New Anglia Local Enterprise Partnership Board Meeting

Wednesday 26th February

10.00am to 12.30pm

Gallery Three, Ipswich Town Hall, Cornhill, Ipswich, IP1 1DH

Agenda

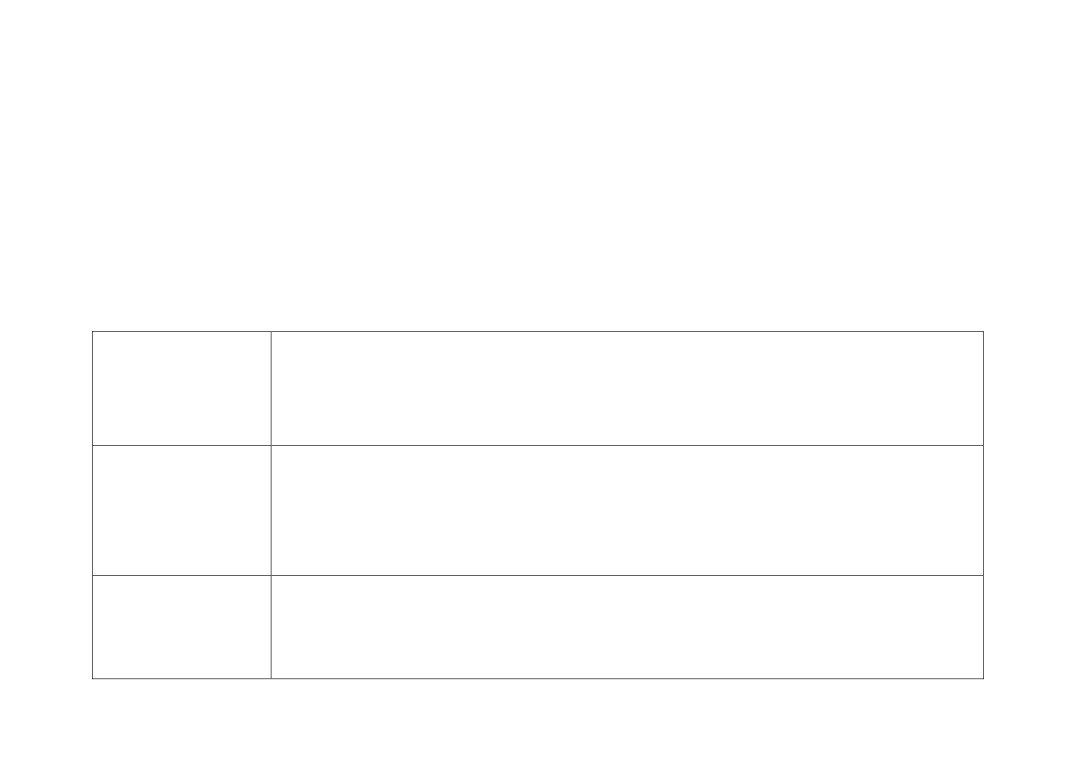

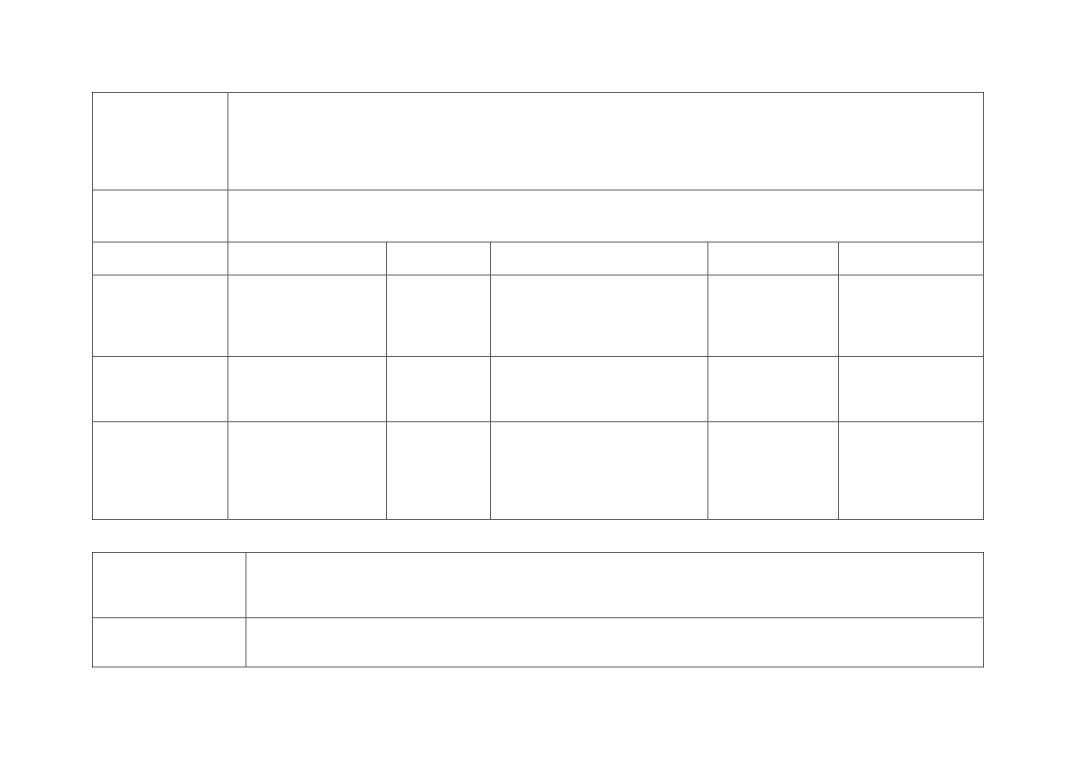

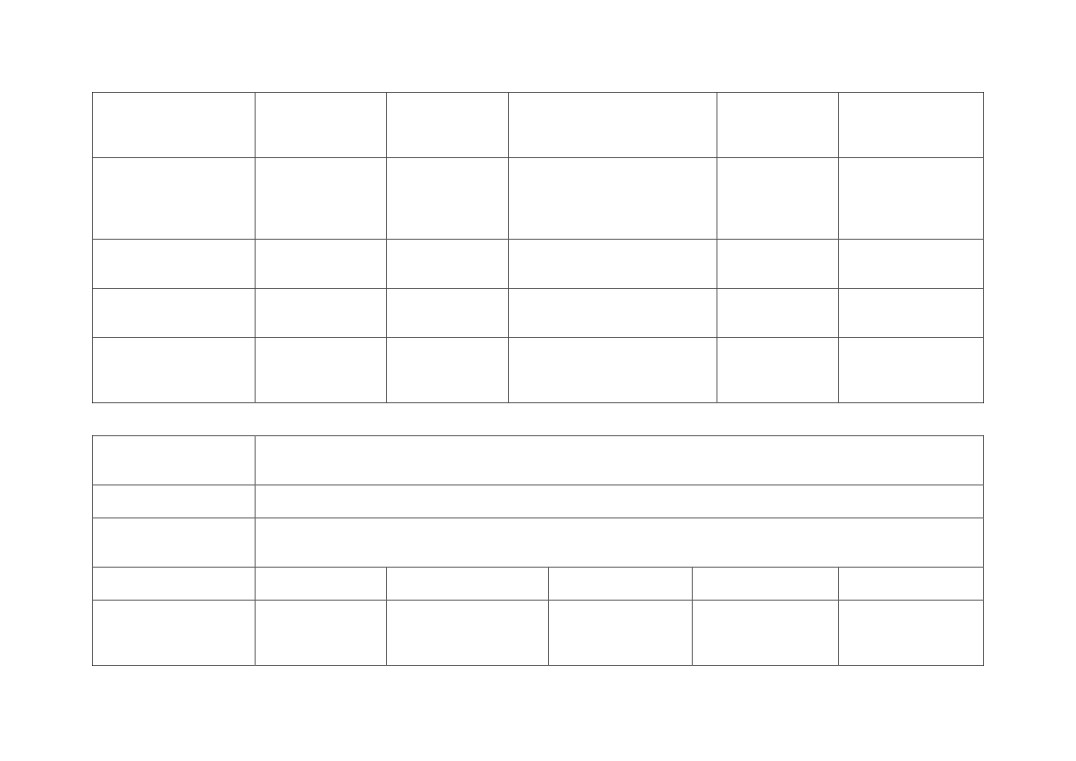

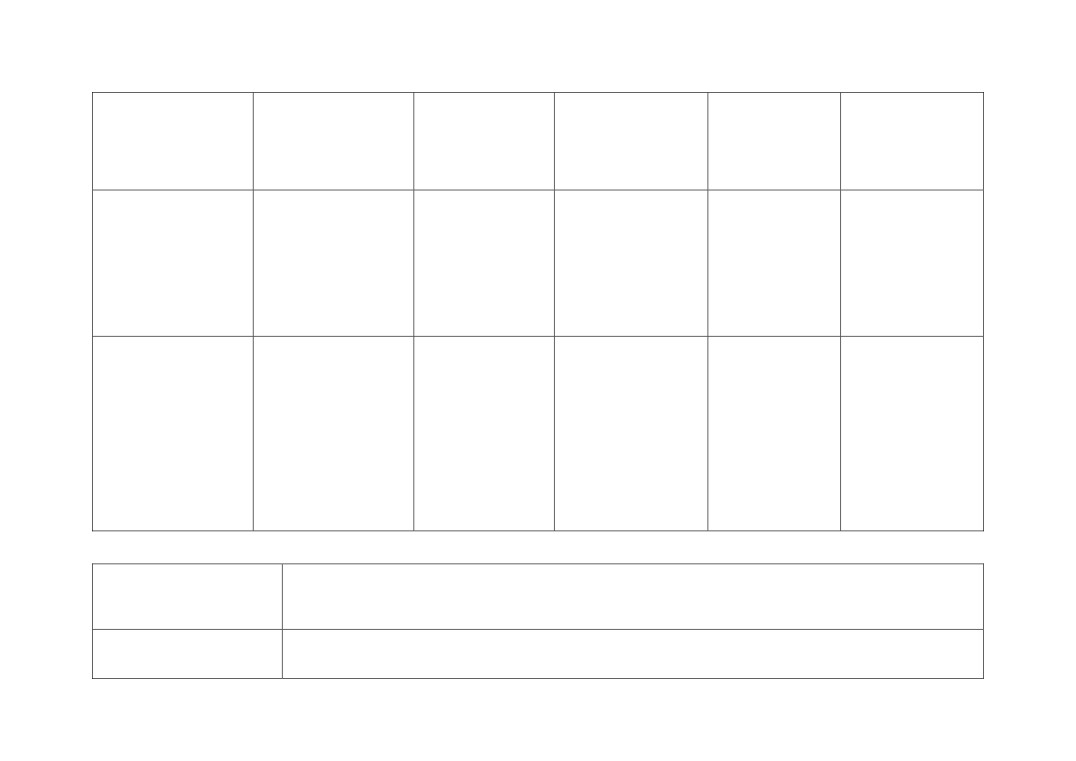

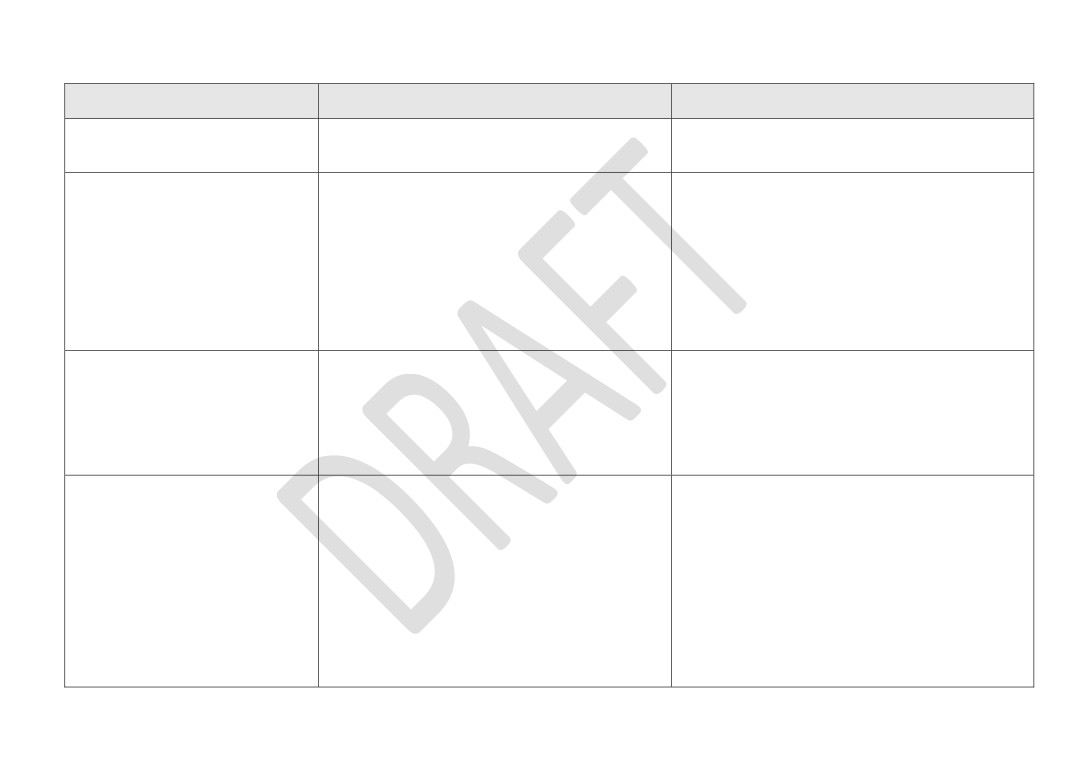

No.

Item

Duration

10 mins

1.

Welcome from the Chair

2.

Apologies

3.

Declarations of Interest

4.

Welcome from Cllr David Ellesmere

5.

Actions / Minutes from the last meeting

Forward Looking

50 mins

6

Establishment of Clean Growth Taskforce and Action Plan

For Approval

7.

Approach to Developing a Tourism Sector Action Plan

For Approval

Break

10 mins

Governance and Delivery

80 mins

8.

Investment Plan Pipeline - confidential

For Approval

9.

Governance - Sub-Board Reporting

For Approval

10.

Election of Deputy Chair

For Approval

11.

Chief Executive’s Report including confidential item

Update

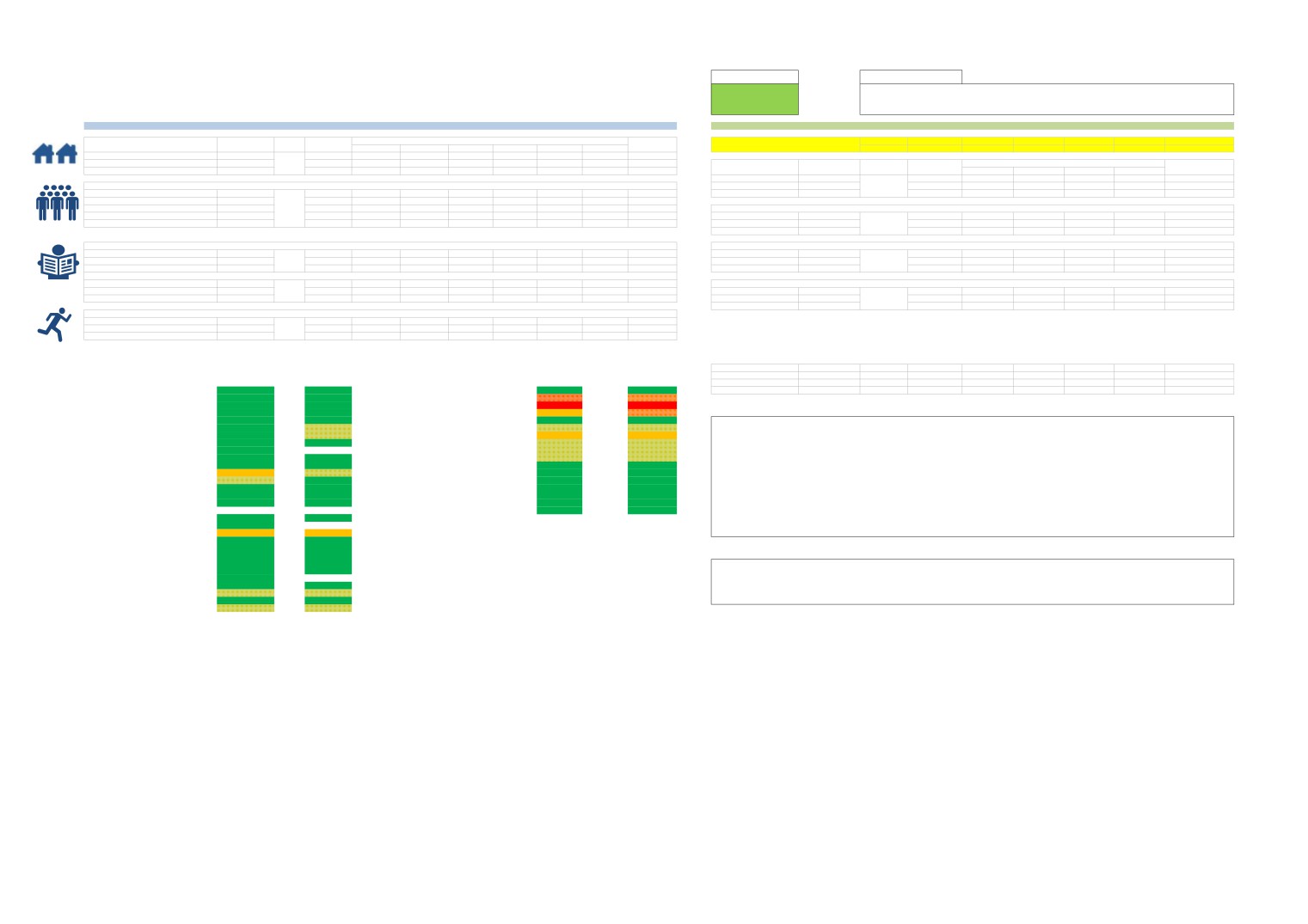

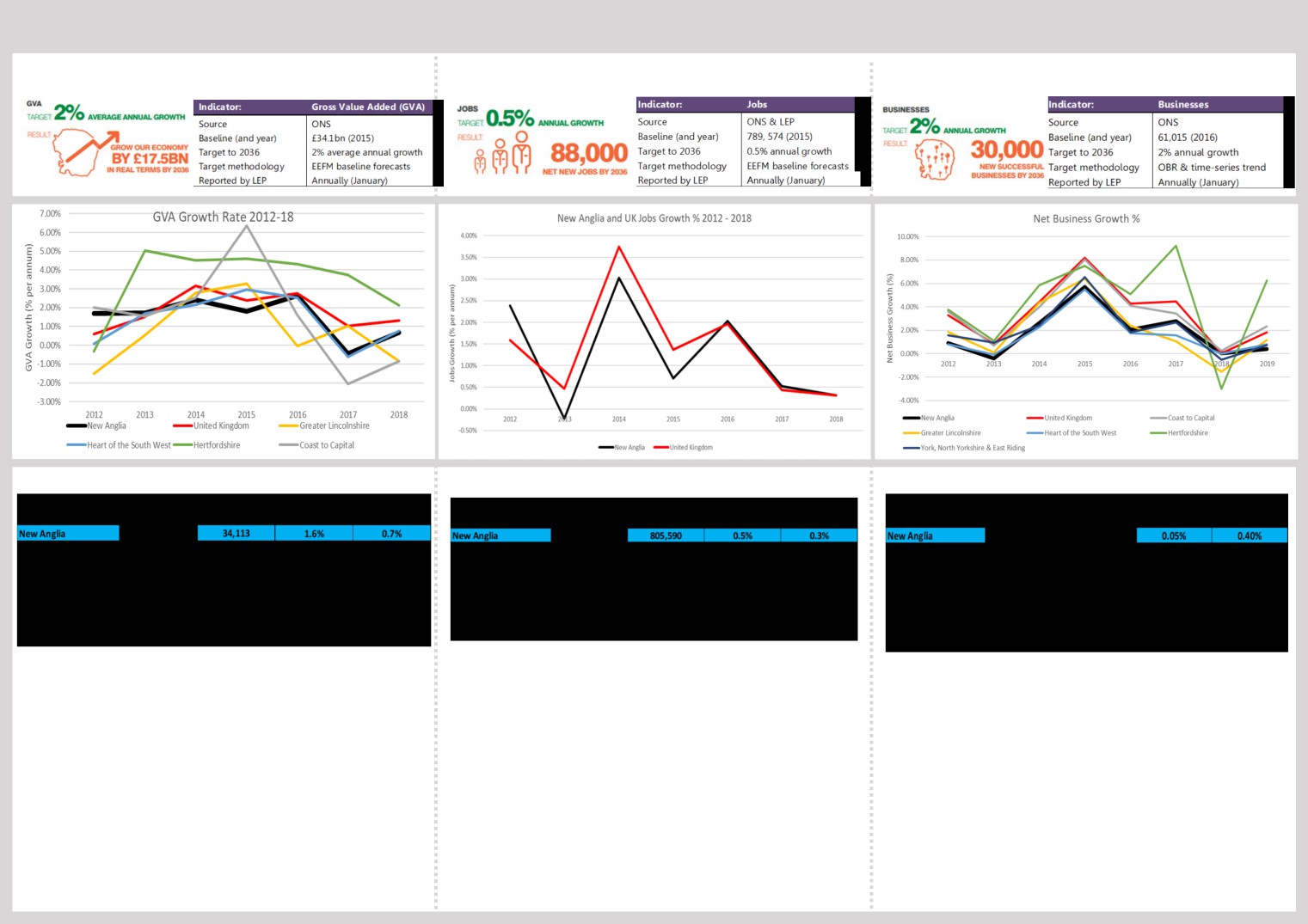

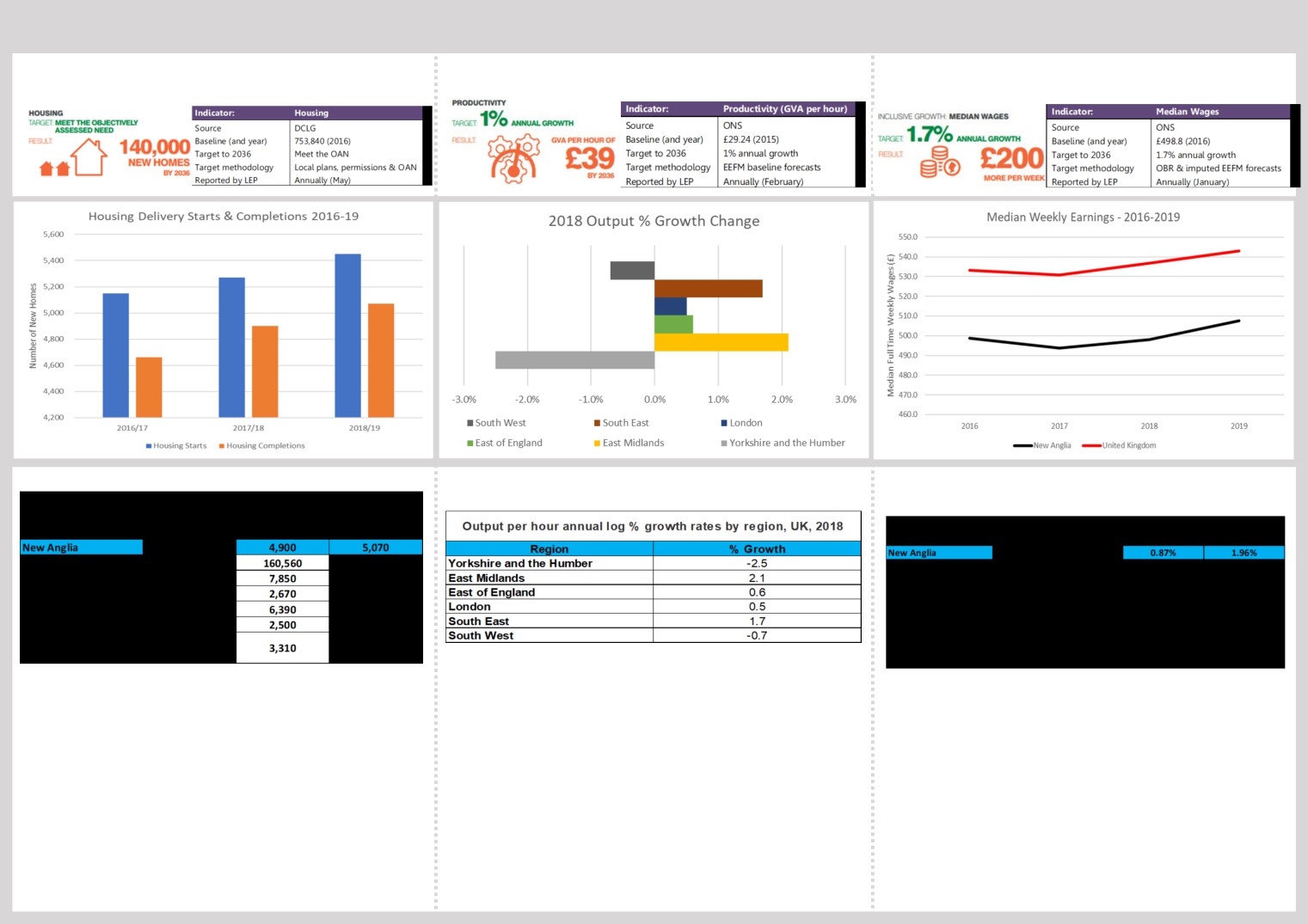

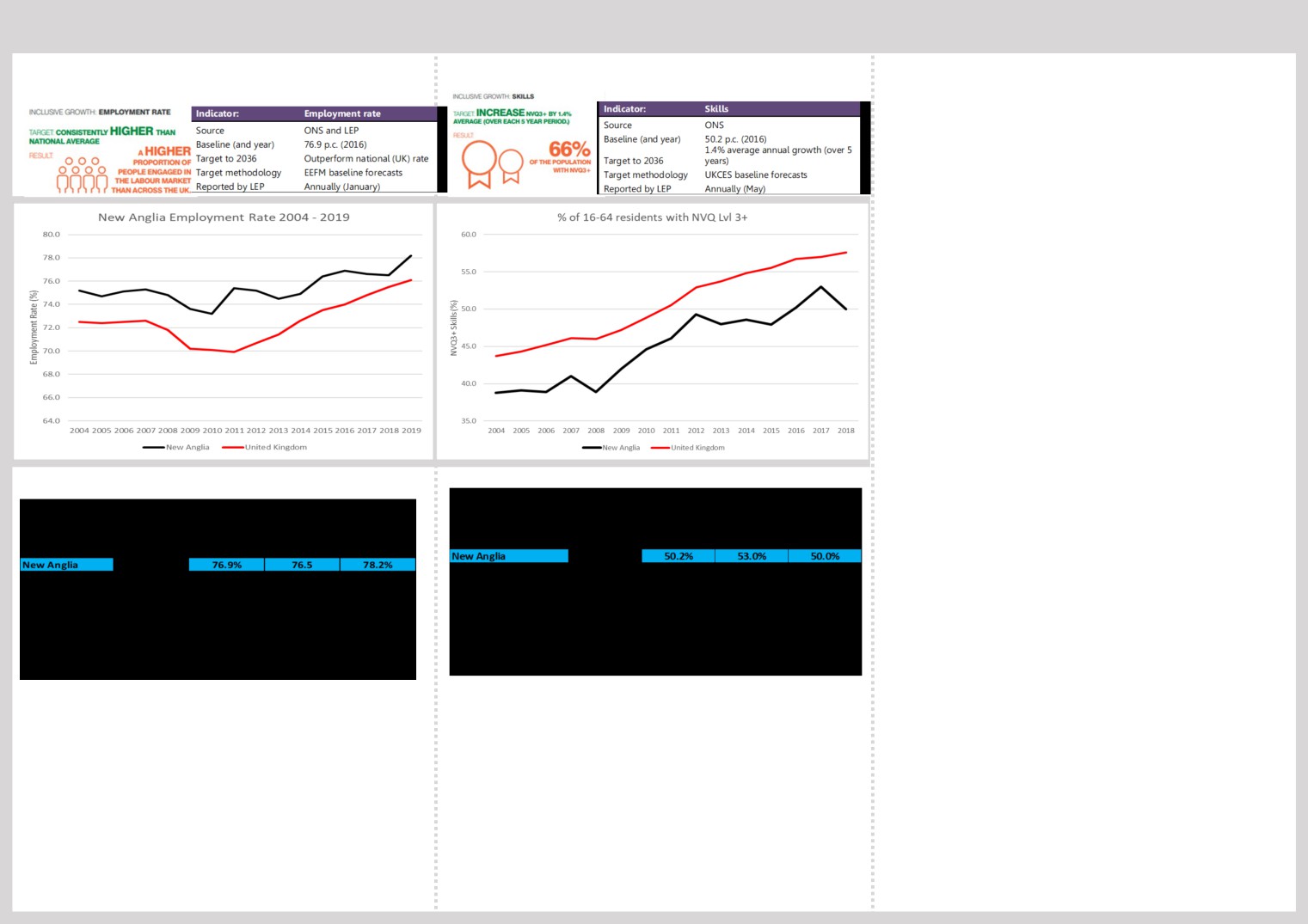

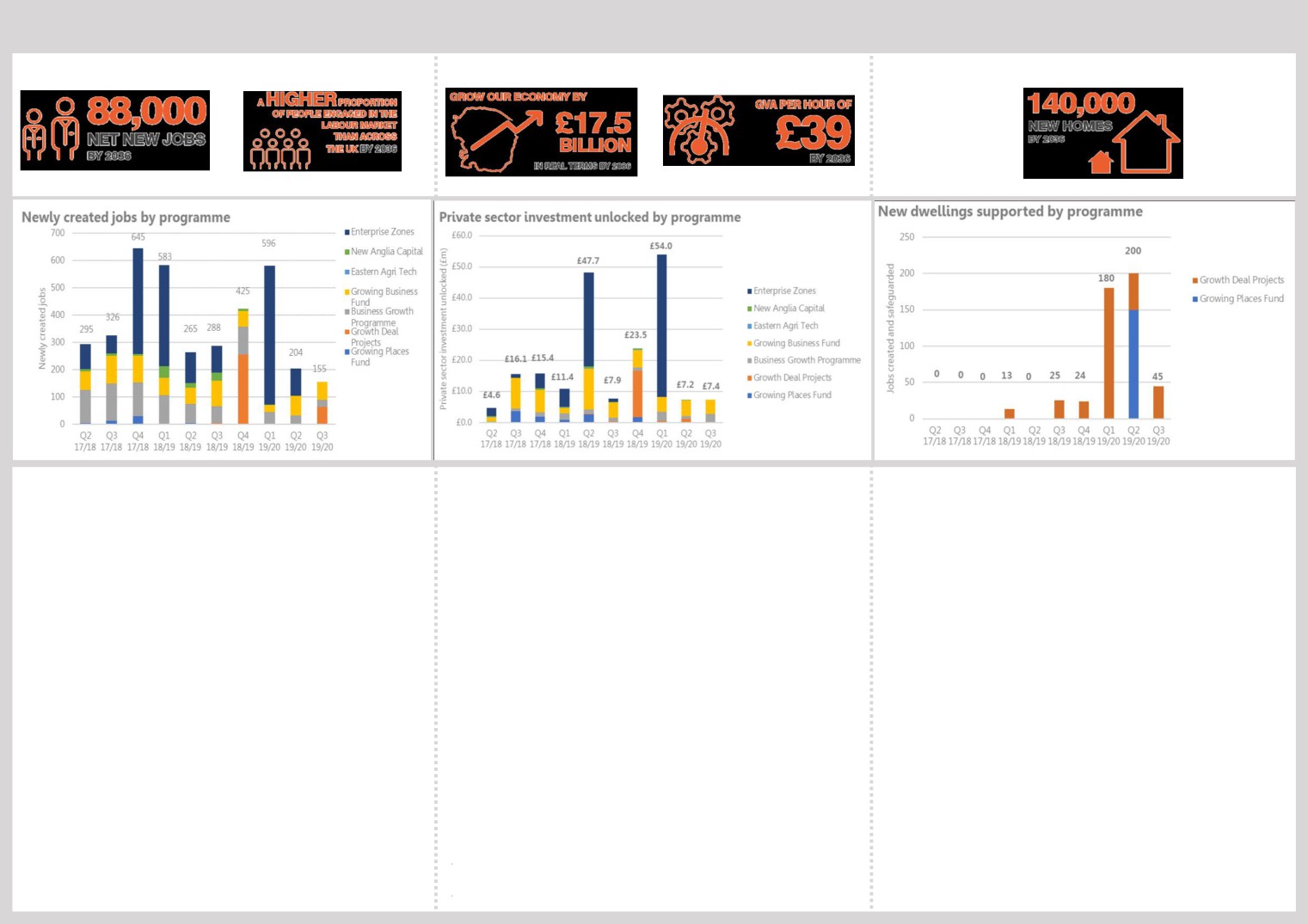

February Programme Performance Reports including Economic

12.

For Approval

Strategy and LEP programmes dashboards

13.

Board Forward Plan

Update

14.

Any Other Business

1

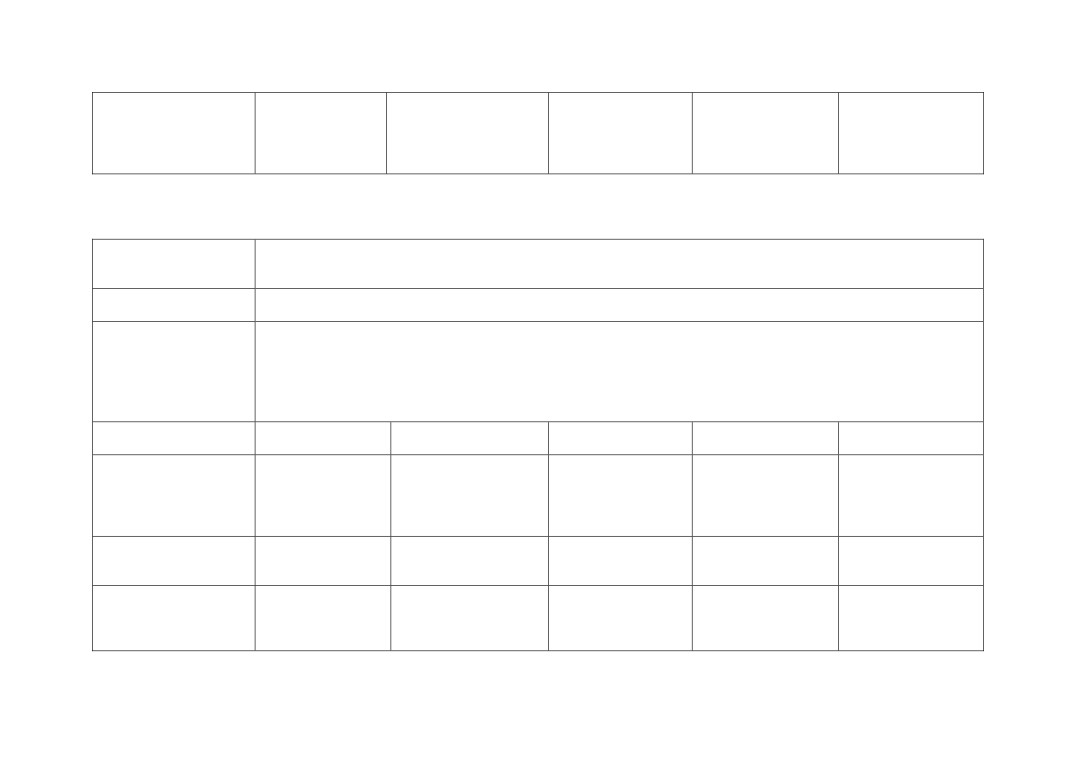

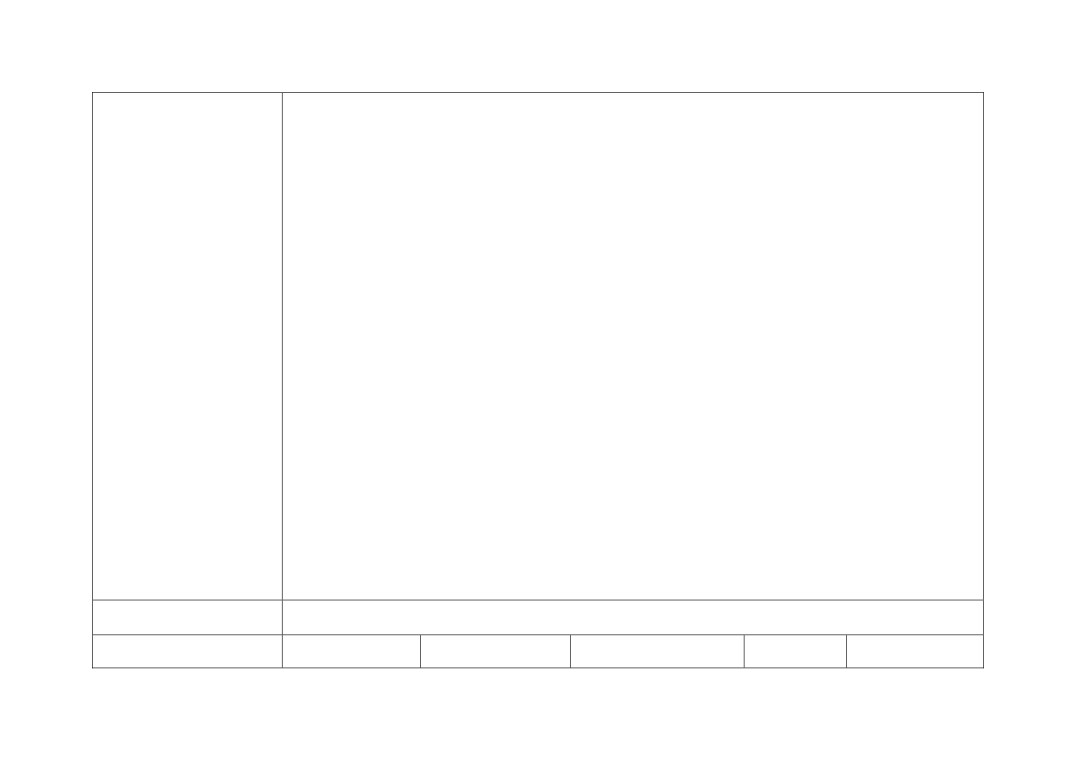

New Anglia Board Meeting Minutes (Unconfirmed)

29th January 2020

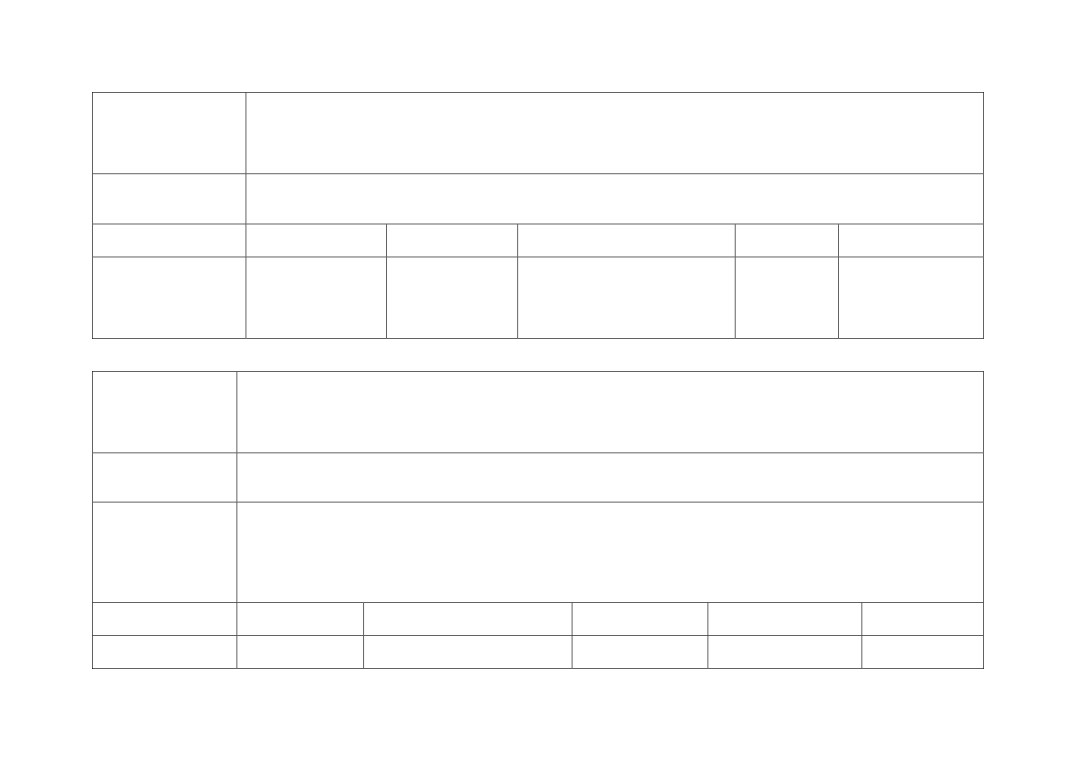

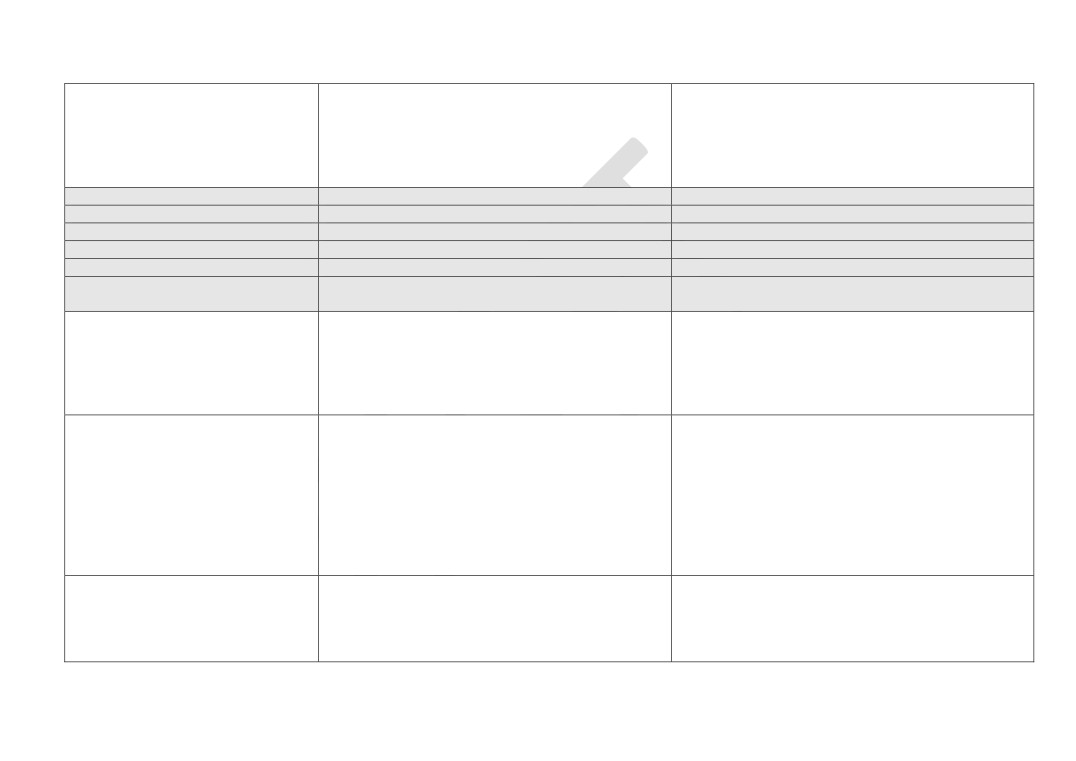

Present:

Sam Chapman-Allen (SC)

Breckland Council

Claire Cullens (CC)

Norfolk Community Foundation

David Ellesmere (DE)

Ipswich Borough Council

Doug Field (DF)

East of England Coop

Pete Joyner (PJ)

Shorthose Russell

Helen Langton (HL)

University of Suffolk

Dominic Keen (DK)

Britbots

Corrienne Peasgood (CP)

Norwich City College

Andrew Proctor (AP)

Norfolk County Council

Johnathan Reynolds (JR)

Opergy

Sandy Ruddock (SR)

Scarlett & Mustard

Alan Waters (AW)

Norwich City Council

Jeanette Wheeler (JW)

Birketts

Tim Whitley (TW)

BT

Attendees

Shan Lloyd (SL)

BEIS

Hannah Grimes

Norfolk County Council

James Allen (JA)

New Anglia LEP - For Item 7

Chris Dashper (CD)

New Anglia LEP - For Item 13

Lisa Roberts (LR)

New Anglia LEP - For Items 8 and 9

Chris Starkie (CS)

New Anglia LEP

Rosanne Wijnberg (RW)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

1

3

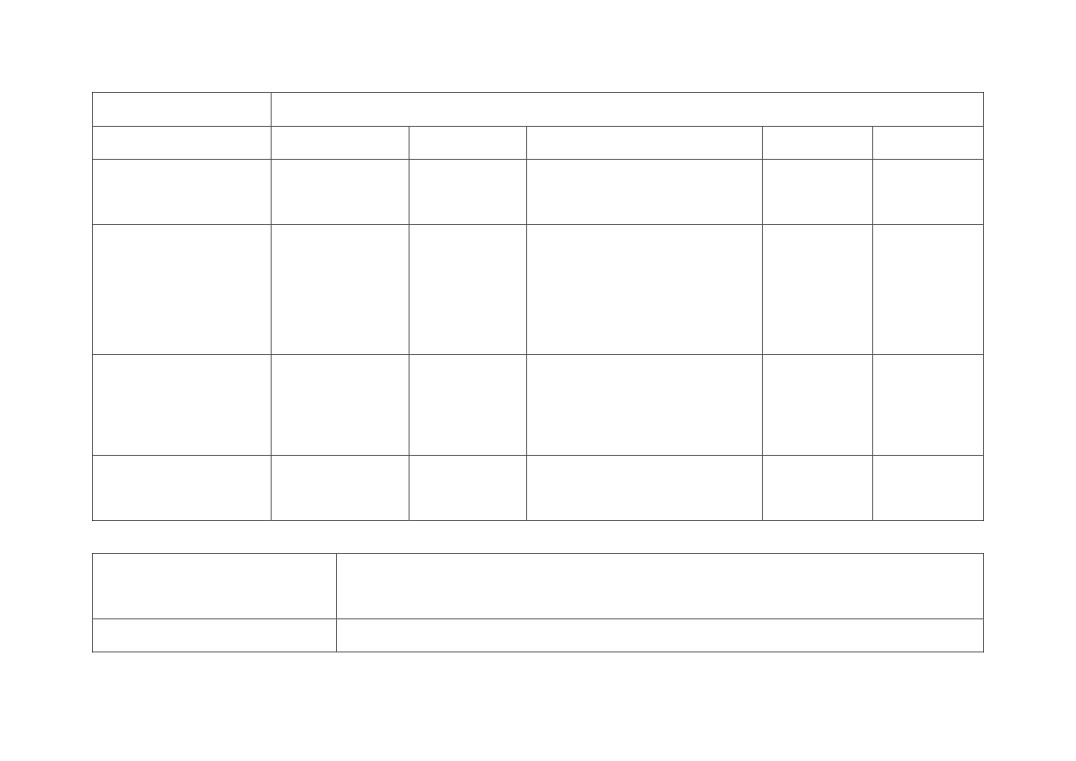

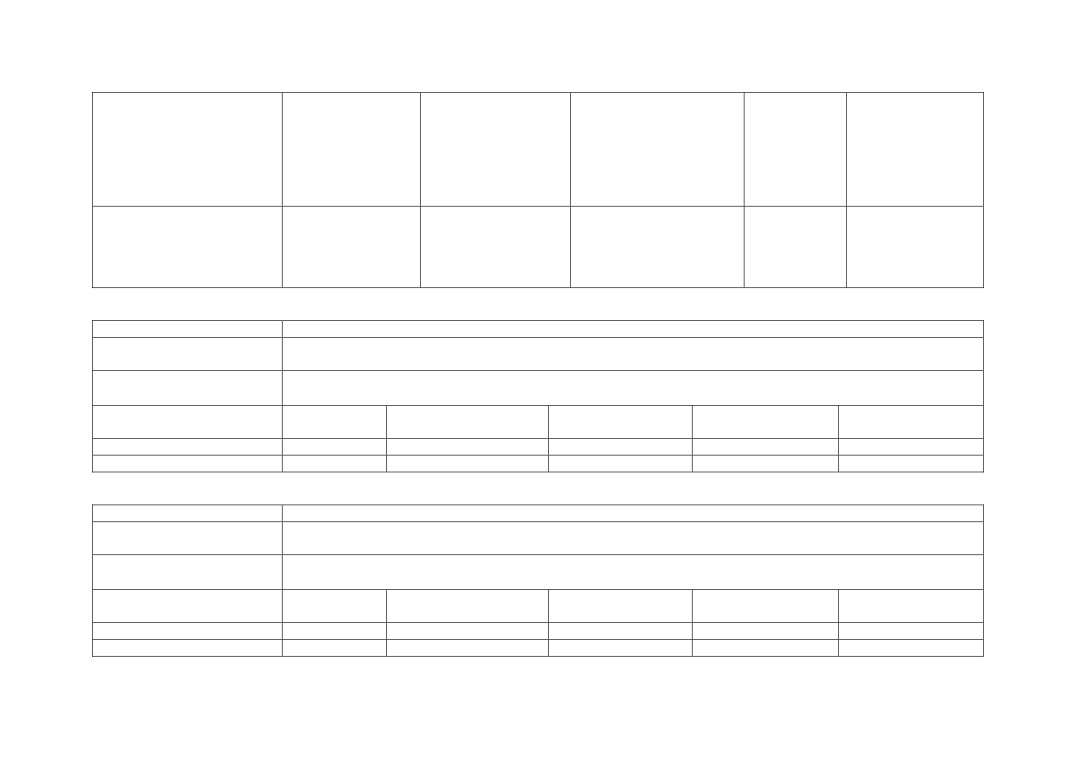

Actions from the meeting: (29.01.20)

Local Industrial Strategy - Investment Plan

The tactical pipeline of projects to be produced and reported to the board

LR

The development of the Investment Plan to be reported to the Board on a regular basis

LR

Evaluation Framework

The option of employing someone to carry out evaluations to be investigated

LR

Board Recruitment

Details of job board vacancies to be circulated to Board members for onwards promotion

CP

1

Welcome from the Chair

Doug Field (DF) welcomed everyone to the meeting and thanks Ali Clabburn (AC) from Liftshare for

hosting the meeting.

2

Apologies

Apologies were received from Lindsey Rix, John Griffiths, Steve Oliver and Matthew Hicks.

3

Declarations of Interest

Full declarations of interest can be found at http://www.newanglia.co.uk/about-us/the-board.

Item 13: January Programme Reports: New Anglia Capital Report: DF declared an interest in Nova

Farina and SupaPass.

4

Welcome from Liftshare

AC, CEO of Liftshare, welcomed the LEP Board to Liftshare. The Board were provided with a

presentation highlighting the volumes of empty seats in cars when commuting and the

progress that Liftshare are making in working with organisations to fill that excess capacity.

AC noted that commuting was now the highest source of carbon emissions and that Liftshare

had set a target of saving 1bn miles by the end of March 2020 and that this target would be

reached during February.

Liftshare are working with companies to join them to the network to reduce numbers of

journeys thus saving on emissions, reducing costs and freeing up parking all of which has

been proven help with recruitment.

AC was pleased to confirm that Liftshare had been awarded the Queen’s Award for

Enterprise for the second time and the Board congratulated him on the achievement.

5

Minutes of the last meeting 27th November 2019

Two typing errors were corrected in the attendees’ details.

The minutes were then accepted as a true record of the meeting held on 27th November

2019.

Actions from last meeting updated as follows:

Chris Starkie (CS) advised that the outstanding actions relating to Enterprise Zones were

covered in the report which annexes the January Performance Report.

6

Aims & Objectives for the Year

The Board received an update from CS which reviewed progress and key deliveries over the

past year and identified the key areas the LEP would be focussing on in 2020 under the

headings implement, promote, deliver and strengthen. The presentation also covered the

external drivers which the LEP needs to take into account when planning for the year ahead

which can be grouped under the areas of Brexit, the focus on the North and Midlands, the

devolution white paper and the future funding landscape.

The Board agreed:

To note the content of the presentation

To support the themes identified as areas of focus for 2020

7

Brexit Impact Report

2

4

James Allen (JA) presented the updated Brexit Intelligence report which explores the

implications for Norfolk and Suffolk of the two possible scenarios of a withdrawal agreement

with a trade deal and a no deal situation. It sets out implications and responses for

consideration as part of delivery plans for the Economic Strategy and Local Industrial

Strategy.

JA proposed that a light touch action plan be produced which will be reported back to the

Board on a bi-monthly basis.

Implications and responses to consider have been set out under the consistent headings of

workforce, funding and investment, trade and regulation, the majority of which are consistent

with the implementation plans in place for the Economic Strategy and Local Industrial

Strategy.

Jeanette Wheeler (JW) noted that there was a large gap in the technology developed for the

agri-food industry and that used on large estates around the region and suggested that the

LEP could work with the agritech industry to support the implementation of these innovations

on the ground.

Pete Joyner (PJ) proposed that, due to the size of the issue and the difficulties in influencing

Government policy, the LEP should focus on providing practical support for affected

companies.

Johnathan Reynolds (JR) suggested that work was needed in mapping supply chains across

Norfolk & Suffolk to help businesses target and win large contracts by demonstrating local

capacity.

The Board agreed:

To note the content of the report

To agree that its recommendations are used to influence the implementation plans for the

Economic Strategy and Local Industrial Strategy

8

Local Industrial Strategy - Investment Plan

Lisa Roberts (LR) presented the Board with the designed version of the Norfolk and Suffolk

Local Industrial Strategy (LIS) employing the Norfolk and Suffolk Unlimited branding.

The Board agreed the following amendments:

Descriptions to be added to all photos for consistency

Hethel signage to be updated

Adastral Park to be included as a High Potential Opportunity (HPO)

JW asked that impact publishing the LIS would have. Shan Lloyd (SL) confirmed that it would

ensure Government buy in at a senior level and would provide support when highlighting

projects and targeting investment at a ministerial level.

The Board were asked for approval of the proposed approach and timeline for developing the

Investment Plan.

The Board requested that details of the tactical projects pipeline be included in the plan and

shared with the board as well as the strategic longer term projects.

DF expressed concern that the proposed timescales were too long & asked if priority projects

could be identified and progressed while the consultation continues.

Rosanne Wijnberg (RW) confirmed that there was a tactical pipeline which could be slotted

into the timeline immediately.

ACTION: The tactical pipeline of projects to be produced and reported to the board at the

LR

March meeting.

Claire Cullens (CC) advised that the members of the Skills Advisory Panel (SAP) were keen

to be involved and wanted to understand which projects could be included and the right

approach to take when identifying them.

3

5

LR confirmed that the investment plan needed to contain both capital and revenue projects

and should include shovel ready projects. They should also include those which are longer

term but have business cases in place should funding be made available.

CS reiterated that this plan was looking at new aspirational projects as much of the pipeline

contained projects which had been around for some time.

JR queried whether the LEP can be smarter at identifying funding opportunities and be more

proactive in employing them. LR confirmed that work is ongoing to identify sources of funding

and will produce a one-page summary of each which can be publicised when opportunities

become available.

The Board agreed:

To note the content of the report

To approve the designed version of Norfolk and Suffolk Local Industrial Strategy

To approve the approach and timetable for developing the Investment Plan and supporting

tools with regular updates provided to the Board

To receive details of the tactical projects pipeline at the March meeting

9

Evaluation Framework

LR presented the Board with the revised Evaluation Framework, the programme of evaluation

and the proposed approach to implementing the framework. The proposal includes using a

call-on, call-off list of companies that will provide external, independent support in the evaluation

process.

LR advised that the framework sets out a more robust approach to evaluation and ensures

that it is also embedded at the design stage of projects and programmes.

LR also confirmed that the Enterprise Advisor Network would be evaluated in conjunction with

the Careers Enterprise Company and would focus on the quality and not just the quantity of

the contacts provided.

Helen Langton (HL) queried whether £50k would be enough to complete the evaluations. LR

confirmed that this was based on previous evaluations and that there would be a further ask

of the Board if required.

JR asked of the £50k could be better used strengthening the LEP team by employing

someone to complete the evaluations. LR noted this would lose the independent measure

and queried whether the skill set was available.

ACTION - The option of employing someone to carry out evaluations to be investigated.

LR

The Board agreed:

To note the content of the report

To approve the updated Evaluation Framework and programme of evaluation for inclusion

in the 2020 Local Assurance Framework

To approve the approach of having call-on, call-off list of companies that will provide

external support

To approve a £50K allocation of the Growth Deal top slice to appoint a company to carry

out an evaluation on three LEP programmes

10

Board Recruitment

DF presented the Board paper advising that there would be 2 board vacancies over the year

including that of Chair.

David Ellesmere (DE) clarified whether the new Chair was being recruited externally and CS

confirmed that Government requirements dictate that the vacancy for the Chair need to be

advertised externally but that existing private sector board members could apply.

The Board agreed that the advert needs to clarify the required time commitment of the role so

that the expectations are clear to applicants.

4

6

ACTION - Adverts to be issued to Board members for onward promotion.

CP

The Board discussed the requirements of specific sectors noting that the key LIS sectors

need to be strengthened as did ensuring the Board had access to relevant financial expertise.

It was noted that the vice-chair vacancy would be available from April and a process would be

in place to fill this role.

HL, JW, DE and PJ volunteered to assist on interviews panels.

The Board agreed:

To note the content of the report and approve the recruitment packs subject to clarification

of the required time commitments of the roles

To support and promote the opportunities

To approve the interview panels for the vacancies

11

Remuneration Committee Terms of Reference

JW presented the paper highlighting the key findings of the Gender Pay Gap Report noting

that the results were very positive and would be monitored going forwards.

The revised Remuneration Committee Terms of Reference were presented and JW

highlighted the amendment to holding the committee once a year as it only reviews the salary

of the CEO.

DE noted that gender gap was positive that but given the relatively small size of the

organisation changes in personnel could change the results significantly. The Board agreed

that other types of diversity should also be monitored.

SL noted that Black and Minority Ethnic (BME) diversity was also being looked at by

Government and should reflect the makeup of the geographical area.

The Board agreed:

To note the content of the report

To agree the revised Remuneration Committee Terms of Reference

12

Chief Executive’s Report

CS noted some of the highlights of the report and asked for questions from the board.

CS highlighted the request to transfer £4.1m from the Enterprise Zone Accelerator Fund to the

Growing Places Fund (GBF) and explained that this was because there was now insufficient

time to agree and defray funds on any co-investment opportunities before the end of the

Growth Deal in March 2021 but that £4.1m remained unallocated. The LEP is already

engaged with an applicant looking for co-investment of up to £5m and without this transfer there

are insufficient funds in the GPF budget to consider the application.

This was approved by the Board.

CS noted that Norfolk and Suffolk Unlimited had received successful coverage as part of an

item on Horecava on Look East and provided an update on the event planned for MPs on 5th

February highlighting infrastructure requirements.

CS confirmed that the Peer Review meeting with the Heart of the South West LEP had

resulted in positive outcomes largely around the sharing of information. A visit to the New

Anglia LEP has been requested which will focus on operational matters.

The Board agreed:

To note the content of the report

To approve the transfer of £4.1m from the Enterprise Zone Accelerator Fund to the

Growing Places Fund

5

7

13

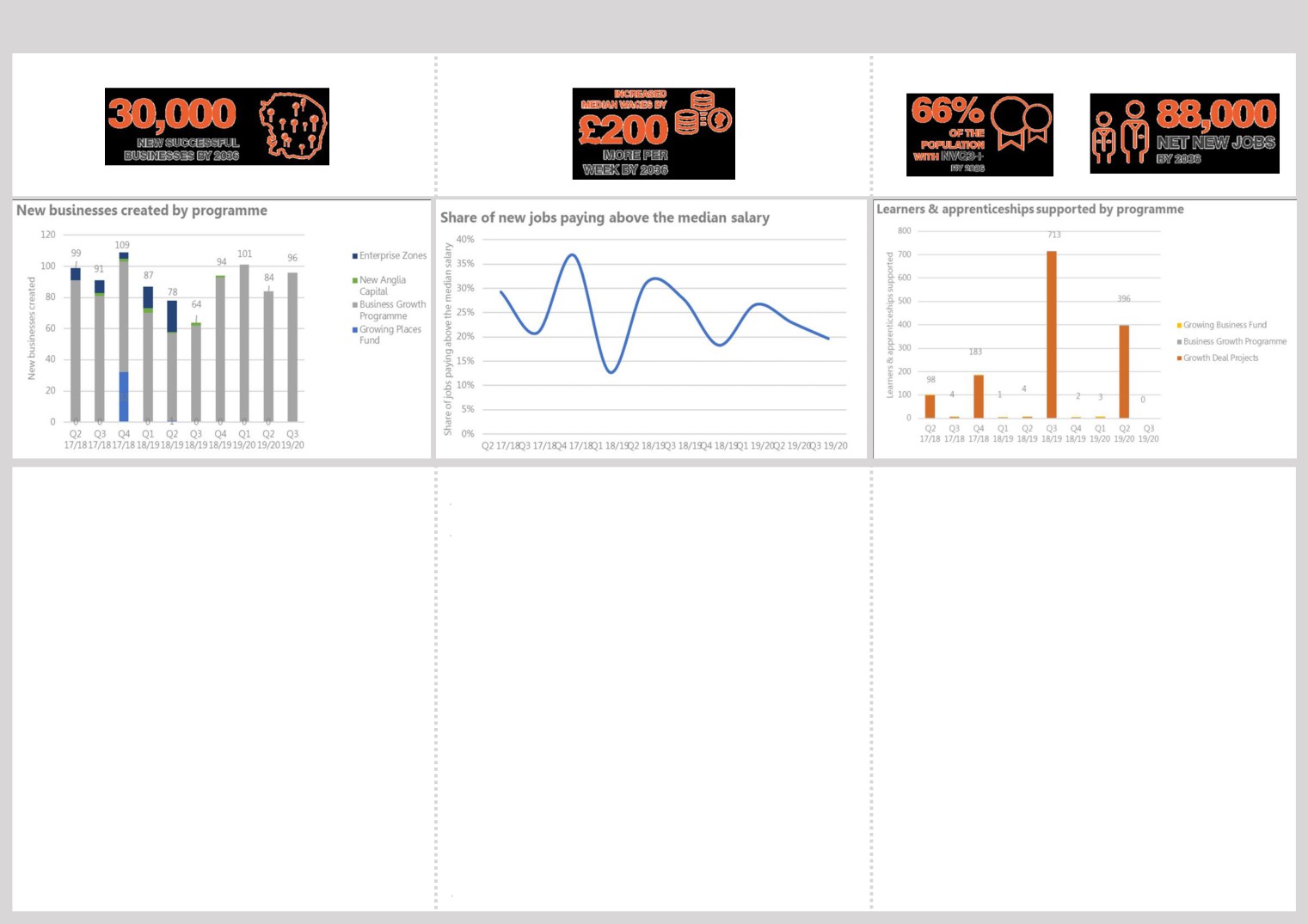

January Programme Performance Reports

RW reviewed the reports for January noting that applications to the Small Grants Scheme are

still progressing well and have not slowed down and confirmed that the ESF bid has been

submitted to extend the Enterprise Advisor Network.

RW advised that the focus in 2020 will be on promoting Enterprise Zones over the next year

and noted that the annexe to the report addressed the outstanding board actions.

Andrew Proctor (AP) reviewed the New Anglia Capital report.

The Board agreed:

To note the contents of the reports

14

Quarterly Management Accounts

RW highlighted key items from the report noting that income has been received from Norfolk

and Suffolk County Councils to support the Innovative Projects Fund and the awards have not

been made yet.

Other variations were highlighted as follows:

Wages and salaries - there are variations around the timing of filling vacancies but there are

no current gaps in the team.

Innovative Projects Fund - there is a time lag on the spend.

Grants - It was assumed £30m would be paid by now however this figure is currently at £16m

paid out as claims are awaited.

The Board agreed:

To note the content of the report

15

Board Forward Plan

CS reviewed the content of the next board meeting and asked for any additional items from

the Board.

The Board agreed:

To note the content of the plan

16

Any Other Business

Tim Whitley (TW) confirmed that, as part of the High Potential Opportunities Scheme,

Adastral Park had hosted an inward investment delegation from Finland which has received

excellent feedback.

CS noted the LEP would be supporting SMEs at the Mobile World Congress in Barcelona in

March.

Next meeting:

Date and time of next meeting:

10.00am - 12.30pm, 26th February 2020

Venue: Gallery Three, Ipswich Town Hall, Cornhill, Ipswich, IP1 1DH

6

8

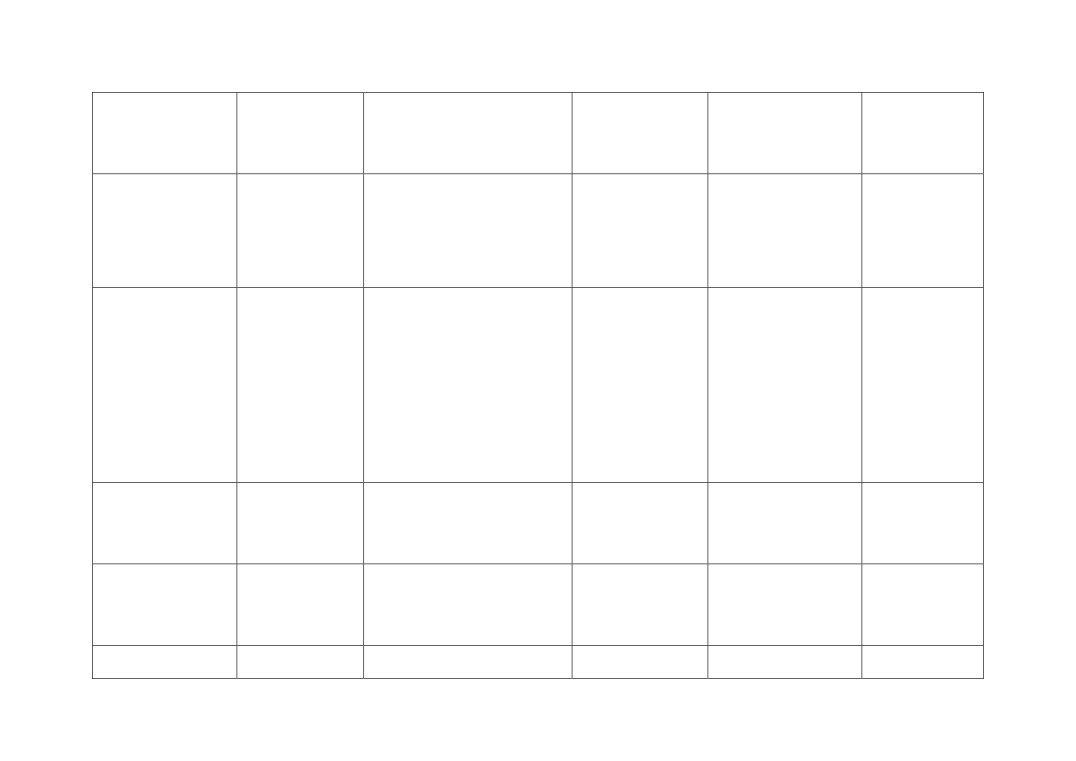

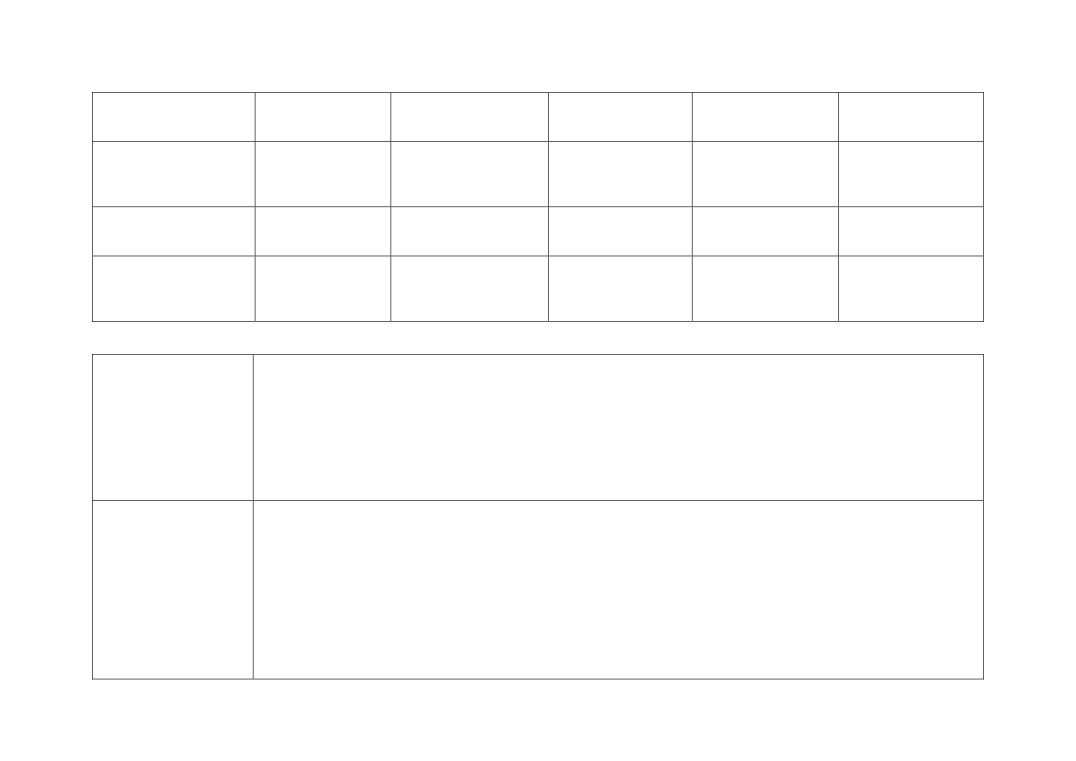

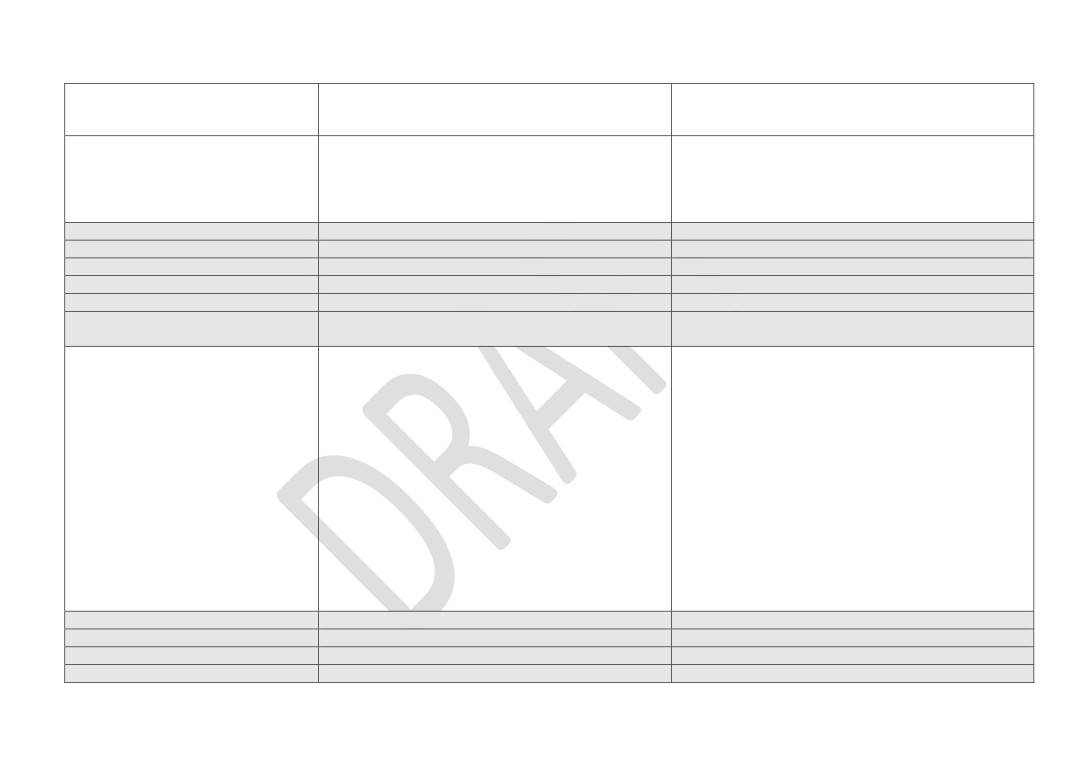

Actions from New Anglia LEP Board Meetings

Date

Item

Action

Update

Actioned

Target Date

By

29/01/2020

Local Industrial Strategy -

The tactical pipeline of projects to be produced and reported to the board

Included on the February Board agenda

LR

Complete

Investment Plan

29/01/2020

Local Industrial Strategy -

The development of the Investment Plan to be reported to the Board on a regular basis

To be included as a standing item within the Chief Executive's Report

LR

Complete

Investment Plan

29/01/2020

Evaluation Framework

The option of employing someone to carry out evaluations to be investigated

This option has been investigated however due to the requirement for

LR

Complete

independent evaluation it has been decided to proceed with the use of

external companies.

29/01/2020

Board Recruitment

Details of job board vacancies to be circulated to Board members for onwards promotion

Circulated to Board members

CP

Complete

25/06/2019

GE Update Report

To provide the Board with regular reporting of the pipeline of visits relating to inward

To be included in the next Inward Investment update report

DD

May-20

investment and subsequent outcomes

23/05/2019

Growth Hub Presentation

Growth Hub Annual review to be circulated to the Board when published

Review began in autumn 2019. Final report is expected in spring 2020

CD

May-20

9

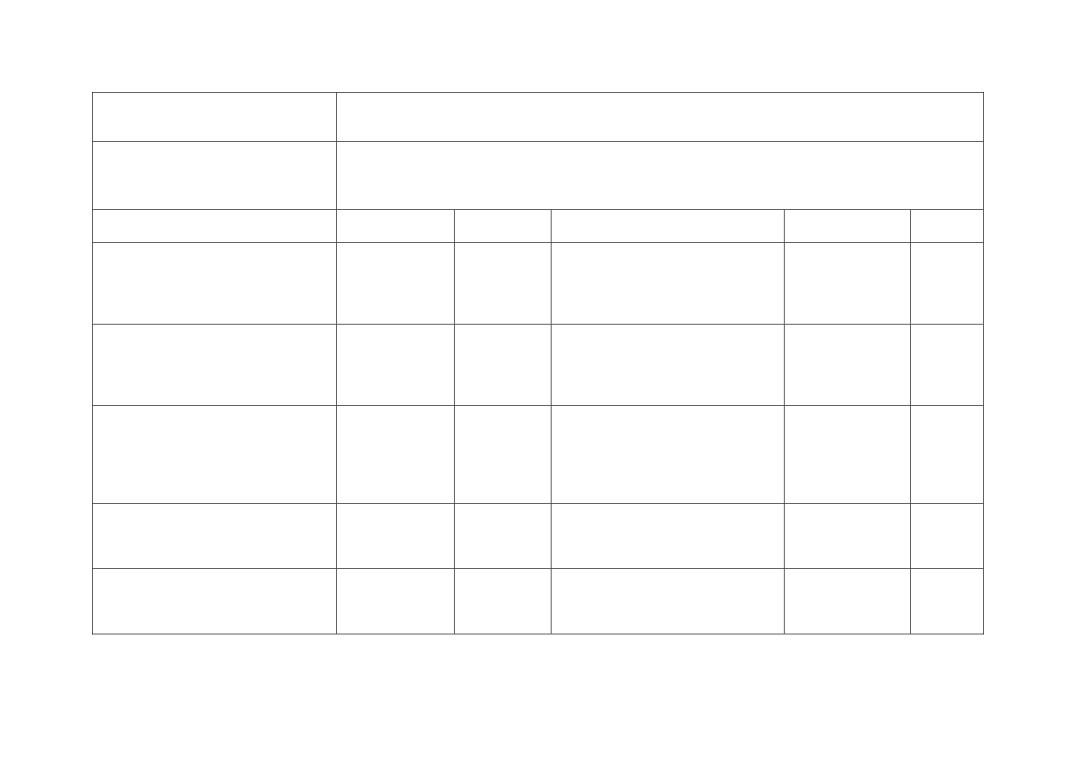

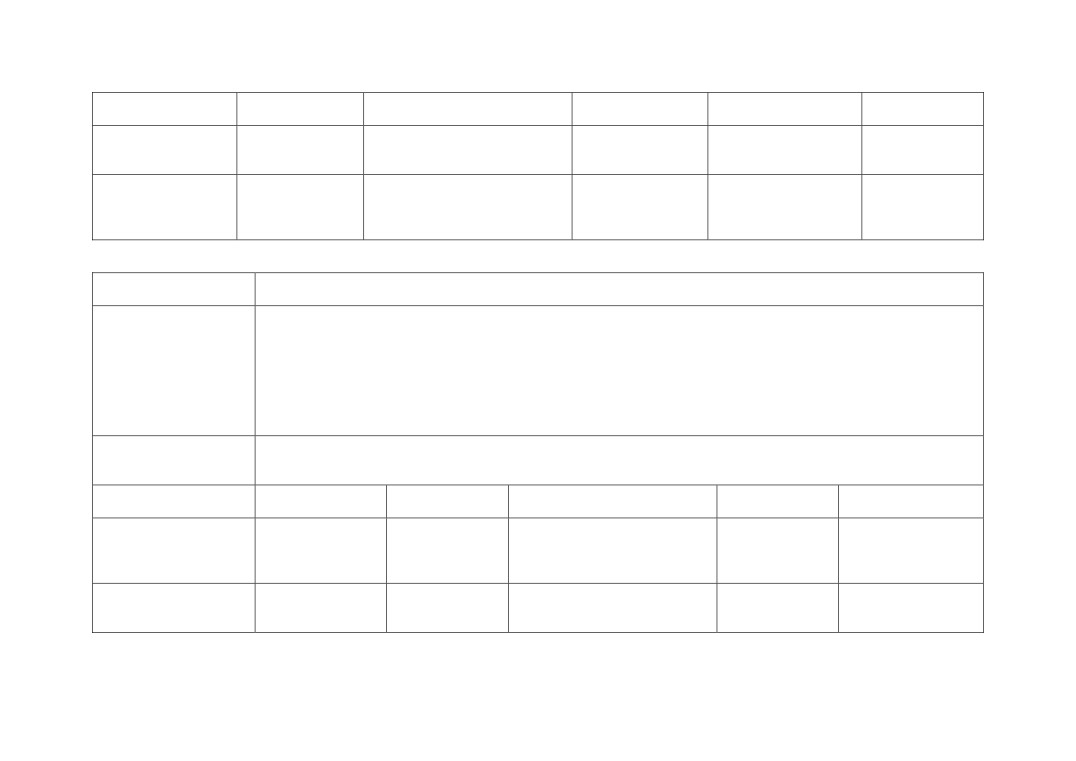

New Anglia Local Enterprise Partnership

Board Decision Log 2020 - Public

Date

Decision

Decision Made

Making Body*

05/02/2020

Growing

The Panel approved the following application:

Business Fund

Focus Trovex LLP - Agreed to support

Panel

Approved Grant: £73,400

Condimentum Ltd - Agreed to support

Approved increase to the existing grant - £118,483

29/01/2020

LEP Board

The Board made the following decisions:

Local Industrial Strategy - Investment Plan

To approve the designed version of Norfolk and Suffolk Local Industrial Strategy

To approve the approach and timetable for developing the Investment Plan and supporting tools with regular updates provided to the

Board

Evaluation Framework

To approve the updated Evaluation Framework and programme of evaluation for inclusion in the 2020 Local Assurance Framework

To approve the approach of having call-on, call-off list of companies that will provide external support

To approve a £50K allocation of the Growth Deal top slice to appoint a company to carry out an evaluation on three LEP programmes

Board Recruitment

To note the content of the report and approve the recruitment packs subject to clarification of the required time commitments of the roles

To support and promote the opportunities

To approve the interview panels for the vacancies

Remuneration Committee Terms of Reference

To agree the revised Remuneration Committee Terms of Reference

Chief Executive’s Report

To approve the transfer of £4.1m from the Enterprise Zone Accelerator Fund to the Growing Places Fund

* New Anglia Local Enterprise Partnership Board, Investment Appraisal Committee, Growing Business Fund Panel, Remuneration Committee, Audit & Risk Committee

10

New Anglia Local Enterprise Partnership Board

Wednesday 26th February 2020

Agenda Item 6

Establishment of a Clean Growth Taskforce and Action Plan

Author: Lisa Roberts Presenter: Lisa Roberts

Summary

This report sets out the recommended steps needed to develop a clean growth action plan

which all partners are signed up to delivering. It provides a DRAFT action plan which is a

starting point and seeks agreement from the Board to establish a Clean Growth Taskforce

which would take the lead in developing further the Clean Growth Action Plan working with

partners across Norfolk and Suffolk and embedding clean growth into the LEP infrastructure.

Attached to the report are Appendices A, B and C.

Recommendation

The Board is asked to:

Agree to the establishment of the Clean Growth Taskforce and its terms of reference

(Appendix A).

Review the DRAFT action plan (Appendix B) and agree steps outlined in the report to

develop further.

Note the LEP team’s existing Environmental policy and action plan (Appendix c) and

agree that the Board will identify a pledge that they will deliver, and which will sit within

the LEP’s own action plan.

Background

In July 2019 the Board received a presentation from the University of East Anglia on the

Climate Change Adaption and Carbon Reduction Scoping Report and agreed to the

development of an action plan to tackle some of the key findings of the report.

In September 2019 the Board agreed to endorse and sign off the Norfolk and Suffolk Local

Industrial Strategy. The LIS has been submitted to government and is awaiting their approval.

Clean growth sits at the heart of this Local Industrial Strategy - with Norfolk and Suffolk

positioned as the UK’s clean growth region.

At the same time the Norfolk and Suffolk Unlimited brand was launched with ‘Welcome to the

UK’s Clean Growth region’ front and centre of the marketing campaign.

The LIS states our ambition to be:

A globally recognised, technology-driven and inclusive economy which is leading the transition

to a post-carbon economy through sustainable food production and sustainable energy

generation.

1

11

Norfolk and Suffolk is at the forefront of tackling the challenges and opportunities of climate

change - the area affected earliest by rising sea levels and changing rainfall pattern and with

major research and business strengths in adapting to the change.

The area’s major strengths in energy generation and usage, high tech, sustainable agri-food

present major opportunities. The cross-sector opportunities are particularly exciting, delivering

solutions such as energy self-sufficiency in farming, or using older gas platforms for renewable

energy generation, for example, to make a major contribution to the UK’s transition to a post

carbon economy.

Norfolk and Suffolk’s key strengths and assets make it well placed to be at the forefront of the

clean growth revolution.

As the UK’s leading producer of renewable and low carbon energy and a significant

producer of low carbon goods and services.

As a testbed for innovation in industries such as farming and food production,

transportation and construction which need to reduce their carbon footprint and adapt to a

changing climate.

As an area with an outstanding natural environment and natural resources which are

particularly vulnerable to climate change but where innovative new mitigation measures

and technologies are being pioneered.

As an area with a wealth of world class innovation and thinking, and exportable skills.

Along with many award-winning businesses, that are on the leading edge of a low-carbon

future.

Key Considerations

Addressing the challenges of climate change will require actions across society and by many

different organisations. Coordination of interventions and actions between sectors is critical to

achieving future clean inclusive growth.

Clean growth will not be achieved if it is not embedded within decisions, intervention

development, delivery, it is not a separate piece of work and it will take time. Changing they

way people think and work is always challenging.

The LEP can play a vital role in facilitating collaboration with partners to change the way we

work; the way decisions are made so that clean growth is considered at all stages.

Set out below are the steps that the LEP should take to bring together key partners to

collaborate, drive and implement the actions needed to ensure the areas strengths as the UK’s

clean growth region are fully realised.

1 Leadership and collaboration - Establishing a Clean Growth Taskforce whose

members will be ambassadors for the ‘UK’s Clean Growth Region’ and help drive

forward and embed the clean growth framework across Norfolk and Suffolk and beyond.

To drive forward the clean growth agenda through the existing LEP governance it is proposed

that we establish a Clean Growth Taskforce. This would sit below the LEP Board and have

representatives from existing LEP groups and others who would act as clean growth advocates.

It is anticipated that the Taskforce will be supported by existing local authority Climate Change

Partnerships subject to their formal agreement.

The purpose of the taskforce would be to embed clean growth in the development and delivery

of actions and decisions which deliver the Economic Strategy and Local Industrial Strategy.

12

2

Appendix A is a draft terms of reference for the Taskforce and provides more detail.

2 Focus - Identify and agree to focus on the actions in areas that the LEP and partners

can achieve the biggest gains and impact.

There are many contributing factors to climate change and there is a need for local partners to

identify and agree the areas that the biggest gains can be achieved, and which actions will be

focused on.

It would be the role of the Taskforce to make recommendations to the LEP Board on what

these focuses should be.

3 Evidence - Work with Government to develop and agree robust ways of measuring and

monitoring the impact of interventions and actions.

This is an objective we have discussed with Government officials during the development of the

Local Industrial Strategy. Many places and organisation have set targets and pledges which are

supported by little or volatile evidence.

To ensure our actions are ones that will make the biggest difference we will develop and agree

robust ways of measuring and monitoring the impact of interventions and actions. Which in turn

will enable us to set realistic pledges, targets and ensure the right interventions are in place.

4 Action - Work with partners develop a mitigation and adaptation clean growth action

plan which provides the right balance for sustainable economic growth.

Clean growth cannot be delivered by one partner alone or by one strand of investment or

actions. It is important that partners play a role in developing the action plan to secure their buy

in and for them to own their role in delivering it.

Appendix B is the DRAFT Norfolk and Suffolk Clean Growth action plan which is a starting point

for the Taskforce to pick up and drive.

It builds on the evidence of the Local Industrial Strategy and the Climate Change Adaption and

Carbon Reduction Scoping Report to outline the areas that Norfolk and Suffolk should consider

with respect to delivering clean growth.

They include at the highest level:

Private sector - the energy and agri-food/land management sectors in particular

Public sector - individual local authorities and local climate change partnerships

Voluntary sector - Rural Community Energy and other local funds

Infrastructure - transport, energy and water in particular

Housing - retrofitting as well as new build

Green finance - engage with and increase focus on access to.

Communications - key messages including a more holistic approach to the Norfolk and

Suffolk Energy Coast

The actions in the draft plan have come from existing activity and early discussions with some

partners.

To ensure success the plan needs developing further and refining engaging partners to ensure

they recognise their role in delivering and achieving the goals.

The next stage of developing the action plan will involve agreeing measures of success for

each of the actions which is part of the evidence work required.

3

13

New Anglia LEP Team

The LEP team wants to lead by example and is committed to environmental protection and the

minimisation of the negative environmental effects of its direct business activities. The LEP

team has its own existing Environmental Policy and action plan which is part of the staff

handbook (Appendix C).

The LEP team are keen to take this plan even further and are in the process of developing and

agreeing three pledges which the organisation will work towards during 20/21.

This is likely to include a development of a clean travel plan and reducing the number of miles

travelled by staff; reducing the use of paper and looking at how we influence our own supply

chain.

The Board are asked to consider and agree to identify a pledge that the Board will work

towards and which will sit within the LEP’s own action plan.

Next steps

The key next steps are as follows:

Establish a Clean Growth Taskforce

Spring 2020

Recruit an independent Chair

Spring 2020

Work with existing Climate Change Partnerships to gather

On going - Transport Board

additional intelligence and develop the Clean Growth Action

reviewing on 25th Feb.

Plan

Subgroups and Board to review draft action plan and provide

On going

input

First meeting of the Taskforce

May/June

Recommendation

The Board is asked to:

Agree to the establishment of the Clean Growth Taskforce and its terms of reference

(Appendix a).

Review the draft action plan (Appendix b) and agree steps outlined in the report to

develop further.

Note the LEP team Environmental policy and action plan and agree that the Board will

identify a pledge that they will deliver, and which will sit within the LEP’s own action

plan.

4

14

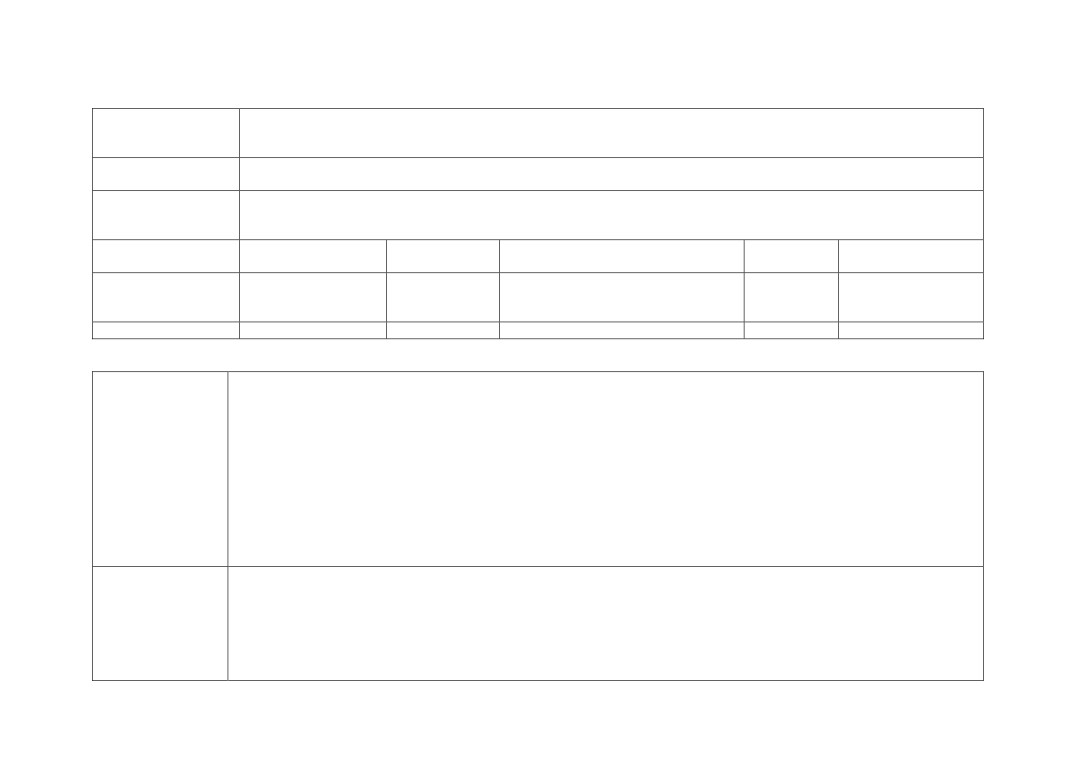

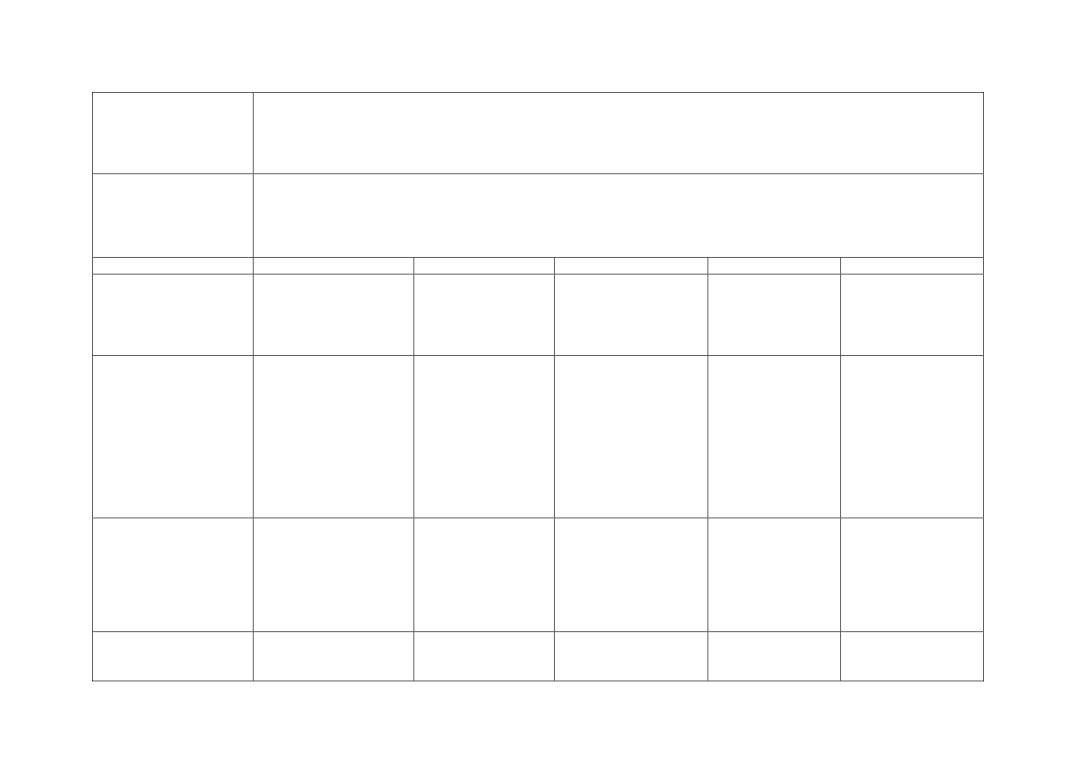

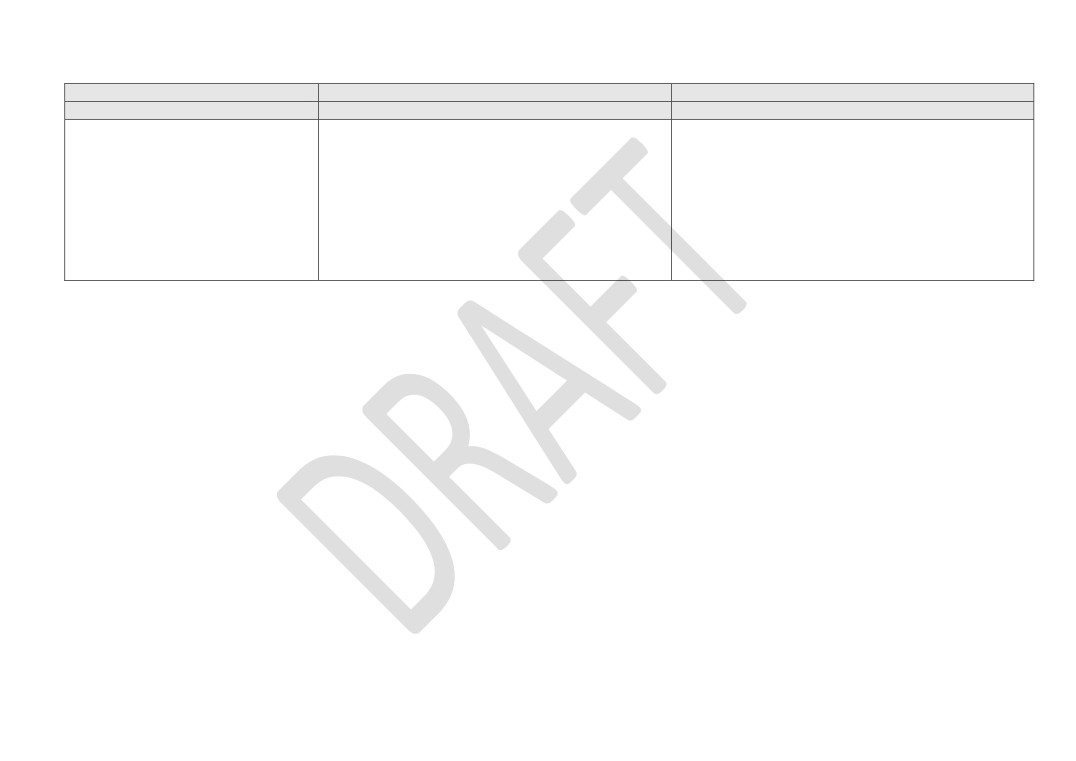

Appendix A - Draft Terms of Reference for Clean Growth Taskforce

Purpose of

To embed clean growth in the development and delivery of actions and

the

decisions which deliver the Economic Strategy and Local Industrial Strategy.

Taskforce:

Functions:

Members of the Taskforce will be expected to:

i. Attend meetings, contribute ideas, experience, expertise, and resource as

considered appropriate, and gather views from colleagues in respective group,

industries or organisations.

ii. Further develop the clean growth action plan for Norfolk and Suffolk

engaging relevant partners to securing their buy in to deliver the action plan,

through respective groups and networks.

iii. Identify and recommend to the LEP board the areas of focus that the biggest

gains can be achieved, and which actions will be focused on.

iv. Promote Norfolk and Suffolk as the UK’s Clean Growth Region helping to

raise the profile of the major contribution the area plays in the UK’s transition to

a post carbon economy, representing the area national, regionally and locally.

v. Ensure clean growth is embedded in the discussion, actions and decision of

your respective group, reporting back to the taskforce as appropriate.

vi. Recommend or source appropriate experts to inform certain aspects of the

action plan, convene working groups as appropriate and consult with sector

peers as agreed within the Taskforce under the direction of the Chair.

vii. Oversee the development and agree robust ways of measuring and

monitoring the impact of interventions and actions, making recommendations to

the LEP board on any relevant targets or pledges.

viii. provide the LEP Board with quarterly progress reports.

ix. Annually, bring together the wider network of clean growth champions to

share knowledge and best practice.

Membership:

The taskforce would have an independent chair and be accountable to the LEP

Board.

Each LEP sub board would nominate a representative - LEP Board, LEP’s

three industry councils, Innovation Board, Skills Advisory Panel, Transport

Board and Investment Appraisal Committee. In addition there would be eight

representatives invited to join from Business intermediaries, Local Authorities,

the Environment Agency and the Voluntary sector.

Frequency

The taskforce would initially meet every 6 to 8 weeks to drive the development

of the action plan; once developed meetings would be quarterly.

Accountability

The taskforce would report to the LEP Board.

Reporting

The agenda and minutes of meetings will be published on the LEP website and

procedures

the taskforce will report to the LEP Board through the sub board reporting

mechanism.

Attendance of

Members of the LEP team, sub boards, committees and Local Authorities may

non-members

also be invited to attend meetings where appropriate.

at meetings

Delegated

Can hold other groups - including Task and Finish groups - to account. It has

Authority

the authority to task a sub-board, group or committee to deliver action within

15

5

the delivery plan.

Where the Taskforce convenes working groups, it should set out the terms of

reference for the working group to guide its objectives, ways of working,

handling of information and the rules on external communication.

Managing

Members of the Taskforce are all representatives of their industry sector or

Conflicts of

community of interests and have a responsibility to act on behalf of their wider

Interest

constituency at all times in relation to the work of the LEP Clean Growth

Taskforce.

Members of the board will be asked to complete an annual declaration of their

interests which will be held in a register at the LEP office and members will be

asked at the beginning of each meeting to declare any conflicts of interest

pertaining to the agenda items to be discussed.

Review

The ToR of the Taskforce will be review annually and agreed by the LEP board.

6

16

Item 6 Appendix B is the DRAFT Norfolk and Suffolk Clean Growth action plan

Context

This DRAFT action plan is a starting point for the Clean Growth Taskforce to pick up, develop and drive forwards, working with partners. It

builds on the evidence of the Local Industrial Strategy and the Climate Change Adaption and Carbon Reduction Scoping Report to outline the

areas that Norfolk and Suffolk should consider with respect to delivering clean growth.

The actions in this draft plan have come from existing activity and initial discussions with partners. To ensure success the plan needs

developing further and refining engaging partners to ensure they recognise their role in delivering and achieving the goals.

The next stage of developing the action plan will involve agreeing measures of success for each of the actions which is part of the evidence

work required.

Industrial Sector

Background

The Government’s clean growth strategy demonstrates a clear understanding of the potential for cost-effective

energy efficiency in the commercial and industrial sector, adding that £6 billion could be saved in 2030 through

investment in cost-effective energy efficiency technologies.

There are various funding pots to support businesses in improving their energy efficiency. Nationally, the Carbon

Trust Green Business Fund is dedicated to supporting SMEs and providing opportunities to improve energy

efficiency and reduce energy costs. This fund has supported thousands of small businesses to identify an

average potential saving of £8,320 on their energy spend.

Norfolk and Suffolk

The industrial sector accounts for 34% of all carbon dioxide emissions in Norfolk and Suffolk.

Context

The Business Energy Efficiency (BEE) Anglia programme provides free support to eligible organisations across

Norfolk and Suffolk to help them become more energy efficient with independent expertise, Carbon Charter

accreditation and grant funding available up to 40% of total project costs (or up to £20k).

Business intermediaries and networks are actively supporting businesses across the region, with a range of

activities planned throughout 2020 and manifesto pledges. Highlights include Innovate UK’s event at Norwich

Research Park in March, various Chamber events across the region and CBI’s Net Zero event with the UEA in

May.

Data available

Industrial business energy use

(include baseline if

Emission intensity of industrial business energy use

have)

Number of businesses with carbon chapter accreditation

Recycling and materials efficiency monitoring data

Rate of clean energy supplier usage

Projects to install energy generation (e.g. solar panels) as part of facilities management approach

1

17

Assessment of the age (and associated energy efficiency) of plant and machinery involved in major

manufacturing processes

Action

Responsible /

Deadline/

Result

Resources

Potential

Status

milestones

barriers

Explore the expansion of

LEP Executive &

March 2021

Potential to roll out on a wider

BEE Anglia

Future of

existing business

Growth Hub

basis and for the Growth Hub to

UEA

Funding

resilience / resource

have a suite of projects to signpost

Chambers of

efficiency services

to on clean growth.

Commerce

Build momentum with

LEP Executive

March 2021

Case studies of businesses leading

Chambers of

business intermediaries

the way will help encourage others

Commerce

and networks to enhance

to do the same and in turn enhance

FSB

business

the Norfolk and Suffolk Unlimited

CBI

awareness/understanding,

brand.

IoD

disseminate best practice

Understanding of specific local

Local

and source case studies

challenges and opportunities and

authorities

particular sector vulnerabilities

Assess how we can

LEP Executive &

March 2021

Assessment of LEP programmes to

Evidence

Need business

further support

Growth Hub

ensure they support our clean

behind CO2

buy-in

businesses (including our

growth ambitions as a region.

report which

largest emitters) in

highlights

mitigating impacts

largest emitters

Ensure clean growth is

Norfolk and Suffolk

Ongoing

Cements Norfolk and Suffolk’s

LEP

central to the region’s

Unlimited

position as the clean growth region

Local

focus on inward

authorities

investment

Energy Sector

Background

Government’s clean growth strategy sets out the ambition to drive towards clean energy with

emissions from the power sector close to zero by 2050. The document sets out the ambition that we

may even see negative emissions from the sector if sustainable bio-energy and carbon capture and

storage are used together.

Norfolk and Suffolk Context

With the highest concentration of nationally significant energy projects, Norfolk and Suffolk play a key

role as a leading generator of renewable energy.

2

18

Clean energy has been identified as one of the three strategic opportunities set out in Norfolk and

Suffolk’s Local Industrial Strategy, given the potential for economic growth, productivity

enhancements and importantly the direct links to the golden thread of that strategy, clean growth.

Data available

Emissions from generation

(include baseline if have)

Share of generation from clean sources

Proportion of private/industrial/public sector energy users specifically sourcing a ‘clean energy’

provider

Action

Responsible /

Deadline/

Result

Resources

Potential

Status

milestones

barriers

All Energy Industry Council takes a

All Energy

Quarterly

Norfolk & Suffolk’s all energy

ORE Catapult

leadership role in driving clean

Industry Council

meetings

cluster widely recognised as a

Inward

growth across the Norfolk and

- formed and

leader in innovative clean

Investment

Suffolk energy cluster.

meeting

technology and emissions

regularly

reduction

Increase evidence around the

LEP Executive

Supply chain

Energy Sector Capability matrix

All Energy

Needs all

energy sector’s supply chain and

mapping

Evidence around the carbon

Industry Council

partners

capabilities and explore

work

footprint of the sector

East of England

to buy-in

opportunities to reduce the sector’s

commencing

Energy Group

carbon footprint

early 2020

Drive forward carbon capture and

All Energy

March 2021

Adoption of innovative new clean

East of England

storage; solar; tidal; onshore; and

Industry Council

technologies across the energy

Energy Group

biofuel; as well as other ‘new

sector and the determination of

ORE Catapult

process’ opportunities - scoping to

start-up support needed

Innovation Board

determine start-up support as well

& Forum

as technology adoption

Growth Hub

Improve evidence around the

LEP Executive

March 2021

Enhanced evidence base and

electrical needs for future changes

awareness of future electrical

(e.g. EVs, heat, digital connectivity,

needs for Norfolk and Suffolk

interconnected home)

Expand current sector hubs /

Innovation

Ongoing

Clear and strong links between

All Energy

incubators / grow-on spaces as

Board

hubs

Industry Council

necessary and link to innovation

Development of low carbon

Innovation Forum

hubs

innovation hubs (LIS intervention)

3

19

Green sector

Background

Green sector jobs growth has outperformed growth in the wider economy recently and there is significant opportunity

to drive further jobs growth in the sector in the years to come given the current emphasis being placed on clean

growth and zero carbon nationally.

Norfolk and Suffolk

Norfolk and Suffolk are well placed to take advantage of this opportunity given our clean growth focus. Skills

Context

developed locally can be marketed to other regions seeking to decarbonise in the future.

Data available

As above

(include baseline if

have)

Action

Responsible /

Deadline/

Result

Resources

Potential barriers

Status

milestones

Green finance

LEP Executive

Ongoing

Better understanding of opportunities

LEP

Scale of opportunity

opportunities to be

for the green sector as well as the

Executive

explored

wider economy

Others - tbd

Public Sector

Background

In December 2015, the United Nations Climate Conference met in Paris to agree the first-ever universal, legally binding

global climate change agreement. This set out a global framework to avoid dangerous climate change by limiting global

warming to well below 2oC and pursuing efforts to limit it to 1.5oC. The deal also aims to strengthen countries’ abilities

to deal with the impacts of climate change and support them in their efforts. The UN COP26 Conference takes place in

Glasgow from 9-20th November 2020.

In June 2019, the UK government became the world’s first major economy to pass laws to end its contribution to global

warming by 2050. This target requires the UK to bring all greenhouse gas emissions to net zero by 2050, compared

with the previous target of at least 80% reduction from 1990 levels.

The clean growth strategy was published in 2017 as part of the national Industrial Strategy. Ministers said in

September 2019 that this strategy was in line for a significant refresh to help meet the new 2050 net zero target.

Highly ambitious local government leaders have set up a network, UK100, which pledges to secure the future for their

communities by shifting to 100% clean energy by 2050.

Norfolk and

The following local authorities have declared climate emergencies across the region: Norfolk - Breckland; North

Suffolk Context

Norfolk; Suffolk - Babergh and Mid-Suffolk; East Suffolk; Ipswich Borough; West Suffolk; and Suffolk County.

Norwich City Council is currently the only local authority signed up to the UK100 network.

Norfolk County Council haven’t declared a climate emergency however at the end of November 2019 announced a

package of £1m for capital projects and £350k for revenue projects to deliver against the 2030 target. An

Environmental Policy has been published by the County Council with a number of ambitious objectives, which will

guide all future decisions and ensure that the County at large goes beyond the net zero carbon target.

4

20

Suffolk’s local authorities are working collectively, alongside the University of Suffolk and Environment Agency, through

the Suffolk Climate Change Partnership to make the county carbon neutral by 2030. The partnership will publish an

updated action plan this year to analyse existing, publicly available data and related tools to provide a clear, evidence-

based baseline of carbon emissions in Suffolk per key sector and then set out indicative emissions reduction pathways

per key sector to meet the carbon neutral by 2030 target. The partnership is developing their own policy responses to

the climate emergency declarations.

Data available

Emissions intensity of non-industrial business and public energy use

(include baseline

Non-industrial business and public energy use per £ million output

if have)

Set targets for reduction in private car mileage for public sector activities?

Action

Responsible / Status

Deadline/

Result

Resources

Potential barriers

milestones

Encourage local

LEP Board

As soon as

Greater awareness of the

Local authorities

Climate

authorities to sign

possible

emergencies declared across

emergencies have

up to the UK100

Norfolk and Suffolk and

not been declared

Network

activities driving clean growth

across every local

authority yet

Effective

LEP Executive

Expected -

Showcase positive case studies

LEP Comms team

Prime Minister

communications

May 2020

from across various sectors

Industry Councils /

needs to sign off on

plan during Green

Sector Groups

this date, so may be

Great Britain week

postponed

Strong public-

LEP Executive

Ongoing

Ensure that activity at county

Partner buy-in

private

and district level aligns with the

required to avoid

collaboration to

needs of the private sector and

overlaps as partners

deliver progress

key parties are involved as

move forward with

activities progress at the local

local activities

level

Voluntary, Community & Social Enterprise Sector

Background

There are various national and local initiatives/funds that aim to support local communities in their efforts to deliver

sustainability and tackle climate change.

The Rural Community Energy Fund is a £10 million programme which supports rural communities in England to

develop renewable energy projects, which provide economic and social benefits.

Norfolk and Suffolk

Across Norfolk and Suffolk, there are a range of local and national environmental charities which seek to enhance

Context

our natural capital and prioritise climate mitigation. Most of these charities have declared climate emergencies and

are playing an important role in tackling climate change.

5

21

The Sheringham Shoal Community Fund is a good example of offshore wind farm developers working with local

communities to fund projects that deliver against one or more objectives, including climate mitigation and the

promotion of environmental sensitivity or the benefits of renewable energy.

King’s Lynn & West Norfolk Borough Council has created a new small grants fund to tackle two specific issues

across the community - the reduction of single use plastics and voluntary action to clear the community of litter.

Data available

Tracking of projects and associated outcomes/outputs the VCS sector is engaged in - including direct

(include baseline if

carbon emission reductions, power generation volumes, ‘green skills’ initiatives, and materials efficiency and

have)

recycling

Action

Responsible /

Deadline/

Result

Resources

Potential barriers

Status

milestones

Engage the VCSE

VCSE Sector

These two groups

Importance is high on the

Local

Large sector with

sector leadership

Leadership Groups

meet regularly

agenda for the sector at large -

authorities

various constraints

groups for Norfolk and

for Norfolk and

pulling together measurable

Suffolk to establish

Suffolk

actions and case studies of

measurable actions

community action

Infrastructure: Transport

Background

Given the significant contribution the transport sector plays in emissions it is critical that we consider how it can

reduce its contribution over time.

The Government’s ‘Road to Zero’ strategy stated that the UK will end the sale of new conventional petrol and diesel

cars and vans by 2040. Since its original publication in 2018 this target has been reviewed and brought forward to

2035.

Norfolk and Suffolk

38% of carbon emissions in Norfolk and Suffolk are from the transport sector. In 2005 this proportion was only 29%.

Context

While transport emissions have reduced over time, other sectors have observed greater reductions hence the

proportion of emissions from transport has actually increased.

Data available

Understanding emissions by mode, vehicle type, journey distance and journey type, and transport inter-

(include baseline if

connectivity (business or leisure) would add further knowledge to how successful interventions may be.

have)

Any additional data on the provision of adequate levels of broadband connectivity, especially in rural locations

- to enable more widespread working from home/closer to home options

Potentially ask for LA planning authorities to provide their assessments of EV charging point connectivity and

projected public EV charge point connectivity schedules and requirements

Action

Responsible /

Deadline/milestones

Result

Resources

Potential

Status

barriers

Imbed clean growth

All

Ongoing

Clean growth

Existing budgets

Acceptance of

ambitions in

In development

considered as part

should cover this as it

challenging

6

22

transport strategies

LEP Board tasked Transport

of the overall

is a shift in focus.

ambitions/

and policies

Board with this in Nov ‘19.

decision-making

Additional evidence

targets in this

County Councils LTPs

process with

may be needed in

area.

currently in review.

respect to

support of this action.

transport.

Reduce the need to

County Councils

95% superfast broadband by

More people able

tbd

Rural delivery

travel through better

In development/

2020.

to work flexibly and

challenges.

digital connectivity

delivery

Full fibre coverage by 2025.

on the move,

and flexible working.

Better mobile connectivity

boosting

The internet of

ASAP inc. 5G pilots.

productivity as well

things can also help

as inclusive and

drive efficiencies.

clean growth.

Improve access to/

County Councils

County Councils LTPs

More people

Ongoing business

Reliance on the

use of sustainable

In development/

currently in review.

encouraged to use

case development in

private car in

modes/models

delivery

Ongoing work/ delivery in

sustainable modes

this area in order to

rural areas

through integration

urban areas.

as access to and

secure funding.

although

and behaviour

Ongoing work on road network

ease of use

opportunities for

change

to reduce congestion/ improve

improves.

car sharing and

air quality.

Reduced

cleaner vehicles.

Transforming Cities and Future

congestion helps to

Mobility Zone bids for Norwich.

support clean

Ongoing work to improve rail

growth ambitions.

freight and passenger

connectivity inc. Sizewell C.

Work with the CPC

Transport Board

Blue tech proposal with Port of

Increased transport

tbd - possible

Encouraging

to drive transport

In development

Felixstowe and BT - ongoing.

innovation and best

Innovative Projects

those who are

innovation and

Connections Café on 25

practise spreading

Fund bid.

not already

support for SMEs

February.

within the sector.

engaged to get

involved.

Develop an EV

tbd

tbd

Greater take up of

tbd - Greater South

Rural networks.

strategy focussed on

Concept

EVs/lower

East Energy Hub

supporting

emissions vehicles

doing some work in

infrastructure as well

this area.

as take up

Consider freight and

tbd

tbd

tbd

tbd

tbd

air as modes/ types

Concept

7

23

for further

exploration

Air quality

LAs

Ongoing

Improvements in

Existing

Increased urban

improvements

In development/

air quality

transport

delivery

Increase

Infrastructure

Ongoing

More resilient

tbd

Resource

infrastructure

providers

infrastructure

resilience

In development/

delivery

Infrastructure: Energy

Background

It is critical that we consider non-traditional methods of solving the future energy challenge with local energy being

at the heart of this.

Norfolk and Suffolk

At present, there are significant capacity constraints on the electricity distribution network in many parts of Norfolk

Context

and Suffolk. Added to that we have a significant national energy asset in our Energy Coast which needs to be

considered strategically.

Work has already begun in this arena in the shape of the Local Energy East Strategy commissioned alongside the

Greater Cambridge Greater Peterborough and Hertfordshire LEPs. Indeed, the Greater South East Energy Hub

established by BEIS is tasked with increasing the number, scale and quality of local energy projects and their

delivery. As a later addition, the Hub is also responsible for determining the Rural Community Energy Fund which

has been underutilised to date in Norfolk and Suffolk.

Data available

Please see above under ‘Energy’ heading

(include baseline if

have)

Action

Responsible /

Deadline/

Result

Resources

Potential barriers

Status

milestones

Develop a strategy to

tbd

tbd

More local energy solutions,

tbd

Resources

over grid constraints

Concept

energy generators matched

with high users and better

utilised planning policy

Develop a strategy to

tbd

tbd

More local energy solutions,

tbd

Resources

decarbonise heat

Concept

less reliance on oil, reduction

in fuel poverty

8

24

Develop an investment

New Anglia LEP

tbd

Better disseminated

tbd

Resources

prospectus covering

Concept

information and more upfront

electricity and heat

investment

opportunities

Investigate the

New Anglia LEP

tbd

More resilience and less

tbd

Resources - likely to

extension of HV

Concept

impact on local communities/

be significant

transmission network to

businesses

coast inc. potential for

offshore solution

Reduce energy

All

ASAP

Less demand for energy

tbd

Resources

demand and increase

Concept

energy efficiency

Boost applications to

Greater South

Ongoing

More rural community energy

tbd

Promotion

RCEF

East Energy Hub

schemes

Delivery

Consider future power

New Anglia LEP

tbd

EVs, a more digitally

tbd

Resources

needs

Concept

connected, smart economy

and the decarbonisation of

heat included

Infrastructure: Water

Background

Improved water management needs to be a priority for coming decades, both in terms of increased storage

capacity and greater use efficiency. The Water Resources East partnership initiative provides an excellent wider

regional platform for planning game-changing initiatives in this area.

Norfolk and Suffolk

The ambitious plans for both the Norfolk Water Resources Management Plan and the Suffolk Holistic Water

Context

Management Project are a good starting point in our area.

Data available

tbc

(include baseline if

have)

Action

Responsible /

Deadline/milestones

Result

Resources

Potential barriers

Status

Develop and deliver a

In development -

Projects in

Holistic solutions to

Investments in

Need to secure

regional sustainable

a number of

development in 2020 -

water management

feasibility, capital

funding and need to

water management

collaborative pilot

Regional Management

maximising the

build, data capture

focus ambitious

plan, in particular

projects are

Plan 2023

resources we have,

and testing

agenda on

9

25

addressing water

underway in

and ensuring

deliverable

access issues, water

Norfolk and

adequate supply

initiatives. Long term

capture and storage

Suffolk - Water

timescales for some

and the potential for

Resources East

projects.

water trading

and partners

Infrastructure: Flooding - section to be developed

Housing

Background

While we must ensure all new build meets the challenge of achieving clean growth it is critical to acknowledge that

much of our housing stock is old, energy inefficient and needs a significant retrofit programme in order to

contribute to this agenda.

Norfolk and Suffolk

28% of carbon emissions in Norfolk and Suffolk are from the domestic sector.

Context

Data available

Home Energy Use per household

(include baseline if

Emissions Intensity of home energy

have)

Share of homes with EPC

Understanding the impact of new build versus retrofit, and to what standard, would be useful information to gather,

particularly the scale of additional qualified labour required to achievement installation targets and associated costs

for the consumer/business.

Action

Responsible /

Deadline/milestones

Result

Resources

Potential barriers

Status

Increase energy

Construction

tbd

Reduced energy use

tbd

Resources and

efficiency and use the

industry

challenging

most of natural

In development

timescales

resources in new and

old stock

Decarbonise heating

Greater South East

No new fossil fuel

Reduced carbon

tbd

Resources and

Energy Hub(?)

boilers post 2025

emissions

challenging

In development

timescales

Use of more

Construction

Ongoing

Increased efficiency

tbd

Resources

sustainable and

industry

innovative

In development

materials/methods

10

26

Promote the whole life

tbd

tbd

Better

tbd

Challenging

benefits of sustainable

Concept

understanding

perceptions

homes

Imbed sustainable

Planning/

ASAP

Higher quality, more

tbd

Resources and

quality in the early

construction

sustainable homes

challenging

development stages to

industry

perceptions

reduce costs

Concept

Influence legislation to

New Anglia LEP/

tbd

More sustainable

tbd

Resources

include more

local authorities

homes

sustainable measures

Concept

Consider how planning

LPAs

Ongoing as part of

More sustainable

tbd

Other considerations

policy can contribute to

In development

Local Plan reviews

growthh

to be taken into

the clean growth

account

agenda

Natural capital, agriculture, food processing and land management

Background

The Agriculture Bill and Environment Bill being considered by Parliament propose far-reaching changes to the way

we manage our land and the value placed on particular interventions. The Agriculture Bill proposes a future

emphasis on ‘public money for public goods’ with funding potentially linked to actions which protect biodiversity,

increase woodland, improve soils and protect natural habitats. The Environment Bill potentially supports this with

the proposed creation of Nature Recovery Networks to improve and connect key habitats, and the importance

placed on valuing Natural Capital.

These changes could provide a funding landscape which enables significant environmental benefits. However,

Basic Payments are being phased out for farmers, and decisions on our future trading relationships are critical for

the sector, so there could be challenges in ensuring productivity and growth alongside environmental gains.

Norfolk and Suffolk

Improved water management needs to be a priority for coming decades, both in terms of increased storage

Context

capacity and greater use efficiency. The Water Resources East partnership initiative provides an excellent wider

regional platform for planning game-changing initiatives in this area, and the ambitious plans for both the Norfolk

Water Resources Management Plan and the Suffolk Holistic Water Management Project, which aims to capture

pumped drainage water for agricultural and domestic use, are a good starting point in our area.

Improvements in water management also support improved soil quality, which is needed to enable sustainable

agriculture, and to improve biodiversity and carbon sequestration. This area is currently being explored with Water

Resources East and a number of landowners, and potential projects are being developed.to address the soil

improvement challenge in a water management context.

Opportunities will exist for landowners and managers to contribute to carbon sequestration - the proposed Natural

Capital East regional initiative and other 25 Year Environment Plan activity will help develop the evidence base that

11

27

is needed to prioritise carbon sequestration where it makes the most economic and environmental sense. The

Eastern Claylands project from the Woodland Trust is an ambitious initiative already working on this challenge.

An ever-changing landscape in the funding of local renewable generation of heat and power will provide

opportunity for landowners and public bodies to develop renewable generation projects. Making the relevant

funding and support information widely available will support this aim.

Data available

A number of carbon and soil health tools available - many challenges with extrapolating data in a

(include baseline if

meaningful way from micro to farm or landscape scale (see actions below).

have)

Natural Capital Baseline assessment for Norfolk and Suffolk being developed by UEA for Norfolk and

Suffolk County Councils using the indicators in the Government’s 25 Year Environment Plan - due to be

completed early 2020.

Action

Responsible / Status

Deadline/milestones

Result

Resources

Potential barriers

Develop a Natural

Being delivered - UEA

Initial baseline

A robust baseline with

Existing data from

None

Capital baseline

/NCC/SCC and key

completed May

data against many of

a wide range of

assessment for Norfolk

environment/ farming

2020

the measures in the

sources, checked

and Suffolk to inform

stakeholders plus the

25 Year Environment

and analysed by

future planning

LEP

Plan

UEA

Explore the potential to

In development - LEP

Develop initial

Region wide initiatives

Project

Need to separate

develop regional

and other partners

projects with WRE

are developed and

development time

out clearly

natural capital

actively working with

in 2020; scope the

secure funding

initially

deliverable projects

enhancement and

Water Resources East

Natural Capital East

resource management

on a range of ideas,

initiative during

projects with the

and the LEP part of the

2020

proposed Natural

steering group for

Capital East initiative

Natural Capital East

and Water Resources

East

Develop and test data

In development - LEP

Develop project by

A robust methodology

On-farm costs of

Need to secure

assessment

with data specialists,

summer 2020

to propose to Defra

testing methods,

funding - fast

methodology for

UEA and leading local

and a case for the

data capture and

moving and

comparing the carbon

farmers

value of improving

analysis tools and

competitive field.

sequestration and soil

carbon sequestration

process, academic

quality benefits of a

on productive land.

input.

range of measures.

Develop biodiversity

Water Resources East,

Aim to have some

Habitat improvement,

Cost of landscape

Many smaller

and water

key environmental

developed initiatives

improved water

interventions,

projects delivered -

quality/resource

groups, NCC/ SCC and

in 2020

quality and water

measuring and

12

28

projects in river

the farming sector -

resource

monitoring

challenge of

catchments and wildlife

concept stage but

management, new

equipment and

delivering at scale

corridors and marginal

some projects in initial

and transferable

data analysis, and

land

development stage

methodologies and

project

partnership

management

approaches

Deliver a new Food

Funding bids under

Results of bids

Increase in innovation

Capital build of

Need to secure

Innovation Centre to

consideration - SNDC

2020, project 2021-

in the food sector in

new centre, and

funds

support food sector

and partners

23.

Norfolk and Suffolk

revenue

businesses to innovate,

and the development

programme of

tackle food and health

of an agrifood cluster

support.

challenges, and

aware of and tackling

develop new products,

clean growth agenda

in the context of clean

growth

Develop and deliver

In development - a

Projects in

Holistic solutions to

Investments in

Need to secure

sustainable water

number of potential

development in

water management

feasibility, capital

funding, and need to

management plans for

projects under

2020 - Regional

maximising the

build, data capture

focus ambitious

Norfolk and Suffolk, in

consideration for

Water Management

resources we have,

and testing

agenda on

particular addressing

funding /further

Plan 2023

and ensuring

deliverable

the water access

development - Water

adequate supply

initiatives. Long

issues around

Resources East and

term timescale for

abstraction, water

partners

some projects

capture and storage on

drained land, and the

potential for water

trading

Green Finance

Background

Green Finance is one of the fastest changing areas of funding opportunity, with a menu of grant, loan and

equity options for private and public sectors, with different packages in terms of project management and

delivery, risk management, and returns. However, there is still an issue with resourcing the development of

new project ideas and testing their feasibility.

Norfolk and Suffolk

There is a growing range of finance options with the potential to enable the delivery of clean growth projects.

Context

The European Regional Development Fund has supported a number of projects which provide grants, advice

or equity investment to projects which deliver carbon savings -

13

29

BEE Anglia, £4.1m low carbon specialist assessment and grants programme run by Suffolk County

Council and supported by the ERDF programme, operates across the LEP area and has enabled carbon

savings in participating businesses.

Low Carbon Innovation Fund 2, a regional equity investment opportunity co-financed with £8m ERDF

funding, and run by UEA and Norfolk County Council, offers low carbon investment opportunities for

businesses in the East of England.

Eastern New Energy - a multi-LEP project starting in 2020, with just under £1m allocated to Norfolk and

Suffolk activity, run by the University of East London, with UEA and the University of Suffolk among its

partners. It will work towards identifying and developing energy storage projects, enabling renewable and

retrofit projects, and supporting innovation in the LCEGS sector.

There is a growing range of equity options for funding large scale renewable and clean energy projects, many

of them aimed at managing and mitigating risk for the public sector. The UK100 group of public sector

authorities committed to achieving 100% clean energy by 2050 have built up considerable expertise in

delivering major clean energy investments using a range of investment packages, and they are happy to share

case studies and expertise.

Green finance opportunities include -

SALIX - Government interest-free loans for energy efficiency /low carbon projects funded by BEIS.

Macquarie - Green Investment Group (GIG) - flexible and development capital for green infrastructure

projects.

SDCL (Sustainable Development Capital) - a major global investor which funds and manages projects

and takes on the risk via and Energy Service Company (ESCO) model.

There are many other organisations offering finance, including all major banks, and a range of smaller

investors and crowdfunding platforms, each with a slightly different model of ownership, project management

and delivery, risk and returns. However, there is still an acknowledged funding gap in enabling the initial pre-

investment feasibility work which is harder to finance.

Innovate UK funding and the Industrial Strategy Challenge Fund offer opportunities for ambitious clean growth

projects in a range of sectors and themes. These calls have short turnaround times when issued, and often

require very specific partnerships - often with an SME lead - and deliverables. Developing a pipeline of

suitable partnerships and project ideas for future opportunities as part of the LEP Investment Plan would be

helpful.

Data available

Carbon savings (EU projects)

(include baseline if have)

No of businesses supported to make carbon reductions (EU projects)

Action

Responsible /

Deadline/milestones

Result

Resources

Potential barriers

Status

14

30

Deliver the ERDF low

SCC - BEE Anglia,

Delivery by close

Businesses supported to

ERDF funding

carbon projects, and

and SCC/UoS

2023

make carbon savings,

measure the impact

Eastern New

and new low carbon

/benefits to inform future

Energy, NCC

projects identified

programmes

LCIF2. LEP

(Eastern New Energy).

evaluation at

programme level.

Consider any other

LEP with partners -

tbc

Pipeline of projects ready

tbc

resources needed to

do we need

for green finance

address project

resource to develop

opportunity

development/feasibility gap

projects to

feasibility stage?

Skills - tbd

Background

Norfolk and Suffolk

Context

Data available

(include baseline if have)

Action

Responsible

Deadline/milestones

Result

Resources

Potential barriers

/ Status

Clean growth adaptation - tbd

Background

Norfolk and Suffolk

Context

Data available

(include baseline if have)

Action

Responsible

Deadline/milestones

Result

Resources

Potential barriers

/ Status

15

31

Environmental Policy

Introduction

The LEP has a longstanding commitment to environmental sustainability, most

recently in the Norfolk and Suffolk Local Industrial Strategy, with its vision for Norfolk

and Suffolk as the ‘UK’s Clean Growth region’. The LEP is working with all its

partners and stakeholders to develop an action plan to deliver this vision, and

continually reviews its policy and practice to improve sustainability. The LEP is

committed to environmental protection and the minimisation of the negative