New Anglia LEP Investment Appraisal Committee

Wednesday 21st March 2018

9am to 9:45am

The Jockey Club, Newmarket, Suffolk

Agenda

No.

Item

1.

Welcome

2.

Apologies

3.

Declarations of Interest

4.

Minutes from last Meeting

Papers for discussion

5.

Stowmarket Atex - Confidential

6.

Carlton Marshes

7.

Snetterton Heath Power- Confidential appendices

8.

Norwich Area Transportation Strategy

9.

Ipswich Cornhill

10.

Verbal update Great Yarmouth Investment

Governance

11.

Growing Places Fund Horizon Projects - Confidential

12.

Terms of Reference - Growing Business Fund

13.

Terms of Reference - Investment Appraisal Committee

Other

14.

Any Other Business

Date and time of next meeting: Wednesday 18th April, 2018. 9am-9:45am

Venue: Green Britain, Swaffham, Norfolk

New Anglia Investment Appraisal Committee

Meeting Minutes (Unconfirmed)

21st February 2018

Present:

Tracie Ashford (TA)

New Anglia LEP

Cllr David Ellesmere (DE)

Ipswich Borough Council

Doug Field (DF)

East of England Coop

Lindsey Rix (LR)

Aviva

Chris Dashper (CD)

New Anglia LEP

Iain Dunnett (ID)

New Anglia LEP

Actions from meeting

Capital Growth Programme Verbal Update

CD/ID to review cultural projects

CD/ID

CD to oversee review of Growth Deal projects in May

CD

Terms of Reference

CD to make amendments to Terms of Reference and ensure on website by 28/02/18

CD

AOB

ID to bring a dashboard of headline projects to the next meeting

ID

1

Welcome from the Chair

Lindsey Rix welcomed everyone to the meeting

2

Apologies

None

3

Declarations of Interest

Full declarations of interest can be found at http://www.newanglia.co.uk/about-us/the-board/.

Declarations relevant to this meeting: None

4

Minutes of the last meeting

The committee agreed the minutes from the last meeting

Actions from last meeting updated as follows:

CD to circulate new Terms of Reference before next meeting - Complete

5

Ipswich Malthouse and Winerack

Malthouse - Progress report updated committee on project.

Winerack - Progress report updated committee on project. Contractor RG Carter is on site

and work has started. Scaffolding is expected to be up in March and a ministerial visit is

hoped for the end of March.

The committee agreed that

ID will continue to manage Malthouse loan arrangements and Winerack drawdown

6

Capital Growth Programme Verbal Update

Cultural projects have expressed frustration at timescales for decisions on Growth Deal

decisions. DF suggested that the Cultural Board be requested to comment on funding

priorities for cultural projects as part of a process where projects are given a clear

expectation of the funding process timeline. A possible development would be for cultural

projects to be considered for Growing Places Fund grants.

Page 1 of 2

An overall review of all Growth Deal pipeline projects will be completed in May. Expectation

management is required of projects where by a project is aware of a customer journey when

embarking on a Growth Deal application.

The committee agreed that

CD/ID to review cultural projects

CD/ID

CD to oversee review of Growth Deal projects in May

CD

7

Honingham Food Hub and Snetterton

Honingham - CD has met with and advised project developers on LEP funds. CD to

support further.

Snetterton - Breckland District Council will be seeking a decision on this from the LEP by

April. Further information and a review of the project will be bought to the IAC.

The Committee Agreed that

CD will continue to support and advise Snetterton and Honingham developments

Terms of Reference (TOR) - Growing Business Fund (GBF) and Investment Appraisal

7&8

Committee (IAC)

CD presented the TOR for GBF and explained there were many changes to bring them in

line with the IAC TOR.

The following questions raised were in relation to both TOR documents.

DE said the Terms were not explicit on substitutes to which everyone agreed and the rules

around this must be added to both TOR.

LR asked why both TOR had the same delegated authority of £500,000. It was broadly

agreed that the IAC sets the overall fund size for GBF and the GBF panel works within this

funding boundary.

LR said there needed to be parameters set within the TOR around decision making, with at

least one panel member consistent between the two groups.

DF said there was no reference to a mandatory advisor review in the TOR and this needed

to be added. A list of all advisors is to be circulated to the committee ahead of the next IAC

meeting with details of when they were last reviewed and when the next review is due.

The committee agreed that

CD to make amendments to Terms of Reference and ensure on website by 28/02/18

CD

8

AOB

ID said there were two projects he would like to bring to the board in March.

ID also listed a pipeline projects that are likely to approach the LEP for funding.

LR and DF would like a draft dashboard of headline projects/fund availability at the

next IAC meeting.

The committee agreed

ID

ID to bring a dashboard of headline projects to the next meeting

Next meeting:

Wednesday 21st March 2018, 9am - 9.45am

The Jockey Club, Newmarket, Suffolk,

Page 2 of 2

New Anglia Local Enterprise Partnership Investment Appraisal Committee

21st March 2018

Agenda Item 6

Carlton Marshes, Southern Gateway to the Broad’s National Park: Growing

Places Fund grant request

Author: Iain Dunnett

Summary

The following paper provides a summary of the financial request from the Suffolk Wildlife Trust

for the development project - “The Southern Gateway to the Broad’s National Park” located at

Carlton Marshes near Lowestoft.

The application is for a Growing Places Fund Grant of £250,000 which will be utilised to

contribute to the cost of the development of a Landmark Visitor and Education Centre and the

purchase of land adjacent to Carlton Marshes Nature Reserve.

Recommendation

The Investment Appraisal Committee is recommended to support this application and to make

an offer of a grant of £250k to the Suffolk Wildlife Trust for the development.

Background

The project will deliver a Landmark Visitor and Education Centre with links into the skills and

attainment aspirations of the community in Lowestoft and its surrounds. Through purchase of

adjoining areas to the Carlton Marshes Nature Reserve this project will provide an attractive

400ha location in the Broads National Park, which will act as a significant entrance point to the

Southern Broad’s with benefit to the areas visitor economy.

The Esmee Fairbairn Foundation has enabled the project, by providing over £2million of loan

provision to hold the land in-trust whilst the Suffolk Wildlife Trust undertake to raise funds to

complete the project. This is the largest ever loan-purchase commitment on a national scale

from Esmee Fairbairn in collaboration with a local organisation, and it represents the single

biggest landscape scale development currently in Norfolk and Suffolk. The project is

strategically linked to the objectives of the Broads Authority and the Broads Plan.

The development will attract people from across the UK providing an additional attraction to the

developing visitor economy of Lowestoft, which is currently undergoing a range of innovations

such as the reinvigoration of the CEFAS site and the Seafront/ Wayne Hemingway re design.

1

For local people, the visitor centre will be a hub of activity for learning and outdoor recreation,

offering wide-ranging training opportunities for young people and volunteers to develop skills

that they can take into the wider economy and a social space which fosters community

cohesion and wellbeing. This project represents the western end of a crescent of projects which

stretch across Lowestoft Harbour to Ness Point, bringing positive development to all sides of

Lowestoft.

The scale of the opportunity to restore a damaged Broadland landscape is unprecedented and

will be one of the largest landscape/ visitor facility creation projects ever undertaken in the

Broads National Park.

Key issues

Financial

The grant request for the project is based on the following key points. The LEP has

applied a degree of due diligence to these points appropriate to this full project

appraisal:

o

Total project cost is £8,277,414 plus repayment of £2m loan

This is the overall project cost including the purchase of land and a loan from

Esmee Fairbairn.

Funding secured inclusive of;

o

Loan support of £2million from Esmee Fairbairn. This loan provision has enabled

the Suffolk Wildlife Trust to purchase land adjacent to Carlton Marshes Nature

Reserve. The loan will be fully paid off at the point that the Suffolk Wildlife Trust

have reached fund raising targets sufficient to develop the facilities and with the

a residue of funds to pay off the loan.

o

Suffolk Wildlife Trust has committed its own funds of £1,312,000, plus an in-kind

commitment of £652k, which is £1,964,000 in total.

o

The Trust have raised £800k through a public fundraising appeal.

Ongoing fundraising inclusive of;

o

The Trust has applied to the HLF for a grant of £4,063,000 (stage 1 approval

achieved and stage 2 decision imminent)

o

Charitable Trust and other grants (decisions pending) = £650K

o

Local businesses (sponsorship) = £75k

o

Future legacy gifts for loan repayment over next 3 years = £475,414

o

LEP (grant requested) = £250k

Sustainability - The HLF funding includes funding for new staff posts for 4 years and

the Suffolk Wildlife Trust is already committed to the existing 2 staff posts.

2

LEP intervention - The intervention from the LEP has been requested based on similar

LEP grants made to organisations such as the National Horse Racing Museum, Gt

Yarmouth Waterways and Norwich Writers Centre.

Eligibility for LEP support - The development is eligible for a grant from the Growing

Places Fund.

State Aid - State Aid Exempt due to the Cultural/Environmental Block Exemptions

ruling. This grant would equate to the value of £250,000 of State Aid which is compliant

under GBER Articles 4 and 53 enabling aid for Culture and Heritage Conservation. The

level of investment aid is less than 1 million euros, with a maximum investment aid

threshold of 80% of total eligible costs.

Timeline

o

HLF Stage 2 Funding Decision April/May 2018

o

Project Start Date May 2018

o

Land Purchase June 2018

o

Habitat Creation June 2018 - 2021

o

Visitor Centre and Access Works June 2018 - March 2020

o

Centre Opening Spring 2020

Risks

o

Land purchase does not go ahead - The land has been bought from the

commercial vendor by the UK Charitable trust, the Esmee Fairbairn Foundation,

who are holding it in trust.

o

Centre build is delayed by technical or cost issues - Interdisciplinary build team

brought together early in the project development, and proposals reviewed by

two independent Quantity Surveyors to enable financial planning. Contingency

for build costs built into HLF grant

o

Visitor Centre not financially viable - Independent market research and business

planning undertaken by specialist Agency ‘The Research Box’ in spring/summer

2017 to test the business model.

Link to the economic strategy

The potential LEP investment in this project represents a significant economic and social

investment for the LEP in Lowestoft, an important growth location in the strategy;

The visitor centre will be a hub of activity for learning and outdoor recreation for local

people. It will offer wide-ranging training opportunities for young people and volunteers

to develop skills they can take into the wider economy, and a social space which fosters

community cohesion and wellbeing.

Overall the project will create:

o

1 new business

3

o

5.5 FTE jobs and support 2 FTE existing jobs

o

4 apprenticeships per annum

o

155 ha of new employment land

o

400 ha restored landscape

o

Strategically the project utilises natural capital as an economic generator

The Broads Tourism Strategy has three objectives that are the drivers of the strategy

-

all of which this project will strongly support, particularly addressing the imbalance

between the north and south Broads. The three objectives are:

o To raise awareness of the broads as the UKs only unique wetland National Park

based on its waterways, heritage, landscapes and wildlife.

o To strengthen the variety, distinctiveness and quality of the Broads tourism offer,

capable of generating visits throughout the year.

o To stimulate and manage the flow of visitors round the Broads with consequent

benefits for communities and the environment.

With a new landmark visitor centre to bring the location to life, Carlton Marshes will

become a spectacular year round destination attracting visitors from across East Anglia,

and beyond.

The health and well-being benefits of free access to 12.5km of paths within this urban fringe

wild area, and of a variety of volunteering opportunities, are considerable.

Recommendation

The committee is recommended to support this application and to make an offer of a grant of

£250k to the Suffolk Wildlife Trust for the development.

4

New Anglia Local Enterprise Partnership Board

Wednesday 21st March 2018

Agenda Item 7

Capital Growth Programme: Snetterton Heath Employment Area, IAC Recommendation

Author: Chris Dashper

Summary

The Capital Growth Programme call for projects was launched immediately following the

October 2017 LEP Board meeting.

Under the call, £9m of grant funding from the Growth Deal was made available to support

projects that help to deliver the new Economic Strategy.

At the January meeting of the LEP Board, the board agreed to support 2 of the 29 project

applications received. The remainder of the applications were either deferred pending further

information or rejected. The updated table of deferred projects is included for reference as a

confidential appendix to this paper.

One of the deferred projects, Snetterton Heath Employment Area Electricity Upgrade Scheme

has now supplied the required additional information necessary for a decision to be made on

the financial support for the project.

Appendices 2 and 3 are deemed confidential because they contain commercially sensitive

information.

Recommendation

The Investment Appraisal Committee are asked to recommend to the LEP Board a grant of

£2.65m from the Capital Growth Programme is awarded to the the Snetterton Heath

Employment Area Electricity Upgrade Scheme.

Background

The Capital Growth Programme Call for Projects was launched after the October LEP Board

meeting, with £9m from the Growth Deal made available to support projects that helped to the

deliver the new Economic Strategy.

A total of 29 project Expressions of Interest were received as a result of the call, with sectors

including infrastructure, transport, employment projects, skills and cultural themed projects.

At the January 2018 LEP Board 2 projects, Bacton to Walcott Coastal Management Scheme

and CEFAS Research Centre were approved, allocating £2.48m of the £9m round. A further 20

of the project applications were deferred, pending further information. One of the deferred

projects was the Snetterton Heath Employment Area Electricity Upgrade scheme.

1

Since the January LEP Board meeting, the applicant for thw Snetterton project, Breckland

District Council, has provided significant additional information on the delivery of the Snetterton

Heath Employment Area project and has also secured planning permission for the electricity

substation, one of the principle outstanding requirements necessary to allow approval of the

project.

Key issues

The Site

Snetterton Heath is the one of the largest of the A11 employment sites and one of the most visible

from the A11, five miles west of Attleborough and located in the Breckland District Council area.

It is an established location, with most of the spine infrastructure already provided including grade

separated A11 access. The Snetterton motor racing circuit, an internationally recognised venue

forms part of the site and provides a potential basis for further employment. The only

infrastructure issue restricting the growth of site is the electricity constraints, an upgrade of the

supply being necessary to encourage further development.

Funding

Breckland District Council has applied to New Anglia LEP for a Capital Growth Programme grant

of

£2.65m towards the cost of a £3.5m scheme to upgrade the electricity supply to the

employment land. The costs of the project include a new substation to be located within the

boundary of the nearby Biomass Powerstation and new cabling to various parts of the

employment area. The balance of funding required will come from a grant from the Norfolk

Business Rates Pool.

Project proposal

The project proposal is to construct a new substation at the biomass plant to convert 33kv to 11

kv and link to the existing UKPN network. 11kv cable will then be run to the edge of each

landholding but no further. It will be the landowner’s responsibility to distribute the power

thereafter to individual parcels. Occupiers will also need to provide their own onsite substations

to step down the 11kv supply. Breckland proposes to fund the whole cost upfront so that

individual users can connect, as and when they arrive.

Consents

Heads of terms have been agreed for the siting of the substation. The majority of the cable runs

are along public highways and Norfolk County Council has confirmed that these can be

accessed without difficulty. There is no need to cross any other land not owned by the local

landowners. With planning permission now in place, this means there are no major constraints

to delivery of the project.

State Aid

State Aid is often an issue for projects involving the supply of utilities. New Anglia LEP has

commissioned an independent legal report on the State Aid issues facing this project. The legal

advice confirms that in this circumstance, the aid is a permissible subsidy to UKPN to extend its

network, to the boundary of each site, to which the public has the right to connect. The effect of

the subsidy is to enable the serviced land to be offered at market price rather than at above

market price and does not give it a competitive advantage over other sites on the A11.

Ultimately the site would not be viable if the full cost of connection had to be met. An alternative

loan arrangement would not work in this circumstance.

2

Timescale

Breckland District Council are intending to start work almost immediately after approval of the

grant request. This ensures that the price quoted by UKPN remains viable. Cabinet approval of

the grant will be required and this has been scheduled for discussion in early April 2018.

Project history

New Anglia LEP has been supportive of the concept of improving the electricity supply at

Snetterton, this being a well-known local issue for some time. A previous attempt to address

this situation, with a confirmed grant offer from the Growth Deal could not ultimately be

delivered due to the costs involved and complex access rights including passing under the

railway line. The grant offer had to be withdrawn, the funding recycled back into the Growth

Deal and therefore forming part of the funding for the current Call for Projects.

The current version of the project is a much improved, comprehensive arrangement,

considerably more deliverable than before and fully State Aid compliant.

Financial implications

Approval of the project would bring the total formal allocation under the £9m call to £5.13m,

including the £2.48m allocated at the January 2018 Board meeting.

This would leave £3.87m to be allocated to the remaining deferred projects, subject to

additional information and appraisal. A further review paper on these projects is scheduled for

the May 2018 Board meeting.

A further £23m would then remain for a future call to be held in the summer/autumn. This could

support some of the deferred projects.

Link to the economic strategy

New Anglia LEP has previously invested in infrastructure including the A11 corridor and has

supported other successful large-scale employment sites with direct and indirect infrastructure

investment, including the 16 Enterprise Zone sites across Norfolk and Suffolk. Rarely viable in

conventional investment terms, this type of site often requires a public intervention to allow

progress to be made towards achieving growth, appropriate outputs and addressing issues such

as productivity.

The Cambridge-Norwich Tech Corridor and its developable employment areas including

Snetterton Heath are key aspects of the new Economic Strategy.

Recommendation

The Investment Appraisal Committee are asked to recommend to the LEP Board a grant of

£2.65m from the Capital Growth Programme is awarded to the the Snetterton Heath

Employment Area Electricity Upgrade Scheme.

Appendix 1: Appraisal process

Appendix 2: Confidential - consultants appraisal

Appendix 3: Confidential - deferred projects tabl

3

Appendix 1: Appraisal Process

Hewdon Consulting have been engaged to complete the initial appraisal of the project

applications received during the Call for Projects launched in October 2017.

All projects have been appraised in accordance with HM Treasury Green Book principles of

viability, value for money, achievability, affordability and need.

Following the receipt of additional supporting information, the Snetterton Heath Employment

Area project has been reappraised by Hewdon Consulting and re-scored in line with the October

2017 Call for Projects key criteria:

Capital Growth Programme Core outputs

Connectivity- investing in essential projects and assets that improve the infrastructure

and which create a modern, mobile, accessible future-proof digital connected economy.

Unlocking Growth- investing in infrastructure that unlocks or protects housing or

commercial developments in our key growth locations.

Investing in skills- investing in projects that deliver the higher level skills needed to drive

growth across our economy with a particular emphasis on our ‘innovation’ and ‘enabling’

sectors,

Key project assessment criteria

Whether the need for the project has been clearly demonstrated

Evidence of option appraisal and business case

How well the project meets the priorities of the Economic Strategy

How well the project fits with local and sub-regional plans and priorities

Potential for alternative funding, partnering and joint schemes

Estimated costs with level of detail to reflect the current stage of the project

Potential of the project to contribute to economic growth

Potential of the project to achieve payback

How likely the project is to be successful

How risks will be managed and mitigated

Economic outputs and impacts created by the project

How the benefits of the project will be sustained after LEP funding finished

Appraisal techniques used in the assessment of projects:

Justification of local economic need

Evidence of failure in commercial markets

Viability gaps for development of sites

Opportunity to accelerate delivery of development

State Aid

Strategic Prioritisation Framework

Projects have also been assessed against the LEPs own Prioritisation Framework,

which

includes the following key assessment criteria

Strategic Fit.

Consideration of whether the aim of the project is referenced in the Economic Strategy.

Also consideration of national economic development policy priorities, particularly those

in the Autumn Budget 2017 and the Industrial Strategy White Paper.

4

Deliverability

The main criterion was whether the project was sufficiently well advanced to draw down

LEP funding in 2018/19 and to complete by 2020/21 as the Call required. Key indicators

of deliverability included:

o Planning consent and land acquisition in place

o Other funding being committed

o A well-developed business case

Additionality

Projects should be able to demonstrate the addition of measurable direct outputs

corresponding to those in the Economic Strategy - such as jobs, houses, or Gross

Value Added (GVA) increase.

Economic Impact and VfM.

Ideally the outputs should be converted to a monetary value such as GVA and

compared with the cost to obtain the Net Present Value of the intervention. The

exception is transport projects for which a Benefit: Cost Ratio (BCR) is used.

5

New Anglia Local Enterprise Partnership Board

Wednesday 21st March 2018

Agenda Item 8

Growth Deal project amendment: Norwich Area Transportation Strategy (NATS)

Author: Chris Dashper & Jonathan Rudd

Summary and Recommendation

That the Investment Appraisal Committee recommend to the LEP Board that the following

adjustments be made to the existing Norwich Area Transportation Strategy projects funded through

the Growth Deal:

1. Transfer of £350,000 from the NATS A11 Corridor Package to the NATS City Centre Package

to balance out an underspend on one scheme (Daniels Road Junction) and overspend on

another (Guardian Road Junction).

2. Inclusion of a new scheme (Plumstead Road Roundabout) in the NATS City Centre Package to

replace a £400,000 scheme which is no longer deliverable (Salhouse Road Bus Rapid Transit

Scheme).

Background

Prior to the Growth Deal capital programme, the Department of Transport delegated responsibility

for allocating funding for capital transport projects to the Norfolk and Suffolk Local Transport Body

(LTB), an unincorporated entity. The LTB was subsequently subsumed into the LEP as a sub-

committee of the LEP Board and the LEP is responsible for managing the LTB capital programme.

The LTB operates a two-stage approval process which incorporates DfT requirements; an initial

assessment as part of the appraisal on new projects prior to Growth Deal Programme entry and a

further approval of constituent schemes on completion of the design stage involving a

proportionate Business Case.

The Norwich Area Transportation Strategy (NATS) is a Growth Deal project, approved by the LEP

board in 2015. It was originally promoted as a city-wide collection of schemes, but at the request

of government it was divided into the following two packages:

NATS City Centre Package (£7M) - principally to improve connectivity and accessibility within

the core retail and business district by removing through traffic from the city centre, but

retaining access to car parks, businesses and other premises. The package comprises of:

o Phase I; Chapelfield North scheme (pre-Growth Deal),

o Phase II (£2M); Golden Ball Street, Westlegate, All Saints Green, Ber Street and

Finkelgate

o Guardian Rd Junction (£1.55M); with A1074 Dereham & A140 Sweetbriar.

o Roundhouse Way Bus Interchange (£0.45M); Northwest of A11 junction.

o Phase III (£2.6M); Prince of Wales Road, Rose Lane and Agricultural Hall Plain.

1

o Salhouse Road Bus Rapid Transit (£0.4M).

NATS A11 Corridor Package (£4.175M) - focussed on the A11 corridor, to connect Norwich

city centre to growth areas in the south west including at the Norwich Research Park,

University and Hospital cluster, Cringleford, Wymondham and Hethersett:

o Part 1 (£2.175m);

UEA Bus/Transport Interchange, major upgrade,

Cycle link extension from Hethersett to Wymondham (off-carriageway),

A11 North slip road - Cringleford cycle track,

Eaton Centre to Newmarket Rd south slip Rd cycle facilities,

Toucan crossing on Newmarket Rd between poplar Ave & Unthank Rd.

o Part 2 (£2m); Junction improvement at A11 (Daniels Rd) & Outer Ring (Newmarket &

Mile End Roads).

Key Issues

1. Transfer of £350,000 Between NATS Packages.

Introduction. On 23 Feb 18, the Local Transport body was asked to support a request to

reallocate £350,000 funds between the two NATS packages for the following reason:

Delivery of the Guardian Road junction improvement, part of the NATS City Centre Package,

will likely cost £700,000 more than the initial forecast of £1.55M.

Conversely, the cost of delivering the Daniels Road scheme within the NATS A11 Package is

estimated to be £350,000 below the initial forecast of £2M.

NCC raised the likely overspend on the Guardian Road junction back in October 2017, and the

possibility of covering the cost through virement from the NATS A11 was discussed. However,

planning for the Daniels Road scheme was not mature enough to present to the LTB or accurately

predict the saving. Consequently, NCC submitted an Expression of Interest to the November 2017

Call for Projects. This was rejected, since it is a standard condition that the total funding amount

set out in our grant agreements is the maximum allocated to deliver the Project, irrespective of any

cost increase, and there is no commitment to any uplift in the level of funding offered.

Notwithstanding this, in their feedback the LEP reiterated the possibility of covering the cost

overrun from the likely underspend in the NATS A11 package and stated that “the LEP Board

would be happy to receive a formal proposal to this effect via the Local Transport Body”. The

formal proposal was submitted to the LTB on 23 Feb 18, who recommended to approve the

transfer of £350,000 from the NATS A11 Corridor Package to the NATS City Centre Package.

Delivery

Guardian Road Junction. Provision of a new enlarged roundabout in place of the existing

roundabout, controlled pedestrian (toucan) crossings, reduction in the length of an existing bus

lane, new 30mph limits and altered segregated footway/cycleways.

Daniels Road Junction. Involves provision of dedicated turn lanes on selected arms of the

roundabout and reconfiguration of traffic lights and toucan crossings at adjacent junctions.

Funding. The saving from Daniels Road junction to be reallocated to the Guardian Road junction

to make up half of the increased cost, with NCC to meet the remaining £350,000, as follows:

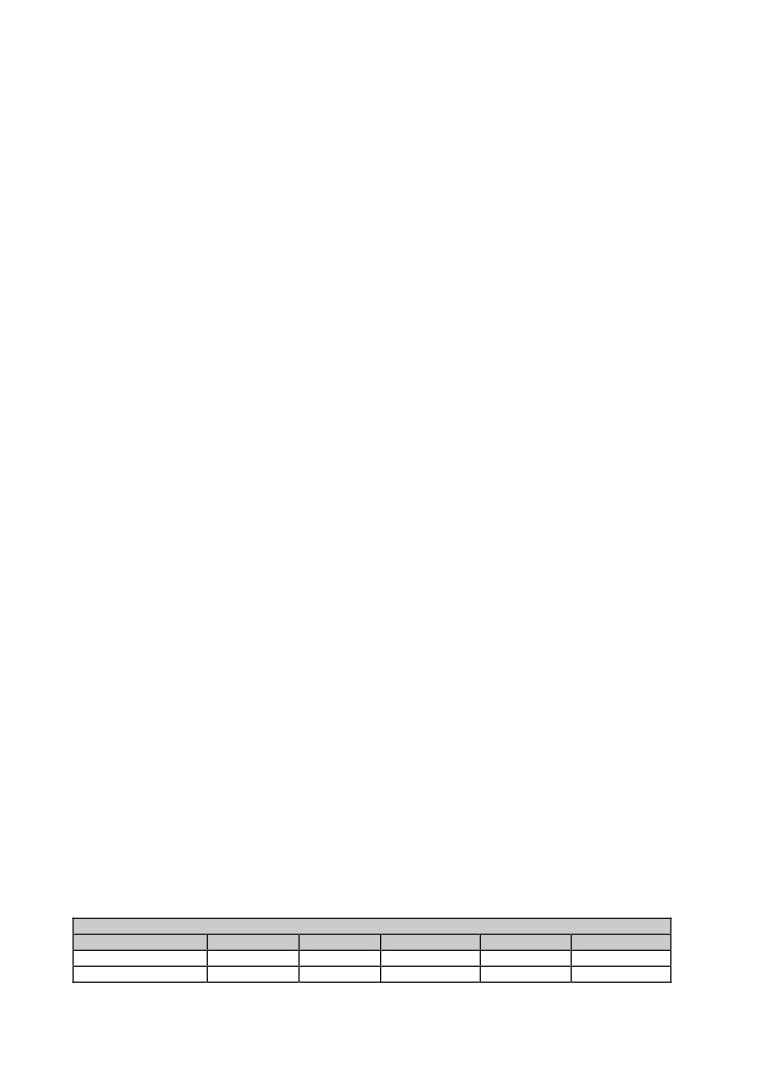

Guardian Road Scheme Delivery timetable

Funding Source

15/16

16/17

17/18

18/19

Total

Growth Deal

£50,000

£1,451,000

£499,000

£1,900,000

NCC

£350,000

£350,000

2

Totals

£50,000

£1,801,000

£499,000

£2,250,000

Link to Economic Strategy

Guardian Road Junction. This scheme will improve connectivity and access within Norwich;

reduce congestion and journey times for businesses and commuters, improve bus reliability

and conditions for pedestrians and cyclists, and bring forward growth.

Daniels Road Junction. This aims to reduce delays experienced by bus passengers and

general traffic on Newmarket Road (A11) and ensure the ring road remains sufficiently free

flowing. This will benefit all modes of transport on this key transport corridor linking the city

centre with the radial routes to the south-west of Norwich where growth is planned at housing

and employment sites in Cringleford, Hethersett and Wymondham, as well as further afield at

Thetford.

2. Plumstead Road Roundabout.

Introduction. This is a new scheme under the pre-agreed NATS City Centre Package. It is

proposed to replace the Salhouse Road Bus Rapid Transit (BRT) scheme that formed part of the

original LEP Board approval. The BRT scheme is currently undeliverable due to both insufficient

demand and support from the bus operators.

Delivery. The scheme includes the redesign of a 3-arm offline roundabout, designed as part of

initial planning by property developers Lothbury, to incorporate a 4th arm and spur onto Broadland

District Council land. Planning permission has been granted for this new roundabout junction and

an agreement has been drafted with Lothbury to share the costs of developing and building the

junction. This will enable Lothbury to deliver the permitted 600 homes to the south of Plumstead

Road and provide access to a parcel of land in the ownership of Broadland District Council which

could be developed for a further 35 houses.

Funding. Growth Deal Funding remains consistent with the approved allocation of which £400k of

Local Growth Fund has been earmarked. The full £1M cost of the scheme will be met as follows:

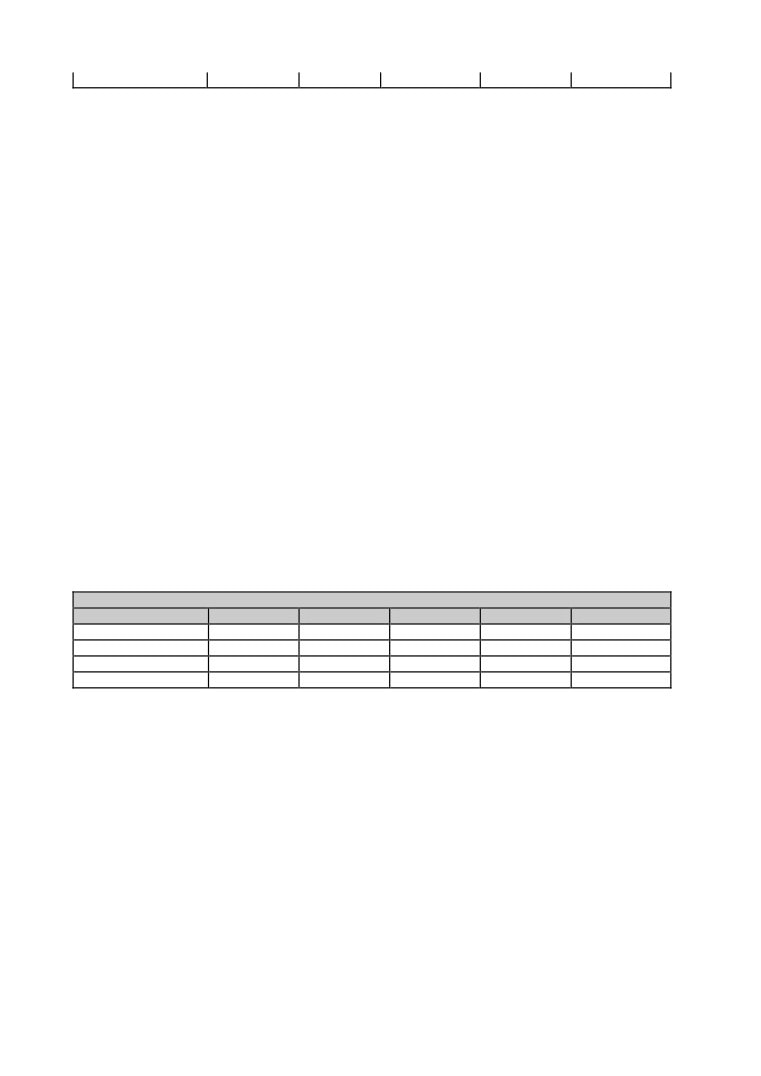

Plumstead Road Scheme Delivery timetable

Funding Source

15/16

16/17

17/18

18/19

Total

Growth Deal

£10,000

£189,000

£201,000

£400,000

Developer

£400,000

£400,000

Local Authority/Other

£200,000

£200,000

Totals

£10,000

£189,000

£201,000

£600,000

£1,000,000

Link to Economic Strategy. This roundabout is aligned with the new Economic Strategy by

accessing land for two new housing developments. The new junction forms part of a strategic

growth area to the North East of Norwich identified in Broadland District Council’s Growth Triangle

Area Action Plan (GTAAP). The GTAAP was adopted in July 2016 and allocates sites within the

growth area for delivery of 7,000 houses by 2026.

Approval is sought for this scheme since the purpose falls outside of that approved for the whole

package; connectivity and accessibility within the core retail and business district. The formal

proposal was submitted to the LTB on 23 Feb 18, who recommended to approve this scheme

within the package and use of £400,000 of Growth Deal funds previously allocated to the Salhouse

Road Bus Rapid Transit scheme.

Summary and Recommendation

The LEP Board is requested to approve;

1.

Transfer of £350,000 from NATS A11 Corridor Package to the NATS City Centre Package.

3

2.

Inclusion of the Plumstead Road roundabout scheme into the NATS City Centre Package

and use of £400,000 of previously allocated funds.

4

New Anglia Local Enterprise Partnership Investment Appraisal Committee

21 March 2018

Agenda Item 9

Request for Additional Funding for the Cornhill Project, Ipswich

Author: Chris Starkie/Cathy Frost

Summary

To enable the successful completion of the Cornhill Regeneration Scheme in Ipswich, an

additional £50K is requested from New Anglia LEP to cover a slight shortfall in funding as a result

of exceptional circumstances. This project is a major town centre enhancement scheme

supported financially by Ipswich Borough Council, Suffolk County Council, New Anglia LEP and

Ipswich Central.

It is one of the main objectives of the Ipswich Vision and is supported by the seven main

stakeholders of the project (New Anglia LEP, IBC, SCC, UOS, Suffolk Chamber in Greater

Ipswich, Ipswich Central and Sandy Martin MP).

This contribution, a small proportion of the overall cost, will leverage match funding of £350k

already offered by other partner organisations. Without this additional money the project will be

unable to reach a satisfactory conclusion and compromises will have to be made to the design,

detrimentally affecting the original brief and impact for the town.

Recommendation

The IAC is asked to recommend to the LEP Board the provision of an additional £50k to cover

the shortfall in the funding as a result of exceptional circumstances.

Background

The Cornhill Regeneration Project will provide a high-quality design and revitalisation to the

Cornhill central square in order to solidify its status as the main activity hub in the town centre

and is recognised as one of the main priorities for the Ipswich Vision.

It will enable the Cornhill to become a flexible and unique space. Local contractor Brooks and

Wood started on site on 29th January 2018, with a target completion date of 30th October 2018.

There will be a phased approach to the delivery of the project in order to minimise as far as is

possible the disruption to the town centre and those businesses trading in and around the area.

The Ipswich Market has already been relocated to Princes and Queen Street. The project will

comprise of the following elements

Levelling and repaving of the Cornhill square

Centrally located water feature incorporating water jets which can be turned off

Four sculptural archways approximately 4.5m high-public art element

1

Series of benches, new bins, lighting element and 5 new trees.

There is evidence that during the development and promotional phase of the project, there has

been significant interest from the business community and renewed confidence and investment

in the town centre.

It will act as a hub for creative events, scoping is now being undertaken by IBC to ensure a varied

number of events are programmed. It will also showcase the heritage and architecture on the

square itself and the wider offer of the town and waterfront. This will in part be achieved through

the storytelling on the 4 arches, public engagement has already been sought to help identify the

important stories. This activity will have a positive impact on the visitor economy, helping to attract

new visitors to the area and boosting retail trade and local services.

The LEP is currently providing £1.6m of the total £3.2m of the scheme, with significant

contributions coming from Ipswich Borough Council and Suffolk County Council.

Key considerations

Since the budget for the scheme was agreed, costs have risen. This is chiefly because the public

consultation led to changes in the overall design which have led to different features and

materials being utilised.

Further the Ipswich Vision partners had hoped to use £750k secured from the Coastal Communities

Fund, but the CCF Fund ruled has to be ringfenced for work on St Peter’s Dock.

Partners have sought to reduce the cost of the scheme by value engineering - with this achieving

a saving of £234k. The shortfall is now confirmed as £400k, with the overall cost rising from

£3.2m to £3.6m.

In order to meet this shortfall, there is now commitment of an additional £100k from Suffolk

County Council, £50k from Ipswich Central and £200k from Ipswich Borough Council.

It is vital that this project can secure this additional funding from New Anglia LEP in order to

release the sizeable financial commitments made by the project partners.

The LEP executive team has already identified a small amount of underspend in the annual

allocation of funding which is set aside to administer the Growth Deal programme which can be

utilised to provide the £50k.

Link to the economic strategy

Ipswich and the surrounding area have been identified in the Economic Strategy as a priority

place. The revitalisation of the Cornhill will lead to Ipswich having a strong central commercial

area ready to meet the changing demands on the use of town centres.

We have already seen two new businesses commit to the Cornhill - Pret a Manger and a new

public house since the plans were announced.

There is also interest from several restaurant chains in the old Post Office Building. All of these

businesses will directly benefit from the work and there is no doubt that this business confidence

will be a catalyst for further inward investment and strengthen the position of Ipswich as part of

our wider ‘offer to the world’.

The Cornhill has and will continue to play an important role in the visitor economy of the town, a

key sector recognised within the Economic Strategy, and this work will have a significant positive

impact on the perceptions of the town to increase visitor numbers and boost retail trade.

2

Recommendation

The IAC is asked to recommend to the LEP Board the provision of an additional £50k to cover

the shortfall in the funding as a result of exceptional circumstances.

3

Growing Business Fund

Terms of Reference

Purpose

To ensure the allocation of funding to the Growing Business Fund programme is delivered

appropriately and in accordance with the Assurance Framework through the mechanism of the

Growing Business Fund and that the funding allocation supports the delivery of the Economic

Strategy through individual projects.

Functions

•

Consider applications requesting financial support from the Growing Business Fund and

reach an agreed decision to support or reject each application.

•

Provide support to applicants and partners to ensure that a quality standard of application

and subsequently project is achieved.

•

Support New Anglia LEP and the New Anglia Growth Hub and in the promotion and

publicity of the Growing Business Fund to improve and sustain the flow of quality

applications for funding.

•

Approve grants to individual applicants with values between £25k and £500k in accordance

with delegated decision making powers from the New Anglia LEP Investment Appraisal

Committee (IAC).

•

Approve financial interventions in accordance with guidance on State Aid for SMEs.

•

Consider applications in line with Growing Business Fund criteria and in accordance with

the New Anglia LEP Economic Strategy.

•

Approve contract variation to funding agreements after initial approval by the committee

only where necessary.

Membership and Appointment

The committee will comprise a total of seven voting members. All voting members will be from the

private sector including the independent Chair. At least two members of the panel will be private

sector LEP board members who are also members of the LEP’s Investment Appraisal Committee.

They will act as LEP board champions for the GBF programme. .Each Panel Member will be

expected to sign a Declaration, in confirmation of their appointment to the Panel and acceptance of

these Terms of Reference. Substitute attendees are not permitted at GBF panel meetings.

Two panel members will take the roles of Chair and Deputy Chair of the Panel. The full Panel will

elect them on an annual basis, at its April meeting.

Membership of the Panel is undertaken on a voluntary basis and is for a period of twelve months,

renewable at the discretion of New Anglia LEP and confirmed at the September Panel meeting,

unless a Member’s appointment is terminated.

A Panel Member may terminate membership of the panel by giving at least three months’ notice in

writing to New Anglia. New Anglia may terminate the Panel Membership of any Member if they do

not act at all times in accordance with these Terms of Reference. Panel Membership will be

terminated if the GBF programme comes to an end.

Quorum

Four members of the panel should be in attendance and in agreement for a decision to be made.

Budget Setting

The Investment Appraisal Committee will set the annual budget for the Growing Business Fund for

each forthcoming financial year and will agree any variance to the budget during the delivery year

should this be necessary.

Attendance of non-members at meetings

Officers from the LEP Executive will attend meetings and present reports but will not be entitled to

vote. Project applicants will not normally be entitled to attend meetings. Other attendees at the

meeting will include at least 1 representative of SCC (the accountable and delivery body) and at

least 1 representative of Finance East (the independent appraisers). In addition, 1 representative

from each of NCC and SCC’s Economic Development teams may attend to provide local knowledge

and context to the discussion. On occasion, a single representative from the Growth Hub may attend.

No-one other than the private sector voting members will have a vote on any of the applications.

Meetings of the Investment Appraisal Committee will not be open to observers or other attendees.

Advisers

The Growing Business Fund uses independent appraisers to conduct the due diligence on each

applicant to the programme. Adviser contracts will be compulsorily reviewed every 3 to 5 years.

Meeting Frequency

Panel meetings will be held monthly, with dates, times and locations determined at least three

months in advance. Meetings will be located evenly between venues in Norfolk and Suffolk, usually

Ipswich and Norwich and arranged and coordinated by New Anglia LEP.

Panel Members will be expected to attend at least eight meetings a year. Any apologies should be

advised at least one week before meetings are held. Panel Members unable to attend a meeting

should ensure that they submit their vote by email in advance, with any further relevant comments

on each grant application to be considered at that meeting. In some instances it may be deemed

more efficient to ask the whole panel to provide their vote by email, particularly if there is only one

application to consider.

Declarations of Interest

If a Panel Member has a personal or professional pecuniary or non-pecuniary interest in any

organisation or project to be considered by the Panel, they should declare that interest at the

beginning of the meeting and leave the meeting before any discussion on that item commences. The

Panel Member will have no right to vote on that particular application.

Panel Members should not enter into any discussion on applications prior to a meeting, other than

to clarify matters of detail in relation to those applications. Opinions on the eligibility or quality of

applications should be reserved for Panel meetings. Questions on matters of detail should be

submitted to Finance East, who will respond to all interested parties to ensure consistency of

information.

In addition all panel members must complete the standard LEP register of interests form and is

responsible for ensuring this form is kept up to date. The form is published on the LEP website.

Delegated Authority including limits

The committee will have a delegated responsibility from the Investment Appraisal Committee for

financial decisions up to £500k.

Authority is also delegated, through the GBF panel, to the ERDF funded Small Grant Scheme. The

SGS, an on-line panel will report decisions made to the GBF panel. The maximum award size under

SGS will be £25k.

Reporting procedures

The minutes of GBF meetings will be taken by a member of the New Anglia staff team and circulated

to all members of the LEP Board and will be published on the LEP website.

The minutes will not contain commercially sensitive information but will include the applicant name

and the amount awarded.

The GBF panel will also provide information on decisions taken for the IAC.

The minutes will include a record of decisions made by the Small Grant Scheme, which has

delegated financial approval from the Investment Appraisal Committee through the Growing

Business Fund panel. Minutes will be published ten days after meetings in accordance with LEP

governance arrangements. In accordance with new General Data Protection Regulations, panel

members will delete all emails relating to projects after meetings and destroy all papers.

Decisions taken by the GBF Panel and Small Grants Panel will also be included in the LEP’s Register

of Decisions which is published on the LEP website.

Communications

Meeting agendas will be circulated 5 working days before each meeting in accordance with LEP

governance arrangements. Agendas will include all appropriate papers required to support any

decisions to be made. Additional papers may be circulated by email between meetings as necessary.

Decisions will be communicated to applicants in advance of minutes being published.

Review:

The membership of Growing Business Fund panel will be reviewed annually. The Committee shall

review its own performance and terms of reference annually to ensure it is operating at maximum

effectiveness and recommend any changes it considers necessary to the LEP Board for approval.

Approved by LEP Board: 21st February 2018 (Subject to amendments delegated to LEP Chairman)

Last Updated: 27th February 2018 (Approved by LEP Chairman)

Investment Appraisal Committee

Terms of Reference

Purpose

To ensure allocation of funding is delivered appropriately and in accordance with the Assurance

Framework through the mechanism of LEP Programmes - Growing Places Fund, Growing

Business Fund, Capital Growth Programme, EZ Accelerator Fund - or other funds as appropriate,

and that the funding allocations support the development of schemes that deliver the Economic

Strategy.

Functions

•

Making an assessment as to the long term financial and legal viability of offering Growing

Places Fund loan finance to clients and other.

•

Making assessments on projects received through Capital Growth Programme, ensuring

value for money, additionality and alignment with the Economic Strategy ambitions and

Economic Indicators.

•

Consider proposals for co-investment of the Enterprise Accelerator Fund for projects to be

developed on Enterprise Zones, generating a rental return through co-ownership of a

suitable built asset.

•

Provide scrutiny to the Growth Deal spend profile and agree any reallocation of funds.

•

Providing a strategic assessment of proposed LEP Programme bidding calls.

•

Providing a final strategic assessment of projects and to make a decision on which projects

should be approved for funding where the value of the LEP intervention is £500k or less.

•

Make a recommendation to the LEP Board to approve or reject each request for funding

received exceeding £500K.

•

Approve contract variation to funding agreements after initial approval by the committee

within £500k of the original agreed funding or delivery profile.

•

Lead on the development of the LEP Investment Plan making recommendations to the LEP

Board in the summer of each year which sets out the framework for LEP Programmes for

the proceeding financial year.

Membership and Appointment

The committee will comprise a total of eight members. Seven committee members will be

members of the LEP Board- four private sector members, three public sector. The Chair of the

Committee will be appointed by the LEP Board, and a Deputy Chair shall be appointed to chair the

Committee in the Chair’s absence or if he/she elects to delegate the chair. The remaining member

will be the Accountable Body Section 151 officer or their representative. Substitutes may only be

accepted in exceptional circumstances and only for public sector members at the discretion of the

Chair.

Quorum

Four members, of which at least two shall be private sector directors and includes relevant LEP

Board Champion for the programme, one public sector Board member and the chair.

Attendance of non-members at meetings

Officers from the LEP Executive will attend meetings and present reports and recommendations,

but will not be entitled to vote. Project applicants will not be entitled to attend meetings unless it is

deemed necessary. Meetings of the Investment Appraisal Committee will not be open to observers

or other attendees.

Advisers

The Growing Business Fund uses independent appraisers to conduct the due diligence on each

applicant to the programme. Adviser contracts will be compulsorily reviewed every 3 to 5 years

Meeting Frequency

A meeting will be scheduled to be held before each LEP Board meeting. If no decisions are

forthcoming, the meeting can be cancelled. Ad hoc meetings can be scheduled if necessary,

particularly to review changes to outstanding projects.

Delegated Authority including limits

The committee will have a delegated responsibility from the LEP Board for financial decisions up to

£500k.

The Investment Appraisal Committee will set the annual budget for the Growing Business Fund for

each forthcoming financial year and will agree any variance to the budget during the delivery year

should this be necessary.Authority will be delegated for Growing Business Fund (GBF) decisions

to the GBF panel, which the LEP Board Champion for GBF and member of the IAC attends. The

maximum award size under GBF will be £500k. A report will be provided on awards made by the

GBF panel for each IAC meeting.

Authority is also delegated, through the GBF panel, to the ERDF funded Small Grant Scheme. The

SGS, an on-line panel, will report decisions made to the GBF panel and in turn to the IAC. The

maximum award size under SGS will be £25k.

Reporting procedures

The minutes of meetings will be circulated to all members of the LEP Board and will be published

on the LEP website. The IAC will receive minutes from GBF, incorporating Small Grants Panel

decisions to ensure alignment with investment decisions. IAC minutes will be published 10 days

after meetings in accordance with LEP governance arrangements.

Decisions made by the IAC, GBF panel and Small Grants panel will be recorded in the LEP’s

register of decisions which is published online.

Communications

Meeting agendas will be circulated 5 working days before each meeting in accordance with LEP

governance arrangements. Agendas will include all appropriate papers required to support any

decisions to be made. Additional papers may be circulated by email between meetings as

necessary.

Key stakeholders such as the Skills Board and the Local Transport Body will be consulted and

informed on projects and decisions made.

Decisions will be communicated to applicants in advance of minutes being published.

Review

The membership of the Investment Appraisal Committee will be reviewed annually. The

Committee shall, review its own performance once a year and terms of reference to ensure it is

operating at maximum effectiveness and recommend any changes it considers necessary to the

LEP Board for approval.

Approved by LEP Board: 21st February 2018 (Subject to amendments delegated to LEP Chairman)

Last Updated: 27th February 2018 (Approved by LEP Chairman)