Clean Energy

Data Pack

Final Version - March 2019

Contents

Introduction to the Sector Data Pack

Page 3

Introduction to and Definition of the Clean Energy Sector

Page 3

Low Carbon & Renewable Energy (LCRE) Sector Definition

Page 4

National LCRE Sector Analysis

Page 7

Norfolk and Suffolk LCRE Sector Estimates

Page 19

Renewable Electricity Statistics Analysis

Page 25

Labour Insight Jobs tool sector analysis

Page 38

A Future View of the LCRE Sector in Norfolk and Suffolk

Page 49

2

Introduction

Introduction to the Sector Data Pack

The role of the Sector Data Pack is to bring together the latest socio-economic and labour market data and present

both an up-to-date, and future view, of the sector and any underlying issues within the area that could impact upon it.

Data is presented in a navigable format without comment with interpretation at this stage mainly left to the reader. In

most instances data has been analysed and presented down to local authority level. In some instances, and even

where local authority data is available, it has not been presented in the data pack due to issues of unreliability and

small sample sizes.

Introduction to the Clean Energy Sector

Defining the Clean Energy sector is particularly difficult given that it is a relatively new sector. As a result, Standard Industrial

Classification (SIC) codes (which do a great job in measuring traditional sectors such as manufacturing and construction) are yet to

catch up and as such do not adequately capture the sectors activity. Activity within the sector can also be hidden due to the fact that

it is not always a firms main operating activity (meaning that it can get recorded against a less suitable SIC code and lost within

official statistics). Further complicating matters is the fact that it also cuts across many traditional sectors.

The Office for National Statistics recognise these issues and to combat this, in recent years they have conducted a national survey

of Low Carbon and Renewable Energy businesses. We have drawn on this source of sector information heavily within this data

pack, with the assumption that national trends in employment and turnover will be broadly reflected at the local level. In addition, we

have used this information to arrive at employment estimates for Norfolk and Suffolk, and a number of comparator areas.

3

LCRE Sector

Definition

Low Carbon & Renewable Energy (LCRE) Sector Definition

• ONS define the low carbon economy as ‘economic activities that deliver goods and

services that generate significantly lower emissions of greenhouse gases; predominantly

carbon dioxide’.

• The low carbon sectors are: offshore wind, onshore wind, solar photovoltaic, hydropower,

other renewable energy, bioenergy, alternative fuels, renewable heat, renewable

combined heat and power, energy efficient lighting, energy efficient products, energy

monitoring, saving or control systems, low carbon financial and advisory services, low

emission vehicles and infrastructure, carbon capture and storage, nuclear power, fuel

cells and energy storage systems.

• These low carbon sectors are then subsequently grouped into six low carbon groups: low

carbon electricity, low carbon heat, energy from waste and biomass, energy efficient

products, low carbon services, and low emission vehicles etc.

4

LCRE Group

LCRE Sector

Offshore wind

Onshore wind

Solar photovoltaic

Hydropower

Low Carbon Electricity

Other renewable electricity

Carbon capture and storage

Nuclear

Renewable heat

Low Carbon Heat

Renewable combined heat and power

Bioenergy

Energy from waste and biomass

Alternative fuels

Energy efficient lighting

Other energy efficient products

Energy efficient products

Energy monitoring, saving or control systems

Low Carbon financial and advisory services

Low Carbon Services

Low emission vehicles and infrastructure

Low emission vehicles, infrastructure,

fuel cells, and energy storage

Fuel cells and energy storage

5

d

3%

3%

Onshore wind

15%

ic

2%

Hydropower

ar

6%

3%

d

2%

Renewable heat

er

5%

4%

Bioenergy

s

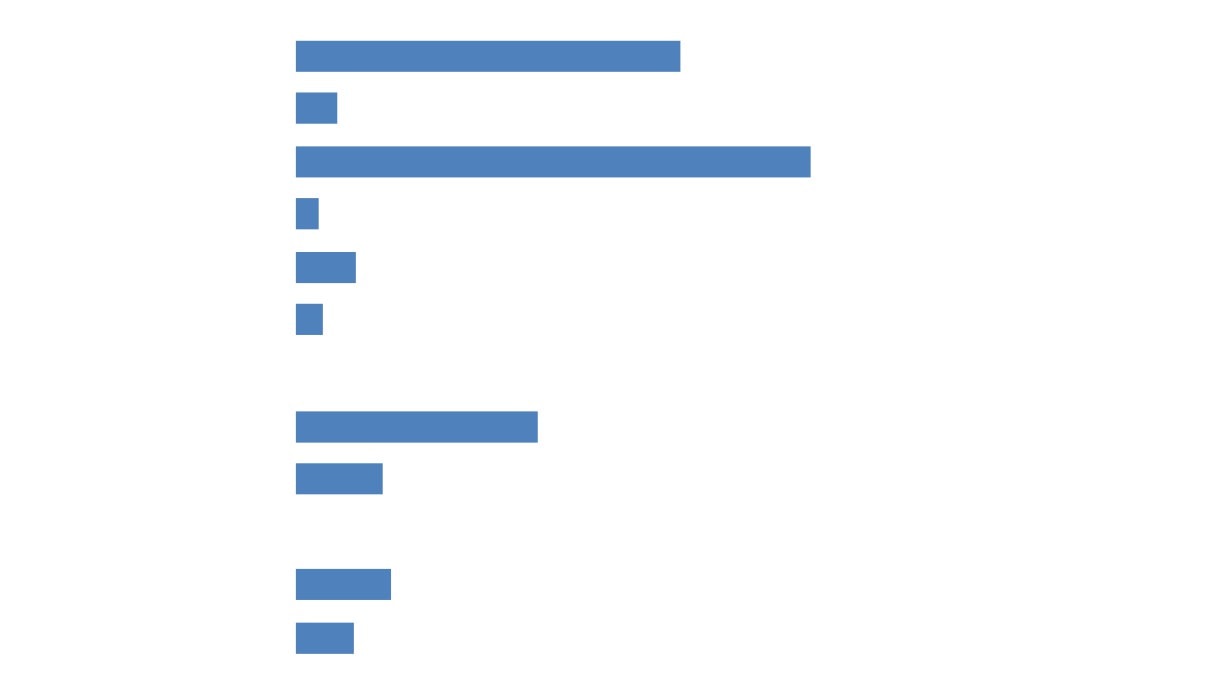

Proportions

Energy efficient

13%

LCRE direct

lighting

employment

(FTEs) by L

Group and

sector, 2017

68%

y

47%

s

Source: Office for National

Statistics, Low Carbon and

Renewable Energy Sector

Survey

Energy monitoring, saving

8%

or control systems

al

4%

4%

s

Low emission vehicles

4%

5%

and infrastructure

6

e

National LCRE

Sector Analysis

The following section uses the results from the latest 2017 Low Carbon and Renewable Energy sector (LCRE) business

survey to show the size, shape, and direction of the sector at the national level. This information can be accessed at

The figures provided by this Office for National Statistics (ONS) release are survey-based estimates. Surveys gather

information from a sample rather than from the whole population. The sample is designed to allow for this, and to be as

accurate as possible given practical limitations such as time and cost constraints, but results from sample surveys are

always estimates and not precise figures. This means that they are subject to some uncertainty.

Activity in the low carbon and renewable energy (LCRE) economy is spread across a wide range of industries. Many

sectors are small but growing and for many businesses LCRE activity is secondary rather than primary. For this reason,

estimates of the number of businesses are subject to particular volatility.

Trends in the data are presented as far back as 2014, when the survey was first set up. A more complete picture of how

the LCRE economy is changing over time will be possible once longer-term trends are available.

Estimates rely on businesses self-reporting their activity. Where a business is active in the low carbon services sector, if

they provide services entirely in relation to another low carbon sector then they may choose to report their estimates

there. For example, a business that provides financial services to the onshore wind sector may report their estimates

under onshore wind only. Estimates of low carbon financial services may therefore be an underestimate.

7

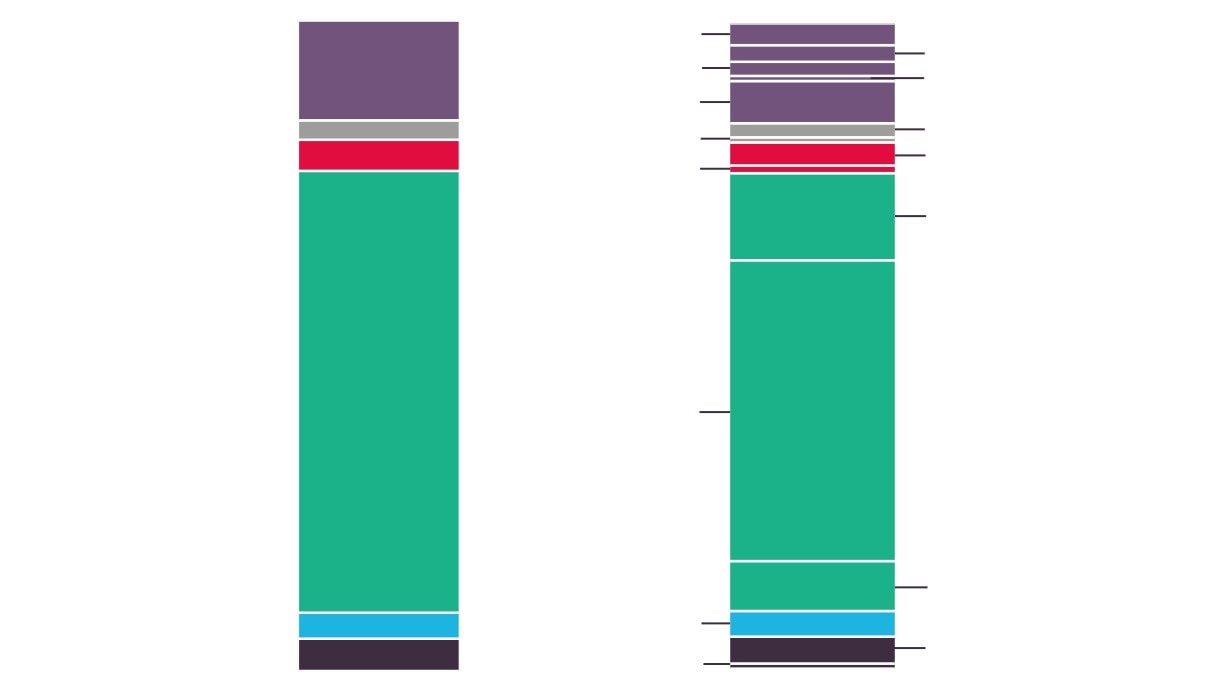

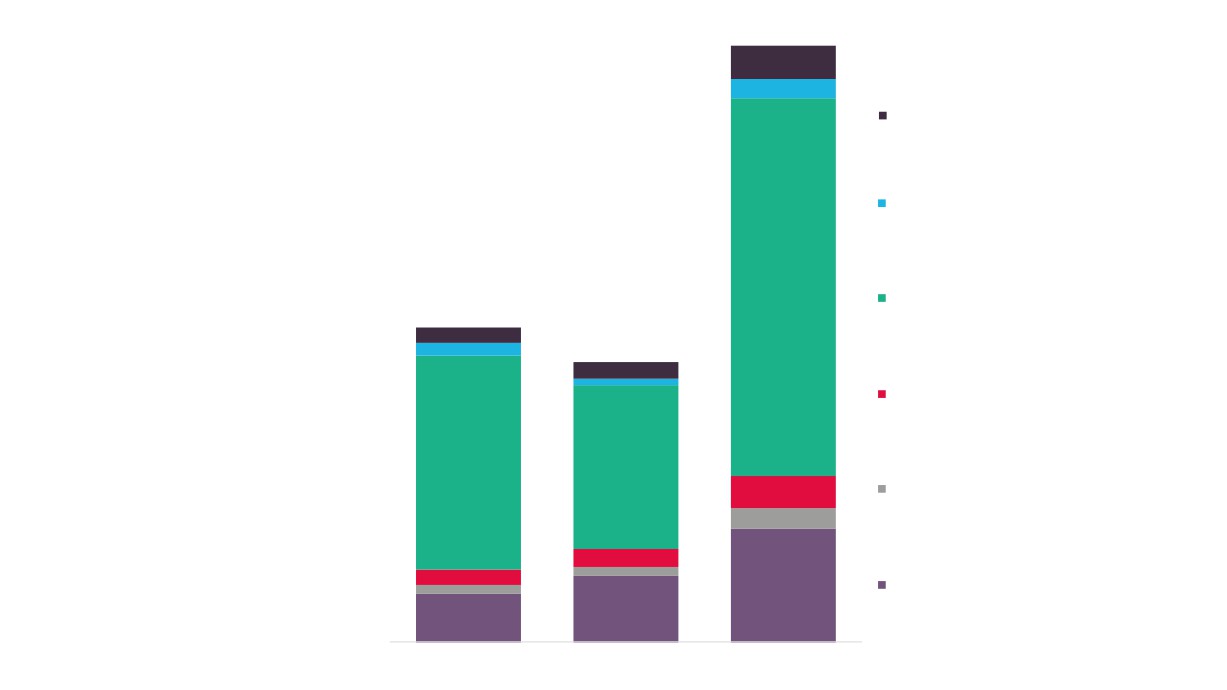

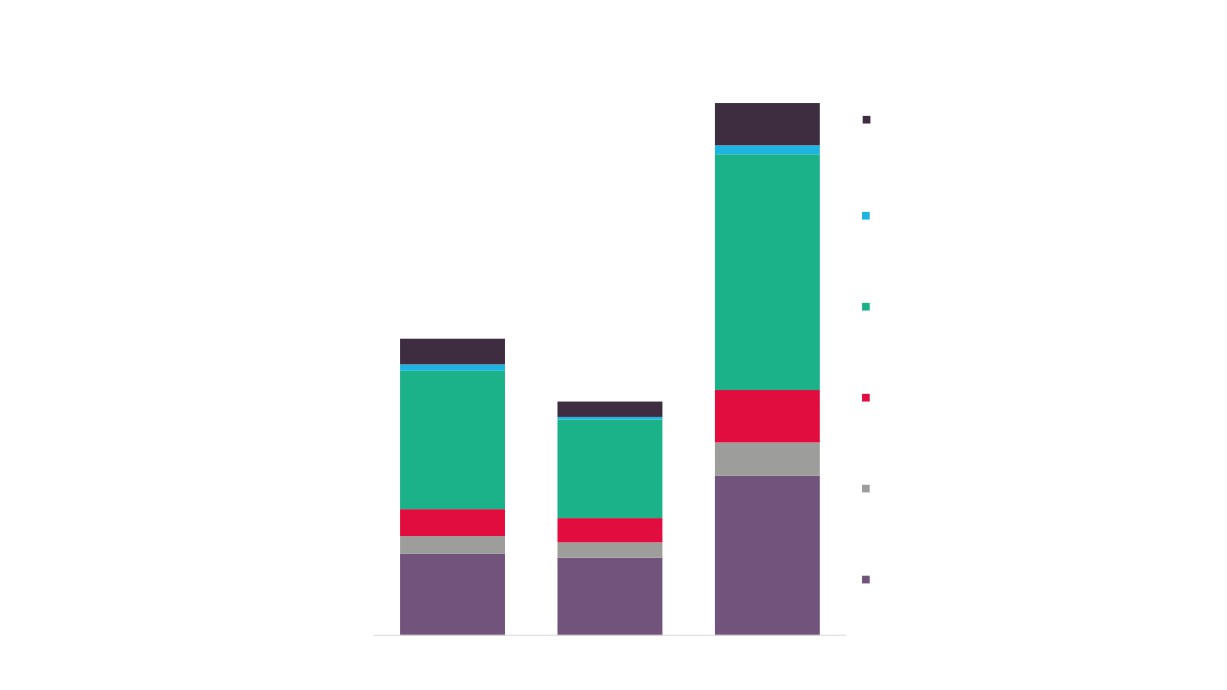

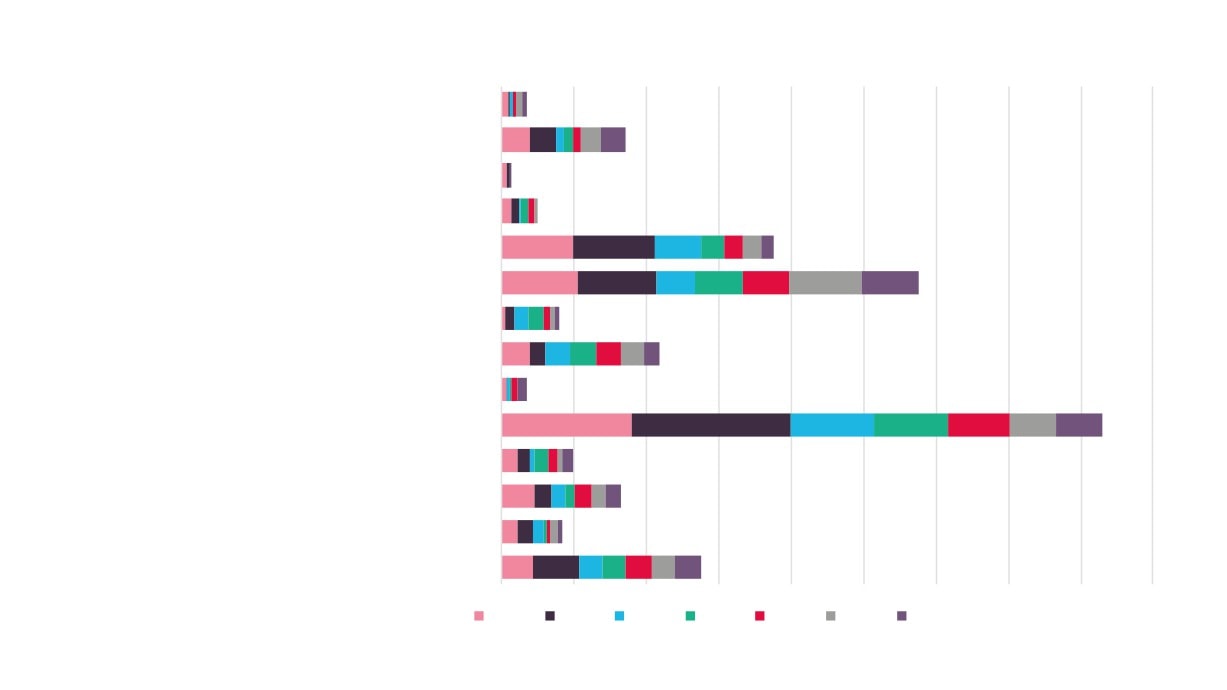

National LCRE Sector businesses, FTEs, and turnover by LCRE

Group, 2017

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

90%

Numb

81,500

Number of businesses

23%

4%

4%

63%

2%

5

Turnover

28%

6%

9%

46%

2%

£44.5bn

2%

9

Full-t

Full-time equivalents

15%

3% 5%

68%

4%209,

500

4%

Low

Low Carbon Electricity

Low Carbon Heat

En

Energy from waste and biomass

Energy efficient products

Low

Low Carbon services

Low emission vehicles, infrastructure, fuel cells and energy storage

and energy

Source: Office for National Statistics, Low Carbon and Renewable Energy Sector Survey

8

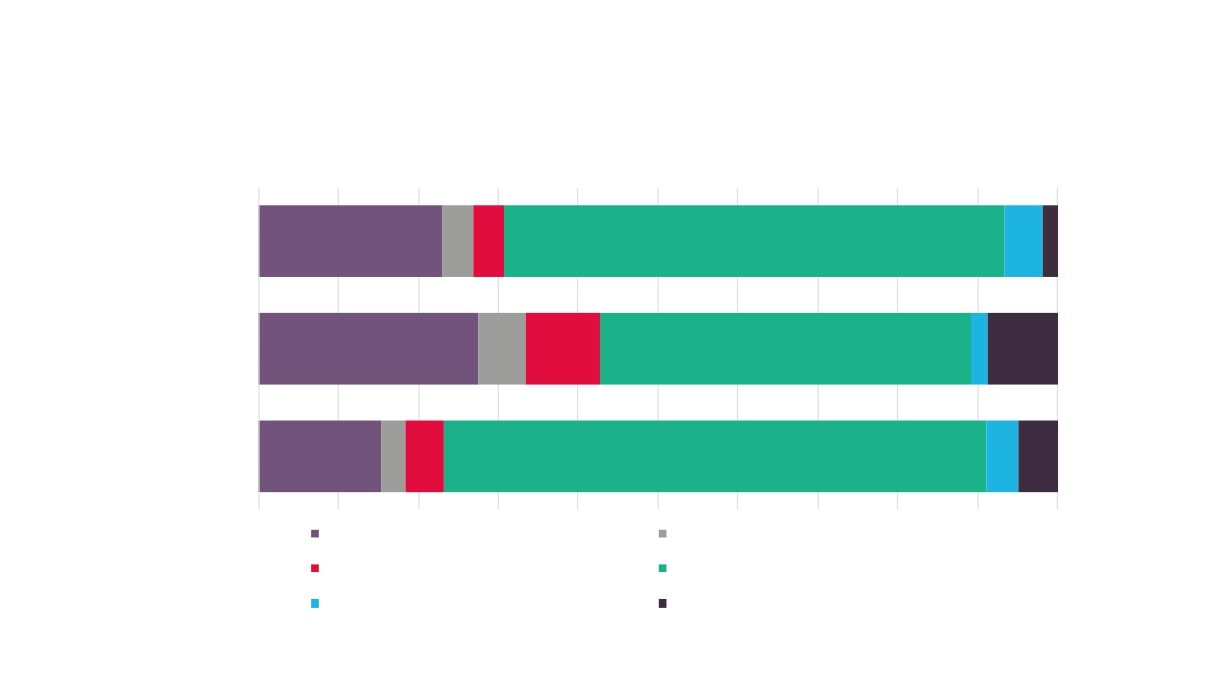

National LCRE Sector Exports and Imports by LCRE Group, 2017

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

90%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2%

5

Exports

13%

3%

23%

57%

£4.9bn

2%

9

Imports

14%

4%

20%

32%

28%

£5.9bn

%

4%

Low Carbon Electricity

Low Carbon Heat

Energy from waste and biomass

orage

and energy

Energy efficient products

Low Carbon services

Low emission vehicles, infrastructure, fuel cells and energy storage

9

National LCRE Acquisitions and Disposals by LCRE Group, 2017

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

90%

Number of businesses

23%

4%

4%

63%

5%

2%

5

£5.6bn

Turnover

28%

6%

9%

46%

2%

9%

2%

9

£181m

Full-time equivalents

15%

3% 5%

68%

4% 5%

4%

Low Carbon Electricity

Low Carbon Heat

Low

Energy from waste and biomass

Energy efficient products

Low Carbon services

Low emission vehicles, infrastructure, fuel cells and energy storage

and energy

Ene

Low Carbon services

Low emission vehicles, infrastructure, fuel cells and energy storage

10

44%

42%

Low carbon services

2%

2%

1%

9%

8%

7%

Low emission vehicles,

0%

infrastructure, fuel cells and energy

Direct

Indirect

Total

storage

Employment

Employment

Employment

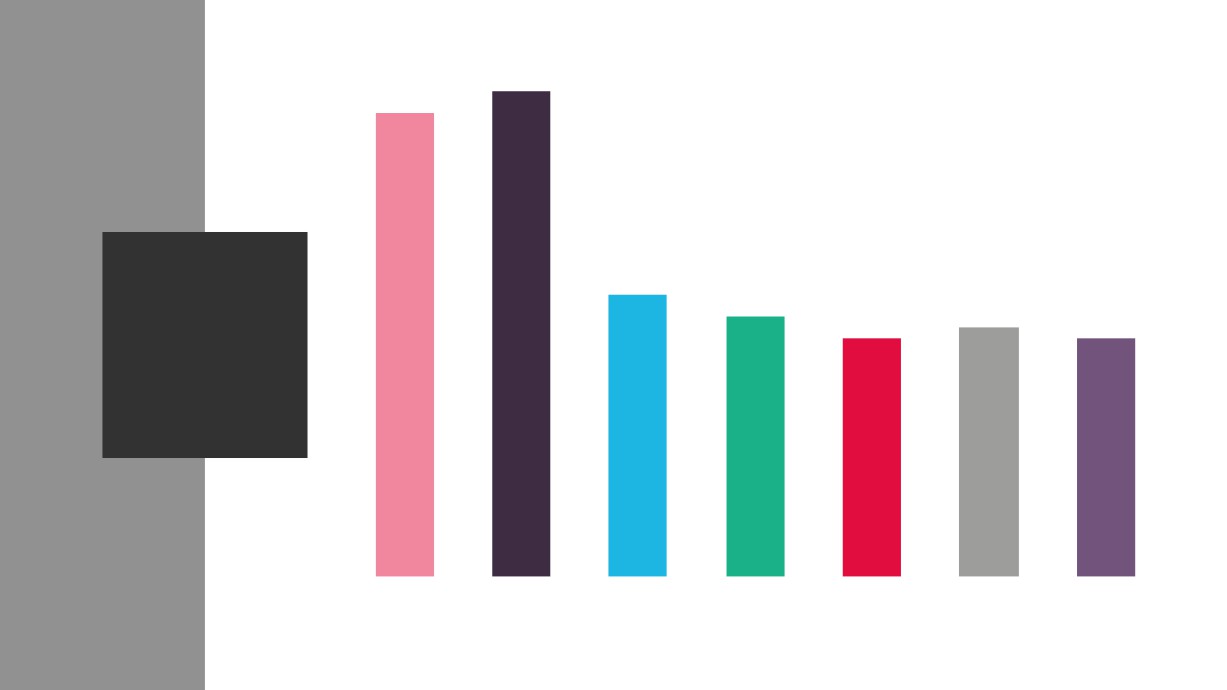

National LCRE

Low carbon services

direct, indirect

and total

employment

251,400

Energy efficient products

209,600

(FTEs) by LCRE

10,300

8,500

186,600

Group, 2017

11,400

4,000

Energy from waste and biomass

Source: Office for National

Statistics, Low Carbon and

Renewable Energy Sector

142,100

Survey

109,300

Low carbon heat

21,600

13,000

11,400

6,700

10,200

76,000

Low carbon electricity

6,300

43,800

32,200

Direct Employment Indirect Employment Total Employment

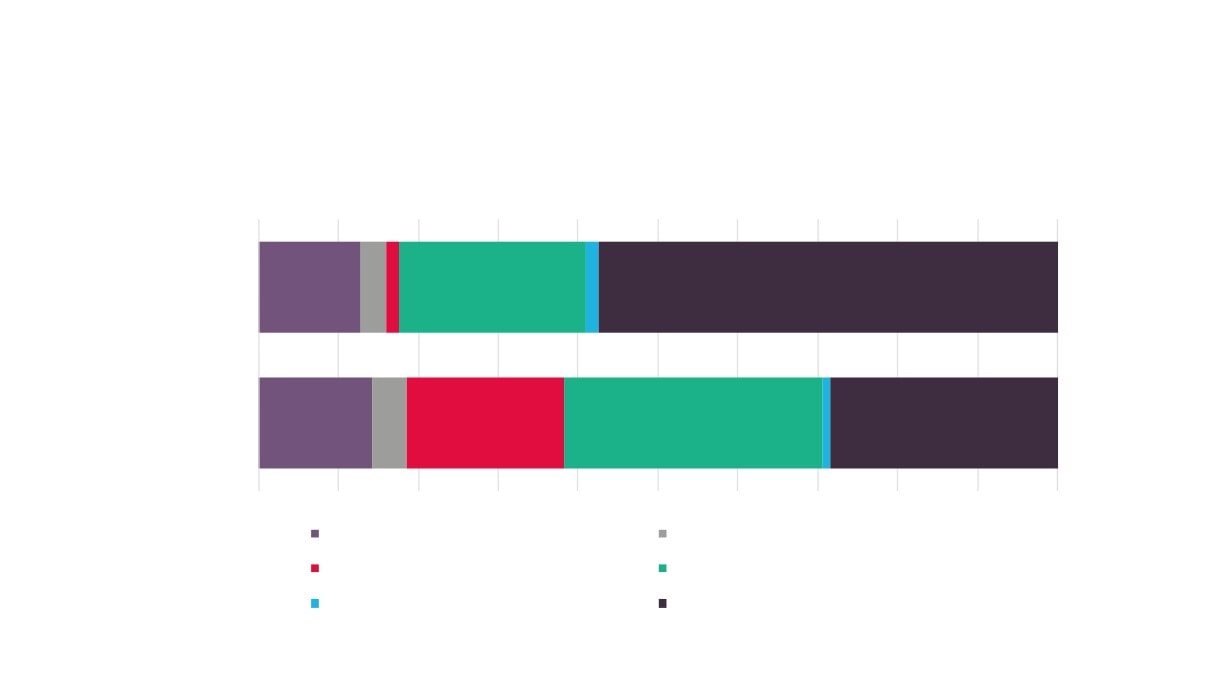

1

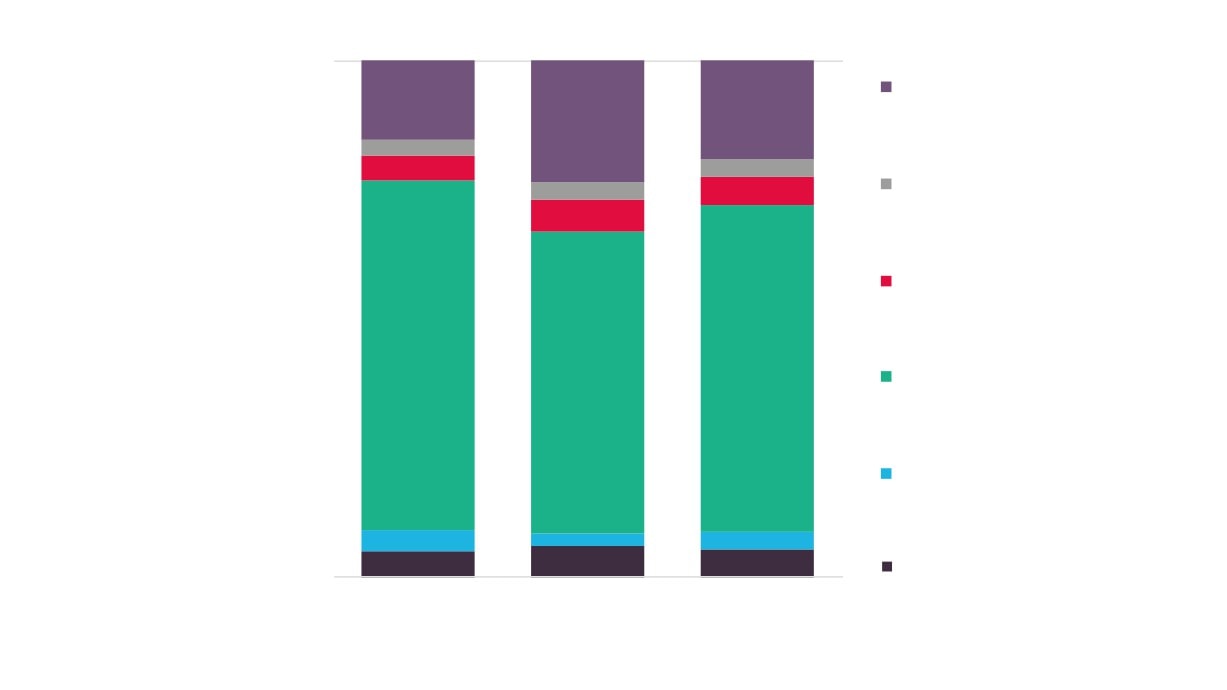

100%

100%

Low carbon electricity

28%

30%

Proportions of

33%

LCRE direct,

Low carbon heat

6%

indirect and tota

6%

7%

9%

employment

10%

Energy from waste and biomass

10%

(FTEs) by LCRE

Group, 2017

Energy efficient products

Source: Office for National

46%

Statistics, Low Carbon and

44%

42%

Renewable Energy Sector

Survey

Low carbon services

2%

2%

1%

9%

8%

7%

Low emission vehicles,

0%

0%

infrastructure, fuel cells and energy

Direct

Indirect

Total

storage

Employment

Employment

Employment

12

100%

3.4%

Proportion of

Other

90%

15.3%

LCRE Direct

80%

N : Administrative and support service activities

Employment by

3.0%

Broad Industrial

70%

M : Professional, scientific and technical activities

Group, 2017

60%

39.2%

G : Wholesale and retail trade; repair of motor vehicles and motorcycles

50%

F : Construction

40%

3.2%

6.8%

30%

E : Water supply; sewerage, waste management and remediation activities

20%

D : Electricity, gas, steam and air conditioning supply

29.1%

10%

C : Manufacturing

0%

Source: Office for National Statistics, Low Carbon and Renewable Energy Sector Survey

13

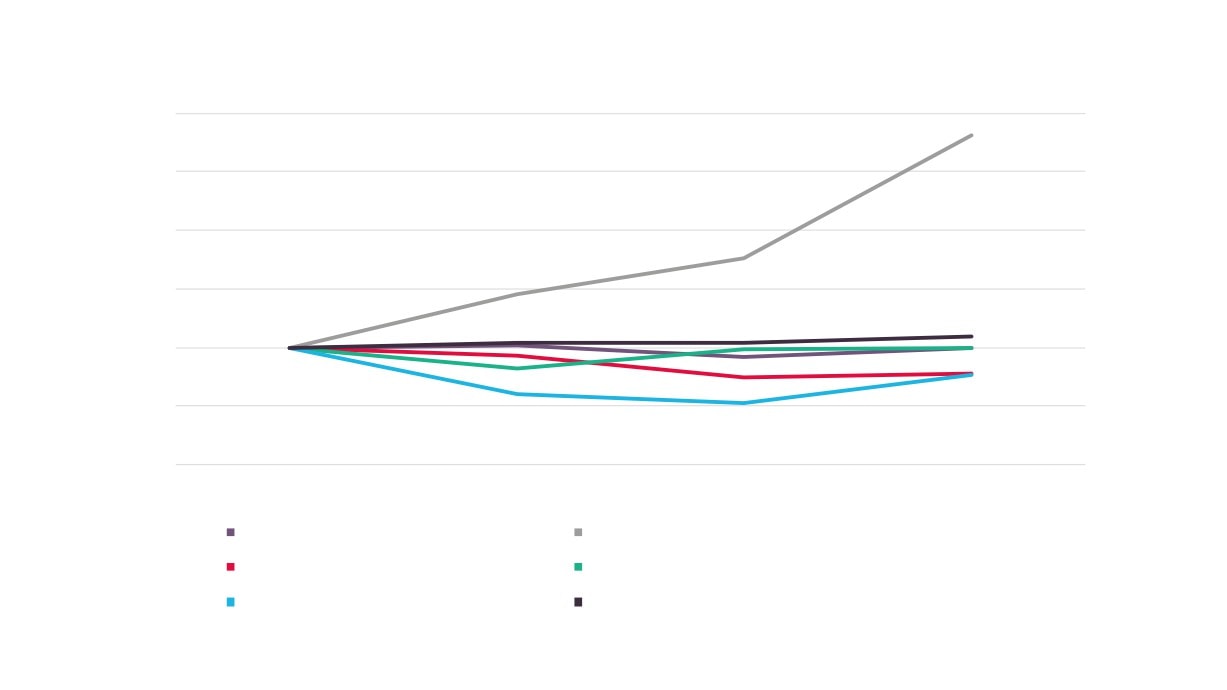

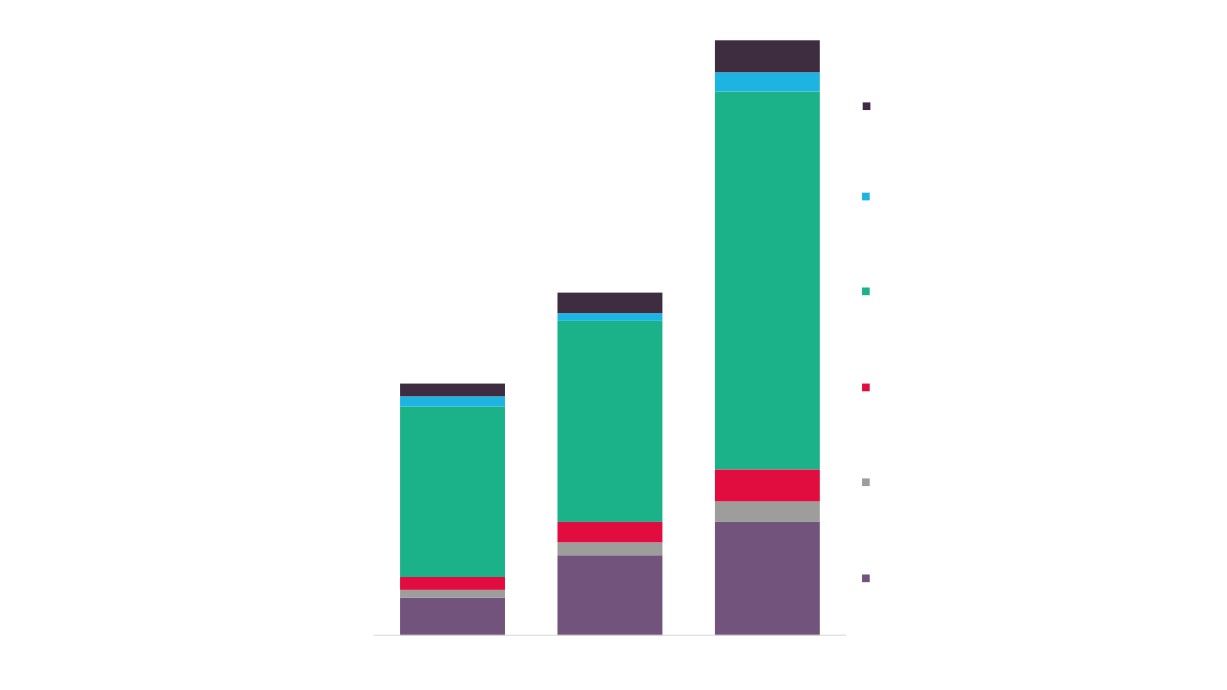

Direct employment (FTEs) over time by LCRE Group

160

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

90%

100%

Number of businesses

23%

4%

4%

63%

5%

2%

5%

2%

Turnover

28%

6%

9%

46%

2%

9%

2%

9%

Full-time equivalents

15%

3% 5%

68%

4% 5%

4% 5%

Low Carbon Electricity

Low Carbon Heat

Energy from waste and biomass

Energy efficient products

Low Carbon services

Low emission vehicles, infrastructure, fuel cells and energy storage

and energy storage

Source: Office for National Statistics, Low Carbon and Renewable Energy Sector Survey

Low emission vehicles, infrastructure, fuels cells and energy storage

14

44%

42%

Low carbon services

2%

2%

1%

9%

8%

7%

Low emission vehicles,

0%

infrastructure, fuel cells and energy

Direct

Indirect

Total

storage

Employment

Employment

Employment

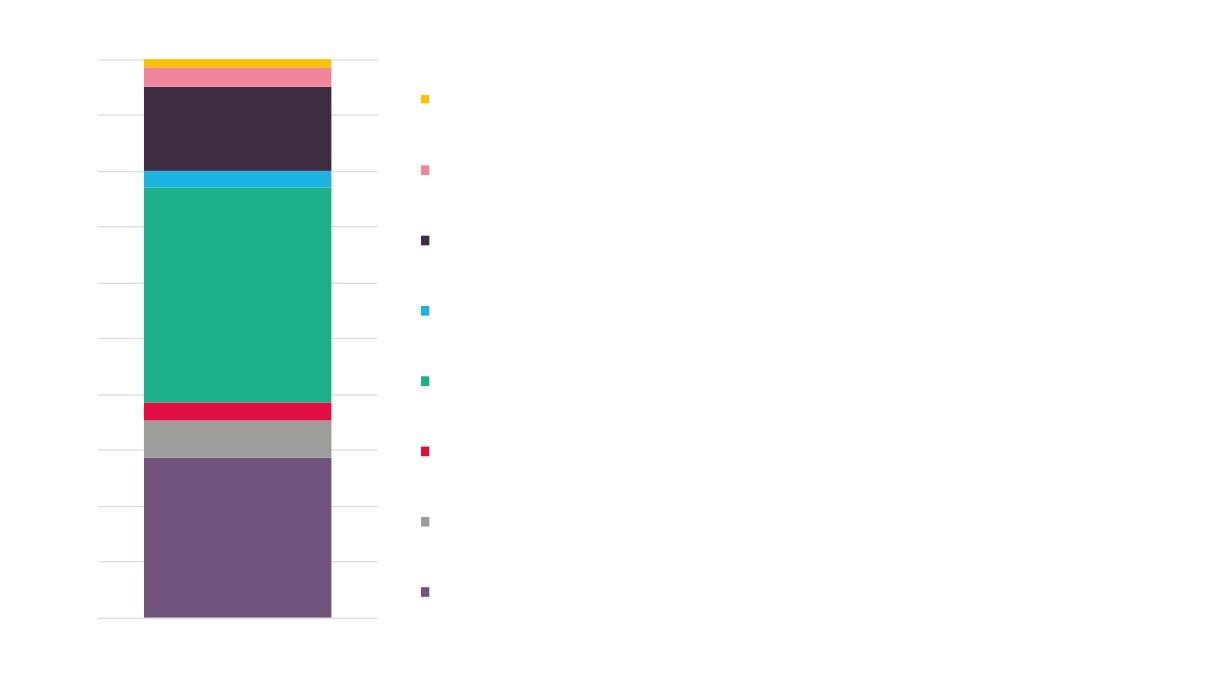

National LCRE

Low carbon services

direct, indirect

and total turnover

35.3

(£bn) by LCRE

Energy efficient products

£44.5bn

Group, 2017

3.9

£35.1bn

Energy from waste and biomass

2.4

Source: Office for National

7.7

Statistics, Low Carbon and

20.7

Renewable Energy Sector Survey

5.1

14.7

Low carbon heat

4.1

3.6

2.6

2.4

23.9

Low carbon electricity

12.3

11.6

Direct Turnover

Indirect Turnover

Total Turnover

15

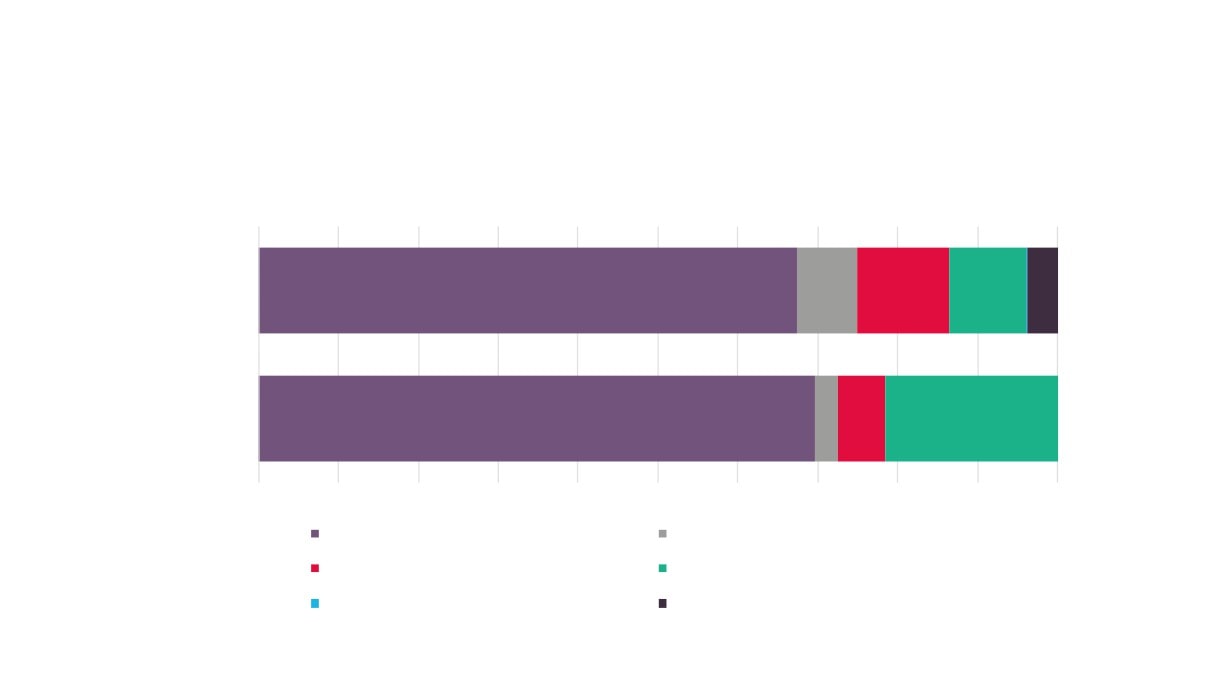

1

100%

Low carbon electricity

28%

30%

33%

Proportions of

Low carbon heat

LCRE direct,

6%

6%

indirect and tota

7%

9%

10%

Energy from waste and biomass

turnover by

10%

LCRE Group,

2017

Energy efficient products

46%

44%

Source: Office for National

42%

Statistics, Low Carbon and

Renewable Energy Sector Surve

Low carbon services

2%

2%

1%

9%

8%

7%

Low emission vehicles,

0%

infrastructure, fuel cells and energy

Direct

Indirect

Total

storage

Employment

Employment

Employment

16

Direct turnover over time by LCRE Group

300

250

0%

100%

200

Number o

5%

2%

150

100

2%

9%

50

4% 5%

Full-time

0

2014

2015

2016

2017

Low carbon electricity

Low C

Low carbon heat

Energy from waste and biomass

Energy

Energy efficient products

Low C

energy storage

Low carbon services

Low emission vehicles, infrastructure, fuels cells and energy storage

17

Employment

Turnover

1

100%

Low carbon electricity

28%

30%

Comparison

33%

LCRE direct

Low carbon heat

6%

employment

6%

7%

9%

and turnove

10%

Energy from waste and biomass

10%

LCRE Grou

2017

Energy efficient products

46%

Source: Office for Natio

44%

Statistics, Low Carbon a

42%

Renewable Energy Sect

Low carbon services

2%

2%

1%

9%

8%

7%

Low emission vehicles,

0%

infrastructure, fuel cells and energy

Direct

Indirect

Total

storage

Employment

Employment

Employment

9%

18

5%

Norfolk & Suffolk

LCRE Sector

Estimates

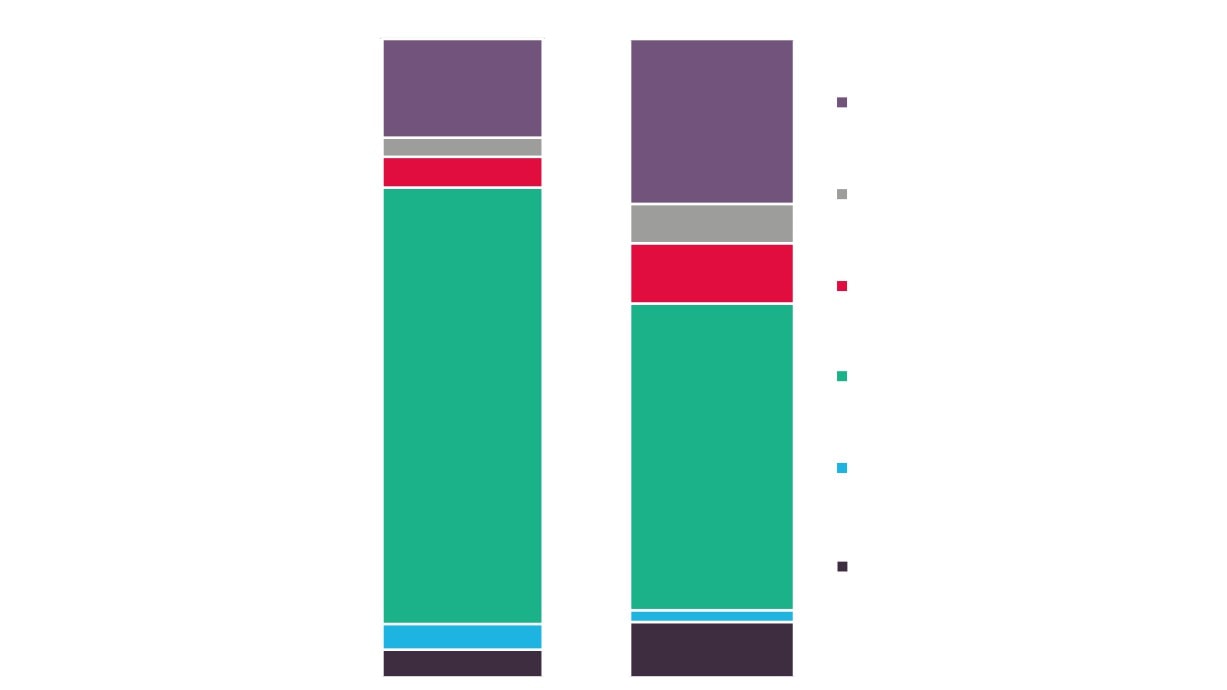

The following section builds on the national data previously covered, and using estimates for LCRE activity across the

economy by Broad Industrial Group, presents estimates (produced by SkillsReach) for LCRE direct, indirect, and total

employment (FTE) for Norfolk and Suffolk, and LCRE direct employment for a number of comparator LEP areas.

Slide 23 presents work that was previously undertaken by New Anglia LEP as part of the evidence base for its Strategic

Economic Plan, and is presented here to provide estimates for value and business numbers.

19

42%

Low carbon services

2%

2%

1%

9%

8%

Norfolk and Suffolk

7%

Low emission vehicles,

0%

infrastructure, fuel cells and energy

Direct

Indirect

Total

LCRE direct, indirect

storage

Employment

Employment

Employment

and total

Low carbon services

employment (FTEs)

estimates by LCRE

8,000

8,800

Group, 2017

Energy efficient products

500

200

Figures rounded to the nearest

100; totals may not sum due to

rounding

5,900

300

Energy from waste and biomass

200

Source: Office for National

4,700

Statistics, Low Carbon and

Renewable Energy Sector

Survey; Business Register and

Low carbon heat

800

4,000

Employment Survey 2017

500

500

300

2,700

Low carbon electricity

300

200

1,900

900

Direct Employment Indirect Employment Total Employment

20

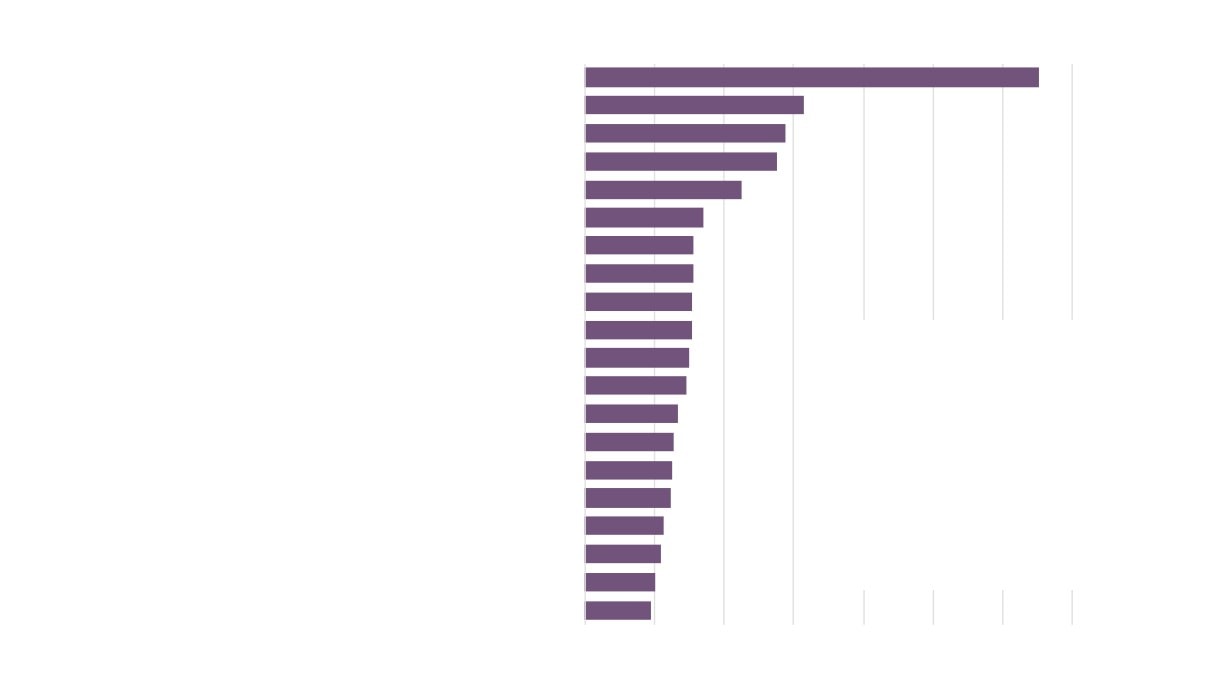

Cumbria

2,400

Greater Lincolnshire

4,300

LCRE direct

Heart of the South West

6,200

employment (FTEs)

across comparator

Humber

4,100

areas, 2017

Liverpool City Region

4,500

New Anglia

5,800

South East

13,500

Tees Valley

2,100

York, North Yorkshire and East Riding

4,300

Source: Office for National Statistics, Low Carbon and Renewable

Energy Sector Survey; Business Register and Employment Survey 2017

21

Referring back to the previous slide then we note the high level of employment

in the LCRE sector in the South East LEP (though this is proportional to overall

employment as shown in slide 23).

One of the key traditional sector’s skills sets that plays a significant role in

driving LCRE sector development is that of Construction, and in this image we

have highlighted the numbers of FTEs in the sector for both New Anglia LEP

and South East LEP.

As the image shows, New Anglia LEP is perfectly positioned geographically to

provide access to this suitably skilled and experienced workforce, particularly

in Essex, which borders Suffolk to the south.

LCRE FTEs - 5,800

New Anglia LEP

Construction FTEs - 32,500

Source: Office for National Statistics, Low Carbon and Renewable

Energy Sector Survey; Business Register and Employment Survey 2017

LCRE FTEs - 13,500

South East LEP

Construction FTEs - 99,000

22

Cumbria

1.26%

Greater Lincolnshire

1.18%

Heart of the South West

1.08%

Humber

1.26%

LCRE direct

employment (FTEs)

Liverpool City Region

0.87%

as a % of total

New Anglia

1.04%

employment (FTEs)

South East

1.04%

across comparator

Tees Valley

0.99%

areas, 2017

York, North Yorkshire and East Riding

1.05%

England

0.97%

Source: Office for National Statistics, Low Carbon and Renewable

Energy Sector Survey; Business Register and Employment Survey 2017

23

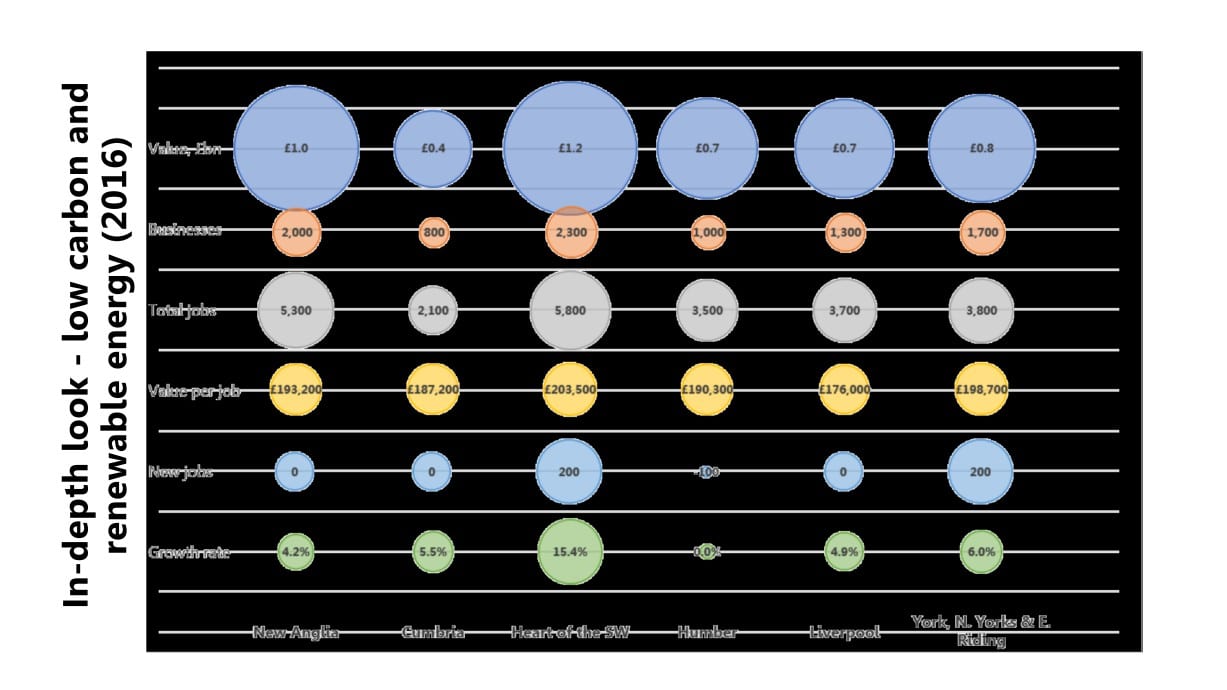

Extract from New Anglia LEP produced Energy sector comparator datapack

24

Source: ONS and LEP analysis

Renewable

Electricity

Analysis

The following section considers the latest release of Department for Business, Energy and Industrial Strategy (BEIS)

Renewable Electricity Statistics covering the period 2014 to 2017.

For the first time this data has been made available at local authority level and so we have been able to present figures

for capacity, generation, and sites for each of New Anglia LEPs local authority areas. This information is also summed up

to present LEP level analysis alongside a national comparator.

25

Renewable Electricity Capacity

Between 2014 and 2017, renewable electricity

capacity has doubled in Norfolk and Suffolk

3,000 MW

40,630 M

(2017)

(2017)

100%

63%

1,499 MW

24,914 M

(2014)

(2014)

Source: Renewable Electricity Statistics, Department

for Business, Energy and Industrial Strategy

26

Babergh

61%

Breckland

66%

Broadland

69%

Forest Heath

416%

Great Yarmouth

3%

Ipswich

85%

King's Lynn and West Norfolk

1607%

Mid Suffolk

13%

North Norfolk

136%

Change in

Norwich

85%

South Norfolk

174%

Renewable

St Edmundsbury

20%

Electricity Capacity,

Suffolk Coastal

14%

2014 - 2017

Waveney

47%

New Anglia

100%

UK

63%

Source: Renewable Electricity Statistics, Department for Business, Energy and Industrial Strategy

27

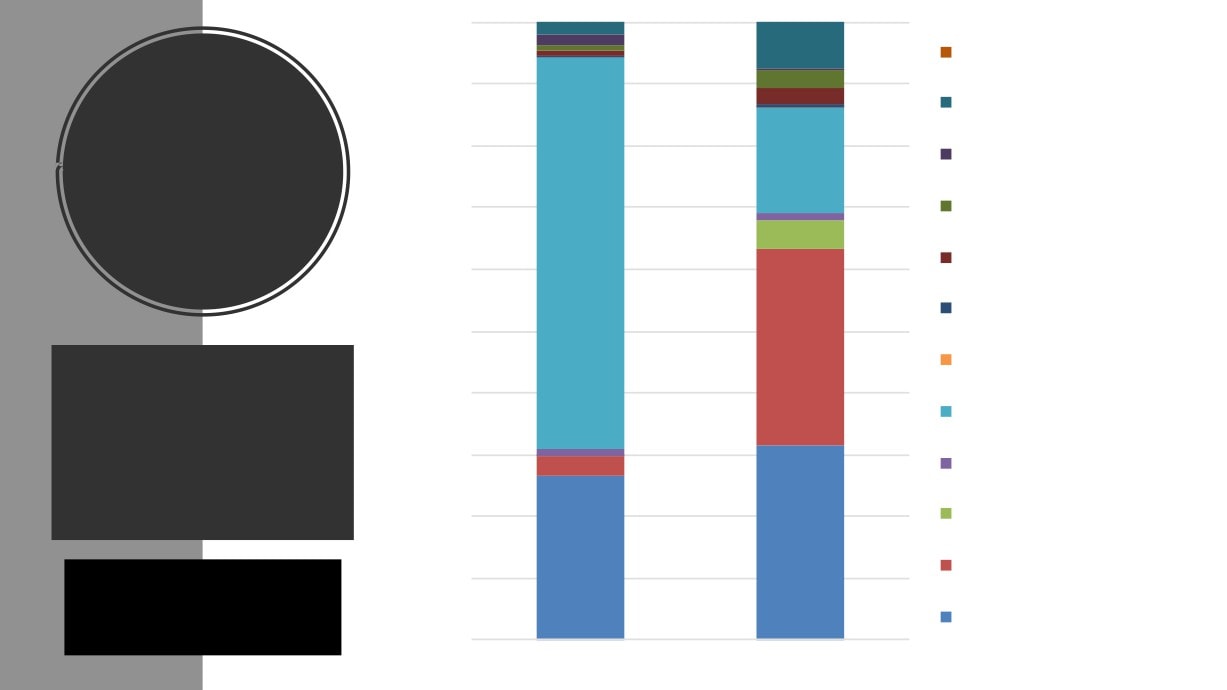

100%

8%

Cofiring

3%

90%

3%

Plant Biomass

Renewable

80%

Electricity

Animal Biomass

17%

Capacity by

70%

Municipal Solid Waste

Type, 2017

5%

63%

Landfill Gas

60%

Sewage Gas

50%

32%

Wave/Tidal

Offshore wind

40%

makes up nearly two

Offshore Wind

thirds of Norfolk and

30%

Anaerobic Digestion

3%

Suffolk’s renewable

20%

Hydro

electricity capacity

32%

27%

Onshore Wind

Source: Renewable Electricity

10%

Statistics, Department for

Business, Energy and Industrial

Photovoltaics

Strategy

0%

28

New Anglia

UK

Proportion of UK Renewable Electricity Capacity

Provided by Type in Norfolk and Suffolk, 2017

0%

100%

Photovoltaics

6%

94%

Onshore Wind

99%

Norfolk and Suffolk

are responsible for

Hydro

100%

over a quarter of the

Anaerobic Digestion

7%

93%

countries offshore

Offshore Wind

27%

73%

wind generated

Wave/Tidal

100%

renewable electricity

Sewage Gas

97%

capacity, and over two

Landfill Gas

97%

fifths of that resulting

Municipal Solid Waste

98%

from animal biomass

Animal Biomass

43%

57%

Plant Biomass

98%

Cofiring

100%

New Anglia

Rest of UK

Source: Renewable Electricity Statistics, Department for

Business, Energy and Industrial Strategy

29

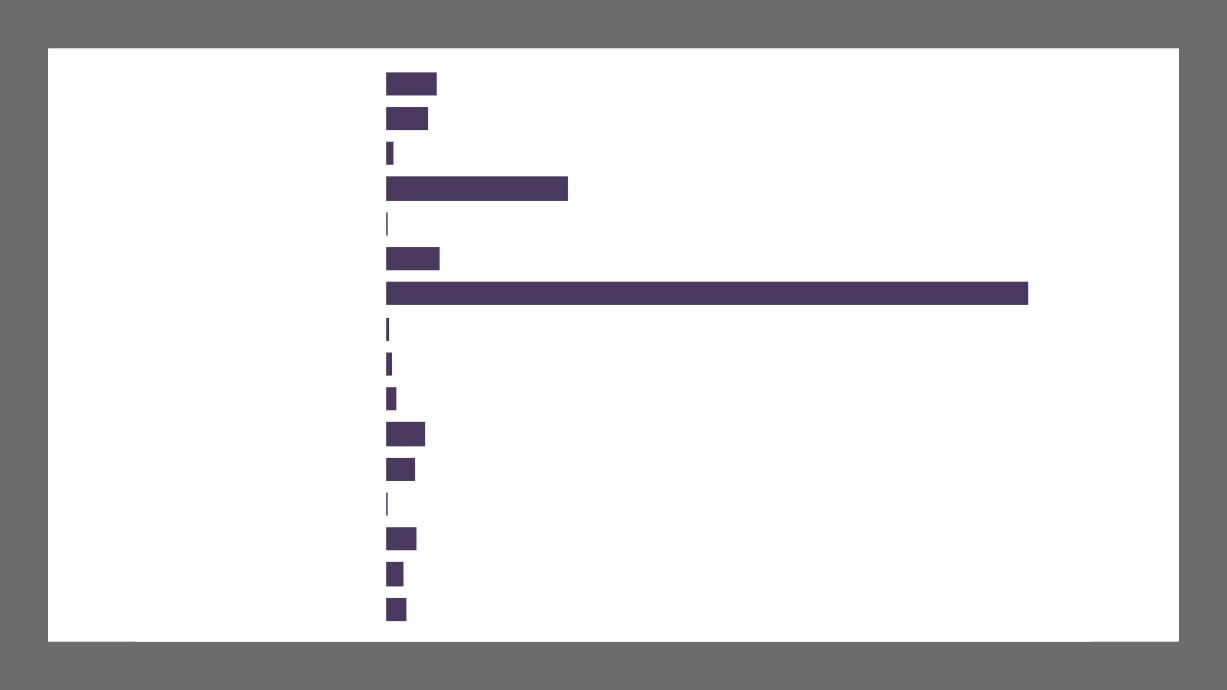

North Norfolk

30.2%

King's Lynn and West Norfolk

22.5%

Suffolk Coastal

21.6%

Breckland

6.7%

Waveney

3.1%

Proportion of Norfolk

Coastal local

Mid Suffolk

3.0%

and Suffolk Anglia

authorities dominate

St Edmundsbury

2.9%

Renewable

renewable electricity

capacity

Great Yarmouth

2.9%

Electricity Capacity

South Norfolk

2.1%

Provided by Local

Forest Heath

2.1%

Authority Area, 2017

Broadland

1.7%

Source: Renewable Electricity Statistics,

Department for Business, Energy and

Ipswich

0.5%

Industrial Strategy

Babergh

0.4%

Norwich

0.3%

30

Renewable Electricity Generation

In Norfolk and Suffolk between 2014 and 2017,

renewable electricity generation has increased by

nearly 50%

6m MWh

99.4m MW

(2017)

(2017)

48%

54%

4.1m MWh

64.5 MW

(2014)

(2014)

Source: Renewable Electricity Statistics, Department

for Business, Energy and Industrial Strategy

31

Babergh

133%

Breckland

110%

Broadland

21%

Forest Heath

481%

Great Yarmouth

2%

Ipswich

143%

King's Lynn and West Norfolk

1699%

Mid Suffolk

6%

North Norfolk

16%

Norwich

27%

Change in Renewable

South Norfolk

102%

Electricity Generation,

St Edmundsbury

76%

2014 - 2017

Suffolk Coastal

5%

Waveney

81%

New Anglia

48%

UK

54%

Source: Renewable Electricity Statistics, Department for Business, Energy and Industrial Strategy

32

100%

5%

Cofiring

6%

90%

20%

Renewable

Plant Biomass

Electricity

80%

Animal Biomass

3%

Generation

4%

by Type,

70%

Municipal Solid Waste

2017

Landfill Gas

60%

21%

Sewage Gas

68%

50%

3%

Over two thirds of

Wave/Tidal

6%

renewable electricity

40%

generated in Norfolk

Offshore Wind

and Suffolk in 2017

30%

Anaerobic Digestion

was via offshore wind,

29%

compared to only a

20%

Hydro

3%

fifth nationally

4%

Onshore Wind

10%

Source: Renewable Electricity

12%

12%

Statistics, Department for

Photovoltaics

Business, Energy and Industrial

0%

Strategy

33

New Anglia

UK

Proportion of UK Renewable Electricity Generated

by Type in Norfolk and Suffolk, 2017

0%

100%

Photovoltaics

6%

94%

Norfolk and Suffolk

Onshore Wind

99%

are responsible for

Hydro

100%

two fifths of the

Anaerobic Digestion

7%

93%

countries offshore

Offshore Wind

20%

80%

wind generated

Wave/Tidal

100%

renewable electricity

Sewage Gas

97%

and nearly three fifths

Landfill Gas

98%

of that generated from

Municipal Solid Waste

100%

animal biomass

Animal Biomass

57%

43%

Plant Biomass

99%

Cofiring

100%

New Anglia

Rest of UK

Source: Renewable Electricity Statistics, Department for

Business, Energy and Industrial Strategy

34

Suffolk Coastal

32.6%

North Norfolk

22.2%

King's Lynn and West Norfolk

18.1%

Breckland

12.3%

Great Yarmouth

3.3%

Mid Suffolk

2.8%

St Edmundsbury

2.0%

Proportion of

Waveney

1.9%

Norfolk and Suffolk

South Norfolk

1.5%

Renewable

Broadland

1.3%

Electricity

Forest Heath

0.9%

Generation by

Ipswich

0.5%

Local Authority

Babergh

0.3%

Area, 2017

Norwich

0.2%

Source: Renewable Electricity Statistics, Department for Business, Energy and Industrial Strategy

35

Renewable Electricity Installations

Cofiring

1

Plant Biomass

11

Number of

Animal Biomass

2

Renewable Electricity

Municipal Solid Waste

1

Installations by Type

Landfill Gas

19

in Norfolk and

Suffolk, 2017

Sewage Gas

4

Not shown here are Photovoltaics

Wave/Tidal

-

(37,179) and Onshore Wind (614)

Offshore Wind

6

Source: Renewable Electricity Statistics,

Department for Business, Energy and

Industrial Strategy

Anaerobic Digestion

34

Hydro

2

36

Cofiring

25%

Plant Biomass

3%

Animal Biomass

33%

Municipal Solid Waste

Landfill Gas

4%

Proportion of UK

Sewage Gas

2%

Renewable

Wave/Tidal

Electricity

Installations by

Offshore Wind

16%

Type in Norfolk and

Anaerobic Digestion

6%

Suffolk, 2017

Hydro

Source: Renewable Electricity Statistics,

Department for Business, Energy and

Onshore Wind

6%

Industrial Strategy

Photovoltaics

4%

37

Labour Insight

Jobs

The following section presents data from Labour Insight, a Burning Glass analytical tool. This

tool collects details of online job postings from multiple sources and enables the analysis of

these postings based on specific skills, educational requirements, and job titles, for example.

Please note that whilst Labour Insight will capture more information on the jobs market than

more traditional Department for Work and Pensions vacancy data, the fact that not all job

vacancies are advertised means that there will still be gaps in the findings.

In terms of highlighting ‘Clean Energy’ occupations then we have searched for vacancies using

the keywords / phrases of ‘renewables’ or ‘low carbon’ and ‘energy’.

Based on this search, and according to the Labour Insight Jobs tool, there were 3,560 postings

for the sector in Norfolk and Suffolk between Jan. 1, 2012 and Dec. 31, 2018.

38

Burning Glass Labour Market Analysis of ‘Clean Energy’

Occupations, 2018

Work Area

Job Postings Job Postings per 1000 people employed Location Quotient

Ipswich

108

0.7

Average demand

Lowestoft

34

0.6

Average demand

King's Lynn

34

0.5

Lower demand than average

Norwich

80

0.4

Much lower demand than average

Bury St Edmunds

30

0.4

Much lower demand than average

Great Yarmouth

18

0.4

Much lower demand than average

Thetford & Mildenhall

16

0.3

Much lower demand than average

Cromer & Sheringham

5

0.3

Much lower demand than average

Source: Burning Glass Labour Market Analysis tool

39

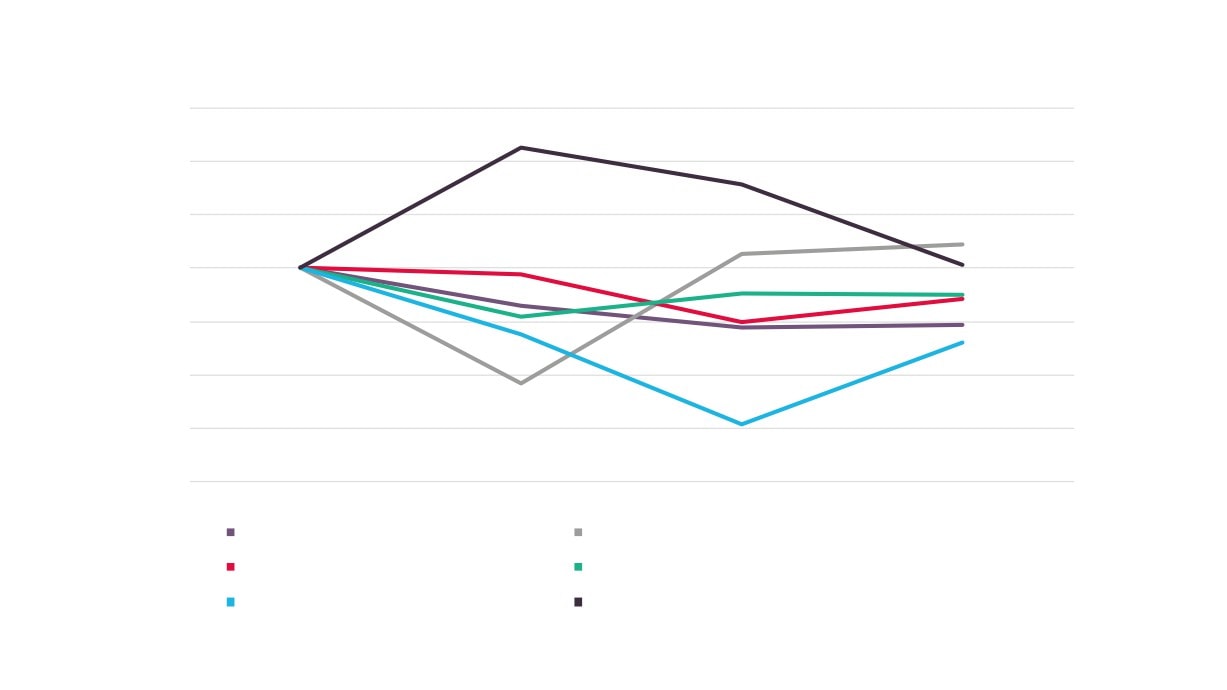

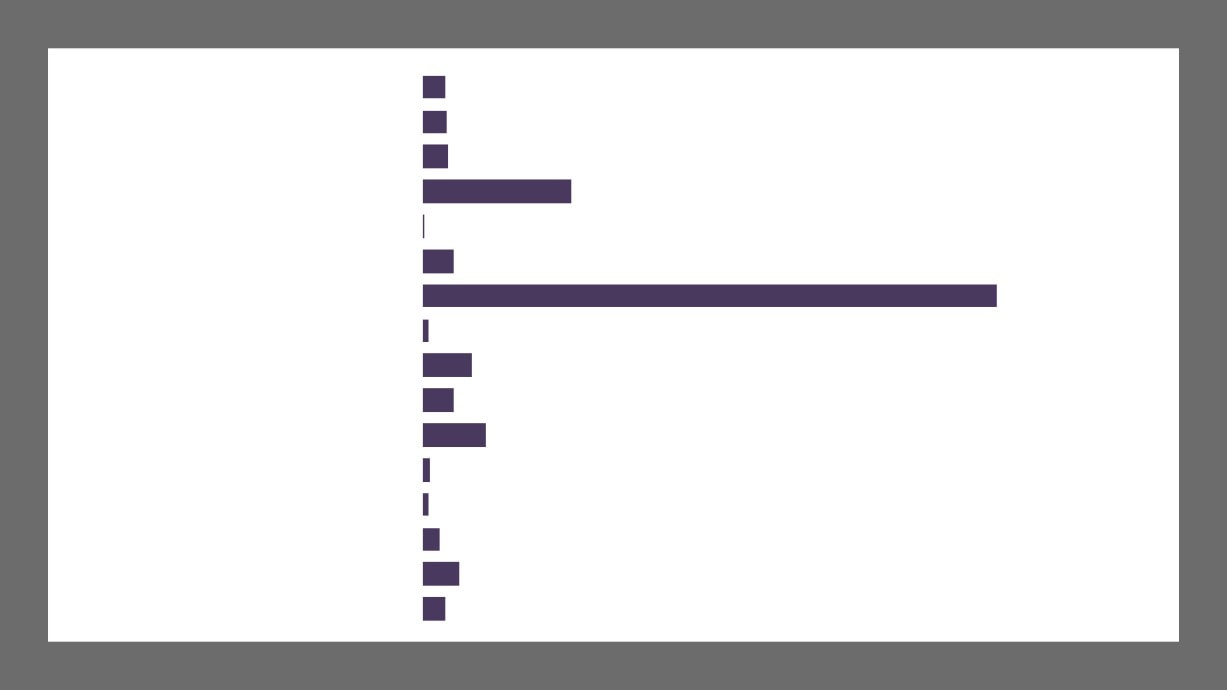

657

628

Norfolk and Suffolk ‘Clean

Energy’ Vacancies Over Time

Vacancies have

been identified

through the key

381

352

words search of

337

323

321

‘low carbon’ or

‘renewable’, and

‘energy’

2012

2013

2014

2015

2016

2017

2018

Source: Burning Glass Labour Market Analysis tool

40

0

100

200

300

400

500

600

700

800

900

‘Clean Energy’

Babergh

Vacancies Across

Breckland

Norfolk and

Broadland

Forest Heath

Suffolk Over Time

Great Yarmouth

Ipswich

King's Lynn and West Norfolk

Mid Suffolk

North Norfolk

Norwich

South Norfolk

St Edmundsbury

Suffolk Coastal

Waveney

2012

2013

2014

2015

2016

2017

2018

Source: Burning Glass Labour Market Analysis tool

41

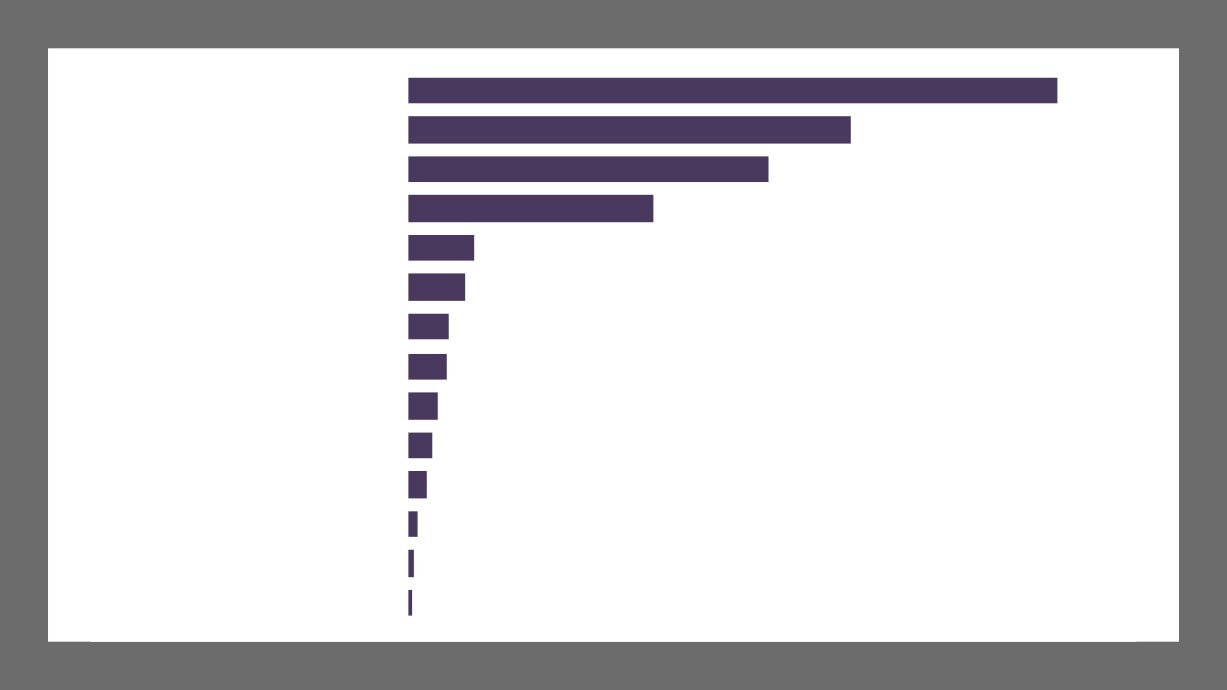

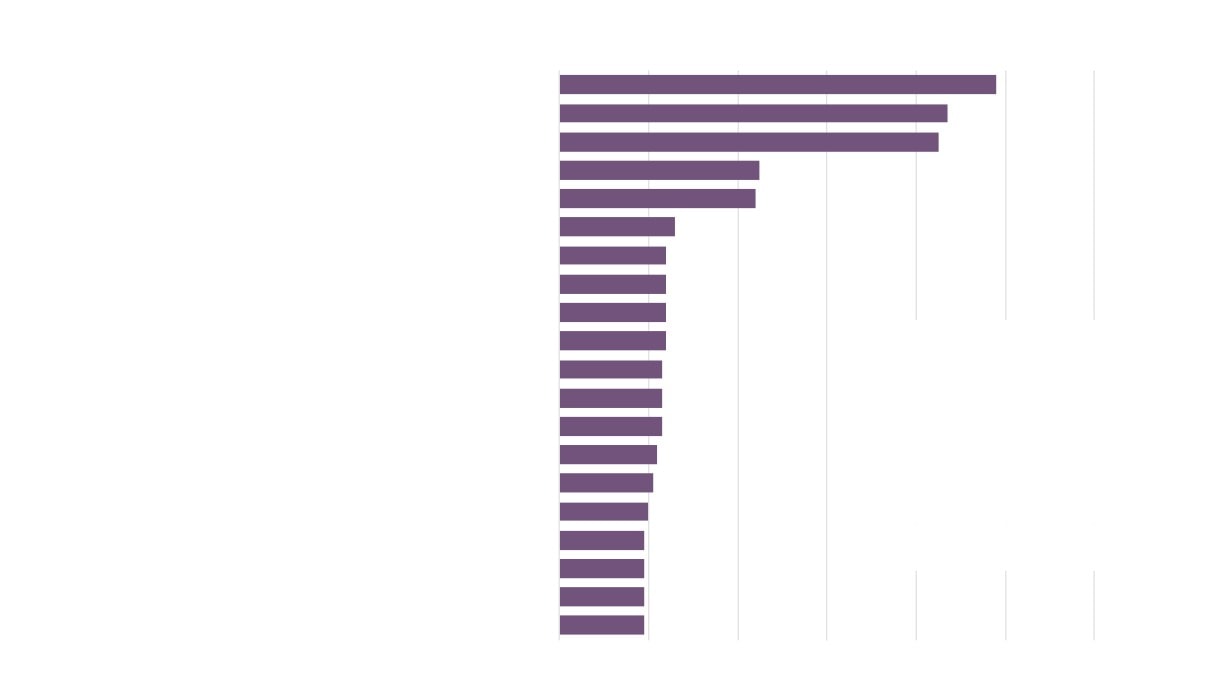

0

50

100

150

200

250

300

350

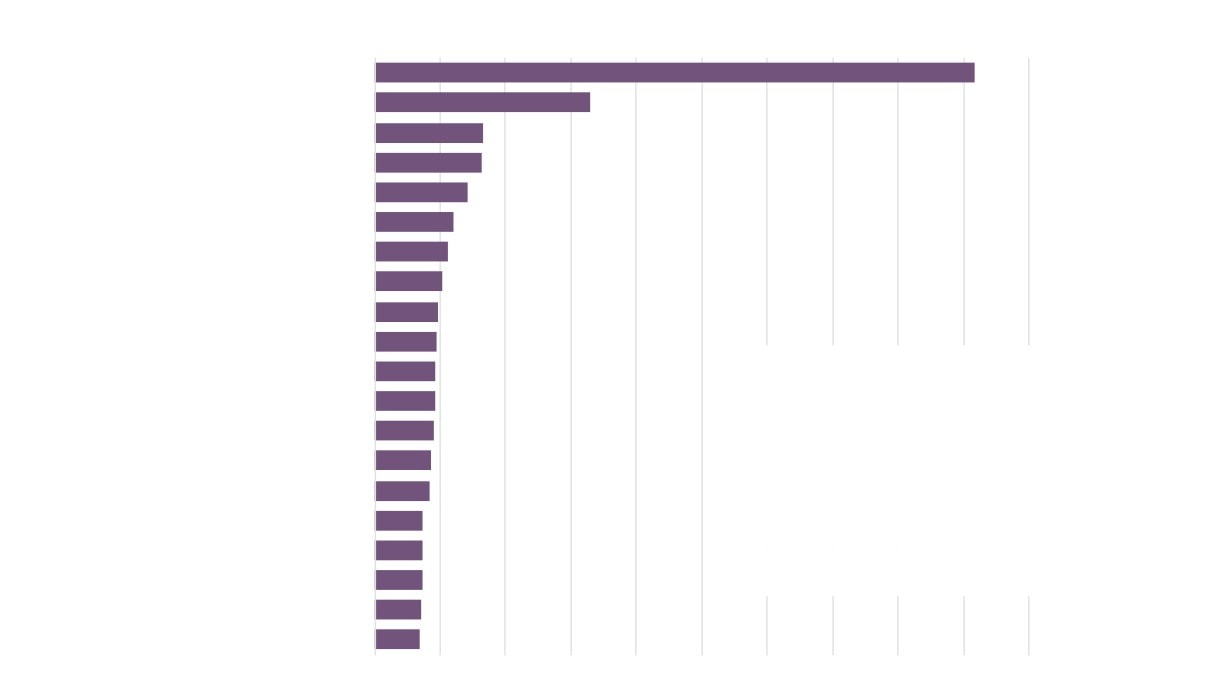

Sales related occupations n.e.c. (7129)

Engineering technicians (3113)

Managers and proprietors in other services n.e.c. (1259)

Engineering professionals n.e.c. (2129)

Marketing and sales directors (1132)

Electrical engineers (2123)

Other skilled trades n.e.c. (5449)

Plant and machine operatives n.e.c. (8129)

Other administrative occupations n.e.c. (4159)

Plumbers and heating and ventilating engineers (5314)

Top 20 Occupations

Civil engineers (2121)

with Vacancies

Electrical and electronic trades n.e.c. (5249)

Containing the

Draughtspersons (3122)

Keywords ‘Low

Mechanical engineers (2122)

Carbon’ or ‘Renewable’

Business sales executives (3542)

and ‘Energy’ in Norfolk

Electricians and electrical fitters (5241)

and Suffolk

Science, engineering and production technicians n.e.c. (3119)

Jan 2012 - Dec 2018

Production managers and directors in manufacturing (1121)

Source: Burning Glass Labour

Market Analysis tool

Design and development engineers (2126)

Estimators, valuers and assessors (3531)

42

Top 10 Occupations with Vacancies Containing

Top 10 Occupations with Vacancies Containing

the Keywords ‘Low Carbon’ or ‘Renewable’ and

the Keywords ‘Low Carbon’ or ‘Renewable’ and

‘Energy’ in Norfolk and Suffolk, 2012

‘Energy’ in Norfolk and Suffolk, 2018

Occupation (SOC)

Vacancies

Occupation (SOC)

Vacancies

Sales related occupations n.e.c. (7129)

87

Engineering technicians (3113)

36

Marketing and sales directors (1132)

35

Plant and machine operatives n.e.c. (8129)

24

Managers and proprietors in other services n.e.c. (1259)

31

Engineering professionals n.e.c. (2129)

20

Business sales executives (3542)

30

Managers and proprietors in other services n.e.c. (1259)

20

Collector salespersons and credit agents (7121)

24

Electricians and electrical fitters (5241)

18

Telephone salespersons (7113)

19

Design and development engineers (2126)

13

Civil engineers (2121)

17

Marketing and sales directors (1132)

13

Engineering professionals n.e.c. (2129)

15

Electrical and electronic trades n.e.c. (5249)

12

Science, engineering and production technicians n.e.c. (3119)

15

Electrical engineers (2123)

12

Book-keepers, payroll managers and wages clerks (4122)

13

Mechanical engineers (2122)

11

Source: Burning Glass Labour Market Analysis tool

43

-

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

Renewable Energy

Sales

Project Management

Customer Service

Budgeting

Teamwork / Collaboration

Business Development

Commissioning

AutoCAD

Technical Recruiting

Top 20 Specialist Skills

Carbon Reduction

Detailed in Vacancies

Biomass

Containing the Keywords

Wind Power

‘Low Carbon’ or

Mechanical Engineering

‘Renewable’ and ‘Energy’

Direct Sales

in Norfolk and Suffolk

Quality Management

Jan 2012 - Dec 2018

Sales Management

Source: Burning Glass Labour Market

Plumbing

Analysis tool

Procurement

Scheduling

44

Top 10 Specialist Skills in Vacancies Containing

Top 10 Specialist Skills in Vacancies Containing

the Keywords ‘Low Carbon’ or ‘Renewable’ and

the Keywords ‘Low Carbon’ or ‘Renewable’ and

‘Energy’ in Norfolk and Suffolk 2012

‘Energy’ in Norfolk and Suffolk, 2018

Specialist Skill

Vacancies

Specialist Skill

Vacancies

Renewable Energy

323

Renewable Energy

213

Sales

199

Carbon Reduction

49

Project Management

68

Customer Service

48

Business Development

66

Teamwork / Collaboration

36

Budgeting

52

Budgeting

35

Direct Sales

46

Technical Recruiting

31

Sales Management

45

Biomass

29

Customer Service

37

Site Surveys

28

Product Sales

37

Business Development

27

Solar Energy

37

Commissioning

27

Source: Burning Glass Labour Market Analysis tool

45

0

10

20

30

40

50

60

70

80

90

Sales Representative

Sales Executive

Electrician

Maintenance Engineer

Sales Manager

Business Development Executive

Engineering Manager

Sales Advisor

Structural Engineer

Electrical Engineer

Sales Engineer

Top 20 Job Titles in

Contract Manager

Vacancies Containing the

Customer Service Advisor

Keywords ‘Low Carbon’ or

Electrical Design Engineer

‘Renewable’ and ‘Energy’

Energy Engineer

in Norfolk and Suffolk

Project Manager

Jan 2012 - Dec 2018

Telemarketer

Source: Burning Glass Labour Market

Field Service Engineer

Analysis tool

Mechanical Engineer

Plant Manager

46

Top 10 Job Titles in Vacancies Containing the

Top 10 Job Titles in Vacancies Containing the

Keywords ‘Low Carbon’ or ‘Renewable’ and

Keywords ‘Low Carbon’ or ‘Renewable’ and

‘Energy’ in Norfolk and Suffolk, 2012

‘Energy’ in Norfolk and Suffolk, 2018

Job Title

Vacancies

Job Title

Vacancies

Sales Executive

26

Electrician

17

Sales Representative

21

Building Engineer

11

Canvasser

16

Business Development Executive

10

Sales Manager

15

Maintenance Engineer

8

Sales Advisor

14

Energy Engineer

7

Sales Engineer

14

Plant Operator

7

Business Development Executive

11

Sustainability Engineer

7

Call Centre Staff

9

Technical Analyst

7

Telemarketer

9

Contract Manager

6

Sales Consultant

8

Mechanical Engineer

6

Source: Burning Glass Labour Market Analysis tool

47

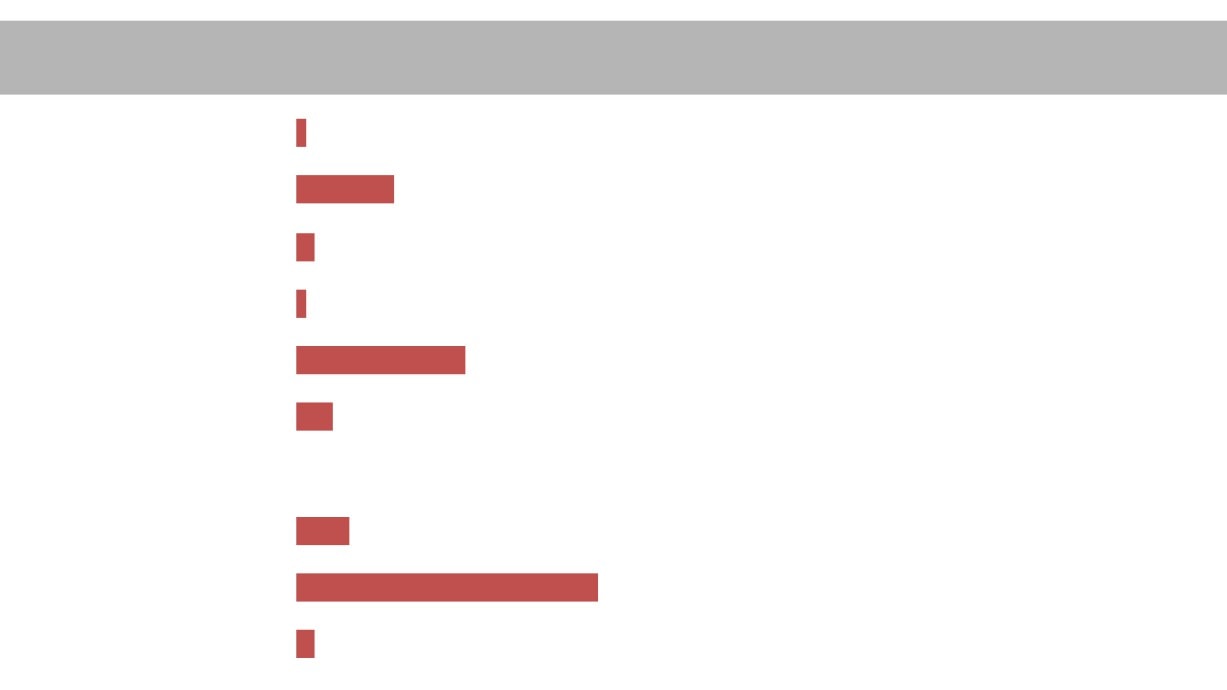

0

20

40

60

80

100

120

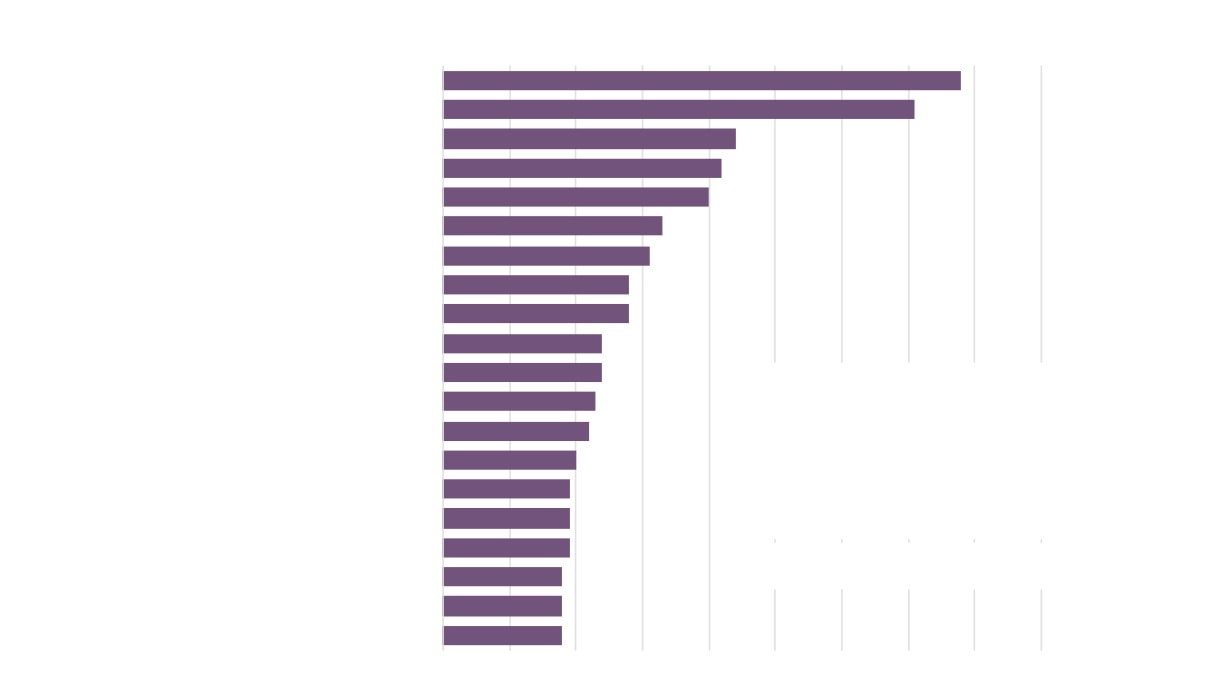

Other business support service activities n.e.c. (82.99)

Treatment and disposal of non-hazardous waste (38.21)

General public administration activities (84.11)

Tertiary education (85.42)

Plumbing, heat and air-conditioning installation (43.22)

Market research and public opinion polling (73.20)

Activities of head offices (70.10)

Legal activities (69.10)

Other construction installation (43.29)

Other retail sale not in stores, stalls or markets (47.99)

Top 20 Industries with

Distribution of gaseous fuels through mains (35.22)

Vacancies Containing

Manufacture of other electrical equipment (27.90)

the Keywords ‘Low

Trade of electricity (35.14)

Carbon’ or ‘Renewable’

Construction of other civil engineering projects n.e.c. (42.99)

and ‘Energy’ in Norfolk

and Suffolk

Production of electricity (35.11)

Jan 2012 - Dec 2018

Collection of non-hazardous waste (38.11)

Construction of residential and non-residential buildings (41.20)

Source: Burning Glass Labour

Market Analysis tool

Management consultancy activities (70.22/9)

Specialised design activities (74.10)

Urban planning and landscape architectural activities (71.11/2)

48

Future View of the

A Future View of the LCRE Sector

LCRE Sector

in Norfolk and Suffolk

We have shown in previous work for the Energy sector (which encapsulates a significant

proportion of the LCRE sector) that it is projected to grow by 6% between 2017 and 2024 (based

on the UK Commission for Employment and Skills Working Futures 2014-2024 data). Given the

emerging and important nature of the LCRE sector, and its local high profile, then clearly it will

play a major role in driving this growth.

The recently announced (March 2019) Offshore Wind Sector Deal sets out the following

ambitions for growth between now and 2030:

• Increased offshore wind capacity in the UK from 8GW to 30GW at a cost of £40billion, of which

the East of England would represent 14.5GW, or nearly 50%;

• Increase employment from 12-13,000 jobs now, adding a further 27,000 by 2030.

The focus of the sector on the East of England, and the fact that Norfolk and Suffolk already

delivers 20% of the country’s offshore wind generated electricity would suggest that we could

expect at least a similar proportion of the jobs target would be met in Norfolk and Suffolk i.e.

5,400 jobs.

This coupled with the Nuclear Sector Deal, means that we can expect to see an increase in low

carbon and renewable energy vacancies across Norfolk and Suffolk in the near future.

49