New Anglia

Sector Skills Plan

Construction

A partnership plan aligning private and public resources to

jointly address the skills priorities of the construction

sector in Norfolk and Suffolk

September 2016

This plan is supported by the

‘New Anglia LEP Construction Labour and Skills’

Research Report provided by the CITB

1

A Skills Plan for New Anglia’s Construction Sector

The Construction Sector in New Anglia

The construction sector is a major component of New Anglia’s economy, accounting

for £2.4bn of GVA1 and with a workforce of over 59,0002 - many of whom are

working outside of Norfolk and Suffolk. There are around 7,370 construction

businesses with the overwhelming majority (93%) being micro sized companies with

less than 10 employees. It provides a greater proportion of our GVA (over 7%) than

the industry provides on average in other LEP areas making it integral to the health

and growth of our economy.

The Sector Skills Plan

This Sector Skills Plan (SSP) is an industry-led document developed by the New

Anglia Local Enterprise Partnership Building Growth Group in partnership with,

industry bodies, training providers and local authorities. It provides a framework for

aligning public and private sector investment in skills through mainstream funding

and locally delivered initiatives such as the New Anglia Skills Deals Programme and

Skills Support for the Workforce. It aims to highlight the skills priorities that need to

be addressed to support the sector’s growth ambitions and the LEP’s Strategic

Economic Plan to build 117,000 new houses, create 95,000 more jobs and 10,000

new businesses by 2026.

As with many sectors, reaching a universally accepted definition of the construction

sector is challenging. For the purposes of this plan, and to align with national

research, the construction sector is assessed as including the following functions:

•

Construction of buildings

•

Architectural and engineering activities

•

Civil Engineering

•

Specialised construction activities

•

Manufacture and retail of construction related goods

Forecast Growth and the Skills Need

Construction skills shortages are significantly affecting the delivery of projects across

the industry. After a prolonged downturn, in which the sector lost people and skills -

many of whom have not returned, it has recently experienced a period of significant

growth (grew more than any other sector in 20143) which has seen firms struggling

to find skilled labour in professional roles and manual trades. More than 400,000 UK

construction workers are expected to retire over the next five to ten years4 adding to

this crisis.

1 ONS/NOMIS 2014

2 ONS/NOMIS (2015) Annual Population Survey workplace analysis by industry Jan-14 to Dec-14

3 ONS 2016

4 19% (equivalent to 406,000 people) of UK construction workers aged 55+ are set to retire in the next 5-10 years. CITB, UK construction

industry facing skills ‘time bomb’, ugust 2013.

2

The impact of the recession was also felt by colleges, universities and other training

providers. With less demand many downsized their construction departments or

reduced their intake. Just over 5,300 construction and building services related

learning aims were delivered in New Anglia in 2014/15, a decline of 50 since

2012/13. The number of apprenticeship starts in construction related fields has also

fallen over the last few years. The proportion of overall apprenticeships starts in

construction related areas in New Anglia has fallen from 4.2% in 2011/12 to 3.6% in

2014/15 - a drop in real terms of almost 100 apprenticeship starts. This is compared

to 30% in health and public services, 25% in business and administration and 17% in

retail and commercial enterprise.5

The limited supply of skills has the potential to threaten the delivery of New Anglia’s

housing target and key infrastructure projects and has resulted in severe and

immediate skills shortages, rising wages and increased competition between firms.

82% of employers in the UK believe there is a skills shortage in the sector and that

this will slow down projects important for growth.6

The Construction Industry Trade Body (CITB) estimates that more than £5.4bn will be

invested in construction projects over the next four years. This is a conservative

estimate based on projects within the planning system, rather than a total forecast of

construction projects. It omits some nationally significant infrastructure projects and

some projects included may not go ahead or be subject to delay whilst new projects

are continually being created. The CITB also forecasts significant growth with 4260

jobs created every year for the next five years in the East of England.

Figure 1: Value of the construction sector in New Anglia 2015 - 20197

Infrastructure

Commercial

Housing

Industrial

Public

£1.748bn

£385m

£2.3bn

£230m

£762m

By project type housing represents the single largest sector in Norfolk and Suffolk,

with a total of £2.3bn expected to be delivered, the largest concentration of which will

be in Ipswich and Norwich and Kings Lynn. Public non-residential and infrastructure

activity also comprises significant parts of the total spend, the latter mostly owing to

offshore wind installations.

The CITB analysis estimates that the total labour demand for the construction sector

will rise from 93,250 people in 2015 to a peak of 98,700 people by 2019. This

includes significant demand for carpenters, general labourers, electricians, and

plumbing and heating engineers. This demand is expected to be further increased if

and when the work planned for Sizewell C Nuclear new build commences. It is

5 Skills Funding Agency LEP Datacube.

6 Skills in Construction, CIOB, 2013

7 CITB New Anglia LEP Construction Labour and Skills Research, February 2016

3

estimated that across the two counties the peak demand for the Sizewell project will

equate to almost 10% of the rest of the workload.8

To note. The potential impact of Brexit on these forecasts cannot be ignored although no new

modelling is currently available. If the impact is less immigration and less growth this could result in

less construction and less jobs. However, as there is already a skills shortage with future reductions in

the supply of labour expected, it would seem prudent to continue developing plans to meet this

current and future need.

Key Challenges and priorities

A steady supply of talent: The image of construction has long been a barrier to

attracting young people many of whom associate the industry with insecurity, difficult

working conditions and low pay. The pool of people employed in the industry

younger than 25 years old has shrunk significantly since 2008. Those aged 25 to 49

dropped 16% and those older than 50 fell by 8%.9 The sector is stereotyped as being

male and working class. Women make up just 13% of the workforce in New Anglia.

The construction sector offers a wide variety of roles in trades and professions and

clear progression paths. However, this is rarely showcased and there is not a

coordinated approach to debunking misperceptions or promoting the positive

aspects of working in the sector.

Boom and Bust: More so than in most other sectors, the construction sector has

historically endured a boom and bust cycle that many in the industry accept as an

intractable issue. This cyclical nature means that companies may adopt short-term

horizons that makes investing in people a difficult choice. Through the development

of the sector skills plan, solutions to help create a steadier demand for works were

discussed. Whilst initiatives were suggested to help ensure the demand for skills and

labour across the area is understood and therefore planned for, it was agreed that no

single solution was likely to solve this wicked problem but that the actions identified

to address other specific issues should be implemented with the intention of

mitigating the negative effects of boom and bust.

Improving Training Provision: The provision of training needs to be of the quantity,

quality and type to match the forecast need for skills in the sector. This includes the

training made available to the current workforce as well as the training of new

entrants for the sector. Barriers to achieving this include the capacity and resources

of businesses (the majority of which are small or micro businesses) to upskill their

workforce, the ability of training providers to recruit teachers and lecturers of a high

quality and the matching of training to the ever changing needs of the sector

resulting from such factors as the introduction of new methods and technology.

In order to help mitigate the effects of the cyclical nature of the industry the provision

of training that looks to provide a workforce with the skillset and flexibility to move

between sectors is also desirable.

8 CITB New Anglia LEP Construction Labour and Skills Research, February 2016.

9 CIOB, Face of Construction, 2014

4

Actions (details can be found in Annex A)

To help to address the key challenges identified above the following actions have

been agreed against three main priorities:

Provision - Training provision to match forecast need

We will pilot, develop and establish a work experience brokerage scheme

We will create and promote a New Anglia Construction Training Fund

We will establish an effective mechanism to identify and address specific skills

gaps in the sector

We will develop, pilot and establish a programme of pre-employment skills

training designed to enhance reskilling and conversion pathways into

construction.

Perception and Inspiration - Enhance sector image to increase volume and diversity

We will conduct an audit of existing communication and look to identify key

messages to be used consistently across organisations and platforms

We will place the construction sector at the forefront of the New Anglia Youth

Pledge

Meeting Demand - Plan to address the forecast growth in labour demand

We will establish a Building Growth Nuclear Forum to understand the wider

impact of Sizewell C on all planned construction projects.

5

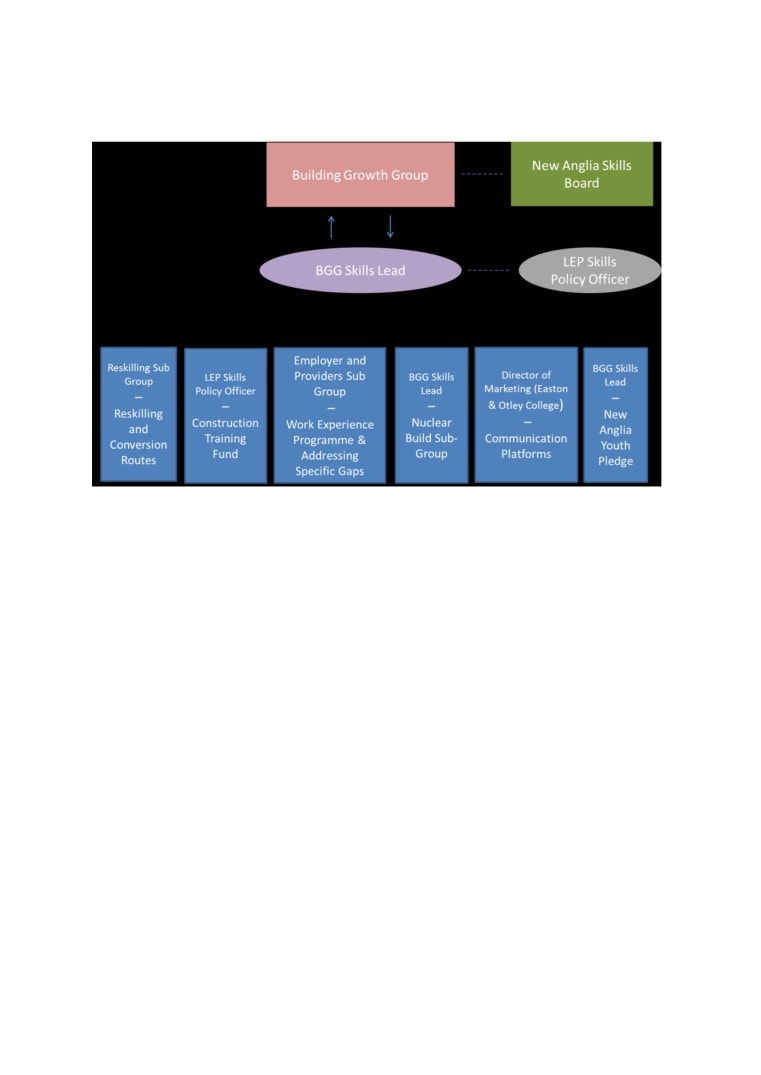

Monitoring and Implementation

This plan is owned and overseen by the New Anglia Building Growth Group working

with the New Anglia Skills Board. Both groups have approved the plan. The New

Anglia Skills Board will look to support the implementation of this plan where

possible.

Progress on implementation will be reported up to the Building Growth Group

through a Skills Lead nominated by the Board. A LEP Skills Policy Officer will work

with the Skills Lead to help coordinate implementation of the whole programme of

activity.

Each action will be owned and led by an identified lead as described in more detail in

Annex A.

6

ANNEX A - Action Plan Details

PRIORITY 1

PROVISION: Training provision to match forecast need

Action 1

We will pilot, develop and establish a work experience brokerage scheme

Need

In order to improve the chances of securing employment at the end of any training period,

young people require experience of work and employability skills. There are challenges for

construction businesses taking on young people such as initial training needs and the costs

associated with the cyclical/project nature of the industry.

Description

A brokerage mechanism will be established to allow employers to access apprentices and

learners for paid work. The brokerage will address HR issues on the employers behalf and

work with learners to support their experience of work, addressing any employability concerns.

Initially this will be run as a pilot by City College Norwich as an expansion of their existing

catering brokerage. This will then be expanded through the college network. This work will be

overseen by the Employer and Training providers sub-group of Building Growth to allow best

practice to be shared.

A pilot looking at the underlying barriers to creating work experience placements in

construction has been delivered by Cheryl Willis of Suffolk Coastal and Waveney District

Councils. Lessons learned will be shared across Norfolk and Suffolk.

The New Anglia Youth Pledge is a separate priority in this Sector Skills Plan. This will also

increase the opportunities for work experience (see Priority 2 Action 2).

This action will contribute to the New Anglia Skills Manifesto by:

Encouraging and enabling more employers to get involved in better preparing young

Strategic Links

people for work.

Contributing to the New Anglia Youth Pledge to increase the number of opportunities

for young people including work experience and apprenticeships

Ownership and

Once established the Employer and Training Providers Building Growth Sub-Group will

Accountability

drive this work

Building Growth Group with support from the LEP and Local Authorities to coordinate

the establishing of this group.

Cheryl Willis (Economic Development Officer - East Suffolk) will share details of the

Lowestoft pilot to help encourage roll-out of similar approaches across the region.

Establish the Employer and Training Providers Building Growth Sub-Group

Initial Actions

Immediate

to oversee and lead this work.

Autumn/Winter

Roll-out Lowestoft pilot lessons to other areas

2016

Run brokerage pilots in construction via City College Norwich.

Early 2017

Expand access to existing HR and brokerage apps to other FE providers

2017/18

and employers.

Academic Year

Measures of

Development and roll-out of brokerage app to wide group of training providers

Success

Expansion of work experience pilot

Additional work experience opportunities created

Increase in apprenticeship starts in construction related fields

7

PRIORITY 1

PROVISION: Training provision to match forecast need

Action 2

We will create and promote a New Anglia Construction Training Fund

Need

To maximise the potential of employers across the region to upskill their workforce, the support

available must be made as prominent and accessible as possible. This will help ensure that the

right skills are available to help the construction industry grow and that standards are maintained

on site.

Description

Local funds such as the Employer Training Incentive Pilot, the New Anglia Skills Deals

Programme, grants from local training providers as well as sector specific support, such as funds

from the CITB, are available to help incentivise and enable employers to provide development

opportunities for their workforce. Actions will be taken to enhance and increase the visibility of

these schemes. Some funding programmes are due to end in March 2017 but this will be an

ongoing commitment covering all funds that are available at any given time related to the sector.

A ‘New Anglia Construction Training Fund’ will be established as an umbrella brand

under which will sit the various support products available. This will help ensure

employers are aware of the funding that is available to them by promoting existing

schemes.

Opportunities will be explored to create a support programme specifically for the

construction industry by ring-fencing and blending some of the funds available in order

to provide the support required that falls outside of the remit of the current schemes.

Opportunities to link funding to finance individual projects will be explored. Project ideas may be

sourced from various groups such as the Building Growth Group. The Employers and Providers

sub-group of the board, which will be looking at gaps in current and future provision (please see

Priority 1, Action 3), will be a further possible source of ideas.

This action builds on and enhances the reach of the funding already made available to the sector

for skills needs and tailors it to maximise the benefit to the construction sector.

This action will contribute to the New Anglia Skills Manifesto by:

Strategic Links

Aligning collective effort to meet the skills needs of the sector

Developing better ways of supporting employers to invest more and reap the benefits of

upskilling their workforce

Identifying and nurturing management and leadership talent

Ownership and

Michael Gray, Senior Skills Policy Officer at Suffolk County Council will lead discussions between

Accountability

the New Anglia LEP, the Local Authorities, the CITB, training providers and other stakeholders.

Agreement to be reached between stakeholders on the brand and remit of the

Initial Actions

Autumn 2016

New Anglia Construction Training Fund.

The need to merge funding into a new programme for the construction sector

Autumn 2016

and the potential to do so to be explored.

Winter 2016 /

Promotion of the New Anglia Construction Training Fund

Spring 2017

Measures of

Establishment of the New Anglia Construction Training Fund

Success

Additional take-up of support by the construction sector

Additional number of businesses providing development opportunities for their workforce.

Development of additional skills projects for the construction sector

8

PRIORITY 1

PROVISION: Training provision to match forecast need

We will establish an effective mechanism to identify and address specific skills gaps

Action 3

in the sector

Need

There is a need to adapt provision to current and future need to ensure we have the right

skills at the right time for the industry to flourish.

Description

The Employer and Training Providers Sub-Group will look to identify gaps in the current

system including provision for specific skills needs and hard to fill vacancies. Provision will

be driven through close collaboration with existing providers and a programme of wider

engagement with other construction sector groups. Opportunities such as the Skills Deals

Programme will be explored.

Immediate action will be taken where gaps or needs have already been identified. For

example due to an aging workforce and competition for quality candidates from the higher-

paid private sector, public sector planning has an emerging skills gap. Part of the proposed

solution is to pilot a new public sector apprenticeship scheme across local authorities in

Suffolk. Further conversations to take place as to rolling out the approach into Norfolk and

across the whole New Anglia region.

Both the New Anglia Skills Board and the Building Growth Group have an objective to help

link provision to the needs of the local economy. This action will build on and enhance the

work that these Boards oversee by providing a mechanism to identify needs.

This action will contribute to the New Anglia Skills Manifesto by:

Supporting employers to better communicate their current and future skills needs

Strategic Links

to schools, training providers, colleges, universities and Government.

Identifying specific skills gaps in our growth sectors and aligning our collective

effort to meet these challenges.

Ensure there are clear and complete training pathways for each sector that enable

people to get into and progress within their chosen career, and develop the higher

skill levels needed.

Ownership and

Once established the Employer and Training Providers Building Growth Sub-Group

Accountability

will drive this work

Building Growth Group with support from the LEP and Local Authorities to

coordinate the establishing of this group.

Suffolk County Council are progressing the work to address the planning skills gap.

Further project leads will be identified as needs are identified by the Employer and

Providers Sub-Group.

Public sector planning technician apprenticeship scheme advertised

Summer 2016

Initial Actions

September

First meeting of the Employers and Providers Sub-Group

2016

First planning technician apprenticeship cohort to start

October 2016

Share initial findings of skills needs and ‘hard to fill’ vacancies with

Early 2017

Building Growth Group and other employer forums.

Evaluate impact of Suffolk planning technician apprenticeship scheme

Mid 2017

and roll-out with Norfolk

Measures of Success

Identification of specific skills gaps and ‘hard to fill’ vacancies which is tested with

and confirmed by the employers groups.

The need for new provision identified and solutions developed and delivered.

Creation of provision identified as needed by employers - especially high level

qualifications including apprenticeships

Funding allocated to Skills Deals projects.

9

PRIORITY 1

PROVISION: Training provision to match forecast need

We will develop, pilot and establish a programme of pre-employment skills training designed

Action 4

to enhance reskilling and conversion pathways into construction.

Need

The CITB report suggests there is a shortage of skilled workers for both current and future sector

needs. In order to address this shortage we will need to do more than simply attract and train those

currently in education. Reskilling and cross-sector pathways should also be explored.

Current barriers to reskilling include:

Trainees may not have essential paperwork important for employment (eg. CSCS cards)

Trainees may need additional technical, English and Maths competence and softer skill

support to be job ready.

Employing a “hard to reach” trainee is seen as a risk eg quality of work, attitude and risks of

employing ex-offenders.

Employers may be unable to pay a “fair” wage to higher risk trainees initially requiring

additional support and supervision although trainees need to earn sufficient wage to support

themselves and rebuild their lives.

Areas of construction industry need sub-contractors rather than employees which may be

harder for “hard to reach” trainees to adapt to.

Description

A Building Growth Reskilling Sub-Group will be established to explore how cross-sector pathways

and reskilling can be used by engaging more employers to work with non-traditional recruitment

sources including local agencies and social enterprises.

The Reskilling Sub-Group will aim to develop and deliver targeted pre-employment skills training

including certification essential for employment together with appropriate support. Applicants likely to

be invited from a wide range of “hard to reach” backgrounds. Applicants to be assessed on their

ability to succeed in permanent employment with age not being a barrier. The ambition is to develop

a 2 year pilot programme which, if successful, would then be rolled out taking into account any

lessons learnt.

Details, results and lesson learned from the pilot will be shared widely with the NALEP Principals

Group, the Building Growth Group, Skills Board, New Anglia Learning Providers Group and other

construction groups and forums eg Norfolk Constructing Excellence.

This action will contribute to the New Anglia Skills Manifesto by:

Supporting employers to better communicate their current and future skills needs to schools,

training providers, colleges, universities and Government.

Strategic

Links

Identifying specific skills gaps in our growth sectors and aligning our collective effort to meet

these challenges.

Ensure there are clear and complete training pathways for each sector that enable people to

get into and progress within their chosen career, and develop the higher skill levels needed.

Ownership

Project co-ordination to be led by Reskilling Sub-group of Building Growth Skills Group.

and

Building Growth Group to establish this group through Christina Sadler.

Accountability

Activity will require involvement from key stakeholders including but not limited to the LEP,

Local Authorities, New Anglia Colleges, VETS East, Norfolk and Suffolk Police and Crime

Commissioners, HMP Norwich, Britannia Enterprises and DWP.

September

Initial Actions

First meeting of the Reskilling Sub-Group

2016

Project Delivery Plan to be agreed

October 2016

Potential pilot project with Easton & Otley College to developed and launched

January 2017

Potential pilot project with West Suffolk College focused on military veterans

January 2017

developed and launched

Pilot to be completed

July 2018

10

Measures of

Number of “hard to reach” individuals in Norfolk and Suffolk engaged by the pilot projects.

Success

Number of trainees assisted into permanent employment or self-employment as a result of

this activity.

Number of veterans successfully trained, supported and placed into employment within the

construction industry (including as construction lecturers).

Number of additional construction employers employing re-skilled individuals

PERCEPTION & INSPIRATION : Enhance sector image to increase volume and

PRIORITY 2

diversity

We will conduct an audit of existing communication and look to identify key messages to be

Action 1

used consistently across organisations and platforms.

Need

The construction sector offers a wide variety of roles in trades and professions and clear

progression paths. However, this is rarely showcased and there is not a coordinated

approach to debunking misperceptions or promoting the positive aspects of working in the

sector.

Description

An audit of existing communication platforms and careers guidance will be undertaken to

identify 3 key messages that should be used to promote the sector.

Work across stakeholders will be undertaken to establish these messages as consistent

across all media and platforms.

Promotion of these messages on platforms such as ICANBEA and ‘Go Construct’ will be

undertaken as well as increasing employer involvement on these platforms. Members of

the Building Growth Network will be encouraged to support the ICANBEA website as an

opportunity to promote their business and career opportunities.

The ‘East Prospectus’ currently being developed by NALEP to promote the image of the

East (Norfolk and Suffolk) will be used in conjunction with key messages to develop the

Building Growth communications and website to promote opportunities, for those

considering a career in construction, reskilling into the sector or relocating to the area.

By undertaking this work we will gain an understanding of where best practice exists and

share this across platforms. This will include a look at:

•

Stereotypes of the industry, around gender and low skills

•

Career routes into the sector and diversity of opportunities, focusing on skills

shortages and needs identified in the CITB research report

•

Promotion of Norfolk and Suffolk as a destination to train and work in.

This action will contribute to the New Anglia Skills Manifesto by:

Ensuring that all young people have access to the information they need to make

Strategic Links

informed decisions about their future.

Supporting employers to better communicate their current and future skills needs to

schools, training providers, colleges, universities and government.

Showcasing the local economy to young people and their advisers.

Ownership and

Work will be undertaken by Clare Dyble - Eason and Otley College, Director of

Accountability

Marketing and Enterprise

Work will be reported into the Building Growth Group who will oversee delivery.

Development of Building Growth website to promote sector and

Initial Actions

opportunities and signpost to relevant sources of information and

Immediate

guidance.

Audit of existing messages and advice

Jan 2017

11

Focus groups with schools and career advisers on perceptions

Jan 2017

Development of 3 key messages

Spring 2017

Influence across communication platforms and careers advice to

Ongoing

promote messages.

From Spring

Use of joint materials across stakeholders

2017

Measures of Success

Greater connectedness between the various platforms and sources of information

established.

Key messages prominent across platforms

Key messages understood and informing the opinions of young people and

advisers

Increased uptake in construction training across providers including higher level

qualifications

Reducing the gap between supply and demand for skills provision

PERCEPTION & INSPIRATION : Enhance sector image to increase volume and

PRIORITY 2

diversity

Action 2

We will place the construction sector at the forefront of the New Anglia Youth Pledge

Description

The New Anglia Youth Pledge Marque provides a further opportunity to enhance

perceptions about the opportunities for new entrants into the sector.

The Building Growth Group network will promote the New Anglia Youth Pledge Marque and

set targets for sign up. Through the group this opportunity will be promoted to the wider

construction network.

The Enterprise Advisor Network is one of the main components of the Pledge Marque. This

will be promoted and individuals encouraged to sign up as a way of changing perceptions

in schools around construction careers and the opportunities that exist such as removing

the stereotypes around diversity and low skilled opportunities. The Enterprise Advisor role

allows for strategic input to individual schools, allowing promotion and shaping of careers

provision, as well as business links to raise aspirations and widen the views of

opportunities available.

This action will contribute to the New Anglia Skills Manifesto by:

Ensuring that all young people have access to the information they need to make

informed decisions about their future.

Strategic Links

Supporting employers to better communicate their current and future skills needs to

schools, colleges, training providers, universities and government.

Showcasing the local economy to young people and their advisers.

Ownership and

Building Growth Group to work with the Skills Board to encourage involvement

Accountability

from the sector.

From

Initial Actions

Pledge Marque promotion at Building Growth meetings to increase

September

uptake and for wider sharing in networks. Targets to be set.

2016

Construction sector pledge marque case studies to be developed so they

October 2016

can be promoted

Measures of Success

High proportion of employers in the construction sector signed up to the Youth

Pledge Marque.

Increase in the amount of construction sector Enterprise Advisers.

Construction one of the most prominent sectors engaged in the Youth Pledge

Marque.

12

PRIORITY 3

MEETING DEMAND : Plan to address the forecast growth in labour demand

We will establish a Building Growth Nuclear Forum to understand the wider impact of

Action 1

Sizewell C on all planned construction projects.

Need

The Sizewell C development will have an impact on other construction projects within the

region. The need for this forum is to share information and develop an action plan to allow

the construction sector to be better placed to plan for the changes in demand, rather than

having to react as the impact is felt.

Understanding the challenges and demand that the Sizewell C project will place on the

area will help shape the provision priority above, as well as inform any key messages or

marketing collateral produced by the Building Growth group.

Description

The formation of the Building Growth Nuclear Forum builds on the experience from the

Hinkley Nuclear Project. A group will look at the lessons learned from Hinkley and use this

to establish a forum to focus on the skills impact from the proposed Sizewell C

development and the wider impact on other construction projects in the area.

It is proposed that EDF takes a lead on this group to assist with the lessons learned from

Hinkley.

There are a number of other groups that exist related to construction and energy skills such

as the Suffolk Energy Coast Skills Sub-group. This forum is not meant to duplicate these

groups, but bring together key people to identify strategies that are already happening, and

enhance these, as well as identify areas which need new provision or strategies. This

forum, through its make-up, will ensure linkages to the other sector skills plan priorities. As

and when necessary, and as is the nature of a forum, other key personal will join or leave

the group as appropriate to provide input and linkages. However, there will continue to be

Strategic Links

a key lead in Tom McGarry and representatives of the Building Growth Group who will

ensure linkages to the wider landscape.

This action will contribute to the New Anglia Skills Manifesto by:

Supporting employers to better communicate their current and future skills needs to

schools, training providers, colleges, universities and government.

Identifying skills shortages and aligning collective effort to meet these challenges.

Ownership and

Tom McGarry - Head of Communications, Sizewell C will look to establish the forum and

Accountability

report into the Building Growth Group.

EDF share lessons learnt, including the proposal to integrate the Skills

Initial Actions

TBC

Strategy and Employer Strategy into one combined proposal

Meetings to be set up quarterly to share best practice, increasing as

TBC

momentum on the project increases.

Measures of Success

Greater understanding of the flow of labour required during the project to better

respond to the project demands

Increased supply of labour to predominately come from Norfolk and Suffolk without

impacting on the supply of labour to other construction projects.

13