New Anglia Emerging

Technology Skills Plan

2019

February 2019

New Anglia Skills Board version

‘We are stuck with technology when what we really want is

stuff that works’

In The Salmon of Doubt (2002 posthumous collection) by Douglas Adams (author of

the Hitchhikers Guide to the Galaxy and the Answer to Life, the Universe and

Everything)

emerging-tech-sector-skills-plan-skills-board-final-feb-19 (1)

Page 2

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

Contents

Executive Summary

3

The Emerging Technology Sector Skills Plan

4

Context for Emerging Technology

5

Impact of Emerging Technology in New Anglia

9

Consultation Feedback

16

Emerging Technology Skills Plan

24

Skills Actions to be Taken

27

Action 1 - ICT and Digital in the Local Industrial Strategy

28

Action 2 - Train Young People to be Industry 4.0 Professionals

31

Action 3 - Upskill existing Industry 4.0 workforce

32

Action 4 - Integrate Industry 4.0 awareness into all courses at school/FE/HE

33

Action 5 - Upskill existing sectors workforce to adopt Industry 4.0

34

Annex 1 - Background to the Emerging Technology Challenge

35

What is Industry 4.0?

38

Impact across the Economy

39

The Evidence Base

42

International Reports

42

EU Report and Initiatives

46

National Reports

47

Regional Reports

53

Annex 2 - New Anglia Sector Skills Plans & the Adoption of Emerging Technology

54

Digital Tech

55

Life Sciences and the Bio-economy

55

Advanced Manufacturing and Engineering

56

Agri Food Tech

58

Energy

59

Ports and Logistics

59

Financial and Insurance Services

60

Cultural Sector

62

Skills Needs in Construction and Health and Social Care

63

Future work on Digital Creative and Education sectors

64

The Retail Sector

65

Annex 3 - Common Themes on Emerging Technology in the Sector Skills Plans

68

Annex 4 - Consultees

74

Page 3

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

Executive Summary

The development of emerging technology or Industry 4.0, based on digital and

engineering technologies, is leading to major changes in large sectors of the

economy. The obvious example is retail and distribution, where online sales now

represents £1 in every £5 of the sector. Not surprisingly we are seeing jobs

displaced from the traditional retail sector and many established retail companies

failing whilst new online only companies emerge.

Reports suggest that 30% of current job roles in New Anglia, could be lost or change

fundamentally and many more will need new skills as digitalisation and automation

impactson both public and private sectors. Allaying fears, the rebalancing of jobs

towards higher skills presents a real opportunity for upskilling and lifelong learning.

However, the Industry 4.0 revolution is occurring at a time of historically low

unemployment, with the dependency ratio rising and most employers struggling to

secure the workforce needed. The local economy will also be able to expand if it is

nationally and internationally competitive. If New Anglia is World class in its adoption

of Industry 4.0, the productivity benefits this brings will lead to economic growth,

more higher paid, higher skilled jobs and enough jobs for everyone.

The technology supply sector is anticipated to grow as the demand for Industry 4.0

solutions grow offsetting some of the jobs displaced in other sectors. Job creation

will though not be limited to the technology sector, with new jobs and job roles

created right across the economy as Industry 4.0 facilitates the creation of new

products and services, improves competitiveness and enables new job roles.

Skills is an essential enabler of this transition. Whilst new skills will be needed in the

companies supplying Industry 4.0 solutions, in terms of scale, the bigger opportunity

is in ensuring that the 90%+ of the economy which is an end user of Industry 4.0

technologies has the skills to be expert in using Industry 4.0 to increase productivity.

The scale and speed with which job roles will change means that the transition to

Industry 4.0 will require a substantial increase in retraining for the existing workforce.

Given the focus in the New Anglia Local Industrial Strategy on digitalisation,

addressing the implications of Industry 4.0 should be a strategic priority for the LEP.

Action is needed in 4 main areas to deliver on the potential of Industry 4.0:

• Increasing student supply into the technology sector with Industry 4.0 skills;

• Upskilling the technology workforce to spearhead adoption of Industry 4.0;

• Ensuring all students, regardless of sector, have Industry 4.0 in their courses;

• Upskilling and retraining the existing workforce in end user sectors for new or

changed job roles enabled by Industry 4.0.

Page 4

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

The Emerging Technology Sector Skills Plan

The Emerging Technology Sector Skills Plan has been developed by Norfolk and

Suffolk, working alongside the New Anglia Local Enterprise Partnership, the New

Anglia Skills Board and supported by SkillsReach.

SkillsReach was contracted to facilitate and prepare sector skills plans for the New

Anglia LEP priority sectors. The project was commissioned by the Education and

Skills Funding Agency, in partnership with New Anglia LEP, and funded through the

European Social Fund. Each Sector Skills plan and supporting Data Pack has been

developed in collaboration with local employers and other stakeholders.

The New Anglia Skills Board places employers at the centre of decision making on

skills in Norfolk and Suffolk to ensure the skills system becomes more responsive to

the needs of employers, and the future economy.

Whilst there is currently not a formal industry led sector group for Emerging

Technologies which covers the whole of New Anglia, there are a range of bodies

such as the Institute of Productivity (IoP) and proposed Eastern Institute of

Technology (EIoT), which focus on and represent the stakeholder community.

SkillsReach is an established East of England-based strategic skills consultancy with

an associate project team with extensive experience of developing skills plans.

Acknowledgements

The New Anglia LEP wish to thank the employers, training providers and

stakeholders who contributed to the plan by attending events, being interviewed or

by making referrals to employers and organisations in the sector. This sector skills

plan was developed in 2018 by SkillsReach.

Page 5

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

Context for Emerging Technology

The World Economic Forum report in 2018 on the Future of Jobs1 states that:

The Fourth Industrial Revolution is interacting with other socio-economic and

demographic factors to create a perfect storm of business model change in all

industries, resulting in major disruptions to labour markets. New categories of jobs

will emerge, partly or wholly displacing others. The skill sets required in both old and

new occupations will change in most industries and transform how and where people

work. It may also affect female and male workers differently and transform the

dynamics of the industry gender gap.

The Fourth Industrial Revolution is being driven by Emerging Technology and in its

breadth and speed is creating a rapid change in the skills needed right across the

economy.

This skills plan is therefore different to the other Sector Skills Plans developed by

New Anglia during 2016-’19, because it has to cover the whole economy. This need

to focus on emerging technology and Industry 4.0 was clearly evident in the New

Anglia Cross Cutting report (summer 2018) which reviewed the common themes

which were emerging from the individual New Anglia sector skills reports.

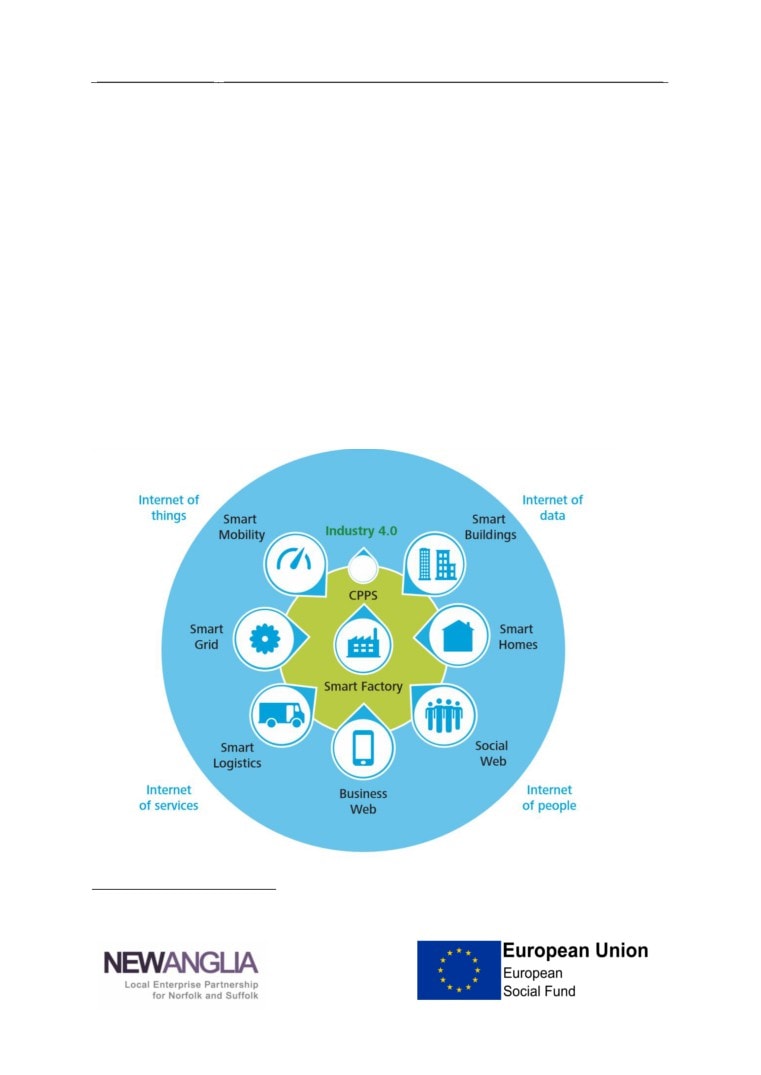

The Fourth Industrial Revolution is also called Industry 4.0 and many descriptions

also uses terms such as the Internet of Things or the Internets of Data, Systems and

People - in practice it is all of these and is the transition in the economy facilitated by

the merging of the physical and digital environments.

The results are potentially very large for the economy with reports suggesting that:

•

15-30% of jobs could be displaced completely within the next decade;

• And, the nature of the roles in a further 30-40% of jobs may change substantially;

• New roles will also be created as all employers (public and private) utilise

emerging technology to offer new or enhanced products and services.

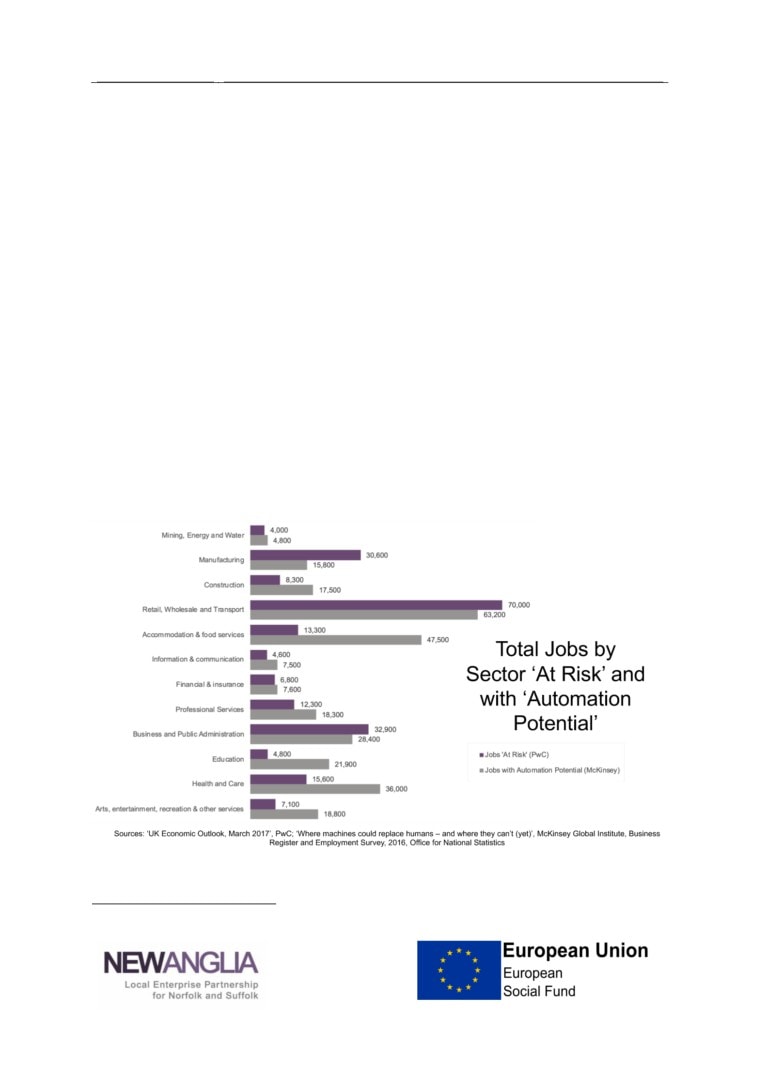

Applying analysis by PWC (2017) to assess which jobs are at risk due to Industry 4.0

suggests that over 303,000 jobs in New Anglia could be displaced, with similar

analysis by McKinsey (2016) on jobs which have potential for automation suggesting

that 287,000 jobs in New Anglia could be affected by automation (see figure 1). The

magnitude of this change, by 2030, clearly shows the scale of potential impact.

1 World Economic Forum (2018), Insight Report: The Future of Jobs Report 2018, Centre for the New Economy

and Society

Page 6

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

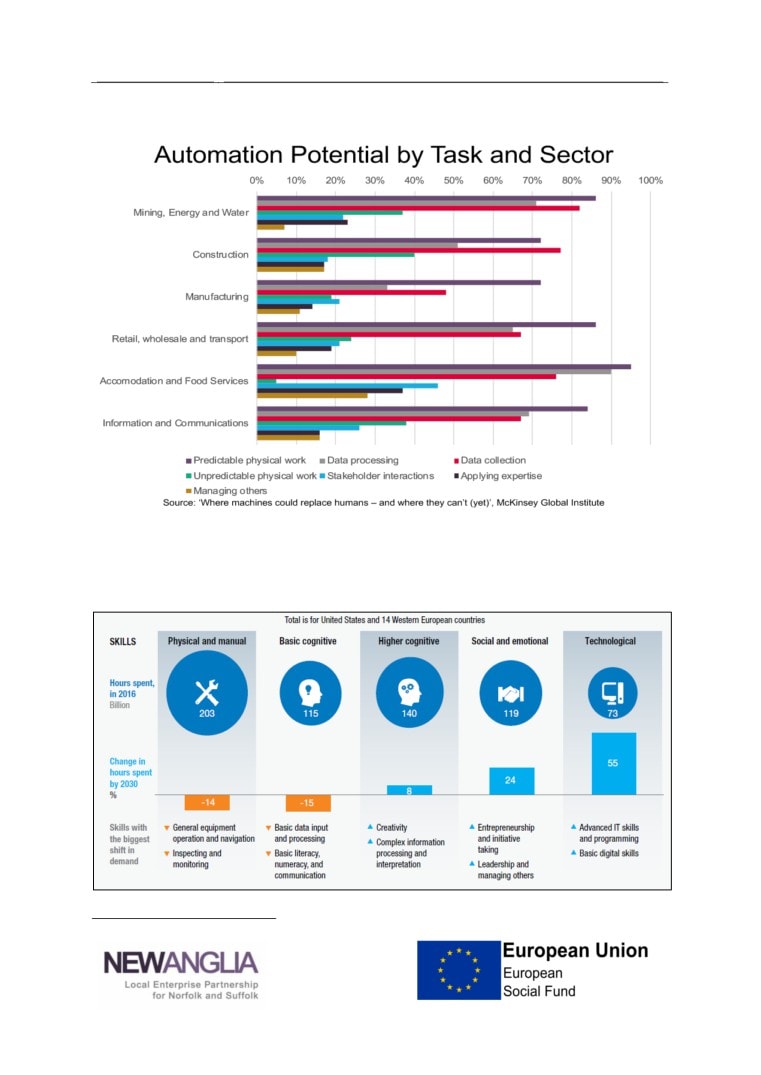

Figure 1 - Automation Potential by Task & Sector of the New Anglia Economy

The difference in the impact on different types of skills is also illustrated by other

work2 which shows big anticipate changes in the balance of skills needed:

Figure 2: Changes in the balance of skills needed

2 McKinsey Global Institute (2018), Skill Shift Automation and the Future of the Workforce

Page 7

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

In responding to Industry 4.0 the region will obviously require new skills in

technology supply companies, but the larger effect in terms of the numbers of people

impacted will be in those sectors which use technology (in both the public and

private sectors).

This is because these end user sectors are physically much larger and have more

job roles which are at risk or will change due to automation and Industry 4.0. Whilst

this is a challenge for initial training, the larger need will be for new skills amongst

the existing workforce if we are to help the established workforce adapt to these

changes.

Process to Develop the Plan

The process to develop the Emerging Technology Sector Skills Plan has involved:

• Drawing on other New Anglia Sector Skills plans;

• Reviewing reports on emerging technology from local to global level;

• Developing data to explore the impact of emerging technology on job roles and

the workforce at aggregate and sectoral levels;

• Attendance at and running meetings and events to consult with stakeholders on

the way in which emerging technology will impact workforce and skills issues.

New Anglia Sector Skills plans

Over the last 2 years New Anglia has developed 10 sector skills plans:

•

2 in 2016 (in house) which looked at: Construction; Health and Social Care.

•

8 during 2017-18, led by SkillsReach, which looked at: AgriFood Tech; Digital

Tech; Advanced Manufacturing & Engineering; Financial & Insurance Services;

Energy; Life Sciences & the Bio-economy; Ports & Logistics; Cultural Sector.

• A further 2 (in addition to this plan) are currently in development.

Details of the way in which each of these plans approached emerging technology

and the key conclusions in each plan in relation to this challenge are set out in

Annex 2.

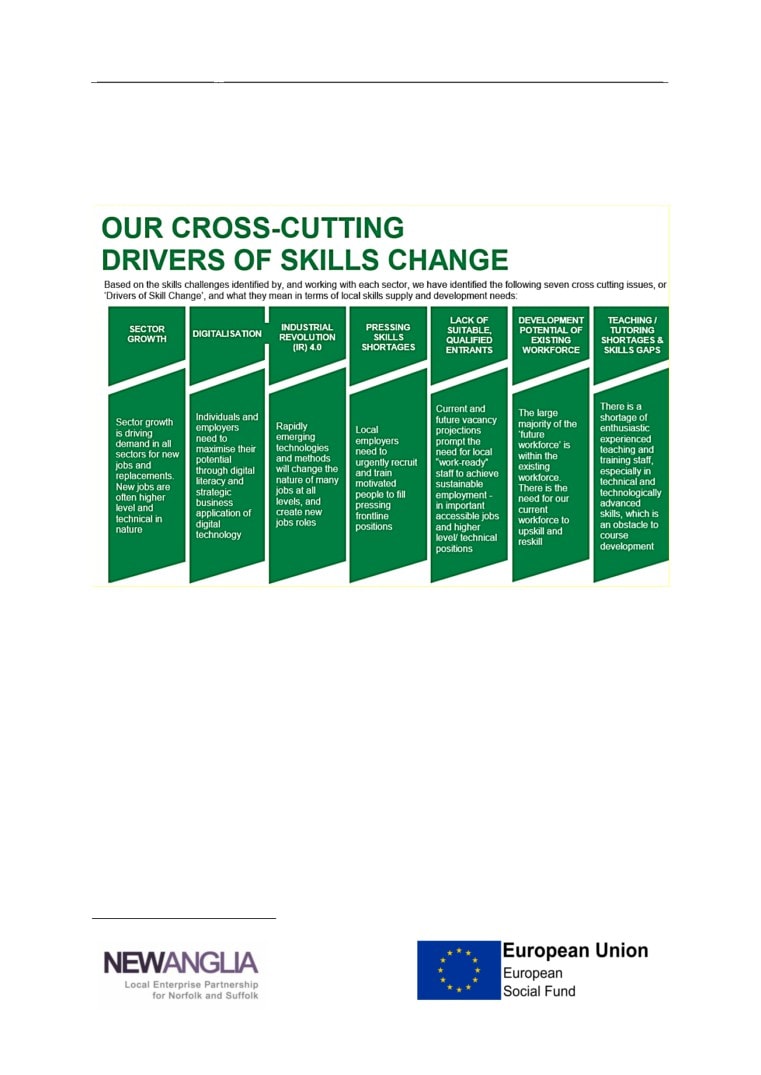

In addition to the individual sector skills plans, in summer 2018, SkillsReach also

developed a cross cutting report which brought together common issues from across

all the individual sector skills plans. This process clearly identified emerging

technology as a cross cutting theme (figure 3):

• Both as a challenge in its own right - Industrial Revolution 4.0;

Page 8

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

• And also through the pervasive nature of digitalisation of the economy and thus

workforce skills, which is a key enabler and driver of the fourth Industrial

Revolution, or Industry 4.0.

Figure 3 - Drivers of Skills Change, New Anglia Cross Cutting Report 2018

(Source: New Anglia Sector Skills Plans Cross Cutting Report, 2018)

This same approach, with Industrial Revolution 4.0 (or Industry 4.0) as both a

challenge in its own right and as a driver of change across the economy, was also

recognised in the Made Smarter Review (originally known as the Industrial

Digitalisation Review or IDR) published by the UK government in November 2017.

Accenture led this national work which concluded that investing in digitalisation could

be worth £455bn to the UK economy over a decade3.

Reports on emerging technology from local to global level

This plan also reviews a wide range of reports from regional to global level which

have looked at how new, digitally enabled, technologies and Industry 4.0 will impact

on job roles and the workforce. Annex 1 includes highlights from these reports.

3 HMG (2017), Made Smarter Review

Page 9

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

Impact of Emerging Technology in New Anglia

Data on job roles and potential impacts

In parallel to the consultations and review of reports undertaken, SkillsReach have

mapped the impact that the expected change in job roles created by Emerging

Technology will have on the workforce at aggregate and sectoral levels in Norfolk

and Suffolk (at both district and LEP levels).

The data is presented in full in a separate datapack, which supports this sector skills

plan.

The key conclusions drawn from these assessments, which draw on global and UK

research by McKinsey Global Institute (2016)4 and PWC (2017)5, suggests that the

New Anglia economy is as exposed as any region to the changes which Industry 4.0

and Emerging Technology will mean for the economy, employers and workers

themselves (see figure 4)

Figure 4 - Total Jobs by Sector ‘At Risk’ (PWC) or with ‘Automation Potential’

(McKinsey)

4 McKinsey Global Institute (2016), Where machines could replace humans - and where they can’t (yet)

5 PWC (2017), UK Economic Outlook, March 2017

Page 10

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

The main impacts are likely to be:

• Employees with lower levels of qualifications are more at risk of seeing their job

automated - 46% of those with only GCSE or below levels qualification are at

risk, compared to only 12% of those with degree level qualifications (see table 1);

Table 1 - New Anglia workforce ‘At Risk’ of Automation by Qualification Level

(see datapack for full details and referencing)

Higher

% with degree or equivalent & above - aged 16-64

221,300

Education

Number at Risk

26,600

(12% at Risk)

% with higher education below degree level - 16-64

73,800

% with GCE A level or equivalent - 16-64

247,600

Medium

% with GCSE grades A-C or equivalent - 16-64

222,100

Education

(36% at Risk)

Total

543,500

Number at Risk

195,700

% with other qualifications (GCSE) - 16-64

99,500

Low

% with no qualifications (GCSE) - 16-64

77,400

Education

Total

176,900

(46% at Risk)

Number at Risk

81,400

Total at Risk

303,600

Population Aged 16-64

941,700

Totals

% at Risk

32%

•

15-30% of jobs could be displaced completely within the next decade by new

technology which automates a role entirely making it redundant, but with large

variation between sectors (see table 2);

• The nature of the job roles which need to be undertaken in a further 30-40% of

jobs may change substantially, necessitating these staff to develop new skills

(see table 3);

Page 11

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

Table 2 - Analysis of Key Determinants of Job Numbers at risk by sector (see

datapack for full details and referencing)

Highest impact

Lowest impact

Number of

70,000 jobs have automation

4,800 jobs have automation

job roles at

potential (McKinsey) &

potential (McKinsey) & 4,000

risk by

63,200 (PWC) are at risk in

(PWC) are at risk in mining, energy

sector

retail, wholesale & transport

& water

The sector with the highest

The sectors with the lowest

proportion of automation

proportion of automation potential

potential (McKinsey) is

(McKinsey) are manufacturing with

accommodation & food

30% and business & public

service with 75%

administration with 31%

Table 3 - Analysis of Key Determinants of % of Job at risk by sector (see

datapack for full details and referencing)

Highest impact

Lowest impact

Sector

46% jobs in manufacturing at

8.5% jobs in education sector at

risk (McKinsey 2016)

risk (PWC 2017)

The impact on sectors varies due to:

• Substantial difference in terms of the numbers of job roles at risk, based on both

the proportion of job roles in the sector at risk and large variations in employment

by sector. The largest impacts are likely in sectors with a large workforce, many

of whom do repetitive roles.

• Using PWC analysis 3 sectors account for 63.5% of all jobs at risk:

o Retail, wholesale & transport at 70,000 jobs;

o Business & public administration at 32,900 jobs;

o Manufacturing at 30,600 jobs.

• In contrast other sectors are likely to see many fewer staff displaced as they are

smaller employment sectors with a smaller % of job roles at risk of automation.

• In some sectors there is a big gap between jobs at risk (PWC analysis) and those

where the job role may change due to automation of some roles which are

currently performed by people (McKinsey analysis) e.g. health and social care,

accommodation and food service.

The conclusion is that there is a large degree of variation between sectors of the

economy in terms of what proportion of jobs are at risk. As a generalisation sectors

Page 12

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

which have more jobs roles which require problem solving, creativity & inter-personal

skills have less potential for automation than those where repetitive, manual tasks &

routine data recording or input are required.

Furthermore:

• New job roles will be created as all employers (public and private) utilise

emerging technology to offer new or enhanced products and services, but many

of these new roles are not yet apparent and so are hard to plan for;

• Industry 4.0 will require new skills in technology supply companies, whose market

is likely to grow necessitating the recruitment of extra staff as well as the

development of new skills;

• Overall, the changes expected will have a larger effect in terms of the numbers of

people impacted in those sectors which use technology (in both the public and

private sectors), with most sectors seeing half or more of their current job roles

either displaced completely or substantially changed by technology;

• The speed of change also means that we cannot be focused just on young

people entering the workforce for the first time. To respond positively to Industry

4.0 will require a significant increase in upskilling of the existing workforce.

The data analysis therefore shows that the impact of Emerging Technology will be

felt right across the economy and across all districts in New Anglia.

Every sector will be affected, with some sectors which have not been seen as

priorities by New Anglia e.g. retail and public and business administration, seeing

some of the biggest anticipated changes in terms of the number of job roles which

are at risk.

In the case of retail, the development of online retailing and the displacement of high

street stores means that the largest private sector employer in New Anglia, the retail,

wholesale and transport sector, is likely to see a rapid displacement of workers (see

annex 2 for further analysis of this).

Page 13

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

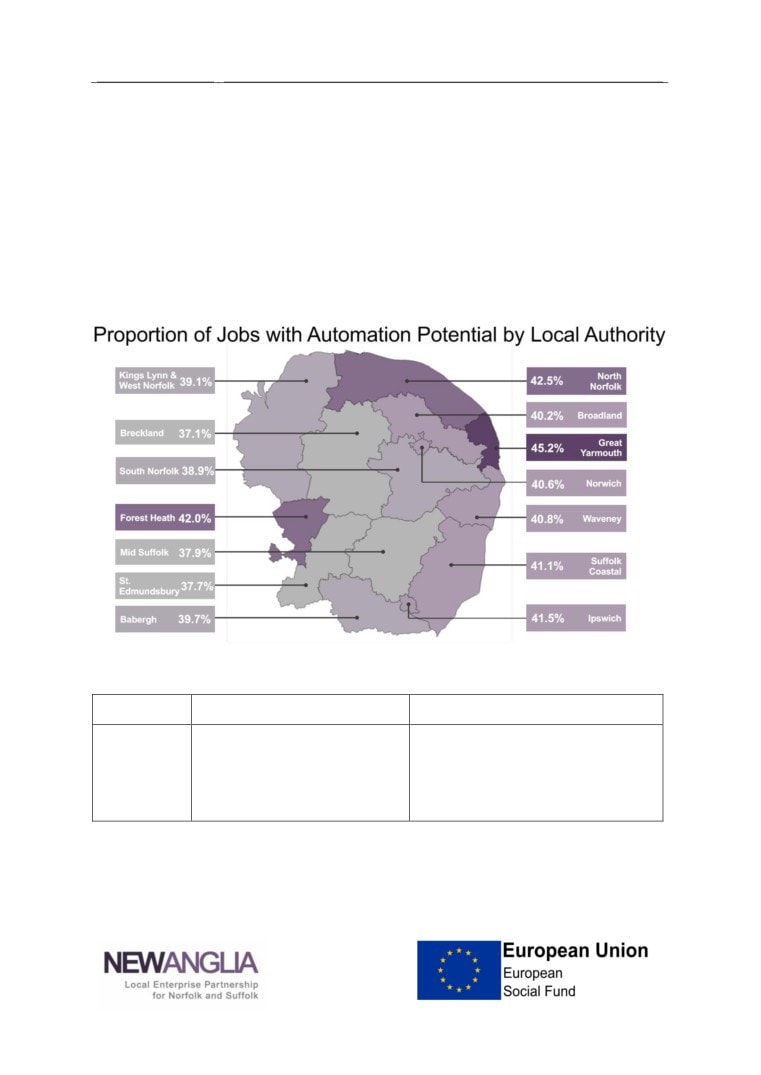

Spatial Impact

The variation between districts in terms of the % of jobs with automation potential is

relatively low, suggesting that all districts will be impacted to a medium to large

extent (figure 5).

The district level variation is primarily driven by variations in the sectors which

predominate in the local economy at district level (table 4).

Figure 5 - Proportion of Jobs with Automation Potential by Norfolk and Suffolk

Local Authority

Table 4 - Districts level impact (see datapack for full details and referencing)

Highest impact

Lowest impact

District

Proportion of jobs roles with

Proportion of jobs with automation

automation potential is

potential is lowest at 37.1% in

highest at 45.2% in Great

Breckland

Yarmouth

Page 14

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

The potential for economic gain

However, reports also suggest that, in common with previous Industrial Revolutions

the changes we are likely to see due to Industry 4.0 will also:

• Increase growth;

• Create new industries and job roles, many of which don’t currently exist.

The Made Smarter Review (2017), as noted above, projects that embracing Industry

4.0 will unlock growth across the economy, worth £455billion in the first decade.

Other reports make similar projections with a recent report from BEIS (2019) on

Artificial Intelligence (AI)6 reporting on work by Accenture which suggests that AI

could add £630billion to the UK economy by 2035 and increase GVA growth from

2.5% to 3.9% (much higher than has been seen in the last 20 years).

Furthermore, wider changes in the economy and demographics mean that young

people entering the jobs market and those displaced from existing roles are likely to

find jobs, because:

• In New Anglia and the UK, over the long term birth rates have fallen meaning that

there are fewer young people entering the workforce;

• Average age in the workforce is increasing and many industries are struggling to

find enough young entrants to replace those who retire;

• Unemployment rates have fallen and are now at the lowest rates since the early

1970s meaning that there is very little slack in the jobs market.

The real economic challenges are therefore that:

• The economy needs to address wage growth which lagged inflation for nearly a

decade after the economic crash in 2007-’08, with a squeeze on family incomes

and growing political impacts as workers saw the value of their earnings eroded

by inflation for the longest period in at least 70 years;

• The dependency ratio is rising (i.e. how many people each worker supports),

meaning that the economy needs to increase the productivity generated by each

worker so they can support more of those who are not working (whether as

children, students or the retired);

• Workforce supply is the growing challenge for most employers.

6 Professor Dame Wendy Hall and Jérôme Pesenti (2019), Growing the Artificial Intelligence Industry in the

UK, BEIS

Page 15

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

Productivity growth is therefore needed to increase wealth and real wages through

creating higher paid, higher skilled jobs which are more productive.

This analysis suggests that even if 30% or more of current job roles are lost to

digitalisation & automation (as some suggest), we will not be short of jobs.

Those displaced will find new jobs, in new industries or by undertaking new roles in

their current industry or for their current employer. However, Industry 4.0 is, like

other industrial revolutions, likely to change the structure of the economy across the

country and indeed the World.

No LEP area is immune from this change and whether this change allows an area to

improve its position will primarily depend on the speed with which it is able to

respond.

A critical determinant of whether an employer, sector, LEP area or the whole of the

UK is able to benefit from the potential productivity gains created by Industry 4.0 will

be its ability to ensure that it has the skills and knowledge to embrace this change.

This must encompass both ensuring the young have the skills needed to prosper in

the new working environment and that the existing workforce is supported to gain the

skills needed for new or changed job roles.

In a new paper McKinsey7 argues that we have to embrace lifelong employability by

changing the way that we train workers for new roles. The key need they identify is

to support existing workers to gain the new skills needed through tailored, bite sized,

regular, participatory and social learning, which becomes a standard part of

organisational culture, rather than formal, standardised and occasional courses.

They argue that unless this change is embraced workers will find it increasingly

difficult to keep up to date with the skills needed in the workplace as it embraces

technology, with artificial intelligence (AI) being particularly disruptive to job roles.

7 McKinsey (2019), Competitive Advantage with a Human Dimension: from Lifelong Learning to Lifelong

Employability

Page 16

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

Consultation Feedback

Meetings and Events

In developing the Emerging Technology Skills Plan a number of local, regional,

national and international meetings were attended to provide feedback on how

different sectors, stakeholders and regions see this challenge. This included:

• Liaising with providers and stakeholders in the Institute of Technology (IoT)

(meetings in July and September 2018) & Institute of Productivity (IoP)

development group (meeting October 2018) to understand how these initiatives

can support New Anglia in responding to the Emerging Technology challenge;

• Engaging with employer stakeholders to understand how the challenge paper

conclusions relate to their experience through consultations at:

• The 17th September 2018 productivity challenge event run by Hethel

Innovation at UEA;

• The 16th November 2018 employers engagement event run to support the

Eastern Institute of Technology (EIoT) proposal.

The plan was also be informed by feedback gained by Martin Collison (SkillsReach

team) from engaging with a range of regional, national and international events

focused on Industry 4.0 and digital technology adoption, including (all funded

separately to the skills plan):

• Speaking to the Lincolnshire Industry 4.0 skills working group 30th August 2018;

• Speaking at the Agricultural Economics in Transition conference XV in Budapest

on how technology will change the food chain 11th September 2018;

• Attending the Greater Lincolnshire Innovation Council meeting on Industry 4.0 on

19th September 2018;

• Speaking at the EU SKIN Project technology event in Hungary on 25th

September 2018;

• Speaking at the EFFAT EU Trade Union’s events: Budapest on 25th October

2018; Copenhagen on 5th February 2019, on technology impacts on job roles;

• Speaking at the West Sussex Growers Association in Chichester on 26th October

2018 on how technology will affect the agricultural and horticultural industry;

• Presenting the draft plan to the New Anglia Innovation Board on 19th February

2019 to debate how best the region can rise to the challenge of Industry 4.0.

Page 17

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

Employer Consultee Feedback

Employer representatives at the EIoT meeting reported that many people and

organisations are still not clear what is meant by Industry 4.0, or how this will impact

their workplace and thus are uncertain how skills needs are likely to change.

It was reported that some major sectors, e.g. construction, know that Industry 4.0 will

impact them, but very few in this sector have begun to address this challenge to

date, largely due to more pressing short term issues and a lack of certainty about

how it may impact them.

A straw poll of 12 employers at the consultation exercise for the Eastern Institute of

Technology (EIoT) showed that on a scale of 1-5 (where 1 = not ready and 5 =

ready):

• For employers who were primarily technology end users (7 companies): the

average score for their organisation’s preparedness for Industry 4.0 was 2.7

compared to 2.4 for their sector as a whole;

• For purely technology provider companies (1 company) they rated their own

company at 5, but their sector still only at 1;

• For companies which both provide and buy technology (4 companies), the rating

was 3.8 for their own readiness but only 2.0 for their sector as a whole.

This is broadly consistent with other reports and surveys, which show that many

companies and employees rate their own preparedness for Industry 4.0 more highly

than the sector in which they work.

In August 2018 the Fabian Society and Trade Unions launched a 2 year commission

into Workers and Technology8, with the publication of new evidence on British

workers hopes and fears for automation in the next decade. Their initial evidence

shows that (based on an online survey of over 1,000 workers):

• Overwhelmingly, workers are positive about their own ability to navigate change:

73% are confident they will be able to change and update their skills if new

technology affects their job. After learning about how technological changes will

affect the workplace, over half (53%) were optimistic about their future working

life and job prospects.

• However, a significant minority were anxious about the impact of automation over

the next 10 years: 37% of workers (i.e. circa 10 million people nationally) are

Page 18

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

worried their job will change for the worse; and 23% of workers (i.e. 6

million people) are worried that their current job may no longer be needed.

Whilst the balance of those consulted were optimistic about their own chances of

coping with the changes brought about by Industry 4.0, this contrasted sharply with

their views about the help on offer to them to help them embrace Industry 4.0:

•

9% of workers think that the UK government is taking steps to prepare them for

new workplace technologies;

•

16% (with a trade union in their workplace) think their union is taking steps to

help ensure new technologies improve working life;

• And, only 27% think their employer is taking action to prepare them for change.

Caution is needed in interpreting this data, because those who are more likely to

respond to these surveys are usually those who have already engaged with the

issues and are thus likely to be more prepared.

However, the local evidence and national reports consistently suggest that, at

sectoral or economy level, many employers have yet to understand the impact that

Emerging Technology may have on their organisation.

What Action is Needed

Key areas which local employer and stakeholder consultees considered the region

needs to focus on to provide the skills needed for emerging technology were:

• Apprenticeships - there was concern that the levy and reforms have disrupted

established successful models in the technology sector. There is a need for

apprenticeships to have more status and for greater flexibility in how

apprenticeships are managed. Employers felt that the frameworks and standards

were too rigid and not flexible enough to meet the rapidly changing employer

needs which Industry 4.0 implies;

• Applied courses - degrees need to be more applied e.g. including placements, so

that students are prepared for the way in which emerging technologies can be

applied. Employers also favour ‘HNC’9 type provision and think this should be

used to address the emerging technology skills need;

• Work experience - it was felt strongly that current work experience is failing

young people and that children, from age 14, should be supported to use their

holiday time to gain experience of work (employers stressed that the excuse that

this is stopped by H&S can be overcome with the correct risk assessments even

9 Employers favoured part time, practically applied provision which employees can combine with work and

which are delivered on a block or day release basis with further practical study in the workplace

Page 19

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

in very physical environments such as construction). This work experience should

be accredited;

•

Vocational pathways - there is a need for a vocational pathway at GCSE. It was

felt that ‘T’ Levels are too late as by this stage most students are fixed on an

academic route even if this does not suit them;

•

Young workers as trainers - employers reported that many young staff in their

organisation had a much better understanding of the potential of emerging

technology and could be used to train older staff in how to optimise the use of

new technology;

•

Local delivery - employers stressed that local delivery is essential because many

students and workers will not/cannot travel easily across the region. To deliver

new skills for Emerging Technology it will therefore be important to include virtual

outreach, blended learning (so that learners get a social experience as well) and

similar models (e.g. video conferencing), so that the whole workforce can

participate at a time and pace which suits them and their other commitments;

•

Bite size delivery is also needed for industry 4.0 using videos, practical

applications and test centres, with this particularly important for the established

workforce who need to fit training in around their other commitments;

•

Culture change - it was felt that the biggest challenges to adopting Industry 4.0

relate to culture change and thus a focus on soft skills is needed alongside

technical education and training to support business uptake.

Delivery also needs to recognise that:

• Working through established business groups can be very effective - many

business groups have HR manager forums/groups which can be used as an

effective conduit to promote training and to ensure that regional programmes

align with employers’ internal programmes;

• Need to reduce the bureaucracy - if businesses are expected to manage the

process this is likely to fail, because the administration of publicly supported

training is simply too complex (including apprenticeships) and, if businesses are

expected to do this themselves, many will not take part.

It was felt that the most important issue for employers is to get rid of educational

jargon and produce a simple, clear 2 page explanation of the emerging technology

training offer, which ends with a very clear set of next steps which they can take to

engage in the process. It was felt that unless this is implemented most businesses

will not choose to engage and will continue to try to meet their needs through

recruitment rather than training their own staff.

Page 20

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

Strategic Alignment

Consultees at the New Anglia Innovation Board suggested that:

•

There is a need to co-ordinate local action being taken on Industry 4.0 related

provision by the Institute of Productivity (IoP) at UEA with the Institute of

Technology (subject to approval);

•

The review of Post-18 Education10 led by Philip Augar is important in reviewing

both FE and HE provision and how this can provide seamless progression, which

is important in the context of Industry 4.0;

•

It is important for the work on Industry 4.0 to focus on how to support productivity

growth by working with employers to co-create programmes which meet their

changing skills needs;

•

It is important to recognise that many young people have excellent digital skills as

‘digital natives’, but don’t have the formal qualifications to prove these skills. It is

important for employers to utilise these skills even if they are unaccredited;

•

Meeting the training needs of the established workforce in relation to Industry 4.0

is a larger challenge than training young people and it is important that

educational policy and local delivery embraces this so that the benefits of

Industry 4.0 can be captured across the economy;

•

It is important for Industry 4.0 transition support to integrate training provision with

business support, as is proposed in the New Anglia Strength in Places Fund

application (subject to approval);

•

Employers engaged in existing business support programmes have very mixed

views on digitalisation, but most don’t know what possibilities digital technologies

offer to them. This means they are unable to identify their needs unless they are

supported to understand what might be possible. This is a key role for the

Growth Hub and local business support programmes so that employers can be

signposted to the most appropriate provision;

•

The needs of technology adoption in end user sectors of the economy is more

important than the needs of the technology sector itself, due to the scale of the

wider economy and the need to ensure that the breadth of the economy (public

and private sector) is World class in technology adoption;

•

It would be useful to use LEP sector groups to help undertake and regularly

update foresight exercises to identify how Industry 4.0 may impact their sectors

and to identify the training needs which arise from this;

Page 21

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

• This foresight activity must link to the LEP economic strategy and be clear on

both the opportunities and challenges facing the area in adopting Industry 4.0.

This also needs to be clear why it maybe more challenging in areas such as New

Anglia, e.g. the rural and sparse nature of much of the geography, or the absence

of a Mayoral Authority with greater delegated powers;

• The magnitude of the change which Industry 4.0 will lead to means that a

strategic approach is needed. To deliver this it is important to establish an

Industry 4.0 task force or similar structure to co-ordinate the actions taken both to

support the technology industry, e.g. by the Digital Skills Taskforce, IoP and IoT,

with wider support for the adoption of technology across the economy by the

Skills Board, Innovation Board and Local Industrial Strategy. Alignment with the

ICT and digital strand of the Local Industry Strategy is important.

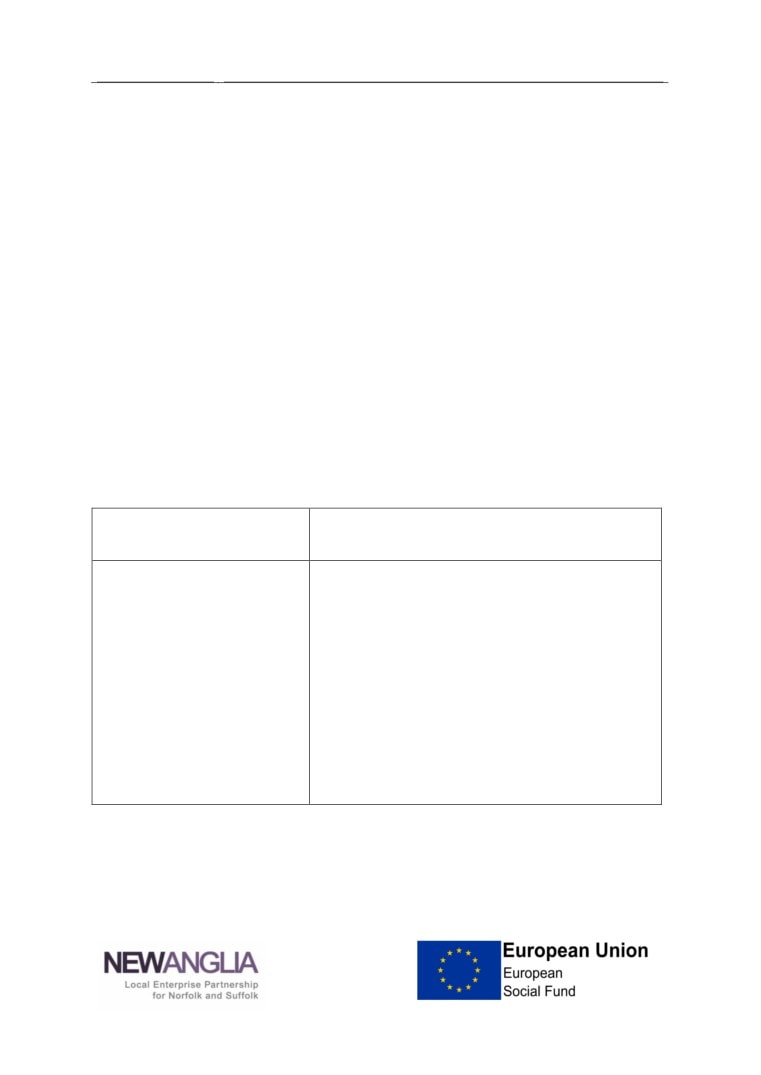

Summary of Findings on Training Provision for Emerging Technology

In developing a skills plan for how to support the adoption of emerging technology,

there are a series of key questions which need to be addressed about whether the

current skills system is equipped to respond to this challenge, as set out in table 5.

Table 5 - Headline Questions and Evidence on Industry 4.0

Key questions and

Evidence

challenges

Starting points - are school,

Evidence from the earlier skills plans and the

college and university leavers

consultations for this plan suggests the answer is

gaining the right skills (hard

no.

and soft) to embrace current

Too few students study the skills which are

and future technologies?

needed and the curriculum is poorly aligned with

employer needs.

There are big gaps in the supply of students with

the skills needed despite those with the right

skills to power the adoption of emerging

technology commanding higher salaries.

Page 22

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

Do the trainers have the right

There are reports showing this is a major problem

skills to facilitate the take up

nationally and the skills plans developed in 2016-

of emerging technology in

18 for New Anglia showed this is a challenge

education?

locally across multiple sectors.

And, is there an adequate

The earlier sector skills plan identified challenges

supply of trainers?

in recruiting staff with digital/ICT skills, as well as

related areas such as engineering. The main

challenge is that staff in these areas can earn far

more in industry than they can in education and it

is therefore very hard to retain them in the

education system.

Technology is a major driver of change in the

economy and it is vital that the educational

workforce itself has the skills to develop students

abilities in the skills needed to adopt Industry 4.0.

Is there appropriate

Evidence from the New Anglia skills plan

curriculum available or will it

consultations show that there is a problem with

have to be adapted or made

the curriculum failing to keep up with the speed of

bespoke?

technological change.

What levels and delivery

There is also clearly a link to the point above on

styles will be needed?

teachers and trainers lacking the skills needed

and providers struggling to recruit staff in many

Will accredited or non-

technology focused disciplines.

accredited training be

needed?

Some data has also shown that the number of

students studying ICT has been falling despite

How can funding be aligned

increased demand for these skills.

with employer needs?

Page 23

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

Are there cultural barriers

National and EU level reports suggests that in

which restrict the willingness

many cases culture change and skills challenges

to embrace technological

are more significant than the availability of

change amongst both

technology itself and our local consultations

employers and employees?

reached the same conclusions.

If so, how can these be

Employers recognise that adopting new

tackled?

technology normally requires new systems to be

designed, management structures to change and

companies to change working practices.

Globally the availability of technology will

continue to develop rapidly, but whether local

economies, such as New Anglia, benefit will be

more to do with whether their economies

embrace the possibilities it provides, with culture

change and skills at the heart of the economy’s

ability to respond.

To respond to these challenges there is a need to

provide leadership, both technical and

management, whilst helping employers to

recognise the potential that emerging technology

may have in their organisation.

Page 24

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

Emerging Technology Skills Plan

Many commentators argue that we are truly on the cusp of the next Industrial

Revolution, Industry 4.0, which will, like previous revolutions, affect the whole

economy. However, this time the transition is likely to be faster (as we are already

seeing in retailing) and in the process we are likely to see many business failures

whilst new ones emerge.

There is growing awareness that whether employers survive this process will, as with

Darwin’s Theory of Natural Selection, be more dependent on the ability to adapt

rather than their fitness for purpose at any particular time.

It is this ability to adapt rapidly which is at the heart of the skills challenge which

Industry 4.0 (and the Emerging Technology which is driving it) is creating across the

New Anglia economy.

Evidence shows that there is a generic shortfall of workforce supply across the

economy (not only in New Anglia, but across much of Northern Europe) as birth

rates have fallen, average age is increasing and unemployment rates have fallen.

The challenge is therefore that:

• The dependency ratio is rising (i.e. the number of people who are dependent on

each worker) and this means that society needs to focus on increasing the

productivity of those in the workforce;

• Workforce supply is the growing challenge for most employers with vacancies

across the economy and historically very low unemployment (lowest for 2

generations);

• Productivity growth is needed to increase wealth & real wages following a

decade, since the global slowdown, of falling real wages.

This suggest that even if 30% or more of current jobs are lost or changed

substantially by Industry 4.0 digitalisation & automation (as some suggest), we will

not be short of jobs. Those displaced will find new jobs or new job roes with their

current employer, assuming that they are assisted to transition to new job roles by

investing more in skills & retraining & doing this fast enough.

Whilst the adoption of technology can increase productivity it will also lead to many

jobs roles being completely or partially automated and this process needs to be

managed. Evidence also suggests that new job roles will need to be undertaken to

support the adoption of emerging technology.

Page 25

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

These new job roles could be to design, build, install and manage the new systems

which are created, but are equally likely to be created by allowing end user sectors

of the economy to develop new or enhanced services.

For example, in health and social care, telemedicine, automated diagnosis or robotic

care assistants may well render many current roles redundant, but could free

clinicians and care assistants to interact more directly with those in their care

focusing on the person and their psychological as well as their physical care needs.

In the logistics industry automated cranes, forklifts and trucks are likely to reduce the

demand for drivers, whilst at the same time increasing the demand for engineers,

ICT specialists and logistics planners.

In other sector, such as retail, the transition is likely to mean completely different

business models reduce workforce size and release staff to join other sectirs.

For New Anglia it is important to consider how Emerging Technology will enable the

Industry 4.0 transition and to provide leadership to this process, so that the region

gains from the opportunities Industry 4.0 provides.

The transition in the economy, will, as is shown in the evidence base for this plan,

have different impacts in different sectors, impact those with higher qualifications

less than those with lower qualifications and affect some job roles far more than

others. However, no sector is immune from the change and as shown all districts in

New Anglia currently have between 37-45% of their job roles at risk from automation.

The impacts will thus be region wide and affect every sector, with most areas seeing

both positive and negative changes which they need to respond to.

The result is likely to be that:

• Some sectors grow their workforce whilst that in other sectors fall substantially

(even if the GVA or economic value of the sector does not change given the

different potential for automation);

• The aggregate demand for some skills will fall whilst for others it will rise. For

example every report suggests the demand for digital skills is rising, but this is

not being reflected in more course enrolments. If the region wants to

successfully manage the transition to Industry 4.0, this needs to change;

• The need for different skills should impact the choices made by young people to

help prepare them for the new job roles which will be available in the economy,

but in terms of numbers the bigger challenge is how to help existing workers

develop the skills needed to remain relevant in the workforce;

Page 26

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

• The demand for hours spent across the economy on physical, manual and basic

cognitive skills will fall by 14-15% by 203011, whilst the demand for hours spend

on higher cognitive skills will rise by 8%, those on social and emotional skills by

24% and technology skills by 55%;

• Furthermore, the impact of new technology on new skills requirements will

disproportionately impact those with lower qualifications. More jobs roles will also

demand higher levels of qualification and thus reduce the jobs market potential

for those with skills at lower levels;

• Most employees are likely to have multiple job roles during their career and as a

result rather than seeing education as a single major event followed by a career,

we need to see education and training as a continuous process throughout life.

This is a major challenge to established educational and funding models. In the

consultation for this plan the need for change in educational structures was

clearly identified by employers.

However, the challenge created by emerging technology and Industry 4.0 is not

simply a skills one and in addressing this proactively New Anglia needs to

understand, plan for and proactively support economic change by using all the levers

it and its partners have, including planning, business support, incentives and grants,

thought leadership and skills.

Consultees were clear that the transition to Industry 4.0 needs to be a strategic,

cross sectoral challenge which the LEP seeks to address both through its economic

strategy as well as through skills policy.

Existing New Anglia skills plans, notably the ones for DigitalTech and Advanced

Manufacturing and Engineering (AME), already deal with the skills challenges of the

technology sector itself. Therefore in addressing the supply of emerging technology

skills for those companies in New Anglia who provide Industry 4.0 technologies and

solutions, these two existing skills plans should be used.

As noted by consultees the larger challenge, in terms of numbers of students or the

existing workforce, who will need new skills due to Industry 4.0, arises in those

sectors which will use Industry 4.0 solutions (supplied to them in most cases by

companies in the DigitalTech and AME sectors) to improve productivity. It is these

end users of Industry 4.0 on which the skills actions identified in this plan should

primarily focus.

11 McKinsey Global Institute (2018), Skill Shift Automation and the Future of the Workforce

Page 27

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

Skills Actions to be Taken

Based on the evidence collected it is recommended that embracing Industry 4.0 is

adopted as a cross cutting need which pervades all aspects of the New Anglia

economy and linked to the ICT and Digital strand of the Local Industrial Strategy.

To address this successfully New Anglia will need to provide leadership on the

economic changes which this will lead to across the economy and consider how:

• The region ensures that it can grow sectors to the economy which will benefit

from Industry 4.0;

• Manage the decline or reinvention of sectors where Industry 4.0 may eliminate

many of the existing jobs, job roles and/or companies/organisations;

• Facilitate the movement of the existing workforce between sectors or job roles as

some existing jobs are displaced and new ones created;

• A co-ordinated effort by skills providers, working collectively given the magnitude

of the impacts which are likely to be seen, can proactively facilitate the resultant

economic transition.

If this transition is successfully managed it could:

• Allow New Anglia to embrace the new economy Industry 4.0 will lead to more

rapidly than other areas, increasing its growth rate and economic success;

• Support the move to a knowledge led economy;

• Help workers to have more rewarding, higher skilled and better paid jobs, with

less physical stress and a reduced need to undertake boring repetitive roles.

The all-encompassing nature of Industry 4.0 means that the region will need to

address:

Two key challenges:

• Ensuring that the technology industry itself can scale up to provide the solutions

needed across the economy;

• Supporting adoption of industry 4.0 by end user sectors so that they remain

competitive (commercial sector) or can deliver enhanced public services within

constrained budgets (public sector).

Each of which in turn have two dimensions:

• Initial training and education so that those entering the workforce for the first time

bring with them the skills needed to embrace the opportunities, offered by

Industry 4.0;

• And workforce development so that the existing workforce is equipped with the

skills needed to enhance their career prospects as Industry 4.0 pervades the

economy.

Page 28

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

Action 1 - ICT and Digital in the Local Industrial Strategy

To successfully deliver a response to the challenges created by Emerging

Technology a commitment is needed to put in place a robust leadership model,

supported by both the public and private sector, to proactively drive this change in

the New Anglia economy.

The challenge requires leadership in terms of both thought leadership as well as

proposing, developing, resourcing and leading practical actions to position New

Anglia to benefit from the 4th Industrial Revolution.

This could be best delivered through a public/private Industry 4.0 led theme in the

ICT and digital strand of the Local Industrial Strategy (LIS), to develop and

implement practical policies to support positive economic change.

This must embrace both the opportunities provided by Industry 4.0 at the same time

as addressing the socio-economic challenges created by rapid changes in how and

where people work. In doing this it is important to address:

For major sectors of the economy:

• How industry 4.0 will affect the sector (public and private sectors) by working with

established New Anglia sector groups to continually update foresight exercises

for their sector relating to the technology that they will adopt;

• Clarify the skills and knowledge challenges the sector has to address to adopt

Industry 4.0;

• Identify how skills and knowledge interventions can be aligned with other support

for technology adoption (e.g.: business support; innovation support and grants;

commercial investment and grants for investments in new technology).

For the education and skills response:

• The changes needed to education and skills provision to meet future economic

needs due to Industry 4.0;

• How education and training provision and economic development support can

work together to support the transition to a new economy through packages of

training and education, business support and investment.

New Anglia is fortunate that local partners have already begun to develop work in

this area and should seek, in developing the ICT and digital strand of the LIS, to

build on the initiatives already being taken.

Consultees stressed that the breadth of the challenge means that this should seek to

unite those who focus on technology development with representatives of those who

need to adopt Industry 4.0 solutions. They stressed the need to support technology

adoption as the prime focus.

This work will initially focus on four additional skills actions:

Page 29

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

• Action 2 Train Young People to be Industry 4.0 Professionals - to increase

recruitment and training of young people for Industry 4.0 technology supply

companies;

• Action 3 Upskill existing Industry 4.0 workforce - workforce development for

the Industry 4.0 supply industry;

• Action 4 Integrate Industry 4.0 awareness into all courses at school/FE/HE -

to ensure they understand how Industry 4.0 will impact their chosen career;

• Action 5 Upskill existing sectors workforce to adopt Industry 4.0 - to develop

awareness of Industry 4.0 amongst the existing workforce across all sectors.

Actions 2 and 3 will be delivered primarily by building on and uniting the interventions

identified in the New Anglia DigitalTech and Advanced Manufacturing and

Engineering Sector Skills Plans and be led by the groups already charged with

delivering these plans.

Actions 4 and 5 are new and will be the core delivery focus for this Emerging

Technology Sector Skills Plan, aligned with the LIS theme on ICT and digital. They

will be delivered by working with the sector skills plans sub groups for each of the

existing plans to support their work on emerging technology adoption.

The Industry 4.0 theme in the LIS will also need to advocate with employers on the

need to adopt Industry 4.0 and produce a simple employer guide on Industry 4.0 and

where they can seek help with skills for technology adoption.

The Industry 4.0 deployment agenda in the Local Industrial Strategy needs to draw

on local existing expertise and activities linked to Industry 4.0, including:

• New Anglia Innovation Board

• Institute of Productivity (IoP including NAAME)

• Eastern Institute of Technology (EIoT)

• Digital Skills Task Force

Page 30

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

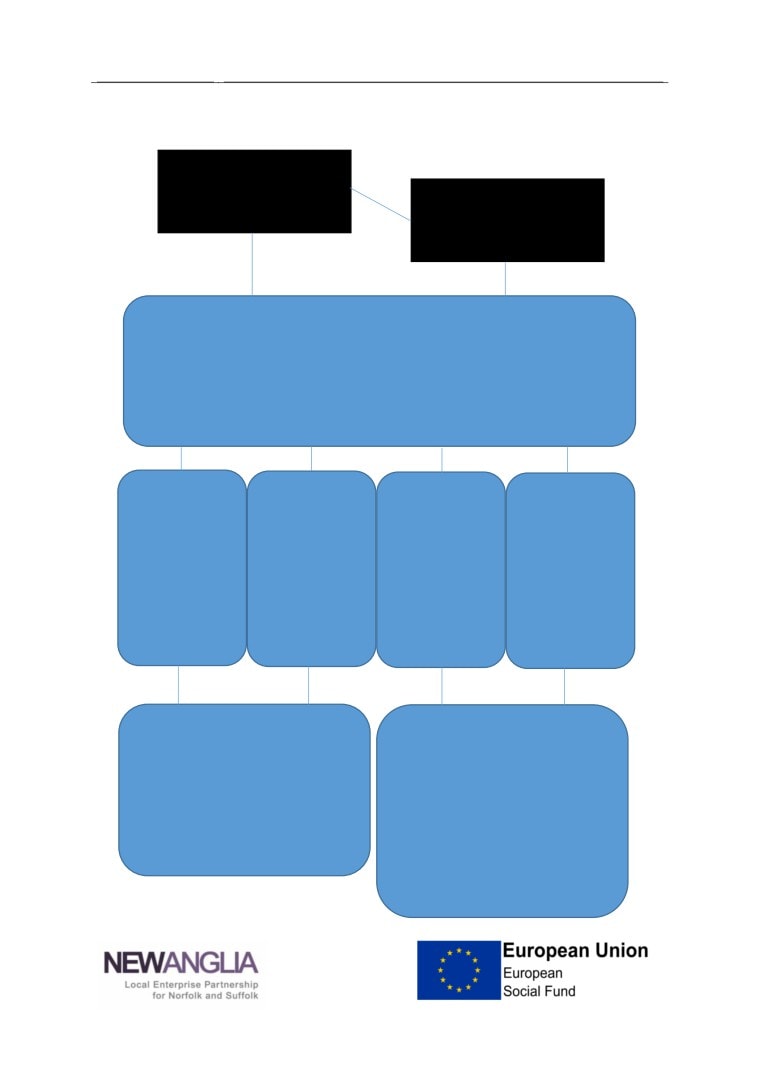

The suggested Industry 4.0 delivery structure brings together a range of existing

initiatives aligned with the ICT and Digital strand of the LIS, including:

New Anglia LEP Board

New Anglia Skills Board

Industry 4.0 theme under ICT and Digital strand of the Local Industrial

Strategy (LIS), drawing on expertise from:

New Anglia Innovation Board

Institute of Productivity (IoP including NAAME)

Eastern Institute of Technology (EIoT)

Digital Skills Task Force

Action 2:

Action 3:

Action 4:

Action 5:

Train Young

Upskill

Integrate

Upskill

People to be

existing

Industry 4.0

existing sectors

Industry 4.0

Industry 4.0

awareness into

workforce to

professionals

workforce

all courses at

adopt Industry

school/FE/HE

4.0

Digital Skills

Digital Skills

Task Force,

Task Force,

LIS ICT &

LIS ICT &

IoP & EIoT

IoP & EIoT

digital theme

digital theme

Sector skills plan sub groups for:

Link to & support sector skills

plans sub groups for:

Digital Tech;

AgriFood Tech;

Advanced Manufacturing &

Construction;

Engineering (AME)

Energy;

Financial & Insurance Services

Health & Social Care;

Life Sciences & the Bioeconomy

Ports & Logistics

Tourism & Culture

Page 31

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

Action 2 - Train Young People to be Industry 4.0

Professionals

Rationale: the technology suppliers (e.g. ICT, engineering companies) who

support the adoption of Industry 4.0 can expect to see their market grow as the

uptake of Industry 4.0 grows. It is essential that the industry promotes the

opportunities in the sector and works with education and training providers to

ensure that the technology suppliers can expand their workforce.

Action to be Taken: the supply of young people with the right school and post

compulsory training and education to support the development and deployment of

Industry 4.0 has to be increased. This action has to start in school and ensure that

more children study the STEM subjects which underpin Industry 4.0 adoption.

This requires:

• More students to leave school with formal STEM and particularly digital

qualifications & training and to progress to College and University courses

which equip them for careers in the supply of Industry 4.0 solutions;

• Careers information and guidance has to be reinforced to promote the growing

importance of Industry 4.0 and the skills needed to enter the sectors which will

support adoption of emerging technology across the economy;

• Work placements which include Industry 4.0 applications;

• A focus on apprenticeships, including higher apprenticeships, focused on the

technology supply industry;

• Colleges and Universities need to provide more courses which combine digital

and Industry 4.0 themes with other disciplines to drive applications of the

technology across the economy (e.g. digital with management, arts, design,

sectoral/vocational etc.).

Leadership: this action will be led by the Digital Skills Task Force and Institutes of

Technology and Productivity to help Universities and Colleges increase their focus

on courses which provide Industry 4.0 skills. The sector skills plan groups for

Digital Tech and AME will align their work to provide employer input to guide this

action.

When: the need to increase the supply of young people in the Industry 4.0 sector

is current and work has already begun through initiatives such as the EIoT, IoP

and new facilities at Colleges and Universities.

Resources and support: this action requires constant updating of the curriculum

for technology courses and investment in the technology available to deliver

courses.

Page 32

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

Action 3 - Upskill existing Industry 4.0 workforce

Rationale: the speed of technological change in Industry 4.0 means that there is a

need for constant updating and expansion of the existing workforce in technology

supply companies to ensure they have the skills needed to help their customer

base adopt the latest technology

Action to be Taken: the key action to be taken is to ensure that the New Anglia

emerging technology supply industry is embracing the latest technology from

across the World and developing the skills to help implementation of these

technologies across the economy. This action should also encourage those with

strong sectoral backgrounds and understanding of how technology can support

organisational performance to join Industry 4.0 technology suppliers to help

facilitate adoption of emerging technology across the economy.

This requires:

• Bite size, blended local delivery of training and education to communicate the

latest technology effectively to those already in the technology sector;

• A focus on additional training to help technical experts in Industry 4.0 acquire

the skills to support their customer base in adopting Industry 4.0. This needs to

include training in both technology and how it can be implemented (e.g. the

business case and soft skills required in the end user company etc.);

• More focus on the development of multi-skilled professionals to deliver

applications across the economy (e.g. emerging technology for health care), by

ensuring that staff with a range of technical backgrounds can work together to

deploy Industry 4.0. This can include recruiting and training workers from other

sectors with sectoral specialism and understanding to work alongside technical

experts to deploy Industry 4.0 solutions.

Most programmes will include a range of these skills and attention will also focus

on ensuring that clear progression pathways for the industry are established.

Leadership: this action will be led by employers with the support of the Digital

Skills Task Force and NAAME.

When: the need for updating is ongoing and needs to build on existing in house

and sector based programmes of professional development, training and

demonstration.

Resources and support: the resources needed for this action will primarily come

from employers, but will be supported with specialist input and advice from the

Digital Skills Task Force, NAAME, IoP and EIoT.

Page 33

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

Action 4 - Integrate Industry 4.0 awareness into all courses

at school/FE/HE

Rationale: the future workforce will be entering jobs in which the use of technology

based on Industry 4.0 is a standard feature of their working life. Whichever part of

the public or private sector students will ultimately work in, it is therefore vital for

them to gain experience in how Industry 4.0 based technologies will support the

job roles they will undertake and to ensure that they have the skills to apply these

technologies effectively. If students acquire these skills they will be able to secure

good jobs, not least because they will be able to bring new skills to their employers

and potentially fulfil a role in helping existing employees understand how these

technologies can be applied effectively.

Action to be Taken: the key action which is needed is to ensure that all young

people, regardless of the disciplines they study, learn the skills to successful adopt

emerging technologies which drive productivity and effectiveness. This requires:

• The integration of Industry 4.0 adoption skills (technical, management of

change and culture) into all programmes at all levels;

• Digital and Industry 4.0 skills to be treated like Maths & English as foundational

skills which are central to employability in every sector.

Most programmes will include a range of these skills and attention will also focus

on ensuring that clear progression pathways for the industry are established.

Leadership: this action needs to be taken forward by Universities and Colleges in

New Anglia with the Enterprise Advisor Network (EAN) and initiatives such as the

Institute for Technology and Institute of Productivity, which can provide specialist

expertise to help lecturers and academics identify areas to apply Industry 4.0

within the curriculum.

When: there is a need to start the redesign of courses during 2020 and to maintain

this action for at least the next 5 years as Industry 4.0 continues to change the

skills needed right across the economy.

Resources and support: the main resources needed initially are for curriculum

redesign to ensure that Industry 4.0 is integrated into courses. This will lead to a

need for continued investment in facilities (potentially with technology suppliers) to

provide examples of technology. Given that many lecturers and academics are not

technology experts, a project to assist them to review their curriculum and identify

areas in which Industry 4.0 can be applied should be supported by the LEP in

conjunction with the Institute of Productivity and Institute of Technology. Training

for lecturers is also needed to equip them with the skills to deliver Industry 4.0.

Page 34

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

Action 5 - Upskill existing sectors workforce to adopt

Industry 4.0

Rationale: the majority of the workforce in New Anglia work in ‘end user’ parts of

the public and private sector, where the challenge is how to adopt Industry 4.0 so

that it improves productivity and effectiveness. Evidence suggests that over a third

of the current New Anglia workforce will be impacted by either the need to develop

a new career if their job is displaced by technology, or to obtain new skills to

secure their job role as technology changes how work is performed.

Action to be Taken: the scale of the long term challenge and lack of established

provision at the scale or with the focus needed, means that action needs to be

developed in at least two phases:

• A pilot phase during 2020-’21 to work with at least two end user sectors to

undertake a foresight exercise to understand how Industry 4.0 will change the

skills needed in their sector and to pilot ways of supporting members of the

existing workforce to either gain the skills needed in the future in their sector, or

to retrain for other sectors where demand in increasing;

• Rollout of the successful models for workforce upskilling developed in phase 1

to the rest of the New Anglia economy.

This action is central to the ability of the New Anglia economy to respond to the

opportunities and challenges resulting from Industry 4.0 and must therefore be

aligned with the Economic Plan and the Local Industrial Strategy.

This action can be supported by the Mid Life MOT support linked to the

government Pension Service and National Careers Service. This also needs to

build on Adult Education and Skills Support for the Workforce programmes.

Leadership: this will be led by the LIS ICT & digital team in conjunction with the

sub groups of the Skills Board working on each sector skills plan.

When: there is a need for a major programme over at least the next decade to

develop models of support which work for this challenge. Pilot projects should be

run in the next 2 years to identify how best to support employers and training

providers to deliver the training needed.

Resources and support: the scale of the upskilling challenge will continue to

grow as emerging technology impacts on more areas of the economy and as new

technology is developed. The replacement for structural funds, the UK Shared

Prosperity Fund, should be used to support upskilling of the existing workforce

alongside employer investment. Consideration should be given to whether for

larger employers the apprenticeship levy can also be aligned with this challenge.

Page 35

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

Annex 1 - Background to the Emerging Technology

Challenge

It is widely accepted that the economy is seeing a period of rapid change as

technology pervades virtually every aspect of the economy. Whilst clearly

technology has been with us for hundreds of years, starting with the industrial

revolution, most commentators suggest that we are now witnessing the start of the

4th Industrial Revolution, or Industry 4.0.

The World Economic Forum (2016)12 has defined the position as:

‘The First Industrial Revolution used water and steam power to mechanize

production. The Second used electric power to create mass production. The Third

used electronics and information technology to automate production. Now a Fourth

Industrial Revolution is building on the Third, the digital revolution that has been

occurring since the middle of the last century. It is characterized by a fusion of

technologies that is blurring the lines between the physical, digital, and biological

spheres.

There are three reasons why today’s transformations represent not merely a

prolongation of the Third Industrial Revolution but rather the arrival of a Fourth and

distinct one: velocity, scope, and systems impact. The speed of current

breakthroughs has no historical precedent. When compared with previous industrial

revolutions, the Fourth is evolving at an exponential rather than a linear pace.

Moreover, it is disrupting almost every industry in every country. And the breadth and

depth of these changes herald the transformation of entire systems of production,

management, and governance.’

The World Economic Forum (2016) goes on to state that:

Like the revolutions that preceded it, the Fourth Industrial Revolution has the

potential to raise global income levels and improve the quality of life for populations

around the world. To date, those who have gained the most from it have been

consumers able to afford and access the digital world; technology has made possible

new products and services that increase the efficiency and pleasure of our personal

lives….

In the future, technological innovation will also lead to a supply-side miracle, with

long-term gains in efficiency and productivity. Transportation and communication

costs will drop, logistics and global supply chains will become more effective, and the

12 World Economic Forum, Klaus Schwab (2016), The Fourth Industrial Revolution: what it means, how to

respond

Page 36

New Anglia LEP

Emerging Technology Sector Skills Plan, February 2019

cost of trade will diminish, all of which will open new markets and drive economic

growth.

At the same time, as the economists Erik Brynjolfsson and Andrew McAfee have

pointed out, the revolution could yield greater inequality, particularly in its potential to

disrupt labor markets. As automation substitutes for labor across the entire economy,

the net displacement of workers by machines might exacerbate the gap between

returns to capital and returns to labor. On the other hand, it is also possible that the

displacement of workers by technology will, in aggregate, result in a net increase in

safe and rewarding jobs.

We cannot foresee at this point which scenario is likely to emerge, and history

suggests that the outcome is likely to be some combination of the two….. This will

give rise to a job market increasingly segregated into “low-skill/low-pay” and “high-

skill/high-pay” segments, which in turn will lead to an increase in social tensions.

….. Technology is therefore one of the main reasons why incomes have stagnated,

or even decreased, for a majority of the population in high-income countries: the

demand for highly skilled workers has increased while the demand for workers with

less education and lower skills has decreased. The result is a job market with a

strong demand at the high and low ends, but a hollowing out of the middle.

This section of the World Economic Forum report neatly summarises the challenges

which many others have discussed in relation to Industry 4.0 or the 4th industrial

revolution:

1. Will Industry 4.0 displace so many employees that it is impossible for the creation

of new, as yet unimagined, jobs or growth of new industries to replace the jobs

lost?

2. Or will the wave of productivity growth created drive an economic renaissance by

increasing the quantity, quality and value of jobs benefitting everyone?

History suggests that the second scenario is more likely, but others argue that this

time is different, not least because of the speed with which whole industries are

being transformed and the fact that this is happening across so many industries at

the same time.

Building on this earlier work the World Economic Forum published a report in 2018