New Anglia Local Enterprise Partnership Board Meeting

Wednesday 21st March 2018

10.00am to 12.30pm

The Jockey Club, 101 High St, Newmarket, Suffolk CB8 8JL

Agenda

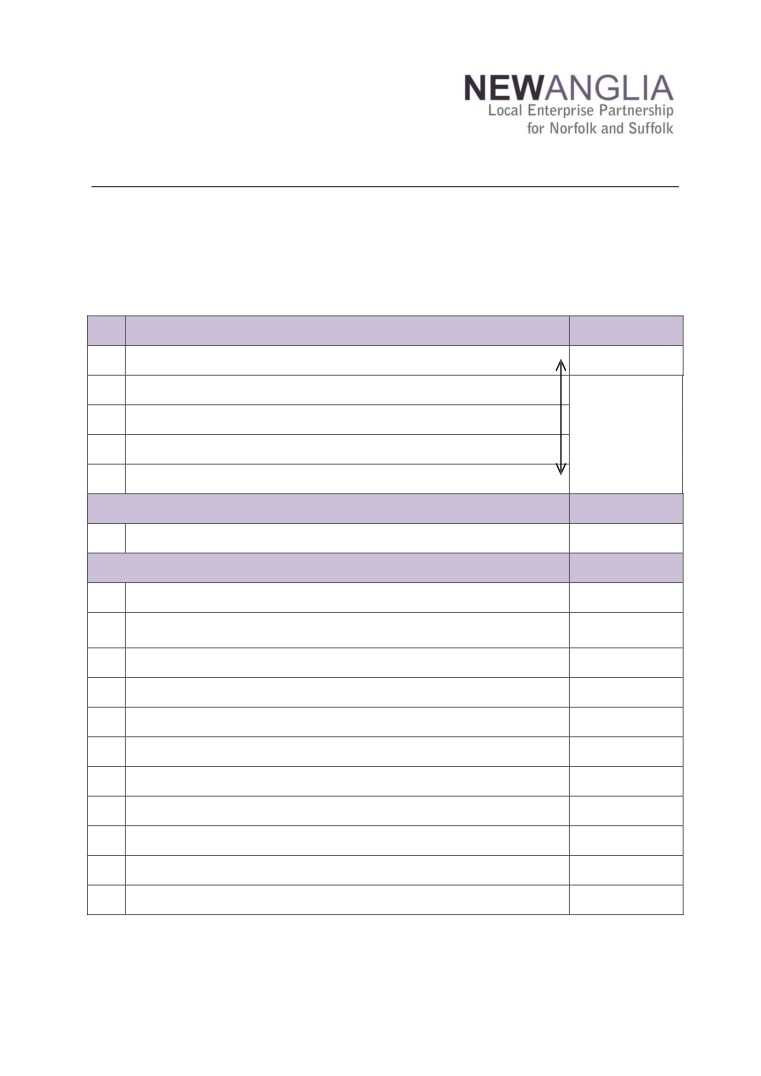

No.

Item

Duration

1.

Welcome

20 mins

2.

Apologies

3.

Declarations of Interest

4.

Horse Racing Industry Presentation from Rachel Hood

5.

Actions / Minutes from the last meeting

Forward looking

30 mins

6.

Institute of Technology - Confidential

Update

Governance and delivery

100 mins

7.

2018/2019 Budget - Confidential

For approval

Capital Growth Programme Bid - Snetterton Heath including

8.

For approval

Confidential Appendices 2 and 3

9.

Growth Deal Funding Change Request - NATS Packages

For approval

10.

Growth Deal Funding Change Request - Cornhill

For approval

11.

Growing Places Fund - Atex Business Park - Confidential

For approval

12.

Scheme of Delegation

For approval

13.

Chief Executive’s report including PwC Implementation Plan

Update

14.

Finance Report including Confidential Appendices

Update

15.

Board Forward Plan

Update

16.

Any Other Business

Update

Date and time of next meeting: 18th April 2018. 10am-12.30pm

Venue: The Green Britain Centre, Turbine Way, Swaffham PE37 7HT

1

New Anglia Board Meeting Minutes (Unconfirmed)

21st February 2018

Present:

Cllr David Ellesmere (DE)

Ipswich Borough Council

Doug Field (DF)

East of England Coop

Cllr Cliff Jordan (CJ)

Norfolk County Council

Dominic Keen (DK)

High Growth Robotics

Colin Noble (CN)

Suffolk County Council

Steve Oliver (SO)

MLM Group

Cllr Andrew Proctor (AP)

Broadland District Council

Johnathan Reynolds (JR)

Nautilus

Prof David Richardson (DR)

UEA

Lindsey Rix (LR)

Aviva

Sandy Ruddock (SR)

Scarlett & Mustard

Jeanette Wheeler (JW)

Birketts

In Attendance:

Vivienne Gillespie (VG)

Suffolk New College (For Nikos Savvas)

Mike Stonard (MS)

Norwich City Council (For Alan Waters)

Vince Muspratt (VM)

Norfolk County Council (For Tracy Jessop)

Shan Lloyd (SL)

BEIS

Chris Dashper (CD)

New Anglia LEP

Chris Starkie (CS)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

Sue Roper (SuR)

Suffolk County Council

Steven Greenwood (SG)

Cities and Local Growth Unit

Peter Sutton (PS)

Cities and Local Growth Unit

Jeannine Hoeckx

Government Internal Audit Agency

Patrick White (PW)

Metro Dynamics - For Items 6 and 7

Page 1 of 6

3

Actions from the meeting: (21.02.18)

Declarations of Interest - Ascertain whether regular Board substitutes need to complete

CS

Declaration of Interest Forms.

Economic Indicator Trajectories and Targets: To receive a paper on CO2 reductions for

CS/JR

consideration of inclusion in the economic strategy targets.

Brexit Analysis - To receive an action plan detailing the next steps, timescales and measures of

LiR

success

Governance Review - To receive a proposed scheme of delegation and decisions log at the

CS

March meeting

1

Welcome from the Chair

Doug Field (DF) welcomed everyone to the meeting and thanked Lindsey Rix for hosting. He welcomed

the attendees including Vivienne Gillespie, deputising for Nikos Savvas, Mike Stonard deputising for Alan

Waters and Vince Muspratt, deputising for Tracy Jessop.

Chris Starkie (CS) updated the meeting on the Annual Conversation and the resulting deep dives being

carried out on a number of underperforming LEPs. New Anglia has been identified as a high performing

LEP and will be used as a control deep dive over the next 3 days. DF then welcomed those carrying out

the deep dive namely Jeannine Hoeckx who was in attendance and Steven Greenwood and Peter

Sutton, who joined the meeting at 10.20.

2

Apologies

Apologies were received from:

Cllr Alan Waters

Cllr John Griffiths

Dr Nikos Savvas

Tim Whitley

Tracy Jessop

Lisa Roberts

3

Declarations of Interest

The board were reminded that declarations of interest are required as part of LEP scrutiny and must be

submitted to the LEP office at the earliest convenience.

Declarations relevant to this meeting: None

Mike Stonard (MS) questioned whether those who regularly attend Board meetings as substitutes needed

to complete the Declarations of interest form. CS agreed to investigate further and advise the Board.

4

Welcome from Aviva

LR welcomed attendees to the meeting and gave an overview of Aviva, its role as a large local

employer and its importance to the region.

5

Minutes of the last meeting 17th January 2018

Actions from last meeting updated as follows:

Capital Growth Programme Projects - Identify whether other LEPS have received requests

CD

for investment in flood defence schemes. Investigations are ongoing.

Chief Executive’s Report

CS

For CS to produce a paper on the impact of GCGP changes - complete

Andrew Proctor (AP) queried whether the incorrect scoring on the Capital Growth Fund paper

presented at the last board had impacted on the decisions made about the bids. CS confirmed

that that decisions were based on the correct scoring.

6

Brexit Analysis

CS took the majority of the paper as read and provided background information on the Brexit

analysis carried out by Metro Dynamics.

Patrick White (PW) from Metro Dynamics updated the meeting on the background to the

research and the approach taken which aimed to link the analysis to the Economic Strategy.

The approach reviewed key sectors and then targeted individual companies to assess the

Page 2 of 6

4

impacts of Brexit specifically focussing on the impacts on trade, regulations, workforce and

funding.

The impact on the workforce was specifically identified as particular issue for this region given

the reliance on seasonal working and the issues already faced by companies in recruiting staff

with appropriate skills.

It was also noted that a replacement for current EU funding will be required however the details

of how this will be delivered remain unclear.

DF advised that the main report contained an initial action plan which will be progressed and

developed together with actions and targets. Timescales and measures of success will be

brought back to the Board in April or May.

David Ellesmere (DE) noted that companies employ staff elsewhere in the EU and the fall in

the value of the pound has already impacted upon the cost of employing them,

Jeanette Wheeler (JW) stated that companies were already struggling to recruit workers from

the EU and the LEP should focus on what can be done to assist in recruitment as all vacancies

will not be filled from within the UK.

Colin Noble (CN) felt that the LEP could have an important role post Brexit as it is a non-

political body which can have a key role in bringing together individuals and organisations

across the political lines. He also identified the skills shortage as the main issue and felt that

the LEP can lead on this point.

David Richardson (DR) agreed that the skills shortage would be significant and felt that the

LEP could be leading on co-delivery of programmes which would help to address this. He

requested that work start immediately to identify the skills gaps and investigate how they can

be addressed rather than leaving the work until Brexit has actually happened.

The meeting discussed how the Brexit research tied in with the Economic Strategy.

Shan Lloyd (SL) updated the meeting on Government work on the replacement of EU funding

advising that LEPs would play a key role in defining requirements.

The Board agreed:

To note the content of the report

To support the recommendations in the report

To receive an action plan detailing the next steps, timescales and measures of success

LiR

7

Economic Indicator Trajectories and Targets

CS took the majority of the paper as read and updated the meeting on the process followed to

build the trajectories and targets.

Dominic Keen (DK) queried whether economic fluctuations would be accounted for in the

projections. CS confirmed that progress against the targets was unlikely to be smooth but the

trajectory took this into account.

LR noted that having up to date data was key to ensuring that the projections were as accurate

as possible and also asked whether any qualitative measures were place. CS confirmed that

these would be included and proposed surveying businesses as an example of how these

could be gaged. LR proposed using a set of sample businesses who would participate in a

roundtable on a regular basis in order to monitor opinions.

Johnathan Reynolds (JR) proposed using sector groups and CS suggested contacting those

businesses which had received LEP funding to obtain views.

Vivienne Gillespie (VG) asked whether the skills targets could be broken down further. PW

confirmed that sub-metrics existed which would be recorded and reported back to the Skills

Board.

Page 3 of 6

5

The meeting discussed the role that the LEP should play in housing development given that the

LEP can drive provide infrastructure and help businesses in order to boost the demand for

housing but is not directly responsible for the provision of homes.

JR noted that there were no targets on CO2 emissions which were identified as key in the

Pathfinder project and recommended that this be included. It was agreed that a paper would

be submitted to a future Board meeting for consideration.

The Board agreed:

To note the contents of the report

Agree the methodologies that have been developed to set the targets for each of the

indicators up to 2021.

Agree the approach to monitoring and reporting on the indicators to the Board.

JR/CS

To receive a paper on CO2 reductions for consideration of inclusion in the economic

strategy targets.

PW left the meeting.

8

Governance Review

DF noted that, in order for the LEP to remain compliant, all Terms of Reference needed to be

published on the web site by 28th February and suggested that they be agreed by the Board

before going to each individual committee for approval. Part of each committee’s work

programme would be an annual review of its terms of reference to ensure its appropriateness.

CS updated the meeting on the background to the review and on work carried out to date. CS

thanked those Board members who had volunteered to sit on the various committees and

reviewed the high level details of the groups. He also confirmed that work was continuing on

the Scheme of Delegation and the Decision Log which would be brought to the March Board.

Chris Dashper (CD) outlined the Terms of Reference for the Investment Appraisal Committee

explaining its link to the Growing Business Fund Panel. Changes suggested at the recent

committee meeting would be incorporated into Terms of Reference.

It was noted that the Terms of Reference needed to include details of the committee

substitution policy.

DE proposed using the same approach to substitution as the main Board. This was agreed.

JW noted that the duration of appointment to each Board should be included.

The Board agreed:

To note the content of the report.

To agree the Terms of Reference for each of the Committees and Board subject to the

above changes.

To confirm the appointment of members to the new committees within the new

structure.

CS

To receive a proposed scheme of delegation and decisions log at the March meeting

9

24 Month Operational Plan Review

CS took majority of the paper as read and those areas where improvement had been made.

CJ asked whether sustaining businesses should be included as future aim as well as growing

the local economy. CS advised that this paper was a review of the previous plan which had

focussed on growth and agreed that this was included in future objectives as part of the

Economic Strategy. It was noted that the Board had agreed not to intervene in struggling

businesses but should support those existing ones which wish to evolve and expand.

JR queried the current status of the Oil & Gas Taskforce. CS advised that this was still

operational and he would be happy for JR to be involved in the future.

Page 4 of 6

6

The Board agreed:

To note the content of the report and the progress made against the 24 month

Operational Plan

10

New Anglia LEP ERDF Bid

CD took the majority of the paper as read and updated the meeting on the issues encountered

during the approval process for the last bid.

The Board was advised that, should the approval be delayed then there is a risk that there will

not be funding available for the Small Grants Scheme and Growth Hub after 31st August 2018

when current funding expires.

CD proposed that the Growth Hub and Small Grant Scheme continue in their current form until

the end of October 2018 to allow for possible delays and reduce the risk of the Programme

being disrupted. This would be achieved by using BEIS Growth Hub funding and Growing

Business Fund funding and would be recouped when ERDF funding was approved. In the

event that a decision on funding from MHCLG is still pending by September, the LEP Executive

would present a paper on future options to September’s board meeting.

The Board agreed:

To note the content of the paper.

To support the submission of a request for £7.4m of ERDF funding

To agree to the allocation of £150,000 of BEIS funding and £200,000 of the Growing

Business Fund to continue activity, should ERDF approval be delayed beyond August

2018.

11

Sub-National Transport Forum

CS took the majority of the paper as read and updated the meeting on the background to the

sub-national transport bodies and progress of the various bodies created to date.

A meeting was held in December 2017 which agreed to establish a sub-national transport

forum to be known as Transport East.

Steve Oliver (SO) asked how the LEP Transport Strategy was linked to this. CS advised that

the LEP would have its own strategy which will be presented at the May Board. Individual

counties or towns could also have strategies and this forum would pull together the various

strategies at a regional level.

The Board agreed:

To note the content of the report.

To agree to be a full member of Transport East

For DK to be a New Anglia LEP representative on Transport East

12

Chief Executive’s report including PwC and Mary Ney Review Implementation Plan

DF advised that a COO had been appointed with view to starting early in the summer. DF

thanked all those involved in the recruitment process.

CS took the majority of the paper as read and provided an update on the following items:

Growth Deal - CS reviewed the delivery of the Growth Plan detailing changes in spending from

last month.

Capital Growth Programme - CS advised that CEFAS & Bacton had been advised of the

decision. Deferred projects will be brought back to the Board meetings together for future

consideration.

Mary Ney Review - CS reviewed progress against the implementation plan.

The meeting was advised that the assurance framework needed to be updated in the light of

the changes agreed at this Board Meeting. This will be updated by the LEP team and added to

the web site by 28th February.

Page 5 of 6

7

JW asked whether requests for funding made to the Growing Business Fund would be added

to the web site. CS confirmed that only details of approved requests would be added as this

involved the spending of public funds. Those declined would not be included

The Board agreed:

To note the content of the report

13

Finance Report

CS took the majority of the papers as read and asked for questions from the Board.

It was noted that the cost of the Opportunity Area Director & her assistant were not included in

the budgeted costs but neither was the associated income so the net effect was nil.

The Budget will be presented to the March Board

The Board agreed:

To note the content of the report.

14

Any Other Business

DF advised that the Board Forward Plan would be a standing item at future meetings.

DF asked Board members whether they would prefer to receive appendices to Board papers as

a separate pack or as part of main paper. Board members agreed that they wished to continue

to receive them as part of the main pack.

Next meeting:

Date and time of next meeting: 21st March, 2018. 10am-12.30pm

Venue: The Jockey Club, Newmarket, Suffolk

Page 6 of 6

8

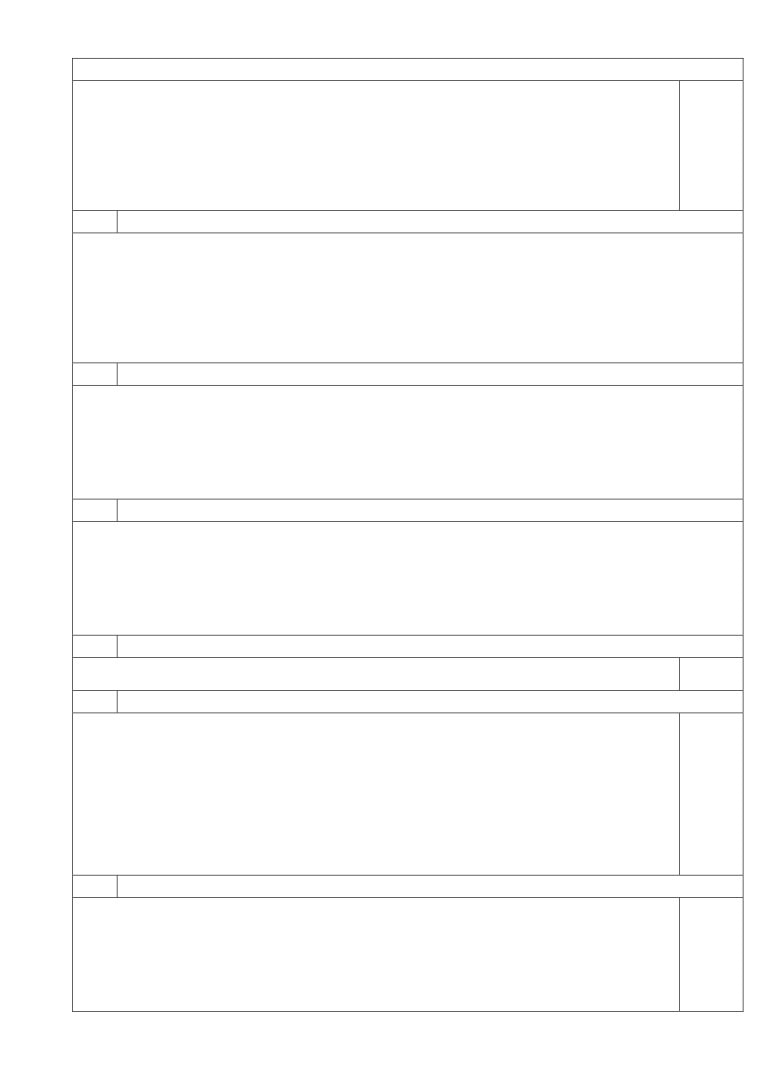

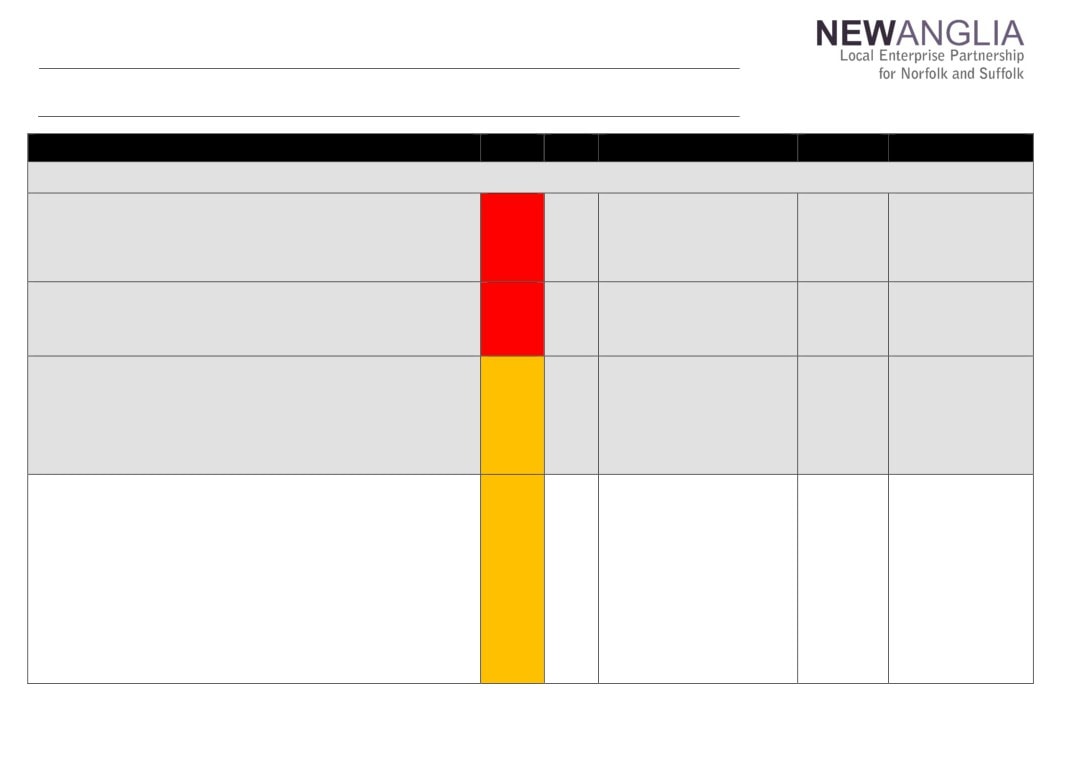

Actions from New Anglia LEP Board Meetings

Date

Item

Action

Update

Actioned By

Status

21/02/2018

Declarations of Interest

Ascertain whether regular Board substitutes need to complete

Declarations will be required. Charley Purves will

CS

On-Going

Declaration of Interest Forms.

contact Board substitutes to arrange completion

21/02/2018

Economic Indicator

To receive a paper on CO2 reductions for

CS and JR liaising

CS/JR

On-Going

Trajectories and Targets:

consideration of inclusion in the economic strategy targets

21/02/2018

Brexit Analysis

To receive an action plan detailing the next steps, timescales and measures of

Draft action plan is being produced

LiR

On-Going

success

21/02/2018

Governance Review

Governance Review - To receive a proposed scheme of delegation and decisions

Scheme of Delegation presented at March Board

CS

On-Going

log at the March meeting

meeting

17/01/2018

Capital Growth Programme

Identify whether other LEPS have received requests for investment in flood

Verbal update to be provided at March Board

CD

Complete

Projects

defence schemes.

meeting

22/11/2017

Business Performance

To receive a proposal on the Eastern Agi-Tech initiative by email.

On hold pending clarification on the situation at

CS

On Hold

Reports

GCGP

9

New Anglia Local Enterprise Partnership Board

Wednesday 21st March 2018

Agenda Item 8

Capital Growth Programme Bid: Snetterton Heath Employment Area

Author: Chris Dashper

Summary

The Capital Growth Programme call for projects was launched immediately following the

October 2017 LEP Board meeting.

Under the call, £9m of grant funding from the Growth Deal was made available to support

projects that help to deliver the new Economic Strategy.

At the January meeting of the LEP Board, the board agreed to support two of the 29 project

applications received. The remainder of the applications were either deferred pending further

information or rejected. The updated table of deferred projects is included for reference as a

confidential appendix to this paper.

One of the deferred projects, Snetterton Heath Employment Area Electricity Upgrade Scheme

has now supplied the required additional information necessary for a decision to be made on

the financial support for the project.

Appendices 2 and 3 are deemed confidential because they contain commercially sensitive

information.

Recommendation

The Board are asked to:

Approve the award of Capital Growth Programme grant funding in the amount of

£2.65m to the Snetterton Heath Employment Area Electricity Upgrade Scheme,

following recommendation by the Investment Appraisal Committee.

Background

The Capital Growth Programme Call for Projects was launched after the October LEP Board

meeting, with £9m from the Growth Deal made available to support projects that helped to the

deliver the new Economic Strategy.

A total of 29 project Expressions of Interest were received as a result of the call, with sectors

including infrastructure, transport, employment projects, skills and cultural themed projects.

At the January 2018 LEP Board 2 projects, Bacton to Walcott Coastal Management Scheme

and CEFAS Research Centre were approved, allocating £2.48m of the £9m round. A further 20

1

25

of the project applications were deferred, pending further information. One of the deferred

projects was the Snetterton Heath Employment Area Electricity Upgrade scheme.

Since the January LEP Board meeting, the applicant for the Snetterton project, Breckland

District Council, has provided significant additional information on the delivery of the Snetterton

Heath Employment Area project and has also secured planning permission for the electricity

substation, one of the principle outstanding requirements necessary to allow approval of the

project.

Key issues

The Site

Snetterton Heath is the one of the largest of the A11 employment sites and one of the most visible

from the A11, five miles west of Attleborough and located in the Breckland District Council area.

It is an established location, with most of the spine infrastructure already provided including grade

separated A11 access. The Snetterton motor racing circuit, an internationally recognised venue,

forms part of the site and provides a potential basis for further employment. The only

infrastructure issue restricting the growth of site is the electricity constraints, an upgrade of the

supply being necessary to encourage further development.

Funding

Breckland District Council has applied to New Anglia LEP for a Capital Growth Programme grant

of

£2.65m towards the cost of a £3.5m scheme to upgrade the electricity supply to the

employment land. The costs of the project include a new substation to be located within the

boundary of the nearby Biomass Powerstation and new cabling to various parts of the

employment area. The balance of funding required will come from a grant from the Norfolk

Business Rates Pool.

Project proposal

The project proposal is to construct a new substation at the biomass plant to convert 33kv to 11

kv and link to the existing UKPN network. 11kv cable will then be run to the edge of each

landholding but no further. It will be the landowner’s responsibility to distribute the power

thereafter to individual parcels. Occupiers will also need to provide their own onsite substations

to step down the 11kv supply. Breckland proposes to fund the whole cost upfront so that

individual users can connect, as and when they arrive.

Consents

Heads of terms have been agreed for the siting of the substation. The majority of the cable runs

are along public highways and Norfolk County Council has confirmed that these can be

accessed without difficulty. There is no need to cross any other land not owned by the local

landowners. With planning permission now in place, this means there are no major constraints

to the delivery of the project.

State Aid

State Aid is often an issue for projects involving the supply of utilities. New Anglia LEP has

commissioned an independent legal report on the State Aid issues facing this project. The legal

advice confirms that in this circumstance, the aid is a permissible subsidy to UKPN to extend its

network, to the boundary of each site, to which the public has the right to connect. The effect of

the subsidy is to enable the serviced land to be offered at market price rather than at above

market price and does not give it a competitive advantage over other sites on the A11.

Ultimately the site would not be viable if the full cost of connection had to be met. An alternative

loan arrangement would not work in this circumstance.

2

26

Timescale

Breckland District Council are intending to start work almost immediately after approval of the

grant request. This ensures that the price quoted by UKPN remains viable. Cabinet approval of

the grant will be required and this has been scheduled for discussion in early April 2018.

Project history

New Anglia LEP has been supportive of the concept of improving the electricity supply at

Snetterton, this being a well-known local issue for some time. A previous attempt to address

this situation, with a confirmed grant offer from the Growth Deal could not ultimately be

delivered due to the costs involved and complex access rights including passing under the

railway line. The grant offer had to be withdrawn, the funding recycled back into the Growth

Deal and therefore forming part of the funding for the current Call for Projects.

The current version of the project is a much improved, comprehensive arrangement,

considerably more deliverable than before and fully State Aid compliant.

Financial implications

Approval of the project would bring the total formal allocation under the £9m call to £5.13m,

including the £2.48m allocated at the January 2018 Board meeting.

This would leave £3.87m to be allocated to the remaining deferred projects, subject to

additional information and appraisal. A further review paper on these projects is scheduled for

the May 2018 Board meeting.

A further £23m would then remain for a future call to be held in the summer/autumn. This could

support some of the deferred projects.

Link to the economic strategy

New Anglia LEP has previously invested in infrastructure including the A11 corridor and has

supported other successful large-scale employment sites with direct and indirect infrastructure

investment, including the 16 Enterprise Zone sites across Norfolk and Suffolk. Rarely viable in

conventional investment terms, this type of site often requires a public intervention to allow

progress to be made towards achieving growth, appropriate outputs and addressing issues such

as productivity.

The Cambridge-Norwich Tech Corridor and its developable employment areas including

Snetterton Heath are key aspects of the new Economic Strategy.

Recommendation

The Board are asked to:

Approve the award of Capital Growth Programme grant funding in the amount of £2.65m to the

Snetterton Heath Employment Area Electricity Upgrade Scheme, following recommendation by

the Investment Appraisal Committee.

Appendix 1: Appraisal process

Appendix 2: Confidential - consultants appraisal

Appendix 3: Confidential - deferred projects table

3

27

Appendix 1: Appraisal Process

Hewdon Consulting have been engaged to complete the initial appraisal of the project

applications received during the Call for Projects launched in October 2017.

All projects have been appraised in accordance with HM Treasury Green Book principles of

viability, value for money, achievability, affordability and need.

Following the receipt of additional supporting information, the Snetterton Heath Employment

Area project has been reappraised by Hewdon Consulting and re-scored in line with the October

2017 Call for Projects key criteria:

Capital Growth Programme Core outputs

Connectivity- investing in essential projects and assets that improve the infrastructure

and which create a modern, mobile, accessible future-proof digital connected economy.

Unlocking Growth- investing in infrastructure that unlocks or protects housing or

commercial developments in our key growth locations.

Investing in skills- investing in projects that deliver the higher level skills needed to drive

growth across our economy with a particular emphasis on our ‘innovation’ and ‘enabling’

sectors,

Key project assessment criteria

Whether the need for the project has been clearly demonstrated

Evidence of option appraisal and business case

How well the project meets the priorities of the Economic Strategy

How well the project fits with local and sub-regional plans and priorities

Potential for alternative funding, partnering and joint schemes

Estimated costs with level of detail to reflect the current stage of the project

Potential of the project to contribute to economic growth

Potential of the project to achieve payback

How likely the project is to be successful

How risks will be managed and mitigated

Economic outputs and impacts created by the project

How the benefits of the project will be sustained after LEP funding finished

Appraisal techniques used in the assessment of projects:

Justification of local economic need

Evidence of failure in commercial markets

Viability gaps for development of sites

Opportunity to accelerate delivery of development

State Aid

Strategic Prioritisation Framework

Projects have also been assessed against the LEPs own Prioritisation Framework,

which

includes the following key assessment criteria

Strategic Fit.

Consideration of whether the aim of the project is referenced in the Economic Strategy.

Also consideration of national economic development policy priorities, particularly those

in the Autumn Budget 2017 and the Industrial Strategy White Paper.

4

28

Deliverability

The main criterion was whether the project was sufficiently well advanced to draw down

LEP funding in 2018/19 and to complete by 2020/21 as the Call required. Key indicators

of deliverability included:

o Planning consent and land acquisition in place

o Other funding being committed

o A well-developed business case

Additionality

Projects should be able to demonstrate the addition of measurable direct outputs

corresponding to those in the Economic Strategy - such as jobs, houses, or Gross

Value Added (GVA) increase.

Economic Impact and VfM.

Ideally the outputs should be converted to a monetary value such as GVA and

compared with the cost to obtain the Net Present Value of the intervention. The

exception is transport projects for which a Benefit: Cost Ratio (BCR) is used.

5

29

New Anglia Local Enterprise Partnership Board

Wednesday 21st March 2018

Agenda Item 9

Growth Deal: Norwich Area Transportation Strategy (NATS)

Author: Chris Dashper, Jonathan Rudd

Summary and Recommendation

The LEP Board is requested to approve;

1. Transfer of £350,000 from the NATS A11 Corridor Package to the NATS City Centre Package

to balance out an underspend on one scheme (Daniels Road Junction) and overspend on

another (Guardian Road Junction).

2. Inclusion of a new scheme (Plumstead Road Roundabout) in the NATS City Centre Package to

replace a £400,000 scheme which is no longer deliverable (Salhouse Road Bus Rapid Transit

Scheme).

Background

Prior to the Growth Deal capital programme, the Department of Transport delegated responsibility

for allocating funding for capital transport projects to the Norfolk and Suffolk Local Transport Body

(LTB), an unincorporated entity. The LTB was subsequently subsumed into the LEP as a sub-

committee of the LEP Board and the LEP is responsible for managing the LTB capital programme.

The LTB operates a two-stage approval process which incorporates DfT requirements; an initial

assessment as part of the appraisal on new projects prior to Growth Deal Programme entry and a

further approval of constituent schemes on completion of the design stage involving a

proportionate Business Case.

The Norwich Area Transportation Strategy (NATS) is a Growth Deal project, approved by the LEP

board in 2015. It was originally promoted as a city-wide collection of schemes, but at the request

of government it was divided into the following two packages:

NATS City Centre Package (£7M) - principally to improve connectivity and accessibility within

the core retail and business district by removing through traffic from the city centre, but

retaining access to car parks, businesses and other premises. The package comprises of:

o Phase I; Chapelfield North scheme (pre-Growth Deal),

o Phase II (£2M); Golden Ball Street, Westlegate, All Saints Green, Ber Street and

Finkelgate

o Guardian Rd Junction (£1.55M); with A1074 Dereham & A140 Sweetbriar.

o Roundhouse Way Bus Interchange (£0.45M); Northwest of A11 junction.

o Phase III (£2.6M); Prince of Wales Road, Rose Lane and Agricultural Hall Plain.

o Salhouse Road Bus Rapid Transit (£0.4M).

1

35

NATS A11 Corridor Package (£4.175M) - focussed on the A11 corridor, to connect Norwich

city centre to growth areas in the south west including at the Norwich Research Park,

University and Hospital cluster, Cringleford, Wymondham and Hethersett:

o Part 1 (£2.175m);

UEA Bus/Transport Interchange, major upgrade,

Cycle link extension from Hethersett to Wymondham (off-carriageway),

A11 North slip road - Cringleford cycle track,

Eaton Centre to Newmarket Rd south slip Rd cycle facilities,

Toucan crossing on Newmarket Rd between poplar Ave & Unthank Rd.

o Part 2 (£2m); Junction improvement at A11 (Daniels Rd) & Outer Ring (Newmarket &

Mile End Roads).

Key Issues

1. Transfer of £350,000 between NATS Packages.

Introduction. On 23 Feb 18, the Local Transport body was asked to support a request to

reallocate £350,000 funds between the two NATS packages for the following reason:

Delivery of the Guardian Road junction improvement, part of the NATS City Centre Package,

will likely cost £700,000 more than the initial forecast of £1.55M.

Conversely, the cost of delivering the Daniels Road scheme within the NATS A11 Package is

estimated to be £350,000 below the initial forecast of £2M.

NCC raised the likely overspend on the Guardian Road junction back in October 2017, and the

possibility of covering the cost through virement from the NATS A11 was discussed. However,

planning for the Daniels Road scheme was not mature enough to present to the LTB or accurately

predict the saving. Consequently, NCC submitted an Expression of Interest to the November 2017

Call for Projects. This was rejected, since it is a standard condition that the total funding amount

set out in our grant agreements is the maximum allocated to deliver the Project, irrespective of any

cost increase, and there is no commitment to any uplift in the level of funding offered.

Notwithstanding this, in their feedback the LEP reiterated the possibility of covering the cost

overrun from the likely underspend in the NATS A11 package and stated that “the LEP Board

would be happy to receive a formal proposal to this effect via the Local Transport Body”. The

formal proposal was submitted to the LTB on 23 Feb 18, who recommended to approve the

transfer of £350,000 from the NATS A11 Corridor Package to the NATS City Centre Package.

Delivery

Guardian Road Junction. Provision of a new enlarged roundabout in place of the existing

roundabout, controlled pedestrian (toucan) crossings, reduction in the length of an existing bus

lane, new 30mph limits and altered segregated footway/cycleways.

Daniels Road Junction. Involves provision of dedicated turn lanes on selected arms of the

roundabout and reconfiguration of traffic lights and toucan crossings at adjacent junctions.

Funding. The saving from Daniels Road junction to be reallocated to the Guardian Road junction

to make up half of the increased cost, with NCC to meet the remaining £350,000, as follows:

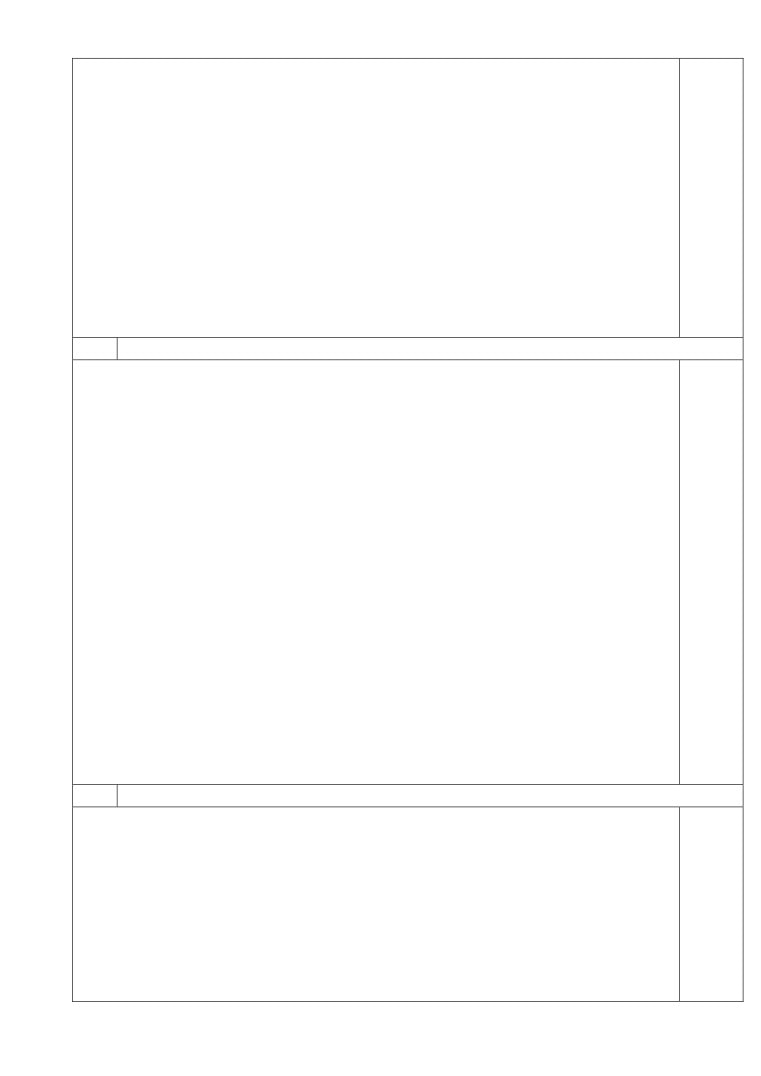

Guardian Road Scheme Delivery timetable

Funding Source

15/16

16/17

17/18

18/19

Total

Growth Deal

£50,000

£1,451,000

£499,000

£1,900,000

NCC

£350,000

£350,000

Totals

£50,000

£1,801,000

£499,000

£2,250,000

2

36

Link to Economic Strategy

Guardian Road Junction. This scheme will improve connectivity and access within Norwich;

reduce congestion and journey times for businesses and commuters, improve bus reliability

and conditions for pedestrians and cyclists, and bring forward growth.

Daniels Road Junction. This aims to reduce delays experienced by bus passengers and

general traffic on Newmarket Road (A11) and ensure the ring road remains sufficiently free

flowing. This will benefit all modes of transport on this key transport corridor linking the city

centre with the radial routes to the south-west of Norwich where growth is planned at housing

and employment sites in Cringleford, Hethersett and Wymondham, as well as further afield at

Thetford.

2. Plumstead Road Roundabout.

Introduction. This is a new scheme under the pre-agreed NATS City Centre Package. It is

proposed to replace the Salhouse Road Bus Rapid Transit (BRT) scheme that formed part of the

original LEP Board approval. The BRT scheme is currently undeliverable due to both insufficient

demand and support from the bus operators.

Delivery. The scheme includes the redesign of a 3-arm offline roundabout, designed as part of

initial planning by property developers Lothbury, to incorporate a 4th arm and spur onto Broadland

District Council land. Planning permission has been granted for this new roundabout junction and

an agreement has been drafted with Lothbury to share the costs of developing and building the

junction. This will enable Lothbury to deliver the permitted 600 homes to the south of Plumstead

Road and provide access to a parcel of land in the ownership of Broadland District Council which

could be developed for a further 35 houses.

Funding. Growth Deal Funding remains consistent with the approved allocation of which £400k of

Local Growth Fund has been earmarked. The full £1M cost of the scheme will be met as follows:

Plumstead Road Scheme Delivery timetable

Funding Source

15/16

16/17

17/18

18/19

Total

Growth Deal

£10,000

£189,000

£201,000

£400,000

Developer

£400,000

£400,000

Local Authority/Other

£200,000

£200,000

Totals

£10,000

£189,000

£201,000

£600,000

£1,000,000

Link to Economic Strategy. This roundabout is aligned with the new Economic Strategy by

accessing land for two new housing developments. The new junction forms part of a strategic

growth area to the North East of Norwich identified in Broadland District Council’s Growth Triangle

Area Action Plan (GTAAP). The GTAAP was adopted in July 2016 and allocates sites within the

growth area for delivery of 7,000 houses by 2026.

Approval is sought for this scheme since the purpose falls outside of that approved for the whole

package; connectivity and accessibility within the core retail and business district. The formal

proposal was submitted to the LTB on 23 Feb 18, who recommended to approve this scheme

within the package and use of £400,000 of Growth Deal funds previously allocated to the Salhouse

Road Bus Rapid Transit scheme.

Summary and Recommendation

The LEP Board is requested to approve;

1.

Transfer of £350,000 from NATS A11 Corridor Package to the NATS City Centre Package.

2.

Inclusion of the Plumstead Road roundabout scheme into the NATS City Centre Package

and use of £400,000 of previously allocated funds.

3

37

New Anglia Local Enterprise Partnership Board

21st March 2018

Agenda Item 10

Growth Deal: Request for Additional Funding for the Cornhill Project, Ipswich

Author: Chris Starkie/Cathy Frost

Summary

To enable the successful completion of the Cornhill Regeneration Scheme in Ipswich, an

additional £50K is requested from New Anglia LEP to cover a slight shortfall in funding as a result

of exceptional circumstances. This project is a major town centre enhancement scheme

supported financially by Ipswich Borough Council, Suffolk County Council, New Anglia LEP and

Ipswich Central.

It is one of the main objectives of the Ipswich Vision and is supported by the seven main

stakeholders of the project (New Anglia LEP, IBC, SCC, UOS, Suffolk Chamber in Greater

Ipswich, Ipswich Central and Sandy Martin MP).

This contribution, a small proportion of the overall cost, will leverage match funding of £350k

already offered by other partner organisations. Without this additional money the project will be

unable to reach a satisfactory conclusion and compromises will have to be made to the design,

detrimentally affecting the original brief and impact for the town.

Recommendation

The Board is asked to agree the provision of an additional £50k to cover the shortfall in the

funding as a result of exceptional circumstances.

Background

The Cornhill Regeneration Project will provide a high-quality design and revitalisation to the

Cornhill central square in order to solidify its status as the main activity hub in the town centre

and is recognised as one of the main priorities for the Ipswich Vision.

It will enable the Cornhill to become a flexible and unique space. Local contractor Brooks and

Wood started on site on 29th January 2018, with a target completion date of 30th October 2018.

There will be a phased approach to the delivery of the project in order to minimise as far as is

possible the disruption to the town centre and those businesses trading in and around the area.

The Ipswich Market has already been relocated to Princes and Queen Street. The project will

comprise of the following elements

Levelling and repaving of the Cornhill square

Centrally located water feature incorporating water jets which can be turned off

Four sculptural archways approximately 4.5m high-public art element

1

39

Series of benches, new bins, lighting element and 5 new trees.

There is evidence that during the development and promotional phase of the project, there has

been significant interest from the business community and renewed confidence and investment

in the town centre.

It will act as a hub for creative events, scoping is now being undertaken by IBC to ensure a varied

number of events are programmed. It will also showcase the heritage and architecture on the

square itself and the wider offer of the town and waterfront. This will in part be achieved through

the storytelling on the 4 arches, public engagement has already been sought to help identify the

important stories. This activity will have a positive impact on the visitor economy, helping to attract

new visitors to the area and boosting retail trade and local services.

The LEP is currently providing £1.6m of the total £3.2m of the scheme, with significant

contributions coming from Ipswich Borough Council and Suffolk County Council.

Key considerations

Since the budget for the scheme was agreed, costs have risen. This is chiefly because the public

consultation led to changes in the overall design which have led to different features and

materials being utilised.

Further the Ipswich Vision partners had hoped to use £750k secured from the Coastal Communities

Fund, but the CCF Fund ruled has to be ringfenced for work on St Peter’s Dock.

Partners have sought to reduce the cost of the scheme by value engineering - with this achieving

a saving of £234k. The shortfall is now confirmed as £400k, with the overall cost rising from

£3.2m to £3.6m.

In order to meet this shortfall, there is now commitment of an additional £100k from Suffolk

County Council, £50k from Ipswich Central and £200k from Ipswich Borough Council.

It is vital that this project can secure this additional funding from New Anglia LEP in order to

release the sizeable financial commitments made by the project partners.

The LEP executive team has already identified a small amount of underspend in the annual

allocation of funding which is set aside to administer the Growth Deal programme which can be

utilised to provide the £50k.

Link to the economic strategy

Ipswich and the surrounding area have been identified in the Economic Strategy as a priority

place. The revitalisation of the Cornhill will lead to Ipswich having a strong central commercial

area ready to meet the changing demands on the use of town centres.

We have already seen two new businesses commit to the Cornhill - Pret a Manger and a new

public house since the plans were announced.

There is also interest from several restaurant chains in the old Post Office Building. All of these

businesses will directly benefit from the work and there is no doubt that this business confidence

will be a catalyst for further inward investment and strengthen the position of Ipswich as part of

our wider ‘offer to the world’.

The Cornhill has and will continue to play an important role in the visitor economy of the town, a

key sector recognised within the Economic Strategy, and this work will have a significant positive

impact on the perceptions of the town to increase visitor numbers and boost retail trade.

2

40

Recommendation

The Board is asked to agree the provision of an additional £50k to cover the shortfall in the

funding as a result of exceptional circumstances.

3

41

New Anglia Local Enterprise Partnership Board

Wednesday 21st March 2018

Agenda Item 12

Scheme of Delegation

Author: Chris Starkie

Summary

This paper asks for board approval of the LEP’s new scheme of delegation. The scheme of

delegation has been developed as part of the implementation of the PwC review of the LEP’s

governance and operations. It sets clear lines of responsibility for key areas such as

governance, strategy, finance, programmes and human resources.

Recommendation

The board is invited to approve the LEP’s new scheme of delegation.

Background

The PwC review of Governance and Operations made a number of recommendations designed

to improve the overall effectiveness of the LEP.

These were endorsed by the LEP board last year along with an implementation plan.

This has included:

The creation of the roles of chief executive and chief operating officer.

A review of the structure of key LEP boards and terms of reference.

A review of the format of board meetings and the content of board papers.

A review of the LEP’s Assurance Framework.

A new appraisal mechanism for capital projects.

The PwC review also recommended the creation of a scheme of delegation.

Key issues

Schemes of delegation set out the main responsibilities and functions of an organisation and

the level to which they have been delegated.

They provide clarity and certainty to the board and also executive team members over where

responsibility and accountability lies.

In looking for best practice - it is clear there is no single model for a scheme of delegation.

Schemes of delegation range from a single page covering a very small range of functions, to a

very complex document covering hundreds of functions.

1

47

In developing the LEP scheme of delegation, we examined schemes of delegation for other

LEPs where available and a range of other organisations from the public and private sector.

New Anglia LEP’s proposed scheme of delegation can be found at Appendix 1.

It is designed to focus on the LEP’s key responsibilities and functions, and strike a balance

between brevity and detail.

It should also be seen as a part of a suite of LEP governance documents including:

Local Assurance Framework, the LEP’s articles of association, terms of reference of sub-

boards and sub-committees and the legal agreement between Suffolk County Council as

accountable body and the LEP.

Link to the Economic Strategy

The scheme of delegation will improve the governance and processes of the LEP, supporting

more effective delivery of the economic strategy.

Recommendation

The board is invited to approve the LEP’s new scheme of delegation

Appendix 1

New Anglia LEP scheme of delegation

2

48

Appendix 1

New Anglia LEP Scheme of Delegation

Context

The New Anglia Local Enterprise Partnership is company limited by guarantee, with 16

voluntary directors, supported by a full-time executive team.

This scheme of delegation sets out the main responsibilities and functions of the organisation

and the level to which they have been delegated.

The scheme of delegation is part of a suite of LEP governance documents including:

Local Assurance Framework, Articles of Association, terms of reference for sub-boards and

sub-committees, and agreement between Suffolk County Council (accountable body) and the

LEP.

The scheme of delegation is reviewed annually and changes require board approval.

Key responsibilities of the LEP Board

The board is responsible for:

Approving the strategic direction of the LEP

Agreeing clear objectives to focus activity and drive ambition

Ensuring the LEP runs efficiently and effectively with appropriate controls in place

covering performance, finance and risk

Upholding the values, ethos and culture of the organisation

Scheme of Delegation

Issue

Delegated To

Strategy

Vision, mission and values

Board

Development and approval of Economic strategy

Board

Implementation of Economic strategy

Economic Strategy Delivery

Coordination Board

recommendations to main Board

Changes to the overall operating structure of the LEP

Board

Approval of the Organisation brand

Board

1

49

Programmes

Design of capital and revenue funding programmes

Board (on recommendations from

Investment Appraisal Committee

and relevant sub-boards)

Awarding of capital or revenue funding to programmes

Board (on recommendations above

£500k

from IAC)

Awarding of capital or revenue funding to programmes

IAC

£500k or below

Awards from Growing Business Fund up to £500k

GBF panel

In programme funding changes above £100,000

Board

In programme funding changes up to £100,000

IAC

Change requests from programmes/projects with no

IAC

financial implications but major changes to outputs

or timeline

Change requests from programmes/projects with no

CEO - reported retrospectively to

financial implications but minor changes to outputs

the Board quarterly

or timeline

Governance

Responsibility for compliance with Government

Chair and CEO

National Assurance Framework

Board

Annual declaration of compliance to Government

Suffolk County Council 151 Officer

Maintenance of Register of Interests

Board and CEO

Timely publication of agendas, reports and minutes

Chair, CEO and COO

Committee and Delivery Board appointments

Board

Code of conduct, Complaints and Whistleblowing policies Board

Finance

Approval of financial budgets and forecasts

Board

Approval of annual accounts and financial statement

Board on recommendation

and audit letter of representation

from Audit and Risk Committee

Approval of bank account and mandate policy

Board on recommendation of Audit

and Risk Committee

2

50

Treasury policy

Board on recommendation of Audit

and Risk Committee

Bank investments execution

Audit and Risk committee

Prior authorised expenditure for day to day business, in

accordance with strategy budget and approved policies:

Over £150,000

Board

Between £50,000 and £150,000

Chair and CEO or COO

Up to £50,000

CEO and COO or financial controller

Human Resources

Performance management and remuneration of CEO

Chair and Remuneration Committee

Remuneration of Chief Operating Officer

Chair, CEO and Remuneration

Committee

Recruitment of board members

Board (with recommendations from

sub panel comprising board

members)

Recruitment of CEO

Board (with recommendations from

sub panel comprising board

members)

Operational procedures and policies for Leadership team CEO in conjunction with COO and

and below

Leadership team

3

51

New Anglia Local Enterprise Partnership Board

Wednesday 21st March 2018

Agenda Item 13 - Chief Executive’s Report

Author: Chris Starkie

Overview

This section provides a snapshot of main LEP team activity since the February board meeting

Governance review

The LEP has been given positive feedback following the deep dive conducted by the

Government. Government colleagues spent two days with the LEP examining our

processes and governance, speaking with board members and a number of the LEP

executive team.

It follows our annual conversation with Government where the LEP was rated as one of

the top four LEPs in the country for our governance, strategy and delivery.

For more information see below.

Institute of Technology

A number of members of the LEP executive have played a key part in the bid for an

Institute of Technology. The LEP has played a key role bringing partners together, but

also in writing several sections of the bid with colleagues from the county councils and

colleges. A full update is available at agenda item 6

Economic strategy consultation

The latest round of our economic strategy consultation with businesses has now

concluded after a series of events across Norfolk and Suffolk.

The consultation events, which were attended by nearly 300 people, gave businesses

the chance to talk about how they would help contribute to the delivery of the strategy.

Growth Deal

The focus of the Growth Deal team continues to be managing delivery of live projects,

finalising legal agreements and ensuring payments to projects.

As outlined below, there have been a number of projects which have suffered delays and

some continuing challenges in getting some projects to claim funding.

Following the close of the financial year we will be conducting a review of all projects to

see if there are any additional ways of speeding up delivery of projects.

Communications

Media coverage was dominated by the Brexit analysis report, which gained exposure on

television, radio, in print and online.

In Ipswich, the start of work on the Cornhill has gained significant media coverage.

53

Finances

Management accounts for 11 months to 28 February 2018 - year to date income

£1,248k with an operating surplus of just under £170k which is ahead of budget by just

over £135k

Operating cash balance is £303k which is in line with management expectations.

The LEP draft budget has been developed and will be discussed in more detail - Agenda

item 7

LEP actions and activity

This section provides a detailed update on other activities and key issues since the January

board meeting

Governance deep dive

As board members are aware, New Anglia LEP was rated good with exceptional

qualities in the Annual Conversation, which is the Government’s annual review of

LEPs.

This ranking placed New Anglia LEP in the top category of LEPs, with just three of the

37 other LEPs given this ranking.

In total one LEP was judged to be inadequate, the bottom ranking, with a further 19

judged as requiring improvement. A further 14 were rated as good, with just four,

including New Anglia LEP rated as good with exceptional qualities.

As a consequence of this, New Anglia LEP was invited to participate in a control deep

dive of our governance and processes. This was in order to help the Government team

prepare for a series of deep dives with 10 underperforming LEPs.

Three members of the Government’s deep dive team attended February’s board

meeting and participated in two days of interviews with LEP board members and

executive team members.

We are awaiting the formal report on the deep dive, but the verbal feedback received

has been very positive.

A small number of recommendations have been made, which are being actioned.

These include: ensuring SME champion accompanies the text on the website for our

private sector board members with that responsibility (Sandy Ruddock and Dominic

Keen), continuing to implement the PwC review, providing training for executive staff

on the new complaints and governance policies and asking members of the Growing

Business Fund and Small grants panels to sign the register of interests. Finally for

substitute board members also to sign register of interests.

Mary Ney Review

The LEP is now compliant with all aspects of the Mary Ney review. This has included

publishing our updated Assurance Framework on our website. This was also a

requirement of the PwC review.

A number of updates have been made to the LEP website. This has included new Sub

Board and Committee pages to include membership, terms of reference and papers

for all sub boards.

An internal process of signing-off minutes and papers in order to be uploaded to the

website in line with government deadlines is now in place.

2

54

General Data Protection Regulations (GDPR)

Work to ensure that the organisation is compliant with GDPR regulations continues. In

late February, all managers were invited to a GDPR workshop, led by our IT providers

Breakwater. They were talked through the regulations, what they mean for us,

changes which need to be made and a data audit has started, mapping where

personal data is stored on our systems so that a complete review can be undertaken.

Integrated Transport Strategy

The Integrated Transport Strategy is currently in the final stages of development and

was reported to and endorsed by the recent Local Transport Board meeting on 23

February.

In developing this work over the past few months we have focussed on aligning the

Strategy with the Economic Strategy. During April we will seeking endorsement from

partners by presenting to the Chambers of Commerce, the Norfolk Strategic Growth

Group, the Suffolk Growth Programme Board ahead of it being presented to the LEP

Board in May for approval. Both Norfolk and Suffolk County Councils will be reporting

it to Members ahead of this decision.

Transport East

The first meeting of Transport East took place on 13 March. The inaugural meeting

considered governance, the future work programme and DfT’s consultation on the

Major Road Network. Dominic Keen represented the Board and brought attention to

the importance of LEP’s in the regional debate and in their ability to provide strategic

evidence and transport priorities to feed into Transport East’s regional strategy work -

it was noted by the Forum that the voice of business was critical.

There was some debate regarding funding which officers have asked for additional

information about before committing any contribution. Dominic will provide any

additional feedback as necessary.

Local Energy East Strategy

The tri-LEP Local Energy East project has been funded by the Department for

Business, Energy and Industrial Strategy (BEIS) since March 2017. Greater

Cambridge Greater Peterborough (GCGP), New Anglia and Hertfordshire LEPs have

developed the Local Energy East Network which has a lead coordinating role amongst

nine similar networks across the country. Local Energy East is investigating the

demand and supply issues relating to grid connectivity, as well as wider local energy

market opportunities.

On 26th February 2018 nearly 100 stakeholders took part in the Big Strategy

Conversation at Newmarket Racecourse. Stakeholders provided feedback on the

analysis and emerging strategy themes. Local and whole area (the tri-LEP area)

priorities where identified and will inform the Strategy for the tri- LEP area.

Metro Dynamics have been appointed to work with the partnership to draft and

produce the strategy. The draft Strategy will be presented to the LEP Board in April

providing an opportunity to input with a final strategy being signed off by all three LEPs

in May.

Delivering the Local Energy Strategy will require resources and BEIS has allocated

3

55

funding for the co-ordination, management and technical feasibility studies needed to

promote and accelerate delivery of new local energy infrastructure.

This will be in the form of five Energy Hubs being established from April 2018 in

England to resource this need. GCGP LEP on behalf of 11 LEPs covering the East of

England, Greater London, the South East and the Oxford to Cambridge growth

corridor will create and manage the Hub team with project managers and technical

specialists. BEIS have committed to fund these Hubs for a period of 2 years from April

2018 onwards.

Brexit action

A draft action plan has been developed building on what was agreed at February’s

Board meeting and the recommendations set out in the Brexit report. On 21st March

the LEP is meeting with Norfolk and Suffolk County Councils to discuss and develop

further the action plan. We are in the process of approaching business intermediaries

and businesses to gather the latest Brexit intelligence. James Allen has now started in

the role of Growth Manager to lead on gathering business intelligence moving forward.

LEP Programme Delivery

Growth Deal

The LEP Growth Deal programme has 25 live projects/programmes and 11 projects

are now complete.

We continue to develop legal agreements for new projects, including those allocated

funding under the third round of Growth Deal.

Currently, eleven projects have an ‘amber’ status. These are predominately due to

delays in delivery or issues that need to be resolved before the legal agreement can

be put in place.

As the financial year end approaches the LEP team has been focused on working with

project promoters to keep projects on track.

Many of the amber projects are Norfolk County Council schemes and we have made

good progress in the last month ensuring spend remains on track.

The main issue has not been the delivery of the projects, but the time lag the authority

takes in submitting claims for payment or to agree the legal agreement.

However delays in spend do mean that there will be an under spend in 2017/18. Most

of this will be accommodated through capital swaps with Norfolk and Suffolk County

Councils, the mechanism for which has been agreed.

Despite this the capital swaps will not fully cover the underspend. This underspend

(10% of the annual allocation) will be rolled over into the following financial year and

spent early in the 2018/19 financial year. This has been discussed and agreed with

central Government colleagues.

4

56

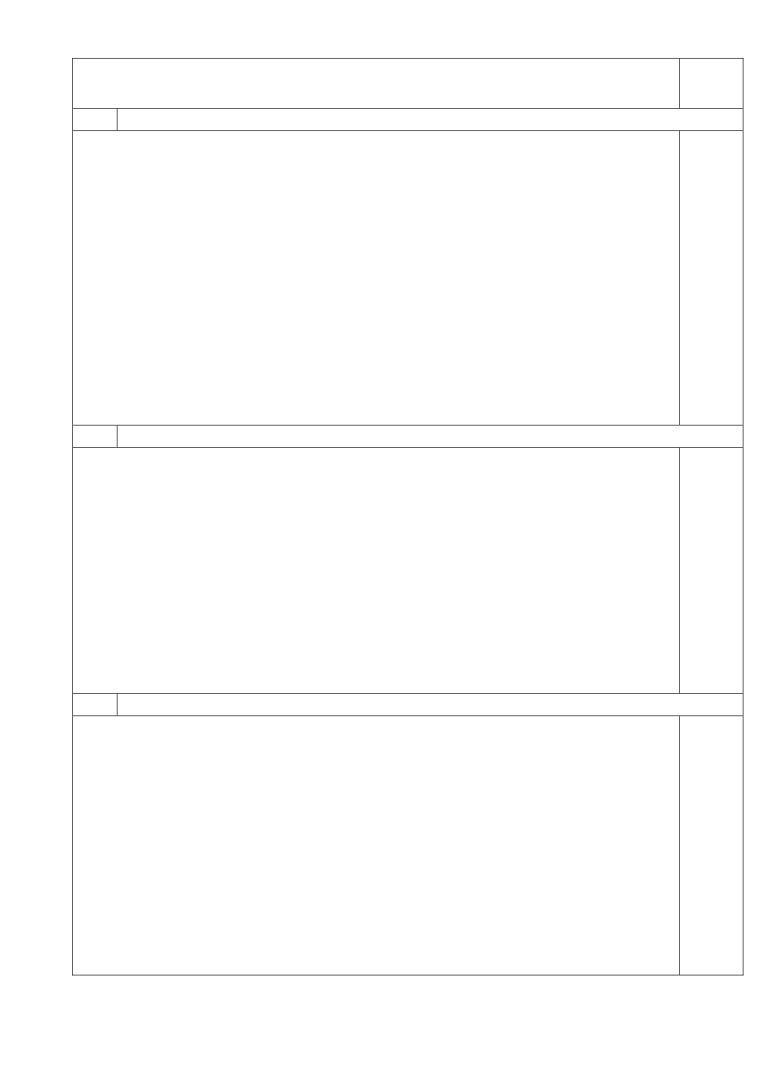

Growth Deal Spend in 2017/18

Amount

Change

Government allocation

£41.334M

£0.0M

(This is the government allocation of funding for 2017/18).

Spend paid to projects

£12.370M

+£0.972M

(Note that a project can only be paid once the project has a legal agreement in place

and has provided evidence of eligible expenditure).

Projects with legal agreements in place

£16.989M

-£0.332M

(This is projects with legal agreements in place which allows them to claim spend

when ready).

Projects with legal agreements pending

£2.015M

-£0.641M

(This is projects with legal agreements not yet in place, they therefore cannot be paid

any funds).

Under allocation

£9.960M

£0.0M

(This is the amount of funding that has not been allocated in the current financial

year. This is due to slippage on a number of projects.).

Status of projects:

Note: amounts given below in brackets refer to the total Growth Deal grant amount and the

budgeted allocation for this financial year. The majority of current projects are being delivered

over multiple financial years.

Amber: Attleborough Sustainable Transport Package (£4.6m - £0.275m) - major slippage

occurred due delays associated with the public consultation, with £1.2M of funds moved

backward into the 2018/19 financial year.

Amber: Great Yarmouth Transport Package (£8.875m - £2.361m) - delivery of cycle and

pedestrian schemes has improved following delays due to extensive consultation. There will

likely still be a small underspend this financial year.

Amber: A47/A1074 Longwater Junction, Norwich (£2m - £1.196m) - the project has been

further delayed by land acquisition, but it is scheduled for delivery by 2019 with the remainder

of the LEP funding being claimed early next financial year.

Amber: Norwich Area Transportation Strategy - City Centre Package (£7m- £2.433m)-

Although we anticipate an overall overspend, the project is ‘amber’ as delivery of Phase 3, the

Prince of Wales Road and Rose Lane gyratory, was delayed pending public consultation, and

requires further extension to the funding timeline.

Amber: Norwich Area Transportation Strategy - A11 Corridor (£4.175m- £1.332) - work in

progress. The project is ‘amber’ as there has been slippage in delivery due to an unexpected

requirement for land acquisition (for cycle way) & changes to parking restrictions.

Amber: Beccles Southern Relief Road (£5m - £3.692m) - works started in August 2017 and

is expected to take one year to complete. The spend for this year is going well, with a forecast

overall overspend, but given the substantial amount to be claimed this FY, it remains on the list

of projects at risk.

Amber: Lowestoft Flood Alleviation Scheme (£10m - £0.7m) - the project is in progress.

Detailed design is underway with a final business case anticipated to be submitted Spring-

Summer 2018. Progress is being made with the Grant Agreement, although the delivery

schedule and expenditure has slipped.

Amber: Ely Area Rail Enhancement Scheme (£3.3m -£0.286m) - The legal agreement is now

in place and the first grant claim is paid, but overall the delivery has been delayed and the

impact needs further clarification at the next Project Board meeting.

5

57

Amber: Enterprise Zone Accelerator Fund (£15m -£1.5m) - The total of this year’s funding

will support construction of a new headquarters for Proserv at Beacon Park Enterprise Zone.

Loan Agreement should be in place end of March 2018.

Amber: West Suffolk College Engineering and Innovation Centre (£7m- £0m) - Phase One

is complete, the premises & site has been acquired using Growth Deal funds. Phase Two is

now focusing on refurbishment of the building. After a delay to occupation, the detailed

application is being developed for consideration by the LEP Board. Completion of this has been

slower than anticipated following queries arising from the LEP appraisal.

Amber: East Coast College Energy Skills & Engineering Centre (£10m -£2.138m) - the

LEP Board approved this project in May 2017. Works are beginning Autumn 2017 for opening

in September 2018. The due diligence on the project has now been completed and the legal

agreement is in place. In Amber as slippage is likely.

Norwich and Ipswich Opportunity Areas

The LEP team continues to play an active part in both Norwich and Ipswich

Opportunity Areas.

Chief executive Chris Starkie represents the LEP on both partnership boards which

meet on a monthly basis.

He also chairs the advice, transitions and destinations working group on the Norwich

OA and participates in the equivalent group within the Ipswich OA.

The LEP also hosts the Norwich EA director post along with her admin assistant. The

University of Suffolk provides a similar hosting role

Ipswich OA officially launched its plan on February 1st. Key priorities are: ensuring all

children are prepared to learn for life by developing key behaviours such as resilience

and self-regulation.

Strengthening the teaching profession in Ipswich by providing world class support and

development.

Improving attainment for disadvantaged pupils by embedding evidence based practice

in English and maths.

Inspire and equip young people with the skills and guidance they need to pursue an

ambitious career pathway.

In Norwich key priorities are: Improving speech and language in early years. Improving

Continuous Professional Development for schools to boost attainment. Reduce

exclusions and improve support and information for young people at transition points.

In Norwich two thirds of schools have significantly engaged with the programme and

are looking at ways they can align their School Improvement Plans to activity planned

in the year ahead.

Key projects now commissioned include: Communications Champions - a speech and

language initiative to improve the communication of early years children.

The development of an Inclusion charter, which will ensure all schools work together

and have the support to reduce exclusions.

Community mentoring. A programme to develop a network of volunteers to support

and provide positive role models for young people.

In both OAs there is a real focus on evaluating the impact of any interventions in order

to maximise the impact, drive value for money and ensure sustainability of the

6

58

programme.

New Anglia Careers and Enterprise Conference

Around 200 delegates from schools, colleges and employers were expected to attend

Bridging the Gap - the New Anglia Careers and Enterprise conference on Thursday

March 15th at Center Parcs at Elveden.

The conference aimed to strengthen links between schools, colleges and businesses

across Norfolk and Suffolk and was organised by the New Anglia Enterprise Adviser

Network, which is part-funded by the LEP.

The conference provided updates on the Government’s new Careers Strategy, work of

the Careers and Enterprise Company and the LEP, as well as showcasing best

practice.

There was a particular focus on the two Opportunity Areas, the Enterprise Adviser

programme and the Network of East Anglian Collaborative Outreach programme

(NAECO). This programme run by our universities provides an outreach service to

schools to encourage more people to enter higher education.

Great Eastern Mainline Taskforce

The Great Eastern Main Line Rail Taskforce, which is chaired by Will Quince MP and

coordinated by New Anglia LEP, met at Westminster on 26 February 2018.

Attendance included a number of regional MPs including Chloe Smith, Bernard Jenkin,

Sandy Martin, Vicky Ford, Therese Coffey, Priti Patel and Giles Watling, as well as

senior representatives from Network Rail, Greater Anglia and the Department for

Transport and the South East and New Anglia LEPs.

At this meeting, Will Quince MP announced that he was stepping down as Chair, due

to his recent promotion as Minister of Defence, and Priti Patel MP has agreed to take

over this role. New Anglia LEP continues to provide project management and

communications support to the Taskforce.

The Taskforce recognised the challenge in securing funding for rail infrastructure

priorities which are essential to achieve ‘Norwich in 90’ in what is now a much more

mobile environment, rather than working to a fixed control period.

The Taskforce agreed that there is an urgent need to refresh the economic case for

the Great Eastern Main Line - reiterating the economic benefits that investment in key

priority projects will bring to our region and ensuring that these economic benefits are

widely promoted. This evidence refresh will be led by New Anglia LEP and supported

by the South East LEP.

Business Engagement

Our economic strategy delivery plan events were attended by nearly 300 people,

including many businesses which have not engaged with us in the past. The events

were well received and feedback from attendees has been positive.

Other conference and speaking engagements

Doug Field spoke at the NAAME Advanced Manufacturing sector conference,

prompting businesses in the sector to engage with the LEP on issues around

productivity and growth.

7

59

Doug also spoke at the Suffolk Chamber networking lunch and a Sustainability in the

Food Chain Conference.

Recommendations

The board is invited to note the contents of this report.

8

60

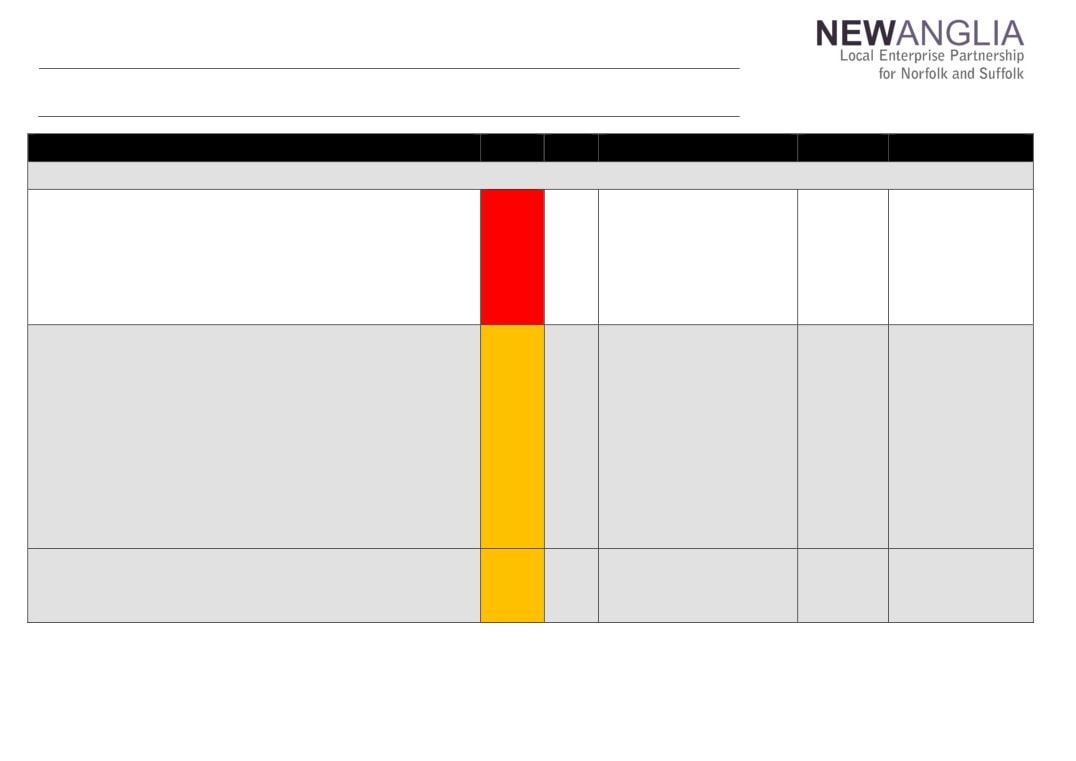

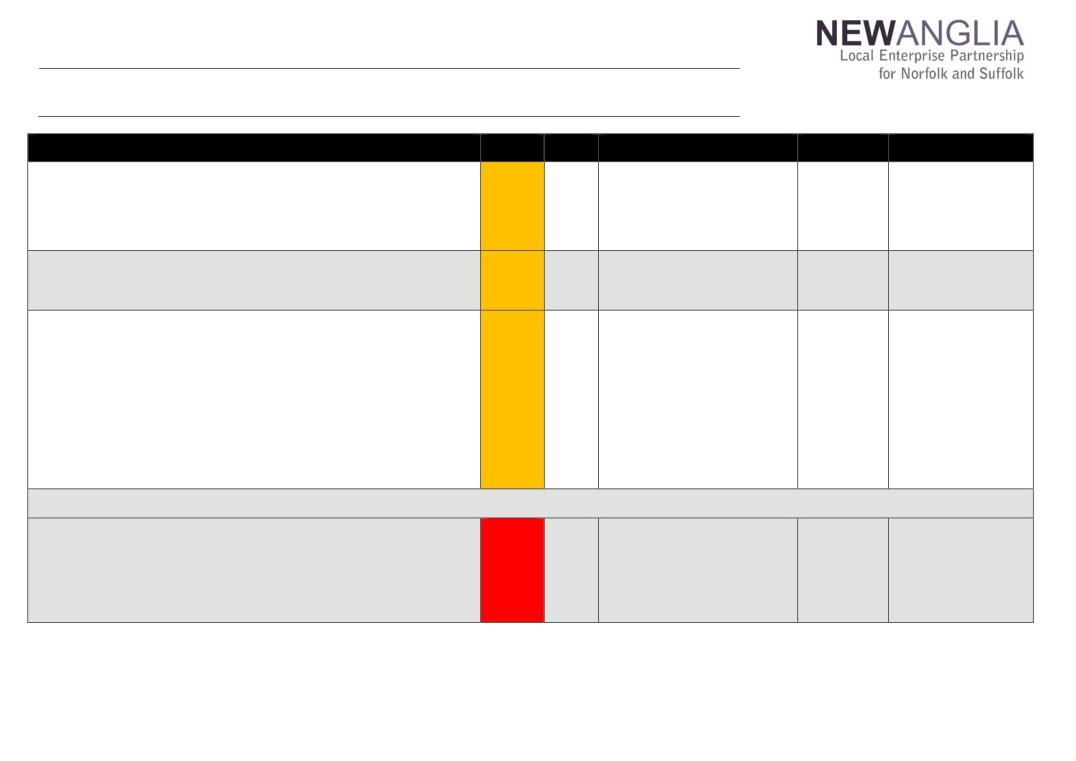

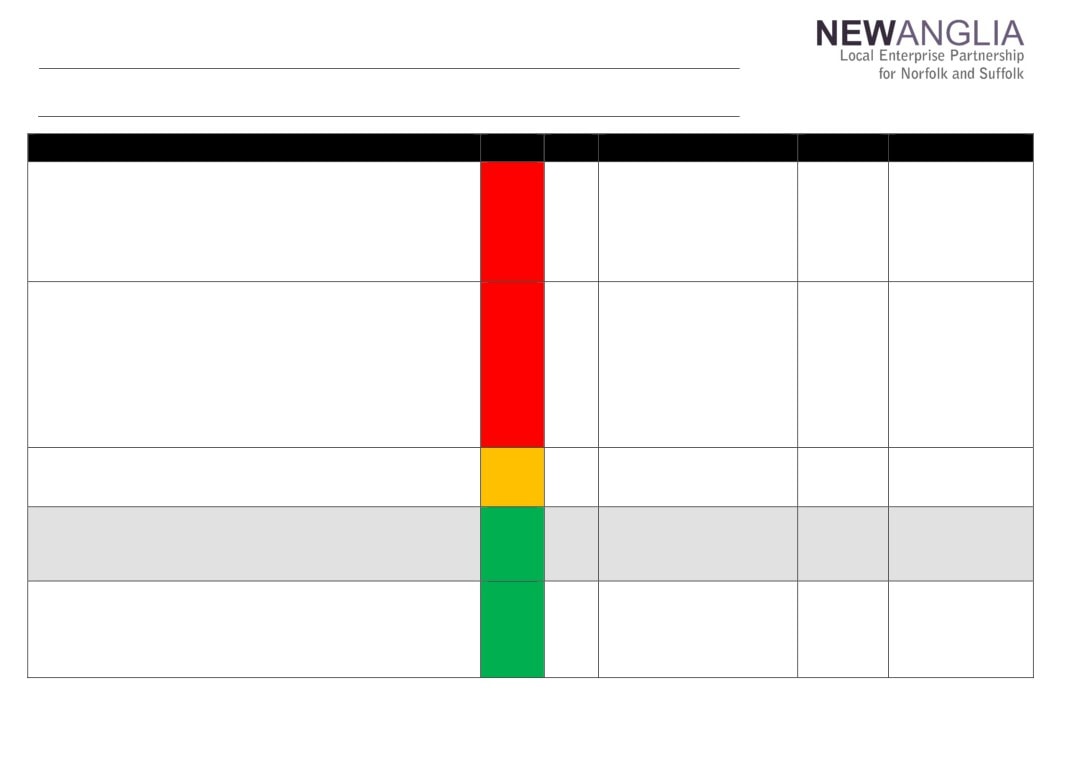

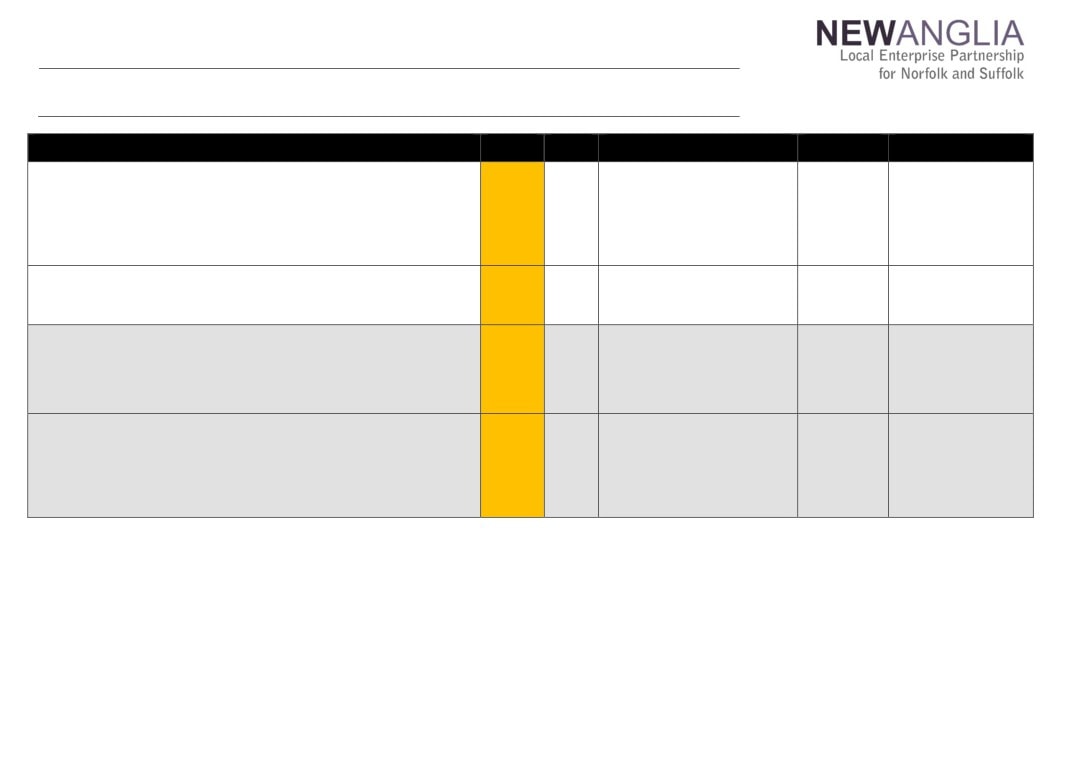

Agenda Item 13

Review of our Governance and Operations - Recommendations and Implementation Plan

Recommendation

Rating

Owner

Way Forward

Status

Next Steps

1.

Board

1.

Review the options available to the board to ensure transitional

Chair to have discussion

Pure

Interviews completed.

High

Board

arrangements are made for the handover of activities currently

with individual board

Executive

Offer made and

undertaken by the existing chair. Options may include one or a

members.

appointed for

accepted.

combination of the following:

Organisation to be reviewed

COO

Start date being

Re-allocation of strategic and representative duties to other Board

- CEO / COO roles to be

recruitment

confirmed.

members.

agreed

Creation of the position of a Deputy Chair(s)

Or creation of a new executive position focused on delivery of some of

the activities currently undertaken by the Chair.

2.

Undertake a review of the current committees and groups, including

Once economic strategy

Complete

Medium

Exec

their roles and responsibilities, in order to simplify the governance

published in October:

structure of the organisation and to improve the transparency of the

Review committees, sub-

decision making process. In particular, consideration should be made

board and groups to ensure

with respect to:

they align with priorities

Creation of a single Investment Committee, responsible for assessment of

Design reporting structure

all investment proposals (perhaps with the exception of the Micro Grant

for committees, sub-board

bids);

and groups

Review the purpose of the Performance and Risk Committee within

NALEP governance structure and clarify the rationale for the Board

Members attendance at the Committee. This should include consideration

if the committee should continue to operate as a Board Committee or a

management group.

Review the quality of the Committee outputs for the Board to ensure the

Board has clarity over the Committee’s activities.

3.

Review the focus of the Board, including the Board papers, to ensure

Medium

Board

Chair to work with Exec team to

Complete

balance between providing strategic focus and vision to NALEP and

align Board meetings with

reviewing operational matters and decisions. Review the format and

ambitions detailed in economic

content of the Board papers and management information reported to the

strategy

Board in order to increase quality of the Board reporting.

1 of 5

61

Agenda Item 13

Review of our Governance and Operations - Recommendations and Implementation Plan

Recommendation

Rating

Owner

Way Forward

Status

Next Steps

4.