AgriFood Tech Sector

Data Pack

Version Final

Contents

Page

-

Introduction to the Sector Data Pack

3

-

Introduction to and Definition of the AgriFood Tech Sector

3

-

Key Findings from the Data Analysis

5

-

The AgriFood Tech Sector in New Anglia

6

o GVA

9

o Employment

11

o Businesses

34

o NiNO registrations

39

o Exports

43

o Wages

49

o Qualifications and Skills

51

o Vacancies

53

-

A Future View of the AgriFood Tech Sector

59

-

Views from Stakeholder Consultations

66

o AgriFood Tech survey findings

67

-

Appendices

77

o Appendix 1 - AgriFood Tech sector definition

78

o Appendix 2 - AgriTech sector definition

81

2

Introduction to the Sector Data Pack

The role of the Sector Data Pack is to bring together the latest socio-economic and labour market data and present both an up-to-date, and

future view, of the sector and any underlying issues within the area that could impact upon it. Information and feedback collected from

stakeholder consultation (through workshops, meetings, and survey) is also presented and summarised (where available and applicable).

The Data Pack sits below the Sector Skills Plan, with the key findings from the data analysis helping to inform the priorities developed in the

plan. In most instances data has been analysed and presented down to local authority level. In some instances, and even where local authority

data is available, it has not been presented in the data pack due to issues of unreliability and small sample sizes. This is particularly the case

with data from the Annual Population Survey and the Annual Survey of Hours and Earnings.

Throughout the Data Pack findings are also presented for the areas of Lincolnshire (county), Greater Cambridge and Greater Peterborough

(GCGP) Local Enterprise Partnership (LEP), Greater Lincolnshire LEP (GLLEP), and South East LEP (SELEP). These comparator areas were

agreed in consultation with the AgriFood Tech sector group and New Anglia LEP officers.

Introduction to and Definition of the AgriFood Tech Sector

New Anglia is arguably the most productive farming region in the UK, with the most profitable farms, a dynamic food chain and the largest

concentration of agri-food research in Europe. New Anglia’s agriculture has a turnover of £1.65billion, including 52% of the UK sugar beet

production, 20% of its cereals, 21% of the pig herd and 21% of the duck, geese and turkey flocks.

Taking the tighter AgriFood Tech definition, which excludes food retail and catering, it can be broken down into three elements as follows:

AgriFood

In scope:

-

Agricultural, horticultural and forestry production (crops, livestock, ornamental crops, biomass and biofuels, renewable materials)

-

Food and drink processing (including artisan foods)

-

Input supplies (e.g. machinery, fertilisers, seeds, packaging etc.)

-

Food wholesaling and marketing

-

Food logistics

AgriTech (see full national definition in appendix 2)

In scope:

3

-

Plant genetic improvement; plant health; crop storage and silage

-

Animal genetic improvement; animal nutrition; animal health and welfare

-

ICT systems

-

Soil and substrate management; environmental interactions; harvest and early stage processing

-

Engineering and precision farming

-

Infrastructure

-

Advisory services

Food Tech:

-

Food production technology

-

Dietary health and consumer food technology

Full details of the Standard Industrial Classification codes that are used to captures these activities can be found in appendix 1.

4

Key Findings from the Data Analysis

-

The AgriFood Tech sector in New Anglia was worth over £2.5bn in 2015

-

This £2.5bn equates to just over 7 per cent of New Anglia’s economy total value, which is more than double what the sector is worth to

the national economy

-

Growth in value in the sector has been broadly in line with that of national and comparator area trends

-

50,000 people were employed in the sector in 2015, around 7.4 per cent of the total workforce, and of the comparator areas then only

Greater Lincolnshire has a higher proportion

-

Employment in the sector has fallen over the last five years whereas many of its comparators areas have experienced growth

-

Across New Anglia then some of the largest areas of employment such as Breckland, Mid Suffolk, and King’s Lynn and West Norfolk,

have experienced falls in employment

-

New Anglia’s AgriFood Tech sector Location Quotient is 1.9 which means that employment in the sector is nearly twice as important to

the local economy compared to the national level.

-

Mid Suffolk Coastal has the highest LQ of all the local authority districts at 4.0

-

Full time employment in the New Anglia AgriFood Tech sector has fallen over the last five years whereas many of its comparator areas

have experienced increases

-

There are 7,875 AgriFood Tech businesses in New Anglia and unlike employment, this number has grown between 2010 and 2015

albeit at a lower rate than all comparator areas

-

The proportion of New Anglia residents with higher level qualifications is increasing but remains below national averages

-

Growth in AgriFood Tech sector apprenticeships has been strong since 2006 and at a higher rate than both regionally and nationally

-

Employment in the sector is forecast to fall further, however, at the same time, replacement demand and expansion demand within

more skilled occupations will maintain and grow the demand for higher skills within both the sector and the New Anglia area.

-

With the projected drop in employment, by 2024 there is a potential gap (driven by retirements) in the New Anglia AgriFood Tech sector

workforce of 18,000

5

The AgriFood Tech Sector

in New Anglia

6

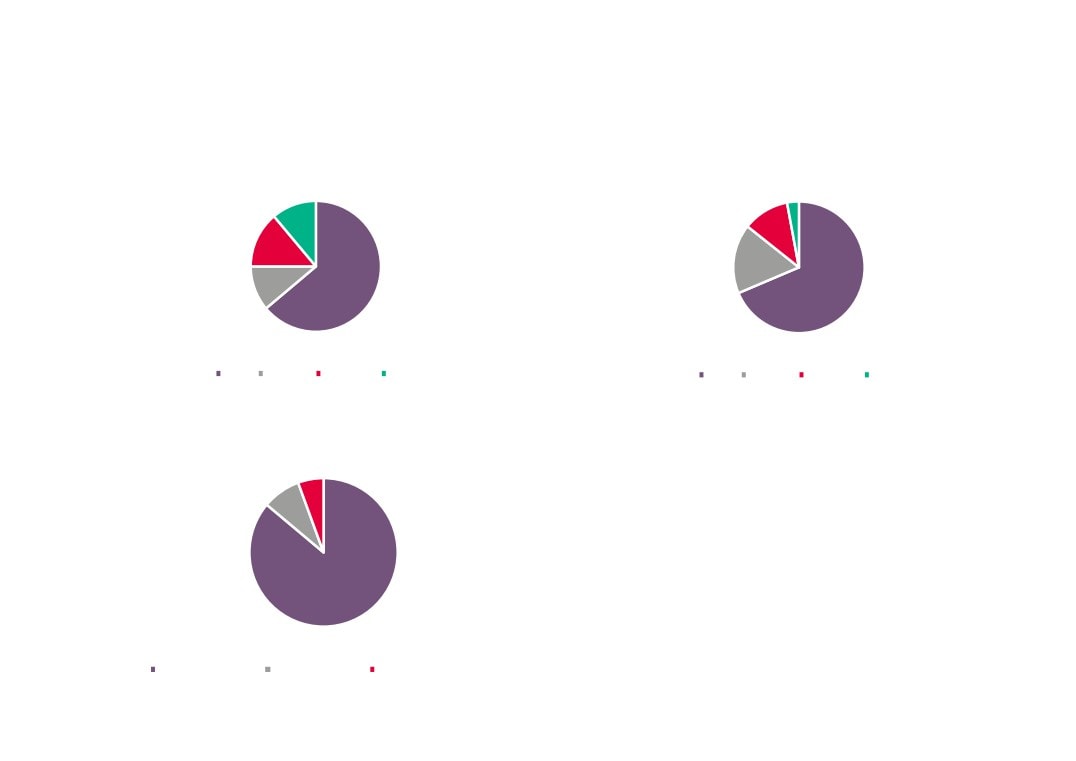

AgriFood Tech sector’s contribution to the local economy

The AgriFood Tech sector contributes the

10.8%

following to the New Anglia LEP economy:

-

Over 7 per cent total economic value

(Gross Value Added or GVA) generated,

which is over £2.5bn of the £35.5bn

generated by the New Anglia economy is

2015.

7.4%

7.1%

-

7.4 per cent of total employment

(675,500), equating to nearly 50,000

employees in 2015.

-

Nearly 11 per cent of businesses, 7,900

of the 72,900 businesses in New Anglia.

Sources: Sub-regional GVA; Business Register

and Employment Survey, UK Business Counts;

all Office for National Statistics; 2013

Agricultural Survey, Department for

Environment, Food, and Rural Affairs (Defra)

GVA

Employment

Businesses

Please note that values for GVA are based on the sectors of ‘Agriculture’, ‘Food products, beverages and tobacco’, and

a proportion of both ‘basic pharmaceutical products and preparations’ and ‘Transport and storage’. They have been

calculated by applying regional proportions of sectoral GVA at the New Anglia LEP level. Values for employment and

businesses based on the SIC codes detailed in the appendices.

7

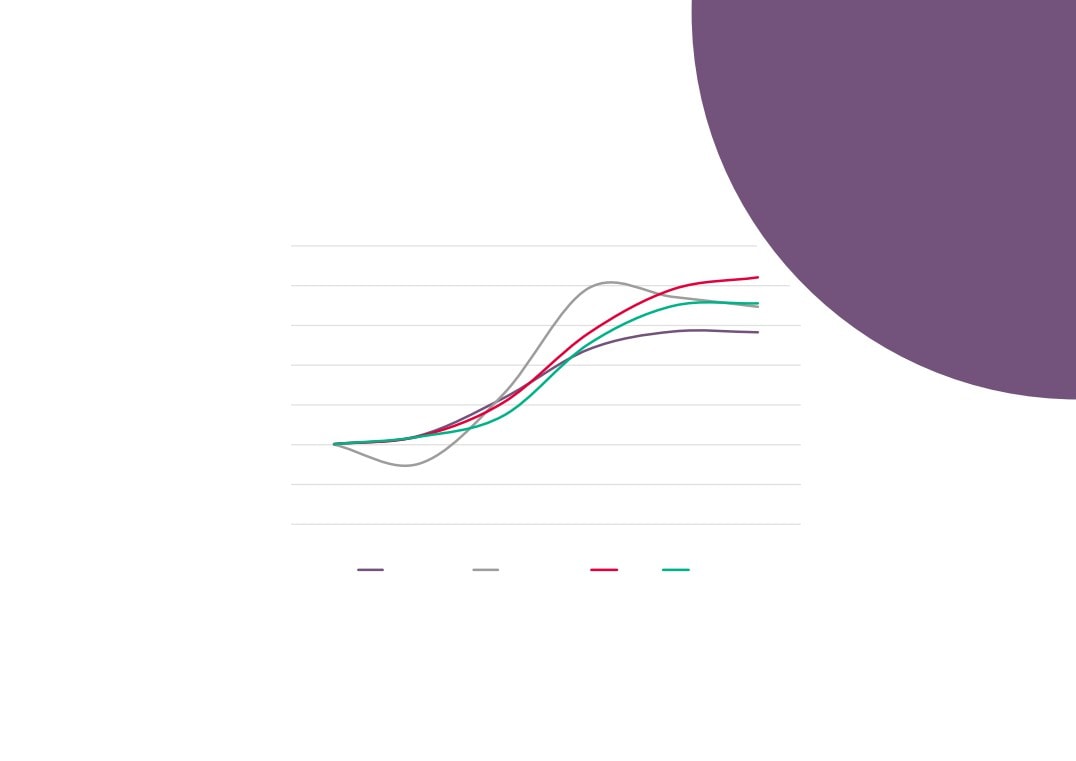

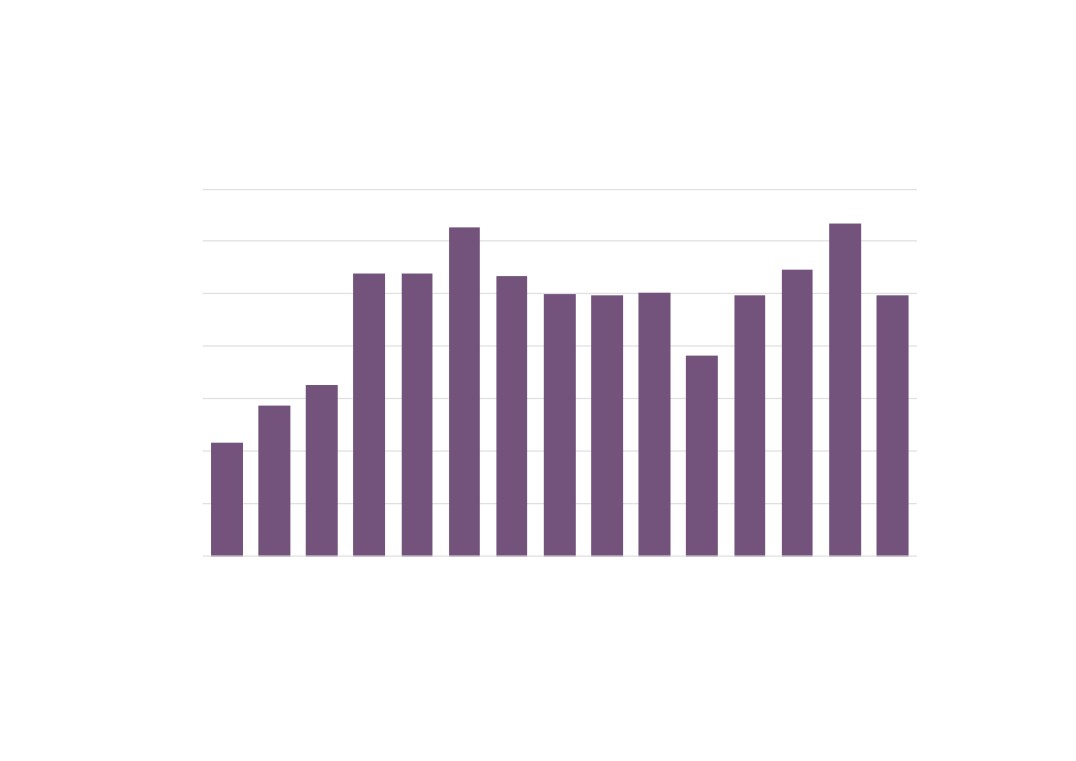

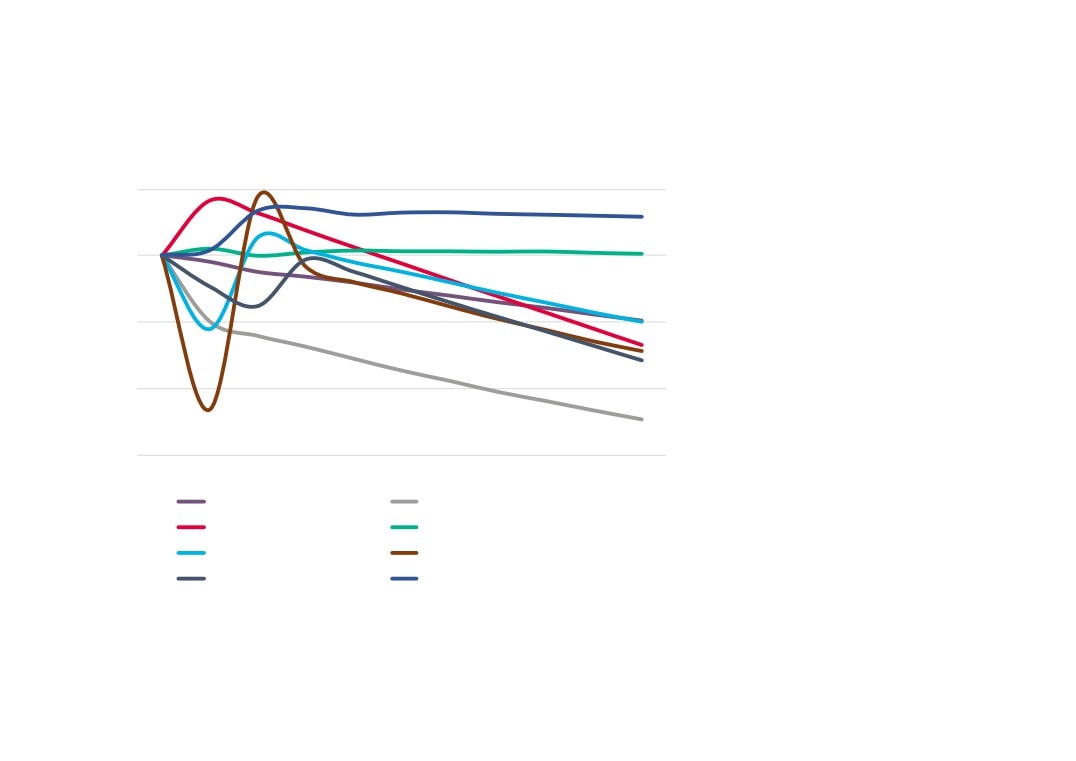

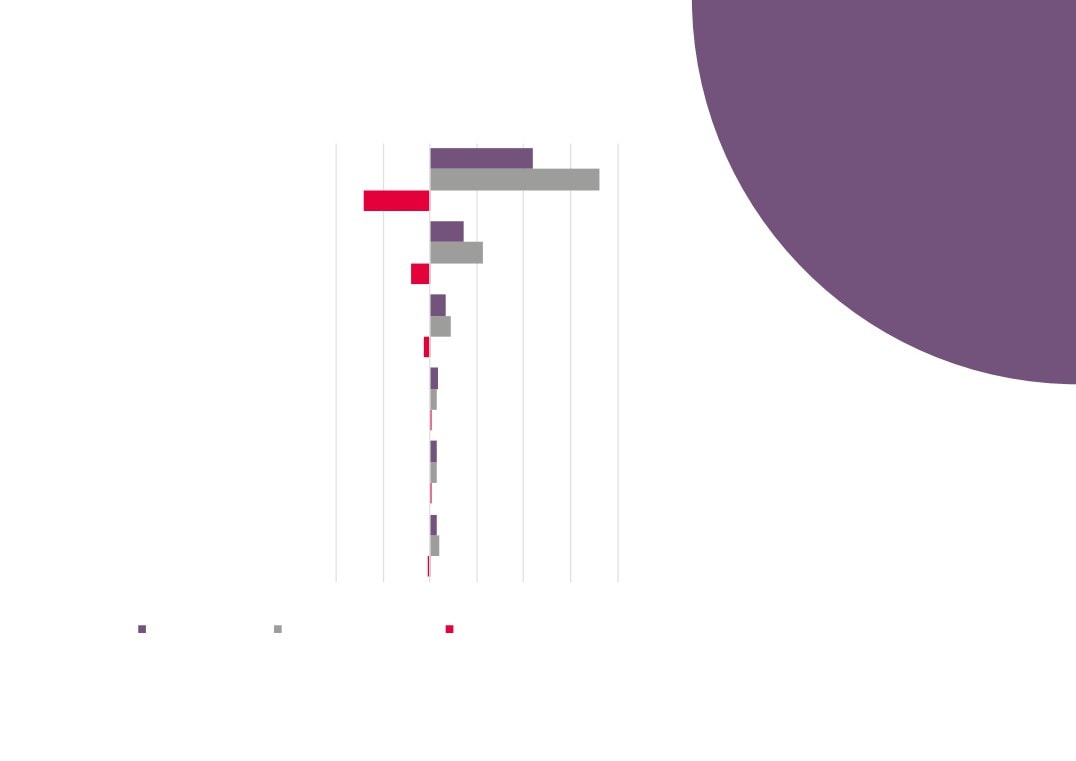

AgriFood Tech sector’s contribution to growth in the local economy

(2010=100)

120

Growth in both GVA and business numbers in

the sector have been broadly in line with total

growth in New Anglia. Turning to employment,

then looking at the general trend it is one of low

110

but negative growth over the five year period in

question.

Sources: Sub-regional GVA; Business Register

100

and Employment Survey, UK Business Counts;

all Office for National Statistics; 2013

Agricultural Survey, Department for

Environment, Food, and Rural Affairs (Defra)

90

2010

2011

2012

2013

2014

2015

2016

AgriFoodTech GVA

AgriFoodTech Employment

AgriFoodTech Business

Total GVA

Total Employment

Total Business

8

AgriFood Tech

is more than

twice as

Proportion of total GVA generated by

AgriFood Tech sector across selected

important to

comparator areas, 2015

New Anglia as

10.0%

it is nationally

7.1%

4.4%

3.5%

New Anglia LEP

Lincolnshire

East of England

UK

Sources: Sub-regional Gross Value Added (GVA), Office for National Statistics

9

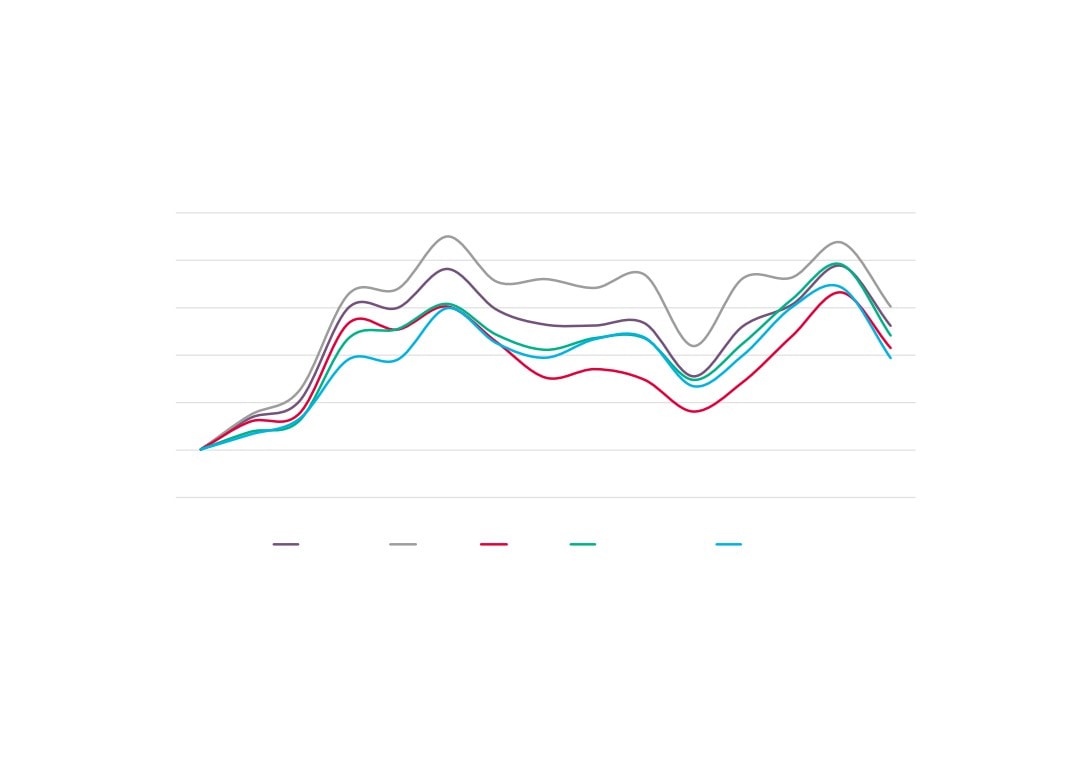

Trends in growth in

New Anglia’s

AgriFood Tech sector

have been broadly in

Change in AgriFood Tech sector GVA

line with that of

across comparator areas (2010 = 100)

comparator areas

125

120

115

110

105

100

95

90

2010

2011

2012

2013

2014

2015

New Anglia

Lincolnshire

East

UK

Sources: Sub-regional Gross Value Added (GVA), Office for National Statistics

10

50,000 people

Employment in the AgriFood Tech sector

were employed in

across comparator areas, 2015

New Anglia’s

New Anglia

50,000

AgriFood Tech

sector in 2015

Norfolk

26,800

Suffolk

23,200

Lincolnshire

41,100

GCGP

40,700

GLLEP

53,600

SELEP

62,900

Source: Business Register and Employment Survey 2015, Office for National Statistics, and

Agricultural Census 2013, Department for Environment, Food, and Rural Affairs (Defra)

11

In terms of

comparator areas

Proportion of employment provided by the

then only Greater

AgriFood Tech sector across comparator

Lincolnshire has a

areas, 2015

higher proportion

New Anglia

7.2%

of employment

provided by

Norfolk

7.2%

AgriFood Tech

Suffolk

7.1%

Lincolnshire

13.9%

GCGP

5.9%

GLLEP

12.2%

SELEP

3.9%

East of England

4.4%

England

3.9%

Source: Business Register and Employment Survey 2015, Office for National Statistics, and

Agricultural Census 2013, Department for Environment, Food, and Rural Affairs (Defra)

12

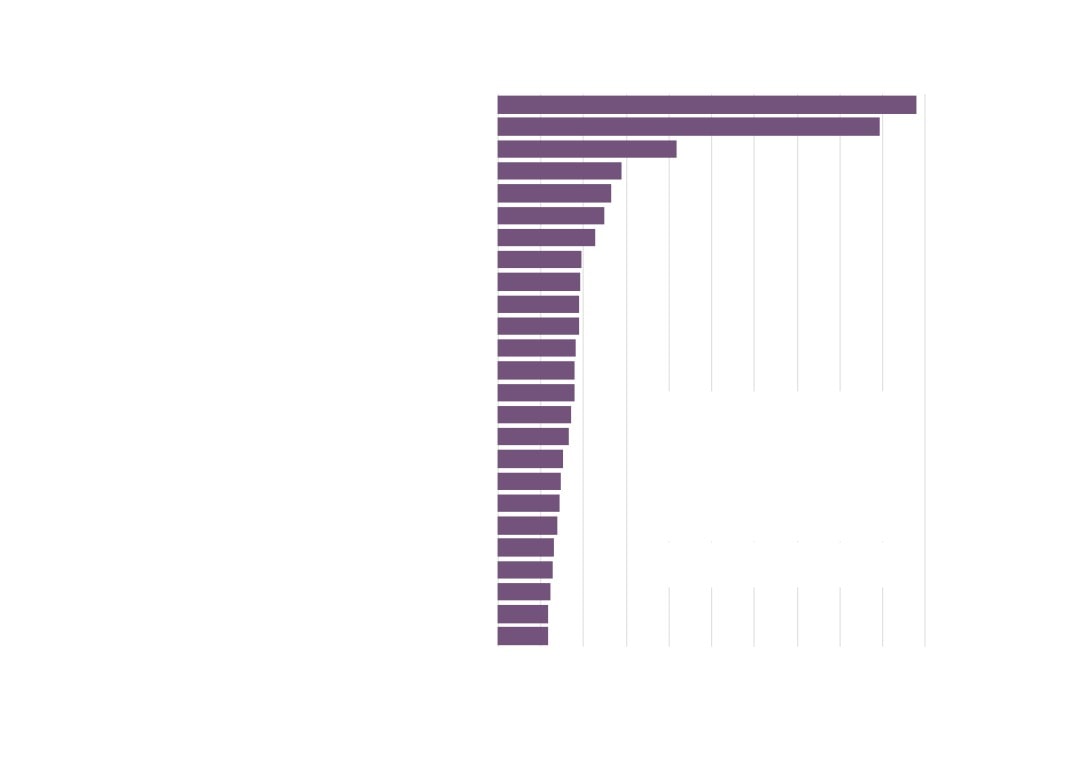

Employment in the AgriFood Tech sector across New Anglia, 2015

Breckland

6,600

Kings Lynn and West Norfolk

6,500

Mid Suffolk

5,700

St Edmundsbury

4,800

North Norfolk

4,500

Suffolk Coastal

3,600

Waveney

3,600

South Norfolk

3,500

Broadland

3,100

Babergh

2,300

Forest Heath

2,200

Norwich

1,800

Ipswich

1,000

Great Yarmouth

900

Source: Business Register and Employment Survey 2015, Office for National Statistics, and

Agricultural Census 2013, Department for Environment, Food, and Rural Affairs (Defra)

13

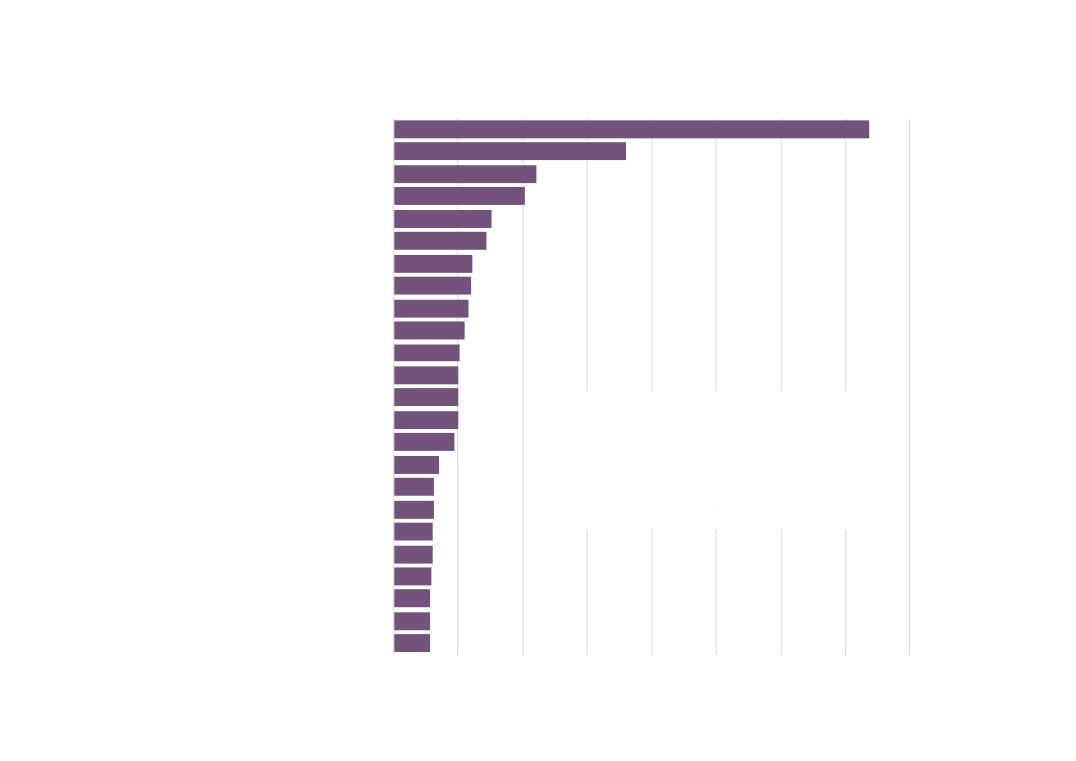

Proportion of employment provided by the AgriFood Tech sector across comparator areas, 2015

Mid Suffolk

15.3%

North Norfolk

12.8%

Breckland

12.8%

Kings Lynn and West Norfolk

11.3%

Waveney

8.6%

Forest Heath

8.6%

St Edmundsbury

7.5%

Babergh

7.0%

Suffolk Coastal

6.9%

South Norfolk

6.5%

Broadland

6.4%

Great Yarmouth

2.4%

Norwich

2.0%

Ipswich

1.5%

Source: Business Register and Employment Survey 2015, Office for National Statistics, and

Agricultural Census 2013, Department for Environment, Food, and Rural Affairs (Defra)

14

Change in AgriFood Tech sector employment

across comparator areas, 2010 - 2015

New Anglia

-3%

Norfolk

-1%

Suffolk

-5%

Lincolnshire

8%

GCGP

-2%

GLLEP

5%

SELEP

7%

East of England

-1%

England

5%

Source: Business Register and Employment Survey 2015, Office for National Statistics, and

Agricultural Census 2013, Department for Environment, Food, and Rural Affairs (Defra)

15

Change in AgriFood Tech sector employment

across New Anglia, 2010 - 2015

Babergh

-9%

Breckland

11%

Broadland

-14%

Forest Heath

13%

Great Yarmouth

-26%

Ipswich

1%

King`s Lynn

and West Norfolk

-5%

Mid Suffolk

-12%

North Norfolk

11%

Norwich

-16%

South Norfolk

3%

St Edmundsbury

-8%

Suffolk Coastal

3%

Waveney

-4%

Source: Business Register and Employment Survey 2015, Office for National Statistics, and

Agricultural Census 2013, Department for Environment, Food, and Rural Affairs (Defra)

16

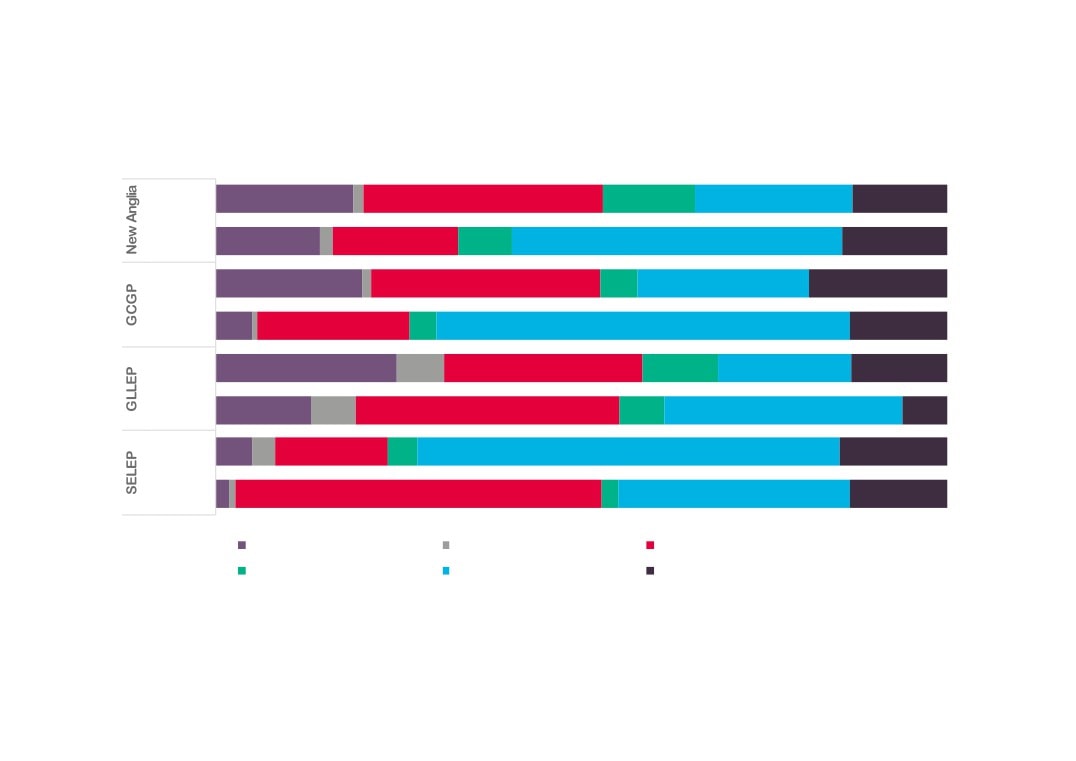

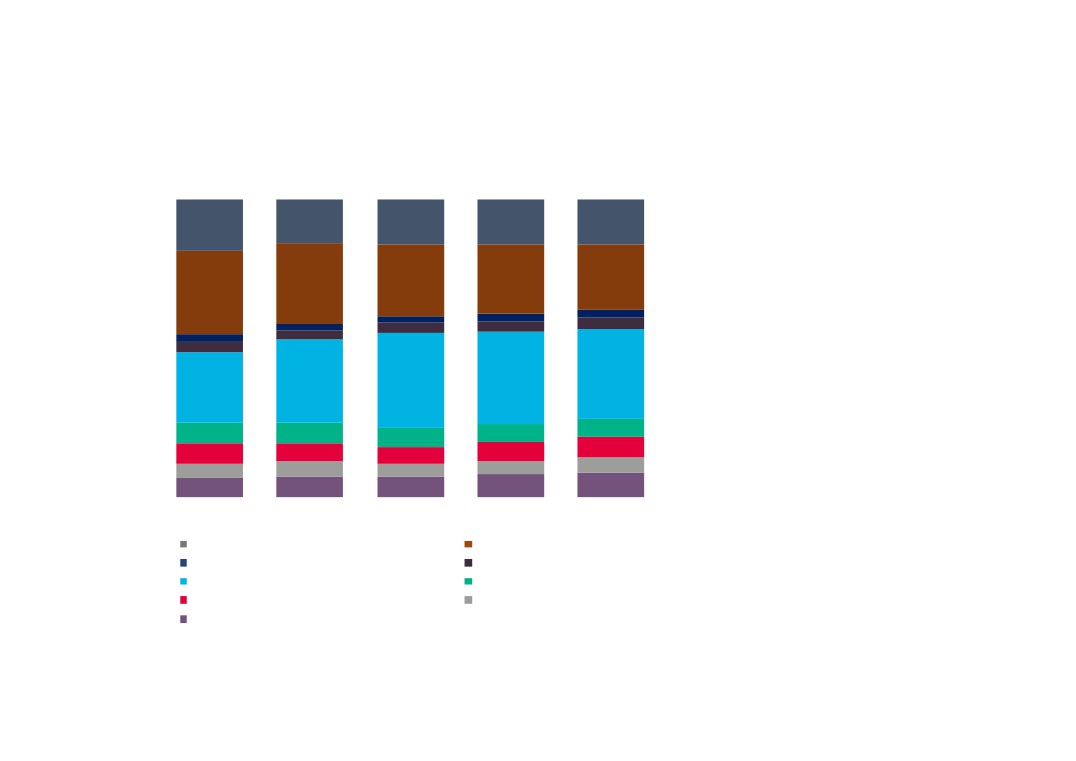

AgriFood Tech sector employment split by sub-sector across comparator areas, 2015

80%

100%

New Anglia

92%

7%

Norfolk

91%

9%

Suffolk

94%

6%

Lincolnshire

94%

6%

1%

GCGP

89%

10%

1%

GLLEP

94%

5%

1%

SELEP

92%

8%

East of

91%

8%

1%

England

England

93%

6%

AgriFood

AgriTech

FoodTech

Source: Business Register and Employment Survey 2015, Office for National Statistics, and

Agricultural Census 2013, Department for Environment, Food, and Rural Affairs (Defra)

17

AgriFood sector employment split by sub-sector across comparator areas, 2015

New Anglia

46%

5%

35%

10%

5%

Norfolk

51%

4%

34%

9%

3%

Suffolk

40%

6%

35%

12%

6%

Lincolnshire

35%

4%

40%

15%

6%

GCGP

42%

5%

29%

14%

11%

GLLEP

30%

5%

44%

15%

5%

SELEP

44%

7%

16%

28%

4%

East of

39%

7%

29%

18%

7%

England

England

35%

6%

35%

21%

3%

Agricultural, horticultural and forestry production

Food logistics

Food processing

Food wholesaling and marketing

Input supplies

Source: Business Register and Employment Survey 2015, Office for National Statistics, and

Agricultural Census 2013, Department for Environment, Food, and Rural Affairs (Defra)

18

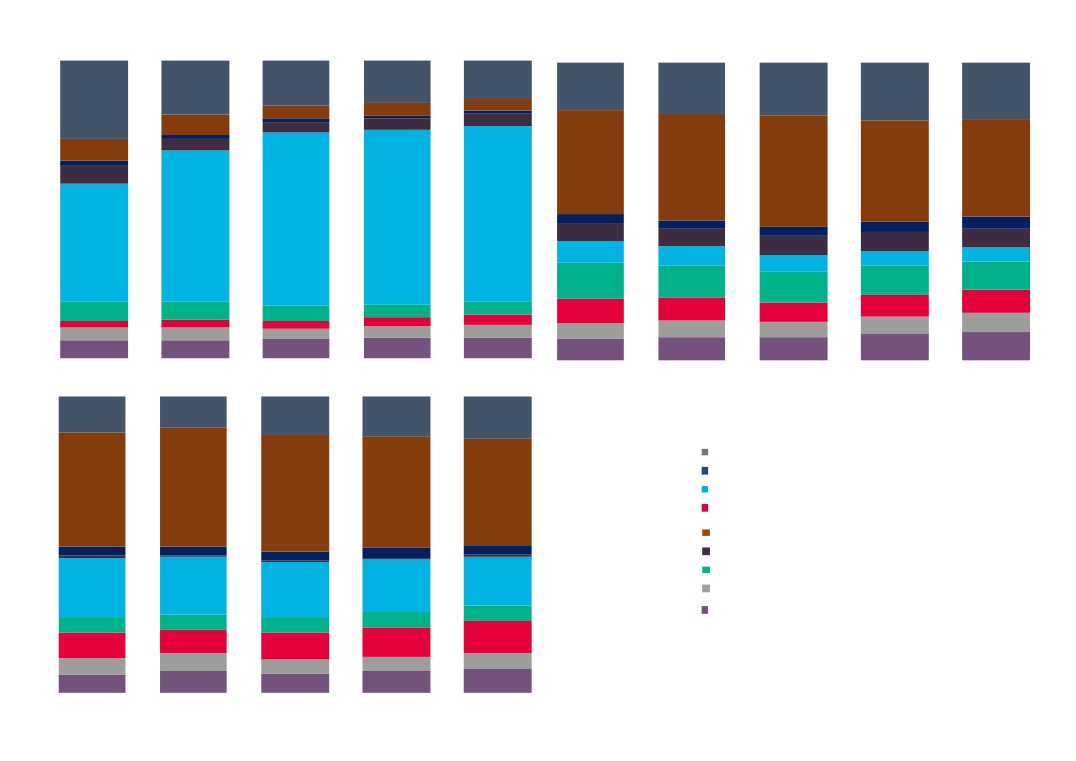

AgriFood Tech sector employment split by sub-sector across New Anglia, 2015

70%

100%

Babergh

91%

9%

Breckland

93%

7%

Broadland

92%

7%

Forest Heath

89%

11%

Great Yarmouth

86%

14%

Ipswich

94%

6%

King`s Lynn and West Norfolk

94%

5%

1%

Mid Suffolk

95%

4%

1%

North Norfolk

93%

7%

Norwich

79%

21%

South Norfolk

86%

14%

St Edmundsbury

95%

5%

Suffolk Coastal

90%

10%

Waveney

98%

2%

AgriFood

AgriTech

FoodTech

Source: Business Register and Employment Survey 2015, Office for National Statistics, and

Agricultural Census 2013, Department for Environment, Food, and Rural Affairs (Defra)

19

AgriFood sector employment split by sub-sector across New Anglia, 2015

Babergh

62%

4%

25%

7%

2%

Breckland

44%

4%

43%

6%

2%

Broadland

40%

2%

47%

9%

2%

Forest Heath

63%

2%

23%

10%

Great Yarmouth

55%

11%

13%

21%

Ipswich

9%

5%

44%

41%

King`s Lynn and West Norfolk

58%

3%

26%

7%

5%

Mid Suffolk

40%

6%

33%

12%

9%

North Norfolk

55%

3%

31%

7%

4%

Norwich

6%

63%

30%

South Norfolk

76%

4%

12%

8%

St Edmundsbury

23%

4%

59%

8%

5%

Suffolk Coastal

64%

19%

11%

6%

Waveney

25%

1%

66%

7%

Agricultural, horticultural and forestry production Food logistics

Food processing

Food wholesaling and marketing

Input supplies

Source: Business Register and Employment Survey 2015, Office for National Statistics, and

Agricultural Census 2013, Department for Environment, Food, and Rural Affairs (Defra)

20

Top 10 AgriFood Tech sub sectors,

2015

% of total

Change in

Industry Sector Code

Industry Sector Name

Employment AgriFoodTech sector

employment 2010 -

employment

2015

01000

DEFRA/Scottish Executive Agricultural Data

20,600

41%

1%

10120

Processing and preserving of poultry meat

4,300

9%

52%

10130

Production of meat and poultry meat products

3,000

6%

-30%

49410

Freight transport by road

2,200

4%

4%

28302

Manufacture of agricultural and forestry machinery (other than agricultu

1,400

3%

-6%

46610

Wholesale of agricultural machinery, equipment and supplies

1,400

3%

-8%

46390

Non-specialised wholesale of food, beverages and tobacco

1,200

2%

-27%

11050

Manufacture of beer

1,200

2%

85%

46210

Wholesale of grain, unmanufactured tobacco, seeds and animal feeds

800

2%

-40%

10850

Manufacture of prepared meals and dishes

700

1%

219%

Source: Business Register and Employment Survey 2015, Office for National Statistics, and

Agricultural Census 2013, Department for Environment, Food, and Rural Affairs (Defra)

21

Top growth AgriFood Tech sub sectors with 100 employees or more

% of total

Change in

Industry Sector Code

Industry Sector Name

Employment AgriFoodTech sectoemployment

employment

2010 - 2015

10850

Manufacture of prepared meals and dishes

700

1%

219%

Agents involved in the sale of agricultural raw materials, live animals,

46110

100

0%

178%

textile raw materials and semi-finished goods

10520

Manufacture of ice cream

100

0%

124%

77310

Renting and leasing of agricultural machinery and equipment

100

0%

92%

11050

Manufacture of beer

1,200

2%

85%

46170

Agents involved in the sale of food, beverages and tobacco

100

0%

83%

46370

Wholesale of coffee, tea, cocoa and spices

100

0%

78%

82920

Packaging activities

100

0%

75%

01640

Seed processing for propagation

100

0%

72%

01621

Farm animal boarding and care

300

1%

54%

10120

Processing and preserving of poultry meat

4,300

9%

52%

Source: Business Register and Employment Survey, Office for National Statistics, and

Agricultural Census, Department for Environment, Food, and Rural Affairs (Defra)

22

Employment in the

AgriFood Tech

AgriFood Tech sector location quotients

across comparator areas, 2015

sector is nearly

twice as important

New Anglia

1.9

locally as it is

nationally

Norfolk

1.9

Suffolk

1.9

Lincolnshire

3.6

Location quotients (LQs) are a

GCGP

1.5

useful way of showing a sectors

importance to the local economy

GLLEP

3.2

relative to the national picture. The

analysis presented here uses

SELEP

1.0

employment with an LQ above 1

showing a higher concentration than

nationally, and an LQ of below than

1 a lower concentration.

East of England

1.1

Source: Business Register and Employment Survey, Office for National Statistics, and

Agricultural Census, Department for Environment, Food, and Rural Affairs (Defra)

23

AgriFood Tech sector location quotients

across New Anglia, 2015

Breckland

3.3

Broadland

1.7

Great Yarmouth

0.6

Kings Lynn and West Norfolk

2.9

North Norfolk

3.3

Norwich

0.5

South Norfolk

1.7

Babergh

1.8

Forest Heath

2.2

Ipswich

0.4

Mid Suffolk

4.0

St Edmundsbury

1.9

Suffolk Coastal

1.8

Waveney

2.2

Source: Business Register and Employment Survey, Office for National Statistics, and

Agricultural Census, Department for Environment, Food, and Rural Affairs (Defra)

24

AgriFood Tech sub sectors with location quotients (LQs) above 3

% of total

Industry Sector Code

Industry Sector Name

Employment AgriFoodTech sector LQ

employment

11060

Manufacture of malt

500

1%

19.1

10810

Manufacture of sugar

700

1%

17.0

01640

Seed processing for propagation

100

0%

14.5

28302

Manufacture of agricultural and forestry machinery (other than agricultural

1,400

3%

9.2

10120

Processing and preserving of poultry meat

4,300

9%

8.6

20200

Manufacture of pesticides and other agrochemical products

400

1%

6.9

11030

Manufacture of cider and other fruit wines

200

0%

4.8

10130

Production of meat and poultry meat products

3,000

6%

4.5

11050

Manufacture of beer

1,200

2%

3.5

46610

Wholesale of agricultural machinery, equipment and supplies

1,400

3%

3.3

10920

Manufacture of prepared pet foods

500

1%

3.3

46210

Wholesale of grain, unmanufactured tobacco, seeds and animal feeds

800

2%

3.3

10320

Manufacture of fruit and vegetable juice

100

0%

3.2

10840

Manufacture of condiments and seasonings

600

1%

3.0

Source: Business Register and Employment Survey, Office for National Statistics, and

Agricultural Census, Department for Environment, Food, and Rural Affairs (Defra)

25

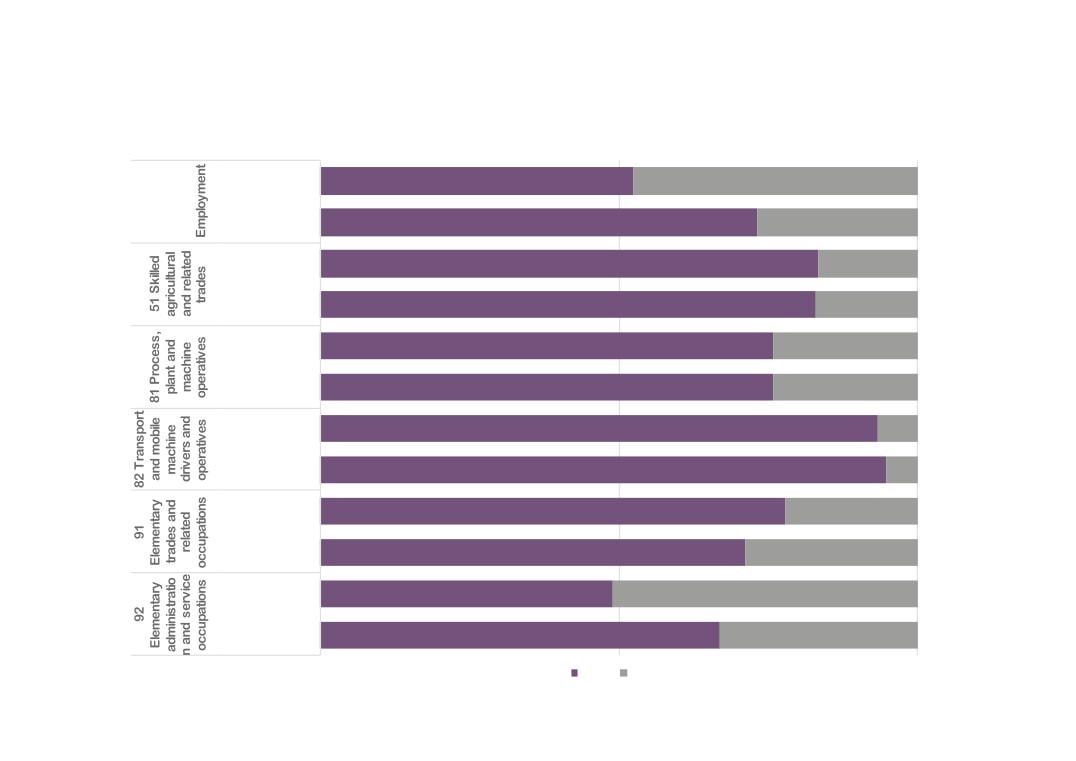

AgriFood Tech sector employment by full-time / part-time

split across comparator areas, 2015

0%

100%

New Anglia

90%

10%

Norfolk

90%

10%

Suffolk

89%

11%

Lincolnshire

92%

8%

GCGP

91%

9%

GLLEP

90%

10%

SELEP

88%

12%

East of England

90%

10%

England

88%

12%

Full time

Part time

Source: Business Register and Employment Survey, Office for National Statistics

26

0%

100%

Babergh

90%

10%

Breckland

90%

10%

AgriFood Tech sector

Broadland

90%

10%

employment by full-time /

Forest Heath

85%

15%

part-time split across

Great Yarmouth

82%

18%

Ipswich

84%

16%

New Anglia, 2015

Of particular note here is that those areas with

King`s Lynn and West Norfolk

93%

7%

high levels of employment in the sector tend to

be geared towards more full time employment,

Mid Suffolk

94%

6%

for example Mid Suffolk and King’s Lynn and

North Norfolk

93%

7%

West Norfolk.

Norwich

90%

10%

Please note that this analysis does include Defra

Agricultural Census data.

South Norfolk

87%

13%

Source: Business Register and Employment

St Edmundsbury

91%

9%

Survey, Office for National Statistics

Suffolk Coastal

87%

13%

Waveney

85%

15%

Full time

Part time

27

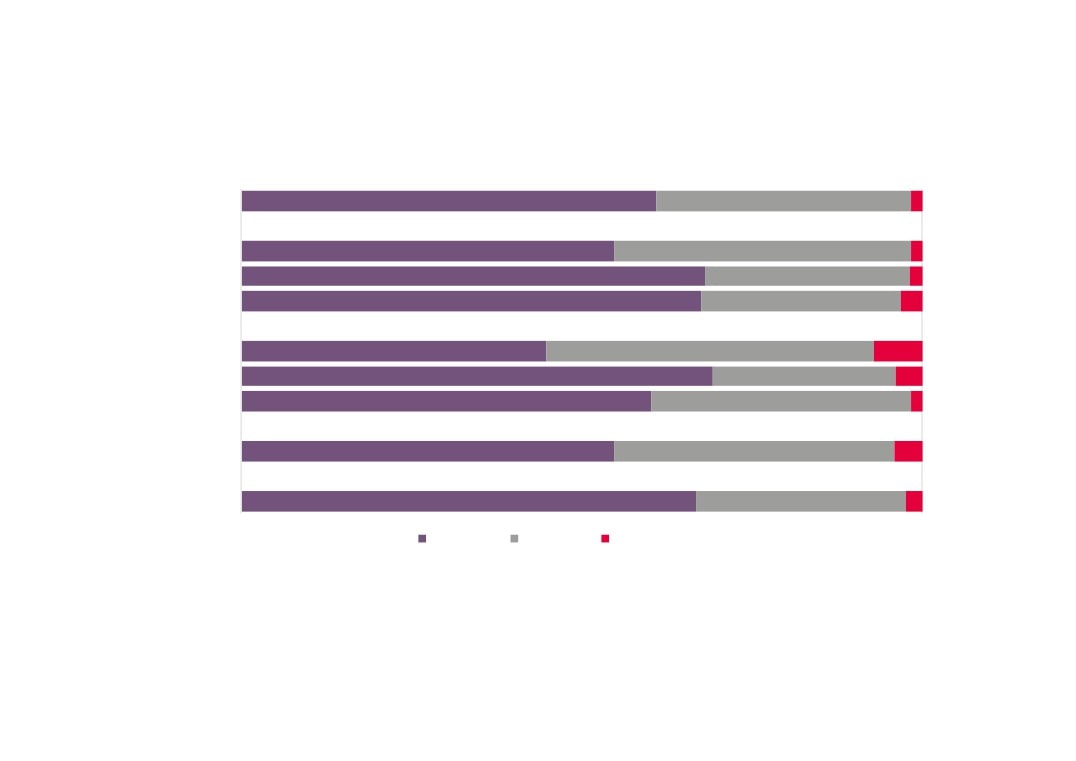

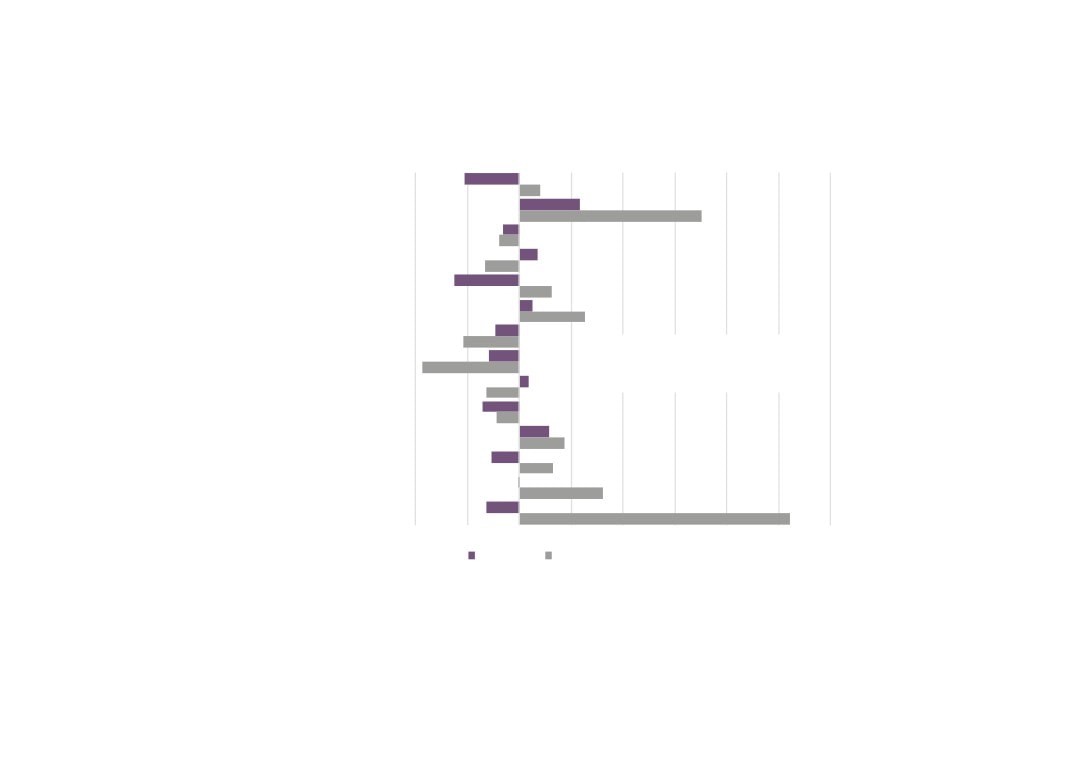

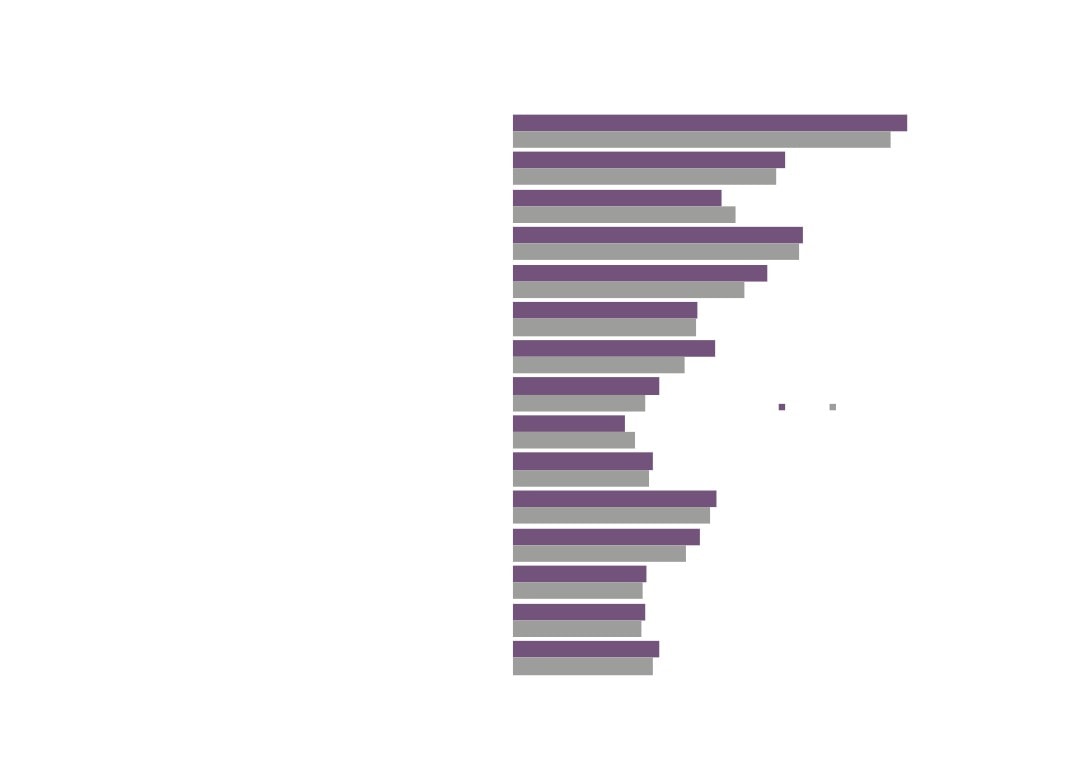

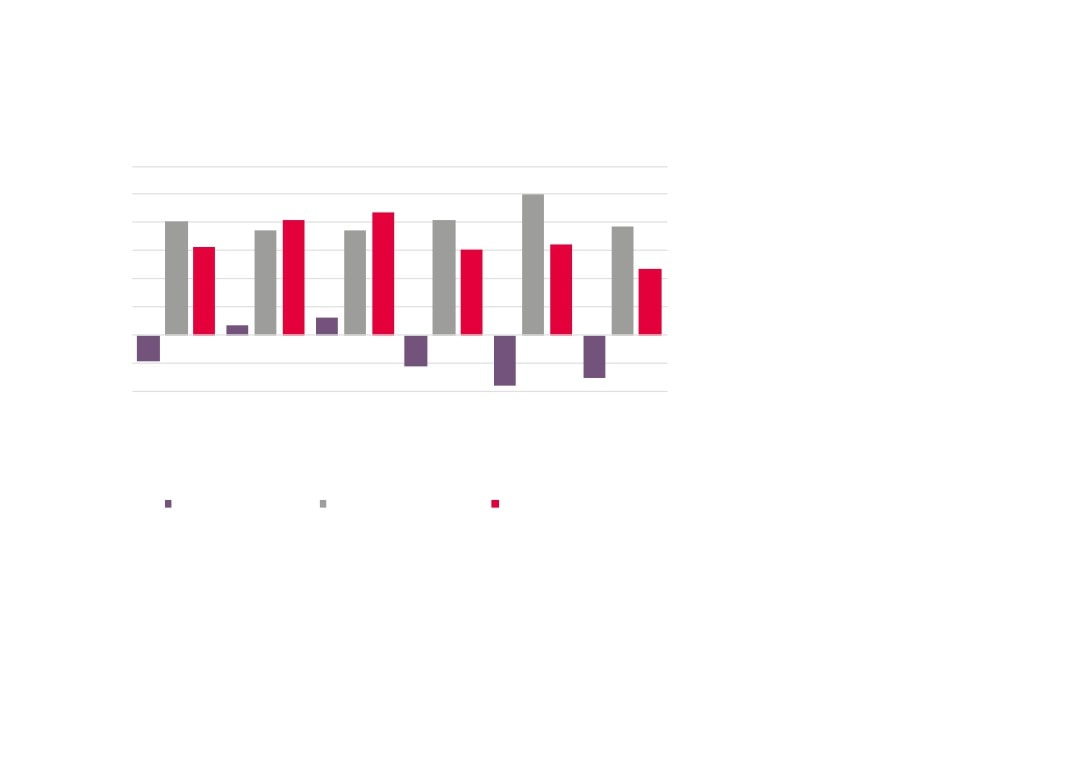

Change in AgriFood Tech sector full-time and part-time

employment across comparator areas, 2010-2015

-15%

-10%

-5%

0%

5%

10%

15%

20%

25%

New Anglia

Norfolk

Suffolk

Lincolnshire

GCGP

GLLEP

SELEP

East of England

England

Full time

Part time

Source: Business Register

Please note that this analysis

and Employment Survey,

does not include the Defra

Office for National Statistics

Agricultural Census data.

28

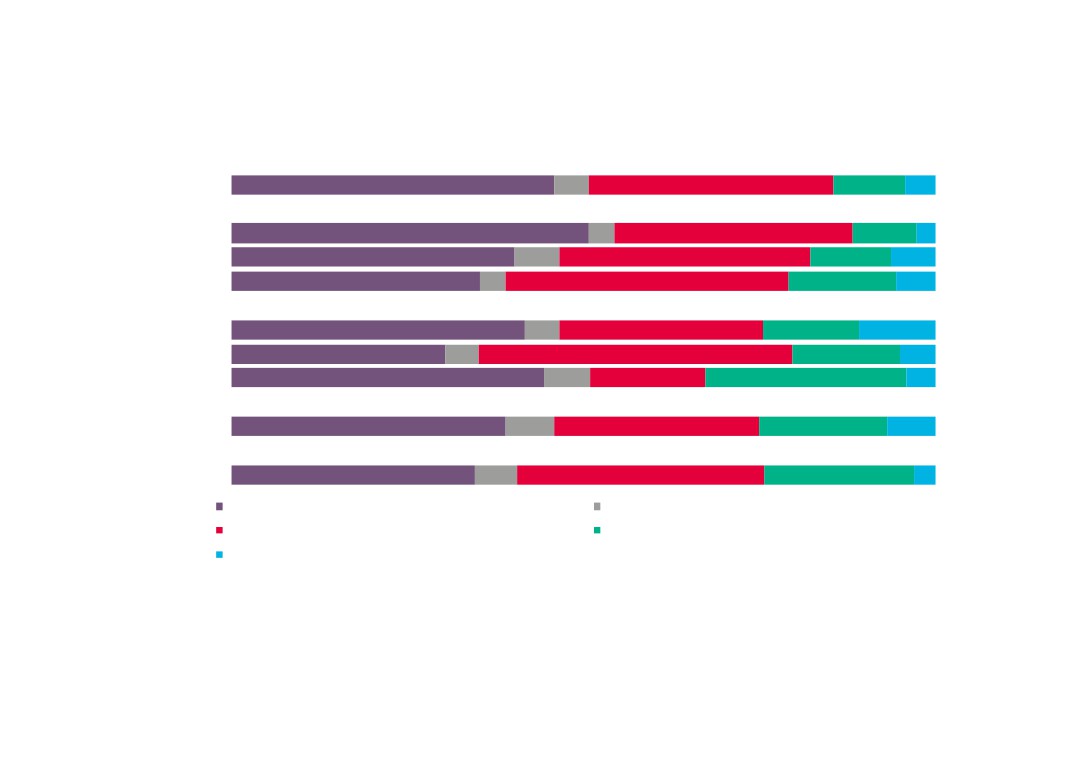

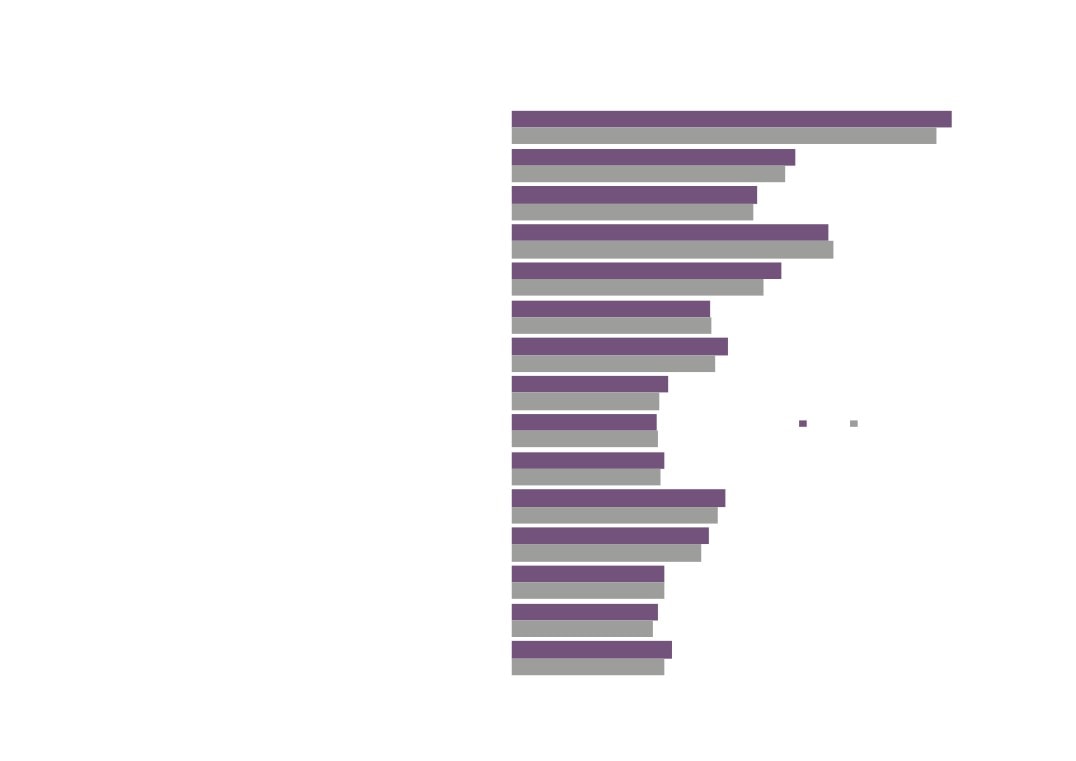

Change in AgriFood Tech sector full-time and part-time

employment across New Anglia, 2010-2015

-40%

-20%

0%

20%

40%

60%

80%

100%

120%

Babergh

Breckland

Broadland

Forest Heath

Great Yarmouth

Ipswich

King`s Lynn and West Norfolk

Source: Business Register

Mid Suffolk

and Employment Survey,

Office for National Statistics

North Norfolk

Norwich

South Norfolk

St Edmundsbury

Suffolk Coastal

Waveney

Full time

Part time

It is worth noting here that both Mid Suffolk and King’s Lynn and West Norfolk, which made up two of the top

three local authority areas for employment numbers in the sector, have experienced declines in both full time

and part time employment. In contrast, Breckland, which had the highest number for employment in the

sector, has experienced growth in both full and part time employment in the sector over the same period.

Please note again that this analysis does not include the Defra Agricultural Census data.

29

Male and Female employment in the AgriFood Tech

Sector and Top 5 Occupations for Employment

0%

50%

100%

Total

52%

48%

AgriFood Tech

73%

27%

Total

83%

17%

AgriFood Tech

83%

17%

Total

76%

24%

AgriFood Tech

76%

24%

Source: UKCES

Working Futures

2014 - 2024

Total

93%

7%

AgriFood Tech

95%

5%

Total

78%

22%

AgriFood Tech

71%

29%

Total

49%

51%

AgriFood Tech

67%

33%

Male Female

Self-employment in the AgriFood Tech sector

All Sectors

86%

14%

Source: New Anglia LEP Economic Strategy evidence base

work

AgriFood Tech

87%

13%

Employees

Self Employment

31

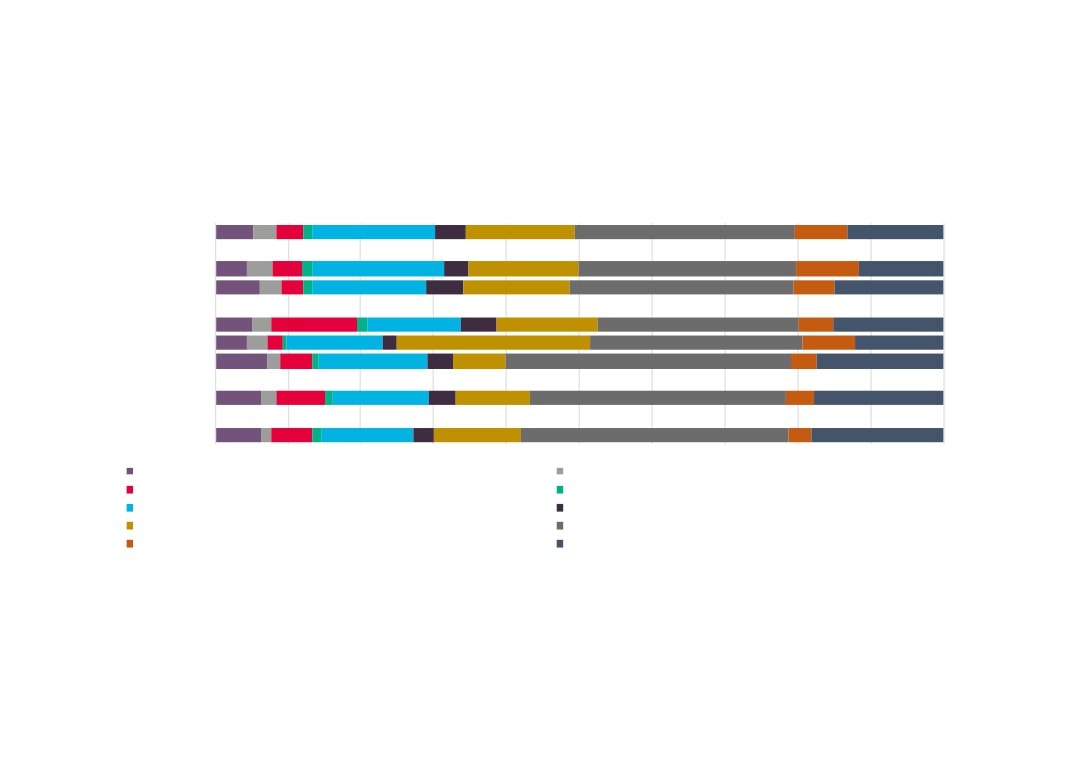

Workplace AgriFood Tech employment 2011 by broad Standard

Occupational Classification (SOC) across comparator areas

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

New Anglia

Norfolk

Suffolk

GCGP

GLLEP

SELEP

East of England

England

116 Managers and Directors in Transport and Logistics

121 Managers and Proprietors in Agriculture Related Services

211 Natural and Social Science Professionals

214 Conservation and Environment Professionals

511 Agricultural and Related Trades

613 Animal Care and Control Services

811 Process Operatives

821 Road Transport Drivers

911 Elementary Agricultural Occupations

926 Elementary Storage Occupations

Source: 2011 Census, Office for National Statistics

32

Workplace AgriFood Tech employment 2011 by broad Standard

Occupational Classification (SOC) across New Anglia

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Babergh

Breckland

Broadland

Forest Heath

Great Yarmouth

Ipswich

King`s Lynn and West Norfolk

Mid Suffolk

North Norfolk

Norwich

South Norfolk

St Edmundsbury

Suffolk Coastal

Waveney

116 Managers and Directors in Transport and Logistics

121 Managers and Proprietors in Agriculture Related Services

211 Natural and Social Science Professionals

214 Conservation and Environment Professionals

511 Agricultural and Related Trades

613 Animal Care and Control Services

811 Process Operatives

821 Road Transport Drivers

911 Elementary Agricultural Occupations

926 Elementary Storage Occupations

Source: 2011 Census, Office for National Statistics

33

AgriFood Tech sector business numbers across

comparator areas, 2016

48

New Anglia LEP

7,875

49

No

Norfolkrfolk

4,345

Number of

Business Units

47

Su

Suffolkffolk

3,515

71

LiLincolnshirere

5,200

42

G

GCGPLEP

6,015

59

G

6,270

GLLEPLEP

23

So

SELEPEast

9,655

Number of Business

Units per 10,000

Population

30

East

of England

Source: UK Business Counts, and

Sub-national Population Estimates,

27

EngEngl

Office for National Statistics

and

34

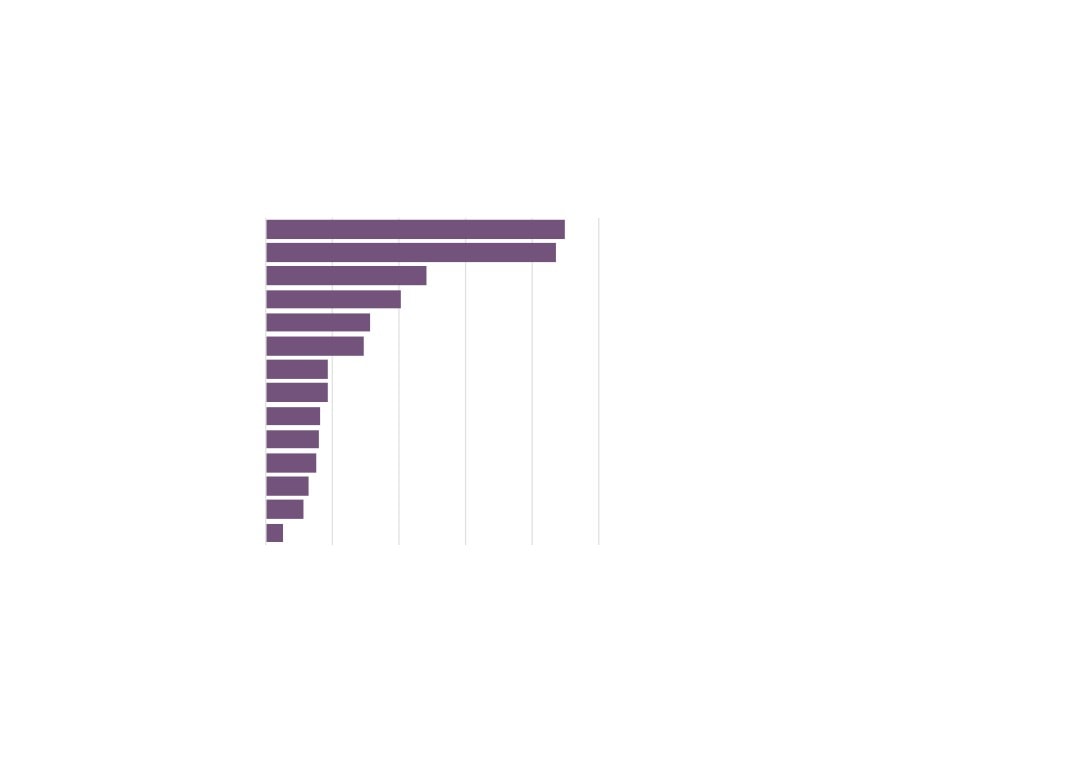

AgriFood Tech sector business numbers across

New Anglia, 2016

Ipswich

95

100

Norwich

Breckland, King’s Lynn and West Norfolk,

and Mid Suffolk again all make up the top

Great Yarmouth

160

three (as they did for employment) though

with less of a margin against other areas

Forest Heath

320

which suggests that this is where the

larger employers in the sector are

Waveney

355

situated.

St Edmundsbury

475

Broadland

475

Babergh

505

North Norfolk

695

Suffolk Coastal

725

South Norfolk

880

Mid Suffolk

920

King`s Lynn and West Norfolk

930

Breckland

935

Source: UK Business Counts, Office for National Statistics

35

80%

85%

90%

95%

100%

New Anglia

90%

8%

1%

AgriFood Tech sector business

Norfolk

91%

8%

1%

numbers by size across

Suffolk

91%

7%

1%

Lincolnshire

91%

7%

1%

comparator areas, 2016

Source: UK Business Counts, Office for

GCGP

91%

8%

1%

National Statistics

GLLEP

90%

8%

1%

SELEP

90%

8%

1%

At LEP and County level then there is very little

East of England

90%

8%

2%

to choose between areas in terms of the make-

up of businesses by employee numbers.

England

91%

7%

2%

However, as noted previously, Mid Suffolk, and

King’s Lynn and West Norfolk feature with

No. of employees

0-9

10-49

50-249

250+

notable groupings of businesses employing 50

to 249 people. St. Edmundsbury also features in

Waveney

97%

3%

terms of the presence of some 250 plus

Suffolk Coastal

92%

8%

employee businesses. Please note that at Local

St Edmundsbury

93%

6%

1%

Authority level, numbers of businesses

South Norfolk

96%

4%

employing more than 250 people can be

rounded out of analysis due to their very small

Norwich

81%

19%

numbers and resulting disclosive nature.

North Norfolk

91%

9%

Mid Suffolk

94%

5%

King`s Lynn and West Norfolk

91%

9%

AgriFood Tech sector

Ipswich

88%

12%

business numbers by size

Great Yarmouth

93%

7%

Forest Heath

95%

5%

across New Anglia, 2016

Broadland

95%

5%

Source: UK Business Counts, Office for

Breckland

94%

6%

National Statistics

Babergh

98%

2%

80%

85%

90%

95%

100%

0-9

10-49

50-249

250+

Change in AgriFood Tech business units

across comparator areas, 2010 - 2016

New Anglia

7.4%

Norfolk

6.6%

Suffolk

8.3%

Lincolnshire

11.6%

GCGP

8.7%

GLLEP

10.9%

SELEP

11.6%

East of England

10.1%

England

13.3%

Source: UK Business Counts, Office for National Statistics

37

Babergh

2%

Breckland

12%

Change in AgriFood Tech

Broadland

2%

business units across

Forest Heath

19%

New Anglia, 2010 - 2016

Great Yarmouth

-9%

Below the New Anglia geography then we can

Ipswich

90%

observe some very different fortunes in business

growth across the local authorities. However,

King`s Lynn and West Norfolk

3%

please note the small bases for measuring

change here. Ipswich in particular has seen

business unit numbers increase by 90 per cent

Mid Suffolk

5%

but from a comparatively small base.

The largest employment and business areas of

North Norfolk

-1%

Breckland, King’s Lynn and West Norfolk, and

Mid Suffolk, all experienced growth in business

Norwich

-17%

unit numbers over the period in question.

South Norfolk

12%

Source: UK Business Counts, Office for

National Statistics

St Edmundsbury

12%

Suffolk Coastal

11%

Waveney

-1%

38

NINo registrations to adult overseas nationals entering the UK

over time, New Anglia

14,000

12,000

10,000

8,000

6,000

4,000

2,000

0

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

Source: Department for Work and Pensions

39

Change in NINo registrations to adult overseas nationals entering

the UK over time, New Anglia, 2002 = 100

350

300

250

200

150

100

50

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

New Anglia

Norfolk

Suffolk

East of England

England

Source: Department for Work and Pensions

40

0%

100%

2002

New Anglia

25%

49%

17%

7%

East of England

28%

48%

16%

5%

Change in the

demographic of NINo

England

30%

49%

14%

5%

registrations to adult

Less than 18

18-24

25-34

35-44

45-54

55-59

60 and over

overseas nationals

entering the UK over

New Anglia

34%

36%

17%

9%

time, New Anglia

Source: Department for Work and Pensions

East of England

33%

37%

17%

8%

England

33%

38%

17%

8%

2016

Less than 18

18-24

25-34

35-44

45-54

55-59

60 and over

41

NINo registrations to adult overseas nationals entering the UK,

2002 - 2016, across New Anglia

Norwich

25,019

Ipswich

23,841

King's Lynn and West Norfolk

18,029

Breckland

16,759

Great Yarmouth

12,307

Forest Heath

9,590

St Edmundsbury

8,155

Suffolk Coastal

7,195

North Norfolk

6,747

Waveney

4,644

South Norfolk

4,234

Babergh

3,846

Broadland

3,221

Mid Suffolk

2,758

Source: Department for Work and Pensions

42

Total Export levels to EU and Non-EU

countries across comparator areas, 2015

New Anglia

£1,611m

£1,286m

GCGP

£2,546m

£2,596m

GLLEP

£1,831m

£1,078m

SELEP

£4,662m

£6,383m

EU Non-EU

Source: 2015 Growth Hub Data - Exports, HM Revenues and Customs

43

New Anglia export levels by type, 2015

0 Food and Live Animals

£479m

1 Beverages and Tobacco

£23m

2 Crude Materials

£45m

5 Chemicals

£738m

6 Manufactured Goods

£295m

7 Machinery and Transport

£910m

8 Miscellaneous Manufactures

£388m

9 Other commodities nes

£15m

Source: 2015 Growth Hub Data - Exports, HM Revenues and Customs

44

Proportion of exports by type across

comparator areas, 2015

New Anglia

17%

25%

10%

31%

13%

GCGP

12%

26%

4%

40%

16%

Please note that

analysis for the GLLEP

GLLEP

13%

5%

22%

6%

18%

7%

does not equal 100%

due to some withheld

data

SELEP

3%

35%

3%

42%

14%

0 Food and Live Animals

1 Beverages and Tobacco

2 Crude Materials

5 Chemicals

6 Manufactured Goods

7 Machinery and Transport

8 Miscellaneous Manufactures

9 Other commodities nes

Source: 2015 Growth Hub Data - Exports, HM Revenues and Customs

45

New Anglia export levels by type and EU and Non-

EU countries across comparator areas, 2015

0 Food and Live Animals

£300m

£179m

2 Crude Materials

5 Chemicals

£522m

£216m

6 Manufactured Goods

£203m

£92m

7 Machinery and Transport

£342m

£568m

8 Miscellaneous Manufactures

£203m

£180m

EU Non-EU

Source: 2015 Growth Hub Data - Exports, HM Revenues and Customs

46

Proportion of exports by type and EU and Non-

EU countries across comparator areas, 2015

EU

11%

1%

18%

7%

12%

7%

Non-EU

6%

1%

8%

3%

20%

6%

EU

10%

1%

15%

2%

12%

9%

Non-EU

3%

11%

2%

28%

7%

EU

12%

3%

14%

5%

9%

7%

Non-EU

7%

3%

18%

3%

16%

3%

EU

2%

1%

6%

2%

24%

6%

Non-EU

1%

29%

1%

18%

8%

0 Food and Live Animals

2 Crude Materials

5 Chemicals

6 Manufactured Goods

7 Machinery and Transport

8 Miscellaneous Manufactures

Source: 2015 Growth Hub Data - Exports, HM Revenues and Customs

47

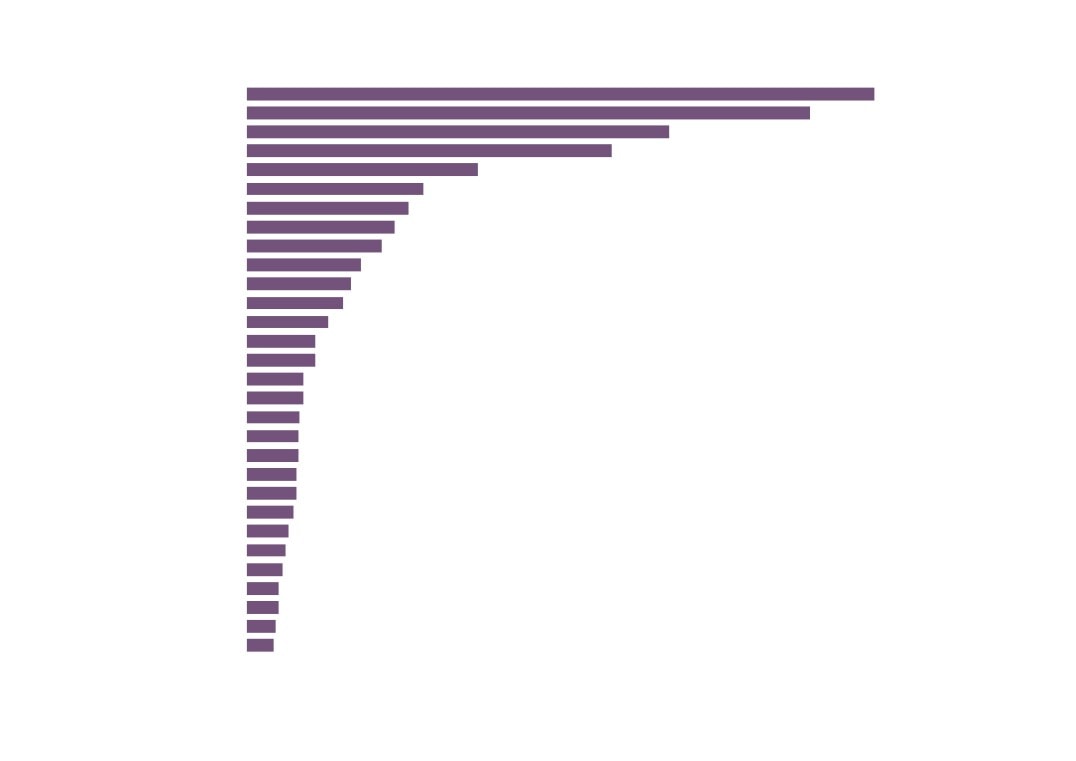

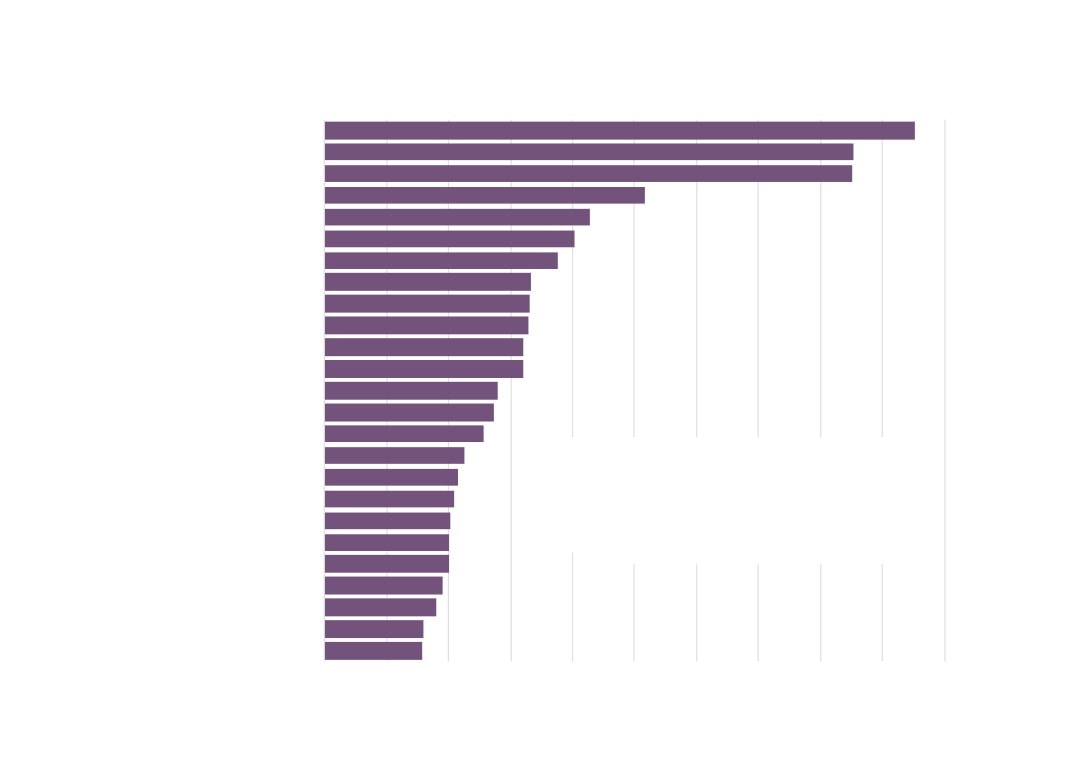

Netherlands

£392m

USA

£352m

Irish Republic

£264m

Germany

£228m

France

£144m

Italy

£110m

Spain

£101m

Belgium

£92m

Japan

£84m

China

£71m

Saudi Arabia

£65m

Hong Kong

£60m

Sweden

£51m

Australia

£43m

UAE

£43m

Singapore

£35m

New Anglia total export levels by

South Korea

£35m

Poland

£33m

country, 2015

Denmark

£32m

India

£32m

Source: 2015 Growth Hub Data - Exports, HM Revenues and Customs

Norway

£31m

Egypt

£31m

Hungary

£29m

Portugal

£26m

Czech Republic

£24m

Canada

£22m

Turkey

£20m

Switzerland

£20m

South Africa

£18m

Malaysia

£17m

48

Selection of AgriFood Tech sector role wages - Mean gross annual pay all employees (UK)

£52,172

Production managers and directors in manufacturing (1121)

(4%)

£49,964

£36,076

(4%)

Managers and directors in transport and logistics (116)

£34,829

Figures in brackets

£27,564

(-7%)

denote percentage

Managers and proprietors in agriculture related services (121)

£29,509

change between 2014

£38,361

and 2016

Biological scientists and biochemists (2112)

(1%)

£37,988

£33,727

Conservation and environment professionals (214)

(10%)

£30,607

£24,411

(0.4%)

Transport and distribution clerks and assistants (4134)

£24,325

£26,798

Farmers (5111)

(18%

£22,772

)

£19,375

Horticultural trades (5112)

(10%

£17,607

)

2016

2014

£14,905

(-8%)

Animal care and control services (613)

£16,147

£18,516

Food, drink and tobacco process operatives (8111)

(2%)

Please note that mean wages have

£18,074

been used (as opposed to the

£27,018

(3%)

Large goods vehicle drivers (8211)

median, which is the preferable

£26,198

option of averaging wage levels)

£24,757

due to missing figures for median

Agricultural machinery drivers (8223)

(8%)

£22,975

values.

£17,640

(2%)

Source: Annual Survey of Hours and

Elementary agricultural occupations (911)

£17,231

Earnings, Office for National Statistics

£17,472

(2%)

Packers, bottlers, canners and fillers (9134)

£17,070

£19,460

(5%)

Elementary storage occupations (9260)

£18,539

49

AgriFood Tech sector wages - Mean gross annual pay full time employees (UK)

£57,155

Production managers and directors in manufacturing (1121)

(4%)

£55,137

£36,838

Managers and directors in transport and logistics (116)

(4%)

£35,456

£31,898

Managers and proprietors in agriculture related services (121)

(2%)

£31,314

£41,127

Biological scientists and biochemists (2112)

(-2%)

£41,755

£34,980

Conservation and environment professionals (214)

(7%)

£32,661

Figures in brackets

£25,800

(-0.1%)

Transport and distribution clerks and assistants (4134)

denote percentage

£25,835

change between 2014

£28,079

(6%)

and 2016

Farmers (5111)

£26,459

£20,213

Horticultural trades (5112)

(5%)

£19,173

£18,804

2016

2014

Animal care and control services (613)

(-0.5%)

£18,894

£19,807

(3%)

Food, drink and tobacco process operatives (8111)

£19,305

£27,757

Large goods vehicle drivers (8211)

(4%)

£26,704

Please note that mean wages have

£25,523

been used (as opposed to the

Agricultural machinery drivers (8223)

(4%)

£24,651

median, which is the preferable

option of averaging wage levels)

£19,776

(-0.2%)

Elementary agricultural occupations (911)

due to missing figures for median

£19,817

values.

£18,882

Packers, bottlers, canners and fillers (9134)

(3%)

Source: Annual Survey of Hours and

£18,259

Earnings, Office for National Statistics

£20,829

Elementary storage occupations (9260)

(5%)

£19,858

50

New Anglia AgriFood Tech Apprenticeships

2011/12

2012/13

2013/14

2014/15

Agriculture

115

130

150

150

Animal Care

15

15

15

15

Environmental Conservation

5

Food and Drink

155

145

150

215

Horticulture

55

85

65

85

International Trade and Logistics Operations

30

20

Land-based Engineering

30

40

Logistics Operations

15

10

5

15

Print and Printed Packaging

20

5

5

10

Supply Chain Management

5

10

Trees & Timber

5

5

15

5

Veterinary Nursing

20

15

20

15

Warehousing & Storage

100

95

90

80

Total

505

495

575

665

Source: Skills Funding Agency Data Cube

51

Growth in AgriFood

Tech sector

apprenticeships has

been consistently

Change in AgriFood Tech

higher than regional

Apprenticeships, Index 2005/6 = 100

and national rates

300

250

200

Please note that this

analysis uses a less

150

precise definition of the

AgriFoodTech sector

(Agriculture, Horticulture

100

and Animal Care

apprenticeships) as

opposed to the previous

50

data cube analysis.

New Anglia LEP

East of England

England

Source: FE Data Library, Department for Education

52

AgriFood Tech sector vacancies across New Anglia,

0

200

400

600

800

1,000

Jan 2012 - Dec 2016

Norwich

According to the Labour Insight Jobs tool, then

there were 5,507 postings for the sector in New

St. Edmundsbury

Anglia between Jan. 1, 2012 and Dec. 31, 2016.

Breckland

A further 1,111 postings had the potential to be

Ipswich

within the sector but a final judgement could not

be made on these due to their unspecified or

Kings Lynn and West Norfolk

unclassified nature.

North Norfolk

The definition for the AgriFood Tech sector in this

Great Yarmouth

exercise is narrower than that we have defined

but it still provides us with some useful

Mid Suffolk

information on vacancy numbers and types.

Waveney

The definition used in this exercise captures the

South Norfolk

following industry and sectors: ‘Agriculture,

Forestry and Fishing’, ‘Manufacture of food

Suffolk Coastal

products’, and ‘Manufacture of beverages’.

Babergh

Please note that some caution needs to be

Forest Heath

applied to this data as results may reflect the way

Broadland

different sectors recruit rather than real

differences in the number of jobs.

Source: Labour Insight Jobs, Burning Glass Technologies

53

Cranswick

Birds Eye Iglo Group

Country Grounds Maintenance Ltd

Newstar Bakery Ltd

Blue Spark Ltd

Bernard Matthews Farms

Synergi Search Select Ltd

Crisp Malting Group

Top AgriFood Tech Sector

Britvic

McCormick

Employers across New Anglia

Caffe Nero Group

2 Sisters Food Group

Jan 2012 - Dec 2016

RA Group Services Ltd

Source: Labour Insight Jobs, Burning Glass Technologies

Dairy Crest Group

2 Agriculture Ltd

Allied Bakeries

Colorcote

Ringtons Holdings

BOCM Pauls

The Sterling Choice Ltd

Kerry Foods

RSPB

BUPA

Nestle

Mars Incorporated

0

10

20

30

40

50

60

70

80

90

54

0

50

100

150

200

250

300

350

400

450

500

Production managers and directors in manufacturing (1121)

Engineering technicians (3113)

Engineering professionals n.e.c (2129)

Quality assurance and regulatory professionals (2462)

Plant and machine operatives n.e.c. (8129)

Buyers and procurement officers (3541)

Sales accounts and business development managers (3545)

Programmers and software development professionals (3545)

Sales related occupations n.e.c. (7129)

Electrical engineers (2123)

Other administrative occupations n.e.c. (4159)

IT specialist managers (2133)

Managers and proprietors in other services n.e.c. (1259)

Business sales executives (3542)

Financial accounts managers (3538)

AgriFood Tech

Mechanical engineers (2122)

sector vacancies by

Chartered and certified accountants (2421)

Managers and directors in retail and wholesale (1190)

occupation

Electricians and electrical fitters (5241)

Food, drink and tobacco process operatives (8111)

Jan 2012 - Dec

Design and development engineers (2126)

Source: Labour Insight Jobs, Burning

Marketing associate professionals (3543)

Glass Technologies

Book-keepers, payroll managers and wages clerks (4122)

Other skilled trades n.e.c. (5449)

Van drivers (8212)

55

0

50

100

150

200

250

300

350

400

Maintenance Engineer

Production Manager

Electrical Engineer

Sales Executive

Production Worker

Manaufacturing Manager

Engineering Manager

Account Manager

Food Technologist

Multi-Skilled Engineer

Technical Manager

Production Supervisor

Assistant Manager

Quality Assurance Manager

AgriFood Tech sector

Shift Manager

vacancies by job title

Production Planner

Cleaner

Jan 2012 - Dec 2016

Npd Technologist

Source: Labour Insight Jobs, Burning Glass Technologies

Business Development Executive

Engineering Team Leader

Marketing Manager

Npd Manager

Area Sales Manager

National Account Manager

56

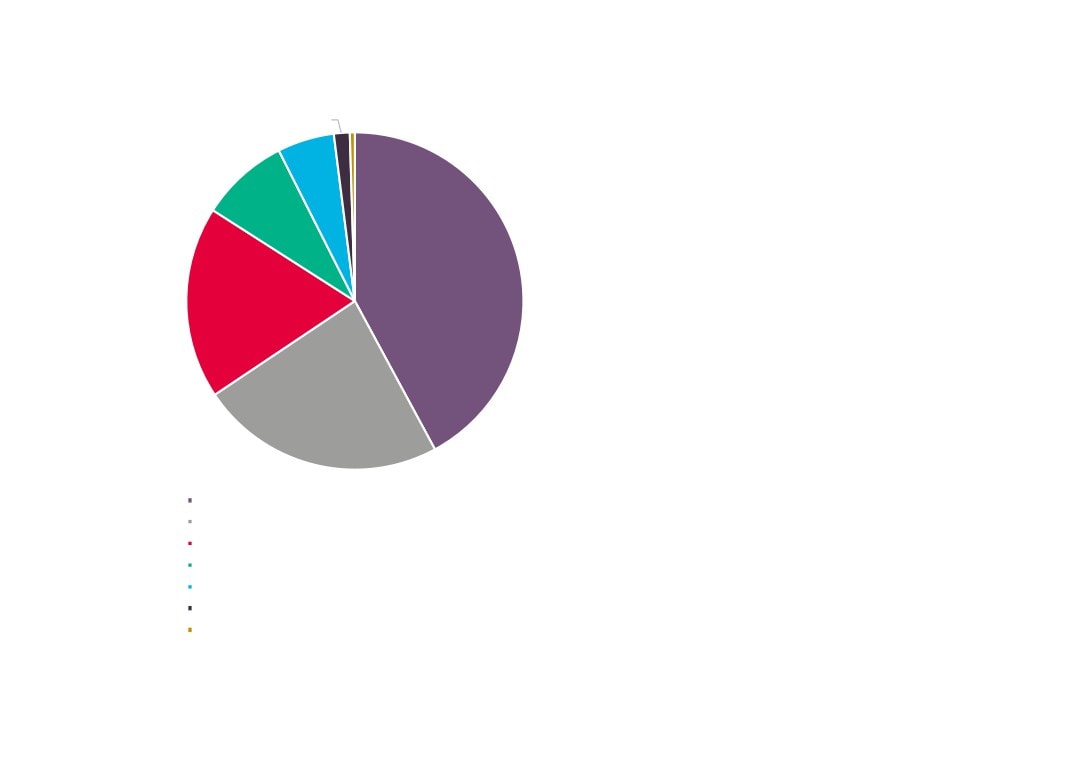

2%

0%

5%

9%

42%

AgriFood Tech sector

vacancies by qualification level

18%

required, Jan 2012 - Dec 2016

Source: Labour Insight Jobs, Burning Glass Technologies

23%

Bachelor's degrees, graduate certificates and diplomas

A-Levels, Highers, and Level 3 S/NVQs

GCSEs, Standard Grades, and Level 2 S/NVQs

Level 4 diplomas and certificates, HNCs, Level S/NVQs

Foundation degrees and HNDs

Post graduate degrees, Level 5 S/NVQs, certificates and diplomas

Level 1 S/NVQs

57

0

100

200

300

400

500

600

700

800

900

1,000

Marketing Sales

Contract Recruitment

Advertising Services

Food Service Industry Background

Packaging

Business Management

Key Performance Indicators

Machinery

Customer Service

Microsoft Excel

Operations Management

Food Safety

Product Sales

Lean Methods

Accountancy

Project Management

AgriFood Tech sector

Repair

Purchasing

vacancies by skills required

Electrical Engineering

Jan 2012 - Dec 2016

Customer Contact

Source: Labour Insight Jobs, Burning Glass Technologies

Good Manufacturing Practices

Mechanical Engineering

Lean Manufacturing

Sales

Food Science

58

A Future View of the

AgriFood Tech Sector

59

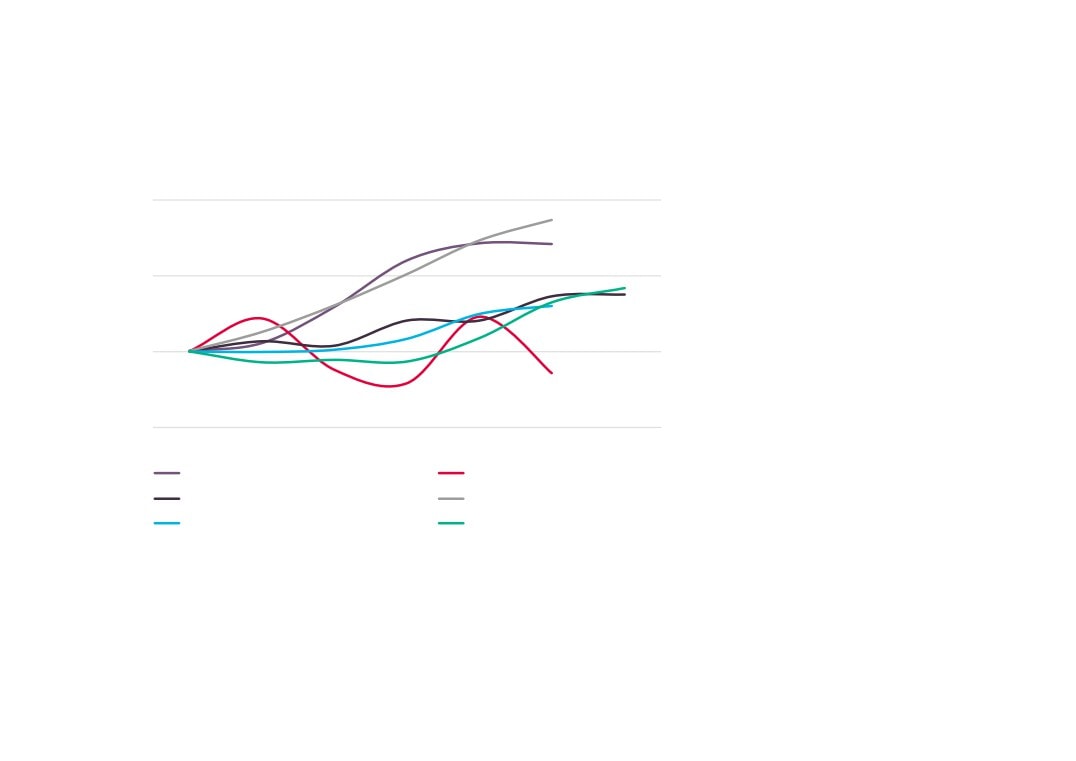

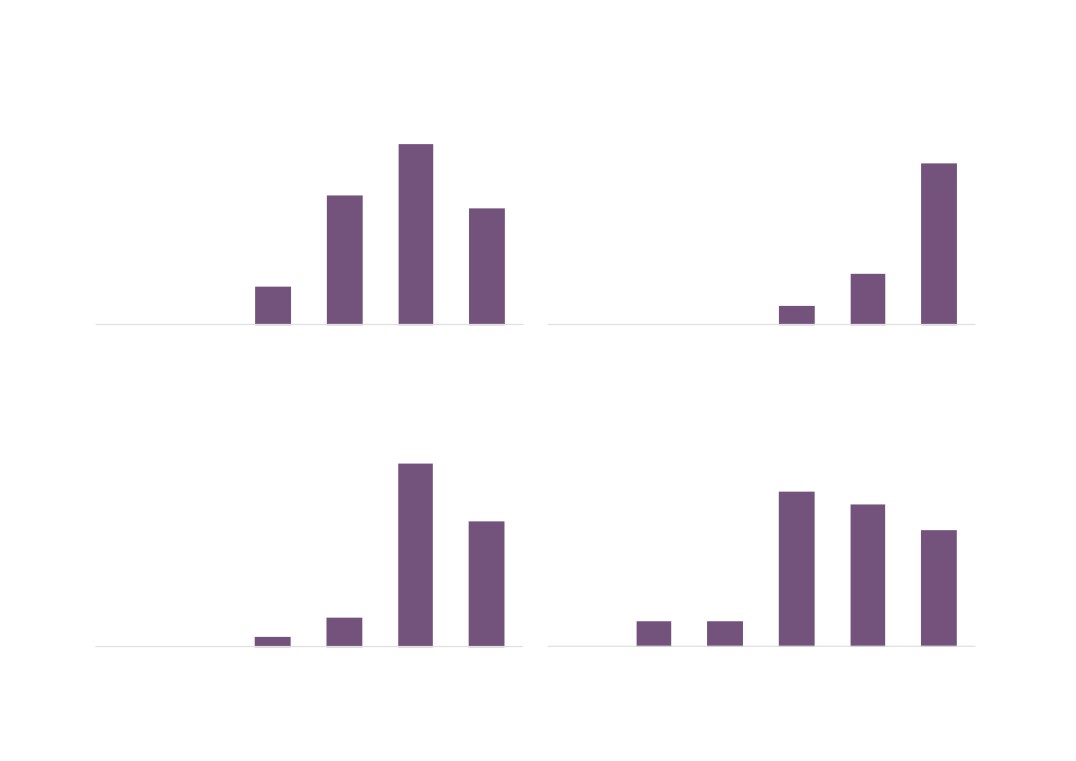

Forecasts for change in AgriFood Tech employment, New

Anglia

110

The data presented in this chart is from the

East of England Forecasting Model (EEFM)

and the UKCES Working Futures data (WF).

In each case the AgriFood Tech sector has

been approximated from the sector splits

100

available in each model. In the case of the

East of England Forecasting Model then

‘Agriculture’, ‘Food manufacturing’, and

proportions of both ‘Pharmaceutical

90

manufacturing’ and ‘Land transport’ have

been summed to arrive at an AgriFood Tech

sector. For the Working Futures data then

‘Agriculture’, ‘Food, drink and tobacco’, and

80

a proportion of ‘Transport and storage’ have

been summed. In both cases, then both

models project a decline in employment in

the AgriFood Tech sector overall. It is

70

however worth noting at this stage then

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

neither set of figures take into account New

Anglia LEPs growth ambitions.

AgriFoodTech (EEFM)

Agriculture (EEFM)

Manufacturing - food (EEFM)

Land transport (EEFM)

Sources: East of England Forecasting Model,

AgriFoodTech (WF)

Agriculture (WF)

Cambridge Econometrics; UKCES Working

Food drink and tobacco (WF)

Transport and storage (WF)

Futures 2014 - 2024

60

Occupational composition of employment in New Anglia’s

AgriFood Tech sector over time

AgriFoodTech

Management positions, professional

Digital Tech

and associate professional

100%

occupations are all set to maintain

4%

4%

5%

5%

4%

their positions in terms of the

8%

7%

7%

employment they provide in the

12%

10%

80%

6%

6%

AgriFood Tech sector.

8%

9%

13%

Process, plant and machine

23%

23%

operative jobs are set to reduce in

22%

60%

22%

importance whilst at the same time

21%

skilled trade occupations will grow.

These trends are however very

40%

39%

different for the sectors that make

37%

38%

33%

up the AgriFood Tech sector in this

30%

analysis.

20%

15%

15%

16%

13%

14%

Source: UKCES Working Futures 2014 - 2024

0%

2004

2009

2014

2019

2024

Elementary occupations

Process, plant and machine operatives

Sales and customer service

Caring, leisure and other service

Skilled trades occupations

Administrative and secretarial

Associate professional and technical

Professional occupations

Managers, directors and senior officials

61

Agriculture

Transport & Storage

15%

14%

13%

18%

16%

17%

18%

19%

19%

26%

4%

5%

4%

4%

4%

Digital Tech

7%

3%

4%

100%

7%

35%

4%

3

5%

5%

6%

8%

Digit

Digital Tech

58%

59

51%

100%

100%

2

40%

5%

5%

5%

5%

4%

8%

12%

10%

10%

80%

12%

80%

8%

9%

9%

13%

13%

6%

6%

4%

3

5%

3%

2

2%

3%

3%

22%

4%

4%

3%

4%

60%

22%

60%

22%

6%

6%

7%

7%

21%

21%

Food, Drink and Tobacco

2004

2

40%

1

37%

3

33%

33%

12%

10%

30%

13%

13%

14%

20%

n

14%

13%

14%

15%

1

r

40%

0%

38%

36%

40%

38%

2009

2004

2009

2014

2

Food,

tions

Elementary occupations

Process, plan

Drink &

3%

3%

3%

r service

3%

3%

Sales and customer service

Caring, leisur

Tobacco

pations

Skilled trades occupations

Administrativ

17%

20%

20%

18%

18%

nal and technical

Associate professional and technical

Professional

s and senior officials

Managers, directors and senior officials

5%

5%

5%

5%

5%

11%

Source: UKCES Working Futures 2014 - 2024

8%

10%

9%

9%

6%

5%

6%

5%

5%

6%

8%

7%

7%

8%

2004

2009

2014

2019

2024

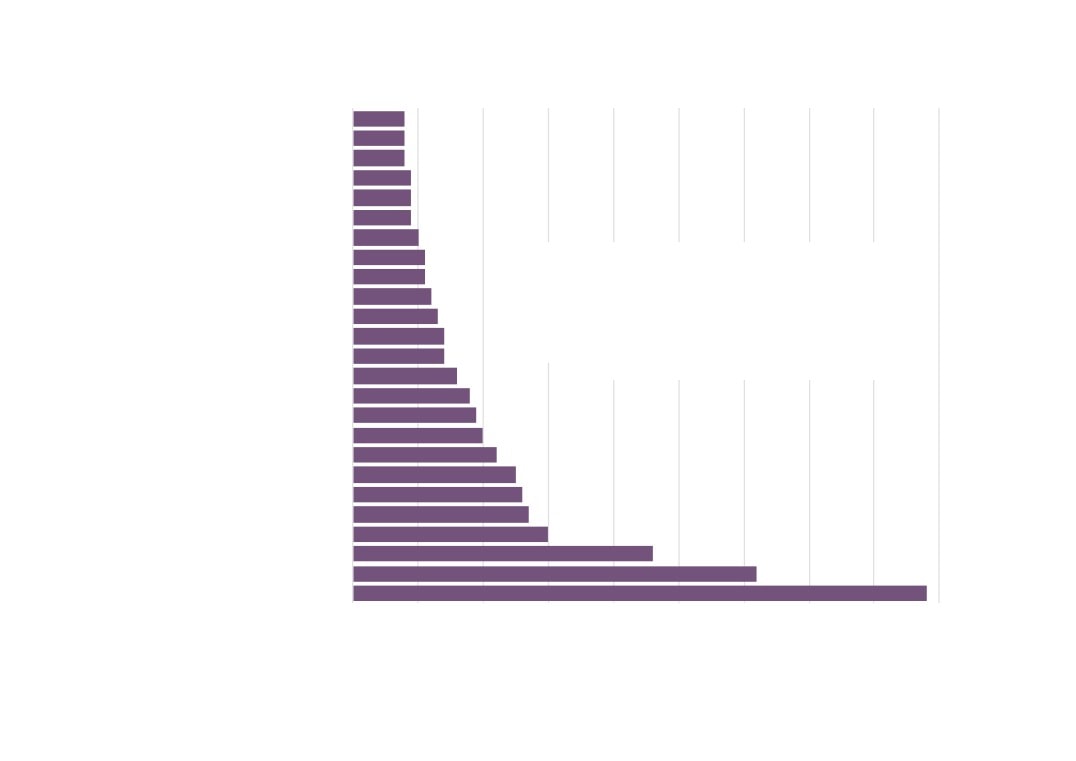

By 2024, there is

AgriFood Tech Replacement and

Expansion Demand by Occupation

a potential gap in

the New Anglia

All occupations

AgriFood Tech

sector workforce

Given the baseline

of 18,000

51 Skilled agricultural and related trades

projection of a falling

level of employment

seen in the previous

section then the net

82 Transport and mobile machine drivers

requirement of posts to

and operatives

be filled across the

sector is driven by

replacement demand i.e. people leaving or

retiring from the workforce. Between now and

11 Corporate managers and directors

2024 then there will be over 18,000 positions

created through retirement that will need filling.

However, if we go below the ‘All occupations’ element and

35 Business and public service associate

have a look at the top five occupations (based on total net

professionals

requirement of jobs over the period 2014-2024) in the sector

then we can see that there are elements of expansion

demand albeit small despite the projected drop in

employment.

41 Administrative occupations

Source: UKCES Working Futures 2014 - 2024

-10,000

-5,000

0

5,000

10,000

15,000

20,000

Net requirement

Replacement demand

Expansion demand

63

60%

50%

Replacement and

40%

30%

Expansion Demand by

20%

Occupation

10%

The following chart displays the same

information, but this time replacement and

0%

expansion demand are displayed as

-10%

percentages of the total employment by

occupation in the sector in 2014. This

-20%

helps to give a sense of churn within the

41

35 Business

11 Corporate

82 Transport

51 Skilled

All

sectors workforce over the next decade.

Administrative

and public

managers

and mobile

agricultural

occupations

occupations

service

and directors machine

and related

Source: UKCES Working Futures 2014 - 2024

associate

drivers and

trades

professionals

operatives

Expansion demand

Replacement demand

Net requirement

64

Replacement and Expansion Demand by Qualification

-6,000

-4,000

-2,000

0

2,000

4,000

6,000

8,000

Please note that the Working Futures data

QCF 7-8

(700)

uses the following breakout of qualification

levels:

QCF 4-6

(6,900)

QCF8 - Doctorate

QCF7 - Other higher degree

QCF6 - First degree

QCF 3

(2,000)

QCF5 - Foundation degree; Nursing;

Teaching

QCF4 - HE below degree level

QCF 2

(3,000)

QCF3 - A level & equivalent

QCF2 - GCSE (A-C) & equivalent

QCF1 - GCSE (below grade C) &

equivalent

QCF 1

(0)

No Q - No Qualification

Source: UKCES Working Futures 2014 - 2024

No Qual

(-1,600)

The figures in brackets denote the net

demand for each qualification group.

Replacement Demand

Expansion Demand

The UKCES Working Futures data also enables us to consider levels of future replacement and expansion demand in terms of the

levels of qualifications that will be leaving and required in the workforce as it changes over time. As we can see from the chart, positive

expansion demand within the AgriFoodTech sector is going to be dominated by the demand for higher education qualifications (QCF4

and above), and at the same time whilst the sectors requirement for lower level skills will reduce there will still be a demand for them.

65

Views from Sector

Stakeholders

66

AgriFood Tech survey findings

As part of the consultation process, a short on-line questionnaire was circulated widely by industry groups to seek the views of employers on

key gaps in current skills provision, how they thought skills needs may evolve in the future, and the areas in which further investment in skills is

needed. In total, 36 responses to the survey were received. The following sets out the feedback that was received.

Q1. Over the next ten years, in your opinion which type of jobs will be on the increase in the New Anglia agricultural, food and related technology

sectors? (Please tick all that apply)

Middle / Senior management

13

(36%)

Professional / Higher technical (but non managerial)

26

(72%)

Supervisory

14

(39%)

Skilled manual / Lower technical

25

(69%)

Semi-skilled manual

10

(28%)

Administrative

11

(31%)

Unskilled

3(8%)

No change

3(8%)

67

Q2. How important on a scale of 1 to 5 (where 1 is not that important, to 5 is vital to the future of the industry) are the following skills to the

future of the agricultural, food and related technology sectors?

Advanced IT Skills

New technologies for agricultural or food

production

18

16

13

9

7

6

1

1

1

0

0

1

2

3

4

5

0

1

2

3

4

5

Environmental and sustainability skills

Oral communication

13

12

15

10

10

7

4

1

0

1

2

3

4

5

0

1

2

3

4

5

68

Written communication

Meeting customer needs

14

25

10

9

8

3

3

0

1

2

3

4

5

0

1

2

3

4

5

Team working

English as a second or other language

19

12

11

13

9

3

2

2

1

0

1

2

3

4

5

0

1

2

3

4

5

69

Quality / continuous improvement

Planning and organising

17

16

20

13

3

3

0

1

2

3

4

5

0

1

2

3

4

5

People, leadership and professional skills

Strategic management

17

20

13

12

2

2

2

2

1

0

1

2

3

4

5

0

1

2

3

4

5

70

Numeracy

Literacy

22

21

10

10

3

2

2

1

1

0

1

2

3

4

5

0

1

2

3

4

5

71

Q2. Average Score - How important on a scale of 1 to 5 (where 1 is not that important, to 5 is vital to the future of the industry) are the following

skills to the future of the agricultural, food and related technology sectors?

Literacy

4.6

Numeracy

4.4

Strategic management

4.4

People, leadership and professional skills

4.4

Planning and organising

4.3

Quality / continuous improvement

4.2

English as a second or other language

4.2

Team working

4.2

Meeting customer needs

4.1

Written communication

4.0

Oral communication

4.0

Environmental and sustainability skills

3.9

New technologies for agricultural or food production

3.8

Advanced IT Skills

3.6

72

Q3. What one action would improve the skills system to ensure that the agricultural, food and related technology sectors have the skills they

need in the future?

-

Offer internships

-

More 1-3 day technical courses during the winter months

-

A stable, suitably funded College and provider sector that can deliver the skills that are needed

-

Good solid training with a test at the end

-

Focus in colleges on producing highly qualified operators rather than degree students that want to be managers

-

Promote agriculture as an interesting, well paid futuristic industry

-

Fast Broadband

-

Technical/IT ability

-

Better rewards

-

Better schooling aligned to industry

-

Make managers work closer with workforce. Most managers like telling not listening. They could then equip their staff with skills and

training needed. Or employ the right person to fill skills gap

-

Understanding IT for the middle level older employees

-

Clarity and integrity of trading arrangements post 2020

-

More funding

-

Must speak English to enter or work in UK

-

Including horticulture/agriculture in the school curriculum

-

Liaison between colleges and the market; together with lifelong learning schemes put in place

-

It is an ageing workforce and younger talent is required across the board. Need to attract young people into Agriculture. Care ers advice

and development at school age and relevant apprenticeships geared up for post 16 age

-

More technically skilled staff

-

Education

-

Attracting the right people to the industry

73

-

A long term plan for sustainable agriculture in the UK

-

Better sharing of specific skills across sector by experts

-

More applied training for young people

-

More direct involvement with apprenticeships

-

Engagement with sixth form schools

-

Using a university linked knowledge exchange program like they do in the USA

-

Making the public aware of the industry

-

Training courses provided which provide some of the above

-

Better engagement with schools to get high calibre individuals interested

-

The ability to communicate in writing with brevity and accuracy

-

Literacy and attitude. Having all the skills is nothing without the right attitude to work

-

The answer is probably that the great British public need to accept that they have to spend more of their income on food, so that we can

pay higher wages

74

Q4. If there is anything else that you would like to tell us about your experiences of the New Anglia skills system / labour market in relation to

the agricultural, food and related technology sectors then please do so here:

-

Send employees on courses

-

Without access to European labour who are willing to do hard/mundane jobs we will be in trouble

-

Skills delivered locally are more likely to retain future staff than those delivered beyond the region. Effective partnership working with

employers and training providers will be essential if the labour needs of the sector are to be met.

-

More farmers should sell direct to the consumer

-

We must continue to lobby government at all levels to allow access of foreign workers to us all.

-

More integration

-

Farm labour is no longer a low skilled job. Good understanding of computers/satellite, good literacy and numeracy skills, and good

spoken English are all vital. We ask them to drive machinery worth £400,000+, handle chemicals and communicate with our customers

(but there are still mundane tasks that need doing as well)

-

For following question - I run a training group so do not employ many staff. But we train over 500 people a year in rural business's in

East Anglia

-

Young people need to be encouraged to strive for excellence. Good enough just isn't. There needs to be a change from school level

upwards.

-

Shortage of workers willing to work with livestock

-

On farm skill sets are narrow and largely consist of tractor driving and machinery operation with little scientific, environmental or

financial knowledge.

-

A skills shortage will lead to wage inflation. Need to improve conditions of employment and housing.

-

No skill training locally as it is not a dairy area, I have to get in consultants or send people to France/Wales/Cornwall, I have tried

attracting people from college catering departments but they are into restaurant food and don’t want to do manufacturing

75

Profile of survey respondents

How many people do you employ in total?

How many people do you employ in Norfolk and Suffolk?

1

(3%)

4

(11%)

4

(11%)

5

(14%)

6

(17%)

4

(11%)

23

(63%)

24

(69%)

1-9

10-49

50-249

250+

1-9

10-49

50-249

250+

How long has the business been trading?

2

(6%)

3

(8%)

31

(86%)

Up to 5 years

5 - 20 years

More than 20 Years

76

Appendix 1 - AgriFoodTech sector definition

% elgible for AgriFoodTech defn

2007 SIC

Description

AgriFoodTech element

(100% if blank)

Code

Businesses Employment

GVA

1000

DEFRA/Scottish Executive Agricultural Data

Agricultural, horticultural and forestry production

1110

Growing of cereals (except rice), leguminous crops and oil seeds

Agricultural, horticultural and forestry production

1120

Growing of rice

Agricultural, horticultural and forestry production

1130

Growing of vegetables and melons, roots and tubers

Agricultural, horticultural and forestry production

1140

Growing of sugar cane

Agricultural, horticultural and forestry production

1150

Growing of tobacco

Agricultural, horticultural and forestry production

1160

Growing of fibre crops

Agricultural, horticultural and forestry production

1190

Growing of other non-perennial crops

Agricultural, horticultural and forestry production

1210

Growing of grapes

Agricultural, horticultural and forestry production

1220

Growing of tropical and subtropical fruits

Agricultural, horticultural and forestry production

1230

Growing of citrus fruits

Agricultural, horticultural and forestry production

1240

Growing of pome fruits and stone fruits

Agricultural, horticultural and forestry production

1250

Growing of other tree and bush fruits and nuts

Agricultural, horticultural and forestry production

1260

Growing of oleaginous fruits

Agricultural, horticultural and forestry production

1270

Growing of beverage crops

Agricultural, horticultural and forestry production

1280

Growing of spices, aromatic, drug and pharmaceutical crops

Agricultural, horticultural and forestry production

1290

Growing of other perennial crops

Agricultural, horticultural and forestry production

1300

Plant propagation

AgriTech

1410

Raising of dairy cattle

Agricultural, horticultural and forestry production

1420

Raising of other cattle and buffaloes

Agricultural, horticultural and forestry production

1430

Raising of horses and other equines

Agricultural, horticultural and forestry production

1440

Raising of camels and camelids

Agricultural, horticultural and forestry production

1450

Raising of sheep and goats

Agricultural, horticultural and forestry production

1460

Raising of swine/pigs

Agricultural, horticultural and forestry production

1470

Raising of poultry

Agricultural, horticultural and forestry production

1490

Raising of other animals

Agricultural, horticultural and forestry production

1500

Mixed farming

Agricultural, horticultural and forestry production

1610

Support activities for crop production

AgriTech

1621

Farm animal boarding and care

AgriTech

1629

Other support activities for animal production

AgriTech

1630

Post-harvest crop activities

AgriTech

1640

Seed processing for propagation

AgriTech

1700

Hunting, trapping and related service activities

Agricultural, horticultural and forestry production

2100

Silviculture and other forestry activities

Agricultural, horticultural and forestry production

2200

Logging

Agricultural, horticultural and forestry production

2300

Gathering of wild growing non-wood products

Agricultural, horticultural and forestry production

2400

Support services to forestry

Agricultural, horticultural and forestry production

3110

Marine fishing

Agricultural, horticultural and forestry production

3120

Freshwater fishing

Agricultural, horticultural and forestry production

78

% elgible for AgriFoodTech defn

2007 SIC

Description

AgriFoodTech element

(100% if blank)

Code

Businesses Employment

GVA

3210

Marine aquaculture

Agricultural, horticultural and forestry production

3220

Freshwater aquaculture

Agricultural, horticultural and forestry production

10110

Processing and preserving of meat

Food processing

10120

Processing and preserving of poultry meat

Food processing

10130

Production of meat and poultry meat products

Food processing

10200

Processing and preserving of fish, crustaceans and molluscs

Food processing

10310

Processing and preserving of potatoes

Food processing

10320

Manufacture of fruit and vegetable juice

Food processing

10390

Other processing and preserving of fruit and vegetables

Food processing

10410

Manufacture of oils and fats

Food processing

10420

Manufacture of margarine and similar edible fats

Food processing

10511

Liquid milk and cream production

Food processing

10512

Butter and cheese production

Food processing

10519

Manufacture of other milk products

Food processing

10520

Manufacture of ice cream

Food processing

10611

Grain milling

Food processing

10612

Manufacture of breakfast cereals and cereals-based food

Food processing

10620

Manufacture of starches and starch products

Food processing

10710

Manufacture of bread; manufacture of fresh pastry goods and cakes

Food processing

10720

Manufacture of rusks and biscuits; manufacture of preserved pastry goods and cakes

Food processing

10730

Manufacture of macaroni, noodles, couscous and similar farinaceous products

Food processing

10810

Manufacture of sugar

Food processing

10821

Manufacture of cocoa and chocolate confectionery

Food processing

10822

Manufacture of sugar confectionery

Food processing

10831

Tea processing

Food processing

10832

Production of coffee and coffee substitutes

Food processing

10840

Manufacture of condiments and seasonings

Food processing

10850

Manufacture of prepared meals and dishes

Food processing

10860

Manufacture of homogenized food preparations and dietetic food

Food processing

10890

Manufacture of other food products n.e.c.

Food processing

10910

Manufacture of prepared feeds for farm animals

Food processing

10920

Manufacture of prepared pet foods

Food processing

11010

Distilling, rectifying and blending of spirits

Food processing

11020

Manufacture of wine from grape

Food processing

11030