New Anglia Local Enterprise Partnership Board Meeting

Wednesday 30th October

10.00am to 12.30pm

The Main Auditorium, The Carnegie, Cage Lane,

Thetford, IP24 2EA

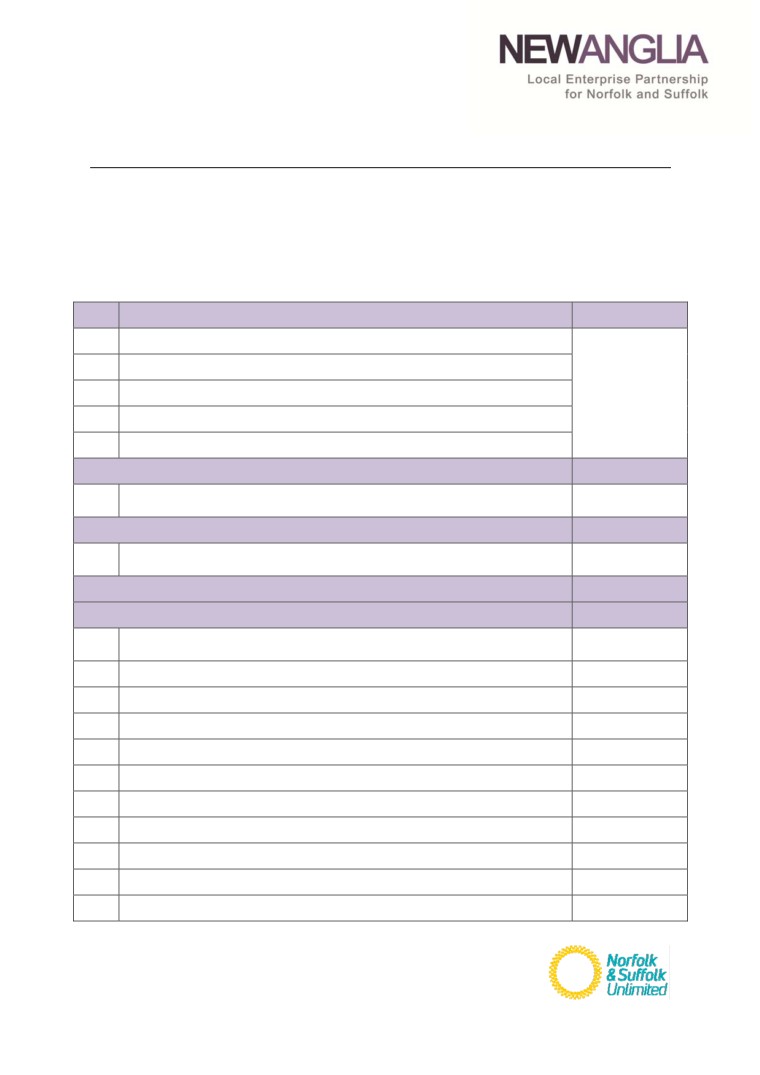

Agenda

No.

Item

Duration

10 mins

1.

Welcome from the Chair

2.

Apologies

3.

Declarations of Interest

4.

Actions / Minutes from the last meeting

5.

Welcome from Cllr Sam Chapman - Allen

Forward Looking

30 mins

Update and

6.

Cambridge - Norwich Tech Corridor

discussion

Governance and Delivery

20 mins

Update and

7.

Norfolk & Suffolk Unlimited - Next Steps inc Confidential appendix

Approval

Break

10 mins

Governance and Delivery

80 mins

Growing Business Fund Large Company Scheme Applications -

8.

For Approval

Confidential

9.

Equality and Diversity action plan

For Approval

10.

Housing Update including appendices

Update

11.

Brexit

Update

12.

The Role of the Chair / Chair job description

For Approval

13.

Skills Advisory Panel Chair

For Approval

14.

Chief Executive’s Report including confidential items and appendix

Update

15.

October Programme Performance Reports

Update

16.

Quarterly Management Accounts - Confidential

Update

17.

Board Forward Plan

Update

18.

Any Other Business

1

New Anglia Board Meeting Minutes (Unconfirmed)

25th September 2019

Present:

Sam Chapman-Allen (SC)

Breckland Council

Claire Cullens (CC)

Norfolk Community Foundation

David Ellesmere (DE)

Ipswich Borough Council

Doug Field (DF)

East of England Coop

Matthew Hicks (MH)

Suffolk County Council

John Griffiths (JG)

West Suffolk Council

Pete Joyner (PJ)

Shorthose Russell

Dominic Keen (DK)

Britbots

Helen Langton (HL)

University of Suffolk

Andrew Proctor (AP)

Norfolk County Council

Johnathan Reynolds (JR)

Nautilus

Nikos Savvas (NS)

West Suffolk College

Alan Waters (AW)

Norwich City Council

Jeanette Wheeler (JW)

Birketts

Tim Whitley (TW)

BT

Attendees

Louise Aynsley (LA)

Suffolk County Council

Shan Lloyd (SL)

BEIS

Josh Fedder (JF)

BEIS

Jai Raithatha (JaR)

Suffolk County Council

Vince Muspratt (VM)

Norfolk County Council

Chris Dashper (CD)

New Anglia LEP - For Items 8 and 9

Julian Munson (JM)

New Anglia LEP - For Item 5

Lisa Roberts (LiR)

New Anglia LEP - For Item 6

Chris Starkie (CS)

New Anglia LEP

Rosanne Wijnberg (RW)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

1

3

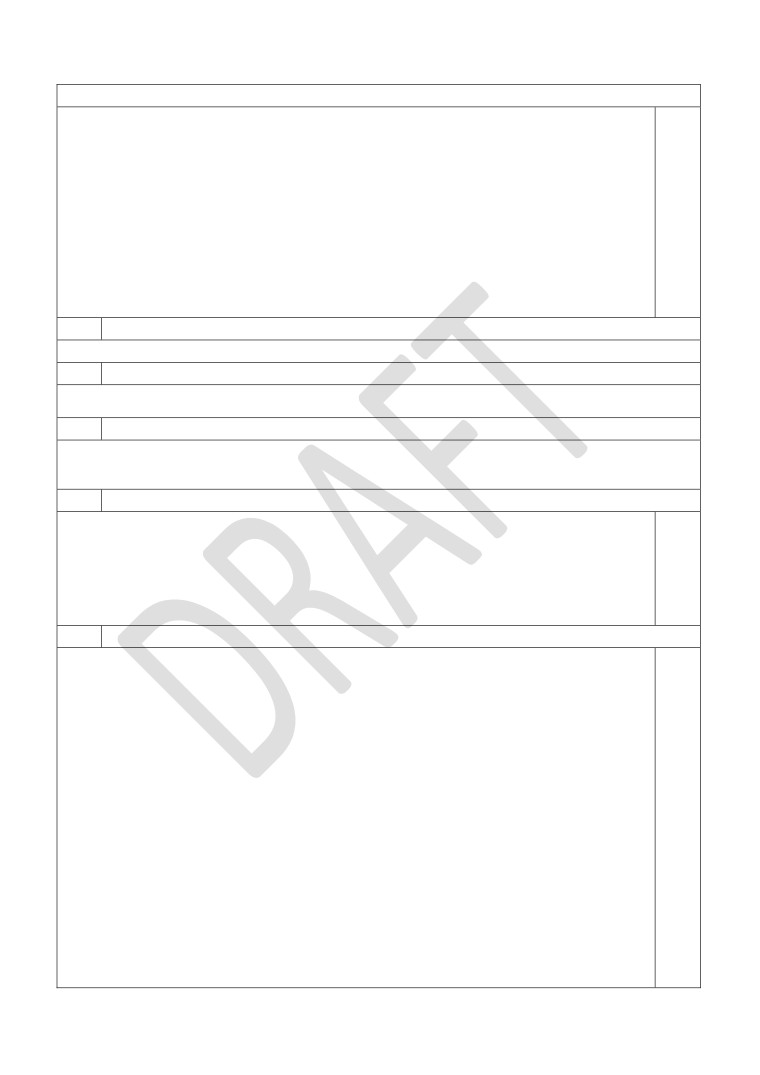

Actions from the meeting: (25.9.19)

Action Log

Enterprise Zones

Details of the overall EZ investment and the funding split to be provided

JM

A confidential update on the stalled sites to be provided to the Board

JM

Local Industrial Strategy

A one page summary of the key points of the LIS to be distributed to board members

LiR

Revised foreword to be circulated to board members

LiR

Apprenticeship Levy Transfer Pool

To be added to the reporting cycle and included as a major board item along with the skills

RW

update

AOB

CO2 Action Plan to be added to the forward plan

HW

Details of funding streams and relative timescales to be produced

CD

1

Welcome from the Chair

Doug Field (DF) welcomed everyone to the meeting

2

Apologies

Apologies were received from Steve Oliver, Lindsey Rix and Sandy Ruddock

3

Declarations of Interest

Full declarations of interest can be found at http://www.newanglia.co.uk/about-us/the-board.

Nikos?

4

Minutes of the last meeting 23rd July 2019

The minutes were accepted as a true record of the meeting held on 23rd July 2019.

Actions from last meeting updated as follows:

UEA Enterprise Fund - Chris Starkie (CS) reminded board members that there was still a

vacancy on the Enterprise Fund Board. Claire Cullens (CC) and Dominic Keen (DK)

expressed and interest and it was agreed that they would rotate the role between them.

5

Enterprise Zones

Julian Munson (JM) presented the Board with an update on the Enterprise Zones (EZs).

JM provided high level details of each of the current EZs highlighting the levels of investment

and noting any ongoing issues with the sites.

The board was advised that the development of EZs has provided the dual advantage of

allowing local firms to expand as well as attracting new companies to the area.

DK asked for further details about the tenants occupying the sites and the split between

smaller and larger companies. The board was advised that there was an even split between

business types and that sites and prospective tenants were reviewed on a case by case basis

on application.

Tim Whitley (TW) asked if the total investment could be provided including a public and

private split and also splitting the figures between the Norfolk and Suffolk EZs.

ACTION: Details of the overall investment and the funding split to be provided

JM

David Ellesmere (DE) noted that most Ipswich EZs were very successful and that although

progress had been very slow on the Island Site he felt that steps were now being taken and

would like the site to retain its status.

The Board discussed those sites which were being promoted at MIPIM in October.

2

4

Pete Joyner (PJ) asked if there were any requests from prospective tenants which could not

be met. JM advised that there was limited offer available in terms of residential and student

accommodation as most of the sites offered industrial units or offices.

Sam Chapman-Allen (SC) enquired about the stalled sites and what was being done to

progress them.

JM advised that North Norfolk District Council had chosen not to proceed with the Egmere

site. The South Lowestoft site has land ownership issues and work is ongoing to resolve this

with the possibility of transferring the EZ status which is challenging in itself. The Board

asked to be kept updated on the progress of the stalled sites.

ACTION: A confidential update on the stalled sites to be provided to the Board

JM

The Board agreed:

To note the content of the report and presentation

To receive updates on the stalled EZ sites and also details of the total investment split by

private / public investment and into Norfolk and Suffolk EZs

6

Local Industrial Strategy

Lisa Roberts (LiR) provided the Board with the background to the introduction of Local

Industrial Strategies (LIS) and the work undertaken by the LEP to produce the LIS for Norfolk

and Suffolk.

The approach was agreed by the Board in September 2018 and the process has included

extensive collaboration between partners which has included partner summits and 3 leaders’

sessions.

The updated evidence base, along with these sessions, have highlighted key themes and

emerging interventions. LiR advised that the evidence base has been scrutinised by

Government and the link from evidence to interventions has been praised.

The draft LIS has been issued to partners and the 70 pages of feedback received has been

reviewed and changes incorporated where possible. LiR confirmed that the structure of the

document has been laid down by Government and is not subject to change.

LiR highlighted the key strategic opportunities identified in the LIS and noted that partners

were keen to progress many of the interventions as soon as possible. Work is ongoing to

identify funding sources to support these opportunities.

LiR noted that the inclusion of the digital sector as a unique area of opportunity was originally

challenged by Government and she thanked partners for providing the additional evidence

which supported its inclusion.

LiR provided high level information on the key areas of the LIS.

PJ noted that 3 specific sectors where highlighted and it made sense to concentrate on those

areas of the economy where we are unique but noted that other sectors ie tourism may feel

alienated. LiR agreed and confirmed that a tourism action plan would be produced and

further work would also incorporate the voluntary sector to ensure inclusion.

DE congratulated LiR and her team on the work carried out and noted the limitations imposed

by Government. He asked for amendments to be made to the infrastructure links so that they

noted that investment was required to realise these opportunities. He also asked for

reference to the Cambridge - Ipswich - Norwich triangle to be included.

TW also expressed his support for the work and confirmed that Adastral Pak had been

identified as the leading source of patents in the country. TW noted that the foreword

reinforced the idea of the area being a leading agriculture area and that ICT was not

mentioned. He proposed that the foreword should be revised to make it more cutting

edge.

3

5

LiR advised that the amendments requested by the Board will be made and the LIS will then

be submitted to Government for review. The exact process for this review be still being

agreed but on completion any amendments will be incorporated.

ACTION: The revised forward is to be circulated to board members

LiR

Matthew Hicks (MH) noted that the endorsement process for local authorities had posed

challenges given that the LIS was still being revised during the process.

CS advised that format for the process had been put to chief executives and that both

counties had produced different proposals for endorsement.

Jeanette Wheeler (JW) asked what the key areas of focus would be for the Board and asked

for them to be included in a future report back to the Board.

Helen Langton (HL) reitereated this and asked for a one page summary to be provided to the

Board to ensure that a clear message is communicated.

ACTION: A one page summary of the key points of the LIS to be distributed to board

LiR

members

DF proposed that the Chair and the CEO should have the authority to make minor

amendments to the LIS with any more significant changes being returned to the Board for

approval.

The draft LIS was endorsed by the Board who requested to receive a copy of the final version

which will be submitted to Government.

The Board agreed:

To note the content of the report

To endorse and sign off the Norfolk and Suffolk Local Industrial Strategy subject to the

amendments agreed at the meeting

To delegate authority to make minor amendments to the LEP Chair and CEO with major

changes to be returned to the LEP Board for approval

To receive the revised Foreword and a one page summary of the key points

7

Apprenticeships Levy Transfer Pool

CS presented the proposal to the meeting which provides further details of the business case

as requested at the July board meeting.

The meeting discussed the challenges faced in creating and filling apprenticeships.

It was noted that it was important that those businesses using the fund were recognised. The

scheme also needs to be incorporated into the reporting schedule.

ACTION: The Apprenticeship Levy Transfer Pool is to be added to the reporting cycle and

RW

included as a major board item when the skill update is provided

The Board agreed:

To note the content of the report

To endorse the outlined business plan

To endorse a further £60,000 of funds to allow support to continue for an additional year

To receive future reports on the outputs of the scheme

8

Innovative Projects Fund

Chris Dashper (CD) presented the proposal which requested an annual allocation of £500k to

the programme for 2019/20 and 2020/21 from LEP funds.

The board was advised that, following the successful first call of the Innovative Projects Fund,

local authority partners in Norfolk and Suffolk agreed to match the LEP’s funding allocation

through their respective pooled business rates. This has resulted in a £1.5 million pot being

made available to prospective projects under a 2019/20 call.

4

6

It was noted that during the last call the applicants had been local authorities and this time

there would be increased promotion to SMEs to attract more applicants from businesses.

The Board agreed:

To note the content of the report

To approve the establishment of the £1.5m Innovative Projects Fund jointly with local

authorities from Norfolk and Suffolk

To approve the new governance arrangement including the Terms of Reference

To approve the launch of a 2019/20 Innovative Projects Fund Call in October 2019

9

Voluntary and Community Sector

CD presented the paper providing the board an update on the LEP’s Voluntary and

Community Sector Challenge Fund.

The Board agreed:

To note the content of the report

10

Brexit

CS reviewed the latest Brexit report and updated the board on the funding being allocated by

Government to support businesses.

It is proposed that, rather than the LEP running extra events for companies, the LEP will

supporting those already being run such as those organised by the Chambers of Commerce.

CS advised that Government has made 3 offers of funding to aid Growth Hubs to provide

various elements of business support but that some funding must be used end by the end of

October therefore the LEP is assessing the benefits of this support to ensure that is is used

effectively.

CS advised that there has been a slow down in applications to the funding programmes and

the LEP is proposing the establishment of a taskforce to provide support for businesses

facing short term difficulties following Brexit.

Andrew Proctor (AP) expressed concern about the use of public funds to support ailing

businesses and highlighted the challenges in applying criteria to funding requests.

He expressed support for providing advice but not funding. This view was supported by John

Griffiths (JG).

CS proposed bringing further details back to the October board meeting.

JW agreed that this was a difficult area but that the LEP had supported businesses in the past

who faced short term issues.

AP agreed that the funding could be used to provide further capacity to support companies.

DE suggested that the proposed criteria for funding applications be brought to the next board

meeting.

The Board agreed:

To note the content of the report

To receive details of the funding criteria at the October board meeting

11

Working Agreement with the Cambridge and Peterborough Combined Authority

CS presented the paper and the agreement which had been drafted by CPCA.

DE asked whether the agreement could be amended and asked for the inclusion of the

development of the East-West Rail link to Ipswich.

JG suggested it was reviewed by the Economic Development Officers to update the

agreement to include local developments.

The Board agreed:

To note the content of the report

To approve the agreement subject to the above amendments

5

7

12

Chief Executive’s Report

CS asked for questions from the board on the report.

He updated the board on Kwasi Kwateng’s visit to Lowestoft and confirmed that he had raised

the issue of the impact of wind farms on Suffolk coastal villages.

CS reviewed Appendix A which requested approval of the investment in the Anglia Capital

Group by New Anglia Capital which is a reallocation of existing funds.

The Board agreed:

To note the content of the report

13

September Programme Performance Reports including Dashboards

Rosanne Wijnberg (RW) reviewed the reports for September and highlighted key areas.

RW noted that excellent progress has been made in catching up on the underspend from last

year.

Nikos Savvas (NS) noted that the target for providing homes was 2026 and asked how the

shortfall would be met. CS noted this target was in line with those set by local authorities and

the LEP would work with them to support them meeting the targets.

The Board agreed:

To note the contents of the report

14

Board Forward Plan

CS reviewed the Forward Plan and asked for requests for additional items.

The Board agreed:

To note the content of the plan

15

Any Other Business

Johnathan Reynolds (JR) asked when the action plan for targeting CO2 reduction will be

produced.

ACTION: Action plan to be added to the forward plan - HW

DK asked for details of the various funding streams detailing when each pot will run out.

ACTION: Details of funding stream and their relative timescales to be produced - CD

Next meeting:

Date and time of next meeting:

10.00am - 12.30pm, 30th October 2019

Venue: The Main Auditorium, The Carnegie, Cage Lane, Thetford, IP24 2EA

6

8

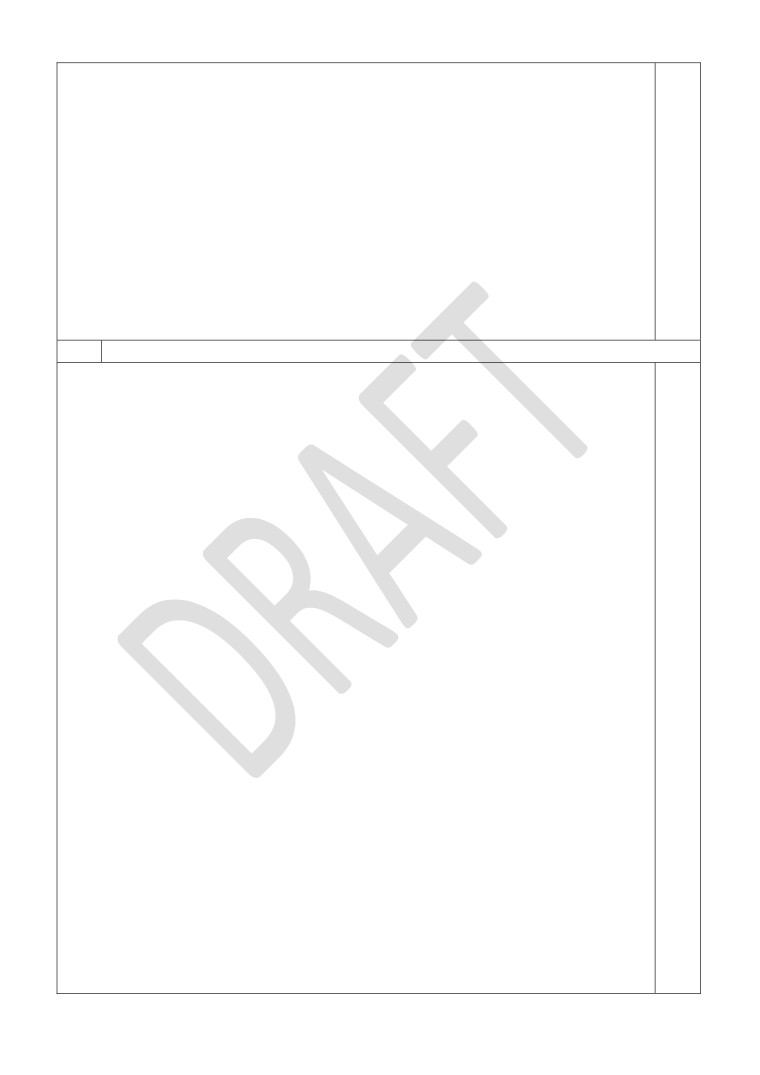

Actions from New Anglia LEP Board Meetings

Date

Item

Action

Update

Actioned

Target Date

By

25/09/2019

AOB

CO2 Action Plan to be added to the forward plan

Added to Forward Plan Items to be scheduledin Q1 2020.

HW

Complete

25/09/2019

AOB

Details of funding streams and relative timescales to be produced

Included in the October CEO Report

CD

Complete

25/09/2019

To be added to the reporting cycle and included as a major board item along with the skills

To be included in the Board Forward Plan and PPR reporting cycle for

RW

Jan-20

Apprenticeship Levy Transfer Pool

update

2020.

25/09/2019

LiR

Nov-19

Local Industrial Strategy

A one page summary of the key points of the LIS to be distributed to board members

25/09/2019

Local Industrial Strategy

Revised forward to be circulated to board members

Issued to Board members 8th October

LiR

Complete

25/09/2019

Enterprise Zones

Details of the overall EZ investment and the funding split to be provided

To be provided by November Board meeting

JM

Jan-20

25/09/2019

Enterprise Zones

A confidential update on the stalled sites to be provided to the Board

To be provided by November Board meeting

JM

Jan-20

23/07/2019

July Programme Performance

A programme summary including performance against targets will be included in future NAC

To be included in the next NAC report in January 2020

Jan-20

CD

Reports

reports

25/06/2019

GE Update Report

To provide the Board with regular reporting of the pipeline of visits relating to inward

To be included in the next Inward Investment update report

JM

Jan-20

investment and subsequent outcomes

23/05/2019

Growth Hub Presentation

Growth Hub Annual review to be circulated to the Board when published

Expected autumn 2019

CD

Nov-19

23/11/2018

Infrastructure

For the LEP team to ensure that links are progressed with other sub-national transport bodies

Progress will be included in the next infrastructure update in November

EG

Nov-19

9

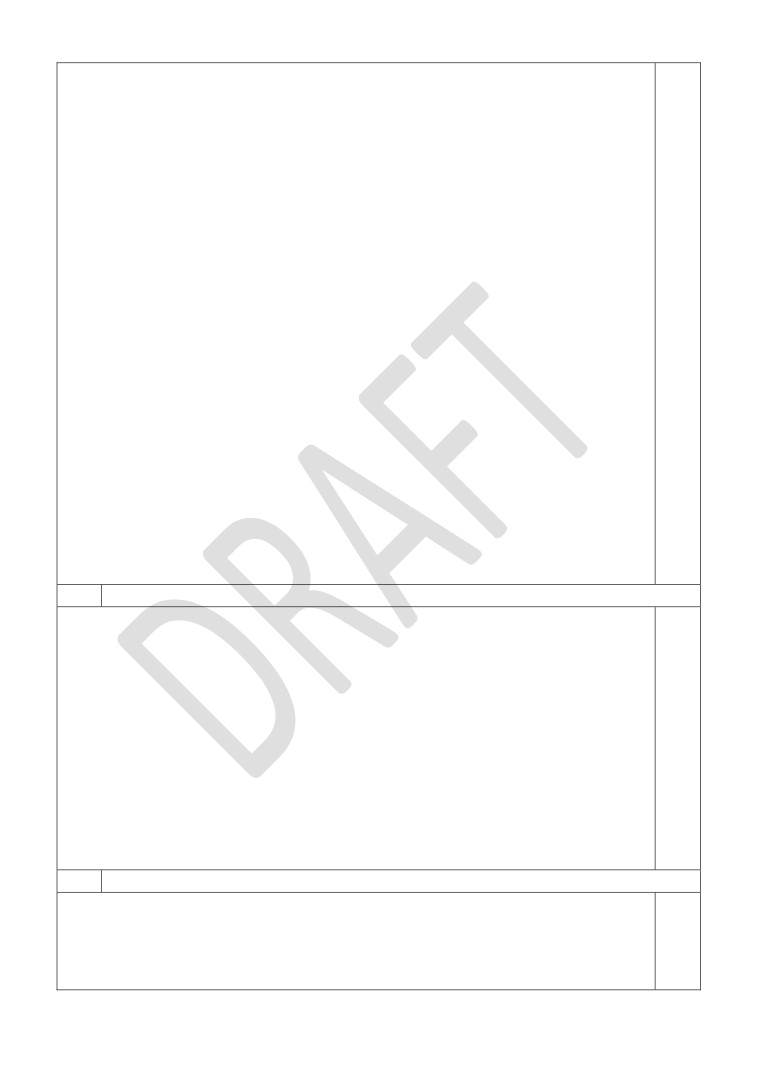

New Anglia Local Enterprise Partnership

Board Decision Log - Public

Date

Decision

Decision Made

Making Body*

25/9/19

LEP Board

The Board made the following decisions:

Local Industrial Strategy

To endorse and sign off the Norfolk and Suffolk Local Industrial Strategy subject to the amendments agreed at the meeting.

Apprenticeships Levy Transfer Pool

To approve the business plan and to endorse a further £60,000 of funds to allow support to continue for an additional year

Innovative Projects Fund

• To approve the establishment of the £1.5m Innovative Projects Fund jointly with local authorities from Norfolk and Suffolk

• To approve the new governance arrangement including the Terms of Reference

• To approve the launch of a 2019/20 Innovative Projects Fund Call in October 2019

Working Agreement with the Cambridge and Peterborough Combined Authority

To approve the agreement subject to the above amendments

10/9/19

Investment

The IAC made the following decisions:

Appraisal

Innovative Projects Fund Proposal

Committee

To approve the proposal recommending the fund and the call to the LEP Board. To approve the Terms of Reference.

7/8/19

Growing

The Panel approved the following applications:

Business Fund

• William Morfoot Limited - Agreed to support

Panel

Approved Grant: £50,000

• Timber Frame Management Limited - Agreed to support

Approved Grant: £35,662

23/7/19

LEP Board

The Board made the following decisions:

Skills Delivery Board

To approve the transition from a Skills Board to a Skills Advisory Panel as required by Government and to continue to endorse its activities

Climate Change Adaption and Carbon Reduction Action Plan

To support the development of an action plan to tackle some of the key findings of the report

Draft Annual Financial Statements

To approve the annual financial statements and audit management letter for signing by the Chair

Apprenticeships Levy Transfer Pool

To approve the £60,000 budget to develop a cost-effective model to support the transfer of apprenticeship levy to SMEs in partnership with

colleagues from Norfolk and Suffolk County Councils

Growing Business Fund: Large Company Grant Programme

To approve the introduction of a GBF Large Company Grant programme

23/7/19

Investment

The IAC made the following decisions:

Appraisal

Growing Places Fund Large Company Grant Request (Confidential)

Committee

To approve a grant of £379,318 subject to approval of the capital grant programme by the board, provision of a suitable State Aid statement by

the applicant and evidence of confirmation by the parent company that the company would remain in Norwich.

* New Anglia Local Enterprise Partnership Board, Investment Appraisal Committee, Growing Business Fund Panel, Remuneration Committee, Audit & Risk Committee

New Anglia Local Enterprise Partnership Board

Wednesday 30th October 2019

Agenda Item 6

Cambridge Norwich Tech Corridor

Author and presenter: Linn Clabburn

Summary

The paper gives an overview and update on the Cambridge Norwich Tech Corridor (CNTC)

initiative. The initiative aims to drive investment, high-value job creation, productivity, business

growth and cluster creation by working across three strategic deliverables; Reputation and

Promotion, Clusters and Assets and Infrastructure.

Recommendation

The Board is asked to continue supporting the CNTC with an allocation of £62k for the financial

year 2020/21 and to agree to work with corridor partners to secure their future commitment to

the project.

Background

The Cambridge Norwich Tech Corridor is a partnership between Norfolk, Suffolk and

Cambridgeshire County Councils; Norwich City Council; Broadland, South Norfolk, Breckland

and West Suffolk District Councils and New Anglia LEP with the ultimate aim of driving

investment, high-value job creation, productivity, business growth and cluster creation across

the Tech Corridor area.

The 2018 feasibility study by Cambridge Econometrics recommended that the Tech Corridor

initiative should aim to grow a knowledge-led, technology driven economy across the Corridor

area by creating the ‘right’ conditions for existing tech companies, attract additional tech

businesses and strengthen connections and collaboration within the Corridor. The study

identified Agri-food/Agri-tech/Food science; Life sciences, Med-tech and Pharmaceuticals;

Advanced Manufacturing, Engineering and Materials; IT, AI, Robotics, Sensors, and Big Data

as strong sectors which the Tech Corridor should continue to build on. It concluded that a

knowledge-led ‘technology corridor’ with connected, complementing technology clusters has

the potential to house an additional 46,000 additional people, 26,000 additional jobs, create

value of an additional £2.75bn to the economy and increase average salaries by £1,300 per

annum by 2036.

Based on the work by Cambridge Econometrics, the CNTC partnership agreed a vision for the

Tech Corridor area to be;

“Internationally recognised as a top-tier destination for technology firms looking to establish,

grow and cluster, for highly skilled workers looking for a rewarding career with a strong purpose

and a rich quality of life, and for businesses and investors seeking the next high-value,

sustainable opportunity”.

1

11

Key Considerations

As of September 2018, a public-private Delivery Board and a small Operational Team (2.5 FTE)

is working to accelerate the delivery plan agreed by the CNTC Partnership. The delivery plan

has three strategic deliverables; 1. Reputation and Promotion; 2. Clusters and Assets; and 3.

Infrastructure. These deliverables are achieved through a three-stage strategy to; a. build

credibility, gain buy-in and support from internal and external stakeholders; b. clearly define the

Tech Corridor’s offer and identify key ‘customers’ and; c. bring the Tech Corridor offer to market

and raise demand from internal and external ‘customers’. In the past 12-18 months, the Tech

Corridor team has used the three-stage strategy to accelerate delivery across all three

deliverables. A selection of the Tech Corridor’s key activities and outputs in the past 12 months

are summarised below.

1. Strategic Deliverable - Reputation and Promotion

Goal: To raise the profile of the Tech Corridor to be recognised as a leader in high value, tech-

driven economic and societal growth in order to attract tech businesses and skilled workforce,

investors and government and provide a respected voice in the tech conversation.

Key activities and outputs to date

Tech Corridor Recognition and Network - The Tech Corridor is the only sector agnostic

platform that aims to connect Norwich, Cambridge and surrounding towns and villages into

one network and providing a ‘front door’ for collaboration. As such, the Tech Corridor plays

an important role in creating connections, drive collaborations and support value chains

across the region. In the 2019 Tech Nation Report, James Patron, MD at the Bradfield

Centre in Cambridge highlighted the Cambridge Norwich Tech Corridor as a “key enabler

for collaboration”. With team members based across the Corridor, the initiative is

successfully promoting Norfolk and Suffolk and their opportunities within the Cambridge

business ecosystem - evidenced through several relationships and collaborations brokered

by the Tech Corridor team.

Tech Corridor Ambassador Programme - The Ambassador Programme is the main way

for private sector stakeholders to engage with the Tech Corridor initiative. The programme

has received strong buy-in and partnerships with businesses and individuals across the

Corridor including corporates including Astra Zeneca and Lotus and organisations such as

Cambridge Cleantech and Hethel Innovation. The Ambassador Network currently has 97

members.

Tech Corridor Profile - The Tech Corridor profile has grown significantly over the past 12

months with features on BBC and ITV, inclusion in Tech Nation 2019 report, Cambridge

and Peterborough and New Anglia LEP Local Industrial Strategies. The Tech Corridor has

developed a video series in collaboration with the UEA and the EDP called ‘The Disruptors’

which shines a light on innovative businesses in the region and helps promote clustering

opportunities in the Corridor.

2. Strategic Deliverable - Clusters and Assets

Goal: To connect, enhance and sweat our existing assets and clusters to drive collaboration,

knowledge-sharing, innovation, commercialisation and regional supply chain development to

ultimately drive business growth and expansion in the Corridor and attract new businesses to

our clusters.

Key activities and outputs to date

Building Partnerships with key Stakeholders - As a sector agnostic initiative, stretching

across a large geography, the Tech Corridor is actively building relationships with sector-

specific organisations such as Tech East, Agritech East, OneNucleus, Cambridge Wireless,

etc. Rather than duplicating the work of these organisations, the Tech Corridor aims to bring

organisations together across traditional sectors and geographies to collaborate, innovate

and share knowledge. Relationships with the London Stansted Cambridge Consortium and

the Cam-Mk-Ox Arc have also been developed with the aim of collaborating to attract

investment and supporting growth.

Knowledge sharing, collaboration and regional value chain building - the Tech

Corridor has organised a range of events in the last 12 months to support collaboration,

2

12

innovation and regional supply chain building. Events such as the UN Sustainable

Development Goals Innovation Challenge at West Suffolk College on the 8th October is an

example of how the Tech Corridor brought together regional businesses, students,

academics, research institutes such as the Welding Institute and organisations including

Hethel Innovation and Cambridge Wireless to work together. Over 200 businesses have

engaged in a range of events or benefitted from introductions to large corporates and

potential collaboration partners.

The East of England Investment Catalyst - the Investment Catalyst was initiated by the

Tech Corridor and is a collaboration between the Tech Corridor, Barclays, Price Bailey,

UEA, InvestEast, Anglia Capital Group and New Anglia LEP to help a small number of high-

growth companies in the Tech Corridor to access investors and raise investment rounds of

£1m+ to grow and scale. 11 companies are currently going through a programme of

masterclasses to do a showcase on the 26th November in London. The Investment Catalyst

also aims to promote the region as a location for private investors to engage with and to

build partnerships with private sector investors. Strategic partnerships with national VCs

such as Cambridge Innovation Capital, Aster Capital, Foresight Ventures (managers of the

£100m East of England Investment Fund) have been developed to date as part of the

Investment Catalyst.

3. Strategic Deliverable - Infrastructure

Goal: To create and enable inclusive growth by providing joined-up physical and digital

infrastructure, space for businesses to grow and cluster and attractive propositions for

investors.

Key activities and achievements to date

Tech Corridor Spatial Growth Vision - To enable more targeted promotion of sites and

opportunities, the Delivery Board commissioned a spatial growth vision with renowned

masterplanners Perkins + Will. The data-driven spatial growth vision is due in December

2019 and will be used to identify and promote key investment and clustering opportunities

and provide basis for further inward investment activities.

SETI - The Tech Corridor are working closely with the UEA (project lead) and partners to

develop a bid and identify funding opportunities for SETI (Smart Emerging Technologies

Institute), a proposed high-speed data-loop connecting the NRP, BT at Adastral Park,

Cambridge Science Park and Essex University. The project has the potential to be a game-

changer for the whole region as a national asset for Big Data which could be used to

underpin all the priority sectors within the Corridor.

Investment in Tech Corridor Sites - Promotional materials for individual sites within the

Corridor has been developed and for the Snetterton site, the additional promotional work

has generated a 5x increase in the number of enquiries according to Breckland District

Council.

The Tech Corridor was set up using a combination of contributions from the New Anglia LEP,

the Local Authority partners and Business Rates Pool to deliver outputs over a 2-20 year

period. The intention is for the project to run continuously, beyond the initial 2-year period to

deliver the expected outputs.

Negotiations are beginning with partners towards extending their contributions beyond the

current end date of September 2020.

We are seeking board approval to continue the LEP’s commitment of £62k per annum for the

2020/21 financial year, as our current commitment runs until March 31st 2020.

Link to the Economic Strategy and Local Industrial Strategy

The Tech Corridor is identified as a ‘Priority Place’ in the Economic Strategy and the strategic

deliverables have been developed to align and deliver components of the Economic Strategy

and Local Industrial Strategy for Norfolk and Suffolk.

Within the Local Industrial Strategy (LIS) framework, the Tech Corridor initiative will support

delivery of the foundations of productivity with a focus on; Ideas - supporting collaboration

between businesses within the Corridor and making links outside the Corridor; Infrastructure -

3

13

developing a roadmap for sustainable, inclusive development and economic growth in the

Corridor; Businesses Environment - enhancing the business environment through a range of

activities such as the East of England Investment Catalyst. The Tech Corridor is also well

placed to support the delivery of strategic projects identified in the LIS, including the SETI

project where work is already underway.

Next Steps

The current delivery plan for the Tech Corridor stretches until September 2020 and three-year

outline plan for the Corridor initiative sets key activities until end of 2021 includes key activities

across the Strategic Deliverables:

1.

Strategic Deliverable - Reputation and Promotion

Targeted Sector Promotion - working in collaboration with Norfolk and Suffolk

Unlimited (NSU), the Tech Corridor is continuing to develop joined-up, sector-specific

propositions for businesses and investors to promote proactively through a range of

media. As an initial opportunity the Tech Corridor, in collaboration with OneNucleus, the

London Stansted Cambridge Consortium and NSU, will develop a joined-up offer and

presence at the 2019 Gensis conference in London in December.

International Partnerships - as part of raising the Tech Corridor profile internationally,

the Tech Corridor team is continuing to develop strategic partnerships with regions,

organisations and investors in locations such as Amsterdam, Scandinavia and Canada.

2.

Strategic Deliverable - Clusters and Assets

East of England Investment Catalyst - following the final showcase in London on the

26th November the aim is for the East of England Investment Catalyst to be a

reoccurring programme that will host a showcase once or twice per year.

‘Network with a purpose’ events programme - following the successful delivery of

collaboration and innovation events to bring businesses and stakeholders from across

the Tech Corridor together, a programme of events will continue in partnership with a

range of organisations in the Corridor. The events link SMEs in the Corridor with other

businesses, academics, students and corporates to build regional value chains and

‘network with a purpose.

Cluster Building Innovative Projects Fund bid - In collaboration with Broadland

District Council, the Tech Corridor is developing a bid to fund a programme to support

the development of advanced engineering and manufacturing clusters across the

Corridor. The project includes an innovative ‘talent sharing’ platform that can be rolled

out across all sectors in the Corridor.

3.

Strategic Deliverable - Infrastructure

Targeted Promotion of Tech Corridor locations - following the development of the

Spatial Growth Vision for the Tech Corridor, the report form the foundation for targeted

promotion and marketing of the Tech Corridor and clusters. The Tech Corridor are

exploring opportunities to work with the LEP and partners to present the Growth Vision

at MIPIM Cannes 2020. In addition, the Growth Vision will be used in communication

with funding bodies and as a foundation to develop a ‘red carpet’ treatment for

investors.

SETI - the technical feasibility study for the SETI project has been completed and the

coming months will see the partners come together to develop the SETI ‘offer’ in terms

of potential job creation, etc. In 2020, the Tech Corridor team envisage working with the

SETI partners to identify funding opportunities and lobby for investment in SETI.

Recommendation

The Board is asked to continue supporting the CNTC by agreeing an allocation of £62k for the

financial year 2020/21 and to agree to work with corridor partners to secure their future

commitment to the project.

4

14

New Anglia Local Enterprise Partnership Board

Wednesday 30th October 2019

Agenda Item 7

Norfolk & Suffolk Unlimited

Authors: Hayley Mace and Julian Munson Presenter: Julian Munson

Summary

This paper provides an update on the Norfolk & Suffolk Unlimited place branding to help

coordinate and amplify our Offer to the World and bring together our world-class inward

investment, business location and skills offer. The new brand was successfully launched at a

high-profile business event on 25th September.

Accompanying this paper is confidential Appendix 1 which recommends the creation of a

pooled inward investment service, Invest Norfolk and Suffolk.

Recommendation

The Board is asked to note progress to date and endorse the forward plan of activity.

Background

The LEP Board agreed and signed off the new umbrella brand ‘Norfolk & Suffolk Unlimited’ in

February 2019 with approval to proceed with phase 2 which included the development of a new

web platform and promotional website, videos, business case studies and investment

prospectus which have all been completed.

A high-profile business launch of Norfolk & Suffolk Unlimited took place at Kesgrave Hall near

Ipswich on 25th September attracting over 120 delegates from across the area with senior

representation from industry, education and Government.

With the event chaired by Doug Field, the line-up of high-profile speakers included Phil

Popham, CEO of Lotus and Kieran Miles, CEO of Duco clothing. Although very different

businesses and operating in different sectors, both firms presented their exciting plans for

growth and future investment and importantly their commitment to the region and support for

the Norfolk & Suffolk campaign.

LEP Board member Jeanette Wheeler presented on the background to developing the new

brand and our new international proposition and put out a call for business ambassadors to

help us promote the area and attract new business and talent.

A video message from James Cartlidge, Member of Parliament for South Suffolk, confirmed his

commitment to the campaign and stressed the importance of coming together to promote the

region and the UK as a while to attract global interest and investment to help boost local

employment opportunities.

15

Overall the launch event was very well received with much positive feedback from partners and

businesses. Around 65 business leaders have since contacted the LEP to sign up to become

official brand ambassadors and to work with us and partners to help raise the profile of the area

nationally and internationally.

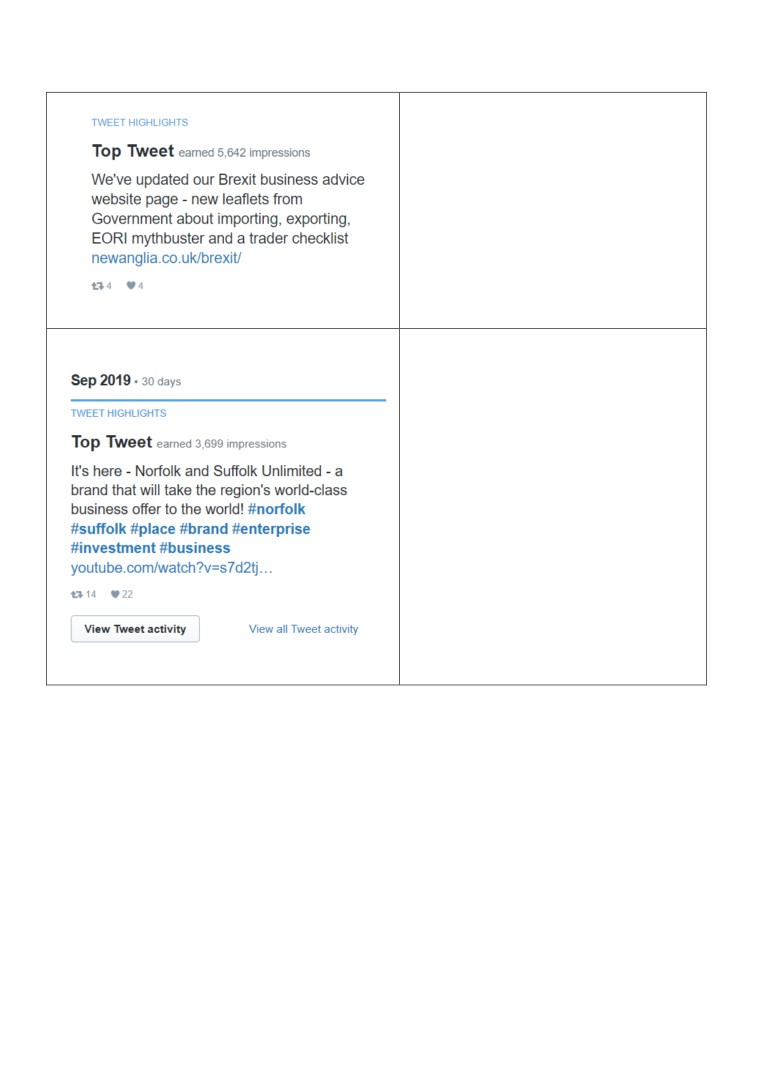

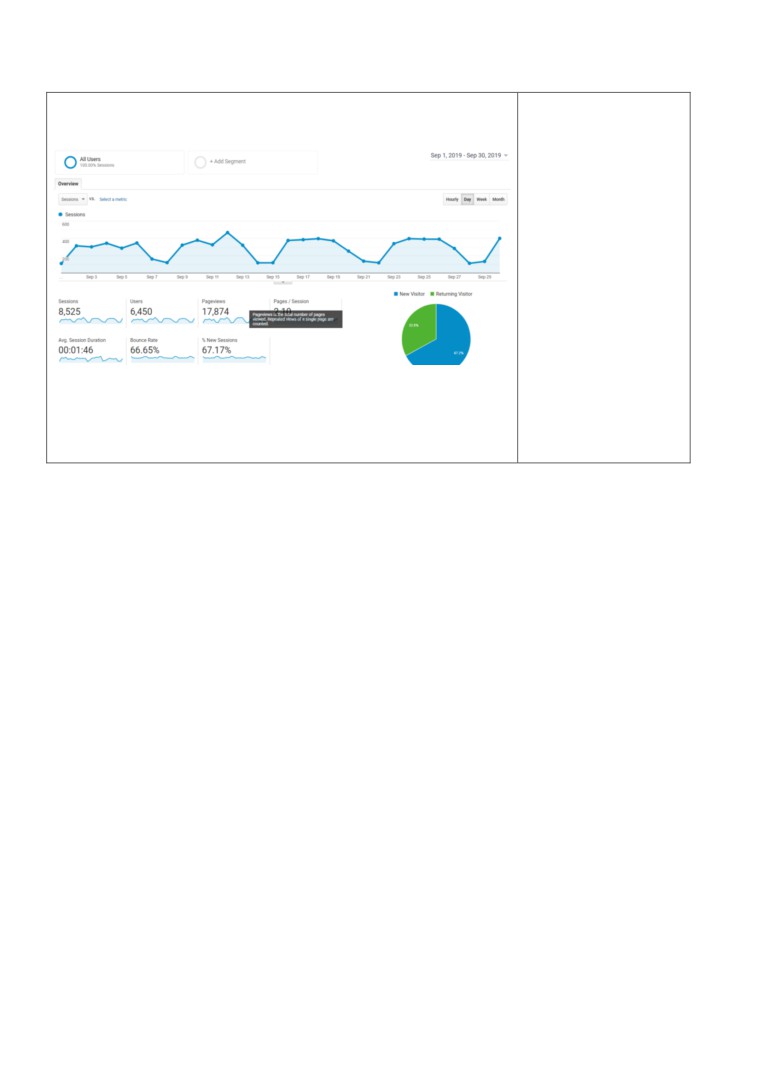

There has also been much positive engagement via social media. The Twitter account has 160

followers and tweets have received 41,500 impressions (the number of times users saw our

tweets) with an average of 24 engagements a day (likes, retweets etc).

The Linkedin page is very active, with 265 followers who are regularly sharing and commenting

on our posts. Posts have received 24,200 impressions (likes, comments, shares) and the most

shared posts have been around our presence at MIPIM UK.

The website has received over 5,875 visits since the launch, with most people visiting the

Invest and Sector Opportunities pages. The news pages are regularly updated with relevant

stories.

Forward Plan of Activity

Events Programme

A programme of events (local, national and international) is now underway to showcase the

brand and our investment opportunity across our key sectors and priority locations.

For example, the new investment prospectus, video and website - norfolksuffolkunlimited.co.uk

- were profiled at Offshore Energy in Amsterdam in early October.

The brand also featured on our exhibition materials for MIPIM UK in London on the 14/15

October, which included an investors brunch seminar with 45 attendees.

MIPIM UK provided an opportunity to highlight the new brand, talk about our key growth sectors

and showcase key development sites (Cambridge Norwich Tech Corridor, A14 Global Trade

Corridor, All Energy Coast and King’s Lynn Enterprise Zone, Ipswich and Norwich).

A number of promising leads are already being followed up from the event.

Other trade events focused on food and drink and ICT sectors are also being planned.

Developing a network of ambassadors

Brand advocacy is vital to our success. It is important that local partners and businesses ‘buy

in’ to our message, understand our ambitions and help us to promote it.

Through launch attendees, subsequent networking events and engagement on social media, a

network of 65 ambassadors has already been set up. We will continue to grow this network,

focusing on getting business leaders involved.

Hayley Mace has spoken at events in Norwich and King’s Lynn to promote the new brand and

to encourage businesses to become more involved. She spoke to 35 Cambridge Norwich Tech

Corridor ambassadors about the new brand, its development and its message for tech

businesses. It was very well received and nine businesses who attended have since signed up

to support the Unlimited ambassador campaign.

Ambassadors have been encouraged to engage with us on social media, use our collateral

(logo, prospectus, website) to help promote their own businesses, share their success stories

with us and to join us at networking breakfasts which are being arranged for early December.

16

We will use these events to update on our plans for 2020 and to showcase interesting projects

- we will be hosting at the International Aviation Academy Norwich and at the Malthouse in

Ipswich. Over 25 ambassadors have already signed up to attend.

We will continue to track and measure the level of engagement and develop a strategy for

regional advocacy and engagement (in addition to the inward investment strategy and business

location/sector campaign activity).

The LEP executive is also deploying some additional resourcing for a short term period in the

current financial year, working with the Head of Communications, to maintain the campaign’s

momentum - to help drive local engagement with our business intermediaries (Chambers etc),

business networks and ambassadors to promote the brand, as well as building a stronger

presence on social media.

Development of the inward investment website and commercial property system

It is critical that we translate greater awareness of our area into concrete leads and then

investment. Work is under way to develop the next phase of the new Norfolk and Suffolk

Unlimited website and online systems. This will include an enhanced report building feature to

allow visitors to create their own PDF document using statistics and information from the site to

create a bespoke brochure with tailored information about Norfolk and Suffolk.

We have also negotiated access to the Estates Gazette property database, which will populate

the website map with live information about available commercial property and development

sites with interactive search functionality. We plan for this phase of work to be live in early

2020.

This work is being led by the Head of Enterprise Zones and Innovation and will provide an

enhanced service to new and expanding businesses seeking new premises and commercial

sites which includes the Enterprise Zone sites across Norfolk and Suffolk.

Creation of a new digital marketing platform

The next phase also includes the creation of a new digital campaign platform enabling the LEP

and partners to develop bespoke proactive campaigns relating to specific sectors and locations

and then target potential investors. A level of integration with the LEP/Growth Hub CRM system

will also enable leads and enquiries to be captured and tracked more effectively with the ability

to measure outcomes in a more coordinated way.

This activity overall is being led by the LEP (Head of Enterprise Zones and Innovation and

Head of Communications) in partnership with Norfolk and Suffolk County Councils as part of

the Invest East initiative and is therefore part funded by ERDF European funds and will enable

a more proactive and targeted approach to marketing and generating new inward investment

leads.

Creation of a single inward investment team

Proposals to develop a joined-up, more cohesive Norfolk/Suffolk wide inward investment team

are progressing with the LEP working in partnership with the County Councils.

The initial concept of a ‘single agency model’ for inward investment was agreed as an action in

the Norfolk and Suffolk Economic Strategy and supported by the LEP Board. This will help

deliver a more effective and proactive service for promoting the area and attracting new

investment leads. More detail on this can be found in the confidential appendix 1.

17

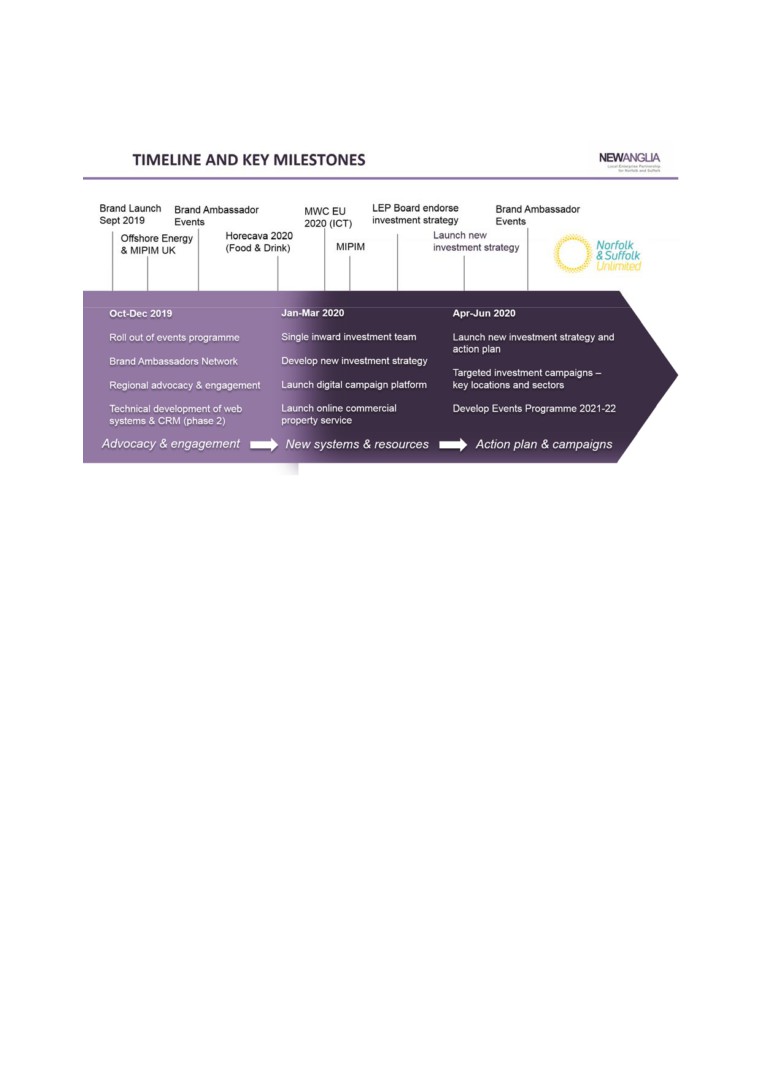

Overall timeline and key milestones

Governance and Resourcing

A place brand steering group, bringing together public and private sector partners, has been in

place during the development of the new brand and will continue to meet. This includes

representation from County and District Local Authorities, LEP and Chambers of Commerce.

The steering group is chaired by the Head of Enterprise Zones and Innovation.

As outlined in the accompanying appendix a new board will be created to oversee the pooled

inward investment service, including its business plan and KPIs. This will replace the existing

LEP inward investment and trade board.

Recommendation

The Board is asked to note progress to date and endorse the forward plan of activity.

18

New Anglia Local Enterprise Partnership Board

Wednesday 30th October 2019

Agenda Item 9

Equality and Diversity Action Plan

Author: Charley Purves

Presenter: Rosanne Wijnberg

Summary

This paper provides a summary of activity since January 2019 on the diversity agenda and sets

out the actions to be taken over the next twelve months.

Recommendation

The board is requested to endorse the Equality and Diversity Action Plan.

Background

The board appointed David Ellesmere as the Diversity Champion for the board in January 2019

and accepted that part of the remit would be to accept an annual report on progress and

consider improvements.

The Diversity Champion will assess the diversity progress of the LEP board itself, as well as the

executive team and the boards and sub-committees that feed into the main LEP board. New

Anglia LEP is committed to ensuring that at least a third of its main Board members are female

by 2020 and that there is equal representation by 2023. However, equality and diversity is

about more than just a gender balance. It is about ensuring that the community the LEP is

working for and landscape of Norfolk and Suffolk are fully represented.

Following wider board input, the Equality and Diversity Policy has been further developed and

strengthened, and an external facing Equality and Diversity Statement has been created which

Diversity-Policy-Policy-Statement-May-2019.pdf.

Key Considerations

Three areas have been identified as priority areas of activity:

Recruitment and membership

Ensuring that our recruitment processes are open and transparent, and no particular

group are precluded from applying. That the boards and sub-committees are

representative of the local communities.

Decision making

Providing the rights skills and knowledge for the boards and sub-committees to make

decisions and recommendations without discrimination or bias.

1

29

Workforce

Ensure that opportunities for employees and prospective employees of the LEP are

accessible and all reasonable adjustments are made where practicable to remove any

substantial disadvantages.

Next Steps

The executive team are undertaking a review of current membership of boards and sub-

committees as well as an internal survey in order to benchmark statistics.

Over the next twelve months, it is proposed that the following actions take place:

Equality and Diversity training to be arranged for board members within a board meeting

to cover responsibilities including the public sector duty and provision of goods and

services, types of discrimination and unconscious bias.

Equality and Diversity training to be rolled out to the LEP executive team.

Review of recruitment practice for boards and committees as well as workforce and a

review of the work experience offer including internships.

Women in Business dinners hosted by Jeanette Wheeler to engage female business

leaders in the work of the LEP and create a pool of future candidates.

Review and update the criteria used for grant and loan funding decisions to ensure

equality, diversity and inclusion are taken into consideration.

Produce an action plan addressing further issues for the following twelve months.

Further progress reports, with statistical evidence, will be brought to the board on an annual

basis.

Recommendation

The board is requested to endorse the Equality and Diversity Action Plan.

2

30

New Anglia Local Enterprise Partnership Board

Wednesday 30th October 2019

Agenda Item 10

Housing Update

Author and presenter: Ellen Goodwin

Summary

This paper summarises the work of the LEP on the housing agenda and recommends

actions for the LEP to support SMEs housebuilders as a key element in achieving the

140,000 home target in the Norfolk and Suffolk Economic Strategy.

It also summarises the work of our construction sector group, Building Growth Group and

proposes a reconstitution to align with progress on this agenda since its inception almost five

years ago.

Recommendation

The Board are asked to:

Agree in principle the commissioning of a research piece to identify construction and

housebuilding SME activity in Norfolk and Suffolk, identifying barriers and what can

be done about them with the view of diversifying the industry in the longer-term. The

brief for this work will be developed with partners;

Delegate authority to the Chief Executive to commission the above research once an

brief with partners has been agreed; and

Agree the reconstitution of the Building Growth Group to align with the Norfolk and

Suffolk Economic Strategy, the Local Industrial Strategy and the outputs of the

Housing Conference. The overarching theme of the group will be clean growth.

Background

Housing White Paper - Fixing our broken housing market

The Government’s White Paper focuses on planning for the right homes in the right places;

building homes faster; diversifying the market and helping people now.

Norfolk and Suffolk Economic Strategy

The Norfolk and Suffolk Economic Strategy recognises the importance of housing as an

economic driver and enabler and sets a target to deliver 140,000 new homes across the

area by 2036. The Strategy commits to building the right kind of housing and commercial

space where it is needed and highlights the need for coordinated investment in housing and

31

infrastructure that people and businesses need. It also looks to deliver a smoother planning

system and explore innovative approaches to funding and financing.

At the last Board meeting Chris Starkie noted that the housing target in the Economic

Strategy was in line with those set by local authorities and the LEP would continue to work

with them to support them in their delivery.

The Board last received an annual update on the Norfolk and Suffolk Economic Strategy

housing target in February 2019. It showed that during 2017/18 housing completions in

Norfolk and Suffolk totalled 4,900 compared to an Objectively Assessed Need (OAN) figure

of 6,978 new homes.

The challenge to meet OAN is part of a wider domestic trend, where supply has not met

demand in the housing market for a number of years. However, Local Plan allocations and

permissions data do indicate that there could be quite a substantial upswing in housing

completions to 2021.

Given the historic delivery against OAN, the target in the Norfolk and Suffolk Economic

Strategy is considered ambitious. With the growth in the housing market also reliant on

wider economic conditions such as low interest rates and the wide availability of credit short-

term economic uncertainty could reduce demand for housing which would in-turn impact

completion figures.

The Local Industrial Strategy

The Local Industrial Strategy highlights the housing delivery challenge but recognises the

upswing in Local Plan allocations and planning permissions. It also focusses on the

importance of forward funding infrastructure to unlock growth and the commitment from

partners to quality design, integrated infrastructure and the sustainability agenda.

What are we already doing?

Local Authorities

District and Borough Councils are responsible for planning and determining future

development at the local level. This means that they are responsible for developing Local

Plans as well as development management. In addition, local authorities are also

designated housing authorities.

Broadland District Council, Norwich City Council and South Norfolk Council are working with

Norfolk County Council through the Greater Norwich Development Partnership to develop a

Joint Local Plan for the Greater Norwich area.

The majority of local authorities in Norfolk and Suffolk, including the two County Councils,

have also set up their own Housing Companies responsible for housing delivery. Although

the scale of delivery of these companies is generally still quite small compared to overall

delivery rates, there is potential for significant growth.

Housing Associations

Housing Associations in England are independent companies established for the purpose of

providing low-cost social/affordable housing for people in housing need on a non-profit-

making basis. There are a number of Housing Associations active in Norfolk and Suffolk.

These too have the potential to deliver more social housing as well as open market housing

in the longer term.

32

New Anglia LEP

Whilst not directly responsible for planning or housing delivery, the LEP is supporting

housing growth in a number of ways.

Influencer

The LEP continues to influence national housing policy through the LEP Network and its

strong relationship with Homes England, Government (MHCLG) and others. The Network

offers the opportunity to share intelligence and look at best practise from across the country,

enabling us the opportunity to test pilots with the view of accelerating housing delivery and

rolling out where successful.

The LEP will continue to work with the Housing and Finance Institute to engage MPs in the

housing delivery debate. It will also continue to engage with How Should Norfolk Grow,

Suffolk Design and other initiatives as appropriate to help accelerate the delivery of high-

quality, sustainable homes across Norfolk and Suffolk.

Communicator

The LEP will continue to ensure the link between economic growth and housing is well

understood. It will do this through initiatives such as Norfolk and Suffolk Unlimited as well as

the Economic Strategy and the Local Industrial Strategy.

Evidence

The LEP will continue to boost its evidence around housing need and delivery. We will

continue to develop more granular housing sub-metrics to better understand need, demand

and affordability and share data across the area.

Funding

The LEP already uses its Growth Deal and the Growing Places Fund to unlock housing

sites. Growth Deal has helped to unlock 476 new homes to date while the Growing Places

Fund has helped to deliver a further 468 new homes to date.

Building Growth sector group

Much of the LEP’s activity on housing is driven by its Building Growth Sector Group. The

group which brings together partners from the private, public and voluntary sectors and has

been active for almost five years.

It has focused mainly on four key stakeholder objectives to date based on initial stakeholder

feedback: housing, planning, skills and utilities. Since its inception it has also considered

place and innovation. While some of these work strands have progressed well it is vital that

the Group remains adaptable into the future as priorities change.

One of the ways in which the Building Growth Group has already considered its ongoing

work programme was through the Housing Conference entitled “Quantity, Quality and

Affordability: how do we deliver the sustainable homes we need?” More details of this event

can be found below.

Housing conference - 11 July 2019

Working with the Housing Finance Institute and Suffolk Growth Programme Board a housing

conference focussed on quantity, quality and affordability took place at Wherstead Park on

11 July 2019.

The overview of the conference report which can be found at Appendix A describes the

event as:

33

“A well-attended event that used both traditional conference approaches (e.g. keynote

speeches / sector overviews) combined with panel sessions and the use of technology to

enable greater audience participation. The interest in this event was overwhelming with the

mix of public and private sector being 41%/59% respectively. It proved how passionately the

whole sector feels about the housing agenda and working collaboratively to find innovative

solutions to the challenges we face in Norfolk and Suffolk. Overall the event provided a

positive, productive and thought-provoking debate.”

Barriers and issues identified at the housing conference

The following next steps were agreed as tangible next steps from the housing conference:

Consider the climate change challenge including more environmental and modern

methods of construction, sustainable materials and smart technology

Develop and promote the construction skills offer through new or expanded skills

academy/ies to broaden sector appeal

Develop a Norfolk and Suffolk developer forum with planners to help develop

relationships, smoother planning and promote better design in Norfolk and Suffolk

Consider how to boost housebuilding capacity and diversity be encouraging new

entrants to the market including SMEs

Consider how we further promote the sector through initiatives such as Norfolk and

Suffolk Unlimited

Engage MPs in the ongoing housing delivery debate to establish if there are any

legislative changes that could further boost housing delivery

Building Growth Group to consider its governance and re-structure accordingly, re-

engaging members with refreshed terms of reference and work programme

The Building Growth Group and partners will need to continue to consider how we deliver on

these as part of the ongoing thinking on the housing agenda.

What the LEP will do next

Influencer

We will further strengthen our role as a facilitator to bring together local authority (including

housing companies), government, private sector partners (developers, contractors,

landowners etc.) and Housing Associations to assemble information and think more

strategically and commercially about accelerating housing delivery over a wider than LPA

geography, focussed on Priority Place. This will be done through a re-constituted Building

Growth Group as described below.

Communicator

We will work with the Housing Finance Institute to deliver a Westminster summit for MPs.

The timing for this event will be considered to ensure maximum impact.

Evidence

We recommend commissioning a short research piece to identify SME construction and

housebuilding activity in Norfolk and Suffolk, identifying barriers and what can be done about

them with the view of diversifying the industry in the longer-term. The brief for this work will

be developed with partners.

Supporting SMEs is a key priority for the LEP and a lack of SME players in the

housebuilding sector has been identified as a gap in the marketplace. But we need to

understand in much greater detail the challenges being faced by these companies and what

would help support their growth.

34

As a result of this work, we would hold events to attract new entrants and to support the

supply chains using both the New Anglia Growth Hub and the Norfolk and Suffolk Unlimited

brand. Funding for this work can be accommodate by existing budgets.

Funding

We could decide to use our programmes to further focus on accelerating housing delivery

including possible site acquisition and servicing. However, we would need to better

understand what is holding delivery back as infrastructure/ site development funding/ finance

is likely to not be the only reason explaining slower than needed delivery.

Governance

It is proposed that the Building Growth Group reconstitute itself to overcome some of the

barriers and capture some of the opportunities identified by this paper as well as any new

ones which come forward.

It is proposed that clean growth will be the overarching theme of Building Growth Group and

that the supporting work strands will be as follows:

People, including skills to increase the number and diversity of people entering the

industry and ensuring they have the right skills to deliver at scale and of a high quality,

sustainable design

Funding and finance, tasked with looking at the innovative ways of funding and financing

clean growth developments in Norfolk and Suffolk

Design and Innovation, working with Suffolk Growth Programme Board and the

Innovation Board to champion and promote quality and the use of new, more

sustainable materials. This work strand would also consider the deployment of

innovative delivery methods at scale

Land pipeline, to ensure sufficient and appropriate land is available, allocated and

appropriately consented to encourage sustainable growth

Recommendation

The Board are asked to:

Agree in principle the commissioning of a research piece to identify construction and

housebuilding SME activity in Norfolk and Suffolk, identifying barriers and what can

be done about them with the view of diversifying the industry in the longer-term. The

brief for this work will be developed with partners;

Delegate authority to the Chief Executive to commission the above research once a

brief with partners has been agreed; and

agree the reconstitution of the Building Growth Group to align with the Norfolk and

Suffolk Economic Strategy, the Local Industrial Strategy and the outputs of the

Housing Conference. The overarching theme of the group will be clean growth.

Appendix A - housing conference report

Appendix B - housing data

35

APPENDIX A - Housing Conference Report

Quality, quantity or affordability?

How do we deliver the sustainable homes we need?

Thursday, 11 July 2019: 10am - 4pm

The Atrium, Wherstead Park, Ipswich, IP9 2BJ

Overview

A well-attended event that used both traditional conference approaches (e.g. keynote

speeches / sector overviews) combined with panel sessions and the use of technology to

enable greater audience participation. The interest in this event was overwhelming with the

mix of public and private sector being 41%/59% respectively. It proved how passionately the

whole sector feels about the housing agenda and working collaboratively to find innovative

solutions to the challenges we face in Norfolk and Suffolk. Overall the event provided a

positive, productive and thought-provoking debate.

Summary of conference sessions

Introduction: Doug Field

Doug Field welcomed people to the event and challenged people to think about the

challenge we face in Norfolk and Suffolk to delivering 140,000 new homes by 2036. He

stated that a home is more than bricks and mortar and that it was imperative that we build

the right homes in the right place and in a way that is environmentally sustainable,

something that is particularly important given the clean growth challenge we all face.

Keynote: Tony Pidgley

The conference then heard from Tony Pidgley of Berkley Homes. Tony stressed the

importance of planning for people and building communities ahead of profit. He noted the

criticality of communication and a collaborative culture. Finally, he challenged policy makers

to be flexible in their approach in order to achieve the ambitions we all agree are needed.

CITB announcement: Sarah Beale

Sarah Beale, CITB launched a £17.8m fund for an additional 20 ‘hubs’ to support onsite

training opportunities. She stated that attracting people to the industry was a difficult with

access to training not always easy. Industry engagement also proves challenging. Sarah

also highlighted that there would be a shortage of 170,000 workers by 2023 and outlined

CITB’s six initiative responses. She stressed the importance of innovative methods.

36

Building Skills Panel - Saul Humphrey, Sarah Beale (CITB), Tom Oliver (Ilke Homes) and

Nikos Savvas (West Suffolk College)

Saul Humphrey introduced the skills panel and the members. Key points:

-

Agreement from panel members that construction skills courses need to ensure

participants are site ready - not just the technical skills but the behaviours that are

needed on a site. Ilke Homes highlighted they look for wider skill sets e.g. ability to

work as part of team etc. 85% of Ilke workforce have no particular construction skills

on appointment...

-

Apprenticeships need to deliver better outcomes for both the participant and industry.

How can we make the levy more flexible to encourage greater take up?

-

Industry is currently quite fragmented, we need to make it more inclusive,

overcoming the perceptions that many have about the industry. Move away from

traditional view and promote higher skills levels, e.g. increasing use of technology in

construction; move towards sustainable methods and new materials; reflect on skills

needs on a project by project basis

-

Improving skills requires new entrants and new/more tutors. Need to look at

encouraging more assessors into the industry but have to address wage levels for

tutors, look at greater college/employer collaboration to deliver skills training and

increase course to industry retention rates (currently 15% of those on courses enter

the industry)

Key questions from the audience:

1. Aren’t creativity, design, place and deep sustainability key to changing the culture of

this industry to attract and keep people?

2. There is a huge demand across all sectors for civil engineers and designers.

However, businesses are still going bust, why is this still happening?

3. How will CITB, employers and trainers collaborate to address housing’s contribution

to CO2 emissions in light of the government’s commitment to net zero by 2050?

4. What else can the industry do to help particularly smaller businesses to take on more

apprentices? Businesses find the current process too complicated

5. How can we support subcontractors in recruiting new entry roles when they

predominantly rely on self-employed gangs who are paid on piece work and quality?

37

Embedding Quality Panel - Wayne Hemmingway (Hemingway Design), Chris Lamb (Design

South East), Mark Chapman (Taylor Wimpey), Andrew Dobson (Crest Nicholson), Ed Gilder

(Badger Building), Stuart McAdam (Persimmon Homes) and Will Vote (Rose Builders)

Wayne Hemingway introduced the Panel session and members. Highlighted the fact that

Panel represented 3 of the UK’s national housebuilders (Taylor Wimpey, Crest Nicholson

and Persimmon Homes) and recognised the strength of the conference in securing 5

housebuilders to jointly discuss design and quality issues.

Key points to note:

-

Communities at the heart of change

-

FTSE index has fewer housebuilders currently than at any time

-

Rate of delivery between large housebuilders/smaller firms is roughly the same (100

homes per site per annum) - larger housebuilders just have more sites. But given

c.£28 million is needed to deliver 100 homes per annum (company’s investment)

where are SME builders/developers meant to get this money given the current

position of the banks/lending market?

-

Need to address the issue of land value and the impact the cost of land has on the

design/quality of homes

-

Need to define what we mean by high quality early in the process and stick to it…

quality means different things to different people (e.g. an architect, a customer, a

local authority, a community). This must be recognised alongside the market forces

that mean different products are needed for different budgets.

-

Need to engage with communities early in the process: three-way conversations

between housebuilders/communities/local authorities

-

Need to address what can be covered in legislation and whether Government has an

appetite to introduce national design standards as a ‘level playing field’ for

developers. Agreement that environmental agenda is likely to drive this legislation

forward more quickly in the coming months/years.

Key questions from the audience:

1. We build the smallest expensive low-quality homes in Europe. How do developers

up their game to build homes not units?

2. Should there be more pressure on housebuilders to do more to ensure improved

quality of construction? Often and press on poor quality construction

3. When will developers embrace environmental sustainability and see that it can be a

selling point rather than an unnecessary cost to development?

4. Industry and planners aren’t trusted by communities. What could we do to develop

and embed that trust?

5. To embed true environmental quality in and industry that is inherently profit driven do

we need legislation and tighter conditions locally?

6. How do we get mainstream contractors building homes in areas of dire need but

where the market doesn’t support viability?

38

Strategic Context and Key Housing Issues: Natalie Elphicke

Natalie Elphicke of the Housing and Finance Institute laid out the strategic context and key

housing issues from her perspective. She highlighted the significant progress made by all

since the 2008 crash with regard to delivery but stressed that the 300,000 new homes p.a.

was a huge challenge moving forward. Natalie referenced the constantly changing market

and the importance of flexibility and adaptability. Finally, she stated that investment from

across the public and private sector and commitment at the national and local level will help

boost delivery further.

Attracting Investment Panel: how partnership working can boost housing and infrastructure

delivery? Pete Gladwell (Legal and General), Richard Bacon (MP for South Norfolk), Ben

Denton (Legal & General), Natalie Elphicke (HFI) and Paul Kitson (Homes England)

Pete Gladwell introduced the session and the panel members. Key points:

-

Investment models currently focus on subsidising demand, need to balance these

with approaches to subsidising supply

-

Greater emphasis needed on boosting funding for infrastructure (upfront in some

cases) and address viability issues

-

Agreement that greater partnership working is needed to deliver the homes - local

authorities could be more involved, e.g. direct deliver, use of public land, role for

strategic planning, reducing risk. Critical to understand local specifics

-

Greater mix of investment models needed, e.g. serviced plots for self-build (Dutch

model); use of patient capital; mix of finance for build costs / running costs (e.g.

building homes that cost nothing to heat); longer term landowner legacy culture

Key questions from the audience:

1. The last time that 300,000 new homes were built in this country Council’s built a good

percentage of them. Shouldn’t government get Council’s building again at scale?

2. Are Homes England going to provide true leadership in providing the finance needed

to deliver housing in areas of need where viability challenges the market?

3. Do you think CIL is working? Is it actually delivering?

4. Why can’t the government make utility companies join in more strategic

conversations around infrastructure rather than the old-fashioned approach site by

site?

5. Building societies and the OBR agree that help to buy has added around £12,500 to

the price of a home. Has it been worth it?

6. The brownfield register is a great planning incentive, but the sites aren’t delivered.

Why isn’t Government offering a financial incentive?

Conference summary: Chris Starkie

Chris Starkie, New Anglia LEP summed up the day’s events and reiterated the need to

improve, streamline and speed up housing delivery across Norfolk and Suffolk in the coming

years, making sure we have the right homes in the right place and that they are built to a

high sustainable quality

39

APPENDIX B - Housing data

Norfolk and Suffolk Economic Strategy: 140,000 new homes by 2036 target

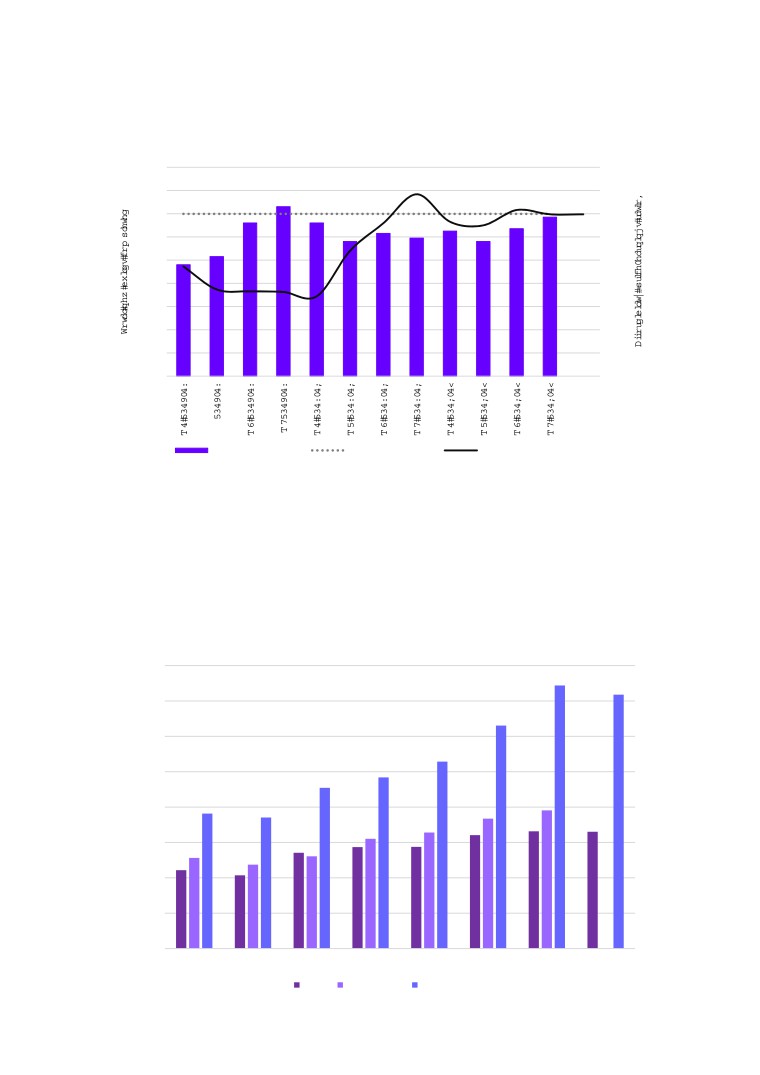

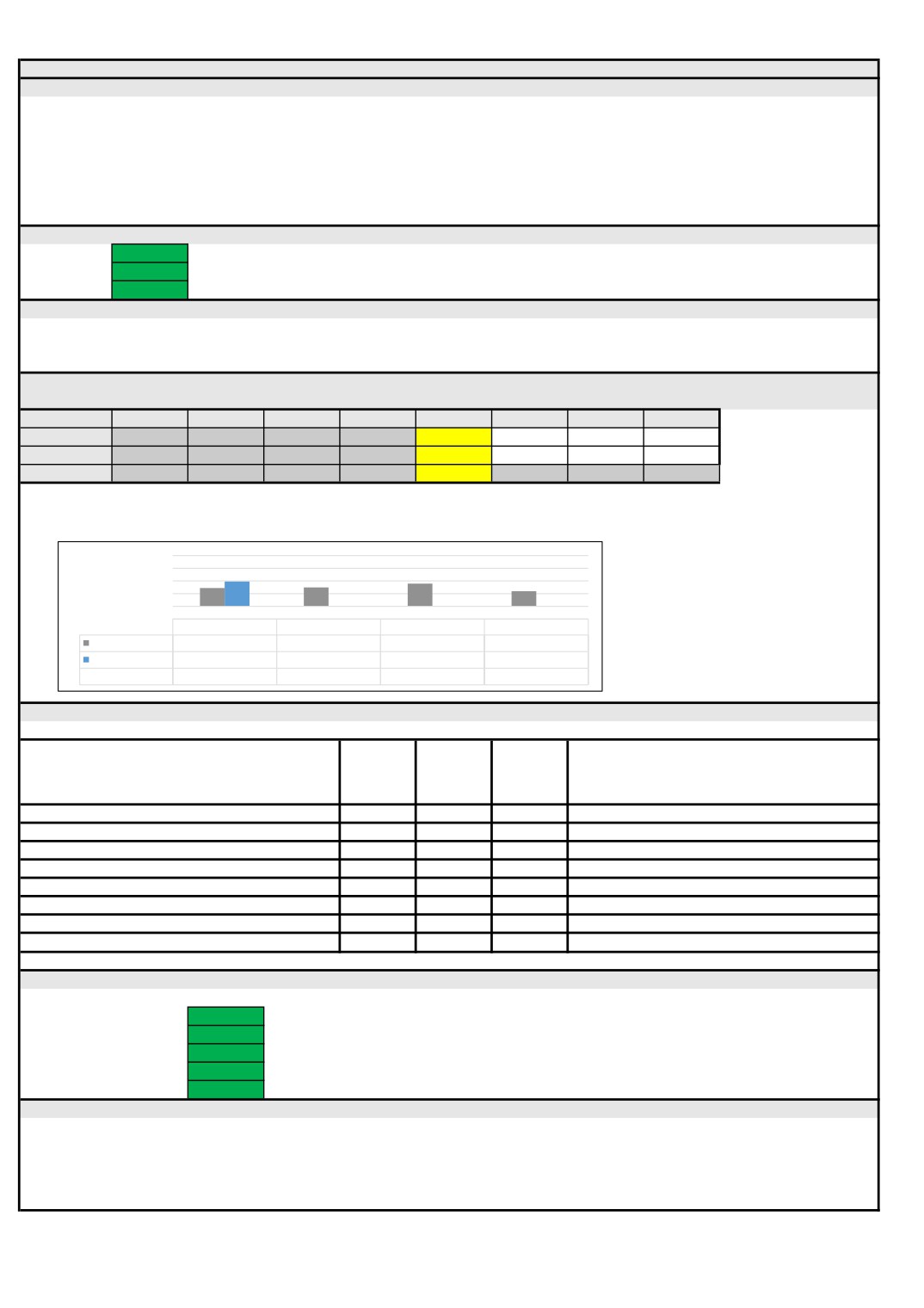

Fig. 1 Housebuilding and affordability

' %! (%

)

* *

* $

+

NOTE: Proxy metrics (used below) are leading indicators used to informally track quarterly trajectory and context - actual progress of ES indicators

will be officially reported annually (Feb)

Housing delivery continued a strong trend, building on the progress since previous Q

Although still somewhat below the OAN targets, this trajectory is encouraging

It has not been possible to provide a specific update on the affordability ratio this Q

There was a slight dip in median salaries advertised, so its unlikely much has shifted

Fig. 2 - number of housing units started, completed (data not available for 18-19) and those granted

detailed planning permission in England (data for 18-19 based on pro-rata information from 3 Qs)

,

,

,

,

,

,

!

!

&

!

SOURCE: Glenigan/HBF and HMCLG live tables 208 and 120

40

New Anglia Local Enterprise Partnership Board

Wednesday 30th October 2019

Agenda Item 11

Brexit

Author: James Allen Presenter: Chris Starkie