New Anglia Local Enterprise Partnership Board Meeting

Thursday 23rd May 2019

10.00am to 12.30pm

The Council Chamber, King's Lynn Town Hall, Saturday Market Place,

King's Lynn, PE30 5DQ

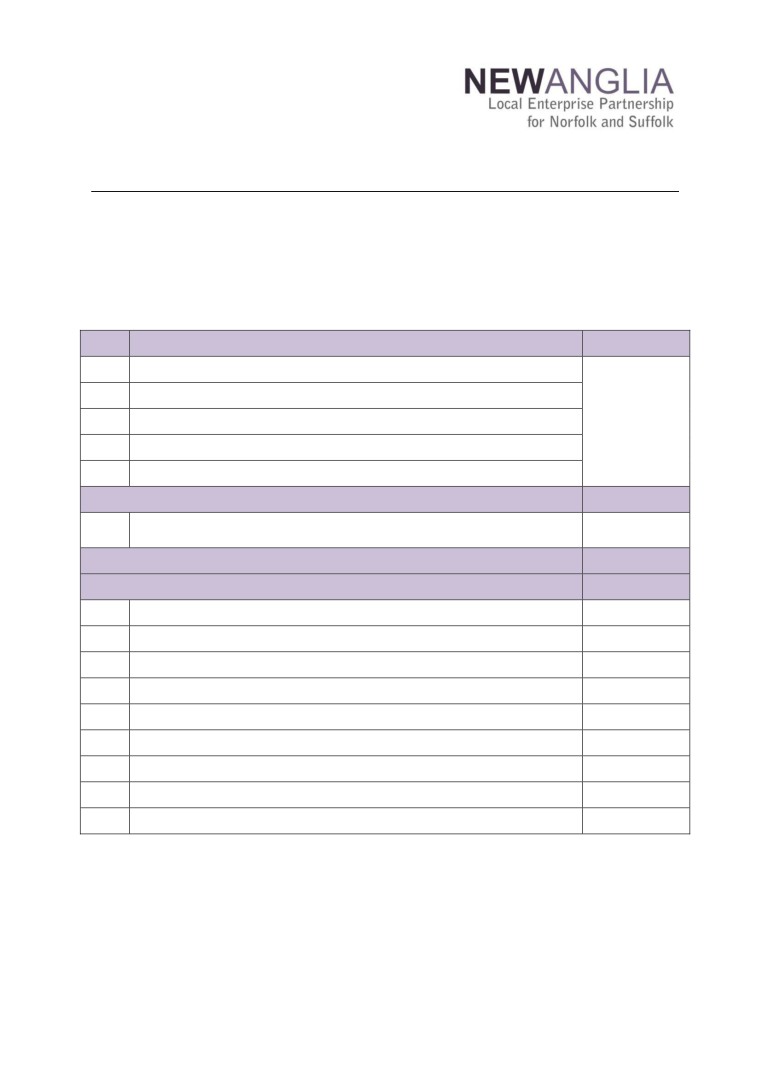

Agenda

No.

Item

Duration

20 mins

1.

Welcome from the Chair

2.

Apologies

3.

Welcome from Ray Harding, CEO King’s Lynn and West Norfolk BC

4.

Declarations of Interest

5

Actions / Minutes from the last meeting

Forward Looking

50 mins

Presentation

6.

New Anglia Growth Hub - performance to date and future plans

and discussion

Break

10 mins

Governance and Delivery

70 mins

7.

Enterprise Zone Accelerator Fund Proposal - Confidential

For Approval

8.

LEP Capital Budget 2019/20 - Confidential

For Approval

9.

Chief Executive’s Report

Update

10.

May Programme Performance Reports including Dashboards

Update

11.

Brexit

Update

12.

South East Energy Hub - progress report and future plans

For Approval

13.

Board Forward Plan

Update

14.

Any Other Business

Next Meeting: 10.00am - 12.30pm, 25th June 2019

Venue: Gainsborough’s House, Sudbury

1

New Anglia Board Meeting Minutes (Unconfirmed)

27th March 2019

Present:

David Ellesmere (DE)

Ipswich Borough Council

Doug Field (DF)

East of England Coop

John Griffiths (JG)

St Edmundsbury Borough Council

Matthew Hicks (MH)

Suffolk County Council

Dominic Keen (DK)

High Growth Robotics

Steve Oliver (SO)

MLM Group

William Nunn (WN)

Breckland District Council

Andrew Proctor (AP)

Norfolk County Council

David Richardson (DR)

UEA

Lindsey Rix (LR)

Aviva

Sandy Ruddock (SR)

Scarlett & Mustard

Nikos Savvas (NS)

West Suffolk College

Alan Waters (AW)

Norwich City Council

Jeanette Wheeler (JW)

Birketts

Tim Whitley (TW)

BT

Attendees

Shan Lloyd (SL)

BEIS

Sue Roper (SuR)

Suffolk County Council

Chris Dashper (CD)

New Anglia LEP

Chris Starkie (CS)

New Anglia LEP

Rosanne Wijnberg (RW)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

1

3

Actions from the meeting: (27.3.19)

Amendments to Articles of Association

To include details of the term of appointment of the Deputy Chair

RW

March Performance Reports

To provide details of employment numbers for the agri tech sector

CS

1

Welcome from the Chair

Doug Field (DF) welcomed everyone to the meeting including Jonathan Agar (JA), the CEO of

Birketts and thanked him for hosting the board meeting.

2

Apologies

Apologies were received from Johnathan Reynolds, Claire Cullens and Pete Joyner

3

Welcome from Birketts

JA welcomed the Board to the meeting and provided a presentation covering the history of the

company, its wide ranging work and its mix of clients. JA stressed the importance of continually

developing the company and the benefits of being based on an Enterprise Zone .

The meeting was given details of the range of clients currently using Birketts including many

household names and also the plans for development focussing on the education, energy and the

public sectors.

JA also reviewed the Birketts Charitable Fund which donated £75k across Norfolk and Suffolk in

2018 and encourages staff to take part in volunteering and charity work. He also stressed the

importance of the staff health and wellbeing and the ongoing support provided to staff within the

organisation.

DF thanked JA for his presentation and invited David Richardson (DR) to address the meeting.

DR raised the issue of mental health problems in particular in relation to the recent deaths among

students at the UEA. DR noted the issues faced by the Norfolk and Suffolk Trust and advised that

additional support would be provided for students at the university. DR asked all Board members

for their support in raising awareness of the issues faced and in and providing support where

possible.

Tim Whitley (TW) expressed his support to DR.

He then updated the meeting on Quantum Tech and advised that on 26th March the first

presentation of a high speed link using Quantum Tech had taken place at Adastral Park. This now

forms part of national research infrastructure and promoted the region on the national stage

4

Declarations of Interest

Full declarations of interest can be found at http://www.newanglia.co.uk/about-us/the-board.

Item 9: Capital Growth Programme Projects

Projects for Approval

Board members declared an interest in specific projects and left the room for discussion of and

voting the relevant project - Andrew Proctor (AP), Matthew Hicks (MH), Tim Whitley (TW), David

Richardson (DR) and Sue Roper (SuR)

5

Minutes of the last meeting 27th February 2019

The minutes were accepted as a true record of the meeting held on 27th February 2019.

Actions

Chris Starkie (CS) advised the meeting that the update on the inclusion of CO2 reductions in

the Economic Strategy would be included at the July meeting.

6

Delivery Plan

Rosanne Wijnberg (RW) updated the meeting on the work carried out to date on the LEP

delivery plan which is based on the guidelines received from Government.

2

4

AP queried the figures detailing the number of homes constructed.

CS advised that these figures related to homes completed by LEP investment in

infrastructure projects.

David Ellesmere (DE) asked if, given the recommendation received following the Annual

Review, there were plans to include a ministerial quote in the plan. Shan Lloyd (SL)

advised that, as there are 38 LEPS all of which have delivery plans, there were no current

plans to include ministerial quotes in them.

RW asked for comments and amendments to be sent to her.

The Board agreed:

To note the content of the report

To approve the Delivery Plan and delegate the authority to the LEP Chief Executive to

make minor amendments as required before publication

7

2019/2020 Budget

RW reviewed the proposed 2019/20 budget.

Dominic Keen (DK) queried the level of certainty in future income. CS advised that future

funding was dependant on the Government Funding Review which was hoped for in the

Autumn.

Lindsey Rix (LR) asked whether further clarity could be provided on the 3 year plans even if

it includes a level of uncertainty in some of the income streams.

CS confirmed that Keith Spanton is currently working on future budgets based on known

funding.

RW proposed providing an update on core and programme financials to the Board on a

quarterly basis.

DF thanked RW for her work on the budget.

The Board agreed:

To note the content of the report

To approve the operating budget for 2019/20

To approve the proposal on financial reporting

8

Brexit

CS highlighted the key points of the report and noted that, given the fluid situation, it was

challenging to write the report as the data constantly required updating.

He advised that the LEP was continuing to provide the most up to date information to

business and noted that the Suffolk Chamber of Commerce was taking on 2 additional

members of staff to support businesses on Brexit.

William Nunn (WM) noted that the same proposal could be discussed at the next Norfolk

Leaders meeting.

The Board agreed:

To note the content of the report

9

Capital Growth Programme Call including Confidential Discussions

DF proposed that board members with interests in each application to leave as and when

the item was discussed.

Chris Dashper (CD) provided the meeting with an overview of the process carried out and

details of the numbers of applications received. He advised that those projects deemed to

be rejected were being considered for signposting to other sources of funding.

3

5

Confidential

The Board discussed those projects recommended for approval:

AP, Matthew Hicks (MH) and Sue Roper (SuR) declared an interest in this item and left the

room.

Norfolk and Suffolk County Councils - Norfolk & Suffolk Innovation Network: £440k

This was approved by the Board.

AP, MH and SuR returned to the room

TW declared an interest in this item and left the room

University of Suffolk - Digital Skills & Innovation Accelerator: £6.497m

This was approved by the Board.

TW returned to the room

Suffolk New College - Digital & Technology Skills Hub: £1.6m.

City College Norwich - Digital Technology Factory: £6.098m

These were approved by the Board.

DR declared an interest in this item and left the room

University of East Anglia - Institute of Productivity (IoP): £4.461m. (£14,130,161m

requested)

Confidential

4

6

A conditional grant was approved by the Board.

AP voted against the proposal.

DR returned to the room

The Board discussed those projects recommended for deferral

CD advised that those projects in Table 2 which are based within Enterprise Zones and

therefore further investigations into alternative funding options is appropriate.

John Griffiths (JG) if the JAYNIC Innovation Centre was only being rejected as it was on an

EZ as it has scored relatively highly.

CD noted that there were other funding options available to this project and that there were

delivery and cost benefit issues with this project.

The Board agreed to defer these projects.

The Board approved the grant of £200k from the Growing Places Fund to the National Trust,

Releasing the Sutton Hoo Story.

The Board agreed to the reject of the projects detailed in Table 3

The Board agreed:

To note the content of the report

To approve the funding to the following projects:

o

£440k to Norfolk and Suffolk County Councils- Norfolk & Suffolk Innovation Network

o

£6.497m to the University of Suffolk- Digital Skills & Innovation Accelerator

o

£1.6m to Suffolk New College- Digital & Technology Skills Hub

o

£6.098m to City College Norwich- Digital Technology Factory

To provide an offer of £4.461m to the University of East Anglia’s Institute of Productivity

with the condition that the proposal is put back before the Board for final approval

following the completion of further investigation

To approve the recommended decision option for each of the projects in tables 2 and 3.

(Table 2: Recommended to defer and Table 3: Recommended to reject)

To approve the Growing Places Fund grant of £200,000 to the National Trust, Releasing

the Sutton Hoo Story

TW left the meeting

10

Local Assurance Framework

RW reviewed the process carried out to update the Local Assurance Framework and asked

for approval from the Board

SL Confirmed that the framework was a consolidated one based on the recent Government

reviews.

The Board agreed:

To note the contents of the report

To adopt the 2019 Local Assurance Framework

To adopt the updated Scheme of Delegation

To adopt the updated Accountable Body Agreement

11

European Structural and Investment Funds Strategy

CS reviewed the paper included in the meeting papers and asked for questions from the

Board.

5

7

The Board agreed:

To approve the contents of the European Investment Strategy Update and

recommended its adoption to the New Anglia ESIF Committee

12

Amendments to the Articles of Association

RW reviewed the paper and highlighted those areas of change requiring Board approval.

Observers Policy - RW advised that the existing Articles of Association do not allow for

alternate directors to attend and vote at Board meetings. Any amendment to directors

would have to follow a formal process to revoke and appoint each director for any given

board meeting.

It is recommended to retain the clause not permitting alternate directors but to adopt a policy

of allowing observers who can participate in Board meetings and discussions but will not

vote or contribute to the quorum.

Substitutes at committees - RW recommended that substitutes are not permitted at

committee level in order to align with the above policy.

Term of chair - Previously this was not specified but the wording has been amended to

clarify the term.

It was agreed that the term of appointment for the deputy chair would also be included.

ACTION

To amend the Articles of Association to include details of the term of the Deputy Chair

RW

NS proposed the inclusion of 6th Form Colleges under Item 5.3.1 as a source of Education

Sector members.

RW advised that there 28 days from the date of issue to sign which allowed West Suffolk

and East Suffolk Council to be members rather than their predecessor authorities.

The Board agreed:

To approve the following documents

o The Articles of Association of New Anglia Local Enterprise Partnership Limited,

amended to reflect the agreed changes to the LEP Board as a result of the LEP Review

o The written resolution to be sent to the LEP’s members to approve the adoption of the

new articles

o The class consents for each of the three classes of members, consenting to the

variation of their class rights through the adoption of the new Articles of Association

o The letter to the company’s auditors informing them of the proposed written resolution

To retain the clause in the Articles of Association not permitting alternate directors

To permit directors to appoint an observer at directors’ meetings who will have no voting

rights or form part of the quorum

Not to allow substitutes at Committee level

To amend the Articles of Association to confirm the term of appointment of the Chair as

three years

To include details of the term of appointment of the Deputy Chair

13

Chief Executive’s Report

CS presented the paper to the Board and asked for questions.

CS advised that, following an open recruitment process, Martin Williams from Santander

Corporate Banking, is proposed as the new independent member of the Investment

Appraisal Committee (IAC).

This appointment was confirmed by the Board.

It was noted that County representation on the IAC is still to be agreed.

6

8

Local Industrial Strategy - It is proposed that an Independent Economic Panel is set up

which will provide quality, independent advice and information to the LEP. The Panel will be

made up with 3 or 4 experts from business and academia with strong reputations within their

respective fields who come from outside Norfolk and Suffolk. The Board are asked to

approve the proposed approach for the Independent Economic Expert Panel.

This was agreed by the Board.

Sizewell C - CS confirmed that the draft LEP response to the consultation paper had been

circulated to Board members for comment. MH proposed strengthening the response and

advised he would feed in his comments for inclusion.

Annual Review - CS reviewed the letter received following the Annual Review and noted the

change in ratings advising that this was the case for many LEPS.

CS advised that they were seeking greater clarification on what steps are required to obtain

an exceptional ranking.

CS reviewed the Place Branding paper and the timescales for the next phase of work and

noted that a stakeholder group would be established which would report into the main Board

on a monthly basis.

The Board was advised that a meeting had been held with the Combined Authority and

West Norfolk Council to discuss the future working relationship

The Board agreed:

To note the content of the report

To confirm the appointment of Martin Williams to the IAC

To agree to the formation of a Local Industrial Strategy Independent Expert Panel

14

March Programme Performance Reports

RW reviewed the March reports and asked for questions from the Board.

Agri Tech Report - AW queried asked how many people were employed in the agri tech

sector.

CS advised he will confirm numbers.

The Board agreed:

To note the content of the reports

To receive details of employment numbers for the agri tech sector

CS

15

Growth Deal Project Change Request

CD reviewed the change request to reallocate £415k from the NATS A11 Corridor Package

to the NATS City centre Package.

This was approved by the Board.

The Board agreed:

To note the content of the reports

To reallocate £415k from the NATS A11 Corridor Package to the NATS City centre

Package

16

Finance Report

RW reviewed the finance report and asked for questions from the Board.

The Board agreed:

To note the content of the report

17

Board Forward Plan

CS advised that the plan has been updated and will be circulated with the minutes.

As requested by the Board the Growth Hub will be providing a presentation at the May

Board.

7

9

The Board agreed:

To note the content of the plan

18

Any Other Business

DE provided an overview of the Princes Street Enterprise Zone noting that the Birketts office

sits at the heart of the zone which is fully occupied. He updated the Board on other key

developments in the area including the Connexions building which has been redeveloped as

office space, The Maltings development and potential investments by hotel chains in another

site. DE advised that there as a high level of interest in development in other buildings

including plans for a multi-story car park.

Next meeting:

Date and time of next meeting:

10.00am - 12.30pm, 23rd May 2019

Venue: The Council Chamber, King’s Lynn Town Hall, King’s Lynn, Norfolk

8

10

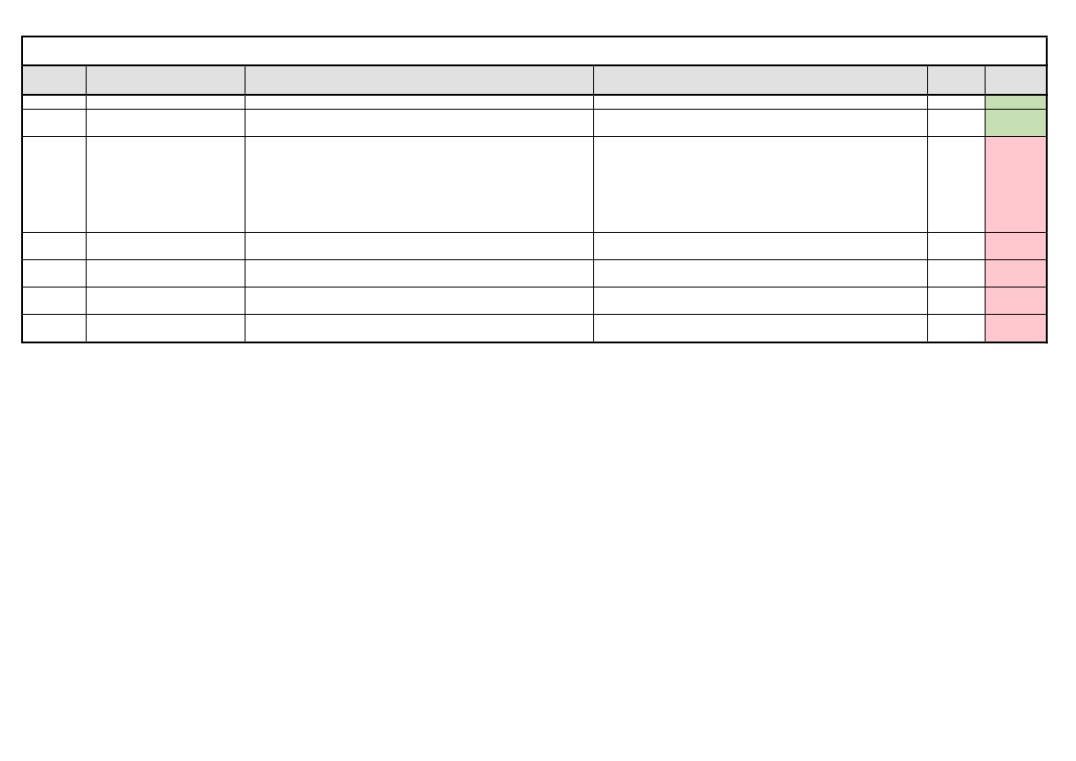

Actions from New Anglia LEP Board Meetings

Date

Item

Action

Update

Actioned

Status

By

27/03/2019

March Performance Reports

To provide details of employment numbers for the agri tech sector

Included in the May Performance Report paper

RW

Complete

27/03/2019

Amendments to Articles of

To include details of the term of appointment of the Deputy Chair

Complete

RW

Complete

Association

27/02/2019

Place Branding

Investigate the retention of the agency for ad hoc work on the brand

Agencies CMS/ Jacob Bailey have completed the next stage of the

LvD

On-Going

project in preparation for phase 2 which includes workshops and

messaging matrix.

The tender process for

the delivery of the digital platform and marketing collateral is being

finalised. Intereviews with agencies have taken place and the

process to appoint the successful agency is nearing completion.

30/01/2019

Aims and Objectives for the

Arrange a presentation from the Growth Hub on the support being

Scheduled for May Board meeting

CS

On-Going

Year

provided to business

30/01/2019

LEP Board Diversity Champion

To submit comments on the LEP’s Diversity Policy to DE

ALL

On-Going

23/11/2018

Infrastructure

For the LEP team to ensure that links are progressed with other sub-

Progress will be included in the next infrastructure update in

EG

On-Going

national transport bodies

October

21/02/2018

Ad Hoc

To receive a paper on CO2 reductions for

An interim meeting is being held at the UEA on 17th May and a

CS/JR

On-Going

consideration of inclusion in the economic strategy targets

presentation will be made at the July Board

11

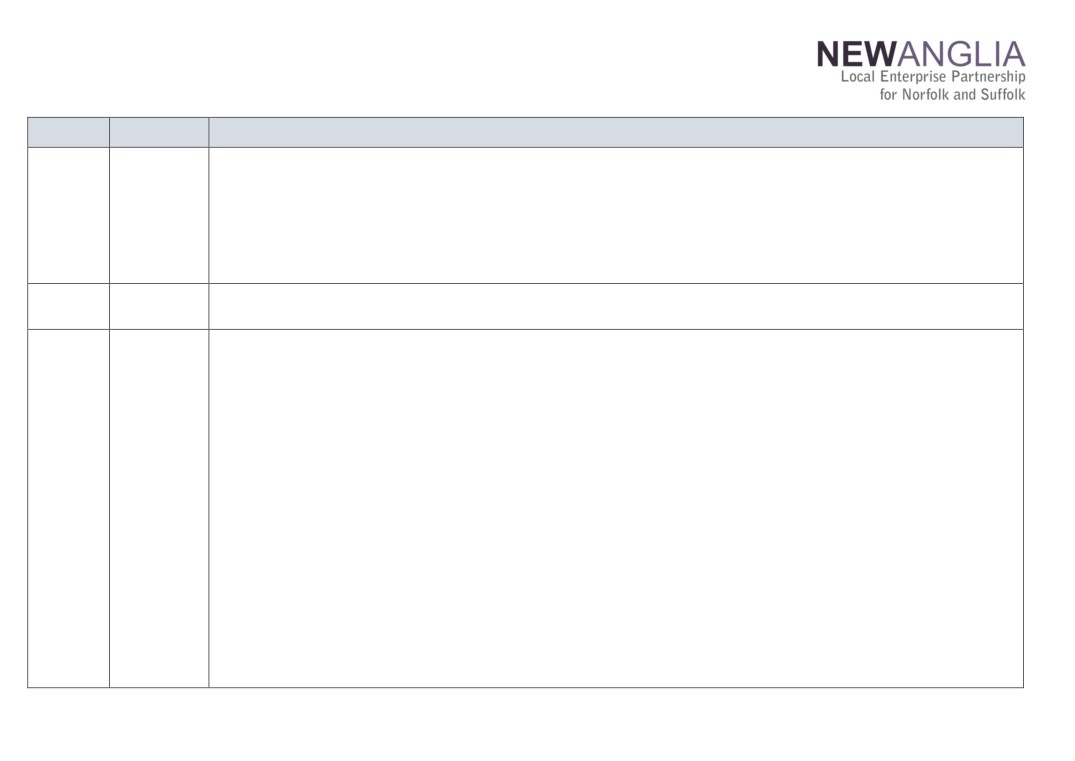

New Anglia Local Enterprise Partnership

Board Decision Log - Public

Date

Decision

Decision Made

Making Body*

01/05/19

Growing

The Panel approved the following applications:

Business Fund

• Portable Space Limited - agreed to support

Panel

Approved Grant - £78,378

• Goldwell Manufacturing Services Limited - agreed to support

Approved grant - £40,000

• Belle Coachworks Limited - agreed to support

Approved grant - £36,000

• HBD Europe Limited - agreed to support

Approved Grant - £52,388

03/04/19

Growing

The Panel approved the following applications:

Business Fund

• Anglian Plant Limited - agreed to support with conditions

Panel

Approved grant - £170,000

27/03/2019

LEP Board

The Board Made the following decisions:

Delivery Plan

To approve the Delivery Plan and delegate the authority to the LEP Chief Executive to make minor amendments as required before

publication

2019/2020 Budget

To approve the operating budget for 2019/20

To approve the proposal on financial reporting

Capital Growth Programme Call

To approve the funding to the following projects:

•

£440k to Norfolk and Suffolk County Councils- Norfolk & Suffolk Innovation Network

•

£6.497m to the University of Suffolk- Digital Skills & Innovation Accelerator

•

£1.6m to Suffolk New College- Digital & Technology Skills Hub

•

£6.098m to City College Norwich- Digital Technology Factory

•

To provide an offer of £4.461m to the University of East Anglia’s Institute of Productivity with the condition that the proposal is put back

before the Board for final approval following the completion of further investigation

• To approve the Growing Places Fund grant of £200,000 to the National Trust, Releasing the Sutton Hoo Story

Local Assurance Framework

To adopt the 2019 Local Assurance Framework

To adopt the updated Scheme of Delegation

To adopt the updated Accountable Body Agreement

European Structural and Investment Funds Strategy

To approve the contents of the European Investment Strategy Update and recommended its adoption to the New Anglia ESIF Committee

Amendments to the Articles of Association

To approve the following documents

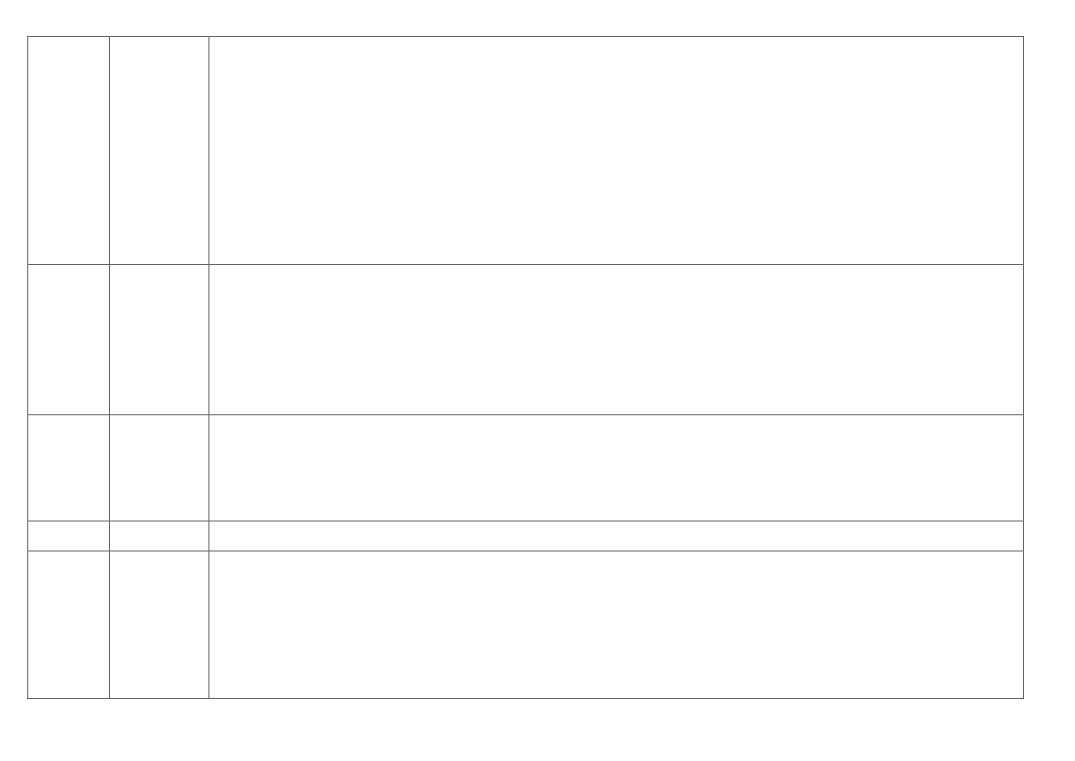

* New Anglia Local Enterprise Partnership Board, Investment Appraisal Committee, Growing Business Fund Panel, Remuneration Committee, Audit & Risk Committee

• The Articles of Association of New Anglia Local Enterprise Partnership Limited, amended to reflect the agreed changes to the LEP Board

as a result of the LEP Review

• The written resolution to be sent to the LEP’s members to approve the adoption of the new articles

• The class consents for each of the three classes of members, consenting to the variation of their class rights through the adoption of the

new Articles of Association

• The letter to the company’s auditors informing them of the proposed written resolution

• To retain the clause in the Articles of Association not permitting alternate directors

• To permit directors to appoint an observer at directors’ meetings who will have no voting rights or form part of the quorum

• Not to allow substitutes at Committee level

• To amend the Articles of Association to confirm the term of appointment of the Chair as three years

Chief Executive’s Report

To confirm the appointment of Martin Williams to the IAC

To agree to the formation of a Local Industrial Strategy Independent Expert Panel

Growth Deal Project Change Request

To reallocate £415k from the NATS A11 Corridor Package to the NATS City centre Package

27/03/19

Investment

The IAC made the following decisions:

Appraisal

Innovative Projects Call Paper

Committee

To award Innovative Projects funding to the following projects:

• Norfolk County Council - Building Supply Chains Capacity - £22,000

• Visit East Anglia - Growing the Year-Round Economy - £110,000

• Catapult - ORE Offshore Renewable Energy £50,000

To approve that the Innovative Projects Fund becomes an annual rolling programme, with a minimum allocation of £500k each for the 2019

and 2020 calls

GD Funding for Attleborough Virement

The meeting approved the reallocation of £275,000 within the Attleborough Transport package as per the meeting paper.

06/03/19

Growing

The Panel approved the following applications:

Business Fund

• Kiezenbrink UK Limited - agreed to support

Panel

Approved grant - £26,255 awarded under de minimus

• Precision Refrigeration Limited- agreed to support

Grant approved - £34,154 awarded under de minimus

• JSM Home Improvements - agreed to support

Approved Grant - £54,700

06/03/2019

Remuneration

The Remuneration Committee agreed a salary increase for the Chief Executive in line with the market.

Committee

06/03/2019

Investment

The IAC made the following decisions:

Appraisal

Capital Growth Programme Call - Confidential

Committee

Changes to Norwich Area Transport Strategy Funding

To recommend to the LEP Board that the transfer of £415k from NATS A11 Corridor to NATS City Centre package should be approved.

To approve the reallocation of Growth Deal funding within the NATS A11 Corridor Package;

a) utilising a £395,000 underspend from the A11 Daniels Road Junction Improvement and Scheme Development toward the Wymondham to

Hethersett Cycle Link.

b) a further £100,000 from the A11 Daniels Road Junction for an extension to the Wymondham to Hethersett Cycle link, part of a bid toward

the Transforming Cities Fund.

* New Anglia Local Enterprise Partnership Board, Investment Appraisal Committee, Growing Business Fund Panel, Remuneration Committee, Audit & Risk Committee

New Anglia Local Enterprise Partnership Board

Wednesday 23rd May 2019

Agenda Item 9 - Chief Executive’s Report

Author: Chris Starkie

Summary

This report provides an overview of LEP team activities since the March board, structured

around:

1) Programmes

2) Strategy

3) Engagement and promotion

4) Governance, Operations and Finance

The media dashboard is attached as an appendix to the report

Recommendations

The board is asked to:

Note the contents of the report

1) Programmes

This section provides a headline update on the LEP’s main programmes.

Growth Deal

Emerging forecasts for the 2019-20 Financial Year present a very positive picture. All the new

capital projects approved in March 2019, along with the remainder of those approved in May

2018 will start in earnest over the coming few months. Consequently, it is very likely we will

reverse the trend of the past two years with significant rollover, to a position where final Q4

payments may be delayed until we receive the 2020-21 LGF allocation from central

government.

Outputs continue to rise slowly against forecasts and agreed targets. In particular we expect

the number of dwellings, both houses and flats, to rise significantly over the coming year

through developments at Lynnsport in Kings Lynn, in association with the Bury Relief Road

and through the Wine Rack. The numbers of learners should also rise significantly in the

Autumn as both West Suffolk College and East Coast College developments should reach

completion.

On 30 April Nikos Savos of West Suffolk College, Ian Gallin of West Suffolk Council and Chris

Dashper of New Anglia LEP took part in a photograph outside the new West Suffolk College

Engineering and Technology Centre. The centre is on target to open in September 2019

following a £7m award from the Growth Deal.

More detailed performance information on the Growth Deal can be found in Item 10

(Programme Performance Reports).

Growth Programme

The Small Grant Scheme element of our flagship business support programme - the Growth

Programme - is exceeding forecast performance and by the end of May 2019, the grant

programme will have passed the August 2019 target.

MHCLG have conducted a six-month review meeting with the LEP delivery team in line with

the conditions attached to the award of the extension funding for the programme during 2018.

1

27

New Anglia Local Enterprise Partnership Board

Wednesday 23rd May 2019

Agenda Item 9 - Chief Executive’s Report

Author: Chris Starkie

With the small grant scheme outperforming expectations and output achievement compared

with targets, there are no concerns regarding funding for the funding for the programme to

2021 and MHCLG have indicated that they are content with the overspend position of the

programme. More detailed performance information can be found in Agenda item 10

(Programme Performance Reports).

Change requests for additional funding and for a further extension of the programme through

to 2022 will be submitted through ERDF over the next few months to take advantage of the

continued availability of ERDF funding. This will provide an extension to the entire programme

which is made up of our Growth Hub, Small Grants Scheme and start up programmes.

In addition, a bid for an Innovation, Research and Development programme to operate

alongside the existing Growth Programme will be submitted to ERDF to commence operation

in October 2019. This will offer R&D grants for businesses.

Further updates on the extension of the Growth Programme and our Innovation, R&D

programme will be provided in future board reports.

Growing Places Fund

Ipswich Winerack

The Winerack project in Ipswich continues to deliver at pace, with over 30 apartments now

completed and the first sales completed, with funds recycled into completion of further stages

of the project. Repayment of the £5m LEP loan for the project remains on track.

Growing Places Fund Confidential

2

28

New Anglia Local Enterprise Partnership Board

Wednesday 23rd May 2019

Agenda Item 9 - Chief Executive’s Report

Author: Chris Starkie

Innovative Projects Fund

Eight projects were taken to the IAC for consideration on 27th March, all projects were

approved, five with conditions.

The total amount approved was £649,068. Four of the approved projects require funding over

2 or more financial years. The IAC approved the decision to launch a further two consecutive

annual calls of the Innovative Projects Fund with a minimum of £500,000 for each call for the

years 2020/21 and 2021/22.

This will allow for a rolling programme that will give sufficient headroom to accommodate multi-

year projects. Since the IAC meeting on March 27th, offer letters for four projects have been

drafted or issued and applicants will be commencing their respective projects imminently:

Norfolk County Council; Building Supply Chain Skills Capacity: £22,000

Visit East of England; Visit East Anglia, Growing the tear round economy: £110,000

Catapult; ORE Offshore Renewable Energy: £50,000

Great Yarmouth BC; Norfolk and Suffolk Offshore Wind £98,268

Both Suffolk and Norfolk County Councils have indicated interest in matching any New Anglia

LEP’s future allocation to the Innovative Projects Fund through their respective pooled

3

29

New Anglia Local Enterprise Partnership Board

Wednesday 23rd May 2019

Agenda Item 9 - Chief Executive’s Report

Author: Chris Starkie

business rates. This would result in a significant pot being made available to prospective

projects under a 2019 call but is dependent on agreement from all local authority leaders.

New Anglia Capital

The New Anglia LEP has allocated £3m to New Anglia Capital since the project began in 2014.

Since then, £2.4m has been invested into 15 early stage, high growth potential businesses,

matched to private investors from NAC’s project partner Anglia Capital Group.

Of that figure, £770k was invested in 2018, into a range of sectors including Agritech, Biotech,

Foodtech and Cleantech. Also in 2018, New Anglia Capital saw its first exit from Fraser Well

Management. The initial investment saved 10 highly skilled jobs in the energy sector in Great

Yarmouth.

Anglia Capital Group, the organisation commissioned by New Anglia Capital to build a network

of angel investors across Norfolk and Suffolk saw its membership double over 2018, with 48

investors now in the network. They saw a record level of investment within the group, at £1.4

million - this was double their target figure.

New Anglia Capital has made two investments since the start of the year. The first was a

further £15,000 into Rainbird Technologies in order to avoid dilution. The second was

£120,000 into Glyconics, a company that relocated from Cambridge to Suffolk to develop a

diagnostic device for Chronic Obstructive Pulmonary Disease.

Anglia Capital Group members have invested £210,000 so far this calendar year, with further

interest to invest in companies that pitched to the group in late April.

A proposal to invest a further £1m into New Anglia Capital is included in agenda item 8

(Capital Budget)

Agritech

The legal agreement for the funding from New Anglia is now at final draft, having been

reviewed by New Anglia LEP, Suffolk County Council and the Cambridgeshire and

Peterborough Combined Authority.

LEP Funding will then be released in a minimum of two tranches, subject to evidence of future

demand. The initial payment will cover existing accrued expenditure on projects in the LEP

area and the administration of the programme.

Reporting arrangements have been agreed and a programme performance update will be

submitted to the LEP board every 4 months.

2) Strategy

This section provides an update on the work being undertaken by the LEP’s strategy team

since the last board meeting. This includes work around skills, infrastructure and transport.

Delivery of the Economic Strategy

The Economic Strategy Delivery Co-ordinating Board met on 13th May, the Board underwent a

deep dive on three of the objectives in the Economic Strategy. The aim of deep dive

discussion are to review the current activity, test the activity to ensure maximum impact is

being achieved and to identify any gaps in delivery and initiative ideas on interventions to fill

gaps. The Board also review progress on the Local Industrial Strategy.

4

30

New Anglia Local Enterprise Partnership Board

Wednesday 23rd May 2019

Agenda Item 9 - Chief Executive’s Report

Author: Chris Starkie

CO2 scoping report

UEA has been commissioned to scope environmental metrics as part of the ongoing

monitoring of the Norfolk and Suffolk Economic Strategy. They are currently looking at climate

change and emissions data to help shape our thinking in this regard. The project will report

back to the Board in July.

Industrial Strategy - Sector Deals

Offshore Wind Sector Deal

Since the launch of the national Sector Deal in our region on 7th March, several projects

funded through the innovative projects call will assist with delivery of the Sector Deal.

The ‘building supply chain capacity’ project led by Norfolk County Council, Norfolk Chamber of

Commerce and Vattenfall forms a key part of delivery. On 2nd May, Vattenfall launched its

national supply chain campaign in Norwich as part of its commitment to the Sector Deal, with

around 300 local companies gathering to hear about the opportunities ahead.

Great Yarmouth Borough Council was awarded funding to deliver a branding and marketing

campaign for the Norfolk and Suffolk Offshore Wind Programme.

Additionally, the Offshore Renewables Engineering (ORE) Catapult will have a presence in the

region supporting innovation with a new regional innovation manager post set to be advertised

in the coming weeks.

Nuclear Sector Deal

The latest version of the business case for the nuclear supply chain programme was submitted

to BEIS in late March and was assessed by BEIS analysts and management. The decision

was made by BEIS management that further amendments are required for the business case

to progress. A number of details require more clarification on the national programme and we

will continue to work with LEPs from nuclear regions to enhance the nuclear places

programme.

We are working with local partners ahead of EDF’s Development Consent Order submission

(likely to be early-2020) as EDF are consulting stakeholders to outline and definite future

scope of delivery on several workstreams (including skills, employment and education; and

supply chain).

Tourism Sector Deal

Visit East of England was launched at Holkham Hall on 28th March with the LEP and Visit

Britain setting out the key opportunities linked to working together as a region to grasp the

Sector Deal opportunities.

Visit Britain have submitted their industry commitments to Government now, so the

negotiations are well underway. The LEP is engaging with both parties to assist and promote

the region in any way we can.

The most recent Tourism Industry Council meeting took place on 16th April. The tone of

discussions was positive, but it is clear that the Deal will need cross-government departments

support before it can be finalised.

5

31

New Anglia Local Enterprise Partnership Board

Wednesday 23rd May 2019

Agenda Item 9 - Chief Executive’s Report

Author: Chris Starkie

Food and Drink Sector Deal

The LEP Executive attended the most recent Food and Drink LEP Network meeting on 13th

May which feeds into Sector Deal negotiations.

In addition, the LEP Executive has been in contact with DEFRA as negotiations progress. The

latest update seems to be that EU exit negotiations have somewhat slowed down the timetable

for delivering the Sector Deal.

Local Industrial Strategy (LIS)

National update

Government has confirmed that there will be a template for Local Industrial Strategies. This will

be available once the first LIS is published.

BEIS is in on-going dialogue with Technopolis (their appointed consultants) to determine a

bench-mark/comparator framework, in order to apply an objective assessment across multiple

Local Industrial Strategies - they are due to have something agreed by July - after which we

will have a better understanding of the framework, and how to shape our LIS accordingly.

While the core focus of the LIS remains on firmly identifying ways and means to enhance

productivity, how to raise ‘earning power’ has increased in importance in a wider political

context, we will be mindful in terms of highlighting linkages and opportunities between

enhanced productivity and increasing earning power, as our LIS develops.

The first Local Industrial Strategy agreed with Government - one for the West Midlands - was

published on May 16th. A couple more may be published before summer recess.

Development of New Anglia LIS

i) Economic & Social Research Council (ERSC) - LEP & UEA joint research project

The ERSC have confirmed funding to support a concise joint research project between New

Anglia LEP and UEA, in support of the development of our Local Industrial Strategy.

We have held discussions with UEA and have identified a team of researchers who could help

us to take a deeper dive into the data and provide some fresh insight regards development of

interventions and actions. We are expecting a researcher to be allocated to the project by the

17th May.

ii) Engagement Sessions

The LEP is leading eight business engagement events across Norfolk and Suffolk throughout

May and June to engage with businesses and academia to help shape the Local Industrial

Strategy (LIS) and develop the interventions that will deliver actions to make businesses grow.

Businesses and academics can book on events via the LEP website.

The first session took place on 9th May focusing on the AI and Data Grand Challenge and the

ICT and digital strategic opportunity. The session was attended by 20 businesses and

academics who all actively engaged and provide excellent input and ideas to shape the LIS.

An engagement pack has been developed and is available on the New Anglia LEP website for

partners to use at their own meetings/events. Partners are being encouraged to use the pack

and help build the qualitive evidence and ideas for interventions which will deliver the strategic

opportunities identified.

6

32

New Anglia Local Enterprise Partnership Board

Wednesday 23rd May 2019

Agenda Item 9 - Chief Executive’s Report

Author: Chris Starkie

A Partner Summit is planned for 11th June which will bring Local Authority, Educational,

Volunteer and Community Sector and Business Intermediary officers together to review the

evidence base and emerging interventions. The second Leaders session is on 19th June.

iii) LIS Independent Economic Expert Panel

Following agreement by the LEP Board in March, the Economic Strategy Delivery Coordinating

Board identified several experts to be invited on the LIS Independent Economic Expert Panel.

The role of this panel is to provide quality, independent advice and information to the LEP;

testing and challenging the evidence; scrutinising the interventions, testing the link between

the evidence and interventions and determining whether they will deliver what is expected.

Prof. Tim Besley - Economics and Political Science and W. Arthur Lewis Professor of

Development Economics at the LSE, Rebecca Riley - Director @CityREDI University of

Birmingham and Head of Research and Office for Data Analytics (ODA) at West Midlands

Combined Authority, and Alex Plant - Programme Director, Market Reform and Head of Policy

& Regulatory Strategy at Anglian Water, have agreed to join the Panel. The first meeting will

be end of June/early July.

Inclusive Growth

The LEP has supported and presented at the launch of the Norfolk and Suffolk LIFT

Community Grants. The launch events took place in Ipswich on 9th May and Norwich on 10th

May for local stakeholders to hear more about this new funding for employability projects

offering a learning path to work in Norfolk and Suffolk. The LIFT programme has secured

another ESF contract to distribute over £800,000 of funding for projects that will support people

to gain confidence, skills and knowledge to move into employment or into formal accredited

learning and skills provision. Funding is available for local VCSE organisations and up to

£20,000 per project can be offered for up to 100% of project costs.

The latest meeting of the Inclusive Growth Group for Great Yarmouth and Lowestoft will take

place on 16th May.

Skills

Apprenticeships

The Government has re-issued its non-levy payers delivery contract to training providers.

Unfortunately, many have had their provision cut dramatically which will really impact what can

be delivered. It is a complicated process, but providers have to either increase their provision

aimed at levy payers and/or encourage levy payers to pass part of their levy to an

apprentice(s) in a non-levy business. This will allow the providers to deliver this training if they

have a contract to deliver to levy payers.

Providers are already looking at how to address this financial shortfall if they cannot identify

levy payers.

We believe the LEP has a role to play resolving this issue as it will lead to a reduction in

apprenticeship starts at a time amongst SMEs when we are looking for an increase. We are

looking at how best we can support the work with identifying levy payers and encouraging

them to share their levy plus what mechanism is best to use to support them through the

government online systems.

7

33

New Anglia Local Enterprise Partnership Board

Wednesday 23rd May 2019

Agenda Item 9 - Chief Executive’s Report

Author: Chris Starkie

Youth Pledge

Following a relaunch of the Youth Pledge at the Norfolk Skills and Careers Festival, we have

meet with Norfolk and Suffolk County Councils and DWP to review the focus. We are currently

reviewing how best to support an ESF bid made by NCC/SCC and the Mason Trust with

current resourcing levels. The apprenticeship agenda comes into the Youth Pledge work as

well so the Pledge must be one that moves with the current economic and educational times.

New Anglia Enterprise Adviser Network

The New Anglia Enterprise Adviser Network has grown the number of Educational

Establishments it is engaging with across Norfolk and Suffolk through February to April to 109

and has seen a significant increase, 24%, in Mainstream and FE Schools matched to an

Enterprise Adviser from the beginning of February to the end of April.

This increase puts the Network in line to achieve the Careers and Enterprise targets set for

July 2019. The team has welcomed a new Enterprise Coordinator (EC) - Ashley Ruthven - to

replace a recent departure due to relocation. With the Network absorbing nine schools in West

Norfolk we have successfully recruited a new EC Kieren Buxton due to start on 20th May which

will take the team to eight Enterprise Coordinators and an EAN and Careers Hub Manager.

The Careers Hub was successfully launched on the 28th of March with a number of

stakeholders attending and keynote speeches delivered by Chris Starkie and Will Morlidge

from the Careers and Enterprise Company. We continue to focus in the coming months on

recruiting quality Enterprise Advisers to support schools to deliver inspirational careers

strategies as well as developing resources to support these strategies.

Infrastructure

Transport Board - 21 May

The next Transport Board is scheduled for 21 May and will consider the ‘Agile to Change’

theme of the Integrated Transport Strategy. The meeting will hear from DfT and the newly

created Connected Places Catapult on the ‘Future of Mobility’ Grand Challenge from the

Industrial Strategy as well as consider the necessary behaviour and cultural change needed to

facilitate such future mobility opportunities.

Roads Investment Strategy

The LEP has been liaising with DfT Ministers on the delivery of the currently committed

schemes on the A47 and will be attending an A47 Alliance lobbying meeting in Westminster on

4 June to highlight the need for further investment. It has also recently pushed the case for

improving the A14 as part of the second Roads Investment Strategy and will be attending the

next A14 Strategy Board meeting on 31 May to help push the case further.

Transport East - 12 June

The next meeting of Transport East will take place on 12 June. The meeting will consider

governance, future direction and resourcing as well as the Regional Evidence Base for Large

Local Major and Major Road Network schemes and the ambitions for environmental

sustainability.

Great Eastern Mainline Taskforce

Work on the evidence refresh for the Great Eastern Main Line is well underway. Network Rail

has completed the Rail Capacity Study and Jacobs have been appointed to develop the

technical Strategic Outline Business Case (SOBC). Lichfields have been appointed to

undertake a wider economic benefits study. This work will be completed in parallel to the

8

34

New Anglia Local Enterprise Partnership Board

Wednesday 23rd May 2019

Agenda Item 9 - Chief Executive’s Report

Author: Chris Starkie

technical web-tag compliant SOBC and provide a wider picture of the economic benefits which

could be realised with investment on the GEML.

A project board has been set up to oversee progress of the evidence refresh, it is led by the

LEP and includes representatives from Essex, Suffolk and Norfolk County Councils, the train

operator, Network Rail and DfT (in an advisory capacity). Both the SOBC and the wider

economic benefits study are expected to be complete before Parliament breaks for summer

recess.

A stakeholder conference is being arranged for Thursday, 11th July in Chelmsford where early

findings of the evidence refresh will be shared with key stakeholders.

Housing Conference - 11 July

The LEP is developing a Housing Conference with the Housing and Finance Institute, the

Building Growth Group and the Suffolk Growth Programme Board. The event is scheduled for

11 July and the programme is being worked up with the view of sending invitations out in mid-

May.

3) Engagement

This section covers engagement activity with local stakeholders, including local authorities,

local businesses and MPs. It also covers activity with Government and our wider international

activity. The Communications and Engagement Dashboard is included as Appendix A to this

report.

Place Branding Update

Following the formal sign off by the LEP Board in February of the creative design stage of the

place branding activity, ‘phase 1’ has now been successfully completed with brand narrative,

values and visual identity developed by CMS/Jacob Bailey.

The next stage (phase 2) focuses on the development of essential digital tools to create and

manage sector and place based campaigns, target decision makers/investors and help build

and manage client relationships. Phase 2 essentially covers the following two main elements;

Production of a ‘brochure investment website’, high level promotional prospectus with

imagery and short video (by July)

Development of new digital platforms and ‘online sales tools’ with integration into the

existing CRM system (used by LEP, Growth Hub and Local Authority partners) (by

December)

Phase 2 is being funded jointly by the LEP and through the Invest East ERDF programme. To

ensure a joined-up approach and complete integration of the brand across a new investment

website and online platforms, an external tender proposal was developed by the LEP with

partners and advertised via Norfolk County Council (as the accountable body for the ERDF

programme).

There was a high level of interest with a shortlist agreed by partners. Agencies were invited to

present on 10th May and interviewed by a panel covering representatives from New Anglia

LEP, Suffolk and Norfolk County Councils.

9

35

New Anglia Local Enterprise Partnership Board

Wednesday 23rd May 2019

Agenda Item 9 - Chief Executive’s Report

Author: Chris Starkie

A Project Steering Group has now been set up, led by New Anglia LEP, and includes

representatives from County Councils, County Chambers of Commerce and City/Boroughs to

reflect the main urban centres of Ipswich and Norwich.

This group will steer and manage the phase 2 activity over the coming months and importantly

help us roll out the promotional activity to position Norfolk and Suffolk as a prime location for

business, inward investment and skilled talent.

In addition, there are a number of national and international trade and sector-based events at

which attendance is being planned. These include MIPIM UK (London, October 2019),

Offshore Energy (Amsterdam, October 2019) and Horecava Food & Drink (Amsterdam,

January 2020).

A formal launch of the Norfolk and Suffolk campaign to help promote Norfolk and Suffolk’s

inward investment and business location offer has been provisionally scheduled for the

morning of Friday 26th July at Adastral Park with further details to follow.

Food Enterprise Park

Chris Starkie represented the LEP at the ground cutting ceremony at the Food Enterprise Park

near Norwich. The ceremony formally marked the start of infrastructure works on the site and

the start of construction of the new mustard milling and mint processing facility for

Condimentum.

The facility which will create 25 jobs, will mill and process mustard and mint for Colman’s,

retaining the link with Norwich following the decision by parent company Unilever to close the

Carrow Works. Condimentum has been set up by the 15 mustard growers and five mint

growers from the local area and will serve Unilever.

The company is also looking to win contracts to supply other companies with mustard and mint

and other ingredients.

As board members will be aware, the LEP has supported the infrastructure on the FEP with a

£1m Growth Deal grant and also the Condimentum factory with a £290,000 Growing Business

Fund grant.

Hempnall Roundabout

Chris Starkie represented the LEP at the start of works ceremony for the Hempnall roundabout

on the A140. The LEP is providing funding towards the project through the Growth Deal.

The scheme will alleviatre congestion as well as imprve safety at what is a very dangerous

crossroads.

It also provides the first piece of infrastructure necessary to bring foward the Long Stratton

bypass which is a key LEP priority.

Education Select Committee

Chris Starkie represented the Norwich and Ipswich Opportunity Areas at a hearing of the

Education Select Committee.

A cross section of members of the partnership boards from the 12 OAs were invited to answer

questions from the committee which is chaired by Harlow MP Robert Halfon.

10

36

New Anglia Local Enterprise Partnership Board

Wednesday 23rd May 2019

Agenda Item 9 - Chief Executive’s Report

Author: Chris Starkie

These included representatives from education, business and the voluntary sector.

The committee were interested in understanding the impact of the programme, value for

money and what lessons had been learned to date.

Norfolk MPs infrastructure briefing

Rosanne Wijnberg and Ellen Goodwin represented the LEP at a meeting in Westminster

organised by Norfolk County Council leader and LEP board member Andrew Proctor to brief

Norfolk MPs on key infrastructure priorities for the county.

It was a good opportunity to reinforce LEP support for a range of improvements including the

A47, the Western Link, the Long Strattton bypass as well as improvements to the rail network

and broadband and mobile coverage.

The LEP team will also be participating in a House of Commons reception promoting the A47

next month.

4) Governance, Operations and Finance

This section provides an update for the board on any key operational matters as well as a

headline summary of the LEP’s core finances.

Governance

Local Assurance Framework and Scheme of Delegation

New Anglia’s 2019 Local Assurance Framework and Scheme of Delegation was approved by

the LEP Board in March.

The 2019 Local Assurance Framework follows the mandatory requirements and additional

best practice guidance set out in the Government’s National Local Growth Assurance

Framework, which seeks to provide a common framework of understanding of the assurance

required for local growth funding.

New Anglia LEP’s Scheme of Delegation sets out the main responsibilities and functions of

the organisation and the level to which they have been delegated. It is a requirement of the

National Local Growth Assurance Framework for the LEP to have a comprehensive Scheme of

Delegation which is reviewed and updated annually.

The Accountable Body Agreement is a key element of the LEP’s Governance arrangements,

alongside the Articles of Association, the Assurance Framework and Scheme of Delegation. It

sets out the respective roles of the LEP and Suffolk County Council as the Accountable Body.

It is important that we ensure that we comply with the requirements of the framework on an

ongoing basis. We have recruited an additional team member to manage this function and

monitor our compliance.

The National Local Growth Assurance Framework checklist will provide the basis for our

compliance monitoring process.

An owner will be assigned to each area and will be accountable for compliance. This will be

monitored on a quarterly basis and reported to the Audit and Risk Committee, the first report

scheduled for 1 July 2019.

11

37

New Anglia Local Enterprise Partnership Board

Wednesday 23rd May 2019

Agenda Item 9 - Chief Executive’s Report

Author: Chris Starkie

Any updates to the documents required for example by Government policy changes or the

introduction of new programmes will be reported to the LEP board for consideration.

Articles of Association

The revised Articles of Association were circulated to all members for their agreement after the

March LEP Board meeting.

The written resolution and class consents have been passed by the requisite majority of

members, and the new articles will now be adopted as the Articles of Association of the

company.

The documents with supporting signatures have been passed to Mills and Reeve who will file

them at Companies House on our behalf.

Finance

As agreed at the March board meeting the LEP will now report consolidated accounts on a

quarterly basis. The first quarter figures will be April 19 - June 19 and included in the July

board paper. There are no extraordinary or unexpected costs to report in April.

However, a Growing Places loan which was issued to MSF in early February with an agreed

repayment date of 30 April 2019 has not been to date. Please see the update under the

Growing Places Fund section for further details.

Following the successful conclusion of the annual review we received our 2019/20 Growth

Deal allocation of £24.6m from government along with core funding of £500k. We are still

waiting to receive separate communication regarding arrangements on the second year

£200,000 capacity funding. This funding is to help assist with the implementation of the LEP

review and development of our Local Industrial Strategy.

The LEP’s newly appointed auditors Price Bailey have started their on-site audit. Allowing for

remaining off site work and partner review an audit clearance meeting will take place with the

Audit and Risk committee early July.

Recommendation

The board is asked to:

Note the contents of the report

12

38

Appendix A

Communications &

Engagement April 2019

This dashboard shows outcomes and impact of communication during April 2019

through owned media - the information which we control and issue ourselves - and

earned media (third-party outlets). (*Refers to pre-GDPR numbers)

Owned media - social media and e-newsletters

March 19

April 19

April 18

Number of Twitter followers

7,634 (up

7,709

6,961

92)

(up 75)

Number of clicked links per month

599

349

n/a

Average Twitter engagements per day

100

46.77

51.5

(likes, retweets etc.)

Number of impressions (number of times

120.7K

74.3K

n/a

users saw our tweet)

Number of LinkedIn company page

704 (up 24)

754 (up50)

236

followers

E-newsletter: open rate

38.13%

39.18%

38.35%

E-newsletter: click-through rate

25.54%

33.1%

17.86%

Earned media - coverage achieved through third-party outlets

April

18

April 19

Coverage of our press releases in target media list

66%

100%

(EDP, EADT, Lynn News, Ipswich Star, Bury Free

Press, BBC, ITV)

Average coverage achieved per press release

2.7 articles

2 articles

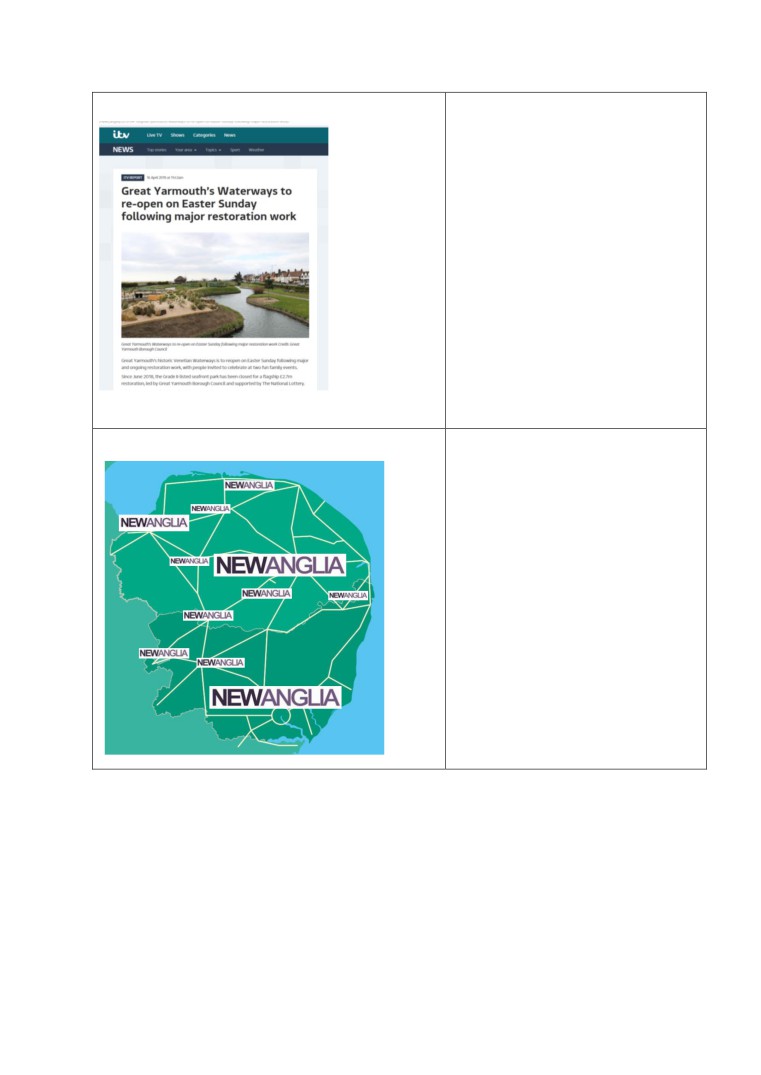

Top Tweet

The top tweet this month was

regarding the Innovative project

answers call to supercharge

economy.

This tweet received 4,943

impressions with 57 engagements

39

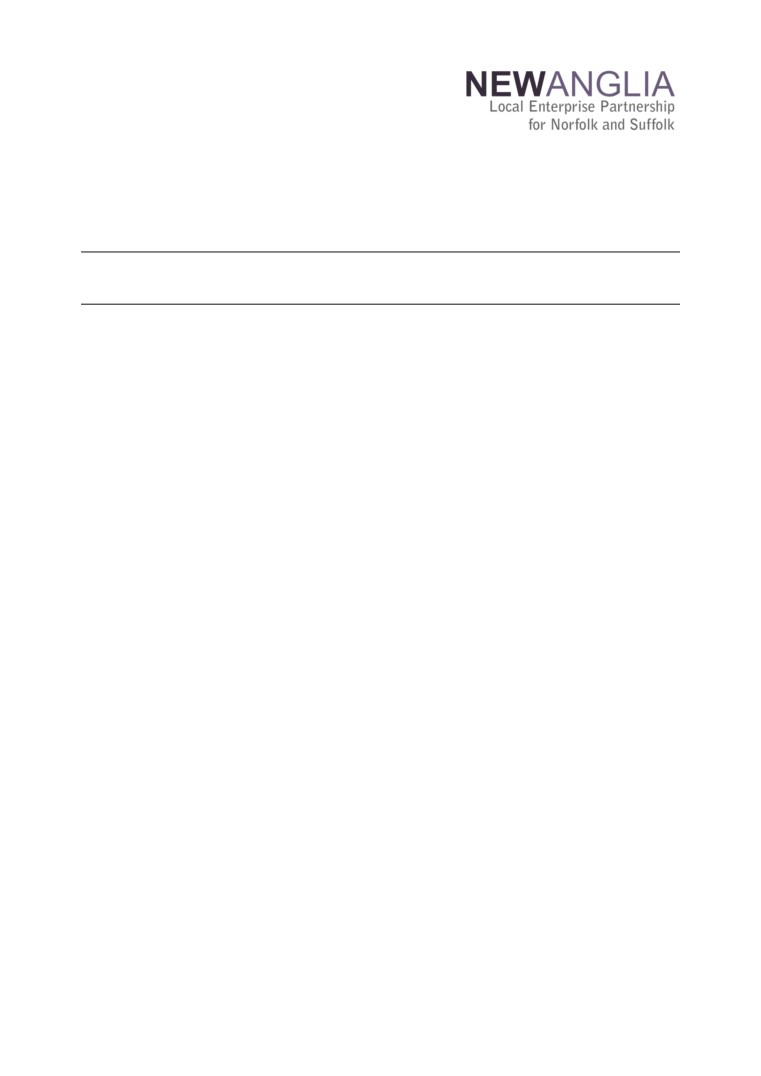

Media coverage

A great amount of coverage was

secured on the Great Yarmouth

Public Engagements

The board and executive team

attended 18 (5 out of region)

engagements during the past

month.

40

Google Anaylstics

In the last month we had 16,358

unique page views with the top

pages being the home page,

careers, our team and small grant

scheme.

People spend an average of

1minute 49 seconds on the site

We had 33.6% number of returning

visitors and 66.4% new visitors

41

New Anglia Local Enterprise Partnership Board

Thursday 23rd May 2019

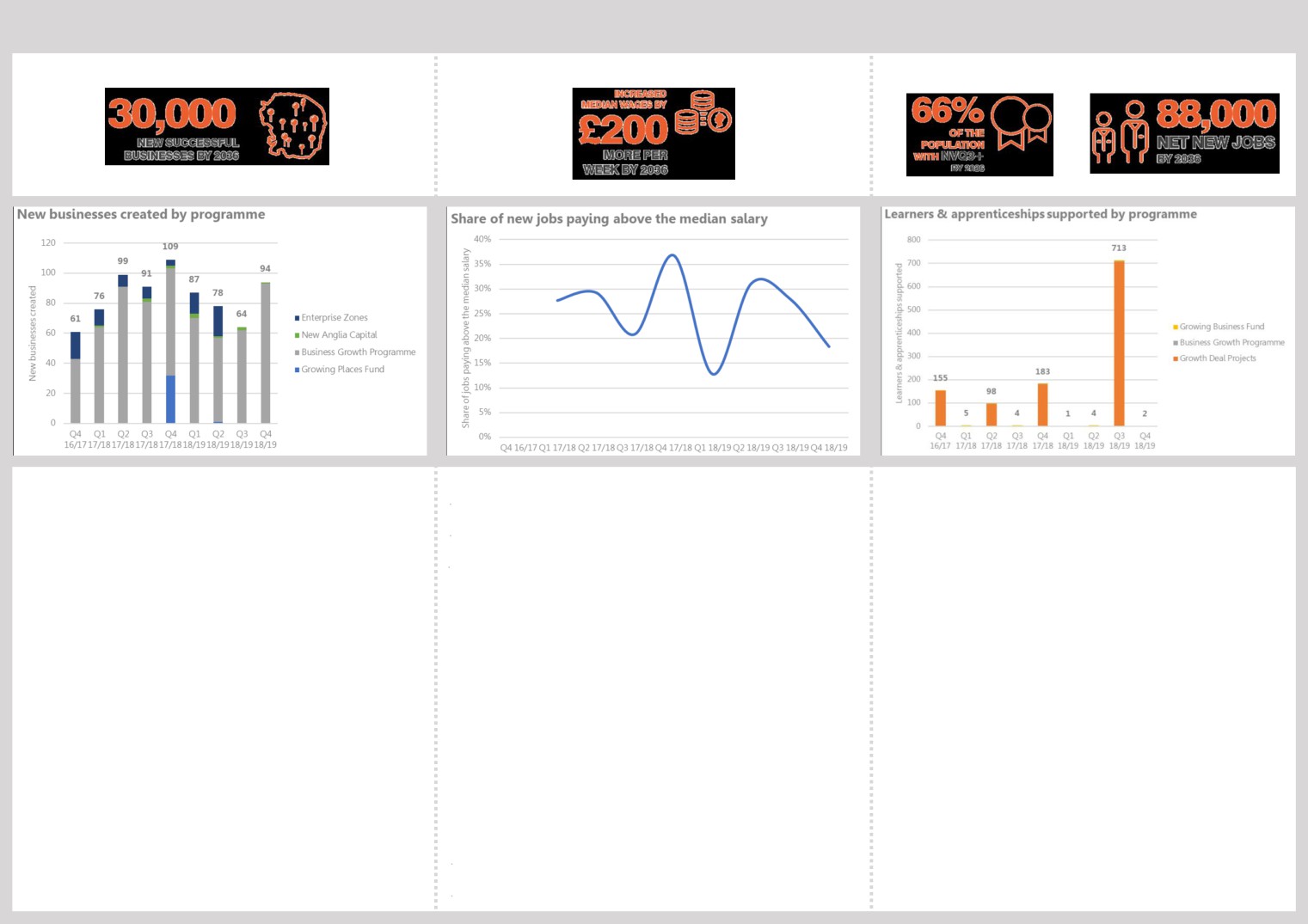

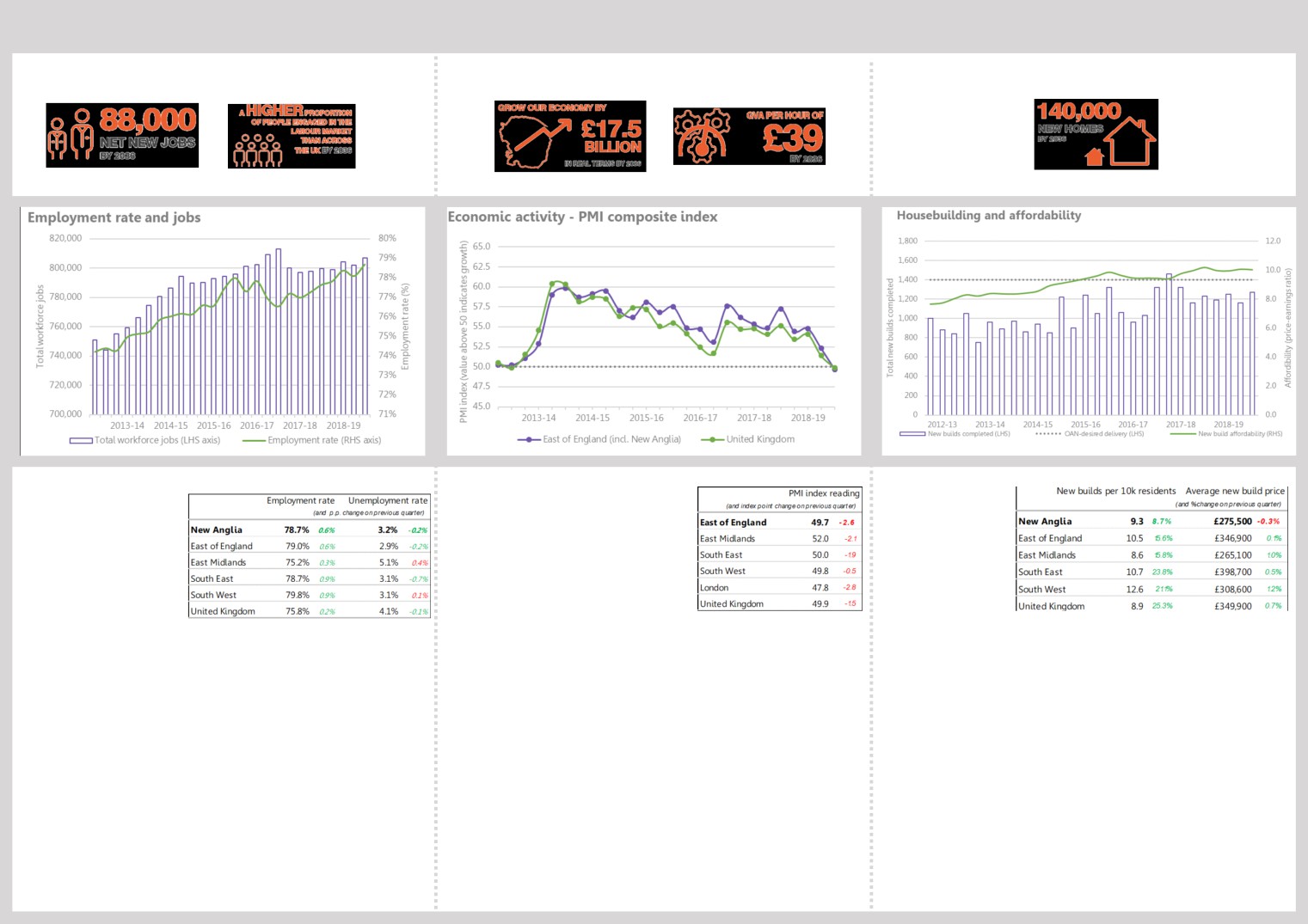

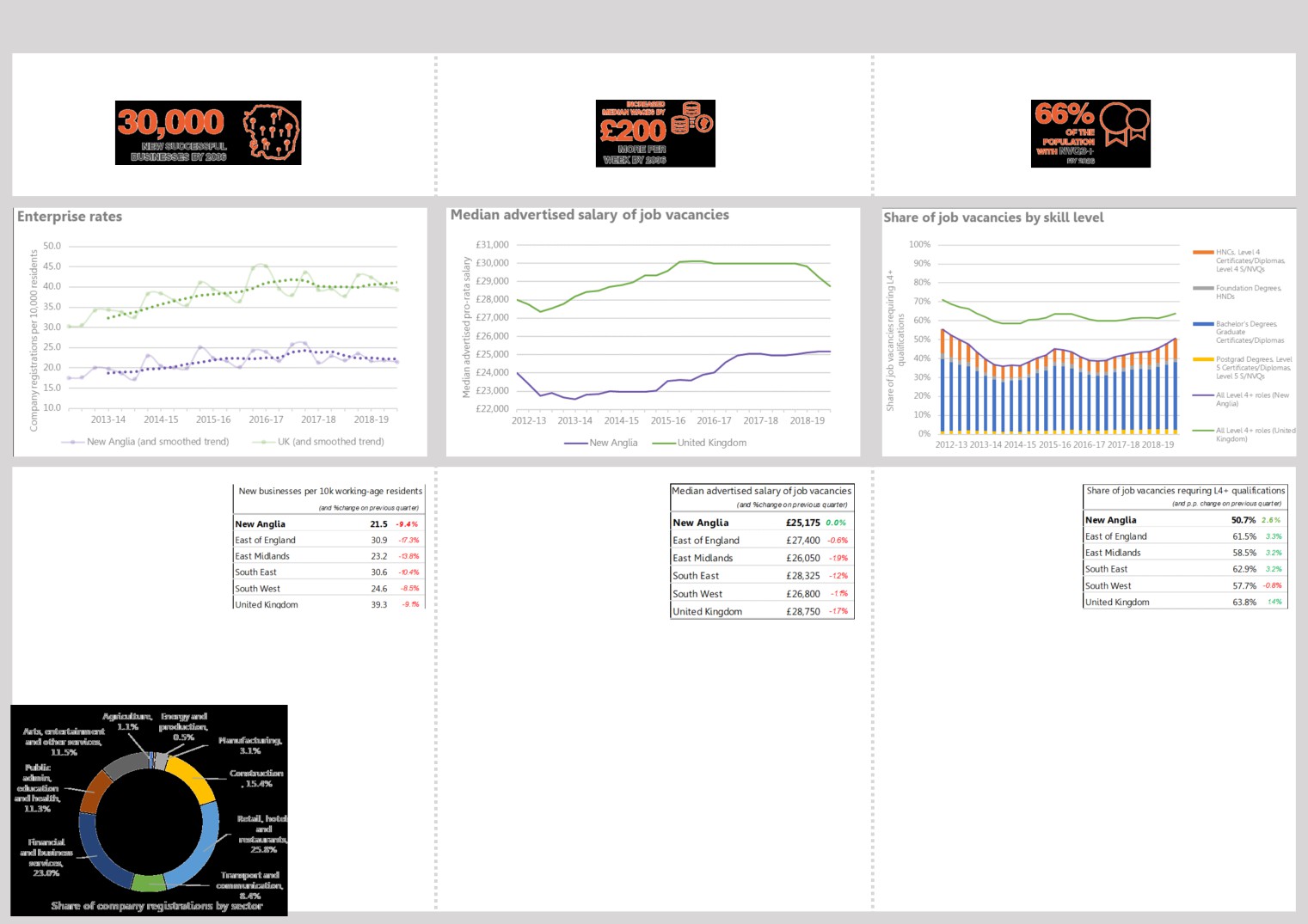

Agenda Item 10

May Programme Performance Reports

Author: Programme leads;

Presenter: Rosanne Wijnberg

Summary

The following reports follow for review by the LEP Board this month:

-

Growth Deal; Jonathan Rudd

-

Growth Programme; Jason Middleton

-

Economic and Programme Dashboards; Alex Riley

LEP Board Action - Employment in Agri-Food Tech Sector

At the last Board meeting we were asked to provide more detail on employment in the agritech

sector. The summary below has been compiled from the information in our Agri Food Tech

Data Pack - the full pack is available on our website.

New Anglia is arguably the most productive farming region in the UK, with the most profitable

farms, a dynamic food chain and the largest concentration of agri-food research in

Europe. New Anglia’s agriculture has a turnover of £1.65billion, including 52% of the UK sugar

beet production, 20% of its cereals, 21% of the pig herd and 21% of the duck, geese and turkey

flocks.

Taking the tighter Agri-Food Tech definition, which excludes food retail and catering, it can be

broken down into three elements as follows:

Agri-Food:

-

Agricultural, horticultural and forestry production (crops, livestock, ornamental crops,

biomass and biofuels, renewable materials)

-

Food and drink processing (including artisan foods)

-

Input supplies (e.g. machinery, fertilisers, seeds, packaging etc.)

-

Food wholesaling and marketing

-

Food logistics

Agri-Tech:

-

Plant genetic improvement; plant health; crop storage and silage

-

Animal genetic improvement; animal nutrition; animal health and welfare

-

ICT systems - Soil and substrate management; environmental interactions; harvest and

early stage processing

-

Engineering and precision farming

-

Infrastructure

-

Advisory services

1

43

Food Tech:

-

Food production technology

-

Dietary health and consumer food technology

Employment

Approximately 50,000 people are employed across Norfolk and Suffolk in the Agri-Food Tech

sector, under the above definition, the split between the counties is as follows:

Norfolk: 26,800

Suffolk: 23,200

Employment in Agri-Food Tech Sector 2015 - Comparator Areas

LEP

Employment

New Anglia

50,000

Greater Cambs/Peterborough

40,700

South East LEP

62,900

Greater Lincolnshire

53,600

The above accounts for 7.2% of all employment across Norfolk and Suffolk, a comparative

table regarding employment proportionality is below:

LEP/Area

Proportion of overall employment

New Anglia

7.2%

Greater Cambs/Peterborough

5.9%

South East LEP

3.9%

Greater Lincolnshire

12.2%

East of England

4.4%

England

3.9%

Recommendation

The board is asked to:

-

Note the PPR reports

-

Approve the Growth Deal Quarterly Dashboard

2

44

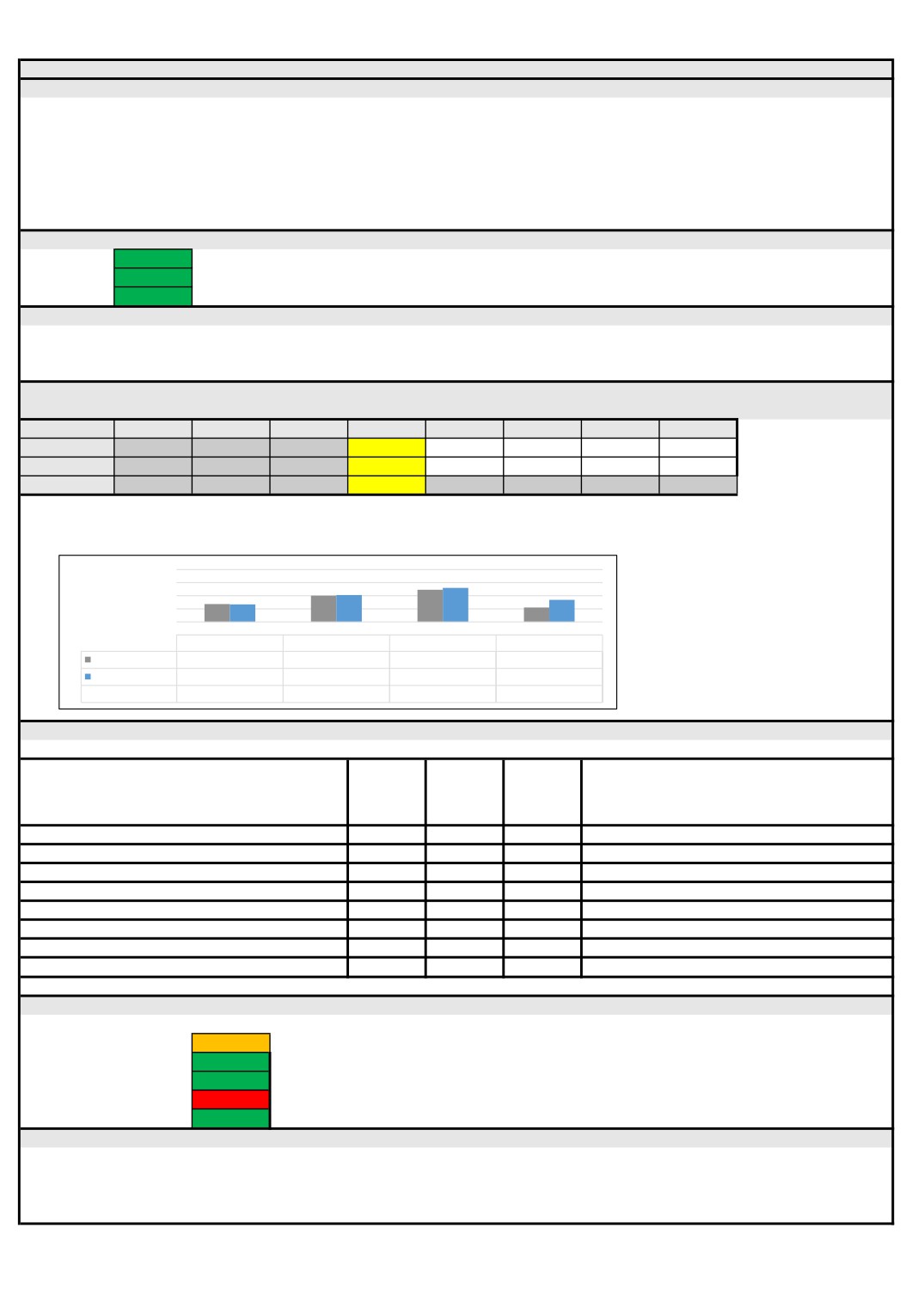

Growth Deal Performance Report

30/04/2019

Programme Overview - What is the Growth Deal?

• Programme duration: April 2015 - March 2021.

• Value: £223m (excluding funding awarded directly to Norfolk County Council).

• Aims: to boost the region’s skills, drive innovation, target support to help small businesses to grow and improve transport and infrastructure.

• Contribution to the Economic Strategy: estimated to create 54,750 new jobs, 6,800 new homes and to generate an additional £628m public and private investment.

Capital Projects

Growing Places Fund

Growing Business Fund

EZ Accelerator Fund

Total £m

£164

£27

£17

£15

£223

What is the Overall Programme Status?

Finance

Amber↑

Likely that some grants will not be claimed in accordance with forecast draw down schedule and funding profile.

Outputs

Green→

Reasonably on track to meet our forecast outputs.

Delivery

Green↓

Some slippage on the delivery schedule has occurred but is still within reasonable parameters overall.

What are our Key Updates?

• Programme progress: generally good; only a few projects have significant variations

• Refining the forecast of expenditure for the 2020/21 financial year with the cooperation of all approved projects; likely to exceed the allocation and rollover.

• Key concerns: Significant delay in 3 major projects has undermined outturn for the financial year. We continue to monitor & engage to determine any mitigation.

What is our Financial Position?

Financials (£ million)

Actual

Actual

Actual

Forecast

Forecast

Forecast

Financial Year

2015/16

2016/17

2017/18

2018/19

2019/20

2020/21

Total

Brought Forward

0.000

12.008

0.000

19.189

18.060

-6.093

Gov Allocation

36.900

38.549

41.334

34.660

24.662

47.412

223.517

Spend [Act/Fcst]

-24.892

-50.556

-22.145

-35.789

-44.500

-33.043

-210.926

Unallocated

0.000

0.000

0.000

0.000

-4.315

-8.276

-12.591

Carried forward

12.008

0.000

19.189

18.060

-6.093

0.000

Spend progress quarter by quarter:

2018/19 Expenditure Profile

•Some Q3 Claims paid in Early Q4.

30

36

24

20

Unallocated £12.591m

10

12

•Capital Projects £4.461m (conditional allocation)

0

0

•Enterprise Zone Accelerator Fund £8.130m

Q1-18/19

Q2-18/19

Q3-18/19

Q4-18/19

Qtrly Forecast

10.857

7.896

12.637

8.824

Qtrly Claims

6.108

8.616

12.431

8.634

Remaining spend

34.106

25.491

13.060

4.425

What is our contribution to the Economic Strategy?

Quarter/ year:

4 (Jan-Mar) 2019

Forecast to

Percentage

Outputs - cumulative from April 2015 to Quarter 2 2018/19

Actual to date

Change

2021

Progress

New Homes

245

545

45%

+24

New Jobs

2,192

1,808

120%

+335

New Learners

1,136

2,522

43%

0

Match Funding (‘Non-LGF Expenditure’)

£492.020m

£510.494m

96%

+83.657

Note: in line with government reporting, this data refers to the previous quarter. Forecasts were updated during Q2.

• Homes: forecast to be met by development of housing sites associated with Lynnsport Access Road, Bury St Edmunds Eastern Relief Road and the Wine Rack.

• Jobs: forecast to be met primarily through Growing Business Fund.

• Learners: forecast to be met following construction & refurbishment of new learning centres, particularly East Coast College and West Suffolk College.

• Match funding: forecast to be met following completion of projects, particularly large scale infrastructure projects (Incl. Ipswich Flood Barrier & Wine Rack).

What is the Project Delivery Status?

Overall:

Green→

Physically

Significant

Under

Complete

On track

Small Variation

Total Projects

Complete

Variation

Development

Black

Blue

Green

Amber

Red

Purple

-

10

8

14

8

1

7

48

Change

0

0

+2

-1

0

+3

+4

• Projects complete: NTR.

• Projects change / callout: Bacton-Walcott Flood Grant Agreement in place; improvement in delivery of WSC Engineering and Innovation Centre

• Projects in development: Eye Airfield Access & Hempnall Roundabout in final draft, GY Flood in negotiation with EA. Remainder in draft.

What are the Next Steps?

•Determine latest LGF drawdown forecasts and develop grant agreements for newly approved projects.

•Investigate opportunities for projects deferred or rejected from the recent focused call for projects, particularly those within our Enterprise Zones.

•Develop pipeline of future projects to meet the ambitions of the Economic Strategy in preparation for future funding, including the UK Shared Prosperity Fund.

45

Appendix 1 - Growth Deal Performance Report as at 30 April 2019

Below is an update on all Growth Deal projects, reflecting the ‘Project Status’ section of the

Performance Report.

Purple: Eye Airfield Access Link Roads- approved by the board in May 2018, to construct two

new roundabouts and a link road to unlock Eye Airfield for development. Grant Letter will be

issued shortly.

Purple: Great Yarmouth Flood Defences- approved by the board in May 2018, to upgrade or

replace existing sea defences to protect more homes, business & critical infrastructure. The

Environment Agency are proposing amendment to our standard Grant Agreement for 2019.

Purple: A140 Hempnall Roundabout- approved by the board in May 2018, to construct a

roundabout on the A140 to improve congestion and safety at the junction and support delivery of

housing at Long Stratton. Grant Letter will be issued shortly.

Purple: UoS Digital Skills & Innovation Accelerator- approved by the board on 27 March, to

establish a number of laboratories at Adastral Park for ICT education, training & collaboration.

Purple: CCN Digi-Tech Factory- approved by the board on 27 March 2019, to produce an

inspirational facility for digital skills development for growing the numbers of students of all ages.

Purple: SNC Digital & Technology Skills Hub- approved by the board on 27 March 2019, to

deliver tailored workshops for teaching technology and digital sector in response to the needs of

employers & stakeholders offering the latest training & qualifications.

Purple: Norfolk & Suffolk Innovation Network- approved by the board on 27 March 2019, to

create a network of masts across Norfolk & Suffolk to support an Internet of Things technology.

Red: Norwich Area Transportation Strategy - City Centre Package-Delivery of the Prince of

Wales Road gyratory, Roundhouse Way Bus Interchange and Plumstead Road Roundabout

schemes have all been delayed, and drawdown of grant is significantly slower than anticipated.

Costs of the Prince of Wales Rd scheme have increased and additional funding has been

transferred from the NATS A11 package.

Amber: Norwich Area Transportation Strategy - A11 Corridor- work in progress. The size

and scope of the Daniels Road scheme is now reduced, introducing a saving of funds which has

now been transferred to the NATS City Centre Package.

Amber: Attleborough Sustainable Transport Package- Delivery of schemes has begun,

although later than forecast and additional delays continue to slow delivery and the drawdown of

grant.

Amber: Great Yarmouth Transport Package- delivery of cycle and pedestrian schemes has

improved following delays due to extensive consultation. Delivery remains slower than

anticipated, although preparation and planning activity has increased, and expenditure has risen

in line with latest forecasts.

Amber: Snetterton Employment Area- Delivery was delayed and only small amount of grant

was drawdown in Q4 of the 2018/19 financial year, although activity is now expected to increase

considerably over the forthcoming year.

Amber: Great Yarmouth Rail Station Interchange- Delay and uncertainty over the Vauxhall

Gardens element of the package and potential to request transfer of funding for improvement

elsewhere in the town.

Amber: Ely Area Rail Enhancement Scheme- Progress has been slower than anticipated, with

the need to integrate highways schemes and resulting additional cost. Consequently, drawdown

of grant has been slower than anticipated.

Amber: Lowestoft Flood Risk Management Project- Limitations on port entrance closure

periods for tidal barrier has increased cost significantly, delayed planning and start of

construction between 6-9 months, and increased risk to achieving outputs in full.

46

Amber: Enterprise Zone Accelerator Fund- no new delivery took place during the 2018/19

financial year and significant funds remain unallocated. A proposal for development on the

Norwich research Park will be presented to the LEP Board in May 2019.

Green: Growing Business Fund (Subject to sperate Performance Report).

Green: Growing Places Fund (Subject to sperate Performance Report).

Green: West Suffolk College Engineering and Innovation Centre.

Green: Suffolk Broadband Programme.

Green: A47/A1074 Longwater Junction, Norwich

Green: Ipswich Transport Package (‘Ipswich Radial Corridor’).

Green: Thetford Transport Package.

Green: Ipswich Cornhill.

Green: East Coast College Energy Skills & Engineering Centre

Green: Great Yarmouth Third River Crossing

Green: Cefas Marine Science Hub.

Green: Snape Maltings Flood Defences.

Green: Honingham Thorpe Food Enterprise Park.

Green: Bacton to Walcott Coastal Management Scheme.

Blue: Easton & Otley College Construction Training Centre.

Blue: Lynnsport Access Road (King's Lynn).

Blue: Bury St Edmunds Eastern Relief Road.

Blue: King's Lynn Innovation Centre.

Blue: Ipswich Waterfront Innovation Centre.

Blue: International Aviation Academy Norwich

Blue: South Lowestoft Industrial Estate - Phoenix Park officially opened.

Blue: Norwich Northern Distributor Road.

Black: College of West Anglia University Centre.

Black: Upper Orwell Crossing Feasibility study.

Black: Lowestoft Third Crossing Feasibility study.

Black: Norfolk Broadband programme.

Black: Beccles Southern Relief Road.

Black: Bury St Edmunds Sustainable Transport Package.

Black: Haverhill Innovation Centre.

Black: Growth Hub Programme.

Black: Sudbury Western Bypass Study.

Black: Felbrigg Junction Improvement.

47

Growth Deal Dashboard

LEP Name

New Anglia LEP

Growth Deal Performance

Area lead comments

This Quarter:

Q4_1819

G

Deliverables Progress

Financial Progress

Financial Year

2015-16

2016-17

17-18

18-19

19-20

20-21

Total

This Quarter

15-17

Total

LGF Award

Housing

17-18

18-19

19-20

20-21

21-25

£36,900,000

£38,548,555

£41,334,111

£34,659,957

£24,661,848

£47,412,132

£223,516,604

Houses Completed

24

176

7

62

0

0

-

245

Forecast for year

150

0

40

150

200

155

545

Financial Year

15-17

Total

Progress towards forecast

16%

-

18%

41%

0%

0%

-

45%

LGF Outturn

This Quarter

17-18

18-19

19-20

20-21

Actual

£

8,634,183

£

75,448,555

£

28,621,444

£

29,312,509

£

-

£

-

£

133,382,509

Jobs

Forecast for year

£

35,655,941

£

75,448,555

£

28,621,445

£

35,655,941

£