New Anglia Local Enterprise Partnership Board Meeting

Meeting by conference call

Tuesday 21st April

2.30pm - 3.30pm

Via MS Teams

(TBC)

Agenda

No.

Item

1.

Welcome from the Chair

2.

Apologies

3.

Declarations of Interest

4.

Actions / Minutes from the last meeting

5.

LEP Response to COVID-19

Update

6.

COVID-19 Business Resilience and Recovery Scheme

For Approval

7.

Board Recruitment - Confidential

For Approval

8.

LEP Continuing Business - including confidential items

For Information

9.

Board Forward Plan

Update

10.

Any Other Business

1

New Anglia Board Meeting Minutes (Unconfirmed)

25th March 2020

Present:

David Ellesmere (DE)

Ipswich Borough Council

Doug Field (DF)

East of England Coop

John Griffiths (JG)

West Suffolk Council

Matthew Hicks (MH)

Suffolk County Council

Pete Joyner (PJ)

Shorthose Russell

Helen Langton (HL)

University of Suffolk

Dominic Keen (DK)

Britbots

Steve Oliver (SO)

MLM

Corrienne Peasgood (CP)

Norwich City College

Andrew Proctor (AP)

Norfolk County Council

Johnathan Reynolds (JR)

Opergy

Sandy Ruddock (SR)

Scarlett & Mustard

Alan Waters (AW)

Norwich City Council

Jeanette Wheeler (JW)

Birketts

Attendees

Paul Claussen (PC)

Breckland District Council

Jai Raithatha (JR)

Suffolk County Council

Vince Muspratt (VM)

Norfolk County Council

Shan Lloyd (SL)

BEIS

Chris Starkie (CS)

New Anglia LEP

Rosanne Wijnberg (RW)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

1

Actions from the meeting: (25.03.20)

COVID-19 Impact on the LEP and the Local Economy

Arrange a one hour teleconference in April for an update on the current crisis

HW

LEP Operating Budget 2020/21

To investigate the LEP’s responsibilities with regards to payment of the apprenticeship levy

RW

1

Welcome from the Chair

Doug Field (DF) welcomed everyone to the meeting and welcomed Paul Claussen who was

deputising for Sam Chapman-Allen.

2

Apologies

Apologies were received from Lindsey Rix, Claire Cullens and Sam Chapman-Allen.

3

Declarations of Interest

Full declarations of interest can be found at http://www.newanglia.co.uk/about-us/the-board.

None

4

Minutes of the last meeting

The minutes were accepted as a true record of the meeting held on 26th February 2020.

Actions

Chris Starkie (CS) confirmed that the paper on the Freeports consultation was included in

the board papers and that letters of thanks to staff retiring from the LEP had been

completed.

5

COVID-19 Impact on the LEP and the Local Economy

CS presented the paper to the board and provided detail on the main strands of work being

carried out by the LEP.

LEP Internal processes - staff are working from home, the leadership team are holding daily

teleconferences, leadership responsibilities have been amended as required to ensure focus

and team members are in daily contact with their manages.

Growth Hub - This is being promoted as the key support for businesses as preferred by

Government. Daily updates are received on sources of funding and Governmental advice

which are being transposed into scripts by the Communications team. Work is ongoing to

source additional staff as call numbers increase. Initial calls will go through a triage system

where an advisor will call back as required.

Norfolk Economy Cell - CS is chairing the Economy Cell of the Norfolk response to the

emergency which contains 8 workstreams supported by LEP and Local Authority staff along

with other key partners. Discussions are ongoing to provide similar support to Suffolk.

CS confirmed that the workstreams identified are:

• Business Support - support with loan applications, liaising with banks etc and advising

on funding sources

• Business Intelligence - reports are being submitted weekly with ad hoc intelligence

provided where needed. This stream is also assisting in identifying gaps in support and

funding

• Local Funding - reviewing current programmes to identify what funds can be rediverted

and coordinating local funding to ensure it achieves maximum impact

• Government Response Funding - Developing a local script to ensure consistent

messaging and identifying gaps in delivery

• Workforce - identifying workforce gaps and challenges across the sectors.

• PPE - Coordinating demand and supply and working with large scale manufacturers to

speed up production and distribution

2

• Sectors and Supply Chain - Identifying strategically important sectors and those worst

affected

• Economic Impact - Ascertaining long term impacts and identifying where further

intervention will be required

The Board discussed the unprecedented situation and the impacts it is having on the

businesses and economy of Norfolk and Suffolk and provided examples based on their own

experiences and contact with businesses.

CS provided further comment on the points raised by board members.

He agreed that the size of the tourism sector within the two counties meant that that it needs

to be considered a priority as are food and medical supplies.

CS noted that £4m remains unallocated from the Growth Deal which will provide limited

support to businesses and that the LEP network has submitted a bid for £2b to Government.

CS confirmed that the LEP is in daily contact with both chambers and the FSB to work on

providing consistent, clear messaging across both counties.

It was suggested that, as there is no scheduled April board meeting, a teleconference

should be held to provide the board with an update on the rapidly changing situation.

The Board agreed:

To note the content of the report

To hold a one hour teleconference in April to receive an update

ACTION:

Schedule an April teleconference to provide an update on the COVID-19 crisis

HW

6

LEP Delivery Plan

Rosanne Wijnberg (RW) presented the new LEP delivery plan for 20/21 which provides an

outline of the main objectives, initiatives and targets of the LEP over the coming 12 months

and asked for approval in principle for the plan from the Board.

The Board agreed:

• To note the content of the report

• To approve the Delivery Plan and delegate to the LEP chief executive authority to make

minor changes necessary ahead of publication on 1 May 2020

7

LEP Operating Budget

RW presented the operating budget for the LEP for 2020/21 financial year noting that it

reflected the running costs the LEP operation. The capital budget will follow in May.

RW highlighted key changes and noted that the budget sees an increase in operating income

of 34% and expenditure of around 33% compared with 20/21 reflecting the LEP’s additional

responsibilities including the Innovative Projects Fund and the ERDF Growth Through

Innovation programme.

RW confirmed that salaries are the highest element of spend and that amount is not

envisaged to change however staff would be redeployed to support current circumstances.

Johnathan Reynolds (JR) queried whether the LEP now needs to contribute to the

apprenticeship levy as it is over the threshold of £3m.

RW agreed and confirmed to investigate this issue.

ACTION

RW to investigate the LEP’s responsibilities with regards to payment of the apprenticeship

RW

levy.

The Board agreed:

• To note the content of the report

3

• To approve the operating budget for 2020/21

8

Governance

RW presented the changes to the LEP’s Assurance Framework, Scheme of Delegation and

Accountable Body Agreement which have been updated to ensure they are in line with

newly published Government guidance and that all the information contained in them is

accurate and up to date.

The Board agreed:

• To approve:

o The 2020 Local Assurance Framework

o The Scheme of Delegation

o The Accountable Body Agreement

9

Freeports Consultation

CS presented the paper providing an update on the Freeports consultation as requested at

the February Board meeting.

The Board agreed:

• To note the content of the report

10

EU Exit Transition

CS presented the paper which provides an update on activities during the transition period,

intelligence from the Norfolk and Suffolk business community and sets out a light touch

delivery plan against the key recommendations agreed at the January Board meeting.

It was noted that the COVID-19 crisis was likely to have an impact on Brexit planning and

negotiations.

The Board agreed:

• To note the content of the report

9

Election of Deputy Chair

CS advised that one nomination has been received for the post of deputy chair which had

been proposed and seconded in accordance with the LEP’s policy and invited the Board to

ratify the appointment of Jeanette Wheeler as deputy chair of New Anglia LEP.

The Board agreed:

• To note the content of the report

• To ratify the appointment of Jeanette Wheeler as deputy chair of New Anglia Local

Enterprise Partnership on a three year term

11

Chief Executive’s Report

CS noted some of the highlights of the report and asked for questions from the board.

CS confirmed that the funding application to extend the Business Growth Programme has

now been approved in principle by MHCLG. In the current circumstances formal sign off of

the contract will take longer than usual however this approval in principle does provides the

LEP with the reassurance needed to continue the implementation of the extension.

Innovative Projects Fund - CS noted that some projects are not proceeding due to the

current restrictions and the team are investigating how those funds can be reallocated.

Planning is underway for an emergency fund for businesses impacted by the Covid-19 crisis

and details will be submitted to board members for approval by written procedures to ensure

this is launched as quickly as possible.

CS confirmed that board recruitment is continuing with applications received from a number

of quality applicants. Virtual interviews will be held in April.

4

Steve Oliver (SO) asked whether the repayment profile for the Winerack project would be

impacted by the current situation which will have implications for the housing market.

RW confirmed that the first payments had been received on time and future scheduled

payment dates would be monitored with options for a revised plan drawn up if required.

The Board agreed:

• To note the content of the report

12

March Programme Performance Reports

RW reviewed the reports for March and asked for questions.

RW confirmed that the work of the Enterprise Advisor Network is currently on hold therefore

staff will be redeployed.

The Board agreed:

• To note the contents of the reports

13

Board Forward Plan

It was agreed that the emergency fund for businesses will be signed off via written

procedures and that a teleconference would be arranged in order to receive an update on

the COVID-19 crisis.

The Board agreed:

• To note the content of the plan

• To receive a paper on the proposed business emergency fund for approval by written

procedures

14

Any Other Business

None

5

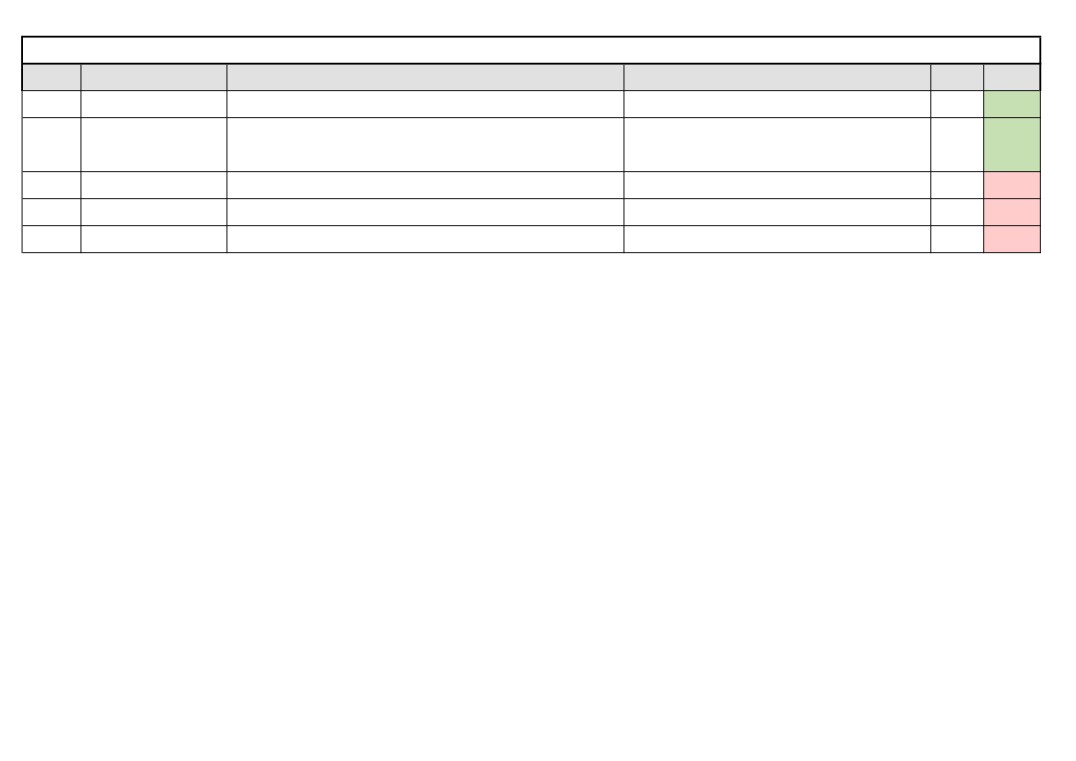

Actions from New Anglia LEP Board Meetings

Date

Item

Action

Update

Actioned

Target Date

By

25/03/2020

COVID-19 Impact on the LEP and

Arrange a one hour teleconference in April for an update on the current crisis

HW

Complete

the Local Economy

25/03/2020

LEP Operating Budget 2020/21

To investigate the LEP’s responsibilities with regards to payment of the apprenticeship levy

The payroll budget is just above £3m the threshold, though that includes

RW

Complete

small contingency. We will continue to monitor. The Levy at 0.5% of

£3m would equate to £15k, with offset allowance of £15k.

26/02/2020

Clean Growth Taskforce

Board members to consider a pledge which the Board could make and submit suggestions to

All

Apr-20

the Chair.

25/06/2019

GE Update Report

To provide the Board with regular reporting of the pipeline of visits relating to inward

To be included in the next Inward Investment update report

DD

May-20

investment and subsequent outcomes

23/05/2019

Growth Hub Presentation

Growth Hub Annual review to be circulated to the Board when published

Review began in autumn 2019. Final report is expected in spring 2020

CD

May-20

9

New Anglia Local Enterprise Partnership Board

Tuesday 21st April 2020

Agenda Item 5

LEP Response to COVID-19

Author: Marie Finbow / Lisa Roberts

Presenter: Chris Starkie

Summary

This report provides the board with a comprehensive update on the LEP’s response to the

Covid-19 pandemic. Whilst many of the LEP’s programmes and schemes are continuing to

operate as normal, the LEP team and operations have been restructured to respond to the

economic shock caused by the Covid-19 pandemic.

Over the past three weeks this has included ramping up our one to one business support offer

through the New Anglia Growth Hub, gathering intelligence on issues faced by business and

gaps in support, as well as helping dozens of businesses access financial support.

The LEP is also overseeing a campaign to improve supplies of PPE, has launched a

recruitment campaign for key workers and starting plans to support key sectors including

tourism and agri-food. Plans for a regional recovery plan have also been initiated.

Recommendation

The LEP Board is asked to note the contents of this report.

Background

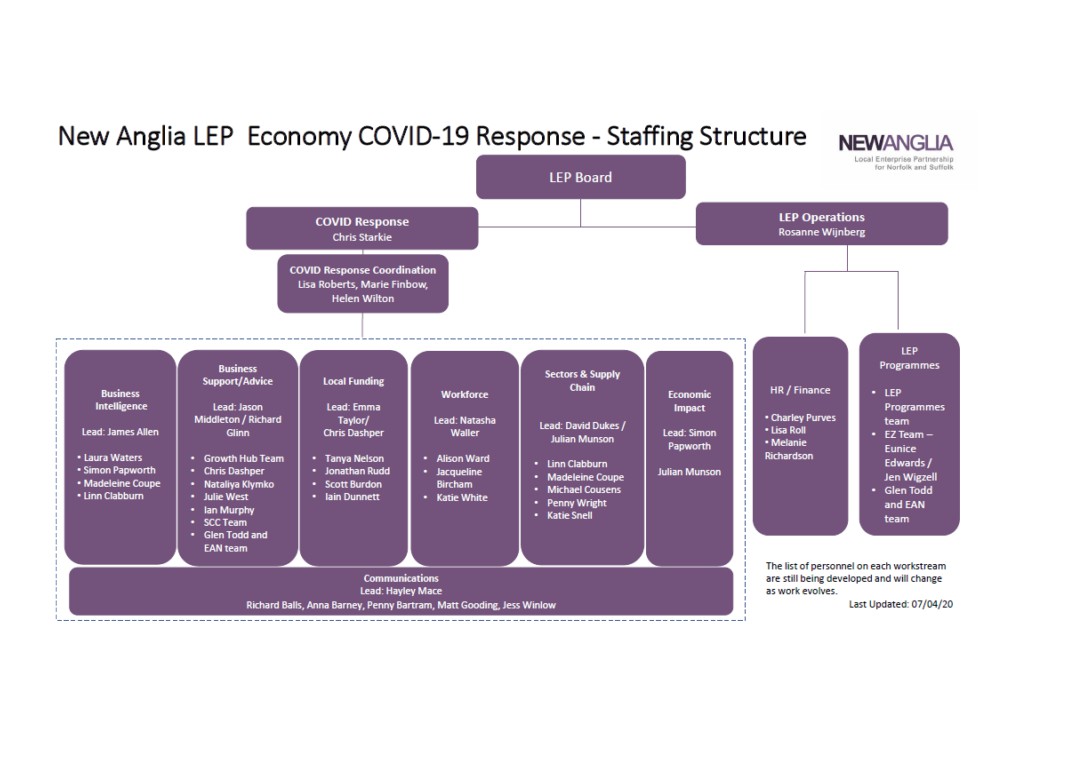

The LEP has updated its staffing structure and redeployed staff to focus on the response to

COVID-19 which has had a profound impact right across the local economy.

The LEP team is working closely with local authority partners across Norfolk and Suffolk, the

chambers of commerce in both counties, the FSB, our industry councils and sector groups

and a wide range of other partners.

In Norfolk the LEP’s chief executive is chairing the Economy Delivery Group of the Norfolk

Resilience Forum which is coordinating Norfolk’s economic response.

In Suffolk the LEP’s chief executive is participating in the Suffolk Growth Programme Board,

chaired by the chief executive of East Suffolk Council, which is coordinating Suffolk’s

economic response.

LEP staff are working across Norfolk and Suffolk to support activity being delivered in the

two counties and the majority of the workstreams listed below are operating on a two county

basis.

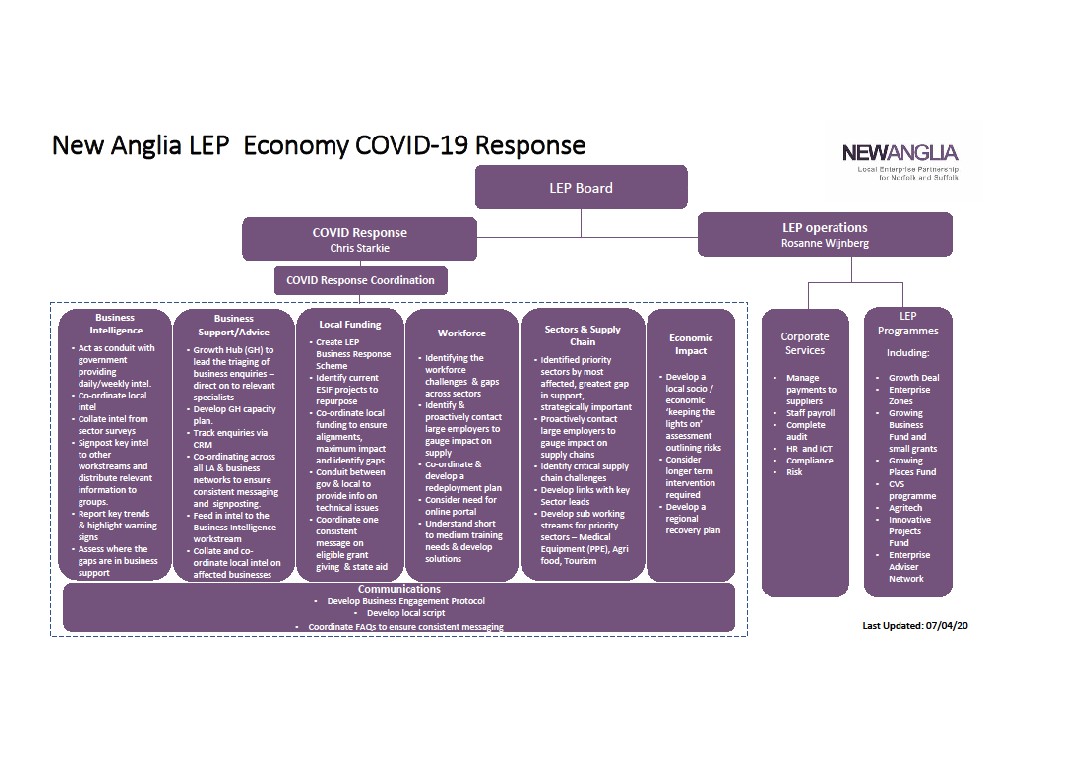

The LEP’s work is structured under the following seven workstreams:

1

11

1. Business Intelligence

2. Business Support and Advice

3. Local Funding

4. Workforce

5. Sectors and Supply Chain

6. Economic Impact

7. Communications

Appendix 1 provides more information on each of these workstreams, the members of the

LEP team who are leading and supporting these workstreams and their areas of focus.

Set out below is a summary of the key activity which has taken place within each of these

workstreams over the last few weeks.

The priorities for the workstreams are being reviewed on a weekly basis to ensure they

remain focused.

1 Business Intelligence

Priorities for this workstream:

Act as a conduit with Government providing daily/weekly intelligence in and out of

Government.

Coordinate local intelligence to submit weekly intelligence returns to Government.

Assess the ease of access to business support packages and identify gaps.

The focus is now moving towards tracking trends from intelligence reports submitted to

Government to enable us to enhance our feedback to Government and provide intelligence

to other workstreams.

We have developed a log capturing gaps in Government support, which we are using in

discussions with Government and MPs.

We are also working with business intermediaries, industry councils, sector groups and our

local authority partners to capture intelligence from surveys.

Issues raised by businesses over the past three weeks include:

Cashflow is the critical issue for the majority of businesses. Whilst most were able to

survive through March, businesses will run out of cash in April.

A large number of businesses are furloughing staff. A Norfolk Chamber of Commerce

survey found more than 30 per cent of members responding were furloughing staff.

Accessing Covid Business Interruption Loans is problematic for businesses as

response from banks is so slow, and many viable businesses are having loans

rejected.

Gaps in provision for significant cohorts of businesses such as start-ups and owner

managed businesses.

Insurance claims for business interruption are being rejected across the board. Chief

reason is because the pandemic is not restricted to the local area.

Small and independent businesses are struggling to access government support.

Businesses have raised significant concerns regarding social distancing - a particular

problem in construction industry.

Demand is either extremely high in certain sectors or flat lining across others -

leisure and cultural sectors have felt impact immediately.

Strength of supply chain is concerning for NHS and food suppliers - pressure on

warehouses, demand for workers and shortage of materials.

2

12

Businesses are diversifying and using spare capacity where possible to produce

medical equipment.

There’s a perception of an increase in rural crime - fly tipping and theft with police

attention elsewhere. However crime levels are around 30 per cent down.

Projects/contracts in the offshore and renewable sectors are being cancelled or

postponed.

2 Business Support / Advice

The LEP and Growth Hub’s role is to act as the primary local conduit to ensure local

businesses have access to the latest support being provided by Government and local

partners.

Priorities for this workstream:

Ensure the LEP/Growth Hub and local authorities provide the very best information

and support to businesses across Norfolk and Suffolk.

Ensure robust communication channels and protocols are established and utilised to

share accurate information between and across the Workstream.

The Growth Hub is now operating as a phone-based service and has expanded its capacity,

having temporarily redeployed nine of the LEP’s Enterprise Coordinators.

This has enabled the Growth Hub to run a service over the Easter weekend operating

between 10am and 4pm every day.

The Growth Hub has received more than 1,000 phone enquiries over the past four weeks

and a similar number of email enquiries. Call and email volumes have increased

approximately five-fold on pre-pandemic levels.

Each call lasts anywhere between 20 - 45 minutes and the nature of these calls can be

emotionally demanding, especially as businesses are becoming more desperate for support.

We are working closely with the Suffolk Chamber of Commerce to provide wellbeing support

for advisers and call handlers.

The CRM has been modified to enable a greater understanding of the support that

businesses are requesting, this information is being shared with Government and partners.

The LEP and Growth Hub teams are working with their regional and national colleagues to

ensure our advisers are fully briefed on government support and most importantly the best

ways to access it.

In order to ensure consistent support is given by the LEP, the Growth Hub and local

authority economic development teams, the LEP communications team produces a daily

business support script.

This script is updated on a daily basis and contains the latest available information on the

Government’s range of schemes as well as local support and is supplied to all local authority

EDO teams.

3 Local Funding

Priorities for this workstream:

Create a LEP business response scheme.

Identify current European Structural Investment Fund (ESIF) projects to repurpose,

working with government to enable this.

3

13

Co-ordinating local funding to promote opportunities, aligning programmes and

identifying gaps.

A review is underway on existing LEP programmes to investigate opportunities to adjust the

criteria to meet the current demand and circumstances. This could include measures such

as an extension to the Enterprise Zone rates relief period and adapting support measures for

our grants programmes and Growth Hub.

We are working closely with all of our European Regional Development Fund and European

Social Fund project managers to identify where projects can repurposed to support the

response to COVID19 and to identify any rule changes required. The LEP are discussing

with the Managing Authorities the rule changes needed for projects to be repurposed.

A proposal to utilise LEP funding to create a COVID-19 business resilience and recovery

fund is covered at agenda item 7.

4 Workforce

Priorities of this workstream:

Identify and work with businesses who are facing the most pressing challenges

(currently Health and Social Care, agri-food, visitor economy and retail).

Ensure key messages around business support and redeployment opportunities are

collated and shared with stakeholders.

Ensure ‘vulnerable’ people are supported to enable them to return to work promptly

or supported by the voluntary sector / education providers.

The LEP has published a list of employment opportunities on its website to support

businesses during COVID-19 and to help them find the staff they need to continue to operate

at this challenging time.

This includes more than 70 businesses in a range of sectors.

The LEP is also collating details of redeployment opportunities, both in and out of the LEP

area.

Key messages are being developed to support these and additional signposting to other

interventions, e.g. benefits, training and mental health support.

Large scale redundancies are being fed into Steadfast Training where they are working with

the National Careers Service to offer 1:1 careers advice via telephone or online meetings.

The LEP is also working with partners to support colleges and universities and private

training providers.

The LEP is also liaising closely with the Cambridgeshire and Peterborough Combined

Authority (CPCA) and the South East LEP to ascertain areas of support that can take place

across the LEP areas.

The LEP is in the process of collating a list of mental health support organisations so that

information can be relayed to businesses and residents.

5 Sectors and Supply Chain

Priorities of this workstream:

Identify priority business sectors and key businesses for critical urgent response

activity.

4

14

Identifying key sectors and businesses within those sectors for the development of

recovery plans working with sector groups/industry councils.

Exploring key issues affecting the viability of sectors and businesses, gaps in

government support and how best to respond.

The LEP has identified the priority sectors looking at the most affected, greatest gap in

support and strategic importance. A list of key businesses has been developed and will be

contacted to ascertain short term and longer term resilience in terms of - cashflow, staff,

supply chain, supporting infrastructure, local and national business support on offer and

customer base (demand and ability to meet it).

For those sectors which are particularly affected, including Agri food and visitor economy

(tourism, culture and hospitality businesses), the LEP is working partners to facilitate a

joined-up approach, identifying the critical/ urgent issues and gaps in Government support

and seeking to understand the long-term impacts which will feed into the development of a

regional recovery plan.

The LEP was starting to develop a tourism action plan for the visitor economy, working with

the region’s tourism bodies. This work is now being accelerated to develop a resilience and

recovery plan for the sector.

The LEP is supporting the efforts around the supply of PPE and medical equipment, putting

out a call for companies to submit information via a web form and via the Growth Hub direct

- more than 100 businesses have responded to date adding to a local database of over 150

businesses who can supply PPE.

The database captures companies that can source and supply, donate and manufacturer

PPE and is helping to facilitate connecting supply and demand.

The LEP team is also working with the consortiums at UEA, Norwich University of the Arts

and BT who are supporting PPE innovation and production.

Over 20 businesses who have come forward through the LEP call who have said they are

not currently manufacturing PPE but have the capability to.

These are being followed up to understand what they can do and what support is required.

One of these businesses - Panel Graphic has been supported with a £100,000 contingency

grant from the LEP to scale up manufacturing of its face visors.

We have also awarded a £10,000 grant to a consortium of 400 independent sewers called

Norfolk Scrubs, who are producing scrubs for health professionals across Norfolk and

Suffolk. The grant will enable the sewers to purchase more materials and ramp up

production.

6 Economic Impact

Priorities for this workstream:

Develop an economic assessment framework to track and highlight short, medium

and long-term impacts and risks.

Use this evidence base to identify potential interventions that may be required to

support economic recovery feeding into the development of a regional recovery plan.

A small advisory panel with some of the members of the Data Practitioners Group to support

the development of the assessment framework has been set up.

An initial outline assessment has been completed, detailing immediate threats and medium

to longer-term risks and potential opportunities.

5

15

This is evolving daily, in light of updates from central government in terms of support

measures - combined with monitoring the effectiveness of the UK’s current lockdown

measures.

Over the next few weeks this work will evolve into the development of an economic recovery

plan for Norfolk and Suffolk.

7 Communications

The communications workstream underpins all the LEP’s COVID-19 response workstreams.

Priorities for this workstream:

Co-ordinate consistent, priority messaging for businesses, particularly around new

Government grants with Local Authorities and business intermediaries.

Lead communications on a public campaign for PPE, on behalf of the Norfolk

Tactical Co-ordination Group.

The LEP continues to monitor daily briefings from government and information is passed

through to all workstreams as and when government announcements are received.

Government briefings have been turned into a local script for business advisers, which is

updated daily and shared with the Growth Hub and Local Authorities.

A business engagement protocol has now been developed and agreed with partners.

The LEP’s website has been updated to hold details of Local Authority grants, what

businesses need to do and includes links to each Local Authority for more information.

The LEP is running a public appeal for PPE supply, which was launched on 8th April.

The LEP is also showing its support for the national Feed the Nation Campaign, with the

creation of website and social media content and linked with the employment opportunities

web page referred to above.

Recommendation

The LEP Board is asked to note the contents of this report.

6

16

New Anglia Local Enterprise Partnership Board

Tuesday 21st April 2020

Agenda Item 6

Covid-19: Business Resilience and Recovery Scheme

Author: Chris Dashper

Summary

The Covid-19 Coronavirus pandemic has impacted businesses of all sizes and from all sectors

across the New Anglia region.

The Business Intelligence report for the week commencing 13 April indicates that 77% of

businesses surveyed cited cashflow as their biggest concern.

43% of businesses were still operational in essential sectors and with key workers but

struggling to maintain normal business.

32% had furloughed staff and 2% had made redundancies.

In terms of support for businesses Small Business Rate Grants of £10k and the Retail,

Hospitality and Leisure Grant Fund of £25k have been made available by Government to

provide initial cashflow support for businesses.

The new Coronavirus Business Interruption Loan Scheme has been introduced to be delivered

through mainstream banks, but the banks have been slow to react to urgent cashflow

requirements, largely due to the number of enquiries received.

New Anglia LEP grant programmes including the Growing Business Fund and the Small Grant

Scheme remain open to businesses. The GBF has a budget allocation of £2.79m for 2020/21.

New Anglia LEP Board discussed at their March 2020 meeting the possibility of introducing an

additional programme, complimentary to the existing LEP interventions, but targeted at more

immediate support for businesses and for future recovery.

Recommendation

The Board is recommended to support a new intervention, the Business Resilience and

Recovery scheme, with an initial budget of £3.5m to provide support to businesses in the New

Anglia region in the form of advice, guidance and grant support for initial resilience and longer

term recovery.

A bridging loan element for businesses applying to the Coronavirus Business Interruption Loan

Scheme but awaiting a decision is under development. £500k of the £3.5m could be allocated

to a repayable loan fund.

1

19

Background

The impact of the lockdown enforced on 23 March 2020 to manage the spread of the

coronavirus has been felt directly by individual businesses forced to temporarily or permanently

close. Other businesses remaining operational for essential purposes are struggling to maintain

business as usual with staff shortages impacting productivity due to illness and self-isolation

and materials shortages in supply chains.

The obvious impact of the lockdown is the financial implication on businesses mothballed with

staff furloughed, affecting sales, delivery of contracts, manufacturing, product deliveries, raw

materials and ultimately cashflow.

Short term recovery requires businesses and supply chains to restart once phased releases

from lockdown are allowed and longer-term recovery may require repositioning of a business

model to best utilise existing resources.

Nationally, Government has encouraged industry to increase production to compensate for the

shortfall within supply chains such as PPE manufacturing and Innovation R&D to tackle the

virus. This may require short term investment to change production but with a view to returning

to previous production later or pivoting the business model to shift on a permanent basis.

Diversification exposes businesses to financial risk and the threat of overstretching. To support

investment or diversification, appropriate business advice is vital.

The Business Resilience and Recovery scheme is designed to support short term business

resilience projects through capital grant and potential loan support and longer term

diversification and recovery through dedicated advice and guidance from a business adviser of

the Growth Hub or an external consultant dependant on the advice required.

Grant process

Typical projects to be supported through capital grants include:

Support for the manufacture of products to tackle the Coronavirus outbreak

Support for Coronavirus related Research and Development

Development of new technology or innovation and productivity improvements

Short term manufacturing diversification

Longer term development for future recovery and diversification

Identification and mobilisation into new markets

Unlike other LEP programmes there is no requirement to support new job creation, but projects

should safeguard jobs wherever possible and projects should aim to support measures to

incorporate innovation and productivity.

Advice and guidance

Advice and guidance provided by New Anglia Growth Hub advisers or external contractors

could include support on subjects such as.

Access to finance - seeking advice on leveraging working capital

Financial and business planning

Market appraisal, including overseas markets

Creating a more efficient business operation by reducing costs

Diversification into other appropriate sectors

2

20

Creating a pipeline of products or services or commercialisation of a new product

Collaboration with other businesses or R&D institutions to develop new technology or

ideas

Stabilising losses on contracts by reducing overheads

Reducing staff in a way that does affect viability and paves way for longer term growth

Loan Support

A potential bridging loan element of the programme is under development to help manage

delays experienced by businesses applying to the Coronavirus Business Interruption Loan

Scheme delivered by mainstream banks. £500k of the available programme fund could

potentially be allocated as loans. The LEP is currently discussing the loan element with Suffolk

County Council, the LEPs Accountable Body.

Key Issues

Finance

The LEP Investment Appraisal Committee had previously agreed to set aside £4.1m of funding

for the proposed One Farm project. This funding came originally from underspend in the

Enterprise Zone Accelerator Fund.

The One Farm project has not progressed due to issues in identifying suitable private

investment, although the project remains under development, with regular updates from the

project development team to the LEP. However, the project is unlikely to be in a position for

LEP investment during 20/21.

The funding provisionally allocated to the One Farm project may therefore now be used for the

new programme. Following the March IAC where two Growing Places Fund projects were

approved and taking account of other project commitments, the balance available is £3.5m.

This figure will be kept under review and could be increased if necessary.

The Growing Business Fund has a budget of £2.79m for 2020/21. The programme will be kept

under review and if demand decreases, budget from GBF could be moved across to the

Business Resilience and Recovery Scheme to increase the size of the fund available.

State Aid

Emergency State Aid measures for SME’s were agreed by the European Commission on the

25 March 2020. These allow grant aid of up to €800k to SME’s impacted by the Coronavirus

pandemic.

Emergency aid measures can cumulate without penalty with existing de-minimis aid regulations

which allow for an intervention of up to €200k in any 3 years.

Grants of between £25,000 and £50,000 will be made available under this programme, with a

maximum intervention rate of 50% of the cost of the project. This intervention ensures the fund

could potentially support up to 100 businesses across the region, although the average grant is

likely to be £30-50K. Businesses must provide 50% match funding, either cash or in-kind.

Additional State Aid guidance on specific interventions including support for larger companies

and for projects with specific objectives including prioritisation of the manufacture of PPE has

been agreed for the UK by the EU and will be included in the scheme guidance once published.

Qualifying businesses must have been solvent at 31 December 2019.

Emergency State Aid regulations will remain in place until 31 December 2020.

3

21

Governance

The programme will operate on an open call basis.

Initial contact with businesses interested in the scheme will be through the Growth Hub.

Consultancy advice and support on diversification will be provided by experienced local

contractors appointed by the business from an approved framework.

Businesses will be referred to the most appropriate option from the LEP programmes suite,

particularly if projects are more suited to the larger grants on offer from GBF or the smaller

Small Grant Scheme or Growth through Innovation programmes.

Decisions on projects requesting support of up to £50k from the resilience and recovery

scheme will be made on a delegated basis, with a panel of three, from the LEP’s Programmes

Team providing recommendations.

Any other projects will be brought to the board for approval, potentially by written procedures to

avoid delays to decisions.

All projects will receive a formal offer letter from via SCC as the Accountable Body as with all

other grant programmes. The letter will outline all conditions of funding and details of the State

Aid article used to make the award.

Link to the Economic Strategy and Local Industrial Strategy

This programme represents an immediate and significant response to the Coronavirus

pandemic.

All LEP priority sectors will be eligible for support under the programme.

Priority will initially be given to projects which directly tackle the Coronavirus pandemic, either

through the production of new products, or new technology and innovation. Additional priority

will be given to projects looking at diversification and the pivot of existing business models

within businesses.

Recommendation

The Board is recommended to support a new intervention, the Business Resilience and

Recovery scheme, with an initial budget of £3.5m to provide support to businesses in the New

Anglia region in the form of advice, guidance and grant support for initial resilience and longer

term recovery.

A bridging loan element for businesses applying to the Corporate Business Interruption Loan

Scheme but awaiting a decision is under development. £500k of the £3.5m could be allocated

as a repayable loan fund.

4

22

Business Resilience and Recovery Grant Scheme Criteria

Introduction

The Business Resilience and Recovery Scheme will provide support to businesses in Norfolk

and Suffolk that have been affected by the Covid-19 Coronavirus and are looking at ways to

recover and strengthen their business performance.

The scheme provides a range of interventions to help businesses to adapt and cope with the

effects of the downturn, safeguarding businesses and jobs, including

50% grant towards capital costs involved in initial resilience and future recovery

projects, up to £50k

Costs of consultancy support for pivot and diversification projects

Potential development of a bridging loan element for applicants to the Coronavirus

Business Interruption Loan Scheme, until formal loan is received

The scheme is operated across all districts and boroughs in Norfolk and Suffolk.

Funding Available

The Business Resilience and Recovery Grant Scheme commences with an initial allocation of

£3.5m from the New Anglia LEP Growth Deal.

Maximum grant intervention through the programme will be 50% of eligible capital costs.

Support Provided

The scheme provides support to assist companies during the challenging business

environment facing many sectors as a result of the Covid-19 pandemic. The support could

take the form of one or more of the variety of interventions including:

Support for the production of products to tackle the Coronavirus outbreak

Support for Coronavirus related Research and Development

Development of new technology or innovation and productivity improvements

Short term manufacturing diversification

Longer term development for future recovery and diversification

Identification and mobilisation into new markets

As part of the process, an initial in-depth diagnostic exercise will be undertaken by the New

Anglia Growth Hub advisers, to determine eligibility of the business and identify what type of

support they require.

Examples include advice on:

Access to finance - seeking advice on leveraging working capital

Financial and business planning

Market appraisal, including overseas markets

Creating a more efficient business operation by reducing costs

Diversification into other appropriate sectors

Creating a pipeline of products or services or commercialisation of a new product

Collaboration with other businesses or R&D institutions to develop new technology or

ideas

Stabilising losses on contracts by reducing overheads

23

Reducing staff in a way that does affect viability and paves way for longer term growth

Grants provided for consultancy

The size of the grants awarded depends on the size of the company. The maximum size of

grants awarded is as follows:

For 1-4 employee businesses £2,000 excl VAT

For 5-49 employee businesses £4,000 excl VAT

For 50-249 employee businesses £6,000 excl VAT

Consultancy support can be cumulated with capital grant support.

Capital Grant Programme

The second scheme is based around a capital grant model providing grants of up to £50k to

support projects based around the potential options for support listed above.

A business applying under the Business Resilience and Recovery Scheme can apply for up

to a maximum of £50,000 of grant support. Maximum capital grant intervention is 50% of the

eligible costs of the project.

To be eligible for grant funding, applicants must meet the following essential criteria:

• Be a trading enterprise;

• Be based in Norfolk or Suffolk;

• Be ready to invest or expand in the local area;

• Must not have been a company in difficulty on 31 December 2019

Potential Coronavirus Business Interruption Loan Scheme underwriting facility (under

development)

A mechanism to offer short term bridging loans to applicants to the CBILS loan scheme

waiting to receive their business loans. LEP loan to be repaid on receipt of CBILS loan.

Eligibility

To be eligible for assistance, the company must be registered in the UK and have a base in

Norfolk or Suffolk.

Enquiry

Businesses wishing to apply for support should first contact the New Anglia Growth Hub on

24

New Anglia Local Enterprise Partnership Board

Tuesday 21st April 2020

Agenda Item 8

LEP Continuing Business

Author: All, Rosanne Wijnberg

Presenter: Rosanne Wijnberg

Summary

This report provides an overview of LEP team ‘continuing business’ activities since the March

board, structured around:

1) Programmes

2) Strategy

3) Engagement and promotion

4) Governance, Operations and Finance

The media dashboard is attached as an appendix to the report

Recommendations

The board is asked to note the contents of the report

1) LEP Programmes

Growth Deal (Capital Growth Programme)

The delivery of all large capital projects is being disrupted to some degree by COVID-19. Several

construction sites have been closed; others are affected by the absence of staff who are self-

isolating.

Access to materials may also become a factor. In addition, we are experiencing some delays in

information exchange and decision making as a result of remote working. The extent of the

impact both on project delivery and expenditure cannot be assessed until we are clearer on

length of the lockdown and the approach taken when these restrictions are eased.

Preparations for construction of the Eye Airfield Access Link Road and Roundabouts on the A140

have been taking place. Detailed design is complete and tree clearance and diversion of utilities

have taken place. Land negotiation is expected to be complete in early April 2020 and main

works are planned to begin almost immediately afterwards.

A revised Strategic Outline Business Case for the Ely Area Rail Capacity Enhancement Project is

to be presented to the Network Rail Anglia Programme Board on 20 April 2020. This SOBC will

be requesting additional funding from the Department of Transport to continue development work

and produce an Outline Business Case allowing this project to progress through to detailed

design. The project is expected to be delivered in phases from 2024 onwards.

1

37

City College Norwich has been engaged in a process of Value Engineering with their preferred

contractor, design team and supply chain in relation to the construction of the Growth Deal

supported DigiTech Factory. This process was undertaken to consider the opportunities for

savings, to reduce risk, and ensure CCN get value for money. It is hoped that main construction

works will take place over the summer.

Business Growth Programme

The Business Growth Programme remains ahead of its output and spend profile, with the upturn

in the Small Grant Scheme continuing, with four applications totaling £78,915 approved, with

match funding of £317,164, during March. The Q1 claim for the Programme (December 2019 to

February 2020) is being finalised, with an estimated claim of £1.295m, taking the 2019/20

cumulative total to £6.107m or 103% of the 2019/20 target.

Our Project Change Request (PCR), requesting £1.1m of additional ERDF funding to enable the

Growth Hub and Small Grant Scheme to operate until the end of November 2021 has now been

approved by MHCLG and we are anticipating receiving formal written confirmation of this in the

coming weeks, although the understandable redirection of resources across government means

that this may take a little longer.

MHCLG have indicated that the national ERDF call for further funding will not happen. However,

additional funds have been allocated by BEIS for business support and Growth Hub activities.

We have been allocated £249.5k and are currently awaiting details on the funding criteria; initial

planning on the effective use of this allocation is underway. Current circumstances mean that the

fourth annual evaluation of the Programme has been slightly delayed, however, we anticipate

that it will be published during May.

Growth through Innovation

The Growth Through Innovation (GTI) fund has now been launched, providing grants between

£1,000 and £25,000 for capital and revenue investment into SMEs for a wide range of Innovation,

Research and Development activities, including equipment and testing.

We are already seeing our first application going through the assessment process and are

working with the Growth Hub and a wide range of other partners to raise awareness of the fund

to potential applicants.

The application and approval process is in line with the Small Grant Scheme - application form

submitted for review by a virtual panel. We anticipate that take up of the fund will be high, with

priority given to COVID-19 related activities.

Growing Business Fund

In March the fund saw a continued increase in the number of expressions of interest and

applications submitted, and this has continued into early April. The Panel meeting planned for

April has been cancelled and applications are continuing to be reviewed and approved via email.

In March four companies were awarded grants totaling £430k. This will ensure that we start

2020/21 with a positive commitment. We are working with applicants to ensure that we maintain

a healthy pipeline of projects. Thank you to Jeanette Wheeler for her input over the past three

years, as she steps down from the panel this month.

Eastern Agri-tech Initiative

The Agri-tech panel has been voting via email. There have been three recent applications to the

fund, including one for the New Anglia area. The voting will be completed this week. Interest in

the grant scheme continues and a reasonable pipeline of potential projects exists.

Growing Places Fund

At the most recent meeting of the Investment Appraisal Committee grant offers were made to the

New Wolsey Theatre in Ipswich and to develop the community and economic elements of St

Peters Church in Sudbury, offers were made for £225k and £226k respectively.

2

38

A range of variation requests are being made by existing projects that have received funding and

are now affected by the COVID-19 situation.

The Winerack and Atex Business Park have requested revisions to the payment terms on their

loans; and a number of projects are predicting slower drawdown of LEP funds due to the

cessation of construction, staff being furloughed and / or a change in short term priorities.

Requests for variations to existing loan terms will be summarised and presented to the

Investment Appraisal Committee at the meeting in May.

The knock-on effect of the overall situation for the Growing Places Fund is likely to be a slower

return to the LEP on loans and a slower drawdown of grant funds by projects.

New Anglia Capital

The immediate impact of the COVID-19 outbreak was that the last NAC Board meeting,

scheduled for 23rd March was cancelled entirely due to the lockdown. Unfortunately, this

prevented two existing portfolio companies from pitching for further investment: Spark EV

technology and PBD Biotech. Our response to this has been to circulate urgent investment

proposals to the Board via e-mail for decision. The plan is to hold the next Board meeting in June

via video conference facility if the social distancing restrictions are still in force.

NAC portfolio companies are in the very high-risk category by nature, they are all early stage

companies, mostly not in profit yet and heavily reliant on outside investment. From the

communication with portfolio companies we have had to date, all have been impacted and are

suffering from reduced revenue. However, all are still currently trading and are doing their upmost

to cut costs, access government support and take advantage of the furloughing scheme. We will

know more about individual company circumstances when we draft the next NAC Board report.

The danger lies in a lack of investor confidence in the economy and therefore should any

portfolio company require an injection of cash they may struggle to raise investment from the

private sector.

UEA Enterprise Fund

The Service Level Agreement for the UEA Enterprise Fund has been signed and payment of

£250,000 for Year One has been paid.

LEP Innovative Projects Fund

Innovative Projects Fund (2018 Call) - £500,000.

Summary of Progress:

Seven projects under the 2018 call of the Innovative Projects Fund have a combined IPF allocation

and commitment of £539,531.

A total of £61,246 was paid to three projects in the last quarter which means that £140,000 has

been paid from the Innovative Projects Fund to date.

This has enabled the creation of 4 part time jobs and the availability of support to 25 businesses.

A total of £57,709.99 has been spent by Local Authorities and Private Match Funding of £61,750.35

has been reported.

All projects have been put on hold by the COVID 19 outbreak and this is likely to impact on the

timeframe required to complete projects.

3

39

Innovative Projects Fund (2019 Call) - £1.5m - Confidential

4

40

Inward investment

Work continues with plans to attend Wind Europe in Hamburg in September and Global offshore

Wind in Manchester and Offshore Energy in Amsterdam, both scheduled for October. We will be

exhibiting and promoting Norfolk and Suffolk as primary partners of DIT, alongside local

businesses and in October will launch our new energy sector branding.

We have organised a webinar, at the end of April, with a number of US based energy companies

who will promote Offshore Wind opportunities to our locally based supply chain. A follow up visit

is anticipated later this year.

Activity - a few examples of recent activity

The proposal we assembled for a second High Potential Opportunity (HPO) for Norfolk

and Suffolk has been approved by DIT to proceed to the next round. It is centred around

the Norwich Research park with a focus on food, diet, health and nutrition and how it

contributes to the Ageing Society Grand Challenge

We have responded to a significant inward investment enquiry linked to battery

manufacturing. This project will deliver up to 250 jobs, building c30,000 cells per year. We

worked closely with a local company to develop a joint proposal which will involve using

an existing building on their site, which offers a unique opportunity for the investor. It also

fits their tight timeline. We have already had a positive response to this offer and expect

to host visits once the lockdown is lifted

We have been entertaining an enquiry from a chocolate producer, which is seeking a 12

acre site for a new primary processing plant. We have been in detailed discussions with

the company regarding taking over an existing site in Suffolk. We are in competition with

the Humber for this project. In addition we have received 3 other smaller enquiries to

which we have responded.

Invest East project is on target in terms of spend and outputs. However, there is a

COVID-19 impact. The investment readiness programme delivery has moved online and

a recent seminar was delivered using this method with favourable responses. Eligible

inward investment impact is negatively impacted due to cancellation/postponement of

trade shows for lead generation. However, new staff resources for team will mitigate

against this, and inward investment enquiries (DIT and other derived) are

continuing. Match-funding in the form of staff time from SCC and New Anglia was

negatively impacted from Sept 2019 by personnel changes.

The penultimate “data cut” from DIT has been provided and we have extracted

information from it to provide a provisional picture of last year’s performance. 351 new

(inc a few safeguarded) jobs. 105 in Norfolk and 246 in Suffolk. A full report will follow in

May.

2)

Strategy

Evaluation

The tender for the Evaluation Procurement Framework closed on Thursday, 9th April following a

short extension given the coronavirus outbreak and allowing companies more time to submit

tenders. A total of 15 tender submissions have now been received. We will be reviewing these

when resources allow over the coming weeks to develop a procurement framework, with a view

to commencing the first evaluation albeit over a longer timeframe than originally planned. This

evaluation will cover the four programmes as agreed by the LEP Board in January - New Anglia

Capital, Eastern Agri-Tech Initiative, Growing Places Fund and the Growing Business Fund.

6

42

Development of Investment Plan

Due to the current situation, the call for Expressions of Interest for the Investment Plan will

remain open and under review. A new closing date will be published once we have a better idea

of timescales.

The LEP will be reviewing all those Expressions of Interest that have been submitted to date,

albeit over a longer timeframe than originally planned.

Skills

The next meeting of the Skills Advisory Panel is scheduled for 21st May.

The planned projects for the investment plan are currently being reviewed and reshaped to

ensure that they meet the anticipated requirements of the COVID-19 recovery.

The apprenticeship levy work has slowed down but not stopped completely. The LEP has

supported Norfolk and Suffolk County Councils with an apprenticeship provider survey and its

results are being used to review and support our providers and inform government of local

challenges.

EAN and Careers Hub

The Enterprise Adviser Network has continued to provide support to available Careers Leads and

Enterprise Advisers during the last couple of weeks, through virtual CPD sessions and the

collation and dissemination of online and virtual resources to support remote careers learning.

During half term, the team, have focused on completing in-depth SWOT analysis of their

caseloads of schools to identify short, medium and long-term needs. Additionally, from 10th April,

they will be supporting the Growth Hub advisers with fielding COVID-19 enquiry calls.

Infrastructure

Transport Board

The next meeting of the Transport Board is scheduled to take place on 2nd June, focusing on

regional connectivity and our priority places.

Trowse Rail Bridge Upgrade

Progress is being made on the Trowse Railway Bridge upgrade, with the development of the

Reliability and Capacity study which is expected to be finalised at the end of May. A meeting to

look at actions to build political momentum around the project is arranged for 21st April.

Transport East

Consultants have been commissioned by the Transport East Senior Officer Group to undertake a

Decarbonisation study with a storyboard and stakeholder engagement plan.

Blue Tech Cluster Opportunity

Work has continued in exploring the opportunity to develop a Blue Tech cluster an intervention in

the LIS. Work has commenced on scoping the Blue Tech Hot House event centered around

innovation and opportunities at Felixstowe Port. Discussions are taking place with Felixstowe

Port, the Connected Places Catapult and BT to agree the aims of the event and the best format

for achieving these.

Greater South East Energy Hub

The Greater South East Energy Hub Board met in March and requested feedback on the types of

grid constraint issues being experienced and an update on existing sites. Information is currently

being collated from Local Authorities to feedback to the Board.

7

43

Clean Growth Action Plan

Mapping is underway of the climate change groups established across the area, helping us to

understand how their activities can help deliver the clean growth action plan and identify potential

members who could join a clean growth taskforce. The main bulk of this work has been put on

hold whilst LEP staff are supporting the COVID19 response.

European Structural and Investment Funds (ESIF)

The £5.5m funding application to ERDF to support the development of a Food Innovation Centre

and associated innovation support programme, was submitted on 30th March. MHCLG have

indicated that appraisal of the project may be slightly delayed by Covid 19 response work, but the

LEP will be urging them to minimise delay as the project has the potential to form a key part of

the recovery and growth plans of the food sector in Norfolk and Suffolk from next year.

Knowledge and Evidence

The LEP’s economic analysis resource has been engaging with external partners and the LEP

skills team to assess additional data analysis tools, to support our on-going Skills Advisory Panel.

This has highlighted the potential for additional analytical tools that have clear benefit, however,

we are still assessing the accessibility of these benefits, as its unlikely we could reap the full

benefits these tools offer - without additional dedicated resource from both the LEP, and our local

authority partners.

3) Engagement

This section covers engagement activity with local stakeholders, including local authorities, local

businesses and MPs. It also covers activity with Government and our wider international activity.

The Communications and Engagement Dashboard is included as Appendix A to this report.

Norfolk & Suffolk Unlimited / Norfolk and Suffolk Commercial Property System

As part of the Norfolk and Suffolk Unlimited activity, a new online tool has been developed to

help local businesses and potential inward investors search for available commercial property

and land across Norfolk and Suffolk. The tool allows users to search an extensive database

which is updated daily by a direct feed from the Estates Gazette (EGI) service with data sourced

from commercial agents. The new system also allows the LEP’s Enterprise Zone team to directly

update and promote specific Enterprise Zone development opportunities.

A soft launch and phased roll out is planned, in light of the current situation. This will include, at

the next stage, the addition of an option for users to download personalised, bespoke investment

reports to cover key sector and location information as well as specific commercial property

details that they have selected. The option to create and profile specific, wider geographic zones

will also be added in future to help promote areas such as the Cambridge Norwich Tech Corridor

and the A14 Corridor as examples.

In addition to this, New Anglia LEP has also signed up to the national Estates Gazette Radius

Data Exchange. Over 200 agents are signed up to this service and contribute and share the

latest data and intelligence on the commercial property market including vacancy rates, planning,

deals activity, lease data and news on regional market activity. For the first time the LEP will be

able to access important data to help assess and track market performance and trends as well as

receiving the latest real estate news. Radius is the only platform that offers commercial property

transaction information contributed directly from agents as well as tracking planning and

construction activity to help inform our local strategies and marketing campaign activity.

New Anglia Innovation Board

The New Anglia Innovation Board has a programme of activity which drives business-led

innovation and supports access to innovation funding. Whilst a number of activities, including the

Innovation Forum (digital meets clean energy) and Innovation Marketplace have been put on

8

44

hold whilst social distancing measures are in place, there is still a considerable amount of activity

still being delivered. Supporting the Ideas Foundation of the Local Industrial Strategy, activities

include an innovation mentoring scheme which supports businesses to access Innovate UK

funding as well as the development of the Innovation Prospectus to link up and promote centres

of excellence - timing of launch will be carefully planned around the recovery phase.

Sector Groups and Industry Councils

Work on the Agri-Food, Digital and All Energy Industry Councils is progressing, with each Council

now having a draft Delivery Plan which sets out the Council’s key priorities and actions to support

delivery of the Local Industrial Strategy and Economic Strategy. A number of sector projects

were successful in securing funding in the last round of Innovative Projects Fund, including the

New Anglia Advanced Manufacturing and Engineering (NAAME), New Anglia Cultural Board and

ORE Catapult, so work is underway to rescope these projects in order to maximise their potential

for supporting economic recovery.

Ipswich Vision

Although events are currently on hold in Ipswich including the Cornhill based activity as a result

of the COVID19 lock down, communication with the Ipswich Vision partners continues as we

track potential impact of COVID19 on the high street and the retail and leisure sector in

particular. The Government’s official guidance on the national Towns Fund which was

announced last year, of which Ipswich is included, has been delayed but it is expected that

details will be released soon allowing work to progress on a bid to support regeneration in central

Ipswich as part of the post-COVID19 recovery.

Cambridge Norwich Tech Corridor

The Tech Corridor team is continuing to deliver the 2020 plan and so work is progressing but due

to current circumstances, all events have been postponed. The team has reallocated part of their

time to work with the Norfolk and Suffolk COVID -19 response, supporting the Comms activities

(e.g. updating the business script), supporting the Economic Impact workstream and leading one

of the PPE supply chain workstreams. The team will continue to work on ongoing activities such

as a development plan for the Engineering and Manufacturing Sector which secured £180,000 of

funding through the Innovative Projects Fund.

Key diary dates

The LEP is involved in a number of key launches and events over the next few months.

Listed below are some of the key events planned. These are obviously subject to change.

10-13 March 2020 MIPIM Cannes - rescheduled to 2-5 June

May 2020

Launch of The Hold expected

July 2020

Expected completion of building work on new CEFAS headquarters

2020/21 academic

UEA, UoS, City College Norwich and Suffolk New College projects to

year

launch. Suffolk Digitech centre expected to launch in December 2020.

4) Governance, Operations and Finance

This section provides an update for the board on any key operational matters as well as a

headline summary of the LEP’s operational finances.

Governance

Risk Register

The current risk score for risk 11, Growth Deal Delivery, has increased from medium to high. The

coronavirus pandemic has introduced additional delays, where some projects had recently

overcome planning constraints and land purchase issues. The LEP may need to consider

advance payments and capital swaps with councils when judged to be appropriate.

9

45

Annual Performance Review

Our Annual Performance Review meeting was held on 7th February. On 3rd April we received

formal notification from Government that our outcomes across the three themes were:

Governance: Good

Delivery: Good

Strategic Impact: Requirements Met (Scoring in this category is Met / Not Met)

The notification also confirmed that we will receive our grant offer letter relating to our Local

Growth Fund and core funding allocations for the 2020/21 year shortly.

Finance

At this difficult time our operational priority is to pay our suppliers and staff on time to ensure we

do not contribute to the financial hardship of others.

We have commenced preparation work for our audit and undertook a comprehensive planning

call with Price Bailey on 27th March. This covered confirmation of the operation of systems and

processes as well as agreement of audit arrangements. The final audit is due to take place in the

two weeks commencing 18th May, with the Audit and Risk Committee scheduled for 23rd June.

We are currently working towards these key dates however given coronavirus we may

experience unavoidable slippage. For information, the local authority deadline for publication of

final, audited accounts has been pushed back from 31 July 2020 to 30 November 2020.

Recommendation

The board is asked to:

Note the contents of the report

10

46

Communications activity

March 2020

This dashboard sets out the outcomes and impact of communication during March

2020 through owned media - the information which we control and issue ourselves -

and earned media (third-party outlets). (*Refers to pre-GDPR numbers)

Owned media - social media channels and e-newsletters

March 2019

Feb 2020

March 2020

New Anglia LEP

Number of Twitter followers

7,634

8,246

8,322

Number of clicked links per month

599

261

212

Average Twitter engagements per

100

58

68

day (likes, retweets etc.)

Number of impressions (the

120.7K

100K

121K

number of times a tweet showed in

someone’s timeline)

Number of Linkedin followers

704

1,882

2,097

Number of impressions on Linkedin

N/A

N/A

45.1K

E-newsletter: open rate

38.13%

30.73%

33.77%

E-newsletter: click-through rate

25.54%

17.58%

17.65%

Norfolk & Suffolk Unlimited

Number of Twitter followers

N/A

404

426

Number of clicks per month

N/A

53

37

Average Twitter engagements per

N/A

20.48

31

day (likes, retweets etc.)

Number of impressions (number of

N/A

38.3K

37K

times users saw our tweet)

Number of LinkedIn followers

N/A

667

731

47

Top Tweet - New Anglia LEP

A call to action for businesses to

provide personal protective equipment

for frontline workers during COVID-19

attracted a huge amount of

engagement on Twitter. It earned

almost 7,000 impressions and was

shared 37 times.

Top Tweet - Norfolk & Suffolk Unlimited

Norfolk & Suffolk Unlimited’s best

performing tweet was a Friday Fact

about Thetford Forest, attracting

almost 2,000 impressions and 34

engagements.

48

Media coverage - New Anglia LEP

Our story about our Growing Business

Fund and Small Grant Scheme grants

reaching £30m was the lead story in

the Eastern Daily Press and East

Anglian Daily Times business section

and published online. Against a

backdrop of COVID-19, this was a very

positive piece showcasing the

significant support available to

businesses from the LEP and the

Growth Hub.

This region’s leading role in the growth

of tech businesses was underlined in

the latest Tech Nation report and this

was covered by the EDP and EADT.

Cambridge Norwich Tech Corridor

programme director Linn Clabburn was

quoted in the article.

Other positive coverage in the EADT

included the £70,000 grant awarded to

Suffolk sausage firm Musk’s towards

its expansion, and the first tenant at

The Maltings office complex in Ipswich,

the development of which was

kickstarted by a £600,000 loan from

our Growing Places Fund.

49

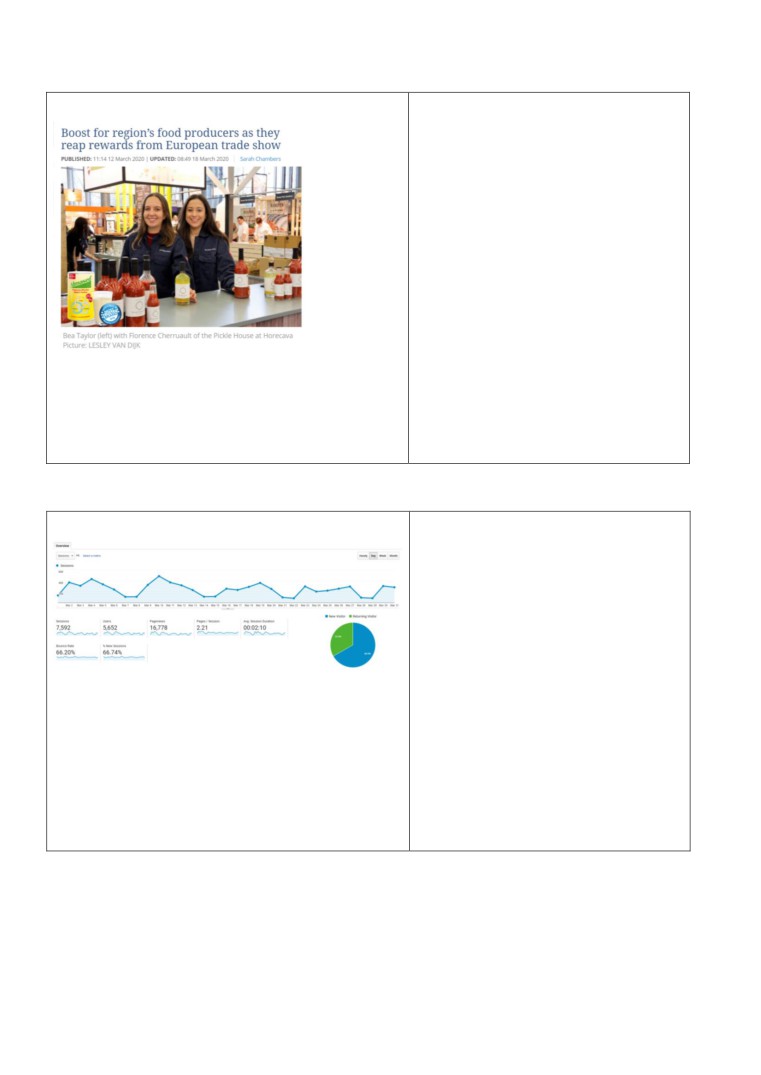

Media coverage - Norfolk & Suffolk Unlimited

Some of the businesses who joined

Norfolk & Suffolk Unlimited’s trade

mission to a major food and drink

event in Amsterdam earlier this year

have clinched deals as a result. The

Pickle House, based in Stowmarket,

now has a distributor in The

Netherlands and the company was

featured in a story in the EADT.

Google Analytics - New Anglia LEP website

In March, the LEP website had 16,778

page views (up 783 on February), and

the most popular pages were those

offering information about business

support during COVID-19 and the

Small Grant Scheme.

Visitors spent an average of 2:10

visiting the site (up 1 minute and 16

seconds) and of those visiting the site,

66.8% were new visitors (down 2.2%

and 33.2% were returning (up 2.2%).

50

New Anglia LEP Board Forward Plan - 2020

Date

Venue

Forward Looking

Governance & Delivery

29th January

Liftshare

Aims and Objectives for the Year

Local Industrial Strategy - investment plan

Norwich

Brexit impact report

Evaluation Framework

Board Recruitment

Remuneration Committee ToR

Growth Programme, EAN, Enterprise Zones & NAC Reports

Quarterly Management Accounts

26th February

Ipswich Town Hall,

Establishment of Clean Growth Taskforce and framework

Governance - reporting from industry councils and other sub-boards

Ipswich

Development of Tourism sector action plan

Investment Plan Pipeline

Economic and Programme Dashboards

Growth Deal Performance Report

25th March

Teleconference

LEP Delivery plan 20/21

LEP updated Local Assurance Framework 20/21

LEP Operating Budget 20/21

Freeports

Economic Shocks - Brexit & COVID-19

Election of Deputy Chair

Enterprise Zones, EAN and Agritech Performance Reports

21st April

Teleconference

LEP Continuing Business

LEP Response to COVID-19

Business Resilience and Recovery Scheme

Board recruitment

20th May

Teleconference

Growth Programme and Growth Deal Performance Reports

Economic and Programme Dashboards

Capital Budget 20/21

Quarterly Management Accounts

Investment Plan Update

23rd June

Teleconference

Enterprise Zones and Agritech Performance Reports

Equal Opportunity & Diversity Policy Report

Modern Slavery and Human Trafficking statement

21st July

Felixstowe Port,

Innovation Board progress report

Tourism Action Plan

Felixstowe

Transport Board progress report

Draft accounts

Investment Plan Sign Off

Growth Programme Performance Report

NAC Bi-Annual Report

Apprenticeship Levy Pool

Quarterly Management Accounts

August

No Board Meeting

23rd September

National Centre for

Enterprise Zones

Enterprise Zones Performance Report

Writing, Norwich

Agritech Industry Council progress report

Economic and Programme Dashboards

Growth Deal Performance Report

23rd September

New Anglia LEP AGM

21st October

Sutton Hoo

Skills Advisory Panel update

Evaluation on LEP programmes

Suffolk

ICT Digital Industry Council progress report

Growth Programme Performance Report

Agritech Report

Quarterly Management Accounts

25th November

Centrum, Norwich,

Growth Deal

Economic and Programme Dashboards

Growth Deal Performance Report

December

No Board Meeting

51

Standing Items (where relevant)

B rexit

Local Industrial Strategy

IAC recommendations

Chief Executive’s Report including updates on

o Programmes

o Strategy

o Engagement and promotion

o Governance, Operations and Finance

Board Forward Plan

Items to be Scheduled

Equality & Diversity Training

Investment Plan

Social Investment

Town Deals (May)

Digital Skills Project

Inward investment strategy

Skills Advisory Panel plans and progress

Energy Industry Council progress report

Opportunity Areas progress report

52