New Anglia LEP Investment Appraisal Committee

Wednesday 30th October 2019

9.00am - 9.45am

The Guildhall Council Chamber, Cage Lane, Thetford, IP24 2EA

Agenda

No.

Item

1.

Welcome

2.

Apologies

3.

Declarations of Interest

4.

Minutes of previous meeting held on 15th October 2019 Confidential

5.

Horizon Paper - Confidential

Reporting - Growing Places Fund

6.

Growing Places Fund Performance Report

6.1

Growing Places Fund project RAG rating

Reporting - Growing Business Fund

7

Growing Business Fund Performance Report

7.1

Growing Business Fund approvals

7.2

Small Grant Scheme approvals

Items for discussion

8

Growing Places Fund Grant: The Nest - Confidential

9

Large Company Grant application - Confidential

10

Growing Places Fund Loan: Bungay Housing - Confidential

11

Revised IPF project request: NUA Connecting Creative Capital

Other

12

Any Other Business

1

Committee Members

Lindsey Rix

Aviva

Cllr David Ellesmere

Ipswich Borough Council

Andrew Proctor

Norfolk County Council

Sandy Ruddock

Scarlett and Mustard

Alan Waters

Norwich City Council

Tim Whitley

BT

Dominic Keen

High Growth Robotics

Martin Williams

Santander

Exec Members

Rosanne Wijnberg

New Anglia LEP

Chris Dashper

New Anglia LEP

Iain Dunnett

New Anglia LEP

Tanya Nelson

New Anglia LEP

Date and time of next IAC meeting: Wednesday, 27 November 9-9:45am

Venue: Adastral Park, Martlesham, Ipswich IP5 3RFTBC - Suffolk

2

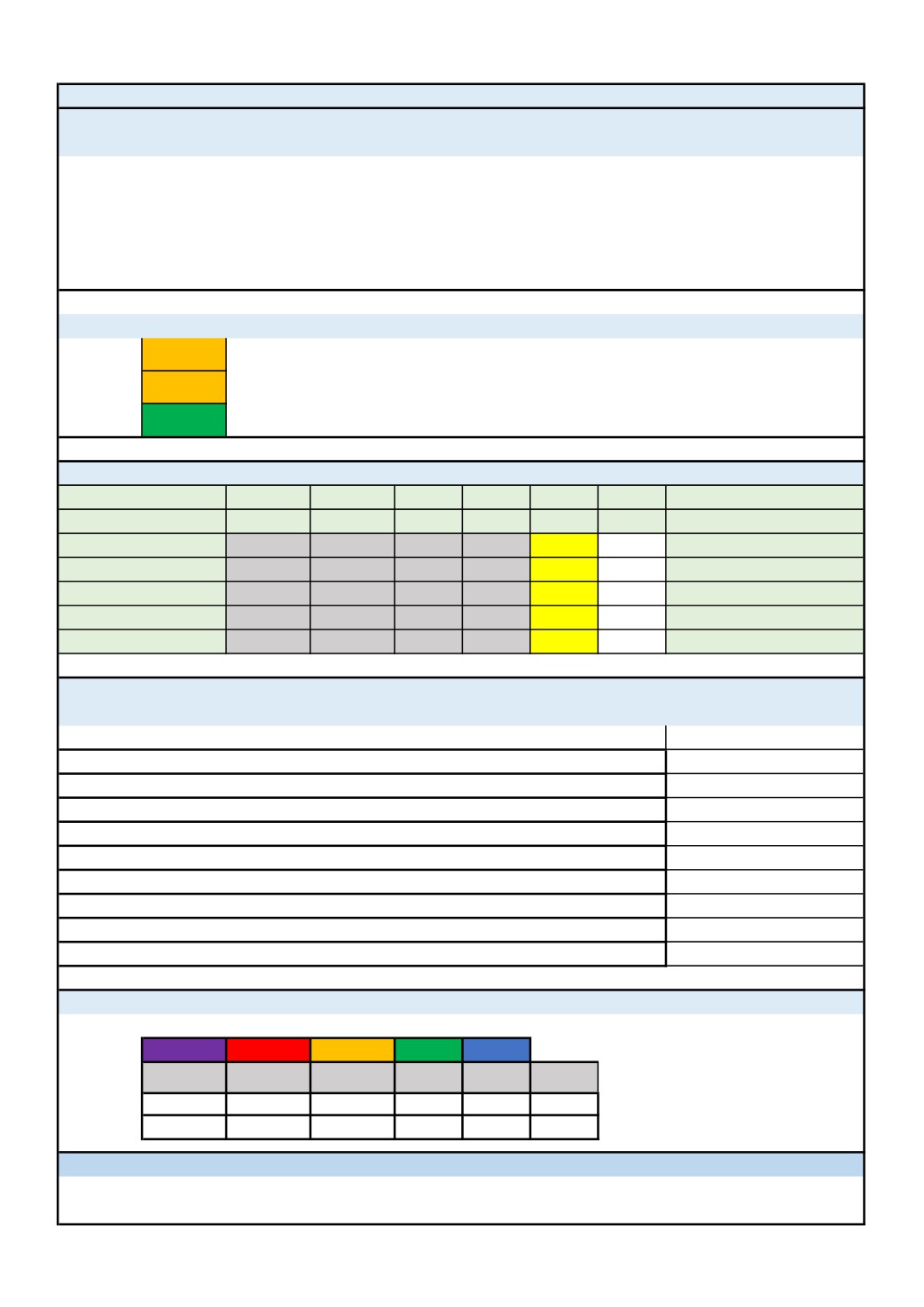

Item 6- Growing Places Fund Performance Report

Programme Overview - What is the Growing Places Fund?

• Programme duration under Growth Deal funding: 2015 - 2021͘

• Value: £31m͘ This is the £31m Growing Places Fund element of the Growth Deal. Completed projects date back to previous funding from 2012.

• Invested £22.5 million loan capital in region’s infrastructure, sectors and growth locations͘ £8.5 million of grants provided to projects demonstrating

significant regional or local economic benefit.

• Contribution to the Economic Strategy: The fund has leveraged £279m public and private investment, created 1422 new jobs, 468 new homes, created

17,416 square metres of industrial space, provided premises for 112 new businesses to be created, supported 27 capital build projects, and 6 sector

developments in the private and public sector.

What is the Overall Programme Status?

Amber

Loans position

See separate update on MSF.

Amber

Grants position

Recent grant offers all issued, grant payments underway where eligible costs incurred.

Outputs

Green

Output delivery on profile.

achieved

What is our financial position?

Financials (£ millions)

Actual

Actual

Actual

ual/Forecast

Forecast

Forecast

Total

Financial Year

2015/16

2016/17

2017/18

2018/19

2019/20

2020/21

Brought Forward

0.000

0.000

2.729

4.415

1.525

7.928

Repaid

0.000

2.088

1.597

1.031

6.000

2.342

13.058

Gov Allocation

7.967

4.092

2.790

3.720

3.720

1.280

23.569

Spend [Act/Fcst]

-7.967

-3.451

-2.701

-7.641

-3.317

-0.370

-25.447

Carried forward

0.000

2.729

4.415

1.525

7.928

11.180

What is our contribution to the Economic Strategy?

Programme performance to date

Outputs - cumulative from pril 2012 to Quarter 3 2019

Actual to date

New homes built

468

New jobs created

1,422

Industrial Space created (m2)

17,416

New businesses created through provision of premises

112

Capital Build projects supported

27

Sector Developments supported

6

Match Funding - Public (£m)

142

Match Funding-Private (£m)

137

Total Match (£m)

279

What is the Project Status?

Current status of all projects.

Overall status

Purple

Red

Amber

Green

Blue

Please see RAG Rating for full project

Pipeline

At risk

Claim stage

Live

Complete

Total

list.

17

1

3

13

19

53

Change

7

1

-1

1

1

What are the next steps?

Continue developing pipeline of future loan applications.

Ensure payback returns contribute to a revolving loan fund development.

9

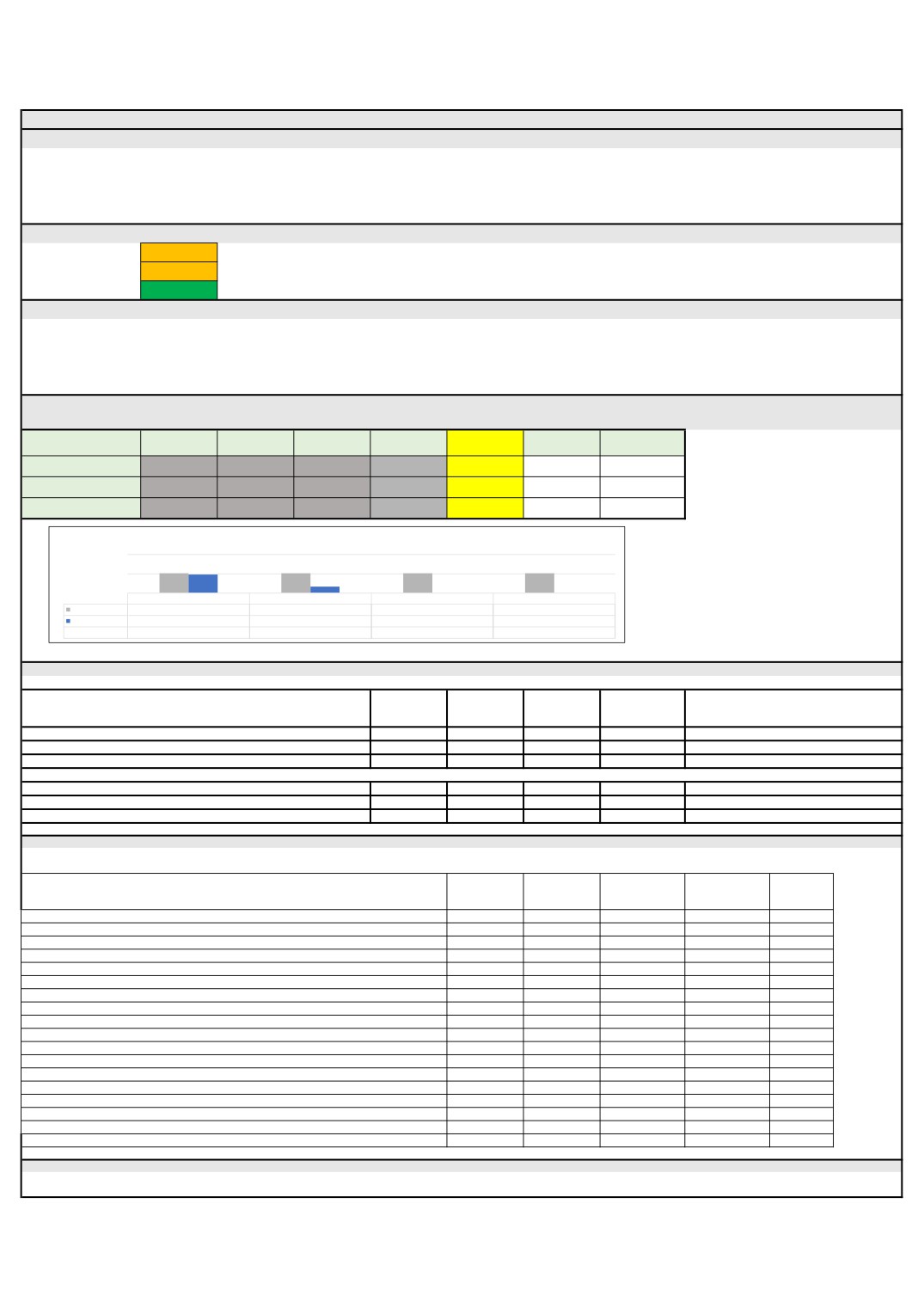

Item 7- Growing Business Fund Performance Report - August 2019

Programme Overview - What is the Growing Business Fund?

Launched in April 2013, the Growing Business Fund provides grants for businesses to enable growth, an increase productivity and job creation.

Capital grants between £25,000 and £500,000 are provided at up to 20% of project costs for SMEs, with an enhanced rate for small businesses located in an Assisted Area (until 2021)

Funding for the Growing Business Fund is provided on an annual basis by the LEP's Growth Deal.

The fund is accessed through the New Anglia Growth Hub with Due Diligence undertaken by Finance East and agreed by the GBF panel

What is the overall Programme Status?

Finance

Amber

Over the summer we have seen a slowing of applications, however, the pipeline is strengthening with circa £1m of projects under development.

Amber

Outputs

Based on recent grant applications, spend and pipeline, the scheme will probably underperform against the targets for the year 2019/20.

Delivery

Green

The pipeline of applications coming forward has slowed, however, existing approvals will ensure that the fund performs well.

What are our key updates?

Participant SMEs of the Scale Up New Anglia programme are being offered a range of support including applications to GBF (where appropriate)

This is still the LEP flagship grant scheme with many enquiries, however, perhaps due to Brexit we are seeing requests for funding for smaller less ambitious projects actually submitted.

New updated guidelines and application forms are now available on the LEP website.

Of our 2019/20

£4.121m budget, 16 applications, £1.686m is existing commitment from 2018/19; of which £561,310 (4 applications) is still to be claimed and 2 applications have withdrawn.

What is our financial position?

Financials (£ million)

Year

2013 to 2016

2016/2017

2017/2018

2018/2019

2019/2020

2020/2021

Total

Profile Spend (£m)

£12.000

£3.536

£3.050

£5.096

£4.121

£2.790

£30.593

Actual Spend (£m)

£11.999

£3.001

£3.049

£4.764

£1.302

£24.115

Remaining Spend (£m)

£0.001

£0.535

£0.001

£0.331

£2.819

£2.790

£6.477

2019/2020 Expenditure Profile

2

1

0

Q1-18/19

Q2-18/19

Q3-18/19

Q4-18/19

Quarterly Forecast

£1.030

£1.030

£1.030

£1.030

Quarterly Spend

£0.963

£0.339

£0.000

£0.000

Variance

£0.067

£0.691

£1.030

£1.030

What is our contribution to the Economic Strategy?

Actual to end of

Monthly

Outputs April 2019 to March 2020

Target

Shortfall

Notes

August 2019

Change

Value of grants approved

£4,121,000

£641,297

£85,662

£3,479,703

Value of private sector match approved

£16,484,000

£2,839,331

£425,716

£13,644,669

Number of New Jobs to be Created

206

46

5

160

Value of grants claimed

£4,121,000

£1,302,035

£138,755

£2,818,965

Private sector match funding drawn down

£16,484,000

£4,956,801

£300,717

£11,527,199

Number of New Jobs Created

206

83

38

123

What is the project status?

The following table shows grants approved by sector since the start of the programme in 2013/14

Number of

Projects

Grants

Private

Total Project

Jobs to be

Sector

Approved

Approved

Match

Costs

Created

A - Agriculture, Forestry and Fishing

3

£

235,899

£

1,018,543

£

1,254,442

58.0

B - Mining and Quarrying

1

£

100,000

£

1,654,600

£

1,754,600

10.0

C - Manufacturing

125

£

13,980,060

£

90,811,758

£

104,791,818

1538.5

E - Water supply, sewerage, waste management and remediation activities

5

£

295,594

£

1,260,379

£

1,555,973

28.0

F - Construction

16

£

1,136,486

£

5,514,740

£

6,651,226

144.5

G - Wholesale and retail trade; repair of motor vehicles and motorcycles

26

£

2,829,816

£

52,382,892

£

55,212,708

386.0

H - Transportation and Storage

8

£

666,992

£

3,275,957

£

3,942,949

90.0

I - Accommodation and Food Service Activities

5

£

372,000

£

2,342,138

£

2,714,138

45.5

J - Information and Communication

10

£

717,700

£

3,537,616

£

4,255,316

74.0

K - Financial and Insurance Activities

1

£

30,000

£

79,425

£

109,425

3.0

L - Real Estate Activities

1

£

100,000

£

232,500

£

345,000

10.0

M - Professional, Scientific and Technical Activities

20

£

2,364,241

£

14,496,363

£

16,860,604

259.6

N - Administrative and Support Service Activities

21

£

2,088,771

£

11,212,136

£

13,300,907

248.0

P - Education

1

£

20,000

£

102,191

£

122,191

4.0

Q - Human Health and Social Work Activities

1

£

31,580

£

126,320

£

157,900

3.5

R - Arts, Entertainment and Recreation

8

£

502,921

£

3,159,776

£

3,662,697

55.5

S - Other Service Activities

2

£

320,000

£

4,737,413

£

5,057,413

32.0

Total

254

£

25,792,060

£

195,944,747

£

221,749,307

2990.1

What are the next steps?

The LEP is working with delivery partners, to ensure that the scheme has a greater focus on business growth and productivity.

As part of the marketing Action Plan a number of case studies have been commissioned and the growth hub website revamped, literature and banners are being redesigned and relaunched

15

Item 7.1 New Anglia LEP

Growing Business Fund

Grant Approvals - April 2019 to date

Approval

Grant

Company Name

Business Size Reason for Support

Date

Awarded

Apr-19

Anglian Plant Ltd

170,000

Small

Capital investment to support business growth

May-19

Portable Space Ltd (2)

78,378

Small

Capital investment to support business growth

May-19

Goldwell Manufacturing Services Ltd

40,000

Small

Capital investment to support business growth

May-19

Belle Coachworks Ltd (4)

36,000

Small

Capital investment to support business growth

May-19

HBD Europe Ltd (2)

52,388

Medium

Capital investment to support business growth

Jul-19

Bendart Ltd

42,500

Small

Capital investment to support business growth

Jul-19

Cater Cunningham Ltd (Creative Displays (UK) Ltd (2) t/a

40,000

Medium

Capital investment to support business growth

Jul-19

Hugh Crane Cleaning Equioment Ltd

56,369

Medium

Capital investment to support business growth

Jul-19

Anglia Indoor Karting (Ipswich) Ltd

40,000

Small

Capital investment to support business growth

Aug-19

William Moorfoot Ltd

50,000

Small

Capital investment to support business growth

Aug-19

Timber Frame Management Ltd

35,662

Small

Capital investment to support business growth

Total GBF Scheme

641,297

Grants approve17April 19 to date

Item 7.2 Small Grant

Scheme Grant Approvals

2019/20

Date

Grant Business

Company Name

Reason for Support

Approved

Awarded

Size

Apr-19

DXB Pumps & Power Ltd

16,845

Small

Capital investment to support business growth

Apr-19

Bradleys (Stowmarket) Ltd (2)

17,919

Small

Capital investment to support business growth

Apr-19

Praxis42 Ltd

6,362

Small

Capital investment to support business growth

Apr-19

Edmondson Hall

25,000

Small

Capital investment to support business growth

Apr-19

The Penny Bun Bakehouse Ltd

7,203

Micro

Capital investment to support business growth

Apr-19

Criterion Ices Ltd

19,515

Small

Capital investment to support business growth

Apr-19

Fruitful Media Ltd

8,805

Micro

Capital investment to support business growth

Apr-19

Tosier Chocolate Ltd

2,724

Micro

Capital investment to support business growth

May-19

Apex Print & Promotion Ltd

9,930

Micro

Capital investment to support business growth

May-19

Pastonacre Ltd

4,305

Micro

Capital investment to support business growth

May-19

Donald Utting & Sons Ltd (2)

24,973

Small

Capital investment to support business growth

May-19

Safety Devices International Ltd

5,600

Small

Capital investment to support business growth

May-19

A J Laminated Beams Ltd

5,500

Small

Capital investment to support business growth

May-19

P J Lee Hire & Sales Ltd

6,600

Micro

Capital investment to support business growth

May-19

Newton Automotive Ltd (2)

16,160

Medium

Capital investment to support business growth

May-19

P J Lee Hire & Sales Ltd

6,600

Micro

Capital investment to support business growth

Jun-19

Timberwolf Ltd

18,275

Medium

Capital investment to support business growth

Jun-19

CapTrac Ltd

25,000

Micro

Capital & Revenue investment to support business growth

Jun-19

Yum Yum Tree Fudge Ltd

10,905

Micro

Capital investment to support business growth

Jun-19

N-Ergise Ltd

25,000

Small

Capital investment to support business growth

Jun-19

Emkay Plastics Ltd

14,453

Small

Capital investment to support business growth

Jun-19

Vinyl Installation Ltd

7,200

Micro

Capital investment to support business growth

Jun-19

C.S. (Computer Services) Ltd

1,749

Micro

Capital investment to support business growth

Jul-19

The Space Burston

9,313

Micro

Capital investment to support business growth

Jul-19

Clenshaw Minns Ltd

21,740

Small

Capital investment to support business growth

Jul-19

Able Cleaning & Hygiene Supplies

1,113

Micro

Capital investment to support business growth

Jul-19

Sabrefix (UK) Ltd

4,260

Small

Capital investment to support business growth

Jul-19

E Rand & Sons Ltd

4,247

Small

Capital & Revenue investment to support business growth

Aug-19

EGM Products Ltd

12,575

Small

Capital investment to support business growth

18

Aug-19

Saw Media Ltd

1,611 Micro

Capital investment to support business growth

Aug-19

ASBT Holdings Ltd

6,188 Micro

Capital investment to support business growth

Aug-19

Intelligent Resource Management Ltd

3,000 Small

Capital investment to support business growth

Aug-19

Suffolk Yacht Harbour Ltd

2,919 Small

Capital investment to support business growth

Aug-19

Twyfords To You Ltd

12,545 Small

Capital investment to support business growth

Total SGS scheme

366,134

19

New Anglia Local Enterprise

Investment Appraisal Committee

Wednesday 30th October 2019

Agenda Item 11

Innovative Projects Fund (2018).

Norwich University of the Arts (NUA) - Revised application ‘Connecting Creative

Capital’.

Author: Tanya Nelson

Presenter: Chris Dashper.

Summary

This paper summarises a request from Norwich University of the Arts (NUA) to consider a

revised application in return for the £100,000 grant offered to them under the 2018 call of the

Innovative Projects Fund.

Recommendation:

The IAC is asked to:

Consider a revised proposal from NUA and approve a grant of £100,000 from the 2018

allocation of the Innovative Projects Fund.

Background

During the 2018 call of the Innovative Projects Fund, the Programmes Team received 21

applications. Of those 21 projects, 18 projects were independently appraised using a

comprehensive range of criteria. At the 27th March 2019 meeting of the IAC, 3 projects were

given outright approval and 5 projects were given conditional approval pending further

discussions with the project applicants.

NUA’s Connecting Creative Capital project was one of the 5 projects to receive conditional

approval. The project’s remit is to increase local employment rates amongst graduates from

the creative industries sector and consequently graduate retention in Norfolk. The project

will demonstrate the benefits of employing graduates from the creative industries within a

cross sector of industries. The project was given conditional approval because delivery of

the Connecting Creative Capital project in its entirety was dependent on approval of funding

of £300,000 from the Office of Students (OfS). This project would have supported the

creation of 45 high value full time jobs and given business support to 50 businesses and

levered in match funding of £441,735.

NUA was unsuccessful in attracting funding from OfS. At that time NUA requested that the

Connecting Creative Capital project continue as a stand-alone initiative, but the LEP

49

Executive encouraged NUA to try again to leverage alternative external funding. NUA

investigated the possibility that monies secured via a parallel internship programme for

creative industry (£60,000 per year) through the Enabling Innovation Research to Application

project t(EIRA) could be a suitable match - but the EIRA team stated that this is not possible

due to the derivation of their funding.

In April NUA applied to the Research England RED fund UEZ funding call, again linking the

proposal to the IPF bid. This application was also unsuccessful.

The strategic need for the Connecting Creative Capital remains unchanged, and the

University would like the project to be considered in the following format.

Connecting Creative Capital - Revised Proposal

The core focus for a revised plan will focus on building ‘creative thinking’ and expertise into

other sectors of the New Anglia economy. This would support the Local Industrial Strategy,

working with Clean Energy, Tech (in its broadest sense) and Agri-food.

The programme would be delivered over 2 years (the original proposal was 3), with the first

phase of work focussed on the development of creative input into other sectors, and the

second on the delivery of knowledge exchange and new graduate pathways for those

sectors. These are businesses/sectors that have not traditionally employed creative

graduates. Initially, core delivery would be to develop and deliver a series of workshops

with organisations in target sectors where NUA would tackle problems they find difficult to

solve. NUA has used this model effectively in their pilot project with Marsh. NUA has

indicated that the first phase of the project, delivery of the workshops with business, is

crucial. In those workshops the NUA team will work with business to help them identify how

creative thinkers could add a new thinking dimension to the way they tackle intractable

problems. It is only after the workshops are completed that NUA will be able to identify the

new graduate pathways for creative thinkers in these sectors.

The second element of the project would see the delivery of an innovative graduate

internship scheme specifically for ‘creative’ graduates employed in target non-creative

sectors. NUA would develop pathways for 15 graduates in a cohort model that would run in

the same format as the Creative Internship Scheme previously funded by NALEP. NUA

estimates that it would need to engage with 20-25 business in order for 15 pathways to

result.

Like the Creative Interns project, the graduates would be employed by NUA for a fixed term

of 12 weeks and loaned to the host business who would pay a flat consultancy rate for the

scheme. NUA will offer centrally delivered mentoring and training, but it will have a different

focus to previous, as the interns would be pioneers working in environments such as energy,

fintech, agri-tech, advanced manufacture etc.- the interns would return to NUA on

Wednesdays for peer to peer learning and structured support through the University’s

gamified Profile skills framework.

50

Project Costs and Outputs - a comparison.

Original Project approved

Revised Project

Difference

by the IAC in March 2019

LEP Grant

£100,000

£100,000

0

requested

Match Funding

£393,305

£60,061

--84%

NUA Own funds

£48,430

£3,076

-94%

Overall Cost

£541,735

£163,137

-69.9%

Original Project approved

Revised Project

by the IAC in March 2019

Jobs Created

45

15

Business Support

50

22

The cost of each FTE is £10,876 which represents good value for money for a job in a high-

value sector. The Programmes Team enquired with the project applicant as to the

significant increase in staff time on the proposed project (compared to the Creative Interns

Project that was approved earlier in 2018). NUA confirmed that the first project did not

require the identification of pathways (as the demand was always there). This time the

innovation lies in the way NUA will work with cross sector businesses to identify the role for

diverse thinking styles (Creative Interns) which accounts for the increase in staff time

required on the project.

Recommendation:

The IAC is asked to:

Consider a revised proposal from NUA and approve a grant of £100,000 from the 2018

allocation of the Innovative Projects Fund.

51