Final Version for LEP Officers : Confidential. 14 Feb 2019

Enabling Growth in the New

Anglia Creative Industries

Sector through Skills

Development

Creative Industries Sector Skills Plan

Version for New Anglia Skills Board

CONFIDENTIAL

28 February 2019

F

BACKGROUND CONTEXT

The development of this Creative

Industries Skills Plan has been led by the

New Anglia Creative Industries Group

working alongside the New Anglia Local

Enterprise Partnership, the New Anglia

Skills Board and supported by

SkillsReach.

SkillsReach was contracted to facilitate

and prepare sector skills plans for the New

Anglia LEP priority sectors. The project

was commissioned by the Education and

Skills Funding Agency, in partnership with

New Anglia LEP, and funded through the

European Social Fund. Each Sector Skills

plan and supporting DataPack has been

developed in collaboration with local

employers and other stakeholders.

The New Anglia Skills Board places

employers at the centre of decision

making to ensure the local skills system

becomes more responsive to the needs of

employers, residents and the future

economy.

The New Anglia Creative Industries Group

led on the consultation and development

of this plan.

SkillsReach is an established East of

England-based strategic skills consultancy

with an associate project team with

extensive experience of developing skills

plans.

ACKNOWLEDGEMENTS

New Anglia LEP wishes to thank the

employers, skills providers and

stakeholders including Royal Television

Society (East), Screen Suffolk and Hot

Source who contributed to the

development of this plan.

Final Version for LEP Officers : Confidential. 14 Feb 2019

Contents

INTRODUCTION FROM THE CHAIR OF THE NEW ANGLIA CREATIVE

INDUSTRIES TASK AND FINISH GROUP

4

THE STEPS TOWARDS A SKILLS PLAN

5

THE SKILLS PLAN OVERVIEW

7

A CREATIVE OPPORTUNITY FOR NEW ANGLIA

8

Valuing the Creative Industries sector

8

The economic challenge for New Anglia

14

Realising potential

15

THE MAKE-UP OF THE NEW ANGLIA CREATIVE INDUSTRIES

16

CREATIVE TALENT DEMAND AND SUPPLY

19

Developing a skills strategy for success

19

Summing up the strategic skills challenge for New Anglia:

27

THE SKILLS PLAN

28

Priorities - drivers and outcomes

29

Interventions - actions and success indicators

30

Timeline

32

Page 3

Final Version for LEP Officers : Confidential. 14 Feb 2019

Introduction from the Chair of the New Anglia Creative

Industries Task and Finish Group

This Creative Industries Skills Plan for New Anglia sets out a

collective vision for how skills development can support the

growth of our high potential sector which, although very diverse,

shares a simple, common purpose of making things using

creative digital technologies.

This plan is a key step to strengthening local partnerships to

ensure skills investment supports businesses and local residents,

to enable them to prosper through local sector growth. We look

SARAH STEED

forward to collaboration between local employers and education

NORWICH UNIVERSITY

providers to support the development of the New Anglia Creative Industries

OF THE ARTS

sector.

Our ambition is to add major value to support the development of a dynamic, high-

profile inclusive New Anglia Creative Industries sector that contributes right across the New Anglia

economy and beyond; with local career pathways, collective skills leadership, smooth transitions into

work; and a cutting-edge local workforce

This plan recognises the enormous potential of our sector locally and will focus upon all of New Anglia

seizing the opportunity for a ‘joined-up sector,’ whilst recognising the importance of stakeholders that

have a specific focus such as screen, culture, ICT

The Creative Industries Group has led the development of this plan and will steer its implementation,

working in partnership with other key stakeholders for various sector elements.

The Skills Plan has three key priorities:

1. Ensuring clearer, more diverse pathways for people - especially local people - to enter the

sector with local employers

2. Improving the transition from education into the workplace or business

3. Supporting our local workforce (including freelancers) to gain and sustain competitive

advantage through their skillsets

To achieve this, we will need to collaborate, be even more connected and share best practice across

the Creative Sector and beyond.

We look forward to working with existing and new partners to implement an action plan to make a real

difference to the sector, the region and its residents.

Chair

New Anglia Creative Industries Group

Page 4

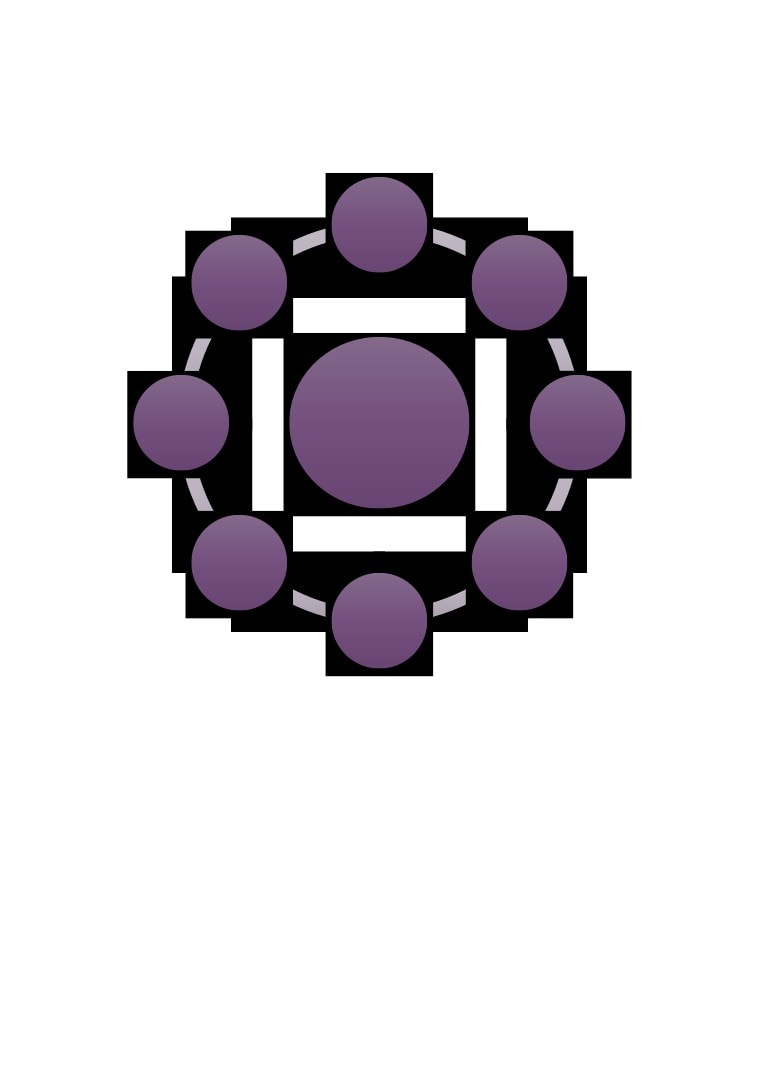

The steps towards a Skills Plan

RAISING COMPETITIVE ADVANTAGE FOR

NEW ANGLIA’S CREATIVE INDUSTRIES SECTOR

The steps involved in devising a sector skills plan to support the New Anglia Local Enterprise Partnership

and its partners in developing a competitive and sustainable local economy

mapping

Collaborative

The Sector

Evidence-

Skills Plan

based

Steer &

Employer-led

Oversight

Long Game

Structural &

& Quick

Strategic

Wins

Final Version for LEP Officers : Confidential. 14 Feb 2019

Mapping

Collaborative

Evidence based

Employer-led

• Collaborative approach with

• Quantitative assessment of

• Qualitative cross-cutting

stakeholders, employers and

the labour market and

analysis through

providers, including:

economic data, locally and in

•employer consultation using

•Inception meeting with New

the national context,

online surveying

Anglia LEP, Norfolk and

including:

•stakeholder consultation

Suffolk County Councils and

•Desk-based research

using both individual

business representatives

gathering evidence from

interviews and group

•A New Anglia Creative

national, sector and local

meetings

Industries Task & Finish

reports on the local

• What we asked:

Group, chaired by Sarah

economy, the creative

•What is the current and

Steed of Norwich University

industries sector and local

future skills supply and

of the Arts (NUA) to steer

groups, initiatives and plans

demand to support sector

the consultation and

•Data-analysis utilising a

growth?

development of the plan.

range of national and local

•What actions are needed to

The group recommended

data sources including: ONS

address identified skills and

sources and direction for

/ UKCES / ESFA DataCube /

workforce challenges?

research and consultation,

East of England Forecasting

and contributed to the

Model / Burning Glass

articulation of the plan

priorities and initial

interventions

Structural &

Long Game &

Steer & Oversight

Strategic

Quick Wins

• Focus on the strategic

•Set out a plan with both

•Review and approval

structural skills issues that

quick wins and longer-term

gateways throughout, via:

increase:

strategic interventions where

•The Task & Finish Group

•the effectiveness of those

industry can help by taking

•Stakeholders and providers

providing skills services

the lead, steering and

•New Anglia LEP Officers

locally

delivering interventions,

•New Anglia Skills Board

investing in the sector’s

•the investment made

future alongside the public

nationally in building a

sector

world-class skills

infrastructure;

•the leadership that

employers can develop by

articulating and taking

ownership of their future

skills needs.

Page 6

Final Version for LEP Officers : Confidential. 14 Feb 2019

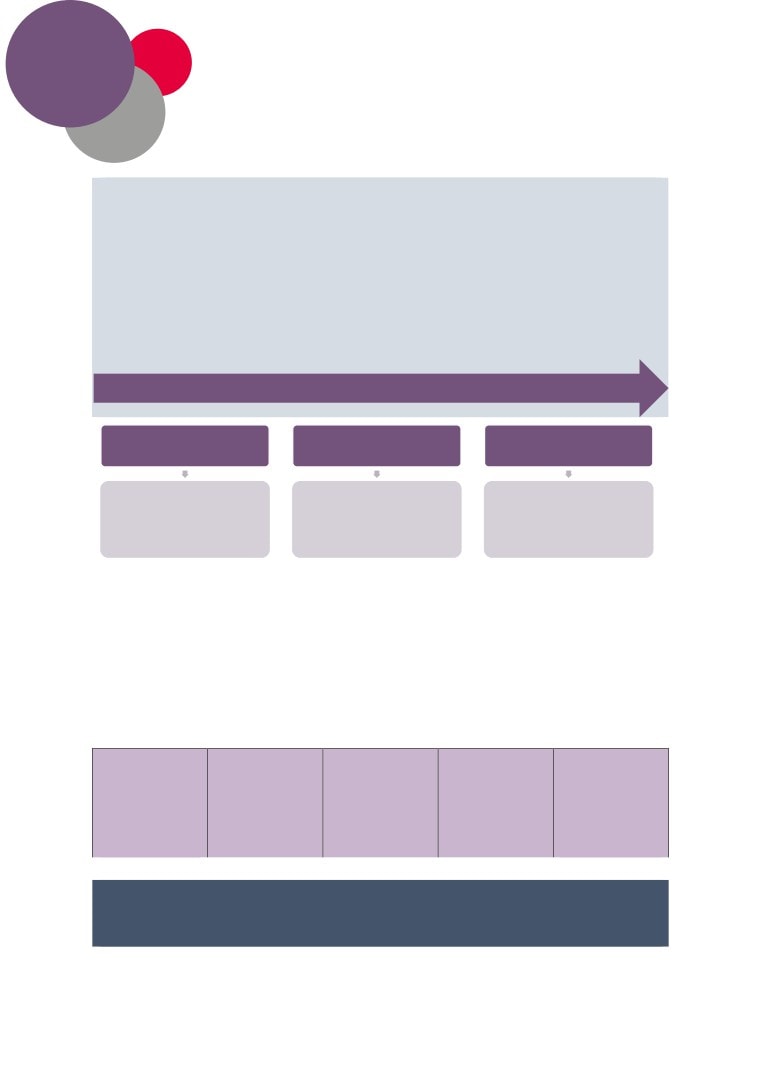

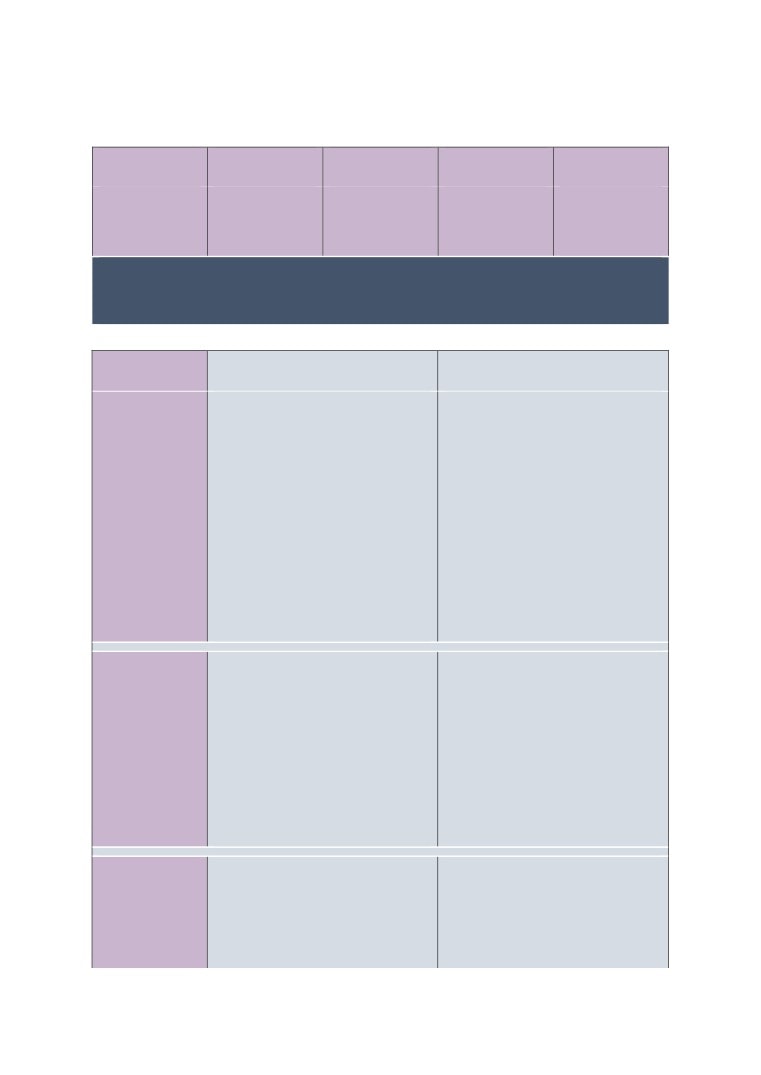

The Skills Plan Overview

Shaping the future for our makers using creative digital technologies

Our ambition is for a dynamic New Anglia Creative Industries sector that is high performing, inclusive and

contributing across the New Anglia economy and beyond.

Our vision is an environment where creative businesses can thrive and innovate and where local people can

make the most of their talents to build careers and explore entrepreneurial ambitions.

Our focus is to realise the tremendous growth potential of this sector through inspiring our future talent and

ensuring smooth transitions to work, supporting local career progression.

Through collective skills leadership, our initial focus will be on:

• Improving local career pathways

• Smoothing out transitions to work

• The lifelong learning of our cutting-edge local businesses and employees

Realising the full potential of people and business in New Anglia

Priority 1

Priority 2

Priority 3

Smoothing out the

Supporting the upskilling

Improving local career

transitions between

of cutting-edge local

pathways

education and local work

businesses and

opportunities

employees

A more diverse sector workforce in

A more diverse sector workforce in

More small / micro businesses

New Anglia

New Anglia

growing and benefiting from skills

A clear sector route map

Communications and support for

investment

demonstrating a greater diversity of

new entrants regarding employer

Local CPD becoming a strength of

routes into the sector

expectations of technical and creative

the region

Identifying stronger apprenticeship

business skills for new entrants

Creative local alternatives to national

pathways

Strengthening partnerships

funding ‘fill the gap’ for small

Boosting work experience

between local educators and local

businesses

opportunities - particularly with small

business

/ rurally-located businesses

Retaining creative talent in New

Attracting great talent to study and

Anglia

work in New Anglia

Intervention 1

Intervention 2

Intervention 3

Intervention 4

Intervention 5

Representing and

Appraising the

Identifying new

Pilot of a CI Sector

championing the

Developing a CI

feasibility of a New

apprenticeship

business/work

sector to potential

Graduate Academy

Anglia Creative CPD

pathways

experience hub

new entrants

Hub

INTERVENTION TIMELINE Development Phase : June 2019 to May 2020

Built upon a sector-wide collective skills leadership foundation

A new and influential collective skills voice for New Anglia Creative Industries, complementing existing

interest groups and building new conduits to ensure a representative voice from across the sector

SKILLS VOICE TIMELINE Foundation Phase : May 2019

Page 7

Final Version for LEP Officers : Confidential. 14 Feb 2019

A creative opportunity for New Anglia

THE POWER OF

The economic perspective for the sector

TEN…

Creative industries are the fastest growing part of the UK economy

Advertising & Marketing

and are recognised as having huge potential.

Architecture

This section reviews the economic picture, drawing on the national

and local evidence base and relevant feedback from the employer

Crafts

consultation and stakeholder interviews conducted during the

Fashion

development of this skills plan.

Film, TV and Radio

In reviewing both national statistics and local data, different

organisations may use different categorisations, meaning data

IT, Software & Computer Services

may not be directly comparable, but we have included such

Music & Performance

comparisons where it may aid understanding.

Specifically, the local evidence base has identified ten sub-sector

Publishing

groupings, as listed alongside, which have been adopted to reflect

Specialised Design

the specific profile and priorities of New Anglia. However, these

do not align with the national sector categories and locally Music &

Textiles

Performing Arts is led by the New Anglia Culture Board through

the Cultural Sector Skills Plan.

A comprehensive DataPack (available on request) has also been

The task and finish group identified

produced cataloguing the extensive data analysis undertaken in

ten defined operating areas that

developing this plan.

reflect the local composition of the

creative industries where ‘makers

using creative digital technologies’

Valuing the Creative Industries sector

are operating

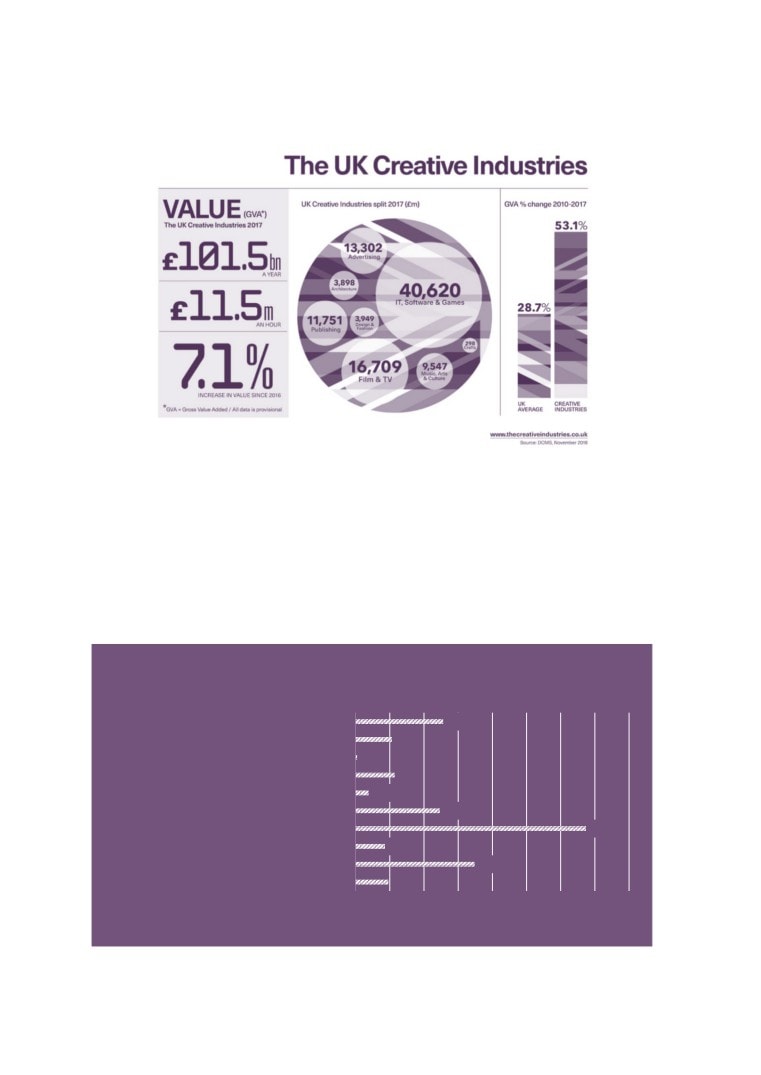

Economic Contribution

Nationally, the creative industries account for 3.12m jobs (Figure 1) and £101.5bn (Figure 2) of Gross

Value Added (GVA)1. The sector is growing twice as fast as the economy as a whole and the

Figure 1

Page 8

Final Version for LEP Officers : Confidential. 14 Feb 2019

Government’s Industrial Strategy: Creative Industries Sector Deal describes the Creative Industries

as lying at the heart of the nation’s competitive advantage.

Figure 2

Through its rapid expansion (Figure 1 and Figure 2) the sector is providing new job opportunities and

increased GVA, and making an impact on other sectors, such as boosting the visitor economy and

playing an increasingly important role in new areas through innovative engagement strategies such as

gamification. UK labour market projections show that the rate of growth for creative occupations will

be more than double the average job growth across the whole UK economy between now and 2024.

Film and high-end TV alone attracted over £2bn of inward investment to the UK in 2017, creating

employment, boosting tourism and bringing global talent to the UK2 and it is hoped that by 2023

creative industries will be worth £150bn and create 600,000 new jobs.”3

Creative jobs are also expected to be future-proof, with 87% of creative jobs considered to be at low

or no risk of automation, compared with 40% of jobs in the UK workforce as a whole4.

NEW ANGLIA CREATIVE INDUSTRIES

SUB SECTOR GVA VALUE (£M)

ADVERTISING & MARKETING

128

ARCHITECTURAL ACTIVITIES

53

CRAFTS

2

DESIGN

57

FASHION

19

FILM, TV, VIDEO, RADIO & PHOTOGRAPHY

123

IT, SOFTWARE & COMPUTER SERVICES

337

MUSIC, PERFORMING & VISUAL ARTS

43

PUBLISHING

174

TEXTILES

48

0

50

100

150

200

250

300

350

400

VALUE (GVA)

Figure 3

Page 9

Final Version for LEP Officers : Confidential. 14 Feb 2019

While the sector is diverse, comprising a number of key sub-sectors which are broken down into

further specialisms, each makes a significant contribution to the UK economy5.

Locally (Figure 3), the creative industries contributed £5bn GVA to the East of England economy in

20166 with Norwich ranked 14th in the UK’s creative clusters (Figure 4) according to the Government’s

Industrial Strategy, Creative Industries Sector Deal.7 Currently categorised as a high concentration

cluster, it has been identified as having the potential to become a high concentration and high growth

cluster.

The East is recognised as being at the

forefront of digital innovation and both

Ipswich and Norwich are recognised as

tech clusters in the Government’s Tech

Nation Report with the focus on Norwich’s

fast-growing digital creative hub and on

Ipswich’s world-leading centre of

innovation in communications technology

at BT Adastral Park, which is home to a

cluster of 100 businesses. The ICT

sector in New Anglia is worth £1.9bn with

local ambitions to create 5,000 jobs and

generate a further £650m GVA of

economic growth and to be one of the

UK’s Top 5 tech clusters by 2020. 8

Beyond these two major conurbations, the

sector’s businesses and jobs are

relatively evenly distributed throughout

the local authority areas (Figure 5) of New

Anglia, providing a real opportunity for

growth across the region - perhaps

particularly engaging those rurally-located

micro-businesses.

Employment Profile

Across the UK, the creative sector is

comprised primarily of SMEs, mostly

Figure 4

micro businesses and with many self-

employed people working as freelancers.

Nationally, almost 90% of creative industry businesses (Figure 6) employ fewer than 5 people9 and

this figure is reflected in New Anglia, at 89.7%. This is a much higher percentage than in the

economy as a whole, which is 78% nationally and 75.1% in New Anglia. Very few creative industry

businesses in New Anglia employ 50 or more people, emphasising the important role played by

smaller creative businesses in the sector. Nationally, 94.2% of those businesses operating in the arts

have no employees at all, compared to 75.9% of businesses in the rest of the economy.10

As outlined above, different approaches to categorisation mean there are anomalies between national

and local New Anglia data; for example, the national statistics do not include freelance workers, but

recognising the importance of this group to the New Anglia economy, they have been identified and

included in locally derived figures, as included here.

While there is potential to support businesses to scale up, the high numbers of smaller businesses

present an opportunity for greater collaboration. Similarly, while the high numbers of freelancers are

often working remotely or out of the area, predominantly in London, this presents an opportunity to

create work opportunities in New Anglia for such freelancers.

Page 10

Final Version for LEP Officers : Confidential. 14 Feb 2019

NEW ANGLIA : EMPLOYMENT AND

ENTERPRISE BY LOCAL AUTHORITY AREA

Figure 5

Employment Enterprises

BUSINESS SIZE BY EMPLOYEE NUMBERS:

ENGLAND AND NEW ANGLIA

0 to 4

5 to 9

10 to 19

20 to 49

50 to 99

100 to 249

250 to 499

500 to 999

1000+

NEW ANGLIA CREATIVE INDUSTRIES +

89.7%

5.8%

ENGLAND CREATIVE INDUSTRIES +

89.1%

5.4%

ALL BUSINESSES - NEW ANGLIA

75.1%

13.1%

ALL BUSINESSES - ENGLAND

78.0%

11.2%

Figure 6

Page 11

Final Version for LEP Officers : Confidential. 14 Feb 2019

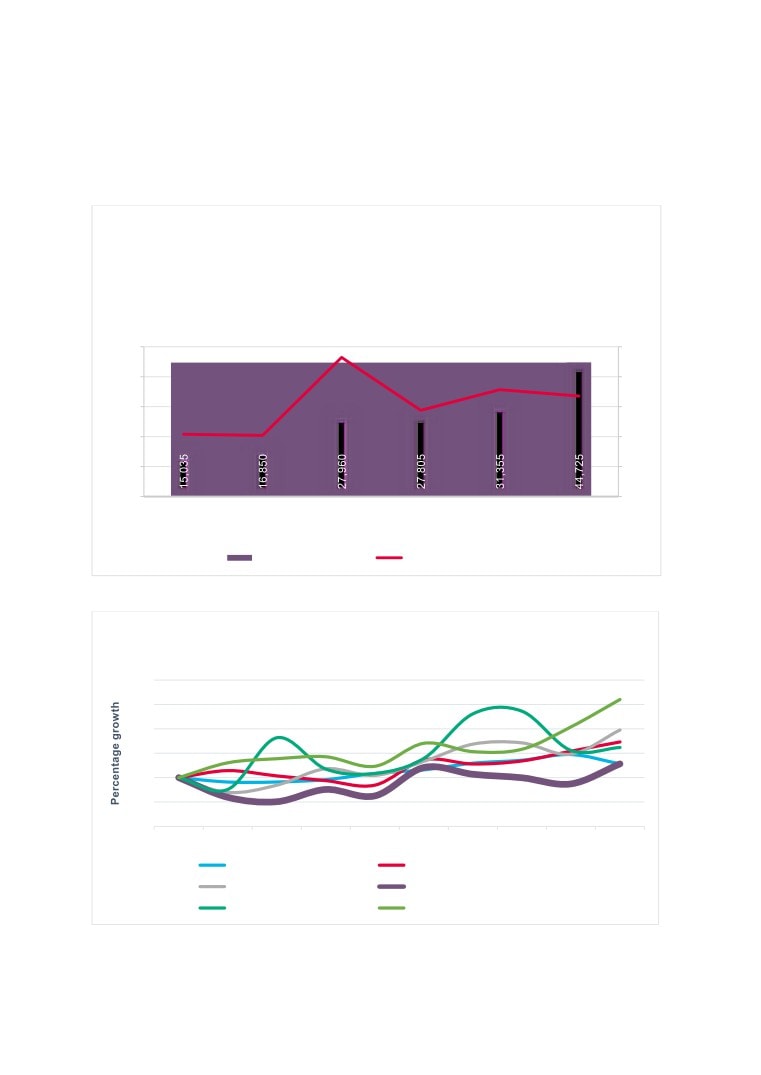

Looking at how New Anglia stands against its comparator LEP areas, the local profile (Figure 7)

shows overall employment at around 15000 representing some 2.1% of overall employment in the

area, and growth in the sector since 2009 demonstrates a consistent performance, in line with other

areas. Currently the percentage engaged in the creative industry in New Anglia is lower than in most

other comparator areas (Figure 8) shown, demonstrating an opportunity for future growth to achieve a

greater percentage employed within the sector.

EMPLOYMENT FOR NEW ANGLIA AND

COMPARATOR LEP AREAS

4.6%

50000

5%

40000

3.6%

4%

3.4%

2.9%

30000

3%

2.1%

2.0%

20000

2%

10000

1%

0

0%

New Anglia

North East

West of England

Greater

Coast to Capital

Greater

Birmingham and

Manchester

Solihull

Numbers employed

% of overall employment

Figure 7

GROWTH FOR NEW ANGLIA AND COMPARATOR LEP

AREAS

180

160

140

120

100

80

60

2009

2010

2011

2012

2013

2014

2015 v1

2015 v2

2016

2017

Coast to Capital

Greater Birmingham and Solihull

Greater Manchester

New Anglia

North East

West of England

Figure 8

Page 12

Final Version for LEP Officers : Confidential. 14 Feb 2019

Sector strengths and cluster capabilities

Overview

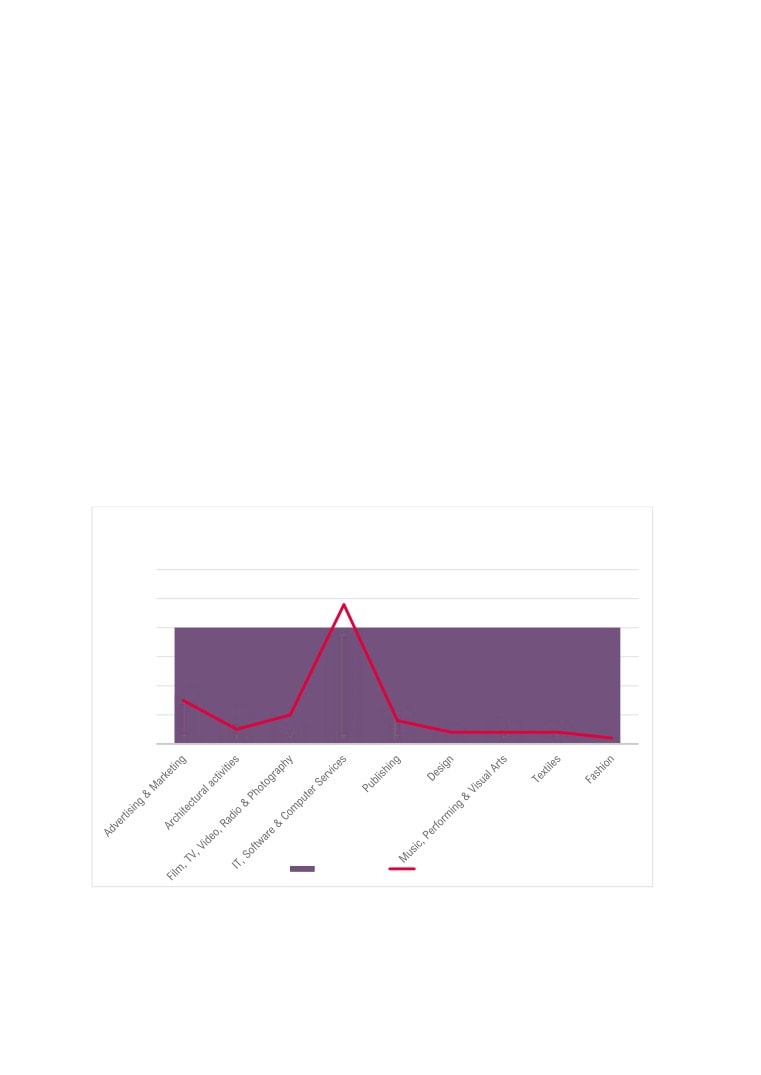

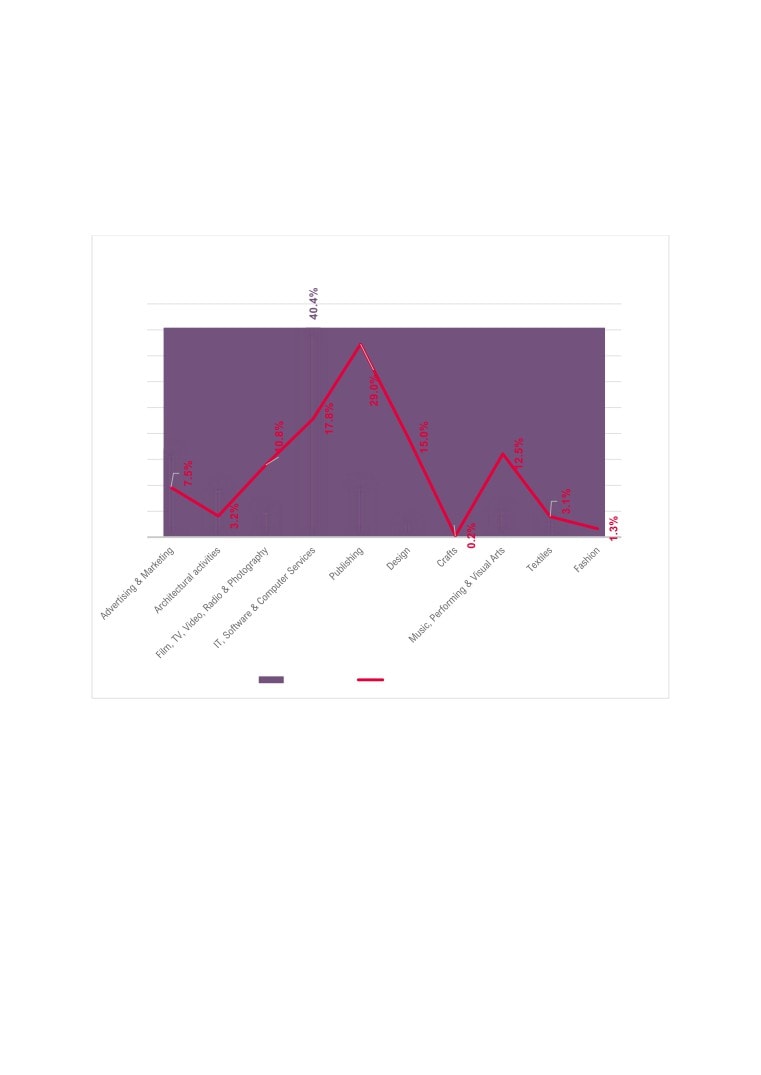

The distribution of creative industry activity by sub-sector (Figure 9) across the UK is reflected in New

Anglia, demonstrating a mature sector with broad potential.

New Anglia has a higher percentage of jobs in architecture, publishing, advertising & design, music &

the performing arts and textiles, than nationally, and a slightly lower number of jobs in the film, TV &

radio arena.

In line with the national picture, New Anglia’s largest sub-sector is IT and software, including

computer games, other software, computer programming and consultancy11. The region is at the

forefront of digital innovation with strengths in cyber security, quantum technology, Internet of Things,

UX design and fintech.

The stature of Norwich as a top-ranking creative cluster in the UK-wide leader-board and the

recognised tech prowess of the city, together with Ipswich, reflects its strengths across:

• Digital Advertising & Marketing

• E-commerce & Marketplace

• App & Software Development

• Digital media and entertainment

Ipswich has strengths also in game design, software development and VR/AR. Across the rest of New

Anglia there are a number of nationally influential sector employers.

SUB-SECTOR SIZE BY EMPLOYEE NUMBERS:

ENGLAND AND NEW ANGLIA

60%

50%

40%

30%

20%

10%

0%

New Anglia

England

Figure 9

During the employer consultation process, there proved to be quite an imbalance in the level of

engagement across the sub-sectors, which reflects the relative strengths of industry groupings and

Page 13

Final Version for LEP Officers : Confidential. 14 Feb 2019

routes to consultation within the sub-sectors. Hence, there was high engagement from the film and

gaming elements but relatively low levels of engagement from areas such as fashion and textiles.

A more detailed profile of the sub-sectors, the skills issues faced by them, and where future potential

lies, is covered in the later section: The make-up of the New Anglia Creative Industries.

The economic challenge for New Anglia

While the creative industries represent a growing, resilient sector with local assets and huge potential,

the sector is fragmented and viewed as having a relatively low profile by many consultees. As shown

in the labour market analysis from Burning Glass (see the table below) despite local sector resilience

and growth, the demand for sector jobs has been lower across New Anglia than in comparator

regions, which suggests there are opportunities to create jobs locally, which could help to retain

home-grown talent.

BURNING GLASS : LABOUR MARKET ANALYSIS

JOB

TOTAL JOB

POSTINGS

RANK

WORK AREA

LOCATION QUOTIENT

POSTINGS

PER 1K

EMPLOYED

1

London

330,619

77

Much higher demand than average

2

Cambridge

19,536

53

Higher demand than average

3

Bristol

20,207

47

Higher demand than average

6

Birmingham

31,676

43

Average demand

13

Manchester

41,266

34

Average demand

14

Brighton

5,642

32

Average demand

41

Ipswich

2,987

18

Much lower demand than average

49

Newcastle

7,896

16

Much lower demand than average

51

Norwich

3,579

16

Much lower demand than average

66

Bury St Edmunds

956

14

Much lower demand than average

130

King's Lynn

360

6

Much lower demand than average

133

Lowestoft

269

5

Much lower demand than average

135

Great Yarmouth

224

5

Much lower demand than average

163

Thetford & Mildenhall

208

3

Much lower demand than average

214

Cromer & Sheringham

21

1

Much lower demand than average

A recognition of the importance of small creative business to the economy, and the opportunity to

provide sector-based support for business start-up, sustainability and scale-up is vital. Traditionally,

the focus has been upon Norwich and Ipswich, where employment and clustering predominate,

(Figure 5) but creative industry businesses are relatively evenly located across the towns and rural

areas of New Anglia. This demands a response that encompasses the bigger geographical picture,

but reaching these smaller, often rural businesses can pose a challenge.

Page 14

Final Version for LEP Officers : Confidential. 14 Feb 2019

‘A sector that is misunderstood with low visibility and profile locally’1

The region features outstanding facilities such as BentWaters Parks, the UK's largest film and TV

production site set on 2500 acres; but technical skills in sectors such as film still need to be imported.

Other skills shortages in the sector mean that local projects are often outsourced from London.

‘We need more freelance stage management,

MADE IN NEW

lighting and sound technicians available’

ANGLIA

The dynamics of the sector tend to feature project and short-term

working, which can preclude traditional skills development solutions

requiring longer term commitment, such as apprenticeships.

VFX artist Stuart Craig, OBE : Oscar

winner for his work on the Harry

‘We need a creative industries pipeline’

Potter series

Sculptor Anthony Gormley : based in

There is a need for better connectivity, not just within the sector, but

Suffolk

also across the wider economy and there is a real opportunity to

foster a collaborative culture across New Anglia. Critical to this is

Phil Carter : prominent graphic

increased convergence within and beyond the sector demanding

designer and owner of Carter Studio

enterprising sub-sector groups.

Keith Chapman : founder of

Chapman Entertainment and creator

‘We need more collaborative working across both

of Bob the Builder

industries and education, as well as long term local

Graphic Artist Brian Bolland : creator

support’

of Judge Dredd

If New Anglia’s creative industries are to realise their tremendous

Suffolk-based film producer Adam

potential, the various sub-sectors of the creative industries have the

Tandy : creator of The Detectorists

opportunity to work together collaboratively, sharing common themes

Ember Films : contributors of film

and good practice to resolve any barriers to growth and to make a

content for Planet Earth II

greater contribution across the breadth of the New Anglia economy.

Sophia George : Games BAFTA

Winner and first Games Designer in

Realising potential

Residence at the V&A

The economic picture outlined above demonstrates the tremendous

Major games festivals : Norwich

potential of this sector. To achieve our ambition for a high performing

Gaming Festival and Game Anglia in

Ipswich

and dynamic New Anglia Creative Industries sector, where

innovative businesses and skilled individuals can thrive, demands a

strategic approach focused on identified skills needs and targeted

action and intervention.

‘It’s frustrating as both Norfolk and Suffolk have great potential’

Our response to the evidence base collected through this project is outlined in the next section,

covering our planned approach to sector skills leadership through local career progression pathways,

collective skills leadership, and smooth transitions to work.

‘We need a more joined up approach to enhancing opportunity sharing and

collective understanding of who offers what’

1 Comments included in this document as styled here are taken from feedback given during the New Anglia employer sample consultation

Page 15

Final Version for LEP Officers : Confidential. 14 Feb 2019

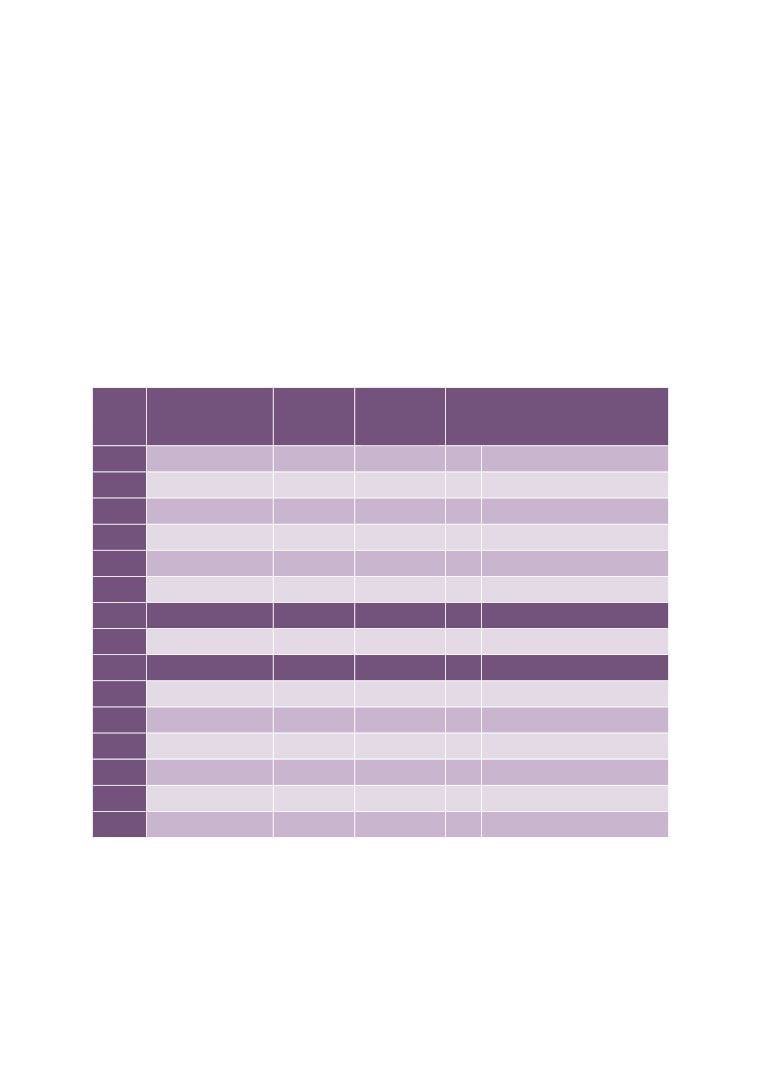

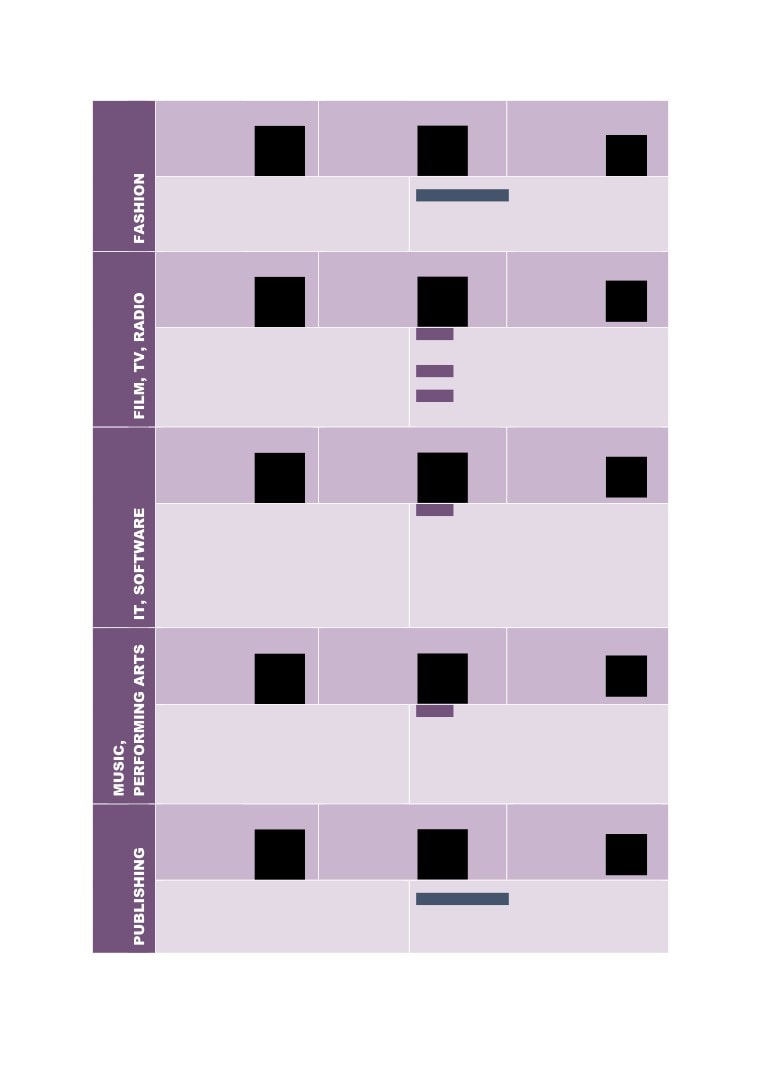

The make-up of the New Anglia Creative Industries

Reported employment and skills

Local Priorities relating to the

challenge

Sector Skills Plan

GVA

Jobs

Self Employed

£128m

2,875

439

In March 2018, Marketing Week revealed the results of a

Stakeholders raised:

survey of 8,405 UK students aged 18-24 with 51% saying

Intervention 1 - representing and championing the sector

marketing was ‘never’ or ‘hardly ever’ mentioned at their

to potential new entrants

school with just 3% believing marketing offers a real

Intervention 2 - Identifying new apprenticeship pathways

career opportunity.”12

GVA

Jobs

Self Employed

£53m

1,750

186

“International architects make up 1 in 4 of the UK

Stakeholders raised:

architecture workforce, and without them the £4.8 billion

Priority 1 - Attracting great talent to study and work in New

contribution the sector makes to the economy would be in

Anglia

jeopardy… It is not simply about numbers though - our

Priority 2 - Strengthening partnerships between local

sector thrives on diversity, benefitting from different ways

education and business

of working, backgrounds and experience.” RIBA Chief

Intervention 2 - identifying new apprenticeship pathways

Executive Alan Vallance 13

GVA

Jobs

Self Employed

£2m

25*

13*

Growth predicted in artisanal employment, such as

Stakeholders raised:

barbering, brewing, textiles and ceramics (including some

Leadership Foundation The need to engage this sector

crafts occupations) incorporating elements of craft-based

locally to support CI-wide sector and skills leadership

technical skill which are higher-end, and more expensive,

*These figures relate to reported employment data and it is

than in the past.14

acknowledged that the sector has substantially more people

involved - often on an informal, second job basis

GVA

Jobs

Self Employed

£57m

600

880

Design Council has put the design skills shortage partly

Stakeholders raised:

down to the Government’s focus on STEM (science,

Priority 2 - Support for new entrants regarding employer

technology, engineering and maths), and the resulting

expectations of technical and creative business skills

drop in students taking up design, technology and art

Intervention 3 - Pilot of a CI business/work experience hub

subjects throughout education, from GCSE through to A-

Level and university.

Design Council has put forward recommendations to

reduce the skills gap, which include shifting the focus

from STEM to STEAMD (science, technology, engineering,

arts, maths and design).15

Page 16

Final Version for LEP Officers : Confidential. 14 Feb 2019

GVA

Jobs

Self Employed

£19m

125*

74*

“As the apparel industry begins to recognise and

Stakeholders raised:

implement digitalisation as a way of delivering on speed,

Leadership Foundation The need to engage this sector

customisation and transparency, it is revealing gaps in the

locally to support CI-wide sector and skills leadership

specialized skills set of its workforce,”Janice Wang, CEO of

*These figures relate to reported data and it is

Alvanon16

acknowledged that the sector probably has significantly

more people involved

GVA

Jobs

Self Employed

£123m

1,030

636

UK VFX film industry is almost entirely in London (98%).17

Priority 1 - A more diverse sector workforce in New Anglia /

It employs more than 10,000 people and is the fastest

a clear sector route map / boosting work experience

growing part of the UK film industry, predicted to grow

opportunities

14% by 2022.18 30% of visual effects designers from EU.19

Priority 2 - Support for new entrants regarding employer

expectations of technical and creative business skills

Priority 3 - More small/micro businesses growing and

benefitting from skills investment and job growth

GVA

Jobs

Self Employed

£337m

6,825

1,043

Across the UK, employer demand is outstripping supply of

Priority 2 - Support for new entrants regarding employer

digital tech skills.20 UK needs 134,000 new tech specialists

expectations of technical and creative business skills

every year21 In the New Anglia the Digital Tech skills plan

identified, a recruitment gap of 7,000 by 2024.22

Intervention 2 - Identifying new apprenticeship pathways

The pace of change challenges teachers and lecturers who

Intervention 3 - Pilot of a CI sector work experience hub

may be unaware of how digital skills are being applied in

Intervention 4 - Developing a Graduate Academy

the workplace.”23

Intervention 5 - Appraising the feasibility of a local Creative

CPD Hub

The digital workforce lacks diversity, particularly in relation

to gender.24

GVA

Jobs

Self Employed

£43m

1,000

734

A lack of diversity, with those studying theatre, more likely

Priority 1 - A more diverse sector workforce in New Anglia

to be white and educated privately.25

A focus in education on ‘performance roles’ rather than

Intervention 1 - representing and championing the sector

the business side of the industry.26

to potential new entrants

Stakeholders raised a local shortage of sound production

This area is directly led through the Cultural Sector Skills

specialists

Plan by the New Anglia Culture Board

GVA

Jobs

Self Employed

£174m

1,815

1,701

In publishing, 9.5% of the workforce in 2015 was from

Stakeholders raised:

Europe, while 4% was made up on non-European talent.27

Leadership Foundation The need to engage this sector

locally to support CI-wide sector and skills leadership

Page 17

Final Version for LEP Officers : Confidential. 14 Feb 2019

GVA

Jobs

Self Employed

£48m

835

181

The textile industry is worth around £9bn to the UK

Stakeholders raised:

economy, and generating year-on-year growth. According

Leadership Foundation The need to engage this sector

to government predictions, the sector could generate

locally to support CI-wide sector and skills leadership

somewhere in the region of 15,000 new jobs by 2020,

largely being driven by sourcing fabrics and apparel from

the UK becoming ever more attractive, in terms of quality

and competitive costs. However, the growth is at risk of

being undermined by a significant skill shortage; an issue

which urgently needs to be addressed if the nation is to

repatriate and capitalise on future demands28

GVA

Jobs

Self Employed

5,875

£984m

16,880

All figures relate to New Anglia. GVA, 2015; Jobs and Self Employed, 2018

Page 18

Final Version for LEP Officers : Confidential. 14 Feb 2019

Creative talent demand and supply

The skills perspective for the sector

The economic picture shows that creative industries are the fastest growing part of the UK economy

and are recognised as having huge potential. Despite this, learning in creative subjects has fallen

over recent years and employers say that candidates are lacking core skills. Education and skills

support needs to be more closely aligned with today’s employment models and the workforce of the

future, both nationally and regionally.

This section reviews the existing New Anglia talent pipeline and how that supply meets the needs of

sector employers, to identify the strategic structural skills issues that need to be addressed to support

future development and achieve ambitions for the sector.

This draws on the national and local evidence base and the employer consultation and stakeholder

interviews conducted during the development of this skills plan.

Developing a skills strategy for success

Skills provision

Educational assets in New Anglia are highly valued, and the area has strong and specialist university

provision, such as the renowned creative provision at UEA, Norwich University of the Arts and the

University of Suffolk. Employers also recognised the educational strengths of Further Education

provision and emerging opportunities such as the potential for a local Institute of Technology and the

forthcoming T Level pilots such as the sector pilot led by Suffolk New College.

‘A real strength in nationally and globally recognised

educational provision’

However, employers believe there are misconceptions about the sector and its unique characteristics,

career dynamics and the opportunities offered. They point to a gap across careers education, parents

and teachers, in articulating the unique career offer of the creative industries.

‘It’s very difficult for young people to picture the jobs’

Alongside, concerns were expressed among employers over the decline of creative subjects being

taught in school, and that sector skills - creative and computer science - were insufficiently covered

in education generally.

‘The decline in creative subjects in school is a real problem’

Concern was expressed also over the shortage of industry-experienced, technically qualified teachers

in schools and FE, suggesting an opportunity for education-business collaboration to ensure up-to-

the-minute industry awareness amongst teachers.

‘We need a better understanding about creative career

pathways within education

Page 19

Final Version for LEP Officers : Confidential. 14 Feb 2019

T Levels were broadly welcomed, although there were collective concerns about how to ensure that

the demanding work experience requirements could be met locally in a sector primarily composed of

very small businesses.

Frustration was expressed over the slow pace of apprenticeship

reform and the availability of new standards. Apprenticeships are

not currently a significant part of the talent pipeline which tends to

THE SKILLS GAP

be based on graduate entry. As outlined below, low demand from

employers also makes the viability of developing and sustaining

new local provision a real challenge for local learning providers

68%

‘Career entry is a bit like the wild west - who you

know - this excludes great talent’

of New Anglia employers in

our sample reported a

Gaps in provision identified in employer feedback included

significant gap between the

management and operational skills for small businesses,

skills base of their current

improved collaborations and peer working between industry and

workforce and their business

higher education. There was also support for innovation start-up

needs

hubs for the sector, particularly for games and film developers.

Skills Base

Feedback from employers in New Anglia identified skills shortages and a lack of diversity in the

workforce, with the new entrants’ pool often viewed as not being job-ready and lacking in technical or

creative business skillsets. Employers also highlight the importance of fusion skills incorporating both

creative and data science knowledge.

Skills shortages are especially reported at Level 4 and above for specific job roles such as VX,

animator, programmer and post-production, with such shortages reportedly exacerbated by the Brexit

process.

‘An acknowledged shortage of craft skills - such as

editors and sound specialists’

The fast pace of technological change makes it vital that the existing workforce is kept up to date and

upskilled, but there is a gap in structured CPD locally. There is also a need to provide specialist

sector support for creative industry start-ups and to support high potential micro-businesses in scaling

up.

There is a reported lack of fit between national skills funding models and a sector characterised by

flexible, project-based employment and resourcing through freelancers. As shown here (Figure 10),

29% of New Anglia’s creative industry is self-employed, compared with just 14% of the whole

workforce, which has implications for long term learning and connectivity with others in the sector.

LEVELS OF SELF EMPLOYMENT NEW ANGLIA :

OVERALL AND CREATIVE INDUSTRIES

NEW ANGLIA

57%

29%

14%

CREATIVE INDUSTRIES

55%

16%

29%

Full time

Part time

Self Employed

Figure 10

Page 20

Final Version for LEP Officers : Confidential. 14 Feb 2019

‘Freelancers need to be able to network with like-minded businesses and

access short courses in areas such as IP, contracts, and prIcing’

As shown, the distribution of self-employment across the sub-sectors (Figure 11) is concentrated in

broadcast and video, publishing and design, while architecture, IT, advertising & marketing have

relatively low levels of self-employment.

OVERALL EMPLOYED AND SELF EMPLOYED

BY SUB SECTOR IN NEW ANGLIA

45.0%

35.0%

40.0%

30.0%

35.0%

25.0%

30.0%

20.0%

25.0%

20.0%

15.0%

15.0%

10.0%

10.0%

5.0%

5.0%

0.0%

0.0%

New Anglia

New Anglia self employed

Figure 11

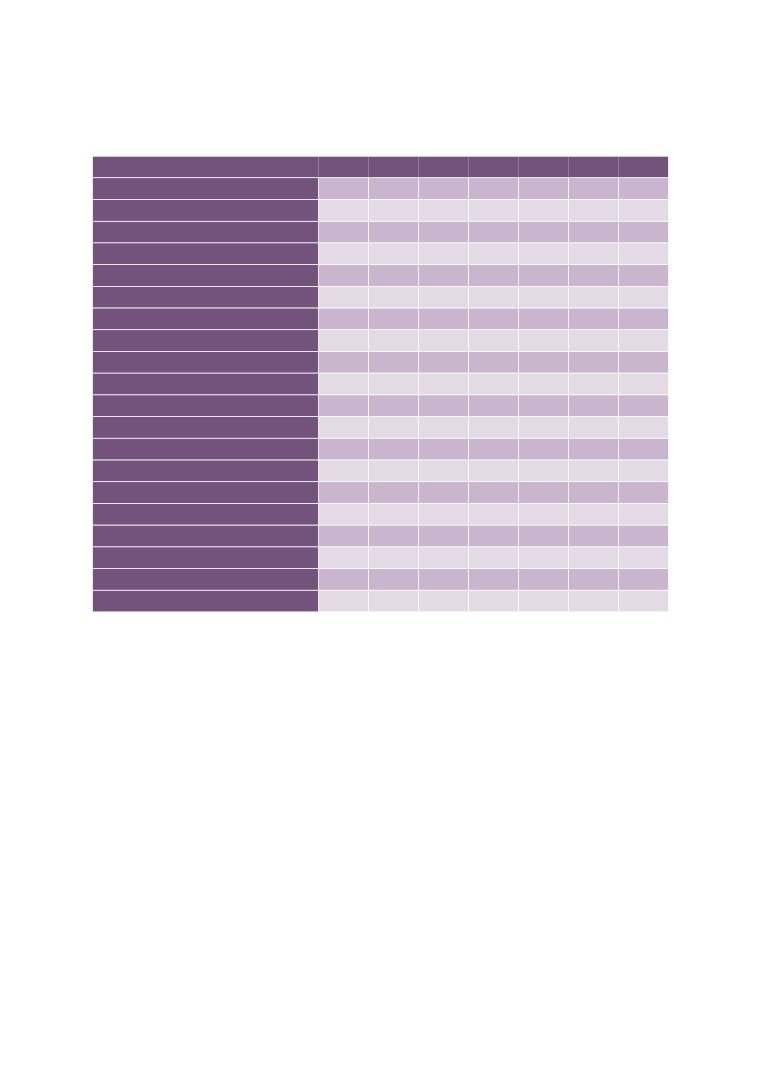

Apprentices

The sector’s focus on graduate entry workers is reflected in very low take-up of apprenticeships and

many sub-sectors are virtually unrepresented, as demonstrated in the following table. This confirms

that apprentices are not a major feature in the creative industries talent pipeline and indeed only 55%

of employers sampled ranked apprenticeships as important to the sector. Other factors were raised

by stakeholders as barriers to apprenticeship development, including the very slow progress with the

introduction of new sector-specific standards; the challenges of achieving viable cohorts in sparsely

populated rural areas; and the predominance of very small businesses that are historically less likely

to hire an apprentice. There may be the potential as degree and post-degree apprenticeships become

more available for small business leaders / senior managers to upskill, either in leadership or higher

professional skills, with an employer contribution post April 2019 of only 5% of total costs.

Page 21

Final Version for LEP Officers : Confidential. 14 Feb 2019

NUMBERS OF APPRENTICESHIPS IN NEW ANGLIA 2011 - 2018

APPRENTICESHIP FRAMEWORK

2011/12

2012/13

2013/14

2014/15

2015/16

2016/17

2017/18

Broadcasting Technology

Community Arts

5

5

5

Creative and Digital Media

10

5

5

10

Cultural and Heritage Venue Operation

Design

5

5

Digital Learning Design

Fashion and Textiles

Furniture, Furnishing and Interiors Manuf.

10

10

Glass Industry

30

60

30

IT Application Specialist

165

120

60

65

70

30

20

IT, Software, Web & Telecoms Professional

100

120

120

170

180

130

170

Jewellery, Silversmithing and Allied Trades

Journalism

5

5

Live Events and Promotion

5

5

Marketing

15

25

25

15

20

20

10

Photo Imaging

Public Relations

Social Media and Digital Marketing

5

35

50

40

20

Technical Theatre, Lighting, Sound & Stage

TOTAL

290

285

225

305

370

290

250

Diversity

Replicating the national trends, the local workforce is characterised by a lack of diversity and is

primarily comprised of non-white, male candidates from middle-class backgrounds.

‘A key challenge in Norfolk / Suffolk is the diversity mix - it tends to be

very white and middle class with few people from a lower socio-economic

background’

However, Further Education provides an opportunity to encourage a more diverse sector entry in

future, with increasing demand reported for those FE courses that provide a route into the sector in

areas such as Gaming and Media.

‘The key problem is the transition into work - from quite generalist studies

into jobs which require more specialist skills’

Page 22

Final Version for LEP Officers : Confidential. 14 Feb 2019

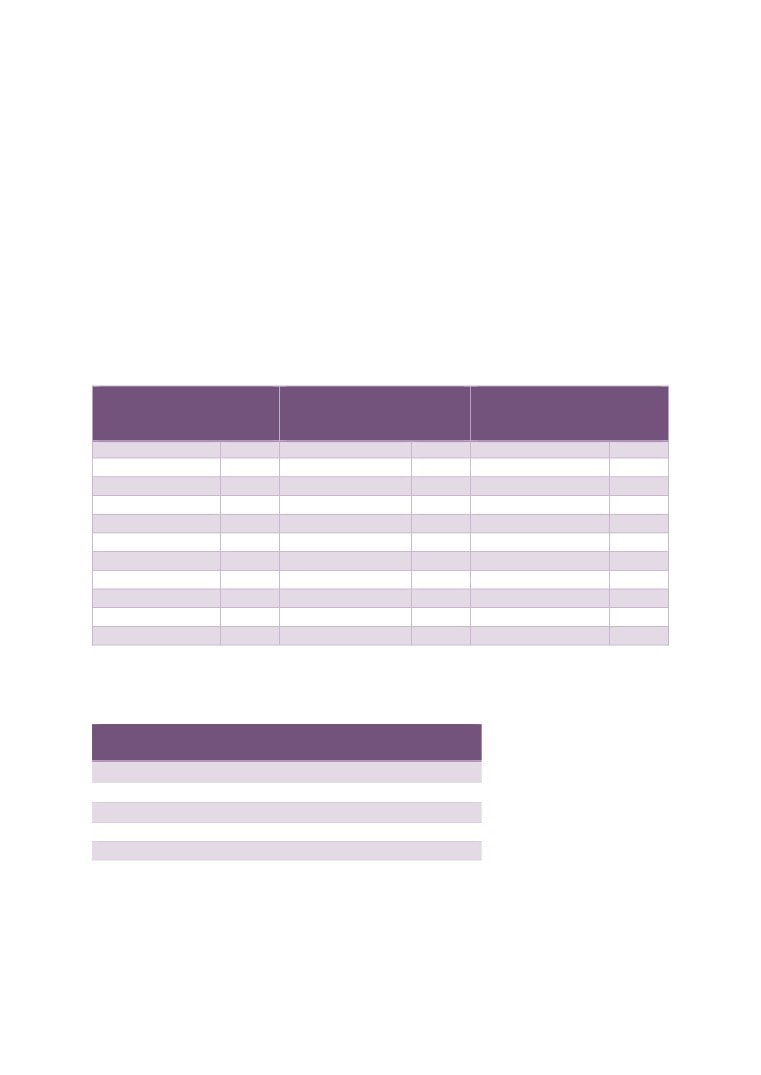

Business skills

Data collected on New Anglia skills demand through the Burning Glass analytics software showed

that employers valued more generic creative business skills, showing that attention to detail, project

management or communication skills were equally important as technical sector-specific creative

skills, as shown in the following tables.

‘Teach young people to think - too much of the curriculum

lacks an emphasis on critical thinking’

Feedback from employers suggests that the current system may not tackle such needs sufficiently,

with those surveyed recording business skills as the most prevalent skills gap, at 26%.

SPECIALISED AND BUSINESS SKILLS SOUGHT BY EMPLOYERS

Top ten specialised skills identified by Burning Glass in job postings for three

example creative industry sub-sectors

ARCHITECTURAL

PRODUCT, GRAPHIC &

IT, SOFTWARE AND

OCCUPATIONS

FASHION DESIGN

COMPUTER SERVICES

OCCUPATIONS

OCCUPATIONS

Skills

Postings

Skills

Postings

Skills

Postings

AutoCAD

891

Graphic Design

720

SQL

11,762

Revit

445

Adobe Photoshop

631

Microsoft C#

11,070

Project Management

290

Adobe Indesign

501

JavaScript

11,005

Landscape Architecture

251

Adobe Acrobat

341

.NET

9,947

SketchUp

239

Adobe Illustrator

328

Software Development

8,912

Adobe Photoshop

189

Adobe Creative Suite

326

Web Development

7,785

Budgeting

168

Web Site Design

206

Active Server Pages (ASP)

6,693

Scheduling

165

Digital Design

197

ASP.NET

6,120

Project Architecture

161

Teamwork/Collaboration

187

SQL Server

5,976

Adobe Indesign

126

Sales

186

jQuery

5,724

Top five creative business skills identified by Burning Glass across all creative

industry sub-sectors

TOP FIVE CREATIVE BUSINESS SKILLS

Communication Skills

Creativity

Detail-Orientated

Organisational Skills

Planning

Page 23

Final Version for LEP Officers : Confidential. 14 Feb 2019

Talent development

Development

The majority of those working in the sector are educated to degree level, reflected in the minimum

education standard (Figure 12) stipulated in job advertisements, and those surveyed said that

undergraduate internees and recent graduate employees (Figure 13) were most important to sector

development.

However, employers indicate that not all roles require a degree, suggesting some people are over-

skilled for the jobs they are doing. This offers scope to increase entry at different skills levels which

could achieve greater diversity in the workforce together with local social mobility. Such opportunities

could be supported by focused careers education, to open-up ambition and expectations.

MINIMUM ADVERTISED EDUCATION FOR

CREATIVE INDUSTRY OCCUPATIONS 2012-18

GCSES, STANDARD GRADES, LEVEL 2 S/NVQS

16%

A-LEVELS, HIGHERS, LEVEL 3 S/NVQS

10%

HNCS, LEVEL 4 CERTIFICATES/DIPLOMAS,

5%

LEVEL 4 S/NVQS

FOUNDATION DEGREES, HNDS

2%

BACHELOR'S DEGREE, GRADUATE

CERTIFICATES/DIPLOMAS

64%

POSTGRADUATE DEGREES, LEVEL 5

2%

CERTIFICATES/DIPLOMAS, LEVEL 5 S/NVQS

0%

10%

20%

30%

40%

50%

60%

70%

Figure 12

Page 24

Final Version for LEP Officers : Confidential. 14 Feb 2019

NEW ANGLIA SKILLS SURVEY : HOW

IMPORTANT ARE THESE FACTORS TO

FUTURE GROWTH?

1 - Not important at all

2

3

4

5 - Very important

APPRENTICESHIPS

29%

26%

UNDER/GRADUATE PLACEMENTS AND

42%

42%

INTERNSHIPS

NEW AND RECENT GRADUATE EMPLOYEES

35%

45%

TRAINING FOR EXISTING WORKFORCE

32%

42%

LEADERSHIP/MANAGEMENT DEVELOPMENT

42%

26%

FORMAL QUALIFICATIONS

10% 3%

Figure 13

Retention

Concerns about the loss of potential high calibre new

entrants to London are prevalent.

THE SKILLS DRAIN

Many local graduates are not staying (Figure 14) and

there are felt to be insufficient local jobs or anchor

employers in some parts of the sector, for example

gaming. Additionally, employers emphasised the

80%

importance of creative internships and some

challenges about matching demand with supply.

of New Anglia employers in our

sample reported new and recent

‘We’re currently educating and training

graduate employees as important to

for other areas - especially London and

future growth, but there are concerns

that high calibre entrants are being

the South East’

lost to London

With talent leaving the area (Figure 15) to take up jobs

elsewhere, particularly in London, there is an

opportunity for the local area to derive greater benefit

from the learning within the region if such talent can be retained.

Page 25

Final Version for LEP Officers : Confidential. 14 Feb 2019

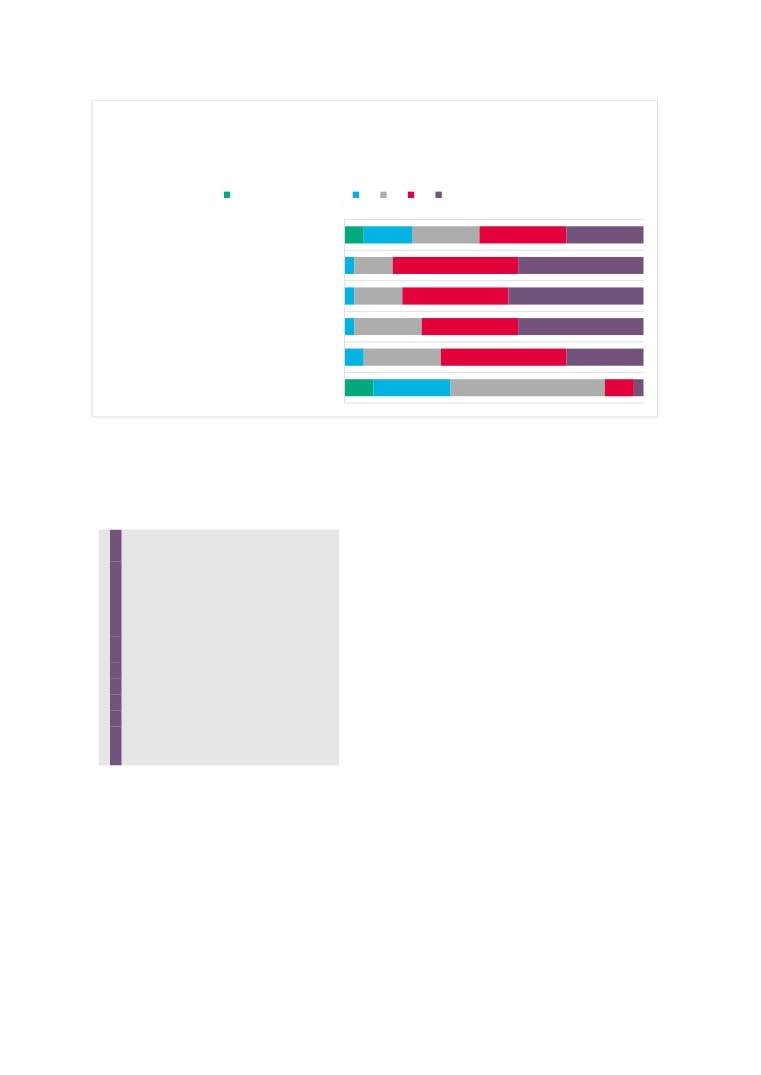

Figure 14

Figure 15

Page 26

Final Version for LEP Officers : Confidential. 14 Feb 2019

Summing up the strategic skills challenge for New Anglia:

Talent loss to

London

Need to create

Poorly

new pathways

established

as well as

Apprenticeship

graduate entry

routeways

SKILLS

CHALLENGES

Insufficient

Technical skills

IN NEW

local

shortages and

employment

gaps

ANGLIA'S

opportunities

CREATIVE

INDUSTRIES

Decline in take-

Too few

up of creative

placements for

subjects

internships

Support for

sector

innovation and

start up

Page 27

Final Version for LEP Officers : Confidential. 14 Feb 2019

The Skills Plan

Three priorities founded on collective leadership

Our ambition is for a dynamic New Anglia Creative Industries sector that is high performing, inclusive and

contributing across the New Anglia economy and beyond.

Our vision is an environment where creative businesses can thrive and innovate and where local people

can make the most of their talents to build careers and explore entrepreneurial ambitions.

Our focus is to realise the tremendous growth potential of this sector through inspiring our future talent

and ensuring smooth transitions to work, supporting local career progression.

Through collective skills leadership, our initial focus will be on:

• Improving local career pathways

• Smoothing out transitions to work

• The lifelong learning of our cutting-edge local businesses and employees

Realising the full potential of people and business in New Anglia

Priority 1

Priority 2

Priority 3

Smoothing out the

Supporting the upskilling

Improving local career

transitions between

of cutting-edge local

pathways

education and local work

businesses and

opportunities

employees

A more diverse sector workforce in

A more diverse sector workforce in

More small / micro businesses

New Anglia

New Anglia

growing and benefiting from skills

A clear sector route map

Communications and support for

investment

demonstrating a greater diversity of

new entrants regarding employer

Local CPD becoming a strength of

routes into the sector

expectations of technical and creative

the region

Identifying stronger apprenticeship

business skills for new entrants

Creative local alternatives to national

pathways

Strengthening partnerships

funding ‘fill the gap’ for small

Boosting work experience

between local educators and local

businesses

opportunities - particularly with small

business

/ rurally-located businesses

Retaining creative talent in New

Attracting great talent to study and

Anglia

work in New Anglia

Intervention 1

Intervention 2

Intervention 3

Intervention 4

Intervention 5

Representing and

Appraising the

Identifying new

Pilot of a CI Sector

championing the

Developing a CI

feasibility of a New

apprenticeship

business/work

sector to potential

Graduate Academy

Anglia Creative CPD

pathways

experience hub

new entrants

Hub

INTERVENTION TIMELINE Development Phase : June 2019 to May 2020

Built upon a sector-wide collective skills leadership foundation

A new and influential collective skills voice for New Anglia Creative Industries, complementing existing

interest groups and building new conduits to ensure a representative voice from across the sector

SKILLS VOICE TIMELINE Foundation Phase : May 2019

Page 28

Final Version for LEP Officers : Confidential. 14 Feb 2019

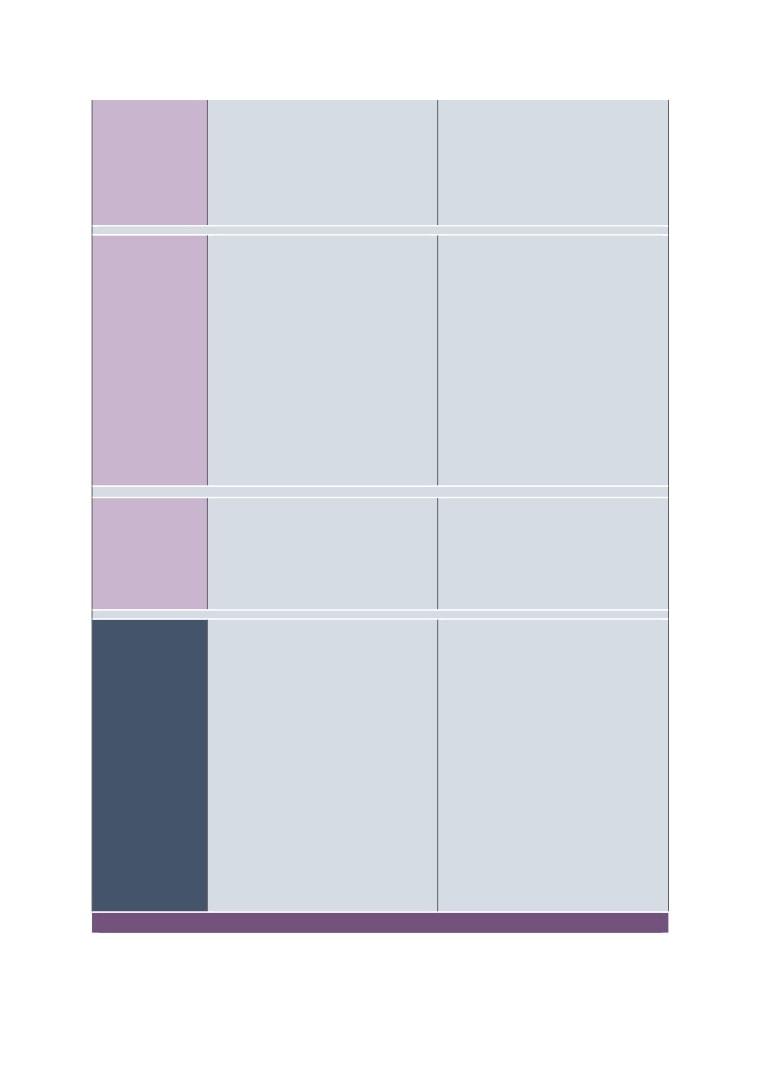

Priorities - drivers and outcomes

Priority 1

Priority 2

Priority 3

Smoothing out the

Supporting the upskilling

Improving local career

transitions between

of cutting-edge local

pathways

education and local work

businesses and

opportunities

employees

Key Drivers

Concerns that the sector

Employer concerns about specific

The sector is especially reliant on

characteristics, skillsets and job-

technical skills gaps in potential new

micro-businesses and freelancers

availability are not understood by

entrants

The economy needs more micro-

potential entrants, teachers, parents

Employer concerns about the

businesses to ‘scale up’ and/or form

and advisors

broader ‘Creative Business’ skills

competitive local collaborations

A desire to develop the diversity of

required in new entrants

creating local jobs or enhancing

new sector entrants particularly those

Challenges arranging work

productivity

with lower initial attainment levels,

experience and internships with the

Fast emerging technological

thereby tackling the national

micro business (and freelance)

developments require upskilling within

challenge of entry dominated by

community that is key important to

the existing workforce and small

white, middle-class male graduates

this sector in New Anglia

business community

Apprenticeships are currently an

Concerns about the ‘creative bleed’

National skills funding models such

insignificant contributor to the local

of local learners to London and the

as Apprenticeships, EU funded

talent pipeline

South East

approaches do not always adapt to the

Opportunities relating to impending

needs of the smallest businesses

‘T’ Levels, although concerns about

The opportunity to integrate

the meeting the greatly increased

business collaboration and skills

demand for work experience

development - as a way of supporting

cross-area business inclusion

Outcomes

A more diverse sector workforce in

A more diverse sector workforce in

Significantly more small / micro

New Anglia

New Anglia

businesses growing, collaborating and

A clear sector route map

Communications and skills support

benefiting from skills investment

demonstrating a greater diversity of

for new entrants regarding technical

Local CPD becoming a strength of

routes into the sector

and Creative Business skills

the region

An increase in Apprenticeship

expectations

Creative local alternatives to national

opportunities - especially at entry

Enhanced creative use of

funding models ‘fill the gap’ for small

levels

technologies such as VR/AR/ER to

businesses

Significant increase in work

prepare people for work

experience opportunities -

particularly with small and / or rurally-

located businesses

Sector-wide collective skills leadership

Key Drivers

Outcomes

The lack of a clear CI-sector wide ‘sector voice’ for skills

Sector wide collective skills leadership - A new influential

and economic development

collective skills voice for New Anglia Creative Industries

The lack of a sector skills oversight for the whole region

that complements the strong existing sub sector groups

The opportunity to include key elements of the sector

such as those active around Film and Digital

not actively engaged l

The longer-term opportunity to evolve a broad sector

development strategy that would be underpinned by skills

development and investment

The opportunity to connect better across the sector and

raise its current low profile across the local economy and

beyond

Page 29

Final Version for LEP Officers : Confidential. 14 Feb 2019

Interventions - actions and success indicators

Intervention 1

Intervention 2

Intervention 3

Intervention 4

Intervention 5

Representing and

Appraising the

Identifying new

Pilot of a CI Sector

championing the

Developing a CI

feasibility of a New

apprenticeship

business/work

sector to potential

Graduate Academy

Anglia Creative CPD

pathways

experience hub

new entrants

Hub

Built upon a sector-wide collective skills leadership foundation

A new and influential collective skills voice for New Anglia Creative Industries, complementing existing

interest groups and building new conduits to ensure a representative voice from across the sector

Intervention

Action

Success indicator

1. Position the New Anglia Creative Industries

Supporting local business growth through a

sector in relation to the range of Careers/IAG

strengthened local creative talent pipeline with

support available and set priorities for change /

route maps for local people who understand,

improvement - particularly in relation to

and are inspired by, the CI sector

clearer sector ‘route-map’ for those

considering a CI career

2. Clarify and articulate what the sector means

1

by employability and the creative business and

Representing and

technical skills required by the sector

championing the

3. Evaluate the benefits of an annual high

sector to potential

profile Creative Industries Careers Day,

new entrants

showcasing the sector and local opportunities

4. Ensure that representative, inspiring

information is available for Careers Advisors,

Providers, Parents and Learners to help them

appreciate the unique characteristics,

challenges and opportunities on offer within

the sector locally and nationally

1. Identify a small number of Apprenticeship

A clarified local CI Apprenticeship offer with

standards best-suited to promote local job

targeted development, through partnership, in

entry below degree level - architecture and

a number of occupational areas

marketing were suggested

2

2. Identify provider partnerships that are in a

position to increase sector apprenticeship

participation

Identifying new

3. Identify how local providers can collaborate

apprenticeship

to deliver a robust, sustainable, local

pathways

apprenticeship offer

4. Support businesses and local providers to

promote local job entry at all levels through

apprenticeships, including upskilling for the

existing workforce

1. Investigate the feasibility of a Sector

Increased, high quality CI work experience

Creative Skills Hub, perhaps initially located in

opportunities available for local young people

3

an FE College, supporting young people to gain

through engaging with small, often rural-

high quality business-led work experience in

based, businesses and also utilising innovative

Pilot of a CI Sector

partnership with local CI businesses.

virtual reality (VR) technologies

business/work

2. Consider the fit and feasibility of funding

experience hub

models and policy initiatives in respect of:

•Further Education

Page 30

Final Version for LEP Officers : Confidential. 14 Feb 2019

•Traineeships and Apprenticeships (ATAs)

•Forthcoming T-Levels

•Business innovation and incubation

(including virtual)

3. Consider how the creative application of

technologies, including VR/AR/ER could

support the quality of work experience and the

engagement (particularly) of rural small

enterprises

The development of a sector Graduate

An added value regional resource to support

Academy to support recent graduates gain

new and recent graduates make a smooth

professional career opportunities in the New

transition to local jobs and local businesses

Anglia area - both in the sector and also

can source the creative talent required for

across the wider New Anglia economy. This

business growth

programme could include:

• Targeting sector and non-sector

4

employers with the potential to recruit local CI

talent

Developing a CI

• Providing immersive learning and work

Graduate Academy

experiences in sector and non-sector work-

contexts through innovative use of Virtual

Reality

• Offering a sector-based Internship

scheme

• Support Creative business skillset

development alongside technical skills learned

in the workplace

1. Investigate the feasibility and financial

Accessible professional, technical, leadership

5

sustainability of a CI professional and

and enterprise development making a real

enterprise development facility for New Anglia

difference to the growth and productivity of the

2. Confirm the local business appetite to get

sector and having an impact across the whole

Appraising the

involved, including preparedness to contribute

economy by including CI professionals working

feasibility of a New

through purchase of training places, as

in other sectors

Anglia Creative CPD

trainers, educators and participants

Hub

1. Review, consult and agree an updated

Sector wide collective skills leadership - A new

Terms of Reference for the New Anglia

influential collective skills voice for New Anglia

Creative Industries Group

Creative Industries that complements and adds

2. Review the constituency of the current

value to the existing important groups

group to ensure representation from across

both counties, including rural areas and

conurbations, and using technology to

maximise participation and minimise

unnecessary travel

Sector-wide

• Review the constituency of the current

collective skills

group to ensure representation from each key

leadership

element of the sector. This includes:

o Architecture

o Fashion

o Advertising and marketing

3. Ensure working partnerships with parts of

the CI sector which already have skills

leadership arrangements in place

4. Consider the opportunity to contribute to a

broader local CI sector development strategy

that would be underpinned by skills

Page 31

Final Version for LEP Officers : Confidential. 14 Feb 2019

Timeline

Foundation phase : May 2019

Develop sector-wide Collective Skills Leadership

Development phase : June 2019 to May 2020

Progress the Three Priorities through development and implementation of the Five

Interventions

Complete initial phase of the

Skills Plan implementation

Commence development

around the Five Interventions

Develop sector-wide

Collective Skills Leadership

MAY 2019

JUNE 2019

MAY 2020

Realising the full potential of people and business in New Anglia

Page 32

Final Version for LEP Officers : Confidential. 14 Feb 2019

DATAPACK

A comprehensive DataPack is available on request,

cataloguing the extensive data analysis undertaken in

developing this plan.

Page 33

Final Version for LEP Officers : Confidential. 14 Feb 2019

1 The Creative Industries : The UK Creative Industries in infographics, November 2018.

Also:

2 Government. Industrial Strategy: Creative Industries Sector Deal.

3 Government. Industrial Strategy: Creative Industries Sector Deal.

5 NUA Stakeholder view of the DCI Industry

6 NUA Stakeholder view of the DCI Industry

7 Government. Industrial Strategy: Creative Industries Sector Deal.

8 New Anglia Digital Tech Skills Plan 2017

9 Creative Industries Evidence Base Executive Summary

10 CCS. Building a Creative Nation: Current and future skills needs. Addressing skills gaps and shortages in the creative and

cultural industries. PDF

11 NUA Stakeholder view of the DCI Industry

13 Creative sector report warns of ‘disastrous skills shortage’

14 NESTA file:///C:/Users/emmak/Downloads/the_future_of_skills_employment_in_2030_0.pdf

17 VFX Skillset Leaflet (Jan 2018) Yen Yau

18 VFX Skillset Leaflet (Jan 2018) Yen Yau

19 Creative sector report warns of ‘disastrous skills shortage’

20 TechNation Report 2018: Connection and collaboration: powering UK tech and driving the economy

21 BCS announced new Head of Apprenticeships - March 2017.

22 Digital Tech: A Skills Plan for New Anglia: Putting skills at the heart of building a competitive and sustainable economy.

23 The Greater Manchester Digital Strategy 2018-2020

24 The Greater Manchester Digital Strategy 2018-2020

25 A Skills Audit of the UK Film and Screen Industries.

26 CCS. Building a Creative Nation: Current and future skills needs. Addressing skills gaps and shortages in the creative and

cultural industries. PDF.

27 NESTA: A closer look at creatives: using job adverts to identify the skill needs of creative talent (April 2018)

Page 34