New Anglia LEP Investment Appraisal Committee

Wednesday 27 January 2021

Teams Meeting

9am to 9:45am

Agenda

No.

Item

1.

Welcome

Main Agenda

2.

Apologies

3.

Declarations of Interest

Minutes of previous meetings - 21 October 2020 and 23 September 2020 (for

4.

reference).

5,

Horizon Paper and GPF repayments - Confidential

5a

Items for Approval

6,

Growing Places Fund - Loan application and Grant Thornton Report (appendix

6a

6a) - Confidential

Reporting: Growing Business Fund

7,

Growing Business Fund Programme Performance Report and SGS/GTI and

7a-e

Visitor Economy/Wider Economy grant award appendices

Reporting: Innovative Projects Fund

8,

Innovative Projects Fund Programme Performance Report

8a-b

Reporting: Resilience and Recovery Fund

9,

Resilience and Recovery Fund Programme Performance Report and

9a

project approvals appendix - confidential

Other

10.

Any Other Business

Committee Members

Cllr David Ellesmere

Ipswich Borough Council

Andrew Proctor

Norfolk County Council

Sandy Ruddock

Scarlett and Mustard

Alan Waters

Norwich City Council

Tim Whitley

BT

Dominic Keen

High Growth Robotics

Kathy Atkinson

Kettle Foods Ltd

Martin Williams

Williams Business Advisory

Exec Members

Rosanne Wijnberg

New Anglia LEP

Chris Dashper

New Anglia LEP

Iain Dunnett

New Anglia LEP

Date and time of next meeting: Wednesday 24 February 2021. 9am-9:45am

Venue: Teams Meeting

New Anglia Investment Appraisal Committee

Meeting Minutes (Unconfirmed)

23rd September 2020

Present:

Committee Members

David Ellesmere (DE)

Ipswich Borough Council

Andrew Proctor (AP)

Norfolk County Council

Dominic Keen (DK)

High Growth Robotics

Sandy Ruddock

Scarlett & Mustard

C-J Green (CJG)

Brave Goose

Alan Waters (AW)

Norwich City Council

Martin Williams (MW)

Independent IAC Member

In Attendance

Kathy Atkinson (KA)

Kettle Foods

Rosanne Wijnberg (RW)

New Anglia LEP

Chris Dashper (CD)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

Iain Dunnett (ID)

New Anglia LEP

ACTIONS

Growing Places Fund - Investment Opportunity and business plan

To receive the financial due diligence report from Grant Thornton

ID

1

Welcome from the Chair

David Ellesmere (DE) welcomed everyone to the meeting.

2

Apologies

Apologies were received from Tim Whitley.

3

Declarations of Interest

Andrew Proctor (AP) declared an interest in Item 9, the Growing Placed Fund Investment, as it refers to

Norfolk County Council. It was agreed that this would be addressed last.

4

Minutes of previous meeting (26th August 2020)

The minutes of the previous meeting were approved by the committee.

5

Growing Places Fund Horizon Paper (Confidential)

Iain Dunnett (ID) highlighted key points from the Horizon paper.

The Committee agreed:

• To note the content of the reports

6

Growing Business Fund Programme Performance Report and SGS/GTI appendices

Chris Dashper (CD) reviewed the Project Performance Reports included in the meeting papers and noted

that that interest in the GBF was now picking up.

The Committee agreed:

• To note the content of the report

Page 1 of 2

7

Innovative Projects Fund Programme Performance Report

CD confirmed that TCHC’s VG Incubator has submitted its first claim and that claims for the remaining 10

projects are expected anytime between now and mid-October.

The Committee agreed:

• To note the content of the report

Resilience and Recovery Fund Programme Performance Report and project approvals

8

appendix

CD confirmed that 1-2 applications continue to be received every day and a full paper will go to the LEP

board in October.

The Committee agreed:

• To note the content of the report

9

Growing Places Fund - Investment Opportunity and business plan - Confidential

This item was addressed last on the agenda.

AP left the meeting

10

Growing Places Fund- L’Arche supplemental grant request - Confidential

11

Hydrogen East feasibility study- Confidential

12. AOB

None

Page 2 of 2

Growing Business Fund Performance Report - November 2020

Programme Overview - What is the Growing Business Fund?

Launched in April 2013, the Growing Business Fund provides grants for businesses to enable growth, an increase productivity and job creation.

Capital grants between £25,000 and £500,000 are provided at up to 20% of project costs for SMEs, with an enhanced rate for small businesses located in an Assisted Area (until 2021).

Funding for the Growing Business Fund is provided on an annual basis by the LEP's Growth Deal.

The fund is accessed through the New Anglia Growth Hub with Due Diligence undertaken by Finance East and agreed by a GBF panel which meets monthly as required .

What is the overall Programme Status?

Finance

Green

Since the autumn there has been an increase in the number of applications coming forward, these are now being progressed slowly to panel.

Outputs

Green

Based on grant approvals, the scheme started 2020/21 ahead of target.

Green

Delivery

Pipeline is greater than the funding remaining uncommitted. Regular panel meetings continue to approve applications

What are our key updates?

Participant SMEs of the Scale Up New Anglia programme are being offered a range of support including applications to GBF (where appropriate).

This is still the LEP flagship grant scheme attracting interest: despite COVID-19, we are seeing confidence in that some businesses submitting grant applications.

Many of the busiensses are proceeding with their growth plans especially those of a medium size with a healthy pipeline of larger grant applications

GBF has been really successful and grants cocntinue to be drawn down quickly, by January 2021- £2.8m committed of which £2,200,426 has been defrayed

The GBF pipeline contines to be buoyant with growth projects requesting support.

What is our financial position?

Financials (£ million)

Year

2013 to 2016

2016/2017

2017/2018

2018/2019

2019/2020

2020/2021

Total

Profile Spend (£m)

£12.000

£3.536

£3.050

£5.096

£4.121

£2.790

£30.593

Actual Spend (£m)

£11.999

£3.001

£3.049

£4.764

£2.533

£1.267

£26.613

Remaining Spend (£m)

£0.001

£0.535

£0.001

£0.331

£1.588

£1.523

£3.979

2020/2021 Expenditure Profile

2

1

0

Q1-20/21

Q2-20/21

Q3-20/21

Q4-20/21

Quarterly Forecast

£0.698

£0.698

£0.698

£0.698

Quarterly Spend

£0.678

£0.117

£0.472

£0.000

Variance

£0.019

£0.581

£0.225

£0.698

What is our contribution to the Economic Strategy?

Actual to end of

Outputs April 2020 to March 2021

Target

Monthly Change

Shortfall

Notes

March 2021

Value of grants approved

£1,759,771

£1,589,744

£382,450

£170,027

Value of private sector match approved

£7,039,084

£10,980,207

£2,765,500

-£3,941,123

Number of New Jobs to be Created

88

102.5

29.5

-15

Value of grants claimed

£2,790,000

£1,266,932

£372,701

£1,523,068

Private sector match funding drawn down

£11,160,000

£8,139,664

£2,254,840

£3,020,336

Number of New Jobs Created

140

43.5

5.0

96

What is the project status?

The following table shows grants approved by sector since the start of the programme in 2013/14

Number of

Projects

Grants

Private

Total Project

Jobs to be

Sector

Approved

Approved

Match

Costs

Created

A- Agriculture, Forestry and Fishing

3

235899

1018543

1254442

58

B - Mining and Quarrying

1

100000

1654600

1754600

10

C - Manufacturing

138

15186237

95741810.31

110928047.3

1618.5

E - Water supply, sewerage, waste management and remediation activities

6

520000

2166000

2686000

38.5

F - Construction

22

2297336

13633863

15931199

236.5

G - Wholesale and retail trade; repair of motor vehicles and motorcycles

27

2909816

53119892

56029708

390

H - Transportation and Storage

9

915801

5235429

6151230

103

I - Accommodation and Food Service Activities

5

372000

2342138

2714138

45.5

J - Information and Communication

11

753200

3792342

4545542

76

K - Financial and Insurance Activities

1

30000

79425

109425

3

L - Real Estate Activities

26

3207666

20880393

24088059

313.6

M - Professional, Scientific and Technical Activities

1

20000

102191

122191

4

N - Administrative and Support Service Activities

1

31580

126320

157900

3.5

P - Education

8

502921

3159776

3662697

55.5

Q - Human Health and Social Work Activities

2

320000

4737413

5057413

32

R - Arts, Entertainment and Recreation

20

1660100

9434097

11094197

200

S - Other Service Activities

1

100000

232500

345000

10

Total

282

29,162,556

217,456,732

246,631,788

3,197.6

What are the next steps?

The LEP is working with delivery partners, to ensure that the scheme can be accessed by businesses to facilitate growth during the current COVID-19 Pandemic.

As we are nearing the end of the fund, we are closely monitoring the applications that are submitted to ensure they can complete on time, 31st March 2021

New Anglia LEP

Growing Business Fund

Grant Approvals - April 2020 to March 2021

Approval

Grant Business

Company Name

Reason for Support

Date

Awarded Size

May-20

A J Hodgson and Sons

£82,010 Small

Capital investment to support business growth

May-20

Mid Anglian Enterprise Agency Ltd (MENTA)

£49,390 Small

Capital investment to support business growth

May-20

Crowland Cranes Ltd

£384,900 Medium

Capital investment to support business growth

Jun-20

Primo Manufacturing Ltd

£120,000 Medium

Capital investment to support business growth

Jul-20

Freightforce Distribution Ltd

£248,809 Medium

Capital investment to support business growth

Sep-20

CTR Secure Services Ltd

£160,000 Small

Capital investment to support business growth

Sep-20

Polar Systems Ltd

£130,000 Medium

Capital investment to support business growth

Sep-20

Slic Sheet Metal Fabrication Ltd

£31,185 Small

Capital investment to support business growth

Oct-20

Armultra Ltd

£73,000 Medium

Capital investment to support business growth

Oct-20

AKS SkipHire Ltd

£66,000 Small

Capital investment to support business growth

Nov-20

Pink Office Ltd

£46,660 Small

Capital investment to support business growth

Nov-20

Olympic Construction (Norfolk) Ltd

£42,910 Small

Capital investment to support business growth

Nov-20

Wrightform Ltd

£25,620 Medium

Capital investment to support business growth

Total

£1,460,484

Small Grant Scheme

Grant Approvals April 2020 to March 2021

Date

Grant Business

Company Name

Reason for Support

Approved

Awarded Size

Apr-20

Genesis Sporthomes Ltd

£10,272

Micro

Capital investment to support business growth

Apr-20

James White Drinks Ltd (2)

£24,434

Small

Capital and revenue investment to suport business growth

Apr-20

Frugalpac Limited

£13,427

Small

Capital investment to support business growth

Apr-20

Xcell Misting Ltd

£7,200

Small

Capital investment to support business growth

May-20

Gnaw Chocolate Ltd (2)

£4,508

Small

Capital investment to support business growth

May-20

Electrical Installation and Appliance Testing (UK) Ltd

£5,538

Small

Capital investment to support business growth

May-20

ASAP Branding Ltd

£5,120

Micro

Capital and revenue investment to support business growth

Jun-20

CMI Print Services Ltd

£13,389

Small

Capital investment to support business growth

Jun-20

Smart Offices Ltd

£9,000

Small

Capital investment to support business growth

Jun-20

Total Site Services

£4,575

Micro

Capital investment to support business growth

Jun-20

Lifeline24 Ltd

£4,297

Small

Capital investment to support business growth

Jun-20

Spa Pavilion Ltd

£24,360

Small

Capital investment to support business growth

Jun-20

Brief Media Ltd.

£3,900

Micro

Capital investment to support business growth

Jun-20

WhataHoot Ltd.

£24,044

Micro

Capital investment to support business growth

Jun-20

Rob Sambrook Photography

£1,026

Micro

Capital investment to support business growth

Jul-20

Norfolk Bluebell Wood Ltd

£2,440

Micro

Capital investment to support business growth

Jul-20

Tosier Chocolate Ltd (2)

£6,742

Micro

Capital investment to support business growth

Jul-20

Newmans Cleaning Services Ltd

£3,000

Micro

Capital investment to support business growth

Aug-20

Gutter Force Ltd (2)

£3,578

Micro

Capital investment to support business growth

Aug-20

Jake Austin Window Cleaning Services

£4,565

Micro

Capital investment to support business growth

Sep-20

Global Chair Components Ltd (2)

£25,000

Medium

Capital investment to support business growth

Sep-20

Robert Fuller t/a RFA Media

£1,585

Micro

Capital investment to support business growth

Sep-20

Titchmarsh & Goodwin Fine Furniture Ltd

£7,018

Small

Capital investment to support business growth

Sep-20

Marketplace Amp Ltd

£3,162

Micro

Capital and revenue investment to support business growth

Sep-20

Anglia Business Growth Consultants Ltd

£2,990

Micro

Capital investment to support business growth

Sep-20

Norwich Glass Company Ltd

£4,393

Small

Capital investment to support business growth

Sep-20

Fish Fabrications Ltd

£2,794

Micro

Capital investment to support business growth

Sep-20

One Traveller Ltd

£11,087

Small

Capital investment to support business growth

Sep-20

DJB Investments (UK) Ltd

£2,737

Small

Capital investment to support business growth

Oct-20

Kiezebrink UK Ltd (3)

£5,280

Medium

Capital investment to support business growth

Oct-20

TGA Trading Ltd (2)

£4,600

Micro

Capital investment to support business growth

Oct-20

A&T Optimus Ltd

£12,636

Micro

Capital investment to support business growth

Oct-20

Bacons Firewood

£2,610

Micro

Capital investment to support business growth

Oct-20

Banqueting Hire Service Ltd

£11,548

Small

Capital investment to support business growth

Oct-20

Gammax Independent Inspection Services Ltd

£4,173

Micro

Capital investment to support business growth

Oct-20

Smart Bookkeeping & Accounts Ltd

£3,600

Micro

Capital and revenue investment to support business growth

Oct-20

JHW Business Services Ltd

£2,107

Micro

Capital investment to support business growth

Oct-20

Felgains Ltd

£5,580

Small

Capital investment to support business growth

Oct-20

STC Solutions Ltd

£5,525

Micro

Capital investment to support business growth

Oct-20

Cubiqdesign Ltd

£16,433

Small

Capital investment to support business growth

Oct-20

Norfolk Coffee Co

£5,625

Micro

Capital investment to support business growth

Nov-20

Ipswich Glass Ltd

£25,000

Small

Capital investment to support business growth

Nov-20

Cousins of Emneth Ltd

£2,880

Small

Capital investment to support business growth

Nov-20

XL Scales Ltd

£6,118

Micro

Capital investment to support business growth

Nov-20

Chris Wood Light Ltd

£25,000

Micro

Capital investment to support business growth

Total SGS scheme

£374,896

New Anglia LEP

Growth Through Innovation

Grant Approvals - April 2020 to March 2021

Approval

Grant

Business

Company Name

Reason for Support

Date

Awarded

Size

May-20

Agricultural & Mechanical Services Ltd (AgriMech)

£22,500

Medium

Revenue investment to support R&D or Innovation

Jun-20

Geotekk Ltd

£21,487

Micro

Revenue investment to support R&D or Innovation

Jun-20

Offshore Digital Engineering Ltd

£17,100

Micro

Revenue investment to support R&D or Innovation

Jun-20

MBASO Ltd

£24,997

Small

Revenue investment to support R&D or Innovation

Jun-20

Spark EV Technology

£11,082

Micro

Revenue investment to support R&D or Innovation

Jun-20

Showbiz Software Limited

£20,925

Micro

Revenue investment to support R&D or Innovation

Jul-20

Developing Experts Ltd

£21,892

Small

Revenue investment to support R&D or Innovation

Jul-20

Siametric Systems Ltd

£16,848

Micro

Capital investment to support R&D or Innovation

Jul-20

Purple Line Ltd

£25,000

Small

Revenue investment to support R&D or Innovation

Jul-20

G-Lok Systems Ltd

£11,161

Micro

Revenue investment to support R&D or Innovation

Jul-20

Coracle Online Ltd

£22,500

Micro

Revenue investment to support R&D or Innovation

Aug-20

Captain Fawcett Ltd

£3,440

Micro

Revenue investment to support R&D or Innovation

Aug-20

James White Drinks Ltd

£13,860

Small

Revenue investment to support R&D or Innovation

Aug-20

Ensemble Architecture Ltd

£9,409

Small

Revenue investment to support R&D or Innovation

Aug-20

Thyngs Limited

£25,000

Micro

Revenue investment to support R&D or Innovation

Aug-20

Pharmweigh Limited

£14,388

Micro

Revenue investment to support R&D or Innovation

Aug-20

RATS Marine Limited

£22,500

Micro

Revenue investment to support R&D or Innovation

Aug-20

Evans (Instruments) Limited

£3,094

Micro

Revenue investment to support R&D or Innovation

Aug-20

Just Another Label Ltd

£3,150

Small

Revenue investment to support R&D or Innovation

Sep-20

Ansible Motion Limited

£14,999

Small

Revenue investment to support R&D or Innovation

Oct-20

Exo Environmental Ltd

£21,220

Micro

Revenue investment to support R&D or Innovation

Oct-20

Merxin Ltd

£25,000

Micro

Revenue investment to support R&D or Innovation

Oct-20

Blue Novation Ltd

4,035.00

Small

Revenue investment to support R&D or Innovation

Nov-20

Olthem Payments Ltd

£8,325

Micro

Revenue investment to support R&D or Innovation

Nov-20

Master Henry Ltd

£19,310

Micro

Revenue investment to support R&D or Innovation

Total for GTI scheme

£403,222

New Anglia Visitor Economy Grant (VEG)

Grant Approvals April 2020 to March 2021 (scheme started in September 2020)

Date

Grant

Business

Company Name

Reason for Support

Approved

Awarded

Size

Sept-20

Aldeburgh Food and Drink Festival CIC

£2,846.00

Micro

Revenue investment to support business growth

Sept-20

The Mindful Cook

£2,977.00

Micro

Revenue investment to support business growth

Sept-20

Starlight Concerts Live (Entertainment) Ltd

£3,000.00

Micro

Revenue investment to support business growth

Sept-20

Kerry Ellis t/as Epic Event Hire

£2,999.00

Micro

Revenue investment to support business growth

Sept-20

Shaunandmartin Ltd t/as The Virginia Court Hotel

£2,022.00

Micro

Revenue investment to support business growth

Sept-20

S Lay & N Roe t/as Hay Hay

£2,900.00

Micro

Revenue investment to support business growth

Sept-20

Andrew Patton t/as Cycle Breaks, Suffolk Cycle Breaks & Walking Breaks

£2,665.83

Micro

Revenue investment to support business growth

Sept-20

Turner-Mann Enterprises Ltd

£3,000.00

Micro

Revenue investment to support business growth

Sept-20

BritPark Leisure Limited t/as Play2day

£2,795.00

Small

Revenue investment to support business growth

Sept-20

Justine Paul t/as Suffolk Market Events

£3,000.00

Micro

Revenue investment to support business growth

Sept-20

H. E. Hipperson Limited

£2,749.59

Micro

Revenue investment to support business growth

Sept-20

Peter Williamson t/as The Old Penny Arcade

£2,446.56

Micro

Revenue investment to support business growth

Sept-20

House of Mutt LLP

£2,897.92

Small

Revenue investment to support business growth

Sept-20

Reubjon Ltd t/as Farmer Freds

£2,565.00

Small

Revenue investment to support business growth

Oct-20

Woodbridge Tide Mill Charitable Trust t/as Woodbridge Tide Mill Museum

£1,536.77

Small

Revenue investment to support business growth

Oct-20

Jason Elmer t/as Fresh Look Catering

£1,516.99

Micro

Revenue investment to support business growth

Oct-20

Ringshall Grange

£3,000.00

Small

Revenue investment to support business growth

Oct-20

Hilltop Experiences t/as Hilltop Outdoor Centre

£2,670.00

Small

Revenue investment to support business growth

Oct-20

Bury St Edmunds Association of Registered Tour Guides

£2,900.00

Micro

Revenue investment to support business growth

Oct-20

Stephan Genovese T/as The Pitstop

£3,000.00

Micro

Revenue investment to support business growth

Oct-20

Fat Teds Events Ltd

£2,856.80

Micro

Revenue investment to support business growth

Oct-20

Woodbridge Riverside Trust

£2,902.80

Small

Revenue investment to support business growth

Oct-20

Explore 4X4

£2,839.00

Micro

Revenue investment to support business growth

Oct-20

Lal Bagan Ltd T/as Tamarind

£2,999.00

Micro

Revenue investment to support business growth

Oct-20

St EdmundsBury Cathedral Enterprises Limited

£2,000.00

Small

Revenue investment to support business growth

Oct-20

Anglian Chauffeur Service

£1,677.00

Micro

Revenue investment to support business growth

Oct-20

River Cruise Resturants T/as Lady Florence River Cruise Resturants

£1,680.00

Small

Revenue investment to support business growth

Oct-20

Fired Up Food Limited

£3,000.00

Small

Revenue investment to support business growth

Oct-20

Toby Jug Management Services Ltd trading as The Garden House.

£3,000.00

Micro

Revenue investment to support business growth

Oct-20

Mark Jolly Promotions Limited

£2,994.00

Micro

Revenue investment to support business growth

Oct-20

Art Safari Limited t/as Art Safari/Art Safari Editions/Close Encounters Travel

£2,499.00

Micro

Revenue investment to support business growth

Oct-20

Copdock Kennels

£2,785.00

Micro

Revenue investment to support business growth

Oct-20

Labyrinth Norwich Limited

£3,000.00

Micro

Revenue investment to support business growth

Total VEG scheme £87,720.26

New Anglia Wider Economy Grant (WEG)

Grant Approvals April 2020 to March 2021 (scheme started in September 2020)

Date

Grant

Business

Company Name

Reason for Support

Approved

Awarded

Size

Sep-20

Cheddar Creative Limited

£2,899.00

Micro

Revenue investment to support business growth

Sep-20

Farrow Associates

£2,898.00

Micro

Revenue investment to support business growth

Sep-20

Haven Port Yacht Club

£1,932.00

Micro

Revenue investment to support business growth

Sept-20

The Willmaker Group Limited

£2,997.00

Micro

Revenue investment to support business growth

Sept-20

EggCup Web Design Limited

£2,545.00

Micro

Revenue investment to support business growth

Sept-20

Nigel Keeble

£1,028.82

Micro

Revenue investment to support business growth

Sept-20

Paul Nixon Photography

£2,955.00

Micro

Revenue investment to support business growth

Sept-20

Debenvale

£3,000.00

Small

Revenue investment to support business growth

Sept-20

Box River Studios

£2,865.83

Micro

Revenue investment to support business growth

Sept-20

PX2

£2,895.33

Micro

Revenue investment to support business growth

Sept-20

Grant Nurden

£2,347.00

Micro

Revenue investment to support business growth

Sept-20

The Marketing Copywriter

£1,829.00

Micro

Revenue investment to support business growth

Sept-20

Building Partnerships Limited

£1,722.68

Micro

Revenue investment to support business growth

Sept-20

Production Services Entertainment Limited

£2,874.58

Micro

Revenue investment to support business growth

Sept-20

Hot Gossip (East Anglia) Limited t/as Hot Gossip Media

£2,930.00

Micro

Revenue investment to support business growth

Sept-20

Aylsham Community Gym (2) - Annette Marsh

£2,299.00

Micro

Revenue investment to support business growth

Sept-20

Herring Bone Design Limited

£2,928.00

Micro

Revenue investment to support business growth

Sept-20

East Coast Accounting Limited

£2,708.27

Micro

Revenue investment to support business growth

Sept-20

Morton's Event Hire Ltd

£3,000.00

Micro

Revenue investment to support business growth

Sept-20

Imogen Clarke t/as Inspire Personal Training Studio

£2,997.99

Micro

Revenue investment to support business growth

Oct-20

David Palmer (Birds i Images)

£2,923.64

Micro

Revenue investment to support business growth

Oct-20

Elizabeth Cullen

£2,466.98

Micro

Revenue investment to support business growth

Oct-20

Lisa Mason School of Dance

£2,981.01

Mirco

Revenue investment to support business growth

Oct-20

Angela Rowe School Of Dance

£2,832.00

Mirco

Revenue investment to support business growth

Oct-20

Active Fakenham Limited

£3,000.00

Mirco

Revenue investment to support business growth

Oct-20

Tracey Curl ta Norwich Hypnotherapy

£1,396.00

Micro

Revenue investment to support business growth

Oct-20

Liam Bailey Limited

£2,976.00

Micro

Revenue investment to support business growth

Oct-20

Nick Webster

£2,698.00

Micro

Revenue investment to support business growth

Oct-20

GLF Steel Limited

£2,933.00

Micro

Revenue investment to support business growth

Oct-20

Money Properties Limited

£2,254.86

Micro

Revenue investment to support business growth

Oct-20

Simply C Photography

£3,000.00

Micro

Revenue investment to support business growth

Oct-20

Clarick Cleaning Limited

£2,929.97

Small

Revenue investment to support business growth

Oct-20

Paul Nixon Photography (2)

£2,955.00

Micro

Revenue investment to support business growth

Oct-20

Mrs Lindsay Want-Beal Trading as Xtrahead

£2,865.00

Micro

Revenue investment to support business growth

Oct-20

Pierrot Limited Trading as Pierrot Stationers

£2,526.00

Micro

Revenue investment to support business growth

Oct-20

Find A Job (East Anglia) Limited

£2,689.86

Small

Revenue investment to support business growth

Oct-20

Simon Greene Associates Limited

£3,000.00

Micro

Revenue investment to support business growth

Total WEG scheme £98,079.82

Innovative Projects Fund - 2018 Projects Call

Programme Overview - What is the Innovative Projects Fund

The Innovative Projects Fund is a revenue grant programme that provides funding towards innovative projects to support the delivery of the themes and activities identified in the

Economic and Local Industrial Strategies. The first call of the Innovative Projects Fund was made in October 2018 with a remit to facilitate innovative projects supporting economic

growth and the delivery of the Economic Strategy utilising revenue from the Enterprise Zone Pot C.

What is the Overall Programme Status?

Overall:

Green

7 out of the 7 projects have Offer Letters.

Delivery:

Green

7 out of 7 projects are now in their delivery phase. The Ipswich Cornhill Project has been completed.

Spend:

Green

Profiled Spend to the end of 2020/21 Quarter 3 is £267,057. Actual Spend to date is £224,758.97 (41.62%).

Outputs:

Green

No accumulated outputs were forecast by the end of Quarter 3.

What are our Key Updates?

•There are 7 projects under the 2018 call of the Innovative Projects Fund with a combined allocation and commitment of £539,531.

•The value of claims for the first year (2019/20) was 140,001.15.

•Profiled Spend to the end of Quarter 3 2020/21 was £267,057. Actual Spend to date is £224,758.97 (41.62%).

•The profiled spend for Quarter 3 was £69,105.24, actual spend for the quarter was £23,719.

•£84,757.82 has been claimed so far in this financial year. The total project spend to date is £476,299.14

•Public match funding of £138,704 and Private match funding of £112,836 has been recorded.

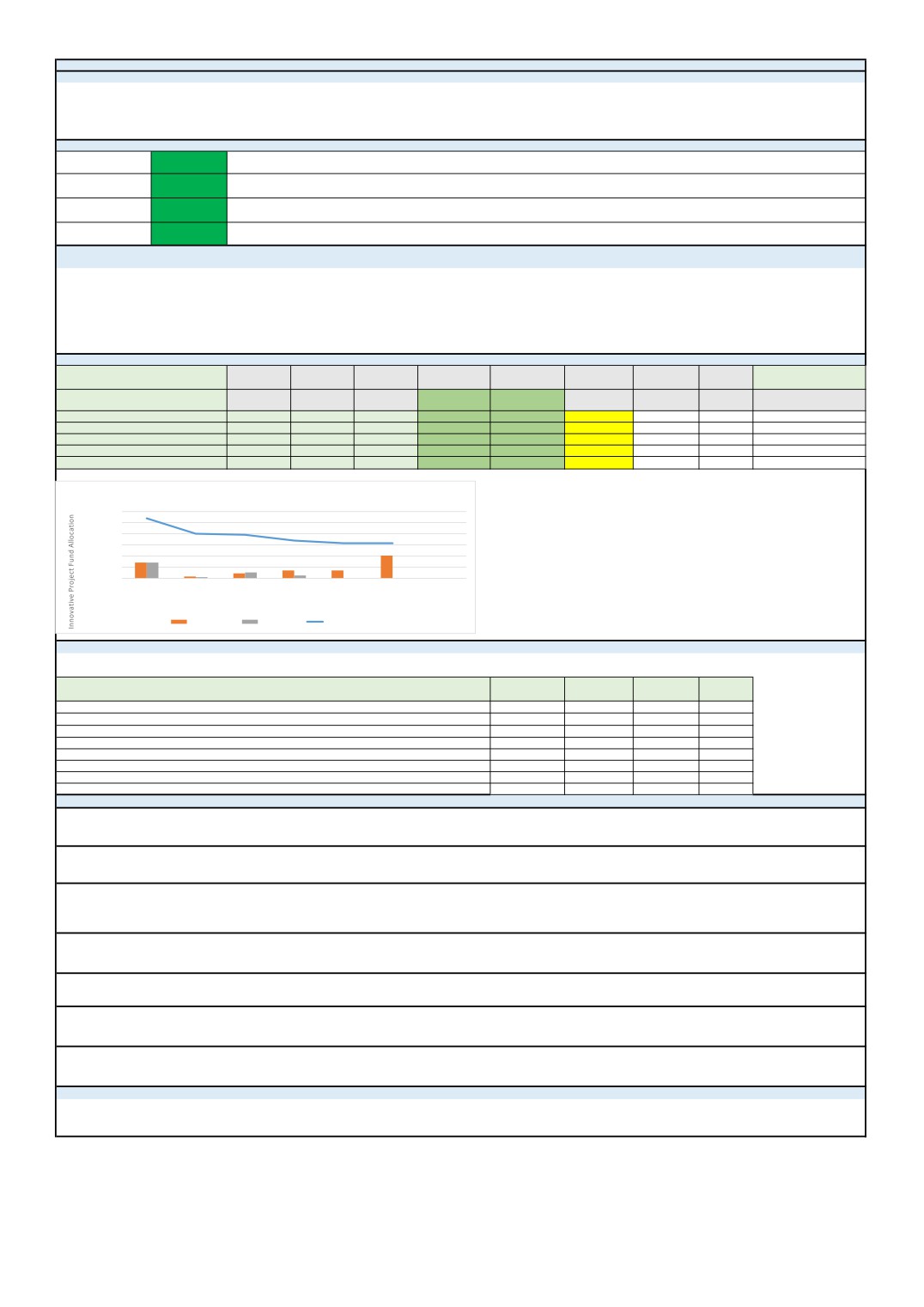

What is our Financial Position?

Financials (£ million)

Forecast

Actual

Forecast

Actual

Actual

Actual

Actual

Forecast

Financial Year

2019/20

2019/20

2020/21

Q1-20/21

Q2-20/21

Q3-20/21

Q4-20/21

2021/22

Brought Forward

0.000

0.400

0.400

0.391

0.339

0.203

LEP Allocation

0.540

0.540

0.000

0.000

0.000

0.000

0.000

Spend [Act/Fcst]

0.170

0.140

0.197

0.009

0.052

0.024

0.203

Committed

0.170

0.000

0.197

0.188

0.136

0.112

0.203

Carried forward

0.369

0.400

0.203

0.391

0.339

0.315

0.000

2020/21 Expenditure

600,000.00

500,000.00

400,000.00

300,000.00

200,000.00

100,000.00

-

2019/20

Q1-20/21

Q2-20/21

Q3-20/21

Q4-20/21

2021/2022

Axis Title

Qtrly Forecast

Qtrly Claims

Available IPF

What is our contribution to the Economic Strategy?

Quarter/ year:

3 (Oct - Dec) 2020

Programme Target

Outputs - cumulative from April 1st 2019 to 31st Dec 2020 (Quarter 3)

Actual to date

to 2021

Number of Direct Full-Time Jobs Created

1

65

High Value Jobs created

1

59

Number of Jobs Safeguarded

10

60

Number of businesses created

0

12

Number of Businesses Supported (at least 12 hrs of support)

25

94

Number of Learners

0

49

Number of businesses created

0

41

Number of part time jobs created

4

0

What is the Project Delivery Status?

Building Supply Chains - NCC: This full grant award has now been paid to this project. The project has been suspended during the COVID Restrictions and delay of the offshore

Vattenfall development. The project has so far, provided 25 businesses with at least 10 hours of support each. Public match funding of £5,298.39 and private match funding of

£20,220.35 has been spent to date. The project is now being brought back under a new name ‘Gearing Up to Grow’ led by a partnership of NCC and EEEGR.

The Ipswich Cornhill Action Plan- Ipswich Central: A claim of £23,712.05 was submitted late for Quarter 3 and a further claim of £2,032.95 was paid in Quarter 4. This project has

been completed. The project attracted £57,391.41 in Public Match Funding and £34,301.74 in Private Match funding. It created 62 new events in the Cornhill, increased dwell time by

9.75% and created a 27.75% increase in visits to the area.

Growing the Year-Round Economy - Visit East of England: A 4th claim was paid in quarter 3 totalling £16,844.28. Two data stewards and administrator are now facilitated in an

office with the Affinity Agency who are developing the website. This gives them instant access to developers and client manager and help speed their work. The accommodation

booking API is now functional and VEE is working with partners ‘Staylists’ to encourage more accommodation venues to sign up.

The Catapult - The Catapult Network: The Catapult - The Catapult Network: The new post holder, Andy Holyland based at Orbis Energy in Lowestoft started on 1st January 2020. 3

claims have been paid to date totalling £20,814. The same total of Private Match has been recorded. A 4th Claim is expected in the second week of January 2021 for £6,875.

Norfolk & Suffolk Offshore Wind Competitiveness Positioning Programme - GYBC: A first claim has been received evidencing total expenditure of £108,437. £32,422 has been

paid to GYBC. The claim highights Local Authority match funding of £27,499 and other public match of (Pot B)

£48,514.

Fit for Nuclear - West Suffolk College: The project started in 2020. However, due to COVID and Sizewell still awaiting the Final Investment Decision (FID) this project has not

progressed as well as hoped. The project lead (WS College) has indicated that they are confident that there will be an announcement on Sizewell in March/April 2021 and Sizewell will

get its FID. Phil is confident the flood gates will then open for companies who will want to prepare themselves for the new build.

Creating Creative Capital - NUA: This project was re-approved by the IAC in October 2019. The project has submitted a signed offer letter and has claimed £20,000 to kick start the

project. This project is being paid in stages. The next payment of £70,000 is expected to be paid in April 2021. A monitoring report has been recieved for the first quarter.

What are the Next Steps?

The Programmes Case Worker for the IPF Programme is working with Project Leaders of the 2018 project call to ensure claims and associated monitoring reports are received for

Quarter 4 of 2020/21.

Innovative Projects Fund - 2019 Projects Call

Programme Overview - What is the Innovative Projects Fund

The Innovative Projects Fund is a revenue grant programme that provides funding towards innovative projects to support the delivery of the themes and activities identified in the

Economic and Local Industrial Strategies. The second call of the Innovative Projects Fund was made in October 2019 with a remit to facilitate innovative projects supporting

economic growth and the delivery of the Economic Strategy utilising revenue from the Enterprise Zone Pot C.

What is the Overall Programme Status?

15 out of the 18 projects have Offer Letters. 2 projects are finalising details prior to Offer Letter stage and the 3rd (SCC Transport

Overall:

Green

Innovation Hub) is yet to return a re-profile sheet.

Delivery:

Green

15 out of 18 projects are now in their delivery phase.

Profiled Grant Spend to the end of Quarter 3 (2020/21) was £462,836. Actual Spend to the end of Quarter 3 was £164,954.73. Additional

Spend:

Amber

payments were made the first week of quarter 4 bringing total grant claims to £174,186.59. The majority of projects have started delivery in

this quarter therefore accelerated spend is expected.

Outputs:

Green

No accumulated outputs were forecast by the end of Quarter 3.

What are our Key Updates?

•18 projects have a combined allocation of £1,522,372.

•15 projects now have their Grant Offer Letters and have commenced.

•£174,186.59 has been claimed so far in this financial year.

•Private match funding of £26,450 and public match funding of £128,962.67 has been recorded.

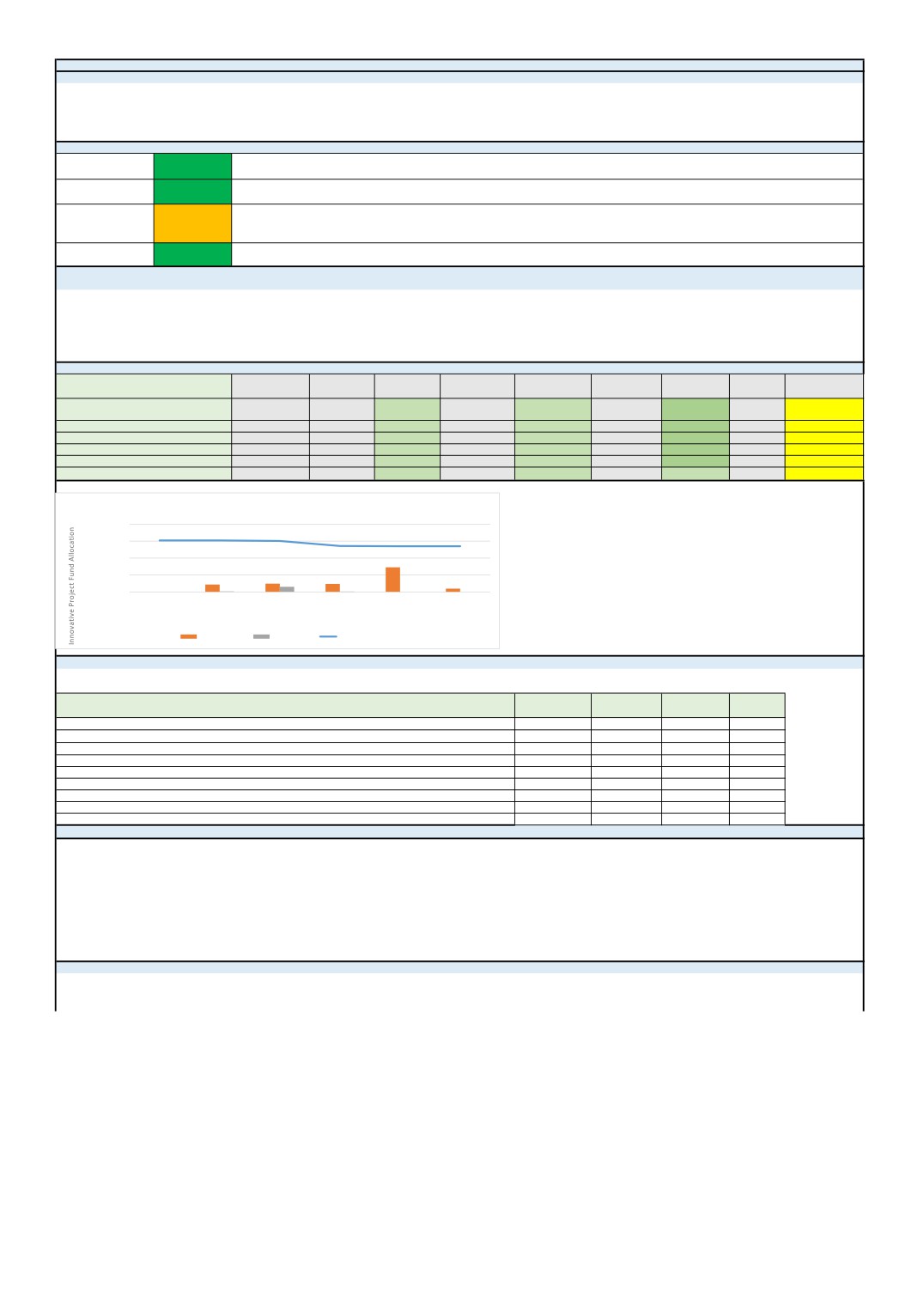

What is our Financial Position?

Financials (£ million)

Forecast

Forecast

Actual

Forecast

Actual

Forecast

Actual

Forecast

Actual

Financial Year

2020/21

Q1-20/21

Q1-20/21

Q2-20/21

Q2-20/21

Q3-20/21

Q3-20/21

Q4-20/21

Q4-20/21

Brought Forward

1.522

1.522

1.522

1.522

1.306

1.507

1.357

LEP Allocation

1.522

0.000

0.000

0.000

0.000

0.000

0.000

Spend [Act/Fcst]

0.000

0.000

0.000

0.217

0.016

0.246

0.149

0.009

Committed

1.522

1.522

1.522

1.306

1.507

1.060

1.357

Carried forward

1.522

1.522

1.522

1.306

1.507

1.060

1.357

Expenditure

2,000,000.00

1,500,000.00

1,000,000.00

500,000.00

-

Q1-20/21

Q2-20/21

Q3-20/21

Q4-20/21

2021/2022

Axis Title

Qtrly Forecast

Qtrly Claims

Available IPF

What is our contribution to the Economic Strategy?

Quarter/ year:

3 (Oct - Dec) 2020

Programme

Outputs - cumulative from April 1st 2019 to 31st Dec 2020 (Quarter 3)

Actual to date

Target to 2022

Number of Direct Full-Time Jobs Created

1

High Value Jobs created

1

Number of Jobs Safeguarded

Number of businesses created

Number of Businesses Supported (at least 12 hrs of support)

Number of Learners

49

Number of businesses created

No of Businesses Engaged

5

Number of part time jobs created

4

What is the Project Delivery Status?

See Appendix A for roject delivery status.

What are the Next Steps?

The Programmes Case Worker for the IPF Programme is working with Project Leaders of the 2019 project call to ensure claims and associated monitoring reports are received for

Quarter 4 of 2020/21.

Appendix 1 - Innovative Projects Fund - Q3 2020-21 Programme Performance Report

Below is an update on all Innovative Projects Fund ‘2019 Call’ Projects, reflecting the

‘Project Delivery Status’ section of the Programme Performance Report.

Ref

Status

Project Name & Project Update

Offer

Letter

Signed &

Returned?

IPF-19-1

GREEN

NCW - Collaboration: Place: Change

Y

Percentage of grant Claimed: 10.43%

The National Writing Centre has submitted its first claim for £7,564.93. The

project has created 2 P/T posts and has so far achieved 15 leadership

qualification /learner outputs.

IPF-19-2

AMBER

East Suffolk - East Suffolk Smart Towns.

Y

Percentage of grant Claimed: 0%

In early November, the East Suffolk Team launched their pilot Digital Advice

Service. The pilot will enable an insight for the larger

‘springboard’

programme that forms part of the Innovative Projects Bid for East Suffolk

Smart Towns. This pilot programme will run for approx. 3 months, support

200 businesses and also have a small grant scheme attached. It is primarily

being marketed to consumer facing business such as retail, salons, indie

pubs/restaurants and food/drink/consumer product makers.

The project has not made a claim yet.

IPF-19-3

RED

UEA - Sunrise Coast - Seed corn.

N

Percentage of grant Claimed: 0%

The project has been completed (prior to signing the Offer Letter). The

project should have created two new, fixed term, part time, positions within

the UEA. However, the project timeframe was constricted due to the late

release of the UKRI Strength in Places programme guidance and earlier

submission requirement. The UEA took the decision to hire consultants to

undertake delivery. That said, the eventual total project value was closer to

£32 million (original estimate £20million) and if successful will lead to the

direct creation of 21 jobs for the region as part of the programme and with

the potential to support the creation of many thousands of additional high

value jobs. We are awaiting a project expenditure breakdown to assess

whether we can support the project given its different profile and output.

IPF-19-4

GREEN

SCC - Culture Drives Growth

Y

Percentage of grant Claimed: 11.11%

The New Anglia LEP Culture Board has Commissioned Tom Fleming Creative

Consultancy to deliver the development of the Cultural Strategy.

A claim for £1,666.66 has been submitted and paid.

IPF-19-5

GREEN

Y

Netmatters - SCION Project

Percentage of grant Claimed: 44.25%

The project is the furthest along and has now submitted 2 claims to the

value of £44,250. The value of Match Funding to date is £51,000 and it has

created 19 learner positions/opportunities.

IPF-19-6

RED

South Norfolk DC - SETI

N

Percentage of grant Claimed: 0%

Awaiting match funding confirmation before proceeding to Offer Letter

Stage.

IPF-19-7

AMBER

Innovation Labs Stowmarket

Y

Percentage of grant Claimed: 0%

Awaiting a first claim from this project. The project has advertised the

availability of subsidised space and training at the hub.

IPF-19-8

AMBER

CNTC - NAAME

Y

Percentage of grant Claimed: 0%

Led by Broadland District Council - the project is underway, and the first

claim is now due.

IPF-19-9

RED

NCC - Norwich Good Economy Project

N

Percentage of grant Claimed: 0%

Awaiting confirmation of the funding package and then this project will be

sent an Offer Letter.

IPF-19-10

RED

SCC - Innovation Hub within Transport Strategy

N

Percentage of grant Claimed: 0%

Awaiting information from Suzanne Buck.

IPF-19-11

GREEN

TCHC - VG Incubator

Y

Percentage of grant Claimed: 42.14%

This project is progressing well. There were a few teething problems that

have now been ironed out. There are 28 students on the programme at

present. The target for the project is 80. The project is receiving very

good feedback - notably one team of students will be meeting with games

giant ‘Ubisoft’ to discuss their Indie game.

IPF-19-12

GREEN

NCC - Innovate UK Mentoring Project

Y

Percentage of grant Claimed: 52.88%

This project will submit its first claim come the end of January. An upfront

payment was made in December talling £50,760. The project is progressing

well. A panel of businesspeople with Innovative grant success have been

enlisted to support forthcoming Innovate UK applicants.

IPF-19-13

AMBER

Coderus - LOCKE

Y

Percentage of grant Claimed: 0%

This is a private sector led project that expressed a wish to delay the

project by 6 months due to COVID. The Growth Hub is now in touch with

Coderus regarding starting the IPF project.

IPF-19-14

GREEN

Catapult - F4ORE

Y

Percentage of grant Claimed: 17.13%

The project has made a first claim and identified the 10 businesses to start

the Fit 4 Offshore qualification. The project has benefited from addition

NSF grant funding too to increase the number of businesses by 5.

IPF-19-15

GREEN

BCKLWN - GAME ON

Y

Percentage of grant Claimed: 7.03%

The project has made a first claim. The core team has been hired and pre-

production work has commenced. Production should start in December

/January. The project manager has noted efficiency has improved since

remote working became the norm. The second claim has been submitted.

IPF-19-16

GREEN

First Light Lowestoft

Y

Percentage of grant Claimed: 2.76%

The project has made a first claim. A comprehensive communications plan

has been created. The project has been marketing and delivering comms

for the Fiery Sun Winter Solstice event which will be produced on the

weekend of the 12th December to be streamed over the solstice weekend

on the 19/20/21st December.

IPF-19-17

AMBER

NCC - Celebrating Culture

Y

Percentage of grant Claimed: 0%

Awaiting first claim due end of January.

IPF-19-18

AMBER

ICM - Ipswich Cornhill

Y

Percentage of grant Claimed: 0%

Awaiting first claim.

Business Resilience and Recovery Programme

Programme Overview - What is the Business Resilience and Recovery Programme.

The Business Resilience and Recovery Scheme provides support to businesses in Norfolk and Suffolk that have been affected by the Covid-19 Coronavirus and are looking at ways to

recover and strengthen their business performance. Companies applying under the scheme can apply for a 50% grant towards capital costs involved in initial resilience and future

recovery of their business. A grant of £25,000 up to a maximum of £50,000 is available to support projects.

Figures reflect the period to 08/01/2020.

What is the Overall Programme Status?

The Business Resilience and Recovery scheme has supported 112 businesses to date.

105 businesses have received their first payments and

Overall:

Green

41 have had their final payments.

The first tranche of funding for the programme (from the LGF) is now fully committed. Expenditure of the LGF was due by the end of the calendar

Delivery:

Green

year (LGF - £3,500,000). The programme has now started allocating funds from the Get Building Fund allocation (£2,623,680).

£ 4,315,098 has been awarded to 112 projects, representing 70.47% of the total programme budget. £2,714,020 has been paid out to 105

Spend:

Green

businesses (41 of which have had their final payments).

£ 4,315,098 has been awarded to 112 projects. The has enabled 112 businesses and their associated supply chains to start the journey to

Outputs:

Green

recover from the consequences of COVID-19 restrictions. 182 FTEs have been created and 2532.5 FTEs have been safeguarded.

What are our Key Updates?

•The Business Resilience and Recovery Scheme was launched on Monday 4th May and the scheme has proved popular with several enquiries already being handled, developed and

progressed through the Growth Hub.

•112 businesses have now been supported, the most recent being 'An Accounting Gem', awarded £25,501.

•Total R&R grant value awarded to date is £4,315,098 with a total projects value of £10,938,322.09. Private match of £6,623,674.09 has been committed. £2,714,020 has been paid

out to 105 businesses (41 of which have had their final payments).

•Investment in these 112 businesses will create 182 FTEs and safeguard 2532.5.

•Of the 112 businesses supported, 70 are in Norfolk (£2,641,507) and 42 are in Suffolk (£1,673,591).

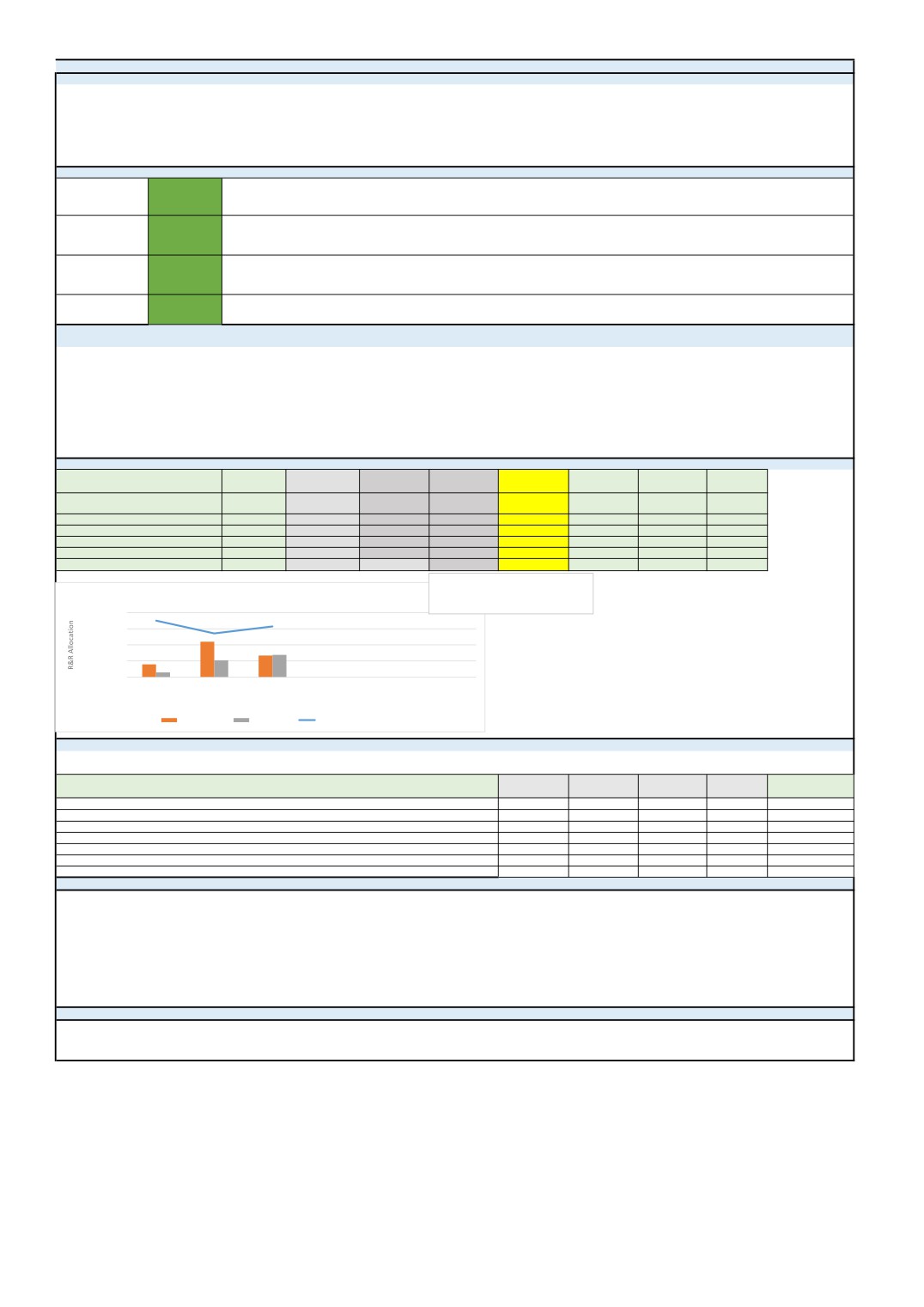

What is our Financial Position?

Financials (£ million)

Forecast

Actual

Actual

Actual

Actual

Financial Year

2020/21

Qtr 1 2020/21

Qtr 2 2021/22

Qtr 3 2021/22

Qtr 4 2021/22

Brought Forward

0

0

LEP Allocation

£3,500,000.00

£3,500,000.00

£2,709,864.00

£3,144,185.00

Spend [Act/Fcst]

£3,500,000.00

£290,639.00

£1,047,528.00

£1,375,853.00

Committed

£3,500,000.00

£790,136.00

£2,189,359.00

£1,335,603.00

Carried forward

£3,500,000.00

£2,709,864.00

£520,505.00

£1,808,582.00

This figure combines the balance of the

LGF (£520,505) and the additional

Business Resilience and Recovery Programme

£2,623,680 from the Get Building Fund

£4,000,000.00

£3,000,000.00

£2,000,000.00

£1,000,000.00

£0.00

Q1-20/21

Q2-20/21

Q3-20/21

Q4-20/21

Axis Title

Qtrly awarded

Qtrly Claims

R&R Budget Allocated

What is our contribution to the Economic Strategy?

Quarter/ year:

Outputs - cumulative from April 1st to 09/11/2020

Actual Qtr 1

Actual Qtr 2

Actual Qtr 3

Actual Qtr 4

Total

Number of Direct Full-Time Jobs Created

10

40

132

182

Number of Direct Full-Time Jobs Safeguarded

706

1,180

647

2532.5

Private Match (£)

£1,221,274.00

£3,431,035.00

£1,971,365.00

£6,623,674.00

Public Match (£)

£0.00

£0.00

£0.00

£0.00

Commercial Floor Space (SqM)

TBC

TBC

TBC

What is the Project Delivery Status?

LGF Committed = £3,504,706 (Allocating grant awards in full to one fund means that the total exceeds £3,500,000 LGF allocation slightly).

•90 businesses supported in total

•55 businesses in Norfolk (£2,075,176)

•35 businesses in Suffolk (£1,429,530)

Getting Building Fund Committed - £810,392

•22 businesses supported in total

•15 businesses in Norfolk (£566,331)

•7 businesses in Suffolk (£244,061)

What are the Next Steps?

Qtr 4 - The Growth Hub will continue to signpost, develop and progress R&R applications to the Finance East's Due Diligence Team. Regular Team meetings are held to review

processes and suggest improvements to the scheme and its wider dissemination and take up.