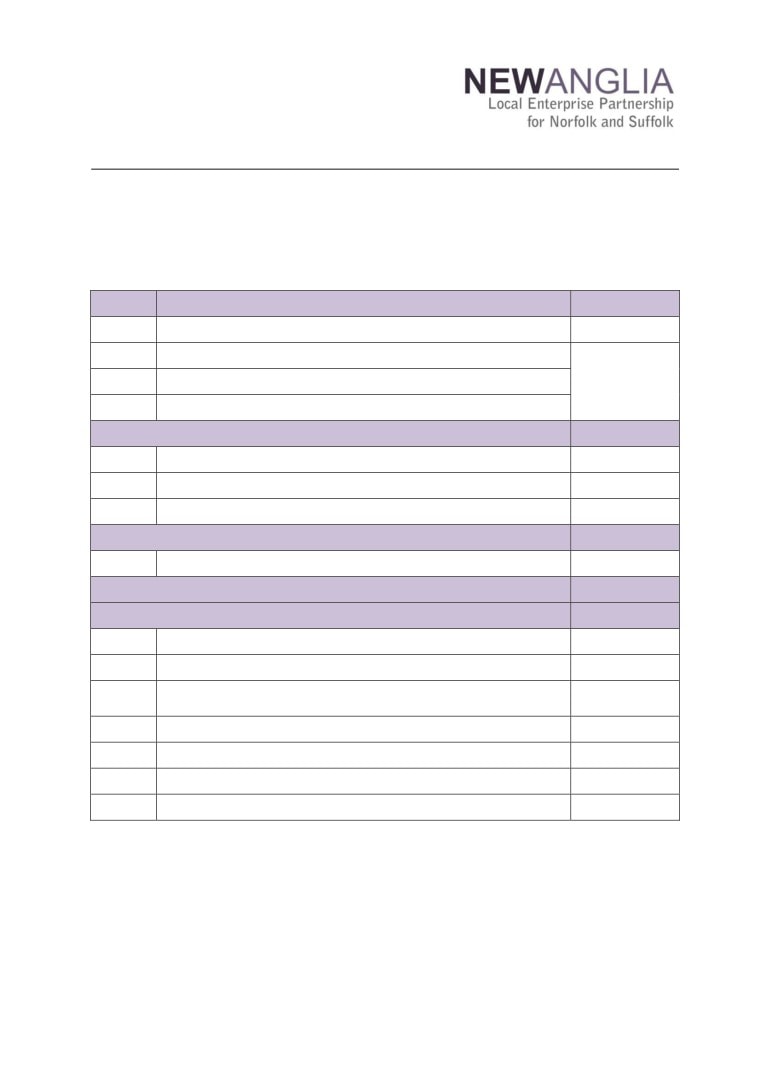

New Anglia Local Enterprise Partnership Board Meeting

Wednesday 19th September 2018

10.00am to 12.30pm

The Bleriot Room, The Aviation Academy, Anson Road, Norwich, NR6 6ED

Agenda

No.

Item

Duration

1.

Welcome

20 mins

2.

Apologies

3.

Declarations of Interest

4.

Actions / Minutes from the last meeting

Forward Looking

45 mins

5.

Place Brand Development for Norfolk and Suffolk

Update

6.

Economic Strategy Delivery Plan

For Approval

7.

Local Industrial Strategy

For Approval

Governance and Delivery

15 mins

8.

LEP Review

For Approval

Break

10 mins

Governance and Delivery

60 mins

9.

Chief Executive’s Report

Update

10.

Programme Performance Reporting

For Approval

Update & For

11.

September Programme Performance Reports

Approval

12.

Finance Report including Confidential Appendices

Update

13.

Board Forward Plan

For Approval

14.

Any Other Business

Next Meeting:

10.00am - 12.30pm, 18th October 2018

Venue:

Sizewell B Vistor Centre, Leiston, Suffolk. IP16 4UR

1

New Anglia Board Meeting Minutes (Unconfirmed)

20th June 2018

Present:

Doug Field (DF)

East of England Coop

John Griffiths (JG)

St Edmundsbury Borough Council

Matthew Hicks (MH)

Suffolk County Council

Steve Oliver (SO)

MLM Group

Andrew Proctor (AP)

Norfolk County Council

William Nunn (WN)

Breckland District Council

David Richardson (DR)

UEA

Alan Waters (AW)

Norwich City Council

Jeanette Wheeler (JW)

Birketts

Lindsey Rix (LR)

Aviva

In Attendance:

Corrienne Peasgood (CP)

Norwich City College (For Nikos Savvas)

Warren Ralls (RaW)

LEP Network (Guest)

Vince Muspratt (VM)

Norfolk County Council

Sue Roper (SuR)

Suffolk County Council

Shan Lloyd (SL)

BEIS

Paul Winter (PW)

Skills Board (For Item 9)

Chris Dashper (CD)

New Anglia LEP (For Item 12)

Hayley Mace (HM)

New Anglia LEP (For Item 7)

Julian Munson (JM)

New Anglia LEP (For Item 8)

Lisa Roberts (LiR)

New Anglia LEP (For Item 9)

Chris Starkie (CS)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

Rosanne Wijnberg (RW)

New Anglia LEP

1

3

Actions from the meeting: (20.06.18)

None

1

Welcome from the Chair

Doug Field (DF) welcomed everyone to the meeting including Corrienne Peasgood deputising for Nikos

Savvas and Warren Ralls from the LEP Network. DF also welcomed new Board members Matthew Hicks

and William Nunn.

2

Apologies

Apologies were received from: Nikos Savvas, Sandy Ruddock, Dominic Keen, Johnathan Reynolds,

David Ellesmere and Tim Whitley.

3

In Memorium

The meeting held a minute’s silence in memory of Cllr Cliff Jordan who passed away earlier in the month.

4

Declarations of Interest

Item 12: Honingham Thorpe Food Enterprise Park - Jeanette Wheeler

5

Introduction - David Richardson

David Richardson (DR) gave the meeting a presentation on the UEA providing details of the wide range

of activities carried out at the university including environmental studies, clean energy, digital skills and

heath.

DR also provided details on the network partners engaged with the UEA and the ongoing work to bring

together the private and public sectors in development projects.

6

Minutes of the last meeting 23rd May 2018

The minutes were accepted as a true record of the meeting held on 23rd May.

Actions from last meeting updated as follows:

Item 6 Enterprise Zones

To receive further information on the make up of jobs on EZs and the rationale for companies

JM

moving into the zones. Work is ongoing and will be presented back at the September Board

7

Place Branding

Hayley Mace (HM) presented the paper on Place Branding which outlined plans for further

development of a single place brand for Norfolk and Suffolk (currently branded as The East).

HM proposed tendering for a branding agency to progress the work to develop the brand

messages, the visual identity and to carry out testing of the Brand as it is developed. The Board

was asked to agree funding of £50,000 for the first stage of brand development and also to agree

the timeline of activity.

The Board was asked to note proposals for the second stage of work, which included the creation

and implementation of a set of marketing tools likely to include an online portal. The second stage

of work will be funded, in part, by the successful ERDF Invest East bid.

Chris Starkie (CS) noted that this will not replace any established brand but will complement

existing more local or sectoral brands.

The meeting discussed the importance of having an overarching brand but noted that it was

important to have a clear picture of existing brands so that their clarity and positioning was not

diluted

Steve Oliver (SO) stressed that the current picture of multiple brands was not sufficiently clear

but these would be brought together under one brand with a clear communications strategy.

Jeanette Wheeler (JW) noted there were other similar brands across the country which sat

above other sub-brands without confusion.

HM confirmed that she had researched the costs from agencies and other similar work already

carried out nationally and by other LEPS and that the £50k requested was competitive.

2

4

Matthew Hicks (MH) asked for more detail on the costs of the 2nd stage of the work.

Julian Munson (JM) advised that the ERDF funded Invest East project would include funding

for this work and £148,000 would be allocated to the second phase which included marketing

and events.

Alan Waters (AW) asked whether there would be any review points included along the process.

HM confirmed that this could be built into the tender brief.

The Board agreed:

To note the content of the report

To agree funding of £50,000 for the first stage of brand development

To agree the timeline of activity.

8

Inward Investment

JM provided the Board with a presentation on the Inward Investment Strategy.

It was highlighted that the strategy did not just cover investment from overseas but also

domestic companies investing in the region, the expansion of existing companies and also the

retention of businesses already operating in the region.

JM described the progress made since the last Board paper in 2017, ongoing work and details

of overseas investment in eastern counties over the past year.

JM also reviewed the proposed delivery model stressing that the strategy needed to include the

varied offers available from the region including systems, services, science and technology and

skills and talent. Board members were updated on current work aimed at building international

relations across the world including that centred on the Guangdong province in China.

The meeting was advised that the £1.8m ERDF Invest East project would be starting in

September 2018. This will focus on how investment leads are drawn into the local area and

providing specific support enabling a business to develop its investment proposal.

The meeting discussed the importance of producing a strategy under a single brand. AP noted

that the joint working with partners needed to be highlighted within the strategy and CS

confirmed that it was based on a collaborative approach.

DR noted the importance of making the right first impression when establishing links with

Guandong and that many businesses already have such links with the province and these

could be built on and steered by the LEP.

The Board agreed:

To endorse the approach and development of the Inward Investment and International

Strategic Framework set out in the paper

To support the launch and activity of the Invest East ERDF business support / inward

investment project

To approve the investigation of a suitable inward investment agency delivery model

To consult with the county councils on a pilot project to advance relations with Guangdong

province in China

9

Skills

Paul Winter (PW) presented the Board with an update on the work of the Skills Board over the

past year and the challenges faced by the region in relation to skills.

He reviewed the Skills Board vision and delivery steps which form part of the Economic Strategy

Delivery Plan and reiterated the four ‘key messages’ of the Skills Board which Board members

were requested to support and champion.

The importance of lobbying Government was stressed and DF confirmed that this issue had

been raised at the LEP Network meeting with the Prime Minister.

The Board agreed:

To note the content of the report

3

5

To endorse the Skills Board vision and delivery steps

To champion the ‘key messages’ of the Skills Board.

10

Enterprise Adviser Network

CS presented the paper on the Enterprise Adviser Network (EAN) highlighting the bid to host a

careers hub, the progress made by the EAN and the recommendation to bring the programme

within the LEP.

Board members were advised that the EAN has encountered challenges in recruiting enterprise

advisers, the churn of staff within schools and commitment from schools following the initial

expression of interest.

Corrienne Peasgood (CP) asked whether there was any link between those schools who have

not engaged and those who have received initiatives and funding from elsewhere. CS felt that

the biggest influence on engagement was the approach of the Headteachers as not all saw the

benefit of engagement with the EAN.

MH noted that there were many similar schemes which could make the options for schools

confusing. CS replied that this approach was designed to clarify this for schools.

The Board agreed:

To approve further 12 months funding for the EAN at a value of £135,000

To endorse the development of the Careers Hub and the integration of its management

with the EAN

11

Local Energy Strategy

Lisa Roberts (LiR) presented the paper on the Local Energy Strategy to the Board.

The Board was advised that responses have been requested by 6th July however the deadline

will be extended to allow local Authorities to complete their endorsement processes.

90 applications have been received for the role of Regional Hub Manager with New Anglia LEP

being part of the interview panel.

The Board agreed:

To endorse the Local Energy Strategy

To agree the next steps regarding the Strategy’s Delivery Plan

12

Capital Growth Programme - Honingham Thorpe Food Enterprise Park - Confidential

The Board agreed:

For the executive team to develop a supplementary paper for the IAC to review

For the recommendation from the IAC to then be considered by the full board by written

procedures

13

Revenues Funding Framework

CS presented the paper produced on the proposed revenue funding framework for Pot C

income.

SO asked whether there were established Governance criteria for the call for innovative

projects from external partners.

CS advised that these would be included in the framework which would be developed before

being presented to the IAC.

The Board agreed:

To approve the allocation of £135,000 set aside in Pot C for core LEP costs to fund the

Enterprise Adviser Network for 18/19

To approve the allocation of £100,000 from Pot C towards the LEP projects budget for

18/19

To approve the allocation of £500,000 from Pot C towards the call for innovative projects

from external partners which will help deliver the Economic Strategy

4

6

14

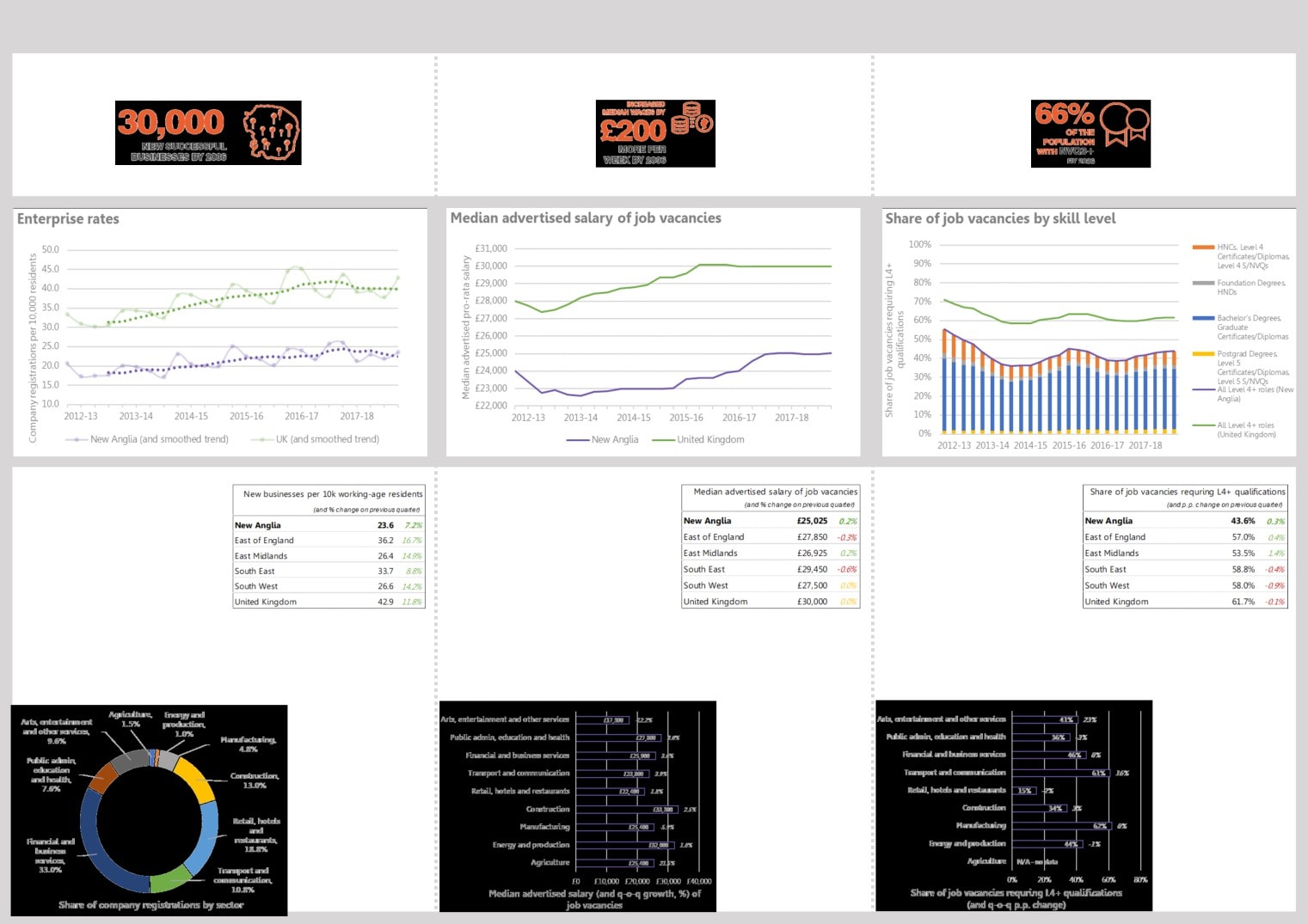

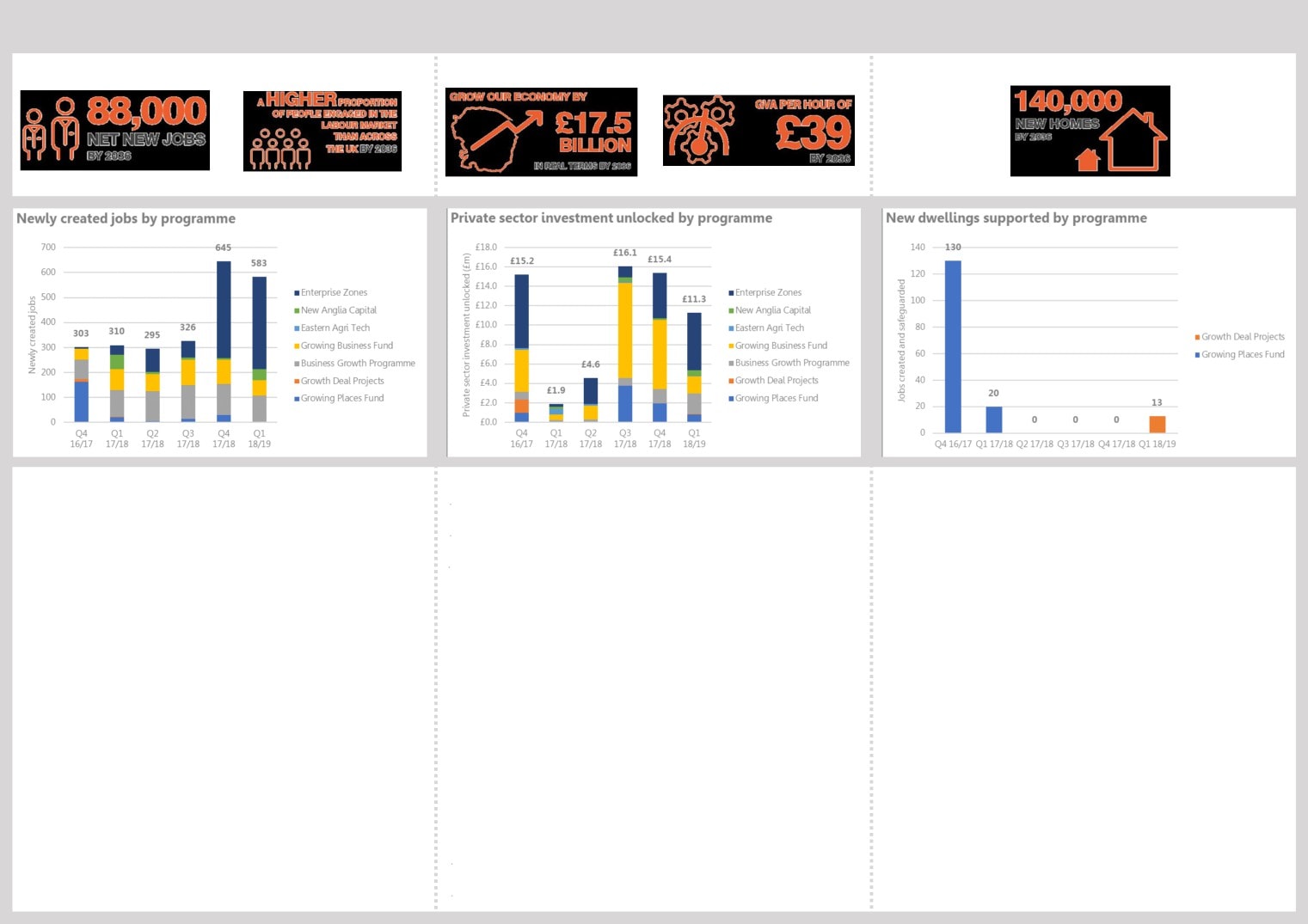

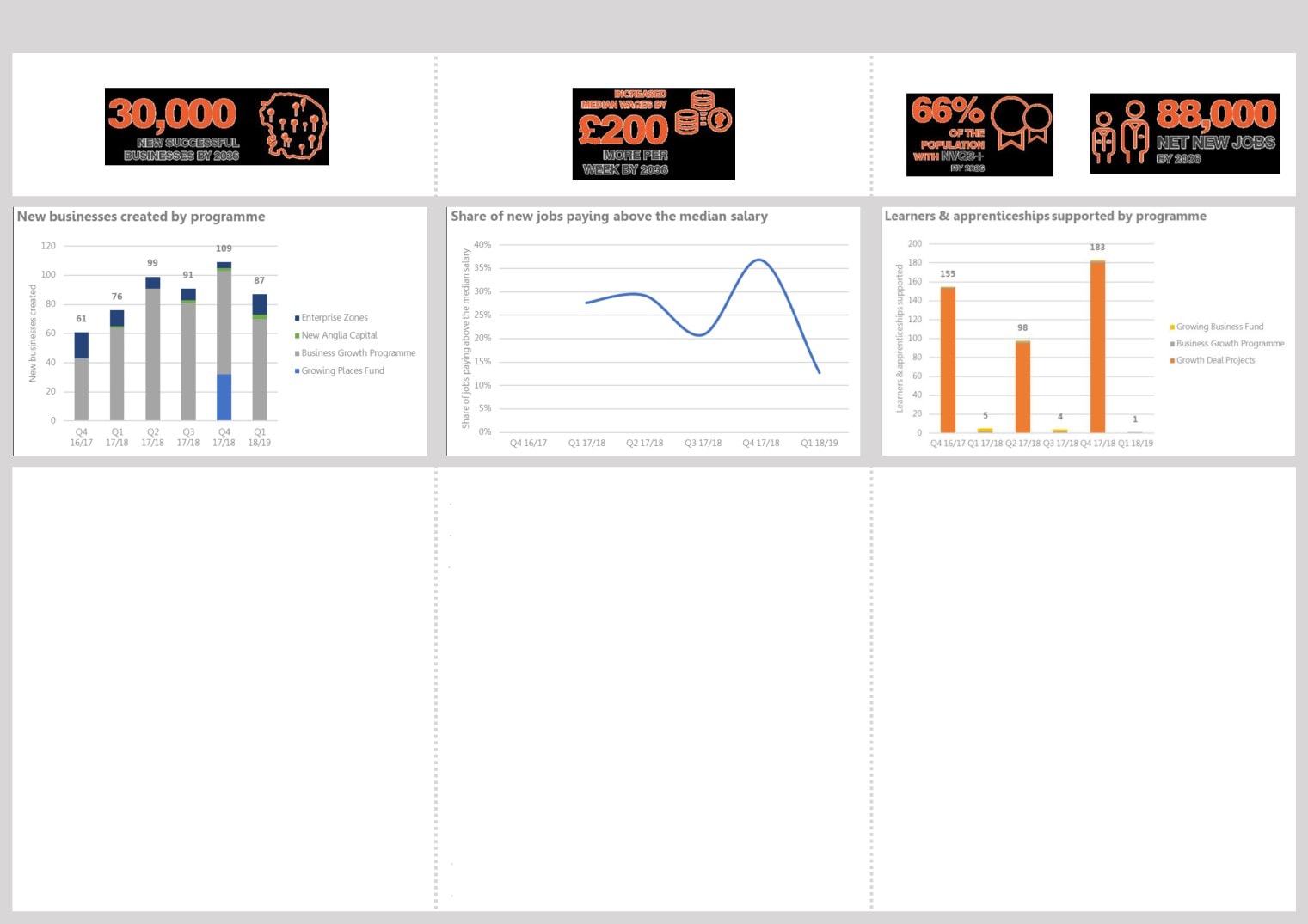

Growth Deal Quarterly Dashboard

CD reviewed the paper and the quarterly dashboard for submission to Government.

AW asked whether a further breakdown of the details of the jobs created was available.

CD confirmed that they were all FTEs but further work would be required to ascertain the

quality of jobs provided.

CS advised that this dashboard was as set out as per Government requirements however this

detail would be built into the ongoing development of BPRs which would be presented after the

summer.

SO queried the delivery of housing which appeared to be behind target. CD confirmed that

outputs were delivered on an ad hoc basis as developments were completed and so figures

would increase on completion.

The Board agreed:

To endorse the dashboard

15

Chief Executive’s Report

CS asked the Board for any questions on his report.

DF updated the meeting on the meeting of LEP Chairs with the Prime Minister on 19th June

where the PM had expressed support for the work of LEPs across the country. DF thanked

Warren Ralls for organising the event.

The Board agreed:

To note the content of the report

16

Finance Report

Rosanne Wijnberg (RW) reviewed the finance report and asked for questions from the Board.

As the July LEP Board has been cancelled it was proposed that the Annual Accounts would be

issued electronically for approval by email in July.

The Board agreed:

To note the content of the report

To receive the Annual Statements via email for approval following the recommendation

of the Audit and Risk Committee.

17

Board Forward Plan

CS reviewed the items to be covered at the September Board.

The Board agreed:

To note the content of the plan

18

Any Other Business

John Griffiths (JG) asked whether substitutes can attend the IAC as well as the Board.

Next meeting:

Date and time of next meeting:

10.00am - 12.30pm, 19th September 2018

Venue: The Aviation Academy, Norwich

5

7

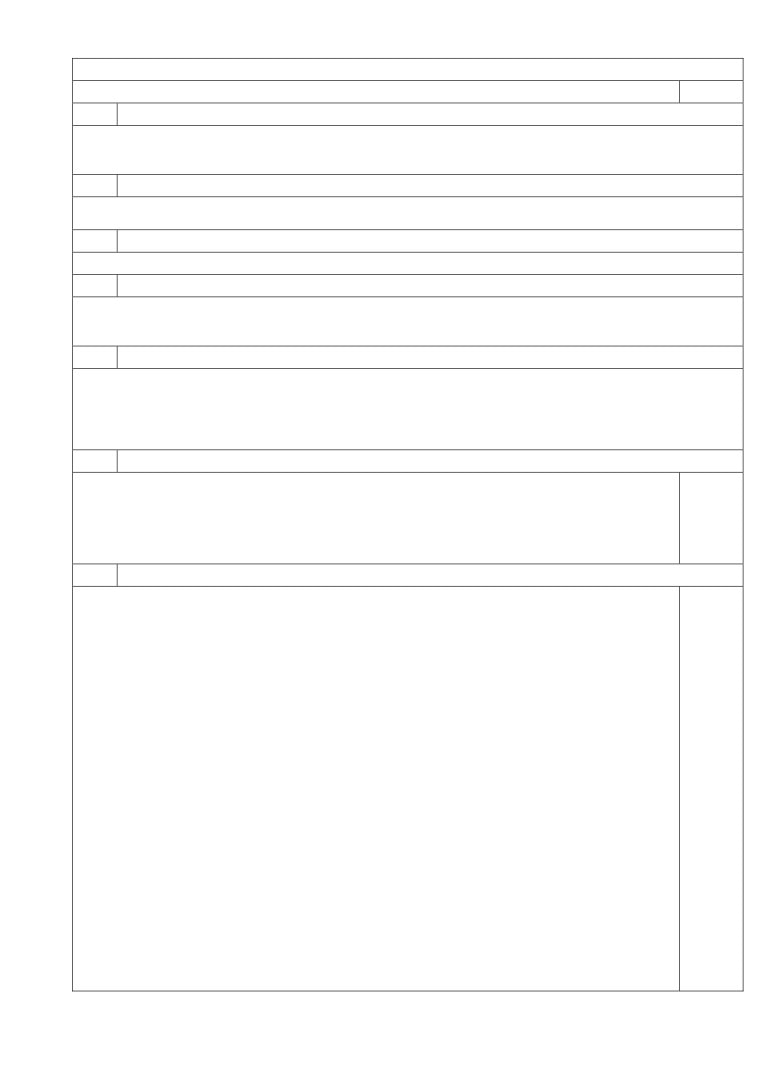

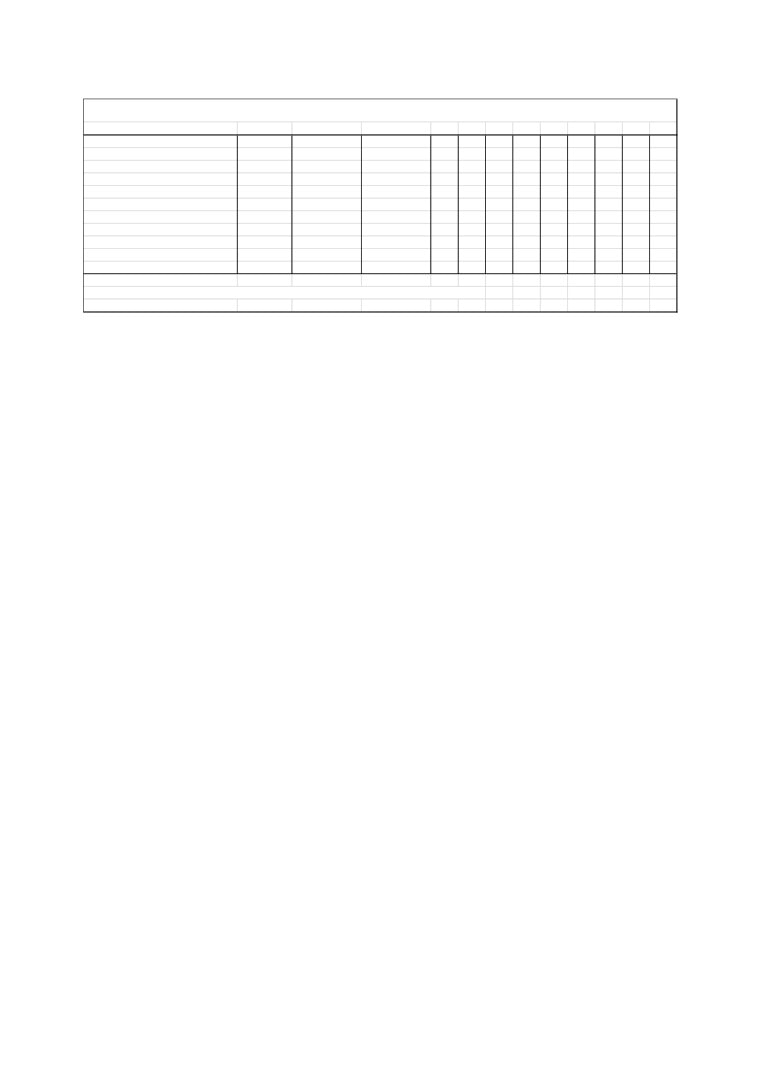

Actions from New Anglia LEP Board Meetings

Date

Item

Action

Update

Actioned By

Status

23/05/2018

Enterprise Zones

To receive further information on the make up of jobs on EZs and the rationale

See update paper following the Action Log

JM

Complete

for companies moving into the zones.

21/02/2018

Economic Indicator

To receive a paper on CO2 reductions for

Work is ongoing in conjunction with the UEA

CS/JR

On-Going

Trajectories and Targets:

consideration of inclusion in the economic strategy targets

21/02/2018

Brexit Analysis

To receive an action plan detailing the next steps, timescales and measures of

Analysis is ongoing and will be incorproated into

LiR

On-Going

success

the Local Industrial Strategy

22/11/2017

Business Performance

To receive a proposal on the Eastern Agi-Tech initiative by email.

CS has been in communication with the Combined

CS

On-Going

Reports

Authority and a paper will go to a future Combined

Authority Board meeting

8

Board Actions Update

23/05/2018: NALEP Board Action: “To receive further information on the make up of

jobs on the EZs and the rationale for companies moving into the zones”

Response from New Anglia LEP Enterprise Zone Team:

The vast majority of companies moving onto our Enterprise Zone sites are doing it for

reasons of expansion. This shows up as net jobs on our monitoring returns. Furthermore a

number of the District Councils (Collection Authorities) operating the rate grant rebate have a

displacement check on their processes that avoids this possible distortion.

It should be noted that the full expansion might not be immediate as companies are

sometimes taking on larger premises with a view to employing more staff in the future as

they gain new contracts/work.

A few firms also move into larger premises on the zones because they provide modern

premises to allow them to operate in a more productive way. The rate grant incentive of

course ends in March 2021 (for Space to Innovate EZ) and in reality, is modest in relation to

the costs of moving premises.

The average rate grant award is below £25k per annum and even for five years this is only a

modest contribution to company operating costs. There have been a limited number of

occasions where a company move is driven by consolidation rather than growth. In these

circumstances the prism by which it is examined is the risk of jobs being lost to the New

Anglia area i.e. job retention.

An analysis has been carried out for the Great Yarmouth and Lowestoft Enterprise Zone as

the data is a better quantifiable base of data to monitor increase and decreases in

companies as the zone has been in place for a number of years (the Space to Innovate EZ

has only been in situ for 2 ½ years).

After analysing the Great Yarmouth & Lowestoft monitoring data, as collected over the past

7-year period, of those businesses that have expanded they have, on average, taken on

30% more staff since they moved an Enterprise Zone site.

We have had only one business (out of 52) which has decreased its staffing from 65 to 23.

This is entirely related to the downturn in the oil and gas sector, but the company have

remained afloat without any public sector assistance and are still pivotal in the energy sector

in the coastal region.

9

New Anglia Local Enterprise Partnership Board

Wednesday 19th September 2018

Agenda Item 5

Place Brand Development for Norfolk and Suffolk : Agency introduction

Author: Hayley Mace and Julian Munson Presenter: Steve Oliver

Summary

This paper outlines an introduction to the agency selected to carry out the place brand

development work for Norfolk and Suffolk.

Background

In June 2018, the Board agreed funding for the first stage of place brand development. A tender

was issued following the Board meeting and 20 submissions were received, with high quality

entries from agencies across the UK.

The submissions were reviewed and scored by Hayley Mace, Julian Munson and the three

members of the Board steering group for the project - Steve Oliver, Jeanette Wheeler and Sandy

Ruddock. Six agencies were invited for interview, with Steve Oliver, Sandy Ruddock, Julian and

Munson and Hayley Mace sitting on the panel.

A joint submission from Ipswich-based CMS and Jacob Bailey was selected by the interview

panel. They have placemaking and branding experience, working with a number of towns, cities

and Business Improvement Districts across the UK. As part of the Savills group, CMS can offer

access to input and testing on international investors which will be of significant benefit to this

project.

An inception meeting was held on 30th August to discuss plans for stakeholder engagement

sessions, which will take place over the coming months.

Neil Prentice (Jacob Bailey) and Fiona Wright (CMS) will give a brief introduction to their proposal

and timeline at the September Board meeting. It is envisaged that work will be completed by the

end of January 2019, with the final project findings to be brought back to the LEP Board in

February 2019.

1

15

New Anglia Local Enterprise Partnership Board

Wednesday 19th September 2018

Agenda Item 6

Economic Strategy Delivery

Author: Lisa Roberts Presenter: Lisa Roberts

Summary

This paper provides an update on the Economic Strategy delivery plan and sets out the

proposed concept of game changers which would boost delivery and deliver material impact on

the Economic Strategy Ambitions. Appendix A which accompanies the report is a more detailed

presentation which will be delivered at the board meeting.

Recommendation

The Board is asked to:

Note the progress the development of the Economic Strategy delivery plan for the

Economic Strategy;

Agree the concept of developing game changers.

Background

Since the Economic Strategy was published in Autumn 2017 work has been underway to

develop delivery plans. There have been three stages to development - mapping existing

activity, identifying gaps and identifications of innovative solutions.

All three stages have involved engagement with a wide range of partners including businesses,

business intermediary groups, Local Authorities, education providers and the Voluntary and

Community Sector to help shape delivery (see pages 5 & 6 of appendix A).

We have continued to enhance and evolve the evidence base which has helped to shape and

support interventions. The publication of a range of national and local strategies and plans has

also been considered.

The Economic Strategy Delivery Coordinating Board (ESDCB) has been established meeting

for the first time on 4th September (see page 12 appendix A).

Delivering the Economic Strategy

Delivery of the Economic Strategy started the day it was signed off with several existing

projects and interventions already contributing to the delivery of the strategy. As highlighted in

the Strategy it is not being delivered by one partner alone or by one strand of investment.

There are two levels of delivery - local and strategic.

1

17

Local - The ambitions and priorities that were agreed in the Strategy provide the

direction and strategic case for a wide range of partners to develop their own plans and

interventions that contribute to achieving our shared ambitions. Several local partners

have reviewed their own strategies and plans to align with the Economic Strategy,

shaping the right approach to delivery locally - in ‘Places’.

Strategic - Our priority themes are those economic-wide opportunities where the

evidence shows that investment and collaborative action will have the greatest impact

on our ambitions. A strategic delivery plan has been developed using the Objectives

Key Results approach (see page 9 Appendix A) . The plan links directly to the objectives

set out under each of the themes detailing the collaborative activities and interventions

which will deliver them. It is a living document which will evolve over time.

The ESDCB will be responsible for driving and coordinating the delivery of the strategic

plan, discussing delivery plan gaps and identifying innovative solutions to deliver the

objectives. Members of the board will also act as champions for the strategy and liaise

with local plans and places to facilitate join up.

Game Changers Concept

There are three game changer opportunities that have emerged through the engagement

session and the evidence (page 11 appendix A). These are opportunities where focused

collaborative action and prioritisation would have the potential to turbo boost delivery, providing

a significant shift towards the strategic objectives and delivery material impact on our ambitions

and economic indicators.

At the heart of each opportunity there is a key initiative or project that will act as a catalyst and

create wider impact.

This paper is seeking agreement from the LEP Board to agree to proceed with the Game

Changer concept. The Economic Strategy Delivery Board will review the evidence behind the

emerging opportunities and develop delivery plans for each.

Next Steps and Key Dates

26th September - ongoing

The Economic Strategy Delivery Board - Review the strategic

delivery plan and identify solutions for gaps. Consider game

changer opportunities and develop delivery plans.

November - January

Light touch review of Economic Strategy Evidence Base

Late February

LEP Board, LA Leaders and Sector Charis - Economic Strategy

annual progress review.

Recommendation

The Board is asked to:

Note the progress the development of the Economic Strategy delivery plan for the

Economic Strategy;

Agree the concept of developing game changers.

Appendices

Appendix A - Economic Strategy Delivery

2

18

Item 6.1 Appendix A - Economic Strategy Delivery

1

19

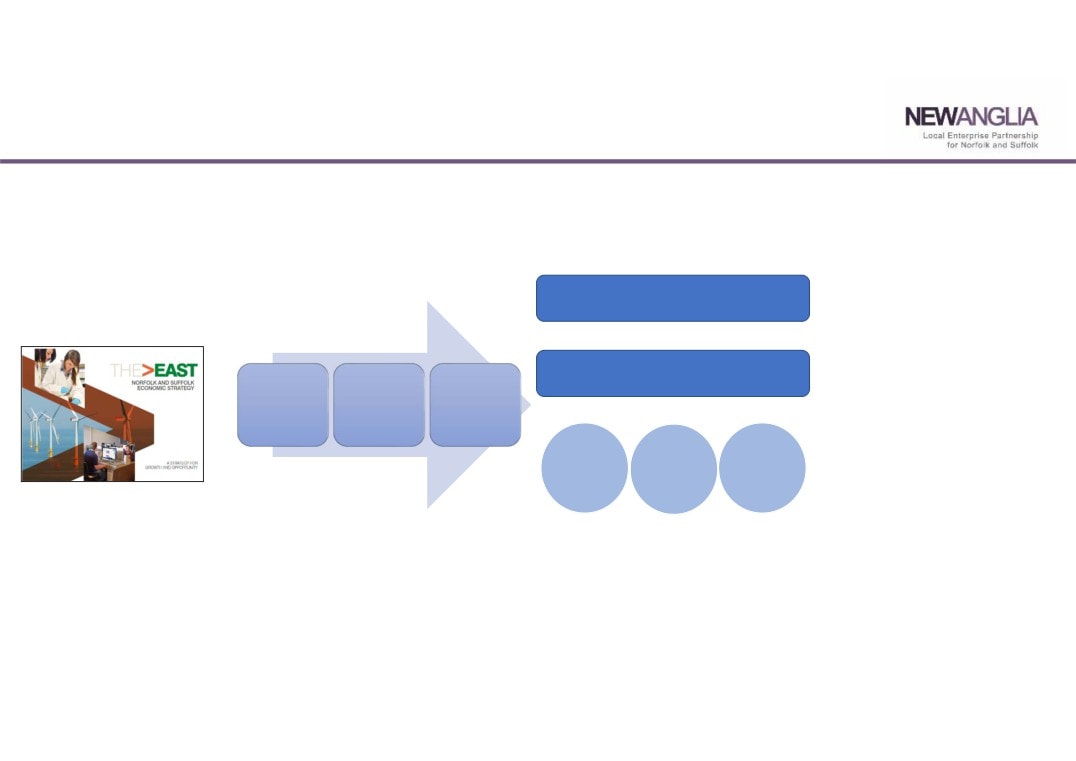

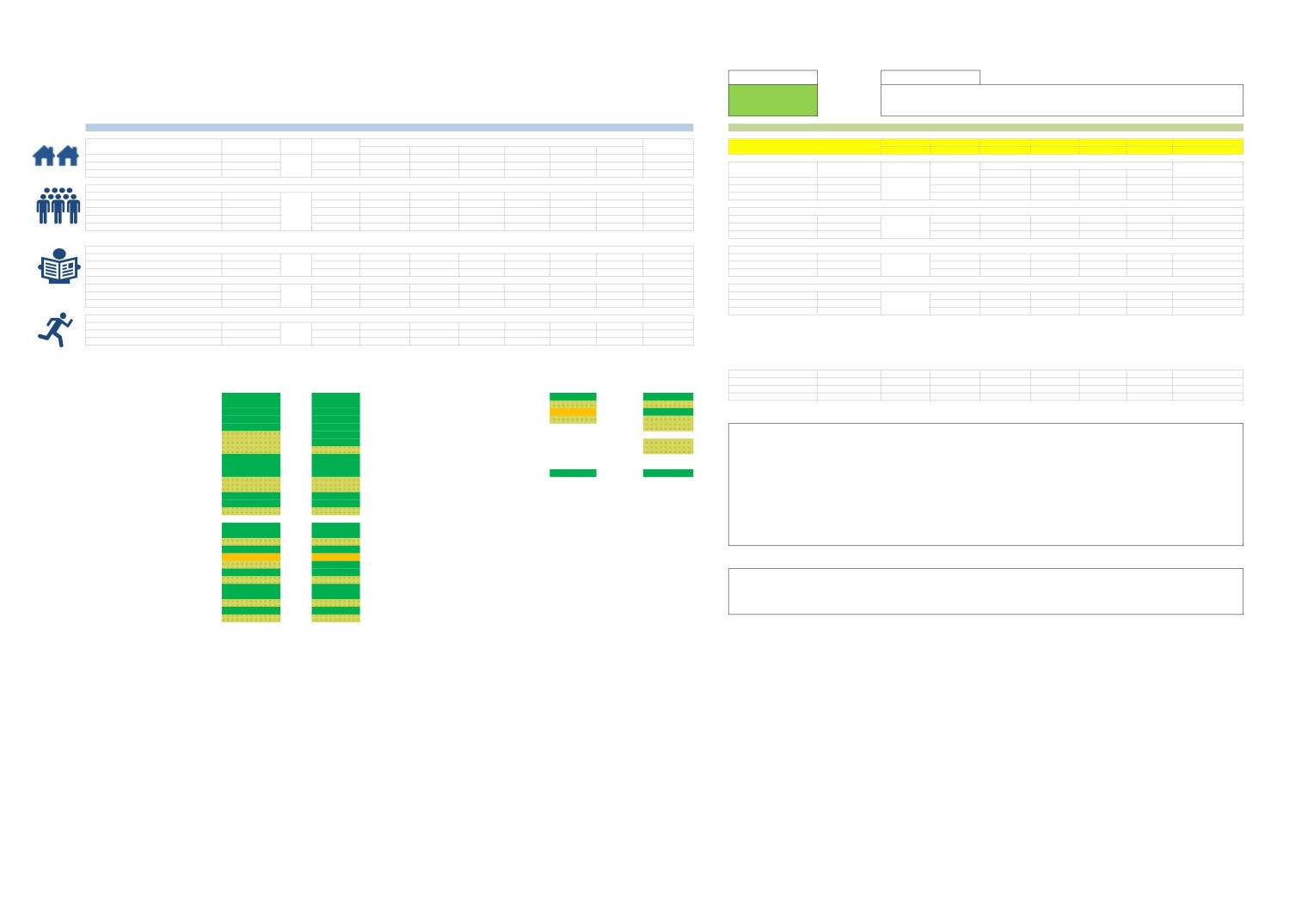

Delivering Norfolk & Suffolk Economic Strategy

• Published Autumn 2017

• Looks ahead to 2036 but focuses on action we need

to take over next three years to help secure long

term success.

• A dynamic and living blueprint to guide the work and

investment of many partners.

• A shared endeavour between private, public,

education and Voluntary and Community Sector

(VCS).

• Underpinned by robust evidence base and

extensive engagement and consultation.

• Sets out agreed ambitions and targets.

• Inclusive growth and productivity is a golden thread.

2

20

Economic Strategy Delivery - The Journey So Far…

Local partners have reviewed own

Alignment of local strategies &

strategies and plans to align with

Economic Strategy

plans

Published Autumn 2017

Strategic plan developed using the

Objective Key Results approach. A

Engagement with

Strategic Delivery Plan

Review of National

living plan which outlines the high level

Evidence & Data

over 350

and Local Policy to

Analysis to help

stakeholders

objectives for each of the five themes

help identify

identify

mapping out existing

opportunities and

and the planed activity has been

interventions.

activity & developing

alignment.

innovative ideas

developed.

Building the

Integrated

Innovation

Game Changer approach which will

workforce of

Investment

Ecosystem

turbo change delivery.

the future

& Trade

3

21

Economic Strategy Delivery - The Journey So Far…

Building the

Integrated

Innovation

workforce of

Investment &

• Strategic delivery plan developed in consultation

Ecosystem

the future

Trade

with partners to identify existing and new activity.

•

10 events, 350 individuals from across business,

• Three Game changing opportunities identified

education, VCS and LAs.

through engagement session and links to evidence.

Seeking support on concept.

• A living plan which will evolve over time.

What are ‘game changing’ opportunities….

• Economic Strategy Delivery Co-ordinating Board

established who will drive and coordinate the

….an opportunity that effects a significant shift towards

delivery of the strategic plan. Ensuring all partners

the strategic objectives….

play a part in delivering the ambitions and targets.

….and delivers material impact on the

• Next steps to identify new and innovative

ambitions/economic indicator

interventions to address the gaps in the plan.

At the heart of each there is a key initiative or project

4

that will act as a catalyst and create wider impact

22

Economic Strategy Delivery- Journey so far

Event

Aim

What we did

Outputs

Business

To identify activities which will

Focusing on 3 themes:

Examples included the need to

engagement

drive delivery of the Economic

Our Offer to the World

leverage the Norwich Research Park

sessions

Strategy.

Driving Business Growth

as a local asset; exploring the local

and Productivity

appetite for a Stowmarket tech hub;

Driving Inclusion and Skills

developing a one-stop-shop for

These were interactive

business advice taking lessons from

sessions with businesses

the BBfA and developing a

completing the templates

promotional plan for tourism which

provided.

coordinates the activity taking place

across sectors.

On-line Survey

To identify activity currently

Focusing on all five themes

Enabled us to understand what

taking place and what is

in the Economic Strategy.

activity is already underway and to

needed to deliver the

This on-line survey ran for

identify the gaps in activity and the

Economic Strategy. Also to

three months from mid

priorities we need to focus on in the

identify priorities for delivery

November 2017 - mid

first 12 months of delivery.

in the first year.

February 2018.

5

23

Economic Strategy Delivery- Journey so far

Event

Aim

What we did

Outputs

Economic

To identify 3 - 4 measurable

Involved all LAs, Sector

Captured further activity underway or

Strategy

key results against each of the

Groups & business

planned for delivery over the next

Summit

Economic Strategy high-level

intermediaries focusing on

three years and identified Game

objectives and to identify

three themes; Our Offer to

Changer opportunities.

innovative / game changer

the World, Driving Business

projects.

Growth & Productivity &

Driving Inclusion & Skills

‘Sprint’

To generate one or two game-

Included a select number of

A number of ‘game-changer’

changer opportunities which

‘innovative thinkers’ from

opportunities were identified and

will drive business growth and

across the public, private

explored; these included: Creating an

productivity across our region

and voluntary sector to

innovation culture across the region

over the next three years and

focus on two themes:

and developing a programme to

identify opportunities to get

Driving Business Growth

deliver true innovation; becoming THE

the most out of partnership

and productivity and

place where people aspire to come

working.

Collaborating to Grow.

and growth their high-growth

businesses; creating a Growth Hub +

(one stop shop for every day business

6

support)

24

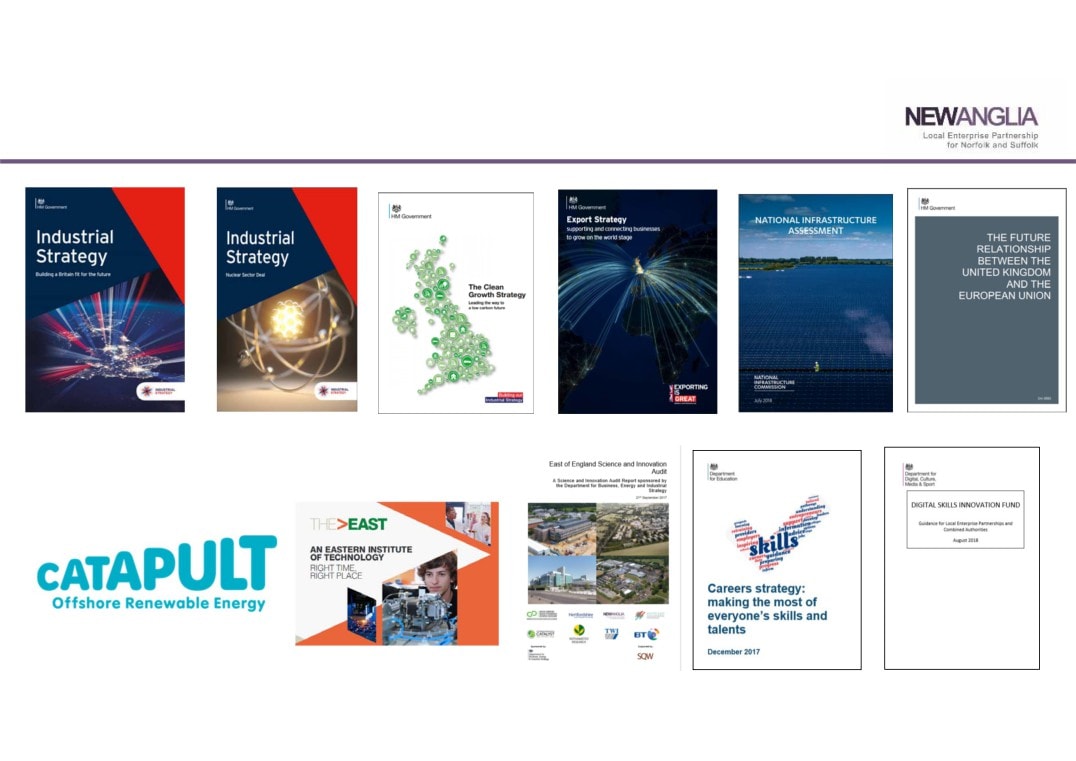

Government Policies and Strategies (published since October ’17)

7

25

Economic Strategy - Evolving Evidence Base

Our evidence base is continuing to evolve and since publication

of the Economic Strategy and supplementary Evidence Report

in November 2017, the following has been developed /

published:

• Five Sector Skills Plans:

• Construction

• Health and Social Care

• Digital Tech

• Life Sciences and Bio-Economyey Chan

• Agri-Food Tech

• A new Skills Module has been added to the

East of England Forecasting Model.

• Data workbooks available to all partners with

which are updated as new data is published.

• Data practitioners group continues to consider current and

new data.

8

• Light touch refresh of evidence report due in Spring 2019.

26

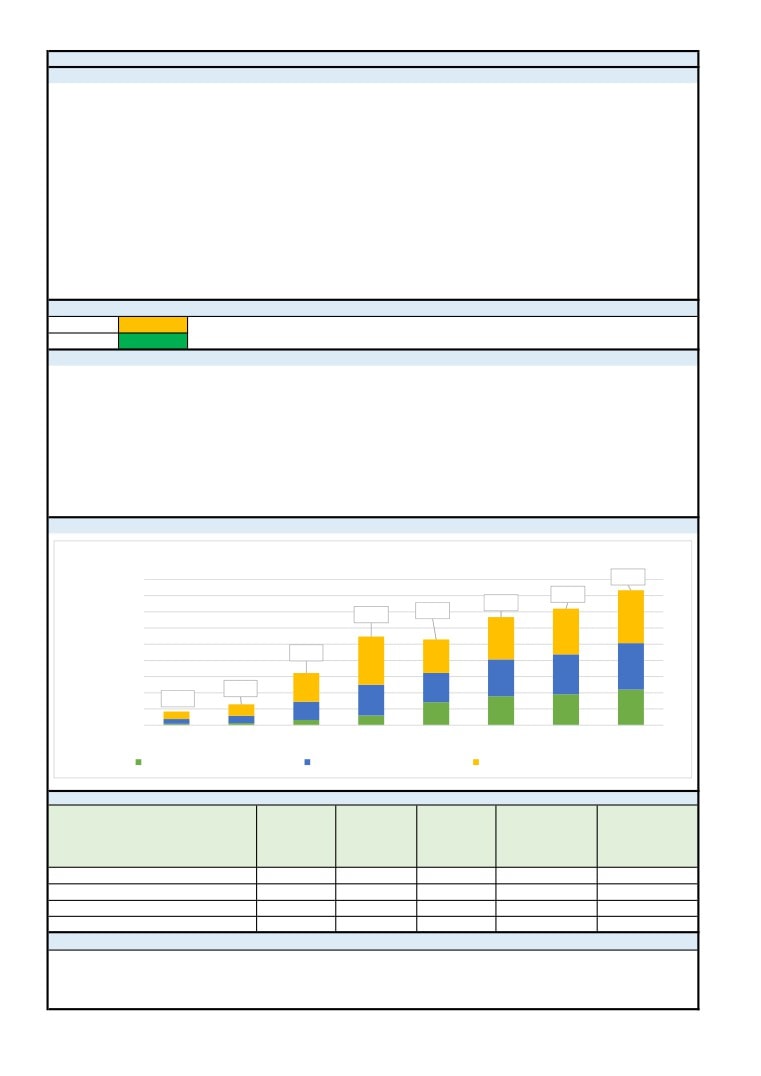

Economic Strategy Delivery- Objective Key Results

We are using the Objective Key Results (OKR) approach for the Economic Strategy Strategic Delivery Plan. A framework for defining and

tracking objectives and their outcomes. Several well know companies uses this approach - Google, Twiter and Uber.

The framework aims to define "objectives" along with linked and measurable "key results" to provide "a critical thinking framework and ongoing

discipline that seeks to ensure employees (in this case partners) work together, focusing their efforts to make measurable contributions.

In practice, using OKRs is different from other goal-setting techniques because of the aim to set very ambitious goals. When used this way,

OKRs can enable teams to focus on the big bets and accomplish more than the team thought was possible, even if they don’t fully attain the

stated goal.

A proper goal must describe both what you will achieve and how you are going to measure its achievement. The key words here are “as

measured by,” since measurement is what makes a goal a goal. Without it, you do not have a goal, all you have is a desire.

I/we will (Objective) as measured by (this set of Key Results).

Objective

Objectives under each of the Economic Strategy themes that partners agreed to deliver together

which would achieve the ambitions and targets in the strategy.

Key

A set of metrics that measure progress towards the Objective. For each Objective in the delivery

Results

plan, we will have a set of 2 to 5 Key Results.

Outputs

Each key result, we will have clear outputs.

9

27

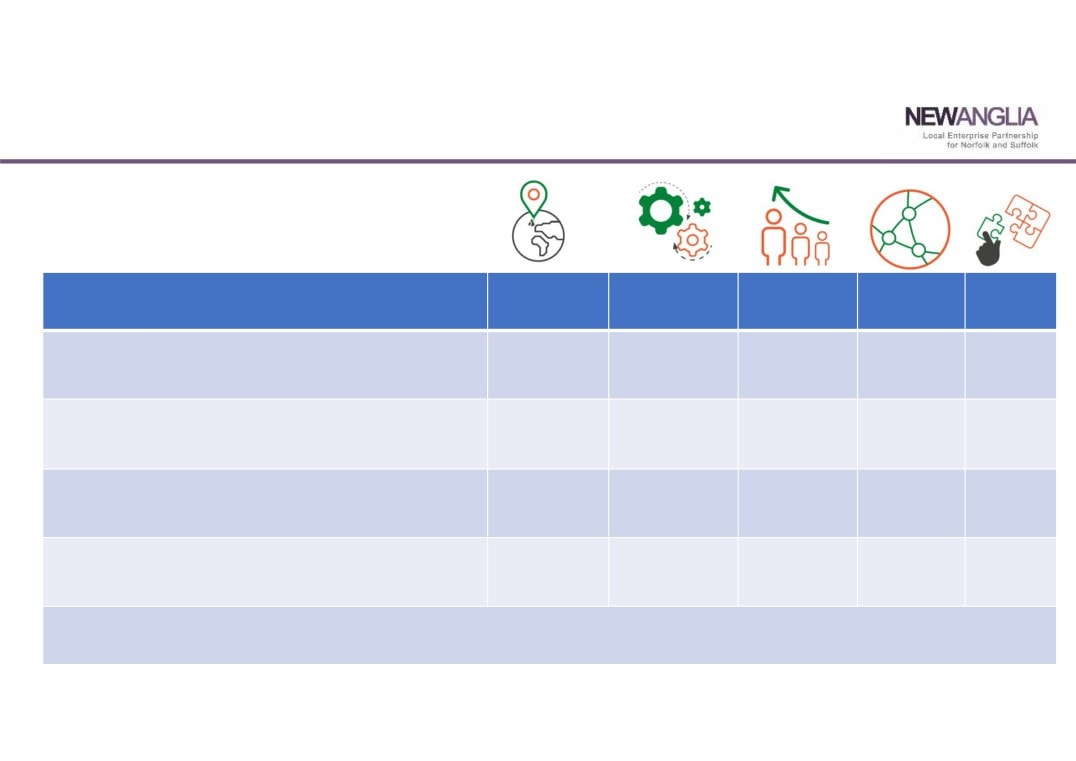

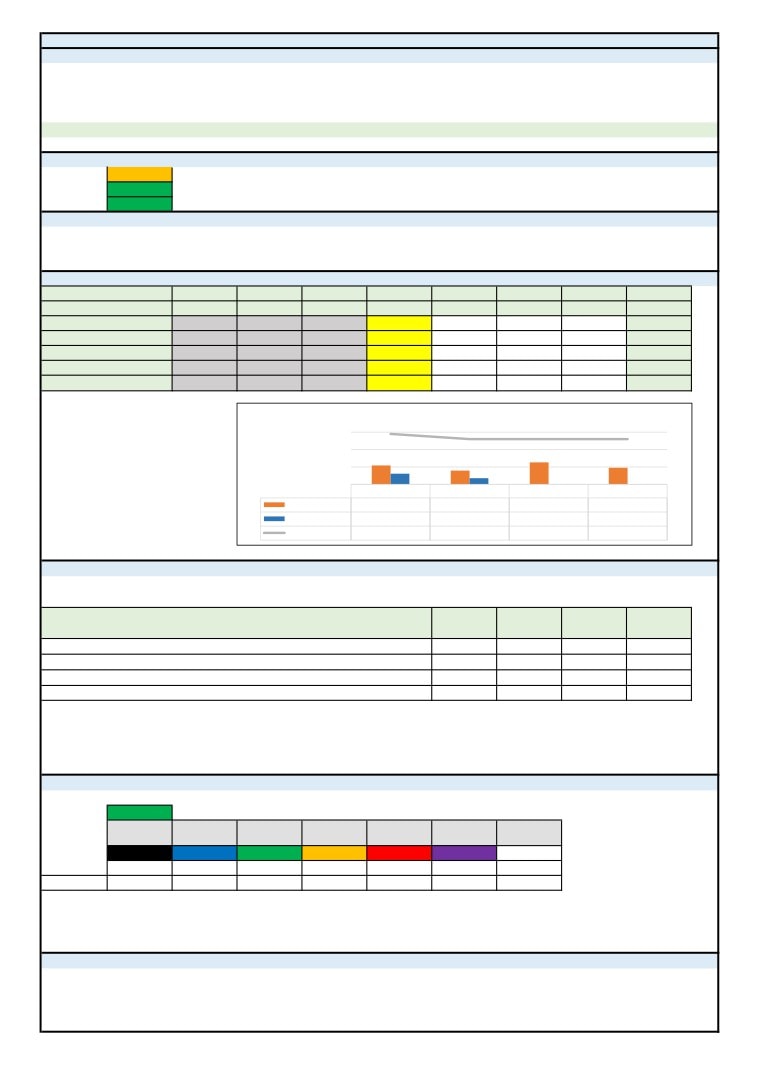

Economic Strategy Delivery

Delivery of the strategy has been ongoing since October 2017.

This is an example on how we could illustrate and make clear

links between decisions, delivery and the Themes within the

strategy.

Decisions made by the LEP Board illustrating links to delivering the

Our Offer to the

Driving Business

Driving Inclusion

Competitive

Collaborating

World

Growth &

and Skills

Clusters close to

to Grow

objectives within each theme.

Productivity

Global Centres

£50,000 funding to develop ‘The East’ brand. (June ‘18)

√

√

√

√

√

Growing the number of Enterprise Advisors and establishing the

Careers Hub. (June ‘18)

√

Support bid for an Eastern Institute of Technology. (March ’18)

√

√

√

√

√

Local Energy Strategy Agreed (April ‘18)

√

√

NB: Bigger ticks indicates direct link to an objective within the Economic Strategy theme.

28

Economic Strategy Delivery - Game Changers …

Building the

Three/four Game changing opportunities identified

workforce of

through engagement session and links to evidence.

the future

Seeking support on concept.

• Concept to be agreed with LEP

What are ‘game changing’ opportunities….

Board on 19th September. If

agreed:

….an idea that effects a significant shift towards the

Integrated

strategic objectives….

Investment &

• ESDCB to consider emerging Game

Trade

Changer opportunities and develop

a robust plan for each.

….and delivers material impact on the

ambitions/economic indicator

At the heart of each there is a key initiative or project

that will ach as a catalyst and create wider impact.

Innovation

Ecosystem

Smart infrastructure is a key thread which runs through

all.

11

29

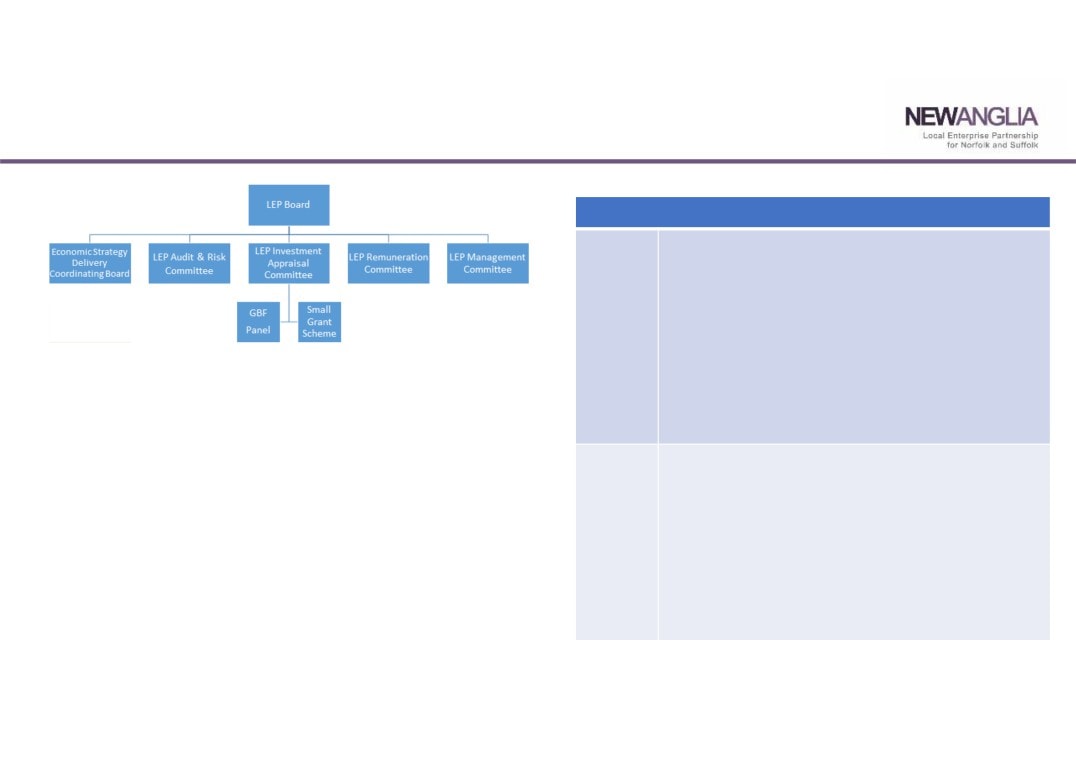

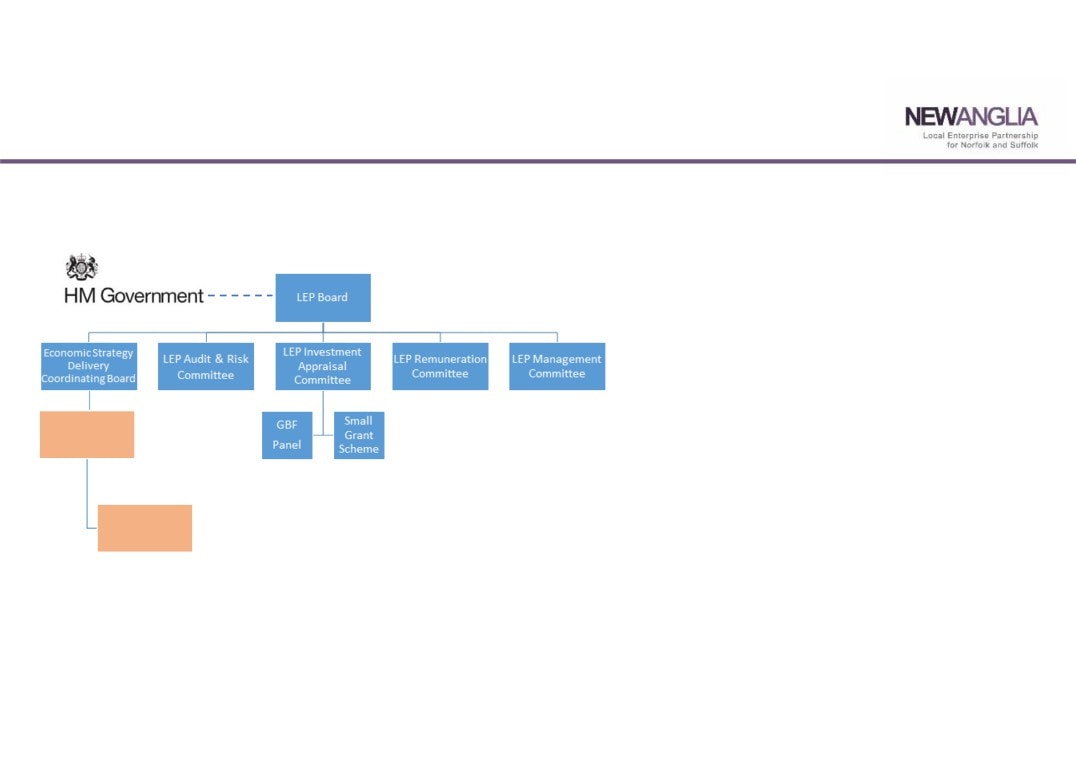

Economic Strategy Delivery- Governance

Economic Strategy Delivery Coordinating Board

Purpose

To continue the collaboration between businesses, local

authorities, education providers, voluntary and

community sector and the LEP, drive and coordinate the

delivery of the economic strategy. Ensuring all partners

play a part in delivering the ambitions and targets in the

Economic Strategy for Norfolk and Suffolk. It will be

responsible for developing and driving implementation of

Key Information

the high-level delivery plan, reporting regularly on

•

Suggested 6 to 8 weekly meetings

progress to the LEP Board and to Local Authority Leaders

and Sector Leads through the annual performance

•

At each meeting the ESDCB will:

process. This Board is an officer level Board.

• review a progress report on the strategic delivery

Members

Total of 14 members - The Chair LEP CEO, Suffolk

plan; and

Chambers of Commerce, Norfolk Chambers of Commerce,

• Discuss delivery plan gaps and identify innovative

Federation Small Business, CBI, Suffolk Council’s Growth

solutions to deliver the objectives.

Programme Partnership Manager, East Suffolk Council,

Suffolk County Council, South Norfolk, Breckland, Great

•

Each member to feedback and seek input from the

Yarmouth Norfolk County Council and LEP Head of

organisaion/s they represent.

Strategy.

•

Annual reporting to LEP Board, Leaders’ and Sector

Suffolk have a rotating seat and Norfolk councils will

Chairs - February 2019.

rotate their seats every 6 month.

12

30

Economic Strategy Delivery - The Journey So Far

Recap…

Local partners have reviewed own

Alignment of local strategies &

strategies and plans to align with

Economic Strategy

plans

Published Autumn 2017

Strategic plan developed using the

Objective Key Results approach. A

Engagement with

Strategic Delivery Plan

Review of National

living plan which outlines the high level

Evidence & Data

over 350

and Local Policy to

Analysis to help

stakeholders

objectives for each of the five themes

help identify

identify

mapping out existing

opportunities and

and the planed activity has been

interventions.

activity & developing

alignment.

innovative ideas

developed.

Building the

Integrated

Innovation

Game Changer approach which will

workforce of

Investment

Ecosystem

turbo change delivery.

the future

& Trade

13

31

New Anglia Local Enterprise Partnership Board

Wednesday 19th September 2018

Agenda Item 7

Local Industrial Strategy

Author: Lisa Roberts Presenter: Lisa Roberts

Summary

This paper sets the context for Local Industrial Strategies, how it links with the Economic

Strategy and presents the proposed approach to developing a Local Industrial Strategy for

Norfolk and Suffolk. Appendix A accompanying the report is a more detailed presentation which

will be delivered at the board meeting.

Recommendation

The Board is asked to:

Agree the proposed approach to developing the Local Industrial Strategy;

Note that the Economic Strategy Delivery Coordinating Board will take on the role of

Local Industrial Strategy Steering group.

Background

Government’s Industrial Strategy White Paper was published in November 2017, setting out a

long-term plan to boost the productivity and earning power of people throughout the UK.

The components of the Industrial Strategy include:

•

Five Foundations of Productivity

•

Four Grand Challenges + Industrial Strategy Challenge Fund (70 plus pots of funding)

•

Sector Deals

•

Local Industrial Strategies (LIS)

•

Links with UK Shared Prosperity Fund (UKSPF)

One of the five foundations of productivity is places. The vision is to drive towards more

prosperous communities and tackle the regional and local disparities that exist across the UK.

Local Industrial Strategies are central to this focus.

LEPs or Combined Authorities will co-develop Local Industrial Strategies with Central

Government and will be responsible for delivering them alongside local partners, who will be

integral to the process.

A Local Industrial Strategy should bring together a strong, well-informed evidence base about

an area’s economy and outline a long-term set of priorities that capitalise on existing

opportunities in the economy, address weaknesses and resolve an area’s needs.

1

33

The UK Industrial Strategy states that Government will ensure that local areas continue to

receive flexible funding for their local needs. Following the UK’s departure from the European

Union, they will launch the UK Shared Prosperity Fund. Consultation on the design and

priorities for the fund starts in October. It is understood that LEPs will be responsible for

delivering the fund. The fund will be linked to the delivery of the Economic Strategy and Local

Industrial Strategy.

Link to the Economic Strategy

The Local Industrial Strategy is the next stage in the evolution and implementation of the

Economic Strategy. Although called a Local Industrial ‘Strategy’ it will be a plan.

It will build on the Economic Strategy but be a deeper and more focused piece of work, looking

in more detail at Norfolk and Suffolk’s areas of competitive area of strength - Clean Energy,

Agri Food and ICT. It will involve developing a plan which sets out how the LEP and partners

will collectively cultivate these strengths to accelerate growth. It will also articulate how

collectively we work more actively with Government and other parts of the country.

Developing a Local Industrial Strategy - Proposed Approach

Government are yet to set out the development and sign off process for Local Industrial

Strategies. Nine pilot areas have been announced, we are not one of them. However,

Government officials have said we should proceed with our plans to develop one. All areas are

expected to have one in place by Early 2020.

Page 10 of appendix A sets illustrates the proposed approach and timeline for developing a

Local Industrial Strategy for Norfolk and Suffolk.

Officials have shared the following expectations:

A stronger evidence base, on area of competitive advantage is developed, which is

signed off by government. This will include more analysis of supply chains, areas of

business and technology specialisms

Looking in more detail at the opportunities and threats faced by these strengths.

Looking at our long-term ambitions and identifying a few strategic interventions -

gamechangers.

Alongside our ambitions, we also need to see how our local assets can support the

delivery of the grand challenges and which parts.

It is expected that evaluation fill be built in from an early stage.

We will be starting in a much stronger position than most LEPs having developed our Economic

Strategy and its evidence base.

Economic Strategy Delivery Co-ordinating Board

Economic Strategy Delivery Coordinating Board will take on the role of Local Industrial Strategy

Steering group. It will expand its purpose to oversee and provide direction on the day to day

development of the Local Industrial Strategy ensuring alignment with the Economic Strategy.

Recommendation

The Board is asked to:

Agree the proposed approach to developing the Local Industrial Strategy;

Note that the Economic Strategy Delivery Coordinating Board will take on the role of

Local Industrial Strategy Steering group.

Appendices

Appendix A - Developing a Local Industrial Strategy

2

34

Item 7.1 Appendix A - Local Industrial Strategy

1

35

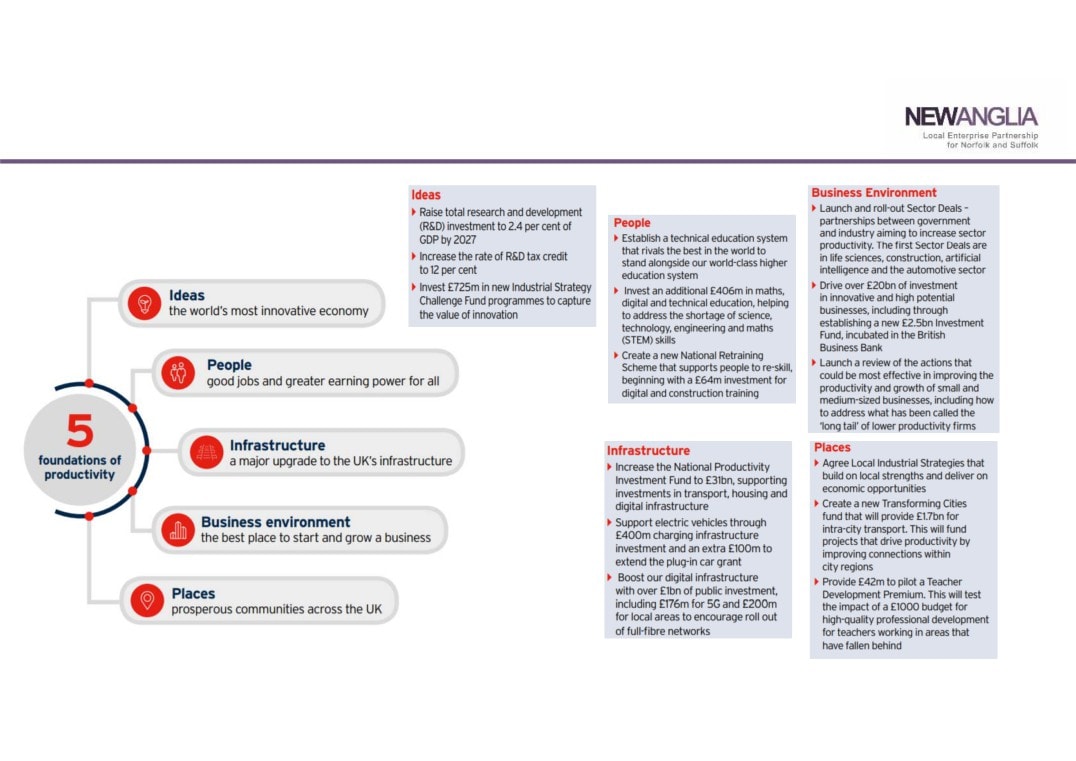

UK Industrial Strategy

• Published Autumn 2017

• Sets out long-term plan to boost the productivity and

earning power of people throughout the UK.

• Components of the Industrial Strategy:

• Five Foundations of Productivity

• Four Grand Challenges + IS Challenge Fund

• Sector Deals

• Local Industrial Strategies

• Links with UK Shared Prosperity Fund

• Committed to creating an independent Industrial

Strategy Council to assess progress and make

recommendations.

2

36

Foundations of Productivity

3

37

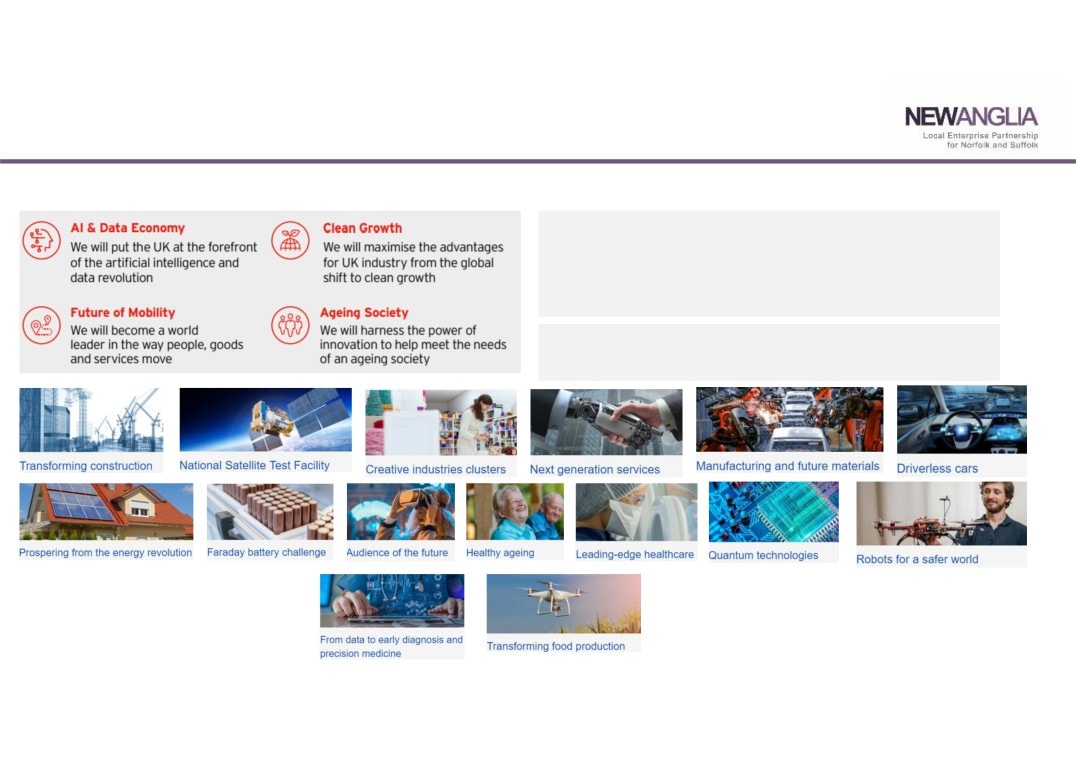

Grand Challenges

The 4 Grand Challenges

Industrial Strategy Challenge Fund (ISCF)

The ISCF aims to bring together the UK’s world-

leading research with business to tackle the grand

challenges of our time. This

£725m is part of

government’s £4.7bn investment in R&D over 4 years.

Current Industrial Strategy Challenge Fund calls

include:

4

38

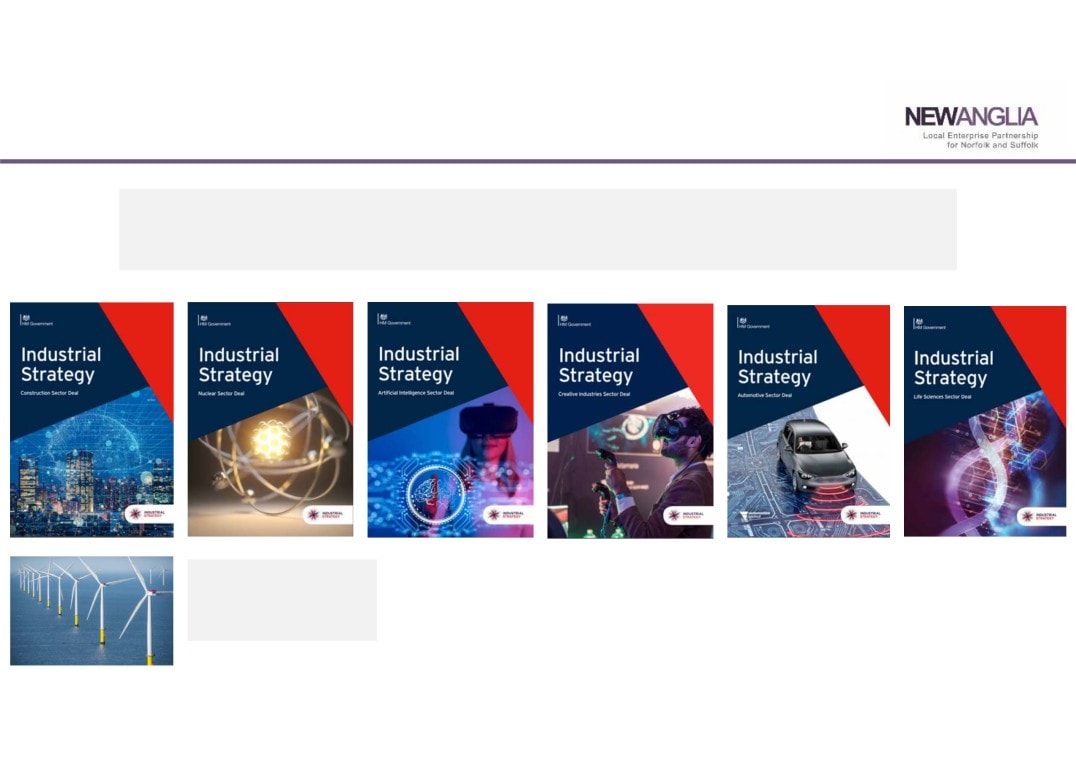

Sector Deals

Sector Deals are partnerships between government and industry on sector-specific issues, focusing

on the five foundations of productivity and the grand challenges. Sector Deals have been published

for the following sectors - Construction, Nuclear, AI, Creative Industries, Automotive & Life Sciences.

Offshore wind Sector

Deal is expected

later this year.

5

39

Local Industrial Strategies

• LEPs or Combined Authorities will co-developed LIS with

• Three trailblazers announced in March 2018 to

Government and will be responsible for delivering them

publish in March 2019.

alongside local partners, who will be integral to the process.

• Sets long-term ambition that is grounded by evidence and

capitalises on existing opportunities in the economy,

addresses weaknesses and resolves an area’s need.

• Shouldn’t be exhaustive - focus on a few areas of strength.

• Six further pilots announced on 23rd July 2018 to

• Evidence to be signed of by government analytical team -

be published in 2019.

needs to be proportional, focus on productivity, tied to

interventions, show comparability and include opportunities,

threats and barriers.

• To involve external experts and experts from Universities.

• Include how local assets will be used to deliver.

6

• All areas to publish LIS by March 2020

40

Economic Strategy Delivery - The Journey So Far…

Local partners have reviewed own

Alignment of local strategies &

strategies and plans to align with

Economic Strategy

plans

Strategic plan developed using the

Objective Key Results approach. A

Strategic Delivery Plan

living plan which outlines the high level

Published Autumn 2017

objectives for each of the five themes

and the planed activity has been

developed.

Engagement with

Review of National

Evidence & Data

over 350

Building the

Integrated

and Local Policy to

Analysis to help

stakeholders

Innovation

Game Changer approach which will

identify

mapping out existing

help identify

workforce of

Investment

opportunities and

Ecosystem

turbo change delivery.

interventions.

activity & developing

the future

& Trade

alignment.

innovative ideas

Local Industrial Strategy present an

Agri

opportunity to deliver Economic

ICT

Food

Strategy with a focus on our

competitive advantage. It will be a plan

that details how we will work with

Clean

government to deliver game changer

Energy

opportunities within the competitive

advantage areas.

7

41

Delivering Norfolk & Suffolk Economic Strategy

Blue print for inclusive growth and

Economic Strategy for Norfolk and Suffolk

improved productivity

Clean

Energy

Areas of competitive advantage which will

Local

help deliver UK Industrial Strategy & ES

Codesigned with

Industrial

Government & partners

Strategy

Agri

Food

ICT

Strategic delivery plan and game changer

Strategic

Developed

opportunities

Delivery

with partners.

Building the

Cohesive

Innovation

workforce of

Investment &

Ecosystem

the future

Trade

Place /Local

Developed by individual

Delivery

Partners developed own plans and

organisations

Alignment of local strategies & plans

interventions that contribute to delivery.

8

42

Local Industrial Strategy Governance

• Economic Strategy Delivery Co-ordinating

Board will take on the role of Steering Group

for the day to day development reporting to

the LEP Board and Government.

• LEP Board, LA Leaders and Sector Chairs

sessions similar to those held during the

development of the Economic Strategy -

Feb, June & Sep

Delivery Team

• Updates on progress provide to the LEP

board through the CEO report.

Data

Practitioners

Group

• Government and LEP Board will jointly sign

off the Local Industrial Strategy following an

endorsement process with partners.

9

43

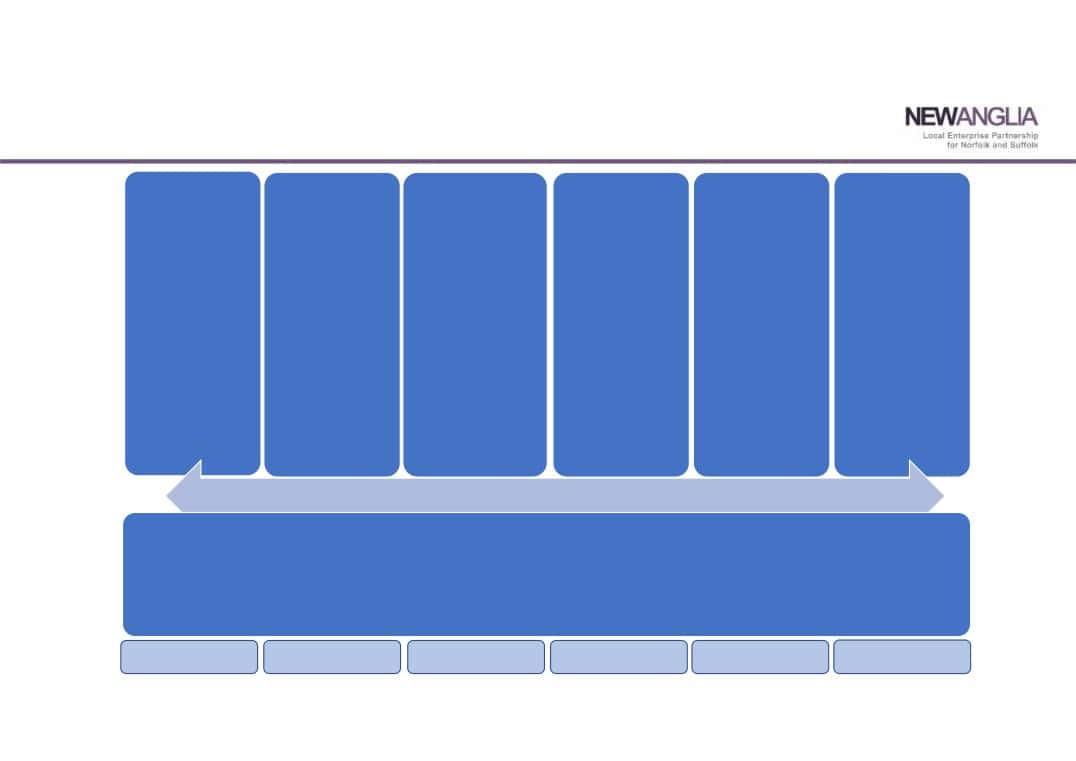

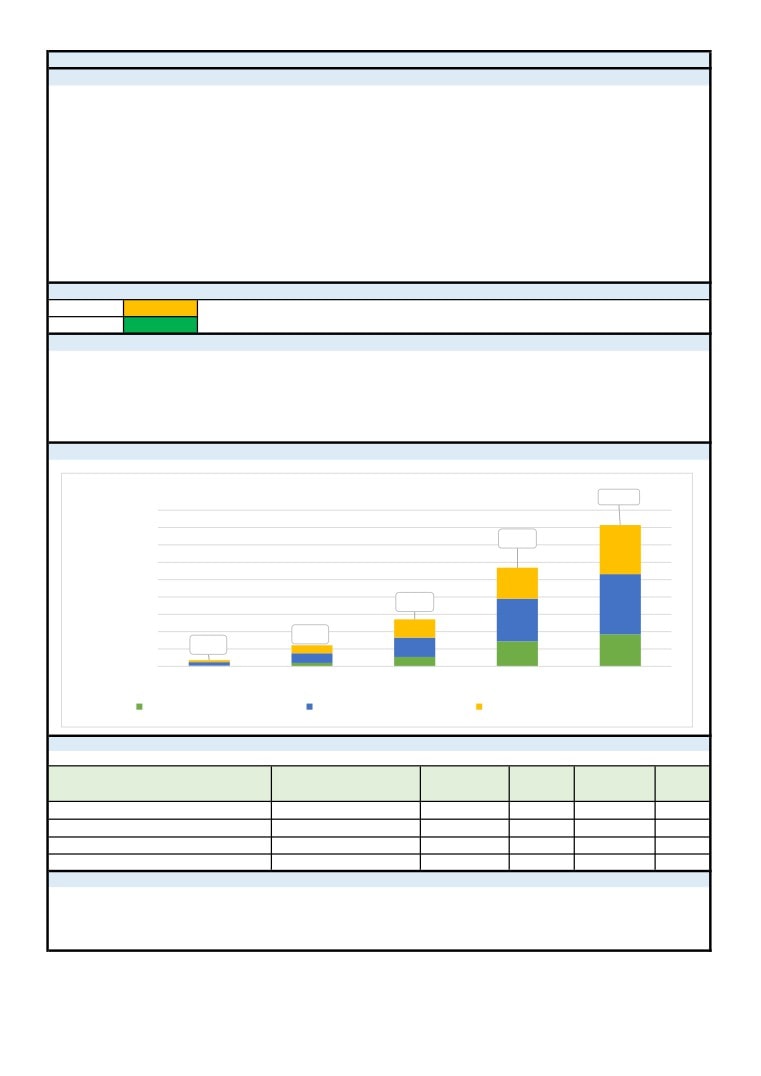

Our approach to develop Local Industrial Strategy

Scoping &

Building the

Development of

Draft &

Sign Off

Publish LIS

Defining

Evidence Base

Game Changer

Design

• Agree approach to

Interventions

• Carry out supply chain

• Government and LEP

• Launch with

developing the LIS

mapping of

• Draft & design

• Use evidence and

Board sign off .

Government

strategy

competitive areas of

engagement with

strategy document.

• Stress test existing

strength.

partners to develop

evidence, map

• Key Stakeholders

• Carry out SWOT.

interventions to deliver

• LEP Board, local

evidence needed,

endorse/sign off

• Review of Economic

game changers.

authority leaders and

identify gaps &

strategy including

Strategy progress.

• Consider how UKSPF will

sector chairs review

appropriate methods

sector groups,

• Identify game changer

support delivery.

draft.

to fill them.

business

opportunities through

• Identify how local assets

• Define the scope by

intermediaries, Local

evidence and

will be used to deliver

identify & securing

• Design and develop

authorities, MPs.

consultation with

ambitions.

shared agreement on

reporting score card

partners.

• Agree how success will

key strategic choices &

& reporting pack.

• Grand Challenge

be monitored, measured

imperatives .

engagement sessions.

& reported.

• Agree LIS scope and

• Develop & proof read

• Identify how

• Seek sign off on evidence

evidence framework

final draft.

evaluation will be

by government analysts.

with government.

embedded.

Engagement & Communications

Develop

Inform partners of

Implement

Local Industrial Strategy

Identify the

communications and

intentions of

Communications &

developed in

different methods

engagement plan to

Promote Local

developing a Local

Engagement plan.

of promoting Local

support implementation

Industrial Strategy.

collaboration with

Industrial Strategy.

Stakeholders help to

government and

Industrial Strategy

of Local Industrial

Implement

Develop

inform & develop

to stakeholders &

Strategy which focuses

stakeholders co-designing

communication and

Communications &

evidence base through

develop materials

on exploiting

which doubles up as

engagement plan.

Engagement Plan &

a range of methods &

consultation on strategy.

required.

opportunities to

set up coms tools.

tools.

businesses.

Autumn/Winter

Winter/Spring

Spring/Summer

Summer

Autumn

Autumn

10

2018

2019

2019

2019

2019

2019

44

New Anglia Local Enterprise Partnership Board

Wednesday September 19th 2018

Agenda Item 8

LEP Review

Author: Chris Starkie

Summary

This paper updates board members on the review of LEPs published by the Government over

the summer. It provides information about the key areas of focus of the review and steps that

New Anglia LEP will be required to undertake.

One of these steps is the removal of geographic overlaps. The paper recommends a course of

action for the board to consider ahead of the Government’s September 28th deadline.

Wider recommendations will be brought back to the October board ahead of the submission of

a delivery plan which needs to be submitted to Government at the end of October.

Recommendation

The board is asked to agree the LEP submission to Government on geography which retains

the geography of New Anglia LEP as Norfolk and Suffolk but also recognises the close links

with Cambridgeshire and Peterborough and seeks to strengthen the relationship with the

Cambridgeshire and Peterborough Combined Authority.

The LEP board is also asked to note the other recommendations of the LEP Review, in

anticipation of a more detailed implementation plan being brought to the October board meeting

for agreement ahead of the Government’s October 30th deadline.

Background

Over the past few months the Government has conducted a review of LEPs in support of a

manifesto commitment to strengthen their role and remit.

The review led by ministers from HM Treasury, MHCLG and BEIS and backed by Number 10,

published its report “Strengthened Local Enterprise Partnerships” towards the end of July.

Key issues

The report covered five main areas: 1 Role and responsibilities, 2 Leadership and

organisational capacity, 3 Accountability and performance, 4 Geography and 5 Implementation.

The review has been welcomed by LEPs including New Anglia LEP as a positive statement by

Government on the role of LEPs moving forward.

1

45

This report takes the five areas in turn.

1 Role and responsibilities

The review stated that the primary role of LEPs is on enhancing productivity which will be

achieved through the development of Local Industrial Strategies.

The review reiterated that LEPs will lead on the development of Local Industrial Strategies and

all LEP areas will agreed their LIS with Government by early 2020.

This was helpful as until that point that had not been clarity over whether all areas would have

their own LIS.

New Anglia LEP’s new economic strategy is already focused on enhancing productivity. Our

strategy does also place an emphasis on inclusive growth.

As outlined in earlier board papers, we have not been chosen as a pilot for an early Local

Industrial Strategy. However have started, with the agreement of Government, on preparatory

work for our Local industrial Strategy.

This will build on and help accelerate the delivery of the Economic Strategy.

LEPs are also now required to produce an annual delivery plan and end of year report. We will

be working with Government colleagues on the desired format for this. The first delivery plan

will be for April 2019 and end of year report a year later.

Our aim will be to create a delivery plan which fulfils a role for board members as well as

Government.

2 Leadership and organisational capacity

The review confirmed that the Prime Minister will host two meetings with LEP chairs per year -

the PM’S council. In addition senior Whitehall officials will be appointed as sponsors to each

LEP.

New Anglia LEP’s senior sponsor is Catherine Frances, a deputy director in HMT. She is

visiting New Anglia LEP later this month.

The Government is also providing an additional £200k per LEP for two years to support

additional capacity. This funding is earmarked to enable LEPs to implement the review and

develop their LIS.

We are looking at using this additional funding on a small number of roles to assist performance

and delivery and the development of the Local Industrial Strategy.

The review also encourages boards to consult widely on the appointment of chairs and set term

limits. We already comply with this.

The Government wants to increase the proportion of private sector board members, whilst

limiting board sizes to 20. The Government’s aspiration is for two thirds of the board to be from

the private sector.

Currently New Anglia LEP has a 50 / 50 split. We are looking at ways of complying with this

request.

The Government has also set a target of one third female board members by 2020 and

expectation of 50/50 by 2023. Again we are looking at ways of complying with this.

2

46

The review also requires LEPs to have a secretariat independent of local government to

support LEP’s decision making. New Anglia LEP already complies with this requirement.

3 Accountability and performance

The review requires LEPs to have a legal personality. The preferred model is for incorporation -

which is New Anglia LEP’s model.

The review asks LEPs to hold annual general meetings and open them to the public, which

New Anglia LEP already does, as well as participate in local authority scrutiny sessions which

the LEP again already does.

LEPs are also required to set out clearly the responsibilities of the chair, board, directors and

accountable body. We already comply with this.

The Government will also be more robust about measuring performance of LEPs which will

form part of the LEP’s delivery plan.

There are also plans to strengthen the peer to peer work already being undertaken through the

LEP Network.

4 Geography

The review asked LEP chairs and other stakeholders to come forward with proposals by the

end of September on geographies that best reflect real functional economic areas, remove

overlaps and where appropriate propose wider changes such as mergers.

The review also asked LEPs and mayoral combined authorities to move towards coterminous

geographies where appropriate in line with the wider discussions on LEP geographies.

The review also says Government will support LEPs collaborating across boundaries where

interests are aligned.

Implications for New Anglia LEP

Currently the Borough Council of Kings Lynn and West Norfolk and the two West Suffolk

Council districts (St Edmundsbury and Forest Heath) are members of New Anglia LEP and

were previously members of the Greater Cambridge Greater Peterborough LEP.

GCGP LEP is in the process of being turned into the Business Board, which will be the LEP, sat

within the Mayoral Combined Authority.

The Business Board is expected to have a board of 10 people - eight business leaders and two

public sector members (the mayor and deputy mayor). Recruitment of board members is

ongoing.

The LEP Review means that West Suffolk and West Norfolk will need to decide if they wish to

remain part of New Anglia LEP or join the new Mayoral Combined Authority Business Board.

At the same time the Cambridgeshire and Peterborough Combined Authority will need to

decide whether to make its LEP boundary co-terminous with its own boundary (ie covering just

Cambs and Peterborough).

Our view is that the businesses and residents of West Suffolk and West Norfolk would be best

served by remaining part of New Anglia LEP, whilst at the same time continuing to develop and

indeed strengthen working links with the Mayoral Combined Authority in areas of mutual

interest.

3

47

This could include place based activities, sectoral activities as well as thematic areas such as

transport.

New Anglia LEP already works on a number of joint projects with GCGP, and we would seek to

strengthen this to ensure the economies of West Suffolk and West Norfolk can continue to

benefit from their proximity to Cambridgeshire and Peterborough.

The new working arrangement with the combined authority could take a number of different

forms, ranging from simple bilateral arrangements between for example West Norfolk Council

and the MCA to more formal arrangements covering specific areas.

The rationale for this approach is:

1 The New Anglia LEP area is a real economic functional area. A key determinant of this is

its level of self-containment. That is the percentage of people who live and work in the area.

The New Anglia LEP figure is over 92 per cent - making it the third highest of any LEP area.

2 Track record of investment. New Anglia LEP’s economic strategy sees West Norfolk and

West Suffolk as key areas for growth. As a consequence New Anglia LEP has invested

significant sums in both areas, with more investment planned.

To date more than £35m has been invested in the three districts in infrastructure, innovation

and skills projects as well as direct support for businesses.

3 Views of stakeholders. Stakeholders from the business community and including the

chambers of commerce and education partners have expressed a preference towards the three

districts remaining part of New Anglia LEP.

4 Co-terminosity with the Combined Authority. Government wishes LEPs to be

conterminous with their mayoral combined authorities. The legislation which created the

Cambridgeshire and Peterborough Combined Authority only included the districts of

Cambridgeshire, Peterborough and Cambridgeshire County Council.

The three Norfolk and Suffolk districts are not part of the combined authority and remaining with

New Anglia LEP would assist the MCA in complying with the co-terminosity requirement.

Over the summer we have been holding conversations with the Combined Authority, West

Norfolk Council and West Suffolk Council.

The two councils have indicated their preference to remain with New Anglia LEP, whilst

strengthening links with the Combined Authority.

The Combined Authority has indicated that it intends to align its Business Board boundary to

that of the Combined Authority. This however need to be ratified by the Business Board at its

meeting on September 24th.

An agreement amongst all parties seems highly likely therefore, in time for the Government’s

deadline of September 28th.

Recommendation

The board is asked to agree the LEP submission to Government on geography which retains

the geography of New Anglia LEP as Norfolk and Suffolk but also recognises the close links

with Cambridgeshire and Peterborough and seeks to strengthen the relationship with the

Cambridgeshire and Peterborough Combined Authority.

The LEP board is also asked to note the other recommendations of the LEP Review, in

anticipation of a more detailed implementation plan being brought to the October board meeting

for agreement ahead of the Government’s October 30th deadline.

4

48

New Anglia Local Enterprise Partnership Board

Wednesday 19th September 2018

Agenda Item 9 - Chief Executive’s Report

Author: Chris Starkie

Summary

This report provides an overview of LEP team activities since the June board, structured around:

1) Programmes

2) Strategy

3) Engagement

4) Operations and Finance

Recommendation

The board is asked to note to contents of the report.

1)

Programmes

This section provides a headline update on the LEP’s main programmes. More detailed

performance information on individual programmes can be found at agenda item 11.

Growing Places Fund

Ipswich Winerack - construction of the building is progressing well. £2m of the £5m LEP loan

has now been drawn down and the majority of the remaining £3m is likely to be drawn down

during the 2018/19 financial year. The first of the housing units in the development are likely to

be completed by the spring of 2019 with occupation soon after. In line with the LEP request

fire precaution steps for the development are being closely monitored and an interim paper on

this has been requested from Carters, who are constructing the building.

Ipswich Malthouse - work is underway to convert the former Malthouse building in Ipswich into

small business units and drawdown of the LEP loan of £600k commenced in July 2018. The

remainder of the loan will be drawn down in full before the end of the 2018/19 financial year.

Atex Developments, Stowmarket - Development of this Business Park began in July and

works will be advanced enough for the developer to submit claims for the drawdown of the

LEP loan in September.

Proserv, Great Yarmouth - drawdown of the full £1.5 million investment occurred in July and

the new site is fully operational. Feedback from Proserv to the LEP has been extremely

positive regarding the new building and the impact on their operation.

Growth Deal

The focus for the Growth Deal team has been developing grant agreements for the eight new

projects approved by the Board earlier this year. This has helped to accelerate spend,

however there is some slippage in this financial year. The Growth Deal Performance Report

and appendices provide more details, including actions being taken.

The Board is also being asked to approve the Government Dashboard this month, confirming

the spend and outputs of the programme from April- June this year.

A Board paper proposing a focused call to allocate the remaining Growth Deal funding will go

to the Board in October.

New Anglia Capital

New Anglia Capital achieved its first financial return in July 2018, when the £150k loan made

to Fraser Well Management in February 2016 was repaid with interest. The loan helped FWM

to retain skilled personnel during the oil price crash, with 9 out of the original 11 skilled staff

still employed by the Great Yarmouth based company today.

1

49

New Anglia Local Enterprise Partnership Board

Wednesday 19th September 2018

Agenda Item 9 - Chief Executive’s Report

Author: Chris Starkie

Retaining these key personnel has allowed the company to diversify and expand away from

the UK into the worldwide market, supplying specialist oil and gas well management and

services.

Growth Programme

Following extensive negotiations supported by the LEP Chair and senior staff in the LEP

Executive over the summer period, a three-year extension to the Growth Programme funded

by the European Regional Development Fund has now been secured, the offer being received

during the first week of September.

This ensures, subject to satisfactory performance, that the Growth Hub, business start up

schemes and the Small Grant Scheme will continue until at least August 2021.

The total ERDF offer equates to around £12.9m of financial support, with the programme

generating the same value in match funding, making the total value of the programme over 6

years around £25.8m, which is the largest ERDF programme in the region.

Growing Business Fund

The Growing Business Fund has performed strongly all year and is forecasting to spend or

exceed the current budget allocation for the 2018/19 financial year.

Of particular note is the award to LDH La Doria, an ambient food importer who have chosen to

build a £41.6m innovative food storage and distribution centre on the former British Sugar site

in Sproughton, Ipswich, one of the Space to Innovate Enterprise Zone sites.

A £500k grant award from the GBF programme has helped to secure the investment, creating

a minimum of 29 new jobs by 2020 and a flagship new occupier for the site which has lain

empty for a number of years. Further investment in the local infrastructure will also be

provided as part of the regeneration of the local area.

2)

Strategy

This section provides an update on the work being undertaken by the LEP’s strategy team

since the last board meeting. This includes work around skills, infrastructure, transport and

sector development.

Work on the Economic Strategy Delivery Plan and Local Industrial Strategy is covered

separately under agenda items six and seven.

Skills

Eastern Institute of Technology

The Eastern Institute of Technology bid has been successful securing one of the fifteen places

in governments composition. The partnership has been invited to submit a detail bid in

November. Government have issued interim guidance. Several groups have been established

with a key focus on different aspects of the bid. An employer dinner will take place on October

2nd to review progress to date and provide further steer to shape a compelling bid.

Further employer engagement will take place over the autumn to widen the support and

develop the curriculum offer. A financial model can be submitted to Government in October

and will be commented on without it having an impact on the outcome at this stage. Although

2

50

New Anglia Local Enterprise Partnership Board

Wednesday 19th September 2018

Agenda Item 9 - Chief Executive’s Report

Author: Chris Starkie

progress is positive, further work on establishing a coherent and engaged group of

stakeholders is fundamental for the ultimate success of the IoT.

Sector Skills Plans

All our key sectors now have a sector skills plan which has been endorsed by the Skills Board.

Many of the sectors are working through the recommendations laid out in the plans. Some,

such as Life Sciences, still need an established group who are willing to take this forward, this

will be addressed over the coming weeks.

The Educations and Skills Funding Agency (ESFA) have agreed an extension of the work that

Skills Reach are undertaking. This will result in a further four plans being produced with the

initial ones being Education, Emerging Technologies and Creative Industries.

Infrastructure

Building Growth Group Utilities Infrastructure workshop - 20 September

As previously communicated, the Building Growth Group is holding a workshop looking at the

barriers to productivity in the construction industry associated with utilities infrastructure. The

collaborative workshop will focus on how we can collectively overcome these barriers.

Local Energy East Strategy

Comments on the endorsement draft were received from all Local Authorities in Norfolk and

Suffolk and minor amendments are being made accordingly. A launch event is being planned

for early October, as is a Norfolk and Suffolk Delivery Plan workshop, looking at what we need

to do to the deliver on the Strategy’s ambitions.

Greater South East Energy Hub

The Greater South East Energy Hub is a collaboration of eleven LEPs who are working

together to increase the number, quality and scale of local energy projects being delivered

across the South East of the UK. The Regional Hub Manager started in post on 3 September

and will be working closely with a Norfolk and Suffolk Project Manager to ensure our local

ambitions are well understood and promoted. A formal launch of the Hub will happen in

October.

New Anglia Climate Change and CO2 Reduction Plan

Johnathan Reynolds and David Richardson attended a meeting on 29 June with other UEA

academics and a representative from the LEP Executive Team to discuss taking forward the

New Anglia Climate Change and CO2 Reduction Plan.

The meeting followed a request from the LEP board to see how carbon reduction targets

might be included in our Economic Strategy.

The meeting explored how we might deliver the ambitions of the Climate Change Committee’s

sector focussed work locally. The UEA were keen to work collaboratively to develop more

recent emissions data than current government reporting. More up to date evidence would

help us to model scenarios and develop options and recommendations aligned with the Local

Energy East Strategy and to help refine options on delivery of the new Economic Strategy.

A scoping report will act as a catalyst to provide a replicable framework for the LEP Network

and show Climate Change Committee that we are leading the way in this work area. This

work is currently being pursued with UEA.

3

51

New Anglia Local Enterprise Partnership Board

Wednesday 19th September 2018

Agenda Item 9 - Chief Executive’s Report

Author: Chris Starkie

Transport

Local Transport Board Meeting - 18 September

The Local Transport Board will be visiting the Transport Systems Catapult in Milton Keynes on

18 September. They will also receive a presentation from Highways England on the new

Lower Thames Crossing.

Transport East

Dominic Keen will represent the LEP at the next Transport East meeting in Bury St Edmunds

on 14 September. At the last meeting the forum agreed to focus on three main strategic

themes: ports and airports, supporting growth and coastal communities.

East West Rail

The New Anglia LEP will be represented for the first time at the East West Rail Consortium

meeting in Cambridge on 11 September.

Great Eastern Main Line Rail Taskforce

The Taskforce last met on 2nd July and Network Rail has commenced work on a Rail Study for

the Great Eastern Main Line. The purpose of this study is to determine what the new baseline

for economic growth is, given the introduction of a new fleet of trains and a revised timetable

coming into operation during 2019.

Network Rail’s study will feed into the development of a wider economic study and a Strategic

Outline Business Case which will be published in Spring 2019.

The Business Case will comply with the Department for Transport’s new enhancements

funding process. New Anglia LEP is contributing towards the cost of employing consultants to

undertake the wider economic study and develop the Strategic Outline Business Case. The

LEP will also lead a programme of stakeholder engagement in support of the revised business

case early in the New Year working closely with Network Rail and the train operator.

Sector Deals

Nuclear Sector Deal, Offshore Sector Deal

Linked to the Industrial Strategy, the Nuclear Sector Deal was published on 27th June. Since

publication, the LEP has been working closely with Cumbria LEP, Heart of the South West

LEP and the Nuclear Advanced Manufacturing Research Centre on the Supply Chain and

Productivity Improvement Programme to pull together a bid.

The three LEPs are working together to attract £3m of the £10m announced by Government

as part of this programme, with NAMRC bidding to secure the rest on a national basis for

larger manufacturers in the nuclear supply chain.

The proposal from New Anglia LEP would see our region learn the lessons from Hinckley

Point C’s supply chain programme and look to build on the Sizewell C supply chain portal

managed by Suffolk Chamber of Commerce. Another exciting announcement in the Sector

Deal was regarding the potential for the East to host an Eastern Hub of the National College

for Nuclear.

4

52

New Anglia Local Enterprise Partnership Board

Wednesday 19th September 2018

Agenda Item 9 - Chief Executive’s Report

Author: Chris Starkie

The Offshore Wind Sector Deal is expected be published later this year. The LEP is working

closely with local stakeholders and government to ensure that our expertise is recognized in

the Sector Deal, similar to the references to our region in the Nuclear Sector Deal.

Strength in Places Fund

The LEP brought together local stakeholders to collaborate and submit a bid to the

Government’s Strength in Places Fund. Given the specifications in the proposal, it was

decided that UEA would lead the expression of interest. The expression of interest (Digital

New Anglia) was submitted on 25th July.

Digital New Anglia (DNA) will focus on the digital technology cluster, with its key subsectors of

software development; telecommunications and networking; digital marketing; digital media;

gaming and gamification; and e-commerce. Developing this cluster will benefit other key Area

clusters: Agriculture and Food, Energy, and Finance, all end users of innovative digital

technology.

Successful expressions of interest will receive up to £50k seedcorn to develop full stage

proposals over a period of 24 weeks. After the second, full stage assessment, a number of the

highest quality proposals will then receive funding for between 3 - 5 years, depending on the

individual proposal, to deliver a bespoke package of interventions in that locality. In this first

wave of funding, UKRI expects to fund between 4 and 8 bids.

3)

Engagement

This section covers engagement activity with local stakeholders, including local authorities,