New Anglia Local Enterprise Partnership Board Meeting

Wednesday 20th May

10.00am - 12.00pm

Via MS Teams

Agenda

No.

Item

1.

Welcome from the Chair

2.

Apologies

3.

Declarations of Interest

4.

Actions / Minutes from the last meeting

5.

LEP Response to COVID-19

Update

6.

Restart and Rebuild - Covid-19 Economic Recovery Plan

For Approval

Growing Place Fund - Food Innovation Centre Investment -

7.

For Approval

confidential

8.

LEP Capital Budget 20/21- confidential

For Approval

9.

LEP Continuing Business - including confidential items

Update

10.

Management Accounts - Q1 2020

Update

11.

May Performance Reports and Programme Dashboard

For Approval

12.

Investment Appraisal Committee Chair, Vice Chair and Membership

For Approval

13.

Board Forward Plan

Update

14.

Any Other Business

1

New Anglia Board Meeting Minutes (Unconfirmed)

21st April 2020

Present:

Claire Cullens (CC)

Norfolk Community Foundation

David Ellesmere (DE)

Ipswich Borough Council

Doug Field (DF)

East of England Coop

John Griffiths (JG)

West Suffolk Council

Matthew Hicks (MH)

Suffolk County Council

Pete Joyner (PJ)

Shorthose Russell

Helen Langton (HL)

University of Suffolk

Dominic Keen (DK)

Britbots

Steve Oliver (SO)

MLM

Corrienne Peasgood (CP)

Norwich City College

Andrew Proctor (AP)

Norfolk County Council

Johnathan Reynolds (JR)

Opergy

Sandy Ruddock (SR)

Scarlett & Mustard

Alan Waters (AW)

Norwich City Council

Jeanette Wheeler (JW)

Birketts

Attendees

Sue Roper (SR)

Suffolk County Council

Vince Muspratt (VM)

Norfolk County Council

Shan Lloyd (SL)

BEIS

Chris Dashper (CD)

New Anglia LEP - For Item 6

Chris Starkie (CS)

New Anglia LEP

Rosanne Wijnberg (RW)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

1

Actions from the meeting: (21.04.20)

COVID-19 to be added as an item to future board meetings

HW

1

Welcome from the Chair

Doug Field (DF) welcomed everyone to the meeting

2

Apologies

Apologies were received from Tim Whitley.

3

Declarations of Interest

Full declarations of interest can be found at http://www.newanglia.co.uk/about-us/the-board.

None

4

Minutes of the last meeting

The minutes were accepted as a true record of the meeting held on 25th March.

5

LEP Response to COVID-19

Chris Starkie (CS) presented the paper to the board noting that some programmes are still

ongoing and this work is covered in Item 8 on the agenda.

CS highlighted the work carried out to set up a database of PPE suppliers which has now

been made available to organisations looking to source PPE. Promotion of this is ongoing.

Work is also starting on a recovery plan to support the local economy in the short and longer

term including a specific group which has been established to focus on supporting the

tourism industry and the challenges it faces.

Andrew Proctor (AP) highlighted the importance of co-ordinating the different strands of the

tourism industry and CS confirmed that the Destination Marketing Organisations (DMOs) are

working with the LEP as part of this group.

Jeanette Wheeler (JW) noted that staff in construction want to be working again but may be

prevented from doing so due to issues in the supply chain and the LEP could play a role in

resolving these problems.

JW also suggested that Richard Ross has details of business angels are looking to provide

business consultancy and could be available to the Growth Hub.

Claire Cullens (CC) noted that they could also provide support to the Voluntary Sector.

John Griffiths (JG) asked for an update on the gaps identified in current funding and also on

other problems businesses are reporting.

CS confirmed that gaps in funding had been identified such as bed & breakfast owners

paying council tax rather than rates. The refusal of insurance companies to pay some

claims has also been an issue as well as queries over furloughing staff. These are being

escalated and some gaps are being plugged over time.

The meeting discussed the issues around the procurement of PPE.

The Board agreed:

• To note the content of the report

6

COVID-19 Business Reliance and Recovery Plan

Chris Dashper (CD) presented the new scheme with an initial budget of £3.5m providing

capital grant support for initial resilience and longer term recovery.

2

AP expressed his support for the proposal but noted the size of the fund. CS agreed that

this would not cover all requirements but felt that it complemented other existing LEP

programmes.

CD noted that other programmes continued and that if they did not spend all their funding

then further monies could be made available.

The meeting discussed potentially targeting the scheme at specific sectors and the issues

this created and the potential for offering more funding at a later date.

CS confirmed that discussions were ongoing with Government for approval to reallocate

funds from capital to revenue projects and to obtain further future funding.

DF proposed that the launch of the scheme would initiate enquiries which would help steer

any targeting in the future.

CD confirmed that, on approval the first payments can go out within 10-12 days.

The Board agreed:

• To note the content of the report

• To approve the new Business Resilience and Recovery scheme with an initial budget of

£3.5m

7

Board Member Recruitment

David Ellesmere (DE) reviewed the process which had been carried out to recruit a private

sector board member and a Chair and detailed the rationale behind the decision. He said

the panel was unanimous in its recommendations.

The Board agreed:

• To note the content of the report

• To endorse the appointment of C-J Green as private sector board member

8

LEP Continuing Business

DF proposed that any questions should be directed to Rosanne Wijnberg outside the meeting.

The Board agreed:

• To note the content of the report

9

Board Forward Plan

DF requested that COVID 19 is added as a standing item to the next few meetings.

ACTION: Board Forward Plan for be updated accordingly

HW

The Board agreed:

• To note the content of the plan

10

Any Other Business

DE noted that there is still a vacancy on the Investment Appraisal Committee and that a new

Chair also needs to be appointed.

3

New Anglia Local Enterprise Partnership Board

Wednesday 20th May 2020

Agenda Item 5

LEP Response to COVID-19

Author: Marie Finbow

Presenter: Chris Starkie

Summary

This report provides the board with an update on the LEP’s response to the Covid-19

pandemic.

Whilst many of the LEP’s programmes and schemes are continuing to operate as normal, the

LEP team and operations have been restructured to respond to the economic shock caused

by the Covid-19 pandemic.

It is important to stress that the LEP is working closely with a wide range of partners including

all Norfolk and Suffolk local authorities, business groups such as the chambers and FSB,

colleges, universities and LEP sector groups.

Recommendation

The LEP Board is asked to note the contents of this report

Background

As previously outlined to the board, the LEP’s Covid-19 response is structured under seven

workstreams:

1. Business Intelligence

2. Business Support and Advice

3. Local Funding

4. Workforce

5. Sectors and Supply Chain - Sub workstreams PPE, Visitor Economy, Agri Food,

Energy and Construction.

6. Economic Impact

7. Communications

Set out below is a summary of the key activity which has taken place within each of these

workstreams over the last few weeks.

The LEP is working closely with local partners including all Local Authorities, Chambers of

Commerce, Federation of Small Businesses, Job Centre Plus and Department for Work and

Pensions.

1

9

1 Business Intelligence

Intelligence reports continue to be submitted to Government on a weekly basis.

Information is typically gathered from around 50 different sources each week including local

authorities, businesses and sector groups.

Most recently the narrative is shifting towards businesses reopening and what is needed

when they do to remain safe. Business sentiment from surveys seems to be improving in

terms of cashflow concerns and concerns about overall closures.

Highlights from the weekly return sent on 11th May include:

An urgent ask for the Job Retention Scheme to evolve with partial furloughing as we

enter the next phase.

Intelligence from the All Energy Industry Council, including a bleak outlook for oil and

gas; the short-term impact of refocusing on what is needed for offshore wind turbines

to keep spinning, ensuring safe shift patterns, and allowing for the good use of

planned outage periods; and ports highlighting the impacts of a reduction in activities.

In addition to the weekly returns we are now using the information to develop further

intelligence products:

A weekly high-level trends document summarising the trends from each intelligence

return.

A ‘gaps in support’ log has also been created setting out the specific gaps in the

government support schemes which is used to escalate issues and monitors

resolutions.

The intelligence collected is enabling us to be fleet of foot to escalate issues locally and

nationally, consider local solutions where appropriate and is supporting the discussions and

helping to shape all three stages of work- response, restart and rebuild.

It is enabling us to respond quickly in providing evidence and case studies to government,

MPs and local partners.

Business intelligence submitted by LEPs and other partners has resulted in policy

changes by Government including: changes to the furloughing regime, the introduction of

additional funding and flexibility in business grants awarded by local authorities and changes

to the Covid Business Interruption Loan scheme.

2 Business Support / Advice

The Growth Hub is continuing to provide support to businesses through its phone-based

service. This service complements on the ground support provided by local authority

colleagues.

A new rota system was introduced in early April, with additional capacity provided by the

Enterprise Adviser Network team, to bring the number of Growth Hub advisers able to take

calls to 25 people.

During March and April the Growth Hub provided in depth support to more than 2,000

businesses on Covid-19 related issues.

Enquiries into the Growth Hub have been broken down by theme:

Small Business Grant - 24%

Grants/Finance - 20%

Workforce and Employees - 12%

Support for self-employed - 10%

2

10

Business Interruption Loan Scheme - 10%

Business Rates Relief/Holiday - 10%

Deferring VAT & Income Tax - 9%

Commercial Tenants - 2%

Insurance - 2%

Companies House - 1%

The LEP is also helping local authorities provide up to date information to businesses on the

Government support schemes and other support through the production of a business

support script.

The script is updated on a daily basis and made available to the Growth Hub advisers and

local authority colleagues.

3 Local Funding

Business Resilience and Recovery Fund (£3.5 million)

The Business Resilience and Recovery Scheme was launched on Monday 4th May and

provides support to businesses in Norfolk and Suffolk that have been affected by the Covid-

19 Coronavirus and are looking at ways to recover and strengthen their business

performance.

As part of the process, an initial in-depth diagnostic exercise is undertaken by the New

Anglia Growth Hub advisers, to determine eligibility of the business and identify what type of

support they require.

Those companies applying under the scheme can also apply for a 50% grant towards capital

costs involved in initial resilience and future recovery of their business, A grant of £25,000 up

to a maximum of £50,000 is available to support projects. The scheme has proved popular

and several enquiries are already being handled, developed and progressed by the Growth

Hub.

The first application for £50,000 was approved by the end of the first week for a company in

Thetford. The grant will be used to obtain a new model of laser cutter which will enable the

business to secure additional contracts for work that is outside of their current capability

and increase efficiency (due to a decrease in downtime experienced with the old machine).

Covid-19 business tool kit

A new funding section has been added to the Covid-19 business toolkit, with links to key

external funding opportunities for businesses and charities. Information around Covid-19 is

changing rapidly and the toolkit has been created to provide the latest information, guidance

and support available to businesses all in one place.

VCSE sector

There is an emerging work priority around supporting the VCSE sector to respond to new

funding opportunities, working in partnership with both County Councils and VCSE sector

support organisations.

4 Workforce

Work continues identifying workforce challenges and gaps across sectors, working with

partners and the Department for Work and Pensions.

The employment opportunities page on the LEP website continues to grow rapidly.

There are now 144 listings with most of these having more than position available.

3

11

More than 2,000 people viewed the vacancies page in the first week of May alone.

The webpage is being further developed to include careers information, case studies, sector

insights and linked training opportunities.

5 Sectors and Supply Chain

Sub-workstreams currently include: PPE, Visitor Economy, Agri-Food, Energy and

Construction.

1. Personal Protective Equipment (PPE)

The LEP PPE supplier database now contains 196 suppliers and producers of PPE with

around 50% of the businesses listed based in Norfolk or Suffolk.

Around 850 different PPE products are now available on the system.

To date, more than 160 users have registered to use the system to source PPE - all

health or care providers or other front-line service.

We are in the process of seeking feedback from these users to help us shape the system

going forward.

Ten users of the system have so far informed us they have used the system to make

significant purchases of PPE.

Consideration is now being given to giving businesses access to the system, given the

expected increase in demand for PPE in the wider economy.

A further area of focus has been enhancing the manufacturing capabilities or upskilling of

companies to increase the supply of PPE locally. Work is underway in contacting potential or

existing PPE manufacturers across Norfolk and Suffolk to understand the scale

up/diversification challenges and support interventions they might need.

The team are also exploring ways to understand the long-term PPE requirements and local

demand to support this work.

Manufacturers are being linked to potential customers which has resulted in several

significant orders for local firms.

Local manufacturing capabilities are being fed into the new national database of capabilities

managed by Make UK.

2. C-19 Visitor Economy Group

It is widely recognised that the visitor economy has been hardest hit by the pandemic, and

the LEP and Visit East of England and all local authorities, the industry and destination

management organisations to establish a group to respond to the pandemic.

A region-wide survey of businesses to inform next steps and provide a foundation for a

recovery plan for the sector has been undertaken with 776 responses received, led by Visit

East of England. A draft report has been circulated, and the first analysis of the responses

has revealed:

Greater confidence from parts of the sector such as self-catering, Broads boats and

outdoor attraction of being able to adhere to social distancing. Some hospitality, retail

and catering businesses will find it more of a challenge and will impact the viability of

opening if they cannot operate at full capacity.

Timing of the easing of restrictions will be a key determining factor on business

survival - if businesses can open before the school holidays then recovery will be

easier.

Government intervention and packages are generally welcomed, more is needed,

particularly on VAT and Business Rates relief.

4

12

Visitor economy businesses need a move towards ‘flexible furloughing’ as many

have a lot of preparation work to do before they can open and start to see income

return.

Safe tourism is critical - both for visitors and residents. There is an opportunity to

promote Norfolk and Suffolk as a ‘safe destination’ with lots of space.

Adaptability - better digitization of businesses for example, online advance bookings

to manage footfall is needed.

The sector highlighted a need for more networking and sharing. Also creating better,

resilient supply chains between local businesses.

Continuing development of a year-round visitor economy would mitigate current

reliance on Easter to September and enable greater resilience in the long term.

The LEP has supported the region’s Destination Management Organisations (DMOs) with

bids to the Visit Britain Resilience Fund.

Five bids were submitted, to the first come first serve fund, four have been successful - Visit

East of England, Suffolk Coast, Ipswich, and Newmarket - Great Yarmouth are still waiting

to hear the outcome of their bid.

A call has been launched for accommodation providers who can open for key workers after

reports that those working on critical infrastructure e.g. offshore cannot find accommodation.

An online registration form has already been set up and is hosted on the LEP website with

details disseminated to accommodation providers by Visit of East of England.

28 responses have been received to date. When finalised, the list will be sent to Visit East of

England to host on their website and the LEP will use the sector networks to promote the list

to key workers looking for accommodation.

3. Other sectors

The LEP is working with partners to understand the impact of the pandemic on individual

sectors that make up the Norfolk and Suffolk economy.

Sector heat maps are being developed to look at the challenges and issues impacting each

sector.

A more detailed update on other sector activity will be provided in June’s report.

6 Economic Impact

A range of activity to assess the economic impact is underway. Agenda item x sets out a

proposal for developing an Economic Recovery plan. The proposed approach has two

phases - ‘Restart’ covering the next 10 to 12 months, with the first edition to be published in

June and updated every six weeks and ‘Rebuild’ covering 3-5 years to be published in

Summer 2021 and be informed by more robust evidence.

Metro-Dynamics has been commissioned, through the LEP’s framework agreement, to

support the work on impact assessment, scenario planning and developing the recovery

plans.

7 Communications

The PPE campaign about how organisations which do not usually need PPE can source it

received good coverage in local media, including BBC Look East on 27th April. The comms

team are now compiling case studies of firms producing PPE, to promote good news stories.

5

13

The ‘Big Business Check In’ campaign was launched on 28th April - encouraging people to

share grants information to their favourite local businesses to tell them what’s available and

gained good coverage in the local media.

We have continued to see a significant increase in traffic to the LEP’s website, with the most

popular pages being covid-19 related. The employment page alone saw 2,000 views in the

first week of May which equated to 22% of our website traffic for that week.

Focus is now moving towards social distancing messages as businesses turn their attention

to reopening. Whilst we await official guidelines, discussions are taking place with the Social

Distancing Communications Lead about how to start getting messages out and sharing good

practice.

LEP Network and wider engagement

As well as working with partners at a local level to respond to the Covi-19 pandemic, the

LEP has also been working at a national level via the LEP Network.

Working with the LEP Network and fellow LEPs is enabling the New Anglia LEP team to

articulate work being done locally and influence national policy.

National LEP activity has included:

Leading on the development of a policy paper around the relaunch of the Government’s

Enterprise Zones policy.

Participation in a LEP Network/Chambers of Commerce working group to look at

strengthening links between the organisations.

Participation in LEP Network chairs meeting with Government ministers.

Recommendation

The LEP Board is asked to note the contents of this report

6

14

New Anglia Local Enterprise Partnership Board

Wednesday 20th May 2020

Agenda Item 6

Restart and Rebuild - Covid-19 Economic Recovery Plan

Author & Presenter: Chris Starkie

Summary

The Covid-19 pandemic has been a significant health crisis, but also inflicted significant

damage to the economy.

LEPs were established by Government to facilitate private sector growth in their local areas by

bringing together local authorities, business and education. This has seen the LEP invest

significantly in projects and programmes to grow the economy, as well as produce with partners

the Economic Strategy and Local Industrial Strategy.

The LEP has supported local partners led by local authorities in the response to the pandemic.

As businesses prepare to recover from the pandemic, this paper recommends the development

of an economic recovery plan for Norfolk and Suffolk.

This paper has incorporated feedback from local authorities in both counties and is endorsed by

the chambers of commerce in both Norfolk and Suffolk and the FSB.

The plan will be developed by local partners and complement county and district plans, and will

comprise two phases: Restart, a tactical plan covering the next 12 months and Rebuild, a

strategic plan covering the 3-5 year period which follows.

Recommendation

The LEP board is asked to endorse the development of a Norfolk and Suffolk economic

recovery plan in two phases Restart and Rebuild as outlined in the paper

Background

The Covid-19 pandemic has been a very significant health crisis - but it has also inflicted

significant damage to our local economy.

Thousands of businesses have been forced to stop trading entirely, or seen income levels

reduce sharply, with the impact particularly felt in the tourism and retail sectors.

In the Response phase, local authorities have paid out millions of pounds in funding to local

businesses, thousands of businesses have been give support in accessing Government and

local support schemes, and the LEP’s new jobs service has helped workers find new roles.

But with the Government’s recovery road map now published (May 11) and businesses looking

to start trading again, an economic recovery plan for Norfolk and Suffolk is now required.

1

LEPs were established by Government to facilitate private sector growth in their local areas by

bringing together local authorities, business and education. This has seen the LEP invest

significantly in projects and programmes to grow the economy, as well as produce with partners

the Economic Strategy and Local Industrial Strategy. This means the LEP is well placed to help

coordinate an economic recovery plan, working in close partnership with local authority,

business and education colleagues.

Getting the economy back on its feet will not be achieved by one partner alone or by one strand

of investment or actions.

The economy is most successful when we work together for the benefit of the people who live,

learn and work in Norfolk and Suffolk.

A Norfolk and Suffolk wide economic recovery plan will complement local recovery plans being

developed at county and district levels which will cover individual places as well as health and

education. The plan will also feed into the Government’s national recovery plan. There is also

an expectation from Government that recovery plans will be developed covering LEP

geographies.

Whilst a two-county plan it will recognize different approaches and emphases between the two

counties and within the two counties, including urban and rural and types of business.

It will be developed by local authorities, business groups, educational institutions, the voluntary

sector and the LEP.

The economic recovery plan also needs to balance the short term need for action with the

recognition that recovery will take many years.

Therefore, the economic recovery plan needs to be divided into two distinct parts.

Restart: A tactical plan covering the period starting from June and covering the subsequent 12

months while businesses restart and start trading in an environment dominated by social

distancing.

This will of course include initiatives already launched in the Response phase.

Rebuild: A longer term 3-5 year plan to rebuild the economy which builds on the Economic

Strategy and Local Industrial Strategy and responds to long term changes brought about by the

pandemic.

There will be different phases of recovery as the Government’s recovery plan states the

lockdown will be lifted gradually, in phases. This will impact different parts of the economy at

different times meaning some response and recovery activity may run simultaneously.

And there will needs to be recognition that there will be differences in recovery plans in Norfolk

and Suffolk to reflect local circumstances and priorities.

It is important that our approach considers the transition between response and recovery and

be agile to the possibility that we may need to transition back into response if there are further

lock downs and to respond to potential issues caused by the ending of Government support

packages.

2

Restart - short term

Rebuild - long-term

Economic Recovery Plan

Economic Recovery Plan

•

A live plan covering the next 12 months

•

3 to 5+ year - plan recognising long term

which is flexible and regularly updated in

nature of the recovery

the light of new evidence and changing

•

Published in Summer 2021 replacing the

circumstances.

Restart plan.

•

First edition to be published in June 2020.

•

Builds on Economic Strategy and LIS and

•

Informed by business intelligence analysis

interventions in the Restart plan.

and scenario planning.

•

Retains focus on clean growth and

•

Considers the impact of the pandemic on

inclusive growth.

different sectors such as tourism, energy

•

Will take into account structural changes

and agri-food and develops support

to the economy brought about by

packages for each.

pandemic.

•

Covers role of local authorities in managing

•

Informed by a more robust evidence base

and supporting reopening of public spaces

- Baseline date which will start to show

and premises as well as other critical

impact will not available until 2021/2022

regulatory functions.

•

Looks at opportunities presented by the

•

Sets out clearly the role different partners

pandemic to support greater local

- LAs, LEP, BROs and others will play in

purchasing both by the public sector and

providing support to businesses.

the private sector.

•

Identifies funding programmes and other

•

Uses foundations of productivity as a

interventions needed to help businesses

framework for development - Business

navigate a working environment

Environment, People, Ideas,

dominated by social distancing as well as

Infrastructure and Place.

diversify.

•

Sets out medium to long term

•

Considers the role of transport as an

interventions and a local investment plan.

enabler of the recovery.

•

Signed off by local partners with

•

Considers the impact of the pandemic on

Government.

the labour force and required skills and

employment interventions

•

Sets out steps to create long term plan.

Evidence Base

Both the Restart plan and the Rebuild plan will need to be built on sound evidence.

Much of the statistical impact on the economy will not be available for some time. Baseline data

will start to be available from Spring 2021.

Business intelligence and scenario planning will be the most effective way in the short term to

help inform a recovery plan.

The evidence base that informs the Restart plan is made up of a number of products some of

which have already been developed by the LEP, Suffolk County Council, Norfolk County

Council and other partners including the chambers of commerce and FSB.

3

We already have a detailed understanding of the economic make-up of the two counties down

to district level, as well as up to date data on employment and increasing information on the

take up of Government schemes.

The following additional products have already been developed by the LEP and local authority

partners as part of the Response phase.

• Trend analysis of business intelligence. This sets out an analysis of trends identified

in the weekly business intelligence reports and is aligned with government

announcements on support schemes.

• Sector heat map which considers the risks and opportunities for each sector covering -

demand, supply chain, workforce and operations.

• Business support gaps analysis - sets out the identified gaps in government support

schemes.

• Escalation log - A record of issues and challenges effecting the economy which have

been escalated to government.

• Data on take up of Government schemes. Some information is available on the

increase in claimant counts, redundancies and where funding has been distributed to

businesses.

Additional products can be developed over the next three weeks:

• Scenario planning - a series of scenarios which will build projections as to when the

Norfolk and Suffolk economy could expect to return to pre-outbreak levels of growth.

• Sector snapshots - an illustration of the challenges and opportunities initially focused

on critical sectors which will include some projected data based on a range of scenarios.

• Place snapshots - an illustration of the challenges and opportunities within a

geographical area.

• Analysis of impact on projects and initiatives - assessment on local projects

identifying potential delays.

Much of the development work can be done by LEP and local authority colleagues, but we will

also utilize Metro Dynamics to provide a small amount of specialist support, particularly to look

ahead to how emerging trends such as home working and changes to commuting patterns will

impact on the restart and rebuild of the economy.

Metro Dynamics have previously provided support through the Economic Strategy and LIS as

well as Brexit work. Funding for this piece of work (£30k) can be resourced from the LEP’s

existing budget.

It will be important to develop a more robust evidence base and the mechanisms to inform

intervention developments, monitor progress and ensure interventions are creating the most

appropriate environment to support a fast recovery.

Over the next 12 months working with partners we will also need to:

• Review and carry out an assessment of economic indicators and develop new

mechanisms to help track the economy.

• Expedite the work on supply chain analysis.

• Update of evidence bases in Q1 2021.

• Set up sector Focus groups of up to 12 businesses who will invited to take part in a

series of sessions over a period of time, to measure and track changes in

circumstances and inform the Rebuild plan.

It is also our intention to work in partnership with our local universities on developing the

evidence base and scenario planning.

4

Interventions

It is important that both the Restart and Rebuild recovery plans provide clear direction on the

interventions available to support the economy to get back on its feet as quickly as possible, as

well as making advances where possible.

Some of these interventions will be LEP wide, with others county wide or district wide.

The proposed approach to identify and develop the interventions for the Restart plan includes:

• Review the impact of interventions delivered through the response phase to consider

extending or amending.

• Review the Economic Strategy and LIS interventions to identify relevant intervention

currently being implemented.

• Work with Local Authorities to consider local authority led interventions which use their

regulatory and statutory powers e.g. business rates relief discretionary grants and

changes to planning rules.

• Review the Expression of Interest received to date as part of the development of the

LEP’s Investment Plan.

• Complete a mapping and gap analysis of local and central funding.

• Consider new interventions including ones that will support people made redundant and

require skills support.

• Consider new interventions to support businesses move online and adapt their

operations in the light of social distancing measures.

Governance

It is proposed that an officer led Economy Recovery group (which will be based on a similar

structure to the Economic Strategy Delivery Coordinating Board) will form and take on the role

of Steering Group for the day to day development.

This would include staff from local authorities, the LEP as well as other partners such as the

chambers of commerce, FSB and education partners.

This would report into the LEP Board and the Local Authority Leaders groups in Norfolk and

Suffolk on a regular basis.

The LEP Board, LA Leaders and Sector Chairs will be engaged during the development and is

proposed to be done through a series of briefings and existing meetings to ratify direction and

test the emerging plan.

5

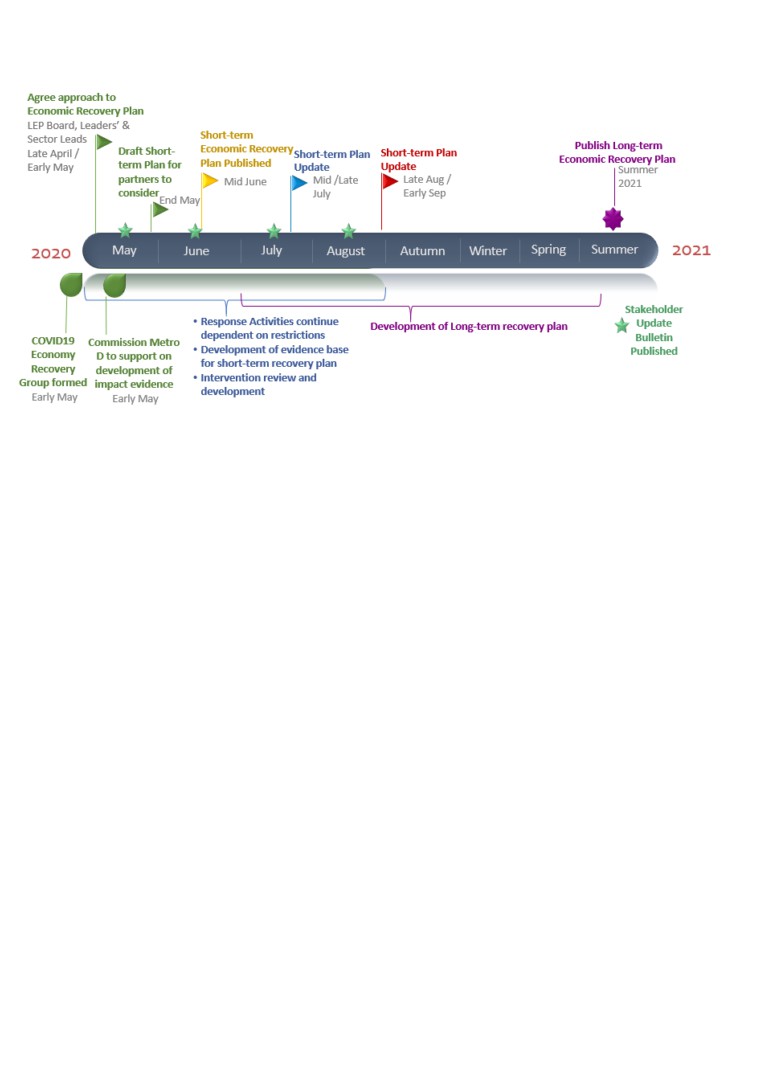

Timeline

Recommendation

The LEP board is asked to support the development of the recovery plan in two phases Restart

and Rebuild as outlined in the paper

6

New Anglia Local Enterprise Partnership Board

Wednesday 20th May 2020

Agenda Item 9

LEP Continuing Business Report

Author: All, Rosanne Wijnberg

Presenter: Rosanne Wijnberg

Summary

This report provides an overview of LEP team ‘continuing business’ activities since the April

board, structured around:

1) Programmes

2) Strategy

3) Engagement and promotion

4) Governance, Operations and Finance

The media dashboard is attached as an appendix to the report

Recommendations

The board is asked to note the contents of the report

1) LEP Programmes

Growth Deal (Capital Growth Programme)

Delivery of all large capital projects has slowed considerably over the past two months, with

many construction sites closed or reducing work for safety reasons. Several projects have used

this time to plan and reschedule activities to minimise the impact.

Work on refurbishing and replacing part of the headquarters of the Centre for Environment,

Fisheries and Aquaculture Science (CEFAS) in Lowestoft is only progressing where social

distancing guidelines can be adhered to. Consequently, demolition of the former Grand Hotel to

enable extension of the car park and landscaping has been stopped and completion of the

project has been pushed back from the end of summer 2020 to later in the year.

The revised Strategic Outline Business Case and supporting papers for the Ely Area Rail

Enhancement Project has received approval from a special Anglia Programme Board led by

Network Rail and the Department for Transport. This is the first positive step toward securing

additional funding for further development of the programme, to include environmental surveys,

consultation work and preparation of a Transport & Works Act Order that will authorise alteration

to the railway path and boundaries.

Business Growth Programme

The Business Growth Programme remains ahead of its output and spend profile. A further four

applications, totalling £55,333 were approved in April, with match funding of £221,336.

1

The Q1 claim for the Programme (December 2019 to February 2020) has been submitted to

MHCLG and totals £1.295m, taking the 2019/20 cumulative total to £6.107m or 103% of the

target. We are still awaiting sign off of our Project Change Request (PCR), requesting an

additional £1.1m of ERDF funding to enable the Growth Hub and Small Grant Scheme to operate

until the end of November 2021 We understand that this will take longer than usual due to the

current situation. We have been advised that we are due to receive an additional £249.5k from

BEIS for business support activities. We await details on the funding criteria.

Growth through Innovation

The Growth Through Innovation (GTI) fund is now operational, providing grants between £1,000

and £25,000 for capital and revenue investment into SMEs for a wide range of Innovation,

Research and Development activities. We have nine projects under development, supported by

the Growth Hub. One application for £22,500 has been approved. We are working with a range

of partners to promote the fund and have seen a high number of ICT businesses showing

interest.

Growing Business Fund

Interest in the GBF continues, particularly from the manufacturing sector. In April an application

for £82,010 was approved, with private sector match of £328,040. We have a further two

applications for May - for £434,290 of funding with £3,908,742 of private sector match. The three

applications will generate 34 new jobs between them. The pipeline remains buoyant, although

payments for grants has slowed during the past month.

Eastern Agri-tech Initiative

After a long delay three applications are with the panel for voting. A further four companies have

applied for grants, due diligence is being carried out by Norfolk County Council and they will be

considered by the panel shortly.

A considerable pipeline of further projects exists, but the CPCA has temporarily prioritised

delivery of their new capital intervention programme. We are in discussion with them regarding

future delivery.

Growing Places Fund

In April the LEP Board approved the transfer of the uncommitted balance of this fund to support

the new Resilience and Recovery Fund - £3.5m.

Gainsborough’s House development drew down its full allocation of £250k in April. A slowing in

project drawdown now seems inevitable.

The Winerack loan arrangements are subject to review by Homes England following a request

from the developer. The loan arrangements and the view of Homes England on these

arrangements will be considered by the IAC in the near future. This has taken longer than

anticipated.

Work with Lotus is ongoing to identify what development costs are eligible, under State Aid, for

LEP support. We estimate that an initial payment of circa £300,000.

New Anglia Capital

New Anglia Capital directors have continued to review potential investments first considered at

the January NAC Board meeting.

A proposal has been put forward to review the terms of NAC investments to see if the fund could

be better used to support businesses through the Covid-19 emergency. A meeting will take place

prior to the next NAC Board meeting, to be held in June.

2

Anglia Capital Group continue to support NAC. Hannah Smith, having left ACG in early April, has

been retained for one day per week to support NAC for the next few months.

LEP Innovative Projects Fund

Innovative Projects Fund (2018 Call) - £500,000.

IPF1 Summary of Progress:

7 projects under the 2018 call of the Innovative Projects Fund have a combined IPF allocation and

commitment of £539,531. The value of claims for the first year (2019/20) was £140,001. Since the

end of the financial year a further £9,076 has been spent. This now brings actual spend to date to

£149,077. Forecast spend of £214,507 is expected for 2020/21.

The Ipswich Cornhill Project has now been completed (IPF1). The project attracted £57,391 in

Public Match Funding and £34,301 in Private Match funding. It created 62 new events in the

Cornhill, increased dwell time in the Cornhill area by 9.75% and created a 27.75% increase in visits

to the area. The project was awarded a further £50,000 under the 2019 call of the IPF.

Project delivery has been impacted by Covid-19 restrictions. Two projects continue to make

progress - the Fit for Nuclear Project will deliver its course online until August 2020, at which point

the course will revert back to the classroom environment if possible. Visit East of England’s project

also continues as this represents mostly desk based work at this current time.

Enterprise Zones Update

Work is progressing well on the construction of the major new distribution centre for Amazon on

the Eastern Gateway Enterprise Park at Sproughton near Ipswich, one of the Space to Innovate

Enterprise Zone sites. Despite Covid-19 restrictions, development has been able to continue

almost as planned and so is due for completion by June. Approximately 100 jobs will be created

initially including permanent jobs recruited by Amazon and additional posts hired by independent

delivery companies.

Plans for the major Gateway 14 development site at Stowmarket has also taken a step forward,

developers Jaynic have been officially appointed to oversee the scheme. Part of this strategically

important site, located close to the A14, is designated a Space to Innovate Enterprise Zone site.

3

Overall, up to 2.3 million sq ft of business, logistics and commercial space can be provided over

the next 10-15 years on Gateway 14 and a planning application will be submitted later this year

The New Anglia LEP Enterprise Zone Team continues to liaise with Local Authority partners,

landowners and developers to identify any specific issues arising from Covid-19 impact on

construction and delivery of our Enterprise Zone sites.

Inward investment

Invest East ERDF project: Investment Readiness activity continues with seminars (for the first

time) taking place using a web-based format for the third cohort of the programme involving over

30 companies. Participants are from a wide range of sectors including: agri-robotics, clothing,

cosmetics, digital HR, marketing, gaming, media, energy and energy supply chain, construction,

training, and fintech.

A bid to create a second, High Potential Opportunity (HPO) was submitted to Dept for

International Trade (DIT), centred around Norwich Research Park with a focus on the healthy

ageing Grand Challenge. DIT’s HPO programme has been successful so far, generating a

number of leads and 3 successes already, after only a few months of promotion.

Working with colleagues from DiT and BT, a training presentation resource is being created on

the first New Anglia HPO (Adastral Park 5G) to enable colleagues to promote the 5G opportunity

effectively. This involves a set of digital material from our team and partners, building upon

assets created by the Tech East network.

A US offshore wind supply chain initiative is being explored with the Dept of Economic

Development in Virginia Beach, the biggest city in Hampton Roads, Virginia. A 2.7GW array is

planned off the coast comprising 220 turbines. Online discussions have taken place to enable

local businesses to engage with the opportunity this market may represent.

The inward investment team are currently managing 12 new enquiries, pertaining to interest in

investing into the medtech sector, energy storage, offshore port services, food processing and

production and healthy living technology.

2) Strategy

Skills:

The LEP has provided evidence to the Skills Advisory Panel team at the Department of

Education of our 2019/20 spend; and submitted the signed memorandum of understating for

2020/21. Part of the agreement moving forward is to produce a Local Skills Report which has

been drafted and shared with Skills officers at Norfolk and Suffolk County Councils.

Institute of Technology (IOTs)

The Department for Education has published a prospectus for phase 2 IOTs outlining criteria for

bids. It is expected that only one proposal will proceed going forward and the LEP team and LAs

are considering the best approach.

Careers Hub

The LEP has submitted an Expression of Interest to the Careers Enterprise Company to support

the expansion of the careers hub across Norfolk and Suffolk which would enable the proposal

under the ESF bid to commence from September, ahead of successfully securing ESF funding.

4

Enterprise Advisor Network

The Enterprise Adviser Network continues to provide support to Careers Leads and Teachers

through virtual CPD sessions and online resources.

Infrastructure:

Transport Board

The next meeting of the Transport Board on 2nd June will take place virtually focusing on the

impact COVID-19 on transport and considering the challenges and opportunities for recovery.

Integrated Ticketing

Progress on integrated ticketing being made with Suffolk colleagues. Discussions taking place

with Norfolk.

Trowse Rail Bridge Upgrade

The Reliability and Capacity study is expected to be finalised at the end of May. A joint position

statement is also being developed for discussion.

Transport East

A ‘ways of working’ workshop is arranged for 19th May to build on what already works well, and

scope out how the expanding partnership team could work better. The decarbonisation study is

progressing with the first phase expected to be complete by June.

Blue Tech Cluster Opportunity

Work has commenced on scoping the Blue Tech Hot House event centred around innovation and

opportunities at Felixstowe Port.

3) Communications and Engagement

This section covers engagement activity with local stakeholders, including local authorities, local

businesses and MPs. It also covers activity with Government and our wider international activity.

The Communications and Engagement Dashboard is included as Appendix A to this report.

New Anglia LEP website

The redeveloped New Anglia LEP website launched in mid-April. The new site has been

designed to improve the user journey, making it clearer for businesses to understand what the

LEP does and how we can help them. Among the new features is an interactive investment map.

A number of new Coronavirus business support pages have also been added.

Delivery plan

The New Anglia LEP delivery plan has been published on the website at

New Anglia Innovation Board

The New Anglia Innovation Board held their May Board meeting with an update from Cefas on

the multi-million-pound redevelopment of their site at Lowestoft, supported by the LEP. With a

theme of ‘innovation in energy’, presentations were also given on the All Energy Industry Council

and Offshore Renewable Energy Catapult and the progress being made to date. There are plans

to develop new project activity including a proposed Centre of Excellence for Energy Systems

Integration.

A delivery plan for the Innovation Board has now been developed which highlights how planned

projects and activity align with the LIS interventions and also how these might support recovery

plans post-Covid19 across key sectors. The innovation centres, technology parks, research

institutes and universities all have an important role to play in supporting economic recovery for

Norfolk and Suffolk and at a national level.

5

Sector Groups and Industry Councils

The Agri-Food Industry Council and All Energy Industry Council held their main board meetings

on 21st and 30th April respectively with a key focus of the discussion on the impact of Covid-19 on

the sectors and importantly how industry can work together with the LEP, Local Authorities and

other partners on recovery plans going forward. Industry Councils will have an important role to

play in helping drive economic recovery going forward as well as supporting the key strategic

interventions set out in the Local Industrial Strategy.

The LEP and partners continue to engage and work closely with other sector groups such as

manufacturing (NAAME), visitor economy and culture etc. to progress plans on future support for

these key sectors and any specific interventions required to aid post-Covid19 economic recovery

plans.

4) Governance, Operations and Finance

This section provides an update for the board on any key operational matters as well as a

headline summary of the LEP’s operational finances.

Risk Register

The current risk score for risk 11, Growth Deal Delivery, remains at high risk. The coronavirus

pandemic has introduced additional delays. We will continue to work with individual projects to

mitigate against this impact and will consider capital swap arrangement if appropriate.

Finance

In previous years our Growth Deal allocation has been paid in April. We have recently been

advised that the payment of our 2020/21 Growth Deal allocation of £47.4m from Government will

be staged - with 2/3 to be paid in May and 1/3 to be paid in September, the final payment being

subject to a review of progress. This will have an impact on our interest earned and the

assumptions made in our operating budget.

Our £500k Core Funding was received at the end of April.

Our draft 2020/21 Capital Budget is included in this month’s papers for Board approval.

Preparations are ongoing for our 2019/20 audit. Price Bailey will undertake the audit remotely

during the two weeks commencing 18th May. The Audit and Risk Committee is scheduled for 23rd

June.

Recommendation

The board is asked to:

• Note the contents of the report

6

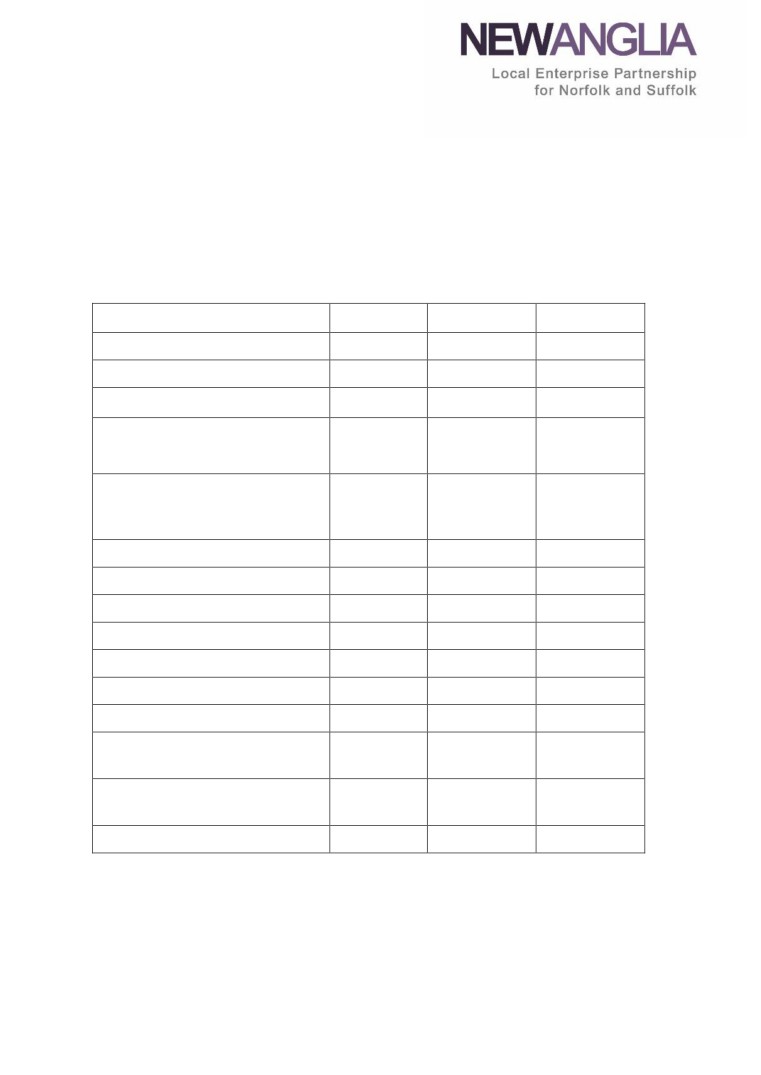

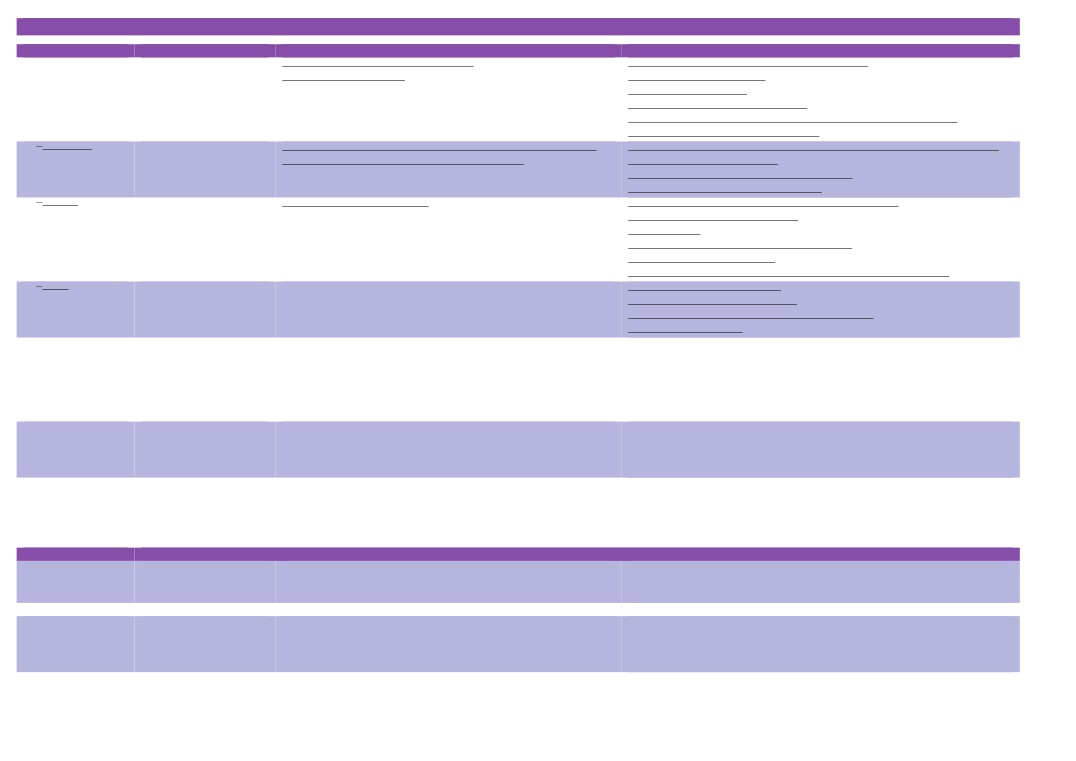

Communications activity April

2020

This dashboard sets out the outcomes and impact of communication during April

2020 through owned media - the information which we control and issue ourselves -

and earned media (third-party outlets). (*Refers to pre-GDPR numbers)

Owned media - social media channels and e-newsletters

April 2019

March 2020

April 2020

New Anglia LEP

Number of Twitter followers

7,709

8,322

8,402

Number of clicked links per month

349

212

741

Average Twitter engagements per

46.77

69.1

157.53

day (likes, retweets etc.)

Number of impressions (the

74.3K

121K

252K

number of times a tweet showed in

someone’s timeline)

Number of LinkedIn followers

754

2,097

2,292

Number of impressions on LinkedIn

N/A

45.1K

39.5K

E-newsletter: open rate

39.18%

33.77%

37.84%

E-newsletter: click-through rate

33.1%

17.65%

23.38%

Norfolk & Suffolk Unlimited

Number of Twitter followers

N/A

426

456

Number of clicks per month

N/A

37

33

Average Twitter engagements per

N/A

16.5

25.56

day (likes, retweets etc.)

Number of impressions (number of

N/A

37K

25.2K

times users saw our tweet)

Number of LinkedIn followers

N/A

731

761

30

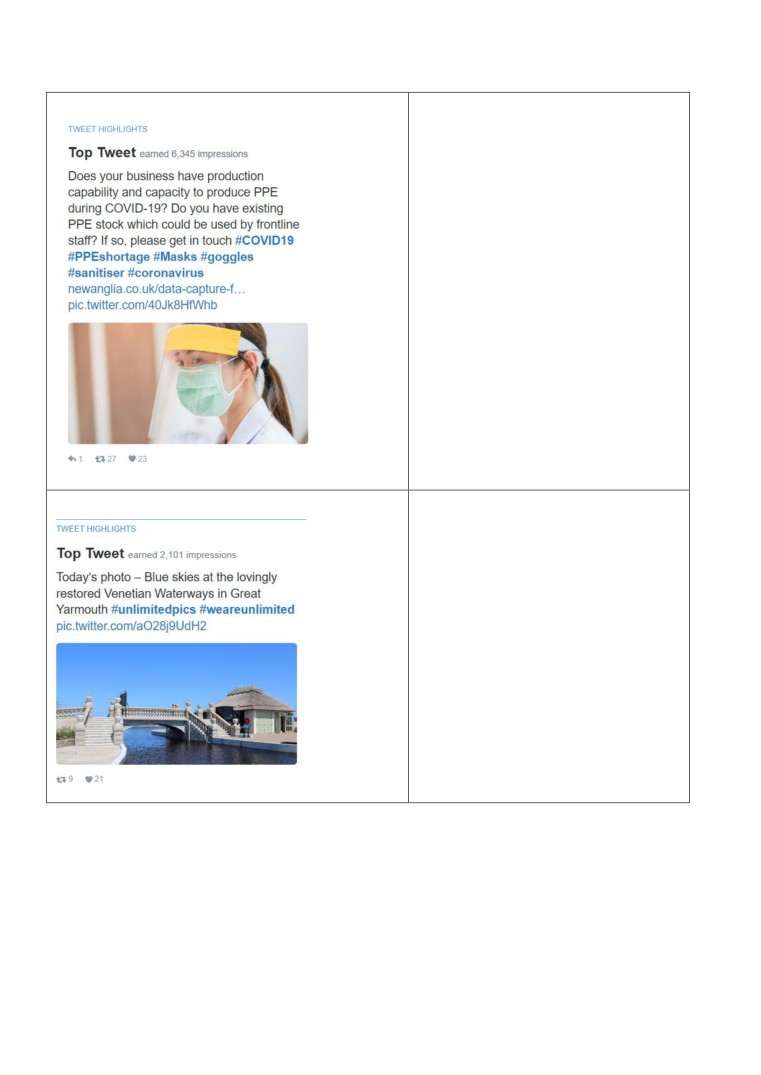

Top Tweet - New Anglia LEP

We have played a key role in

coordinating the appeal for businesses

to manufacture or supply personal

protective equipment (PPE) to frontline

workers. This produced our best

performing tweet, earning more than

6,300 impressions, 23 likes and 27

retweets.

More than 180 companies have

responded to the appeal for

businesses to help supply PPE and the

posting and sharing of posts like this

has really helped promote this

campaign.

Top Tweet - Norfolk & Suffolk Unlimited

Our top tweet for April was a photo of

the restored Venetian Waterways in

Great Yarmouth, which earned more

than 2,000 impressions, 21 likes and 9

retweets.

31

Media coverage - New Anglia LEP

The LEP’s proactive and coordinated

response to the Covid-19 pandemic,

especially around the PPE shortage,

has earned widespread media

coverage. The Eastern Daily Press ran

a story (opposite) about the appeal for

local businesses to get involved in

meeting the demand for equipment for

those on the frontline, quoting Chris

Starkie. He was also interviewed about

the issue on BBC Look East.

We have also been helping councils

promote the availability of grants to

help small businesses through the

crisis, with Chris Starkie interviewed on

BBC Radio Suffolk. In addition, we

introduced the Big Small Business

Check-In, which encouraged people to

let their favourite business know they

might be eligible for funding. This was

covered by the East Anglian Daily

Times.

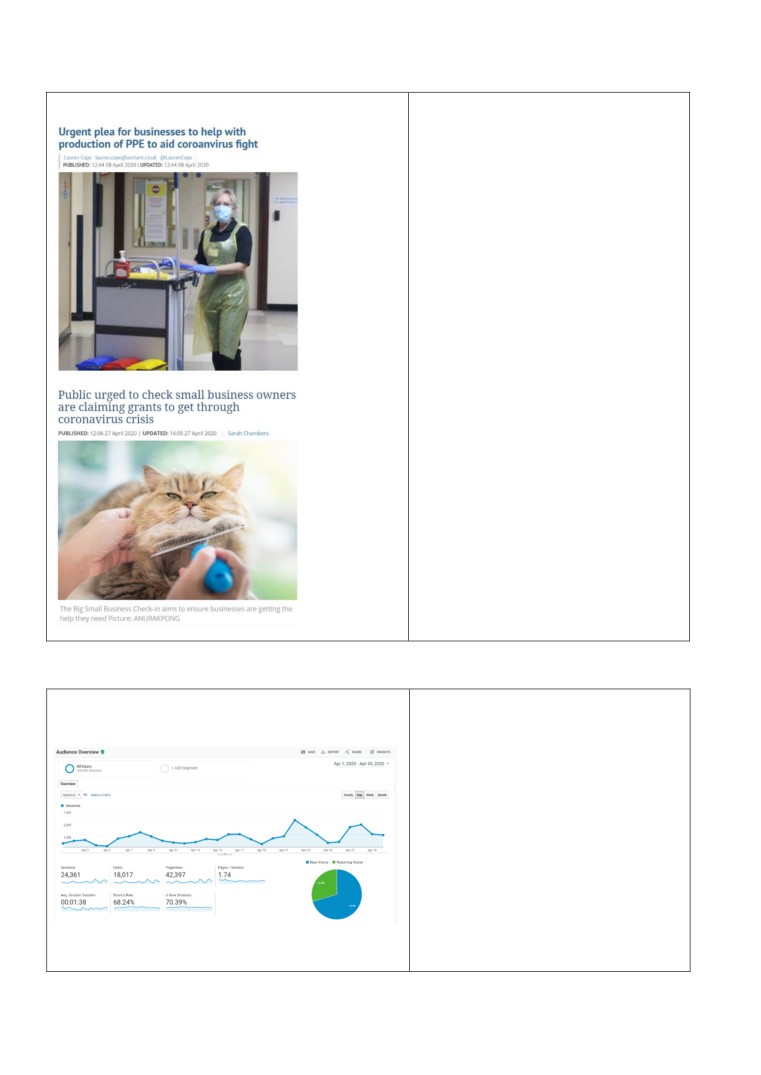

Google Analytics - New Anglia LEP website

Traffic to the LEP website soared

during April, with 42,397 page views

(up 26,616 on March) and 18,017

users (up 12,365 on March). The

most popular pages were COVID-19-

related: employment opportunities

(13,703), PPE data capture (4,307),

business grants available through local

authorities (1,224) and free support for

your business during Coronavirus

(709).

Visitors spent an average of 1:38

visiting the site (down 32 secs) and of

those visiting the site, 70.466.8% were

new (up 3.6%) and 29.6% were

returning (down 3.6%).

32

New Anglia Local Enterprise Partnership Board

Wednesday 20th May 2020

Agenda Item 10

Management Accounts - January to March 2020

Author: Rosanne Wijnberg

Presenter: Rosanne Wijnberg

Summary

This report provides board members with an update on the LEP’s finances for the period ending

31 March 2020. The report includes confidential appendices:

Appendix A - management accounts period ended 31 March 2020

Appendix B - grant analysis period ending 31 March 2020 (graphs)

Recommendation

The board is asked to review and note the management accounts and accompanying graphs.

Management accounts - 31 March 2020

In previous years we have reported performance monthly against the Core Budget. We have

amended the approach for the 2019/20 financial year and the management accounts are now

being reported quarterly and will reflect the consolidated position, showing both Core and

Programmes.

The LEP’s consolidated management accounts for the period Apr 2019 to March 2020 are

attached in Appendix A.

As a reminder, Core covers the work of the LEP including:

-

Developing and delivering the economic strategy.

-

Engagement with central Government and national agencies.

-

Engagement with our local authority partners, education partners, with business and the

voluntary sector.

-

Governance and management of the LEP

-

Management of our sector groups

-

Innovation and Inward investment

-

Support for partnership initiatives such as Cambridge Norwich Tech Corridor, Ipswich

Vision and the Opportunity Areas

Programmes covers programmes and projects delivered or managed by the LEP including:

Growth Deal, Growth Programme, Enterprise Zones, Growing Business Fund, Growing Places

Fund, Enterprise Adviser Network and Apprenticeship Levy Fund.

1

33

Income Explanatory Notes

New Anglia core

This is core funding the LEP receives from government, plus the match funding received from

our local authority partners. This also includes the additional £200k capacity funding to support

the development of our Local Industrial Strategy.

New Anglia grant/programme income

Most of this income is the LEP’s Growth Deal - £24.6m this year. The grant element is allocated

when it is received, the top slice is accrued on a monthly basis, as costs are incurred.

This category also includes income from the LEP’s Enterprise Zone Pot C, which is recognised

as it is received.

In addition, the LEP has received contributions from our local authority partners for round two of

the Innovative Projects Fund - and additional £1m. This initiative was not included in our budget,

resulting in a variance.

New Anglia Recharges

This is mostly the recovery of costs from the Business Growth Programme (ERDF programme).

It also includes income (recovered costs) from other LEP initiatives such as the Norwich

Opportunity Area and Cambridge Norwich Tech Corridor.

EAN Income (Enterprise Adviser Network)

This income is from claims submitted to the Careers & Enterprise Company, plus contribution

from the LEP’s Enterprise Zone Pot C fund. This match funding contribution was previously

agreed by the board.

Interest received

The LEP receives interest from money it loans out through its Growing Places Fund. It also

receives interest from Suffolk County Council (Accountable Body) for funds which they hold on

our behalf. As the payment of Growth Deal grants is significantly below budget, the balance that

is subject to interest is much higher than anticipated in the budget. In the budget we assume

interest in the month of receipt (cash basis); in the accounts interest is accrued monthly. This

explains the large variance between actual and budget.

Expenditure Explanatory Notes

The material expenditure items are described in more detail below.

Wages & Salaries

This covers all staff, including those team members charged to specific programmes. It also

includes staff costs for LEP initiatives, these are then reclaimed from the external funding

partners. We have a small favourable variance against budget as a result of small differences in

timing.

Consultancy and Subcontracting

The budget was flat profiled over the twelve months. Costs have been consistently ahead of

profile - additional Norfolk Enterprise Festival costs and a contribution of £32k to the GEML Task

Force had not been budgeted for. These increases were offset by underspend in other areas.

Projects

The annual budget for projects, as agreed at the March board is £852k. Project costs are

accounted for when incurred, however due to the difficulty in anticipating these costs the budget

was flat profiled over the twelve months i.e. split evenly. The variance against budget largely

reflects the delay in spend and claims made against the Innovative Projects Fund.

Marketing and Events

We have incurred additional costs in this category, the majority of which has been recovered from

partners e.g. Norwich Opportunity Area.

2

34

Legal & Professional

Most of these costs are incurred through the Growth Deal and Enterprise Zone programmes and

they have been lower than budget.

Irrecoverable VAT

The budget includes irrecoverable vat due to the LEP not being able to claim back VAT. VAT is

budgeted against relevant costs, which are flat profiled throughout the year. Some of the incurred

project costs have included VAT which would not have been known at the time of the budget.

This will therefore show an adverse variance on irrecoverable vat but will be offset by a similar

amount as a favourable variance in ‘project’ costs.

Grant analysis - Appendix - B

Growth Deal

This chart represents grant payments made to Growth Deal projects. The budget reflects the

Growth Deal annual allocation plus the rollover from 2018/19. The figures do not include Growing

Places or Growing Business Fund, these are shown separately. It does not include any loans or

investments made through the Enterprise Zone Accelerator Fund (EZAF). Fourth quarter claims

were less than forecast resulting in a carryover of £15.9m. We expect this slowdown to continue.

Growing Business Fund

This chart represents grant payments made through the LEP’s Growing Business Fund. There is

a sizeable pipeline however these enquiries are taking longer to convert into applications.

Growing Places Fund

The Growing Places Fund (GPF) is different to the other LEP ‘grant based’ programmes. The

GPF programme is a hybrid comprising both loans and grant payments.

This current graph only charts progress of grant payments made through the year which are

treated as an expense rather than an investment.

Small Grants Scheme (ERDF)

The amount shown is actual grants paid and does not include private match.

Innovative Projects Fund

This is the LEP’s newest fund and is a revenue-based fund. This initial fund is now fully

committed. To date around £140k has been paid out with most of the remaining grants now likely

to be paid in the next financial year.

Recommendation

The board is asked to review and note the management accounts and accompanying graphs.

3

35

New Anglia Local Enterprise Partnership Board

Wednesday 20th May 2020

Agenda Item 11

May Programme Performance Reports

Author: Programme leads;

Presenter: Rosanne Wijnberg

Summary

The following reports follow for review by the LEP Board this month:

-

Growth Deal; Jonathan Rudd

-

Growth Programme; Jason Middleton

Recommendation

The board is asked to:

-

Note the reports

-

Approve the Growth Deal Quarterly Dashboard

1

39

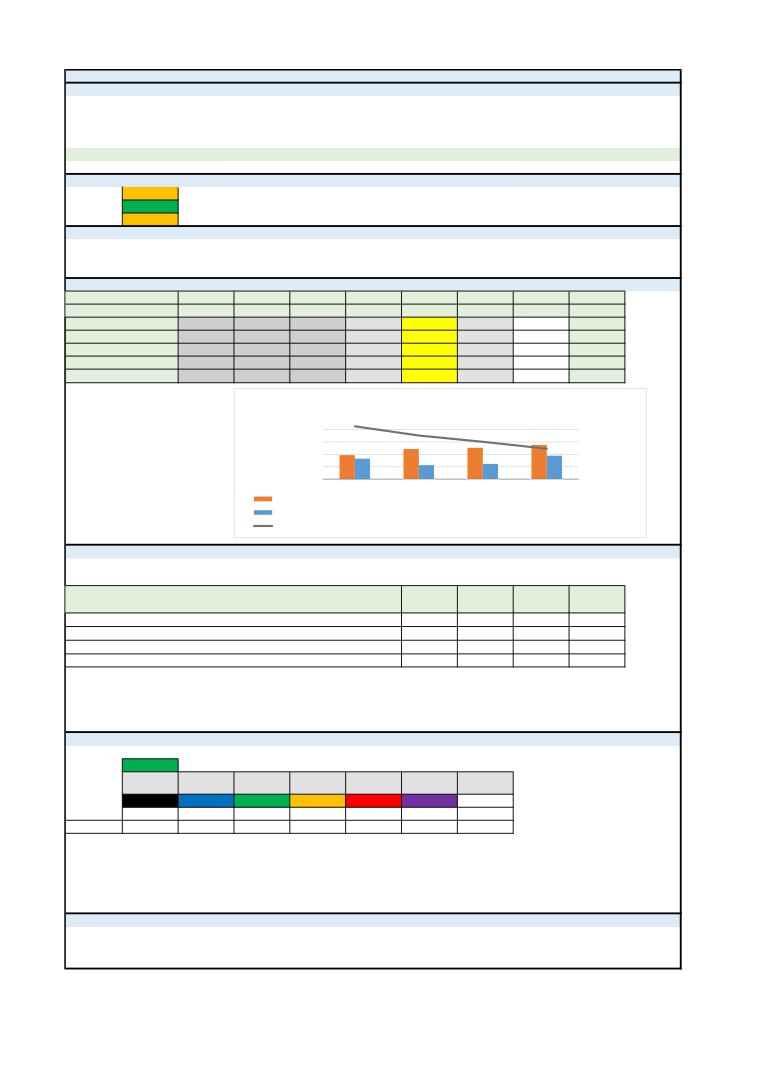

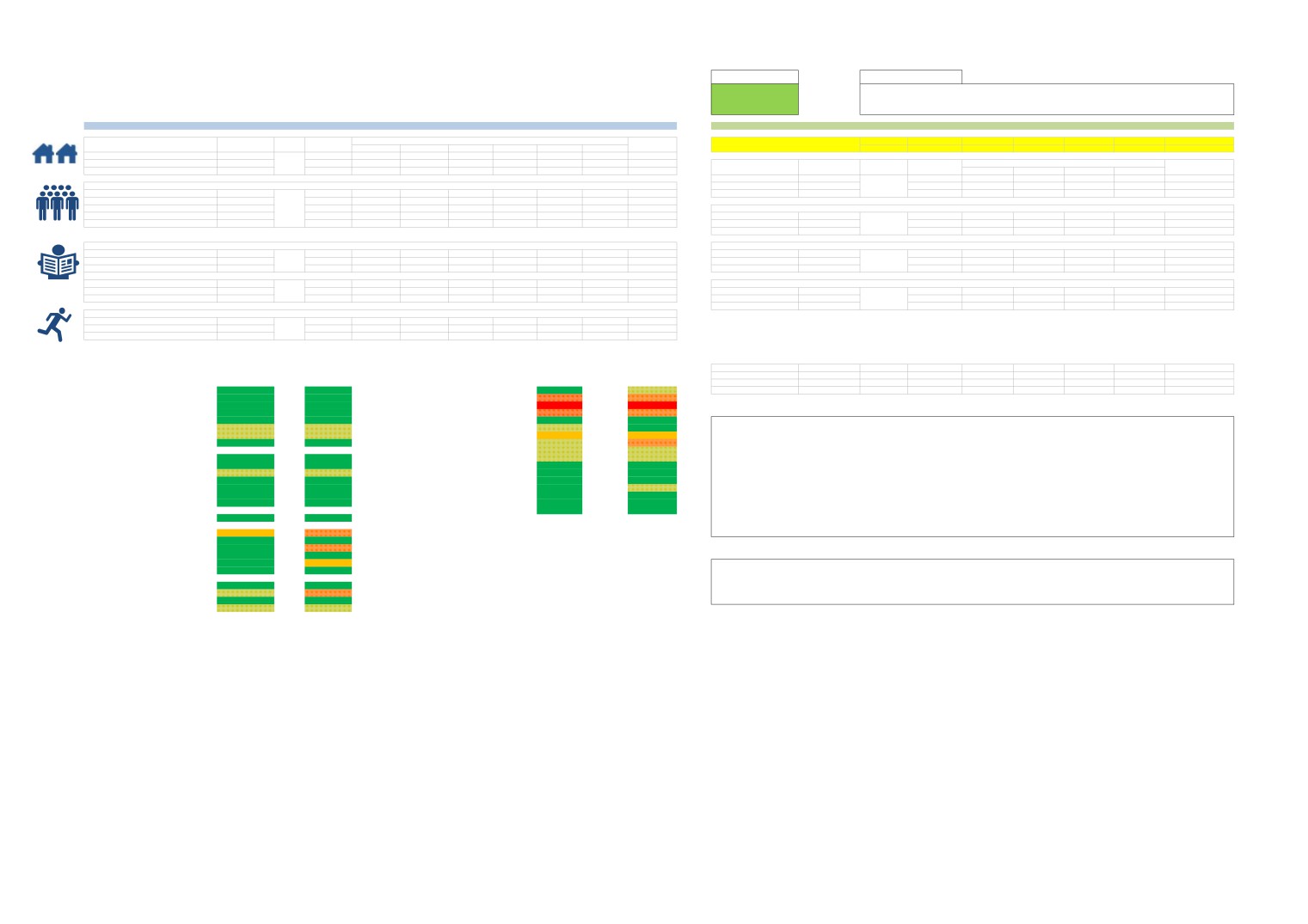

Growth Deal Performance Report

Q4 2019/20

Programme Overview - What is the Growth Deal?

• Programme duration: April 2015 - March 2021.

• Value: £223.517 million (excluding funding awarded directly to Norfolk County Council).

• Aims: to boost the region’s skills, drive innovation, target support to help small businesses to grow and improve transport and infrastructure.

• Contribution to the Economic Strategy: estimated to create 54,750 new jobs, 6,800 new homes and to generate an additional £628m public and private investment.

Capital Projects

Growing Places Fund

Growing Business Fund

EZ Accelerator Fund

Total £m

£164.081

£30.116

£18.450

£10.870

£223.517

What is the Overall Programme Status?

Finance

Amber→

Some grants will not be claimed in accordance with forecast draw down schedule and funding profile.

Outputs

Green↓

Reasonably on track to meet our forecast outputs, with some areas at risk of late or low achivement..

Delivery

Amber↑

Significant delay to a number of projects has occurred.

What are our Key Updates?

• Programme progress: generally good; only a monirity of projects are experiencing significant delay to delivery, with minimal impact on long term outcomes.

• Refining the forecast of expenditure for remaining Growth Deal period to March 21 with the cooperation of all approved projects.

• Key concerns: Delay in project delivery will undermine outturn for the remaining financial year.

What is our Financial Position?

Financials (£ million)

Actual

Actual

Actual

Actual

Forecast

Forecast

Financial Year

2015/16

2016/17

2017/18

2018/19

2019/20

2020/21

Total

Brought Forward

0.000

12.008

0.000

19.189

18.060

16.355

Gov Allocation

36.900

38.549

41.334

34.660

24.662

47.412

223.517

Spend [Act/Fcst]

-24.892

-50.556

-22.145

-35.789

-26.367

-58.000

-217.750

Unallocated

0.000

0.000

0.000

0.000

0.000

0.000

0.000

Carried forward

12.008

0.000

19.189

18.060

16.355

5.767

5.767

Spend progress quarter by quarter:

2019/20 Expenditure Profile

•Q4 spend well below forecasts due to late claims &

Financial Quarters

20

delayed delivery.

40

15

Forecast

•This delayed delivery & late claims increased rollover

30

Available LGF

& Claims

to more than £16m

20

10

(£m)

(£m)

10

5

Apportionment:

0

0

Q1-19/20

Q2-19/20

Q3-19/20

Q4-19/20

• Approx. £3.5m of funds to be set aside for a

potential business recovery fund.

Qtrly Budget

8.654

10.808

11.256

12.259

Qtrly Spend

7.399

5.066

5.507

8.395

Available LGF

42.583

35.184

30.118

24.611

What is our contribution to the Economic Strategy?

Quarter/ year:

4 (Jan-Mar) 2019/20

Forecast to

Percentage

Outputs - Cumulative from April 2015 to Quarter 4 2019/20

Actual to date

Change

2025

Progress

New Homes

738

1005

72%

17

New Jobs

2,820

2,478

114%

387

New Learners

1,612

6,707

24%

82

Match Funding (‘Non-LGF Expenditure’); forecast to 2021 only.

£603.183m

£618.875m

97%

£48.834m

Forecasts have been updated to include Homes, Jobs & Learners from projects anticipated out to 2025.

• Homes: 17 from Lynnsport Access Road.

• Jobs: being met primarily through GBF. Q4 increase includes jobs at Kings Lynn Innovation Centre, South Lowestoft Inductrial Estate & the Voluntary Sector Challenge.

• Learners: increase this quarter from University of UEA Productivity East initiative.

• Match funding: progessing well.

What is the Project Delivery Status?

Overall:

Green→

Physically

Significant

Under

Complete

On track

Small Variation

Total Projects

Complete

Variation

Development

Black

Blue

Green

Amber

Red

Purple

-

10

8

17

7

7

0

49

Change

0

0

-1

-2

+4

-1

0

• Project change: Grant Agreement with University of Suffolk Digital Technology Centre now in place. Purple to Green.

• Project change: Croxley Road Cycle Route element of Thetford Transport Package delayed. Green to Amber.

• Project change: Rail Station Carpark elements of Attleborough Transport Package delayed by upto 9 months. Amber to Red.

• Project change: Hall Plain element of Great Yarmouth Transport Package likely delayed by 12 months due to public enquiry. Amber to Red.

• Project change: Vauxhall Gardens element of Great Yarmouth Rail Station Package delayed upto 9 months by land acquisition. Amber to Red.

• Project change: Delivery of Snetterton Area Power Upgrade delayed by 9-12 months by increased costs & indemnity clause in lease of preferred site. Amber to Red.

What are the Next Steps?

•Determine impact of COVID-19 epidemic on Growth Deal delivery schedule and expenditure profile, and offer support to projecst where possible.

•Proceed with Evaluating completed Projects, .

•Support developing a list of future projects to meet the ambitions of the Economic Strategy & Local Industrial Strategy in preparation for future funding.

40

Appendix 1 - Growth Deal Performance Report for May 2020

Below is an update on all Growth Deal projects, reflecting the ‘Project Status’ section of the

Performance Report.

Red: Attleborough Sustainable Transport Package- Delivery of schemes has begun,

although later than forecast and additional delays due to public consultation, land purchase and

planning permission continue to slow both delivery & drawdown of grant.

Red: Great Yarmouth Transport Package- Delivery remains slower than anticipated, although

preparation & planning activity increased, and expenditure has risen. Hall Plain/Quay scheme

delayed 12 months by consultation and likely public inquiry.

Red: Snetterton Employment Area- Delivery has been delayed by 9-12 months; firstly, by a

30% cost plan estimate increase and contract renegotiation between Breckland DC and UK

Power Network, and secondly by an indemnity clause in the site lease agreement with owners

BWSC. Both are resolved. Delivery, expenditure and claims expected to restart in Q1 2020-21.

Red: Lowestoft Flood Risk Management Project- Delivery of tidal defence elements are

delayed by 9 to 12 months, as a legal issue held up both ground & marine investigations. These

have now been separated and planning permission was granted for construction of tidal walls,

which should now take place throughout the 2020-21 financial year.

Red: Ely Area Rail Enhancement Scheme- Programme development and option selection has

been delayed by various factors. Rail system complexity, integration of a road scheme for

Queen Adelaide and the scale of interventions at level crossings to mitigate risk are the principal

issues. NR are submitting a business case for £13.1m additional funding from DfT for continuing

development work through to an Outline Business Case submission in 2022 for a ‘Decision to

Design’ the preferred solution.

Red: Enterprise Zone Accelerator Fund-Projects at Nar Ouse EZ and Norwich Research Park

were approved in Nov 18 and May 19 respectively. Project development was much slower than

anticipated and no grant claims took place in during the 2019-20 Financial Year.

Red: Snape Maltings Flood Defences- delivery delayed by an ongoing Internal Drainage

Board (IDB) application to the Environment Agency for Flood Defence Grant in Aid (FDGiA).

Funding decision expected June 2020, with construction progressing in earnest from October.

Amber: Growing Business Fund (Subject to separate Performance Report).

Amber: Growing Places Fund (Subject to separate Performance Report).

Amber: Norwich Area Transportation Strategy - City Centre Package- Delivery of Prince of

Wales Road gyratory scheme progressing well, although there is a remaining delay to the

Plumstead Road Roundabout scheme.

Amber: Thetford Transport Package-No substantial progress or claims have been submitted

for the past 9 months. Delivery schedule for final elements of package not yet known.

Amber: Great Yarmouth Rail Station Interchange- Delay and uncertainty remain over the

Vauxhall Gardens element of the package for which a CPO may be used to acquire land.

Amber: Eye Airfield Access Link Roads- delivery delayed by more than 6 months to spring &

summer 2020 in accordance with contractor’s advice regarding progress during better weather.

Amber: SNC Digital & Technology Skills Hub- Delivery schedule not known. Project team

have not yet submitted their first claim & monitoring report.

Green: West Suffolk College Engineering and Innovation Centre.

Green: Suffolk Broadband Programme.

Green: A47/A1074 Longwater Junction, Norwich.

Green: Ipswich (Radial) Transport Package.

41

Green: Norwich Area Transportation Strategy - A11 Corridor.

Green: Ipswich Cornhill.

Green: East Coast College Energy Skills & Engineering Centre.

Green: Great Yarmouth Third River Crossing.

Green: Cefas Marine Science Hub.

Green: Bacton to Walcott Coastal Management Scheme.

Green: Great Yarmouth Flood Defences.

Green: A140 Hempnall Roundabout.

Green: Honingham Thorpe Food Enterprise Park.

Green: CCN Digi-Tech Factory.

Green: UoS DigiTech Centre.

Green: Norfolk & Suffolk Innovation Network.

Green: UEA Productivity East.

Blue: Easton & Otley College Construction Training Centre.

Blue: Lynnsport Access Road (King's Lynn).

Blue: Bury St Edmunds Eastern Relief Road.

Blue: King's Lynn Innovation Centre.

Blue: Ipswich Waterfront Innovation Centre.

Blue: International Aviation Academy Norwich

Blue: South Lowestoft Industrial Estate.

Blue: Norwich Northern Distributor Road.

Black: College of West Anglia University Centre.

Black: Upper Orwell Crossing Feasibility study.

Black: Lowestoft Third Crossing Feasibility study.

Black: Norfolk Broadband programme.

Black: Beccles Southern Relief Road.

Black: Bury St Edmunds Sustainable Transport Package.

Black: Haverhill Innovation Centre.

Black: Growth Hub Programme.

Black: Sudbury Western Bypass Study.

Black: Felbrigg Junction Improvement.

42

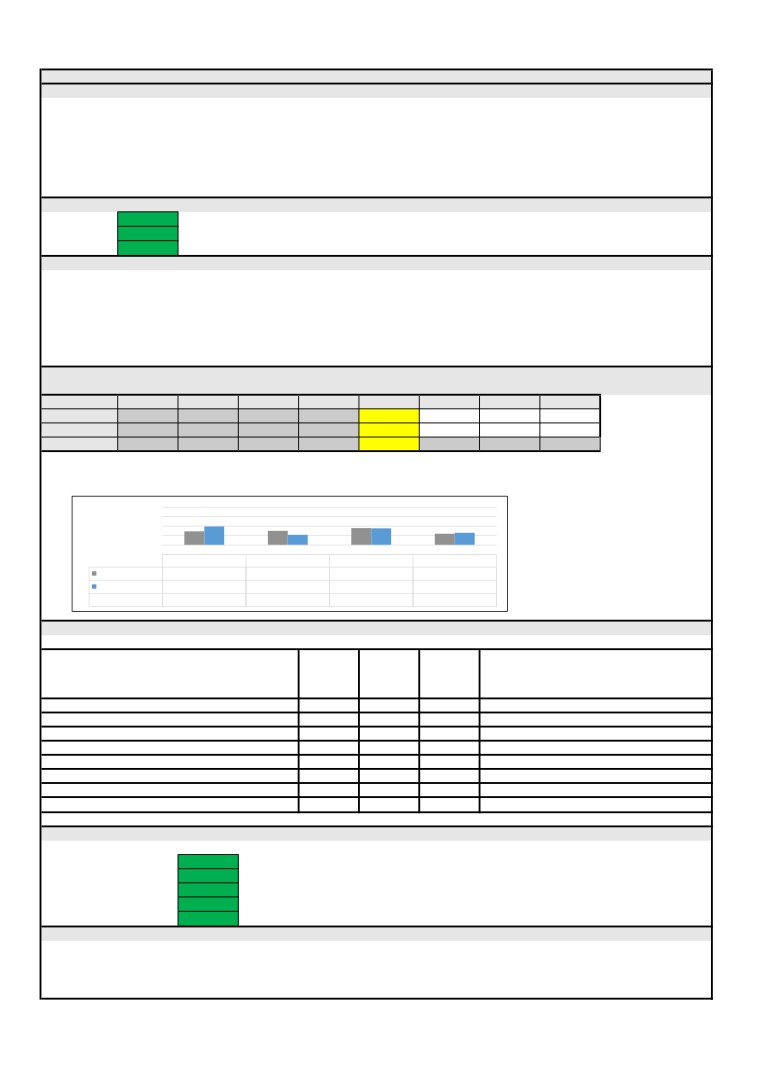

Growth Deal Dashboard

LEP Name

New Anglia LEP

Growth Deal Performance

Area lead comments

This Quarter:

Q4_1920

G

Deliverables Progress

Financial Progress

Financial Year

2015-16

2016-17

17-18

18-19

19-20

20-21

Total

This Quarter

15-17

Total

LGF Award

Housing

17-18

18-19

19-20

20-21

21-25

£36,900,000

£38,548,555

£41,334,111

£34,659,957

£24,661,848

£47,412,132

£223,516,604

Houses Completed

17

176

7

62

493

0

-

738

Forecast for year

350

0

40

150

350

155

310

1,005

Financial Year

15-17

Total

Progress towards forecast

5%

-

18%

41%

141%

0%

-

73%

LGF Outturn

This Quarter

17-18

18-19

19-20

20-21

Actual

£

7,966,471

£

75,448,555

£

28,621,444

£

29,312,509

£

25,938,681

£

-

£

159,321,190

Jobs

Forecast for year

£

43,547,372

£

75,448,555

£

28,621,445

£

35,420,467

£

43,547,372

£

40,242,892

£

223,280,731

Jobs Created

387

173

1,345

648

626

0

-

2,792

Progress towards forecast

18%

100%

100%

83%

60%

0%

71%

Apprenticeships Created*

0

8

7

10

3

0

-

28

Jobs including Apprenticeships

387

181

1,352

658

629

0

-

2,820

LGF Expenditure

Forecast for year

407

598

393

605

407

216

259

2,478

Actual

£

4,045,930

£

73,694,786

£

22,489,457

£

37,198,266

£

22,018,139

£

-

£