New Anglia Local Enterprise Partnership Board Meeting

Wednesday 20th June 2018

10.00am to 12.30pm

The Council House, University of East Anglia, Norwich

Agenda

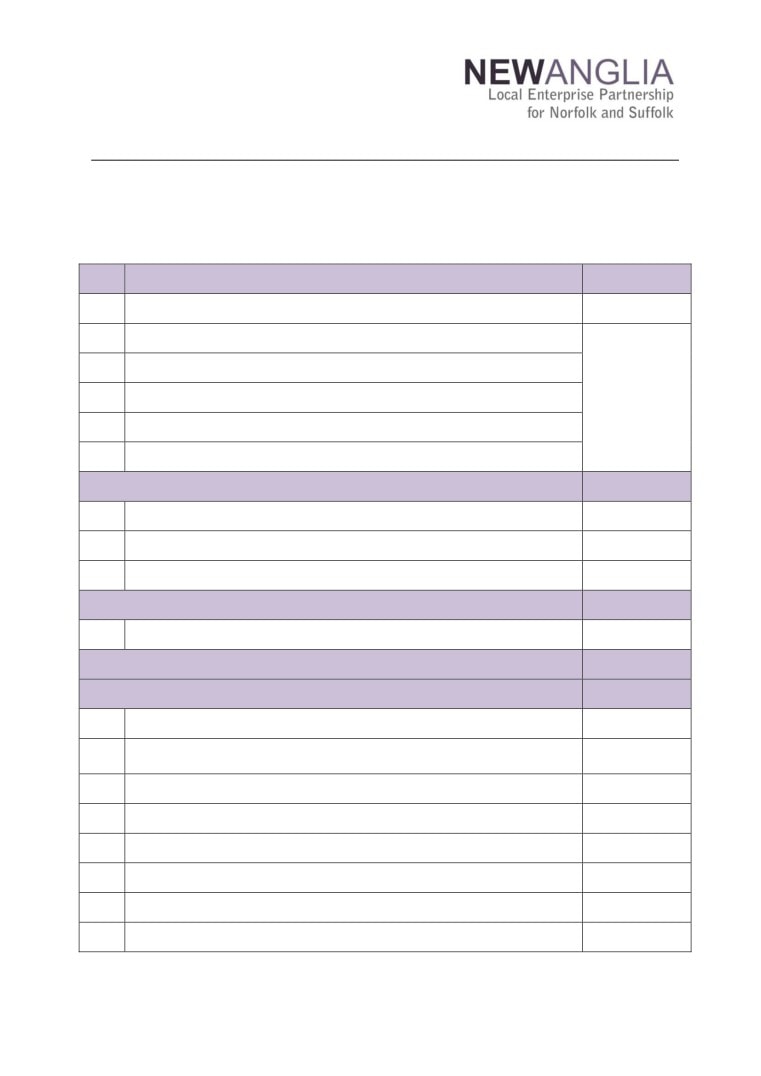

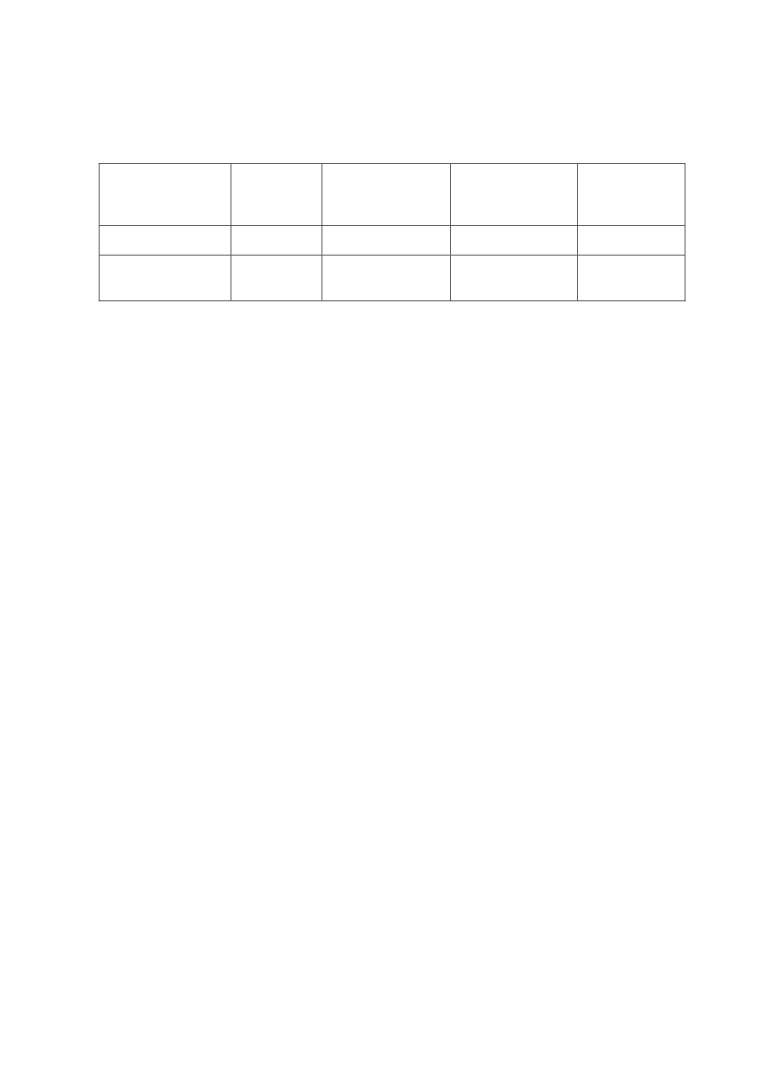

No.

Item

Duration

1.

Welcome

20 mins

2.

Apologies

3.

In Memorium - Minute’s Silence for Cliff Jordan

4.

Declarations of Interest

5.

Introduction - David Richardson

6.

Actions / Minutes from the last meeting

Forward Looking

45 mins

7.

Place Branding

For Approval

8.

Inward Investment

For Approval

9.

Skills

Update

Governance and Delivery

15 mins

10.

Enterprise Adviser Network

For Approval

Break

10 mins

Governance and Delivery

60 mins

11.

Local Energy Strategy

For Approval

Capital Growth Programme: Honingham Thorpe Food Enterprise Park

12.

For Approval

- Confidential

13.

Revenue Funding Framework

For Approval

14.

Growth Deal Quarterly Dashboard

For Approval

15.

Chief Executive’s Report

Update

16.

Finance Report including Confidential Appendices

Update

17.

Board Forward Plan

Update

18.

Any Other Business

Update

Next Meeting: 10.00am - 12.30pm, 19th September 2018

Venue:

Aviation Academy, Anson Road, Norwich

1

New Anglia Board Meeting Minutes (Unconfirmed)

23rd May 2018

Present:

Cllr David Ellesmere (DE)

Ipswich Borough Council

Doug Field (DF)

East of England Coop

John Griffiths (JG)

St Edmundsbury Borough Council

Dominic Keen (DK)

High Growth Robotics

Colin Noble (CN)

Suffolk County Council

Andrew Proctor (AP)

Broadland District Council

Johnathan Reynolds (JR)

Nautilus

Sandy Ruddock (SR)

Scarlett & Mustard

Alan Waters (AW)

Norwich City Council

Jeanette Wheeler (JW)

Birketts

Tim Whitley (TW)

BT

In Attendance:

Alison Thomas (AT)

Norfolk County Council (For Cliff Jordan)

Richard Lister (RL)

University of Suffolk (For David Richardson)

Corrienne Peasgood (CP)

Norwich City College (For Nikos Savvas)

Sue Roper (SuR)

Suffolk County Council

Vince Muspratt (VM)

Norfolk County Council

Shan Lloyd (SL)

BEIS

Chris Dashper (CD)

New Anglia LEP

Ellen Goodwin (EG)

New Anglia LEP (For Item 5)

Julian Munson (JM)

New Anglia LEP (For Item 6)

Chris Starkie (CS)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

Rosanne Wijnberg (RW)

New Anglia LEP

1

3

Actions from the meeting: (23.05.18)

Item 6 Enterprise Zones

To receive further information on the make up of jobs on EZs and the rationale for companies

JM

moving into the zones.

1

Welcome from the Chair

Doug Field (DF) welcomed everyone to the meeting and including Corrienne Peasgood deputising for

Nikos Savvas and Richard Lister deputising for David Richardson.

DF asked Alison Thomas (AT) to pass on the best wishes of the Board to Cliff Jordan.

DF welcomed Board members to the Coop Education Centre and introduced a short film celebrating 150

years of the Coop.

2

Apologies

Apologies were received from: Cliff Jordan, Steve Oliver, David Richardson, Lindsay Rix and Nikos

Savvas

3

Declarations of Interest

Item 8 Capital Growth Programme Projects

Projects recommended for Rejection

Colin Noble, Corrienne Peasgood, Richard Lister, Sue Roper

Projects recommended for Approval

Alan Waters, Andrew Proctor, Alison Thomas and Vince Muspratt.

Attendees were reminded that all Board deputies would be required to complete a Register of Interests

Form.

4

Minutes of the last meeting 18th April 2018

The minutes were accepted as a true record of the meeting held on 18th April 2018.

Actions from last meeting updated as follows:

Chief Executive’s Report

HM

To receive regional branding examples from Hayley Mace - Complete

Institute of Technology

An IoT brochure is being completed and will be circulated to Board members when available -

HM

More copies of the brochure are being printed but PDF versions of the document are available

for Board Members at the meeting - Complete

Chris Starkie (CS) reviewed the updates to the action log and advised that he had written to the

Combined Authority and is now liaising over a paper which will go to the June Combined

Authority Board meeting.

5

Integrated Transport Strategy

Ellen Goodwin (EG) provided the Board with details of the work carried out to date to produce

the Integrated Transport Strategy and the next steps in the approval process.

The strategy has been endorsed by Norfolk and Suffolk County Councils and, subject to minor

amendments requested by both Councils, will progress to proofing and then publication.

A delivery plan will be produced and presented at the September Board meeting.

The meeting discussed the strategy and noted that projects should be prioritised in order to

achieve the most deliverables. The strategy should also link in to Transport East’s plans.

Johnathan Reynolds (JR) suggested that the strategy should link to the sector plans and also

be more explicitly tied in with the Energy Strategy.

2

4

The Board agreed:

To note the content of the report

To adopt the Integrated Transport Strategy

To support the next steps in the strategy

6

Enterprise Zones

Julian Munson (JM) provided the Board with a presentation on the background to the current

Enterprise Zones (EZs) and their achievements to date.

The Board was advised that work is ongoing on the development of an inward investment

delivery plan which will include EZs as part of the region’s attraction to businesses.

DF asked what level of LEP resource was required to support the EZs. JM confirmed that two

full-time and one part-time member of the LEP executive managed the EZs with additionally 50

per cent of JM’s time. Significant additional resource was also provided by local authority

partners. A service charge to Local Authorities was in place to cover the LEP’s costs.

It was noted that additional resource may be required in future for lead generation.

Jeanette Wheeler (JW) advised the meeting that Birketts was about to move into their new

building on an EZ and stressed the quality of the site. The Board was invited to hold a future

meeting at the office.

The meeting discussed the importance of understanding numbers of new jobs created, whether

they were truly additional or just sustaining existing employment, and those which have just

relocated when a company moves onto an EZ.

The Board agreed that the issue of job displacement needed to be understood more fully and

asked for analysis on new and sustained jobs. This analysis should also include the

company’s motives for moving.

AP asked about the spending plans for the income from the EZs.

JM noted there is a delivery plan for each site using Pot B funds. CS advised that the Pot C

revenue is funding available to be invested by the LEP and that a proposal for using this money

would be presented at the June Board.

Tim Whitley (TW) requested further detail of investment already carried out in the region which

would support marketing of the East and demonstrate the extent of historical and ongoing

investment in the region.

John Griffiths (JG) stressed the importance of highlighting successful case studies.

The Board agreed:

To note the content of the presentation

To endorse the approach to inward investment and forward plan.

To receive further information on the make up of jobs on EZs and the rationale for

JM

companies moving into the zones.

7

West Suffolk College Engineering Centre 2nd Phase

Chris Dashper (CD) presented the paper on the Engineering and Technology Centre at West

Suffolk College and requested approval from the Board on the recommendation of the

Investment Appraisal Committee

(IAC) to release of the remaining

£3 million for the

refurbishment of part a building in order to create a new Engineering and Technology Centre.

The Board agreed:

To note the content of the report

To approve the release of £3m to fund the 2nd Phase of the West Suffolk College

Engineering Centre

8

Capital Growth Programme Projects

CD reviewed the assessment process carried out to date on those projects which had provided

further information as part of the latest call.

A number of projects had chosen to withdraw from the process.

3

5

The Board was advised that the remaining projects had been then been divided into three

categories - Recommend Rejection. Recommend Approval and Recommend Approval as an

award from the Growing Places fund.

The meeting then reviewed each group of recommendations in turn.

Recommendations for Rejection

Colin Noble (CN), Corrienne Peasgood (CP), Richard Lister (RL) and Sue Roper (SuR) left the

room.

CS advised that these projects, whilst recommended for rejection, would be able to reapply at

the future call.

CD confirmed that all rejected projects would receive a full response and would be advised

when a future call take place. They would be also given feedback on the appraisal carried out.

David Ellesmere (DE) advised that the LEP’s Investment Appraisal Committee had met prior to

the Board meeting on 23rd May to review the recommendations.

The committee supported all the recommendations bar one.

He outlined that the IAC has agreed that The Hold Project should be awarded £250k from the

Growing Places Fund, which is in line with similar cultural and heritage projects also supported

by GPF.

The board agreed that this decision, because of the value of the award (£250k) falls within the

remit of the IAC. The board endorsed the IAC decision.

The Board agreed to reject the remaining projects as per the recommendation.

JG, CP & RL returned to the room.

Alan Waters (AW), Andrew Proctor (AP), Alison Thomas (AT) and Vince Muspratt (VM) left the

room.

Projects for Approval

CD noted that there was an over-allocation against the £9m allocated to the original call due to

the inclusion of the Gt Yarmouth Flood Defences.

The Board was advised that if this project was put back to a future call there was a significant

risk of losing matched funding from the Environment Agency of more than £31m.

This still leaves £19.5m left for the next call.

DE noted that the Norwich Castle Investment was dependant on Heritage Lottery Funding and

LEP support would significantly assist this bid.

JW asked whether the amounts agreed were as per the original requests. CD advised that all

had been negotiated down but projects remained deliverable.

JR queried the number of jobs created through the GY project as the figures were based

before the oil price crash. The board was reassured that even if the numbers were revised

downwards the cost benefit of the scheme was still significantly above the required level to

justify the investment.

The Board approved the recommendations as per the proposal.

All remaining Board members returned to the room.

Board agreed:

To note the content of the report

To approve the award of Capital Grant Programme grant funding to the following projects:

o A140 Hempnall Roundabout - £650,770

4

6

o Eye Airfield Link Road - £1.46m

o Great Yarmouth Flood Defences - £8.2m

o Snape Maltings Flood Defences - £125k

o To reject those projects as recommended with the exception of The Hold - Suffolk

Archives Services

o To endorse the decision of the IAC to award The Hold, Suffolk Archives Services, a

£250,000 Growing Places Fund Grant.

To award Growing Places Fund Grants to the following projects:

o Gainsborough House National Centre - £250k

o Norwich Castle ‘Gateway to Medieval England’ - £500k (subject to the award of

Heritage Lottery Funding

9

Speculative Development

CD reviewed the paper as included in the Board pack which was requested by the IAC to cover

the engagement in speculative development.

DF queried the success rate of the repayment of loans provided to date. CD confirmed that all

had been repaid including those where the loan period had been renegotiated.

DE confirmed that the IAC recommended supporting the strategy.

The Board was advised that any such investments would require prior investment and would

need business plans in place being presented to the LEP.

Investments up to £500k can be approved by the IAC but it was agreed that the first few

investments would be presented to the Board for approval as well for reassurance.

The Board agreed:

To approve adoption of the framework for speculative development.

10

Growing Places Fund - Atex Park Loan

CD presented the paper on Atex Park and provided the Board with the background to the

investment and advised that a tenant has now been identified for the business units.

The investment has been assessed as per the speculative development framework and scored

within the agreed range to secure investment.

DE confirmed that the IAC recommended approval.

DF requested that in future similar proposals include details of what the applicant originally

requested and what was originally agreed.

The Board agreed:

To approve a recommendation made by the IAC to offer of a £630,000 loan to the

applicant towards the development of commercial space on Atex Park.

11

Data Dashboard

Rosanne Wijnberg (RW) presented the two dashboards to the meeting.

DF asked whether there was any issues highlighted by the data.

CD advised that private sector investment and new dwellings were reported as behind target

but there were no concerns that these would not be achieved. The results were captured when

projects were completed resulting in timing issues in reporting the figures.

Board members were requested to provide feedback to Rosanne Wijnberg (RW).

Tim Whitley (TW) requested that comparison data be included in future report.

The Board agreed:

To note the content of the dashboards

12

PwC Report - Review of Implementation

CD reviewed the updates to the PWC Implementation Plan.

AT requested that any regular Board deputies be included in any future training provided for

Board members.

DE suggested that formal vice-chairs be appointed for each body.

CD noted that the Board can agree for each body to amend its own Terms of Reference to

include Vice-chairs.

5

7

The Board agreed:

To note the content of the report

For Vice-Chairs to be appointed for each of the main LEP Bodies.

13

Chief Executive’s Report

CS reviewed the Chief Executive’s report and highlighted the following items:

Audit & Risk Committee - An introductory meeting had been held with Nick Banks as the

prospective independent chair of the Committee. CS requested approval to appoint Nick

Banks from the Board.

EIoT - A successful dinner has been held and the response to the bid is awaited. Copies of the

brochure are available for Board members at the meeting.

Careers Hub - a bid will be submitted by 25th May with over 30 schools and colleges already

signed up.

Table of Related Parties - Current entries had been circulated to Board members for review

and amendment as required. Any queries should be submitted to Keith Spanton.

The Board agreed:

To note the content of the report

To appoint Nick Banks as Chair of the Audit and Risk Committee

14

Finance Report

CS reviewed the key points of the paper and asked for questions from the Board.

He advised that the audit is underway and a tender will be carried out for the next year’s audit.

The Board agreed:

To note the content of the report

15

Board Forward Plan

CS reviewed the items to be covered at the June Board.

The Board agreed:

To note the content of the plan

16

Any Other Business

DK noted that there were businesses approaching the GBF re investment in automation and

further investigation into these requests would be useful.

TW informed the Board that BT are looking for apprentices at Adastral Park. JW noted that

Norfolk Schools were not always advised about such subjects. TW agreed to ensure that future

communications covered both Norfolk and Suffolk schools and colleges.

DF thanked CN for his time on the Board. This was fully supported by the meeting.

Next meeting:

Date and time of next meeting:

10.00am - 12.30pm, 20th June 2018

Venue: The Council House, UEA, Norwich

6

8

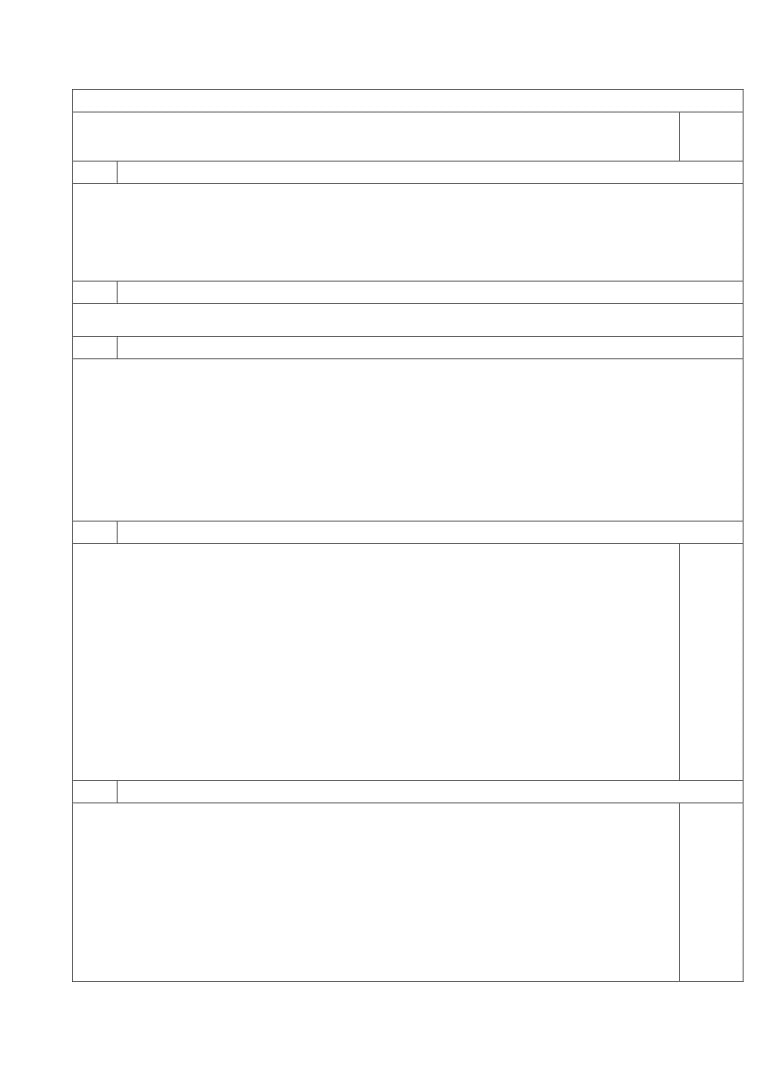

Actions from New Anglia LEP Board Meetings

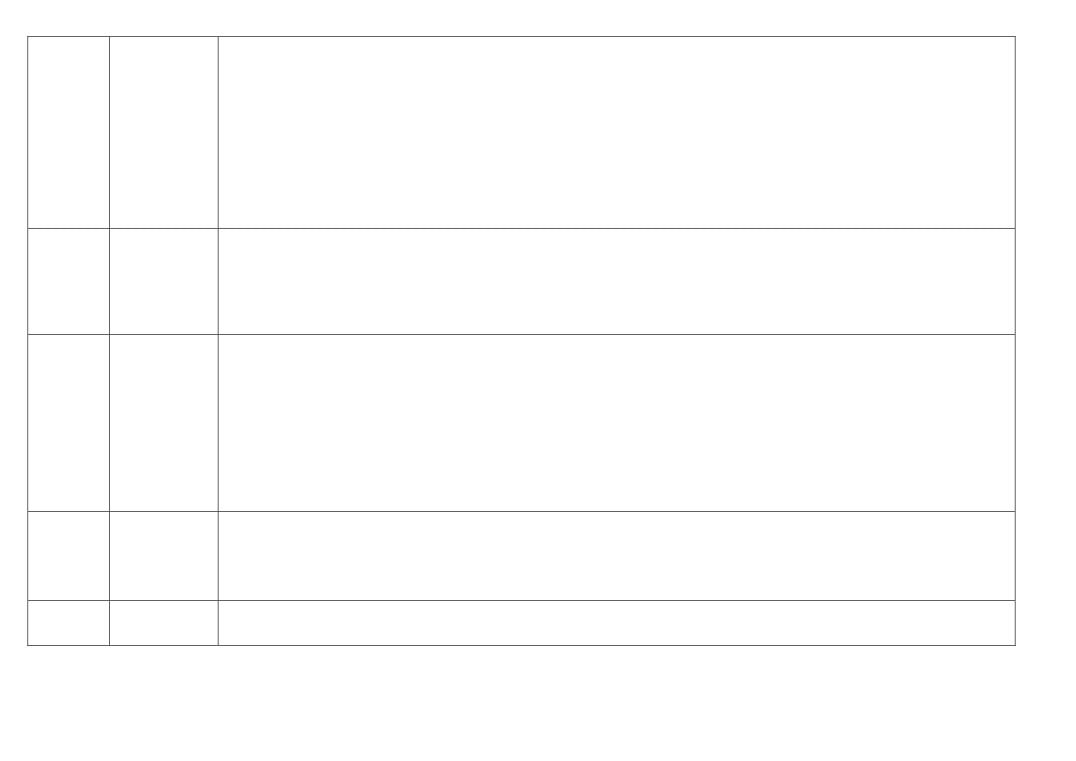

Date

Item

Action

Update

Actioned By

Status

23/05/2018

Enterprise Zones

To receive further information on the make up of jobs on EZs and the rationale

Furrther investigation is ongoing

JM

On-Going

for companies moving into the zones.

21/02/2018

Economic Indicator

To receive a paper on CO2 reductions for

CS and JR liaising

CS/JR

On-Going

Trajectories and Targets:

consideration of inclusion in the economic strategy targets

21/02/2018

Brexit Analysis

To receive an action plan detailing the next steps, timescales and measures of

Draft action plan is being produced & will be

LiR

On-Going

success

presented at the September Board meeting

22/11/2017

Business Performance

To receive a proposal on the Eastern Agi-Tech initiative by email.

CS has written to the Combined Authority and is

CS

On-Going

Reports

now liaising over a paper which will go to the June

Combined Authority Board meeting

9

New Anglia Local Enterprise Partnership

Board Decision Log

Date

Decision

Decision Made

Making Body*

06/06/2018

Growing

The Panel approved the following applications:

Business Fund

Omega Ingredients Limited - Agreed to support

Panel

Condition applied: £40,000

Advance Engineering (UK) Limited - Agreed to support

Approved Grant: £98,600

23/05/2018

LEP Board

The Board Made the following decisions:

Integrated Transport Strategy

To adopt the Integrated Transport Strategy and support the next steps in the strategy

Enterprise Zones

To endorse the approach to inward investment and forward plan.

West Suffolk College Engineering Centre 2nd Phase

To approve the release of £3m to fund the 2nd Phase of the West Suffolk College Engineering Centre

Capital Growth Programme Projects

To approve the award of Capital Grant Programme grant funding to the following projects:

A140 Hempnall Roundabout - £650,770

Eye Airfield Link Road - £1.46m

Great Yarmouth Flood Defences - £8.2m

Snape Maltings Flood Defences - £125k

To reject those projects as recommended with the exception of The Hold - Suffolk Archives Services

To endorse the decision of the IAC to award The Hold, Suffolk Archives Services, a £250,000 Growing Places Fund Grant.

To award Growing Places Fund Grants to the following projects:

Gainsborough House National Centre - £250k

Norwich Castle ‘Gateway to Medieval England’ - £500k (subject to the award of Heritage Lottery Funding

Speculative Development

To approve adoption of the framework for speculative development.

Growing Places Fund - Atex Park Loan

To approve a recommendation made by the IAC to offer of a £630,000 loan to the applicant towards the development of commercial space

on Atex Park.

PwC Report - Review of Implementation

For Vice-Chairs to be appointed for each of the main LEP Bodies.

Chief Executive’s Report

To appoint Nick Banks as Chair of the Audit and Risk Committee

23/05/2018

Investment

The IAC made the decision to present the following items to the LEP Board Meeting on 23rd May for approval:

Appraisal

Capital Growth Programme

Committee

The A140 Hempnall Road - £650,770

The Eye Airfield Link Road - £1,460,000

* New Anglia Local Enterprise Partnership Board, Investment Appraisal Committee, Growing Business Fund Panel, Remuneration Committee, Audit & Risk Committee

10

The Great Yarmouth Flood Defences - £8,200,000

The Snape Maltings Flood Defences - £125,000

Growing Places Fund

The Gainsborough’s House National Centre - £250,000

The Norwich Castle `Gateway to Medieval England` - £500,000 (subject to receipt of HLF Funding)

The Hold - Suffolk Archives Services - £250,000

The IAC also agreed to present the committee recommendation at the LEP board meeting on the 23rd May 2018 for the Projects

recommended for rejection are rejected with the exception of The Hold- Suffolk Archives Services

Speculative Development Paper

The IAC agreed to present the committee recommendation at the LEP board on 23rd May 2018 for the Speculative Development document

to form part of the decision making process when assessing speculative development loans.

Atex Developments

To present the committee recommendation at the LEP board on 23rd May 2018 for a loan of £630,000 to Atex Developments

02/05/2018

Growing

The Panel approved the following applications:

Business Fund

Warren Services Limited - Agreed to Support

Panel

Approved Grant: £32,000

Food Forensics Limited - Agreed to Support

Approved Grant: £36,980

Renvale Limited - Agreed to Support

Approved Grant: £184,552

18/04/2018

LEP Board

The Board made the following decisions:

LEP Capital Budget 2018/ 19 - Confidential

To approve the 2018/19 capital budget

To approve the allocation of £1m from the GPF fund budget to New Anglia Capital.

To approve the allocation of £1m to Agritech subject to the production and approval of a business plan

Review of Professional Advisers

To approve the development of a supplier procurement framework

To carry out a retendering process for the audit

Decision Log

To approve adoption of the decisions log

Growth Deal Quarterly Dashboard

To agree the Quarterly Dashboard.

18/04/2018

Investment

The IAC made the following decisions:

Appraisal

West Suffolk College Engineering and Technology Centre

Committee

It was agreed that the proposal would be presented at the LEP board meeting on the 23rd May 2018 for the release of the remaining £3m

to West Suffolk College Engineering and Technology Centre

Any Other Business

Cash Deposits - It was agreed that funding would be deposited until drawn down by the approved projects

11/04/2018

Remuneration

The Committee made the following decisions:

Committee

360-degree feedback

The committee agreed that this would be used initially with the CEO in August 2018.

* New Anglia Local Enterprise Partnership Board, Investment Appraisal Committee, Growing Business Fund Panel, Remuneration Committee, Audit & Risk Committee

11

New Anglia Local Enterprise Partnership Board

Wednesday 20th June 2018

Agenda Item 7

Place Brand Development for Norfolk and Suffolk

Author: Hayley Mace and Julian Munson Presenter: Hayley Mace

Summary

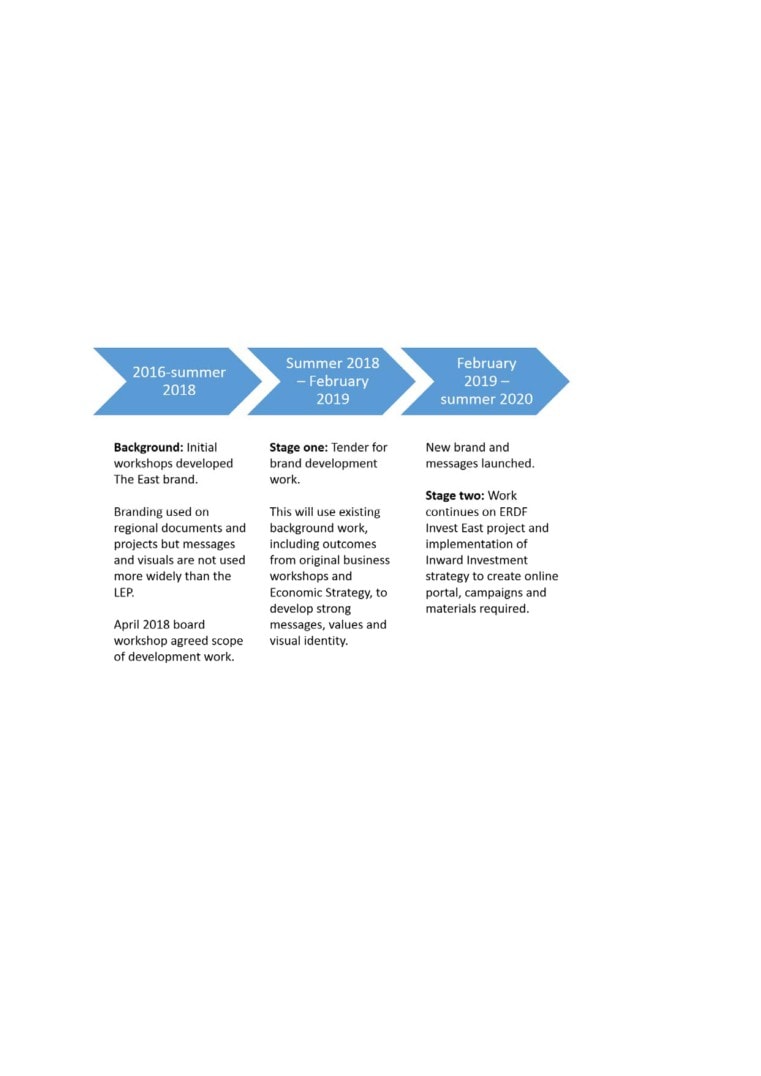

This paper outlines plans for further development of a single place brand for Norfolk and Suffolk

(currently branded as The East). It connects strongly with agenda item 7 - inward investment

and international strategic framework.

Recommendation

The Board is recommended to agree funding of £50,000 for the first stage of brand development

and to agree a timeline of activity.

The Board is also asked to note proposals for second stage of work, which includes creation and

implementation of a full-mix marketing suite and online portal. The second stage of work will be

funded, in part, by the ERDF Invest East bid.

Background

In summer 2016, initial work was carried out to develop a unifying place brand for Norfolk and

Suffolk. Two workshops were held, involving local authorities, businesses, charities and

education groups, and The East brand was established.

Since 2016, this branding has been applied to a range of projects. These include partnership

projects to highlight initiatives which belong to the region and not to the LEP alone, such as the

Economic Strategy for Norfolk and Suffolk, the Transport Strategy, and the Institute of

Technology bid. It has also been used for inward investment activities, including the overarching

branding for both counties at MIPIM UK.

However while the logo is used by the LEP, the high-level brand values and messages are not

widely used and work is required to develop values and messages which will garner support from

local partners and businesses.

As the Economic Strategy firmly emphasises the need for consistent place branding and an

overarching International Offer, it has been agreed that further brand development work is

required to develop strong and cohesive messages, values and a visual identity which brings

together our world-class inward investment and business location offer to stand alongside other

areas of the UK and the world.

The development of the strategy identified a number of strong local assets and opportunities, but

partners believed that many are currently undersold. This unifying brand will sit as an ‘umbrella’

above a large number of more local place, business and investment brands (such as Invest

Suffolk, Locate Norfolk and other initiatives such as the Cambridge to Norwich Tech Corridor). It

1

13

is intended to coordinate and amplify our region’s Offer to the World, and not to replace any

existing campaigns or brands.

A workshop was held in April 2018 with three LEP board members to discuss the values the

brand needs to highlight, how this brand can be used by businesses and the marketing materials

which will be required to deliver efficient, proactive campaigns in future. It was agreed that as

well as inward investment activity, this brand - and the materials subsequently produced in the

second stage of work - will be used for campaigns to attract skilled people to work in the region.

This is another key element in the Economic Strategy.

It was agreed at the workshop that while creating a professional visual identity is important, work

also needs to be undertaken to develop the strong messages, brand values and USP for the

region. Much of this will be based on the significant work already carried out to develop the

Economic Strategy for Norfolk and Suffolk. The input from this workshop has been used to inform

the recommendations in this board paper.

Key Considerations

Stage one proposal:

To develop a strong business brand for Norfolk and Suffolk, a specialist place narrative and

branding agency will be commissioned through a full tender process. The work they will

undertake will include a destination audit, looking at the offer and opportunities in our place, the

target markets for the brand and future campaigns and the current de-facto East brand - looking

at the existing destination experience and perception of place which is presented to different

markets.

Using this audit research, and work undertaken in the development of the Economic Strategy

and its delivery plans, brand values can be determined. This will ensure that as well as a visual

identity which appropriately represents our area, we have very clear and agreed messages about

the area’s core offer and how the brand will make different audiences feel about our place. This

brand can then be tested on target market audiences and implemented.

2

14

The brand will be tested on local, regional, national and international audiences, including

partners at the Department for International Trade.

Once this brand is established, it will be launched with partners and businesses and we will start

to use it on relevant materials and for relevant campaigns.

Stage two proposal:

Once a strong business brand is in place, a further paper will be brought to the Board to outline

plans for the development of a full-mix suite of marketing materials and an online portal to

promote the area.

Websites such as Invest in Liverpool and Business in Copenhagen were shown in the board

workshop in April and it was agreed that such a professional and comprehensive online portal

should be the aspiration for our area. It is envisaged that this will be developed in line with the

ERDF Invest East project and the Inward Investment Strategy through 2019/2020.

Link to the Economic strategy

The Economic Strategy, and the business consultation work we have undertaken as part of its

development, have highlighted the key theme of Our Offer to the World and the need to develop

consistent place branding to showcase our overarching offer. This will support work to promote

our inward investment and business location offer, to attract the highly skilled people we need

and to ensure that our region is promoted to Government.

Next Steps

As a full tender process will be required for this work, the timeline below is proposed:

Tender opens: 21st June 2018

Tender closes: 20th July 2018

Interviews with shortlisted agencies: By 10th August 2018

Agency appointed: By 17th August 2018

Work to be completed: By end of January 2019

Objective is to bring the work to the February 2019 board for approval (subject to agency

agreement of timeline).

Recommendation

The Board is recommended to agree funding of £50,000 for the first stage of brand development

and to agree a timeline of activity.

3

15

New Anglia Local Enterprise Partnership Board

Wednesday, 20th June 2018

Agenda Item 8

Inward Investment and International Strategic Framework

Author: Nicole Kritzinger and Julian Munson. - Presenter: Julian Munson

Summary

This paper updates the board on progress in the development of a client-focussed Inward

Investment and International Strategic Framework plan, to be delivered with local partners.

In 2017, the board and partners (including the Norfolk and Suffolk Growth Groups) agreed the

need for enhanced delivery of this agenda.

Since then the Economic Strategy for Norfolk and Suffolk has been published and the LEP’s

Inward Investment and International Sub-Group has been formed to take forward this work.

A completed delivery plan, following continuing engagement and consultation with local delivery

partners, will be presented to the board for endorsement later in 2018.

Recommendation

The LEP Board is asked to:

endorse the approach and development of the Inward Investment and International

Strategic Framework set out in the paper

approve the launch and activity of the Invest East ERDF business support/Inward

Investment project

approve the investigation of a suitable investment agency delivery model

support international market development activity where there is potential economic

benefit and agree to work with ‘Links East’ and County Councils on a pilot project to

advance relations with Guangdong province in China

Background

Inward investment and exports play a crucial role growing and diversifying the local economy,

not only by creating thousands of new jobs but in supporting the development of supply chains

that provide a major boost to existing local companies.

Inward investment also plays a key role nurturing innovative economic growth in sectors where

our competitive advantage attracts investment and occupiers to our Enterprise Zones.

Norfolk and Suffolk has achieved some success with the attraction of new businesses. In

2016/7 the UK achieved 2,265 projects involving nearly 107,900 jobs and around 1,700 jobs for

Norfolk and Suffolk, with 25 projects (source: Department of International Trade).

‘FDi’, European Cities and Regions of the Future 2018/19 intelligence report, does not rank

Norfolk and Suffolk (‘The East’) as an investment location (although the ‘East of England (six

counties) ranks 11/25). FDi intelligence is an economic ranking executed by the Financial

1

17

Times that seeks to promote the most promising cities and regions across the whole of Europe.

This is a ranking that informs decision makers such as investors and global site selectors who

choose areas for investment

The Norfolk/Suffolk investment proposition is currently not differentiated, neither are the

propositions and economic opportunity benefits clear to investors.

New Anglia LEP and partners have been involved in an increasing level of inward investment

and international development opportunities in recent months and a summary of the highlights

is included in Appendix 2.

Delivering successful investment requires far more than a persuasive narrative around USPs.

It requires investable opportunities based on clear, economic delivery actions, with a workforce

skilled to attract investors, alongside infrastructure

(physical, natural and technological),

innovation and assets that deliver return on investment for companies and wealth creation for

our economy.

Supporting businesses to expand and grow and deliver to their customers, be they abroad

(exports) or as part of an attractive supply chain offer to investors, requires a client-centric,

single agency investment model. This is necessarily a co-ordinated, multi-stakeholder delivery

approach.

Individual Local Authorities (Counties, Districts and Boroughs) have attractive offers but in

isolation will not easily attract sufficient attention among key influencers, particularly at the

international level.

Gains can be made through achieving investment in the Competitive Clusters in ‘The East’

(Norfolk and Suffolk) which by their nature are intra-regional and cross-sectoral and are in

competitive markets (e.g. Energy, Life Sciences and Financial Services).

Additionally, a continued shift in government focus on areas such as the ‘Northern Powerhouse’

and the ‘Midlands Engine’ creates further pressure on Norfolk and Suffolk to present a stronger

offer. A

‘Team East’, centralised approach will provide more weight, a critical mass of

advantages and opportunity, which could capture the interest of influencers and multipliers.

In mid-2017, the board and partners (including the Norfolk and Suffolk Growth Groups) agreed

the need for enhanced delivery of the inward investment and international agenda. Since then a

focussed Inward Investment function has been set up within the LEP with the appointment of an

Inward Investment Manager and a Business Development Manager for the Cambridge Norwich

Tech Corridor initiative.

This is complemented by the Inward Investment and International LEP Sub-Group formation to

aid in informing this work as well as regular meeting with delivery partners to shape actions and

develop the Inward Investment and International Strategic Framework aligning with the new

Economic Strategy for Norfolk and Suffolk.

In addition, progress has also been made on an ERDF funded inward investment and business

growth project, ‘Invest East’. Led by Norfolk County Council and delivered in a partnership

between Norfolk and Suffolk County Councils, Adapt (UEA) and New Anglia LEP, it will

commence September 2018 for a 3 year period.

The project involves targeting local SMEs with scale-up potential to ensure

‘investment

readiness’. Part of the ERDF funding will also enable new proactive profile raising and digital

tools including marketing activity targeting overseas investment prospects and the development

of new web-based material for inward investment. More information on the Invest East

programme can be found in appendix 3.

2

18

Key Considerations

The main strategic aim for the inward investment agenda is to deliver increased investment,

making Norfolk & Suffolk a business destination of choice, for innovation, knowledge and

enterprise. This includes increasing the area’s share of global exports and attracting skilled

talent.

In order to fully realise the global investment and trade potential of Norfolk and Suffolk,

particularly centred on our emerging technologies, research, niche clusters and skills, there is a

need to accelerate our activity with a more targeted and focused, partnership driven approach.

There is a significant opportunity to position the area as a serious and credible investment

location with a more proactive approach to accelerate new investment leads and export

opportunities.

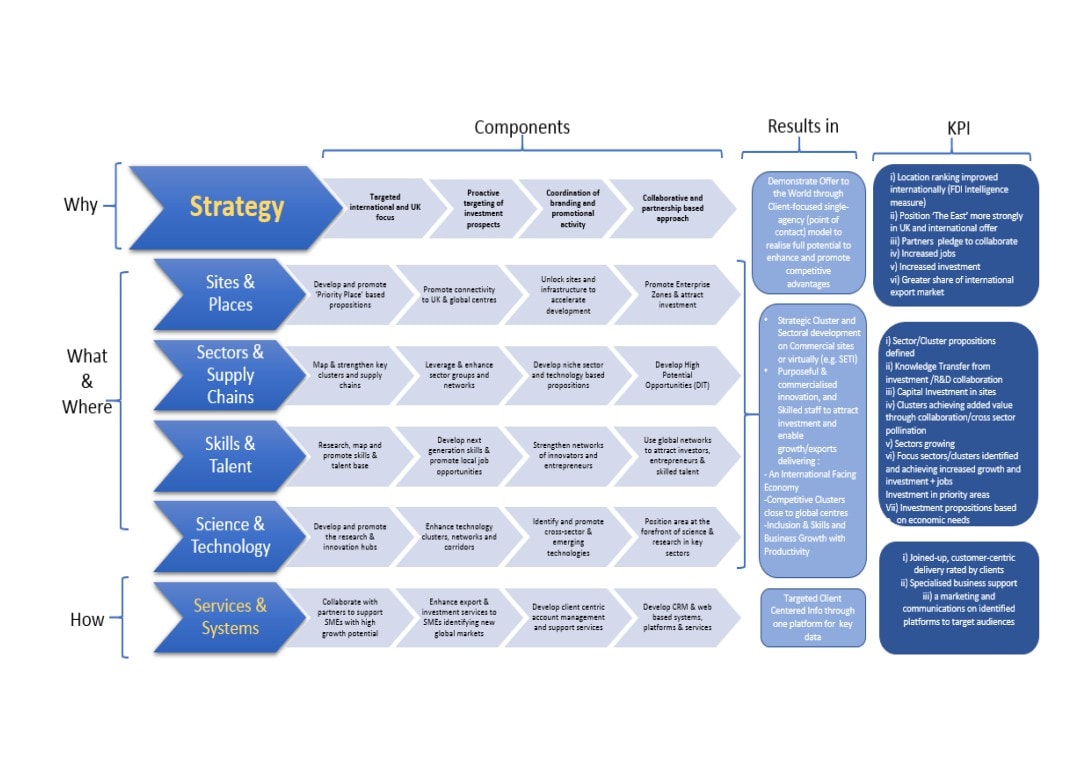

The overarching strategic framework (Appendix 1) sets out the suggested key areas of focus.

This framework aligns with and will help deliver the Economic Strategy for Norfolk and Suffolk.

Delivery will be a partnered approach between public and private sector stakeholders as well as

academia, and organisations having a role and contribution to make to inward investment and

the international agenda.

However, a review of the current delivery model and structure will be required to ensure we

evaluate progress, identify opportunities and better understand potential to evolve the delivery

model. Ultimately there may be scope to develop a more sustainable and private/public sector-

based delivery model with proactive lead generation activity and business account

management. Board approval is sought to investigate possible delivery models.

International relations are a key focus of this area of work. We are actively working with

partners to identify key global regions which demonstrate specific investment, trade, research

and education opportunities. These include the USA, Canada, Netherlands, Scandinavia and

Australia, as some examples. In addition, there is much focus on China and there are a number

of regions which will be evaluated going forward.

One example of this activity is with Guangdong province in China with an organisation known

as ‘Links East’. The organisation is proposing a relationship with the province, having built links

and as such is requesting partners (LEP, Norfolk and Suffolk County Councils to endorse the

approach). Our recommendation is to endorse this approach and support activity where there

are clear economic benefits to Norfolk and Suffolk and our key sectors.

What we want to achieve is:

1) A clear, proactive and persuasive strategic framework

(for inward investment and

exports) supported by an operational delivery and marketing plan, with the focus on the

client (i.e. company; investor/exporter). This framework aligns with and will help deliver

the new Economic Strategy for Norfolk and Suffolk.

2) The key focus areas of the framework are summarised in Appendix 1 with a clear

strategic approach to matching our offer with world needs. Action will be needed to:

a. Strengthen and promote our existing offer (around sectors & supply chains, sites,

infrastructure assets and spatial advantages coupled with our quality of life, housing

and education offer)

b. take advantage of emerging global industries and clusters (with a more proactive

approach, targeting international investment prospects, highlighting our USPs)

c. take advantage of innovative, game changing opportunities and emerging

sectors/clusters (e.g. Fintech, Connected Health, Functional Food, Industry 4.0)

caused by digital, technical and social disruption

3

19

d. Raise our awareness of global political and macroeconomic influences (e.g. US

policy change implications, changing international investment priorities and

Brexit)

3) Renewed focus on higher value activity and increased productivity through a targeted

approach involving prioritisation and promotion of innovation and high value niche

sectors, places, and propositions of competitive advantage.

4) Enhance understanding of the talent and skills base available, particularly in niche areas

of specialism to attract further investment.

5) Creation of an identity with global promotion coupled to lead generation from an

investor/client perspective that can proudly sit alongside ‘Britain is Great’ and such

international positioning as well as the place brand for Norfolk and Suffolk (The East).

Consideration of cultural marketing to specialised regions (e.g. China) and industry

markets is also required. This approach also enables local place and cluster brands to

still be used as required e.g. county brands, Greater Norwich, Ipswich, Tech Corridor,

etc.

Appendix

1 summarises the approach with a draft Inward Investment and International

Strategic Framework which the Board is asked to endorse. A delivery plan will be developed

with key delivery partners and will be presented to the board for endorsement later in 2018.

Link to the Economic strategy

Inward investment, exporting and the international promotion of the area is identified as an

integral part of the Norfolk & Suffolk Economic Strategy. Actions taken will enable delivery of

the identified ambitions, places and priority themes.

It is a cross-cutting function that underpins economic growth and is intertwined with underpins

such as the Skills, Infrastructure and housing needs of the area. In addition, growth

opportunities require collaboration between companies that will also attract and bring

investment. Inward Investment is therefore a key component to drive economic growth,

diversify the local area economy and create higher value employment.

Next Steps

The immediate next steps are highlighted as below:

June 2018 - Board endorsement of the high level draft Strategic Framework

July-October 2018 - Partner consultation and development of the delivery plan (as part

of the Economic Strategy)

September 2018 - Commencement of the ERDF Invest East activity which includes;

o Development and launch of new web-based material to promote the East offer

(by mid-2019)

o Development of a new investment campaign platform

(to enable targeted

promotion of key sector/site-based prospects) (by mid-2019)

o Identify competitive advantages, develop the East offer and marketing material

o Develop pipeline of investment prospects around target industries

o Supply chain analysis and sector research

o Enhance CRM system

November 2018 - Board endorsement of the delivery plan

Autumn 2018 - review of East place branding with Board approval/execution in 2019.

Autumn 2018 - review of delivery model for inward investment and recommendations to

Board.

Develop information and material around commercial sites and premises

Develop, with partners, improved methodology and protocols around enquiry handing

and key account management

4

20

Recommendation

The LEP Board is asked to:

endorse the approach and development of the Inward Investment and International

Strategic Framework set out in the paper

approve the launch and activity of the Invest East ERDF business support/Inward

Investment project

approve the investigation of a suitable investment agency delivery model

support international market development activity where there is potential economic

benefit and agree to work with ‘Links East’ and County Councils on a pilot project to

advance relations with Guangdong province in China

Appendices

Appendix 1: Draft Inward Investment and International Strategic Framework

Appendix 2: NALEP Inward Investment Activity - Progress Update

Appendix 3: Invest East - ERDF Project

5

21

Appendix 1: Draft Inward Investment and International Strategic Framework

Aim:

To deliver increased International Investment, making ‘The East’ (Norfolk & Suffolk area) a

business destination of choice for Innovation, Knowledge and Enterprise.

Emerging Objectives:

Development of emerging sectors and clusters, with global economic growth potential

Develop and refine niche and bespoke sector supply chains to attract appropriate

investment and be export ready

Investing in existing sectors and with special focus on those with a distinct competitive

advantage

An increase in the number of inward investment enquiries and increase of lead

conversion opportunities

Developing high-quality commercial propositions to attract Investment

An increase in high-value inward investment successes

An increase in the number of jobs created

Increased Foreign and Domestic Investment

Increase in the number of companies, goods and services being exported

An increase in profile in the international, national and local markets through promotion

with leading brands and Sectors (e.g. GREAT campaign)

Increasing the ranking of Norfolk & Suffolk as a recognised destination for investment

6

22

Appendix 1 (Continued) INVESTMENT FRAMEWORK: KEY FOCUS AREAS

7

23

Appendix 2: NALEP Inward Investment Activity - Progress Update

Progress to date has included a range of multifaceted partnership activity. Some examples and

highlights include:

Establishment of an Inward Investment Function

Recruitment of an Inward Investment Manager, hosted by NALEP

Recruitment of the Cambridge-Norwich Tech Corridor Project Manager, hosted by

NALEP

Building stronger relationships with DIT teams, Innovate UK, BEIS, Growth Hub,

Chambers of Commerce, Enterprise Agencies, Sector Groups, etc., to develop the

International Offer

Support and achievement of agreement for the ERDF ‘Invest East’ bid working in

partnership with Norfolk and Suffolk County Councils (to enhance service delivery and

support investment in expanding businesses located in Suffolk and Norfolk).

Development of Investment Opportunities with DIT - Showcased of Kings Lynn and

Bury St Edmunds EZ Capital Investment Opportunities in the International Prospectus,

working with the District/Borough Councils (a competitive, gated qualifying process is in

place

and only a small number are listed.

Example Ref:

lynn )

Participation in MIPIM 2017, with key stakeholders.

Life Sciences Lead Generation: Christian Roghi, Business Development Director of the

Quadram Institute attended a biotech event in Boston and met with pre-identified

companies, following analysis of biotech companies undertaken by the LEP, LAs, NRP

and the DIT, work is on-going through the NRP OPG Group as well as DIT sector teams

A visit to Norwich by the Ambassador of the Netherlands to London took place which

provided fruitful relationships and areas of discussion. To progress matters a visit to

Norfolk and Suffolk in

2018, with Dutch businesses is being planned with key

stakeholders, including Andrew Wood as Consul. A Trade Fair is planned for SMES in

2019

The LEP led a visit from the South African DTI and South African High Commission,

which took place on 1 November 2017. The aim of the visit centred around the

formation of clusters, business & research/science parks and mutual international co-

operation in the fields of bioscience, energy and advanced engineering. The delegation

met with QI, UEA, NRP and Hethel Innovation. This followed a visit to Europe and

Cambridge Science Park. Next steps involve SA DTI identifying sub-sector

engagement levels with stakeholders.

Developing Links with key new markets abroad: Successful actions include:

o Links have been made with the Chinese Embassy Trade Minister as a

representative in post in London from China

o UEA having links with China in Shezhen province.

o Guangdong province relations are developing with an organisation known as

‘Links East’

NALEP and Tech East have progressed relationships with key and emerging tech

based locations. Specific examples include Waterloo, Canada, Boston, USA, Northern

Perth, Western Australia and the Netherlands.

Several FDI Investment Queries with DIT as well as direct enquiries (e.g. LDH La Doria)

Investment and Expansion of a local company, creating up to 400 jobs

8

24

Appendix 3: Invest East - ERDF Project

Project Overview

The Invest East programme aims to enhance the reputation and capability of investment

readiness support to accelerate businesses that wish to scale up and to use the outcomes,

case studies and messages from this work to enhance and provide assurance to foreign

investors that there is a healthy local investment offer and that Norfolk and Suffolk demonstrate

a fantastic opportunity for investment.

Norfolk County Council was the lead applicant for the project. There are 4 delivery partners in

the project, (New Anglia LEP, UEA Adapt and Norfolk- and Suffolk County Councils) each

bringing in their specialism and match to support the bid, providing best value to the target

market for the project. This will be further underpinned by the Growth Hub who will be the main

point of contact, facilitating referrals to and from the programme. All interactions with

businesses will be recorded via the LEP CRM to ensure the most effective support is provided

to the businesses. Areas of provision are:

Investment readiness support: Delivering investment readiness workshops, training

and guidance. UEA (Adapt) will lead, they have been managing the LCIF (Low Carbon

Innovation Fund) for a number of years and have been successfully providing support to

LCIF applicants. This will be enhanced and run across both counties for businesses

targeting any investment fund. There will be 4 cycles of support over the 3 years with

each cycle proving up to 40-50 hours of intensive support for 30 businesses, with

opportunities for other businesses to receive elements of the programme as needed,

referring to and from the Growth Hub network.

Investor Support Programme: landing and account managing external investors,

supporting and developing external promotion offers with New Anglia LEP. Norfolk and

Suffolk will lead in their respective counties and have been providing investor support

since EEDA was abolished in 2012. Through this bid, the local offer and processes will

be greatly enhanced to allow for a joined-up delivery across ‘The East’ (Norfolk &

Suffolk) area.

Promotion and profile raising: External promotion on a national and international

forum to draw in investment and talent. New Anglia LEP will lead, being the entity

national investment stakeholders look to understand the local offer, alongside their local

sector groups which will be crucial in targeting market opportunities and developing

sector offers. A number of web based

The total project size is £1.8m, running Autumn 2018 for 3 years. Only supporting SME’s, it will

deliver 150 intensive business supports, 5 additional SME investors landed, 80 jobs, 40 new

products from businesses and will engage with a rage of investor stakeholders and local

partners to develop/support campaigns.

Support for larger business enquires will still take place but not under the ERDF bid.

9

25

New Anglia Local Enterprise Partnership Board

20th June 2018

Agenda Item 9

Skills Board Delivery

Author: Paul Winter and Natasha Waller. Presenter: Paul Winter

Summary

At the LEP Board on June 2017 it was agreed that Paul Winter, Chair of the LEP Skills Board

would be invited to the LEP Board to discuss the work of the LEP Skills Board. This paper

provides a high-level summary of the Skills Board achievements from the past year and sets

out the vision and area of focus for the coming year. Paul will present and provide more detail

of the activity and vision which is outlined in this paper and Appendix A, at the Board meeting.

Recommendation

To endorse the Skills Board vision and delivery steps (outlined in Appendix A) which will

form part of the Economic Strategy Delivery Plan.

To help champion the ‘key messages’ of the Skills Board.

Background

Much progress has been made over the last year, Key Activity includes:

Expanding the private sector membership from 8 to 15;

Endorsing 8 sector skills plans in our key sectors;

Overseeing local skills delivery funded by ESF;

Approving 10 Skills Deal projects totalling £1.4m of grant funding, leveraging £1.9m of

match and with a total Programme value of £3.3m; and

Supporting the Youth Pledge delivery.

In September 2018, the LEP recruited a Skills Manager (Natasha Waller) to further focus and

drive the work necessary to achieve the ambitions of the Economic Strategy and the skills

agenda.

The Skills Board have taken steps to review its vision and activity to ensure it aligns with the

new Economic Strategy. It has agreed its vision is … ‘to support the growth of an inclusive

economy with a highly skilled workforce where skills and employment provision meets business

need and the aspirations of individuals.’ The Skills Board provides the strategic leadership for

this vision. Each member is asked to be proactive in identifying where they can contribute to

and collaborate in any interventions please see page to of Appendix A for more information.

Key areas of work

Seven new private sector members were recruited in January to extend the sector base and

ensure the Board is predominately employer lead. Nearly all our key sectors are now directly

represented, they bring fresh focus plus a wealth of knowledge and experiences.

1

27

The sector skills plans are completed with the final two plans being presented at the July

Skills Board, for endorsement. Engagement has been varied with some sectors extremely open

to questioning and suggesting solutions, while others have been more challenging. Delivery of

the recommendations has begun in many of the sectors, normally overseen by the sector

groups and ultimately the Skills Board. Sectors such as life sciences and ports & logistics are

difficult to galvanise due to the widespread focus of the sector or competitive sensitivities of the

businesses that are involved. A cross cutting report has been produced which brings together

the shared challenges our sectors face and highlights shared areas of interventions that could

overcome them (see Appendix B). These will be a key focus for the Skills Board moving

forward.

Board representatives have been working with the LEP and TechEast to develop a proposal to

be one of the Governments Local Digital Skills Partnership pilots. If successful, this will

provide a boost to the delivery of the Digital Tech skills plan with a fully funded co-ordinator and

small budget to pilot some interventions.

Capital funding awarded to our educational establishments over recent months has been

positively received. However, there is concern that skills projects are not always scored

favourably as outputs may not directly link to increased amounts of jobs in the short term.

Capital funding is also not always the main requirement to address skills issues and with

continual reduction in most direct funding streams to educational establishments, revenue

funding is required to at the very least maintain the physical structures and replace/modernise

teaching resources.

The Skills Board will identify over the coming months what the key challenges are for the

regional colleges and the extent of the problem. This will shape future discussions with

government departments. It is important that skills feature strongly in the LEPs Investment

Framework which is being developed in the coming months as it is a critical element of

achieving the ambitions in the Economic Strategy.

March 2018 marked the end of the period in which Skills Deals funds could be allocated to

innovative employer-led projects. These deals provided co-funding to enhance the post-16

training offer in an area identified by local employers. This has resulted in both an expansion

and enhancement of the training on offer in line with local economic need.

Funding was derived from Suffolk local authorities, Norfolk County Council, the Education and

Skills Funding Agency (ESFA) and employer match. In total 10 projects have been allocated

£1.4m of grant funding, leveraging £1.9m of match and with a total Programme value of £3.3m.

Most of the projects are now in the process of being delivered or launched with one project,

Fabric First at Easton & Otley College, already completed delivery and continuing to be used in

construction teaching. Skills Deals showed how employers and providers could come together

to deliver new models of courses to respond to a major need of a sector.

The Youth Pledge a New Anglia LEP wide commitment to provide an integrated offer, that

shows and inspires young people about the opportunities that exist and provides support to

enable them to access them, including support into employment. Historically a ‘Marque’ has

been attached to this work and publicised separately but it has recently been agreed that this

focus be embedded in the whole Youth Pledge commitment as it has shifted focus away from

the actual activity such as work experience or supporting school sessions.

The Youth Pledge will be reframed as:

A way for employers to highlight to prospective employees, other businesses,

Government and the wider public what they are doing that will help us achieve the

wider Youth Pledge commitment.

A means for us to highlight as a region (to Government and other areas) what we are

collectively doing to move young people into sustained and fulfilling careers

2

28

A means to ensure employers are aware of, and can navigate through, the guidance

and opportunities that are available to support them to maximise the positive impact

they can have on the prospects for young people in the region.

The Enterprise Adviser Network comes under the Youth Pledge work. This is covered

separately at agenda item 9.

Several projects supported by European Social Funding have been granted extensions in

financial value and/or time until April 2019. We also have the option to bid for further funds

managed by the Education and Skills Funding Agency for delivery from April 2019. We are

proposing

£1,030,293 for Community Grants and

£2,163,331 for Skills Support for the

Workforce.

One current issue is that our programme for Response to Redundancy is coming close to

spending all its allocation with no further options for increased funding. This potentially leaves

those at threat or recently made redundant without targeted support until April 2019 at the

earliest. The Skills Board is reviewing options with the DWP and other bodies to ensure support

is available to these people.

Educational establishments are currently dealing with a large amount of change from recent

and planned curriculum implementations with a backdrop of reduced funding streams and

falling demographics. Nearly all our key sectors are stating that they have a workforce with

major skills shortages and/or lack of staff.

Raising the profile of the skills agenda is essential for our LEP area and beyond. New Anglia

is regularly brought up as being forward thinking and innovative in the post 16 skills agenda.

However, major challenges have occurred over recent months including the loss of private

training providers and changes in apprenticeship funding and curriculum leading to a spiky

profile in recruitment, retention and achievement.

Providers, local authorities and the LEP are fully committed to the apprenticeship agenda but

Government is not currently open to listening to feedback on the result of policy changes and

seems to be hoping that apprenticeship numbers will suddenly increase, and outstanding

apprenticeship levy spent. We are attending meetings arranged by the National Apprenticeship

Service and supporting the Learning and Work Institute’s research and initiatives around

apprenticeships in order to leverage support and change.

Four key messages that the Skills Board would like the LEP Board to raise the profile of are:

1. Securing of increased revenue funding for our post 16 educational establishments is

essential in order for them to deliver high quality and relevant vocational qualifications in

our key sectors.

2. Government need to be open to discussions about curriculum reform and key

educational issues such as apprenticeship standards and the introduction of the levy.

3. The recommendations of the sector skills plans can only be actioned if there is true

partnership working with all stakeholders in the relevant sectors.

4. Our Youth Pledge states that every young person in Norfolk and Suffolk will get the

support they need to get into education, training, an apprenticeship or a job within three

months of leaving education or employment. Much of this work centres around

encouraging businesses to engage with young people more, expose them to careers,

offering work experience and interview practice.

Link to the Economic Strategy

Inclusion and Skills is a clear theme in the Economic Strategy and lays out 10 high level action

points to move the agenda forward, particularly within our key sectors. A delivery plan has been

developed with officers from Norfolk and Suffolk County Council and milestones for activity

derived. This will link into the main Economic Strategy delivery plan.

3

29

Recommendation

To endorse the Skills Board vision and delivery steps (outlined in Appendix A) which will

form part of the Economic Strategy Delivery Plan.

To champion the ‘key messages’ of the Skills Board.

Appendices:

A New Anglia LEP Skills board vision and delivery steps

B New Anglia sector skills plan cross cutting themes report

4

30

New Anglia Local Enterprise Partnership Board

June 20th 2018

Agenda Item 10

Enterprise Adviser Network

Author: Natasha Waller. - Presenter Chris Starkie

Summary

This paper highlights progress being made by the New Anglia Enterprise Adviser Network

which is funded jointly by the Careers & Enterprise Company and the LEP and delivered by the

two county councils.

It recognises that performance against targets has been challenging, largely due to changes in

the educational landscape.

In order to accelerate the performance of the network, the LEP is recommending bringing the

programme in house.

This will enable the network to be integrated with the Careers Hub, a new initiative which is

being led by the LEP and will bring 32 schools and colleges together to share best practice on

enterprise and careers advice. Bringing the programme in house will also improve the links to

the business community.

Recommendation

To approve further 12 months funding for the Enterprise Adviser Network (EAN) at a

cost of £135,000. (This funding is matched by the CEC)

To endorse the development of the Careers Hub and the integration of its management

with the EAN

Background

The Careers and Enterprise Company (CEC) operate the Enterprise Adviser Network (EAN)

across the country in partnership with the LEPs. Enterprise Advisers (EAs) are senior business

volunteers who work closely with a local school or college to help develop a practical careers

plan. Enterprise Co-ordinators (ECs) are the full time employees of the network who establish

the connections with the businesses and the schools and report to the CEC. Locally they are

based within Norfolk and Suffolk County Councils.

The board meeting in April 2017 approved the provision of funding by New Anglia LEP to

support the New Anglia Enterprise Adviser Network for the 12 months from 1st September

2017, subject to the agreement of suitable key performance indicators and an evaluation

framework. These indicators were approved in May 2017 and £131, 051.09 funding was

provided for the network for a 12 month period from 1st September 2017. This was equally co-

funded provided by the Careers and Enterprise Company (CEC).

The EAN is run nationally although we have responsibility for the engagement in our LEP area.

1

31

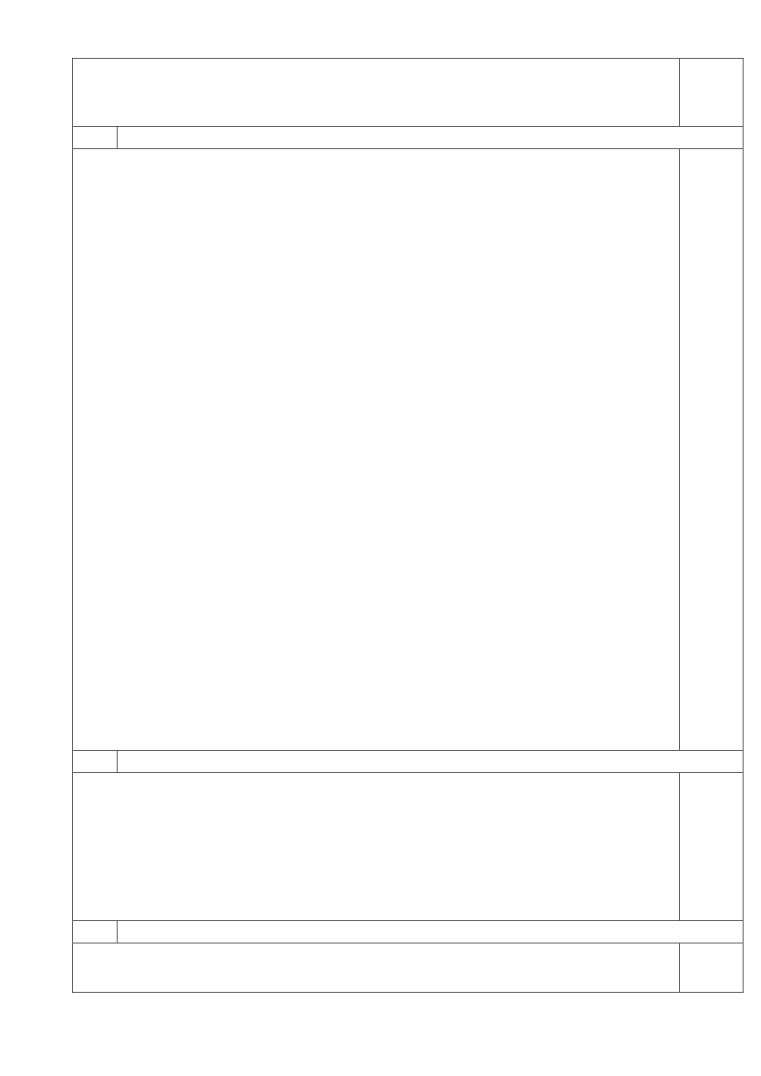

Key considerations

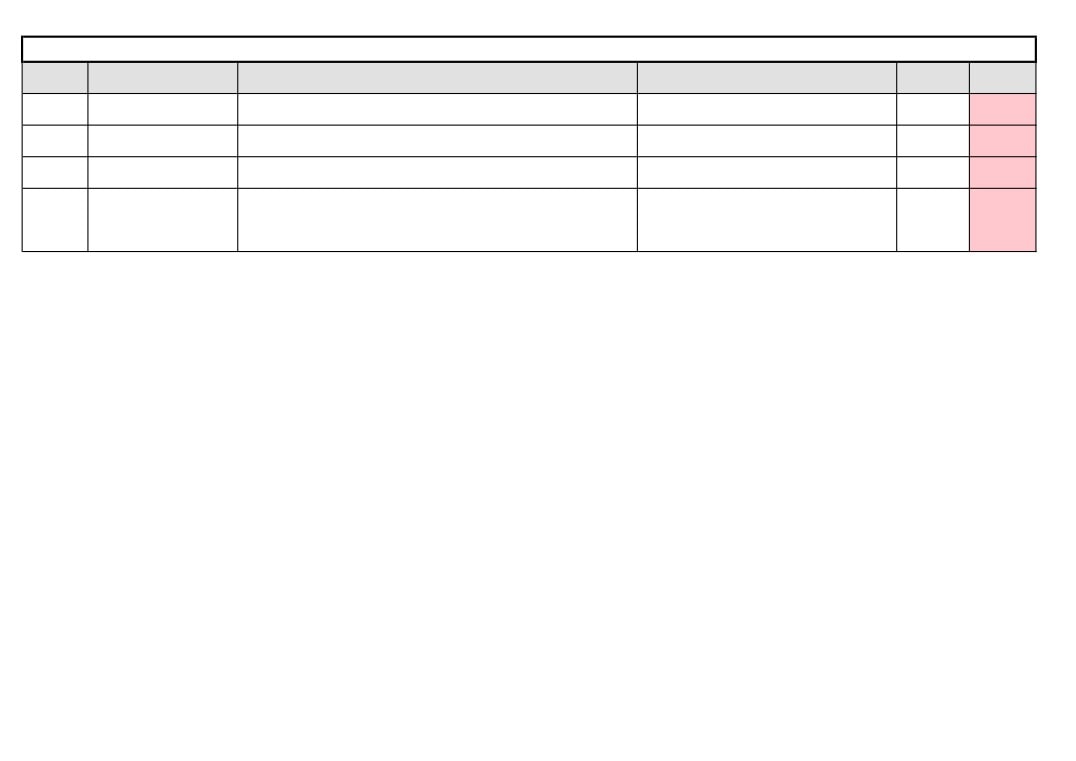

Target: Increase the number of schools engaged and enterprise advisers

Progress has been varied across the Key Performance Indicators.

Number of

Target for

Actual 27/4/18

Targets May

matches

31/7/18

2019

1/4/17

School/colleges

74 (53%)

100 (71%)

64 (45%)

85

Enterprise

76

150

80

110

Advisers

As can be seen from the tables - the number of schools engaged has reduced and the number

of enterprise advisers has increased.

There are a number of reasons for the drop in school and college engagement. The overriding

issue is that enterprise and careers is generally speaking seen by schools as less important

than academic performance and is prioritised as such.

Some of the specific reasons:

Academisation/re-academisation of a number of schools leading to changes in the

Senior Leadership Teams which distorts the relationships built up and often means

developing the ambitions for the schools again.

Changed priorities when OFSTED grading of schools is at Grade

3

(requires

improvement) or 4 (inadequate) and/or drop in academic results resulting in schools

reducing or withdrawing their focus from the network.

Loss/change of Careers Leaders/Advisers as many staff change schools regularly or

private careers advisers contracts do not get renewed. Funding in schools has been cut

and careers advisers are often sacrificed to save money.

Initial sign ups have not all translated into action with school/colleges not making

progress so have been removed from the programme.

Reasons for difficulties in growing number of Enterprise Advisers

Change of job/company/location/personal circumstances are a key factor listed which

makes continuation difficult.

Pressures of work often mean that initial desire to support schools have to be reviewed.

Lack of commitment from schools they are partnered with so the EA becomes

disengaged.

A large amount of effort has needed to be put in by the EC team in effect to stay at similar

engagement levels overall whilst actually forging new relationships for Senior Leadership teams

and EAs. This is masked by the data and ‘churn’ is not currently monitored by the CEC.

One of the targets last year was for an Employer Engagement Plan for every school/college in

the Network within one year of joining. This is to improve their careers and enterprise

education.

Following the publication of the Careers Strategy by the Department of Education, the CEC

have issued guidance on how this should be adopted.

2

32

Therefore over the year, the EAN team have redeveloped their Engagement plan for schools

and this has been a key focus to ensure those in the network have a quality programme rather

than increased school numbers running poor quality interventions.

Compass and Tracker are planning tools which have been updated or rolled out to schools and

engagement is patchy but growing.

Schools are being strongly advised to increase this engagement as from September 2018 as

they need to address all 8 Gatsby benchmarks from years 7 - 13:

1: A stable careers programme

2: Learning from career and labour market information

3: Addressing the needs of each pupil

4: Linking curriculum learning to careers

5: Encounters with employers and employees

6: Experiences of workplaces

7: Encounters with Further and Higher Education

8: Personal guidance

The EAN have already started supporting schools with their planning to address these.

Adapting the Enterprise Adviser model

Target: To ensure the programme supports all state educational settings including special

schools, FE Colleges and PRUs/Short Stay Schools.

The adaptation of the model to different setting remains a national issue and so the ECs have

been working closely both with the CEC to develop local models that can provide appropriate

support to these local schools and colleges.

100% coverage across Norfolk and Suffolk will require engagement of 8 FE Colleges, 20

special schools and 10 pupil referral units. Our sign up and match rates for SEND schools and

the PRUs currently compare very favourably with national rates.

Type of

Number

Target July

Actual

Target May

institution

engaged

2018

27/4/2018

2019

1/4/2017

FE Colleges

4

8

4

8

Special Schools

8

12

8

14

Pupil Referral

5

8

5

10

Units

Conclusion and next steps

It has been internally acknowledged that the targets set last year were overtly ambitious and did

not foresee the speed of change in landscape in our schools, particularly with academy

changes, teacher shortages, the impact of new curriculums being rolled out and large number

of senior managers being redeployed.

Therefore we have set more realistic targets for the coming year.

However the development of the Careers Hub, and bringing the programme in house, together

with the momentum from the Government’s Careers Strategy makes the targets achievable.

Careers Hubs

The CEC are looking to pilot 20 Careers Hubs which involves a group of 20 to 40 schools and

colleges in an area, working with education and training providers, employers and career

professionals to deliver the eight Gatsby Benchmarks.

3

33

In May 2018, the LEP submitted a bid to deliver one of these hubs and outcomes will be known

by the end of June 2018.

32 schools and colleges have submitted expressions of interest to engage in our Hub area

which involves a radius around Norwich, travelling south down the A140, east along the A14 to

Ipswich and onto Felixstowe. Schools in the Opportunity Areas of Norwich and Ipswich are

priorities but we were keen for them to choose to enter/not enter the Hub.

If successful, funding will be awarded by the CEC to recruit a Careers Hub Lead employed by

the LEP plus some additional limited resources.

As part of our bid, we have also been given a clear steer by the CEC to take the management

of all the Enterprise Coordinators into the LEP from Norfolk and Suffolk County Council.

They will report to the Hub Lead who will report into the LEP Skills Board.

We support this approach as it will enable the Careers Hub (32 schools and colleges) and wider

Enterprise Adviser Network (all schools and colleges) to be run as one entity.

We also believe this is critical if the EAN is to meet its revised targets for the 18/19 financial

year.

Link to the Economic Strategy

Under Driving Inclusion and Skills, growing the number of Enterprise Advisers is a key ask of

the strategy. Many challenges outside of the control of the Enterprise Coordinators have been

encountered but the vision of the Enterprise Adviser Network and the new Careers Hubs will

drive young people’s aspirations and allows us to shape awareness in our key sectors

particularly linked to the recommendations in the sector skills plans.

Recommendation

To approve further 12 months funding for the Enterprise Adviser Network (EAN) at a

value of £135,000. (This funding is matched by the CEC)

To endorse the development of the Careers Hub and the integration of its management

with the EAN

4

34

New Anglia Local Enterprise Partnership Board

Wednesday 20th June 2018

Agenda Item 11

Local Energy Strategy

Author: Ellen Goodwin Presenter: Lisa Roberts

Summary

This paper summarises the recent development of the Local Energy East Strategy, last

presented to the Board in April 2018, and seeks endorsement from the LEP Board on the final

draft strategy, noting the local authority engagement and feedback as part of the development

process.

Recommendation

The Board is asked to:

endorse the Strategy presented at Appendix A;

note the ongoing development of the Greater South East Energy Hub; and

agree the next steps regarding the Strategy’s Delivery Plan.

Background

BEIS funding was secured in March 2017, for a tri-LEP Network and Strategy, with supporting

evidence base, covering the New Anglia, Greater Cambridge and Peterborough and

Hertfordshire LEP areas, and their constituent local authorities. The Local Energy Strategy is

based upon baseline information and is the subject of current local authority and partner

endorsement with the aim of publishing in July 2018.

The key thematic priorities identified in the Strategy period to 2030 are as follows:

Clean Economic Growth;

Housing Growth and Commercial Site Infrastructure;

Secure, Affordable Low Carbon Consumption; and

Clean Transport Networks including Electric Vehicles.

The Strategy is considered to be complementary to other initiatives such as those led by the

East of England Energy Group (EEEGR), and Local Authority workstreams and complements

the Economic Strategy for Norfolk and Suffolk.

The Greater South East Energy Hub

Running parallel to the network and strategy work above, BEIS made £1.3m available for the

development of a Greater South East Energy Hub, covering eleven LEP areas and led by a

Hub Steering Board for which Johnathan Reynolds and Lisa Roberts are members. The Hub is

hosted by the Cambridgeshire and Peterborough Combined Authority and recruitment of a

1

35

Regional Hub Manager, a Data and Information Manager and a Technical Support Coordinator

has begun with New Anglia LEP being part of the interview panel.

The Greater South East Energy Hub will:

cover the area of the East of England, Greater London, the South East and the Oxford

to Cambridge Growth Corridor (16 counties plus London/11 LEPs);

provide dedicated technical resource;

provide project identification, feasibility, funding readiness and delivery;

provide the opportunity to test, pilot, scale up and accelerate delivery; and

explore the use of Energy Special Purpose Delivery Vehicles.

Key Considerations

The Greater South East Energy Hub is fully funded by BEIS between until April 2020. There is

an expectation from BEIS that the Hub will be self-financing after this initial two-year period,

which may have financial implications for the LEPs and partners if the hub requires further

financing beyond this initial two-year period.

Link to the Economic Strategy

The Local Energy Strategy builds upon the Norfolk and Suffolk Economic Strategy as well as

national policy including the UK Government’s Industrial Strategy, Clean Growth Strategy, the

25 Year Environment Plan and the Energy Sector Deal. The key linkages are identified as:

opportunities to support the energy sector, a key sector identified in the Norfolk and

Suffolk Economic Strategy, as well as the construction and agri-tech sectors;

growing our Priority Places through the identification, prioritisation and delivery of

energy specific projects through various funding sources, including Growth Deal,