New Anglia Local Enterprise Partnership Board Meeting

Wednesday 17th January 2018

10.00am to 12.30pm

Orbis Energy, Wilde Street, Lowestoft, Suffolk, NR32 1XH

Agenda

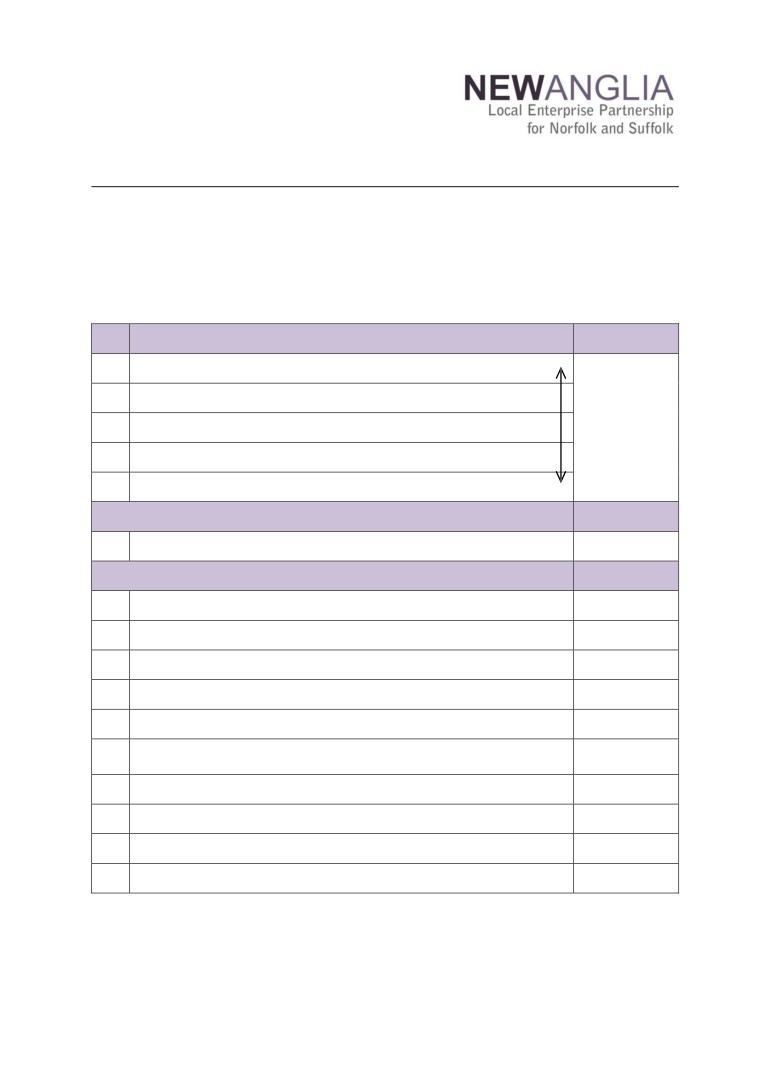

No.

Item

Duration

1.

Welcome

2.

Apologies

3.

Declarations of Interest

20 mins

4.

Welcome from Orbis Energy

5.

Actions / Minutes from the last meeting

Forward looking

30 mins

6.

Aims and Objectives for the Year - Presentation

For discussion

Governance and delivery

100 mins

7.

Capital Growth Programme Projects including Confidential Tables

For Approval

8.

New Anglia Voluntary Community Sector Programme Extension

For Approval

9.

Integrated Health and Employment Service Proposal

For Approval

10.

Growing Places Fund investment The Malthouse - Confidential

For Approval

11.

New Anglia Capital - Confidential

Update

Chief Executive’s report

12.

Update

including PwC and Mary Ney Review Implementation Plan

13.

Finance Report including Confidential Appendices

Update

14.

Appointment of New Director - Confidential

For Approval

15.

Remuneration Committee - Confidential

For Approval

16.

Any Other Business

Date and time of next meeting: 21st February, 2018. 10am-12.30pm

Venue: The Marble Hall, Surry Street, Norwich, NR1 3NG

1

New Anglia Board Meeting Minutes (Unconfirmed)

22nd November 2017

Present:

Cllr David Ellesmere (DE)

Ipswich Borough Council

Doug Field (DF)

East of England Coop

Cllr Cliff Jordan (CJ)

Norfolk County Council

Dominic Keen (DK)

High Growth Robotics

Cllr Colin Noble (CN)

Suffolk County Council

Cllr Andrew Proctor (AP)

Broadland District Council

Prof David Richardson (DR)

UEA

Sandy Ruddock (SR)

Scarlett & Mustard

Dr Nikos Savvas (NS)

West Suffolk College

Jeanette Wheeler (JW)

Birketts

Tim Whitley (TW)

BT

In Attendance:

Cllr Mike Stonard

Norwich City Council (For Alan Waters)

Shan Lloyd

BEIS

Katherine Hunt

BEIS

Chris Dashper (CD)

New Anglia LEP

Hayley Mace (HM)

New Anglia LEP

Lisa Roberts (LiR)

New Anglia LEP

Keith Spanton (KS)

New Anglia LEP

Chris Starkie (CS)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

Tracey Jessop (TJ)

Norfolk County Council

Sue Roper (SuR)

Suffolk County Council

Page 1 of 6

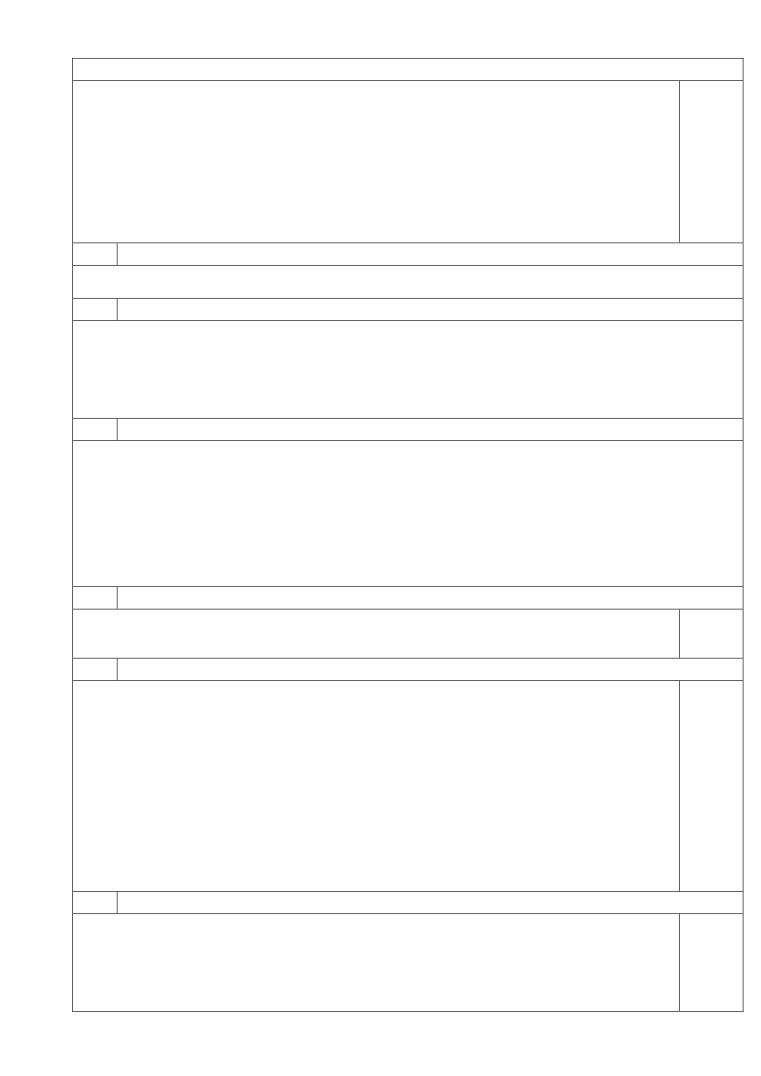

3

Actions from the meeting: (22.11.17)

LEP Governance Review

To express preferences over committee roles to LiR by 1st December

ALL

Business Investment Proposal - Confidential

To receive more detail on the skills spending within the proposal

NK

May Ney Review Including Standards of Conduct

To receive details of where the policies can be accessed.

HM

Board Forward Plan

To provide feedback on the plan and propose any additional items

ALL

Business Performance Reports

To receive a proposal on the Eastern Agi-Tech initiative by email.

CS

1

Welcome from the Chairman

Doug Field (DF) welcomed everyone and thanked Tim Whitley for hosting the meeting. He welcomed

Katherine Hunt from BEIS and Mike Stonard who is deputising for Cllr Alan Waters.

2

Apologies

Apologies were received from:

Cllr John Griffiths

Steve Oliver

Lindsey Rix

Cllr Alan Waters

Julian Munson

3

Declarations of Interest

Full declarations of interest can be found at http://www.newanglia.co.uk/about-us/the-board/.

The board were reminded that declarations of interest are required as part of LEP scrutiny and must be

submitted to the LEP office at the earliest convenience.

Declarations relevant to this meeting:

Jeanette Wheeler (JW) noted an interest in Item 7 and did not take part in the relevant discussion or

decision.

JW also declared an interest in the update on the CITB Announcement provided by Chris Starkie (CS)

within his Chief Executive’s Report.

4

Welcome from Adastral Park

Tim Whitley (TW) welcomed Board members to Adastral Park.

TW provided a presentation on the importance of BT & EE to the immediate geographic area

and gave an overview of the work carried out at Adastral Park.

5

Minutes of the last meeting 25th October 2017

Actions from last meeting updated as follows:

Implementing the Economic Strategy: Review of LEP Programmes

To be advised of the retention rate of jobs created through the VCS Challenge Fund - this has

CD

been requested and a response awaited from the Norfolk Community Foundation.

Investigate whether any Co-Ops have applied for the VCS Challenge Fund - this has been

CD

requested and a response awaited from the Norfolk Community Foundation.

To receive Terms of Reference for each fund - Hard copies are available from Chris Dashper

CD

(CD) or can be emailed on request.

Board to receive business cards with contact details for the Growth Hub and the programmes

HM/HW

team - awaiting delivery.

Britvic and Unilever Presentation

To receive an update from CS following the meeting on 26th October - included in the Chief

CS

Executive’s Report.

6

LEP Governance Review

Lisa Roberts (LiR) took the paper as read and reviewed the proposed scope and approach for

the governance review outlining the recommendations for the Board to consider.

The Board discussed the proposed new structure and the changes to the boards and

committees detailed under the diagram of the First Tier.

Page 2 of 6

4

David Ellesmere (DE) queried whether each of the priority areas should have its own

representative on the new board for the delivery of the Economic Strategy.

LiR advised that the make-up of the Boards had yet to be decided and that the terms of

reference for the Board would be worked up following the decisions made at this Board

meeting. The initial plan was that the priority areas would be represented through the Growth

Groups.

LiR noted that the recommendations being put to the Board were focussed on agreeing the

structure and the way forward and the composition and details would be presented at a later

date.

In order to ensure that the best committee members were in place for each group, the review

would establish membership from scratch and LiR asked that Board members contact her with

expressions of interest in particular boards/committees.

DE noted that the chair of the Economic Strategy Implementation Board should be neutral and

not tied to any particular theme.

The Board agreed:

To note the content of the report

To agree the scope of the governance review

To agree the proposed approach and timetable for phase 2

To agree the recommendations presented for the first tier of the new structure

ALL

To express preferences over committee roles to LiR by 1st December

7

Business Investment Proposal - Confidential

Page 3 of 6

5

The Board agreed:

To receive more detail on the skills spending within the proposal from Nicole Kritzinger

NK

(NK)

That the LEP executive develop relevant funding agreements to ensure the proposed

outcomes are realised, and appropriate clawback mechanisms are in place.

8

May Ney Review Including Standards of Conduct

Chris Starkie (CS) took the majority of the paper as read and reviewed the key points of the

paper.

DE noted that the Standards of Conduct included details of employees remaining politically

neutral and queried whether this meant that they would not attend any meeting at which only

one political party was present.

The meeting discussed the issues around the attendance at meetings with representatives

from political parties and agreed the policy should be amended for clarity over this issue.

CS confirmed that the Whistle-Blowing Policy is currently being updated.

DF requested that all policies be available to access for Board Members.

The Board agreed:

To note the content of the report

To formally adopt the Mary Ney recommendations

To endorse the timetable outlining the implementation of the recommendations.

To adopt the revised polices around conduct, subject to emending the paragraph on

political meetings.

HM

To receive details of where the policies can be accessed.

9

LEP Board Attendance Policy

Doug Field (DF) took the majority of the paper as read and reviewed the key points of the

proposal.

The Board agreed:

To note the content of the proposal

To accept the recommendations made in the report

10

Board Forward Plan

LiR took the majority of the paper as read and asked for questions for the Board.

The Board was advised that the plan would change going forward as the implementation plan

for the Economic Strategy was developed.

Board members were asked for feedback.

The Board agreed:

To note the content of the plan

To provide feedback on the plan and propose any additional items

ALL

11

PwC Report

Doug Field (DF) took the majority of the paper as read and asked the Board for questions

Page 4 of 6

6

Shan Lloyd (SL) noted that while the implementation of the Mary Ney review needed to be

done by 28th Feb 2018 further changes to the Assurance Framework would not be required

until after the further review has been completed.

The Board agreed:

To note the content of the report.

12

Chief Executive’s Report

CS took the majority of the paper as read and provided an update on the following items:

Confidential-

CITB Announcement - A proposal has been made to close the office at Bircham Newton and

relocate the head office to Peterborough. Investigations are ongoing regarding retaining the

card business in situ and also to retain the training section of the site.

Tech Clusters - Plans have been announced to expand the Tech clusters have included

Cambridge but not Norwich or Ipswich. The LEP is supporting the aim to create an East cluster

covering multi-sites and asked for support from the Board.

CS and DF proposed to Greg Clark that the LEP be used to trial the local industrial strategies in

order to be at the front of any changes and have a positive influence in the implementation.

The Board agreed:

To note the content of the report

To support the proposal around a Tech cluster for Norwich, Ipswich and Cambridge.

To ask Government that the New Anglia LEP be a pilot local industrial strategy area.

13

Business Performance Reports

CS took the majority of the papers as read and asked for questions from the Board.

It was noted that, given the ongoing changes to boards, the BPRs will also be subject to review

and so will not be included in the January Board pack.

Ambitions Dashboard - LiR noted that much of the dashboard data was reported annually

and that this would be investigated as part of the implementation of the strategy. The detail

behind the reduction in jobs in the region was being investigated further. The speed of housing

delivery was increasing although still below target.

Call for Projects - Applications are still being received. Those not meeting the conditions of

this call will be held in preparation for future calls.

DK asked how many applications had been received and whether any were turned down due

to lack of available funds.

CD advised that the call for projects under the Capital Growth Programme was likely to be

oversubscribed. He also said that in programmes such as the Growing Business Fund or

Small Grants Programme, bids had not been turned down due to funding availability but were

sometimes scaled down or rejected due to suitability with the criteria. The Growth Deal had

traditionally been oversubscribed so projects were selected that demonstrated the best

strategic fit, deliverability, outcome and value for money. This information can be added into

future reporting.

Growth Deal - Some legal agreements have proved more complex than expected but were

due to be in place before Christmas. The focus is now on chasing spend to ensure it is in place

as agreed however a mechanism for a capital swap has been put in place with Norfolk County

Council for this year.

Page 5 of 6

7

Eastern Agri-Tech - CS provided an update on the programme. GCGP funding is still frozen

however an Agritech panel is still in place to assess and approve projects. A proposal is being

drawn up for the LEP Board on how to manage the financial delivery of projects in Norfolk and

Suffolk approved through that panel, on a case by case basis. This will be circulated to the

Board in December for agreement.

Communications - Hayley Mace (HM) noted that the new website was now live and details of

usage statistics would be built into future reports.

Confidential -

The Board agreed:

To note the content of the report.

To receive a proposal on the Eastern Agi-Tech initiative by email.

CS

14

Finance Report

Keith Spanton (KS) reviewed the Finance report as included in the Board papers highlighting

the following items:

Wages and Salary - LEP staffing is now almost at full capacity. Marketing costs for MIPIM and

Venturefest have come in lower than budgeted.

Legal & Professional fees are higher than budgeted.

The Board agreed:

To note the content of the reports.

15

Eastern Agri-Tech Initiative

To be circulated by email in December.

16

Any Other Business

None

Next meeting:

Wednesday 17th January 2018, 10am-12.30pm

Orbis Energy, Wilde Street, Lowestoft, Suffolk, NR321XH

Page 6 of 6

8

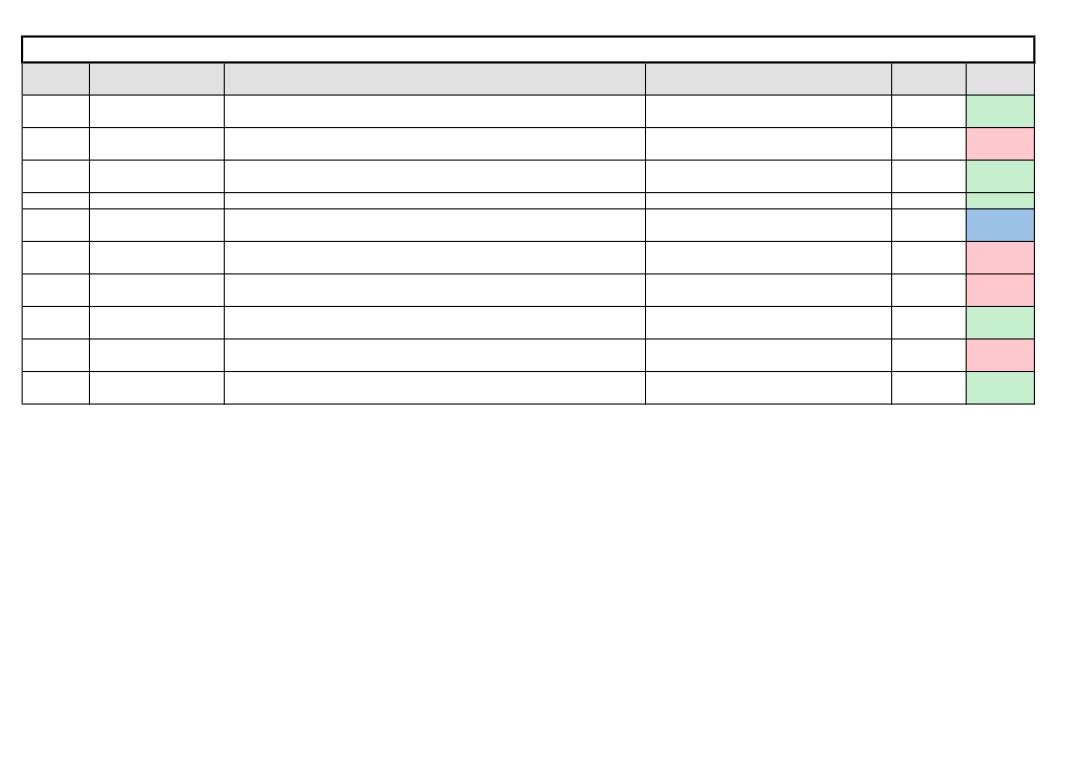

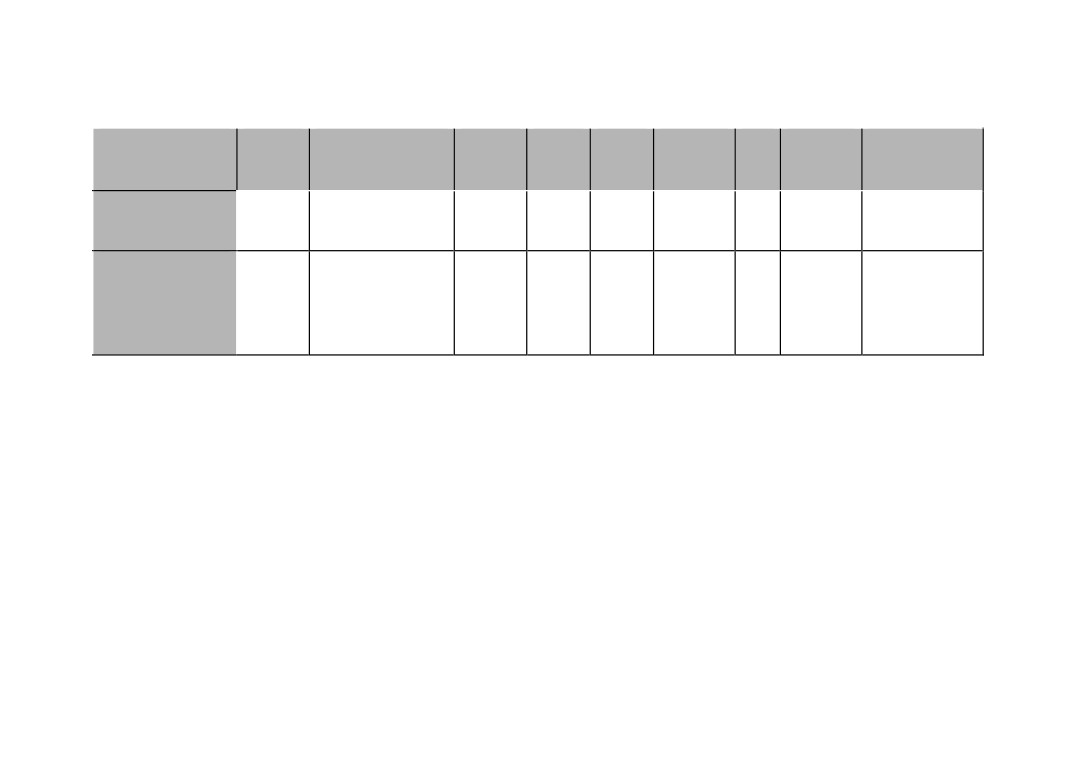

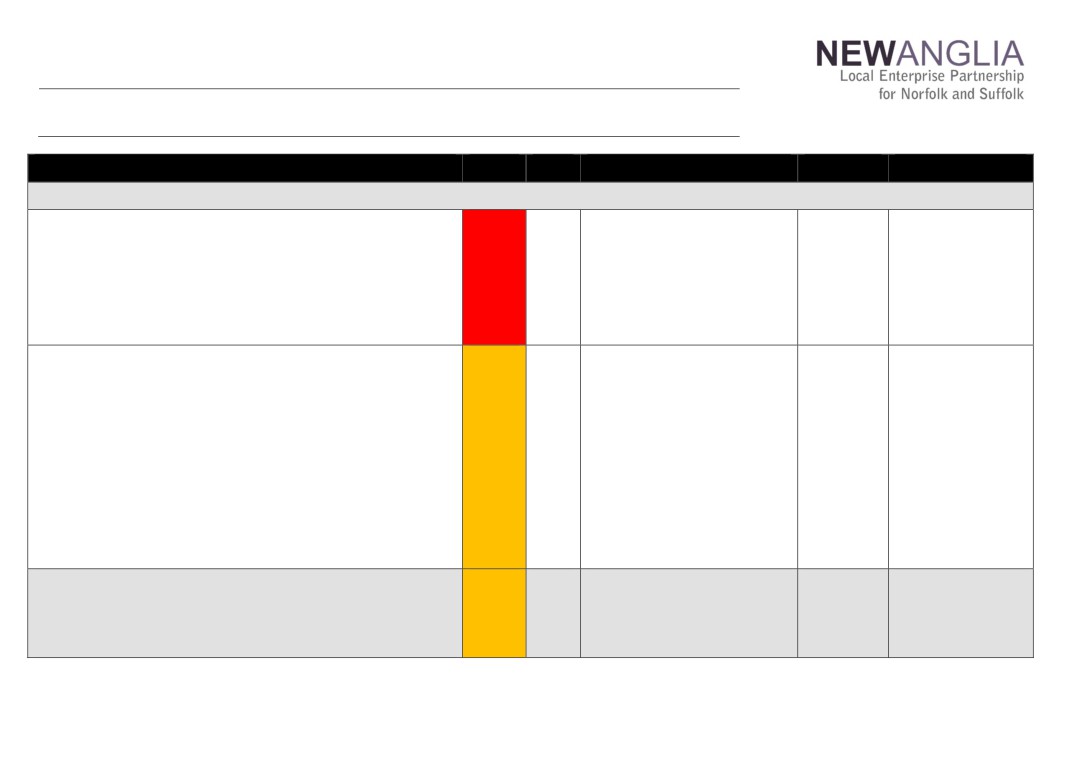

Actions from New Anglia LEP Board Meetings

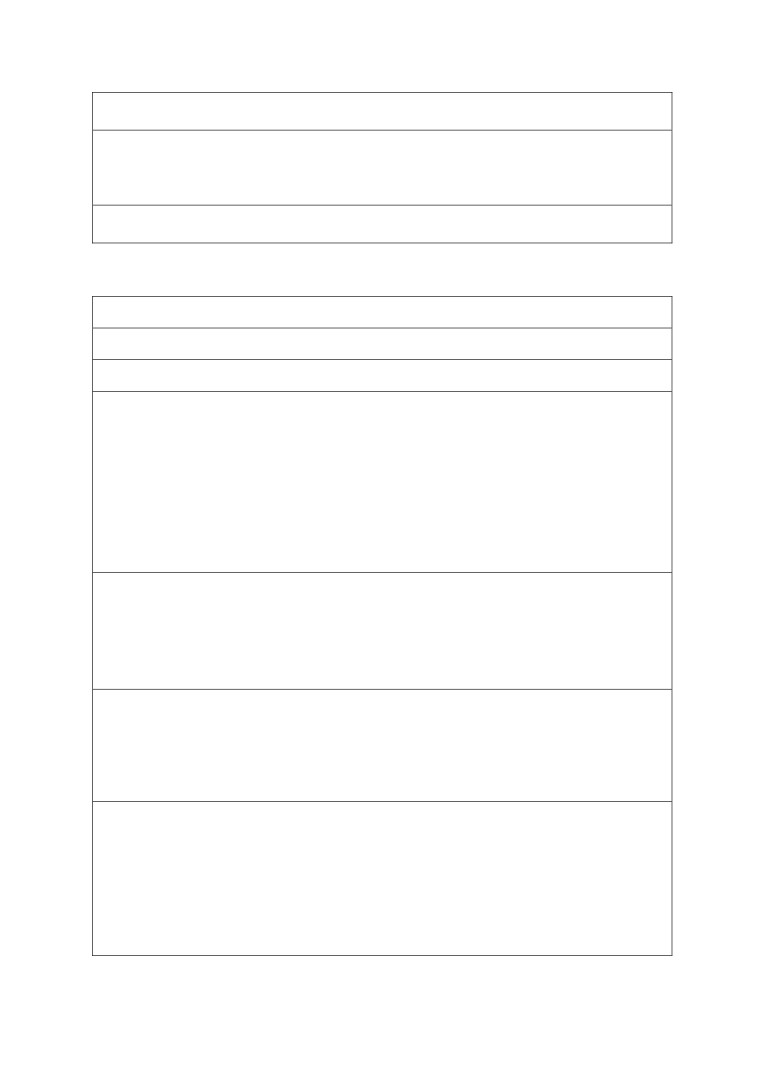

Date

Item No.

Action

Update

Actioned By

Status

22/11/2017

LEP Governance Review

All

Completed

To express preferences over committee roles to LiR by 1st December

22/11/2017

Business Investment

To receive more detail on the skills spending within the proposal

Further details to be included in the funding

NK

On-Going

Proposal

application

22/11/2017

Mary Ney Review

To receive details of where the policies can be accessed.

Published on web site with link issued to Board

HM

Completed

members

22/11/2017

Board Forward Plan

To provide feedback on the plan and propose any additional items

ALL

Completed

22/11/2017

Business Performance

To receive a proposal on the Eastern Agi-Tech initiative by email.

On hold pending clarification on the situation

CS

On Hold

Reports

at GCGP

25/10/2017

Implementing the

To be advised of the retention rate of jobs created through the VCS Challenge

To be provided at the November Board

ID

On-Going

Economic Strategy

Fund

meeting

25/10/2017

Implementing the

Investigate whether any Co-Ops have applied for the VCS Challenge Fund

To be provided at the November Board

CD/ID

On-Going

Economic Strategy

meeting

25/10/2017

Implementing the

Board to receive business cards with contact details for the Growth Hub and the

Card have been ordered and delivery awaited

HM/HW

Completed

Economic Strategy

programmes team.

20/09/2017

Business Performance

To receive a future report on the approach to NAC investments

To be presented to the Board in January

CD

On-Going

Reports

23-May-17

Inward Investment

An inward investment/international committee to be created with Jeanette

A committee has been established with the

JM

Completed

framework

Wheeler, David Richardson, Mark Goodall and Tim Whitley.

first meeting being planned

9

New Anglia Local Enterprise Partnership Board

17th January 2018

Agenda Item: 7

Capital Growth Programme Call: Project recommendations

Author: Chris Dashper

Summary

The Capital Growth Programme call for projects was launched immediately following the

October 2017 LEP Board meeting.

Under the call £9m of grant funding from the Growth Deal has been made available to

support projects that help deliver the new Economic Strategy.

A total of 29 project Expressions of Interest were received, with sectors including

infrastructure, transport, employment projects, skills and cultural themed projects.

All projects have been independently appraised using a comprehensive range of criteria.

However questions raised by the independent appraisers means that the majority of the

projects need to supply further information to allow a more detailed assessment to take

place before a decision can be made on whether or not they should be recommended for

funding.

This paper recommends approving two projects which satisfy the criteria and require a timely

decision, deferring decisions on a further 20 projects pending further information and

rejecting seven projects.

Deferred projects, depending on when they are ready, would be brought back to a spring

board meeting or referred to a further Growth Deal funding round, currently scheduled for the

summer or autumn of this year.

Recommendation

The Board are asked to:

Approve the award of Growth Deal grant funding to the following projects in table 1:

Bacton to Walcott Coastal Management Scheme

Cefas Research Centre

Approve the recommended decision option for each of the projects in tables 2 and 3:

Table 2: Recommended to defer

Table 3: Recommended to reject

1

11

Background

The Capital Growth Programme call for projects was launched immediately following the

October 2017 LEP Board meeting.

Under the call £9m of grant funding from the Growth Deal has been made available to

support projects that help deliver the new Economic Strategy.

Of this funding £4.3m came from the deallocation of existing projects in Growth Deals One

and Two and £4.7m from our Growth Deal Three allocation.

The call for projects closed on 30 November 2017. A total of 29 project Expressions of

Interest were received, with sectors including infrastructure, transport, employment projects,

skills and cultural themed projects.

Following a first stage sift of the projects, our independent appraisers Hewdon Consulting

have completed the initial appraisal of the project applications received.

All projects have been appraised in accordance with HM Treasury Green Book principles of

viability, value for money, achievability, affordability and need.

To ensure that projects reflect New Anglia LEP priorities and most importantly assist in the

delivery of the Economic Strategy, the Strategic Prioritisation Framework, developed with

Metro Dynamics has also been applied by Hewdon Consulting.

Key areas have been scored 1-5 for each project, with 5 being the highest.

Details of the appraisal methodology can be found after the tables at appendix 1.

The top two projects are recommended for approval. Their scoring was clearly higher than

all other projects and they require a timely decision. These projects would utilise £2.48m of

the £9m. Details of these projects are in table one.

Most of the other projects need to supply further information to allow a more detailed

assessment to take place before they can be brought forward for a decision by the board.

None of these projects requires an urgent decision to be made. Details of these projects are

in table two. The information contained in this table should be considered confidential.

We recommend the LEP executive continues to engage with these projects, with a second

batch brought for consideration at a spring board meeting when ready. Funding available for

this would be £6.52m, being the balance of the £9m assuming the two projects for approval

are agreed.

Looking further ahead, once the £9m from this call is fully allocated, the Capital Growth

Round will still have £23m available and we are planning a second call for projects later in

the year. This will be in the summer or autumn.

Deferred projects if not ready to be funded in the spring round, will be encouraged to bid into

this new round.

Given the learnings from this round, chiefly that very few projects provide the level of

information required for a decision to be made, the next round will need some tweaks to the

process.

The main change will be to allow more time between the completion of the independent

appraisal and the board decision.

2

12

This will allow project promoters to supply more information which was lacking in their

application, or to answer specific queries raised by the project assessor.

We will also be working to ensure that applications to the new call are of a higher standard.

Finally there were a number of projects which were not strictly eligible for funding via this

mechanism. There were also a few applicants seeking additional funding for projects which

have already received funding from the Growth Deal. The LEP board has previously

indicated it would only put more money into a project if there were additional outputs

generated as a result of the further investment. Details of these projects are in table three.

The information contained in this table should be considered confidential.

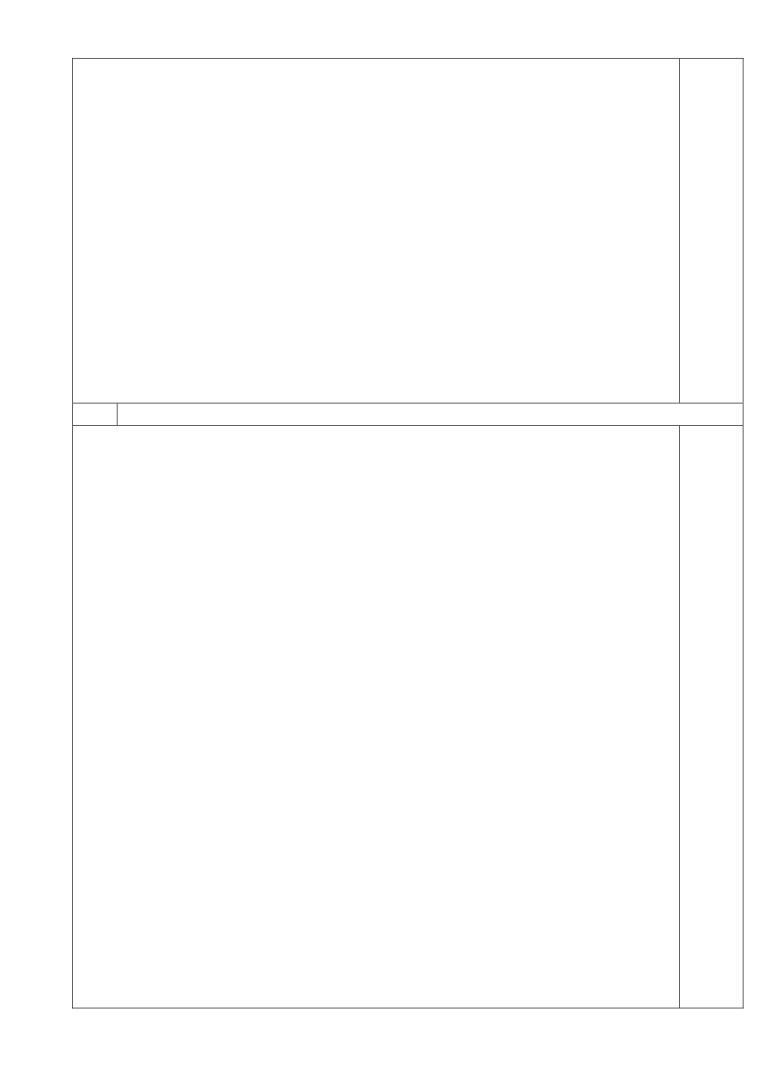

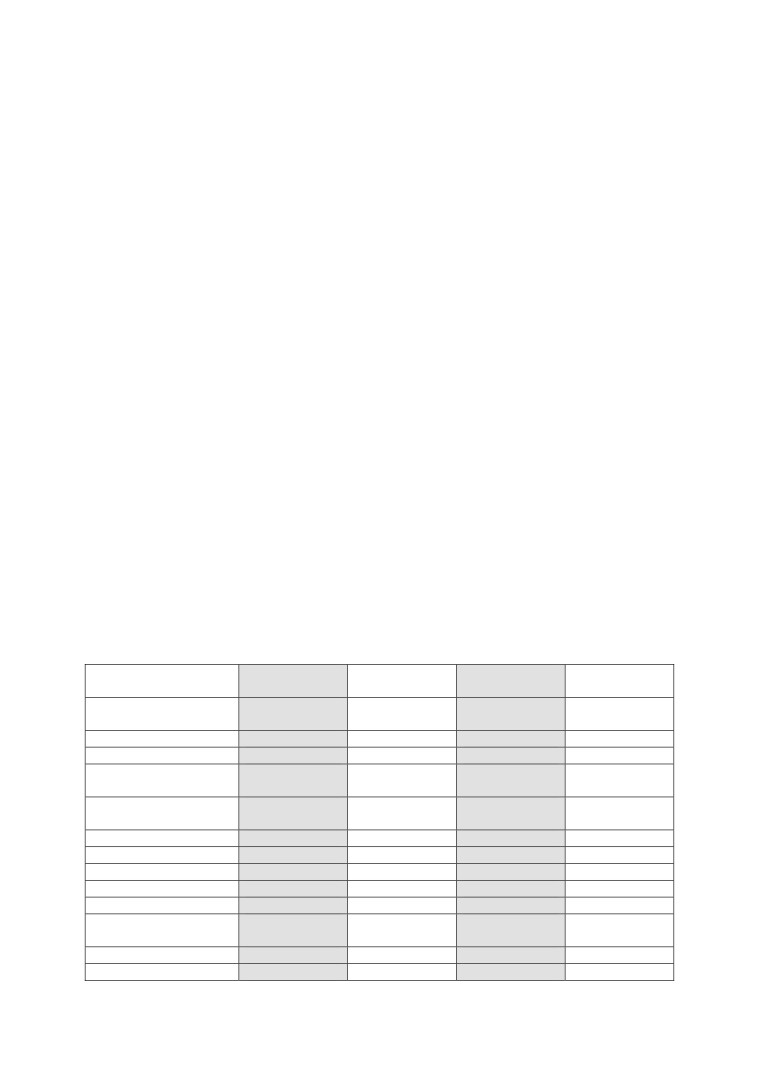

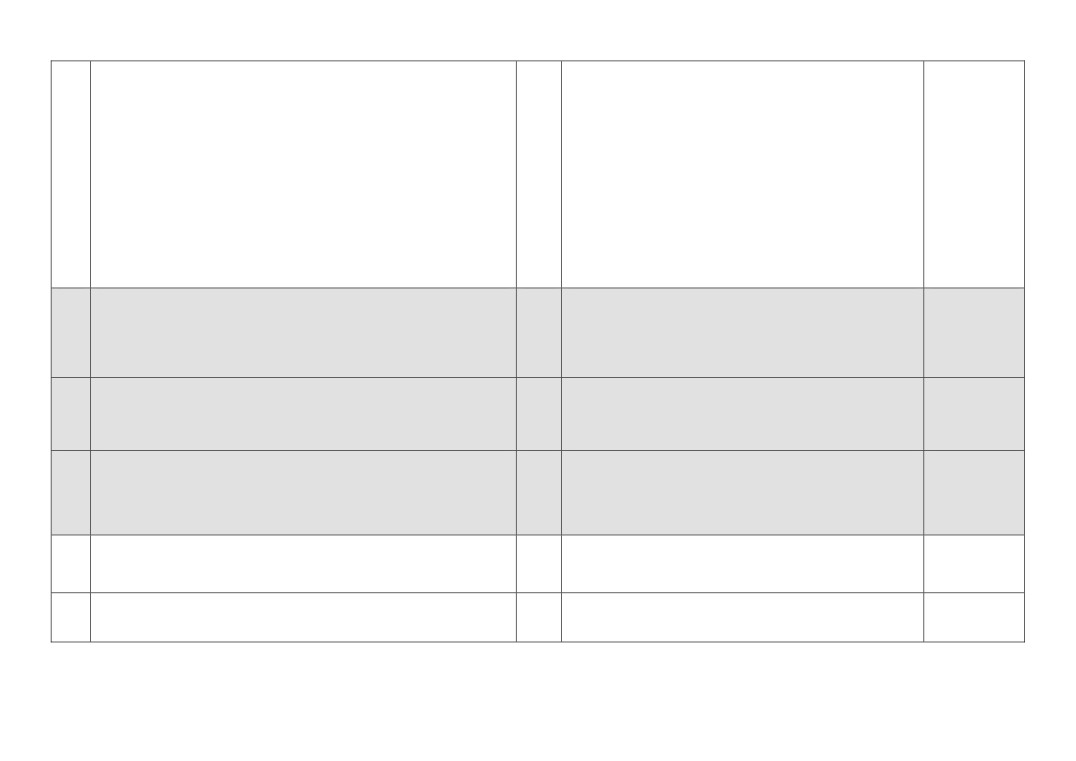

Project sectors by county

Project Sector

Norfolk

Suffolk

Total

Flood defences and

6

2

8

Infrastructure

Transport

2

5

7

Employment Space

2

3

5

Skills

2

4

6

Tourism Culture and Media

2

1

3

Total

14

15

29

Financial implications

The two projects recommended for approval would utilise £2.48m of the £9m.

This would enable £6.52m to be available for a spring approval round.

A further £23m would then remain for a future call to be held in the summer/autumn.

Recommendation

The Board are asked to:

Approve the award of Growth Deal grant funding to the following projects in table 1:

Bacton to Walcott Coastal Management Scheme

Cefas Research Centre

Approve the recommended decision option for each of the projects in tables 1 and 2:

Table 2: Recommended to defer

Table 3: Recommended to reject

3

13

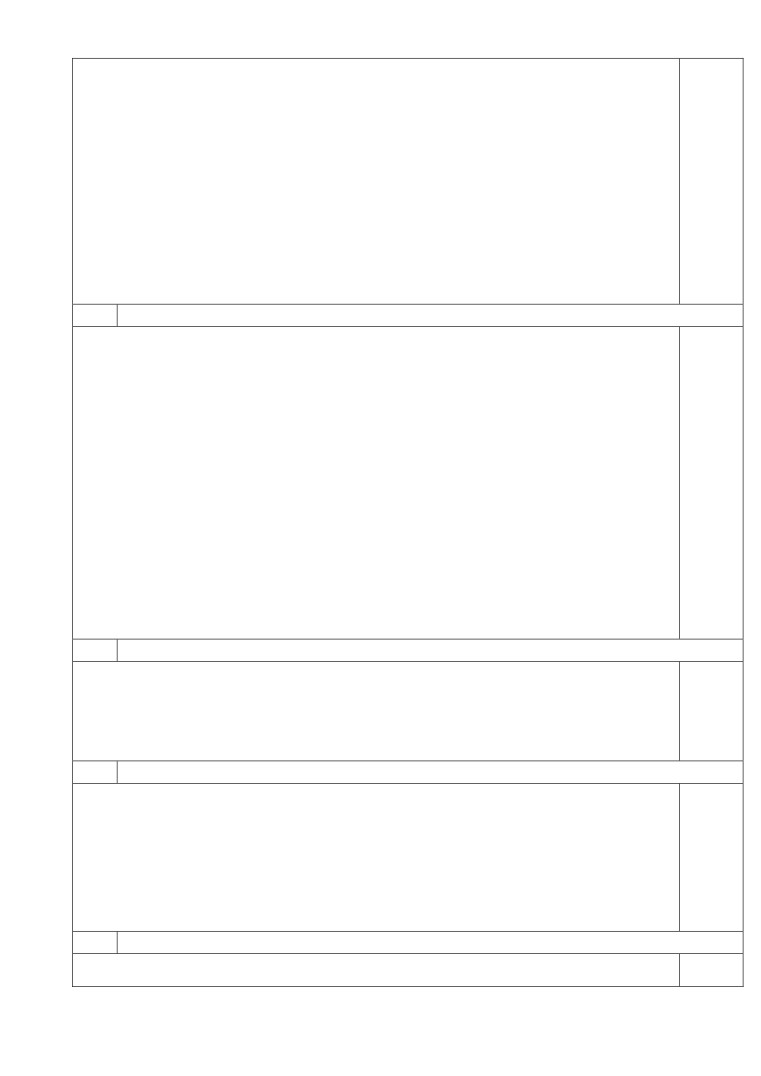

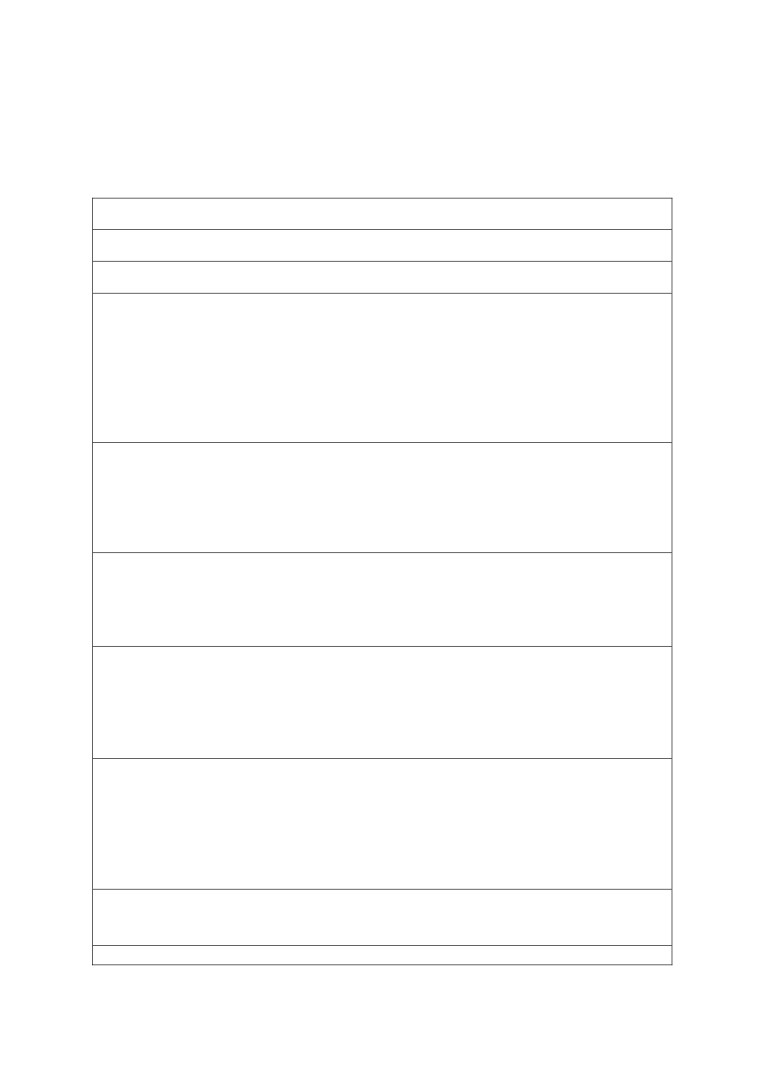

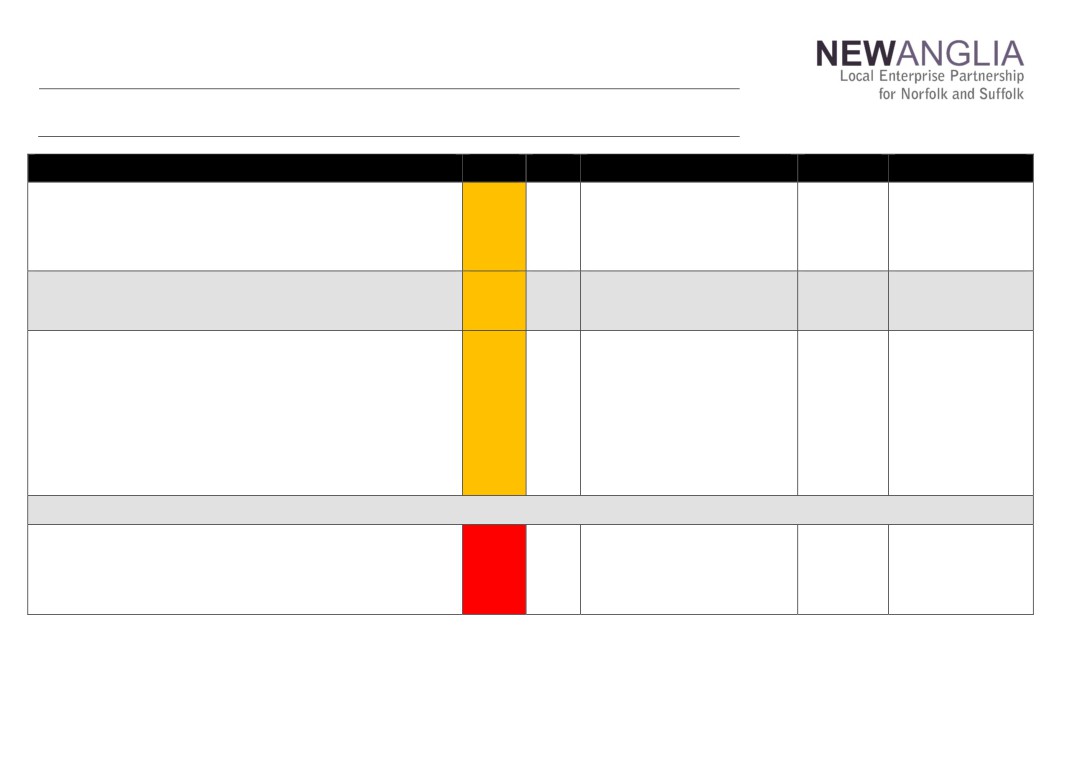

Projects to be approved (Table 1)

Name of Project

£

Outputs

Strategic

Deliver-

Additio-

Economic

Total

State Aid

Recommendation

Request

fit

ability

nality

Impact

Compliant

Bacton to Walcott

1.08

1258 jobs

5

5

5

5

20

Yes

Approve

Coastal Management

222 homes protected

Scheme

230 businesses

£51m GVA

Cefas Research

1.40

450 jobs safeguarded

5

5

3

3

16

Yes

Approve

Centre upgrade

50 new jobs created

3200m2 office space

5300m2 refurbished

space

11-15 Apprenticeships

4

14

Appendix 1

Appraisals for approved projects

Bacton to Walcott Coastal Management Scheme £1.08m

Project

Bacton to Walcott Sandscaping Project

Applicant

North Norfolk District Council

Request

£1,080,000

Summary of Proposal - The Bacton to Walcott Sandscaping Project seeks to protect

Bacton Gas Terminal and the adjacent villages from coastal erosion by an innovative

Dutch ‘Sandscaping’ method. Large volumes of sediment (1.5-1.8 M cubic metres) will be

placed on the beaches in front of the soft cliffs to protect the area’s sea defences from

damage. The project cost is £17-20m and it is scalable, with the higher cost enabling more

sand to be poured and better protection. The private sector (Bacton Terminal) is

contributing £12.2-13.4m and £6.5m is coming from various public sector sources. The

contribution from the LEP would help the project reach optimum size.

Outputs

1,258 jobs secured

222 homes protected from flooding

Project supports 230 businesses and £51 million of annual GVA

In addition the flat sand beach created could attract sand yachts, kite surfing etc and boost

the tourist economy.

Strategic fit - The Economic Strategy recognises Bacton Gas Terminal as “a major

component of UK energy infrastructure, providing one third of the UK gas supply, making it

an essential component in ensuring the future energy security of the UK.” It also says that

“Infrastructure improvements underpin all our priority places and themes [including] Flood

defences that unlock or protect housing and commercial development.”

Deliverability of Project

This is a very sophisticated project with an international consultant team and subject to the

rigorous EA Green Book appraisal process. It is expected to receive Outline Business

Case approval in early 2018, leading to completion of detailed design and consents. The

project would start in Spring 2019 and take 4 months to complete. Even if the programme

were to slip, it should still be possible to draw down LEP funding in 2018-19.

Additionality

As this is a flood defence project, it largely safeguards existing activity and the additionality

in terms of increased economic activity is poor. For this reason, the government assesses

flood defence projects in terms of activity safeguarded, which is a more appropriate

measure. For this project, the “do nothing” option is to put a third of the UK gas supply at

risk. More guidance is set out in EA’s “Guidance for Risk Management Authorities” (Feb

2014)

Value for money

To obtain OBC approval the project will have to demonstrate a BCR in excess of 1:1. The

bid states that it is estimated as a minimum of 1:1.34 and could be as high as 1:6

State Aid Compliance

8

18

More detailed due diligence will be required but the state aid position appears to be

acceptable.

Comments

This project has national importance, is deliverable and will pass the government’s own

additionality test before proceeding. There is a slight concern about state aid although the

risk of challenge appears very slight.

Recommendation

Approve, subject to due diligence, particularly on state aid issues.

Cefas Research Centre

Project

CEFAS Marine Science Hub

Applicant

Department for Environment, Food & Rural Affairs

Request

£1,400,000

Summary of Proposal - To provide a long-term, fit-for-purpose marine science facility that

will secure the Centre for Environment, Fisheries and Aquaculture Science (CEFAS) in the

region for the next 40 years. Defra have considered a range of national alternatives. The

project will deliver:

- The replacement of Victorian, 1930’s and 1960’s buildings with a modern, fit for

purpose facility saving £2m per annum in capital and running costs;

- Scientific operations will be greatly enhance as physical interactions are enabled

driving innovations;

- Significant image and brand enhancement to better attract global customers and staff;

Outputs

Safeguard 450 CEFAS jobs

3200m2 of new office space

5300m2 of refurbished laboratory and office space

12-15 apprenticeships per annum

50 immediate subcontractor jobs

Strategic fit - CEFAS is specifically referenced in both the SEP and the Economic

Strategy. Its presence in Lowestoft is seen as a vital component of the Life sciences

cluster which includes University of East Anglia and Norwich Research Park with two

major UK life science centres in the John Innes Centre and Sainsbury Laboratory. This

project secures CEFAS in Lowestoft. Their presence provides a critical mass to the

ambition for a Life Sciences cluster.

Deliverability of Project - the project appears to be in the advance stages of preparation,

though final costings are now expected by April 2018. The application states the following

have been obtained / secured:

Full planning permission approved in July 2017

Defra funding

Experienced contractor appointed

A fully developed business case

Designs developed to RIBA stage 3

9

19

This information is taken at face value for now but each should be evidenced if an award is

to be made.

Additionality

- While no new jobs, or dwellings will result from this project, the

application does state that this project will support CEFAS Lowestoft with potential for 10-

20% growth over coming years. The 34,000 additional sqft could play a role in this though

as the project includes the demolition of the former grand hotel building and ancillary

buildings it is not clear how much net additional space is being created.

Value for money - The development of a more modern and fit-for purpose working

environment and facility to support the 440 skilled jobs directly supported by CEFAS are

vital to this area of Norfolk and Suffolk. Two minor points require confirmation before the

final offer is released:

.No breakdown of the build costs was included in the application. The project appears

to deliver a cost per sqm of new or refurbished spaced for £1,800 which is acceptable.

However further review is needed on the refurbishment costs in particular, to be clear

on the extent of works being undertaken and the added value generated by the

refurbished space.

The project also includes the demolition of the former grand hotel building and ancillary

buildings. It is not clear from the application how much net additional space is being

created.

State Aid Compliance - As a government agency housed in a building owned by a

government department, it is assumed that any public funding would be state aid

compliant.

Comments - CEFAS is a world class centre for marine science, research and

sustainability and is a key player in the economic offer of Norfolk and Suffolk. The LEP

considers CEFAS to be a strategic partner in the delivery of the outcomes contained in its

Economic Strategy, and believes that the CEFAS’ expansion plans involve an attractive

and progressive design very much in keeping with the wider regeneration of the Lowestoft

sea front. The development of a more modern and fit-for purpose working environment is

vital to this area of Norfolk and Suffolk. New Anglia LEP held the June Board meeting at

the current CEFAS building.

Recommendations - This project is supportable subject to final due diligence.

Appendix 2 Appraisal Process

New Anglia LEP Strategic Prioritisation Framework - key areas

Strategic Fit

Consideration of whether the aim of the project is referenced in the Economic Strategy. Also

consideration of national economic development policy priorities, particularly those in the

Autumn Budget 2017 and the Industrial Strategy White Paper.

Deliverability

The main criterion was whether the project was sufficiently well advanced to draw down LEP

funding in 2018/19 and to complete by 2020/21 as the Call required. Key indicators of

deliverability included:

o Planning consent and land acquisition in place

10

20

o Other funding being committed

o A well-developed business case

Additionality

Projects should be able to demonstrate the addition of measurable direct outputs

corresponding to those in the Economic Strategy - such as jobs, houses, or Gross Value

Added (GVA) increase.

Economic Impact and VfM.

Ideally the outputs should be converted to a monetary value such as GVA and compared

with the cost to obtain the Net Present Value of the intervention. The exception is transport

projects for which a Benefit:Cost Ratio (BCR) is used.

Call for Projects criteria

In addition to the strategic prioritisation framework, projects have been assessed in line with

the key criteria outlined in the Call for Projects paper from October board including:

Capital Growth Programme Core outputs

Connectivity- investing in essential projects and assets that improve the infrastructure

and which create a modern, mobile, accessible future-proof digital connected

economy.

Unlocking Growth- investing in infrastructure that unlocks or protects housing or

commercial developments in our key growth locations.

Investing in skills- investing in projects that deliver the higher level skills needed to

drive growth across our economy with a particular emphasis on our ‘innovation’ and

‘enabling’ sectors,

Key project assessment criteria

Whether the need for the project has been clearly demonstrated

Evidence of option appraisal and business case

How well the project meets the priorities of the Economic Strategy

How well the project fits with local and sub-regional plans and priorities

Potential for alternative funding, partnering and joint schemes

Estimated costs with level of detail to reflect the current stage of the project

Potential of the project to contribute to economic growth

Potential of the project to achieve payback

How likely the project is to be successful

How risks will be managed and mitigated

Economic outputs and impacts created by the project

How the benefits of the project will be sustained after LEP funding finished

Further Appraisal techniques used in the assessment of the projects:

Justification of local economic need

Evidence of failure in commercial markets

Viability gaps for development of sites

Opportunity to accelerate delivery of development

State Aid

11

21

New Anglia Local Enterprise Partnership Board

Wednesday 17th January 2018

Agenda Item 8

Voluntary and Community Sector Prize Challenge Fund

Author: Iain Dunnett

Recommendation

The Board are asked to:

1. Note the commitment of Norfolk and Suffolk Community Foundations in seeking

further public/private match funding for the Voluntary and Community Sector (VCSE)

Prize Challenge Fund.

2. To agree the re-scoping of the criteria for the fund as described in this paper.

3. To agree that the LEP makes the further commitment of a £250,000 grant from the

Growing Places Fund for 2018/19 and to agree to review further commitments for two

years beyond 2018/19 at an appropriate stage.

4. To agree that two LEP Board Members are selected to sit on the Funds Appraisal

Panel.

Background

In 2014 the New Anglia LEP Board approved a grant of £500,000 from the Growing Places

Fund to develop the VCSE Prize Challenge Fund for the sector.

By working in partnership with the Norfolk and Suffolk Community Foundations the

programme has been able to support ready for work and employment initiatives developed

by VCSE organisations operating across both counties. The funding was split evenly over

three years from 2014 to 17.

The VCSE Prize Challenge Fund was designed to;

Meet employability outcomes by providing grants to grassroots VCSE

organisations.

Enable them to support people furthest from the labour market towards becoming

work ready or into employment.

Encourage innovation in the VCSE around employability and skills.

The model deployed included annual grants of £20,000 per annum awarded to 8 VCSE

sector applicants, with the facility to award further investment of £25,000 later in the project

1

23

to the two best performing projects to help them to scale up and sustain their activity and

deliver more outputs. Those projects selected were able to demonstrate an innovative

approach to supporting those furthest from the labour market and an ability to co-invest

other funds into the programme.

The decision making progress for the allocation of grants involves an application process

overseen by the Community Foundations which includes;

A call for projects.

Applications being assessed by Foundation staff.

Applications considered by an appraisal panel with LEP Board representation.

A decision then conveyed to the organisation.

The lessons learned from the first three years are articulated below as follows:

The VCSE has significant potential to deliver employability outcomes.

The ‘work ready’ aspect needs more definition to enable groups to be able to report

across a spectrum of work readiness outcomes.

The programme has attracted a good range of VCSE organisations.

Outcomes

The outcomes achieved were as follows:

227 people into employment over the three years.

628 people developed to a work ready situation.

30 projects supported in delivering employability and work outcomes.

The specific outcomes per project can be seen in Appendix A. Where there are gaps for

project results the outcome results are still awaited. Data is not available for some projects

until April for the current year projects, and June for those currently working through a year 2

award. Outputs achieved for some individual projects are lower than targets set, but this

must be viewed against the nature of the client group and extreme variations between

projects and individuals on how long it can take to achieve those outcomes, conversely this

is part of the reason to extend LEP funding to ensure the work continues with this client

group and is not a short term “funding one off”.

Although the fund was established prior to the publication of the LEP’s Economic Strategy

the fund has supported the LEP to realise ambitions within the Economic Strategy, in

particular to the development of skills in key sectors, employability and attainment

standards across Norfolk and Suffolk.

Proposal

Now the programme has successfully run for three years further work has been completed

on developing a proposal for a successor programme and re-scoping the criteria to ensure

linkage to the Industrial Strategy Key Sectors; to assist in implementing the LEP Skills Board

approved Sector Skills Plans; and supporting the LEP to realise its ambitions within the

Economic Strategy in particular to the development of skills in key sectors, employability

and attainment standards across Norfolk and Suffolk .

2

24

The LEP Board are requested to consider providing an additional £250k grant from the

Growing Places Fund to extend the programme over 2018/19, and to consider at a suitable

future stage a financial commitment for a further two years of operation, from 2018 to 2021.

This will sustain the positive employment outcomes and impact the fund has had within the

sector, and directly support the delivery of one of the key strands of the Economic Strateg -

“inclusive growth”.

As part of this continued activity the Community Foundations are seeking further

public/private match funding for the Prize Challenge Fund. It is expected that the successful

model used previously will be largely replicated and the general application criteria will be re-

used.

Re-scoping has indicated that further consideration will be given to the development of target

activities that have a high social investment value in relation to the objectives of the LEP and

the VCSE. For instance, the development of Care Farms and Care Social Enterprises,

Cooperatives/projects concerning the disposal of public assets to the voluntary and

community sector, or cultural/museum projects that have a strong volunteer/ tourism/visitor

economy benefit, would potentially be projects that both the LEP and VCSE would share an

interest in supporting.

Proposals for other elements of re-scoping the Community Challenge Fund include the

following:

Offering a two tier programme that offers opportunities for smaller, innovative VCSE

organisations as well as significant multi-year grants for larger organisations capable

of high level delivery and/ or consortium proposals.

Strengthening the links/ match funding requirement from the private sector for large

grant applicants.

In relation to “small” grants the overall targets for each year will be maintained at an

aggregate of 100 people into employment and 300 people becoming work ready.

In relation to “large” grants each application will be judged on its merits. However the

expectation will be that the larger grant awards will deliver significant results against

the new criteria.

New outcome headings will be added to the programme to develop a better

understanding of the projects effectiveness in relation to work readiness and

employment outcomes, and the projects ability to attract match funding. These new

outcome headings will be in the following areas:

1. Entered into self-employment.

2. Entered an apprenticeship.

3. Become a regular volunteer.

4. Achieved accredited qualifications.

5. Completed a work experience placement.

6. Entered or re-entered education or training.

7. Achieved increased basic skills.

8. Projects ability to attract match funding.

9. Job retention rates.

10. Cooperatives supported.

Finances

3

25

The funding required would be an allocation from this year’s LEP’s Growing Places Fund

budget. An allocation was previously agreed as part of this year’s budget and is therefore

available to invest in this project.

Recommendation:

The Board are asked to:

1. Note the commitment of Norfolk and Suffolk Community Foundations in seeking

further public/private match funding for the VCSE Prize Challenge Fund.

2. To agree the re-scoping of the criteria for the fund as described in this paper.

3. To agree that the LEP makes the further commitment of a £250,000 grant from the

Growing Places Fund for 2018/19 and to agree to review further commitments for two

years beyond 2018 at an appropriate stage.

4. To agree that two LEP Board Members are selected to sit on the Funds Appraisal

Panel.

Appendix A

Three year results monitoring report and projects are shown below. Where there are gaps

for project results the outcome results are still awaited. Data is not available for some

projects until April for the current year projects, and June for those currently working through

a year 2 award. Outputs achieved for some individual projects are lower than targets set on

a number of projects, but this must be viewed against the nature of the client group and

extreme variations between projects and individuals on how long it can take to achieve those

outcomes.

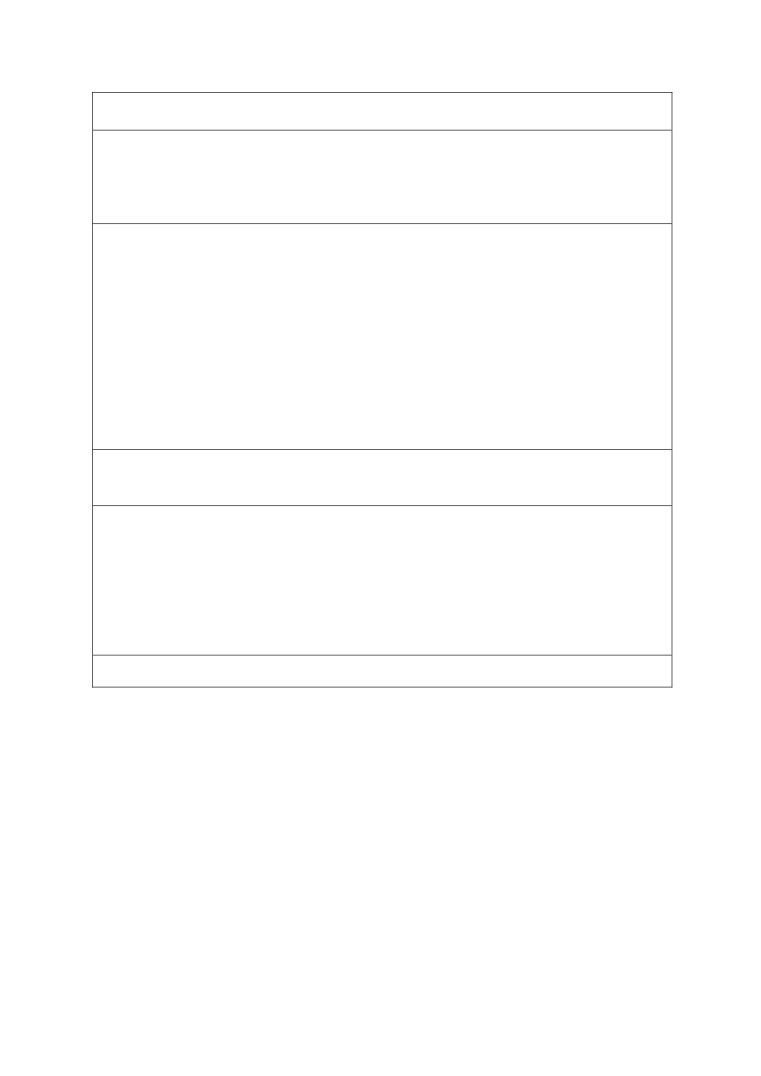

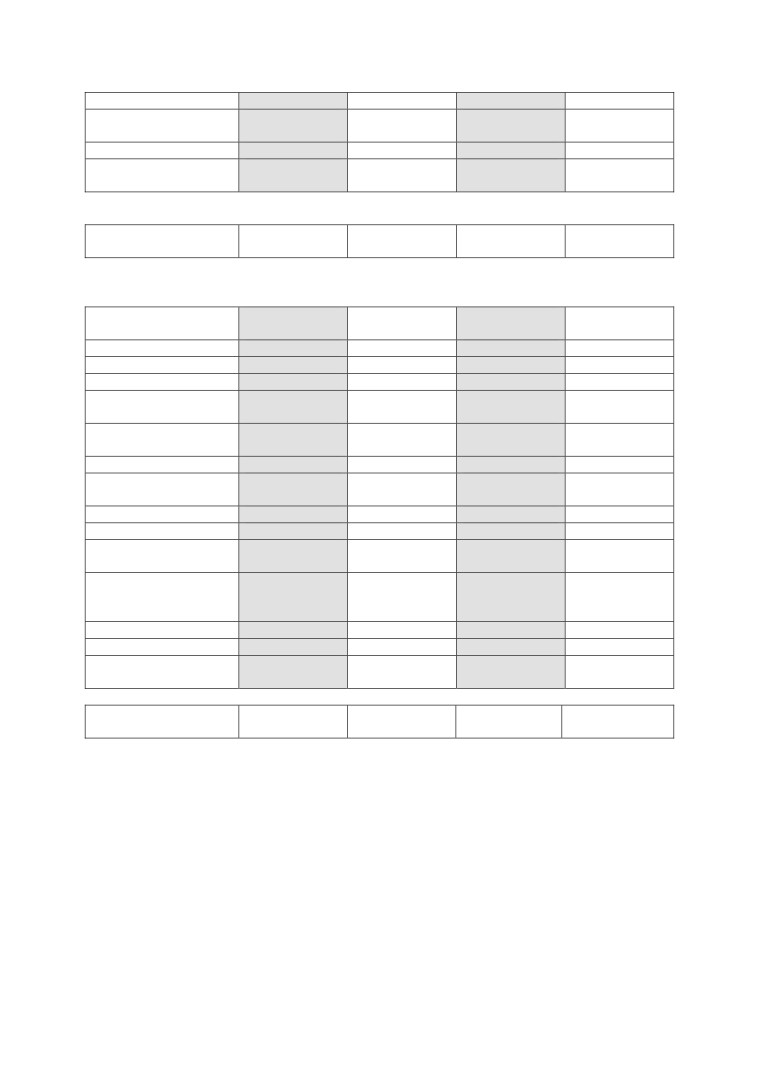

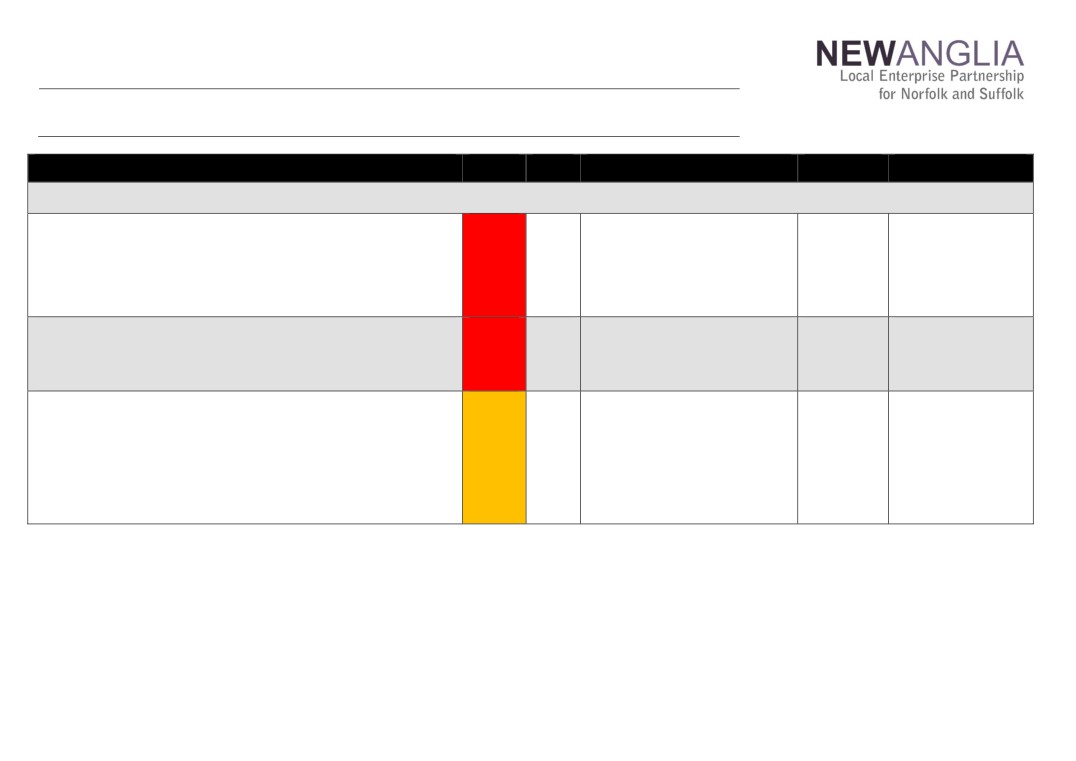

New Anglia LEP Outcomes 2014 - 2017

Suffolk

Organisation

Work Ready -

Work Ready -

Employment -

Employment

supported

Target

Actual

Target

- Actual

Museum of East

20

15

8

15

Anglian Life (MEAL)

Suffolk Sport

40

41

8

27

Julian Support

24

6

24

0

Access Community

50

101

25

28

Trust

Suffolk Sport (Year 2

8

8

4

4

prize)

MEAL (Year 2 prize)

36

27

18

12

Limeskills

30

41

20

17

Headway

25

27

15

21

Pro Corda

15

13

0

7

Cook with Me

40

56

32-48

3

Headway (Year 2

30

20

prize)

The MIX

30

12

Suffolk Refugee

10

5

4

26

Support

Eastern Enterprise

45

20

Hub

Inspire Suffolk

96

52

Access Community

50

30

Trust

Suffolk totals:

549

335

309

134

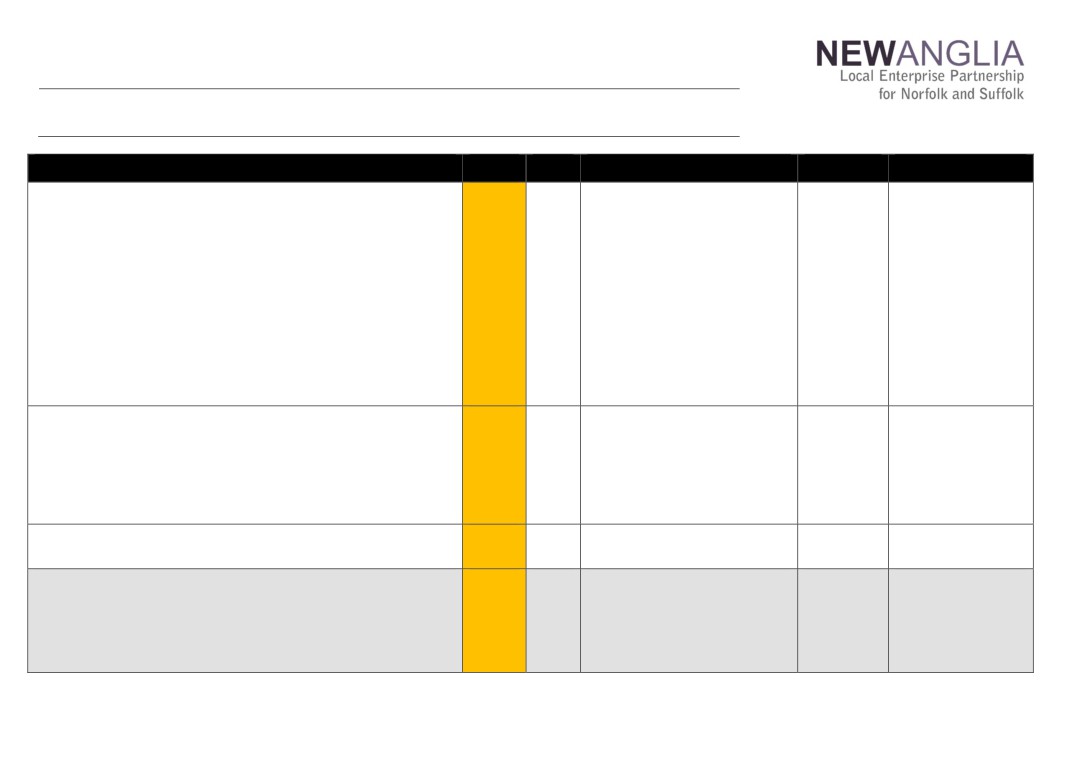

Norfolk:

Organisation

Work Ready -

Work Ready -

Employment -

Employment

Target

Actual

Target

- Actual

Bicycle Links

36

30

8

7

Equal Lives

28

21

7

3

GYROS

69

86

27

16

Harleston Information

25

34

10

18

Plus

Equal Lives (Year 2

5

0

prize)

St Edmunds Society

45

20

25

12

Action Community

24

21

8

9

Enterprises CIC

Purfleet Trust

60

61

15

19

Clinks Care Farm

20

15

10

9

Purfleet Trust (Year 2

80

28

prize)

Action Community

24

10

Enterprises CIC (Year

2 prize)

Voluntary Norfolk

80

21

LEAP East CIC

33

11

Workers Educational

60

18

Association

Norfolk totals:

584

293

198

93

5

27

New Anglia Local Enterprise Partnership Board

Wednesday 17th January 2018

Agenda Item 9

Integrated Health and Employment Service

Author: Iain Dunnett

Summary and Recommendation

The Board are asked to:

1) Support the overall purpose of the proposal against the key LEP objectives of

employability and skills.

2) Agree match funding at a rate of £120k per annum for three years to the project to

assist in leveraging over £2million of European Social Funds (ESF). This is on a co

investment basis alongside Norfolk County Council and other organisations. The

project will have a total value of circa £5million over 3 years across a range of

funding sources.

This LEP match funding would be in the form of an allocated amount of the Growing

Places Fund which organisations delivering the project will bid into.

Background

This proposed project will be a locally Integrated Health and Employment Service (IHES)

delivering personalised support to unemployed or economically inactive people in Norfolk

with health related barriers to work. In relation to the LEPs Economic Strategy this project

has a clear ambition to “develop new approaches and remove barriers to get people back

into work, especially for those further from the job markets”.

In partnership with organisations from across Norfolk, Norfolk County Council have

developed this proposed project to address the fact that in Norfolk alone there are 55,000

people claiming working age benefits of which approximately 60% have a health related

barrier to work. More than half of current claimants of working age benefits are long term

claimants who have not been able to work for many years. The project will support over

3,000 people to move:

-

into work,

-

closer to work; and

-

back into engagement with education, apprenticeships and training

As a comparison to this proposal local investment aligned to ESF and focused on the

Ipswich MyGo project in Suffolk has seen a large impact on youth unemployment and

outcomes for young people seeking work. The aim with this project in Norfolk is to trial a

1

29

more wide ranging integration of services for a harder to reach group who are largely

economically inactive and not able to contribute to the local labour market or the economy.

Mainstream employment services offer very few effective interventions for this group with

complex barriers meaning that claimants with the aspiration or capacity to move back into

work cannot access the support to do so or rely heavily on oversubscribed voluntary sector

interventions. Additionally employment services do not currently engage with health

providers or deliver health related outcomes despite claimants having a health related barrier

to work; this is why an integrated approach will deliver better outcomes.

The partnership brings together voluntary sector organisations with expertise in employability

or social inclusion and health providers who offer solutions to those with physical or mental

health diagnosis. The proposal would be the first in the country to deliver within a more rural

context providing an opportunity for a local innovation to inspire new ways of working and

new mechanisms for delivering social innovation and social or economic benefits.

The proposal has been submitted to the Department of Work and Pensions (DWP) as a

stage 1 application for ESF and it is hoped that it will progress to stage 2 in early 2018 with a

project start date in Summer 2018.The proposal is currently undergoing stage 1 assessment

by DWP for its suitability to attract ESF.

Proposal

This IHES will deliver personalised support to unemployed or economically inactive people in

Norfolk with health related barriers to work e.g. physical or mental health condition, disability

(including learning disabilities). Support will focus on managing health needs within the

context of employment. Norfolk County Council will be the Accountable Body supported by a

strategic partnership of stakeholders. Delivery will be via Voluntary, Community and Social

Enterprise Sector organisations, with participants referred from Local Authorities, GPs,

Housing Associations and DWP.

Delivery organisations will employ Personal Advisers to work with participants creating

bespoke pathways to employment including one-to-one support; and flexible interventions

through a network of expert partners. In collaboration with participants and health

colleagues, Advisers will:

Develop a support plan identifying targets and milestones.

Engage services addressing health barriers to work.

Assist with health condition management and personal well-being.

Outreach via alternative engagement including arts and sports.

This activity will be funded by the ESF element secured by the partnership alongside Local

Authority match.

Advisers will also undertake referrals to services designed to address health barriers to work

and assist with health condition management in partnership with local Care Commissioning

Groups and NHS trusts, who are partners in the project. Advisers will identify opportunities to

improve participants’ ability to compete in the labour market including:

Accredited training.

Employability skills.

Soft skills e.g. confidence, motivation, resilience, well-being, active living and

supported job search.

Developing a system to link clients to employers within the LEP and Industrial

Strategy Key Sectors; to assist in implementing the LEP Skills Board approved

2

30

Sector Skills Plans; and supporting the LEP to realise its ambitions within the

Economic Strategy.

To fund this activity the voluntary sector organisations would be required to bid into the LEP

for match funding to trial client led innovations and interventions to move local residents into

work. This LEP match funding would be in the form of an allocated amount of the Growing

Places Fund which organisations delivering the project will bid into. This will be a similar

process to that currently in operation for the VCSE Challenge Fund operated by the LEP

with the support of the Norfolk and Suffolk Community Foundations. Indeed this successful

existing process may well be utilised for management of LEP funds into the new IHES

project.

The IHES will enable the LEP to continue to invest in local people and local voluntary sector

groups while adding additional rigour to the process with valuable outcomes around

additional skills and employment. This LEP funding will build directly upon the work already

completed and supported by the LEPs VCSE Challenge Fund, and the nature of this support

from the LEP can be traced through the LEPs Economic Strategy, Skills Strategy and

European Structural Investment Framework. Solutions supporting self-employment linked to

the New Anglia Growth Hub could also be explored.

Activities will be delivered over three years across Norfolk ensuring rural and urban

coverage.

Finance

To create a project of sufficient scale New Anglia LEP would be invited to be one of the

anchor co-investors in the project - not only to contribute to the drawing down of significant

ESF contributions - but importantly to secure the role of the voluntary sector in the delivery.

The proposal is that the LEP invests £120k per annum in the delivery of a 3 year project.

This will sit alongside secured local investment with a project finance profile as follows:

LEP - £360,000

Norfolk County Council - £360,000

Norfolk Districts Pooled Business Rates - £350,000.

Sport England - £100,000

Arts Council - £100,000

Housing Associations - £75k

NHS/Health funding - £1.8m

ESF £2.4m

Clinical Commissioning Groups, Housing Association and NHS match funding will be aligned

to this project to deliver the health related provision. Lastly, to support the social inclusion

and healthy living elements partners have also submitted bids with a value of £100,000 each

to Sports England and the Arts Council to wrap around the core offer. The project will have a

total value of circa £5m over 3 years.

Financial implications

The funding of this project by the LEP would be drawn from the Growing Places Fund

budgets from the three years from 18/19.

Taking into account existing commitments of £3m - there is £750,000 available in 18/19. The

commitments do not include the proposal in item 10.

For 19/20 and 20/21 there are no commitments against the annual allocations of £3.75m.

3

31

Outcomes

By integrating employment and health activity to support participants to manage health

conditions within the workplace the project expects:

-

36% of participants to move into work, including self-employment; and

-

25% of participants to move into education or training including apprenticeships.

The project will deliver a range of outcomes clearly linked to the delivery of the Economic

Strategy including:

Increased skills levels.

Better engagement with the local labour market.

Reduction in skills shortages reported by employers.

Reduced social isolation and improved economic independence.

Improve GVA and economic outcomes for the participants.

There is an opportunity via co-investment in this proposal to develop the social impact and

value of Growth Deal investments. LEP supported projects can stimulate growth in the local

economy but the impact is greatly increased if labour market development also takes place.

The social value and innovation behind the delivery of the LEP’s investments into the local

economy can be accelerated through this project which could provide the pipeline of people

and skills required for Growth Deal supported projects.

The normal LEP monitoring process would be utilised for the projects outcomes, and these

would be complimented by shared outputs monitored by the other partners around health

and social improvement.

Summary and Recommendation:

The Board are asked to:

1) Support the overall purpose of the proposal against the key LEP objectives of

employability and skills.

2) Consider whether the LEP should provide matching finance at a rate of £120k per

annum for three years to the project to assist in leveraging over £2million of

European Social Funds (ESF). This is on a co investment basis alongside Norfolk

County Council and other organisations. The project will have a total value of

£5million over 3 years across a range of funding sources.

This LEP Match funding would be in the form of an allocated amount of the Growing

Places Fund which organisations delivering the project will bid into.

4

32

New Anglia Local Enterprise Partnership Board

Wednesday 17th January 2018

Agenda Item 12 - Chief Executive’s Report

Author: Chris Starkie

Overview

This section provides a snapshot of main LEP team activity since the November board meeting

Annual Conversation

Doug Field Chris Starkie and colleagues from our accountable body (SCC) participated

in the annual conversation with Government officials.

The meeting is a stock check of progress being made by the LEP as well as a review of

governance, delivery and strategy. More detail can be found below.

Implementation of Governance reviews

Work continues on the implementation of both the PwC and Mary Ney reviews.

For Mary Ney - key developments have been the tweaking of a number of policies

around whistleblowing, code of conduct and confidential reporting as well as revised

register of interest forms following the publishing of guidance by Government. The new

forms are being circulated to board members.

More details on the Mary Ney review can be found in the table attached to this report.

Key work implementing the PwC review has been work on the membership of the boards

agreed at the November board meeting, and consultation on the structure of the boards.

More details on the PwC implementation can be found in the table attached to this report.

Growth Deal

The £3.3m legal agreement for the Ely Area Rail Enhancement Scheme to be delivered

by Network Rail has now been signed by both New Anglia LEP and GCGP LEPs and is

just awaiting Network Rail’s signature. Once in place the first £286k of funding can be

released before the end of the financial year.

Growing Places Fund

The Winerack project on Ipswich Waterfront has commenced drawdown of the £5m loan

allocated through the Growing Places Fund. The project is on target to request at least

£1.6m of the £5m loan this financial year, with £500k already released. Preparatory

works are underway at the site, with more extensive building projects set to commence

on site in February 2018.

Capital Growth Programme

The £9m call for projects for the new Capital Growth Programme produced 29 bids for

funding with a request of £49m of funding towards projects worth £183m in total. The mix

of projects included infrastructure, roads, skills and cultural projects. The projects have

been appraised by external consultants, Hewdon Consulting. More details can be found

on agenda item 7.

47

Communications

Media coverage in December included newspaper, TV and radio interviews to promote

the signing of contracts for work to start on the Ipswich Winerack and our work with

Britvic and Unilever in Norwich.

The new LEP website continues to develop, with a timetable for regular staff and partner

blogs now being developed to add interesting and timely content. Other new features

include showcasing the firms which hold the Youth Pledge Marque with scrolling logos,

profiles of the Growing Places Fund projects and additional governance FAQs, which are

regularly reviewed in line with our Assurance Framework and the Mary Ney review to

ensure our information is clear and, importantly, easy to find.

To increase engagement on social media, a new Linkedin company page has been set

up. Despite having a large membership, the current locked group gets very little

interaction but the new page is already popular, with regular likes, comments and sharing

of posts.

Finances

Management accounts for period ended 31 December 2017 - year to date income is

£999k with an operating surplus of just under £144k, this is ahead of budget by just

under £129k

Operating cash balance is £434k which is in line with management expectations

The LEP has received additional income from the Enterprise Zone Pot C fund. Further

details can be found in the finance paper.

LEP actions and activity

This section provides a detailed update on other activities and key issues since the November

board meeting

Annual conversation

Doug Field, Chris Starkie Louise Aynsley and Holly Field from Suffolk County Council

(our accountable body) and other LEP team members took part in the Annual

Conversation with Government in December.

The conversation was led by Hannah Rignell, acting director of BEIS London and

South East and supported by Shan Lloyd.

Hannah explained that the annual conversation was a formal process to discuss the

contribution the LEP has made towards driving local economic growth; to review LEP

governance and assurance processes; to look at progress with delivery on key local

growth programmes; and to discuss the LEP’s priorities and challenges for the year

ahead.

Hannah said that the National Audit Office report and the Mary Ney Review had placed

a stronger focus on governance.

It was therefore important that LEPs are implementing all its local policies and

continuing to improve. Hannah acknowledged that New Anglia had commissioned

PWC to carry out a review of governance and this was a good example of proactive

work to strengthen the LEP.

As well as governance, the annual conversation also covered the LEP’s delivery and

strategy, highlighting the difficulties of managing a capital programme on annual

48

budgets.

The LEP’s new economic strategy was also discussed and BEIS Local agreed to

support the LEP’s bid to develop an early Local Industrial Strategy.

In conclusion Hannah’s conclusion said New Anglia continued to be in the top two

LEPs in the London and South East patch: proactive, with a good culture and

continued to put forward a compelling case.

Following the meeting, the assessment of the LEP will now be subject to moderating

process to ensure all conversations are being carried out on a consistent basis.

Any issues of concern will then be fed back to the relevant LEP. We are not expecting

any issues to be fed back.

Growth Deal Government Data Submission

Since the beginning of the Growth Deal programme, the LEP has reported its outputs

to Government via an online system called ‘Logasnet’. This has now been replaced

with a comprehensive new Workbook.

The Workbook includes 23 spreadsheets and requires the input of both forecast and

actuals data from the start of the programme in April 2015 to the end of the

programme in March 2021.

It includes a ‘dashboard’ spreadsheet which draws from the various spreadsheets to

provide a summary of progress on Growth Deal spend and outputs.

The ‘dashboard’ requires sign off by the LEP Board and the Section 151 Officer from

our Accountable Body, Suffolk County Council, by 20th January 2017.

The dashboard is quite unwieldy and difficult to print, therefore copies will be available

at the board meeting.

The LEP has target outputs for Growth Deal agreed with Government. These are:

38,750 jobs

6,800 new homes

£628m public and private sector investment

620 new apprenticeships

1190 new learners.

These numbers include indirect outputs i.e. outputs that are not directly achieved by

the project, but which should come about as a wider consequence of the project. For

example the construction of the Bury Relief Road will lead to the unlocking of land for

jobs and housing.

An update on progress towards the Growth Deal outputs, taken from the Dashboard, is

summarised below.

Output

Actual

Progress

New homes

176

44%

New jobs

177

7%

New learners

248

91%

49

Match funding (‘Non-LGF Expenditure’)

£51.75m

14%

Spend this year (Apr-Sept 2017)

£1.7m

5%

Dashboard data compared with LEP Board Performance Report

LEPs were not consulted on the format of the dashboard nor its contents and it is a far

from perfect tool. The data summarised in the Dashboard differs from outputs reported

in the monthly Growth Deal Board Performance Report (BPR).

There are three reasons for this:

1- Lag in reporting: The Dashboard is 3 months behind the data that is reported

in the BPR. This is a government set reporting period.

2- Indirect outputs not captured: The Dashboard does not collect any ‘indirect’

outputs i.e. for jobs, jobs safeguarded, homes, leverage. It therefore does not

show progress against our targets set by government.

We have agreed with government that we will provide additional targets for

direct outputs, in order to better measure our performance.

3- Different RAG rating: a different Red/ Amber/ Green (RAG) rating has been

used which measures projects against three points: delivery, finances and

reputation. We are looking to align this with our board performance reports in

future.

Recommendation to the board:

The board is invited to endorse the dashboard as required by Government

PwC Implementation

Governance Review and alignment with Economic Strategy

Following decisions made at the November LEP board regarding new committees, the

Economic Strategy steering group met on 14th December to develop the details of the

governance consultation.

The consultation will be carried our through one to ones with key individuals and an

online form for partners to complete if they wish to input.

The priority for February’s Board will be to agree the Terms of Reference for the first

tier of the Governance structure to enable the setup of the Economic Strategy Delivery

Board, as well as revised terms of reference and membership for the Investment

Appraisal Committee, the Audit and Risk Committee and the Growing Business Fund

panel.

Once the Economic Strategy Delivery Board is in place it can drive the development of

the Economic Strategy delivery plan and lead the second phase of the Governance

review to ensure the governance structure will deliver the ambitions of the Economic

Strategy in the most effective and efficient way.

The progress report on all elements of the PwC review can be seen in the

accompanying table.

50

The consultation will continue to gather views and information which will enable the

Economic Strategy Delivery Board to shape the rest of the structure and make a

recommendation to the Board soon after it has been realised.

Implementation of the Economic Strategy - development of delivery plan

Partners including Local Authorities and Business have complete an online form

providing information on what activity is already underway which supports the delivery

of the Economic Strategy ambitions.

They have identified what they see the top three priorities are for the first 12 months.

Analysis of this information is underway and will help inform the development of the

high-level deliver plan.

Stakeholder Delivery Plan Consultation events will take place at the end of January in

to February. There has been a great response from business and we have increased

the number of events to cater for everyone who would like to attend.

The purpose of these events is to engage with stakeholders in heling to develop

delivery plan for the strategy along with supporting them to identify their role in

delivering the ambitions. A piolet session took place with the Norfolk Chambers of

Commerce in December, the feedback from the business attended was positive and

engaging.

There will be another LA, LEP and Growth Hub Summit with the aim to engage officers

in delivery, as well as providing an opportunity to learn how the Inclusive Growth and

Prioritisation toolkits can be used to help inform decisions and develop policy locally.

East of England Transport summit

Chris Starkie represented the LEP at a summit organised by the East of England Local

Government Association to look at options around the creation of a Sub National

Transport Body.

The meeting was also attended by local authority representatives from the region,

including Norfolk and Suffolk County Councils, as well as a number of business

representatives from organisations such as Hutchison Ports.

Sub-national Transport Bodies (STBs) have been made possible by the Government’s

devolution legislation, with four in the process of being established in England so far.

STBs are designed to fill a strategic space in transport between the Government and

LEPs and upper tier local authorities.

They have the potential to be given devolved power from Government over Highways

England roads and influence or control over rail franchises.

They are also expected to develop long term plans for infrastructure investment in their

areas.

Government will not impose STBs on areas, with the onus on STBs to form from the

bottom up.

To date Transport for the North and Midlands Connect are the most advanced. Both

have been awarded Government money to develop their proposals and are on their

way to being fully fledged STBs.

In development are England’s Economic Heartland which links Oxford with Cambridge

and Transport South East, which runs along the south coast.

The East of England meeting agreed that work should commence on developing

51

proposals for an East of England Transport Forum which could be developed into an

STB in its own right or to link with one of the existing STBs.

A key principle agreed was the role of LEPs alongside local authorities on the board of

the STB. Further meetings are planned over the coming weeks and the executive team

will ensure the LEP continues to play an active role in the development of proposals.

Visit by Secretary of State for Housing and Local Communities Sajid Javid

The LEP and Great Yarmouth Borough Council hosted a visit by Sajid Javid and Brexit

minister Steve Baker to Great Yarmouth.

The visit included a tour of the Beacon Park Enterprise Zone, which Mr Javid

acknowledged as being one of the best performing in the country. He saw the new

Proserve building which is a joint development by the LEP and GYBC.

Mr Baker also visited Pasta Foods in Costessey, to learn about their expansion plans

and opportunities that might be presented by Brexit.

The two ministers then hosted a round table organised by the LEP which included

local authority, education and business stakeholders. The round table covered a range

of issues from Brexit to housing, business growth and the opportunities for New Anglia

LEP to be a pilot area for a Local Industrial Strategy.

BEIS SME Round Table Event

The Department for Business, Energy and Industrial Strategy (BEIS) met with a

number of local Norfolk and Suffolk business leaders for a Round Table discussion on

Tuesday 12th December to discuss the issues and concerns they have, with a primary

focus on the EU exit, access to business support and feedback on working with

Government.

This round table also offered the opportunity to allow business to have their say and

raise and discuss other issues they feel affects them in business and government

strategies, both for their sectors and their local areas. A representative from BEIS

heard the feedback from businesses ranging from sole traders to globally trading

organisations covering sectors ranging from retail to engineering.

Those attending felt that the event was indeed a worthwhile and welcome opportunity

to speak one to one with the Government directly about a wide range of issues, which

affect them internationally, nationally and locally.

The meeting, arranged with the assistance of the New Anglia Growth Hub, New Anglia

LEP and was held at the offices of the Suffolk Chamber of Commerce.

Chancellor of the Exchequer Visit

Representatives from the New Anglia LEP attended an Ipswich Suffolk Business Club

event in Kesgrave with the Chancellor of the Exchequer Phillip Hammond being the

key note speaker. The event was well attended by up to 300 business and

Government representatives.

He spoke about Britain having a significant opportunity to transform its economy by

leading on the 4th industrial revolution with scope and expertise to exploit new global

opportunities through embracing new technologies.

52

Whilst productivity and living standards were highlighted as the primary challenge,

investing in our emerging technologies and businesses will be a way of addressing this

and to develop future skills a more collaborative effort will be required. The Industrial

Strategy White Paper was referenced to provide the framework for much of this going

forward.

Greater Thetford Business Round Table

Chris Starkie and Linn Clabburn, the new Cambridge Norwich Tech Corridor manager,

participated in a business round table organised by South West Norfolk MP Elizabeth

Truss.

The round table brought together local authorities, businesses and community leaders

to discuss the future development of Thetford and opportunities presented by

investments such as the dualling of the A11, as well as the proposed extension to the

town.

The LEP is investing in road improvements in Thetford as part of the Growth Deal, has

supported as number of businesses in the town, and Thetford is a key centre in the

Cambridge Norwich Tech Corridor.

Financial Industries (Financial Industry Group):

The second annual conference of Norwich’s Financial Industry Group (FIG) was

held on 23rd November. Over 100 people attended the event at UEA’s Business

School with some attending from outside the sector. The main topic of the evening was

innovation and attendees heard from Professor Amelia Fletcher on how this was

affecting consumers and also from Neil Garner on cashless payments. Professor

Narish Pandit presented a paper Norwich’s emerging financial cluster and Chris

Starkie presented the LEP’s new economic strategy. Based on the success of this

event the Group agreed that the conference should go ahead in 2018.

Chair Steve Davidson updated on recent activities including joint working with the

Councils and NALEP. He also discussed the work with UEA and the possibility of a

joint Executive MBA being developed with FIG in the future.

The website FIGNorwich.org is almost ready for launch and the new site will include a

Trade Directory to strengthen local links and further develop the cluster.

Britvic and Unilever update

The LEP and local authority colleagues have continued to be involved in a range of

discussions around the Britvic and Unilever sites in Norwich.

Just before Christmas Britvic confirmed that it would be going ahead with the closure

of its factory in Norwich.

In the New Year Unilever announced the outcome of its review of manufacturing at the

site.

Under the proposals Unilever’s current Norwich factory would close at the end of

2019. We propose a phased transfer of production to other sites, with the first phase

53

likely to begin in 2018.

The company has stated it wants to protect the historic link between Colman’s and

Norwich by retaining the production and packing of Colman’s mustard powder, the

historic mustard milling process, and mint processing in a new state-of-the-art facility in

the Norwich area, created through a new long-term partnership with a consortium of

local farmers, backed by significant investment from Unilever. The company will also

continue to source mint and mustard locally.

Manufacturing of the vast majority of the other products is planned to move to other

sites in the UK, predominantly to Unilever’s factory in Burton upon Trent in