Creative Industries

Data Pack

Final Version 04.02.19

Contents

Introduction to the Sector Data Pack

Page 3

Introduction to and Definition of the Creative Industries / Plus Sector

Page 3

The Creative Industries in New Anglia

Page 4

Local Economic Contribution

Page 8

GVA

Page 11

Employment

Page 13

Enterprises

Page 39

Creative Industries Sector Skills Supply and Demand

Page 48

Further Education Learning Aims analysis

Page 49

Apprenticeships

Page 56

Higher Education

Page 57

Labour Insight Jobs tool sector analysis

Page 60

‘Where the Work is’ tool sector analysis

Page 67

A Future View of the Creative Industries Sector

Page 72

Results from the Creative Industries Sector Skills Planning Survey

Page 79

Appendices

Page 90

Creative Industries / Plus sector definition

Page 91

Creative Industries Plus Sub Sectors

Page 93

Creative Industries Occupations

Page 96

2

Introduction to the Sector Data Pack

The role of the Sector Data Pack is to bring together the latest socio-economic and labour market data and present both an up-to-date, and future view, of

the sector and any underlying issues within the area that could impact upon it. Data is presented in a navigable format without comment with

interpretation at this stage mainly left to the reader.

In most instances data has been analysed and presented down to local authority level. In some instances, and even where local authority data is

available, it has not been presented in the data pack due to issues of unreliability and small sample sizes. This is particularly the case with data from the

Annual Population Survey and the Annual Survey of Hours and Earnings.

Introduction to the Creative Industries Sector Definition

In order to arrive at a definition for the Creative Industries sector relevant to New Anglia we have started out with those Standard Industrial Classification

(SIC) codes used by the Department for Culture, Media and Sport (DCMS) to define the Creative Industries sector. From these codes, some have been

removed in order to reduce the overlap with the cultural element of the Visitor Economy sector. Full details of these codes and those removed can be

found in the Appendices on page 91.

In addition to a SIC code definition of the sector, DCMS also produced a definition based on Standard Occupational Classification (SOC) codes (refer to

the Appendices page 93 for details). If we consider occupational employment rather than industry employment then the figure is much higher given that

many creative roles are apparent with traditional non-creative industries. For example, nationally then approximately 1.8m people are employed in the

Creative Industries sector, whilst there are approximately 2.8m people employed in the ‘Creative Economy’ (creative roles). This ratio of industry to

occupational employment has been applied at the local level to arrive at the ‘Creative Economy’ employment figure presented on page 6.

3

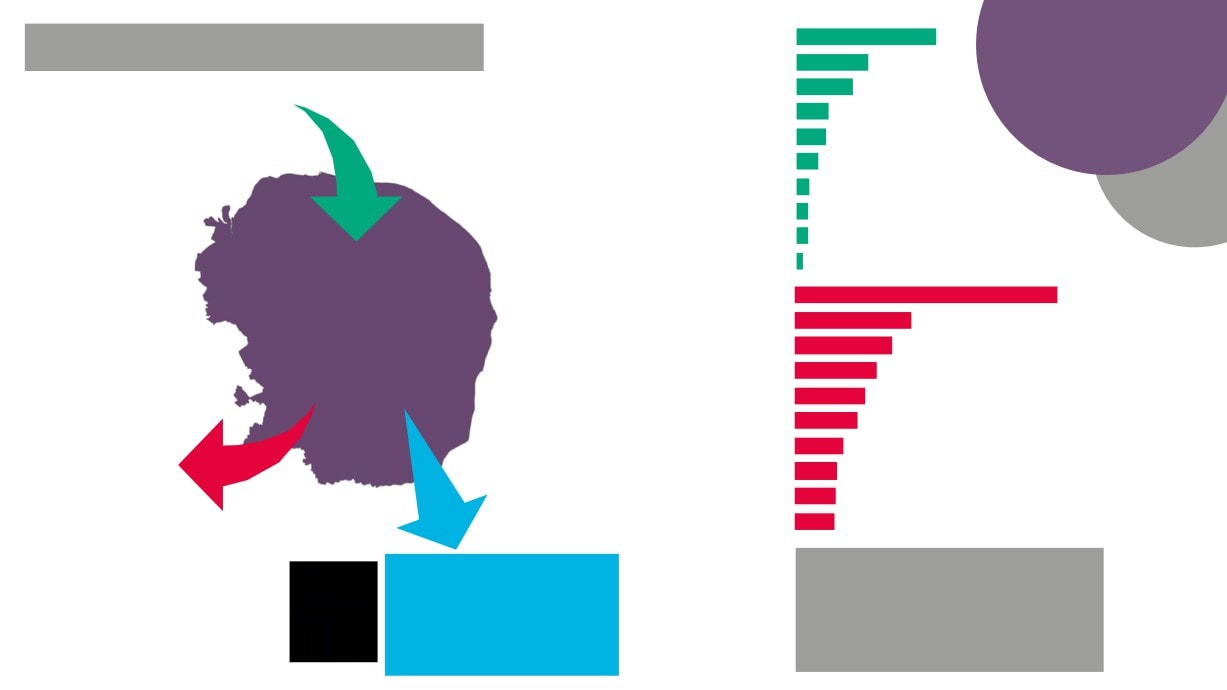

The Creative Industries

Sector in New Anglia

4

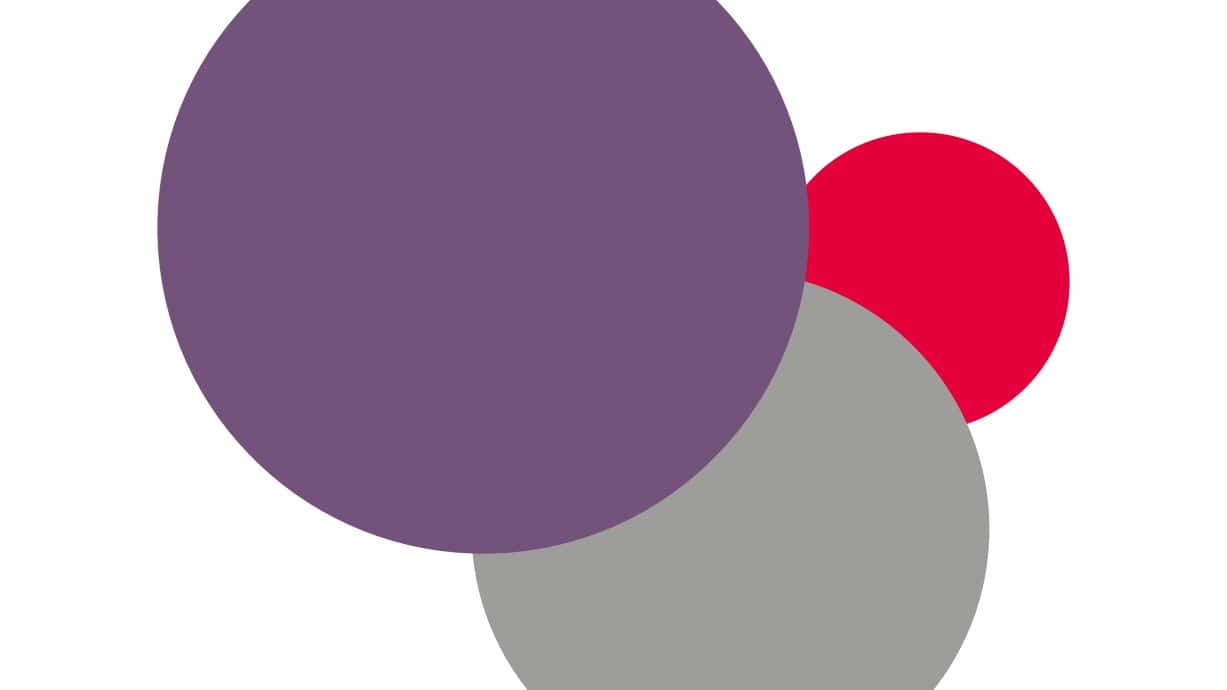

Creative

Creative

18,800

2,300

Industries

Jobs

Industries Jobs

Plus

- Wired and wireless telecoms

- Reproduction of video, sound etc.

- Textiles

- Manufacture of furnishings,

clothing etc.

- Market Research

5

DCMS

Creative

Industries

- Library activities

New Anglia

Creative

- Archive activities

- Motion picture

Creative

Creative

projection

Economy

Industries

- Translation and

Industries

Creative roles in traditionally

Plus

interpretation

non-creative sectors

2,300

- Museum activities

18,800

Approximately

Jobs

- Cultural education

29,300

Jobs

Jobs

6

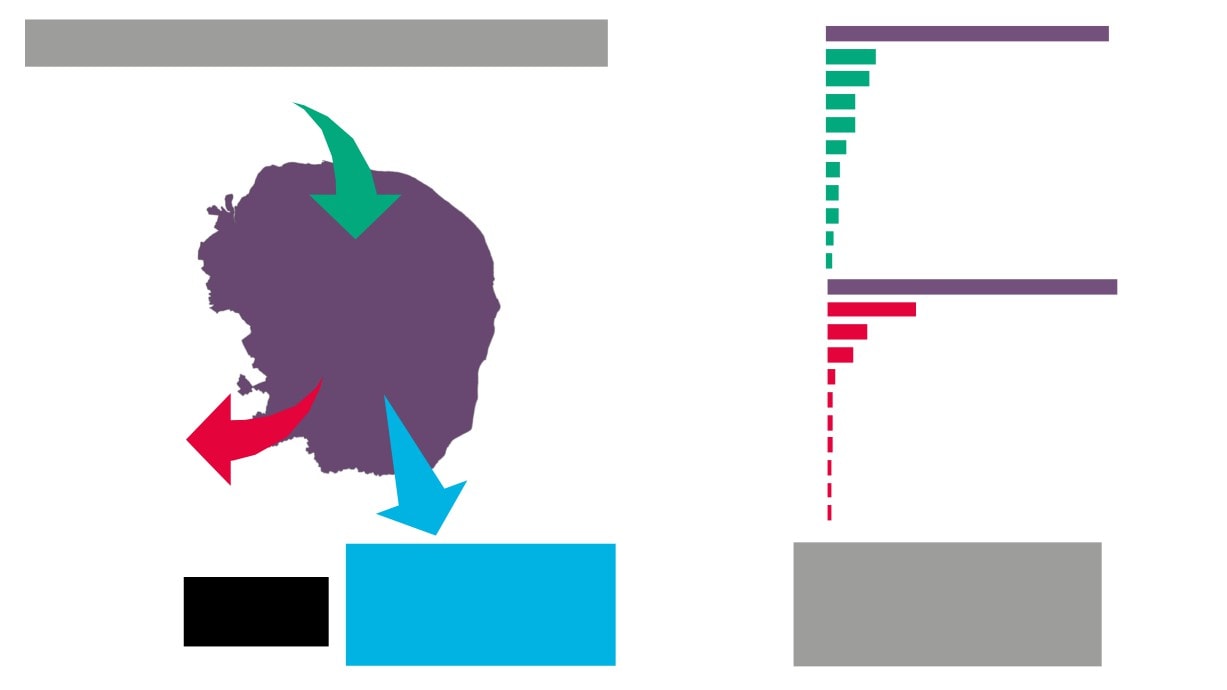

Advanced Manufacturing and Engineering

3,600 jobs

2,700 jobs

6,200 jobs

Visitor

Economy

(Tourism &

Creative

Culture)

Industries

6,300 jobs

Plus

Construction

and

Development

7

Local Economic

Contribution

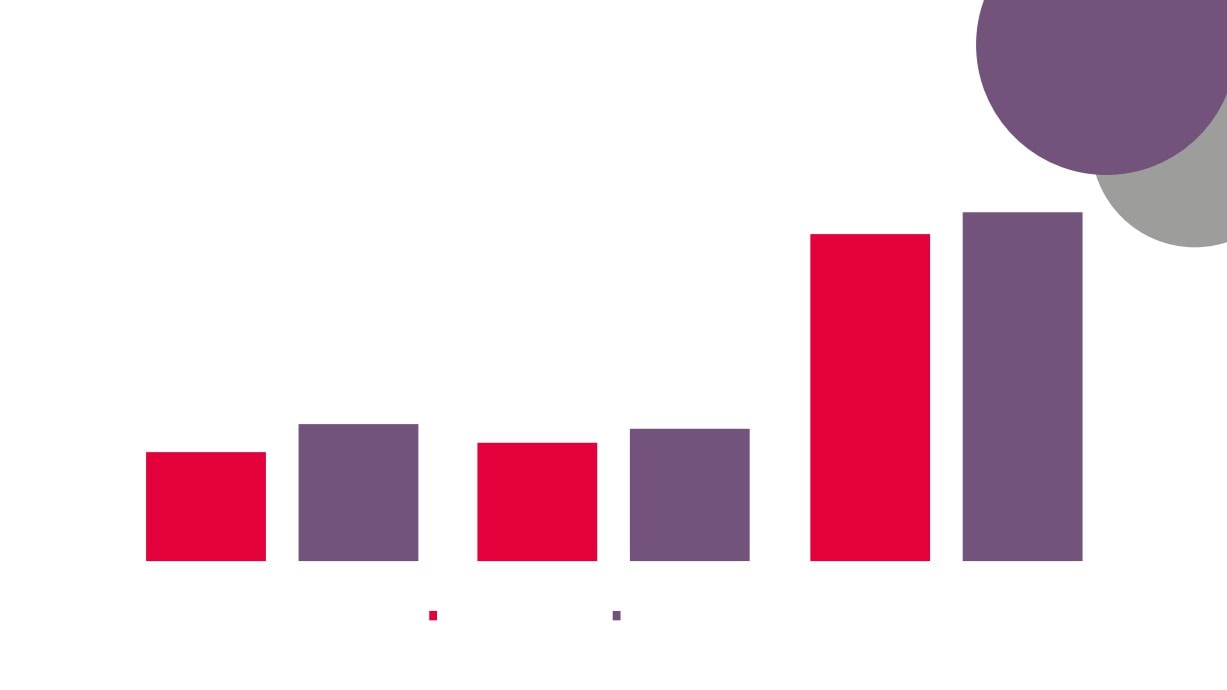

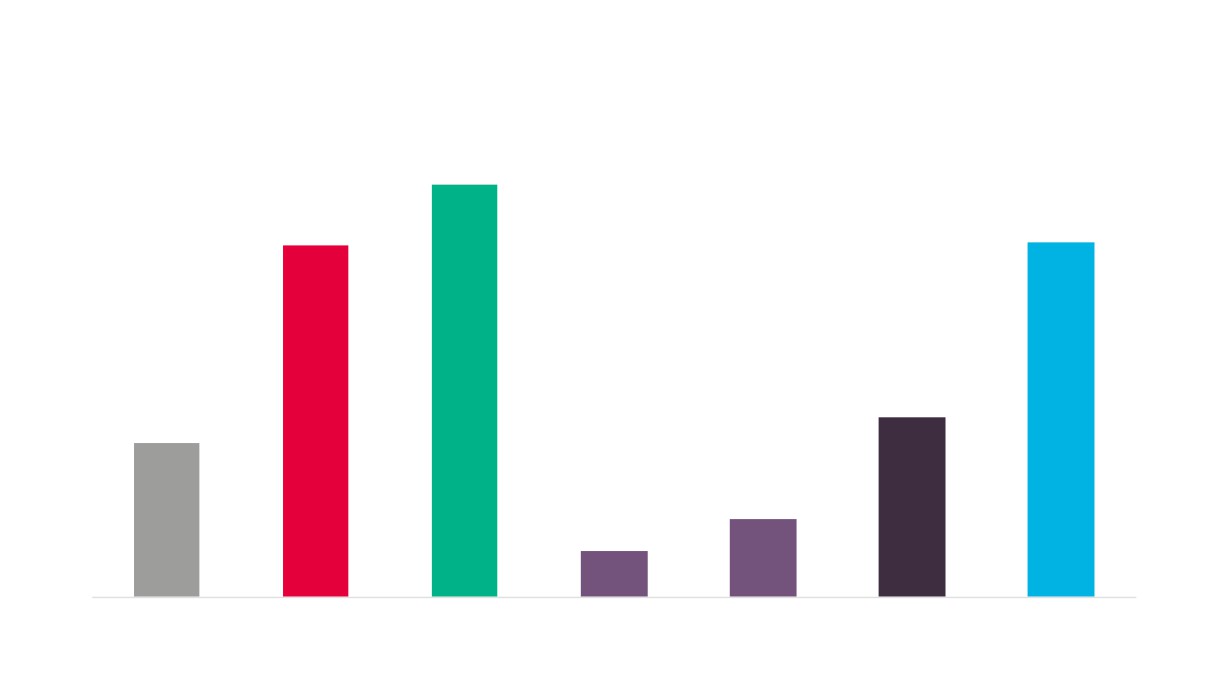

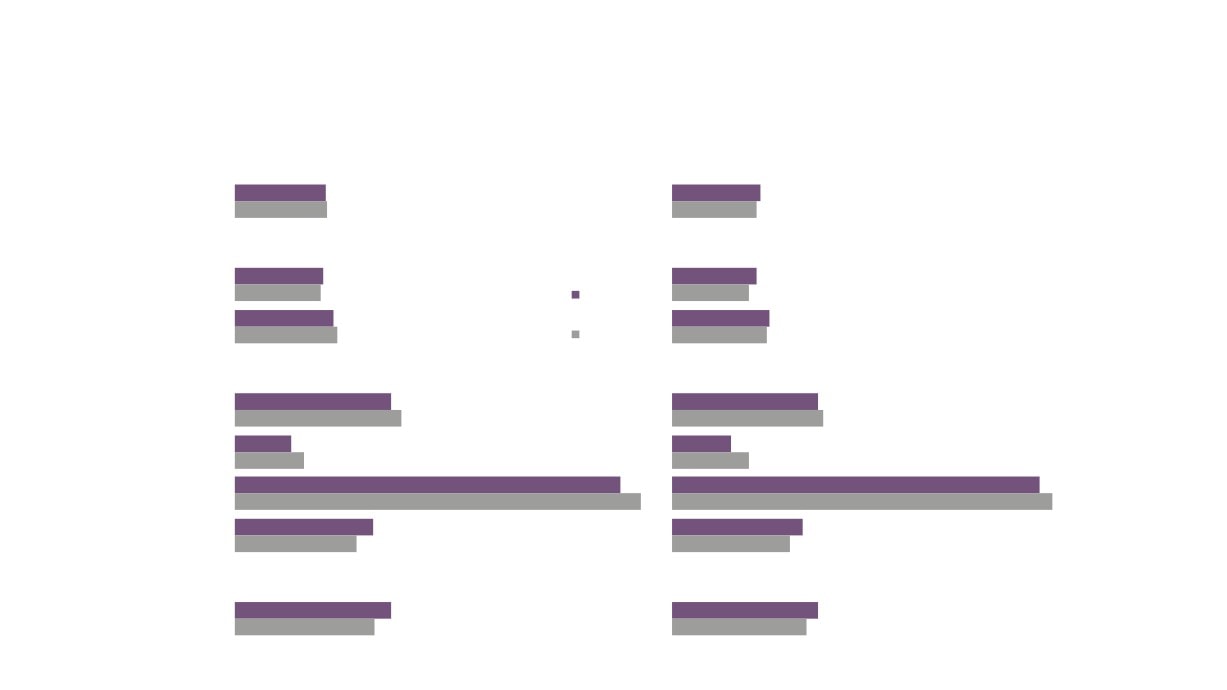

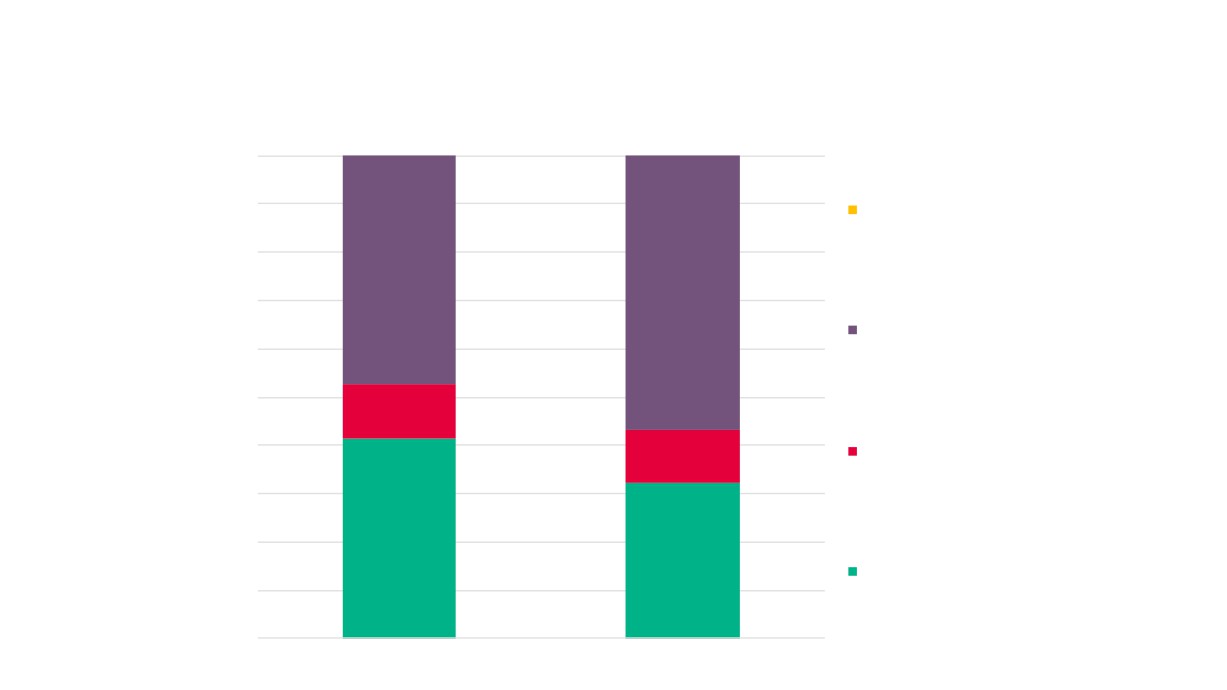

4,260

3,995

7.0%

6.6%

£984m

21,100

18,800

£790m

2.8%

2.7%

2.4%

2.2%

GVA

Employment

Enterprises

Creative Industries

Creative Industries Plus

Source: New Anglia LEP Economic Strategy evidence base work

8

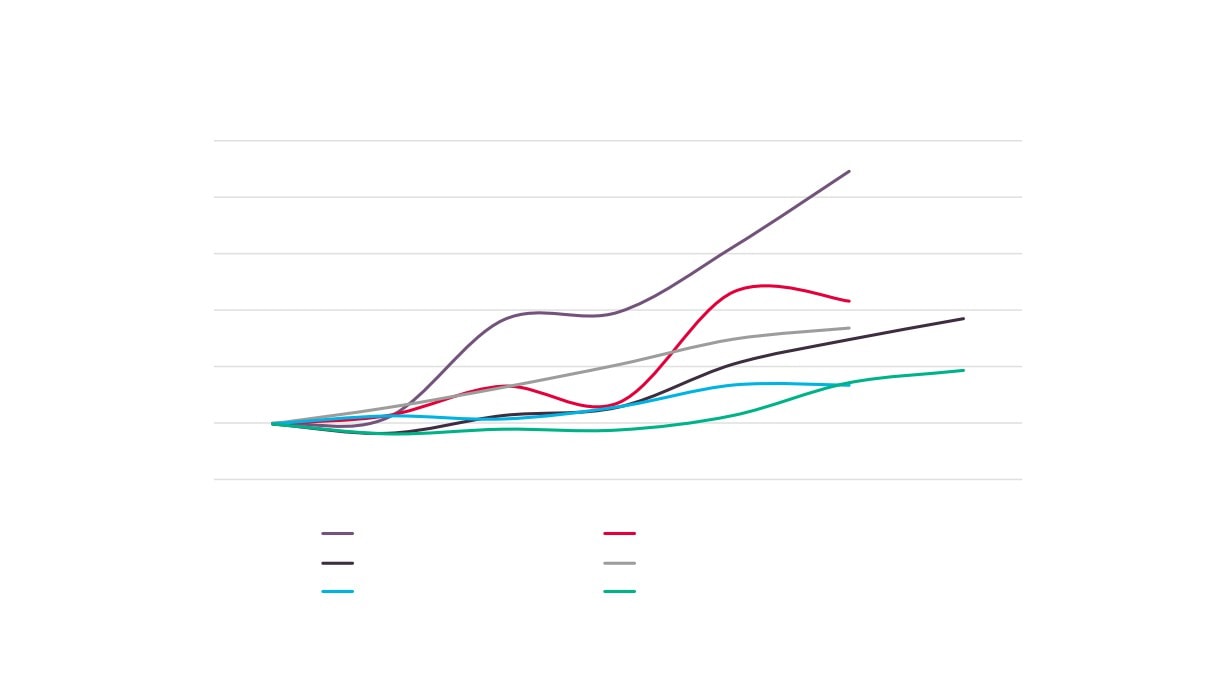

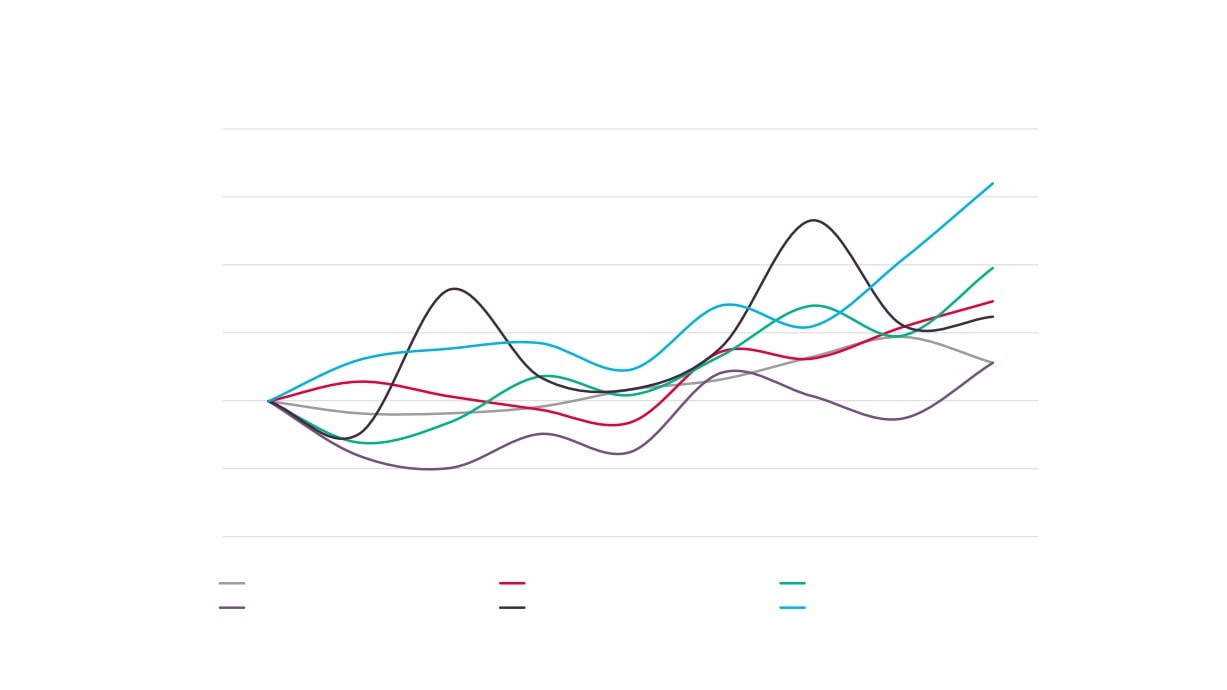

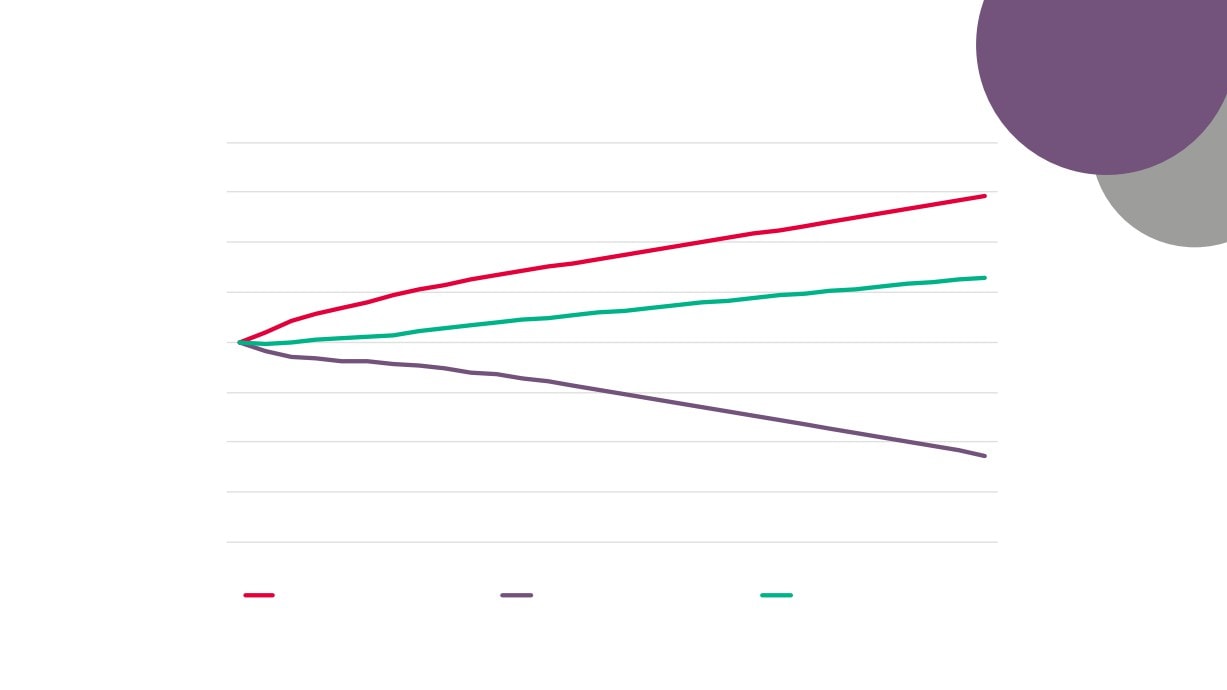

Creative Industries Sector Performance Over Time

150

140

130

120

110

100

90

2010

2011

2012

2013

2014

2015

2016

Creative Industries GVA

Creative Industries Employment

Creative Industries Enterprises

Total GVA

Total Employment

Total Enterprises

Source: New Anglia LEP Economic Strategy evidence base work

9

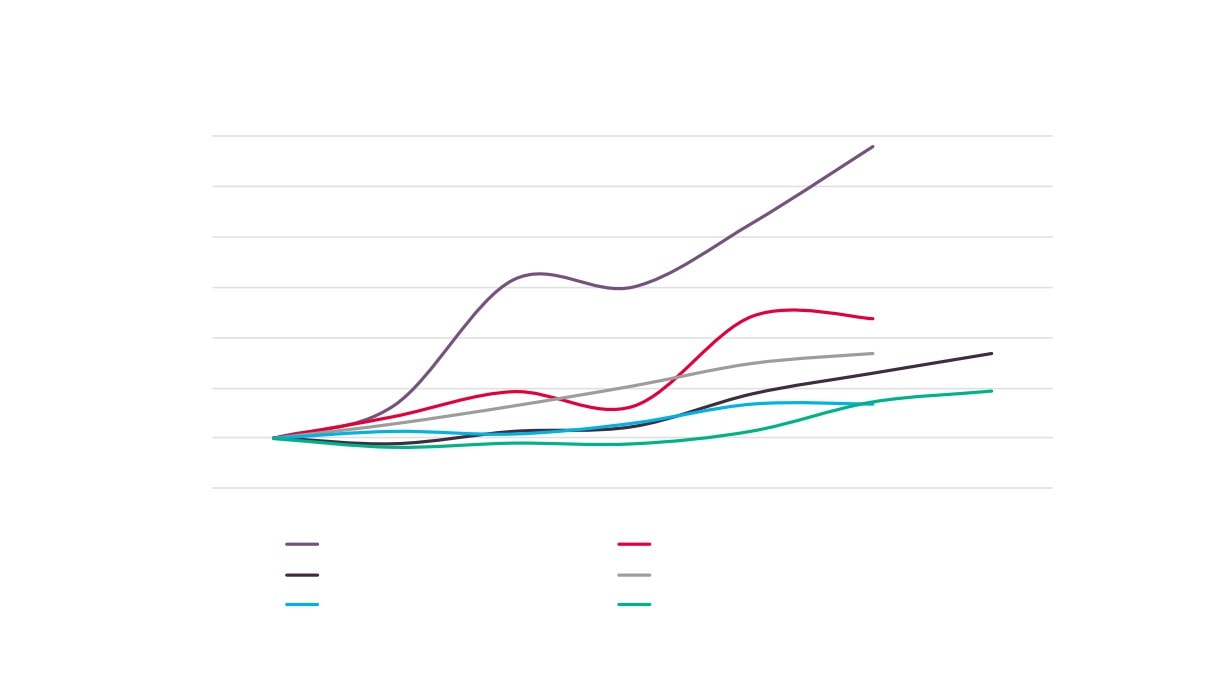

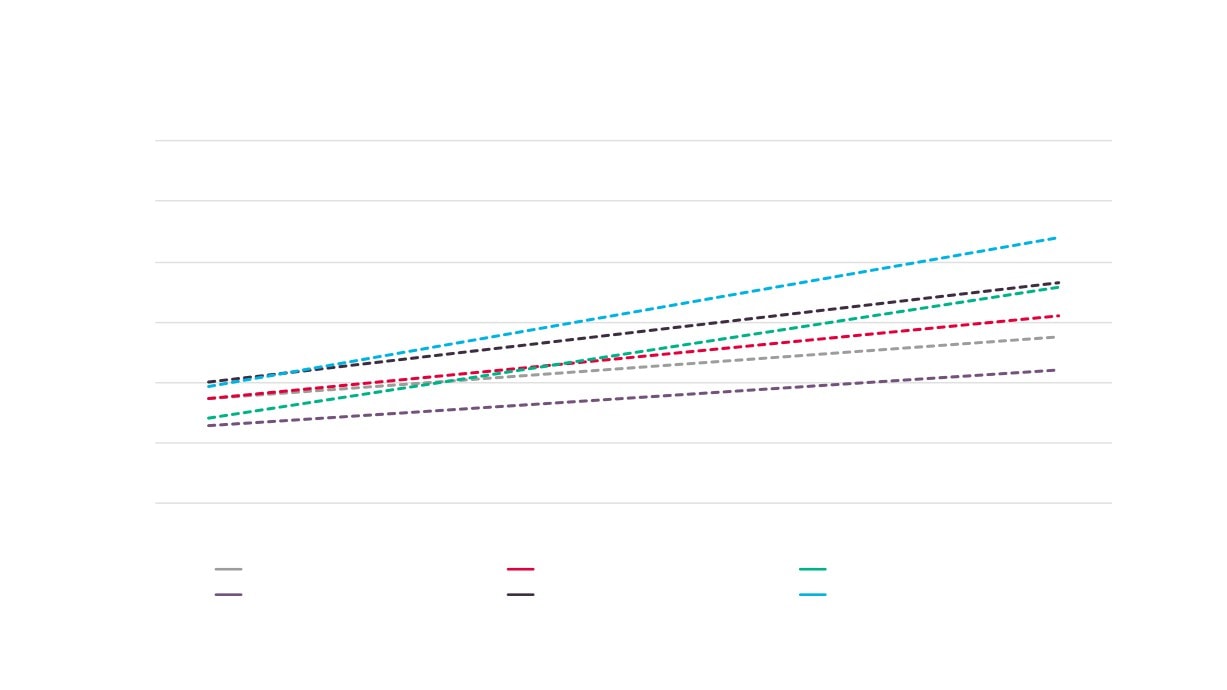

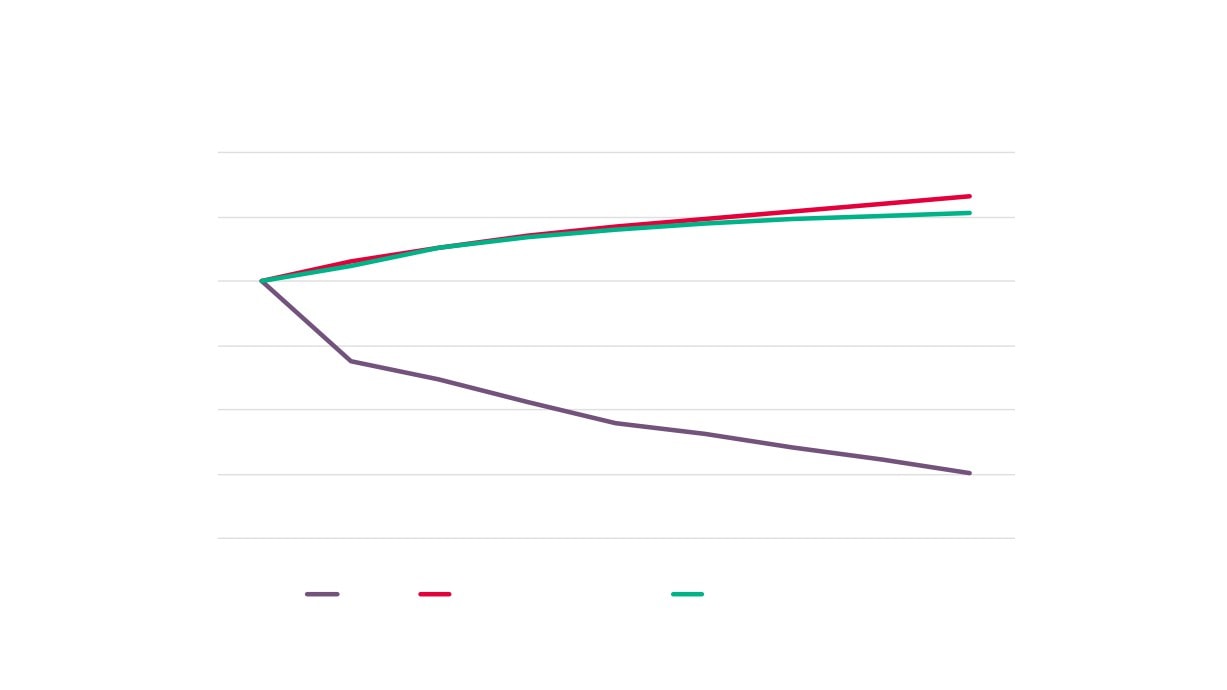

Creative Industries Plus Sector Performance Over Time

160

150

140

130

120

110

100

90

2010

2011

2012

2013

2014

2015

2016

Creative Industries Plus GVA

Creative Industries Plus Employment

Creative Industries Plus Enterprises

Total GVA

Total Employment

Total Enterprises

Source: New Anglia LEP Economic Strategy evidence base work

10

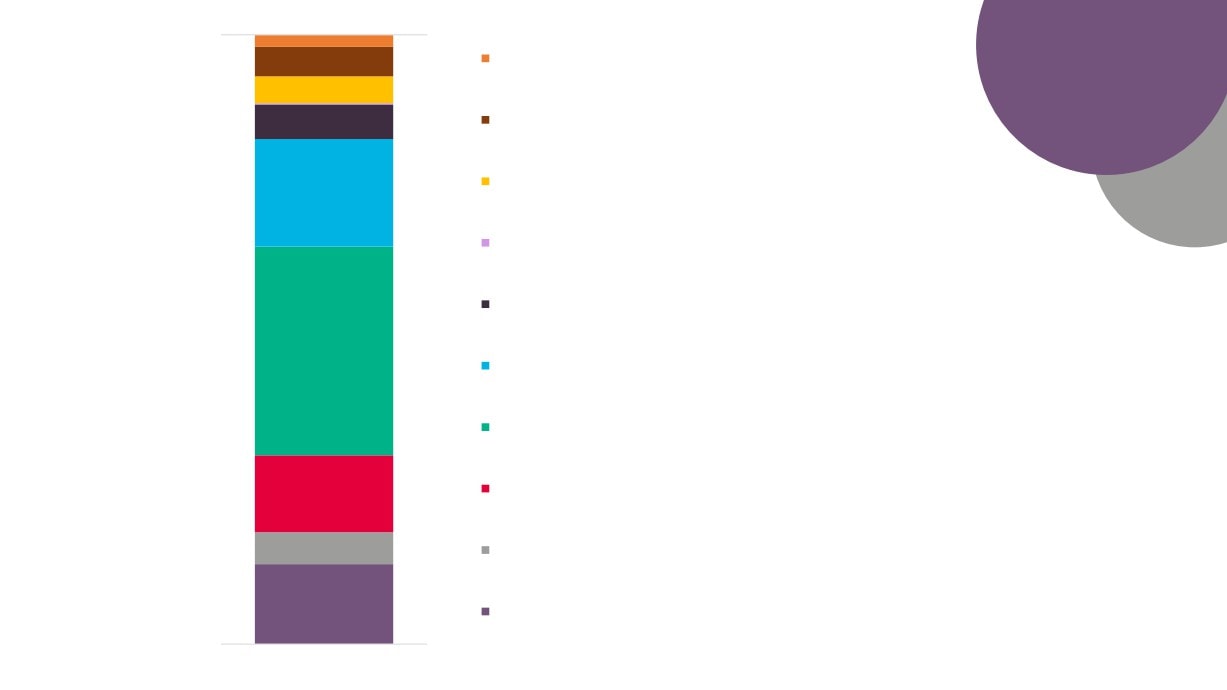

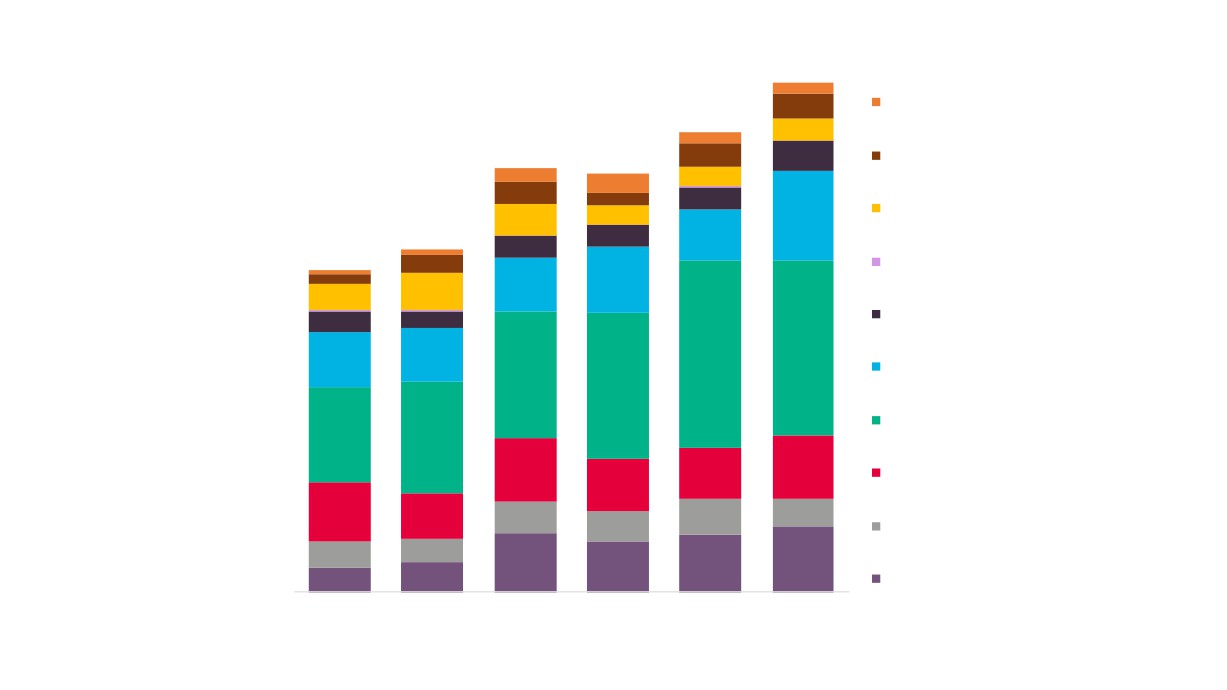

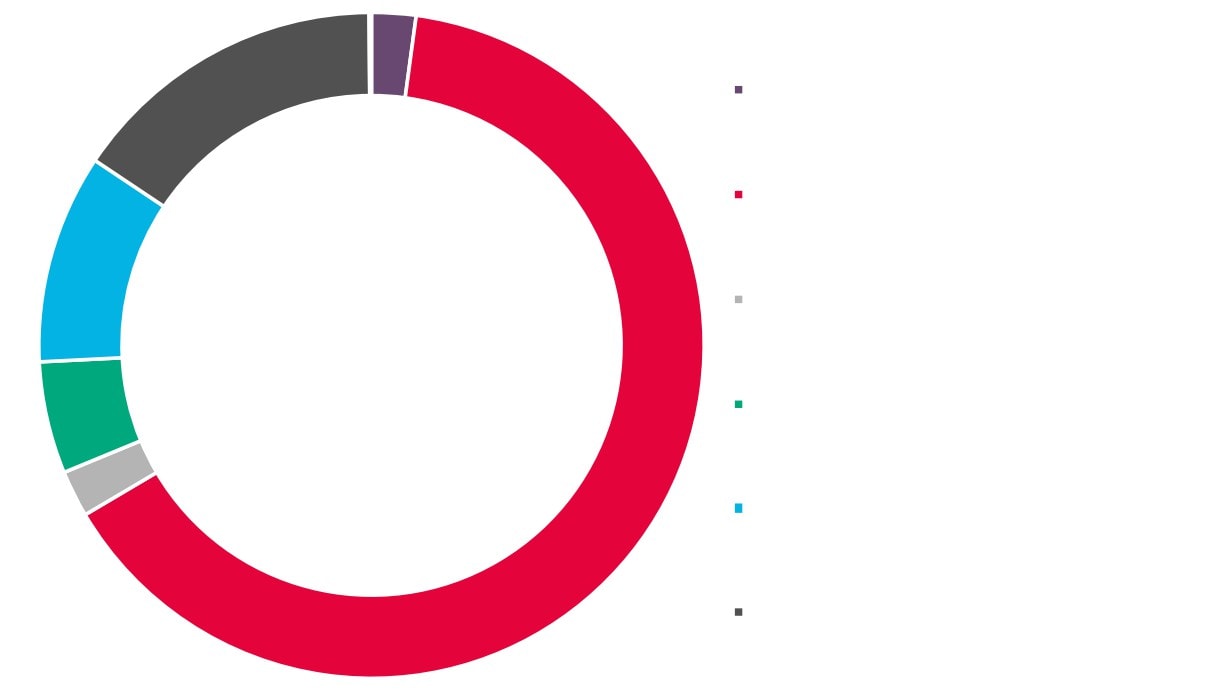

£19m

Gross Value

Fashion

£48m

Added

£43m

£57m

Textiles

Music, Performing & Visual

£174m

Arts

Crafts

GVA by Creative

Design

Industries Plus

£337m

Publishing

Subsector

Source: New Anglia LEP Economic

IT, Software & Computer

Strategy evidence base work

Services

Film, TV, Video, Radio &

£123m

Photography

£53m

Architectural activities

£128m

Advertising & Marketing

11

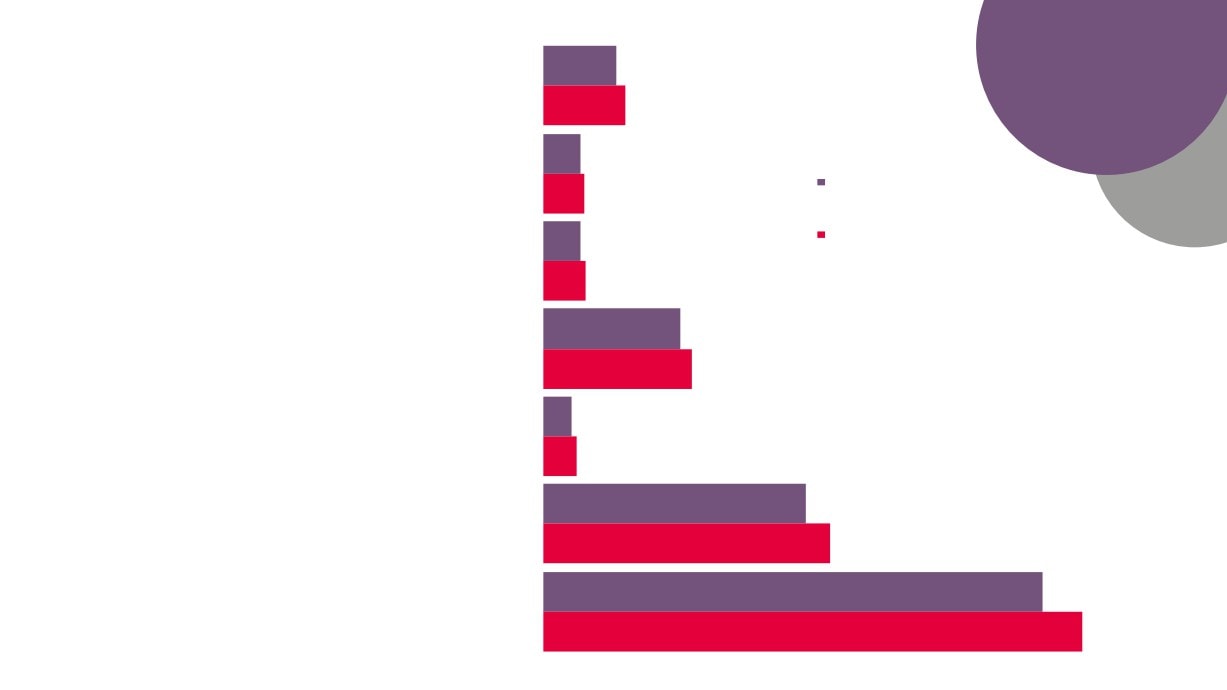

£19

£48

Fashion

GVA (£M)

£43

£23

£43

£57

Textiles

Over Time by

£27

£39

£37

£41

£26

£43

Creative

Music, Performing & Visual Arts

£36

£174

£61

£43

£100

Industries

£43

£37

Crafts

£20

£129

Plus

£103

£72

£49

Design

Subsector

£42

£33

£337

£103

£362

Source: New Anglia LEP

£106

Publishing

Economic Strategy evidence

£246

£282

base work

IT, Software & Computer Services

£183

£215

£123

£123

£97

Film, TV, Video, Radio & Photography

£99

£115

£53

£88

£60

£70

£59

Architectural activities

£46

£50

£128

£114

£99

£112

£48

£58

Advertising & Marketing

2010

2011

2012

2013

2014

2015

12

Employment

13,545

New Anglia

15,200

7,015

Norfolk

Creative Industries

7,710

Creative

Creative Industries Plus

6,835

Industries Sector

Suf folk

7,840

Employment by

25,420

Please note that the figure for New Anglia’s

LEP Comparator

Creative Industries / Plus sector employment is

GCGP LEP

different to that reported on page 8 due to a

27,470

different source being used for this information.

Areas

This is so to enable comparison with other

areas across the UK.

Source: Business Register and

5,195

Employment Survey, Office for

Greater Lincolnshire LEP

National Statistics

6,315

48,695

South East LEP

53,200

92,530

East of England

99,850

13

2.0%

New Anglia

2.2%

1.9%

Norfolk

2.1%

2.2%

Suf folk

Proportion of Total

2.5%

Employment

3.3%

Creative Industries

GCGP LEP

Provided by

3.6%

Creative Industries Plus

Creative Industries

1.2%

Great er Lincolnshire LEP

1.5%

Sector, by LEP

Comparator Areas

8.2%

London LEP

9.1%

Source: Business Register and

Employment Survey, Office for

National Statistics

3.0%

South East LEP

3.3%

3.4%

East of England

3.7%

4.0%

England

4.6%

14

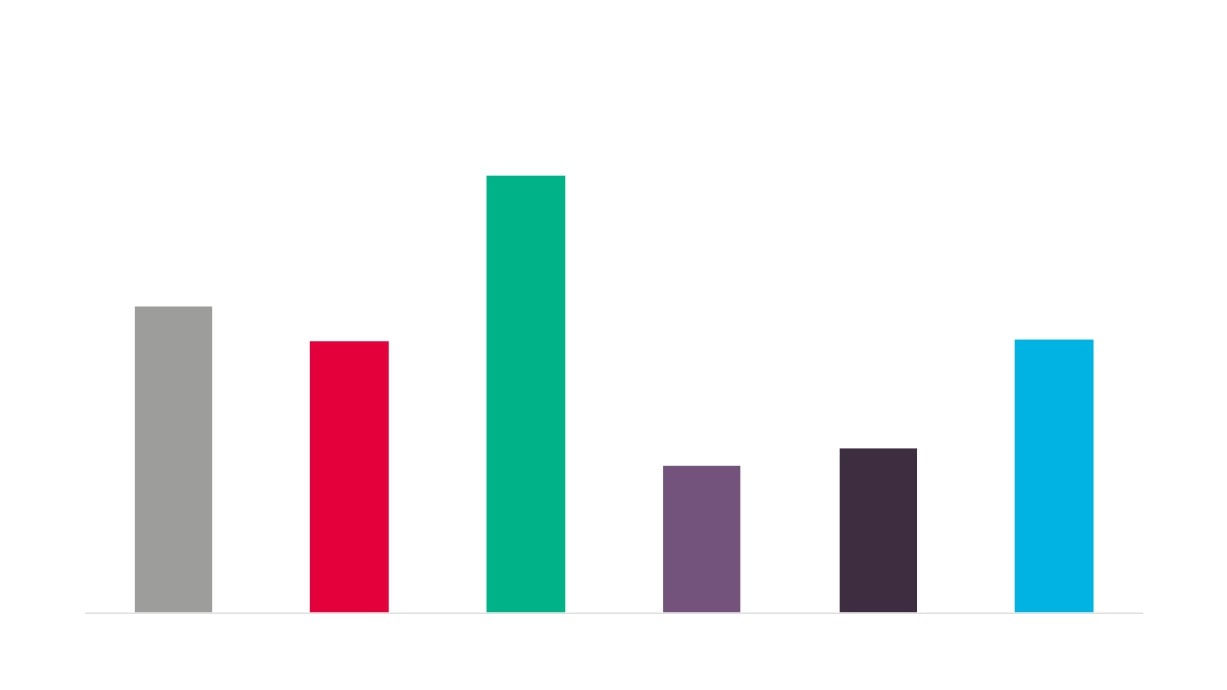

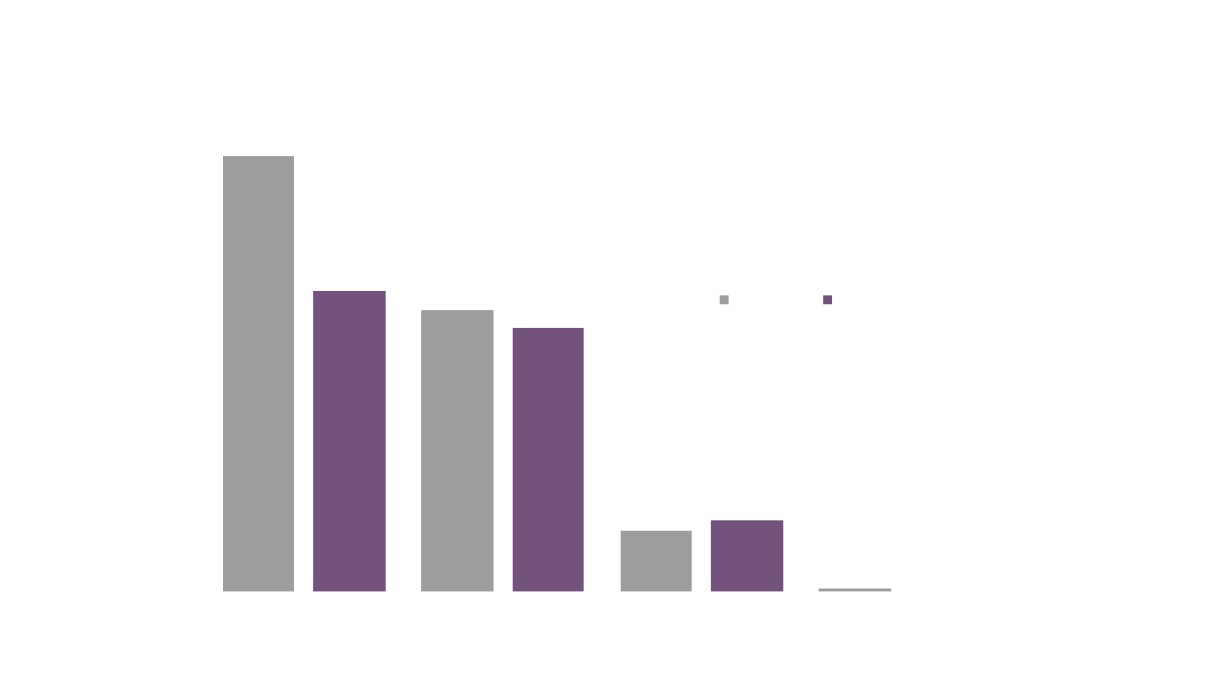

Creative Industries Sector Employment by Additional LEP

Comparator Areas

Source: Business Register and Employment

Please note that the figure for New Anglia’s

Survey, Office for National Statistics

Creative Industries / Plus sector employment is

44,725

different to that reported on page 8 due to a

different source being used for this information.

This is so to enable comparison with other

areas across the UK.

31,355

27,805

27,960

16,850

15,035

Coast to Capital Greater Birmingham Greater Manchester

New Anglia

North East

West of England

and Solihull

15

Proportion of Total Employment Provided by Creative

Industries Sector, by Additional LEP Comparator Areas

Source: Business Register and Employment

Survey, Office for National Statistics

West of

England

Coast to

Greater

Greater

Capital

Birmingham

Manchester

and Solihull

New Anglia

4.9%

3.6%

3.4%

2.9%

2.1%

2.0%

North East

16

Creative Industries Sector Employment by Additional City

Comparator Areas

Source: Business Register and Employment

Survey, Office for National Statistics

17,580

14,975

15,135

7,680

6,585

3,335

1,955

Brighton and

Birmingham

Manchester

Ipswich

Norwich

Newcastle upon Bristol, City of

Hove

Tyne

17

Proportion of Total Employment Provided by Creative Industries Sector,

by Additional City Comparator Areas

Source: Business Register and Employment

Survey, Office for National Statistics

5.5%

4.8%

4.5%

4.1%

3.6%

2.8%

2.7%

18

525

Breckland

590

850

Broadland

885

285

2.0%

New Anglia

2.2%

Creative

1.9%

Industries Sectorfolk

2.1%

Employment by

2.2%

New Anglia LEP

Suf folk

2.5%

Local Authority

3.3%

Areas

Creative Industries

GCGP LEP

3.6%

Source: Business Register and

Employment Survey, Office for National

Creative Industries Plus

Statistics

1.2%

Great er Lincolnshire LEP

1.5%

8.2%

London LEP

9.1%

19

3.0%

South East LEP

2.2%

Suf folk

2.5%

3.3%

Creative Industries

GCGP LEP

3.6%

Proportion of

Creative Industries Plus

1.2%

Total

Great er Lincolnshire LEP

1.5%

Employment

8.2%

Provided by

London LEP

9.1%

Creative

Industries Sector,

3.0%

South East LEP

3.3%

by New Anglia

LEP Local

3.4%

Authority Areasf England

3.7%

Source: Business Register and

4.0%

Employment Survey, Office for National

England

Statistics

4.6%

Suffolk Coastal

2.6%

1.3%

Waveney

1.3%

20

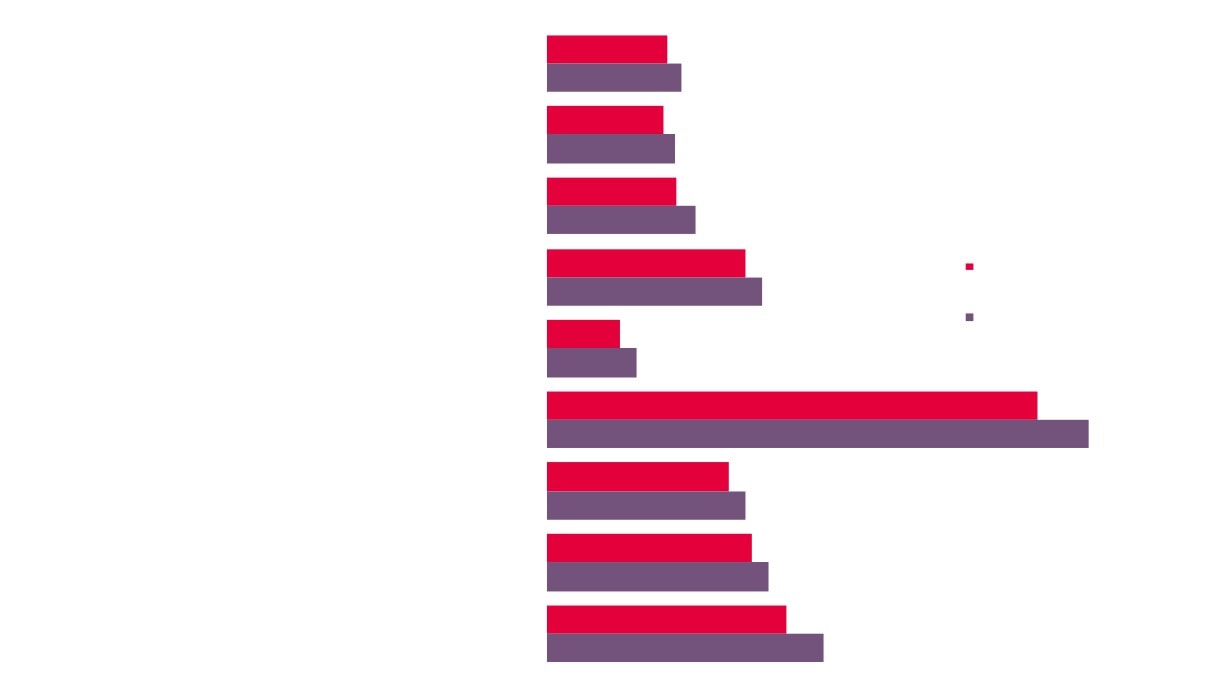

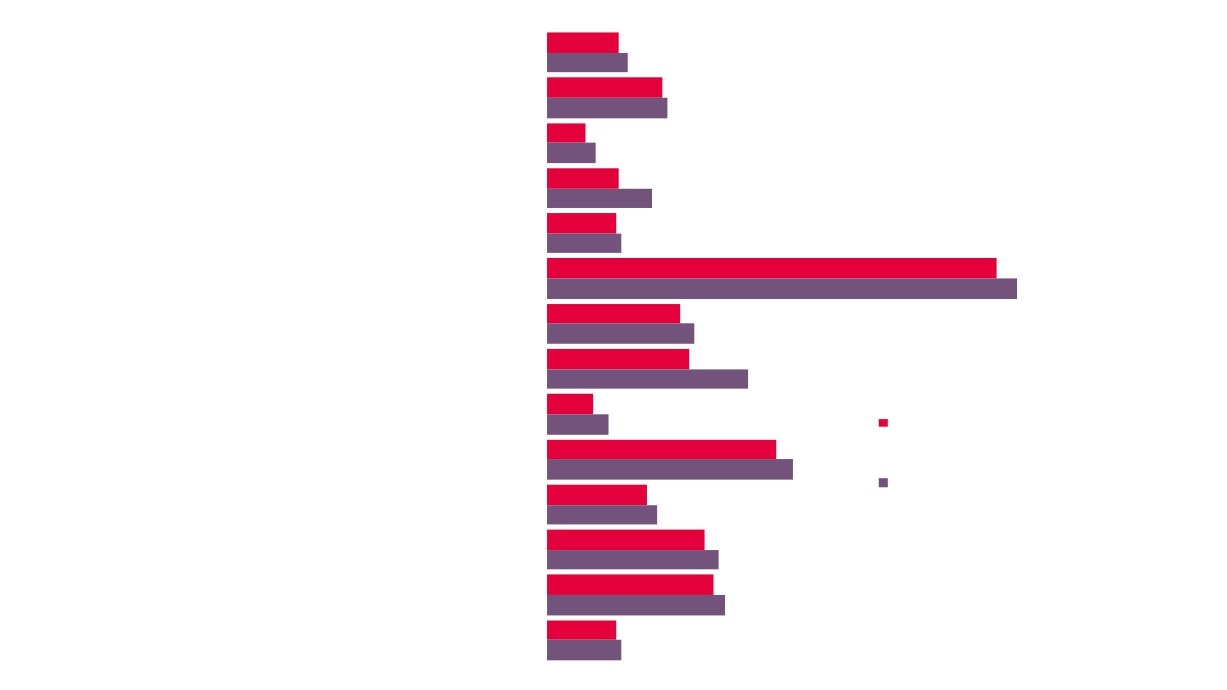

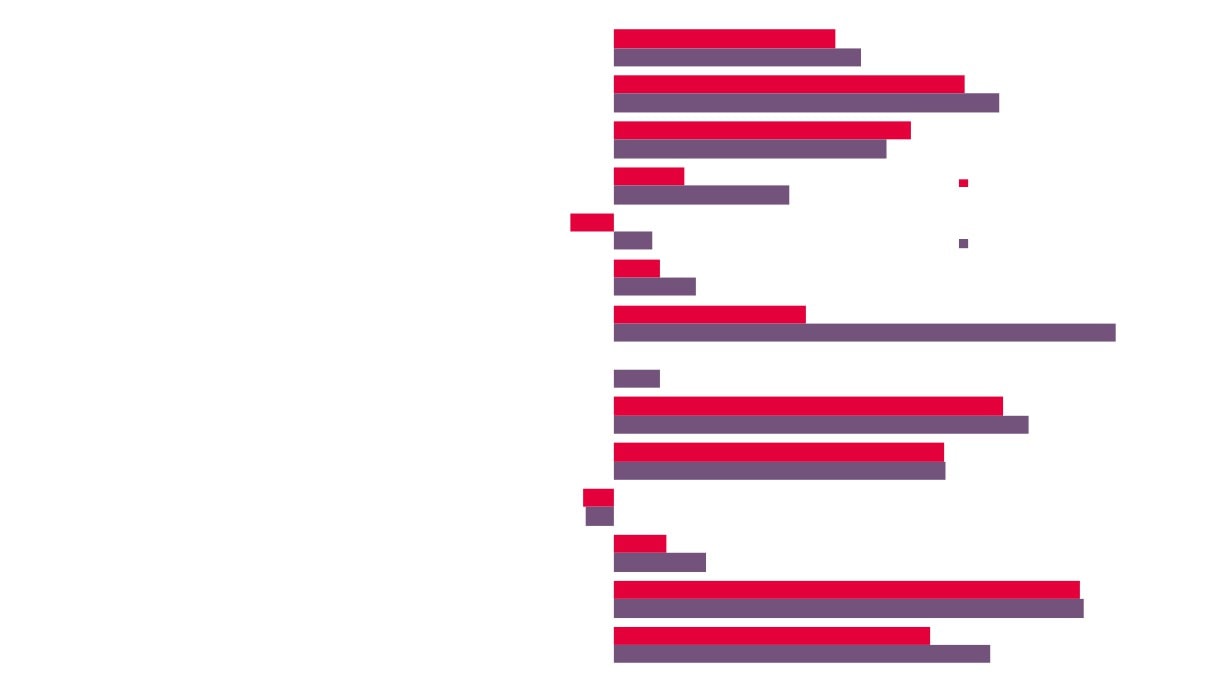

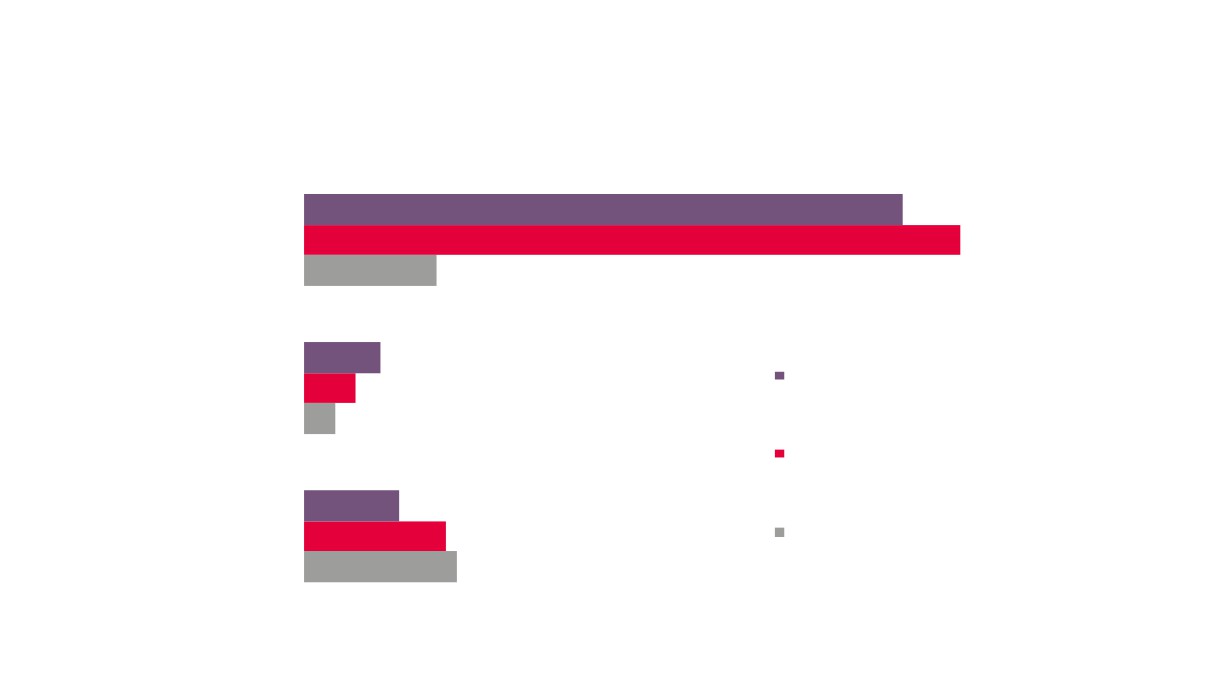

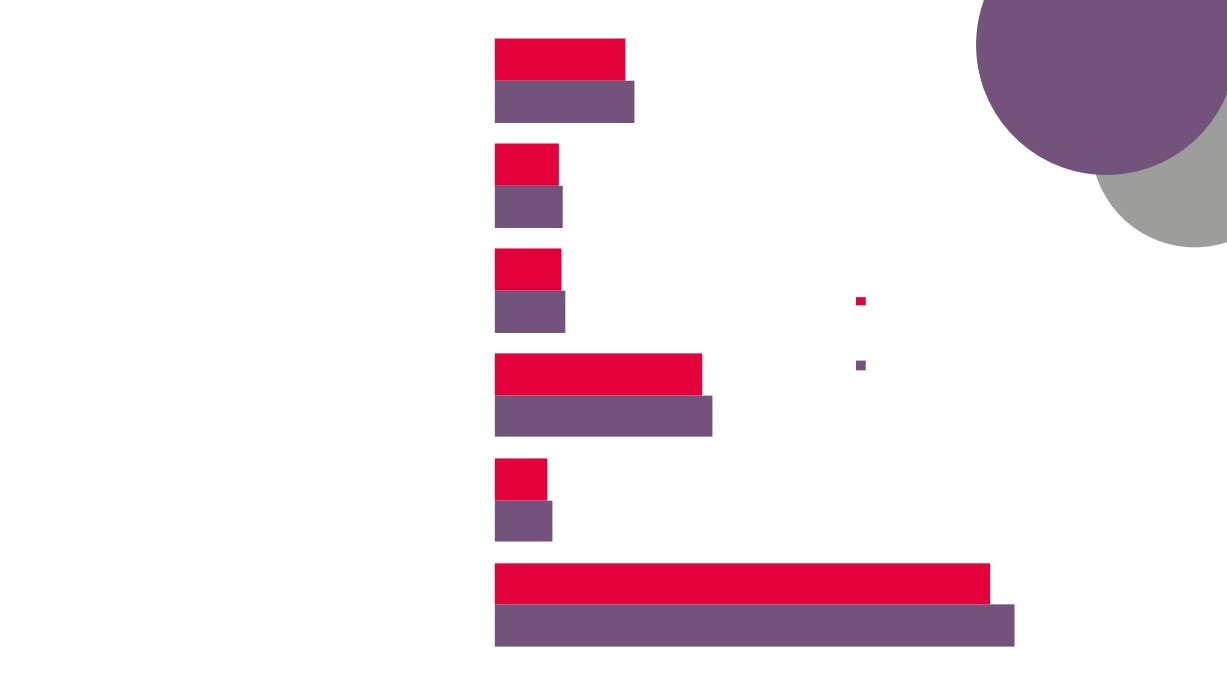

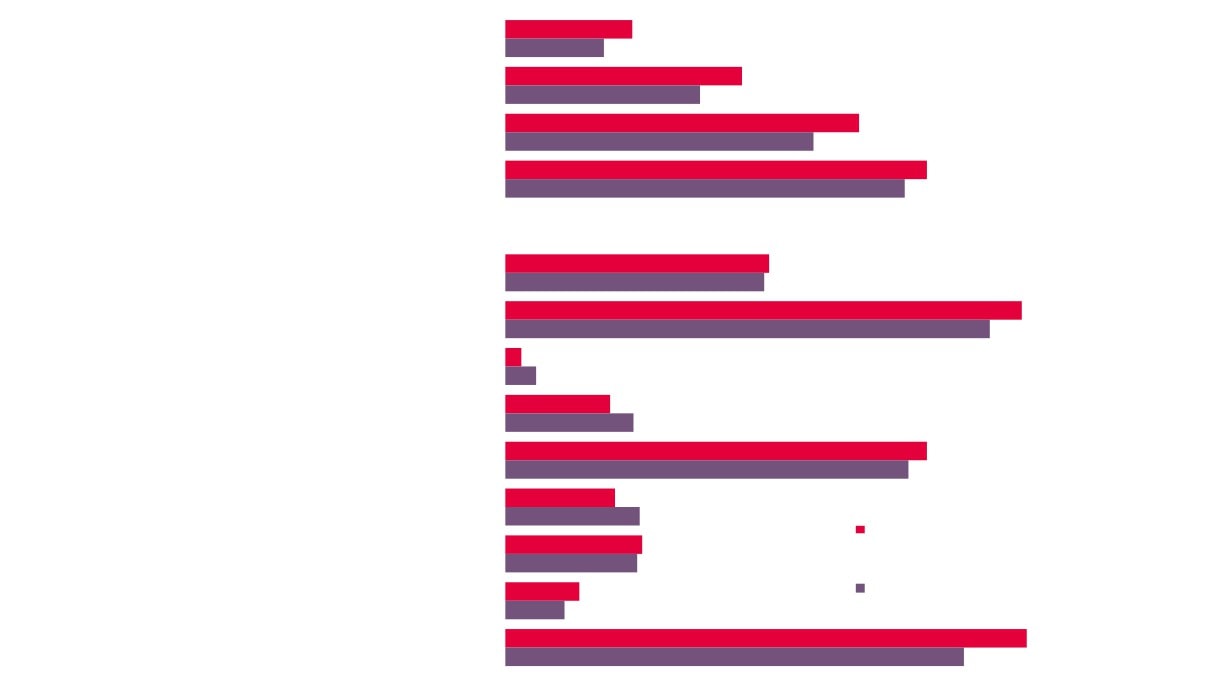

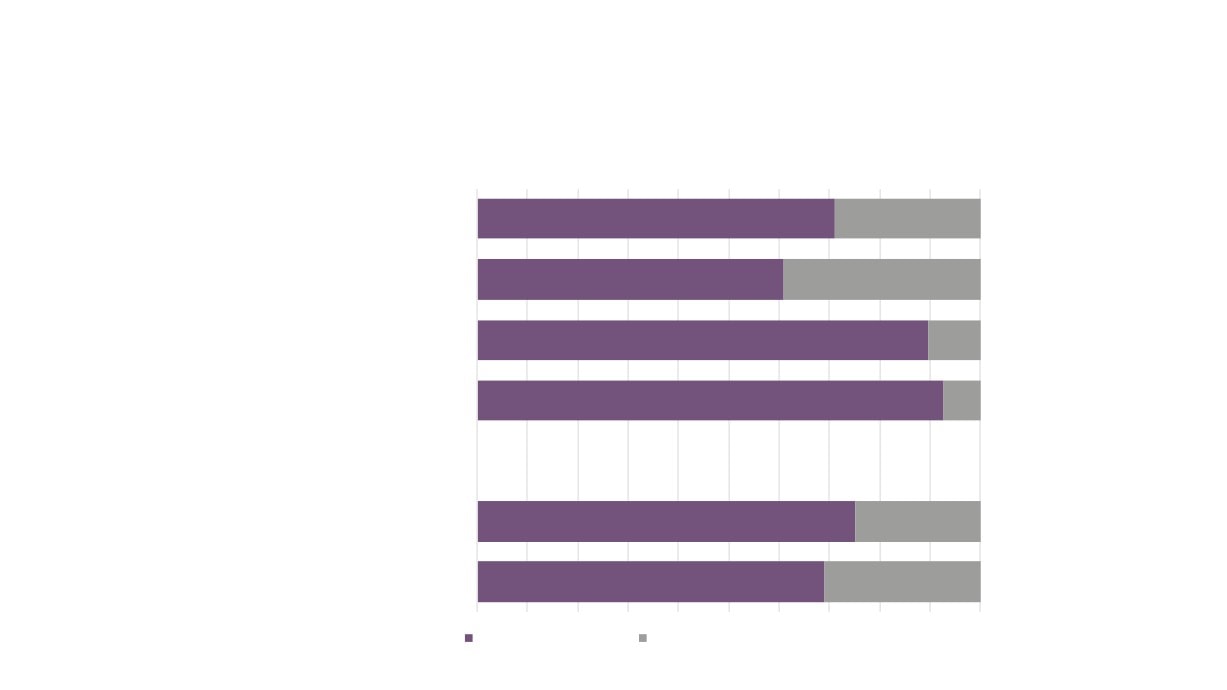

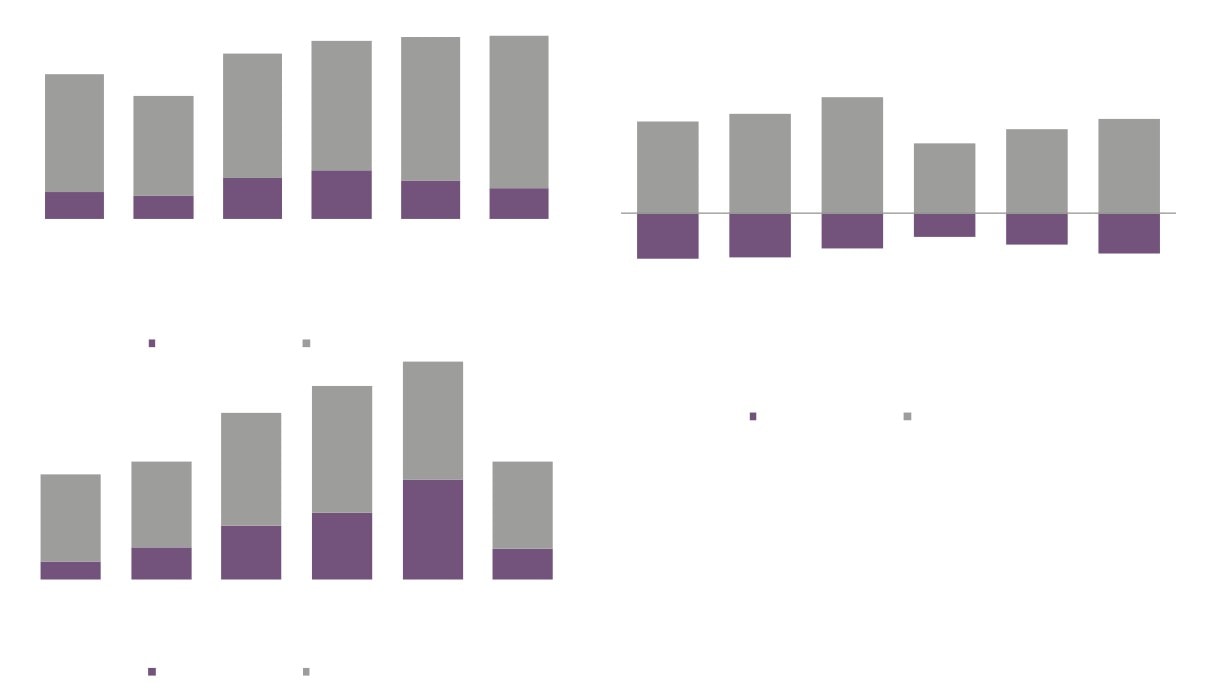

20%

New Anglia

23%

26%

Norfolk

29%

Change in

15%

Suffolk

20%

Creative

Creative Industries

17%

Industries

Creative Industries Plus

GCGP

16%

Sector

-5%

Employment,

Greater Lincolnshire LEP

-13%

2010 - 2015,

26%

London LEP

by LEP

25%

Comparator

38%

South East LEP

Areas

31%

Source: Business Register and

Employment Survey, Office for

39%

National Statistics

East

30%

23%

England

19%

21

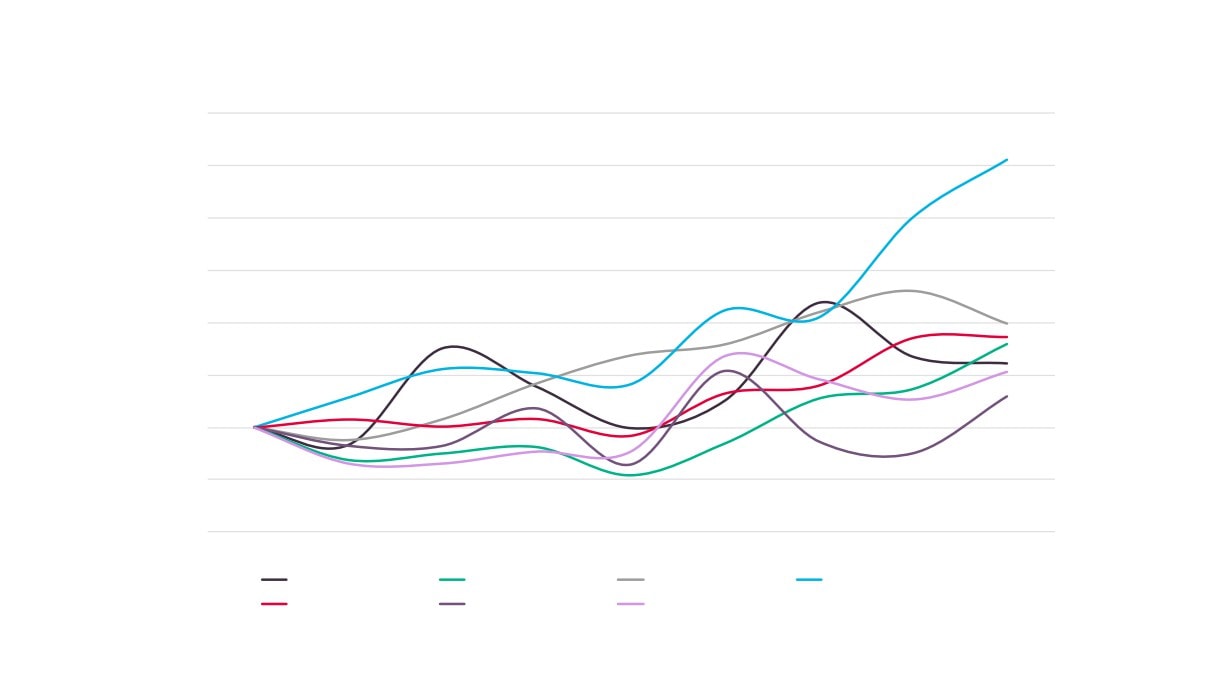

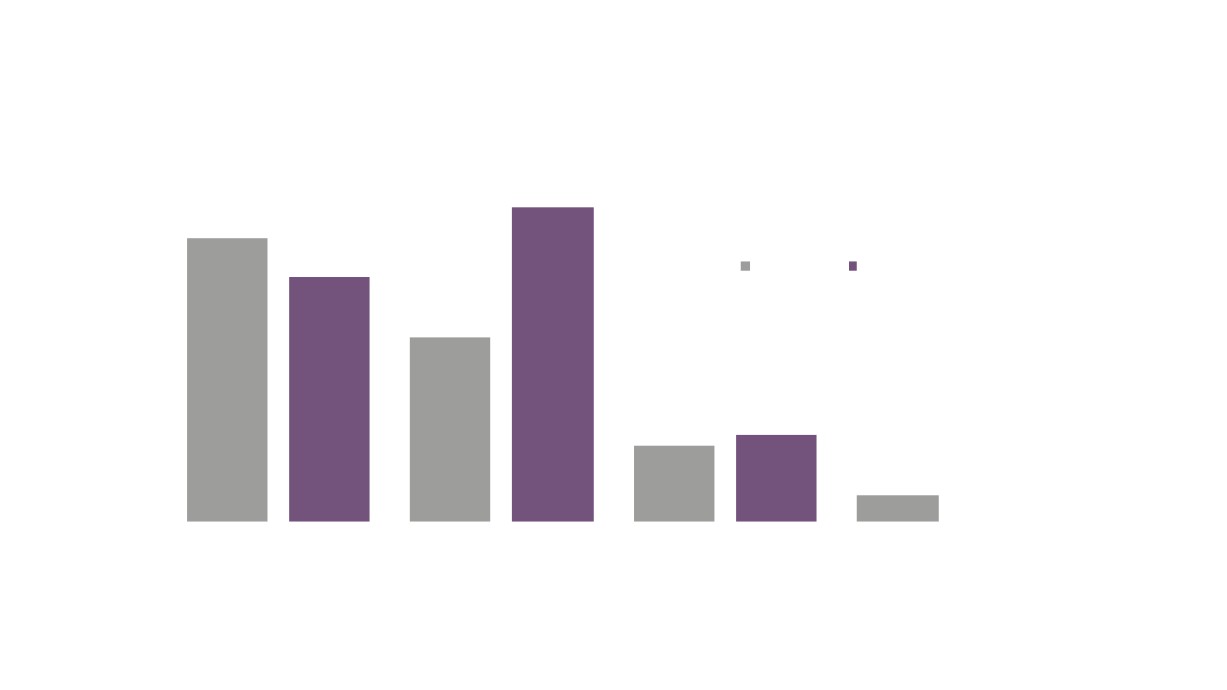

Employment Change by Additional LEP Comparator Areas

180

160

140

120

100

80

60

2009

2010

2011

2012

2013

2014

2015

2016

2017

Coast to Capital

Greater Birmingham and Solihull

Greater Manchester

New Anglia

North East

West of England

Source: Business Register and Employment Survey, Office for National Statistics

22

180

Empl

ds

180

160

140

120

100

80

60

2009

2010

2011

2012

2013

2014

2015

2016

2017

3

Coast to Capital

Greater Birmingham and Solihull

Greater Manchester

New Anglia

Employment Change by Additional City Comparator Areas

220

200

180

160

140

120

100

80

60

2009

2010

2011

2012

2013

2014

2015

2016

2017

Newcastle upon Tyne

Manchester

Brighton and Hove

Bristol, City of

Birmingham

Ipswich

Norwich

Source: Business Register and Employment Survey, Office for National Statistics

24

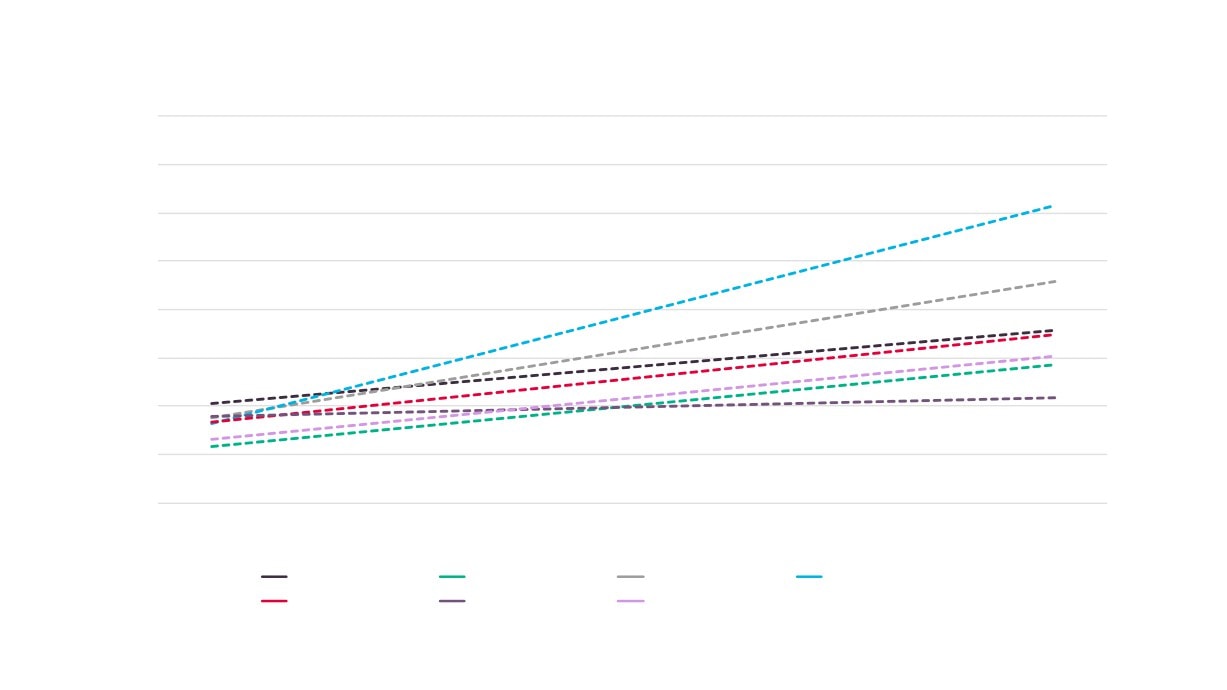

Employment Change by Additional City Comparator Areas - Trends

220

200

180

160

140

120

100

80

60

2009

2010

2011

2012

2013

2014

2015

2016

2017

Newcastle upon Tyne

Manchester

Brighton and Hove

Bristol, City of

Birmingham

Ipswich

Norwich

Linear (Newcastle upon Tyne)

Linear (Manchester)

Linear (Brighton and Hove)

Linear (Bristol, City of)

Linear (Birmingham)

Source: Business Register and Employment Survey, Office for National Statistics

5

Linear (Ipswich)

Linear (Norwich)

1.9%

Norfolk

2.1%

2.2%

Suf folk

2.5%

Change in

Creative

3.3%

Creative Industries

GCGP LEP

Industries

3.6%

Creative Industries Plus

Sector

1.2%

Employment,t er Lincolnshire LEP

1.5%

2010 - 2015,

8.2%

by New Anglia

London LEP

9.1%

LEP Local

3.0%

Authority

South East LEP

3.3%

Areas

Source: Business Register and

3.4%

Employment Survey, Office for

East of England

National Statistics

3.7%

4.0%

England

4.6%

26

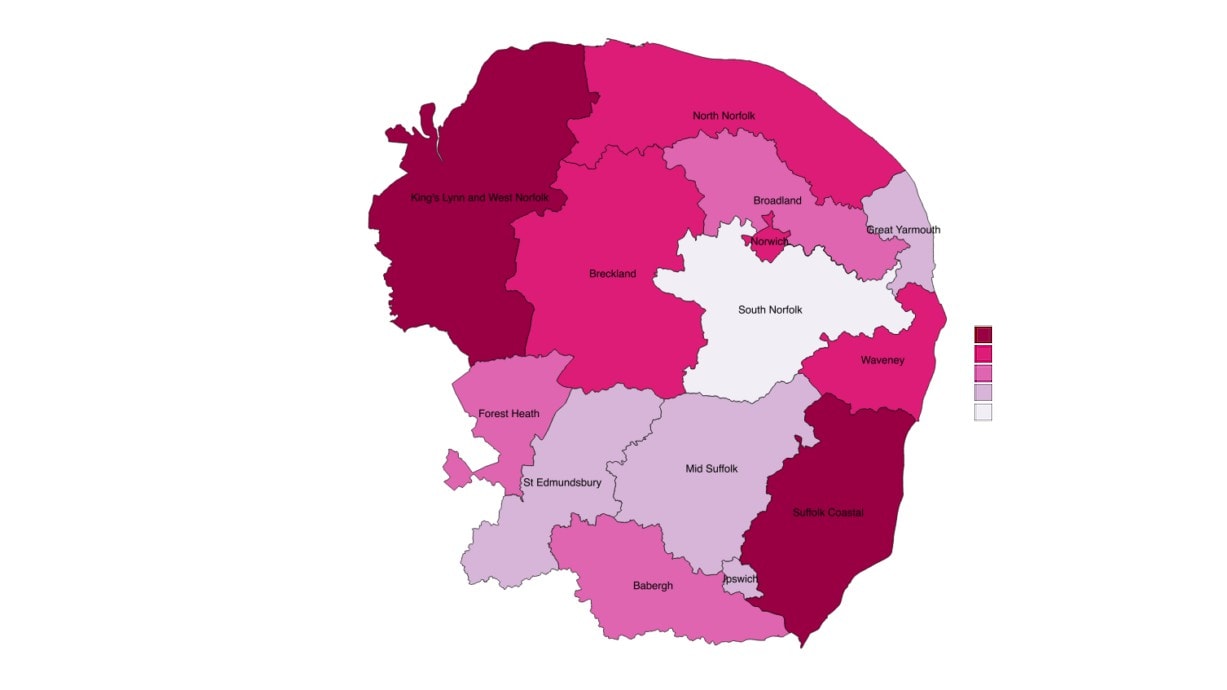

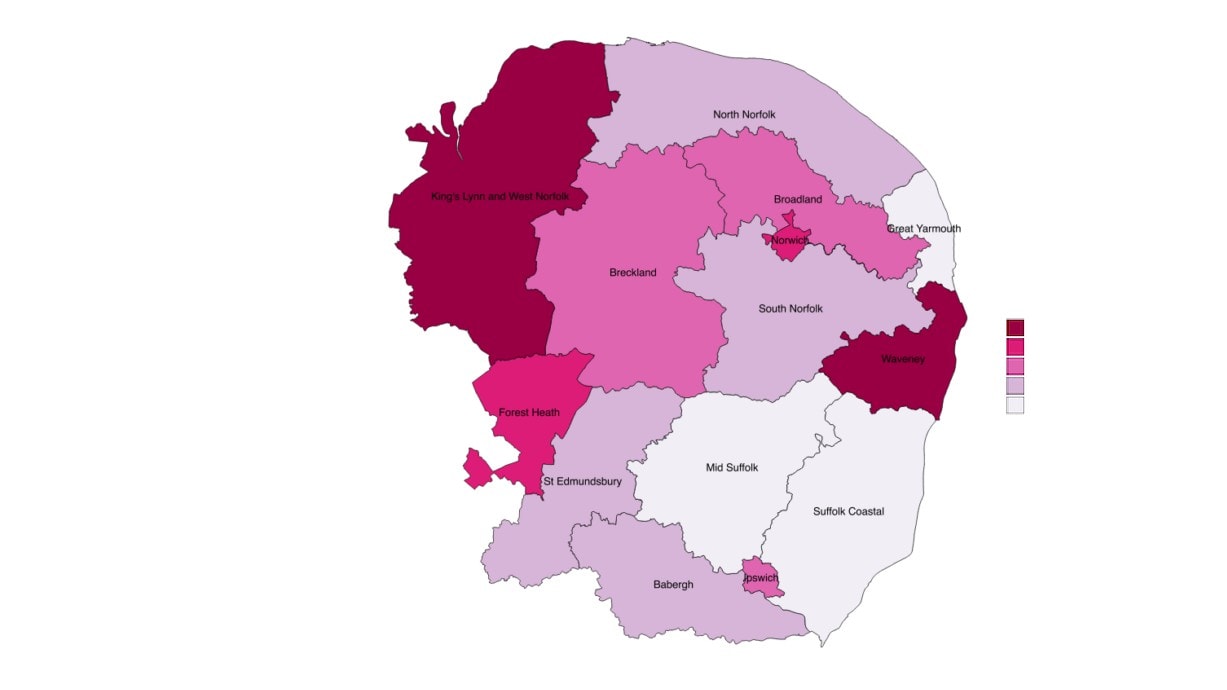

Change in

Creative

Industries Plus

Sector

Employment,

2010 - 2015,

47 - 57%

31 - 47%

by New Anglia

11 - 31%

0 - 11%

LEP Local

-3 - 0%

Authority

Areas

Source: Business Register and

Employment Survey, Office for

National Statistics

27

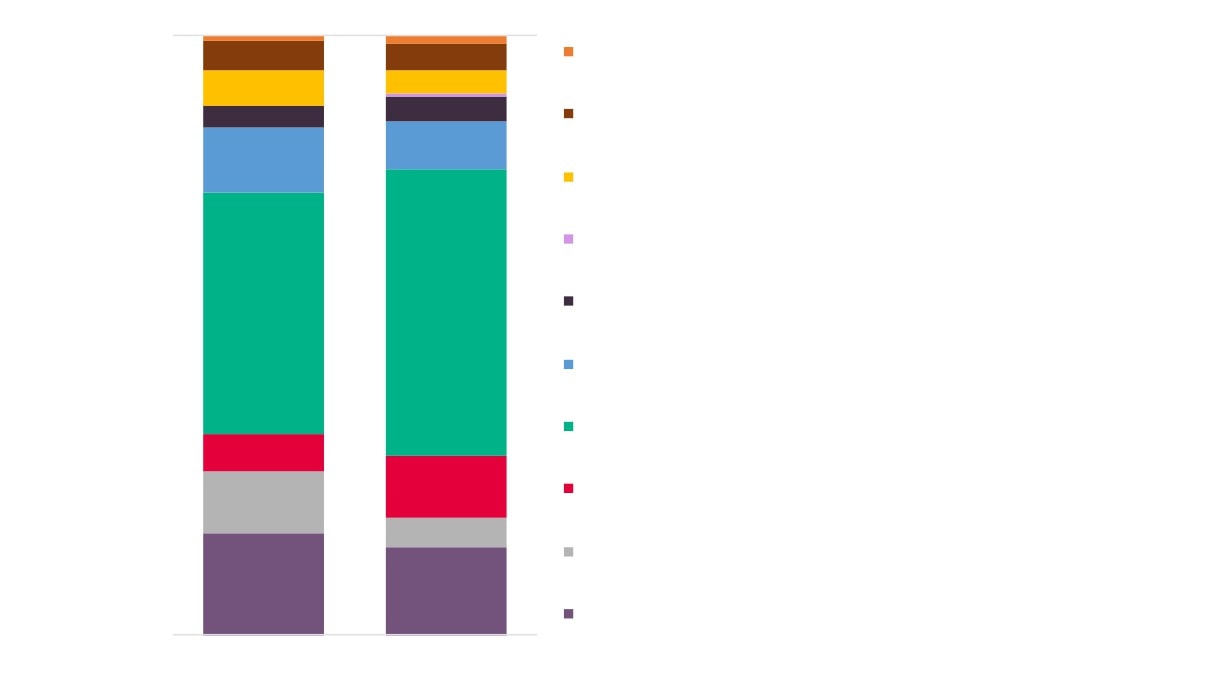

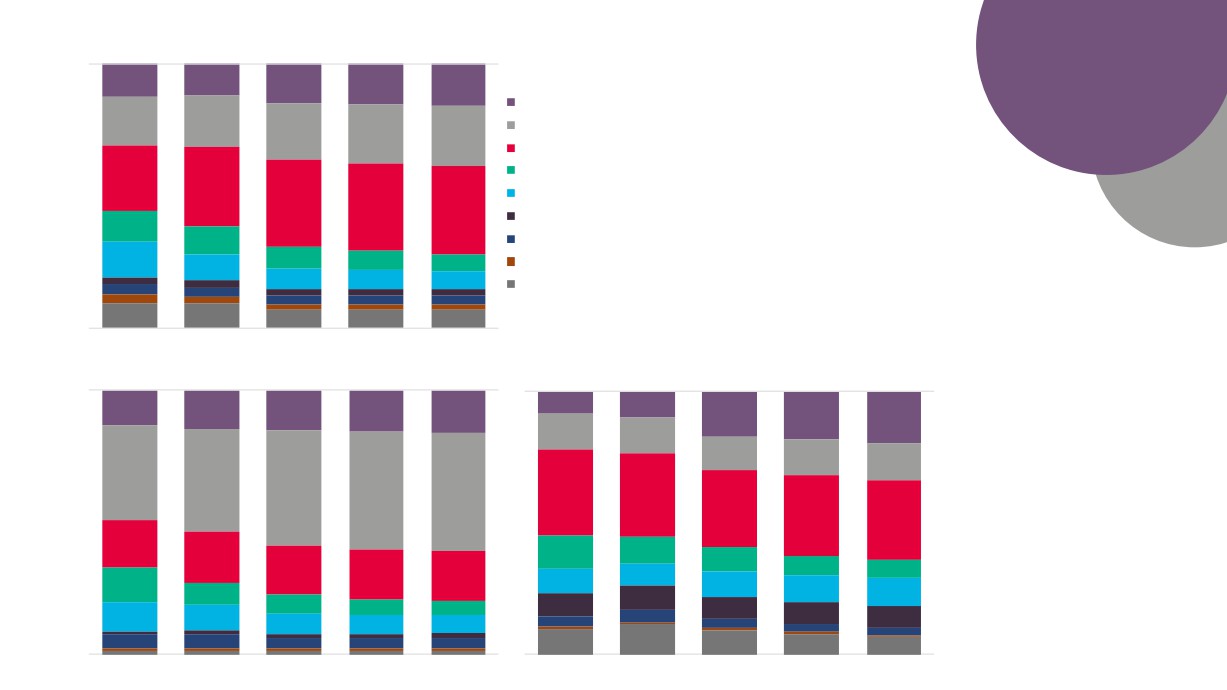

100%

5%

Fashion

4%

4%

6%

4%

Textiles

4%

8%

11%

Music, Performing &

Visual Arts

Crafts

Creative Industries

Plus, Employment by

Design

40%

48%

Sub Sector

Source: Business Register and

Publishing

Employment Survey, Office for

National Statistics

IT, Software & Computer

Services

6%

10%

Film, TV, Video, Radio &

10%

Photography

5%

Architectural activities

17%

15%

Advertising & Marketing

0%

New Anglia

England

28

Top Creative Industries Plus Sub Sectors by Employment, 2015

% of total

Change in

Creative

Industry Sector Code

Industry Sector Name

Employment

employment 2010 -

Industries Plus

2015

employment

62020

Computer consultancy activities

4,300

20%

34%

62012

Business and domestic software development

2,000

10%

52%

58142

Publishing of consumer, business and professional journals and periodi

1,700

8%

325%

74100

Specialised design activities

1,700

8%

-3%

58130

Publishing of newspapers

1,500

7%

20%

73110

Advertising agencies

1,300

6%

1%

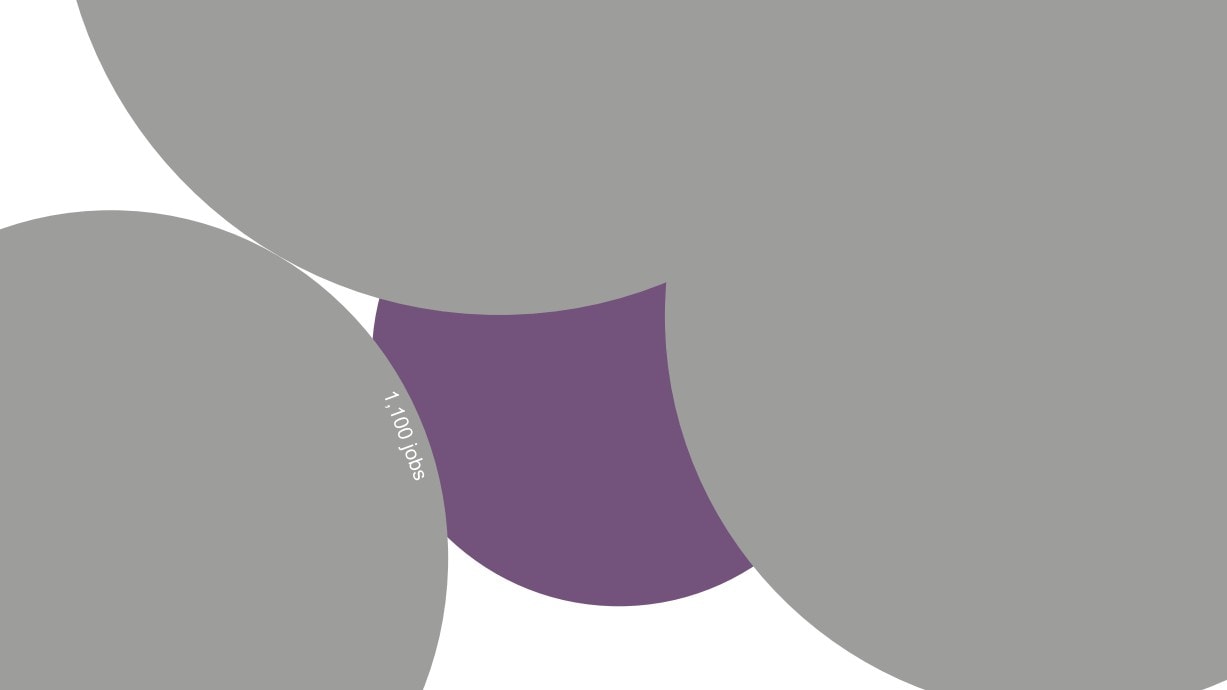

71111

Architectural activities

1,100

5%

-18%

90030

Artistic creation

70

3%

-39%

58110

Book publishing

70

3%

186%

58190

Other publishing activities

600

3%

82%

Source: New Anglia LEP Economic Strategy evidence base work

29

Top Creative Industries Plus Sub Sectors with 100+

Employees by Growth in Employment

% of total

Change in

Creative

Industry Sector Code

Industry Sector Name

Employment

employment

Industries Plus

2010 - 2015

employment

13960

Manufacture of other technical and industrial textiles

200

0.9%

2547%

28940

Manufacture of machinery for textile, apparel and leather production

100

0.3%

2456%

59112

Video production activities

200

1.1%

1893%

58210

Publishing of computer games

100

0.4%

1673%

61200

Wireless telecommunications activities

200

0.9%

1239%

14131

Manufacture of men's outerwear, other than leather clothes and workwear

100

0.7%

967%

58142

Publishing of consumer, business and professional journals and periodicals

1,700

8.0%

325%

59131

Motion picture distribution activities

100

0.6%

231%

13300

Finishing of textiles

100

0.5%

205%

59200

Sound recording and music publishing activities

300

1.3%

192%

58110

Book publishing

700

3.2%

186%

59113

Television programme production activities

300

1.5%

120%

58290

Other software publishing

100

0.7%

111%

59111

Motion picture production activities

400

1.7%

106%

61100

Wired telecommunications activities

100

0.5%

104%

Source: New Anglia LEP Economic Strategy evidence base work

30

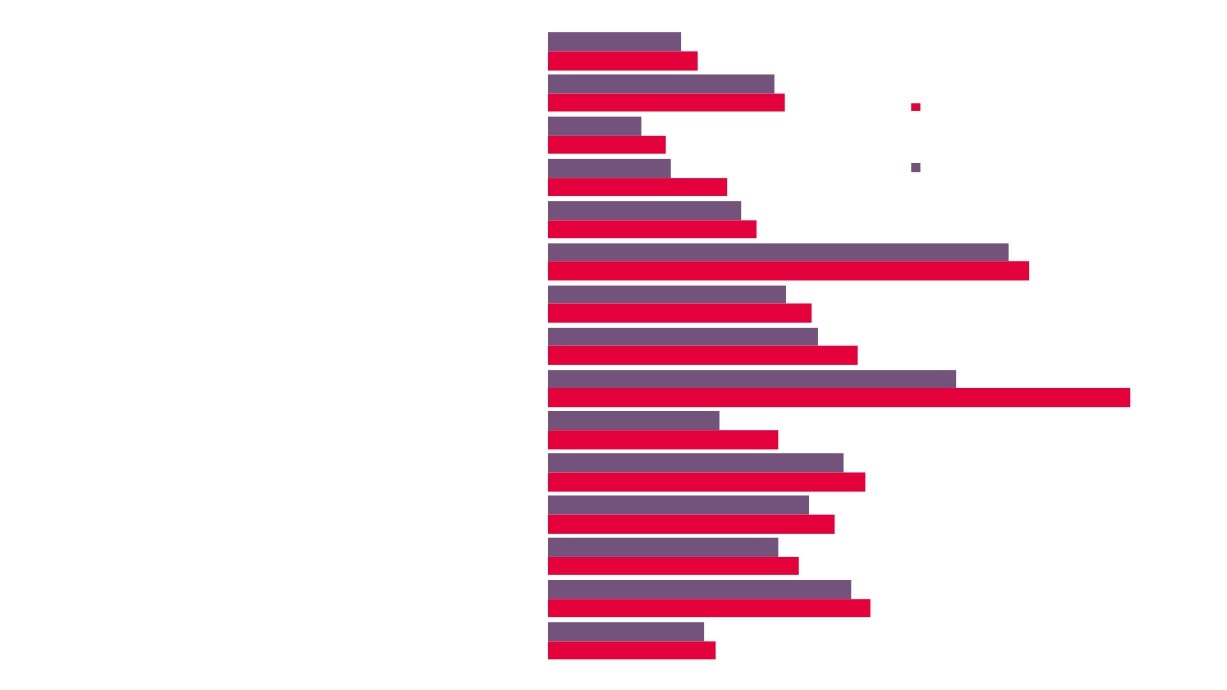

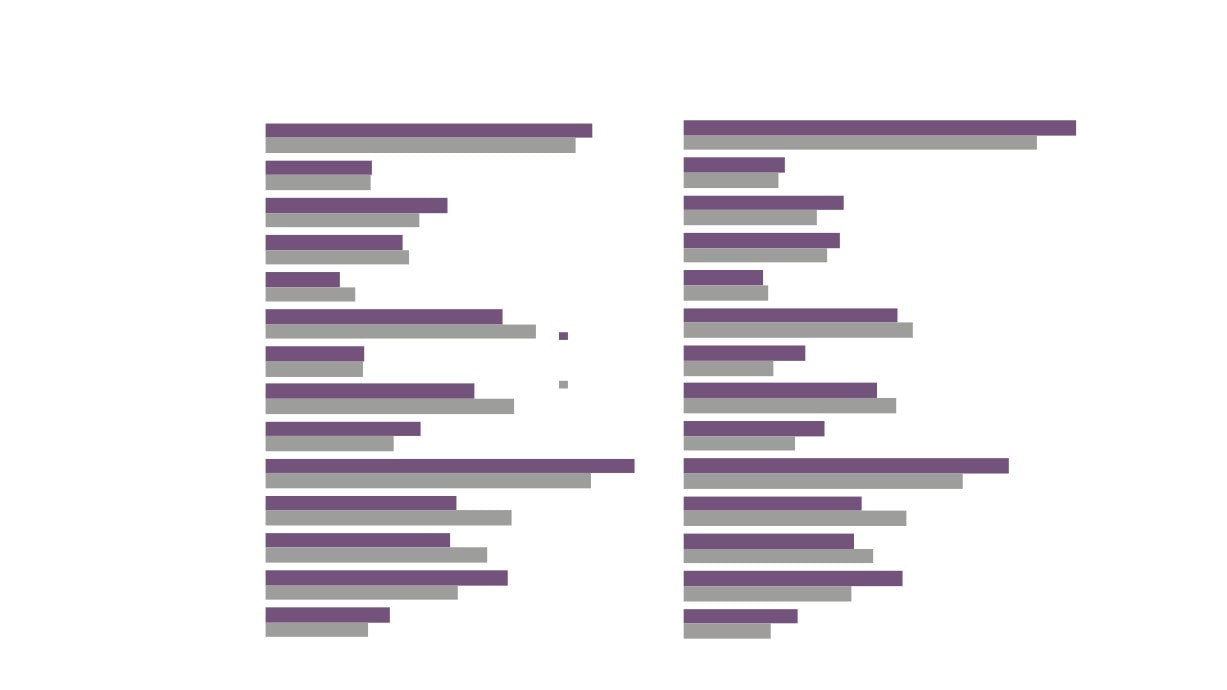

Creative Industries Location Quotients

Across Comparator Areas, 2010 and 2015

Creative Industries

Creative Industries Plus

0.5

0.5

New Anglia

New Anglia

0.5

0.5

Location quotients (LQs) are a

0.5

0.5

useful way of showing a sectors

Norfolk

Norfolk

0.5

0.4

importance to the local economy

relative to the national picture.

0.5

0.5

Suffolk

Suffolk

0.6

0.5

The analysis presented here

uses employment with an LQ

above 1 showing a higher

concentration than nationally,

0.9

0.8

and an LQ of below than 1 a

GCGP

GCGP

0.9

0.8

lower concentration.

0.3

0.3

Greater Lincolnshire

Greater Lincolnshire

0.4

0.4

2.0

London

London

2.1

0.8

0.7

South East

South East

0.7

0.6

0.9

0.8

East

East

0.8

0.7

Source: Business Register and Employment Survey, Office for National Statistics

31

Creative Industries Location Quotients Across New Anglia, 2015

Creative Industries

Creative Industries Plus

0.8

Babergh

h

0.8

0.9

0.3

0.3

Breckland

d

0.3

0.2

0.5

0.4

Broadland

d

0.4

0.3

0.3

0.4

Location quotients (LQs) are a

Forest Heath

h

0.4

0.4

useful way of showing a sectors

0.2

0.2

importance to the local economy

Great Yarmouth

h

0.2

0.2

relative to the national picture.

0.6

0.5

The analysis presented here

Ipswich

h

0.7

0.6

2015

uses employment with an LQ

0.2

0.3

above 1 showing a higher

King`s Lynn and West Norfolk

k

0.2

0.2

concentration than nationally,

2010

0.5

0.5

and an LQ of below than 1 a

Mid Suffolk

k

0.6

0.5

lower concentration.

0.4

0.4

North Norfolk

k

0.3

0.3

0.9

0.8

Norwich

h

0.8

0.7

0.5

0.5

South Norfolk

k

0.6

0.6

0.5

0.4

St Edmundsbury

y

0.6

0.5

0.6

0.6

Suffolk Coastal

l

0.5

0.4

0.3

0.3

Waveney

y

0.3

0.2

Source: Business Register and Employment Survey, Office for National Statistics

32

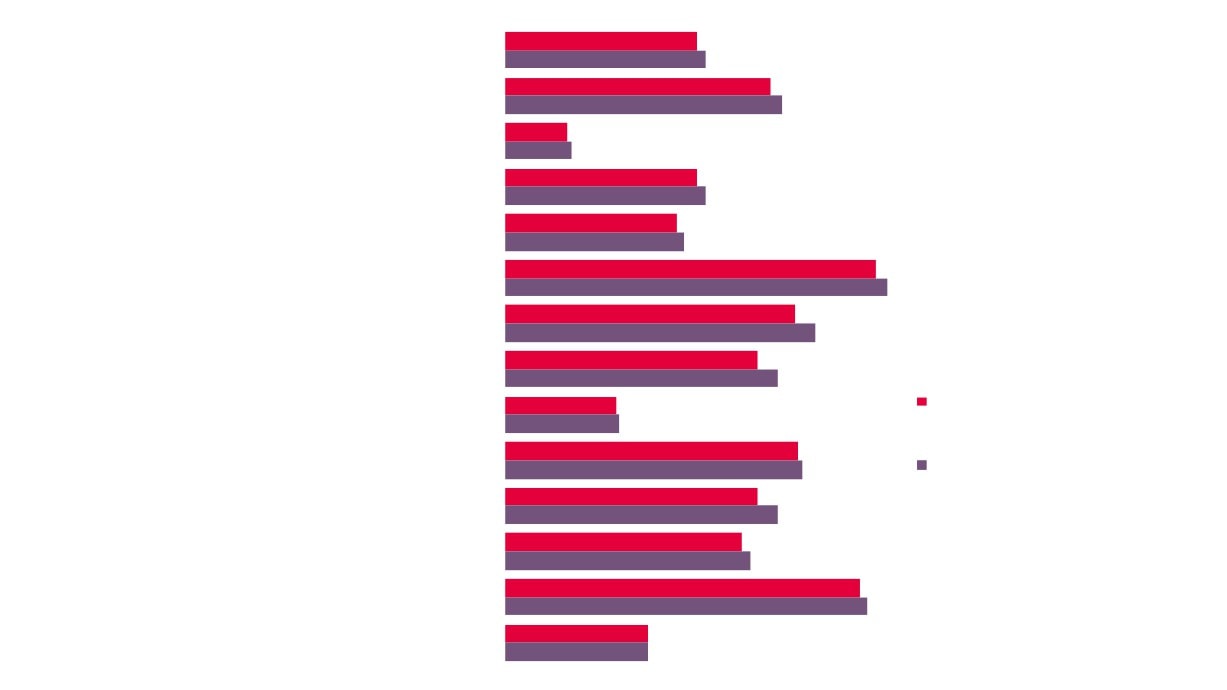

Creative Industries Plus Sub Sectors With Location

Quotients (LQs) Above 1

% of total Creative

Industry Sector Code

Industry Sector Name

Employment Industries Plus

LQ

employment

32200

Manufacture of musical instruments

150

1.0%

6.3

13200

Weaving of textiles

250

1.7%

2.4

13960

Manufacture of other technical and industrial textiles

150

1.0%

1.9

58142

Publishing of consumer, business and professional journals and periodicals

1,000

6.9%

1.2

61100

Wired telecommunications activities

300

2.1%

1.1

90040

Operation of arts facilities

450

3.1%

1.1

Source: Business Register and Employment Survey 2015, Office for National Statistics

33

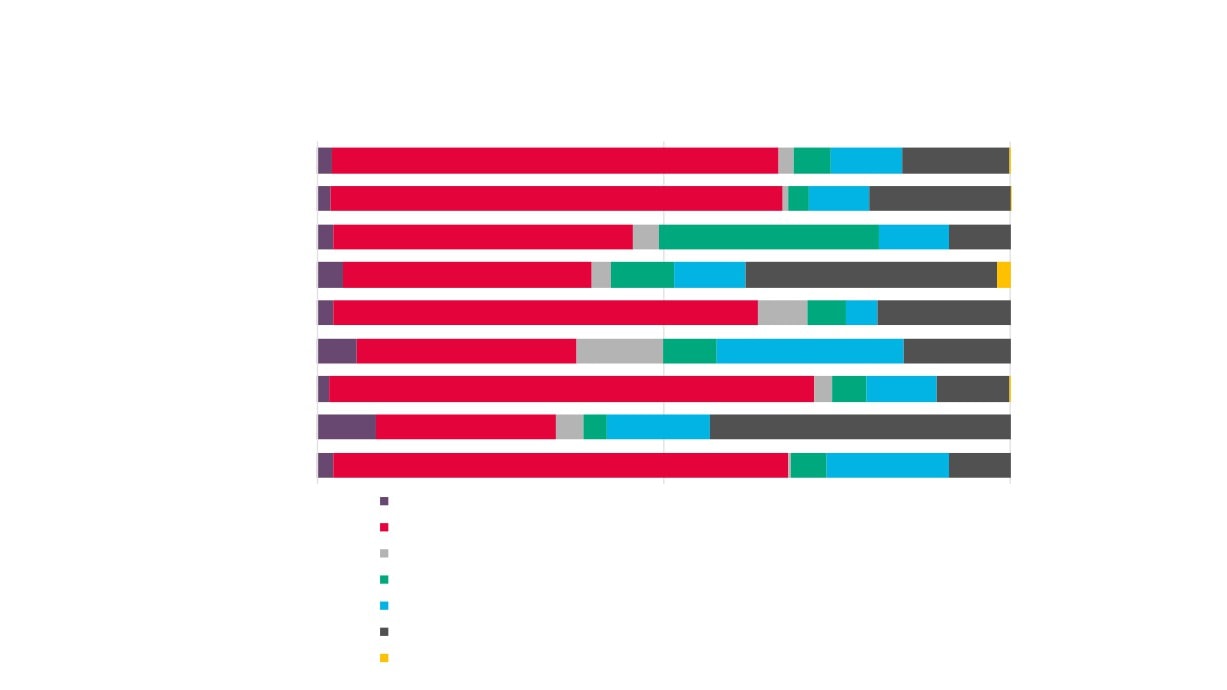

Full time, part time, and self-employment in

the Creative Industries Plus sector, 2015

New Anglia

57%

29%

14%

Creative Industries

55%

16%

29%

0%

100%

Full time

Part time

Self Employed

Source: New Anglia LEP Economic Strategy evidence base work

34

Change in full time, part time, and self-employment

in Creative Industries, 2010 - 2015

39.2%

Full time

43.0%

8.7%

5.0%

Creative Industries

Part time

3.4%

2.1%

Creative Industries Plus

6.2%

New Anglia

Self employed

9.3%

10.0%

Source: New Anglia LEP Economic Strategy evidence base work

35

3%

Fashion

12%

Textiles

Music, Performing & Visual

15%

Arts

Crafts

Design

Self Employment by

29%

Creative Industries

Publishing

Plus Sub Sector

IT, Software & Computer

Source: New Anglia LEP Economic Strategy evidence

Services

base work

18%

Film, TV, Video, Radio &

Photography

Architectural activities

11%

3%

Advertising & Marketing

7%

36

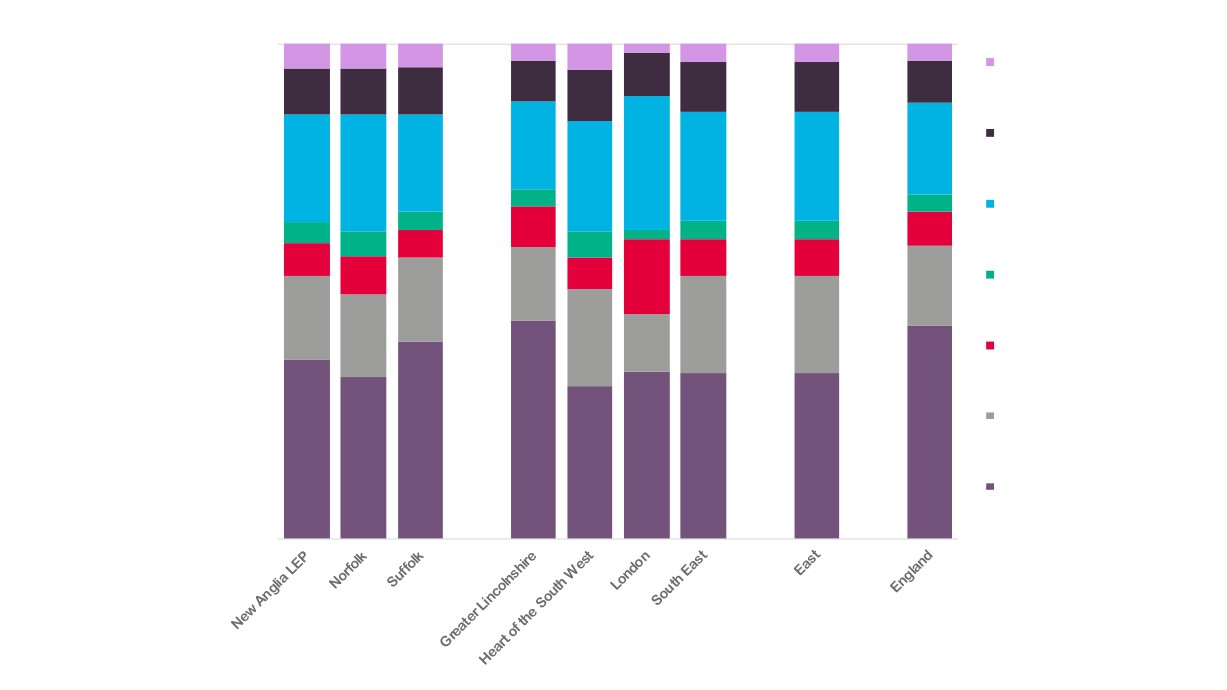

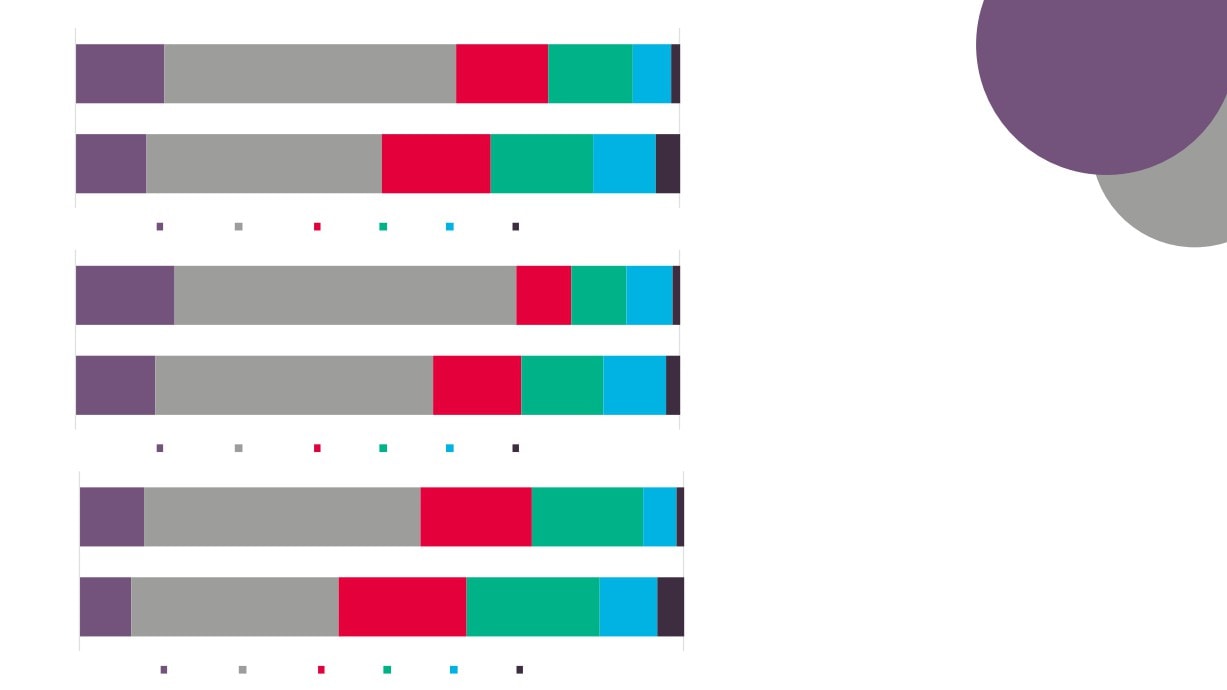

100%

2%

3%

4%

4%

3%

5%

5%

5%

5%

541 Textiles and Garments

Workplace

9%

Trades

8%

9%

10%

10%

9%

9%

9%

10%

Creative

342 Design Occupations

18%

Industries

18%

22%

20%

27%

22%

22%

24%

22%

Employment

3%

3%

341 Artistic, Literary and

4%

Media Occupations

4%

8%

4%

4%

7%

2011 by Broad

2%

5%

6%

5%

7%

7%

7%

8%

6%

312 Draughtspersons and

Standard

15%

15%

16%

Related Architectural

17%

Technicians

17%

Occupational

20%

20%

17%

20%

12%

247 Media Professionals

Classification

(SOC) Across

243 Architects, Town Planners

44%

43%

and Surveyors

40%

Comparator

36%

33%

34%

34%

34%

31%

213 Information Technology

Areas

and Telecommunications

Source: 2011 Census, Office

Professionals

for National Statistics

0%

37

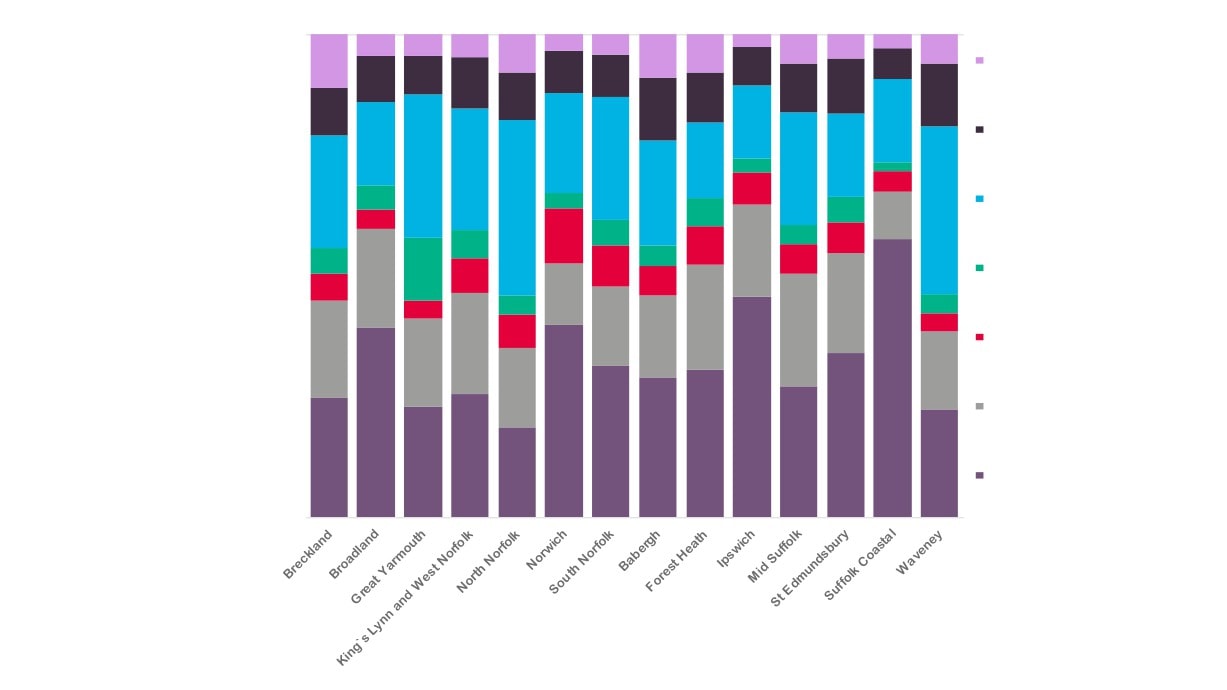

100%

3%

3%

3%

4%

4%

5%

4%

5%

6%

6%

8%

9%

8%

11%

6%

541 Textiles and Garments Trades

8%

Workplace

9%

8%

9%

10%

11%

10%

11%

10%

10%

13%

10%

13%

Creative

15%

17%

342 Design Occupations

17%

21%

Industries

17%

25%

16%

30%

3%

2%

25%

23%

4%

23%

7%

22%

Employment

5%

341 Artistic, Literary and Media

3%

37%

5%

35%

6%

10%

Occupations

4%

11%

6%

4%

6%

2011 by Broad

6%

8%

19%

4%

5%

6%

13%

8%

312 Draughtspersons and Related

20%

7%

Standard

6%

Architectural Technicians

6%

13%

4%

21%

4%

4%

22%

16%

4%

Occupational

7%

23%

17%

247 Media Professionals

21%

20%

18%

Classification

16%

58%

17%

46%

243 Architects, Town Planners and

(SOC) across

39%

40%

Surveyors

34%

31%

30%

29%

27%

New Anglia

25%

26%

23%

22%

19%

213 Information Technology and

Source: 2011 Census, Office

Telecommunications Professionals

for National Statistics

0%

38

2.0%

New Anglia

prises

2.2%

1.9%

Norfolk

2.1%

Number of

2.2%

Suf folk

Creative

2.5%

Industries

3.3%

Creative Industries

Enterprises by

3.6%

Comparator

Creative Industries Plus

1.2%

Great er Lincolnshire LEP

1.5%

8.2%

London LEP

9.1%

3.0%

South East LEP

3.3%

3.4%

39

East of England

3.7%

1.9%

Norfolk

2.1%

2.2%

Suf folk

2.5%

Proportion of

Total

3.3%

Creative Industries

GCGP LEP

3.6%

Enterprises

Creative Industries Plus

provided by

1.2%

Great er Lincolnshire LEP

1.5%

Creative

Industries, by

8.2%

London LEP

9.1%

Comparator

Areas, 2016

3.0%

South East LEP

Source: UK Business Counts,

3.3%

Office for National Statistics

3.4%

East of England

3.7%

4.0%

England

40

4.6%

235

Breckland

245

325

Broadland

2.0%

New Anglia

2.2%

Number of

1.9%

Creative

Norfolk

2.1%

Industries

2.2%

Suffolk

Enterprises by

2.5%

New Anglia

3.3%

Creative Industries

GCGP LEP

3.6%

2016

Creative Industries Plus

Source: UK Business Counts,

1.2%

Office for National Statistics olnshire LEP

1.5%

8.2%

London LEP

9.1%

41

3.0%

South East LEP

New Anglia

2.2%

1.9%

Norfolk

2.1%

2.2%

Suf folk

2.5%

C

3.3%

Creative Industries

GCGP LEP

C

3.6%

Creative Industries Plus

I

1.2%

Great er Lincolnshire LEP

E

1.5%

C

8.2%

London LEP

9.1%

2

Source: UK Business Counts,

3.0%

Office for National Statistics

South East LEP

3.3%

3.4%

East of England

3.7%

4.0%

England

42

4.6%

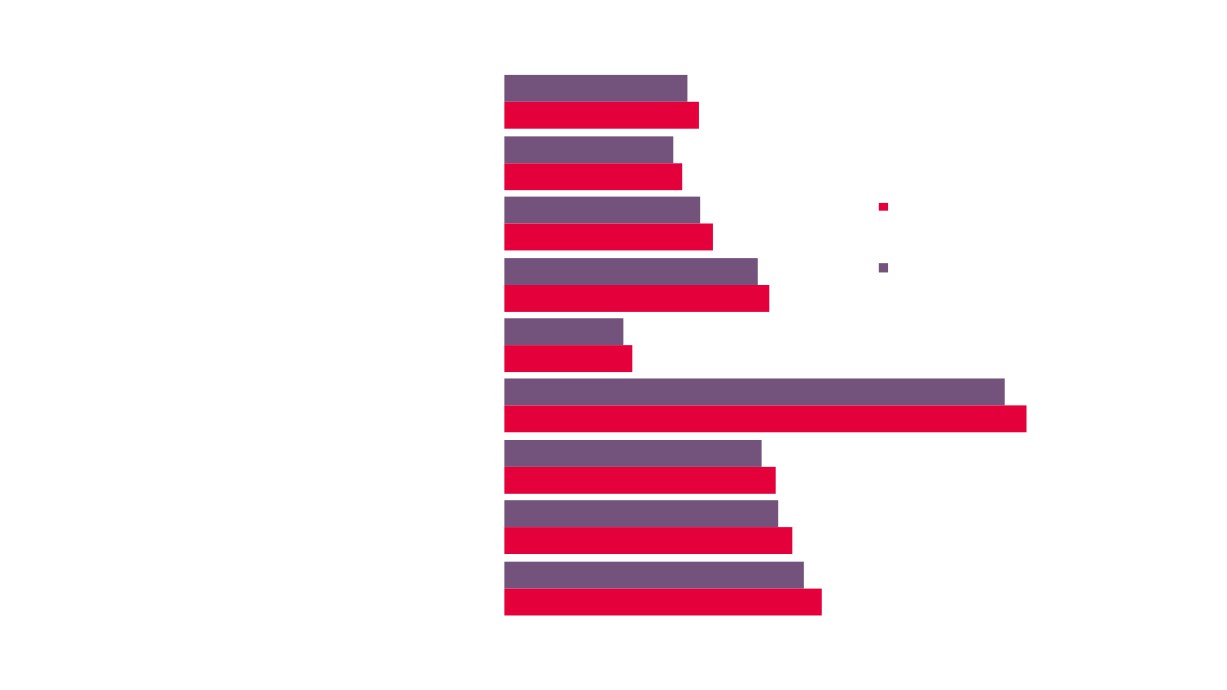

13%

Babergh

10%

24%

Breckland

20%

35%

Broadland

31%

42%

Forest Heath

Change in

40%

Creative

Great Yarmouth

0%

Industries

2.0%

En

New Anglia

2.2%

Ne

1.9%

Lo

Norfolk

2.1%

20

Source: UK Business Counts,

2.2%

Office for National Statistics

Suf folk

2.5%

3.3%

Creative Industries

GCGP LEP

3.6%

Creative Industries Plus

1.2%

Great er Lincolnshire LEP

1.5%

43

8.2%

Change in

Creative

Industries Plus

Sector

40 - 49%

Enterprises,

31 - 40%

13 - 31%

2010 - 2016, by

6 - 13%

0 - 6%

New Anglia Local

Authority

Source: UK Business Counts,

Office for National Statistics

44

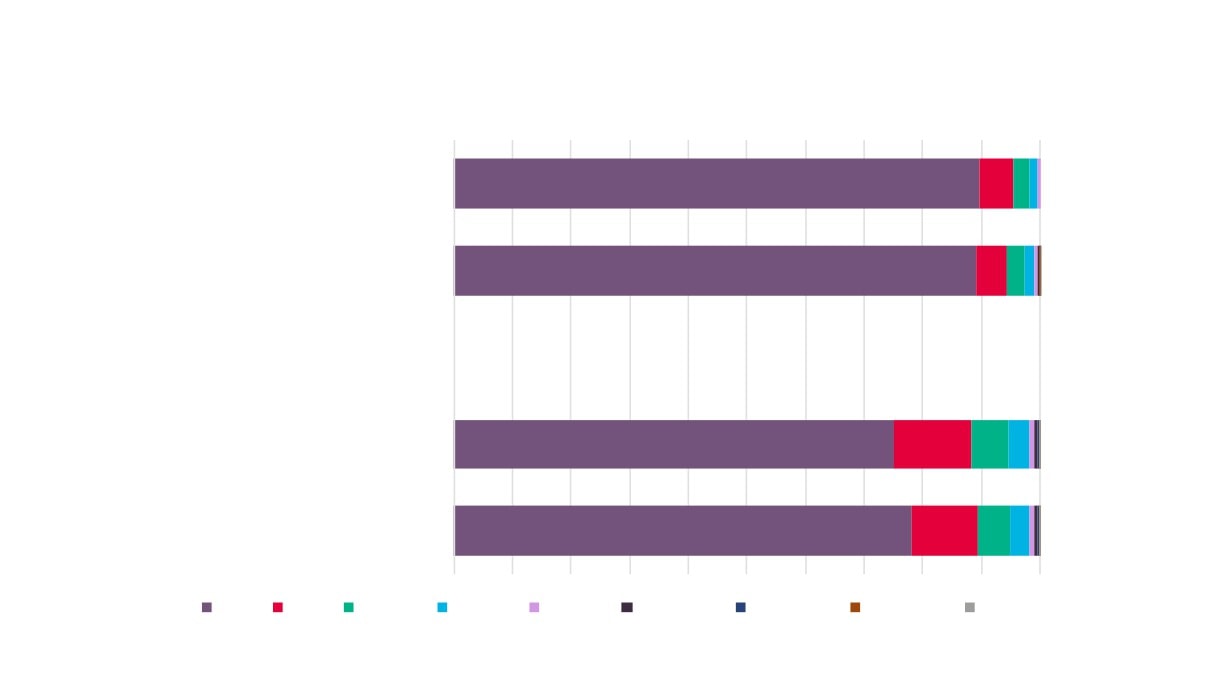

Business (Enterprise) Size by Employee Numbers

0%

10%

20%

30%

40%

50%

60%

70%

80%

90% 100%

New Anglia Creative Industries +

89.7%

5.8%

England Creative Industries +

89.1%

5.4%

All Businesses - New Anglia

75.1%

13.1%

6.3%

All Businesses - England

78.0%

11.2%

5.7%

0 to 4

5 to 9

10 to 19

20 to 49

50 to 99

100 to 249

250 to 499

500 to 999

1000+

Source: UK Business Counts, Office for National Statistics

45

Creative Industries Plus Enterprises by Size

(employee numbers)

New Anglia

75%

13%

6%

4%

Creative Industries Plus

90%

6%

3%

Babergh

94%

5%

Breckland

98%

2%

Broadland

94%

5%

Forest Heath

100%

Great Yarmouth

100%

Ipswich

93%

3%3%

King`s Lynn and West Norfolk

98%

2%

Mid Suffolk

94%

3%3%

North Norfolk

100%

Norwich

86%

7%

4% 2%

South Norfolk

97%

3%

St Edmundsbury

96%

Suffolk Coastal

92%

6%

2%

Waveney

97%

3%

Micro (0 to 4)

Micro (5 to 9)

Small (10 to 19)

Small (20 to 49)

Medium-sized (50 to 249)

Large (250+)

Source: UK Business Counts, Office for National Statistics

46

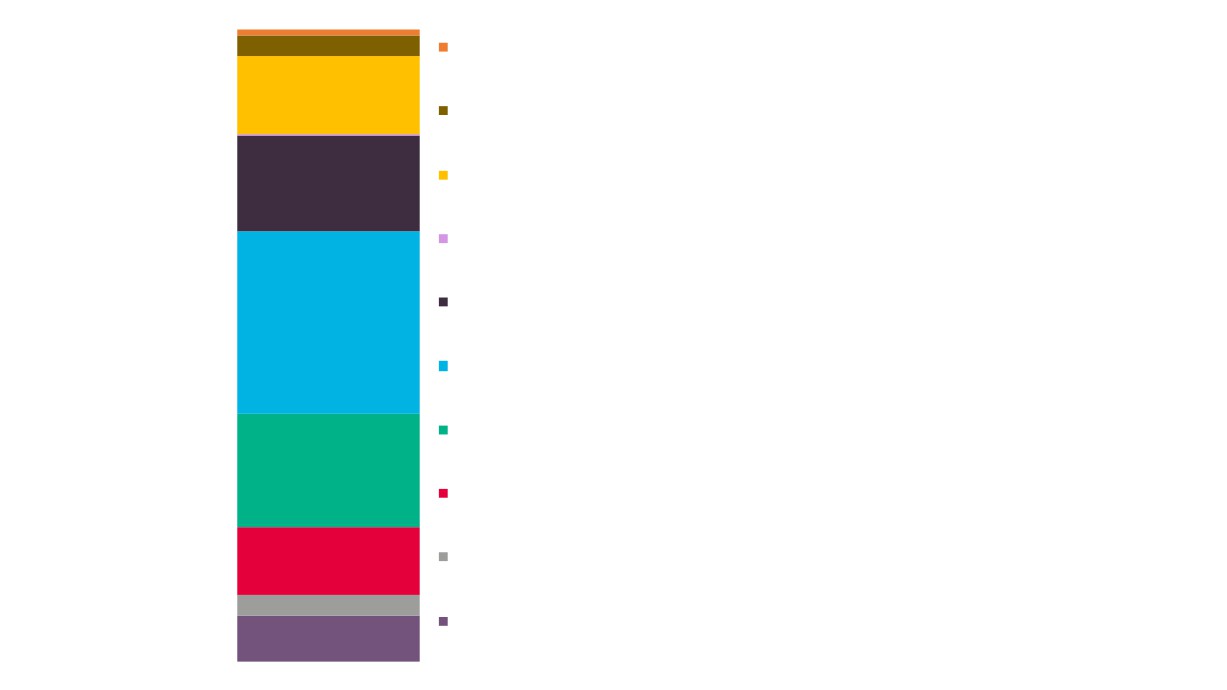

100%

Waveney

4%

4%

Suffolk Coastal

9%

11%

St Edmundsbury

8%

7%

South Norfolk

7%

9%

Norwich

12%

North Norfolk

24%

Employment and

5%

Mid Suffolk

Enterprise Numbers by

8%

King`s Lynn and

4%

New Anglia Local

West Norfolk

5%

6%

Ipswich

Authority Area

4%

9%

Great Yarmouth

12%

2%

3%

Forest Heath

2%

2%

8%

Broadland

6%

6%

4%

Breckland

8%

8%

Babergh

0%

47

Employment

Enterprises

Creative Industries

Skills Supply and

Demand

48

FE Learning

Aims

All data (unless stated otherwise) is sourced from the Department for Education’s Further Education data

In order to present information that is relevant to New Anglia LEPs high performing and underpinning sectors

then we have identified FE and skills provision data split by Sector Lead Body and aligned a best-fit with each

sector.

The Sector Lead Bodies identified as being the most relevant to the Creative Industries sector are: Creative

and Cultural; Creative Media; Business Information Technology and Telecommunication; and Fashion and

Textiles.

However, not all FE and Skills learning aims align with a sector lead body. In fact, on average around two thirds

are classed as unknown. This means that we are basing results here on roughly a third of the data.

Please note that all data is rounded to the nearest 10 and that therefore some figures presented may not add

to the sum totals presented.

49

Creative Industries Sector Learning Aims Delivered to

Domiciled Learners by Sector Lead Body 2012/13

9,690 (4.6%)

443,100 (4.8%)

Total Learners

100%

(% of All Learners)

90%

Fashion & Textiles

80%

4,590

251,500

70%

Business Information Technology &

60%

Telecommunication

50%

1,080

40%

Creative Media

48,800

30%

4,020

20%

142,800

Creative & Cultural

10%

0%

New Anglia

England

50

Creative Industries Sector Learning Aims Delivered to New

Anglia Learners by Sector Lead Body, 2010/11 and 2012/13

6,650

2010/11

2012/13

4,590

4,290

4,020

1,080

920

50

Business Information

Creative & Cultural

Creative Media

Fashion & Textiles

Technology &

Telecommunication

51

Change in Creative Industries Sector Learning Aims

Delivered to Resident Learners by Sector Lead Body

2010/11 - 2012/13

11%

Total inc. Unknown

9%

-19%

Creative Industries

6%

-31%

Business Information Technology &

Telecommunication

6%

-6%

Creative & Cultural

5%

17%

Creative Media

23%

New Anglia National

52

Creative Industries Learning Aims Delivered to New Anglia Residents by

New Anglia Based and External Providers by Sector Lead Body, 2012/13

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Creative Industries

7,400

3,010

Business Information Technology &

2,800

1,790

Telecommunication

Creative & Cultural

3,600

420

Creative Media

1,000

80

Fashion & Textiles

-

Total inc. unknown

158,480

52,170

Total with unknown removed

55,340

24,770

New Anglia Provider

External Provider

53

Creative Industries Learning Aims Delivered to New Anglia Learners by

New Anglia Providers by Sector Lead Body, 2010/11 and 2012/13

3,600

3,260

2,800

2010/ 11

2012/13

2,110

1,000

870

310

-

Business Information

Creative & Cultural

Creative Media

Fashion & Textiles

Technology &

Telecommunication

54

Change in Creative Industries Learning Aims Delivered to Resident

Learners by Domiciled Providers by Sector Lead Body, 2010/11 - 2012/13

5%

Total inc. Unknown

9%

-38%

Total not inc. Unknown

7%

13%

Creative Industries

7%

-14%

Business Information Technology & Telecommunication

6%

71%

Creative & Cultural

5%

15%

Creative Media

23%

New Anglia National

55

Apprenticeships

Apprenticeship Starts by Creative Industries

Related Framework

Apprenticeship Framework

2011/12

2012/13

2013/14

2014/15

2015/16

2016/17

2017/18

Broadcasting Technology

-

-

-

-

-

-

-

Community Arts

-

5

5

5

-

-

-

Creative and Digital Media

-

10

5

5

10

-

-

Cultural and Heirtage Venue Operation

-

-

-

-

-

-

-

Design

5

5

-

-

-

-

-

Digital Learning Design

-

-

-

-

-

-

-

Fashion and Textiles

-

-

-

-

-

-

-

Furniture, Furnishing and Interiors Manufacturing

-

-

-

-

10

10

-

Glass Industry

-

-

-

-

30

60

30

IT Application Specialist

165

120

60

65

70

30

20

IT, Software, Web & Telecoms Professional

100

120

120

170

180

130

170

Jewellery, Silversmithing and Allied Trades

-

-

-

-

-

-

-

Journalism

-

-

5

5

-

-

-

Live Events and Promotion

5

-

-

5

-

-

-

Marketing

15

25

25

15

20

20

10

Photo Imaging

-

-

-

-

-

-

-

Public Relations

-

-

-

-

-

-

-

Social Media and Digital Marketing

-

-

5

35

50

40

20

Technical Theatre, Lighting, Sound & Stage

-

-

-

-

-

-

-

Total

290

285

225

305

370

290

250

56

South East

715

Higher

STUDY 2010/11 - 2014/15

London

365

Education

GCGP

290

2,690

Hertfordshire

160

grew up outside New Anglia and

South East Midlands

150

studied Creative Industries

Greater Lincolnshire

110

subjects in New Anglia

Coast to Capital

65

Top 10 Origins of

Students Coming to

D2N2

55

New Anglia and

Leicester and Leicestershire

55

Studying Creative

Enterprise M3

30

Industries Subjects

London

1,425

9,740

South East

630

grew up in New Anglia and

studied Creative Industries

GCGP

525

subjects in England

Greater Lincolnshire

445

D2N2

380

Leeds City Region

335

Top 10 Destinations

6,730

Leicester and Leicestershire

265

for Students

Solent

225

Growing Up in New

(69%)

Anglia and Studying

Coast to Capital

220

Creative Industries

left and studied outside

West of England

215

Subjects Elsewhere

New Anglia

Total studied Creative Industries

Over the period 2010/11 - 2014/15

subjects in New Anglia

inclusive, New Anglia had a net flow of

students studying Creative Industries

subjects of

5,705

of which 47% came

-4,035

57

from outside New Anglia

New Anglia

1455

EMPLOYMENT 2010/11 - 2014/15

South East

255

London

225

1,820

Greater Lincolnshire

155

studied Creative Industries subjects

GCGP

150

outside New Anglia and subsequently

D2N2

105

found employment in New Anglia

Top 10 Origins of

Leicester and Leicestershire

70

Students Studying

Creative Industries

Leeds City Region

65

Subjects (and

Solent

65

Securing Employment

Coast to Capital

40

in New Anglia

Enterprise M3

35

2,620

New Anglia

1455

studied Creative Industries

London

440

subjects in New Anglia and

South East

200

subsequently secured

GCGP

125

employment in England

Hertfordshire

35

Coast to Capital

25

Greater Lincolnshire

20

1,160

Top 10 Employment

South East Midlands

20

Destinations for

Students Studying

(44%)

Heart of the South West

15

Creative Industries in

left and found

Leeds City Region

15

New Anglia

employment outside

Leicester and Leicestershire

15

New Anglia

Total studied Creative Industries

Over the period 2010/11 - 2014/15

subjects and employed in New Anglia

inclusive, New Anglia had a net flow of

workers who studied Creative

Industries subjects of

3,275

of which 56% came

+655

from outside New Anglia

58

Creative

New

New

COMPARATORS

Industries

National

Anglia

Anglia

Subjects

Stay for study and employment

55.6%

87.6%

27.3%

29.3%

Leave for study, return for employment

30.2%

30.4%

Leave for study, do not return

38.7%

34.3%

Stay for study, leave for employment

44.4%

12.4%

3.9%

6.0%

NOTES ON DATA SOURCES & METHODOLOGY

- The data presented here is from the population of England-domiciled students who studied for a first degree at an English higher education

provider between the academic years 2010-11 and 2014-15 inclusive. Data comes from the Higher Education Statistics Agency (HESA) Student

Record, the Education and Skills Funding Agency’s Individualised Student Record (ILR) data and the Destinations of Leavers from Higher Education

(DLHE) survey.

12%

- Creative Industries subjects defined here as ‘Architecture, building and planning’, ‘Computer Science’, ‘Creative arts and design’, and ‘Media

Studies’

- Numbers are Full Person Equivalents. This is because individuals can be taught through collaborative arrangements at two (or more) institutions.

In order to count provision against both institutions, student counts have been divided between teaching institutions in proportion to the percentage

of time taught at each.

- Data presented on mobility between home and study, where ‘home’ refers to the domicile of a student before they go to university, is for the

population of students who entered higher education between 2010-11 and 2014-15 and who have a valid postcode for both home and study. This is

taken from the HESA Student Record and the ILR. The total FPE for this population was 1,817,855.

- Data using employment location is restricted to students who left higher education between 2010-11 and 2014-15 and who provided a valid full or

partial employment postcode in response to the DLHE survey. The total FPE for this population was 710,800.

- Because these two populations differ significantly means that we are unable to make direct comparisons between the two i.e. calculate the true

59

retention of students, and movements into employment, for an area.

Labour Insight

Jobs

The following section presents data from Labour Insight, a Burning Glass analytical tool. This tool collects details

of online job postings from multiple sources and enables the analysis of these postings based on specific skills,

educational requirements, and job titles, for example.

Please note that whilst Labour Insight will capture more information on the jobs market than more traditional

Department for Work and Pensions vacancy data, the fact that not all job vacancies are advertised means that

there will still be gaps in the findings.

In terms of Creative Industries occupations then, according to the Labour Insight Jobs tool, there were 80,730

postings for the sector in New Anglia between Jan. 1, 2012 and Dec. 31, 2018.

The Standard Occupational Classification codes used to capture this Creative Industries recruitment activity are

those set out by the Department for Culture, Media and Sport and are detailed in the Appendices on page 93.

60

Burning Glass Labour Market Analysis of Creative Industries

Occupations for Year Ending 30th November 2018

Rank Work Area

Job Postings Job Postings per 1,000 employed Location Quotient

1

London

330,619

77

Much higher demand than average

2

Cambridge

19,536

53

Higher demand than average

3

Bristol

20,207

47

Higher demand than average

6

Birmingham

31,676

43

Average demand

13

Manchester

41,266

34

Average demand

14

Brighton

5,642

32

Average demand

41

Ipswich

2,987

18

Much lower demand than average

49

Newcastle

7,896

16

Much lower demand than average

51

Norwich

3,579

16

Much lower demand than average

66

Bury St Edmunds

956

14

Much lower demand than average

130

King's Lynn

360

6

Much lower demand than average

133

Lowestoft

269

5

Much lower demand than average

135

Great Yarmouth

224

5

Much lower demand than average

163

Thetford & Mildenhall

208

3

Much lower demand than average

214

Cromer & Sheringham

21

1

Much lower demand than average

61

2%

16%

Postgraduate Degrees, Level 5

Certificates/Diplomas, Level 5 S/NVQs

Bachelor's Degrees, Graduate

Certificates/Diplomas

10%

Education (minimum

Foundation Degrees, HNDs

advertised) for Creative

Industries Occupations

2012 - 2018

HNCs, Level 4 Certificates/Diplomas, Level 4

5%

S/NVQs

2%

64%

A-Levels, Highers, Level 3 S/NVQs

GCSEs, Standard Grades, Level 2 S/NVQs

62

Education (minimum advertised) for Creative Industries (Sub

Sectors) Occupations in New Anglia, 2012 - 2018

0%

50%

100%

Creative Industries

64%

5%

10%

16%

Advertising & Marketing

65%

3%

9%

20%

Architecture

43%

4%

32%

10%

9%

Crafts

4%

36%

9%

10%

36%

Design

61%

7%

6%

5%

19%

Film

6%

32%

13%

8%

27%

15%

IT

70%

5%

10%

11%

Performing Arts

9%

26%

4% 3%

15%

43%

Publishing

66%

5%

18%

9%

Postgraduate Degrees, Level 5 Certificates/Diplomas, Level 5 S/NVQs

Bachelor's Degrees, Graduate Certificates/Diplomas

Foundation Degrees, HNDs

HNCs, Level 4 Certificates/Diplomas, Level 4 S/NVQs

A-Levels, Highers, Level 3 S/NVQs

GCSEs, Standard Grades, Level 2 S/NVQs

Level 1 S/NVQs

63

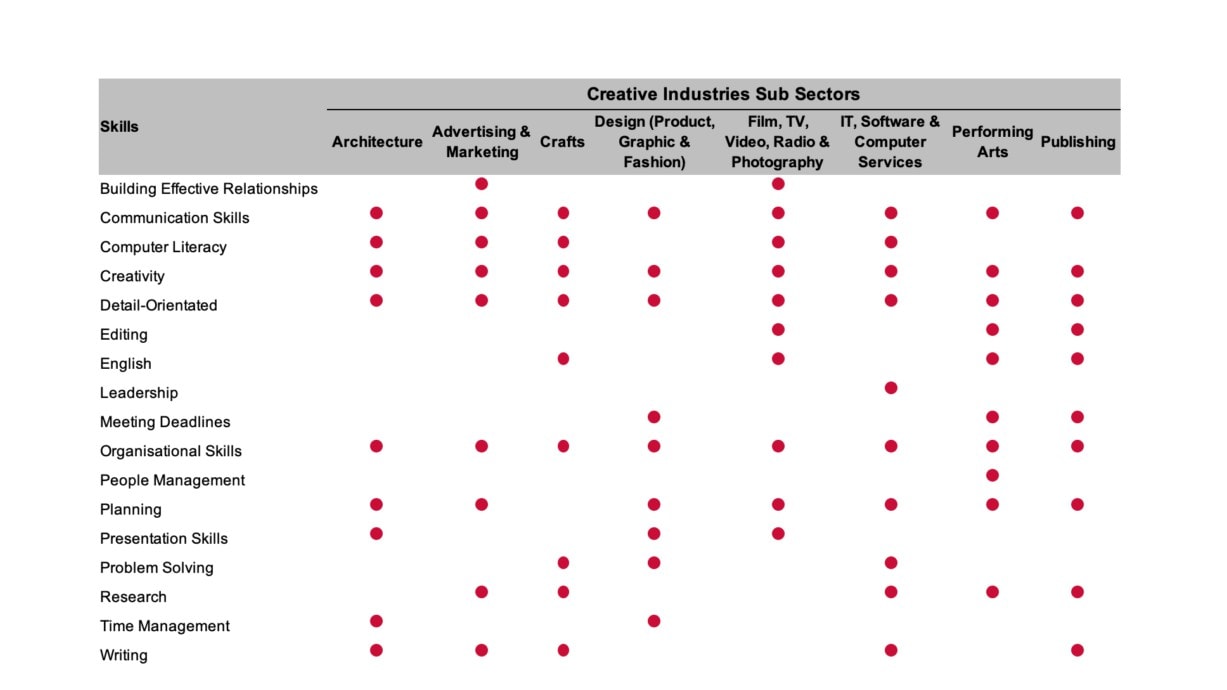

Top 20 ‘Core’ Skills for Creative

Top 20 ‘Specialised’ Skills for Creative

Industries Occupations 2018

Industries Occupations 2018

Skills

Job Postings

Skills

Job Postings

Communication Skills

2,125

Microsoft C#

1,575

Creativity

1,625

SQL

1,538

Planning

1,175

JavaScript

1,492

Organisational Skills

962

Software Development

1,391

Writing

954

Marketing

1,196

Detail-Orientated

787

.NET

1,151

Problem Solving

780

Teamwork / Collaboration

1,134

Microsoft Excel

631

Sales

979

Research

556

Social Media

914

Building Effective Relationships

526

Web Development

903

Microsoft Office

423

Budgeting

876

Leadership

422

Active Server Pages (ASP)

702

Meeting Deadlines

340

Business Development

656

Time Management

324

Software Engineering

655

Editing

320

jQuery

645

Presentation Skills

318

Java

636

English

298

SQL Server

610

Mentoring

265

ASP.NET

597

Energetic

247

Customer Service

594

Troubleshooting

219

Hypertext Preprocessor (PHP)

584

64

Top 5 ‘Specialised’ Skills by Creative Industries Sub Sector 2012 - 2018

Skills

Job Postings

Skills

Job Postings

Film, TV, Video,

Photography

225

Advertising and

Marketing

1,106

Radio and

Sales

853

Music

93

Marketing

Social Media

744

Adobe Photoshop

76

Photography

Occupations

Business Development

602

Customer Service

56

Occupations

Sales Management

506

Teamwork / Collaboration

53

Budgeting

496

Teaching

52

Skills

Job Postings

Skills

Job Postings

AutoCADto-Business

891

SQLs

11,762

IT, Software and

Revitwork / Collaboration

445

Microsoft C#

11,070

Architecture

Computer Services

Project Managementnt

290

JavaScriptesign

11,005

Occupations

.NET

9,947

Occupations

Landscape Architecture

251

SketchUp

239

Software Development

8,912

Web Development

7,785

Adobe Photoshop

189

Skills

Job Postings

Skills

Job Postings

Adobe Photoshop

169

Paint Sprayer

491

ASP.NET

6,120

Scheduling

165

Performing Arts

Cabinetry

190

Teachinger

9

5,916

Project Architecture

161

Painting

187

Singing

5

Occupations

Craft Occupations

5,716

Adobe Indesign

126

Teamwork / Collaboration

186

Adobe Indesign

143

Automotive Painting

179

Music

113

Customer Service

91

Skills

Job Postings

Skills

Job Postings

Design Occupations

Graphic Design

720

Journalism

296

Publishing

Adobe Photoshop

631

Social Media

254

(Product, Graphic

Adobe Indesignment

501

Copy Writing

199

Occupations

and Fashion)

Adobe Acrobat

341

Customer Service

174

Adobe Illustrator

328

Technical Writing / Editing

125

65

Adobe Creative Suite

326

Top 10(ish) ‘Core’ Skills 2012 - 2018

66

Where the

Work is

The following analysis makes use of data and findings available via the online toolkit http://wheretheworkis.org/ . The findings presented

are a result of combining data from the UKCES ‘Working Futures’ programme and job vacancy data from the Labour Market Insight tool

developed by Burning Glass.

Limitations

Though the ‘Where the work is’ tool provides a comprehensive and detailed free-to-use dashboard of supply and demand in the UK, the

following limitations should be taken into account when interpreting the data:

- Senior Management and Elementary roles

Occupations not open to recent HR graduates or FE finishers are not considered. Similarly, occupations that do not require any formal

qualifications or training are also excluded from this tool, since the number of job-seekers cannot be meaningfully quantified.

- Matching supply and demand

Some occupations do not have specific qualifications or subject-specific requirements (such as sales, marketing and related associate

professionals). As a result of this, and despite the fact that many people with a broad range of qualifications can apply for these

occupations, they frequently appear ‘undersupplied’ in the tool, i.e. when the “job opportunity” is low. Occupations with very small sample

sizes (either of finishers or job postings) are excluded from the dataset.

- Internal and international migration

Some occupations do not rely solely on FE finishers or HE graduates from their immediate location. Many people travel to find work, often

moving across the country. Other occupations, such as those on the Migration Advisory Committee’s shortage occupation list, may rely

more heavily on jobseekers arriving from outside the UK.

- Online and offline postings

Burning Glass Technologies (BGT) acknowledge that not all jobs are posted online, although a comparison of the Annual Survey of Hours

and Earnings (ASHE) employment data and BGT postings data for UK in 2014 showed a 94 per cent correlation between ASHE and BGT

occupational distributions. The BGT posting data slightly overestimate the proportion of professional and associate professional

occupations, while slightly underestimating the proportion of elementary occupations.

67

Location

Location Quotient - Measure of Job Posting

Quotient

Density relative to employment indexed to the

national density relative to employment

Architects/Surveyors

0.76

Architectural Techs

1.10

Artistic/Media Occs

0.57

Design Occs

0.71

IT Techs

0.57

Media Profnls

0.45

Printing Trades

2.69

Textiles Trades

0.91

68

Vacancies by

Number of Job Postings asking for entry-level

Opportunity

(2 years of experience or fewer) and school

leaver education levels, further education

levels, and higher education levels

Architects/Surveyors

37

69

271

Architectural Techs

56

38

Artistic/Media Occs

167

167

295

Design Occs

50

45

180

IT Techs

295

190

423

Media Profnls

133

Printing Trades

194

190

School leaver

FE HE

69

Average

Advertised Salaries for Job Postings in 2015

Wages

£41,800

Architects/Surveyors

£45,800

£53,500

£31,200

Architectural Techs

£40,200

£49,400

£37,900

Artistic/Media Occs

£39,500

£47,100

£38,800

Design Occs

£41,900

£47,300

£30,100

IT Techs

£35,200

£38,800

£29,400

Media Profnls

£37,000

£44,100

£31,000

Printing Trades

£29,300

£42,400

£25,800

Textiles Trades

£27,600

£38,200

New Anglia

East of England

England

70

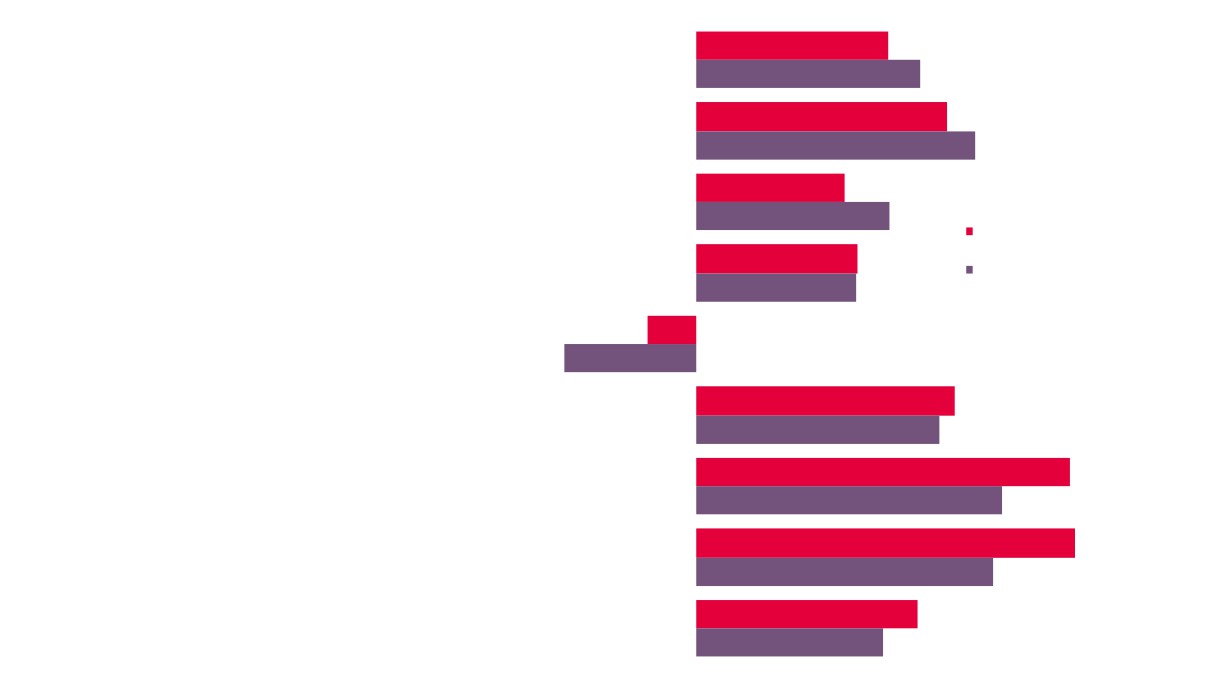

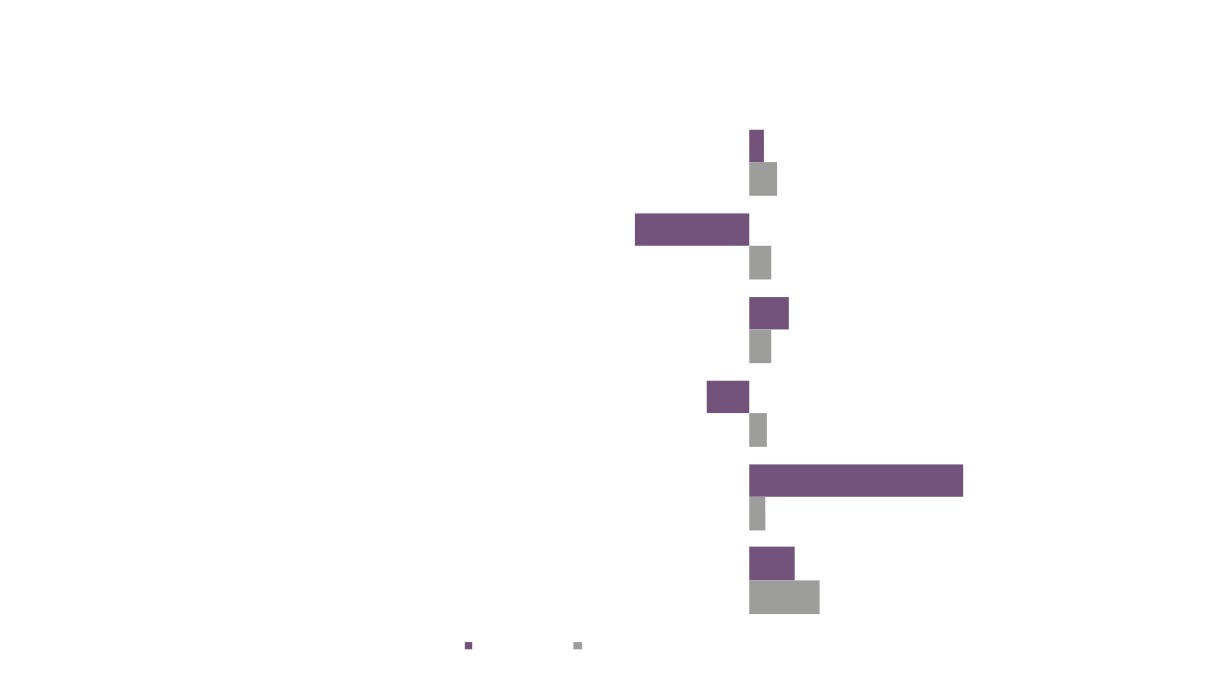

Opportunity Score - Score based on the Demand Opportunity

Supply Ratio of FE / HE postings within a

Scores

geography, from Very Low (0) to Very High (100)

Further Education

Higher Education

42

Architects/Surveyors

51

Architects/Surveyors

99

94

51

40

Architectural Techs

61

Architectural Techs

95

61

49

56

28

75

Artistic/Media Occs

36

Artistic/Media Occs

82

45

80

57

Design Occs

22

Design Occs

79

19

67

48

IT Techs

61

IT Techs

99

56

99

61

56

Media Profnls

58

Media Profnls

99

66

94

58

83

66

Printing Trades

Printin79Trades

70

83

79

75

70

Textiles Trades

Textiles Trades

79

94

71

and

New Anglia

East of England

England

New Anglia

East of England

England

A Future View of the

Creative Industries

Sector

72

Forecasting

Models

The following analysis uses data from the East of England Forecasting Model (EEFM) and the UKCES Working Futures

data (WF). In previous data analysis for other New Anglia LEP key sectors then we have been able to approximate their

workforces using the sector breakouts provided by the models. Unfortunately, given the sub sector and cross cutting

nature of the Creative Industries sector across multiple broad sectors, then this level of analysis has not been possible

for the Creative Industries sector.

Instead, we present in this section the results for each of the sub sectors that captures Creative Industries activity. In

the case of the East of England Forecasting Model then results for ‘Computer Related Activity’ and ‘Publishing and

Broadcasting’ and ‘Arts and Entertainment’ are shown. For the Working Futures data, results are presented for the

sectors of ‘Media’, “Information Technology’ and ‘Arts and Entertainment’. It should be noted that these sub sectors

have not been totalled to create results for the Creative Industries sector as the resulting numbers are much higher than

those seen for the sector.

Please also note that neither model, or the projections they produce, take into account the New Anglia LEPs ambitions

for growth in Gross Value Added (GVA) and employment.

73

Employment

Employment Projections Index (2016 = 100)

Projections

for Sectoral Elements of Creative Industries

140

130

120

110

100

90

80

70

60

2016

2020

2024

2028

2032

2036

2040

2044

Computer Related Activity

Publishing & Broadcasting

Arts & Entertainment

Source: East of England Forecasting Model

74

Employment Projections Index (2016 = 100) for

Sectoral Elements of Creative Industries

110

105

100

95

90

85

80

2016

2017

2018

2019

2020

2021

2022

2023

2024

Media

Information Technology

Arts and Entertainment

Source: Working Futures 2014 - 2024, UK Commission for Employment and Skills

75

Qualification

2024

15%

48%

15%

14%

6%

Projections

Media

2014

12%

39%

18%

17%

10%

4%

0%

QCF 7-8

QCF 4-6

QCF 3

QCF 2

QCF 1

No Qual

100%

Shifts in

2024

16%

56%

9%

9%

8%

Qualifications for

Information

Sectoral Elements of

Technology

2014

13%

46%

15%

13%

10%

Creative Industries

Source: Working Futures 2014 - 2024, UK

0%

QCF 7-8

QCF 4-6

QCF 3

QCF 2

QCF 1

No Qual

100%

Commission for Employment and Skills

2024

11%

46%

18%

18%

5%

Arts and

Entertainment

2014

9%

34%

21%

22%

10%

4%

76

0%

QCF 7-8

QCF 4-6

QCF 3

QCF 2

QCF 1

No Qual

100%

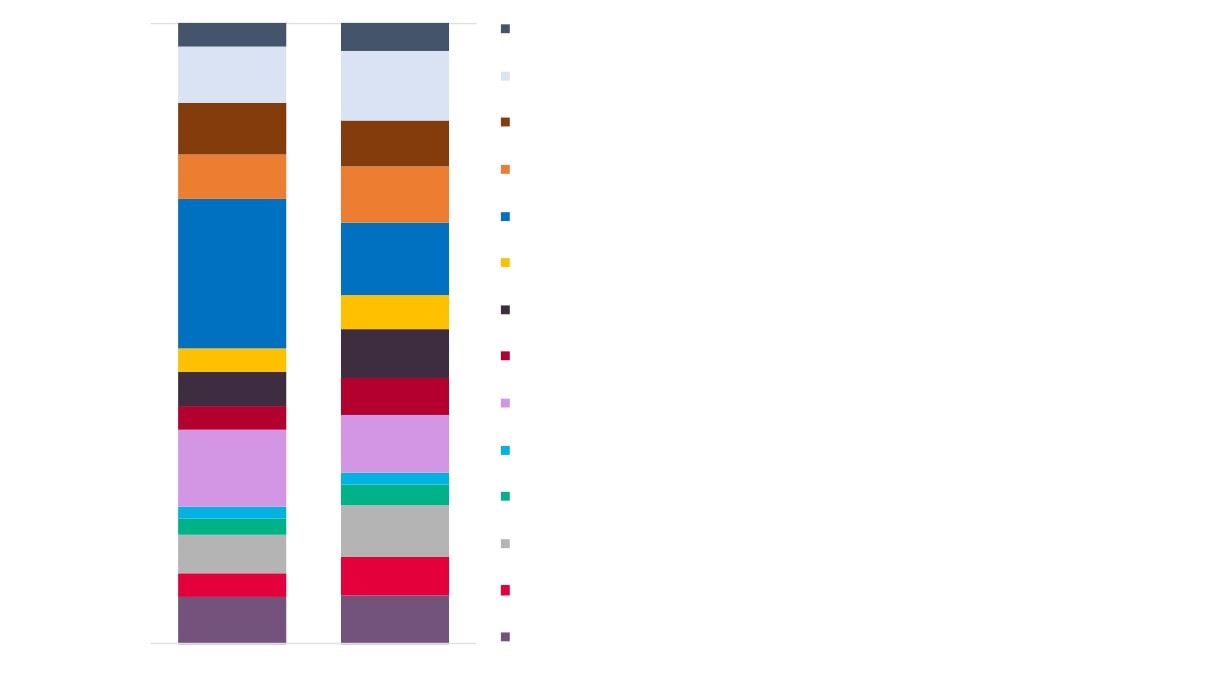

11%

12%

16%

17%

18%

Occupation

20%

0%

22%

24%

24%

24%

24%

Projections

Managers, directors and senior officials

40%

Professional occupations

26%

27%

Associate professional and technical

26%

27%

27%

60%

Administrative and secretarial

13%

10%

Skilled trades occupations

Shifts in

8%

7%

6%

Caring, leisure and other service

10%

9%

80%

9%

9%

9%

Sales and customer service

Occupations for

4%

5%

4%

Process, plant and machine operatives

3%

3%

7%

7%

6%

6%

5%

100%

Elementary occupations

Sectoral Elements of

100%

Creative Industries

Source: Working Futures

19

2024

2014 - 2024, UK Commission

0%

for Employment and Skills

13%

14%

15%

15%

16%

17%

18%

20%

14%

14%

13%

14%

14%

36%

39%

44%

45%

45%

33%

32%

29%

30%

31%

18%

13%

10%

19%

9%

8%

19%

6%

19%

19%

8%

13%

9%

9%

10%

8%

11%

9%

7%

9%

6%

6%

8%

8%

11%

10%

4%

8%

8%

7%

7%

4%

4%

3%

3%

5%

5%

4%

4%

4%

10%

12%

9%

8%

7%

100%

100%

77

Information Technology

Arts & Entertainment

Information

Technology

Media

38%

42%

45%

37%

35%

30%

44%

35%

38%

36%

32%

27%

14%

12%

11%

8%

9%

6%

-9%

-12%

All

21 Science,

11 Corporate

35 Business

24 Business,

41

-17%

-17%

-13%

-15%

occupations research,

managers

and public

media and

Administrative

engineering

and directors

service

public service

occupations

and

associate

professionals

technology

professionals

All

34 Culture,

12 Other

21 Science,

11 Corporate

24 Business,

professionals

occupations

media and

managers and

research,

managers and

media and

sports

proprietors

engineering

directors

public service

occupations

and

professionals

technology

professionals

Arts &

Expansion demand

Replacement demand

Entertainment

60%

64%

57%

Expansion and Replacement

44%

44%

Demand as a Proportion of Current

44%

50%

34%

27%

Workforce by Sectoral Elements of

16%

15%

9%

All

34 Culture,

12 Other

51 Skilled

54 Textiles,

24 Business,

Creative Industries

occupations media and

managers and

agricultural

printing and

media and

sports

proprietors

and related

other skilled

public service

Source: Working Futures 2014 - 2024, UK Commission for

occupations

trades

trades

professionals

Employment and Skills

78

Expansion demand

Replacement demand

Results from the Creative

Industries Sector Skills

Planning Survey

79

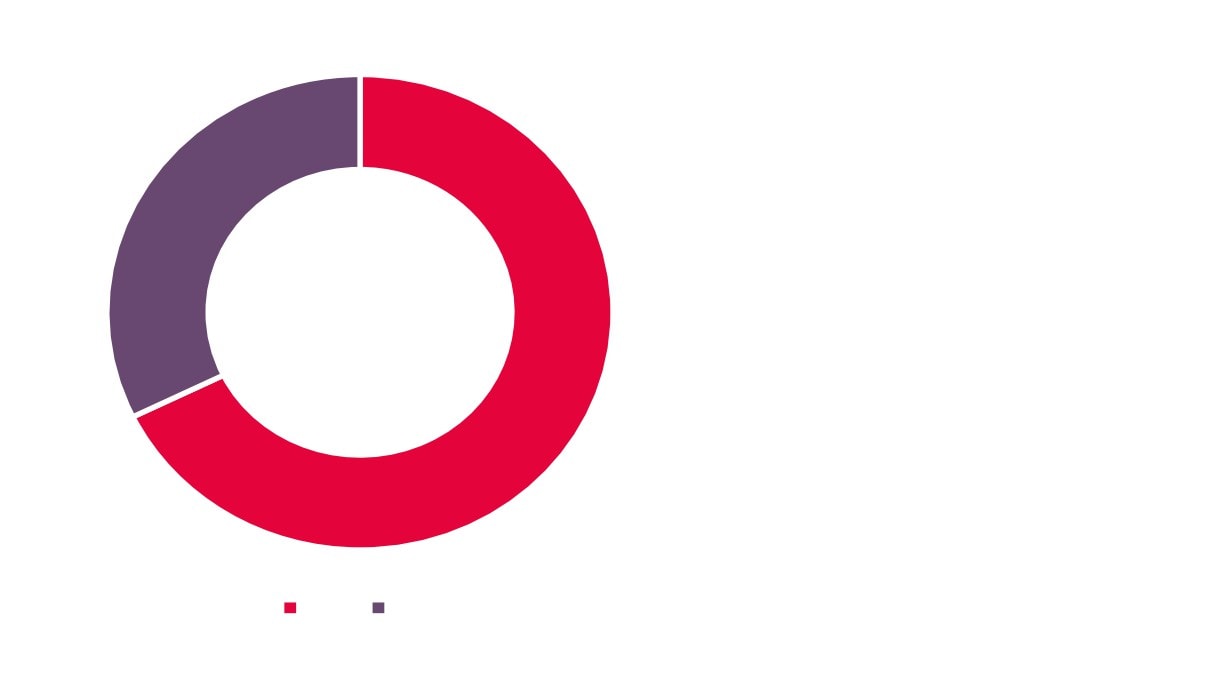

Does the local education and

32%

skills 'system' as a whole

(including schools, universities,

colleges, independent training

providers) meet

your business

needs?

68%

31 responses

No

Yes

80

Yes - Both immediate and longer term business

13%

needs

Is there a

significant gap

Yes - in terms of longer term business needs

between your

26%

only

current

employee skills

Yes - in terms of immediate business needs only

23%

base and the

skills needed

to meet your

No

35%

business

needs?

31 responses

Don't know

3%

81

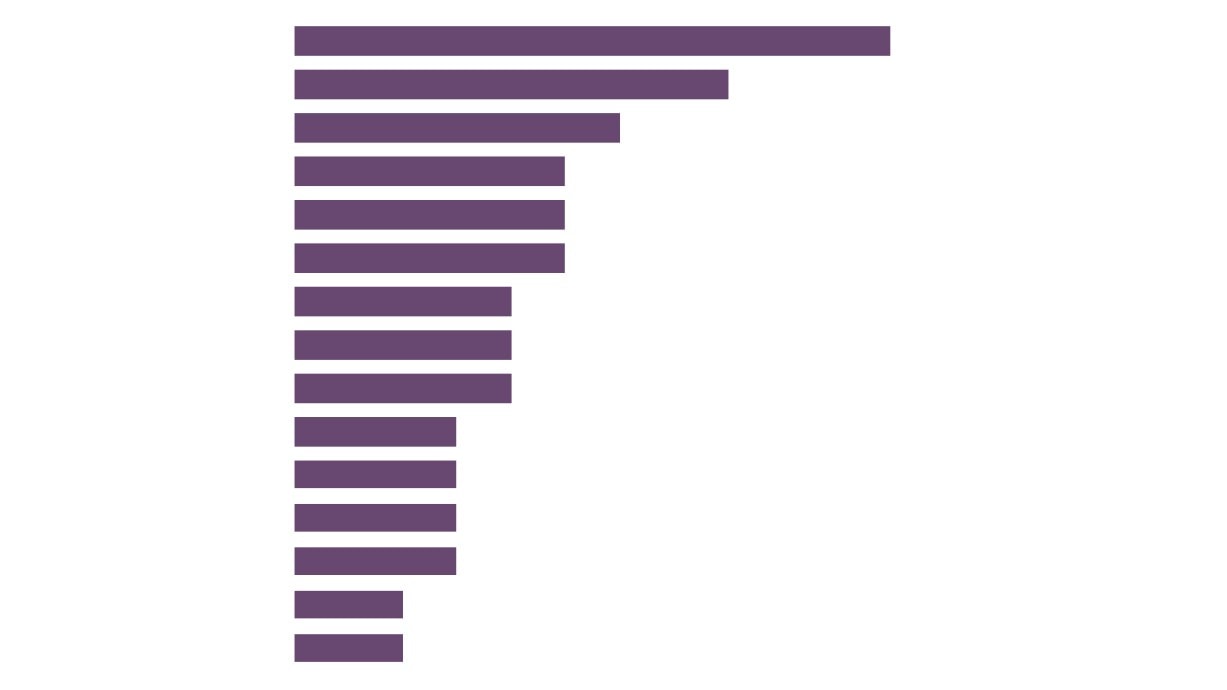

Creative business skills

26%

Designers

17%

UI/UX skills

12%

Film and TV production skills

12%

Web / Front End Developers

7%

Please provide details

Experience

7%

of any skills gaps within

your current workforce

Marketing / Branding Skills

7%

42 responses

NA

5%

Data

5%

Coders

2%

82

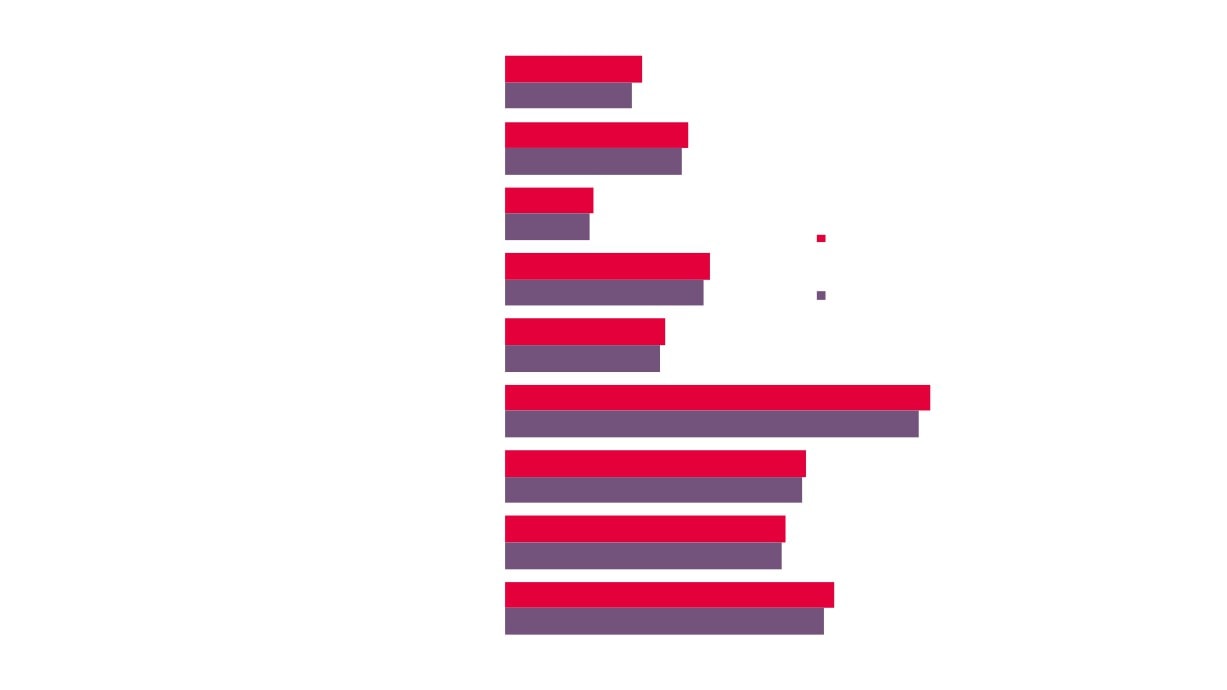

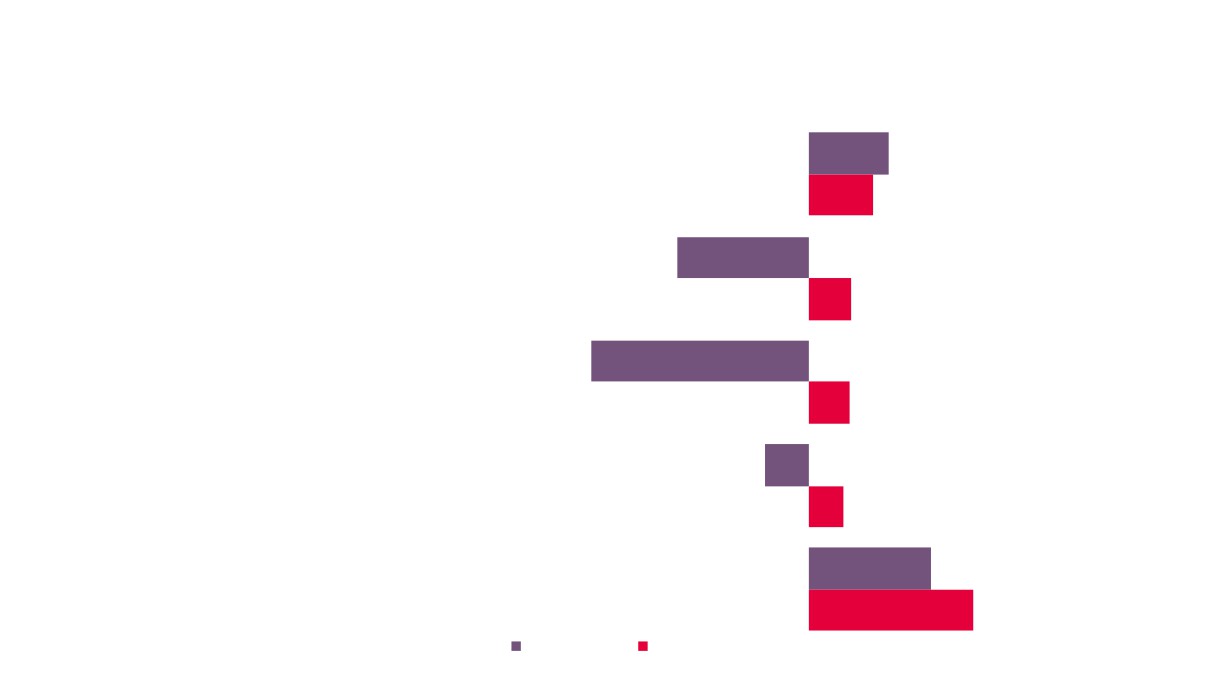

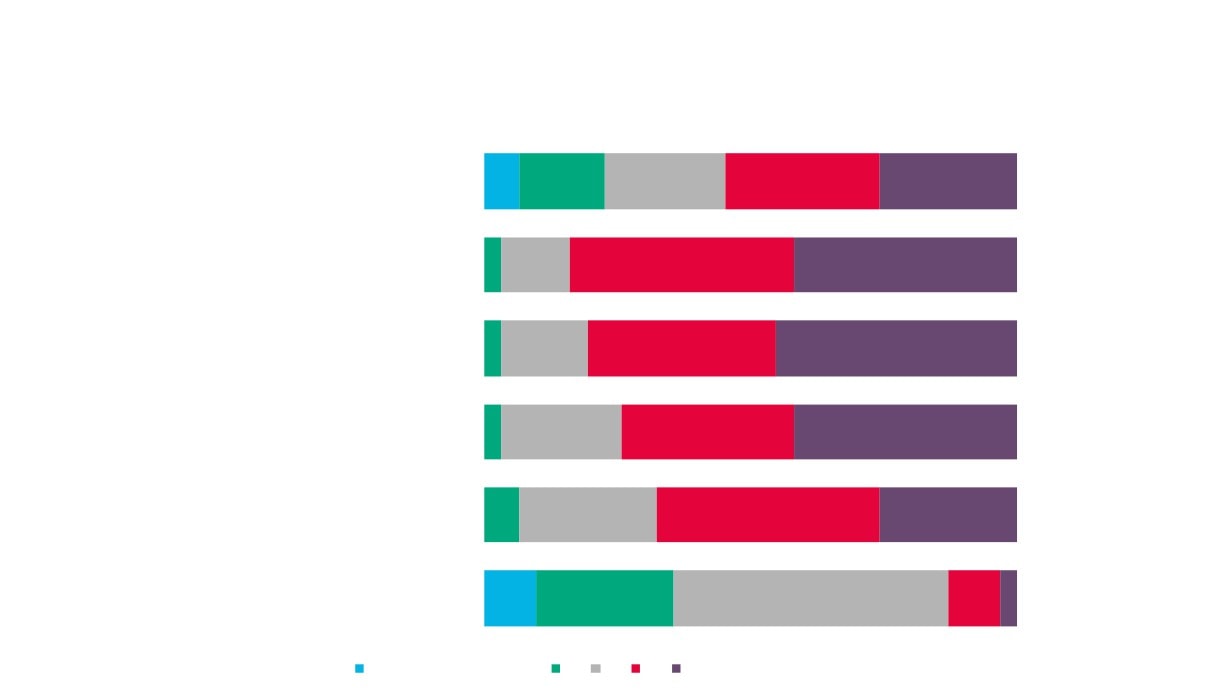

On a scale of 1 to 5, with 1 being 'not important at all' to 5 being 'very

important', how important are the following to the local Creative

Industries sector? 31 responses

Apprenticeships

6%

16%

23%

29%

26%

Under/graduate placements and internships

3%

13%

42%

42%

New and recent graduate employees 3%

16%

35%

45%

Training for existing workforce

3%

23%

32%

42%

Leadership/management development

6%

26%

42%

26%

Formal qualifications

10%

26%

52%

10% 3%

83

1 - Not important at all

2

3

4

5 - Very important

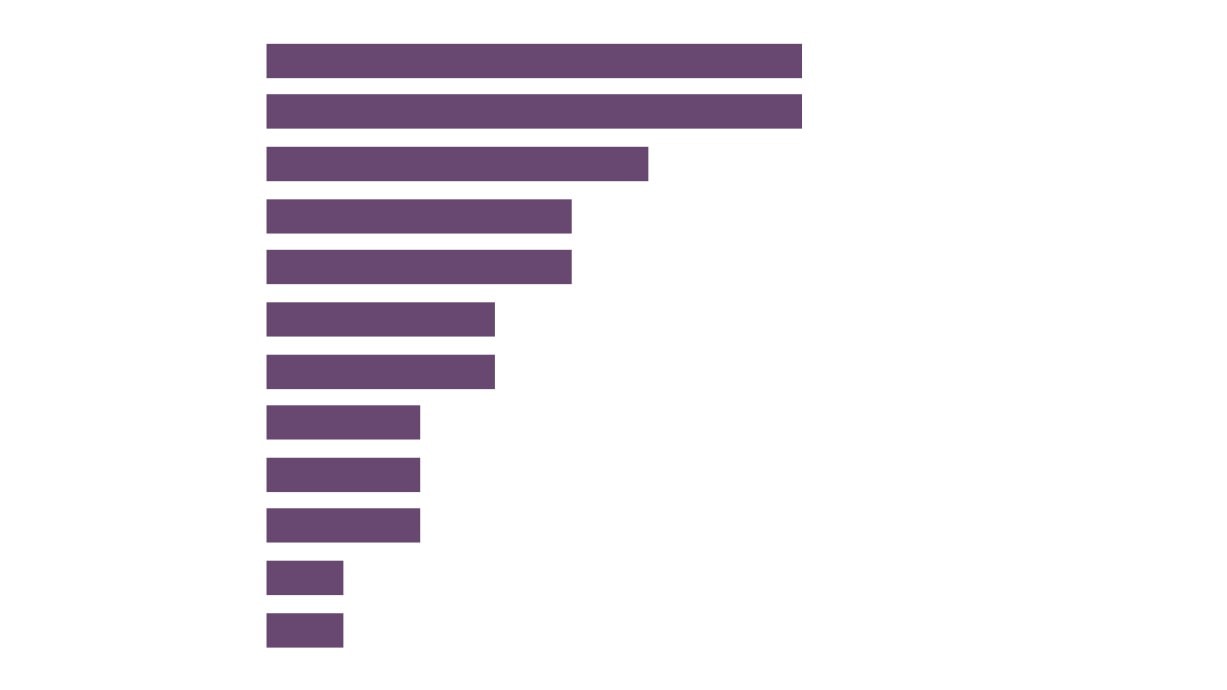

Creative Business skills

16%

Film / TV skills

12%

Other

9%

UI / UX skills

7%

Production Skills

7%

Personal Skills

7%

SFX Skills

6%

Which three skills (specific to the

Programmers

6%

Creative Industries sector) do you

Marketing

6%

expect to see the largest increase in

Designers

4%

skills demand over the next 10 years?

Finance Skills

4%

68 responses

Editing Skills

4%

Developer Skills

4%

Digital Skills

3%

AI / VR Skills

3%

84

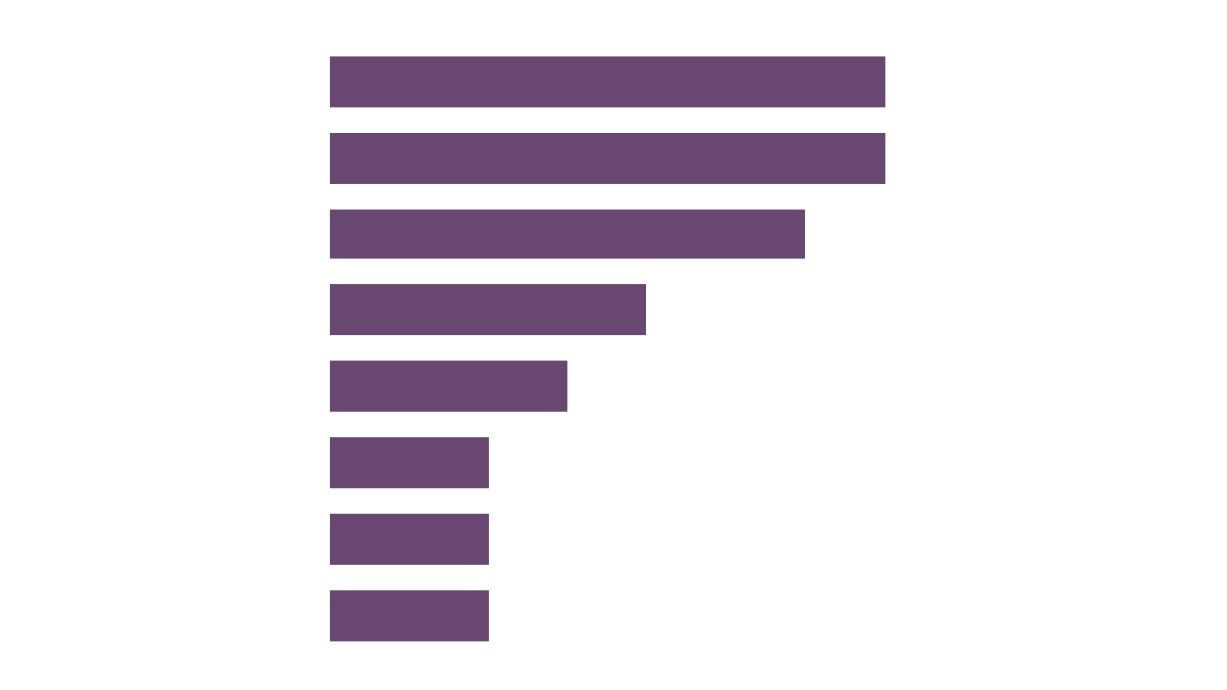

Production roles

17%

Developer roles

17%

Other

12%

On Set roles

10%

Senior business roles

10%

Design roles

7%

Which jobs, if any, do you find it

Editor roles

7%

most difficult to recruit to?

Marketing

5%

41 responses

Programmers

5%

SFX roles

5%

N/A

2%

Finance

2%

85

Local leadership / Ambition

21%

Funding

21%

Other

18%

Geography

12%

Skills

9%

What is the main threat to

London

6%

growth of the Creative Industries

sector in Norfolk and Suffolk?

Image

6%

33 responses

Brexit

6%

86

Which of the Creative Industries sub sectors (self

defined) best describes your business? 31 responses

Performing arts and

heritage (17%)

Film, TV and video

production (17%)

Audio-Visual

Advertising /

(13%)

PR (13%)

Software / Multi-media

Multiple Sub-

Library service

Design (17%)

(13%)

sectors (7%)

(3%)

87

How many people do you employ in Norfolk and Suffolk? 31 responses

10-49 employees (27%)

250+

employees

1-9 employees (63%)

50-249 employees (7%)

(3%)

88

How long has the business been trading? 31 responses

35%

45%

19%

0%

50%

100%

Up to 5 years

5 - 20 years

More than 20 years

89

Creative Industries / Plus Sector Definition

The Standard Industrial Classification (SIC) codes detailed below are those used by the Department for Culture, Media and Sport to define the

Creative Industries sector. These same SIC codes are used to form the basis of the New Anglia ‘Creative Industries’ sector definition but with

those highlighted in red removed.

70210 : Public relations and communication activities

58110 : Book publishing

73110 : Advertising agencies

58120 : Publishing of directories and mailing lists

73120 : Media representation

58130 : Publishing of newspapers

71111 : Architectural activities

58141 : Publishing of learned journals

32120 : Manufacture of jewellery and related articles

58142 : Publishing of consumer, business and professional journals and periodicals

59111 : Motion picture production activities

58190 : Other publishing activities

59112 : Video production activities

58210 : Publishing of computer games

59113 : Television programme production activities

58290 : Other software publishing

59120 : Motion picture, video and television programme post-production activities

74100 : Specialised design activities

59131 : Motion picture distribution activities

74201 : Portrait photographic activities

59132 : Video distribution activities

74202 : Other specialist photography (not including portrait photography)

59133 : Television programme distribution activities

74203 : Film processing

59140 : Motion picture projection activities

74209 : Other photographic activities (not including portrait and other specialist

59200 : Sound recording and music publishing activities

photography and film processing) nec

60100 : Radio broadcasting

74300 : Translation and interpretation activities

60200 : Television programming and broadcasting activities

91011 : Library activities

62011 : Ready-made interactive leisure and entertainment software development

91012 : Archive activities

62012 : Business and domestic software development

91020 : Museum activities

62020 : Computer consultancy activities

85520 : Cultural education

90010 : Performing arts

90020 : Support activities to performing arts

90030 : Artistic creation

90040 : Operation of arts facilities

91

The following SIC codes, when added to those on the previous page, combine to create a ‘Creative Industries Plus’ sector:

61100 : Wired telecommunications activities

13960 : Manufacture of other technical and industrial textiles

61200 : Wireless telecommunications activities

13990 : Manufacture of other textiles nec

78101 : Motion picture, television and other theatrical casting

14110 : Manufacture of leather clothes

18201 : Reproduction of sound recording

14120 : Manufacture of workwear

18202 : Reproduction of video recording

14131 : Manufacture of men's outerwear, other than leather clothes and workwear

18203 : Reproduction of computer media

14132 : Manufacture of women's outerwear, other than leather clothes and workwear

13100 : Preparation and spinning of textile fibres

14141 : Manufacture of men's underwear

13200 : Weaving of textiles

14142 : Manufacture of women's underwear

13300 : Finishing of textiles

14190 : Manufacture of other wearing apparel and accessories

13910 : Manufacture of knitted and crocheted fabrics

14200 : Manufacture of articles of fur

13921 : Manufacture of soft furnishings

14310 : Manufacture of knitted and crocheted hosiery

13922 : Manufacture of canvas goods, sacks etc

14390 : Manufacture of other knitted and crocheted apparel

13923 : Manufacture of household textiles (other than soft furnishings of 13921)

20302 : Manufacture of printing ink

13931 : Manufacture of woven or tufted carpets and rugs

28940 : Manufacture of machinery for textile, apparel and leather production

13939 : Manufacture of carpets and rugs (other than woven or tufted) nec

32130 : Manufacture of imitation jewellery and related articles

13940 : Manufacture of cordage, rope, twine and netting

32200 : Manufacture of musical instruments

13950 : Manufacture of non-wovens and articles made from non-wovens, except

73200 : Market research and public opinion polling

apparel

92

Creative Industries Plus Sub Sectors

These SIC codes have then been grouped to form sub sectors as follows:

Advertising & Marketing

70210 : Public relations and communication activities

73110 : Advertising agencies

73120 : Media representation

73200 : Market research and public opinion polling

Architecture

71111 : Architectural activities

Film, TV, Video, Radio & Photography

59111 : Motion picture production activities

59112 : Video production activities

59113 : Television programme production activities

59120 : Motion picture, video and television programme post-production activities

59131 : Motion picture distribution activities

59132 : Video distribution activities

59133 : Television programme distribution activities

60100 : Radio broadcasting

60200 : Television programming and broadcasting activities

18201 : Reproduction of sound recording

18202 : Reproduction of video recording

74201 : Portrait photographic activities

74202 : Other specialist photography (not including portrait photography)

74203 : Film processing

74209 : Other photographic activities (not including portrait and other specialist photography and film processing) nec

78101 : Motion picture, television and other theatrical casting

93

IT, Software & Computer Services

62011 : Ready-made interactive leisure and entertainment software development

62012 : Business and domestic software development

62020 : Computer consultancy activities

18203 : Reproduction of computer media

61100 : Wired telecommunications activities

61200 : Wireless telecommunications activities

58210 : Publishing of computer games

58290 : Other software publishing

Publishing

58110 : Book publishing

58120 : Publishing of directories and mailing lists

58130 : Publishing of newspapers

58141 : Publishing of learned journals

58142 : Publishing of consumer, business and professional journals and periodicals

58190 : Other publishing activities

Design

74100 : Specialised design activities

Music, Performing & Visual Arts

32200 : Manufacture of musical instruments

59200 : Sound recording and music publishing activities

90030 : Artistic creation

90040 : Operation of arts facilities

94

Textiles

20302 : Manufacture of printing ink

13100 : Preparation and spinning of textile fibres

13200 : Weaving of textiles

13300 : Finishing of textiles

13910 : Manufacture of knitted and crocheted fabrics

13921 : Manufacture of soft furnishings

13922 : Manufacture of canvas goods, sacks etc

13923 : Manufacture of household textiles (other than soft furnishings of 13921)

13931 : Manufacture of woven or tufted carpets and rugs

13939 : Manufacture of carpets and rugs (other than woven or tufted) nec

13940 : Manufacture of cordage, rope, twine and netting

13950 : Manufacture of non-wovens and articles made from non-wovens, except apparel

13960 : Manufacture of other technical and industrial textiles

13990 : Manufacture of other textiles nec

28940 : Manufacture of machinery for textile, apparel and leather production

Fashion

14110 : Manufacture of leather clothes

14120 : Manufacture of workwear

14131 : Manufacture of men's outerwear, other than leather clothes and workwear

14132 : Manufacture of women's outerwear, other than leather clothes and workwear

14141 : Manufacture of men's underwear

14142 : Manufacture of women's underwear

14190 : Manufacture of other wearing apparel and accessories

14200 : Manufacture of articles of fur

14310 : Manufacture of knitted and crocheted hosiery

14390 : Manufacture of other knitted and crocheted apparel

Crafts

32120 : Manufacture of jewellery and related articles

95

32130 : Manufacture of imitation jewellery and related articles

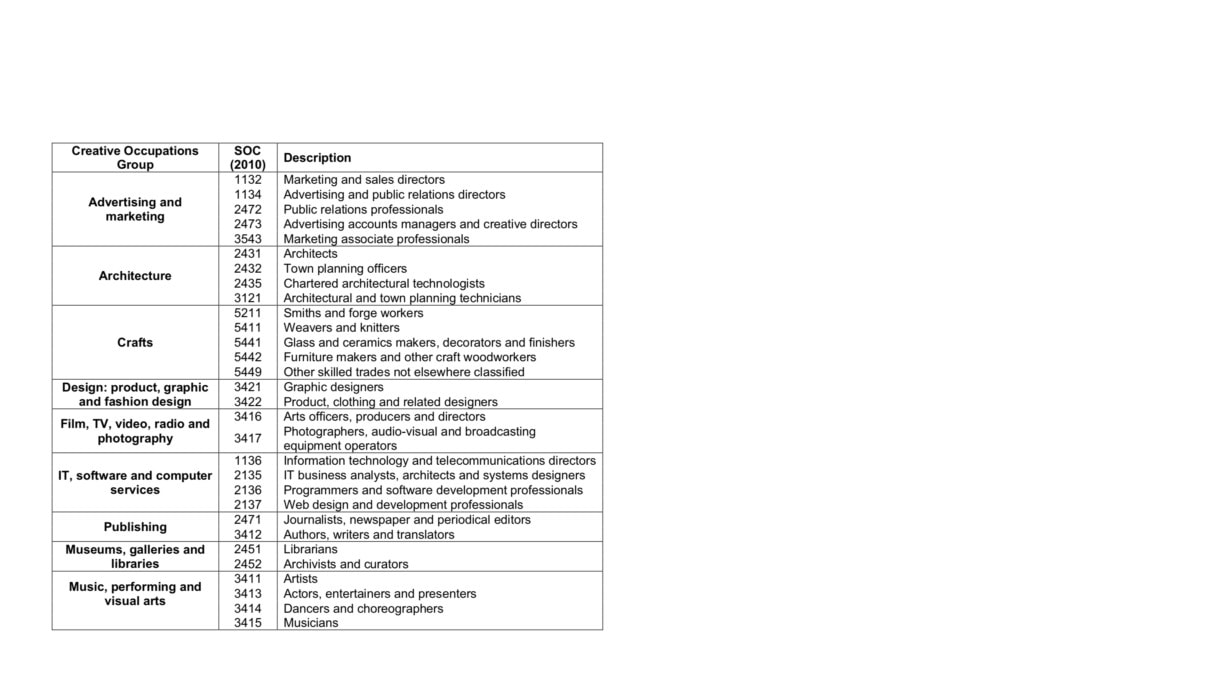

Creative Industries Occupations

The Standard Industrial Classification (SOC) codes detailed below are those used by the Department for Culture, Media and Sport.

96