New Anglia Local Enterprise Partnership Board Meeting

Wednesday 25th November 2020

10.00 - 12.30pm

Via MS Teams

Agenda

No.

Item

1.

Welcome from the Chair

2.

Presentation from Dan Greeves, Managing Director, Pegasus Welfare Solutions

3.

Apologies

4.

Declarations of Interest

5.

Actions / Minutes from the last meeting

Forward Looking

6.

Inward Investment Delivery Plan

For Approval

7.

Economic Recovery Restart Plan Progress Report

Update

BREAK - 15 Mins

Governance

8.

EU Exit / End of Transition Period Report - confidential

Update

9.

Chief Executive’s Report inc a confidential item

Update

10.

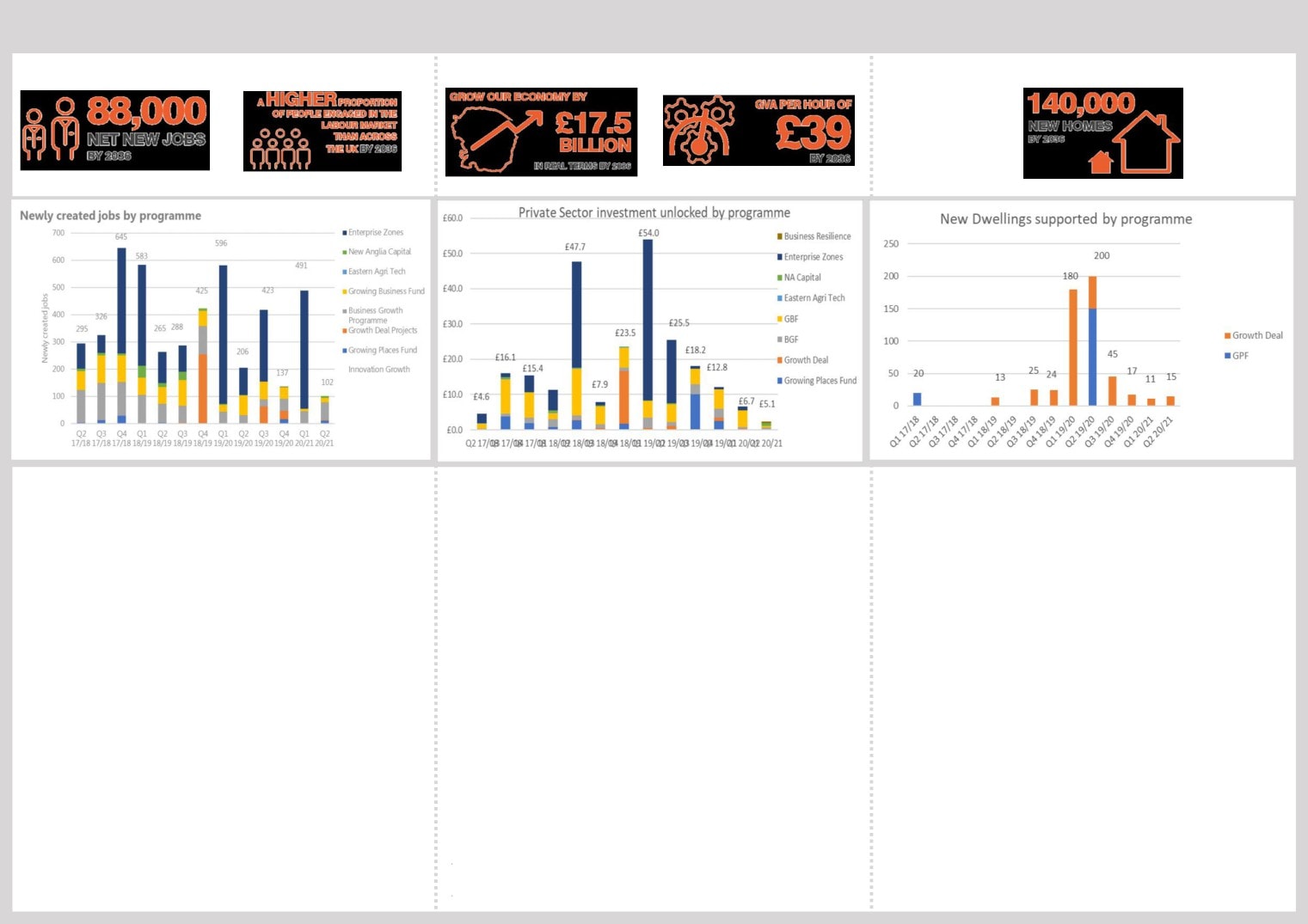

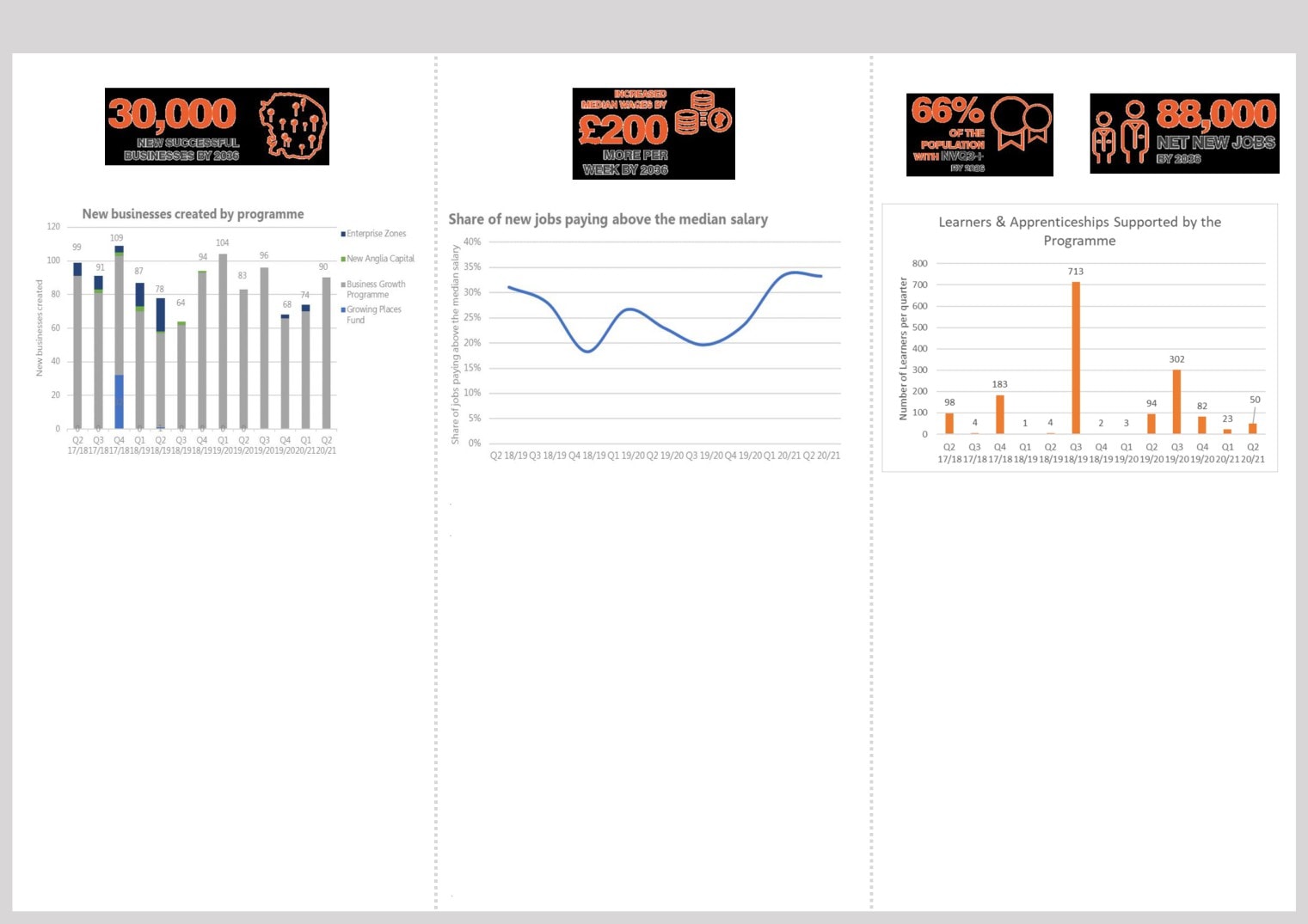

November Performance Report and Economic Dashboards

Update

11.

Board Forward Plan

Update

12.

Any Other Business

1

New Anglia Board Meeting Minutes (Unconfirmed)

21st October 2020

Present:

Kathy Atkinson (KA)

Kettle Foods

Sam Chapman-Allen (SC)

Breckland Council

David Ellesmere (DE)

Ipswich Borough Council

Doug Field (DF)

East of England Coop

C-J Green (CJG)

Brave Goose

John Griffiths (JG)

West Suffolk Council

Matthew Hicks (MH)

Suffolk County Council

Pete Joyner (PJ)

Shorthose Russell

Dominic Keen (DK)

Britbots

Helen Langton (HL)

University of Suffolk

Corrienne Peasgood (CP)

Norwich City College

Andrew Proctor (AP)

Norfolk County Council

Johnathan Reynolds (JR)

Opergy

Sandy Ruddock (SR)

Scarlett & Mustard

Alan Waters (AW)

Norwich City Council

Jeanette Wheeler (JW)

Birketts

Tim Whitley (TW)

BT

Attendees

Paul Forecast (PF)

National Trust - For Item 2

Mark Goodall (MG)

All Energy Industry Council - For Item 7

Bethan Hacche (BH)

BEIS

Mark Ash (MA)

Suffolk County Council

Vince Muspratt (VM)

Norfolk County Council

Julian Munson (JM)

New Anglia LEP - For Item 7

Chris Dashper (CD)

New Anglia LEP - For Item 8

Chris Starkie (CS)

New Anglia LEP

Rosanne Wijnberg (RW)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

1

2

Actions from the meeting: (21.10.20)

Actions from last meeting

Details of the candidate for the NAC Board to be circulated to Board members for approval

CS

Business Resilience & Recovery Scheme

Details of unsuccessful BRR applicants and recipients of the Visitor Economy and Wider

CD

Economy Grants to be circulated when available.

1

Welcome from the Chair

CJ Green (CJG) thanked everyone for attending the meeting and welcomed Kathy Atkinson (KA) as

the new private sector board member.

2

Presentation from Paul Forecast, Regional Director, National Trust

CJG welcomed Paul Forecast (PF), Regional Director of the National Trust, who provided the meeting

with an overview of the work of the National Trust and its economic impact on the region.

PF advised that the National Trust employs 269 members of staff and has over 220k members locally

and that the 1m paying visitors to sites in Norfolk and Suffolk bring £16m into the local economy.

PF provided an overview of the main sources of income and the areas of spend noting that all areas of

the National Trust’s work and investments have been impacted by the pandemic. He confirmed that

the overall financial position was secure however individual areas requiring further support and some

smaller loss-making retail outlets are being closed however the holiday cottages are busy with

demand exceeding supply and investments will continue to be made in this area.

PF thanked the Board for the LEP’s funding towards the development of the Sutton Hoo site and

expressed a hope that the organisations could work together on other projects in the future.

Jeanette Wheeler (JW) asked whether the online offer such as virtual tours and online shopping was

being expanded. PF agreed that footfall was down which impacted retail outlets and that although

member rates had been sustained to date there was a need to provide something in return if physical

visits were not available.

CJG thanked PF for attending the meeting for updating the Board on the work of the National Trust in

the region.

PF left the meeting.

3

Apologies

Apologies were received from Steve Oliver.

4

Declarations of Interest

None

5

Actions/Minutes from the last Meeting

The minutes were accepted as a true record of the meeting held on 23rd September 2020.

Chris Starkie (CS) reviewed the actions from the last board meeting.

He noted that no nominations had been received for an additional New Anglia Capital (NAC)

board members and advised that JW had proposed that one of her colleagues at Birketts could

join which would also provide legal expertise as desired by the NAC board.

ACTION: Details of the candidate for the NAC Board to be circulated to Board members with

CS

the request for approval.

6

Skills Advisory Panel Progress Update

Claire Cullens (CC) provided the meeting with an overview of the Skills Advisory Panel (SAP)

advising that the membership covered all business sectors, the Department of Work and

Pensions, Chambers of Commerce, Education and Skills Funding Agency and councillors &

officers from Norfolk and Suffolk County Councils making around 40 members in total.

CC reviewed the four key aims of the SAP:

2

3

Driving skills progression for the workforce

Providing agile and responsive training provision for key sectors

Equipping young people for success

Tackling barriers to employment

Two projects have been identified for each objective where the most impact can be made

which can also be delivered by the end of 2020. CC advised that details of all projects were

included in the slide pack and a progress report will be produced at the end of the year.

CC also noted that the outputs in the Economy Restart Plan were linked to the SAP

objectives to ensure alignment.

CC highlighted the work of the local authorities including Judith Mobbs and Natasha Waller

from the LEP.

The meeting discussed the importance of skills in the sector deals in particular in STEM

subjects. It was agreed that filling the skills gap was a particular challenge and it was

important to get people to upskill into these specific areas. Education partners and employers

need to work together to identify these gaps, supply the training and education to meet them

and also to encourage people to retrain into these areas.

The Board agreed:

To note the content of the report

To endorse the vision of the Skills Advisory Panel and its current direction of travel and

champion the ‘key messages’ of the Skills Advisory Panel

To support the wider work in response to Covid-19

7

All Energy Industry Council Progress Update

Julian Munson (JM) introduced Mark Goodall (MG), Chair of the All Energy Industry Council

(AEI), and provided an overview of the importance of the sector to the region noting its unique

position in covering all green types of energy.

JM reviewed the objectives of the AEIC:

Profile and Promotion - branding and marketing to national and global audiences.

Proactively promoting the offer to attract global investment and boost exports across the

energy sector

Lobbying and Regulation - strengthening links with Government and other

organisations as identified by the Council to attract support and investment and improve

regulations

Supply chain development - strengthening the cluster, helping businesses work with

each other, including tier one corporates, and maximising export and investment

opportunities

Innovation support - helping businesses improve their performance and enabling them

to enter new markets, develop new products, enhance processes and improve

productivity

Skills development - overseeing the skills sector plan, connecting employers with

providers and responding to industry demands in developing the skilled workforce of

tomorrow

Infrastructure attracting investment to enhance and build the infrastructure required to

support the growth of the industry and improve connectivity and business productivity

The Board received details of the priority projects which had been identified for delivery during

2021 and JM highlighted the work being carried out on the promotion and branding of the

region.

(MG) addressed the board agreeing that historically the various energy sectors had operated

in silos and work was ongoing to bring these together.

MG reviewed the size of the local industry, its unique position and strength of the local energy

sector in offering and developing all areas of green energy.

3

4

MG noted some of the current challenges such as developing the Bacton site and the

development of the onshore infrastructure.

CJG asked what support the LEP could provide. MG felt that the AEIC could be improved by

membership of someone from the energy distribution sector and also noted that the current

regulatory regime hinders development.

JW advised that some board members were participating in a BEIS roundtable tomorrow

focussing on green recovery and requested suggestions for an ask for the Minister.

MG proposed they should highlight the importance of developing key infrastructure projects

and also request support with planning.

Johnathan Reynolds (JR) noted that there had been considerable success achieved in

offshore projects but the biggest challenge was in connecting to the onshore infrastructure. It

was agreed that there was a lack of joined up thinking by Government with 30% of energy

coming ashore in one small area in Suffolk.

The Board agreed:

To note the content of the report

To note and support the approach to producing and delivery a recovery plan for the sector

8.

Business Resilience & Recovery Scheme Progress Update

CS provided an overview of the Business Resilience and Recovery Fund advising that 79 grants

have been awarded to date totalling over £3m. The second tranche of funding for the scheme,

secured from the Getting Building Fund call, has now been accessed and a number of revisions

to the scheme are being introduced to ensure maximum impact is achieved through the

available funds.

Sam Chapman-Allen (SCA) queried whether reducing the intervention rate to 40% would

reduce applications. CS confirmed that this has actually the rate already used on many

applications already processed where the impact of Covid-19 on the business was not clear

or the business had sufficient cash reserves in place to fund the project itself.

John Griffiths (JG) asked if details of unsuccessful applicants could be provided as well as the

details of Visitor Economy and Wider Economy Grants.

ACTION: Details of unsuccessful BRR applicants and recipients of the Visitor Economy and

CD

Wider Economy Grants to be circulated when available.

CC asked if evidence of projects supporting skills progression could be included in the

application process.

Chris Dashper (CD) confirmed that this was routinely asked during the assessment process

for the Growing Business Fund when the project is revisited and would be included in

Resilience and Recovery applications in the future.

The Board agreed:

To note the content of the report and agree the revisions to the scheme

9

Chief Executive’s Report

CS highlighted key items in the Chief Executive’s report noting the success of the Restart

Festival.

CS advised that the Mid Year Review had been carried out and that New Anglia continued to

be rated Good in all areas. CS advised that, in order to be rated exceptional, the LEP needed

to establish a youth engagement panel and also set up its own scrutiny panel. He advised

that the spend on projects is being closely monitored and all efforts are being made to reduce

underspend and that funding would be reallocated if needed.

4

5

The Board leant that the Growth Hub will receive additional funding to support the end of the

transition period and plans are being drawn up to use the funding.

The Board discussed the role of Local Resilience Forums (LRFs) and CS advised that he was

involved in a discussion with the LEP Network on this matter. There are a large number of

LRFs and these were being reviewed to ensure the LEP was presented at the key forums.

The Board agreed:

To note the content of the report

10

October Performance Reports

Rosanne Wijnberg (RW) presented the reports to the Board and highlighted key items.

Business Growth Programme - RW noted that there has been a drop off in applications to the

Small Grants Scheme as expected.

Agri-Tech - The pipeline now exceeds the funds available therefor the pipeline is being

reviewed

The Board agreed:

To note the content of the reports

11

Quarterly Management Accounts

RW presented to the latest management accounts to the Board.

The Board agreed:

To note the content of the plan

12

Board Forward Plan

CS reviewed the forward plan and advised that the 2021 plan would be presented following

agreement with the Chair.

The Board agreed:

To note the content of the plan

12

Any Other Business

The meeting discussed the issues around promoting the region during the pandemic.

PJ noted that many businesses in the visitor economy sector would be closing anyway at this

time of year and it was important to be ready in the spring when they reopened.

5

6

Actions from New Anglia LEP Board Meetings

Date

Item

Action

Update

Actioned

Target Date

By

21/10/2020

Business Resilience & Recovery

Details of unsuccessful BRR applicants and recipients of the Visitor Economy and

Links to details of grant recipients circulated with board papers

CD

Complete

Scheme

Wider Economy Grants to be circulated when available.

23/09/2020

New Anglia Capital

Board members to consider putting themselves forward to join the NAC board

Details of the proposed candidate from Birketts will be circulated to Board

All

Dec-20

members for approval following confirmation from the NAC Chair

23/09/2020

September Programme

Carry out analysis on the impact of EZ planning regulation changes

Raised with Local Authority colleagues with no issues raised and therefore

JM

Complete

Performance Reports

no immediate impacts on EZ sites expected. We will continue to monitor.

26/02/2020

Clean Growth Taskforce

Board members to consider a pledge which the Board could make and submit

No suggestions have been received. This will be revisited when the

All

Complete

suggestions to the Chair.

Taskforce is established.

23/05/2019

Growth Hub Presentation

Growth Hub Annual review to be circulated to the Board when published

This review will now take place early in 2021

CD

Apr-21

7

New Anglia Local Enterprise Partnership

Board Decision Log 2020 - Public

Date

Decision

Decision Made

Making Body*

04/11/2020

Growing

The Panel approved the following applications:

Business Fund

• Olympic Construction Limited - Agreed to support

Panel

Approved Grant - £25,190

• Wrightform Limited - Agreed to support

Approved grant - £57,500

• Pink Office Limited - Agreed to support

Approved grant - £80,000

21/10/20

LEP Board

The Board made the following decisions:

All Energy Industry Council Progress Update

• To support the approach to producing and delivery a recovery plan for the sector

Business Resilience & Recovery Scheme Progress Update

• To agree the revisions to the scheme

21/10/20

Investment

The IAC made the following decisions:

Appraisal

Growing Places Fund additional grant request- Confidential

Committee

•

09/10/20

Growing

The Panel approved the following applications:

Business Fund

• AKS Skip Hire Services Limited - Agreed to support

Panel

Appoved grant - £66,000

• Armultra Limited - Agreed to support

Approved grant - £73,000 - an Assisted Area award

23/09/20

LEP Board

The Board made the following decisions:

Institute of Technology

• To endorse the proposed process and local framework which will be used to set out regional expectations for Institute of Technology

proposals covering Norfolk and Suffolk.

Suffolk Inclusive Growth Investment Fund

• To approve the allocation of £1m capital from the LEP to Suffolk Inclusive Growth Investment Fund and the proposed process for the

management and allocation of the funds as set out in the report

02/09/2020

Growing

The Panel approved the following applications:

Business Fund

• Polar Systems Limited - Agreed to support

Panel

Approved grant - £127,741

• CTR Secure Services Limited - Agreed to support subject to PEP check.

Approved grant - £160,000

• Slic Sheet Metal Fabrications Limited - Agreed to support

Approved grant - £31,185

26/08/2020

LEP Board

The Board made the following decisions:

LEP Accounts 19/20 - Confidential

* New Anglia Local Enterprise Partnership Board, Investment Appraisal Committee, Growing Business Fund Panel, Remuneration Committee, Audit & Risk Committee

New Anglia Local Enterprise Partnership Board

Wednesday 25th November 2020

Agenda Item 6

Inward Investment Delivery Plan

Author: David Dukes, Invest Norfolk & Suffolk team

Presenter: David Dukes

Summary

This paper outlines the Delivery Plan for delivering inward investment across Norfolk and

Suffolk, led by the Invest Norfolk & Suffolk team. The Delivery Plan will steer the activities of the

team over the next 2-3 years in order to help the LEP meet its growth objectives for Norfolk and

Suffolk. A summary of the plan is attached at Appendix 1.

The plan will deliver:

clear and demonstrable value

an uplift in profile, lead generation and projects landed,

leading to business growth and retention and ultimately new jobs.

Recommendation

The Board is asked to note the contents of the report and endorse the proposed approach.

Background

In June 2018 the New Anglia LEP Board agreed to support an advanced model for inward

investment delivery, proposing that New Anglia LEP takes a stronger lead.

This included the development of a centralised inward investment team for Norfolk and Suffolk

bringing together colleagues from Norfolk and Suffolk County Councils and the LEP and which

is now based within the New Anglia LEP and the delivery of the Invest East ERDF project.

Invest Norfolk & Suffolk

The Invest Norfolk & Suffolk team was launched in January 2020, drawing staff from Norfolk

and Suffolk County Councils who are all on assignment to the LEP until 31 March 2023.

This may be extended dependent on outcomes, and the agreement of all parties concerned.

The purpose was to draw together the existing expertise and capabilities within the two County

Councils and place it within a single team that would operate within the LEP but would continue

to call upon the capacity within other agencies, such as the District Councils.

A single team approach would also give greater focus to the work, enable closer collaboration

with other LEP teams as well as with Dept for International Trade. The team is also responsible

for managing the Invest East ERDF business support/inward investment project.

The team comprises five full-time staff; three commenced in post in January and a further two

members of staff were recruited in April and May, respectively.

1

9

The two new members of staff are:

Stuart Catchpole, Inward Investment Manager Stuart’s role includes researching and

promoting our key investment opportunities, generating and managing inward investment

enquiries, working with property and landowners to make the most of our investment assets,

and using our new Norfolk and Suffolk Unlimited branding to raise our profile.

Alice Tomkins, Economic Development Officer Alice’s role involves promoting business

development and inward investment opportunities across the region by working with key

partners to develop and deliver projects that will lead to business growth and ensure growth in

key economic sectors.

Three of the staff have been assigned sector specialisms, with the Head of Service operating

across all sectors and the fifth member of staff taking on a systems and support role, as well as

their existing formal role as compliance officer for the Invest East project. We have avoided a

location-based approach. All staff have a LEP area wide remit.

The team brought a significant amount of knowledge and experience with them, as inward

investment had formed part of the portfolio of work within the County Council’s economic

development teams. A number of new enquiries have arisen over the past few months adding

up to a current pipeline of over 50 projects.

The team has provided regular updates to the Board over the past few months, and despite

being in lockdown for the majority of the time it has seen an increase in enquiries, an

improvement in the quality and consistency of responses and some notable successes.

Invest Norfolk & Suffolk played a central role in landing GCB Cocoa, from Malaysia, who

will redevelop the former Philips Avent plant in Glemsford, near Sudbury, to establish a new

cocoa processing plant. Following an enquiry from Dept of International Trade in March,

we have directly supported the client to locate the right site and facilitated relationships with

a range of stakeholders including Babergh & Mid Suffolk District Council and Savills.

Our intervention directly influenced the client to select Suffolk above other UK locations

they were considering. This c£25m investment is expected to create between 50 - 100 jobs.

Impact of Covid-19

It is an inevitable consequence of the Covid-19 pandemic that our work has been fundamentally

affected. It has hampered our ability to:

learn more about our assets and opportunities.

engage in profile raising activity that aims to result in more lead generation.

handle and respond to enquiries - site visits are clearly difficult to organise.

It is predicted that global FDI flow will fall by 40% in 2020 due to the Covid-19 pandemic. Like

the rest of the LEP, indeed much of the world’s economy, we have had to adapt, but the landing

of GCB Cocoa shows what can still be achieved. We anticipate there will be more successes to

report later this year.

The Delivery Plan approach we are seeking the Board to endorse contains a mixture of

proposed actions that may be amended depending on how quickly, and to what extent we

emerge from lockdown.

We are also conscious that the longer-term landscape and prospects may continue to look a lot

different than it did a year ago and therefore the delivery plan must be agile, able to respond,

and adapt to new approaches and grasp new opportunities.

2

10

Delivery approach

In 2018, the LEP board agreed a framework for delivery. The delivery plan this incorporates

and builds upon the previously agreed framework.

Our aim is to continue to raise the two counties’ profile, promoting our strongest and most

marketable opportunities, utilising the Norfolk & Suffolk Unlimited brand.

We seek to generate, and land more leads thus creating more jobs. We will continue to

research, understand, and recommend improvements to our assets, which will help to inform

our marketing methods and approaches as well as improving our responses to enquiries.

Workstreams

Our work is delivered through six workstreams which are outlined below together with their

respective success measures:

INS1 - Identification of market need: A clear understanding of the markets, sectors,

and businesses, which may be aligned with our assets and opportunities, to whom we

can proactively target communications of our product offerings from Norfolk & Suffolk.

INS2 - Identification of market offer (product): Having a consensus with partners on

the headline offers, so we are able to promote our key assets and opportunities to our

identified market/audience, as well as to build bespoke responses to client enquiries

from an agreed resource set.

INS3 - Communicating/promoting the market offer: Key audiences are aware of the

Invest Norfolk & Suffolk brand and offer and understand the opportunities and how they

may respond to them, increasing the number and quality of enquiries received.

INS4 - Partnership development: Norfolk and Suffolk as a pre-eminent inward

investment area in the UK, attracting private & public investment, and working with, and

supporting our partners in the area and nationally. Includes strategic alignment with LEP

colleagues.

INS5 - Support retention, development, and expansion of existing local

businesses: Reduction in number of businesses relocating activity outside of Norfolk

and Suffolk, successful expansion, GVA uplift. Increase value of investment to local

businesses and the ability of companies to access finance (through Invest East

investment readiness programme).

INS6 - Systems development/management: Seamless communication to all internal

and external stakeholders.

Appendix 1 describes in further detail the specific activity we have been taking or plan to take

that relate to the above workstreams.

Partnership Approach

The Invest Norfolk and Suffolk team is a dedicated inward investment resource - but in order to

maximise its impact draws widely on a range of resources and skills from the LEP and partners.

Internal within the LEP:

o Sector, innovation and Enterprise Zones team - to assist with sector-based

research, specific innovations, business networks, new products, processes etc;

exploitation of EZ sites, knowledge of innovation programmes, linkages to the

three Industry Councils and the LEP Innovation Board, sector groups,

collaboration with CNTC team.

o Communications - lead on the delivery of the Norfolk & Suffolk Unlimited

campaign, and support with other promotional campaigns including attendance

at key events such as MIPIM.

3

11

o Programmes - access to grants, loans and investment, business support

programmes.

o Skills - specific capabilities and links to the Skills Advisory Panel

o Strategy - especially data and market trends (Business Resilience team)

For example: Promoting the Norfolk & Suffolk offer

The Invest Norfolk & Suffolk team have worked with colleagues from the Communications

team to deliver a Commercial Property Finder function that is updated automatically from

Estates Gazette commercial property data and a custom report builder on the Norfolk &

Suffolk Unlimited website to help drive campaigns..

External:

o Enterprise Zone Partnerships, to align inward investment plans with EZ site

development plans

o District and County Colleagues - local knowledge, especially local property and

sites, key account management, new products, processes, developments etc to

support enquiry responses and provide content for offer development

o Research base - universities, institutes and other organisations with research

capability and business support activity

o Major businesses - to understand challenges and opportunities in the

local/national/international economy and support and stimulate inward

investment activity

o DIT - take the Norfolk & Suffolk offer to international markets, provide a pipeline

of FDI enquiries, share regular updates on businesses of significance in Norfolk

& Suffolk

o Innovation Hubs and incubators (including OrbisEnergy, Hethel, InnovationLabs

Stowmarket) - offer support and business growth activity

o Commercial property and other agents - understanding asset availability to

respond to enquiries

o Chambers of Commerce - business intelligence, exchange of local knowledge

and unified approaches regarding range of issues

For example: working with District & Borough colleagues

In February 2020, representatives of each of the Districts and Boroughs across Norfolk and

Suffolk attended a facilitated full-day inward investment workshop, organised by the Invest

Norfolk & Suffolk team. We are now having regular calls with each local team to identify

and share knowledge on the key businesses in each area, based on the DIT OneList, in

addition to consultation to support enquiries and propositions.

For example: working with Dept for International Trade

We are reviewing the national DIT Datahub to identify Norfolk and Suffolk-located

businesses and are contacting each relevant DIT representative. This enables us to

forward scan for issues facing those Norfolk and Suffolk assets as well as ensuring that

DIT are aware of the support that Invest Norfolk & Suffolk can provide.

We have been unable to undertake as much local engagement as we had expected due to

Covid, although we have managed a number of locally focused web-based meetings. We

expect to organise more structured meetings across the two counties in due course.

Invest East ERDF delivery

Invest East is a programme of specialised business support directed at businesses considering

or pursuing high growth strategies and is managed by the Invest Norfolk & Suffolk team in

partnership with the University of East Anglia and Norfolk and Suffolk County Councils.

4

12

The programme is raising the global profile of Norfolk/Suffolk as an investment location by

addressing barriers in high profile growth areas, delivering jobs and increased GVA through key

project work streams:

Investment readiness support for SMEs: over 100 Norfolk and Suffolk SMEs have

participated in intensive investment readiness support to date, with over £900k of

investment secured by supported companies.

Investor support programme: supporting businesses to locate and grow in Norfolk &

Suffolk, participation in international trade shows and delivery of direct business

support.

Promotion and profile-raising: promoting the New Anglia offer through Norfolk & Suffolk

Unlimited.

Link to the Economic Strategy and Local Industrial Strategy

The delivery plan will deliver against the Economic Strategy, Local Industrial Strategy and the

Economic Recovery Plan - see Appendix 1 for further detail.

Appendices

Appendix 1 - delivery plan summary.

Recommendation

The Board is asked to note the contents of the report and endorse the proposed approach.

5

13

Appendix 1

Invest Norfolk and Suffolk Delivery Plan - summary

1. Our Sector Approach

The first three workstreams cover market need, our offer (opportunity) and how we

communicate it. It is important to stress from the outset that our inward investment approach is

primarily driven by our key sectors and this section describes how we follow that approach.

The Norfolk and Suffolk Economic Strategy identifies nine sectors that represent the most

important in terms of the broad impact on our economy. Not all of them are target sectors to

attract inward investment but the Local Industrial Strategy narrows these down to three that

certainly are.

We have looked carefully at all of the key sectors in Norfolk and Suffolk, and having consulted

with a number of partners, we believe the following give us the strongest opportunities for

attracting investment. For the majority of sectors, we already have a good deal of knowledge

and information, and in some cases, this has already been converted into detailed propositions

and activity.

Sector opportunities

What we have delivered or plan to deliver

1.

Clean Energy:

We have a substantial body of knowledge that is

captured in theenergyzone.co.uk which is constantly

Offshore Renewables

updated and has been supplemented by the findings

(manufacturing, O&M and

from WSP on the Great Yarmouth O&M campus. We

construction)

have discussed with EEEGR and the AEIC about

Offshore Gas (new

prospects for investment linked to decommissioning and

opportunities around

offshore gas.

carbon capture, hydrogen)

We are an active partner in EEEZ which is currently

Onshore renewables

delivering a brand development project. This will

Decommissioning

embrace competency and reputation rather than be

Civil Nuclear - especially

directly linked with geography and should therefore nest

as a construction project

well with Norfolk & Suffolk Unlimited.

We are also supporting the region to understand the

opportunities in view of future nuclear projects, including

trade missions focusing on the nuclear supply chain.

We have attended several virtual energy sector

exhibitions: Global Offshore Wind V-fest, SNS 2020 and

Global Offshore Wind 2020.

2.

Agri-Food:

In January 2020 we attended the internationally

significant food and drink expo, Horecava taking with us

Agriculture - new crops,

key local food and drink businesses looking to access

new methods of growing

and grow into international markets.

food locally

Agri-tech - driving

Alignment with Agri-tech Council delivery plan. Plans to

innovation in the industry

support workstream 1, determining market need, to

on an international scale

identify relevant commercial opportunities, audiences for

targeted conferences and events activities to promote the

Adding value to what we

(already) grow

Norfolk & Suffolk Unlimited brand, inward investment and

export opportunities.

3.

ICT and Digital Creative:

We have developed and presented propositions to DIT

linked to:

Health, medtech

especially linked to

Artificial Intelligence

healthy ageing

Cyber Security

6

14

5G, Digitisation, and other

Fintech

creative/digital capabilities

Medtech

We aided the introduction of regional digital tech

businesses to the sector leads in the Department for

International Trade to enhance pitching and internal

marketing. This was focused on attending the MWC 2020

international trade show (subsequently cancelled due to

Covid-19).

We have supported Tech East with the development and

promotion of the Tech100, a new initiative which aims to

shine a spotlight on 100 of the leading-edge tech

businesses located in Norfolk and Suffolk and support

their growth ambitions, with the launch hosted at Adastral

Park.

We have been promoting the current HPO on 5G

technologies, centred on Adastral Park, producing a

training video for overseas DIT posts, presenting to

international DIT delegates and highlighting our digital

strengths in the DIT sector brochure programme (AI and

Cyber Security).

We have commissioned consultants to develop an

investigation into the commercial opportunity for the life

sciences sector, with a focus on health ageing to aid

securing a secondary HPO offer in Norfolk and Suffolk

and to inform a marketing campaign and provide a focus

for key life science institutions across the area.

There are other sub-sectors

We have developed sector propositions with DIT for

which we also believe offer us

automotive engineering and aviation/aerospace.

investment opportunities and we

will also devote time to explore

We are utilising relationships with partners and

what offers we have and what

stakeholders to obtain information relevant to enquiries.

market opportunities may exist:

Niche Manufacturing

Financial Services

Bloodstock and Animal

Health

Transport, Logistics and

Storage

2. Our Asset Base

Many of our sectors align with known assets across Norfolk and Suffolk which will generally

form the heart of our promotional work:

Norwich Research Park

Adastral Park and Innovation Martlesham

Hethel Innovation

OrbisEnergy

Norwich Airport

The Energy Zone

Sizewell

7

15

Ports of Felixstowe, Ipswich, Great Yarmouth, Lowestoft, King’s Lynn.

Corporate research assets

Many of these (but not all) are set within our key growth locations where a number of spatial

offers exist - there is some crossover with our asset base:

Greater Norwich Area

Greater Ipswich

Our Enterprise Zone sites (including Bury St Edmunds, Stowmarket and King’s Lynn)

Haverhill and Sudbury

A14 Corridor

Cambridge Norwich Tech Corridor

Newmarket

In most of the above locations we have at least one substantial, shovel-ready site ready to host

new development. And of course, there is a supply of existing property which varies in nature.

This is supported by:

Market opportunity (as far as we can clarify it and if not already identified by the client)

Incubators and business centres

Academic and research capability at our three Universities

Our various skills and supply chain specialisms

Connections - access to London, airport etc

Access to finance and other business support

Networks and meet up groups

Quality of Life (largely, the tourism offer) - geography, nature, history, sport

(participation and spectator), culture and the arts

Alternative employment opportunities (for partners etc)

3. Responding to enquiries

We have been building up a portfolio of the above attributes over the past few months in order

to populate our outward facing promotional material as well as our bespoke responses to

enquiries. If we are not shortlisted, after an initial response there will generally be no further

engagement, but if there is further dialogue it will give us the opportunity to provide

considerably more information and cover more areas.

Building up a base of information is a continuous process and our colleagues in the District and

County Councils, and those within the LEP covering skills, sectors, communications, and

business support are all actively engaged in supporting our work.

A key part of a response - sometimes initially but more likely during follow up discussions - is

the “Landing Package”. In other words what is our offer to investors? As well as the attributes

described above, we would expect to cover:

Grants and loans availability as well as access to investment funding

Whether we are prepared to directly undertake a development on a greenfield site. This

may be a desired option if a local authority owns the site but even if not, there may be a

willingness to intervene. Alternatively, we can engage a third-party investor.

Liaison with suitable Enterprise Zones that offer a community of like-minded

businesses and enhanced support

Many businesses may require introductions to supply chain, or other businesses with

which to collaborate, or to professional service providers

Introductions to networking groups, academic institutions etc

Introductions to potential customers

8

16

4. Promotion

Norfolk & Suffolk Unlimited has been developing a presence at international trade shows,

marketing and through virtual networking opportunities following Covid-19. These projects have

a twofold benefit, firstly to develop international leads for new businesses to invest here, but to

also help secure investment into our existing businesses.

The way in which we are promoting the region will change in the medium term due to the

impacts on the event industry due to Covid-19. Whilst we anticipate attending fewer events in

person, the team will attend virtual events where the audience meets the needs of Norfolk &

Suffolk Unlimited. The Invest Norfolk & Suffolk team will also provide support to sector groups

when organising events used to promote the region.

To develop an effective strategy, we are utilising the grant secured through the Norfolk

Strategic Fund to explore effective markets and how to position our offer in a post Covid

landscape and the recommendations from that will drive our activity from 2021. In addition we

are seeking funding from the SIGIF.

The work undertaken through INS will mean that we are able to conduct highly targeted

campaigns. This is preferable due to the costs associated with large scale broad marketing

activities and will ensure that the audience meets the offer of Norfolk and Suffolk. The

exception to this rule is the Norfolk & Suffolk Unlimited website which will undergo content

refresh and inclusion of materials discussed with sector groups, for example commercial

property search and recruitment information.

5. Attracting Key Skills

Much of our promotional work is focused on attracting business but a further important target is

the attraction of people with key skills as well as entrepreneurs, especially retention of

graduates. The Board has already endorsed this as a key area of work for the Norfolk & Suffolk

Unlimited brand. We have been building on the N&SU website so that it captures all of the two

counties’ lifestyle attributes which we will use as the foundation for a number of planned sector-

focused initiatives and will work with the Skills Advisory Panel to add further value.

We are starting with the legal profession by developing a forward-facing campaign that will seek

to attract young lawyers to an area that is not perceived as offering sufficient challenge or

onward opportunity. We will work with Hethel Innovation on an engineering campaign before

taking a town-focused approach where businesses tell us there are chronic issues in attracting

key staff in many sectors.

Ultimately, we will be judged on the number of successful landed projects, and their quality

based on salary levels, and longevity/security. A key input will be the number of leads

generated by our promotional activity.

6. Key Account Management

Norfolk and Suffolk are home to a considerable number of major businesses, many of which

are within our key sectors. Our ongoing job is to develop and agree a single database of key

businesses with our local partners, and to agree protocols around engagement and information

sharing.

The work is in progress and we anticipate the list having around 175 Norfolk and 150 Suffolk

companies. Many of the companies are already on the radar of at least one partner, including

the LEP but it is clear some are not, and this is being addressed.

Many of the businesses are foreign owned, with DIT having a relationship with most of them.

This can either be a direct relationship with the local entity, or through a head office elsewhere

9

17

in the UK. DIT has a list of national key accounts (called the OneList) and we have been cross

referencing to identify every account relevant to Norfolk and Suffolk.

Most businesses on the national OneList were known to us and we have pre-existing

relationships with the DIT account manager.

We have reached out to the rest and now have contact with account managers for

larger businesses that are headquartered elsewhere.

We have discovered some that were not obviously foreign-owned due to parent names

being different to the local operation.

Sometimes there is an overseas link via the national embassy which is already proving

useful.

We are investigating why some FDI businesses are not linked with DIT and lobbying for

their inclusion on the national OneList.

We are managing the list with all partners, and the protocols around managing the accounts.

We would expect every business is engaged with at least once per year, and to identify and

promote growth projects that would be captured by the overall performance data in terms of

leads, projects and jobs.

7. Systems

Trello is the online resource that the Invest Norfolk & Suffolk team uses to record, manage and

monitor enquiries and projects. Each member of the team is responsible for managing and

updating the Trello cards for their projects on a regular basis. The team currently operates two

Trello boards:

•

Inward investment enquiries - the main board for day to day work, individual leads,

enquiries and projects.

•

Events/Visits/Missions - for the planning of single event activities such as conferences,

business visits or trade missions.

Trello allows the team to share, manage and report on all activity in an effective and efficient

way.

The New Anglia CRM is used to record direct business support and the team also make regular

use of FAME (structural and financial UK company data) and Beauhurst (searchable database

of UK high-growth companies).

8. Contribution to the NSES/ LIS/Recovery Plan

The activities within the Delivery Plan will play a key role in the delivery of the appropriate

strategy:

1. International Trade - The is central to our work. Branding and marketing our area and to

national and global audiences. Proactively promoting our offer to attract global investment

and boost exports across the sector.

2. Lobbying and Regulation - strengthening links with Government, especially DIT and BEIS

and other bodies to attract support and investment.

3. Supply chain development - working with our sectors (especially our three Industry

Councils) to identify gaps in the supply chain which can lead to investment opportunities.

Working with our colleagues in the Sectors and Skills teams to identify these opportunities

and the interventions required to enhance our offer.

4. Innovation support - Our broad and substantive base of innovative businesses and

research institutions that provide some of our strongest investment assets. We will work

with the Innovation team to continue to identify and work with significant areas or clusters of

innovation, and R&D capacity. Businesses improve their performance and enabling them to

enter new markets, develop new products, enhance processes, and improve productivity.

5. Skills development & labour supply - a critical issue for many investors - existing and

potential. Knowledge of the prevailing skills base, especially in terms of higher level

10

18

technical and professional areas is important. As is being able to influence training

providers over the scope, quality, and scale of existing provision to cater for changing

business needs.

6. Infrastructure - attracting investment to enhance and build the infrastructure required to

support the growth of the industry and improve connectivity and business productivity. This

is another critical issue for current and potential investors.

The Delivery Plan has been put together by the Invest Norfolk & Suffolk team with input from

colleagues in the Strategy, Sectors, Skills and Communications teams, all of whom have a key

role to play in the delivery of this Plan. District Partners and the three Industry Councils have

also been consulted to ensure support and successful delivery of the plan.

11

19

New Anglia Local Enterprise Partnership Board

Wednesday 25th November 2020

Agenda Item 7

Economic Recovery Restart Plan Progress Report

Author: Lisa Roberts

Presenter: Chris Starkie

Summary

This paper seeks the LEP Board’s endorsement to publish the Economic Recovery Restart

Plan Progress Report.

The Progress Report provides an update on the economic picture, as well as an overview of the

progress made against the interventions and actions set out in the Restart plan since it was

published at the end of June 2020. The document is also being used to determine future

actions to support the economy.

Recommendation

The board is asked to:

Note the progress that has been made against the interventions in the Economic

Recovery Restart Plan and approve its publication

Background

The Norfolk and Suffolk Economic Recovery Restart Plan was published at the end of June. It

is a tactical plan that builds on initiatives that were launched in the Response phase and sets

out the actions local partners are taking in the next 6 to 12 months to restart the Norfolk and

Suffolk economy.

It is a multi-partner, multi-level plan which complements local public sector recovery plans and

supports the government’s national recovery plan. It was developed with a wide range of

partners - over 700 individuals and 100 organisations - and an evidence base which provides

an analysis of the sectors which are the focal point of the Economic Recovery Plan.

The plan is agile and evolving and will adapt to the ever-changing landscape and uncertainty.

To do this effectively we need to regularly review the progress and impact that is being made

against the actions and interventions in the plan as well as identify and implement new actions

and interventions.

Economic Recovery Restart Plan Progress Report

Collaboration has always been a strength across Norfolk and Suffolk. All partners have stepped

up and helped to drive forward the actions in the Restart Plan and the enormous efforts are

reflected in the Economic Recovery Restart Plan Progress Report - which can be found at

Appendix 1.

Headlines from the report

Local authorities across Norfolk and Suffolk have provided direct cash support to more than

50% of the business base, awarding £399.33m of grants from the Government’s small business

1

20

grant fund to 34,449 businesses. This funding enabled thousands of businesses to keep trading

and led to fewer insolvencies and business closures than would otherwise have occurred.

In addition to this over 260 targeted grants have been awarded to businesses totalling £10.2m

through the multi-million-pound package of local funding including LEP grants, Norfolk Strategic

Fund and other ERDF grants with further funding made available through the recently launched

Suffolk Inclusive Growth fund.

A Job Support Programme has been launched which includes an employment opportunity

platform on the LEP website that is helping to plug short-term gaps in essential workforce.

There are more than 310 listings on the platform covering all our key sectors with over 11,000

visits to the platform since May.

Sectors have been affected in different ways and sector groups have been taking forward a

range of actions. A Recovery Plan for the Visitor Economy was published in July which brings

together a shared set of actions to help lead the sector through these difficult times and has

been endorsed by the Tourism Minister Nigel Huddleston.

The New Anglia Levy Transfer Scheme has provided timely support to bolster falling

apprenticeship numbers across many sectors. Within the social care sector it has been utilised

to upskill staff to be better prepared for COVID-19 in future months. 30 employees across three

care homes have taken advantage of the scheme and are completing apprenticeships including

the Level 3 Team leading/Supervisor, Level 2 and 3 Adult Care and Level 4 Leader in Adult

Care.

New Anglia LEP and the Growth Hub have worked with the wider partnership, including the

Health Protection Board and Local Resilience Forum structures in Norfolk and Suffolk, to

ensure businesses have easily digestible and accessible information on prevention and

outbreak control as this will shore up business resilience.

Lessons learned from local outbreaks are being shared with the business community to assist

their preparations. Furthermore, we are working closely with the business base to provide

support around business preparedness for the end of the EU transition period.

The Report has been drafted with input from the same organisations who helped to develop the

plan and who are key to delivering the actions. Partners have come forward with a raft of case

studies, more than we could include, which will be used to share best practice.

Progress Report structure

The Progress Report focuses on the progress that has been made in the last four months and

sits alongside the Restart Plan as a sister document.

It covers:

1. Introduction - setting out the purpose of the report

2. What we know so far - an update on the national and local context

3. Key Measures - A reminder of the key measures and commitments, collectively

partners have agreed to take.

4. Foundations of productivity - Sets out the progress made against the interventions

covering Business Environment, People, Ideas, Infrastructure and Places.

5. Sectors - Provides a snapshot of some of the progress made against the sector-

specific actions.

We continue to monitor and analyse the evidence that is available to help shape further

interventions and actions. Working with Norfolk Office of Data Analytics, the Suffolk Office of

Data Analytics and the Economic Recovery Group we have identified some core data sets that

we will use to monitor the impact, and which will help further develop the recovery plan. These

will form the bases of the quarterly economic dashboard that is provided to the Board.

2

21

Link to the Economic Strategy and Local Industrial Strategy

This Restart plan aligns with the foundations and sectors identified in the Local Industrial

Strategy and Economic Strategy with the addition of the Health and Social Care and VCSE

sectors.

Next Steps

The progress report covers interventions and actions from the last four months and we will

continue to monitor, measure and adapt these programmes to ensure lessons are learned and

they are fit for the changing economic circumstances.

There is also more activity to support the economy as part of the Restart Plan which will be

coming on stream over the next few months including:

Plans to connect Norfolk and Suffolk’s innovation clusters by creating a branded, fused network

of centres which share capabilities and drive increased innovation activity across multiple

sectors and within a bigger spectrum of businesses in Norfolk and Suffolk.

Development of agri-food propositions building on recent research on value chain and

commercial opportunities linked to Norwich Research Park, Food Enterprise Zones and the

Department of international Trade’s High Potential Opportunities.

The All Energy Industry council is also developing a focused Energy Recovery Plan which is

due to be published soon.

Norfolk and Suffolk County Councils, district councils and the Chambers of Commerce are

bringing forward the Kick Start programme which will offer young people six month work

opportunities.

It is however clear that challenging times are ahead for the local and national economy.

Much more will need to be done to support sectors, businesses, educational institutes and

individuals to live with and mitigate the impacts of the pandemic at the same time other factors

such as the terms of the UK’s departure from the EU.

Over the coming weeks and months, the LEP will continue to work with partners to consider

both short term and long-term interventions taking account of the changing circumstances and

latest evidence.

The Economic Recovery Group, chaired by the LEP chief executive and with will undergo

number deep dives to examine the actions testing to see if they are delivering maximum

impact, identifying gaps and solutions.

This work will inform the development of the Rebuild plan which is scheduled for development

in the spring.

However, we remain agile to developing this sooner or later, depending on economic

circumstances.

Recommendation

The board is asked to:

Note the progress that has been made against the interventions in the Economic

Recovery Restart Plan and approve its publication.

3

22

New Anglia Local Enterprise Partnership Board

Wednesday 25th November 2020

Agenda Item 9 - Chief Executive’s Report

Author: Chris Starkie

Summary

This report provides an overview of LEP team activities since the October board.

It incorporates both Covid-19 specific activity and business as usual.

The report is split into five parts, reflecting the different strands of LEP activity:

1) LEP programmes

2) Strategy

3) Industry Councils, sector groups and external partnerships

4) Engagement and promotion

5) Governance, Operations and Finance

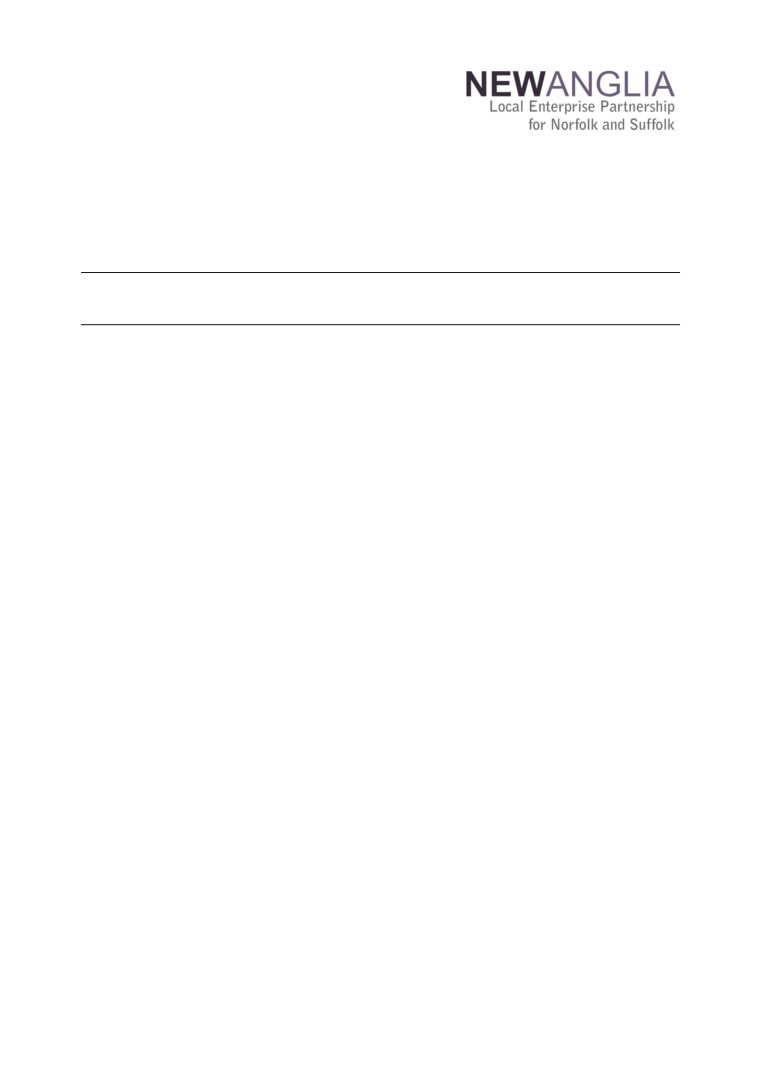

The media dashboard is attached as an appendix to the report.

Recommendation

The board is asked to note the contents of the report

Highlights

Peer to Peer Network Programme

Good progress is being made with the programme - with 57 SMEs out of our target of 253 now

signed up to take part. The rate of sign up means the project is on track.

The first three cohorts have now started, with positive feedback from the 33 SMEs taking part,

the majority of which are SMEs that we have not previously engaged with.

Work is on-going to promote the programme locally with partners, with BEIS also developing a

national marketing campaign.

Business Resilience and Recovery Scheme

Project approvals are continuing, with 97 projects agreed to date, providing grants valued at

£3.75m.

As of the 9th November there were sixteen grant applications with a value of £622k in the

pipeline, being supported by the Growth Hub.

Getting Building Fund

Work has begun on the first of the schemes funded through our £32.1m Getting Building Fund

award - the redevelopment of the former Post Office at the Cornhill in Bury St. Edmunds. This

project is led by West Suffolk Council.

The scheme, which is receiving £2.7m from the LEP, is intended to enhance the environment

around St Andrews Street South and improve the route from the Arc Shopping Centre to the

historic town centre via Market Thoroughfare.

European Social Fund

The LEP has successfully secured £189,000 from the European Social Fund for the New Anglia

Digital Inclusion project. This will enable the LEP to purchase laptops, Chromebooks and pre-

loaded data allowances for at least 200 participants in ESF employability, training and

apprenticeship projects who are experiencing digital exclusion.

This was a really good outcome as only £1m has been awarded nationally in this call.

Ministerial Roundtable

A number of LEP private sector board members participated in a further round table with

colleagues from the Oxford Cambridge Arc with Nadhim Zahawi, a minister in the department of

Business, Energy and Industry Strategy. The roundtable focused on green recovery and enabled

LEP board members to highlight the potential of Norfolk and Suffolk to lead this work.

1

27

New Anglia Local Enterprise Partnership Board

Wednesday 25th November 2020

Agenda Item 9 - Chief Executive’s Report

1) LEP Programmes

Business Support

New Anglia Growth Hub

With England going into its second lockdown, the Growth Hub has seen a slight increase in

enquiries, after a slowdown during September and October.

A total of 3,314 businesses have contacted the Growth Hub since March this year.

Working with the LEP’s Comms team, the Growth Hub are actively promoting business support,

with weekly meetings with Norfolk and Suffolk economic development officers taking place to

coordinate support on the ground and enable us, with partners, to provide the best quality

support possible.

Peer to Peer Network Programme

The programme coordinators have now recruited sufficient SMEs to hold the first five cohorts,

with 57 SMEs out of our target of 253 now signed up to take part in the Programme.

The first three cohorts have now started, with positive feedback from the 33 SMEs taking part,

the majority of which are SMEs that we have not previously engaged with.

Work is on-going to promote the programme locally with partners, with BEIS also developing a

national marketing campaign.

As previously discussed at the board, the programme will target the LEP’s key sectors and will

also pay particular attention to the care sector.

Start-Up Programme

The number of people coming forward seeking support to start their own business is still

increasing, with NWES and Menta providing ongoing virtual based workshops and one-to-one

sessions.

Since June, there has been a steady increase in the number of number of people enquiring about

start up support, and it is anticipated that this will continue to increase with the second Lockdown

and into the Christmas/New Year period, which traditionally sees an increase in requests for

start-up support.

Business Grants

Business Resilience and Recovery Scheme

The scheme continues to be a success, with 97 projects approved to date, providing grants

valued at £3.75m.

As of the 9th November there were sixteen grant applications with a value of £622k in the

pipeline, being supported by the Growth Hub. With regards to payments, to date, £1.58m worth

of grant funding has been paid out to SMEs.

Visitor Economy Grant Scheme (VEGs) and Wider Economy Grant Scheme (WEGs)

Both schemes continue to be extremely popular with 175 SMEs having completed, or in the

process of finalising an application form, supported by the Growth Hub team.

Of these, 74 grants have been approved, awarding grants totalling £196,733 (£99,112.06 to the

Visitor Economy and £97,620.94 to the Wider Economy).

At a meeting with the Ministry of Housing Communities and Local Government w/c 2nd November

we were praised for the speediness in which we have worked to support our SMEs and at the

same time continuing to deliver our existing grant programmes.

Small Grant Scheme

The number of applications coming through to the Small Grant Scheme has continued to pick up,

with the amount of funding unallocated now below £150k. At the current rate of approval, the

2

28

New Anglia Local Enterprise Partnership Board

Wednesday 25th November 2020

Agenda Item 9 - Chief Executive’s Report

scheme will be fully committed early in the new year. We are continuing to talk to MHCLG about

the potential of further funding to support the Small Grant Scheme, as well as the Growth Hub,

beyond the current end date of November 2021, with positive noises coming from MHCLG.

Growing Business Fund

Interest in the GBF has continued to develop, with a significant number of applications coming

forward, particularly from the manufacturing sector. As of the end of October we have approved

£1.089m worth of projects and have a further £1.70m of applications going through the due

diligence process, which we hope will come to the December Panel meetings, for approval.

Priority is being given to applicants that can demonstrate that their project is able to spend and

claim the required funds before the end of March 2021, to ensure that our 2020/21 funding is fully

allocated and spent.

With the Assisted Area Status ending at the end of December, we have had to remove the

potential for large businesses to access GBF funding, as well as remove the 10% uplift for small

and medium sized businesses. This also applies to the SGS and GTI schemes.

Eastern Agri-tech Initiative

Funds within this grant are almost committed, if all of the applications are approved during

November it will be closed in both CPCA and New Anglia areas, there is a message on the LEP

website to that effect: we are signposting applicants to alternative funds where they exist.

Cambridge and Peterborough Combined Authority has agreed to fund all applications in West

Norfolk and West Suffolk and one in Suffolk.

Growth Through Innovation

Since the 1st April, twenty-three projects have been approved, totalling £375k, which takes the

project well on its way towards the £483k target by the end of March 2021. The average grant

value approved to date has slightly reduced to just over £16k and we have two projects totalling

£50k in the pipeline, with anticipated approval during November/December.

LEP Innovative Projects Fund

Innovative Projects Fund 1 (2018 Call) - £500,000.

IPF1 Summary: Seven projects with a combined allocation of £539,531.

All projects are now in the delivery phase apart from the Ipswich Cornhill Project (year one) which

has been completed. Total Claim to date is £224,758.97. The total project spend to date is

£476,299.14. Public match funding of £138,704 and Private match funding of £112,836 has been

recorded.

Innovative Projects Fund (2019 Call) - £1.5m

IPF2 Summary: 18 projects with a combined allocation of £1.522m.

Fourteen projects now have their Grant Offer Letters and have commenced. £51,383.65 has been

claimed so far in this financial year. Private match funding of £18,450 and public match funding of

£52,879 has been recorded.

Of the remaining four projects, two Offer Letters are pending with SCC and two projects are being

reviewed and re-profiled in view of current circumstances.

Growing Places Fund

A rising level of funding enquiries is being experienced in relation to the fund from a very diverse

range of projects including private sector loan enquiries, market town high street community

schemes, enterprise hub locations, venues and cultural/heritage attractions.

In addition a variety of project enquiries where available capital funding has diminished due to

revised funding priorities under Covid, increased voluntary sector needs through Covid and

increased capital costs of projects due to longer project management durations through Covid.

3

29

New Anglia Local Enterprise Partnership Board

Wednesday 25th November 2020

Agenda Item 9 - Chief Executive’s Report

This would suggest a strong demand going forward for the Growing Places Fund across a broad

range of developments.

In October the LEP received a further £0.5m repayment from the Winerack development bringing

the total repayment thus far to over £2m of the total £5m loan, all received during the pandemic.

LEP Growth Deal (Capital Growth Programme)

Construction work is now underway on the DigiTech Factory at City College Norwich following a

ground-breaking event held on 21st July 2020. The project is supported by approximately £6.1m

of the Local Growth Fund. The new facilities will bring together the college’s digital skills provision

into a single, purpose-built space, allowing the college to significantly increase the number of

students and apprentices studying digital courses. It will become home to a wide range of full and

part-time courses, including creative media, software development and programming,

networking, infrastructure development, electronics and automated manufacturing. Construction

is expected to be completed in April 2021, followed by a fit out and handover by Summer 2021.

More information on the Growth Deal can be found in the Programme Performance Report at

Agenda Item 10.

Getting Building Fund

Work is underway on the redevelopment of the former Post Office at the Cornhill in Bury St.

Edmunds, a project led by West Suffolk Council.

The project, which is receiving £2.7m from the Getting Building Fund, is intended to enhance the

environment around St Andrews Street South and improve the route from the Arc Shopping

Centre to the historic town centre via Market Thoroughfare.

This development will conserve the building's Post Office heritage by retaining the Victorian

facade while the rest of the building behind has been demolished.

The new building will include two retail units on the ground floor and 12 residential units above.

The retail units will incorporate new commercial frontage onto St Andrew’s Street South and

Market Thoroughfare, with the latter being widened to provide a more pleasant public space that

will encourage higher transition between The Arc Shopping Centre and the historical town centre,

and vice versa.

Enterprise Zones

Enterprise Zone Accelerator Fund

Norwich Research Park - Zone 4 Building - £2.5m

Construction work by RG Carter is ongoing with Stage 1 fit - out of the building remaining on

track to be delivered by February 2021. Stage 2 of the fit out is expected to be finished in May

2021. A second claim for £628,720 has been paid to South Norfolk Council bringing total spend

to date to £1.225m. The balance of the EZAF funding for the building is expected to be paid prior

to Christmas.

NRP Road Infrastructure and Roundabout Installation from Hethersett Lane (£1.5million)

A first claim of £450,932 has been paid towards the construction of the access road. Work on

the Hethersett Lane roundabout is expected to start early 2021 and is due to complete May 2021.

Inward Investment

New enquiries received - Confidential

4

30

New Anglia Local Enterprise Partnership Board

Wednesday 25th November 2020

Agenda Item 9 - Chief Executive’s Report

Updates and account management

The team has worked closely with Norfolk County Council, Gt Yarmouth Borough Council and Peel

Ports to submit a bid to the Government’s Port Infrastructure Fund. The project aims to expand the

total area within the port estate to 62 hectares. Integral to the bid is a proposal to host a large-scale

component manufacturer which has submitted a very strong letter of support.

An Irish offsite housebuilding company continues to engage with us to establish a new

manufacturing facility in Brandon, Suffolk. Access to grant support is going to important and we

have provided the company with a clear pathway.

Substantive discussions with five other key businesses offering support, information, connections

and guidance on a number of topics ranging from wind energy and nuclear supply chain to site

development, grants and land assembly.

Successes

Lanxess Aktiengesellschaft - German chemicals company, setting up a new warehouse and

expanding production in Sudbury, Suffolk, total investment c£2.062m, 12 jobs.

Weerts Group - Belgian logistics, property and motor-racing company. Weerts Group has chosen

Suffolk Park as the location for its first UK warehouse and has secured just over 42 acres from

developer Jaynic for its new logistics unit. It is the largest ever warehouse transaction to be

undertaken in Bury St Edmunds and the West Suffolk region bringing major new investment and

jobs to the region and was led by West Suffolk Council.

2) Strategy

Local Resilience Forums and Health Protection Boards

The LEP continues to regularly attend Health Protection Board and Local Resilience Forum

meetings in both Norfolk and Suffolk to provide input and support from a business perspective.

We have reinstated the Norfolk Business and Economy Cell which will look at economic

resilience linked to business outbreaks, business support, supply chain, skills, and EU Exit

preparations.

At the request of Norfolk’s LRF, the LEP has sent a letter to Norfolk food processing businesses

employing more than 50 people and recruitment agencies across Norfolk and Suffolk. The letter

provides the latest public health messages and sharing best practice on the work carried out with

recruitment agencies and the poultry industry to date, as well as seeking key information that

public health colleagues require in the event of further outbreaks.

The LEP continues to circulate key prevention and outbreak control messages to businesses

across Norfolk and Suffolk, building on the work of the Health Protection Boards.

The LEP team has also been engaged with public health colleagues on the potential introduction

of mass testing for food processing factory workers.

5

31

New Anglia Local Enterprise Partnership Board

Wednesday 25th November 2020

Agenda Item 9 - Chief Executive’s Report

Brexit / end of transition period

See separate report - agenda item 8

Programme evaluation

This work has now been picked up again, having been on hold due to focusing resources on our

response to the pandemic. Tender assessments have now been carried out, with a view to

finalising the Procurement Framework for evaluation by the end of November and commissioning

the first evaluations for completion by the end of this financial year.

Skills and Employment

Skills Advisory Panel (SAPs)

The panel continues to meet in task and finish groups to progress their objectives. The ‘objective

champions’ and the facilitators have carried out reviews with Claire Cullens identifying lessons

learned and any barriers to delivery.

Both Chambers of Commerce members have stood down due to other work commitments. Nova

Fairbank will take over the Norfolk position and John Dugmore is reviewing the Suffolk vacancy.

Apprenticeship Levy Transfer

The apprenticeship levy transfer continues to support businesses to access funding to recruit

new staff and to upskill current employees to complete an apprenticeship. Despite the pandemic,

we have supported 110 transfers to date with a value of £760,906 across a range of sectors

including: health and social care, construction, early years, digital, general office support.

Currently 30 transfers in the pipeline. A cohort of 9 apprentices will start in February 2021

completing training through the UEA and Open University.

There is significant work being undertaken to promote the development of the Digital Academy in

Suffolk working with Tech East, Suffolk Council, BT Martlesham with BT and EDF supporting the

training through levy transfer.

Challenges continue in accessing levy from transferring employers, commitments are made, but

are slow to come to fruition within the timeframe needed by the training providers and employers

which can cause frustration. However new pledges are coming through, including a recent

connection with Kettle Foods who have pledged to support 2/3 apprenticeships.

EAN and Careers Hub

The Enterprise Adviser Network completed a series of CPD sessions for careers linked

Governors to highlight the statutory requirements of a school or college’s careers programme.

These sessions will continue in November and are linked to one of the objectives of the SAP

Equipping Young People for Success working group. The team are collating Virtual Work

experience opportunities in a database to share with schools as this will be a priority area in the

Spring and Summer terms.

Infrastructure

Transport East

Transport East Forum took place on 3rd November, with the following highlights:

Secured £425k funding for the remainder of 2020/21 from DfT for delivery of the

Transport Strategy technical work and engagement programme, and COVID-19 recovery

studies.

Completed Decarbonisation Evidence Base and Strategic Recommendations

6

32

New Anglia Local Enterprise Partnership Board

Wednesday 25th November 2020

Agenda Item 9 - Chief Executive’s Report

Scoped requirements for COVID-19 recovery work on better models for Active Travel and