New Anglia Local Enterprise Partnership Board Meeting

Wednesday 18th April 2018

10.00am to 12.30pm

The Green Britain Centre, Turbine Way, Swaffham, Norfolk, PE37 7HT

Agenda

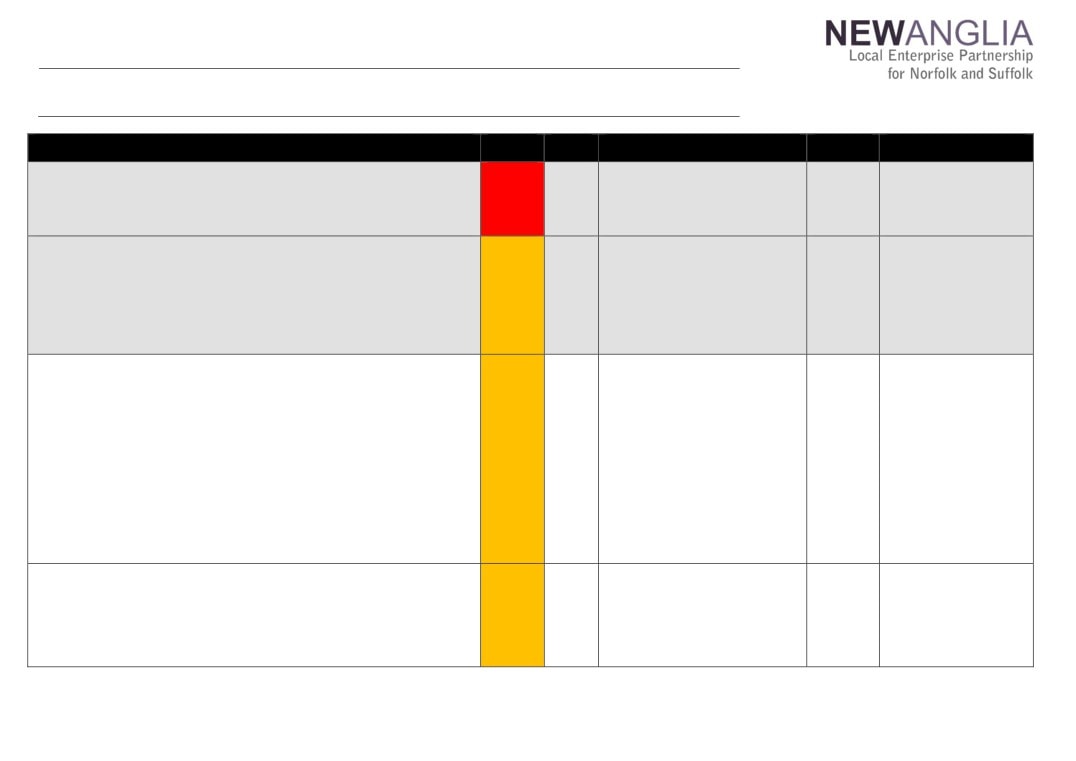

No.

Item

Duration

1.

Welcome

15 mins

2.

Apologies

3.

Declarations of Interest

4.

Actions / Minutes from the last meeting

Forward looking

45 mins

5.

Tri-LEP Local Energy East Strategy

Presentation

6.

Cambridge-Norwich Tech Corridor Presentation

Presentation

Governance and delivery

90 mins

7.

LEP Capital Budget 2018/19 - Confidential

For Approval

8.

Review of professional advisers

For Approval

9.

Decision Log

For Approval

10.

Growth Deal Quarterly Dashboard - Confidential

For Approval

11.

Chief Executive’s report including PwC Implementation Plan

Update

12.

Finance Report including Confidential Appendices

Update

13.

Board Forward Plan

Update

14.

Any Other Business

Update

Date and time of next meeting:

10.00am - 12.00pm, 23rd May 2018

Venue: Co-op Education Centre, 11 Fore St, Ipswich IP4 1JW

1

New Anglia Board Meeting Minutes (Unconfirmed)

21st March 2018

Present:

Cllr David Ellesmere (DE)

Ipswich Borough Council

Doug Field (DF)

East of England Coop

John Griffiths (JG)

St Edmundsbury Council

Dominic Keen (DK)

High Growth Robotics

Colin Noble (CN)

Suffolk County Council

Johnathan Reynolds (JR)

Nautilus

Lindsey Rix (LR)

Aviva (via video call)

Sandy Ruddock (SR)

Scarlett & Mustard

Alan Waters (AW)

Norwich City Council

Nikos Savvas (NS)

West Suffolk College

Jeanette Wheeler (JW)

Birketts

In Attendance:

Sue Roper (SuR)

Suffolk County Council

Richard Lister (RL)

University of Suffolk (for David Richardson)

Alison Thomas (AT)

Norfolk County Council (for Cliff Jordan)

Shan Lloyd (SL)

BEIS

Chris Dashper (CD)

New Anglia LEP

Lisa Roberts (LiR)

New Anglia LEP

Chris Starkie (CS)

New Anglia LEP

Keith Spanton (KS)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

Rachel Hood (RH)

Horse Racing Industry (For Item 4)

1

Actions from the meeting: (21.03.18)

Flood Defence Schemes

Chris Dashper to produce a brief paper on LEP funding of flood defences to be circulated to

CD

Board Members.

Institute of Technology

Board members to be provided with details of the top 3 key messages from the LEP on a

HM

monthly basis

1

Welcome from the Chair

Doug Field (DF) welcomed everyone to the meeting and thanked The Jockey Club for hosting. He

welcomed the attendees including Richard Lister deputising for David Richardson, Alison Thomas

deputising for Cliff Jordan and Rachel Hood who was presenting Item 4. Lindsey Rix joined the

meetings via video call.

2

Apologies

Apologies were received from: David Richardson, Tim Whitley, Andrew Proctor, Steve Oliver, Cliff Jordan

and Tracy Jessop

3

Declarations of Interest

Declarations relevant to this meeting:

Item 9 - Alison Thomas and Alan Waters

Item 10 - David Ellesmere, Colin Noble, Sue Roper and Richard Lister

Nikos Savvas (NS) noted the meeting that he had a personal connection to Oyster Yachts should it arise

as a future agenda item.

4

Horse Racing Industry Presentation from Rachel Hood

Rachel Hood (RH) provided the meeting with an overview of the horseracing industry in

Newmarket and its importance to the economy of the region.

The meeting was informed about the range of the industry which stretches beyond hosting

races to include breeding, training and support functions. It is the most important industry in the

area and the second biggest contributor to the economy in the East, after the Tech corridor,

employing 20,000 people directly and over 120,000 people indirectly. On a national level it

contributes £3.45bn to the economy with Newmarket the largest horseracing economic cluster

in the world.

DF thanked RH for her informative presentation and RH left the meeting.

5

Minutes of the last meeting 21st February 2018

The minutes were accepted as a true record of the meeting held on 21st February 2018.

Actions from last meeting updated as follows:

Declarations of Interest

CS

Ascertain whether regular Board substitutes need to complete Declaration of Interest Forms -

This has been confirmed and forms are being collected from those attending as substitutes.

These will be added to the web site.

Economic Indicator Trajectories and Targets

CS/JR

To receive a paper on CO2 reductions for consideration of inclusion in the economic strategy

targets - Work is ongoing and will be presented at a future Board meeting.

Brexit Analysis

To receive an action plan detailing the next steps, timescales and measures of success - Work

LiR

is ongoing and will be presented at a future Board meeting.

Governance Review

To receive a proposed scheme of delegation and decisions log at the March meeting - A

CS

Scheme of Delegation is being presented at the March Board. The decisions log will be

presented in April.

2

Flood Defence Schemes

Chris Dashper (CD) provided a verbal update on his findings and will produce a brief paper to

CD

circulate to Board Members.

6

Institute of Technology - Confidential

The Board agreed:

To note the content of the report

To support and promote the proposal and the activities of the LEP to help development

of the bid

To receive details of the top 3 key messages from the LEP on a monthly basis to assist

in getting the message to key stakeholders

7

2018/2019 Budget

CS took the majority of the paper as read and updated the meeting on the keys elements of the

2018/19 operating budget which covers the core work of the LEP and the programmes team.

Board members were advised that expenditure had increased largely due to an increase in

salaries as the LEP now has its full complement of staff. This also includes salaries for the 2

Opportunity Area staff although these costs are recovered in full.

It was noted that £150,000 has been set aside for unallocated projects giving the LEP

executive further capacity where work is expected to increase such as Brexit and the

development of a local industrial strategy

The overall impact is that the LEP is budgeting for a reduced operating surplus for 18/19 given

the certainty of almost all the income and costs.

CS provided an overview to the Projects Revenue Fund which has been established using the

Enterprise Zone revenues. The fund currently has £1m available to use in the 18/19 financial

year and CS recommended that the LEP executive develop a framework around the use of the

funds which will initially be considered by the Investment Appraisal Committee (IAC) before

being presented to the LEP Board.

The Board agreed:

To approve the operating budget for 2018/2019

To publish the approved budget in the public domain

For the LEP Executive develop a framework around the use of the revenues budget

Capital Growth Programme Bid - Snetterton Heath including Confidential Appendices 2

8

and 3

CD highlighted the key points of the proposal.

LR noted that the IAC had approved the bid but had requested that the Council reinvest the

business rates received from the project.

David Ellesmere (DE) noted that a clawback mechanism should be included should revenues

be higher than expected.

JR noted that there are many other businesses in a similar situation who would benefit from

such improvements and there was a risk that the LEP receive further similar requests.

The Board agreed:

To approved the Capital Growth Programme grant funding of £2.65m to the Snetterton

Heath Employment Areas Electricity upgrade Scheme subject to the inclusion of a

clawback clause

9

Growth Deal Funding Change Request - NATS Packages

3

Alan Waters (AW) and AT left the meeting.

CD reviewed the key points of the proposal reiterating to the Board that this was not a request

for additional funding but the reallocation of existing funding between projects.

The Board agreed:

To agree the transfer of £350,000 from NATS A11 Corridor Package to the NATS City

Centre Package.

To the inclusion of the Plumstead Road roundabout scheme into the NATS City Centre

Package and use of £400,000 of previously allocated funds.

AT & AW returned to the meeting

10

Growth Deal Funding Change Request - Cornhill

DE, Colin Noble (CN), Sue Roper (SuR), and RL left the meeting.

CS reviewed the keys points of the request for an additional £50,000 to cover a shortfall in

project funding. This contribution will leverage match funding of £350,000 already offered by

other partner organisations.

CS confirmed that this was viewed as a worthwhile project and that there was ongoing local

economic activity directly linked to the project.

The Board agreed:

To provide an additional £50k to cover the shortfall in the funding

DE, CN, SuR, and RL returned to the meeting.

11

Growing Places Fund - Atex Business Park - Confidential

The Board agreed:

To note the content of the report.

To receive a revised paper at the April board meeting

12

Scheme of Delegation

CS took the majority of the paper as read.

Board members discussed the Scheme of Delegation and agreed the following minor changes:

Page 2: Awards from Growing Business Fund up to £500k - GBP Panel “overseen by the IAC”

to be added

Page 3: Remuneration of Chief Operating Officer - CEO to be removed

Page 3: Operation procedures and policies - To be amended to “COO in conjunction with

CEO”

LiR asked whether regular update reports form the Chairs of the committees would be included

in future Board meetings.

CS agreed that this would be built into future Board plans

The Board agreed:

To approve the LEP’s Scheme of Delegation subject to the above revisions.

To receive regular updates from committee Chairs

13

Chief Executive’s report including PwC Implementation Plan

CS updated the meetings on the LEP Chairs and CEOs Workshop which he and DF had

attended on 20th March.

4

The workshop had provided further information on key areas:

Governance Review - This is expected to be completed before the summer recess and CS

advised that he felt the New Anglia was well placed to respond.

Local Industrial Strategy - New Anglia is continuing to press to be included as a pilot LEP.

Shared Prosperity fund - an update was given on the ongoing work to replace European

funding.

CS also advised that a meeting was being set up with the new Chair of the GEML Taskforce.

DF thanked the LEP executive team for their hard work which resulted in New Anglia being

assessed as a high performing LEP.

DF also advised that work was ongoing to agree the independent chair for the Audit & Risk

Committee.

AW echoed DF’s thanks to the LEP team but expressed concern that over half of LEPs were

seen as underperforming. Shan Lloyd (SL) noted that the Annual Conversations were carried

out before Christmas and that significant work had been done by LEPs since then to address

the issues raised.

The Board agreed:

To note the content of the report

14

Finance Report

KS took the majority of the paper as read and asked for questions from the Board.

The Board agreed:

To note the content of the report

15

Board Forward Plan

CS advised that the forward plan was still being developed and asked for suggestions from the

Board.

Jeanette Wheeler (JW) requested the inclusion of an update on the delivery of the housing

target.

It was agreed that updates on by Sector Leads and by Chairs on committee performance would

also be included.

The Board agreed:

To note the content of the report.

To receive the updated plan at future meetings

14

Any Other Business

None

Next meeting:

Date and time of next meeting: 18th April 2018. 10am-12.30pm

Venue: Green Britain, Turbine Way, Swaffham, Norfolk

5

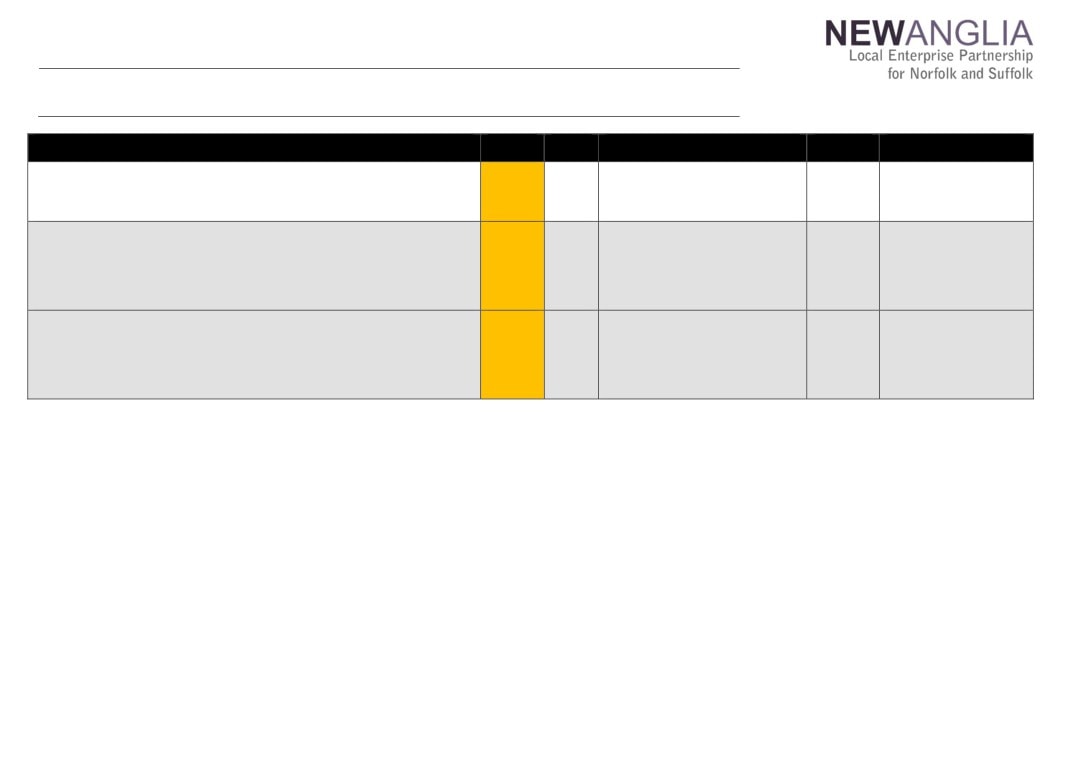

Actions from New Anglia LEP Board Meetings

Date

Item

Action

Update

Actioned By

Status

21/02/2018

Declarations of Interest

Ascertain whether regular Board substitutes need to complete

Declarations will be required. Charley Purves will

CS

On-Going

Declaration of Interest Forms.

contact Board substitutes to arrange completion

21/02/2018

Economic Indicator

To receive a paper on CO2 reductions for

CS and JR liaising

CS/JR

On-Going

Trajectories and Targets:

consideration of inclusion in the economic strategy targets

21/02/2018

Brexit Analysis

To receive an action plan detailing the next steps, timescales and measures of

Draft action plan is being produced

LiR

On-Going

success

21/02/2018

Governance Review

Governance Review - To receive a proposed scheme of delegation and decisions

Decision Log presented at the April Board meeting

CS

Complete

log at the March meeting

17/01/2018

Capital Growth Programme

Identify whether other LEPS have received requests for investment in flood

Verbal update to be provided at March Board

CD

Complete

Projects

defence schemes.

meeting

22/11/2017

Business Performance

To receive a proposal on the Eastern Agi-Tech initiative by email.

On hold pending clarification on the situation at

CS

On Hold

Reports

GCGP

9

New Anglia Local Enterprise Partnership Board

Wednesday 18th April 2018

Agenda Item 5

Local Energy Strategy

Author: Iain Dunnett - Iain to present item

Summary

This paper summarises the development of the Local Energy East Network and its production

of a Local Energy Strategy and seeks comment from the LEP Board on the strategy at this

consultation stage. There will be a fuller presentation at the board meeting. The completed

strategy will be presented to the LEP Board for endorsement at the meeting in May 2018.

Recommendation

The Board is formally consulted on the Local Energy Strategy and the views of the board are

being sought on its content. The completed strategy will be presented to the LEP Board for

endorsement at the Board meeting in May 2018.

Background

BEIS funding became available nationally in March 2017 for LEPs to establish Local Energy

Networks and Strategies. Funding was secured in the East of England for a Tri LEP Network

and Strategy covering the three LEP areas of New Anglia, Greater Cambridge and

Peterborough and Hertfordshire, and their constituent local authorities. This funding secured

resources to develop a Local Energy Network and to produce a Local Energy Strategy in the

period April

2017 to April

2018. The network was led and coordinated by the Greater

Cambridgeshire and Peterborough LEP.

To support this strategy a baseline of information has been completed including Energy

Mapping, Analysis, Modelling, and the development of a Web Portal.

The Local Energy Strategy is based upon this baseline of information and is the subject of

current consultation with the aim of publishing the Strategy in June 2018. The Local Energy

East Network is seeking strategy endorsement by all local authorities and many other partners.

To this end a consultation event occurred at Newmarket Racecourse in February 2018 and

further consultation opportunities will be provided in the spring of

2018. It is particularly

important that full engagement of the strategy occurs across Norfolk and Suffolk and that the

New Anglia LEP takes the full opportunity available through this initiative to support a key

sector in the area.

The Strategy is considered to be complementary to other initiatives such as those led by the

East of England Energy Group, the Norfolk Anglian Water/UK Power Networks/Local

Authorities Utilities initiative and work being completed by the Suffolk Growth Group.

1

11

The key thematic priorities identified in the Strategy period to 2030 are as follows:

Clean Economic Growth

Housing Growth and Commercial Site Infrastructure

Secure, Affordable Low Carbon Consumption

Clean Transport Networks including Electric Vehicles

The Strategy will aim to deliver and facilitate actions in the following areas:

Business, domestic and public sector retrofit and demand reduction

Electricity generation, storage, supply and distribution

Heat generation and distribution

Transport and wider energy demand reduction

The Strategy will encompass the work of EEEGR which is actively seeking funding for the

establishment of Special Interest Groups to consider issues in the areas of distribution, storage,

community generation and smart networks and has worked with Local Energy East to establish

this initiative. The EEEGR Chief Executive is actively engaged in this subject area as the chair

of the UK Power Networks Eastern Region Critical Friends Panel which proactively engages

with local authorities, property developers, contractors and organisations representing

vulnerable customers.

A practical example of a growth location that could benefit from the strategy would for instance

be Snetterton Heath on the A11 Tech Corridor. This location has been the subject of protracted

negotiations to fully develop the site and to overcome the main obstacle to development,

namely a lack of energy capacity. There are a considerable number of sites similar to

Snetterton that will benefit from the connectivity encouraged by the Local Energy Strategy with

the consequent development of technical and financial development models rolled out across

sites with similar requirements bringing benefits of infrastructure scale, procurement and

connectivity.

Running parallel to the network and strategy BEIS have made funding available for the

development of five Energy Hubs across England. The development of a Greater South East

Energy Hub was proposed by BEIS. The eleven LEP areas in the South East, led by the

Greater Cambridge and Peterborough LEP, have coordinated a response to this proposal.

BEIS have made £1.3 million available to establish the Greater South East Energy Hub during

the period April 2018 to April 2020. The responsibility for leading the development of the Energy

Hub has now transferred from the Greater Cambridge and Peterborough LEP to the Combined

Cambridgeshire and Peterborough Authority.

The Greater South East Energy Hub is intended to:

•

Cover the area of the East of England, Greater London, the South East and the Oxford

to Cambridge Growth Corridor (16 counties plus London/11 LEPs).

•

Provide dedicated technical resource.

•

Provide project identification, feasibility, funding readiness & delivery.

•

Provide the opportunity to test, pilot, scale up and accelerate delivery.

•

Explore the use of Energy Special Purpose Delivery Vehicles.

The Greater South East Energy Hub will be fully funded by BEIS over the two year period from

April 2018 to April 2020. There is an expectation from BEIS that the hub will be self-financing

after this initial two year period, which may have financial implications for the LEPs and

partners if the hub requires further financing beyond this initial two year period.

2

12

Link to the Economic Strategy

The Local Energy Strategy aims to build upon LEP Economic Strategies.There are many links

to the New Anglia LEP Economic Strategy, the key links being:

•

The Local Energy Strategy links energy as a common theme through the LEPs

Economic Strategy to the UK Governments Industrial Strategy, Clean Growth Strategy,

the 25 Year Environment Plan and to Local Industrial Strategies.

•

Engagement with stakeholders from all the LEPs key sectors, including the energy,

construction (Building Growth) and agritech sectors, which are key sectors for the LEP.

•

Prioritizing growth location energy needs and funding in a cost efficient manner re

Growth Deal and other funding sources for

- Energy Generation and Storage.

- Grid Capacity, Supply and Distribution. Important link to UK Power Networks.

- Aggregating and Communicating Energy Investment and Procurement

opportunities across private and public partners (£10m or above investment

opportunities).

- New Energy Innovations.

•

Optimal utilization of Local, National and European funding with maximum leverage

achieved.

•

Transport and economic Infrastructure provision to facilitate enhanced energy sector

opportunities.

Develop linkage between regional centres of excellence such as Cambridge University,

University of East Anglia and the Building Research Establishment developing the

regions reputation as a centre of research, innovation and commercial development.

Building upon the Energy Sector Deals, Skills Deal, Sector Skills Plan, the regions

colleges

(in particular the new East Coast College Energy Skills Centre) and

commercial skills providers engineering development and apprenticeship programmes,

including those of the Direct Network Operators.

Recommendation

The Board is formally consulted on the Local Energy Strategy and the views of the board are

being sought on its content. The completed strategy will be presented to the LEP Board for

endorsement at the Board meeting in May 2018.

3

13

New Anglia Local Enterprise Partnership Board

Wednesday 18th April 2018

Agenda Item 6

Cambridge Norwich Tech Corridor

Author: Linn Clabburn - Linn to present item

Summary

This paper summarises and provides an update on the Cambridge Norwich Tech Corridor

(CNTC) initiative and seeks comment from the LEP Board for its planned future activities. Linn

Clabburn will provide a presentation to accompany this report at the board meeting.

The vision and the ambitions for the CNTC were agreed by the Leaders and Chief Execs of the

CNTC partner organisations on the 22nd March 2018 and the strategy and detailed delivery plan

for the initiative is currently being developed to accelerate the initiative.

Recommendation

The Board’s views, comments and support for the proposed strategy (to be presented in more

detail at the Board meeting) are sought. The Board is invited to provide views and comments

on the governance structure and recommendations on private sector representatives to join the

initiative.

Background

The CNTC was initiated in 2015 to maximise impacts from the dualling of the A11 carriageway

between Norwich and Cambridge and is a partnership between the local authorities from the

three counties along the Corridor, New Anglia LEP and GCGP LEP. The initiative seeks to work

closely with the private sector and will invite private sector representatives to join a ‘Delivery

Group’ to develop strategies and individual initiatives and interventions for the CNTC.

Feasibility studies by Bruton Knowles and Cambridge Econometrics suggest that the

Cambridge Norwich Tech Corridor area has potential for significant growth over the coming 15

years and could house an additional 46,000 people, 26,000 additional jobs, create value of an

additional £2.75bn to the economy in real terms, with workers each taking home on average an

additional £1,300 per annum, also in real terms. The Cambridge Norwich Corridor is recognised

as a Priority Place by New Anglia LEP for the significant growth opportunities that the area

offers.

The Cambridge Norwich Tech Corridor comprises not only the UK’s most established tech

cluster in Cambridge but also clusters of businesses and research excellence in a range of

tech-based sectors including:

Advanced engineering, manufacturing & materials

Agri-tech/ food-science

Life science, Med-Tech & Pharmaceuticals

IT, AI, Robotics, Sensors & Big Data

1

15

Energy

The CNTC initiative aims to join up and enhance the assets and strengths within the Corridor

area and to further develop the area into a joined up ‘corridor’ efficiently linking supply and

demand throughout the Corridor. The ultimate desired outcome of the initiative is to support and

stimulate technology-based business clusters to drive investment in new infrastructure,

commercial sites, skills, and housing to ultimately create high value jobs, increase productivity,

and GDP.

Key Considerations

The vision for the CNTC is to be a nationally recognised corridor, home to a number of

nationally significantly clusters of technology businesses with a high level of collaboration,

synergies and innovation between businesses, sectors and local economies and closely linked

to surrounding corridor initiatives. To deliver the vision of a successful corridor, the CNTC team

has developed an outline strategy for the CNTC initiative based around five key ambitions:

Cross-sector cluster development - to develop and enhance existing and emerging

technology clusters through a portfolio for clustering initiatives and to build a cross-

sector cluster to enable technology convergence and innovation and build regional

supply chains.

Skills - to support effective cluster development and inclusive growth by supporting the

Corridor area to become a leader in technical education, raising skill and productivity

levels, attract and retain a skilled workforce

Infrastructure - to support the development and investment in infrastructure to enhance

connectiveness throughout the Corridor area and enable businesses to co-locate in key

cluster locations.

Leadership - to establish leadership and provide coordination of initiatives and activities

to support cluster development and business growth.

Identity building - to build an identity and a brand for the Cambridge Norwich Tech

Corridor to drive engagement between stakeholders and provide a joined-up offer and

investment case for government, businesses and private sector investors.

The outline strategy will be presented in further detail in the Board meeting and the Board is

invited to provide feedback.

The New Anglia LEP is contributing £125k to the CNTC over a 2-year period (equivalent to

funding one senior position for 2 years).

Local authority partners are also making financial contributions.

Link to the Economic Strategy

The CNTC initiative has the potential to deliver several aspects of the Economic Strategy:

(Our offer to the world) An inward investment

‘product’ within the East inward

investment offer joining up the assets and strengths within the Corridor area to promote

several investible opportunities.

(Business growth and productivity) Facilitate the development of infrastructure required

for CNTC based businesses to grow and to attract businesses to the area.

(Our offer to the world) Showcase the opportunities and quality of life aspects of the

Corridor area to attract skilled workforce.

(Business growth and productivity) Support business growth by coordinating and

supporting access to business support, investment, etc.

(Business growth and productivity) Support business growth by building a Corridor-wide

network of supply and demand and build regional supply chains.

2

16

Next Steps

Following the approval of the outline plan on 22nd March, key milestones for the next 12 months

include;

June 2018 - appointment of private sector representatives on Delivery Group

June 2018 - ‘launch’ of CNTC initiatives to businesses in the Corridor area

August 2018 - the new CNTC website launched with detailed mapping of key assets

and opportunities in the Corridor

September 2018 - launch of Breakthrough project to support cross-sector innovation

(subject to successful funding bid)

October 2018 - showcase the CNTC at MIPIM

November 2018 - launch of the CNTC Supply Chain Development Group

2019 - first CNTC annual conference

Recommendation

The Board’s views, comments and support for the proposed strategy (to be presented in more

detail at the Board meeting) are sought. The Board is invited to provide views and comments

on the governance structure and recommendations on private sector representatives to join the

initiative.

3

17

New Anglia Local Enterprise Partnership Board

Wednesday, 18th April 2018

Agenda Item 8

Review of professional advisers

Author: Marie Finbow - Chris Starkie to present item

Summary

The LEP’s current procurement practice for buying in professional advisers is time-consuming

and lengthy. It is proposed to develop a procurement framework and create a list of Approved

Suppliers which would enable the LEP to purchase these services without the need for

individual procurement processes. This process would facilitate greater scrutiny and

transparency, and provide the structure and framework for good procurement practice, driving

good practice and behaviour as well as ensuring value for money.

Recommendation

The Board is recommended to approve the proposed approach to developing a multi-supplier

procurement framework and developing a list of Approved Suppliers of professional support

services.

The board is also recommended to approve a re-tendering exercise for the LEP’s annual audit

from the 2019/20 financial year.

Background

Currently the LEP carries out procurement for professional advisers, such as ICT, consultancy,

legal and other professional advice on an ad-hoc basis.

Choosing specialist suppliers can take a huge amount of time and effort, with each needing to

be procured individually through the LEP’s procurement policy.

To speed up this process, it is proposed to develop and maintain a list of approved suppliers.

These are ‘superstar’ suppliers who have been successful in a tender exercise for specialised

professional support services and which the LEP has thoroughly assessed and reviewed and is

willing to negotiate with on its own terms.

The primary purpose of the approved suppliers list is to ensure the placement of purchase

orders or contracts are limited to those suppliers that meet the LEP’s established criteria for

supplier selection, evaluation, and re-evaluation.

Key Considerations

An ‘approved suppliers list’ can be an informal list of suppliers that have demonstrated an ability

to provide goods/services in the past, or a more formal list of suppliers resulting from the award

of a procurement framework agreement.

1

23

It is proposed to use both approaches, developing and maintaining two lists - firstly an informal

‘open’ list of suppliers for procurement up to the value of £25,000. This would be run on a fair

and formal process, providing the opportunity for new suppliers to join on an annual basis.

Secondly for any procurement above £25,000, it is proposed to develop a multi-supplier OJEU

compliant procurement framework. This is an agreement put in place with a range of pre-

approved providers that enables the LEP to place orders for services without the need to

undertake costly and time-consuming full OJEU procurement processes. This is a ‘closed’ list of

suppliers, which once established offers no opportunity for new suppliers to join for 3 to 5 years.

A framework agreement does not bind the LEP to purchase goods or services. It sets out the

terms and basis upon which contracts will be awarded in the future. In order to purchase goods

or services under a framework agreement the LEP will take an additional step to award a

distinct call-off contract in accordance with the terms of the framework agreement. It is the call-

off contract that constitutes a binding legal obligation on the LEP.

The procurement framework will be divided into ‘lots’ - these are categories of professional

advisers which the LEP wants to buy, such as legal, consultancy, evaluation, HR, ICT,

professional advice, etc.

Through the Framework, contracts will be awarded to pre-approved suppliers through mini

competitions in line with the LEP’s Procurement Procedures (Appendix 2) and follow the

principles of best value, non-discrimination, equality of treatment and transparency.

In order to be appointed to the Approved List, suppliers will need to demonstrate that they have

the capacity and expertise to carry out a broad nature of work and a full tender process is

needed for suppliers to gain a place on the Framework.

Although there is never a guarantee of work even if suppliers are part of a Framework

Agreement, being awarded a place on the framework is a sign to others that their business is a

key player in the industry.

As part of the process we would look to encourage local suppliers, particularly SMEs to

participate and would engage with local trade groups such as the chambers of commerce and

the FSB to advertise the opportunity and benefits of being part of our approved suppliers list.

Over time, procurement frameworks can deliver many benefits, including reducing overall

procurement costs and internal resources; building of long term relationships between the LEP

and its suppliers, particularly local suppliers; providing better long-term value for both the LEP

and its suppliers; capture of knowledge and best practice; ability to commence projects early

based on limited information; as well as aligning procurement practice with government

efficiency agendas and expectations of auditing bodies.

Another key advantage of developing an OJEU compliant procurement framework is that it

could be used by other LEPs, allowing them to benefit from quicker procurement processes and

reduced procurement costs. However, this is only possible if it is written into our Framework at

the outset.

The Approved Suppliers List will be reviewed on an annual basis, allowing the LEP to make

necessary adjustments or replacements of under-performing suppliers.

A draft process for the Approved Supplier List is attached as Appendix 1.

2

24

Re-tender of LEP auditors

Separate to the development of the framework, the executive team is also recommending the

re-tender of the LEP’s annual audit for the 2019/20 year.

Lovewell Blake have been the LEP’s auditors since the formation of the LEP in 2012. A

competitive exercise was run then by the LEP to select the auditor. It is best practice to run a

retendering exercise every few years, and the LEP executive is recommending running a

retendering exercise in line with the LEP’s procurement policy. The process will commence in

the summer of 2018.

Link to the Economic Strategy

The development of a framework will support our Driving Business Growth and Productivity

theme. It will specifically support our ambition to open up supply chain opportunities for local

companies.

It will also indirectly support the Economic Strategy. Streamlining the processes for

procurement, whilst ensuring transparency and accountability, will improve the operational

efficiency of the LEP.

Next Steps

Before developing a procurement framework and a list of approved suppliers of professional

advisers, the LEP will establish criteria for selection, evaluation and re-evaluation of suppliers.

The LEP will also develop its own Terms and Conditions and invitation for the Approved List.

Recommendation

The Board is recommended to approve the proposed approach to developing a multi-supplier

procurement framework and developing a list of Approved Suppliers of professional support

services.

The board is further recommended to approve a retendering exercise for the annual audit.

3

25

Appendix 1

Approved Suppliers List for Professional Advisers

Process

Suppliers currently providing professional support services to the LEP will be invited to

apply to for the Approved Suppliers List and join one lot or multi lots.

To ensure fairness and transparency, an open invitation to apply for the Approved

Suppliers List will be published on the LEP’s website.

Approved suppliers will be notified in writing once they have been accepted on the

Approved Suppliers List.

The list of approved suppliers will be published on the New Anglia LEP website.

New Anglia LEP will review the evaluation criteria for entry onto the Approved Suppliers

List on an annual basis and if any changes are made to the criteria, existing suppliers

will be asked to provide additional information.

At the end of each year all suppliers who are on the Approved Suppliers List will have

their performance and scores reviewed based on the quality of quotes and performance

delivering any projects. Where we consider suppliers have consistently been unable, or

unwilling, to meet our requirements over the course of the year we will remove suppliers

from the Approved Suppliers List.

Suppliers being removed from the Approved Suppliers List will be notified in writing and

will have two weeks to appeal against the decision.

New suppliers wishing to join or re-join the Approved Suppliers List will be asked to

provide information to support their application in line with the Invitation to join the

Approved Supplier List and will be evaluated against the appropriate criteria.

No time limit has been placed on the termination of the LEP’s Approved Suppliers List;

this will be reviewed on an annual basis.

The terms and conditions for the Preferred Supplier List will be as attached in the terms

and conditions document. These terms will apply to all work carried out under the

Preferred Supplier List.

The scope of work, price and timescales will be agreed on a project-by-project basis

and will in no way amend the terms and conditions that override this whole agreement.

A record of results of evaluations will be maintained - which will include any necessary

actions taken as a consequence of the evaluations conducted, such as the removal of a

supplier from the Approved Suppliers List.

4

26

Appendix 2

New Anglia Local Enterprise Partnership

Procurement Procedures

Last Updated 01-11-16

Introduction

New Anglia LEP maintains a purchasing and procurement policy whereby all purchases

must be approved according to the rules outlined by these procedures. Procurement

exercises must be reviewed and approved by a member of the Senior Management Team

and in accordance with the thresholds outlined and within the law as set out by The Public

Contracts Regulations 2015.

Estimating Contract Values

The value of a proposed Contract must be estimated before undertaking a procurement

exercise as this will determine which rules apply. The value of a contract is the estimated

consideration to be paid over its full term and not simply the estimated annual expenditure,

therefore a three year contract at £50,000 per year has a value of £150,000. The amounts

quoted are gross values (i.e. total estimated cost to the LEP before any deductions) for the

full period of a contract and all exclude VAT and other taxes.

Contracts of a similar nature must not be artificially split into different parts to avoid the

application of a contract threshold. At the same time, contracts of a recurring or similar

nature must be joined together into one contract and valued accordingly. If there is any

doubt as to whether contracts must be aggregated, advice must be taken from the LEP’s

Programmes Manager. However, in some circumstances it may be permissible to

separate requirements into smaller contracts (only if there is a good reason) and providing

that if these contracts opportunities are then competed in line with EU OJEU rules. If in

doubt, procurement will follow the procedures for the highest contract value to ensure

compliance.

Before undertaking a procurement, the officer must consider whether a subsequent

contract (such as, for instance, future phases in a works programme where only the initial

phase is the subject of the immediate procurement) may be awarded to the successful firm

by negotiation and without further competition, in the event of the successful firm

completing the initial phase satisfactorily.

1

27

Appendix 2

Procurement Procedure

Contracts will be entered into pursuant to or in connection with the project’s functions and

shall comply with any applicable statutory provisions and relevant EU rules. The eligibility,

financial standing and technical capacity of contractors must be evaluated and recorded.

Procurement must follow the principles of best value, non-discrimination, equality of

treatment and transparency. The following contract value thresholds apply: -

Estimated value

Action

See Page

Under £2,500

Evidence retained to show that Value for Money

Page 3

has been obtained through a price comparison

£2,500 - £25,000

At least 3 written quotes from suitable suppliers,

Page 3

using full tender procedure, if appropriate

Above £25,000 but

Complete a full tendering procedure

Page 3

below OJEU

Thresholds

Above OJEU

OJEU regulations must be followed

Page 6

thresholds

Contracts for Supplies - £164,176 (€207,000)

Contracts for Services - £164,176 (€207,000)

Contracts for Works - £4,104,394 (€5,225,000)

As part of the procurement process, officers

must check the latest current OJEU thresholds

Record Keeping

This applies to all tenders of any value

Page 8

NOTE: For EU funded activity, any procurement above £2,500 must be accompanied with

an “On The Spot Verification Visit Procurement Check Record (Above and below OJEU)

ESIF-Form-4-014” and submitted with the evidence required.

Procurement below OJEU Thresholds

Contracts that are not subject to OJEU requirements must be conducted in line with

procurement best practice and also in line with the principles of the EC Treaty and within

EU Regulations and UK law, to afford fairness, competition and transparency in public

procurement.

Any procurement, regardless of the value there needs to sufficient advertising to enable

competition amongst suppliers. And that the procurement procedures followed must be fair

and transparent.

2

28

Appendix 2

Contracts under £2,500

Low value purchases of under £2,500 must have documentary evidence, which must be

retained to show that Value for Money has been obtained (e.g. through a price

comparison). Where possible, it is advised that written quotes, or cost comparisons are

obtained from three different suppliers, with records of quotes retained.

Contracts between £2,500 and £25,000

For purchases above £2,500 but under £25,000 written quotes should be obtained from at

least three suppliers. Quotes should be in response to clearly defined requirements and

the requirement given to suppliers must be the same in all cases.

Quotes should be received in writing and the supplier meeting the requirement and the

Most Economically Advantageous (MEA) offering selected. The minimum minimum

number of quotes is three, however, it may be beneficial to obtain more quotes in a

competitive market. If requirement falls below the £25,000 threshold but is considered to

be a high risk it may be worth completing a full tendering process as one would for above

the £25,000 threshold detailed in the section “Above £25,000 but below OJEU

Thresholds”.

In exceptional circumstances there may be a contract specification that is considered to be

so specialist as to limit the number of suppliers who may be able to quote. In such

circumstances a full record will be kept detailing the research undertaken to arrive at this

conclusion. A member of the leadership team will be required to approve this in such

circumstances.

For EU funded activity, any procurement above £2,500 must be accompanied with an “On

The Spot Verification Visit Procurement Check Record (Above and below OJEU) ESIF-

Form-4-014” and submitted with the evidence required.

Above £25,000 but below OJEU Thresholds

Tenders above £25,000 should be advertised adequately in order to promote open and fair

competition. When valuing the requirement it is vital to bear in mind that it is the overall

value of the total requirement (the total consideration payable) that is important, not the

value of individual contracts. It is not permissible to try and break down a requirement into

smaller constituent requirements in order to by-pass the constraints imposed on

procurement.

3

29

Appendix 2

Tenders must be invited by way of a written Invitation to Tender and where appropriate,

sought through an Electronic Tendering System (ETS), which in the case of the LEP will

involve publishing the tender on the Contracts Finder website

and opened through the system at the relevant deadline.

Suppliers must be given a reasonable timeframe for responding to the requirement and

preparing a quote, therefore, a minimum of thirty-five days notice must be given.

However, in exceptional circumstances, there may be a case for this time period to be

shortened. If this is to be done, there must be a justified case that is approved by the

Managing Director. In such circumstances, a minimum of fifteen days notice must be

given.

When analysing quotes, the purchaser should look out for any hidden costs or terms that

are not in the best interests of the Institution. Examples of hidden costs may be

maintenance payments or automatic renewal for subscription services.

If necessary a pre-qualification process can be put into place in order to restrict the

number of suppliers that will be receiving an Invitation to Tender. Qualification should be

based on the capacity and capability of suppliers to fulfil the requirement as opposed to

any specific parts of the requirement. If a pre-qualification process takes place, at least

three suppliers should be taken forward to the Tendering stage. The selection criteria

should be, proportionate, objective and the selections justifiable.

A Tender Assessment Form should be prepared at the point that invitations to tender are

published. It is essential that the assessment criteria and weightings of the document are

agreed at this stage and an Assessment Panel appointed, comprising individuals qualified

to critically and objectively assess tender submissions against the

requirements/specifications within the Invitation to Tender.

Tender submissions received after the stated deadline should be recorded on the Tender

Assessment Form and rejected from the assessment process. Similarly, submissions

which do not meet the requirements set out within the Invitation to Tender should be

recorded within the Tender Assessment Form and rejected from the assessment process.

Submissions meeting requirements should be recorded within the Tender Assessment

Form and included in the assessment process.

The Assessment Panel should meet to assess tender submissions, each member using a

copy of the Tender Scoring Sheet to evaluate and score each tender submission against

the requirements/specifications within the Invitation to Tender.

4

30

Appendix 2

The Assessment Panel is subject to declarations of interest. These must be declared prior

to the assessment of tender submissions. Any such panel members should be substituted

for another suitably-qualified individual. A declarable conflict of interest is a set of

circumstances that creates a risk that professional judgment and actions regarding and

influence of a primary interest - the business of the Assessment Panel - will be unduly

influenced by a secondary interest. For these purposes, secondary interests include

financial/pecuniary interests and strategic interests relating to a third party.

Assessment Panel members must declare an interest if they are or become aware that

they have or may have a financial or other beneficial interest in the outcome of a

procurement exercise being considered.

At the conclusion of the assessment, the individual scores assigned should be transposed

from the individual Tender Scoring Sheets into the three Tender Score Matrices within the

Tender Assessment Form. The totals should then be transposed into onto the Collated

Tender Score. The highest scoring tender will be deemed successful, provided it has met

the minimum requirements outlined in the Invitation to Tender.

The name of the successful tendering party should be recorded in the Tender Assessment

Form, any specific conditions/queries noted and the document signed off by all members

of Assessment Panel.

All parties submitted tenders should be contacted via email to notify them of the outcome

of the assessment process and a contract agreed. A fully documented audit trail of the

procurement process, including original signed documentation, is to be retained within

project files and managed in accordance with document retention procedures.

For EU funded activity, any procurement above £2,500 must be accompanied with an “On

The Spot Verification Visit Procurement Check Record (Above and below OJEU) ESIF-

Form-4-014” and submitted with the evidence required.

Procurement above the OJEU Thresholds

OJEU applies when the total estimated value of a contract is more than the EU Thresholds

(£164,176 (€207,000) for Supplies, £164,176 (€207,000) Services and £4,104,394

(€5,225,000) for Works), then the EU Public Procurement Rules apply. In these cases a

minimum of five EU Tenders must be sought. As part of the procurement process, officers

must check the latest current OJEU thresholds.

5

31

Appendix 2

When the estimated value of a contract is above the EU (OJEU) threshold the full

regulations governing procurement apply. When valuing the requirement it is vital to bear

in mind that it is the overall value of the total requirement (the total consideration payable)

that is important, not the value of individual contracts. It is not permissible to try and break

down a requirement into smaller constituent requirements in order to by-pass the

constraints imposed on procurement.

OJEU Tenders must be invited by way of a written Invitation to Tender and sought through

an Electronic Tendering System, which in the case of the LEP will involve publishing the

be necessary to publish a notice in the Official Journal of the European Union (“OJEU

Notice”). Only firms who express interest in the OJEU Notice in the manner stipulated in

that OJEU Notice may be invited to tender. EU Tenders must be returned and opened

through this system at the relevant deadline. Invitation to Tender is a detailed

procurement-specific document.

It should be noted that it is it permissible to separate requirements into smaller contracts (if

there is good reason) if these contracts opportunities are then competed in line with EU

OJEU rules. Failing to do this could be regarded as an attempt to deliberately

disaggregate the requirement, hence this practice is prohibited under the EU Procurement

Regulations.

Invitations to tenders should be issued using the LEP’s Invitation to Tender Template and

advertised via media with adequate scope and relevant audience for thirty-five days (30 if

the process is being conducted electronically, i.e. via email)*. Advertising channels should

include New Anglia LEP social media and third party tenders websites, particularly the

If necessary a pre-qualification process can be put into place in order to restrict the

number of suppliers that will be receiving an Invitation to Tender. Qualification should be

based on the capacity and capability of suppliers to fulfil the requirement as opposed to

any specific parts of the requirement. If a pre-qualification process takes place, at least

three suppliers should be taken forward to the Tendering stage. The selection criteria

should be, proportionate, objective and the selections justifiable.

A Tender Assessment Form should be prepared at the point that invitations to tender are

published. It is essential that the assessment criteria and weightings of the document are

agreed at this stage and an Assessment Panel appointed, comprising individuals qualified

to critically and objectively assess tender submissions against the

requirements/specifications within the Invitation to Tender.

6

32

Appendix 2

Tender submissions received after the stated deadline should be recorded on the Tender

Assessment Form and rejected from the assessment process. Similarly, submissions

which do not meet the requirements set out within the Invitation to Tender should be

recorded within the Tender Assessment Form and rejected from the assessment process.

Submissions meeting those requirements should be recorded within the Tender

Assessment Form and included in the assessment process.

The Assessment Panel should meet to assess tender submissions, each member using a

copy of the Tender Scoring Sheet to evaluate and score each tender submission against

the requirements/specifications within the Invitation to Tender.

The Assessment Panel is subject to declarations of interest. These must be declared prior

to the assessment of tender submissions. Any such panel members should be substituted

for another suitably-qualified individual. A declarable conflict of interest is a set of

circumstances that creates a risk that professional judgment and actions regarding and

influence of a primary interest - the business of the Assessment Panel - will be unduly

influenced by a secondary interest. For these purposes, secondary interests include

financial/pecuniary interests and strategic interests relating to a third party.

Assessment Panel members must declare an interest if they are or become aware that

they have or may have a financial or other beneficial interest in the outcome of a

procurement exercise being considered.

At the conclusion of the assessment, the individual scores assigned should be transposed

from the individual Tender Scoring Sheets into the three Tender Score Matrices within the

Tender Assessment Form. The totals should then be transposed into onto the Collated

Tender Score. The highest scoring tender will be deemed successful, provided it has met

the minimum requirements outlined in the Invitation to Tender.

The name of the successful tendering party should be recorded in the Tender Assessment

Form, any specific conditions/queries noted and the document signed off by all members

of Assessment Panel.

All parties submitted tenders should be contacted via email to notify them of the outcome

of the assessment process and a contract agreed. A fully documented audit trail of the

procurement process, including original signed documentation, is to be retained within

project files and managed in accordance with document retention procedures.

For EU funded activity, any procurement above £2,500 must be accompanied with an “On

The Spot Verification Visit Procurement Check Record (Above and below OJEU) ESIF-

Form-4-014” and submitted with the evidence required.

7

33

Appendix 2

Record Keeping

Any written records relating to a procurement exercise, whether kept under these Rules or

otherwise, should be retained for a period of at least six years from the expiry of the

Contract. Records may, so far as they relate to unsuccessful quotations or tenders, may

be electronically scanned or stored by some other suitable method after 12 months from

the award of the contract, provided there is no dispute about the award.

An external funder may impose different requirements in this respect and this should be

checked if any such funding is being provided.

New Anglia LEP will regularly review applicable OJEU thresholds and update this policy as

required to comply with UK Law as well as EU Regulations.

8

34

New Anglia Local Enterprise Partnership Board

Wednesday 18th April 2018

Agenda Item 9

New Anglia LEP Decision Log

Author: Chris Starkie

Summary

This paper introduces the LEP’s new Decision Log, which will record decisions made by the

LEP’s key boards and committees.

This is being introduced as part of the implementation of the PwC review of operations and

governance and follows the board’s adoption of the scheme of delegation at March’s board

meeting

Recommendation

The board is asked to endorse the LEP’s new decision log.

Background

The PwC review of operations and governance recommended the development of a decision

log which would enable decisions made by the key boards and committees to be recorded in a

single document.

This log will record decisions made by the LEP board, the LEP’s investment Appraisal

Committee, the Remuneration Committee, the Audit and Risk Committee and the Growing

Business Fund Panel.

Decisions made by other committees and boards can be added as appropriate.

A copy of the log is attached at Appendix 1. This has been populated with the decisions made

at March’s LEP board meeting.

The information included in the log will be taken from the minutes produced by each board or

committee and added to the log when the minutes for each are published on the LEP website.

Minutes must be published online within 10 working days of the meeting.

The log will be included in the board papers for each LEP board meeting and will also be

published on the LEP website.

Link to the Economic Strategy

A central remit of the LEP is the coordination of the delivery of the Economic Strategy. A

decision log will ensure greater transparency of decision making and improve the links between

different boards and committees. This will improve the join up and coordination of decisions

which will help in the delivery of the strategy.

1

35

Recommendation

The board is asked to endorse the LEP’s new decision log.

2

36

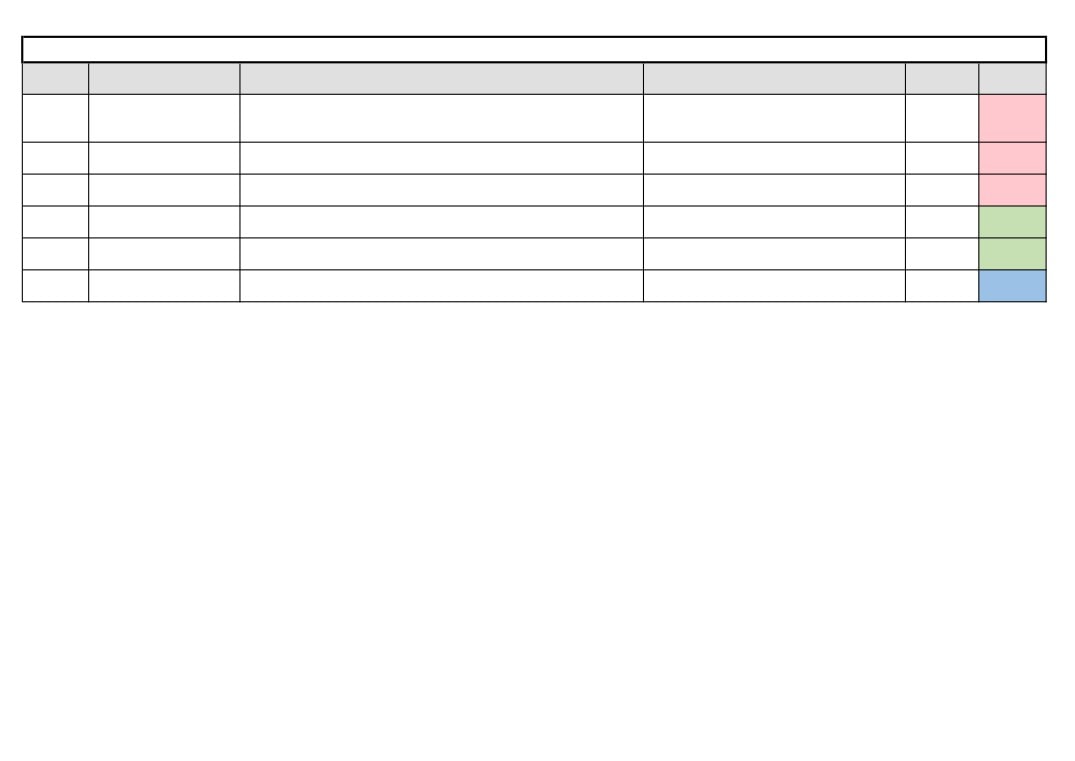

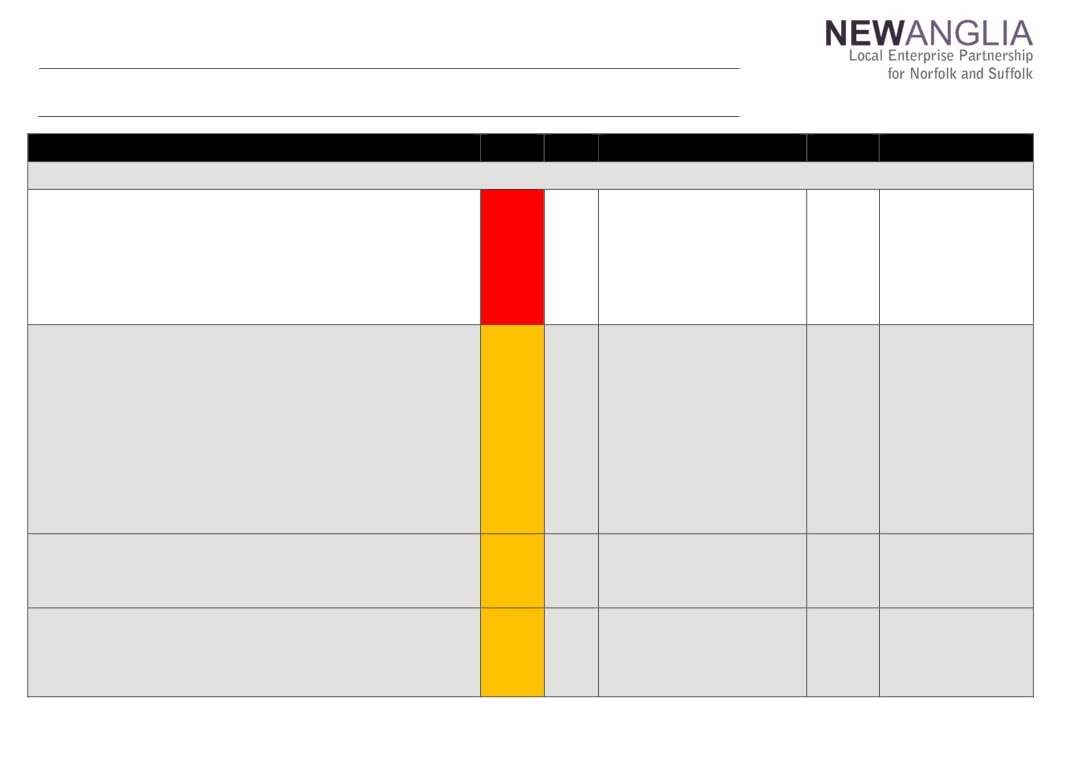

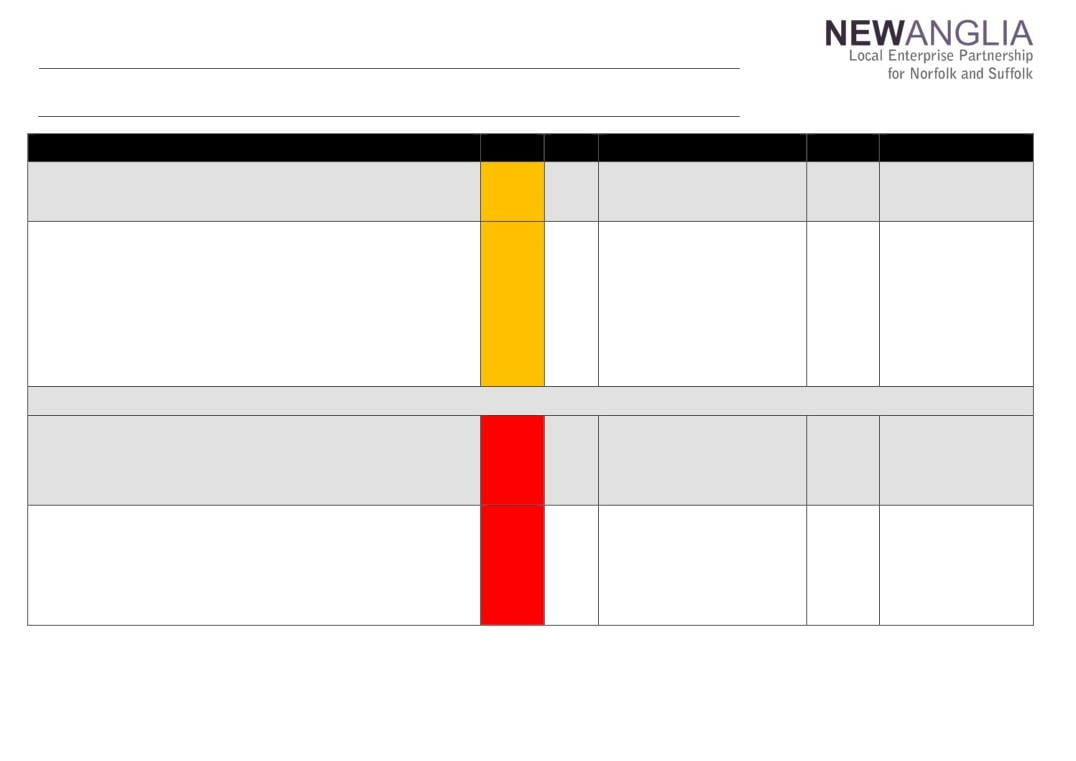

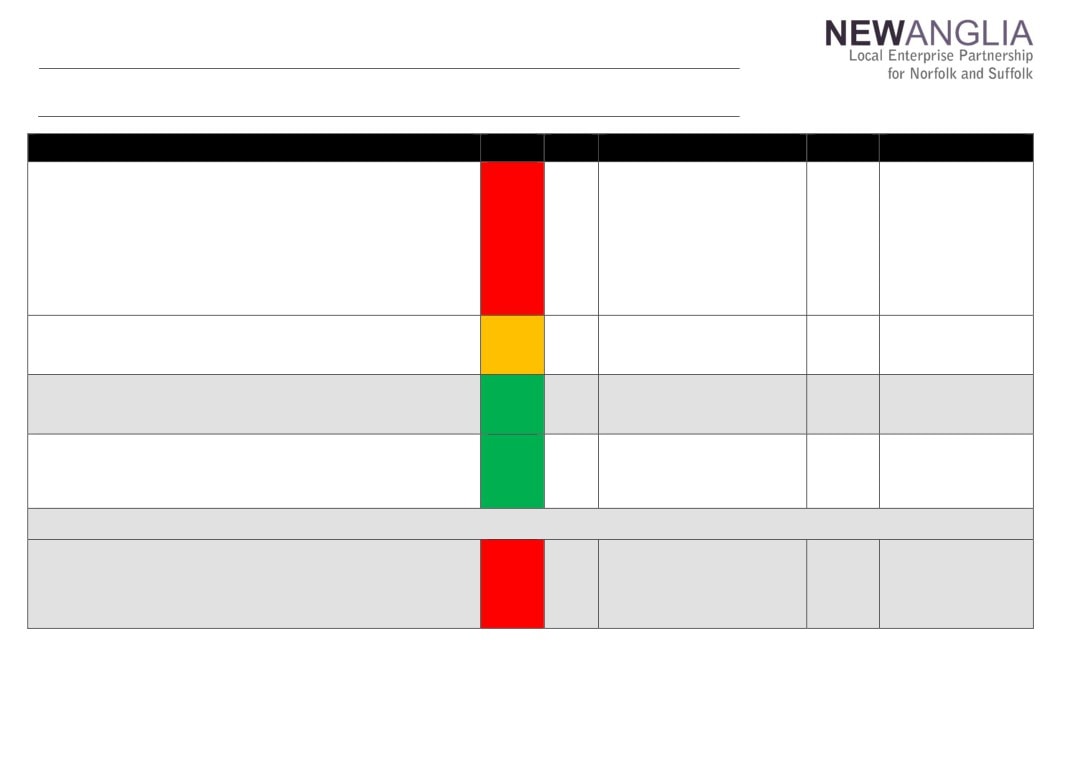

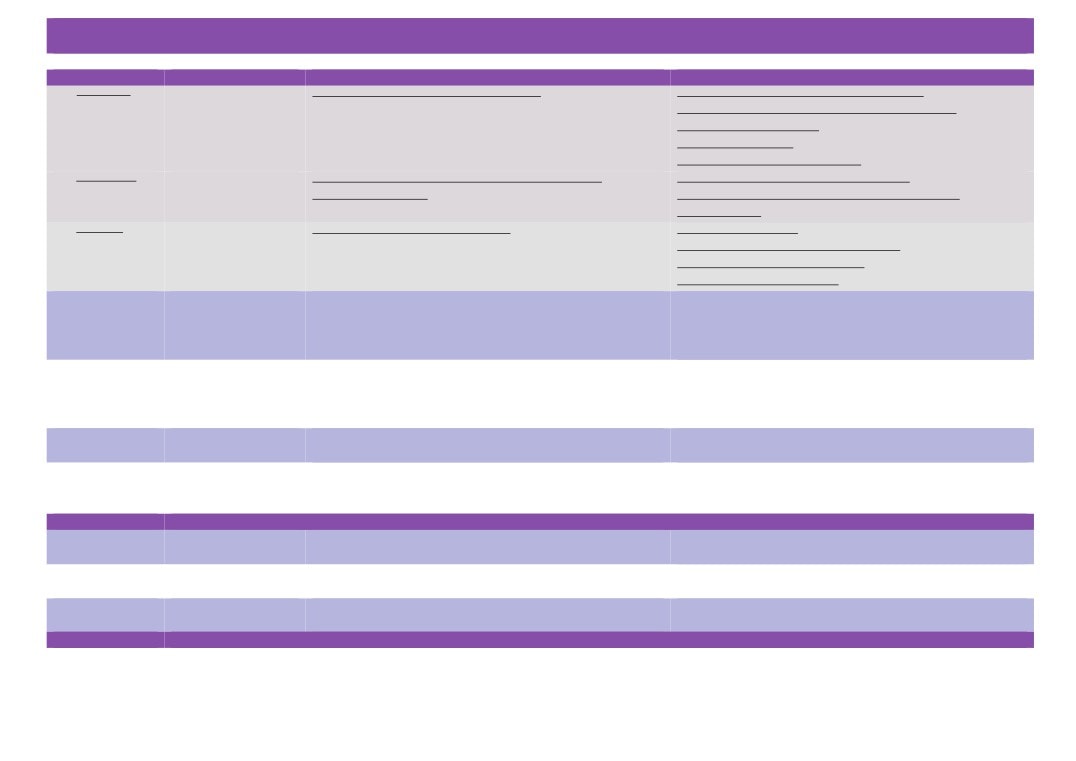

Decision Log

Date

Decision

Decision Made

Comments

Making

Body*

21/03/18

LEP Board

6. Institute of Technology

To support and promote the proposal and the activities of the LEP to help development of the bid

7. 2018/2019 Budget

To approve the operating budget for 2018/2019

To publish the approved budget in the public domain

8. Capital Growth Programme Bid - Snetterton Heath

To approve the Capital Growth Programme grant funding of £2.65m to the Snetterton Heath

Employment Areas Electricity upgrade Scheme subject to the inclusion of a clawback clause 9.

Growth Deal Funding Change Request - NATS Packages

To agree the transfer of £350,000 from NATS A11 Corridor Package to the NATS City Centre

Package.

To the inclusion of the Plumstead Road roundabout scheme into the NATS City Centre Package

and use of £400,000 of previously allocated funds.

10. Growth Deal Funding Change Request - Cornhill

To provide an additional £50k to cover the shortfall in the funding

11.Growing Places Fund - Atex Business Park

To receive a revised paper at the April board meeting

12 Scheme of Delegation

To approve the LEP’s Scheme of Delegation subject to the above revisions.

7

New Anglia Local Enterprise Partnership Board

Wednesday 18th April 2018

Agenda Item 11 - Chief Executive’s Report

Author: Chris Starkie

Summary

This report provides a snapshot of LEP team activities since the March board meeting

(Overview) and more detailed information on other key issues, projects and engagement

activity since the March board meeting (LEP actions and activity)

Recommendation

The board is asked to note to contents of the report

Overview:

This section provides a snapshot of LEP team activity since the March board meeting

LEP Programmes Delivery

Growth Deal

The focus of the Growth Deal team has been accelerating expenditure by partners

ahead of the end of the financial year and developing the capital budget for the 18/19

financial year.

The team increased the amount claimed and paid to projects by £16.2m in March,

making a total spend for the year of £28.62m.

This means £12.71m has been carried forward, but £12m is anticipated to be spent in

the first quarter of 2018. For more information on the performance of the Growth Deal

programme see agenda item 10. For details of the proposed Capital Budget see

agenda item 7.

Growth Programme

Growth Programme continues to deliver well against the programme outputs. Recent

highlights include:

The Growth Hub has now engaged with over 7,000 businesses since the

Growth Programme began, 94% of the programme target.

173 small grants have now been awarded through the programme, with a total

value of £1.679m.

Private match funding generated by the Small Grant Scheme is now forecast to

exceed £7.27m

However concerns have been raised by Government regarding the rate at which

businesses are claiming funds they have been awarded.

This has formed the centre piece of a discussion around our proposed three year

extension to the programme. There is more information on this in the main report

below.

1

45

New Anglia Local Enterprise Partnership Board

Wednesday 18th April 2018

Agenda Item 11 - Chief Executive’s Report

Author: Chris Starkie

Growing Business Fund

The Growing Business Fund enjoyed a strong end to 2017/18, with a number of grants

paid out in the last few weeks of the year, bringing the total spend figure to over £3m. In

addition, the carried-forward commitment into 2018/19 is £1.6m, with a good start to the

year’s delivery and spend anticipated as a result.

Enterprise Zones

A campaign to promote the second birthday of the Space to Innovate Enterprise Zones

has received significant online and press coverage.

The campaign included a video profiled businesses on the Space to Innovate sites,

which is hosted on the LEP website and which has received over 1,000 views through

social media.

The press release about the successful first two years for the Zone received coverage

online and in print media. A digital toolkit was produced and shared with local authority

communications teams to encourage their input into the campaign. Plans are now

under way to create monthly video blogs on a wide range of themes.

LEP Communications

In addition to the EZ campaign, the approval of Capital Growth Programme funding for

an electricity update at Snetterton received significant positive media coverage, in both

print and online.

The LEP team attended a number of business and networking events, including Lisa

Roberts speaking about the economic strategy at the Newmarket Chamber of

Commerce and Doug Field speaking at the Suffolk Chamber of Commerce business

leaders’ dinner.

LEP Finances

Management accounts for the year to 31 March 2018 - year to date income just under

£1,383k with an operating surplus of just over £185k which is ahead of budget by

£140k.

Operating cash balance is £212k which is in line with management expectations.

The LEP draft capital budget has been developed and will be discussed in more detail

under Agenda item 7.

2

46

New Anglia Local Enterprise Partnership Board

Wednesday 18th April 2018

Agenda Item 11 - Chief Executive’s Report

Author: Chris Starkie

LEP actions and activity:

This section provides a detailed update on other activities and key issues since the March board

meeting

Deep Dive

The Government has issued its draft report on the Deep Dive it conducted of New

Anglia LEP during February.

Board members will recall that in the Annual Conversation process with Government,

New Anglia LEP was rated one of the top four performing LEPs nationally.

The annual conversation measured all LEPs in three categories - governance, delivery

and strategy.

New Anglia LEP was judged exceptional in governance and strategy (the highest

category) and good in delivery. This gave us an overall rating of good with exceptional

qualities.

As a consequence of this, the LEP was asked to assist with the Government’s Deep

Dives of underperforming LEPs. We were a “control” deep dive.

The draft report following the Deep Dive has given the LEP the top score in all six

categories which it examined - giving us an overall exceptional rating.

It should be stressed this is a draft report and therefore could be subject to change.

Nonetheless it is a great achievement to be rated as exceptional in all categories.

Copies of the final report will be circulated to board members when signed off by

Government, which is expected to be in a few weeks time.

Growth Programme

As highlighted above, the New Anglia Growth Programme is overall continuing to

perform well.

The programme is the LEP’s main business support programme incorporating the

Growth Hub, small grants programme and business support programmes run by

partners MENTA and NWES.

It is due to come to an end in August this year, and the LEP submitted a bid to Ministry

of Housing, Communities and Local Government for a three year extension.

3

47

New Anglia Local Enterprise Partnership Board

Wednesday 18th April 2018

Agenda Item 11 - Chief Executive’s Report

Author: Chris Starkie

The MHCLG have raised some concerns about the performance of part of the

programme which could impact on the extension, and last month Doug Field and Chris

Starkie met with officials to discuss their concerns.

The chief concern is with the small grants programme. Whilst the programme has

awarded its full allocation of grants, there is a delay in businesses claiming their grants.

To date more than £1.6m of grants have been awarded to 173 companies. However

less than half the grants have been claimed by the businesses.

The programme had always anticipated a timelag of around four months between

award and claim of the funding as businesses need to evidence matched funding and

have all permission in place before funding can be released.

However the average turnaround time is around seven months. In order to tackle this

issue we have instigated an action plan, which will involve much more proactive

engagement with the businesses to support them in submitting their claims.

Rather than relying on the businesses to contact our claims team, we will be more

proactive. This will also enable us to understand if businesses do not wish to pursue

their application.

Having submitted a full plan to MHCLG we expect to continue discussions with them

over the extension over the next few weeks.

Suffolk Health and Wellbeing Board

Doug Field and Chris Starkie met with Councillor Tony Goldson chairman of the Suffolk

Health and Wellbeing Board and director of public health Abdul Razaq.

The purpose of the meeting was to see how the LEP could engage with the board’s

agenda, and how the board could support the LEP’s Economic Strategy.

The meeting agreed that there were a significant number of areas where the ambitions

of both organisations aligned.

For example issues such as improving workplace health - which will in turn boost

productivity which is a key target in the Economic Strategy.

An offer was made for a representative from the LEP to join the health and wellbeing

board.

Given the nature of the meetings it is suggested that initially it should be a senior

member of the executive team (CEO or COO), with feedback provided to the LEP

board through the chief executive’s report.

Unilever and Britvic

Unilever has confirmed the closure of its Carrow Works site following its consultation,

which began at the start of the year.

4

48

New Anglia Local Enterprise Partnership Board

Wednesday 18th April 2018

Agenda Item 11 - Chief Executive’s Report

Author: Chris Starkie

Colleagues from Norwich City Council, Norfolk County Council and the LEP are

meeting with Unilever and Britvic to understand next steps for both companies.

This will include the provision of support to employees as well as beginning discussions

about the future use of the site, which is a priority employment site for Norwich.

The LEP and partners are also continuing to engage with the growers consortium which

is planning to build a new mustard mill and processing plant for mustard and mint in the

Norwich area.

Great Eastern Main Line Taskforce

The Taskforce met on 27 March and agreed the proposed timetable for refreshing the

evidence base and developing an updated business case which is being led by New

Anglia LEP in collaboration with Essex County Council.

This will require a financial commitment from the LEP. Support is also being provided

by Norfolk and Suffolk County Council colleagues.

The aim is to launch the new business case in the Autumn. The LEP will also re-

energise the network of supporters by leading a renewed business stakeholder

engagement programme during the summer/autumn.

At the Taskforce meeting the Department for Transport also launched its new approach

to funding rail enhancements.

All requests for rail enhancements need to be supported by robust business cases in

future which satisfies Government that they can be delivered to the agreed cost and

provide the stated benefits.

Business cases supported by third party investment will be prioritised for investment.

Guidance has also been published to ensure the process for taking forward third-party

proposals and engaging with Government is as clear as possible.

A47 Dualling Campaign

On the 19 March the LEP attended the Norfolk Chamber of Commerce launch event of

the A47 #justdualit campaign. The Chamber are running the campaign with Norfolk

County Council and the EDP. The event was attended by Roads Minister, Jesse

Norman MP as well as a number of local MPs and politicians.

The campaign builds on the success of the previous campaign of the A47 Alliance, for

which the LEP is a member, to deliver improvements along the A47 as part of the first

Roads Investment Strategy.

5

49

New Anglia Local Enterprise Partnership Board

Wednesday 18th April 2018

Agenda Item 11 - Chief Executive’s Report

Author: Chris Starkie

The campaign is seeking full dualling of the route with early priority sections highlighted

for the Acle Straight and Tilney to East Winch sections (including the Hardwick flyover).

The A47 is a priority growth corridor in the Economic Strategy.

EAST Branding Workshop

A branding workshop was arranged by Head of Communications Hayley Mace with

Head of Enterprise Zones & Innovation Manager Julian Munson and involved Board

Members Jeanette Wheeler, Steve Oliver and Sandy Ruddock.

The discussion builds on earlier work following development of ‘The East’ brand which

has already been applied to a number of marketing campaigns and activities, including

the Economic Strategy, commercial sites prospectus (MIPIM) and targeted sector

campaigns for inward investment. The East brand, although a ‘product’ of the LEP, is

used for shared projects and belongs to all.

The main objectives for the workshop session, held on April 4th, were to advance this

activity and specifically to;

1) Share ideas and create consensus about how we brand the region

2) Provide an opportunity for key decision makers to help define the brand and its

values

3) Discuss brand applications and the role that the LEP should play

Best practice examples of place branding and promotion from other areas were

discussed including Leeds, Manchester, Cornwall, Netherlands, Copenhagen and

Waterloo in Canada.

The following was agreed;

Undertake a high level external review of ‘The East’ core messaging, narrative and

brand identity with respect to the various audiences

(including international),

building on earlier work

Develop and progress this work as part of the new inward investment strategy

(under development)

Develop an operational plan with key marketing activity including the development

of a new web based portal

(for inward investment and sector information),

marketing collateral (investment prospectus/brochure) and events activity plan

Prepare an overall costed plan with timeline and milestones

(which will be

presented to the LEP Board for discussion)

A progress update for the LEP Board is expected within a couple of months.

Ipswich Vision

Since the summer of 2017 the Ipswich Vision now has a new Chair, Terry Hunt, a new

logo and a new website. A review of the Vision was also undertaken last year and has

resulted in the formation of 7 work streams, each headed up by a board member and

6

50

New Anglia Local Enterprise Partnership Board

Wednesday 18th April 2018

Agenda Item 11 - Chief Executive’s Report

Author: Chris Starkie

each group having a particular remit, covering all aspects of the Vision and its original

objectives.

Updates on our main projects include

The Cornhill Regeneration project started in January and is due to complete at

the end of October 2018.

The alignments for the Upper Orwell Crossings were released this Spring with

the revised bridge designs being published in early summer. Formal public

consultation will start in September this year.

The Public Realm Strategy has been an ongoing project since last summer. The

final report is due in May. This will form a supplementary planning document to

assist in the delivery of further public realm improvements including in 2019 the

St Peter’s Dock area of the Waterfront.

The Hold Heritage Centre Project was awarded £10m from the Heritage Lottery

Funding last week.

Work has started on the Winerack and the Malthouse. Birketts are shortly to

move into their new offices on Princes Street (part of the Enterprise Zone).

LEP flood defence or alleviation projects across England

At a previous board meeting, board members asked whether other LEPs had supported

flood defence schemes across England.

The request followed the New Anglia LEP’s investment in schemes in Ipswich,

Lowestoft and Bacton and funding bid from Great Yarmouth.

A handful of LEPs appear to be supporting flood defence schemes, although

information has been difficult to source from some LEP websites and there is no central

information source.

Examples include:

Humber LEP

Flood risk alleviation projects in Hull and East Riding are being supported with £2.14m

supporting land purchase for the Holderness Drain Flood Alleviation Scheme and £5m