Financial Services &

Insurance Data Pack

Version 2 05.03.2018

CONFIDENTIAL

Contents

-

Introduction to the Sector Data Pack

-

Introduction to and Definition of the Financial Services & Insurance Sector

-

The Financial Services & Insurance Sector in New Anglia

o Overview

o GVA

o Employment

o Enterprises

o Wages

-

Financial Services & Insurance Sector Skills Supply and Demand

o Qualifications

o UKCES Employer Skills Survey sector analysis

o Further Education Learning Aims analysis

o Apprenticeships

o Labour Insight Jobs tool sector analysis

o

‘Where the Work is’ tool sector analysis

-

A Future View of the Financial Services & Insurance Sector

-

Appendix - Financial Services & Insurance Sector Definition

2

Introduction to the Sector Data Pack

The role of the Sector Data Pack is to bring together the latest socio-economic and labour market data and present both an up-to-date, and

future view, of the sector and any underlying issues within the area that could impact upon it. Data is presented in a navigable format without

comment with interpretation at this stage left to the reader

The Data Pack informs the Sector Evidence Report, the key findings from which help to inform the priorities developed in the Sector Skills Plan.

The Sector Evidence Report is also summarised within the Sector Skills Plan and appears in full in the its appendices.

In most instances data has been analysed and presented down to local authority level. In some instances, and even where local authority data

is available, it has not been presented in the data pack due to issues of unreliability and small sample sizes. This is particularly the case with

data from the Annual Population Survey and the Annual Survey of Hours and Earnings.

Introduction to and Definition of the Financial Services & Insurance

Sector

3

The Financial Services

& Insurance Sector in

New Anglia

a

4

Overview

Financial Services & Insurance sector

contribution to the local economy

£2.14bn

6.0%

29,200

1,920

3.7%

3.2%

GVA

Employment

Enterprises

Source: New Anglia LEP Economic Strategy evidence base work

5

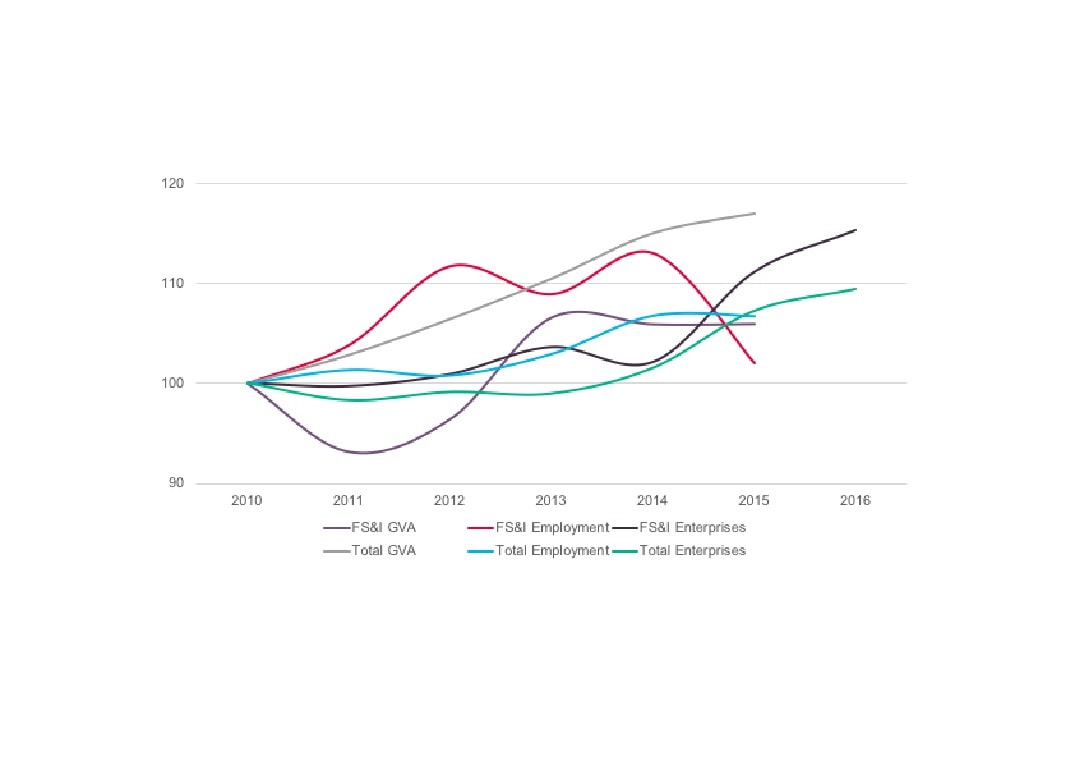

Financial Services & Insurance sector contribution to growth in

the local economy (2010=100)

Source: New Anglia LEP Economic Strategy evidence base work

6

Gross Value

Added (GVA)

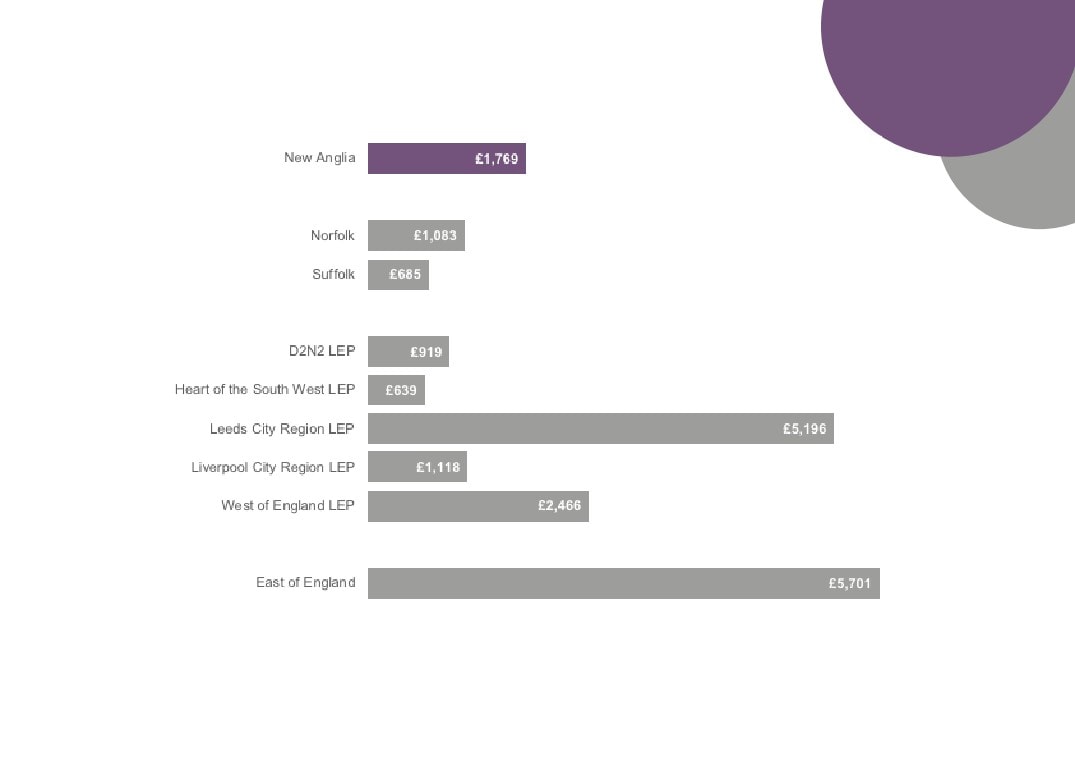

Financial Services & Insurance GVA (£m)

across comparator areas, 2015

Source: Sub-regional Gross Value Added (GVA), Office for National Statistics

Please note that due to the experimental nature of the GVA and employment statistics produced by New Anglia LEP for the New Anglia

area presented on page 5, these have not been able to be replicated for comparator areas, hence why the figure for New Anglia here are

different to those reported previously.

7

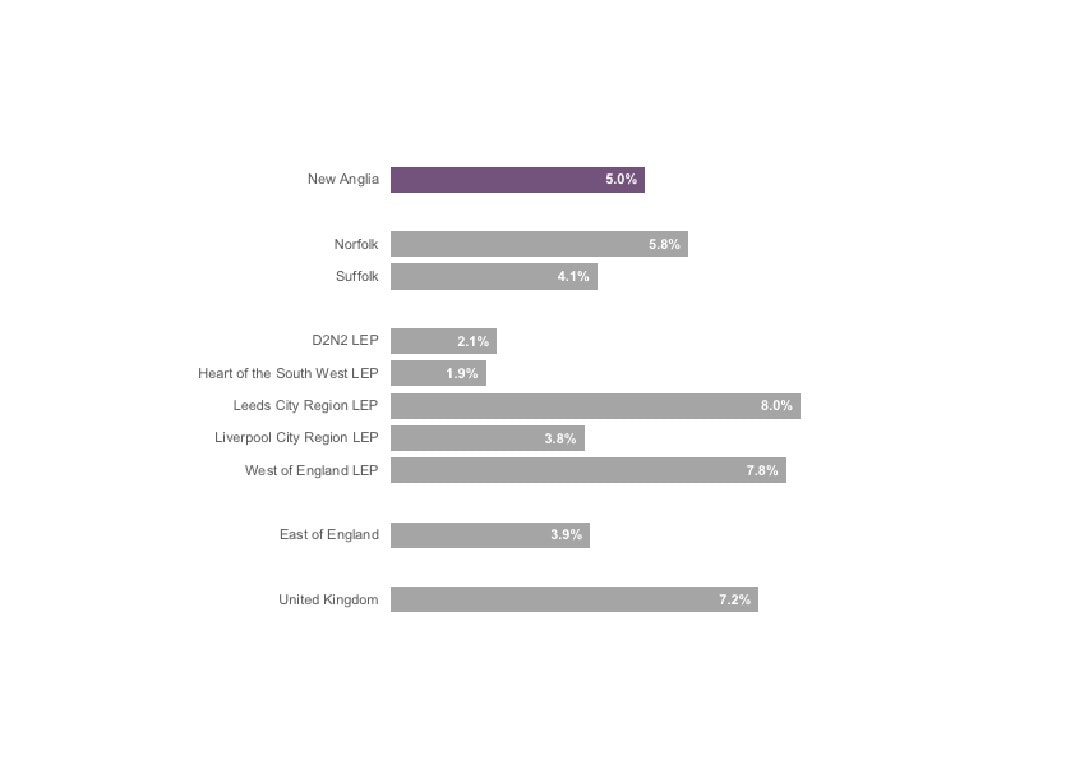

Proportion of total GVA produced by Financial

Services & Insurance across comparator areas, 2015

Source: Sub-regional Gross Value Added (GVA), Office for National Statistics

8

Change in Financial Services & Insurance GVA

across comparator areas (2010 - 2015)

New Anglia

-3%

Norfolk

-5%

Suffolk

0%

D2N2 LEP -31%

Heart of the South West LEP

-17%

Leeds City Region LEP

11%

Liverpool City Region LEP

-18%

West of England LEP

-9%

East of England

-4%

UK

4%

Sources: Sub-regional Gross Value Added (GVA), Office for National Statistics

Please note that due to the experimental nature of the GVA and employment statistics produced by New Anglia LEP for the

New Anglia area presented on page 6, these have not been able to be replicated for comparator areas, hence why the

figures for New Anglia here are different to those reported previously.

9

Employment

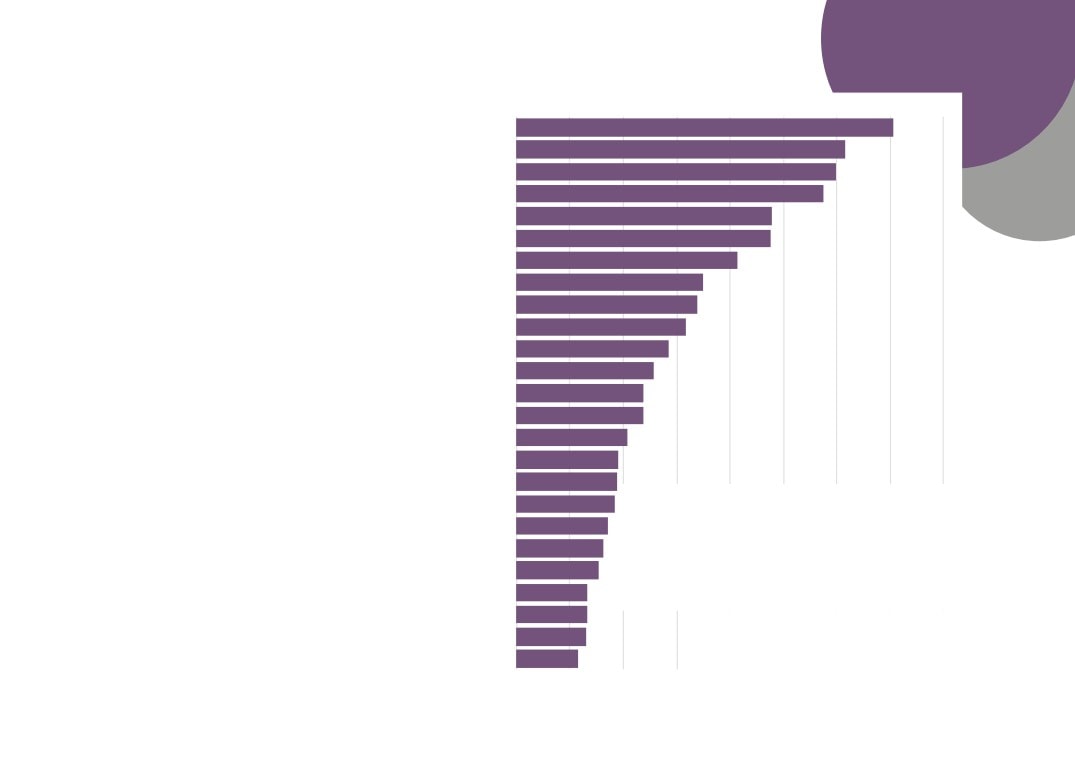

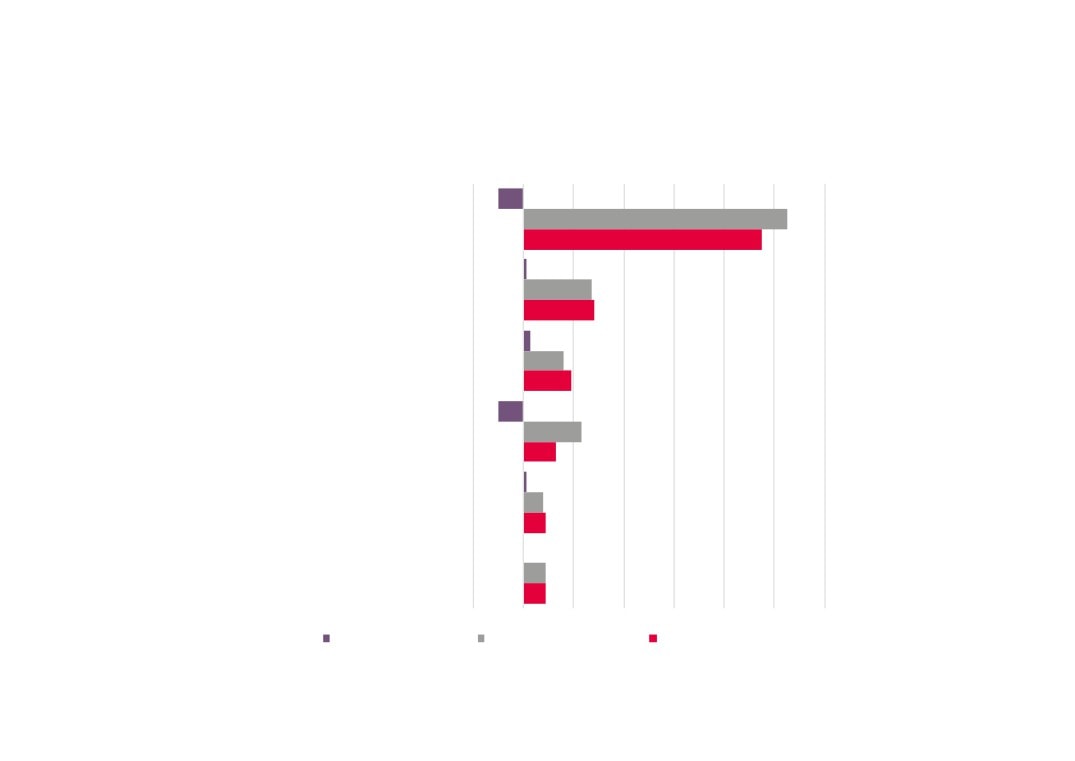

Employment provided by the Financial Services &

Insurance sector across comparator areas, 2015

New Anglia

26,000

Norfolk

14,800

Suf folk

10,800

D2N2 LEP

19,400

Heart of the South West LEP

16,800

Leeds City Region LEP

75,700

Liverpool City Region LEP

21,900

West of England LEP

36,800

East of England

107,000

Source: Business Register and Employment Survey, Office for National Statistics

Please note that due to the experimental nature of the GVA and employment statistics produced by New Anglia LEP for the

New Anglia area presented on page 5, these have not been able to be replicated for comparator areas, hence why the

figures for New Anglia here are different to those reported previously.

10

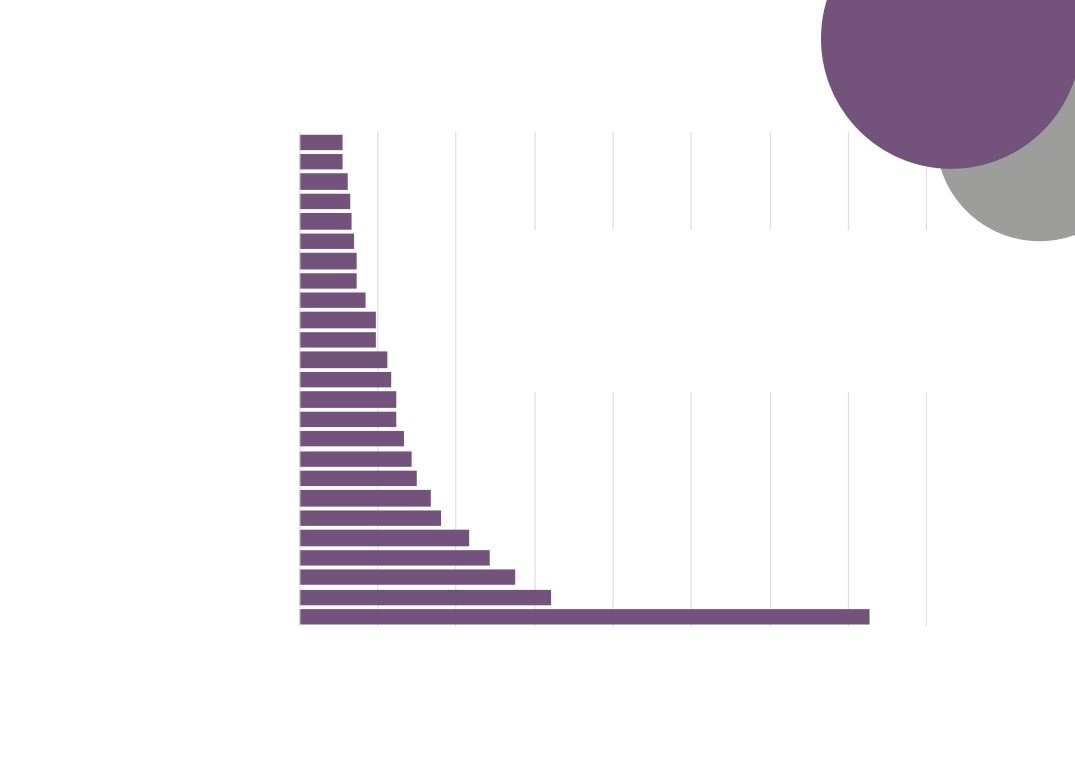

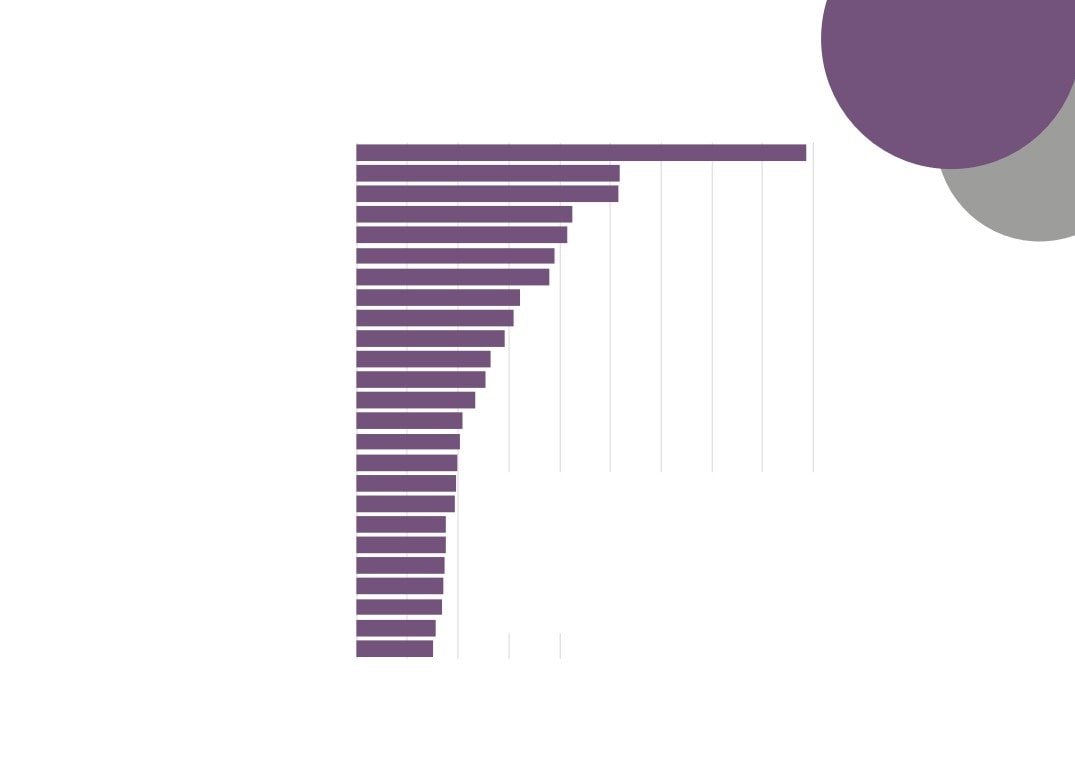

Employment provided by the Financial Services &

Insurance sector across New Anglia, 2015

Ipswich

6,125

Broadland

5,335

Norwich

4,945

King`s Lynn and West Norfolk

1,655

St Edmundsbury

1,570

South Norfolk

895

Breckland

755

Forest Heath

660

Suffolk Coastal

630

Waveney

625

Mid Suffolk

585

Babergh

570

Great Yarmouth

535

North Norfolk

530

Source: Business Register and Employment Survey, Office for National Statistics

11

Proportion of employment provided by the Financial

Services & Insurance sector across comparator areas, 2015

New Anglia

3.8%

Norfolk

4.1%

Suf folk

3.4%

D2N2 LEP

2.1%

Heart of the South West LEP

2.4%

Leeds City Region LEP

5.5%

Liverpool City Region LEP

3.6%

West of England LEP

6.4%

East of England

4.0%

United Kingdom

5.1%

Source: Business Register and Employment Survey, Office for National Statistics

Please note that due to the experimental nature of the GVA and employment statistics produced by New Anglia LEP for the

New Anglia area presented on page 6, these have not been able to be replicated for comparator areas, hence why the

figures for New Anglia here are different to those reported previously.

12

Proportion of employment provided by the Financial

Services & Insurance sector across New Anglia, 2015

Breckland

1.6%

Broadland

11.4%

Great Yarmouth

1.3%

Kings Lynn and West Norfolk

3.2%

North

Norfolk

1.5%

Norwich

5.5%

South Norfolk

1.8%

Babergh

1.9%

Forest Heath

2.9%

Ipswich

8.6%

Mid Suffolk

1.7%

St Edmundsbury

2.6%

Suffolk Coastal

1.2%

Waveney

1.5%

Source: Business Register and Employment Survey, Office for National Statistics

13

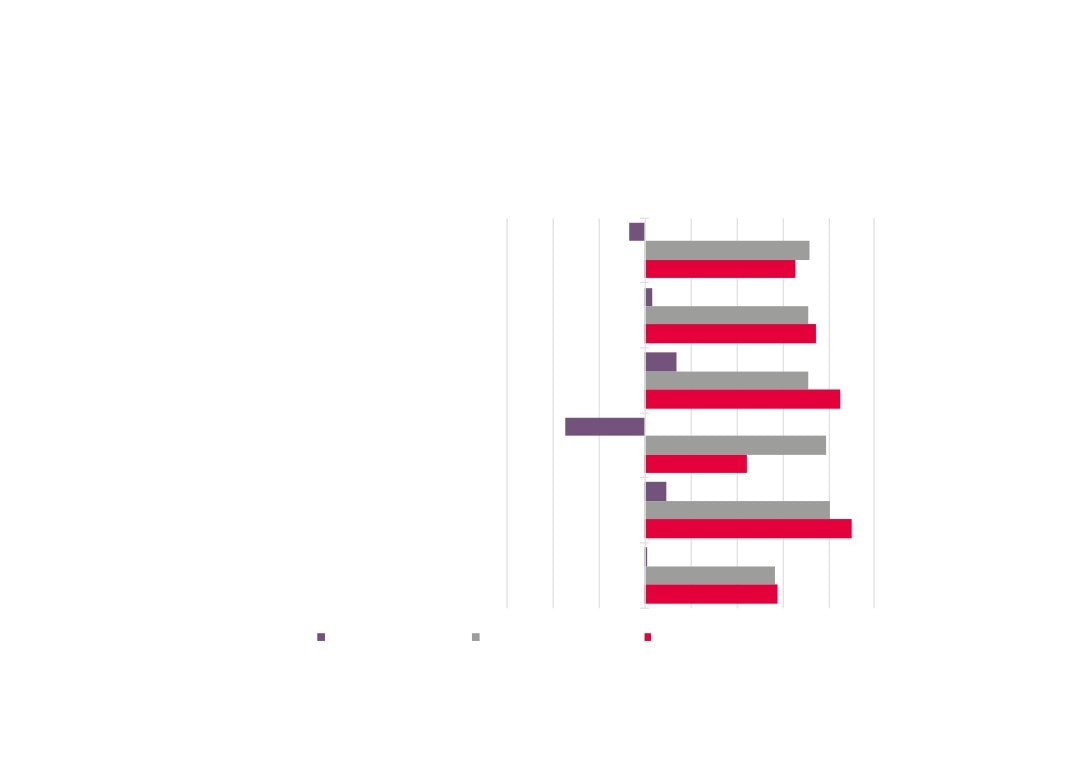

Change in Financial Services & Insurance

employment across comparator areas, 2010 - 2015

New Anglia

4%

Norfolk

-5%

Suffolk

5%

D2N2 LEP -17%

Heart of the South West LEP

9%

Leeds City Region LEP

5%

Liverpool City Region LEP

-3%

West of England LEP

-2%

East

24%

England

10%

Source: Business Register and Employment Survey, Office for National Statistics

14

Change in Financial Services & Insurance

employment across New Anglia, 2010 - 2015

Babergh

34%

Breckland

24%

Broadland

-23%

Forest Heath

27%

Great Yarmouth

-3%

Ipswich

2%

King`s Lynn and West Norfolk

35%

Mid Suffolk

60%

North Norfolk

-2%

Norwich

-1%

South Norfolk

23%

St Edmundsbury

13%

Suffolk Coastal

19%

Waveney

-10%

Source: Business Register and Employment

Survey, Office for National Statistics

15

Top Financial Services & Insurance sub sectors by employment, 2015

% of total Financial

Change in

Services &

Industry Sector Code

Industry Sector Name

Employment

employment 2010 -

Insurance sector

2015

employment

66220

Activities of insurance agents and brokers

9,200

32%

-12%

69201

Accounting, and auditing activities

5,200

18%

39%

64191

Banks

3,000

10%

-20%

66190

Other activities auxiliary to financial services, except insurance and pen

2,200

8%

7%

66290

Other activities auxiliary to insurance and pension funding

2,200

7%

4%

69202

Bookkeeping activities

1,700

6%

201%

65120

Non-life insurance

1,600

5%

4%

66210

Risk and damage evaluation

1,000

3%

16%

Source: New Anglia LEP Economic Strategy evidence base work

16

Top Financial Services & Insurance sub sectors with 100 employees or more by

growth in employment

% of total Financial

Change in

Services &

Industry Sector Code

Industry Sector Name

Employment

employment

Insurance sector

2010 - 2015

employment

69203

Tax consultancy

100

0%

218%

69202

Bookkeeping activities

1,700

6%

201%

64999

Other financial service activities, except insurance and pension funding, (not

800

3%

108%

64910

Financial leasing

100

0%

102%

69201

Accounting, and auditing activities

5,200

18%

39%

70221

Financial management

200

1%

39%

66210

Risk and damage evaluation

1,000

3%

16%

66190

Other activities auxiliary to financial services, except insurance and pension

2,200

8%

7%

66120

Security and commodity contracts brokerage

300

1%

6%

66290

Other activities auxiliary to insurance and pension funding

2,200

7%

4%

65120

Non-life insurance

1,600

5%

4%

Source: New Anglia LEP Economic Strategy evidence base work

17

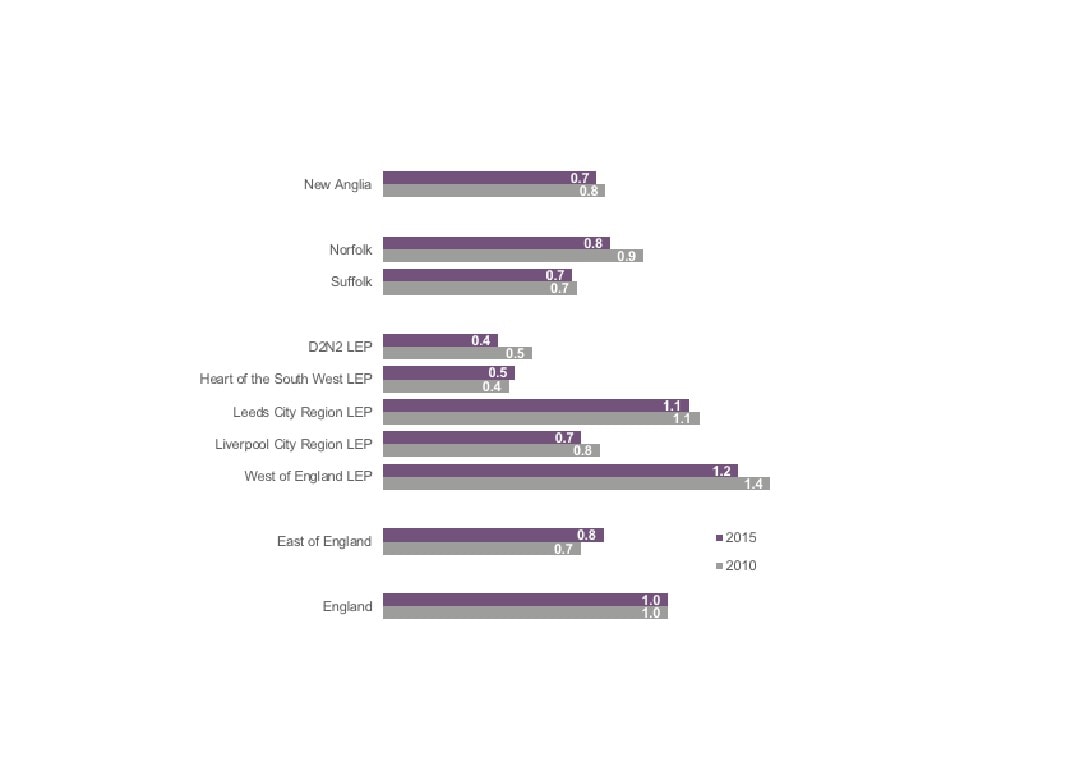

Financial Services & Insurance location quotients

across comparator areas, 2010 and 2015

Location quotients (LQs) are a

useful way of showing a sectors

importance to the local economy

relative to the national picture. The

analysis presented here uses

employment with an LQ above 1

showing a higher concentration than

nationally, and an LQ of below than

1 a lower concentration.

Source: Business Register and Employment Survey, Office

for National Statistics

18

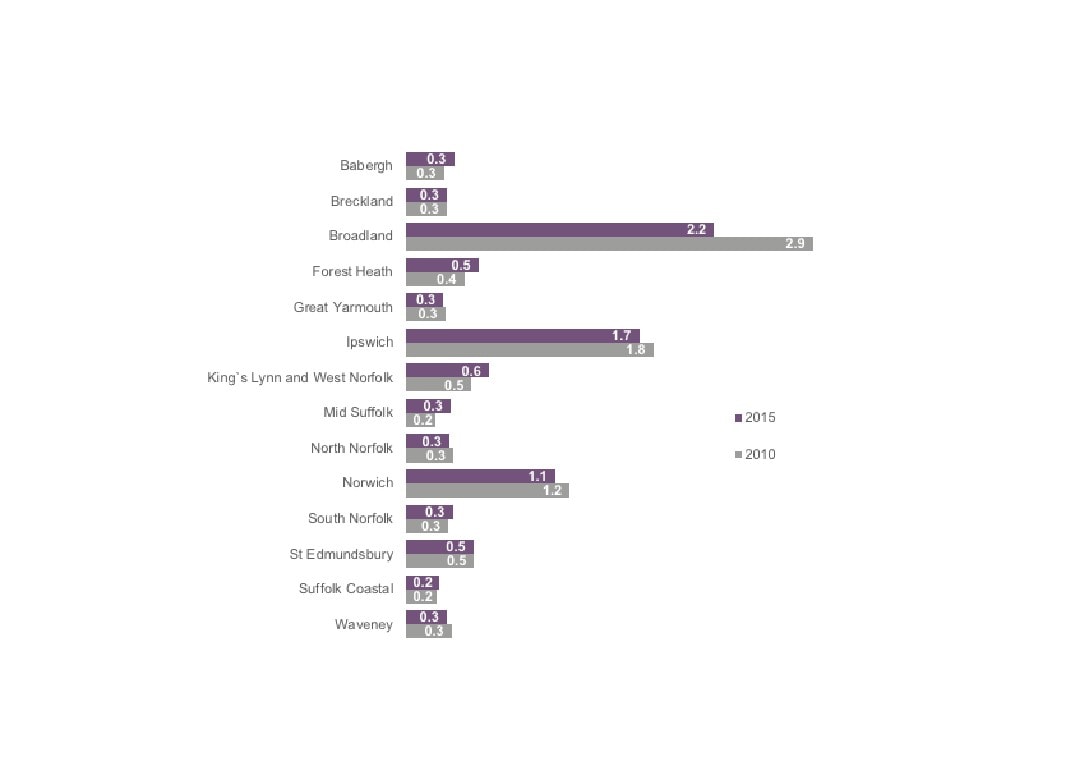

Financial Services & Insurance location

quotients across New Anglia, 2010 and 2015

Source: Business Register and Employment Survey, Office for National Statistics

19

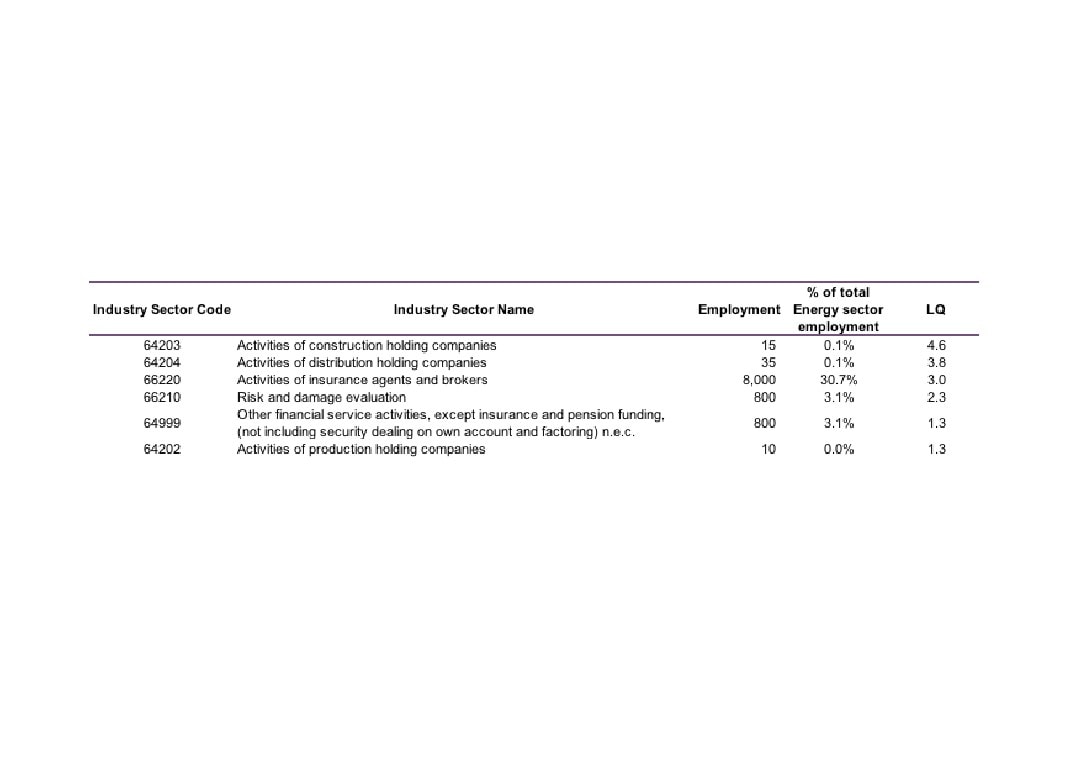

Financial Services & Insurance sub sectors with location quotients (LQs) above 1

Source: Business Register and Employment Survey 2015, Office for National Statistics

20

Full time, part time, and self-employment in the Financial

Services & Insurance sector, 2015

New Anglia

57%

29%

14%

Financial Services & Insurance

70%

18%

12%

0%

100%

Full time

Part time

Self Employed

Source: New Anglia LEP Economic Strategy evidence base work

21

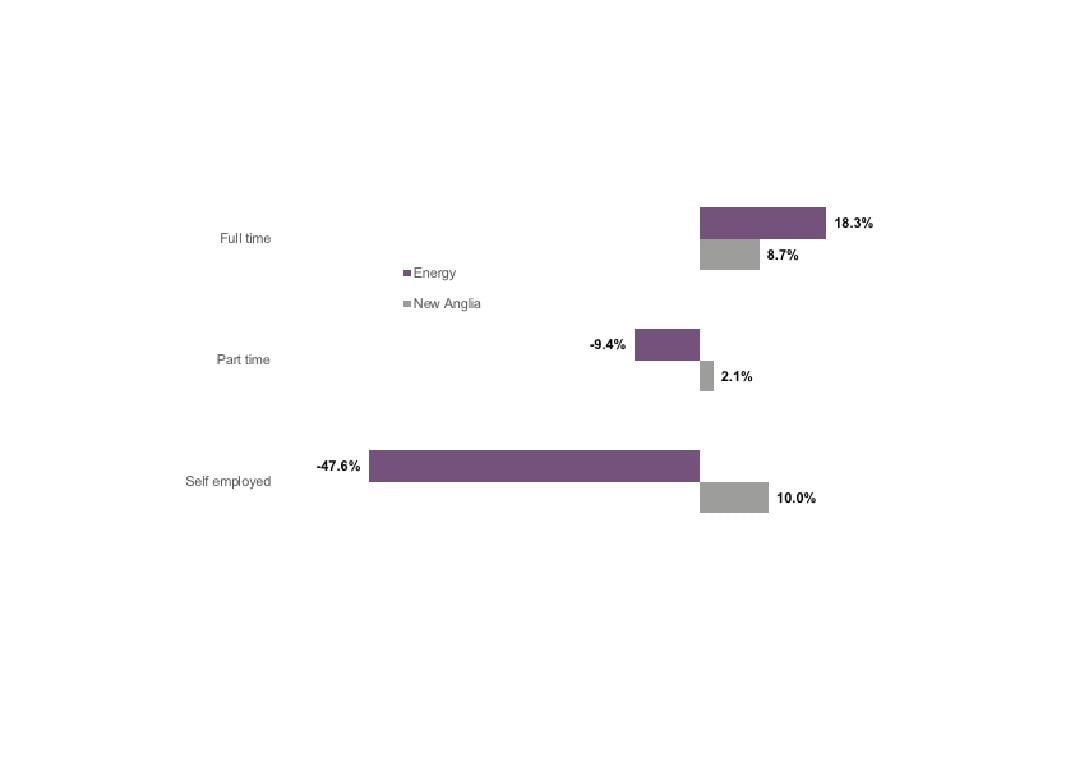

Change in full time, part time, and self-employment in the

Financial Services & Insurance sector, 2010 - 2015

Source: Business Register and Employment Survey, Office for National Statistics

22

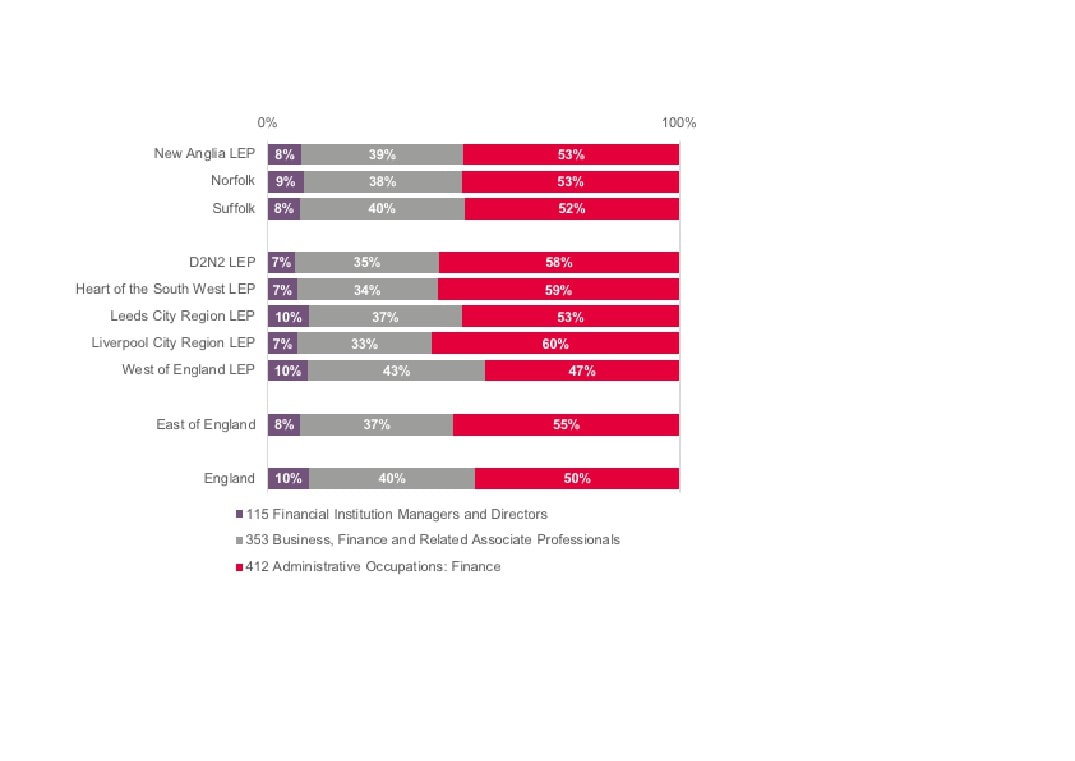

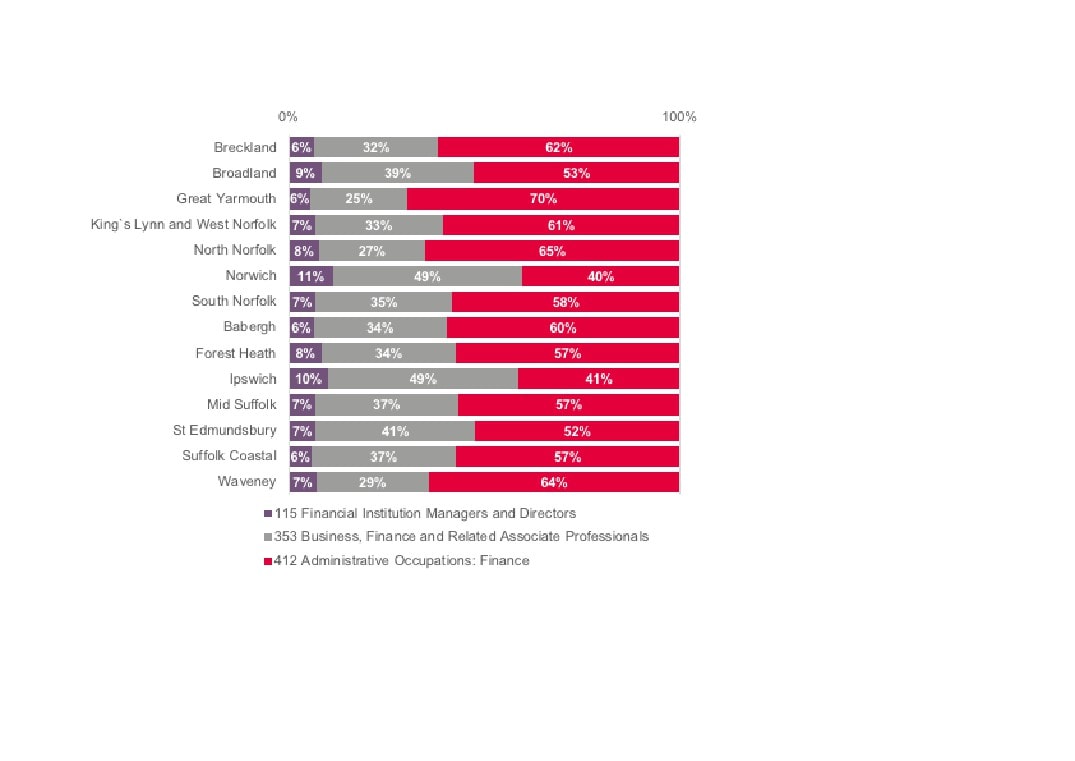

Workplace Financial

Services & Insurance

employment 2011 by broad

Standard Occupational

Classification (SOC) across

comparator areas

Source: 2011 Census, Office for National Statistics

23

Workplace Financial Services

& Insurance employment

2011 by broad Standard

Occupational Classification

(SOC) across New Anglia

Source: 2011 Census, Office for National Statistics

24

Enterprises

Financial Services & Insurance enterprises as a proportion

of total enterprises across comparator areas, 2016

New Anglia

3.1%

Norfolk

2.9%

Suffolk

3.4%

D2N2 LEP

3.6%

Heart of the South West LEP

3.0%

Leeds City Region LEP

4.0%

Liverpool City Region LEP

4.1%

West of England LEP

4.7%

East

4.1%

England

4.5%

Source: UK Business Counts, Office for National Statistics

25

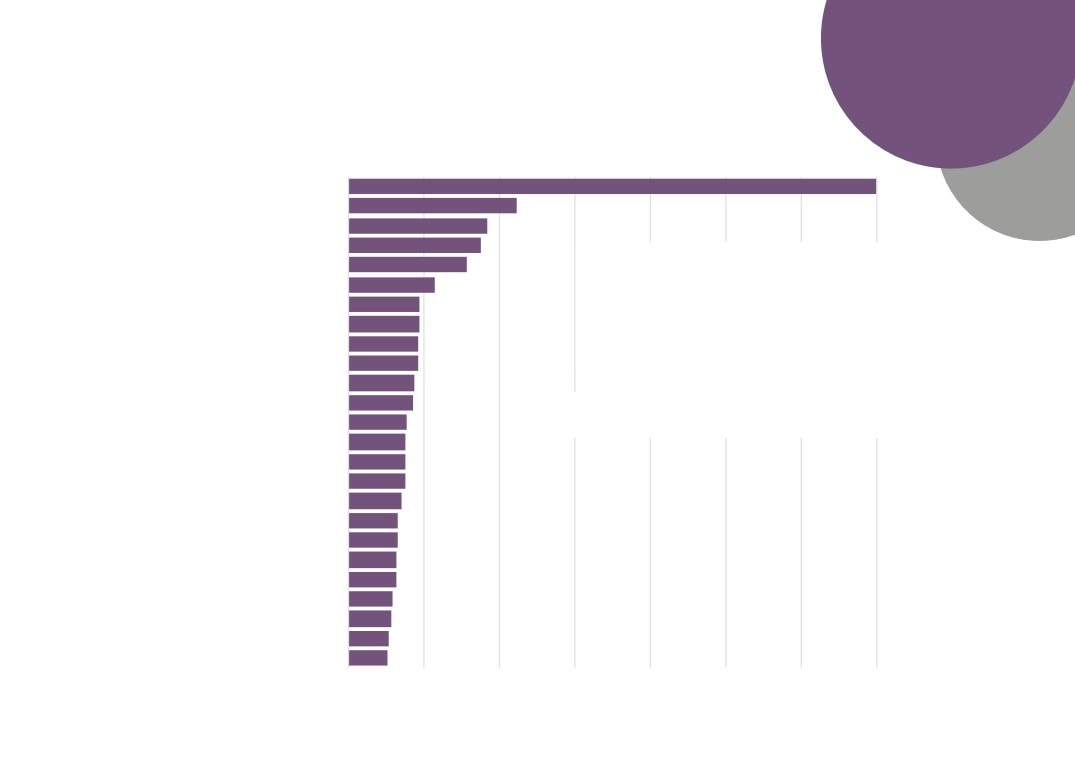

Financial Services & Insurance enterprises as a proportion of total

enterprises across New Anglia, 2016

Forest Heath

18%

North Norfolk

16%

Great Yarmouth

16%

Norwich

15%

Suffolk Coastal

12%

Ipswich

11%

Waveney

11%

Babergh

10%

King`s Lynn and West Norfolk

10%

St Edmundsbury

9%

Breckland

9%

South Norfolk

9%

Broadland

8%

Mid Suffolk

8%

Source: UK Business Counts, Office for National Statistics

26

New Anglia

94%

5%

Norfolk

94%

5%

Suffolk

95%

5%

Financial Services &

D2N2 LEP

94%

6%

Insurance sector enterprise

Heart of the South West LEP

93%

6%

Leeds City Region LEP

93%

6%

numbers by size across

Liverpool City Region LEP

93%

7%

comparator areas, 2016

West of England LEP

94%

6%

East

93%

5%

Please note that at Local Authority level that

businesses employing more than 250 people are

England

92%

6%

not reported due to their very small numbers and

No. of employees

resulting disclosive nature.

Micro (0 to 9)

Small (10 to 49)

Medium-sized (50 to 249)

Large (250+)

Source: UK Business Counts, Office for

Babergh

93%

4%

National Statistics

Breckland

100%

Broadland

94%

Forest Heath

100%

Great Yarmouth

100%

0%

Ipswich

100%

Financial Services &

King`s Lynn and West Norfolk

96%

Insurance sector enterprise

Mid Suffolk

97%

North Norfolk

100%

0%

numbers by size across

Norwich

91%

9%

New Anglia, 2016

South Norfolk

86%

St Edmundsbury

97%

Suffolk Coastal

Waveney

94%

6%

27

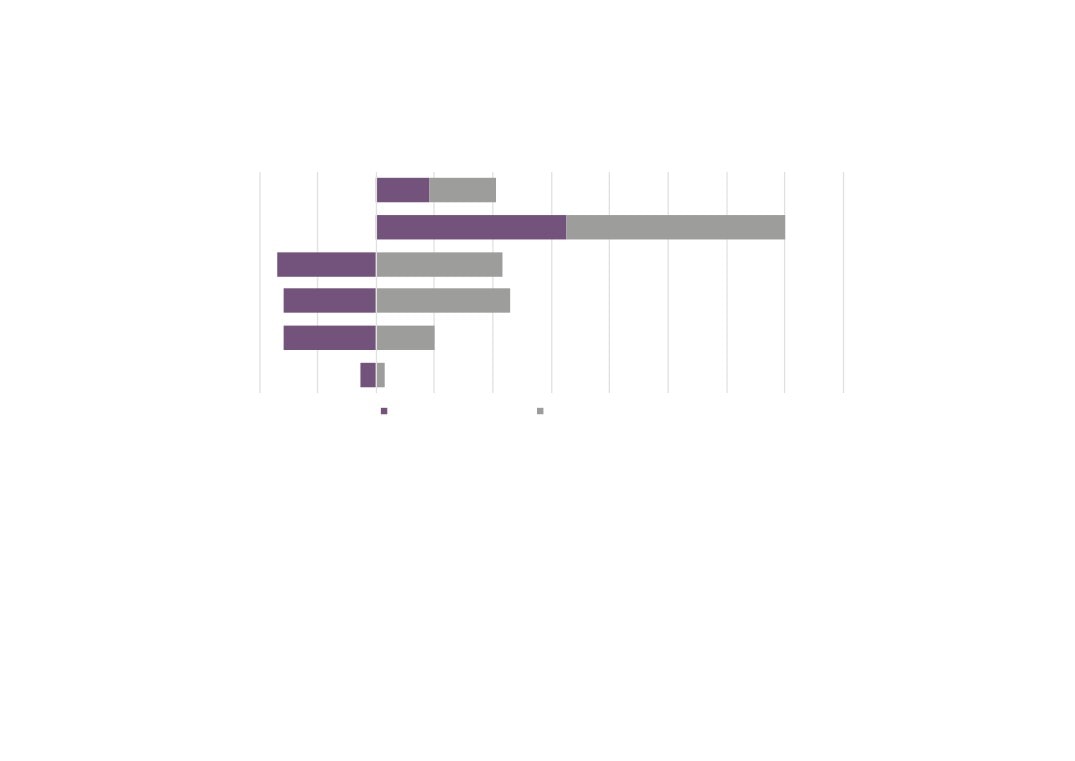

Change in Financial Services &

Insurance enterprises across comparator

New Anglia

15%

Norfolk

16%

Suffolk

18%

D2N2 LEP

26%

Heart of the South West LEP

19%

Leeds City Region LEP

32%

Liverpool City Region LEP

42%

West of England LEP

41%

East

28%

England

32%

Source: UK Business Counts, Office for National Statistics

28

Babergh

-4%

Breckland

17%

Broadland

13%

Forest Heath

50%

Great Yarmouth

-10%

Ipswich

0%

Change in Financial

King`s Lynn and West Norfolk

26%

Services & Insurance

enterprises across New

Mid Suffolk

31%

Anglia, 2010 - 2016

North Norfolk

14%

Sources: UK Business Counts, Office for

Norwich

9%

National Statistics

South Norfolk

17%

St Edmundsbury

6%

Suffolk Coastal

41%

Waveney

20%

29

Financial Services &

Insurance Skills Supply

and Demand

30

Qualifications

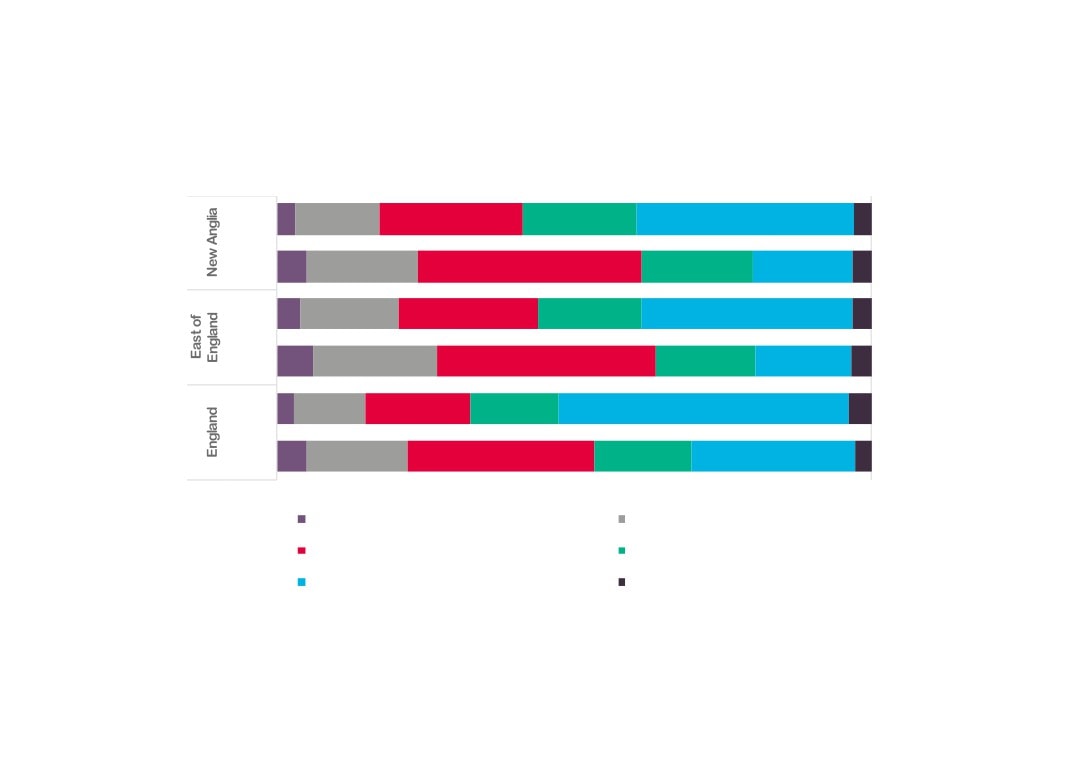

Financial Services & Insurance workplace qualifications across

comparator areas, 2011

New Anglia

3%

14%

24%

19%

37%

3%

Derby, Derbyshire, Nottingham and

3%

14%

22%

18%

40%

3%

Nottinghamshire

Greater Manchester

3%

14%

22%

18%

41%

3%

Leeds City Region

3%

13%

21%

18%

42%

3%

Liverpool City Region

5%

17%

24%

18%

34%

2%

South East

5%

19%

25%

17%

31%

3%

West of England

2%

12%

19%

17%

47%

2%

Source: 2011 Census, Office for National Statistics

East

4%

17%

24%

17%

35%

3%

England

3%

12%

18%

15%

49%

4%

No qualifications

Level 1 qualifications

Level 2 qualifications

Level 3 qualifications

Level 4 qualifications and above

Apprenticeships and other qualifications

31

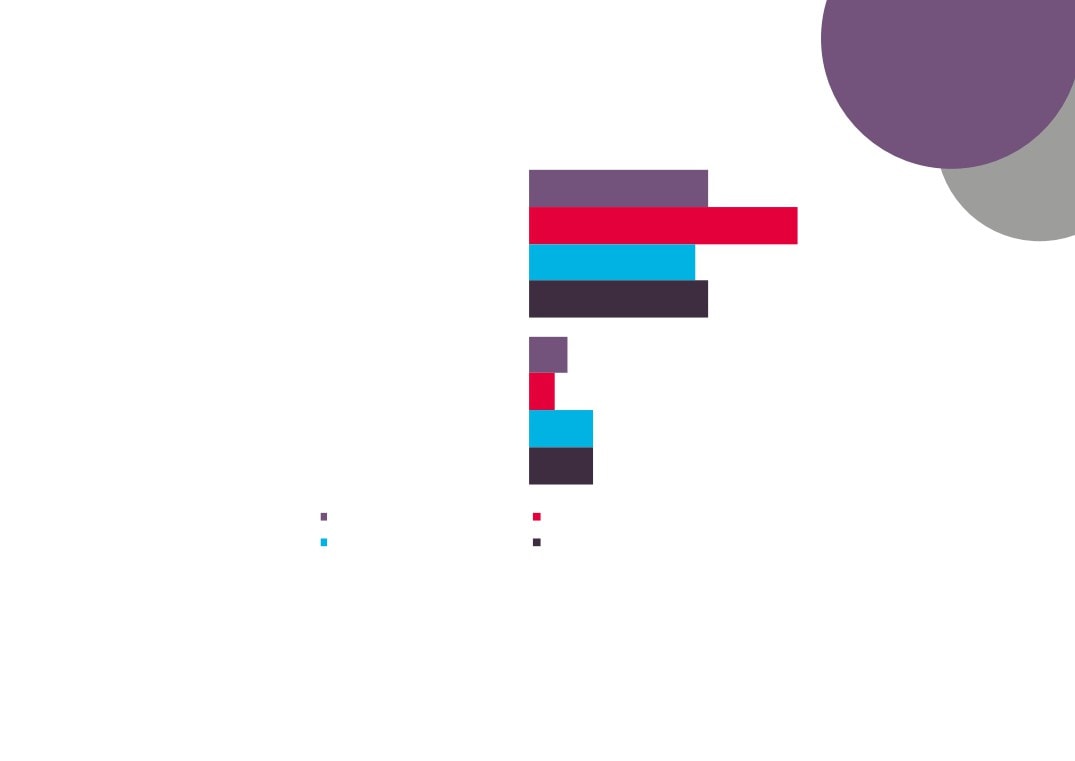

Change in Financial Services & Insurance workplace

qualifications, 2001 - 2011

2011

3%

14%

24%

19%

37%

3%

2001

5%

19%

38%

19%

17%

3%

2011

4%

17%

24%

17%

35%

3%

2001

6%

21%

37%

17%

16%

3%

2011

3%

12%

18%

15%

49%

4%

2001

5%

17%

31%

16%

27%

3%

0%

100%

No qualifications

Level 1 qualifications

Level 2 qualifications

Level 3 qualifications

Level 4 qualifications and above

Apprenticeships and other qualifications

Source: 2001 and 2011 Census, Office for National Statistics

32

UKCES ESS

2015

The following analysis uses the LEP level data released as part of the UK Commission for Employment and Skills (UKCES) Employer Skills

Survey (ESS) 2015. The data covers the areas of vacancies, skills gaps, training, and staff retention and underutilisation.

Data is published for a limited number of broad sectors at LEP level and we have chosen the sector of ‘Financial Services’ as that being closest

to encapsulating Financial Services & Insurance sector activity. In all instances, national, regional, and New Anglia LEP averages are

presented as comparators.

In total, 2,364 employers in New Anglia were surveyed, 73 of which were ‘Financial Services’ employers.

33

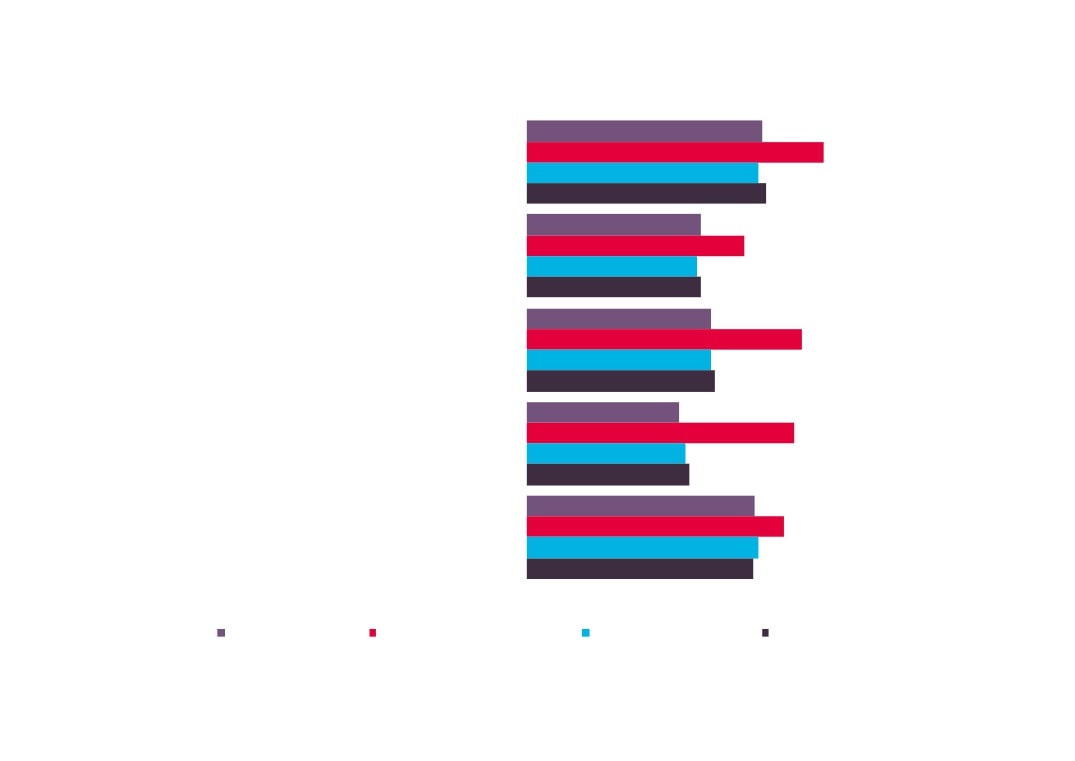

Vacancies

17%

20%

Establishments with any vacancies

19%

20%

6%

8%

Have at least one vacancy that is hard to fill

7%

8%

4%

Have a skills shortage vacancy (prompted or

7%

unprompted)

5%

Source: UKCES Employer

6%

Skills Survey 2015

3%

5%

Number of vacancies as a % of all employment

3%

3%

19%

20%

% of all vacancies which are SSVs

22%

23%

New Anglia (Average)

Financial Services (New Anglia)

East of England (Average)

England (Average)

34

Skills Gaps

14%

21%

% of establishments with any staff not fully

proficient

13%

14%

3%

2%

Number of staff not fully proficient as a % of

employment

5%

5%

New Anglia (Average)

Financial Services (New Anglia)

East of England (Average)

England (Average)

Source: UKCES Employer Skills Survey 2015

35

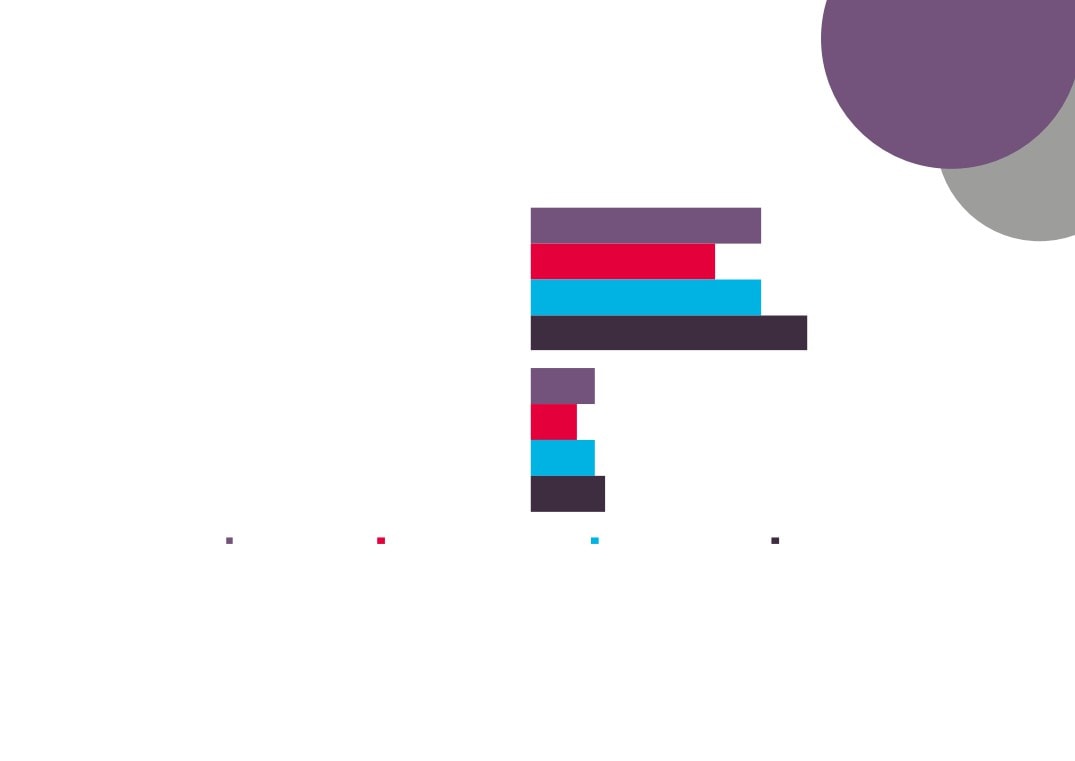

Training

7.5

3.2

Training days per trainee

6.3

6.8

4.7

2.3

Training days per staff

4.0

4.3

New Anglia (Average)

Financial Services (New Anglia)

East of England (Average)

England (Average)

Source: UKCES Employer Skills Survey 2015

36

65%

% of establishments training staff over the last 12

82%

months

64%

66%

48%

% of establishments providing off-the-job training in

60%

the last 12 months

47%

48%

51%

% of establishments providing on-the-job training in

76%

the last 12 months

51%

52%

42%

% of training establishments providing online training

74%

or e-learning in the last 12 months

44%

45%

63%

71%

Number trained as % of total staff

64%

63%

Source: UKCES Employer

Skills Survey 2015

New Anglia (Average) Financial Services (New Anglia) East of England (Average) England (Average)

37

Staff

25%

20%

Establishments with underutilised staff

25%

30%

7%

5%

Whether any jobs in which have difficulties retaining

Source: UKCES Employer

staff

Skills Survey 2015

7%

8%

New Anglia (Average) Financial Services (New Anglia) East of England (Average) England (Average)

38

FE Learning

Aims

All data (unless stated otherwise) is sourced from the Department for Education’s Further Education data library

In order to present information that is relevant to New Anglia LEPs high performing and underpinning sectors then we have

identified FE and skills provision data split by Sector Lead Body and aligned a best-fit with each sector.

The Sector Lead Body identified as being the most relevant to the Financial Services & Insurance sector is ‘Finance, Accountancy & Financial

Services’.

However, not all FE and Skills learning aims align with a sector lead body. In fact, on average around two thirds are classed as unknown. This

means that we are basing results here on roughly a third of the data.

Please note that all data is rounded to the nearest 10 and that therefore some figures presented may not add to the sum totals presented.

39

Financial Services & Insurance sector learning aims delivered to

New Anglia learners by Sector Lead Body, 2010/11 and 2012/13

1,120

770

Finance, Accountancy & Financial Services

2010/11

2012/13

Source: FE Data Library, Department for Education

40

Change in Financial Services & Insurance sector learning aims

delivered to resident learners by Sector Lead Body, 2010/11 - 2012/13

5%

Total inc. Unknown

9%

-38%

Total not inc. Unknown

7%

45%

Finance, Accountancy & Financial Services

33%

New Anglia National

Source: FE Data Library, Department for Education

41

Financial Services & Insurance learning aims delivered to

New Anglia residents by New Anglia based and external

providers by Sector Lead Body, 2012/13

0%

20%

40%

60%

80%

100%

Finance, Accountancy & Financial

1,120

340

Services

Total with unknown removed

55,340

24,770

New Anglia Provider

External Provider

Source: FE Data Library, Department for Education

42

Financial Services & Insurance learning aims delivered to New Anglia

learners by providers by Sector Lead Body, 2010/11 and 2012/13

1,120

770

Finance, Accountancy & Financial Services

2010/11

2012/13

Source: FE Data Library, Department for Education

43

Change in Financial Services & Insurance learning aims

delivered to resident learners by domiciled providers by Sector

Lead Body, 2010/11 - 2012/13

5%

Total inc. Unknown

9%

-38%

Total not inc. Unknown

7%

45%

Finance, Accountancy & Financial Services

33%

New Anglia National

Source: FE Data Library, Department for Education

44

Apprenticeships

Financial Services & Insurance sector

apprenticeship starts by year

350

300

55

70

250

100

70

200

150

265

225

100

195

185

50

0

2011/12

2012/13

2013/14

2014/15

Accounting

Providing Financial Services

Source: Skills Funding Agency Data Cube

45

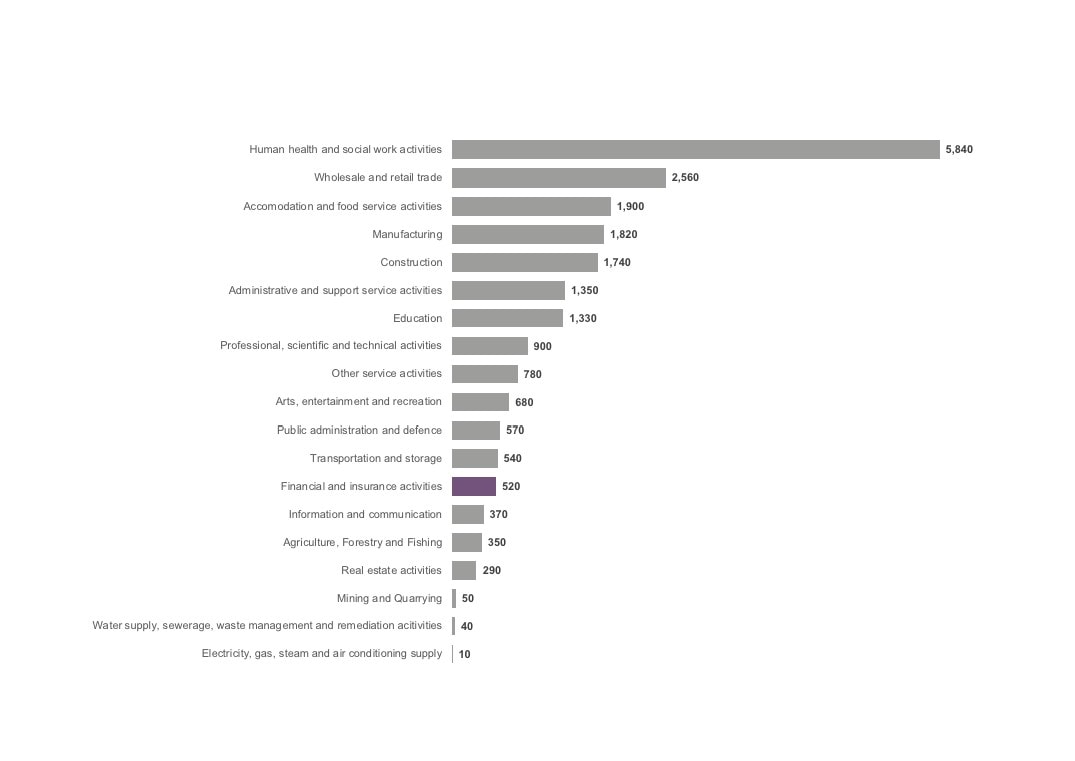

Apprenticeship participation by sector, 2014/15

Source: FE Data Library, Department for Education

46

Apprenticeship participation in the Financial Services &

Insurance sector 2014/15 as a proportion of total participation

2.4%

Financial and insurance activities

3.7%

New Anglia England

Source: FE Data Library, Department for Education

47

Labour Insight

Jobs

The following section presents data from Labour Insight, a Burning Glass analytical tool. This tool collects details of online

job postings from multiple sources and enables the analysis of these postings based on specific skills, educational

requirements, and job titles, for example.

Please note that whilst Labour Insight will capture more information on the jobs market than more traditional Department

for Work and Pensions vacancy data, the fact that not all job vacancies are advertised means that there will still be gaps in

the findings.

According to the Labour Insight Jobs tool, then there were 11,965 postings for the Financial Services & Insurance sector in

New Anglia between Jan. 1, 2012 and Dec. 31, 2016.

The definition for the Financial Services & Insurance sector in this exercise captures the following industry and sectors:

‘Financial and Insurance Activities’, and ‘Accounting, bookkeeping and auditing activities; tax consultancy’.

48

Location

Financial Services & Insurance sector vacancies

across New Anglia, Jan 2012 - Dec 2016

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

Norwich

Ipswich

St Edmundsbury

Forest Heath

King's Lynn and West Norfolk

Breckland

Waveney

South Norfolk

Great Yarmouth

Suffolk Coastal

Babergh

Mid Suffolk

North Norfolk

1,363 unspecified or unclassified postings

Broadland

Source: Labour Insight Jobs, Burning Glass

Technologies

49

Recruiters

Willis Group Limited

Virgin Money

BDO

Direct Line Insurance

Mears Group

HSBC Holdings

Top Financial Services &

Saga Homecare

Countrywide Estate Agents

Insurance sector recruiters across

TSB Bank PLC

New Anglia, Jan 2012 - Dec 2016

Lloyds Banking Group

5,838 unspecified or unclassified postings

Britannia Bank

Travelex

Source: Labour Insight Jobs, Burning Glass

Technologies

Yorkshire Building Society

Legal & General Group

Willis North America Inc

BUPA

Bank of England

Swinton Group

Emcor Group

Barclays

Royal Bank of Scotland

Anglian Water Group

Anglian Group

AXA

Aviva PLC

0

100

200

300

400

500

600

700

800

50

Occupation

0

100

200

300

400

500

600

700

800

Business sales executives (3542)

Finance and investment analysts and advisers (3534)

Insurance underwriters (3533)

Customer service occupations n.e.c. (7219)

Marketing associate professionals (3543)

Pensions and insurance clerks and assistants (4132)

Sales related occupations n.e.c. (7129)

Call and contact centre occupations (7211)

Programmers and software development professionals (2136)

Management consultants and business analysts (2423)

Other administrative occupations n.e.c. (4159)

Financial managers and directors (1131)

Managers and proprietors in other services n.e.c. (1259)

Chartered and certified accountants (2421)

Bank and post office clearks (4123)

Estimators, valuers and assessors (3531)

Financial accounts managers (3538)

Web design and development professionals (2137)

Financial Services &

Book-keepers, payroll managers and wages clerks (4122)

Insurance sector vacancies

Care workers and home carers (6145)

by occupation, Jan 2012 -

Sales and retail assistants (7111)

IT business analysts, architects and systems designers (2135)

Dec 2016

Sales supervisors (7130)

84 unspecified or unclassified postings

Sales accounts and business development managers (3545)

Source: Labour Insight Jobs, Burning

Science, engineering and production technicians n.e.c. (3119)

Glass Technologies

51

Job Title

0

100

200

300

400

500

600

700

Sales Executive

Business Analyst

Commercial Underwriter

Customer Advisor

Commercial Account Handler

Financial Services &

Customer Service Advisor

Insurance sector

Account Manager

Account Executive

vacancies by job title, Jan

Sales Consultant

2012 - Dec 2016

Claims Adjuster

Financial Advisor

0 unspecified or unclassified postings

Accountant

Source: Labour Insight Jobs, Burning Glass

Technologies

Financial Planner

Business Development Executive

Mortgage Advisor

Project Manager

Claims Handler

Mortgage Consultant

Registered Nurse

Accountancy Assistant

Cleaner

Tax Manager

Personal Banker

Administrative Clerk

Branch Manager

52

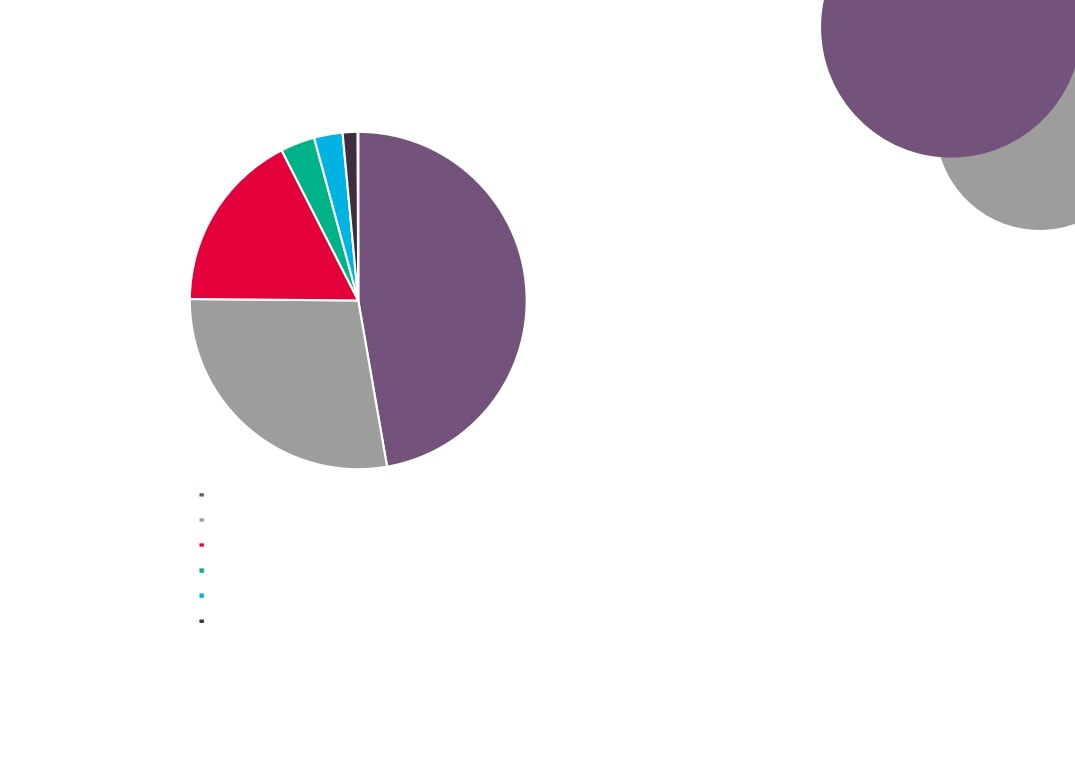

Qualification

Requirements

59 31

71

374

Financial Services & Insurance

1019

sector vacancies by

qualification level required, Jan

2012 - Dec 2016

9,809 unspecified or unclassified postings

Source: Labour Insight Jobs, Burning Glass Technologies

601

GCSEs, Standard Grades, and Level 2 S/NVQs

Bachelor's degrees, graduate certificates and diplomas

A-Levels, Highers, and Level 3 S/NVQs

Post graduate degrees, Level 5 S/NVQs, certificates and

diplomas

Level 4 diplomas and certificates, HNCs, Level S/NVQs

Foundation degrees and HNDs

53

Skills

Requirements

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

Customer Service

Business Management

Microsoft Excel

Accountancy

Customer Contact

Sales

Insurance Underwriting

Product Sales

Key Performance Indicators

Project Management

Microsoft Office

Business Development

Claims Adjustments

SQL

Sales Goals

Negotiation Skills

Product Knowledge

Financial Services &

Financial Industry Experience

Contract Management

Insurance sector vacancies

Insurance Industry Background

by skills required, Jan 2012

JavaScript

Microsoft Windows

- Dec 2016

Business Analysis

2,903 unspecified or unclassified postings

Repair

Source: Labour Insight Jobs, Burning

Budgeting

Glass Technologies

54

Where the

Work is

The following analysis makes use of data and findings available via the online toolkit http://wheretheworkis.org/ . The findings presented

are a result of combining data from the UKCES ‘Working Futures’ programme and job vacancy data from the Labour Market Insight tool

developed by Burning Glass.

Limitations

Though the ‘Where the work is’ tool provides a comprehensive and detailed free-to-use dashboard of supply and demand in the UK, the

following limitations should be taken into account when interpreting the data:

- Senior Management and Elementary roles

Occupations not open to recent HR graduates or FE finishers are not considered. Similarly, occupations that do not require any formal

qualifications or training are also excluded from this tool, since the number of job-seekers cannot be meaningfully quantified.

- Matching supply and demand

Some occupations do not have specific qualifications or subject-specific requirements (such as sales, marketing and related associate

professionals). As a result of this, and despite the fact that many people with a broad range of qualifications can apply for these occupations,

they frequently appear ‘undersupplied’ in the tool, i.e. when the “job opportunity” is low. Occupations with very small sample sizes (either of

finishers or job postings) are excluded from the dataset.

- Internal and international migration

Some occupations do not rely solely on FE finishers or HE graduates from their immediate location. Many people travel to find work, often

moving across the country. Other occupations, such as those on the Migration Advisory Committee’s shortage occupation list, may rely more

heavily on jobseekers arriving from outside the UK.

- Online and offline postings

Burning Glass Technologies (BGT) acknowledge that not all jobs are posted online, although a comparison of the Annual Survey of Hours and

Earnings (ASHE) employment data and BGT postings data for UK in 2014 showed a 94 per cent correlation between ASHE and BGT

occupational distributions. The BGT posting data slightly overestimate the proportion of professional and associate professional occupations,

while slightly underestimating the proportion of elementary occupations.

55

Location

Quotient

Location Quotient - Measure of Job Posting Density

relative to employment indexed to the national density

relative to employment

Administrative: Finance

0.71

Low

Business, Finance and

Related Associate

0.55

Very low

Professionals

56

Vacancies by

Opportunity

Number of Job Postings asking for entry-level (2 years of

experience or fewer) and school leaver education levels,

further education levels, and higher education levels

Administrative: Finance

1,390

386

207

Business, Finance and Related

203

226

572

Associate Professionals

School leaver

FE

HE

57

Average

Wages

Advertised Salaries for Job Postings in 2015

£24,400

Administrative: Finance

£28,000

£37,300

£34,700

Business, Finance and

Related Associate

£37,800

Professionals

£49,800

New Anglia

East of England

England

58

Opportunity

Scores

Opportunity Score - Score based on the Demand

Supply Ratio of FE / HE postings within a

geography, from Very Low (0) to Very High (100)

Further Education

Higher Education

41

Administrative: Finance

52

49

99

47

80

Business, Finance and

Related Associate

59

95

Professionals

53

87

New Anglia

East of England

England

59

A Future View of the

Financial Services &

Insurance Sector

60

The following analysis uses data from the East of England Forecasting Model (EEFM) and the UKCES Working Futures data

(WF). In each case the Financial Services & Insurance sector has been approximated from the sector splits available in each

model. In the case of the East of England Forecasting Model then ‘Finance’ has been used to provide forecasts for the Financial

Services & Insurance sector. For the Working Futures data, the sector ‘Finance & Insurance’ has been referred to.

Please note that neither model, or the forecasts they produce, take into account the New Anglia LEPs ambitions for growth in

Gross Value Added (GVA) and employment.

61

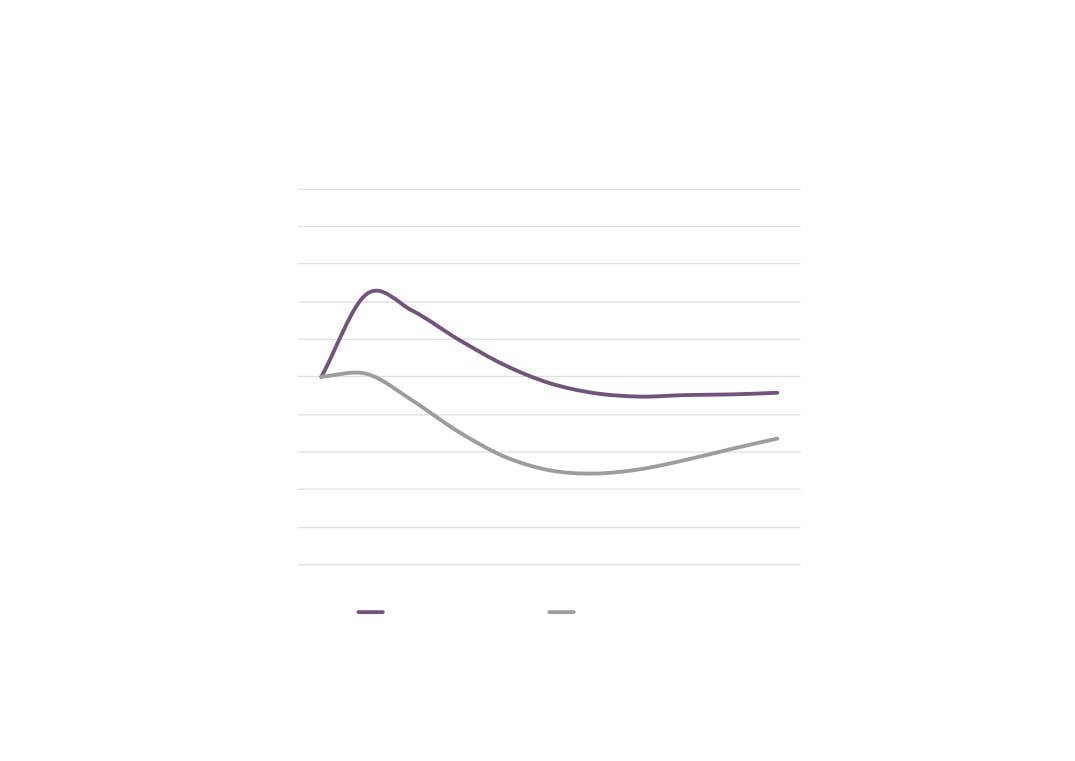

Forecasts for change in Financial Services & Insurance sector

employment in New Anglia (2014 = 100)

110

108

106

104

102

100

98

96

94

92

90

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

Finance (EEFM)

Finance & Insurance (WF)

Sources: East of England Forecasting Model, Cambridge Econometrics;

UKCES Working Futures 2014 - 2024

62

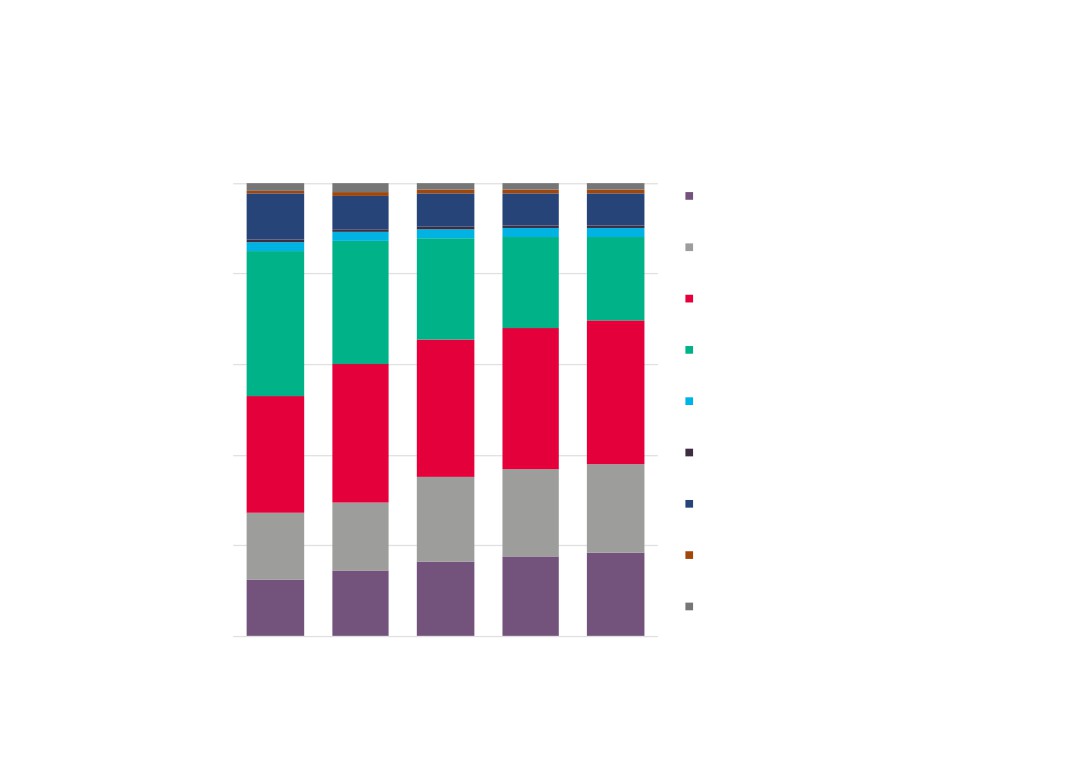

Occupational composition of employment in New Anglia’s

Financial Services & Insurance sector over time

100%

2%

2%

1%

1%

1%

Managers, directors and senior

7%

7%

7%

10%

8%

officials

2%

2%

2%

2%

2%

Professional occupations

80%

18%

20%

22%

Associate professional and

27%

technical

32%

Administrative and secretarial

60%

32%

31%

Skilled trades occupations

30%

31%

40%

26%

Caring, leisure and other service

Sales and customer service

20%

19%

19%

15%

20%

15%

Process, plant and machine

operatives

17%

18%

18%

15%

13%

Elementary occupations

0%

Source: UKCES Working Futures 2014 - 2024

2004

2009

2014

2019

2024

63

Financial Services & Insurance sector replacement and expansion

demand by occupation (top 5 in terms of net requirement), 2014 - 2024

-2,000

0

2,000

4,000

6,000

8,000

10,000 12,000

All occupations

Business and public service associate

professionals

Corporate managers and directors

Administrative occupations

Business, media and public service

professionals

Science, research, engineering and

technology professionals

Expansion demand

Replacement demand

Net requirement

Source: UKCES Working Futures 2014 - 2024

64

Financial Services & Insurance sector replacement and expansion

demand as a proportion of employment by occupation, 2014 - 2024

-30%

-20%

-10%

0%

10%

20%

30%

40%

50%

All occupations

Business and public service associate professionals

Corporate managers and directors

Administrative occupations

Business, media and public service professionals

Science, research, engineering and technology

professionals

Expansion demand

Replacement demand

Net requirement

Source: UKCES Working Futures 2014 - 2024

65

Financial Services & Insurance sector replacement and

expansion demand by qualification, 2014 - 2024

-2,000

-1,000

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

QCF 7-8

QCF 4-6

QCF 3

QCF 2

QCF 1

No Qual

Expansion Demand

Replacement Demand

Source: UKCES Working Futures 2014 - 2024

Please note that the Working Futures data uses the

following breakout of qualification levels:

QCF8 - Doctorate

QCF7 - Other higher degree

QCF6 - First degree

QCF5 - Foundation degree; Nursing; Teaching

QCF4 - HE below degree level

QCF3 - A level & equivalent

QCF2 - GCSE (A-C) & equivalent

QCF1 - GCSE (below grade C) & equivalent

No Q - No Qualification

66

Financial Services & Insurance sector qualifications, 2014 - 2024

2024

15%

48%

15%

17%

4%

QCF 7-8

QCF 4-6

QCF 3

QCF 2

QCF 1

No Qual

2014

11%

36%

21%

22%

10%

0%

100%

Source: UKCES Working Futures 2014 - 2024

Please note that the Working Futures data uses the

following breakout of qualification levels:

QCF8 - Doctorate

QCF7 - Other higher degree

QCF6 - First degree

QCF5 - Foundation degree; Nursing; Teaching

QCF4 - HE below degree level

QCF3 - A level & equivalent

QCF2 - GCSE (A-C) & equivalent

QCF1 - GCSE (below grade C) & equivalent

No Q - No Qualification

67

Appendix - Financial Services & Insurance Sector Definition

The following five digit SIC codes are being used to measure levels of, and change in, both employment and enterprise numbers in the sector.

64110: Central banking

64191: Banks

64192: Building societies

64201: Activities of agricultural holding companies

64202: Activities of production holding companies

64203: Activities of construction holding companies

64204: Activities of distribution holding companies

64205: Activities of financial services holding companies

64209: Activities of other holding companies (not including agricultural, production, construction, distribution and financial services

holding companies) n.e.c

64301: Activities of investment trusts

64302: Activities of unit trusts

64303: Activities of venture and development capital companies

64304: Activities of open-ended investment companies

64305: Activities of property unit trusts

64306: Activities of real estate investment trusts

64910: Financial leasing

64921: Credit granting by non-deposit taking finance houses and other specialist consumer credit grantors

64922: Activities of mortgage finance companies

64929: Other credit granting (not including credit granting by non-deposit taking finance houses and other specialist consumer credit n.e.c.

grantors and activities of mortgage finance companies)

64991: Security dealing on own account

64992: Factoring

64999: Other financial service activities, except insurance and pension funding, (not including security dealing on own account and

factoring) n.e.c.

65110: Life insurance

69

65120: Non-life insurance

65201: Life reinsurance

65202: Non-life reinsurance

65300: Pension funding

66110: Administration of financial markets

66120: Security and commodity contracts brokerage

66190: Other activities auxiliary to financial services, except insurance and pension funding

66210: Risk and damage evaluation

66220: Activities of insurance agents and brokers

66290: Other activities auxiliary to insurance and pension funding

66300: Fund management activities

68100: Buying and selling of own real estate

69201: Accounting, and auditing activities

69202: Bookkeeping activities

69203: Tax consultancy

70221: Financial management

82911: Activities of collection agencies

82912: Activities of credit bureaus

70