Enabling Growth in the New

Anglia Cultural Sector through

Skills Development

(FINAL: Not for further circulation)

New Anglia LEP-

Cultural Sector Skills Plan

(Final for Officers)

April 2018

Page 2 of 42

Background Context

This Cultural Sector Skills Plan has been developed by the cultural sector in Norfolk and Suffolk,

working alongside the New Anglia Local Enterprise Partnership, the New Anglia Skills Board and

supported by SkillsReach.

SkillsReach was contracted to facilitate and prepare eight sector skills plans for the New Anglia

LEP priority sectors. The project was commissioned by the Education and Skills Funding Agency,

in partnership with New Anglia LEP, and funded through the European Social Fund. Each Sector

Skills plan and supporting Datapack has been developed in collaboration with local employers and

other stakeholders.

The Cultural Sector Skills Plan has been developed in partnership with the New Anglia Cultural

Board, the lead organisation taking forward the further development and implementation of this

plan in conjunction with New Anglia LEP, local education institutions and other sector champions.

The New Anglia Skills Board places employers at the centre of decision making on skills in

Norfolk and Suffolk to ensure the skills system becomes more responsive to the needs of

employers, residents and the future economy.

The New Anglia Cultural Board launched its regional strategy Culture Drives Growth 2016 -

2022, in November 2016. “The strategy outlines a clear vision to drive growth across Norfolk and

Suffolk.” The Skills Group of the Cultural Board led on the consultation and development of this

plan.

SkillsReach is an established East of England-based strategic skills consultancy with an

associate project team with extensive experience of developing skills plans.

Acknowledgements

The New Anglia LEP wish to thank the employers, providers and stakeholders who contributed to

the plan by attending events or being interviewed

Page 3 of 42

Contents

Introduction

4

Cultural and Creative Sector - a wider view on impact

4

Section One: Overall Ambition

5

New Anglia Cultural Sector Strategy and Assets

5

How is the Cultural Sector defined?

6

How was the Plan developed?

6

Section Two: New Anglia Cultural Sector Skills Plan

7

An Overview

7

The Skills Plan

9

Key Findings

10

Sector Leadership

11

Priority 1 - Guidance, work encounters and new entrant pathways

12

Intervention 1: An inspiring careers information, advice and guidance environment

12

Intervention 2: Collaborate on a new local work experience model

13

Intervention 3: New strategies to tackle the technical / specialist skills shortages

14

Priority 2 - Cutting edge leadership and in-career development

15

Intervention 4: Targeted local in-career leadership and professional development

15

Intervention 5: Skills and Enterprise support for the local Freelance community

16

Alignments with policies and initiatives

17

Section Three: Understanding the Evidence, Informing the Plan

18

The UK Cultural economy - scale and value

18

New Anglia Economic and Skills Evidence Base

20

UK Sector Skills considerations

22

Key Findings from Local Employer and Stakeholder Consultations

25

Appendices

27

Appendix A - Evidence Report

27

Appendix B - Consultation and development process

32

Appendix C - Reports and References

34

Appendix D - Current Skills and Training Provision

35

Page 4 of 42

Introduction

Welcome to the Cultural Sector Skills Plan for New Anglia. It sets out our collective vision for how

skills development can support the growth of the sector, increasing local competitiveness,

supporting inclusive growth and building high quality local careers. This plan is a key step to

strengthening local collaboration to ensure skills opportunities are maximised across the whole

area. We look forward to employers and education providers coming even closer together to

shape the future of a vibrant New Anglia cultural sector.

Supporting a sustainable and inclusive form of growth, increasing access to opportunities within

the sector across our area and finding new ways to address the real barriers to both these things

will condition our collaborative work across the lifetime of this plan.

We are also very aware of the opportunities now at play through the Sector Deal for the Creative

Industries as part of the Government’s Industrial Strategy1. Norwich’s identification as a creative

cluster (NESTA/ONS Business Structure Database 2016) demonstrates our area has a strong

base on which to build and our sector-leading Culture Board is committed to taking forward the

advantages we have for the benefit of those who live and work here.

Our core priorities in the plan are twofold: to ensure that there are clear, accessible and employer-

led routes to careers in the culture sector in our region, and to ensure that leadership in our sector

is ready and equipped to create sustainable and inclusive growth that maximises opportunities for

local people. Across these priorities, we will maintain a focus on diversity to ensure that all our

communities are represented in our workforce, and on the digital, to ensure we’re maximising the

value of new technologies and skillsets for commercial and community benefit.

Our vision is to create a cultural economy that is dynamic, inclusive and creative in its

leadership as well as its delivery. To achieve this, we will expand and intensify our partnership

working, create connections and shared benefits across sectors and bring in expertise from all

parts of our communities. In turn, we aim to share our learning with, and in turn learn from partners

across other LEPs.

Our next steps will be to engage existing and new partners in the creation of an action plan to

deliver this strategy, and we look forward to talking to you further about this work.

Chris Gribble

Chair, Skills Group - New Anglia Cultural Board

Cultural and Creative Sector - a wider view on impact

“The creative economy is not only one of the most rapidly growing sectors of the world economy,

but also a highly transformative one in terms of income-generation, job creation and export

earnings…when the creative sector becomes part of an overall development and growth strategy,

it can contribute to the revitalization of the national economy where hybrid and dynamic economic

and cultural exchanges occur, and innovation is nurtured. But that is not all. Investing in culture

and the creative sector as a driver of social development can also lead to results that contribute to

the overall wellbeing of communities, individual self-esteem and quality of life, dialogue and

cohesion.”2

1 HM Government, Industrial Strategy: Creative Industries Sector Deal (2018).

2 UN Report on Creative Economy (2013).

Page 5 of 42

Section One: Overall Ambition

Our vision is to create a cultural economy that is dynamic, inclusive and creative in its

leadership as well as its delivery.

Our Skills Ambition: To drive place-based inclusive growth through the recruitment and

development of a skilled, socially mobile and diverse, creative, local workforce by

championing:

1.Well informed new entrants having opportunities to gain high quality work-based

learning and pathways to progress their careers

2.An inclusive, dynamic cross-sector leadership and professional development network

3.Accessible, vibrant local cultural workplaces

4.‘Clustering’ for the benefit of all New Anglia through the collocation, collaboration and

combined skill-sets of the Norwich and Ipswich cultural and creative hubs

New Anglia Cultural Sector Strategy and Assets

New Anglia LEP launched its regional strategy Culture Drives Growth 2016 - 2022, in November

2016

The strategy outlines a clear vision to drive growth across Norfolk and Suffolk, focusing on six key

areas:

• Accelerate creative job growth

• Scaling cultural and creative investment

• Backing creative talent

• Increase cultural and creative diversity

• Build an inspiring place to live, work, visit and invest

• Broadening international engagement

Our vision is to create a cultural economy that is dynamic, inclusive and creative in its leadership

as well as its delivery.

Assets and Opportunities

At the heart of this (New Anglia) cultural strategy lies a dynamic relationship between Norfolk and

Suffolk’s unique sense of place and the cultural offer. It encompasses landscape, historical

buildings and a contemporary cultural offer. We will respond to these with creative ambition,

combining unique settings with compelling ideas and artists, uniting residents and visitors in an

appreciation of all that makes Norfolk and Suffolk shimmer and beguile.3

At the heart of our arts and culture offer in Norfolk and Suffolk lies an array of world class,

nationally significant and regionally unique assets. From the internationally significant festivals at

Snape Maltings and the Norfolk and Norwich Festival, to the leading commissioning and receiving

houses of the New Wolsey, Norwich Theatre Royal and Theatre Royal Bury St Edmunds, to the

national centres of excellence at Dance East and the National Centre for Writing (Writers’ Centre

Norwich) we have a cultural offer that responds to our region but speaks to the nation and the

world. With festivals including SPILL, Out There, PULSE and more, backed by the world class

3 The New Anglia Cultural Board. (Nov. 2016) Culture Drives Growth 2016 - 2022.

Page 6 of 42

assets of Ipswich and Colchester Museum Service and Norfolk Museum and Library Service that

work together with the National Trust, major destination management partners and the private

sector we have a compelling and singular offer.4

How is the Cultural Sector defined?

The definition of the sector used by New Anglia LEP broadly follows that used by the Department

for Culture, Media and Sport to define the Creative Industries. However, that definition used by

New Anglia differs in some key areas in that it does not include activities related to ‘advertising

and marketing’, ‘architecture’, and ‘specialised design activities’. In addition, the New Anglia

definition of the sector captures activity around sports, amusements and recreation, and some

specialised retail. (See Appendix A)

The sector can also be referred to as ‘Culture and the Arts’ and overlaps significantly with Digital

Tech sector activities such as publishing, production, and certain manufacturing elements. It is

also worth noting that there is some overlap between what is considered ‘tourism’ and that

deemed ‘arts’ in respect of cultural tourism.

Nesta (Feb 2018) sets out a number of sub-sectors including Film/TV, Music Performing and

Visual Arts, IT and software. This work has been very helpful in bringing out the diversity of sector

occupations, although this Plan seeks to focus inclusively upon shared skillsets and values and to

think more about communicating effectively across the sector’s different audiences (e.g.

freelancers / micro-business/third sector).5

How was the Plan developed?

The development process for the Cultural Sector Skills Plan was overseen by the Skills Group of

the New Anglia Cultural Board through task and finish groups, which met in November, December

2017 and January, February 2018. An advanced draft of the plan was also supported in principle

by the New Anglia Cultural Board at its meeting on 24th January 2018. There was considerable

consensus from consultees on the opportunities and challenges and the interventions prioritised in

the Plan.

The development of the plan was also informed by individual consultations with cultural sector

stakeholders including other key employers, national / local skills partners, local authorities and

New Anglia LEP. (See Appendix B).

The New Anglia Cultural Board Skills Group was established as a Task and Finish Group for the

Sector Skills Plan and met several times to understand and comment upon the economic and

skills evidence base; set out priority employment and skills challenges for the sector locally and

identify an ambition and priority interventions for the Skills Plan. These meetings were

complemented by a number of individual telephone consultations with cultural sector employers

and stakeholders.

In addition to this sector skills plan document, a supporting detailed Evidence Base Report (see

Appendix A) and a Datapack have been produced outlining the current workforce, trends in skills

levels and how the local Cultural sector in New Anglia compares with other areas. (See Appendix

D for the Current Skills and Training Provision). In the main, this report aligns with the New Anglia

Local Economic Strategy cultural sector definition, although it refers to other useful sources which

4ibid.

5 Creative and Cultural Skills (2015) Building a Creative Nation: the Next Decade.

Page 7 of 42

are based on different sector or geographical definitions Highlights and key evidence are found in

summary format in Section Three.

The Datapack also reports on the underlying socio-economic context for the sector locally and

reports on projected changes in future skills needs. It is presented as a separate document and

provides the data to underpin many of the comments made and could be used as a reference

source in conjunction with the plan.

Section Two: New Anglia Cultural Sector Skills Plan

An Overview

With a key, growing contribution to the New Anglia economy the Cultural sector needs to plan for

the skills needed in the future.

Consultees (See Appendix B) were clear that whilst there is an extensive list of potential actions

by individual organisations or partnerships, it is important to focus these around a few priority

areas. These are all areas in which it is believed that it is possible to align employer support with

public sector interventions.

Our Skills Ambition: To drive place-based inclusive growth through the

recruitment and development of a skilled, socially mobile and diverse,

creative, local workforce by championing:

1. Well informed new entrants having opportunities to gain high quality

work-based learning and pathways to progress their careers

2. An inclusive, dynamic cross-sector leadership and professional

development network

3. Accessible, vibrant local cultural workplaces

4.

‘Clustering’ for the benefit of New Anglia through the collocation,

collaboration and combined skill-sets of the Norwich and Ipswich

cultural and creative hubs

The proposed actions are as follows:

Local sector leadership through stronger strategic partnerships with education and skills providers

• Improving strategic collaboration with FE / HE partners to establish a shared agenda to develop New

Anglia as an Area of Excellence for collaborative cultural skills development.

• Develop innovative approaches to workplace learning and work experience in collaboration with skills

partners that can increase the quality of work experience and the employability of learners as well as

make better use of local cultural venues to inspire and support learners - a ‘hot’ local workplace

learning model to complement academic provision and inspire and attract talent to New Anglia.

• New detailed skills intelligence about specific technical skills gaps in the sector to establish whether a

sustainable business case can be made for new collaborative provision.

Priority 1.

Guidance, work encounters and new entrant pathways

1. Enable an inspiring careers information advice and guidance environment.

2. Champion and collaborate on a new local work experience model that builds a diverse supply of

qualified and ‘skilled’ future employees.

Page 8 of 42

3. Identify new strategies to tackle the technical / specialist skills shortages that are reported by the

sector locally.

What Success looks like for Priority 1

High-quality pre and early employment workplace learning, and experience delivered in close

collaboration with education / skills /IAG providers and local employers ensuring our sector recruitment

needs are met through engaging with the richness of our diverse local communities.

Priority 2.

Cutting edge leadership and in-career development

1. Review and enable a dynamic, targeted local in-career leadership and professional development

programme for the current cultural skills workforce and ensure the sector capitalises on the fast-

emerging opportunities of a digital economy, through a ‘digi-embracing’, developing and

professionally capable workforce.

2. Skills and Enterprise support for the local Freelance community to build and maintain a competitive,

sustainable offer to maximise locally delivered provision and minimise the contribution made locally

by ‘imported services’.

What Success looks like for Priority 2

A dynamic, local learning and enterprise development environment ensuring high quality continuing

leadership, technical and professional development, and a proactive response to the opportunities

provided by digitalisation, for our employees and freelance community.

Two Cross-Cutting theme are seen by stakeholders as providing a direction across the whole skills

plan

1.

Digitalisation: embracing of technology with the understanding and practical skills to exploit it

for artistic, commercial and community benefit.

2.

Diversity: ensuring our workforce becomes more representative of our local communities and

that local skills activity impacts beyond our sector to make an important contribution to New

Anglia as a ‘place-shaper.’

It is proposed that the Skills Plan will be led by the New Anglia Culture Board Skills Group, as overseen by

the full Culture Board and connected through the Chair to the New Anglia Skills Board. This group will

oversee sector skills development; with the opportunity to review its membership to include wider

representation and further foster a collaborative approach.

Page 9 of 42

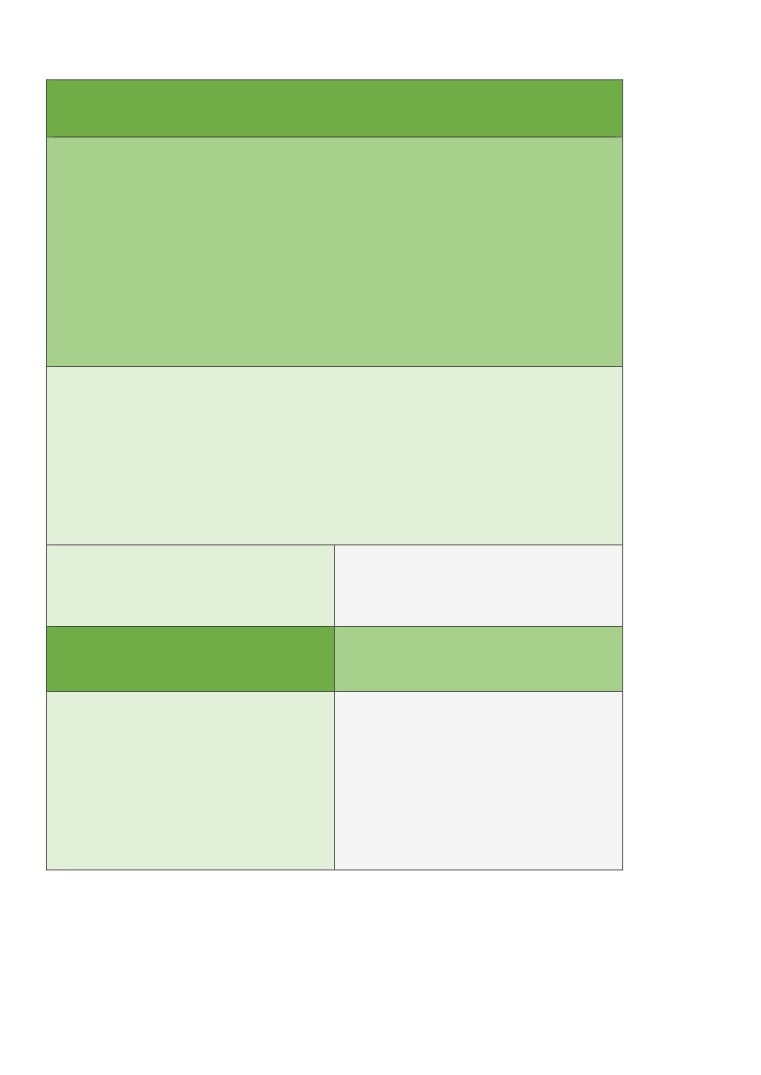

The Skills Plan

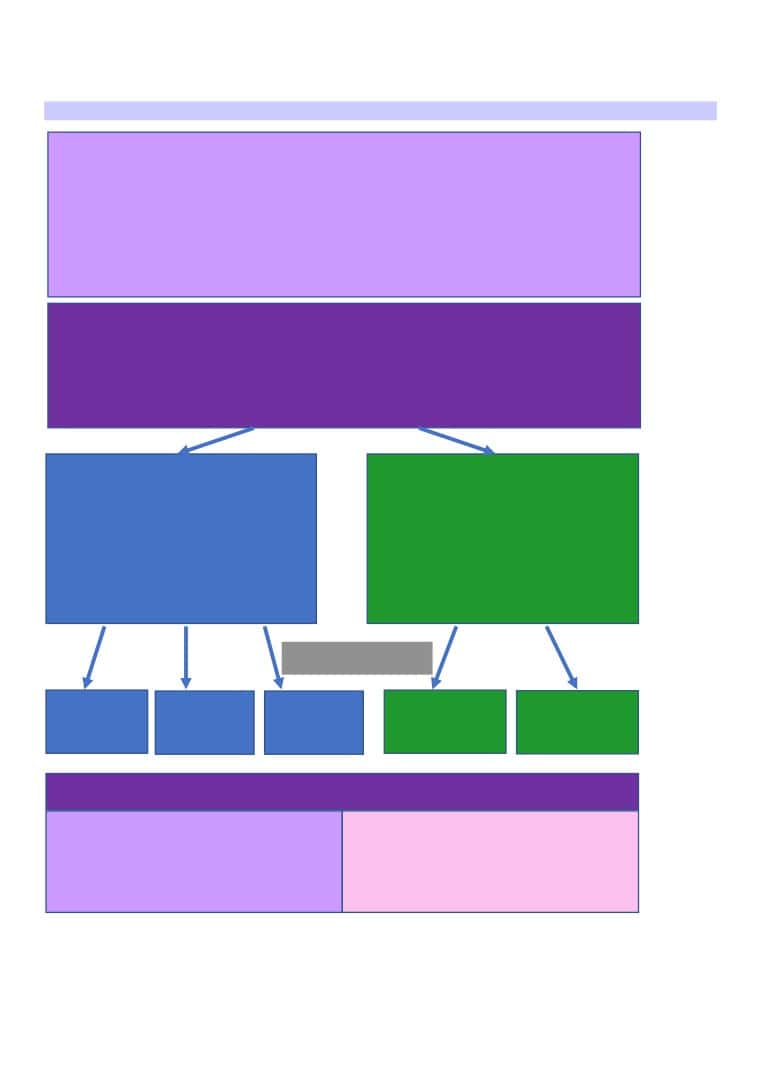

Overall Framework

Our Skills Ambition: To drive place-based inclusive growth through the recruitment and

development of a skilled, socially mobile and diverse, creative, local workforce by championing:

1. Well informed new entrants having opportunities to gain high quality work-based

learning and pathways to progress their careers

2. An inclusive, dynamic cross-sector leadership and professional development

network

3. Accessible, vibrant local cultural workplaces

4.

‘Clustering’ for the benefit of New Anglia through the collocation, collaboration

and combined skill-sets of the Norwich and Ipswich cultural and creative hubs

Sector Leadership

The plan will be led by a dynamic, collaborative cultural employer and skills partnership adding

value to champion and support investment, innovation and excellence in our local sector skills offer,

articulating and responding to employer needs and maximising opportunities for

New Anglia residents

Priority 1

Priority 2

Guidance, work encounters

Cutting edge leadership and

and new entrant pathways

in-career development

to provide exciting local opportunities and

opportunities that support our whole

meet our future, local skills needs

sector (including Freelancers) to grow and

to maximise opportunities for local people

5 KEY INTERVENTIONS

1. Inspiring

2. Work

3. Technical

4. In-career and

5. Freelancer

careers

experience

skills

leadership

development

pathways

development

Two cross-cutting themes for all our skills development

1.

Digitalisation: embracing of

2.

Diversity: ensuring our workforce

technology with the understanding

becomes more representative of

and practical skills to exploit it for

our local communities and that

artistic, commercial and community

local skills activity impacts as a

benefit.

‘place-shaper’

Page 10 of 42

Key Findings

Here is a summary of the evidence base (See Appendix A for the Evidence Report):

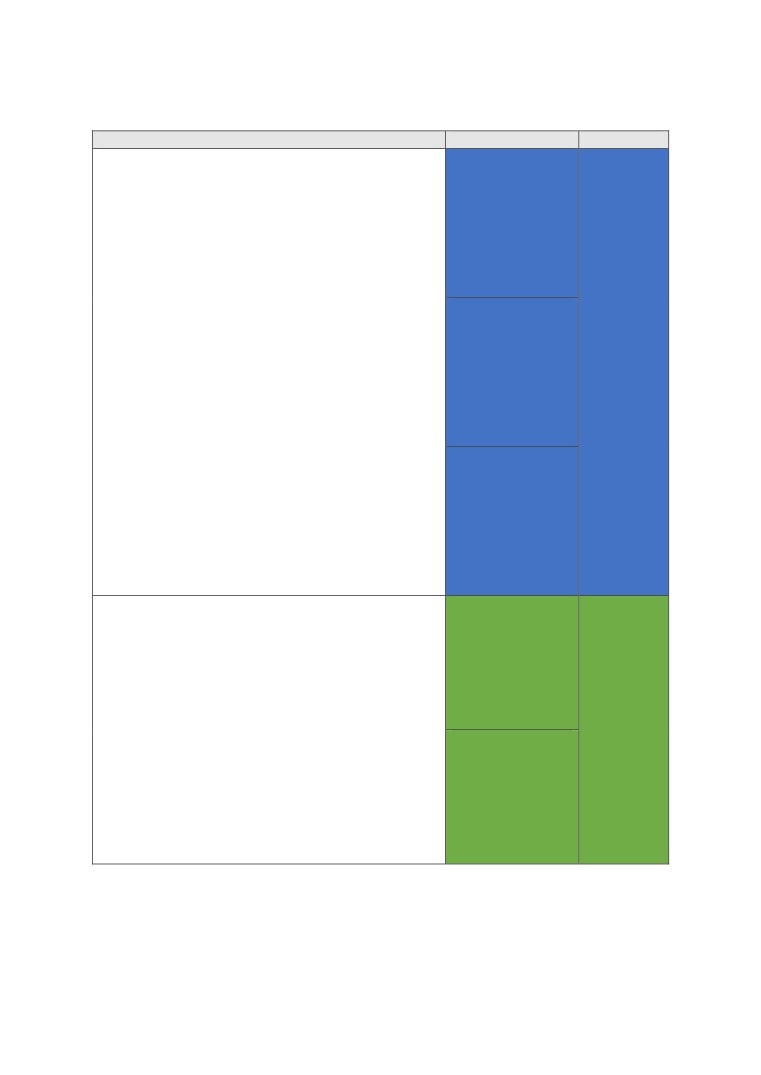

Key Findings

Interventions

Priorities

•The Cultural Economy will have up to one million new

1. Inspiring careers,

jobs nationally by 2030; it is one of the fastest growing

IAG environment

sectors in the UK economy

•Sector perspective: Entry into the sector impeded by

poor understanding of the kinds of careers available.

•Employer perspective - qualifications need to be backed

up by ‘soft skills’

•Employer perspective - Academic and vocational

pathways should both be clearly articulated and valued

2. Collaborate on a

Priority 1

•Local Skills research show that Apprenticeship levels

new local Work

Guidance,

above local averages, although focused on general rather

Experience model

work

than sector specific skills

encounters

•Employer Perspective - Opportunity to build partnerships

and new

between employers, practitioners, skills and education

entrant

providers

pathways

•Employer Perspective - Formulaic FE/HE funding models

do not seem compatible with employment

•Employer Perspective - Work experience needs to be

3. Strategies to

more ‘real’ and fully utilise great local settings

tackle

•Sector perspective - Social mobility is a challenge. 92% of

technical/specialist

creative industry jobs are occupied by the more

skills shortages

advantaged groups of the workforce

•Sector and Employer Perspective - The sector ‘suffers

from an oversupply of graduates’ but requires a wider

range of skilled practitioners

•Local Skills research indicates that future demand will be

4. Targeted local in-

heavily focused on roles at Level 4 or above with job

career leadership

reductions forecast at Level 3 and below.

and professional

•Sector perspective- Cultural leadership skills,

development

entrepreneurial development and high-level management

programme

skills provision needs to develop

Priority 2

•Employer Perspective - Skills shortage of cultural

Cutting edge

leadership and higher technical/professional

leadership

5. Skills and

and in-career

•The Cultural Economy has had an explosion in

Enterprise support

entrepreneurial activity with businesses diminishing in

development

for the local

terms of average size to between 5 and 6 employees

Freelance

•The Cultural Economy recognises Norwich as a nationally

community

significant cultural and creative cluster

•Local research show that self-employment is key at 21%

of sector ‘workforce’

Page 11 of 42

Sector Leadership

Sector Leadership - The plan will be led by a dynamic, collaborative cultural

employer and skills partnership adding value to champion and support investment,

innovation and excellence in our local sector skills offer, articulating and

responding to employer needs and maximising opportunities for New Anglia

residents

Rationale: Some consultees described being ‘disconnected’, uninformed, and frustrated

with local skills initiatives / funding models and a perception of primarily being in the

‘supply chain’ as ‘work experience provider’. There is an appetite for building, at a local

level, stronger more strategic collaboration with the education and skills sector to jointly

tackle skills gaps, develop new provision, improve mutual communication / understanding

and establish a strong sector ‘skills voice’ to influence locally and beyond New Anglia

Action to be Taken:

1. Review membership of Cultural Board Skills Group to ensure greater sector

representation - e.g. FE / HE / Creative and Cultural Skills sector body, Freelancers etc

2. The reviewed Terms of Reference would position the group as not a skills delivery

body, but rather a catalyst and supporter of new ideas, a skills voice for the sector and a

sponsor of collaborative pilots and pathfinders, with a focus upon evaluation and learning

3. Conduct a simple mapping exercise across the sector to identify current working

partnerships and the extent of current skills activities and links

4. Learn from and build upon (including succession planning) successful local

skills/enterprise development projects

5. Identify immediate and longer-term opportunities for proactive, strategic collaboration

and local sector led skills initiatives/programmes across the current and future cultural

workforce in areas such as ‘T Level’ development

6. Identify opportunities for the sector to make a broader skills contribution to

developments of local community / place / health and wellbeing / diversity / social mobility

7. Ensure that New Anglia responds as a sector to skills opportunities relating to Industrial

Strategy Sector Deals

8. Collectively work with New Anglia LEP to identify national and local funding

opportunities

9. Ensure that cross-cutting themes of Digitalization and Diversity are integrated across all

interventions.

Leadership: Existing Cultural Board

When: Quarter 2 2018

Skills Group

A key first step in ensuring closer alignment

The existing skills leadership arrangements

between sector development / improvement

for the New Anglia Culture Board - i.e.

and the skills provision that will inevitably

Skills Group with wider representation of

underpin it.

skills providers, stakeholders and

connecting through the Chair to the LEP /

Skills Board

Resources and support:

Outcomes

The existing in-kind arrangements can

A new collective voice for New Anglia

support this group to evolve without any

cultural skills based upon collaboration and

immediate additional costs

skills innovation

Page 12 of 42

Priority 1 - Guidance, work encounters and new entrant pathways

Intervention 1: An inspiring careers information, advice and guidance environment

Rationale:

Regular concerns raised that potential sector recruits do not understand the quite unique

labour market dynamics of the cultural sector in making informed course and career

choices. The sector workforce has the potential to be more representative of, and reflect

better, the diversity of the New Anglia community.

Action to be Taken:

1. Position the Cultural sector in relation to the range of Careers/IAG support available

and set priorities for change / improvement

2. Identify and articulate what the sector means by ‘employability’ and the softer skills

required by the sector - perhaps developing the ‘renaissance people’ concept as

described by consultees

3. Ensure that information is available for Careers Advisors, Providers, Parents and

Learners to help them appreciate the unique dynamics, challenges and opportunities on

offer within the sector locally and nationally -in partnership with Creative & Cultural Skills

sector body

4. Support the appointment of additional Cultural Sector Enterprise Advisors

Digitalisation:

Diversity:

Optimize digital information sources such

Ensure activity focusses on new talent from

as icanbea… and the Creative Choices

non-traditional parts of the community

digital platform (CCS).

Leadership:

When:

Existing Cultural Board Skills Group

Quarter 3 2018

Resources and support:

Outcomes:

Firstly, connecting to existing supported

The unique dynamics, opportunities,

provision such as Enterprise Advisors,

challenges and employment/skills priorities

Youth Pledge, before identification of gaps,

of the cultural sector are articulated and

new opportunities

understood by those considering careers or

learning opportunities in New Anglia.

Page 13 of 42

Intervention 2: Collaborate on a new local work experience model

Rationale:

The consultation process identified a number of concerns about the ‘employability’ of

people seeking to work in the sector either post-qualifying (at all qualification levels up to

Masters) and also at earlier points such as full-time FE Students or those joining via

Apprenticeships. The group had a shared view that there is a risk of a ‘crisis’ in work

experience with demands from providers increasing (e.g. ‘T Levels’) and the availability of

placements already heavily oversubscribed. Traditional knowledge exchange solutions

such as Knowledge Transfer Partnerships (KTP) provision do not fit well with a sector

dominated by small, agile organisations without longer term skills investment budgets.

Action to be Taken:

1. Identify the scope with learning provider partners for New Anglia Cultural Sector

collaborative high-quality work experience provision that can either encompass all activity

from school workplace encounters, through traineeships / apprenticeships to student,

graduate and post-graduate internships or focus upon a single priority area. The Task and

Finish Group identified Further Education work experience provision as an initial potential

priority

2. Identify, quantify and realise the full potential of New Anglia cultural workplaces as sites

for high quality experience

4. Consider a ‘flagship’ partnership programme as a ‘pathfinder’ targeting a particular

learner audience e.g. HE students / Recent Graduates / Adults with additional needs

5. Develop and articulate to potential funders a local ‘mini-KTP’ approach that will best

engage cultural sector businesses in knowledge transfer partnering

Digitalisation:

Diversity:

Understand how the sector can ensure high

Ensure activity includes non-HE pathways

standards of work experience through

such as Apprenticeships / FE

engaging with new approaches such as

VR/AR digital-led practice

Leadership:

When:

Cultural Board Skills Group

Quarter 4 2018

Resources and support:

Outcomes:

There may be scope to develop proposals

New Anglia is recognised as an area of

for funders around new sector specific

engaging, innovative, collaborative work

provision or creating a sector dialogue with

experience opportunities for all, making

learning providers to establish a

best use of our cultural and heritage asset

collaborative approach

base.

Page 14 of 42

Intervention 3: New strategies to tackle the technical / specialist skills shortages

Rationale:

Consultees raised concerns about a shortage of higher level technical skills, with such

provision either being outsourced or covered by ‘importing’ skills from other areas; this

combined with a lack of uptake of apprenticeship or other learning pathways to enable

local people to develop these skills. There had been local initiatives to tackle this issue,

but they had not proved sustainable in terms of longer term employer / learner demand.

Areas highlighted through consultations include: ‘back-stage’ skills, gaming development

(computer science/coding), visual effects, exhibition development, and virtual / augmented

reality. An ‘oversupply’ of graduate skills was seen as a potential barrier to the

development of new occupational pathways that would support greater diversity through

apprenticeships / further education.

Action to be Taken:

1. Undertake a specific skills audit of targeted employers to identify the scale, type and

level of technical skills shortages and whether there are any areas that can either better

connect to existing provision or provide a potential business case for the development of

new, locally-led provision that can support local pathways and potentially provide solutions

for other areas in the longer term

2. Formulate a local response to the audit that could include:

•An initial focus upon technical roles/skills pathways in Museums and Backstage Theatre

•Co-ordinated local employer support for existing local provision

•Development of new provision in partnership with learning providers

•Connections with national provision

Digitalisation:

Diversity:

Explore opportunities to align with the

Promotion of alternative to HE pathways

renowned local digital creative sector to

such as FE/ apprenticeships perhaps based

optimise return from ‘clustering’

upon new culture sector-specific

apprenticeship standards

Leadership:

When:

Existing Cultural Board Skills Group

Quarter 3 2018

Resources and support:

Outcomes:

Learning providers may support a detailed

New Anglia has increased capacity to

analysis of technical gaps with a view to

support the sustainable development and

establishing whether there is a local market

deployment of identified technical skills

to extend local provision.

which combat local skills gaps, reduce skills

importation and also contribute to national

talent pools

Page 15 of 42

Priority 2 - Cutting edge leadership and in-career development

Intervention 4: Targeted local in-career leadership and professional development

Rationale:

The consultation raised concerns about the number of very senior sector appointments taken

up by applicants from out of the area and the challenges of leadership development in a local,

potentially ‘siloed’ cultural sector dominated by smaller employers.

There was recognition that the sector is positioned to make a greater contribution to wider

community / place developments in areas such as health, wellbeing, employability, although

this would require articulation and development of new skillsets for the existing workforce.

There were consistent views that the local sector needs to build its application of digital

technology and its understanding of how to exploit for artistic / commercial benefit/ community

benefit; embracing the changing patterns of consumption of the arts - e.g. YouTube previews.

Some consultees felt this was both an opportunity and a real risk area for the cultural sector

locally which they perceived to be ‘behind the curve’ in terms of digitalisation.

Action to be Taken:

1. Establish a small pathfinder pilot initiative in partnership with HE partners at UEA and NUA

supporting leadership/professional development to high potential local staff through a number

of possible approaches:

2. Identify seedcorn funding for a pilot project

• A locally-led mentoring scheme supported by local leaders as mentors

• The opportunity to experience and understand various parts of the cultural sector

• Collective access to training events, conferences etc

• The opportunity for local secondments across the local cultural sector

• Access to local HE facilities and development resources

• Ensure easy access for under-represented groups such as ethnic minorities, women with

caring responsibilities, people with disabilities

3. Identify the key digital skills needed to maximise local sector growth at all levels

4. Enable a collective digital awareness and professional development sector programme

delivered collaboratively across the sector

5. Consider whether the existing workforce (including Freelancers) can contribute more as

teachers/tutors to help meet the digital education and skills needs of the sector

6. Consider workforce development priorities to deliver an expanded wider community remit in

areas such as health and wellbeing

Digitalisation:

Diversity:

7.Identify the key digital skills needed to

Ensure easy access for under-represented

maximise local sector growth at all levels

groups such as ethnic minorities, women with

caring responsibilities, people with disabilities

Leadership:

When:

Existing Cultural Board Skills Group

Quarter 4 2018

Resources and support:

Outcomes:

The leadership development initiative would

A diverse talent pool of local ‘leadership-

be initially designed as a small-scale

ready’ people to compete for senior

pathfinder primarily using and combining the

appointments across the Cultural sector and

in-kind and a modest element of existing skills

make a wider contribution as part of their

budgets on a shared cost-basis

development

There may be the opportunity to align these

projects with existing provision such as the

Through partnership, a local cultural sector

ESF leadership / Workforce programmes

that has the skills and appetite to embrace

There may be the potential to connect digital

and capitalise on digitalisation opportunities

awareness and development to business

for artistic, commercial and community benefit

support programme for the majority of cultural

sector businesses, social enterprises or

charities, plus partnership dialogue with

TechEast who lead the Digital Tech sector

skills plan may identify existing

complementary provision / conferences etc

Page 16 of 42

Intervention 5: Skills and Enterprise support for the local Freelance community

Rationale:

The consultation recognises the quite unique and highly valued importance of

Freelancers: both in quantitative ‘workforce’ numbers and qualitative contributions to the

cultural sector. This recognition was balanced by a number of risks which were potentially

impeding the success and competitiveness of the local freelance community. These

included:

• A lack of ‘enterprise skills’ to complement their artistic / production skills

• The potential for freelancers to be isolated and ‘disconnected’

• The lack of professional development available in areas such as digital development

The potential for Freelancers, with support, to be able to help meet the perceived skills

gaps in sector specialist teachers and tutors

Action to be Taken:

1. Appoint a Freelancer to the Skills Group to ensure Freelancer interests are considered

in light of their importance to sector development

2. Understand the strengths, development needs and identify opportunities to learn from,

and succession plan for, the StartEast programme - considering its finite timescales

3. Identify whether any shared development programmes could include Freelancers -

perhaps on a cost-sharing basis

4. Consider whether the existing workforce (including Freelancers) can contribute more to

the education and skills aspects of the sector as teachers / tutors / coaches

Digitalisation:

Diversity:

Ensure that the Freelance community have

Ensure the Freelance community is

access to training and support around

included wherever possible in workforce

digitalization

development initiatives

Leadership: Existing Cultural Board Skills

When: Quarter 4 2018

Group

Resources and support:

Outcomes:

This is based initially on ensuring that the

A connected, developing talent pool of

Freelance community has a stronger skills

Freelancers that make a major contribution

voice and that existing funding and

to the sector locally and nationally

resources are utilised to meet sector growth

need. The longer-term remit would be to

align with, or bid for, new funding

opportunities as part of StartEast

succession planning

Page 17 of 42

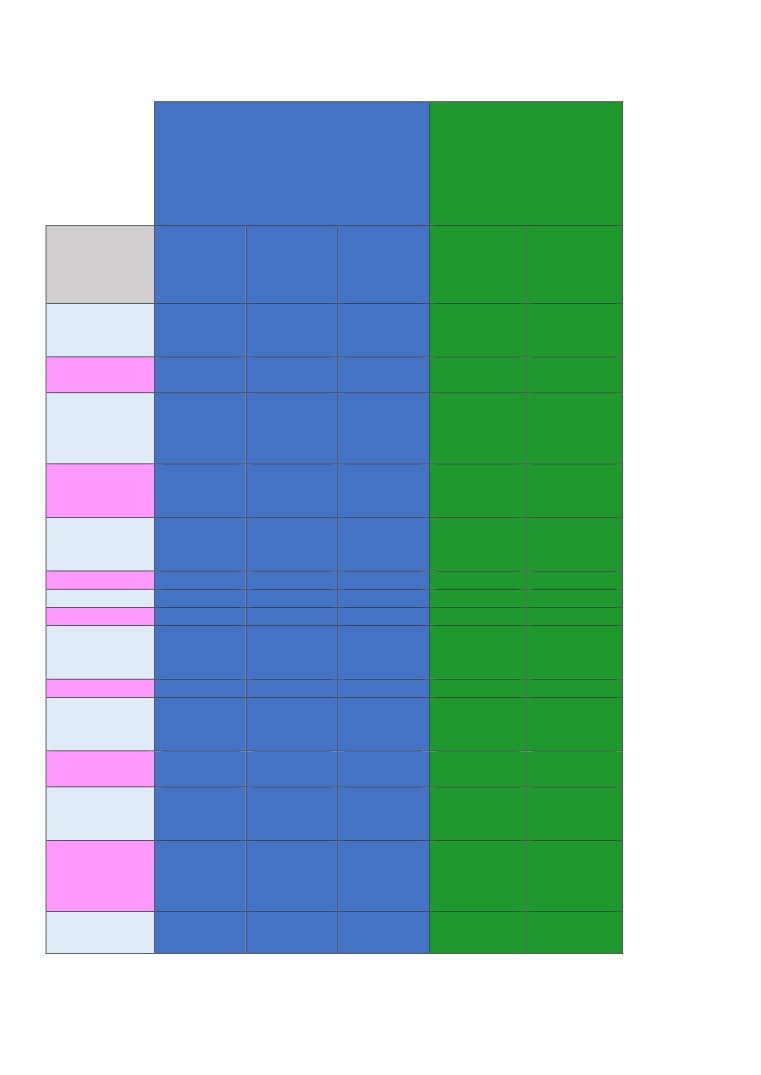

Alignments with policies and initiatives

Priority 1

Priority 2

Guidance, work encounters and

Cutting edge leadership

new entrant pathways

and in-career

development

Alignment

Intervention

Intervention

Intervention

Intervention

Intervention

1

2

3

4

5

Inspiring

Work

Technical

In-career

Freelancer

careers

experience

skills

leadership

development

pathways

development

Careers &

✓

✓

Enterprise

Company

Creative

✓

✓

✓

Clusters

Cultural and

✓

✓

✓

✓

✓

Creative

Skills (CCS)

UK Strategy

Creative

✓

✓

✓

Employment

Programme

ESF

✓

✓

workforce

development

Icanbea

✓

✓

✓

Industry 4.0

✓

✓

Innovate UK

✓

National

✓

✓

Careers

Strategy

NEACO

✓

✓

✓

New Anglia

✓

✓

Digital Tech

sector plan

New Anglia

✓

✓

Growth Hub

New Anglia

✓

✓

Youth

Pledge

Norwich/

✓

✓

✓

Ipswich

Opportunity

Areas

StartEast

✓

Page 18 of 42

Section Three: Understanding the Evidence, Informing the Plan

The UK Cultural economy - scale and value

UK Creative Industries (CIs), to which the cultural and arts sector contributes, and which remains

a key comparative source in terms of data for our work, included in Building our Industrial

Strategy6 Industrial Green Paper) are depicted as a “future facing industry”.

• Official statistics put a UK GVA contribution at £84.1 billion or 5.2% of the whole (UK)

economy. A high growth sector, creative industries grew by 8.9% between 2013 and 2014,

almost twice as fast as the UK as a whole.

• Projected value of UK sector - £128.4 billion to the UK economy by 2025 and help to create

up to 1 million new jobs by 2030.7

• Creative industries are growing more rapidly than other sectors in most parts of the country.

Rapid growth has been experienced in all sub-sectors that make up creative industries and

they are a motor of growth in local economies across the UK. Between 2011 and 2016,

creative industries in the average local economy increased by 11%, twice as fast as the rest

of the economy.8

• The sector is dominated by London - for example, it is estimated that 70% of the Arts/

Culture infrastructure and 37% of all creative industries employment in the UK is in London

plus over 39% of GVA for DCMS Sectors was accounted for in the capital9 - such domination

is a challenge both in terms of providing viable specialist provision in the regions and also in

terms of availability of local jobs in proportion to the numbers of local learners. This research

found that London seems relatively under-served in terms of the volume of locally grown

talent, research and knowledge exchange, suggesting a demand for talent over and above

what can be provided through local universities.10

• The Industrial Strategy Green Paper11 advocates the need for a ‘talent pipeline’ for the

creative and cultural economy which links industry, education and skills. However, growth

and greater productivity in the talent pipeline for these industries are held back by two main

factors: social and informational barriers to entry; and quality, consistency and availability of

post-secondary education and training, which includes further and higher education, and

continuing development.

• A striking feature is the explosion in entrepreneurial activity, measured by the number of

creative businesses. Almost all sectors however experienced a reduction in average firm size

with 96% of the companies in the sector defined as micro-businesses (10% more than other

sectors).12

• “More than a third of the workforce is made up of freelancers or the self-employed, compared

with only a sixth of the UK workforce as a whole. Within the arts and cultural sector, the

proportion is even higher at 47.6 per cent.”13

• Nesta identify 47 creative clusters in the UK including Norwich in New Anglia. A creative

cluster is defined by Nesta as a geographic concentration of creative businesses and

workers, often linked to similar value chains that collaborate and compete. Geographical

proximity has important advantages: creative businesses can tap into critical mass of creative

6 DBEI (2017) Building our Industrial Strategy.

7 Bazalgette, Sir. Peter (Sept. 2017) Independent Review of the Creative industries

8 Creative and Cultural Skills (2015) Building a Creative Nation: the Next Decade

9 DCMS Sectors Economic Estimates 2016: Regional Gross Value Added (GVA) - Experimental statistics

10Juan Mateos-Garcia and Hasan Bakhshi (2016) The Geography of Creativity in the UK.

11 ibid.

12 ibid.

13 NESTA - Armstrong, Harry, et al. (March 2018) Experimental Culture: A Horizon Scan Commissioned by Arts Council England

Page 19 of 42

workers, access clients and collaborate and share information with one another. Clusters can

often include other institutions linked to the value chain such as higher education institutions

(HEIs), cultural institutions, trade associations and government bodies which support the

cluster in several ways. Creative clusters come in different sizes and configurations and can

have a broad array of individual features which facilitate inter-organisational collaboration,

including incubators, accelerators, shared hub space and studios.14

The wider economic impacts of the Cultural Sector

The Independent Review of the Creative Industries15 indicates the role and broad value of the

Creative Economy:

• The Creative Industries are also enablers to other industries.

• Not only is there is significant overlap between the creative and digital sectors (for instance

the IT, software and games sub-sector contribute almost 40% of the GVA of the Creative

Industries) but the wider creative economy - industries which include creative roles - also

has a far larger footprint. For example, 3D modelling - a technology pioneered in the video

games sector - is helping Rolls Royce to develop their understanding of engines, improve

their efficiency and enhance performance in their manufacture.”

• “Alongside the Creative Industries” irrefutable economic contribution sit several intangible

benefits: its outputs, particularly in our cultural sector, enrich the lives of UK citizens, and

promote Britain around the world. As a result, the UK’s cultural influence on soft power is

second only to the US. There is evidence of a direct relationship between cultural assets and

economic impact, with cultural investment creating an ecosystem of impacts.

• Wider value through place-shaping - “There is evidence suggesting that the cultural sector

and creative Industries contribute unique benefits associated with the fusion of skills they

foster alongside economic and social spill overs”16. Emerging evidence from place shaping

research indicates that growth in creative industries is enhanced when an area has a strong

cultural, heritage and sporting offer, enhancing the attractiveness of locations to live and

work and acting as an accelerator for regeneration. Focusing on the cultural and creative

economy supports not just economic improvements but also delivers social benefits, such as

participation and wellbeing, at a local level. Given that there is research showing a positive

correlation between wellbeing and productivity, a place-based focus on the cultural and

creative sectors is increasingly strategically important.

• Culture Drives Growth - the culture sector strategy for New Anglia adds to this perspective.

“Truly successful places are much more than economic powerhouses. Their high level of

performance is always underpinned by a sense of creative vibrancy…and a clear sense of

cultural identity.”

• In summary therefore, “the importance of this sector is underscored when looked at through

a number of lenses: The creative industries will grow as a proportion of the economy in

decades to come; creative occupations foster growth and greater productivity in other

economic sectors; and these industries deliver additional cultural benefits both at home and

abroad.”

14 ibid.

15Sir Peter Bazalgette. (2017) Independent Review of the Creative industries.

16 Ibid.

Page 20 of 42

Industrial Strategy: Creative Industries Sector Deal (2018)17

•

“this deal will invest more than £150m across the lifecycle of creative businesses

including: the places of the future by funding leading creative clusters to compete

globally; the technologies and content of the future via research into augmented reality

and virtual reality; and the creative skills of the future via a careers programme that

will open up creative jobs to people of every background.”

•

“investing to develop world-class creative clusters, we will provide £20m over the next

two years to roll out a Cultural Development Fund.”

•

“up to £2m available …to ensure there is a larger and more diverse intake of talent

and a broader range of routes into the creative industries”

In Summary:

• One of the fastest growing sectors in the UK economy

• Up to one million new jobs nationally by 2030

• Dominated by London in terms of infrastructure and employment

creating a magnet effect, although local economic growth across the

UK impressive

• An explosion in entrepreneurial activity with businesses diminishing

in terms of average size to between 5 and 6 employees

• Norwich recognised as a nationally significant cultural and creative

cluster

• A recognition of the wider economic, community and place benefits

and added value of the cultural sector

• The Creative Industry Sector Deal makes a number of policy and

funding commitments to support Culture Sector development and

skill investment. (2018)

New Anglia Economic and Skills Evidence Base

The Cultural Economy in New Anglia

• The New Anglia sector is worth approximately £676m, sustaining 26,300 jobs (including self-

employment), and 2,535 enterprises. New Anglia is a ‘top ten’ LEP area in terms of cultural

sector employment, although New Anglia employees are estimated at being only one twelfth

of the London workforce - demonstrating the dominance of the capital and its role as a

magnet for cultural careers.

• The New Anglia Culture Board Culture Drives Growth strategy, focusing upon certain sector

elements only reports a value of £83.6m to the economy of Norfolk and Suffolk, employing

5,800 people and with over 1,000 businesses.

• Employment in the sector grew by 17 per cent between 2010 and 2015, compared to a New

Anglia average of seven per cent.

• The sector has much higher rates of self-employment (colloquially termed ‘Freelancers’) at

21 per cent of total jobs, compared to 12 per cent for the Visitor Economy sector, and 14 per

cent of all New Anglia jobs.

• The sector has a large cluster of employment in Norwich, followed by Ipswich and North

Norfolk.

17 HM Government. (2018) Industrial Strategy: Creative Industries Sector Deal.

Page 21 of 42

• Norwich’s creative cluster is one of the 47 significant clusters nationally identified in the

Nesta report constitutes 1,345 creative businesses (which is 7.2% of local businesses);

employs 6,734 people (3.0% of total employees) with a creative GVA of £339,953 and which

is 3.8% of the total GVA generated. (Against an average of 3% across the whole economy.

• If we consider cultural employment as a percentage of total employment, then North Norfolk

has the highest percentage.

• If we consider cultural employer numbers across New Anglia, then there is a much more

even geographical spread with an average firm size between 5 and 6 employees.

Skills Supply and Demand in the New Anglia Cultural Sector

This information below has been summarised from the Evidence Report (See Appendix A) and the

Datapack:

• Based on results from the UKCES Employer Skills Survey 2015, then ‘Arts and Other

Services’ employers are more likely to have a ‘hard to fill’ vacancy compared to the New

Anglia average. They are also less likely to report staff as being not fully proficient, and more

likely to report underutilised staff.

• During 2014/15, there were 680 people participating in apprenticeships in the ‘Arts,

entertainment, and recreation’ sector, 3.1 per cent of total apprenticeship participation in New

Anglia. Nationally, this figure was 2.6 per cent.

• 5,100 learning aims were delivered to New Anglia learners in 2012/13 split by the sector lead

bodies of ‘Creative & Cultural’ (4,020 learning aims) and ‘Creative Media’ (1,080). This figure

was down slightly on the number delivered in 2010/11 (5,210) with falls in ‘Creative &

Cultural’ learning aims driving this. ‘Creative Media’ learning aims rose from 920 to 1,080

over the same period.

• Together, ‘Creative & Cultural’ and ‘Creative Media’ learning aims made up 6.6 per cent of all

known learning aims delivered in New Anglia in 2012/13, compared to 6.1 per cent

nationally.

A Future View of the New Anglia Cultural Sector

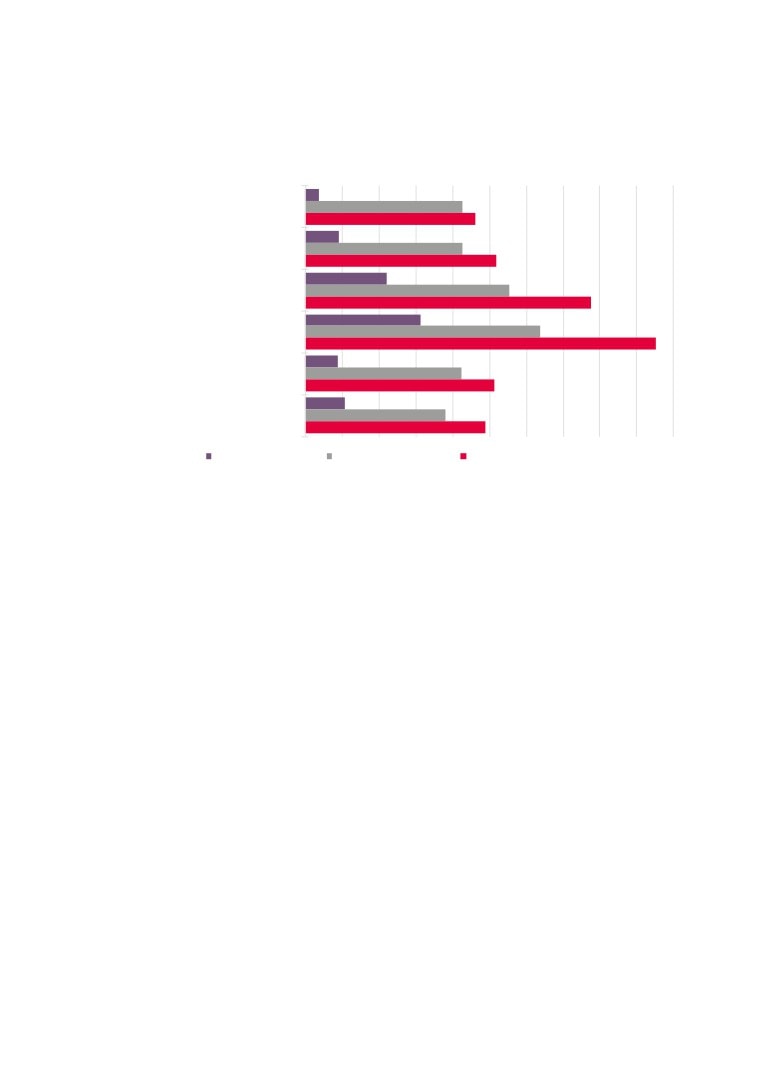

• Looking ahead, the sector is projected to grow in employment terms by around 1,000 jobs (four

per cent, below six per cent projected across the New Anglia economy) between 2014 and 2024.

• Over the same period, replacement demand is expected to be somewhere in the region of

11,000 jobs. This places a net requirement for jobs requiring to be filled in the sector at 12,000.

• Much of replacement demand will take place in Level 4 to 6 (HE to first degree level) roles with

Level 2 (GCSE A-C and equivalent) and Level 3 (A level and equivalent) roles also featuring

strongly. In terms of new jobs created (expansion demand) then this will solely be in Level 4 roles

and higher with job losses in Level 3 roles and below.

In Summary:

• New Anglia a ‘top ten’ LEP by cultural sector workforce size

• Recent employment growth is double that of the New Anglia economy

• Self-employment is a very important part of the sector ‘workforce’

• Under-utilisation of skills a potential issue with employers perceiving an ‘over-supply’ of graduates

• Apprenticeship levels above local averages, although focused on general rather than sector specific

skills

• Future demand will be heavily focused on roles at Level 4 or above with job reductions forecast at Level

3 and below

Page 22 of 42

UK Sector Skills considerations

Creative and Cultural Skills (CCS), the sector skills development agency, characterises the

sector as having a high percentage of freelancers, short-term contracts and SMEs. Due to the

nature of employment many workers in the sector have been unable to access training, investment

or more formal education schemes that generally follow traditional employment structures. The

structure of the creative industries includes 94.7% of businesses employing fewer than 10 people.

Priority skills needs nationally

CCS advocate the following needs to support entry level into the creative and cultural sector (also

endorsed in the Independent Review of the Creative Industries):

• Recognition that vocational and technical education are a key part of the mix of opportunities

that need to be available to young people, such as apprenticeships. This type of training and

education is important in attracting diverse talent into the sector.

• Young people need to have both a perception of, and opportunities to, ‘equal routes’ to technical

and academic pathways, in both status and funding.

• Support for future job and career prospects for young people in schools and colleges need to

ensure a ‘line of sight’ to a job, which could avoid young people embarking on courses without

proper employer-endorsed careers information.

• Promotion of sector growth across the regions and development of creative centres outside of

London - with a focus on cross-sector collaboration, stimulating investment, and addressing skill

shortages and talent retention.

• Assessing (and articulating) the contribution of the sector to wider local socio-economic growth

and its role in place making.

• Assessing the future position of the regions in the international market and their role in

maximising the global reach of the sector, including developing export capabilities and supporting

new trade relationships with emerging markets.

Skills factors affecting growth and productivity

• Ethnic minorities, women (particularly those with caring responsibilities), those with disabilities,

and people from less advantaged backgrounds are seen to face the biggest challenges to entering

and progressing in creative industry sectors. 92% of creative industry jobs are occupied by the

more advantaged groups of the workforce and across the sector social mobility is a challenge.18

•“The demographic that engages with the arts has got more narrow, more entrenched. I think that

for young people who are not in urban centres, not middle class who are not white it’s getting

harder and harder for them to engage as audiences or employees.”19

• Under-represented groups constitute an untapped domestic pool of raw talent that, if provided

with the relevant skills, could be used to fill the skills gaps facing the creative industries. At a

strategic level, industry recognises the importance of addressing its diversity challenges but

coordinated employer-led action is difficult where so many businesses are micro or SME.

• Entry into the sector is impeded by poor understanding amongst pupils, teachers and parents of

the kinds of careers that are available, with a perception amongst many that jobs are poorly paid,

insecure or not open to those without existing links into industry.

18 Nesta (2017) The Future of Skills: Employment in 2030.

19 NESTA - rmstrong, Harry, et al͘ (March 2018) ‘Experimental Culture: Horizon Scan Commissioned by rts Council England’

Page 23 of 42

•“Skills shortages exist in relation to creative sectors like animation, visual effects and video

games. A range of specialist conservation skills are in short supply in museums, and there are

shortages related to specialist technical roles in theatres. Digital skills remain a systemic problem

throughout the sector”20

• Employers report job deficiencies also in the supportive rather than the “visible” roles, with

shortages in non-creative skills, such as management, HR, finance, digital, and marketing skills.

•The quality, consistency and availability of post-secondary education and training is an area

where government intervention is undergoing significant reform, with moves towards employer-led

skills approaches and a greater emphasis on regional strategies. In the creative industries,

employers already work together to deliver a range of excellent specialist training centres and

industry-led initiatives that tackle skills gaps.

• Despite good examples of excellence; quality and consistency for learners (and ‘job-readiness

outcomes’) remains an issue across the sector, not least because it has such a high percentage of

micro enterprise and SME employers for whom a coordinated employer-led approach is

challenging.

(See Appendix D for Current Skills and Training Provision)

Future skills nationally

The Future of Skills: Employment in 2030 - research by Nesta (pub 2017)21 - indicates the

forthcoming changes in employment and the implications for skills, in particular:

• Creative, digital, design and engineering occupations have bright outlooks and are strongly

complemented by digital technology.

• Skills most likely to be in greater demand in the future include interpersonal skills and systems

skills, such as judgement and decision making. The report confirms the importance of higher-order

cognitive skills such as originality, fluency of ideas and active learning.

Key UK-wide issues for skills and talent development in the CCE:

• Cultural leadership and management skills - Cultural leadership skills, entrepreneurial

development, and high-level management skills are underdeveloped across the sector.

• Building the creative generation - In education, sector specific subjects are often regarded as

less important than traditional subjects. Growth and greater productivity in the talent pipeline for

the sector are held back by:

i) social and informational barriers to entry which affect diversity of sector;

ii) quality and availability of post-secondary education and training.

iii) Industry ownership of investment in skills - The breadth of the sector leads to a lack of

coordination and strategic approaches to investment in workforce development. The industry

needs to develop a shared vision, across scale and subsectors, which can mitigate against key

issues such as uneven and short-term investment.

iv) Building the market for high-quality provision - The sector suffers from an oversupply of

graduates but requires a wider range of skilled practitioners- across specialist and general,

technical and creative, business and managerial skills to support and develop the sector.

20 Ibid.

21Nesta (2017) The Future of Skills: Employment in 2030.

Page 24 of 42

v)“We need to find a different way of supporting or enabling freelancers and portfolio workers to A:

make a reasonable living, and B: train and keep their skills up to date.” - Mark Robinson, Thinking

Practice.22

In Summary:

• Social mobility is a challenge - 92% of creative industry jobs are

occupied by the more advantaged groups of the workforce

• The sector ‘suffers from an oversupply of graduates’ but requires a wider

range of skilled practitioners

• Entry into the sector impeded by poor understanding of the kinds of

careers available

• The need for young people to consider both academic and vocational

pathways

• Cultural leadership skills, entrepreneurial development, and high-level

management skills are underdeveloped

22 NESTA - Armstrong, Harry, et al. (March 2018) Experimental Culture: A Horizon Scan Commissioned by Arts Council England

Page 25 of 42

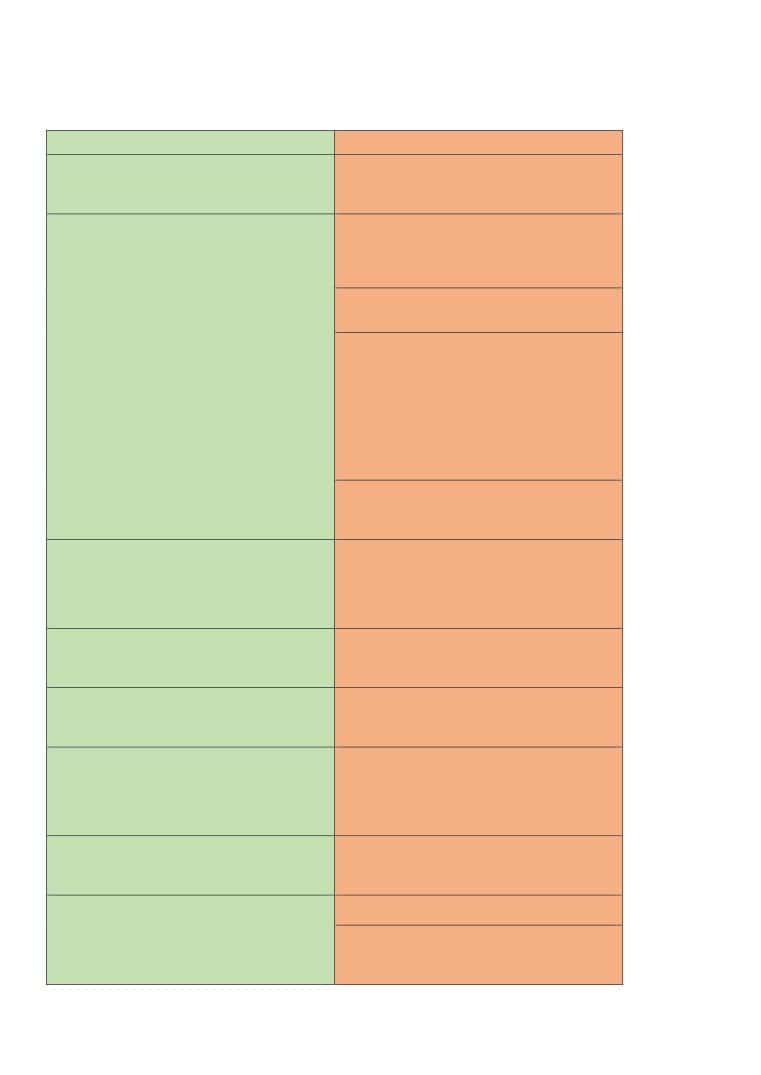

Key Findings from Local Employer and Stakeholder Consultations

Opportunities

Challenges

Build stronger strategic partnerships between

A perceived regulated ‘formulaic’ FE/HE system

employers, practitioners and skills and

with funding-drivers not easily compatible with

education providers

the fluidity and unpredictability of employment

development within the cultural sector

Learn from and build upon current/recent

A lack of ‘employability’ skills of many new

innovative provision such as

potential entrants to the sector at all levels - in

• StartEast

relation to their softer skills rather than their

qualifications

• Creative Employment Programme

Developing sustainable new education and skills

• ACE Resilience-funded Training

provision (especially higher/technical provision)

Museum programme

in a remote, primarily rural area

The current work experience system at all levels

• DanceEast/University of Suffolk

is not providing the ‘real’ work experience

collaboration developing a 2-year

required by those seeking to progress in the

Dance Degree

sector of employers recruiting talent. There was

a common view that talent is best developed in

‘real, coalface’ environments and that current

• Norwich University of the Arts (NUA)

Ideas Factory Graduate Internship

work experience provision often does not

provide this with real risks of talent falling

scheme

through the gaps between learning provision

and local cultural jobs

The risks of an ‘oversupply’ locally vis-à-vis the

number of career opportunities, with perceptions

of a real imbalance between learner numbers

and potential jobs

Place greater emphasis upon ‘employability’

The ‘under-utilisation’ of people with higher skills

with suggestions of a reduced emphasis on

is recognised as a real challenge for the sector

higher qualifications and a focus upon ‘softer

with the risks of

skills’

‘overqualification/underemployment’ a lack of

diversity of new entrants and workforce

frustrations about lack of career progression

Move towards higher quality & potential

Skills shortages in cultural leadership roles

indication of lower quantity ‘real’ work

leading to senior appointments often awarded to

experience in the unique settings that are New

out-of-area candidates

Anglia cultural sector workplaces.

Recruit more cultural sector - specific

A shortage of higher technical/professional roles

apprenticeships as standards-based provision

meaning that technical skills are often ‘imported

becomes available.

in’ to New Anglia - particularly digital tech led

occupations

Potential to develop a defined New Anglia-wide

Apprenticeships viewed as low-profile and often

creative cluster, focusing on cross-sector

insufficiently sector specific, e.g. business

collaboration, stimulating investment, and

administration or customer service

addressing skill shortages and talent retention,

extending from the strong foundations in place

in Norwich

Play a local leadership role in place-shaping and

A heavy reliance on Freelancers and concerns

supporting wider social outcomes such as

about Freelancer skills deficits - particularly

diversity, aspiration, health, inclusion, mobility,

‘enterprise’ skills needed to operate

inclusive growth

independently - e.g. finance, marketing etc.

Align more closely with national and local policy

A lack of specialist Tutors with the latest skills

developments

especially digital creative skills

A lack of effective careers advice/IAG meaning

that the unique dynamics of the sector are not

being communicated to young people

considering careers

Page 26 of 42

(See Appendix B for Consultees; See Appendix D for Current Skills and Training Provision).

In Summary:

• Opportunity to build partnership between employers, practitioners, skills and

education providers.

• Emphasis on employability and focus on softer skills

• Formulaic FE/HE courses do not seem compatible with employment

• Students need soft-skills development

• Work experience needs to be more ‘real’

• Skills shortage of cultural leadership and higher technical/professional

Page 27 of 42

Appendices

Appendix A - Evidence Report

Definition - Cultural Sector in New Anglia

The definition of the sector used by New Anglia LEP broadly follows that used by the Department

for Culture, Media and Sport to define the Creative Industries. However, that definition used by

New Anglia differs in some key areas in that it does not include activities related to ‘advertising

and marketing’, ‘architecture’, and ‘specialised design activities’. In addition, the New Anglia

definition of the sector captures activity around sports, amusements and recreation, and some

specialised retail.

In full then, and in no particular order, the sector covers the following areas:

-

Crafts

-

Film, TV, video, radio and photography

-

Publishing

-

Museums, galleries and libraries

-

Music, performing and visual arts

-

Retail and wholesale activities related to music, video, arts and antiques

-

Operation of historical sites, botanical and zoological gardens, and similar sites of interest

-

Gambling and betting activities

-

Sports facilities and activities

-

Amusement / theme parks, and amusement / recreation facilities

Headlines

-

The sector is worth approximately £676m, sustaining 26,300 jobs, and 2,535 enterprises.

-

Employment in the sector grew by 17 per cent between 2010 and 2015, compared to a New

Anglia average of seven per cent.

-

The sector has much higher rates of self-employment at 21 per cent of total jobs, compared

to 12 per cent for the Visitor Economy sector, and 14 per cent of all New Anglia jobs.

-

The sector has a large cluster of employment in Norwich, followed by Ipswich and North

Norfolk

Norwich

3,470

Ipswich

2,270

North Norfolk

2,105

Suffolk Coastal

1,575

St Edmundsbury

1,455

Culture and The Arts

Great Yarmouth

1,455

Employment by Local

Waveney

1,325

Authority District Area, 2015

Breckland

1,285

Forest Heath

1,155

King`s Lynn and West Norfolk

1,135

Source: Business Register and

South Norfolk

1,055

Employment Survey, Office for

Broadland

1,055

National Statistics

Mid Suffolk

940

Babergh

755

Page 28 of 42

-

However, if we consider Culture and The Arts employment as a percentage of total

employment then North Norfolk has the highest percentage

North Norfolk

6.5%

Forest Heath

4.7%

Norwich

3.9%

Culture and The Arts

Great Yarmouth

3.8%

Employment as a % of total

Waveney

3.2%

employment by Local

Ipswich

3.2%

Authority District Area, 2015

Suffolk Coastal

3.1%

Mid Suffolk

2.7%

Breckland

2.6%

Source: Business Register and

Babergh

2.4%

Employment Survey, Office for

St Edmundsbury

2.3%

National Statistics

Broadland

2.3%

King`s Lynn and West Norfolk

2.1%

South Norfolk

2.1%

-

However, if we consider Culture and The Arts employer numbers across New Anglia then

there is a much more even spread. Again, Norfolk comes out on top but the fact that it does

not stand out as with employment, suggests that it is home to the larger employers in the

area.

Norwich

310

Suffolk Coastal

270

Forest Heath

270

North Norfolk

225

St Edmundsbury

200

Culture and The Arts Business

South Norfolk

200

Units by Local Authority

Mid Suffolk

200

District Area, 2016

Breckland

195

Babergh

190

Ipswich

175

Source: UK Business Counts,

Office for National Statistics

King`s Lynn and West Norfolk

165

Broadland

155

Waveney

140

Great Yarmouth

120

-

Based on results from the UKCES Employer Skills Survey 2015, then ‘Arts and Other

Services’ employers are more likely to have a vacancy that is hard to fill compared to the

New Anglia average. They are also less likely to report staff as being not fully proficient.

-

However, ‘Arts and Other Services’ employers more likely to report underutilised staff.

-

During 2014/15, there were 680 people participating in apprenticeships in the ‘Arts,

entertainment, and recreation’ sector, 3.1 per cent of total apprenticeship participation in

New Anglia. Nationally, this figure was 2.6 per cent.

-

5,100 learning aims were delivered to New Anglia learners in 2012/13 split by the sector

lead bodies of ‘Creative & Cultural’ (4,020 learning aims) and ‘Creative Media’ (1,080). This

figure was down slightly on the number delivered in 2010/11 (5,210) with falls in ‘Creative &

Page 29 of 42

Cultural’ learning aims driving this. ‘Creative Media’ learning aims rose from 920 to 1,080

over the same period.

Together, ‘Creative & Cultural’ and ‘Creative Media’ learning aims made up 6.6 per cent of all

known learning aims delivered in New Anglia in 2012/13, compared to 6.1

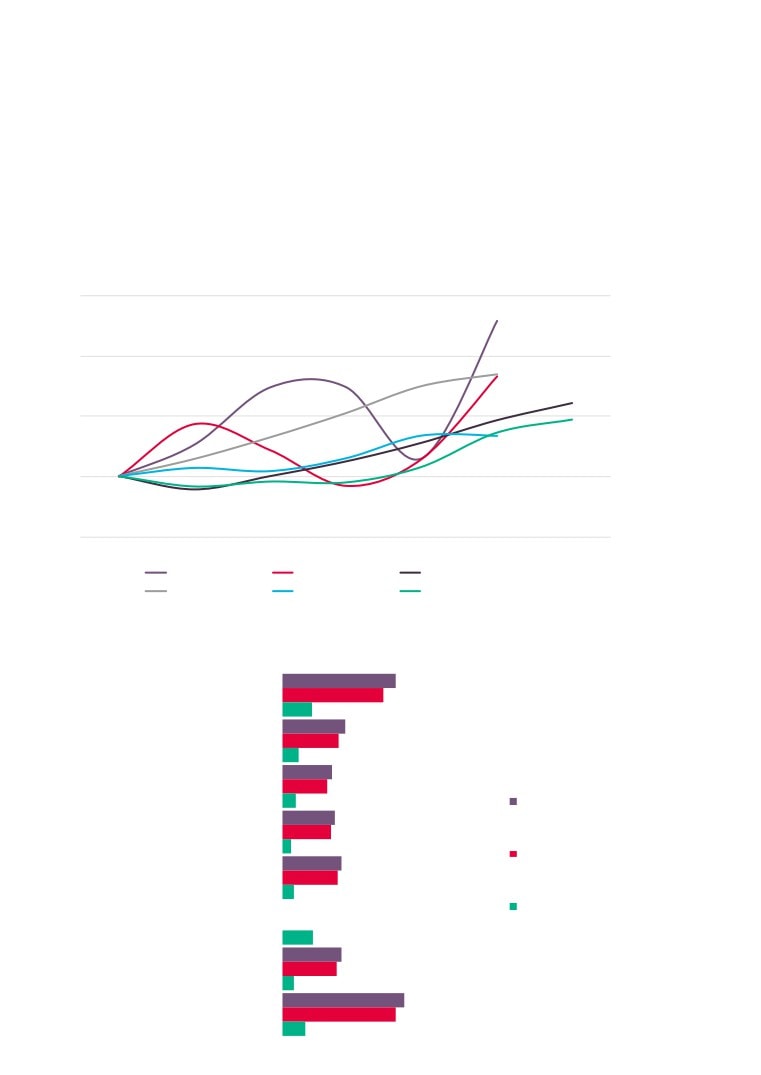

Cultural Sector contribution to growth in the local economy (2010=100)

Source: New Anglia LEP Economic Strategy evidence base work

130

120

110

100

81,400

New Anglia

72,865

21,600

45,400

Norfolk

40,650

11,725

36,000

Employment provided by the Visitor Economy (Tourism and Culture)

9,645

across comparator areas, 2015

37,600

ornwall and Isles of Scilly LEP

35,045

6,415

42,600

Source: Business Register and Employment

Dorset LEP

40,010

Survey, Office for National Statistics

8,130

GCGP LEP

Visitor Economy

21,900

42,400

Tourism

Greater Lincolnshire LEP

39,435

8,620

87,700

Cultural

Heart of the South West LEP

81,545

16,710

London LEP

266,325

186,700

South East LEP

162,640

49,190

288,700

8,620

87,700

Cultural

Heart of the South West LEP

81,545

16,710

London LEP

266,325

186,700

South East LEP

162,640

49,190

288,700

East of England

246,360

82,480

Full time, part time, and self-employment in the Visitor Economy

(Tourism and Culture), 2015

New Anglia

57%

29%

14%

Culture

40%

39%

21%

Tourism

39%

51%

11%

Visitor Economy

40%

48%

12%

0%

Full time

Part time

Self Employed

100%

Source: New Anglia LEP Economic Strategy evidence base work

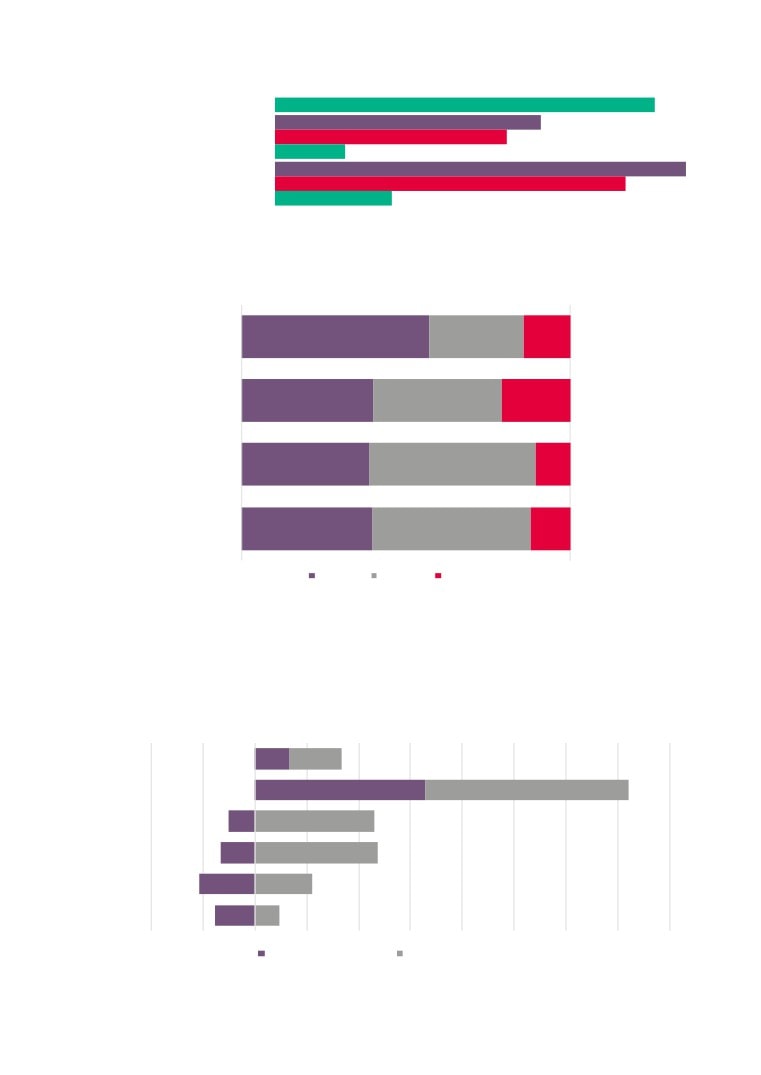

Culture sector replacement and expansion demand by qualification,

2014 - 2024

-2,000

-1,000

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

QCF 7-8

QCF 4-6

QCF 3

QCF 2

QCF 1

No Qual

Expansion Demand

Replacement Demand

Page 31 of 42

Please note that the Working Futures data uses the

following breakout of qualification levels:

QCF8 - Doctorate

QCF7 - Other higher degree

QCF6 - First degree

QCF5 - Foundation degree; Nursing; Teaching

QCF4 - HE below degree level

QCF3 - A level & equivalent

QCF2 - GCSE (A-C) & equivalent

QCF1 - GCSE (below grade C) & equivalent

No Q - No Qualification

Source: UKCES Working Futures 2014 - 2024

Culture sector replacement and expansion demand by occupation

(top 5 in terms of net requirement), 2014 - 2024

0

1,000

2,000

3,000

4,000

Culture, media and sports occupations

Other managers and proprietors

Skilled agricultural and related trades

Business, media and public service professionals

Corporate managers and directors

Expansion demand

Replacement demand

Net requirement

Source: UKCES Working Futures 2014 - 2024

Culture sector qualifications, 2014 - 2024

2024

11%

46%

18%

18%

6%

2014

9%

35%

21%

21%

10%

0%

100%

QCF 7-8

QCF 4-6

QCF 3

QCF 2

QCF 1

No Qual

Page 32 of 42

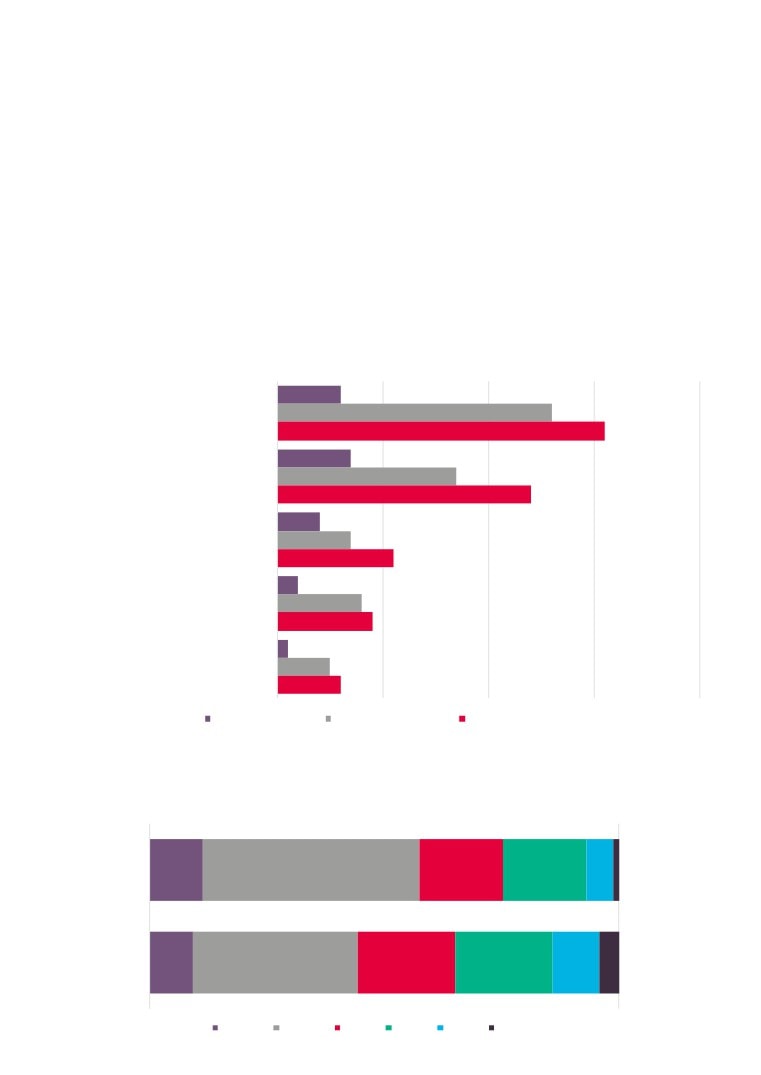

Culture sector replacement and expansion demand as a proportion

of employment by occupation, 2014 - 2024

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%