivery of Start Up activity in the future. As part of this

process, we are holding an event in March to bring together key players in Start Up delivery,

together with local authority partners, so we can develop a long term plan for Start Up support.

Business Grants

Business Resilience and Recovery Scheme

Project approvals are continuing, with 115 projects agreed to date, providing grants valued at

£4.4m. The programme has attracted £6.9m of private sector match funding - giving a total value

of £11.3m for the 115 projects.

As of 8th February 2021, there were 9 grant applications with a combined grant value of £366,850

in the pipeline, being supported by the Growth Hub.

Investment in the approved projects to date will create 196 Full Time Equivalent (FTE) jobs and

safeguard 2,722. Of the 115 businesses supported, 72 are in Norfolk (£2.7m) and 43 are in

Suffolk (£1.7m).

Visitor Economy Grant Scheme (VEGs) and Wider Economy Grant Scheme (WEGs)

Both schemes continue to be extremely popular. As of 8th February, 160 grant applications

totalling £421,907 have been approved with £186,708 of funding paid out to SMEs. A further 17

grant applications totalling £43,650 are currently under development, leaving £103,287 of funding

remaining to be allocated. MHCLG have recently confirmed that the scheme will be extended in

terms of timescale, with final claims for grants extended to the end of April 2021. The extension

does not include any additional funding for the schemes.

Small Grant Scheme

The number of applications coming through to the Small Grant Scheme has continued to pick up,

with the amount of funding unallocated now below £45k. Since its launch, the SGS has

supported 322 SMEs with £2.99 million of grant funding. A number of grant awards have slipped

due to the impact of Covid-19, however, we anticipate that the fund will be fully committed by the

end of March 2021. There are ongoing conversations with MHCLG as to future additional

funding, with a range of options available to ensure that the scheme continues beyond the

current end date of November 2021.

Growing Business Fund

The fund continues to be popular with businesses across Norfolk and Suffolk. Growth Hub

advisers are meeting businesses who are still keen to progress their growth plans and in

2

38

New Anglia Local Enterprise Partnership Board

Wednesday 24th February 2021

Agenda Item 11 - Chief Executive’s Report

particular there has been an uplift since the autumn of 2020 in businesses looking to move or

extend their premises and employ additional staff.

All funds available for 2020/21 have already been fully committed to projects. There is a very

healthy and growing pipeline of projects for 2021/22 with many businesses looking to proceed

quickly.

Growth Through Innovation

Interest in GTI continues to gain momentum, with further applications coming forward, particularly

from the manufacturing sector. As of the 12th February 2021 there is £654k of unallocated

funding remaining, with a further £1.2m worth of projects under development. We continue to

prioritise applicants that can demonstrate that their project is able to spend and claim the

required funds before the end of March 2021, to ensure that the 2020/21 funding is fully allocated

and spent.

Eastern Agri-tech Initiative

Funds within this scheme are now fully committed, and the grant scheme is closed to new

applications in both the Cambridge and Peterborough Combined Authority (CPCA) area and New

Anglia areas. Applicants are being signposted to alternative funds where they exist.

LEP Innovative Projects Fund

Innovative Projects Fund 1 (2018 Call) - £500,000.

IPF1 Summary: Seven projects with a combined allocation of £539,531.

All projects are progressing well. Year One of the Ipswich Cornhill Project has been completed.

£91,634 has been claimed so far in this financial year (£224,759 in total). The total project spend

to date is £490,049. Public match funding of £138,705 and Private match funding of £119,711

has been levered in. Norfolk County Council’s Project ‘Building Supply Chain Skills Capacity’ is

being re-launched under the new name ‘Gearing Up to Grow’ in partnership with EEEGR.

Innovative Projects Fund (2019 Call) - £1.5m

IPF2 Summary: 18 projects with a combined allocation of £1.522m.

Fifteen projects now have their Grant Offer Letters and have started delivery. £244,099 has

been claimed so far in this financial year. Private match funding of £56,326 and public match

funding of £184,731 has been levered into the region. Of the remaining three projects, 2 projects

are finalising details prior to Offer Letter stage and the 3rd (SCC Transport Innovation Hub) is yet

to return a re-profiled proforma.

Growing Places Fund - confidential

3

39

New Anglia Local Enterprise Partnership Board

Wednesday 24th February 2021

Agenda Item 11 - Chief Executive’s Report

LEP Growth Deal (Capital Growth Programme)

The Growth Deal, which has helped fund 41 projects as part of the Capital Growth Programme

over the past six years, officially comes to an end on 31 March 2021.

Of these, 21 projects have achieved practical completion, most notably providing various

improvements to our transport network and significant enhancement to skills provision in our

area. Progress with many ongoing projects has been affected and slowed to some degree by the

Coronavirus Pandemic, mainly through the adoption on-site health restrictions.

However, most ongoing projects are well underway and will all likely be completed over the next

year, involving the drawdown of our remaining Local Growth Fund allocation.

Getting Building Fund

The development of projects receiving financial support through the Getting Building Fund is

making good progress. Delivery of projects including the Bury St Edmunds Cornhill

Regeneration, the new Marina Centre on the Great Yarmouth Seafront and the Integrated Care

System Academy at University of Suffolk are underway.

Plans for the extension of the Norfolk Local Full Fibre Network are near completion and delivery

is expected to begin soon.

Additionally, planning for the East Suffolk Smart Towns and Micro-Generation & Storage of

Energy in Sudbury and Stowmarket are making good progress. Delivery of these and the

remaining projects are expected to start in the Spring and Summer of 2021, with almost all

scheduled for completion by early to mid-2022.

Enterprise Zones

Despite it being a challenging quarter, the two LEP Enterprise Zones are still welcoming new

businesses and demand, especially for small units, remains high.

A strong return for Q4 is predicted as buildings on the Space to Innovate Zone are completed

and occupied ahead of the deadline for benefits at the end of March 2021. This is familiar to the

EZ team as a similar pattern was seen when benefits came to an end on the Great Yarmouth and

Lowestoft EZ in 2018.

Handover of the Dr Ella May Barnes building (EMB), formerly known as the Zone 4 joint

NALEP/SNC building, on the Norwich Research Park EZ site will be in February and landscaping

is underway. This project is covered in more detail under agenda item nine. Elsewhere on the

NRP, the new multistorey car park will officially open on March 1st, alongside the new Hethersett

Lane roundabout.

All the speculative buildings at the Wolesley Business Park on the Mobbs Way, Lowestoft

Enterprise Zone site have been sold or let, with businesses moving onto this site during Q3.

The Gateway14 development site at Stowmarket is progressing with a planning application now

submitted and the statutory period of consultation running until 3rd March 2021. We anticipate the

application being determined in April/May. 17 hectares of Gateway 14 is designated as an

Enterprise Zone. New Anglia LEP will continue to work closely with Local Authority partners and

developers Jaynic in progressing development opportunities on the site.

As part of the work on developing the new 5-year Strategic Plan for Enterprise Zones, the LEP

has been engaging with Local Authority partners across Norfolk and Suffolk to understand the

pipeline of potential investments across all EZ sites and importantly trying to plan for demand

going forward with a need to better understand any potential impacts on the market from

Covid19.

The draft EZ Strategic Plan is scheduled to be presented at the next LEP Board meeting.

4

40

New Anglia Local Enterprise Partnership Board

Wednesday 24th February 2021

Agenda Item 11 - Chief Executive’s Report

Enterprise Zone Accelerator Fund

Items on Nar Ouse and Norwich Research Park are covered separately under items seven and

nine.

Inward Investment - Confidential

2) Strategy

Health Protection Board/Resilience Forum

Work has progressed closely with both Health Protection Boards and Resilience Forums to

support engagement with the business community.

5

41

New Anglia Local Enterprise Partnership Board

Wednesday 24th February 2021

Agenda Item 11 - Chief Executive’s Report

Stuart Catchpole has led on behalf of the LEP Executive to support both counties with their roll

out of the asymptomatic testing for workers that cannot work from home - which has included

updates to businesses and passing on interested businesses to the county teams.

This programme will ramp up over the coming days with the Growth Hub and other LEP team

members proactively contacting businesses to raise awareness of the asymptomatic testing

process and benefits for business.

We have supported in getting preventative information out to businesses in the construction and

logistics sectors, which built on the work we assisted with on food processing.

Discussions are ongoing with partners around the peer to peer digital marketing campaign that

we have committed to undertake working with both counties to capture best practice of adapting

business models with innovative preventative measures amongst the business community.

Business Intelligence

The LEP continues to submit weekly business intelligence returns to central government, local

MPs, and local authority partners.

This information has been useful in assessing the impact of Covid-19 on our business base and

key sectors, as well as capturing detailed information on whether businesses are affected or not

by the new UK-EU Trade and Cooperation Agreement.

The business intelligence we capture in the coming weeks and months will be particularly useful

as we look towards the medium to longer term Economic Recovery Plan and for our evidence

base.

Economic Evidence

The LEP has provided input to the initial draft of the productivity task & finish group report,

specifically focusing on aspects relating to the three strategic opportunities listed in the Local

Industrial Strategy and aligning discussion with the Clean Growth golden thread.

We are in discussions with Norfolk County Council officers regards the formation and shaping of

their five year economic recovery scenario work. We will continue to liaise with Andrew Staines at

NCC, in order to ensure that this analysis aligns with the broader recovery and renewal strategy

development going on across both Norfolk and Suffolk.

In addition, we are meeting with the Norfolk Office of Data Analytics and the Suffolk Office of

Data Analytics, in order to discuss how we will collectively formulate, structure, and shape an

evidence base to inform both the next Covid recovery update in the summer, and lay the

foundations for the renewal plan later this year.

We have agreed to draft a bi-monthly skills and employment report, combining intelligence and

data from a range of sources, which will be circulated to inform economic development officers

across Norfolk and Suffolk. This report will feature metrics directly related to Covid business

support schemes, as well as tracking other key metrics such as the local unemployment and job

vacancy rates.

EU Transition

Business intelligence continues to come in as businesses assess what the deal means for them

and as businesses are affected by particular issues. For example, Make UK have set out that

supply chain disruption for manufacturers has been felt immediately; even those manufacturers

that deemed themselves ready have faced some disruption; new rules for products including

rules of origin, conformity and product markings are a whole new world for many; not all

7

43

New Anglia Local Enterprise Partnership Board

Wednesday 24th February 2021

Agenda Item 11 - Chief Executive’s Report

companies have taken the necessary steps to ensure they are ready for the changes brought in

through the Northern Ireland protocol; and manufacturers which regularly send employees to the

EU for business are seeing challenges.

Across the first three weeks of the V4 Services’ contract to provide outreach support to

businesses on behalf of New Anglia LEP and Growth Hub - 244 calls have been made to

businesses. 174 of these have been supported through basic outreach and 19 through

specialist/in-depth support and 34 signposted on. These conversations have helped raise

awareness of businesses as to what they should be doing and also where opportunities might be.

Specific intelligence includes businesses commonly reporting a lack of knowledge on VAT

changes to EU imports and exports; confusion over incoterms; uncertainty around business

travel; trouble in understanding commodity codes and how to fill in customs declarations; reports

of customs intermediaries not having capacity to take on new clients; businesses seeking to

understand the rules of origin and how to track origin of materials through documentation;

businesses seeking more information on trading with Northern Ireland to ensure they continue to

trade there; businesses trying to understand UKCA/CE marking changes and how this impacts

their products; and some reports of goods held up due to border disruption.

Skills and Employment

Skills Advisory Panel (SAPs)

The SAP met in January to review the draft Local Skills Report. This followed a period of wider

stakeholder consultation over the Christmas/New Year period plus feedback from the

Department of Education. Some minor amendments have been made and we should have a

designed version for our website to review later this month.

In mid-January the Government launched the ‘Skills for Jobs: Lifelong Learning for Opportunity

and Growth’ White Paper. The ambitions include giving employers a greater involvement in

curriculum development and standalone Level 4 and 5 qualifications.

The LEP Network is in discussion with the Department for Education regarding the development

of Local Skills Improvement Plans and how this aligns with our Local Skills Report and the SAP.

Chambers of Commerce are cited to have a larger role in education under the changes outlined

in the paper.

We have had some constructive conversation with the chambers who are keen and eager to be

involved in this space but concerned of expectations and demands being placed on them.

It has been agreed that it is a good idea to build from the SAP structure and supporting

resources. We will put ourselves forward as a trailblazer. If we don’t succeed in becoming a

trailblazer, we will proceed anyway if we can.

Apprenticeship Levy Transfer

Levy Transfer continues to grow demand. Currently 160 transactions have been completed, with

40 pending approval with transferring employers and 20 new applications received in the last

month. There is a current need to engage with more transferring employers to meet the demand

and through January an active campaign targeting those companies has been taking place which

will carry on into February. This includes working with our comms team and using social media to

complete case studies.

There has been in increased demand from the social care sector for funding to support the up

skill of staff to meet the increased need for supporting individuals with more complex needs at

home or in care homes whereas previously they may have been treated in hospital.

8

44

New Anglia Local Enterprise Partnership Board

Wednesday 24th February 2021

Agenda Item 11 - Chief Executive’s Report

We are currently working with UoS, TechEast, Suffolk County Council and the Chamber to

promote and support the development of digital skills from level 4 to 7, seeking to partner with

large national companies to use levy transfer to fund the apprenticeships. We will roll the same

programme out to Norfolk in due course.

EAN and Careers Hub

The EAN in collaboration with STEM Learning hosted an LMI Week from the 1st of February

consisting of sessions from representatives of the three Growth Sectors of ICT/Digital, Agri Tech

and Clean Energy. Sessions were attended by Careers Leads and Teachers to increase their

understanding of the local labour market and future opportunities.

Migrating schools to the Careers Leads dashboard of Compass + continues to be a priority with

New Anglia outperforming CEC’s National average to date.

During February the EAN will be collaborating with Speakers for Schools on two webinars

showcasing virtual work experience to schools and businesses with the intention of increasing

local opportunities for young people.

For Apprenticeship Week the EAN has developed resources to support greater understanding of

apprentices and will be hosting apprentices on a Careers and Coffee session on the 9th of

February.

Skills Data

The writing of the Local Skills Report has enabled us to compile a large amount of skills data with

support from the Department for Education. This includes attainment levels of our residents,

destination after qualification completion and skills supply/demand. This data will be hosted on

our website and updated at least annually.

Decarbonisation Academy

Dates for the four task and finish groups covering: Curriculum, Decarbonising Infrastructure,

Market Forces, Research and Commercialisation have been set to begin developing a plan for

the Norfolk and Suffolk pilot. These groups will explore the evidence around assets and

opportunities as well as consider how we deliver maximum impact for our area.

In addition to these task and finish groups we will be delivering a private sector session to test

our thoughts further. We continue to work with the other pilot areas including Coast to Capital as

the project develops.

Infrastructure

Transport Board

A wider Transport Board update is offered under agenda item 6.

Transport East

Strategy development continues with a consultation expected over summer 2021. Officers

recently attended a ports roundtable to discuss challenges and opportunities for the sector which

will feed into this strategy development process alongside other themes including passenger

transport, active travel and rural connectivity. The next Forum meeting is due to take place on 24

March with the wider Transport East summit planned for 9 March.

9

45

New Anglia Local Enterprise Partnership Board

Wednesday 24th February 2021

Agenda Item 11 - Chief Executive’s Report

Great Eastern Main Line (GEML)

The Summary Business Case is currently being finalised following the GEML Taskforce meeting

on 28th January. This document brings together the key elements from both the Strategic Outline

Business Case and the Wider Economic Benefits study and the purpose is to replace the original

business case published in 2014, as the key lobbying document for GEML investment.

Utilities

Energy

Alternative fuels - outputs from the private sector forum were shared with the LA working group

in January. Since then, New Anglia LEP has been working with the Cambridge and

Peterborough Combined Authority on a high-level strategic approach that would support the

delivery of Alternative Fuels across the wider region.

Greater South East Energy Hub

The most recent Hub Board meeting largely focussed on the governance of the Green Homes

Grant programme:

Total fund worth £78.35m - 12% will be capitalised leaving the remainder for home energy

efficiency improvements across the 11 LEP Hub area - £68.948m.

Grants available for low-income households to improve energy efficiency of homes with poor

EPC ratings, including public and private rented sectors, in order to make them warmer and more

adaptable to climate change.

The programme will support clean growth as well as green recovery and economic resilience and

provide cost effective carbon savings by delivering domestic energy efficiency at scale.

The Hubs have been chosen to lead in order to maximise the pace of delivery - the programme

needs to be delivered this calendar year in addition to any under delivery from previous

programmes.

LEPs are asked to provide strategic guidance for grant allocation through methodology

agreement.

Norfolk and Suffolk each have their own Local Authority delivery consortia led by a lead Local

Authority yet to be determined.

Indicative allocations for the fund have been worked out based on population and those in fuel

poverty. Deliverability of previous programmes will need to feed into the final allocations in order

to maximise the supply chain’s ability to deliver.

European Structural Investment Funds (ESIF)

Performance of Norfolk and Suffolk ERDF and ESF projects funded as part of the £80m

investment from the national programme continues to be strong, despite the impact of Covid 19

on delivery. These programmes are being delivered to their full timescales in 2023 and continue

to adhere to EU funding rules during that period.

National Reserve - ERDF

The ERDF Reopening High Streets Safely Fund which was issued via District Councils last

summer has been extended to June 2021, as have the Visitor Economy and Wider Economy

schemes being distributed in Norfolk and Suffolk via the LEP.

Interreg France Channel England funding programme

The LEP is working with six other organisations in France and England, including Norfolk County

Council, on C-CARE (Covid-19 Channel Area Response Exchange), a COVID-19 response bid

led by Kent County Council to the Interreg France Channel England funding programme. If

successful, the project will bring around £1m funding to the LEP for activity which enhances our

response to the pandemic.

10

46

New Anglia Local Enterprise Partnership Board

Wednesday 24th February 2021

Agenda Item 11 - Chief Executive’s Report

The project also involves an in-depth evaluation of Covid response interventions across the

partnership, and the development of best practice case studies and guides for future

emergencies. The outcome of the bid will be known before the end of March 2021 and the

project is due to start by June.

3) Industry Councils, sector groups and external partnerships

Sector Groups and Industry Councils

Visitor Economy

Work is progressing on the development of a Tourism Action Plan, with discussions taking place

between VEE, LEP, DMOs, Local Authorities. There is yet to be any formal announcement from

Government on the timeline for bidding for Tourism Zones but it is understood to be put back

several months.

All Energy Industry Council (AEIC)

The All-Energy Industry Council meets on the 22nd February with a focus of the discussion being

the draft Energy Sector Recovery and Resilience Plan and the role of the Industry Council

members in its delivery.

The LEP is also working closely with Local Authority partners, Suffolk Chamber of Commerce,

EDF Energy and representatives from the Sizewell C Consortium to develop and progress the

plans around maximising future economic opportunities in relation to supply chain, business

support, inward investment and skills. A draft Statement of Economic Intent has been prepared to

clarify the scope of this activity.

Advanced Manufacturing and Engineering (NAAME)

The NAAME engineering success project, funded by the LEP’s Innovative Projects Fund and

hosted by the Cambridge Norwich Tech Corridor is making significant progress with a planned

launched for the new website, trade and member directory as well as the Talent Sharing Platform

(TSP) for the end of February.

The delivery plan has now been approved by the NAAME Industry Council and covers four main

objectives for the coming years. Additionally, the Industry Council have approved the

development of a NAAME Skills Subgroup looking to address the skills gap and develop the

engineers of tomorrow. The group has direct reporting lines into the LEP SAP and will provide

direct links between the region’s colleges, the universities (Productivity East, in particular) and

industry.

Financial Industries Group (FIG)

A programme of events is being developed for 2021-22 and will be run using online platforms. A

wide range of topics are being planned, with some directly related to the impact of Covid on work

practices, including employment law and returning to the workplace and staff wellbeing. Wider

topics are also under consideration such as climate and sustainability (and links to insurance,

lending etc) and skills and students in the workplace.

Cambridge Norwich Tech Corridor

The Cambridge Norwich Tech Corridor has recently joined a steering group formed by the UEA,

to help develop a Branding cluster for Norwich - in order to attract new

creative/marketing/branding revenue as well as talent into the city by raising the region’s

reputation for this sector. Focus areas for this steering group include: 1) Strategy & Research 2:

Communication 3: Networking 4: Education and 5: Talent.

11

47

New Anglia Local Enterprise Partnership Board

Wednesday 24th February 2021

Agenda Item 11 - Chief Executive’s Report

As part of this group, the Tech Corridor has created an opportunity for Norwich to become a pilot

city for a nationwide roll out of AD-Cademy, a free, online advertising course aimed at helping to

address the lack of diversity in advertising, created by the Brixton Finishing School.

The programme is primarily aimed at 18- to 25-year-olds from multi-cultural, gender diverse,

neurodiverse and working-class backgrounds. The course has been designed to upskill

participants in key aspects of marketing, creativity and digital and help will help young people

enhance their employability through practical support, advice and mentoring.

The Tech Corridor is also part of a new group set up by the East of England Local Government

Association to coordinate and enable joined up messages for inward investment. The group

(which also includes Norfolk and Suffolk Unlimited) will aim to identify opportunities where a

joined effort might be beneficial, such as MIPIM.

4) Engagement and Promotion

Launch of Freeport East bid

CJ Green and Chris Starkie represented the LEP at the launch of the Freeport East bid. The

event was attended by MPs, businesses and local authority partners from Suffolk, Essex, Norfolk

and Cambs.

the bid which includes the ports of Felixstowe and Harwich as well as the Gateway 14 site at

Stowmarket.

We are encouraging businesses and other interested parties to sign up to the bid, which was

submitted earlier this month and is in competition with proposals from across the UK.

Support with Covid-19 and EU Exit business messaging

Business support scripts for Covid-19 and EU Exit continue to be updated and circulated to

partners at least weekly, and our website pages are updated to ensure business-facing

information is up to date and easy to navigate. We have supported national and local authority

messaging about Lateral Flow Tests, helping with the development of business FAQs and

promoting testing through our website and digital channels.

5) Governance, Operations and Finance

This section provides an update for the board on any key operational matters as well as a

headline summary of the LEP’s operational finances.

Risk Register

The current risk score for risk 11, funding to support LEP programmes, has increased from 15

(amber) to 20 (red) as the longer-term view of infrastructure funding remains unclear.

Annual Performance Review

Our Annual Performance Review meeting with Government took place on 28 January. We have

received a note of the meeting with provisional scores of ‘met’ across each of the three themes;

governance, delivery and strategic impact. The final outcome letter is due in April after

consideration of Q3 data returns and national moderation.

Finance

The next set of management accounts will be the full financial year, April 20 - March 21 reporting

to the May Board meeting. There have been no extraordinary or unexpected costs since

reporting last month.

The Audit and Risk Committee met on 11 February and Price Bailey presented their audit plan

for the forthcoming year end. Key audit focus will again be on impairment of loans/investments

and also going concern as auditors are required to undertake more work following revision to the

12

48

New Anglia Local Enterprise Partnership Board

Wednesday 24th February 2021

Agenda Item 11 - Chief Executive’s Report

auditing standard in this area. The audit timetable will be tight this year, however some early

audit work will be undertaken in advance of the onsite visit to review provisional information,

select samples and request initial information. A meeting of the Audit and Risk Committee has

been scheduled for 29 June to review the draft accounts and Management Letter ahead of the

July LEP Board.

Recommendation

The board is asked:

To note the contents of the report

13

49

Communications activity

during January 2021

This dashboard sets out the outcomes and impact of our communications activities

during January 2021.

Media coverage

-

3 press releases

-

17 pieces of coverage

-

6 reactive media enquiries

Top 3 stories

Eastern Daily Press

The Dig helps to lift profile of potential East Anglian filming sites

East Anglian Daily Times

Transport chiefs urged to back region’s rail network with big cash windfall

East Anglian Daily Times

More than 100 firms sign up for downturn boost

Website

-

24,047 page views

(up 8,444 on previous month)

-

New features - updated Coronavirus business support page, updated EU Exit

pages

-

Project to improve accessibility of web and digital content

-

Links to top stories

50

Covid-19 respon

- Support with regional Lateral Flow Testing messaging

-

5 versions of business support script issued to partners

-

Business support website page updated weekly

-

Employment opportunities website page updated weekly

EU Exit comms

-

5 versions of business support script issued to partners

-

Website page updated weekly, including Deal outline, videos and webinars

-

Support with social media messaging about settled status for workers and

Rules of Origin for exporters

Social media and e-newsletters

Jan 2021

Dec 2020

New Anglia LEP

Number of Twitter followers

8,922

8,857

Average Twitter engagements per day (likes, retweets etc.)

67.48

53.32

Number of impressions (times a tweet showed in someone’s

160K

135K

timeline)

Number of LinkedIn followers

3,754

3,635