New Anglia Local Enterprise Partnership Board Meeting

Meeting by conference call

Tuesday 23rd June

10.00 - 12.00pm

Via MS Teams

Agenda

No.

Item

5 minutes

1.

Welcome from the Chair

2.

Apologies

3.

Declarations of Interest

4.

Actions / Minutes from the last meeting

5.

LEP Response to COVID-19

Update

20 minutes

6.

Covid-19 Economic Recovery Plan

For Approval

30 minutes

7.

Impact on Employment

Update

20 minutes

8.

LEP Continuing Business - including confidential items

Update

15 minutes

9.

June Performance Reports

Update

10 minutes

10.

LEP Operating & HR Policies

For Approval

10 minutes

11.

Board Forward Plan

Update

5 minutes

12.

Any Other Business

5 minutes

Next Meeting: 10.00-12.00, Tuesday 21st July

1

New Anglia Board Meeting Minutes (Unconfirmed)

20th May 2020

Present:

Sam Chapman-Allen (SC)

Breckland Council

Claire Cullens (CC)

Norfolk Community Foundation

David Ellesmere (DE)

Ipswich Borough Council

Doug Field (DF)

East of England Coop

C-J Green (CG)

Brave Goose

John Griffiths (JG)

West Suffolk Council

Matthew Hicks (MH)

Suffolk County Council

Pete Joyner (PJ)

Shorthose Russell

Helen Langton (HL)

University of Suffolk

Dominic Keen (DK)

Britbots

Corrienne Peasgood (CP)

Norwich City College

Andrew Proctor (AP)

Norfolk County Council

Johnathan Reynolds (JR)

Opergy

Alan Waters (AW)

Norwich City Council

Jeanette Wheeler (JW)

Birketts

Attendees

Kathy Atkinson (KA)

Kettle Foods

Mark Ash (MA)

Suffolk County Council

Sue Roper (SR)

Suffolk County Council

Vince Muspratt (VM)

Norfolk County Council

Shan Lloyd (SL)

BEIS

Chris Dashper (CD)

New Anglia LEP - For Item 6

Chris Starkie (CS)

New Anglia LEP

Rosanne Wijnberg (RW)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

1

Actions from the meeting: (20.05.20)

Restart and Rebuild - Covid-19 Economic Recovery Plan

To receive a paper on the effects of the Covid-19 crisis on employment in the region

N Waller

Investment Appraisal Committee Nominations

Private sector board members to forward nominations for the vacant position on the IAC to

Private

RW

Sector

1

Welcome from the Chair

Doug Field (DF) welcomed everyone to the meeting and welcomed C-J Green, Kathy Atkinson and

Mark Ash.

2

Apologies

Apologies were received from Tim Whitley, Sandy Ruddock and Steve Oliver.

3

Declarations of Interest

Jeanette Wheeler, (JW), Corrienne Peasgood (CP) and Andrew Proctor (AP) declared an interest in

Item 7 - Growing Places Fund Food Innovation Centre Investment.

Full declarations of interest can be found at http://www.newanglia.co.uk/about-us/the-board.

4

Minutes of the last meeting

The minutes were accepted as a true record of the meeting held on 21st April.

5

LEP Response to COVID-19

Chris Starkie (CS) presented the paper to the board and highlighted key areas.

CS confirmed that the first applications to the Resilience and Recovery Scheme had been

received with the first application processed and funds paid out within 10 days. Enquiries

continue to be received and the fund has a healthy pipeline.

The vacancies page on the LEP website has proved successful with 2000 views in the first

week in May. Work is ongoing to improve the functionality of the pages.

The PPE database has 300 suppliers registered of which 50% are local companies offering

850 different types of PPE. 198 users from the care sector have registered as users. The

next phase is to open it up to businesses and provide access to products assisting them in

getting employees back into the workplace.

The meeting discussed promotion of the scheme and the successful applicants and CS

confirmed that all would be promoted as soon as all commercial details had been finalised.

Matthew Hicks (MH) noted that Suffolk County Council were setting up a similar database

and CS confirmed that the LEP were in regular conversation with SCC on activities.

Communications teams from the LEP also hold regular meetings with counterparts from

local authorities to ensure that all messages are consistent.

The Board agreed:

• To note the content of the report

6

Restart and Rebuild - Covid-19 Economic Recovery Plan

CS reviewed the paper noting that the proposed approach was also being presented to the

Norfolk and Suffolk Leaders for approval.

The plan aims to work with local partners to build a phased approach to economic recovery

beginning with a 12 month tactical restart phase providing practical support to businesses

which will be followed by a 3-5 year strategic plan.

2

Claire Cullens (CC) highlighted the importance of the Voluntary Sector (VS) as a key

partner which would provide opportunities for skills development and employment in the

future.

CS agreed and confirmed that each sector would have its own workplan and that sectors

would be broader than those detailed in the Local Industrial Strategy (LIS). It was agreed

that those key sectors identified in the LIS would not be lost but would be widened with

other sectors included.

The board agreed that it was important for the tactical plans to be in place as soon as

possible.

CS confirmed that the restart phase would focus on activity and the rebuild phase would

incorporate details from the LIS and the Economic Strategy (ES) to provide a new strategy

to be published next summer.

Johnathan Reynolds (JR) stressed the support for rebuilding using clean growth and noted

the potential jobs losses in the oil and gas industry could impact heavily in the region

CS confirmed that clean and inclusive growth would be part of the plan and, although the

establishment of the Clean Growth Taskforce has been delayed, it could form part of the

next phase.

Helen Langton (HL) asked whether the Norfolk & Suffolk Unlimited branding would be used

in the plan and suggested that the use of the word “unlimited” be incorporated to stress the

continued belief in the local economy.

HL also noted the significant impact the crisis was having on unemployment and skills and

felt that this area needed to be given more emphasis with reference to upskilling and

redeployment.

CS confirmed that the NSU brand would be included and that references to key Brexit

dates and impacts would be added as per MH’s request.

The Board noted the concerns that that significant numbers of redundancies were possible

when the furlough scheme ended.

It was agreed that the Board would receive a paper on redundancies and economic

impacts at the next meeting.

CS noted that the plan was organic and had an aggressive timeline in order for it to be

signed off in June.

The Board agreed:

• To note the content of the report

• To endorse the development of a Norfolk and Suffolk economic recovery plan in two

phases Restart and Rebuild as outlined in the paper

N Waller

• To receive a paper on the effects of the Covid-19 crisis on employment in the region

7

Growing Places Fund - Food Innovation Centre Investment - Confidential

JW, CP & AP left the meeting

JW, CP & AP returned to the meeting

3

8

LEP Capital Budget 20/21- Confidential

Rosanne Wijnberg (RW) presented the budget and highlighted key items.

The Board agreed:

• To note the content of the report

9

Continuing Business

RW presented the paper to the Board and highlighted key items noting that the process for

identifying the next phase of Institutes of Technology was on hold but that discussions

were continuing with partners.

RW advised that the payments of Local Growth Funding had been split this year with 2/3

paid on in May with the remaining 1/3 in September subject to a review on the progress of

projects.

Growth Through Innovation Fund - JR asked for the programme to be linked to the

Innovation Board to ensure priorities are aligned. RW confirmed that she will contact JR to

make sure communication with the Innovation Board is maintained.

New Anglia Capital (NAC) - Dominic Keen (DK) updated the meeting on the discussions at

the latest NAC board meeting. DK asked for the Board’s approval for NAC to reduce its

conditions on employment and match funding requirements to allow companies to get

funding in place. CS confirmed the support of the LEP Executive team for the change and

JW offered to provide support on the parameters.

The amendments were agreed by the Board

The Board agreed:

• To note the content of the report

• To approve the amendments to the operating parameters of NAC as detailed

10

Management Accounts - Q1 2020

RW presented the quarterly management accounts to the board noting there was a rollover

of £16m in grants due to slower than anticipated spend.

JR asked if there were any themes to the delays across the projects.

RW advised that some were due to issues within the projects such as delays in obtaining

planning permission but more recent delays are as a result of the Covid-19 crisis. Projects

have been asked to review and restructure spend.

RW also noted that the audit is underway and is being carried out by uploading documents

to an online portal.

• To note the content of the report

11

May Performance Reports and Programme Dashboard

RW presented the reports for May and asked for approval of the Growth Deal Dashboard.

The Board agreed:

4

• To note the contents of the reports

• To approve the Growth Deal Quarterly Dashboard

12

Investment Appraisal Committee Chair, Vice Chair and Membership

RW advised the meeting that, following the departure of Lindsey Rix, there is a vacancy for

the role of Chair of the IAC.

RW confirmed that David Ellesmere (DE) and DK had been nominated for the roles of

Chair and Vice Chair respectively and asked for approval from the Board for both

appointments.

The appointments were approved unanimously by the Board.

RW asked for nominations from the private sector board members for the current vacancy

on the IAC.

The Board agreed:

• To endorse the appointments of David Ellesmere and Dominic Keen as Chair and Vice

Chair of the IAC

• For private sector board members to forward nominations for the vacant position on the

Private

IAC to RW

Sector

13

Board Forward Plan

CS advised that the agenda for the June meeting is being finalised and agreed that the

Economic Recovery Plan and an update paper on Brexit will be added.

The Board agreed:

• To note the content of the plan

14

Any Other Business

CS briefed the Board on the roundtable held with the Minister for Business and Industry

Nadhim Zahawi MP and the Minister for Regional Growth and Local Government Simon Clarke

MP in which New Anglia LEP participated along with the Oxford-Cambridge Arc LEPs. 5

current and one past LEP private sector board members participated and were able to pose

questions to the ministers.

5

Actions from New Anglia LEP Board Meetings

Date

Item

Action

Update

Actioned

Target Date

By

20/05/2020

Restart and Rebuild - Covid-19

To receive a paper on the effects of the Covid-19 crisis on employment in the region

Included in the June meeting papers

N Waller

Complete

Economic Recovery Plan

20/05/2020

To receive a proposal detailing how the £4.9m repaid loan funds may be used to support

Funds arestill available in both GBF and R&R to support recovery. The

RW

Jul-20

Capital Budget 20/21

recovery

aim is to bring a paper to the July Board

20/05/2020

Investment Appraisal Committee

Private sector board members to forward nominations for the vacant position on the IAC to

Private

Jul-20

Nominations

RW

Sector

26/02/2020

Clean Growth Taskforce

Board members to consider a pledge which the Board could make and submit suggestions to

All

Nov-20

the Chair.

25/06/2019

GE Update Report

To provide the Board with regular reporting of the pipeline of visits relating to inward

An update on all the enquiries received will be provided monthly as part

DD

Complete

investment and subsequent outcomes

of the Continuing Business Report

23/05/2019

Growth Hub Presentation

Growth Hub Annual review to be circulated to the Board when published

The reviwe will now be published in Autumn 2020 to include the period

CD

Nov-20

since March.

9

New Anglia Local Enterprise Partnership Board

Tuesday 23rd June 2020

Agenda Item 5

LEP Response to COVID-19

Author: Marie Finbow

Presenter: Chris Starkie

Summary

This report provides the board with an update on the LEP’s response to the coronavirus

pandemic.

The LEP continues to work closely with a wide range of partners on our response to Covid-19

including all Norfolk and Suffolk local authorities, business groups such as the chambers and

FSB, colleges, universities and LEP sector groups.

Through the response phase, the focus has been on gathering business intelligence and

providing financial and other support to businesses, as well as action to support the workforce

and key sectors.

Over the past few weeks attention has increasingly focused on the recovery phase, as

businesses look to restart and rebuild.

The first phase of the economic recovery plan - Restart - is covered separately on the agenda.

This report provides a headline update on the activities undertaken by the LEP team covering

both phases since the May board meeting.

Recommendation

The LEP Board is asked to note the contents of this report.

Background

As previously outlined to the board, the LEP’s Covid-19 response is structured under the

following workstreams:

1. Business Intelligence

2. Business Support and Advice

3. Local Funding

4. Workforce

5. Sectors and Supply Chain - Sub workstreams include: Personal Protective Equipment

(PPE), Visitor Economy, Agri Food, Energy and Construction.

6. Economic Recovery Plan

7. Communications

Since the last board meeting the emphasis has shifted from short term business advice and

funding, to the restart and rebuild elements of the economic recovery.

Set out below is a summary of the key activity which has taken place within each of these

workstreams over the last few weeks.

1

11

1 Business Intelligence

Intelligence reports continue to be submitted to Government on a weekly basis. Information

is typically gathered from around 50 different sources each week including local authorities,

businesses and sector groups. A trends document is also produced weekly and circulated to

local authorities, business intermediaries, sector groups and the East of England Local

Government Association, providing week by week trends from the intelligence returns

submitted.

Key trends from intelligence reports submitted in May:

New Anglia Growth Hub:

The 1st week of May saw the highest number of enquiries (113) and the highest level

of interactions with as many longer/more detailed appointments as telephone/basic

signposting, but the overall trend for May is a decreasing one (75% reduction from

enquiries on 1st May compared with those on 22nd May); telephone/basic signposting

down 52% and longer/more detailed appointments down 74%. Similarly website hits

have seen a reduction by 66% during May.

Continued trend of highest number of enquiries coming from the manufacturing,

wholesale and retail trade and accommodation and food service sectors.

Largest number of enquiries in May (47%) relate to government small business grant

fund and grants/finance.

General intelligence

Small businesses and the self-employed are still struggling to access government-

initiated support.

Recovery will take longer than expected with the ability to maintain social distancing

and cash flow cited as two key concerns.

Supply chain and safety of operations continue to hold back the construction sector.

Various sectors and business intermediaries have expressed concerns about a 14-

day quarantine period for arrivals to UK and ensuring workers are not turned away

during this busy period. Particular issues raised by the food sector and Norwich

Airport.

The Voluntary, Community and Social Enterprise Sector’s most significant issue is

medium term finances and if the situation continues for 12 months, 31% of

organisations report they would be at the point of failure.

Businesses in the hospitality sector have identified challenges around their

commercial viability with current social distancing measures, particularly those with a

lack of outdoor space.

Norfolk and Suffolk Venues Consortium has highlighted the impact on its 19 live

performance venues across Norfolk and Suffolk projecting a total collective loss of

income to the end of September 2020 of £15,389,450.

The Zoological Society of East Anglia have announced a survival business plan,

cutting almost 70 jobs. At the heart of this plan is a proposed restructure with urgent

cost cutting measures which will protect the life of the charity in the unprecedented

circumstances of Covid-19.

A number of businesses have identified the need for maintained business

engagement during the test, track and trace programme as it could potentially cause

whole sites and businesses to shut down. It is important that businesses include this

in any contingency plan they pull together.

2

12

2 Business Support / Advice

The Growth Hub is continuing to provide support to businesses through its phone-based

service. This service complements on the ground support provided by local authority

colleagues.

During May, the Growth Hub received 437 incoming telephone calls, a reduction from 977 in

April and 933 in March. Email enquiries since March are now standing at 1,164.

The majority of these enquiries have been Covid-19 related but more recently there has

been a return to other enquiries, including grant enquiries as businesses are looking to

resume trading.

Peer to peer network

The LEP is in the process of developing a Peer to Peer Network scheme in response to a

funding call from BEIS.

This is a new scheme targeting SMEs in the Agri-food, Manufacturing, Visitor and Health

and Social Care sectors.

It will provide up to 200 SMEs with peer to peer support initially delivered online, with

workshops when the lockdown is lifted.

The scheme will match experienced SMEs to assist others in areas such as the business

change cycle, tech adoption and leadership/management.

It will form a key component in the ramping up of business support in the Restart plan.

Further information will be provided once we receive confirmation of the bidding process

from BEIS, but we expect to be able to launch the scheme in September.

3 Local Funding

The LEP’s new Business Resilience and Recovery Scheme has seen a significant increase

in interest. As of Monday June 15th, 19 applications have been approved with a total value of

just over £440,000. Together with match funding from applicants the total investment in the

19 projects is more than £1m.

Examples of Business Resilience and Recovery Scheme grants issued include:

Sudbury print and design firm Indigo Ross investing in new printing presses to print

on a wider range of materials

Norwich theatre company Curious Directive transforming a Medieval church into a

laboratory for ground-breaking theatre projects

Funding for product development for Beccles-based Twyfords to support growing

demand from small shops and for home deliveries

New kitchen equipment for Wisbech farm shop Worzals to support demand for home

deliveries

A new CNC cutting machine for Pegasus Profiles in Thetford to bring more work in

house

New equipment for Ipswich indoor climbing centre Clip ‘n’ Climb to allow it to be sued

by more climbers while maintaining social distancing

New machinery for automotive engineers TTV Industrial, in Ipswich, to develop a new

range of parts for European clients

Press releases for some of the projects are attached at appendix 1.

Another six applications going through the due diligence and approval process and there are

a further pipeline has 39 proposals. Together these 45 proposals have a value of £1.9m.

3

13

The fund has £3.5m available - which means that awarded projects and those in the pipeline

now account for roughly two thirds of the fund value.

At the current rate of applications, the fund will therefore be fully allocated within a few

months. Therefore, further funding for the fund is being sought from Growth Deal Round 4.

Interest in the LEP’s other business grant programmes is also picking up. Further

information on these can be found in the LEP continuing business report (item 8).

4 Workforce

Work continues on identifying workforce challenges and gaps across sectors, working with

partners and the Department for Work and Pensions.

The employment opportunities webpage continues to attract significant attention, with almost

3,000 views in May. There are around 150 listings with most of these having more than

position available. Most popular areas are Health & Social Care, Food & Farming and Food

Retail.

More information on employment is captured in the employment paper elsewhere on the

agenda (item 7).

5 Sectors and Supply Chain

Sub-workstreams include PPE, Visitor Economy, Agri-Food, Energy and Construction.

PPE and return to work equipment

The LEP’s PPE supplier database has been upgraded with a new user interface, making it

easier to navigate and ensuring the database has up to date details of products.

Suppliers can now automatically update and amend products/records and users looking for

supplies can find information much more directly.

The database now has over 375 listed suppliers and producers of equipment to combat

Covid-19 with around 45% of the businesses listed based in Norfolk or Suffolk. Just over

1,500 products are now available on the system.

To date, more than 200 users have registered to use the system to source equipment to

combat Covid-19 - health care providers or other front-line services.

With the demand across care services reducing, focus has turned to what equipment

businesses need to safely reopen and information has been collated on return to work items

(i.e. sneeze screens, signage, hand sanitiser stations, etc).

The database currently has just over 250 ‘return to work’ items and the team are working

with Local Authority partners as well as the Chamber and Business Improvement Districts to

share information about suppliers. South Norfolk Council has procured ‘return to work

equipment’ for the public realm from companies identified through the database.

The database is now available to businesses wanting to purchase return to work items, and

was officially launched on June 8th ahead of the reopening of non-food retailers. The site had

5,500 viewers in the first five days following the launch.

A small number of companies who are looking for long term opportunities to pivot and

diversify production to PPE and ‘return to work’ equipment are currently working with the

Growth Hub team on grant applications for the Business Resilience and Recovery Scheme.

The team is planning to develop the database model further as part of the Restart plan to

look at supporting local food producers.

4

14

Visitor Economy

The Visitor Economy has a focussed Covid-19 Visitor Economy Group which is developing a

recovery plan for the Sector. This plan will be brought to the July board for sign-off.

Agri-Food

Effects of the pandemic on the Agri-food sector have been complex with the closure of the

hospitality industry having a major impact on producers. There has been an increase in

interest from the public in locally produced food which has been welcomed, with many

businesses setting up distribution channels. The labour challenges for the harvest remain a

huge concern.

Specific actions relating to Covid-19 impacts and recovery include support for the Flavours

Connexion project to match suppliers with potential trade buyers and consumers, so any

surplus food can be redirected.

The Agri-Food Council has a Delivery Plan in place which was written pre-Covid-19. This will

be rescoped/prioritised for recovery.

Key issues in the Agri-Food sector are being fed into Government.

The LEP is working with both Norfolk and Suffolk County Councils to undertake a research

project to set out opportunities for businesses to exploit new consumer trends.

Energy

Key intelligence/ concerns from the energy sector include the drop in the oil and gas price,

postponement of projects leading to job losses and concerns about the impact on the supply

chain. Offshore wind has remained resilient although concerns have been raised over

Government delays to the planning process for Vattenfall’s Norfolk Boreas windfarm. There

are also delays reported by EDF to the DCO process for Sizewell C nuclear newbuild.

Specific actions relating to Covid-19 impacts and recovery include:

The All Energy Industry Council met on 30 April and discussed current Covid-19

issues and challenges to recovery.

The East of England Energy Group (EEEGR) has surveyed its members and results

fed into the Business Intelligence returns.

Next meeting on 25 June will look at recovery of the sector and what actions are

needed.

Sub-groups including Building World Class research, All Energy Capability Matrix

and Cohesive Marketing Message have all continued to make progress with updates

expected at the meeting in June.

Other Sectors

Fishing

We continue to track and record issues in response to Covid-19 impact on this sector.

There have been severe restrictions on supplies to the ‘traditional’ customer base, namely

restaurants and pubs, due to lockdown, as well as export markets and the larger fishing

operators have mainly ceased to operate during this time.

Some smaller fishing vessels continue to operate off the Norfolk and Suffolk coast and to

help open up new direct customer channels, the LEP alongside Norfolk and Suffolk County

Councils and East Suffolk Council have worked together to support and promote the

Call4Fish platform in our region. Call4Fish is a digital platform established in the South West

to support the fishing trade and now rolled out nationally.

5

15

So far approximately eight fishing businesses have been supported and promote their fish

direct to the customer via this platform with further promotion planned.

Financial Industries

The extraordinary Financial Industry Group (Norwich) Board Meeting took place on 20th May

to look at the Norfolk wide response to the pandemic, New Anglia Growth Hub central

resource and the draft Economic Recovery Plan.

There has been continuing engagement with the Financial Industry Partnership (FIP)

(Ipswich) and intelligence fed into the Business Intelligence returns.

Both groups report concerns over the number of business clients in financial difficulty and

incurring debt, there are regulatory implications of having staff working at home and the

pressure to supply credit has increased.

Manufacturing and Engineering

Since the pandemic, the manufacturing groups have continued to meet, with Greater

Norwich, Greater Ipswich and North Norfolk groups having met virtually in the last few

weeks. The New Anglia Advanced Manufacturing and Engineering Board met on 15 April

with presentations from the LEP on the response to the pandemic and calls for PPE

manufacture.

Businesses are reporting very different levels of impact on their operation based on which

sectors they serve. e.g. manufacturers for the aerospace industry have lost a large

proportion of orders and income whilst others are extremely busy.

Businesses are reporting impacts in certain areas of their supply chains - from sub-suppliers

and of raw materials. Certain types of raw materials have been re-directed for the

manufacturing of PPE and other materials are stockpiled by other countries.

Specific actions relating to Covid-19 impacts and recovery include:

LEP staff presenting at manufacturing groups outlining support offered at the Growth

Hub and new funding schemes.

Progressing the ‘Engineering Success’ project to prepare a development plan for the

sector and talent sharing platform. Press release and call to action sent out.

Significant engagement with businesses in the sector in relation to the PPE

workstream.

Building Growth

An extended webinar to the construction industry organised by the LEP and Building Growth

took place on 21 May with 148 participants. The event focussed on impacts of Covid-19 and

recovery for the construction and housing sector. The LEP staff presented on the economic

recovery plans and support and funding for business.

Concerns raised by the sector include:

•

Health risks on building sites.

•

Increased death rates within industry.

•

Extended working hours.

•

Subsistence issues for staff that have to travel.

•

Supply issues.

•

Insolvency risks for those in the supply chain.

•

Drops in productivity - work taking longer to complete.

•

Utility and construction alignment concerns.

•

Staff furlough issues - lack of staff.

•

Contractual issues - servicing sites.

6

16

Major construction projects in Norfolk and Suffolk have continued, on the whole, but with

some time delays reported due to issues with suppliers and external contractors.

Construction work continues to make progress on some of the Enterprise Zone sites,

including Norwich Research Park, Bury St Edmunds and Ipswich but with some delays

reported on others.

Creative Industries

The Creative Industries Sector Group has continued to meet regularly throughout the

pandemic. Intelligence has shown that some parts of the sector have been more resilient

than others. Film and TV production has been badly impacted as shoots have been

cancelled. UX design, games design and augmented reality (VR and AR) have seen a major

uplift as companies looking for virtual ways of engaging with their customers.

Specific actions relating to Covid-19 impacts and recovery include:

Regular attendance at Creative Industry meetings to inform group of funding and

support opportunities.

Meeting on 7 May focussed on advice for businesses looking to ‘pivot’

Creative Industries tracker survey fed into the Business Intelligence returns.

Engagement with the film sector businesses over ideas to develop a screen agency

in Norfolk.

Cultural Board

The New Anglia Cultural Board met on 1 April for a roundtable discussion on the impacts of

the lockdown on the cultural sector. Like tourism, the cultural sector has faced very

immediate and deep impact due to the restrictions of the lockdown. The sector reported

serious concerns for venues such as theatres which make most of their income from

commercial activity. Those funded directly through the Arts Council NPO scheme have been

more protected. Businesses are making extensive use of the furlough scheme. The sector is

made up of a lot of freelance practitioners with concerns about their viability.

Specific actions relating to Covid-19 impacts and recovery include:

Cultural Board meeting on 1 April with information fed into the Business Intelligence

workstream

Cultural Board’s tracker survey fed through to the Business Intelligence returns

Meetings with Cultural Board members to discuss rescoping of two IPF projects to

align with and support of the Visitor Economy Recovery Plan.

Ports and Logistics

Although there is no formal sector group for ports and logistics, there is continuous

engagement with stakeholders though various networks and other sector groups. Trends

and insights include:

Ports generally entering a period of low activity which is expected to go on for the next two

months (May-July). After an initial spike in activity following the onset of the crisis, shipping is

now entering a steadier stage. Maritime traffic appears to be more resilient than other

modes, for example road freight. Passenger traffic and/or tourism-related port activities

suffered more significantly.

Ongoing activity includes:

Blue Tech event meeting with Connected Places Catapult 22nd May to plan next

steps.

Regional Maritime UK Council meeting took place 30th April.

COVID 19 Risk Register highlights main concerns around delays in infrastructure

projects and cash flow to maintain the port.

7

17

6 Economic Recovery Plan

Work has continued at pace on development of Restart - the first part of the Economic

Recovery Plan, with the first draft being sent out to partners on 8th June for comments.

Partner feedback has been incorporated into the designed version, which is covered

elsewhere on the agenda (item 6)

7 Communications

The Covid-19 webpages continue to attract significant interest, drawing in between 14% -

15% of all LEP website traffic with over 9,000 hits in May. The employment page alone had

nearly 3,000 views in May.

The Covid-19 script, which contains all the latest Covid-19 guidance and information

continues to be updated and circulated to every local authority and key business partners, 7

days a week.

We are continuing to publish case studies on businesses which have remained open

throughout the pandemic, sharing tips and best practice on measures they have in place for

safe working to help other businesses as they look to reopen in the coming weeks.

Recommendation

The LEP Board is asked to note the contents of this report

8

18

New Anglia Local Enterprise Partnership Board

Tuesday 23rd June 2020

Agenda Item 7

Impact on Employment

Author: Natasha Waller Presenter: Chris Starkie

Summary

This paper sets out the potential impact on employment across Norfolk and Suffolk following

this outbreak of Covid 19.

Unemployment has risen due to the pandemic, with universal credit claims rising sharply. But

the full impact has been significantly mitigated by the Government’s furlough scheme, help for

the self-employed and other measures.

However as the furlough and self-employed scheme comes to an end and businesses adjust to

the “new norm” redundancy levels are anticipated to rise very sharply as we move into the

autumn of 2020 and in early 2021.

Forecasting is challenging as the economic recovery will be impacted by the status of the

pandemic - but the paper provides a range of unemployment projections, based on different

scenarios. Under all scenarios, unemployment rises.

The paper also outlines the existing support programmes and those in development that can

assist with minimising the impact to the area and support people to quickly enter employment

again and to utilise their transferable skills, and recommends additional actions to provide

further support to businesses and individuals.

Recommendation

The Board are asked to agree the following actions, several of which are included in the

Restart plan.

For the LEP and partners to create a Norfolk and Suffolk redundancy support

programme which builds on and brings together existing initiatives. Working with DWP,

Job Centre plus and professional services to ensure employers and employees are

aware and have access to available support programmes at the earliest point.

Work with partners to accelerate interventions outlined in this paper, understand where

further capacity is required, increasing their exposure, and ensuring collaboration to

maximum impact.

Run a local campaign to encourage businesses to contact the LEP via the Growth Hub

if they are considering making redundancies.

Develop further the LEP’s Employment Opportunities platform utilising existing networks

to include a redundancy triage service to help connect people to new training and

employment opportunities.

1

Work with the universities to put in place tailored support for students that are due to

graduate this summer, to help increase their chances of securing employment or further

their education.

Work with DWP, Local Authorities, wider partners and Metro Dynamics to explore and

identify a way to monitor the impacts on employment in the coming months given the

lack of access to data.

Background

The fall in business output has significant implications for employment levels. Given the wide-

ranging uncertainty of economic conditions over the coming months, it is very challenging to

make precise projections regarding impact on future employment level.

However, many reputable analytical sources are projecting that the UK unemployment rate will

increase to around 10-15% at its peak in the second quarter of 2020, before making a gradual

recovery over the next year or so, though it appears likely that the unemployment figure could

remain at around 5%-10% even through Q4 of 2021.

Universal Credit applications rose by 40% between March and April and under even the most

optimistic scenario around 25% of those furloughed are forecast to be made redundant at the

end of the 4th quarter of 2020/21. The overall impact will remain very hard to tell until the

Coronavirus Job Retention Scheme begins to taper off.

At the end of May government announced that 8.7m workers were on the furlough scheme. Set

against previous estimates that at the end of 2019 there were 35.8m jobs in the UK, this is

nearly a quarter (24.3%) of all pre-crisis jobs.

For the workforce of businesses that were continuing to trade, the highest incidences of

furloughing were in the accommodation and food services sector (40%), and construction (32

%).

People with the lowest income are most vulnerable with a significant number of jobs at risk in

occupations with relatively lower wages such as retail, tourism and food services, which are

forecast to be some of the hardest hit by the economic impacts of Covid 19.

Key Considerations

Access to intelligence and data

Local level figures around furloughing have recently been provided by HMRC.

On the net page is a table showing the number of jobs in each local authority, the percentage

and volume of jobs in each local authority that have been furloughed.

As can be seen the numbers furloughed are very significant and there are very real concerns

about redundancies when the furlough scheme begins to taper in August and ends in October.

The ‘total’ jobs figure in the table overleaf reflects the number of jobs registered against

companies that make PAYE returns - the total does not include self-employed, HM forces, or

reflect residents who are employed outside of Norfolk and Suffolk.

2

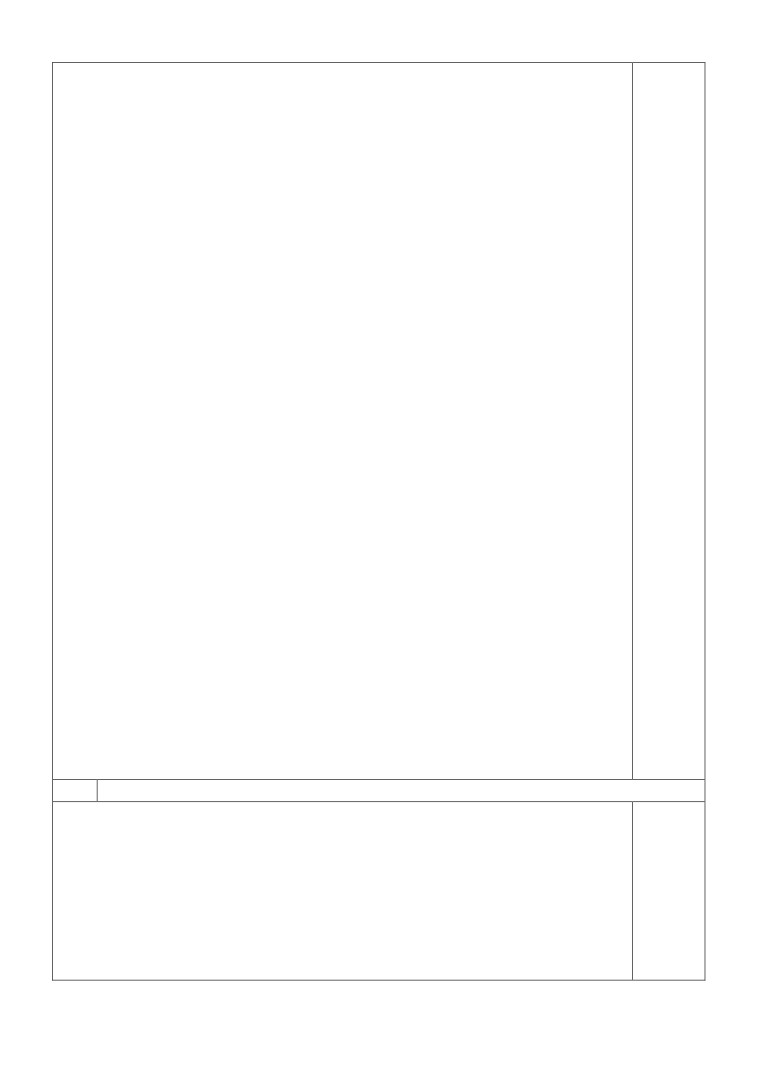

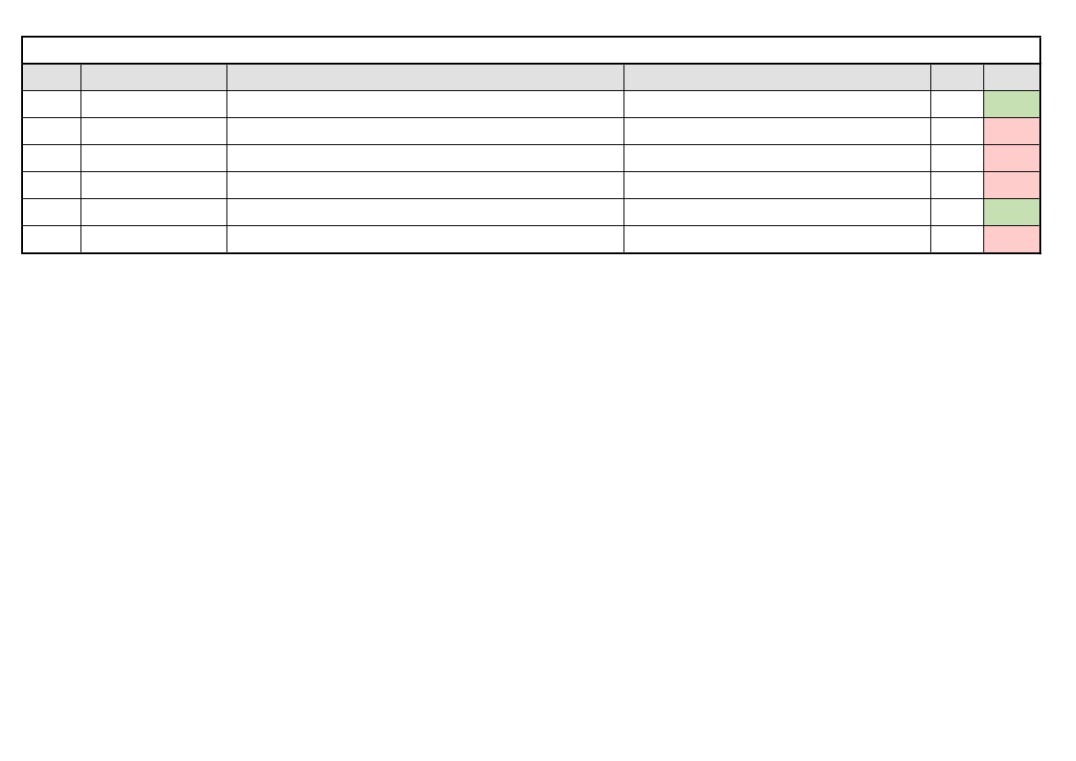

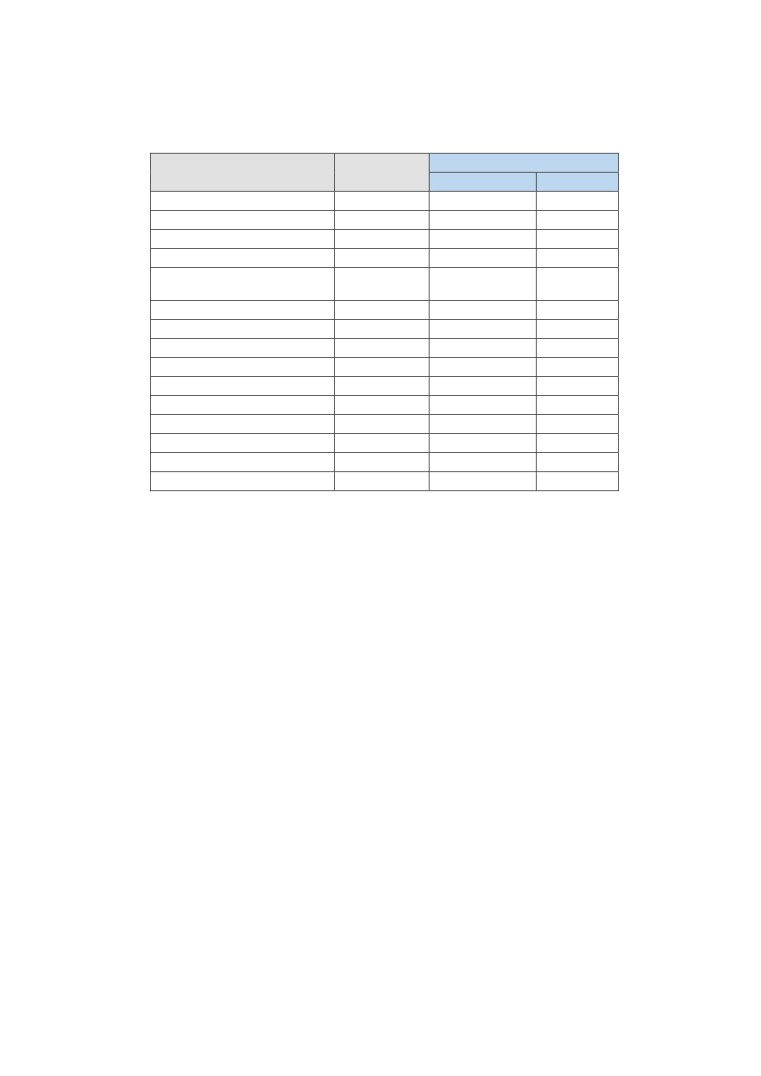

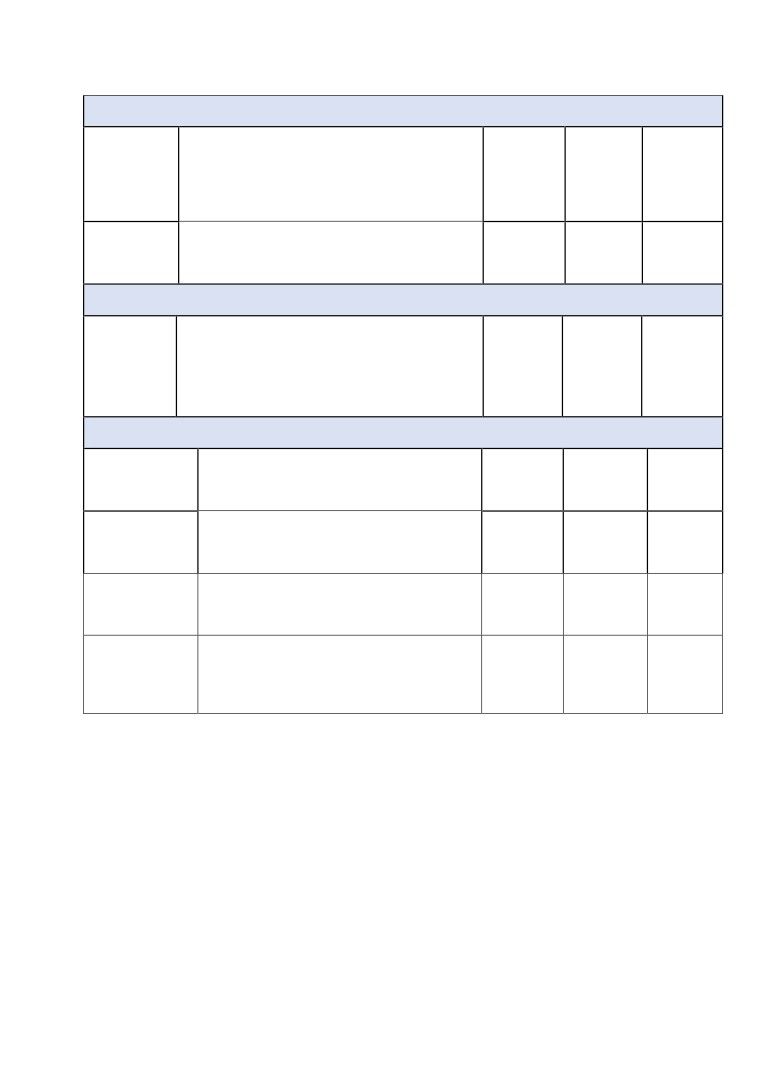

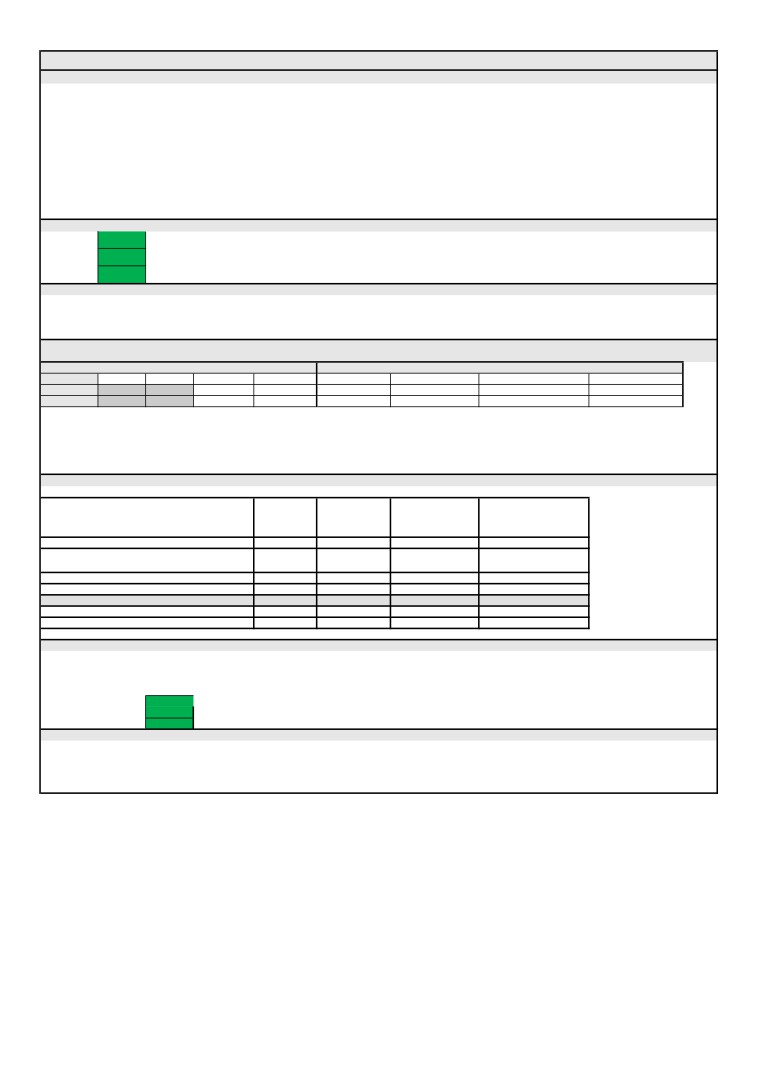

Table Showing the Volume and Percentage of furloughed staff

Workforce

Furloughed

Local Authority

Jobs Total

Volume

%

Norfolk County

361,000

97,800

27.1%

Breckland

46,000

14,700

32.0%

Broadland

47,000

15,100

32.1%

Great Yarmouth

37,000

10,900

29.5%

King's Lynn and West

Norfolk

53,000

15,700

29.6%

North Norfolk

31,000

11,200

36.1%

Norwich

93,000

15,900

17.1%

South Norfolk

53,000

14,300

27.0%

Suffolk County

319,000

85,600

26.8%

Babergh

31,000

10,500

33.9%

East Suffolk

89,000

26,500

29.8%

Ipswich

72,000

16,200

22.5%

Mid Suffolk

35,000

11,700

33.4%

West Suffolk

93,000

20,700

22.3%

New Anglia

680,000

183,400

27.0%

(The furlough figures are taken from the latest release from HMRC)

Metro Dynamics has produced projections for possible impact on employment across Norfolk

and Suffolk based on three scenarios, see appendix A.

Best case - a quick return to economic growth (a “v-shaped” recession).

Middle case - a slow return to economic growth (a “U-shaped” recession); and

Worst case - a lingering cloud over economic growth (a “L-shaped” recession).

In all scenarios the projections are stark. Even in the best-case scenario shows unemployment

has the potential peak at just of 50,000 jobs at the last quarter of 2020. It is considered that the

middle case is most likely with an unemployment peak of just over 123,000. (This figure is

based on the latest NOIS data which indicates 801,000 people are in employment tin Norfolk

and Suffolk, this figure includes the self employed and those residents that work outside of both

counties.)

From the local information that we are receiving, redundancies range from national high street

brands through to local SMEs. The Department of Work and Pensions has indicated that there

has been disparity around our market towns but the claimant count (Job Seekers Allowance &

Universal Credit) of those customers actively seeking employment has risen in all areas from

March 2020 to May 2020. Some examples include Mildenhall from 245 to 725, Leiston from

215 to 575, North Walsham from 395 to 995 and King’s Lynn from 1755 to 3670. In many

cases, DWP has been able to respond promptly to the increased business need for staff such

as with the NHS in King’s Lynn or food processing businesses in Thetford.

(Please note that this information was released on 16/6/2020 and more in-depth analysis will be

given at the Board).

3

Currently any data we have access to on redundancies is reactive, we tend to know about it

after it has happened due to the sensitivity of the data. If we were able to access this

information earlier there would be a greater chance that interventions could be targeted to

minimise the impact.

We are therefore proposing a local campaign to encourage businesses to contact the LEP via

the Growth Hub if they are considering making redundancies.

This would enable the Growth Hub to support the business to explore options which could avoid

redundancies as well as signposting to support that is available for people being made

redundant so they can access it as soon as possible.

It would also mean that we had access to intelligence that would enable interventions to be

targeted at areas of need.

Redundancy Support Programme

The Restart plan sets out our intention to create a redundancy support programme which

builds on and brings together existing initiatives. Working with DWP, Job Centre plus and

professional services the aim is to ensure employers and employees are aware and have

access to available support programmes at the earliest point.

During the response phase the LEP has been working closely with the DWP and other

partners, to support redeployment of the workforce through the Employment Opportunities

page. It currently lists 150 organisations, many with multiple positions. It is important to offer

choices to our residents therefore some of opportunities fall outside of the area.

It is important to build on the existing programmes and initiatives. There are several European

Social Fund (ESF) projects currently delivering employability support in the area, these are

detailed in appendix B.

There are also further projects currently being appraised by the ESF programme which will

delivery further redundancy support, training and sector development support in the period

2021-2023 when the programme ends. The LEP team are working closely with DWP and all

the project applicants to ensure the smooth delivery of the programme and to promote,

coordinate and signpost projects effectively. The total value of projects listed in Appendix B is

£31.6m (ESF £15.8m).

The LEP team working with local authority, DWP and third sector colleagues, will map these

programmes to identify gaps and whether the schemes have enough capacity to handle the

expected volumes of activity.

Young people

Young people may be particularly affected. Around 30% of employees aged under 25 work are

in a sector most affected by shut down, compared with 13% of those over 25. The Resolution

Foundation estimate that those leaving education this year will be less likely than previous

cohorts to have a job in 3 years’ time, with graduates being 13% less likely and those with

fewest qualification 37% less likely to have a job.

Apprenticeship start numbers have also tumbled - during March and April, there were 13,020

reported starts versus 26,330 for the equivalent period in 2019. Under 19s were particularly

impacted. A recent survey carried out jointly by Norfolk and Suffolk County Councils and the

LEP showed a worrying number of apprentices have been made redundant, furloughed, and/or

4

had a break in learning. There are also challenges with many apprentices not being able to

complete as their end point assessments needs face to face conditions.

In addition to projects above there is an additional investment of £8m (£4m ESF) in projects in

support of the New Anglia Youth Pledge, and in projects enabling and encouraging

apprenticeships - outlined in Appendix B.

The LEP is continuing to promote the use of apprenticeship levy transfer and both Norfolk and

Suffolk County Councils have apprenticeship teams promoting the value of apprenticeships.

We are also working closely with the Education and Skills Funding Agency to address some of

the current apprenticeships landscape challenges.

Working with Department of Work and Pensions (DWP)

We have close working relationships with Julia Nix, East Anglia District Manager for

Department of Work and Pensions plus her staff. Julia is a member of the Skills Advisory Panel

where she is supporting us to drive forward the objective ‘Tackling barriers to employment’ plus

she chairs our Youth Pledge Advisory Group.

DWP is committing to designing and influencing strategies and implementing activities, in

collaboration with partners, to address the employability and skills needs of young people to

help them engage in the labour market and move into, and progress in the workplace. We are

fortunate that this work is likely to be tailored to the needs of districts and sectors, where

appropriate.

DWP will also work with existing contracted providers and other partners to deliver more

support to all other claimants, particularly older workers who are likely to be more at risk of

long-term unemployment.

The programmes listed in appendix B, all have referral routes from local DWP offices, and we

are committed to ensuring we maximise the exposure of the offer available from DWP and

between these local networks.

Link to the Economic Strategy and Local Industrial Strategy

This paper links to the ambitions of the People Chapter of the Local Industrial Strategy and the

Driving Inclusion and Skills in the Economic Strategy. It also plays a significant role in the

Recovery plan.

Recommendations

The Board are asked to agree the following actions, several of which are set out in the Restart

plan.

For the LEP and partners to create a Norfolk and Suffolk redundancy support

programme which builds on and brings together existing initiatives. Working with DWP,

Job Centre plus and professional services to ensure employers and employees are

aware and have access to available support programmes at the earliest point.

Work with partners to accelerate interventions outlined in this paper, understand where

further capacity is required, increasing their exposure, and ensuring collaboration to

maximum impact.

Run a local campaign to encourage businesses to contact the LEP via the Growth Hub

if they are considering making redundancies.

5

Develop further the LEP’s Employment Opportunities platform utilising existing networks

to include a redundancy triage service to help connect people to new training and

employment opportunities.

Work with the universities to put in place tailored support for students that are due to

graduate this summer, to help increase their chances of securing employment or further

their education.

Work with DWP, Local Authorities, wider partners and Metro Dynamics to explore and

identify a way to monitor the impacts on employment in the coming months given the

lack of access to data.

Appendices

Appendix A - Projected Impact on Employment

Appendix B - Existing projects funded by European Social Fund

6

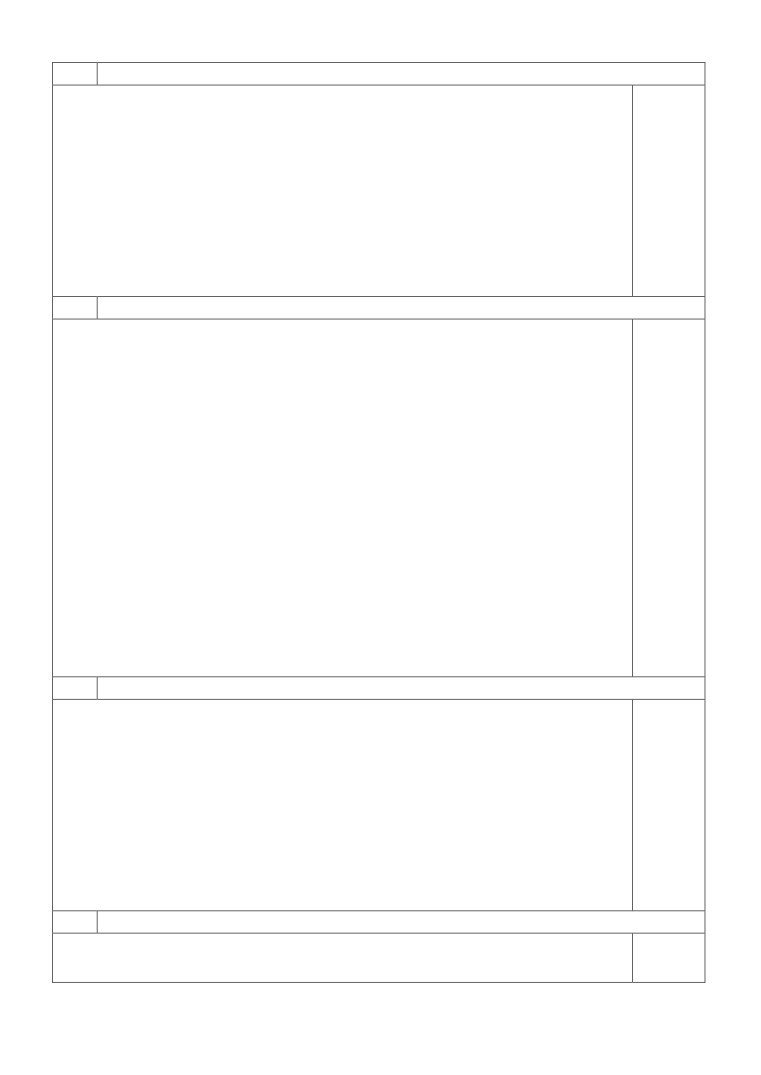

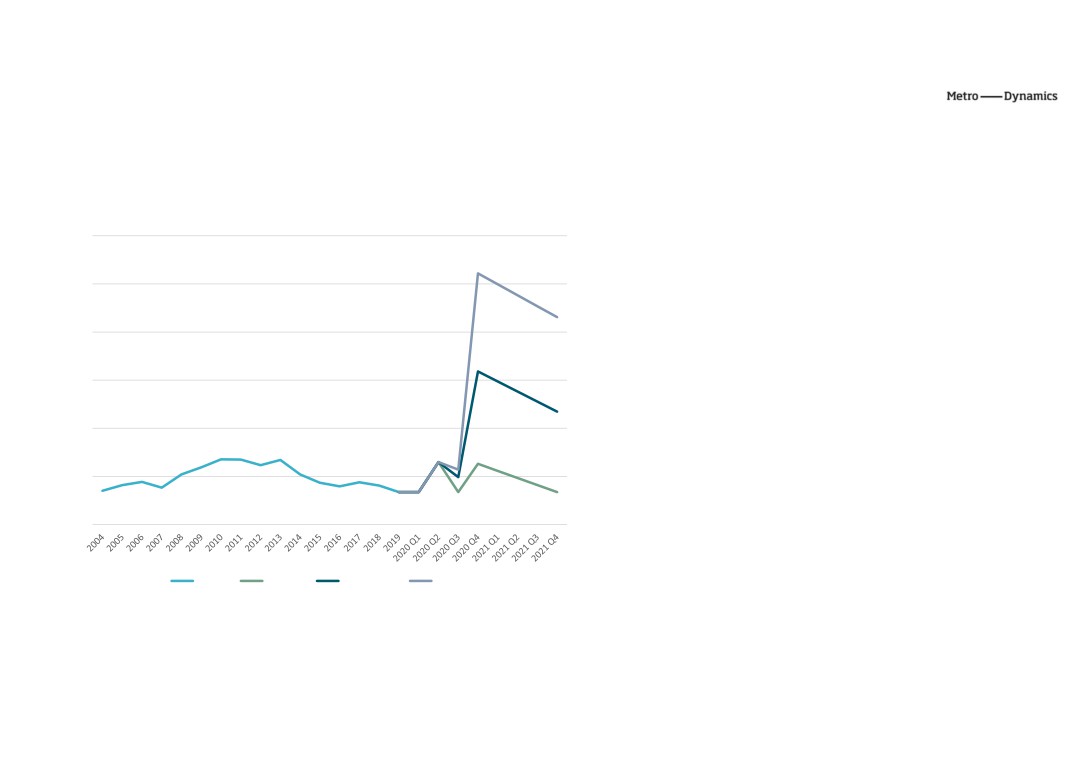

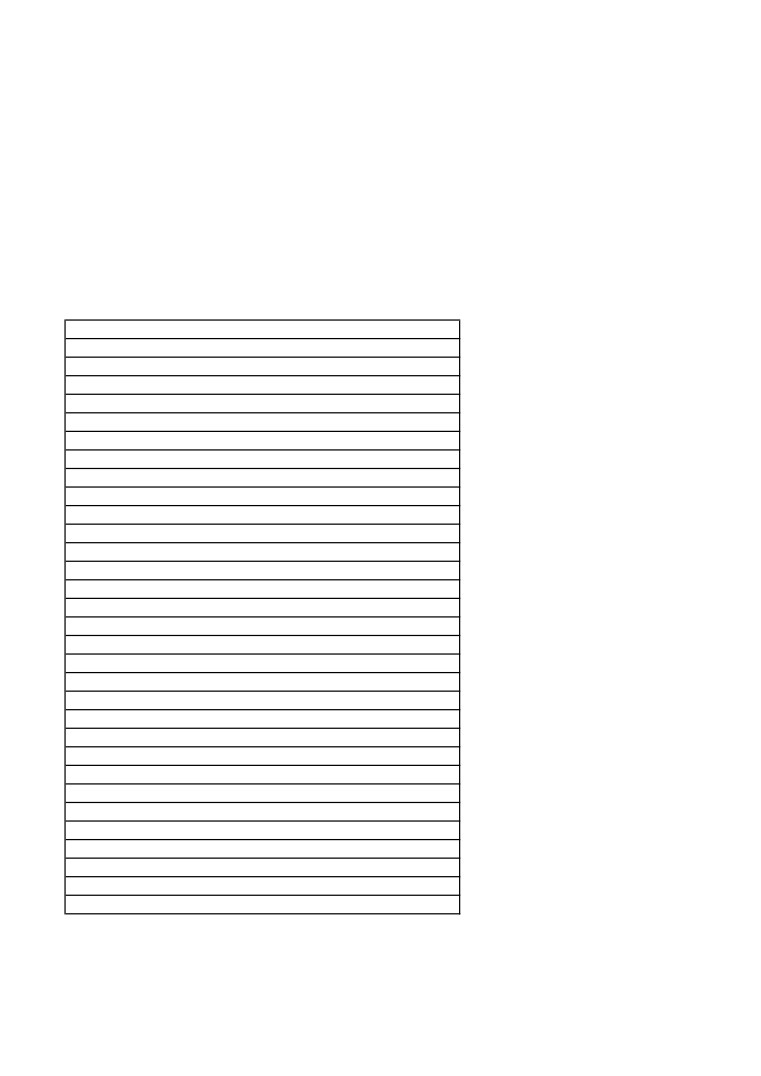

Item 7 Appendix A - Projected impacts on employment

In its most recent update (27th May), the Government announced that 8.7m

Norfolk and Suffolk: Historic and projected unemployment under three scenarios

workers were now on the furlough scheme. Set against the ONS’ previous

30%

estimates that at the end of 2019 there were 35.8m jobs in the UK, this is

nearly a quarter (24.3%) of all pre-crisis jobs. Our scenarios need to take into

account both the increase in unemployment which has happened as a result of

202k

recent disruption, and the likely path for taking workers back off furlough and

25%

into either employment or unemployment. We have made the following

assumptions:

•

Unemployment numbers in Q2 of 2020 is increased by a scale factor of

20%

1.925, in line with the average of forecasters’ projections in the Bank of

England data. This corresponds to an unemployment rate of 6.5% in New

123K

Anglia - circa 50,200 residents. It is the highest the rate has been since

15%

2013.

•

In Q3, the furlough scheme continues. Some workers return to work. In the

best case the unemployment rate falls to 3.4%, in the medium case the

10%

rate falls to 4.9% as half of those unemployed return to work, and in worst

case falling to 5.7% as only a quarter of those return to work.

50K

•

In Q4, the furlough scheme ends in all scenarios. In the best case the

5%

unemployment rate rises to 6.3% (45,900), but is below the rate in 2019. In

the medium case the rate rises from 4.9% to 15.9% (123,200). In the worst

case, the rate reaches 26.1% (202,150).

0%

•

The “unwinding” of unemployment then takes a year in the best case, three

years in the medium case, and five years in the worst case. In all cases

unemployment begins to gradually fall, but the rate at which it falls

depends on the level of economic scarring within the area, which increases

Historic

Best case

Medium case

Worst case

with time.

*Unemployment rate calculated as number of unemployed / number of economically active residents. Unemployment rate

Unemployment has the potential to peak at 202,150 (26.1%) in the worst case

figures for 2020 and 2021 use data on economic inactivity from 2019, so shouldn’t be quoted as definitive figures.

scenario, whereas in the best case, the peak will be around 50,200 (6.5%).

1

DRAFT

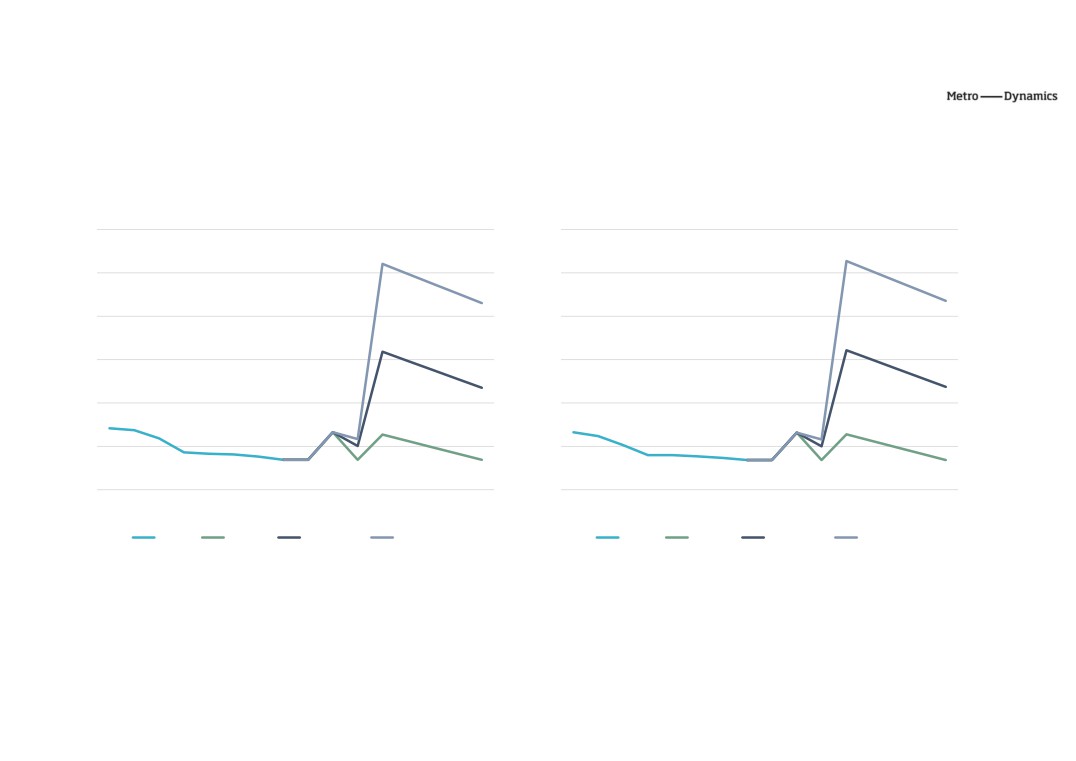

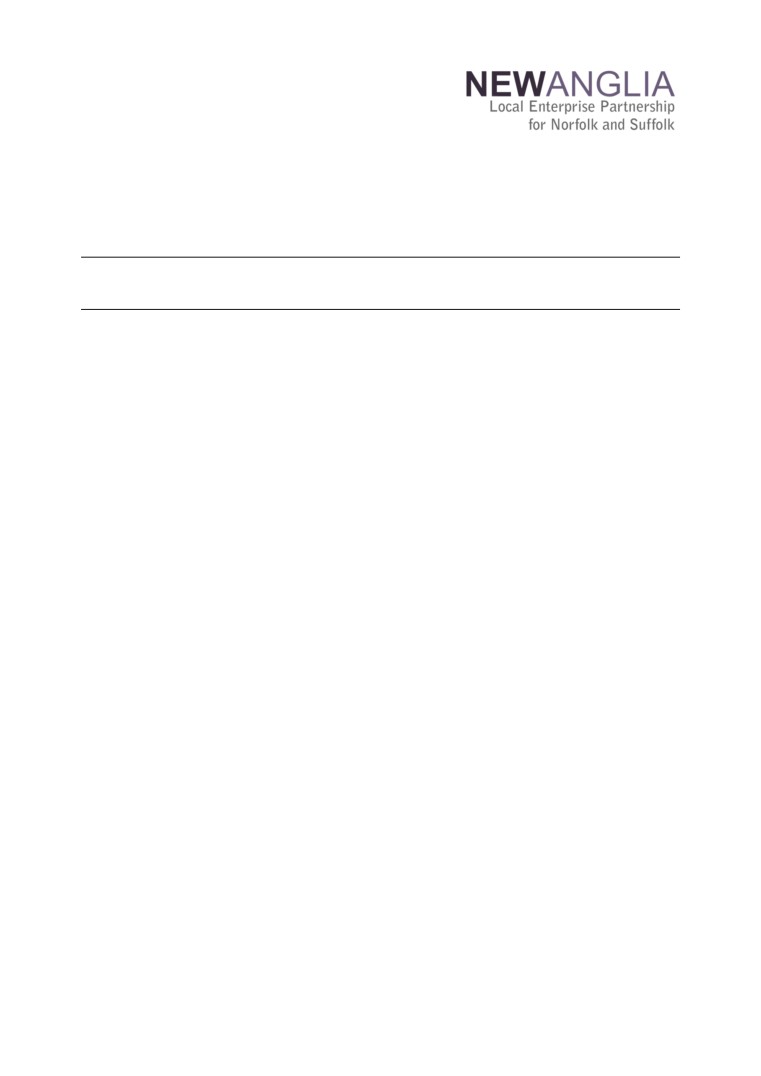

Impacts on employment

Norfolk: Historic and projected unemployment under three scenarios

Suffolk: Historic and projected unemployment under three scenarios

30%

30%

25%

25%

20%

20%

15%

15%

10%

10%

5%

5%

0%

0%

2012 2013 2014 2015 2016 2017 2018 2019 2020

2020 2020 2020 2021 2021 2021 2021

2012 2013 2014 2015 2016 2017 2018 2019 2020 2020 2020 2020 2021 2021 2021 2021

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Historic

Best case

Medium case

Worst case

Historic

Best case

Medium case

Worst case

Norfolk has had historically higher rates of unemployment than Suffolk, but at the peak under all scenario, modelling suggests that Suffolk will have a

marginally higher unemployment rate in 2020Q4. In the best case, 6.36% in Norfolk and 6.38% in Suffolk; in the medium case, 15.9% in Norfolk and 16.07%

in Suffolk; and in the worst case, 26.03% in Norfolk and 26.36% in Suffolk.

Source: ONS Employment and Labour Market bulletin; MD analysis

2

Unemployment rate calculated as number of unemployed / number of economically active residents. Unemployment rate figures for 2020 and 2021 use data on economic inactivity from

2019, so shouldn’t be quoted as definitive figures.

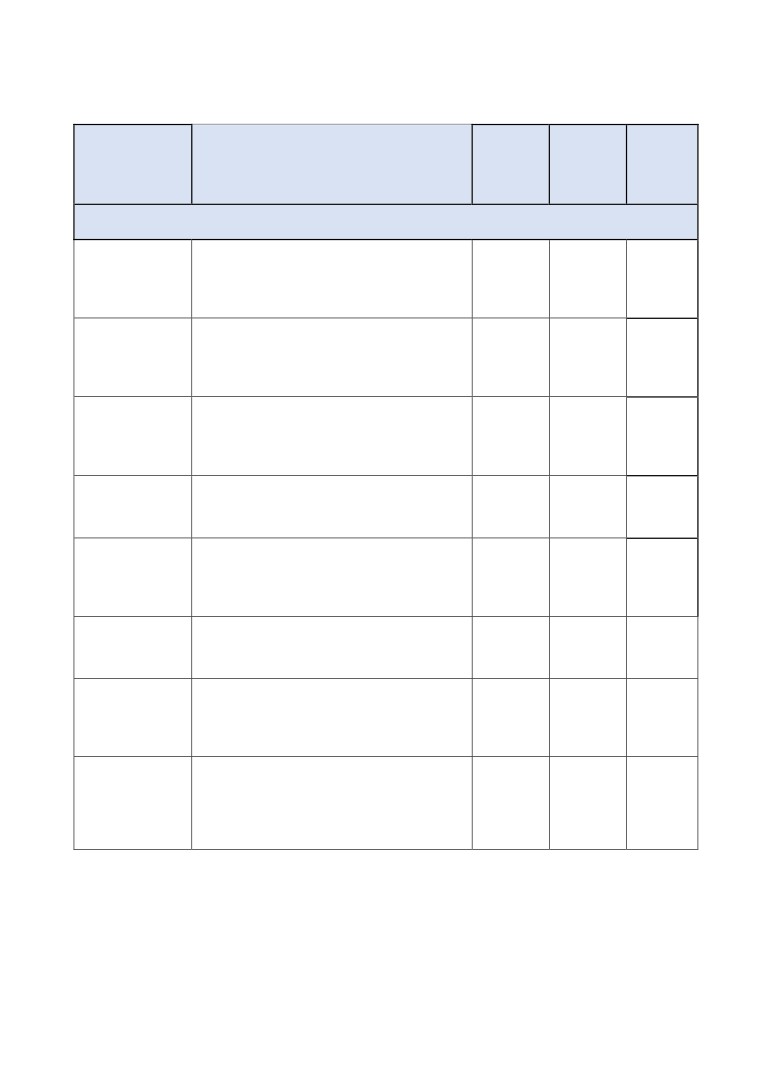

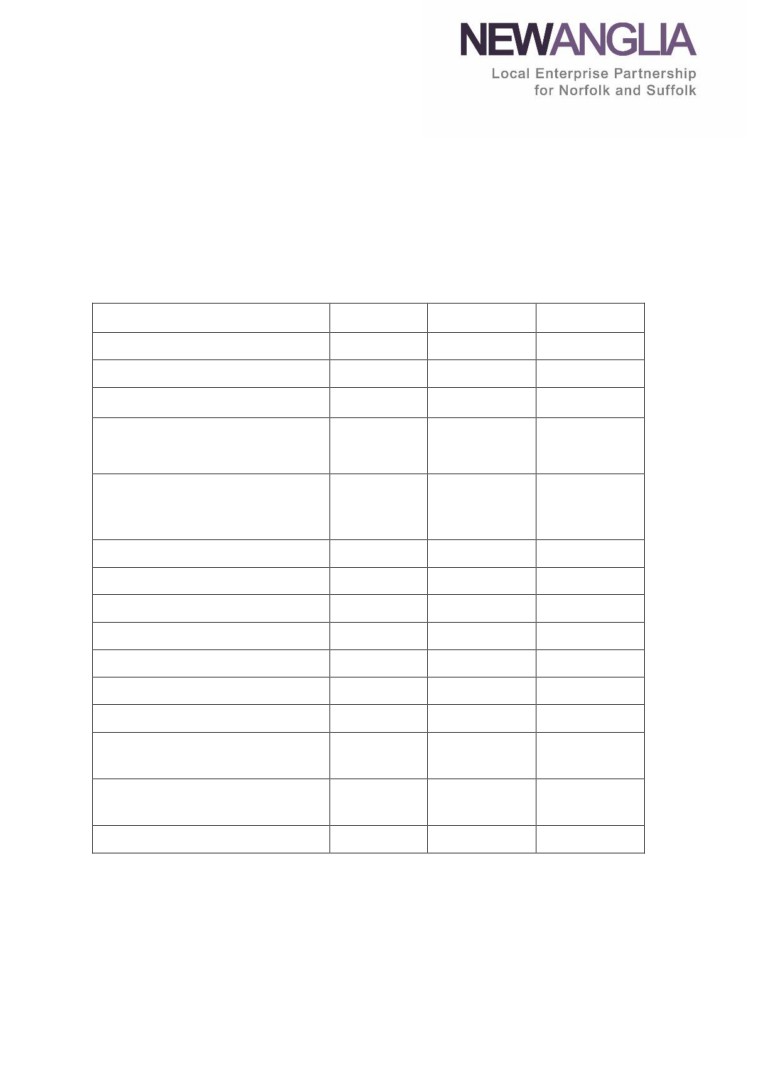

Appendix B - Existing projects funded by European Social Fund

Name of

Status of

Delivered

Area

Summary of project

project

project

by:

covered

Employability projects

Multi-partner project to deliver an

Starting

Norfolk

integrated health and employment service

CHANCES

summer

County

Norfolk

to unemployed people with long term

2020

Council

health conditions in Norfolk

Multi-partner project to deliver an

Starting

Suffolk

Work Well

integrated health and employment service

summer

County

Suffolk

Suffolk

to unemployed people with long term

2020

Council

health conditions in Suffolk

Norfolk and

Project to support unemployed people with

Starting

Norfolk

Waveney

East Coast

long term health conditions on the east

summer

and

Community

College

Coast

2020

Suffolk

Projects

Norfolk

Co-funded by the National Lottery

Delivery

East Coast

Community

Community Fund, this project provides

Norfolk

underway

College

College project

employability support to adults in Norfolk.

Co-funded by the National Lottery

Community Fund, this project provides

Delivery

Matthew

On Track

Norfolk

employability support to young people in

underway

Project

Norfolk.

Co-funded by the National Lottery

Opportunity

Delivery

Community Fund, this project provides

TCHC

Suffolk

Suffolk

underway

employability support to adults in Suffolk.

Co-funded by the National Lottery

Community

Community Fund, this project provides

Delivery

Minding the Gap

Action

Suffolk

employability support to young people in

underway

Suffolk

Suffolk.

Great

Great Yarmouth

Grant scheme for community projects

Delivery

Yarmouth

Inclusion Project

Norfolk

providing employability support.

underway

Borough

Grant Scheme

Council

1

Supporting young people facing barriers to employment

Rural Youth

Supporting young people in rural areas of

Pledge for

Starting

West

Norfolk

Norfolk and Suffolk to improve their life

Employment

summer

Suffolk

and

chances by maximising their skills and making

(RYPE)

2020

College

Suffolk

informed career choices

project

Starting

East

Norfolk

Skills

Supporting young people in the east of the

summer

Coast

and

Connect

region into further education or employment

2020

College

Suffolk

Training programmes

Skills

Co-funded by ESFA, a training programme

Support for

Norfolk

providing fully funded employee training for

Delivery

Steadfast

Redundancy

and

businesses, and skills development for those

underway

Training

and the

Suffolk

facing redundancy

Workforce

Youth pledge, apprenticeships and careers

Delivering the youth pledge through

Starting

Norfolk

Norfolk

Youth Pledge

employer engagement with colleges and

summer

County

and

for Employers

school leavers

2020

Council

Suffolk

Starting

Suffolk

Apprenticeships

Brokering apprenticeships between

summer

County

Suffolk

Suffolk

employers and potential apprentices

2020

Council

Norfolk

Apprenticeships

Brokering apprenticeships between

Delivery

Moore

and

New Anglia

employers and potential apprentices

underway

Networking

Suffolk

Developing

The programme aims to improve access to

Norfolk

Starting

Norfolk

Skills in Health

qualifications cross Norfolk and Suffolk. It

and Suffolk

Summer

and

& Social Care

will provide training for new recruits

County

2020

Suffolk

programme

through to well established staff.

Councils

2

New Anglia Local Enterprise Partnership Board

Tuesday 23rd June 2020

Agenda Item 8

LEP Continuing Business Report

Author: LEP Team

Presenter: Rosanne Wijnberg

Summary

This report provides an overview of LEP team ‘continuing business’ activities since the May

board, structured around:

1) Programmes

2) Strategy

3) Engagement and promotion

4) Governance, Operations and Finance

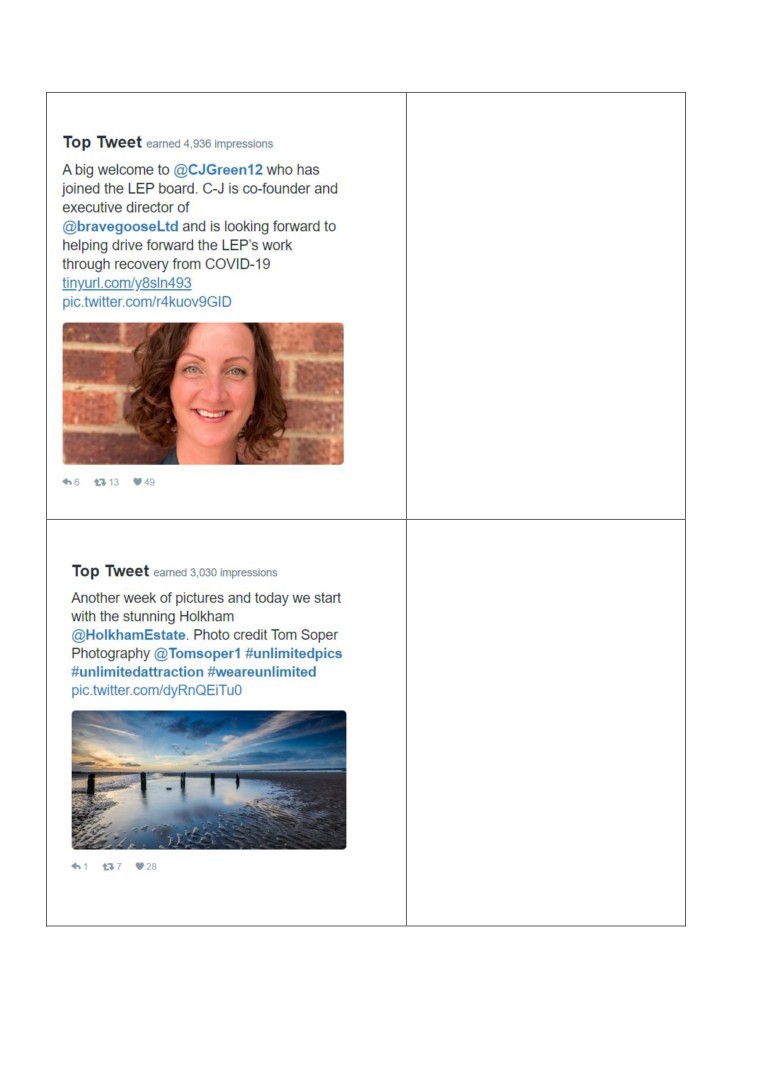

The media dashboard is attached as Appendix A to the report.

Recommendations

The board is asked to note the contents of the report

1) LEP Programmes

Growth Deal (Capital Growth Programme)

The delivery of large capital projects is beginning to increase at pace following a few months of

reduced activity. Our delivery partners and contractors are making the necessary adjustments to

working practices to adhere to the social distancing guidelines and protect the health of their

workforce. The overall impact has been to delay the completion of most construction projects by

2 to 4 months, with a proportional effect on expenditure and grant claims.

At the end of May we received 2/3 of our Growth Deal allocation for the year - funds of £31m - to

support the commitments we have made to projects. The payment of the final 1/3 is subject to a

review of progress. We met with our area lead last week and completed our data submission in

support of this review.

Robert Jenrick, Secretary of State for Housing, Communities and Local Government, has written

to all LEPs to call for a list of ‘shovel ready’ projects which could be supported by a further round

of Growth Deal funding (Growth Deal 4). The projects must be deliverable by March 2022. We

are working from our tactical pipeline, reviewed by the LEP Board in February 2020, and with

regional partners to develop this list. This information will be circulated to LEP Board members in

advance of our submission to government, deadline 18 June 2020.

Business Growth Programme

The Business Growth Programme remains ahead of its output and spend profile. Current

circumstances have resulted in a significant increase in calls to the Growth Hub, with 1,392

COVID-19 related enquiries since that start of the outbreak in mid-March. Wholesale/retail,

1

29

accommodation and food services, and manufacturing have accounted for over a third of the

COVID-19 enquires received to date. We continue to receive applications to the Small Grant

Scheme, with just £285k of the Programme’s £3,459k target uncommitted. At the current rate of

approval, it is anticipated that the scheme will be fully committed by the end of 2020.

The number of new clients coming forward for start-up support reduced significantly during April,

with just three people assisted, compared with 59 in April 2019. Our partners, Nwes and Menta,

have indicated that they are now seeing an uplift in people asking for start-up support and advice.

Growth through Innovation

During 2020/21 it is anticipated that the GTI Fund will approve £483k worth of grants to at least

25 SMEs. This should generate £600k of match funding from private sector sources during the

same.

Since the 1st April, three projects have been approved, totalling £61k. A further five projects

totalling £96k are going through the application process, giving a commitment of £157k against

the £483k target.

Our legal agreement form MHCLG has now arrived and will be signed off in the coming

weeks. We have been assigned the same Contract Manager as we have for our Business

Growth Programme, which will facilitate project operations.

Growing Business Fund

Interest in the GBF continues, particularly from the manufacturing sector. In May, two

applications for £434k of funding were approved, with £3.9m of private sector match. There are

currently five applications with a value of just over £1m going through the application and

approval process.

Eastern Agri-tech Initiative

Three applications remain in the approval/panel process with a further five totalling £330k in the

pipeline. We have experienced some delays as the CPCA allocated resource to support their

COVID-19 grant scheme. This has now completed so resource is again available to provide

support to the Agri-tech Initiative.

Julie West is the point of contact for Suffolk, with Norfolk County Council taking on that role for

Norfolk. We continue our work with CPCA to ensure that funding is fully allocated and drawn

down by applicants by the end of March 2021.

Growing Places Fund

The Malthouse (£600k), Winerack (£5m) and Atex Business Park (£630k) developments have all

received LEP loans. The Winerack has sold 10 apartments and has repaid £1.4m to the LEP;

Atex development continues with 8 units completed, and then leased or sold; the Malthouse has

just let a further unit - and much of this has been achieved during the lockdown period.

We anticipate a slowdown in the repayment of the Winerack loan and are waiting for a revised

repayment forecast.

GPF grants - £250k has been drawn down in the last month by Gainsborough’s House, the

Voluntary and Community Sector Challenge (VCSE) Fund also drew down £250k. we expect a

claim of £500k from Norwich Castle in June.

Norfolk and Suffolk Community Foundations have made awards from the VCSE Fund to a wide

range of initiatives in this sector relating to employability and skills.

New Anglia Capital

Following the agreement at the May LEP Board meeting to change the New Anglia Capital

employment and match funding requirements, the first interim NAC pitching meeting was held on

15 June.

2

30

At the meeting, the board considered pitches from three of the existing NAC portfolio companies,

including businesses with projects to support the recovery from COVID -19 and agreed to invest

in two of them. A further request was considered from a project which has already received the

maximum £250k investment from NAC.

The full NAC Board meeting will be held in July.

LEP Innovative Projects Fund

Innovative Projects Fund (2018 Call) - £500,000.

IPF 1 Summary: 7 projects supported, with a combined allocation and commitment of £539k. An

amount of £9k has been claimed in this financial year, bringing the spend to date to £149k. Local

Authority match funding of £63k and Private match funding of £87k has been recorded.

Project status:

Complete - The Cornhill project has been completed.

For the remaining 6 projects:

We expect 4 projects to evidence spend and make claims by mid-July.

The NUA project, Connecting Creative Capital, staged payments agreed, and next

payment is not expected until 1st April 2021 (£70,000).

Norfolk County Council’s ‘Building Supply Chain Skills Capacity’ project has been affected

by COVID restrictions. The project builds on the opportunities presented by Vattenfall’s

Offshore Wind construction programme. However, delays in obtaining ministerial

permission for the development and in local highways consultations, has meant that the

project leader is now looking at other construction projects that the supply chain can look

to support.

Innovative Projects Fund (2019 Call) - £1.5m

IPF2 Summary: 18 projects with a combined allocation of £1,472,372.

5 projects now have their

Grant Offer Letters and will commence shortly. Claims for these projects are expected in mid-July

(for Quarter 1). A further 6 projects are awaiting their Offer Letters from SCC.

The remaining projects are being reviewed and re-profiled in view of current circumstances.

The Ipswich Cornhill project (events) is unable to proceed now and we continue to discuss next

steps.

The UEA’s Sunrise Seed Corn project is awaiting confirmation of its match funding (delayed

because of COVID-19).

Enterprise Zones

The Enterprise Zone team continue to work closely with Local Authority colleagues, landowners

and developers to track progress on developments. The previous quarter results indicate some

level of COVID-19 impact, with lower than expected outputs for both the Great Yarmouth and

Lowestoft and Space to Innovate Enterprise Zone.

The Amazon distribution centre at Sproughton is expected to complete this month and be

operational from July. Work continues at the new Treatt facility at Suffolk Park in Bury St

Edmunds. Construction of the new Zone 4 building and road infrastructure at Norwich Research

Park is well underway.

Agricultural biotech start-up, Tropic Biosciences, based at Norwich Research Park, has raised

investment of $28.5m. The company uses gene-editing technology to produce high-performing

(disease resistant) commercial tropical crops including bananas, coffee and rice. The funds will

be used to further develop and scale its technology - and secure future expansion on the NRP

Enterprise Zone site (into the new Zone 4 building).

3

31

Work is now progressing on the Princes Street/Portman Road site in Ipswich, with plans for a

new multi-storey car park, hotel, and office development. Planning applications have been

submitted.

The Enterprise Zone team are engaged with representatives from other LEPs to progress a

detailed business case to be presented to Government to request an extension to the Enterprise

Zone rate relief benefits beyond March 2021 to assist with economic recovery.

Inward investment

Despite Covid-19 causing significant disruption to businesses across the world, we have seen

continued interest from companies considering investing in Norfolk and Suffolk.

East of England Energy Zone (EEEZ) - A tender process under way to assess the current

branding and whether it needs refreshing or replacing. We have also been exploring how we can

participate in various energy related exhibitions and seminars in the autumn. It is looking

increasingly likely these will be virtual events using new technology. It may be that we are able to

gain greater profile, with more delegates and generate more leads.

Adastral Park 5G HPO - we have worked with DIT to produce a video that emphasises the key

selling points of our offer as part of the HPO.

4

32

An annual Inward Investment report, highlighting successes in 2019/20 and other information will,

be published shortly.

2) Strategy:

Brexit

June is a key month for the EU exit negotiations as UK and EU leaders are set to meet to take

stock of negotiations to date and agree the schedule of negotiations for the second half of 2020.

The LEP continues to capture intelligence from businesses regarding how they are preparing for

the UK’s exit from the EU and how a deal or no deal exit may affect them. Recent intelligence

from the business intelligence returns highlights the challenging situation for businesses that are

attempting to deal with COVID-19 and prepare for EU exit, without an indication of what form this

will take.

The UK government has ruled out an extension to the transition period, which lasts to the end of

2020. Therefore, the LEP will continue to monitor negotiations as they progress, with an eye on

key announcements as they are made, such as the recent UK Global Tariff announcement.

The LEP and Growth Hub have continued to update the EU exit webpage for businesses and will

share the latest government notices from relevant departments as soon as these become

available.

There is a need to focus attention on what the potential combined impact of both COVID-19 and

the UK’s exit from the EU could have on the local economy. This is will form a key component of

the economic recovery/rebuild analysis and recommendations following the publication of the

restart plan.

The LEP will be attending the Suffolk Scrutiny Committee item on ‘Suffolk Preparations for Brexit’

on 2nd July.

5

33

Skills

Norfolk & Suffolk Skills Advisory Panel (SAP)

Continuing to develop and evolve the underlying evidence base and investigate the feasibility of

additional analytical tools, working closely with EMSI - a company providing a range of analytical

solutions. EMSI has undertaken extensive research around the impact of COVID-19. The LEP is

in the process of co-ordinating with partners, including both county councils - to develop various

options.

Enterprise Advisor Network

The Enterprise Adviser Network continues to support Careers Leads and students across the

region with virtual and online careers and CPD resources.

The Careers and Enterprise Company with the support of some of the region’s Cornerstone

Employers will be hosting an online “My Week of Work” programme for Year 10 students who will

not be able to access work experience this year.

Institutes of Technology

The Department for Education has published a prospectus for phase 2 IOTs, outlining criteria for

bids. It is expected that only one proposal will proceed and the LEP team and LAs are

considering the best approach.

The LEP along with Norfolk and Suffolk County Council are recommending that a Technical Skills

statement - which will set out the vision and parameters of what Norfolk and Suffolk technical

provision should look like - is developed.

This statement will provide the framework against which the IoT and any other Technical Skills

project will be assessed on. If the Board agrees to this the Technical Skills statement will be

presented to the July Board for approval.

Although the LEP does not have sight of all the submitted Expressions of Interest (EoI) it is our

understanding that there were three. Over the next couple of weeks, the LEP will be seeking

confirmation that all prospective bids meet the criteria set out in the DfE prospectus.

Infrastructure

LEP Transport Board

The Transport Board had a positive meeting on the 2nd June with insights shared on the impacts

of COVID-19 and potential opportunities for the rebuild phase of recovery. The Transport East

strategy director also presented at the meeting setting out four work packages for his first 100

days in the role.

Transport East

We have been working closely with Transport East to ensure the transport priorities for the New

Anglia area are embedded in the developing strategy, including how Transport East can assist in

the communications strategy for the Ely Area Enhancements.

Rail projects

A final draft joint position statement has been produced for the Trowse rail bridge upgrade with

each authority agreeing to seek political sign off before the next meeting in mid-June.

The next meeting of the Great Eastern Main Line Taskforce will be held on 6th July, which will

consider the first draft Strategic Outline Business Case for the Great Eastern Main Line and

agree the list of priority enhancements which are emerging through the business case. The key

priority for investment is Bow Junction and associated infrastructure which will increase capacity

on the mainline.

6

34

Freeports

The Government is undertaking a major consultation on the introduction of Freeports into the UK

after we have exited the EU. Originally the consultation was due to close in April, now extended

to the 13th July 2020. Following discussions with port operators and relevant local authorities,

New Anglia LEP will be able to respond, as a stakeholder, to the consultation in July. The

consultation is a long and technical one at over 46 pages and 68 questions.

Our response will welcome the opportunity afforded by Freeports as a key regional tool to assist

the economy recover from the COVID-19 pandemic. We will also enquire why the number of

Freeports is being suggested as capped nationally at 10. Given the number of ports in our area,

we will not be backing any particular proposal from our area as we are not at the bid stage yet

and we don’t know the selection criteria that will be used to judge such cases.

Blue Tech Cluster Opportunity

Working with BT and Felixstowe port we have agreed to hold a virtual Blue Tech Cluster event.

We are now developing a set of objectives with Felixstowe Port for the event, these objectives

will then be used by the Connected Places Catapult to connect with SMEs who have experience

in innovation and technology that can benefit the port.

Electric Vehicle Strategy

The Cambridgeshire and Peterborough Combined Authority (CPCA) have shared their EV

strategy brief, highlighting the benefits of strategies aligning and strategic opportunities. The LEP

is working with local authority partners to develop an EV strategy brief for Norfolk and Suffolk,

building on the CPCA work.

3) Communications and Engagement

This section covers engagement activity with local stakeholders, including local authorities, local

businesses and MPs. It also covers activity with Government and our wider international activity.

The Communications and Engagement Dashboard is included as Appendix A to this report.

New Anglia LEP website

The new LEP website, which launched in April, received over 32,000 visits during May. The

Employment Opportunities, Business Resilience and Recovery Scheme and Local Authority

grants pages were the most popular, with more than 20% of the traffic. We continue to enhance

the information about LEP projects, with details of European funded projects being added.

Norfolk and Suffolk Enterprise Festival

While a physical event will not happen this summer, the LEP is the main supporter of a revised

two-county approach to the previous Norfolk Enterprise Festival. A virtual two day event will take

place in September, with webinars, panel sessions, bookable sessions with Growth hub advisers