New Anglia Local Enterprise Partnership Board Meeting

Wednesday 27th February 2019

10.00am to 12.30pm

The Ideas Factory, Cavendish House,

St Andrews Street, Norwich NR2 4AEV

Agenda

No.

Item

Duration

20 mins

1.

Welcome from the Chair

2.

Apologies

3

Welcome from Norwich University of the Arts

4.

Declarations of Interest

5

Actions / Minutes from the last meeting

Forward Looking

60 mins

6.

Place Branding - Phase 1: Brand Narrative, Values and Visual Identity

Presentation

7

Place Branding - Phase 1 & 2: Branding, Delivery and Timeline

For Approval

8.

Local Industrial Strategy

For Approval

9.

Norfolk and Suffolk All Energy Industry Council

For Approval

Break

10 mins

10.

Brexit

Update

Governance and Delivery

60 mins

11.

Private Sector Board Appointments

For Approval

12.

Chief Executive’s Report

Update

13.

February Programme Performance Reports Including Dashboards

Update

14.

Finance Report including Confidential Appendices

Update

15.

Board Forward Plan

Update

16.

Any Other Business

Next Meeting: 10.00am - 12.30pm, 27th March 2019

Venue: Birketts Solicitors, Providence House, 141-145 Princes St, Ipswich IP1 1QJ

1

New Anglia Board Meeting Minutes (Unconfirmed)

30th January 2019

Present:

David Ellesmere (DE)

Ipswich Borough Council

Doug Field (DF)

East of England Coop

Dominic Keen (DK)

High Growth Robotics

Steve Oliver (SO)

MLM Group

Andrew Proctor (AP)

Norfolk County Council

Johnathan Reynolds (JR)

Nautilus

Sandy Ruddock (SR)

Scarlett & Mustard

Nikos Savvas (NS)

West Suffolk College

Alan Waters (AW)

Norwich City Council

Jeanette Wheeler (JW)

Birketts

Tim Whitley (TW)

BT

Attendees

Helen Langton (HL)

University of Suffolk (For David Richardson)

Shan Lloyd (SL)

BEIS

Sue Roper (SuR)

Suffolk County Council

Chris Dashper (CD)

New Anglia LEP

Julian Munson (JM)

New Anglia LEP

Chris Starkie (CS)

New Anglia LEP

Rosanne Wijnberg (RW)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

1

3

Actions from the meeting: (30.1.19)

Minutes of the last meeting 23rd November 2018

To provide an update on the Ports and Logistics Group

EG

Aims and Objectives for the Year

Arrange a presentation from the Growth Hub on the support being provided to business

CS

Brexit

To ensure that Brexit intelligence is distributed to all MPs

CS

LEP Board Diversity Champion

To submit comments on the LEP’s Diversity Policy to DE

ALL

Amendments to Committee Terms of Reference

To obtain authorisation in writing from Mark Jeffries that the Board has the legal authority to

CS

amend the Articles of Association

To agree a suitable date for attendance with the Section 151 Officer

RW

To consider the voting rights of deputies at sub-committees

RW

Finance Report

To submit a proposal on consolidating reporting

RW

1

Welcome from the Chair

Doug Field (DF) welcomed everyone to the meeting including Helen Langton (HL) who was

deputising for David Richardson. DF thanked HL for hosting the board meeting.

2

Apologies

Apologies were received from William Nunn, Matthew Hicks, David Richardson, John Griffiths and

Lindsey Rix

3

Welcome from the University of Suffolk Vice-Chancellor

HL welcomed all board members to the meeting and provided an overview of the progress the

University has made over recent months including becoming a full university with degree powers.

She advised that the future focus will be on recruitment and ensuring the university can offer areas

of distinctiveness to attract students in an era of high competition between universities.

4

Declarations of Interest

Full declarations of interest can be found at http://www.newanglia.co.uk/about-us/the-board.

DF declared an interest in the investments in Novafarina and Supapass as detailed in the New

Anglia Capital report.

5

Minutes of the last meeting 23rd November 2018

The minutes were accepted as a true record of the meeting held on 23rd November 2018.

Matters arising & actions

For the LEP team to ensure that links are progressed with other sub-national transport

bodies

CS advised that a meeting had been held with England’s Economic Heartland to identify

areas of collaboration.

Jeanette Wheeler (JW) requested an update on the Network Ports and Logistic Group.

EG

To receive a paper on CO2 reductions for consideration of inclusion in the economic

strategy targets

Johnathan Reynolds (JR) advised that a proposal from the UEA to develop a Scoping

Report on the Climate Change Adaptation and Carbon Reduction Strategy for New Anglia

had been submitted for comment.

6

Aims and Objectives for the Year

Chris Starkie (CS) provided the Board with an overview of the LEP’s priorities for 2019

focussing on the current challenges to delivery and the priority themes for the coming year.

CS also highlighted how the LEP has delivered against its objectives to date identifying key

projects and the positive effect their realisation has had on Norfolk and Suffolk.

2

4

CS reviewed the progress being made against targets confirming that progress was being

made in all areas but noted that the LEP was not the only influence on these targets and

that some factors were outside of the LEP’s control.

The presentation also covered the wider economic and political context within which the

LEP is operating and the challenges that it faces at the current time.

CS stressed that the Government has reconfirmed its support for LEPs both in the

development of the Local Industrial Strategies and the Shared Prosperity Fund.

CS advised that, given the current challenges, the Executive team had examined the

Economic Strategy and firmly believed that it remained pertinent and the priorities it

established remained unchanged.

CS advised that the aims and objectives fell into four key areas:

1. Deliver the Economic Strategy - including the Local Industrial Strategy which will

be key to obtaining Government backing for gamechanging projects

2. Promote our Place - progressing the place branding work and making the most of

opportunities to promote Norfolk & Suffolk. The LEP will also develop and

implement a new inward investment strategy to maximise inward investment and

trade

3. Strengthen our Governance - complete implementation of the LEP review, and a

review the LEP’s operating structure to ensure it delivers outstanding results and

value for money

4. Drive Local Growth - The LEP will set, monitor and achieve stretching targets in all

its funded and delivered programmes and will support local businesses and exploit

opportunities as they are identified

CS reiterated that the fundamental approach of the Economic Strategy is still right namely

improving productivity and promoting inclusive growth.

CS presented an overview of what would success look like in 12 months time covering 5 key

areas:

1. Signing off an ambitious Local Industrial Strategy with Government

2. Launching and starting to see the benefits from the place branding exercise.

3. Maintaining the LEP’s strong reputation with Government for governance and

delivery

4. Securing the confidence of the board in the work of the LEP

5. Realising strong progress on the delivery of the Economic Strategy despite

economic and political challenges.

DF thanked CS for the presentation and asked for questions.

The meeting discussed the key role the LEP could play in providing strong leadership during

the current period of uncertainty.

David Ellesmere (DE) asked about how New Anglia performed against other LEPS. CS

agreed that this would be useful and would investigate what data was available on similar

LEPS.

Jennette Wheeler (JW) asked if the LEP had the sufficient resource and capacity required to

deliver against all the areas of work in which it is involved. Rosanne Wijnberg (RW)

confirmed that a planning exercise was ongoing to confirm resource against the projects and

that the findings would be brought back to the Board but that both she and CS felt that

resourcing was correct.

JW asked whether the Growth Hub had the sufficient knowledge and resource to support

businesses at this critical time

DF asked if the Growth Hub could present at the Board to present their approach to

business support.

3

5

The Board discussed the importance of productivity and how the LEP can contribute to

improvements in this area.

The Board agreed:

To note the content of the presentation

To agree with the approach and the continued focus on the delivery of the Economic

Strategy

To receive performance data on LEPs similar to New Anglia

CS

To receive a presentation from the Growth Hub

7

Place Branding

Steve Oliver (SO) provided the board with a verbal report on the work carried out to date

with Jacob Bailey on developing the place branding strategy to deliver an umbrella brand.

The Board was advised that research had been carried out from September which included

engagement with over 100 stakeholders and has been followed by detailed discussion

resulting in the brand narrative.

SO confirmed that local authority leaders had been involved in the process and advised that

CMS and Jacob Bailey will be presenting at the February Board to present the brand.

The Board agreed:

To note the content of the report

8

Brexit

CS presented the board paper for this standing item.

CS noted that the key area for the LEP was providing support to businesses and the LEP

would look at existing support funds to ascertain if any could be amended to provide more

assistance to companies.

DE asked if MPs were receiving the intelligence provided by LEPs and councils.

CS confirmed that sessions had been held with some MPs but an action would be taken to

ensure this was provided to all.

The Board agreed:

To note the content of the report

To ensure that Brexit intelligence is distributed to all MPs

CS

9

New Anglia LEP Diversity Champion

CS presented the report and advised the board that the appointment of a diversity champion

was recommended as best practice in the LEP review.

CS advised that DE had been approached and agreed to take up the role subject to

ratification to the Board.

DE stated that he would review the LEP’s current diversity policy and asked for feedback

from the board before he reported back in March.

JW noted that there should be clarification on what is internal and external policy and will

provide comments to DE.

SO asked what success the success criteria would be. DE advised that success would be

about more than board gender diversity but also about other areas such as those

businesses receiving funds and LEP staffing.

The Board agreed:

To endorse the appointment of DE as Diversity Champion

To submit comments on the LEP’s Diversity Policy to DE

ALL

10

Election of Deputy Chair

DF presented the paper proposing the appointment of Lindsey Rix (LR) as the Deputy Chair.

It was passed by the Board and agreed that her term as Deputy Chair and as a Board

member will tie in together.

The Board agreed:

To appoint Lindsey Rix as Deputy Chair of the Board

4

6

11

Amendments to Committee Terms of Reference

RW presented the paper formalising the changes to governance agreed at the October

board meeting and updating other relevant documents. These are divided into 4 key areas:

Amendments to Articles of Association - These have been updated to reflect the changes to

the LEP Board membership and the quorum has been amended as a result of these

changes.

JW queried whether the Articles of Association need to be amended by Special Resolution

at a General Meeting rather than the Board. CS advised that he had received advice that

the Board could confirm the changes.

The Board agreed to confirm the changes subject to confirmation in writing that they had the

authority to do so without a general meeting.

ACTION: CS to ensure obtain authorisation in writing that the Board has the legal authority

CS

to amend the Articles of Association.

LEP Board Attendance and Deputisation Policy - RW reviewed the changes to the policy and

requested Board approval for the amendments.

Nikos Savvas (NS) queried whether deputies had voting rights. RW confirmed that they do

have the right to vote and would update the policy for clarity.

The Board agreed to the proposed changes.

Investment Appraisal Committee (IAC) - RW advised that, at the request of the chair of the

IAC, it is proposed to expand the membership by one additional private sector member,

independent of the LEP Board, to strengthen the expertise of the committee.

Andrew Proctor (AP) raised the importance of having county representation on the IAC.

This would mean that one of the three local authority representatives would be a county

representative.

The Board agreed to both proposed changes.

Audit and Risk Committee - RW asked the Board to approve an amendment to the Terms of

Reference to allow the S151 Officer to delegate authority for attendance at this committee to

a suitable representative.

The Board agreed to the proposed change.

It was noted that it had been raised at the LEP Review that the Section 151 Officer should

attend the LEP Board once a year.

ACTION: To agree a suitable date for attendance with the Section 151 Officer.

RW

NS queried whether deputies on sub-committees have voting rights.

RW advised that this will be considered further and brought back to the Board.

ACTION: To consider the voting rights of deputies at sub-committees

RW

New Anglia Capital (NAC) - DF advised that Kevin Horne had left the Board and asked for

suggestions for nominations to be submitted to Chris Dashper (CD).

Dominic Keen expressed his interest in joining the NAC Board.

The board agreed to nominate Dominic Keen to the NAC board.

The Board agreed:

To note the content of the report

To agree the proposed changes to the Articles of Association subject to confirmation

in writing that they had the authority to do so.

To agree to the two proposed changes to the IAC Terms of Reference.

To agree to the proposed change to the Audit and Risk Committee Terms of

Reference.

To receive clarification on the voting rights of deputies at LEP sub-committees.

To nominate Dominic Keen to the NAC Board

5

7

12

Chief Executive’s Report

CS presented his report to the Board and asked for questions.

CS advised that there had been significant interest in the recent project calls and noted that

discussions have been held with local authorities regarding the possibility of expanding the

Innovative Projects Fund.

Enterprise Adviser Network (EAN) - CS advised that the TUPE transfer had been completed

however one of the team members is seriously ill in hospital. The LEP team are providing

pastoral care for his family and the EAN team. DF asked for the best wishes of the Board to

be passed on.

Offshore Wind Sector - CS provided an update on work to promote the offshore sector

including the production of a prospectus detailing the collective approach to the Offshore

Winder Sector Deal which was being presented to Clare Perry, the Energy Minister.

Johnathan Reynolds (JR) endorsed the prospectus and noted that on-shore energy also

needed the same focus.

JW asked for further information on the economic shocks detailed in the report.

CS advised that Heatrae Sadia was consolidating at a larger plant in the Midlands and the

decision to close was a management one due to spare capacity at the other plant.

The Board was advised that Phillips Avent was also consolidating its operating sites.

The LEP was working with the management team to offer support to staff.

Agritech - CS advised that discussions with the Combined Authority have been ongoing but

there is still no definitive date on when ministers will make a decision on the release of

funding.

The board was recommended to set a deadline of March 31st for continued participation in the

Eastern Agri Tech programme. If funds are not released by March 31st by Government, the

£1m allocated should be deallocated and a fresh proposal for its use brought to the board.

This was agreed by the Board.

Board Recruitment - The Board was advised that 15 applications have been received.

CS & RW have carried out an initial review and will make recommendations as to which

candidates to interview. The recommendations for board appointments will made at the

February board meeting.

NWES - CS updated the meeting on recent news reports concerning NWES and confirmed

that the LEP had carried out due diligence on the loan for the KLIC and that the loan had

been repaid on time.

A sale has been agreed on Rouen House where the LEP had agreed not to implement the

clawback clause on its grant subject to the building continuing with the same use as an

enterprise centre.

The Board agreed:

To note the content of the report

To set a deadline of March 31st for continued participation in the Eastern Agritech

programme. If funds are not released by March 31st by Government, the £1m allocated

will be deallocated and a fresh proposal for its use brought to the board.

13

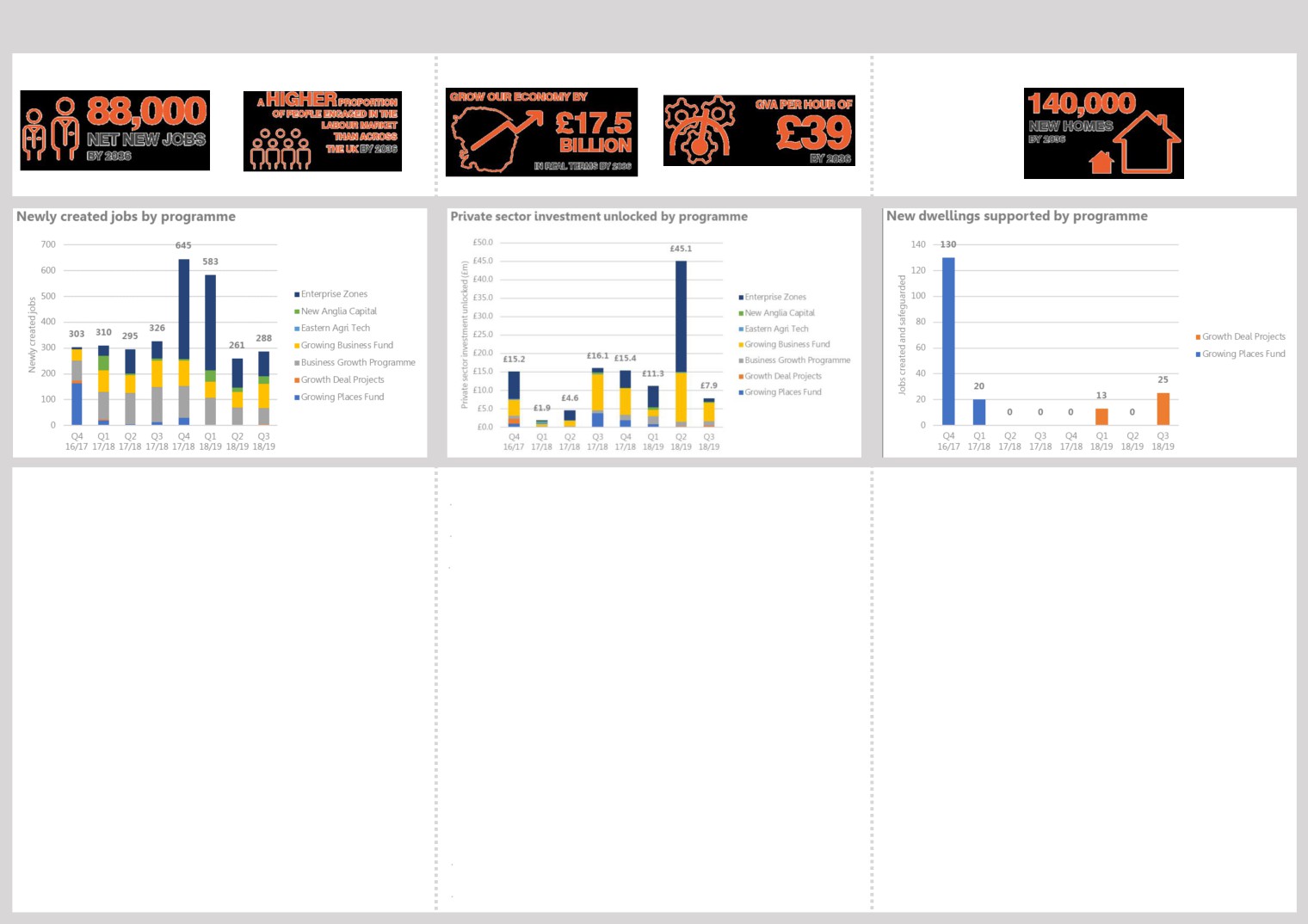

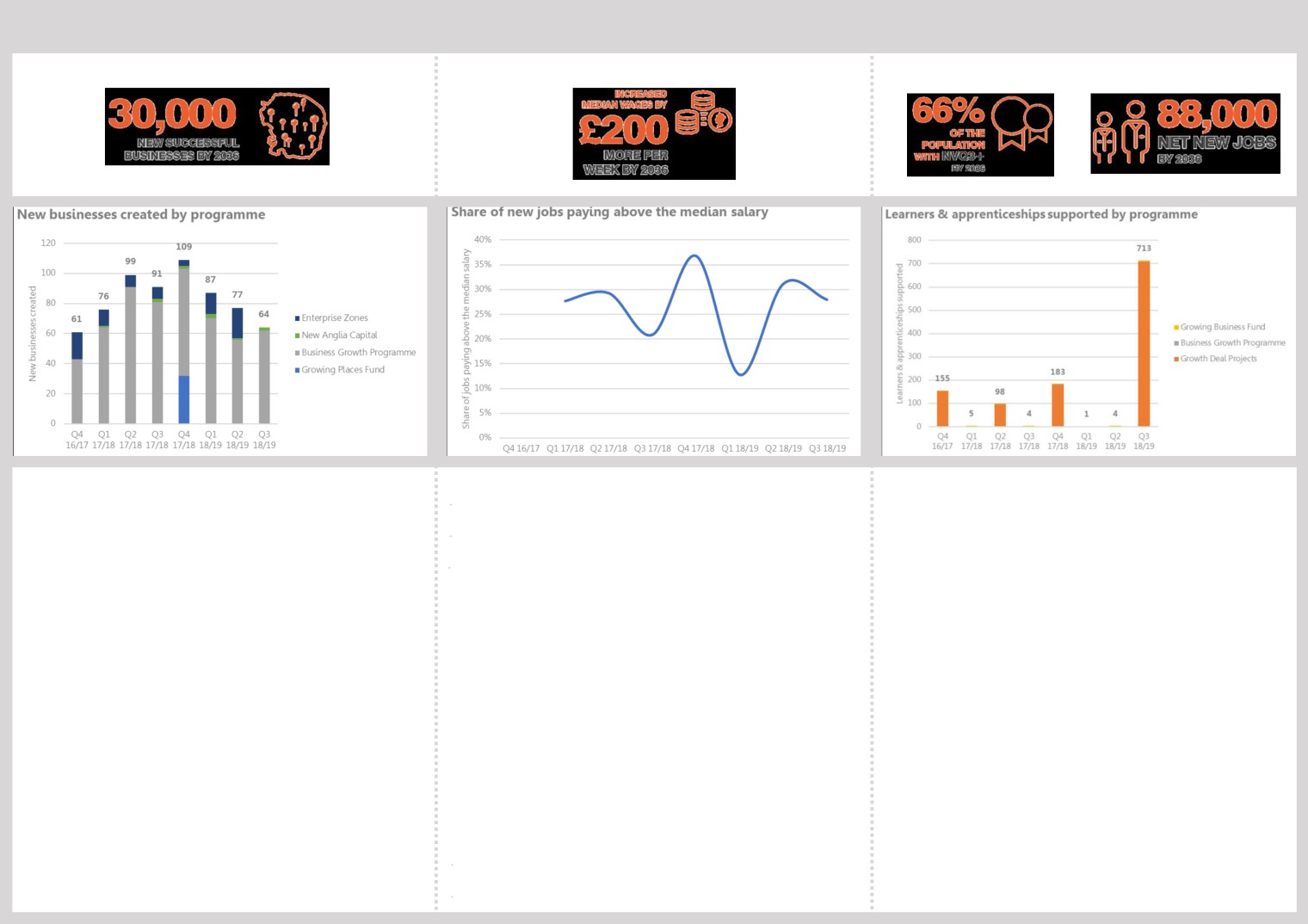

January Programme Performance Reports

RW reviewed the performance reports and updated the meeting as on the following:

Business Growth Programme - The programme was now rated green as funding had been

secured and targets restructured.

NWES delivery is rated as red due to the delays to delivery. NWES is producing a plan to

address the delays and an additional partner has been engaged to help deliver programmes

to start ups to fill the shortfall.

6

8

Enterprise Zones - these are long term projects. Job numbers realised are lagging behind

target and this will be monitored. Julian Munson (JM) noted that there is often a lag

between realising floor space and achieving the relevant job numbers.

The Board agreed:

To note the content of the reports

14

Finance Report

RW reviewed the finance report and clarified how finances were reported as requested at

the last Board meeting.

RW suggested bringing back a proposal on consolidating reported to the March board

meeting.

Core Finances - RW reviewed the reports noting key variances.

The Board agreed:

To note the content of the report

To receive a proposal on consolidating reporting

RW

15

Board Forward Plan

CS reviewed the Forward Plan and asked for suggestions for agenda items from the Board.

The Board agreed:

To note the content of the plan

16

Any Other Business

None

The Board held a private session to discuss Item 17

17

Remuneration Committee Update - Confidential

DF provided an update on discussions held at the last committee meeting in December and

asked Board members for their comments.

The findings of the Remuneration Committee were endorsed by the Board.

Next meeting:

Date and time of next meeting:

10.00am - 12.30pm, 27th February 2019

Venue: The Ideas Factory, Cavendish House, St Andrews St, Norwich NR2 4AEV

7

9

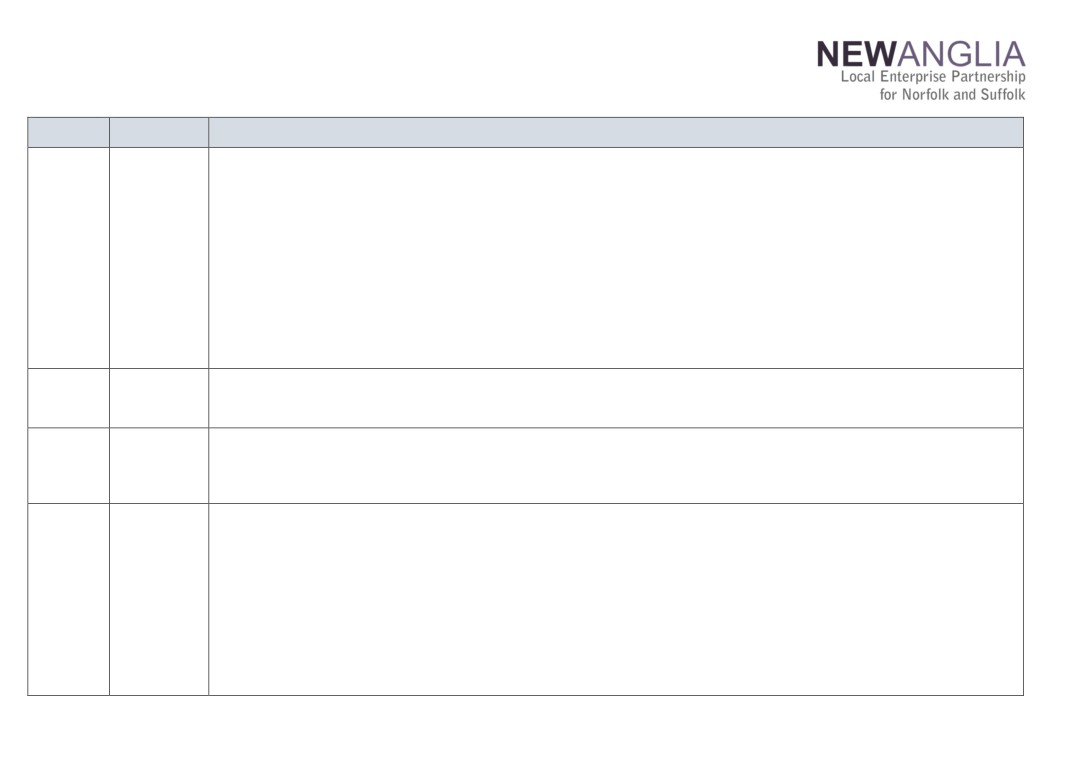

Actions from New Anglia LEP Board Meetings

Date

Item

Action

Update

Actioned

Status

By

30/01/2019

Minutes of the last meeting

To provide an update on the Ports and Logistics Group

Included in the February Chief Executive's Report

EG

Complete

23/11/2018

30/01/2019

Aims and Objectives for the

Arrange a presentation from the Growth Hub on the support being

Added to the Board forward plan

CS

On-Going

Year

provided to business

30/01/2019

Brexit

To ensure that Brexit intelligence is distributed to all MPs

The weekly Brexit intelligence report is now being

CS

Complete

distibuted to all MPs in the New Anglia area

30/01/2019

LEP Board Diversiry

To submit comments on the LEP’s Diversity Policy to David Ellesmere

ALL

On-Going

Champion

30/01/2019

Amendments to Terms of

To obtain authorisation in writing that the Board has the legal authority

We have engaged Sam Sutton, Mills&Reeve to review the

CS

On-Going

Reference

to amend the Articles of Association

amendments to the Articles of Association and support

formal adoption of these changes.

30/01/2019

Amendments to Terms of

To agree a suitable date for attendance with the Section 151 Officer

It has been agreed that the Section 151 Office will attend

RW

Complete

Reference

the September Board meeitng

30/01/2019

Amendments to Terms of

To consider the voting rights of deputies at sub-committees

It is recommended that deputies are NOT permitted at the

RW

Complete

Reference

sub-committee level.

23/11/2018

Infrastructure

For the LEP team to ensure that links are progressed with other sub-

Ongoing

EG

On-Going

national transport bodies

23/11/2018

Finance Report

To receive further detail on the receipt of loan repayments and interest

After discussion with Lindsey Rix further consideration will

RW

On-Going

receipts

be given to providing a briefing session to Board members

on 2019/20 funding.

21/02/2018

Economic Indicator

To receive a paper on CO2 reductions for

Work is ongoing in conjunction with the UEA

CS/JR

On-Going

Trajectories and Targets:

consideration of inclusion in the economic strategy targets

11

New Anglia Local Enterprise Partnership

Board Decision Log - Public

Date

Decision

Decision Made

Making Body*

30/01/2019

LEP Board

The Board Made the following decisions:

Aims and Objectives

To agree with the approach and the continued focus on the delivery of the Economic Strategy

New Anglia LEP Diversity Champion

To endorse the appointment of David Ellesmere as Diversity Champion

Election of Deputy Chair

To appoint Lindsey Rix as Deputy Chair of the Board

Amendments to Committee Terms of Reference

To agree the proposed changes to the Articles of Association subject to confirmation in writing that they had the authority to do so.

To agree to the two proposed changes to the IAC Terms of Reference.

To agree to the proposed change to the Audit and Risk Committee Terms of Reference.

To nominate Dominic Keen to the NAC Board

Chief Executive’s Report

To set a deadline of March 31st for continued participation in the Eastern Agritech programme. If funds are not released by March 31st by

Government, the £1m allocated will be deallocated and a fresh proposal for its use brought to the board.

30/01/2019

Investment

The IAC made the following decisions:

Appraisal

VCSE Challenge Fund

Committee

To commit £500k grant funding from the Growing Places Fund for the VCSE Challenge Fund, allowing a challenge fund of £250k per year.

That two LEP Board members should to sit on the VCSE appraisal panel

05/12/2018

Growing

The Panel approved the following applications:

Business Fund

• Spectra Packaging Limited - Agreed to support

Panel

Approved Grant: £74,486 under De Minimis

• Stephen Walters & Sons Limited - Agreed to support

Approved Grant: £118,049 under De Minimis

21/11/2018

LEP Board

The Board Made the following decisions:

Tier 2 Review

To accept the recommendations as detailed above.

To receive a future paper from both the Innovation Board and the International and Inward Investment Sub-Group following the review their

own TORs

To require LEP sector groups to develop common Terms of Reference focusing on the leadership and promotion of the sector

That sector groups need their own governance distinct from membership bodies

To receive regular reports from all Sector groups

LEP Board Governance

To adopt the process for the appointment of the deputy chair

Enterprise Zone Accelerator Project - Confidential

November Programme Performance Reports

To receive clarification on the Dashboard outputs and RAG status. Once received approve the submission of the Government Dashboard

* New Anglia Local Enterprise Partnership Board, Investment Appraisal Committee, Growing Business Fund Panel, Remuneration Committee, Audit & Risk Committee

New Anglia Local Enterprise Partnership Board

Wednesday 27th February 2019

Agenda Item 7

Place Branding - Phase 1 & 2: Branding, delivery and timeline

Authors: Lesley van Dijk and Julian Munson

Summary

This paper updates on progress on the development of a single overarching place brand

(umbrella brand) for Norfolk and Suffolk and supports a presentation to the LEP Board outlining

the process and research undertaken over the past six months resulting in the final proposed

brand narrative, values and identity. This paper also outlines the proposed key stages of

communication, engagement and implementation of the brand.

Recommendation

The Board is asked to approve the umbrella brand

The Board is also asked to approve the timeline, communication and implementation

plan as outlined in this report.

Background

The Economic Strategy for Norfolk and Suffolk emphasises the need for consistent place

branding and an overarching international offer in order to accelerate the economic growth of

our two counties.

Recent stakeholder lunches with businesses as well as events organised by both chambers of

commerce have continued to highlight the lack of a strong brand identity holding back the

potential of our businesses.

It was agreed by the LEP Board and key stakeholders that further brand development work was

required to develop strong and cohesive messages, values and a visual identity which brings

together our world-class inward investment and business location offer.

It is to coordinate and amplify our Offer to the World, and not to replace any existing campaigns

or brands.

It was agreed that this brand will enhance our inward investment activity and will help attract

skilled people to work or study in the area.

As outlined in the paper presented to the LEP board on 20 June 2018, the Board approved the

first stage of brand development and agreed a timeline of activity including presenting back to

the Board in February 2019.

1

13

Following a competitive tender process, agencies CMS and Jacob Bailey were commissioned

to progress the first stage of brand development, overseen and managed by a Steering Group

comprising members of the LEP Board and Executive Team, as agreed.

The brief: ‘Develop an umbrella brand that brings together our world-class inward investment

and business location offer. To stand out from other areas of the UK and the global economy.’

CMS and Jacob Bailey have applied a thorough and robust method to develop the place

branding, including the ‘5i approach’ (investigate, insight, inspire, implement and interrogate).

During the research stage more than a hundred people from the public and private sectors

have been engaged (incl. telephone interviews with LEP Board members, sector leads and

partnership organisations; face to face interviews at MIPIM UK and online survey with industry

leads, businesses and local economic development officers). In addition to this, workshops with

stakeholders have taken place, and LEP/ Growth Hub teams and economic development

officers have been engaged in the brand development project.

Throughout the process the Department for International Trade has been involved in the

development of the branding and has endorsed the process.

The outcomes of the analyses, evidence and detailed responses have fully informed the brand

narrative, values and visual identity.

CMS and Jacob Bailey will present at the board meeting, giving board members the opportunity

to consider the work undertaken to date and inform its development.

Engagement and implementation plan

The presentation to board members is very much the first stage in the process.

For the brand and accompanying narrative to be adopted and used proactively promoting

Norfolk and Suffolk to the national and international business community, it is imperative to get

a wide range of stakeholders on board to become ambassadors for the brand.

Therefore, it is proposed to engage on a personal level with stakeholders and the media.

During this engagement period, a marketing and media campaign will need to be developed in

readiness to be launched publicly in July.

This will include the development of a new website and other appropriate collateral will be

commissioned and developed.

At a public event the narrative, values, identity and branded website aimed at investors,

businesses and professionals will be revealed.

The event will help promote and showcase our offer through success stories to a wider group,

including local businesses, Government officials and VIPs. A targeted national and international

roll-out will follow at key expos and through sector campaigns.

The communication, engagement and marketing activity is intended to support and advance

trade activity which is in line with the ERDF funded Invest East programme (see 20 June 2018

Board paper ‘Inward investment and international strategic framework’).

2

14

Timeline

Feb-May ‘19

July 2019

July ‘19 onwards

Engage

February - Presentation of narrative, visual identity and application at LEP Board meeting.

March to May 2019 - To ensure key stakeholders have the first opportunity to see the new

branding and narrative, the following engagement events are proposed:

-

Large engagement event early March in a central location with local authority officers

(economic development leads), business intermediaries, sector group chairs and

stakeholders who were involved during the brand development process

-

MPs event.

-

local and regional media briefings.

The team will also engage with other stakeholders through participating in meetings organised

by other partners.

Groups identified include the Norfolk leaders and chief executives group, the Suffolk Public

Sector Leaders Board, the Suffolk Growth Programme Board, Ipswich Vision, LEP sector group

meetings, Cambridge Norwich Tech Corridor as well as meetings of business intermediaries

such as the chambers of commerce the CBI and IoD. We will also want to engage with the New

Anglia Colleges Group, all three universities and the voluntary sector.

Launch

July 2019 - Public reveal of branding and website promoting the area’s offer at a special

location in Norfolk or Suffolk eg Adastral park, Norwich Research Park.

The event will launch the new branding officially to approx. 500 guests, including LEP Board,

local businesses, MPs, LA representatives, Government officials (DIT, BEIS, DoE, DfT and

Treasury), chambers of commerce, FSB, IOD, CBI and media.

Promote

July onwards - Local and national marketing and media campaign starts.

Oct 2019 - International launch at MIPIM UK in London and at All Energy Expo in Amsterdam,

the Netherlands.

Oct 2019 onwards - Sector launch campaigns, prospecting and conversion.

Recommendation

The Board is asked to approve the umbrella brand as presented.

The Board is also asked to approve the timeline, communication and implementation plan as

outlined in this report.

3

15

New Anglia Local Enterprise Partnership Board

Wednesday 27th February 2019

Agenda Item 8

Local Industrial Strategy (LIS) Update

Author: Lisa Roberts

Summary

This report provides an update on the development of the Norfolk and Suffolk Local Industrial

Strategy and seek budget approval from the Board to allocate some funds to support its

development. This Local Industrial Strategy will be a standing item for the LEP Board going

forward.

Recommendation

The Board is asked to note the contents of the report and to approve a budget of £55K to

secure external support to support the development of the Local Industrial Strategy.

Background

The Government has asked all parts of England to develop a Local Industrial Strategy, to show

how growth and productivity will continue to be achieved and to make the case for investment

once the current round of local growth funding and EU funding has ended.

For Norfolk and Suffolk, this does not mean revisiting all the ambitions and priorities set in the

Economic Strategy. We do not need “another strategy.” Rather it is a good opportunity to

assess how national and global economic trends are affecting our area and our businesses. To

take stock of progress in implementing our economic strategy, and to focus on the actions we

need to take to continue to support businesses to take the opportunities ahead as the post

Brexit economy evolves.

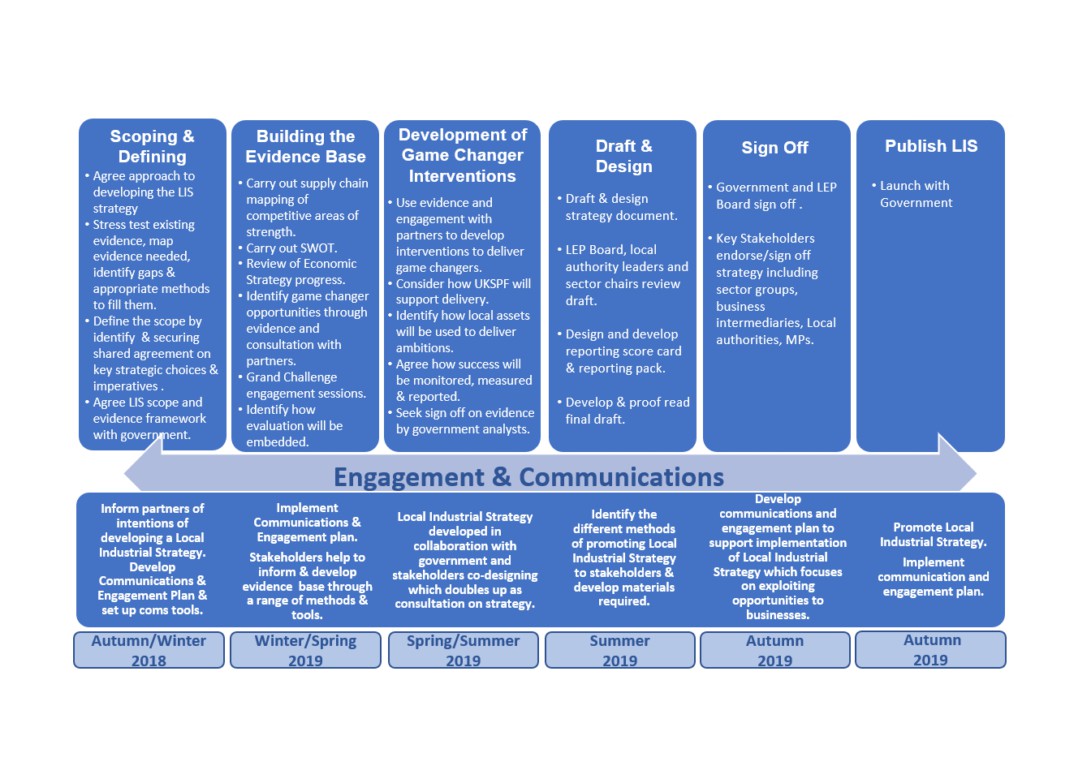

In September 2018 the LEP Board agreed the six stage approach to the development of the

LIS (see Appendix 1) and the Economic Strategy Delivery Coordinating Board (ESDCB) would

become the steering group for the development of the LIS.

Progress Update

Good progress has been made since September and work is nearing the end of the Scoping

and Defining stage. Please see appendix 2 which provides a snapshot of activity since

September and an overview of next steps.

1

17

Local Leaders Local Industrial Strategy Workshop 5th March Event

During the development of the Economic Strategy we held series of three workshops with the

LEP Board, LA Leaders, Education Leaders and Sector leads to oversee and guide the

development of the Norfolk and Suffolk Economic Strategy.

This was really important in order to give partners opportunities to feed in their priorities and

ideas into the development of the strategy - not the traditional approach of consulting on a

completed document.

As a consequence we developed a strategy that strongly reflected local strengths and

opportunities, which has been well received by Government and has the support of local

partners.

We are proposing that the work on developing the LIS is again overseen by local leaders, with

a series of three sessions during 2019. The first of these is on 5 March at Adastral Park

Ipswich.

The aim of this session is to:

1 Take stock of our collective progress against the Economic Strategy.

2 See how the national economy and situation has changed since we published it.

3 Agree how we use the LIS to drive implementation and set out our stall with Government for

further investment, particularly focussing on growing the areas where we have clear advantage

and opportunity, targeting support where it is going to have most impact.

The session will start with the Economic Strategy annual progress and will included an

overview of National and Global Trends - what has changed and changing; outline what a

Local Industrial Strategy is and how it relates to the Economic Strategy; and start to explore the

big opportunities that our LIS should take advantage of.

Sector Deals

Sector deals form an important part of the national Industrial Strategy.

It is therefore critical that our Local Industrial Strategy reflects sector deals as well as the

national Industrial Strategy.

Please see appendix

3 for more information on published Sector Deals and those in

development.

New Anglia LEP has been actively engaging with several sector deals which are relevant to the

Norfolk and Suffolk economy.

Offshore Wind Sector Deal - Ahead of the launch of the Offshore Wind Sector Deal, the

LEP has submitted an offshore wind prospectus to Government and the Offshore Wind

Industry Council mapping out our region’s cluster in terms of assets and vision. We are

liaising with Cabinet Office to ensure they promote our cluster on the day of the launch

and have enquired whether the deal could be launched in our region. Agenda Item 9

covers the Offshore Wind Industry Council which has been set up by the LEP in response

to our Local Industrial Strategy and sector deals.

Tourism Sector Deal - Following positive meetings with DCMS and Visit Britain in

January, the LEP Executive has kept discussions going on the Tourism Sector Deal as

we look to be recognised as a Tourism Zone in the deal. Visit East of England’s launch on

28th March at Holkham Hall provides the LEP with another good opportunity to showcase

our assets and vision given DCMS will be in attendance.

2

18

Nuclear Sector Deal - The business case for the nuclear supply chain programme has

been submitted to BEIS, where the LEP has worked closely with Heart of the South West

LEP, Cumbria LEP and Nuclear AMRC. The bid includes a national programme run by

Nuclear AMRC and regional programmes to be run by the LEPs. Given the strong links

between Hinkley Point C and Sizewell C, Heart of the South West LEP and New Anglia

LEP are working very closely together. We will keep the Board informed of developments

as the bid is considered by BEIS and the final decision has been made.

External Support and Budget Request

We have been continuing to utilise Metro Dynamics as our external consultants for the first part

of the development of the Local Industrial Strategy.

Metro Dynamics provided external support in the development of our Economic Strategy and

our contract with them gave us the opportunity to continue working with them for this stage.

They have been engaged to carry out an independent review of our evidence base, compare it

against the pilot LIS areas, identify gaps and produce a framework for the LIS evidence pack

which builds and enhances the Economic Strategy evidence base.

This support will conclude at the end of March 2019 and has been invaluable particularly in the

interim period while we recruit our new economic analyst.

The Economic Strategy Delivery Coordinating Board, which is chaired by the LEP chief

executive and includes representatives from key partners developing the LIS has agreed that

additional external support is required to support the next stages of the development of the

Local Industrial Strategy.

The support will bring additional skills and expertise that will complement the LEPs delivery

team supporting the development of the evidence and interventions for the LIS.

Government have provided LEPs with £200k to assist the development of the Local Industrial

strategy and to help build an evidence base that shapes interventions and has geographical

external validation.

The majority of that funding will be used to support in house resources - for example paying for

the LEP’s economic analyst and other team members now working full time on the LIS.

However we believe it is reasonable a proportion of the funding is used for external support.

The Board are asked to approve a budget of £55K to secure external support.

The funding is sufficient to secure the level of support required to take the development of the

LIS from the position it will be in at the start of April until publication in the autumn.

The request has come ahead of the LEP Budget as we will need to utilise March to undertake

the procurement process, including advertising the tender, so the support can be in place at the

start of April.

Link to the Economic Strategy and Local Industrial Strategy

Together with partners we have set out a clear vision, priorities and targets in the Norfolk and

Suffolk Economic Strategy - our blue print for inclusive growth and productivity. The Local

Industrial Strategy is the next stage in the evolution and implementation of our economic

strategy. It will build on the Economic Strategy by setting out in more detail the interventions we

will undertake to improved productivity and drive growth, with a particular focus on those market

opportunities where we have distinctive strengths and abilities - Clean Energy, Agri Food and

ICT.

3

19

Next Steps

See Appendix 2.

Recommendation

The Board are asked to approve a budget of £55K to secure external support to support the

development of the Local Industrial Strategy. here more information is required for board

members.

4

20

Appendix 1 - Approach to developing the Norfolk and Suffolk Local Industrial Strategy

5

21

Appendix 2 - Local Industrial Strategy progress update and next steps

September

LEP Board approved LIS approach and agreed the LEP’s Economic Strategy

2018

Delivery Coordinating Board would be steering group for LIS. Economic Strategy

Delivery Coordinating Board established meets every 6 to 8 weeks.

October

Defining and mapping stage underway. Government published the LIS Policy

2018

Prospectus. Meeting with Joe Manning Deputy Director Industrial Strategy and

colleagues - green light on our approach was secured.

November

Evidence review and development of draft evidence framework for LIS. Agreed

2018

Shan Lloyd will join the ESDCB

December

Metro D support secured under current additional services framework in the

2018

existing contract to support evidence and intervention development.

Met with David Campbell, Local Industrial Strategy Analytical (LISA) team Leader

to discuss and seek feedback on current evidence base.

January

Defining and mapping stage continues. Expression of Interest submitted to BEIS

2019

funding for graduate support (still waiting for outcome). Induction meeting with

Metro D - project pan developed.

LIS discussion with Rowena Limb, Shan Lloyd and other Communities and Local

Growth Unit (CLGU) colleagues, a government requirement which formally started

the process of LIS development. New Anglia LEP’s overall approach and timeline

for the development of the LIS was agreed by Government.

Nuclear Sector Deal meeting BEIS, AMRC, Heart of the South West LEP to

support the development of the sector deal. Meeting with DCMS tourism sector

deal to show case the opportunities across Norfolk and Suffolk with the aim to

secure engagement with the sector deal.

February

Economic Strategy annual performance reviewed and draft produced.

2019

ESDCB met and reviewed the Economic Strategy annual progress report; the

aims and objectives for the development of the LIS; proposed approach and

framework for the LIS Evidence; Terms of Reference for the Independent Expert

Panel (LEP Board paper March 2019); the plan for the 5th March Local Leaders

session; and the draft tender for external expert support in developing the LIS.

Next Steps

March

5th March first of three sessions with LEP Board, Sector Leads, Leaders and

2019

Education Leaders. Paper to LEP Board seeking approval to set up the

Independent Expert Panel who would test and examine the LIS evidence and

interventions which aims to deliver on Government expectation to involve external

experts from business and academia.

Development of LIS Evidence base commences. Government LIS Branding

guidance expected. Lunch of Offshore Wind Sector Deal expected.

April -

Development of evidence base and interventions through a range of stakeholder

July 2019

activities including events, surveys, focus group discussions and other activities.

Innovative ways of engaging business are being explored.

First of two sessions with the Independent Expert Panel.

LIS story board developed providing the framework for the LIS. Second Local

Leaders session - provisional date 19th June.

July -

Review of evidence base and interventions. Seek sign off, of LIS evidence base

September

and interventions from Government. Drafting of the LIS commences.

2019

September

Final Local Leaders Session to review the Norfolk and Suffolk LIS. Seek

- October

endorsement from local partners. LEP Board and Government sign off LIS.

2019

November

Joint launch of LIS with Government.

2019

As the LIS is being co-developed with Government the proposed times above may change.

6

22

Appendix 3 - Industrial Strategy Sector Deals

Nuclear

The Nuclear Sector Deal was published on 27th June 2018, following negotiations between the

Nuclear Industry Council and Government. The main ambitions in the Sector Deal are:

o a new approach to building power plants — with a target for a 30% reduction in the cost

of new build projects by 2030

o a long-term vision of innovation-led growth that delivers successively lower generation

costs and a 20% reduction in decommissioning costs to the taxpayer

o a more competitive supply chain, with more UK companies using advanced

manufacturing methods and entering domestic and export markets for nuclear goods

and services.

The main opportunity for businesses in Norfolk and Suffolk came in the form of the national

supply chain and productivity improvement programme (£10m contribution from Government

and £20m from industry through £10m funding and £10m contribution-in-kind). We have worked

closely with Heart of the South West LEP and Cumbria LEP to develop regional applications of

the programme, with Nuclear AMRC leading on the national programme. The programme aims

to support businesses wishing to work in the nuclear supply chain and learn the lessons of the

programme linked to Hinkley Point C in the South West. The business case for this this joint bid

has been submitted to BEIS and we are working with BEIS as feedback comes through.

Creative Industries

The Creative Industries Sector Deal was published on 28th March 2018. Norwich is mapped out

as a high-concentration creative industries cluster in the Sector Deal, which provided us with a

great opportunity to build on the ambitions of the Sector Deal.

Government will provide £20m over two years from the Cultural Development Fund for local

partnerships of businesses, museums and galleries and universities to bid in for. Industry will

develop a supporting Creative Kickstart Programme to provide firms in clusters with mentoring

and advice on finance, exports and IP including a creative industries roadshow to introduce

businesses and investors.

£64m will be provided between Government and industry to the Arts and Humanities Research

Council Creative Industries Clusters Programme bringing together businesses and universities

and ensuring that business needs are fully integrated into the research and development

partnerships.

Construction

The Construction Sector Deal was published on 5th July 2018. This Sector Deal is obviously

more of a national sector deal, rather than focusing on particular clusters.

The main ambitions of the Sector Deal are:

o Attracting, retaining and developing people and skills for the industry through:

o Investing £34m to scale up innovative training models across the country to

support the delivery of 1.5m new homes by 2022.

o Establishing a National Retraining Partnership (with CBI & TUC) which will

target construction skills shortages as a priority.

o Develop new apprenticeship standards, working with sector and Institute for

Apprenticeships.

o Work with industry to build capacity and prepare for the implementation of

new construction T-Levels. First high quality construction industry

placements within the first T-Levels will be from September 2020.

o Make effective use of public procurement to encourage skills development in

construction supply chains.

7

23

o Investing £170m from the Industrial Strategy Challenge Fund in the Transforming

Construction: Manufacturing Better buildings programme. Funding will be provided

for digital technologies, manufacturing technologies, energy generation and storage

technologies and R&D programmes. (The sector will invest £250m directly aligned

with this programme and support the commercialisation of new construction

technologies and techniques).

o Establishing the UK as a global leader in the global infrastructure market - using the

network of overseas posts and working with UK Export Finance to ensure availability

of finance for UK consortia.

o Taking forward public sector investment set out in the National Infrastructure and

Construction pipeline, contributing to the delivery of more than £460bn of planned

infrastructure investment.

o Improving the lifetime performance of buildings through embedding ‘procure for

value’ approach in public procurement.

o Strengthening the supply chain for mineral and construction products across the

whole of the UK.

Life Sciences

Two Life Sciences Sector Deals have been published on 5th December 2017 and 6th December

2018.

Given we have international expertise in the field of food, health and the microbiome, and an

advanced cluster of animal health and emerging pharmaceutical manufacture, the Sector Deal

has strong links to our region.

Life Sciences Sector Deal 1 set out the following ambitions:

Government will establish the Health Advanced Research Programme through which

industry, charities, NHS, universities and government will collaborate on long-term

healthcare projects with industrial benefits (approach to be laid out in future phases of

the sector deal. Initial collaborations include the ‘Data to early diagnostics and precision

medicine’ programme with up to

£210m from ISCF

(incl. genomics and digital

diagnostics).

Government to invest £146m from the ISCF to support measures to grow medicines

manufacturing (incl. £12m medicines manufacturing innovation centre; £66m vaccines

development & manufacturing centre; £12m expansion of cell & gene therapy catapult

manufacturing centre in Stevenage;

£30m to establish three advanced therapies

treatment centres; £25m to support collaborative R&D).

Further £16m from ISCF will grow advanced therapies manufacturing capacity in viral

vectors.

Government has committed to implement a regional approach to the life sciences sector

deal by working closely with key clusters (mentioning Leeds, Sheffield, Oxfordshire

Housing Deal, Cambridge South station, Cam-Mk-Ox Expressway).

Life Sciences Sector Deal 2:

Brings together 10 companies and is backed by wide range of organisations from

across the sector, includes more than £1.3 billion of investment between the public and

private sectors. It ensures the UK remains in pole position in the treatments of today,

while creating the industries and treatments of the future such as genomics and AI-

powered diagnosis.

In the ‘Places’ section of the deal, it sets out details of clusters/investments/innovations

across the UK’s regions. The deal states the East of England region has 39,410 jobs in

life sciences and a turnover of £16,229m. Unfortunately, the deal does not go into more

detail for the East of England other than refer to the East-West rail link investment.

8

24

Artificial Intelligence

The Artificial Intelligence Sector Deal was published on 26th April 2018 with the following

ambitions:

o Enhance the existing digital infrastructure

o Develop a highly skilled workforce

o Stimulate AI uptake within the public sector

o Drive innovation to increase productivity

The AI Sector Deal is more national in its approach, with a focus on certain AI powerhouses.

The following case study was in the Sector Deal: BT is funding AI research at 15 leading

universities across the UK, and is the UK’s largest telecoms and ICT investor in R&D. In

addition, BT is leading a five year, £5m partnership with the Universities of Lancaster,

Cambridge, Surrey and Bristol, as part of EPSRC’s £78m Prosperity programme, creating an AI

powered next generation data infrastructure for the UK. BT is expanding its global R&D centre

and start-up cluster at Adastral Park in East Anglia. Specifically, BT is committed to creating

carrier scale and critical national infrastructure ready AI technology. This is an integral part of

the evolving consortium of UK companies and institutions behind a proposed national Future

Networks Research Centre with its hub at Adastral Park to drive AI into the global telecoms

infrastructure.

The additional Sector Deals have also been published:

Rail (6th December 2018)

Aerospace (6th December 2018)

Automotive (10th January 2018)

Awaiting publication

Offshore Wind

The Offshore Wind Sector Deal is expected early March. The LEP Executive has worked

closely with EEEGR and stakeholders (public and private) linked to the offshore wind sector to

pull together a prospectus mapping out the region’s offshore wind cluster around the five

foundations of productivity and vision for the future. This document was submitted to the

offshore wind industry council and government.

The LEP is working closely with Cabinet Office ahead of the Sector Deal’s launch regarding

feedback and regional facts and figures.

Tourism

The Tourism Sector Deal is expected in March. The main opportunity linked with the Tourism

Sector Deal is the potential creation of Tourism Zones across the UK. The LEP Executive has

met with DCMS’ Head of Tourism to outline our assets and vision for the region and liaising

closely with the DCMS team and Visit Britain as the Sector Deal progresses.

Food and Drink

Food and Drink Sector Deal is expected in March. The main ambitions in the Sector Deal link to

innovation, skills and exports.

Others on the horizon include: Retail, Industrial digitalisation, Marine, Oil and Gas

9

25

New Anglia Local Enterprise Partnership Board

Wednesday 27th February 2019

Agenda Item 9

Norfolk and Suffolk Energy Industry Council

Authors: Madeleine Coupe and James Allen

Summary

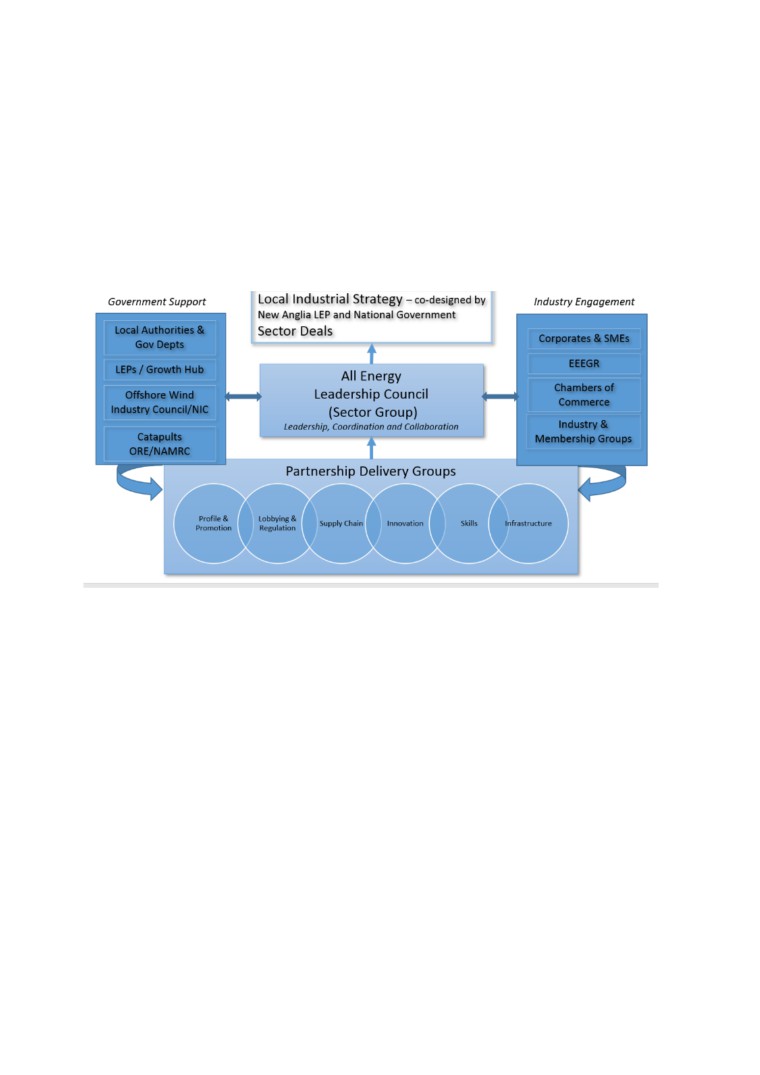

This paper updates the board on the development of the All Energy Industry Council as the

LEP’s new energy sector group. The group will bring together business, academia and the

public sector and act as a focal group to promote the area’s energy assets, as well as

champion issues such as skills, the supply chain and innovation.

Recommendation

The board is asked to endorse the establishment of the All Energy Industry Council as the

LEP’s sector group for the energy sector

Background:

In November 2018, the LEP Board agreed to the recommendations set out in the Tier 2

governance review paper.

For sector groups, this will mean the groups must be accountable to the LEP Board, and -

where the group is part of a membership organisation - a separate sector group must be

developed to focus on leadership and coordination.

The East of England has become the UK’s epicentre for energy generation with its unique mix

of renewable (and in particular offshore wind), gas and nuclear energy production.

The significant opportunities presented by the Industrial Strategy and Offshore Wind Sector

Deal have galvanised local partnerships in order to develop a collective vision for developing

the cluster.

To realise this vision, the cluster needs strong and clear leadership and a structure which

strengthens the strategic relationships between industry, government and academia.

Hitherto the East of England Energy Group has acted as the LEP’s energy sector group.

However as a membership body, it has been hard for the group to represent all interests of the

sector from business, academia and the public sector, whilst also specifically serving the needs

of its paid membership.

1

26

All Energy Industry Council: proposed model

Following a meeting of stakeholders in December 2018, the LEP proposed the establishment of

an All Energy Leadership Council to act as the energy sector group for Norfolk and Suffolk to

deliver the Economic Strategy, Local Industrial Strategy and energy-related Sector Deals. The

LEP board was represented at the meeting by private sector board member Johnathan

Reynolds.

Stakeholders such as industry representatives, EEEGR, chambers of commerce and Orbis

Energy are vital to ensuring the approach remains business focussed and industry-led.

The council will represent the wider energy sector, taking advantage of the East of England’s

unique status as the UK’s only All Energy region, incorporating oil and gas, nuclear, wind, solar

and wave energy.

Delivery groups, led by different partners and aligned with specific objectives, will drive

forward activity and report into the council.

The council will be strongly connected to key LEP groups/strategies such as the Innovation

Board; Skills Board; Transport Board and will be linked into the Economic Strategy for Norfolk

and Suffolk. In addition, the council gives us the vehicle to drive collaboration with other key

clusters.

At the meeting of stakeholders there was broad consensus around the following aims and

objectives for the council.

1. Profile and Promotion

a. Branding and marketing the area and cluster to national and global audiences

b. Proactively promoting the offer to attract global investment and boost exports

across the energy sector

2. Lobbying and Regulation - strengthening links with Government and Offshore Wind

Industry Council and other bodies to attract support and investment and improve

regulations.

3. Supply chain development - strengthening the cluster, helping businesses work with

each other, including tier one corporates, and maximising export and investment

opportunities.

2

27

4. Innovation support - helping businesses improve their performance and enabling them

to enter new markets, develop new products, enhance processes and improve

productivity.

5. Skills development - overseeing the skills sector plan, connecting employers with

providers and responding to industry demands in developing the skilled workforce of

tomorrow.

6. Infrastructure - attracting investment to enhance and build the infrastructure required

to support the growth of the industry and improve connectivity and business productivity.

The group is perfectly placed to address the Clean Energy focus area of the Local Industrial

Strategy and the delivery of Sector Deals linked to the Industrial Strategy - building on the

Offshore Wind work and pulling together the work done to date on the Nuclear Sector Deal.

The group’s first achievement was to support the LEP in producing a prospectus for the

Offshore Wind Industry Council (OWIC).

The prospectus, which has been well received by OWIC outlines the vision for the Norfolk and

Suffolk cluster, and will help support the development of the Offshore Wind Sector Deal.

Next steps

A second meeting of the All Energy Industry Council takes place on Monday February 25th. This

will consider the offshore wind and nuclear sector deals, governance and membership of the

council and the LEP’s clean energy sector skills plan.

An update on this meeting will be given to the LEP board.

Recommendation

The board is asked to endorse the establishment of the All Energy Industry Council as the

LEP’s sector group for the energy sector

3

28

New Anglia Local Enterprise Partnership Board

Wednesday 27th February 2019

Agenda Item 10

Brexit

Author: James Allen Presenter: Chris Starkie

Summary

The report provides an update on steps being taken by the LEP to gather intelligence on

preparations for and the impact of Brexit and work being undertaken to support businesses in

Norfolk and Suffolk.

Recommendation

The Board is asked to note the contents of the report.

Background

As we near the official date for the UK’s departure from the EU (29th March 2019), the LEP has

set out its proposed role as follows:

1. Assisting businesses through Brexit by ensuring government understands the

opportunities and challenges faced by businesses across Norfolk and Suffolk.

2. Providing those businesses with useful information regarding how they can prepare for

Brexit and what they can be doing to Brexit-proof their business for the coming years.

3. Lobbying for the future funding landscape to be fit for purpose post-Brexit.

4. Ensuring that LEP programmes react to the opportunities and challenges posed by

Brexit.

Providing businesses with useful information on preparing for Brexit

Over the past month the Government has significantly increased the amount of information

available for businesses.

The LEP and Growth Hub teams are working closely to ensure that the Brexit webpage on both

websites is updated on a daily basis.

The has also begun a social media campaign to raise awareness of the information available

on its website.

Providing Brexit intelligence to Government

The LEP and Growth Hub continue to provide weekly Brexit intelligence through case studies

from business to BEIS and MHCLG. This intelligence is now also going to regional MPs each

week to support them.

1

29

The latest template for the intelligence includes a series of questions for business from

Government and the LEP and Growth Hub have used our case studies to shape responses:

1. Do you think the UK leaving the EU is going to impact your business/organisation (Yes

or No)? If yes, will this be a positive or negative impact, and can you provide more detail

on that impact?

2. How prepared do you feel in the event of a No-deal EU Exit?

3. What are your top five priorities regarding your business right now in the context of EU

Exit?

4. Do you have any concerns regarding the UK leaving the EU in relation to your business

operations?

5. Are you undertaking any activities to prepare your business for Brexit? If so, what are

these? If not, please explain why?

6. What are the upcoming issues/challenges your business is facing (i.e. looking to the

short, medium and long term)?

7. What are the barriers/ blockers to progress faced by your business/organisation right

now?

8. What tier of the supply chain do you primarily operate in? Do you have a view on the

potential impacts of EU Exit or a no-deal exit on your supply chain?

9. Do you transfer personal data to and from countries in the European Economic Area

(EEA)?

10. If you do receive data from organisations or data centres in the EEA, have you identified

a legal basis for this to continue in the event of a No Deal? If so, what is this?

11. If you are not taking any steps to ensure you can continue to receive personal data from

organisations in the EEA in the event of a No Deal EU Exit, is there a reason for

this? E.g. lack of awareness, lack of resources, have decided it is not a priority, are

waiting to see if no deal is likely to happen.

Some of the latest intelligence we have received locally:

At the Norfolk Farming Conference it was made it clear that a ‘no deal’ would be

catastrophic for farming.

The importance of being able to export effectively was also raised from meat producers

at the conference.

A number of manufacturers have highlighted concerns around import and export costs

and times.

British Sugar have highlighted the need for a ‘level playing field’ to be able to compete

globally - reciprocity of tariffs is key, especially as other major producers worldwide

have the benefit of greater subsidy and less stringent regulation which helps them keep

costs down.

There are further examples of stockpiling of raw materials taking place. This is

particularly noticeable in manufacturing and engineering companies. A number of whom

have taken on additional warehousing capacity to house the materials.

Firms particularly in the hospitality sector are concerned about labour shortages with

employees returning home.

LEP chief executive Chris Starkie participated in a Brexit panel session at the Norfolk Chamber

of Commerce debate in Norwich.

The audience included a wide range of businesses. The message from the audience was a

need for certainty and fear of a no deal scenario.

Identify changes to LEP and other programmes to react to opportunities and threats

posed by Brexit.

As the LEP and Growth Hub receive intelligence from the business community on the potential

impacts of Brexit, we are working together to analyse the case studies and identify particular

2

30

trends. This will enable us to determine the best support the LEP programmes can provide for

businesses affected by Brexit.

Work to shape the future funding landscape for business support.

The LEP is currently reviewing its European Structural and Investment Fund (ESIF) strategy in

line with the Economic Strategy for Norfolk and Suffolk. This paper will be brought to the Board

in March.

Recommendation

The Board is asked to note the contents of the report.

3

31

New Anglia Local Enterprise Partnership Board

Wednesday 27th February 2019

Agenda Item 11

Private sector board appointments

Author: Chris Starkie

Summary

This paper updates the board on the process for the recruitment of two additional private sector

board members which has been undertaken over the past few weeks.

Recommendation

The Board is asked to endorse the recommendations of the appointments panel. This is that

Claire Cullens and Pete Joyner are appointed to the LEP board as private sector board

members.

Background

As part of the implementation of the Government’s LEP Review, the LEP board agreed to

recruit two additional private sector board members.

This would take the total number of private sector board members to 12 - 10 business

representatives and two education representatives.

It enables the LEP to satisfy the Government’s requirement that two thirds of the board are

classed as private sector.

The recruitment process

Over the past few weeks the two board vacancies were extensively advertised in the local

media, through business intermediary groups, sector groups, the LEP website and social media

and other avenues.

We were delighted to receive a total of 16 high quality applicants for the two roles.

Of these 16, five were shortlisted for interview.

LEP deputy chair Lindsey Rix and board member David Ellesmere agreed to form the

appointments panel and interviewed the five candidates. One candidate was known to Lindsey,

so Doug Field asked Chris Starkie to interview that candidate with David Ellesmere.

Recommendation

The board are now being asked to endorse the recommendation from Lindsey Rix and David

Ellesmere that Claire Cullens, chief executive of the Norfolk Community Foundation, and Pete

Joyner, managing director of Shorthose Russell are appointed to the board.

(Confidential) Claire and Peter’s CVs are attached for further information

1

33

New Anglia Local Enterprise Partnership Board

Wednesday 27th February 2019

Agenda Item 12 - Chief Executive’s Report

Author: Chris Starkie

Summary

This report provides an overview of LEP team activities since the November board, structured

around:

1) Programmes

2) Strategy

3) Engagement

4) Operations and Finance

The media dashboard is attached as an appendix to the report.

Recommendation

The board is asked to note to contents of the report.

1)

Programmes

This section provides a headline update on the LEP’s main programmes.

Growth Deal

The programme performance report for the Growth Deal can be found under agenda item 13.

Capital Growth Programme call

The LEP Executive has met with Hewdon Consulting for initial feedback on the assessment of

project applications received during the Focussed Call for Projects which closed to applicants

on the 11 January 2019.

The round which was focused on skills, innovation and productivity, has £19m available and

the LEP received 27 submissions, requesting a total of £83m of funding. All projects must be

fully spent by the end of March 2021.

The consultants report will feed into a paper for the Investment Appraisal Committee at its

February 27th 2019 meeting. Recommendations from the IAC are then due to be brought for

consideration by the LEP board at its March 27th meeting.

Growing Places Fund

Ipswich Flood Barrier

The official opening of the Ipswich Flood Barrier took place on Friday 8 February.

Attended by Doug Field, with Chris Dashper and Jim Rice of the LEP Executive team, the

opening included a visit to the actual barrier and its control centre, with a demonstration of the

fully operational barrier being raised and lowered.

The LEP contributed £6.6m towards the £30m cost of the actual barrier, from its Growing

Places Fund, with the wider project including other flood protection measures around the tidal

zone bringing the total project cost to £67.4m, the majority of which was met by the

Environment Agency. Therese Coffey unveiled the barrier in her capacity as Floods Minister.

MSF Technologies

The Investment Appraisal Committee approved a short-term bridging loan facility of £500k for

MSF Technologies at an additional meeting of the committee on 28 January 2019.

1

35

New Anglia Local Enterprise Partnership Board

Wednesday 27th February 2019

Agenda Item 12 - Chief Executive’s Report

Author: Chris Starkie

Ipswich Winerack building

The Winerack development on Ipswich Waterfront is proceeding well. The project has drawn

down the full £5million loan from the LEP and continues to draw down the £15million loan from

Homes England.

On site construction progress is very evident and the developer estimates the first residential

units will be completed and occupied by May 2019 with the contract completion date being

January 2020. The important element of fire safety has been fully addressed in a strategy

commissioned by Ingleton Wood and completed by the International Fire Consultants Group

Ltd.

Innovative Projects Fund

Hewdon Consulting has now completed the first stages of assessment on the projects

received for the call for the Innovative Projects Fund, which closed at 5pm on 21st December

2018, with a total of £500,000 available for projects.

Of the 21 projects received during the call, 18 will now be appraised against the call criteria,

with the results and recommendation presented to the Investment Appraisal Committee at its

March meeting.

Of the remaining projects, one has been rejected as a capital bid and two others have been

awarded funding directly by the LEP from project funds because of the urgency in decision

making.

These two projects are as follows:

East Anglia Skills Initiative

£15,000 per year for 3 years awarded to the Norfolk and Suffolk Agricultural Associations to

jointly organise annual skills and careers events (subject to an annual evaluation). Each event

is attended by approximately 5-6,000 youngsters and over 200 businesses and have been

proven to be of increasing value to young people and employers. At the end of the project

term it is envisaged that the project will be successful enough to attract a private sector

sponsor to ensure the events are self-sustaining for years to come. he project is also

financially supported by Suffolk and Norfolk County Councils.

Museum of East Anglian Life

£15,000 awarded to the Museum of East Anglian Life, which has been match funded by Mid

Suffolk Council, to start the process to transform the Museum into the National Museum of

Food; a destination which will significantly grow tourism to the region and benefit other

businesses in the area. Colleagues will be involved in the process and funding will be put

towards commissioning a business case and an associated funding plan.

2

36

New Anglia Local Enterprise Partnership Board

Wednesday 27th February 2019

Agenda Item 12 - Chief Executive’s Report

Author: Chris Starkie

Growing Business Fund

The Growing Business Fund continues to perform strongly, both in terms of demand and

spend. At the latest panel meeting in February 2019 a total of £644k was awarded to 7 new

projects and 2 projects had revised offers agreed. Details of awards are included in the

decision log which accompanies board papers.

The programme has now exceeded the annual forecast spend of £4.1m. With support from

the Investment Appraisal Committee, funding will be drawn forward from future years of the

Growth Deal to support the overspend, which will increase overall spend on the Growth Deal

in the current financial year.

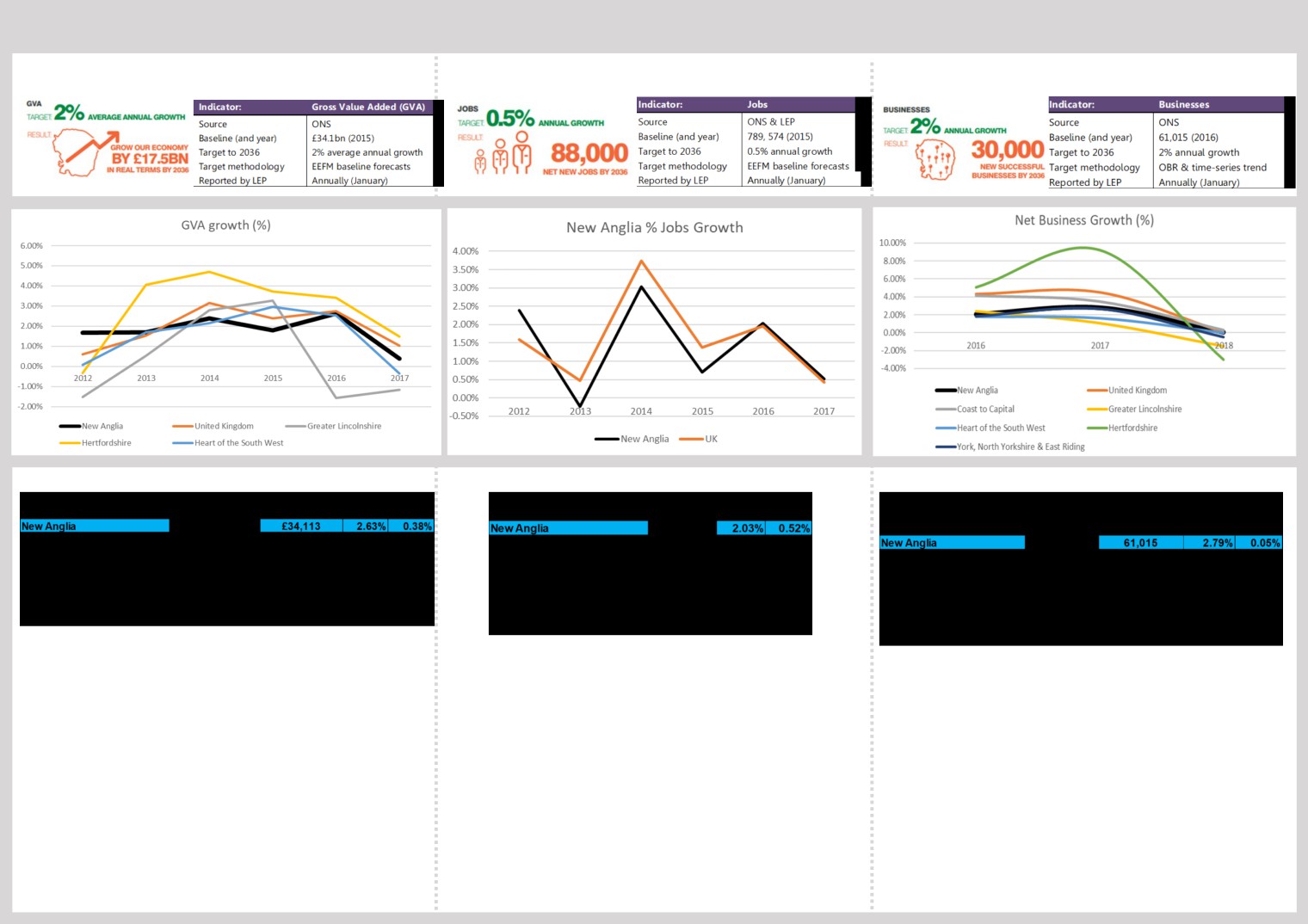

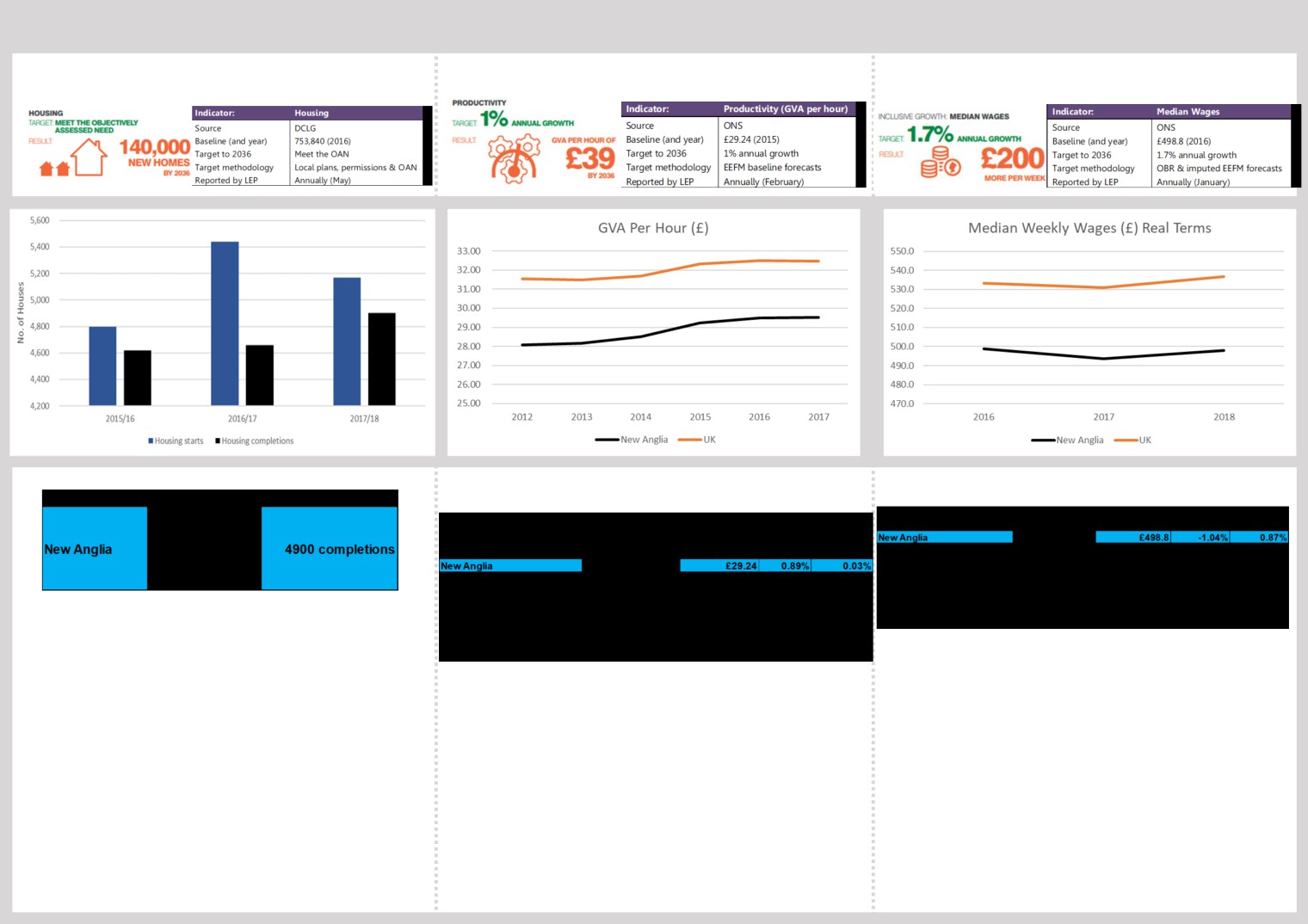

2)

Strategy

This section provides an update on the work being undertaken by the LEP’s strategy team

since the last board meeting. This includes work around skills, infrastructure and transport.

Delivery of the Economic Strategy

The Economic Strategy Delivery Co-ordinating Board met on 15th February where they

discussed the first draft of an annual progress report on the Economic Strategy. The

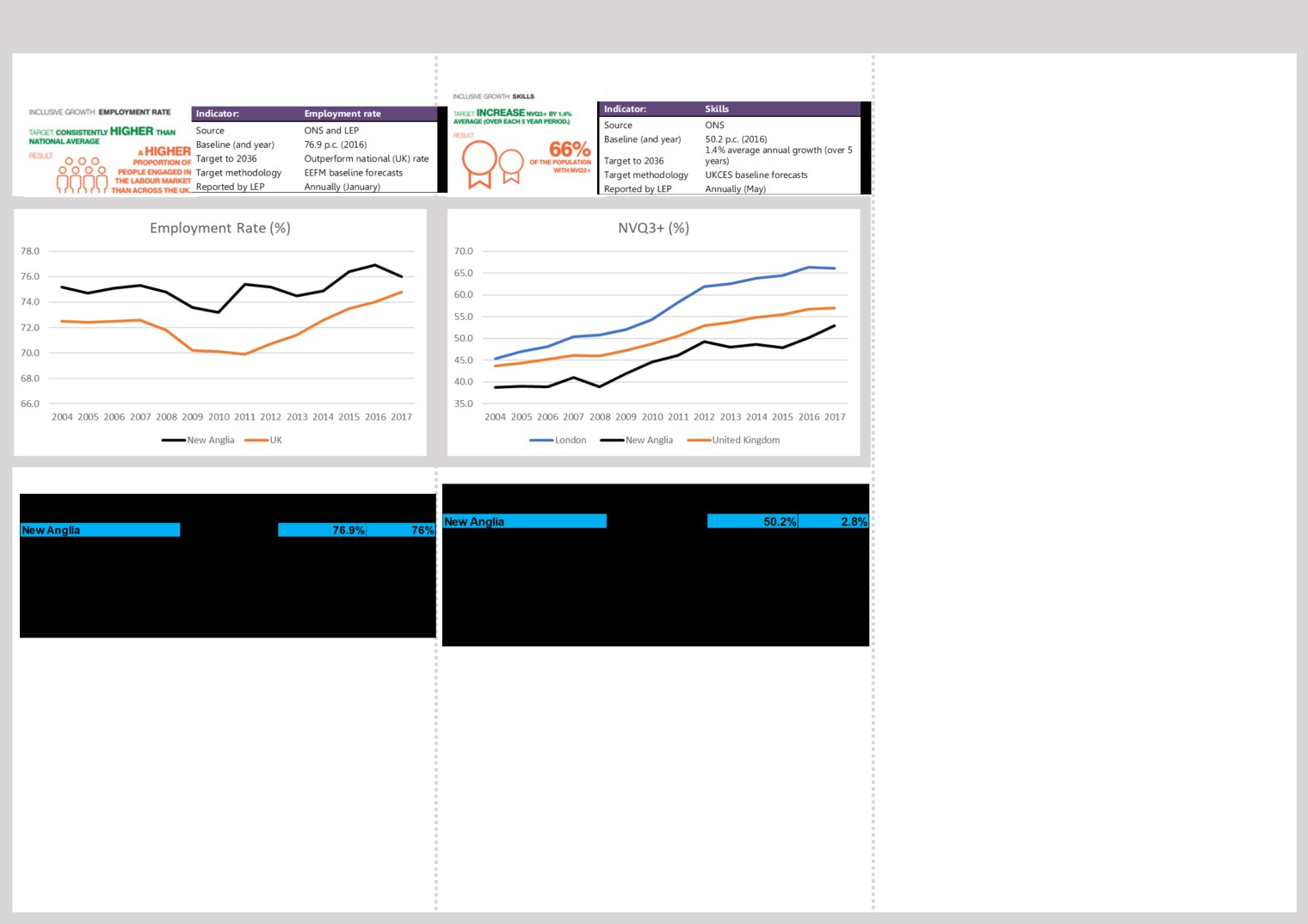

Economic Dashboard which is included in the Board papers under item 13, provides the

progress against the Economic Strategy economic indicators.

An overview of the Economic Strategy Annual Progress Report will be presented at the Local

Industrial Strategy workshop taking place on Tuesday, 5th March at BT Adastral Park. If you

have not already responded, please let Marie Finbow know whether you are able to attend:

Data Practitioners Group

The Data Practitioners group met on 6th February which consists of data experts from across

Local Authorities and partner organisations. The group peer reviewed the Economic Strategy

progress against the economic indicators along with the proposed evidence framework for the

Local Industrial Strategy and provide input to shape and ensure the evidence was relevant.

Inclusive Growth

The Voluntary Community & Social Enterprise (VCSE) Sector met with Sue Lowe from DCMS

to discuss data protection in relation to Brexit on 31st January. The next meeting of the

Inclusive Growth Group for Great Yarmouth and Lowestoft is 14th March.

Funding

The LEP has been working with Norfolk County Council and UEA on the proposals for a Low

Carbon Innovation Fund successor project across the New Anglia, Cambridge and

Peterborough and Hertfordshire LEP areas. The LEP has also been working extensively on