New Anglia Local Enterprise Partnership Board Meeting

Wednesday 21st November 2018

10.00am to 12.30pm

Keystone Innovation Centre, Thetford, Norfolk

Agenda

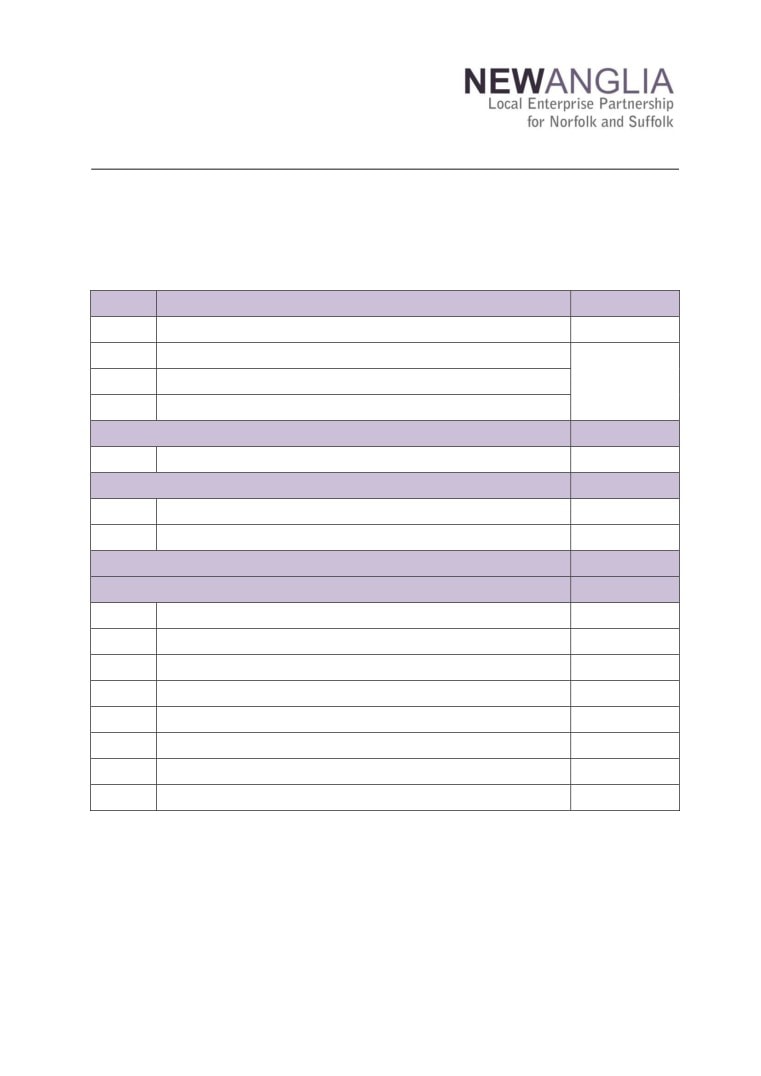

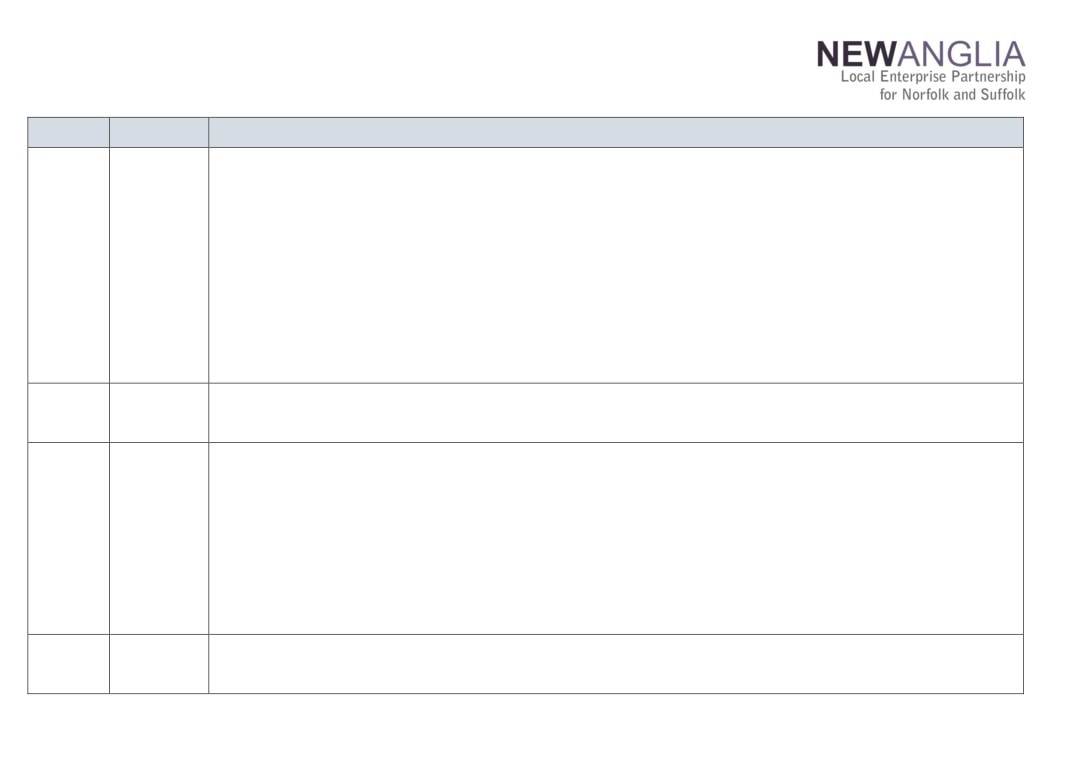

No.

Item

Duration

1.

Welcome

25 mins

2.

Apologies

3.

Declarations of Interest

4

Actions / Minutes from the last meeting

Forward Looking

20 mins

5.

Infrastructure

Update

Governance and Delivery

25 mins

6.

Tier 2 Review

For Approval

7.

LEP Board Governance

For Approval

Break

10 mins

Governance and Delivery

50 mins

8.

Enterprise Zone Accelerator Project - Confidential

For Approval

9.

Brexit

Update

10.

Chief Executive’s Report

Update

11.

November Performance Reports

Update

12.

Finance Report including Confidential Appendices

Update

13.

Board Forward Plan

Update

14.

Any Other Business

Next Meeting: 10.00am - 12.30pm, 30th January2019

Venue:

The Innovation Centre, University of Suffolk, Ipswich

1

New Anglia Board Meeting Minutes (Unconfirmed)

18th October 2018

Present:

Doug Field (DF)

East of England Coop

Dominic Keen (DK)

High Growth Robotics

Johnathan Reynolds (JR)

Nautilus

David Richardson (DR)

University of East Anglia

Lindsey Rix (LR)

Aviva

Sandy Ruddock (SR)

Scarlett & Mustard

Nikos Savvas (NS)

West Suffolk College

Jeanette Wheeler (JW)

Birketts

In Attendance:

Martin Wilby (MW)

Norfolk County Council (For Andrew Proctor)

Mark Bee (MB)

East Suffolk Coastal & Waveney Council (For John Griffiths)

Kevin Maguire (KM)

Norwich City Council (For Alan Waters)

Tom McGarry (TM)

EDF Energy - For Item 3

Jacqueline Bircham (JM)

Norwich Opportunity Area - For Item 6

Vince Muspratt (VM)

Norfolk County Council

Shan Lloyd (SL)

BEIS

Chris Dashper (CD)

New Anglia LEP (For Items 9 & 10)

Chris Starkie (CS)

New Anglia LEP

Rosanne Wijnberg (RW)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

1

3

Actions from the meeting: (18.10.18)

Brexit

To receive details of the impact of Brexit on current LEP Projects

CD

Capital Growth Programme Call

To build a process into the call to ensure that all applicants receive a timely response

CD

LEP Review

To receive clarification re the term of appointment for education members following the

CS

reclassification

1

Welcome from the Chair

Doug Field (DF) welcomed everyone to the meeting including Martin Wilby, Mark Bee and Kevin

Maguire who were deputising for Andrew Proctor, John Griffiths and Alan Waters respectively.

DF thanked Tom McGarry for hosting the Board meeting at Sizewell.

2

Apologies

Apologies were received from: David Ellesmere, John Griffiths, Matthew Hicks, Steve Oliver,

Andrew Proctor, William Nunn, Alan Waters and Tim Whitley.

3

Welcome to Sizewell

Tom McGarry (TM) provided the meeting with an update on the Sizewell C project advising

that the next phase of consultation was due to start in January 2019 with the planning

application to be submitted in 2020 and construction due to start 2021.

The presentation covered the plan to replicate large amounts of Hinkley Power Station when

building Sizewell C in order to reduce costs.

TM discussed the skills requirements for the project and the ongoing work to meet shortfalls.

TM stressed the benefits of Sizewell C and requested support from the Board in promoting

the project.

The Board agreed:

To note the content of the presentation

4

Declarations of Interest

Item 9 - Capital Growth Programme Call: Nikos Savvas and David Richardson.

5

Minutes of the last meeting 19th September 2018

The minutes were accepted as a true record of the meeting held on 19th September 2018.

6

Opportunity Areas

Jackie Bircham (JB) presented the Board with an overview of the Norwich and Ipswich

Opportunity Areas (OAs) which had been identified as areas facing challenges to social

mobility based on the Social Mobility Commission’s Index. The Board was advised that the

OA projects will run for 3 years after which findings will be implemented as appropriate to

other areas of the country.

JB reviewed the priority areas identified in both Ipswich and Norwich and the Board watched

a video on the work carried out in the Norwich Opportunity area.

JB stressed that the work to date had showed that there was no lack of aspiration in young

children in these areas but they needed to be shown the route to achieve them.

Jeanette Wheeler (JW) asked about the impact of the lack of SENCO support given the

numbers of pupils identified as needing further help with their learning.

JB advised that the Inclusion Charter considered this issue and noted that schools had been

asked to come up with proposals regarding what would make a difference to pupils which

could include addressing this problem.

Kevin Maguire (KM) asked about the impact of the proposed closures of the Childrens

Centres should they proceed.

JB agreed that this would be an issue as the original plan had been to contact the relevant

families via the Childrens Centres. The project is now having to consider other ways to

2

4

reach out to the relevant children and families wherever they are rather than focussing on

the centres. This could include supermarkets and other community venues.

As a member of the Ipswich OA Board Nikos Savvas (NS) updated the meeting on the

challenges the OAs faced with the limited funding available to them.

Sandy Ruddock (SR) noted the importance of good diet and regular exercise on the ability

to learn and suggested that the latter issue could be implemented with minimal cost.

JB agreed but noted the challenges schools face in delivering the main curriculum meant

that they often focussed on this even though exercise could help their educational

achievements. JB noted that research was being carried out and when the evidence was

produced on the results of programmes such as the Daily Mile it may be incorporated in the

future.

NS stressed that the OAs had no power to change the curriculum or force schools to adopt

any of the measures suggested.

JB asked to Board to support businesses going into schools and also in offering work

experience and also raise the profile of Norwich and Ipswich as OAs.

The Board agreed:

To note the content of the presentation

To support the OAs by raising their profile with businesses

7

Brexit

Chris Starkie (CS) presented the meeting with a paper covering the LEP’s work to date on

Brexit as requested at the last Board meeting.

The Board was advised that there were four main workstreams:

Intelligence - The LEP will continue to act as an information resource to government based

on engagement with business, business intermediaries and local authorities.

Advice - A plan is being developed to provide succinct information on areas of concern to

businesses including the impact of the future UK-EU relationship on companies.

Funding - The LEP is working both regionally and nationally to help shape the future of

funding and has been making the case to Defra regarding transitional funding.

Strategic Opportunities - The LEP is delivering on the ambitions set out in the Economic

Strategy and many actions will be impacted by Brexit either as opportunities or challenges.

Dominic Keen (DK) asked what the LEP could do to help business if market conditions

deteriorated significantly.

CS advised that the workstreams he cited were interlinked and funding would be used to

increase capacity for support as required in order to support companies across the LEP

area.

Lindsey Rix (LR) asked if Board members were receiving questions about Brexit from

businesses. JW felt that businesses were still largely ignorant on the support available for

them now and this would need to be addressed by promoting the help which the LEP could

provide.

LR asked if an analysis of the LEPs current projects had been carried out. CS confirmed

that this would be completed.

Mark Bee (MB) noted that even small changes would have a significant impact of

businesses and it would be beneficial to have the information on these impacts collated in

one place.

David Richardson (DR) suggested that it would be useful to understand the benefits

available from early trade agreements.

JW asked if work was being done to understand the increased costs of doing trade, the

impacts of these on businesses and whether the Board can do anything to address these.

Johnathan Reynolds (JR) noted the importance of understanding impact on specific sectors

and whether any challenges can be exploited as game-changing opportunities.

The Board agreed:

To support the approach detailed in the paper

To receive details of the impact of Brexit on current LEP Projects

CD

3

5

8

LEP Review

CS presented the paper included in the meeting pack detailing the progress made on

implementing the LEP Review.

LR asked whether the level of female representation was a specific target. Shan Lloyd (SL)

advised that this was an ambition and that Government recognised the challenges given the

number of Board members coming from Local Authorities which was outside the LEP’s

control.

It was agreed to change the wording from “target” to ”ambition”.

The Board was advised that, in order to achieve the requirement of having two thirds of

board members from the private sector, it was proposed to amend the LEP’s articles of

association to class education members as private sector and to then to recruit 2 more

private sector members in order to increase the number of private sector board members to

12.

Martin Wilby (MW) asked if the Board was able to be challenge the requirements laid down

for the split of private and public sector board members. CS advised some councils had

already asked for this to be reconsidered but that Government had reiterated that the

requirement would stand.

KM asked if the 3rd Sector was represented and was advised that these were included as

private sector.

NS stressed that this provided the opportunity to recruit 2 new high quality board members.

JW agreed and noted that this would also give the chance to expand the representation of

sectors on the board.

NS asked if he and DR needed to leave the room for the vote. It was agreed that this was

not a requirement.

DR asked for clarification re term of appointment for education members following the

reclassification.

JR noted that a change to the articles would be needed to allow Education board members

to send substitutes.

The meeting voted on the proposal to amend the LEP’s articles of association to increase

the number of private sector board members to 12.

10 Board members voted in favour of the proposal with 1 Board member voting against.

DF proposed that the Articles be amended to allow the Board Members representing

Education to be allowed to send deputies.

This was agreed by the meeting.

The Board agreed:

To note the content of the report

To maintain its existing approach to the recruitment of its chair.

To appoint a deputy chair by February 28th 2019.

To amend the LEP’s articles of association to class education members as private

sector.

To amend the LEP’s articles of association to increase the number of private sector

board members to 12.

To amend the articles of association to allow education sector board members to

send deputies to board meetings

To amend the wording from “target” to ”ambition” in relation to the recruitment of

female board members

Agree to work towards increasing the female representation amongst private sector

board members.

4

6

Ask the LEP chair to write to education and local authority members to highlight the

gender balance recommendations in the LEP Review and ask for support in helping

the LEP board achieve the targets set by Government.

To receive clarification re the term of appointment for education members following

CS

the reclassification

9

Capital Growth Programme Call

DR & NS left the room.

Chris Dashper (CD) reviewed the paper as included in the pack noting that the call would

focus on projects relating to skills, productivity and innovation.

DF noted the importance of infrastructure in the delivery of economic growth across the

region and stressed the importance of understanding how such projects would be delivered

if there were not prioritised in the call.

DF also asked for the mechanism for replying to applicants to be included.

CD noted that there would be other opportunities for infrastructure projects in future funding.

MW stressed the importance of importance of infrastructure in the delivery of productivity

gains and jobs. CD agreed but noted the call was focussing on delivering direct outputs

rather than these indirect outputs.

CS noted the £34m awarded to Norfolk County Council for infrastructure projects some of

which had been carried over from the previous financial year as it was unspent and there

was still slippage in the current ongoing projects.

The Board agreed:

To approve the launch of a focused call on Skills, Innovation and Productivity, to

allocate the remaining £19m of the Capital Growth Programme

For a process to be built into the call to ensure that all applicants received a timely

CD

response.

NS & DR returned to the room

10

Innovative Projects Call

CD reviewed the paper as included in the pack detailing the background to the call and the

source of the fund as Pot C revenue.

CD advised that this funding will be available again and will increase as occupancy of the

Enterprise Zones increases.

JW stressed her support for the proposal and noted that some projects may not

automatically have the sustained funding in place which was detailed in the paper but would

still benefit from support at this stage.

DK asked if there was a preference for the number and size of projects.

CD advised that there was no specific requirements and the focus would be on the outputs

and contribution to the delivery of the Economic Strategy.

JR asked if the call could be linked to the Innovation Board as projects are presented to the

Board and which cannot be funded.

CD advised that this had been considered but it was felt that the call could not be linked to

only one Board however the views of the Innovation Board could be fed in.

MB asked about the funding for expanding Broadband across Norfolk and Suffolk.

It was agreed that this fell under the capital projects call and that it was important to have

funding available for innovative projects.

NS noted that there were various projects going on to delivery digital connectivity locally and

it would be beneficial to pull these together.

The Board agreed:

5

7

To approve the specification and launch of a call for innovative growth projects to be

supported through EZ Pot C income

To approve the eligibility framework

11

Eastern Agritech Report

Rosanne Wijnberg (RW) updated the Board on the progress made on the Eastern Agritech

initiative and recommended to the Board that New Anglia continues to support the initiative

subject to the conditions laid down in the paper.

DF asked if there was an alternative option available which would maintain the programme if

the Cambridgeshire and Peterborough Combined Authority failed to secure the funding

detailed in the paper.

CD advised that if this occurred the framework allowed for the LEP to pick the initiative up

and deliver it alone.

DF clarified the reporting requirements and RW advised that reporting to the Board would

take place on a quarterly basis.

DR stressed the importance of equal branding for the project as historically the role of New

Anglia in the initiative had not been obvious.

The LEP Board agreed:

To approve the continuation of the programme in partnership with the Cambridge

and Peterborough Combined Authority, providing a financial contribution of £1m

towards the programme in 2018/19 under the terms laid out in the report

12

Chief Executive’s Report

CS presented his report to the Board and asked for questions.

CS provided an update on Banham Poultry and advised that he is meeting the MD on 19th

October to discuss development plans and investment.

DF advised the meeting that Emily Manser was leaving the LEP as Growth Deal Manager.

DF expressed the thanks of the Board for Emily for her hard work in delivering the

programme.

The Board agreed:

To note the content of the report

13

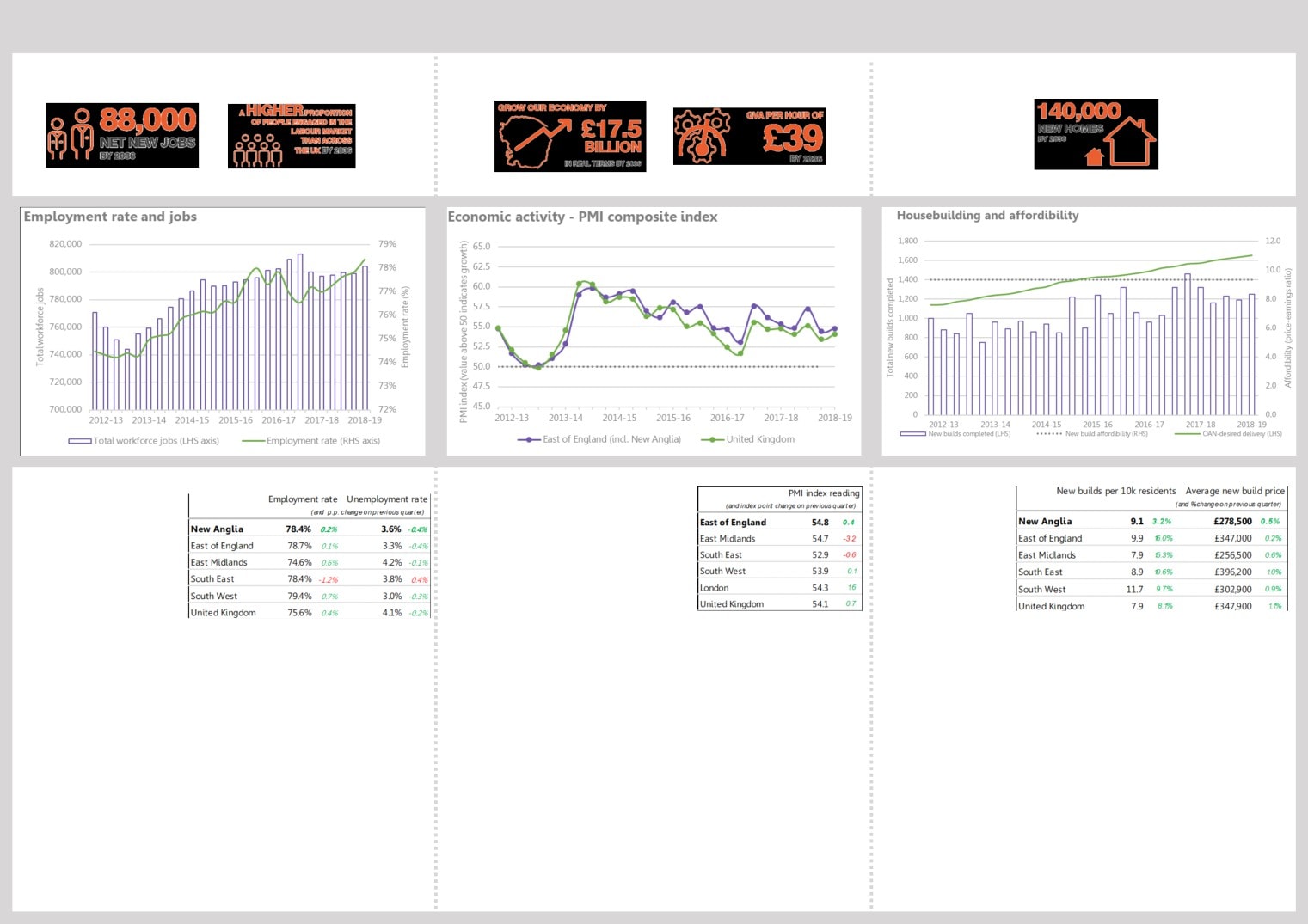

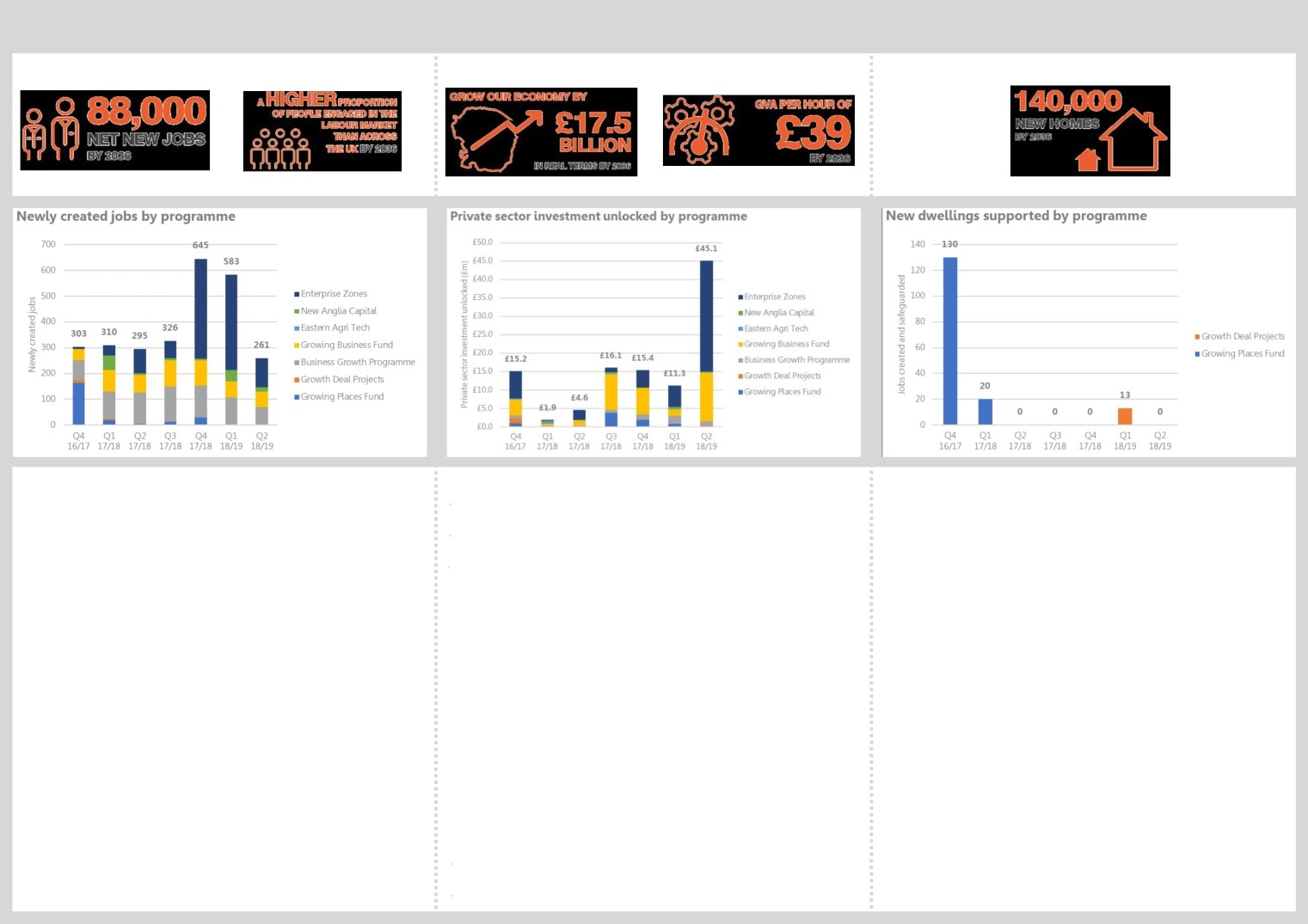

October Programme Performance Reports

RW presented the report included in the meeting pack.

The Board agreed:

To note the content of the reports

14

Finance Report

RW reviewed the finance report and asked for questions from the Board.

DF asked if the further £200k from Government for the implementation of the LEP Review

had been factored in. CS advised that this would be done when confirmation was received.

RW confirmed to the Board that, at the AGM on 19th September, approval had been given

for the Board to appoint the new auditors and confirmed that Price Bailey had been

selected.

The Board agreed:

To note the content of the report

To approve the appointment of Price Bailey as auditors

15

Board Forward Plan

CS reviewed the items to be covered at the November Board meeting and that revisions to

the programme was ongoing

6

8

The Board agreed:

To note the content of the plan

16

Any Other Business

NS updated the Board on the Festival of Learning which is an annual event bringing

educators from around the UK and asked for the support of the Board.

CS advised that as part of the Nuclear Sector Deal £10m is being made available to support

the supply chain. Government has agreed that this should be divided up and a proportion of

this spent regionally and a business case has been submitted to this effect.

Next meeting:

Date and time of next meeting:

10.00am - 12.30pm, 21st November 2018

Venue: Keystone Innovation Centre, Thetford

7

9

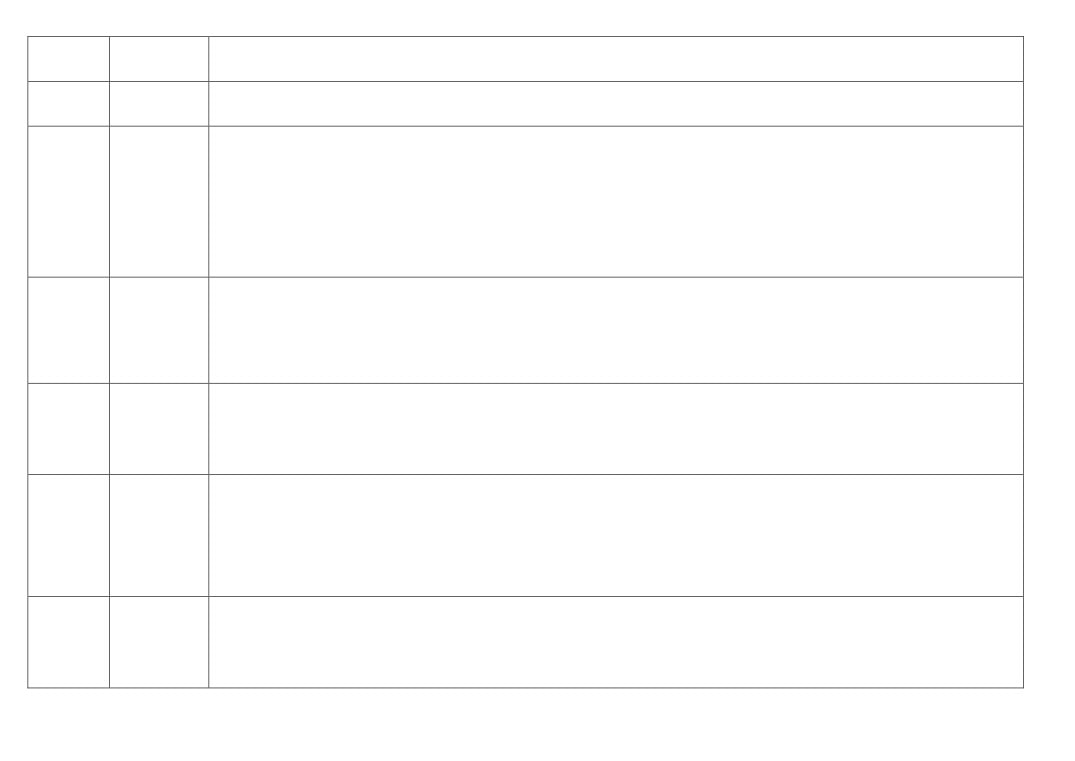

Actions from New Anglia LEP Board Meetings

Date

Item

Action

Update

Actioned By

Status

18/10/2018

Brexit

To receive details of the impact of Brexit on current LEP Projects

This has been included in the November Brexit update

CD

Complete

paper.

18/10/2018

Capital Growth Programme

To build a process into the call to ensure that all applicants receive a

The process for manaing applications includes timely

CD

Complete

Call

timely response

responses to all applicants

18/10/2018

LEP Review

To receive clarification re the term of appointment for education

Details included in the paper tabled at the November

CS

Complete

members following the reclassification

Board meeting

19/09/2018

Chief Executive's Report

To provide an update on the delivery timescales of major infrastructure

An update will be provided a the November Board

EG

Complete

projects including East West Rail

meeting

21/02/2018

Economic Indicator

To receive a paper on CO2 reductions for

Work is ongoing in conjunction with the UEA

CS/JR

On-Going

Trajectories and Targets:

consideration of inclusion in the economic strategy targets

21/02/2018

Brexit Analysis

To receive an action plan detailing the next steps, timescales and

This will now be a standing agenda item.

LiR

Complete

measures of success

22/11/2017

Business Performance

To receive a proposal on the Eastern Agi-Tech initiative by email.

The LEP Board approved the proposal to continue

CS

Complete

Reports

delivering the Agritech Programme in partnership with

the Combined Authority, subject to certain criteria being

met. The Agritech Programme Performance reports will

be submitted to the LEP Board as per the agreed

reporting cycle.

10

New Anglia Local Enterprise Partnership

Board Decision Log - Public

Date

Decision

Decision Made

Making Body*

18/10/2018

LEP Board

The Board Made the following decisions:

LEP Review

To maintain its existing approach to the recruitment of its chair.

To appoint a deputy chair by February 28th 2019.

To amend the LEP’s articles of association to class education members as private sector.

To amend the LEP’s articles of association to increase the number of private sector board members to 12.

To amend the articles of association to allow education sector board members to send deputies to board meetings

To work towards increasing the female representation amongst private sector board members

Capital Growth Programme Call

To approve the launch of a focused call on Skills, Innovation and Productivity, to allocate the remaining £19m of the Capital Growth Programme

Innovative Projects Call

To approve the specification and launch of a call for innovative growth projects to be supported through EZ Pot C income

To approve the eligibility framework

Eastern Agritech Report

To approve the continuation of the programme in partnership with the Cambridge and Peterborough Combined Authority, providing a financial

contribution of £1m towards the programme in 2018/19 under the terms laid out in the report

18/10/2018

Investment

The IAC made the following decisions:

Appraisal

Albert Bartlett Growing Business Fund Grant Request - Confidential

Committee

MSF Growing Places Fund bridging loan request - Confidential

Nar Ouse Enterprise Zone Investment - Confidential

19/09/2018

LEP Board

The Board Made the following decisions:

Economic Strategy Delivery Plan

To adopt the concept of developing Game Changers.

That the ESDCB should also coordinate development of the Local Industrial Strategy

Local Industrial Strategy

To agree the approach to developing the Local Industrial Strategy

LEP Review

To agree the LEP submission on geography

Programme Performance Reporting

To approve the reporting cycle with the inclusion of NAC

To approve the reporting template

September Programme Performance Reports

To approve the Growth Deal Quarterly Dashboard

19/09/2018

Investment

The IAC made the following decisions:

Appraisal

Capital Growth Programme Autumn Call

Committee

To recommend to the LEP Board that the recommendations in the paper should be supported and the call launched after the October LEP

board meeting

* New Anglia Local Enterprise Partnership Board, Investment Appraisal Committee, Growing Business Fund Panel, Remuneration Committee, Audit & Risk Committee

Revenue Budget Framework

To recommend to the LEP Board that the recommendations in the revenue paper should be supported and the call launched after the

October LEP board meeting

06/09/2018

Investment

The IAC made the following decisions:

Appraisal

Rouen House Grant Variation - Confidential

Committee

05/09/2018

Growing

The Panel approved the following applications:

Business Fund

• Zedbox UK Limited - Agreed to support

Panel

Approved Grant: £120,000

• Westover Vets Limited - Agreed to support

Approved Grant: £126,000

The Panel ratified the following applications:

• DB Sheetmetals Limited (considered and approved by email in August) - Agreed to support

Approved Grant: £60,000

• TML Precision Engineering Limited - Update report

Approved to continue to support - Revised Grant: £95,294

01/08/2018

Growing

The Panel approved the following applications:

Business Fund

• Mirus Aircraft Seating Limited - Agreed to support

Panel

Approved Grant: £140,000

• Vanilla Electronics Limited - Agreed to support

Approved Grant: £39,994

• TBI Manufacturing Limited - Agreed to support

Approved Grant: £69,500

30/0/72018

LEP Board

By written procedures the Board made following decision:

Financial Statements 31st March 2018

To approve the 2017/2018 accounts as detailed in the following papers:

• draft accounts paper

• audit completion document - Confidential

• draft annual financial statements year ended 31 March 2018- Confidential

05/07/2018

LEP Board

By written procedures the Board made following decision:

Capital Growth Programme Honingham Thorpe Food Enterprise Park

To approve a grant of £1m with the following conditions:

• Confirmation of the signature of the contract between Unilever and Condimentum.

• Planning Permission secured for the Condimentum site on the Food Enterprise Park.

• A suitable State Aid mechanism prepared to cover wash-through, clawback and repayment of the grant, to be incorporated into the legal

agreement.

• All terms and conditions to be agreed by the applicant.

04/07/2018

Growing

The Panel approved the following applications:

Business Fund

• LDH (La Doria) Limited - Agreed to support

Panel

Approved Grant: £500,000

• Glowcroft Limited - Agreed to support

Approved Grant: £38,742

• Pecksniffs Bespoke Fragrances & Cosmetics Limited - Agreed to support

* New Anglia Local Enterprise Partnership Board, Investment Appraisal Committee, Growing Business Fund Panel, Remuneration Committee, Audit & Risk Committee

New Anglia Local Enterprise Partnership Board

Wednesday 21st November

Agenda Item 5

Infrastructure Update

Author: Ellen Goodwin

Summary

The provision of high quality infrastructure to support economic growth is a key element of the

LEP’s Economic Strategy.

The LEP plays a number of roles with partners in planning, securing and delivering this

infrastructure.

Appendix A, which will be presented to the board meeting by the LEP’s infrastructure manager,

outlines the different roles of the LEP and partners in the provision of infrastructure and highlights

the progress being made in key strategic projects.

Recommendation

The Board are asked to note the update.

Background

The September board meeting requested an update on the delivery timescales of major

infrastructure projects across Norfolk and Suffolk and beyond where relevant.

The Economic Strategy states that “Infrastructure improvements underpin all our priority places

and themes” so it is critical for the Board and its partners to continue in their role of providing

leadership, lobbying for improvements and securing as well as agreeing funding.

Appendix A outlines the key strategic infrastructure projects which we believe will help to unlock

growth across Norfolk and Suffolk. It is not an exhaustive list of projects being worked on across

the area and there are many key partners involved in the delivery of this infrastructure. The

presentation will be delivered at the Board meeting.

Link to the Economic Strategy

Boosting our infrastructure is central to delivering all our Economic Strategy ambitions. As such

is it a key underpinning priority throughout the Strategy.

Our key policies associated with infrastructure are:

Build the right kind of housing and commercial space where it is needed

Use new rail investment to further improve connectivity

Prioritise digital and physical infrastructure projects

1

13

Commit to further supporting businesses through a smoother planning system,

At a regional level, continue to work with other areas, in particular Cambridge and

Essex, on major physical and digital infrastructure improvements,

Recommendation

The Board are asked to note the update.

Appendix A - Infrastructure presentation to the board

2

14

Appendix A - Infrastructure Update

15

The LEPs role in unlocking infrastructure

FUNDING

Growth Deal

LOBBYING

Key player engagement

LEADERSHIP

Local Transport Board

16

Delivering Norfolk & Suffolk Economic Strategy

•

Make sure that investment markets have the

information they need to take the decision to invest in

infrastructure.

•

Build the right kind of housing and commercial space

where it is needed and integrate infrastructure to build

the communities and places people want to live.

•

Prioritise digital and physical infrastructure projects to

support businesses to develop and provide the space

that new and existing firms need to grow.

•

Commit to further supporting businesses through a

smoother planning system, linking housing and

infrastructure provision with flexible investment plans,

working with Homes England and the Housing Finance

Institute.

•

At a regional level, continue to work with other areas,

Infrastructure improvements underpin

on major physical and digital infrastructure

improvements, and proactively identify opportunities to

all our priority places and themes

create bigger gains across the East.

17

Infrastructure Specifics

Integrated Transport Strategy:

Strengthening the reliability of high

quality mobile coverage

Completing the provision of high speed

broadband

Utility provision for business and new

communities, including local energy

networks

Flood defences that unlock or protect

housing and commercial development

18

Summary of achievements to date

Capital Growth Programme profile:

Invested £83m in connectivity

Invested £68m in unlocking growth

£280.05m public/private leverage

41,640 new/safeguarded jobs

6,300 new homes

Projects agreed in the October 2017 call:

• Bacton Flood Scheme

• Cefas Research Centre

• Snetterton Electricity Scheme

• A140 Hempnall Roundabout

• Eye Airfield Link Road

• Great Yarmouth Flood Defences

• Snape Maltings Flood Defences

Credit: Mike Page

• Honingham Thorpe Food Enterprise Park

19

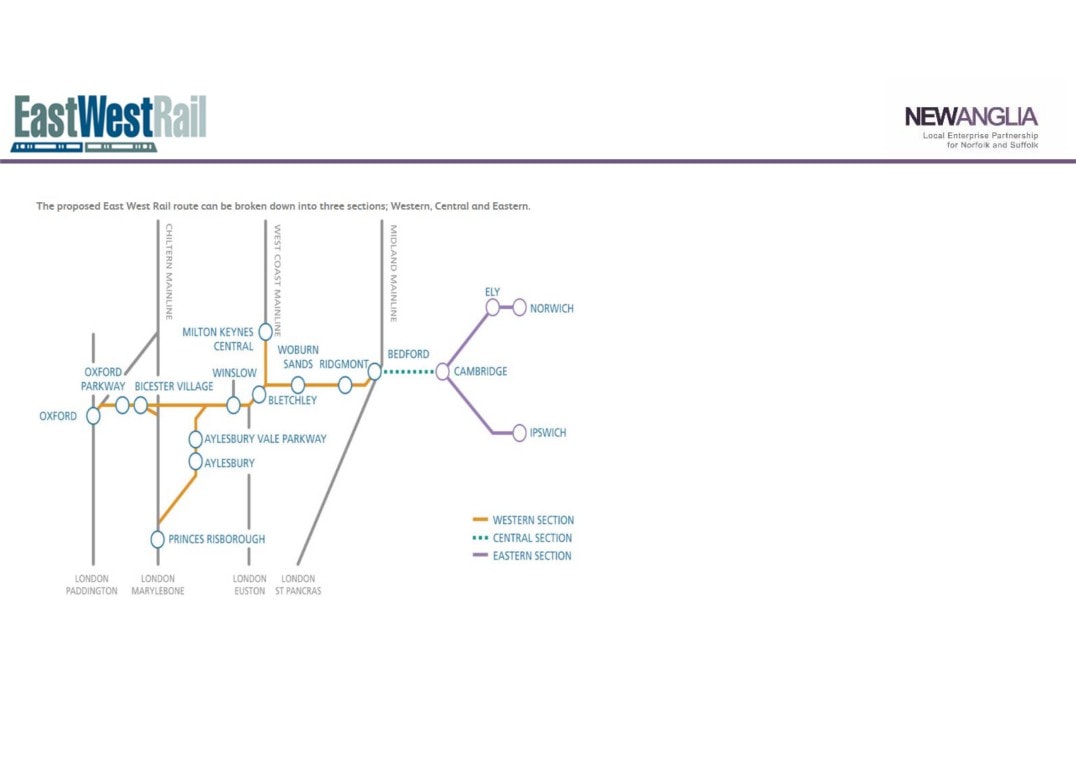

East West Rail

•

Much progress made on moving towards delivering

both the western and central sections - £20m

announced in the Autumn Budget for the central

section

•

Local authorities have been members of the East

West Rail Consortium for some time but the LEP

agreed to join in September 2018 to help boost the

case for delivering improvements to the eastern

section

•

An eastern section prospectus is being developed

by a focussed group (led by SCC) which is due to be

submitted to the next Consortium meeting on 11

December. It outlines how the delivery of the

eastern section will promote economic growth,

improve national and international connectivity and

add freight capacity to the network.

•

With the necessary support, the eastern section

improvements could be in place during the early to

mid-2020s.

20

Ely area road and rail improvements

•

Ely Taskforce, led by the Borough Council of King’s

Lynn and West Norfolk.

•

In March 2017 the Board agreed to fund the

advancement of the Ely area improvement scheme

by £3.3m as part of a wider funding package. Since

then significant progress has been made in

developing the scheme and identifying potential

road and rail solutions by May 2019.

•

A recent visit to the Chancellor outlined the

economic benefit of the scheme which will allow for

improved passenger services as well as freight

capacity on the network. The LEP co-funded and led

on the work and design of the document.

•

Haughley junction is now being advanced as part of

the wider Ely programme to ensure wider benefits.

•

If future funding is secured it is possible that early

outputs could be delivered during the early 2020s.

21

Great Eastern Mainline Taskforce

• The Great Eastern Mainline (GEML) Taskforce have previously

identified five key priorities for improving the line between

Norwich and London.

• The GEML Taskforce is currently chaired by the Rt. Hon. Priti Patel

MP and has previously been co-chaired by the LEP. The LEP

provides the secretariat support for the Taskforce and the driving

force behind the work programme.

• Network Rail has commenced work on an updated study for the

GEML. Network Rail’s study will feed into the development of a

wider economic study and a Strategic Outline Business Case

which will be published in Spring 2019. New Anglia LEP is

contributing towards the cost of the work.

• The LEP will also lead a programme of stakeholder engagement in

support of the revised business case early in the New Year

working closely with Network Rail and the train operator.

22

Strategic Road Network

No more A14 delays in Suffolk

The multi-partner ‘No More A14 Delays in Suffolk’ campaign, led by the

Suffolk Chamber of Commerce is working to secure improvements to the

A14. Improvements would increase GVA by £362m, help to deliver 7,000

new jobs and offer an average journey time saving of 13 minutes per trip

per day. Suffolk Growth Programme Board have recently commissioned

an EIA of A14 road and adjacent rail corridor.

The A47 Alliance, led by Norfolk County Council, has already been successful in

securing a number of improvements to the A47 as part of Highways England’s first

Roads Investment Strategy. Two further schemes are currently being promoted.

In the longer term the A47 Alliance is campaigning for full dualling of the A47 through

its #justdualit campaign with the Norfolk Chamber of Commerce.

The campaigns are being promoted as part of Highways England’s Roads Investment Strategy post 2020 for delivery before

2025. An announcement is expected in 2019.

23

New Crossings

New Crossings are being progressed in Great Yarmouth, Ipswich and Lowestoft with each having received funding from

Growth Deal and DfT.

Great Yarmouth: Norfolk County Council expect to award the contract for this project by January 2019 after a competitive

dialogue procurement process. The project remains on track to start main works in October 2020 with completion by the end

of January 2023. Local contributions are currently being pursued to support the delivery of the project.

Ipswich: a recent report by Jacobs highlighted a funding gap of £43.2m. Suffolk County Council are currently in discussions

with a number of relevant bodies about closing the funding gap to enable the Upper Orwell Crossings project to proceed.

Lowestoft: the planning application for the new crossing has recently been accepted. The start of the public examination is

expected to begin on 5 December with a decision expected in 2019. Construction is programmed to begin in 2019 or 2020

and is scheduled to complete in 2022. Local contributions are currently being pursued to support the delivery of the project.

24

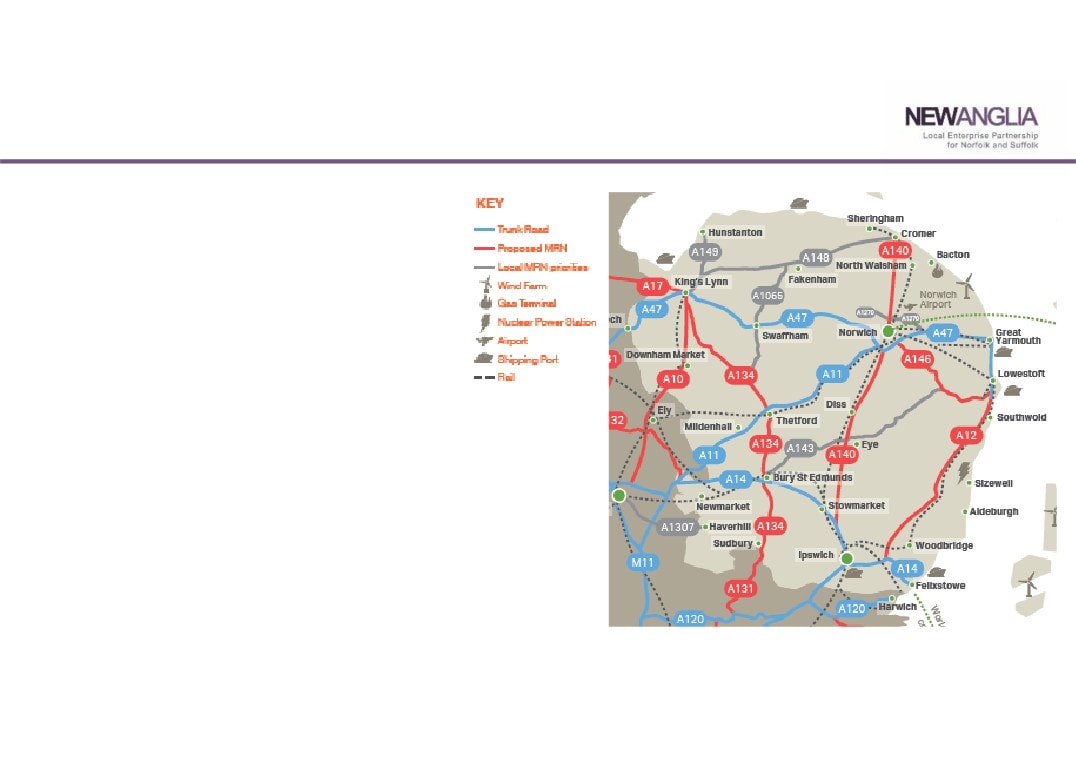

Major Road Network

• A10 improvements

• A12 Suffolk Energy GateWay (SEGWay)

• A1307 improvements

• Ipswich Northern Route/s

• Long Stratton Bypass

• Norwich Western Link

• Sudbury junction improvements

• West Winch Housing Access Road

With the support of Transport East, Norfolk County Council has

submitted a Strategic Outline Business Case to DfT for the early

release of MRN funding to deliver the A140 Long Stratton bypass.

Transport East has also written to government to make DfT aware

of projects that are likely to be priorities for future funding in the

short term. The schemes put forward in Norfolk and Suffolk are the

Sudbury congestion relief scheme and the A10 West Winch

Housing Access Road.

25

Innovation in transport

To respond to the future challenges we must

remain AGILE TO CHANGE

The Mobility as a Service

•

Open to innovative new technologies

(MaaS) model puts the

•

Connectivity - not just physical - reducing the

customer first and frames

need to travel

the mobility systems

•

Use data to enable the more intelligent operation

around customer

of our networks

preferences. MaaS offers

•

Electric/hydrogen vehicles and associated air

an opportunity to

quality improvements

improve how people and

•

Connected and Autonomous Vehicles

goods move, both from

•

Behaviour change

the perspective of the

•

Local Transport Board working with Transport

policy maker and for

Systems Catapult

travellers themselves.

•

Transforming Cities Fund - Norwich second phase

•

£90m for Future Mobility Zones

26

Utilities

Utility provision for business and new communities, including

local energy networks

Strong local authority leadership to date

Norfolk and Suffolk Energy Coast (including Sizewell and

offshore wind opportunities) a Priority Place in the Norfolk and

Suffolk Economic Strategy

Co-partner on the Local Energy East Strategy with the Combined

Authority and the Hertfordshire LEP/Energy Hub Board member

Funded and led the work package for the recent Building

Growth Group Utilities Workshop focussed on resourcing,

regulation, relationships and funding.

£2.65m to expand existing electricity supply capability and

support substantial industrial business growth at Snetterton

Heath by building a new substation and installing new cabling to

improve electricity supply to the site.

27

Digital and Flooding

Strengthening the reliability of high quality mobile coverage

Completing the provision of high speed broadband

Strong local authority leadership - Better Broadband programme

Through our Growth Deal, we have invested £10 million in

projects in both counties to support an increase in the extensive

network of fibre cables and roadside cabinets to enable homes

and businesses to have access to faster broadband.

Flood defences that unlock or protect housing and commercial

development

Local Lead Flood Authorities and Coastal Partnership East

£10m in Lowestoft

£8.2m in Great Yarmouth - and innovative funding solutions

£6.6m in Ipswich Growing Places loan

£1.08m Bacton to Walcott

28

2019

OBC for Ely area

2023

RIS2 decision

Great Yarmouth crossing

2021

GEML SOBC finalised

open

Growth Deal projects

RIS1: GY junctions begun

complete

New train rollout - Norwich

RIS1: Blofield to Burlingham

in 90/Ipswich in 60 4x a day

and North Tuddenham to

Easton dualling begun

Mid 2020s

East West Rail delivered*

2020

Ely road and rail

Energy Hub financially

improvements delivered*

sustainable

RIS2 projects delivered*

98% superfast broadband

East Anglia franchise

coverage in Suffolk, more

2022

renewed

than 95% in Norfolk

Lake Lothing crossing open

*subject to preferred options and funding

RIS1: Thickthorn junction

decisions

begun

29

Key Next Steps

Funding

• Delivery of Growth Deal projects by 2021

• Secure a strong funding allocation from the UK’s Shared Prosperity Fund

Lobbying

• Ultra fast broadband, full-fibre solutions and better mobile connectivity

for the whole of Norfolk and Suffolk

• Greater South East Energy Hub engagement to ensure our ambitions are

well understood at the strategic level

• Advance the Ipswich Northern Route/s and Norwich Western Link projects

• Commitment to Ely area and Haughley junction improvements

• RIS2 funding announcements for A14 and A47

• GEML and East-West Rail lobbying to ensure our message is heard

Leadership

• Local Transport Board governance review

• Innovative utility solutions

• Innovation in flood defence funding

• Local Energy East Delivery

30

New Anglia Local Enterprise Partnership Board

Wednesday 21st November 2018

Agenda Item 6

Tier 2 Governance Review

Author and presenter: Chris Starkie

Summary

This paper makes a number of recommendations as part of the review of Tier Two Governance

instigated by the PwC review into the LEP’s governance and operations.

It aims to bring into line the governance of advisory boards covering transport, skills, innovation,

inward investment and sectors.

This builds on the work done to improve the Governance of the main LEP board and its boards

responsible for finance and corporate governance.

A diagram of the boards covered by tier one and tier two reviews can be seen at appendix 1.

Recommendations

The LEP board is asked to endorse the continued role of the LEP Skills Board with its

terms of reference amended in the paper.

The LEP board is asked to agree to amalgamate the Local Transport Body and Board

into a single forum with greater emphasis on developing and implementing the

Integrated Transport Strategy Delivery Plan.

The LEP board is asked to agree further work to determine the required composition,

membership and name of the new transport group and produce appropriate Terms of

Reference, ensuring it aligns with other bodies in the second tier Governance review.

The LEP board is asked to endorse the continued role of the LEP Innovation Board and

approve a review into its Terms of Reference, membership and outputs.

The LEP board is asked to support a review of the aims, objectives and terms of

reference of the International and Inward Investment Sub-group.

The LEP board to ask the LEP executive to work with the sector groups to develop

common terms of reference which improve their accountability to the LEP board.

In some cases this will mean developing the existing terms of reference of the groups.

Where the group is part of a membership organisation, this will mean creating a

separate sector group to focus on the leadership and coordination of the sector.

Background

1

31

In autumn 2017 the LEP board agreed a plan to implement the recommendations of a report

into the LEP’s governance and operations.

The PwC report made a series of recommendations aimed at strengthening the organisation

and governance of the LEP to ensure it remains best in class.

Further recommendations around governance were then introduced in winter 2017 as part of

the Government’s review of LEP governance undertaken by Mary Ney.

These additional recommendations were implemented alongside the PwC recommendations

during winter 2017 and the first half of 2018.

A third round of governance changes was then adopted by the LEP board in autumn 2018

following the Government’s Review of LEPs which was published in summer 2018.

Having reviewed the PwC implementation plan and the Ney Review, one remaining element of

the PwC plan still needs to be endorsed by the LEP board - the review of Tier Two

Governance.

For context the Tier One Governance structures were agreed by the LEP board at the end of

2017.

That is the terms of reference and scheme of delegation for the LEP board itself, the Audit and

Risk committee, the Investment Appraisal Committee and the Remuneration Committee.

Terms of reference was also agreed for executive team led sub-groups - the Economic Strategy

Coordinating Delivery Board and the LEP Management Committee.

Tier Two Governance covers other boards and groups which sit beneath the main LEP board.

Key Issues

The specific action in the PwC review around tier two governance was as follows:

Formalise the reporting process from the sub-committees, boards and groups to the Board on

the activities undertaken by those bodies. Such updates can range from a regular formal

update papers with request to scrutinise and approve decisions, to an annual or bi-annual

presentation on activities undertaken by the sector groups.

Our review of these groups places them into three categories:

1 Formal sub-boards or sub-committees of the LEP

2 Sector groups

3 Partnership bodies which are supported by the LEP

This paper proposes how the LEP formalises its arrangements for the first two categories of

group. A further paper at a future date will cover the third category.

1. Formal sub-boards of the LEP

These groups have been established by the LEP and are fully accountable to the LEP for their

actions.

The Tier One review covered sub-boards or sub-committees had either a delegated financial or

governance role.

2

32

These groups have all been established to provide advice and support to the LEP board on

specific parts of the LEP’s overall remit.

The groups are as follows:

1. New Anglia LEP Skills Board

2. New Anglia LEP Local Transport Body

3. New Anglia LEP Local Transport Board

4. New Anglia LEP Innovation Board

1) Skills Board

The LEP Skills Board was established by the main LEP board to provide focused leadership on

the skills agenda.

It enables a wide body of skills experts to come together to provide advice and support to the

LEP board on the employment and skills agenda.

It also provides a forum for skills providers, the private sector and other bodies such as Job

Centre Plus to work together to support the skills agenda.

Activities have included the development of sector skills strategies and the oversight of a

number of European funded skills programmes.

Its terms of reference were revised in March 2018 to fit in with the PwC review and also to

support delivery of the LEP’s Economic Strategy.

Responsibility for funding of skills projects is currently retained by the LEP board and the

Investment Appraisal Committee, with the Skills Board serving as an advisory body.

The terms of reference are attached at Appendix 2.

The LEP board recently agreed that the private sector chair of the Skills Board would provide

two updates a year on progress being made by the board, which will provide a clear conduit of

information to the LEP board.

We believe the Skills Board fulfils a meaningful role and should be retained in its current form.

To bring fully into line with the LEP’s governance the terms of reference will need a minor

revision - with the board members annual declarations of interest being available online.

Recommendation

The LEP board is asked to endorse the continued role of the LEP Skills Board with its terms of

reference amended as above.

2) Local Transport Body and 3) Local Transport Board

Local Transport Body

Generally, the Local Transport Body oversees the delivery of the LEP’s transport schemes, and

the Local Transport Board advises the LEP on transport related needs and priorities.

The Body is a voluntary committee comprising Norfolk and Suffolk County Councils and New

Anglia LEP. It was formed in 2013 in response to a Department for Transport (DfT) initiative to

devolve the control of capital funds for major transport schemes to Local Enterprise Partnership

(LEP) areas, in line with the Government's localism agenda.

Since the Body was established the way transport funding has been allocated and managed

locally has fundamentally changed. In 2015 Government announced that funding for transport

3

33

schemes would be directed through the LEP’s Growth Deal. In response to this, the New Anglia

LEP Board took over responsibility for agreeing funding for the transport projects originally

approved through the Body.

Local Transport Board

The Local Transport Board was set up in 2014 to help shape our local transport system by

bringing together key transport specialists from both local authorities, regional and national

bodies, and transport operators. It was intended to pool their expertise to:

•

Provide strategic direction on transport issues;

•

Understand the partners’ transport ambitions;

•

Ensure the transport network satisfies the needs of business;

•

Allow for the design and shaping of an Integrated Transport Strategy for New Anglia;

•

Assess how New Anglia and partners can best deliver the Integrated Transport

Strategy.

The Local Transport Body’s current role is to:

1. advise to the LEP board which transport investments should be programmed,

2. review and approve individual business cases for those investments, and

3. ensure effective delivery of the programme.

Our recently approved Integrated Transport Strategy is presenting a clearer picture about the

types of transport projects we need to meet the ambitions of our Economic Strategy. Therefore,

selecting which transport projects should be programmed has been made simpler, and to

rationalise our governance it is a role that the Transport Board can undertake.

In January 2018 as part of the implementation of the PwC review, the role of the LEP’s

Investment Appraisal Committee (IAC) was extended to review and approve all LEP investment

decisions. This means that the Local Transport Body no longer needs to perform this function

and presents an opportunity for rationalisation. There are just £375,000 worth of allocated funds

still to be considered within 3 detailed business cases pertaining to separate highway schemes.

These can be considered by the IAC.

The effectiveness of delivery is currently presented to each meeting in a Performance

Management Report (PMR), which includes a Red-Amber-Green (RAG) rating and comments.

This report lacks detail, accuracy and alignment to the wider Growth Deal programme plan.

This can be better achieved through open and frank dialogue between delivery partners and the

LEP Executive, with performance reported up through the LEP Management Committee.

Considering revised local governance arrangements, the majority of LEPs have already

dissolved Local Transport Bodies, with only 9 of 38 LEPs retaining them.

Whilst providing strategic direction on transport issues, the Local Transport Board was tasked

with:

• Acting as a forum for information and expertise sharing, discussion and debate;

• Acting as a powerful advocate for Norfolk and Suffolk on behalf of New Anglia LEP;

• Developing a stakeholder management plan;

• Producing a work programme summarising individual scheme progress;

• Offering recommendations for prioritisation of projects for funding.

In its current form, the Board has provided a useful forum for the sharing of information

regarding all manner of transport related topics, local as well as regional initiatives and projects.

4

34

It has discussed a wide breadth of topics, garnered opinion and advise, and supported specific

actions.

Notwithstanding this, it proved difficult to engage the Board in specific workstreams due to its

large and diverse nature. There are opportunities to make the Board more focussed now that

the Integrated Transport Strategy moves towards the implementation phase.

Additionally, the establishment of a Sub-national Transport Forum, Transport East, is starting to

assume responsibility for considering wider regional transport needs and their advocacy,

through which the needs of Norfolk and Suffolk could also be effectively channelled.

Proposal

We propose the amalgamation of the Local Transport Body and Board into a single forum, the

Transport Implementation Group, with an emphasis on implementing the Norfolk and Suffolk

Integrated Transport Strategy.

This proposal involves the dissolution of the Local Transport Body and incorporation of its

functions into alternative LEP governance structures, as follows:

1

Advise to the LEP board which transport

Transport Implementation

investments should be programmed

Group

2

Review and approve individual business

IAC (<=£500k)

cases for those investments

/ LEP Board (>£500k)

3

Ensure effective delivery of the

Management Committee

programme

Focused on a programme of delivery, the Transport Implementation Group will be able to

advise the LEP Board which transport investments should be supported. This approach can

also better align the approval of transport investments with other projects and would remove

duplication between the Body and both the Investment Appraisal and Management

Committees.

While the purpose and ambitions of the Transport Board largely still stand, and the Integrated

Transport Strategy has been adopted, the relationship between a redefined group and the

wider LEP governance could be improved with revised and output focussed terms of reference.

Activities should include:

•

Develop, maintain and execute the Integrated Transport Strategy Delivery Plan,

reporting to the Economic Strategy Co-ordinating Delivery Board;

•

Meet quarterly for discussion and prioritisation of delivery;

•

Manage the work and tasks of members;

•

Produce and execute a Stakeholder Management Plan;

•

Direct the formation and tasks of working groups to tackle specific topics.

It is therefore proposed the Transport Implementation Group is given the following purpose:

“Ensure current & future transport networks meet the needs of both businesses and

residents in order to support economic development & growth.”

This group would offer advice and prioritise transport initiatives and projects, although all future

investments will be subject to the standard process of appraisal, considered by the IAC first and

then if necessary by the LEP Board.

5

35

The Transport Implementation Group would also contribute a Norfolk and Suffolk perspective

into Transport East.

The Transport Implementation Group or a subset of it could also act as a task and finish group

for the recently adopted Ports and Logistics Sector Skills Plan. This group would report to both

the Transport Implementation Group and the Skills Board.

Membership

Membership of the Transport Implementation Group will need to be reviewed to ensure the

agreed purpose can be met. District and borough Councils have expressed a wish to be

members, so this will need to be considered as part of this process.

It is proposed that the Chair continues to be LEP appointed and from the private sector.

As part of this process it is proposed the secretariat for the group is transferred to the LEP

Executive Team.

Recommendation:

The LEP board is asked to agree to amalgamate the Local Transport Body and Board into a

single forum with greater emphasis on developing and implementing the Integrated Transport

Strategy Delivery Plan.

The LEP board is asked to agree further work to determine the required composition,

membership and name of this group and produce appropriate Terms of Reference, ensuring it

aligns with other bodies in the second tier Governance review.

4) New Anglia LEP Innovation Board

The Innovation Board was set up in 2015 to provide a focus for decision making and leadership

regarding innovation strategy, programme and project development. Since its inception, it has

championed a number of initiatives including the Government Science and Innovation Audits

and building strategic relationships with national organisations such as Innovate UK and the

Smart Specialisation Hub.

Innovation is at the centre of the Government’s Industrial Strategy and a key focus within New

Anglia’s Local Industrial Strategy. Given this increasing focus, we believe that the Innovation

Board fulfils a meaningful role and should be retained. However, structural changes are needed

to enable the Board to fully support the delivery of the Economic Strategy and Local Industrial

Strategy and to provide wider engagement with innovation stakeholders across the region.

A review of the Innovation Board is currently underway and LEP executive are in the process of

meeting with Innovation Board members individually to get their input into the plans.

The next stage will be to present a revised Terms of Reference, Delivery Plan and Forward

Plan for approval at the next Innovation Board meeting in the new year.

Recommendation

The LEP board is asked to endorse the continued role of the LEP Innovation Board and

approve a review into its Terms of Reference, membership and outputs.

6

36

International and Inward Investment Sub-Group

Established in 2017, a small sub group of the LEP board was established to oversee and steer

the international relations, trade, inward investment and place promotion activity of New Anglia

LEP.

In light of emerging opportunities as a result of national sector deals, international trade deals,

the Local Industrial Strategy and the drive for stronger collaboration and promotion to attract

new investment to Norfolk and Suffolk, there is a need to review this group.

An assessment of its aims, objectives and Terms of Reference will be undertaken with

recommendations on enhancing membership and developing a focused strategy and delivery

plan for 2019-20.

Recommendation

The LEP board is asked to support a review of the aims, objectives and terms of reference of

the International and Inward Investment Sub-group.

Sector Groups

The Economic Strategy identifies nine priority sectors and in most cases sector groups have

been the primary point of reference and voice for these sectors. They are not part of the LEP’s

governance structure but provide specialist advice and intelligence to the LEP on behalf of their

sector.

LEP sector groups come together as communities of interest and as such, are expected to be

self-motivated and set their own general objectives within the framework of the Economic

Strategy.

Some groups were established pre-LEP, which means they have their own governance

structures and remit. Others were set up in partnership with the LEP and are much more

aligned and engaged with LEP priorities and strategic aims.

Examples of the different business models include the East of England Energy Group

(EEEGR), Visit East Anglia and TechEast which are private companies, charging for

membership and operating independently to the LEP. The New Anglia Cultural Board, Food

Drink and Agriculture Board and Cultural Creative Industries Group were set up with the LEP

and work closely with us on sector development initiatives.

Sector Groups provide an essential service to the LEP, acting as proactive ambassadors of the

LEP, supporting the development and delivery of the Economic Strategy, and providing sector-

focussed input into a variety of policy, strategy development and programmes.

However, the groups that function best for the LEP’s strategic aims retain a strong focus on

sector development.

For example, the New Anglia Cultural Board is a strategic, proactive group which has a clear

role: to provide a focus for decision making and leadership regarding cultural issues,

opportunities, strategies, programmes and projects. This model has enabled a series of

successful initiatives, such as the £1m Start East, the sector’s first business support

7

37

programme which has so far helped more than 350 businesses in the sector to start up, grow

and create jobs.

Similarly, the project Look Sideways East has contributed to a 16% increase in the number of

cultural tourists visiting our region. The Cultural Board is considered nationally as an exemplar,

accounting for the quality of delegates from across the country at the recent summit.

Where the organisation acting as sector group is a private limited company - especially

servicing a membership - the strategic focus on the Economic Strategy is less defined, with

sector development just one of a series of competing priorities.

A new model is currently being tested by the visitor economy sector. A new sector group, the

New Anglia Visitor Economy Board is being constituted in partnership with Visit East Anglia

(VEA).

VEA will retain responsibility for business activity including tourism promotion, but sector

development and leadership will be the responsibility of the new Board. VEA could provide the

management of the new sector board - but wold be accountable to the LEP not the VEA board.

The sector group will provide leadership of sector development initiatives such as delivering the

sector skills plan, bidding for external funding and acting as the voice of the sector. Critically it

will be accountable to the LEP and able to support the LEP board’s Economic Strategy.

We believe this model should be extended to other sector groups which are currently run by

membership bodies.

Each of the remodelled sector groups would therefore have a clearer focus and terms of

reference which connect more with the LEP board.

Recommendation:

The LEP board to ask the LEP executive to work with the sector groups to develop terms of

reference which make them accountable to the LEP board.

In some cases this will mean developing the existing terms of reference of the groups.

Where the group is part of a membership organisation, this will mean creating a separate sector

group to focus on the leadership and coordination of the sector.

Summary of recommendations:

The LEP board is asked to endorse the continued role of the LEP Skills Board with its

terms of reference amended in the paper.

The LEP board is asked to agree to amalgamate the Local Transport Body and Board

into a single forum with greater emphasis on developing and implementing the

Integrated Transport Strategy Delivery Plan.

The LEP board is asked to agree further work to determine the required composition,

membership and name of the new transport group and produce appropriate Terms of

Reference, ensuring it aligns with other bodies in the second tier Governance review.

8

38

The LEP board is asked to endorse the continued role of the LEP Innovation Board and

approve a review into its Terms of Reference, membership and outputs.

The LEP board is asked to support a review of the aims, objectives and terms of

reference of the International and Inward Investment Sub-group.

The LEP board to ask the LEP executive to work with the sector groups to develop

common terms of reference which improve their accountability to the LEP board.

In some cases this will mean developing the existing terms of reference of the groups.

Where the group is part of a membership organisation, this will mean creating a

separate sector group to focus on the leadership and coordination of the sector.

9

39

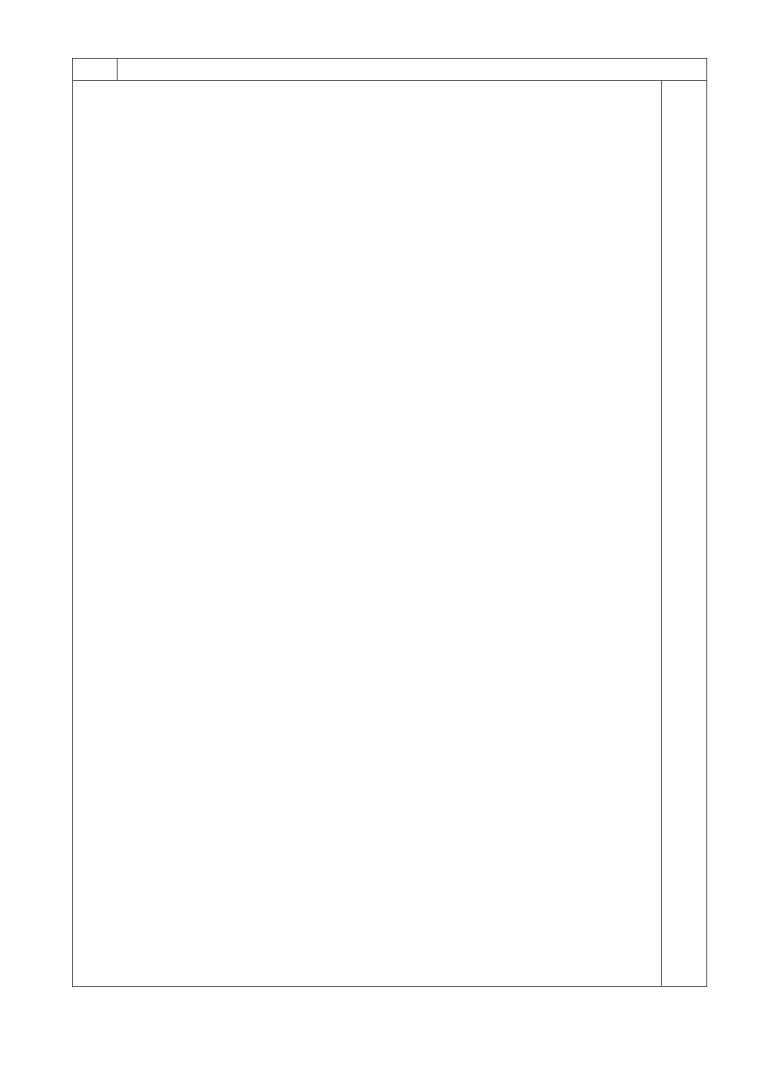

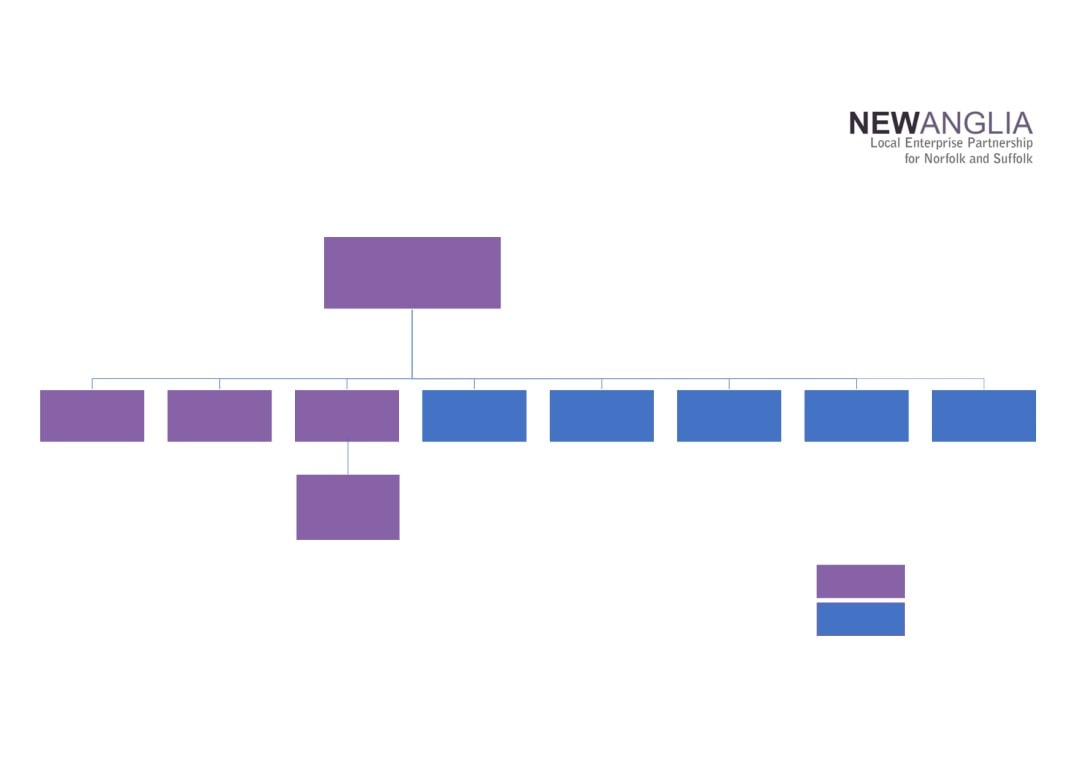

Appendix 1

Tier 2 Review

Proposed Structure

LEP Board

Governance

Financial

Advisory

Remuneration

Audit & Risk

Investment

Inward

Committee

Committee

Appraisal

Skills

Transport

Sector Groups

Investment /

Innovation

Committee

Trade

Growing

Business

Fund

Tier 1 Review

Tier 2 Review

40

Appendix 2

New Anglia LEP Skills Board

Terms of Reference

Revised March 2018

Purpose

The Skills Board exists to support the growth of an inclusive economy with a highly skilled

workforce where skills and employment provision meets business need and the aspirations

of individuals. It oversees the development of a skills and employment system to help enable

business growth and enhance the employment and progression prospects for individuals

working and living in Norfolk and Suffolk.

The Board provides the collective leadership and a strategic steer for skills and employment

activity across Norfolk and Suffolk to deliver on this objective.

Role of the Board

The Skills Board:

• develops and supports key skills and employment interventions

• provides a strategic steer for the LEP Board on the employment and skills agenda

• lobbies to achieve required freedoms, flexibilities and resources and raise the profile

of New Anglia

• collaborates proactively to identify barriers and opportunities in delivering these key

interventions

• galvanises the wider employer base to be involved in skills development

• provides coordination across the the skills system

Operation

The Skills Board is chaired by a member of the Board representing the private sector.

The Skills Board Chair reports directly to the LEP Board.

If a vote is required on any matter it will be decided on a simple majority with the Chair

having the casting vote.

The Board will determine the frequency and timing of meetings according to the programme

of work required.

Wherever possible the Skills Board uses SMART targets to drive the delivery of key projects.

Managing Conflicts of Interest

Members of the Board will be asked to complete an annual declaration of their interests

(based on a financial year) which will be held on record.

At the beginning of each meeting Members are also required to declare to the Chair any

conflicts of interest specifically pertaining to the agenda items to be discussed.

41

Membership

The membership of the Skills Board will be reviewed at a frequency of at least every three

years and as agreed by the Board itself. Each review will lead to Skills Board Members

either being reappointed or relinquishing their membership of the Board.

At least half the Skills Board members should represent the interests of private sector

businesses. This includes members from a range of sectors and business types/sizes, and

location.

Private Sector - At least nine representatives drawn from across Suffolk and Norfolk and

ensuring a spread of representation of our key sectors and varying sizes of employers.

Members are selected through an open call for nominations and a process agreed by the

Board. In addition, both the Chambers of Commerce and the Federation of Small

Businesses are invited to nominate representatives.

Post 16 and Further Education - 5 representatives comprising of 4 Post-16 Principals and

a representative for independent (private or VCS post-16 provider). Members are selected

by the Norfolk and Suffolk Principals Group and the New Anglia Learning Providers Group

respectively.

Higher Education - 1 representative. Nominated by the three HEIs within Norfolk and

Suffolk.

Local Authorities - 1 Councillor each from Suffolk and Norfolk County Council. Nominated

by the respective authorities.

Job Centre Plus - DWP District Manager.

Government Agencies - support for the Board provided by Government departments such

as the Education Skills Funding Agency and BEIS.

Officer Support - support for the Board provided from the LEP Executive Team, Suffolk

County Council and Norfolk County Council. Officers are non-voting members.

42

New Anglia Local Enterprise Partnership Board

Wednesday 21st November 2018

Agenda Item 7

LEP Deputy Chair Appointment

Author: Chris Starkie

Summary

This paper proposes a process for the appointment of a deputy chair of the LEP.

This follows the board decision at the October board meeting to agree to the appointment of a

deputy chair by February 28th 2019.

Recommendation

The board is invited to agree the process for the appointment of deputy chair as set out in the

paper.

Background

At last month’s board meeting the LEP board agreed a number of proposals to comply with the

governance requirements emanating from the Government’s Review of LEPs.

One of these was the appointment of a deputy chair by February 28th 2019. This paper sets out

a process for that appointment to be undertaken.

Key issues

One of the recommendations of the Government’s LEP Review was that all LEPs should have

a deputy chair.

Whilst not explicitly stated that this individual should be from the private sector, we have had a

very strong indication from Government that the expectation is that it would be from the private

sector.

This was accepted by the LEP board at its meeting in October and it was agreed to have a

deputy chair in place by February 28th 2019.

The LEP’s articles of association already permit a deputy chair, but we do not currently have a

published policy in place on how the deputy chair is appointed.

The proposed approach is based on the principles in the agreed process for the appointment of

chair.

1

43

Stage 1

The chair notifies all board members of the vacancy and requests nominations from private

sector board members. This can be done formally at a board meeting, or by email to all board

members. The nominations process must be open for a minimum of 14 days.

Stage 2

Potential candidates put themselves forward in writing to the chair.

Those nominated must be 1) one of the private sector board members and 2) willing and able

to serve as deputy chair for a three year term.

Each nomination should have a proposer and a seconder. The proposer and seconder can be

from the public or private sectors.

Stage 3

The outcome of the nominations process (stage 2) is considered at the next available board

meeting.

If there is only one nomination, that candidate is duly appointed, subject to ratification at that

board meeting by the board.

If more than one board member is proposed then there is a secret ballot of all board members

at that board meeting on the basis of one director one vote.

In the event of a tie fresh nominations are sought, and the election process re-run.

Issues to consider

The main issue to consider is in the eventuality that no candidate is willing to put themselves

forward to be deputy chair.

One option would be to expand the board to specifically recruit a deputy chair.

However our recommendation is that approach is not followed as this would further change the

balance between public and private sector representatives.

Instead the recruitment of a deputy chair would take place when there is a vacancy for a private

sector board member. This would mean leaving open the post of deputy chair for a period of

time.

Therefore stage 4 would look like:

Stage 4

In the event of no candidate putting themselves forward the post of deputy chair would remain

unfilled until a private sector vacancy occurs on the board.

At that point the first available private sector vacancy would be advertised as the role of deputy

chair.

Next steps

If this process is agreed by the board, the chair can seek nominations in order for the board to

consider the nominations at its January meeting.

Recommendations

The board is invited to agree the process for the election of deputy chair as set out in the paper.

2

44

New Anglia Local Enterprise Partnership Board

Wednesday 21st November 2018

Agenda Item 9

Brexit

Author: James Allen Presenter: Chris Starkie

Summary

The LEP’s role in assisting businesses pre- and post-Brexit covers four headings.

1 Providing Brexit intelligence to Government.

2 Providing information to businesses on changes brought about by Brexit.

3 Work to shape the future funding landscape for business support.

4 Identify changes to LEP and other programmes to react to opportunities and threats posed by

Brexit.

The Board will be updated on progress and proposed actions in each of these headings. This

report focuses on heading 2 - the information which will be provided to businesses.

In addition the report also responds to a request at the October board for an analysis of the

impact of Brexit on the LEP’s programmes.

Recommendation

The Board is asked to note the contents of the report

Background

As we near the official date for the UK’s departure from the EU (29th March 2019), the LEP has

set out its proposed role in assisting businesses through Brexit by ensuring government truly

understands the opportunities and challenges faced by businesses across Norfolk and Suffolk;

providing those businesses with useful information regarding how they can prepare for Brexit

and what they can be doing to Brexit-proof their business for the coming years; lobbying for the

future funding landscape to be fit for purpose post-Brexit; and ensuring that LEP programmes

react to the opportunities and challenges posed by Brexit.

LEP activity & proposed actions

The LEP commissioned Metro Dynamics to carry out a detailed assessment of the potential

impacts of Brexit on the workforce, regulations, trade and funding for key sectors across Norfolk

and Suffolk, which was published in November 2017. This report provided businesses with

details on the key issues for them to be assessing internally and checking within their supply

chain to prepare in advance of Brexit.

New Anglia LEP is working closely with counterparts in the LEP Network to share best practice

regarding the provision of information to the business community on changes brought about by

1

47

Brexit. This has been a useful exercise and the provision of detail from LEPs and Growth Hubs

greatly varies.

New Anglia Growth Hub will be an extremely valuable resource in providing post-Brexit advice

and support to the business community once the future UK-EU relationship has been defined

and the opportunities and challenges for business become more evident.

The LEP will increase the visibility of the provision of information/advice to businesses across

Norfolk and Suffolk through the creation of a dedicated Brexit webpage.

The LEP is proposing to set up a Brexit webpage on both the LEP and Growth Hub websites,

which will provide businesses with the headline information regarding the process of

negotiations and signpost businesses to useful notices / checklists / reports that detail how they

can prepare for certain scenarios and ensure that their business is Brexit-ready.

This webpage will also enable businesses to provide feedback on whether they have begun to

prepare for Brexit and whether there are opportunities and/or challenges that they are facing as

the UK leaves the EU.

For example, this website would signpost businesses to the following pieces of information:

The Government has published a series of technical notices in the case of a ‘no deal’

Brexit. These informative notices cover a wide range of issues for businesses, including

funding; driving and transport; farming and fishing; importing and exporting; labelling;

regulation; taxation; personal data and consumer rights; energy; environment; state aid;