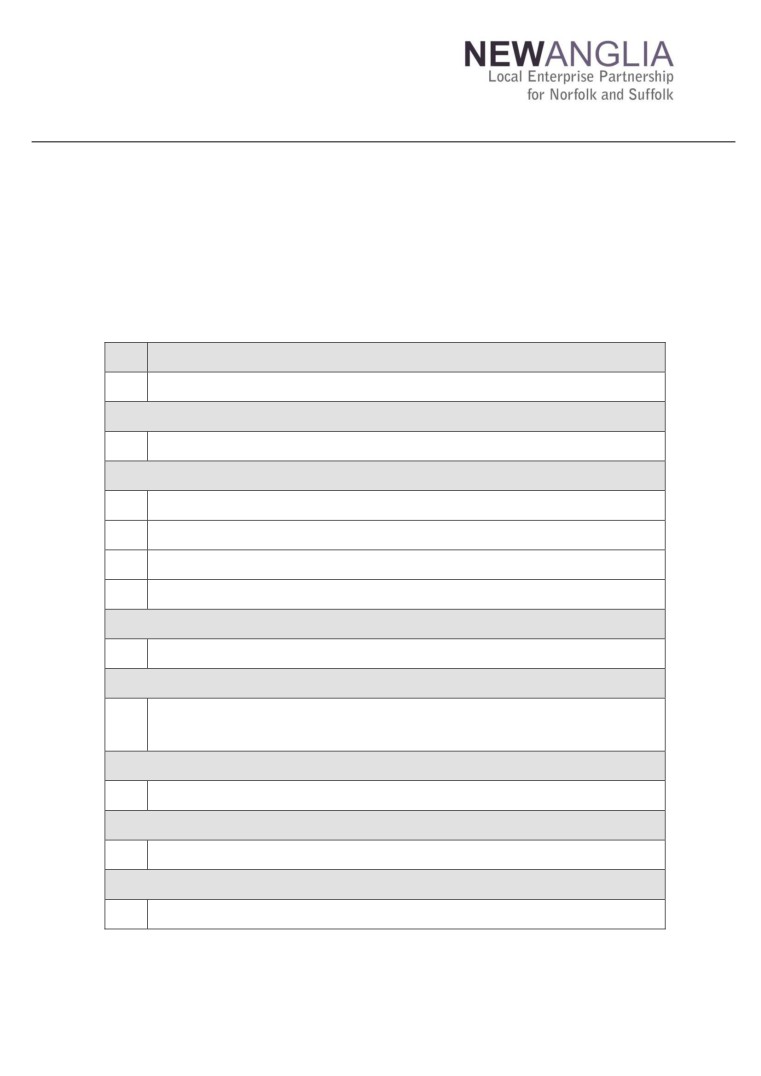

New Anglia LEP Investment Appraisal Committee

Wednesday 20th May 2020

Telephone meeting

9am to 9:45am

Via MS Teams

Agenda

No.

Item

1.

Welcome

Governance

2.

Governance paper

Main Agenda

3.

Apologies

4.

Declarations of Interest

5.

Minutes of previous meeting- 25 March 2020

6.

Horizon Paper- Confidential

Reporting: Growing Places Fund

7.

Growing Places Fund Programme Performance Report

Reporting: Growing Business Fund

8,

8a

Growing Business Fund Programme Performance Report and appendices

8b.

Reporting: Innovative Projects Fund

9.

Innovative Projects Fund Programme Performance Report

Items for Approval

10.

Growing Places Fund: Covid-19 loan repayment adjustments

Other

11.

Any Other Business

Committee Members

Cllr David

Ipswich Borough Council

Ellesmere

Andrew Proctor

Norfolk County Council

Sandy Ruddock

Scarlett and Mustard

Alan Waters

Norwich City Council

Tim Whitley

BT

Dominic Keen

High Growth Robotics

Martin Williams

Exec Members

Rosanne Wijnberg

New Anglia LEP

Chris Dashper

New Anglia LEP

Iain Dunnett

New Anglia LEP

Date and time of next meeting: Wednesday 23 June 2020. 9am-9:45am

Venue: Telephone meeting

New Anglia Investment Appraisal Committee

Teleconference

Meeting Minutes (Unconfirmed)

25th March 2020

Present:

Committee Members

Alan Waters (AW)

Norwich City Council

Sandy Ruddock (SR)

Scarlett and Mustard

David Ellesmere (DE)

Ipswich Borough Council

Andrew Proctor (AP)

Norfolk County Council

Dominic Keen (DK)

High Growth Robotics

Martin Williams (MW)

Independent IAC Member

In Attendance

Rosanne Wijnberg (RW)

New Anglia LEP

Chris Dashper (CD)

New Anglia LEP

Emma Taylor (ET)

New Anglia LEP

Tanya Nelson (TN)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

Mike Dowdell (MD)

New Anglia LEP

Iain Dunnett (ID)

New Anglia LEP

ACTIONS

1

Welcome from the Chair

David Ellesmere welcomed everyone to the meeting.

2

Apologies

Apologies were received from Lindsey Rix and Tim Whitley.

3

Declarations of Interest

David Ellesmere (DE) declared an interest in Item 9, the Wolsey Theatre application.

Andrew Proctor (AP) declared an interest in Item 11, the Food Innovation Centre application.

Both committee members left the call for the duration of the discussion of the above items.

4

Minutes of previous meeting (29th January 2020)

The minutes of the previous meeting were approved by the committee.

5

Growing Places Fund Horizon Paper (Confidential)

Iain Dunnett (ID) highlighted key points from the Horizon paper.

6

Growing Places Fund Programme Performance Report and RAG Rating

6a

The monthly GPF report and accompanying appendices were reviewed by the Committee.

Page 1 of 2

7

Growing Business Fund Programme Performance Report and appendices

The Growing Business Fund Performance Report was presented to the meeting.

Chris Dashper (CD) confirmed that future GBF reports will reflect the current business climate. The fund

is being reviewed and amended to ensure it is fit for purpose to provide appropriate support to

businesses at this time.

11

The Food Innovation Centre - Confidential

It was agreed that item 11 would be addressed first.

AP returned to the call

9

Growing Places Fund: Wolsey Theatre, Ipswich Grant Application

DE left the call.

ID reviewed paper detailing the application for £225k from the Growing Places Fund towards the

redesign of the theatre’s immediate environment and upgrading the facilities.

The Committee agreed:

• To offer a maximum grant of £225,000 towards the cost of refurbishment of the New Wolsey Theatre

in Ipswich which will be reduced to the amount required to complete the total funding package if all

outstanding funding is secured

DE returned to the call

10

Growing Places Fund: Grant application for St Peters Church, Sudbury

ID presented the application for a grant of £226,000 from the Growing Places Fund to the development of

the largest community space in Sudbury, located in the St Peters Church building, for the purposes of

tourism, cultural, economic and community use.

The Committee agreed:

• To offer of a grant of £226,000 from the Growing Places Fund to the development of the largest

community space in Sudbury, located in the St Peters Church building

12

Innovative Projects Fund - Tender Approval for Culture Drives Growth Project

Tanya Nelson (TN) presented Tender Brief for the Culture Drives Growth project which was awarded

£15,000 from the 2019 call of the Innovative Projects Fund subject to the approval of the Consultant

Tender Brief by the IAC.

The Committee agreed:

• To approve the Tender Brief for the appointment of consultants for the ‘Culture Drives Growth Project

11

Any Other Business

Date and time of next IAC meeting: Wednesday, 20th May 9-9:45am

Venue: TBC

Page 2 of 2

New Anglia Local Enterprise Partnership

Investment Appraisal Committee

Wednesday 20th May 2020

Agenda Item 2

Governance Paper: Election of Chair, Vice Chair and annual review of Terms of

Reference

Author: Chris Dashper

Summary

This paper serves to:

1) Elect a new Chair and Vice Chair for the Investment Appraisal Committee following

nominations by IAC members. Appointments to be confirmed by LEP Board.

2) To review and adopt the Terms of Reference for the Committee, attached.

Investment Appraisal Committee

Terms of Reference

Purpose

To ensure allocation of funding is delivered appropriately and in accordance with the Assurance

Framework through the mechanism of LEP Programmes - Growing Places Fund, Growing

Business Fund, Capital Growth Programme, Growth Through Innovation Fund, EZ Accelerator

Fund and the Innovative Projects Fund or other funds as appropriate, and that the funding

allocations support the development of schemes that deliver the Economic Strategy.

Functions

•

Making an assessment as to the long term financial and legal viability of offering

Growing Places Fund loan finance to clients and other.

•

Making assessments on projects received through Capital Growth Programme, ensuring

value for money, additionality and alignment with the Economic Strategy ambitions and

Economic Indicators.

•

Consider proposals for co-investment of the Enterprise Accelerator Fund for projects to

be developed on Enterprise Zones, generating a rental return through co-ownership of a

suitable built asset.

•

Provide scrutiny to the Growth Deal spend profile and agree any reallocation of funds.

•

Providing a strategic assessment of proposed LEP Programme bidding calls.

1

•

Providing a final strategic assessment of projects and to make a decision on which

projects should be approved for funding where the value of the LEP intervention is

£500k or less.

•

Make a recommendation to the LEP Board to approve or reject each request for funding

received exceeding £500K.

•

Approve contract variation to funding agreements after initial approval by the committee

within £500k of the original agreed funding or delivery profile.

•

Lead on the development of the LEP Investment Plan making recommendations to the

LEP Board in the summer of each year which sets out the framework for LEP

Programmes for the proceeding financial year.

Membership and Appointment

The committee will comprise a total of eight members. Seven committee members will be

members of the LEP Board- four private sector members, three public sector. A further private

sector member will be independent of the LEP Board. The Chair of the Committee will be

approved by the LEP Board following election by the IAC members , and a Deputy Chair shall

be appointed to chair the Committee in the Chair’s absence or if he/she elects to delegate the

chair. Substitutes may only be accepted in exceptional circumstances and only for public sector

members at the discretion of the Chair.

Quorum

Five members, made up of at least two private sector directors of the LEP Board, at least

opublic sector director of the LEP Board and the IAC chair or deputy chair.

Attendance of non-members at meetings

Officers from the LEP Executive will attend meetings and present reports and

recommendations but will not be entitled to vote. Project applicants will not be entitled to attend

meetings unless it is deemed necessary. Meetings of the Investment Appraisal Committee will

not be open to observers or other attendees.

Advisers

The Growing Business Fund uses independent appraisers to conduct the due diligence on each

applicant to the programme. Adviser contracts will be compulsorily reviewed every 3 to 5 years

Declarations of Interest

Members should clearly indicate any declaration of interest, either pecuniary, non-pecuniary or

local non-pecuniary at the commencement of the meeting. Members should leave the meeting

for any item where an interest has been declared and not return until a decision has been

reached on the item. Members should not attempt to influence any decision where there is a

conflict of interest but may on occasion be asked to provide technical insight to assist other

members in their decision making.

Meeting Frequency

A meeting will be scheduled to be held before each LEP Board meeting. If no decisions are

forthcoming, the meeting can be cancelled. Ad hoc meetings can be scheduled if necessary,

both in person and by conference call, particularly to review changes to outstanding projects.

Delegated Authority including limits

The committee will have a delegated responsibility from the LEP Board for financial decisions

up to £500k.

The Investment Appraisal Committee will set the annual budget for the Growing Business Fund

for each forthcoming financial year and will agree any variance to the budget during the delivery

year should this be necessary. Authority will be delegated for Growing Business Fund (GBF)

2

decisions to the GBF panel, which the LEP Board Champion for GBF and member of the IAC

attends. The maximum award size under GBF will be £500k. A report will be provided on

awards made by the GBF panel for each IAC meeting.

Authority is also delegated, through the GBF panel, to the ERDF funded Small Grant Scheme

and the Growth Through Innovation schemes. The SGS through, an on-line panel, will report

decisions made to the GBF panel and in turn to the IAC. The maximum award under SGS will

be £25k. GTI approvals will be reported directly to the IAC. The maximum award under GTI will

be £25k.

Reporting procedures

The minutes of meetings will be circulated to all members of the IAC and will be published on

the LEP website. The IAC will records of decisions made under GBF, incorporating Small

Grants Panel decisions to ensure alignment with investment decisions. In addition, records of

decisions on the Growth Through Innovation (GTI) scheme and other LEP programmes will be

provided to the IAC where IAC delegated authority is used to support decisions made. IAC

minutes will be published

10 days after meetings in accordance with LEP governance

arrangements.

Decisions made by the IAC, GBF panel, Small Grants panel and the Growth Through

Innovation panel will be recorded in the LEP’s register of decisions which is published online.

Communications

Meeting agendas will be circulated 5 working days before each meeting in accordance with

LEP governance arrangements. Agendas will include all appropriate papers required to support

any decisions to be made. Additional papers may be circulated by email between meetings as

necessary.

Key stakeholders such as the Skills Board and the Local Transport Body will be consulted and

informed on projects and decisions made.

Decisions will be communicated to applicants in advance of minutes being published.

Review

The membership of the Investment Appraisal Committee will be reviewed annually. The

Committee shall, review its own performance once a year and terms of reference to ensure it is

operating at maximum effectiveness and recommend any changes it considers necessary to

the LEP Board for approval.

Last Updated: 12 May 2020

3

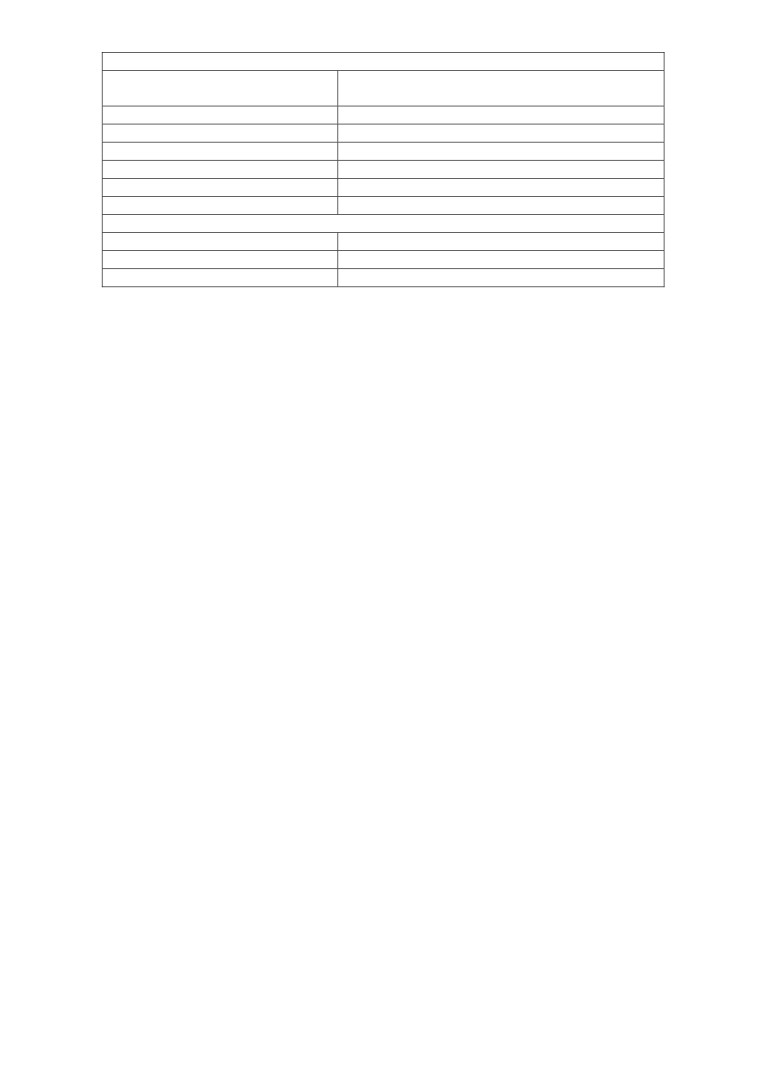

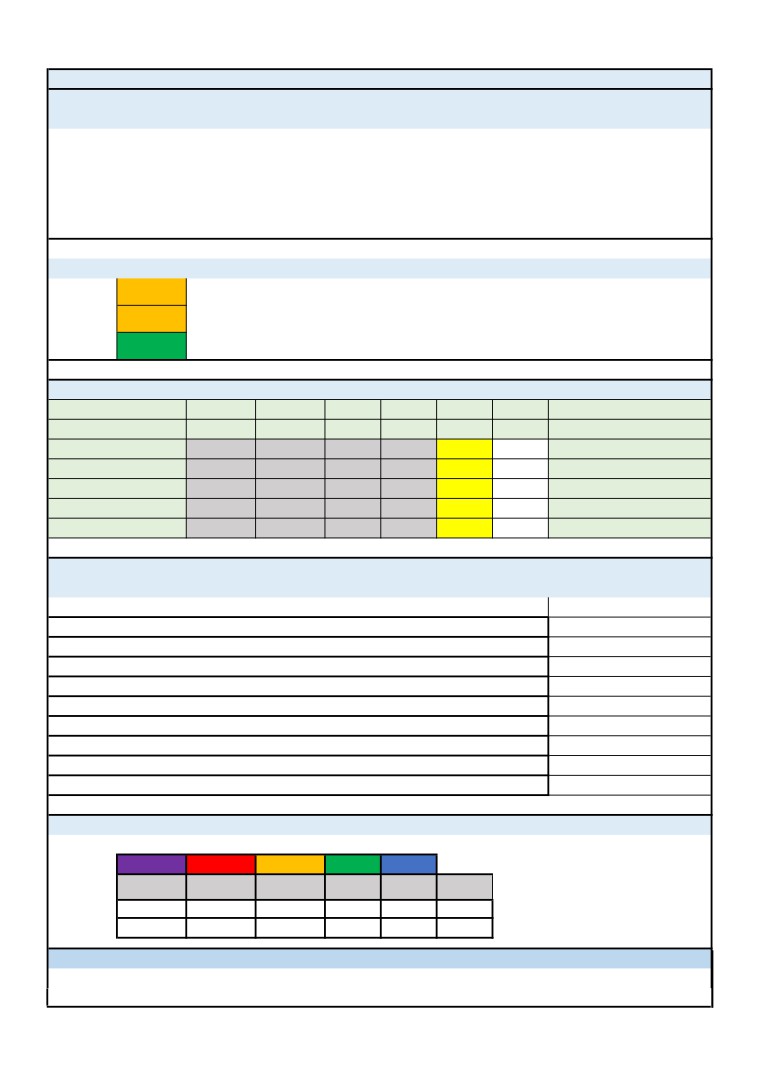

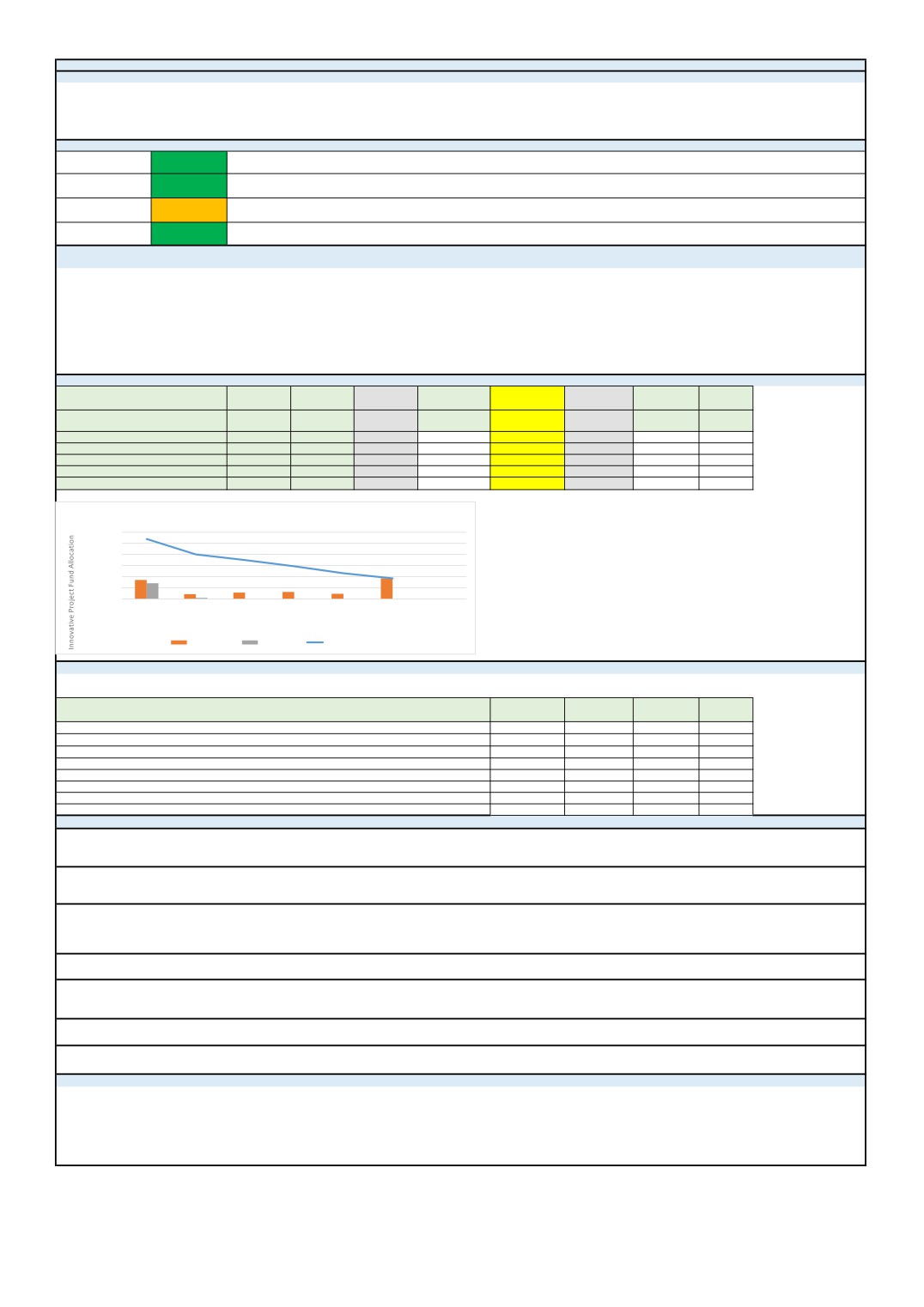

Item 7 - Growing Places Fund Performance Report

Programme Overview - What is the Growing Places Fund?

• Programme duration under Growth Deal funding: 2015 - 2021.

• Value: £35m. This is the £35m Growing Places Fund element of the Growth Deal. Completed projects date back to previous funding from 2012.

• Invested £22.7 million loan capital in region’s infrastructure, sectors and growth locations.£13 million of grants provided to projects demonstrating

significant regional or local economic benefit.

• Contribution to the Economic Strategy: The fund has leveraged£143m of public investment and £149m of private investment, created 1475 new jobs, 468

new homes, created 18,703 square metres of industrial space, provided premises for 112 new businesses to be created, supported 35 capital build projects,

and 6 sector developments in the private and public sector.

What is the Overall Programme Status?

Amber

Loans position

See separate update on MSF. Winerack loan subject to review due to Covid 19.

Amber

Grants position

Grants under review with existing projects to understand effect of Covid 19 on project grant drawdown.

Outputs

Green

Output delivery on profile.

achieved

What is our financial position?

Financials (£ millions)

Actual

Actual

Actual

ual/Forecast

Forecast

Forecast

Total

Financial Year

2015/16

2016/17

2017/18

2018/19

2019/20

2020/21

Brought Forward

0.000

0.000

2.729

4.415

1.524

4.849

Repaid

0.000

2.088

1.597

1.031

2.129

5.583

12.427

Gov Allocation

7.967

4.092

2.790

3.720

3.720

6.646

28.935

Spend [Act/Fcst]

-7.967

-3.451

-2.701

-7.641

-2.524

-6.546

-30.830

Carried forward

0.000

2.729

4.415

1.524

4.849

10.532

What is our contribution to the Economic Strategy?

Programme performance to date

Outputs - cumulative from April 2012 to Quarter 1 2020

Actual to date

New homes built

468

New jobs created

1,475

Industrial Space created (m2)

18,703

New businesses created through provision of premises

112

Capital Build projects supported

27

Sector Developments supported

6

Match Funding - Public (£m)

143

Match Funding-Private (£m)

149

Total Match (£m)

292

What is the Project Status?

Current status of all projects.

Overall status

Purple

Red

Amber

Green

Blue

Pipeline

At risk

Claim stage

Live

Complete

Total

16

1

4

15

22

58

Change

-1

0

1

2

3

What are the next steps?

Review effect of Covid 19 on current loan and grant arrangements.

Ensure payback returns contribute to LEP finances.

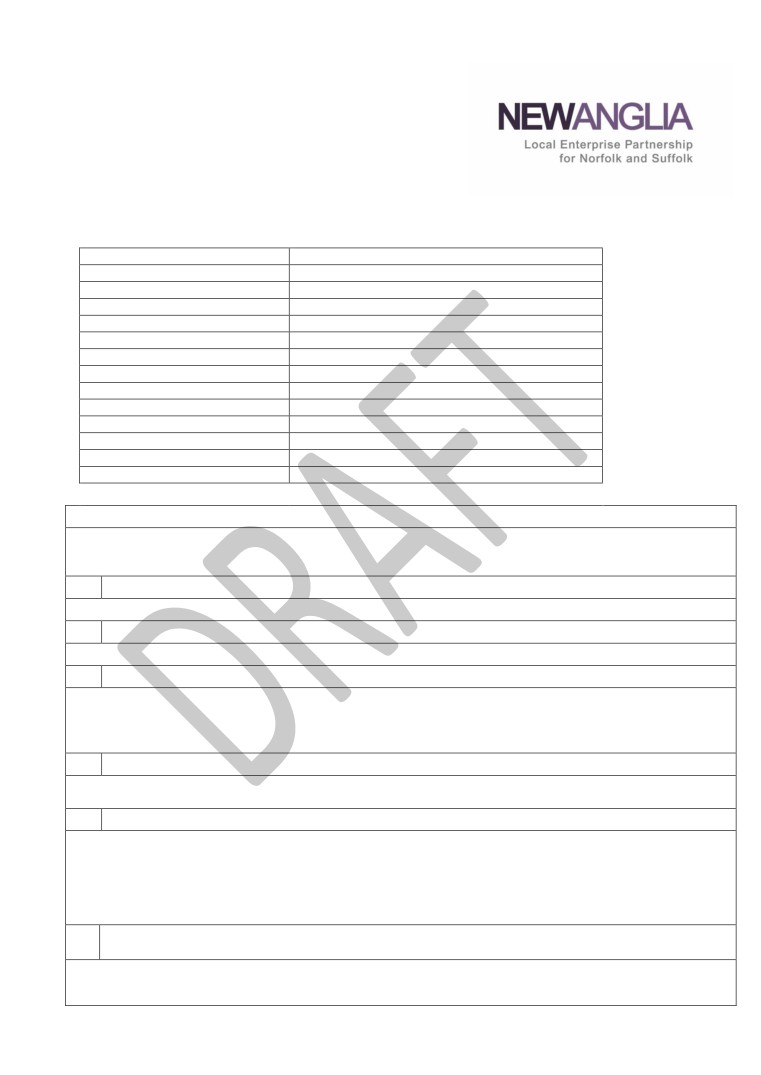

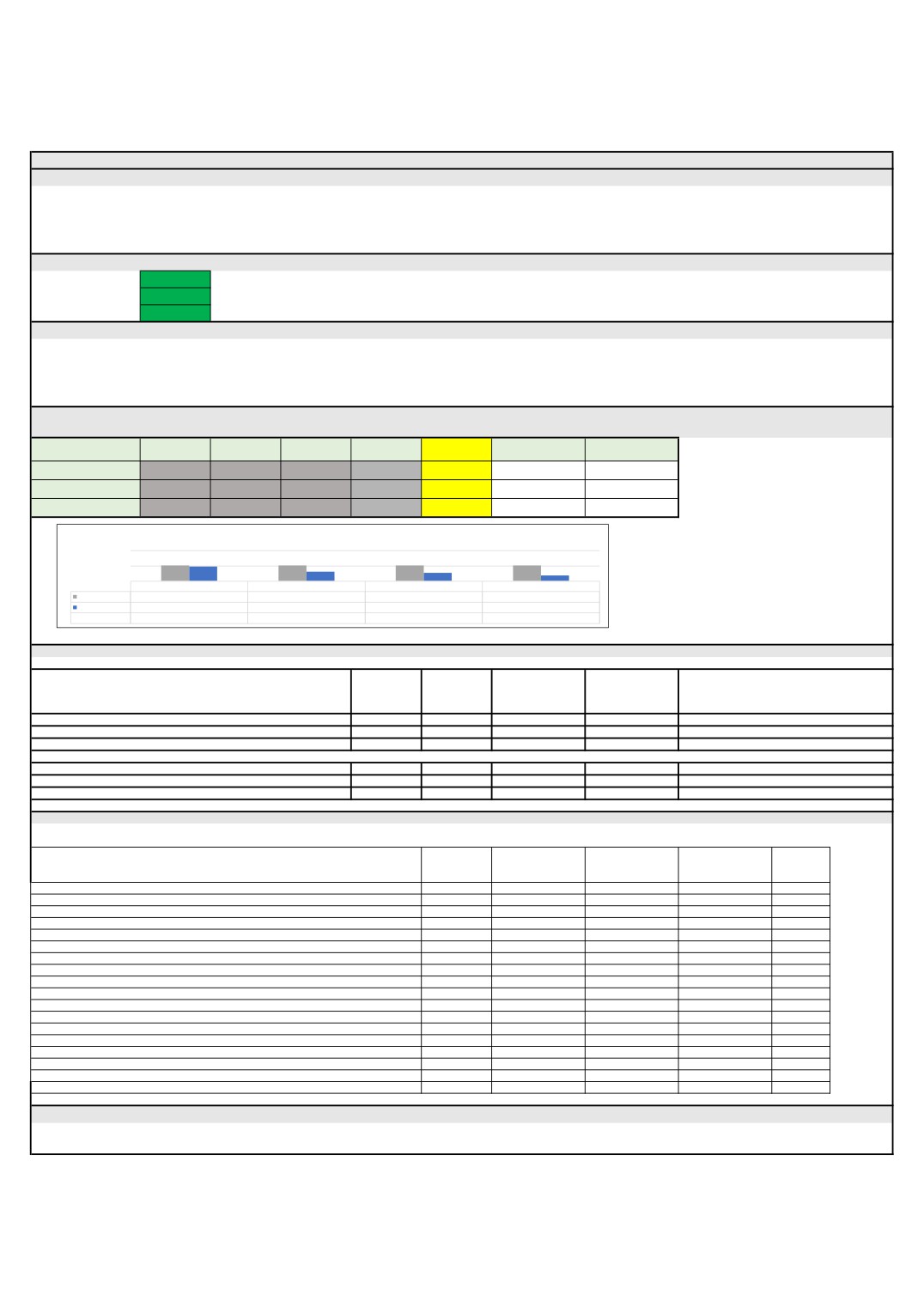

Growing Business Fund Performance Report - March 2020

Programme Overview - What is the Growing Business Fund?

Launched in April 2013, the Growing Business Fund provides grants for businesses to enable growth, an increase productivity and job creation.

Capital grants between £25,000 and £500,000 are provided at up to 20% of project costs for SMEs, with an enhanced rate for small businesses located in an Assisted Area (until 2021).

Funding for the Growing Business Fund is provided on an annual basis by the LEP's Growth Deal.

The fund is accessed through the New Anglia Growth Hub with Due Diligence undertaken by Finance East and agreed by a GBF panel which meets monthly as required .

What is the overall Programme Status?

Finance

Green

Since the autumn there has been an increase in the number of applications coming forward, these are now being progressed quite quickly to panel.

Outputs

Green

Based on grant approvals, the scheme reached its outputs target for 2019/20 and starts 2020/21 ahead of target.

Delivery

Green

Despite COVID-19, we still have a healthy pipeline of applications being developed and coming forward for approval .

What are our key updates?

Participant SMEs of the Scale Up New Anglia programme are being offered a range of support including applications to GBF (where appropriate).

This is still the LEP flagship grant scheme attracting interest: despite COVID-19, we are seeing confidence is some businesses submitting grant applications

The slow down seen at the end of 2019 has continued to pick up, however, some applicants are struggling to find match funding, as the economy slows down.

At the end of 2019/20 we spent £2.533 million of the £4.121 million allocation, which included the adional funds given to the Fund.

What is our financial position?

Financials (£ million)

Year

2013 to 2016

2016/2017

2017/2018

2018/2019

2019/2020

2020/2021

Total

Profile Spend (£m)

£12.000

£3.536

£3.050

£5.096

£4.121

£2.790

£30.593

Actual Spend (£m)

£11.999

£3.001

£3.049

£4.764

£2.533

£25.346

Remaining Spend (£m)

£0.001

£0.535

£0.001

£0.331

£1.588

£2.790

£5.246

2019/2020 Expenditure Profile

2

1

0

Q1-19/20

Q2-19/20

Q3-19/20

Q4-19/20

Quarterly Forecast

£1.030

£1.030

£1.030

£1.030

Quarterly Spend

£0.963

£0.631

£0.554

£0.386

Variance

£0.067

£0.399

£0.476

£0.645

What is our contribution to the Economic Strategy?

Actual to end

Outputs April 2019 to March 2020

Target

Monthly Change

Shortfall

Notes

of March 2020

Value of grants approved

£4,121,000

£1,735,736

£429,900

£2,385,264

Value of private sector match approved

£16,484,000

£7,515,086

£2,050,326

£8,968,914

Number of New Jobs to be Created

206

99

22

108

Value of grants claimed

£4,121,000

£2,533,429

£0

£1,587,571

Private sector match funding drawn down

£16,484,000

£11,541,407

£0

£4,942,593

Number of New Jobs Created

206

225

22

-19

What is the project status?

The following table shows grants approved by sector since the start of the programme in 2013/14

Number of

Projects

Grants

Private

Total Project

Jobs to be

Sector

Approved

Approved

Match

Costs

Created

3

£

235,899

£

1,018,543

£

1,254,442

58.0

B - Mining and Quarrying

1

£

100,000

£

1,654,600

£

1,754,600

10.0

C - Manufacturing

130

£

14,572,909

£

92,603,285

£

107,176,194

1564.5

E - Water supply, sewerage, waste management and remediation activities

5

£

454,000

£

1,902,000

£

2,356,000

35.0

F - Construction

17

£

1,196,486

£

5,954,740

£

7,151,226

147.5

G - Wholesale and retail trade; repair of motor vehicles and motorcycles

26

£

2,829,816

£

52,382,892

£

55,212,708

386.0

H - Transportation and Storage

8

£

666,992

£

3,275,957

£

3,942,949

90.0

I - Accommodation and Food Service Activities

5

£

372,000

£

2,342,138

£

2,714,138

45.5

J - Information and Communication

11

£

753,200

£

3,792,342

£

4,545,542

76.0

K - Financial and Insurance Activities

1

£

30,000

£

79,425

£

109,425

3.0

L - Real Estate Activities

1

£

100,000

£

232,500

£

345,000

10.0

M - Professional, Scientific and Technical Activities

23

£

2,533,331

£

15,611,382

£

18,144,713

269.6

N - Administrative and Support Service Activities

22

£

2,145,771

£

11,440,136

£

13,585,907

251.0

P - Education

1

£

20,000

£

102,191

£

122,191

4.0

Q - Human Health and Social Work Activities

1

£

31,580

£

126,320

£

157,900

3.5

R - Arts, Entertainment and Recreation

8

£

502,921

£

3,159,776

£

3,662,697

55.5

S - Other Service Activities

2

£

320,000

£

4,737,413

£

5,057,413

32.0

Total

265

£

26,864,905

£

200,415,640

£

227,293,045

3041.1

What are the next steps?

The LEP is working with delivery partners, to ensure that the scheme can be accessed by businesses to facilitate growth during the current COVID-19 Pandemic.

We are working with Finance East and other partners to implement the new State Aid Regulations, to enable GBF to support as many businesses as possible.

New Anglia LEP

Growing Business Fund

Grant Approvals 1st April 2019 to 31st March 2020

Date

Total Project Jobs to be

Business Name

Grant Awarded Private Match

Approved

Cost

CreatedDescription of Support Given

Apr-19

Anglian Plant Ltd

£170,000

£681,915

£851,915

8

Capital grant to support business growth

May-19

Portable Space Ltd (2)

£78,378

£313,513

£391,891

5

Capital grant to support business growth

May-19

Goldwell Manufacturing Services Ltd

£40,000

£96,200

£136,200

2

Capital grant to support business growth

May-19

Belle Coachworks Ltd (4)

£36,000

£85,151

£121,151

5

Capital grant to support business growth

May-19

HBD Europe Ltd (2)

£52,388

£341,133

£393,521

6

Capital grant to support business growth

Jul-19

Bendart Limited

£42,500

£99,495

£141,995

4

Capital grant to support business growth

Jul-19

Cater Cunningham Ltd (Creative Displays (UK) Ltd (2)

£40,000

£162,821

£202,821

4

Capital grant to support business growth

Jul-19

Hugh Crane Cleaning Equioment Ltd

£56,369

£507,327

£563,696

5

Capital grant to support business growth

Jul-19

Anglia Indoor Karting (Ipswich) Ltd

£40,000

£126,060

£166,060

2

Capital grant to support business growth

Aug-19

William Moorfoot Ltd

£50,000

£283,067

£333,067

2.5

Capital grant to support business growth

Aug-19

Timber Frame Management Ltd

£35,662

£142,649

£178,311

2

Capital grant to support business growth

Sep-19

Musks Limited

£71,469

£285,876

£357,345

4

Capital grant to support business growth

Sep-19

Edmondson Hall (Moved from SGS approvals)

£25,000

£371,148

£396,148

0

Capital grant to support business growth

Oct-19

Hollinger Print Ltd

£57,000

£228,000

£285,000

3

Capital grant to support business growth

Oct-19

Equipmake Ltd

£121,997

£487,988

£609,985

7

Capital grant to support business growth

Oct-19

Richmond Defence Systems Ltd

£70,000

£282,500

£352,500

4

Capital grant to support business growth

Nov-19

Plastech Industries Ltd

£56,500

£226,046

£282,546

3

Capital grant to support business growth

Nov-19

LiMAR Oil Tools (UK) Ltd

£70,690

£450,271

£520,961

5

Capital grant to support business growth

Feb-20

Focus Trovex LLP

£73,400

£293,600

£367,000

5

Capital grant to support business growth

Feb-20

Condimentum (increase to earlier award Nov-18)

£118,483

£0

£0

0

Capital grant to support business growth

Mar-20

Dance and Dean Limited

£60,000

£440,000

£500,000

3.0

Capital grant to support business growth

Mar-20

Crafted Media Ltd

£35,500

£254,726

£290,226

2.0

Capital grant to support business growth

Mar-20

Goldstar Metal Traders Ltd GSMT

£180,000

£728,000

£908,000

9.0

Capital grant to support business growth

Mar-20

Dale Sheetmetal Ltd

£154,400

£627,600

£782,000

8.0

Capital grant to support business growth

£1,735,736

£7,515,086

£9,132,339

98.5

Small Grant Scheme Approvals (April 2019 - March 2020)

Total

Jobs to

Date

Grant

Private

Project

be

Description of Support Given

ApprovedBusiness Name

Awarded

Match

Cost

Created

Apr-19 DXB Pumps & Power Ltd.

£16,845

£67,385

£84,230

1.0 Capital investment to support business growth

Apr-19 Bradleys (Stowmarket) Ltd. (2)

£17,919

£71,679

£89,598

0.0 Capital investment to support business growth

Apr-19 Praxis42 Ltd.

£6,362

£25,449

£31,811

4.0 Capital investment to support business growth

Apr-19 Edmondson Hall

£25,000

£371,148

£396,148

0.0 Capital investment to support business growth

Apr-19 The Penny Bun Bakehouse Ltd.

£7,203

£16,807

£24,010

0.0 Capital investment to support business growth

Apr-19 Criterion Ices Ltd.

£19,515

£78,064

£97,579

2.0 Capital investment to support business growth

Apr-19 Fruitful Media Ltd.

£8,805

£35,222

£44,027

7.0 Capital investment to support business growth

Apr-19 Tosier Chocolate Ltd.

£2,724

£10,900

£13,624

1.0 Capital investment to support business growth

May-19 Apex Print & Promotion Ltd.

£9,930

£39,720

£49,650

2.0 Capital investment to support business growth

May-19 Pastonacre Ltd

£4,305

£17,224

£21,529

1.0 Capital investment to support business growth

May-19 Donald Utting & Sons Ltd (2)

£24,973

£99,892

£124,865

0.0 Capital investment to support business growth

May-19 Safety Devices International Ltd

£5,600

£22,400

£28,000

0.0 Capital investment to support business growth

May-19 A J Laminated Beams Ltd

£5,500

£22,000

£27,500

0.0 Capital investment to support business growth

May-19 P J Lee Hire & Sales Ltd

£6,600

£26,400

£33,000

2.0 Capital investment to support business growth

May-19 Newton Automotive Ltd (2)

£16,160

£64,640

£80,800

1.0 Capital investment to support business growth

Jun-19 Timberwolf Ltd

£18,275

£73,100

£91,375

0.0 Capital investment to support business growth

Jun-19 CapTrac Ltd

£25,000

£101,844

£126,844

0.0 Capital investment to support business growth

Jun-19 Yum Yum Tree Fudge Ltd

£10,905

£43,620

£54,525

0.0 Capital investment to support business growth

Jun-19 N-Ergise Ltd

£25,000

£64,285

£89,285

1.0 Capital investment to support business growth

Jun-19 Emkay Plastics Ltd

£14,453

£57,814

£72,267

0.0 Capital investment to support business growth

Jun-19 Vinyl Installation Ltd

£7,200

£16,800

£24,000

0.0 Capital investment to support business growth

Jun-19 C.S. (Computer Services) Ltd.

£1,749

£6,996

£8,745

0.0 Capital investment to support business growth

Jul-19 The Space Burston

£9,313

£52,775

£62,088

2.0 Capital investment to support business growth

Jul-19 Clenshaw Minns Ltd

£21,740

£86,963

£108,703

1.0 Capital investment to support business growth

Jul-19 Able Cleaning & Hygiene Supplies

£1,113

£4,455

£5,568

0.0 Capital investment to support business growth

Jul-19 Sabrefix (UK) Limited

£4,260

£17,040

£21,300

3.0 Capital investment to support business growth

Jul-19 E Rand & Sons Limited

£4,247

£16,991

£21,238

0.0 Capital & Revenue investment to support business growth

Aug-19 EGM Products Ltd

£12,575

£50,304

£62,879

2.0 Capital investment to support business growth

Aug-19 Saw Media Limited

£1,611

£6,447

£8,058

1.0 Capital investment to support business growth

Aug-19 ASBT Holdings Ltd

£6,188

£24,754

£30,942

3.0 Capital investment to support business growth

Aug-19 Intelligent Resource Management Ltd

£3,000

£12,000

£15,000

0.0 Capital investment to support business growth

Aug-19 Suffolk Yacht Harbour Ltd

£2,919

£11,678

£14,597

0.0 Capital investment to support business growth

Aug-19 Twyfords To You Limited

£12,545

£50,182

£62,727

1.0 Capital investment to support business growth

Sep-19 Finn Geotherm UK Ltd

£4,550

£18,200

£22,750

0.0 Capital investment to support business growth

Sep-19 Lexhag Ltd

£9,972

£39,888

£49,860

0.0 Capital & Revenue investment to support business growth

Sep-19 Stephen Green & Associates Limited

£9,973

£39,892

£49,865

1.0 Capital investment to support business growth

Sep-19 Display Products Ltd

£22,500

£52,500

£75,000

6.0 Capital investment to support business growth

Sep-19 Mio Conferencing Limited

£9,105

£36,420

£45,525

1.0 Capital & Revenue investment to support business growth

Sep-19 Edmondson Hall

-£25,000

-£371,148

-£396,148

0.0 Moved from SGS to GBF

Oct-19 The Rainbird Partnership Ltd

3,668

14,673

18,341

1.0 Capital & Revenue investment to support business growth

Oct-19 WBC (Norfolk) Ltd

5,048

20,195

25,243

1.0 Capital investment to support business growth

Oct-19 Steele Media Ltd

25,000

155,000

180,000

1.0 Capital & Revenue investment to support business growth

Oct-19 SSAF Window Films Ltd

3,490

13,961

17,451

0.0 Capital investment to support business growth

Oct-19 Revolution Fitness Academy Ltd

8,007

32,029

40,036

2.0 Capital investment to support business growth

Oct-19 Tom Soper Photography

2,191

8,766

10,957

0.0 Capital investment to support business growth

Oct-19 Surftech Surfaces Ltd

12,210

48,840

61,050

2.0 Capital investment to support business growth

Nov-19 Re Form Sports Fitness Ltd

13,078

52,314

65,392

2.0 Capital investment to support business growth

Nov-19 David Holliday Limited

2,820

11,280

14,100

0.0 Capital investment to support business growth

Nov-19 Creative Image Management Ltd.

10,260

41,040

51,300

0.0 Capital investment to support business growth

Nov-19 Big House Holiday Rentals Ltd.

4,800

19,200

24,000

0.0 Capital investment to support business growth

Nov-19 H. Smith & Sons (Honingham) Limited

8,133

32,533

40,666

0.0 Capital investment to support business growth

Dec-19 F.W. Frost (Engineers) Ltd.

15,097

60,389

75,486

0.0 Capital investment to support business growth

Dec-19 Image Display & Graphics Ltd

12,332

49,328

61,660

1.0 Capital investment to support business growth

Dec-19 DLH Autorecyclers Limited (2)

6,670

26,680

33,350

0.0 Capital investment to support business growth

Dec-19 J&A Garner - Godwick Hall

25,000

102,459

127,459

1.0 Capital investment to support business growth

Dec-19 Cross Media Print and Digital Solutions

25,000

204,979

229,979

1.0 Capital investment to support business growth

Dec-19 Thompson Packaging Limited

8,939

35,760

44,699

1.0 Capital investment to support business growth

Dec-19 DaRo Fibre Products Ltd

8,077

32,308

40,385

6.0 Capital investment to support business growth

Dec-19 Hoseflex Ltd.

3,288

13,152

16,440

0.0 Capital & Revenue investment to support business growth

Jan-20 Tills Innovations Limited

2,120

8,480

10,600

0.0 Revenue investmnet to support business growth

Jan-20 Suffolk Yoga

14,943

34,869

49,812

0.0 Capital investment to support business growth

Jan-20 Distinct Marketing Ltd

2,735

10,943

13,678

0.0 Capital & Revenue investment to support business growth

Jan-20 The Suffolk Distillery Ltd

7,261

29,045

36,306

0.0 Capital investment to support business growth

Jan-20 Kiki Ltd.

22,962

91,851

114,813

1.0 Capital investment to support business growth

Feb-20 Pruce Newman Pipework Limited

4,845

19,380

24,225

0.0 Revenue investmnet to support business growth

Feb-20 Flexion Global Ltd

25,000

106,833

131,833

9.0 Capital investment to support business growth

Feb-20 Humber Doucy Brewery Ltd

5,113

20,455

25,568

1.0 Capital investment to support business growth

Feb-20 Co-Dunkall Ltd (2)

15,000

60,000

75,000

1.0 Capital investment to support business growth

Feb-20 The Light Aircraft Co Ltd

16,991

67,966

84,957

1.0 Capital investment to support business growth

Feb-20 A1 Coffee Limited

4,382

17,528

21,910

0.0 Capital investment to support business growth

Feb-20 Prominent PR Ltd

1,825

7,303

9,128

0.0 Capital & Revenue investment to support business growth

Feb-20 Glideline Ltd

12,810

29,890

42,700

8.0 Capital investment to support business growth

Mar-20 Wrought Iron & Brass Co Ltd (2)

6,040

24,160

30,200

1.0 Capital & Revenue investment to support business growth

Mar-20 Warren Services Ltd (3)

24,775

99,104

123,879

0.0 Capital investment to support business growth

Mar-20 Thomson Sawmills Ltd

23,100

92,400

115,500

0.0 Capital investment to support business growth

Mar-20 International Export Supplies Limited

25,000

101,500

126,500

5.0 Capital investment to support business growth

£808,644

£3,279,323

£4,087,967

89.0

SGS Grants Approved Apr19-Mar20

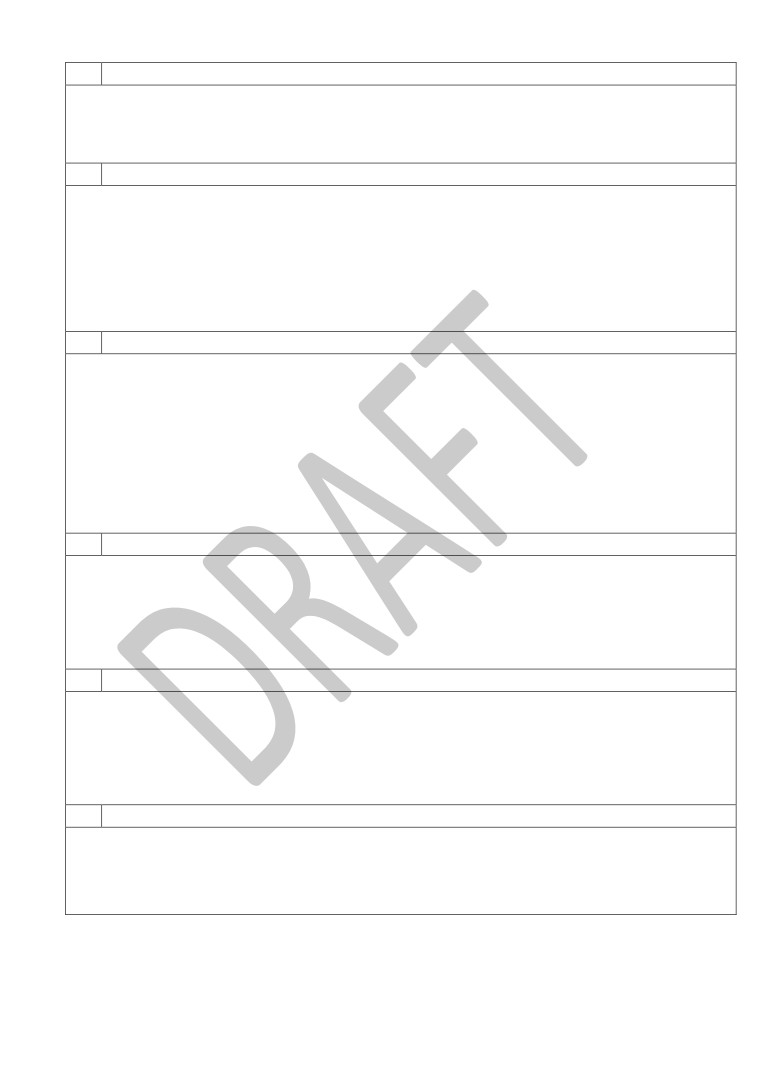

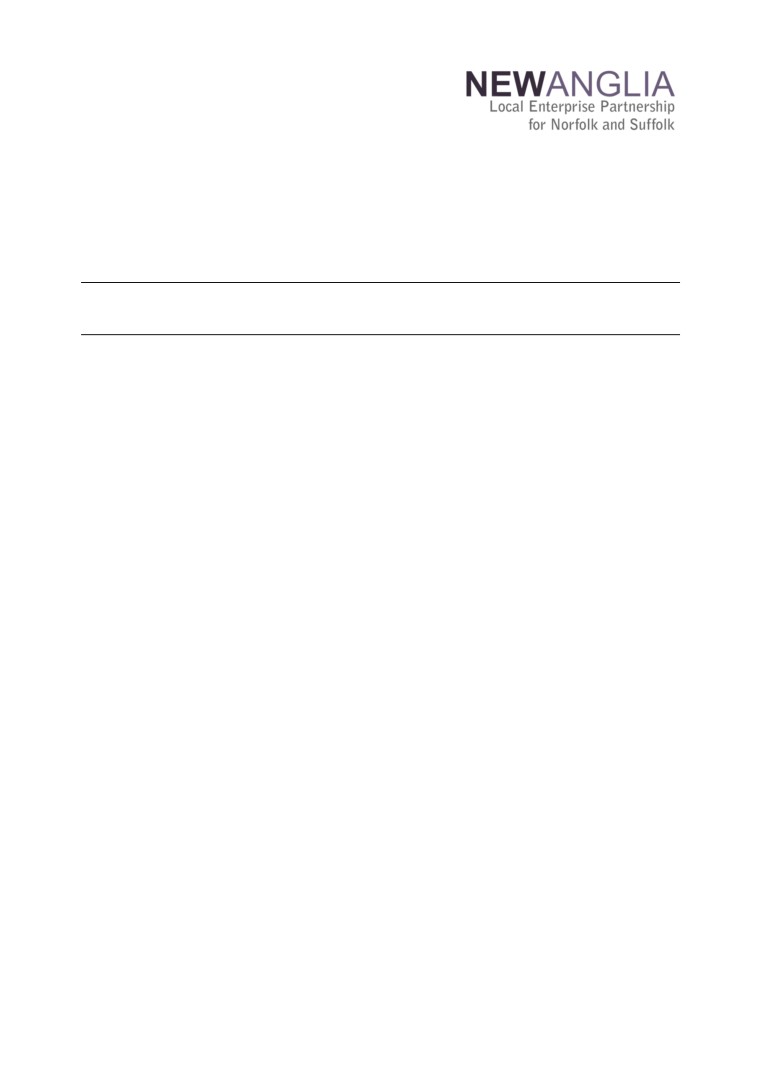

Innovative Projects Fund - 2018 Projects Call

Programme Overview - What is the Innovative Projects Fund

The Innovative Projects Fund is a revenue grant programme that provides funding towards innovative projects to support the delivery of the themes and activities identified in the

Economic and Local Industrial Strategies. The first call of the Innovative Projects Fund was made in October 2018 with a remit to facilitate innovative projects supporting economic

growth and the delivery of the Economic Strategy utilising revenue from the Enterprise Zone Pot C.

What is the Overall Programme Status?

Overall:

Green

7 out of the 7 projects have Offer Letters. Awaiting receipt of a signed Offer Letter from West Suffolk College for the Fit for Nuclear Project.

Delivery:

Green

7 out of 7 projects are now in their delivery phase. The Ipswich Cornhill Project has been completed.

Profiled Spend to the end of 2019/20 Quarter 4 was £170,460.55. Actual Spend to the end of Quarter 4 was £140,001.53. An underspend of

Spend:

Amber

£30,459.02.

Outputs:

Green

No accumulated outputs were forecast by the end of Quarter 4.

What are our Key Updates?

•There are 7 projects under the 2018 call of the Innovative Projects Fund with a combined allocation and commitment of £539,531.

•The value of claims for the first year (2019/20) was 140,001.53.

•Profiled Spend to the end of 2019/20 Quarter 4 was £170,460.55. Actual Spend to the end of Quarter 4 was £140,001.53. An underspend of £30,459.02.

•Since the end of the financial year a further £9,076.54 has been spent. This now brings actual spend to date for the IPF to £149,077.69

•Local Authority match funding of £62,689.80 has been recorded. Private Match Funding of £86,565.68 has been recorded. Total match funding of £149,255.48 has been recorded up

until the end of April 2020.

•To date, 4 part time jobs have been created, 10 jobs have been safeguarded and 25 businesses have been supported.

What is our Financial Position?

Financials (£ million)

Forecast

Actual

Forecast

Actual

Forecast

Financial Year

2019/20

2019/20

2020/21

2020/21

2021/22

Brought Forward

0.000

0.400

0.400

0.185

LEP Allocation

0.540

0.540

0.000

0.000

0.000

Spend [Act/Fcst]

0.170

0.140

0.215

0.009

0.185

Committed

0.170

0.000

0.215

0.205

0.185

Carried forward

0.369

0.400

0.185

0.185

0.000

2020/21 Expenditure

600,000.00

500,000.00

400,000.00

300,000.00

200,000.00

100,000.00

-

2019/20

Q1-20/21

Q2-20/21

Q3-20/21

Q4-20/21

2021/2022

Axis Title

Qtrly Forecast

Qtrly Claims

Available IPF

What is our contribution to the Economic Strategy?

Quarter/ year:

4 (Jan -Mar) 2020

Programme Target

Outputs - cumulative from April 1st 2019 to 31st March 2020 (Quarter 4)

Actual to date

to 2021

Number of Direct Full-Time Jobs Created

0

65

High Value Jobs created

0

59

Number of Jobs Safeguarded

10

60

Number of businesses created

0

12

Number of Businesses Supported (at least 12 hrs of support)

25

94

Number of Learners

0

49

Number of businesses created

0

41

Number of part time jobs created

4

0

What is the Project Delivery Status?

Building Supply Chains - NCC: This full grant award has now been paid to this project. The project has been suspended during the COVID Restrictions. A meeting is scheduled

with the Programmes Caseworker on 19th May 2020. The project has so far, provided 25 businesses with at least 10 hours of support each. Public match funding of £5,298.39 and

private match funding of £20,220.35 has been spent to date.

The Ipswich Cornhill Action Plan- Ipswich Central: A claim of £23,712.05 was submitted late for Quarter 3 and a further claim of £2,032.95 was paid in Quarter 4. This project has

been completed. The project attracted £57,391.41 in Public Match Funding and £34,301.74 in Private Match funding. It created 62 new events in the Cornhill, increased dwell time by

9.75% and created a 27.75% increase in visits to the area.

Growing the Year-Round Economy - Visit East of England: This project made a second claim for £17,534.65. The project received sponsorship of £25,000 from Greater Anglia.

Two data stewards and administrator are now facilitated in an office with the Affinity Agency who are developing the website. This gives them instant access to developers and client

manager and help speed their work. The accommodation booking API is now functional and VEE is working with partners ‘Staylists’ to encourage more accommodation venues to

sign up.

The Catapult - The Catapult Network: The Catapult - The Catapult Network: The new post holder, Andy Holyland based at Orbis Energy in Lowestoft started on 1st January 2020. A

claim of £7,043.59 has been paid and private match of £7,043.59 has been recorded.

Norfolk & Suffolk Offshore Wind Competitiveness Positioning Programme - GYBC: The project has been delayed somewhat pending the appointment of SCC's Business

Development Manager and the Offshore Wind Marketing Manager. These posts have since been filled (February 2020) The project has incurred some expenditure via Offshore Wind /

promotional events. The Programmes Caseworker has requested an update and expectsthis following the lifting of COVID restrictions.

Fit for Nuclear - SCC: This project has now met the conditions of the IAC's Innovative Projects Fund Offer. £118,000 has been approved. The project will now be led by West Suffolk

College. The project will commence ASAP after receipt of a signed Offer Letter.

Creating Creative Capital - NUA: This project was re-approved by the IAC in October 2019. The project has submitted a signed offer letter and has claimed £20,000 to kick start the

project. This project is being paid in stages. The next payment of £70,000 is expected to be paid in April 2021.

What are the Next Steps?

On 11th March 2020, the Innovative Projects Fund Panel considered all 38 applications from the 2019 Innovative Projects Fund Call. 18 projects were approved, and 4 projects were

deferred for potential underspend from the 2019 programme (pending further development). £1,472,372 of the 2019 call of the Innovative Projects Fund has been awarded. A PPR will

be available from Quarter 2.

The Programmes Case Worker for the IPF Programme is working with Project Leaders of the 2018 project call to ensure claims and associated monitoring reports are received for

Quarter 1 of 2020/21.

New Anglia Local Enterprise Partnership

Investment Appraisal Committee

May 20th, 2020.

Agenda Item 10

Winerack - LEP Loan Arrangements

Author: Iain Dunnett

Summary

Homes England have provided a £17m loan to the Winerack development in Ipswich, alongside

a £5m loan from the LEP. Homes England have taken a lead role in managing the finances of

this development over the 2 years of construction.

This paper provides an early indication to the LEPs Investment Appraisal Committee that

Homes England are currently considering a request for a variation on the loan arrangements by

the developers of the Winerack.

Recommendation

The committee are recommended to note that Homes England are considering a variation on

this loan and that the proposal will be bought to the LEPs Investment Appraisal Committee for

its consideration as soon as definitive variation arrangements are identified.

Homes England are likely to accommodate an extension of the period over which the Homes

England and LEP loans are repaid. This is an ongoing negotiation with the developer and a

verbal update will be provided to the Investment Appraisal Committee at the meeting.

Background

Loan arrangements with Homes England - The LEP is in a pari passu arrangement

with Homes England. The LEP is being repaid at the same rate and simultaneously as

repayments are made to Homes England, the repayment profile allows the LEP to be

repaid before Homes England are repaid.

Homes England have provided the larger proportion of the loan commitment to this

development and have taken a lead role in managing the finances.

Covid 19 - The current Covid 19 situation will slow the pace of sales of residential and

commercial units in the construction sector in general, and this is the case for the

Winerack.

1

Key Financial Background

LEP loan value and repayment - Original loan value was £5,472,722 including interest

at a rate of 6%. The existing repayment profile would see the LEP loan paid off by

September of 2020.

Sales linked to repayment - 150 residential units were constructed as part of the

development and 70 units have been sold as of mid-April 2020.The repayment profile

assumes a sales figure of 6 residential units sold per month, a figure agreed by Homes

England and the developer. This sales figure has been slowed by Covid 19 with

effectively 6 sales occurring throughout the 2-month period from mid-March to mid-May.

Timeline - The Homes England Credit Committee is likely to consider a loan variation

proposal by mid-May. The proposal will be bought to the LEPs Investment Appraisal

Committee for its consideration as soon as definitive variation arrangements are

identified by Homes England.

Recommendation

The committee are recommended to note that Homes England are considering a variation on

this loan and that the proposal will be bought to the LEPs Investment Appraisal Committee for

its consideration as soon as definitive variation arrangements are identified.

Homes England are likely to accommodate an extension of the period over which the Homes

England and LEP loans are repaid. This is an ongoing negotiation with the developer and a

verbal update will be provided to the Investment Appraisal Committee at the meeting.

2