New Anglia Transport Board

Rural and Coastal

Agenda

9.30am, Thursday 18th March 2021 - Teams

9.30

1.

Welcome and introductions

Chair

9.30

2.

Minutes and matters arising

Chair

Norwich Airport update

Richard Pace

CPC public transport/active travel update

David Cumming

9.40

3.

Terms of reference review

Ellen Goodwin

9.50

4.

Freeport East

Paul Davey - tbc

10.10

5.

The opportunity for hydrogen

Charlotte Farmer

Hydrogen East

10.30

6.

Influencing and enabling

Chair

A47

David Cumming

Improving public and shared transport confidence

Jonathan Denby/

Ali Clabburn

10.45

7.

Transport East update

Andrew Summers

Rural/coastal call for evidence

Laura Waters

10.55

8.

Any other business

All

Forward Plan and items for next meeting

Date of next meeting - 15th June 9.30-11 Teams

Officer Contact

If you have any questions about matters contained on this agenda, please get in touch with:

Ellen Goodwin

07384 258662

1

New Anglia Transport Board

Agile to Change

Meeting Note

9.30-11.00am, Monday 30th November 2020 - Virtual Teams meeting

Board attendance:

Ali Calbburn

Liftshare

Andrew Harston

Associated British Ports

Andrew Summers

Transport East

Andy Walker

Suffolk Chamber of Commerce

David Cumming

Norfolk County Council

Ellen Goodwin

New Anglia LEP

Graeme Mateer

Suffolk County Council

Cllr Graham Plant

Norfolk County representative

James Bradley

Network Rail

Jonathan Denby

Greater Anglia

Karen Chapman

Suffolk Growth Board

Kerry Allen

Suffolk County Council

Laura Waters

New Anglia LEP

Nova Fairbank

Norfolk Chamber of Commerce

Paul Davey

Hutchison Ports

Paul Martin

First Buses

Cllr Phil Smart

Suffolk district representative

Richard Pace

Norwich Airport

Richard Perkins

Suffolk Chamber of Commerce

Steve Oliver

New Anglia LEP

Steve Turner

Connected Places Catapult

Thomas Lawman

Highways England

Apologies:

Cllr Andrew Reid

Suffolk County representative

James Allen

New Anglia LEP

Jamie Burles

Greater Anglia

Suffolk Chamber of Commerce

John Dugmore

Jonathan Rudd

New Anglia LEP

Cllr Martin Wilby

Norfolk County representative

Patrick Ladbury

GT Railway

Paul Ager

Associated British Ports

Paul Horne

Suffolk County Council

Highways England

Simon Amor

2.

Minutes and matters arising

The previous minutes were accepted as a true record and all matters covered in the agenda.

Update on data and level of DfT intervention across Norfolk and Suffolk: work ongoing with DfT but transport usage

data across the country has been collected since March 2020 (updated 25 November) showing usage for cars, light

commercial vehicles, HGVs, rail and buses hit their lowest levels in April, increasing somewhat other the summer

months (peak in September) and since second lockdown have decreased again but not to levels seen in March.

3

Cycling had the reverse pattern with usage peaking in April, remaining above the 100% level until September and in

the latest November figure is now at its lowest level (67%). Data was also shared to the group on Norfolk traffic data,

Liftshare commuter survey findings showing one key change moving forward will be the ongoing demand from

commuters to work flexibly.

Greater Anglia updated that rail usage is much lower than normal and is expected to remain at this level until

restrictions are fully lifted. Do expect an increase in travel over the next 3 weeks for leisure and university students

returning home and customer feedback has been positive. Buses have faired better than rail with higher passenger

levels, but figures are encouragingly higher than the first lockdown.

Norwich airport updated that whilst understanding the government stance on quarantine period it does make the

situation challenging with very low passenger numbers, currently 1 service to Aberdeen and 1 to Amsterdam mainly

for offshore personnel. Do not expect a change until summer 2021. Need test/release alongside other key measures

to increase consumer demand. There has been good lobbying of MPs and traction has been made on the rates

question.

Action: RP to send letter to SO

Action: LW to set up meeting between SO/RP to discuss actions the Board can support.

Transport East circulated final version of decarbonisation report to the Board.

Ely infographic has been completed.

Action: LW to check with HM when this will be circulated to Board members.

3.

Brexit and Covid intelligence

Summary provided on the Brexit and Covid intelligence workstreams and intelligence collected:

Many businesses have been focusing upon recovery and clear guidance from government about the way

forward. Exciting initiatives such as mass vaccination and mass rapid testing are the tools to get us to a more

normal life but rolling this out will still take some time.

Businesses are still to go through the Christmas period and then the quieter start to the new year, before the

business support package tails off.

The Growth Hub has supported thousands of businesses since the pandemic started through their

recovery/growth plans and has worked closely with local authority colleagues. Quite a lot of work has been

focused on high-risk settings and communicating to those workplaces.

At a BEIS update session on 19 November, we were informed that negotiations resumed following an

acknowledgement from both sides of the need for movement. Intensive talks have continued daily, incl.

fisheries, state aid and level playing field.

Close to an agreement in many areas in FTA - goods, services, civil nuclear, aerospace, etc. Text for some of

these has been locked down already. Need enough time to ratify agreement on both sides - long and

complicated on the EU side (but all 3 institutions have discussed how to fast track this). UK ratification

process more agile and can implement using future relationship bill quite quickly.

Two county-wide groups have been set up to look at the UK’s exit from the EU - the Suffolk Brexit Task

Group and the Norfolk EU Transition Group with representation from all districts, the respective local

resilience forum and the LEP.

LEP has produced a business script for Growth Hub business advisers and partners engaging with

businesses. This business script builds on the government’s technical notices and guidance for businesses

and offers a local flavour for conversations. This document outlines the practical steps businesses can take

around issues such as employing staff, data protection and e-commerce.

Advisers are using this detailed information to provide businesses with answers on the new immigration

system from January 2021; and for businesses that are importing and/or exporting, guidance on customs

declarations, tariff rates, product markings and trade agreements.

Many businesses are in full survival mode as a result of Covid-19, they are not concentrating on EU exit and

they need to spend yet more resources, that they currently just do not have. They are not looking closely at

their supply chains and whether there is a European connection that needs to be addressed.

In a poll of around 50 East Anglian import and export businesses conducted by MHA Larking Gowen, 8% said

they were fully prepared while 37% answered they were more than half prepared.

4

In addition, without clarity from Government, as to exactly what businesses have to prepare for, it is very

difficult for them to plan and execute. Businesses have been asked several times to step up their preparations

in the past and nothing happened - businesses have a lack of capacity, resources, and energy to gear up for

the unknown. They need to know what to gear up for specifically.

Board then considered actions it can undertake to support transport and wider sectors as this time:

Move towards improving the testing system to build customer confidence in travelling and as we plan to build back

better in the spring we need to ensure strong messaging that travelling is safe - for example public transport is clean,

reliable and making all relevant safety measures.

Impact on smaller locations, one positive test can currently lead to a large proportion of workforce having to self-

isolate. As the testing system improves need to get people back to work as soon as possible and need to reinforce the

status of key workers.

Focus on encouraging people back to public transport, currently focus on active travel but given the messaging from

Government public transport is seen as unsafe. In the short term as people return to work, we need to give clear

messaging to encourage people to use sustainable transport modes. Need to consider changing travel patterns and

how things such as parking strategy should support this.

Alongside the messages around safety and raising public confidence, need to be clear that changing commuter

patterns to more sustainable modes also has the wider benefits of decarbonising the economy. Liftshare highlighted

that, pre Covid, 80,000 people lift shared on their commute in Norfolk and Suffolk (compared to 8,000 by train and

30,000 who commuted by bus). The impact of reductions in lift sharing on the commute following mixed messaging

around safety from Government will have a significant negative impact on congestion and emissions unless there is

clear communication to raise confidence again. (The average CO2 emissions/passenger km for driving alone = 172g,

lift-sharing = 86g and for bus passengers = 103g)

Transport East support comments on Government messaging and see this as an opportunity to influence DfT with our

key priorities.

Action: New Anglia LEP to produce communications piece on raising the confidence around public transport, lift

sharing and promoting the region.

Action: JD/SO/KC/AS/AC to meet to discuss government messaging, raising confidence in public transport and how

we can secure capital investment in our infrastructure priorities.

4.

Connected Places Catapult New Mobility Technologies

Connected Places Catapult gave a presentation on their role, the catapult network and key workstreams. The CPC is

focussed on local places at varying scales, identifying the challenges for these places and working with SMEs to

provide innovate solutions. These challenges include Covid, Brexit, ageing population, rural mobility and resources to

progress solutions. New Mobility Technology team are here to:

Support the creation of a vibrant intelligent and connected mobility space that meets societies challenges of

today and the future.

Creating new opportunities for innovators, building confidence for buyers

Enabling the increased supply of innovative solutions through a fair, safe and secure operating environment

Projects cover a range of technologies: Ports, active travel, 5G, autonomous vehicles, rail and drones. CPC is starting

to scope an active travel programme and looking to work closely with local authorities.

How can we achieve a balanced approach between public transport and active travel? CPC work with users of both

modes to gain understanding of concerns and challenges, whilst active travel usage has increased public transport will

still be important for longer journeys. Need integrated planning and a demand responsive approach with the current

active travel trajectory considered alongside increasing the uptake of public transport.

Norfolk County Council has received funding from the Government active travel fund, running e-scooter trials and

refreshing walking and cycling strategy so would be very keen to work with CPC on active travel programme.

5

Action: DC/ST to connect on the active travel programme and feedback to the board how a balanced approach

between public transport and active travel can be achieved.

5.

New Anglia LEP Clean Growth Taskforce

Paper shared summarising the role and purpose of the taskforce (February 2020 board paper can be found here on

page 11) and table 1 collates the proposed actions put forward by board members.

Board agreed with action around electrification of rail in East Anglia particularly the opportunity for freight between

Ipswich and Felixstowe. It is estimated that electrification will take 10 years to deliver so we need to ensure we are

prepared for this. The KPMG Decarbonisation report also highlighted the theme on alternative fuels, particularly

relevant for electric vehicles and hydrogen. There is also the DfT Decarbonisation Strategy it would be useful under

item 3 action: JD/SO/KC/AS meeting to also map workstreams so we clear on roles/responsibilities.

Greater Anglia highlighted the new rolling stock and how additional capacity also leads to decarbonisation. We need

to lobby for projects that support both the regional and national recovery. Network Rail supports the view on additional

capacity being a major contributor to decarbonisation and early development has been made on the rail electrification

between Felixstowe/Ipswich with the freight benefits. We need to keep this momentum going and build the message

around improvements in this region creating benefits both the region and nationally.

EDF consulting on Sizewell and it is likely more materials will be transported by rail freight.

6.

Transport East update

Transport East updated on progress made since last board meeting: Secured £425k funding for the remainder of

2020/21 from the DfT for delivery of the Transport Strategy technical work and engagement programme, and COVID-

19 recovery studies, 2 new members of staff in post and consultants have been appointed to work on the TE strategy.

There are three main workstreams within the strategy development are:

1a Non-Transport Outcomes, 1b Three deep dive sessions: International Gateways, Re-energising Coastal and Rural

Communities and Post Covid Economic Recovery, 1c will be looking at a set of future scenarios. With stage 1a almost

complete emerging themes have been identified as

Climate change and adaption

Environmental protection

Carbon reduction

Diverse economy

Digital energy and health

The focus for the next 3 months is delivering the full Strategy engagement programme. This will largely be delivered

between November 2020 and March 2021, aligned with the technical consultants’ work plan. Key elements of this

include:

Focussed 1-to-1 engagement with Forum members and key stakeholders to understand aspirations in detail

Series of thematic, geographic and sectoral workshops to work through issues and identify potential policy

levers, these will include officers, politicians, operators, transport users, charity and representative groups -

for example the Ports roundtable and District council event

Public polling to understand pan-regional public priorities

Expanding our network through trusted third parties, widening awareness and understanding in preparation

for the Strategy consultation in summer 2021

Hosting our annual Transport East summit in early 2021, to ensure our wider partners are fully engaged in the

strategy development.

This work will all be supported and enhanced by the wider Communications and Public Affairs Strategy agreed at the

July meeting to build political advocacy, awareness raising and reputation building.

6

Action: All to contact AS if they have questions on the strategy development.

7.

Forward plan for 2021 and Any other business

Forward Plan

Paper shared on proposed forward plan for 2021 with the next meeting theme being Local and Coastal: Innovative on-

demand transport solutions and improvements to facilitate local sustainable growth, walking and cycling, recognising

local distinctiveness, and offering access to services and opportunities through digital means.

The table shows the themes for each meeting and the clear alignment with Transport East core themes.

Action: Board agreed 2021 forward plan.

Date of next meeting - March 18th meeting invite will be circulated shortly.

AOB

Greater Anglia updated performance levels have been high over the last 8/9 months and also flagged the timetable

consultation for December 2021 is currently live and is open for comments until 12th February 2021.

Suffolk Climate Change emergency plan shared with the Board, which highlights the need to take actions now and

Board members encouraged to read the report.

UK Connectivity Call for Evidence is currently underway and there is an important role for rail freight and Ports in our

region.

Action: TE/LEP to set up meeting between AS/SO/PS/JD to draft response to call for evidence

SO closed the meeting by summarising key discussion points:

Rebuilding confidence and safety around transport regionally and nationally

Importance of wider decarbonisation of transport sector

Link between strategies such as TE and working together to secure investment

Need to bring these key themes forward to Government

7

New Anglia Transport Board

Thursday 18th March 2021

Agenda Item 3

Terms of reference review

Author: Ellen Goodwin

Summary

This paper looks at the evolving role of the Transport Board and looks to review its terms of

reference in line with the broader objectives of the LEP, in particular clean growth. It also

looks to nominate a member of the Board to join the LEP’s Clean Growth Taskforce.

Recommendations

The Board are asked to:

consider the Board’s purpose, aims and objectives given the imperative around clean

growth;

approve the revised terms of reference for the Board;

consider how it might like to connect with other parts of the LEP governance; and

Nominate a member of the Transport Board to join the Norfolk and Suffolk Clean

Taskforce.

Background

The LEP Board received an update on the Transport Board at its February Board meeting.

The update focussed on re-aligning priorities around enabling and influencing, the growing

strength of Transport East and our alignment in terms of priorities, key project updates and

how we meet the wider priorities of the LEP Board: covid-19 response and recovery, clean

growth, international profile and trade and strengthening governance. The update can be

found here. This paper seeks a view on the Transport Board’s work programme, including

engaging with other areas of the LEP governance, in this context.

Clean Growth Taskforce

The purpose of the Clean Growth Taskforce is to embed clean growth in the development

and delivery of actions and decisions which deliver the Economic Strategy, and Local

Industrial Strategy and Renewal Plan. It will also help drive the shared ambition for a low

carbon and inclusive economic recovery that tackles the challenges and opportunities of

climate change.

In doing so the LEP is committed to the following in terms of clean growth:

Leadership and collaboration

A workforce fit for the future

Market forces

Industry decarbonisation

Innovation and commercialisation

Infrastructure decarbonisation

9

The New Anglia LEP executive team are currently reviewing the terms of reference for the

taskforce to reflect the changes seen since February 2020. They are also mapping the

existing partnerships, boards and groups who are already working in this area to understand

their focus/priorities, work programme, delivery actions, communications activity and

governance. This work will help to explore opportunities to work together and inform a gap

analysis to identify the areas where the taskforce could lead.

It is hoped that a Chair for the Taskforce be identified by the Spring and that the Taskforce

meet for the first time in the Summer. This paper seeks a nomination from this Board to the

Clean Growth Taskforce.

Terms of reference

The previously agreed terms of reference have been reviewed to reflect the growing clean

growth imperative. They are attached at Appendix A for the Board’s consideration and

approval.

The Transport Board’s purpose is currently defined as:

The New Anglia Transport Board will ensure current and future transport networks meet the

needs of both businesses and residents in order to support clean and inclusive growth.

This paper seeks a view on this and on the Board’s objectives and expected outcomes

which have been updated to reflect changing circumstances around governance, work

programme and most importantly clean growth, one of the LEP’s four current corporate

priorities.

Objectives:

The New Anglia Transport Board will provide strategic direction on transport issues by:

Acting as a forum for information and expertise sharing, discussion and debate

Acting as a powerful advocate for Norfolk and Suffolk

Maintaining, executing and monitoring the Integrated Transport Strategy Delivery

Plan, reporting to the New Anglia LEP Board

Directing the formation and work programmes of Task and Finish Groups to tackle

specific topics as necessary

Offering recommendations for prioritisation of projects for delivery and

subsequent monitoring of outcomes

Expected outcomes:

A reliable, resilient, integrated and clean transport network with improved

capacity and journey times, providing good connectivity both within and around

Norfolk and Suffolk, and to other UK, European and worldwide destinations

A Delivery Plan for the Integrated Transport Strategy for Norfolk and Suffolk, with

a clean growth focus that is current and valued by transport bodies

Central government understanding of the transport infrastructure needs and

priorities of Norfolk and Suffolk businesses and residents to support inward

investment and clean growth

The Board will monitor its progress via regular reporting to the LEP Board, the latest update

can be found in the February 2021 papers here.

10

Link to the Integrated Transport Strategy

The New Anglia Transport Board will provide a strong voice for Norfolk and Suffolk to ensure

that the best is secured for the area. It will also help to deliver the ambitious objectives set

out in the Norfolk and Suffolk Economic Strategy, the Local Industrial Strategy, the

Economic Recovery Restart/Renewal Plans and the Integrated Transport Strategy for

Norfolk and Suffolk.

Link to Clean Growth

The terms of reference have been reviewed to align with the LEP’s corporate priority around

clean growth and a member of the Board sought to sit on the Clean Growth Taskforce.

Recommendations

The Board are asked to:

consider the Board’s purpose, aims and objectives given the imperative around clean

growth/green recovery;

approve the revised terms of reference for the Board;

consider how it might like to connect with other parts of the LEP governance; and

Nominate a member of the Transport Board to join the Norfolk and Suffolk Clean

Taskforce.

Appendix A - terms of reference (2021)

11

New Anglia Transport Board - Terms of Reference

Introduction

New Anglia LEP is the Local Enterprise Partnership covering the geographical area of

Norfolk and Suffolk.

Norfolk and Suffolk are positioned as the UK’s clean growth region, the golden thread of

our Local Industrial Strategy. Collectively, New Anglia LEP has ambitious plans for

driving business growth and productivity in our diverse economy, for communicating our

offer to the world and for driving inclusion and skills. Norfolk and Suffolk are leading

places in the competitive global economy, with a large number of world leading

competitive clusters already based here.

Deleted: In addition Norfolk and Suffolk is positioned as

UK’s clean growth region, the golden thread of our

A modern, efficient and clean transport system is key to our future success. A mobile,

recently endorsed Local Industrial Strategy.

accessible and increasingly virtual world-class economy will ensure that Norfolk and

Deleted: and

Suffolk retains this enviable position and will benefit thousands of businesses of all sizes

Deleted: and

and open significant opportunities in our extensive supply chain network.

The New Anglia Transport Board will provide a strong voice to ensure that we can

secure the best for the area and deliver the ambitious objectives set out in the Norfolk

and Suffolk Economic Strategy, the Local Industrial Strategy, the Economic Recovery

Restart/Renewal Plans and the Integrated Transport Strategy for Norfolk and Suffolk.

Purpose

The New Anglia Transport Board will ensure current and future transport networks meet

the needs of both businesses and residents in order to support clean and inclusive

growth.

The New Anglia Transport Board brings together key transport specialists, pooling

transport expertise across the region to help shape the future transport system. It will:

Understand partners’ transport ambitions

Encourage a cleaner transport network that satisfies the needs of business and

Deleted: sure

residents both now and in the future

Deleted: the

Assess how New Anglia LEP and partners can best deliver the Integrated

Transport Strategy for Norfolk and Suffolk

Specific Activities/Objectives

The New Anglia Transport Board will provide strategic direction on transport issues by:

Acting as a forum for information and expertise sharing, discussion and debate

Acting as a powerful advocate for Norfolk and Suffolk

Deleted: on behalf of the New Anglia LEP

Maintaining, executing and monitoring the Integrated Transport Strategy Delivery

Plan, reporting to the New Anglia LEP Board

Deleted: Economic Strategy Co-ordinating Delivery

Board

Directing the formation and work programmes of Task and Finish Groups to tackle

specific topics as necessary

Offering recommendations for prioritisation of projects for delivery and

Deleted: <#>Producing and executing a stakeholder

subsequent monitoring of outcomes

management plan ¶

Producing a high-level work programme summarising

individual scheme progress ¶

Expected outcomes

12

A reliable, resilient, integrated and clean transport network with improved

Deleted: and

capacity and journey times, providing good connectivity both within and around

Norfolk and Suffolk, and to other UK, European and worldwide destinations

A Delivery Plan for the Integrated Transport Strategy for Norfolk and Suffolk, with

a clean growth focus that is current and valued by transport bodies

Central government understanding of the transport infrastructure needs and

priorities of Norfolk and Suffolk businesses and residents to support inward

investment and clean growth

Powers

The role of the Board is an advisory one, bringing expertise and transport knowledge. It

will feed into the Investment and Appraisal Committee to enable them to devise, deliver

and manage the relevant programmes.

Composition of the Transport Board (Membership)

ABP

CBI, East of England

Connected Places Catapult

Country Land Owners and Business Association

Department for Transport

East Midlands Trains

Federation of Small Businesses

First Group

Govia Thameslink Railway

Greater Anglia

Highways England

Hutchison Ports

Ipswich Buses

Liftshare

Network Rail

New Anglia LEP

Norfolk Chamber of Commerce

Norfolk County Council

Norfolk district representative

Norwich Airport

Peel Ports

Stansted Airport

Suffolk Chamber of Commerce

Suffolk County Council

Suffolk district representative

Sustrans

Transport East

13

Format and Frequency of Meetings

Meetings will be generally be open to the public

Meetings will take place quarterly and will take place ahead of Transport East

Forums.

Deleted: Venues will alternate between Ipswich and

Norwich

Format of meetings - Chaired by New Anglia LEP

Meetings are formally minuted, with agenda, papers and minutes to be published

via the New Anglia LEP website

Secretariat - New Anglia LEP will supply secretarial services, and meeting

support in terms of accommodation will be hosted/facilitated by Norfolk and

Suffolk County Councils

Papers to be circulated one week prior to Board meetings

The Board will work together by consensus

14

Norfolk and Suffolk Transport Board

Date:

18th March 2020

Item:

Transport East response to the DfT Rural Mobility Call for Evidence

Report by:

Laura Waters

Contact:

Purpose

This report sets out the key points from the Transport East (TE) response to the DfT Future of Transport:

rural strategy - call for evidence. Presenting alternative approaches to planning for rural mobility,

summarising the challenges both at a pan Sub-national Transport Body (STB) and TE level and how TE will

continue to lead the pan STB Rural Mobility Group. The full response can be found in Appendix A.

Recommendations

Norfolk and Suffolk Transport Board Members are asked to note the contents of the report and consider

the questions under section 5 the feedback from which will be used to inform the rural mobility work plan.

Questions for Norfolk and Suffolk Transport Board Members to consider:

What activities are organisations already undertaking to support rural mobility? This could include

strategies, plans, and shared learning.

Do we have examples of successful projects targeted at improving rural mobility in the region?

What are the opportunities to most effectively work collectively on rural mobility?

1.

Introduction

1.1

In 2019, the DfT published the Future of mobility: urban strategy, setting out their approach

to maximising the benefits and managing the risks of new technology in urban areas. The

DfT now want to explore the challenges and opportunities for rural areas.

1.2

Government have already started engaging with academia, industry, new mobility

operators, local authorities and other stakeholders to understand the challenges and

opportunities facing rural areas, and to identify existing good practice. This call for evidence

aims to build on this engagement and ensure that they are able to gather the views of all

those with a stake in how our rural communities can benefit from transport innovation.

1.3

Transport East (TE) responded to the DfT (See Appendix A) whilst also leading on the

response on behalf of the Sub-national Transport Body Group (STB). TE is the STB leading on

rural mobility as it is particularly relevant to region, is an opportunity to directly influence

government on rural issues and raises the profile of Transport East across England/DfT as a

national lead on this theme.

15

2.

Approach to developing response

2.1

Using the headings set out in the Call for Evidence consultation, feedback was collated from

both the STB Group and Transport East Senior Officer Group (TESOG) on the following:

What are the main rural mobility issues and challenges in your area?

What are the opportunities for solutions/innovations?

What strategic approach/principles should we recommend for rural mobility?

What is the role of STBs in rural mobility?

What are the headline points to communicate to the DfT?

2.2

This feedback alongside evidence/data from existing strategies and plans was then used to

develop the response focussing on: car dependency, accessibility to services, issues unique

to the TE region, considerations for innovation in rural areas and the roles of central

government, STBs and local authorities.

3.

Summary of the TE response

3.1

The full Transport East response can be found in Appendix A with the key points including:

A proposal for a place-based approach, based on understanding the specific

challenges within a local rural area, and identifying appraisal principles to establish

what ‘good looks like’, before identifying and testing solutions to address them.

Supporting a user-centric approach in which the needs of both current and future

residents and businesses are fully understood. Better engagement with rural

communities is fundamental to understand and provide better rural mobility

outcomes.

As a result of car dependency, transport in rural areas is generally more carbon

intensive than in urban areas. Reducing emissions needs to be prioritised through

the development of solutions for rural areas, but with due consideration for other

core outcomes including social inclusion and access to employment.

New ideas and technology to reduce the need to travel should be researched and

expanded. Better digital connectivity and new innovations (for example Rural Hubs)

have considerable potential to deliver place-based outcomes and should be

considered alongside any mobility solutions.

Highlighted levels of car dependency with rural households more likely to have two

or more cars, 34% compared to 25% of urban households and work journeys across

the TE region are dominated by cars, with 78% of commuter journeys carried out in

a private vehicle.

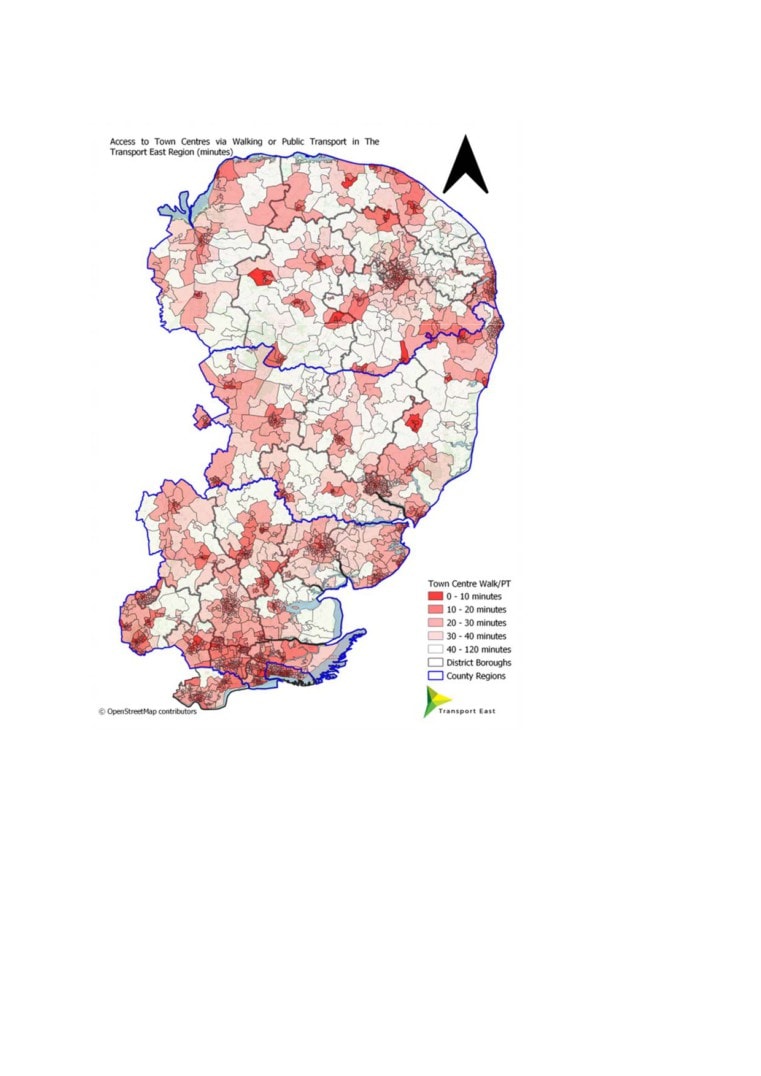

Accessibility mapping showing how just 48% of the TE rural population can access a

town centre within 30 minutes. 47% of the rural TE region are within 60 minutes’

walk/PT of a hospital and there is poorer accessibility to employment opportunities,

on average 48.5% of rural TE area is within a 15 minute walk or public transport

journey of employment compared to 52% of rural England but this falls to 36% of

rural Suffolk.

16

Other issues facing rural communities were raised including: digital connectivity,

ageing population, younger people, decline of rural centres, sparse population,

coastal population, social inequality and the visitor economy.

4.

Next Steps

4.1

To use this response to Initiate and plan the Transport East 2021/22 work programme on

Rural Mobility, identifying potential projects for DfT funding. Share best practice with the

STB Group with a working session on rural mobility strategies and solutions in the spring.

5.

Questions for Norfolk and Suffolk Transport Board Members to consider:

5.1

What activities are organisations already undertaking to support rural mobility? This could

include strategies, plans, and shared learning.

Do we have examples of successful projects targeted at improving rural mobility in the

region?

What are the opportunities to most effectively work collectively on rural mobility?

17

Appendix A

Title

DfT Future of Transport: rural strategy - call for evidence

Date:

16th February 2020

Report by:

Transport East (Sub-national Transport Body)

Contact:

Introduction

This is the joint submission from the seven English Sub-national Transport Bodies (STBs) in

response to the Department for Transport’s Future of Transport: rural strategy call for

evidence with an accompanying appendix setting out the key issues within the Transport

East region.

The role of STBs as set out in the enabling legislation1 is to develop a transport strategy that

meets the needs of persons living or working in, or visiting, the area having regard to social

and environmental impacts and facilitating sustainable economic growth. They bring a

strength of partnership among their membership to engage with government with one

voice.

STBs are working with their own partners, and with each other, to develop consistent, clear,

long term outcomes contained within agreed and evidence led transport strategies looking

out over a 20-30 year period. They therefore have a role in the development of the future

strategy for the rural areas they represent, as well as addressing common rural mobility

challenges across the STB regions, which has prompted this joint response to the call for

evidence.

In view of the timescales for making submissions this response has been prepared by senior

officials from the STBs.

Summary

The key points we wish to make in response to the call for evidence are as follows:

1. The traditional transport business case appraisal and delivery approach does not

provide optimal outcomes for rural residents. Rural areas are extremely diverse across

England, with challenges ranging across poor access to education and employment,

health inequalities, high per capita carbon emissions and social isolation. STBs propose

that a place-based approach should be adopted, based on understanding the specific

challenges within a local area, and identifying appraisal principles to establish what

1 The Local Transport Act 2008 (as amended)

1

19

Appendix A

‘good looks like’, before identifying and testing solutions to address them. Working with

DfT on the levelling up agenda so that decision makers and scheme promoters

understand how to present investment in a rural context.

2.

We also believe that a ‘customer’ focused user-centric approach is critical in

understanding the needs of residents and businesses and in achieving better outcomes

for our rural communities. Recognising that rural areas are both different from urban

ones and are not all rural localities are the same.

3.

As a result of high and often necessary car dependency, transport in rural areas is

generally more carbon intensive than in urban areas2, significantly impacting on our

goal for net zero emissions. Reducing emissions needs to be prioritised through the

development of integrated solutions for rural areas, but with due consideration for

other core outcomes including social inclusion and access to employment. This will be

from a range of solutions including rural hubs, digital connectivity and demand

responsive transport options.

4.

New ideas and technology to reduce the need to travel should be researched and

expanded preferably based on a collective approach. Better digital connectivity and

new innovations (for example rural hubs) have considerable potential to deliver place-

based outcomes and should be considered alongside any mobility solutions.

5.

The seven STBs fully support the development of a future of transport: rural strategy,

and can offer assistance to Government in the following ways:

Supporting delivery of an alternative place-based approach for developing and

appraising rural mobility solutions, starting with the collation of data and evidence

on the national/local challenges and issues, and using this evidence to agree the

strategic principles on which to base appraisal, and then identify location specific

place-based solutions rather than a prescribed approach. In planning for the future,

it is critical to understand the demographic, social, economic and technological

trends impacting on the needs of rural communities. STB’s can work with

Government on developing a programme of mobility options, which can be tailored

to meet local requirements and changing transport demands. For example, adapting

to increased levels of remote working and in some localities the potential for

combining flexible workspace with mobility services.

Helping to understand local needs in the context of national policy on rural

mobility. STBs operate at sub-national scale, developing their evidence base,

transport strategies and engagement within wider local partnerships, enabling us to

ask people, business and users what they want from rural mobility and what their

future needs are, whilst aligning with national government policy direction.

2 Midland Connect carbon baseline suggests that in the Midlands, rural areas account for 58% of the

population, but 75% of carbon from transport is emitted in those areas.

2

20

Appendix A

Prioritising investment to better support outcomes in rural areas. STBs focus on

place-based outcomes ensuring that we can develop solutions which recognise the

uniqueness of rural localities, whilst aligning to both local and national policy

outcomes. This allows our local partnerships to more effectively prioritise, manage

and deliver a portfolio of interventions that will work in their local ‘place’.

Promoting levelling up in rural areas. STBs’ place-based approach enables

investment to ‘level up’ areas - including within rural communities. By the end of

2021, each of the seven STBs in England will have a transport strategy/plan in place.

Developed using robust evidence bases, in partnership with planning authorities, and

through public consultation, these provide a focal point for prioritising infrastructure

investment across English regions. This approach ensures improvements to rural

mobility are coordinated and fully support the delivery of outcomes such as

“levelling up” areas.

Prioritising decarbonisation for rural mobility. The DfT goal to achieve net zero is

currently promoted by STBs through the development of carbon assessment tools,

identifying regional level decarbonisation pathways, and developing holistic

appraisal frameworks that assess carbon impacts. Recognising decarbonisation

solutions such as public transport or rollout of EV charging are often less

commercially viable in rural areas, STBs can work with Government in creating the

conditions that support transport innovations ensuring rural communities are not

left behind.

Bringing together local partners through thought leadership and collaboration on

innovative rural delivery - STBs act as a single voice, using the strength of their

partnership, and set a clear strategic direction for improved connectivity within their

regions. Through working together STBs can share case studies, projects,

prioritisation of projects that support a range of outcomes (e.g. levelling-up,

decarbonisation, accessibility and public health) - not just traditional transport

projects.

The following pages set out our detailed response to the questions set out in the Call for

Evidence:

Current trends facing the transport ecosystem in rural areas

Question: Do you have any evidence for the issues mentioned?

Dependence on the private car

Our evidence demonstrates significant reliance on the private car in rural areas across

England. Car and van accessibility data from the 2011 census showed on average across all

regions 28% of urban households did not have access to a car or van compared to 13% of

rural households. On average across all regions more urban households (43%) had access to

one car or van compared to 40% of rural households, however rural households had much

higher access to two or more cars and vans (47% of rural households compared to 29% of

urban households).

3

21

Appendix A

Transport for the North’s User Insight research34 shows that rural areas have a much higher

proportion of retired people (35%), compared with the overall sample across all areas in the

North (20%) and a lower proportion of people working full-time (27%, compared with 37%).

The proportion of participants with access to car as driver is much higher than average

(84%, compared with 72%). The level of dissatisfaction with current trips of Rural Residents

was higher than average, with main reasons for dissatisfaction being traffic congestion,

roadworks, poor road surfaces/potholes, and overcrowded carriages. Reported constraints

to travel were the unreliability of public transport, infrequency of public transport, and

public transport not being available in the evening/night.

2011 census travel to work data, showed on average across all regions 56% of travel to work

journeys are carried out by driving a car or van, increasing to 60% when London is not

included. Conversely, other modes for travel to work journeys are less popular, for example

10 % by walking, 7% by bus, minibus or coach, 5% as a passenger in a car or van and 3% by

bicycle. This presents an opportunity to consider how technology and innovation can reduce

emissions through the electrification of vehicles but to also explore how to increase

consumer access to other transport options, which could include demand responsive public

transport, new forms of micro mobility such as e-bikes or scooters and active travel for

more local trips.

Similar to car dependency, access to services in rural areas does have local variations and

these need to be understood when developing mobility solutions. The ONS Car or Van

availability data highlights varying levels of car dependency ranging from the regional to

local authority level, for example 22% of rural households in the North East do not have

access to a car or van compared to 10% in the West Midlands and Southeast. Even amongst

Local Authorities with the same rural classification, there are a different ranges of car

dependency for work journeys - e.g. North Norfolk 34% compared to 50% in Forest Heath.

Transport has traditionally been the “glue” which holds rural communities together and

needs to be seen in a wider context considering the needs of rural population and business

to ensure the solutions developed through this strategy understand the differences

between places so the most effective interventions can be deployed.

Access to key services, employment and social isolation

All seven STB Transport Strategies include policies and interventions to create an inclusive

transport network, which is accessible for all and part of a wider system of connectivity.

Within many rural communities, the connectivity options, both physical and digital,

available to residents and businesses are often limited, bringing with it implications that

extend beyond the transport sector.

3 TfN User Insight Phase 1, published July 2018

4 TfN User Insight Phase 2, published June 2019

4

22

Appendix A

Journey statistics data released by the Department for Transport shows that average

minimum journey times (for 8 different services5) by various transport modes can take over

three times longer in rural areas compared to urban. It takes over 3 times longer to access

employment centres with 100-499 jobs by taking public transport or walking, over twice as

long to cycle to employment centres over 500 jobs and twice as long to access further

education facilities by public transport or walking in rural localities than urban. The smallest

difference was between the time taken to make car journeys with these taking on average a

third longer in rural areas, evidencing the current reliance on the car to make journeys

within a reasonable travel time.

The Inequalities in Mobility and Access in the UK Transport System March 20196 Report

supports this, finding over half of the working-age population (57%) live in areas with low

public transport access to jobs, i.e. within reach of 45 minutes travel time and 66% (7.8

million) of elderly people cannot reach a hospital within 30 minutes by public transport. The

gap between accessibility for LSOA rural areas versus LSOA urban areas is clearly evidenced

for employment, education and health care. These access issues disproportionately impact

those without access to a car, severely impacting access to employment opportunities and

key services. Key differences for employment, education and health are set out as follows:

Employment: 19% of the LSOA urban areas have the highest accessibility to

employment opportunities compared to 4% of the LSOA rural areas. The highest

proportion (28%) of the rural LSOA have the lowest level of accessibility to

employment.

Education: Only 1% of the children in urban LSOAs are not within a 30 minute public

transport journey of one school compared to 28% of children in rural LSOAs. 90% of

children in urban LSOAs are within a 30 minute journey of two schools compared to

29% of children living in rural localities.

Health: 91% of rural LSOA are not within a 30 minute public transport journey to a

hospital compared to 55% of urban ones and less than 1% of rural LSOA have access

to two hospitals.

Accessibility by non-car modes is getting worse in many locations, as demonstrated through

local case studies. For example, accessibility indicators monitored for the Norfolk Local

Transport Plan show the % of the population in rural areas able to access a market town or

key employment destination by public transport has declined from 77% in 2010 to 64% in

2019.

As for car dependency, access to services in rural areas does have local variations and these

need to be understood when developing mobility solutions, for example, using another case

study, Journey statistics data released by the Department for Transport shows it takes on

average a 38 minute walk or public transport journey to the nearest town centre in North

Kesteven compared to 7 minutes in Uttlesford but both have the same rural classification.

5 Centres of employment, primary school, secondary school, further education, GP, hospital, food store and

town centre

6 Future of mobility: inequalities in mobility and access in the UK Transport System (publishing.service.gov.uk)

5

23

Appendix A

Question: Do you think there are other issues facing rural areas that we should consider in

the strategy?

Digital connectivity: working from home, online services and home deliveries have

increased significantly since the start of the COVID-19 pandemic, but the Government’s

National Infrastructure Strategy highlights the majority of commercially unviable giga bit

broadband is in rural locations. Digital connectivity and infrastructure are critical for

innovative services to be cost-efficient and successful.

Digital platforms may increase the reach of demand-responsive services (e.g. car/ride-

sharing or demand-responsive buses) and enhance the independent mobility of people in

rural locations. The uptake of digitally enabled transport services depends on the right

digital infrastructure being put in place with measures to encourage the use of digital

platforms, such as demonstrations or pilots, needing to be implemented alongside the

services. These types of projects will need initial financial support that local authorities may

not be able to offer to make the market work and services affordable in rural areas.

Ageing population: From 2016, over 80% of population growth to 2041 will be in the over-

65 age group, with the number of people over 85 almost doubling from 1.6 million to 3.2

million over the same period (Office for National Statistics, 2018a). In some areas, up to 40%

of the population will be over 65 by 2037 (Office for National Statistics, 2016), while people

aged over 65 will become the largest population segment in rural areas by 2040.

Older people today travel more than they did 20-25 years ago, with everyday trip rates

higher and activities outside the home being more common. Transport’s socially enabling

aspects are particularly important for older groups, and with a rural population ageing it is

important to consider older people’s mobility challenges and demands, which differ from

other stages of life.

Younger people: It is not just the low number of public transport routes served that affects

accessibility, it’s also the low frequency and timing of many services makes it less likely that

they meet young people’s requirements for independent mobility, limiting access to work,

education and leisure activities. Without access to a car or digital alternative, the lack of

regular, reliable and affordable public transport is a factor that can affect young people in

rural areas, worsening their job and education prospects meaning an out migration of young

skilled workers to urban locations with better access to employment opportunities and

services.

The Community Life Survey 2016-17 found the ‘loneliest’ age group were those aged 16-24

years. This finding was supported in ‘the loneliness experiment’ which was an online survey

of 55,000 people that found that 40% of 16-24 year olds reported often feeling lonely,

compared with 27% of over 75s. Highlighting the importance of young people in rural areas

having access to a range of services that provide social interactions.

Decline of rural centres: Limited public transport and declining local services are major

factors behind poor accessibility in rural areas and help to explain the car-dependent

behaviour often found. The revival of rural centres that serve local communities offers the

6

24

Appendix A

opportunity to concentrate demand for travel in ways that support connectivity to adjoining

urban areas or areas of economic opportunity.

The Midlands Connect Future of Rural Mobility study demonstrates the concept of ‘rural

hubs’ in more detail. It showed that integrating not just public transport but future mobility

solutions and a comprehensive network of pedestrian and cycling routes within rural

settlements would aid this hub concept. The potential long term changes to work patterns

could help reinvigorate rural centres with more people working from home rather than

travelling to urban areas, using local services improving their viability.

Sparse population: There are difficulties in integrating transport services, given the

dispersed nature of residents, and the low population density in rural areas makes it difficult

to operate profitable commercial local transport services. Demand is also low, due to the

tendency towards car use. As a result, subsidies are often needed to run public transport

services in rural areas. Maintaining subsidies becomes more challenging in times of

economic constraint (and reduced demand caused recently by social distancing). A variety

of different solutions needs to be considered alongside DRT, including lift shares, car shares

and other non-car based transport; e-bikes and rural hubs.

Social Inequality: The Government Office for Science The Future of Mobility report found

rural households on average have to spend 24% more of their income on transport costs

compared to urban households. The consequences of limited transport provision are felt

more severely by poorer households, as they have less financial capacity to adapt (i.e. to use

alternatives). The poorest people have a greater reliance on public transport, so reductions

in services have a greater impact on them with 20% of the most deprived communities

being in rural areas. The impact of car dependency in rural areas is significant, without

access to a car you are effectively excluded for access to economic and social opportunities,

whilst households without a car are relatively rare the effect this has is enormous.

The decline in rural bus service provision: The Campaign for Better Transport highlights the

decline that has occurred in rural bus service provision. Rural areas have significantly lower

rates of bus use compared with urban areas. However, buses remain an important part of

rural life. Over a quarter of all bus passenger journeys in England outside of London are in

predominantly rural areas or towns with rural hinterlands. There has been a spiral of decline

in rural public transport, which has been exacerbated by pressures on local government

finances in recent years resulting in reductions in support for bus services. Between 2011/12

and 2016/17, rural bus mileage fell by over six per cent. The forthcoming National bus

strategy will provide an opportunity to re-evaluate the role of buses in providing for the

mobility need of those in rural areas.

7

25

Appendix A

Developments in innovation for rural transport: Increasing use of active

travel modes, Micromobility, More effective integration of journeys, Digital

models for more flexible services, Data and digital improvements unlocking

market knowledge, New modes and Strong community links?

Question: Do you think there are other trends in innovation we haven’t included?

Quality rural data and evidence base: The STBs recommend using an evidence led approach

to understand different places have varying travel patterns and needs, ensuring solutions

are the right ones required at a local and regional level. These issues can be collated and

used to develop the strategy principles/approach, which lead to the most suitable place-

based solution. There is no one-size-fits-all approach to rural mobility; each place needs a

tailored approach to ensure its challenges are adequately addressed. This would facilitate

long term planning of the transport network that takes a collective approach considering

the needs of the user and the various modes available to find robust solutions.

Engaging hard to reach groups: When developing mobility solutions or new modes of

transport, engagement tends to reach existing users or more affluent parts of society. Those

who rely on public transport away from the larger urban areas often miss both the

opportunity to share their current and future needs and benefit from transport innovations.

To create a viable alternative to using a car we have to reach out to groups who may be

excluded - unemployed, those on lower incomes, need assistance to access a job, training

or education. When planning for rural mobility better data related to young people and

working age people without cars is important to be able to identify the most appropriate

travel option to meet their needs.

Mobility hubs: The establishment of ‘mobility hubs’ that serve local communities offers the

opportunity to offer ‘frictionless’ interchange between modes, primarily bus, rail and active

travel. In addition, mobility hubs provide an opportunity for integrated planning of modes,

integrating not just public transport but future mobility solutions and a comprehensive

network of pedestrian and cycling routes. These hubs will be different in rural areas

compared to urban acting more as service hubs that bring transport solutions together.

Mobility hubs are locations where demand for movement can be concentrated in a way that

supports local public transport services, primarily via bus-provision, ensuring greater

opportunity to run services where they otherwise may not have been viable. This type of

hub can also reduce the need to travel by bringing services into the community. Currently,

with a lack of bus services people have no alternative but to start their journey in a car

however through appropriate investment we should try to ensure they don’t need to also

finish their journey by car. Investing in this type of hub with a rapid transit system will get

people to their final destination efficiently and without causing congestion.

Whole journey approach: Decisions on rural mobility should be made that improve the

whole transport system and considering all modes of transport together will help to achieve

government goals and wider benefits. Alongside measures that maximise the use of

transport infrastructure managing demand is also important. The improvements in

supporting infrastructure such as digital are necessary for on-demand travel with real-time

8

26

Appendix A

information that could remove problems encountered when changing between modes, and

optimisation of the last mile. It may also create new opportunities in rural areas to run

services that are more commercially viable and deliver more affordable mobility to users.

Coordination of freight: The last mile of freight to its final destination (usually smaller

retailers or consumers) is labour intensive, accounting for 30-50% of supply chain costs, it

also generates the most CO2 per tonne moved. Last-mile delivery is becoming increasingly

important with consumers’ demands for faster, more frequent and more precisely timed

deliveries having environmental and economic consequences. In rural areas with smaller

and more frequent deliveries alternative business models such as freight sharing could be

trialled.

Our approach

Question: Do you think the Future of Transport: rural strategy should include the Urban

Strategy principles? Which additional principles would you like to see in the strategy?

The same principles can be applied to the Rural Mobility Strategy to an extent however as

outlined in the ‘developments in innovation’ section, a key principle for the Rural Mobility

Strategy should be to start with the creation of a high quality data and evidence base that

identifies the needs of a rural population, businesses and users to ensure the most effective

solutions are provided.

The principles and approach of the strategy need to be developed before the solutions and

be evidence led. In-depth engagement with a range of stakeholders is required to

understand rural travel patterns, users current and future needs and ensure hard to reach

groups are represented. This evidence is then used to reframe the rural mobility challenge

and a toolkit of the types of solution that are brought out of this covering: accessibility to

services and jobs, supporting skills and education, decarbonisation and digital connectivity.

The Urban Strategy refers to active travel remaining the best options for short journeys;

however, the rural strategy should acknowledge the rural residents make longer journeys

than urban residents and travel 118% more miles per person than someone living in

London.7 It will need to consider the challenges rural locations face in the first and last miles

of their journey and how improvements to cycle and walking routes will be required to

encourage active travel. The strategy should ensure improved accessibility by active travel is

considered for everyday activities such as journeys to work and key services, and not just for

leisure purposes.

The strategy should seek to understand the consequences of changes in connectivity. There

is evidence from Cornwall that improved digital connectivity has led to increased migration

to the area, subsequently creating housing affordability issues for local people. Similarly,

7 The Midlands Connect carbon baseline work suggests that 70% of car emissions made by urban dwellers are

from 1-5 miles (i.e. cycleable length); but this is only 19% in rural areas. 50% of car emissions made by rural

dwellers are from journeys over 10 miles.

9

27

Appendix A

automation of vehicles may lead to increased congestion and the need for reskilling the

workforce, and a reliance on digital connectivity may further isolate those who are digitally

excluded or who use journeys to their local centre for social interaction, unless mitigation is

put in place.

Encouraging transport innovation in rural areas: Testing and trialling

Question: Are there specific considerations for testing and trialling new technologies in

rural areas that you think we should consider?

The decline in the viability of traditional public transport solutions, combined with

continued challenges in accessing reliable digital connectivity, emphasises the need to

encourage new models of connectivity for rural communities and the businesses that

operate in them.

Digital coverage: Digital connectivity is a driver of social change and presents new

opportunities to integrate transport modes, however as evidenced in the National

Infrastructure Strategy, large areas of predominantly rural localities have a much higher

percentage of premises which are uncommercial for gigabit-capable roll-out. The Shared

Rural Network will also have to meet its target to deliver high-quality 4G mobile coverage

from at least one operator across 95% of the UK by 2025. Testing and trialling new

technology in rural areas will need to consider the outcomes using existing coverage and

what can be achieved as coverage improves.

Sparser densities: Rural areas have a lower population density compared to urban areas,

which means there is often a lack of critical mass for both population and businesses to

make testing new technologies viable for the private sector. Innovation should consider how

outcomes can be shared and boosted through collaboration with other projects and

services. The way schemes are currently assessed through traditional methods are often not

suitable for untried territories, excludes latent demand and disadvantages sparser

populations, a new minimum service standard model could be trialled for assessing the

impact of schemes in rural areas.

Non-transport related outcomes: When trialling and testing new innovation, we should

ensure it is designed to support other outcomes relating to health, education and social

exclusion, and ensure this is measured. As set out in the trends section, the population living

in rural areas are some of the most deprived, have to travel further to access services and

may struggle with exclusion. A number of STBs have identified that improving active travel

options in rural areas would contribute towards achieving these types of outcomes.

Increasing visibility: Rural users often have difficulties in seeing the transport services on

offer, with low exposure outside of core passenger groups. It can be difficult for people to

know what journeys are being run and how these join up to destinations. Making

information on these services easy to view and better online booking and payment needs to

be considered when trying to attract new passengers. Visibility needs to improve across all

transport modes with a comprehensive programme of awareness raising and behaviour

10

28

Appendix A

change covering all forms of transport including more informal and community focussed

solutions.

Roles for government, sub-national bodies and local authorities

Question: In your view, what should the role of the below be in encouraging innovation in

rural areas?

Central Government: Outline a clear long-term national vision and goals that are mindful of

diverse local priorities, clear and consistent messaging, taking a whole system approach to

transport, funding aligns with strategy outcomes, be clear on roles and responsibilities.

Sub-national Transport Bodies: STBs provide a Single voice and evidence base for their

regions, taking a place-based tailored approach to local and regional transport planning.

They link strategy to funding, drive knowledge sharing (e.g. by coordinating regional case

studies) and join up opportunities to replicate projects. The partnerships enable

collaborative approach, promoting public and private sector interventions, and prioritisation

of projects that support a range of outcomes.

Local Authorities: Community engagement, local planning, responsibility for delivery of

transport (important to differentiate between Local Authorities and Local Transport

Authorities in 2-tier areas - different roles and remits), detailed knowledge of place, monitor

local indicators, plan and promote active travel options.

Question: Do you think government can encourage the private sector to develop

innovative new transport services in rural areas?

The National Infrastructure Strategy states that where it is less certain what technology will

provide the most effective route to decarbonisation or where it is unclear how the

technology can be scaled commercially, the government will fund R&D programmes to

support innovation, given the challenges of rural areas a fund set up for rural mobility would

support the private sector and enable new innovations to be trialled.

Government plays a role in spurring innovation and can support technology development in

areas where barriers inhibit private sector investment in innovation, or there is a wider

social benefit from directing innovation (which is a key priority of the Governments

Industrial Strategy). There are already examples of Government facilitating innovation

through grants supporting infrastructure for hydrogen fuelling and electric charging points

and funding for electric buses, electric scooters and subsidies for electric cars, but these

projects are often focussed on urban areas with dense populations and are not meeting the

challenges found in rural areas. Through place-based solutions the public sector can

promote opportunities to the private sector and utilise the regional role of STBs to bring

projects together at a scale that makes them commercially viable.

The share of data collected, analysed and managed by the private sector is growing and its

value is increasing. Having access to this data is of importance to local, regional and central

government and other companies, who could use it to plan, operate, better integrate and

provide services.

11

29

Appendix A

Question: How do you think government should encourage the private sector?

The STBs would propose that options include:

Implement a set of rural mobility demonstration/pilot projects where learning can

be shared across regions and where appropriate replicated in other areas. Support

this innovation with a long-term funding plan as rural services take longer to become

commercially viable.

Find and promote synergies with urban areas to expand innovation into rural areas.

Supporting rural innovation clusters where networks of skills, learning and resource

can be shared.

Provide a clear pathway for example on alternative fuels and electric vehicles to give

confidence to the private sector to invest.

Capture the value of investment that generates non-transport related outcomes, for

example linking to elderly care or providing real time information to users or

attracting new businesses to rural hubs. Creating additional incentives to invest in

infrastructure as a means of delivery for new innovative services.

Question: Do you have any other comments on this call for evidence?

No further comments.

12

30

Appendix A

Transport East (TE) Appendix

This appendix complements the national response by providing a focus on the key issues

within the Transport East region. It sets out our top five headlines, and then provides more

details in response to the DfT’s questions.

Transport East - Key Points:

1.This region has a higher than average car dependency with only 13% of households not

having access to a car/van compared to 26% of England. The trend for higher car

dependency increases in rural areas with twice as many households having access to a car

compared to urban areas. Work journeys are also dominated by the car with 78% of

commuter journeys carried out in a private vehicle.

2. Only 10 of the 109 larger rural communities in the TE region have access to ultrafast

broadband, with all but two of the remainder having a superfast option and coverage low

spots are more prevalent in more sparsely populated rural communities. Those

communities that have less than ultrafast broadband could come across limitations to

utilising digital services, for example on average only 38% of the TE residents are able to

work from home.

3. The proportion of the TE population over 65 at 2019 was 20%, higher than the national

average of 18%, Norfolk has a figure of 24.5%. This older population is also anticipated to

grow at a faster rate than the rest of England, on average across the TE region 26% of the

population will be over 65 by 2045 compared to 24.2% England but these figures are higher

in Norfolk (30.5%) and Suffolk (31.2%).

4. The region has below average levels of accessibility to key services and employment

compared to England. Mapping shows how just:

48% of the TE rural population can access a town centre within 30 minutes, this

figure is 36% in Norfolk

47% of the rural TE region are within 60 minutes’ walk/PT of a hospital, 35% for

rural Norfolk compared to rural England 57% and 94% urban England.

48.5% of rural TE area is within a 15 minute walk or public transport journey of

employment compared to 52% of rural England, this figure is 36% in rural Suffolk.

5. The visitor economy of the East of England (includes areas outside the Transport East

region)8 is valued at more than £10bn a year making it the largest industry sector and the

largest employer with 240,000 people employed. The Visit East of England Tourism Business

Survey (June 2020) found 81% of respondents had to temporarily close their business, 46%

had to furlough staff and over half experienced widespread booking cancellations. With a

more positive outlook in 2021 for “staycations” supporting this sector is vital to further

support the resident's businesses and jobs, and to further invest in appropriate transport

infrastructure to facilitate growth.

13

31

Appendix A

The Transport East response to the DfT questions are set out in more detail as follows:

Current trends facing the transport ecosystem in rural areas

Dependence on the private car

2011 Census data shows across the TE region only 13% of households do not have access to

a car, compared to 26% across the whole of England. The majority of households (44%) have

access to 1 car/van and a further 27% have access to 2 cars/van.

The trend for higher car dependency increases in rural areas compared to urban, as 23% of

urban households do not have access to a car/van compared to 12% rural areas. Although a

higher number of households in urban areas (45%) have access to one car/van compared to

rural areas (40%), rural households are more likely to have two or more cars (34% compared

to 25% in urban households), twice as many rural households have three cars/van and four

times as many rural households have four cars/vans or more.

Work journeys across the TE region are dominated by cars, with 78% of commuter journeys

carried out in a private vehicle. The region has a lower than average journey to work bus

mode share (4% compared to an average of 7% for England) and only 2.5% of the workplace

population commute by rail.

By transportation mode, road transport is the largest contributor to emissions, accounting

for 96% of the total transport carbon emission in Essex, Norfolk, Suffolk, Thurrock &

Southend.

There is a need to recognise the differences between places within the TE region and a one

size fits all approach to rural mobility will not lead to the most effective solutions being

implemented. For example, access to one car/van varies from 37% in Essex and 43% in

Norfolk and Local Authorities with the same ‘Mainly Rural’ classification have varying

reliance on the car for their journey to work - 2011 Census method of travel to work data

shows North Norfolk 34% compared to 50% in Forest Heath. Where a solution has been

successful is it important to identify if there are locations with similar characteristics where

it could also be deployed and given the rural and sparse nature of the region solutions may

also need to work across political boundaries.

14

32

Appendix A

Access to key services, employment and social isolation