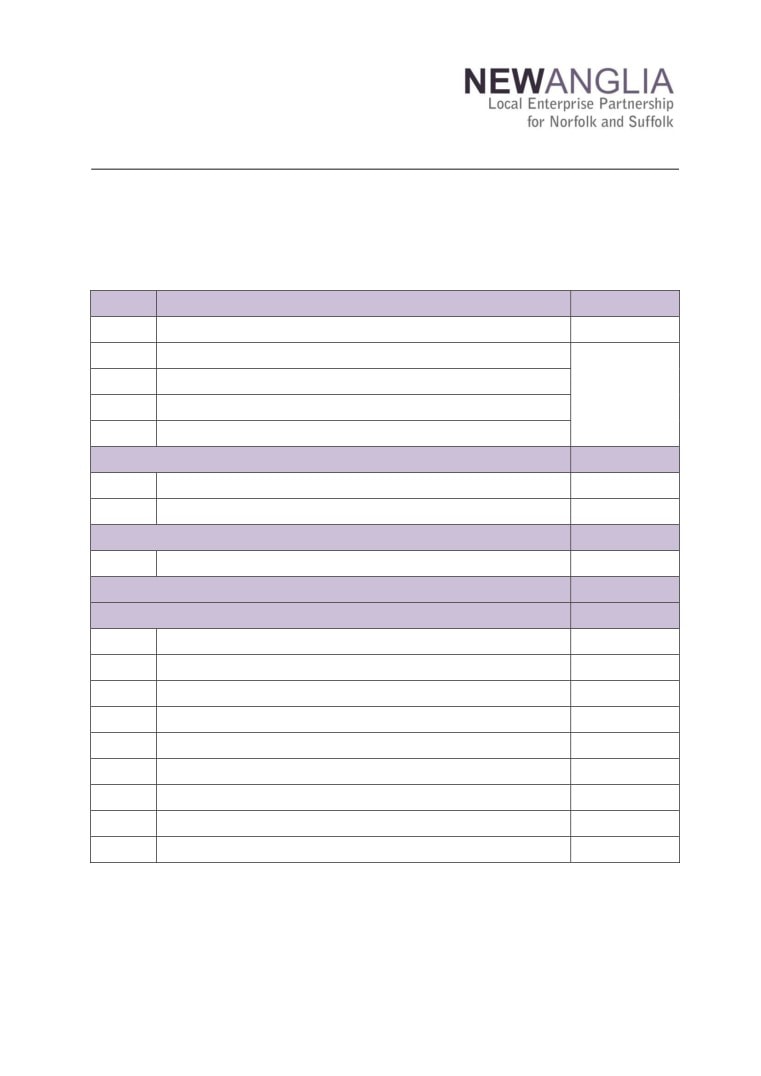

New Anglia Local Enterprise Partnership Board Meeting

Thursday 18th October 2018

10.00am to 12.30pm

Sizewell B Visitor Centre, Leiston, Sizewell, IP16 4UR

Agenda

No.

Item

Duration

1.

Welcome

25 mins

2.

Apologies

3.

Welcome to Sizewell & Nuclear Sector Update

4

Declarations of Interest

5.

Actions / Minutes from the last meeting

Forward Looking

50 mins

6.

Opportunity Areas

Update

7.

Brexit

Update

Governance and Delivery

15 mins

8.

LEP Review

For Approval

Break

10 mins

Governance and Delivery

50 mins

9.

Capital Growth Programme Call

For Approval

10.

Innovative Projects Call

For Approval

11.

Eastern Agritech Proposal

For Approval

12.

Chief Executive’s Report

Update

13.

October Performance Report

Update

14.

Finance Report including Confidential Appendices

Update

15.

Board Forward Plan

For Approval

16.

Any Other Business

Next Meeting: 10.00am - 12.30pm, 21st November 2018

Venue:

Keystone Innovation Centre, Thetford

1

New Anglia Board Meeting Minutes (Unconfirmed)

19th September 2018

Present:

David Ellesmere (DE)

Ipswich Borough Council

Doug Field (DF)

East of England Coop

John Griffiths (JG)

St Edmundsbury Borough Council

Matthew Hicks (MH)

Suffolk County Council

Dominic Keen (DK)

High Growth Robotics

William Nunn (WN)

Breckland District Council

Steve Oliver (SO)

MLM Group

Andrew Proctor (AP)

Norfolk County Council

Johnathan Reynolds (JR)

Nautilus

Lindsey Rix (LR)

Aviva

Sandy Ruddock (SR)

Scarlett & Mustard

Alan Waters (AW)

Norwich City Council

Jeanette Wheeler (JW)

Birketts

Tim Whitley (TW)

BT

In Attendance:

John Last (JL)

NUA (For David Richardson)

Corrienne Peasgood (CP)

Norwich City College (For Nikos Savvas)

Vince Muspratt (VM)

Norfolk County Council

Sue Roper (SuR)

Suffolk County Council

Shan Lloyd (SL)

BEIS

Abigail Cunnliffe-Hall (AC)

BEIS

Fiona Wright (FW)

CMS (For Item 5)

Neil Prentice (NP)

Jacob Bailey (For Item 5)

Chris Dashper (CD)

New Anglia LEP (For Item 12)

Julian Munson (JM)

New Anglia LEP (For Item 5)

Lisa Roberts (LiR)

New Anglia LEP (For Items 6 and 7)

Chris Starkie (CS)

New Anglia LEP

Rosanne Wijnberg (RW)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

1

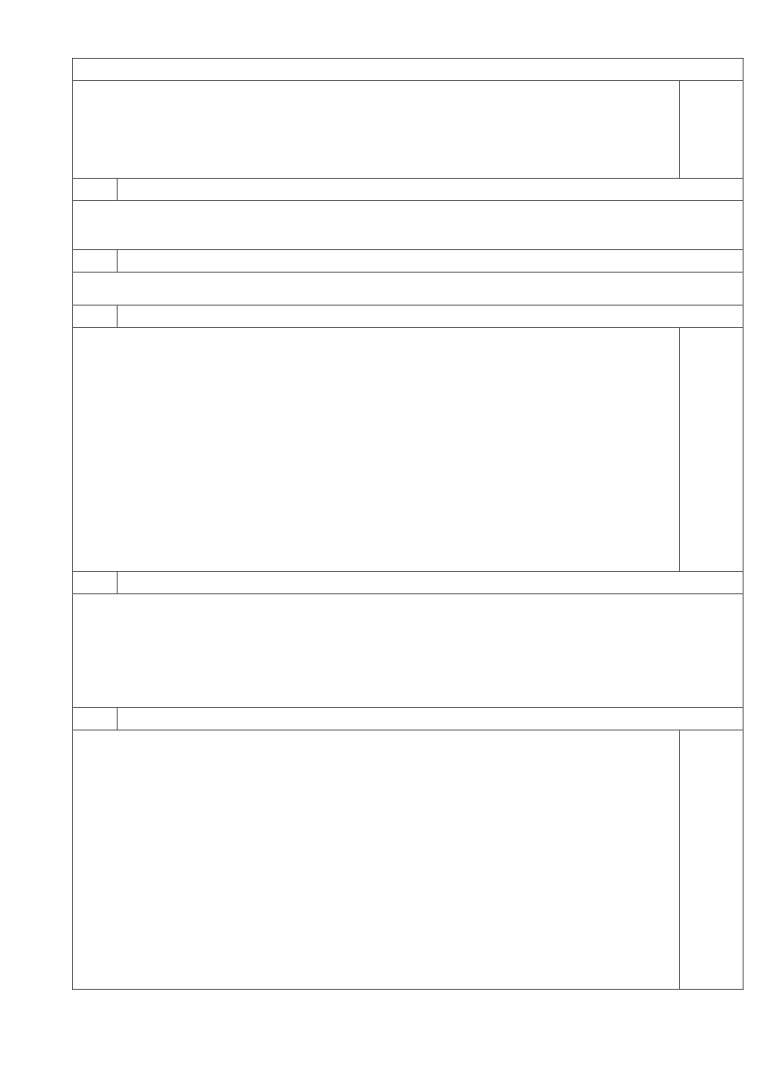

3

Actions from the meeting: (19.09.18)

Brexit Analysis: Brexit to be added to the Board Forward Plan in November

HW

Eastern Agri-Tech: CS to present a paper at the October Board on the options available

CS

To provide an update on the delivery timescales of major infrastructure projects including East

EG

West Rail

Performance Reports: Investigate whether the addition of a percentage of financial slippage

RW

would be relevant

1

Welcome from the Chair

Doug Field (DF) welcomed everyone to the meeting including Corrienne Peasgood deputising for Nikos

Savvas, John Last deputising for David Richardson and Abigail Cunnliffe-Hall from BEIS. DF also

welcomed Fiona Wright from CMS and Neil Prentice from Jacob Bailey.

2

Apologies

Apologies were received from: Nikos Savvas and David Richardson

DF proposed bringing forward Item 5 on the agenda.

5

Place Brand Development for Norfolk and Suffolk

Steve Oliver (SO) introduced the place branding presentation and thanked Julian Munson &

Hayley Mace for their work carried out to date.

He advised the Board that a steering group had been established to progress the next steps

and requested feedback from the board on the proposals.

Fiona Wright (FW) and Neil Prentice (NP) provided the meeting with a presentation on the

place branding experience of both agencies and gave an introduction to their proposals

and the timeline for reporting back to the Board.

The Board was advised that work would begin immediately with stakeholder sessions already

planned for October with completion by the end of January 2019. The final project findings will

be presented to the Board in February 2019.

The Board agreed:

To note the content of the presentation

3

Declarations of Interest

DF declared an interest in the investments in Novafarina and Supapass as detailed in the New Anglia

Capital report.

He also noted that the Co-Op do work with Jacob Bailey although he was not part of the branding tender

process.

4

Minutes of the last meeting 20th June 2018

The minutes were accepted as a true record of the meeting held on 20th June 2018.

Actions from previous meetings updated as follows:

Brexit Analysis: Lindsey Rix (LR) requested an update on the LEP’s response to the

uncertainties facing businesses regarding Brexit. The Board agreed that this was a major issue

and the LEP needed to be proactive in proving support. Chris Starkie (CS) proposed adding

an item to the Board forward plan. It was agreed that this would be included in November.

Andrew Proctor (AP) requested the item be expanded to include the impact on Local

Authorities as well as businesses.

Lisa Roberts (LiR) updated the meeting on the LEP’s ongoing work and Brexit analysis carried

out to date.

Agri-Tech: CS advised the Board that the Combined Authority Business Board was due to hold

its initial meeting on 24th September and a paper on funding of the Agri-tech initiative would go

to its November Board. Given the delay in receiving a response from the Combined Authority

2

4

DF asked CS to produce a paper on the options available to the New Anglia LEP. This will be

presented at the October Board.

ACTION:

Brexit Analysis: Brexit to be added to the Board Forward Plan in November

HW

Eastern Agri-Tech: CS to present a paper at the October Board on the options available.

CS

6

Economic Strategy Delivery Plan

LiR updated the Board on the work carried out to date to progress the Economic Strategy

delivery plan since the publication of the strategy in the Autumn of 2017.

The Board was advised that the Economic Strategy Delivery Coordinating Board (ESDCB) had

been established and met for the first time on 4th September. It would continue to meet every

6-8 weeks to oversee the delivery of the plan.

LiR advised that the concept of game changer opportunities had emerged through the

engagement sessions which are those with the potential to deliver significant progress towards

targets.

LiR requested that the Board approve the Game Changers Approach to the delivery of the

strategy. On approval the LEP team will progress work to identify those opportunities and build

plans for their delivery.

AP supported the approach and asked how the game changers had been identified to date and

what others has been considered.

LiR advised that the specific game changers had not yet been identified and this would form

part of the next stage of the work.

The meeting discussed the importance of infrastructure to the delivery of the plans and LiR

noted that the smart infrastructure ran through all the opportunities presented.

David Ellesmere (DE) asked how the make up of the Board had been agreed and whether the

priority growth areas would be included.

Alan Waters (AW) expressed concern that the urban areas did not have a specific place on the

Board.

CS advised that Local Authorities had been asked to put forward place representatives. He

advised that, when requested, the Norfolk Chief Executives had provided details of their

representatives and the Suffolk Growth Board agreed those from Suffolk.

LiR advised that there was a rotating vacant seat on the Board whereby the Suffolk Chief

Executives could attend depending on the agenda of the meeting.

Vince Muspratt (VM) confirmed that for Norfolk there was a rotating representative who

represented Greater Norwich.

The Board agreed:

To note the progress the development of the Economic Strategy delivery plan for the

Economic Strategy

To adopt the concept of developing Game Changers.

That the ESDCB should also coordinate development of the Local Industrial Strategy

7

Local Industrial Strategy

LiR presented the paper to the Board detailing the context for Local Industrial Strategies, its

link with the Economic Strategy and the proposed approach to developing a Local

Industrial Strategy for Norfolk and Suffolk.

LiR noted that Government have advised all LEPs to produce a Local Industrial Strategy and

Shan Lloyd (SL) confirmed that while the sign off strategy had yet to be agreed it would include

analysis of the evidence used in the production of the strategy.

The LEP aims to produce its strategy by Autumn 2019 however guidance is constantly being

taken from Government.

3

5

Corrienne Peasgood (CP) noted that a local strategy needed to include developments at a

national level to assess how they can be incorporated locally.

CS stated that the strategy needed to identify specific areas where the New Anglia area held a

distinct position and the work would continue to drill down in the sectors identified to date to

focus on the areas of distinctness.

Tim Whitley (TW) agreed that it was vital to identify those areas that Norfolk and Suffolk lead

on a national level.

LR made the observation that there seemed be a conflict between productivity and innovation

between the Local Industrial strategy and the UK Shared Prosperity Fund.

LiR confirmed that work would continue to expand the evidence base and leaders would have

the opportunity to review the work at 3 different stages.

The meeting discussed the complexity of the funding available.

SO thanked the LEP team for their work and expressed his support for the approach and noted

it was vital to identify those opportunities which would provide a compelling argument to

Government for funding.

John Last (JL) noted the importance of highlighting those sectors which, although not

necessarily the largest, would affect the position of the region at a national level.

The Board agreed:

To note the content of the report

To agree the approach to developing the Local Industrial Strategy.

8

LEP Review

CS presented the paper included in the meeting pack detailing the key requirements for the

LEP Review and the impact on New Anglia LEP.

A key issue to resolve is the removal of overlaps. New Anglia LEP is proposing to retain its

existing geography.

The Board was informed that those areas of Norfolk and Suffolk currently covered by both New

Anglia and the Cambridgeshire and Peterborough Combined Authority (CA) have advised that

they intend to remain with the New Anglia LEP and the process to ratify this decision is

ongoing.

At the same time the CA is likely to make its LEP boundaries coterminous with its own thus

removing the overlap.

SO asked what strengthening links with the CA would mean in practice.

CS advised that this had yet to be decided but could take the form of an overriding formal

agreement or agreements on specific issues where combined working was beneficial to all

parties.

The Board agreed:

To note the content of the report and the recommendations of the LEP review

To agree the LEP submission on geography

9

Chief Executive’s Report

CS presented his report to the Board and highlighted key items.

Johnathan Reynolds (JR) updated the Board on a meeting held with the UEA on CO2

reduction targets and their inclusion in the Economic Strategy with the aim of targeting specific

areas producing the greatest results.

JL asked for an update on East West Rail. CS confirmed that the LEP was now a full member

of the consortium but that the last meeting had focussed on the central area. Further details

will be provided in the future. The Board requested further details of the delivery timescales.

ACTION: LEP Infrastructure Manager Ellen Goodwin (EG) will be asked to provide an update

on the delivery timescales for this and other major infrastructure projects.

4

6

CS reviewed progress on sector deals noting the difficulty in becoming involved in some areas

such as life sciences.

AP queried the slippage on Growth Deal spend as it had been described as significant at the

Audit and Risk Committee meeting. CS confirmed that the slippage was significant but that

work was ongoing to manage it.

Matthew Hicks (MH) queried the timing of the visit to Holland in January given that Brexit would

take place shortly after. CS advised that there was already an event planned at this time

therefore the visit coincided with existing plans.

MH asked how previous attendance at MIPIM had been benchmarked. CS advised that

feedback was provided to the Board and metrics on leads were collected.

JW asked if longer term outputs could be tracked and reported back to the Board.

JR also asked whether any learning from MIPIM could be transferred to other similar events.

The Board agreed:

To note the content of the report

To receive up update on delivery timescales for the East West Rail project and other

major infrastructure projects

EG

10

Programme Performance Reporting

Rosanne Wijnberg (RW) presented her report as included in the meeting pack which addresses

the recommendations made by PWC.

LR queried the reporting cycle and format for the New Anglia Capital (NAC) report and

requested a more formal process. The current bi-annual report was agreed to be appropriate

and RW agreed to include this in the reporting cycle.

The Board agreed:

To note the content of the report

To approve the reporting cycle with the inclusion of NAC

To approve the reporting template

11

September Programme Performance Reports

RW presented the reports included in the meeting pack.

RW reviewed the Growth Deal Performance Report in detail.

Sandy Ruddock (SR) requested clarification of the level of slippage and asked if a percentage

of the slippage would be relevant.

CD reviewed the NAC report as included in the meeting papers.

The Board agreed:

To note the content of the reports

To approve the Growth Deal Quarterly Dashboard

For RW to investigate whether the addition of a percentage of slippage would be relevant

RW

12

Finance Report

RW reviewed the finance report and asked for questions from the Board.

RW advised the Board that the AGM would be asked to confirm that the authority to agree

remuneration of the auditors and the responsibility to appoint new auditors be delegated to the

Board.

RW confirmed that the Audit and Risk Committee had gone out for tender and had held a panel

with Price Bailey recommended as the new auditors.

The Board agreed:

To note the content of the report

13

Board Forward Plan

CS reviewed the items to be covered at the October Board meeting

5

7

The Board agreed:

To note the content of the plan

14

Any Other Business

DF reviewed the agenda of the AGM which would follow the Board Meeting.

John Griffiths (HG) highlighted the upcoming West Suffolk Business Festival and also the Building

Foundations event on 16th October and invited Board members to attend.

Next meeting:

Date and time of next meeting:

10.00am - 12.30pm, 18th October 2018

Venue: Sizewell B Visitor Centre, Leiston, Sizewell, IP16 4UR

6

8

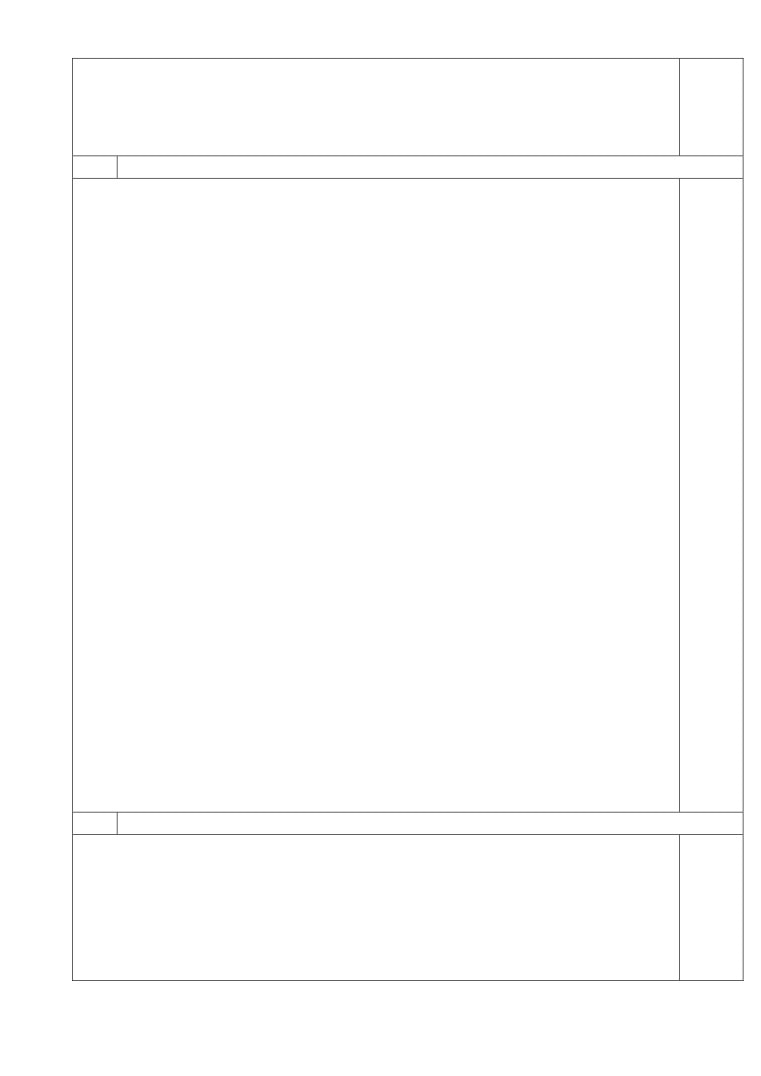

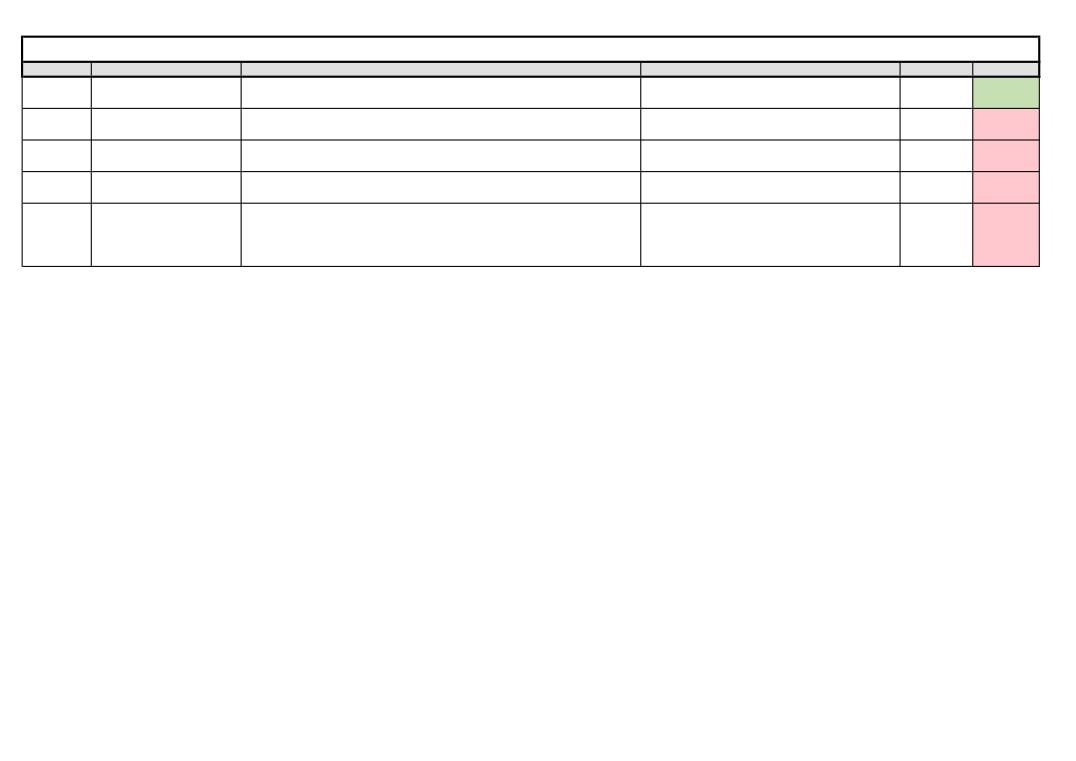

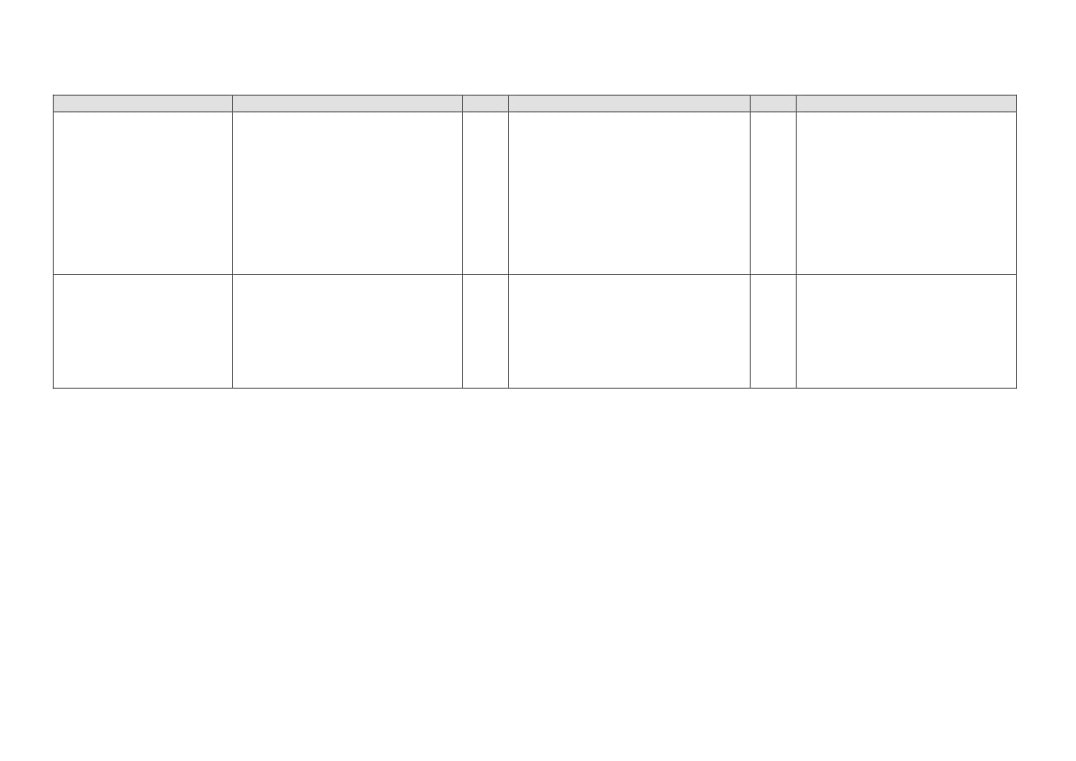

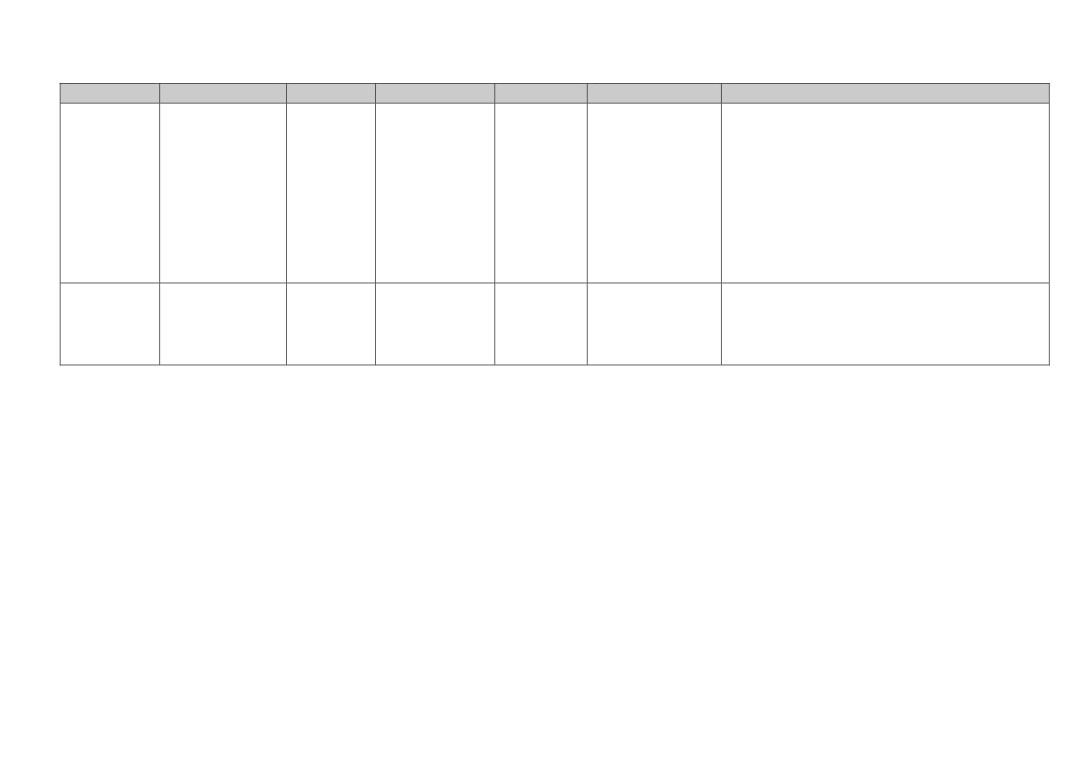

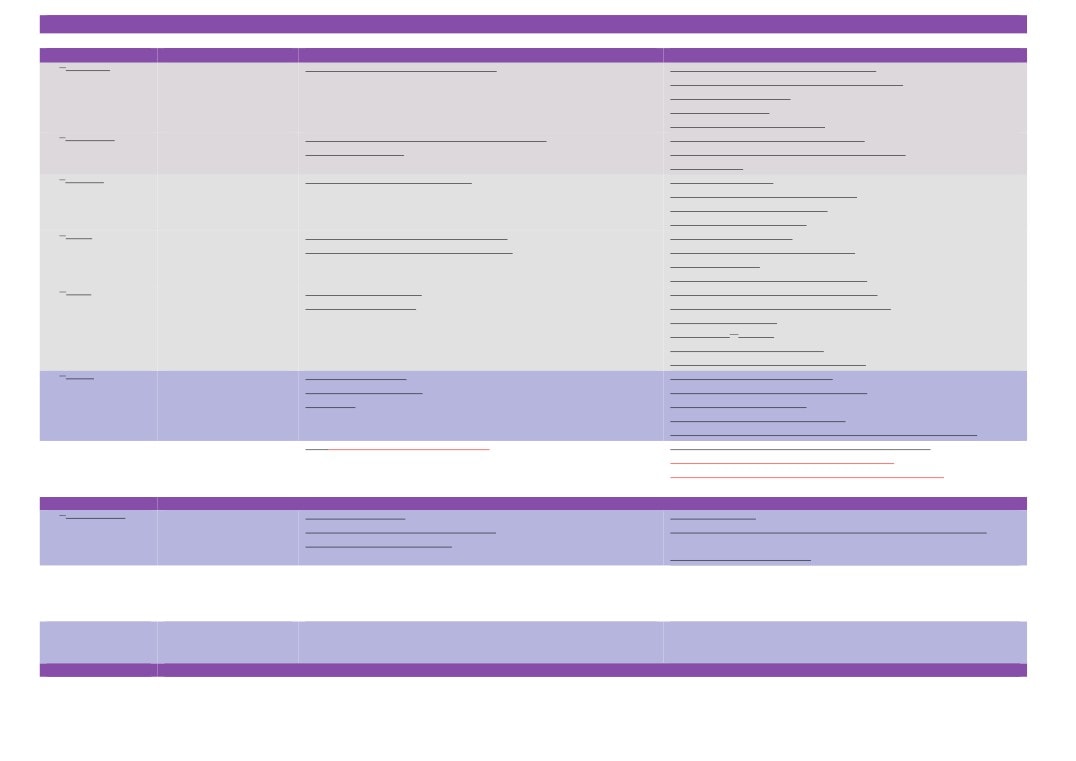

Actions from New Anglia LEP Board Meetings

Date

Item

Action

Update

Actioned By

Status

19/09/2018

September Programme

To investigate whether the addition of a percentage of financial slippage would

RW reviewed the reports with Sandy Ruddock &

RW

Complete

Perforamance Reports

be relevant

agreed that this was not required

19/09/2018

Chief Executive's Report

To provide an update on the delivery timescales of major infrastructure projects

An update will be provided a the November Board

EG

On-Going

including East West Rail

meeting

21/02/2018

Economic Indicator

To receive a paper on CO2 reductions for

Work is ongoing in conjunction with the UEA

CS/JR

On-Going

Trajectories and Targets:

consideration of inclusion in the economic strategy targets

21/02/2018

Brexit Analysis

To receive an action plan detailing the next steps, timescales and measures of

A paper is being presented at the October Board

LiR

On-Going

success

meeting

22/11/2017

Business Performance

To receive a proposal on the Eastern Agi-Tech initiative by email.

A paper will go to the November Combined

CS

On-Going

Reports

Authority Board meeting. A paper detailing

options for the New Anglia Board is being

presented at the October meeting.

9

New Anglia Local Enterprise Partnership Board

18th October 2018

Agenda Item 6

An Update on the work of the Norwich and Ipswich Opportunity Areas

Author: Jacqueline Bircham

Summary

This paper sets out the planned outcomes of the Opportunity Area programme in Norwich and

Ipswich and accompanies a presentation on progress to date by Katrina Gardiner, Programme

Manager for the Ipswich OA, and Jacqueline Bircham, Programme Director for Norwich.

Recommendation

The board is asked to note the ambition and progress of the Norwich and Ipswich Opportunity

Area projects.

Background

Opportunity Areas are a Department for Education project to improve social mobility in 12 areas

in England that ranked in the bottom 10% of areas in the Social Mobility Index 2016. The

delivery plan for Norwich Opportunity Area was published in October 2017, and for Ipswich in

February 2018. These plans set out a strategy to improve social mobility in their respective

areas supported by £6m of funding.

Key Considerations

Both areas have some challenging targets to be achieved by September 2021:

Norwich:

Ipswich:

•

95% of eligible three to four year olds and

•

The gap between the percentage of

75% of eligible two year olds will be

disadvantaged pupils and all other pupils

benefitting from funded early education.

achieving a good level of development at

•

The proportion of children achieving a

the end of Early Years Foundation Stage

good level of development will be in the

will be half what it was in September 2017.

top half for all local authority districts in

•

The gap between the pupil absence rates

England.

for disadvantaged pupils and non-

•

Attainment at key stage 2 and key stage 4

disadvantaged pupils will be half what they

will be in the top half of all local authority

were in September 2017.

districts in England.

•

50% of fourteen to nineteen year olds will

•

50% of nineteen year olds will be qualified

be engaging regularly in youth social

to level three.

action.

•

The gap between the attainment of

•

Childcare and education professionals will

disadvantaged pupils and all pupils will be

report a higher level of job satisfaction

half what it was in September 2017.

•

The full time teacher vacancy rates in

1

11

•

The rate of fixed term and permanent

primary and secondary schools will have

exclusions will have reduced by two thirds

reduced and will be below national

from the rate in 2016/17

average.

•

90% of the

2018-19 cohort who were

•

The proportion of NLEs per 1000 primary

eligible for pupil premium in year eleven

and secondary pupils in Ipswich is at least

will be in a sustained destination 6 months

equal to national average.

after completing key stage 4

•

Attainment at key stage 2 and key stage 4

•

40% of young people in Norwich will go on

will be in the top half of all local authority

to higher education or a higher level

districts in England and the gap between

apprenticeship

the attainment of disadvantaged pupils

•

85% of pupils who were eligible for pupil

and all pupils will be half of what it was in

premium in year eleven and who studied

September 2017.

for a level three qualification will go on to a

•

The proportion of pupils achieving level 2

sustained destination after key stage 5

in English and maths by age

16 will

exceed the national average.

•

95% of disadvantaged young people will

be in a sustained positive destination for at

least the first two terms after finishing key

stage 4, and 90% after finishing key stage

5.

•

44% of disadvantaged young people will

go on to higher education.

•

The percentage of sixteen to eighteen year

olds who are NEET will be half what it was

in September 2017.

•

By 2021, all schools in Ipswich will have

achieved at least six Gatsby Benchmarks

Link to the Economic strategy

Improved aspiration and educational attainment in Norwich and Ipswich, particularly by young

people from families and areas that have traditional faced significant deprivation will contribute

to the aim for Norfolk and Suffolk to be an inclusive economy with a highly skilled workforce. It

is DfE’s aim that learning from Opportunity Areas can be shared in similar contexts throughout

England.

Next Steps

By December 2018 both areas will need to have committed their £6m of funding to projects that

work towards the aims stated above. Work continues to ensure schools and colleges are

engaged, and supported to achieve the programme outcomes.

Recommendation

The board is asked to note the ambition and progress of the Norwich and Ipswich Opportunity

Area projects.

2

12

New Anglia Local Enterprise Partnership Board

Thursday 18th October 2018

Agenda Item 7

Brexit

Author: James Allen Presenter: Chris Starkie

Summary

This paper sets out the latest state of play in the Brexit negotiations and briefly outlines what

each scenario would mean for the UK following its departure from the European Union (EU).

The paper also outlines the role of the LEP in assisting businesses in the run up to Brexit and

post March 31st 2019.

The LEP’s role covers four headings. 1 Providing Brexit intelligence to Government. 2 Providing

information to businesses on changes brought about by Brexit. 3 Work to shape the future

funding landscape for business support. 4 Identify changes to LEP and other programmes to

react to opportunities and threats posed by Brexit.

These four headline areas will form the basis for the LEP’s minimise response to Brexit which is

should be to minimise uncertainty for business and deliver our ambitions for the Economic

Strategy for Norfolk and Suffolk regardless of the outcome of Brexit negotiations.

Recommendation

The Board is asked to:

Agree the proposed approach for the LEP to manage business uncertainty and deliver

the Economic Strategy regardless of the nature of Brexit.

For Brexit to be added as a standing item to the board going forward.

Background

Following the UK’s decision to leave the EU on 23rd June 2016, the official date for the UK’s

departure is 29th March 2019. A transition period has been agreed between 29th March 2019 to

31st December 2020 to allow time to complete final preparations ahead of the new post-Brexit

rules coming into force. However, this transition period will only commence if a withdrawal

agreement is reached between the two parties. A suitable agreement needs to be found on the

Irish border situation to allow both parties to sign the withdrawal agreement.

Cabinet reached an agreement in July 2018 regarding the UK’s vision for the future UK-EU

relationship, known as the Chequers Plan.

This would effectively continue "harmonisation" with EU rules on the trade in goods, covering

only those necessary to ensure frictionless trade; there would be different arrangements for

trade in services with greater "regulatory flexibility" and "strong reciprocal arrangements";

freedom of movement as it stands would end but a "mobility framework" would ensure citizens

can continue to travel and apply for study and work; a new customs arrangement would be

1

13

phased in; the UK could control its own tariffs and develop an independent trade policy; and the

ECJ’s jurisdiction would end.

However key elements of the Chequers Plan were rejected at the most recent informal EU

Summit in September. Negotiations have continued behind the scenes as both sides come

back to the table at the European Council on 18-19th October. If enough progress can be found

at this meeting, then an informal EU Summit will be organised for 17-18 November to finalise

and formalise a deal. Since the September Summit, EU leaders have been more optimistic that

a deal can be secured.

A political declaration setting out the future UK-EU relationship, which will accompany the

withdrawal agreement, is currently being prepared by the EU and will set out the latest state of

play when published in draft format ahead of the October EU Summit. This non-binding

document is key to the ratification of the UK-EU deal as it will map out the proposed future UK-

EU relationship to be agreed upon during a transition period.

As things currently stand a few months away from the official date of departure, several options

remain on the table: The Chequers Plan, a Canada-style option (CETA), a Norway-style option

(EFTA), an extension of the Article 50 negotiations or a no-deal scenario in which both sides

are unable to reach a withdrawal agreement.

There are several differences between these options:

Canada has comprehensive but not complete tariff free trade in goods, limited access to

trade in services, partial regulatory cooperation and an independent free trade policy.

The deal excludes financial contributions to the EU, free movement of persons,

regulatory equivalence and participation in common foreign and security policy.

Norway has tariff free trade in all goods and services (excluding certain fish and

agricultural products; free movement of persons; a financial contribution to the EU;

implementation of all EU Single Market regulations. This deal excludes participation in

current and future EU-third party trade deals, preferential access to the Single Market

for agriculture and fisheries products, trade in goods without non-tariff barriers such as

export licences and rules of origin and Common Agricultural Policy participation and

funding.

A no-deal would be a cliff-edge scenario in which the UK would revert to WTO trade

rules on 29th March 2019 and would be subject to the EU’s external tariffs, EU laws

would be transferred in to the UK’s lawbook, the UK would not be subject to ECJ

rulings, the UK could implement free trade negotiations immediately, the Irish border

question would remain unresolved, the UK would not be required to pay the £13bn

contribution to the EU budget and on immigration - the UK would be free to set its own

immigration rules, however the rights of EU and UK expats remains unclear. Customs

procedures would be suddenly imposed between the UK and EU and this alongside

international law obliging the EU to require checks on lorries and ships coming from the

UK would cause delays and backlogs at European ports. The UK Government has set

out a series of technical notes on how to prepare if there is a no-deal.

Before the end of January 2019, MPs will be offered a vote on the outcome of negotiations -

whether a deal has been secured or not.

This vote could lead to a few options including agreement on a final deal, rejection and leaving

without a deal, seeking to extend the Article 50 negotiations or a call for one final push in

negotiations to agree on an acceptable compromise.

In September 2018, the Migration Advisory Committee published its final report on EEA

migration in the UK. The report states that if free movement ends and the Tier 2 scheme is

extended to EEA citizens, the salary threshold at £30,000 should be retained and the list of

eligible occupations should be expanded to allow employers to hire migrants into medium-skills

jobs.

2

14

The report does not recommend an explicit work migration route for low-skilled workers, except

for a seasonal agricultural workers scheme.

LEP Brexit activity to date

The LEP’s Economic Strategy was published some months after the UK’s decision to leave the

EU alongside a comprehensive economic evidence base.

This means that the Economic Strategy takes into account the decision to leave, but does not

assess the potential impact in any detail.

To address this, the LEP commissioned Metro Dynamics to carry out more detailed work on the

potential impacts on the workforce, trade, regulations and funding for key sectors. We

commissioned Metro Dynamics as they were also involved in the development of the Economic

Strategy and this ensured consistency of research.

The report can be found at this link: ‘the potential implications of Brexit for Norfolk and Suffolk’

It identified a series of recommended actions which were endorsed by the LEP board at its

meeting in February.

1. Develop a Local Industrial Strategy

2. Develop our sector and innovation strengths

3. Drive Inward Investment and place marketing

4. Gather Brexit intelligence

5. Champion local businesses

6. Improve targeting of business support.

7. Support exporters

8. Collaborate with other parts of the UK

LEP Brexit activity going forward

All eight of the actions listed above are being taken forward.

However the discussion at September’s board meeting highlighted the need to take a step back

and agree the role the LEP can play in the Brexit process, and for the issue of Brexit to be more

visible in the work of the LEP. A more comprehensive action plan, building on the initial eight

point plan can then be developed.

The LEP Executive is recommending the LEP’s role should be summarised under the four

headings: Intelligence, advice, funding, strategic intervention.

All four are inter-related but distinct workstreams. They are: Intelligence, Advice, Funding,

Strategic Opportunities.

1 Intelligence

The LEP will continue to act as an information resource to government. Following engagement

with business, business intermediaries and local authorities, the LEP has been able to regularly

feedback Brexit intelligence and highlight the state of business preparedness into Government

through various channels.

3

15

For example, Sajid Javid MP and Steve Baker MP visiting the region to understand the

implications, anecdotal feedback the LEP regularly provides Shan Lloyd, feeding relevant case

studies to local MPs and continued regular dialogue with business intermediaries to discuss

business preparedness and understand their latest Brexit analysis.

2 Advice

From an operational perspective, the LEP has an important role to play in the continued

provision of information to the business community regarding the future relationship with the

EU. We are currently working on a plan to provide succinct information on areas of concern to

businesses including the finer details, once available, regarding what the future UK-EU

relationship will mean for businesses across Norfolk and Suffolk.

The Growth Hub will be a valuable resource in providing advice and support to businesses

post-Brexit. The LEP is proposing to set up an identical Brexit page on the LEP and Growth

Hub websites for businesses to provide intelligence, seek advice and access useful resources

such as information provided by Government, local government and business intermediaries

(e.g. the Chamber’s business Brexit checklist).

We have had positive discussions with the chambers, FSB and CBI on a collaborative

approach around this. LEPs nationally are looking at what resources can be shared and utilised

by respective growth hubs.

3 Funding

The LEP is working both regionally (with local authorities and MPs) and nationally to help shape

the future of funding. The LEP alongside these partners has been making the case to Defra

regarding transitional funding as this funding is scheduled to end in 2019. The consultation has

now begun on the UK Shared Prosperity Fund, which will cover previous EU and domestic

funding moving forward.

The LEP fed into the regional workshop in Norwich on 4th October and will continue to highlight

the region’s needs given the fund will be linked to the delivery of our Economic Strategy and

Local Industrial Strategy.

4 Strategic Opportunities

The LEP is delivering on the ambitions set out in the Economic Strategy and many strategic

actions being taken will be linked to Brexit, whether this is nurturing opportunities or addressing

potential challenges.

The LEP is in the process of assessing whether programmes require adjusting so that they

remain fit for purpose post-Brexit and whether strategic interventions may be required to

continue to deliver business growth (e.g. experts in the Growth Hub on specific Brexit-related

issues such as customs).

Next Steps

We welcome the Board’s views on these proposed actions and welcome proposals for

additional support measures to minimise uncertainty for business and deliver the Economic

Strategy for Norfolk and Suffolk regardless of the nature of Brexit.

If the board agrees to the four headline workstreams, the LEP executive will bring work up short

delivery plans for each of the four workstreams. These would include key activities proposed,

timelines, resources and impact.

4

16

The first three workstreams are relatively self-contained. The fourth will be more complex and

to a greater extent dependent on the outcome of Brexit talks.

Updates on the workstreams would then be brought back to the board on a regular basis.

Recommendation

The Board is asked to:

Agree the proposed approach for the LEP to manage business uncertainty and deliver

the Economic Strategy regardless of the nature of Brexit.

For Brexit to be added as a standing item to the board going forward.

5

17

New Anglia Local Enterprise Partnership Board

18th October 2018

Agenda Item 8

LEP Review

Author: Chris Starkie

Summary

This paper summarises New Anglia LEPs’ proposed plan for the implementation of the LEP

Review.

Following last month’s paper on geography, this paper covers roles and responsibilities,

leadership and organisational capacity and accountability and performance.

In most cases no changes to the structure or operating model of New Anglia LEP is required,

but the paper makes a number of specific recommendations on areas where Government is

requiring change.

Recommendation

The board is asked to approve the implementation plan for the LEP Review as laid out in this

paper and specifically:

Maintain its existing approach to the recruitment of its chair.

Appoint a deputy chair by February 28th 2019.

Amend the LEP’s articles of association to class education members as private sector.

Amend the LEP’s articles of association to increase the number of private sector board

members to 12.

Agree to work towards increasing the female representation amongst private sector

board members. This will include proactively raising the profile of the LEP amongst

female business leaders.

Ask the LEP chair to write to education and local authority members to highlight the

gender balance recommendations in the LEP Review and ask for support in helping the

LEP board achieve the targets set by Government.

1

19

Background

At last month’s board meeting the LEP board agreed to submit a proposal to the Government

around the LEP’s geography which would retain the geography of New Anglia LEP as Norfolk

and Suffolk.

The Government now requires LEPs to submit proposals around three further areas: 1 roles

and responsibilities, 2 leadership and organisational capabilities and 3 accountability and

performance.

Key issues

1 Role and responsibilities

The review stated that the primary role of LEPs is on enhancing productivity which will be

achieved through the development of Local Industrial Strategies.

The review reiterated that LEPs will lead on the development of Local Industrial Strategies and

all LEP areas will agreed their LIS with Government by early 2020.

As board members know, the LEP has begun preparatory work on our Local Industrial Srategy,

with a view to publishing ours in autumn 2019.

LEPs are also now required to produce an annual delivery plan and end of year report. We will

be working with Government colleagues on the desired format for this. The first delivery plan

will be for April 2019 and end of year report a year later.

Our aim will be to create a delivery plan which is useful for board members as well as

Government.

2 Leadership and organisational capacity

Appointment of chair and deputy chair

Government has stated it expects each LEP to consult widely and transparently with the

business community before appointing a new chair and appoints a deputy chair.

Under our current processes, the chair of the board is appointed by the LEP board.

Our process invites applicants from board members to put themselves forward for selection by

other board members.

In the event there are no candidates from the board, then the position of chair is advertised

externally.

This approach ensures that the new chair has the full support of the board, and also has

practical experience of the LEP. It also enables a degree of continuity.

We are recommending that the LEP board retains its existing policy.

The Government review also requires LEPs to appoint a deputy chair by the end of February

2019. The advice does not explicitly state whether this should be a private sector board

member, but this is understood to be the case.

New Anglia LEP’s articles of association provide for a deputy chair or vice chair, and indeed the

LEP used to have a vice chair, but the post is currently not filled.

We recommend that the post of deputy chair is filled.

2

20

The Review asks LEPs to agree defined term limits for chairs and deputy chairs. Our defined

term limit is three years which complies with the request.

Private sector board representation

The Government wants to increase the proportion of private sector board members, whilst

limiting board sizes to 20. The Government’s aspiration is for two thirds of the board to be from

the private sector.

Currently New Anglia LEP has a 50 / 50 split. This is made up of six local authority leaders, two

education sector representatives (one from FE and one from HE) and eight private sector board

members.

Government has confirmed that HE members can be classed as private sector and for local

areas to determine if FE members should also be classed as private sector.

We are recommending that both education members should be classed as private sector. It

would seem odd for HE to be classed one way and FE the other.

The recruitment of two additional private sector board members would then enable the LEP to

be compliant with the LEP Review. The revised board size would be 18 members of whom 12

were private sector and six public sector.

We are recommending amending the LEP’s articles of association to class education

members as private sector and increasing the number of private sector board members

to 12.

In addition, the education board members, if classed as private sector members, would also

need to adhere to the term periods. That is a maximum of two terms of three years.

Board gender balance

The Government has also set a target of one third female board members by 2020 and

expectation of 50/50 by 2023.

Currently we have three female board members out of a board of 16.

We recommend that the LEP board agrees to work towards increasing the female

representation amongst private sector board members.

This will include proactively raising the profile of the LEP amongst female business

leaders.

In addition, we recommend the LEP chair writes to our education and local authority

members to highlight the recommendations in the LEP Review and asks for support in

helping the LEP board achieve the targets set by Government.

Independent secretariat

The review requires LEPs to have a secretariat independent of local government to support

LEP’s decision making.

New Anglia LEP already complies with this requirement.

3 Accountability and performance

Legal personality

The review requires LEPs to have a legal personality. The preferred model is for incorporation -

which is New Anglia LEP’s model.

3

21

Single accountable body

The review requires LEPs to have a single accountable body. We already do - Suffolk County

Council.

Annual General Meeting

The review asks LEPs to hold annual general meetings and open them to the public.

New Anglia LEP already does.

LEPs are also not permitted to operate on a paid membership basis. We don’t operate that

model.

Governance

LEPs have been asked to set out who is responsible for spending decisions, appointments and

overall governance.

These are already set out in our Local Assurance Framework. Chris Starkie is on the national

working group looking at the new National Assurance Framework and we will update our own

assurance framework as soon as the new national framework is published.

Scrutiny and oversight

The review asks LEPs to indicate how they will ensure external scrutiny and expert oversight.

The LEP regularly participates in relevant local authority scrutiny panels.

The LEP’s Audit and Risk Committee provides oversight and monitoring of audit, risk and

ensures compliance with the assurance framework. It has an independent Chair appointed by

the LEP Board and its other members are the Section 151 Officer of the Accountable Body and

two LEP board members who are also appointed by the LEP Board.

As a company limited by guarantee our accounts are audited annually by independent auditors.

We therefore comply with all the scrutiny and oversight requirements laid out in the review.

Recommendations

The board is recommended to approve the implementation plan for the LEP Review as laid out

in this paper and specifically:

Maintain its existing approach to the recruitment of its chair.

Appoint a deputy chair by February 28th 2019.

Amend the LEP’s articles of association to class education members as private sector.

Amend the LEP’s articles of association to increase the number of private sector board

members to 12.

Agree to work towards increasing the female representation amongst private sector

board members. This will include proactively raising the profile of the LEP amongst

female business leaders.

Ask the LEP chair to write to education and local authority members to highlight the

gender balance recommendations in the LEP Review and ask for support in helping the

LEP board achieve the targets set by Government.

4

22

New Anglia Local Enterprise Partnership Board

Thursday 18th October 2018

Agenda Item 9

Capital Growth Programme: Focused Call

Author: Emily Manser / Chris Dashper. Presenter: Chris Dashper.

Summary

The Capital Growth Programme has £19m of capital funding remaining to be allocated and

spent by March 2021.

As has been outlined in previous Board papers, the intention with this final allocation of funds is

to launch a targeted call for strategic projects that will help to deliver the Economic Strategy for

Norfolk and Suffolk.

This paper recommends that the strategic focus and launch of the call for projects should be

Skills, Innovation and Productivity.

This paper was discussed at the Investment Appraisal Committee in September and is

recommended for approval.

Recommendation

The Board is asked to: Approve the launch of a focused call on Skills, Innovation and

Productivity, to allocate the remaining

£19m of the Capital Growth Programme, following

recommendation by the Investment Appraisal Committee.

Background

A Capital Growth Programme call for projects was launched in October 2017 for a wide range

of infrastructure projects that help to deliver the new Economic Strategy. As a result of this call

the Board approved funding for seven projects, as follows:

Bacton Flood Scheme

£1,080,000

Cefas Research Centre

£1,400,000

Snetterton Electricity Scheme

£2,650,000

A140 Hempnall Roundabout

£650,770

Eye Airfield Link Road

£1,460,000

Great Yarmouth Flood Defences

£8,200,000

Snape Maltings Flood Defences

£125,000

Honingham Thorpe Food Enterprise Park

£1,000,000

Total

£16,565,770

1

As outlined in earlier papers on the call, and in our bid to government for the Capital Growth

Programme (‘Growth Deal Three’), the intention is to allocate the remaining funding to strategic

projects.

This would enable the LEP to focus its investment on areas that best meet the needs identified

in the Economic Strategy.

To identify the focus of the new project call, a review of the current Growth Deal investment and

profiled impact has taken place. This is summarised below.

An analysis of the geographic spread of projects shows a good geographic spread of LEP

investment across the area, and across the priority places identified in the Economic Strategy.

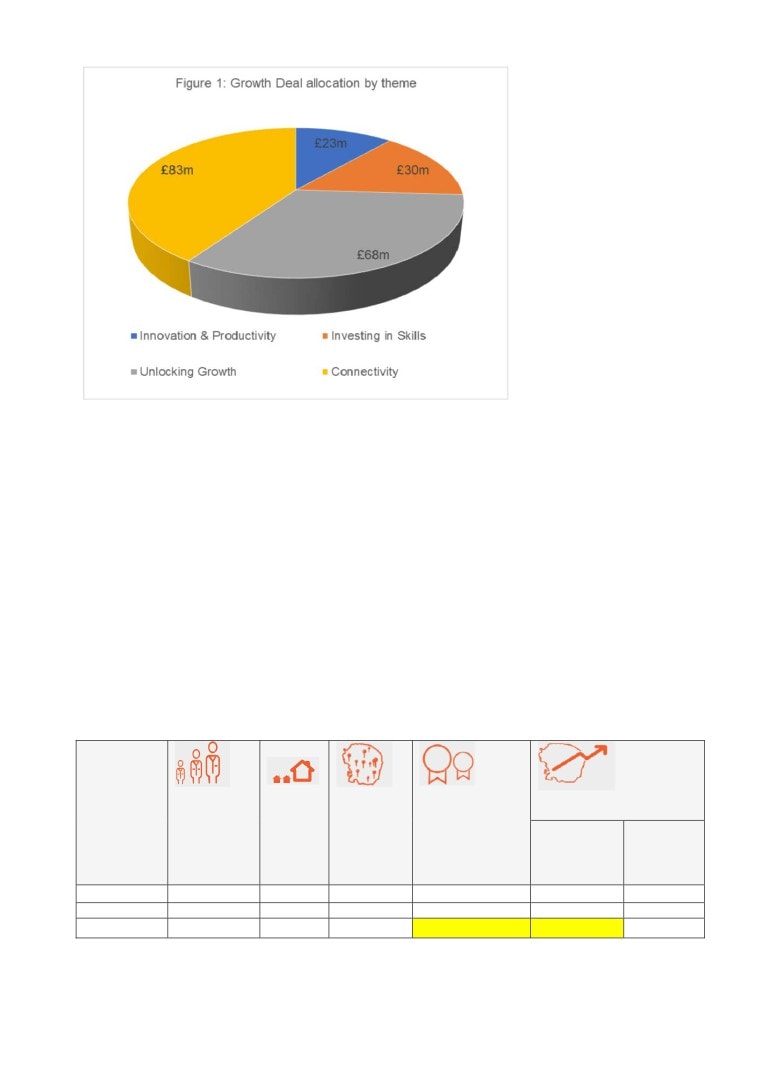

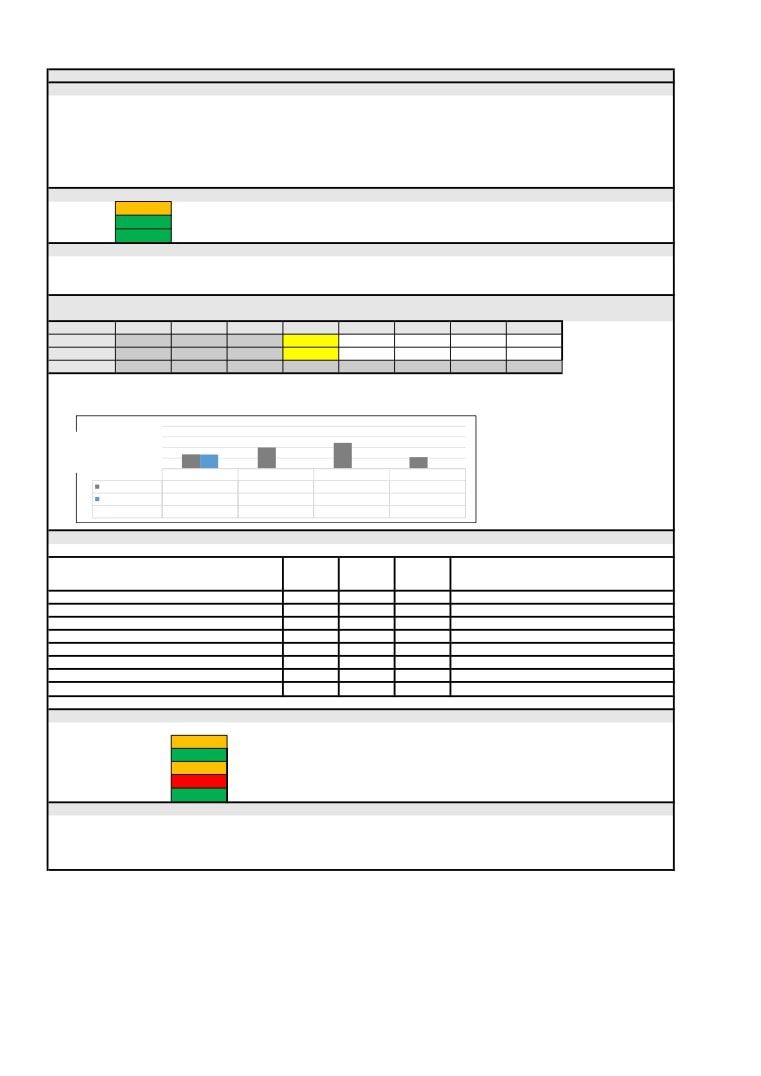

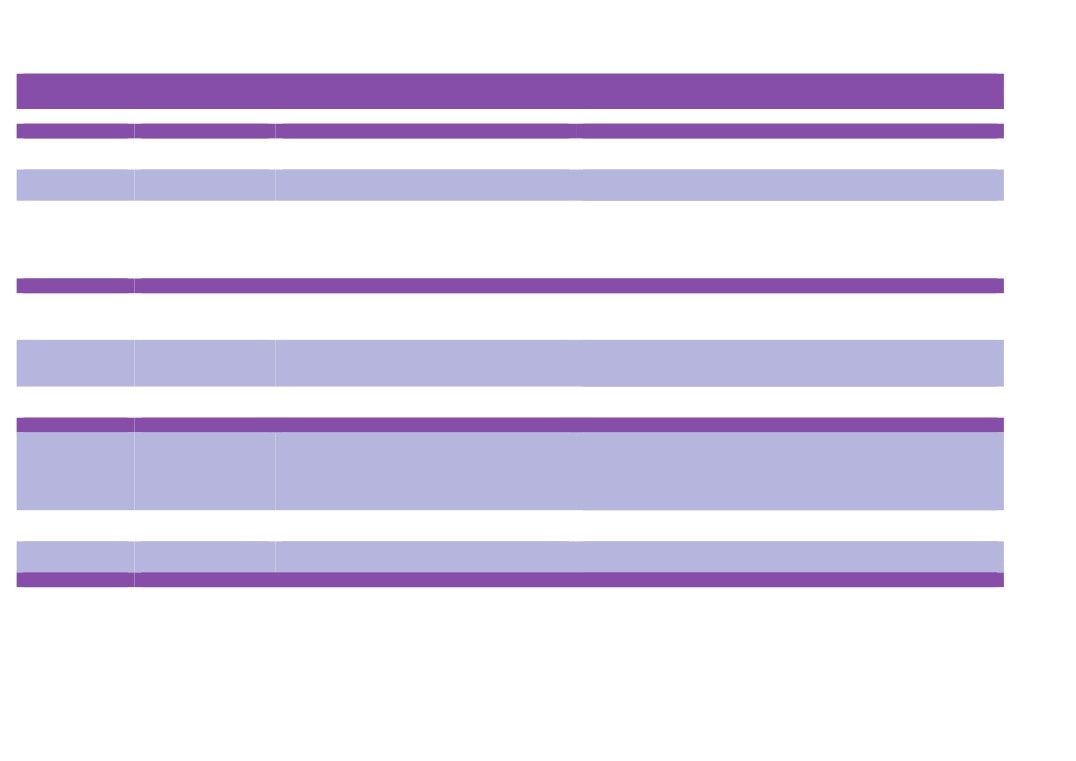

Growth Deal investment by theme

The Government funding award for Growth Deal is £223m. £204m of this is allocated to

projects or programmes, as outlined in Figure 1. The remaining £19m still requires allocation.

An analysis of the Growth Deal financial allocation by theme has been undertaken to identify

any gaps in the investment portfolio.

Growth Deal investment can be grouped into four themes:

Innovation & Productivity: projects that boost innovation and productivity in our

economy. This includes innovation centres and Growing Business Fund projects.

Investing in Skills: projects that deliver the higher level skills needed to drive growth

across our economy.

Unlocking Growth: infrastructure that unlocks or protects housing or commercial

developments in our priority places. This includes the Enterprise Zones, flood defences

and Growing Places projects.

Connectivity: projects and assets that improve the infrastructure and which create a

modern, mobile, accessible, future-proof digital connected economy. This includes

investment in Superfast Broadband and transport infrastructure.

These themes were outlined in the LEP’s Growth Deal Three bid to government.

Figure 1 (below) refers to all financial allocations in Growth Deal i.e. the Growth Deal capital

projects, the Capital Growth Programme, and the three other programmes funded by Growth

Deal (Growing Business Fund, Growing Places Fund, Enterprise Zone Accelerator Fund).

2

This shows that the largest proportion of Growth Deal funding has been invested in Unlocking

Growth and Connectivity, which both relate to improving local infrastructure.

Skills and Innovation & Productivity projects have received proportionally less investment

through Growth Deal.

Impact of the Capital Growth Programme

An analysis of the profiled impact of the Capital Growth Programme has been undertaken to

identify any areas where further investment is required.

Figure 2 relates only to the profiled metrics of the Capital Growth Programme, of which £37m

has been allocated so far. This is so that we can assess the specific impact of this programme

so far, against which the LEP has agreed targets with Government.

As Figure 2 does not include the total profiled impact of Growth Deal, it should be noted that we

are profiled to meet or exceed our overall Growth Deal targets.

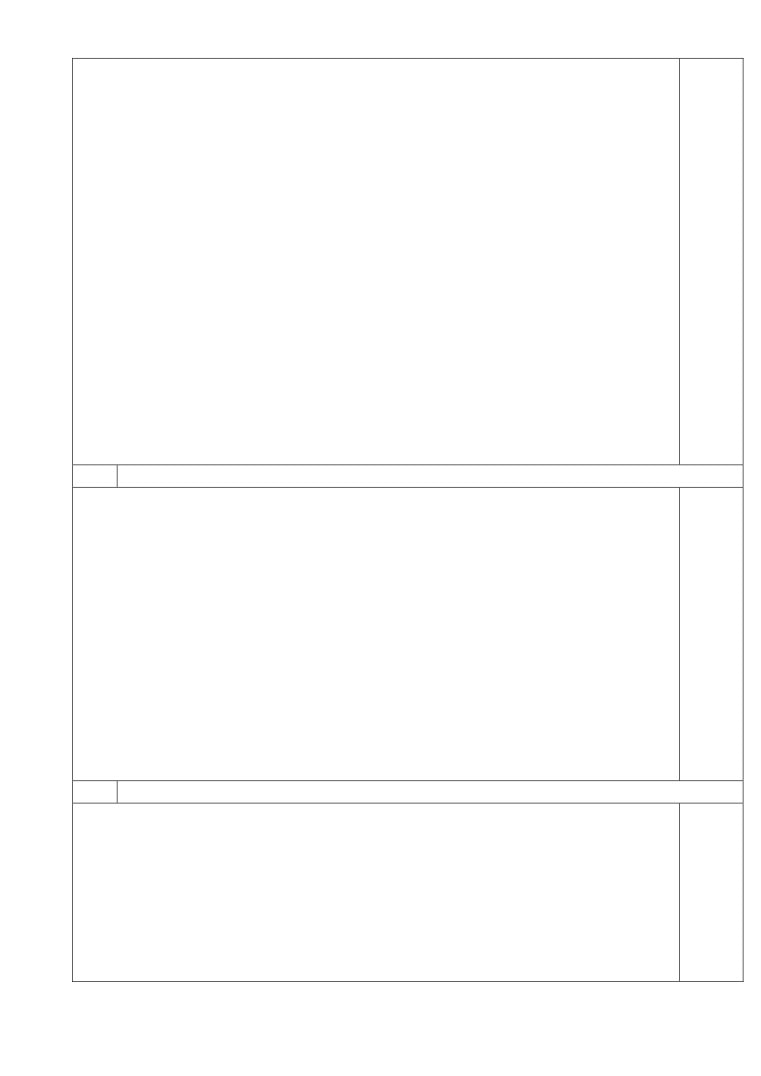

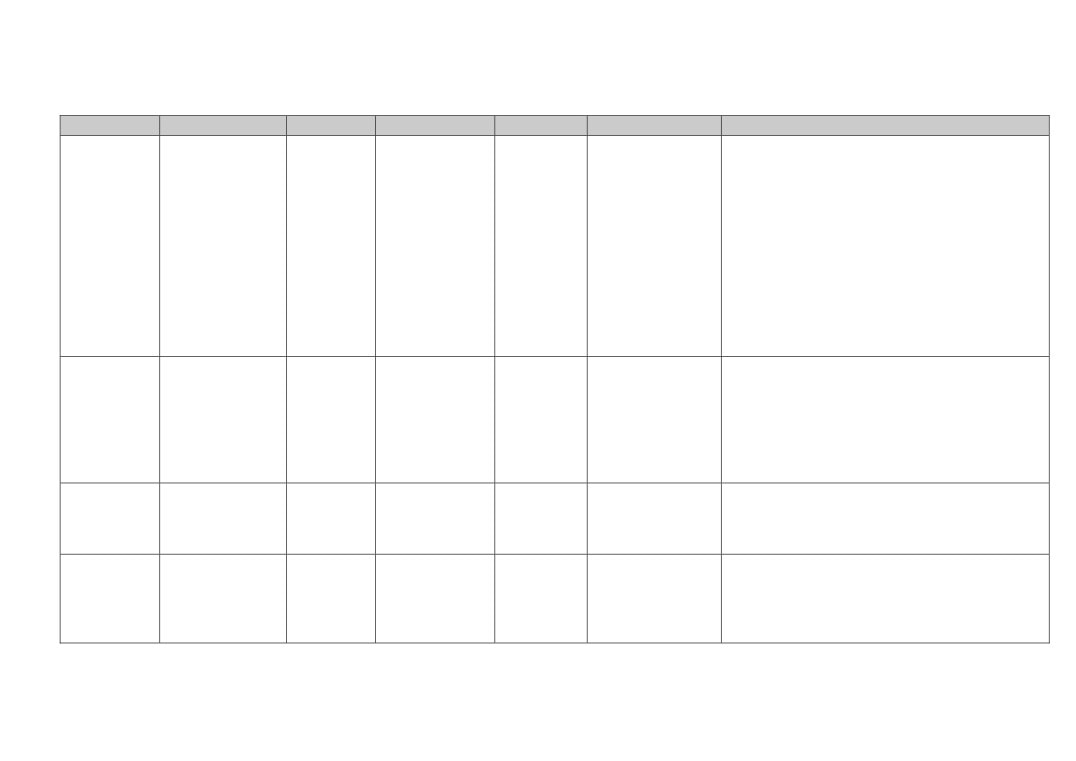

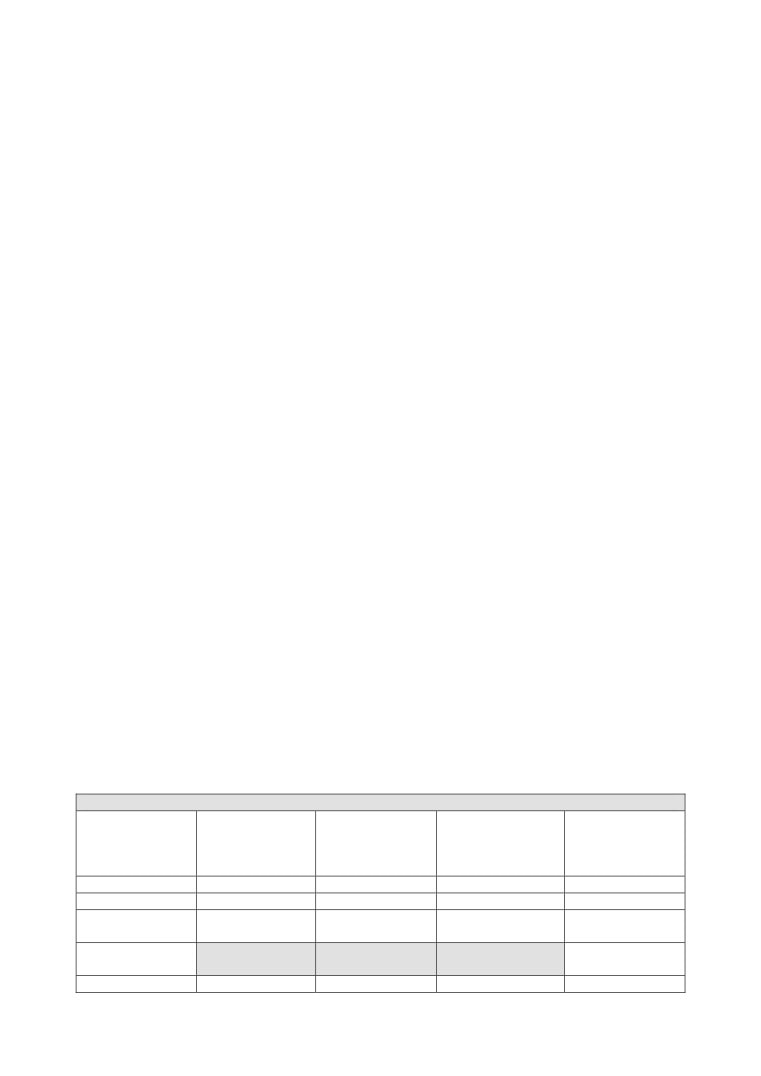

Figure 2: Profiled impact of Capital Growth Programme

Capital

Growth

Programme

88,000 Net

140,000

30,000 new

66% of the

Grow our economy by

new

new jobs by

successful

population with

£17.5bn by 2036

homes

2036 (New/

businesses

nvq3+ (Learners/

Private

Public

by 2036

match

match

Safeguarded

by 2036

Apprenticeships)

jobs)

Profiled

41640

6300

204

36

£22.55m

£257.5m

Targets

37400

3500

75

380

£120m

£40m

Difference

+4240

+2800

+129

-344

-£97.45m

+£217.5m

This shows that learner/ apprenticeships are under-profiled compared to the target. This

reflects the lower investment in skills as outlined in Figure 1.

3

The under-profiled private match reflects that the largest investment so far has been for

infrastructure projects, which in their nature tend to have more public than private investment.

The above analysis indicates the call should be focused on Skills and Innovation &

Productivity.

An example of a capital skills project that the LEP has invested in is the International Aviation

Academy at Norwich Airport. The LEP invested £3.3m in this £11m project to refurbish a WW2

air hangar on the Norwich airport and create a custom designed facility for aviation training. The

facility is the first of its kind in the UK and facilitates close working between education providers

and the aviation industry. It includes classrooms, engineering workshops and a live aircraft in

an emulation zone for students to work on. The project has created a space to run new courses

and is projected to create over a thousand learners and apprenticeships by 2020.

Key Considerations

Taking on board our investment by theme to date and shortfall in profiled impact, the Board is

being asked to consider the launch of a focused call for projects in the themes of Skills and

Innovation & Productivity. This would allocate the remaining £19m in the Capital Growth

Programme, to be drawn down by January 2021 (to enable the LEP to meet its final deadline of

March 2021).

Three options were considered for allocating the remainder of the Capital Growth Programme.

1: An open call similar to the previous one that was run. The key risk is that it might not meet

the profiled impact of the Capital Growth Programme (as outlined in Figure 2).

2: A targeted commission for specific projects that help to meet the ambitions in the Economic

Strategy. The key risk is that this approach is not open and transparent to allow all possible

projects to come forward.

3: A focused call, which is the preferred option. This would enable LEP investment to be

focused on under-invested areas that help to deliver the Economic Strategy, whilst also being

an open and transparent process.

There is a risk that we will not receive projects that are both strategic and deliverable within the

tight timescales we have to spend the funding.

The LEP is aware of a number of potential projects and therefore believes this is a limited risk.

However, should this risk occur the recommendation would be to run an open call for projects.

There is also a risk that this will exclude strong projects in the other priority themes. This should

be balanced against the need to ensure LEP investment is focused on the Economic Strategy

and meets the profiled impact of the Capital Growth Programme.

Link to the Economic strategy

The call for projects will focus on the following priority themes in the Economic Strategy:

Driving business growth and productivity:

Prioritise digital and physical infrastructure projects to support businesses to develop

and provide the opportunities that new and existing firms need to grow.

Establish new centres of excellence to improve productivity and innovation, providing

new skills for business leaders and employees.

4

Driving inclusion and skills:

Prioritise capital investment on provision that will deliver the future skills our sectors and

workforce need.

Projects will ideally deliver against both of the above priority themes.

We would particularly welcome projects that respond to the game changers identified for our

Local Industrial Strategy, i.e. Agri Food, ICT and Clean Energy.

All projects recommended for approval will be appraised and prioritised against their fit with the

Economic Strategy along with other criteria (outlined in Appendix 1).

Next Steps

Launch focused call for projects: 18 October

Call closes/ deadline for applications: 11 January 2019

Project appraisals: January - February 2019

Investment Appraisal Committee: 27 February 2019

Board decision on projects: 27 March 2019

All new projects are expected to be in progress by 2019, for spend of LEP grant by January

2021 (March 2021 at the latest).

Recommendation

The Board is asked to: Approve the launch of a focused call on Skills, Innovation and

Productivity, to allocate the remaining

£19m of the Capital Growth Programme, following

recommendation by the Investment Appraisal Committee.

5

Appendix 1:

Guidance for Applicants - Capital Growth Programme ‘Call for Projects’

Introduction

New Anglia Local Enterprise Partnership is committed to driving economic growth in Norfolk

and Suffolk. Our ambitions for future growth are set out in the Economic Strategy for Norfolk

and Suffolk for the period 2017 to 2036.

The ambitions are:

•

The place where high growth businesses with aspirations choose to be

•

An international facing economy with high value exports

•

A high performing productive economy

•

A well-connected place

•

An inclusive economy with a highly skilled workforce

•

A centre for the UK’s clean energy sector

•

A place with a clear, ambitious offer to the world

We will deliver these ambitions through actions and investment in priority themes and places.

The themes are:

•

Our offer to the world

•

Driving business growth and productivity

•

Driving inclusion and skills

•

Collaborating to grow

•

Competitive clusters, close to global centres

The priority places are:

• Ipswich

• Norwich and Greater Norwich

• The Norfolk and Suffolk Energy Coast, including Bacton, Great Yarmouth, Lowestoft

and Sizewell, with assets on and offshore

• The Cambridge - Norwich corridor

• The East/West corridors along the A47 from Lowestoft to King’s Lynn and the A14

Felixstowe through Ipswich, Stowmarket, Bury St Edmunds, Newmarket and

Haverhill to Cambridge

• King’s Lynn and the A10 and rail corridor to Cambridge

economic-strategy/

Focused Call

Applications are invited for capital grant support towards the following priority themes and

activities identified in the Economic Strategy:

Driving business growth and productivity:

Prioritise digital and physical infrastructure projects to support businesses to develop

and provide the opportunities that new and existing firms need to grow.

6

Establish new centres of excellence to improve productivity and innovation, providing

new skills for business leaders and employees.

Driving inclusion and skills:

Prioritise capital investment on provision that will deliver the future skills our sectors and

workforce need.

Projects will ideally deliver against both of the above priority themes.

We would particularly welcome projects that respond to the game changers identified for our

Local Industrial Strategy, i.e. Agri Food, ICT and Clean Energy.

The funding is available through the Capital Growth Programme (‘Growth Deal’). It must

contribute to one or more of the following key outputs of the programme:

New high quality jobs

New businesses

New learners/ apprenticeships

Match funding (private and/ or public).

Eligibility criteria

Only Capital projects located within the New Anglia Local Enterprise Partnership area may

apply.

All projects must be:

Able to fully draw down LEP funding by 31 January 2021 (note LEP funding can only be

drawn down in arrears upon satisfactory evidence of costs incurred).

State Aid compliant

Able to demonstrate their contribution to the delivery of the Economic Strategy and Call

Focus through direct and indirect outputs.

Able to demonstrate the need for funding and the additionality achieved by the funding.

It will not be possible to support:

revenue costs

costs that have been incurred before a grant offer is made

items that only benefit an individual or sole business

items that are not directly needed to deliver the proposed work

loan repayments or contributions to general appeals

political or religious activities.

The full application criteria are listed below.

Application process

i) Application Form:

Please submit an application form - to receive a copy of the application form, email

You will need to provide sufficient information to help determine if the project meets the

requirements of the Call.

7

To arrive no later than 5pm on Friday 11th January.

No late submissions will be considered.

ii) Selection criteria

Projects will be scored on a competitive basis against the criteria set out in this call:

Strategic Fit

Fit with Call

Deliverability

Additionality

Economic Return

Key areas will be scored 1-5 for each project, with 5 being the highest.

Table 1 provides further detail (see below).

iii) Selection process

Applications will be subject to a full appraisal by an independent consultant once submitted. A

technical appraisal specialist may be sourced for individual projects if necessary.

The appraisal will be in accordance with HM Treasury Green Book principles of viability, value

for money, achievability, affordability and need.

Once submissions have been received, applicants may be required to respond to queries about

their projects from the LEP programmes team as part of the shortlist process.

The New Anglia LEP Board will consider all applications at its 27 March 2019 meeting and

determine whether to approve or reject each application.

iv) Funding: All projects approved for funding will be subject to a legal agreement drawn up in

conjunction with the LEP’s Accountable Body, Suffolk County Council. The agreement will

include the cycle of anticipated drawdown of funding and the outputs expected to be generated

by the project.

Support

Queries on the completion of the Application Form/ Business Case and process should be

Useful information

Economic Strategy for Norfolk and Suffolk

Applicants should ensure that they are familiar with the standards required for full business

case appraisal at an early stage. Guidance for this can be found at: HM Treasury Green Book

Appraisal and Evaluation in Central Government

In addition, reference should be made to the DCLG Appraisal Guide (December 2016).

8

Table 1: Assessment process

Criteria

5

4

3

2

1

Strategic Fit: An

High - strong strategic fit that

Medium - Good strategic fit. Project

Low- Strategic fit not clear,

assessment will be made

directly supports 5 or more

supports 3-5 ambitions & has a

supports <3 ambitions. Perhaps

against both the themes

ambitions and directly delivers

clear link to actions in themes &

ongoing upkeep or sustaining

and places in the strategy,

specific actions in the themes and

places, but delivers limited

activity, but does not directly

incorporating an

places and / or unlocks other

improvement on business as usual

support an action in a theme or

assessment of the

projects that do. A clear inclusive

and/ or marginal inclusivity.

place or will not bring about net

strategic case for public

growth impact.

additional growth or direct

money, where

inclusive growth impact.

appropriate.

Fit with Call: An

Strong fit.

Moderate fit.

Low fit.

assessment will be made

against the project’s fit

with the project call, with a

robust plan in place to

deliver against the criteria.

9

Criteria

5

4

3

2

1

Deliverability: An

High - Project has owners,

Medium - Plan is high level, with

Low - Project plans not

assessment will be made

governance and a clear route to

limited assessment of risk and only

developed, little clear

that considers how the

funding with appropriate delivery

indicative funding, delivery and

assessment of funding.

project will run and

capacity and a plan identified.

governance arrangements. Unclear

includes considerations of

whether delivery skills have been

timescales, capacity,

identified.

experience, risks and

resources, alongside

potential financial viability

(whether the project is

sufficiently well advanced

to draw down LEP funding

in the relevant timeframe).

Additionality: An

High - demonstrates strong

Medium - demonstrates reasonable

Low - demonstrates low

assessment against the

contribution to the metrics; clear

contribution to the metrics; likely to

contribution to the metrics;

information and evidence

process to achieve all metrics.

achieve majority of metrics.

unlikely to achieve metrics.

provided that

demonstrates the net

additional outputs against

the economic indicators in

the strategy. Given this is

designed for strategic

prioritisation, this should

assess additionality in

terms of the overall impact

on the economic

indicators.

10

Criteria

5

4

3

2

1

Economic Return: An

High - demonstrates good value

Medium - demonstrates reasonable

Low - demonstrates minimal

initial assessment of

for money.

value for money.

value for money.

economic impact & return

on investment, to gain

further insight into value

for money. It will consider

the forecast net outputs

compared to the total cost

of the project. Where

available it will also

consider any calculations

relating to Return on

Investment (ROI), GVA

per £ of funding (over 10

years) or Benefit to Cost

Ratio (BCR) where

employment outcomes

are harder to forecast.

11

New Anglia Local Enterprise Partnership Board

Thursday 18th October 2018

Agenda Item 10

Revenue budget framework- Funding call for innovative growth projects

Author: Chris Dashper/Chris Starkie

Presenter Chris Dashper.

Summary

This paper outlines the parameters of a funding call for a programme to facilitate innovative

projects supporting economic growth and the delivery of the Economic Strategy utilising

revenue from the Enterprise Zone Pot C.

The project was reviewed by the Investment Appraisal Committee at its meeting on 19

September 2018. The IAC agreed to recommend that the LEP Board support the proposal.

Recommendation

The LEP Board is requested to:

Approve the specification and launch of a call for innovative growth projects to be

supported through EZ Pot C income

Approve the eligibility framework

Background

At the LEP Board meeting held on

20 June

2018 the board agreed the following

recommendations for the use of Pot C funding for the 18/18 financial year:

1 Approve the allocation of £135k set aside in Pot C for core LEP costs to fund the

Enterprise Adviser Network for 18/19

2 Approve the allocation of £100k from Pot C towards the LEP projects budget for 18/19

3 Invite the executive to develop a specification for a call for innovative projects from

external partners which will help deliver the Economic Strategy

4 Approve the allocation of £500k from Pot C towards the call for innovative projects from

external partners which will help deliver the Economic Strategy

This paper builds on the third and fourth recommendations above, defining the specification

and process for the call for innovative projects to be supported through the Pot C income

stream.

The majority of funding secured by the LEP to date has been capital funding and has been

used accordingly to support capital intervention programmes including Growing Places Fund,

Growing Business Fund and the Growth Deal.

1

35

The limited revenue funding secured from government has been used either to run the LEP’s

operations or to deliver to specific revenue-based projects such as our ERDF funded Growth

Programme.

We have also on a one-off basis been able to fund a number of initiatives such as supporting

tourism through Visit Norfolk and Visit Suffolk, the energy sector by providing support to

EEEGR and projects to support the Creative Cultural sector and Digital Creative Sector.

The LEP’s Enterprise Zones are an important source of revenue funding, generating an income

stream from the retention of the uplift in business rates on each site and it is this income which

can be used to support a revenue-based intervention programme for the region.

In line with the recommendations agreed by the board during the June board meeting, the LEP

Executive has developed the following specification for a call to identify appropriate projects to

support through a revenue-based programme funded by £500k of the Pot C income.

Key Considerations

The Board is being asked to consider the launch of a call for innovative growth projects for

2018/19 in the amount of £500k.

Timetable

The timetable for the call would be as follows:

Board approval for specification and call: October 2018

Call period: October-December 2018

Project review and appraisal: January-February 2019

Investment Appraisal Committee Decisions: March 2019

The majority of approved projects would be expected to draw down funding during the 2019/20

financial year, although some may be able to proceed immediately upon approval by the IAC

and spend in March 2019.

A similar call would be launched in 2019/20 and in subsequent years. Project slippage between

financial years is manageable in this circumstance, since, unlike many LEP funding streams,

there is no requirement to spend the money in defined years.

Eligibility framework

For the first time, the LEP will be launching a call for projects based around a revenue theme,

rather than capital.

Projects applying for capital funding in other LEP projects would be eligible to apply for limited

amounts of revenue funding from the innovative growth fund.

In order to judge one project against another, the projects will need to clearly demonstrate what

they are delivering, in other words what the LEP is purchasing.

Given the different types of project, the different outputs will vary - for example some schemes

might have very tight defined outputs, others more broad impact.

Our assessment process would rank proposals against the following criteria.

1 Demonstration of clear fit with Economic Strategy.

2 Additionality. How is this more than business as usual. The fund should not replace core

funding.

2

36

3 Value for money. Can the project demonstrate this is good use of public money.

4 Leverage. What additional funding, public or private or in-kind support does the project

generate.

5 Impact. What will the project actually deliver and how innovative is the proposal.

6 Sustainability. What will happen when the funding ends.

Each would be scored from one to five, with a total maximum score therefore of 30.

One being low. Three medium and five being good.

We would only anticipate recommending approval of projects which scored four or five across

all six categories.

The assessment criteria is outlined in more detail in Appendix 1 which is the formal guidance

for applicants document.

Types of project

Pot C is ring fenced by the LEP to invest in supporting economic growth and in the delivery of

the LEP’s Economic Strategy.

The proposed revenue framework is designed to ensure that funding generated by Pot C from

the Enterprise Zones is both aligned with the Economic Strategy and can help accelerate the

delivery of the strategy.

We will prioritise projects that can clearly demonstrate direct links to delivering elements of the

Economic Strategy, and in particular the growth of our ambitions, themes, sectors and key

growth locations.

For example we would prioritise projects relating to energy, agrifood, ICT/ digital and creative

industries with clear and demonstrable outputs.

We are also looking for cross-sector collaborations, where specialist skills in one sector can

drive innovation and growth in another would be of particular interest.

And we would also consider proposals for revenue funding to accelerate the impact of LEP

capital schemes.

We would not anticipate supporting transport feasibility studies through this fund.

Recommendation

The LEP Board is requested to:

Approve the specification and launch of a call for innovative growth projects to be

supported through EZ Pot C income

Approve the eligibility framework

3

37

Appendix 1:

Guidance for Applicants - Revenue Programme Call for Projects.

Introduction

New Anglia Local Enterprise Partnership is committed to driving economic growth in Norfolk

and Suffolk. Our ambitions for future growth are set out in the Economic Strategy for Norfolk

and Suffolk for the period 2017 to 2036.

The ambitions are:

•

The place where high growth businesses with aspirations choose to be

•

An international facing economy with high value exports

•

A high performing productive economy

•

A well-connected place

•

An inclusive economy with a highly skilled workforce

•

A centre for the UK’s clean energy sector

•

A place with a clear, ambitious offer to the world

We will deliver these ambitions through actions and investment in priority themes and places.

The themes are:

•

Our offer to the world

•

Driving business growth and productivity

•

Driving inclusion and skills

•

Collaborating to grow

•

Competitive clusters, close to global centres

The priority places are:

• Ipswich

• Norwich and Greater Norwich

• The Norfolk and Suffolk Energy Coast, including Bacton, Great Yarmouth, Lowestoft

and Sizewell, with assets on and offshore

• The Cambridge - Norwich corridor

• The East/West corridors along the A47 from Lowestoft to King’s Lynn and the A14

Felixstowe through Ipswich, Stowmarket, Bury St Edmunds, Newmarket and

Haverhill to Cambridge

• King’s Lynn and the A10 and rail corridor to Cambridge

economic-strategy/

Call for projects

Applications are invited for revenue grant support towards innovative projects to support the

delivery of the themes and activities identified in the Economic Strategy.

Eligibility criteria

Only project applicants located within the New Anglia Local Enterprise Partnership area may

apply.

4

38

All projects must be:

State Aid compliant

Able to demonstrate their contribution to the delivery of the Economic Strategy and Call

Focus through direct and indirect outputs.

Able to demonstrate the need for funding and the additionality achieved by the funding.

It will not be possible to support:

capital costs

Transport feasibility studies

costs that have been incurred before a grant offer is made

items that only benefit an individual or sole business

items that are not directly needed to deliver the proposed work

loan repayments or contributions to general appeals

political or religious activities.

The full application criteria are listed below.

Application process

i) Application Form:

Please submit a copy of your application form or business case. To receive a copy of the

application form, please email @newanglia.co.uk

You will need to provide sufficient information to help determine if the project meets the

requirements of the Call.

Please send completed Application Forms to @newanglia.co.uk

To arrive no later than 5pm on Friday 21st December.

No late submissions will be considered.

ii) Selection criteria

Projects will be scored on a competitive basis against the criteria set out in this call:

Demonstration of clear fit with Economic Strategy.

Additionality. How is this more than business as usual.

Value for money. Can the project demonstrate this is good use of public money.

Leverage. What additional funding, public or private or in kind support does the project

generate.

Impact. What will the project actually deliver.

Sustainability. What will happen when the funding ends.

Key areas will be scored 1-5 for each project, with 5 being the highest.

Table 1 provides further detail (see below).

5

39

Table 1: Assessment process

Criteria

5

4

3

2

1

Guidance

Clear Fit with

High - strong

Medium - Good

Low- Strategic fit not

Applicants should demonstrate for their project:

Economic

strategic fit that

strategic fit.

clear, supports <3

•Does the project or scheme directly support the

Strategy

directly supports 5

Project supports

ambitions. Perhaps

ambitions / themes/ priority places set out in the

or more ambitions

3-5 ambitions &

ongoing upkeep or

Economic Strategy?

and directly delivers

has a clear link to

sustaining activity

•Does the project unlock other projects with a high

specific actions in

actions in themes

but does not directly

strategic fit?

the themes and

& places but

support an action in

•Does it help accelerate delivery of a LEP capital

places and / or

delivers limited

a theme or place or

scheme?

unlocks other

improvement on