New Anglia Local Enterprise Partnership Board Meeting

Wednesday 27th January 2021

10.00 - 12.30pm

Via MS Teams

Agenda

No.

Item

1.

Welcome from the Chair

2.

Presentation from Ian Whitehead, Lane Farm

3.

Apologies

4.

Declarations of Interest

5.

Actions / Minutes from the last meeting

Strategic

6.

2021 LEP Strategic Priorities

For Approval

7.

Trade and Cooperation Agreement Between the EU and the UK

Update

BREAK - 15 Mins

Strategic

8.

Agri-Food Industry Council Report

Update

Operational

9.

Chief Executive’s Report - including confidential items

Update

10.

Connected Innovation

Update

11.

New Anglia Capital Report - Confidential

Update

12.

January Performance Reports - including a confidential report

Update

13.

Quarterly Management Accounts - with confidential appendices

Update

14.

Board Forward Plan

Update

15.

Any Other Business

1

New Anglia Board Meeting Minutes (Unconfirmed)

25th November 2020

Present:

Kathy Atkinson (KA)

Kettle Foods

Sam Chapman-Allen (SC)

Breckland Council

David Ellesmere (DE)

Ipswich Borough Council

C-J Green (CJG)

Brave Goose

John Griffiths (JG)

West Suffolk Council

Matthew Hicks (MH)

Suffolk County Council

Pete Joyner (PJ)

Shorthose Russell

Dominic Keen (DK)

Britbots

Helen Langton (HL)

University of Suffolk

Steve Oliver (SO)

MLM Group

Corrienne Peasgood (CP)

Norwich City College

Andrew Proctor (AP)

Norfolk County Council

Alan Waters (AW)

Norwich City Council

Jeanette Wheeler (JW)

Birketts

Attendees

Dan Greeves (DG)

Pegasus Welfare Solutions - For Item 2

Sian Lloyd (SL)

BEIS

Jai Raithatha (JR)

Suffolk County Council

Vince Muspratt (VM)

Norfolk County Council

Chris Starkie (CS)

New Anglia LEP

Rosanne Wijnberg (RW)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

1

3

Actions from the meeting: (25.11.20)

Economic Recovery Restart Plan Progress Report

Sources of visitors to the vacancy page on the New Anglia Web site to be circulated

CS

Insolvency advice to be provided to the Growth Hub

RW

1

Welcome from the Chair

CJ Green (CJG) thanked everyone for joining noting that the second lockdown will have caused

additional pressures on some sectors.

2

Presentation from Dan Greeves, CEO of Pegasus Welfare Solutions

CJG welcomed Dan Greeves (DG), CEO of Pegasus Welfare Solutions which received £25,400 from

the Business Resilience and Recovery Scheme to support the development of sanitary units for

companies working offshore.

DG provided the board on the background to the company highlighting its aims of attracting more

women into the offshore wind industry and increasing productivity.

The board learnt that all units are constructed in Norfolk with extensive use of the local supply chain

and DG thanked the LEP for the financial support it had provided which allowed the company to

develop and launch a new unit. This is a world first and allows self-contained toilets to be fitted into

wind turbines and enquiries have already been received from 5 of the 6 main developers in the UK.

DG confirmed that the LEP support had been game-changing and had given the company the

confidence to relocate to new premises allowing take on 3 more staff and expand the product line.

Benefits had also been received from the media promotion provided by the LEP.

DG advised that the next stage was development of data collection on the units which will reduce the

need for site visits with large cost saving implications. He confirmed that they were also linking up with

other companies on the new site and worked closely with the UEA to reach staff with the required

skills.

CJG thanked DG for his presentation and he left the meeting.

3

Apologies

Apologies were received from Claire Cullens, Johnathan Reynolds and Tim Whitley.

4

Declarations of Interest

None

5

Actions/Minutes from the last Meeting

The minutes were accepted as a true record of the meeting held on 21st October 2020.

6

Inward Investment Delivery Plan

Chris Starkie (CS) presented the paper highlighting the team’s partnership working with

colleagues across Norfolk and Suffolk and recent successes including the purchase of the

Philips Avent site in Sudbury by GCB.

Jeanette Wheeler (JW) noted that following the recent ministerial roundtable proposed linking

with colleagues from the OxCam arc to investigate companies looking to expand outside that

area and that the team could investigate the opportunities his presented.

CS agreed and confirmed that the team work closely with partners from local authorities,

universities and the Department of Trade.

CS reviewed the six workstreams through which the team delivers:

Identification of market need

Identification of market offer

2

4

Communicating/promoting the market offer

Partnership development

Support retention, development, and expansion of existing local businesses

Systems development/management

The meeting discussed the rationale for GCB’s investment and which including offering an

existing building rather than a new build.

CS confirmed that the Norfolk & Suffolk Unlimited (NSU) site included a property index and

agreed that having details of those properties available for repurposing would be beneficial as

this region did not always have the funding available to support new builds as in other areas.

Andrew Proctor (AP) noted the difficulty in setting targets for inward investment and asked if

the offshore wind investment should be highlighted given the importance of the sector for the

region.

CS agreed that it was challenging to set KPIs in the current climate but confirmed that these

would be developed during 2021.

Pete Joyner (PJ) asked whether there was evidence that the NSU brand was helping in

bringing in enquiries. CS advised that it was difficult to ascertain whether this was the sole

factor but agreed that it helped in raising the profile of the region and to position it alongside

the offers from the other regions.

CS noted that the NSU brand had been very well received by the DIT and provided them with

a simple and precise image of the area had supported them around the world.

The Board agreed:

To note the content of the report

To endorse the proposed Inward Investment Delivery Plan

7

Economic Recovery Restart Plan Progress Report

CS presented the progress report which has been designed to sit alongside the original plan

and included updates on the major programmes and successes.

CJG asked if there was any evidence on the sources of visitors to the site. CS confirmed that

work was being done to trace sources and this would be shared to board members.

ACTION: Sources of visitors to the vacancy page on the New Anglia Web site to be circulated

CS

JW proposed providing information to anyone facing redundancy due to insolvency and

suggested compiling a fact sheet to signpost to further support.

CS noted that work was ongoing to scale up local support, support start ups and also support

companies facing insolvency and agreed that Government support has kept insolvency rates

low at the current time but were likely to increase in 2021.

ACTION: Insolvency advice to be provided to the Growth Hub

RW

PJ asked if any sectors were being prioritised for support. CS advised that challenge was to

help those sectors not normally supported such as retail but that the LEP was considering all

areas funding being provided by Government and by all partners and is therefore focussing

on those sectors who have not received any support.

SO asked if other sub-boards were adjusting future plans to account for the plan. CS

confirmed that this was the aim and he was aware that the Innovation Board and Cultural

Board were doing so.

The Board agreed:

To note the content of the report

To note the progress that has been made against the interventions in the Economic

Recovery Restart Plan and approve its publication

3

5

8

EU Exit / End of Transition Period Report - Confidential

The Board agreed:

To note the content of the report

9

Chief Executive’s Report

CS highlighted key items in the Chief Executive’s report including the open letter sent to

Prime Minister in response to the Ten Point Green Recovery plan and the Peer to Peer

Network which is proving successful with over 70 business included so far most of which are

new engagements.

CS presented the video produced by the LEP highlighted 3 of the companies which had

received BR&R grants and the impact that the grant had made.

CS noted that the recent ministerial roundtable had again proved successful and confirmed

that Government are keen to do more.

JW noted that these provided an opportunity to pitch directly to Government and the LEP

should exploit this opportunity at any future ones.

The Board agreed:

To note the content of the report

10

November Performance Reports

Rosanne Wijnberg (RW) presented the reports to the Board and highlighted key items.

Growth Deal - RW noted that the pandemic has caused delays for some projects therefore

delivery and spend are rated amber. Outputs remain green as it is anticipated they will be

met. A rollover of around £18m is predicted.

RW explained the approach for relocating funding if not spent by individual projects.

The meeting reviewed the programme dashboards.

Helen Langton (HL) noted the significant impact of the pandemic on apprenticeships and

noted that these would not be recover until 2022.

The Board agreed:

To note the content of the reports

To approve the Growth Deal dashboard

11

Board Forward Plan

RW presented the board forward plan and asked for any requests to further items to be

submitted to Helen Wilton.

The Board agreed:

To note the content of the plan

4

6

12

Any Other Business

CS advised that he would be receiving a briefing on the Comprehensive Spending Review at

the end of the day and he would be circulate this to board members.

5

7

Actions from New Anglia LEP Board Meetings

Date

Item

Action

Update

Actioned

Target Date

By

25/11/2020

Economic Recovery Restart Plan

Details will be provided at the January Board meeting.

CS

Complete

Sources of visitors to the vacancy page on the New Anglia Web site to be circulated

Progress Report

25/11/2020

Economic Recovery Restart Plan

Insolvency advice to be provided to the Growth Hub

RW has contacted Jeanette Wheeler to discuss further - work in progress

RW

Feb-21

Progress Report

23/09/2020

New Anglia Capital

Board members to consider putting themselves forward to join the NAC board

Kathy Atkinson has offered to join the NAC Board and has been invited to

CS

Mar-21

meet the NAC directors at the NAC Board meeting in March.

23/05/2019

Growth Hub Presentation

Growth Hub Annual review to be circulated to the Board when published

This review will now take place early in 2021

CD

Apr-21

9

New Anglia Local Enterprise Partnership Board

Wednesday 27th January 2021

Agenda Item 7

Trade and Cooperation Agreement Between the EU and the UK

Author: James Allen. Presenter: Chris Starkie.

Summary

This report is an executive summary of the report on the Trade and Cooperation Agreement

struck between the EU and the UK detailing the contents of the deal, potential implications for

sectors, potential economic impact, emerging intelligence and LEP activity.

Please see Appendix A for the full report

Recommendations

The Board is asked to note the contents of the report.

Background

The UK and EU successfully negotiated the Trade and Cooperation Agreement on 24th

December, which was ratified on 30th December ahead of the end of the transition period on

31st December. This agreement is accompanied by a series of political declarations and

agreements over nuclear and security cooperation. There are commitments for further deals

and announcements in the coming months and years - with a focus on services, financial

services equivalence and data adequacy all announced.

Contents of the deal:

The deal secures zero tariffs and quotas on goods traded between the UK and EU; however

businesses must meet the new ‘rules of origin’ requirements in order to qualify.

Both sides have committed to keep talking to improve access for services. For now, businesses

offering services, such as banking, architecture, and accounting, will lose their automatic right

of access to EU markets and will face some restrictions. Rather than following one set of rules

for the whole of the EU, UK businesses will need to comply with the regulations in each

individual country. There will no longer be automatic recognition of professional qualifications

for people such as doctors, chefs, and architects. It will be harder for people with qualifications

gained in the UK to sell their services in the EU. Individuals will need to check each country's

rules to make sure their qualification is still recognised.

A temporary arrangement has been put in place to allow data to continue being transferred

from the EU to the UK from 1 January. This will initially last for four months (extendable to six

months) while the Commission makes its adequacy decision.

The full report provides additional details around the new immigration system for all non-UK

nationals; the phased approach for the Border Operating Model; what has been agreed on the

environment and climate change; and how state aid is affected.

1

11

Sectoral implications:

The full report breaks down what we know about the deal and intelligence across sectors about

how it is likely to affect agri-food; energy; ICT/digital; financial services; manufacturing; health

and social care; logistics; aviation; creative industries; and fisheries.

Potential economic impact:

In MetroDynamics’ January 2020 report, their assumption was that if a deal were secured,

Norfolk and Suffolk’s GDP would face an average reduction of 4% by 2030 and the UK an

average reduction of 3.5%. We believe that this impact upon the economy is still likely to

remain true.

At this current moment in time, it is very difficult to say what the combined impact will be of the

deal and the Covid-19 pandemic.

Emerging issues:

Examples of issues that have emerged so far:

It is vital for a wide range of sectors that the Commission provides a positive data

adequacy decision. If this is not granted, data will be exchanged based on individual

international transfer rules. At the moment as both the UK and EU have similar rules

based on the GDPR there are clearly defined processes for transferring data requiring

the use of appropriate safeguards, such as standard contractual clauses (SCCs) or

Binding Corporate Rules (BCRs).

There is a phased approach in the Border Operating Model. The full impact is still yet to

come. Stockpiling ahead of the end of the transition period and Christmas has lightened

the load so far, while concern over new procedures and requirements for Covid tests

have made some companies reluctant to send trucks right now.

Companies from the retail, delivery and chilled transport and storage sectors have

highlighted emerging problems at the border regardless of the traffic being relatively

low. We will continue to monitor how companies fare with the new phased-in border

operating model.

Some sectors, such as retail and food and drink, have raised concerns around the rules

of origin chapter given how interdependent supply chains are. Under the deal,

businesses could face tariffs on goods imported from the continent for processing at

British distribution hubs which are then re-exported to member states. For example,

Marks and Spencer have highlighted concerns around Percy Pigs which are

manufactured in Germany, brought to the UK before then being re-exported to M&S

stores in the EU - Ireland, France and Czech Republic as this journey would now face

tariffs.

The current provisions around services could throw up challenges for service providers

to the EU with mutual recognition of professional qualifications potentially on a country-

by-country basis and financial services awaits further details around equivalency.

There are fears the clauses around ease of movement in the EU (90 in 180 days) will

severely curtail the ability of performers to go on tour in Europe and will hamper the

recovery of the arts and creative sector after the devastating impact of the pandemic.

Pig farmers have highlighted the impact on the cull sow trade - whose main customers

are in Germany for cured meat and salami - as UK slaughterhouses are currently not

buying former breeding sows due to fears over the cost of sending shipments which

could be rejected. UK supermarkets do not have sow meats in their sausages. There

are concerns that they might be squeezed out of their well-established trading

partnerships in Germany.

Cycle shops have highlighted that shipping costs are through the roof. Some of their

bicycle suppliers are based in Europe - the likes of Bianchi and Ridley - but they are

either suspending shipping until the middle of January, when more is known about how

the new tariffs will work or factoring in 5% to 10% price increases to cover the extra

costs. Anticipating massive shortages of bicycles later in the year.

2

12

The EU Settlement Scheme ends on 30 June 2021 for EEA nationals (and their

families) working in the UK up until 31 December 2020. Many workers are furloughed

who need to fill this information in, so there could be challenges.

Many firms had delayed considering issues until the dust had settled on this issue but

have now been hit by the fallout from the Covid-19 pandemic. There will be some

unknown issues (opportunities and challenges) that were not foreseen, and these will be

monitored as they come through.

LEP activity:

Communications

The LEP is regularly updating its business script for 80 recipients across the LEP, Growth Hub,

local authorities, and other business support organisations, which includes the most up to date

technical notices and guidance for businesses following the deal and offers a local flavour for

conversations. The business-facing information from the script is also on the LEP’s EU exit

website and social media pages, including details of upcoming local and national webinars.

Growth Hub Support

The Growth Hub continues to run, collectively with partners in our Ox-Cam Arc Growth Hub

cluster, a series of webinars for businesses which continue to March 2021, providing

businesses with updates on key issues. Events held so far have reached c.40 businesses at a

time on issues such as the new trading landscape; importing and exporting; border changes;

developing overseas markets; and effective supply chain management.

In comparison to Covid-19, business enquiries to the Growth Hub have been very low in recent

weeks. We expect to see this demand increase significantly in the coming weeks and months

now that the trading relationship with the EU has been established and businesses seek local

guidance and support.

BEIS funding was secured at the end of 2020 for the delivery of outbound telephone and email

contact with businesses. New Anglia LEP undertook a tendering process to outsource the

delivery of this work and V4 Services have been appointed. Under the contract, they will

contact and proactively engage with at least 3,500 business across Norfolk and Suffolk. To

count as an output, the support must last at least ten minutes and provide the business with EU

Exit help and advice. They will also provide specialist advice to at least 100 businesses. To

count as an output, the specialist advice must be of at least three hours in duration.

In terms of operation, V4 Services will target SMEs that are more likely to be impacted by the

UK leaving the EU, through a rolling target list of SMEs to contact each week. The service will

also be used by the Growth Hub as a way of providing enquires with specialist EU Exit help and

advice, alongside the work of the Suffolk Trade Advisors. The contract runs from the 11th

January 2021 to the 31st March 2021.

Business Intelligence

The LEP continues to share weekly business intelligence returns with central government, local

government and MPs capturing intelligence around the UK’s new trading relationship with the

EU and Covid-19. V4 Services will provide the LEP with a weekly intelligence report that will

directly feed into the business intelligence returns. The information that we capture in the

coming weeks, months and year(s) is key to assess how the introduction of the new

relationship, immigration system, border controls and state aid rules impacts businesses, and

where opportunities will lie for businesses.

From the BEIS funding, there is an additional £14.5k allocated for intelligence and reporting.

This will inform both our intelligence returns, but also our investment plan and the longer-term

economic recovery plan through an assessment of how the deal will affect Norfolk and Suffolk’s

skilled workforce and inward investment in the years to come.

Recommendations

The Board is asked to note the contents of the report.

3

13

Appendix A: Trade and Cooperation Agreement between the UK and EU

Latest Update:

A deal reached was reached between the two negotiating parties on 24 December and

signed off on 30 December ahead of the end of the transition period on 31 December. This

Trade and Cooperation Agreement is accompanied by a series of political declarations and

agreements over nuclear and security cooperation.

A Partnership Council will supervise the operation of the Agreement at a political level,

providing strategic direction.

The TCA will be reviewed every five years. It can be terminated by either side with 12

months’ notice, and more swiftly on human rights and rule of law grounds.

Further deals and decisions are likely to be secured in the coming months and years on a

range of key issues e.g. services, data adequacy and financial services equivalence.

Contents of the deal:

Goods: there are no tariffs or quotas on goods traded between the UK and EU. This is

accompanied by new customs procedures and formalities including new ‘rules of origin’

requirements which are needed in order to qualify for zero tariffs.

On goods, bespoke provisions were agreed to facilitate the 45% of goods trade that flow

through ‘ro-ro’ ports.

Specific annexes were also agreed to reduce the non-tariff barriers for medical products,

automotive, chemical products, organic products, and wine.

Services: businesses offering services, such as banking, architecture, and accounting, will

lose their automatic right of access to EU markets and will face some restrictions. Rather

than following one set of rules for the whole of the EU, UK businesses will need to comply

with the regulations in each individual country.

There will no longer be automatic recognition of professional qualifications for people such

as doctors, chefs, and architects. It will be harder for people with qualifications gained in the

UK to sell their services in the EU. Individuals will need to check each country's rules to

make sure their qualification is still recognised.

However, the UK and EU have pledged to keep talking to try to improve access for the

service sector in the future.

EU programmes: the UK will continue to have access to various EU programmes, including:

the €100bn research and development programme Horizon Europe; the Euratom Research

and Training Programme; the fusion test facility ITER; the earth observation programme

Copernicus; and access to the EU’s Satellite Surveillance & Tracking (SST) services. The

UK will no longer have access to the Erasmus+ student programme (replaced by Turing

Scheme - which begins in September 2021). Additionally, the UK must also find a way to

replace access to the Galileo satellite system’s encrypted military data.

Data: a temporary arrangement has been put in place to allow personal data to continue

being transferred from the EU to the UK from 1 January. This will initially last for four months

(extendable to six months) while the European Commission undertakes to make its

adequacy decision.

1

14

An adequacy decision is in the best interest of both sides as well as businesses and

individuals in the UK and EU. However, if an adequacy decision is not granted by the end of

the six month additional bridge period, the UK and EU will exchange data based on their

individual international transfers rules. At the moment as both the UK and EU have similar

rules based on the GDPR there are clearly defined processes for transferring data requiring

the use of appropriate safeguards, such as standard contractual clauses (SCCs) or Binding

Corporate Rules (BCRs).

Security: a new security partnership provides for data sharing and policing and judicial co-

operation, but with reduced access to EU databases. A new surrender agreement takes the

place of the European Arrest Warrant. Cooperation can be suspended by either side swiftly

in the case of the UK or a Member State no longer adhering to the European Convention of

Human Rights.

Other:

There will be no role in the UK for the European Court of Justice - disputes will be referred

to an independent tribunal.

Continues to allow access for respective businesses to bid for each other’s government

procurement contracts.

The Border Operating Model:

The new border controls are phased in three stages up until 1 July 2021.

From 1 January 2021, the UK will operate a full, external border as a sovereign nation. Full

controls are in place for exports. Full controls are in place for staged imports of controlled

goods. Optional deferred declarations are in place for imports of standard goods. From 1

April 2021, full controls are in place for animals and products of animal origin; plants and

plant products. From 1 July 2021, full controls are in place for all goods.

The new trade deal’s rules of origin chapter is expected to hamper some existing goods

supply chains and has sparked concerns from UK and EU trade associations. By imposing

high tariffs on products shipped to the UK to be sold on in the EU, it may well end the UK’s

role as a distribution hub in the EU.

The mutual recognition of authorised economic operator schemes should mean trusted

traders face less friction when moving goods between the UK and EU.

Businesses need to take a range of actions, but to get started they should:

Make sure they have an EORI number starting with GB.

Consider using a customs intermediary to make declarations.

Check if goods need an import or export license e.g. for chemicals or food and apply

for what is needed.

Make sure they understand VAT responsibilities.

Consider if they want to make use of deferred declarations if they import goods.

Fully understand the ‘rules of origin’ principles.

May want to use the free Trader Support Service to guide them with the way goods

move between GB and NI.

Immigration:

From 1 January 2021, EU citizens are treated the same as those from the rest of the world

through the introduction of the new points-based immigration system.

2

15

How does the scheme work: meeting the mandatory criteria will earn the applicant 50 points

(the offer of a job by an approved sponsor (20pts); job at an appropriate skills level (20pts);

and English language skills at level B1 (10pts).

They must obtain a further 20 “tradeable” points through a combination of points for their

salary, a job in a shortage occupation or a relevant PhD.

Sponsorship: a sponsorship requirement will apply to the Skilled Worker route, to the Health

and Care Visa and to the student route, as well as to some specialised worker routes. This

applies to both EU and non-EU citizens who come on these routes. Although specific

requirements vary by route, for most work routes, sponsors must undergo checks to

demonstrate they are a genuine business, are solvent, and that the roles they wish to recruit

into are credible and meet the salary and skills requirements. The costs for employers

sponsoring EEA nationals (from overseas) will significantly increase from January 2021.

Employers with experience in sponsoring non-EEA workers are already familiar with the fee

levels, however they may come as a surprise to those employers who have not previously

had to pay them.

Sectors: There is a fast-track entry system for doctors, nurses, and other healthcare

professionals. Most care workers will not be covered by the scheme though. Those eligible

for this visa will pay reduced fees and be supported through the application process.

Sectors such as social care and construction could face increasing skills shortages as a

result of the coming changes. Other exposed sectors include food manufacturing,

accommodation, hospitality, and manufacturing.

The technology sector, which brings in numbers of highly qualified, well-paid staff from India,

the US, and other non-EEA countries, is likely to be less affected by the new system. Other

sectors less likely to be negatively affected include financial services, insurance and

research and development.

Seasonal Workers Scheme: expanded to 30,000 workers in 2021. Government will seek to

build on the Pick for Britain campaign and retain more domestic seasonal workers. Farmers

are still concerned about staff shortages this year. A big question mark hangs over the

scheme’s future, with the agriculture industry pushing for the pilot to be made permanent.

EU Settlement Scheme: EEA citizens and their families already living in the UK by 31

December 2020, are not required to go through the new system. Instead, they can apply to

the EU Settlement Scheme, and have until 30 June 2021, to do so. If the applicants are

successful, they will be able to remain in the United Kingdom and claim benefits similar to

UK citizens, if they become unemployed. Irish citizens do not need to apply under the EU

Settlement scheme and will not require permission to come to the United Kingdom, as the

UK and Ireland are both part of a common travel area.

UK citizens working in the EU: From 1 January 2021, UK citizens will no longer have an

automatic right to live or work in the EU, so if they are looking to do this, they will need to

check an individual country's immigration rules. If they have any professional qualifications in

the UK, they will also want to check whether they are recognised where they plan to work.

Work visas may be required for work travel, although in most cases it will be possible to

undertake some business related activities - such as business meetings - without a work

visa. The rules around what activities will be permitted on short term business trips and visa

requirements vary between member states, with country-by-country guidance available from

the government. The deal limits these short term business trips to 90 days in any 180 day

period (although how this time period is calculated varies between member states). Might be

able to apply for an EU Blue Card, which gives highly qualified workers from outside the EU

the right to live and work in an EU country.

3

16

Environment and Climate Change:

In the trade deal, both sides committed not to undermine green standards and to make

efforts to increase environmental protection while promoting sustainable trade. It also allows

for each side to set its own policies on things like air quality, emissions, and biodiversity

conservation without undercutting each other's standards. The mechanism to enforce this is

a consultation between the parties and recommendations by a panel of experts.

State Aid:

The deal ends the EU State Aid regime and allows UK to introduce its own system for state

aid.

Companies in the EU will be able to challenge state aid awarded to UK rivals in the UK’s

national courts if they feel it violates common principles set out in the trade deal. British

companies will enjoy equivalent rights in the EU.

The UK agreed to set up an independent state-aid authority, although the deal does not

require the UK to have an “ex ante” regime that will vet subsidies before they are

granted. Either side would also be able to unilaterally impose tariffs to counter the effect of

trade-distorting subsidies, although the other party could then call for accelerated arbitration.

Sectoral implications:

Agri-Food:

Successfully maintained access for meat, dairy and organic products, all of which are vitally

important to farm businesses in the region. For example, 70% of poultry meat exports go to

the EU, a trade worth £192m in 2019. Last year, almost 90% of our barley exports, worth

£230m, went to the EU. In all, the EU market for UK agri-food exports is worth £14.5bn.

However, not all agri-food products have been included in the terms of the deal, such as

seed potatoes.

The EU will immediately implement tough new checks on agri-food products, with no grace

period.

There will also be restrictions on exports of some animal products, including fresh pork

mince and sausages.

Defra has listed a long list of guidance on its website on changes to country of origin labels,

EU health and identification marks, organic logos and much more. For example, food from

GB must not be labelled as ‘origin EU’.

While food and farming businesses welcomed the fact a deal was reached, they warned that

leaving the customs union and single market would still disrupt the food supply chain with

new requirements, paperwork, checks, restrictions, increased costs, complexities, and

potential delays at ports. This trade friction is could squeeze the already tight margins within

the supply chain. AHDB analysis estimates these costs range from 5% to 8% for livestock

products and 2% to 5% for crops, with farmers likely to ‘bear the brunt of these additional

costs’. These estimates do not include the cost of potential delays at port, which may result

in a further loss of value of perishable loads.

Energy:

The energy provisions support and strengthen the UK and the EU’s respective energy and

climate ambitions. This includes the way in which the parties trade electricity and gas over

interconnectors, work together on security of supply, integrate renewables into our

respective markets and cooperate to develop opportunities in the North Sea.

4

17

The energy chapter expires on 30 June 2026, unless both the EU and the UK agree to

extend the arrangement on an annual basis. So while the 2020 agreement negotiations may

be over, the ones for 2026 are just beginning.

The UK is now out of the EU’s internal energy market, which means it no longer has access

to day-ahead or intraday trading tools that make the exchanges quicker and cheaper. Power

bills that are expected to be 2 to 5 percent more expensive, while energy traders will need to

deal with new paperwork for each exchange made.

The UK is also out of the European Network of Transmission System Operators for

Electricity and Gas (ENTSO-E and ENTSO-G) — the main venue in which transmission

systems operators interact — and the European Union Agency for the Cooperation of

Energy Regulators (ACER), which oversees the EU’s energy and gas markets. This

ultimately leaves consumers exposed to measures on power trading set in rooms from which

the UK is not present. The UK is expected to try to get back in and have an arrangement

similar to the one the Swiss and Norwegians have with both organizations.

The UK has also left the EU’s Emissions Trading System. The UK has created a domestic

version, but linking the systems is supported on both sides of the Channel in order to beef up

the mechanism used to crack down on greenhouse gas emissions.

The Agreement commits both Parties to develop and implement new, efficient trading

arrangements by April 2022. These will ensure that capacity on the interconnectors is

maximised and that there is implicit trading in how this capacity is allocated (i.e. capacity and

electricity are sold together). This will help integrate renewables and other clean

technologies onto the grid in line with domestic commitments to net zero emissions. Whilst

this system is being implemented, alternative trading arrangements will be in place for

electricity. We have also agreed arrangements that will ensure we continue to trade gas

efficiently via the PRISMA platform.

The UK and EU have agreed to enhance cooperation on renewable energy, including in the

North Sea. This will facilitate the development of hybrid projects that combine

interconnectors and offshore windfarms and opens up the potential for a North Sea grid.

Separate to the TCA, the UK and Euratom signed a Nuclear Cooperation Agreement which

gives a legal underpinning to civil nuclear cooperation, including safeguards, safety, and

security.

The Agreement provides for a new set of arrangements for extensive technical cooperation

between the respective regulators and system operators, particularly with regard to security

of supply, market abuse and network development.

The Agreement supports trade and investment in energy goods and raw materials between

the UK and EU. These will help facilitate open and competitive markets, removing

unnecessary barriers to trade.

ICT/Digital:

These provisions will promote trade in digital services and facilitate new forms of trade in

goods and services. The Agreement ensures cooperation on digital trade issues in future,

including emerging technologies. The provision helps to facilitate the cross-border flow of

data by prohibiting requirements to store or process data in a certain location.

The Agreement includes commitments including zero custom duties on electronic

transmissions; keeping source code safe; online consumer protection; and anti-spam

provisions giving consumers strong protections when buying from businesses in either the

UK or the EU.

The Agreement provides a legal framework for common e-signature and trust services.

5

18

It is vital for the sector, and many others, that the Commission reaches a data adequacy

decision for the UK. It is positive that the temporary arrangement has been put in place to

allow data to continue being transferred from the EU to the UK from 1 January for 4-6

months until a decision is made.

Financial Services:

Not covered comprehensively in the full trade agreement. Both sides have committed to

setting out a “framework” for regulatory cooperation in financial services by March 2021 and

will discuss the equivalence decisions which the EU has yet to make. The cooperation

agreement is not expected to be legally binding or open up free trade in financial services,

but merely to provide a framework for future discussion between rule makers.

The focus for financial services firms now will be on what can be achieved through trade

deals and regulatory cooperation with key financial services hubs across the world. For

many financial services firms - which operate digitally and employ significant numbers of

people - the agreements on data and migration will be as important as the detail of the

agreements on financial services itself.

The EU found the UK equivalent on a time-limited basis in two areas: clearing and

transaction settlement, while the UK gave the EU some 17 findings that enable EU firms to

do business in the UK more easily. Ahead of even considering further findings, the EU has

said it wants “clarifications” on the UK’s plans to change its regulations. Meanwhile, the UK

is at the very beginning of this process, meaning that any decisions on either side are at

least months away.

A lack of equivalence decisions would increase the cost of doing business for financial

services firms and the clients they serve. This would impact market efficiencies and the

global competitiveness of financial services businesses operating both in the EU and the

UK.

The financial sector has already implemented plans to continue working with EU clients

without equivalence findings, by gaining regulatory licenses in EU jurisdictions and moving

certain operating functions there. Some 7,000 jobs have shifted from the UK to the EU in

support of these arrangements, according to the Bank of England.

For the time being, financial firms have to carry on with business as best they can. With the

EU yet to recognise the UK’s market rules, EU traders have been forced to shift some

London trading of continental and Irish stocks onto exchanges in the bloc. It remains to be

seen if that is a permanent move, or if some investment houses — always on the hunt for

the best prices and easiest trading — find a workaround.

Manufacturing:

The UK manufacturing sector welcomed the fact tariffs had been avoided that risked wiping

out profits in the sector but warned that companies still faced border delays and the loss of

mutual conformity assessment.

This could mean two lots of certification and testing to meet both EU and UK standards,

according to Make UK. This would add significant complexity and cost, for a sector that

operates on fine margins.

A so-called ‘trusted trader scheme’ — where qualified companies could speed through

customs — was also welcomed, although companies said they would need to see details,

given the costs of participating in the system.

Far fewer companies in the UK have this “authorised economic operator” status than in

Europe, given the costs, which means that it may end up benefiting larger groups with in-

house experts over smaller operators.

6

19

The lack of recognition of professional qualifications has been cited as challenging news for

manufacturers wanting to send engineers to the EU.

Six year phase-in on rules of origin for electric cars is positive for electric car industry.

The Trade agreement delivers on tariff and quota free trade, only so long as exports meet

stringent ‘rule of origin’ requirements. The lack of inclusion of allowing imported non-EU

parts to count towards the agreement’s rules of origin thresholds, which determine whether a

product can be traded tariff-free or not, will provide complications and costs for some UK

business.

According to Make UK the TCA has done nothing to resolve the significant paperwork filling

that businesses will have to get used to - an estimated up to 400 million new forms. The

cost to business from this will be significant and even after all systems have bedded in and

the queues at our ports have normalised, we would still expect each delivery to take longer

than it did before this deal. In today’s optimised supply chains, this could impact operational

efficiency in the longer term and will impact integrated supply chains.

Having dual bodies now in the UK and the EU to certify products containing chemicals. It will

create significantly more cost and increased bureaucracy, without any obvious advantage.

Health and Social Care:

While the deal includes an agreement on mutual recognition of good manufacturing practice

inspections, that is as far it goes. The UK has separately agreed to accept batch testing of

medicines done in the EU, but the EU has not done the same. Companies have prepared for

this by ensuring that all batch testing can take place in the EU, but there are concerns about

the capacity for this and whether everyone will be ready.

More broadly, the UK’s Medicines and Healthcare products Regulatory Agency (MHRA) is

now responsible for medicines approvals, but it is unclear what relationship, if any, the

MHRA will have with the European Medicines Agency.

There is also concern about a possible increase in shortages of medicines as hauliers prefer

longer alternatives to the Dover-Calais route to avoid customs delays. Unlikely to know for

certain for a month or so whether this shifting will lead to an increase in medicine shortages

according to experts.

The effect of new immigration laws are also expected to impact the health and social care

sectors, both of which have significant numbers of EU nationals in their ranks. There is a

specific health-worker visa already in place that requires a minimum salary of £20,480 per

year. However, care workers are not included in the scheme and the sector, which has been

significantly hit by the Covid-19 pandemic, may face difficulties recruiting sufficient staff from

within the UK which would be a particular concern given the age demographic in Norfolk and

Suffolk.

Logistics and Road Haulage:

For UK hauliers the deal contained mixed blessings. The two sides recognised the validity of

each other’s licences and permits and included full transit rights, allowing drivers to cross

multiple countries in order to drop a load. This will enable Irish lorries to use the UK as a

“landbridge” to deliver goods into the EU.

However, the agreement limits UK hauliers to a single drop-off and a single pick-up from

inside an EU member state and two pick-ups and drop-offs when crossing EU member

states - this is a downgrade from EU membership, under which drivers could do three pick-

ups inside an EU country before returning home.

Bus and coach companies can continue to operate to, from and through the EU.

7

20

Aviation:

The deal allows flying rights between the EU and UK to continue, but UK carriers will not be

able to fly between two points within the EU. This was expected, and airlines on both sides

have set up foreign subsidiaries to continue current routes.

Creative Industries:

Disappointments for the sector include confirmation the UK will not be part of Erasmus+

scheme and there will be no more automatic recognition of professional qualifications (e.g.

architecture).

Vital for the sector that key arrangements such as data adequacy and the ease of movement

(e.g. touring) are found moving forward. There are fears the clauses (90 in 180 days) will

severely curtail the ability of performers to go on tour in Europe and will hamper the recovery

of the arts after the devastating impact of the pandemic. This would affect tens of thousands

of people in the UK’s creative industries, including film-makers, technicians, and models as

well as performers.

Includes commitments to protect intellectual property rights to a very high level.

Fisheries:

EU fishing fleets will have a five and a half-year transition period with guaranteed access to

UK water - including the 6 to 12 mile zone from the UK coast. After that, access will depend

on annual negotiations.

During the transition, EU fishing rights in UK waters — currently worth about €650m per year

— will be reduced by one quarter, with British quotas increased by a corresponding amount.

The shift will boost UK boats’ current share of fishing rights in British waters from about a

half to two-thirds.

After the transition, access to waters will depend on annual negotiations, such as those the

EU already has with Norway. But the EU will have some leverage: should the UK revoke

access, it will be able to take compensatory measures, including hitting UK fish exports with

tariffs, and even shutting the UK out of its energy market.

Potential economic impact:

Back in January 2020 Metro Dynamics’ produced a report on the Potential Implications of

Brexit for Norfolk and Suffolk for the LEP Board. This focused around the potential impact on

the key areas of trade, regulation, workforce and funding and investment based on two

scenarios - deal or no deal.

The prediction was that if a deal were secured, Norfolk and Suffolk’s GDP would face an

average reduction of 4% by 2030 and the UK an average reduction of 3.5%. We believe that

this impact upon the economy is still likely to remain true.

We could see in the coming months and years a varied impact across sectors and even sub-

sectors as the realities of the new trading relationship and state aid rules come to fruition.

At this current moment in time, it is very difficult to say what the combined impact will be of

the Brexit deal and the Covid-19 pandemic. We are currently in a national lockdown for the

majority of Q1 2021 with uncertainty beyond. A great deal does rest on the vaccine and

vaccination programme.

Intelligence suggests that we are likely to see redundancies and insolvencies coming

through as a result towards the end of the first quarter of 2021 and throughout 2021.

Tourism, Leisure and Hospitality: the evidence does not suggest that these sectors will be

adversely affected by the Brexit deal, but we are cognisant of the fact that Covid-19 has had

8

21

a detrimental impact on these sectors and continues to see a great deal of uncertainty

through the rest of 2021. Certain sub-sectors within this do hire EU workers who are often

comparatively well experienced.

Emerging issues:

Examples of issues that have emerged so far:

A temporary arrangement has been secured on transfer of personal data whilst the

Commission makes its data adequacy decision. It is vital for a wide range of sectors

that the Commission provides a positive data adequacy decision.

It is anticipated that the full impact is still to come for borders. Stockpiling before the

end of 2020 has lightened the load so far, while concern over new procedures and

requirements for Covid tests made some companies reluctant to send trucks early in

2021. We will continue to monitor how companies fare with the new phased-in border

operating model.

Green grocers and supermarkets have seen supply-side issues as a result of EU exit

as they scramble for stock. The issues have centred around non-seasonal stock like

salads, citrus fruit and items like peaches and nectarines. For some, this has been

exacerbated by the heavy snow in Spain.

Some sectors, such as retail and food and drink, have raised concerns around the

rules of origin chapter given how interdependent supply chains are. Under the deal,

businesses could face tariffs on goods imported from the continent for processing at

British distribution hubs which are then re-exported to member states. For example,

Marks and Spencer have highlighted concerns around Percy Pigs which are

manufactured in Germany, brought to the UK before then being re-exported to M&S

stores in the EU - Ireland, France and Czech Republic as this journey would now

face tariffs.

The current provisions around services could throw up challenges for service

providers to the EU with mutual recognition of professional qualifications potentially

on a country- by-country basis and financial services awaits further details around

equivalency.

There are fears the clauses around ease of movement in the EU (90 in 180 days) will

severely curtail the ability of performers to go on tour in Europe and will hamper the

recovery of the arts and creative sector after the devastating impact of the pandemic.

The EU Settlement Scheme ends on 30 June 2021 for EEA nationals (and their

families) working in the UK up until 31 December 2020. Many workers are furloughed

who need to fill this information in, so there could be challenges.

Pig farmers have highlighted the impact on the cull sow trade - whose main

customers are in Germany for cured meat and salami - as UK slaughterhouses are

currently not buying former breeding sows due to fears over the cost of sending

shipments which could be rejected. UK supermarkets do not have sow meats in their

sausages. There are concerns that they might be squeezed out of their well-

established trading partnerships in Germany.

Cycle shops have highlighted that shipping costs are through the roof. Some of their

bicycle suppliers are based in Europe - the likes of Bianchi and Ridley - but they are

either suspending shipping until the middle of January, when more is known about

how the new tariffs will work or factoring in 5% to 10% price increases to cover the

extra costs. Anticipating massive shortages of bicycles later in the year.

A studio which regularly sells posters to customers in Europe, but those customers

are now facing additional taxes (brokerage charges and sales tax) which is likely to

put them off buying from small independent UK businesses.

Many firms had delayed considering issues until the dust settled on this but have now

been hit by the Covid-19 pandemic. There will be some unknown issues

9

22

(opportunities and challenges) that were not foreseen, and these will be monitored as

they come through.

LEP activity:

Communications: The LEP is regularly updating its business script for Growth Hub business

advisers and partners engaging with businesses. This includes all of government’s most up

to date technical notices and guidance for businesses following the deal and offers a local

flavour for conversations. This script is updated weekly and circulated to 80 recipients across

the LEP, Growth Hub, local authorities, and other business support organisations.

The business-facing information from the script is also on the LEP’s EU exit website pages,

including details of upcoming local and national webinars and useful downloads.

Growth Hub Support: The Growth Hub continues to run, collectively with partners in our Ox-

Cam Arc Growth Hub cluster, a series of webinars for businesses which continue to March

2021, providing businesses with updates on key issues. Events held so far have reached

c.40 businesses at a time on issues such as the new trading landscape; importing and

exporting; border changes; developing overseas markets; and effective supply chain

management.

In comparison to Covid-19, business enquiries to the Growth Hub have been low in recent

weeks. We expect this demand to increase significantly in the coming weeks and months

now the trading relationship with the EU has been established and businesses seek local

guidance and support.

Outreach Support: Following the BEIS funding secured before the end of 2020, New Anglia

LEP has undertaken a tendering process to outsource the delivery of outbound telephone

and email contact with businesses, to secure the required capacity and expertise from V4

Services.

The contract is valued at £110,000. Under the contract, the provider will contact and

proactively engage with at least 3,500 business across Norfolk and Suffolk, providing them

with a greater awareness of the steps they need to take following the deal. To count as an

output, the support must last at least ten minutes and provide the business with EU Exit help

and advice from a list of agreed of subjects outlined in the tender specification, which is in

line with our agreement with BEIS. The contract holder will also provide specialist advice to

at least 100 businesses from a list of agreed of subjects outlined in the tender specification,

which is in line with our agreement with BEIS. To count as an output, the specialist advice

must be of at least three hours in duration.

In terms of operation, the support service will target SMEs that are more likely to be

impacted by the UK leaving the EU, through a rolling target list of SMEs for V4 Services to

contact each week. V4 Services will provide the LEP with a weekly business intelligence

report that will be used to feed into the LEP’s weekly report as well as inform the targeting

process, which can be fine-tuned each week. The service will also be used by the Growth

Hub as a way of providing enquires with specialist EU Exit help and advice, alongside the

work that Suffolk Trade Advisors are also providing.

The contract runs from the 11th January 2021 to the 31st March 2021. The relationship

between the Growth Hub and V4 Services will be seamless and both will have copies of the

business scripts so that businesses receive the most up to date and informed advice locally.

Business Intelligence: The LEP continues to share weekly business intelligence returns with

central government, local government and MPs capturing intelligence around the UK’s new

trading relationship with the EU and Covid-19. This will capture the proactive outreach work

of V4 services.

10

23

From the BEIS funding, there is £14.5k allocated for intelligence and reporting. This will

inform both our intelligence returns, but also our investment plan and the longer-term

economic recovery plans, so that we can take advantage of opportunities present in the

future trading relationship with the EU and the rest of the world and support businesses with

their economic recovery from the pandemic.

The information that we capture in the coming weeks, months and year(s) is key to assess

how the introduction of the new relationship, immigration system, border controls and state

aid rules impacts businesses, and we can flag this in the returns and adapt our support

locally.

Author: James Allen

11

24

New Anglia Local Enterprise Partnership Board

Wednesday 27th January 2021

Agenda Item 8

Agri-Food Industry Council Report

Author: Madeleine Coupe, Emma Taylor Presenter: Corrienne Peasgood

Summary

This paper provides an update on the work of the Agri-Food Industry Council, one of the

three industry councils set up by the LEP as formal LEP sub-boards to drive forward the

Norfolk and Suffolk Local Industrial Strategy.

Recommendations

The Board is invited to:

Note the contents of the paper and sub-board report (Appendix A)

Endorse the approach to reconfiguring the Council’s structure to enable greater private

sector engagement.

Background

In 2019 the LEP convened three Industry Councils to drive forward the aspirations of the

draft Local Industrial Strategy in the three strategic areas of energy, agri-food and digital.

The Agri-Food Industry Council (AFIC) was established as a strategic public/private sector

partnership group to provide a focus for decision making and leadership for the agri-food

sector. The AFIC acts as the LEP’s sector group and provides the strategic direction in

delivering the aspiration to be recognised as a leading agri-food region.

The 22 members of the AFIC are drawn from across the agri-food sector in Norfolk and

Suffolk and include representatives of food and drink businesses, farmers, farmer &

landowner organisations, research institutions, utility companies, academia, show societies

and other representatives from the private sector. The Council was established in

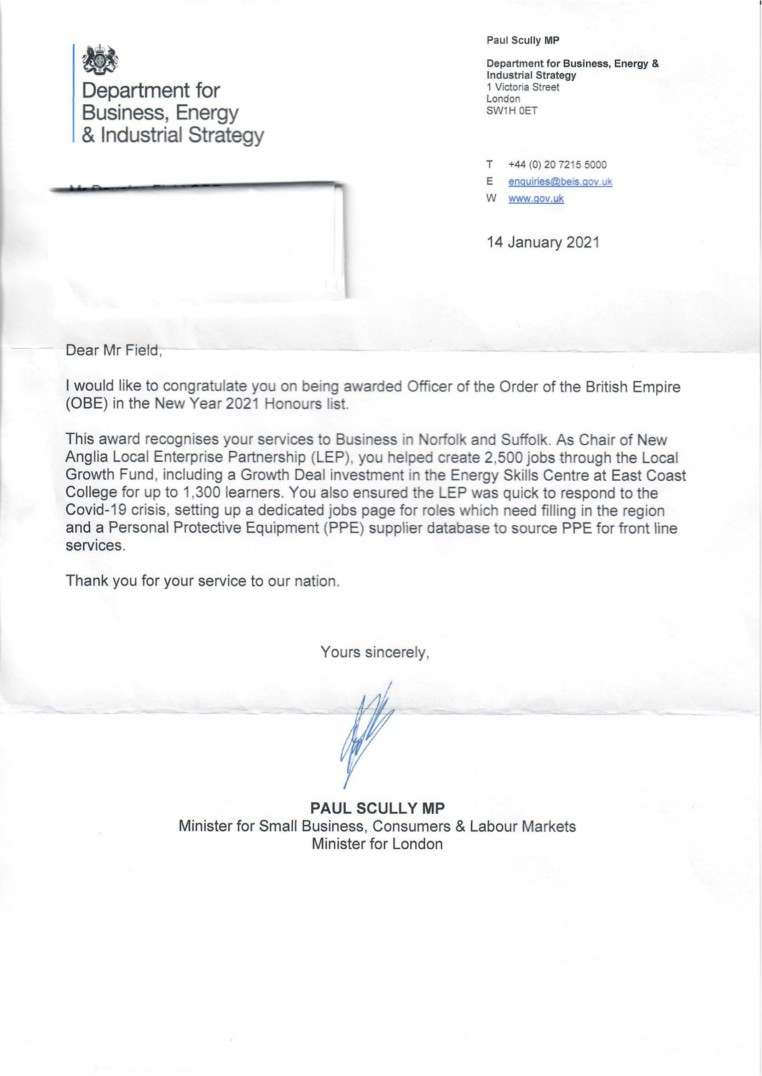

September 2019 and meets three or four times a year. In September 2020, Corrienne

Peasgood OBE, Principal of City College Norwich, took over the role of Chair from Doug

Field OBE.

Agri-Food Industry Council: objectives and delivery

The AFIC has developed a delivery plan which outlines a set of strategic objectives and

scope of work which support the delivery of the Economic Strategy and Local Industrial

Strategy.

1

25

1.

Supporting business recovery, promoting long term growth and ensuring

business resilience.

2.

Explore ways of attracting inward investment to increase the volume and value

of food processing within Norfolk & Suffolk.

3.

Collaborate with partners including Lincolnshire, Cambridgeshire and

Peterborough leveraging the existing strengths of Agri-TechE to realise the

collective power as the UK centre for hi-tech, precision agriculture and food

production.

4.

Support the development of a Food Innovation Centre based at the Food

Enterprise Park at Honingham Thorpe in Norwich, to deliver regional business

growth through innovation, productivity, processing. Also support the further

development of the wider Norwich Food Enterprise Park.

5.

Develop a world-leading hub for plant and microbial research at the Norwich

Research Park.

6.

Understanding, supporting and developing the Clean Growth agenda for the

agri-food value chain.

7.

Enabling Growth in the New Anglia Agri-food sector through skills development.

The AFIC currently has four sub-groups: Skills, Business Intelligence, Inward Investment

and Transformational Projects, each of which links to key LEP officers and workstream.

Key Achievements to date:

The following are the key initiatives set out in the Norfolk and Suffolk Local Industrial

Strategy.

Food Innovation Centre: a new innovation support centre, with 13 food-grade units

on site, will be built at the Food Enterprise Park. The project lead is Broadland

District Council, with New Anglia LEP as a co-investor (subject to confirmation of

ERDF funding, and other contractual processes), and Hethel Innovation and UEA as

delivery partners. ERDF funding for the capital build, and an associated innovation

support service to be delivered by Hethel Innovation and UEA, is currently in

appraisal. Design for the capital build is well underway, with RIBA Stage 2 designs

completed by Christmas, and Stage 3 in preparation. In the meantime, the project

partners have developed a Business Engagement Group for the project, with AFIC

representation, and are developing the wrap around support offer. Funding approval

is expected spring 2021, with the revenue support programme available 2021-3, and

the capital build due to be completed in summer 2022.

Agri-Food Intelligence and Feasibility Project: On behalf of the AFIC, a

partnership of the LEP, Norfolk County Council and Suffolk County Council

contracted Savills Rural Research to carry out a study on the opportunities and

supply chain for of the sector. The output of the report - a list of 200 businesses and

recommendations - has been reviewed by the Council and will help to inform and

progress the work of the Council and its sub-groups. It also provides excellent case

study content for the Norfolk and Suffolk Unlimited website and associated

campaigns.

Regional Agri-Food Narrative: building on the business intelligence gathered from

industry partners at the AFIC, the first edition of a new regular sector report, Agri-

food in Norfolk and Suffolk, has been developed, covering key success stories,

sector statistics, along with challenges and asks of Government. The first edition was

circulated to a number of stakeholders including DEFRA, BEIS and Local Authorities.

Another edition is being planned for February to pick up intelligence on the impacts of

Brexit. This report is a starting point for working with neighbouring LEPs to develop

the common threads of a regional narrative in 2021.

2

26

COVID-19

The AFIC responded quickly to the pandemic and the significant impact that it was having on

food supply chains. bringing together industry stakeholders on the Council gave an

invaluable opportunity for sharing information to help address some of the challenges. The

Council supported the response and recovery by:

-

Council members worked proactively with New Anglia LEP to develop a supply chain

matching service which successfully found new customers for a wide range of

products originally intended for the food service industry.

-

Regular ‘State of the Nation’ roundtables provided a wealth of business intelligence

which helped to inform recovery planning and was fed into Government through the

LEP’s weekly intelligence return.

Looking Ahead - initiatives to support the sector

The Agri-food Industry Council also works to identify and support major initiatives which

have the potential to support the sector to grow. Over the coming months, the LEP will be

considering some of the following with stakeholders -

Any capital development needs to support supply chains, distribution and storage

Further development potential at our Food Enterprise Zone sites in Norfolk and

Suffolk

Potential capital development opportunities arising from new methods of food

production, for example vertical farming.

Opportunities arising from an increased emphasis on natural capital and public goods

in farming and food production

Business support needs of food businesses as they face new challenges

Inward investment potential and commercialisation opportunities for new research.

Looking Ahead - role of the Council

The AFIC is keen to further develop the Norfolk and Suffolk Unlimited agri-food narrative, as

well as regional partnership working, a key LIS intervention. The AFIC will also be closely

involved in supporting the delivery of the Food Innovation Centre cluster initiative. In

addition, building on the work undertaken by Savills, the newly formed Inward Investment

sub-group will work with the Inward Investment Team to investigate areas of competitive

advantage and specialist opportunity, and to support the development of propositions.

In addition, the governance structure for the AFIC is currently under review to ensure that

there is full representation from across all parts of the sector, as well as opportunities for

contributions from Local Authority partners and other relevant organisations. One of the key

aims will be to ensure continuing business intelligence input from the sector into future

editions of the Agri-Food report and LEP feedback to Government.

Recommendations

The Board is invited to:

Note the contents of the paper and sub-board report (Appendix A)

Note and support the approach to reconfiguring the Council’s structure to enable greater

private sector engagement.

3

27

Appendix A

Sub- Board Reporting

Sub-Board:

Agri-Food Industry Council

Representatives:

LEP Board: Corrienne Peasgood

LEP Team:

Meeting Frequency:

Quarterly

Key Objectives and their link to

Update on actions / activity

Next Steps

the NSES and LIS

Develop the evidence base on Norfolk and Suffolk’s sectoral

-

Review the recommendations in the

strengths to underpin the regional narrative and sharpen our inward

Savills report, prioritise and plan for

investment offer.

delivery.

-

Feed into the developing Inward

Through the Savills Rural project, a set of outputs has been

Investment strategy to inform

delivered:

propositions.

1. Competitive Advantage: a strategic review of unique agri-

-

Produce a detailed list of relevant

NSES: Our Offer to the World

food offering of Norfolk and Suffolk including a detailed

conferences taking place in a range of

LIS: Agri-Food

summary of the primary outputs and food chain actors.

geographies during 2021 (& 2022),

2. The Norfolk and Suffolk research base: mapping the

together with a costed plan for which

Collaborate with partners

regional agri-food research capability (both private sector

types of businesses we’d expect to

including Lincolnshire,

and public sector)

attend each event, why & how.

Cambridgeshire and

3. Role and influence of food trends - a detailed analysis of

-

Grow and augment the Agri-Food

Peterborough leveraging the

the potential market opportunity of key crops related

report.

existing strengths of Agri-TechE

to emerging agri-food trends relevant to Norfolk and Suffolk

-

Work with neighbouring LEPs to

to realise the collective power as

4. A revived regional food offer: initial research into whether

develop a regional narrative and

the UK centre for hi-tech,

a new (or revived) ‘regional food offer' would be

messaging on the sector

precision agriculture and food

advantageous to the Norfolk and Suffolk agri-food economy,

production

with analysis of three major regional food initiatives.

5. A narrated database of 200+ noteworthy Norfolk and Suffolk

agri-food businesses developed to provide rich

understanding of the region’s specialisms and strengths.

The report was primarily an evidence base, and granular

examination of the sector to inform our work across the board, but

recommendations included -

29

Suggestions of new crop and other commercialisation

developments which could be explored

Ideas for encouraging processors to source more raw materials

locally

Developing the potential of the A14 corridor as a focus for food

sector investment

Supporting artisan producers with signposting to advice on

distribution and marketing tools to grow

Suggestions for widening the view of innovation opportunities in

the agrifood sector to include tech and engineering sectors in

new thinking.

Next steps in exploring the potential for regional branding and

marketing if we decide to do so.

Published a first edition of the Agri-Food Report outlining nationally

significant news stories, highlighting the size and value of the

sector, challenges, opportunities and ‘ask’ of Government.

NSES: Collaborating to Grow

Develop knowledge of short- & medium-term challenges arising

Business Intelligence sub-group to engage

LIS: Agri-Food

from the UK’s exit from and transition away from EU membership,

with food processing and manufacturing

and its recovery from the COVID-19 pandemic and inform LEP

businesses in Norfolk and Suffolk to gather

Supporting business recovery,

interventions.

intelligence on the barriers and

promoting long term growth and

opportunities for growth in the region.

ensuring business resilience

-

Regular ‘State of the Nation’ updates at Board meetings

-

Continuing to feed into the Business

provided rich intelligence which formed part of the LEP’s

Intelligence workstream with reference

dispatch to Government.

to impacts of the pandemic and Brexit.

-

Support for key initiatives including Call 4 Fish and Flavour

-

Further investigation into the regional

Connexions which provided a ‘match making’ service to food

branding and distribution scheme.

and drink firms and seafood suppliers find buyers for their

Examination of demand and set-up.

produce during the Coronavirus lockdown.

-

Improve and develop engagement with

-

Initiated work into the feasibility of setting up a regional

the fishing sector

branding and distribution vehicle to capitalise on move of

consumers to buy more locally sourced produce caused by the

pandemic. Gathered examples of other regional schemes and

their efficacy.

30

LIS: Agri-Food

Support and inform the development of the Food Innovation

The Food Innovation Centre project will be a

NSES: Driving Business Growth

Centre, with a particular focus on -

focus for main Council meetings in 2021, as

and Productivity

well as receiving support and specialist

Suggesting themes and approaches for the support programme

advice from the business intelligence and

that will be welcomed by businesses in the sector

inward investment sub-groups of the

Engaging businesses to enable the project team to generate a

Council.

pipeline of businesses seeking support

Working with UEA and other partners to support and encourage

the development of an innovation cluster of food businesses as

part of the project

LIS: Agri-Food

. The New Anglia LEP Agrifood Skills group also reports to the

.These priorities will continue in 2021.

NSES: Skills

Skills Advisory Panel. Its key AFIC priorities in 2020 were -

Enabling Growth in the New

The group will also play a key role in

Anglia Agri-food sector through

Ensure the needs of agri-food businesses are reflected in the

supporting the labour needs of the sector,

Skills Development

design and development of new training and support

highlighting successes as well as reporting

programmes

on issues and gaps where further support is

needed.

Active participation in the development of HE education

provision for the agri-food sector in Norfolk and Suffolk to

ensure sector needs are met.

Ensure participation and attendance at skills careers events

and engagement in school careers activity by Council members

(limited in 2020 by the pandemic)

The group has also played a crucial role in monitoring labour

supply and demand for agri-food businesses during the pandemic

and in the light of changes to labour supply as part of the process

of leaving the EU. Feedback from the group has been included in

briefings to BEIS and Defra during 2020.

LIS: Agri-Food

In August, working with Agri-TechE a list of potential

A high level business case briefing to be

NSES: Collaborating to Grow

‘transformational’ projects was developed - initiatives with the

developed for each project.

potential to make a substantial difference to the agri-food sector,

Key connections made.

31

Develop a prioritised list of

and its businesses, in respect of recovery and growth following the

Business cases submitted for consideration

transformational projects which will

difficulties presented by Covid-19.

on the LEP Investment Plan.

make a real impact on the

environment, and agri-food economy

A series of ten potential projects were identified and presented for

in Norfolk & Suffolk.

consideration at the September Council meeting.

This work has now been delegated to the Transformational Projects

sub-group who is tasked with developing a set of projects to outline

business case to be submitted for consideration on the LEP’s

Investment Plan.

NSES: Collaborating to Grow

The Agri-Food Industry Council has attended the Innovation Board

The forward plan for 2021 includes looking

LIS: Clean Growth

and provided an update on the work of the Council as well as an

at the opportunities around Agri-food and

introduction to the Food Enterprise Park.

Energy, Digital and Energy as well as Agri-

Improved dialogue & interaction

food and Digital.

between the AFC & its equivalents

including the Digital Tech Council,

All Energy Industry Council, and

Innovation Board.

32

New Anglia Local Enterprise Partnership Board

Wednesday 27th January 2021

Agenda Item 9 - Chief Executive’s Report

Author: Chris Starkie

Summary