New Anglia Local Enterprise Partnership Board Meeting

Wednesday 25th September

10.00am to 12.30pm

The Mess, Milsoms, Kesgrave Hall, Ipswich, IP5 2PU

Agenda

No.

Item

Duration

5 mins

1.

Welcome from the Chair

2.

Apologies

3.

Declarations of Interest

4.

Actions / Minutes from the last meeting

Forward Looking

35 mins

Update and

5.

Enterprise Zones

discussion

Governance and Delivery

40 mins

6.

Local Industrial Strategy

For Approval

Break

10 mins

Governance and Delivery

60 mins

7.

Apprenticeships Levy Transfer Pool

For Approval

8.

Innovative Projects Fund

For Approval

9.

Voluntary and Community Sector - Confidential

Update

10

Brexit

Update

Working Agreement with the Cambridge and Peterborough Combined

11.

For Approval

Authority

12.

Chief Executive’s Report including a Confidential Appendix

Update

Update and for

13.

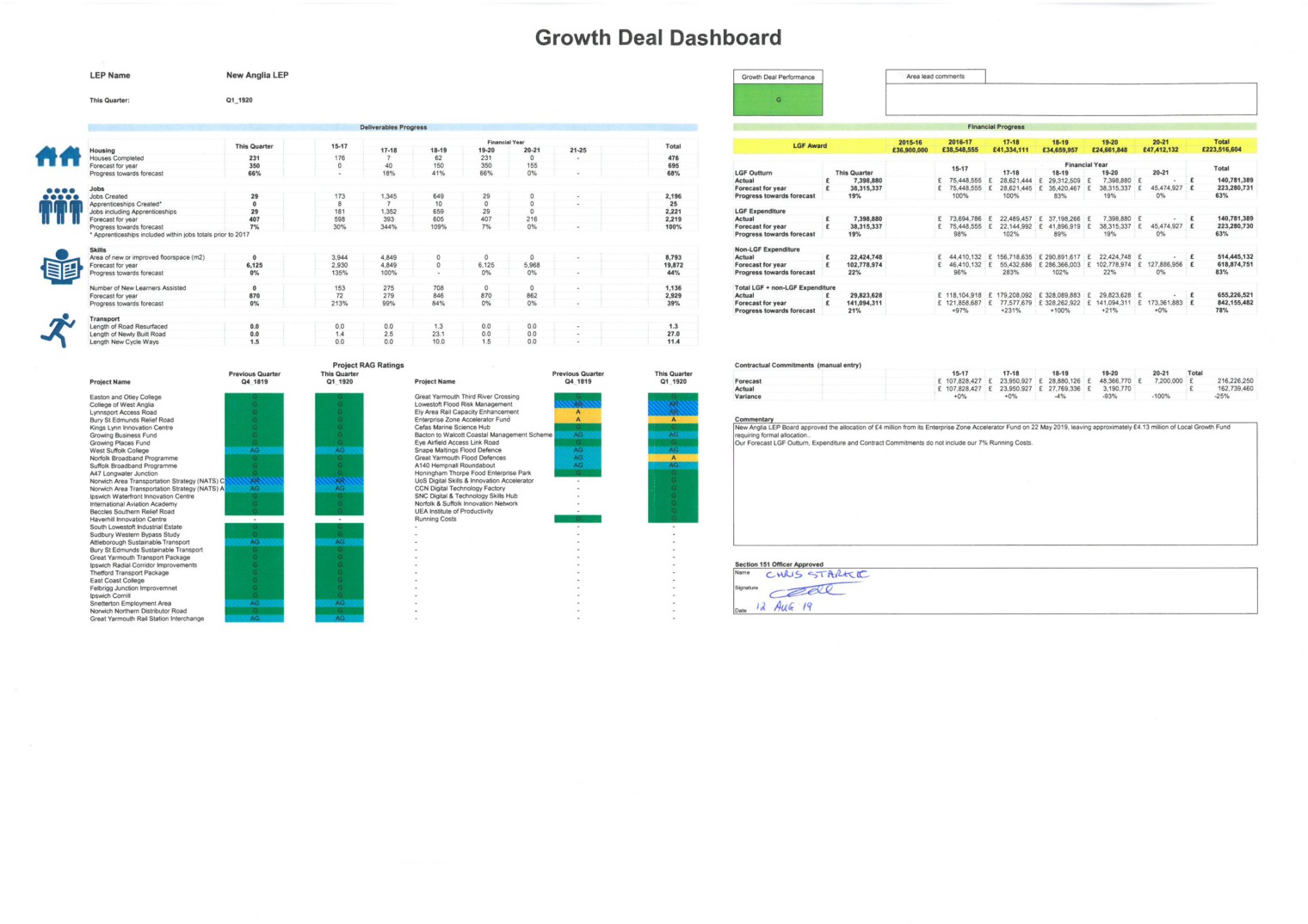

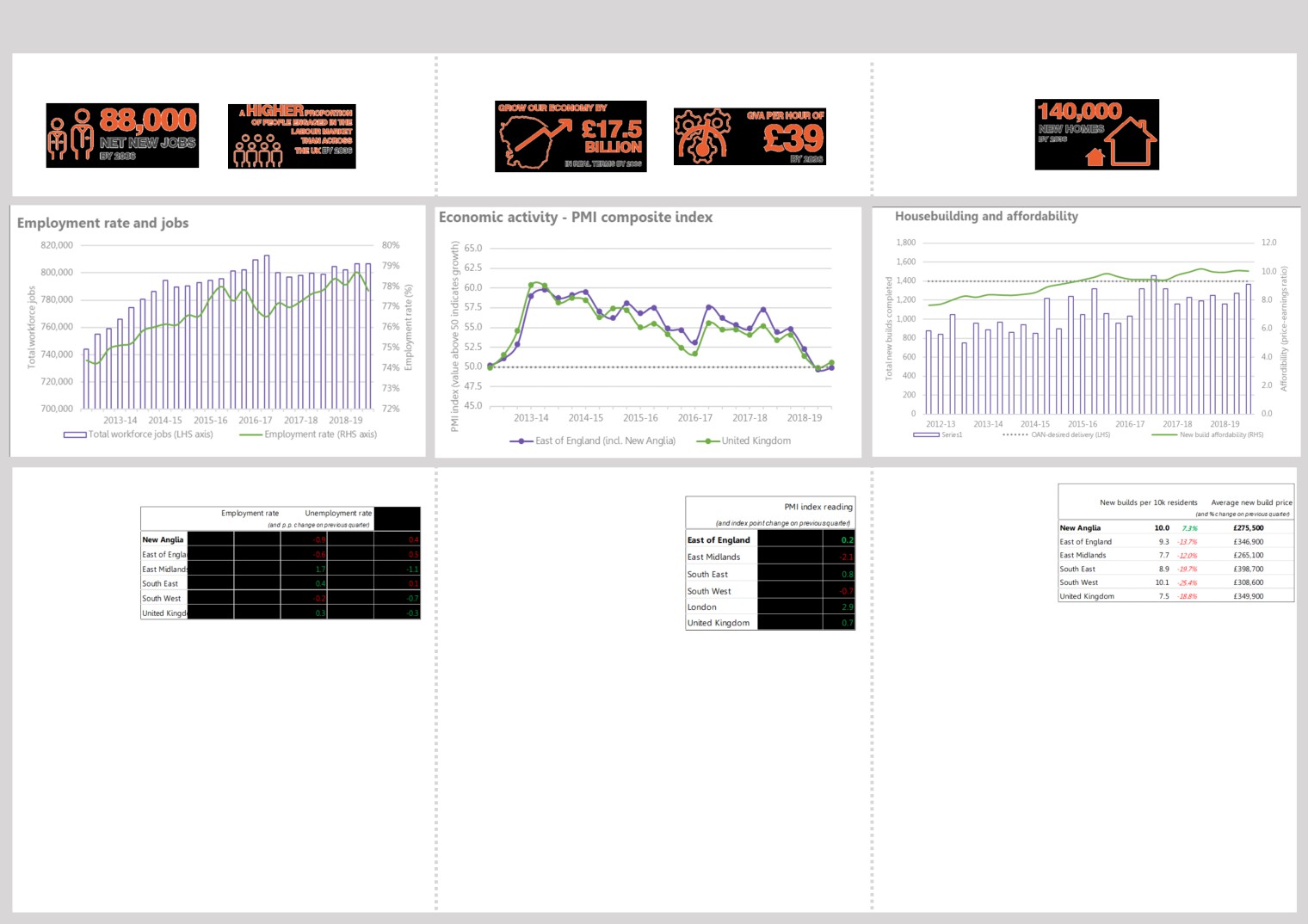

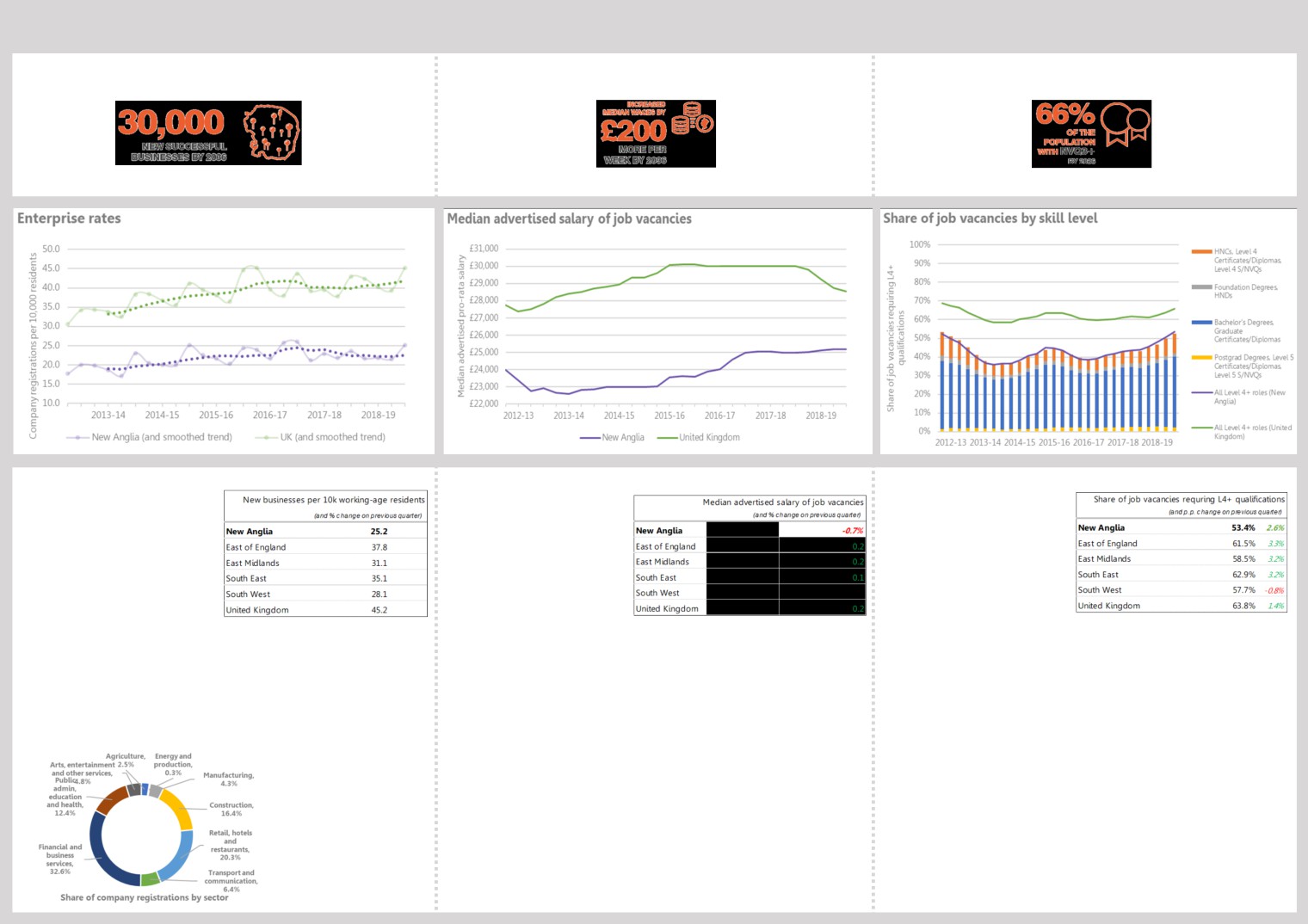

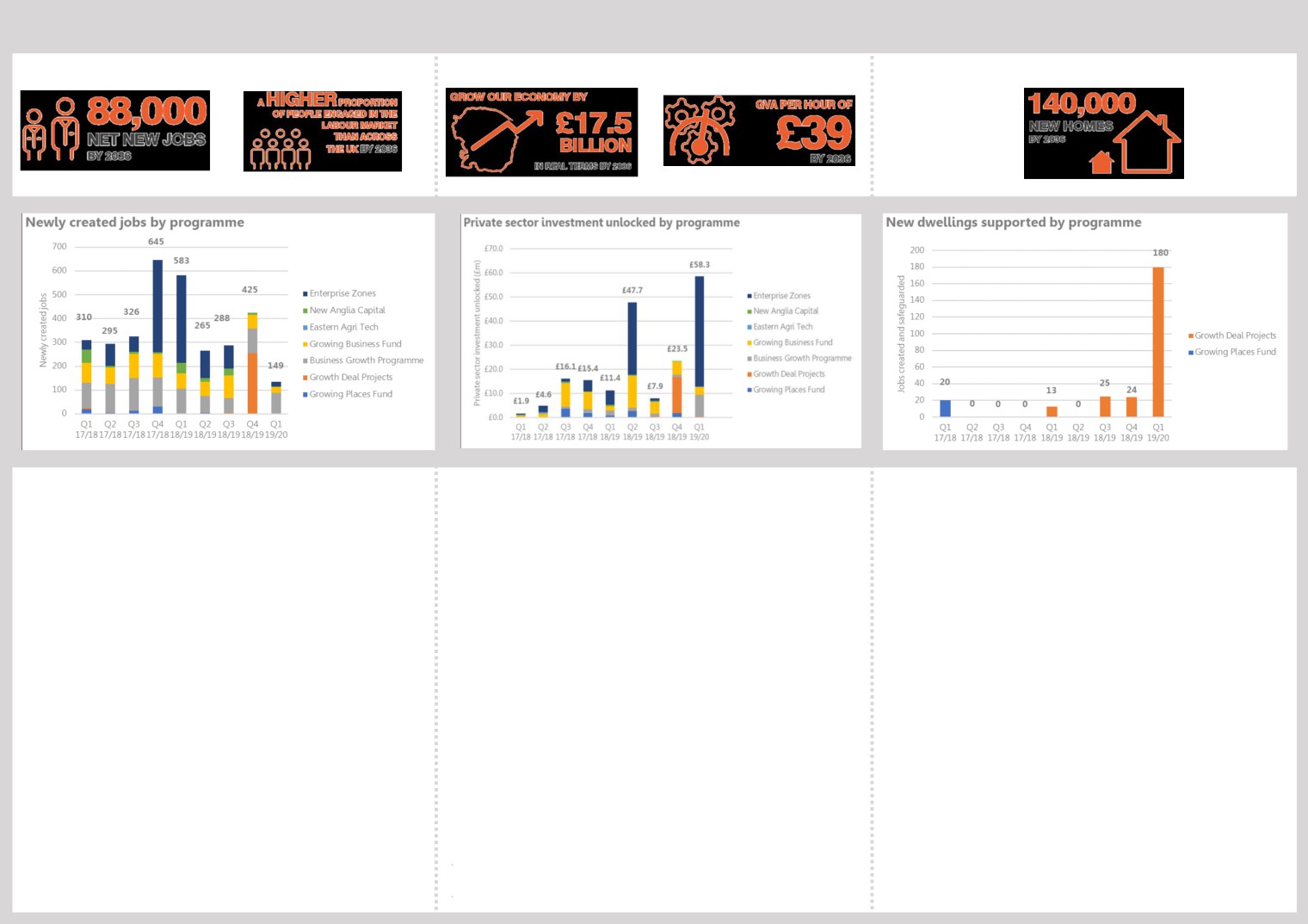

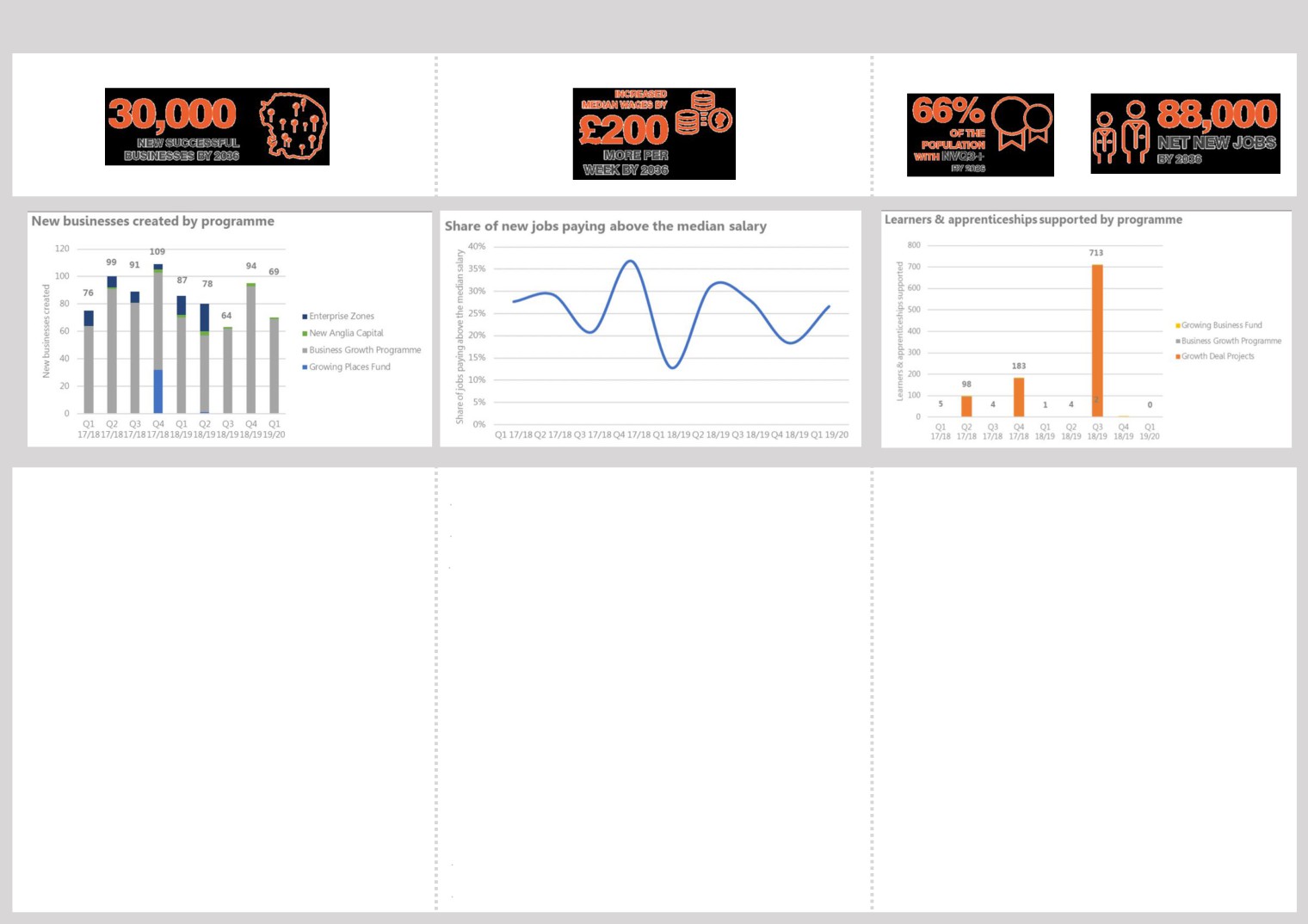

September Programme Performance Reports including Dashboards

Approval

14.

Board Forward Plan

Update

15.

Any Other Business

Next Meeting: 10.00am - 12.30pm, 30th October

Venue: The Carnegie, Cage Lane, Thetford

1

New Anglia Board Meeting Minutes (Unconfirmed)

23rd July 2019

Present:

Claire Cullens (CC)

Norfolk Community Foundation

David Ellesmere (DE)

Ipswich Borough Council

Doug Field (DF)

East of England Coop

Matthew Hicks (MH)

Suffolk County Council

Pete Joyner (PJ)

Shorthose Russell

Johnathan Reynolds

Nautilus

Lindsey Rix (LR)

Aviva

Sandy Ruddock (SR)

Scarlett & Mustard

Alan Waters (AW)

Norwich City Council

Jeanette Wheeler (JW)

Birketts

Tim Whitley (TW)

BT

Attendees

Graham Plant (GP)

Great Yarmouth Borough Council - For Andrew Proctor

Catherine Richards (CR)

East Norfolk Sixth Form - For Nikos Savvas

Mark Ash (MA)

Suffolk County Council - For Sue Roper

Professor Andrew Lovett

UEA - For Item 6

Paul Winter (PW)

Skills Board Chair - For Item 7

Chris Dashper (CD)

New Anglia LEP

Ellen Goodwin (EG)

New Anglia LEP - For Item 6

Chris Starkie (CS)

New Anglia LEP

Natasha Waller (NW)

New Anglia LEP - For Items 7 and 8

Rosanne Wijnberg (RW)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

1

Actions from the meeting: (23.7.19)

Action Log

Change the status column to “target date”

HW

Climate Change Adaption and Carbon Reduction Action Plan

Distribute the presentation to board members

HW

Apprenticeships Levy Transfer Pool

A business case is required which will be presented at the September meeting

NW

July Programme Performance Reports

A programme summary including performance against targets will be included in future NAC

CD

reports

1

Welcome from the Chair

Doug Field (DF) welcomed everyone to the meeting and thanked Jo Warr from Norwich Castle for

hosting.

DF advised that the agenda would be amended so that Item 7 would come before item 6 as the

Skills Board Chair had to leave the meeting early.

2

Apologies

Apologies were received from John Griffiths, Steve Oliver, Andrew Proctor, David Richardson, Sam

Chapman-Allen, Dominic Keen and Nikos Savvas.

3

Welcome from Norwich Castle

Jo Warr (JWa), Head of Development at Norwich Castle, welcomed the Board to Norwich Castle

and thanked the LEP for their support for the current Gateway to Medieval England Project which

aims to raise the profile of Norwich as a cultural centre.

JWa provided an overview of changes to the castle over the past century and reviewed the plans to

reinstate the Norman floor level and reconfigure the internal layout of the keep to replicate the

original rooms. The new layout will incorporate the British Museum Partnership Gallery which will

be the first permanent British Museum exhibition outside London .

When the project has been completed in the spring of 2021 the new design, along with improved

access to all levels, will allow the castle to host a much wider range of functions as part of the

project’s aim to establish the castle as a state of the art cultural and community venue.

4

Declarations of Interest

Full declarations of interest can be found at http://www.newanglia.co.uk/about-us/the-board.

Item 11: July Programme Reports: New Anglia Capital Report: DF declared an interest in Nova

Farina and SupaPass.

5

Minutes of the last meeting 25th June

The minutes were accepted as a true record of the meeting held on 25th June 2019.

Chris Starkie (CS) reviewed the action log. It was agreed to change the status to a date to

provide more detail.

ACTION: Change the status column to “target date”

HW

7

Skills Delivery Board

Paul Winter (PW), Chair of the Skills Board, addressed the meeting and highlighted key

elements of the report detailing the progress made over the past year notably delivery of

skills plans in additional sectors, reviewing Skills Deal projects and reaffirming the Youth

Pledge.

2

PW reviewed the process of setting up the new Skills Advisory Panel (SAP) as required by

Government where minor work is required to fulfil the requirements noting that the new

arrangements will require closer links between the LEP Board and the SAP.

DF asked for further details on the Governance requirements of the SAP. PW advised that

the voluntary sector needed to be included and discussions were underway with the

Community Foundations to address this. PW noted that the Board was currently very large

which may need to be addressed to ensure if remains effective.

The meeting discussed the implications of the end of the ESIF funding. CS advised that this

had been guaranteed by Government until the end of 2022 and would be replaced by the

Shared Prosperity Fund the details of which are still unknown.

Alan Waters (AW) noted that skills environment was very crowded which meant that it was

not always clear where companies could obtain support. PW agreed that there were too

many initiatives and that clarification was required.

The Board agreed:

• To note the content of the report

• To approve the transition from a Skills Board to a Skills Advisory Panel as required by

Government and to continue to endorse its activities

6

Climate Change Adaption and Carbon Reduction Action Plan

Professor Andrew Lovett (AL) addressed the meeting presenting the findings of the scoping

study into CO2 reduction as commissioned by the LEP.

AL advised that the report detailed observed changes in temperature when looking at trends

over two 30 year time periods which take fluctuations into account. It was noted that

Norfolk and Suffolk have experienced a 0.5 degree increase in temperature over summer

months and nearly a 1 degree rise in winter over the two 30 year periods studied.

The study then looked at projected changes based on 4 different pathways representing

different amounts of global surface temperature increase.

AL presented projected changes in temperature and precipitation and also in sea levels

noting that there were significant changes depending on the relevant pathway.

The report noted that there had been a 32% reduction in emission of greenhouse gases

since 2005 largely due to changes in manufacturing and in households but transport

emissions have not reduced by the same amount and consequently now make up a larger

share of CO2 emissions.

The meeting was advised that the national average for CO2 emissions was 5.4 tonnes per

person with both Norfolk and Suffolk slightly above this level. It was noted that to abide by

levels stated in the Paris Agreement this needed to reduce significantly to 1.7 tonnes per

person.

The data was presented split by local authority with variations reflecting the make-up of the

area. It also identified the 37 highest emitters which make up 22% of emissions.

LA advised that the study had identified key priorities where changes could be made and

where the LEP could provide support.

Domestically - adaptation of building stock to improve energy efficiency and develop

heating alternatives for off-gas areas.

Transport - increase public transport and use of electric vehicles with the associated

requirement for more charging points.

Agriculture - improved water management and enhanced carbon sequestration such as

tree planting schemes or improved cultivation processes

3

Energy - improved efficiency as demand increases along with enhanced distribution and

transmission.

Tim Whitley (TW) asked if the study provided a breakdown of transport by vehicle type as

this would assist in identifying which interventions would target the highest emitters. AL

advised that this is not currently part of the study and would require further research.

The meeting noted that the changes could not just be achieved by the LEP alone and

partners would need to work together to achieve the reductions. National policy will also

play a key role.

The Board discussed the issues around bringing in offshore power.

Johnathan Reynolds (JR) advised that the SE energy hub was in the very early stages of

looking at an offshore energy grid and this was vital to the development of the offshore

energy sector. Matthew Hicks (MH) confirmed that 30% of the UK’s energy came ashore

at Sizewell but that development was being done on a piecemeal basis will a lack of

connectivity between projects.

Lindsey Rix (LR) suggested that the LEP could support those companies looking to become

carbon neutral.

David Ellesmere (DE) proposed targeting support for the largest emitters and also for the

LEP to coordinate purchasing requirements related to CO2 reduction in order to provide

increased buying power.

JR noted that the findings of the scoping report needed to be considered in every decision

the Board made and the LEP needed to identify those gamechanger projects which support

CO2 reduction and identify gamechanger projects and carbon offsetting ideas.

The Board agreed:

• To note the content of the report and presentation

• To support the development of an action plan to tackle some of the key findings of the

report

• To receive the presentation

HW

In order to ensure the Annual Accounts were signed off it was agreed that Item 12 would be

addressed before Item 8.

12

Draft Annual Financial Statements - Confidential

RW confirmed that the accounts had been reviewed by the Audit & Risk Committee on 1st

July and changes agreed that the meeting have been made.

DF noted that the LEP now employed over 50 people and proposed discussing with CS how

HR could be monitored going forward.

The Board agreed:

• To note the contents of the report

• To approve the annual financial statements and audit management letter for signing by

the Chair

8

Apprenticeships Levy Transfer Pool

CS presented the proposal to the meeting providing the background to the issues facing

apprenticeship schemes and the proposal to make the funds available for apprenticeships.

The LEP will act as a promoter of the scheme and work with SMEs to ensure they have the

tools and equipment in place to utilise it. CS advised that Aviva has already signed up and

other large companies are being approached

4

CS confirmed that the scheme will need ongoing funding and a meeting with county

representatives will take place in August to progress the business case. A more detailed

plan will be presented at the September Board.

DE proposed that, if successful, the scheme could be expanded and if there is sufficient

demand for specific training this could be used to request additional courses locally.

The Board agreed:

• To note the content of the report

• To approve the £60,000 budget to develop a cost-effective model to support the transfer

of apprenticeship levy to SMEs in partnership with colleagues from Norfolk and Suffolk

County Councils

• To receive a business case at the September board meeting

9

Growing Business Fund: Large Company Grant Programme

Chris Dashper (CD) reviewed the proposal which has already been approved by the IAC

noting that one application has already been received and approved by the IAC subject to

Board approval of the programme.

Jeanette Wheeler (JW) confirmed that this programme would help the Growing Business

Fund Panel where it has been challenging to make applications meet the criteria required for

the other funds.

The Board agreed:

• To note the content of the report

• To approve the introduction of a GBF Large Company Grant programme

MH left the meeting

10

Chief Executive’s Report

CS highlighted key items in the report and asked for questions.

LIS - Further strategies have now been published. New Anglia will publish its LIS in October

having been brought forward to the 2nd wave.

Place Branding - This will be launched at the AGM and the invitation will go out this week to

approximately 300 businesses and partners.

The Board agreed:

• To note the content of the report

11

July Programme Performance Reports

Rosanne Wijnberg (RW) reviewed the reports for July.

Business Growth Programme - The Programme is on track to meet its spend target and

new activity for the next three years is being finalised. The process of seeking additional

ERDF funding to extend the Small Grants Scheme for a further year has begun.

New Anglia Capital- CD reviewed the report and asked for questions from the Board.

DF asked for details of the split between NAC and private funding. CD advised that overall

NAC has invested 40% of funds to the 60% provided by private funding. This is against a

target of a 50/50 split.

DF requested the inclusion of a summary highlighting progress against targets.

ACTION: The summary from the NAC Board report will be included in future NAC

CD

programme reports.

The Board agreed:

5

• To note the contents of the report

13

Management Accounts - Confidential

The Board agreed:

• To note the content of the report

14

Board Forward Plan

CS reviewed the Forward Plan and asked for requests for additional items.

The Board agreed:

• To note the content of the plan

15

Any Other Business

JW proposed bringing younger entrepreneurs to a future Board meeting to engage them in

the work of the LEP.

Next meeting:

Date and time of next meeting:

10.00am - 12.30pm, 25th September 2019

Venue: The Mess, Kesgrave Hall, Ipswich.

6

Actions from New Anglia LEP Board Meetings

Date

Item

Action

Update

Actioned

Target Date

By

23/07/2019

Action Log

Change the status column to “target date”

HW

Complete

23/07/2019

Climate Change Adaption and

Distribute the presentation to board members

Complete

HW

Carbon Reduction Action Plan

23/07/2019

Apprenticeships Levy Transfer

A business case is required which will be presented at the September

Included on the agenda for the September Board

Complete

NW

Pool

meeting

23/07/2019

July Programme Performance

A programme summary including performance against targets will be

To be included in the next NAC report in January 2020

Jan-20

CD

Reports

included in future NAC reports

25/06/2019

GE Update Report

To provide the Board with regular reporting of the pipeline of visits relating

To be included in the next Inward Investment update report

JM

Jan-20

to inward investment and subsequent outcomes

25/06/2019

AOB

UEA Enterprise Fund - Any board member wishing to sit on the board should

A Board member is still required to sit on the Enterprise Fund Board

All

Oct-19

contact Chris Starkie

23/05/2019

Growth Hub Presentation

Growth Hub Annual review to be circulated to the Board when published

Expected autumn 2019

CD

Nov-19

23/11/2018

Infrastructure

For the LEP team to ensure that links are progressed with other sub-national

Progress will be included in the next infrastructure update in October

EG

Oct-19

transport bodies

9

New Anglia Local Enterprise Partnership

Board Decision Log - Public

Date

Decision

Decision Made

Making Body*

7/8/19

Growing

The Panel approved the following applications:

Business Fund

• William Morfoot Limited - Agreed to support

Panel

Approved Grant: £50,000

• Timber Frame Management Limited - Agreed to support

Approved Grant: £35,662

23/7/19

LEP Board

The Board made the following decisions:

Skills Delivery Board

To approve the transition from a Skills Board to a Skills Advisory Panel as required by Government and to continue to endorse its activities

Climate Change Adaption and Carbon Reduction Action Plan

To support the development of an action plan to tackle some of the key findings of the report

Draft Annual Financial Statements

To approve the annual financial statements and audit management letter for signing by the Chair

Apprenticeships Levy Transfer Pool

To approve the £60,000 budget to develop a cost-effective model to support the transfer of apprenticeship levy to SMEs in partnership with

colleagues from Norfolk and Suffolk County Councils

Growing Business Fund: Large Company Grant Programme

To approve the introduction of a GBF Large Company Grant programme

23/7/19

Investment

The IAC made the following decisions:

Appraisal

Growing Places Fund Large Company Grant Request (Confidential)

Committee

To approve a grant of £379,318 subject to approval of the capital grant programme by the board, provision of a suitable State Aid statement by

the applicant and evidence of confirmation by the parent company that the company would remain in Norwich.

3/7/19

Growing

The Panel approved the following applications:

Business Fund

• Creative Displays Limited - Agreed to support

Panel

Approved Grant: £40,000 - awarded under de minimus

• Bendart Limited - Agreed to support

Approved Grant: £42,500

• Hugh Crane Cleaning Equipment - Agreed to support

Approved Grant: £56,369

• Anglian Indoor Karting Ltd - Agreed to support

Approved grant: £40,000

• Stephen Walters and Sons Limited - agreed to support

Approved grant: £118,049 - awarded under de minimus

25/6/19

LEP Board

The Board made the following decisions:

Capital Growth Programme - Institute of Productivity

To approve the award of Capital Growth Programme grant funding of £4.461m to the Institute of Productivity

MIPIM Update Report and Proposal for 2019

To approve the proposal including spend of £28,788, the covering approach, format and costings for MIPIM UK 2019

* New Anglia Local Enterprise Partnership Board, Investment Appraisal Committee, Growing Business Fund Panel, Remuneration Committee, Audit & Risk Committee

New Anglia Local Enterprise Partnership Board

Wednesday 25th September 2019

Agenda Item 5

Enterprise Zones: Progress Update

Author: Julian Munson/Eunice Edwards. Presenter: Julian Munson

Summary

To provide a progress update report on New Anglia Local Enterprise Partnership’s two

Enterprise Zones;

1. Great Yarmouth & Lowestoft (New Anglia) Enterprise Zone (started 2012) & extensions

(started 2017).

2. Space to Innovate Enterprise Zone (started 2016).

This report will cover Enterprise Zone outputs to date, strategy, timeline and forward plan for

delivery (to 2021).

Appendices A and B are the September Enterprise Zone Programme Performance Reports.

Recommendation

The Board is asked to note progress and endorse the proposed strategy and forward plan.

Background

New Anglia LEP successfully bid to Ministry of Housing, Communities and Local Government

(MHCLG) for two ‘multi-site’ Enterprise Zones in Norfolk & Suffolk.

Enterprise Zones are designated areas that provide business rates discounts of up to £275k

over a five-year period to businesses if locating in the zones in the first 5/6 years & simplified

planning. Enterprise Zones are part of the Government’s wider Industrial Strategy to support

businesses and enable local economic growth.

The Great Yarmouth & Lowestoft Enterprise Zone began in April 2012 & encompasses six

sites; Beacon Park in Gorleston, South Denes in Great Yarmouth, Riverside Road in Lowestoft,

Mobbs Way in Oulton, South Lowestoft Industrial Estate in Lowestoft and Ellough in Beccles.

Four of these sites (Beacon Park, South Denes, Mobbs Way and Riverside) were also awarded

extensions where benefits started in 2017. This Enterprise Zone has an energy sector focus.

The Space to Innovate Enterprise Zone began in April 2016 and encompasses 10 sites;

Norwich Research Park, Suffolk Park in Bury St Edmunds, Scottow Enterprise Park near

Coltishall, Egmere Business Zone near Wells-next-the-Sea, Nar Ouse Business Park in King’s

Lynn, Stowmarket Enterprise Park (Gateway 14) and the 4 sites in the Ipswich area are Princes

Street, Futura Park, Waterfront Island and Sproughton Road (Eastern Gateway). The sectors

identified for this Enterprise Zone include: agri-tech, food and health, offshore energy, the green

1

13

economy, ICT and digital creative sectors in which Norfolk and Suffolk has a competitive

advantage.

Enterprise Zones have established themselves as a driving force of local economies as they

unlock key development sites, consolidate infrastructure, attract business and create jobs.

Both EZ’s have long range stretch targets they are working towards with annual targets set with

local authority partners each year. However, progress to date on some sites has been slower

than expected.

Outputs are recorded and reported on a quarterly basis to MHCLG and New Anglia LEP Board.

Activity across the two Enterprise Zones is coordinated by two partnership/development

groups, chaired by New Anglia LEP, involving County and District/Borough Council officers and

MHCLG.

In Summary, to date*, the Great Yarmouth & Lowestoft Enterprise Zone has delivered 1806

Jobs, 806 construction jobs, 63 businesses, £51.25m private investment, £177m public

investment, 20.9ha land developed & 54,455 Sqm floor-space (new and refurbished). Despite

slower progress in earlier years due to the slow down in the oil and gas sector, most of the sites

are now progressing well with good delivery on Beacon Park and further development forecast

for Ellough and around Great Yarmouth port.

To date the Space to Innovate Enterprise Zone has delivered 1151 Jobs, 1723 construction

jobs, 104 businesses, £89m private investment, £132m public investment, 69.2ha land

developed and 83,578 Sqm of floor-space (new and refurbished). In terms of progress against

the 5-year target there is a lag in net number of new businesses and numbers of jobs for some

of the Space to Innovate sites with a couple of the sites experiencing limited progress due to

external factors such as land ownership issues and gaps in infrastructure investment.

(Construction jobs are included in our figures as part of the reporting to Government. A

construction job is counted as a new permanent full time equivalent job created by the

construction activity which are expected to last for at least 26 weeks).

All business rates growth generated by the Enterprise Zones are kept by the Local Enterprise

Partnership and local authorities in Norfolk & Suffolk for 25 years to reinvest in local economic

growth. This reflects the Government’s commitment to long-term economic growth and enables

LEPs to reinvest in site development and other local initiatives.

For the New Anglia Enterprise Zones, the 100% retained rates is split into 4 separate funds;

Fund A1 is for the Collecting (or District) Authority

Fund A2 is for the County Council

Fund B is for the development of the Enterprise Zone sites

Fund C is for New Anglia LEP to fund activity in the Economic Strategy for Norfolk and Suffolk.

New Anglia LEP has strong governance arrangements in place with legal agreements and

MOUs with delivery partners, as required, and Site Delivery Plans signed off by all partners.

*Latest figures to end of Q1 June 2019

Key Considerations

Enterprise Zones remain a key priority programme for New Anglia LEP. They not only

demonstrate an effective method of intervention to unlock and accelerate the development of

key commercial sites but also support local economic development and job creation. In

addition they also enable the retention of business rates income to further enhance the

development and delivery of sites and provide an additional source of income for New Anglia

LEP for other project activity.

2

14

This programme has proven to be effective in unlocking and accelerating commercial

development in the Great Yarmouth and Lowestoft Enterprise Zone and in the case of the

Beacon Park site for example has had a highly significant impact on business investment and

jobs growth for the energy sector supply chain in that area.

There has also been good progress on the majority of the Space to Innovate Enterprise Zone

sites, particularly over the past 12 months. New Anglia LEP continues to work closely with

partners to ensure that we identify creative ways of removing any barriers to development and

provide an even stronger focus on delivery over the next 12-18 months.

There are cases where development has been limited though and the issue of land ownership

and level of ambition to build can be a major factor inhibiting progress. New Anglia LEP with

Local Authority partners has attempted to overcome these barriers in some cases through the

new EZ Accelerator Fund and opportunities around land acquisition and co-investment to help

‘kick start’ new development. Despite this, at least three of the EZ development sites have

effectively stalled and progress is not expected in the short term (without major intervention).

It is also important that the Enterprise Zones ‘offer’ is more proactively marketed through

various channels and leveraging the Growth Hub, grants programmes and inward investment

activity in a more coordinated and targeted way. For example, the new Norfolk and Suffolk

inward investment website (with Norfolk and Suffolk branding) offers a new channel in which to

actively promote the Enterprise Zone sites.

It is important to note that a priority for Enterprise Zones is encouraging a net increase in

investment, business growth and job creation and so careful consideration is always given to

minimising ‘displacement’ within the locality of all enterprise zone sites.

Most of the Enterprise Zone sites have demonstrated the opportunity for businesses to expand

locally rather than risk relocating outside the area. Examples include LDH La Doria at the

Sproughton Enterprise Zone and NOCN at Nar Ouse Enterprise Zone.

The structure of the EZs prevents businesses simply relocating from existing premises to take

advantage of the financial benefits provided by the sites. That is because the capital cost of

new premises, coupled with the increased rent paid, is significantly greater than the incentives

on offer.

The financial package does however provide an incentive for businesses who are considering

relocating to larger premises or moving into Norfolk and Suffolk making that investment

decision.

Most of the Enterprise Zone sites also have a specific sector focus ensuring that we can retain

and attract jobs in those sectors that align with the Economic Strategy.

For example, Great Yarmouth and Lowestoft; energy - advanced manufacturing and logistics;

Princes Street, Ipswich - financial services, ICT digital; Norwich Research Park - food, agri-

tech and life sciences.

There are also some local business rates policies in place for specific sites such as Futura

Park, Ipswich to ensure that some sectors e.g. retail, are not eligible for the business rates

discount, therefore deterring certain sectors & encouraging preferred ones.

Link to the Economic strategy

The New Anglia Enterprise Zone sites are all located in the Priority Places identified with the

new Economic Strategy. These include the Ipswich area, Norwich area, Norfolk/Suffolk Energy

Coast (including North Norfolk, Great Yarmouth and Lowestoft areas), A14 Corridor

(Stowmarket and Bury St Edmunds) and the A47 Corridor (King’s Lynn).

3

15

As an incentive-based programme focused on unlocking and delivering growth on key

commercial sites, Enterprise Zones support the objectives of the following priority themes;

Our Offer to the World

Driving Business Growth and Productivity

Collaborating to Grow

Competitive Clusters, Close to Global Centres

The EZs also play a critical wider role in the delivery of the Economic Strategy through income

generated by Pot C.

Pot C funding is used by the LEP to support wider economic growth and in particular the

Innovative Projects Fund. This ensures that all parts of the area benefit from the success of the

Enterprise Zones. Pot C funding is also used to fund the Enterprise Adviser Network.

Next Steps

There has been significant progress on both the Great Yarmouth and Lowestoft Enterprise

Zone and Space to Innovate Enterprise Zone with some good examples of partnership working

between New Anglia LEP, Local Authorities and private sector developers unlocking potential

on key sites. However further work is required to generate and strengthen the pipeline of

potential enquiries for the Enterprise Zones to help progress with meeting business and job

targets.

The forward plan is;

A stronger focus at MIPIM UK to promote specific sites such as Nar Ouse, Ellough and

Norwich Research Park

Targeted campaigns for potential inward investors and high growth companies via the

new Norfolk and Suffolk Unlimited marketing activity and also the Growth Hub

Recommendation

The Board is asked to note progress on the Enterprise Zones and provide feedback and ideas

on the proposed approach and forward plan to help raise the profile of the Enterprise Zone

development opportunities and strengthen the investment pipeline.

4

16

New Anglia Local Enterprise Partnership Board

Wednesday 25th September 2019

Agenda Item 6

Local Industrial Strategy (LIS)

Author: Lisa Roberts Presenter: Lisa Roberts

Summary

This report provides an update on the development of the Norfolk and Suffolk Local Industrial

Strategy and seek sign off from the Board.

Recommendation

The Board is asked to:

endorse and sign off the Norfolk and Suffolk Local Industrial Strategy- Appendix A; and

delegate authority to the LEP Chair and CEO to agree amendments made following the

LEP Board and any further amendments made by Government

Background

The Norfolk and Suffolk Local Industrial Strategy has been developed in partnership with

business, education and local authorities.

This process began in March with a session involving leaders from local authorities, business

and education where the overall approach and aims for the strategy were agreed.

These were:

a) The Industrial Strategy is an opportunity to drive implementation what has already been

agreed in terms of goals and priorities agreed in 2017 - not start again - we don’t need

“another strategy.”

b) We should focus on the global and national trends that will shape the future of our

businesses and communities and focus on the actions to continue to support

businesses to take the opportunities ahead as the post-Brexit economy evolves.

c) The Local Industrial Strategy will set out the case for continued investment in the

Norfolk and Suffolk economy and provide more detail about how we will deliver the

biggest opportunities for growth and productivity that we identified in our strategy.

d) The Industrial Strategy should be built around the three large scale economic

opportunities that are identified in the Economic Strategy as being where we have

strongest competitive advantage. These are:

Agri-food / Agri-tech

Clean energy

ICT and Digital

e) Each strategic opportunity provides significant scope for high skilled jobs, supply chain

firms and improving in-work progression and skills for our communities. We are also

1

19

proposing to reinforce the actions set out in the Economic Strategy to drive overall

business growth and productivity.

Following the leaders’ session in March, more than 20 consultation events were held with

stakeholders involving around 400 individuals, examining the economic evidence, developing

ideas and testing proposed interventions.

A second leaders’ event took place in June where emerging ideas and interventions from the

business engagement events were tested and the golden thread of Clean Growth agreed.

The third and final session with leaders’ takes place on 18th September. The aim of this session

is to provide an overview of the strategy and receive support from leaders on the document

ahead of adoption by the LEP board and beginning the sign off process with Government.

In addition, an Independent Economic Expert Panel was established to act as a critical friend,

offering independent expert advice.

This panel reviewed the evidence and proposed interventions, providing a number of

recommendations which were included in the strategy.

Members include Professor Tim Besley from LSE, Rebecca Riley from University of

Birmingham, Alex Plant from Anglian Water and David Campbell from the Department of

Business, Energy and Industrial Strategy.

Structure of the strategy and Link to the Economic Strategy

The document has been developed to align with the government’s framework for Local

Industrial Strategies and link with the national industrial strategy.

It also builds on the Economic Strategy for Norfolk and Suffolk which was endorsed by all local

authorities in autumn 2017 and focuses on productivity and inclusive growth.

The Economic Strategy for Norfolk and Suffolk remains the blueprint for growth to 2036 and the

local industrial strategy forms part of the delivery mechanism for this strategy.

As agreed with leaders in March, the local industrial strategy focuses on three opportunity

areas: Clean energy, agri-food and ICT/digital creative.

The strategy does also recognise the importance of a number of underpinning sectors such as

ports and logistics and culture and the visitor economy and financial services and sub-sectors

such as the equine industry, which underpin the economy.

The golden thread which runs through the local industrial strategy is clean growth - with

Norfolk and Suffolk positioned as the UK’s clean growth region.

Each of the three opportunity areas have a number of proposed interventions aimed at

capitalising on these opportunities.

The strategy is then structured around the five foundations of growth identified in the national

industrial strategy and our response to these foundations.

The foundations are: Ideas, people, infrastructure, business environment and places. The

strategy outlines our assets in these areas and proposed interventions to boost productivity,

support inclusive growth and capitalise on our three opportunity areas.

Purpose of the strategy

The development of the strategy has helped focus attention on the key building blocks of our

economy, understand the areas with greatest potential and identify interventions to unlock this

potential.

2

20

Whilst there is no funding specifically set aside by Government for the implementation of local

industrial strategies, by signing up to the document Government is endorsing its aims and

ambitions.

It means that existing Government policy and future plans will need to take into account the

local industrial strategy.

Plans are in place in a number of areas with a number of Government departments to see how

key elements of the strategy can be taken forward.

The process has also significantly raised the profile of our economy and its key components

within Whitehall.

The strategy also provides an agreed plan for local partners to utilise, in tandem with the

Economic Strategy.

We will be developing a plan to take forward the interventions identified in the document and

whilst funding will be required to take forward some of the proposals, funding is in place for

many of the schemes.

Local Authority Endorsement

The draft Local Industrial Strategy is in the process of being endorsed by local authorities

across Norfolk and Suffolk.

As of 18th September, seven local authorities have endorsed the Strategy. These are: Babergh,

Breckland, Great Yarmouth, Mid Suffolk, North Norfolk, Norwich and Suffolk County Council.

We are anticipating endorsement from most of the remaining authorities before the LEP board

meeting, with a couple scheduled to endorse following the LEP board.

Feedback from those who have endorsed to date have been included in the version of the LIS

at appendix A.

Next steps

After the LEP Board signs off the Strategy it will then enter the sign off process with

Government, with a view to publication during October, although this timeline is subject

to external factors.

This process involves the document being shared with Government departments for

their review and sign off, before being officially signed off by ministers.

The draft attached is therefore a working draft which is subject to amendment by

Government departments and ministers before publication by Government.

It is understood that once agreed by Government and the LEP, three weeks before

publication the government LIS design team will produce a designed version which will

follow the framework of those that have been published to date.

Recommendation

The Board is asked to:

endorse and sign off the Norfolk and Suffolk Local Industrial Strategy; and

delegate authority to the LEP Chair and CEO to agree amendments made following the

LEP Board and any further amendments made by government.

3

21

New Anglia Local Enterprise Partnership Board

Wednesday 25th September 2019

Agenda Item 7

New Anglia Apprenticeship Levy Transfer Pool business case

Author: Natasha Waller

Presenter: Chris Starkie

Summary

The July LEP Board agreed to fund an Apprenticeship Levy Sharing Coordinator position which

will be hosted by the LEP. Since the board meeting good progress has been made including

recruiting a coordinator. In addition to agreeing the funding the board requested an outline

business plan and this paper sets out the purpose of the new role in greater detail with

timelines and targets.

Recommendation

The LEP Board endorse the outlined business plan

The LEP Board endorse a further £60,000 of funds to allow support to continue for an additional

year

Background

Apprentice numbers have dropped significantly in recent years due to apprenticeship reforms

making businesses more cautious, new standards not being available and/or more training

being focussed on existing staff members.

Across the East of England, apprenticeship starts have declined from 46, 650 (2015-16) to 36,

700 (2017 - 18). The biggest impact has been on the Level 2 Intermediate Apprenticeships

which have fallen from 25, 640 to 14, 620 in that time period. The 16 - 24 year old age group

are the biggest age group impacted.

This mirrors the national picture with starts falling from 509, 360 (2015 - 16) to 375, 760 (2017

- 18).

Intervention is required in order to boost the number of apprenticeship starts particularly

amongst SMEs, which make up the vast majority of employers in the area. At the July Board,

an initial budget of £60,000 was allocated to fund the development and first year running costs

of the New Anglia Apprenticeship Levy Transfer Pool.

Progress since the July board

Since the July Board, there has been a further meeting between the LEP, Norfolk County

Council and Suffolk County Council. It was agreed that we would align our commitments

around apprenticeships to further encourage apprenticeship awareness, growth and levy

transfer.

1

23

Recruitment of the coordinator has taken place and following interviews as of September 18th

an appointment is due to be made.

Our project was also praised by Gavin Williamson, Education Secretary, in the House of

Commons in response to a question about apprenticeships from Waveney MP Peter Aldous. Mr

Williamson said the initiative had the Government’s support.

We are in regular contact with the Education and Skills Funding Agency Key Account Manager

for our region and he has advised us on what approach we should take. He will support us with

raising the profile and supporting the stakeholders involved.

We are working with Aviva to trial apprenticeship levy transfer in our area. We have identified 3

positions which need such a transfer to make them viable opportunities as training providers

are short of available contract to deliver such work. We have also brokered a meeting between

Aviva and City College Norwich and we will be working with them over the coming months to

recruit a new cohort of apprentices who are funded by Aviva’s levy share.

A launch is being planned for the Suffolk Skills and Careers Festival on October 16th at Trinity

Park.

Outline business case

In response to the comments at the July Board, this paper provides an outline of the business

case for the allocated funds.

What are we using the money for?

Staff costs: £45k - one coordinator post including on costs.

Employer engagement/marketing: £15k

The post will be hosted by the LEP. Comparable roles within the County Councils will align with

this post to maximise efforts across the region.

Year 1 would run from September 2019 to October 20

We believe it would be prudent for the post to be a two year post - which would require

the agreement of an additional £60,000 for year 2.

Year 2 would run from October 20 to October 21

We believe a two year post is sensible, as a successful first year will build momentum which

needs to be maintained in a second year.

However given the amount of changes to the apprenticeship machinery and possible changes

in the future, it would also be prudent to establish the programme as a two year project with the

possibility of an extension.

What are we doing and when?

Summer 2019

Soft trialling of the concept. We are currently trialling transfers from a levy

payer with a large regional presence to 4 positions that a local private

training provider want to deliver the apprenticeship standard to.

September 2019

Recruitment of coordinator

October 2019

Launch of the scheme at the Suffolk Skills and Careers Festival (16th

October at Trinity Park).

Initial communications to press and on LEP website. Encourage

stakeholders to replicate.

Autumn 2019

Further mapping of landscape - which levy payers are currently being

engaged with by providers delivering in Norfolk and Suffolk, further

identify potential levy payers who can be approached and develop a

stakeholder group. Identify and build database of SMEs interested in the

scheme.

Initial engagement meetings - providers and employers.

2

24

Develop communications plan.

Winter 2019/20

Initiation of major series of engagement meetings with levy payers and

potential receiving businesses.

First formal meeting of stakeholder group to propose matches -

anticipate regular monthly meetings.

February 2020

Publicity campaign centred around National Apprenticeship Week

March 2020

Publicity campaign centred around Norfolk Skills and Careers Festival

Spring/Summer 2020 Major push on transfers ready for major intakes in September

Late summer 2020 Review of year to date and plan for forthcoming year

October 2020

Publicity campaign centred around Suffolk Skills and Careers Festival

January 2021

Celebration event

The coordinator will be utilised where the support is needed. Different providers/sectors may

have different requirements so a one size fits all is not anticipated at this stage. Obviously there

will need to be a review of time allocation to ensure reasonable equities.

Metrics

Currently, everyone is learning the intricacies of the transfer system and at this stage, it

shouldn’t be underestimated how long each transfer may take. It is anticipated that this will

improve over time and as the ESFA work through their digital account pilot.

It must also be remembered that providers are reviewing/consolidating their apprenticeship

offering which may make starts challenging.

Average apprenticeship cost

£11,000

Transfer targets across New Anglia in programme year one

50

Anticipated transfer value

£550,000

The aim would be for metrics to be recorded for transfers holistically in the region - some may

not directly involve the coordinator but this reinforces the ambition that this is a collaboration.

It is anticipated that 80% of the focus will link with the LEP key sectors but where

time/opportunities lie, other sectors will be supported as ultimately this will support our

providers and residents.

The ideal will be to support individuals who are living, working and training in our LEP area but

we need to be realistic that all 3 may not always be possible.

Levy payers also need to be approached who are outside our LEP area but have a willingness

to support individuals in Norfolk and Suffolk.

Campaigns can be developed around particular sectors and also align with supporting the LIS

and any sector deals.

Year two metrics

The apprenticeship landscape has had to cope with a number of changes in recent years and

frameworks are being withdrawn in summer 2020. We have to be prepared for other

developments with the changes within government.

We anticipate that the process will become slicker and engaged businesses will want to repeat

the processes - both levy payers and receivers.

Transfer targets across New Anglia in programme year two

100

Anticipated transfer value

£1.1m

Links to County Council apprenticeship initiatives

The LEP is proposing to fund the coordinator post for the length of the programme, with a small

budget for promotion.

The scheme is one element of a wider series of actions to support apprenticeships across

Norfolk and Suffolk. It is important therefore that the project is plugged into the range of

initiatives being undertaken by the county councils.

3

25

It will be the responsibility of the county councils to provide these links into individual team

members and wider programmes.

Stakeholder relations

There needs to be a coordinated approach across stakeholders and a willingness to openly

communicate plans. This will ensure we can maximise opportunities and restrict employers

being engaged multiple times by different stakeholders which will potentially result in their total

disengagement.

The stakeholder group will consist of the LEP, county councils and providers who are keen to

deliver to those receiving the levy funds.

There will be a review of potential levy available, levy payers preferences and provider offers.

There will also be discussions around receiver wishes and agreed LEP/provider approaches

over the coming months to source levy.

The Chambers of Commerce, CBI, FSB, business networks and industry councils/sector

groups all need to be informed and engaged with on a regular basis to support the signposting

of opportunities.

Reporting Structure

The coordinator will be line managed by Natasha Waller, Skills Manager.

There will be regular reporting into the Skills Advisory Panel, the LEP Board, the New Anglia

Learner Providers group and Youth Pledge stakeholder meetings.

Link to the Economic Strategy and Local Industrial Strategy

Our Economic Strategy asks for us to ‘step up our efforts to promote and support the delivery of

high quality apprenticeships providing clear entry routes into our focus sectors, directly

producing the skills and capabilities our economy needs. The Local Industrial Strategy

reinforces this. Lack of intervention at this stage will not allow this to happen.

Recommendation

The LEP Board endorse the outlined business plan

The LEP Board endorse a further £60,000 of funds to allow support to continue for an additional

year

4

26

New Anglia Local Enterprise Partnership Board

Wednesday 25th September 2019

Agenda Item 8

Innovative Projects Fund

Author: Tanya Nelson and Chris Dashper Presenter: Chris Dashper

Summary

This paper provides some background around a proposal for the delivery of a 2019/20 call of

the Innovative Projects Revenue fund. This follows LEP Investment Appraisal Committee

approval for an annual allocation of £500k to the programme for 2019/20 and 2020/21 from

LEP funds.

Following the outcome of the first call of the Innovative Projects Fund in 2018, local authority

partners in Norfolk and Suffolk indicated interest in matching New Anglia LEP’s future

allocations of the Innovative Projects Fund through their respective pooled business rates. This

would result in a £1.5 million pot being made available to prospective projects under a 2019/20

call.

The paper outlines how delivery of the Innovative Projects Fund in partnership with Norfolk and

Suffolk local authorities will be undertaken in terms of impact and governance, utilising match

funding from their respective pooled business rates.

Business rates funding is an important source of revenue funding that can be used as an

intervention programme for the region. Pooling the two funds together would enable:

Greater alignment with the Economic and Local Industrial Strategies;

Better value for money and outcomes;

Potential for investment synergies across the two counties.

The proposal to combine LEP, SCC and NCC funds for the purpose of a larger Innovative

Projects Fund was approved by Norfolk and Suffolk leaders at their meetings on July 25th 2019

and 26th July 2019 respectively.

At its meeting on 23rd July 2019, the IAC approved in principle, the establishment of the larger

Innovative Projects Fund jointly with local authorities from Norfolk and Suffolk - with final sign

off at the September LEP board meeting.

Recommendation

The Board is asked to:

Approve the establishment of the £1.5million Innovative Projects Fund jointly with local

authorities from Norfolk and Suffolk and;

27

Approve the new governance arrangement required to approve applications to the fund.

A Terms of Reference is provided as appendix A, it includes an organogram depicting

the project approval process.

Approve the launch of a 2019/20 Innovative Projects Fund Call in October 2019.

Background

On 27th March 2019, eight projects from the October 2018 Call of the Innovative Projects Fund

were taken to the NA LEP Investment Appraisal Committee. Three projects were approved and

five were subject to conditional approval. The total amount approved was £648,268. Four of

the projects required funding over 2 or more financial years.

At the same meeting, the IAC approved a recommendation that the Innovative Projects Fund

becomes an annual rolling programme, with a minimum annual allocation of £500k from Pot C

for calls in both 2019 and 2020.

The LEP Executive was invited to develop a specification for a 2019/20 call for innovative

projects from external partners which will help deliver the Economic Strategy and explore the

possibility of a joint partnership with Norfolk and Suffolk County Councils.

This paper builds on the approval above, defining the specification and process for the 2019/20

call for Innovative Projects Fund in partnership with Norfolk and Suffolk Councils.

Context of a 2019/20 Call of the Innovative Projects Fund.

The total amount available to allocate to projects through the Enterprise Zones’ Pot C income is

expected to increase year on year as businesses continue to relocate, expand and start up in

the Space to Grow and Space to Innovate Enterprise Zones across the New Anglia LEP area.

This will ensure sufficient headroom to accommodate multi-year projects and provide the

budget for approved project calls in 2019 and 2020.

Following the outcome of the first call of the Innovative Projects Fund, both Suffolk and Norfolk

County Councils indicated interest in matching New Anglia LEP’s future allocation to the

Innovative Projects Fund through their respective pooled business rates. At the end of July

2019, the respective County leaders’ groups approved £500,000 each to co-fund NA LEP’s

Innovative Project Fund. This has resulted in £1.5 i being made available to prospective

projects under a 2019/20 call.

Preference is that projects bidding for funds from the 2019/20 Innovative Projects Fund are

regional in nature. However, this would not preclude countywide or locality-based projects from

being supported. The economic strategy advises that action and investment is focussed on a

clear set of priority themes and places to maximise impact and achieve our shared ambitions

and targets. Interestingly, in terms of regional spread, the last call of the Innovative Projects

Fund (2018) produced an equal number of projects that were funded from each county, with an

additional number covering the Norfolk and Suffolk area in its entirety.

There is great synergy between the current criteria for the allocation of funding to applicants

bidding to the Councils’ pooled business rate funds and that of the LEP’s Innovative Projects

Fund. The high-level objectives for Norfolk and Suffolk County Council’s Delivery Plan mirror

the LEP theme objectives outlined by the Economic Strategy for Norfolk and Suffolk. The two

criteria have been merged under a combined programme.

Additionally, it is agreed that the new Innovative Projects Fund call for 2019/20 should

encourage projects that support our competitive strengths and the high growth sectors (clean

energy, agri-food and ICT/digital) thereby supporting the Local Industrial Strategy.

28

A 2019/20 would again look favourably on cross-sector collaborations, where specialist skills in

one sector can drive innovation and growth in another. Furthermore, proposals for revenue

funding to accelerate the impact of LEP or council led capital schemes will also be considered.

The 2019/20 call will focus on Innovation across the LEP geography. A concerted effort will be

made to publicise the availability of the programme to the LEP area’s growth sectors via the

respective sector groups. Where required, the Programmes Case Worker will attend meetings

of the sector groups to outline the programme and answer any questions. Furthermore, the

same offer will be extended to the Growth Hub to ensure that the advisors meeting businesses

that are demonstrating innovative project ideas are alerted to the programme at the earliest

opportunity and are able to submit applications that meet the criteria.

The launch of the programme with be publicised via the normal LEP networks and media

pathways, likewise through the County Councils.

Management and Administration.

A jointly funded Innovative Projects Fund Programme will continue to be led, managed and

monitored by the LEP. £500,000 from each partner would be held by Suffolk County Council as

the Accountable body for the LEP. A sum of £60,000 is required to pay for management costs,

assessment of applications and delivery of the programme. If necessary, this cost could be met

from LEP funds.

Process for the review and appraisal of projects.

Appraisals of all eligible applications to the fund will be undertaken by an independent body,

this is currently Hewdon Consulting.

The assessment process would rank proposals against the following criteria.

1 Demonstration of clear fit with the Economic and Local Industrial Strategy.

2 Additionality. How is this more than business as usual. The fund should not replace core

funding.

3 Value for money. Can the project demonstrate this is good use of public money.

4 Leverage. What additional funding, public or private or in-kind support does the project

generate.

5 Impact. What will the project actually deliver and how innovative is the proposal.

6 Sustainability. What will happen when the funding ends.

Each would be scored from one to five, with a total maximum score therefore of 30.

One being low. Three medium and five being good.

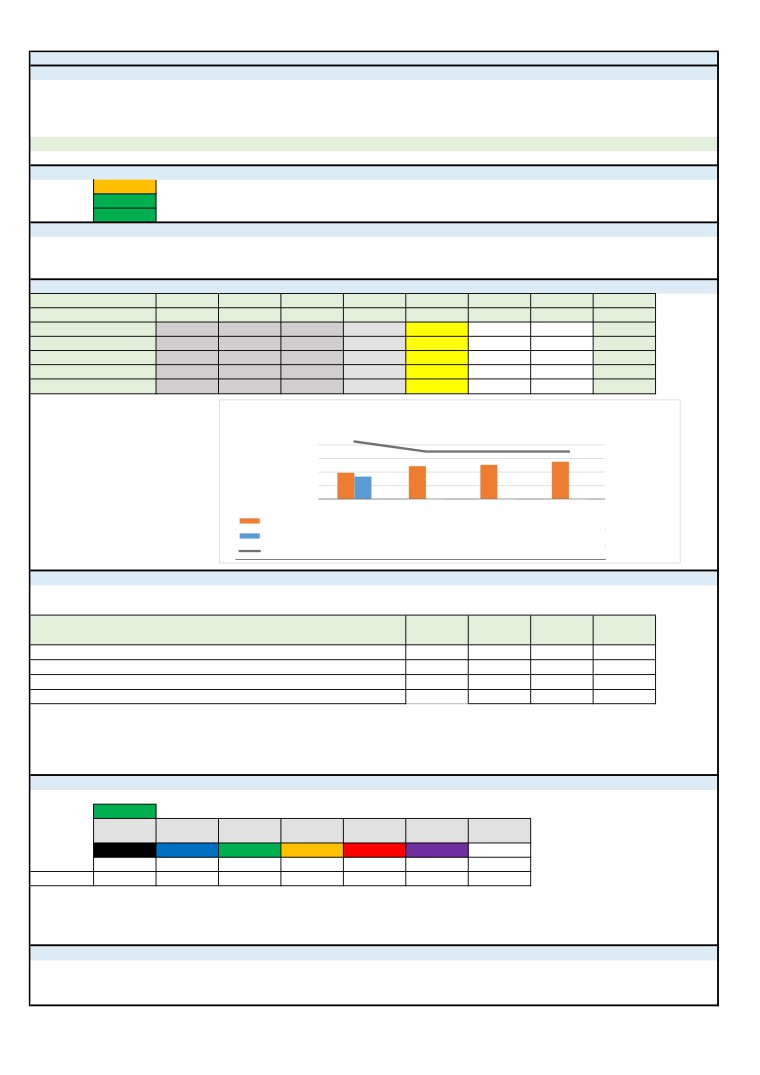

Governance and approval

A partnership arrangement between the LEP’s IAC and the two local authorities will be put in

place to consider eligible applications for funding. This will create a panel for the Innovative

Projects Fund (IPF Panel). The IPF Panel would comprise two private sector members of the

IAC and two local authority representatives from Norfolk and two from Suffolk, selected by their

respective leaders’ groups. The two private sector members in attendance at the IPF panel will

have delegated authority from the board to approve projects up to £500,000.

An independent consultant will appraise and score all the project applications that meet the

eligibility criteria. A copy of all project applicants’ appraisal and corresponding criteria score

(projects will be scored and ranked highest first based on their ability to meet the programme

criteria) will be issued to nominated members on the IPF Panel.

29

The Panel will be provided with a report containing the information necessary to enable them to

reach a decision to approve or reject an application including a recommendation from the

executive officer at the LEP. Where necessary, Panel members can request and receive

additional information to help them reach their decision. Officers from the LEP Exec will attend

meetings to provide project summaries and recommendations.

A Terms of Reference is provided as appendix A, it includes an organogram depicting the

project approval process.

Monitoring and Reporting

SCC as the accountable body for the LEP will arrange for the Offer Letters for projects

approved by a 2019/20 Innovative Projects Fund call to be sent to the respective project lead

organisations. The NA LEP Programmes Caseworker will then liaise with the project managers

to monitor the progress of their projects against their agreed outputs and expenditure. The NA

LEP Programmes Case Worker will also provide programme monitoring reports to the relevant

meetings / boards as required.

Timetable

A suggested timetable for the 2019/20 call is as follows:

Programme Call Launch - October 2019

Programme Call Closes - December 2019

Projects review and appraisal: January- February 2020

Funding Decisions: March 2020

Recommendation

The Board is asked to:

Approve the establishment of the £1.5m Innovative Projects Fund jointly with local

authorities from Norfolk and Suffolk and;

Approve the new governance arrangement required to approve applications to the fund.

A Terms of Reference is provided as appendix A, it includes an organogram depicting

the project approval process.

Approve the launch of a 2019/20 Innovative Projects Fund Call in October 2019.

30

New Anglia Local Enterprise Partnership

Innovative Projects Fund Panel

Agenda Item 8.1

Draft Terms of Reference for Innovative Projects Fund Panel

Author: Tanya Nelson

1

Background

The Innovative Projects Fund is a revenue grant programme that provides funding towards

innovative projects to support the delivery of the themes and activities identified in the

Economic and Local Industrial Strategies. The first call of the Innovative Projects Fund

was made in 2018 and led solely by New Anglia LEP with a remit to facilitate innovative

projects supporting economic growth and the delivery of the Economic Strategy utilising

revenue from the Enterprise Zone Pot C. Following the outcome of the first call of the

Innovative Projects Fund, Councils in Suffolk and Norfolk agreed to match New Anglia

LEP’s future 2019 allocation of the Innovative Projects Fund through their respective

pooled business rates. In doing so, a £1.5 million pot has been made available to

prospective projects under a 2019/20 call. It is likely that two funding calls will be required

to allocate the funding.

2

Remit

The remit of the Innovative Projects Fund Panel is to ensure an allocation of funding is

made through the Innovative Projects Fund, and that this allocation supports the

development of projects that deliver the aims and objectives of:

The Norfolk and Suffolk Economic Strategy,

The Local Industrial Strategy (where applicable)

The respective economic strategies of the local authority from where the project

originates (where applicable).

1

31

Allocations of funding will be achieved through the following process:

-

The panel will be provided with a strategic assessment of projects by independent

consultants and these projects will be ranked in order of score.

-

The panel will make decisions on which projects should be approved for funding on

each application it considers.

-

The panel will have a delegated responsibility from the LEP Board for financial

decisions up to a limit of £500,000.

-

The panel will be required to approve material changes to funding agreements as

invariably further developments of a funding agreement will occur after initial approval

by the panel.

2

Membership

The panel will be formed of six members which will be appointed by the LEP

Investment Appraisal Committee, Suffolk Leaders Board and Norfolk Leaders

Board, two will be private sector members of the IAC and four will be from the Local

Authorities. All six members will commit to attending meetings (either in person or

by telephone) and, unless they are required to declare an interest in an item, vote

on all items brought to the meeting.

Three private sector members of the Investment Appraisal Committee will be

appointed to the Innovative Projects Fund Panel but only two shall attend at only

one meeting.

The membership of the Innovative Projects Fund Panel will be reviewed annually.

No delegations shall be permitted.

A Chair of the Panel shall be appointed.

A Deputy Chair shall be appointed to chair the Panel in the Chair’s absence or if

he/she elects to delegate the chair.

Officers from the LEP Executive will attend meetings and present reports and

recommendations but will not be entitled to vote. Project applicants will not be

entitled to attend meetings unless it is deemed necessary.

Meetings of the Innovative Projects Fund will not be open to observers or other

attendees.

The terms of reference will be reviewed on an Annual basis.

3

Quorum

A quorum of four members will be required, of which at least two shall be private

sector representatives.

In the event of a vote, a decision is approved if it receives a majority of the votes

cast.

4

Meetings

The panel will meet twice a year to discuss and make a decision on approval of

applications under the Innovative Projects Fund.

An offer of funding will be limited to a period of 6 months within which the applicant

must accept the offer and terms. If an acceptance is not forthcoming within the 6

month period then a new application must be submitted.

2

32

Further quarterly meetings will be scheduled (either in person or by telephone) to

discuss the progress and performance of the programme and cancelled if there is

no business to conduct.

Where there is urgent business which cannot wait for the next meeting, with the

agreement of the Panel’s Chair, a written procedures process will operate as

follows:

- Panel Members will be circulated with details of the proposal and will be given five

working days to consider the proposal.

- A telephone conference will require a quorum where a majority approval or disapproval

is reached on a decision.

- Any Panel Member with an interest to declare must abstain from voting.

- Decisions made by written procedures and telephone conference will be noted at the

next meeting of the Panel.

5

Declarations of Interest

All Members of the Panel are expected to declare an interest in any projects in

which they have a pecuniary interest outside their role in the New Anglia LEP.

The maxim is “if in doubt declare”.

Contributions of fact from the individual may aid the group in reaching its decision;

however the Chair will exercise discretion in allowing contributions.

Members who have declared a pecuniary interest will not be allowed to vote, if a

vote becomes necessary.

6

Information to be provided

A secretariat function provided by the LEP will provide administrative support to

the Innovative Projects Fund Panel, coordinating the preparation for meetings and

following up on decisions made.

For each item on the agenda, the Panel will be provided with a report containing

the information necessary to enable them to reach a decision and including a

recommendation from the executive officer at the LEP responsible for supporting

the applicant towards submission of the project. Where necessary, Panel

Members can request and receive additional information to help them reach their

decision.

Officers from the LEP Exec will attend meetings to provide project summaries and

recommendations.

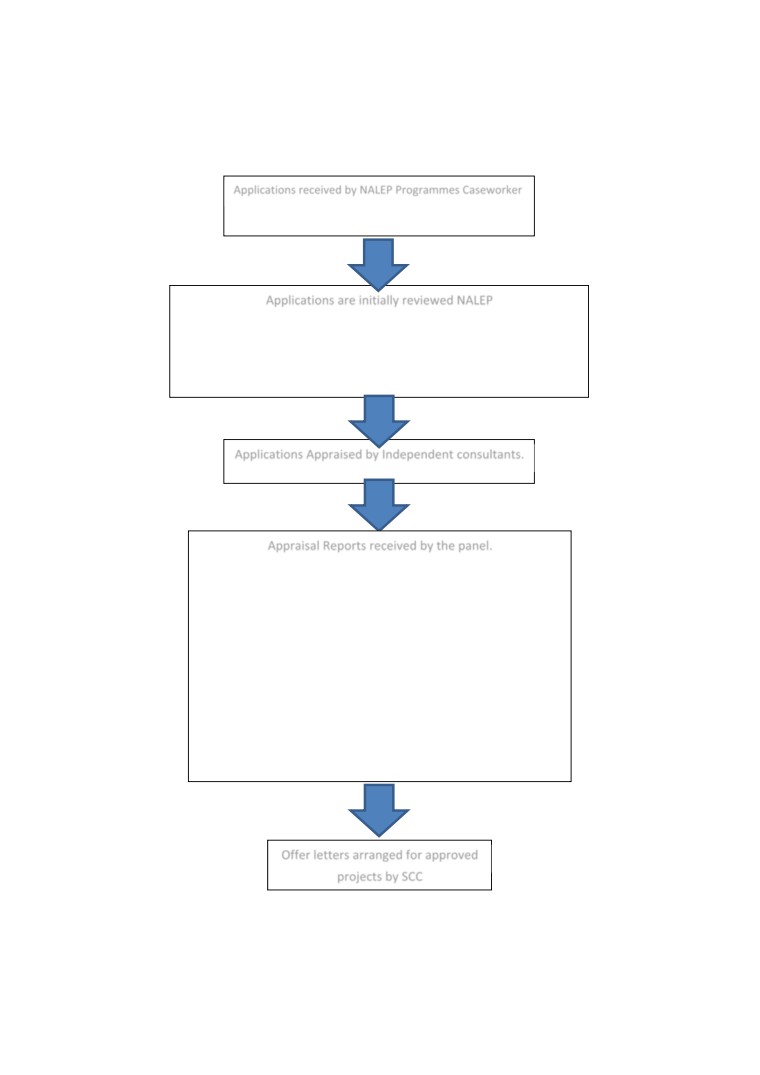

The process for the 2019 call is outlined in the organogram in Appendix A.

3

33

Appendix A: Organogram.

Applications received by NALEP Programmes Caseworker.

Summary of all applications shared with the partnership

Applications are initially reviewed NALEP

Applications are rejected as ineligible or passed to Independent body

for appraisal.

Rejected applications are justified to partners.

Applications Appraised by Independent consultants.

Appraisal Reports received by the panel.

The panel will be provided with a strategic assessment of

projects by independent consultants and these projects will be

ranked in order of score.

The panel will make decisions on which projects should be

rejected or approved for funding on each application it considers.

Panel Composition:

2 Private members from the IAC

2 members from the Norfolk Leaders Board

2 members from the Suffolk Leaders Board

Offer letters arranged for approved

projects by SCC

4

34

New Anglia Local Enterprise Partnership Board

Wednesday 25th September 2019

Agenda Item 10

Brexit

Author: Jason Middleton Presenter: Chris Starkie

Summary

This report provides an update on key activity being undertaken by the LEP and the Growth

Hub in the run up to the UK’s scheduled departure from the European Union on October 31st.

LEP activity has been focused on business support, communications and relationships with key

local stakeholders.

Recommendation

The Board is asked to note the contents of the report and the establishment of the New Anglia

Brexit taskforce.

Background

The LEP’s agreed strategy towards Brexit covers the four key headings:

1. Assisting businesses through Brexit by ensuring government understands the

opportunities and challenges faced by businesses across Norfolk and Suffolk.

2. Providing those businesses with useful information regarding how they can prepare for

Brexit and what they can be doing to Brexit-proof their business for the coming years.

3. Influencing policy development around future funding.

4. Ensuring that LEP programmes react to the opportunities and challenges posed by

Brexit.

Providing businesses with information

There are a wide range of sources that businesses can gain information regarding Brexit.

One of the issues identified by the Growth Hub is that businesses can be overwhelmed by the

range and amount of information available, which can lead to confusion.

To ensure that business can access the information they need easily, we are working with a

wide range of partners to ensure that the message is consistent and information is kept up to

date.

LEP Website

The LEP website continues to act as the focal point for all sources of online information

regarding Brexit, with the site updated daily, with information sent through to the Comms Team.

Local authority and other local partners’ websites are using their sites to point to the LEP

website as the main point of information.

1

43

In turn the LEP website points towards the Government’s Brexit website, which has been

significantly improved in recent weeks, both in terms of the information provided but crucially in

terms of its usability.

Growth Hub

The Growth Hub plays a central role in accessing business support, both local and national

support programmes. The Growth Hub team continues to gather information on Brexit from the

LEP’s Brexit Team and other partners, so that the Growth Hub is able to provide businesses

with the latest information regarding Brexit, in a range of ways, including:

Telephone Support

A team of qualified Growth Advisers within the Growth Hub are available Monday to Friday to

help signpost businesses to the type of support that they may need to get them ready for a no

deal Brexit.

One to One Support

The Growth Advisers are providing face to face support to businesses that have been identified

by the LEP as requiring face to face support. This support is targeted at key sectors and key

businesses that will be impacted most be a no deal Brexit. In Suffolk, this support is followed

with support from the two Brexit Advisers now based in Suffolk Chamber of Commerce.

Newsletter and social media

Working with the LEP, the Growth Hub is continuing to provide information on Brexit related

issues through their newsletter ‘The Loop’, as well as providing information and links to support

through a wide range of social media, including LinkedIn, Twitter and Facebook, to give as wide

an audience as possible.

Events and Workshops

The LEP and Growth Hub are coordinating Brexit related Events and Workshops, and sharing

information with partners, to coordinate local activity.

In the run up to October 31st the focus is supporting and promoting events organised by

Government.

For example, the LEP is working with the Department for International Trade, who are holding

three joint ‘EU Exit’ Workshops. The events will be held on the following dates and at the

following venues:

Thurs 26th September - Suffolk - The Apex

Tues 1st October - Norfolk - Dunston Hall

Thurs 17th October - Norfolk - Lynford Hall

From November we are planning a series of ‘Brexit Workshops’ and/or the promotion of

Workshops/Events being held by other organisations.

In the event of the UK having left the EU these will support businesses dealing with the change.

In addition to the Workshops, there is also ongoing work to identify the needs of particular

sectors, so that more specialist support can be provided to groups of businesses.

Supply Chain Support

The Growth Hub Advisers are working to identify businesses that may have supply chain issues

and ensuring that where possible, local alternative suppliers can be identified. Part of this

activity will be to set up a ‘matching’ service, to bring together local businesses and local

suppliers, to boost the number of local businesses in local supply chains.

2

44

Targeting

As well as promoting the support available to businesses as widely as possible though

partners, leaflets, emails and social media, the LEP and Growth Hub Team have developed a

target list of all the businesses that the Growth Hub have supported over the last five years.

This list provides a breakdown of businesses by sector and district, and is being used to target

businesses who may need information and guidance and/or access to financial support.

The LEP is also identifying businesses that may not have taken a grant forward due to them

being an undertaking in difficulty or them having a shortage of match funding as a result of

Brexit. It is anticipated that the number of businesses will be small, however, there may be

some businesses that will benefit specific or specialist support.

Business Readiness Funding

The Government has made funding available to support activity in the run up to October 31st

and in the aftermath.

The LEP is supporting Norfolk and Suffolk Chambers of Commerce to apply to the Brexit

Readiness Funding (BEIS Funding), to provide funding for business representative bodies and

organisations, to engage and provide advice to businesses to help them understand the impact

of Brexit on their business. The Chambers are proposing a joint application, to develop a

locally based marketing campaign that will signpost businesses to a wide range information and

advice. The application deadline is the end of September, with activity delivered before 31st

October.

BEIS are also providing £3m of funding to LEPs and Growth Hubs, to deliver a range of

business support services. Working with the Oxfordshire/Cambridgeshire Arc, led by SEMLEP,

we are applying for a share of £223,000 to deliver Brexit based business support. Working with

SEMLEP, we are developing a range of support services, delivered around the Growth Hub,

including telephone advice, signposting through the Better Business for All Programme and

Economic Development Officers, as well as specialist support and workshops. It is envisaged

that we will receive approximately £40k for this activity, which will be delivered before the 31st

March 2020.

Work with other partners

The LEP is working with a wide range of organisation to facilitate the communication of

information between partners, including Local Authorities and business intermediaries,

including the Chambers, FSB, IoD and CBI.

The LEP has established a strong working relationship with the two Brexit business advisor

posts that sit in the Suffolk Chamber of Commerce’s policy team and are working with them to

share their knowledge through the Norfolk and Suffolk Economic Development Officers Group