New Anglia Transport Board

Connecting the East, Accessing the World

Agenda

9.30-11.00am, Tuesday 25th August 2020 - Virtual Teams

9.30

1.

Welcome and introductions

Chair

9.30

2.

Minutes and matters arising

Chair

9.35

3.

New Anglia LEP Recovery Plan

Laura Waters

• Restart plan published

• Rebuild plan timeline

9.40

4.

Strategic Connections

All

• What are the recovery and rebuild opportunities?

• How do we improve perception of the region?

• What do we need to do to deliver quicker and reliable

connections?

10.25

5.

Ely Communications Actions

Hayley Mace

• Progress to date

• Key messages

• Next actions

10.45

6.

Transport East update

Andrew

• Strategy development progress

Summers

10.55

7.

Any other business

All

• Forward Plan and items for next meeting

• Date of next meeting - TBC

Officer Contact

If you have any questions about matters contained on this agenda, please get in touch with:

Laura Waters

07384 258662

New Anglia Transport Board

Assessing impact and Recovery Plan

Meeting Note

9.30-11.00am, Tuesday 2nd June 2020 - Virtual Teams meeting

Board attendance:

Ali Clabburn

Liftshare

Andrew Chillingsworth

GT Railway

Andrew Harston

AB Ports

Andrew Reid

Suffolk County Council

Andrew Summers

Transport East

Andy Walker

Suffolk Chamber of Commerce

Carmen Szeto

Sustrans

Carolyn Barnes

East Suffolk

Chris Soule

CLA

David Cumming

Norfolk County Council

Doug Field

New Anglia LEP

Graeme Mateer

Suffolk County Council

Cllr Graham Plant

Norfolk district representative

James Bradley

Network Rail

Jonathan Cage

Norfolk Chamber of Commerce

Jonathan Denby

Greater Anglia

Jonathan Rudd

New Anglia LEP

Karen Chapman

Suffolk Growth Programme Board

Laura Waters

New Anglia LEP

Cllr Martin Wilby

Norfolk district representative

Nova Fairbank

Norfolk Chamber of Commerce

Paul Ager

Associated British Ports

Paul Davey

Hutchison Ports

Paul Horne

Suffolk County Council

Paul Martin

First Buses

Cllr Phil Smart

Suffolk district representative

Richard Pace

Norwich Airport

Richard Perkins

Suffolk Chamber of Commerce

Simon Amor

Highways England

Steve Bryce

Ipswich Buses

Suzanne Buck

Suffolk County Council

Apologies:

John Dugmore

Suffolk Chamber of Commerce

Jonathan Oates

MAG

Patrick Ladbury

GT Railway

West Suffolk

Sara Noonan

Steve Wickers

First Buses

Norfolk district representative

Stuart Clancy

2.

Minutes and matters arising

The previous minutes were accepted as a true record.

An update was provided on the action from the February meeting to develop an influencing strategy for Ely. The

Strategic Outline Business Case has been submitted to Government with a decision on funding to progress to next

stage likely to be announced in July. Communications is on the agenda to be discussed at the next Ely taskforce

meeting and the New Anglia LEP and Transport East will also be attending the next meeting of the Ely

communications working group. Network Rail are working with the DfT on making the case to the treasury but there is

a need for coordinated pressure over the summer to accelerate activity.

3.

Impact of Coronavirus

LW presented paper summarising the impacts Covid-19 has had on various modes of transport, which will help in

understanding the most critical areas and identify interventions for restart and rebuild phases of recovery planning.

Key updates and feedback:

Transport will need to adapt to how businesses operate differently with working from home and staggered working

hours with the need to understand new commuter patterns. We need to balance the reopening of the economy with

maintaining the benefits seen during the lockdown such as improved air quality.

Increased working from home has demonstrated need for better broadband. Market towns and cities are implementing

measures to reopen safely on June 15th including guides/helpers to give confidence to shoppers. NCC received £400k

towards these measures and Local Authorities have also received funding.

All three ABP ports at Ipswich, Lowestoft and Kings Lynn have operated normally throughout the period since the end

of March and this had also been the case at Felixstowe.

Major issue for airports is the 14-day quarantine restriction, lobbying is taking place to refine the parameters of this

including air bridges and testing on arrival. Domestic flights restarting in July. Opportunity around regional

connectivity, currently public service obligation routes are focussed around London, but this is an opportunity to

connect all regions.

Bus operators are facing challenges, number of passengers reduced to 10-15% of normal levels and services have

been reduced to reflect this. Key routes for employment and access to hospital have been maintained. Peak services

will be increased to align with easing of lockdown restrictions. Social distancing measures do significantly decrease

capacity and will now have to see if buses can cope with passenger numbers.

All that can be done in terms of funding and support for buses is being undertaken and similar to other operators in not

knowing what patterns will look like as lockdown restrictions are eased. Difference between rail and buses,

government has an obligation in worst case to step in support rail, but this is not the case for buses. Based on this we

should lobby for grants and support for buses.

Can the bus and rail operators be financially supported until such a time when passenger numbers make services

viable? There is a definite need for a rural transport network in our area, but could some modelling work be

undertaken to understand the level of support needed? Reports that businesses may want to relocate from London to

areas such as Norfolk and Suffolk. As noted above it is a positive that cycling has increased but with cars returning to

the roads a communication/safety campaign is needed around cycling safety on the roads.

Active travel will be a key part of recovery; Ipswich needs improved cycle lanes which has been discussed with

Transport East.

Minimal rail services at the start of lockdown these have now increased since Mid-May. Similarly, to buses social

distancing at its current levels does create a capacity issue. Since February, all new trains in place which has provided

increased capacity. Once the restrictions are lifted there is a shift from discouraging anything but essential travel to

encouraging journeys, these journeys are going to involve public confidence measures such as face masks.

DfT acted quickly for rail with all operations since March on emergency arrangements with the provision to extend,

working with DfT to anticipate changing patterns and take the opportunity to plan positively.

Thameslink and Great Northern lines: minor step-up in service on 15 June and bigger increase in services from early

July.

Need increased uptake of broadband, Government has bought in grants for businesses/homes for full fibre to

premises, which the county councils will lead on. A focus on strategic road projects and more improvements are

needed on smaller roads to support businesses in these areas. Norfolk County Council just received £22m from the

Pothole Fund which will be used to improve all our roads including rural ones.

Given the reduced capacity on public transport and messages about its usage, it is likely that increased car use at

least temporarily is likely during the recovery period. Currently the safest option to maintain social distancing is to use

your own car and a strong communications strategy is needed to get people using public transport again. The

communications will also need to stress that short trips can be undertaken by walking/cycling, especially in towns.

Social distancing has also had a big impact on viability of services and airlines have no direct support from

government. Agree with the opportunity mentioned earlier about the draw from London to Norfolk and Suffolk and

promoting the Norwich to Amsterdam gateway.

Liftshare has undertaken a survey of members which found: a significant increase in working from home, car use

returning to 60% of normal levels and in longer term up to 80%, public transport usage not picking up until later in the

year and car sharing levels have remained steady. Liftshare are working with businesses in getting staff back to work

using data to mobilise the workforce.

Action: ACl to circulate Liftshare commuter survey

The Chair welcomed these comments and how these will feed into the New Anglia LEP recovery plan work.

4.

Transport East Update

AS briefly introduced himself and his role as strategy director of Transport East. AS summarised the Transport East

100-day plan, four proposed work packages and next steps for activity. The priority is to get a strategy in place, which

clearly sets out the uniqueness of the East to government.

Need to focus on delivery, authorities have campaigned and successfully secured funding for road schemes, but these

are not being delivered. The A47 schemes are a priority for HE and this was reaffirmed in the RIS2.

The County Council is frustrated about the lack of delivery of committed schemes and that no new priorities were

allocated in RIS2. Positively £100m has been recently announced to progress development of Western Link scheme.

In securing the funding and delivery of schemes we need to be one strong voice.

The number one objective should be to secure funding for this region and Transport East needs to be outward looking

and strategic in its thinking. This region needs its share of the levelling up debate. Need to ensure businesses are

aware of Transport East and the Chambers can help promote its role and activities to the wider business community.

We are clear on the rail priorities for the New Anglia area but need constructive and effective pressure to get projects

delivered.

Engagement with Transport East on airports would be welcomed.

AS: Welcomes this feedback and the investment/delivery part of the strategy will be key and agrees Transport East

needs to project itself as a substantial body, increasing its profile with ministers to focus on this region.

Action: Transport East to be added as a standing update item

5.

New Anglia LEP Recovery Plan

LW presented paper setting out the approach to preparing the plan and the phases of response, restart and recovery.

The economic recovery plan will be circulated the 8th June and due to tight timescales comments will need to be

received by mid-day on the 11th June.

In the evidence base section, it sets out that the statistical impact on the economy will not be available for some time

and baseline data will start to be available from Spring 2021. Can we gather data sooner than this to inform recovery

plan? New Anglia LEP are utilising Metro Dynamics to provide a small amount of specialist support, particularly to look

ahead to how emerging trends but will check when this will be available.

Board supports the development of the plan.

Action: LW to check with economic impact lead when emerging trends data will be available and what it will cover

Action: LW circulate economic recovery plan on the 8th June

Action: All to provide comments on the plan by mid-day 11th June to LW

6.

New Anglia LEP Sub Board Reporting

LW presented paper on the New Anglia LEP Sub Board reporting process and proposed updates on activity.

Needs to be updated to include Transforming Cities Fund bid was resubmitted last Friday, seeking £32m in funding

and should hear if successful in July.

Board agreed (once updated to reflect updates from today’s meeting) to the table of activities and actions.

7.

Any other business

Forward plan - Connecting the East, Accessing the World: Ports and airports, Strategic road network and Strategic

Rail.

Date of next meeting - 9.30am, 25 August 2020, virtual meeting or at Endeavor House

New Anglia Transport Board

Tuesday 25th August 2020

Agenda Item 3

New Anglia LEP Recovery Plan

Author: Laura Waters

Summary

This paper provides a summary of the New Anglia LEP economic recovery plan work, with

the recently published Restart Plan being the first of a two-stage economic recovery plan for

our area.

The restart plan is focussed on the short-term actions required for the next six months, agile

and evolving as the full impacts of lockdown become clear and has been developed by a

range of partners. The restart plan was published in June and in the autumn, this plan will

be followed by our Renew Plan - a longer-term plan for jobs and sustainable growth which

will also serve to support the Government national recovery plan.

The renew plan looks to a longer-term horizon of 3-5 years and will include activities to

rebuild the economy which builds on the Economic Strategy and Local Industrial Strategy

and responds to long term changes brought about by the pandemic.

Recommendation

The Transport Board is asked to:

• Support the development of the renew plan and consider the opportunities and actions

for the rebuild phase of recovery.

Aim

Develop a plan that accelerates the economic recovery from the impacts of Covid-19 across

Norfolk and Suffolk which builds upon the Economic Strategy and Local Industrial Strategy.

Approach

This Restart Plan is the first of a two-stage economic recovery plan for our area. It will

support businesses, individuals, communities, anchor institutions and further and higher

education providers to start trading and living life with confidence, in an environment

dominated by social distancing and economic uncertainty, as quickly and safely as possible.

The Restart Plan is:

Short-term - It focuses on actions for the next six months. It outlines measures to help

those who lose their jobs, young people seeking work and businesses and entrepreneurs

who require support, assisting the different sectors which make up our economy - especially

those hit hardest by the crisis.

Agile and evolving - Our approach will evolve as the full impacts of the lockdown become

clear. Actions will be regularly reviewed to ensure they remain relevant and further measures

will be developed where necessary.

Multi-partner, multi-level - This plan has been developed and will be delivered by range of

partners. It complements local public sector recovery plans and those being developed by

other institutions as well as individual businesses and sectors. Many actions will be funded

from existing budgets, re-prioritising where necessary. However, we are clear that the scale

of the task will require further Government investment, alongside private sector, and local

funding.

We are determined to rebuild a better future for our economy, working with government and

focusing on more sustainable and inclusive economic growth. In the autumn, this plan will be

followed by our Renew Plan - a longer-term plan for jobs and sustainable growth which will

also serve to support the Government national recovery plan.

Evidence Base

The New Anglia LEP and the Norfolk and Suffolk Offices of Data Analytics (NODA and

SODA) have worked to gather data sets and other statistical evidence to support the plan.

This has been supplemented by Metro Dynamics, which has helped to develop an evidence

base, which is predominantly based on an analysis of the sectors which are the focal point of

the Economic Recovery Plan. It is covers:

1. What we know so far - information on the national context

2. Assessing local impacts - information on what is happening at a local level, split by local

authority where possible

3. Impacts on businesses - information on what is happening in Norfolk and Suffolk’s

businesses

4. Scenario modelling - projections of what may happen to Norfolk and Suffolk’s economy

and labour market in best / middle / worst case scenarios, and assessments of major risks

and implications for the sectors included in the Recovery Plan.

Key findings from this evidence include:

• Unemployment has the potential to peak at 202,150 (26.1%) in the worst-case

scenario, whereas in the best case, the peak will be around 50,200 (6.5%)

• The use of transit stations decreased at its lowest point to 60% of normal levels in

Norfolk and Suffolk. Suffolk has seen levels recover to around 40% of normal levels

in June 2020 whilst Norfolk was at around 50% of normal levels.

•

18% jobs at risk in the transportation and storage sector across Norfolk and Suffolk

•

The sectors most able to work from home are the smaller sectors within Norfolk and

Suffolk. Those larger sectors within the region have found it more difficult to adapt.

• Norfolk and Suffolk’s largest sector in terms of employment, wholesale and retail

trade and repair of motor vehicles is set to be hit hard with a 50% fall in projected

output in Q2 2020. The large manufacturing sector is also set to be one of the

hardest hit, with a 55% fall.

Renew Phase

The renewal phase of recovery will need to consider how we can future proof and adapt

infrastructure to the new economic “normal” and ensure we are resilient to any future similar

shocks. The evidence suggests in the best-case scenario the renew phase will begin in the

autumn of 2020 however if recovery takes longer in a worst-case renewal planning may not

begin until the end of 2021.

A large proportion of the feedback on the restart plan related more to rebuild which has

provided a really good base in the development of the rebuild plan. Key areas of

consideration include:

• Clean growth - electrification of transport, capturing benefits of active travel and

shifting more freight from road to rail

• Improved connectivity - securing investment in strategic routes, accessing global

markets through our ports and airports

• Innovation and technology - complete superfast broadband coverage and the

delivery of ultra-fast broadband, deliver 5G coverage and promote the East as being

‘open’ to innovative new technologies, particularly where change could facilitate

growth

• Visitor economy - making whole journey reliability and attracting visitors with “easy”

journey planning

Governance

It is proposed that an officer led Economy Recovery group (which will be based on a similar

structure to the Economic Strategy Delivery Coordinating Board) will form and take on the

role of Steering Group for the day to day development. This would report into the LEP Board,

the Local Authority Leaders groups and the Norfolk and Suffolk Local Resilience Forum

recovery groups.

The LEP Board, LA Leaders and Sector Chairs will be engaged during the development and

is proposed to be done through a series of briefings and existing meetings to ratify direction

and test the emerging plan.

Recommendation

The Transport Board is asked to:

• Support the development of the recovery plan in two phases Restart and Rebuild as

outlined in the paper

New Anglia Transport Board

Tuesday 25th August 2020

Agenda Item 4 Strategic Connections

Norfolk and Suffolk priorities

Author: Laura Waters

Summary

This paper outlines the strategic transport connections identified in the Norfolk and Suffolk

Economic Strategy (NSES), Local Industrial Strategy (LIS) and Integrated Transport Strategy (ITS)

and the measures included in the recently published Covid-19 Economic Recovery Restart Plan.

The meeting is asked to consider opportunities to develop our strategic connections in the context

of the “new normal” environment and what actions would help both the local, regional, and national

economy rebuild stronger.

Questions for discussion

The Board are asked to:

• Discuss the priorities for strategic connectivity and what will have the greatest impact on

recovery?

• Consider how can the momentum for improved digital connectivity, active travel and green

recovery be utilised for transport improvements?

• Consider how clean growth can be incorporated into the development of these strategic

opportunities and the ongoing work of the Transport Board?

Background

The NSES sets out that infrastructure improvements underpin all our priority places and themes and

identified strategic connections:

• Felixstowe to Nuneaton rail freight corridor and A14 - Core to the UK’s freight and logistics

system

• Ports at Felixstowe, Ipswich, Great Yarmouth, Lowestoft and King’s Lynn and airports at

Norwich and Stansted

• Rail routes to London and Cambridge

• A14, A47, A11 and A12 road connections could further drive growth opportunities for Norfolk

and Suffolk

• Strengthening the reliability of high-quality mobile coverage and complete the provision of

high-speed broadband.

The LIS expands on this, exploring the productivity and clean growth gains that can be delivered

along these strategic connections through integrated transport. Highlighting the need to improve

accessibility between our economic centres to provide better access to jobs, education, and

healthcare, encourage the clustering benefits of development and services, and attract inward

investment.

Infrastructure objectives

•

Secure rail improvements,

especially on the key Great

Eastern Main Line, East-West

and Norwich/Kings Lynn and

Cambridge/Stansted corridors,

Felixstowe to the North rail

freight corridor.

•

Improve reliability, frequency,

journey times and wi-fi, through

the new franchise and capital

investment in rail infrastructure

upgrades

•

Further develop the A47, A14,

A11, A10, bypasses to relieve

congestion, improve last mile

connectivity and commuting

transport in our priority places

•

Strengthening the reliability of

high-quality mobile coverage

•

Completing the provision of

high-speed broadband

•

Integrate utility, road, rail,

digital and green infrastructure

to build the communities and

places people want to live

•

Explore innovative approaches

to infrastructure delivery

The LIS identified opportunities for our strategic transport corridors:

• Electrification of transport

• Last mile connectivity

• Wider innovation in engineering, technology, and business models

• Encourage modal shift and active travel

• Network efficiency and flexibility

• improved digital connectivity

The ITS set out several socioeconomic trends in

2018 that presented both challenges and

opportunities for the East, impacting on how, when, and why we access and use out transport network:

• Demographic - A growing and ageing population, many of whom may work longer, the

impacts of net migration and the ongoing trend of urbanisation.

• Social - The rise of the sharing economy and the growth in immediacy expectations will impact

the traditional models of transport access, ownership, and use, particularly in younger

generation.

• Environmental - Impacts of climate change, particularly in low-lying and coastal areas,

scarcity of resources and the role of renewable energy.

• Technological - ‘Big Data’, Artificial Intelligence (AI) and cognitive thinking, automation and

robotics, propulsion and energy decarbonisation, cheaper and more functional materials, 3D

printing and shared mobility.

• Economic - The rise of the gig economy and local manufacturing

• Political - Devolution of decision-making, future economic uncertainty regarding national

political decisions, changes in legislation, the impacts of globalisation and the protectionism

of markets.

The ITS focussed on making the most of our advantageous location with respect to accessing global

markets whilst meeting the needs of varied geography: urban centres, market towns, rural and coastal

communities. To achieve these advantages transport needs to:

• Improve capacity and journey times, as well as reliability and resilience in times of stress

• Support our competitive clusters

• Drive social inclusion and skills uplift - access to employment hubs, skills opportunities

through electrification of transport

• Adapt to environmental challenges - achieve modal shift, improve air quality

• Accommodate ageing population - integrating digital technology

As discussed at the previous Transport Board whilst it is difficult to predict the impact of the pandemic

on transport demand in the longer term, the scale of change that has taken place over the last few

months has presented challenges and uncertainties but also opportunities for new pathways to deliver

transport. The objectives are still those required to develop transport in the East but have morphed

as a result of the “new normal” environment and we need to assess how the changes to transport

during the pandemic have impacted our strategic corridors, what activities will best support the rebuild

phase of recovery and how we can maximise government funding opportunities.

In response to the pandemic the government announced various measures to support the economy:

Supporting Jobs

• Introduction of a Job Retention Bonus to help firms keep furloughed workers.

• New £2 billion Kickstart Scheme will be launched to create fully subsidised jobs for young

people.

• Businesses will be given £2,000 for each new apprentice they hire under the age of 25.

•

£111 million investment to triple the scale of traineeships in 2020-21.

•

£17 million of funding to triple the number of sector-based work academy placements in 2020-

21.

•

£900 million to double the number of work coaches in job centres to 27,000.

•

A £32 million investment in the National Careers Service.

Creating Jobs

•

£8.8 billion to be spent on new infrastructure, decarbonisation, and maintenance projects (as

announced in his March Budget and more recently by the Prime Minister last week).

•

£3 billion green investment package to support around 140,000 green jobs.

•

£2 billion Green Homes Grant scheme to enable homeowners and landlords to make energy

efficient improvements to their properties.

•

£1 billion programme to improve energy efficiency in public sector building such as hospitals

and social housing.

Protecting Jobs

• The Government will introduce an Eat Out to Help Out discount scheme.

• VAT will be cut on most tourism and hospitality-related activities from 20% to 5% from 15 July

until 12 January 2021.

• The stamp duty threshold will rise from £125,000 to £500,000 until 31 March 2021.

We need to consider how our strategic transport connections can support these measures and deliver

clean, smart, sustainable, and resilient growth by:

• Securing commitment to delivering strategic road, rail and digital improvements that increase

reliability and resilience - strong narrative supporting recovery, clean growth, levelling up and

Brexit.

• Utilising improved digital connectivity and the working from home shift

• Improving access to employment hubs for young people

• Identify training and apprenticeship opportunities - development and construction of major

infrastructure projects, skills for electrification of transport

• Where can we most effectively decarbonise our transport network - alternative fuels across

all transport modes, digital solutions, freight to rail, electric vehicle infrastructure, incentivising

public transport

• How we can maximise the active travel funding to improve strategic connectivity - linking to

last mile connections in urban centres

• Identify how we link our transport connectivity to support visitor economy

- improve

perceptions and setting out “easy” travel options for visitors

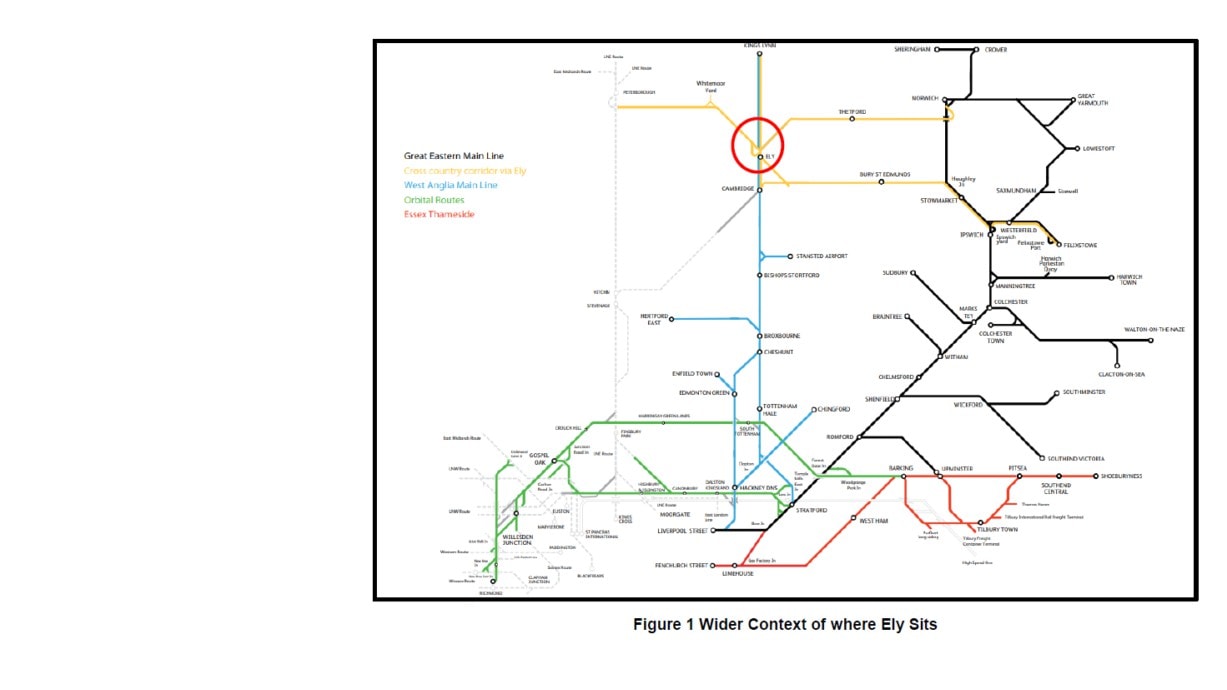

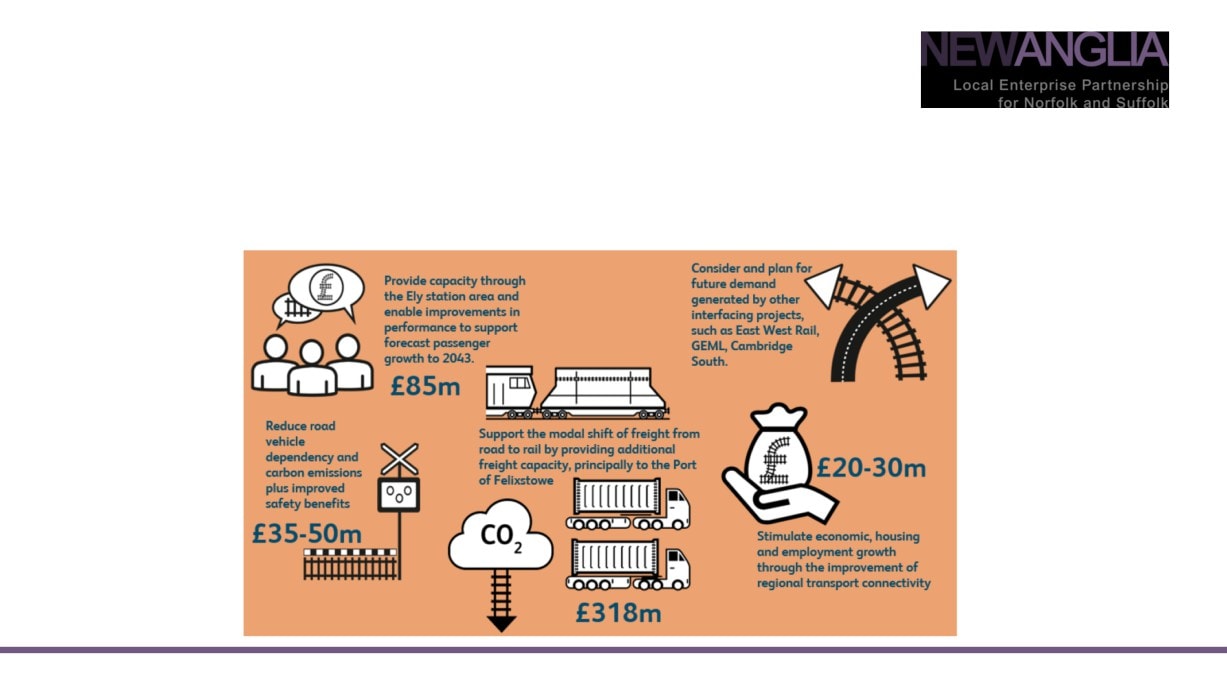

Ely Area Capacity

Enhancement programme

What can Norfolk and Suffolk

do to strengthen the case for

investment?

Ely is strategically located in

the West Anglia region and

serves routes to and from

Ipswich, Norwich, King’s

Lynn and Peterborough. The

location is a key interchange

for busy commuter and

leisure travellers using the

West Anglia Main Line from

London Liverpool Street and

Stanstead Airport, as well as

Freight routes alongside

Cross-Country commuters.

What role can we play?

• We have our own story to tell - why is this important to our

region? Which priority projects rely on investment at Ely?

• The LEP has invested time and money into the SOBC and

continues to support the Ely taskforce, so our own strong

messages can be part of the wider picture

• We want businesses, MPs and other stakeholders to

understand our message and the full case for investment

• Feeding up into Taskforce and Transport East comms

Why is it important that we

promote the programme?

• Ely capacity directly linked to UK’s growth. We can highlight the national benefits

• Integral to freight and passenger strategy to 2043, current infrastructure can only support

2019 levels

• Ely is the artery of the UKs highest priority rail freight corridor and supply chain

• Ely dictates the capacity of the entire route - improvements elsewhere will not increase

capacity

•

70% of containers that arrive at Felixstowe are delivered to Midlands, Manchester, Liverpool

and Yorkshire.

• Felixstowe port is committed to rail with an existing 28% modal share, the highest of any UK

port

•

301,859 minutes lost at Ely - equivalent of playing 3,354 football matches or 629 work days

lost

• Ely is the enabler of government levelling up the north, hitting carbon target and Brexit

Actions…1

• Create infographics highlighting importance of the

work (from previous bullet points - example below)

Actions…2

• Produce a simple factsheet / brochure which we

can share with our MPs, businesses and

stakeholders

• Produce short bulletin update for key partners

• Identify which projects or opportunities will be

impacted by or enhanced by investment in Ely

Timeline for activity

• Announcement expected in autumn 2020 if DfT awards £13.1m

for Ely Core Work

• Announcement from DfT that Ely project can move to Outline

Business Case expected autumn 2020

• Network Rail Ely consultation begins in early autumn 2020

• Communications ahead of Autumn Statement

• Next potential milestone is to push for the renewal of level

crossings between Ely and Ipswich