New Anglia Local Enterprise Partnership Board Meeting

Wednesday 21st October 2020

10.00 - 12.30pm

Via MS Teams

Agenda

No.

Item

1.

Welcome from the Chair

2.

Presentation from Paul Forecast, Regional Director, National Trust

3.

Apologies

4.

Declarations of Interest

5.

Actions / Minutes from the last meeting

Forward Looking

6.

Skills Advisory Panel Progress Update

Update

7.

All Energy Industry Council Progress Update

Update

BREAK - 15 Mins

Governance

8.

Business Resilience & Recovery Scheme Progress Update

Update

9.

Chief Executive’s Report

Update

10.

October Performance Reports

Update

11.

Quarterly Management Accounts with confidential appendices

Update

12.

Board Forward Plan

Update

13.

Any Other Business

1

New Anglia Board Meeting Minutes (Unconfirmed)

23rd September 2020

Present:

Sam Chapman-Allen (SC)

Breckland Council

David Ellesmere (DE)

Ipswich Borough Council

Doug Field (DF)

East of England Coop

C-J Green (CJG)

Brave Goose

John Griffiths (JG)

West Suffolk Council

Matthew Hicks (MH)

Suffolk County Council

Pete Joyner (PJ)

Shorthose Russell

Dominic Keen (DK)

Britbots

Helen Langton (HL)

University of Suffolk

Steve Oliver (SO)

MLM Group

Corrienne Peasgood (CP)

Norwich City College

Andrew Proctor (AP)

Norfolk County Council

Johnathan Reynolds (JR)

Opergy

Sandy Ruddock (SR)

Scarlett & Mustard

Alan Waters (AW)

Norwich City Council

Jeanette Wheeler (JW)

Birketts

Tim Whitley (TW)

BT

Attendees

Kathy Atkinson (KA)

Kettle Foods

Mark Ash (MA)

Suffolk County Council

Vince Muspratt (VM)

Norfolk County Council

Julian Munson (JM)

New Anglia LEP - For Item 5

Chris Dashper (CD)

New Anglia LEP - For Item 9

Chris Starkie (CS)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

1

Actions from the meeting: (26.08.20)

Chief Executive’s Report

BR&R data to be circulated to board members

CS

New Anglia Capital

Board members to consider putting themselves forward to join the NAC board

All

September Performance Reports

Carry out analysis on the impact of EZ planning regulation changes

JM

AOB

Suggestion for presenters to be supplied to HW who will organise a programme

All/HW

1

Welcome from the Chair

Doug Field (DF) welcomed everyone to the meeting. He noted that latest Government

announcements regarding the changes in restrictions to tackle the recent surge in Covid-9 cases and

reiterated the need for the LEP to provide strong leadership at the challenging time for the local

economy.

2

Apologies

Apologies were received from Claire Cullens

3

Declarations of Interest

DF declared an interest in Supapass, under Item 9, the New Anglia Capital Bi-Annual Report.

Helen Langton (HL), Corrienne Peasgood (CP) and Jeanette Wheeler (JW) declared an interest in

item 6 - the Institute of Technology.

John Griffiths (JG), Matthew Hicks (MH) and David Ellesmere (DE) expressed an interest in Item 7 -

Suffolk Inclusive Growth Investment Fund

Full declarations of interest can be found at http://www.newanglia.co.uk/about-us/the-board.

4

Minutes of the last meeting

The minutes were accepted as a true record of the meeting held on 21st July 2020

Chris Starkie (CS) confirmed that both outstanding actions were on schedule for

completion by their target date of November 2020.

5

Innovation Board Update

Julian Munson (JM) presented the board with an update on the work of the Innovation

Board and highlighted the successes achieved in cross-sector innovation across the

region.

JM confirmed that Norfolk County Council was already represented on the Board and that

a letter would be going to Suffolk County Council asking for a representative so that both

local authorities were represented.

JM noted the hard work of his team and advised that, going forwards, they would also be

investigating the opportunities to work more closely with the Skills Advisory Panel (SAP).

Johnathan Reynolds (JR), Chair of the Innovation Board, highlighted the progress

achieved and the important role of local authorities in innovation advising that the board

was keen to continue to work closely with the public sector.

He also noted the benefit of inviting representatives from other bodies, such as the LEP’s

industry councils, to speak at the meetings as this helped to provide a clear understanding

of their requirements.

JR expressed his thanks to JM and his team for their support.

HL queried whether the Innovation Board would be involved in the applications to host an

Institute of Technology (IoT).

2

JR advised that there was not enough clarity on IoTs at the current time but agreed that

the Board would be working closely educational establishments as the requirements are

ascertained.

The Board agreed:

• To note the content of the report

6

Institute of Technology

HL, JW and CP declared an interest in this item. It was agreed that they would remain for

the discussion but would not participate in the discussion or in the vote.

CS presented the meeting with an update on the process for applying for an IoT and the

local framework which has been drawn up to assist applicants. He advised that LEPs

would be involved in the process but would not have a key decision making role.

CS reviewed the background to the IoTs which aim to bring together business and

technology and noted that the submission of an Expression of Interest earlier in the year

was optional and does not exclude any new applicants submitting to stage one which

formally starts in the Autumn.

The framework is intended to help applicants ensure that their proposals are developed in

line with priorities for the local economy set out in the Economic Strategy, Local Industrial

Strategy and the new Economic Recovery Restart Plan. Expectations and are centred

around 4 key themes - additionality, strategic fit, leverage and deliverability.

The meeting discussed the lessons learnt from the previous application process.

The Board agreed:

• To note the content of the report

• To endorse the proposed process and local framework which will be used to set out

regional expectations for Institute of Technology proposals covering Norfolk and

Suffolk.

7.

Suffolk Inclusive Growth Investment Fund

JG, MH and DE declared an interest in this item. It was agreed that they would remain for

the discussion but would not participate in the discussion or the vote.

CS reviewed some of the projects included in the Norfolk Strategic Fund which has

previously been awarded £1m of LEP capital funds. He then presented the

the request for £1m of LEP capital funds to the Suffolk Inclusive Growth Investment Fund to

support economic recovery. The Board also received details of the proposed principles for

the process of allocation of the funds and the role of the LEP.

The contribution will be part of a one-year fund that will be open to public sector partners

including the LEP for applications.

The Board agreed:

• To note the content of the report

• To approve the allocation of £1m capital from the LEP to Suffolk Inclusive Growth

Investment Fund and the proposed process for the management and allocation of the

funds as set out in the report

8.

Chief Executive’s Report

CS presented the report and highlighted key items.

He noted the success of the Business Resilience and Recovery scheme and advised that

a paper providing further information on recipients of the funding would be presented at the

October board meeting.

CS stated that round 500 companies had now signed up for the Restart Festival and

encouraged board members to promote the festival.

3

CS highlighted the launch of the Tech 100, a virtual event where presentations were

provided by Stephen Fry and Tim Whitley (TW) who confirmed the success of the occasion

which promoted the top 100 innovative and high-potential digital tech companies from the

region.

Peer to Peer Network - CS advised that the first cohort of businesses was being recruited

and they would ensure that the care sector was included in the allocations of spaces for

businesses

Banham Poultry Covid-19 outbreak - CS confirmed that the LEP has worked closely with

the company and other businesses in the poultry industry to provide support during the

outbreak and to ensure lessons learnt are carried forward.

JG asked for details ofgrant recipients to be circulated.

CS confirmed that the appraisal process for the Visitor Economy Grants (VEGs) and Wider

Economy Grants (WEGs) was still ongoing but details of the Business Resilience and

Recovery (BRR) funding would be provided.

ACTION:

BRR data to be circulated to board members

CS

CS noted the successful work across the Economic Development Officers across the

region in promoting the scheme.

The Board agreed:

• To note the content of the report

9

New Anglia Capital Bi-Annual Report - Confidential

The New Anglia Capital Board has requested another member to enhance capacity.

Volunteers were requested from the Board.

ACTION: Board members to consider putting themselves forward to join the NAC board

All

The Board agreed:

• To note the content of the report

10

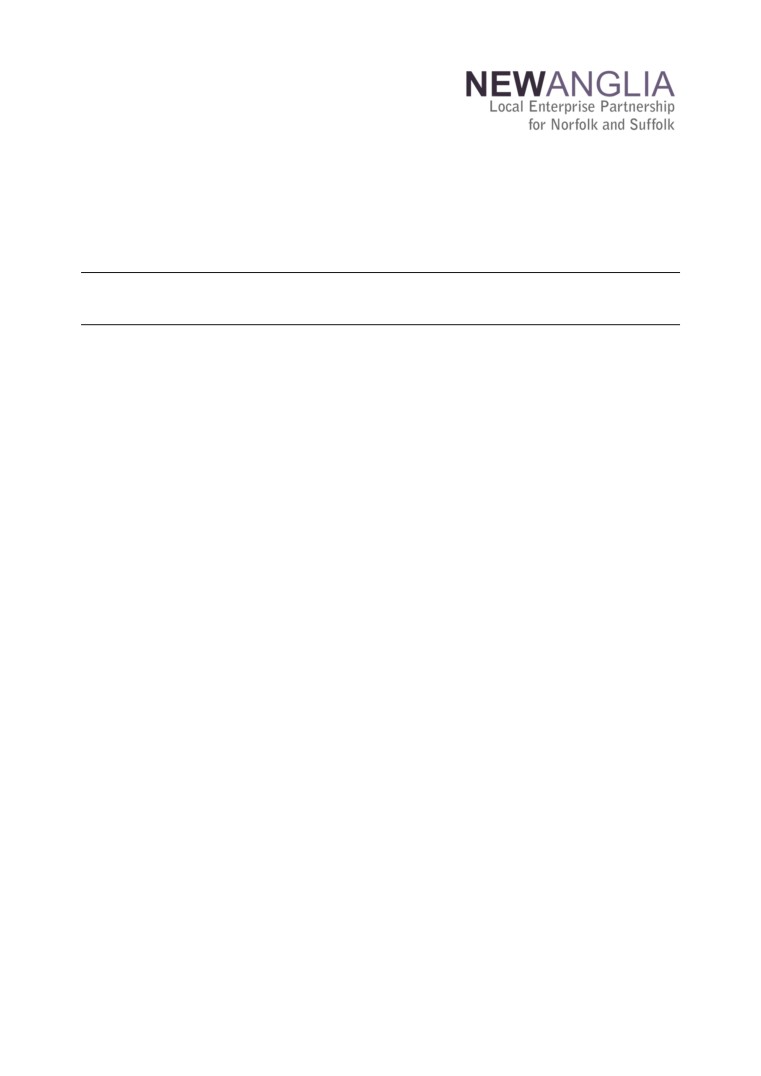

September Performance Reports

Rosanne Wijnberg (RW) presented the reports to the Board and highlighted key items.

Growth Deal - The dashboard covers Q1 April to June demonstrating how the pandemic

impacted on delivery and finances. It is anticipated that the projects will slow down but

outputs will still be achieved.

Enterprise Advisor Network - the report details that 2 targets were missed which relate to

direct contact with employers. The EAN team have used innovative approaches to

supporting students and their best practice is being considered for further roll out.

Enterprise Zones (EZs) - JR asked the recent changes to planning regulations would

impact on the EZs or provide more opportunities.

RW confirmed that this would be investigated further on a site by site basis

4

ACTION: Carry out analysis on the impact of EZ planning regulation changes

JM

The Board agreed:

• To note the content of the reports

• To approve the Growth Deal Dashboard

11

Board Forward Plan

JW noted that the Board had previously met in different locations allowing projects and

partners to present to them and asked if a programme of presentations could be included

in future virtual meetings. The Board agreed with the suggestion.

ACTION: Suggestion for presenters to be supplied Helen Wilton (HW) who will organise a

All

programme

The Board agreed:

• To note the content of the plan

12

Any Other Business

CS confirmed that the LEP response to the Comprehensive Spending Review had been issued

for comments by the board with the board papers and as all were content would now be signed

off by DF and submitted.

At his final meeting as LEP Chair DF expressed his thanks to the board members for their

support during his term as chair and wished C-J Green (CJG) success as she took over the

role.

CS and the board thanked DF for his hard work and commitment to the region during his time

both as a board member and as its chair.

CJG proposed a vote of thanks to DF on behalf of the board and personally thanked him for the

assistance he had provided to her as incoming chair.

Her comments were strongly supported by the board members who added their thanks.

DF was also presented with a card and gift vouchers and a photo book highlighting key events

during his time as chair.

5

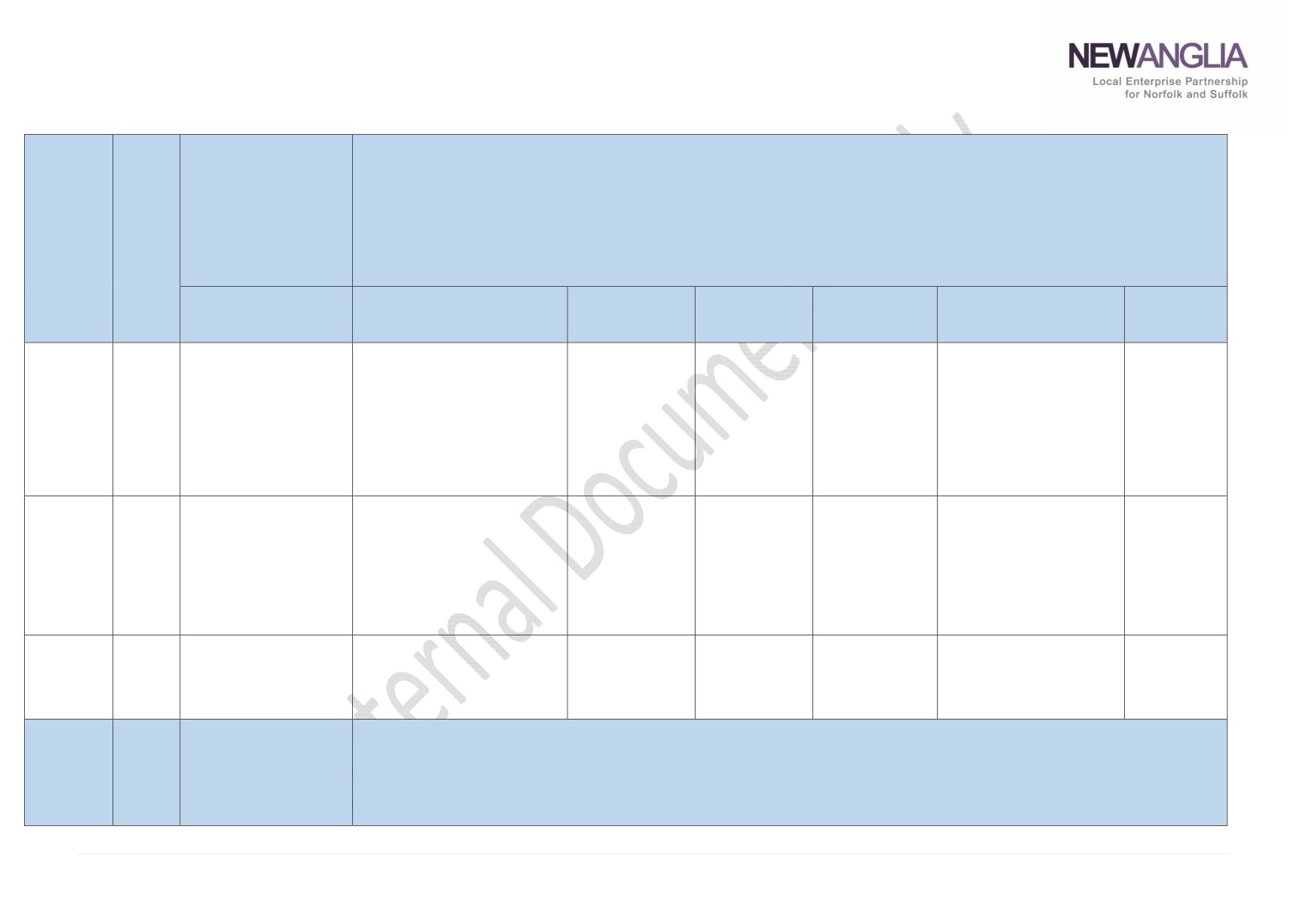

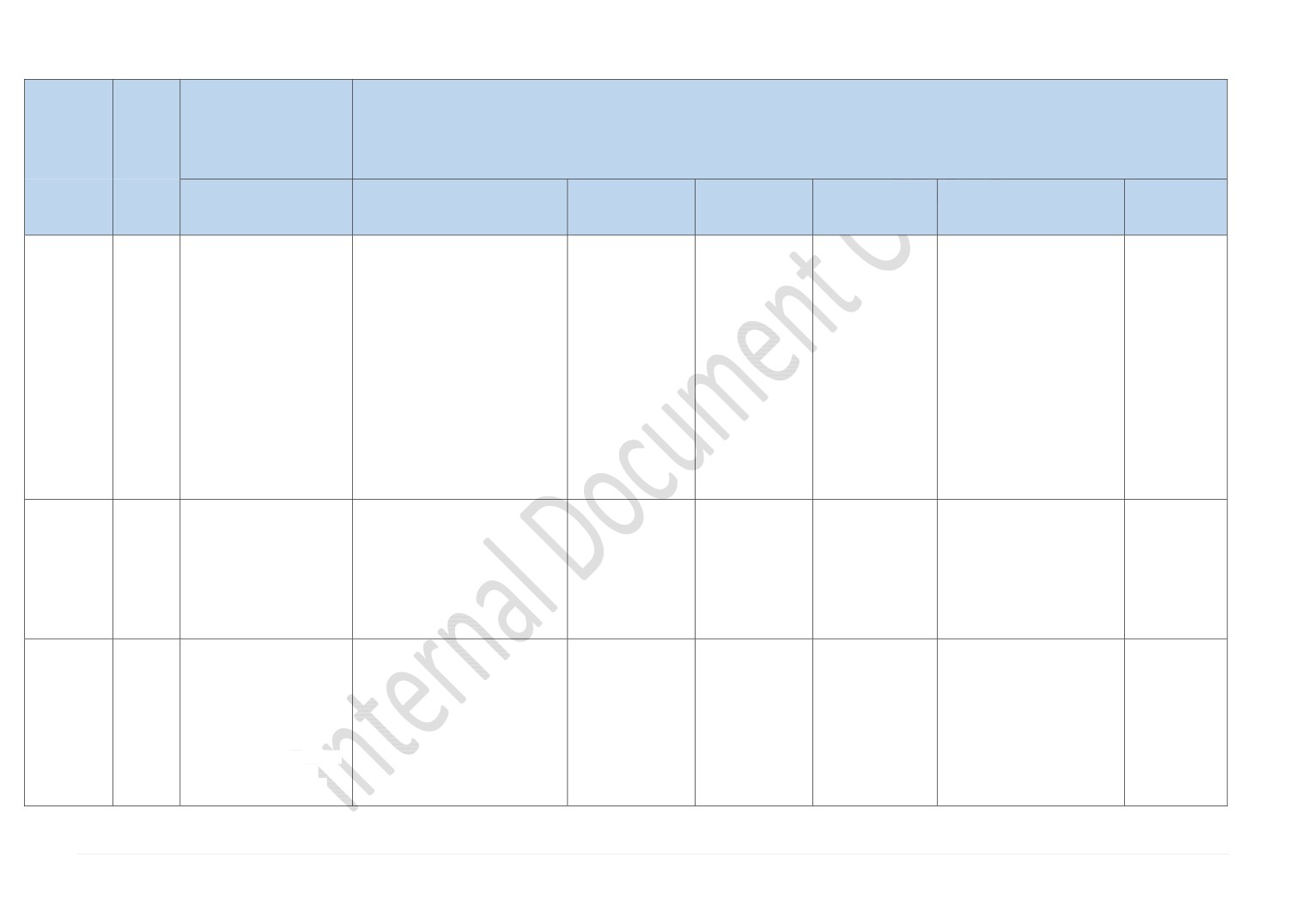

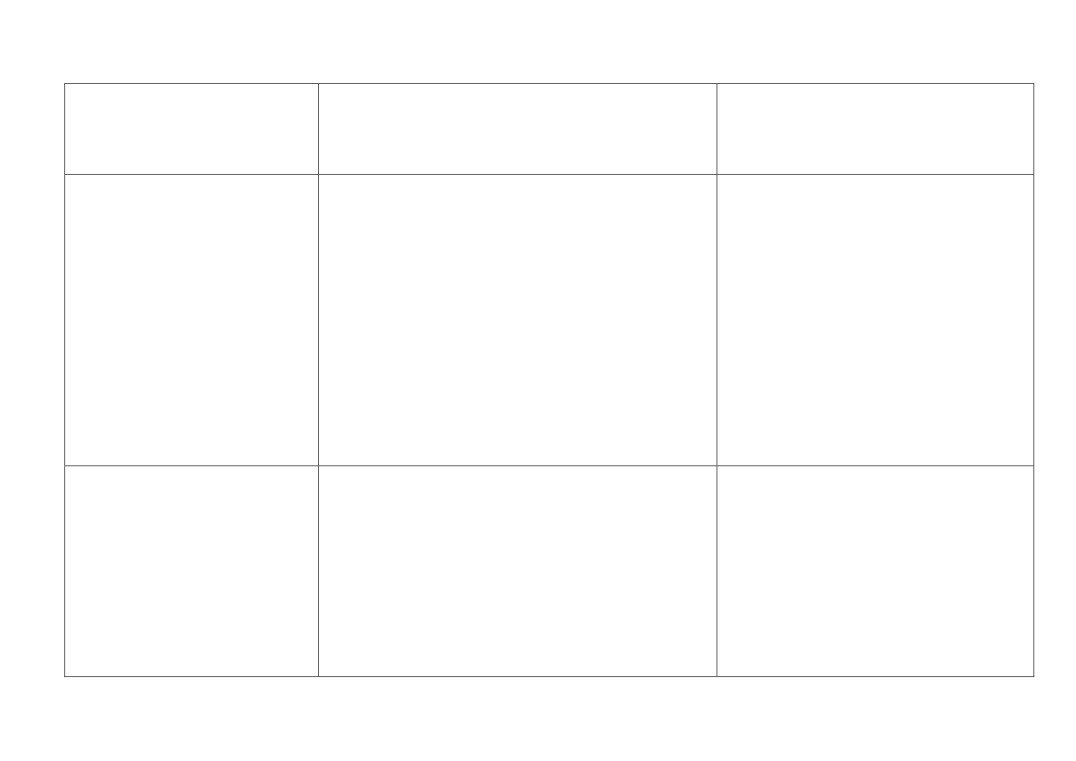

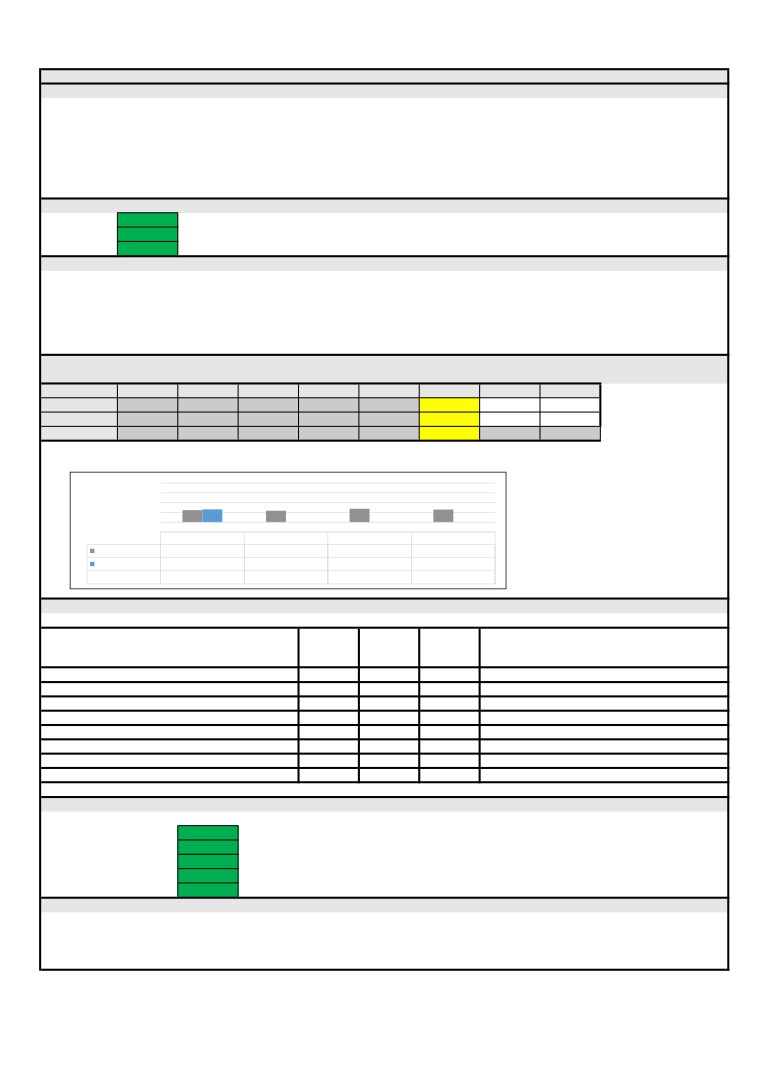

Actions from New Anglia LEP Board Meetings

Date

Item

Action

Update

Actioned

Target Date

By

23/09/2020

Chief Executive’s Report

BR&R data to be circulated to board members

Circulated 1st October

CS

Complete

23/09/2020

New Anglia Capital

Board members to consider putting themselves forward to join the NAC board

All

Nov-20

23/09/2020

September Programme

Carry out analysis on the impact of EZ planning regulation changes

JM

Nov-20

Perforamance Reports

23/09/2020

AOB

Suggestion for presenters to be supplied to HW who will organise an ongoing programme

Regional director of the National Trust will address the October Board

All / HW

Nov-20

meeting. Further presenters will be arranged.

26/02/2020

Clean Growth Taskforce

Board members to consider a pledge which the Board could make and submit suggestions to

All

Nov-20

the Chair.

23/05/2019

Growth Hub Presentation

Growth Hub Annual review to be circulated to the Board when published

The reviwe will now be published in Autumn 2020 to include the period

CD

Nov-20

since March.

9

New Anglia Local Enterprise Partnership Board

Wednesday 21st October 2020

Agenda Item 6

Skills Advisory Panel Progress Update

Author: Claire Cullens and Natasha Waller. Presenter: Claire Cullens

Summary

This paper provides a high-level summary of the current priorities of the Skills Advisory Panel

(SAP), its activity over the last year, and sets out the direction of travel for the coming year.

Recommendations

To continue to endorse the vision of the Skills Advisory Panel and its current direction of

travel.

To continue to champion the ‘key messages’ of the Skills Advisory Panel.

To support the wider work in response to Covid-19 supporting People such as that of

the Workforce Workstream.

Background

At the LEP Board on July 2019 Paul Winter, Chair of the LEP Skills Board updated the LEP

Board on progress of the LEP Skills Board and sought agreement to change to a Skills

Advisory Panel in response to a request by the Department for Education.

Paul stood down in the autumn of 2019 and Claire Cullens was appointed as the new Chair, to

lead the re-launched Skills Advisory Panel. On conferring with the Panel about their aspirations,

it was clear they wanted to see tangible outcomes from their involvement whilst still capturing

the essence of the existing objectives.

The vision of the Skills Advisory Panel is ‘to support the growth of an inclusive economy with a

highly skilled workforce where skills and employment provision meets business need and the

aspirations of individuals.’

It is made up of private sector members covering our key sectors, post 16 providers,

Department of Work and Pensions, Chambers of Commerce, Education and Skills Funding

Agency and councillors & officers from Norfolk and Suffolk County Councils.

The Panel meets 6 times a year and each member is asked to be proactive in identifying how

and where they can contribute to and collaborate in any key interventions between meetings.

Key areas of work

o The Skills Advisory Panel has four objectives:

o Driving skills progression for the workforce - encouraging lifelong professional

development, upskilling and reskilling which will future-proof New Anglia business, boost

productivity and improve the quality of our products, services and supply chains.

1

11

o Providing agile and responsive training provision for key sectors - working in

partnership with businesses, developing innovative training courses, able to meet the

emerging needs of the New Anglia economy

o Equipping young people for success - unlocking the abilities, confidence and

potential of young people, equipping this future generation with the technical skills,

digital, entrepreneurship and problem-solving capabilities for further and higher

education and ultimately employment in our evolving technical sectors

o Tackling barriers to employment - Developing stepping stone opportunities for

vulnerable and disadvantaged groups to develop the skills required to enter, re-enter or

transfer employment to benefit from productive careers in our technical sectors.

Following a consultation exercise, Panel members agreed a framework for action with a SAP

private sector member acting as Champion for each objective group, an education link and a

LEP/county council officer acting as a facilitator. Panel members were aligned to each group to

develop two projects based around a framework agreed by all members. These projects need

to deliver initial outputs by the end of 2020.

The basis of these projects are laid out in the PowerPoint presentation in appendix 1 (slides 5 -

8). You will also see a flavour of the skills interventions taking place in the region that the SAP

members have a role in driving or supporting (slide 4). We are encouraging engagement with

existing interventions but with clear understanding of where the SAP is adding value. Having a

targeted approach means that we can have some tangible outcomes from our work. Scattering

ourselves thinly over a wide number of projects was not the approach that members were

wanting to adopt at this stage.

These objectives cannot be looked at as discrete entities, so we are asking some members to

spend time with another group from time to time plus invite non-SAP members to objective

meetings where appropriate.

The outputs from this work will be showcased in the Local Skills Report that we need to

produce by the end of March 2021. This is a requirement of our funding from the Department

for Education. Our report and those of other LEPs will be a key source of local skills information

that enable cross-area comparison and feed local intelligence to the soon to be formed national

Skills and Productivity Board (SPB) and central government. The Skills and Productivity Board

will be an expert committee established by the Department for Education (DfE) to provide the

Government with independent advice and analysis on skills mismatches and to help ensure that

the skills system is aligned to employers’ future needs.

Our Local Skills Report will help to grow the influence of the SAP by:

- acting as an engagement tool

- being a 'go-to' document for everything local-skills related

- clearly setting out key skills needs

- offering valuable insight and evaluation

Response to Covid-19

In addition to the new framework and objectives, in recent months, the SAP has been asked to

oversee the work of the Workforce Workstream which was established by the LEP and partners

across Norfolk and Suffolk in response to the Covid-19 pandemic.

This group includes a number of members of the SAP, colleagues of SAP members and wider

partners such as district councils and the National Careers Service.

It provided input into the Norfollk and Suffolk Economic Recovery Restart Plan which was

signed off by the LEP and published in July.

To turn that plan into action it has now developed the People component of the Economic

Recovery Restart Delivery Plan. This has been endorsed by SAP members and mapped

against our 4 objectives and accompanies this report as Appendix 2.

2

12

Other notable work includes the New Anglia Skills Deals Programme - over the past 12 months

initiated and overseen by the Skills Board and now the Skills Advisory Panel, these have

continued to enhance the local training offer through the development and delivery of new

employer-led provision. Highlights have included the successful delivery of new Gas

Assessment qualifications at Suffolk New College, the further development of the Milburn

Campus construction site at West Suffolk College and the extension of the Offshore Wind Skills

Deal project at East Coast College. This means that the Skills Deals Programme has now

benefitted over 1000 learners and created 38 new courses.

European Social Fund investment since 2015 in Norfolk and Suffolk amounts to £33.4m in

completed and contracted projects to date. There is more committed and we have been

successful in securing further funds through the National Reserves. We work closely with the

programmes to ensure they deliver on our ambitions and achieve the designated outputs. New

projects currently being established include those delivering on our Youth Pledge - “Every

young person in Norfolk and Suffolk will have the support they need to get into education,

employment, training or an apprenticeship.”

The LEP Board are also reminded of skills papers that have been presented in recent months

on apprenticeship levy sharing, the Institute of Technology and the challenges around

employment. Our work as a collective panel and that of the LEP & County Council skills officers

is strategic for the mid to long term but will also be responsive to changes in economic climates

and educational policy change.

Link to the Economic Strategy

Inclusion and Skills is a clear theme in the Economic Strategy and lays out 10 high level action

points to move the agenda forward, particularly within our key sectors.

Our work helps to close the skills and labour gaps plus continues to build skills across the

strategic opportunity areas as set out in the Local Industrial Strategy.

Recommendations

To continue to endorse the vision of the Skills Advisory Panel and its current direction of

travel.

To continue to champion the ‘key messages’ of the Skills Advisory Panel.

To support the wider work in response to Covid-19 supporting People such as that of

the Workforce Workstream.

Appendix:

1 - A New Anglia LEP Skills Advisory Panel vision and delivery steps PowerPoint presentation.

2 - Economic Recovery Restart Delivery Plan - People

3

13

@NewAngliaLEP

Appendix 1

New Anglia Skills Advisory Panel

Vision and Delivery Steps

15

@NewAngliaLEP

Vision Statement

To support the growth of an inclusive economy with a highly skilled workforce where skills and employment

provision meets business need and the aspirations of individuals.

Role and Operating Principles of the Skills Advisory Panel (SAP):

The New Anglia Skills Advisory Panel provides the strategic leadership for this vision. Each member should

be proactive in identifying where they can contribute to and operate in line with agreed membership

expectations.

develops and supports key skills and employment interventions with clear focus areas

to ensure post-16 educational outcomes meet business needs in the New Anglia LEP

region

provides a strategic steer for the LEP Board on the employment and skills agenda

lobbies to achieve required freedoms, flexibilities and resources and raise the profile

of the New Anglia LEP region

collaborates proactively to identify barriers and opportunities in delivering these key

interventions

galvanises the wider employer base to be involved in skills development

provides analytical evidence and subsequent coordination across the skills system in

line with key strategies such as the Economic Strategy for Norfolk and Suffolk & Local

Industrial Strategy

16

@NewAngliaLEP

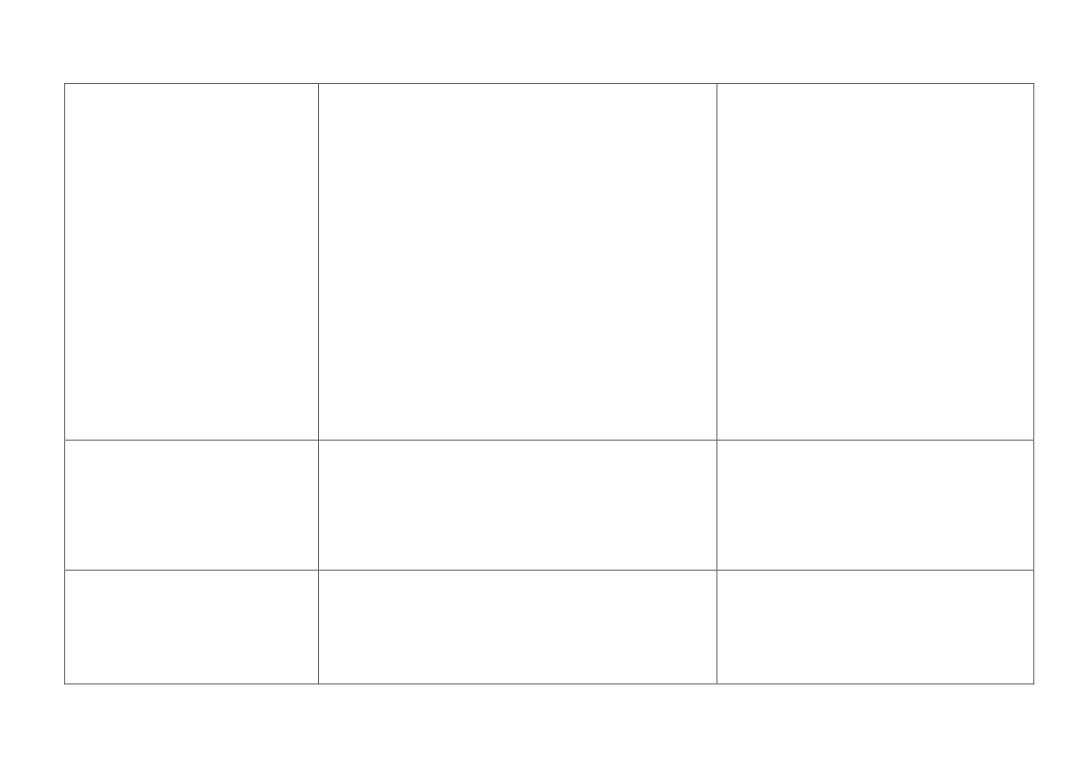

Skills Advisory Panel Strategic Objectives

Providing

Driving

Agile &

Equipping

Skills

Tackling

Responsive

Young

Progression

barriers to

training

People for

for the

employment

provision for

success

workforce

key sectors

Metrics (RAG)

Economic Strategy Delivery Plans

Our Offer to the World

Growth and Productivity

Inclusion and Skills

Collaboration

Cluster Plans

17

@NewAngliaLEP

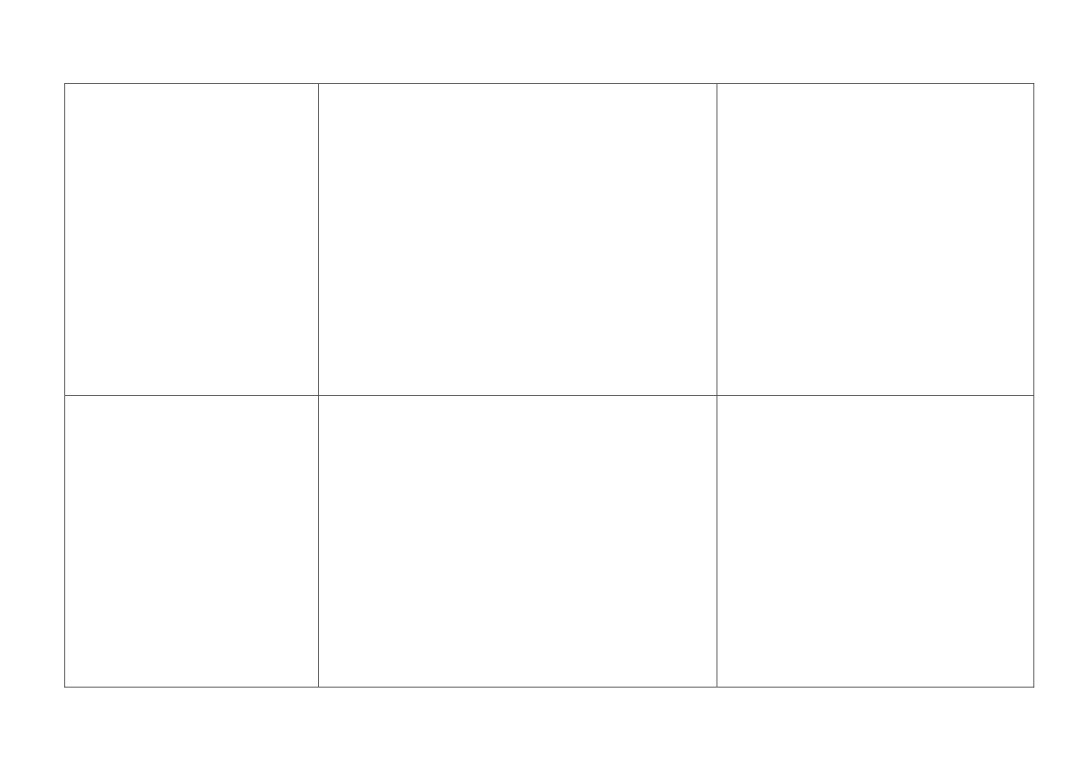

Current and Ongoing Activity

Equipping Young People

Providing Agile and

Driving Skills Progression

Tackling Barriers to

for Success

Responsive Training

for the Workforce

Employment

Provision for Key Sectors

•

New Anglia Youth Pledge

•

Digital/ICT provision/new

•

Skills Support for the

•

Job Support Programme

•

Enterprise Advisor

builds.

Workforce

including triage referrals

Network

•

Skills Support for the

•

Apprenticeship levy

•

DWP Flexible Support

•

Apprenticeship focussed

Workforce

transfer

fund, Youth Hubs and

projects and support

•

Response to Sector Skills

•

NAAME Talent Sharing

sector based work

•

Kickstart and

Plans

•

Basic Skills provision

academies

Traineeships

•

New Anglia Skills Deals

through adult and

•

LIFT Community Grants

•

Virtual work experience

•

ESF Programme e.g.

community funding

•

ESF/BLF Building Better

•

Icanbea

Health & Social Care

•

Sector Skills Plans and

Opportunities

•

Skills Shows

•

Apprenticeship standards

groups

•

Supporting graduates

•

Opportunity Areas

& T level consultation

•

ESF Sector Skills and

into the workplace

•

Norwich for Jobs and

•

New Anglia Learning

Supply Chain Call

•

Integrated Work and

parallel district initiatives

Providers group

Health (IHES)

•

NEACO services

consultation

•

Norfolk Police & Crime

•

Young Apprenticeship

Commissioner - Gateway

Ambassador Network

to Employment

Post-16 Educational Provision

18

@NewAngliaLEP

Driving Skills Progression for the Workforce

Champion - Christine Futter

Priority - Sector approaches to encourage in work progression

Develop a higher level version of the Skills Support for the Workforce programme with an

accompanying campaign to raise the profile around targeted training leading to greater

productivity and business resilience.

Priority - Clear pathways to enter /progress in/between key sectors

Series of campaigns raising awareness of training and mentorship, including Adult Learning

and apprenticeships for all ages.

Highlighting transferable skills will be important here and at this time.

19

@NewAngliaLEP

Providing agile and responsive training provision for key sectors

Champion - Lynsey Sweales

Priority - Training providers response to the sector skills plans

Develop a regional strategic prioritisation statement for Norfolk and Suffolk highlighting our

economic priorities for the development of training provision.

Priority - Tutor shortages in key sectors

Develop a campaign centred around highlighting the opportunities to get into FE teaching.

Establish an industry visiting lecturer programme that provides the infrastructure to

support those working in priority sectors to undertake college teaching

placements/associate lectureships.

20

@NewAngliaLEP

Equipping Young People for Success

Champion - Ben Miller

Priority - Equipping young people with the confidence and work-ready skills

Highlighting a suite of activity programmes across Norfolk and Suffolk that aim to give

young people confidence and resilience, targeting disadvantaged young people in

particular.

Priority - Careers Inspiration & Improving CEIAG, Employer involvement & economy info

A series of communications/activities to ensure that CEOs and Governing Boards of those

schools and colleges engaged with the Enterprise Adviser Network are aware of the role

and workings of the programme.

21

@NewAngliaLEP

Tackling Barriers to Employment

Champion - Guy Hazlehurst

Priority - Pathways into employment for the economically inactive

Original aim was to supporting the Fuller Working lives agenda - actively reviewing

recruitment policies, mid-life MOTs and supporting those with family caring responsibilities.

Additional aim to support young people into employment through schemes in the

Chancellor’s A plan for jobs, e.g. Kickstart, apprenticeships and traineeships

Priority - Basic Skills

Carry out research into why there is still a basic skills issue in the region and develop a

promotion campaign and work to break down the barriers with English, Maths and Digital

skills development.

This work is likely to be heavily supported by other champions due to the change in focus

on young people.

22

@NewAngliaLEP

Thank you

23

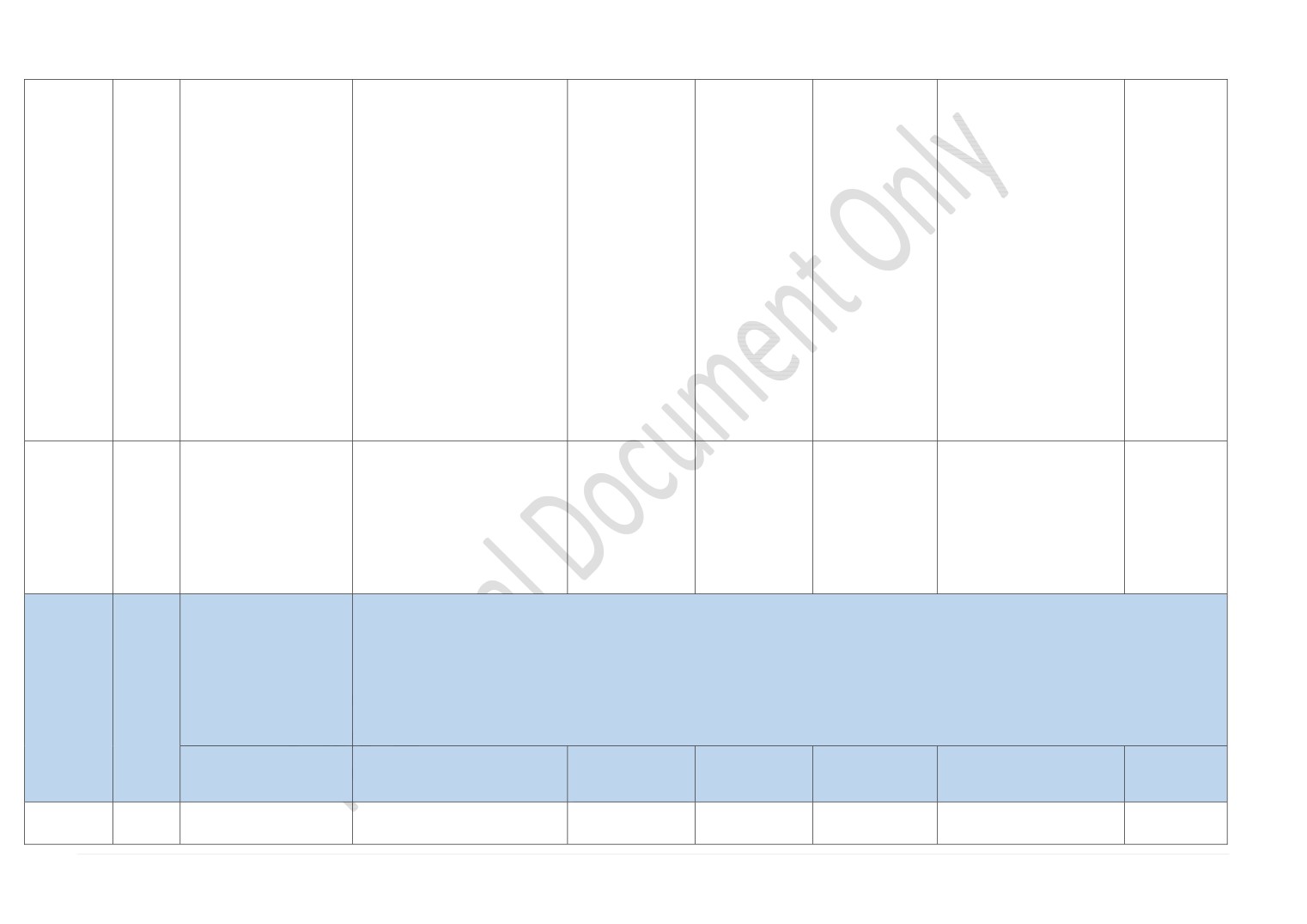

Appendix 2

Economic Recovery Restart Delivery Plan

Key Measure:

Responding to

What does success look like?

redundancies

We will support individuals

Key stakeholders and professional services are aware of the support available to businesses.

being made redundant and

help businesses looking for

Businesses and employees are engaging with this support whether in a period of growth, consolidation or contraction.

Foundation /

LIS/ ES

workers, through a new

Sector

Code

local partnership of

businesses and local and

national agencies.

What is the output

SAP Objective

Measurable Key Result

Who is

What is the output of the activity

of the activity

Who is leading the

(SMART) - actions to be

responsible for

Who is consulted / informed

for July 2020 to December

beyond December

activity

undertaken)

the activity (LEP)

2020

Create a redundancy support

Driving Skills

A developed communication plan

programme which builds on

Progression for

alerting businesses to a health check

and brings together existing

To date: Workforce

the Workforce

up and skills matrix. Potential

ES-00W2

initiatives. Working with DWP,

Jan Feeney

workstream/Growth Hub

upskilling, reskilling, recruitment and

ES-DIS10

Job Centre plus and

Richard Glinn

Tackling Barriers

redundancy outcomes will result in

Continuation as

People

LIS-PL1

professional services to

Natasha Waller

Julia Nix

In future: Professional Services

to Employment

clear signposting to support services.

appropriate.

LIS-PE2b

ensure employers and

Mary Scales

groups, Suffolk Chamber of

Government support packages will

LIS-PE2c

employees are aware of and

Andy Mawby (SCC)

commerce, FSB, CBI, sector

also be highlighted.

have access to available

groups and VCSE.

Update the Growth Hub Skills Portal

support programmes at the

to support this activity.

earliest point.

Stemming from the Employment

To date: Workforce

Equipping

Develop further the

Opportunities page:

workstream/Growth Hub/ESF

Young People

employment opportunity

- an individualised referral system to

employability related

For Success

Regular updating of

platform utilising existing

redundancy support programmes

Michael Schneider

programmes

ES-DIS10

information.

Natasha Waller

networks to include a

- improved sector specific training

John Morgan

Tackling Barriers

People

LIS-PE2b

Enhanced focus on

Emma Taylor

redundancy triage service to

information and signposting

Andy Mawby

In future:

to Employment

LIS-PE2c

sectors where need

help connect people to new

- signposting to business start up

Denise Saadvandi

DWP work coaches, VCSE,

is greatest

training and employment

support

Adult Learning, early help teams

opportunities.

and non-ESF employability

programmes.

Launch a pilot of the Talent

Driving Skills

ES-00W2

Sharing Platform by

Progression for

People /

ES-DIS10

September, a novel tool to

the Workforce

Manufacturing

LIS-PL1

(LC to develop outputs)

Linn Clabburn

To date: NAAME

support businesses to share

& Engineering

LIS-PE2b

workforce and fuel new

LIS-PE2c

employment opportunities.

Key Measure: Youth

What does success look like?

Pledge

Every young person in

LIS/ ES

Young People have opportunities to be well supported in making decisions about the next stage of their education or career choice and

Norfolk and Suffolk will

Code

this support system is clearly communicated to those who advise this age group.

have the support they need

to get into high quality

Employers are still prepared to support this agenda through a range of methods as appropriate to Covid-19 restrictions.

education, employment,

1 | P a g e

25

training, or an

apprenticeship.

What is the output

SAP Objective

Measurable Key Result

Who is

What is the output of the activity

of the activity

Who is leading the

(SMART) - actions to be

responsible for

Who is consulted / informed

for July 2020 to December

beyond December

activity

undertaken)

the activity (LEP)

2020

Continue to produce Youth Pledge

Equipping

newsletters to inform employers and

Young People

stakeholders on a range of activity

For Success

that is taking place.

To date: Workforce

Tackling Barriers

Review the engagement level of

workstream/Youth Pledge

to Employment

Accelerate the delivery of the

employers and reaffirm pledges.

Individual projects

Advisory Group/ESF

Youth Pledge projects,

are meeting their

Tom Humphries

employability related

ES -

providing an integrated offer

Appraised Youth Pledge ESF projects

targets.

(NCC)

programmes/DWP work

Natasha Waller

People

DIS5

that links young people to

are operational.

Sector/place based

Jasmine Joolia

coaches

Alison Ward

LIS-PE1d

opportunities and support to

Communication/signposting channels

focus needs respond

(SCC)

help them into education,

are strong for young people,

to most need &

Mary Scales

In future:

training and employment.

businesses and youth supporting

opportunities.

VCSE, early help teams, non-

organisations.

ESF employability programmes,

EAN and OA teams.

Navigate employers through the

range of employer incentives that the

Government has announced related

to skills.

ES -

Equipping

DIS5

Young People

ES -

Deliver a pilot to test

For Success

Successful delivery

DIS8

innovative virtual solutions for

Coordinate and confirm supportive

of a pilot virtual work

Jacqui Phipps

LIS-PE1d

work experience placements

People

stakeholders. Create a project plan

experience in the

Glen Todd

Karin Porter (or

LIS-PE3

to help the continuation of

for the initiative.

Spring / Summer

colleague)

LIS-

high-quality career

Term 2021.

PE1a

engagement.

LIS-PE3b

Provide coordinated support

Equipping

that schools and colleges can

Young People

draw on that enables,

For Success

ES -

enhances, and improves

To onboard schools within the EAN

DIS5

careers provision across

into the expanded Careers Hub. To

ES -

Norfolk and Suffolk. This

continue to support schools and

Continuation as

Jacqui Phipps

People

DIS8

Glen Todd

includes working with the

colleges to work towards achieving

appropriate

Melvyn Ruff

LIS-PE1d

Careers and Enterprise

the Gatsby Benchmarks through the

LIS-PE3

Company to expand the New

EAN and supporting stakeholders.

LIS-PE3b

Anglia Careers Hub right

across Norfolk and Suffolk

from September.

2 | P a g e

26

To work with the ESF programmes

Equipping

which promote apprenticeship

Young People

opportunities to support them to meet

For Success

their outputs.

Tackling Barriers

To continue to promote the use of

to Employment

apprenticeship levy transfer funds to

small/medium employers to enable

Reshape existing

future connections with regards to

apprenticeship projects to

funding apprenticeships.

help stimulate the creation of

Sally Moore (Moore

To date: Workforce Workstream/

ES -

quality apprenticeships and to

Networking)

ESF programme leads

To work with providers, Norfolk

DIS6

enable those existing

Paul Wright (Moore

Apprenticeships and Apprenticeships

Continuation as

People

LIS-PE3

apprenticeships who have

Alison Ward

Networking)

In future:

Suffolk, the Growth Hub and other

appropriate

been made redundant be

Debbie McArthur

Providers, employability

appropriate stakeholders to promote

connected to new

(SCC)

programmes, EAN, OA teams,

the governments financial initiatives

opportunities, working with

Katy Dorman (NCC)

VCSE and early help teams.

with regards to employing

businesses to show them the

apprentices to stimulate economic

value of apprenticeships.

growth.

To develop a robust local process for

supporting redundant/at risk

apprentices using the government’s

planned new Redundancy Support

Service for Apprentices

framework/platform.

Equipping

A series of interventions to support

To date: Gurpreet Jagpal (UoS)

Young People

Work with Universities to put

recent graduates living in Norfolk and

Julie Schofield (UEA)

For Success

ES -

in place tailored support for

Suffolk and alumni of local

Sarah Steed (NUA)

OOW8

students that are due to

universities living outside the region

Continuation and

Natasha Waller

Workforce workstream group

Providing Agile

ES -

People

graduate this summer, to help

including raising the profile of

building on initial

Glen Todd

Michael Gray

& Responsive

DIS5

increase their chances of

employment/internship opportunities,

interventions

In future: sector groups,

Training for Key

LIS-PE3

securing employment or

online careers inspiration

business networks, Suffolk

Sectors

LIS-ID3c

further education.

webinars/blogs and signposting to

Chamber of commerce, FSB

additional education pathways.

and CBI.

Tackling Barriers

to Employment

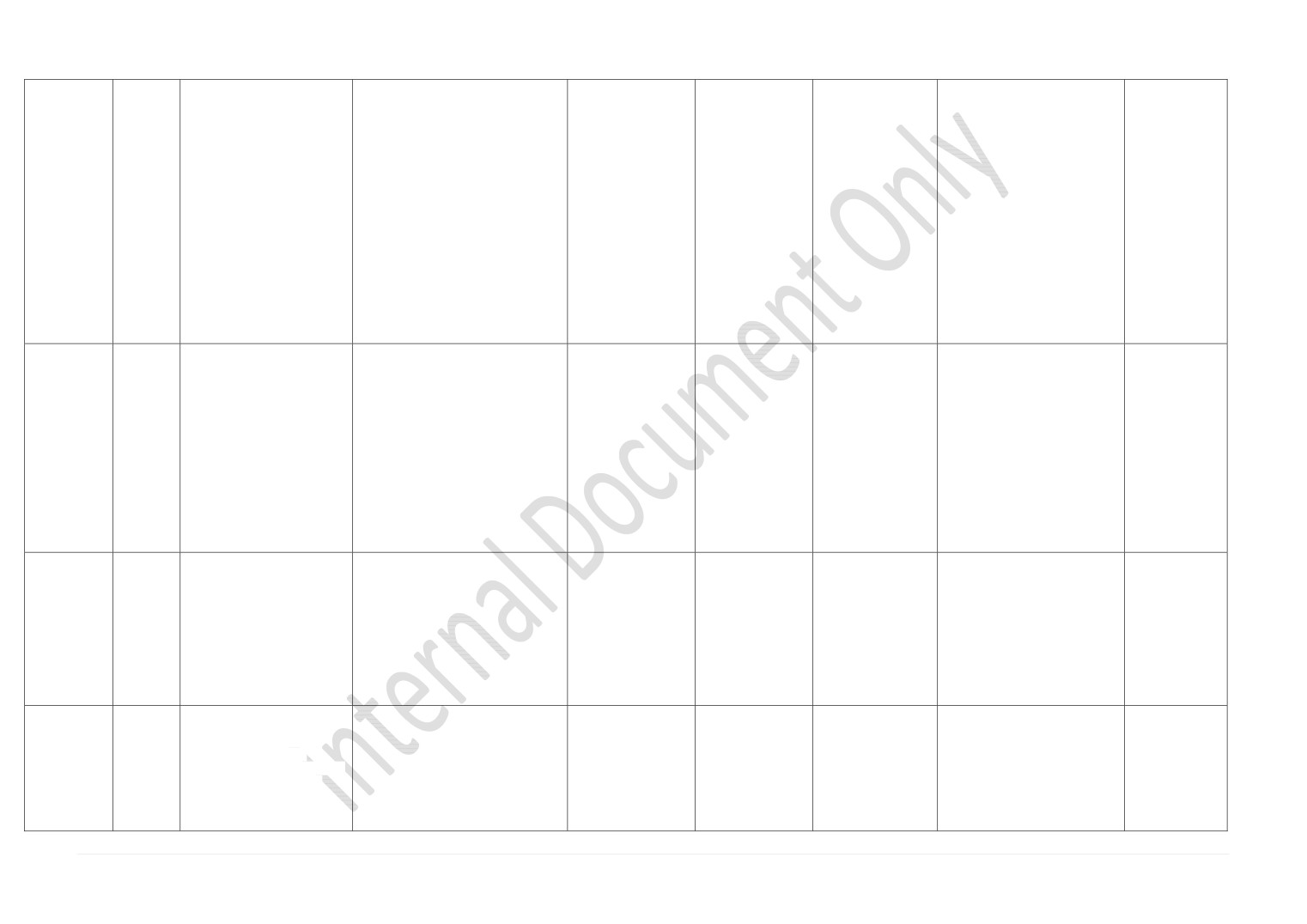

Key Measure:

Transforming Skills

We will ensure every

What does success look like?

individual has access to

opportunities to upskill and

Providers have reflected on their curriculum offer for the 2020/21 academic year (FT,PT & Commercial) and widely promote it to ensure it

reskill, adapting the skills

responds to key challenges for both people and our key sectors.

LIS/ ES

provision so that it meets

Code

the changing needs of

businesses and the

aspirations of individuals.

What is the output

SAP Objective

Measurable Key Result

Who is

What is the output of the activity

of the activity

Who is leading the

(SMART) - actions to be

responsible for

Who is consulted / informed

for July 2020 to December

beyond December

activity

undertaken)

the activity (LEP)

2020

Building on investments

Providers have active support to gain

Continuation as

Maddie Coupe

Thomas Ballantyne

To date: Workforce workstream,

Equipping

ES -

People

already made in digital skills

industry placements for their T-level

appropriate.

Natasha Waller

(SCC)

digital taskforce and SAP.

Young People

DIS6

infrastructure, working with

provision in Digital Production,

Glen Todd

Tim Robinson

For Success

3 | P a g e

27

ES -

our Higher and Further

Design and Development including

Engage the sector

Angela Berry

Future: Providers, wider set of

DIS10

education providers, provide

promoting the placement funding

further with the EAN.

Thomas Humphries

digital employers and EAN.

Providing Agile

LIS-PE1

a range of opportunities that

opportunities.

(NCC)

& Responsive

LIS-PE2

enable all residents to upskill

Denise Saadvandi

Training for Key

LIS-PE2a

throughout their lives,

There is an initial increase in the

Sectors

LIS-PE2c

including developing a digital

uptake of Digital Functional Skills or

skills programme and working

similar qualifications plus non-

Driving Skills

with industries to scale up

traditional education (e.g. Netmatters,

Progression for

existing initiatives.

Creative Computing Club).

the Workforce

Stemming from the Digital Taskforce,

Tackling Barriers

digital provision is mapped out and

to Employment

promoted wider to careers advisers

and support organisations.

Work with the Enterprise Adviser

Network to map out digital provision

and attainment within schools plus

skills sets of those who deliver it.

Equipping

Address the skills shortages

Young People

and challenges to

For Success

recruitment, capitalising on

A meeting with Maddie Coupe,

the high levels of positive

Natasha Waller, Alison Ward &

Providing Agile

ES -

public interest resulting from

Christine Futter is taking place on

& Responsive

OOW2

Health and

the pandemic, and through

September 24th to determine next

Training for Key

ES -

Social Care /

refocussing the sector skills

steps.

TBC

TBC

TBC

TBC

Sectors

DIS10

People

plan for Health and Social

LIS-PE1c

Care. Develop initiatives to

EAN team delivering a Health &

Driving Skills

LIS-PE2c

make the sector more

Social Care event on November 18th

Progression for

accessible for younger

for Careers Advisers/teachers.

the Workforce

people, providing clear career

progression and pathways.

Tackling Barriers

to Employment

Develop a Sector Skills Plan

for the VCSE sector, which

Driving Skills

recognises the sector’s

To date: Some of the VCSE

Progression for

significant offer to the wider

groups that Claire Cullens has

the Workforce

LIS -

business community through

Determine funding source for this

Publish the plan and

recently engaged with.

VCSE /

Claire Cullens

Tom Brown

DIS1

meaningful skills acquisition.

plan.

deliver the

Tackling Barriers

People

James Allen

Tom Humphries

LIS-PE1c

To create a professional

Procure the plan.

recommendations

Future: Wider VCSE groups,

to Employment

responsive, evolving, fit for

careers advisers and education

purpose sector across all

providers.

levels and size in Norfolk and

Suffolk.

Work with the Construction

To develop a robust local process for

Equipping

Industry Training Board

supporting redundant/at risk

Young People

(CITB) with its National

construction apprentices using the

Helen Clements

For Success

ES - DIS5

Construction Centre at

government’s planned new

Laura Waters

(Building Growth

Construction /

ES -

Continue as

Building Growth members

Bircham Newton, and all local

Redundancy Support Service for

Alison Ward

Skills Group Chair)

Driving Skills

People

DIS6

appropriate.

initially

FE Colleges and Training

Apprentices framework/platform.

Katie Snell

Corrienne Peasgood

Progression for

LIS-PE3

Providers to support

Katy Dorman

the Workforce

apprentices and trainees in

Continue to promote the sector as an

the industry.

industry of choice focussing on key

4 | P a g e

28

areas of need as appropriate whilst

Tackling Barriers

encouraging employers to continue to

to Employment

value training.

Equipping

Capitalise on increased public

Young People

Angela Berry

ES -

awareness and attention to

For Success

Life Sciences

Natasha Waller

Lorraine Moody

OOW2

life sciences and biotech -

Continue as

& Biotech /

Establish Life Sciences SSP group

Maddie Coupe

Kirsty Culley

LIS-PE1c

showcasing the careers

appropriate

Driving Skills

People

Glen Todd

Additional members

LIS-PL1

available locally and

Progression for

TBC

increasing the talent pipeline.

the Workforce

Key Measure: Mental

Health and Wellbeing

What does success look like?

We are creating a

programme that provides

employers and employees

LIS/ ES

with the mental health and

Code

wellbeing support need.

What is the output

SAP Objective

Measurable Key Result

Who is

What is the output of the activity

of the activity

Who is leading the

(SMART) - actions to be

responsible for

Who is consulted / informed

for July 2020 to December

beyond December

activity

undertaken)

the activity (LEP)

2020

To identify current programmes,

Tackling Barriers

Create a programme, building

support, and activities that

to Employment

To date: Workforce workstream

on existing initiatives, that

businesses can access with regards

Further enhancement

LIS-PE2c

provides employers and

to promoting positive mental health

Alison Ward

Michael Gray

of offer

In Future: Councils/ chambers/

employees with mental health

the workforce, through signposting,

Growth Hub

and wellbeing support.

events, and case studies.

5 | P a g e

29

New Anglia Local Enterprise Partnership Board

Wednesday 21st October 2020

Agenda Item 7

All Energy Industry Council Progress Update

Author: Julian Munson

Presenter: Julian Munson

Summary

This paper provides an update on the All Energy Industry Council, a sub-group of New

Anglia LEP.

Recommendations

The Board is invited to:

Note the contents of the paper and sub-board report (appendix 1)

Note and support the approach to producing and delivering a recovery plan for the sector

Background

Norfolk and Suffolk is fast becoming the UK’s epicentre for energy generation and systems

integration with a unique mix of onshore and offshore renewables, oil and gas and nuclear

and is experiencing significant levels of investment, particularly in the offshore wind sector.

The All Energy Industry Council (AEIC) was set up in 2019 recognising the strategic

importance and value of the energy sector as identified in the draft Local Industry Strategy.

The AEIC is one of three Industry Councils, established as strategic public/private sector

partnerships to provide a focus for decision making and leadership in the high value sectors

for Norfolk and Suffolk. The AEIC acts as the LEP’s sector group for energy and provides

the strategic direction in delivering the aspiration to be recognised as the UK’s All Energy

Region.

All Energy Industry Council - Progress Update on Delivery

In addition to its strategic role in connecting with Government, including BEIS and the

Catapult network, and the relevant national Sector Deals, the AEIC has developed a delivery

plan aligning with the draft LIS with key interventions and priority projects backed by the

AEIC partners. The AEIC is chaired by Mark Goodall, Senior Manager of Aker Solutions and

has representation from major energy companies, education providers, local authorities,

Government and the East of England Energy Group (EEEGR).

The AEIC has agreed a set of strategic objectives:

1. Profile and Promotion - branding and marketing the area and cluster to national

and global audiences. Proactively promoting the offer to attract global investment and

boost exports across the energy sector.

31

2. Lobbying and Regulation - strengthening links with Government and other

organisations as identified by the Council to attract support and investment and

improve regulations.

3. Supply chain development - strengthening the cluster, helping businesses work

with each other, including tier one corporates, and maximising export and investment

opportunities.

4. Innovation support - helping businesses improve their performance and enabling

them to enter new markets, develop new products, enhance processes and improve

productivity

5. Skills development - overseeing the skills sector plan, connecting employers with

providers and responding to industry demands in developing the skilled workforce of

tomorrow

6. Infrastructure - attracting investment to enhance and build the infrastructure

required to support the growth of the industry and improve connectivity and business

productivity.

Following consultation with industry partners, it was agreed that a shortlist of priority projects

would be developed and progressed during 2020-21 and are summarised in appendix 1.

Of particular note is the progress made with the following activities;

Profile and Promotion - development of the East of England Energy Zone branding

into a stronger ‘All Energy’ branding

Supply Chain - progress the development of a capability matrix and support for

supply chain opportunities via the roll out of the Fit4Offshore Renewables

programme (led by the ORE Catapult and part funded by the LEP)

Science and Research - progress the science and research-based activity in the

energy sector including support for the SuNRISE Coast project (Strength in Places

Fund bid led by UEA)

Looking Ahead

The impact of Covid19 has been significant on the sector with delays to contracts relating to

major projects and some uncertainty around progress of new offshore wind and nuclear new

build projects following delays with Government approval processes.

The AEIC has agreed to develop a recovery plan for the energy sector to provide a stronger

focus on the key issues impacting on the energy sector and raise the profile of the economic

value and importance of the sector.

The plan will also respond to the Government’s new Energy White paper and Sector Deal,

both expected to be launched by December 2020.

The recovery plan for Norfolk and Suffolk’s energy sector will support a range of priorities

and interventions to drive growth, investment and innovation, strengthen the supply chain

and boost sustainable employment in Norfolk and Suffolk. Work is underway on the draft

plan, led by the LEP with a sub-group of AEIC partners, and is expected to be finalised and

launched early in 2021.

Part of the process will also include a review of the delivery structure and governance of the

All Energy Industry Council and its task groups etc to ensure that it is robust and fit for

purpose to help deliver the key interventions which will be outlined in the recovery plan for

the sector.

This work will also include a review of membership to ensure that there is full representation

from across all parts of the sector and a stronger role for sub-groups to represent the

32

industry, education and Local Authority interests in relation to specific parts of the sector and

with responsibility to deliver key interventions.

Recommendations

The Board is invited to:

Note the contents of the paper and sub-board report (appendix 1)

Note and support the approach to producing and delivery a recovery plan for the sector

33

Appendix 1

Sub- Board Reporting

Sub-Board:

All Energy Industry Council

Representatives:

LEP Board: Johnathan Reynolds

LEP Team: Julian Munson

Meeting Frequency:

Bimonthly

Key Objectives and their link to the

Update on actions / activity

Next Steps

NSES and LIS

The AEIC identified the that a cohesive marketing message

Production Bureau will work with partners to

was important for the region. Part of this work will look at the

develop the enhanced branding to fully reflect

NSES: Our Offer to the World

brand and enlisting the support of an external organisation to

the all-energy offer.

AEIC Priority Project:

help develop this.

A marketing plan will be produced with a

EEEZ Operational Group has undertaken significant EEEZ

programme of marketing activity including key

stakeholder engagement to build a detailed SWOT analysis

industry events in 2021-22.

AEIC to develop a single, joined-up

which was used to inform the branding tender brief document.

energy brand and set of key

Final branding and plan will be presented to the

The following points were raised by the group:

AEIC.

messages which can be amplified by

all partners.

To ensure that the brand is not just seen as Offshore Wind, to

New recovery plan for the energy sector (under

think about how we and others can use it to engage with all

A marketing offer which raises

development) to use new branding.

areas of energy covering onshore and offshore.

awareness of the region’s capabilities

and increases inward investment

The marketing tender process has been concluded and

opportunities, government support,

marketing agency Production Bureau have been awarded the

business growth and exporting.

contract to work with partners to develop the new/enhanced

branding.

NSES: Collaborating to Grow

Building World Class Research (BWCR) was voted as a top

First Questionnaire to be further developed by

AEIC Priority Project:

priority project for the AEIC. A Task and Finish Group was

UEA and ORE Catapult and to be shared with

formed at the beginning of the year to identify the capabilities

the group.

AEIC to support the region’s energy

in our region. This Group is made up of AEIC and external

projects with world class research.

stakeholders who can add value.

Letter and first questionnaire to be sent out to a

Identify regional academia and

nominated stakeholder to “test” the response

capabilities within the region.

and obtain feedback.

35

They have since developed a plan of action and two

LIS: Clean Energy

questionnaires in order to reach out to organisations to

ascertain and understand their research capabilities.

Expand our reach to maximise on

opportunities

through

research,

The first questionnaire sets out to understand if organisations

technology

and

innovation

would be happy to engage and aims to build a relationship,

programmes that will build on the

the second has “technical” questions to capture capabilities.

region’s ambitious sustainable clean

growth agendas.

A stakeholder engagement letter has been written to

accompany the first questionnaire and introduces the

strategic ambitions of the AEIC.

The UEA have produced the draft questionnaires and they

have been circulated within the task and finish group for

review. Following feedback from the Task and Finish Group,

the questionnaire is being further developed.

LIS: Clean Energy

The Strength in Places Fund (SIPF) is a competitive funding

NSES: Driving Business Growth

scheme led by UK Research and Innovation and takes a

Full application for the SuNRISE Coast project is

and Productivity

place-based approach to research and innovation funding in

being prepared and UEA and partners are

order to support regional growth. SIPF is a competitive fund

engaging with key stakeholders including the

Build on existing clean energy

for collaborative bids between businesses, universities and

LEP.

strengths in the region. Specifically,

research organisations and Catapults.

the SuNRISE Coast bid to the

Key themes will be;

Strength in Places Fund.

The bid for development funding has been successful with

the project now undertaking work to develop the £29m

Theme 1: A Digital Energy Coast

second round bid.

Theme 2: Marine Biodiversity Net Gain

This is the first time that the three world leading research

institutes of CEFAS, ORE Catapult and UEA have worked

Theme 3: Future Clean Energy Technology

together.

UKRI’s feedback on the first stage submission highlighted the

Full bid to be submitted by 25th November.

region’s diversity in energy generation, with a mixture of

offshore wind, gas and nuclear, that could benefit from

greater integration and collaboration between research

centres and industry.

36

The UKRI panel recognised the application’s high quality,

which was considered “highly innovative”.

New Anglia LEP has provided a letter of support for the SIPF

for Wave 2 and funding to support the bid work.

LIS: Clean Energy

The opportunities around Hydrogen has formed part of the All

The Group continue to explore potential

Energy Industry Council agenda, members were informed

projects, for example Bacton Terminal and how

Explore emerging opportunities and

about the local opportunities and the work of Hydrogen East.

this could become a major new Hydrogen

technologies within the energy sector

Terminal, ‘Bacton2.0’ offering potential for large-

Hydrogen East is a newly formed group who are looking to

scale grid injection.

drive H2 across East Anglia. This group includes founding

members such as New Anglia Energy, Opergy, EDF Energy,

Some feasibility work on the Bacton project

TCP ECO and CPH2. Arup, EEEGR, New Anglia LEP, ORE

commences in October with support by the Oil &

Catapult and OGTC are providing early stage support and

Gas Technology Centre, New Anglia LEP and

endorsement.

North Norfolk District Council with a final report

expected by February.

The ambition is to develop a broad regional network across

all key sectors: power, heat, transport, buildings, industry,

In addition to Hydrogen the AEIC have been

shipping and beyond. Integrated with offshore wind and

encouraged to look at other energy forms which

desalination facilities and supporting regional carbon capture.

can be brought to the Council meetings such as

solar, bioenergy and onshore renewables.

NSES: Collaborating to Grow

ORE Catapult has developed an “ESI-CoE” Concept, a

An event proposal is being put together between

LIS: Clean Growth, Infrastructure

Centre of Excellence focusing on Energy Systems Integration

the ORE Catapult, Suffolk County Council and

- a whole systems approach which looks to provide a

New Anglia LEP.

AEIC to support the developments of

cleaner, decarbonised, integrated energy system offering

a clean energy holistic approach to

energy security and smarter connectivity with great flexibility,

Four events are being planned with the

energy.

reliability and balance between generation and consumption.

Catapults and based on planning, challenges,

opportunities, building inter-collaborative

The rationale behind this approach is that there are a lot of

projects along with the products and services of

Develop a system which looks at

good energy transition projects that are happening in

the Catapults which could be provided in order

production, transmission, distribution

isolation. If the region was to take a difference approach it

to support an integrated approach.

and consumption.

would reduce the levelised cost of energy, instilling an ethos

of sustainable production and the wise use of energy.

The Catapults include the Energy Systems

Catapult, Connected Places Catapult, ORE

37

The onshore capacity cannot handle offshore production and

Catapult as well as the Greater South East

therefore there is need to look at Battery Storage, Hydrogen

Energy Hub. Example projects would be

Production (and the uses of the bi-products), Off shore ‘Ring-

provided for example those such as Net Zero

Main’ / Interconnector with connectivity of Gas Operators,

Leiston, Milford Haven which all benefit the

Carbon Capture and Storage, Using old platforms for

community.

Hydrogen production, Plugging in Nuclear, solar, biomass

and offshore wind to the big energy picture.

It has been proposed that the audience would

be the same for each session and would include

The infrastructure onshore needs to look at consumption but

selected members from industry - developers,

also the production potential. In addition to linking to the grid

Local Authority Head Planners and Policy

there is need to look at:

members. MP’s and other people of influence to

help put this concept on the map. It could also

-Batteries

include other sectors such as ICT - Digital,

-Hydrogen storage and the use as a fuel

Utilities and those from Water Resources East

-HGVs and Vessels (we already see Hydrogen buses in -

for example.

London as well as Local Authority Waste disposal trucks)

-EV charging and infrastructure

The first event will take place in November.

-Heating and cooling (residential and commercial)

-Energy monitoring systems and smart controls

The broad range of this concept has heavily influenced the

proposed next steps.

NSES: Collaborating to Grow

The AEIC and Agri-tech Council have attended the Innovation

The ICT Digital Creative Industry Council will be

LIS: Clean Growth

Board and provided an update on the work of the Council as

invited to the next Innovation Board in

well as an introduction to the Food Enterprise Park.

December.

Improved dialogue & interaction

The forward plan for 2021 includes looking at

between the AEIC & its equivalents

the opportunities around Agri-food and Energy,

including the Digital Tech Council,

Digital and Energy as well as Agri-food and

Agri-food Council, and Innovation

Digital.

Board.

NSES: Driving Business Growth

Developing an All Energy Capability Matrix was voted on as a

Share SCOPE with Task and Finish Group,

and Productivity

top priority project for the AEIC.

obtain any final amends. Share final version and

close out. Advise next steps as follows:

A Task and Finish Group was set up to develop an all-energy

AEIC to support the development of a

capability matrix. This will help demonstrate what the region

Panel of 6 will select top two/three matrices to

connected supply chain to

has to offer and use as a tool for procurement teams to

be taken to the next industry council meeting

demonstrate the regions offer.

ensure regional companies have a presence on tender lists.

(22nd October).

38

Develop an All Energy Capability

The group met and specifically discussed the following

The AEIC will select the matrix which they would

Matrix

matrices which were already in the public domain:

like to take forward and work with industry to

progress.

Great Yarmouth Borough Council - a matrix of 89

offshore wind companies

Inn2POWER- a European funded project which looks at

the eastern region as well as 11 European clusters.

EIC’s all energy UK wide capability matrix

EEEGR’s 260 company membership directory

It was confirmed that no one matrix exists in providing an all

energy approach therefore a SCOPE would be required to

develop a matrix further and this has now been prepared for

the Task and Finish Group.

LIS: Clean Energy

Fit 4 Offshore Renewables (F4OR) is a programme

The LEP are looking to support an additional 4

NSES: Driving Business Growth

developed to help the UK supply chain get ready to bid for

businesses through the F4OR Programme with

and Productivity

work in the offshore renewable energy sector. It aims to work

extra funding support from the Norfolk Strategic

with competent and competitive UK supply chain companies

Fund. This is in response to over 50 applications

AEIC to support the delivery of the FIT

to support their entry and growth in the offshore renewable

being received with strong demand from local

4 Offshore Renewables Programme.

energy industry.

businesses. It is now closed to further

applications.

Support the ORE Catapult and

The programme began in Scotland and the Norfolk/Suffolk

promote the Fit4OR programme

programme is the first programme in England.

developing business excellence and

sector expertise.

The objective of the programme is to support the

development of competent, capable, and competitive UK

offshore renewable energy supply chain - maximising

opportunity for the UK supply chain.

It has been designed for established businesses with 10 or

more employees or with a turnover of £1 million and upwards.

Participating companies can range from those with no

39

offshore renewables experience aiming to take a first step

into the sector, to established, tier 1 suppliers wanting to

benchmark their position and drive business excellence.

The first cohort was in September and since a panel selected

10 businesses to take through the 12-18-month programme.

LIS: Infrastructure

New Anglia LEP works closely with East Suffolk Council and

The LEP requires sign off of MOUs by Local

NSES: Driving Business Growth

Great Yarmouth Borough Council and County Councils to

Authorities to enable spend against EZ Pot B

and Productivity

support the development of the Enterprise Zone sites in Great

monies. This funding can be used to support

Yarmouth and Lowestoft with a focus on the energy sector

specific interventions to progress site

supply chain.

development and marketing.

Growth within the Energy Enterprise

Zones

The new inward investment team is working with

partners to understand the investment offer for

EEEZ and ensure new leads for EZ sites.

LIS: Business Environment

New Anglia LEP supports a business case submitted to BEIS

Awaiting decision by BEIS.

NSES: Driving Business Growth

to help maximise knowledge transfer and supply chain activity

and Productivity

from Hinckley to help support future plans for SZC and boost

New Anglia LEP to engage more closely with

local contract value in the region.

NAMRC and link with NAAME to maximise

opportunities in the manufacturing/engineering

AEIC to support the national supply

cluster to support nuclear new build.

chain programme (for nuclear new

build)

Build on the nuclear places

programme bid, which has been

submitted to BEIS through New

Anglia LEP, Heart of the South

West LEP and Nuclear AMRC.

40

New Anglia Local Enterprise Partnership Board

Wednesday 21st October 2020

Agenda Item 8

Business Resilience and Recovery Scheme Progress Update

Author: Chris Dashper

Summary

The Resilience and Recovery Fund was launched six months ago as one of the LEP’s key

responses to the Covid-19 crisis. This paper provides a summary of the scheme to date along

with examples of some of the projects supported.

Moving forward, as the second tranche of funding for the scheme, secured from the Getting

Building Fund call over the summer, is accessed, a number of revisions to the scheme are

being introduced to ensure maximum impact is achieved through the available funds.

Recommendation

The Board is invited to note the contents of the report and the revisions to the scheme.

Background

The New Anglia Business Resilience and Recovery scheme was launched in April 2020 as a

direct response to the Covid-19 pandemic.

The scheme channelled £3.5m of capital funding from the New Anglia LEP Growth Deal into a

bespoke programme to provide support to SMEs in the region, specifically those looking to

diversify and pivot their businesses.

Eligible expenditure includes, for example, additional machinery and equipment, premises

improvement, stock and warehouse management systems, minor works to improve social

distancing and vehicles for delivery efficiency or to offer mobile services.

The scheme was designed to complement grants being offered by central Government and

delivered by local authorities which provided cash flow support.

The LEP scheme was designed to help businesses invest to diversify or develop their

businesses.

The performance of the scheme has exceeded initial expectations, both in terms of take-up and

project delivery.

Applications have been received from sectors including manufacturing, retail, warehousing,

hospitality and catering, performance entertainment, vacation services and energy provision

and servicing. The list is not exhaustive and the sector coverage continues to expand.

1

41

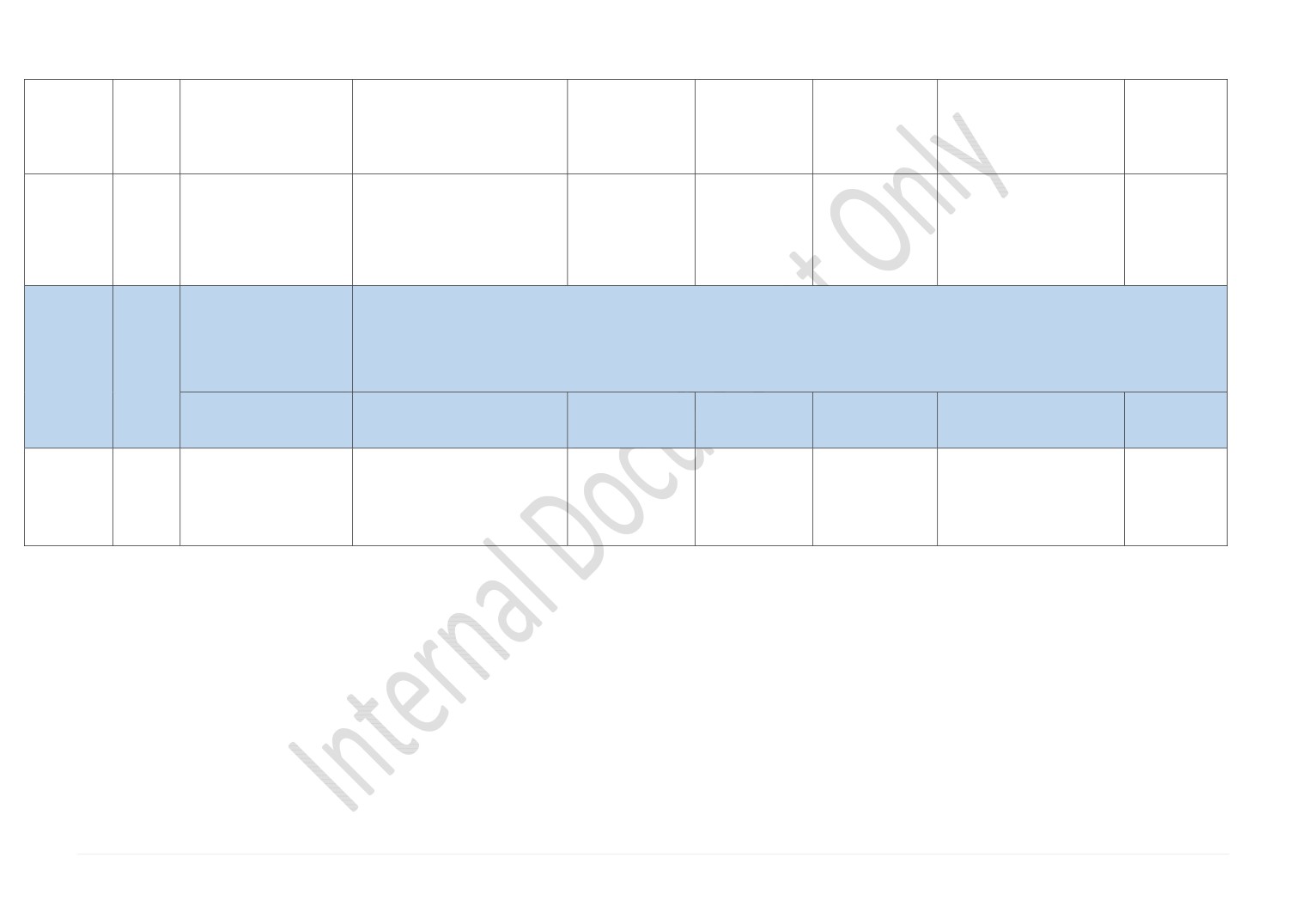

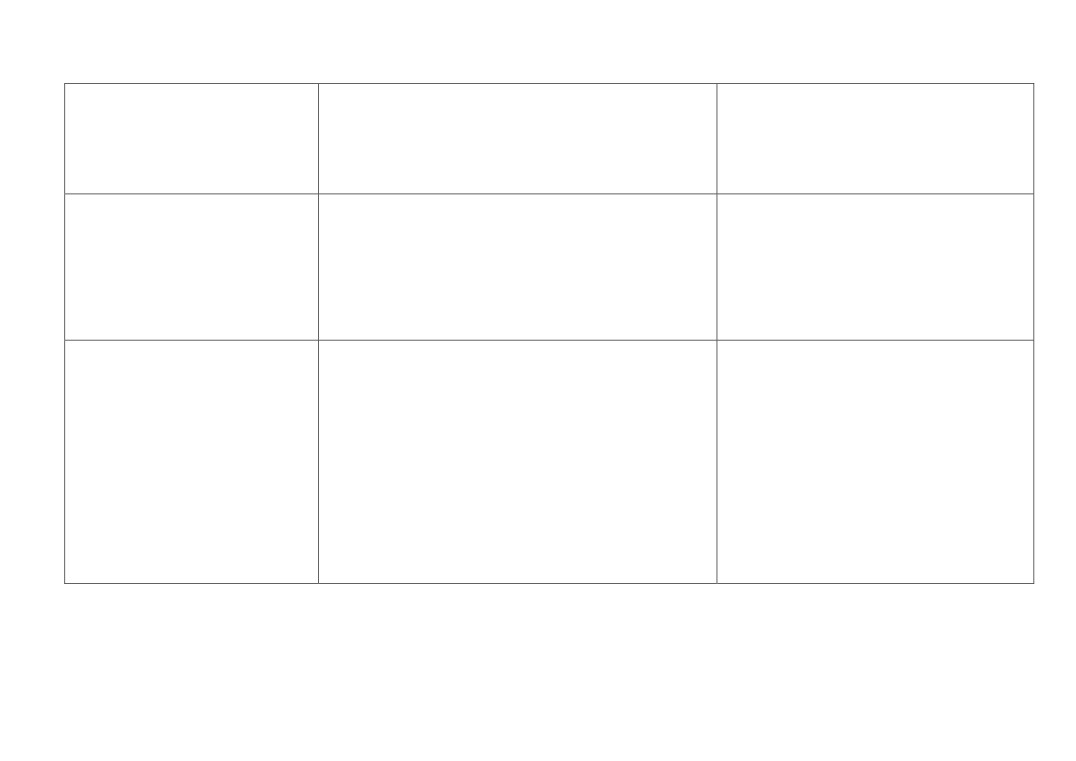

At the 5 October 2020, the delivery statistics are as follows:

Resilience and Recovery Fund

No.

Tranche 1

£

Total Fund Availability

3,500,000

Total Grants Approved

79

3,015,348.00

Funding remaining

484,652

Private Match Funding levered

4,760,217

Jobs sustained

1756

Jobs created

50

New products to be created

40

Case Studies

Micropress Printers Ltd

Micropress Printers Ltd, based in Reydon, East Suffolk, are a one-stop print solution company

offering everything from design to typesetting, repro to proofing, printing to binding and mailing.

It also offers a full design and scanning service, allowing images to be manipulated to the

highest quality. Some of the company's products include: greeting cards, postcards,

promotional material, brochures, stationery, catalogues, newsletters, point of sale material,

annual reports, and training manuals.

Covid-19 had a significant impact on the business, putting a number of jobs in the company at

risk.

The R&R project involves the purchase of a UV Spot Printer, offering a change in the business

model for the company, the chance to move into a new area, and an increased customer base

as a result. The grant provides the reassurance for the company to take on the risk of delivering

the project.

The project also creates one new, skilled job and helps to sustain 150 other jobs in the

company.

Grant awarded £50k, or 31% of the project costs of £159,500.

Clip n Climb Ltd

Clip n Climb is an indoor rock-climbing activity centre with café and soft play facility, a

successful and popular leisure attraction.

Based in Ipswich, the business has been impacted by closure during lockdown and by further

restrictions on numbers of visitors allowed into the facility under social distancing regulations.

With restrictions on the number of paying visitors continuing for some time to come, and

affecting the ongoing viability, the solution is to add 3 more specific areas of capital equipment;

a straight forward climbing wall, a caving ladder and a more challenging climbing wall. This

equipment will allow the facility to be used to its maximum.

Grant awarded £27,131 or 50% or eligible costs of £54,262

The Light Aircraft Co Ltd

The Light Aircraft Co Ltd is the only active light aircraft manufacturer in the UK and is within the

priority sectors of advanced manufacturing and aerospace. They are based in Little Snoring,

North Norfolk.

The company experienced early impact from Covid 19, but the business stabilised shortly after,

allowing consideration of options for diversification and development of the business.

The proposed project has been designed around a recent change to EU aircraft manufacturing

regulations, increasing allowable take-off weight. The company proposes to build to this new

standard whilst reducing production costs through high-quality CNC processes, achieved by the

2

42

introduction of a new lathe, which will also reduce build times. The applicant was expecting to

move to the new regulations, but the impact of Covid-19 has hastened this action.

The project will focus predominantly on the pre-manufactured, self-build aircraft models from

the company’s portfolio and is expected to increase sales, supporting the sustainability of the

company.

Grant awarded £47,250 or 50% of eligible costs of £94,500.

Garden Guardian Ltd

The Garden Guardian is a grounds maintenance contractor to mainly local council, village halls,

churches and housing estates. The service is mainly a grass cutting contract service for playing

fields, parks, gardens, church yards, cemeteries and road verges. The company is based in

Little Plumstead in Broadland.

Impacted by Covid-19 due a decline in the requirement for traditional services, Garden

Guardian Ltd have devised a diversification project to invest in robotic line marking. This type of

service is seen to be fast, accurate, efficient and overall more professional and will also open

up further contract opportunities.

In addition, the company will diversify into the renovation and maintaining of sports pitches

through re-seeding. The re-seeding option is something that they do not currently offer and

work has to be turned away. The disc seeding machine will enable them to provide this

additional an additional vehicle is required to operate the disc seeder and this is also included

in the application.

The current staffing levels will be sustained and one new FTE created.

Grant awarded £25,932 or 50% of eligible cost of £51,865.

Key issues

The scheme operated initially on the emergency State Aid protocols introduced as a result of