New Anglia LEP Investment Appraisal Committee

Wednesday 21st October 2020

Teams Meeting

9am to 9:45am

Agenda

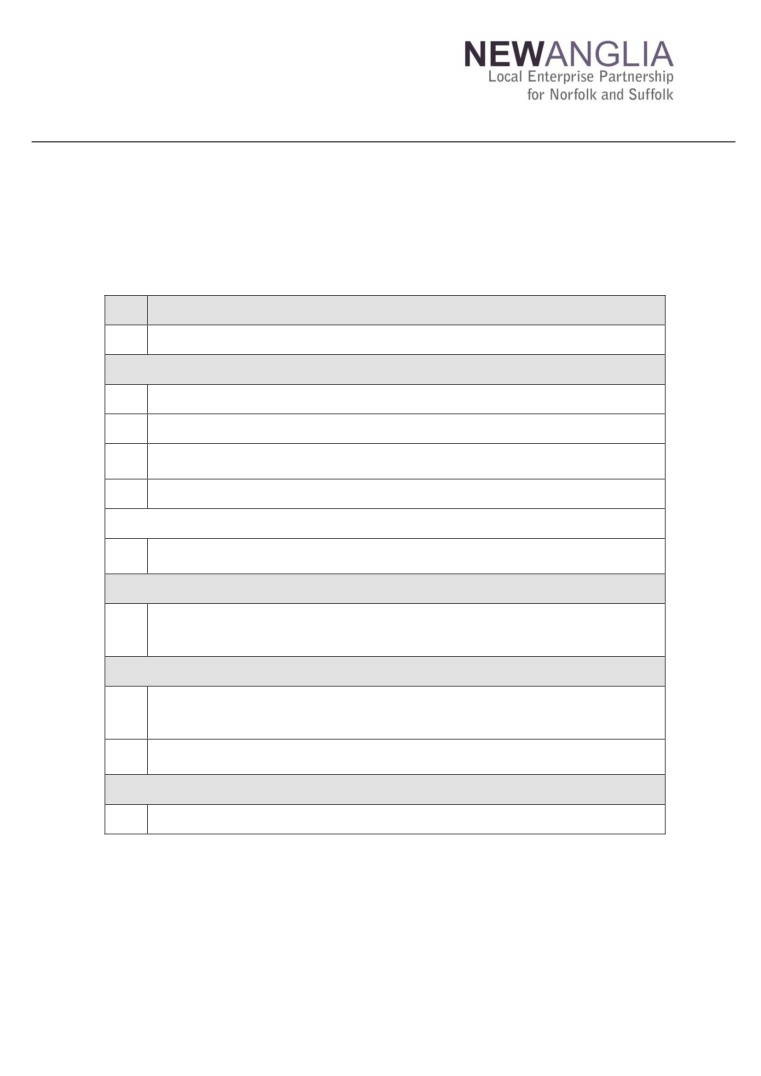

No.

Item

1.

Welcome

Main Agenda

2.

Apologies

3.

Declarations of Interest

4a,

Minutes of previous meetings - 23 September 2020 and 5 October 2020

4b.

(additional meeting)

5

Horizon Paper and GPF repayments - Confidential

Reporting- Growing Places Fund

6,

Growing Places Fund Programme Performance Report and project RAG rating -

6a

confidential

Reporting: Growing Business Fund

7,

Growing Business Fund Programme Performance Report and SGS/GTI

7a

appendices

7b.

Items for Approval

8,

Growing Places Fund loan request - Snack Creations - Confidential. Including

8a,

confidential appendices

8b

Growing Places Fund additional grant request- Saxmundham Creative

9.

Enterprises - Confidential

Other

10.

Any Other Business

Committee Members

David Ellesmere

Ipswich Borough Council

Andrew Proctor

Norfolk County Council

Sandy Ruddock

Scarlett and Mustard

Alan Waters

Norwich City Council

Tim Whitley

BT

Dominic Keen

High Growth Robotics

Kathy Atkinson

Kettle Foods

Martin Williams

Williams Business Advisory

Exec Members

Rosanne Wijnberg

New Anglia LEP

Chris Dashper

New Anglia LEP

Iain Dunnett

New Anglia LEP

Date and time of next meeting: Wednesday 25 November 2020. 9am-9:45am

Venue: Teams Meeting

New Anglia Investment Appraisal Committee

Meeting Minutes (Unconfirmed)

23rd September 2020

Present:

Committee Members

David Ellesmere (DE)

Ipswich Borough Council

Andrew Proctor (AP)

Norfolk County Council

Dominic Keen (DK)

High Growth Robotics

Sandy Ruddock

Scarlett & Mustard

C-J Green (CJG)

Brave Goose

Alan Waters (AW)

Norwich City Council

Martin Williams (MW)

Independent IAC Member

In Attendance

Kathy Atkinson (KA)

Kettle Foods

Rosanne Wijnberg (RW)

New Anglia LEP

Chris Dashper (CD)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

Iain Dunnett (ID)

New Anglia LEP

ACTIONS

Growing Places Fund - Investment Opportunity and business plan

To receive the financial due diligence report from Grant Thornton

ID

1

Welcome from the Chair

David Ellesmere (DE) welcomed everyone to the meeting.

2

Apologies

Apologies were received from Tim Whitley.

3

Declarations of Interest

Andrew Proctor (AP) declared an interest in Item 9, the Growing Placed Fund Investment, as it refers to

Norfolk County Council. It was agreed that this would be addressed last.

4

Minutes of previous meeting (26th August 2020)

The minutes of the previous meeting were approved by the committee.

5

Growing Places Fund Horizon Paper (Confidential)

Iain Dunnett (ID) highlighted key points from the Horizon paper.

The Committee agreed:

• To note the content of the reports

6

Growing Business Fund Programme Performance Report and SGS/GTI appendices

Chris Dashper (CD) reviewed the Project Performance Reports included in the meeting papers and noted

that that interest in the GBF was now picking up.

The Committee agreed:

• To note the content of the report

Page 1 of 2

7

Innovative Projects Fund Programme Performance Report

CD confirmed that TCHC’s VG Incubator has submitted its first claim and that claims for the remaining 10

projects are expected anytime between now and mid-October.

The Committee agreed:

• To note the content of the report

Resilience and Recovery Fund Programme Performance Report and project approvals

8

appendix

CD confirmed that 1-2 applications continue to be received every day and a full paper will go to the LEP

board in October.

The Committee agreed:

• To note the content of the report

9

Growing Places Fund - Investment Opportunity and business plan - Confidential

This item was addressed last on the agenda.

AP left the meeting

10

Growing Places Fund- L’Arche supplemental grant request - Confidential

11

Hydrogen East feasibility study- Confidential

12. AOB

None

Page 2 of 2

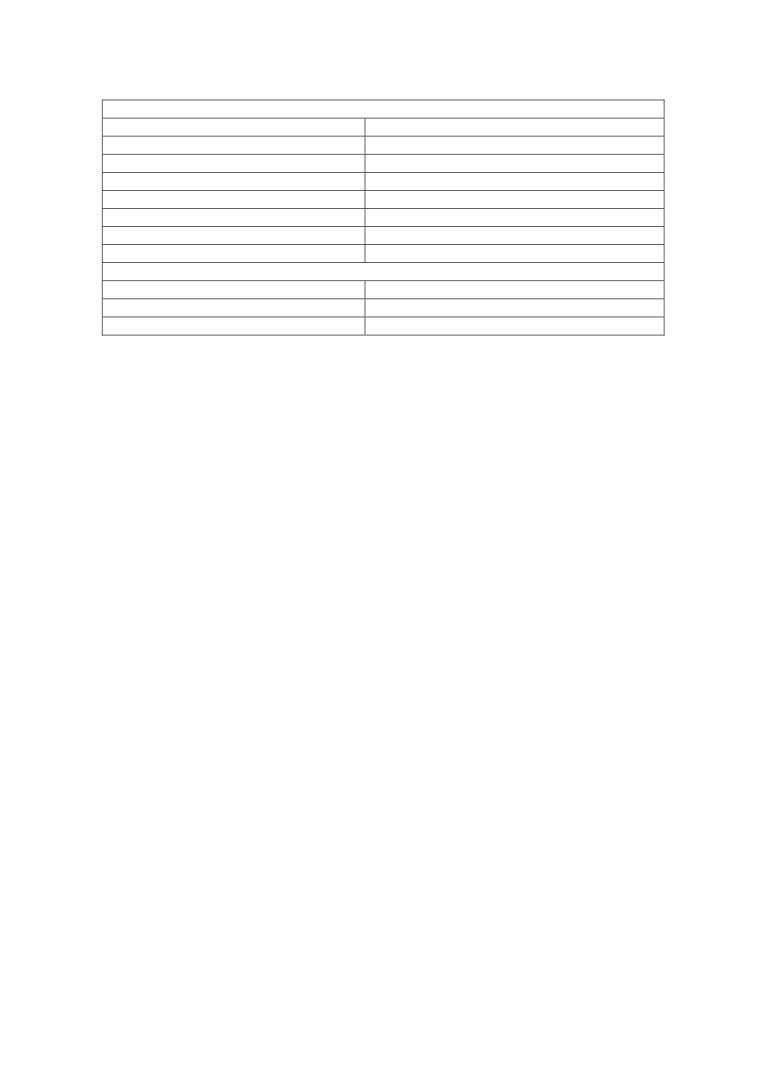

Item 6 - Growing Places Fund Performance Report

Programme Overview - What is the Growing Places Fund?

• Programme duration under Growth Deal funding: 2015 - 2021.

• Value: £35m. This is the £35m Growing Places Fund element of the Growth Deal. Completed projects date back to previous funding from 2012.

• Invested £22.7 million loan capital in region’s infrastructure, sectors and growth locations. £13 million of grants provided to projects demonstrating significant regional

or local economic benefit.

• Contribution to the Economic Strategy: The fund has leveraged £143m of public investment and £149m of private investment, created 1475 new jobs, 468 new homes,

created 18,703 square metres of industrial space, provided premises for 112 new businesses to be created, supported 45 capital investment projects, and 6 sector

developments in the private and public sector.

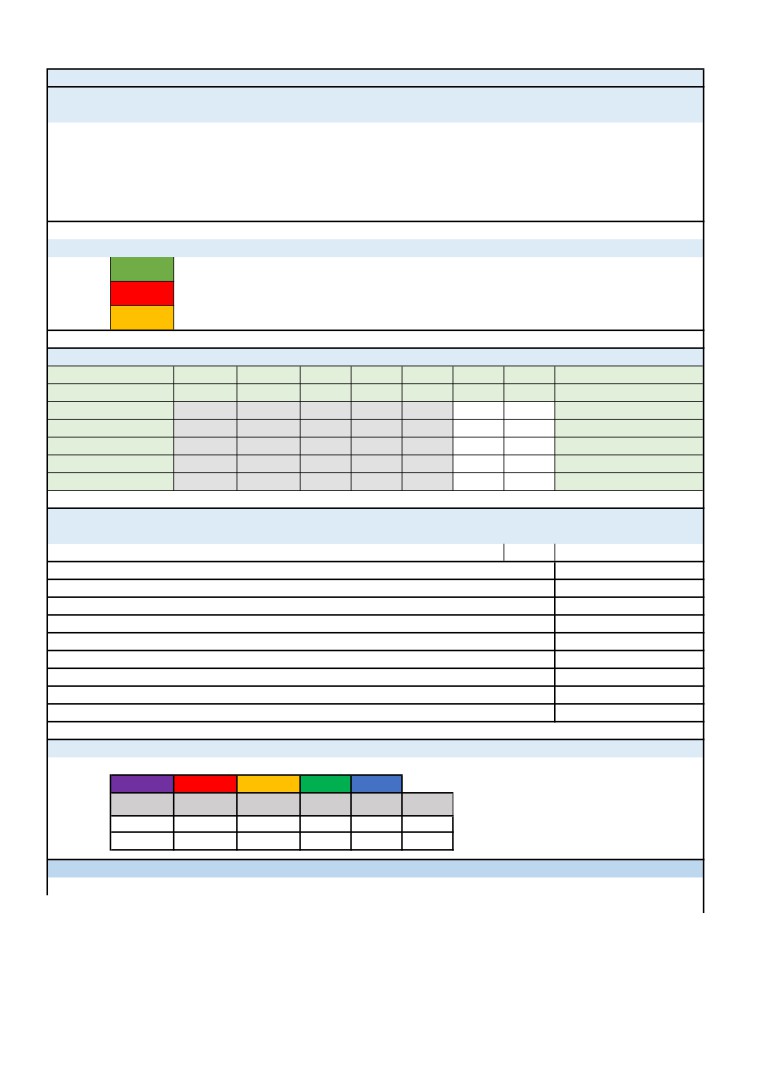

What is the Overall Programme Status?

Green

Loans position

Winerack repayments have now exceeded £2 million.

Red

Grants position

Grants under review with existing projects to understand effect of Covid 19 and likely knock on of drawdown from 20/21 to 21/22.

Outputs

Amber

Output delivery under review.

achieved

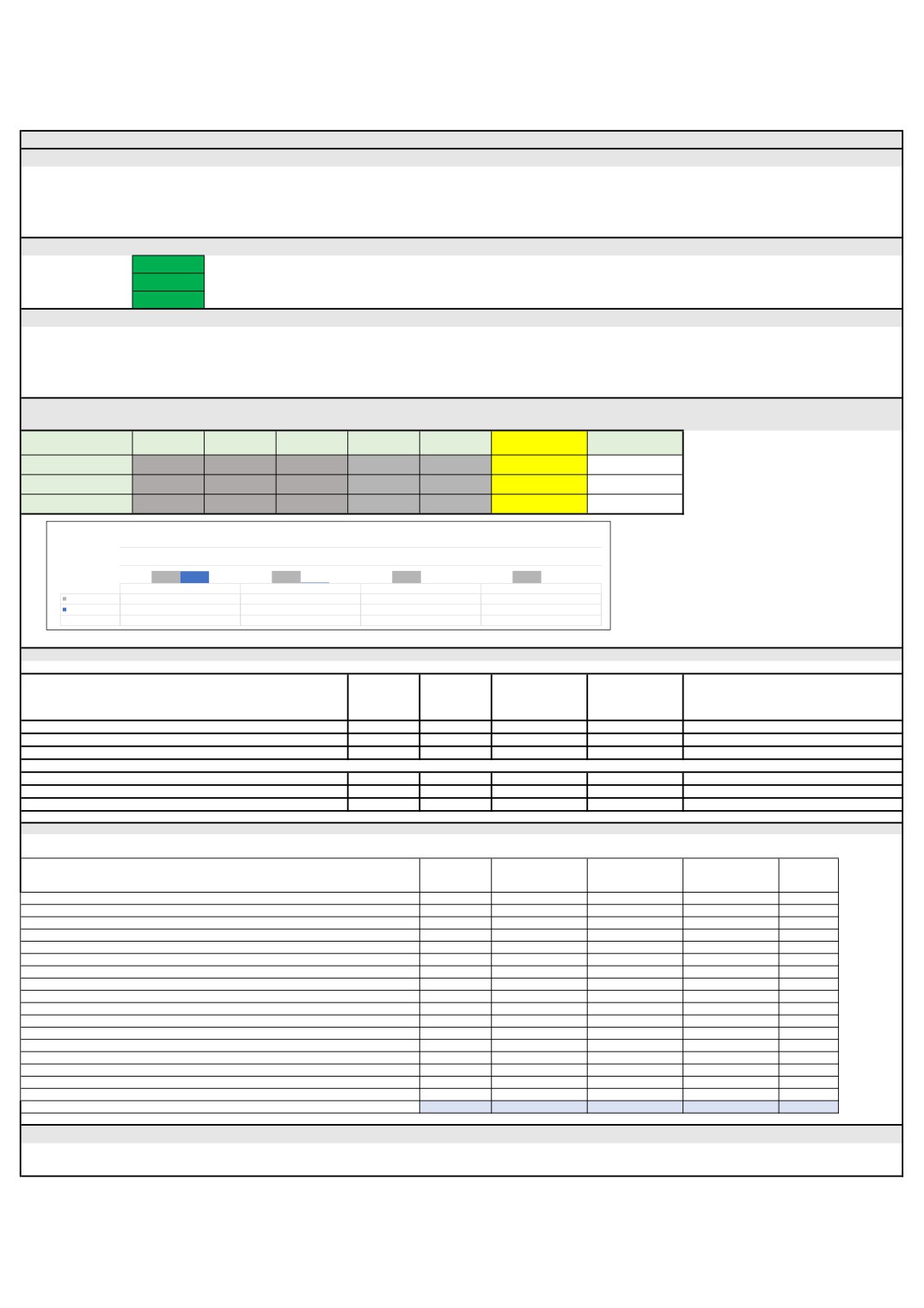

What is our financial position?

Financials (£ millions)

Actual

Actual

Actual

Actual

Actual

Forecast

Forecast

Total

Financial Year

2015/16

2016/17

2017/18

2018/19

2019/20

2020/21

2021/22

Brought Forward

0.000

0.000

2.729

4.415

1.524

4.849

10.788

Repaid

0.000

2.088

1.597

1.031

2.129

5.838

2.575

15.257

Gov Allocation

7.967

4.092

2.790

3.720

3.720

6.646

0.000

28.935

Spend [Act/Fcst]

-7.967

-3.451

-2.701

-7.641

-2.524

-6.546

0.000

-30.830

Carried forward

0.000

2.729

4.415

1.524

4.849

10.788

13.362

13.362

What is our contribution to the Economic Strategy?

Programme performance to date

Outputs - cumulative from April 2012 to Quarter 2 2020

Actual to date

New homes built

468

New jobs created

1,749

Industrial Space created (m2)

18,157

New businesses created through provision of premises

112

Capital Build projects supported

27

Sector Developments supported

6

Match Funding - Public (£m)

121

Match Funding-Private (£m)

136

Total Match (£m)

278

What is the Project Status?

Current status of all projects.

Overall

Purple

Red

Amber

Green

Blue

status

Pipeline

At risk

Claim stage

Live

Complete

Total

8

2

7

9

25

51

Change

4

1

-2

-1

1

What are the next steps?

Continue to review effect of Covid 19 on current loan and grant arrangements.

Ensure payback returns contribute to LEP finances.

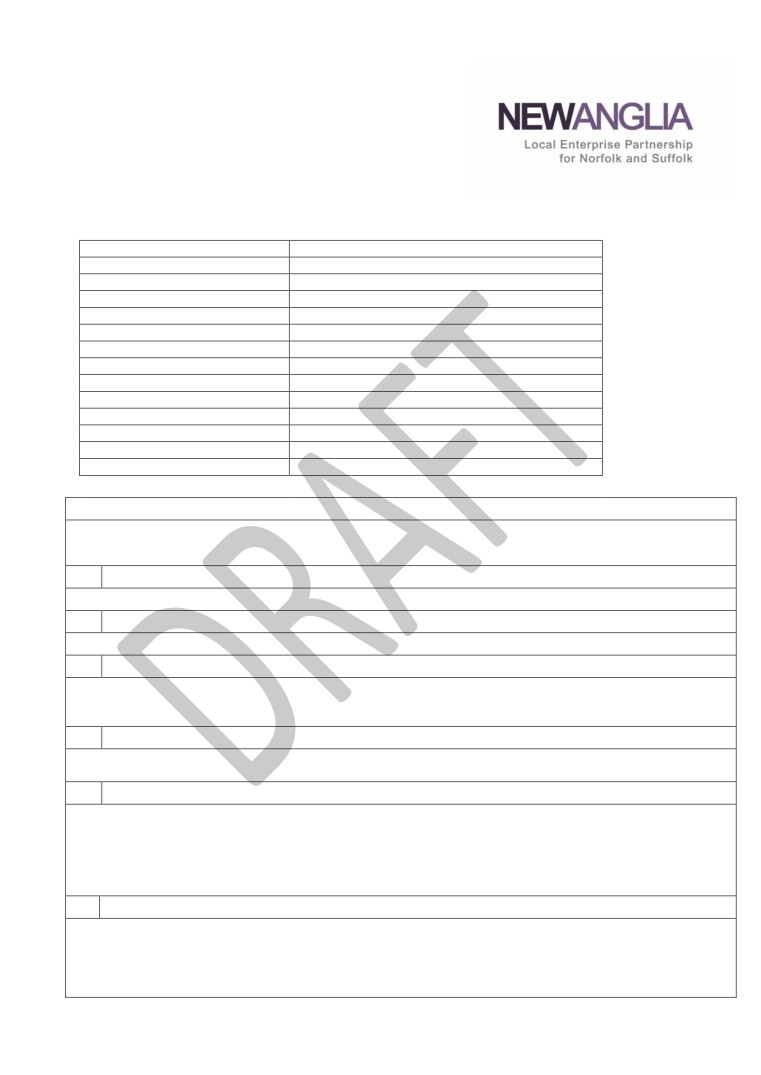

Growing Business Fund Performance Report - August 2020

Programme Overview - What is the Growing Business Fund?

Launched in April 2013, the Growing Business Fund provides grants for businesses to enable growth, an increase productivity and job creation.

Capital grants between £25,000 and £500,000 are provided at up to 20% of project costs for SMEs, with an enhanced rate for small businesses located in an Assisted Area (until 2021).

Funding for the Growing Business Fund is provided on an annual basis by the LEP's Growth Deal.

The fund is accessed through the New Anglia Growth Hub with Due Diligence undertaken by Finance East and agreed by a GBF panel which meets monthly as required .

What is the overall Programme Status?

Finance

Green

Since the autumn there has been an increase in the number of applications coming forward, these are now being progressed slowly to panel.

Outputs

Green

Based on grant approvals, the scheme started 2020/21 ahead of target.

Delivery

Green

Pipeline is greater than the funding remaining uncommitted .There was no panel meeting in August

What are our key updates?

Participant SMEs of the Scale Up New Anglia programme are being offered a range of support including applications to GBF (where appropriate).

This is still the LEP flagship grant scheme attracting interest: despite COVID-19, we are seeing confidence in that some businesses submitting grant applications.

We have seen some of the businesses cancel their plans due to Covid-19 and withdraw their applications, however as many are still proceeding especially those of a medium size

At the end of 2019/20 we transferred £1m and the £331k underspend into the 2019/20 Growing Places Fund. Until the end of August we have paid out grants totaling £1,471,010.

What is our financial position?

Financials (£ million)

Year

2013 to 2016

2016/2017

2017/2018

2018/2019

2019/2020

2020/2021

Total

Profile Spend (£m)

£12.000

£3.536

£3.050

£5.096

£4.121

£2.790

£30.593

Actual Spend (£m)

£11.999

£3.001

£3.049

£4.764

£2.533

£0.724

£26.070

Remaining Spend (£m)

£0.001

£0.535

£0.001

£0.331

£1.588

£2.066

£4.522

2019/2020 Expenditure Profile

2

1

0

Q1-19/20

Q2-19/20

Q3-19/20

Q4-19/20

Quarterly Forecast

£0.698

£0.698

£0.698

£0.698

Quarterly Spend

£0.678

£0.046

£0.000

£0.000

Variance

£0.019

£0.652

£0.698

£0.698

What is our contribution to the Economic Strategy?

Actual to end of

Outputs April 2020 to March 2021

Target

Monthly Change

Shortfall

Notes

March 2021

Value of grants approved

£1,759,771

£885,109

£0

£874,662

Value of private sector match approved

£7,039,084

£6,697,529

£0

£341,555

Number of New Jobs to be Created

88

51

0

37

Value of grants claimed

£2,790,000

£723,800

£10,000

£2,066,200

Private sector match funding drawn down

£11,160,000

£5,108,589

£40,000

£6,051,411

Number of New Jobs Created

140

11

2

129

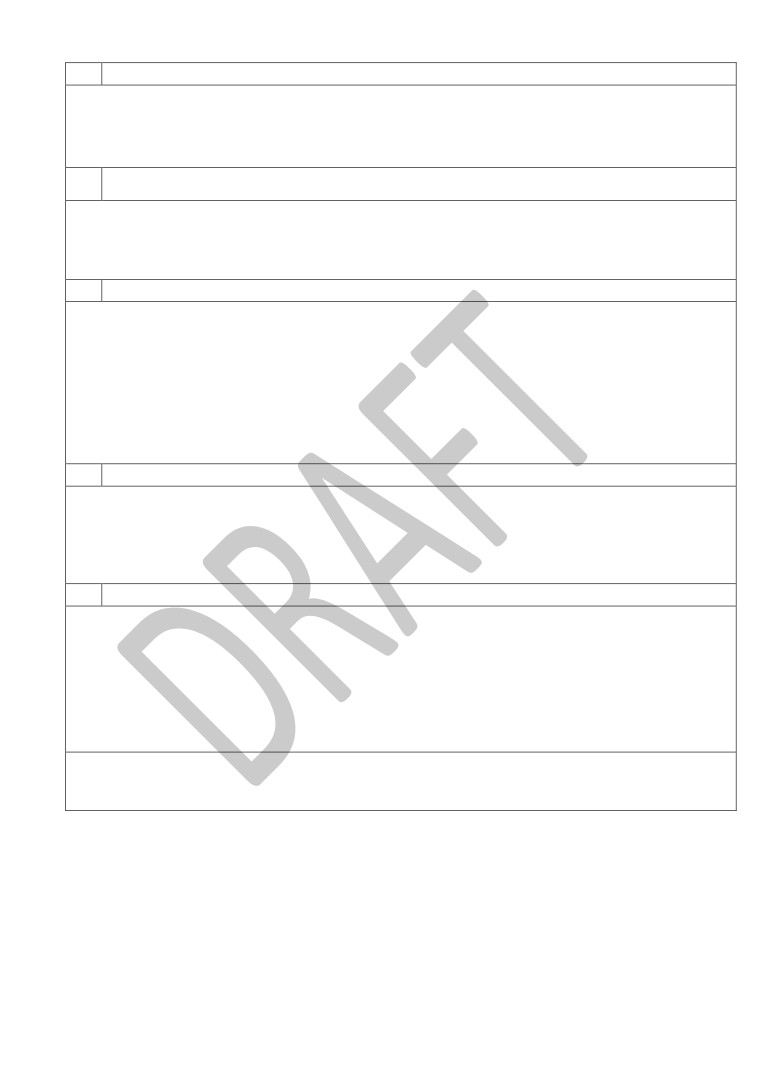

What is the project status?

The following table shows grants approved by sector since the start of the programme in 2013/14

Number of

Projects

Grants

Private

Total Project

Jobs to be

Sector

Approved

Approved

Match

Costs

Created

A- Agriculture, Forestry and Fishing

3

£

235,899

£

1,018,543

£

1,254,442

58.0

B - Mining and Quarrying

1

£

100,000

£

1,654,600

£

1,754,600

10.0

C - Manufacturing

132

£

14,774,919

£

93,432,600

£

108,207,519

1579.5

E - Water supply, sewerage, waste management and remediation activities

5

£

454,000

£

1,902,000

£

2,356,000

35.0

F - Construction

18

£

1,581,386

£

9,418,963

£

11,000,349

167.5

G - Wholesale and retail trade; repair of motor vehicles and motorcycles

26

£

2,829,816

£

52,382,892

£

55,212,708

386.0

H - Transportation and Storage

9

£

915,801

£

5,224,238

£

6,151,230

103.0

I - Accommodation and Food Service Activities

5

£

372,000

£

2,342,138

£

2,714,138

45.5

J - Information and Communication

11

£

753,200

£

3,792,342

£

4,545,542

76.0

K - Financial and Insurance Activities

1

£

30,000

£

79,425

£

109,425

3.0

L - Real Estate Activities

23

£

2,533,331

£

15,611,382

£

18,144,713

269.6

M - Professional, Scientific and Technical Activities

1

£

20,000

£

102,191

£

122,191

4.0

N - Administrative and Support Service Activities

1

£

31,580

£

126,320

£

157,900

3.5

P - Education

8

£

502,921

£

3,159,776

£

3,662,697

55.5

Q - Human Health and Social Work Activities

2

£

320,000

£

4,737,413

£

5,057,413

32.0

R - Arts, Entertainment and Recreation

23

£

2,195,161

£

11,884,655

£

14,079,816

254.0

S - Other Service Activities

1

£

100,000

£

232,500

£

345,000

10.0

Total

270

27,750,014

207,101,978

234,875,683

3,092.1

What are the next steps?

The LEP is working with delivery partners, to ensure that the scheme can be accessed by businesses to facilitate growth during the current COVID-19 Pandemic.

As we are nearing the end of the fund, we are closely monitoring the applications that are submitted to ensure they can complete on time, 31st March 2021

New Anglia LEP

Growing Business Fund

Grant Approvals 1st April 2020 to 31st March 2021

Date

Total Project Jobs to be

Business Name

Grant Awarded Private Match

Approved

Cost

CreatedDescription of Support Given

Apr-20

£0

May-20

A J Hodgson and Sons

£82,010

£328,040

£410,050

7.0

May-20

Mid Anglian Enterprise Agency Ltd (MENTA)

£49,390

£444,519

£493,909

3.0

May-20

Crowland Cranes Ltd

£384,900

£3,464,223

£3,849,123

20.0

Jun-20

Primo Manufacturing Ltd

£120,000

£501,275

£621,275

8

Jul-20

Freight Force Distribution Ltd

£248,809

£1,959,472

£2,208,281

13

Aug-20

£0

Aug-20

£0

Sep-20

£0

Sep-20

£0

Oct-20

£0

Oct-20

£0

Oct-20

£0

Nov-20

£0

Nov-20

£0

Feb-21

£0

Feb-21

£0

Mar-21

£0

Mar-21

£0

Mar-21

£0

Mar-21

£0

£885,109

£6,697,529

£7,582,638

51.0

Small Grant Scheme Approvals (April 2020 - March 2021)

Total

Jobs to

Date

Grant

Private

Business Name

Project

be

Description of Support Given

Approved

Awarded

Match

Cost

Created

Apr-20 Genesis Sporthomes Ltd

10,272

41,088

51,360

2 Capital investment to support business growth

Apr-20 James White Drinks Ltd (2)

24,434

97,736

122,170

1 Capital & Revenue investment to support business growth

Apr-20 Frugalpac Ltd

13,427

53,712

67,139

13 Capital investment to support business growth

Apr-20 Xcell Misting Ltd

7,200

28,800

36,000

1 Capital investment to support business growth

May-20 Gnaw Chocolate Ltd (2)

4,508

18,033

22,541

5 Capital investment to support business growth

Electrical Installation and Appliance

May-20

1 Capital investment to support business growth

Testing (UK) Ltd

5,538

22,152

27,690

May-20 ASAP Branding Ltd.

5,120

20,480

25,600

0 Capital & Revenue investment to support business growth

Jun-20 CMI Print Services Ltd

13,389

31,242

44,631

0 Capital investment to support business growth

Jun-20 Smart Offices Ltd

9,000

36,000

45,000

0 Capital investment to support business growth

Jun-20 Total Site Services

4,575

18,300

22,875

1 Capital investment to support business growth

Jun-20 Lifeline24 Ltd

4,297

17,190

21,487

0 Capital investment to support business growth

Jun-20 Spa Pavilion Ltd

24,360

97,440

121,800

0 Capital investment to support business growth

Jun-20 Brief Media Ltd.

3,900

20,000

23,900

1 Capital investment to support business growth

Jun-20 WhataHoot Ltd.

24,044

96,176

120,220

2 Capital investment to support business growth

Jun-20 Rob Samrook Photography

1,026

4,098

5,124

0 Capital investment to support business growth

Jul-20 Norfolk Bluebell Wood Ltd

£2,440

9,760

12,200

0 Capital investment to support business growth

Jul-20 Tosier Chocolate Ltd (2)

£6,742

26,968

33,710

1 Capital investment to support business growth

Jul-20 Newmans Cleaning Services Ltd

£3,000

12,000

15,000

0 Capital investment to support business growth

Aug-20 Gutter Force Ltd (2)

3,578

14,312

17,890

1 Capital investment to support business growth

Aug-20 Jake Austin Window Cleaning Services

4,565

18,260

22,825

1 Capital investment to support business growth

£175,415

£683,748

£859,163

30

SGS Grants Approved Apr20-Mar21