New Anglia Local Enterprise Partnership Board Meeting

Wednesday 31st March 2021

10.00 - 12.30pm

Via MS Teams

Agenda

No.

Item

1.

Welcome from the Chair

2.

Presentation from Peter Brady - Innovation Labs, Stowmarket

3.

Apologies

4.

Declarations of Interest

5.

Actions / Minutes from the last meeting

Strategic

6.

Industry Council for Digital Tech Progress Report

Update

7.

Norfolk and Suffolk Enterprise Zones: Strategic Plan 2021-26

For Approval

Operational

BREAK - 15 Mins

8.

Future Role of LEPs

Update

9.

Large Company Grant Scheme Application - Confidential

For Approval

10.

Getting Building Fund - Suffolk Broadband Scheme - Confidential

For Approval

11

LEP Delivery Plan 2021/22

For Approval

12.

LEP Operating Budget 2021/22 - Confidential

For Approval

13.

New Anglia LEP Governance

For Approval

14.

Chief Executive’s Report - including confidential items

Update

15.

March Programme Performance Reports

Update

16.

Board Forward Plan

Update

17.

Any Other Business

18.

Chief Executive’s Pay Award - Confidential

For Approval

1

Confidential

New Anglia Board Meeting Minutes (Unconfirmed)

24th February 2021

Present:

Kathy Atkinson (KA)

Kettle Foods

Sam Chapman-Allen (SC)

Breckland Council

Claire Cullens (CC)

Norfolk Community Foundation

David Ellesmere (DE)

Ipswich Borough Council

C-J Green (CJG)

Brave Goose

John Griffiths (JG)

West Suffolk Council

Matthew Hicks (MH)

Suffolk County Council

Pete Joyner (PJ)

Shorthose Russell

Dominic Keen (DK)

Britbots

Helen Langton (HL)

University of Suffolk

Steve Oliver (SO)

MLM Group

Corrienne Peasgood (CP)

Norwich City College

Andrew Proctor (AP)

Norfolk County Council

Johnathan Reynolds (JR)

Opergy

Sandy Ruddock (SR)

Scarlett & Mustard

Alan Waters (AW)

Norwich City Council

Tim Whitley (TW)

BT

Attendees

Mohammad Dastbaz (MD) University of Suffolk - For Item 2

Shan Lloyd (SL)

BEIS

Mark Ash (MA)

Suffolk County Council

Vince Muspratt (VM)

Norfolk County Council

Ellen Goodwin (ET)

New Anglia LEP - For Item 10

Julian Munson (JM)

New Anglia LEP - For Item 6

Chris Starkie (CS)

New Anglia LEP

Rosanne Wijnberg (RW)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

1

Actions from the meeting: (24.2.21)

Confidential Items

1

Welcome from the Chair

CJ Green (CJG) welcomed everyone to the meeting and noted the challenges ahead following the

announcement of the roadmap out of lockdown.

2

Presentation from Professor Helen Langton and Professor Mohammad Dastbaz

CJG welcomed Professor Mohammad Dastbaz (MD) to the meeting and invited him and Professor

Helen Langton (HL) to present the board with an overview of the 10 year plan and vision for the

University of Suffolk.

HL provided details of the increases in student numbers and highlighted high level of mature and

female students largely linked to the care related courses provided.

HL highlighted the five main areas of focus - Learning and teaching, Business Engagement, Research

& Scholarly Activity, People and Places and International, both attracting international students to the

campus and widening the horizons of domestic students.

HL reviewing current important projects highlighting the Integrated Care Academy which will develop

an existing building which will hold the health and wellbeing centre and thanked the LEP for its support

for the project.

Deputy Vice-Chancellor, Mohammad Dastbaz, presented details of the Digitech Centre at Adastral

Park noting the support from the LEP. Work started in February 2020 and even with the impact of the

pandemic work is nearing completion. One masters course has already started and the laboratories

are hoped to be used from March 2021 onwards.

Claire Cullens (CC) advised that the Skills Advisory Panel was looking to identify skill requirements in

the voluntary sector and noted that there were opportunities to link in with the Integrated Care

Academy.

CJG thanked them for the presentation and MD left the meeting

3

Apologies

Apologies were received from Jeanette Wheeler.

4

Declarations of Interest

Andrew Proctor (AP) declared an interest in Item 8 and left the room for the duration of this

item.

5

Actions/Minutes from the last Meeting

The minutes were accepted as a true record of the meeting held on 27th January 2021.

6

Energy Sector Recovery and Resilience Plan

Julian Munson (JM) presented the board with the Energy Recovery and Resilience Plan

which has been produced with the support of an Energy Recovery Task and Finish Group

made up of selected members from the All-Energy Industry Council including Local Authority

partners.

JM provided the board with an overview of the extensive impact of the energy sector on the

local economy and examples of the opportunities which the sector provided included those for

the supply chain.

JM advised that the plan includes current projects and investments within Norfolk and Suffolk

and also medium-long interventions highlighting the unique mix of energy both onshore and

offshore.

2

Corrienne Peasgood (CP) noted that some projects such as Sizewell could cause tensions for

other sectors such as the drain in skills from other areas and that this needed to be identified

and acted upon before it became an issue.

Matthew Hicks (MH) noted the existence of National Energy and Climate Plans and

highlighted the issue in Suffolk of offshore energy being brought onshore along a 20 mile area

of coastline and the impact of this on the area.

The meeting agreed that there is no joined up thinking from Government on the energy sector

and the opportunities should not be exploited at any cost.

The meeting discussed the wider impact of the developments such as on the environment

and noted that these legitimate concerns and plans need to be as joined up as possible to

ensure the benefits to the region are realised.

Johnathan Reynolds (JR) thanked JM and his team for the work on the plan and confirmed

that better connectivity with other all industry councils was required to exploit cross-over

opportunities.

He highlighted the ruling to overturn the Vattenfall approval meant that there were no clear

timescales on the future of the project and it was possible that the decision would impact on

other offshore wind farms with a potential delay of 2-3 years on other projects unless urgent

action is taken.

JM confirmed that final sign off of the plan lay with the LEP Board and that any comments

made today would be incorporated.

The Board agreed:

• To note the content of the report

• To endorse the Recovery and Resilience Plan for Norfolk and Suffolk’s energy sector

• To delegate final sign off to CJG and Chris Starkie (CS) following inclusion of minor

amendments

7

Enterprise Zone Accelerator Fund Amendment - Nar Ouse - Confidential

8

Great Yarmouth O&M Campus - Confidential

9

Enterprise Zone Accelerator Fund - Norwich Research Park - Confidential

3

10

Norfolk & Suffolk Transport Board Update

Steve Oliver (SO) presented the board on with an overview on how the various strands of the

transport strategy are being pulled together under the banner of clean growth and decarbonisation

Ellen Goodwin (EG) presented details of some of the key initiatives including an update on Ely

Junction as requested at the last board meeting.

JR noted that Transport East did not have decarbonisation and clean growth highlighted on their

agenda.

EG advised that the LEP is working the Combined Authority on the alternative fuel strategy which

is is about to be put out to tender.

AP asked what was being done regarding improved East-West connectivity.

SO confirmed that the A14 and A47 traskforces work to promote the region and EG advised that

they are also speaking to the Ox Cam Arc and other transport corridors.

CJG thanked SO for taking on the chair of the Transport Board.

The Board agreed:

• To note the content of the report

11

Chief Executive’s Report

CS updated the meeting on the work the LEP is doing on support Covid-19 testing in busineses

and confirmed that the LEP’s bid to the ESF fund to extend the Enterprise Advisor Network has

been confirmed.

It was noted that applications to the Business Resilience and Recovery programme had slowed

during lockdown but now was showed signs of increasing.

Nineteen cohorts are now participating in the Peer to Peer Network with further funding secured

for next year.

Alan Waters (AW) asked if intelligence gathered on the exit from the EU is being fed to

Government. CS confirmed that it was and that all LEPs have been asked to provide more

details.

The Board agreed:

• To note the content of the report

12

February Performance Reports

Rosanne Wijnberg (RW) presented the reports to the Board and highlighted key items noting

that £18.9m rollover remains in Growth deal spend. Outputs have been impacted in the last

financial year but overall remain positive.

Programme outputs dashboard - RW confirm that achievements of some outputs had been

delayed but this was to be expected and the outputs were still expected to be realised when

the projects complete.

The Board agreed:

4

• To note the content of the reports

• To approve the Growth Deal Dashboard

13

Board Forward Plan

The Board agreed:

• To note the content of the plan

14

Any Other Business

None

5

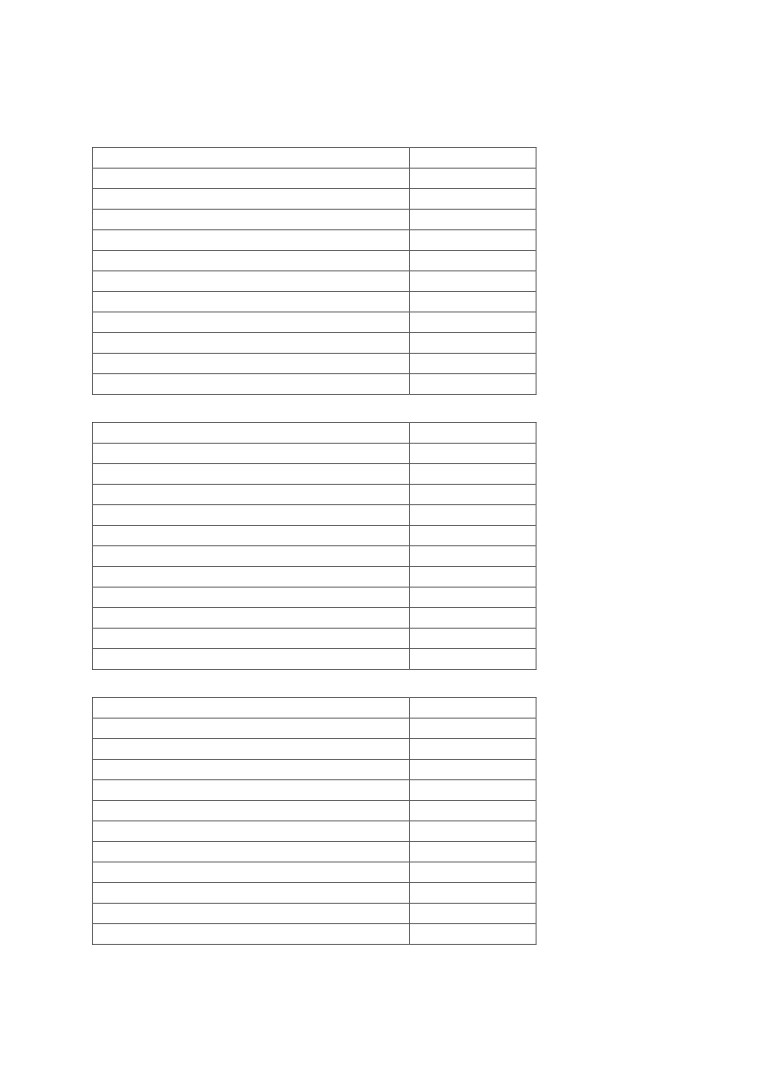

Actions from New Anglia LEP Board Meetings

Date

Item

Action

Update

Actioned

Target Date

By

24/02/2021

Gt Yarmouth O&M Campus

The LEP to produce details of alternative projects should the funds be released in the

A verbal update will be provided at the March Board meeting.

CS

Complete

future

24/02/2021

Enterprise Zone Accelerator Fund

CS to investigate the impact of state aid regulations on the proposed changes to the

The project was taken forward initially on the basis of a 50% investment

CS

Complete

- Norwich Research Park -

investment.

(£2.5m) for a 20 year return of c £2.4 to £2.6m. If the sale went ahead it

Confidential

would generate a shorter-term return to the LEP of c£3.6m. There should

be no aid or subsidy to the LEP as it is not acting as an

undertaking/economic actor and would put the funds back into its

revolving fund to disseminate according to its powers granted under

statue.

25/11/2020

Economic Recovery Restart Plan

Insolvency advice to be provided to the Growth Hub

Information has been provided to the Growth Hub

Complete

RW

Progress Report

23/09/2020

New Anglia Capital

Board members to consider putting themselves forward to join the NAC board

Kathy Atkinson was confirmed a member of the NAC Board on 23rd March

CS

Complete

23/05/2019

Growth Hub Presentation

Growth Hub Annual review to be circulated to the Board when published

This review will now take place early in 2021

CD

Apr-21

9

New Anglia Local Enterprise Partnership Board

Wednesday 31st March 2021

Agenda Item 6

Industry Council for Digital Tech - Progress Update Report

Author: Julian Munson

Presenters: Julian Munson/Neil Miles/Tim Robinson

Summary

This paper provides an update on the work of the Industry Council for Digital Tech, one of

the three industry councils set up by the LEP as formal LEP sub-boards to drive forward the

Norfolk and Suffolk Local Industrial Strategy.

Recommendations

The Board is invited to:

Note the contents of the paper and progress update by the Council for Digital Tech.

Background

In 2019 the LEP convened three Industry Councils to drive forward the aspirations of

the draft Local Industrial Strategy in the three strategic areas of energy, agri-food and ICT

digital. The Industry Council for Digital Tech (CDT) was established as a strategic

public/private sector partnership group to provide a focus for decision making and

leadership for the ICT digital sector. The CDT acts as the LEP’s sector group and provides

the strategic direction in delivering the aspiration to be recognised as a leading region for

digital technologies.

The members of the CDT are drawn from across the ICT business and education sector in

Norfolk and Suffolk and include representatives of businesses, academia and research,

Government and Chambers of Commerce, Tech Nation and other representatives from the

private sector. The Council was established in Summer 2019 and meets three or four

times a year. The Council is currently chaired by Neil Miles, co-founder and CEO of

Inawisdom, a leading AI and machine learning services business, recently acquired by

Cognizant. The CDT has been supported by Tech East.

Industry Council for Digital Tech: objectives and delivery

The CDT has developed a delivery plan which outlines a set of strategic objectives and

scope of work which support the delivery of the Economic Strategy and Local Industrial

Strategy.

1

11

The CDT has sub-groups focusing on key focus areas including digital skills, hubs/innovation

spaces, advocacy/policy, business intelligence and digital adoption. New Anglia LEP also

continues to work closely with Tech East, a key delivery partner, on a range of events and

activity to support the sector.

Key Achievements to date:

The Council for Digital Tech’s second year of operation has been characterized by a

strategic response to both short term factors relating to COVID-19 as well as progressing the

medium/long term interventions set out in the Local Industrial Strategy.

1. Boosting our innovation and growth capabilities

Ensuring that the region has a world-class offer for businesses, responsive to the ‘new

normal’ of working post COVID-19.

A successful collaborative bid, led jointly by the Council for Digital Tech (through the

Innovation Hubs task and finish group) and the LEP Innovation Board has resulted in

the new Connected Innovation project, achieving funding from both the Norfolk

Strategic Fund and the Suffolk Inclusive Growth Fund for the LEP to deliver the

project in partnership with Tech East

Towns Deal - the Council had consistently highlighted the need for a business-

centric Norwich tech hub - the bid was supported in July 2020 with success for

Norwich being announced in the Autumn. This will provide the city with a nexus for

digital business growth.

2. Policy influencing and advocacy

During the last 12 months the Council and its members have actively influenced UK

Government in developing new policies that respond the needs of the ICT/digital sector in

the region as well as providing a showcase for major new programmes that attract the

interest of decision makers beyond the region.

The ongoing influencing of HM Government regarding the offer and ask of the UK

and regional ICT/digital sector has been a priority and has involved both direct

influencing of DCMS and via the UK Tech Cluster Group (including the Recovery

Roadmap event and report) of which Tech East is a founding member. Our region’s

relationship with Tech Nation has strengthened (Thea Goodluck’s contribution to the

CDT should be noted). Members of the Council participated in the Tech Nation East

of England summit on 3 November 2020 and we have been consulted ahead of the

publication of the 2021 report and were given a preview on 11 March 2021

Government’s startup-focused Future Fund was announced by the Chancellor

(following input to UKTCG and Coadec in the planning stages)

Two major programmes and events have effectively spotlighted the region The Tech

East 100 was launched and delivered in September 2020, helping spotlight the

breadth and depth of ICT/digital businesses in the region. The inaugural AI Festival

(jointly led by BT and Orbital Media) was delivered with international speakers on 24-

25 February 2021

3. Enabling digital skills

Continuing to build capacity, capability and new pathways into the sector across multiple

partners, projects and programmes.

The four new major LEP funded capital projects are all progressing to address the

region’s digital skills shortage: Digitech Centre (University of Suffolk/BT), Digitech

Factory (City College Norwich), Digital Campus (Suffolk New College) and

2

12

Productivity East (UEA). The Council provides a home for collaborative discussion for

these and other programmes.

A bid was submitted to government in December 2020 for a New Anglia Institute of

Technology bid led by business and coordinated by the University of Suffolk,

supported by members of the Council.

New skills provisioning has advanced considerably in the last 12 months. A

successful bid for ESF funding for digital short courses at the University of Suffolk

was announced in February 2021 following the support of businesses and groups

represented on the Council. Bootcamps bids (via Department for Education) is being

actively encouraged - members of the Skills Group from the LEP, Norfolk County

Council, Suffolk County Council and Tech East have supported a potential joint bid

between QA Consulting and Netmatters in February 2021. Suffolk County Council is

developing a Virtual Work Experience (VWEX) pilot with support from members of

the Council. LEP/STEM Learning CPD events to provide Local Market Information for

schools careers leaders have been delivered on 2 and 9 Feb with speakers from BT

and Tech East.

The Institute of Coding/UK Tech Cluster Group digital skills audit was published in

February 2021 with strong levels of response from the East of England providing

fresh insight into the current and emerging digital skills needs of businesses.

4. Accelerating digital adoption

One of the most important challenges raised by COVID-19 has been how to effectively

support non-tech SMEs in adopting digital technology to help them restart and recover

working with trusted tech suppliers. A number of activities have taken place during the period

leading to increased awareness of digital opportunities within the region’s wider business

community. Each has been led by or supported by members of the Council for Digital Tech:

Events designed to enable SME digitization have been delivered including: Tourism

+ Tech conference; RISE! conference (food and drink sector); Deep dive events

following on from both Tourism + Tech and RISE! (the first on Search Engine

Optimisation and the second on Digital Content Marketing); Cybersecurity 101 and

the major Restart Festival

The Go Digital programme from Norfolk County Council offering SMEs the

opportunity for free advice and the possibility of accessing small grants to help them

with the costs of digitization.

Looking Ahead - role of the Council

The CDT is keen to further develop the Norfolk and Suffolk Unlimited digital/ICT narrative

and there are greater opportunities to work in partnership with the Inward Investment Team

and Growth Hub for targeted communication and development of investment propositions.

This builds on existing work with BT Adastral Park and DIT around promoting the High

potential Opportunity (HPO) for 5G and digitisation, as an example, which has scope to

benefit the wider area and help leverage international opportunities.

There is also greater scope, working with Tech East and other partners, to ensure that we

continue to profile our key strengths and competitive advantages. This might involve a

stronger focus on targeted events and business engagement activity. Once example might

be building on the success of the recent AI Festival, developed by BT and Orbital Media, and

supported by New Anglia LEP and others. This can help raise the profile of the area

nationally and internationally.

3

13

Further to this, work is required to develop stronger links across the other industry councils,

sector groups, innovation board and Skills Advisory Panel to ensure that we are fully

recognising the opportunity for digital adoption and innovation across industries as well as

understanding and responding to the needs of the sector with regards to future skills and

recruitment.

The governance and delivery structure for the CDT is currently under review to ensure that

there is full representation from across all parts of the sector, as well as opportunities for

contributions from Local Authority partners and other relevant organisations. One of the key

aims will be to ensure continuing business intelligence input from the sector into future

reports and LEP feedback to Government.

Finally the CDT is keen to identify and progress new activity in relation to the clean growth

agenda responding to latest Government plans and policies as well as those industry

challenges arising from the drive to net zero.

Recommendations

The Board is invited to:

Note the contents of the paper and progress update by the Council for Digital Tech.

4

14

New Anglia Local Enterprise Partnership Board

Wednesday 31st March 2021

Agenda Item 7

Norfolk and Suffolk Enterprise Zones: Strategic Plan 2021-26

Author: Julian Munson

Presenter: Julian Munson

Summary

This report provides a progress update on New Anglia Local Enterprise Partnership’s two

Enterprise Zones and presents a new Strategic Plan for 2021-26. The plan supports a

repositioning of our Enterprise Zones with a greater focus on innovation and clean growth to

help attract new investment and support economic recovery in our priority locations and

growth corridors.

Recommendation

The Board is asked to note progress and endorse the proposed Enterprise Zones Strategic

Plan 2021-26.

Background

Enterprise Zones have for many years been part of the UK Government’s wider plans for

growth to support businesses and enable economic prosperity in key areas. They have

established themselves as the driving force of many local economies as they unlock key

development sites, consolidate infrastructure, attract business and create jobs.

The New Anglia LEP area of Norfolk and Suffolk is home to two multi-site enterprise zones

which were awarded status in 2012 and 2016 respectively (with some site extensions in

2017). The two enterprise zones cover 16 commercial development sites which are all in

key priority locations as identified in the Economic Strategy for Norfolk and Suffolk. These

include the A11 and A14 Corridors (including Bury St Edmunds and Stowmarket), key

coastal zone locations such as Lowestoft and Great Yarmouth and King’s Lynn as well as

larger urban areas such as Greater Norwich and Ipswich and surrounding area.

Enterprise Zones are designated areas that previously have provided business rates

discounts of up to £275k over a five-year period to businesses if locating in the zones in the

first 5/6 years & simplified planning. Enterprise Zones have for many years been part of the

Government’s wider Industrial Strategy to support businesses and enable economic growth.

All business rates growth generated by Enterprise Zones is kept by the relevant LEP and

local authorities in the areas for 25 years to reinvest in local economic growth. This

1

15

compares with the normal arrangement where only half of the business rates is retained

locally in non EZ areas. The other half is paid to central Government.

The LEP and partners have adopted a successful approach regarding the use of the

retained business rates. Pot A which compensates local authorities for the income they

would have retained without and EZ, Pot B an investment fund to accelerate the growth in

the EZ site and Pot C which is retained by the LEP from the portion that would ordinarily

have gone to Government and is used to support growth projects across the LEP area which

support the delivery of the Economic Strategy and Local Industrial Strategy.

Across Norfolk and Suffolk, strong and effective partnerships between New Anglia LEP and

District and County Local Authorities have enabled reinvestment of retained rates income via

Pot B to help unlock commercial sites through new infrastructure as well as supporting

programmes across the wider LEP area through Pot C to assist businesses and supply

chains, boost innovation and enhance skills.

LEP programmes that have been able to be supported to date via Pot C include the

Innovative Projects Fund and the Enterprise Advisors Network, helping to deliver the aims

and aspirations of our Local Industrial Strategy and Economic Strategy.

It is timely to develop a new five-year strategic plan for Enterprise Zones for Norfolk and

Suffolk. The initial five-year business rates relief period closes at the end of March 2021 (for

Space to Innovate sites). There is a need to therefore review the delivery model for

Enterprise Zones as well as our strategic focus going forward.

Importantly our approach needs to reflect on emerging local and national priorities. This

includes Government plans in relation to clean growth/net zero, innovation, infrastructure

and internationalisation as well as recovery from Covid19 and a focus on levelling up.

To this extent, and with the new strategic plan repositioning our Enterprise Zones to help

drive new investment in infrastructure and enhancing net zero growth and innovation, this

presents an opportunity to help deliver the Government’s new Build Back Better: Our Plan

for Growth.

Enterprise Zones: Impact in Norfolk and Suffolk so far

New Anglia Enterprise Zones have boosted the economy in Norfolk and Suffolk focusing

development on 16 commercial sites in priority locations. We have demonstrated a

successful partnership approach between the LEP, County Councils with District Authorities

to deliver a strong place-based approach, unlocking commercial sites and supporting local

business expansion.

Our Enterprise Zones have;

boosted over 3,800 jobs,

supported over 180 businesses,

unlocked 116 ha of development land and

leveraged over £490 million of public and private sector investment.

The total business rates retained in Norfolk and Suffolk across all of the Enterprise Zone

sites (over their lifetime) is over £210 million with significant reinvestment into infrastructure

and marketing to help accelerate development.

The wider positive impact on the construction sector should also be recognised with over

3,500 construction jobs supported so far across the various Enterprise Zone commercial

developments. These include major commercial spaces and HQ’s constructed across a

2

16

number of sites including Futura Park and Princes Street (Ipswich), Eastern Enterprise Park

(Sproughton), Suffolk Park (Bury St Edmunds), Norwich Research Park (South Norfolk),

Ellough Enterprise Park (Beccles) and Beacon Park (Great Yarmouth).

A number of growing businesses and international inward investors have been supported

across the Norfolk and Suffolk Enterprise Zones. Examples include LDH La Doria, Amazon,

Treatt, MH Star, Unipart, Proserv, Leaf Systems, Birketts, Ijyi and Raptor Aerospace.

Key sectors identified for our Enterprise Zones include: agri-tech, food and health, offshore

energy, the green economy, ICT and digital creative sectors, professional services and

advanced engineering. These are all primarily sectors in which Norfolk and Suffolk has a

competitive advantage and align with the focus of our Economic Strategy and Local

Industrial Strategy.

Enterprise Zones have established themselves as a driving force of local economies as they

unlock key development sites, consolidate infrastructure, attract business and create jobs. In

light of recent impacts on Norfolk and Suffolk’s economy and key sectors from Covid19 and

EU transition, these sites present an opportunity to support economic recovery in key priority

locations. Some of these locations can be more economically fragile - coastal and rural

locations for example - and therefore investment in Enterprise Zones can assist where there

is market failure or levelling up is required.

New Enterprise Zone Strategic Plan 2021-26

The proposed plan aims to reposition Enterprise Zones to drive clean growth and innovation

as part of wider strategic investment zones. These areas align with the Priority Places within

the Norfolk and Suffolk Economic Strategy and importantly link Enterprise Zone sites,

innovation clusters and hubs, knowledge and transport assets in a more connected way.

This repositioning and a relaunch with new investment propositions and targeted marketing

will help to raise the profile of Enterprise Zones, unlocking further development potential and

attracting new investment, working with Inward Investment team and Growth Hub.

In terms of innovation, a number of major developments are planned on several Enterprise

Zone sites including new innovation and business centres which aim to accelerate business

growth in key higher value sectors as well as boosting innovative activity. Through this plan,

these centres will be connected into the wider innovation, science and research network to

help enhance the ecosystem of high growth, high value businesses across the wider area.

Clean Growth is the golden thread running through the Norfolk and Suffolk Local Industrial

Strategy and Enterprise Zones can play an important role in enhancing clean growth in the

future, underpinning our drive to net zero. This plan supports a number of activities and

projects aimed at repositioning Enterprise Zones for clean growth - through encouraging low

carbon, low impact developments, alternative local energy sources, supporting greener

business practices in key sectors and encouraging sustainable transport connectivity.

3

17

The overarching model for repositioning and delivering the Enterprise Zones 2021-26 is;

RENEW

Site Delivery

Plans

REVISE

REPACKAGE

Governance

Incentives &

&

Support

Partnerships

REPOSITION

FOR CLEAN

GROWTH AND

INNOVATION

RELAUNCH

RESEARCH

Marketing &

Assets &

Lead

Capabilities

Generation

REFRESH

Investment

Propositions

Measuring Success: Expected impacts for 2021-26

New commercial development activities are planned for many of the Enterprise Zone sites

across Norfolk and Suffolk for 2021-26. These projects include new business incubation

facilities, innovation centres and precincts, new industrial units, office and hotel

developments as well as infrastructure investments to support growth in key sectors such as

renewable energy, health and life sciences, agri-food and advanced manufacturing.

Local Site Delivery Plans are prepared for each of the Enterprise Zone sites which map out

key interventions, development pipelines and expected levels of investments.

With strong collaboration between New Anglia LEP, Local Authorities and private sector

partners, the following overall outputs are forecast over 2021-26 across all Enterprise Zone

sites:

3,377 Direct Jobs Created

972 Construction Jobs Supported

209 New Businesses Supported

37 Hectares of Land Developed

194,000 sq m of New Floorspace Created and 3,700 sq m Refurbished

£265 Million of Public Sector Capital Investment

£98.5 Million of Private Sector Capital Investment

£4.2 Million of Public and Private Sector Revenue Investment

Outputs will continue to be monitored and reported on a quarterly basis to MHCLG and New

Anglia LEP Board. Activity across the two Enterprise Zones is coordinated by two

partnership/development groups, chaired by New Anglia LEP, involving County and

District/Borough Council officers and MHCLG. There are strong governance and financial

processes in place as well as an experienced team based within the LEP.

Recommendation: The Board is asked to note progress and endorse the proposed

Enterprise Zones Strategic Plan 2021-26.

4

18

NORFOLK AND SUFFOLK ENTERPRISE ZONES

FIVE YEAR STRATEGIC PLAN (2021-26)

19

EXECUTIVE SUMMARY:

NORFOLK AND SUFFOLK ENTERPRISE ZONES - FIVE YEAR STRATEGIC PLAN (2021-26)

Introduction: Enterprise Zones - Norfolk and Suffolk

Enterprise Zones have for many years been part of the UK Government’s wider plans for

growth to support businesses and enable economic prosperity in key areas. They have

established themselves as the driving force of many local economies as they unlock key

development sites, consolidate infrastructure, attract business and create jobs.

The New Anglia LEP area of Norfolk and Suffolk is home to two multi-site enterprise zones

which were awarded status in 2012 and 2016 respectively. The two enterprise zones cover

16 commercial development sites which are all in key priority locations as identified in the

Economic Strategy for Norfolk and Suffolk. These include the A11 and A14 Corridors, key

coastal zone locations such as Lowestoft and Great Yarmouth and King’s Lynn as well as

larger urban areas such as Greater Norwich and Ipswich and surrounding area.

All business rates growth generated by Enterprise Zones is kept by the relevant LEP and

local authorities in the areas for 25 years to reinvest in local economic growth. Across

Norfolk and Suffolk, strong and effective partnerships between New Anglia LEP and District

and County Local Authorities have enabled reinvestment of retained rates income to help

unlock commercial sites through new infrastructure as well as supporting programmes

across the wider LEP area to assist businesses and supply chains, boost innovation and

enhance skills.

Enterprise Zones: Impact in Norfolk and Suffolk so far

• New Anglia Enterprise Zones have boosted the economy in Norfolk and Suffolk

focusing development on 16 commercial sites in priority locations

• Our Enterprise Zones have boosted over 3,800 jobs, supported over 180

businesses, unlocked 116 ha of development land and leveraged over £490

million of public and private sector investment

• The total business rates retained in Norfolk and Suffolk across all of the Enterprise

Zone sites over the lifetime is over £200 million with significant reinvestment into

infrastructure and marketing to help accelerate development

• New Anglia Enterprise Zones have demonstrated a successful partnership

approach between the LEP, County Councils with District Authorities to deliver a

strong place based approach, unlocking commercial sites and supporting business

expansion.

• A number of new commercial developments have been completed with major

commercial spaces and HQ’s constructed across a number of sites including Futura

20

Park and Princes Street (Ipswich), Eastern Enterprise Park (Sproughton), Suffolk

Park (Bury St Edmunds), Norwich Research Park (South Norfolk), Ellough Enterprise

Park (Beccles) and Beacon Park (Great Yarmouth)

• A number of growing businesses and international inward investors have been

supported across the Norfolk and Suffolk Enterprise Zones. Examples include LDH

La Doria, Amazon, Treatt, Unipart, Proserv, Leaf Expression Systems, Birketts, Ijyi,

Merxin, Lexhag and Raptor Aerospace.

• Enterprise Zones are an important source of revenue for the LEP with a proportion of

retained business rates income able to support the delivery of the Local Industrial

Strategy and Economic Strategy via key Norfolk and Suffolk wide initiatives and

programmes.

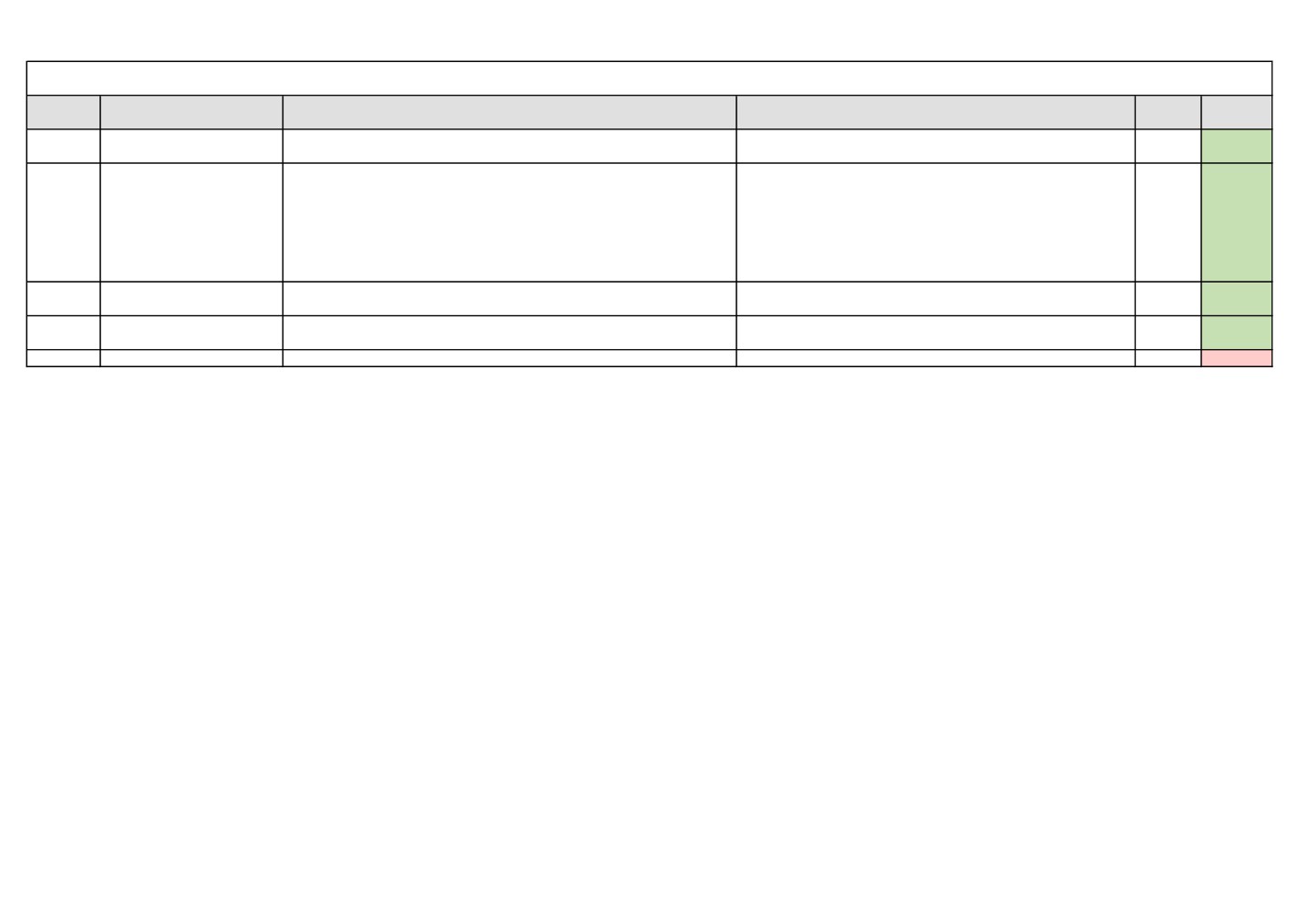

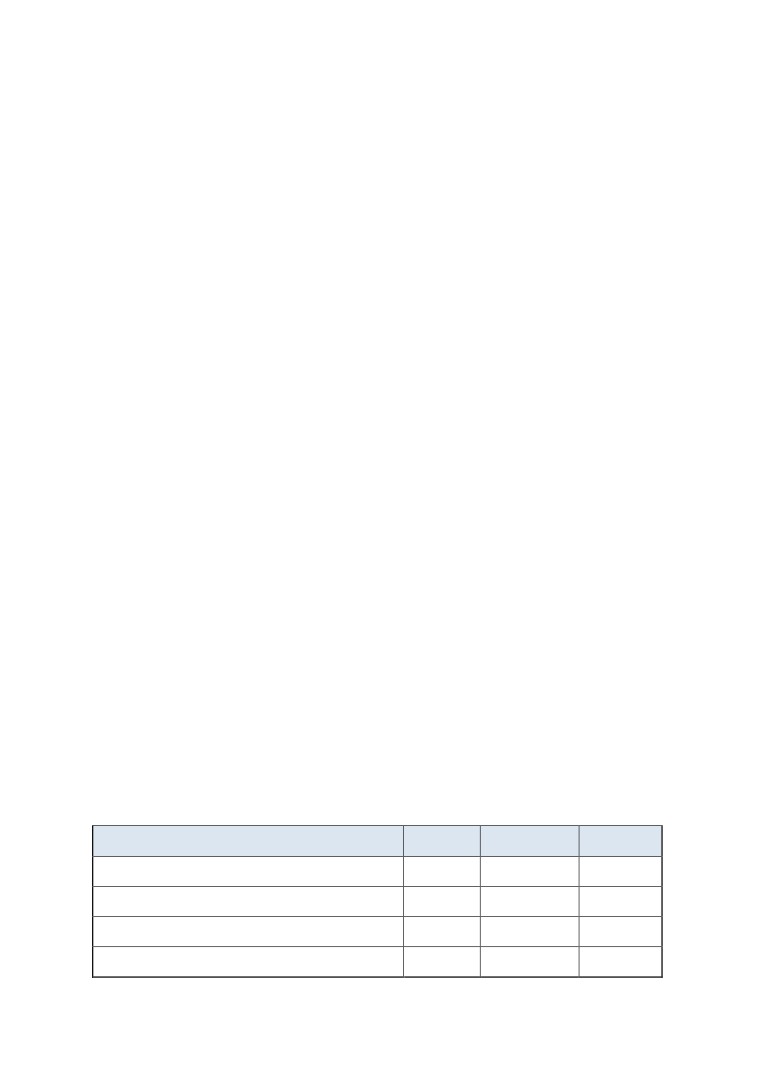

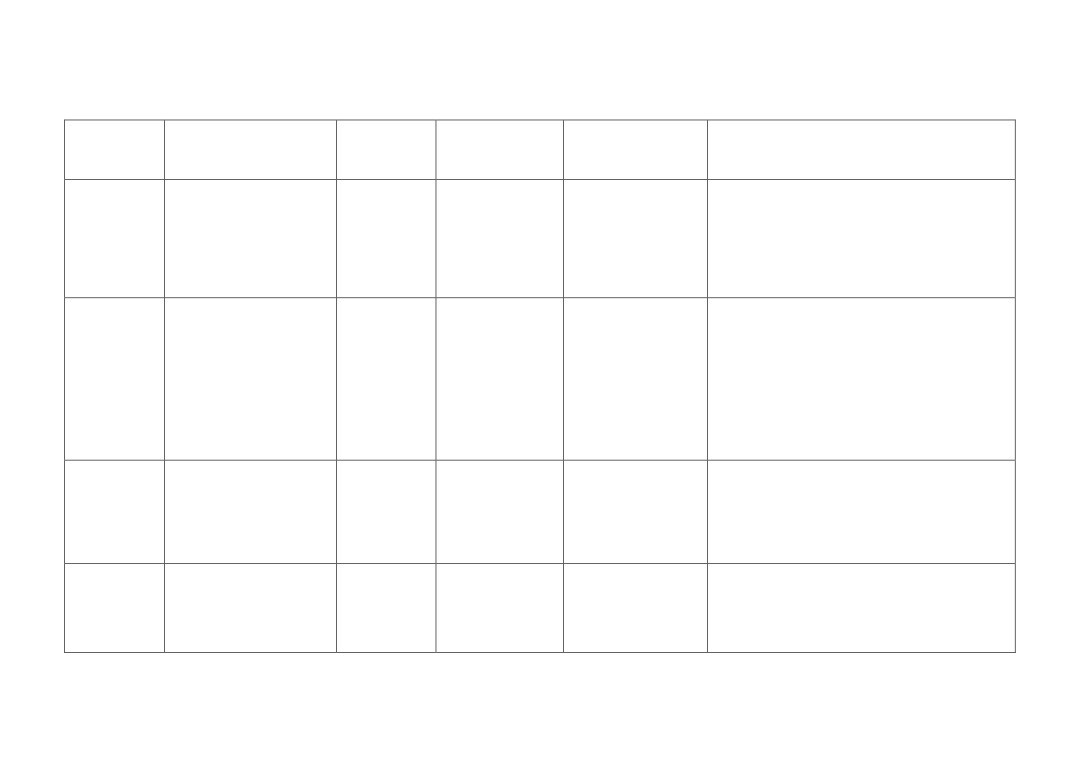

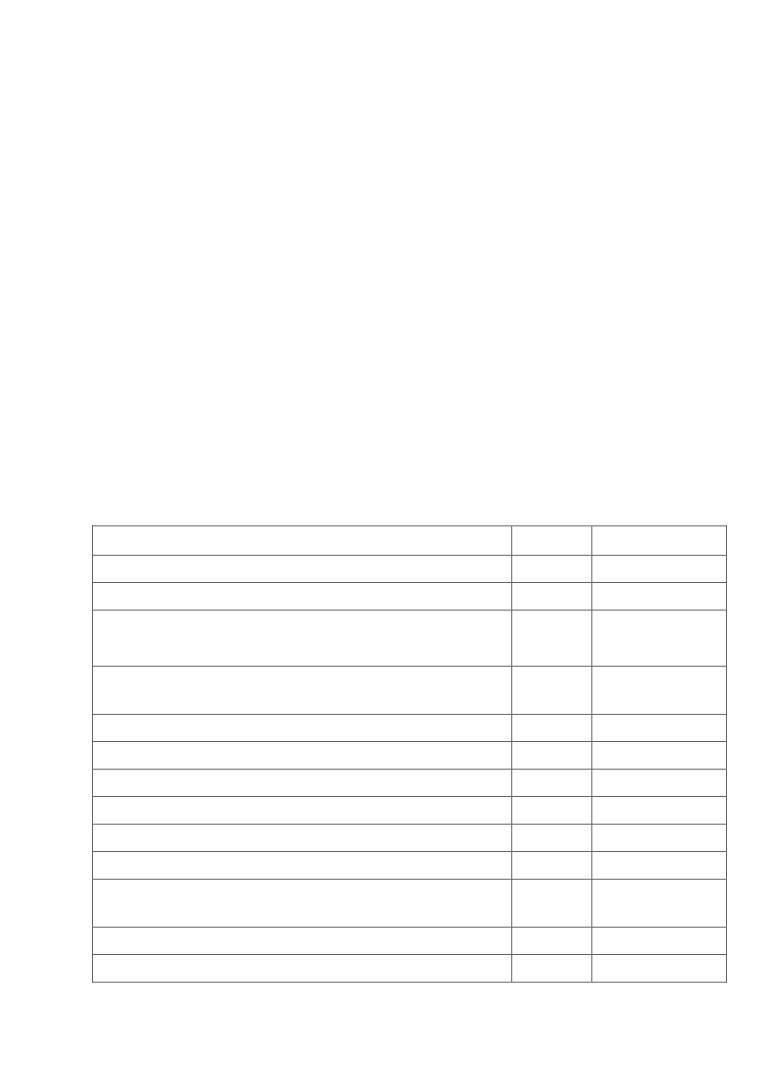

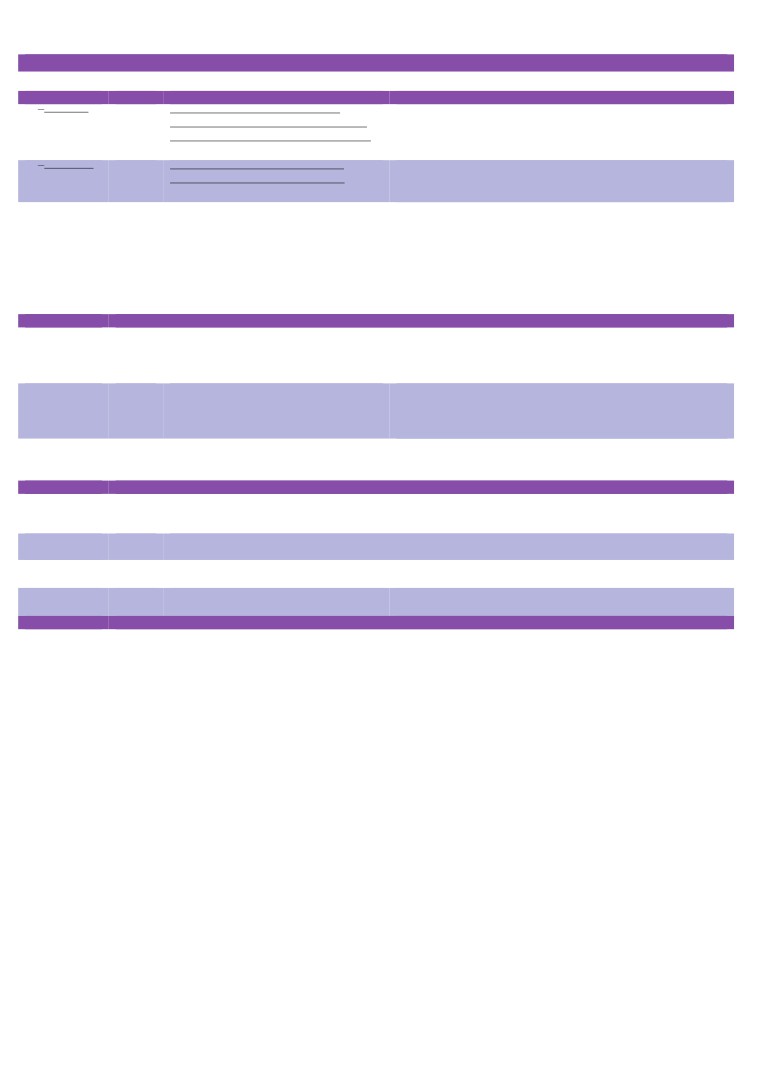

To the end of December 2020, the two enterprise zones have achieved the following

outcomes:

Private

Public

Land made

Enterprise

Jobs

Businesses

Construction

Floorspace

capital

capital

development

Zone

(net)

(net)

jobs

m2

investment

investment

ready (ha)

(£m)

(£m)

Gt

Yarmouth &

Lowestoft

1,937

74

806

32

55,355

51

178

2012

Space to

Innovate

1,927

112

2,809

84

133,488

109

153

2016

Total

3,864

186

3,615

116

188,843

160

331

21

Celebrating Success across Norfolk and Suffolk

Clockwise from top left: Eastern Gateway, Sproughton (LDH La Doria development), Scottow Enterprise Park (Aerial

view), Suffolk Park, Bury St Edmunds (Treatt HQ), Norwich Research Park (Quadram), Nar Ouse, King’s Lynn (KLIC)

Clockwise from top left: Beacon Park, Gorleston (Proserv HQ), Phoenix Enterprise Park, Lowestoft, Mobbs Way,

Lowestoft, Hornbill Business Park, Ellough, South Denes, Great Yarmouth (SeaJacks), Port of Great Yarmouth

22

The 2021-26 Plan: Repositioning Enterprise Zones for Clean Growth and Innovation

This strategic plan recognises and reports on the significant progress made so far but

importantly identifies new opportunities to not only support further commercial development

and investment but to help drive clean growth and boost innovation over the next five years.

This plan aims to reposition Enterprise Zones to drive clean growth and innovation as part of

wider strategic investment zones. These areas align with the Priority Places within the

Norfolk and Suffolk Economic Strategy and importantly link Enterprise Zone development

sites, innovation clusters and hubs, knowledge and transport assets in a more connected

way (and informed by Economic Recovery Plans).

This repositioning and a relaunch with targeted marketing will help to raise the profile of

Enterprise Zones, unlocking further development potential and attracting new investment.

A number of major strategic innovation projects are proposed for development on several

Enterprise Zone sites including new innovation precincts, incubators and business centres

which aim to accelerate business growth in key higher value sectors as well as boosting

innovative activity. Through this plan, these centres will be connected into the wider

innovation, science and research network to help enhance the ecosystem of high growth,

high value businesses across Norfolk and Suffolk.

Clean Growth is the golden thread running through the Norfolk and Suffolk Local Industrial

Strategy and Enterprise Zones can play an important role in enhancing clean growth in the

future, underpinning our drive to net zero. This plan supports a number of activities and

projects aimed at repositioning Enterprise Zones for clean growth - through encouraging low

carbon, low impact developments, alternative local energy sources, supporting greener

business practices in key sectors and encouraging sustainable transport connectivity.

The overarching model for repositioning and delivering the Enterprise Zones 2021-26 is

illustrated below;

RENEW

Site

Development

Plans

REVIEW

REPACKAGE

Governance

Incentives &

&

Support

Partnerships

REPOSITION FOR

CLEAN GROWTH

AND

INNOVATION

RELAUNCH

RESEARCH

Marketing &

Assets &

Lead

Capabilities

Generation

REFRESH

Investment

Propositions

23

Measuring Success: Expected impacts for 2021-26 - an overview

New commercial development activities are planned for most of the Enterprise Zone sites

across Norfolk and Suffolk for 2021-26. These projects include new business incubation

facilities, innovation centres and precincts, new industrial units, office and hotel

developments as well as infrastructure investments to support growth in key sectors such as

renewable energy, health and life sciences, agri-food and advanced manufacturing.

Local Site Development Plans are prepared for each of the Enterprise Zone sites which map

out key interventions, development pipelines and expected levels of investments.

With strong collaboration between New Anglia LEP, Local Authorities and private sector

partners, the following overall outputs are forecast over 2021-26 across all Enterprise Zone

sites:

•

3,377 Direct Jobs Created

•

972 Construction Jobs Supported

•

209 New Businesses Supported

•

37 Hectares of Land Developed

•

194,000 sq m of New Floorspace Created and 3,700 sq m Refurbished

•

£265 Million of Public Sector Capital Investment

•

£98.5 Million of Private Sector Capital Investment

•

£4.2 Million of Public and Private Sector Revenue Investment

24

THE DETAIL:

Our Enterprise Zones - Strategic Locations

SPACE TO INNOVATE ENTERPRISE ZONE: AN OVERVIEW

The Space to Innovate Enterprise Zone covers 10 sites across Norfolk and Suffolk. This

multi-site zone, established in 2016, has potential to help create up to 18,500 jobs over the

25-year lifespan with a focus on a range of higher value sectors such as agri-food, energy,

advanced engineering, professional services, digital ICT and logistics. The sites are;

Norwich Research Park - One of the largest single-site concentrations of research in food,

health and life sciences in Europe, Norwich Research Park has world-leading credentials to

secure the UK’s position as the global leader in these emerging multi-billion pound sectors.

Norwich urban zone. The site provides a unique offering for grow on space, a private high

voltage renewable electricity network and promises to be a strategic business location

across the East and the UK.

next-the-Sea, has the potential to support investment associated with the growing offshore

renewables sector off the North Norfolk Coast.

Nar Ouse Business Park, King’s Lynn - a 15 hectare site on the southern edge of the

town close to the A47, A10 and A17. The site is also home to the King’s Lynn Innovation

Centre (KLIC) which opened in June 2016.

25

Stowmarket (Gateway 14) - a 17 hectare Enterprise Zone which includes the existing Food

Enterprise Zone, located on the edge of the town. The main theme of the Park will be agri-

tech, food and health sectors as well as digital and media-based businesses. Note: This EZ

site is part of Gateway 14, a major development site which has now been designated as a

tax-free zone as part of the successful Freeport East bid.

Business Park, which is seeking to create a successful business environment for companies

in the digital and new media, food and agriculture and high value manufacturing clusters.

Greater Ipswich - a cluster of sites (listed below) to support the delivery of the newly

developed Ipswich Vision, the blueprint for the regeneration of the town:

Futura Park - a market-ready site in south east Ipswich with potential for up to 600,000 sq ft

of new build units in 44 acres of superb landscaping.

Princes Park St Office District - the Princes Street corridor connects the railway station

with the town centre and is a high priority area for employment growth in the Ipswich Vision.

Waterfront Island - The island site is an area of port land within the Ipswich Waterfront that

is bounded by the Wet Dock and the tidal river. Ipswich Waterfront is a major investment

area for the public and private sectors.

Sproughton (Eastern Gateway) - a 14 hectare site between the A14 and Sproughton

Road, in the Babergh district area. It provides excellent road links to the M25, Felixstowe

Port, Cambridge and the Midlands.

SPACE TO INNOVATE ENTERPRISE ZONE - PROGRESS UPDATE

Overall, the Space to Innovate Enterprise Zone is performing reasonably well against initial

5-year forecasts (to March 2021), although some of the ten EZ sites have seen limited

progress to date (Ipswich Island site, Egmere, King’s Lynn and Stowmarket) and this has

impacted on expected outcomes. For other sites there has been strong market demand and

significant investment or business expansion - examples include Scottow, Sproughton and

Ipswich (Princes St./Futura Park).

Although there has been excellent progress against targets for some indicators e.g.

floorspace and capital investment, the business and job numbers continue to lag behind the

initial 5-year targets to end March 2021. This is in part due to a higher number of smaller

businesses located on EZ sites than expected with lower job numbers per area.

For 2021 and beyond there are more positive signs for several of the larger sites including

Norwich Research Park, Gateway 14, Stowmarket (which is now designated as a Freeport

tax site and subject to further changes), Suffolk Park (Bury) and Nar Ouse (King’s Lynn).

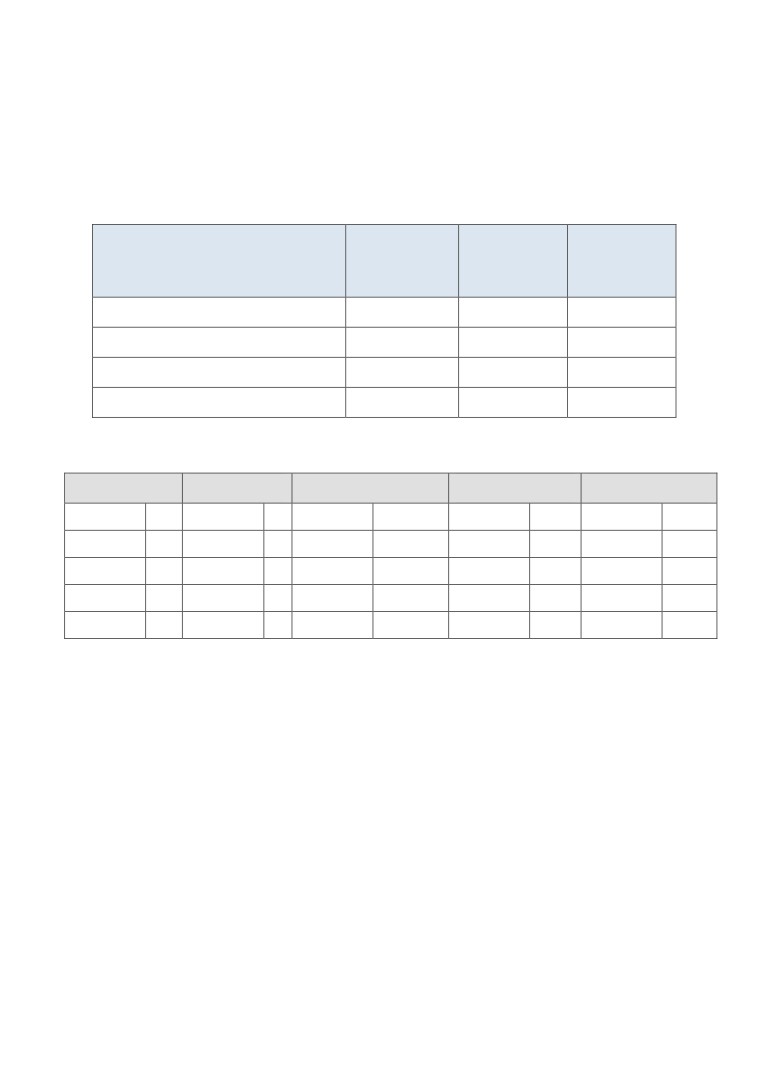

Space to Innovate outputs as at end of

Cume

Forecast to

Progress

December 2020

total

2021

(%)

1,927

4,833

Number of jobs in EZ (Net)

40

112

187

Number of businesses (Net)

60

109.4

80

Private sector capital investment (£m)

137

133,488

114,500

Floorspace - new and refurbished (m2)

117

26

GREAT YARMOUTH AND LOWESTOFT ENTERPRISE ZONE: AN OVERVIEW

There is £138 billion of capital investment in the East of England energy sector forecast by

2050. The Great Yarmouth and Lowestoft Enterprise Zone has been established to

maximise the opportunities in the growing sector, particularly focused on offshore

renewables and the wider energy supply chain.

The Enterprise Zone covers six sites in and around Great Yarmouth and Lowestoft. Its focus

is growing energy-related businesses and creating high skilled jobs. The sites are:

Yarmouth Energy Park. The site covers a large area of the Port of Great Yarmouth, including

the deep-water outer harbour. The site focuses on businesses associated with

decommissioning, nuclear and oil and gas exploration and offshore renewable energy.

Yarmouth focusing on the offshore energy sector. The site has good connections to the A12

and A143 roads and is a hub for global companies and SMEs on the All-Energy Coast.

Park provides 5.1ha of space with good access to the A12 and A146 routes. The location

offers a range of accommodation options for expanding SMEs in various sectors.

Lowestoft’s inner harbour. It sits next to the strategic A12 route and is home to high quality

office accommodation with a diverse sector focus.

the A12. The 20ha site offers a range of opportunities for growing SMEs in the energy

sector, supply chain and other industries.

Lowestoft. The site sits close to the key A146 route and provides a range of options for

growing businesses.

Note: Four of these sites (Beacon Park, South Denes, Mobbs Way and Riverside) were also

awarded extensions where benefits started in 2017.

GREAT YARMOUTH AND LOWESTOFT ENTERPRISE ZONE - PROGRESS UPDATE

The more established Great Yarmouth and Lowestoft Enterprise Zone has generally

performed well against initial targets, although job outputs continue to lag behind (as with

Space to Innovate). Indications are that we will be close to achieving targets across most

indicators, depending on impact of Covid19, particularly on the energy sector.

There has been strong performance for some of the 6 sites such as Ellough (with

construction of new units), Beacon Park (with high occupancy levels) but slower progress on

others such as South Lowestoft Industrial Estate. New investment from the growing offshore

wind sector present new opportunities for expansion of the supply chain. Additional

Government investment such as the Getting Building Fund for the proposed Great Yarmouth

Operations & Maintenance Campus and Towns Funds for both Great Yarmouth and

Lowestoft present new opportunities to enhance the Enterprise Zone sites in these areas.

27

The commitment by Government in the growing offshore renewable energy sector, through

the Energy White Paper and the 10-point plan for the Green Industrial Revolution with the

drive to Net Zero, will help to further strengthen the position of the Great Yarmouth and

Lowestoft Enterprise Zone with it’s primary focus on the energy sector. Existing and

emerging energy sector plans (Offshore Wind, North Sea Transition, Nuclear, Hydrogen etc)

continue to support and strengthen the wider energy sector supply chain, enabling

opportunities for local business expansion and attraction of new inward investment.

Great Yarmouth & Lowestoft outputs

Cumulative

Forecast to

Progress (%)

as at end of December 2020

total

2021

1,937

Number of jobs in EZ (Net)

2,970

65

74

81

Number of businesses (Net)

91

51.25

50

Private sector capital investment (£m)

103

55,355

Floorspace - new and refurbished (m2)

62,000

89

The Star Performers: Top 5 ranked sites across both Enterprise Zones*

Businesses

Private Capital

Public Capital

Jobs (net)

Floorspace m2

(net)

investment (£m)

Investment (£m)

Beacon Park

795

Scottow

70

Scottow

34,634

Suffolk Park

42.58

South Denes

126.15

Riverside

Road

757

Beacon Park

27

Sproughton

33,363

Sproughton

41.10

NRP

101.27

Princes St

490

Nar Ouse

18

Suffolk Park

33,123

Beacon Park

19.30

Beacon Park

25.55

Sproughton

420

Mobbs Way

16

Beacon Park

32,014

South Denes

14.15

Sproughton

14.63

South

NRP

416

Lowestoft

13

NRP

16,155

Futura Park

13.70

Princes St

12.07

*Figures to end of December 2020

Current Service Delivery by New Anglia LEP Enterprise Zone Team

Both Enterprise Zones in Norfolk and Suffolk (covering 16 sites) are serviced by New Anglia

LEP’s Enterprise Zone Team comprising Head of Enterprise Zones and Innovation,

Enterprise Zone Manager and Enterprise Zone Coordinator.

The Team provides a dedicated service working primarily with Local Authorities (economic

development, planning and finance officers) but also with landowners and developers. The

services provided are generally focused on operations and governance in relation to the

finance and legal aspects of the EZ sites as well as preparing quarterly reports to the LEP

Board, Government (MHCLG) and local authorities. This ensures a robust governance

model in place with an experienced team. The LEP also connects with the Growth Hub and

various business support programmes to ensure businesses receive a coordinated service.

The Enterprise Zone Team forms part of a wider team that is responsible for delivering a

range of sector development and innovation programmes including industry councils, sector

groups, Connected Innovation and the Cambridge-Norwich Tech Corridor activity. Additional

resourcing is planned from Q1 2021-22 to help support the enhanced delivery of these

activities and to provide further support for the delivery of the enterprise zones.

28

Enterprise Zones - Driving Economic Recovery and Growth

New Anglia LEP and local authority partners view Enterprise Zones as an important tool to

assist local economies recover from the impacts of Covid 19 and respond to any effects of

EU transition. They are a proven mechanism with structures in place and pipelines of

development to help drive inclusive growth in less resilient rural and coastal locations such

as Great Yarmouth, Lowestoft and King’s Lynn, supporting the levelling up agenda.

Sites in key urban commercial centres such as Ipswich and Norwich have also been

impacted by Covid19 where the commercial office market in particular has been hit.

Investment in these urban Enterprise Zones sites will be important to help boost confidence

in the commercial market.

The New Anglia LEP Enterprise Zone sites are all in key priority locations as identified in the

Economic Strategy for Norfolk and Suffolk including the A11 and A14 Corridors and key

coastal zone locations and supports inclusive growth across key urban and rural

communities.

Some of the New Anglia LEP EZ sites have been delayed by Covid19 with a slowdown in

the construction sector. Due to uncertainty over whether build contracts will be concluded as

originally planned this has affected business decisions or have delayed projects.

New Anglia LEP via the National LEP Network have encouraged the Government to

consider granting an extension to the rates relief period as this would have a significant

positive impact and will quickly enable development to restart on a number of key sites and

help boost confidence to the local business market as well as potential inward investors.

Enterprise Zones are a proven mechanism to leverage in private and public sector

investment and the levels have been considerable. Local Authorities are also able to use

the forecast rates expected as a way of supporting additional borrowing of finance to invest

in site servicing, infrastructure, property development and marketing. This investment is

often then a catalyst for opening up sites by funding infrastructure to service the sites making

them development ready as well as stimulating the market, through speculative

developments, and attracting new commercial investment from outside the area.

Enterprise Zones offer a unique opportunity of contributing to a construction led recovery

and boosting confidence in the market in areas which might be facing fragility in the local

economy or where there is market failure. In addition to the fiscal stimulus previously offered

via business rates relief, specific planning-based interventions such as Local Development

Orders are also often a tool used to ease the process for businesses and help encourage

development.

New Anglia LEP would also support the opportunity to boost the digital infrastructure to

connect enterprise zone sites, over and above the previous Government commitment of

superfast broadband. A commitment for roll out of 5G infrastructure and services for EZ sites

would provide an added incentive to help attract new businesses and investors and helps

strengthen the case for new investment in our network of innovation centres and precincts

across Norfolk and Suffolk.

29

Economic and Financial Benefits

In addition to the direct outcomes generated by the Norfolk and Suffolk Enterprise Zones,

including business and jobs growth, public and private sector investment and new

commercial land and floorspace developed, there are much wider economic benefits.

Within enterprise zones across England 100 per cent of the additional business rates

generated is retained locally until April 2038. This compares with just 50 per cent for all other

locations. In these locations the Government gets the other 50 per cent.

Within the New Anglia LEP Enterprise Zones the 100 per cent is split into four pots. Pots A1

and A2 which are retained by the relevant district and county council. Pot B which is used to

fund development of the site and Pot C is retained by the LEP to invest in wider projects.

Retention of business rates income by Local Authorities and the LEP have provided the

opportunity to invest in necessary infrastructure to help bring forward sites sooner. Often

there is market failure where the high, up-front investment costs required make sites

commercially unviable. The Enterprise Zones in Norfolk and Suffolk have enabled new

financial models where Local Authorities have been able to borrow and invest upfront to

effectively unlock sites. There is clear governance around this with legal agreements in place

signed by all partners to support business rates re-investment and site delivery.

Wider retention of business rates income by New Anglia LEP has enabled the reinvestment

into economic development and business support programmes. This has supported the

delivery of the Local Industrial Strategy and Economic Strategy with a range of projects and

initiatives across Norfolk and Suffolk. One example is the Innovative Projects Fund which

has enabled financial support for a number of economic development and innovation

projects across Norfolk and Suffolk, in turn helping to drive activity at the local level to boost

local economies.

A ‘construction led’ recovery from the effects of Covid19 and transition from the EU will be

important and Enterprise Zones have a wider economic multiplier effect beyond just the

direct investment and jobs. To date the New Anglia EZ sites have attracted around £160m of

private capital investment and £331m of public capital investment. This result is major new

developments with around 120 ha of development land and almost 189,000 square metres

of new floorspace. The positive impact on the construction sector should not be overlooked

with around 3,600 construction jobs supported over the past few years.

Appendix 3 (Confiential) provides a summary of the retained business rates income and forecasts.

Consideration has also been given to the potential areas of future risk, challenges as well as

opportunities. These may be as a result of macro-changes in the wider economy and their

potential impacts as well as changes to Government policies and plans which may also have

a direct or indirect effect on enterprise zone investments and future income.

A list of these possible risks and impacts are listed in Appendix 4.

30

Repositioning Enterprise Zones for Clean Growth and Innovation - the next five years

Driving Innovation and the Knowledge Economy

Enterprise Zones also have a proven track record in stimulating growth and investment in

key sectors and supply chains to encourage higher value job creation, innovation and clean

growth opportunities. Examples include life sciences and health at Norwich Research Park,

renewable energy at Great Yarmouth and Lowestoft and digital creative and professional

services in Ipswich.

Innovation has been a key focus of many of the sites across Norfolk and Suffolk and the

branding and marketing of sites helps encourage clustering and co-location of businesses

which, importantly, helps to strengthen local supply chains and local economies.

This new five-year strategic plan, strengthens the focus on innovation and the knowledge

economy and repositions all sites to encourage greater levels of innovative activity and

attraction of innovative businesses across a number of key sectors including energy,

advanced manufacturing, agri-food and digital ICT. Developing innovation clusters - both

on-site and in the wider local area - will not only enhance the positive identity of local areas

but will support the innovation eco-system and help boost productivity.

Strengthening links between Enterprise Zone sites and the growing network of innovation

centres and hubs across Norfolk and Suffolk is encouraged and the Connected Innovation

programme, launched in 2021 and led by the LEP with funding support from the Norfolk

Strategic Fund and Suffolk Inclusive Growth Investment Fund, will help support this

connectivity and present opportunities to target support for innovation across these localities.

The Enterprise Zones also form an important part of the international inward investment offer

as well and positioning sites in relation to key sectors and innovation assets will help profile

our strategic competitive advantages in a more compelling way. The EZ Delivery Plan

objectives link across to the inward investment workstreams (appendix 2).

Clean Growth and Net Zero

The Norfolk and Suffolk Local Industrial Strategy positions the area as the ‘UK’s Clean

Growth Region’. Norfolk and Suffolk is at the forefront of tackling the challenges and

opportunities of climate change. The area’s major strengths in energy generation and usage,

and high-tech sustainable agri-food, present major opportunities.

As global, national and local economies adapt to climate change and the transition to a zero-

carbon economy, Norfolk and Suffolk is taking action to bring together expertise and

emerging technologies across different disciplines and sector boundaries to provide new

solutions and clean growth opportunities.

“The Enterprise Zone sites across Norfolk and Suffolk present a range of opportunities to not only

support the clean growth agenda but play an increasingly important role in the drive towards net zero

and supporting sustainable development and inclusive growth. Through the 5-year strategic plan,

Norfolk and Suffolk Enterprise Zones can be repositioned as important sites for clean growth and

innovation with a range of interventions and support activity proposed”

- C-J Green, Chair, New Anglia LEP

31

There are three levels of potential intervention and support on Enterprise Zones;

1. Sustainable development and construction - influencing ‘green development’ with

local and sustainable power infrastructure, sustainable building materials, power and

water management/reuse, sustainable transport strategies and initiatives, green

demonstrator projects

2. Clean growth sectors: Focus and support for clean growth sectors including tailored

investment propositions targeting clean energy, agri-food and digital ICT

opportunities for specific sites

3. Sustainable business: Targeted support for businesses on EZ sites to enhance

sustainability credentials, lowering emissions and carbon footprint, boosting

environmental and economic sustainability of businesses

New Anglia LEP will work with a range of partners and networks, including the Clean Growth

Taskforce, to not only monitor and report on clean growth activity but encourage and support

new targeted activity to assist developers and businesses on enterprise zone sites.

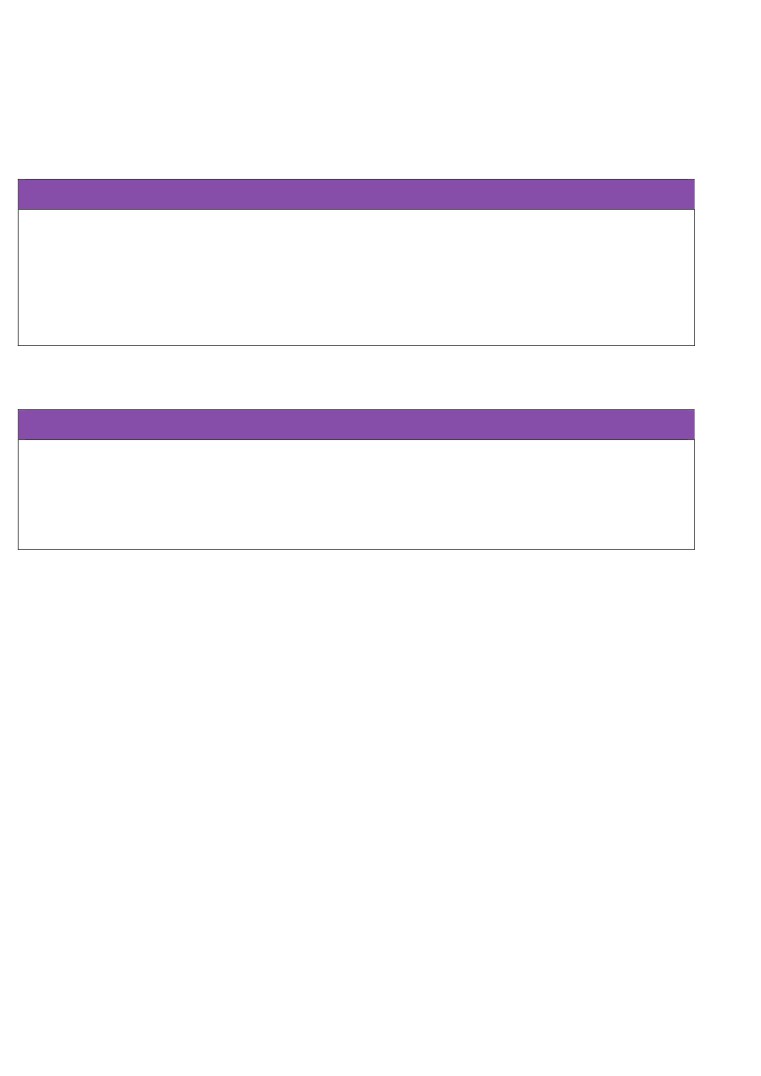

Strategic Delivery Model 2021-26

The graphic below illustrates the high-level model and seven areas of focus which form the

main delivery workstreams.

RENEW

Site

Development

Plans

REVIEW

REPACKAGE

Governance &

Incentives &

Partnerships

Support

REPOSITION FOR

CLEAN GROWTH

AND

INNOVATION

RELAUNCH

RESEARCH

Marketing &

Assets &

Lead

Capabilities

Generation

REFRESH

Investment

Propositions

What are we trying to achieve?

REPOSTION Enterprise Zones in Norfolk and Suffolk to drive clean growth and innovation

as part of wider strategic investment zones - linking development sites, innovation clusters

and hubs, knowledge and transport assets in a more connected way.

32

Why are we doing this?

To drive investment and innovation and accelerate clean growth development to boost jobs

in key locations.

Target outcomes by 2026 for both Enterprise Zones*;

•

3,377 direct jobs

•

209 businesses supported

•

Over 210,000 sq m of floorspace constructed and refurbished

•

Over £360 million of public and private investment*

*Appendix 1 provides more detail on target forecasts for both Enterprise Zones to 2026.

How will we deliver?

A separate delivery plan will be reviewed and updated annually. It includes a range of

actions and interventions that are delivered under the following seven workstreams;

1. Site Development Plans (Renew)

High Level Objective: Renew individual Site Development Plans (SDPs) for 2021-26 to

focus on key development objectives, development pipeline and targets.

This includes: A review of Site Development Plans (SDPs) for each EZ site with stronger

focus on attracting public and private sector investment to unlock development potential,

strengthening links with Town Investment Plans (Towns Fund) and other regeneration

plans/policies, sector plans etc and reflecting market demands post-Covid19, as required.

What does success look like: Each Enterprise Zone site has a clear plan in place with

development objectives, robust financial profiles and specific opportunities and challenges

identified to ensure each site reaches its’ maximum potential with clear and measurable

targets in place.

2. Incentives and Support (Repackage)

High Level Objective: Ensure that any incentives and support available for EZ based

businesses are clearly communicated to maximise opportunities for assistance and financial

support (in place of business rate relief)

What does success look like: Businesses located on Enterprise Zones are aware of

funding and business support opportunities and can access them. Support providers

understand the needs of the sector, help remove barriers and proactively target support

where required.

This includes: A packaging of incentives & support including business rate relief (where

possible), LEP grant support, Growth Deal, LA benefits plus additional information and data

e.g. supply chain contacts, staffing support (skills programmes), equity investors etc

3. Assets and Capabilities (Research)

High Level Objective: Identify and strengthen linkages between EZ sites and key assets

(innovation, skills and infrastructure) across the priority investment zones.

This includes: Researching and mapping locational assets, capabilities and supply chains

[working with Industry Councils, Innovation Board, SAP etc] - linking into supply chain

activity and major construction projects e.g. O&M campus, Sizewell C etc, and other

strategic opportunities such as Freeports and Freeport tax sites.

33

What does success look like: Norfolk and Suffolk Enterprise Zone sites have a stronger

profile and directly linked with the key infrastructure and innovation assets and skills

capabilities to help strengthen the business case around growth in key sectors.

4. Investment Propositions (Refresh)

High Level Objective: Develop clear and compelling investment propositions for EZ

sites/priority zones and ensure these are embedded within place and sector based inward

investment propositions or included within the LEP investment plan.

This includes: Refreshing investment propositions for the strategic investment zones and

specific sectors and locations (working with II Team, CNTC, LAs etc). Link to innovation

hubs (Connected Innovation programme) and digital infrastructure (5G etc) - to align with

Inward Investment delivery plan.

What does success look like: Norfolk and Suffolk Enterprise Zones have clear and

compelling investment propositions to maximise opportunities to attract investment

(public/private) and commercial leads. This activity aligns with and supports the Inward

Investment Plan workstreams highlighted in Appendix 2.

5. Marketing and Lead Generation (Relaunch)

High Level Objective: Develop clear and compelling campaigns and target potential

investors and businesses to increase lead generation and conversion.

This includes: Relaunching marketing activity and developing proactive marketing

campaigns targeting high growth businesses in close proximity to EZ sites (working with

Growth Hub) and potential inward investors (working with Invest East team etc). Use NSU

Commercial Property platform and potentially other digital and video marketing activity to

enhance communication and engagement

What does success look like: Increased proactive marketing activity generating higher

levels of business investment enquiries and an enhanced pipeline of leads for conversion.

6. Governance and Partnerships (Review)

High Level Objective: Ensure that there are robust and transparent governance and

financial arrangements in place with clear partnership legal agreements and reporting

mechanisms.

This includes: Reviewing governance arrangements and partnerships including updating

legal agreements, MOUs and reporting structures and partnership groups, in line with new

SDPs as required. Ensuring clear and transparent governance with robust financial and audit

processes in place.

What does success look like: Strong and robust governance and financial systems in

place with regular reporting and financial monitoring and auditing.

7. Clean Growth and Innovation (Reposition) - Cross cutting theme

High Level Objective: Understanding, supporting and developing the Clean Growth and

cross sector innovation ambitions and reposition Enterprise Zones in line with these.

What does success look like: Greater integration and interaction between the digital, agri-

food, clean energy (and other) sectors within Norfolk and Suffolk Enterprise Zones to

encourage clean growth and innovation to help drive investment in low carbon industries.

Cleaner, greener developments with renewable energy infrastructure on EZ sites.

34

Strategic Investment Zones

This five-year strategic plan has a focus on four main Strategic Investment Zones which

align with the Priority Place areas in the Norfolk and Suffolk Economic Strategy:

A14 Corridor - major strategic transport corridor connecting the Port of Felixstowe through

to Cambridge and the midlands. This growth corridor presents major opportunities for

economic growth across a number of sectors including logistics, digital ICT, professional

services, agri-food and advanced manufacturing. Six of the ten Space to Innovate EZ sites

are located along the A14 Corridor covering Ipswich, Sproughton, Stowmarket and Bury St

Edmunds. Freeport East is expected to have a strong, positive impact on growth.

Cambridge-Norwich Tech Corridor - growth corridor connecting the main Norwich and

Cambridge science and technology clusters with a range of locations along the A11

transport corridor highlighted for growth. EZ sites included are Norwich Research Park,

Scottow, Bury St Edmunds and Haverhill (part of the Cambridgeshire EZ) with a focus on

higher value tech-based activity in key sectors such as digital ICT, life sciences, agri-tech

and advanced engineering.

Norfolk and Suffolk Energy Coast - With up to £138 billion of capital investment forecast

in the East of England by 2050 from the future growth of the energy sector, a number of EZ

sites are strategically positioned to capture new commercial development and ancillary

support and supply chain activity. Locations include Great Yarmouth port (with the proposed

development of a new Operations and Maintenance base and business centre), Beacon

Park, South Lowestoft Industrial Estate and Ellough business park.

King’s Lynn-Cambridge Corridor - a growth area for new residential and commercial

development with significant investment planned to support economic, education and skills

development. Enterprise Zone sites include the Nar Ouse regeneration area on the outskirts

of King’s Lynn, home to the King’s Lynn Innovation Centre (KLIC), and with new commercial

developments planned for 2021-22 and beyond. Other EZ sites (Cambridge Compass sites)

included in this growth corridor include Ely and the Cambridge Research Park.

Site Development Plans

Each district local authority is responsible for working with the LEP, County Council and

private sector partners to develop Site Development Plans (SDPs) which are reviewed and

updated on a regular basis. These plans not only reflect local investment priorities, but they

set out the high level aims and objectives for each EZ site. They also recognise any barriers

for development and opportunities for new investment to help unlock growth.

New Anglia LEP has worked closely with local authorities on developing the new SDPs

which importantly highlight the key development projects in the pipeline and main

interventions. These projects are reflected in this plan and local authorities were consulted

with individually and via the EZ partnership group meetings as part of the process of creating

this overall EZ strategic plan for 2021-26 with final sign off by the New Anglia LEP Board.

The following table provides an overview of the Strategic Investment Zones which link the

Enterprise Zone sites with high value clusters and locational assets (sectors/clusters,

transport, infrastructure, skills, innovation etc) and planned investments and interventions on

the Enterprise Zone sites highlighted from the SDPs.

35

Strategic

Enterprise Zone Sites

Key clusters/

Key Assets

Innovation Assets

Enterprise Zone Major Development Projects

Investment

sector focus

(Transport,

(Hubs and Centres)

and Planned Interventions (Highlights from Site

Zone (Priority

Infrastructure &

Development Plans)

Place)

Knowledge)

Cambridge

Scottow Enterprise Park

Life sciences,

Norwich Airport,

Norwich Research

Norwich Tech

agri-food,

UEA, NUA, WSC,

Park, Norwich Digital

Norwich Research Park: New additional commercial

Corridor

Norwich Research Park

health, ICT,

Cambridge

Hub (planned), Hethel

space and hotel development

advanced

University &

Innovation, Scottow

Suffolk Park (Bury)

engineering,

Science Parks

Enterprise Park, Food

Scottow Enterprise Park - New build expansion and

creative

Innovation Centre

gateway site development

Haverhill Research Park*

(planned), Haverhill

EpiCentre, Bradfield

A14 Corridor

Suffolk Park (Bury)

ICT, Logistics

Ports of Felixstowe

Adastral Park, Ipswich

Suffolk Park - Progress development of new

and

and Harwich (+ new

Waterfront Innovation

commercial units plus build out of EZ site

Gateway 14 (Stowmarket)

distribution,

Freeport zone),

Centre, Stowmarket

Agri-food,

University of

Innovation Labs,

Gateway 14 - Development of new innovation

Eastern Gateway

advanced

Suffolk, West

Gateway 14 innovation

precinct and logistics operations (Freeport East)

(Sproughton)

manufacturing,

Suffolk College

park (planned)

professional

Eastern Gateway - Attraction of major occupiers for

Ipswich sites; Futura Park,

services

at least two further logistics developments

Princes Street & Waterfront

Site

Princes St, Ipswich - Development of multistorey

car park, hotel and office precinct

Norfolk and

Great Yarmouth &

Energy &

Ports at Great

Orbis Energy, CEFAS,

Great Yarmouth - Development of O&M Campus at

Suffolk

Lowestoft sites;

Energy Supply

Yarmouth,

GY Energy Business

Port of GY and new energy business incubator

Energy Coast

Beacon Park (GY), South