New Anglia LEP Investment Appraisal Committee

Tuesday 21st July 2020

Teams Meeting

9am to 9:45am

Agenda

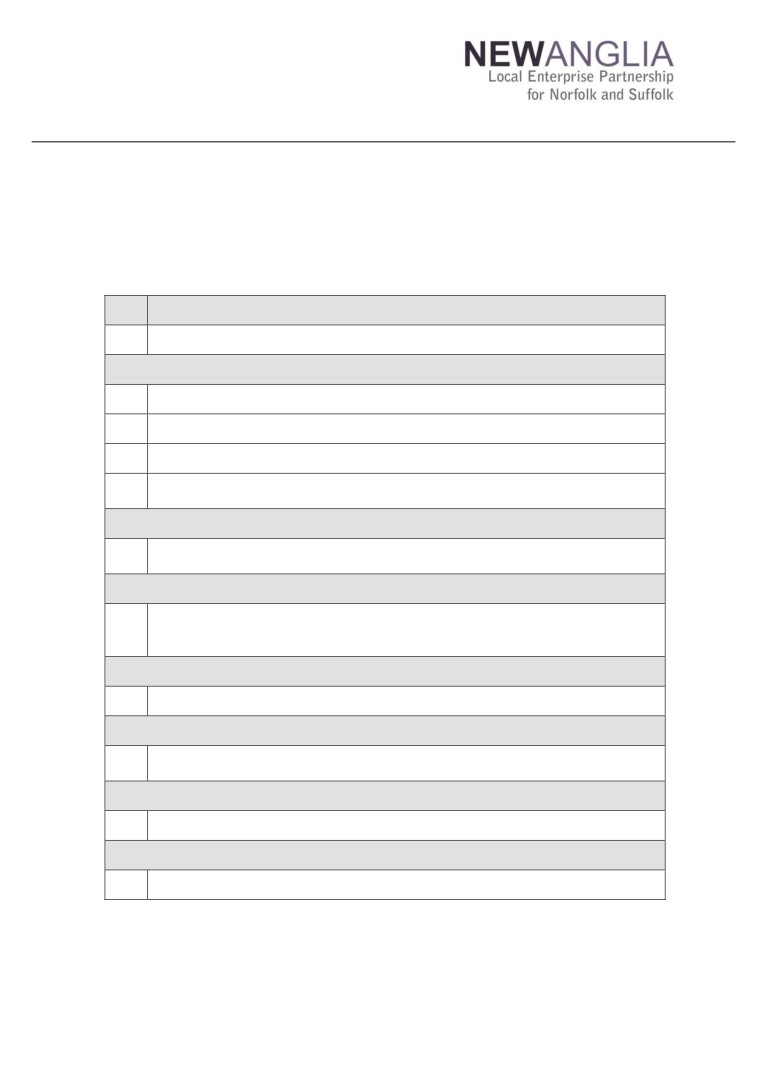

No.

Item

1.

Welcome

Main Agenda

2.

Apologies

3.

Declarations of Interest

4.

Minutes of previous meeting- 20 May 2020

5,

Confidential: Horizon Paper and GPF repayments

5a

Reporting: Growing Places Fund

6,

Growing Places Fund Programme Performance Report & rating - Confidential

6a.

Reporting: Growing Business Fund

7,

Growing Business Fund Programme Performance Report and SGS/GTI

7a

appendices

7b.

Reporting: Innovative Projects Fund

8.

Innovative Projects Fund Programme Performance Report

Reporting: Resilience and Recovery Fund

9,

Resilience and Recovery Fund Programme Performance Report and

9a

confidential project approvals appendix

Items for Approval

10.

Growing Places Fund - ATEX loan Arrangement Variation - Confidential

Other

11.

Any Other Business

1

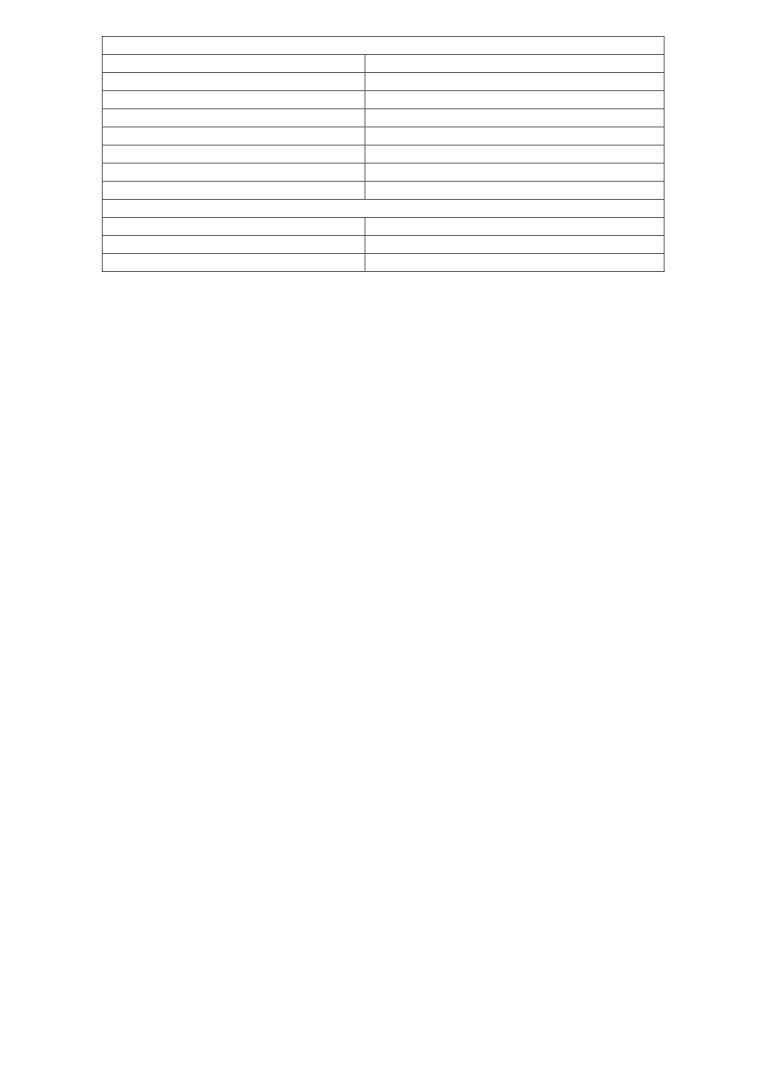

Committee Members

Cllr David Ellesmere

Ipswich Borough Council

Andrew Proctor

Norfolk County Council

Sandy Ruddock

Scarlett and Mustard

Alan Waters

Norwich City Council

Tim Whitley

BT

Dominic Keen

High Growth Robotics

C-J Green

Brave Goose

Martin Williams

Williams Business Advisory

Exec Members

Rosanne Wijnberg

New Anglia LEP

Chris Dashper

New Anglia LEP

Iain Dunnett

New Anglia LEP

Date and time of next meeting: Wednesday 26th August 2020. 9am-9:45am

Venue: Teams Meeting

2

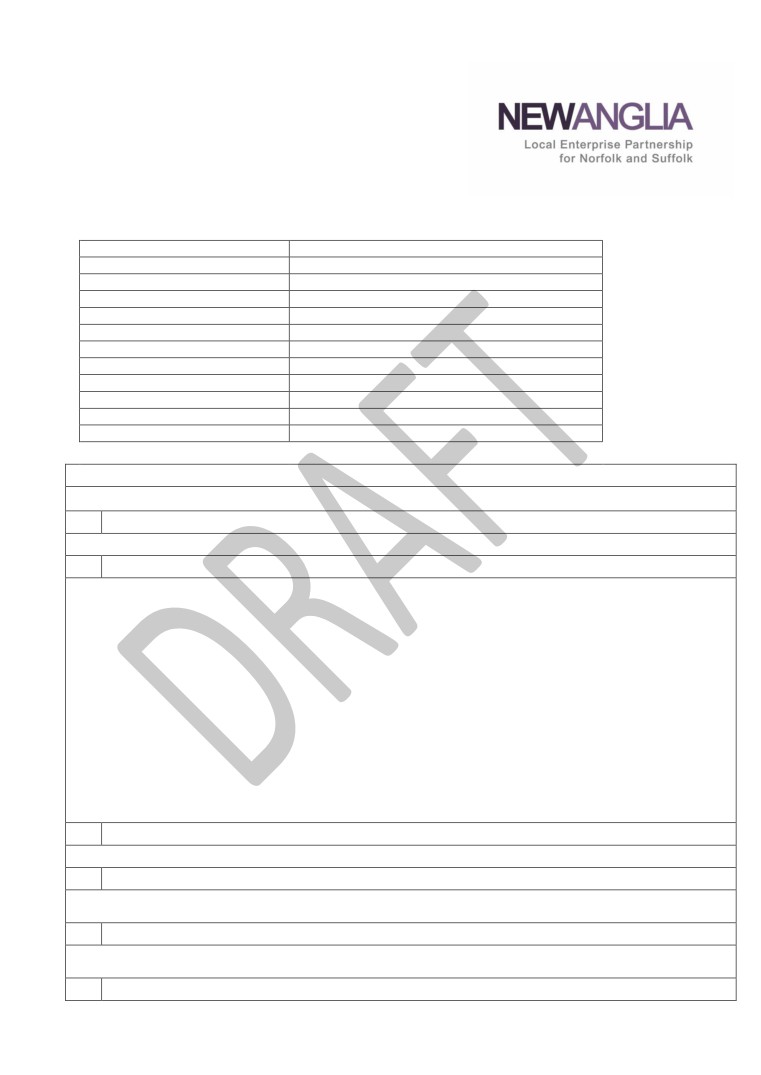

New Anglia Investment Appraisal Committee

Meeting Minutes (Unconfirmed)

20th May 2020

Present:

Committee Members

Alan Waters (AW)

Norwich City Council

Sandy Ruddock (SR)

Scarlett and Mustard

David Ellesmere (DE)

Ipswich Borough Council

Andrew Proctor (AP)

Norfolk County Council

Dominic Keen (DK)

High Growth Robotics

Tim Whitley (TW)

BT

Martin Williams (MW)

Independent IAC Member

In Attendance

Rosanne Wijnberg (RW)

New Anglia LEP

Chris Dashper (CD)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

Mike Dowdell (MD)

New Anglia LEP

ACTIONS

None

1

Welcome from the Chair

David Ellesmere welcomed everyone to the meeting.

2

Governance

Chris Dashper (CD) presented the Governance paper including the revised Terms of Reference (ToR).

Andrew Proctor (AP) suggested amending the ToR to put more emphasis ensuring that the applications

approved by the IAC assisted with the rebuild of the economy. It was agreed that the ToR would be

amended to ensure the IAC was aligned with the Restart and Rebuild strategy of the LEP.

RW presented the nominations of David Ellesmere as Chair and Dominic Keen as Vice-Chair. These

were approved by the meeting.

It was noted that a request for a new private sector board member would be made to the LEP Board at

the May meeting.

The committee agreed

• To approve the Terms of Reference subject to the agreed amendment

• To approve the appointment David Ellesmere as Chair and Dominic Keen as Vice-Chair

3

Apologies

None.

4

Declarations of Interest

None

5

Minutes of previous meeting (25th March 2020)

The minutes of the previous meeting were approved by the committee.

6

Growing Places Fund Horizon Paper (Confidential)

Page 1 of 3

Iain Dunnett (ID) highlighted key points from the Horizon paper.

ID noted that progress on capital projects had slowed by 1-2 months. Some projects had completed

much of their work prior to lockdown while others had been heavily impacted. ID is monitoring progress

and advised that the drawdown of funding will be delayed in many cases.

ID is in touch with applicants to discuss options including considering new funding schemes if more

suitable.

The Committee agreed:

• To note the content of the report

7

Growing Places Fund Programme Performance Report and RAG Rating

The monthly GPF report and accompanying appendices were reviewed by the Committee.

The Committee agreed:

• To note the content of the report

8

Growing Business Fund Programme Performance Report and appendices

The Growing Business Fund Performance Report was presented to the meeting.

CD confirmed applications are continuing and the panel met last week to approve £500,000 worth of

payments with potentially £300,000 worth of grants to be discussed in June.

The focus of the GBF is being reviewed to ensure it reflects the future requirements of the economy.

CD provided an update on the Reliance and Recovery Fund and advised that 3 projects had been

approved to date. Overall the scheme has been well received and 30 further projects are in various

stages of the process.

A PPR report will be included from June.

The Committee agreed:

• To note the content of the report

9.

Innovative Projects Fund Programme Performance Report

CD provided an update on the projects which have been awarded funding to date noting that projects had

received their offer letters and some had started to draw down funds.

Many projects be delayed in the current crisis but those cultural projects reliant on the visitor economy

may be more heavily impacted. The LEP will work with the projects to understand timescale for any

delays to understand what can be delivered in the future.

Projects are being closely monitored and the IAC will be kept informed of any changes.

The Committee agreed:

• To note the content of the report

10

Growing Places Fund: Covid-19 Loan Repayment Adjustments

ID reviewed the paper detailing a potential request for adjusting the loan repayments on the Winerack.

ID advised that the situation is changing rapidly but that 2 more units had been sold last week allowing

another repayment to the LEP.

A potential extension to the loan period of 3 months is being discussed and is dependent on sales in the

building.

The IAC will be kept informed.

MW noted that 3 months may not be sufficient in the current climate and a longer extension could be

required.

The meeting discussed the impacts of the crisis on the property market.

Page 2 of 3

Martin Williams (MW) asked for an update on the Maltings and whether they had asked for any extension

to the loan repayment. ID confirmed that another tenant should be in residence shortly and that no

extension had been requested yet.

The Committee agreed:

• To note the content of the report

11

Any Other Business

None

Date and time of next IAC meeting: Tuesday 23rd June, 9-9:45am

Venue: Teams

Page 3 of 3

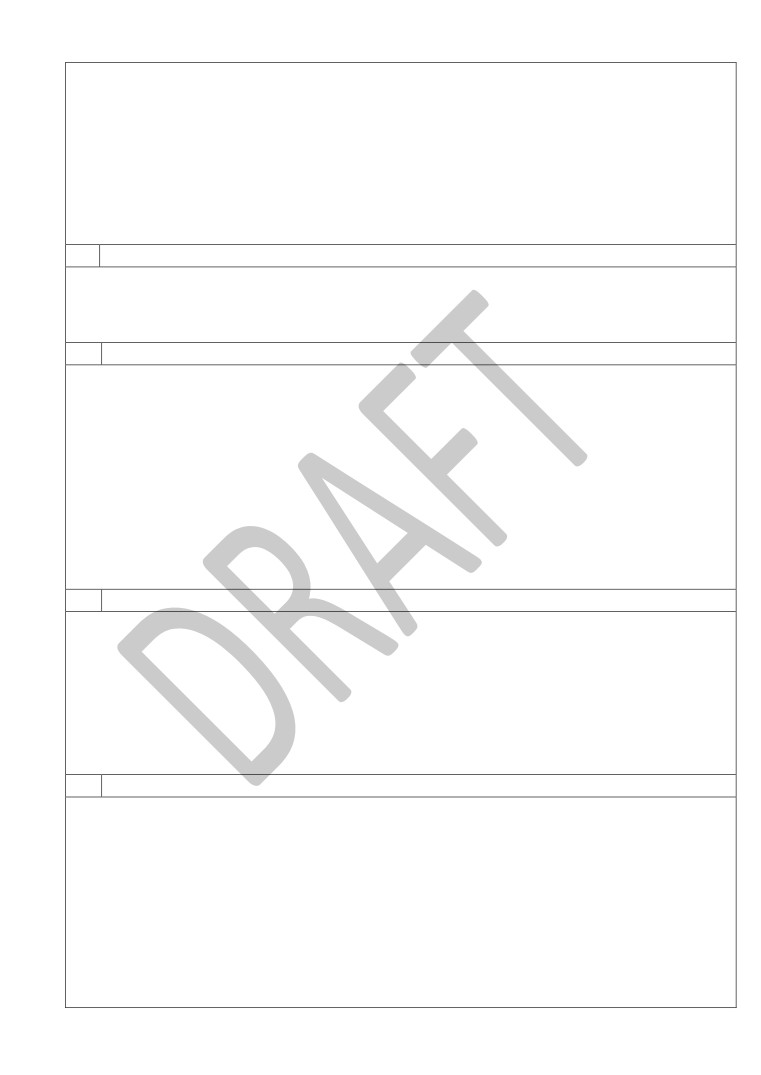

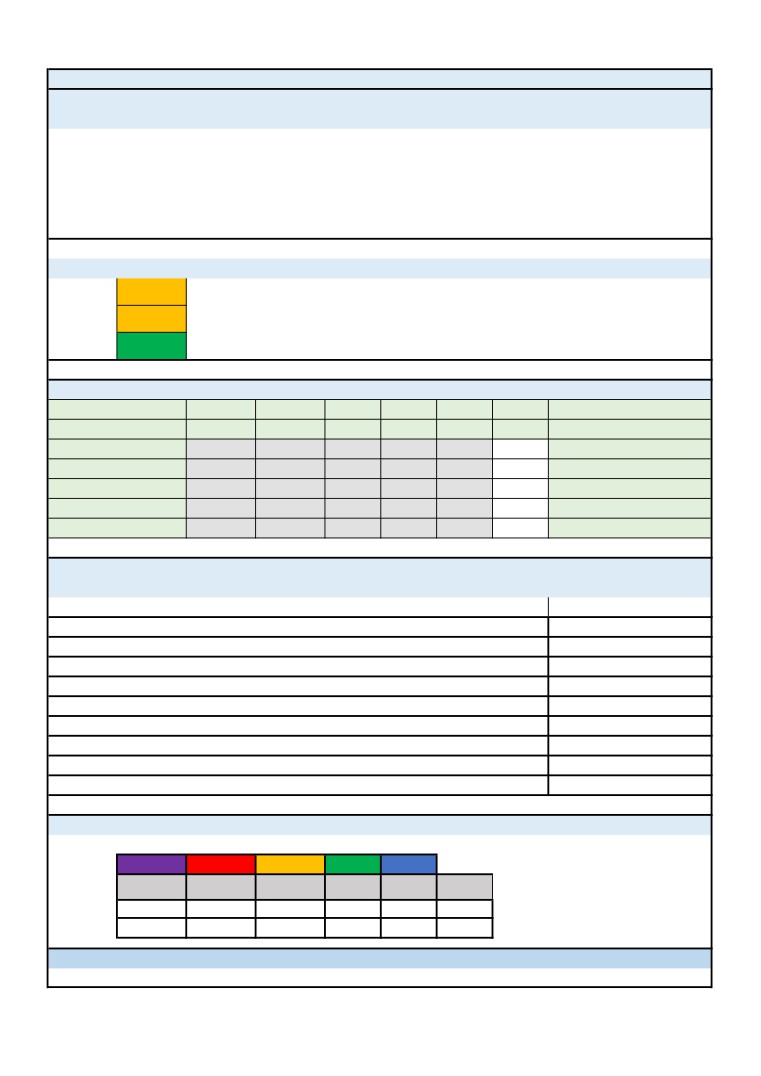

Item 6: Growing Places Fund Performance Report

Programme Overview - What is the Growing Places Fund?

• Programme duration under Growth Deal funding: 2015 - 2021.

• Value: £35m. This is the £35m Growing Places Fund element of the Growth Deal. Completed projects date back to previous funding from 2012.

• Invested £22.7 million loan capital in region’s infrastructure, sectors and growth locations.£13 million of grants provided to projects demonstrating

significant regional or local economic benefit.

• Contribution to the Economic Strategy: The fund has leveraged£143m of public investment and £149m of private investment, created 1475 new jobs, 468

new homes, created 18,703 square metres of industrial space, provided premises for 112 new businesses to be created, supported 35 capital build projects,

and 6 sector developments in the private and public sector.

What is the Overall Programme Status?

Amber

Loans position

See separate update on MSF. Winerack loan subject to review due to Covid 19.

Amber

Grants position

Grants under review with existing projects to understand effect of Covid 19 on project grant drawdown.

Outputs

Green

Output delivery on profile.

achieved

What is our financial position?

Financials (£ millions)

Actual

Actual

Actual

Actual

Actual

Forecast

Total

Financial Year

2015/16

2016/17

2017/18

2018/19

2019/20

2020/21

Brought Forward

0.000

0.000

2.729

4.415

1.524

4.849

Repaid

0.000

2.088

1.597

1.031

2.129

5.838

12.682

Gov Allocation

7.967

4.092

2.790

3.720

3.720

6.646

28.935

Spend [Act/Fcst]

-7.967

-3.451

-2.701

-7.641

-2.524

-6.546

-30.830

Carried forward

0.000

2.729

4.415

1.524

4.849

10.788

What is our contribution to the Economic Strategy?

Programme performance to date

Outputs - cumulative from April 2012 to Quarter 1 2020

Actual to date

New homes built

468

New jobs created

1,749

Industrial Space created (m2)

18,157

New businesses created through provision of premises

112

Capital Build projects supported

27

Sector Developments supported

6

Match Funding - Public (£m)

121

Match Funding-Private (£m)

136

Total Match (£m)

278

What is the Project Status?

Current status of all projects.

Overall status

Purple

Red

Amber

Green

Blue

Pipeline

At risk

Claim stage

Live

Complete

Total

4

1

9

10

24

48

Change

-12

0

+5

-5

2

What are the next steps?

Review effect of Covid 19 on current loan and grant arrangements. Ensure payback returns contribute to LEP finances.

13

Growing Business Fund Performance Report - May 2020

Programme Overview - What is the Growing Business Fund?

Launched in April 2013, the Growing Business Fund provides grants for businesses to enable growth, an increase productivity and job creation.

Capital grants between £25,000 and £500,000 are provided at up to 20% of project costs for SMEs, with an enhanced rate for small businesses located in an Assisted Area (until 2021).

Funding for the Growing Business Fund is provided on an annual basis by the LEP's Growth Deal.

The fund is accessed through the New Anglia Growth Hub with Due Diligence undertaken by Finance East and agreed by a GBF panel which meets monthly as required .

What is the overall Programme Status?

Finance

Green

Since the autumn there has been an increase in the number of applications coming forward, these are now being progressed slowly to panel.

Outputs

Green

Based on grant approvals, the scheme started 2020/21 ahead of target.

Delivery

Green

Despite COVID-19, we still have a healthy pipeline of applications being developed and coming forward for approval .

What are our key updates?

Participant SMEs of the Scale Up New Anglia programme are being offered a range of support including applications to GBF (where appropriate).

This is still the LEP flagship grant scheme attracting interest: despite COVID-19, we are seeing confidence is some businesses submitting grant applications.

Companies submitting EOIs during the last six to nine months are now facing a new set of issues, which is slowing down their progress with their growth plans.

At the end of 2019/20 we transferred £1m and the £331k underspend into the 2019/20 Growing Places Fund.

What is our financial position?

Financials (£ million)

Year

2013 to 2016

2016/2017

2017/2018

2018/2019

2019/2020

2020/2021

Total

Profile Spend (£m)

£12.000

£3.536

£3.050

£5.096

£4.121

£2.790

£30.593

Actual Spend (£m)

£11.999

£3.001

£3.049

£4.764

£2.533

£0.000

£25.346

Remaining Spend (£m)

£0.001

£0.535

£0.001

£0.331

£1.588

£2.790

£5.246

2019/2020 Expenditure Profile

2

1

0

Q1-19/20

Q2-19/20

Q3-19/20

Q4-19/20

Quarterly Forecast

£0.698

£0.698

£0.698

£0.698

Quarterly Spend

£0.000

£0.000

£0.000

£0.000

Variance

£0.698

£0.698

£0.698

£0.698

What is our contribution to the Economic Strategy?

Actual to end of

Outputs April 2020 to March 2021

Target

Monthly Change

Shortfall

Notes

March 2021

Value of grants approved

£1,759,771

£516,300

£516,300

£1,243,471

Value of private sector match approved

£7,039,084

£4,236,782

£4,236,782

£2,802,302

Number of New Jobs to be Created

88

30

30

58

Value of grants claimed

£2,790,000

£0

£0

£2,790,000

Private sector match funding drawn down

£11,160,000

£0

£0

£11,160,000

Number of New Jobs Created

140

0

0

140

What is the project status?

The following table shows grants approved by sector since the start of the programme in 2013/14

Number of

Projects

Grants

Private

Total Project

Jobs to be

Sector

Approved

Approved

Match

Costs

Created

A- Agriculture, Forestry and Fishing

3

£

235,899

£

1,018,543

£

1,254,442

58.0

B - Mining and Quarrying

1

£

100,000

£

1,654,600

£

1,754,600

10.0

C - Manufacturing

131

£

14,654,919

£

92,931,325

£

107,586,244

1571.5

E - Water supply, sewerage, waste management and remediation activities

5

£

454,000

£

1,902,000

£

2,356,000

35.0

F - Construction

18

£

1,581,386

£

9,418,963

£

11,000,349

167.5

G - Wholesale and retail trade; repair of motor vehicles and motorcycles

26

£

2,829,816

£

52,382,892

£

55,212,708

386.0

H - Transportation and Storage

8

£

666,992

£

3,275,957

£

3,942,949

90.0

I - Accommodation and Food Service Activities

5

£

372,000

£

2,342,138

£

2,714,138

45.5

J - Information and Communication

11

£

753,200

£

3,792,342

£

4,545,542

76.0

K - Financial and Insurance Activities

1

£

30,000

£

79,425

£

109,425

3.0

L - Real Estate Activities

1

£

100,000

£

232,500

£

345,000

10.0

M - Professional, Scientific and Technical Activities

23

£

2,533,331

£

15,611,382

£

18,144,713

269.6

N - Administrative and Support Service Activities

23

£

2,195,161

£

11,884,655

£

14,079,816

254.0

P - Education

1

£

20,000

£

102,191

£

122,191

4.0

Q - Human Health and Social Work Activities

1

£

31,580

£

126,320

£

157,900

3.5

R - Arts, Entertainment and Recreation

8

£

502,921

£

3,159,776

£

3,662,697

55.5

S - Other Service Activities

2

£

320,000

£

4,737,413

£

5,057,413

32.0

Total

268

27,381,205

204,652,422

232,046,127

3,071.1

What are the next steps?

The LEP is working with delivery partners, to ensure that the scheme can be accessed by businesses to facilitate growth during the current COVID-19 Pandemic.

We are working with Finance East and other partners to implement the new State Aid Regulations, to enable GBF to support as many businesses as possible.

19

Item 7a- Annexe 1

New Anglia Small Grant Scheme projects approved in May 2020

Grant

Total Project

No. Approved

Awarded (£)

Cost (£)

1 Gnaw Chocolate Ltd (2)

4,508

22,541

2 Electrical Installation and Appliance Testing (UK) Ltd

5,538

27,690

3 ASAP Branding Ltd.

5,120

25,600

Total

15,166

75,831

20

Item 7b- Annexe 2

New Anglia Growth Through Innovation projects approved in May 2020

Grant

Total Project

No. Approved

Awarded (£)

Cost (£)

1 Agricultural and Mechanical Services Limited

22,500

50,000

Total

22,500

50,000

21

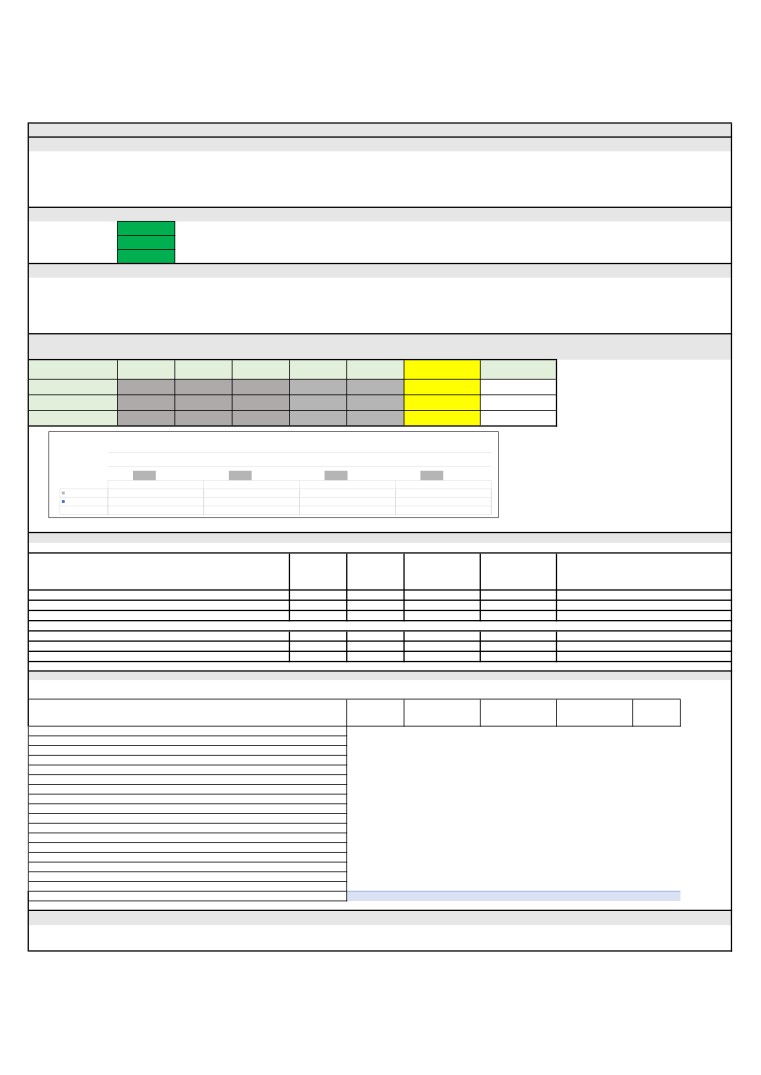

Innovative Projects Fund - 2018 Projects Call

Programme Overview - What is the Innovative Projects Fund

The Innovative Projects Fund is a revenue grant programme that provides funding towards innovative projects to support the delivery of the themes and activities identified in the

Economic and Local Industrial Strategies. The first call of the Innovative Projects Fund was made in October 2018 with a remit to facilitate innovative projects supporting economic

growth and the delivery of the Economic Strategy utilising revenue from the Enterprise Zone Pot C.

What is the Overall Programme Status?

Overall:

Green

7 out of the 7 projects have Offer Letters.

Delivery:

Green

7 out of 7 projects are now in their delivery phase. The Ipswich Cornhill Project has been completed.

Spend:

Amber

Profiled Spend to the end of 2020/21 Quarter 1 was £172,328 Actual Spend to the end of Quarter 1 was £149,078. An underspend of £23,250.

Outputs:

Green

No accumulated outputs were forecast by the end of Quarter 1.

What are our Key Updates?

•There are 7 projects under the 2018 call of the Innovative Projects Fund with a combined allocation and commitment of £539,531.

•The value of claims for the first year (2019/20) was 140,001.15.

•Profiled Spend to the end of Quarter 1 2020/21 was £172,328. Actual Spend to the end of Quarter 1 was £149,078. An underspend of £23,250

•Since the start of the financial year (up to 10/07/20)

£21,721 has been spent. This now brings actual spend to date for the IPF to £161,722, meaning the programme is behind by

£10,606

•Local Authority match funding of £62,689 has been recorded. Private Match Funding of £99,066 has been recorded. Total match funding of £161,755 has been recorded.

•To date, 4 part time jobs have been created, 10 jobs have been safeguarded and 25 businesses have been supported.

What is our Financial Position?

Financials (£ million)

Forecast

Actual

Forecast

Actual

Actual

Actual

Actual

Forecast

Financial Year

2019/20

2019/20

2020/21

Q1-20/21

Q2-20/21

Q3-20/21

Q4-20/21

2021/22

Brought Forward

0.000

0.400

0.400

0.391

0.203

LEP Allocation

0.540

0.540

0.000

0.000

0.000

0.000

Spend [Act/Fcst]

0.170

0.140

0.197

0.009

0.013

0.203

Committed

0.170

0.000

0.197

0.19

0.18

0.203

Carried forward

0.369

0.400

0.203

0.391

0.378

0.000

2020/21 Expenditure

600,000.00

500,000.00

400,000.00

300,000.00

200,000.00

100,000.00

-

2019/20

Q1-20/21

Q2-20/21

Q3-20/21

Q4-20/21

2021/2022

Axis Title

Qtrly Forecast

Qtrly Claims

Available IPF

What is our contribution to the Economic Strategy?

Quarter/ year:

4 (Jan -Mar) 2020

Programme Target

Outputs - cumulative from April 1st 2019 to 31st March 2020 (Quarter 4)

Actual to date

to 2021

Number of Direct Full-Time Jobs Created

0

65

High Value Jobs created

0

59

Number of Jobs Safeguarded

10

60

Number of businesses created

0

12

Number of Businesses Supported (at least 12 hrs of support)

25

94

Number of Learners

0

49

Number of businesses created

0

41

Number of part time jobs created

4

0

What is the Project Delivery Status?

Building Supply Chains - NCC: This full grant award has now been paid to this project. The project has been suspended during the COVID Restrictions and delay of the offshore

Vattenfall development. A meeting is to be arranged with the LEP Sector Team to assist the BSCS Project. The project has so far, provided 25 businesses with at least 10 hours of

support each. Public match funding of £5,298.39 and private match funding of £20,220.35 has been spent to date.

The Ipswich Cornhill Action Plan- Ipswich Central: A claim of £23,712.05 was submitted late for Quarter 3 and a further claim of £2,032.95 was paid in Quarter 4. This project has

been completed. The project attracted £57,391.41 in Public Match Funding and £34,301.74 in Private Match funding. It created 62 new events in the Cornhill, increased dwell time by

9.75% and created a 27.75% increase in visits to the area.

Growing the Year-Round Economy - Visit East of England: This project made a third claim for £12,644. A 4th claim is imminent. Two data stewards and administrator are now

facilitated in an office with the Affinity Agency who are developing the website. This gives them instant access to developers and client manager and help speed their work. The

accommodation booking API is now functional and VEE is working with partners ‘Staylists’ to encourage more accommodation venues to sign up.

The Catapult - The Catapult Network: The Catapult - The Catapult Network: The new post holder, Andy Holyland based at Orbis Energy in Lowestoft started on 1st January 2020. A

claim of £7,043.59 has been paid and private match of £7,043.59 has been recorded. A second claim is due second week of July.

Norfolk & Suffolk Offshore Wind Competitiveness Positioning Programme - GYBC: A first claim has been received evidencing expenditure of £109,621 but as yet has not been

processed for payment. The claim highights the creation of 2 FTEs, Local Authority match funding of £27,799 and other public match of (Pot B)

£49,047.

Fit for Nuclear - SCC: This project has now met the conditions of the IAC's Innovative Projects Fund Offer. £118,000 has been approved. The project will now be led by West Suffolk

College. The project has started and a project claim is expected 2nd week of July.

Creating Creative Capital - NUA: This project was re-approved by the IAC in October 2019. The project has submitted a signed offer letter and has claimed £20,000 to kick start the

project. This project is being paid in stages. The next payment of £70,000 is expected to be paid in April 2021. A monitoring report has been recieved for the first quarter.

What are the Next Steps?

On 11th March 2020, the Innovative Projects Fund Panel considered all 38 applications from the 2019 Innovative Projects Fund Call. 18 projects were approved, and 4 projects were

deferred for potential underspend from the 2019 programme (pending further development). £1,472,372 of the 2019 call of the Innovative Projects Fund has been awarded. A PPR will

be available from Quarter 2.

The Programmes Case Worker for the IPF Programme is working with Project Leaders of the 2018 project call to ensure claims and associated monitoring reports are received for

Quarter 1 of 2020/21.

23

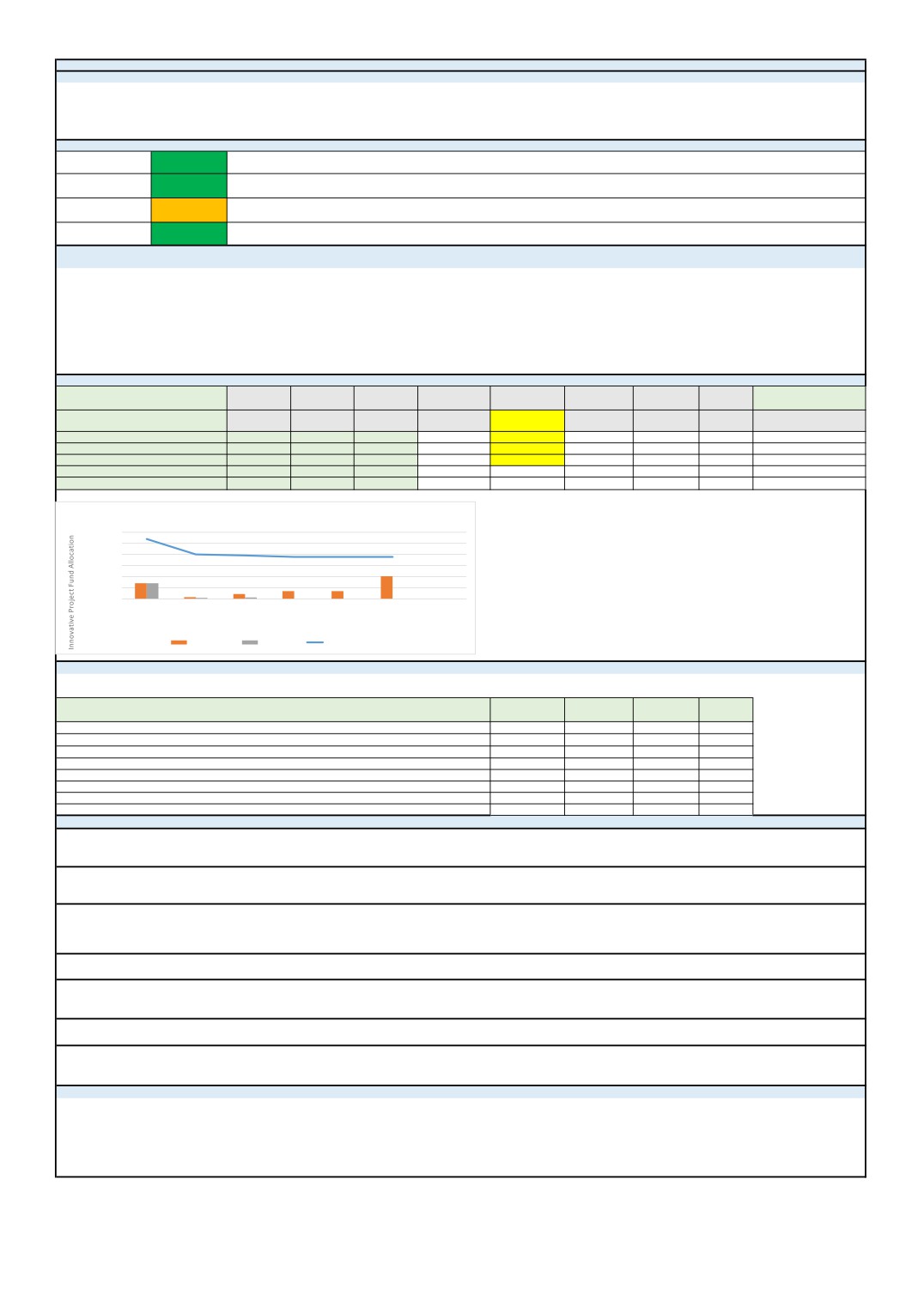

Business Resilience and Recovery Programme

Programme Overview - What is the Business Resilience and Recovery Programme.

The Business Resilience and Recovery Scheme provides support to businesses in Norfolk and Suffolk that have been affected by the Covid-19 Coronavirus and are looking at ways to

recover and strengthen their business performance. Companies applying under the scheme can apply for a 50% grant towards capital costs involved in initial resilience and future

recovery of their business. A grant of £25,000 up to a maximum of £50,000 is available to support projects.

What is the Overall Programme Status?

The Business Resilience and Recovery scheme has made a positive start having supported 36 businesses since its launch 10 weeks ago.

Overall:

Green

Momentum in the enquiries and associated applications is growing, 9 applications are in the system and the Growth Hub has reported another

34 applications in the pipeline with a grant value of £1,391,156.

Expenditure is required by the end of the financial year. All applications are appraised on the applicant's ability to deliver the projects by the end

Delivery:

Green

of the current financial year. At present all projects are set to deliver by the end of the current calendar year.

Spend:

Green

£1,379,958 has been awarded to projects, representing 40% of the programme budget. £479,744 has been paid out to 24 businesses.

£1,379,958 has been awarded to 36 businesses. The has enabled 36 businesses and their associated supply chains to start the journey to

Outputs:

Green

recover from the consequnces of COVID-19 restrictions. 22 FTEs have been created and 1038 FTEs have been safeguarded.

What are our Key Updates?

•The Business Resilience and Recovery Scheme was launched on Monday 4th May and the scheme has proved popular with several enquiries already being handled, developed and

progressed through the Growth Hub.

•In its first 10 weeks 36 businesses have been supported, the most recent being AKS Skip Hire approved on 13/07/2020 with a grant of £40,000.

•Total R&R grant value awarded to date is £1,379,958 with a total projects value of £3,391,383. Private match of £2,011,424 has been committed. £479,744 has been paid out to 24

businesses.

•Investment in these 36 businesses will create 22 FTEs and safeguard 1038

•Of the 36 businesses supported, 20 are in Norfolk (£749,665) and 16 are in Suffolk (£630,293).

What is our Financial Position?

DD

Financials (£ million)

Forecast

Actual

Actual

/Appraisal

Qtr 1

Qtr 2

Financial Year

2020/21

Qtr 3 2020/21

Qtr 4 2020/21

2020/21

2021/22

Brought Forward

0

0

LEP Allocation

£3,500,000.00

£3,500,000.00

£2,709,864.00

Spend [Act/Fcst]

£3,500,000.00

£290,639.00

£189,105.00

Committed

£3,500,000.00

£499,497.00

£400,717.00

£359,222.00

Carried forward

£3,500,000.00

£2,709,864.00

£2,120,042.00

Business Resilience and Recovery Programme

£4,000,000.00

£3,000,000.00

£2,000,000.00

£1,000,000.00

£0.00

Q1-20/21

Q2-20/21

Q3-20/21

Q4-20/21

Axis Title

Qtrly awarded

Qtrly Claims

R&R Allocated

What is our contribution to the Economic Strategy?

Quarter/ year:

Outputs - cumulative from April 1st to 31st December 2020

Actual Qtr 1

Actual Qtr 2

Actual Qtr 3

Actual Qtr 4

Total

Number of Direct Full-Time Jobs Created

10

12

22

Number of Direct Full-Time Jobs Safeguarded

706

332

1038

Private Match (£)

£1,221,274.00

£790,150.00

£2,011,424.00

Public Match (£)

£0.00

£0.00

£0.00

Commercial Floor Space (SqM)

TBC

TBC

What is the Project Delivery Status?

See Appendix 1

What are the Next Steps?

Qtr 2 - The Growth Hub will continue to signpost, develop and progress R&R applications to the LEPs Due Diligence Team. Regular Team meetings are held to review processes and

suggest improvements to the scheme and its wider dissemination and take up.

25