New Anglia Local Enterprise Partnership Board Meeting

Tuesday 23rd July

10.00am to 12.30pm

The Auditorium, Norwich Castle, Norwich

Agenda

No.

Item

Duration

20 mins

1.

Welcome from the Chair

2.

Apologies

3.

Welcome from Norwich Castle, Joanne Warr, Head of Development

4.

Declarations of Interest

5.

Actions / Minutes from the last meeting

Forward Looking

60 mins

Update and

6.

Climate Change Adaptation and Carbon Reduction Action Plan

discussion

Update and

7.

Skills Board Delivery

discussion

Break

10 mins

Governance and Delivery

60 mins

8.

Apprenticeships Levy Transfer Pool

For Approval

9.

Growing Business Fund: Large Company Grant Programme

For Approval

10.

Chief Executive’s Report - Including confidential item

Update

July Programme Performance Reports - Including a confidential

11.

Update

report

12.

Draft Annual Financial Statements to 31st March 2019 - Confidential

For Approval

13.

Management Accounts (Q1 April - June 2019) - Confidential

Update

14.

Board Forward Plan

Update

15.

Any Other Business

Next Meeting: 10.00am - 12.30pm, 25th September 2019

Venue: Kesgrave Hall, Suffolk

1

New Anglia Board Meeting Minutes (Unconfirmed)

25th June 2019

Present:

Claire Cullens (CC)

Norfolk Community Foundation

David Ellesmere (DE)

Ipswich Borough Council

Doug Field (DF)

East of England Coop

John Griffiths (JG)

West Suffolk Borough Council

Matthew Hicks (MH)

Suffolk County Council

Pete Joyner (PJ)

Shorthose Russell

Dominic Keen (DK)

High Growth Robotics

Steve Oliver (SO)

MLM

Andrew Proctor (AP)

Norfolk County Council

David Richardson (DR)

UEA

Nikos Savvas (NS)

West Suffolk College

Lindsey Rix (LR)

Aviva

Alan Waters (AW)

Norwich City Council

Jeanette Wheeler (JW)

Birketts

Attendees

Shan Lloyd (SL)

BEIS

Sue Roper (SuR)

Suffolk County Council

Vince Muspratt (VM)

Norfolk County Council

Gordon Chetwood (GC)

Pasta Foods - For Item 5

Jonny Newton (JN)

Newton Commercial - For Item 5

Steve Earl (SE)

Panel Graphics - For Item 5

Carly Earl (SE)

Panel Graphics - For Item 5

Chris Dashper (CD)

New Anglia LEP

Julian Munson (JM)

New Anglia LEP - For Items 8, 10 and 12

Chris Starkie (CS)

New Anglia LEP

Glen Todd (GT)

New Anglia LEP - for Item 6

Rosanne Wijnberg (RW)

New Anglia LEP

Helen Wilton (HW)

New Anglia LEP

1

Actions from the meeting: (25.6.19)

GE Update Report - Confidential

To provide the Board with regular reporting of the pipeline of visits relating to inward

JM

investment and subsequent outcomes

MIPIM 2019

To provide the Board with an update on the brand strategy

JM

LEP Operating and HR Policy Updates

An annual update on the progress of the Equal Opportunities and Diversity Policy to be

HW

added to the Forward Plan

Any other Business

UEA Enterprise Fund - Any board member wishing to sit on the board should contact Chris

ALL

Starkie

LEP Beneficiaries: Circulate those presentations made to the Board and add the item to the

HW

Forward Plan

1

Welcome from the Chair

Doug Field (DF) welcomed everyone to the meeting.

2

Apologies

Apologies were received from Sandy Ruddock, Tim Whitley and Johnathan Reynolds.

3

Declarations of Interest

Full declarations of interest can be found at http://www.newanglia.co.uk/about-us/the-board.

David Richardson (DR) and Jeanette Wheeler (JW) declared an interest in item 7.

4

Minutes of the last meeting 23rd May

The minutes were accepted as a true record of the meeting held on 23rd May 2019.

5

LEP Programme Beneficiaries

Chris Dashper (CD) presented that item noting that New Anglia LEP has recently reached

the milestone of awarding the 700th grant to local businesses in Norfolk and Suffolk through

its growth grants programmes Growing Business Fund (GBF) and Small Grants Scheme

(SGS). He confirmed that the board would be receiving individual presentations from 3

companies which had benefited from LEP funding to demonstrate the impact on their

business.

Pasta Foods

Gordon Chetwood (CG) addressed the Board and provided an overview of the history of the

company advising that they had received £500k from the GBF as well as a bridging loan to

allow the installation of a new production line at a time when the bank would not support

their investment plans. The installation of production line capital which was a major factor

in supporting the business recovery at a challenging time.

GC advised that the uncertainty over Brexit has resulted in customers using Pasta Foods

rather than suppliers in Europe and capacity has now been increased significantly.

GC explained that Pasta Foods is the only company in the world producing pasta and snack

pellets in the way it does and this unique approach has enabled the company to grow and

benefit from the current market conditions.

GC thanked the Board for the support provided by the LEP both in the funding and the

flexibility in its approach.

The Board and CG discussed the staffing, skills and salary levels at Pasta Foods. CG

stressed the importance of supporting staff and advised that training is provided for all

employees including for middle management to assist in career progression.

2

Newton Commercial

Jonny Newton (JN), MD of Newton Commercial, addressed the Board and provided an

overview of the company which makes interior and trim for British Classic cars.

The skills and techniques are traditional and carried out by hand but in 2017 LEP funding

was used to purchase a CAD/CAM cutter allowing patterns to be digitalised. This makes

cutting is more efficient with less waste allowing reskilling of staff to work in other areas of

the business.

Further funding with the LEP has been secured and be used for additional investment.

JN reiterated the importance of the funding the LEP provides and the difference it makes to

small businesses.

Alan Waters (AW) asked about the various skill levels within the businesses. JN advised

that apprentices were taken on who were them moved onto the minimum wage and then

progressed through the factory. Flexitime, bonuses and other staff benefits are important

and this culture is a key factor in their high level of staff retention.

JG asked for details of the main competitors and JN confirmed that there were other

companies who worked on a smaller scale whereas Newton Commercial specialised in key

areas and was looking to expanding into other markets such as hot hatch cars.

JN advised that any future legislation banning older cars would have significant impact on

the business.

Panel Graphics

Steve Earl (SE) briefed the meeting on the successful history of the company including

winning a Queens Award for International Trade. This achievement was applauded by the

Board.

SE explained that the company produces non-reflective coatings for plastic which are used

in cars and planes and in the medical and maritime industries among others.

Carly Earl (CE) confirmed that Panel Graphics have received 3 GBF grants since 2014

which have been used for industrial units, and state of the art milling machines and office

facilities.

Turnover has grown from 200k in 1998 to £6m in 2019 and net profit has tripled in the past

2 years.

SE stressed the impact the LEP’s funding had made on the business in providing

investment when there were no other sources available and the positive effect this has had

on staff recruitment.

AW enquired about the range of pay rates within the company. SE advised that the starting

rates was around £9 per hour but there were escalation processes in place allowing staff to

progress more through pay grades. Staff retention rates are excellent and a package of

staff benefits is in place with regular and social events held.

SE advised that the next possible investment was a glass cutting machine as there was

potential in this market. There is scope for company expansion but this requires purchase

of land which is currently prohibitively expensive therefore the solution could be a joint

investment with other companies.

JW asked if the company was involved in R&D. SE advised that they applied for R&D

grants each year and carry out R&D to come up with solutions to customer issues.

JW noted that those companies which had presented had been through the funding

application process multiple times which meant that there was a real business case for

allowing multiple investment requests.

DE noted it was important for the LEP to maintain support for some companies faced

challenges in repaying loans.

The Board agreed:

• To note the content of the report and presentations

3

6

Enterprise Adviser Network

Glen Todd (GT) provided an overview of the EAN which is made up of 8 Enterprise

Coordinators some of whom where TUPE’d over from Norfolk & Suffolk County Councils

and are managed by the EAN and Careers Hub manager.

GT confirmed that the Network is engaging with 83 mainstream and FE schools giving a

76% coverage of the 144 schools across the region. He stated that, given that there will

always be some schools who do not engage, he felt that a rate of 90-95% would be viewed

as successful. GT noted that the team was on target to meet or surpass their target of

engaging with 85 schools.

GT asked the Board to be ambassadors for the network and support in the recruitment of

Enterprise Advisors as the team worked to allocate one advisor per school.

GT noted that the team are specifically looking to include advisors from the agrifood and

renewable energy sectors.

Andrew Proctor (AP) asked whether the team were involved in apprenticeships. GT advised

that the team are promoting apprenticeships as well as the Youth Pledge and the range and

content of apprenticeship is promoted within schools to parents as well as pupils.

The Board discussed the challenges faced when engaging schools and the aim of the EAN

in providing information on the wide range of training and educational options available for

students.

The Board agreed:

• To note the content of the report

• To receive the EAN presentation

• To support the recruitment of Enterprise Advisers by championing the Network

7

Capital Grant Programme - Institute of Productivity

JW and DR left the room.

CD presented the paper and reviewed the history of the application noting the reduction in

funding from that in the original request. The Board had already approved the reduced

amount and asked for details of the delivery outputs from the smaller grant.

CD advised that the proposal reflects the same outputs and delivery as the existing

application but uses an existing building which will be refurbished rather than building a new

one.

Match funding has also been secured reducing the LEP’s funding to around 60% of the total

cost.

CS noted that one of the considerations from the last meeting was that the businesses had

not yet been involved given the speed it had progressed but the UEA have assured that they

will be in the future. It is proposed that their involvement be a condition of the funding.

It was agreed that a member of the LEP Executive team should sit on the board.

The Board agreed:

• To note the content of the report

• To approve the award of Capital Growth Programme grant funding of £4.461m to the

Institute of Productivity

JW and DR returned to the room.

8

GE Update Report - Confidential

4

DF asked for the Board to be kept up to date on similar events and conversations with a

pipeline of contacts and outcomes established.

ACTION: To provide the Board with regular reporting of the pipeline of visits relating to

inward investment and subsequent outcomes

The Board agreed:

• To note the content of the report

• To receive regular reports on key visits and discussions relating to inward investment

JM

9

Chief Executive’s Report

CS thanked all those who had been involved in the ongoing development of the Local

Industrial Strategy and asked for questions on the report.

Steve Oliver queried the delay to the spending on the Gt Yarmouth Flood Defences. CS

confirmed that the Environment Agency to whom the funding has been allocated will be

spending their £8.2 m in the following year after that of the Treasury. The project will

continue as planned but the spend will be in the next financial year.

The Board agreed:

• To note the content of the report

10

MIPIM Update Report and Proposal for 2019

JM presented the paper to the Board and provided an update on the results of MIPIM 2018

and the resulting leads.

JM reviewed the revised approach to MIPIM 2019 and the proposal being presented to the

board of the condensed model focussing promoting a reduced number specific investment

opportunities at key events.

AP expressed his support but noted that taking fewer sites posed challenges in ensuring

that the right sites were included.

JM proposed also using the opportunity to launch the new brand and stated that it was vital

to include those sites which are ready for investment noting that the exact number of sites

included was flexible.

Matthew Hicks (MH) asked for specific details of the outcomes of leads generated from

2018. JM advised that contacts for investments in Norwich and Gt Yarmouth were close to

signing and there had also been interest in Bury and along the A14 corridor.

The meeting discussed the challenges in recording outputs and noted that not all contacts

come from MIPIM and could have taken place anyway made regardless of attendance at

that event.

DR noted that absence from such events can be noted but that the costs should be kept

down where possible.

Pete Joyner (PJ) noted that importance of using opportunities to promote and reinforce the

new brand.

The Board requested an update on the strategy for using the new brand.

The Board agreed:

• To note the contents of the report

• To approve the proposal including spend of £28,788, the covering approach, format and

costings for MIPIM UK 2019

• To receive details of the brand strategy

JM

5

11

June Programme Performance Reports

Rosanne Wijnberg (RW) reviewed the June reports and asked for questions from the Board.

JM reviewed the Enterprise Zone reports noting that job creation was slightly lower than

expected and initial estimates for the space were being reviewed.

SO proposed including details of productivity as a success monitor as well as job numbers

The Board agreed:

• To note the contents of the report

12

Innovation Board Chair Appointment

JM reviewed the paper and thanked DR for his contribution.

DR noted the success of the Board and felt that recent expansion of the Board had been

very successful. DR proposed Johnathan Reynolds as the new Chair.

AP proposed the inclusion of a Local Authority members of the board.

The meeting discussed the suggestion with DR noting that it needed to be someone who

was committed and able to attend regularly.

The Board agreed:

• To note the contents of the report

• To approve Johnathan Reynolds as Chair of the Innovation Board

• To add a member of a Local Authority to the Board

• To endorse the thanks to DR for his contribution over the past 3 years

• To approve the Innovation Board’s Terms of Reference

13

LEP Operating and HR Policy Updates

RW presented policies as included in the meeting pack and asked for approval from the

board.

David Ellesmere (DE) reviewed the process carried out to amend the policy and thanked JW

for her input.

It was noted that the Diversity and Equality Policy had been split into internal and external

sections and the Government’s requirements for female board representation had been

included. The policies will be reviewed annually by the board.

The Board discussed how the policy would be monitored and was agreed that an annual

report on the implementation of the policy would be made to the Board and would be added

to the forward plan.

The Board agreed:

• To note the content of the report

• To approve the Modern Slavery and Human Trafficking Statement

• To approve the Equal Opportunities and Diversity Policy and Statement

• To receive an annual report covering progress of the Equal Opportunities and Diversity

HW

Policy implementation including examples. To be added to the Forward Plan

14

Board Forward Plan

The Board agreed:

• To note the content of the plan

15

Any Other Business

UEA Enterprise Fund - CS advised that he will be the board member for the LEP Executive

team and asked for a volunteer from the Board in addition.

ACTION: Board members to contact CS if they are interested in joining the board (ALL).

Nikos Savvas advised that the International Festival of Education had just taken place and

has been very successful with over 60 speakers involved.

It was agreed that the presentations from beneficiaries of LEP funding had been very useful

and it was agreed that this should be an annual board item.

6

ACTION: Helen Wilton (HW) to circulate those presentations made to the Board and add the

item to the Forward Plan.

DF advised that board that DR was stepping down as a board member and thanked him for

his dedicated service and support for the LEP. A gift was presented on behalf of the LEP.

DR thanked the Board and expressed his enjoyment of his time as a board member and

wished the LEP every success going forward.

Next meeting:

Date and time of next meeting:

10.00am - 12.30pm, 23rd July 2019

Venue: Norwich Castle, Norwich, Norfolk

7

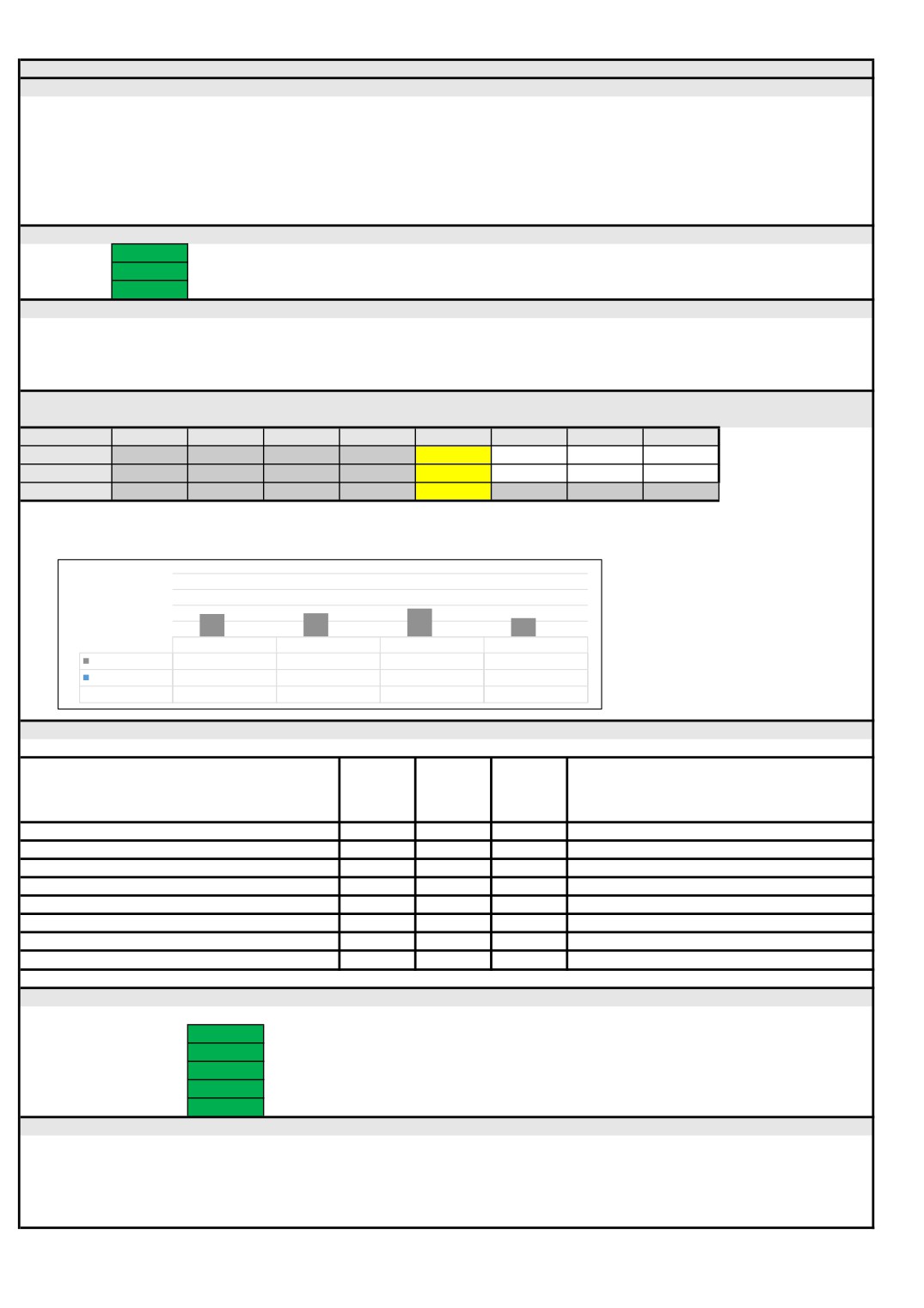

Actions from New Anglia LEP Board Meetings

Date

Item

Action

Update

Actioned

Status

By

25/06/2019

GE Update Report

To provide the Board with regular reporting of the pipeline of visits

Work is ongoing on the development of a report

JM

On-Going

relating to inward investment and subsequent outcomes

25/06/2019

MIPIM 2019

To provide the Board with an update on the brand strategy

Included in the Chief Executive's Report

JM

Complete

25/06/2019

LEP Operating and HR Policy

An annual update on the progress of the Equal Opportunities and

Tthe item has been included in the list awating scheduling in the

HW

Complete

Updates

Diversity Policy to be added to the Forward Plan

2020 Forward Plan

25/06/2019

AOB

UEA Enterprise Fund - Any board member wishing to sit on the board

All

On-Going

should contact Chris Starkie

25/06/2019

AOB

LEP Beneficiaries: Circulate those presentations made to the Board

Presentations were circulated with the minutes and the item has

HW

Complete

and add the item to the Forward Plan

been included in the list awating scheduling in the 2020 Forward

Plan

23/05/2019

LEP Capital budget 2019/20

The criteria for the Growing Business and Growing Places Funds to be

Information about the main programmes was included in the LEP

CD

Complete

circulated to Board members

Programme Beneficiaries paper presented at the June Board

meeting

23/05/2019

Growth Hub Presentation

Growth Hub Annual review to be circulated to the Board when

Expected autumn 2019

CD

On-Going

published

30/01/2019

LEP Board Diversity Champion

To submit comments on the LEP’s Diversity Policy to DE

Policy approved at the June board meeting

ALL

Complete

23/11/2018

Infrastructure

For the LEP team to ensure that links are progressed with other sub-

Progress will be included in the next infrastructure update in

EG

On-Going

national transport bodies

October

21/02/2018

Ad Hoc

To receive a paper on CO2 reductions for

Included in the July meeting

CS/JR

Complete

consideration of inclusion in the economic strategy targets

10

New Anglia Local Enterprise Partnership

Board Decision Log - Public

Date

Decision

Decision Made

Making Body*

3/7/19

Growing

The Panel approved the following applications:

Business Fund

• Creative Displays Limited - Agreed to support

Panel

Approved Grant: £40,000 - awarded under de minimus

• Bendart Limited - Agreed to support

Approved Grant: £42,500

• Hugh Crane Cleaning Equipment - Agreed to support

Approved Grant: £56,369

• Anglian Indoor Karting Ltd - Agreed to support

Approved grant: £40,000

• Stephen Walters and Sons Limited - agreed to support

Approved grant: £118,049 - awarded under de minimus

25/6/19

LEP Board

The Board made the following decisions:

Capital Grant Programme - Institute of Productivity

To approve the award of Capital Growth Programme grant funding of £4.461m to the Institute of Productivity

MIPIM Update Report and Proposal for 2019

To approve the proposal including spend of £28,788, the covering approach, format and costings for MIPIM UK 2019

Innovation Board Chair Appointment

To approve Johnathan Reynolds as Chair of the Innovation Board

LEP Operating and HR Policy Updates

To approve the Modern Slavery and Human Trafficking Statement and the Equal Opportunities and Diversity Policy and Statement

25/6/19

Investment

The IAC made the following decisions:

Appraisal

Large Company Grant Programme

Committee

To recommend the Programme to the LEP Board

23/5/19

LEP Board

The Board made the following decisions:

Enterprise Zone Accelerator Fund Proposal - Confidential

LEP Capital Budget 2019/20

• To approve the capital budget for the 19/20 financial year

• To approve the allocation of £1m to New Anglia Capital

South East Energy Hub

• To delegate authority to Chris Starkie New Anglia LEP CEO to sign the Accountable Body agreement for the Greater South East Energy

Hub on behalf of the LEP

• To delegate authority to Lisa Roberts, Head of Strategy, to represent and make decisions for the LEP on the Greater South East Hub

Board and to Ellen Goodwin, Infrastructure Manager as Deputy, to operate subject to and within the guidelines and parameters laid down

by the LEP Board.

* New Anglia Local Enterprise Partnership Board, Investment Appraisal Committee, Growing Business Fund Panel, Remuneration Committee, Audit & Risk Committee

23/5/19

Investment

The IAC made the following decisions:

Appraisal

Croxton Road Cycle Link

Committee

To reallocate £450k from the existing transport scheme towards the delivery of a cycle link within the area

UEA Enterprise Fund Output Metrics

To approve the metrics for the project

01/05/19

Growing

The Panel approved the following applications:

Business Fund

• Portable Space Limited - agreed to support

Panel

Approved Grant - £78,378

• Goldwell Manufacturing Services Limited - agreed to support

Approved grant - £40,000

• Belle Coachworks Limited - agreed to support

Approved grant - £36,000

• HBD Europe Limited - agreed to support

Approved Grant - £52,388

03/04/19

Growing

The Panel approved the following applications:

Business Fund

• Anglian Plant Limited - agreed to support with conditions

Panel

Approved grant - £170,000

27/03/19

LEP Board

The Board Made the following decisions:

Delivery Plan

To approve the Delivery Plan and delegate the authority to the LEP Chief Executive to make minor amendments as required before publication

2019/2020 Budget

To approve the operating budget for 2019/20

To approve the proposal on financial reporting

Capital Growth Programme Call

To approve the funding to the following projects:

•

£440k to Norfolk and Suffolk County Councils- Norfolk & Suffolk Innovation Network

•

£6.497m to the University of Suffolk- Digital Skills & Innovation Accelerator

•

£1.6m to Suffolk New College- Digital & Technology Skills Hub

•

£6.098m to City College Norwich- Digital Technology Factory

•

To provide an offer of £4.461m to the University of East Anglia’s Institute of Productivity with the condition that the proposal is put back

before the Board for final approval following the completion of further investigation

• To approve the Growing Places Fund grant of £200,000 to the National Trust, Releasing the Sutton Hoo Story

Local Assurance Framework

To adopt the 2019 Local Assurance Framework

To adopt the updated Scheme of Delegation

To adopt the updated Accountable Body Agreement

European Structural and Investment Funds Strategy

To approve the contents of the European Investment Strategy Update and recommended its adoption to the New Anglia ESIF Committee

Amendments to the Articles of Association

To approve the following documents

• The Articles of Association of New Anglia Local Enterprise Partnership Limited, amended to reflect the agreed changes to the LEP Board as

a result of the LEP Review

• The written resolution to be sent to the LEP’s members to approve the adoption of the new articles

* New Anglia Local Enterprise Partnership Board, Investment Appraisal Committee, Growing Business Fund Panel, Remuneration Committee, Audit & Risk Committee

New Anglia Local Enterprise Partnership Board

Tuesday 23rd July 2019

Agenda Item 6

Climate Change Adaptation and Carbon Reduction Action Plan

Author: Ellen Goodwin

Presenter: Professor Andrew Lovett, UEA

Summary

This paper is in response to a discussion the Board has had previously on climate change and

sets out the current national and local context with regard to this agenda. It outlines the high-

level evidence from the Climate Change Adaptation and Carbon Reduction Action Plan Scoping

Report at Appendix A and suggests future steps the Board may want to take as part of its

ongoing work relating to this subject.

Recommendation

It is recommended that the Board agree to:

Note the contents of the UEA scoping report;

Develop an action plan to tackle some of the key findings of the report; and

Consider the ongoing resources needed to support the development of this workstrand.

Background

At their February 2018 meeting the Board received a paper entitled “Economic Indicator

Trajectories and Targets”. As part of the related discussion it was noted that there were no

targets on carbon dioxide emissions which were identified as a key recommendation in the

Green Economy Pathfinder project. As a result, the Board resolved to receive a paper on

carbon dioxide reductions for consideration of inclusion in the economic strategy targets at a

future meeting.

Recent action on climate change by central and local government

The UK government has declared an environment and climate emergency and has agreed to

amend the Climate Change Act (2008) to commit the country to a 2050 target of net zero

greenhouse gases.

Locally, climate emergencies have been declared by North Norfolk District Council, Norwich

City Council and Suffolk County Council.

North Norfolk Council has resolved to engage widely and prepare an Environmental

Sustainability & Climate Change Strategy and associated action plan with ‘route map’ to deliver

a sustainable, low carbon future for their community.

Norwich City Council has resolved to consider the climate emergency alongside social and

economic emergencies and have pledged to make the city of Norwich carbon neutral as soon

as possible. The City Council is also a member of the UK100, a network of leaders in the

climate change space.

On 16 July Suffolk County Council considered a strategic framework to deliver the ambition of

creating the greenest county and tackling the previously declared climate emergency. They

13

also considered receiving findings from their newly formed Policy Development Panel’s

investigation into the ambition to create a carbon neutral Council by 2030.

Norfolk County Council recognise the serious impact of climate change globally and the need

for urgent action and is committed to supporting the delivery of the Government’s 25-year

Environment Plan. It has agreed to consider environmental impacts when making key

decisions in future.

Climate Change Adaptation and Carbon Reduction Action Plan Scoping Report

In March 2019 New Anglia LEP commissioned the University of East Anglia to undertake a

climate change adaptation and carbon reduction scoping report.

Key issues

The key findings identified in the Executive Summary of the scoping report found in Appendix A

are as follows:

The climate of Norfolk and Suffolk has become warmer, warmer spells are becoming

longer and with higher temperatures and cold spells are becoming shorter and less cold.

Temperature trends under climate projections continue those indicated by observed

data. Scenarios are projecting higher increases in mean summer temperatures than

winter ones;

Rainfall intensity and extremely wet days are becoming more frequent over time. There

is less certainty regarding the direction and magnitude of potential future precipitation

changes when compared to temperature but the median of each of the scenarios tested

suggest that the most likely outcome will be less summer rainfall but more winter

rainfall;

Under the ‘no mitigation’ scenario projections indicate that sea level rise by the middle

of the century approximates to 0.2 - 0.4m and by the end of the century sea level could

rise by 0.6 - 1.0m;

UK carbon dioxide emissions have fallen by 31.6% between 2005 and 2016 but

emissions from road transport have increased. Norfolk and Suffolk are near to national

averages with regard to per capita CO2 emissions at 5.7 and 5.6 tonnes per year per

person respectively. Areas will need to reduce their emissions to no greater than 1.7

tonnes per year person to meet the Paris Agreement (a 68.5% reduction); and

Point source emitters in Norfolk and Suffolk account for 22.6% of all total CO2

emissions. Of these point source emitters 53% are from the energy sector and 36% are

from the food processing sector.

The reports key thoughts on developing a climate change adaptation and carbon reduction

action plan are:

“… the main climate challenges to businesses (in the East) include flooding and coastal

erosion, increased competition for water and disruption of transport and communication

links… the degree to which individual organisations are affected depends upon their

level of vulnerability and adaptive capacity… there are potentially significant advantages

to be gained for those businesses taking on the challenge” Sustainability East, 2012;

Assisting businesses with identifying potential climate change impacts that might affect

their operation or profitability, helping them examine their own contribution to climate

change and how they can mitigate this and helping them plan for and adapt to climate

change is an important part of the overall response that society needs to make to meet

the challenges ahead;

Local business and vulnerability is likely to be business specific and will therefore

require an appropriate response;

Business impacts can be both direct (the need to relocate) or indirect (affecting supply

chains). Business function risk can be categorised into six themes: products and

services, employee and labour productivity, site location, distribution, supply chain and

access to capital; and

The UK’s latest Climate Change Risk Assessment considers engineering, tourism,

finance and insurance, food and utilities to be most vulnerable to climate change.

Agriculture has been identified as both one of the most vulnerable sectors to climate

change as well as being the 4th highest greenhouse gas emitting sector globally.

14

The report concludes that there are issues that need particular attention in any action plan for

Norfolk and Suffolk:

Domestic Sector - The existing building stock will need to be adapted to provide suitable

conditions for people to live and work in a warmer climate. This will be important for

business productivity and also represents an opportunity for local construction

businesses. An additional consideration in rural areas that are not connected to the

national gas grid will be to develop alternative means of heating provision, both to meet

decarbonisation targets and reduce reliance on oil.

Transport Sector - Increased use of public transport and electric vehicles will need to be

a central element of decarbonising transport in the next 30 years. Provision of public

electric charging points is currently limited in many parts of Norfolk and Suffolk and

requires investment.

Agricultural Sector - Improved water management needs to be a priority for coming

decades, both in terms of increased storage capacity and greater use efficiency.

Opportunities will exist for landowners and managers to contribute to carbon

sequestration and to develop enterprises based on new crops or to meet demand for local

renewable generation of heat and power.

Food Processing Sector - Several processing plants make a substantial contribution to

regional greenhouse gas emissions and options to reduce their carbon footprints should

be investigated.

Energy Sector - The region is already a leading generator of renewable energy and the

coming decades will see a growing demand for electricity, particularly from domestic and

transport sectors. At present, there are constraints on the capacity of the electricity

transmission and distribution network in many parts of Norfolk and Suffolk and developing

an investment strategy to rectify this situation is fundamental to both meeting

decarbonisation objectives as well as supporting future economic growth. Extension of

the existing high-voltage transmission network to a coastal destination would also be

beneficial to the marine renewables industry.

Many of these priorities interact with each other so it is important that an action plan

should involve coordination between sectors as well as initiatives within them. Overall,

the challenges of climate change mitigation and adaptation are considerable, but they will

be less formidable if action is taken sooner than later, and this could also provide

important opportunities and benefits for businesses and residents in Norfolk and Suffolk.

Next steps for consideration

In response to the report’s findings there are a number of things New Anglia LEP could do in

order to advance our work in this area.

1) Develop an action plan

The LEP could develop an action plan to tackle some of the key findings of the report

and identify how Norfolk and Suffolk will contribute to the Climate Change Act 2008

target amendment of net zero greenhouse gases by 2050.

In particular, we could consider how our transport systems could reduce their emissions

how water resources could be managed in the future and how we retrofit buildings to be

more resilient to a changing climate.

This plan could also include how we consider climate change impacts when making key

decisions in the future for both our strategies and programmes, for example, how can

investment improve community and infrastructure resilience to adapt to the possibility of

more flooding events in the future?

15

This action plan could also consider how we might disseminate key messages and

facilitate wider understanding of the issues facing us so that Norfolk and Suffolk can

both contribute to reducing emissions, manage any risks that might arise from the

changing climate but also maximise the opportunities it may present.

a. Work with businesses

As part of this action plan the LEP could also work with businesses to understand the

specific local challenges and opportunities presented by climate change.

In order to do that we must understand the granularity of the information.

This could include how climate change may affect business, what plans they have in

place to adapt to climate change in the future and how they themselves might mitigate

their impacts; this will be particularly important for the largest emitters in both then

energy and food processing sectors.

In order to support business in adapting to the changing climate we must understand

their local vulnerability, particularly in sectors we know to be most likely to be impacted

and help them develop appropriate strategies and action plans moving forward.

Part of this work could include looking at existing business resilience services and

rolling them out on a wider basis. The LEP’s Growth Hub has a clear role to play in

assisting this together with projects such as BEE Anglia.

Link to the Economic Strategy and Local Industrial Strategy

The Economic Strategy currently has eight indicators against which we review progress. As

clean growth is emerging as a golden thread in our draft Local Industrial Strategy it seems

appropriate to consider what targets we may want to include as part our strategic monitoring

framework to help ensure that growth in Norfolk and Suffolk is sustainable from an economic,

social and environmental perspective.

Any interventions developed as part of an action plan would be included in both the Economic

Strategy and the Local Industrial Strategy.

Recommendation

It is recommended that the Board agree to:

Note the contents of the UEA scoping report;

Develop an action plan to tackle some of the key findings of the report; and

Consider the ongoing resources needed to support the development of this workstrand.

Appendix A: Climate Change Adaptation and Carbon Reduction Action Plan Scoping Report -

Executive Summary Extract

16

Appendix A

Scoping Report for the New Anglia LEP

Climate Change Adaptation and Carbon Reduction Action Plan

EXECUTIVE SUMMARY EXTRACT

Research Team:

Prof Andrew Lovett

Dr Trudie Dockerty

Ms Gilla Sűnnenberg

Dr Clare Goodess

Prof Corinne Le Quéré

3rd Draft / 14th July 2019

17

The Registry

UEA Norwich Research Park

Norwich

NR4 7TJ

Executive Summary

Climate change is increasingly recognised as a major and urgent global challenge, with existing and

projected impacts on many dimensions of sustainable development. This is reflected in the recent

decision of the UK government to adopt a target of net zero greenhouse gas (GHG) emissions by

2050 and declarations of a ‘Climate Emergency’ by many local government bodies.

The purpose of this scoping study is to help develop an action plan to incorporate climate change

adaptation and carbon reduction ambition into the objectives of the New Anglia LEP for Norfolk and

Suffolk. It is in three main sections and reviews:

Existing knowledge on observed and projected climate changes

Trends and geographical distribution of greenhouse gas emissions

Local priorities for climate change mitigation and adaptation

Observed and Projected Climate Change

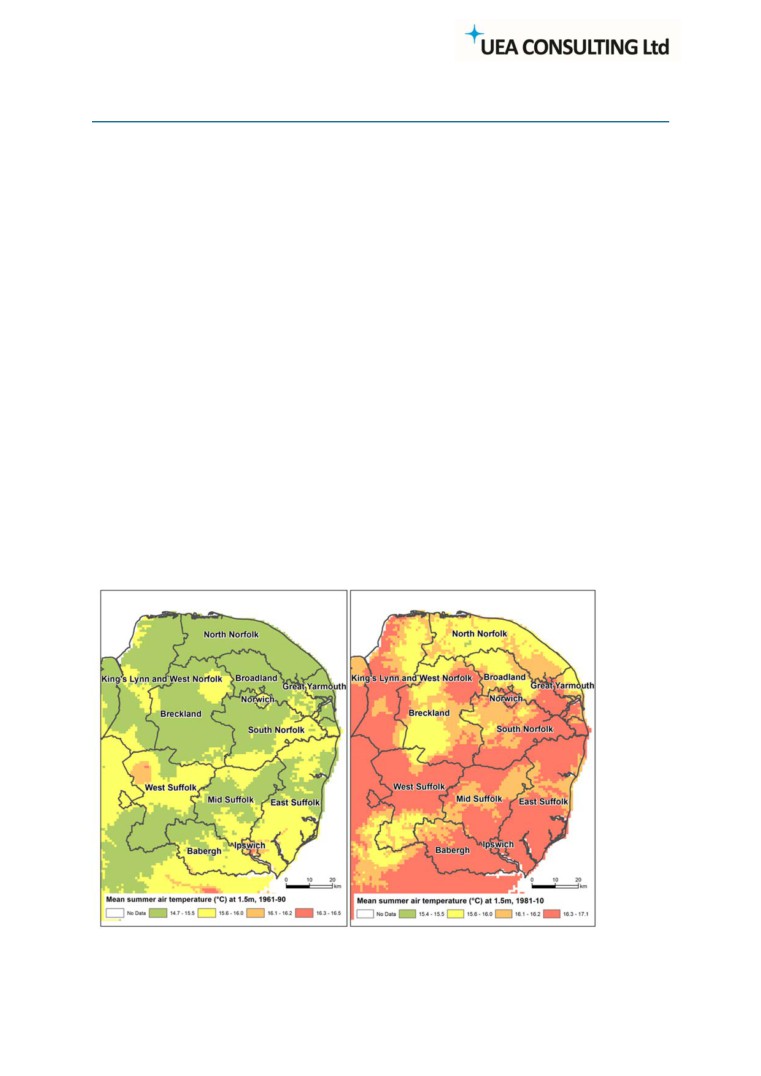

Details from the Met Office HadUK-Grid dataset have been analysed for two 30-year baseline time

periods (1961-90 and 1981-2010) to examine recent changes in temperature and precipitation. The

trends are stronger for temperature than precipitation and generally show an increase in indicators

of higher summer temperatures, a reduction in those for colder winter temperatures and greater

rainfall intensity. The maps below, for example, an increase in mean summer temperatures of at

least 0.5°C between the two baseline periods.

2

18

The Registry

UEA Norwich Research Park

Norwich

NR4 7TJ

The UK Climate Projections 18 (UKCP18) outputs from the Met Office present estimates of future

climate for four pathways representing different amounts of global surface temperature increase by

2100. Mapped results at a 25 km cell resolution show little geographical variability across the region

and there is considerable uncertainty in the individual pathway projections. Nevertheless, taking the

mid-point (50th percentile) in projections for the East of England through to around 2040 indicates

the following changes compared to a 1981-2000 baseline.

An increase in mean summer temperature of 1.2°C to 1.6°C

An increase in mean winter temperature of 1.0°C to 1.3°C

A decrease in mean summer precipitation of 1% to 13%

An increase in mean winter precipitation of 5% to 8%

UKCP18 also includes projections for future sea level rise and storm surges. It is expected that the

rise in mean sea level will be greater in the south of the UK than the north and projections for Great

Yarmouth under the most extreme of the four pathways indicate a 0.2 - 0.4m mean sea level rise by

the middle of the century and potentially 0.6 to over 1 metre by 2100. There is considerable

uncertainty in these projections, but they provide an indication of the extent of change that should

be anticipated in long-term planning.

Trends in Greenhouse Gas Emissions

Data on UK greenhouse gas emissions are published by the Department for Business, Energy &

Industrial Strategy (BEIS) and include carbon dioxide (CO2) emissions estimates for local authorities

(2005-16) with a breakdown by 14 economic sectors. UK CO2 emissions declined from 522,857 kt

CO2 in 2005 to 357,470 kt CO2 in 2016. However, the decline for transport was much smaller than

that for many other sectors so its relative contribution increased from 26% in 2005 to 36% in 2016.

Per capita CO2 emissions estimates for the UK declined from 8.7 to 5.4 tonnes/person between 2005

and 2016. Norfolk and Suffolk went from having below UK average per capita CO2 emissions in 2005

to above average in 2016 (5.7 and 5.6 tonnes/person respectively), reflecting their rural character

and the importance of road transport in such regions. These totals will need to reduce to no greater

than 1.7 tonnes CO2e/year per capita by 2050 to meet the objective of the Paris Agreement to limit a

global temperature rise this century to 1.5 °C.

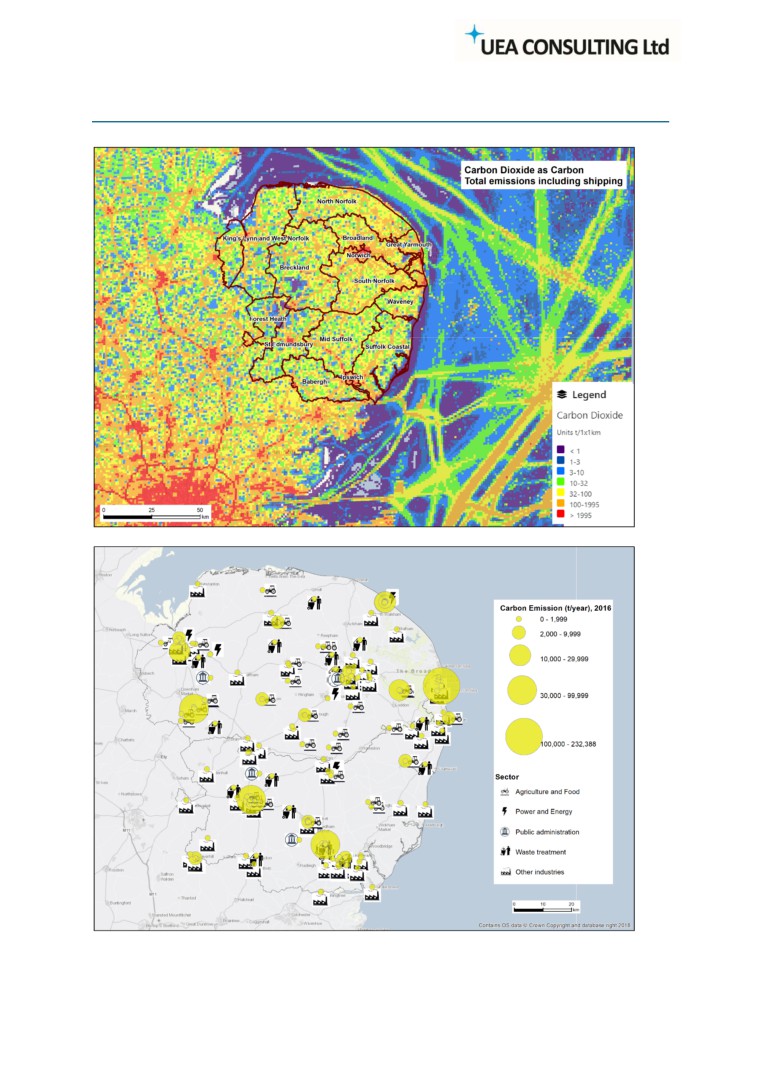

A more geographically detailed perspective on emissions can be obtained from the National

Atmospheric Emissions Inventory (NAEI) which contains both 1 km grid cell emissions estimates and

details of individual ‘point sources’ (i.e. large factories and power stations). The first map on the

next page shows gridded estimates for carbon dioxide and highlights that many parts of Norfolk and

Suffolk have relatively low CO2 emissions compared to the region around London, as well as

illustrating the extent of carbon emissions associated with road transport and shipping routes. A

second map shows major point source emitters such as power stations and food processing plants.

Overall, the 37 point sources accounted for 22.6% of total CO2 emissions in Norfolk and Suffolk

during 2016.

3

19

The Registry

UEA Norwich Research Park

Norwich

NR4 7TJ

4

20

The Registry

UEA Norwich Research Park

Norwich

NR4 7TJ

Local Priorities for Climate Change Mitigation and Adaptation

Based on the data regarding climate and greenhouse gas trends the following are suggested as

issues that need particular attention in an action plan for Norfolk and Suffolk.

Domestic Sector - The existing building stock will need to be adapted to provide suitable conditions

for people to live and work in a warmer climate. This will be important for business productivity and

also represents an opportunity for local construction businesses. An additional consideration in rural

areas that are not connected to the national gas grid will be to develop alternative means of heating

provision, both to meet decarbonisation targets and reduce reliance on oil.

Transport Sector - Increased use of public transport and electric vehicles will need to be a central

element of decarbonising transport in the next 30 years. Provision of public electric charging points

is currently limited in many parts of Norfolk and Suffolk and requires investment.

Agricultural Sector - Improved water management needs to be a priority for coming decades, both

in terms of increased storage capacity and greater use efficiency. Opportunities will exist for land

owners and managers to contribute to carbon sequestration and to develop enterprises based on

new crops or to meet demand for local renewable generation of heat and power.

Food Processing Sector - Several processing plants make a substantial contribution to regional

greenhouse gas emissions and options to reduce their carbon footprints should be investigated.

Energy Sector - The region is already a leading generator of renewable energy and the coming

decades will see a growing demand for electricity, particularly from domestic and transport sectors.

At present, there are constraints on the capacity of the electricity transmission and distribution

network in many parts of Norfolk and Suffolk and developing an investment strategy to rectify this

situation is fundamental to both meeting decarbonisation objectives as well as supporting future

economic growth. Extension of the existing high-voltage transmission network to a coastal

destination would also be beneficial to the marine renewables industry.

Many of these priorities interact with each other so it is important that an action plan should involve

coordination between sectors as well as initiatives within them. Overall, the challenges of climate

change mitigation and adaptation are considerable, but they will be less formidable if action is taken

sooner than later, and this could also provide important opportunities and benefits for businesses

and residents in Norfolk and Suffolk.

5

21

New Anglia Local Enterprise Partnership Board

Tuesday 23rd July 2019

Agenda Item 7

LEP Skills Board Delivery

Author: Paul Winter and Natasha Waller. Presenter: Paul Winter

Summary

At the LEP Board on June 2018 it was agreed that Paul Winter, Chair of the LEP Skills Board

would be invited back to the LEP Board to discuss the work of the LEP Skills Board.

This paper provides a high-level summary of the actions and activities of the Skills Board from

the past year. It also asks for the LEP endorsement for the transition from a Skills Board to a

Skills Advisory Panel as requested by Government.

Recommendation

To approve the transition from a Skills Board to a Skills Advisory Panel as required by

Government.

To continue to endorse the activities of the Skills Board/Skills Advisory Panel

To support the Skills Advisory Panel with resolving key issues identified by its members

and analytical evaluation

Background

Much progress has been made over the last year, key activity includes:

Delivering further sector skills plans in our key sectors and furthering the

recommendations laid out in earlier plans;

Overseeing local skills delivery funded by the European Social Fund;

Reviewing the Skills Deal projects totalling £1.4m of grant funding and

Reaffirming the Youth Pledge focus, updating governance and supporting delivery of

related activities.

The Skills Board is made up of private sector members covering our key sectors, post 16

providers, Department of Work and Pensions, Chambers of Commerce, FSB, Education and

Skills Funding Agency and councillors & officers from Norfolk and Suffolk County Councils.

The Board meets 6 times a year and each member is asked to be proactive in identifying where

they can contribute to and collaborate in any interventions between meetings.

The vision of the Skills Board is ‘to support the growth of an inclusive economy with a highly

skilled workforce where skills and employment provision meets business need and the

aspirations of individuals.’ The Skills Board provides the strategic leadership for this vision.

1

23

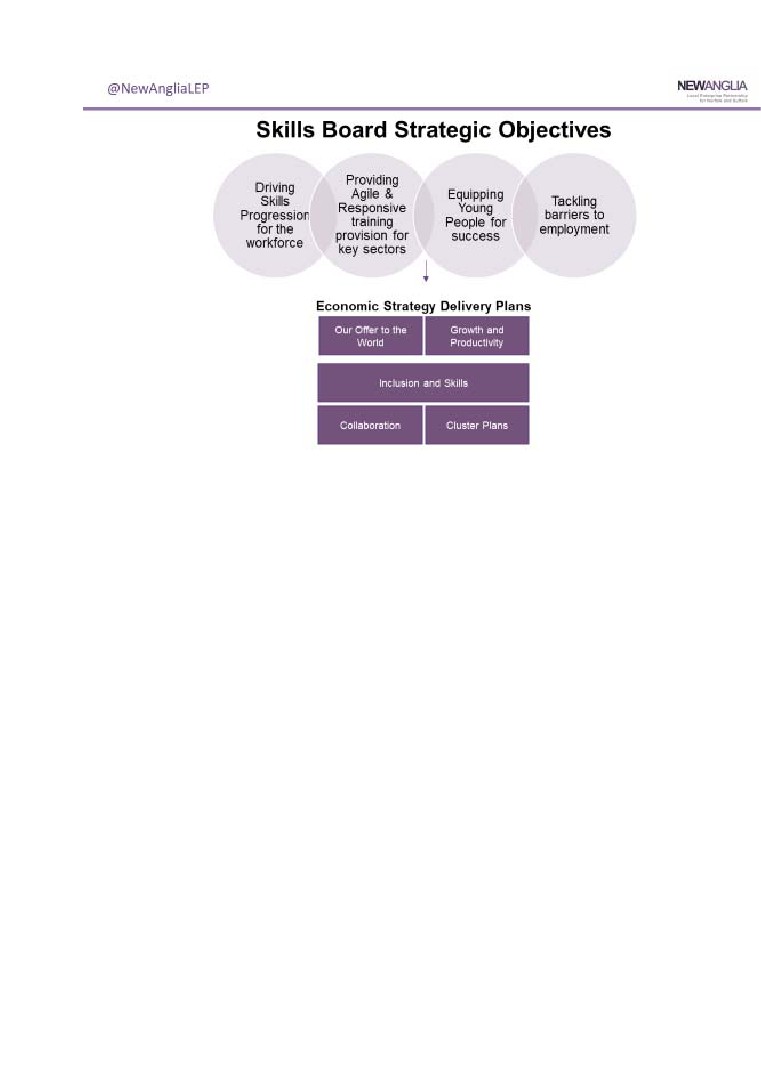

Key areas of work

Outlined below are just some of the areas of work that the Skills Board have covered over the

last year. They have been categorised under the four objectives but there is naturally some

overlap between them.

Objective 1: Driving Skills Progression for the Workforce

The European Social Fund is Europe’s main instrument for supporting jobs, helping people

get better jobs and ensuring fairer job opportunities for all EU citizens. It works by investing in

Europe’s human capital - its workers, its young people and all those seeking a job. Since 2015,

£31m has been available to contract 17 projects in Norfolk and Suffolk. This equates to over 14,

000 individuals receiving employability or training support.

The fund is focused on:

- Priority 1.1 Access to employment for jobseekers and inactive people

- Priority 1.2 Sustainable integration into the labour market of young people

- Priority 1.4 Active Inclusion

- Priority 2.1 Equal Access

- Priority 2.2 Labour market relevance of training and education systems

Emma Taylor was recruited in December as LEP Funding Manager and has really supported

the Skills Manager to maximise the opportunities that are still available. We have invested a

significant amount of time to support existing programmes, shape calls to ensure they support

the Economic Strategy and advise potential bidders on alignment to our ambitions.

Skills Reach were fortunate to receive an increase in the European Social Funding (ESF) for

our sector skills plans which resulted in the commissioning of a further 4 plans - Emerging

Technologies, Clean Energy, Creative Industries, Learning and Skills - bringing our total to 15.

They have been well received in the area and positively commented upon by other LEPs. Very

few LEPs have this level of evidence on their key sectors.

2

24

The recommendations set out in each plan are being taken forward by the sector groups or

linked sector skills groups. Sectors are reporting back to the Skills Board through written reports

every 4 months or via attendance at the Board on a rotation basis.

They are regularly used to support funding bids and with Labour Market Information for

curriculum design and careers advice.

We are developing a further ESF call to be able to develop projects to take the

recommendations forward at a faster rate. These projects can either be sector specific or cross

sector.

Norfolk and Suffolk County Council colleagues are also leading on complementary work under

the driving skills progression for the workforce objective.

With the potential construction of a new nuclear power station and development of the offshore

wind farms alongside significant plans for all other infrastructure development across Norfolk

and Suffolk it is clear that the region will require an increasingly large volume of technical skills

to enable growth.

The Suffolk Growth Programme Board, with funding from Suffolk Local Authorities and Norfolk

County Council, have commissioned the development of a Technical Skills Legacy report -

due to be completed in October - that will help us better understand the requirements for

technical skills over the next 5 to 15 years that growth in the region, including Sizewell C, will

depend on. This will be then be used to help inform planning and curriculum development in the

skills system going forward.

Objective 2: Providing Agile & Responsive training provision for key sectors

As part of the New Anglia Skills Deals programme, 10 ‘Skills Deals’ projects have been

allocated £1.4m of co-funding by the Education Skills Funding Agency, Suffolk Local Authorities

and Norfolk County Council. Each project looks to enable the development and delivery of new

innovative training that address gaps in the local offer identified by employers. To date these

projects have resulted in

29 new courses being delivered,

981 additional learners,

165

apprenticeships and over 190 employers benefitting. Going forward there will be an opportunity

for the Skills Board to allocate underspend from the original funding pot to grow the current

Skills Deals programme.

As the sector skills plans were developed, it became apparent that many of the challenges that

one sector faced were similar to other sectors. A cross-cutting report has brought together

the shared challenges our sectors face and highlights key areas of interventions that could

overcome them. It is regularly used within the Skills Board as a focus when looking at direction

of travel.

One initial success is the increase focus on ICT/Digital training. We were pleased that the LEP

Board approved capital funding for digital provision at City College Norwich, Suffolk New and

the University of Suffolk. The sector skills plans and cross cutting report provided valuable

evidence to steer both the bidders and appraisers.

Norfolk and Suffolk County Councils have also led on additional work under this theme. In

addition to this and the Digital Sector Skills plan, Norfolk County Council have further supported

this sector by developing a Digital/ICT Employer Engagement project. This has the aim of

delivering a programme of intensive engagement with smaller employers in addressing skills

shortages, creating a model that can be replicated across other sectors/ geographical areas.

Norfolk County Council has also developed a Supply Chain project which works in close

partnership with the Norfolk Chamber of Commerce and Vattenfall, establishing the skills

3

25

requirements of SME’s to enter the supply chain of the renewable energy industry, in addition to

imminent Norfolk infrastructure projects. The project is part funded by the LEP’s Innovative

Projects Fund.

We are anticipating that there will be a cross cutting focus for some of the proposals to the ESF

call discussed on page 2.

Objective 3: Equipping Young People for Success

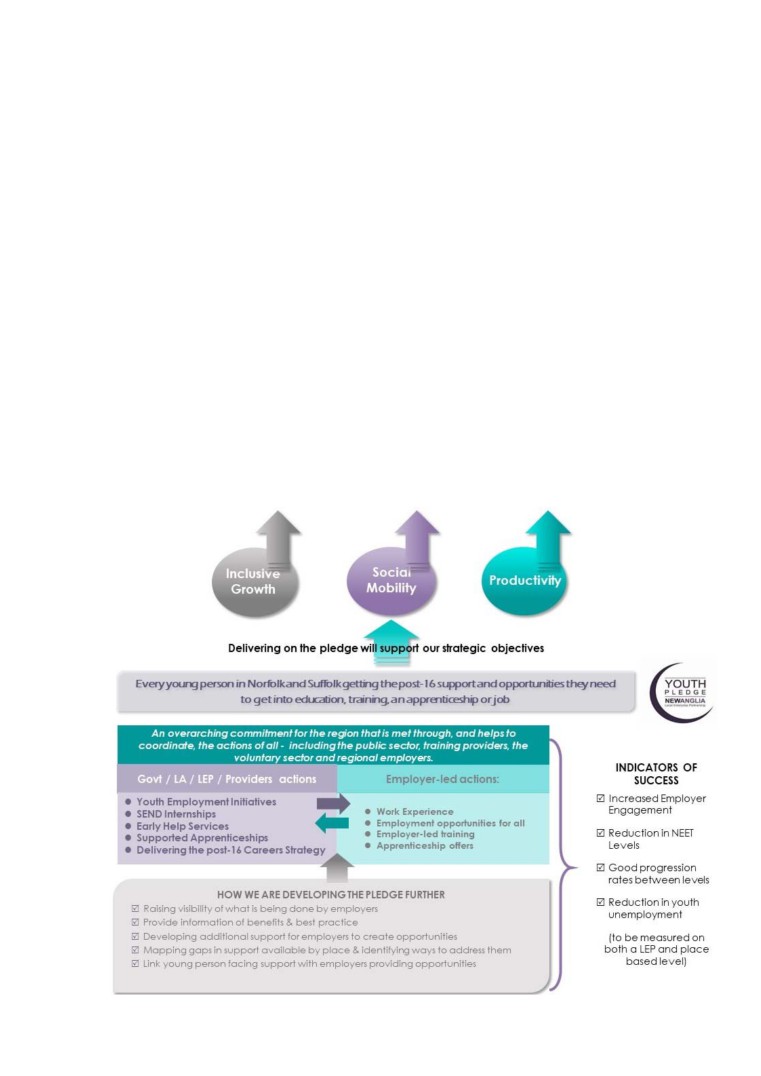

The New Anglia Youth Pledge is a regional commitment made by stakeholders across both

the public and private sectors to work to ensure that every young person in Norfolk and Suffolk

gets the post-16 support and opportunities they need to get into education, training, an

apprenticeship or a job. Employers coming together under this ‘umbrella’ pledge help to

coordinate what is already happening to further the prospects of young people in the area,

stimulates better join-up and collaboration and increases visibility so that we can maximise

impact and identify gaps in current provision.

Key stakeholders have been involved in discussions over recent months to ensure that it is fit

for purpose and easy for businesses to engage with. A linked communication plan can be

developed over the coming months.

There is a vast array of activities that take place under this ‘umbrella’, much of which is not

under the control of the Skills Board but we are keen to maximise the visibility and impact of

them.

4

26

The Enterprise Adviser Network (EAN) is an important programme that supports schools to

develop a careers strategy and it encourages skills interventions to support the achievement of

the Gatsby benchmarks (see LEP Board report from June 2019). Glen Todd, (EAN Manager)

has a place on the Skills Board and the Board has/will receive update on progress.

In January, the LEP agreed £15,000 of financial support over 3 years for the Norfolk Skills

and Careers Festival and the Suffolk Skills and Careers Festival (formally the Suffolk Skills

Show). These are the main ‘go to’ careers events for the secondary schools so we are keen to

support them. The events promote our key sectors and we support them with publicity,

introductions to potential stand holders and with strategic steer. The Royal Norfolk Agricultural

Association and the Suffolk Agricultural Association are working in partnership now to organise

these events and share any lessons learnt. They are also working with the same marketing

agency to engage businesses in the events.

Norfolk and Suffolk County Councils have also continued their support for these Festivals and

we align our focus and expected outputs.

The Norfolk event in March had over 6700 visitors which was the highest number to date. We

are now focussing on the Suffolk event which is on October 16th at Trinity Park in Ipswich.

We have also had an update on the Opportunity Areas and from the Police and Crime

Commissioner teams plus linked stakeholders on their work around county lines drug

prevention activity centred around young people.

Objective 4: Tackling barriers to employment

Skills Support for the Workforce programme is one of the European Social Funded projects

which upskills employed people. It has been monitored by the Skills Board and some members

have provided additional strategic steer. There was a £4.5 million allocation which trained 3,600

people which was delivered by Seetec. A new programme started in April 2019 which is being

delivered by Steadfast training.

An Emerging Leaders programme was run by our FE colleges which trained 200 people, 49%

female.

A new project that is being discussed at the July Skills Board is Community Grants awarded

to Norfolk County Council Adult Education Services. It is a delegated grant scheme available to

community and voluntary organisations that provide training, skills development or support to

help people improve their chances of obtaining work. Funded projects will support people to

engage with the learning offered and enable people to progress into employment or more

formal learning and skills provision. It operates across the LEP area.

Recent calls waiting to be appraised or establish include those with a focus on Youth Pledge,

Apprenticeships, Integrated Work and Health and Work Well Suffolk. Norfolk and Suffolk

County Councils plus local providers have expressed interest in these calls so the Board will be

keen to support successful bidders to maximise impact and prevent unnecessary overlap.

Norwich for Jobs was established by Chloe Smith (MP) in 2013 and is a network of local

employers, charities and organisations volunteering with the aim of getting young people (16 -

24 year olds) the skills and experience they need to get into work.

Over the last year, members of the Skills Board supported this and the newly developed West

Norfolk for Jobs, Breckland for Jobs and South Norfolk for Jobs.

5

27

The Apprenticeship landscape has been challenging over recent months. Many Board

members actively champion apprentices and want additional lobbying to ensure strong uptake

in the region (see paper 8).

Some key concerns of the Skills Board are:

The education landscape needs to stabilise. Reforms need time to become widely and

clearly understood and firmly embedded but change often follows change and results in

a skills system that is unstable. This makes it difficult for providers to plan, for employers

to engage and for learners to make informed decisions.

We need a fully functioning provider base -they are hampered/restricted by the

following:

o Underfunding - particularly revenue in the FE sector when it is typically based

on historical needs

o Development of new innovative provision, including that at higher levels, carries

a significant risk for the providers and current funding/curriculum constraints

don’t easily allow for flexibility.

o There is a stigma of colleges being ‘financially- challenged’ - perception that a

college is not providing quality provision if they are in financial difficulties but not

necessarily the case - this stigma can further hinder colleges which then find

themselves in a perpetual downward spiral.

The current system doesn’t encourage continued professional development. Funding is

nearly all focused on initial entry into the labour market and doesn’t greatly enable the

dipping in and out of the system throughout a professional life hence a reliance on

additional/external funds to facilitate this such as SSW and ESF.

Development of Skills Advisory Panel

The Government is requesting that LEPs develop a Skills Advisory Panel (SAP) in each LEP

area in order to fulfil their local leadership role in the skills system. They will ensure we

understand our current and future skills needs and labour market challenges. There is an

expectation that action plans are drawn up to address these skills issues. This in turn, can give

more people in the local community access to high quality skills provision which potentially

leads to ‘good’ jobs. This will enable the LEP and other stakeholders to make funding decisions

more effectively.

Their remit is also to strengthen the link between public and private sector employers, local

authorities, colleges and universities. They will also reflect the geography of the Local Industrial

Strategies and it is recommended that where existing employment and skills boards are

functioning well, they will take on the Skills Advisory Panel function rather than creating a new

body. We believe this to be the case in our LEP area as our current membership and focus

almost mirrors the expectations.

The SAP should support the aspirations of our Local Industrial Strategy, particularly as

People has such a strong focus.

Provider funding is starting to be linked into engagement with Skills Advisory Panels such as

with the new T Levels plus there is an expectation that providers work together to provide the

skills offer that is needed in the LEP area without undue duplication. It is proposed that this is

reciprocated with a requirement on Skills Advisory Panels to have regard for providers’

missions and capabilities in their planning work.

We have been allocated £75,000 to support us to further our analytical evidence base and we

must report on this spend. We have a signed MOU where we have agreed the following

activities:

6

28

July - September 2019

Mapping out the updating/enhancing of the sector skills plans and

economic strategy date

October - December 2019 Creation of internal skills-focussed workbooks for continued

analysis

January - March 2020

Funding new sources of data and associated training of key staff

April 2020 - March 2021

Continued enhancement of our sector skills plans and economic

strategy data

Our current Terms of Reference will be reviewed at our first Skills Advisory Panel meeting in

September 2019. We will use the current Skills Board version as a basis but we are aware that

we need to strengthen some aspects of the governance. We will bring these back to the LEP

Board for full sign off.

Under the current guidance, we need to recruit a new Skills Board member to represent the

voluntary sector. All other members will be asked if they wish to transfer across.

We would welcome the opportunity to engage further with the LEP Board to ensure we meet all

the expectations placed on us.

Link to the Economic Strategy

Inclusion and Skills is a clear theme in the Economic Strategy and lays out 10 high level action

points to move the agenda forward, particularly within our key sectors. The delivery plan was

developed with officers from Norfolk and Suffolk County Council and milestones for activity

derived. This links into the main Economic Strategy delivery plan and is currently being

monitored and updated as necessary.

Recommendation

To approve the transition from a Skills Board to a Skills Advisory Panel as required by

Government.

To continue to endorse the activities of the Skills Board/Skills Advisory Panel

To support the Skills Advisory Panel with resolving key issues identified by its members

and analytical evaluation

7

29

New Anglia Local Enterprise Partnership Board

Tuesday 23rd July 2019

Agenda Item 8

Apprenticeships Levy Transfer Pool

Author: Chris Starkie and Natasha Waller

Presenter: Chris Starkie

Summary

This paper asks the board to agree to the establishment of a New Anglia Levy Transfer Pool.

The pool will help facilitate the transfer of unspent apprenticeship levy payments from levy

payers to SMEs across Norfolk and Suffolk.

This would retain several million pounds of training funding locally and pay for the training of

hundreds of additional apprenticeships.

Recommendation

The LEP Board is asked to ask the executive to proceed with the development of a cost-

effective model to support the transfer of apprenticeship levy to SMEs in partnership with

colleagues from Norfolk and Suffolk County Councils, and to agree a £60,000 budget.

Background

Apprentice numbers have dropped significantly in recent years due to apprenticeship reforms

making businesses more cautious, new standards not being available and/or more training

being focussed on existing staff members.

Across the East of England, apprenticeship starts have declined from 46, 650 (2015-16) to 36,

700 (2017 - 18). The biggest impact has been on the Level 2 Intermediate Apprenticeships

which have fallen from 25, 640 to 14, 620 in that time period. The 16 - 24 year old age group

are the biggest age group impacted.

This mirrors the national picture with starts falling from 509, 360 (2015 - 16) to 375, 760 (2017

- 18).

The Norfolk and Suffolk Economic Strategy prioritises apprenticeships to support the growth of

our businesses.

Intervention is required in order to boost the number of apprenticeship starts particularly

amongst SMEs, which make up the vast majority of employers in the area.

Issue

Companies with a pay roll in excess of £3m/year must pay the apprenticeship levy at a rate of

0.5% of wage bill, which they can only utilise to fund apprenticeship training. Payments are

taken on a monthly basis through the PAYE system. (Further details can be found at

1

31

After a slow start, many larger employers are utilising the levy to invest in training. There is

some evidence it is primarily being utilised to upskill existing staff rather than employ new

apprentices, although that varies from business to business.

However it is also evident that many levy payers are not utilising their full allocation, in some

cases by a significant amount.

If this allocation is not spent after 24 months then the allocation is retained by Government and

lost from the area.

At the same time training providers have to apply to the Government for funding to train

apprentices working for non-levy payers - any business with a payroll less than £3m per

annum. Many local providers have these contracts but from April 2019, the financial level of

these contracts have been reduced from the evidence that has been put to the LEP and other

stakeholders.

This is already having an impact on apprenticeship provision for predominately SME

businesses and have implications on the providers curriculum offer and potentially staffing

levels.

Levy transfer

In theory, the solution is for levy payers to transfer a proportion of their funding to non-levy

payers in their supply chain. That is because up to 25 per cent of unspent levy can be

transferred by the levy payer to businesses in their ‘supply chain’. These receiving businesses

can then ask for providers to train their apprentices without it impacting the providers non-levy

training allocation.

Individual apprentices need to be identified to ‘receive’ the funds for their training.

However, this is onerous on individual levy payers plus receiving business and without a

simple mechanism in place plus a willingness by all partners, it will simply not happen.

This means that potentially several million pounds of levy funding will be lost from the region

instead of being invested in apprenticeship training.

Proposal

For levy transfer to work effectively and to have a significant impact on our SMEs - it needs to

be done at scale and with support for both the levy payers and the SMEs.

Levy payers (in and outside of the LEP area) with unspent levy need to be identified and

encouraged to allocate some/all of their unspent levy into a virtual pot. Any preferred use of

their funds need to be identified at this stage, e.g. certain apprenticeship standard, sector,

geography.

The LEP or an endorsed partner will then source businesses direct or through an

apprenticeship provider that have potential apprentices who are looking to ‘receive’ the funds.

An introduction will be made and if all parties, including the training provider are happy with the

match then funds can start to be transferred.

Having LEP endorsement of the process has the aim of raising the profile and being an

impartial broker.

2

32

The West Midlands Combined Authority launched its own earlier model earlier this year and we

are receiving advice and support from the Education and Skills Funding Agency on establishing

our own levy transfer pool.

The pool would be developed by the LEP working alongside Norfolk and Suffolk County

Councils as a three partner project. Norfolk and Suffolk County Councils are both realigning

their apprenticeship services at the moment in order to prioritise their services where they are

most needed.

We have already identified a number of levy paying employers in the private and public sectors

who would be willing to participate in the scheme, and the project has the support of the

chambers of commerce.

The FE Colleges are all keen for us to action this promptly and discussions will continue with

them. This service will not disrupt what they currently do with their employers, it will support

those employers that they currently work with and bring new ones to them.

To make the proposal viable we would need to seek a total commitment of between £1m and

£1.5m of unspent levy, which could require somewhere between 10 and 15 levy payers.

We are looking initially for a £60,000 allocation to provide the focused resource to get the

project up and running for a 12 month period.

The resource would identify businesses that are willing to be part of the levy transfer process

and to provide training to all parties to make the transfer in conjunction with an identified

training provider. It is important for us to bring the parties together and ‘hide the wiring’.

In terms of timescales - we will be looking to put in place the resources required to run the

programme, and begin the process of sourcing transfer pledges from levy payers over the

summer.

This would enable the LEP and the county councils to formally launch the project at the Suffolk

Skills and Careers Festival on October 16th.

Link to the Economic Strategy

Our Economic Strategy asks for us to ‘step up our efforts to promote and support the delivery of

high quality apprenticeships providing clear entry routes into our focus sectors, directly

producing the skills and capabilities our economy needs. Lack of intervention at this stage will

not allow this to happen.

Recommendation

The LEP Board is asked to ask the executive to proceed with the development of a cost-

effective model to support the transfer of apprenticeship levy to SMEs in partnership with

colleagues from Norfolk and Suffolk County Councils, and to agree a £60,000 budget.

3

33

New Anglia Local Enterprise Partnership Board

Tuesday 23rd July 2019

Agenda Item 9

Growing Business Fund : Large Company Grant Programme

Author- Chris Dashper

Summary

To present the LEP board with a rationale for supporting grant requests outside the scope of

existing programmes such as the Growing Business Fund and the Growing Places Fund.

The paper was discussed at the June meeting of the Investment Appraisal Committee and is

recommended for approval.

Recommendation

The LEP board is asked to approve the introduction of a GBF Large Company Grant

programme following recommendation by the Investment Appraisal Committee.

The programme will support occasional applications for significant, innovative projects from

large companies based in Norfolk or Suffolk or looking to relocate to the New Anglia region.

Background

New Anglia LEP has recently celebrated the award of the 700th grant to businesses since the

first grant programme was launched in 2012.

The majority of applications for grant funding from Norfolk and Suffolk businesses can be

serviced adequately from existing programmes including the Growing Business Fund, Small

Grant Scheme and the recently introduced Innovative Projects Fund. The Growing Places

Fund has also provided grant interventions of up to £250k to a number of regionally

significant cultural and tourism projects.

Grant schemes have a degree of flexibility built into their criteria to help to support a diverse

range of projects from businesses across the LEP region, with a focus on priority sectors but

with the ability to explore other sector opportunities if necessary.

However, on occasion, some regionally significant projects cannot be supported through

standard grant mechanisms. Usually this is because applicants are classified as large

companies or because the intervention requested exceeds the limits of existing grant

schemes.

1

35

The LEP has been able to support large companies on a one-off basis in the past however, it

has not previously had a formal process in place to consider this type of grant.

Developing a call for new projects

To enable the LEP to consider occasional applications for funding for projects out of scope

for existing programmes, the LEP Executive is proposing the introduction of a new

programme, the GBF Large Company Grant programme.

The programme would operate on an open call basis in the same way as the current

Growing Places Fund and Growing Business Funds.

A gradual reduction in eligible enquiries for commercial loan support from the LEP over the

last few months indicates that there will be some capacity within the GPF budget during

2019/20 and 2020/21, at a time when there is considerable pressure to allocate and spend

the Growth Deal budget by 31 March 2021.

Funding for the Large Company Grant programme will comprise a budget of £2.5m to cover

the financial years 2019/20 and 2020/21, secured by releasing capacity within the Growing

Places Fund budget, part of the overall Growth Deal allocation. The likelihood is that a very

small number of projects could be supported, perhaps 3 or 4 from the budget allocation.