Emerging Technologies

Data Pack

Final Version 31.01.19

Contents

Introduction

Page 3

Transferring the PWC Analysis Results to the Local Level

Page 5

Transferring the McKinsey Analysis Results to the Local Level

Page 16

Comparison of McKinsey and PWC Local Level Outputs

Page 27

Analysis of Norwich’s Regional Role in Retail

Page 32

Analysis of STEM Subject Student and Graduate Destinations

Page 35

2

Introduction to the Sector Data Pack

The role of the Sector Data Pack is to bring together the latest socio-economic and labour market data and present both an up-to-

date, and future view, of the sector and any underlying issues within the area that could impact upon it. Data is presented in a

navigable format without comment (in most cases) with interpretation at this stage mainly left to the reader. In most instances data

has been analysed and presented down to local authority level. In some instances, and even where local authority data is available,

it has not been presented in the data pack due to issues of unreliability and small sample sizes.

Introduction to the Emerging Technologies Analysis

In compiling the data pack for the Emerging Technologies sector skills plans, and in trying to understand and quantify the potential

impacts of IR4.0 at the local level, we have referred heavily to two recent international studies on the matter:

- The PriceWaterhouseCoopers (PWC) article ‘Will robots steal our jobs?’ (UK Economic Outlook, March 2017)

- The McKinsey Global Institute article ‘Where machines could replace humans - and where they can’t (yet)’ (McKinsey Quarterly,

July 2016).

Both pieces of research were based on non-UK labour markets and produced broad level results. In the production of this data pack

we have sought to understand what these findings mean at both a New Anglia LEP and local authority level.

3

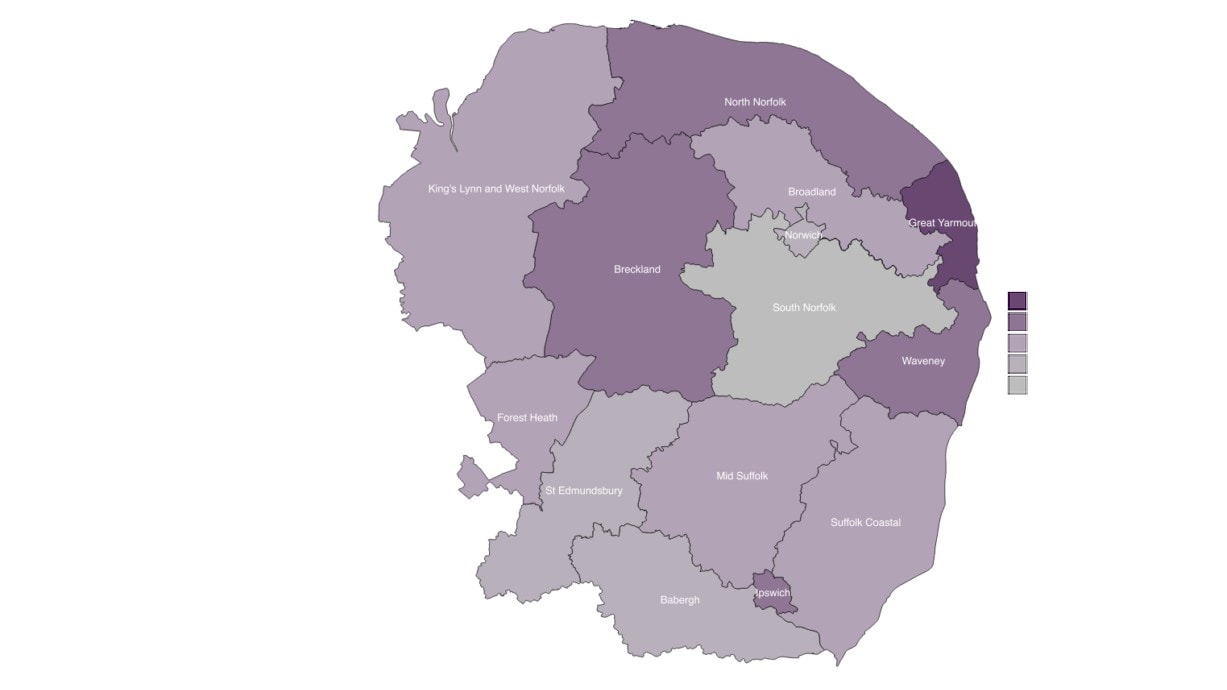

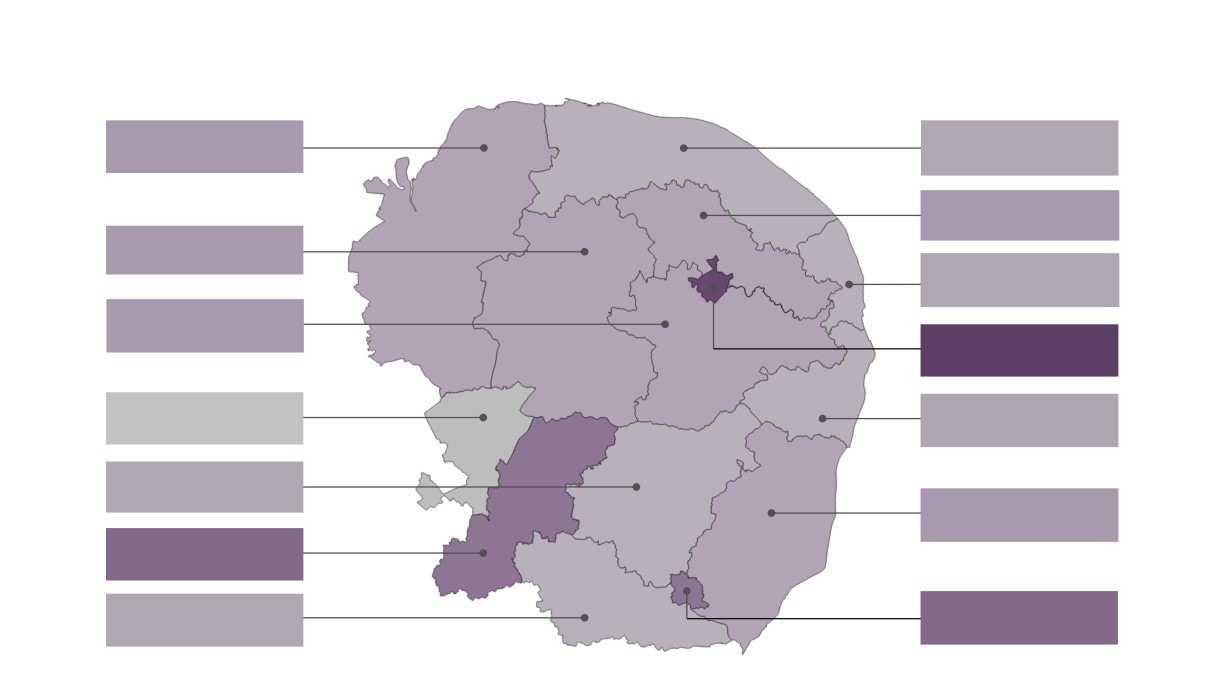

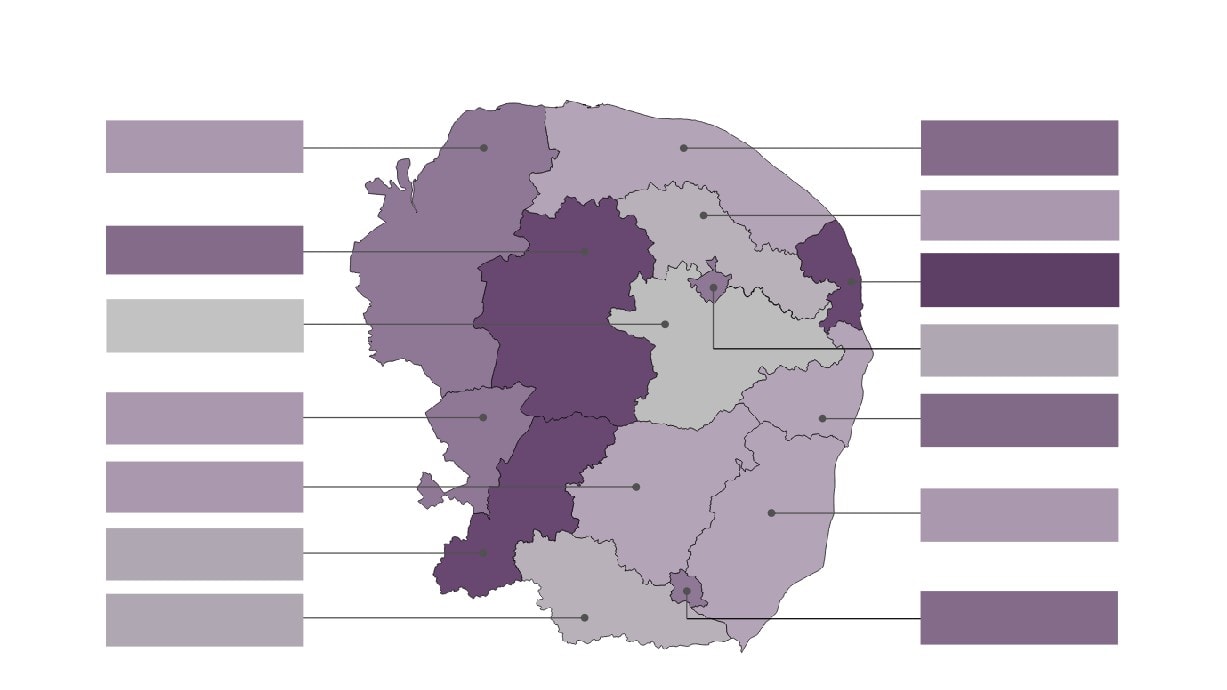

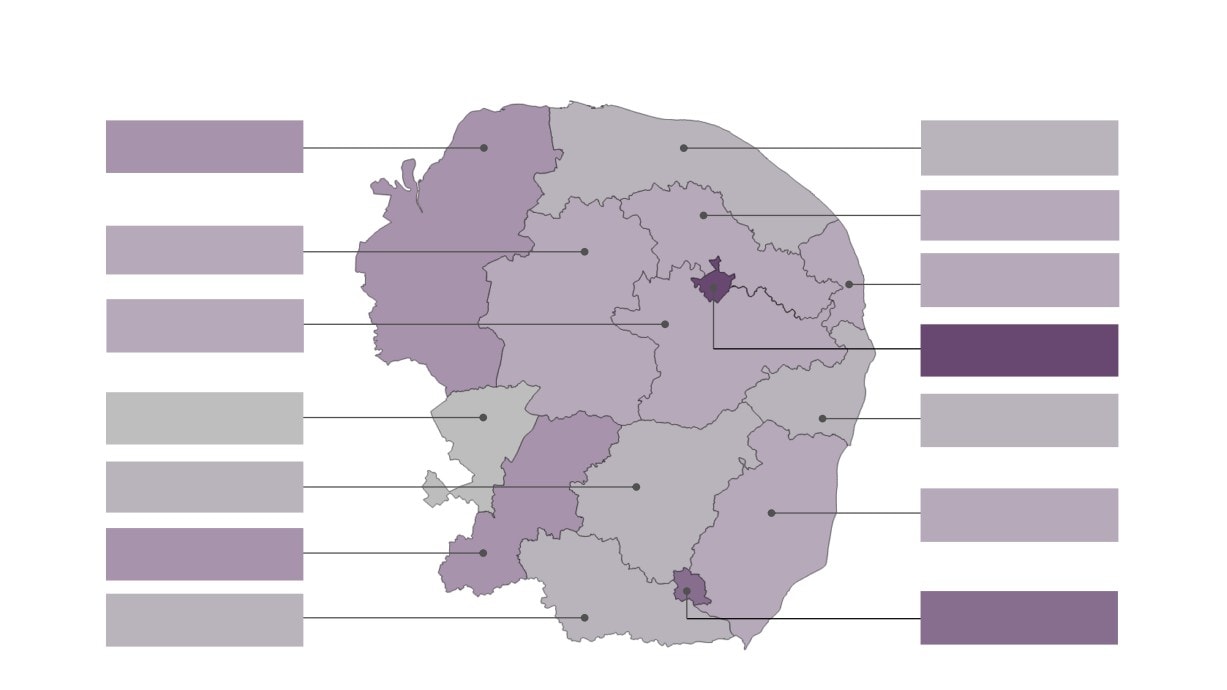

Throughout this Data Pack,

the resulting data analysis

has been mapped for New

Anglia at local authority

level.

High Risk

All the maps are presented

in the thematic style shown

in the image on the right,

Low Risk

graduated from grey (low

risk) to purple (high risk).

All the images also present

detailed figures for each

local authority area.

4

PWC Based

Analysis

Transferring the PWC Analysis

Results to the Local Level

5

PwC Analysis - Introductory Notes

The following analysis is based on the findings of the recent PwC article ‘Will robots steal our jobs?’

(UK Economic Outlook, March 2017).

The first element of the analysis looks at where the jobs are across New Anglia that are most at risk of

automation (between now and early 2030s) based on the proportion of employment provided by

sectors deemed at risk.

The second element looks at the same issue but in terms of residents i.e. where do residents live who

are most at risk to significant job change due to lower levels of education.

Finally we present a future scenario of the New Anglia jobs market, using job projection data from the

East of England Forecasting Model (EEFM) and looking at potential IR4.0 impact on job growth

between 2018 and 2033.

6

New Anglia ‘At Risk’ Jobs by Sector

Job Automation

Total Jobs

(% at potential

Total Jobs

'At Risk'

high risk)

A : Agriculture, forestry and fishing

18.7%

22,565

4,220

B : Mining and quarrying

23.1%

900

208

C : Manufacturing

46.4%

66,000

30,624

D : Electricity, gas, steam and air conditioning supply

31.8%

3,000

954

E : Water supply; sewerage, waste management and remediation activities

62.6%

4,500

2,817

F : Construction

23.7%

35,000

8,295

G : Wholesale and retail trade; repair of motor vehicles and motorcycles

44.0%

113,000

49,720

H : Transportation and storage

56.4%

36,000

20,304

I : Accommodation and food service activities

25.5%

52,000

13,260

J : Information and communication

27.3%

17,000

4,641

K : Financial and insurance activities

32.2%

21,000

6,762

L : Real estate activities

28.2%

9,000

2,538

M : Professional, scientific and technical activities

25.6%

38,000

9,728

N : Administrative and support service activities

37.4%

63,000

23,562

O : Public administration and defence; compulsory social security

32.1%

29,000

9,309

P : Education

8.5%

56,000

4,760

Q : Human health and social work activities

17.0%

92,000

15,640

R : Arts, entertainment and recreation

22.3%

22,000

4,906

S : Other service activities

18.6%

12,000

2,232

Totals

691,965

214,480

Proportion of Total Jobs 'At Risk'

31%

Sources: ‘UK Economic Outlook, March 2017’, PwC; Business Register and Employment Survey, Office for National

7

Statistics; Defra Agricultural Survey 2016

Proportion of Total Jobs ‘At Risk’ by Local Authority

Kings Lynn &

North

30.4%

29.9%

West Norfolk

Norfolk

30.3% Broadland

Breckland

32.8%

Great

29.0%

Yarmouth

South Norfolk

27.9%

30.7%

Norwich

Forest Heath

30.6%

31.9%

Waveney

Mid Suffolk

32.6%

Suffolk

32.5%

Coastal

St.

32.5%

Edmundsbury

Babergh

31.5%

30.6%

Ipswich

8

Total LEP ‘At Risk’ Jobs Apportioned by Local Authority

Kings Lynn &

North

8.2%

4.8%

West Norfolk

Norfolk

Broadland

6.8%

Breckland

7.8%

Great

5.3%

Yarmouth

South Norfolk

6.9%

13.0% Norwich

Forest Heath

3.6%

Waveney

6.1%

Mid Suffolk

5.5%

Suffolk

7.6%

Coastal

St.

9.7%

Edmundsbury

Babergh

10.1%

Ipswich

4.6%

9

New Anglia Residents ‘At Risk’ by Qualification Level

% with degree or equivalent and above - aged 16-64

221,300

Higher Education

(12% at Risk)

Number at Risk

26,600

% with higher education below degree level - aged 16-64

73,800

% with GCE A level or equivalent - aged 16-64

247,600

Medium Education

% with GCSE grades A-C or equivalent - aged 16-64

222,100

(36% at Risk)

Total

543,500

Number at Risk

195,700

% with other qualifications (GCSE) - aged 16-64

99,500

% with no qualifications (GCSE) - aged 16-64

77,400

Low Education

(46% at Risk)

Total

176,900

Number at Risk

81,400

Total at Risk

303,600

Population Aged 16-64

Totals

941,700

% at Risk

32%

Sources: ‘UK Economic Outlook, March 2017’, PwC; Annual Population Survey, Office for National Statistics

10

% of New Anglia Residents ‘At Risk’ by Qualification Level

Kings Lynn &

North

32%

34%

West Norfolk

Norfolk

33% Broadland

Breckland

34%

Great

37%

Yarmouth

South Norfolk

28%

Norwich

31%

Forest Heath

32%

Waveney

35%

Mid Suffolk

32%

Suffolk

32%

Coastal

St.

30%

Edmundsbury

Babergh

34%

Ipswich

29%

11

Looking Ahead

As mentioned previously, the PwC analysis considers a time frame from now until the early 2030s for

jobs to become at risk of automation.

Using the latest version of the the East of England Forecasting Model (EEFM), which presents data

down to local authority level, we have looked at jobs growth by sector between 2018 and 2033 (and

ignored those sectors where jobs are forecast to decline) and applied the previous PwC analysis to

highlight how much of new job growth can be considered as being at risk.

The results of this analysis are presented over the final few slides:

12

‘At Risk’ Job Growth by Sector and Area

UK

East of England

New Anglia

% of Jobs

Job Change

Job Change

Job Change

Job Change

Job Change

Job Change

'At Risk'

2018 - 2033

'At Risk'

2018 - 2033

'At Risk'

2018 - 2033

'At Risk'

Agriculture

18.7%

-18,400

-3,900

-1,600

Mining & quarrying

23.1%

-13,300

-600

-400

Manufacturing

46.4%

-422,900

-31,000

-7,500

Utilities

31.8%

7,800

2,500

-200

-100

Waste & remediation

62.6%

20,500

12,800

3,900

2,400

1,100

700

Construction

23.7%

190,300

45,100

34,500

8,200

7,000

1,700

Wholesale & Retail Trade

44.0%

82,700

36,400

27,400

12,000

4,400

1,900

Transport & Storage

56.4%

33,800

19,000

4,600

2,600

1,500

800

Accommodation & food services

25.5%

201,900

51,500

26,800

6,800

5,300

1,300

Information & Communication

27.3%

147,800

40,300

7,800

2,100

800

200

Finance

32.2%

41,100

13,200

-6,300

-1,000

Real estate

28.2%

89,500

25,200

9,800

2,700

2,600

700

Professional, scientific and technical activities

25.6%

419,200

107,300

39,100

10,000

5,300

1,300

Administrative and support service activities

37.4%

171,600

64,200

17,300

6,500

4,400

1,700

Public administration

32.1%

104,600

33,600

12,500

4,000

2,400

800

Education

8.5%

99,800

8,500

11,600

1,000

800

100

Health & care

17.0%

558,100

94,900

70,800

12,000

14,600

2,500

Arts & entertainment

22.3%

87,800

19,600

6,500

1,400

1,500

300

Other services

18.6%

42,300

7,900

4,100

800

800

100

Total job growth

2,298,800

582,000

276,700

72,700

52,500

14,100

Proportion of job growth 'at risk'

25%

26%

27%

Sources: ‘UK Economic Outlook, March 2017’, PwC; East of England Forecasting Model, Cambridge Econometrics

13

Job Growth 2018 - 2033 by New Anglia Local Authority Area

Kings Lynn &

North

2,200

1,500

West Norfolk

Norfolk

2,400

Broadland

Breckland

2,200

Great

2,500

Yarmouth

South Norfolk

8,200

7,700

Norwich

Forest Heath

1,300

2,200

Waveney

Mid Suffolk

2,600

Suffolk

3,600

Coastal

St.

6,900

Edmundsbury

Babergh

1,800

7,100

Ipswich

14

Job Growth 2018 - 2033 At Risk by New Anglia Local Authority Area

Kings Lynn &

North

27.2%

25.5%

West Norfolk

Norfolk

24.6% Broadland

Breckland

29.3%

Great

30.1%

Yarmouth

South Norfolk

22.3%

28.4%

Norwich

Forest Heath

27.6%

25.8%

Waveney

Mid Suffolk

26.4%

Suffolk

26.3%

Coastal

St.

29.4%

Edmundsbury

Babergh

24.6%

27.2%

Ipswich

15

McKinsey

Transferring the McKinsey Analysis

Based

Results to the Local Level

Analysis

16

McKinsey Analysis - Introductory Notes

The following analysis is based on the McKinsey Global Institute article ‘Where machines could replace

humans - and where they can’t (yet)’ (McKinsey Quarterly, July 2016). The analysis looks at where the

jobs are across New Anglia that have the most potential for automation. These estimates for automation

potential are based on the analysis of the detailed work activities for more than 800 occupations across

the US economy. These work activity types were: Predictable physical work; Data Processing; Data

collection; Unpredictable physical work; Stakeholder interactions; Applying expertise; and Managing

others. These activity types were then assessed for each occupation (and grouped by sector) in terms

of the technical potential for automation through the adaption of currently demonstrated technology.

Whilst initial analysis is presented as hours worked (with the potential for automation), through the use

of LEP level productivity hours worked, average hours worked by sector, and average (mean) hours

worked by full-time and part-time employees (all sourced from the Office for National Statistics), we

have been able to convert these hours worked into both jobs and Full-Time Equivalents (FTEs) with the

potential automation at local authority level.

Please note that at this stage this analysis does not include results for the sector of Agriculture, Forestry and Fishing

17

Overall Automation Potential by Sector

Mining, Energy and Water

63%

Manufacturing

30%

Construction

49%

Retail, Wholesale and Transport

42%

Accommodation & food services

75%

Information & communication

51%

Financial & insurance

37%

Professional Services

40%

Business and Public Administration

31%

Education

35%

Health and Care

36%

Arts, entertainment, recreation & other services

47%

Source: ‘Where machines could replace humans - and where they can’t (yet)’, McKinsey Global Institute

18

Productivity Hours by Task and Sector

0%

100%

Mining, Energy and Water

36%

10%

20%

11%

10%

9%

4%

Construction

16%

10%

21%

30%

6%

10%

7%

Manufacturing

6%

22%

19%

5%

19%

26%

3%

Retail, wholesale and transport

11%

17%

15%

13%

20%

17%

7%

This analysis is based on

the total productivity hours

Accomodation and Food Services

52%

9%

7%

5%

20%

5%

worked per year across

Information and Communications

15%

15%

22%

16%

10%

14%

7%

New Anglia in 2016 (not

including in the Agriculture

Professional Services

5%

27%

18%

5%

18%

21%

6%

sector) of 1,144,863,469.

Finance and Insurance

22%

14%

20%

9%

14%

15%

6%

Source: Office for National

Business and Public Administration

7%

12%

18%

29%

11%

18%

5%

Statistics

Health and Care

8%

16%

18%

14%

17%

15%

11%

Education

10%

11%

18%

13%

13%

20%

14%

Arts, entertainment and other

9%

8%

16%

49%

4%

9%

4%

Predictable physical work

Data processing

Data collection

Unpredictable physical work

Stakeholder interactions

Applying expertise

Managing others

Source: ‘Where machines could replace humans - and where they can’t (yet)’, McKinsey Global Institute

19

Automation Potential by Task and Sector

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Mining, Energy and Water

Construction

Manufacturing

Retail, wholesale and transport

Accomodation and Food Services

Information and Communications

Predictable physical work

Data processing

Data collection

Unpredictable physical work Stakeholder interactions

Applying expertise

Managing others

Source: ‘Where machines could replace humans - and where they can’t (yet)’, McKinsey Global Institute

20

Automation Potential by Task and Sector (cont.)

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Professional Services

Finance and Insurance

Business and Public Administration

Health and Care

Education

Arts, entertainment and other

Predictable physical work

Data processing

Data collection

Unpredictable physical work Stakeholder interactions

Applying expertise

Managing others

Source: ‘Where machines could replace humans - and where they can’t (yet)’, McKinsey Global Institute

21

New Anglia Jobs and FTEs with Automation Potential by Sector

Through the use of data on average hours worked by sector, and the full-time/part-time ratios of employment by sector (at local authority level)

we can get an idea of the ‘human’ impact of automation (rather than just thinking about it in terms of time). For example, the McKinsey analysis

suggests an overall automation potential for ‘Accommodation and food services’ of 75%. However, given that the ratio of full-time/part-time

employees in the sector is high (in New Anglia it is 42/58) with workers on average working 27.2 hours per week, this means that the impact on

jobs (and FTEs) will be higher (88%) than in a sector where there are more full-time workers and where they work longer hours. In line with the

previous PwC analysis, the presentation of results at local authority level is restricted to those for jobs.

Productivity

Total Jobs

% of Jobs

% of FTEs

Total

FTEs With

Hours With

With

With

With

Sector

Productivity

Total Jobs

Total FTEs Automation

Automation

Automation

Automation

Automation

Hours

Potential

Potential

Potential

Potential

Potential

Mining, Energy and Water

14,911,391

9,394,176

9,000

4,800

53%

8,100

4,500

56%

Manufacturing

111,007,022

33,302,107

67,000

15,800

24%

62,000

14,200

23%

Construction

62,959,207

30,850,011

38,000

17,500

46%

31,400

16,600

53%

Retail, Wholesale and Transport

258,464,112

108,554,927

156,000

63,200

41%

117,900

50,300

43%

Accommodation & food services

89,468,346

67,101,260

54,000

47,500

88%

34,900

32,100

92%

Information & communication

28,165,961

14,364,640

17,000

7,500

44%

14,200

6,500

46%

Financial & insurance

36,450,067

13,486,525

22,000

7,600

35%

19,100

6,800

36%

Professional Services

81,184,240

32,473,696

49,000

18,300

37%

39,800

15,800

40%

Business and Public Administration

154,084,374

47,766,156

93,000

28,400

31%

73,500

23,000

31%

Education

92,781,989

32,473,696

56,000

21,900

39%

41,500

16,100

39%

Health and Care

154,084,374

55,470,375

93,000

36,000

39%

65,400

26,200

40%

Arts, entertainment, recreation & other services

61,302,385

28,812,121

37,000

18,800

51%

23,800

13,100

55%

Total

1,144,863,469

474,049,690

691,000

287,300

42%

531,600

225,200

42%

Sources: ‘Where machines could replace humans - and where they can’t (yet)’, McKinsey Global Institute; Business

22

Register and Employment Survey, 2016, Office for National Statistics

Total LEP Jobs With Automation Potential Apportioned by Local Authority

Kings Lynn &

North

8.0%

5.3%

West Norfolk

Norfolk

Broadland

6.9%

Breckland

6.7%

Great

6.3%

Yarmouth

South Norfolk

7.5%

13.2% Norwich

Forest Heath

4.0%

Waveney

6.0%

Mid Suffolk

5.0%

Suffolk

7.6%

Coastal

St.

8.5%

Edmundsbury

Babergh

10.4%

Ipswich

4.6%

23

Total LEP Automation Potential Apportioned by Local Authority

As a % of New Anglia Total

Hours

Jobs

FTEs

Babergh

4.6%

4.6%

4.5%

Breckland

6.8%

6.7%

6.8%

Broadland

7.0%

6.9%

7.1%

The table shows that there is very

Forest Heath

3.9%

4.0%

3.9%

little difference between the

Great Yarmouth

6.1%

6.3%

6.1%

analysis of automation potential

Ipswich

10.5%

10.4%

10.4%

King's Lynn and West Norfolk

8.0%

8.0%

8.0%

across hours worked, jobs, and

Mid Suffolk

5.1%

5.0%

5.2%

FTEs, when the New Anglia level

North Norfolk

5.2%

5.3%

5.2%

numbers are apportioned across

Norwich

13.1%

13.2%

13.0%

the 14 local authorities that make

South Norfolk

7.4%

7.5%

7.5%

up the New Anglia area.

St Edmundsbury

8.6%

8.5%

8.6%

Suffolk Coastal

7.6%

7.6%

7.7%

Waveney

5.9%

6.0%

5.9%

Sources: ‘Where machines could replace humans - and where they can’t

(yet)’, McKinsey Global Institute; Business Register and Employment Survey,

2016, Office for National Statistics

24

Total Automation Potential by New Anglia Local Authority

As a % of Local Authority Total

Hours

Jobs

FTEs

Babergh

41.2%

39.7%

40.0%

Breckland

40.0%

37.1%

37.8%

Broadland

40.6%

40.2%

41.4%

Forest Heath

44.1%

42.0%

42.4%

However, if we consider the results

Great Yarmouth

44.3%

45.2%

46.6%

of the analysis at local authority

Ipswich

40.6%

41.5%

42.4%

level then we can see some marked

King's Lynn and West Norfolk

41.4%

39.1%

39.7%

Mid Suffolk

40.6%

37.9%

40.8%

differences. This will be as a result

North Norfolk

43.5%

42.5%

44.5%

of local authority level differences in

Norwich

40.6%

40.6%

41.9%

both sector and full-time/part-time

South Norfolk

40.4%

38.9%

41.6%

employee ratios.

St Edmundsbury

38.8%

37.7%

37.9%

Suffolk Coastal

43.9%

41.1%

43.1%

Waveney

41.3%

40.8%

42.0%

Sources: ‘Where machines could replace humans - and where they can’t

(yet)’, McKinsey Global Institute; Business Register and Employment Survey,

2016, Office for National Statistics

25

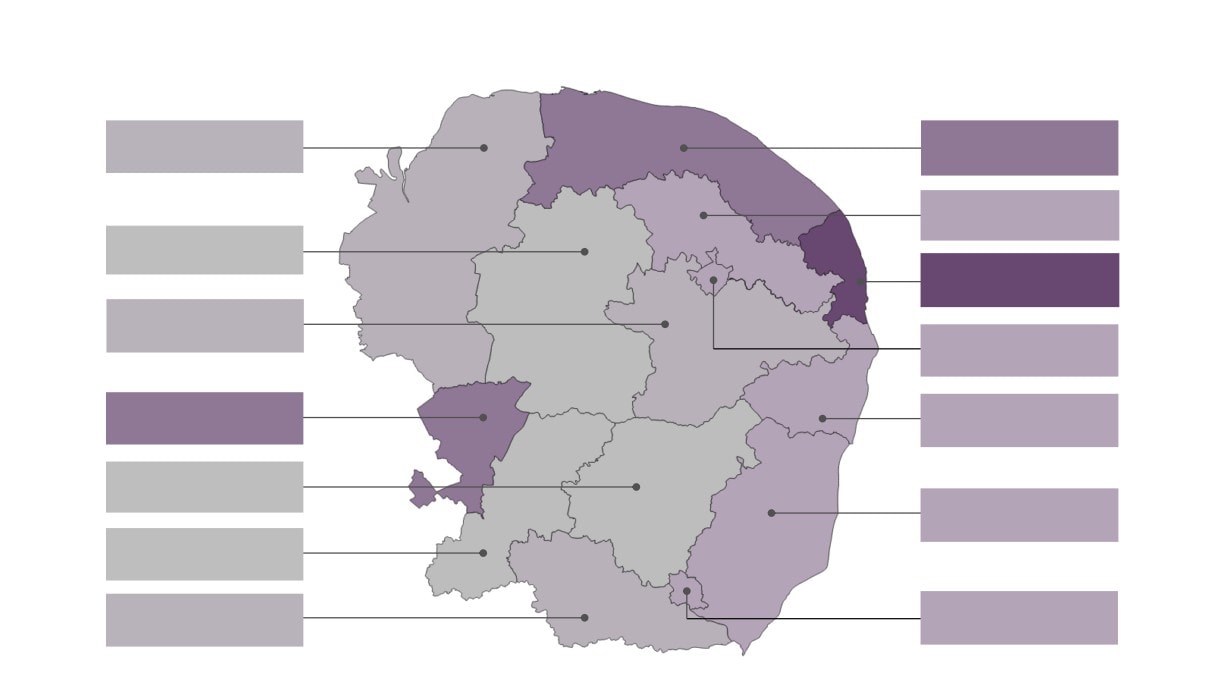

Proportion of Jobs with Automation Potential by Local Authority

Kings Lynn &

North

39.1%

42.5%

West Norfolk

Norfolk

40.2% Broadland

Breckland

37.1%

Great

45.2%

Yarmouth

South Norfolk

38.9%

Norwich

40.6%

Forest Heath

Waveney

42.0%

40.8%

Mid Suffolk

37.9%

Suffolk

41.1%

Coastal

St.

37.7%

Edmundsbury

41.5%

Ipswich

Babergh

39.7%

26

McKinsey / PWC

Comparator

Work

Comparison of PWC and McKinsey

Local Level Outputs

27

Comparison of PwC and McKinsey Research Outputs at Sector Level

McKinsey

PwC 'At

Automation

PwC Sector

McKinsey Sector

Risk' by

Potential by

Sector

Sector

Agriculture, forestry and fishing

18.7%

No Data

Mining and quarrying

23.1%

Electricity, gas, steam and air conditioning supply

Mining, Energy and Water

31.8%

63%

Water supply; sewerage, waste management and remediation activities

62.6%

Manufacturing

Manufacturing

46.4%

30%

Construction

Construction

23.7%

49%

Wholesale and retail trade; repair of motor vehicles and motorcycles

44.0%

Retail, Wholesale and Transport

42%

Transportation and storage

56.4%

Accommodation and food service activities

Accommodation & food services

25.5%

75%

Information and communication

Information & communication

27.3%

51%

Financial and insurance activities

Financial & insurance

32.2%

37%

Real estate activities

28.2%

Professional Services

40%

Professional, scientific and technical activities

25.6%

Administrative and support service activities

37.4%

Business

and Public Administration

31%

Public administration and defence; compulsory social security

32.1%

Education

Education

8.5%

35%

Human health and social work activities

Health and Care

17.0%

36%

Arts, entertainment and recreation

22.3%

Arts, entertainment, recreation & other services

47%

Other service activities

18.6%

Sources: ‘UK Economic Outlook, March 2017’, PwC; and ‘Where machines could replace humans - and where they can’t (yet)’, McKinsey Global Institute

28

4,000

Mining, Energy and Water

4,800

30,600

Manufacturing

15,800

8,300

Construction

17,500

70,000

Retail, Wholesale and Transport

63,200

4,000

Accommodation

Mining, Energy and Water

4,800

30,600

Information

Manufacturing

Total Jobs by

15,800

8,300

Finan

Construction

Sector ‘At Risk’ and

17,500

Retail, Wholesale and Transport

Profe

with ‘Automation

63,200

13,300

Business and Publ

Accommodation & food services

Potential’

47,500

4,600

Information & communication

Jobs 'At Risk' (PwC)

7,500

6,800

Jobs with Automation Potential (McKinsey)

Financial & insurance

7,600

12,300

Arts, entertainment, recreation

Professional Services

18,300

32,900

Sour

Business and Public Administration

28,400

29

4,800

Education

21,900

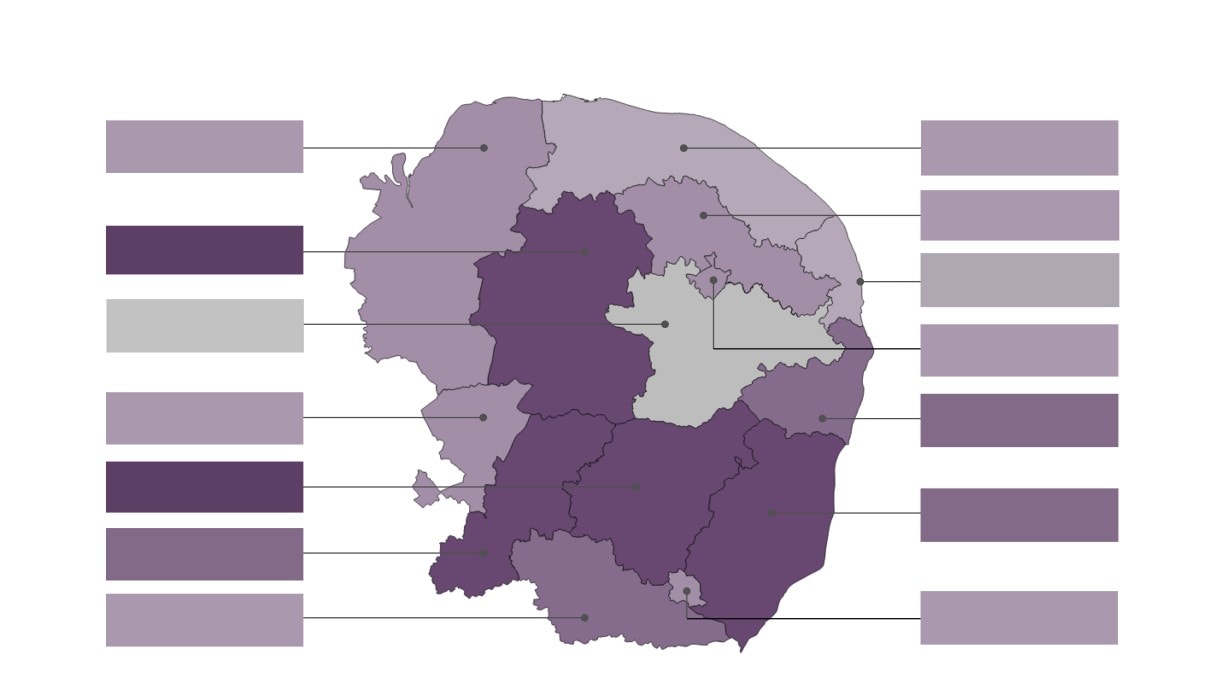

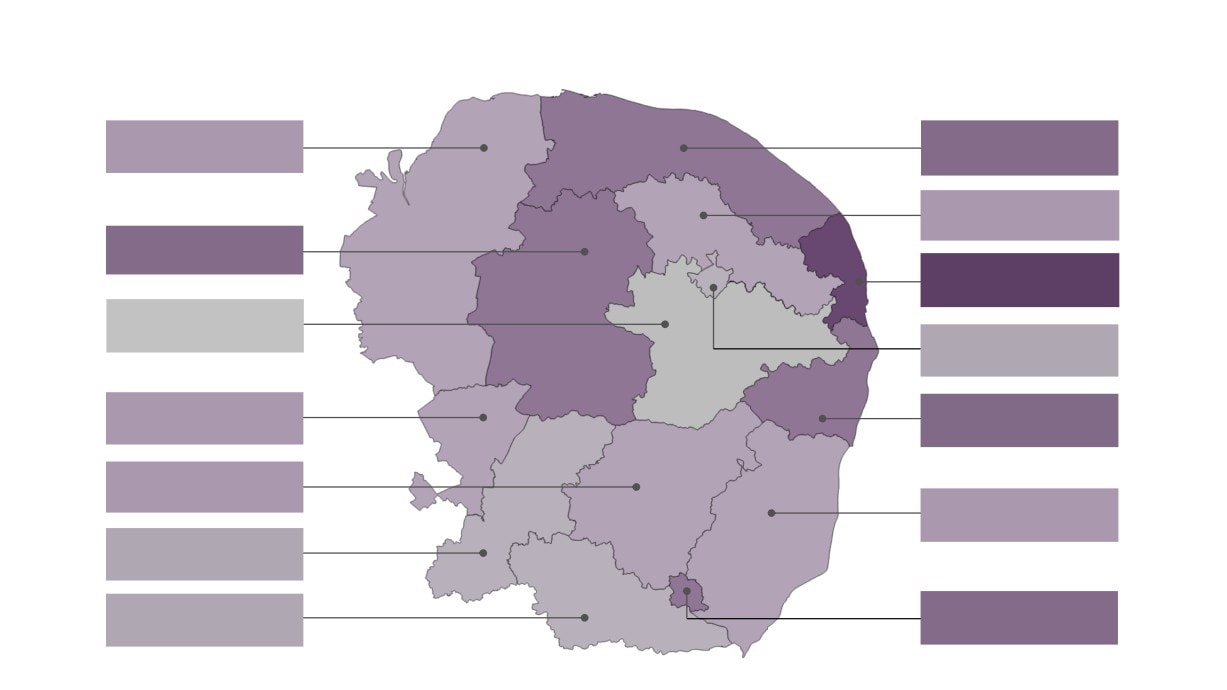

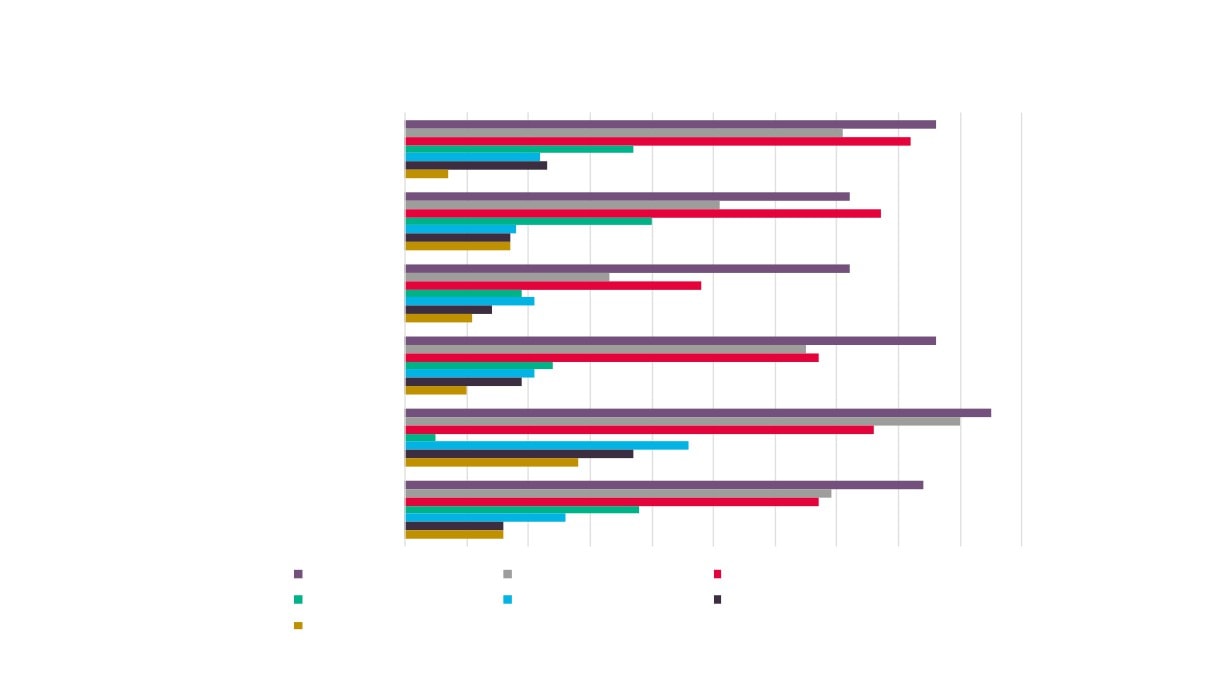

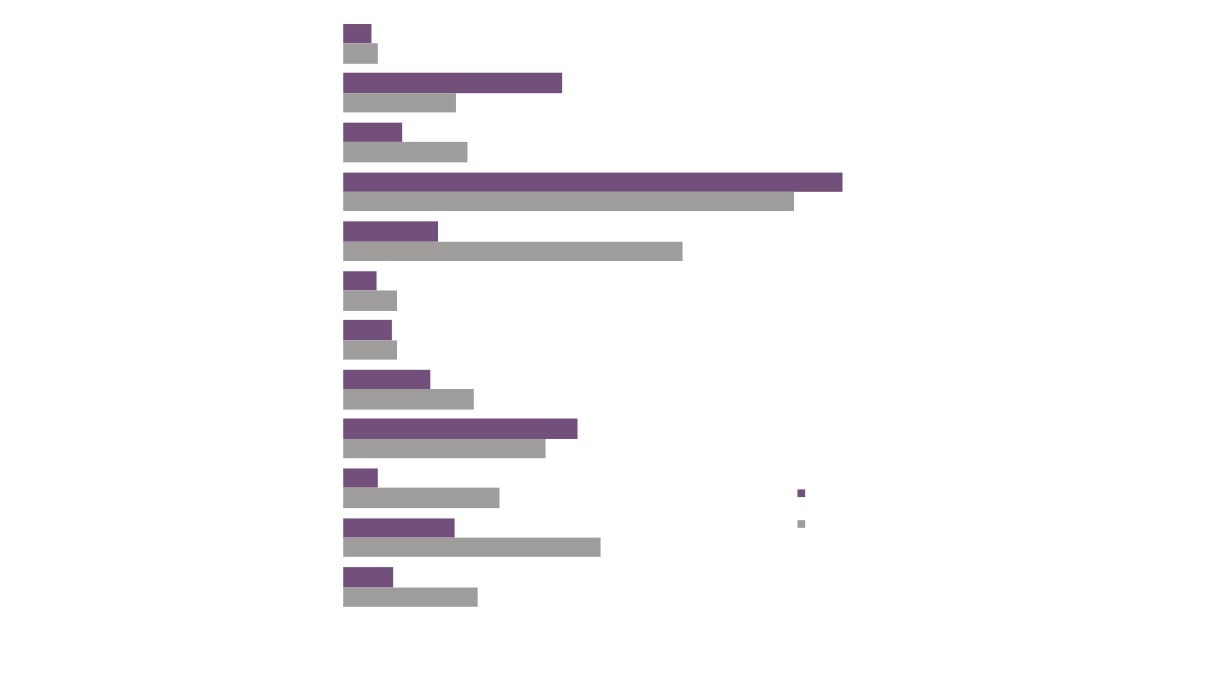

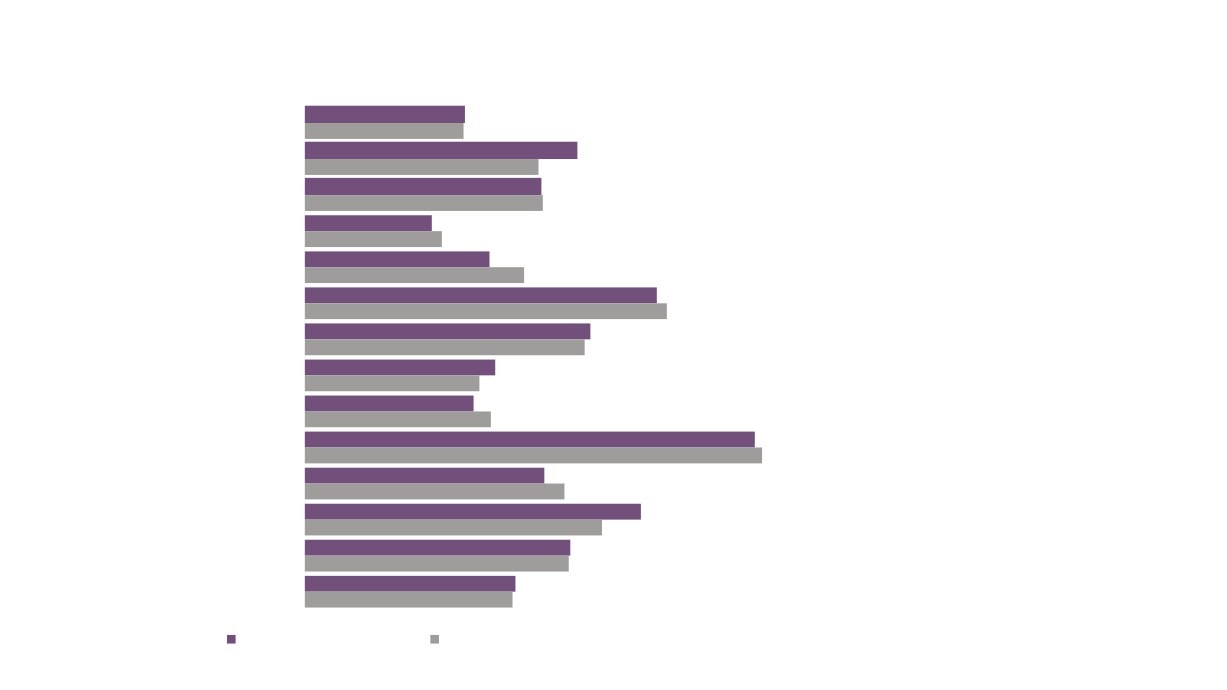

Comparison of PwC and McKinsey Research Based Outputs

4.6%

for New Anglia

Babergh

4.6%

7.8%

Breckland

6.7%

6.8%

Broadland

6.9%

This chart shows the results for the

3.6%

Forest Heath

4.0%

two different analysis for New

5.3%

Great Yarmouth

Anglia jobs apportioned across the

6.3%

10.1%

Ipswich

New Anglia local authority areas.

10.4%

8.2%

There is generally little to choose

King's Lynn and West Norfolk

8.0%

5.5%

between the two but in three areas

Mid Suffolk

5.0%

(Breckland, Great Yarmouth, and

4.8%

North Norfolk

5.3%

St. Edmundsbury) we can see

13.0%

Norwich

13.2%

marked differences.

6.9%

South Norfolk

7.5%

9.7%

St Edmundsbury

8.5%

Sources: ‘UK Economic Outlook, March 2017’,

7.6%

PwC; ‘Where machines could replace humans -

Suffolk Coastal

7.6%

and where they can’t (yet)’, McKinsey Global

6.1%

Institute; Business Register and Employment

Waveney

6.0%

Survey, 2016, Office for National Statistics

PwC Based Analysis

McKinsey Based Analysis

30

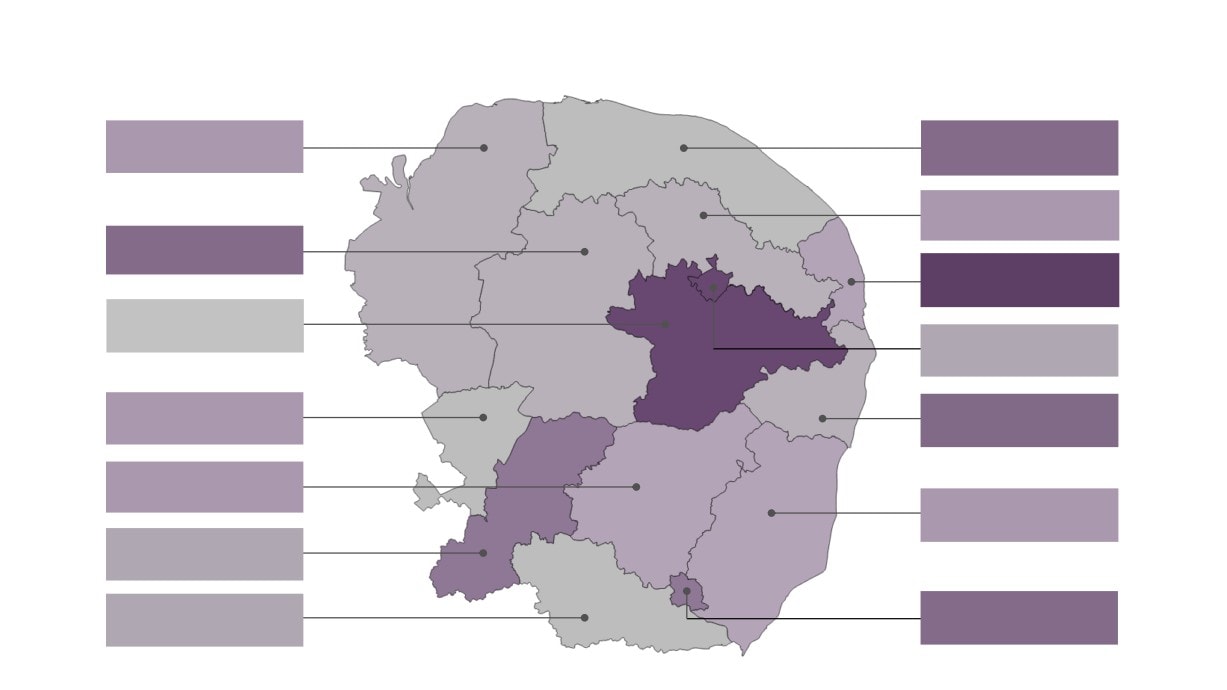

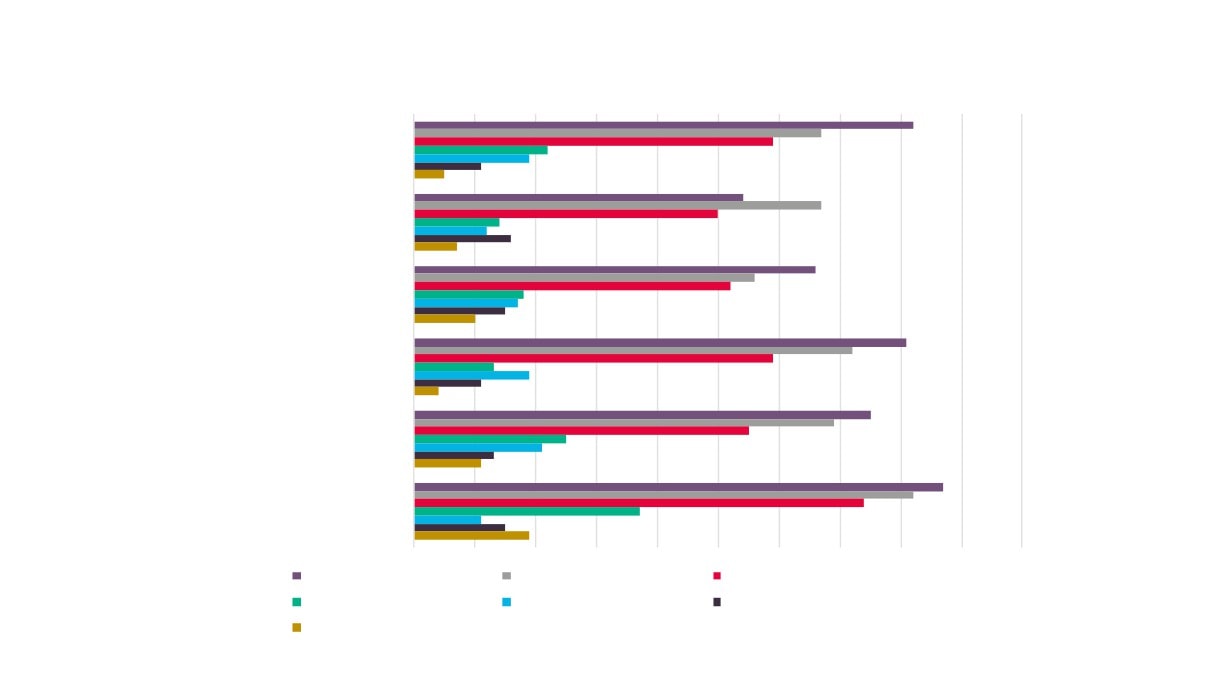

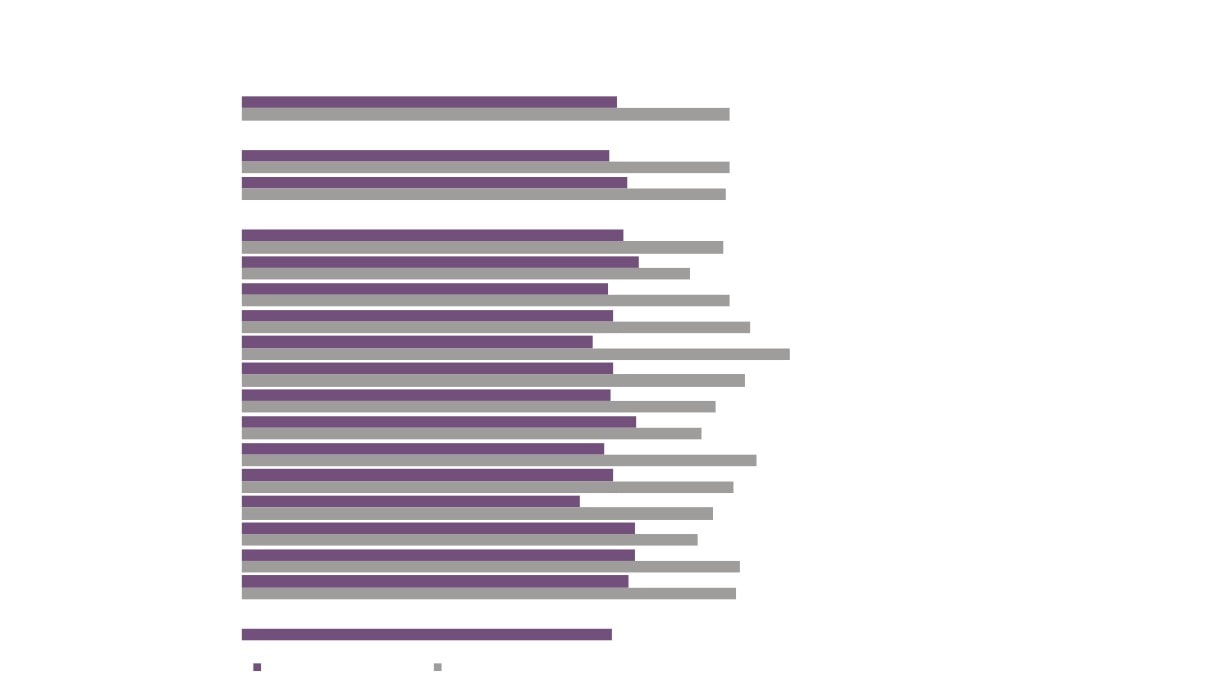

Comparison of PwC and McKinsey Research Based Outputs

for New Anglia (cont.)

31.0%

New Anglia

40.3%

This chart shows the results for the

30.3%

Norfolk

40.3%

31.8%

two different analysis results for the

Suffolk

40.0%

proportion of jobs at local authority

31.5%

Babergh

39.7%

level. On this basis we can see

32.8%

Breckland

37.1%

marked differences in two analyses

30.3%

Broadland

40.2%

across all area.

30.6%

Forest Heath

42.0%

29.0%

Great Yarmouth

45.2%

In general terms the PwC analysis

30.6%

Ipswich

41.5%

results in just over a third of jobs

30.4%

King's Lynn and West Norfolk

39.1%

32.6%

being ‘at risk’, with the McKinsey

Mid Suffolk

37.9%

29.9%

North Norfolk

analysis suggesting around two in

42.5%

30.7%

Norwich

40.6%

five jobs with the potential for

27.9%

South Norfolk

38.9%

automation.

32.5%

St Edmundsbury

37.7%

32.5%

Suffolk Coastal

41.1%

Sources: ‘UK Economic Outlook, March 2017’,

31.9%

Waveney

PwC; ‘Where machines could replace humans -

40.8%

and where they can’t (yet)’, McKinsey Global

Institute; Business Register and Employment

30.6%

England

Survey, 2016, Office for National Statistics

31

PwC Based Analysis

McKinsey Based Analysis

Analysis of Norwich’s

Regional Role in Retail

32

Norwich - A Strong Regional Centre for Retail

Rank

Centre

Retail Spend Potential

1

London West End

£9,141,226,044

Referring to retail specialists Harper Dennis

2

Glasgow

£4,260,877,222

Hobbs ‘2017 Vitality Rankings - Top 50 British

3

Birmingham

£3,738,666,154

4

Manchester

£3,534,636,565

Centres’ publication then we can see that

5

Leeds

£3,180,292,167

Norwich is ranked just outside the top 10 with a

6

Liverpool

£3,102,829,857

retail spend potential of approximately £2.3bn.

7

Nottingham

£3,003,776,127

8

Cardiff

£2,798,170,147

Only three other areas in the East of England

9

Newcastle upon Tyne

£2,796,940,154

region appear in the top 50, all with much lower

10

Edinburgh

£2,346,843,910

retail spend potentials.

11

Norwich

£2,318,506,810

26

Peterborough

£1,776,537,193

35

Ipswich

£1,570,249,828

40

Cambridge

£1,513,016,237

Source: 2017 Vitality Rankings - Top 50 British

Centres’, Harper Dennis Hobbs, June 2017

33

Norwich - A Strong Regional Centre for Retail

Retail Trade

Retail Units per

Despite having one of the lowest

Major Town/City

Population

Business Units

1,000 Population

populations of major towns and

cities in the East of England

Norwich

1,070

140,353

7.6

region, Norwich has the highest

Cambridge

755

124,919

6.0

number of retail business units.

Luton

1,030

214,658

4.8

This again implies that Norwich

Ipswich

630

138,480

4.5

services both a much wider area

St Albans

590

147,100

4.0

and larger population than other

Peterborough

795

198,914

4.0

major towns and cities in the

Chelmsford

540

176,200

3.1

region.

Sources: UK Business Counts 2017, Office for National Statistics; 2017 Mid-

year Population Estimates, Office for National Statistics

34

Analysis of STEM Subject

Student and Graduate

Destinations

35

South East

355

STUDY 2010/11 - 2014/15

London

255

GCGP

125

1,445

Hertfordshire

100

grew up outside New Anglia and

South East Midlands

75

studied STEM subjects in New

Coast to Capital

40

Anglia

Top 10 Origins of

Greater Lincolnshire

30

Students Coming to

eicester and Leicestershire

25

New Anglia and

Enterprise M3

15

Studying STEM

Subjects

D2N2

10

London

535

7,015

GCGP

400

grew up in New Anglia and

D2N2

365

studied STEM subjects in

Leicester and Leicestershire

335

England

South East

315

Top 10

West of England

255

Destinations for

Coventry and Warwickshire

250

Students Growing

Sheffield City Region

250

Up in New Anglia

5,100

and Studying

Solent

235

STEM Subjects

North Eastern

215

Elsewhere

(73%)

left and studied outside

New Anglia

Total studied STEM subjects in

Over the period 2010/11 - 2014/15

New Anglia

inclusive, New Anglia had a net flow of

students studying STEM subjects of

3,365

of which 43% came

36

- 3,650

from outside New Anglia

EMPLOYMENT 2010/11 - 2014/15

New Anglia

570

South East

120

1,155

GCGP

100

studied STEM subjects

London

100

outside New Anglia and

D2N2

75

subsequently found

employment in New Anglia

Leicester and Leicestershire

45

Heart of the South West

35

Top 10 Origins of

Coventry and Warwickshire

30

Students Studying

Leeds City Region

30

STEM Subjects and

North Eastern

30

Securing Employment

Solent

30

in New Anglia

1,100

studied STEM subjects in New

New Anglia

570

Anglia and subsequently

secured employment in

England

London

135

Top 10 Employment

80

South East

Destinations for

540

Students Studying

STEM subjects in New

(49%)

GCGP

60

Anglia

left and found

employment outside

Total studied STEM subjects and

Over the period 2010/11 - 2014/15

New Anglia

employed in New Anglia

inclusive, New Anglia had a net flow of

workers who studied STEM subjects of

1,715

of which 67% came

37

+615

from outside New Anglia

Creative

New

New

National

COMPARATORS

Industries

Anglia

Anglia

Subjects

Stay for study and employment

51.4%

87.6%

27.3%

29.3%

Leave for study, return for employment

30.2%

30.4%

Leave for study, do not return

38.7%

34.3%

Stay for study, leave for employment

48.6%

12.4%

3.9%

6.0%

NOTES ON DATA SOURCES & METHODOLOGY

- The data presented here is from the population of England-domiciled students who studied for a first degree at an English higher education provider between the

academic years 2010-11 and 2014-15 inclusive. Data comes from the Higher Education Statistics Agency (HESA) Student Record, the Education and Skills Funding

Agency’s Individualised Student Record (ILR) data and the Destinations of Leavers from Higher Education (DLHE) survey.

12%

- Creative Industries subjects defined here as ‘Biological Sciences’, ‘Chemistry’, ‘Computer Science’, ‘Engineering and Technology’, ‘Mathematical Sciences’, and

‘Physics and Astronomy’.

- Numbers are Full Person Equivalents. This is because individuals can be taught through collaborative arrangements at two (or more) institutions. In order to count

provision against both institutions, student counts have been divided between teaching institutions in proportion to the percentage of time taught at each.

- Data presented on mobility between home and study, where ‘home’ refers to the domicile of a student before they go to university, is for the population of students who

entered higher education between 2010-11 and 2014-15 and who have a valid postcode for both home and study. This is taken from the HESA Student Record and the

ILR. The total FPE for this population was 1,817,855.

- Data using employment location is restricted to students who left higher education between 2010-11 and 2014-15 and who provided a valid full or partial employment

postcode in response to the DLHE survey. The total FPE for this population was 710,800.

- Because these two populations differ significantly means that we are unable to make direct comparisons between the two i.e. calculate the true retention of students,

and movements into employment, for an area.

38