Life Sciences & Bio-Economy

Sector Data Pack

Version Final

Contents

Page

-

Introduction to the Sector Data Pack

3

-

Introduction to and Definition of the Life Sciences & Bio-Economy Sector

3

-

Key Findings from the Data Analysis

5

-

The Life Sciences & Bio-Economy Sector in New Anglia

6

o GVA

7

o Employment

11

o Businesses

30

o Wages

35

o Apprenticeships

37

o Vacancies

39

-

Appendices

o Appendix 1

45

o Appendix 2

46

2

Introduction to the Sector Data Pack

The role of the Sector Data Pack is to bring together the latest socio-economic and labour market data and present both an up-to-date, and

future view, of the sector and any underlying issues within the area that could impact upon it. Information and feedback collected from

stakeholder consultation (through workshops, meetings, and survey) is also presented and summarised (where available and applicable).

The Data Pack sits below the Sector Skills Plan, with the key findings from the data analysis helping to inform the priorities developed in the

plan. In most instances data has been analysed and presented down to local authority level. In some instances, and even where local authority

data is available, it has not been presented in the data pack due to issues of unreliability and small sample sizes. This is particularly the case

with data from the Annual Population Survey and the Annual Survey of Hours and Earnings.

Throughout the Data Pack findings are also presented for the Local Enterprise Partnership (LEP) areas of Greater Cambridge and Greater

Peterborough (GCGP), Hertfordshire, and South East LEP (SELEP). These comparator areas were agreed in consultation with the AgriFood

Tech sector group and New Anglia LEP officers.

Introduction to and Definition of the Life Sciences & Bio-Economy

Sector

The official Life Sciences definition as set out in the UK Life Sciences Strategy1 is seen as being too narrow for New Anglia as it only focuses

on human health and does not include many other industries which use biology and related life sciences. The New Anglia the life sciences

sector needs to be seen as part of the wider bio-economy so it encompasses all the major areas using biological sciences locally.

The science economy in New Anglia is a diverse sector, from long established sub-sectors e.g. human health with steady but moderate growth

as well as newer, smaller, but faster growing sub-sectors such as industrial and synthetic biotechnology. This is the approach taken by the East

of England Science and Innovation Audit, a Bio-economy review for BIS in 2016, the EU’s Bio-economy programmes and at NRP.

In the UK the life sciences sector is dominated by human health and, whilst New Anglia has a presence in this market, the critical mass of UK

investment in health research is in London and the Midlands, with only relatively few companies in New Anglia. Norfolk and Suffolk do though

have one significant advantage in human health research, based on its stable and relatively elderly population. This makes it ideally suited to

the long term study of conditions normally associated with ageing and the linked rapid growth markets.

1 BIS (2011), Strategy for UK Life Sciences

3

New Anglia has nationally/internationally important critical mass in the wider bio-economy, the sector which uses biology (and other sciences)

to develop innovations in dietary health, agriculture, marine sciences and equine health. There are exciting new developments from the life

sciences research base in areas such as soil health and organisms which affect agriculture as well as the environment and human health.

The New Anglia Life Sciences and Bio-economy sector is therefore defined as:

-

Human life sciences including pharmaceuticals, medical devices and technology;

-

Agritech, food and the microbiome (gut, soil and rhizosphere);

-

Bioinformatics;

-

Equine cluster centred on Newmarket;

-

Marine Sciences centred on CEFAS;

-

Industrial bio-economy including bio-energy.

The Standard Industrial Classification codes that have been used to capture this activity have been drawn from the Association of the British

Pharmaceutical Industry report ‘The economic contribution of the UK Life Sciences industry’ (March 2017), prepared by

PricewaterhouseCoopers LLP, and are presented in detail in appendix 1.

4

Key Findings from the Data Analysis:

-

The Life Sciences & Bio-Economy sector in New Anglia was worth approximately £1.6bn in 2015

-

This £1.6bn equates to 4.5 per cent of New Anglia’s economy total value, slightly less than LEP comparators and nationally

-

25,100 people were employed in the sector in 2015, nearly 4 per cent of the total workforce, which again is slightly below LEP

comparator areas and nationally

-

There are currently approximately 4,055 Life Sciences & Bio-Economy sector businesses in New Anglia, making up nearly 6 per cent of

all businesses

-

Growth in employment and business numbers however has been strong locally, with rates above those seen across the New Anglia

economy as a whole

-

New Anglia’s Life Sciences sector is particularly geared towards the sub sector of Medical Technology Manufacture when compared to

other areas

-

However, it is employment in Life Sciences Research that has experienced the strongest growth between 2010 and 2015, with

employment in that sub sector standing at 11,700 in 2015

-

New Anglia’s Life Sciences & Bio-Economy sector location quotient (0.9) is currently below that of its main comparator areas, but it has

increased since 2010 (0.7)

-

Increases in employment in the sector in New Anglia have been driven by growth in both full-time and part-time employment

-

Apprenticeship numbers are dominated by Health & Social Care with very little in the way of apprenticeships that better fit the sector

definition (such as Laboratory and Science Technicians)

5

Life Sciences & Bio-Economy

Sector in New Anglia

6

Life Science & Bio-Economy sector’s contribution to the

local economy

4,055

5.6%

£1.6bn

4.5%

25,100

3.7%

GVA

Employment

Businesses

Sources: Business Register and Employment Survey, UK Business

Counts (both Office for National Statistics); GVA calculation based on

GVA per employee findings from the PwC report ‘The economic

contribution of the UK Life Sciences industry’ (March 2017) - see

appendix 2 for full details

7

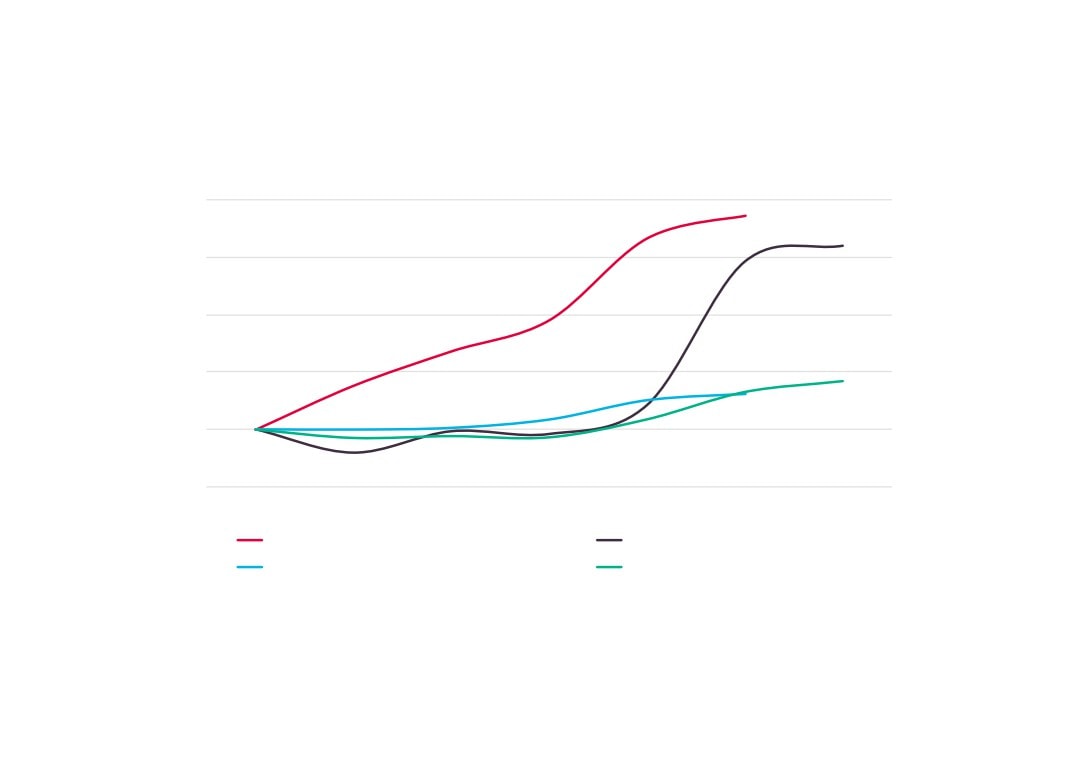

Life Science & Bio-Tech sector’s contribution to growth in the local economy

(2010=100)

140

130

120

110

100

90

2010

2011

2012

2013

2014

2015

2016

Life Sciences & Bio-Tech Employment

Life Sciences & Bio-Tech Business

Total Employment

Total Business

Sources: Business Register and Employment Survey, UK Business Counts; all Office for National Statistics

8

Life Sciences sector GVA (£m) across comparator areas, 2015

New Anglia LEP

£1.6bn

Norfolk

£0.84bn

Suffolk

£0.76bn

GCGP LEP

£2.8bn

Hertfordshire LEP

£2.1bn

South East LEP

£4.7bn

Source: Calculation based on PwC report findings of GVA per employee

9

Proportion of total GVA produced by Life

Sciences sector across comparator areas, 2015

New Anglia LEP

4.5%

Norfolk

4.5%

Suffolk

4.5%

GCGP LEP

7.4%

Hertfordshire LEP

6.1%

South East LEP

5.5%

East of England

5.7%

England

5.0%

Source: Calculation based on PwC report findings of GVA per employee

10

New Anglia

25,100

Employment in the Life Sciences

sector across comparator areas, 2015

Norfolk

13,200

Source: Business Register and Employment

Survey, Office for National Statistics

Suffolk

11,900

GCGP LEP

44,300

Hertfordshire LEP

31,300

South East LEP

74,900

11

Proportion of employment provided by the Life

Sciences sector across comparator areas, 2015

New Anglia

3.7%

Norfolk

3.7%

Suffolk

3.8%

GCGP LEP

6.6%

Hertfordshire LEP

7.4%

South East LEP

4.7%

East of England

4.8%

England

4.4%

Source: Business Register and Employment Survey, Office for National Statistics

12

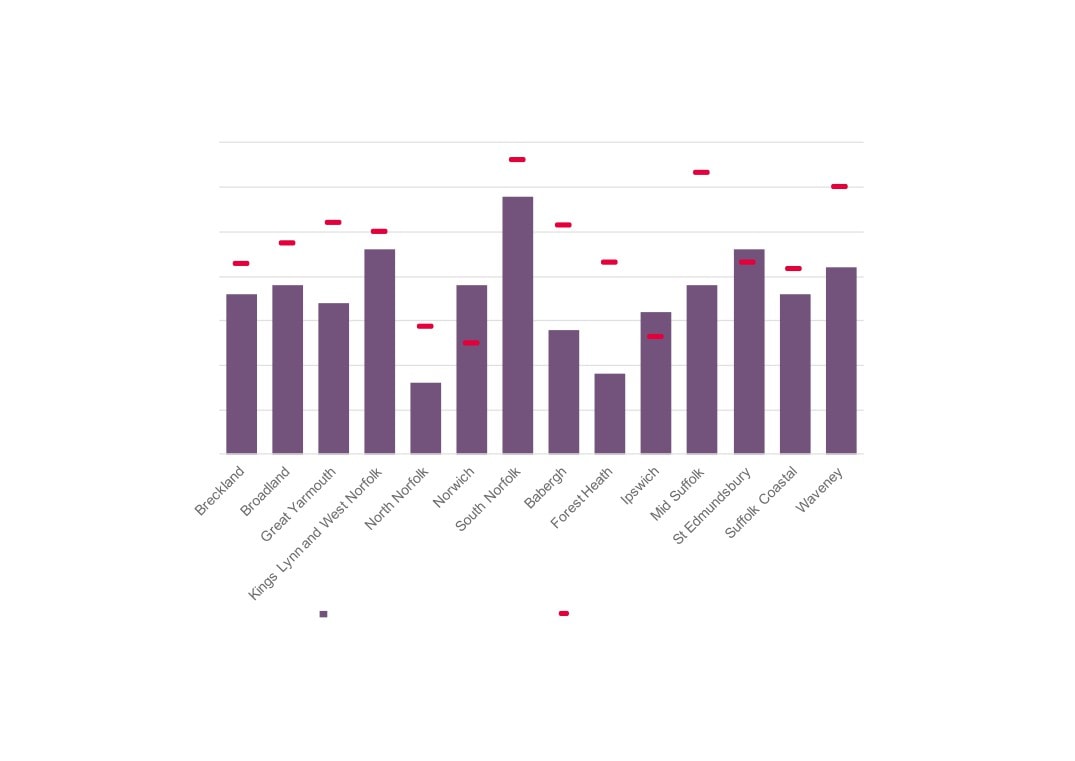

Employment in the Life Sciences sector across New Anglia, 2015

3,500

6%

3,000

5%

2,500

4%

2,000

3%

1,500

2%

1,000

1%

500

0

0%

Life Sciences Employment

% Life Sciences Employment

Source: Business Register and Employment Survey, Office for National Statistics

13

Change in Life Sciences sector employment across

comparator areas, 2010 - 2015

New Anglia

37%

Norfolk

33%

Suffolk

42%

GCGP LEP

20%

Hertfordshire LEP

9%

South East LEP

29%

East of England

16%

England

18%

Source: Business Register and Employment Survey, Office for National Statistics

14

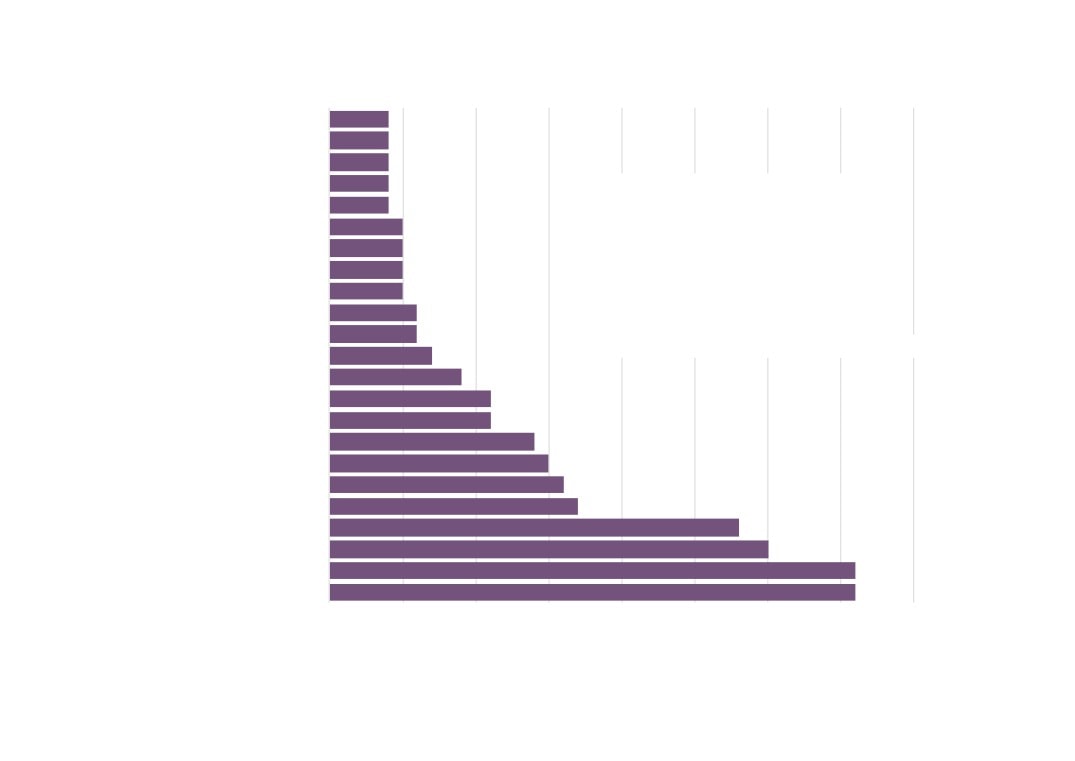

Change in Life Sciences sector employment

across New Anglia, 2010 - 2015

Babergh

11%

Breckland

10%

Broadland

49%

Forest Heath

55%

Great Yarmouth

10%

Ipswich

58%

King`s Lynn and West Norfolk

92%

Mid Suffolk

53%

North Norfolk

13%

Norwich

43%

South Norfolk

27%

St Edmundsbury

55%

Suffolk Coastal

21%

Waveney

56%

Source: Business Register and Employment Survey,

Office for National Statistics

15

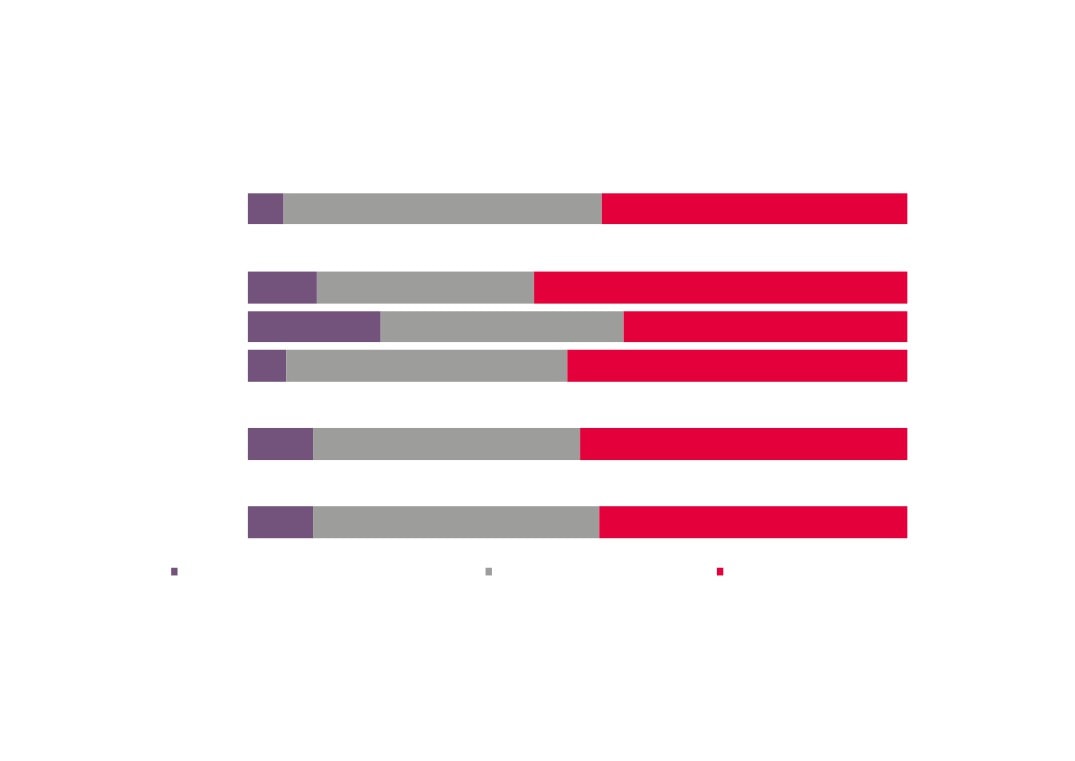

Split in Life Sciences sector employment by component across

comparator areas, 2015

New Anglia LEP

5%

48%

46%

GCGP LEP

10%

33%

57%

Hertfordshire LEP

20%

37%

43%

South East LEP

6%

43%

52%

East of England

10%

41%

50%

England

10%

43%

47%

Pharmaceutical development and manufacture Medical Technology Manufacture Life Sciences Research

Source: Business Register and Employment Survey, Office for National Statistics

16

Split in Life Sciences sector employment by component across New Anglia, 2015

Babergh

4%

77%

19%

Breckland

25%

40%

34%

Broadland

5%

55%

39%

Forest Heath

5%

42%

53%

Great Yarmouth

4%

46%

50%

Ipswich

25%

74%

King`s Lynn and West Norfolk

64%

35%

Mid Suffolk

3%

51%

46%

North Norfolk

66%

34%

Norwich

4%

59%

37%

South Norfolk

38%

61%

St Edmundsbury

17%

39%

43%

Suffolk Coastal

45%

54%

Waveney

42%

58%

Pharmaceutical development and manufacture

Medical Technology Manufacture

Life Sciences Research

Source: Business Register and Employment Survey, Office for National Statistics

17

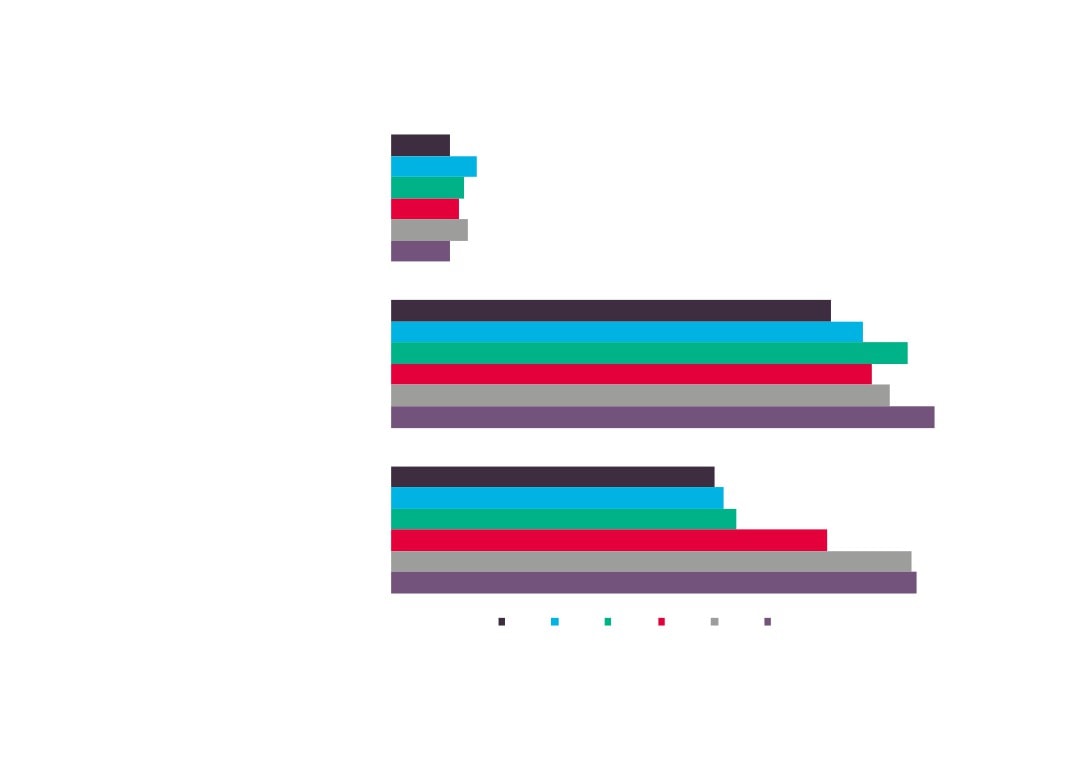

Change in Life Sciences sector employment by

component, New Anglia

1,300

1,900

1,600

Pharmaceutical development and manufacture

1,500

1,700

1,300

9,800

10,500

11,500

Medical Technology Manufacture

10,700

11,100

12,100

7,200

7,400

7,700

Life Sciences Research

9,700

11,600

11,700

2010

2011

2012

2013

2014

2015

Source: Business Register and Employment Survey, Office for National Statistics

18

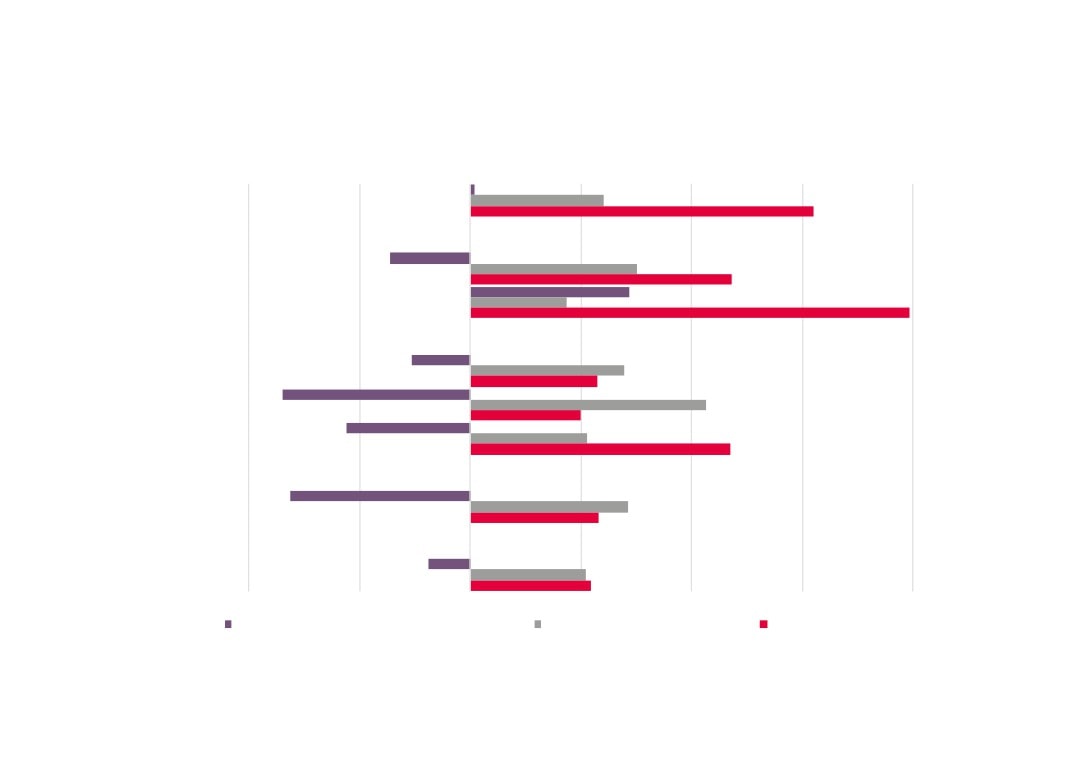

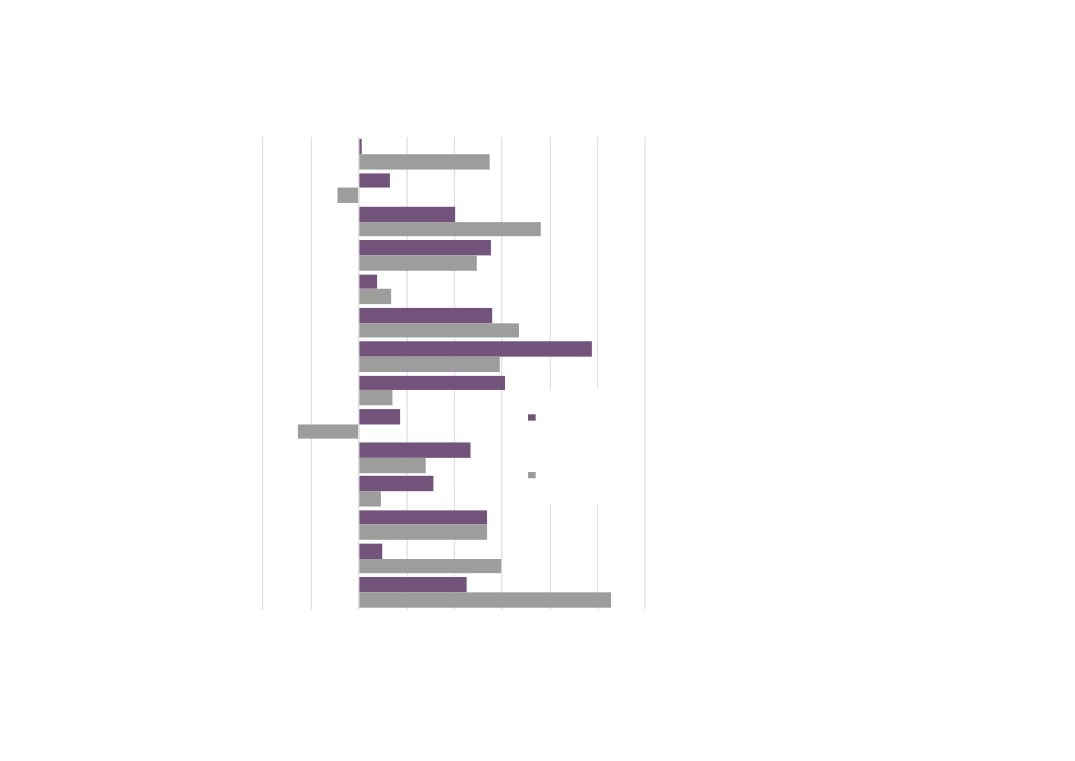

Change in Life Sciences sector employment by component across comparator areas,

2010 - 2015

-40%

-20%

0%

20%

40%

60%

80%

New Anglia

Norfolk

Suffolk

GCGP LEP

Hertfordshire LEP

South East LEP

East of England

England

Pharmaceutical development and manufacture Medical Technology Manufacture Life Sciences Research

Source: Business Register and Employment Survey, Office for National Statistics

19

Top 5 Life Sciences sub sectors, 2015

% of total Life

Change in

Industry Sector Code

Industry Sector Name

Employment Sciences sector

employment 2010 -

employment

2015

86900

Other human health activities

7,800

31%

141%

82990

Other business support service activities nec

4,900

19%

144%

22290

Manufacture of other plastic products

2,400

9%

48%

72190

Other research and experimental development on natural sciences and

2,100

8%

5%

74909

Other professional, scientific and technical activities (not including envi

1,600

6%

-13%

Source: Business Register and Employment

Survey, Office for National Statistics

20

Top growth Life Sciences sub sectors with 100 employees or more

% of total Life

Change in

Industry Sector Code

Industry Sector Name

Employment Sciences sector

employment

employment

2010 - 2015

21100

Manufacture of basic pharmaceutical products

!

1%

1260%

82990

Other business support service activities nec

4,900

19%

144%

86900

Other human health activities

7,800

31%

141%

72110

Research and experimental development on biotechnology

100

1%

72%

22290

Manufacture of other plastic products

2,400

9%

48%

20140

Manufacture of other organic basic chemicals

100

0%

36%

33130

Repair of electronic and optical equipment

200

1%

21%

72190

Other research and experimental development on natural sciences and engineering

2,100

8%

5%

Source: Business Register and Employment Survey, Office for National Statistics

21

Life Science sector location quotients across

comparator areas, 2015

0.9

New Anglia

Location quotients (LQs) are a

0.7

useful way of showing a sectors

importance to the local economy

relative to the national picture. The

analysis presented here uses

0.8

Norfolk

employment with an LQ above 1

0.7

showing a higher concentration than

0.9

nationally, and an LQ of below than

Suffolk

1 a lower concentration.

0.7

2015

2010

1.5

GCGP LEP

1.5

1.2

Hertfordshire LEP

1.4

1.1

South East LEP

0.3

1.1

East of England

1.1

Source: Business Register and Employment Survey, Office

for National Statistics

22

Life Sciences sector location quotients

across New Anglia, 2015

1.0

Babergh

1.1

0.8

Breckland

1.0

0.9

Broadland

0.7

2015

0.9

Forest Heath

0.6

2010

1.0

Great Yarmouth

1.0

0.5

Ipswich

0.4

1.0

King`s Lynn and West Norfolk

0.6

1.2

Mid Suffolk

0.9

0.5

North Norfolk

0.6

0.5

Norwich

0.4

1.3

South Norfolk

1.2

0.8

St Edmundsbury

0.7

0.8

Suffolk Coastal

0.8

1.2

Waveney

0.8

Source: Business Register and Employment Survey, Office for National Statistics

23

Life Science sub sectors with location quotients (LQs) above 1

% of total Energy

Industry Sector Code

Industry Sector Name

Employment

sector

LQ

employment

21100

Manufacture of basic pharmaceutical products

!

!

2.9

26600

Manufacture of irradiation, electromedical and electrotherapeutic equipment

300

1%

2.8

33130

Repair of electronic and optical equipment

200

1%

2.1

22290

Manufacture of other plastic products

2,400

9%

2.0

32990

Other manufacturing nec

1,000

4%

2.0

26110

Manufacture of electronic components

300

1%

1.1

28290

Manufacture of other general-purpose machinery nec

700

3%

1.1

27900

Manufacture of other electrical equipment

300

1%

1.1

Source: Business Register and Employment Survey 2015, Office for National Statistics

24

Life Sciences sector employment by full-time / part-time split

across comparator areas, 2015

New Anglia

78%

22%

Norfolk

79%

21%

Suffolk

76%

24%

GCGP LEP

84%

16%

Hertfordshire LEP

84%

16%

South East LEP

77%

23%

East of England

82%

18%

England

79%

21%

Full-time

Part-time

Source: Business Register and Employment Survey, Office for National Statistics

25

Life Sciences sector employment by full-time / part-time split

across New Anglia, 2015

Babergh

79%

21%

Breckland

83%

17%

Broadland

79%

21%

Forest Heath

75%

25%

Great Yarmouth

78%

22%

Ipswich

69%

31%

King`s Lynn and West Norfolk

82%

18%

Mid Suffolk

81%

19%

North Norfolk

81%

19%

Norwich

72%

28%

South Norfolk

79%

21%

St Edmundsbury

78%

22%

Suffolk Coastal

73%

27%

Waveney

77%

23%

Full-time

Part-time

Source: Business Register and Employment Survey, Office for National Statistics

26

Change in Life Sciences sector full-time and part-time

employment across comparator areas, 2010-2015

36%

New Anglia

36%

0%

0%

34%

Norfolk

19%

37%

Suffolk

56%

0%

0%

25%

GCGP LEP

-4%

6%

Hertfordshire LEP

21%

28%

South East LEP

39%

0%

0%

18%

Full-time

East of England

4%

0%

0%

Part-time

17%

England

12%

Source: Business Register and Employment Survey, Office for National Statistics

27

-40%

-20%

0%

20%

40%

60%

80%

100%

120%

Babergh

Breckland

Change in Life Sciences

Broadland

sector full-time and part-

Forest Heath

time employment across

Great Yarmouth

New Anglia, 2010-2015

Ipswich

King`s Lynn and West Norfolk

Mid Suffolk

Full-time

North Norfolk

Norwich

Part-time

South Norfolk

St Edmundsbury

Source: Business Register and Employment

Suffolk Coastal

Survey, Office for National Statistics

Waveney

28

Self Employment in the Life Sciences & Bio-Economy Sector

Awaiting content from New Anglia LEP

29

Life Science sector business numbers across comparator areas, 2016

21

New Anglia

4,055

Number of Business

Units per 10,000

Population

25

Norfolk

2,205

Number of Business Units

25

Suffolk

1,825

32

GCGP LEP

4,565

38

Hertfordshire LEP

4,385

28

South East LEP

11,470

31

East of England

Source: UK Business Counts, and Sub-national

Population Estimates, Office for National Statistics

32

England

30

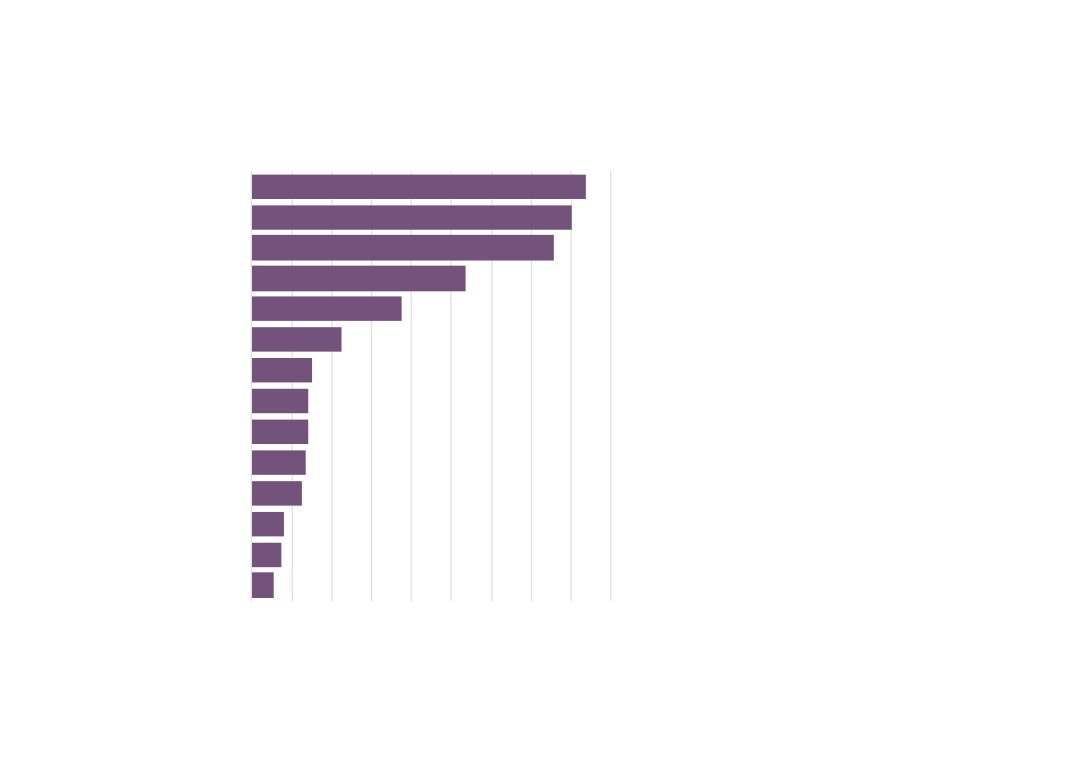

Life Science sector business unit numbers

across New Anglia, 2016

Forest Heath

165

Babergh

230

North Norfolk

235

Waveney

245

Ipswich

250

Great Yarmouth

255

Mid Suffolk

265

St Edmundsbury

305

Breckland

310

King`s Lynn and West Norfolk

315

Broadland

330

Suffolk Coastal

340

Norwich

345

South Norfolk

390

Source: UK Business Counts, Office for National Statistics

31

80%

100%

New Anglia

89%

9%

2%

Norfolk

92%

7%

1%

Suffolk

88%

11%

2%

Life Science sector business

GCGP LEP

86%

11%

3%

Hertfordshire LEP

91%

7%

1%

numbers by size across

South East LEP

91%

7%

1%

comparator areas, 2016

East of England

90%

8%

2%

England

91%

7%

2%

No. of employees

Micro (0 to 9)

Small (10 to 49)

Medium-sized (50 to 249)

Large (250+)

Source: UK Business Counts, Office for

National Statistics

80%

100%

Babergh

95%

5%

Breckland

93%

7%

Broadland

92%

6%

2%

Forest Heath

89%

11%

Great Yarmouth

90%

8%

2%

Life Science sector business

Ipswich

89%

9%

2%

numbers by size across New

King`s Lynn and West Norfolk

94%

5%

2%

Anglia, 2016

Mid Suffolk

90%

8%

2%

North Norfolk

96%

4%

Norwich

93%

7%

South Norfolk

92%

6%

1%

St Edmundsbury

85%

13%

2%

32

Change in Life Science business units across

comparator areas, 2010 - 2016

New Anglia

32%

Norfolk

37%

Suffolk

26%

GCGP LEP

28%

Hertfordshire LEP

40%

South East LEP

40%

East of England

43%

England

56%

Source: UK Business Counts, Office for National Statistics

33

Babergh

15%

Change in Life

Science business units

Breckland

38%

across New Anglia,

Broadland

32%

2010 - 2016

Forest Heath

27%

Great Yarmouth

76%

Mid Suffolk

10%

North Norfolk

34%

Norwich

35%

South Norfolk

37%

St Edmundsbury

30%

Sources: UK Business Counts, Office for

Suffolk Coastal

36%

National Statistics

Waveney

17%

34

Life Science sector wages (selected occupations) - Median gross

annual pay all employees (UK)

£35,012

(2111) Chemical scientists

(12%)

£31,170

£35,041

(2112) Biological scientists and biochemists

(1%)

£34,524

£19,429

(3111) Laboratory technicians

(0%)

£19,421

£25,660

(1%)

(3119) Science, engineering and production technicians n.e.c.

£25,507

£19,697

2016

(3217) Pharmaceutical technicians

(2%)

£19,234

2014

£25,117

(5224) Precision instrument makers and repairers

(-15%)

£29,606

Figures in brackets

£24,954

denote percentage

(8114) Chemical and related process operatives

(5%)

change between 2014

£23,756

and 2016

Source: Annual Survey of Hours and Earnings, Office for National Statistics

35

Life Science sector wages (selected occupations) - Median gross

annual pay full time employees (UK)

£35,321

(2111) Chemical scientists

(8%)

£32,827

£36,845

(-3%)

(2112) Biological scientists and biochemists

£38,095

£20,716

(-5%)

(3111) Laboratory technicians

Figures in brackets

£21,850

denote percentage

change between 2014

£26,276

(3119) Science, engineering and production technicians n.e.c.

(-1%)

and 2016

£26,526

2016

£21,769

(3217) Pharmaceutical technicians

(4%)

2014

£20,883

£25,171

(5224) Precision instrument makers and repairers

(-16%)

£30,034

£25,342

(8114) Chemical and related process operatives

(1%)

£25,120

Source: Annual Survey of Hours and Earnings, Office for National Statistics

36

Life Sciences & Bio-Economy Sectors Apprenticeships

2011/12

2012/13

2013/14

2014/15

Health Assistant Practitioner

-

-

-

90

Health Allied Health Profession Support

5

10

6

5

Health and Social Care

2,045

2,010

2,255

2,680

Health Clinical Healthcare Support

70

110

110

95

Health Dental Nursing

75

110

65

95

Health Healthcare Support Services

25

15

15

40

Health Informatics

-

-

5

15

Health Maternity and Paediatric Support

5

5

10

7

Health Optical Retail

5

5

6

20

Health Pathology Support

5

5

5

5

Health Perioperative Support

5

15

15

9

Health Pharmacy Services

35

35

45

60

Laboratory and Science Technicians

5

20

8

8

Total

2,280

2,340

2,545

3,129

Source: Skills Funding Agency Data Cube

37

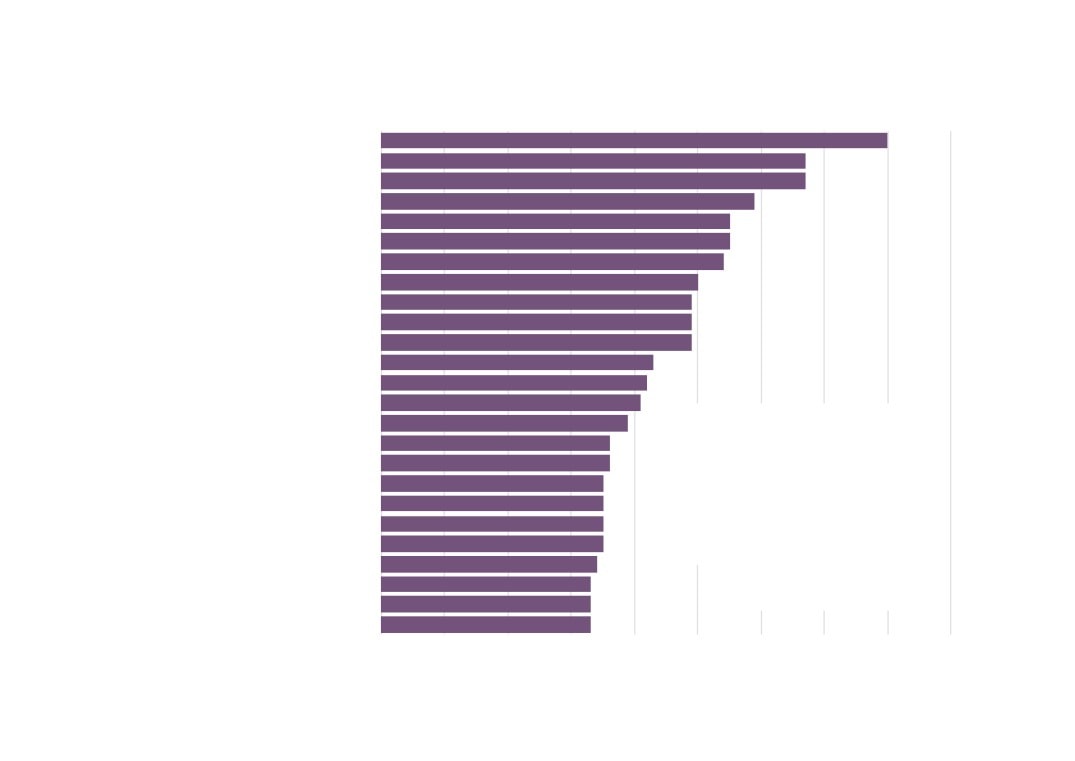

Life Sciences sector vacancies across New Anglia,

0

20

40

60

80

100

120

140

160

180

Jan 2012 - Dec 2016

Norwich

According to the Labour Insight Jobs tool, then

there were 1,295 postings for the sector in New

St Edmundsbury

Anglia between Jan. 1, 2012 and Dec. 31, 2016. A

further 228 postings had the potential to be within

Ipswich

the sector but a final judgement could not be made

on these due to their unspecified or unclassified

Forest Heath

nature.

King's Lynn and West Norfolk

The definition for the Life Sciences sector in this

exercise is slightly different to that we have defined

Mid Suffolk

using SIC codes. The definition used captures the

following industry and sectors: ‘Scientific research

North Norfolk

and development’, ‘Veterinary activities’,

‘Manufacture of basic pharmaceutical products and

Breckland

preparations’, ‘Manufacture of medical and dental

instruments and supplies’, ‘Manufacture of

Babergh

irradiation, electromedical and electrotherapeutic

equipment’, ‘Manufacture of optical instruments

South Norfolk

and photographic equipment’, and ‘Wholesale of

pharmaceutical goods’.

Suffolk Coastal

Please note that some caution needs to be applied

Waveney

to this data as results may reflect the way different

sectors recruit rather than real differences in the

Great Yarmouth

number of jobs.

Source: Labour Insight Jobs, Burning Glass

Broadland

Technologies

38

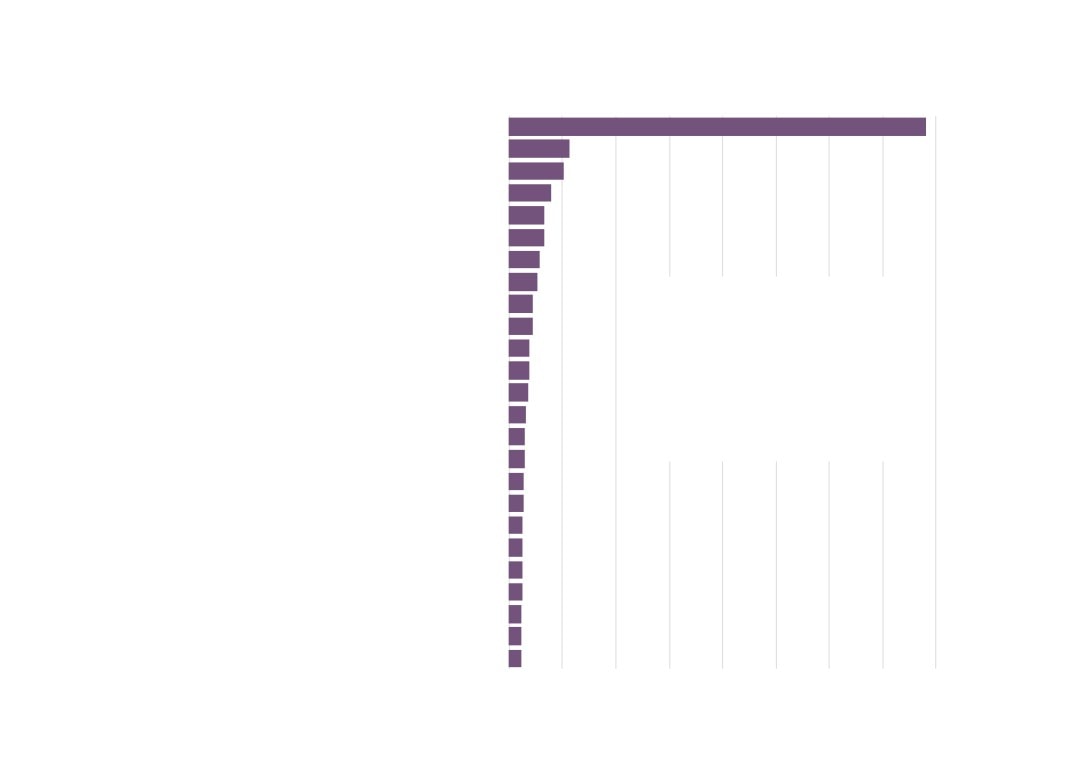

Jarvis Johnson Ltd

Harper Anderton Associates Ltd

Anchorage Veterinary Clinic

AJ Chambers

Top Life Sciences

Hawkedon and Homefield Vets Ltd

TEC Partners

Sector Employers

Swayne and Partners

CK Group

across New Anglia,

Ashfield

Jan 2012 - Dec 2016

Vet Seekers

Bridge Veterinary Practice Ltd

Source: Labour Insight Jobs, Burning Glass Technologies

Chemistree Ltd

Vetco Solutions Ltd

Seven Vets

RB Group Ltd

Envigo RMS, Inc

Medicus Resourcing Ltd

Toll Barn Veterinary Centre

CVS Group PLC

Companion Care Services Ltd

Institute of Food Research

Sanofi UK

Abcam

0

5

10

15

20

25

30

35

40

39

0

50

100

150

200

250

300

350

400

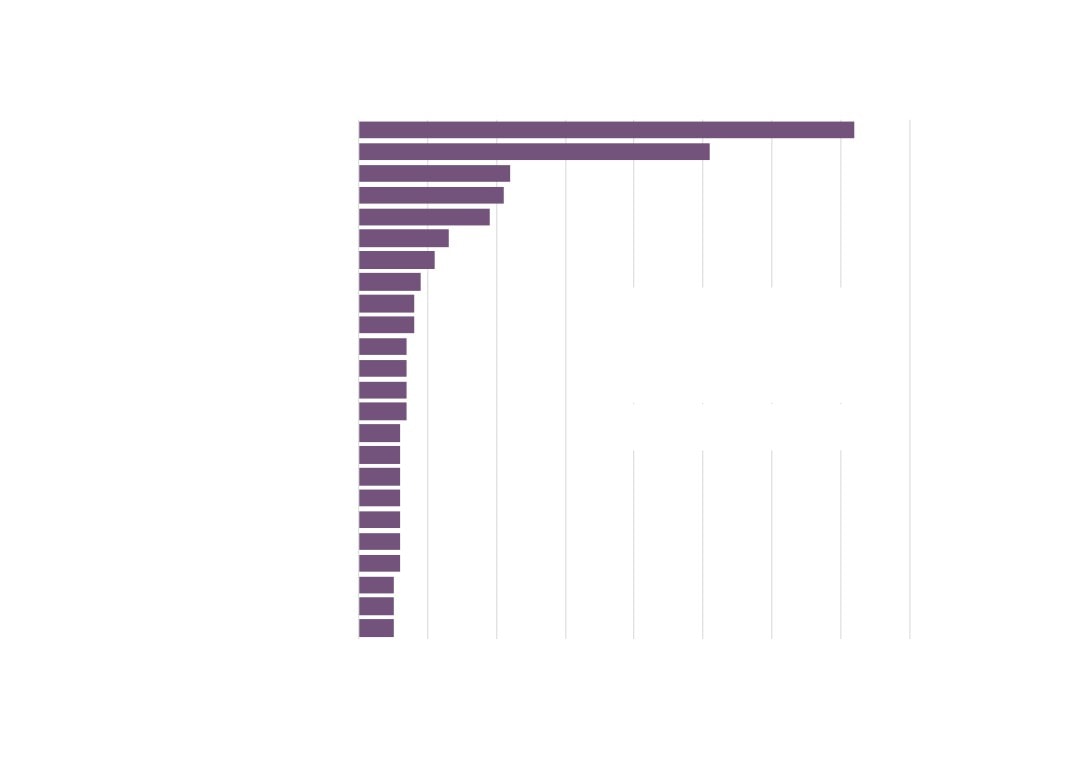

Veterinarians (2216)

Medical practitioners (2211)

Biological scientists and biochemists (2112)

Business sales executives (3542)

Programmers and software development professionals (2136)

Quality assurance and regulatory professionals (2462)

Design and development engineers (2126)

Quality assurance technicians (3115)

IT business analysts, architects and system designers (2135)

Life Sciences

Sales related occupations n.e.c. (7129)

sector vacancies

Marketing associate professionals (3543)

Engineering professionals n.e.c. (2129)

by occupation, Jan

Financial accounts managers (3538)

Routine inspectors and testers (8133)

2012 - Dec 2016

Source: Labour Insight Jobs, Burning

Health professionals n.e.c. (2219)

Glass Technologies

Marketing and sales directors (1132)

Production managers and directors in manufacturing (1121)

Receptionists (4216)

Chartered and certified accountants (2421)

Health services and public health managers and directors (1181)

Sales accounts and business development managers (3545)

Veterinary nurses (6131)

Planning, process and production technicians (3116)

Animal care services occupations n.e.c. (6139)

Draughtspersons (3122)

40

0

10

20

30

40

50

60

70

80

Veterinarian

Veterinary Surgeon

Account Manager

Quality Control Analyst

Quality Assurance Officer

Receptionist

Process Engineer

Clinical Director

Development and Test Engineer

Life Sciences sector

Research Scientist

Small Animal Vet

vacancies by job title,

Systems Engineer

Contract Analyst

Jan 2012 - Dec 2016

Practice Manager

Source: Labour Insight Jobs, Burning Glass

Area Sales Manager

Technologies

Design Engineer

Engineering Manager

Mechanical Design Engineer

Mechanical Engineer

Tax Manager

Territory Manager

Account Executive

Design Support Engineer

Electronics Engineer

41

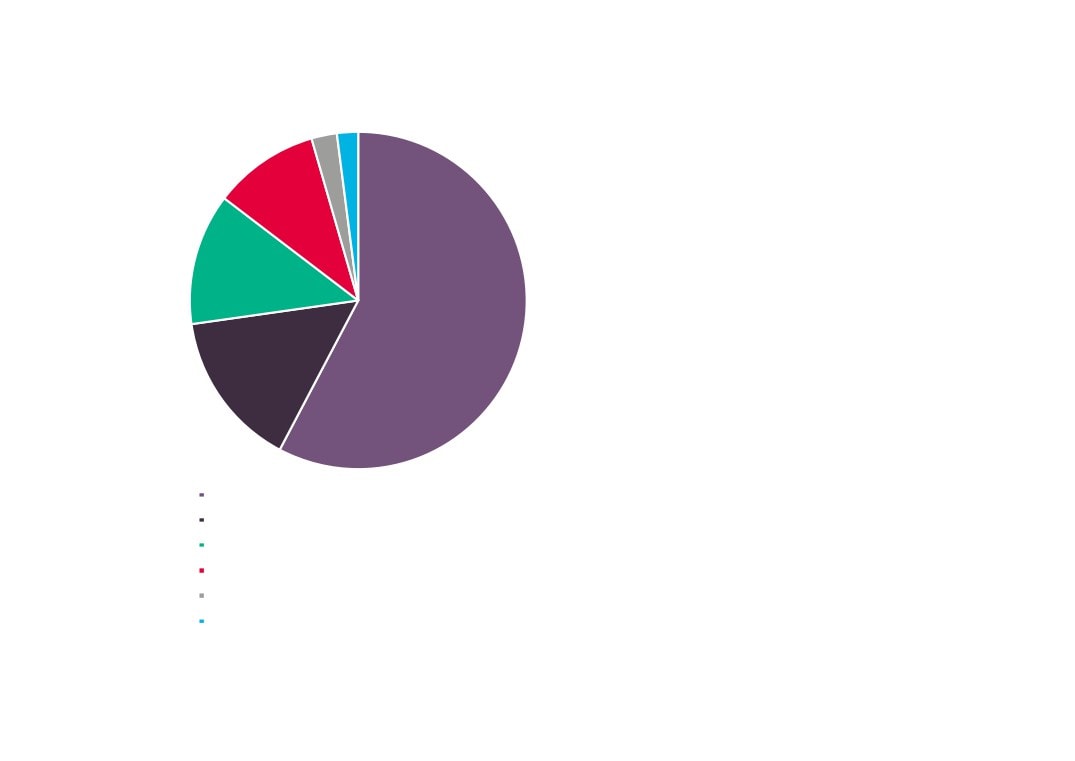

6

5

25

31

Life Sciences sector vacancies

by qualification level required,

142

Jan 2012 - Dec 2016

37

Source: Labour Insight Jobs, Burning Glass Technologies

Bachelor's degrees, graduate certificates and diplomas

Post graduate degrees, Level 5 S/NVQs, certificates and

diplomas

A-Levels, Highers, and Level 3 S/NVQs

GCSEs, Standard Grades, and Level 2 S/NVQs

Level 4 diplomas and certificates, HNCs, Level S/NVQs

Foundation degrees and HNDs

42

0

10

20

30

40

50

60

70

80

90

Project Management

Surgery

Pharmaceutical Industry Background

Good Manufacturing Practices (GMP)

Customer Service

Validation

Business Management

Product Sales

Business Development

Product Research

Technical Support

Computer Aided Draughting / Design (CAD)

Microsoft Office

Microsoft Excel

Marketing Sales

Life Sciences

Purchasing

SQL

sector vacancies by

Biology

Budgeting

skills required,

Primary Care

Jan 2012 - Dec

Product Marketing

Product Testing

Source: Labour Insight Jobs, Burning

Glass Technologies

Chemistry

Budget Management

X-Rays

43

Appendix 1 - Life Sciences & Bio-Economy sector definition (2007 SIC codes)

SIC Code

Pharmaceutical development and manufacture

21100

Manufacture of basic pharmaceutical products

21200

Manufacture of pharmaceutical preparations

46460

Wholesale of pharmaceutical goods

20130

Manufacture of other inorganic basic chemicals

20140

Manufacture of other organic basic chemicals

20590

Manufacture of other chemical products nec

Medical Technology Manufacture

32500

Manufacture of medical and dental instruments and supplies

32990

Other manufacturing nec

26110

Manufacture of electronic components

26511

Manufacture of electronic instruments and appliances for measuring, testing, and navigation, except industrial process control equipment

26512

Manufacture of electronic industrial process control equipment

26600

Manufacture of irradiation, electromedical and electrotherapeutic equipment

26701

Manufacture of optical precision instruments

27900

Manufacture of other electrical equipment

25990

Manufacture of other fabricated metal products nec

22290

Manufacture of other plastic products

28290

Manufacture of other general-purpose machinery nec

28410

Manufacture of metal forming machinery

28990

Manufacture of other special-purpose machinery nec

82990

Other business support service activities nec

33130

Repair of electronic and optical equipment

33140

Repair of electrical equipment

Life Sciences Research

72110

Research and experimental development on biotechnology

72190

Other research and experimental development on natural sciences and engineering

74909

Other professional, scientific and technical activities (not including environmental consultancy or quantity surveying)

86900

Other human health activities

45

Appendix 2 - Estimates for GVA per employee by Life Sciences & Bio-Economy sub sector

GVA per employee

Life Sciences Research

£60,000

Pharmaceutical development and manufacture

£81,000

Medical Technology manufacture

£65,000

These values were calculated for each of the three sub sectors and used to estimate the economic value and employment for small companies

where financial information was not able to be directly collected. The values are based on the median figures obtained in order to minimise the

impact of outliers. These results are based on data for a sample of 107 smaller firms out of the population of around 1,400.

Source: Association of the British Pharmaceutical Industry report ‘The economic contribution of the UK Life Sciences industry’ (March 2017),

prepared by PricewaterhouseCoopers LLP

46